The Daily Shot: 15-May-23

• The United States

• The United Kingdom

• The Eurozone

• Japan

• China

• Emerging Markets

• Cryptocurrency

• Commodities

• Energy

• Equities

• Credit

• Rates

• Global Developments

• Food for Thought

The United States

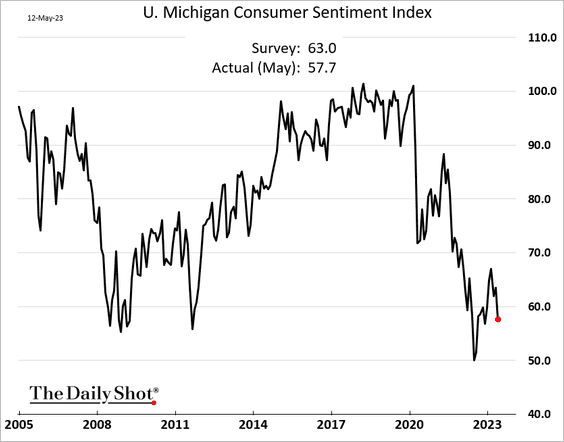

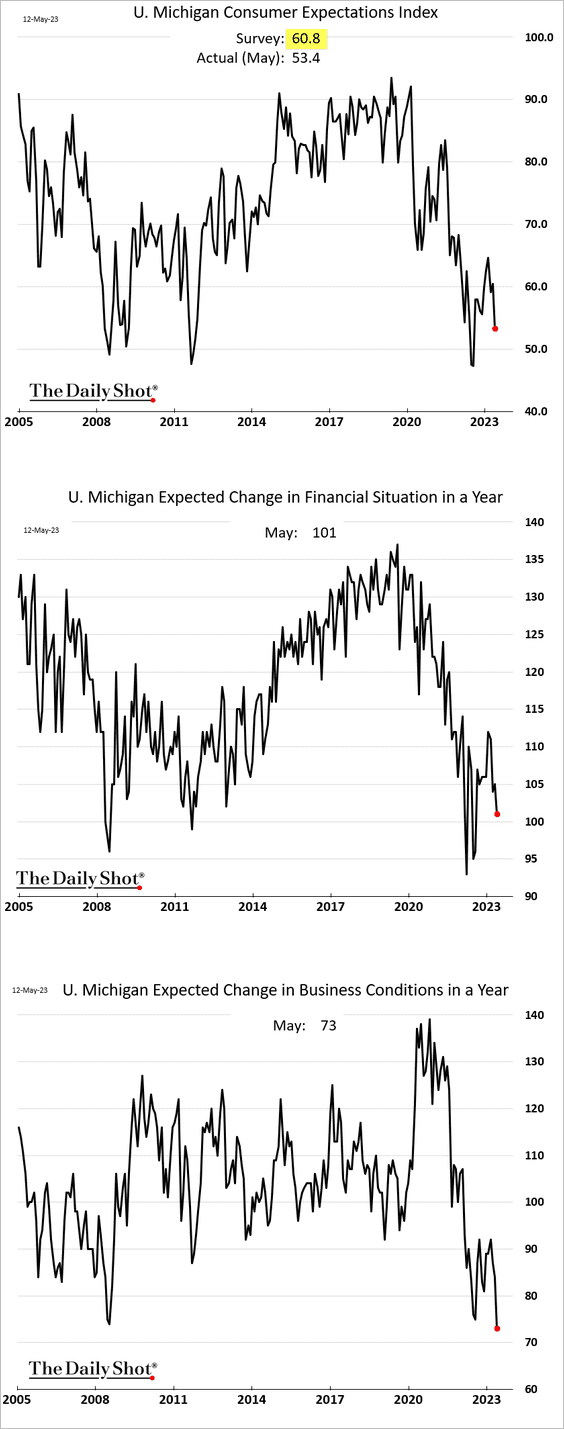

1. The U. Michigan consumer sentiment index declined sharply this month …

… as household expectations deteriorated.

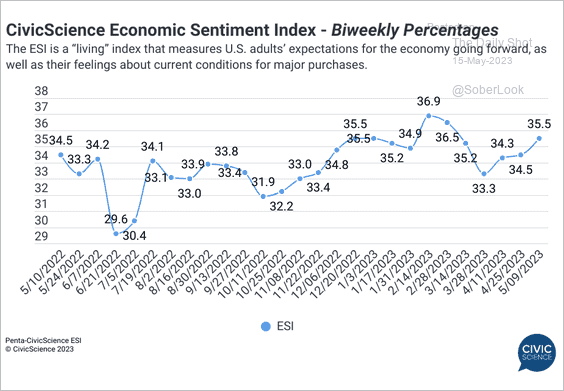

However, a separate report from CivicScience points to an improvement in consumer sentiment.

Source: ESI

Source: ESI

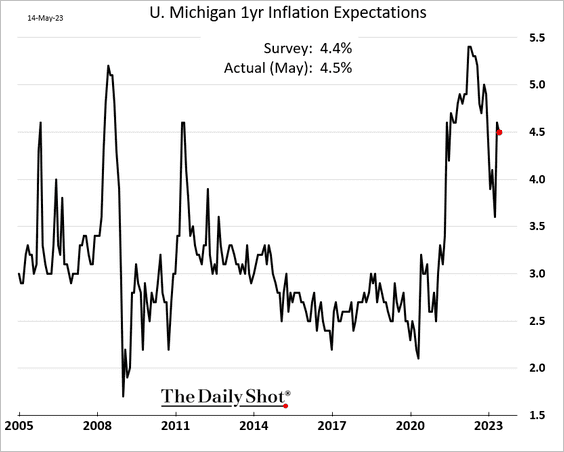

2. The 1-year inflation expectations edged lower, …

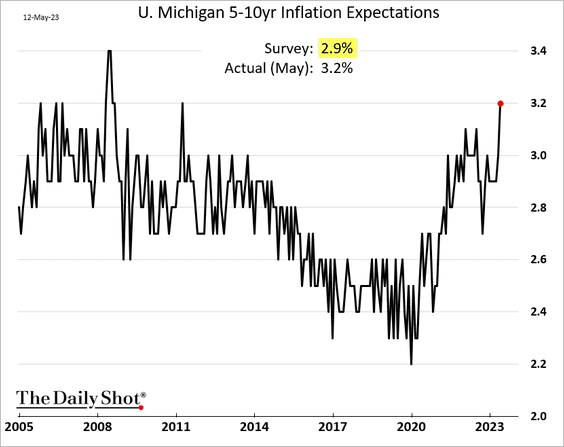

… but longer-term inflation expectations surged. This is not the kind of news the Federal Reserve wants to see.

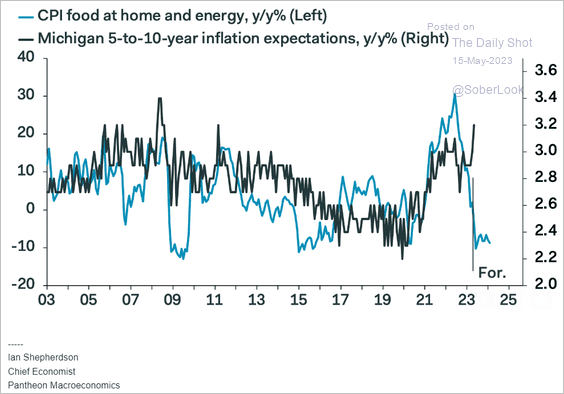

Falling grocery prices may help ease inflation expectations in the months ahead.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

——————–

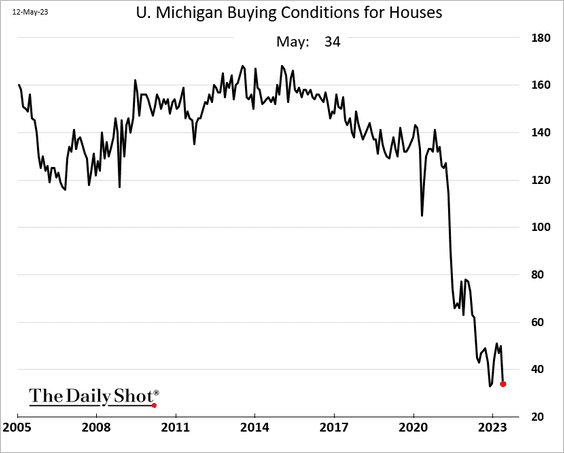

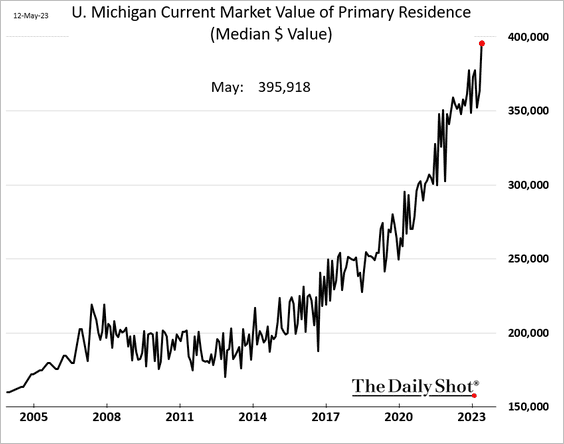

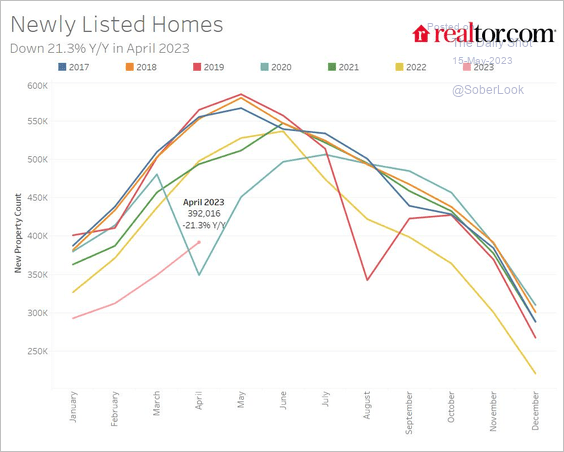

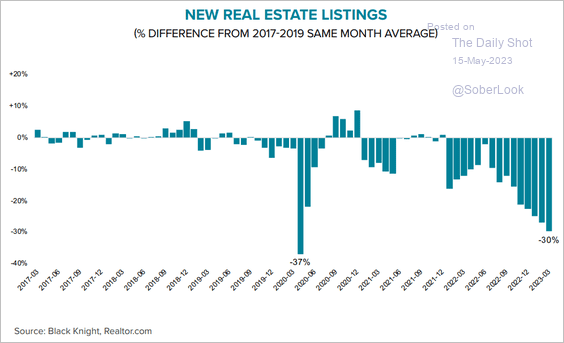

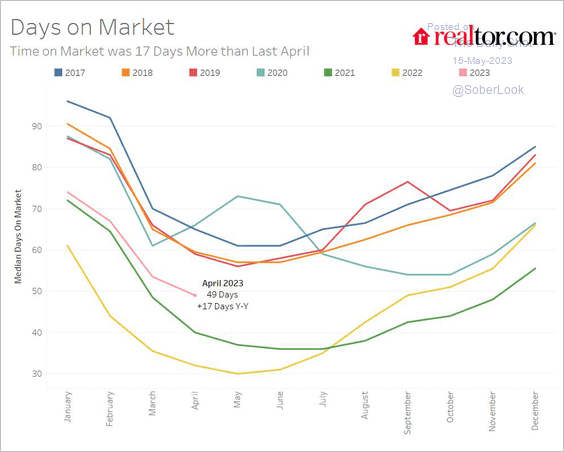

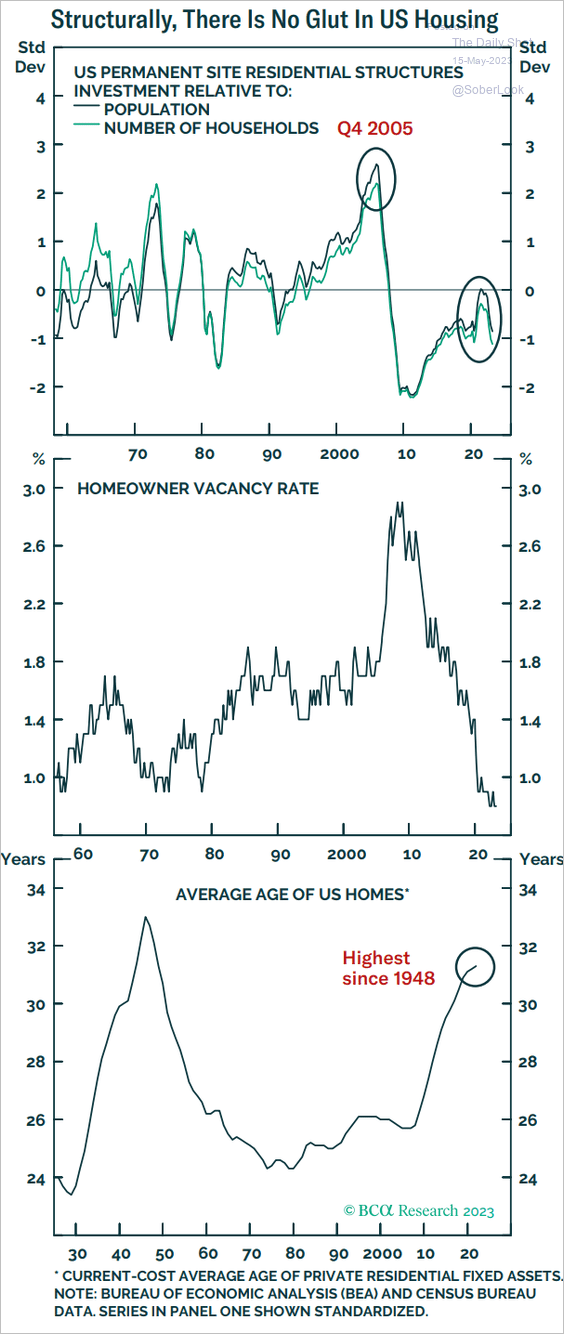

3. Next, we have some updates on the housing market.

• Buying conditions for homes are near multi-year lows.

• Homeowners are refusing to accept the fact that their home values have probably flattened and may have declined.

• New listings of homes for sale are down sharply (2 charts).

Source: realtor.com

Source: realtor.com

Source: Black Knight

Source: Black Knight

• Though the process of selling a home now takes longer, it’s still quicker than it was prior to the pandemic

Source: realtor.com

Source: realtor.com

• There is no glut in the housing market.

Source: BCA Research

Source: BCA Research

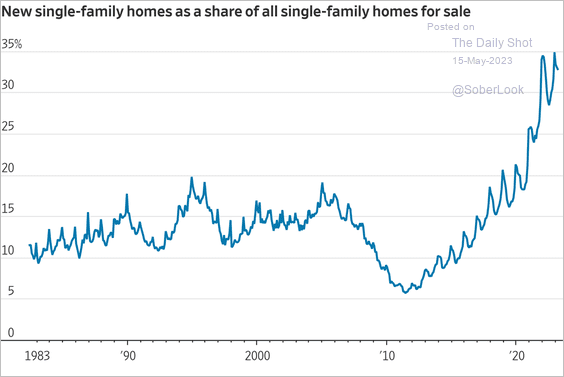

• Newly constructed homes are increasingly accounting for a larger share of total home sales.

Source: @WSJ Read full article

Source: @WSJ Read full article

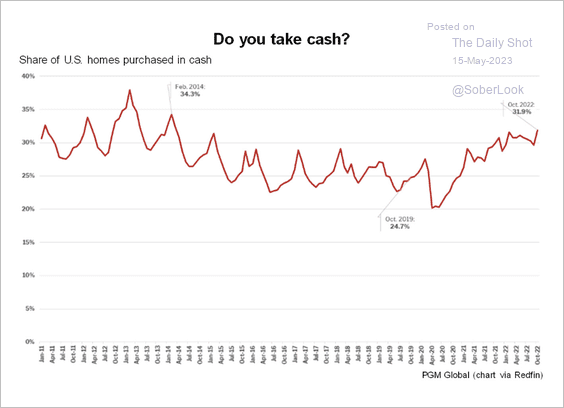

• Almost one-third of all home purchases are paid for in cash, the highest rate in eight years.

Source: PGM Global

Source: PGM Global

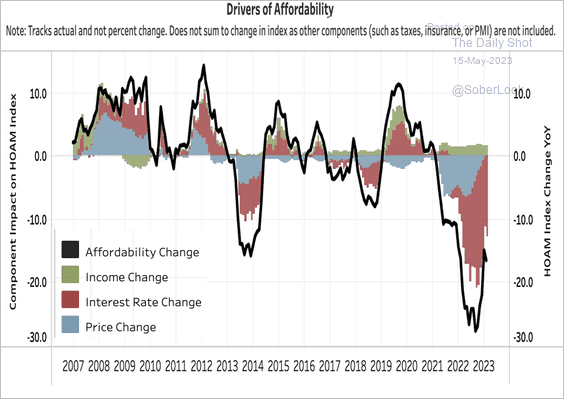

• This chart shows the drivers of housing affordability.

Source: Federal Reserve Bank of Atlanta

Source: Federal Reserve Bank of Atlanta

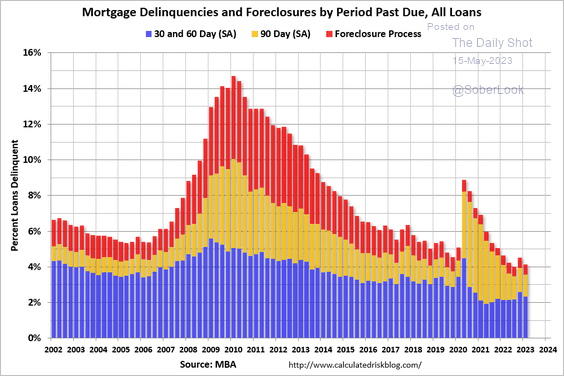

• Mortgage delinquencies remain relatively low.

Source: Calculated Risk

Source: Calculated Risk

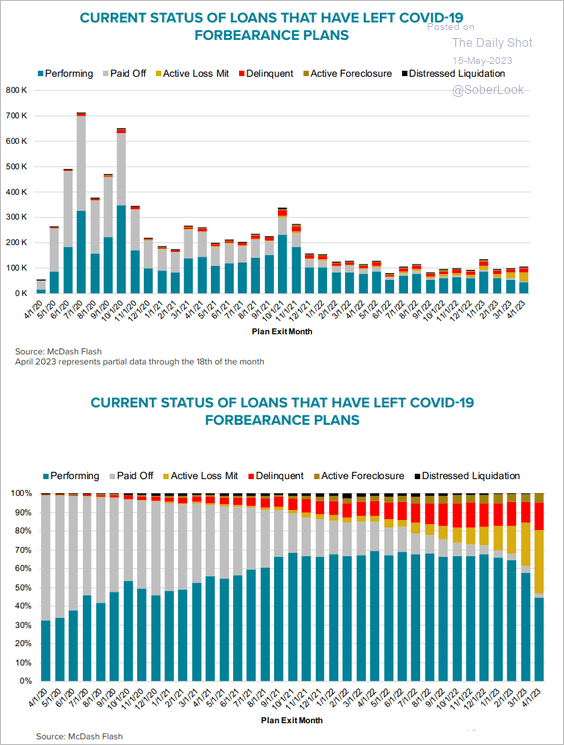

• What happened to mortgages that left the COVID-era forbearance plans?

Source: Black Knight

Source: Black Knight

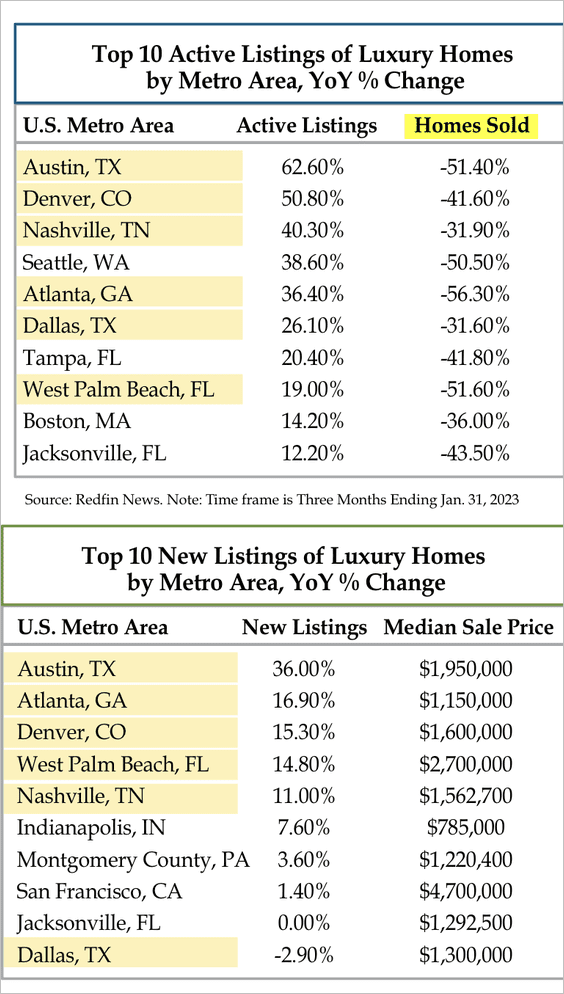

• Here is a look at active and new listings of luxury homes by city.

Source: Quill Intelligence

Source: Quill Intelligence

——————–

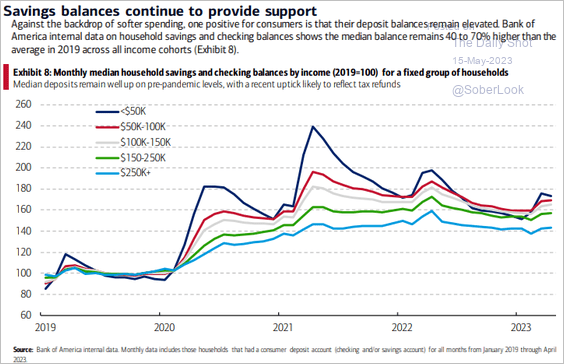

4. Consumer savings balances remain elevated.

Source: BofA Global Research

Source: BofA Global Research

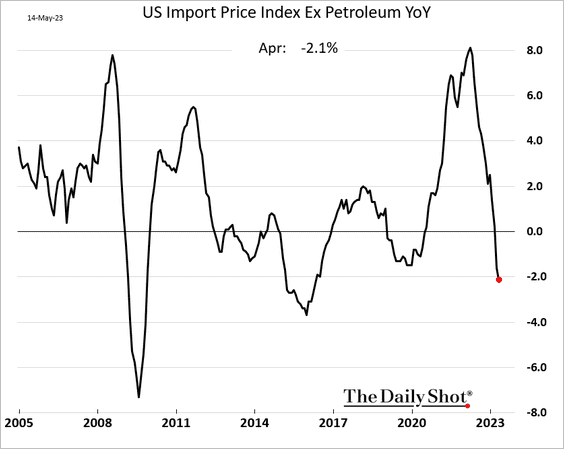

5. Import prices have been falling.

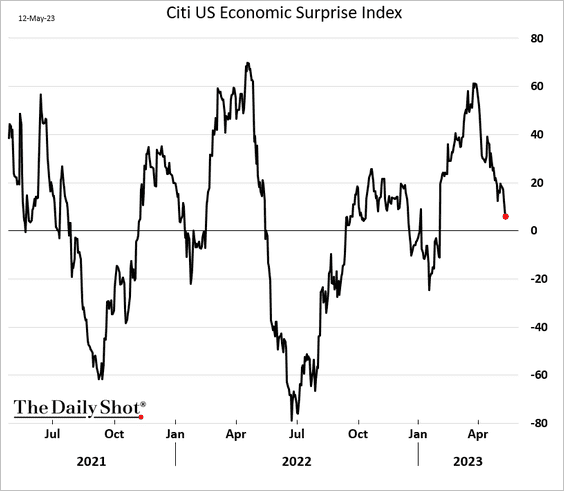

6. The Citi US Economic Surprise Index continues to move lower.

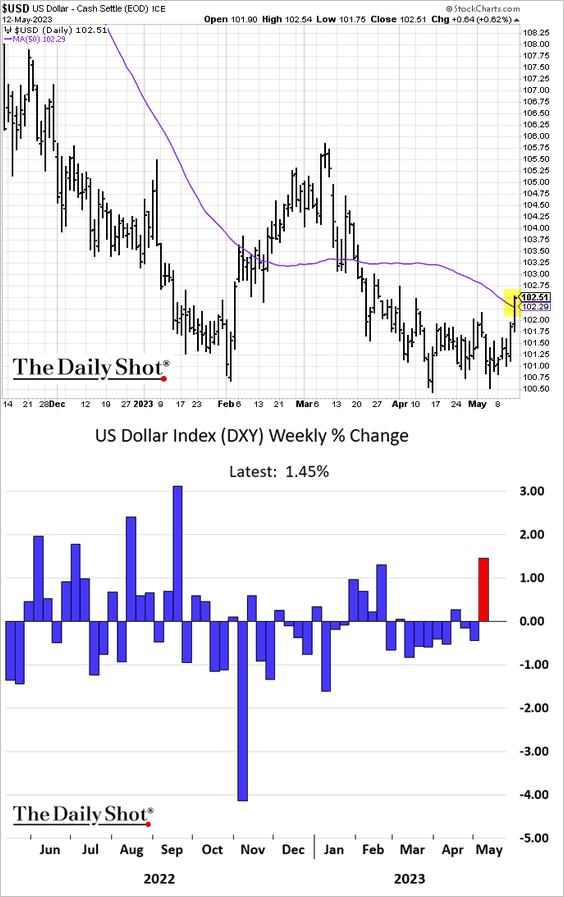

7. The US dollar jumped last week amid debt ceiling concerns.

Source: FXS Read full article

Source: FXS Read full article

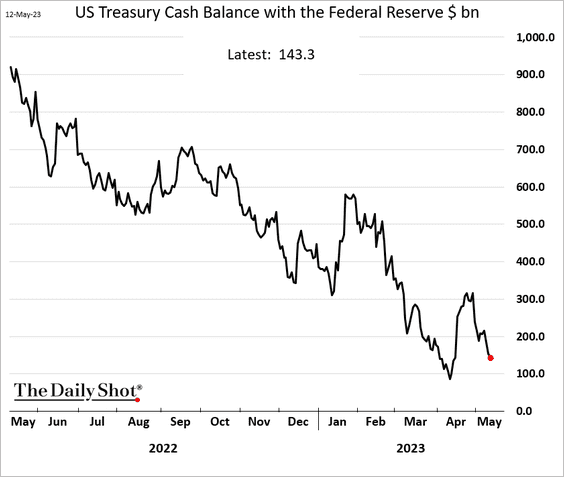

Here is the US Treasury’s cash account at the Fed.

Back to Index

The United Kingdom

1. As we saw last week, the Q1 GDP growth was in line with expectations (at 0.1%).

Source: Reuters Read full article

Source: Reuters Read full article

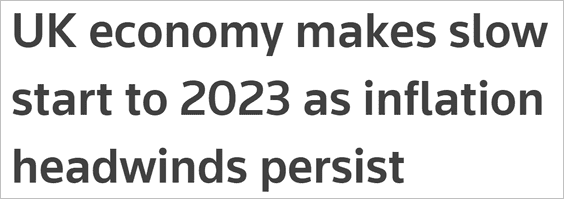

• Growth in private consumption stalled.

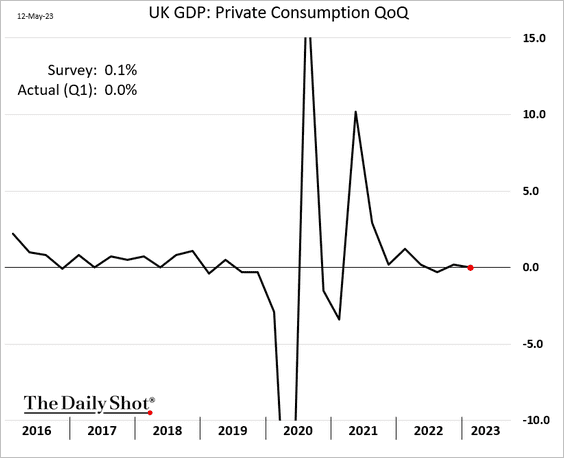

• Business investment unexpectedly increased.

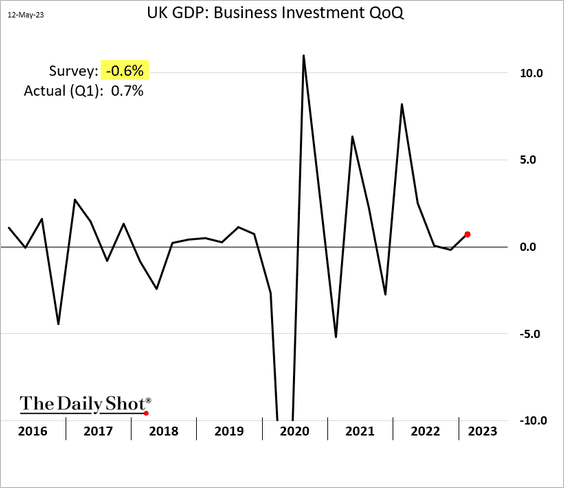

• Government spending declined sharply.

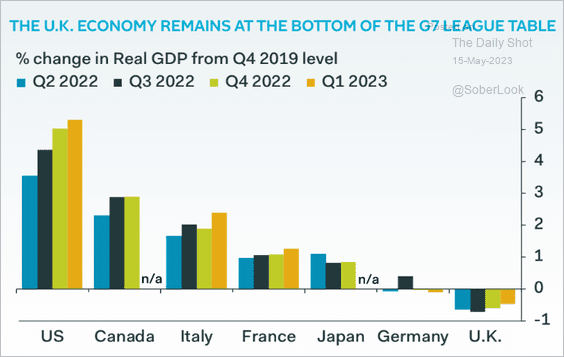

• The COVID-era GDP recovery still lags other G7 economies.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

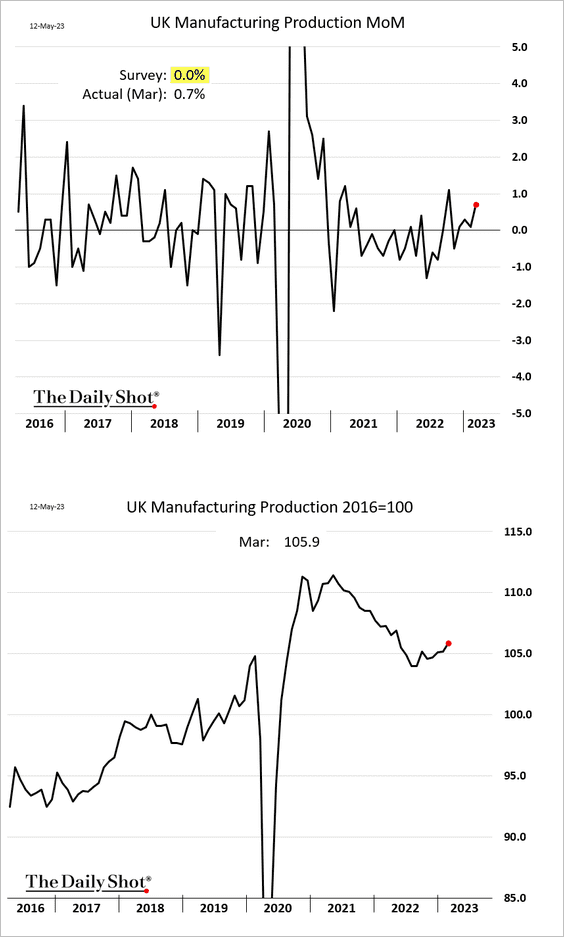

2. Manufacturing production jumped in March.

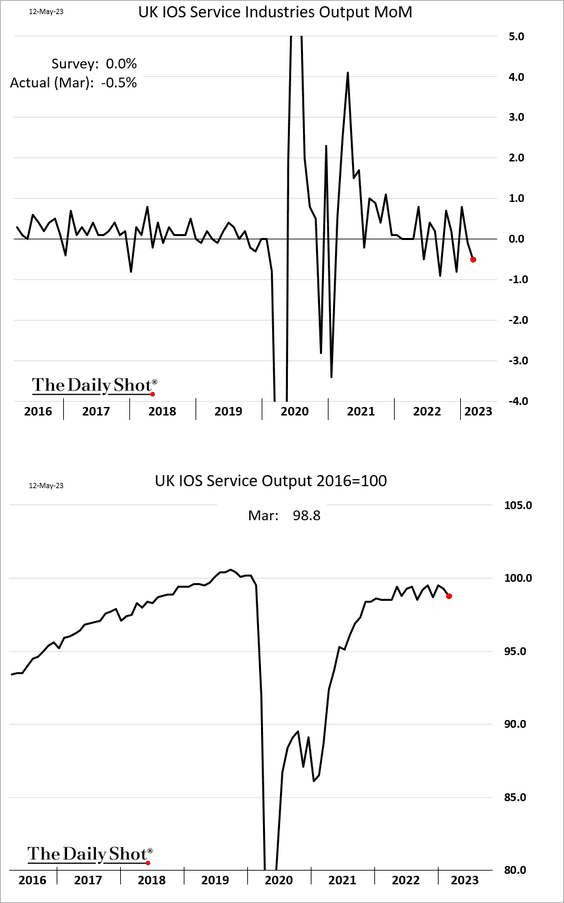

• But services output declined.

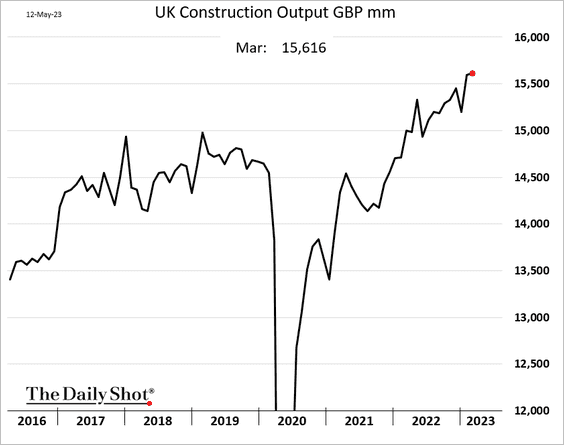

• Construction output keeps climbing.

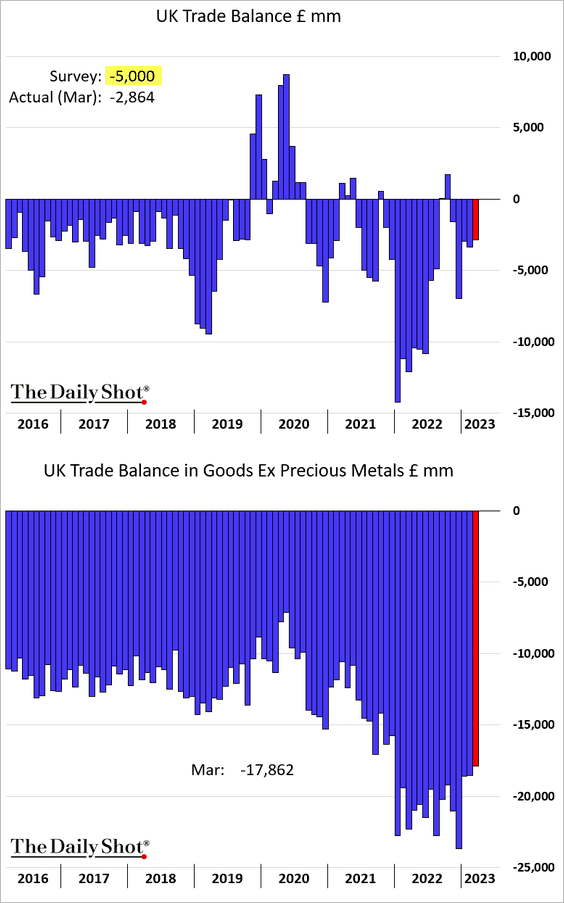

3. The March trade gap was narrower than expected.

——————–

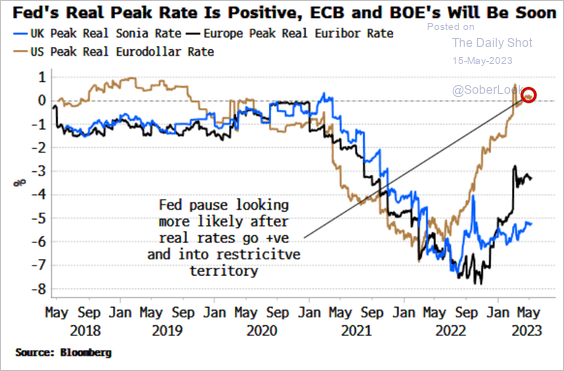

4. UK real rates are still deep in negative territory.

Source: Simon White, Bloomberg Markets Live Blog

Source: Simon White, Bloomberg Markets Live Blog

Back to Index

The Eurozone

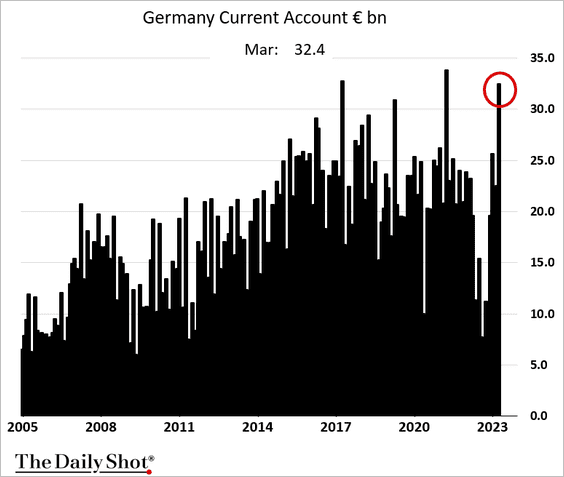

1. Germany’s current account surplus surged in March.

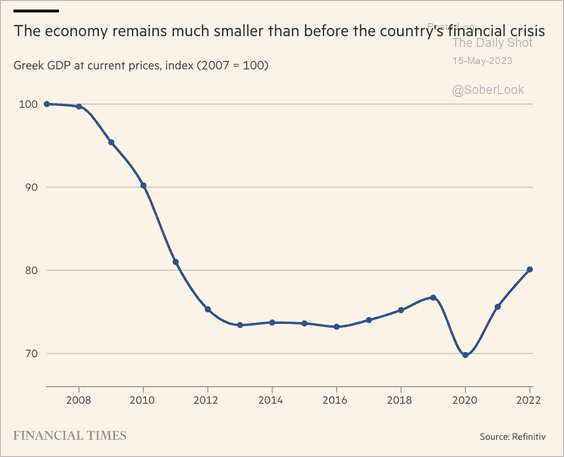

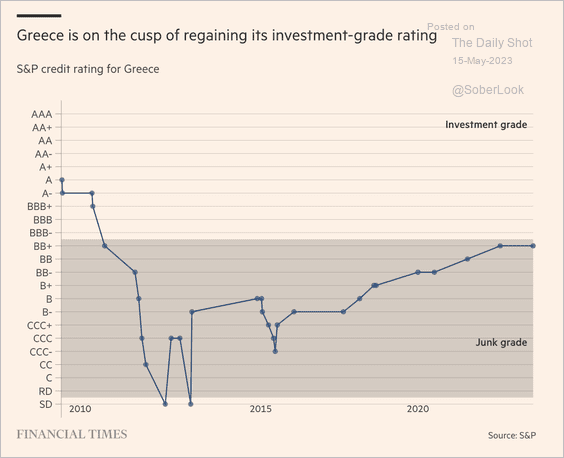

2. Greek economic activity is rebounding.

Source: @financialtimes Read full article

Source: @financialtimes Read full article

Will the debt be upgraded to investment grade?

Source: @financialtimes Read full article

Source: @financialtimes Read full article

——————–

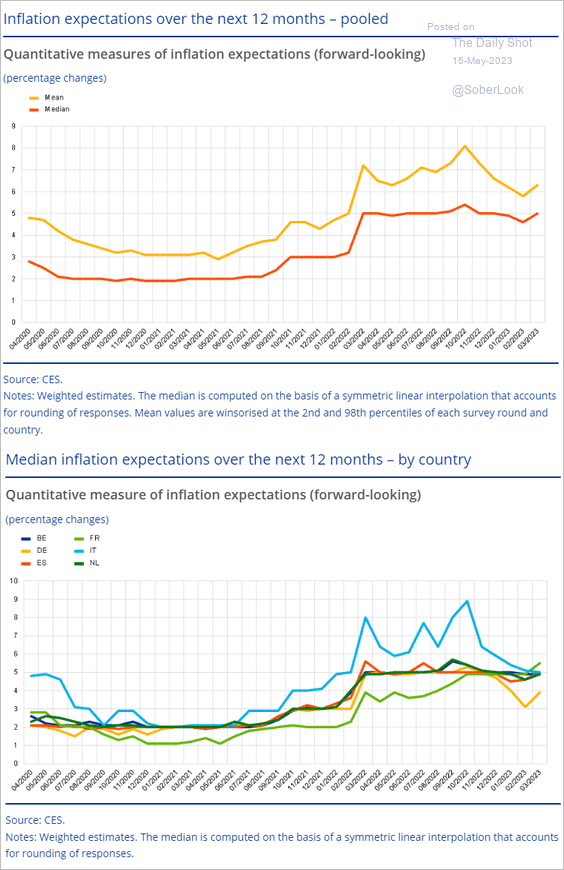

3. Inflation expectations jumped in March.

Source: ECB

Source: ECB

Source: Reuters Read full article

Source: Reuters Read full article

——————–

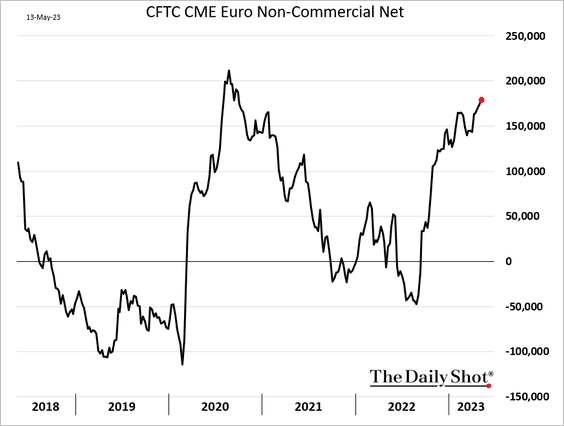

4. Speculative accounts continue to bet on the euro.

Back to Index

Japan

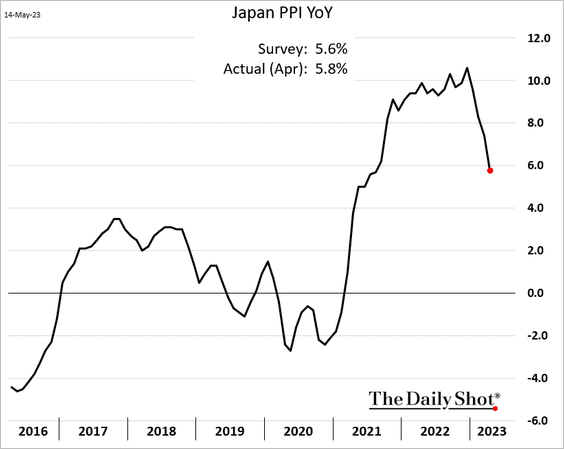

1. The PPI is moderating.

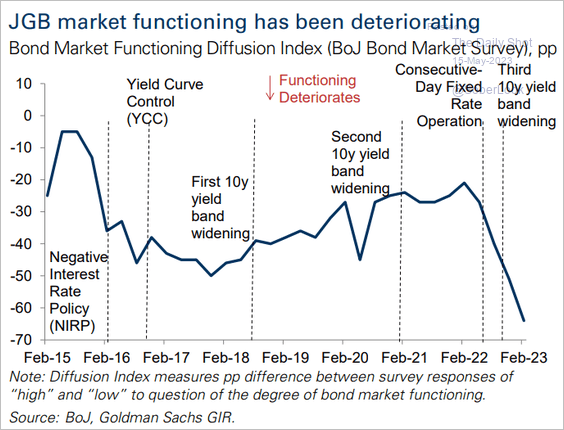

2. The JGB market is increasingly dysfunctional.

Source: Goldman Sachs

Source: Goldman Sachs

Back to Index

China

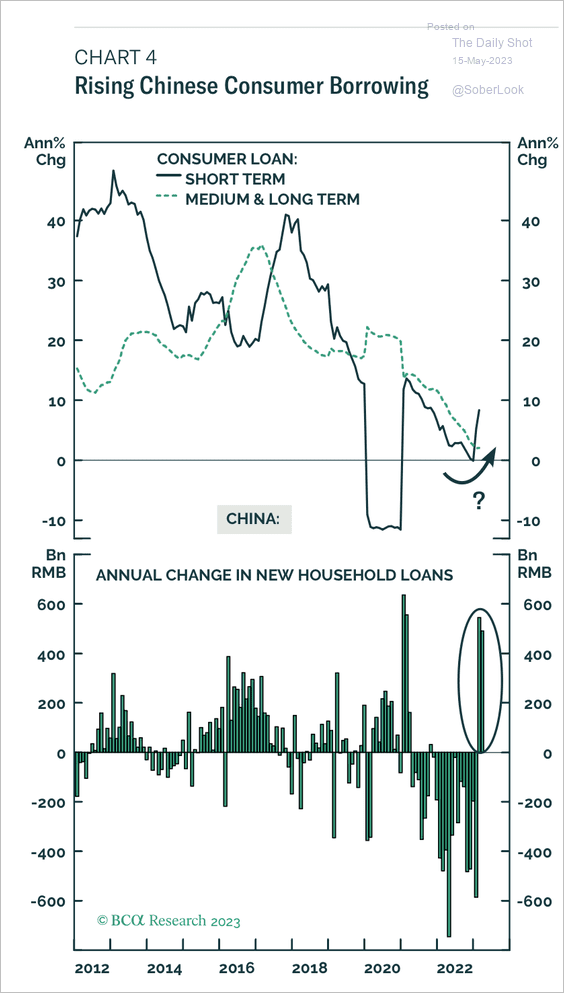

1. Consumer borrowing is picking up.

Source: BCA Research

Source: BCA Research

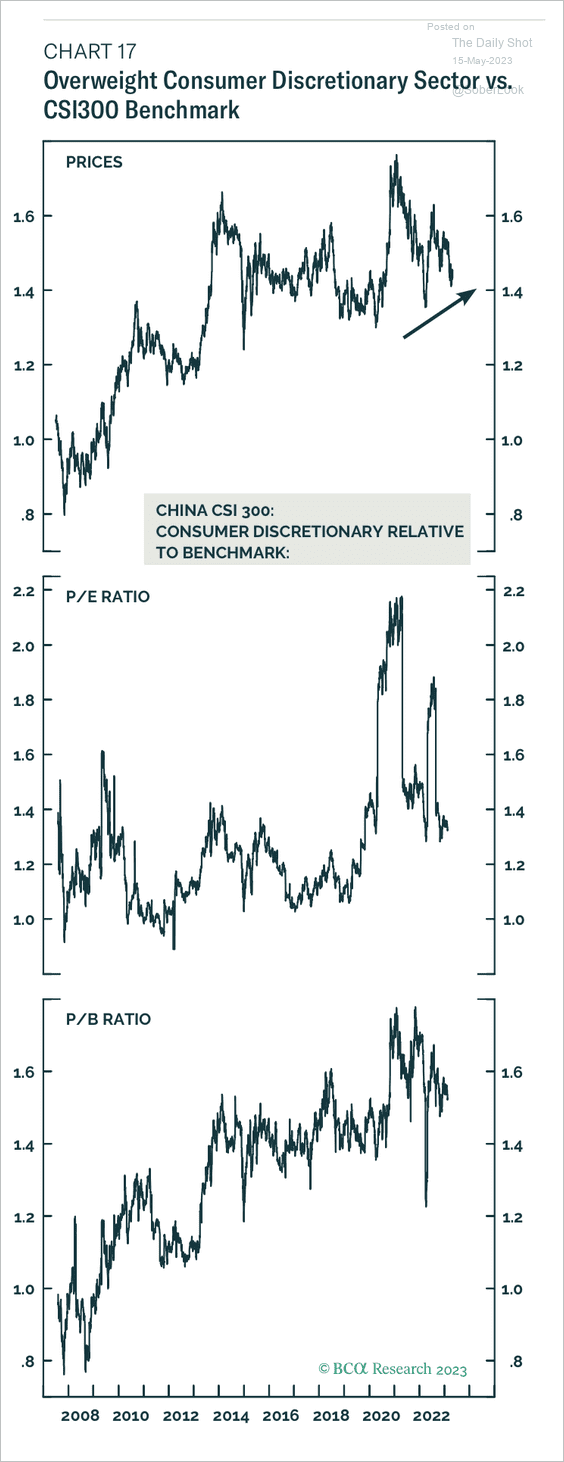

Improving retail sales could support consumer discretionary stocks.

Source: BCA Research

Source: BCA Research

——————–

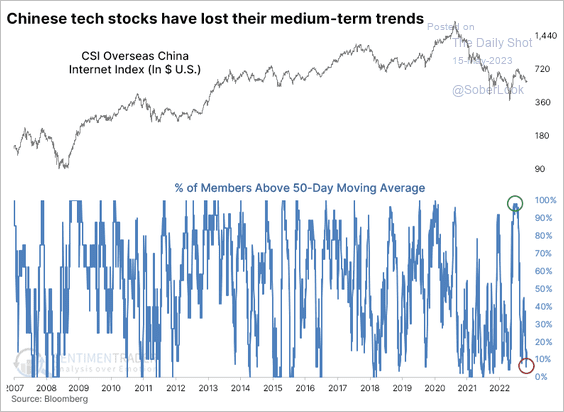

2. Breadth among Chinese tech stocks soared in January and has since pulled back.

Source: SentimenTrader

Source: SentimenTrader

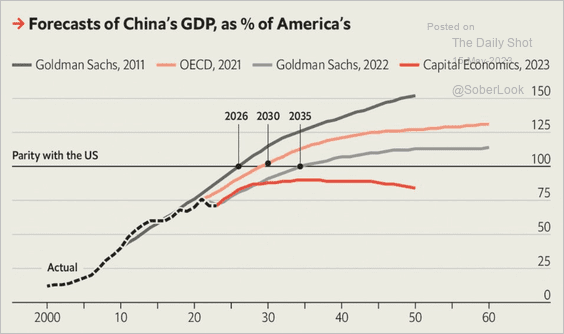

3. Here is a look at GDP forecasts relative to the US.

Source: The Economist Read full article

Source: The Economist Read full article

Back to Index

Emerging Markets

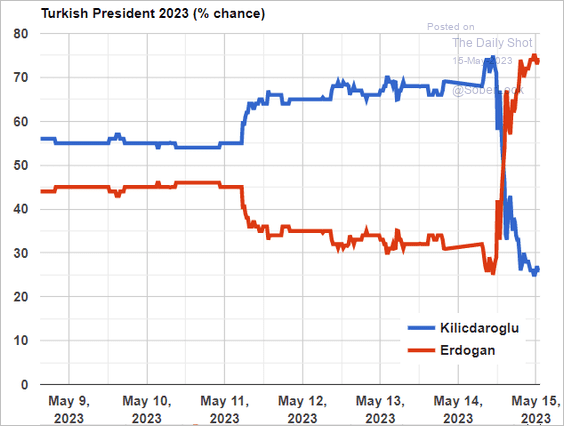

1. Erdogan is now favored to win the presidential race, according to betting market trends.

Source: Election Betting Odds

Source: Election Betting Odds

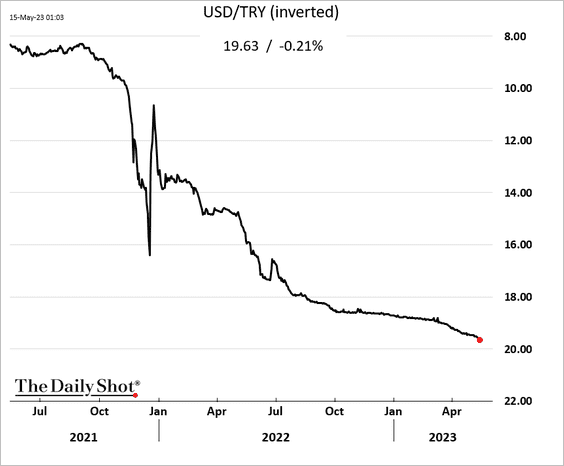

The lira continues to hit new lows despite the government’s pre-election interventions.

——————–

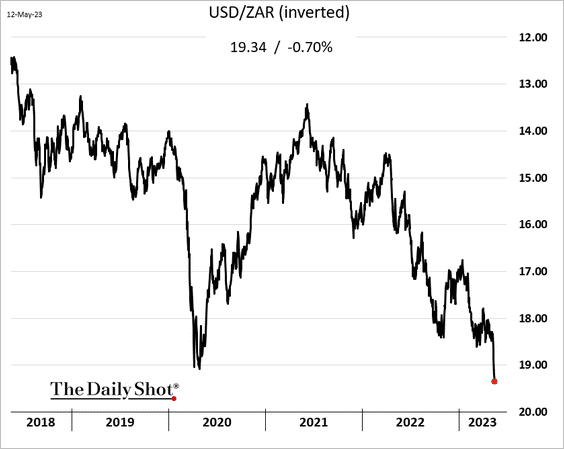

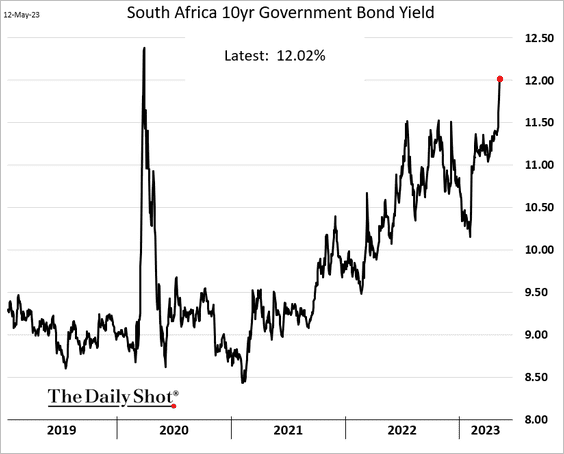

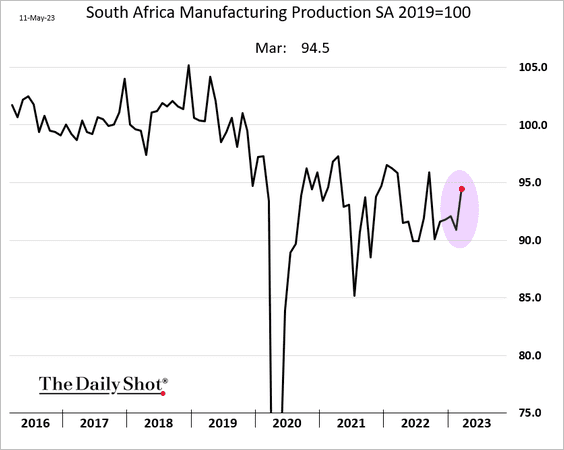

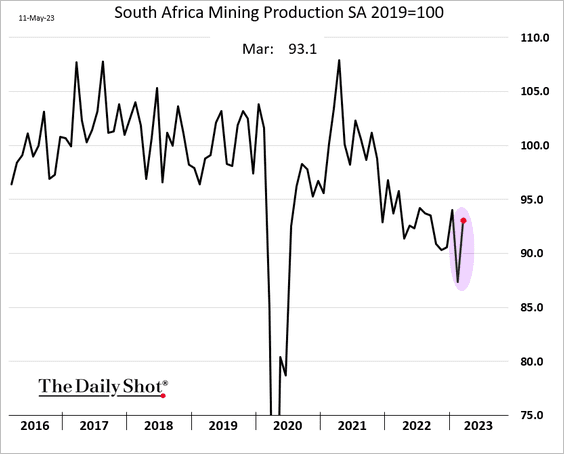

2. Next, we have some updates on South Africa.

• A potential spat with the US …

Source: @financialtimes Read full article

Source: @financialtimes Read full article

… sent bonds and the currency lower.

– The rand (record low):

– Bond yield:

• Manufacturing output jumped in March.

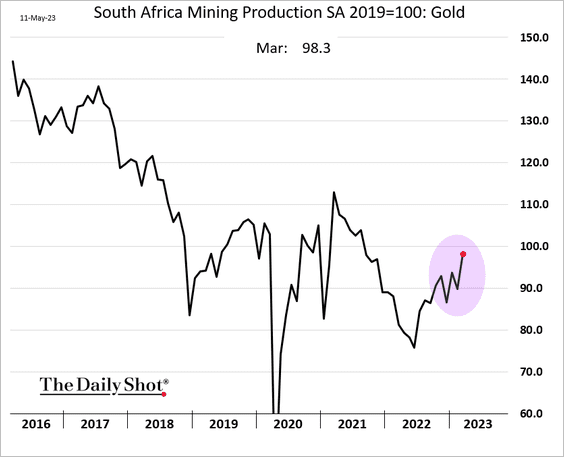

– Mining production also improved (2 charts).

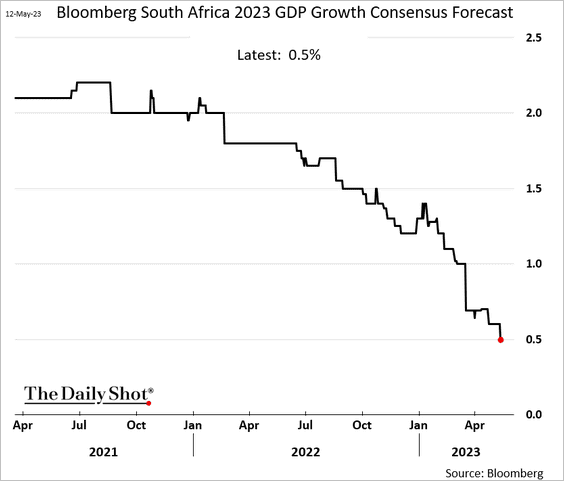

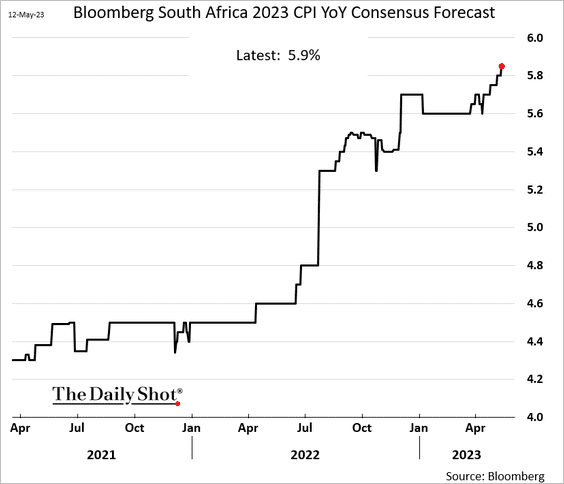

• Economists continue to downgrade South Africa’s GDP growth estimates for this year, …

… while pushing inflation forecasts higher.

——————–

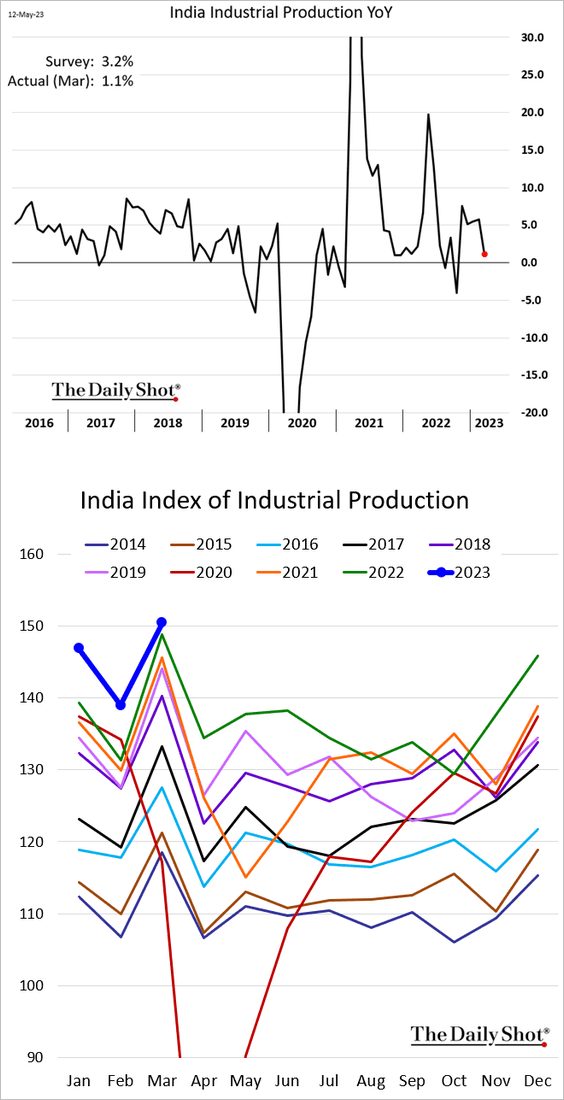

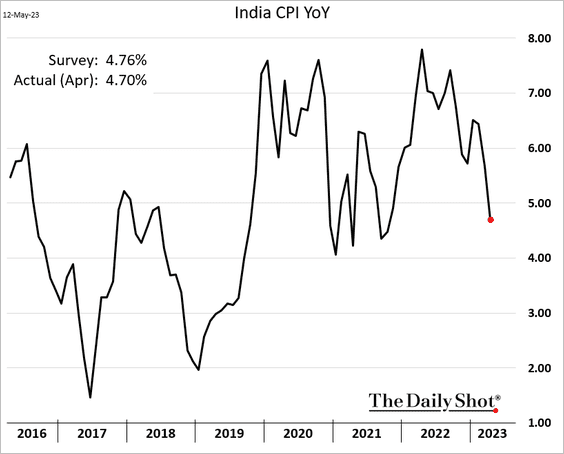

3. India’s industrial production print was lower than expected.

Inflation continues to moderate.

——————–

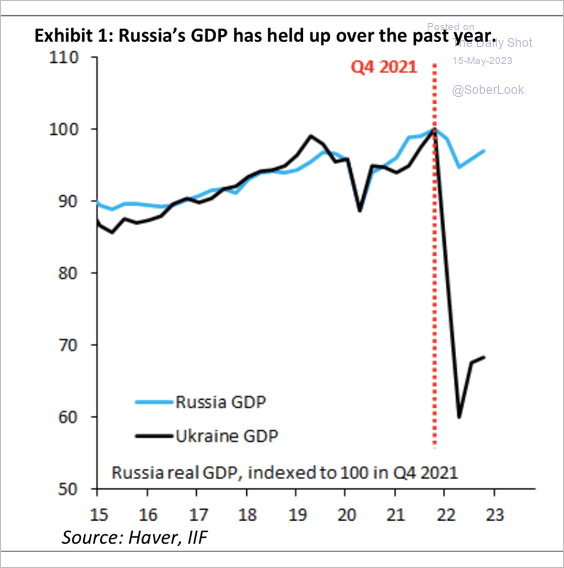

4. Russia’s GDP has held up relative to Ukraine (according to the Russian government).

Source: IIF

Source: IIF

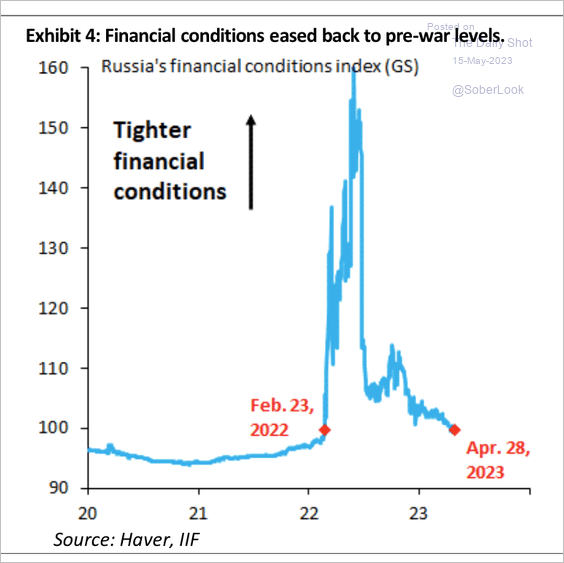

Russia’s financial conditions quickly eased back to pre-war levels as the accumulation of foreign assets shifted from sanctioned to non-sanctioned banks, according to IIF.

Source: IIF

Source: IIF

——————–

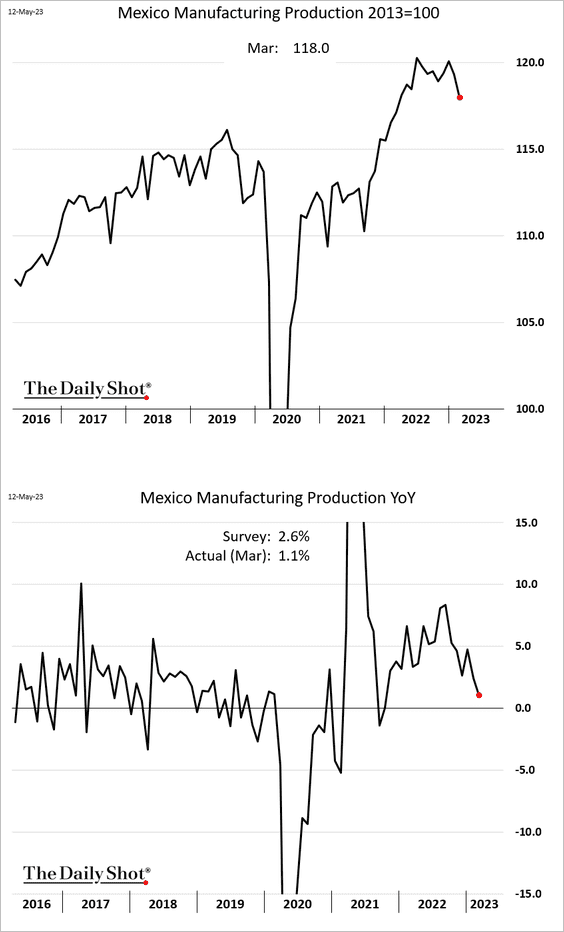

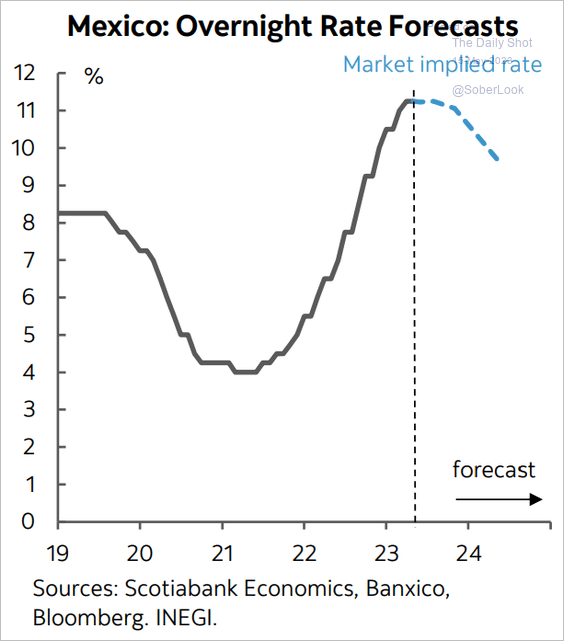

5. Mexico’s manufacturing production is rolling over.

Rate cuts are coming.

Source: Scotiabank Economics

Source: Scotiabank Economics

——————–

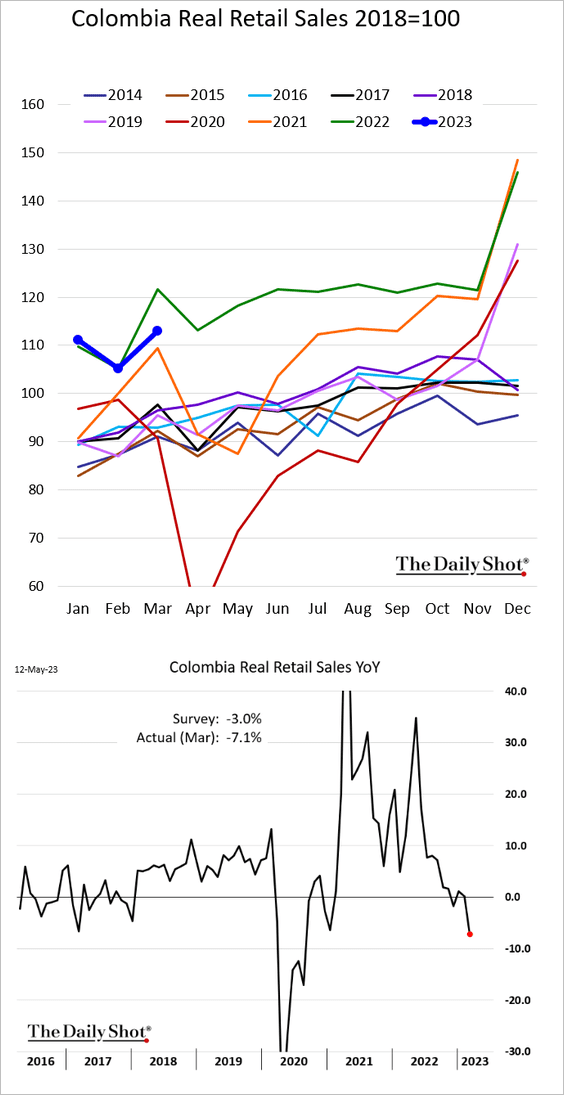

6. Colombia’s retail sales dipped well below last year’s levels.

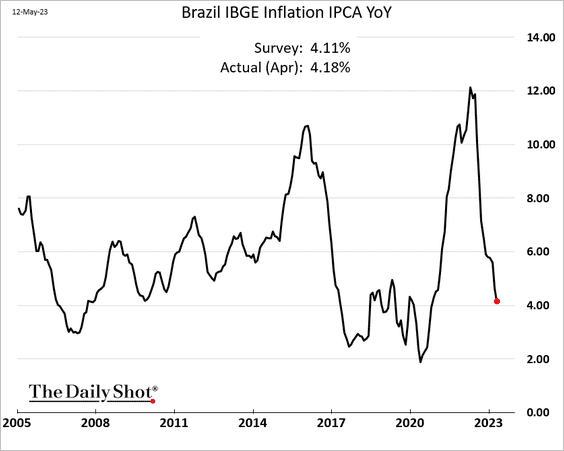

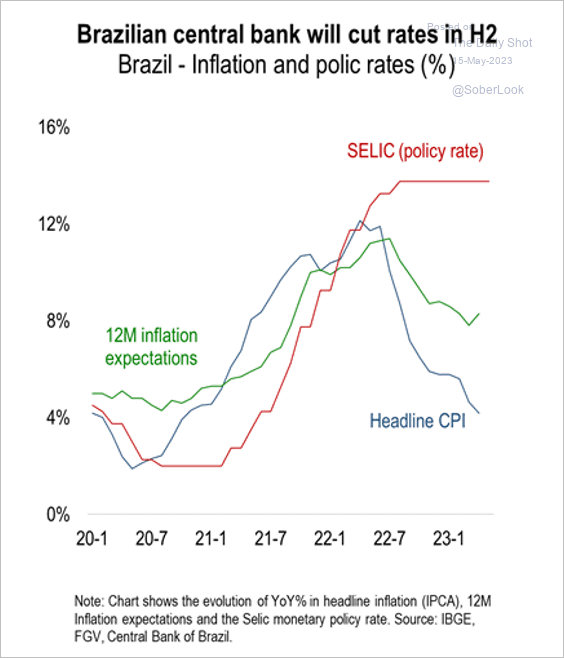

7. Brazil’s inflation continues to moderate.

Rate cuts are coming in the second half of the year.

Source: Numera Analytics (@NumeraAnalytics)

Source: Numera Analytics (@NumeraAnalytics)

——————–

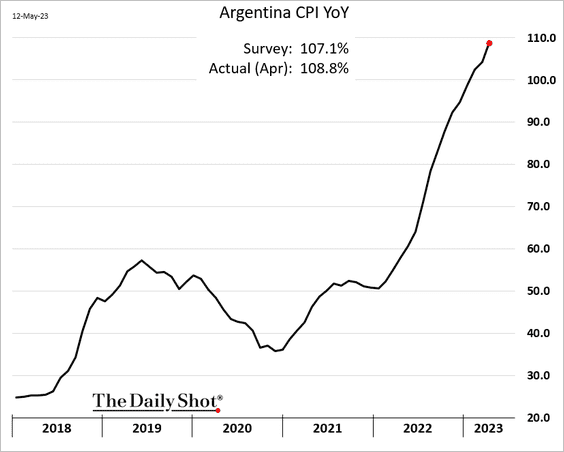

8. Argentina’s inflation continues to surge.

Source: Reuters Read full article

Source: Reuters Read full article

——————–

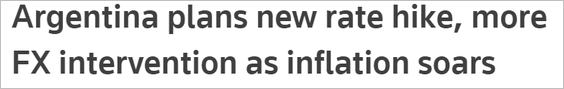

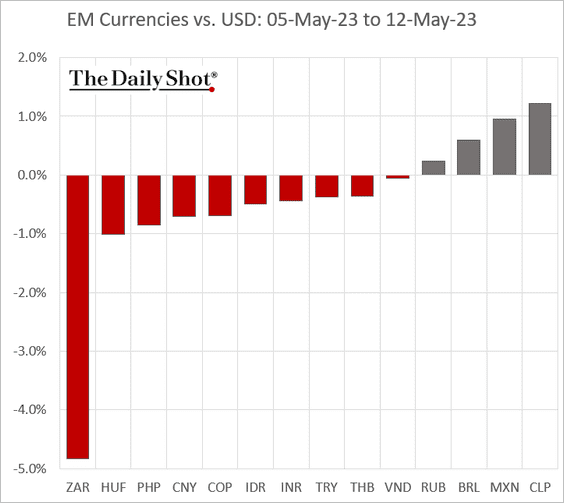

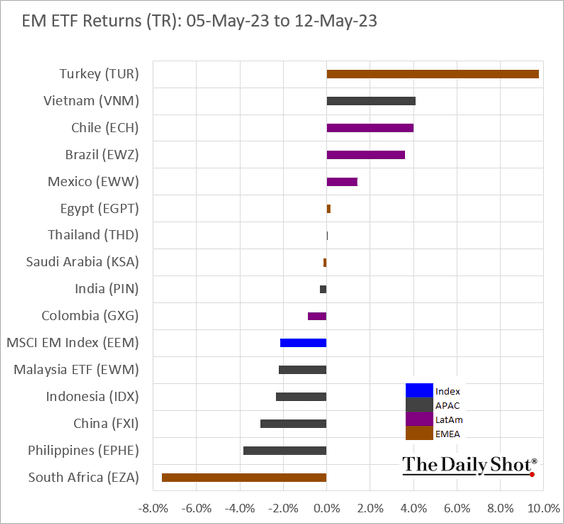

9. Next, we have some performance data from last week.

• Currencies:

• Bond yields:

• Equity ETFs:

Back to Index

Cryptocurrency

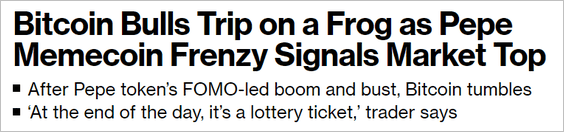

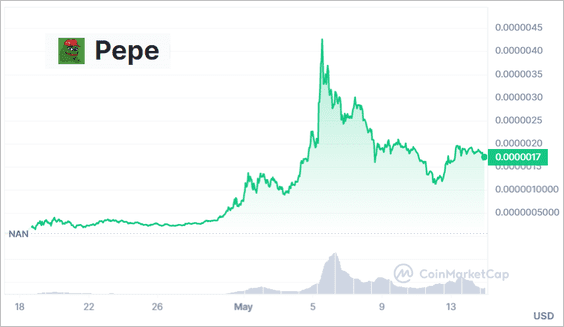

1. The crypto market remains susceptible to speculative fervor.

Source: @olgakharif, @crypto Read full article

Source: @olgakharif, @crypto Read full article

——————–

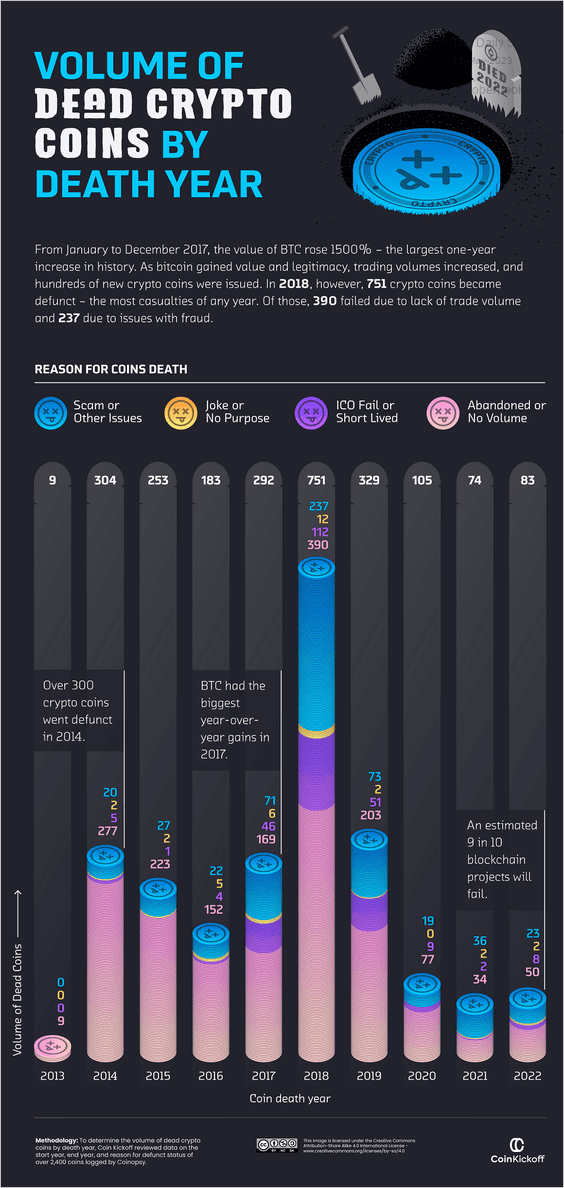

2. Below is a look at dead crypto tokens over time.

Source: Visual Capitalist Read full article

Source: Visual Capitalist Read full article

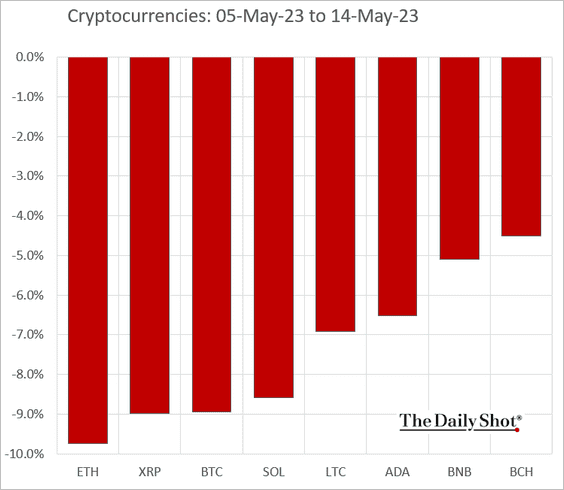

3. Here is last week’s performance across some of the most liquid tokens.

Back to Index

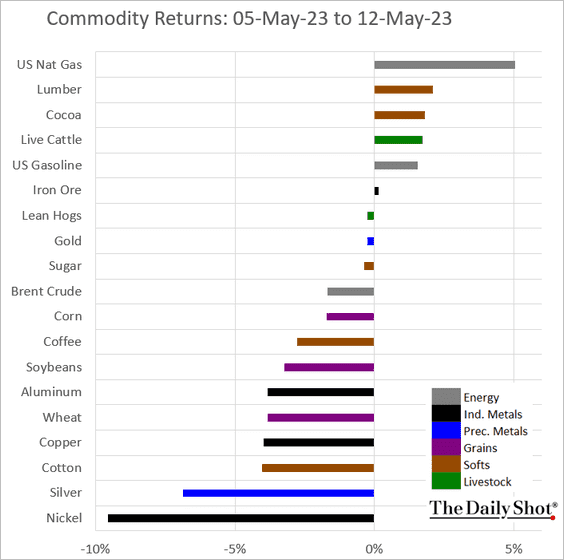

Commodities

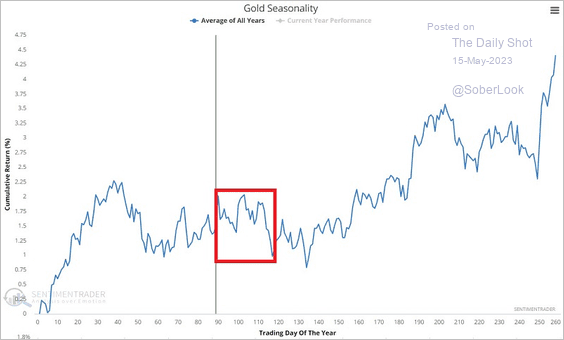

1. Gold is entering a seasonally weak period.

Source: SentimenTrader

Source: SentimenTrader

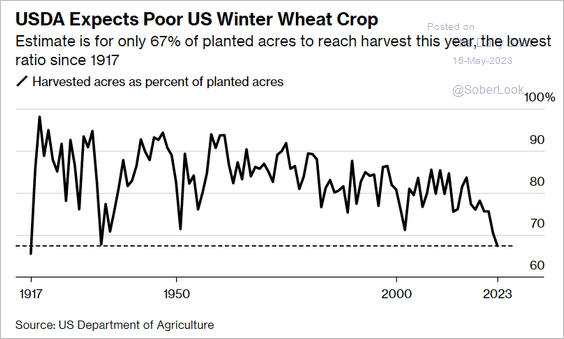

2. US winter wheat outlook has deteriorated.

Source: @mhirtz, @TarsoVeloso, @markets Read full article

Source: @mhirtz, @TarsoVeloso, @markets Read full article

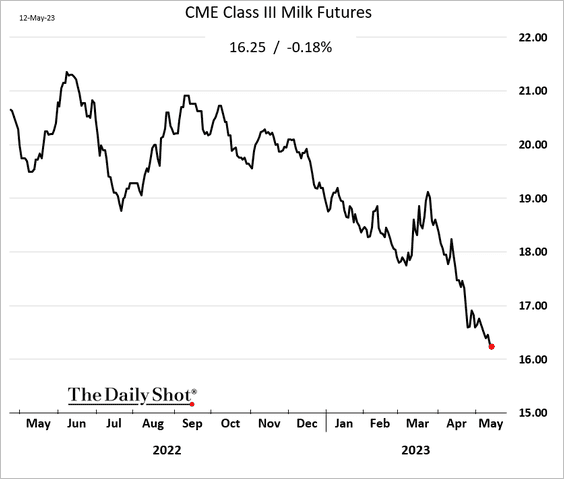

3. Milk futures continue to slide amid softer product prices (cheddar, butter).

4. Here is last week’s performance across key commodity markets.

Back to Index

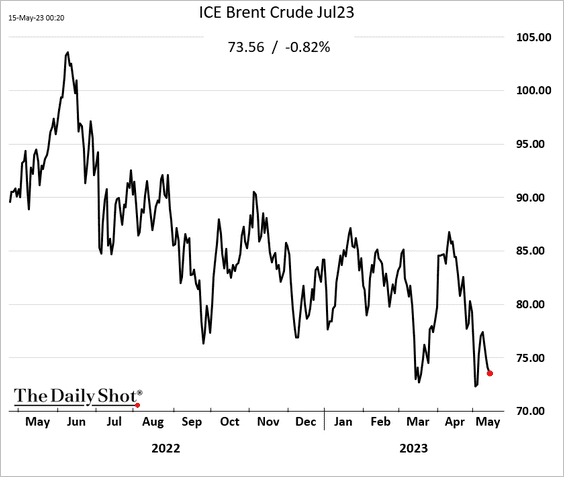

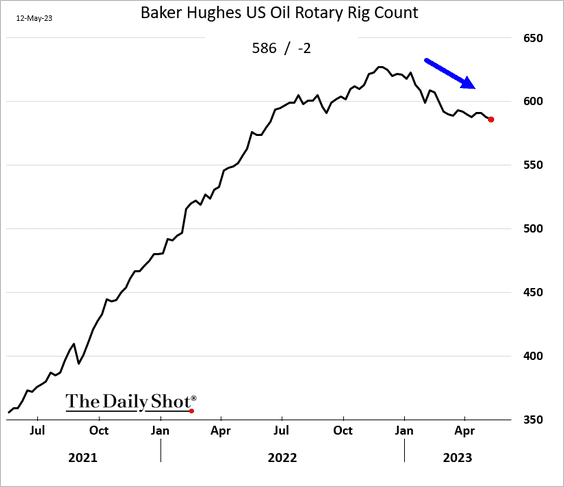

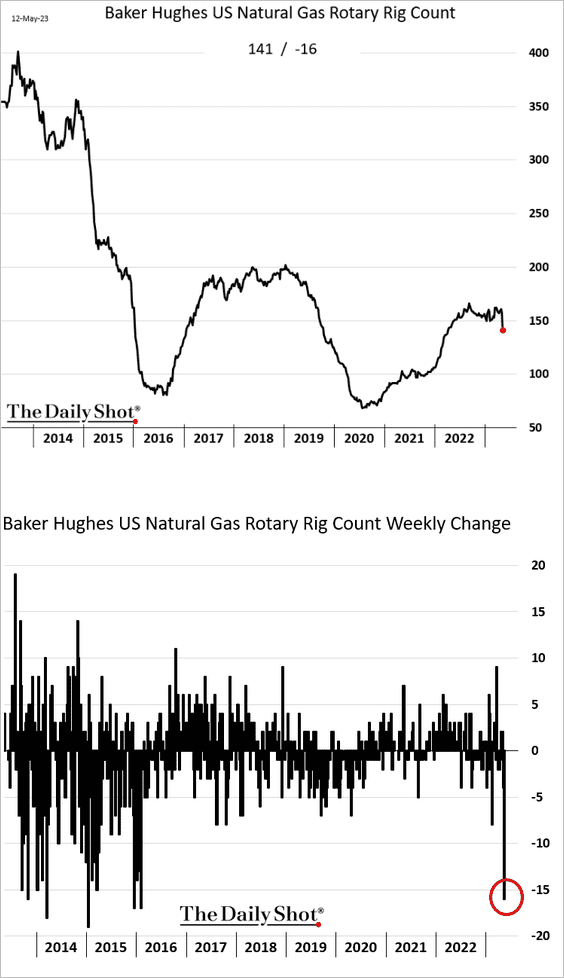

Energy

1. Crude oil futures remain under pressure.

2. US crude oil rig count continues to trend lower.

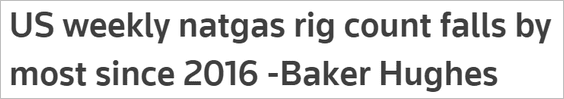

3. The natural gas rig count tumbled last week.

Source: Reuters Read full article

Source: Reuters Read full article

Back to Index

Equities

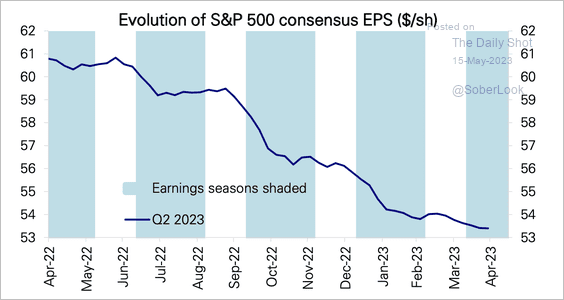

1. Consensus earnings estimates for Q2 continue to decline, albeit at a slower pace compared to prior quarters.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

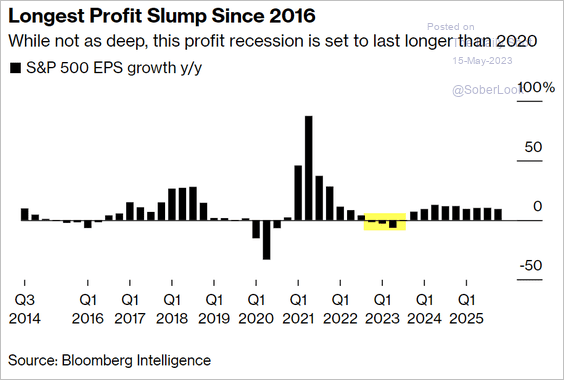

The current US profit recession is expected to be the longest since 2016.

Source: @farahesque, @business Read full article

Source: @farahesque, @business Read full article

——————–

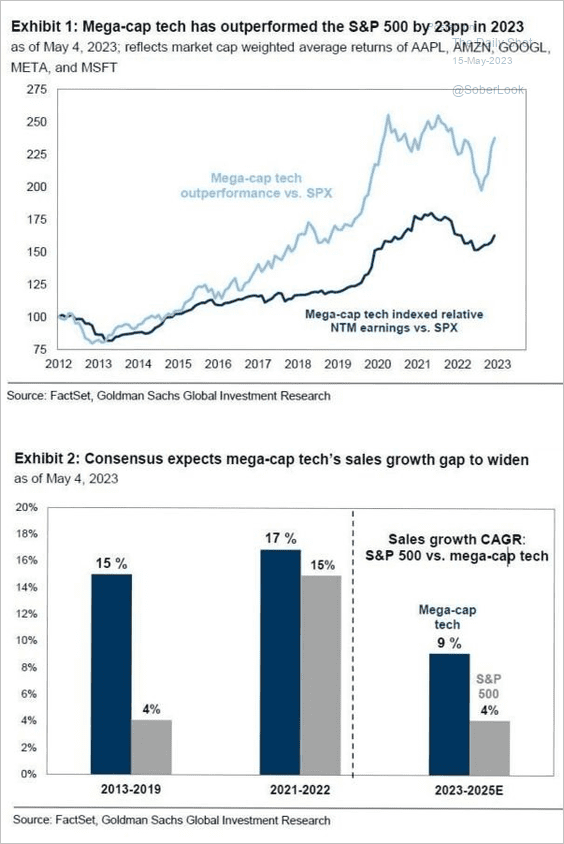

2. The projected earnings and sales forecasts for tech mega-cap companies have been outpacing those for the S&P 500.

Source: Goldman Sachs

Source: Goldman Sachs

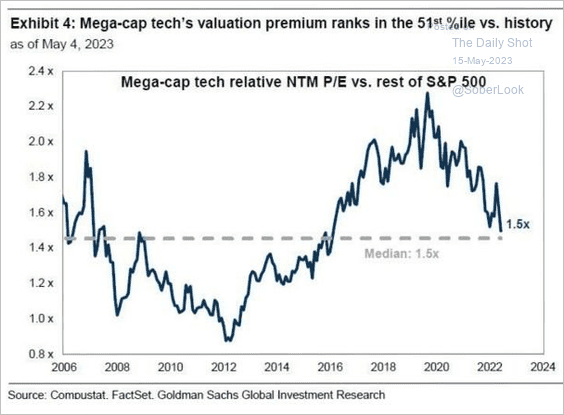

• Mega-cap valuations are not extreme relative to the rest of the S&P 500.

Source: Goldman Sachs

Source: Goldman Sachs

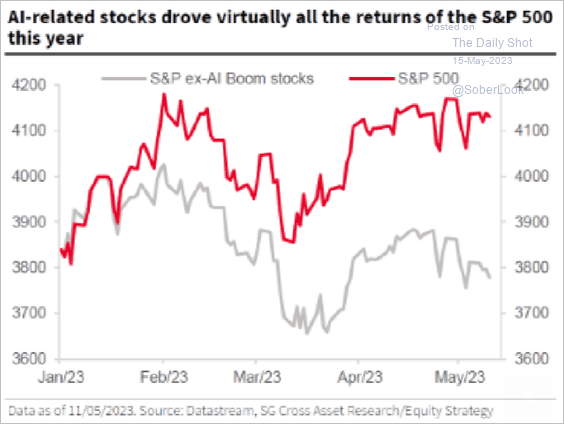

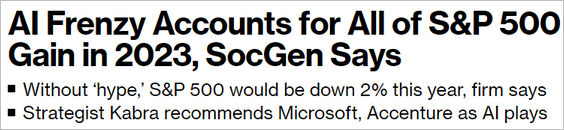

3. Companies that will benefit from the AI boom have been driving the S&P 500 gains this year.

Source: SG Cross Asset Solutions

Source: SG Cross Asset Solutions

Source: @Subrat_Patnaik, @markets Read full article

Source: @Subrat_Patnaik, @markets Read full article

——————–

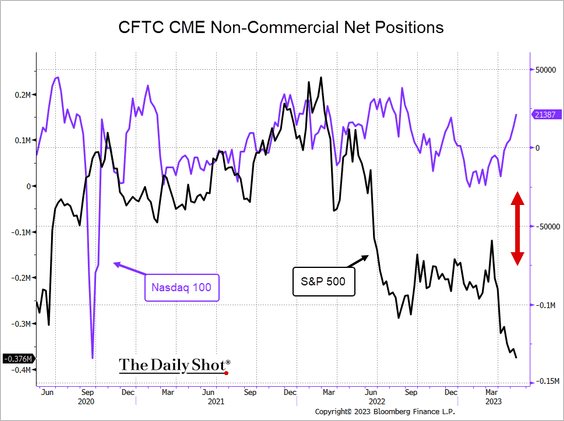

4. Speculative accounts are now net long the Nasdaq 100 futures and increasingly net short the S&P 500 futures.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

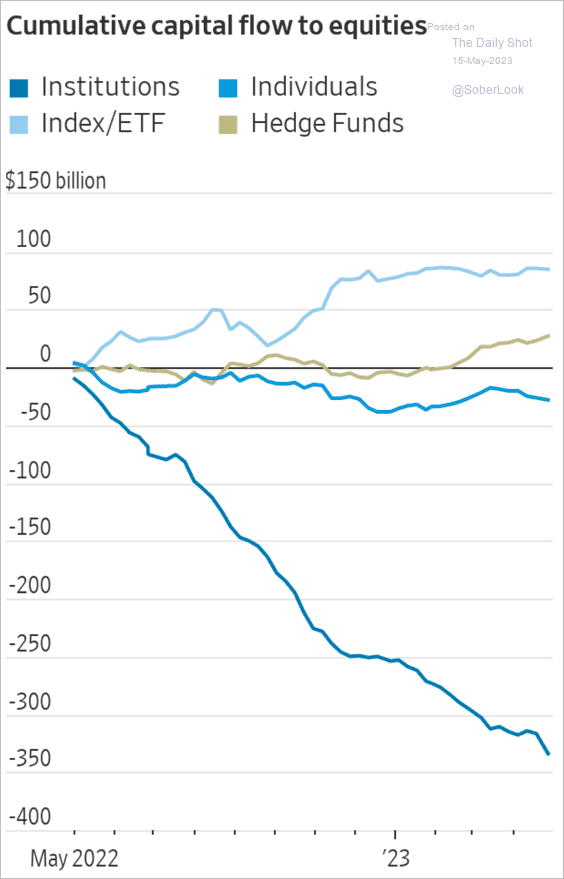

5. Institutional investors have been persistently trimming their equity exposure.

Source: @WSJ Read full article

Source: @WSJ Read full article

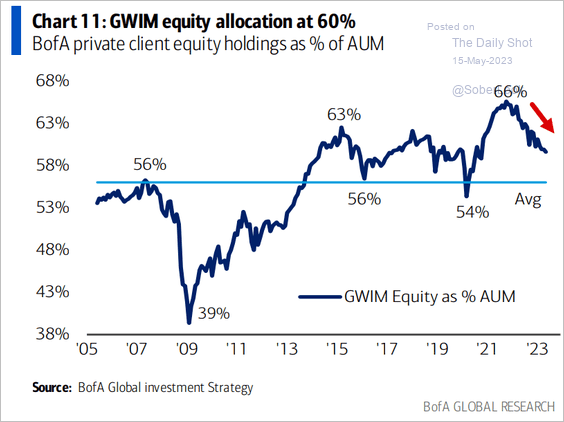

• BofA’s private clients are doing the same.

Source: BofA Global Research

Source: BofA Global Research

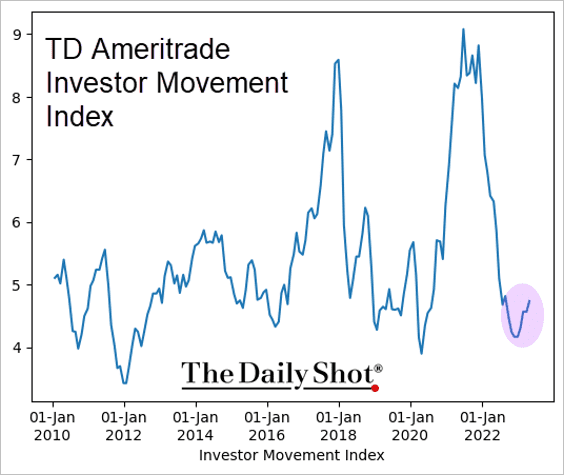

• According to data from TD Ameritrade, retail investor positioning has bottomed.

Source: TD Ameritrade

Source: TD Ameritrade

——————–

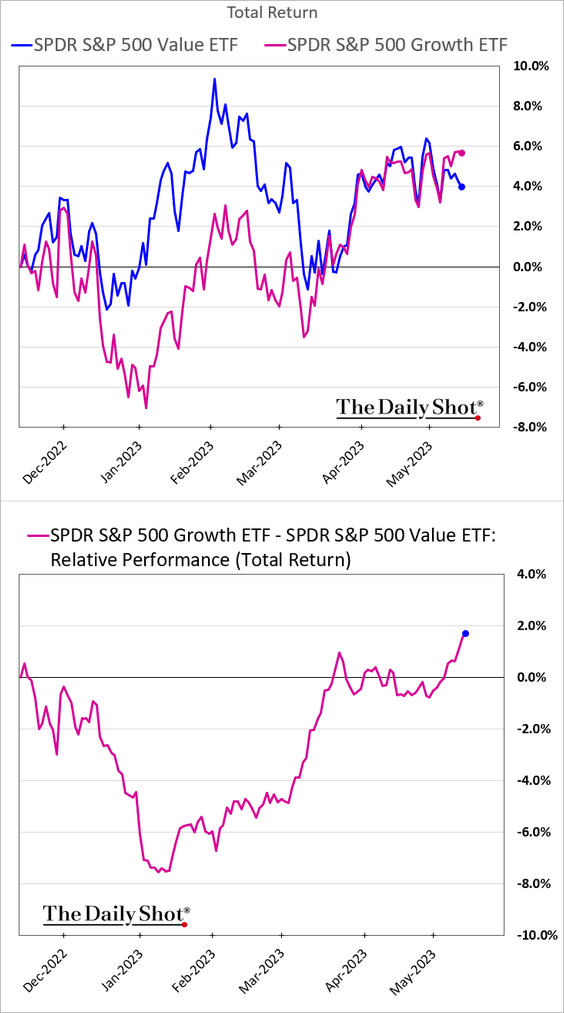

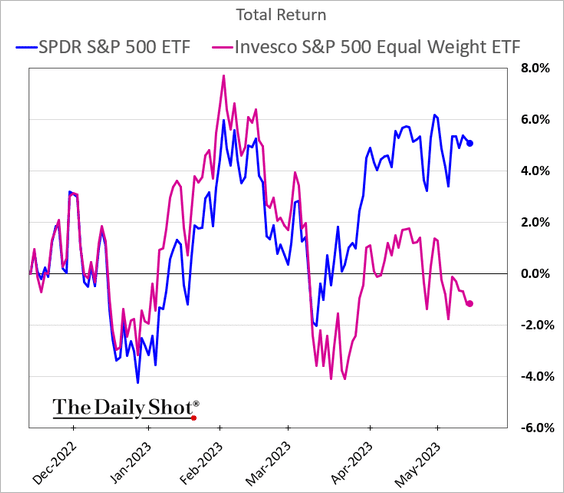

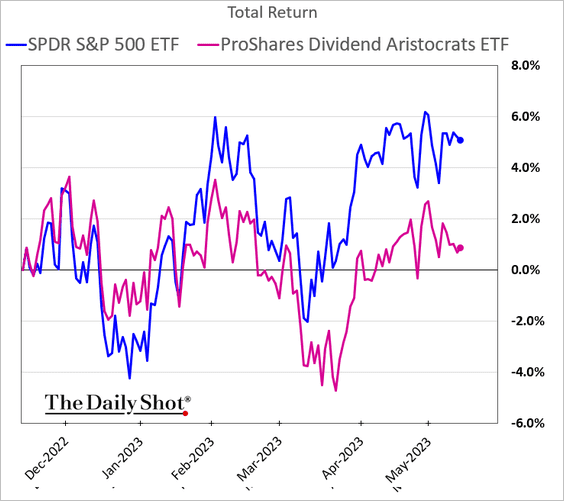

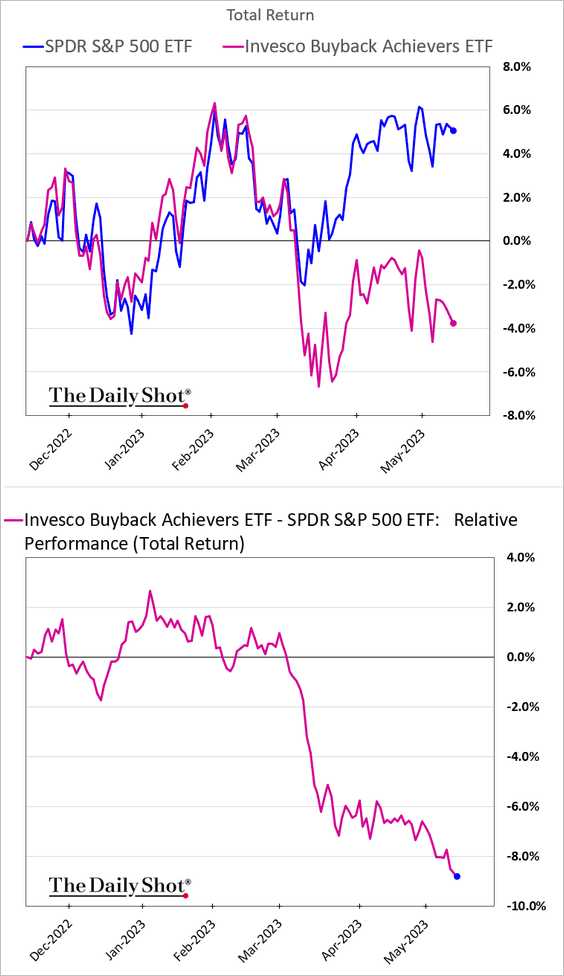

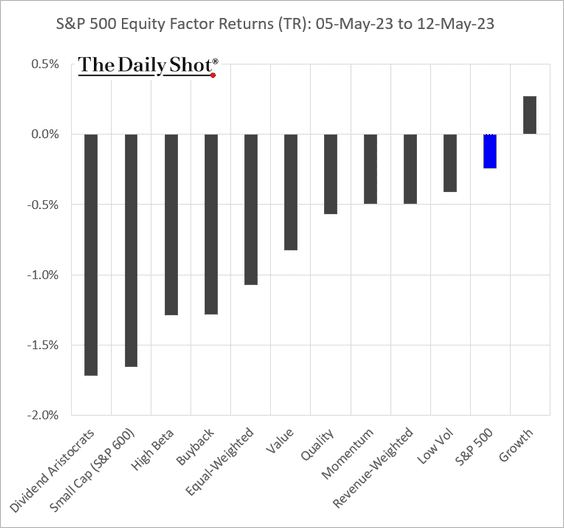

6. Next, we have some equity factor performance data.

• Value vs. growth:

• The equal weight index:

• Dividend aristocrats:

• Companies known for share buybacks:

• Last week’s performance:

——————–

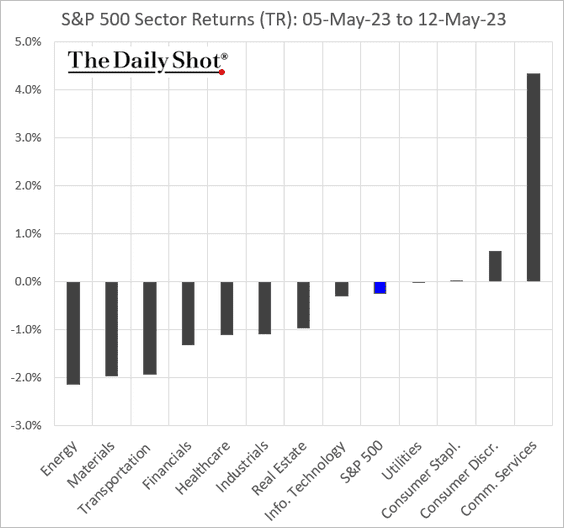

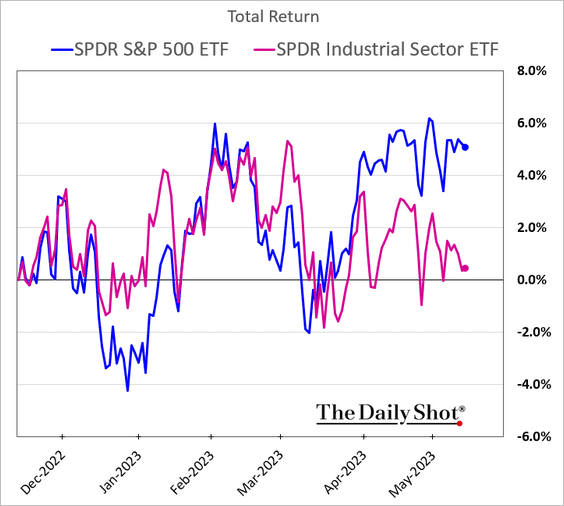

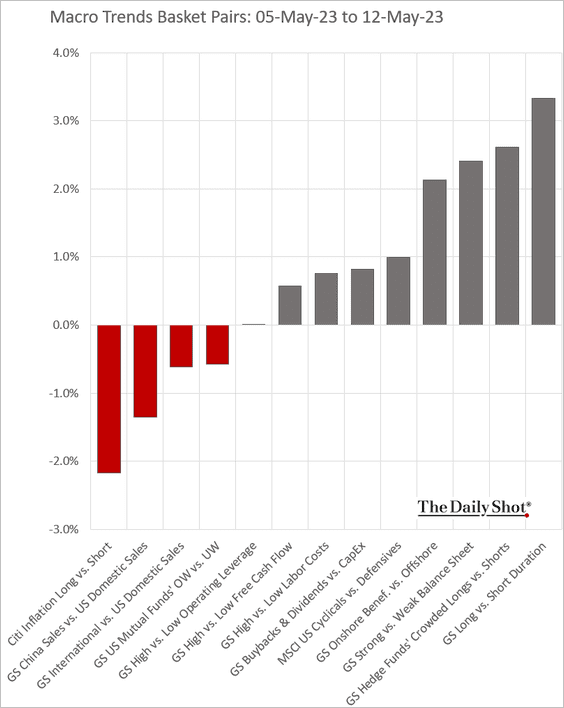

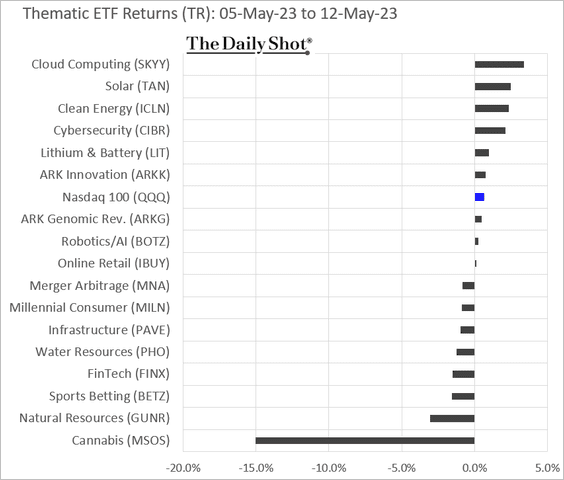

7. Here are some additional performance charts from last week.

• Sectors:

Industrials continue to lag.

• Macro trends basket pairs (relative performance):

• Thematic ETFs:

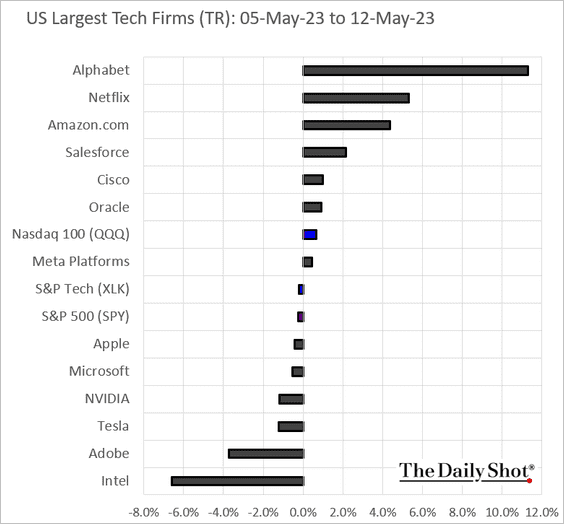

• Largest US tech firms:

Back to Index

Credit

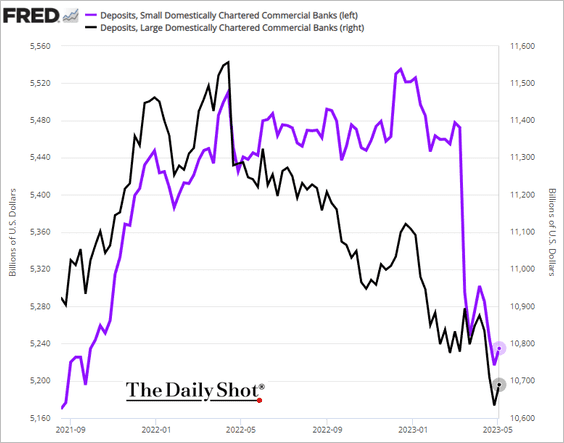

1. Dollar deposits at US domestic banks increased during the week ending on May 3rd.

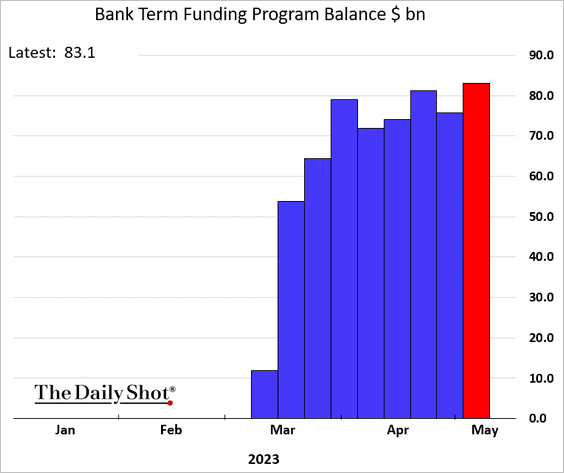

• Emergency lending was higher.

Source: MarketWatch Read full article

Source: MarketWatch Read full article

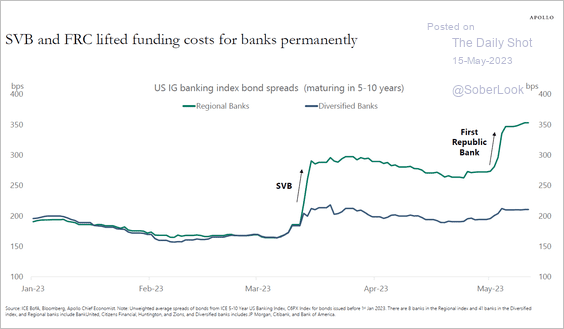

• The cost of funds for small banks has risen sharply since the start of the banking turmoil.

Source: Torsten Slok, Apollo

Source: Torsten Slok, Apollo

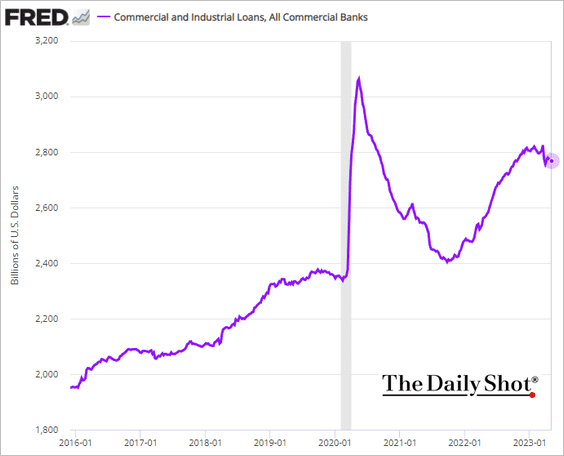

• Business loan balances are rolling over.

——————–

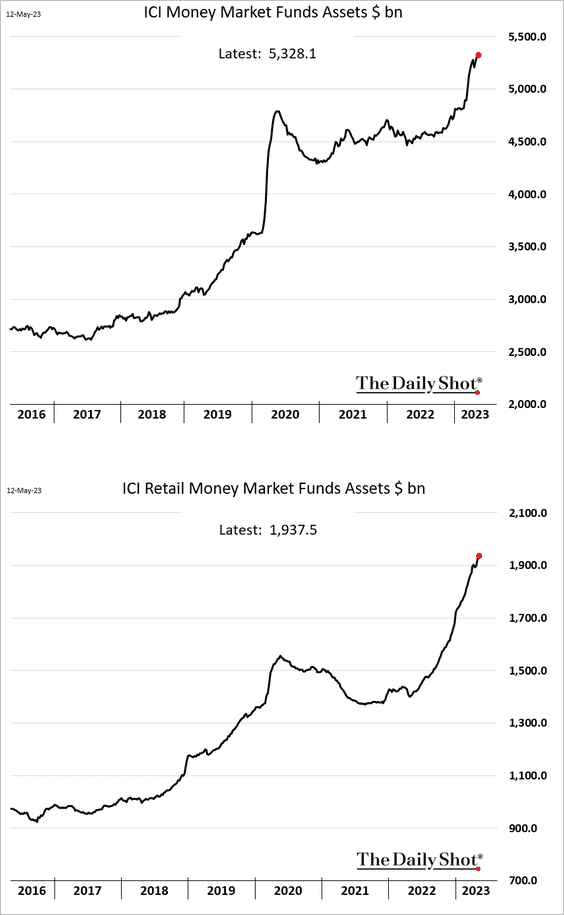

2. Money market funds’ AUM keeps climbing.

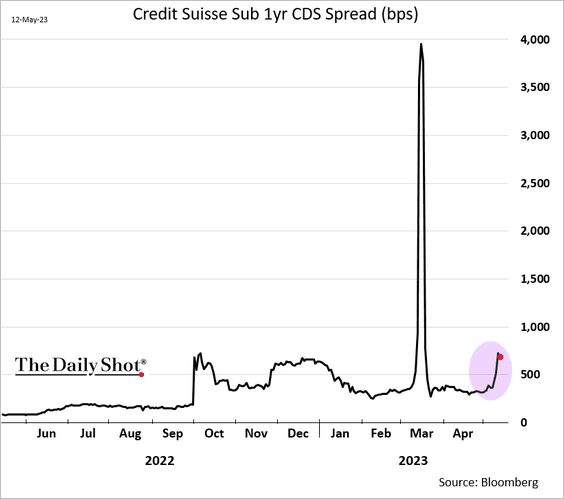

3. Will the Credit Suisse CoCo bond wipeout trigger a default for the subordinated debt CDS?

Source: @claireeboston, @markets Read full article

Source: @claireeboston, @markets Read full article

——————–

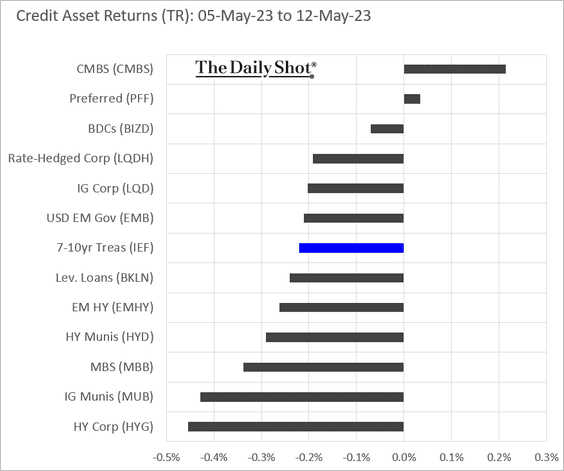

4. Finally, here is last week’s performance by asset class.

Back to Index

Rates

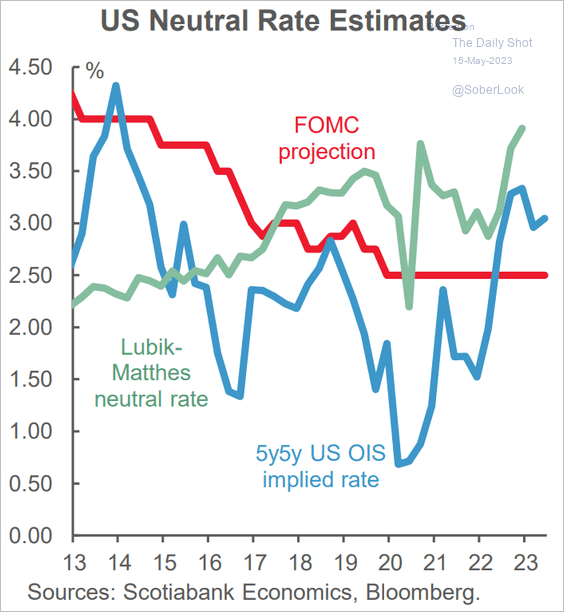

1. Where is the US neutral rate?

Source: Scotiabank Economics

Source: Scotiabank Economics

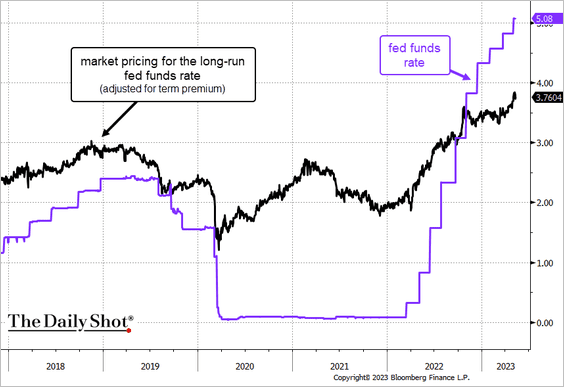

The Fed’s policy looks restrictive relative to market pricing for the long-run fed funds rate.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

——————–

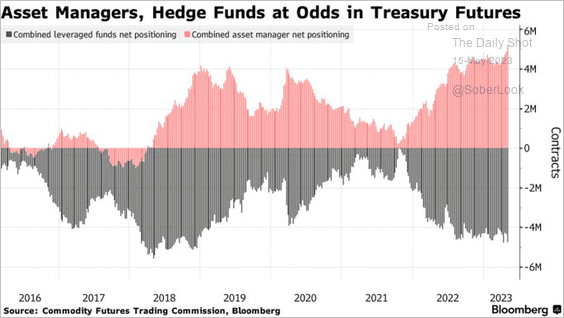

2. Treasury futures positioning gap between asset managers and hedge funds is at a multi-year high.

Source: @GarfieldR1966, @markets Read full article

Source: @GarfieldR1966, @markets Read full article

Back to Index

Global Developments

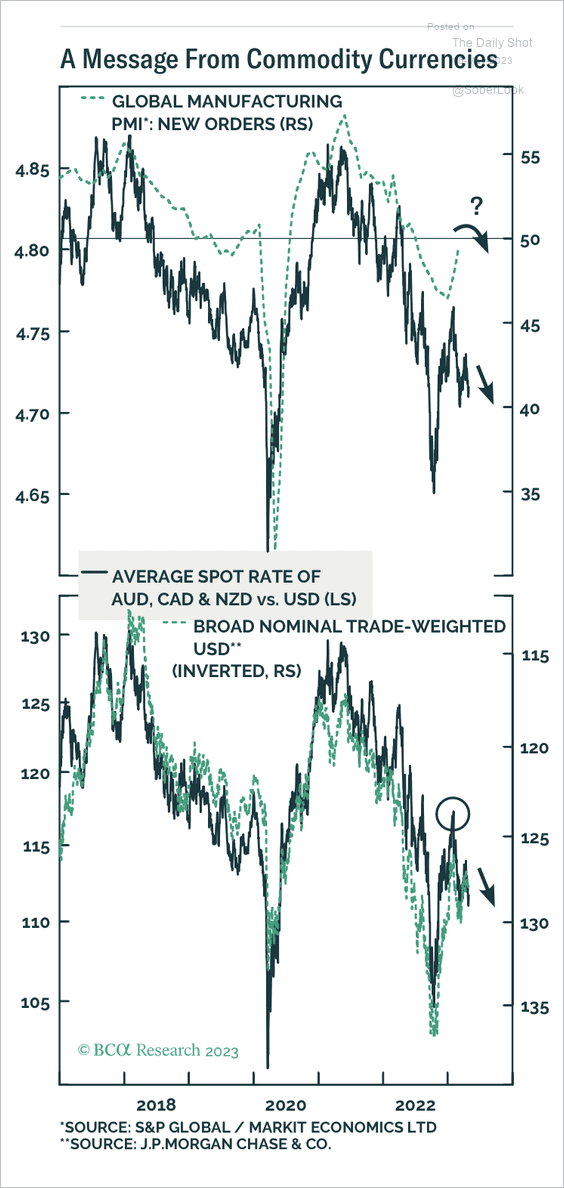

1. Commodity currencies have not confirmed a rebound in global manufacturing conditions.

Source: BCA Research

Source: BCA Research

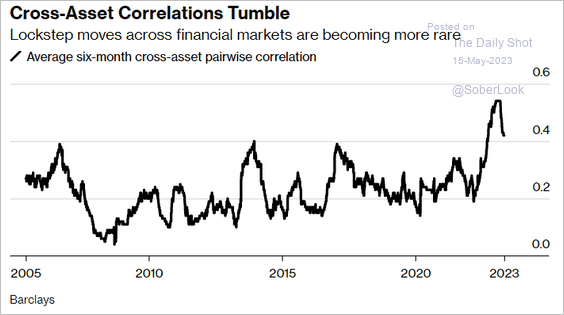

2. Cross-asset correlations have been falling.

Source: @denitsa_tsekova, @luwangnyc, @markets Read full article

Source: @denitsa_tsekova, @luwangnyc, @markets Read full article

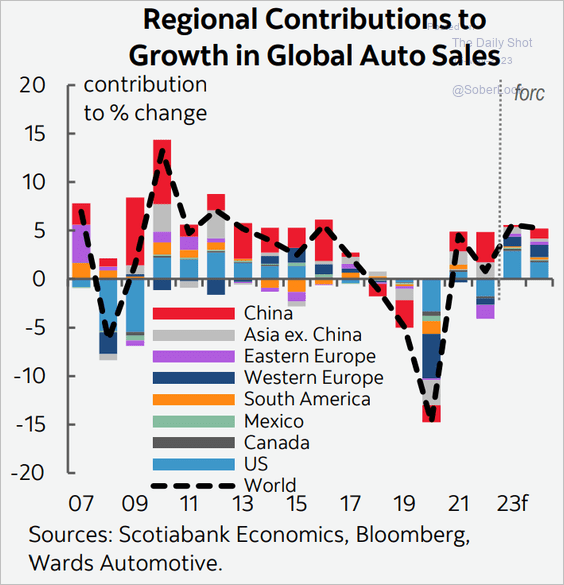

3. Here is the regional attribution of global growth in auto sales, with a forecast from Scotiabank.

Source: Scotiabank Economics

Source: Scotiabank Economics

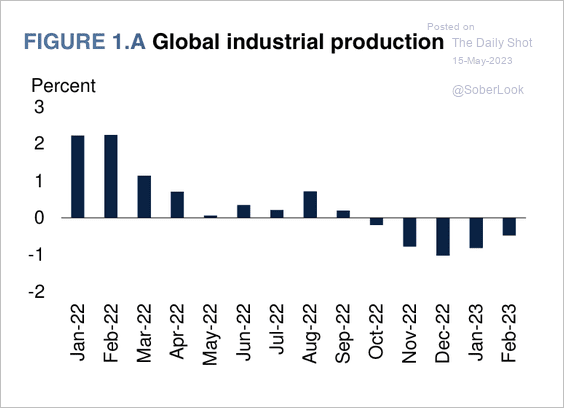

4. Global industrial production has contracted over the past few months.

Source: The World Bank

Source: The World Bank

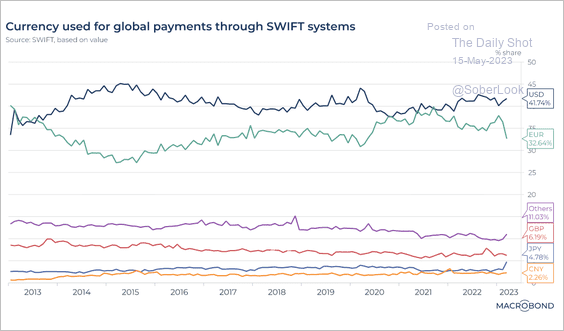

5. The US dollar continues to dominate SWIFT payments.

Source: Macrobond

Source: Macrobond

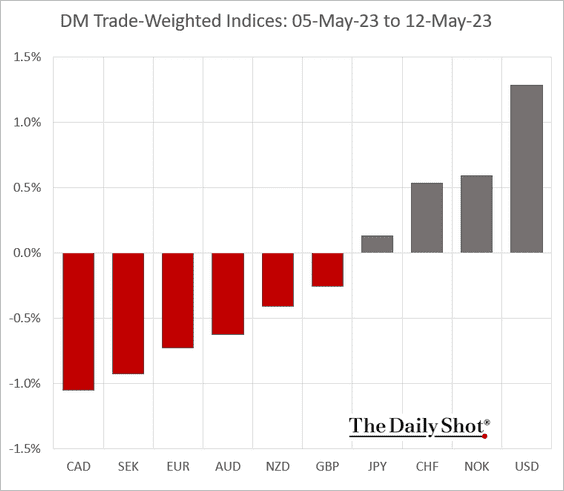

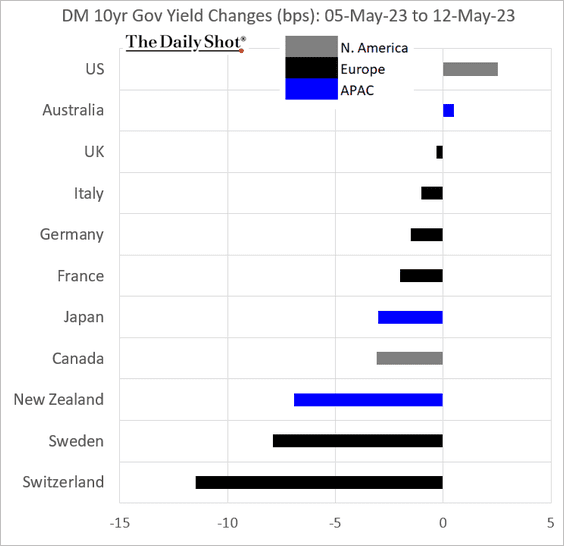

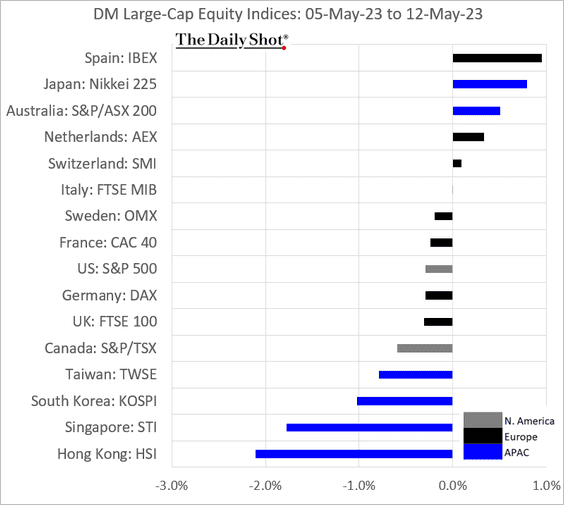

6. Next, we have some performance data for last week.

• Trade-weighted currency indices:

• Bond yields:

• Large-cap equity indices:

——————–

Food for Thought

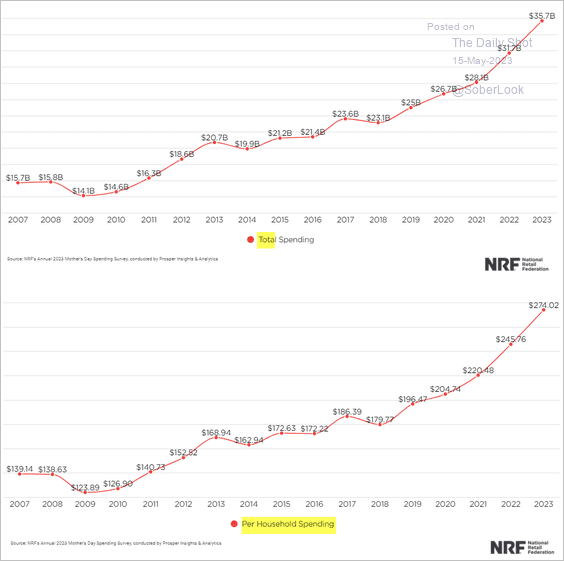

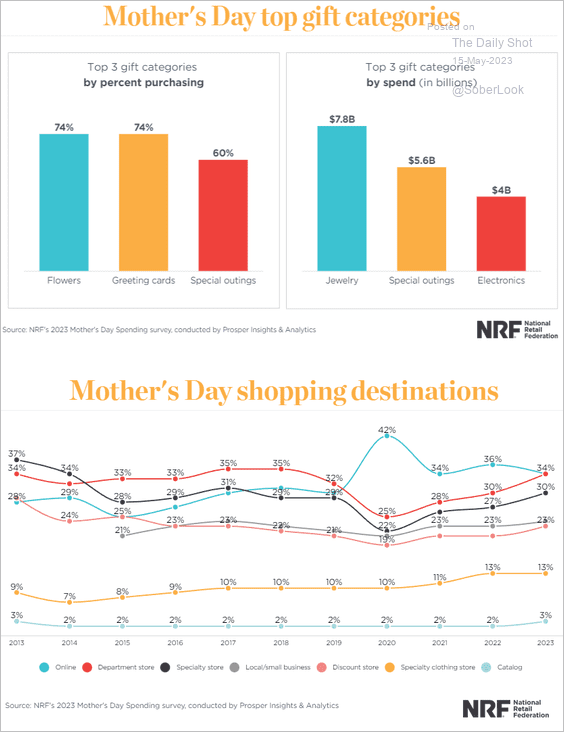

1. Mother’s Day spending:

Source: NRF

Source: NRF

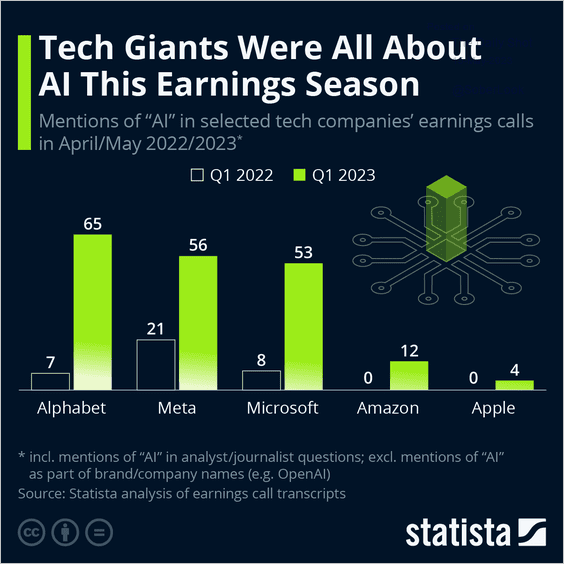

2. AI talk on earnings calls:

Source: Statista

Source: Statista

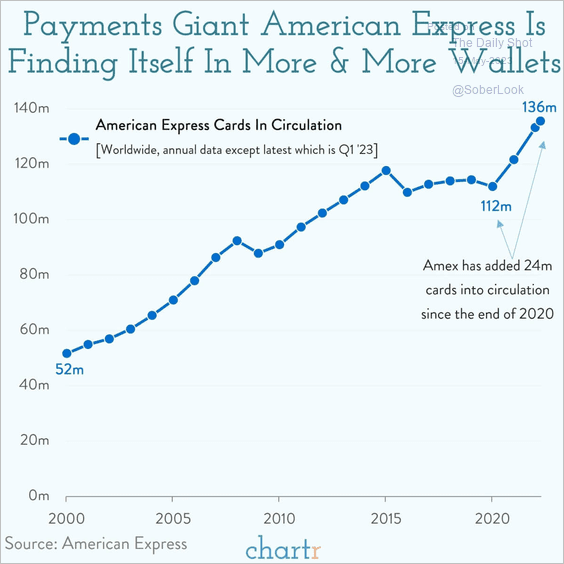

3. Amex cards in circulation:

Source: @chartrdaily

Source: @chartrdaily

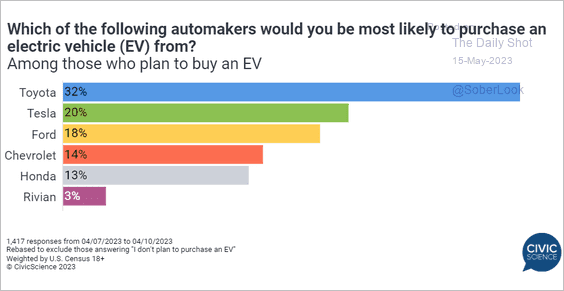

4. Purchasing an EV:

Source: @CivicScience Read full article

Source: @CivicScience Read full article

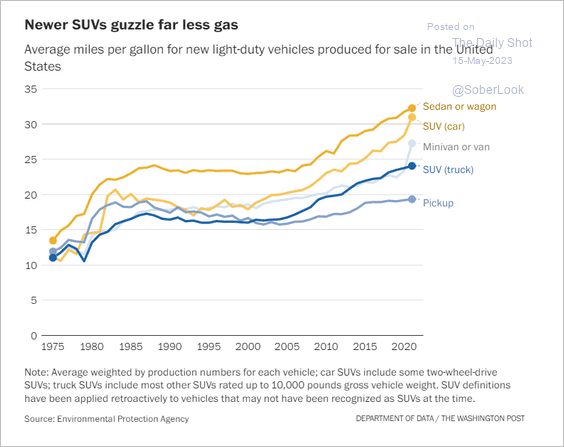

5. Fuel efficiency by truck type:

Source: The Washington Post Read full article

Source: The Washington Post Read full article

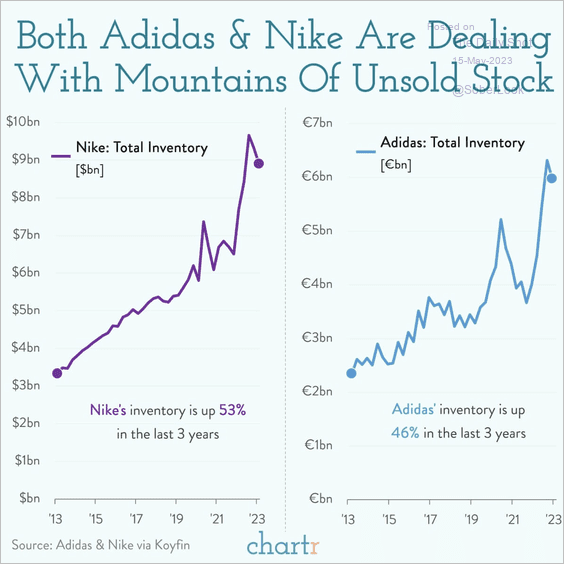

6. Sneaker inventories:

Source: @chartrdaily

Source: @chartrdaily

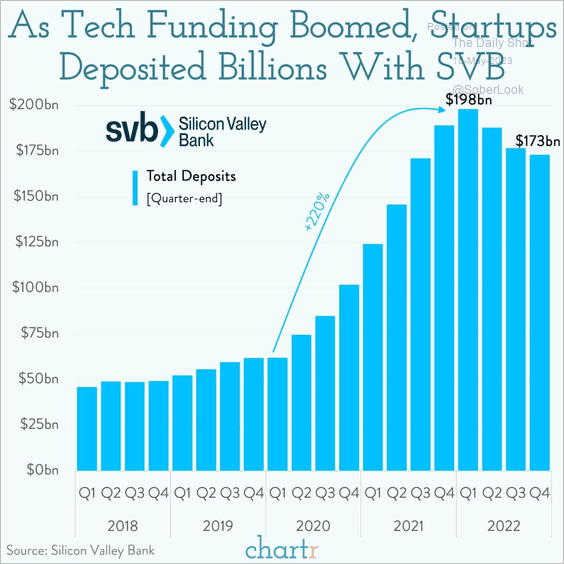

7. SVB’s deposits over time:

Source: @chartrdaily

Source: @chartrdaily

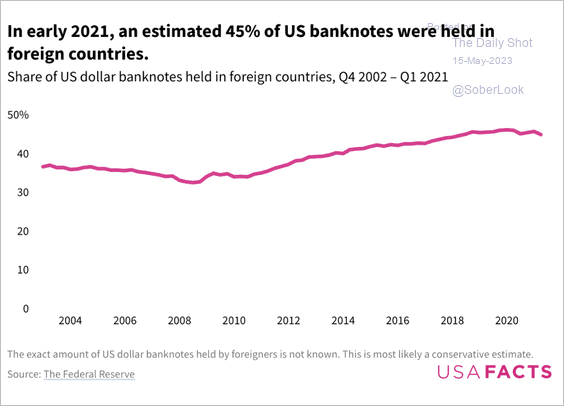

8. US banknotes held in foreign countries:

Source: USAFacts Read full article

Source: USAFacts Read full article

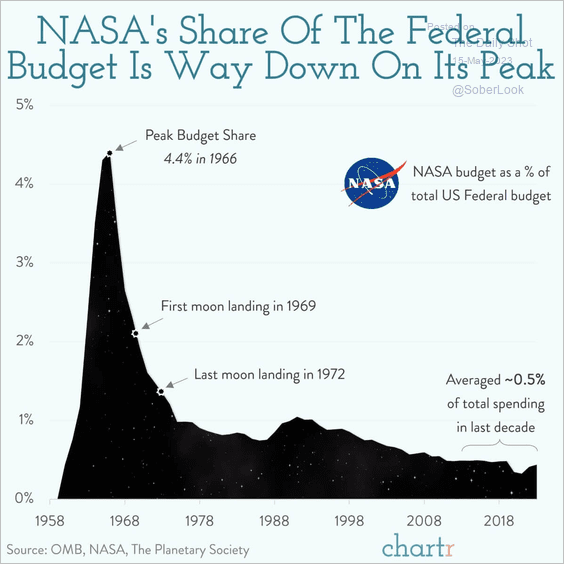

9. NASA’s share of the federal budget:

Source: @chartrdaily

Source: @chartrdaily

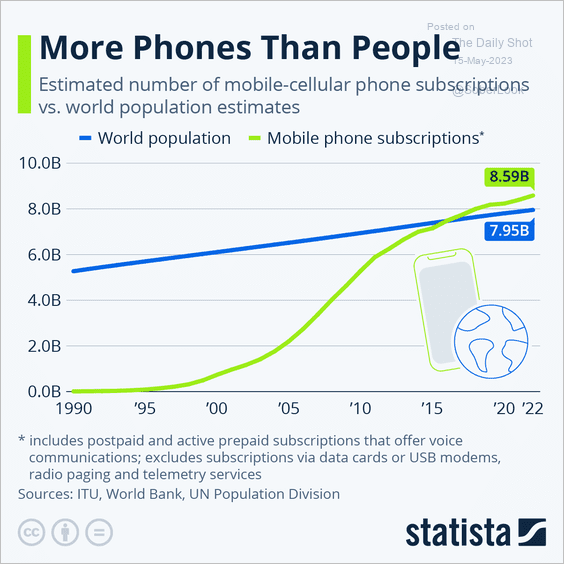

10. Mobile phone subscriptions:

Source: Statista

Source: Statista

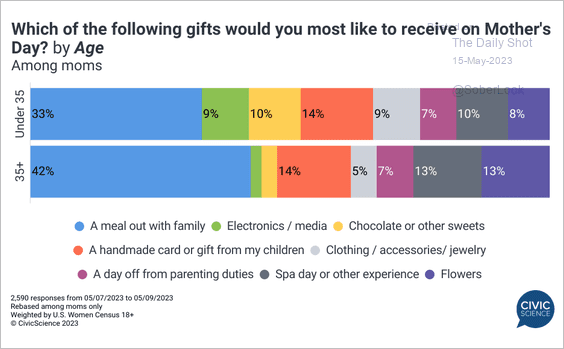

11. Mother’s Day gifts:

Source: @CivicScience Read full article

Source: @CivicScience Read full article

Source: NRF

Source: NRF

——————–

Back to Index