The Daily Shot: 23-May-23

• The United States

• The Eurozone

• Europe

• Asia-Pacific

• China

• Emerging Markets

• Cryptocurrency

• Commodities

• Equities

• Credit

• Rates

• Global Developments

• Food for Thought

The United States

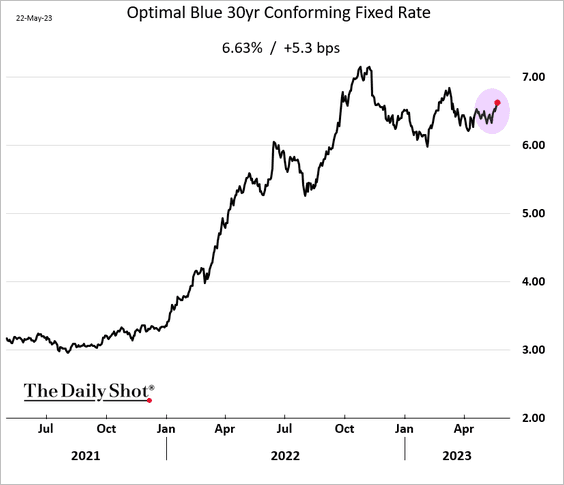

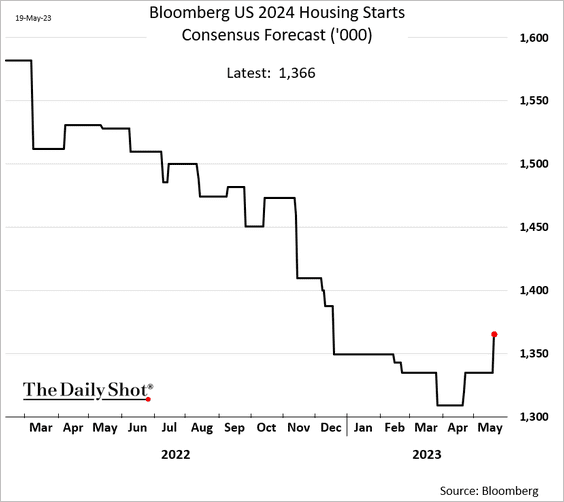

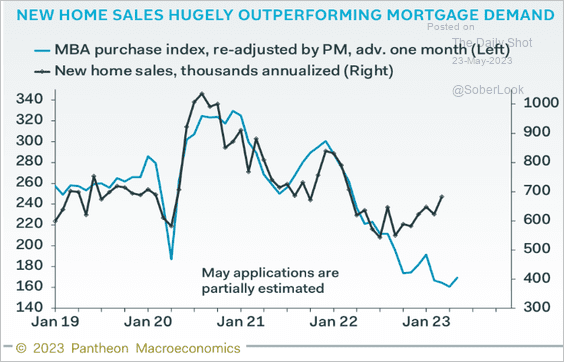

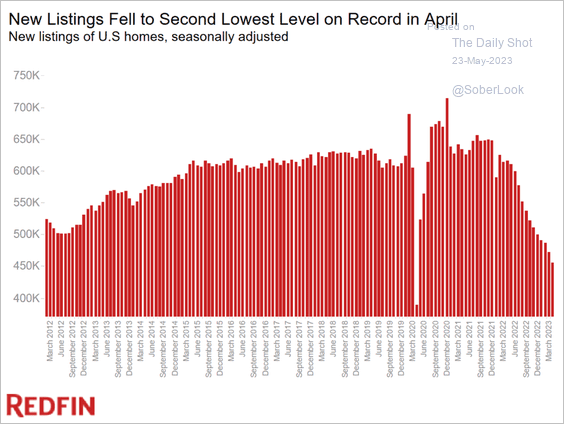

1. Let’s begin with the housing market.

• Mortgage rates have been climbing again.

• Economists boosted their forecasts for next year’s housing starts.

• Depressed mortgage applications point to downside risks for new home sales.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

• With many homeowners “trapped” by their low-rate mortgages, new listings continue to sink.

Source: Redfin

Source: Redfin

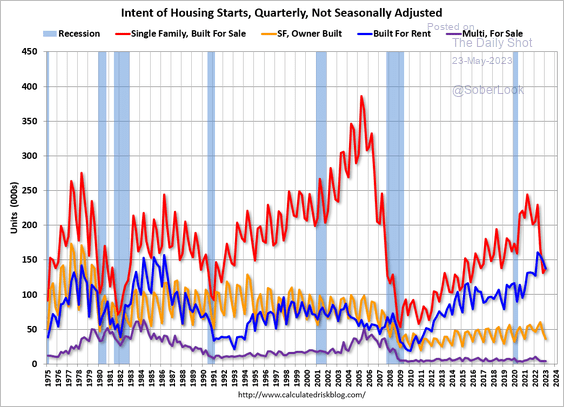

• The number of houses constructed for rental purposes has surpassed those built for sale.

Source: Calculated Risk

Source: Calculated Risk

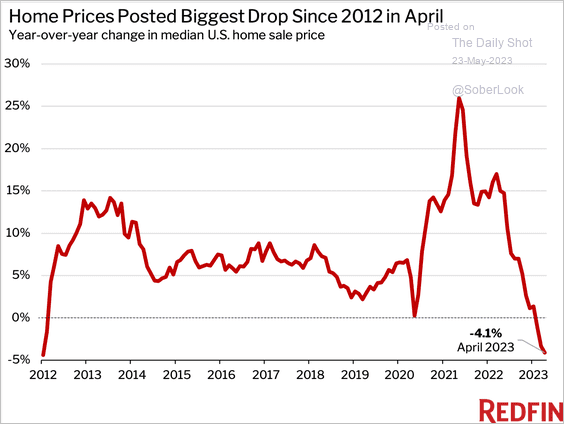

• Redfin’s index of home price appreciation suggests further price declines in April (year-over-year).

Source: Redfin

Source: Redfin

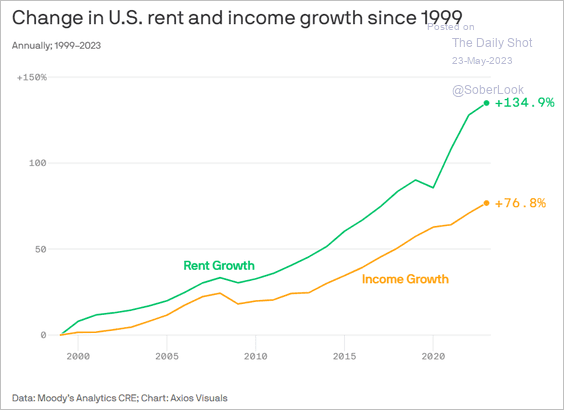

• Rents have significantly outpaced household incomes.

Source: @axios Read full article

Source: @axios Read full article

——————–

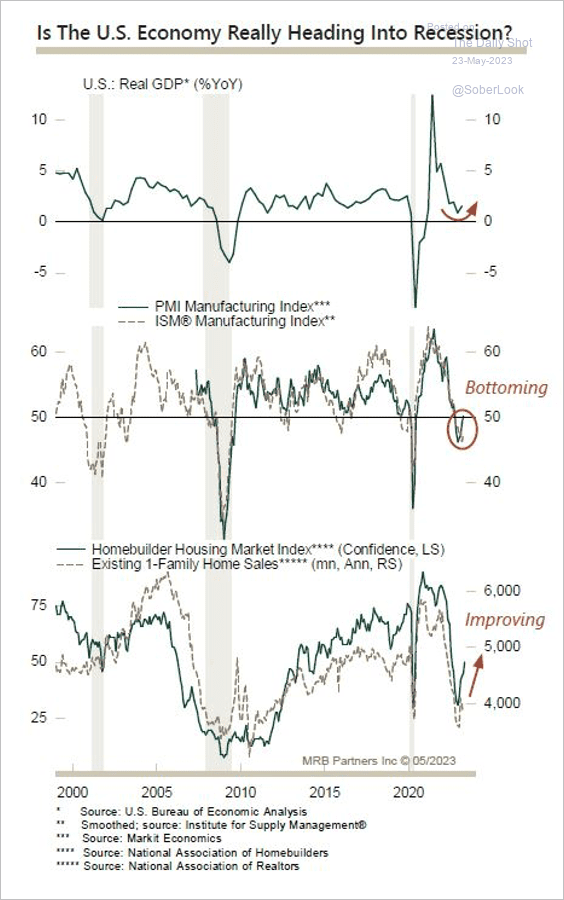

2. Manufacturing and housing conditions are starting to improve, which could stall a recession.

Source: MRB Partners

Source: MRB Partners

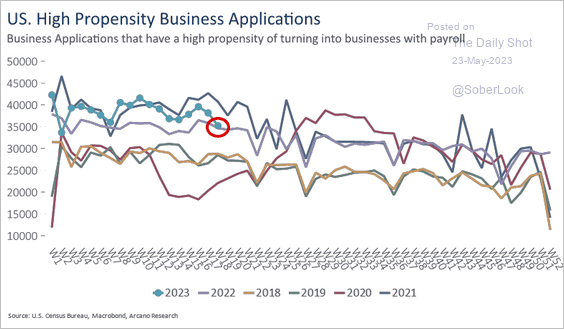

3. Business applications are slowing.

Source: Arcano Economics

Source: Arcano Economics

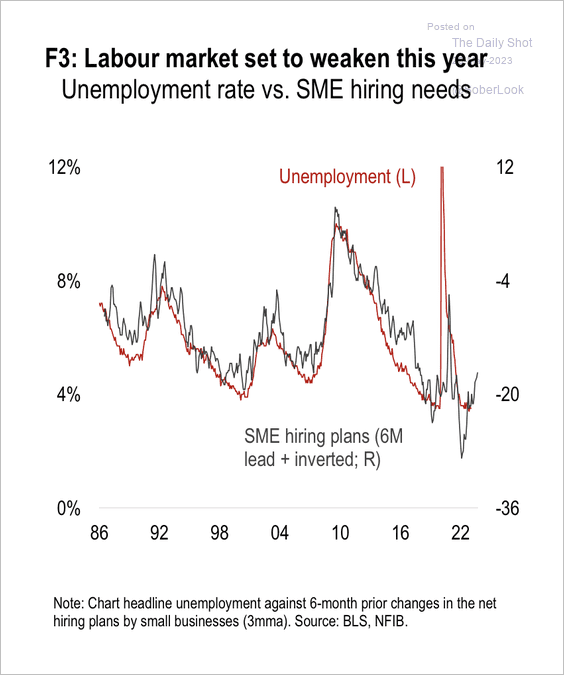

4. The decline in small business hiring plans points to higher unemployment this year.

Source: Numera Analytics (@NumeraAnalytics)

Source: Numera Analytics (@NumeraAnalytics)

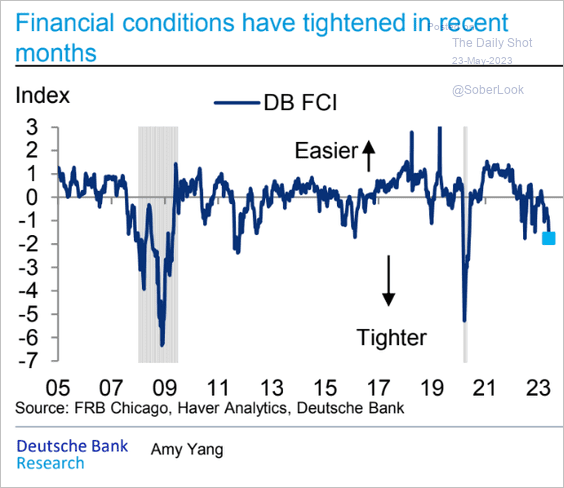

5. Deutsche Bank’s FCI indicator signals tight US financial conditions.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

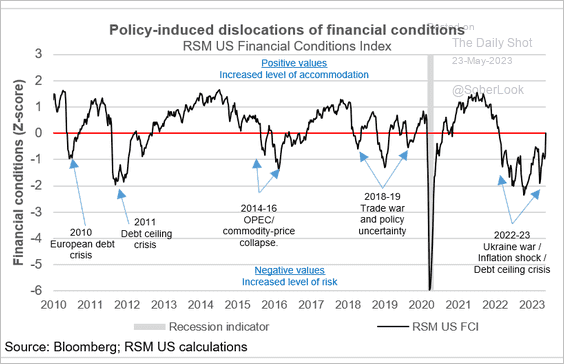

However, the financial conditions index from RSM points to recent easing.

Source: RSM Read full article

Source: RSM Read full article

——————–

6. Finally, here is an update on the debt ceiling situation.

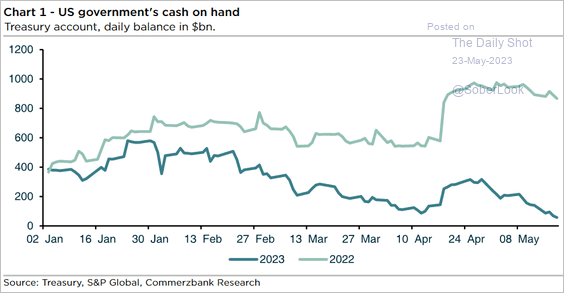

• This chart compares the US Treasury’s cash balance trajectories in 2022 and 2023.

Source: Commerzbank Research

Source: Commerzbank Research

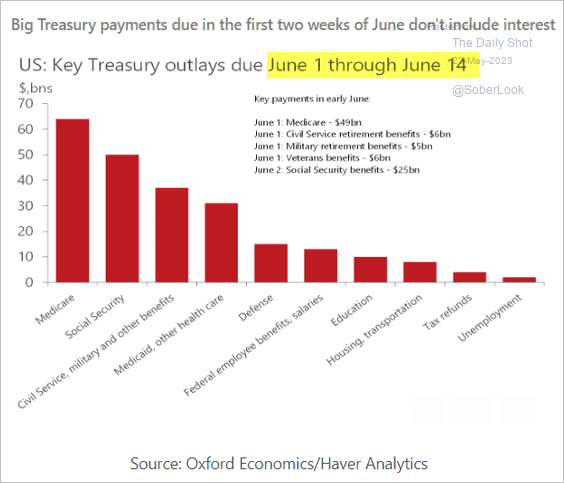

• The US Treasury has the authority to issue new debt to cover the principal, essentially rolling over maturing bonds, a maneuver that does not contribute to surpassing the debt ceiling. According to Oxford Economics, there are no interest payments on Treasury securities in the first half of June, thus significantly mitigating any imminent risk of debt default. However, at the month’s onset, the nation must fulfill obligations amounting to hundreds of billions of dollars earmarked for key government programs such as Medicare and Medicaid, Social Security, and benefits for military personnel and civilian government employees.

Source: Oxford Economics

Source: Oxford Economics

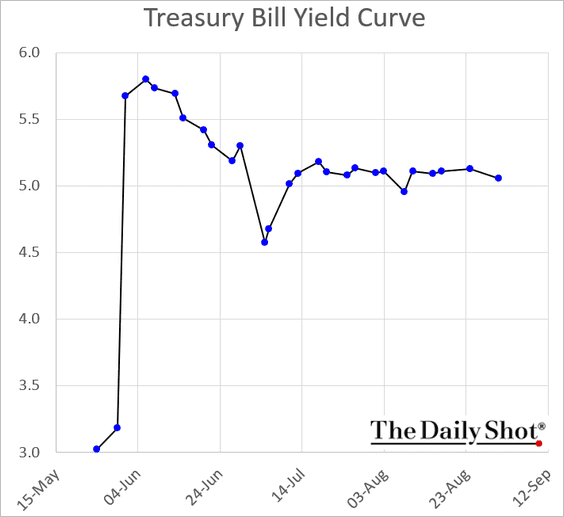

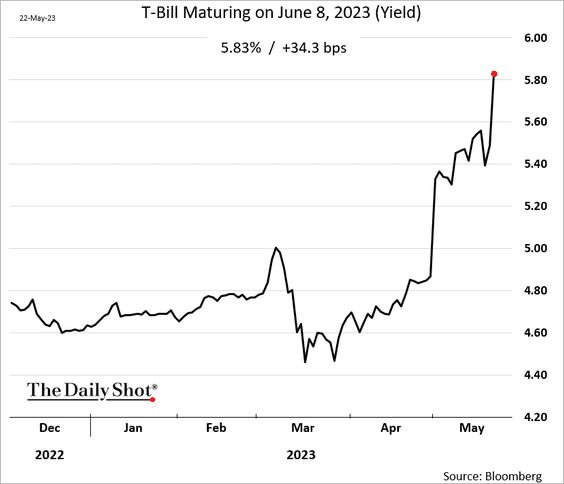

• The Treasury bill market is signaling trouble in early June.

The yield on the June 8th T-bill is nearing 6%.

Back to Index

The Eurozone

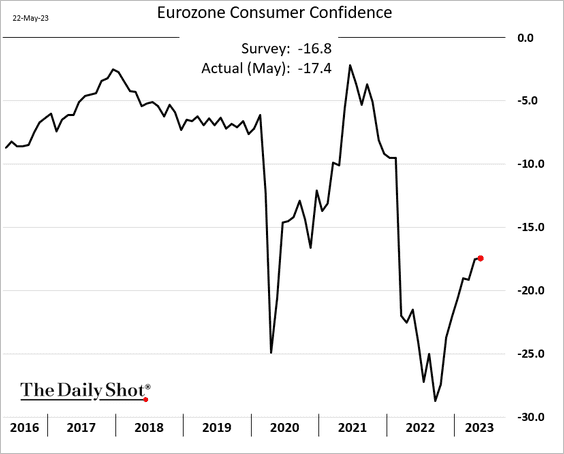

1. The rebound in consumer confidence is stalling.

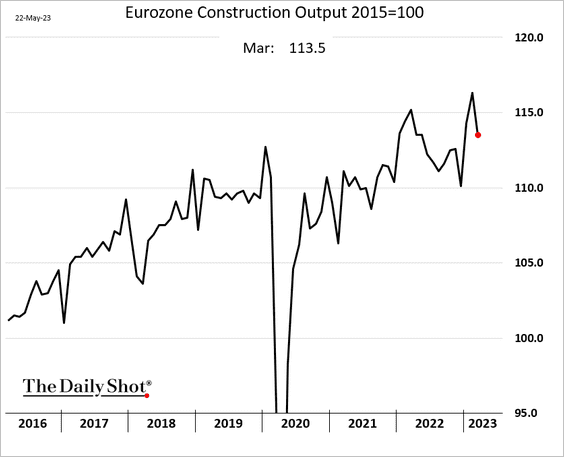

2. Construction output declined in March.

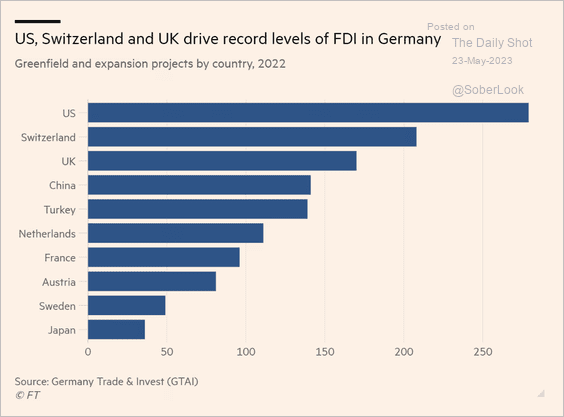

3. Here are the sources of foreign direct investment in Germany.

Source: @financialtimes Read full article

Source: @financialtimes Read full article

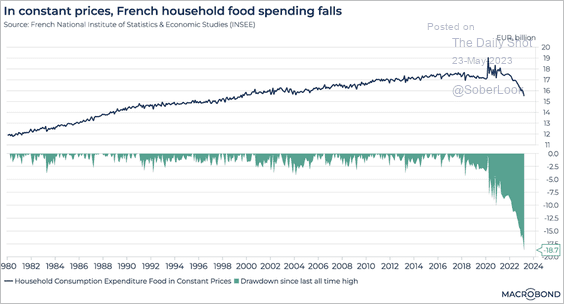

4. French food spending tumbled as inflation pressures the nation’s households.

Source: Macrobond

Source: Macrobond

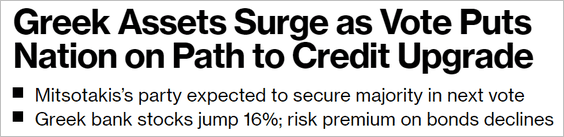

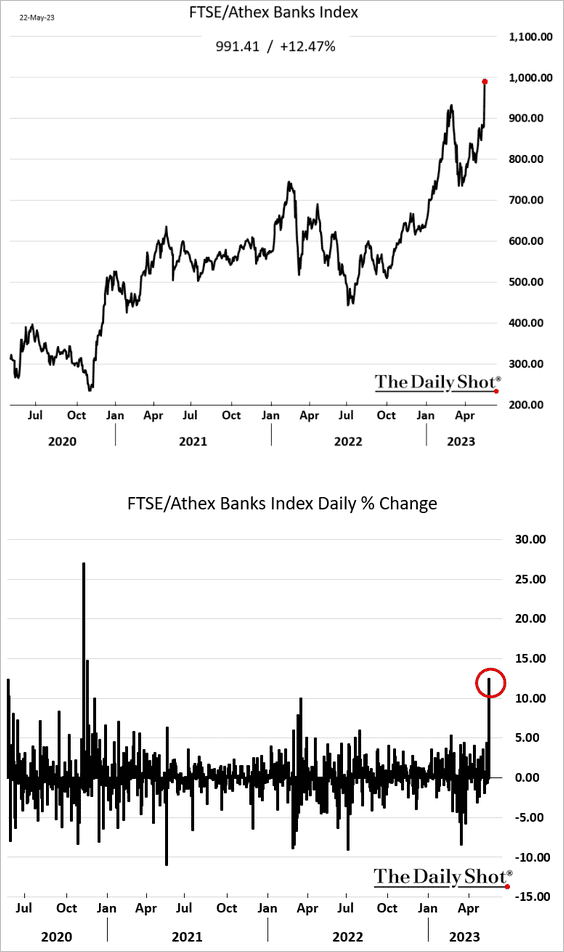

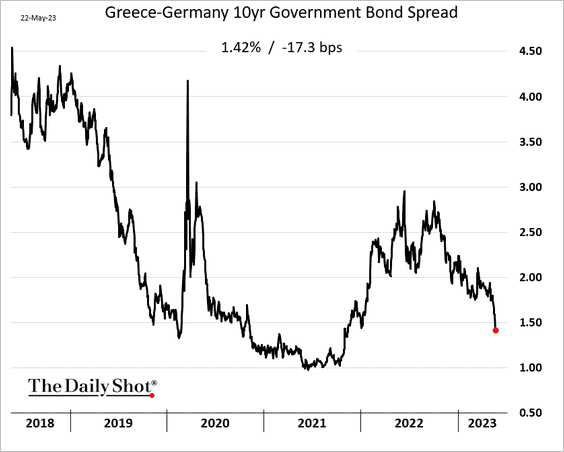

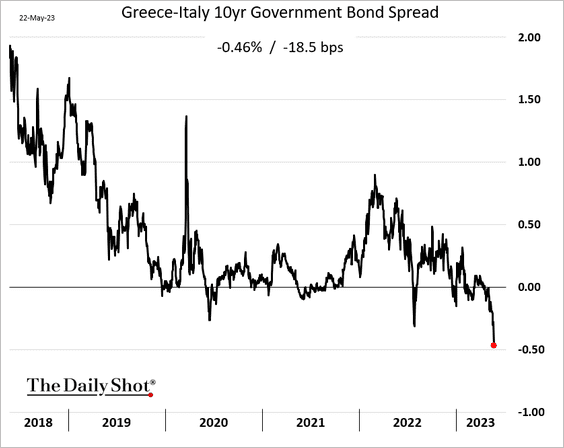

5. Political developments in Greece could result in a debt rating upgrade this year (to investment grade).

Source: @lineoyamada, @markets Read full article

Source: @lineoyamada, @markets Read full article

• Greek bank stocks:

• Greek 10yr spread to Germany:

• Greek 10yr spread to Italy (new low):

Back to Index

Europe

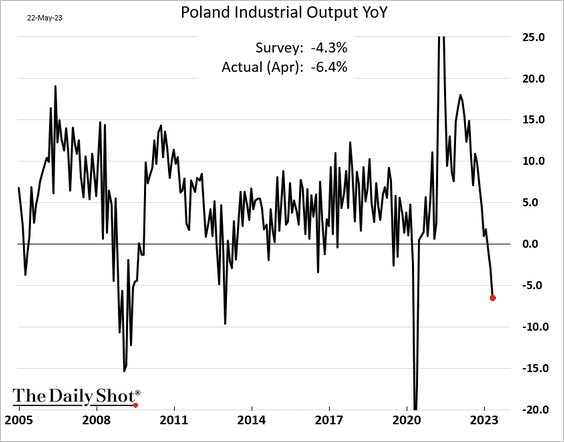

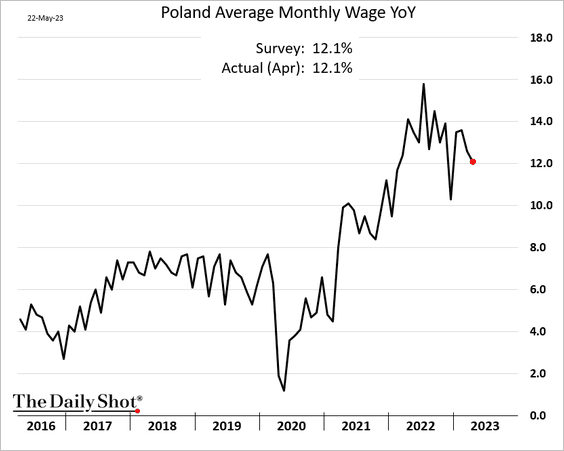

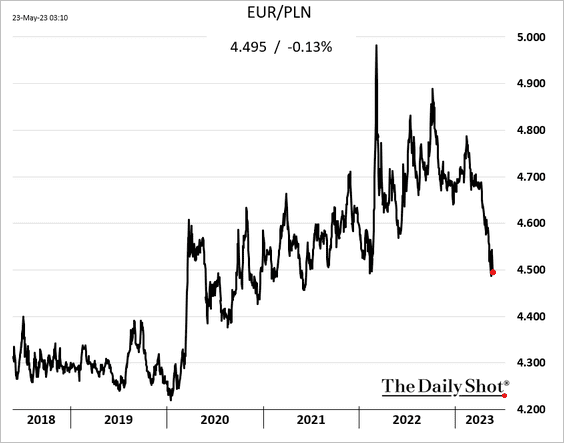

1. Here are some updates on Poland.

• Industrial output is down sharply on a year-over-year basis.

Source: ING Read full article

Source: ING Read full article

• Wage growth remains elevated.

• The Polish zloty has been strengthening.

——————–

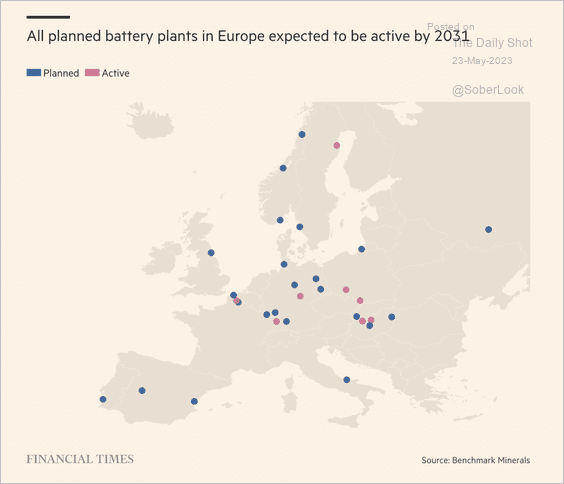

2. Battery plants are popping up throughout Europe.

Source: @financialtimes Read full article

Source: @financialtimes Read full article

Back to Index

Asia-Pacific

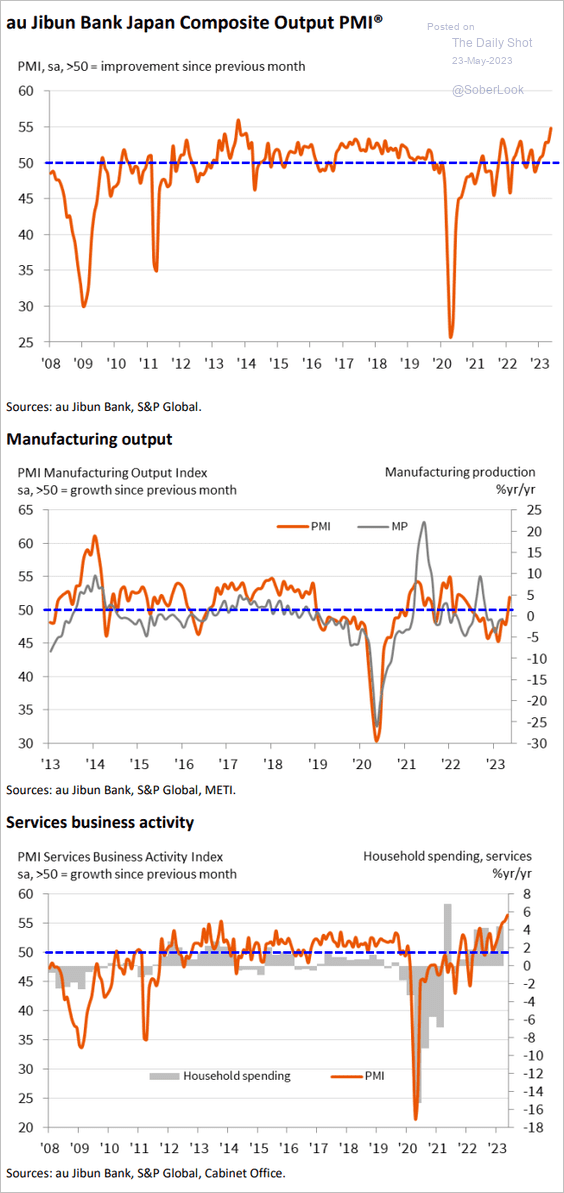

1. The May PMI report showed Japan’s business activity accelerating this month, with services growth surging.

Source: S&P Global PMI

Source: S&P Global PMI

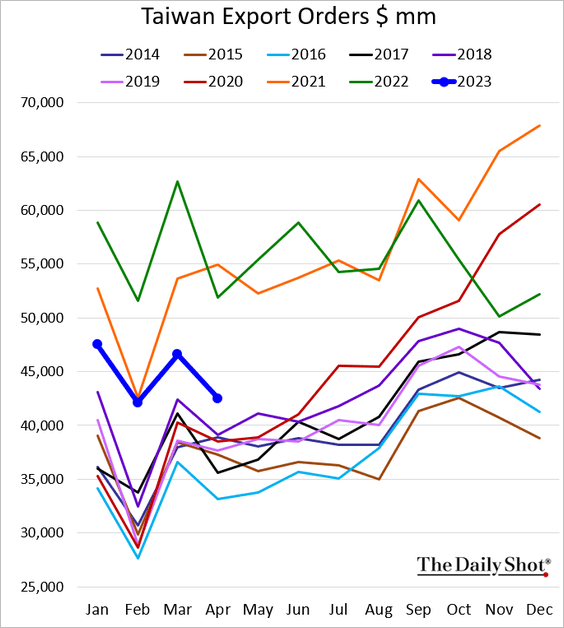

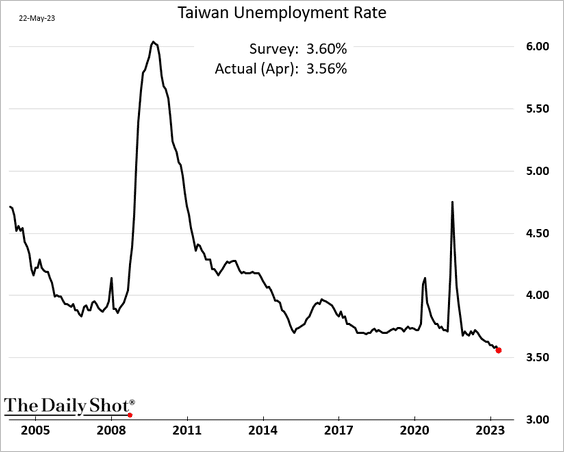

2. Taiwan’s April export orders were below forecasts.

The nation’s unemployment rate continues to fall.

——————–

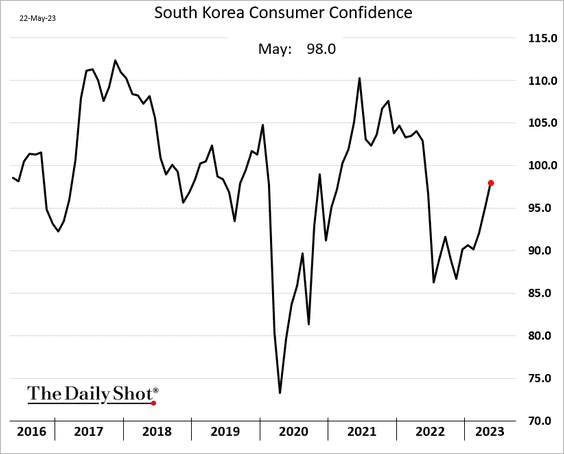

3. South Korea’s consumer confidence is rebounding.

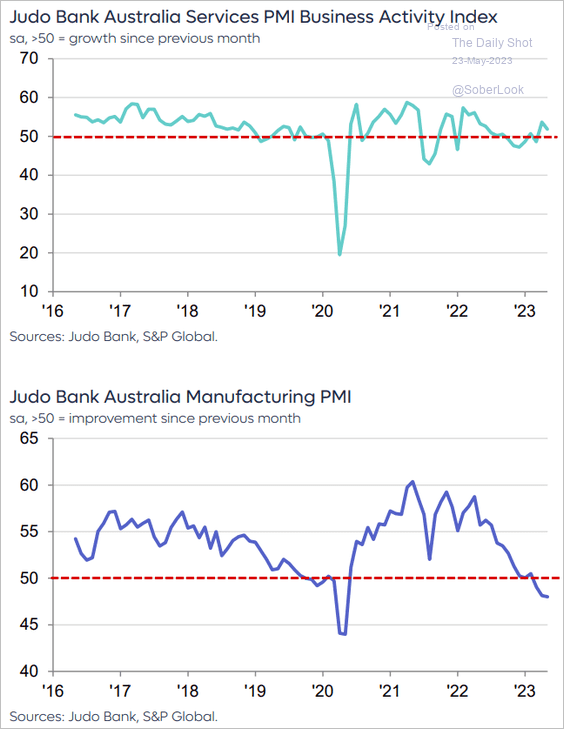

4. Australia’s services remain in growth mode, but manufacturing is contracting.

Source: S&P Global PMI

Source: S&P Global PMI

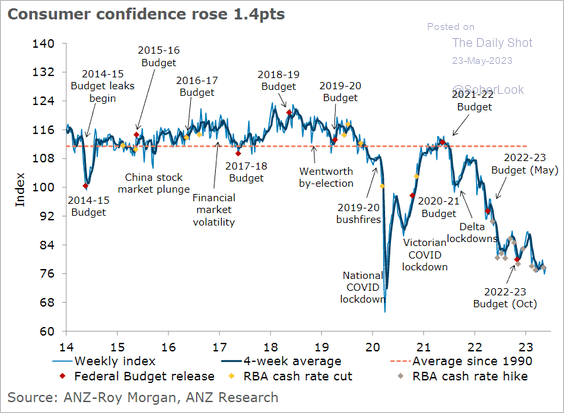

Has Australia’s consumer sentiment finally bottomed?

Source: @ANZ_Research

Source: @ANZ_Research

Back to Index

China

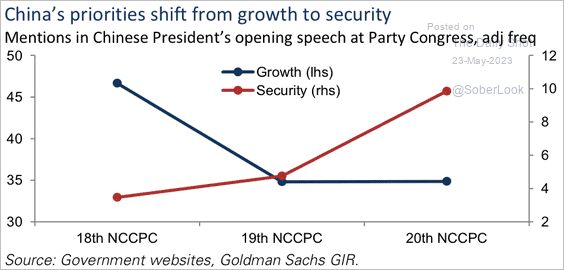

1. China is focusing more on security than growth.

Source: Goldman Sachs

Source: Goldman Sachs

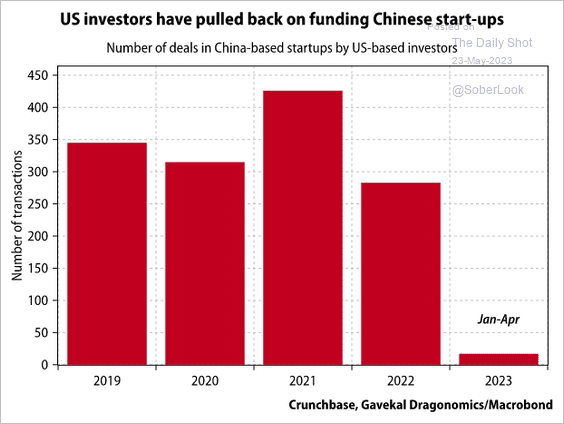

2. US VCs have pulled back on China investments.

Source: Gavekal Research

Source: Gavekal Research

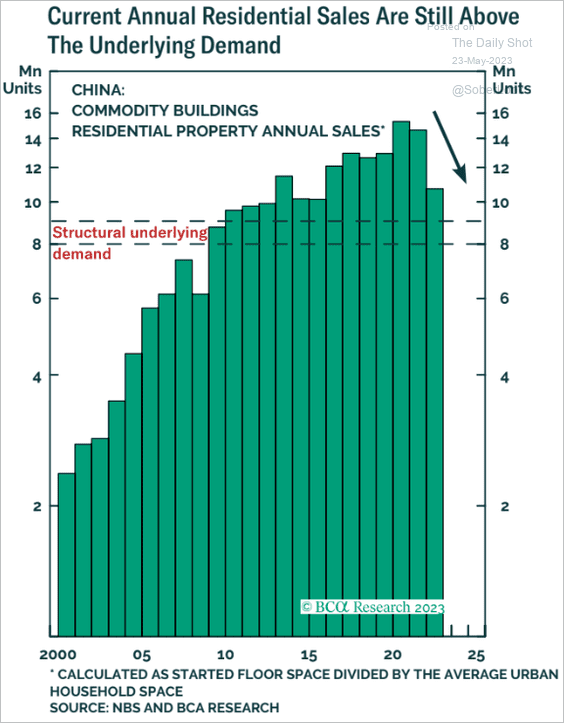

3. Residential sales are still above the underlying demand.

Source: BCA Research

Source: BCA Research

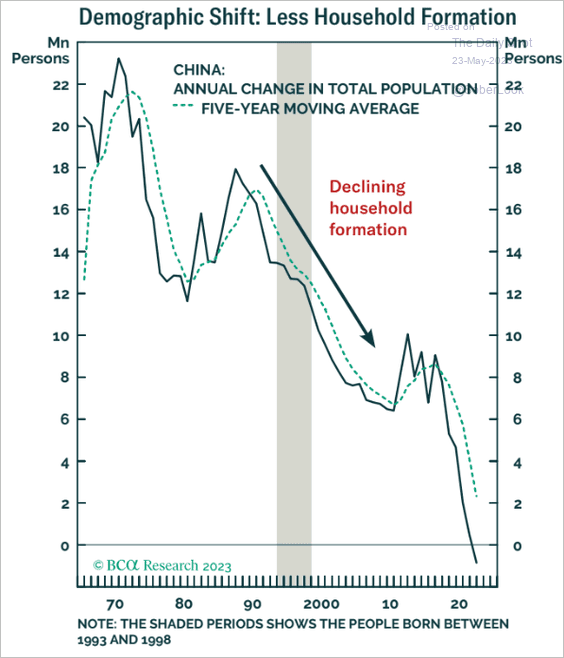

The pace of household formation continues to tumble.

Source: BCA Research

Source: BCA Research

——————–

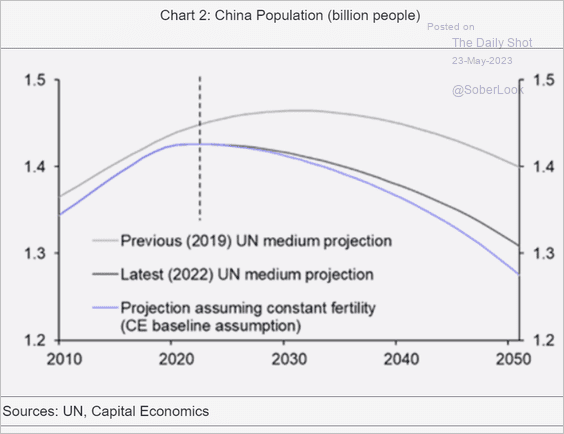

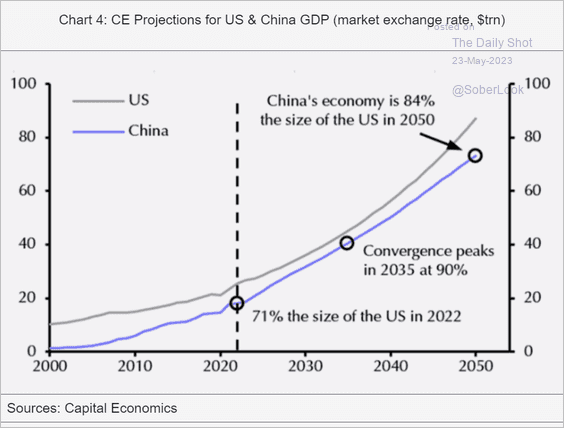

4. For years, numerous forecasts have projected an imminent overtaking of the US GDP by China’s booming economy. Yet, these predictions may not pan out as expected. China’s economy confronts a myriad of significant challenges, including an apparent end to the housing boom and a declining labor force, which will hinder anticipated growth.

Source: Capital Economics

Source: Capital Economics

This projection from Capital Economics does not foresee China’s economy surpassing that of the US for decades, a stark contrast to prevailing forecasts.

Source: Capital Economics

Source: Capital Economics

Back to Index

Emerging Markets

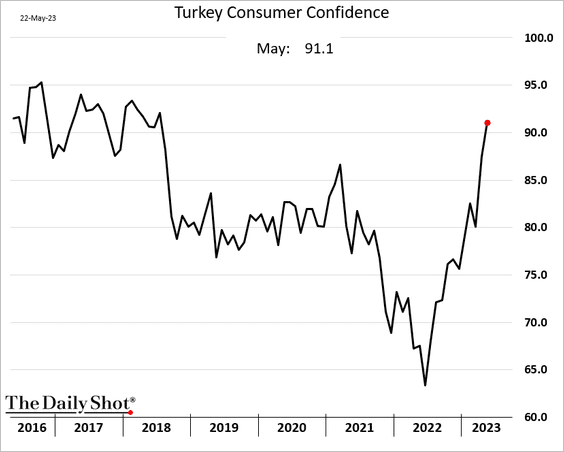

1. Turkey’s consumer confidence is surging.

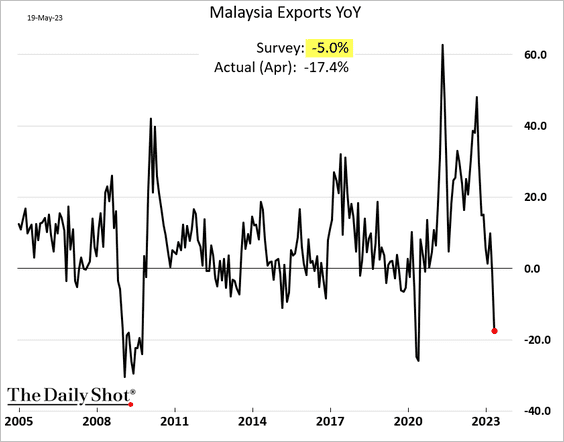

2. Malaysian exports are down sharply relative to last year.

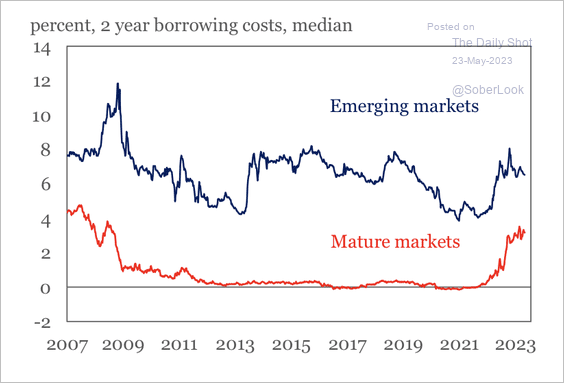

3. The narrowing interest rate differential between EMs and mature markets could reduce the appeal of EM domestic securities.

Source: IIF

Source: IIF

Back to Index

Cryptocurrency

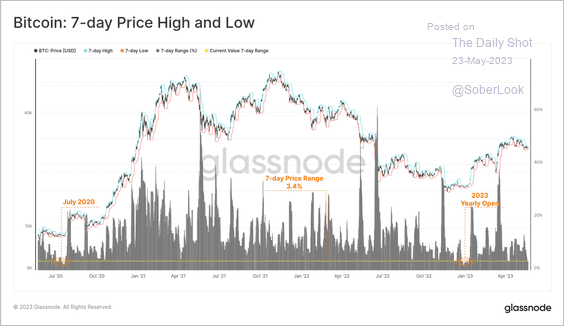

1. Bitcoin’s seven-day price range is one of the tightest over the past three years. Will we see a rise in volatility?

Source: @glassnode

Source: @glassnode

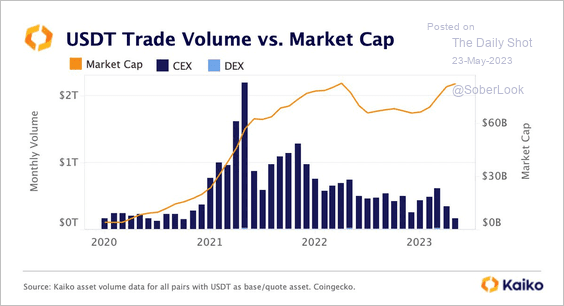

2. Tether’s USDT stablecoin market cap is approaching all-time highs despite declining trading volume.

Source: @KaikoData

Source: @KaikoData

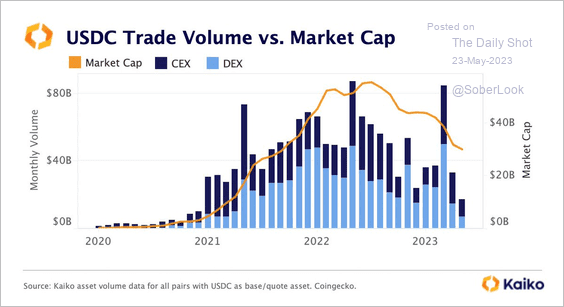

However, Circle’s USDC stablecoin shows declining market cap and trading volume.

Source: @KaikoData

Source: @KaikoData

——————–

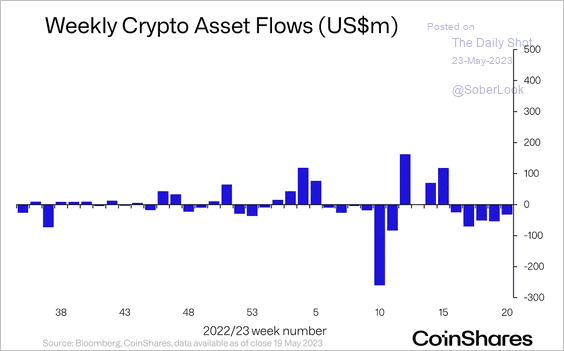

3. Crypto funds saw the fifth consecutive week of outflows.

Source: CoinShares Read full article

Source: CoinShares Read full article

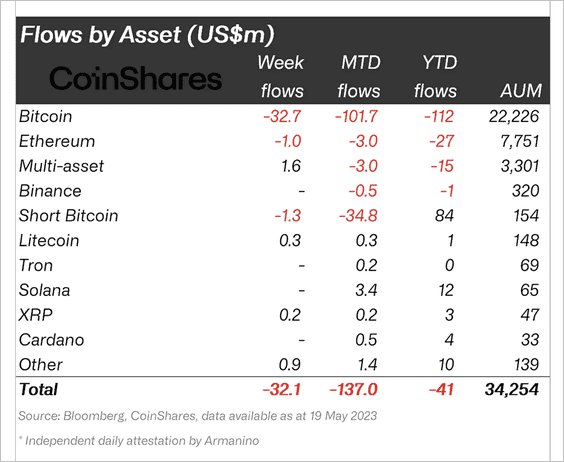

Bitcoin-focused led outflows last week, while multi-asset and altcoin funds saw inflows.

Source: CoinShares Read full article

Source: CoinShares Read full article

——————–

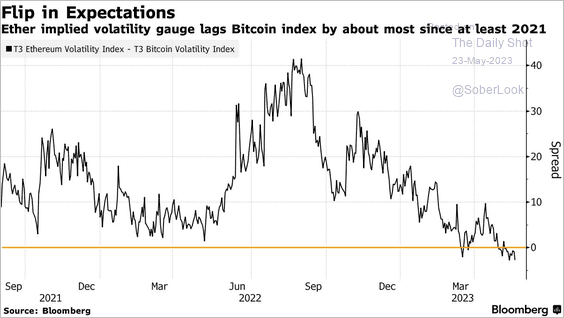

4. Ether’s implied volatility has dropped below that of bitcoin.

Source: @Suvajourno, @sidcoins, @technology Read full article

Source: @Suvajourno, @sidcoins, @technology Read full article

Back to Index

Commodities

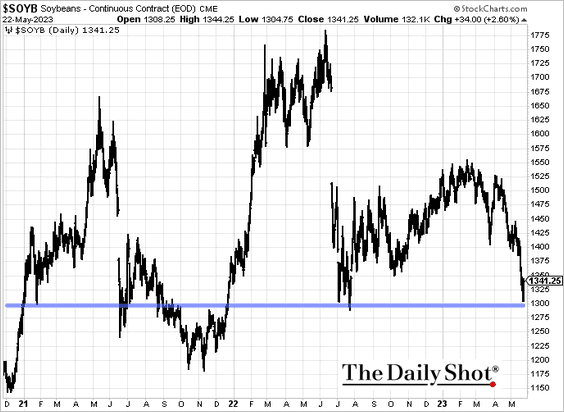

1. Soybeans held support near $13/bushel.

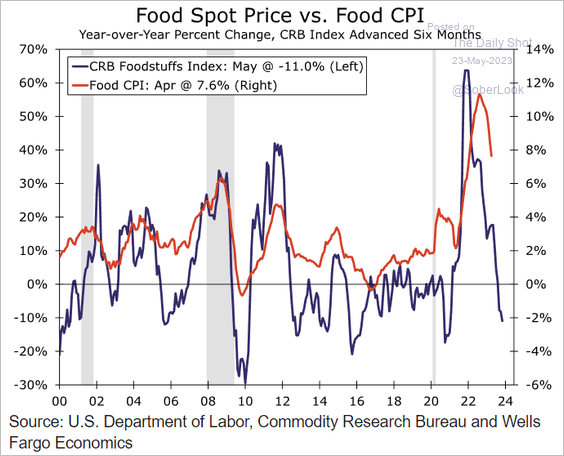

2. Lower agricultural commodity prices are yet to show up at the grocery store.

Source: Wells Fargo Securities

Source: Wells Fargo Securities

Back to Index

Equities

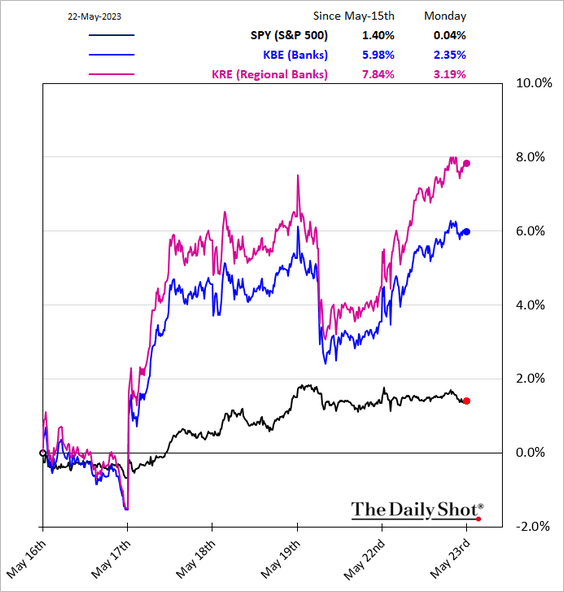

1. Shares of regional banks continue to move higher.

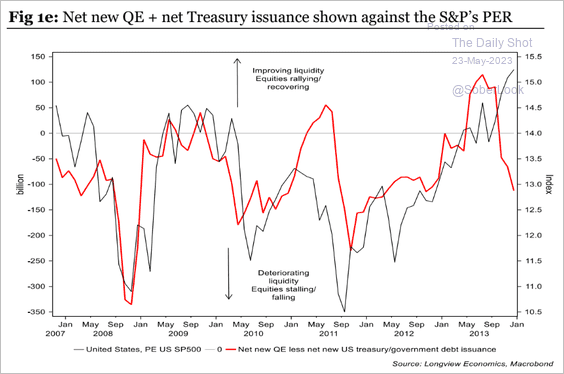

2. Equity valuations keep rising despite deteriorating liquidity.

Source: Longview Economics

Source: Longview Economics

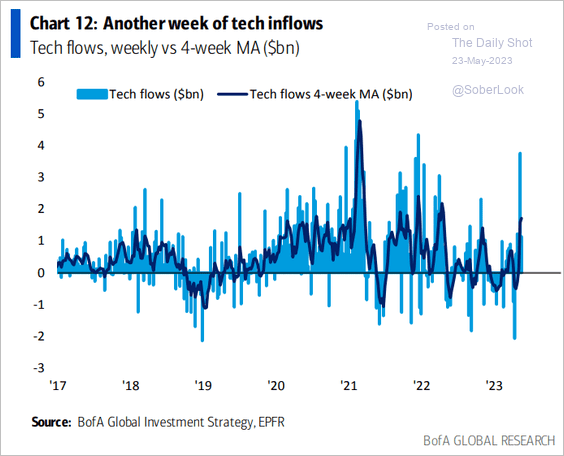

3. Tech fund inflows remain robust.

Source: BofA Global Research

Source: BofA Global Research

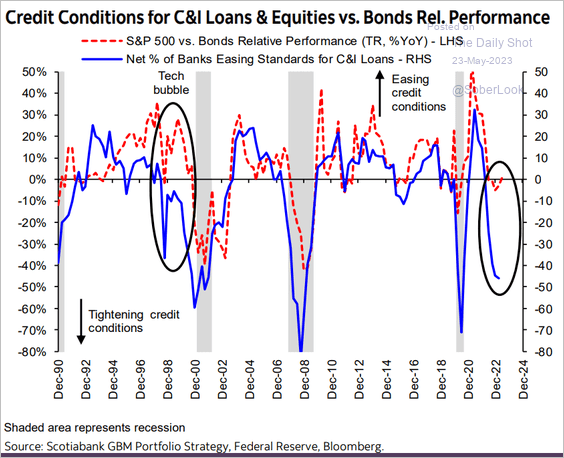

4. Tighter credit conditions point to downside risks for stocks vs. bonds (relative performance).

Source: Hugo Ste-Marie, Portfolio & Quantitative Strategy Global Equity Research, Scotia Capital

Source: Hugo Ste-Marie, Portfolio & Quantitative Strategy Global Equity Research, Scotia Capital

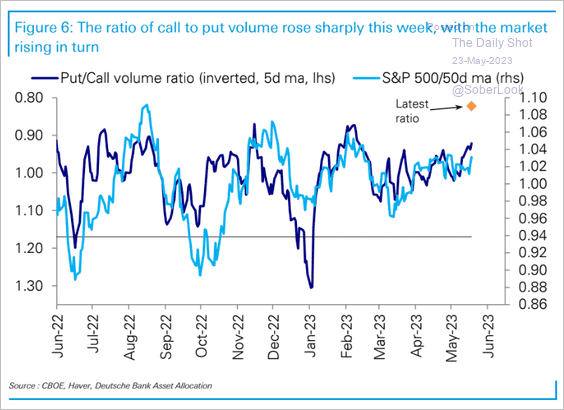

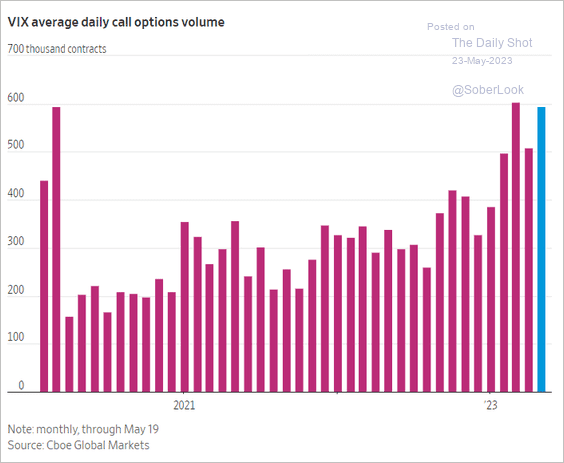

5. Demand for equity call options surged in recent days.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

At the same time, bets on higher volatility remain elevated.

Source: @WSJ Read full article

Source: @WSJ Read full article

——————–

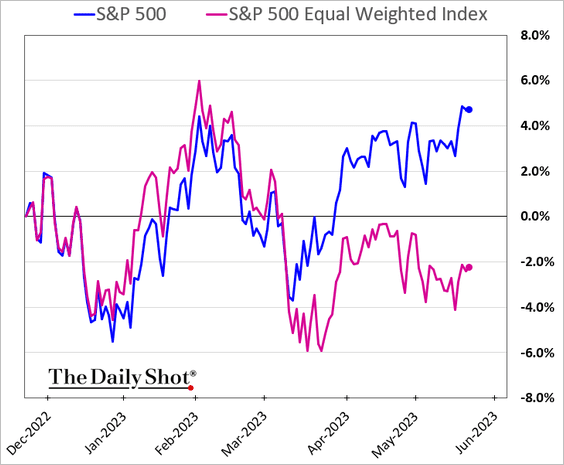

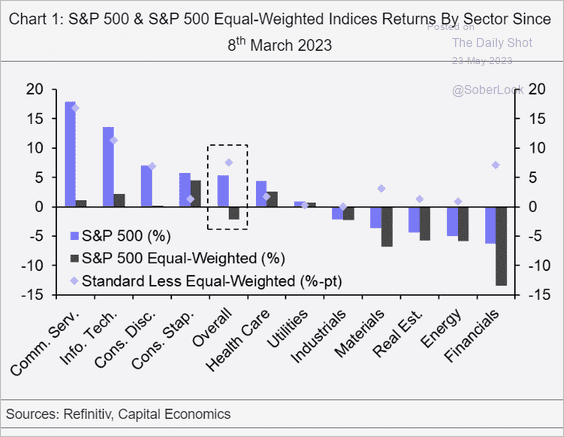

6. The S&P 500 equal-weight index has widened its underperformance.

Here is the equal-weight index performance by sector.

Source: Capital Economics

Source: Capital Economics

——————–

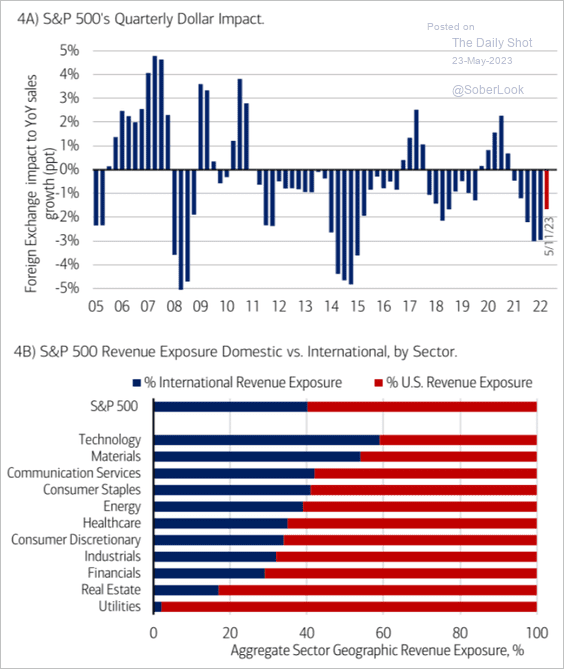

7. How much did F/X rates impact sales growth? What is the S&P 500 currency exposure by sector?

Source: Merrill Lynch

Source: Merrill Lynch

Back to Index

Credit

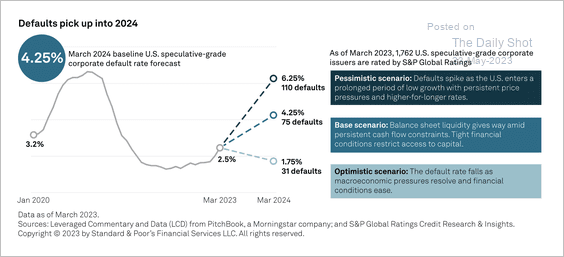

1. S&P Global Ratings expects a rise in the US speculative-grade default rate to 4.25% by March 2024, …

Source: S&P Global Ratings

Source: S&P Global Ratings

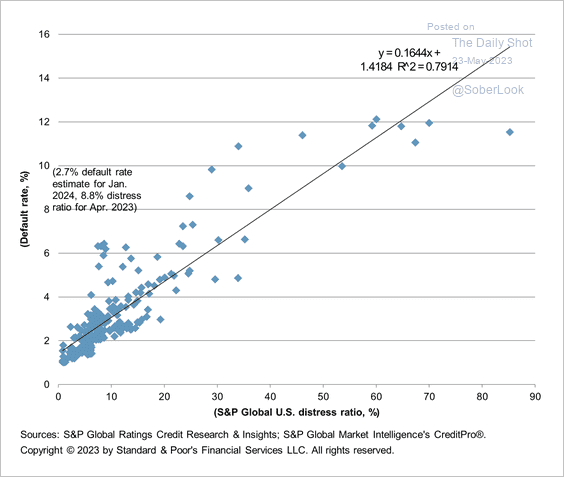

… although a moderate distress ratio points to a low default rate.

Source: S&P Global Ratings

Source: S&P Global Ratings

——————–

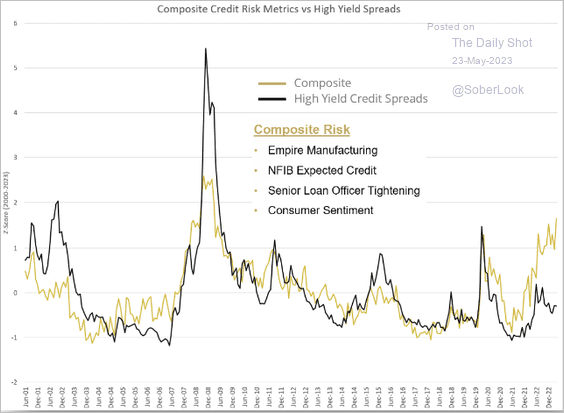

2. High-yield spreads are low relative to macro risk metrics.

Source: @t1alpha, @SimplifyAsstMgt

Source: @t1alpha, @SimplifyAsstMgt

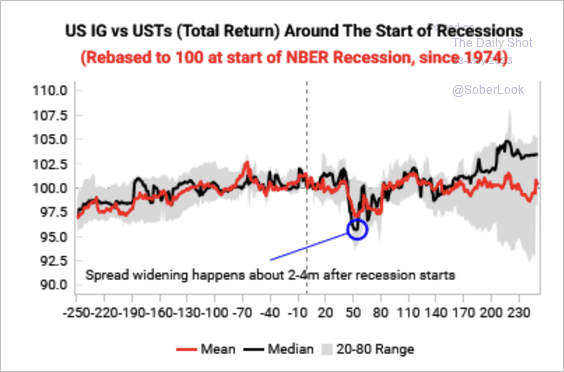

3. US investment-grade credit typically underperforms Treasuries a few months into a recession as spreads quickly widen.

Source: Variant Perception

Source: Variant Perception

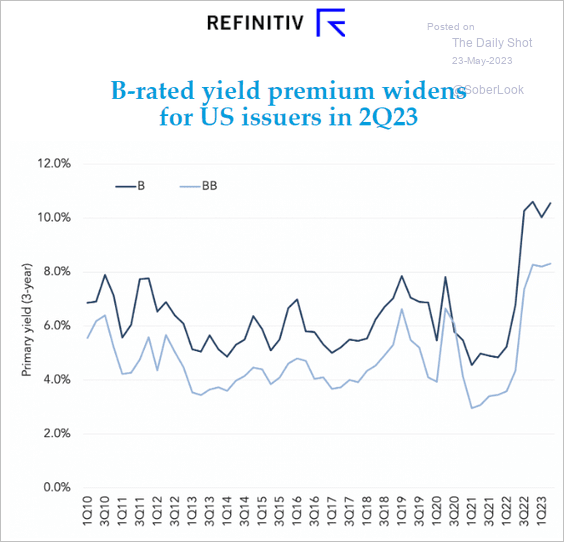

4. New-issue leveraged loan single-B/BB spread has widened.

Source: @theleadleft

Source: @theleadleft

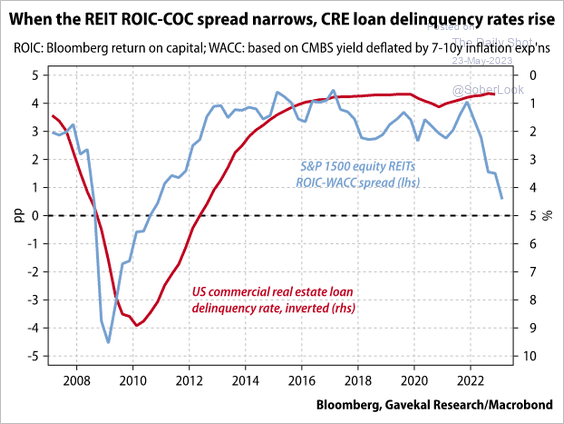

5. REITs’ spread between Return on Invested Capital (ROIC) and the Weighted Average Cost of Capital (WACC) is crashing, which signals declining profitability and increased delinquency rates.

Source: Gavekal Research

Source: Gavekal Research

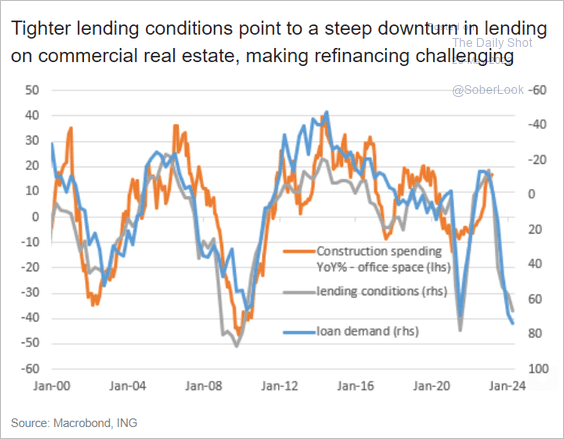

• Commercial real estate construction spending is expected to drop as credit tightens.

Source: ING

Source: ING

Back to Index

Rates

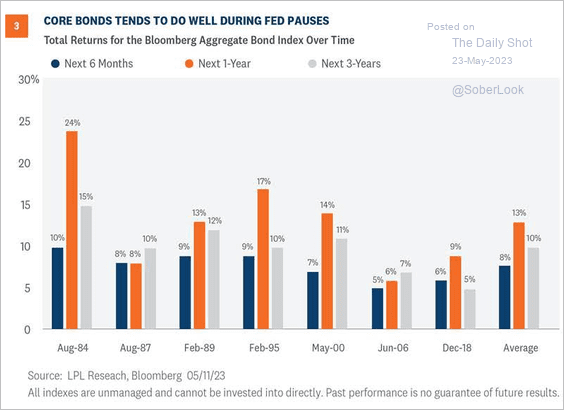

1. Bonds tend to perform well during Fed pauses.

Source: LPL Research

Source: LPL Research

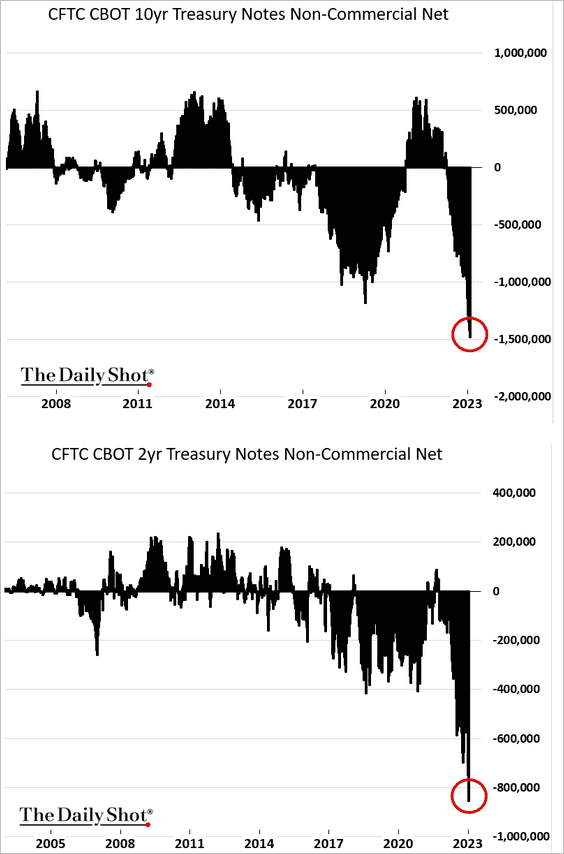

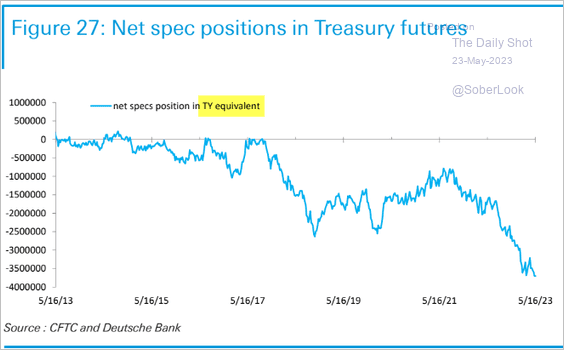

2. Treasury futures positioning remains exceptionally bearish.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

Back to Index

Global Developments

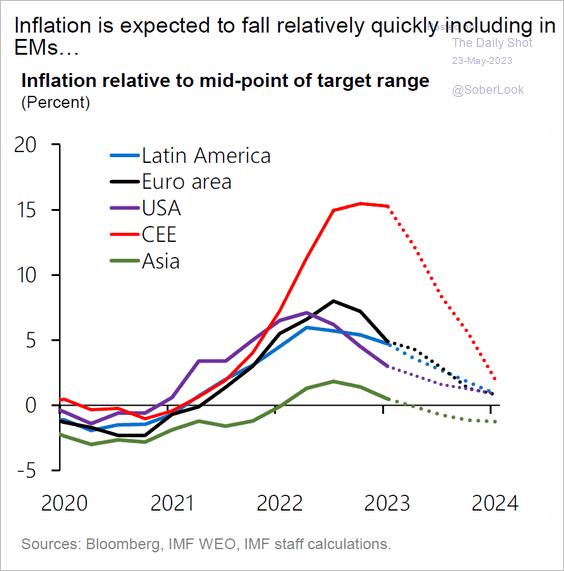

1. Are markets too optimistic about slowing inflation?

Source: IMF

Source: IMF

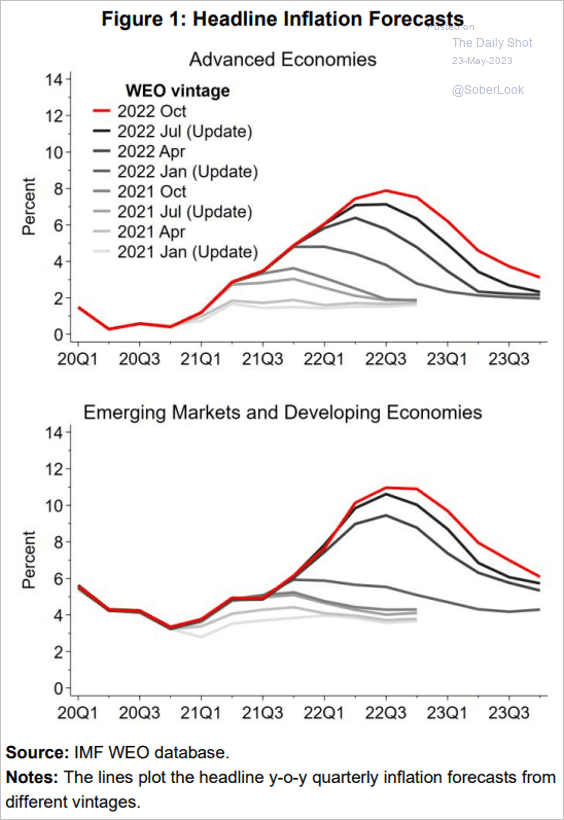

2. In this paper, the IMF investigates their persistent underestimation of inflation.

Source: IMF; h/t Torsten Slok Read full article

Source: IMF; h/t Torsten Slok Read full article

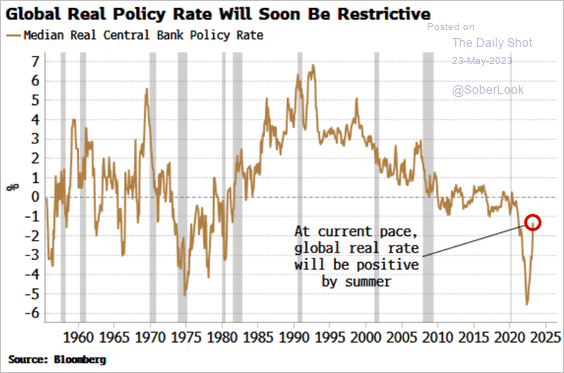

3. The median real policy rate may hit zero over the next few months.

Source: Simon White, Bloomberg Markets Live Blog

Source: Simon White, Bloomberg Markets Live Blog

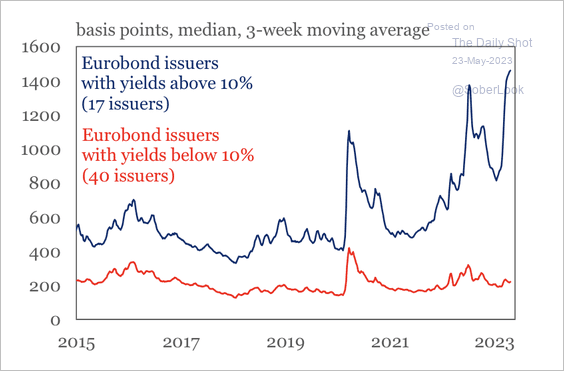

4. Funding costs have spiked for high-yield sovereign borrowers, weighing on their ability to tap international debt markets, according to IIF.

Source: IIF

Source: IIF

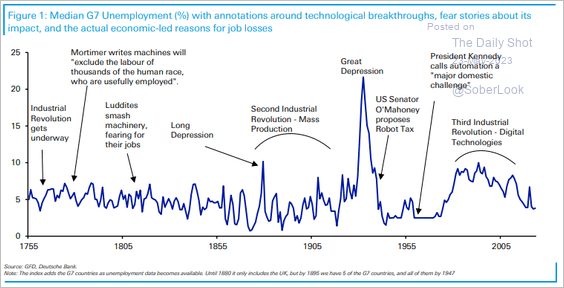

5. This chart shows the median unemployment rate among G7 countries and associated economic events.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

——————–

Food for Thought

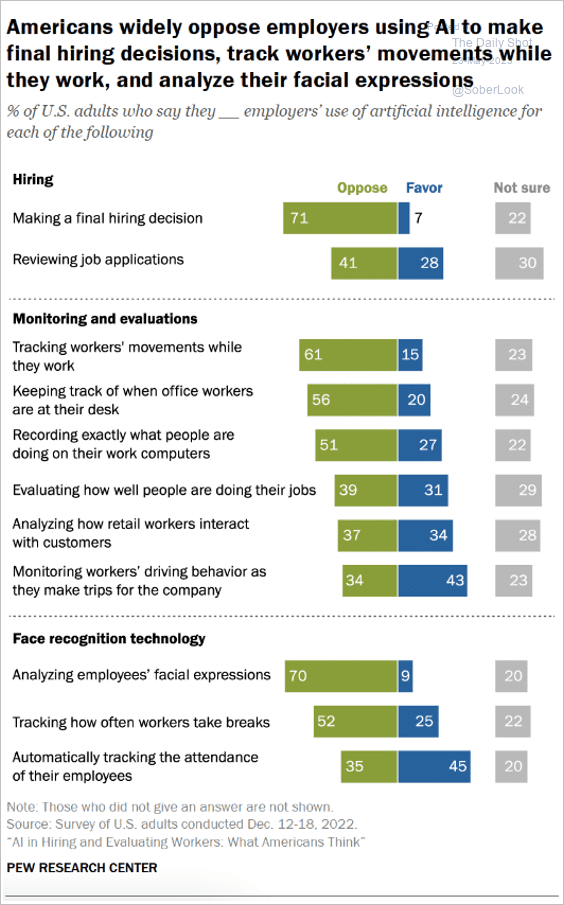

1. Views on using AI to hire and track employees:

Source: Pew Research Center Read full article

Source: Pew Research Center Read full article

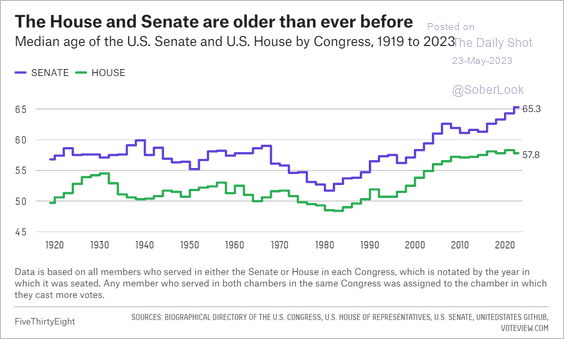

2. The graying US Congress:

Source: FiveThirtyEight Read full article

Source: FiveThirtyEight Read full article

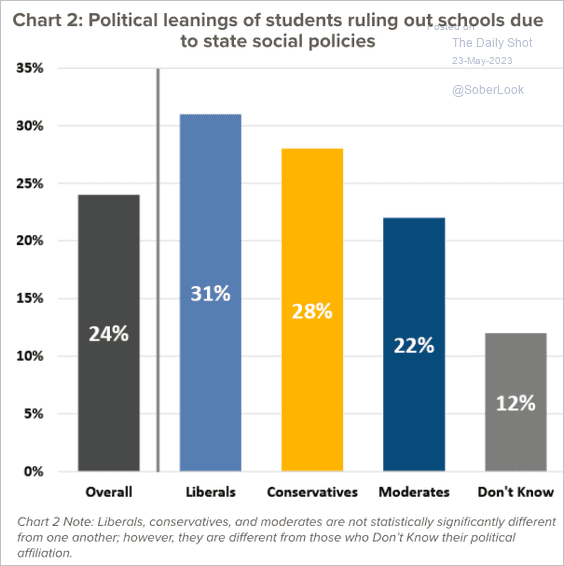

3. Students ruling out college due to state social policies:

Source: Art & Science Group Read full article

Source: Art & Science Group Read full article

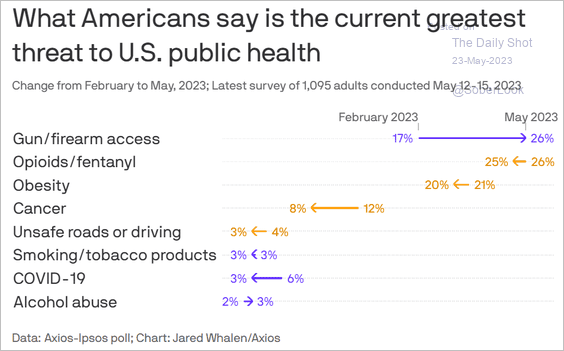

4. The greatest threat to US public health:

Source: @axios Read full article

Source: @axios Read full article

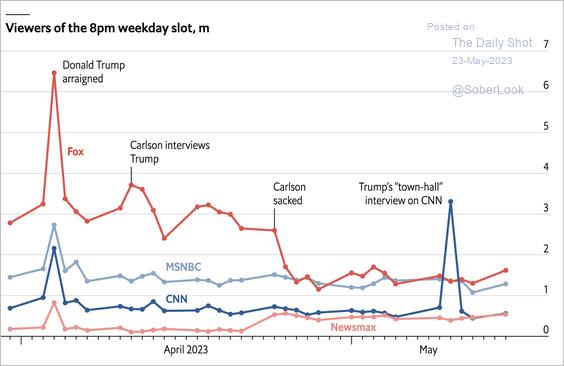

5. Cable viewers of the 8 pm weekday slot:

Source: The Economist Read full article

Source: The Economist Read full article

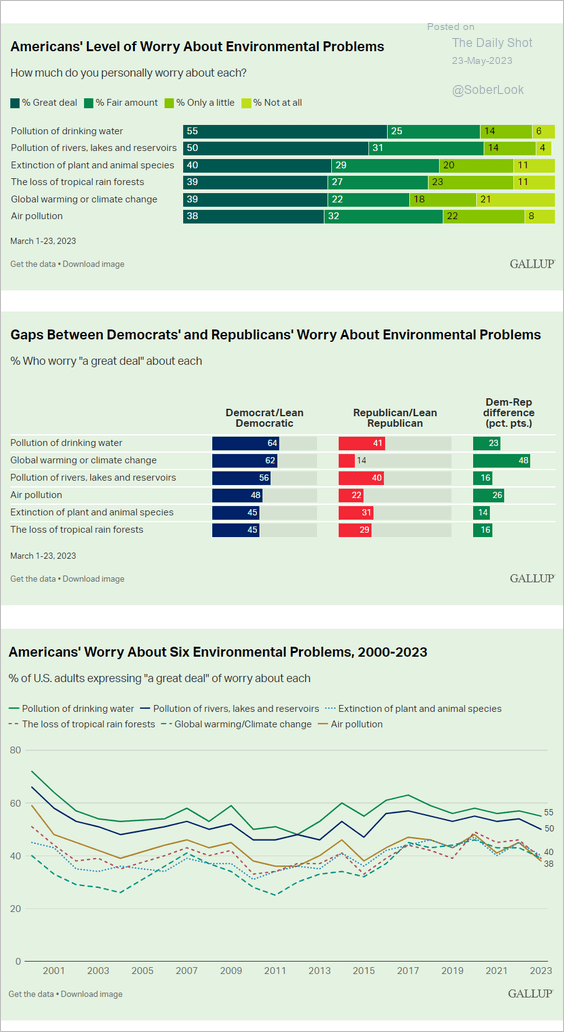

6. Concerns about environmental problems in the US:

Source: Gallup Read full article

Source: Gallup Read full article

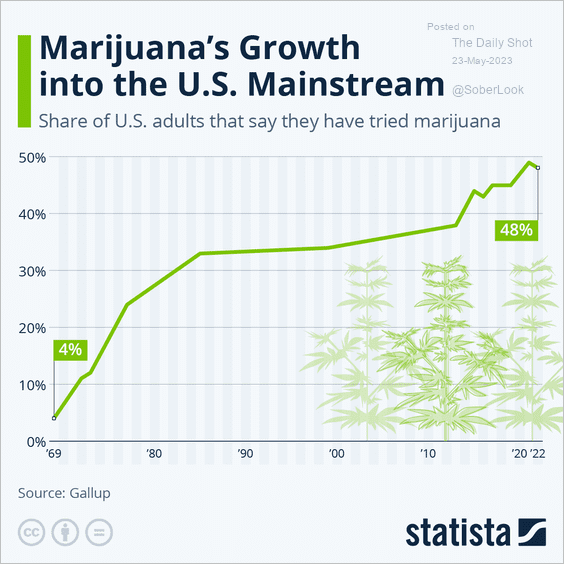

7. Marijuana usage in the US:

Source: Statista

Source: Statista

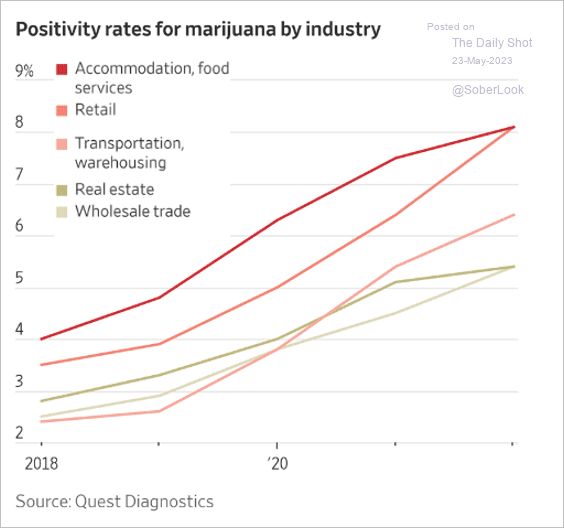

• Marijuana positivity rates by industry:

Source: @WSJ Read full article

Source: @WSJ Read full article

——————–

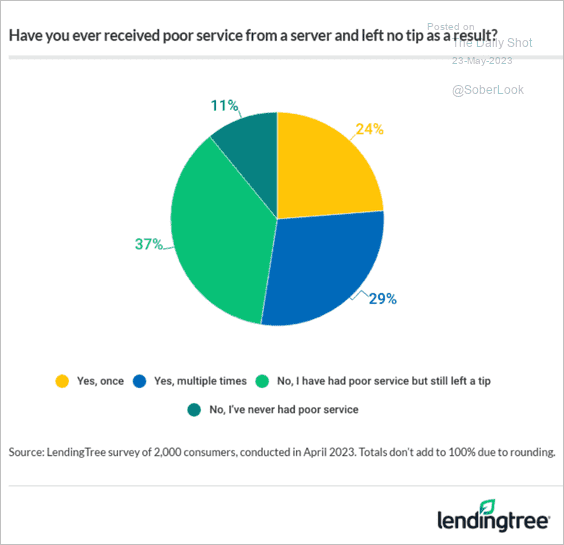

8. Leaving no tip due to poor service:

Source: LendingTree Read full article

Source: LendingTree Read full article

——————–

Back to Index