The Daily Shot: 10-May-23

• The United States

• The United Kingdom

• The Eurozone

• China

• Emerging Markets

• Cryptocurrency

• Commodities

• Energy

• Equities

• Credit

• Rates

• Food for Thought

The United States

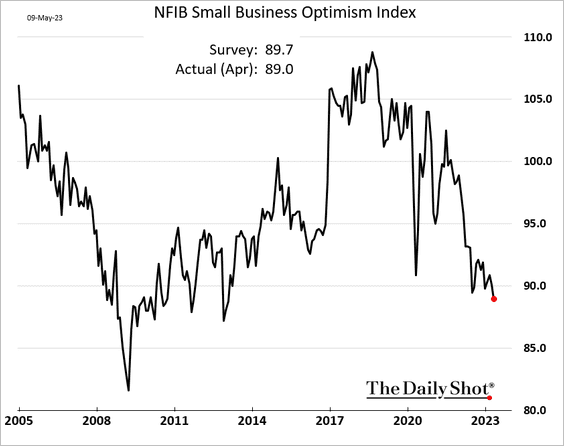

1. The NFIB small business sentiment index hit a multi-year low last month.

Source: Reuters Read full article

Source: Reuters Read full article

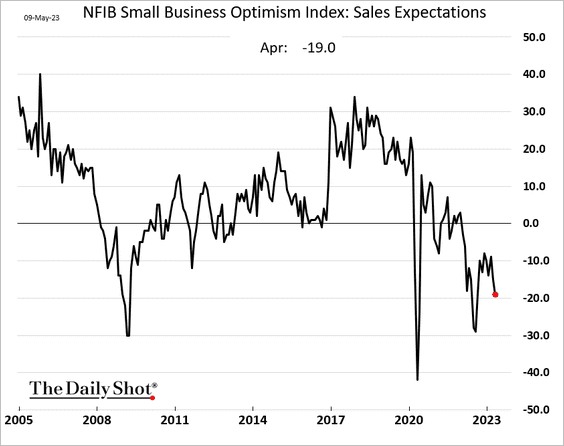

• Sales expectations weakened.

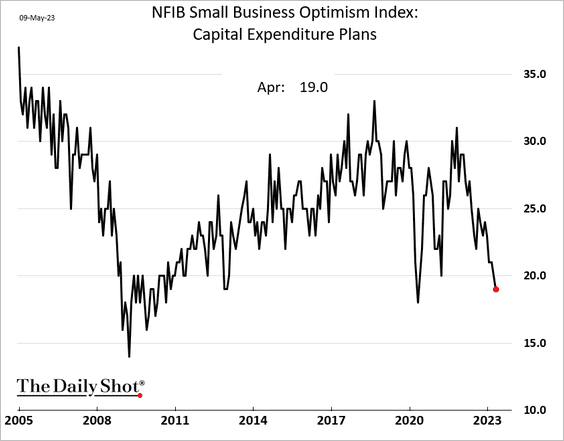

• CapEx expectations are crashing, …

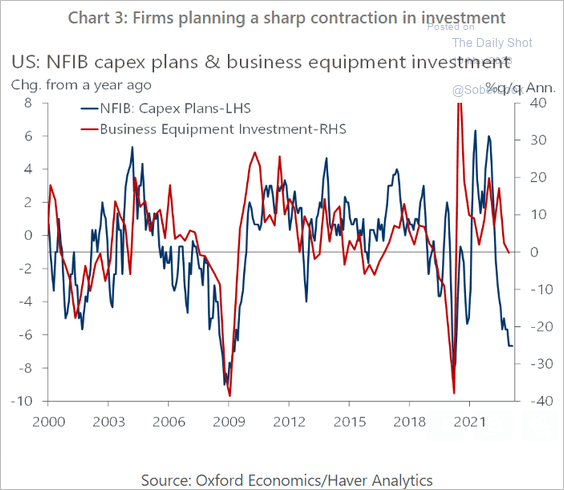

… signaling further deterioration in business investment.

Source: Oxford Economics

Source: Oxford Economics

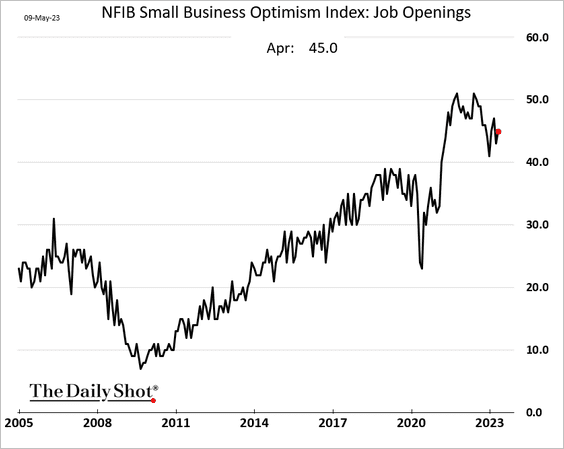

• The index of job openings remains elevated.

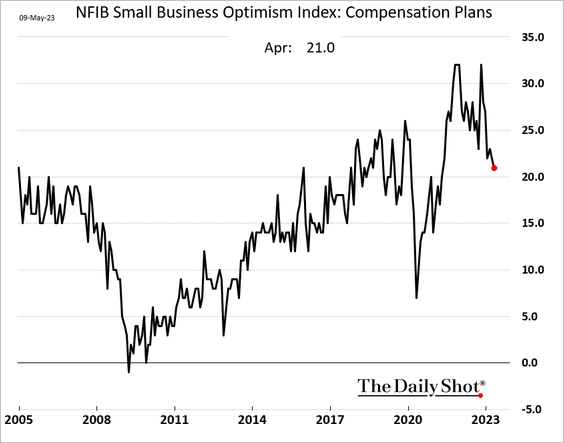

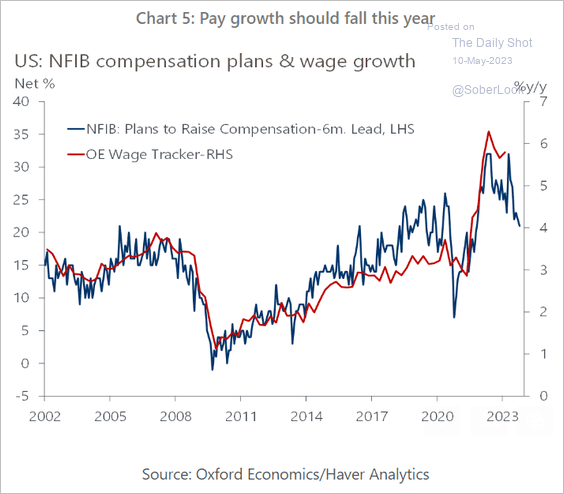

• Compensation plans continue to ease, …

… an indication of slower wage growth ahead.

Source: Oxford Economics

Source: Oxford Economics

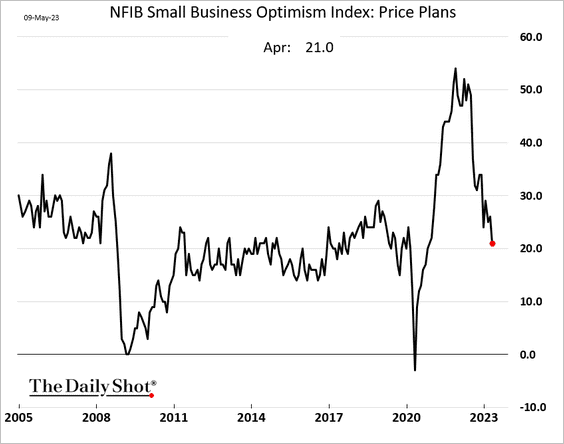

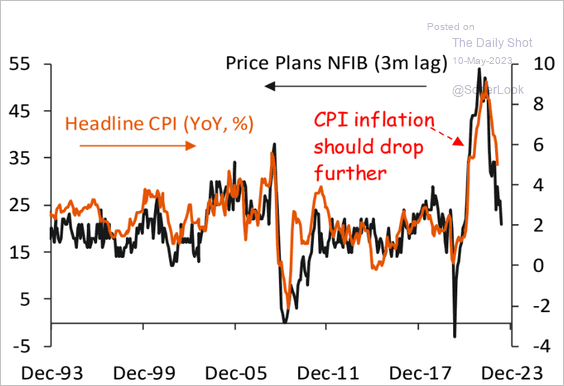

• Price plans are now at pre-COVID levels, …

… which is good news for inflation.

Source: Piper Sandler

Source: Piper Sandler

——————–

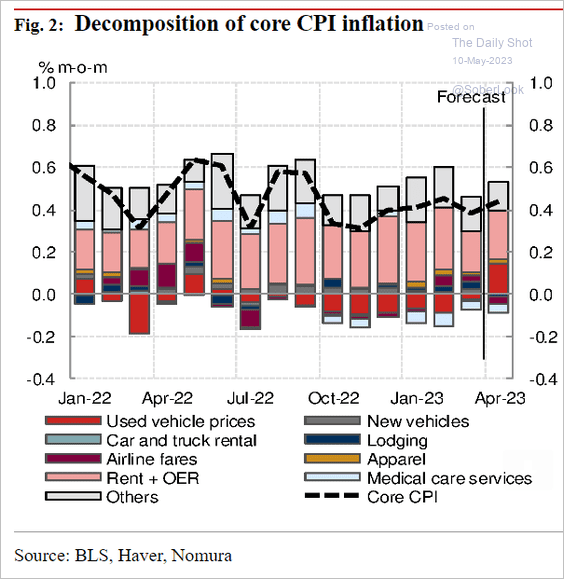

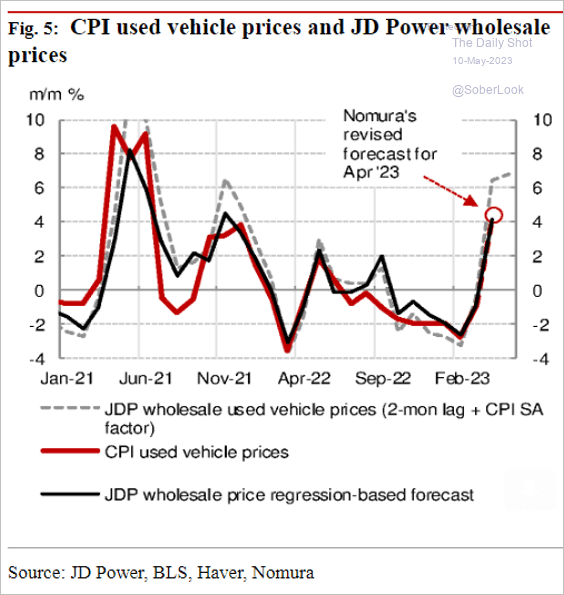

2. Nomura revised its April core CPI estimate higher, …

Source: Nomura Securities

Source: Nomura Securities

… as used vehicle inflation rebounds.

Source: Nomura Securities

Source: Nomura Securities

——————–

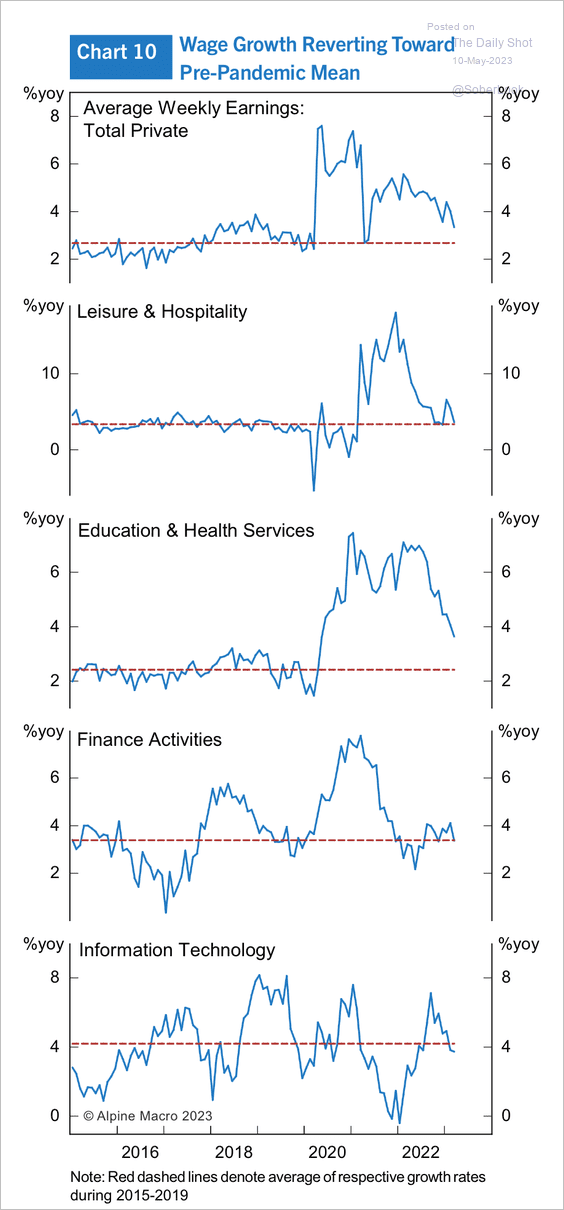

3. Wage growth has peaked across industries.

Source: Alpine Macro

Source: Alpine Macro

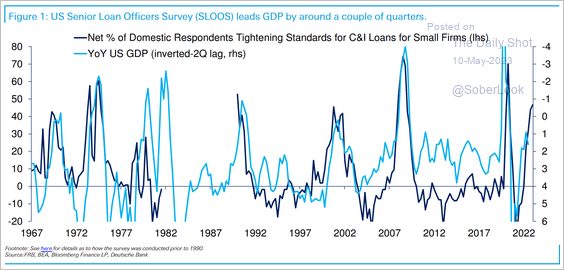

4. The Senior Loan Officers Survey typically leads GDP by a few quarters. So far, tighter lending standards point to a mild recession.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

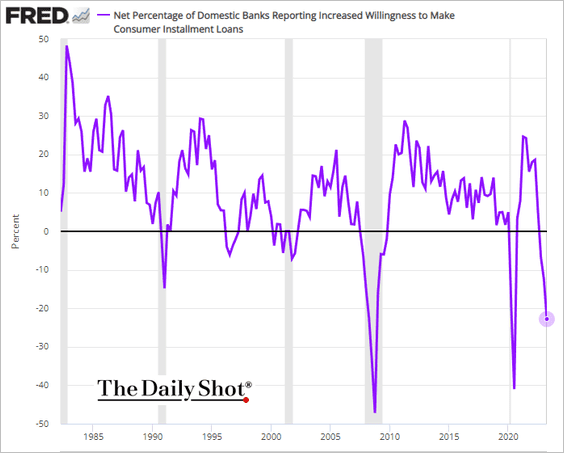

For example, banks are rapidly cutting back on installment loans.

——————–

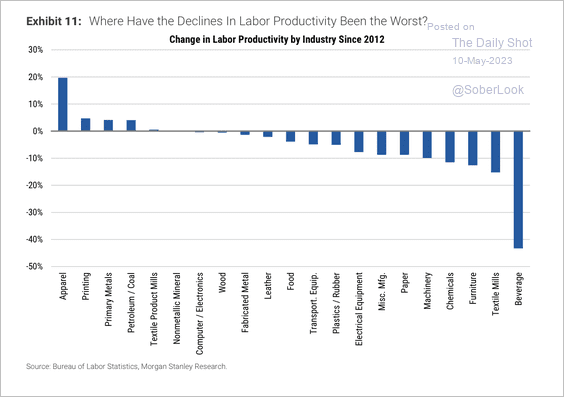

5. Here is a look at labor productivity by sector.

Source: Morgan Stanley Research

Source: Morgan Stanley Research

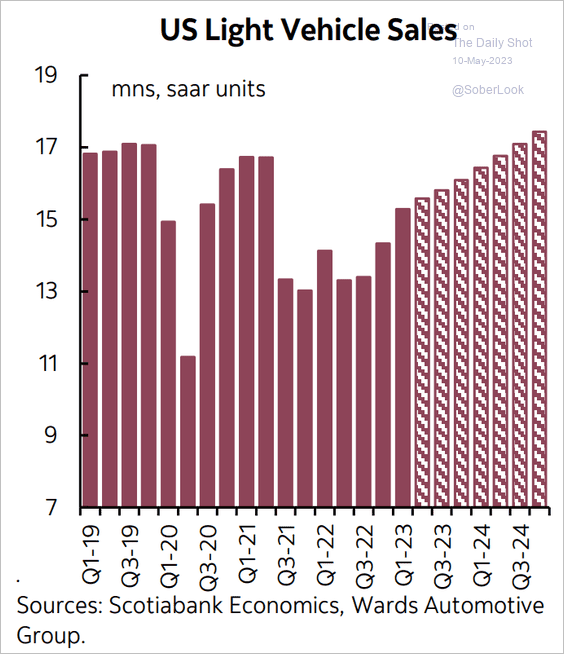

6. The rebound in vehicle sales is expected to continue.

Source: Scotiabank Economics

Source: Scotiabank Economics

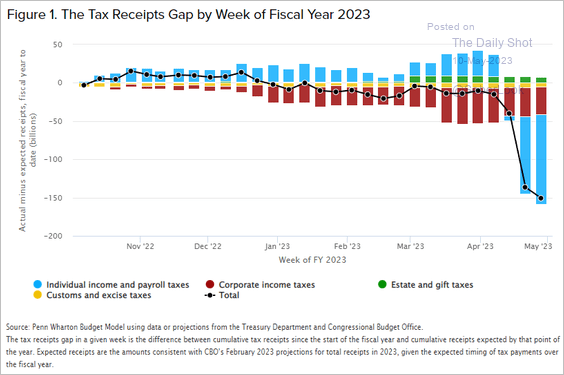

7. In the past, the United States has faced multiple impasses over the debt ceiling, but these have always been settled eventually, even if only at the last minute. As a result, the markets have become accustomed to the idea that these are temporary issues that will ultimately be resolved. There is a widespread belief that politicians will never allow the US to default on its debt, and this has led to a sense of complacency among investors and the public.

However, the current political climate in the US is more polarized than ever before, and the hostile atmosphere in Congress could make it difficult to reach a resolution on the debt ceiling. Many constituents on both sides of the aisle seem unwilling to compromise, and some would rather see the country default than give ground in the negotiations.

Given these factors, it is possible that this time could be different, and that the debt ceiling impasse could have more serious consequences than in the past.

• Tax receipts have been low relative to the CBO’s projections, bringing the X-date forward.

Source: The Wharton School of the University of Pennsylvania Read full article

Source: The Wharton School of the University of Pennsylvania Read full article

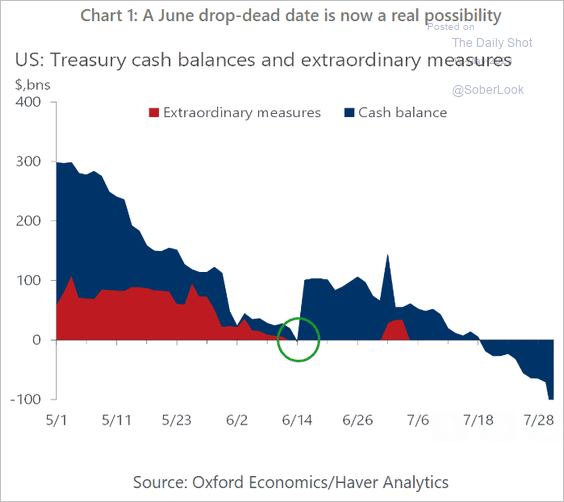

• June is now a possibility – otherwise, it’s July.

Source: Oxford Economics

Source: Oxford Economics

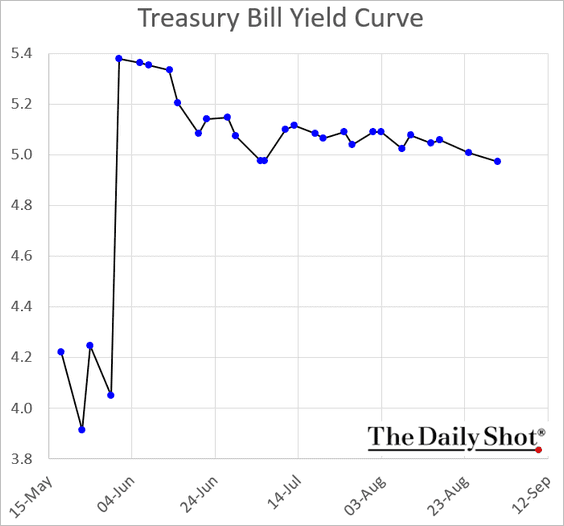

• The T-bill curve says June.

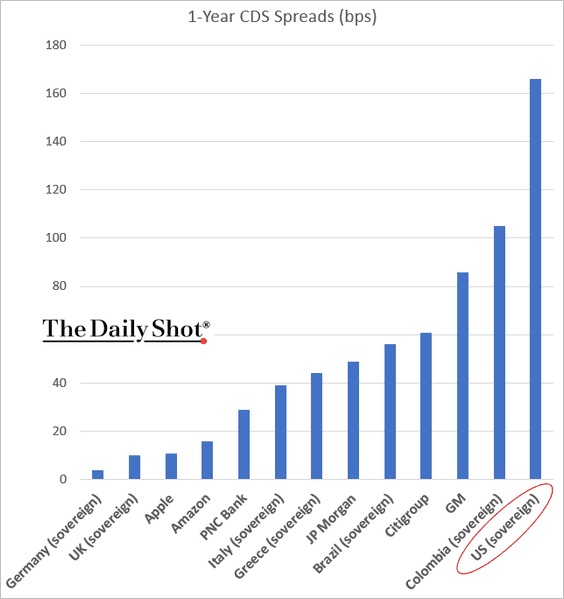

• Finally, let’s put the US sovereign credit default swap spread (an indicator of default probability) into perspective.

Back to Index

The United Kingdom

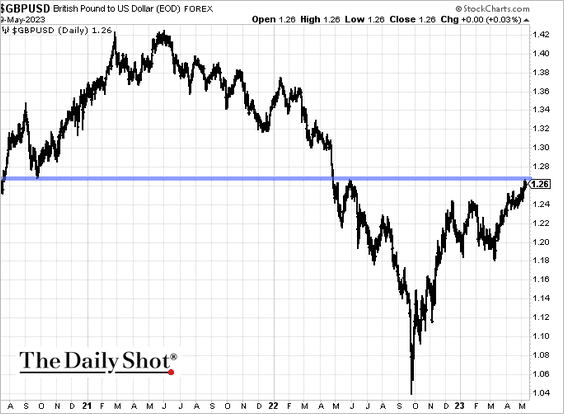

1. GBP/USD is at resistance.

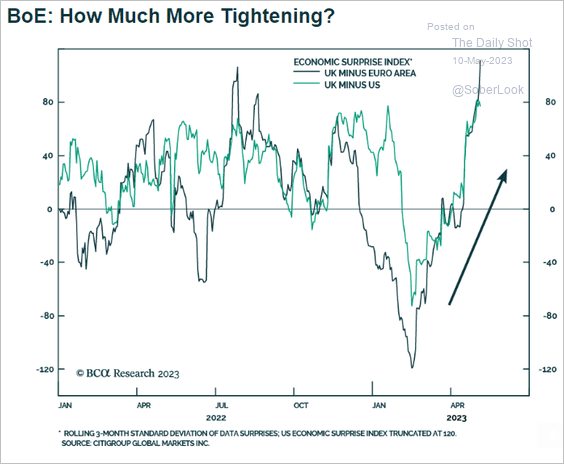

2. The UK economic surprise index has been outperforming the US and the Eurozone.

Source: BCA Research

Source: BCA Research

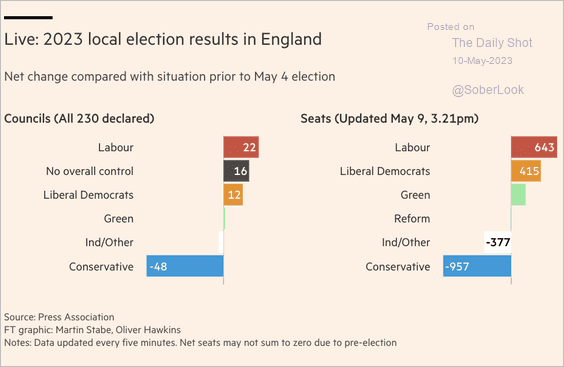

3. Here is a summary of the local elections.

Source: @financialtimes Read full article

Source: @financialtimes Read full article

Back to Index

The Eurozone

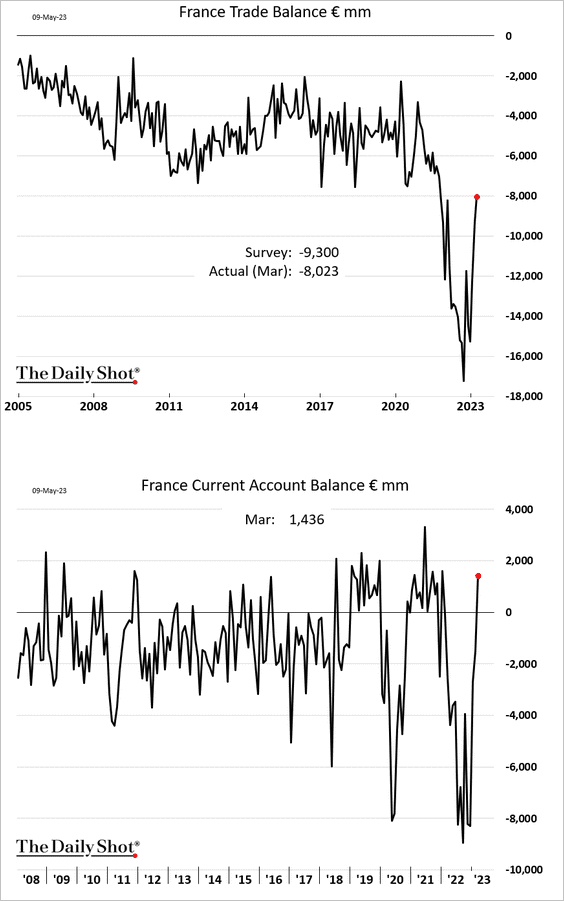

1. The French trade deficit tightened more than expected in March. The current account balance was back in surplus.

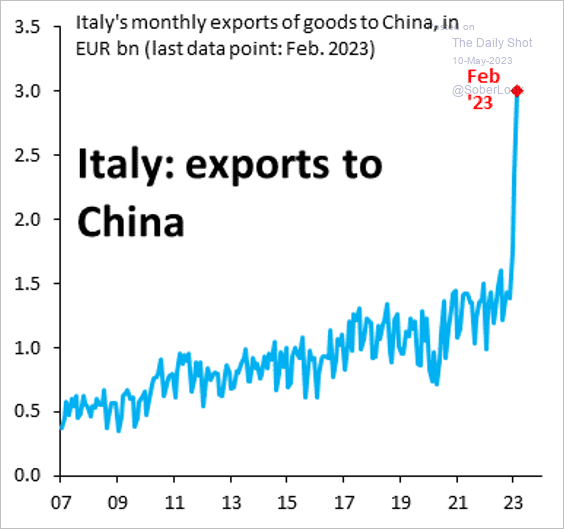

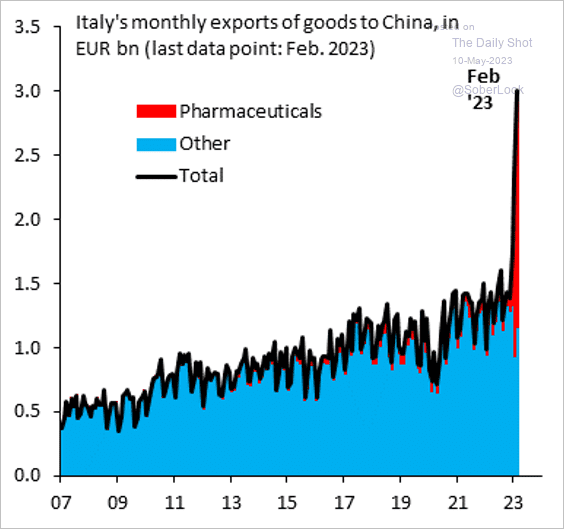

2. Italy’s exports to China surged recently. This is mostly because of demand for a generic liver drug made in Italy that is rumored to prevent COVID-19, according to IIF. (2 charts)

Source: @RobinBrooksIIF

Source: @RobinBrooksIIF

Source: @RobinBrooksIIF

Source: @RobinBrooksIIF

——————–

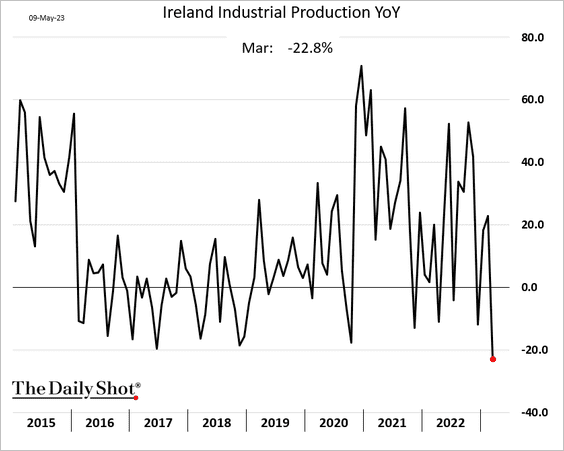

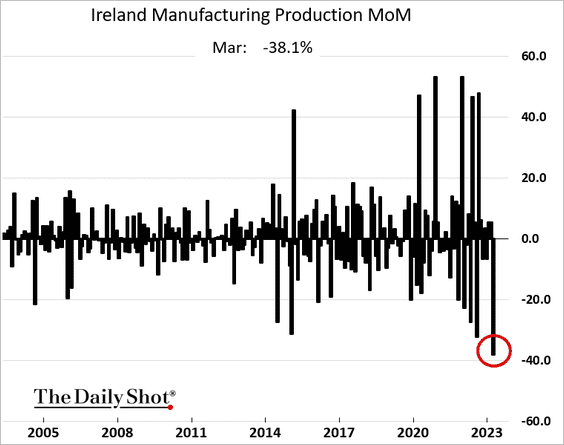

3. Ireland’s industrial production was down sharply in March.

Source: Business Plus Read full article

Source: Business Plus Read full article

——————–

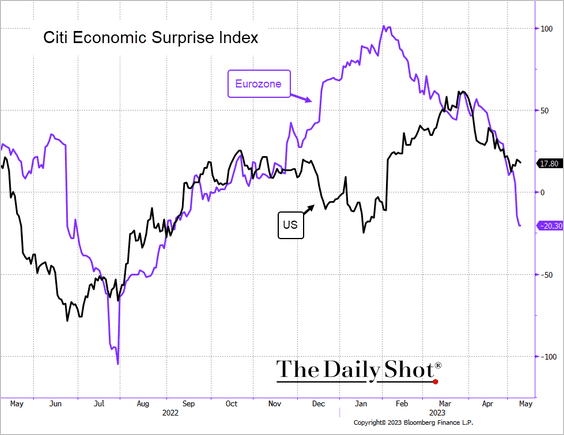

4. The Eurozone’s economic surprises are now underperforming the US.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

Back to Index

China

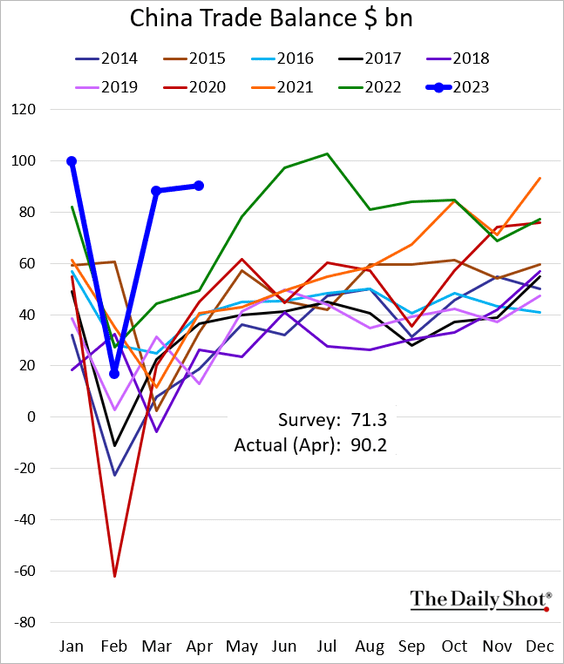

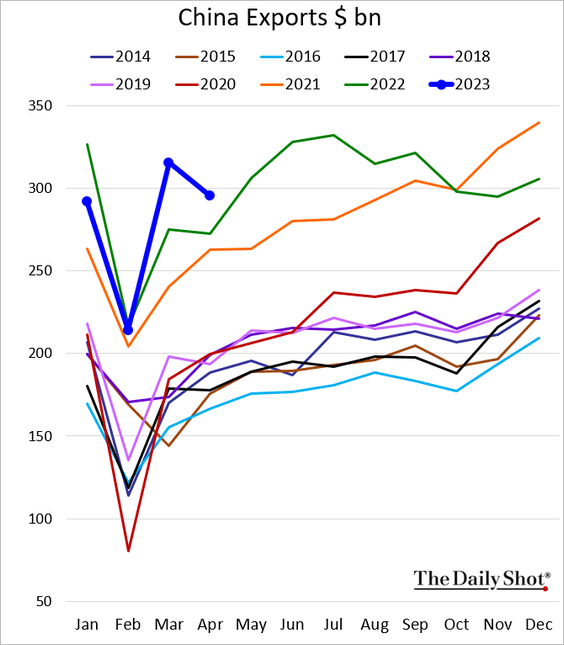

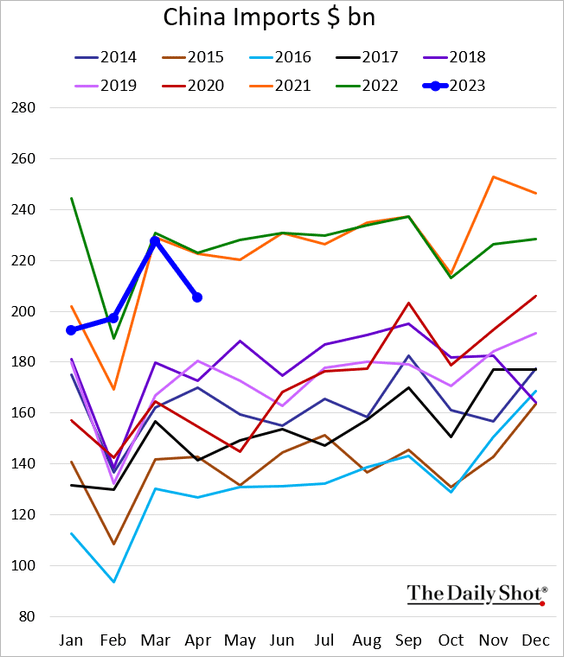

1. China’s trade balance topped expectations, hitting a record high for this time of the year.

Exports are still robust, …

… but imports unexpectedly dropped. Exports could soon decline as well, which spooked the markets on Tuesday.

Source: Reuters Read full article

Source: Reuters Read full article

——————–

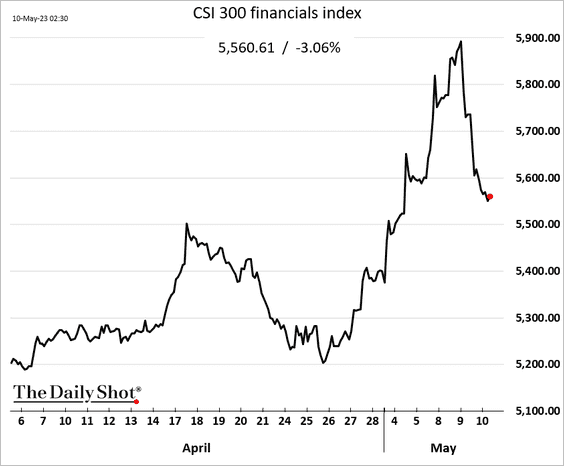

2. Financials (mostly state banks) are reversing the recent rally.

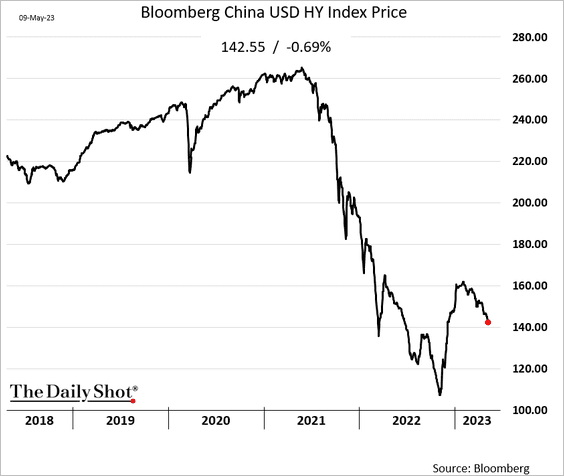

3. The bounce in USD-denominated HY debt is fading (mostly offshore developer debt).

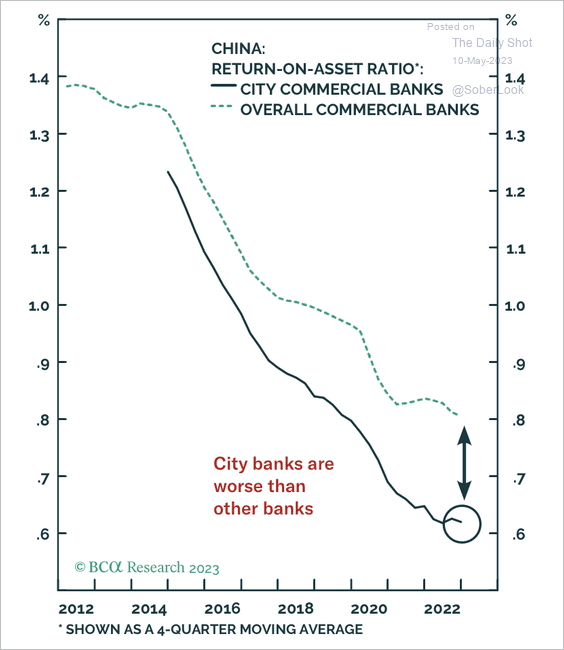

4. Smaller regional banks are the most exposed to LGFV debt.

Source: BCA Research

Source: BCA Research

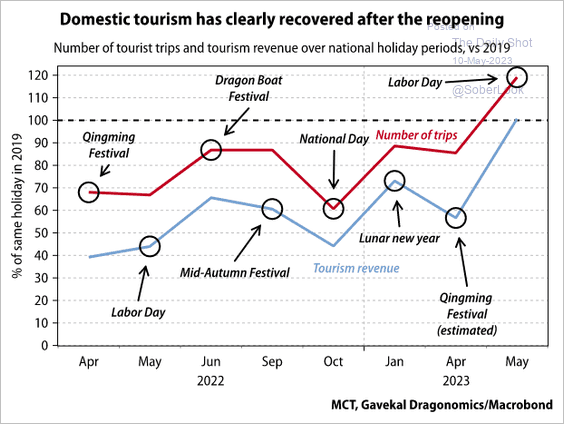

5. Tourism has rebounded.

Source: Gavekal Research

Source: Gavekal Research

Back to Index

Emerging Markets

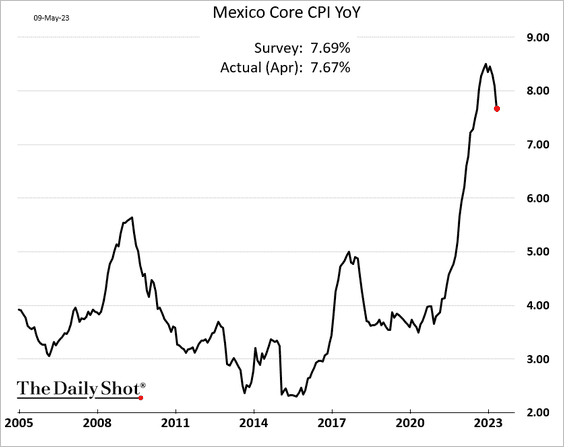

1. Mexico’s inflation is moderating.

Source: @thatsleda, @economics Read full article

Source: @thatsleda, @economics Read full article

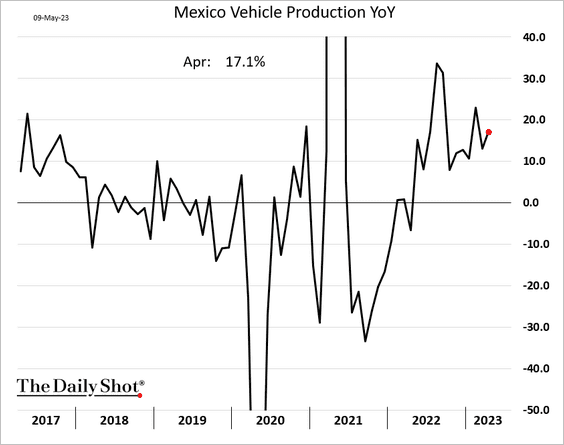

• Vehicle production has been strong.

——————–

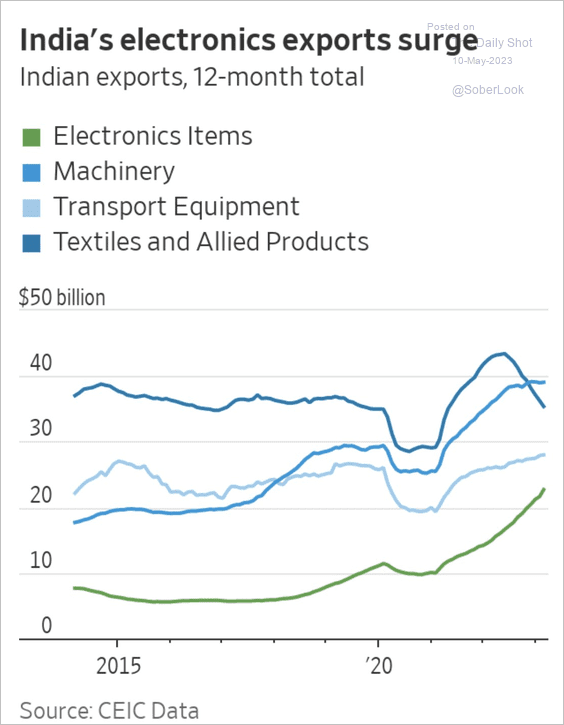

2. India’s electronics exports are finally taking off.

Source: @WSJ Read full article

Source: @WSJ Read full article

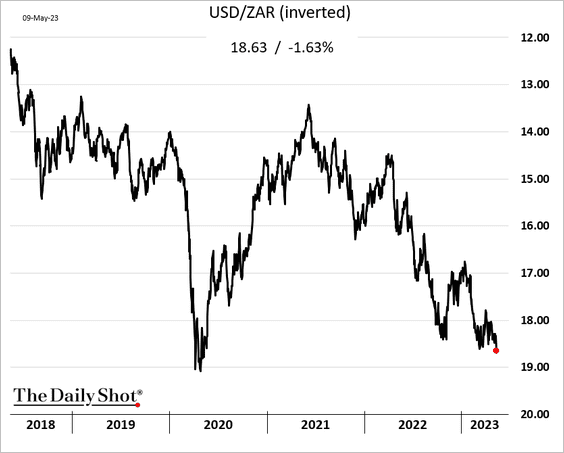

3. The South African rand is under pressure.

Back to Index

Cryptocurrency

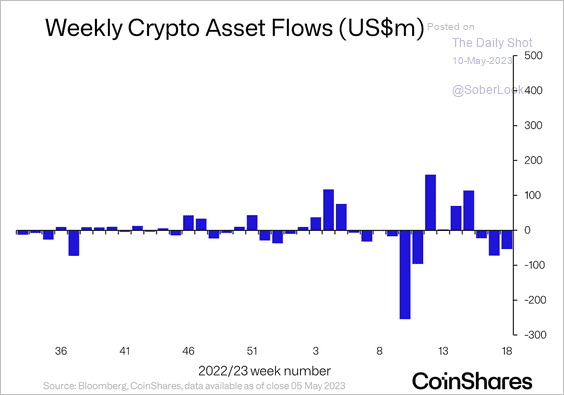

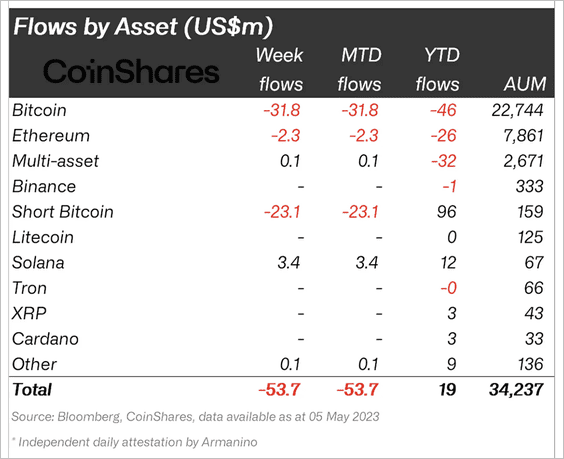

1. Crypto funds saw the third consecutive week of outflows.

Source: CoinShares Read full article

Source: CoinShares Read full article

Bitcoin and Ethereum-focused funds saw the most outflows last week, although short-bitcoin funds saw the largest outflows on record.

Source: CoinShares Read full article

Source: CoinShares Read full article

——————–

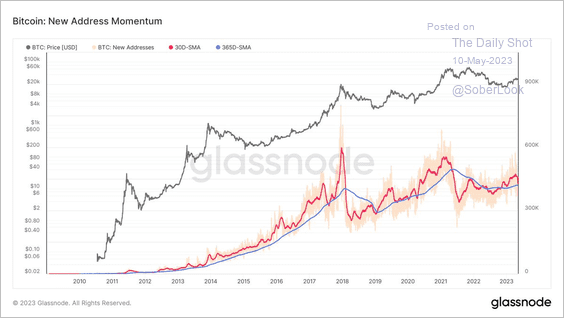

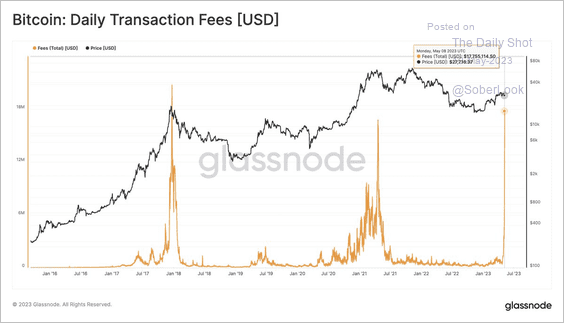

2. Despite record transaction levels, bitcoin’s new active addresses (entities that send or receive BTC recorded on the blockchain) have started to decline…

Source: @glassnode

Source: @glassnode

…which could signal weaker demand, which typically subsides after a sharp uptick in transaction fees. Will we see a deeper pullback in BTC’s price?

Source: @glassnode

Source: @glassnode

——————–

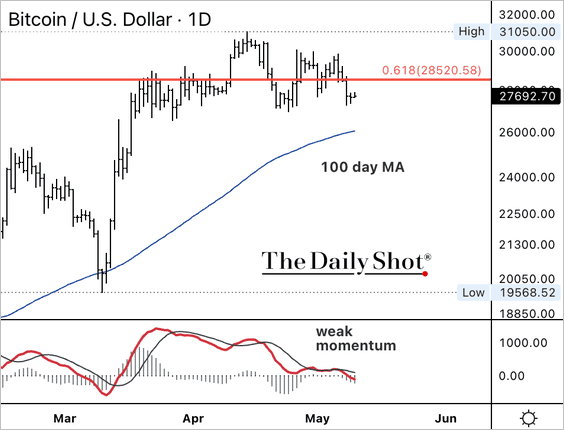

3. The next major support for BTC is around $25K, although momentum has weakened over the past two months.

4. Two of the world’s top market-making firms are pulling back from trading digital assets.

Source: @KatLeighDoherty, @Yueqi_Yang, @crypto Read full article

Source: @KatLeighDoherty, @Yueqi_Yang, @crypto Read full article

Back to Index

Commodities

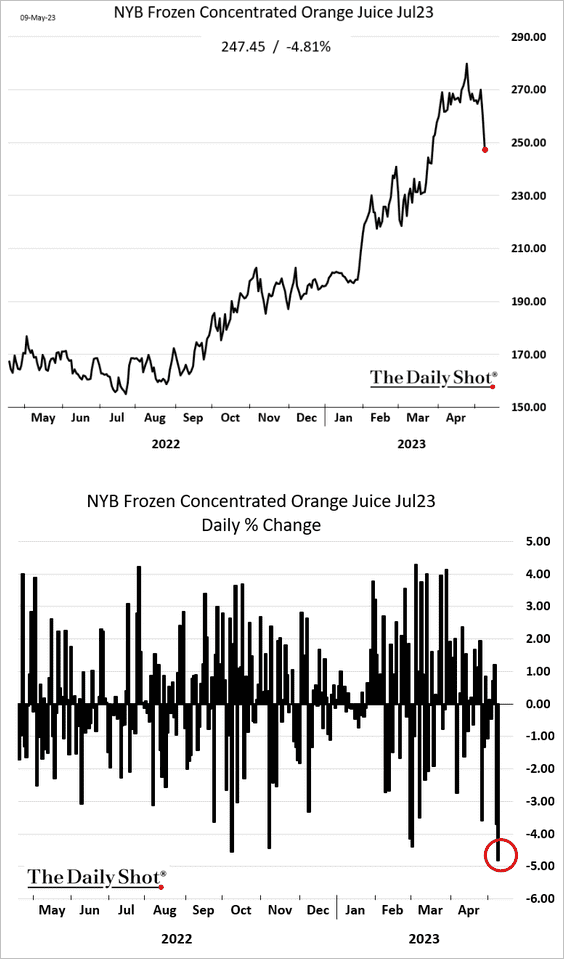

1. Orange juice futures tumbled on Tuesday.

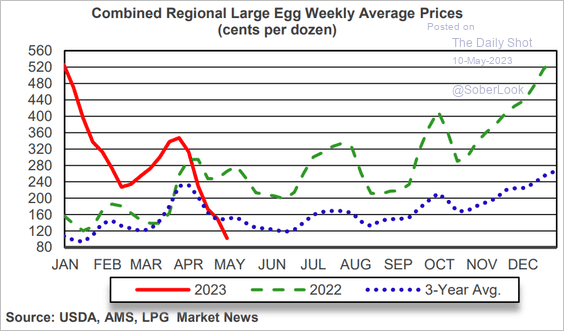

2. Wholesale egg prices are falling rapidly.

Source: Agricultural Marketing Service

Source: Agricultural Marketing Service

Back to Index

Energy

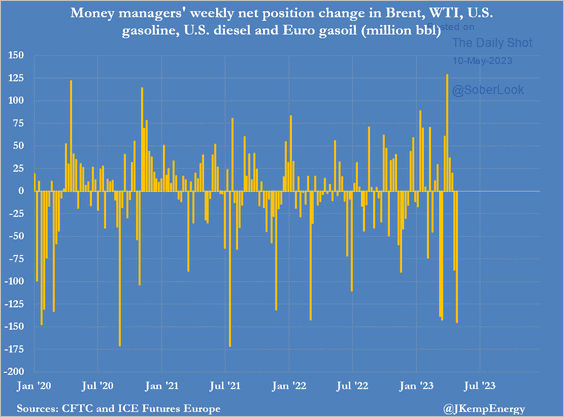

1. Oil and refined products’ positioning declined sharply last week.

Source: @JKempEnergy

Source: @JKempEnergy

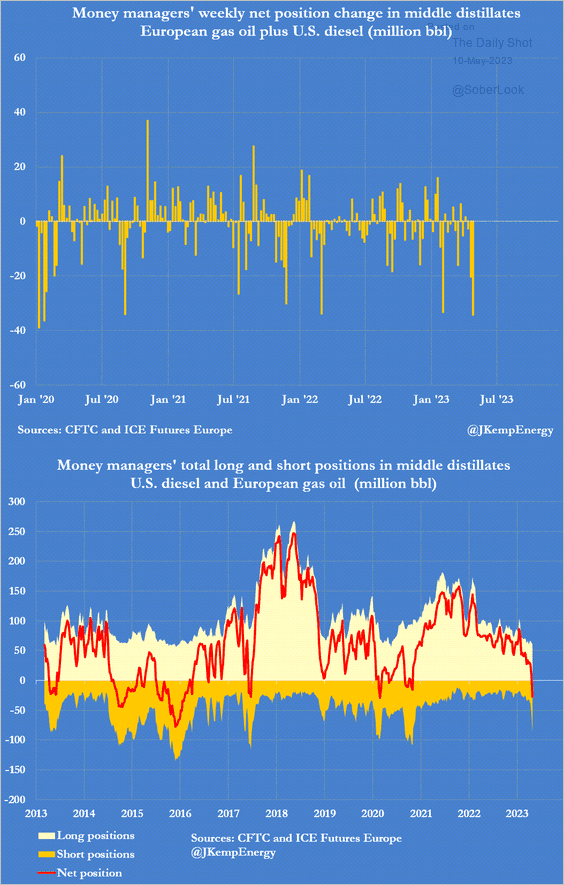

Here is the middle distillates positioning.

Source: @JKempEnergy

Source: @JKempEnergy

——————–

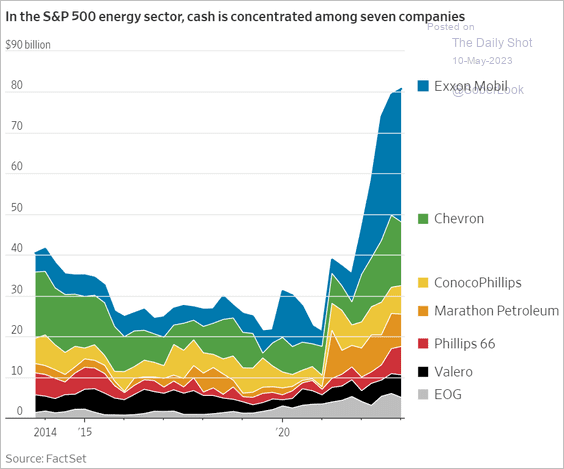

2. Largest US energy companies are sitting on a lot of cash.

Source: @WSJ Read full article

Source: @WSJ Read full article

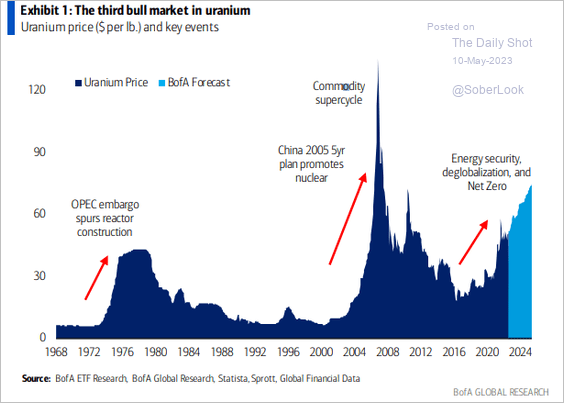

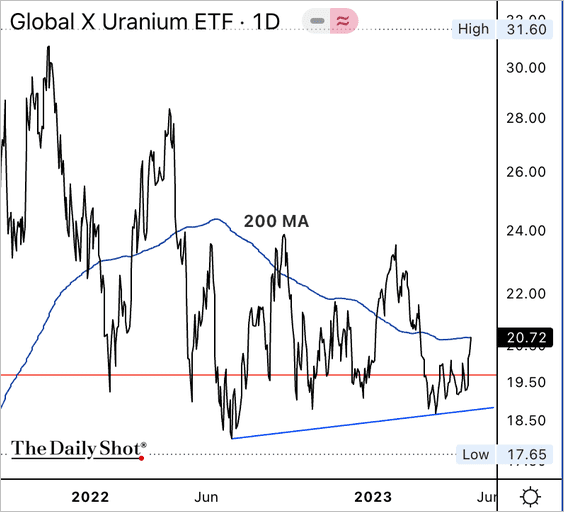

3. Is Uranium about to enter its third bull market?

Source: BofA Global Research

Source: BofA Global Research

The Global X Uranium ETF (URA) is testing resistance at its 200-day moving average. URA’s downtrend has stabilized over the past year.

Back to Index

Equities

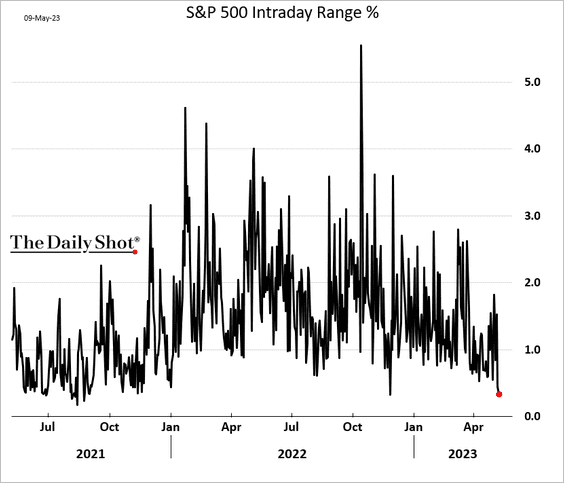

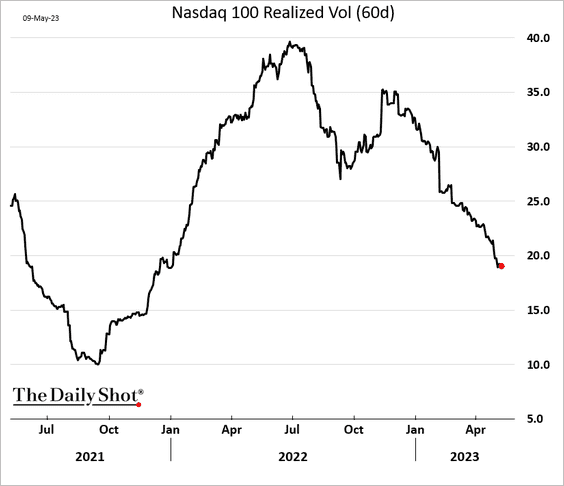

1. Volatility remains subdued.

• S&P 500 intraday range:

• Nasdaq 100 realized vol:

——————–

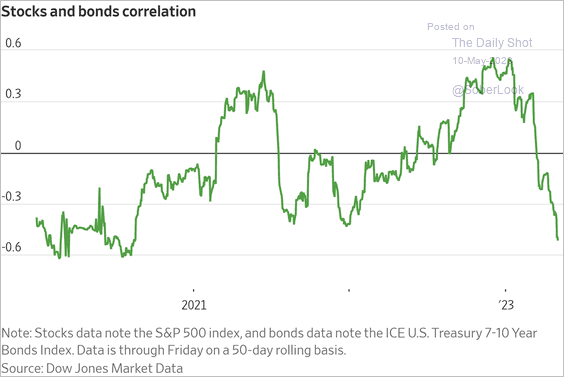

2. The stock-bond correlation is moving deeper into negative territory.

Source: @WSJ Read full article

Source: @WSJ Read full article

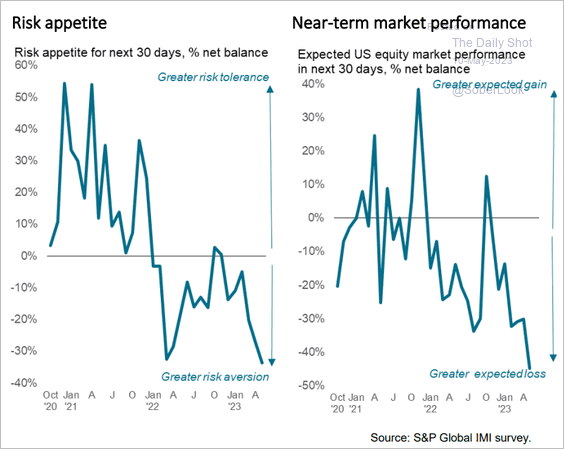

3. Bearish sentiment among global investment managers has reached extreme levels.

Source: S&P Global PMI

Source: S&P Global PMI

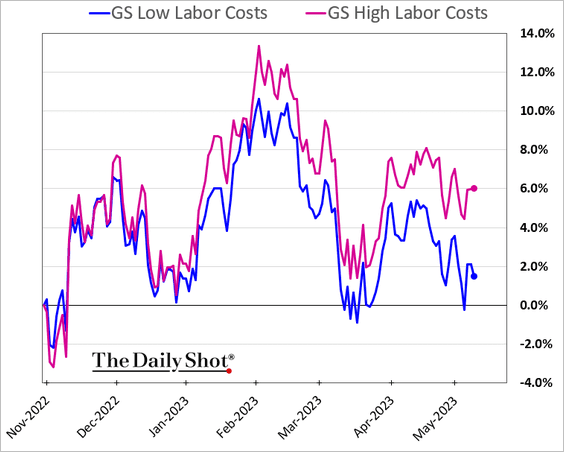

4. The market expects wage growth to moderate. Companies with high labor costs have been outperforming.

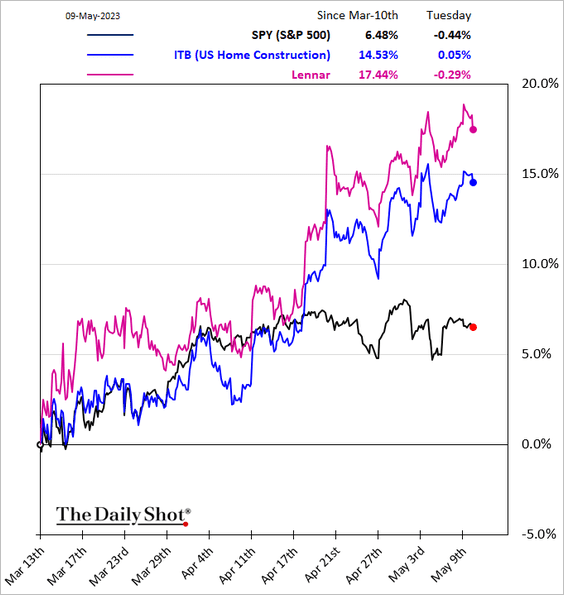

5. Homebuilder shares have been surging.

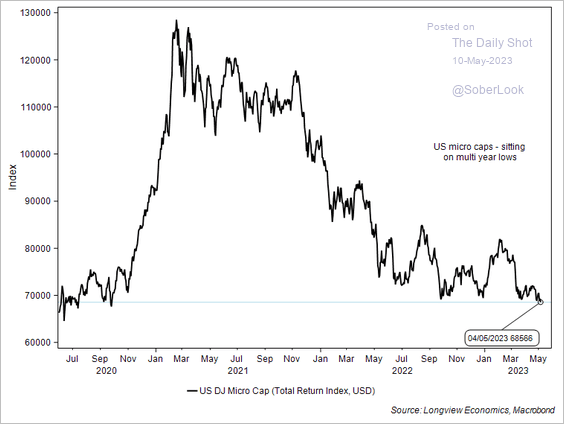

6. The Dow Jones US Micro-Cap Index is testing support.

Source: Longview Economics

Source: Longview Economics

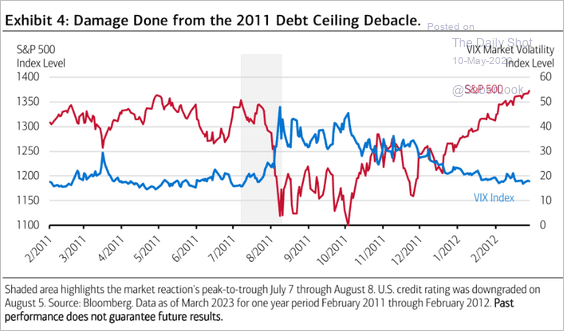

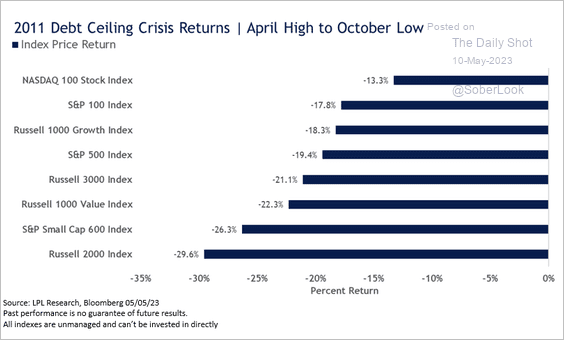

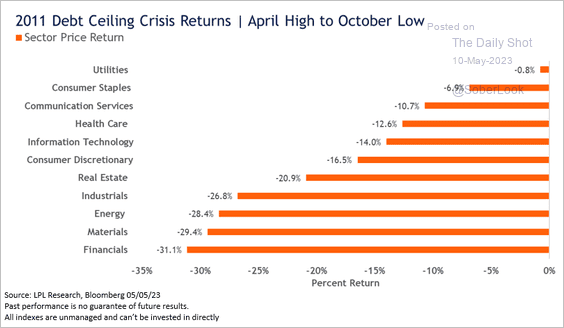

7. What was the damage to the equity markets around the 2011 debt ceiling impasse?

• Indices:

Source: Merrill Lynch

Source: Merrill Lynch

Source: LPL Research

Source: LPL Research

• Sectors:

Source: LPL Research

Source: LPL Research

Back to Index

Credit

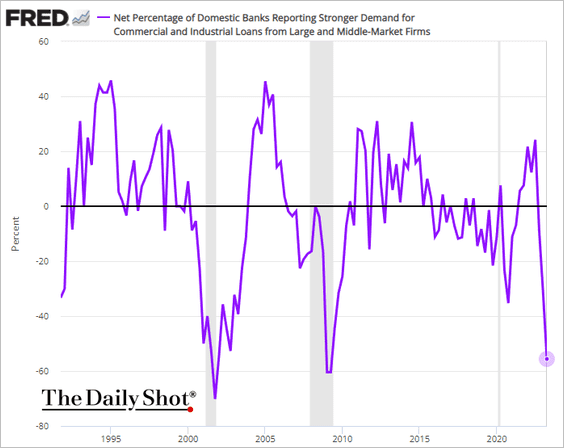

1. Demand for business loans has deteriorated.

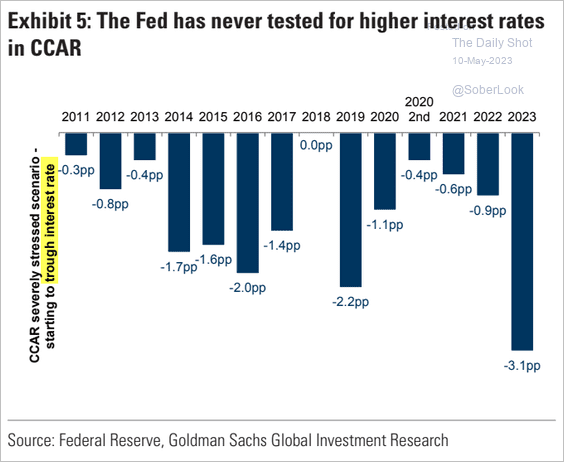

2. The Fed has never tested for a rate shock in the CCAR stress tests.

Source: Goldman Sachs

Source: Goldman Sachs

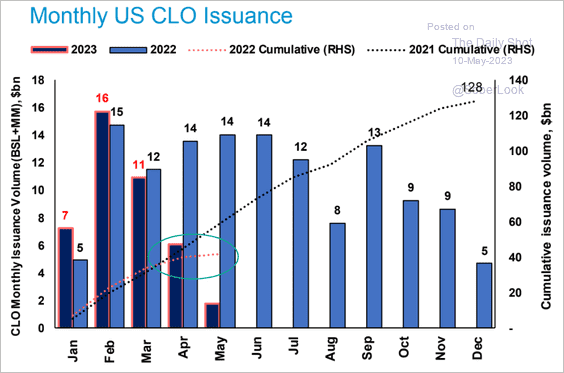

3. CLO issuance has slowed.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

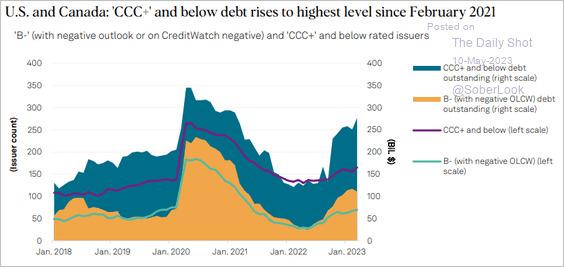

4. Outstanding stressed corporate debt levels continue to climb.

Source: S&P Global Ratings

Source: S&P Global Ratings

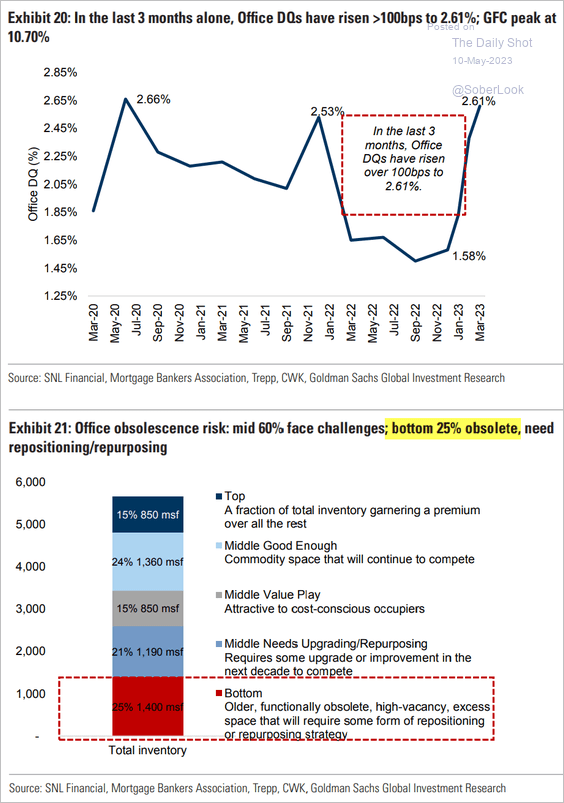

5. Office property delinquencies have been rising.

Source: Goldman Sachs

Source: Goldman Sachs

Back to Index

Rates

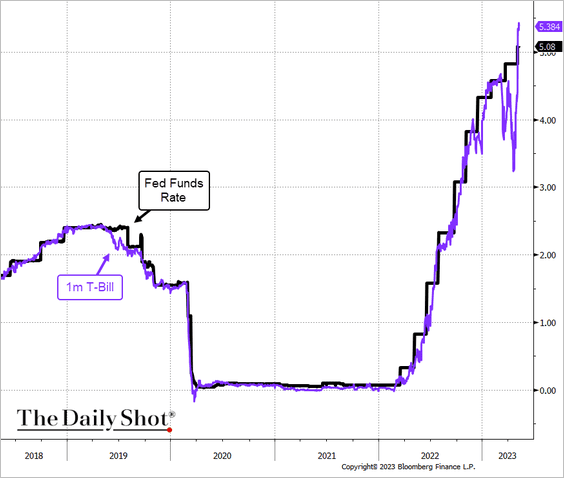

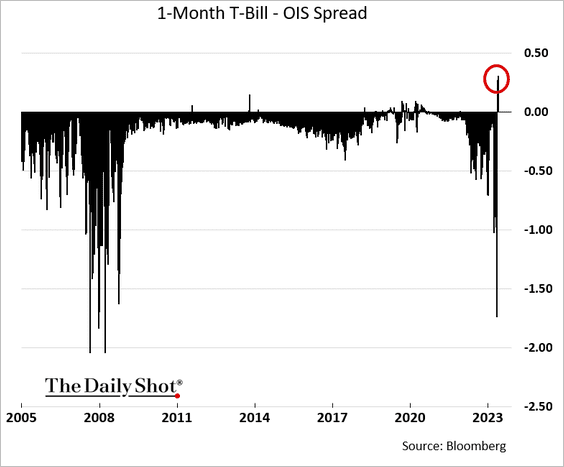

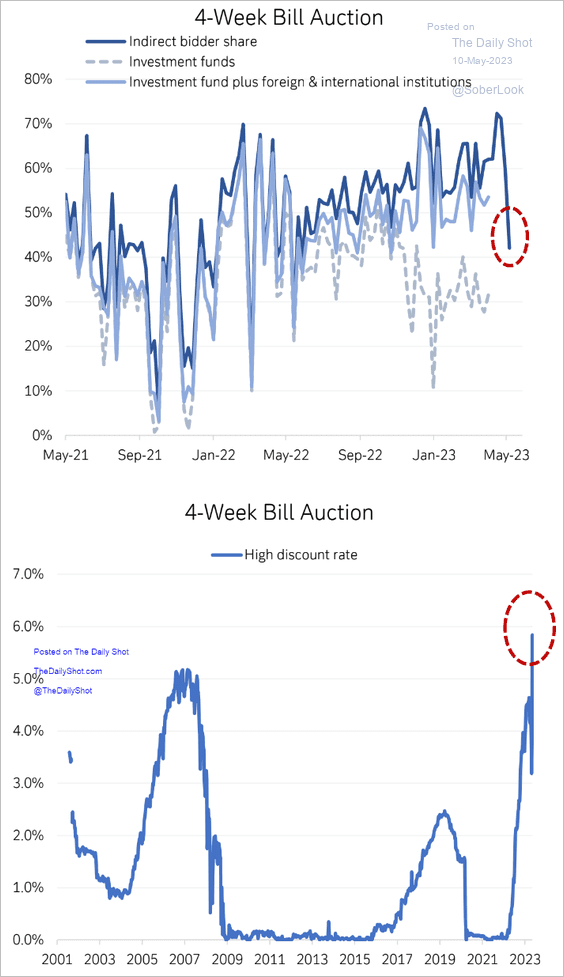

1. The debt ceiling risk is creating more distortions in the T-bill market.

• 1-month T-bill vs. the fed funds rate:

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

– 1-month T-bill – OIS spread (OIS = market expectations of the fed funds rate).

• The 4-week T-bill auction:

Source: Deutsche Bank Research

Source: Deutsche Bank Research

——————–

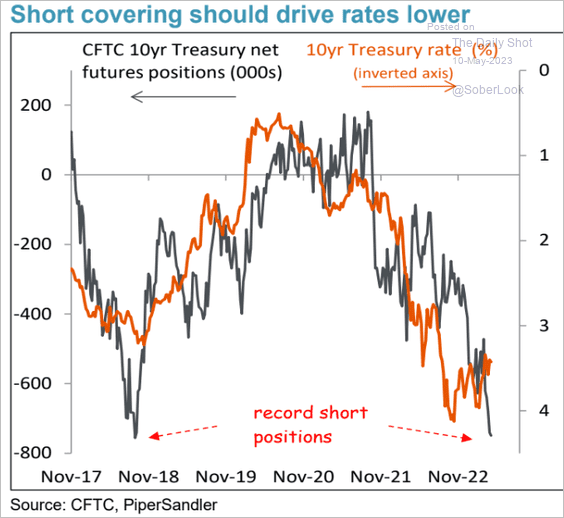

2. Short-covering ahead for Treasuries?

Source: Piper Sandler

Source: Piper Sandler

——————–

Food for Thought

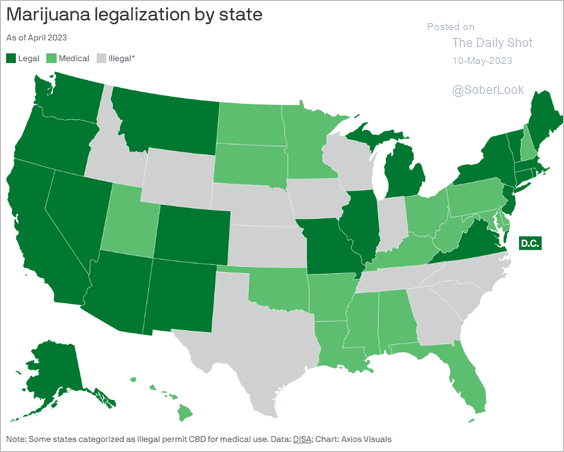

1. Legal status of marijuana:

Source: @axios Read full article

Source: @axios Read full article

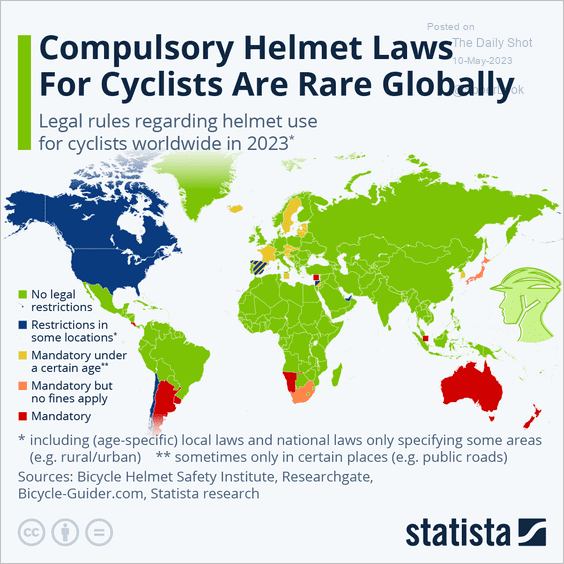

2. Helmet laws for cyclists:

Source: Statista

Source: Statista

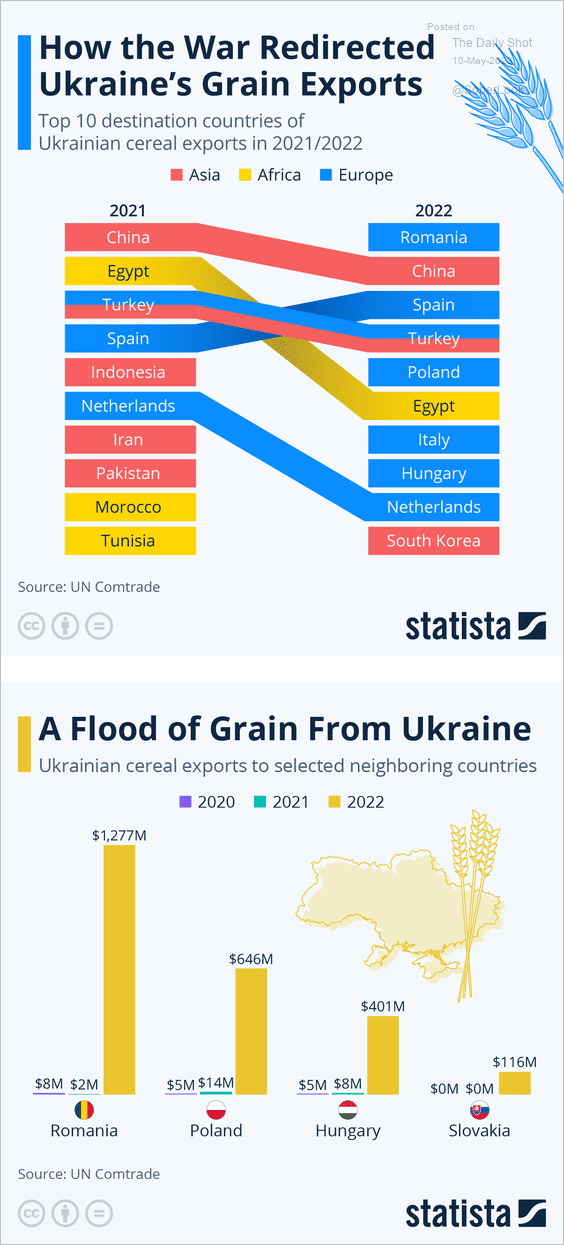

3. Ukraine’s grain exports:

Source: Statista

Source: Statista

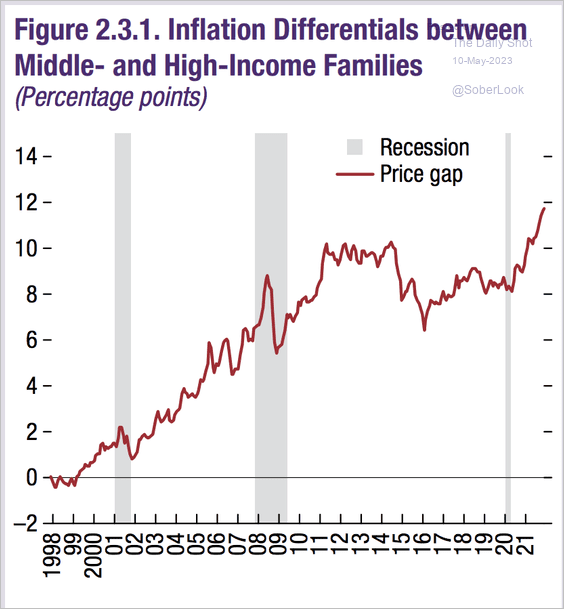

4. US middle-income families’ inflation experience relative to higher-income families:

Source: IMF Read full article

Source: IMF Read full article

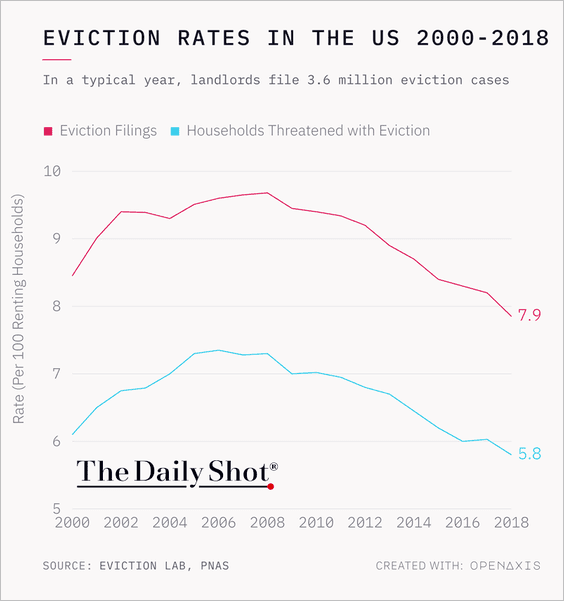

5. Eviction rates in the US:

Source: @TheDailyShot

Source: @TheDailyShot

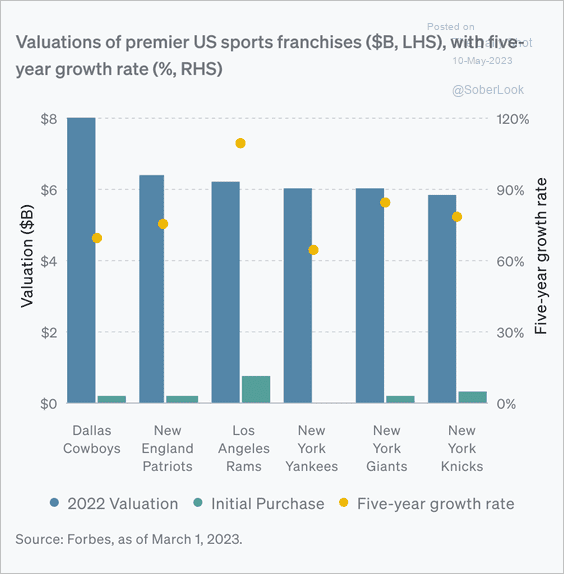

6. Valuations of US sports franchises:

Source: Opto Monthly Read full article

Source: Opto Monthly Read full article

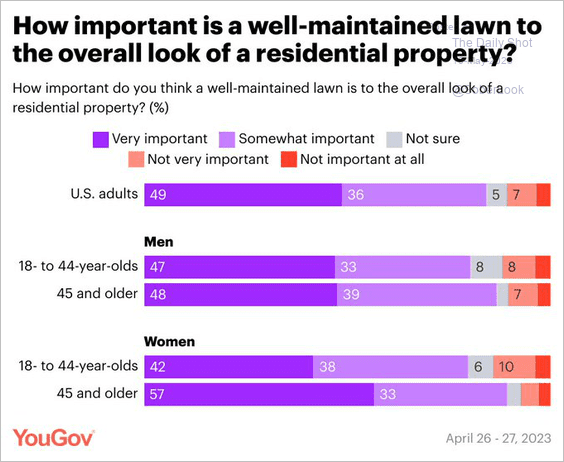

7. How important is a well-maintained lawn?

Source: @YouGovAmerica Read full article

Source: @YouGovAmerica Read full article

——————–

Back to Index