The Daily Shot: 24-May-23

• The United States

• Canada

• The United Kingdom

• The Eurozone

• Asia-Pacific

• China

• Emerging Markets

• Commodities

• Energy

• Equities

• Alternatives

• Credit

• Rates

• Global Developments

• Food for Thought

The United States

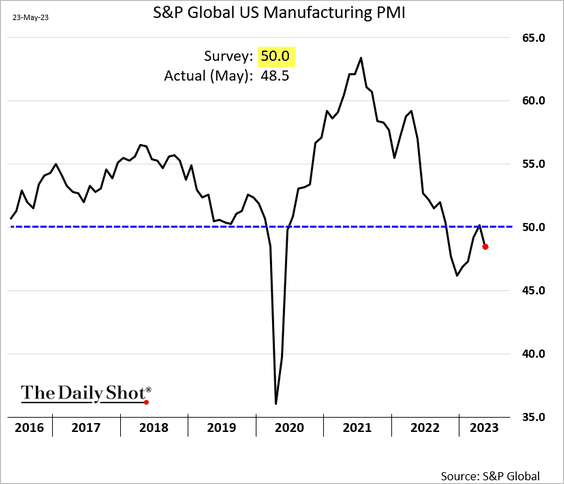

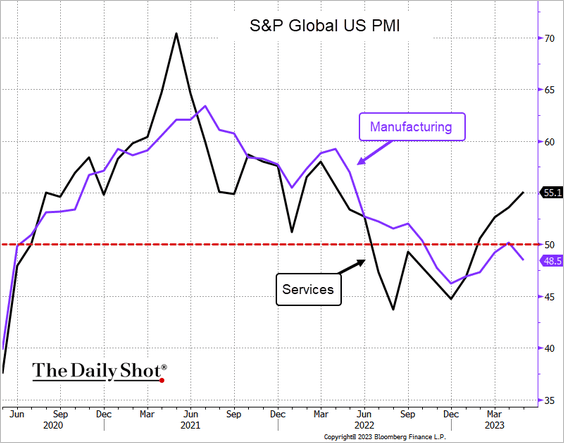

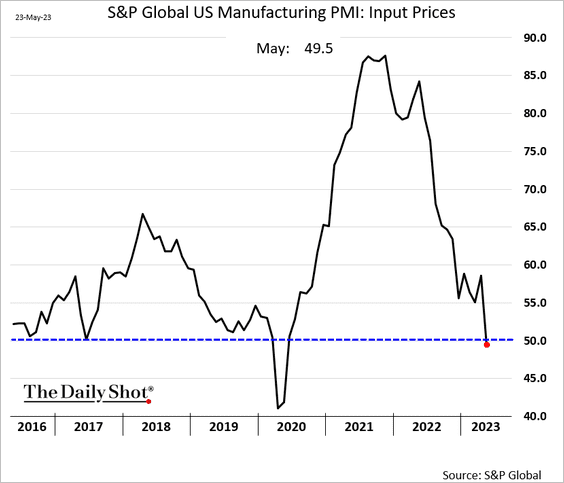

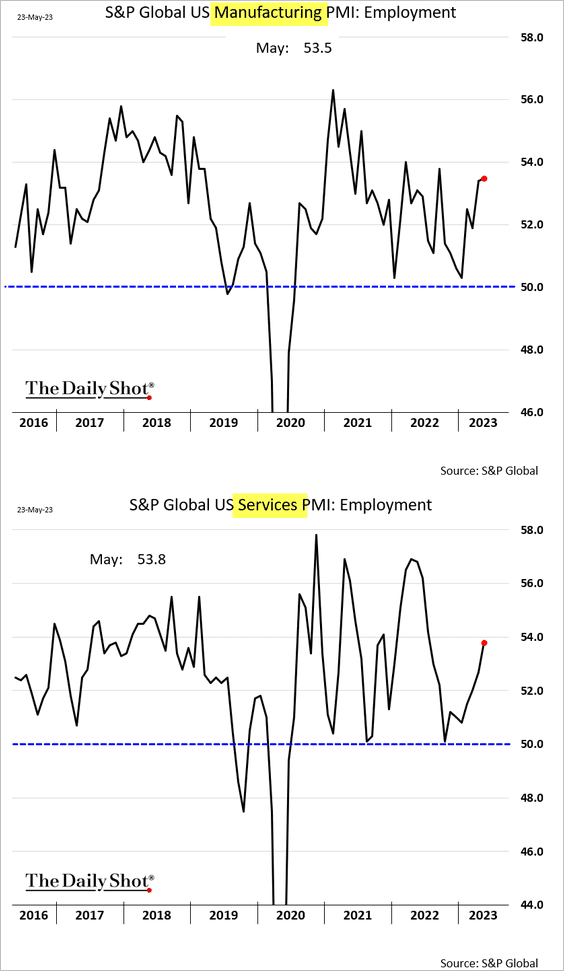

1. The May flash PMI report from S&P Global showed a contraction in US factory activity.

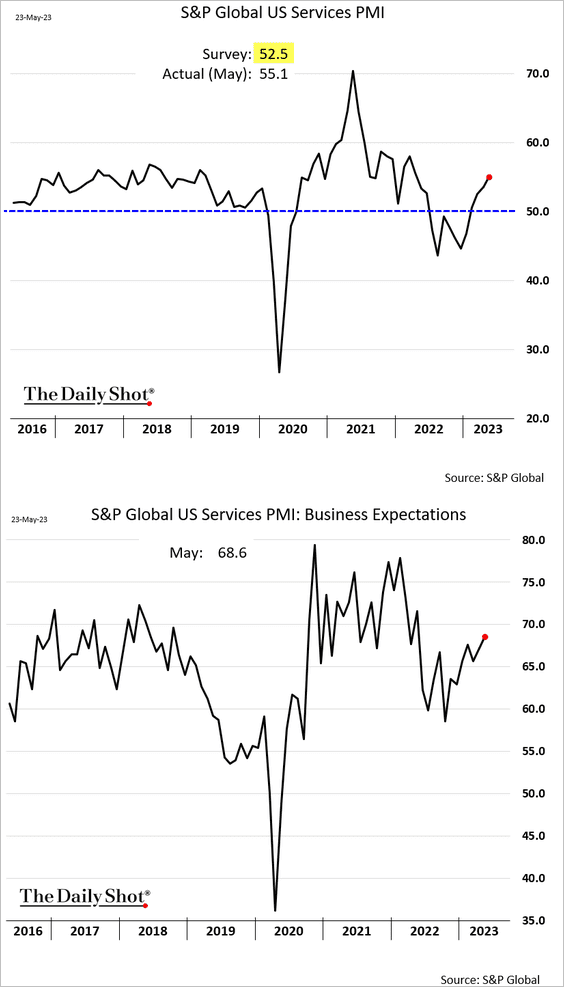

But service-sector growth strengthened.

This divergence is a global phenomenon, with the Eurozone, the UK, Japan, and Australia experiencing similar trends.

Source: S&P Global PMI; @TheTerminal, Bloomberg Finance L.P.

Source: S&P Global PMI; @TheTerminal, Bloomberg Finance L.P.

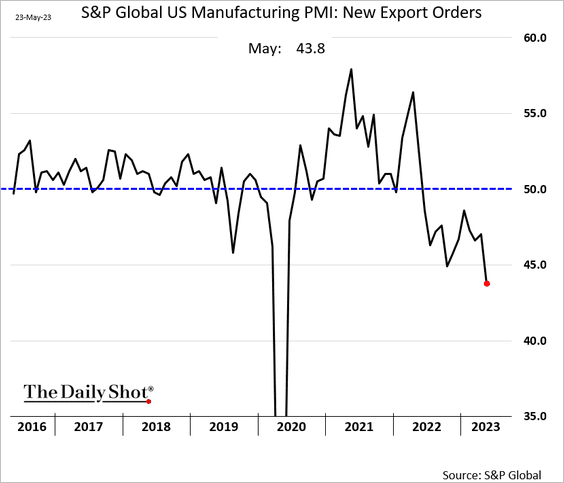

• The manufacturing export orders index is crashing.

• Factory input costs are now falling.

• Employment in both manufacturing and services remains robust.

——————–

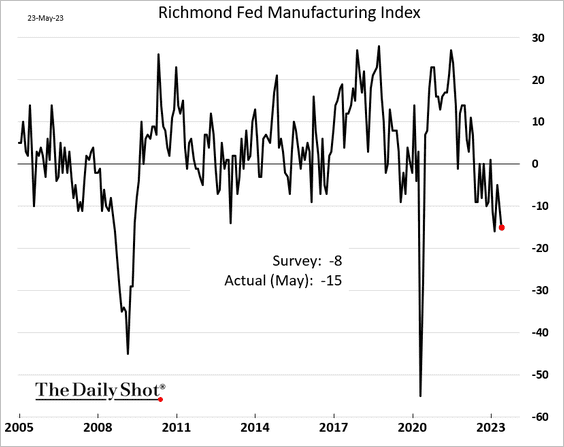

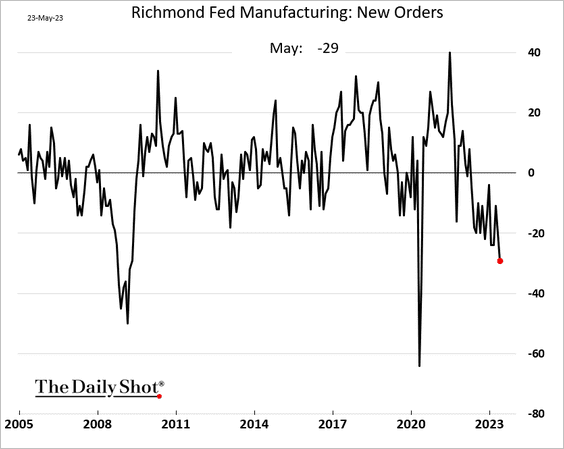

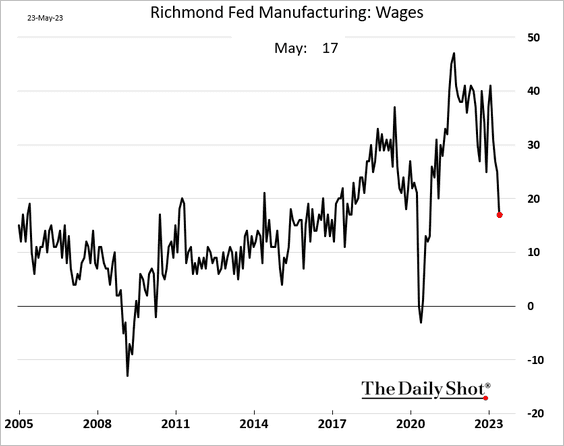

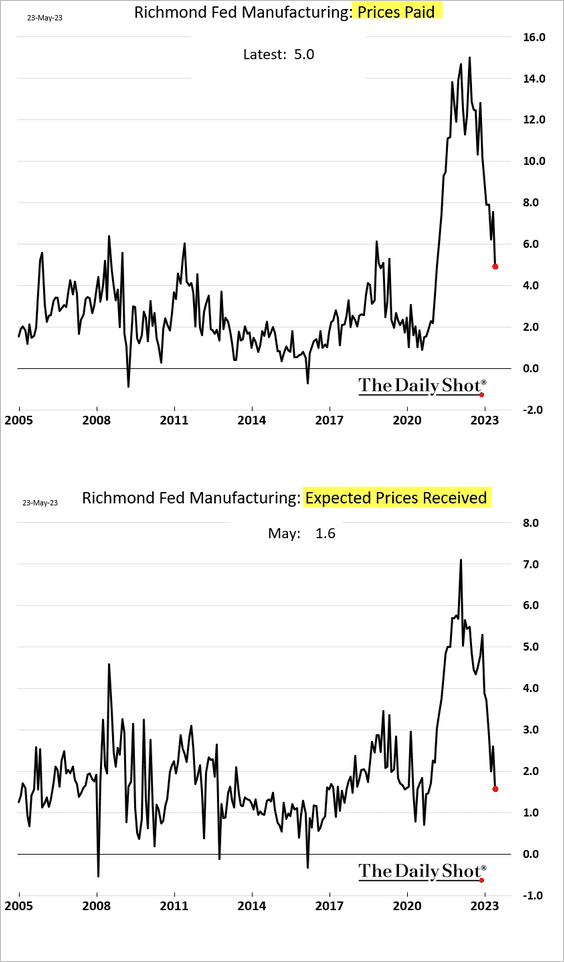

2. The Richmond Fed’s regional manufacturing index showed slowing activity, …

… as demand craters.

• Fewer companies are boosting wages.

• Price pressures are easing.

——————–

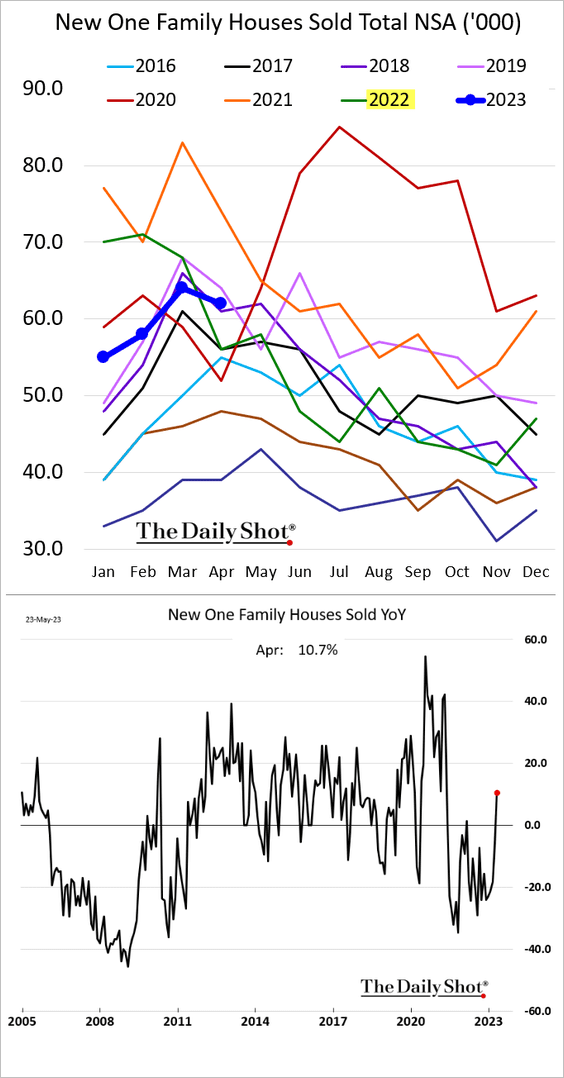

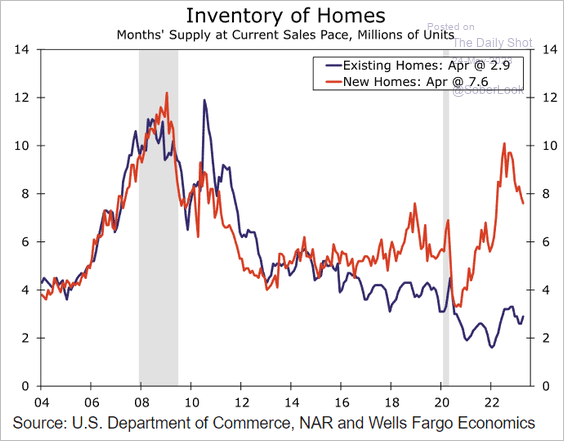

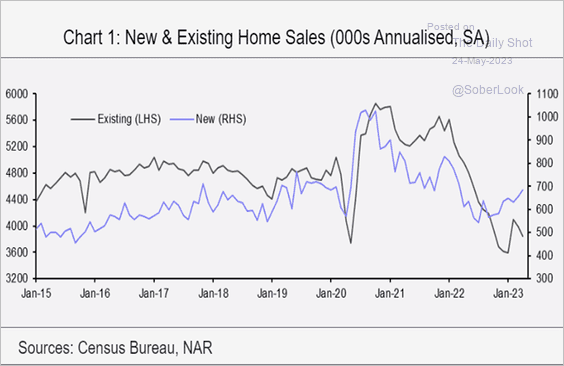

3. New home sales were stronger than expected in April, rising 10.7% above 2022 levels.

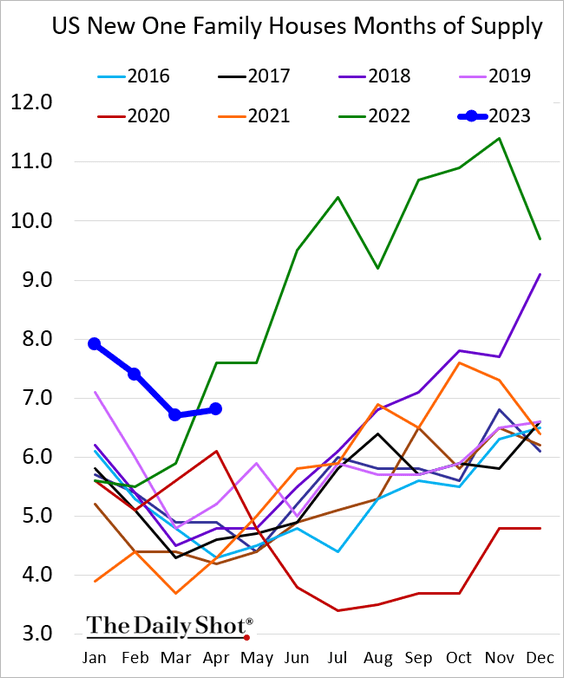

• Inventories of new homes dipped below last year’s levels.

However, the market for new houses is not nearly as tight as with existing homes, …

Source: Wells Fargo Securities

Source: Wells Fargo Securities

… contributing to sustained sales performance.

Source: Capital Economics

Source: Capital Economics

• The median new home price is down 8% year-over-year.

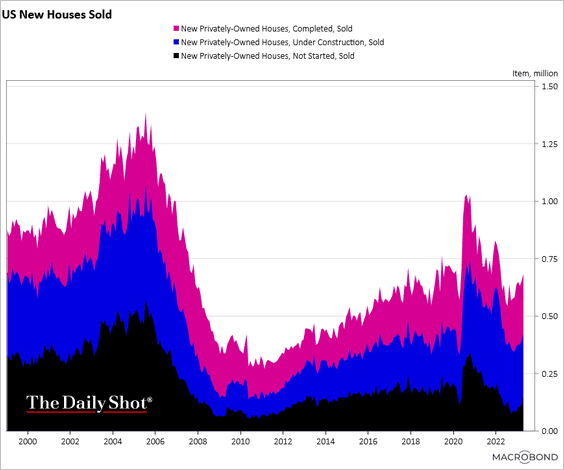

• This chart shows new home sales by stage of construction.

Source: Chart and data provided by Macrobond

Source: Chart and data provided by Macrobond

——————–

4. Next, we have some updates on the debt ceiling situation.

• Here is Deutsche Bank’s forecast for the US Treasury’s cash levels. Early June looks problematic.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

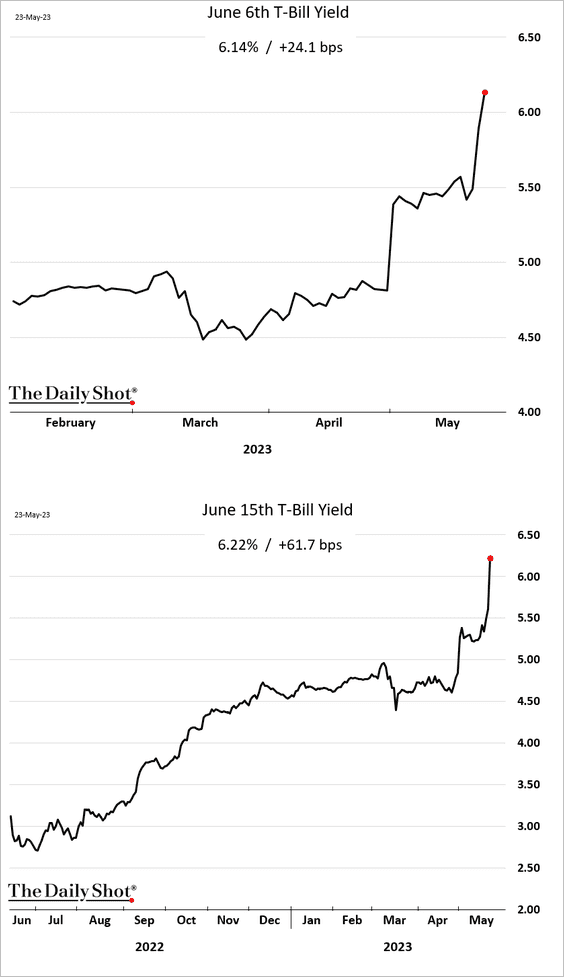

• Some T-bill yields exceeded 6% as the X-date approaches.

Source: @purviso, @markets Read full article

Source: @purviso, @markets Read full article

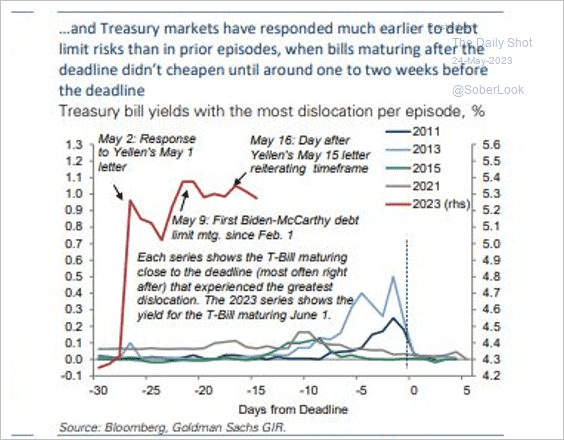

• The T-bill market response has been faster and more severe than in previous debt ceiling episodes.

Source: Goldman Sachs

Source: Goldman Sachs

• The window of opportunity for reaching a deal is rapidly closing. Here is a look at the congressional calendar.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

Back to Index

Canada

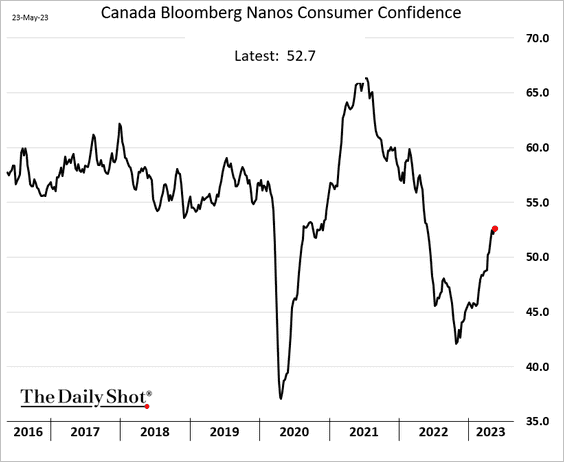

1. Consumer confidence continues to rebound.

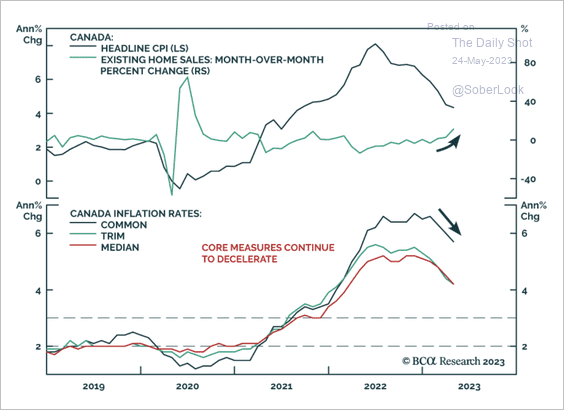

2. Inflation is declining, but the housing market is regaining strength. The BoC’s tightening cycle could persist.

Source: BCA Research

Source: BCA Research

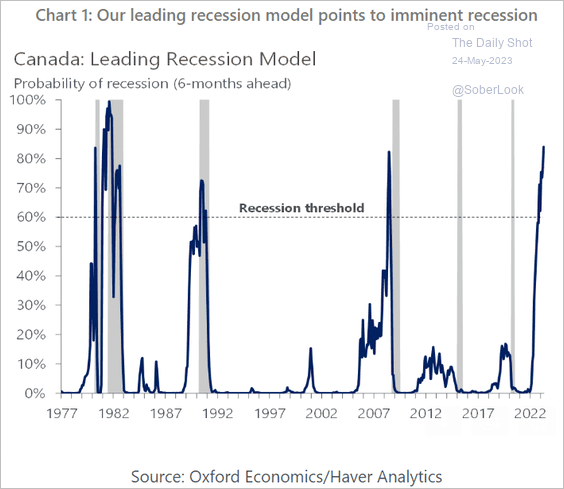

3. Here is the Oxford Economics recession model for Canada.

Source: Oxford Economics

Source: Oxford Economics

Back to Index

The United Kingdom

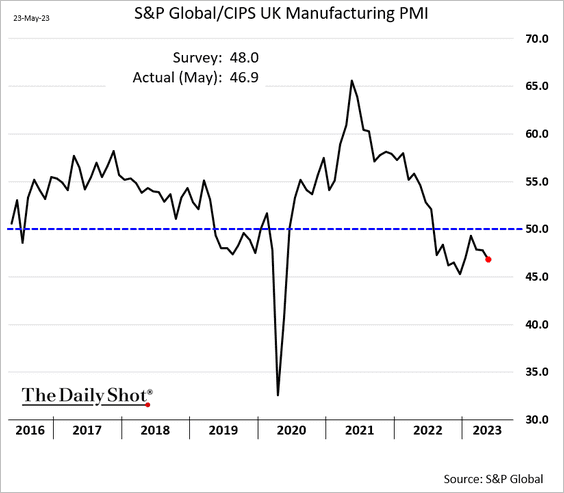

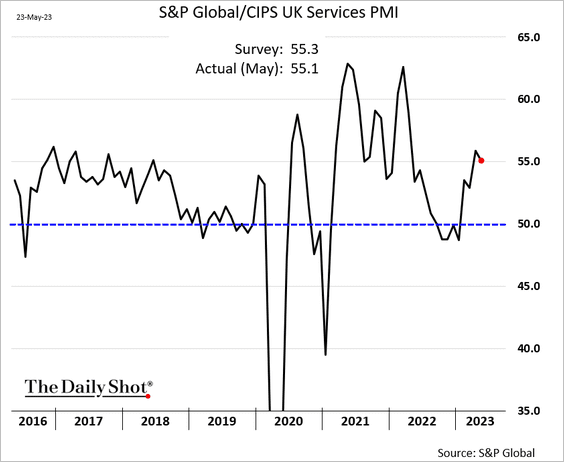

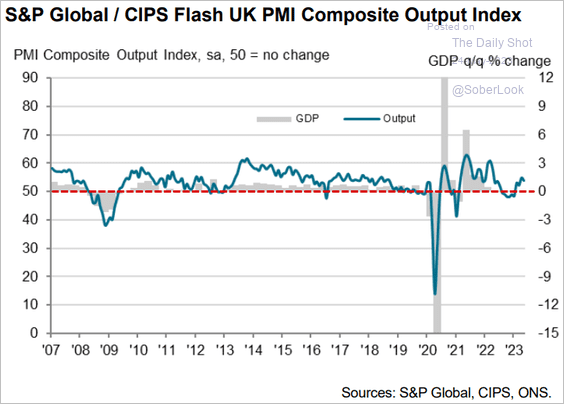

1. Factory activity contracted at a faster pace this month.

But services expansion remains robust, …

… sustaining the overall business growth.

Source: S&P Global PMI

Source: S&P Global PMI

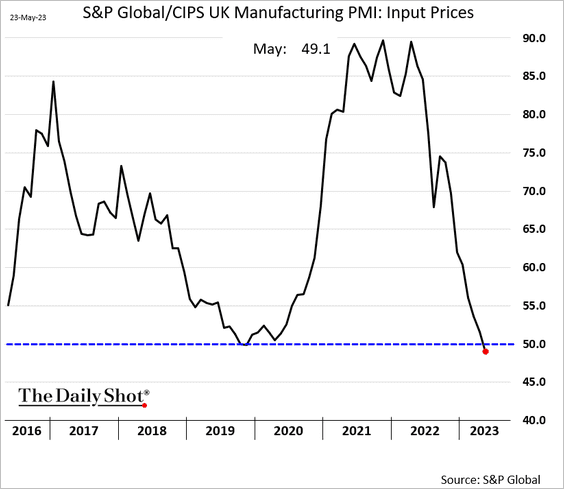

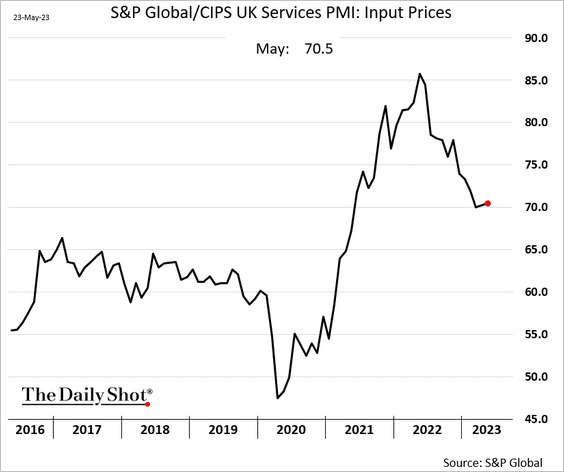

• Manufacturing input prices are now falling.

However, price pressures persist in services.

——————–

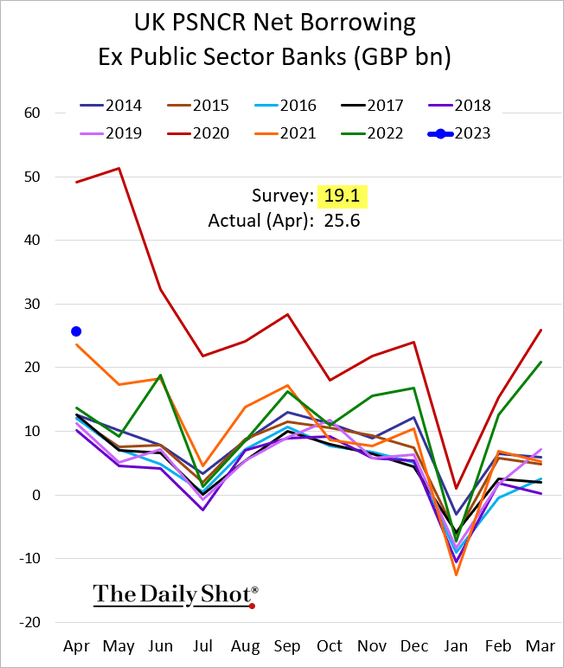

2. Fiscal borrowing was higher than expected in April.

Source: Reuters Read full article

Source: Reuters Read full article

——————–

3. Gilt yields continue to climb.

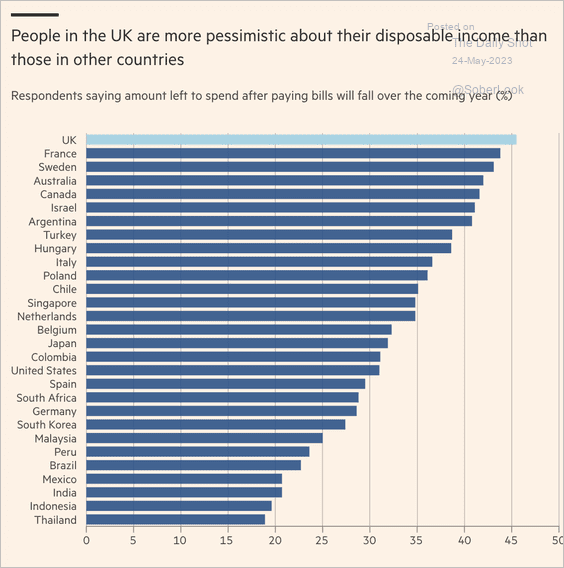

4. Britons are pessimistic about their disposable income.

Source: @financialtimes Read full article

Source: @financialtimes Read full article

Back to Index

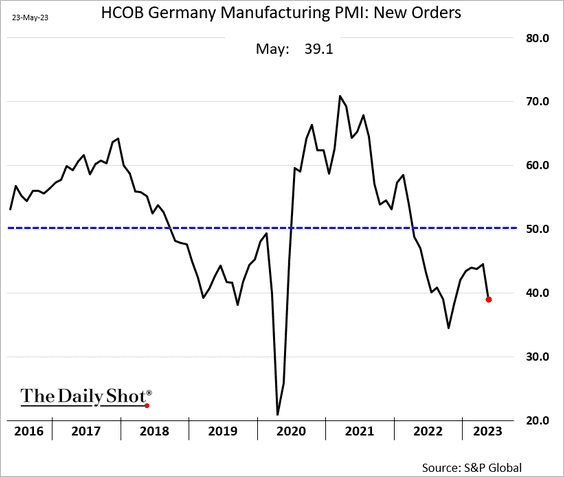

The Eurozone

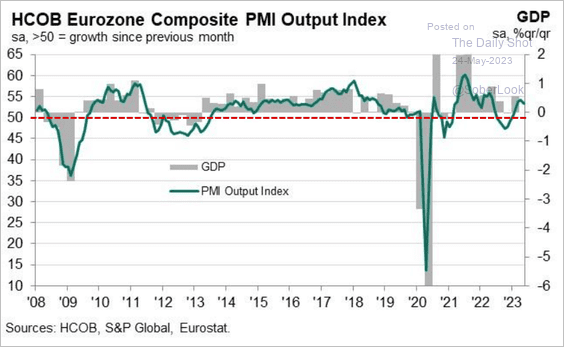

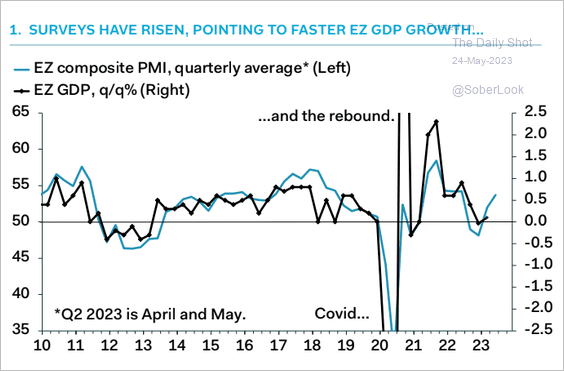

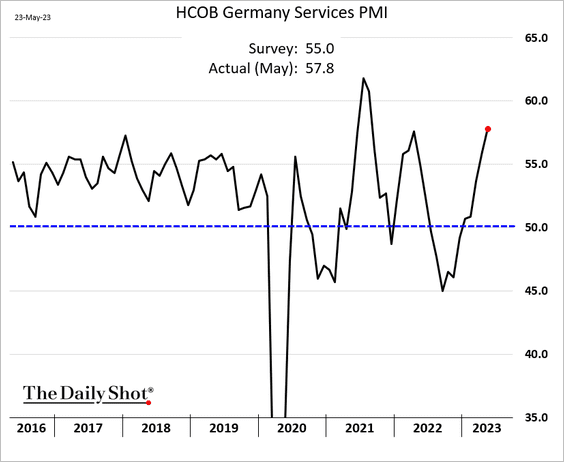

1. The overall business activity continued to grow this month, …

Source: S&P Global PMI

Source: S&P Global PMI

… signaling stronger GDP growth …

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

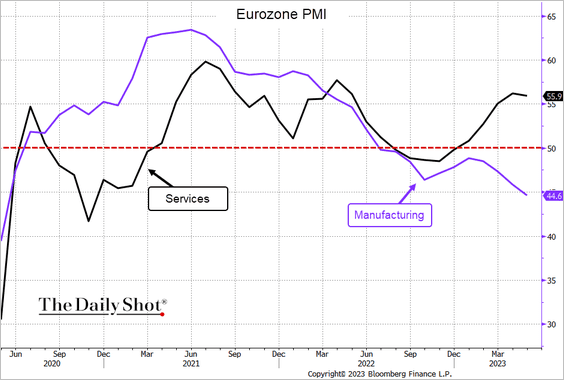

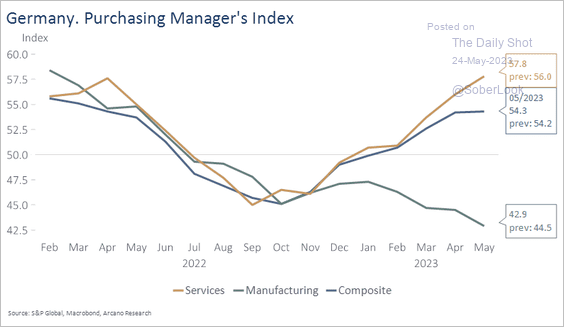

… held up by services.

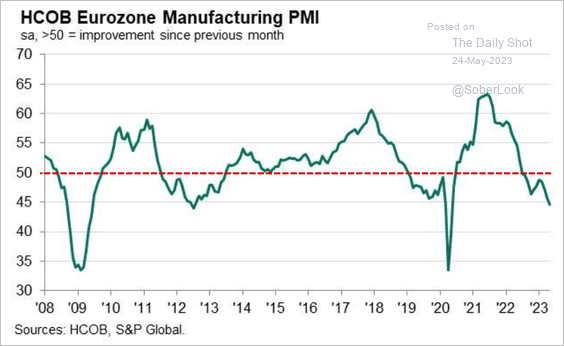

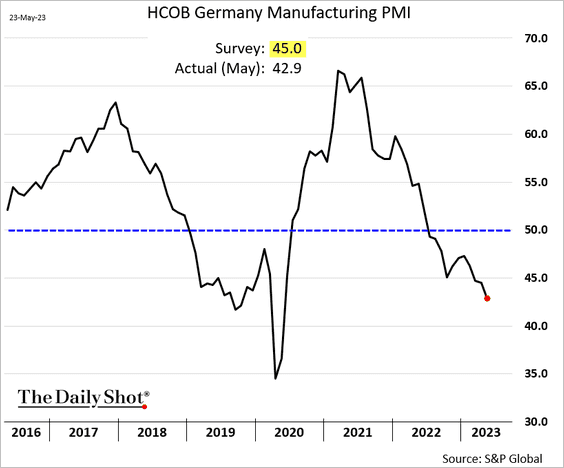

But the manufacturing sector moved deeper into contraction territory, …

Source: S&P Global PMI

Source: S&P Global PMI

Source: @CraigStirling, @economics Read full article

Source: @CraigStirling, @economics Read full article

… as demand softened further.

• The manufacturing/services divergence persists (2 charts).

Source: S&P Global PMI; @TheTerminal, Bloomberg Finance L.P.

Source: S&P Global PMI; @TheTerminal, Bloomberg Finance L.P.

Source: Arcano Economics

Source: Arcano Economics

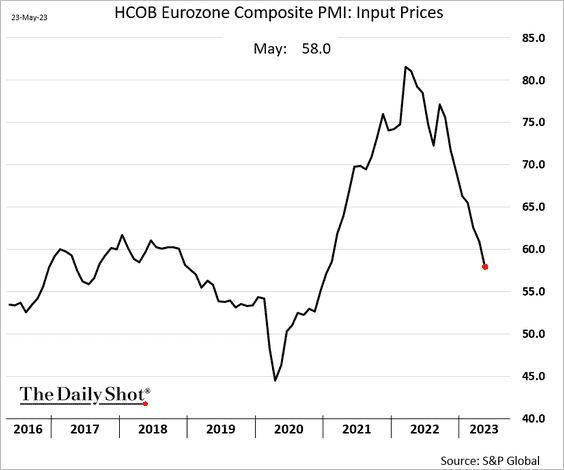

• Price pressures are easing.

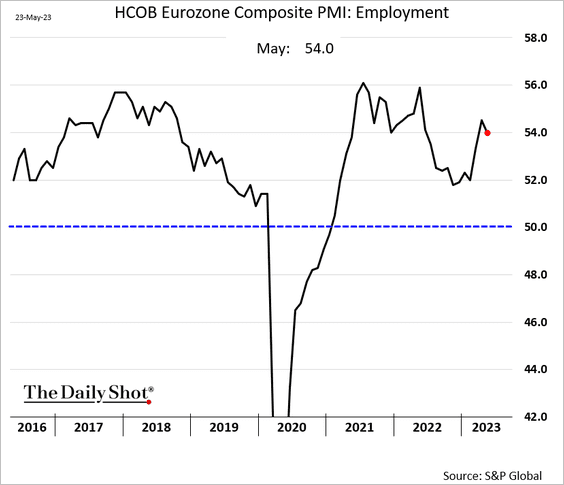

• Employment is holding up well.

——————–

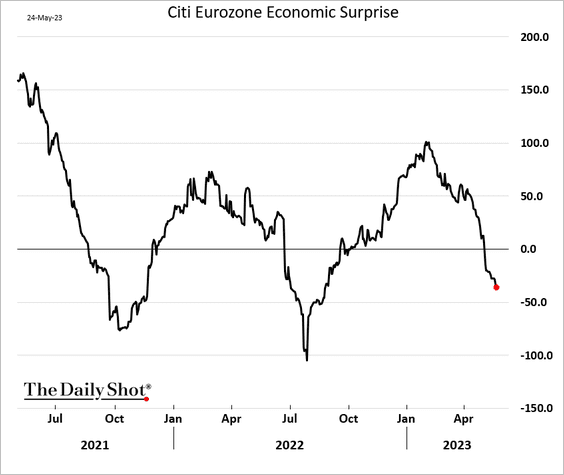

2. The Citi Economic Surprise Index continues to deteriorate.

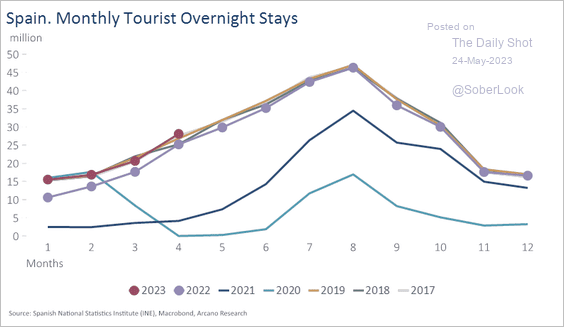

3. Spain’s tourism activity is now above pre-COVID levels.

Source: Arcano Economics

Source: Arcano Economics

Back to Index

Asia-Pacific

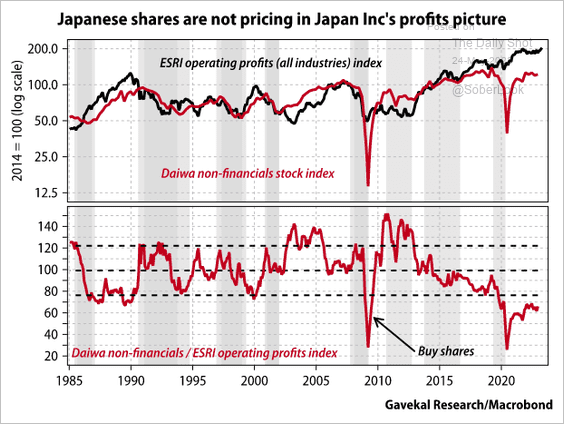

1. Japanese share prices have not kept up with climbing profits.

Source: Gavekal Research

Source: Gavekal Research

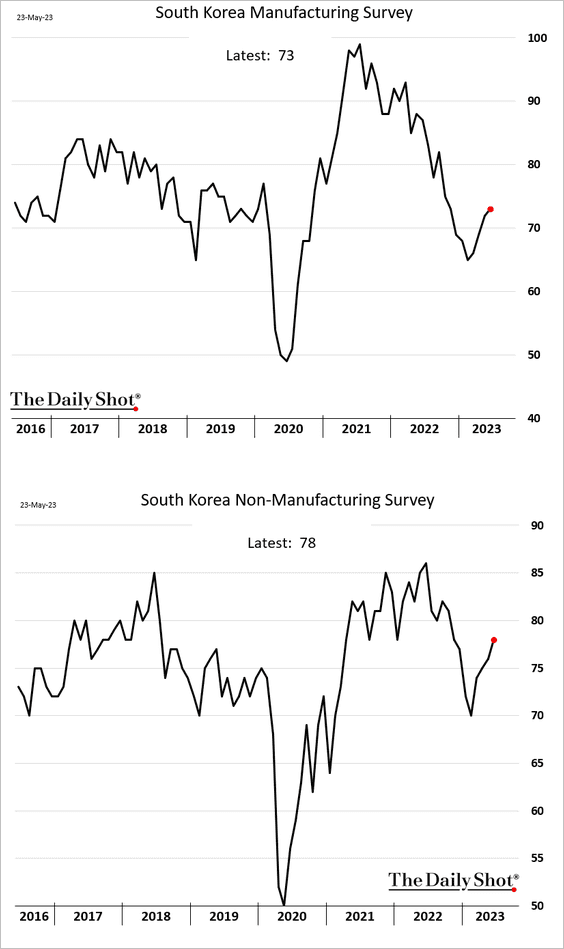

2. The Bank of Korea’s business surveys continue to show improvement.

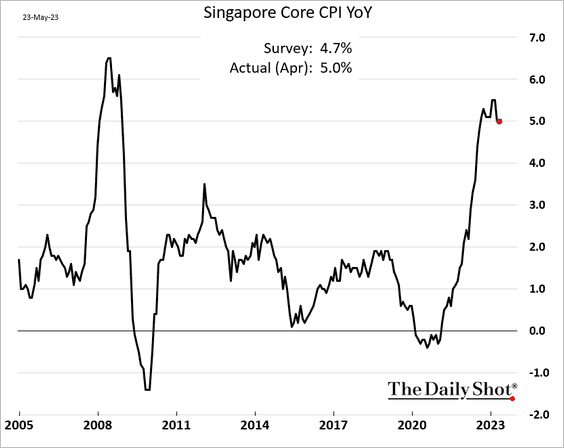

3. Singapore’s inflation surprised to the upside.

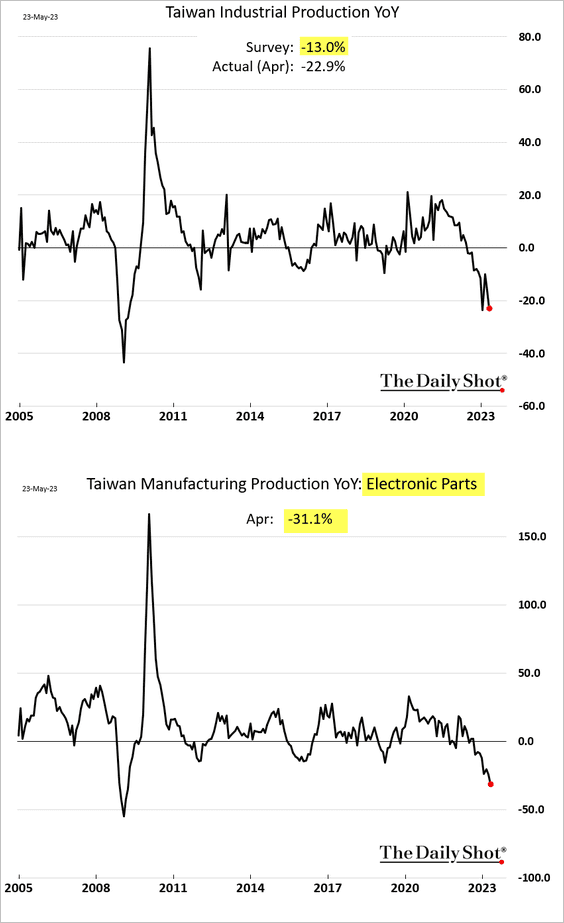

4. Taiwan’s industrial production is down sharply from a year ago, with semiconductor output declining by 31%.

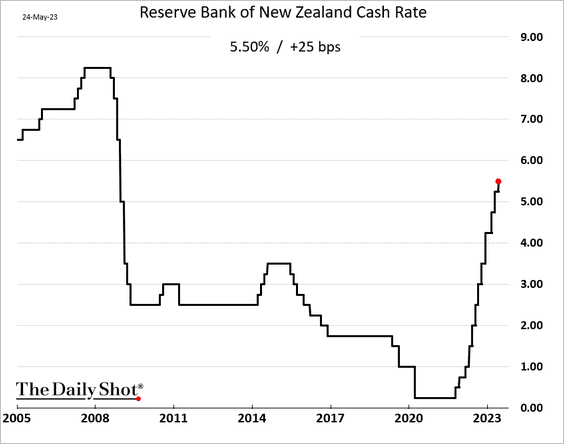

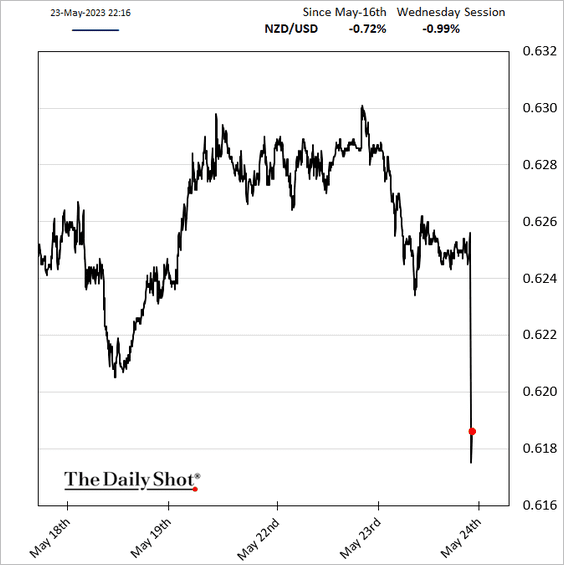

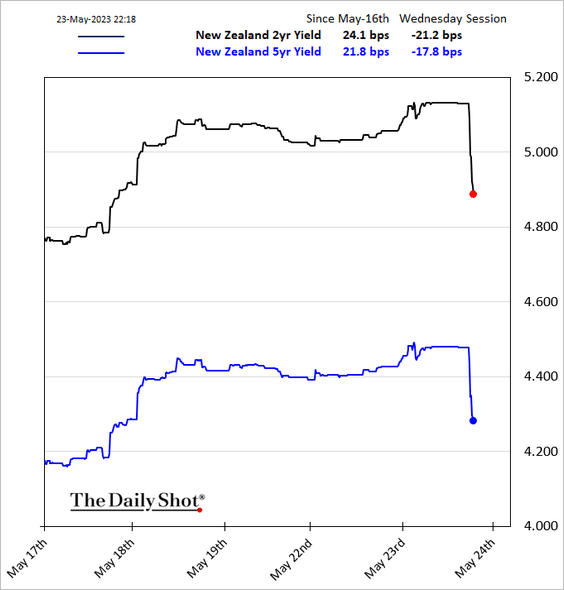

5. As anticipated, New Zealand’s central bank delivered a rate hike but announced that it has reached the end of its tightening cycle.

Source: @tracywwithers, @markets Read full article

Source: @tracywwithers, @markets Read full article

• The Kiwi dollar and bond yields tumbled.

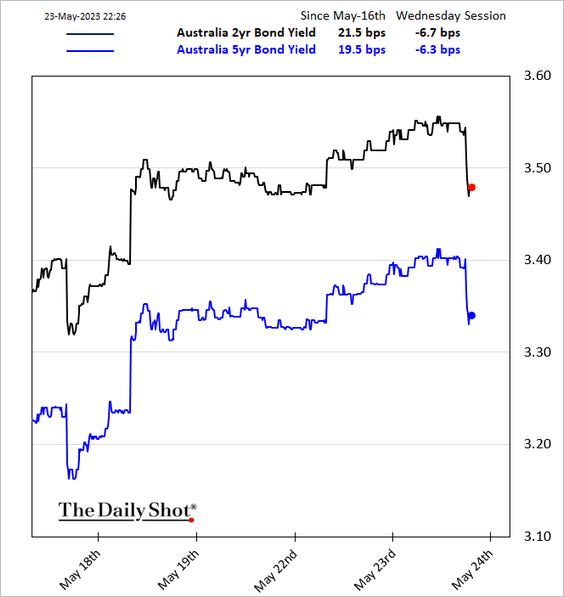

Australian bond yields also declined in response to the RBNZ’s announcement.

Back to Index

China

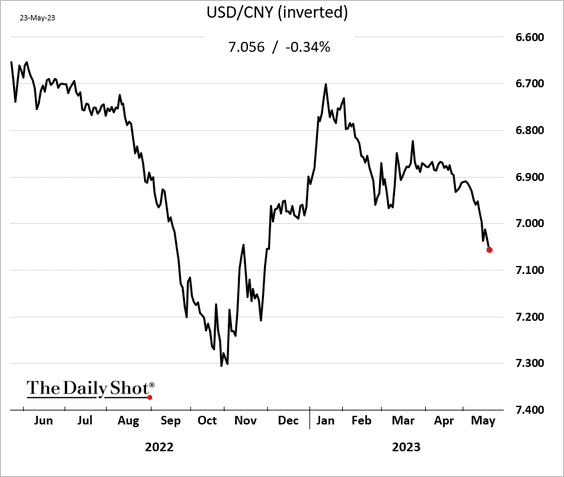

1. The renminbi continues to weaken despite warnings from Beijing.

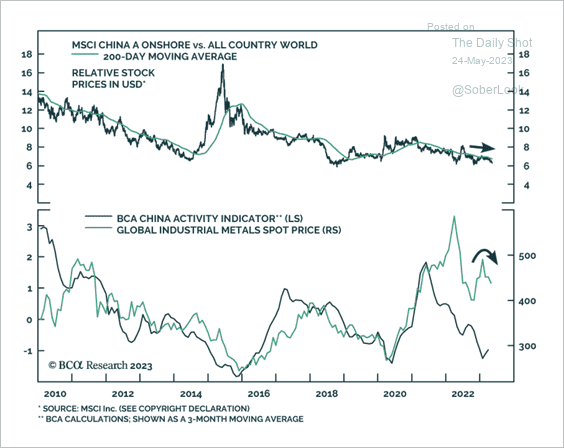

2. Chinese equities are underperforming global counterparts, and falling industrial metal prices reflect disappointing momentum.

Source: BCA Research

Source: BCA Research

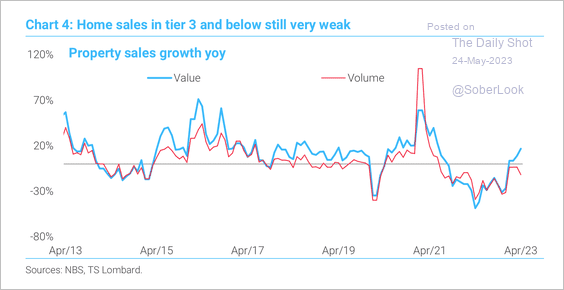

3. Property sales growth is slowly recovering.

Source: TS Lombard

Source: TS Lombard

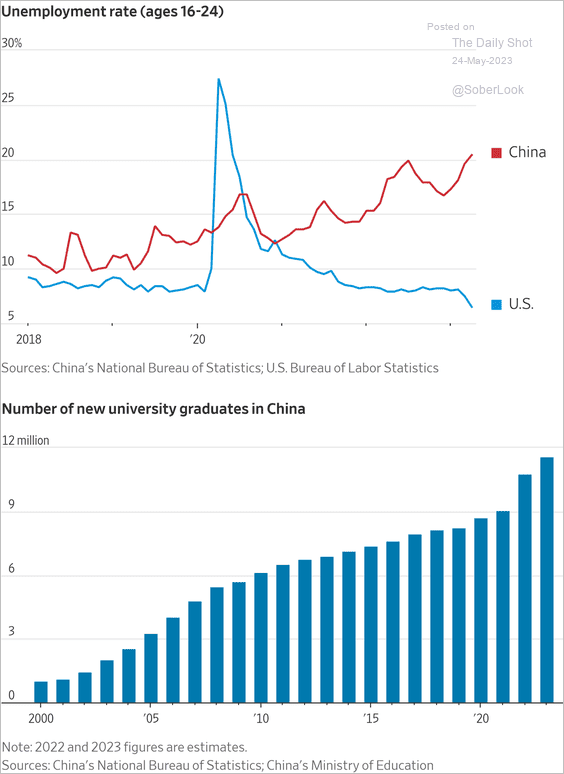

4. China doesn’t have enough white-collar jobs to accommodate the surge in college graduates.

Source: @yifanxie, @WSJ Read full article

Source: @yifanxie, @WSJ Read full article

Back to Index

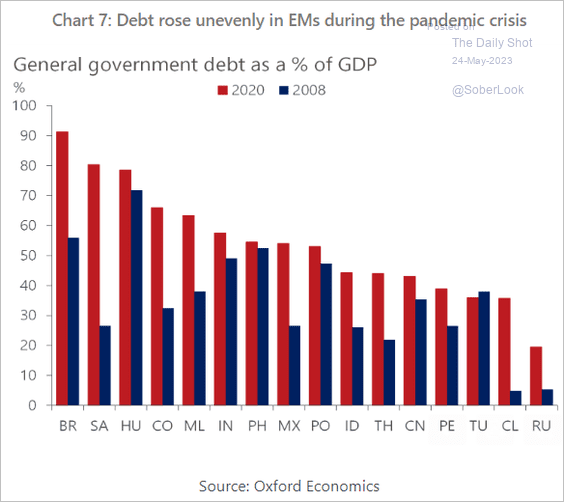

Emerging Markets

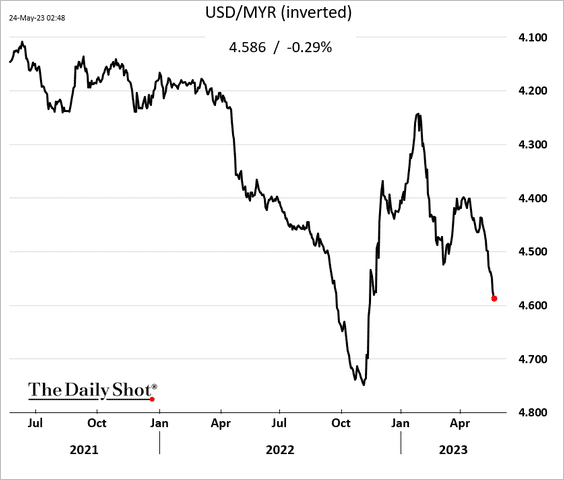

1. The Malaysian ringgit remains under pressure.

2. This chart shows government debt-to-GDP ratios for select economies.

Source: Oxford Economics

Source: Oxford Economics

Back to Index

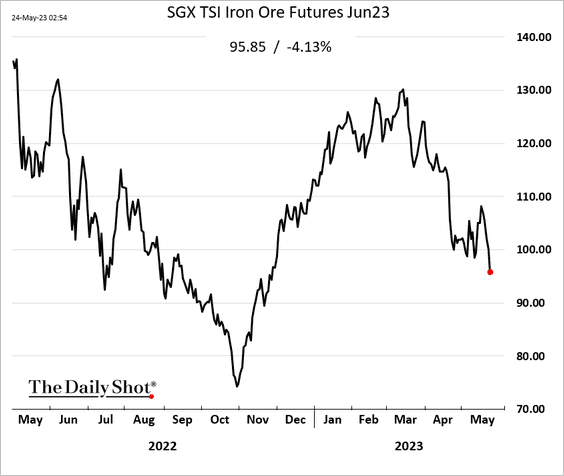

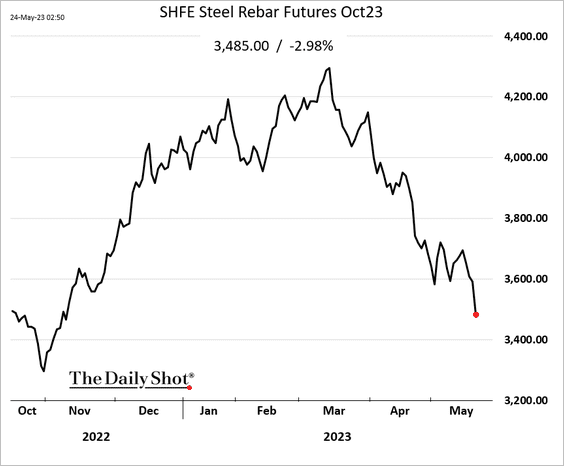

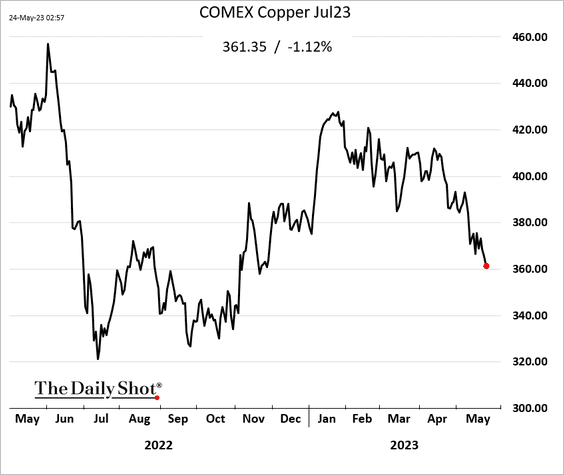

Commodities

1. Industrial commodity prices continue to sink.

• Iron ore (Singapore):

• Steel rebar (Shanghai):

• Copper (New York):

• Bloomberg’s industrial metals index:

——————–

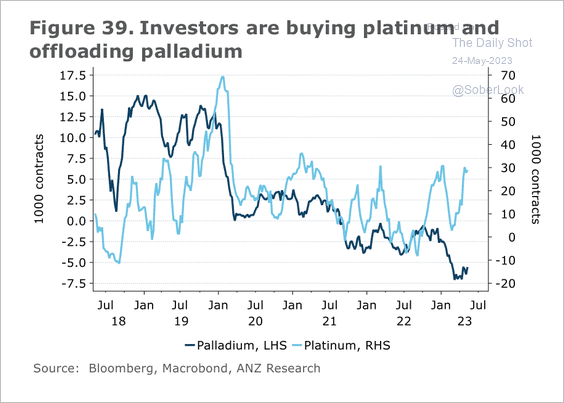

2. Investors increased their bullish bets on platinum futures while shying away from palladium.

Source: @ANZ_Research

Source: @ANZ_Research

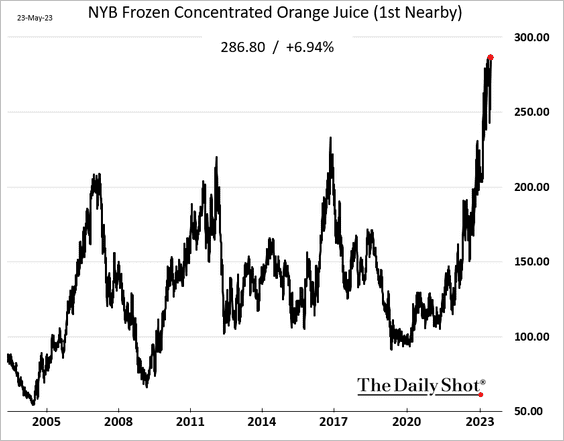

3. With cold storage frozen orange juice inventories approaching their lowest level in over 50 years, US orange juice futures hit a record high.

Back to Index

Energy

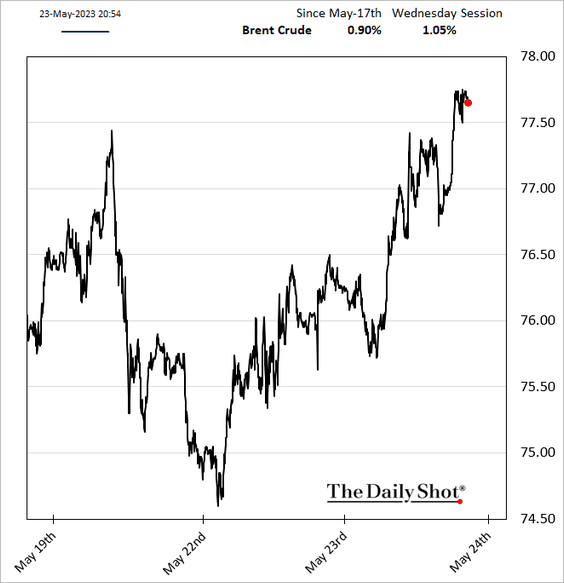

The Saudis are jawboning oil prices higher ahead of the OPEC+ meeting.

Source: CNBC Read full article

Source: CNBC Read full article

Back to Index

Equities

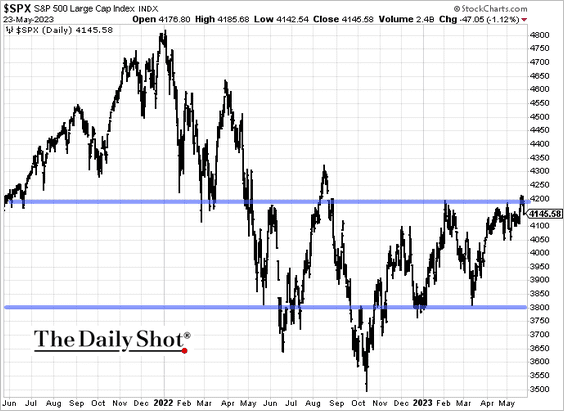

1. The S&P 500 resistance is holding amid debt ceiling concerns.

2. Fund flows do not support the recent gains.

Source: Goldman Sachs; h/t @t1alpha

Source: Goldman Sachs; h/t @t1alpha

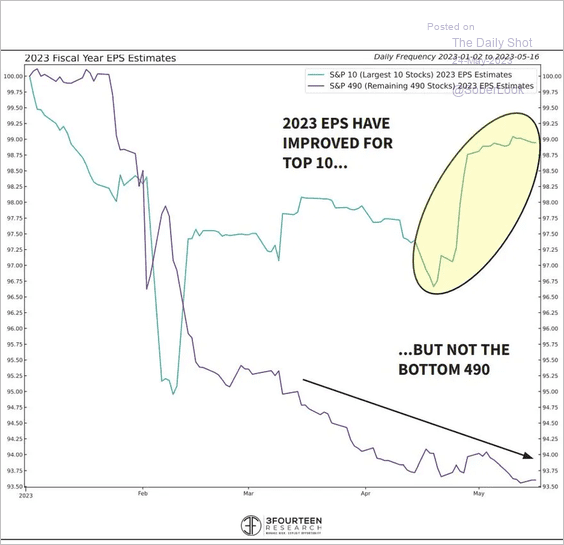

3. The 2023 earnings estimates have been robust for the top ten stocks but not the rest of the index.

Source: @WarrenPies; h/t @dailychartbook

Source: @WarrenPies; h/t @dailychartbook

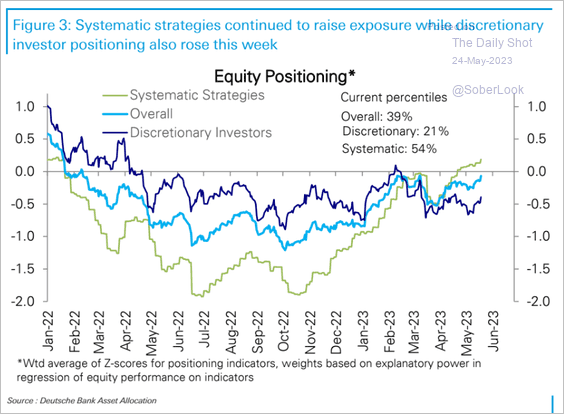

4. Systematic strategies have turned bullish on stocks, but discretionary investors remain cautious.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

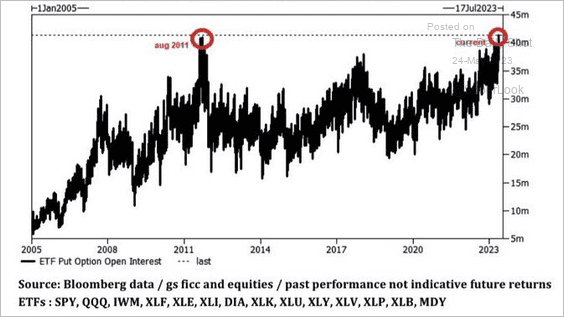

5. Open interest in ETF put options is at multi-year highs.

Source: @Marlin_Capital; h/t @dailychartbook

Source: @Marlin_Capital; h/t @dailychartbook

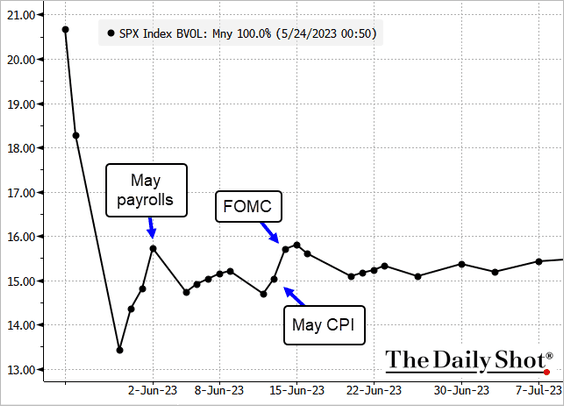

• The S&P 500 vol curve is highly inverted at the front end as traders anxiously await updates on the debt ceiling negotiations.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

——————–

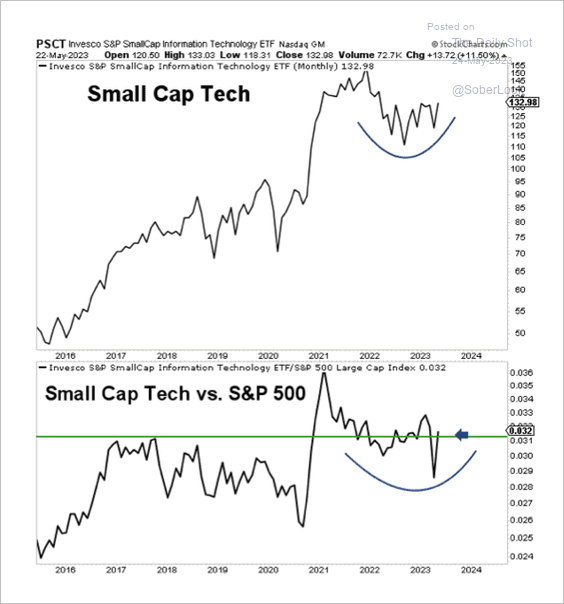

6. Small-cap tech stocks are starting to improve relative to the S&P 500.

Source: Aazan Habib, Paradigm Capital

Source: Aazan Habib, Paradigm Capital

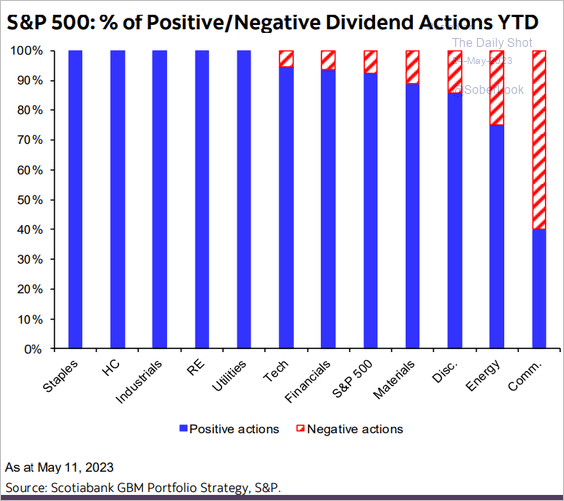

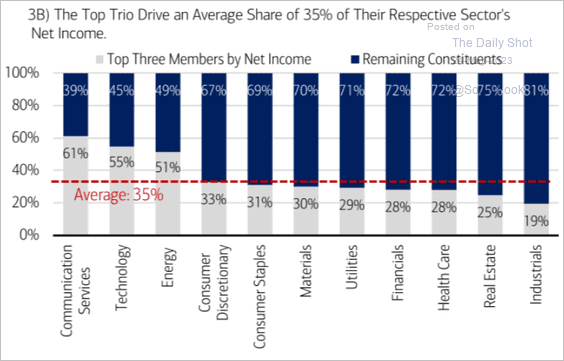

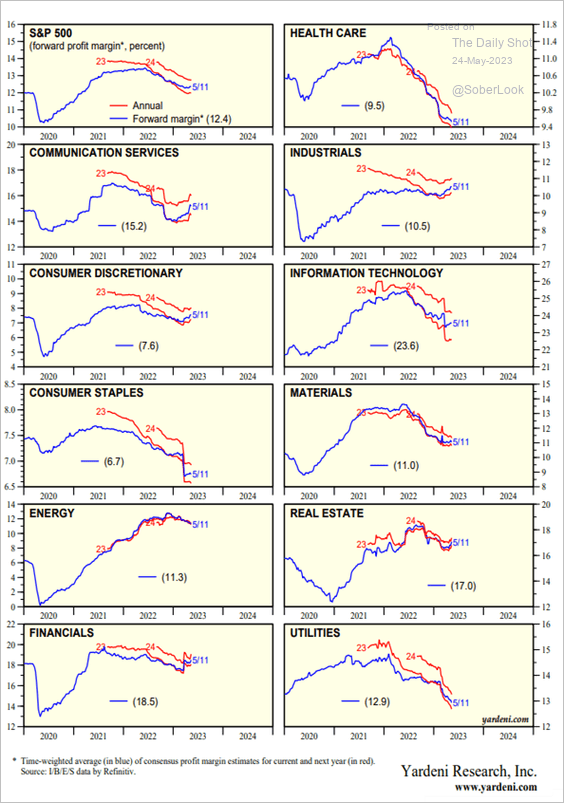

7. Next, we have some sector updates.

• Dividend actions by sector:

Source: Hugo Ste-Marie, Portfolio & Quantitative Strategy Global Equity Research, Scotia Capital

Source: Hugo Ste-Marie, Portfolio & Quantitative Strategy Global Equity Research, Scotia Capital

• Each sector’s top three members by net income:

Source: Merrill Lynch

Source: Merrill Lynch

• Profit margin forward estimates by sector:

Source: Yardeni Research

Source: Yardeni Research

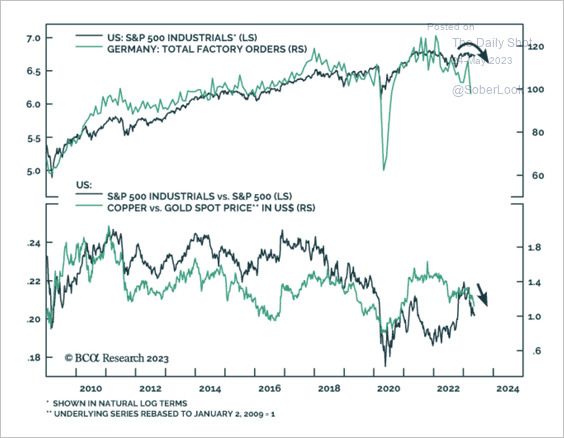

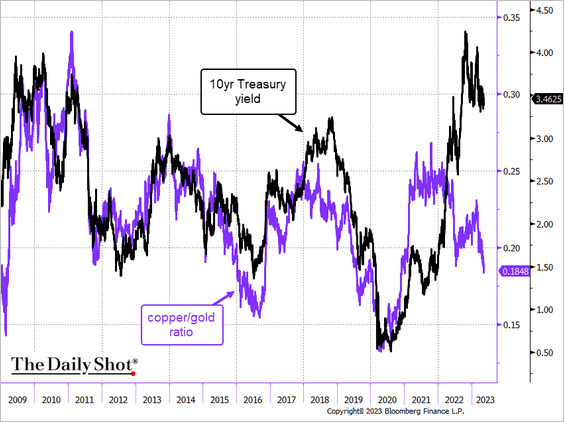

• S&P 500 industrial stocks face headwinds from weaker global growth and a breakdown in the copper/gold ratio.

Source: BCA Research

Source: BCA Research

Back to Index

Alternatives

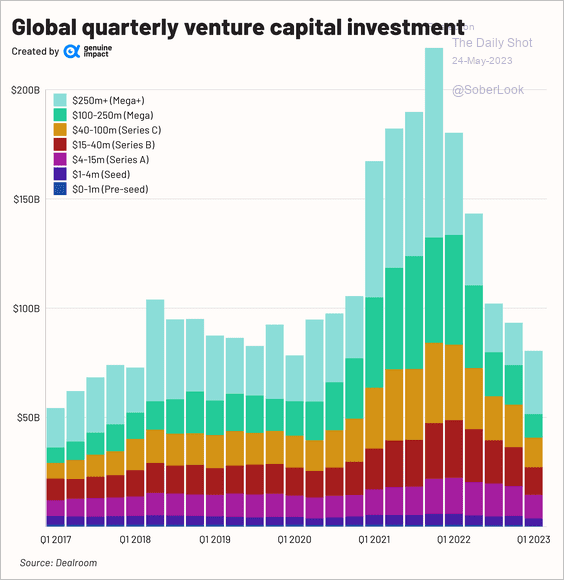

1. This chart shows global VC investment trends by deal size.

Source: @genuine_impact

Source: @genuine_impact

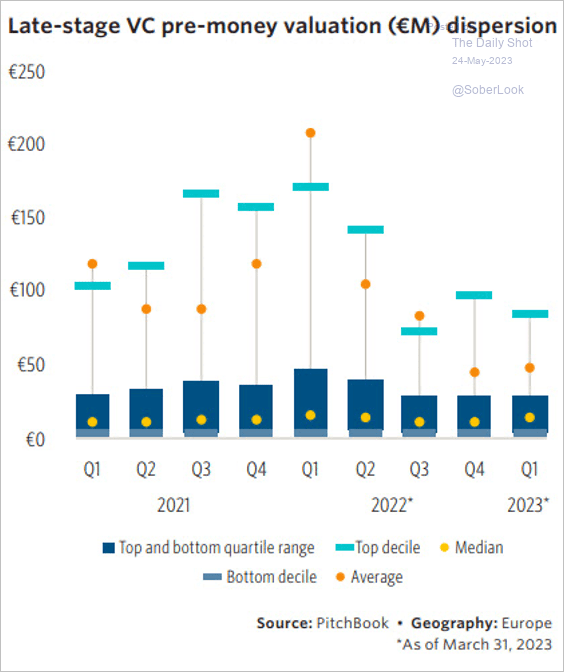

2. Late-stage valuations in European venture capital have significantly declined.

Source: PitchBook

Source: PitchBook

Back to Index

Credit

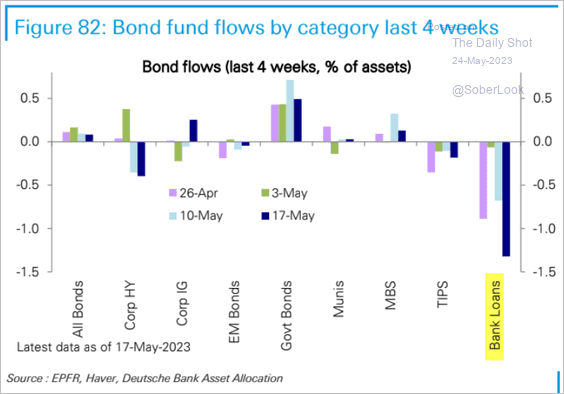

1. Leveraged loan funds continue to see outflows.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

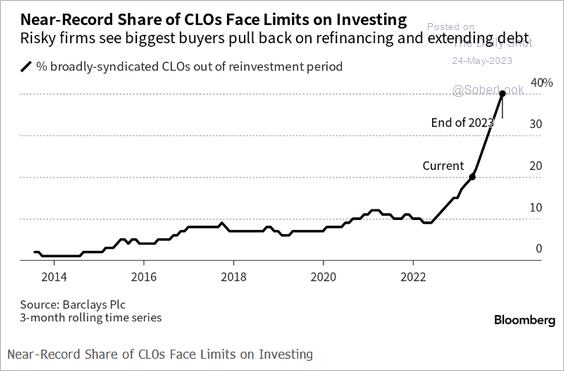

2. A lot of CLOs are out of their investment periods.

Source: Bloomberg Law Read full article

Source: Bloomberg Law Read full article

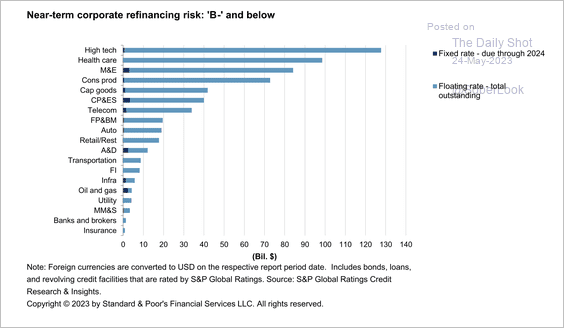

3. Only a small amount of fixed-rate debt is coming due next year in the riskiest ratings.

Source: S&P Global Ratings

Source: S&P Global Ratings

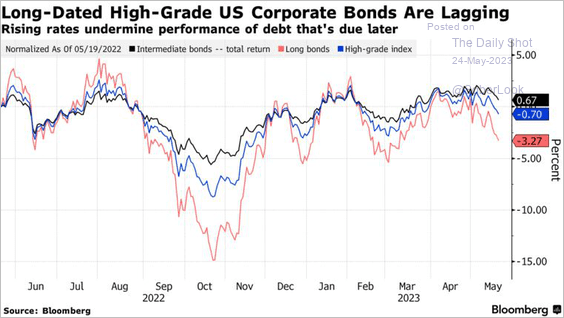

4. Longer-dated IG corporates underperformed this month.

Source: @josyanajoshua, @markets Read full article

Source: @josyanajoshua, @markets Read full article

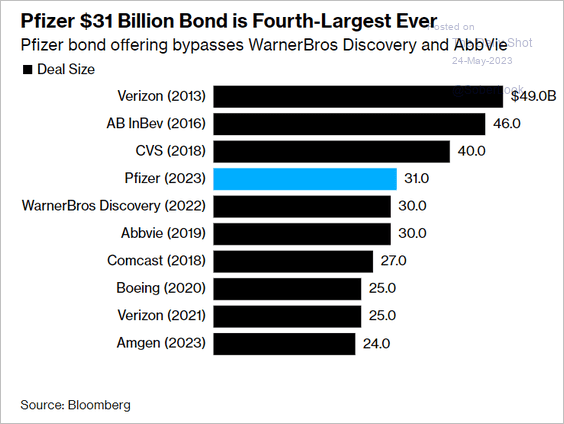

5. Here are the largest corporate bond deals.

Source: @josyanajoshua, @markets Read full article

Source: @josyanajoshua, @markets Read full article

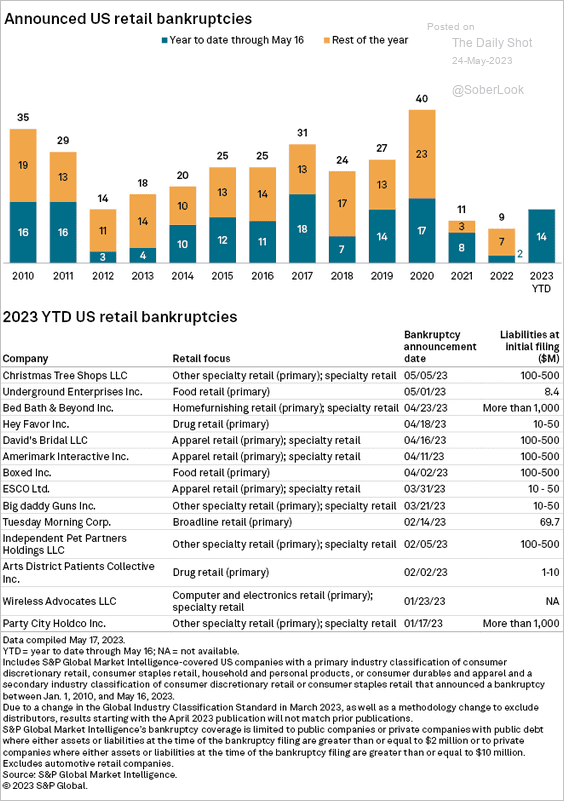

6. This chart shows US retail-sector bankruptcies.

Source: S&P Global Market Intelligence

Source: S&P Global Market Intelligence

Back to Index

Rates

1. Industrial commodities are increasingly pricing a recession. Will Treasury yields follow?

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

2. This chart shows the balances in private repo markets versus the Fed’s RRP facility usage. An overview of “SLR relief” is available here.

Source: Liberty Street Economics Read full article

Source: Liberty Street Economics Read full article

Back to Index

Global Developments

1. The 60-40 portfolio is rebounding this year. The 25/25/25/25 portfolio is also performing well.

Source: BofA Global Research

Source: BofA Global Research

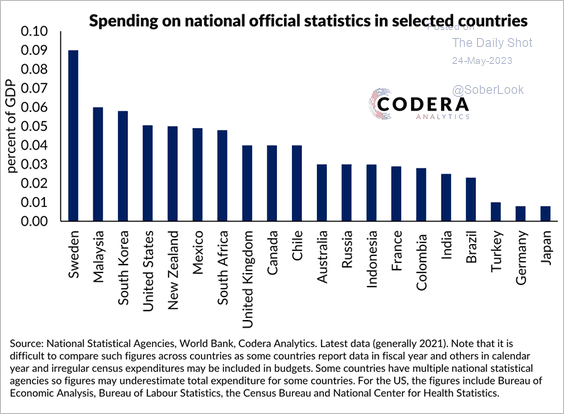

2. The amount of funding allocated to national statistical agencies varies significantly across countries.

Source: Codera Analytics Read full article

Source: Codera Analytics Read full article

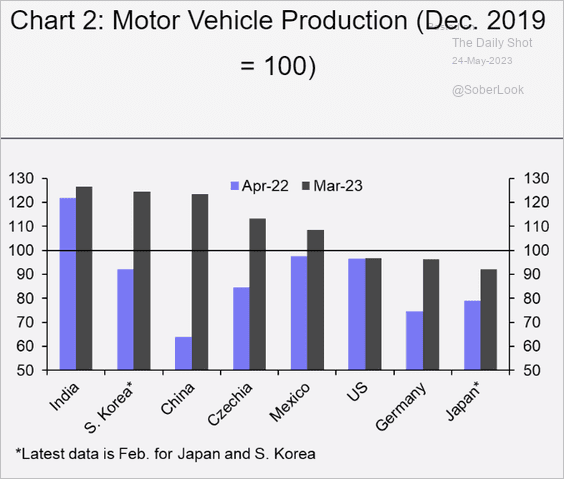

3. This chart shows global vehicle production relative to pre-COVID levels.

Source: Capital Economics

Source: Capital Economics

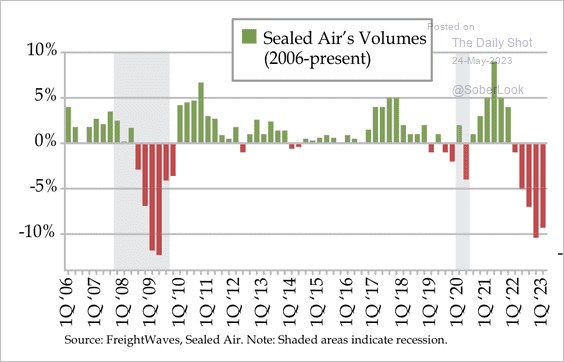

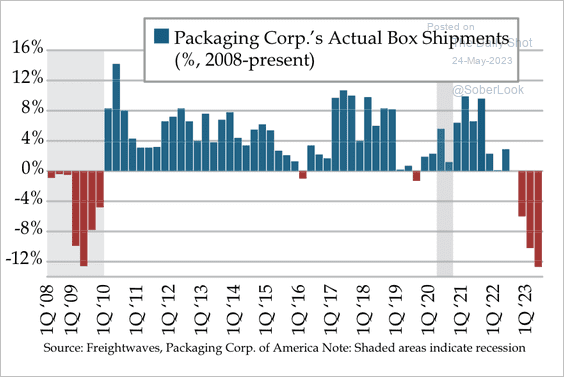

4. Industrial packaging is experiencing its first contraction since the financial crisis. (2 charts)

Source: Quill Intelligence

Source: Quill Intelligence

Source: Quill Intelligence

Source: Quill Intelligence

——————–

Food for Thought

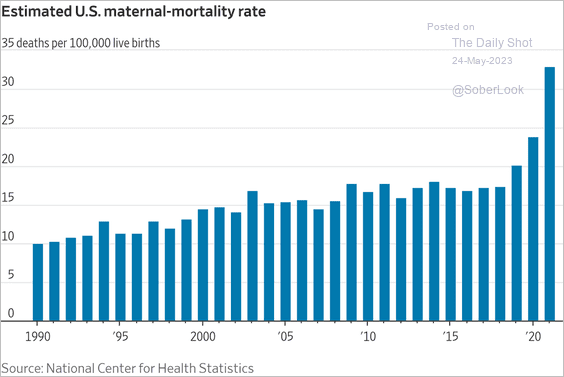

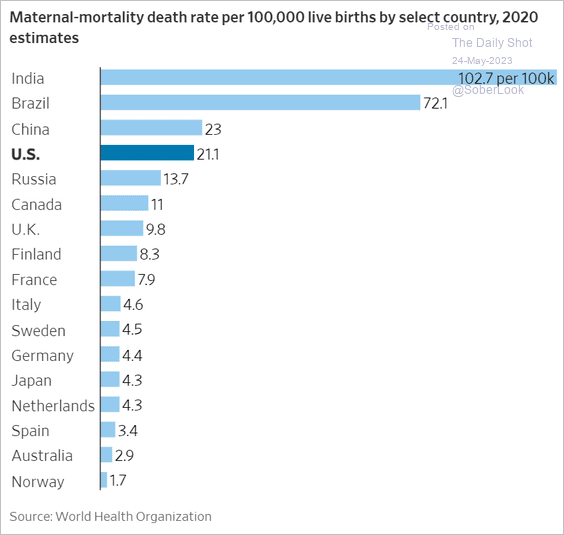

1. Maternal mortality rates (2 charts):

Source: @WSJ Read full article

Source: @WSJ Read full article

Source: @WSJ Read full article

Source: @WSJ Read full article

——————–

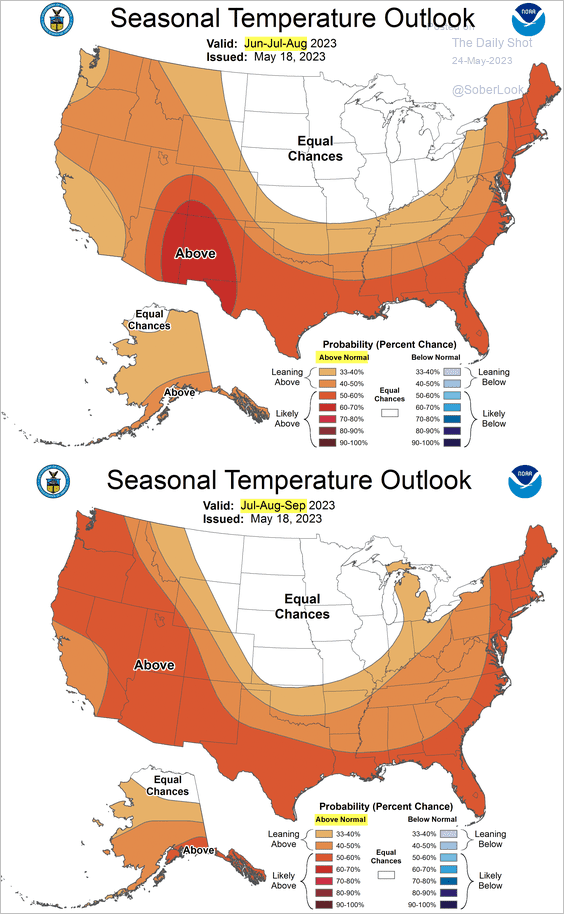

2. It’s going to be a warm summer:

Source: NOAA

Source: NOAA

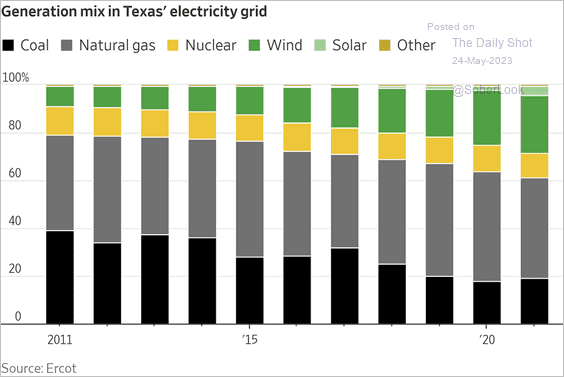

3. Texas electricity generation by source:

Source: @WSJ Read full article

Source: @WSJ Read full article

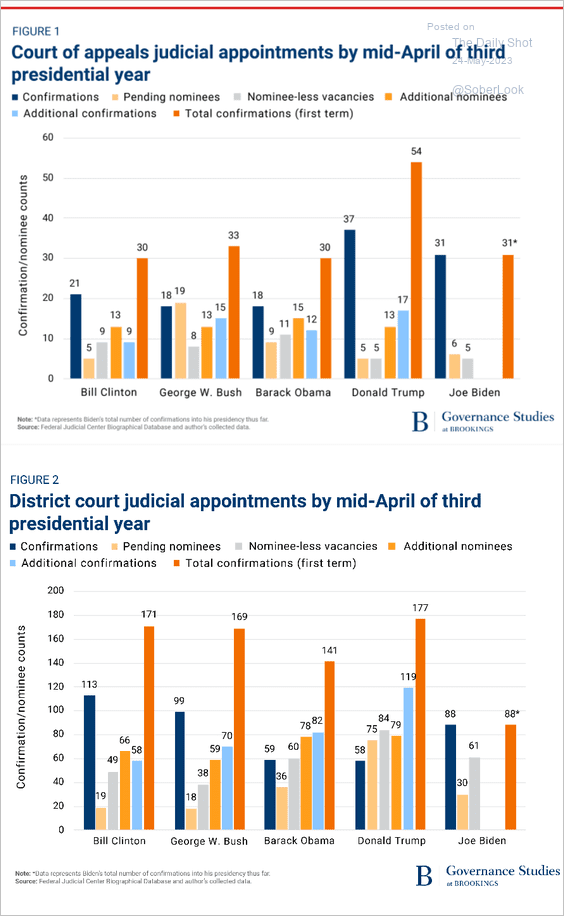

4. Judicial appointments:

Source: Brookings Read full article

Source: Brookings Read full article

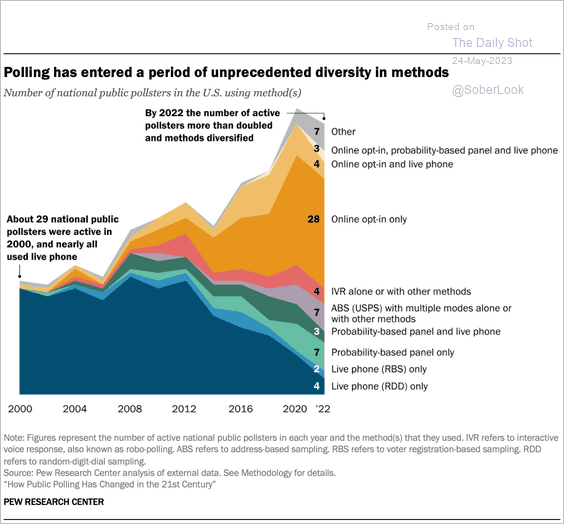

5. Polling methods over time:

Source: Pew Research Center Read full article

Source: Pew Research Center Read full article

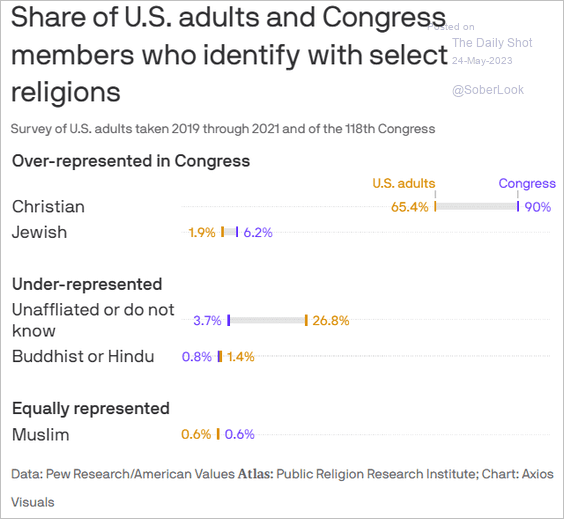

6. Religious affiliations of US adults and Congress members:

Source: @axios Read full article

Source: @axios Read full article

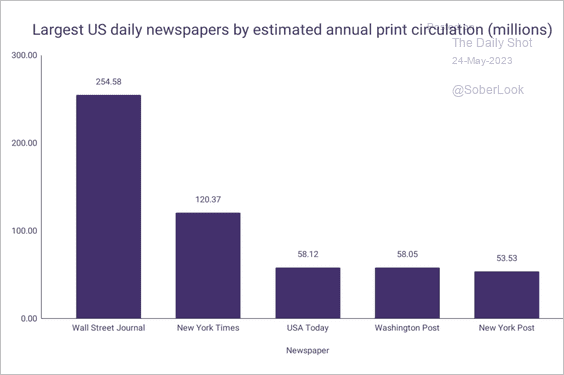

7. US daily newspapers with the largest annual print circulation:

Source: WordsRated; h/t Walter Read full article

Source: WordsRated; h/t Walter Read full article

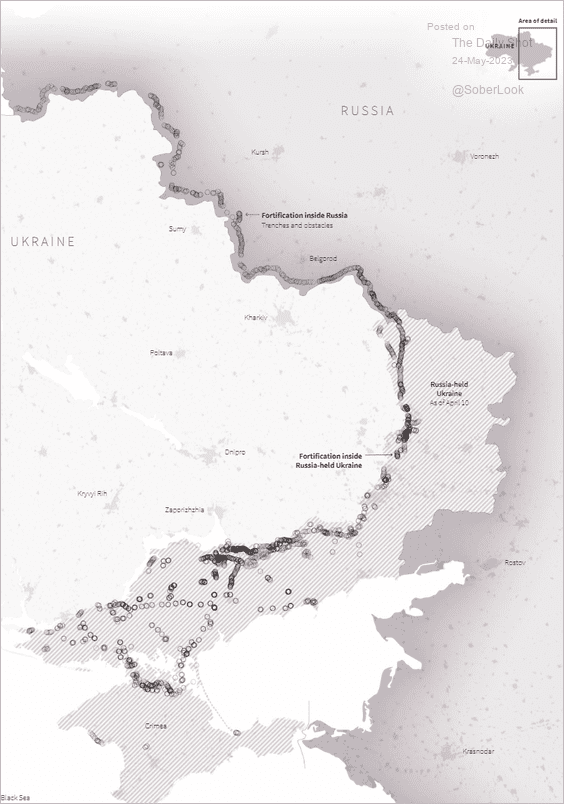

8. Extensive Russian fortifications along the frontline in occupied Ukraine:

Source: Reuters Read full article

Source: Reuters Read full article

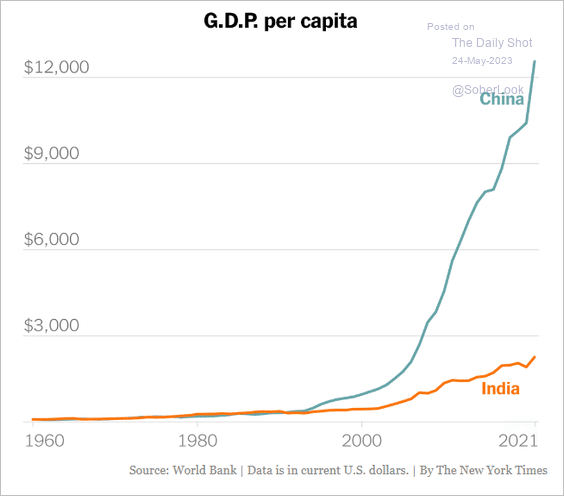

9. GDP per capita in India and China:

Source: The New York Times Read full article

Source: The New York Times Read full article

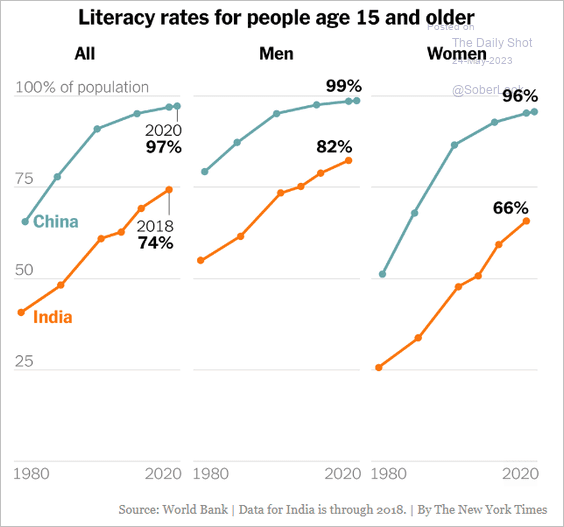

• Literacy rates in India and China:

Source: The New York Times Read full article

Source: The New York Times Read full article

——————–

10. The daily routines of famous creatives:

Source: Visual Capitalist Read full article

Source: Visual Capitalist Read full article

——————–

Back to Index