The Daily Shot: 29-May-23

• The United States

• Canada

• The United Kingdom

• The Eurozone

• Europe

• Japan

• Asia-Pacific

• China

• Emerging Markets

• Cryptocurrency

• Commodities

• Energy

• Equities

• Credit

• Rates

• Global Developments

• Food for Thought

The United States

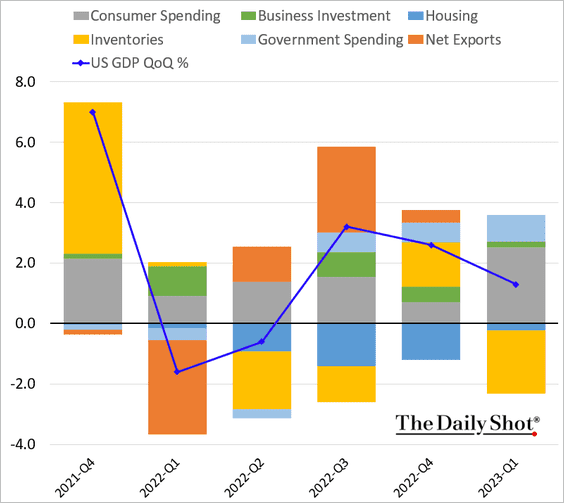

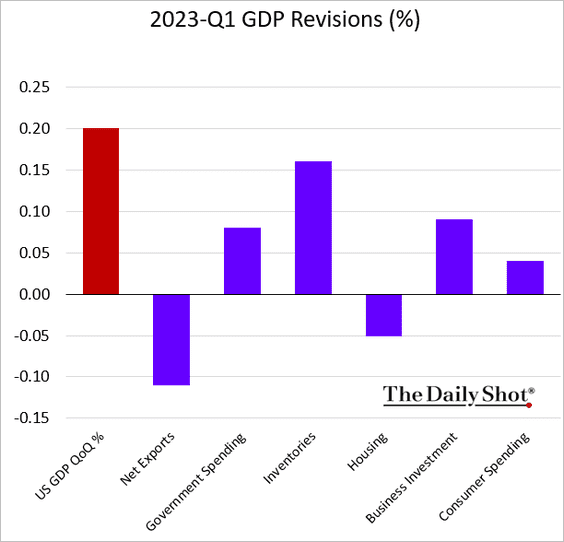

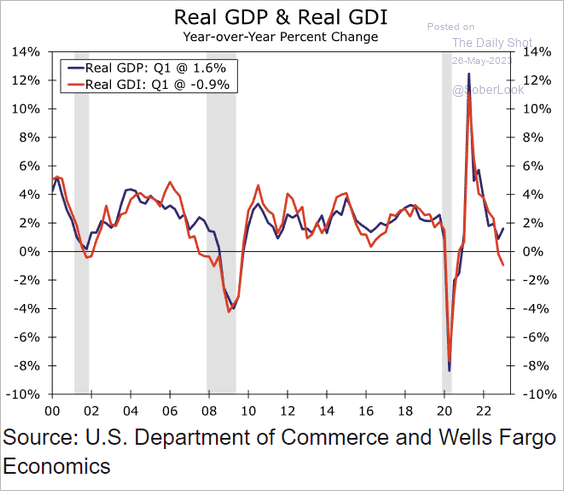

1. The Q1 GDP growth was revised higher, …

… partially due to reduced inventory drag.

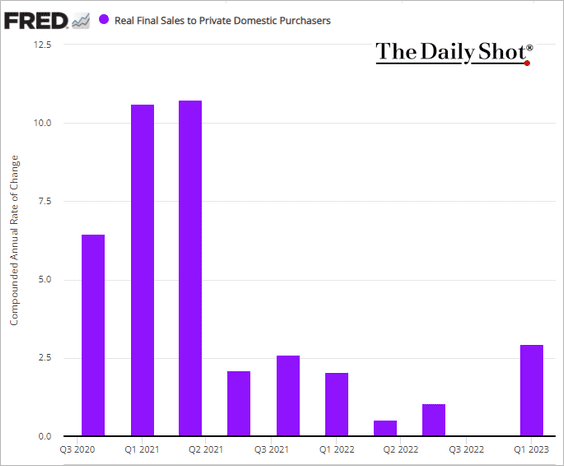

• This chart shows real final sales to private domestic purchasers (the “core” GDP).

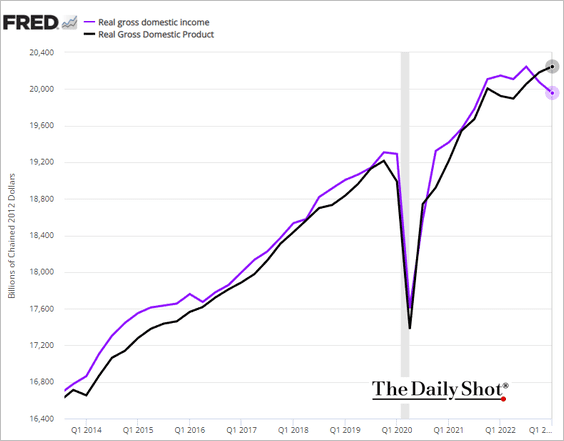

• Unlike the GDP, the GDI measure points to weaker growth (2 charts).

Source: Wells Fargo Securities

Source: Wells Fargo Securities

Source: @readep, @economics Read full article

Source: @readep, @economics Read full article

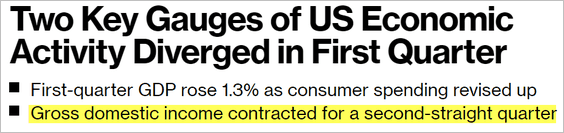

• Corporate profits declined.

Source: Wells Fargo Securities

Source: Wells Fargo Securities

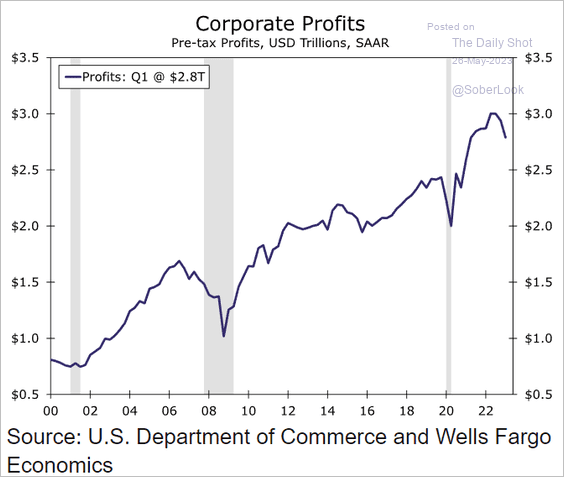

• The Q1 core PCE inflation was revised to 5%.

——————–

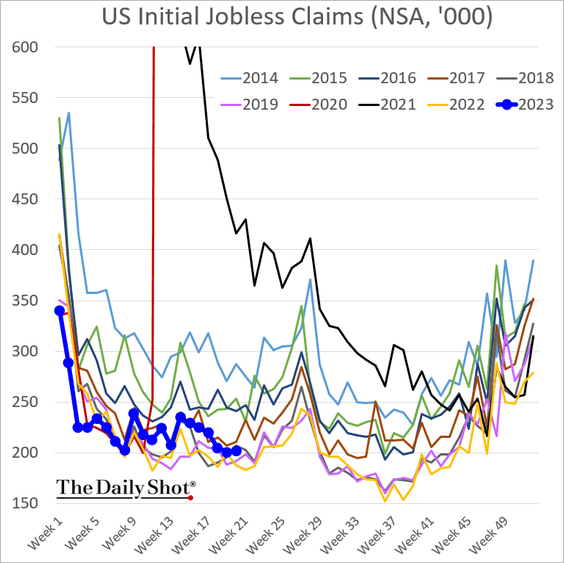

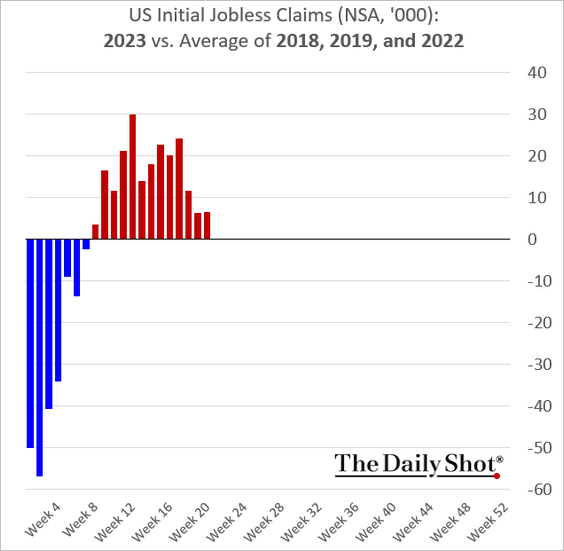

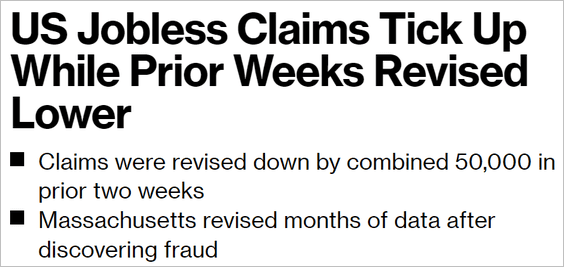

2. Initial jobless claims remain noisy, with further adjustments from the Massachusetts fraud.

Source: @gutavsaraiva, @economics Read full article

Source: @gutavsaraiva, @economics Read full article

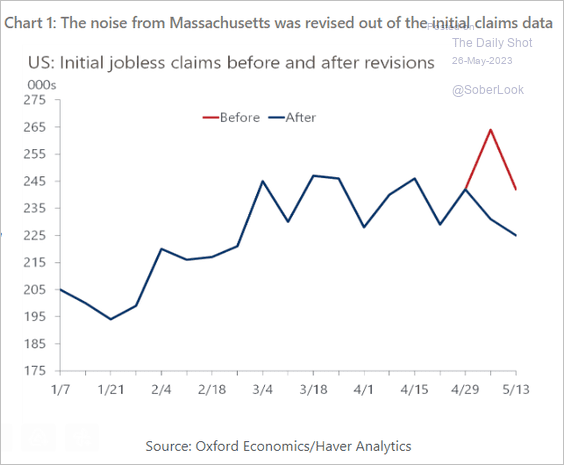

Here is the impact on the seasonally-adjusted claims data.

Source: Oxford Economics

Source: Oxford Economics

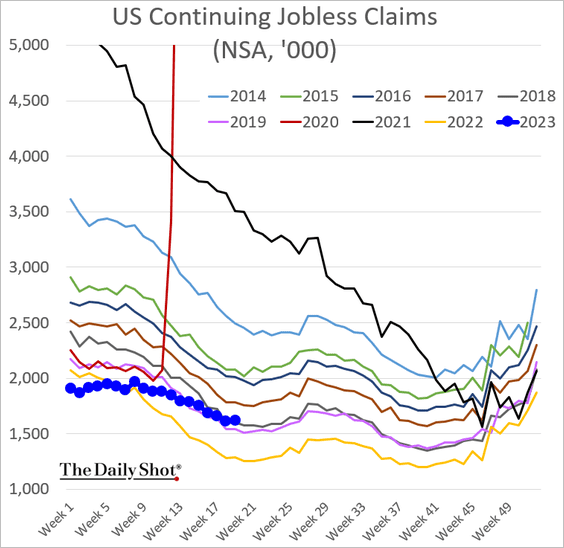

Continuing claims remain 25% above last year’s levels.

——————–

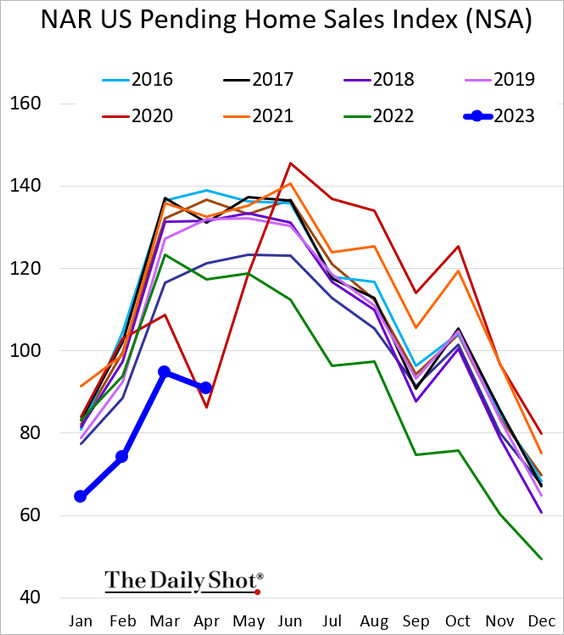

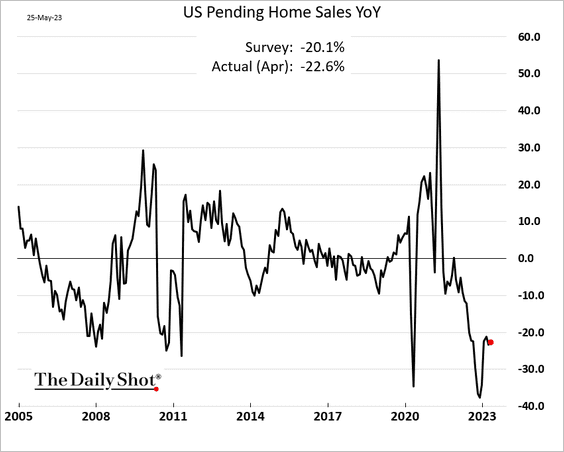

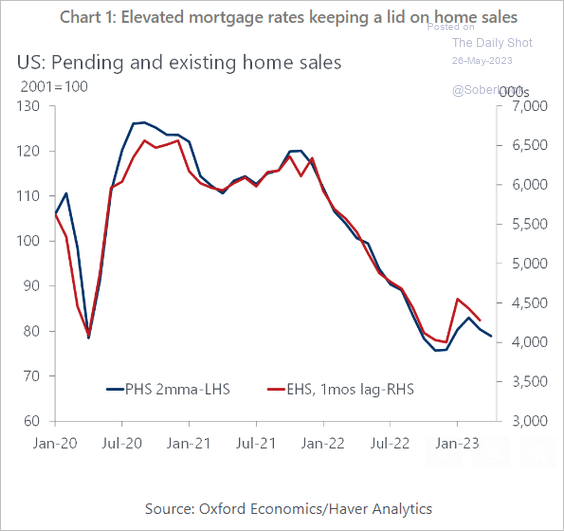

3. Pending home sales were softer than expected last month, …

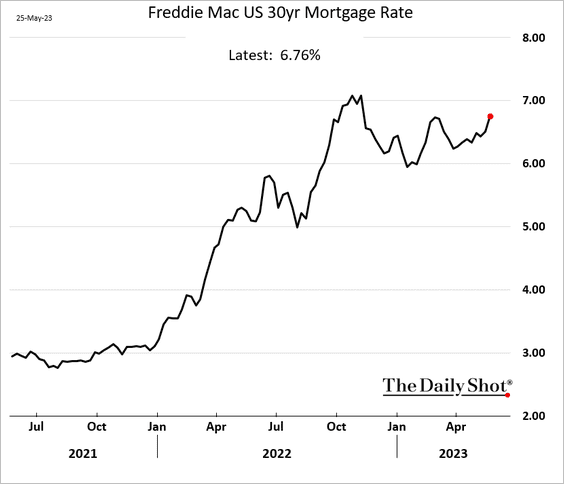

… amid rising mortgage rates.

Softer pending sales point to further weakness in existing home sales.

Source: Oxford Economics

Source: Oxford Economics

——————–

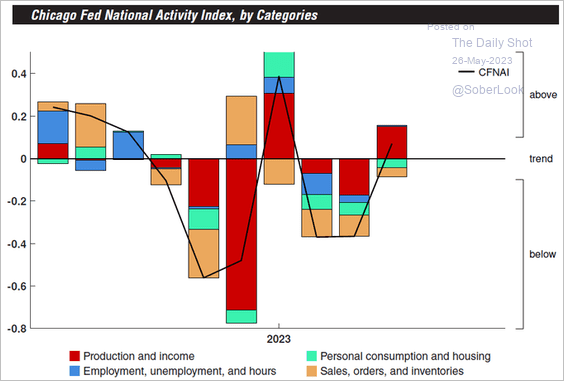

4. The Chicago Fed’s national activity index rebounded last month.

Source: @ChicagoFed; h/t @dailychartbook

Source: @ChicagoFed; h/t @dailychartbook

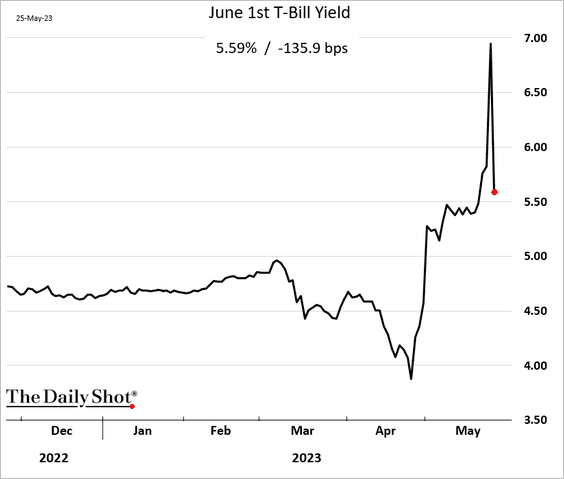

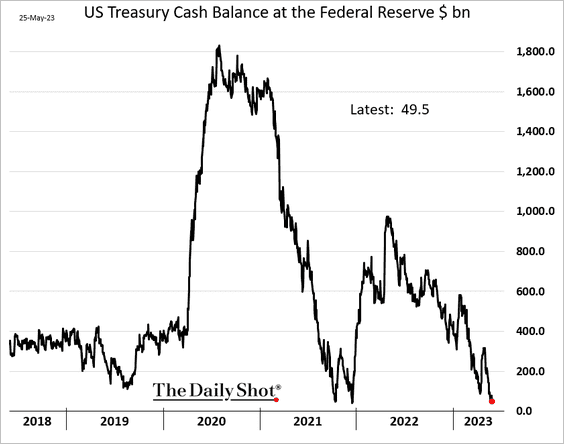

5. There was positive news on the debt ceiling negotiations.

Source: Reuters Read full article

Source: Reuters Read full article

• Some T-bill yields dropped sharply.

• The US Treasury’s cash balance dipped below $50 billion.

——————–

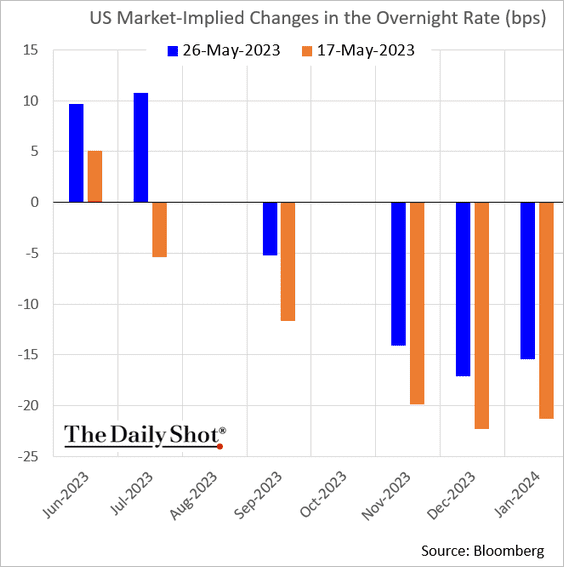

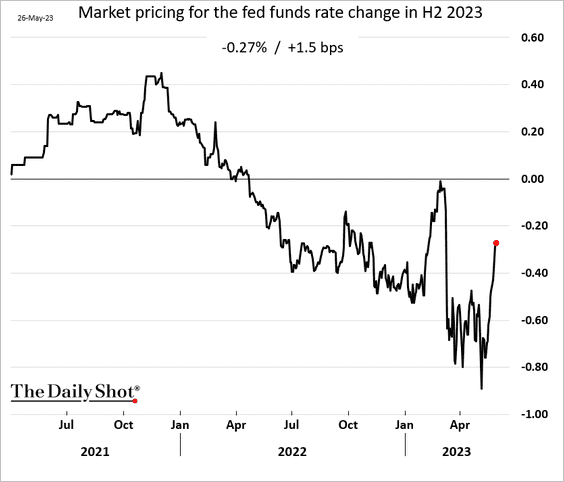

6. Amid positive developments regarding the debt ceiling situation, the market raised expectations of a Fed rate hike in either June or July, …

… while significantly curbing expectations for rate cuts in the latter part of this year.

Back to Index

Canada

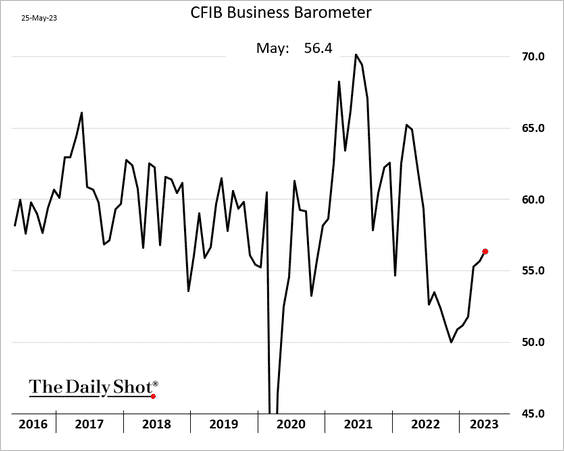

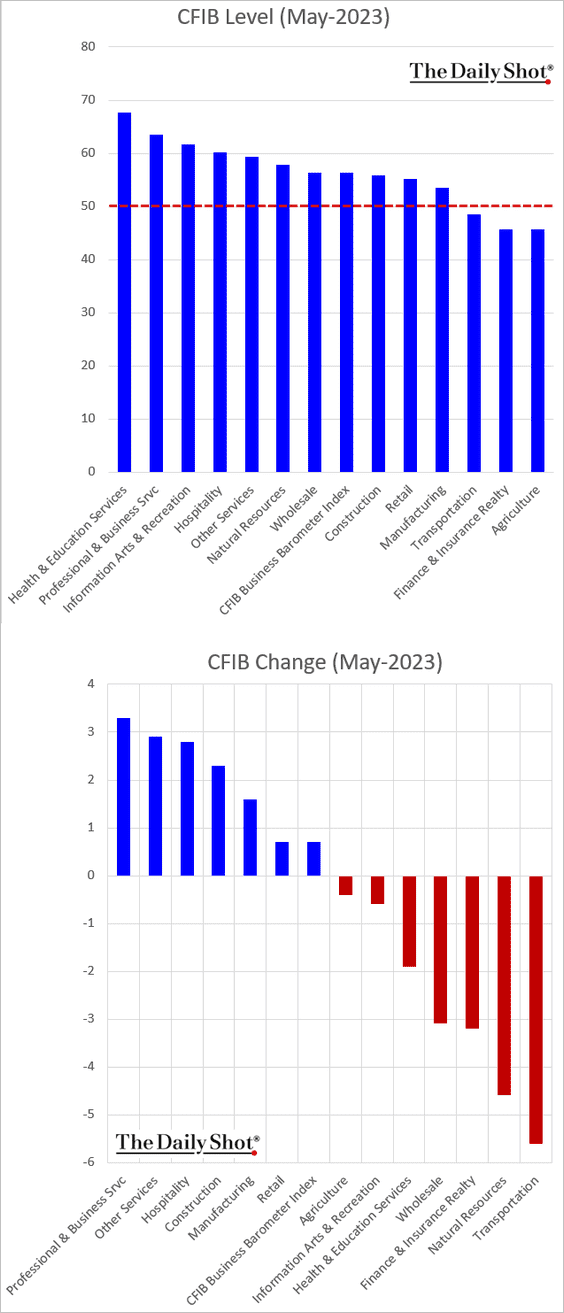

1. The CFIB small/medium-size business indicator improved again this month.

Here is the breakdown by sector (level and changes).

——————–

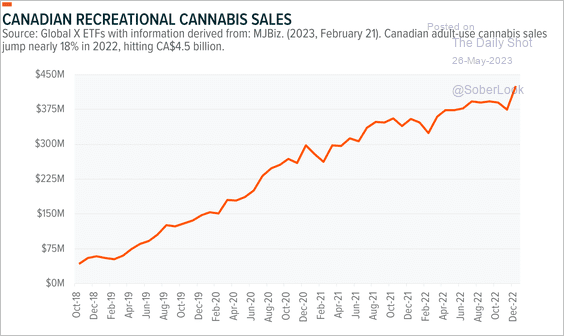

2. Recreational cannabis sales at licensed stores continue to rise.

Source: Global X ETFs Read full article

Source: Global X ETFs Read full article

Back to Index

The United Kingdom

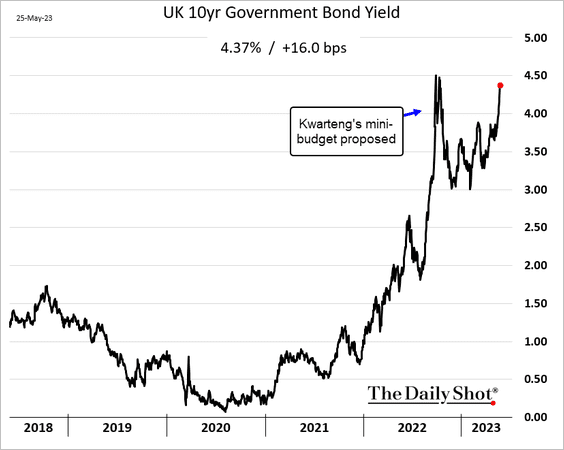

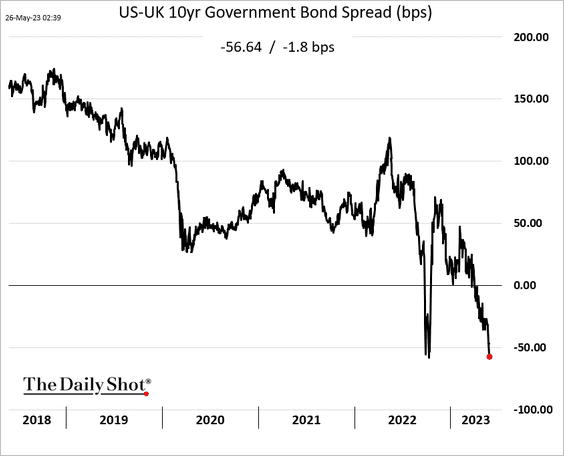

1. Gilt yields keep surging, …

… rapidly outpacing Treasuries.

——————–

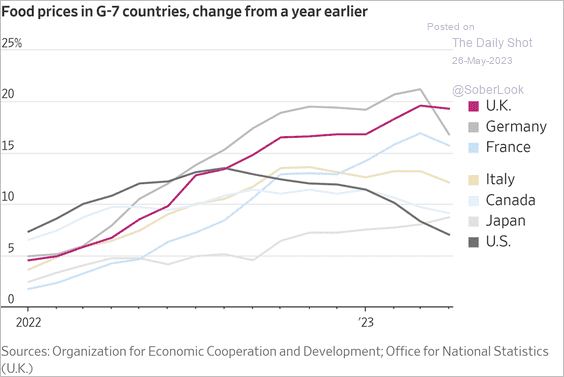

2. UK food inflation has surpassed that of other advanced economies.

Source: @WSJ Read full article

Source: @WSJ Read full article

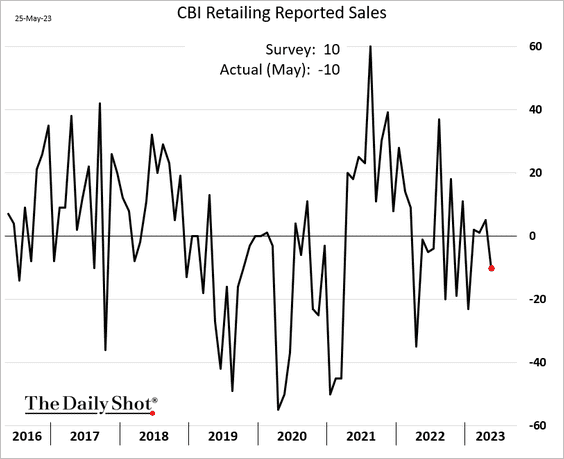

3. The CBI retail sales indicator declined in May.

Source: Reuters Read full article

Source: Reuters Read full article

——————–

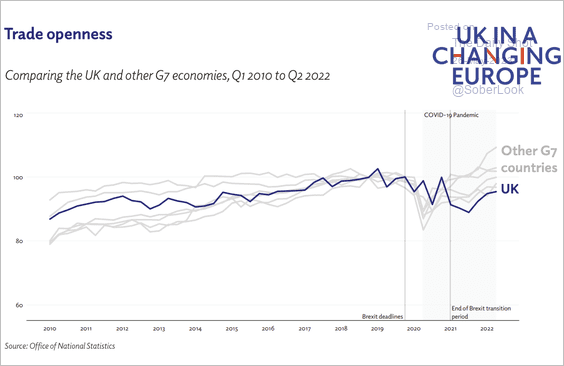

4. UK trade openness has been lagging.

Source: UK in a Changing Europe

Source: UK in a Changing Europe

Back to Index

The Eurozone

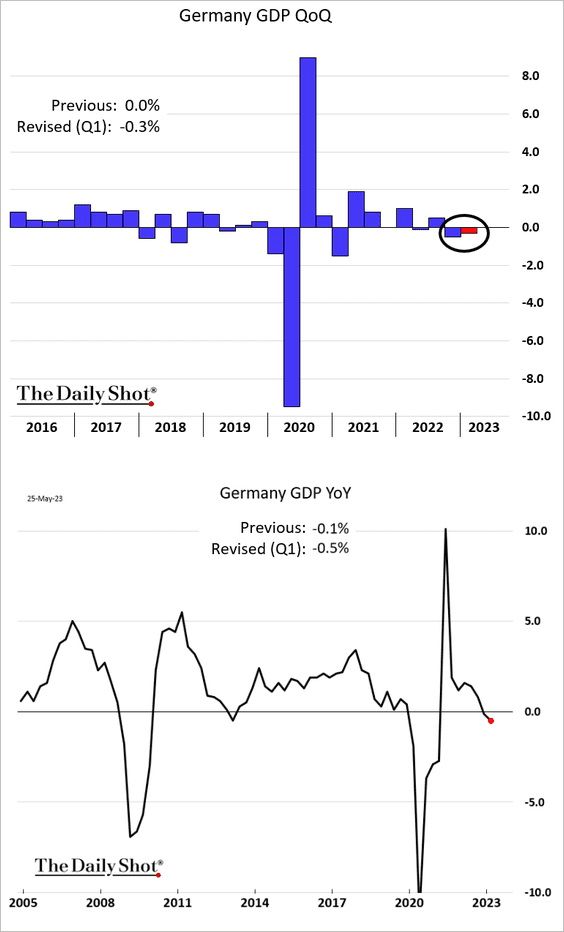

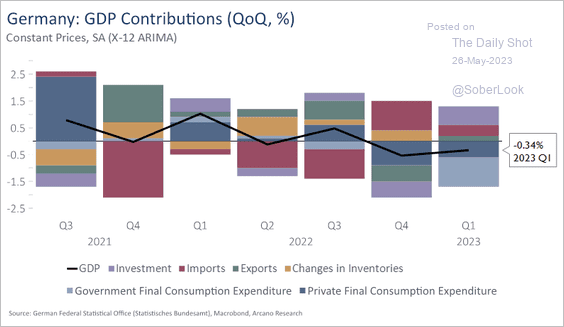

1. Germany’s revised Q1 GDP puts the country into technical recession.

Source: CNBC Read full article

Source: CNBC Read full article

Here are the contributions.

Source: Arcano Economics

Source: Arcano Economics

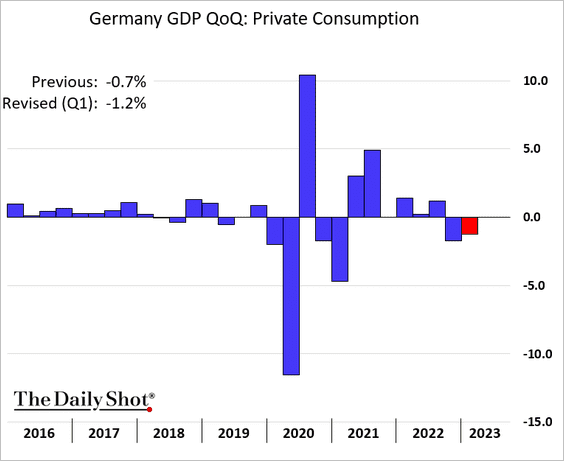

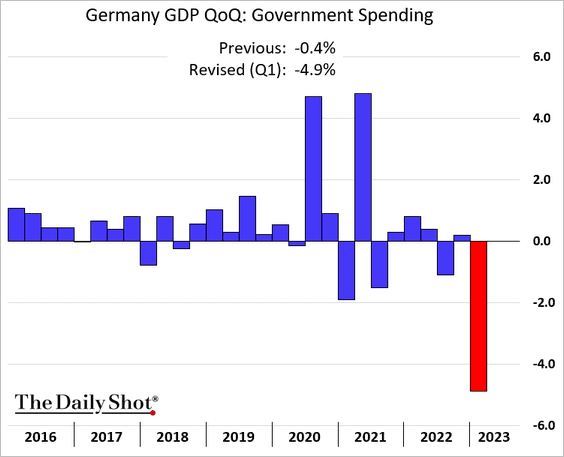

• Private consumption and government spending were revised lower.

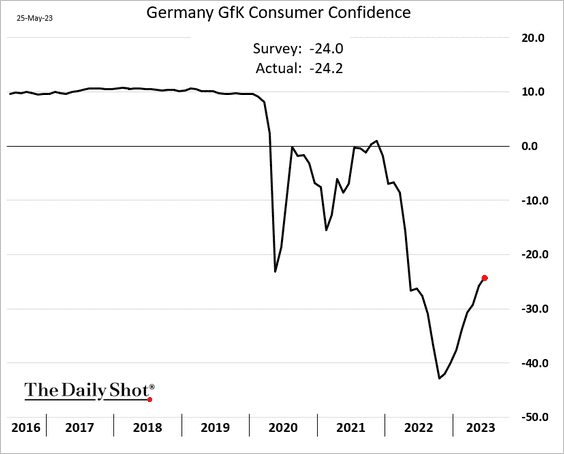

2. Germany’s consumer confidence continues to recover.

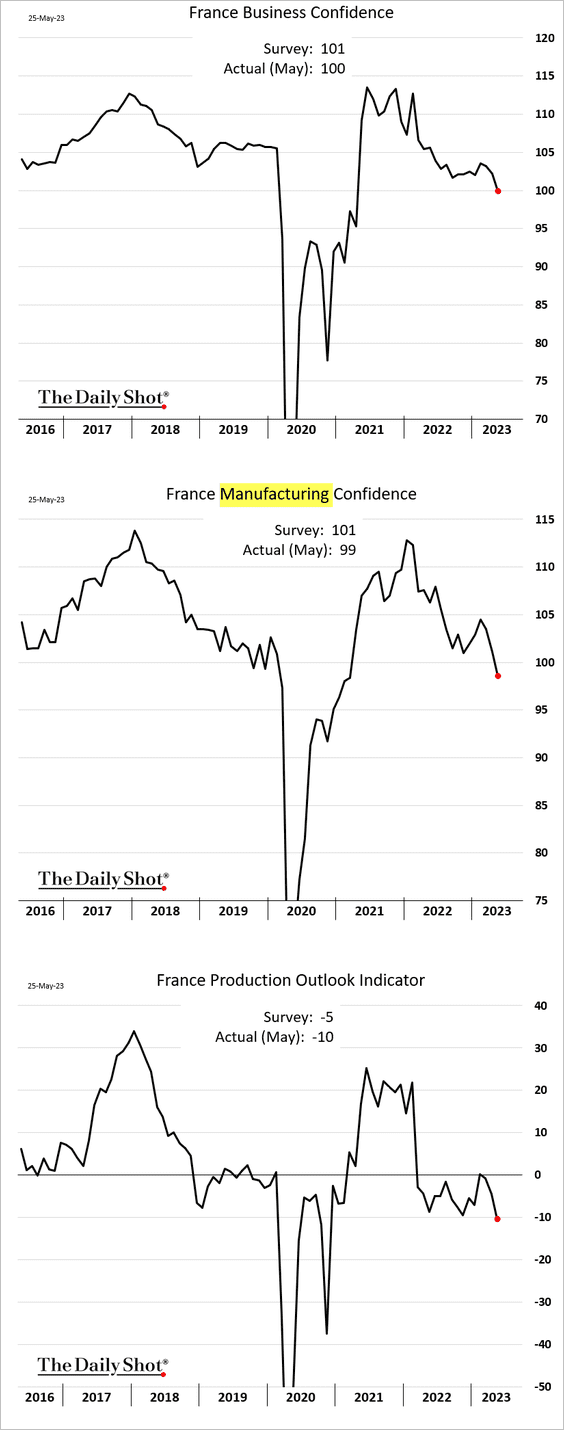

3. French business confidence is rolling over.

Source: ING Read full article

Source: ING Read full article

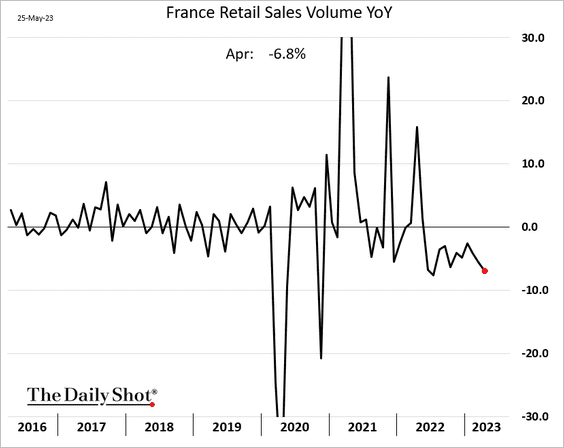

• French retail sales have been softening.

——————–

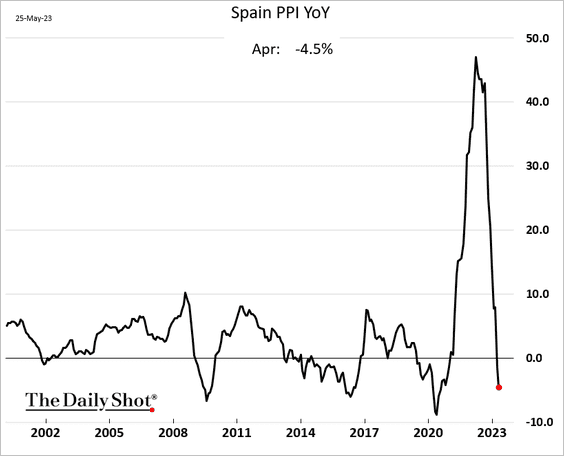

4. Spain’s PPI is now in negative territory.

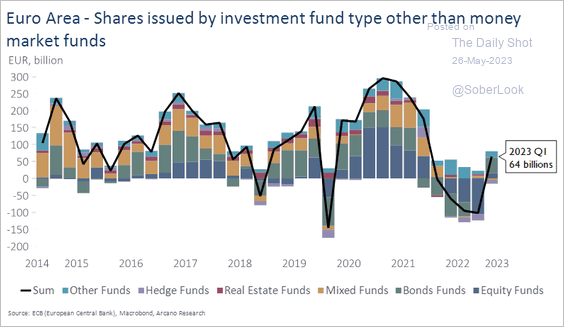

5. Fund outflows finally came to a halt.

Source: Arcano Economics

Source: Arcano Economics

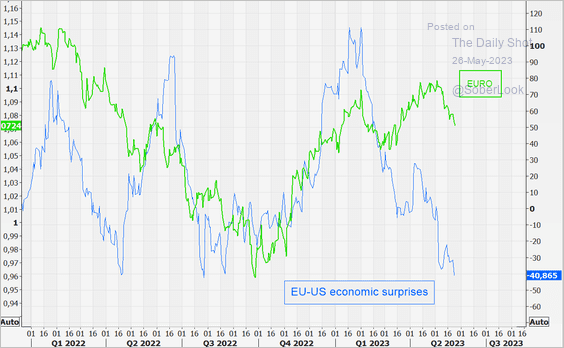

6. Weak economic surprises relative to the US are a headwind for the euro.

Source: @themarketear

Source: @themarketear

Back to Index

Europe

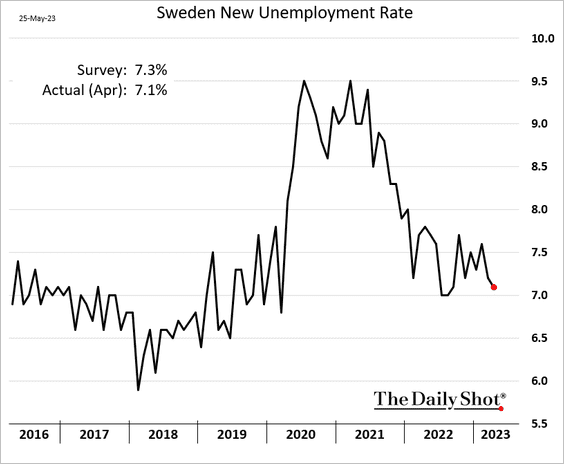

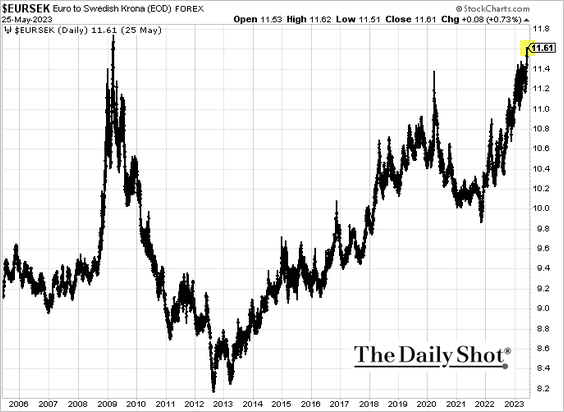

1. Sweden’s unemployment rate was lower than expected.

The Swedish krona is nearing the GFC lows vs. the euro.

——————–

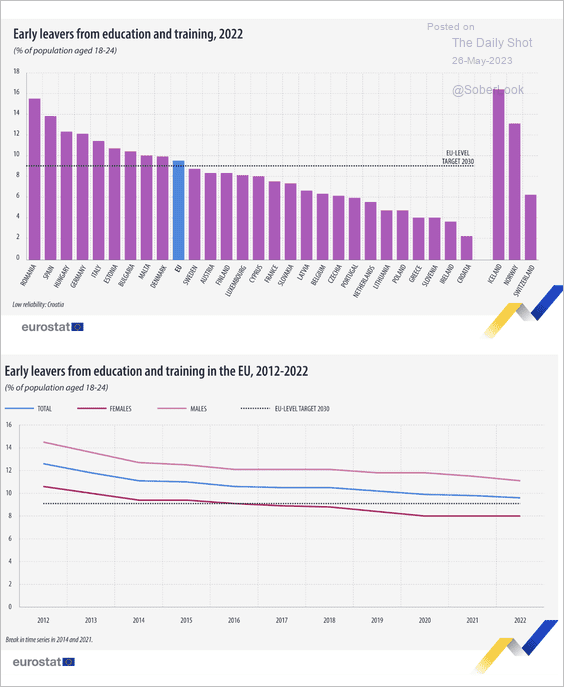

2. Who is quitting school in the EU? The chart shows people aged 18-24 leaving early from education and training.

Source: Eurostat Read full article

Source: Eurostat Read full article

Back to Index

Japan

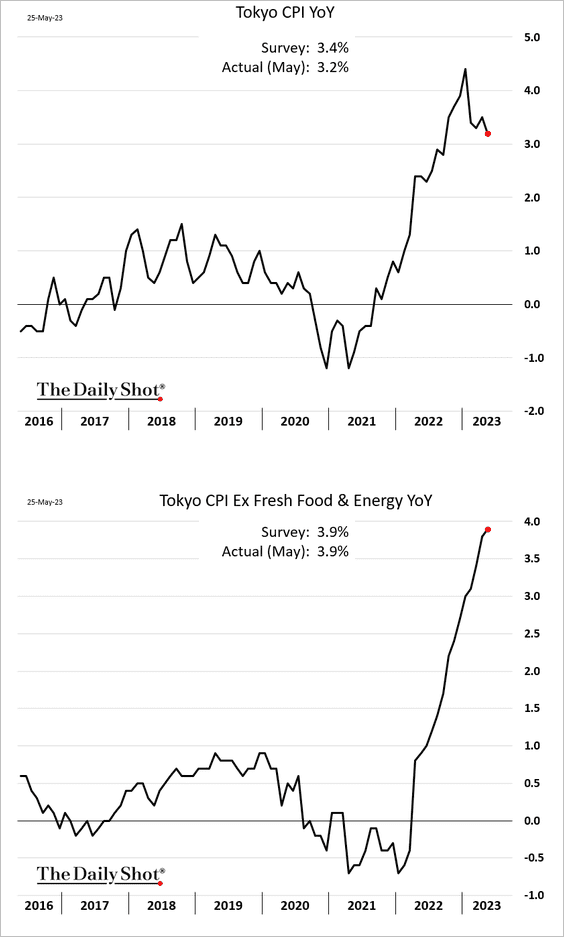

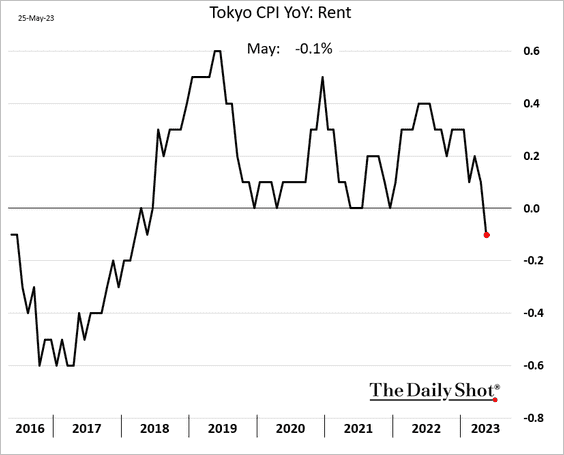

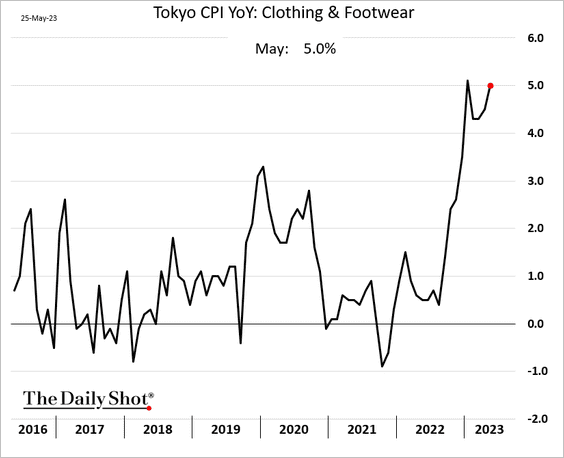

1. The Tokyo CPI declined in May, but the core index continues to climb.

Here are a couple of CPI components.

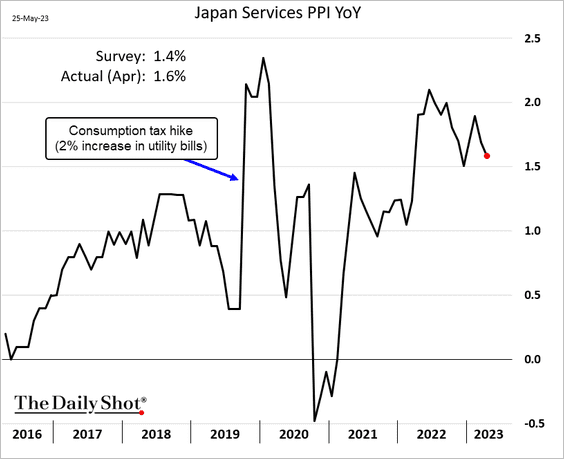

2. The services PPI topped expectations.

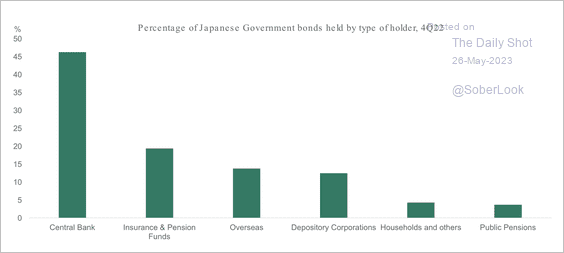

3. Roughly 46% of Japanese government debt is held by the BoJ.

Source: Torsten Slok, Apollo

Source: Torsten Slok, Apollo

Back to Index

Asia-Pacific

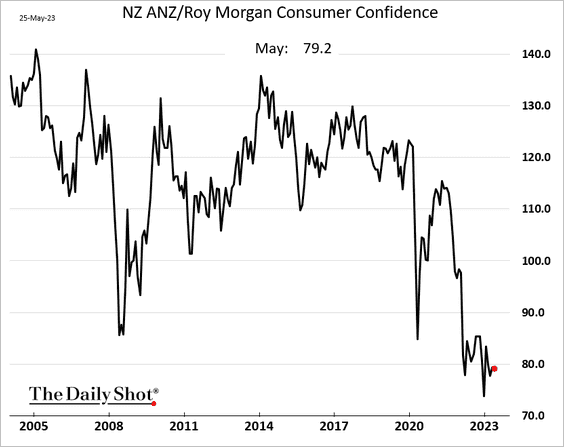

1. New Zealand’s consumer confidence remains depressed.

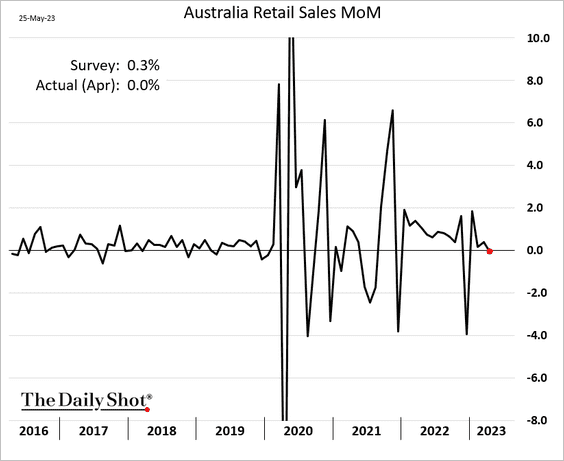

2. Australia’s retail sales were flat last month (an increase was expected).

Source: @WSJ Read full article

Source: @WSJ Read full article

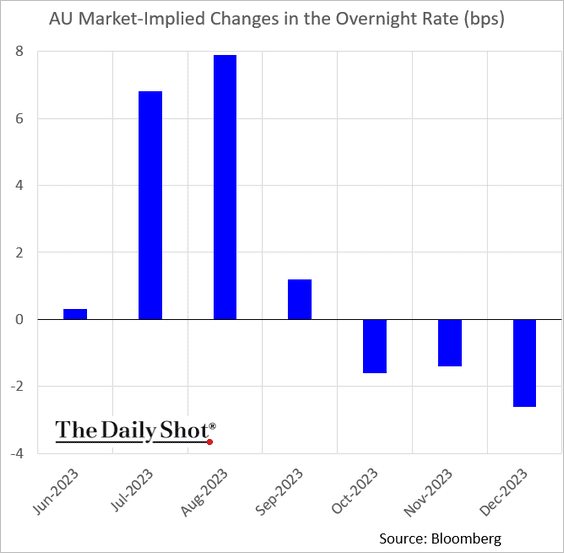

The market sees the RBA holding rates unchanged in June.

Back to Index

China

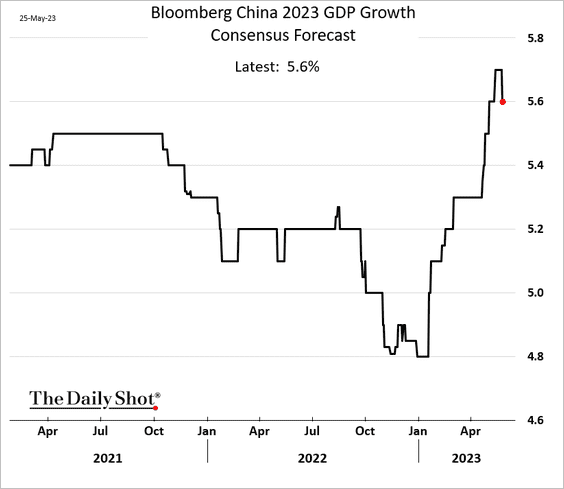

1. Economists downgraded the 2023 GDP projections, but growth is expected to be robust.

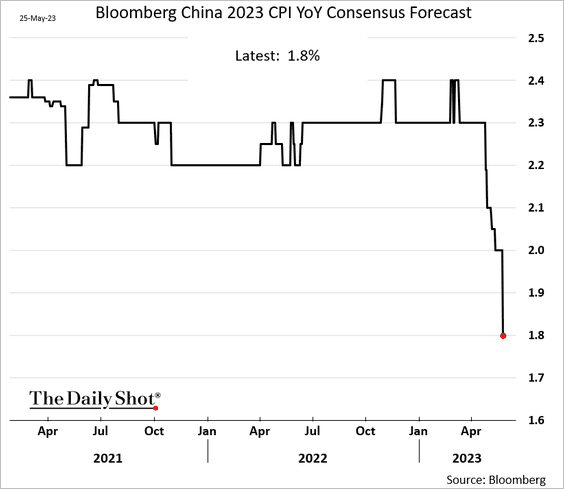

Economists continue to lower China’s CPI forecasts.

——————–

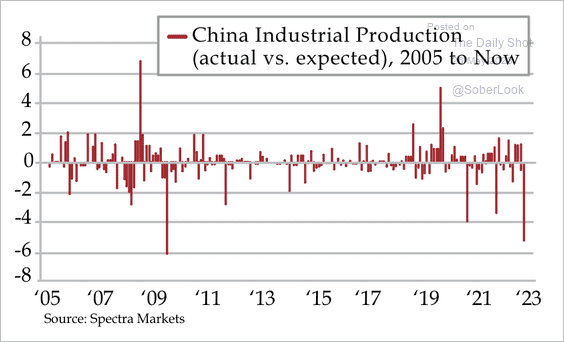

2. Industrial production has been far short of expectations.

Source: Quill Intelligence

Source: Quill Intelligence

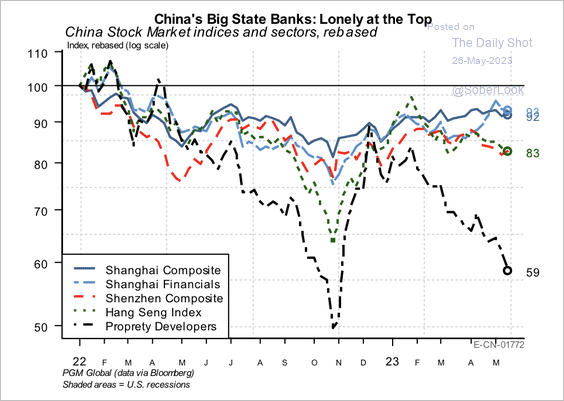

3. Large-cap bank stocks have held up as property developers underperform.

Source: PGM Global

Source: PGM Global

Back to Index

Emerging Markets

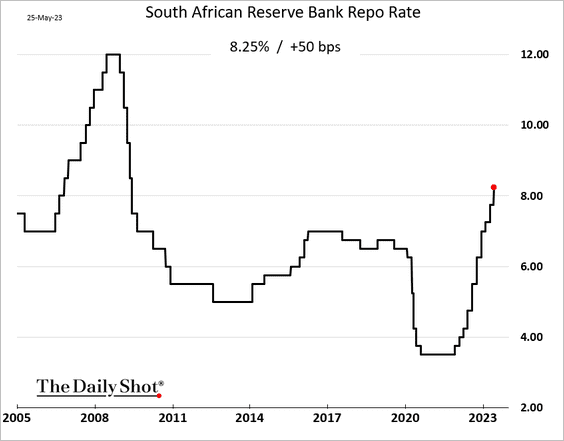

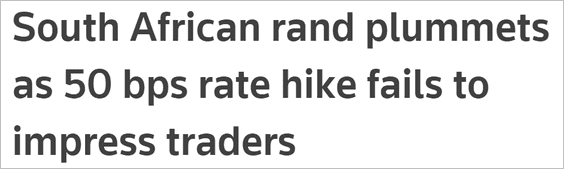

1. South Africa’s central bank hiked rates again.

Source: Reuters Read full article

Source: Reuters Read full article

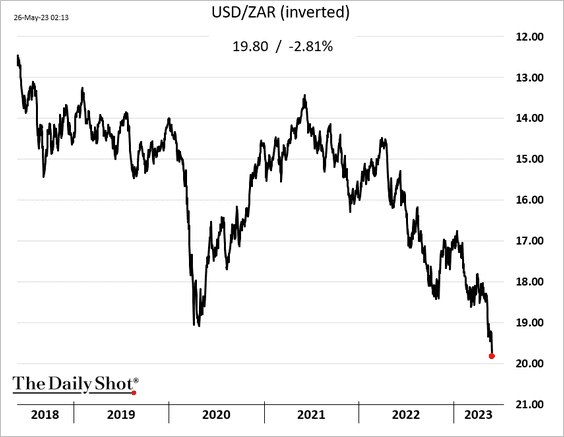

• The rand tumbled to record lows.

Source: Reuters Read full article

Source: Reuters Read full article

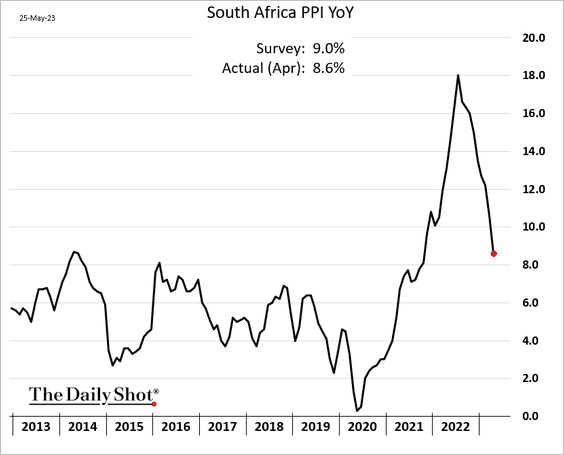

• The PPI continues to moderate.

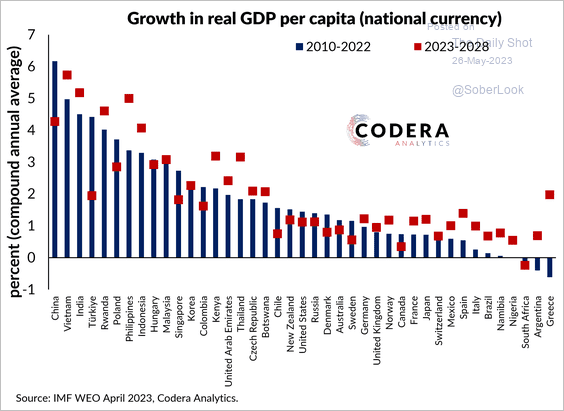

• South Africa is one of only a small number of large economies that have experienced a decline in GDP per capita since 2010. Notably, it is the sole country analyzed by the IMF that is projected to endure a continued decrease in per capita income.

Source: Codera Analytics Read full article

Source: Codera Analytics Read full article

——————–

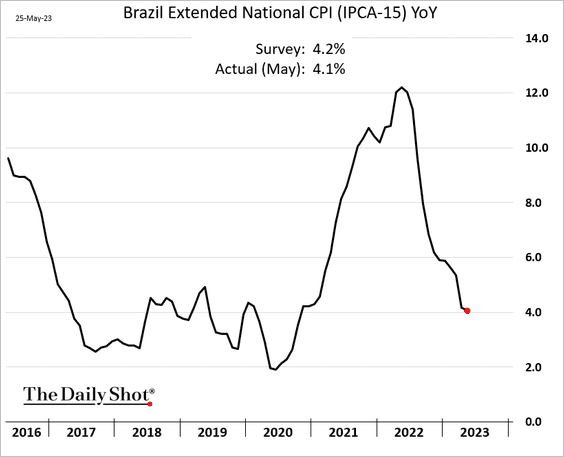

2. Brazil’s inflation continues to moderate.

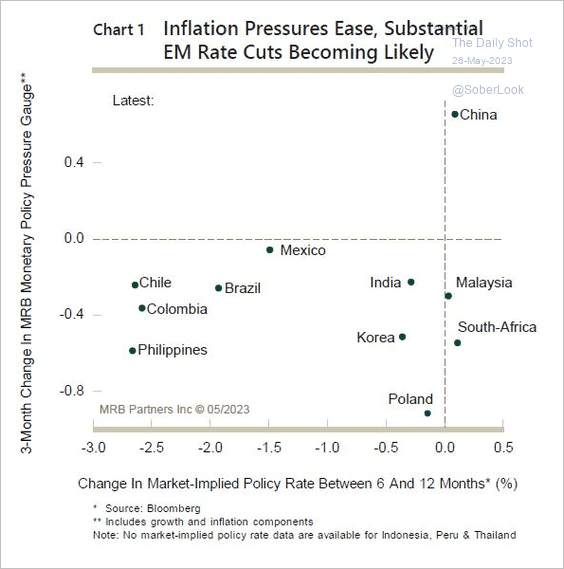

3. Easing inflation pressures could encourage rate cuts in some EM countries.

Source: MRB Partners

Source: MRB Partners

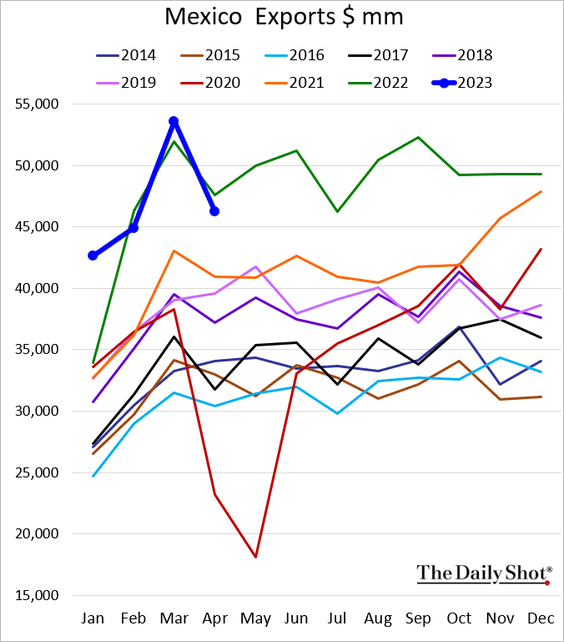

4. Mexico’s exports dipped below last year’s levels.

Back to Index

Cryptocurrency

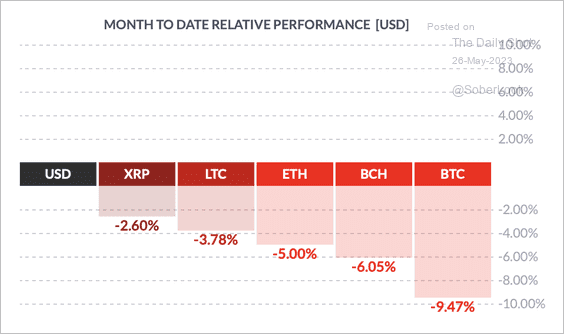

1. It has been a difficult month for cryptos, with bitcoin underperforming other main tokens.

Source: FinViz

Source: FinViz

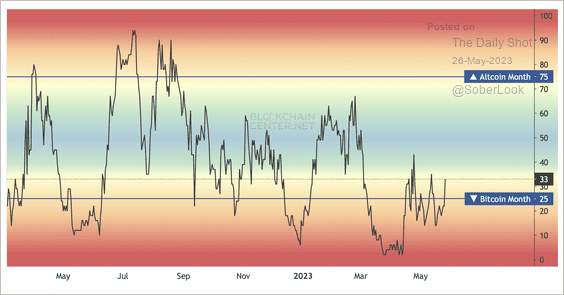

Still, only 33% of altcoins have outperformed bitcoin over the past month.

Source: Blockchain Center

Source: Blockchain Center

——————–

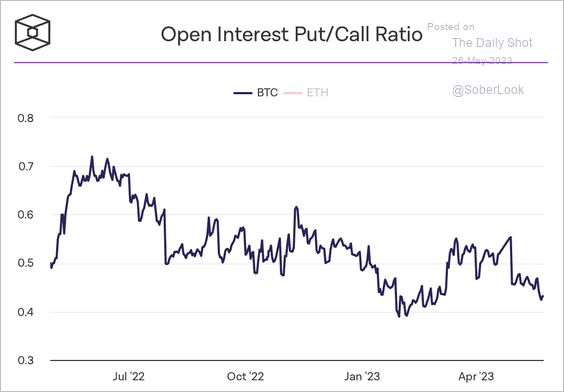

2. Bitcoin’s put/call ratio is trending lower.

Source: The Block Research

Source: The Block Research

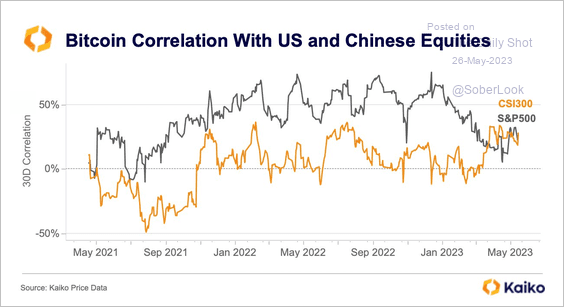

3. Bitcoin’s correlation with Chinese equities is now higher than its correlation with the S&P 500.

Source: KaikoData

Source: KaikoData

4. Binance may have commingled customer funds with company revenue, according to Reuters.

Source: Reuters Read full article

Source: Reuters Read full article

Back to Index

Commodities

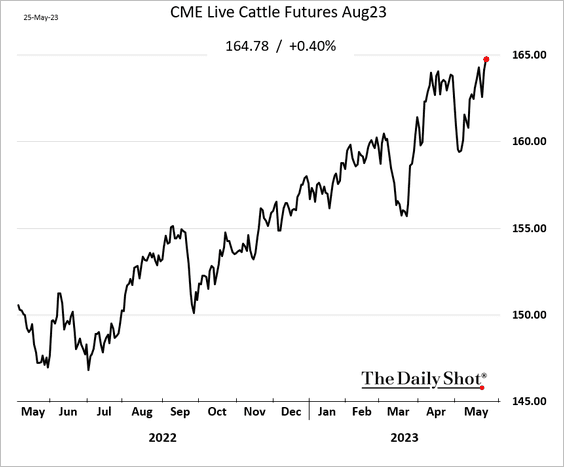

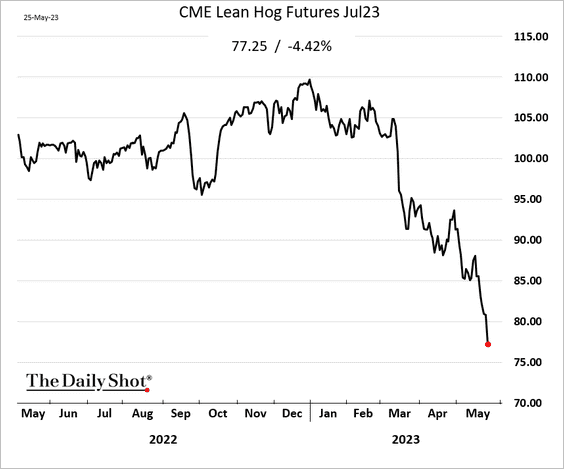

1. Beef is in, pork is out.

• Cattle futures:

• Lean hogs:

Source: Reuters Read full article

Source: Reuters Read full article

——————–

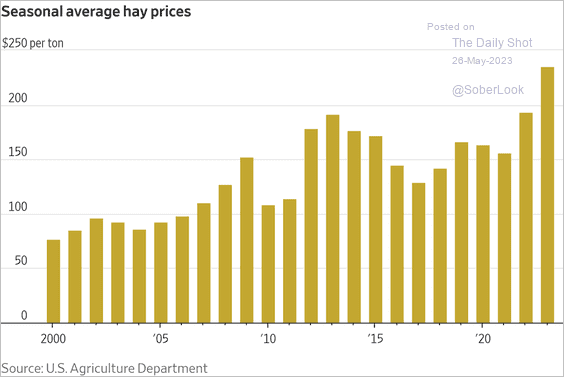

2. The severe drought in Plains states has inflicted significant damage on hay crops, resulting in surging prices.

Source: @WSJ Read full article

Source: @WSJ Read full article

Back to Index

Energy

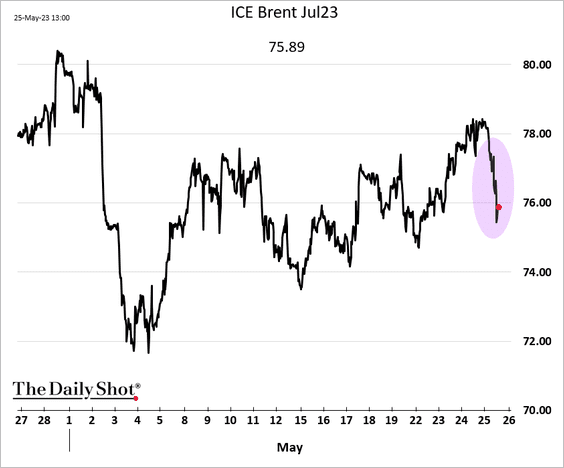

1. Oil futures declined on Thursday.

Source: Reuters Read full article

Source: Reuters Read full article

——————–

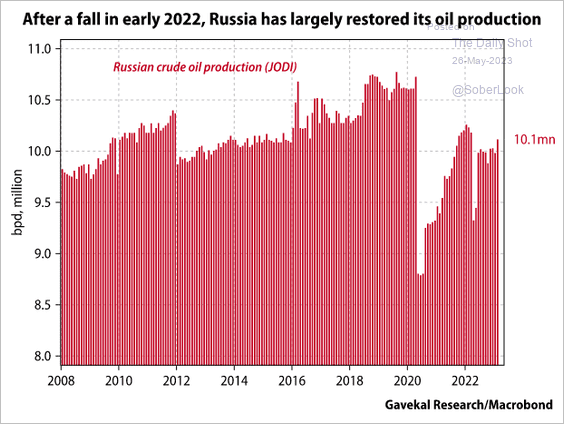

2. Russia’s oil production has been rebounding.

Source: Gavekal Research

Source: Gavekal Research

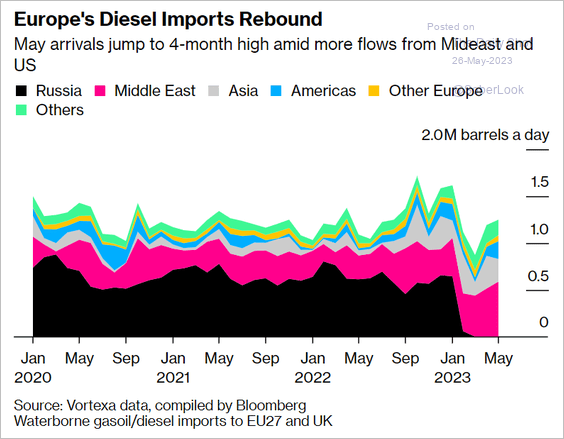

3. This chart shows Europe’s diesel imports.

Source: @CrowleyKev, @markets Read full article

Source: @CrowleyKev, @markets Read full article

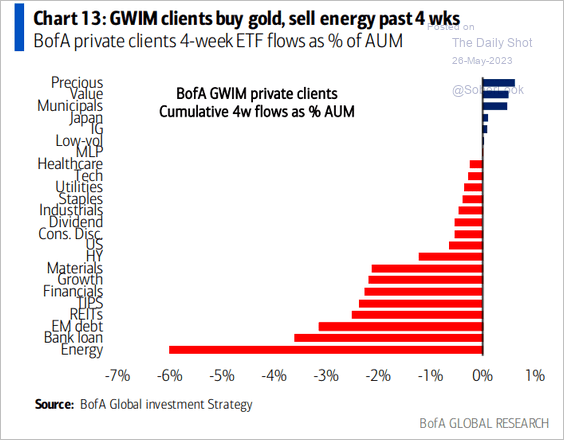

4. BofA’s private clients have been dumping energy stocks.

Source: BofA Global Research

Source: BofA Global Research

Back to Index

Equities

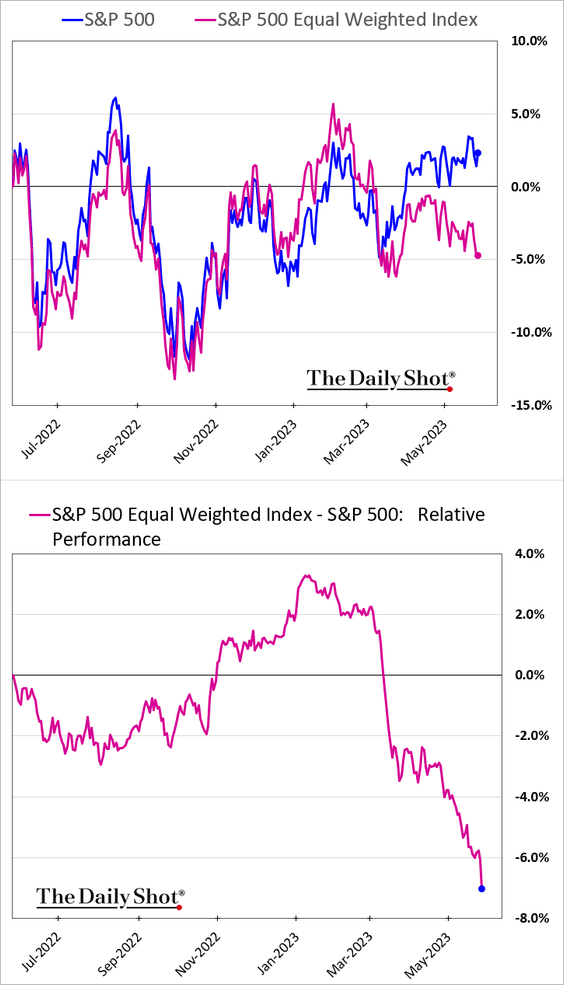

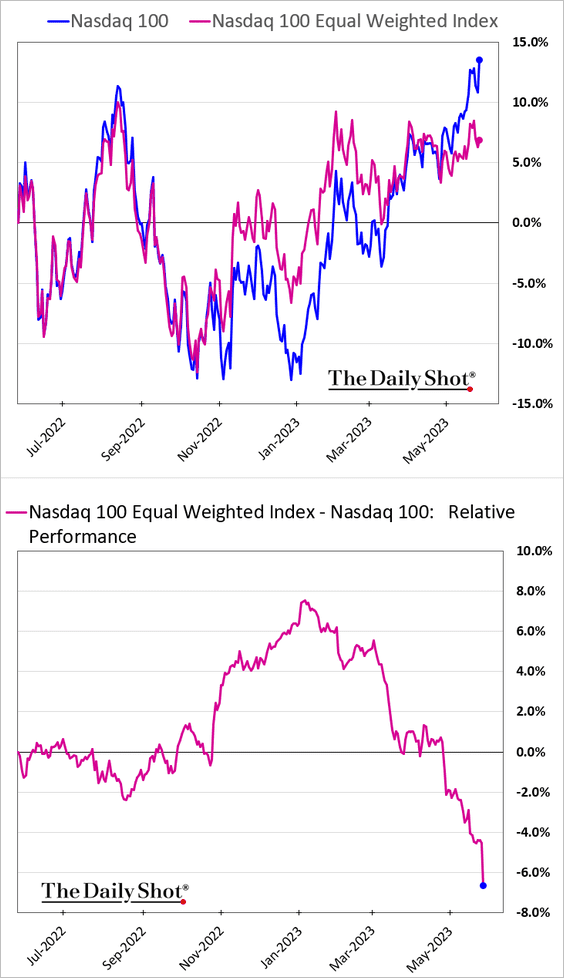

1. Equal-weighted indices continue to widen their underperformance as tech mega-caps surge.

– S&P 500:

– Nasdaq 100:

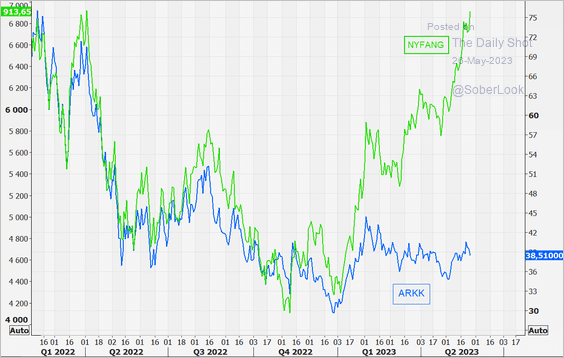

• Tech mega-caps have left the ARK Innovation ETF in the dust.

Source: @themarketear

Source: @themarketear

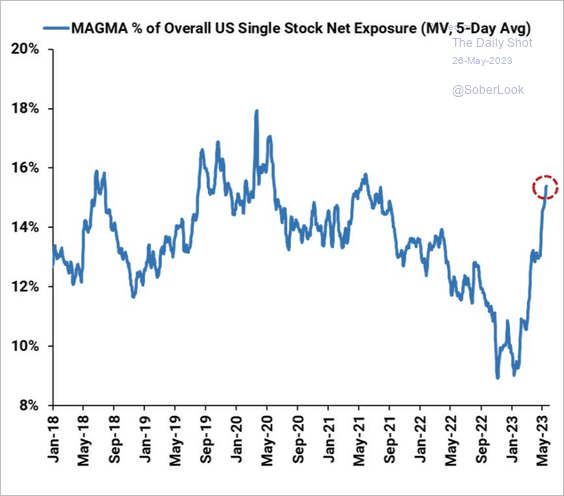

• Hedge funds have been boosting their exposure to tech mega-caps (based on GS prime brokerage data).

Source: Goldman Sachs; @carlquintanilla

Source: Goldman Sachs; @carlquintanilla

——————–

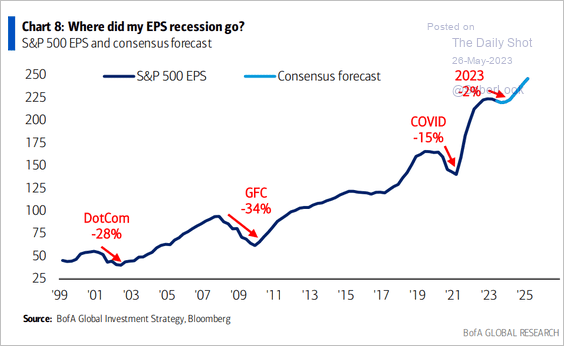

2. If consensus estimates prove accurate, the recent contraction in S&P 500 earnings appears relatively mild compared to historical trends.

Source: BofA Global Research

Source: BofA Global Research

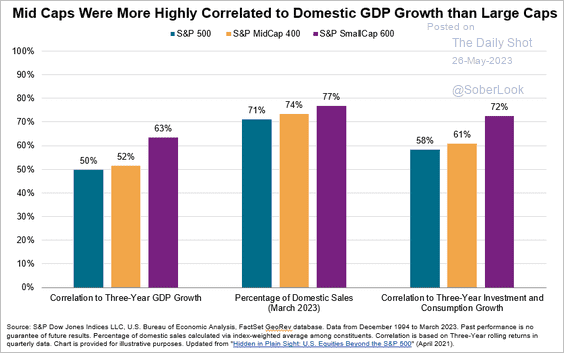

3. How do US stock indices correlate to domestic economic activity?

Source: S&P Dow Jones Indices

Source: S&P Dow Jones Indices

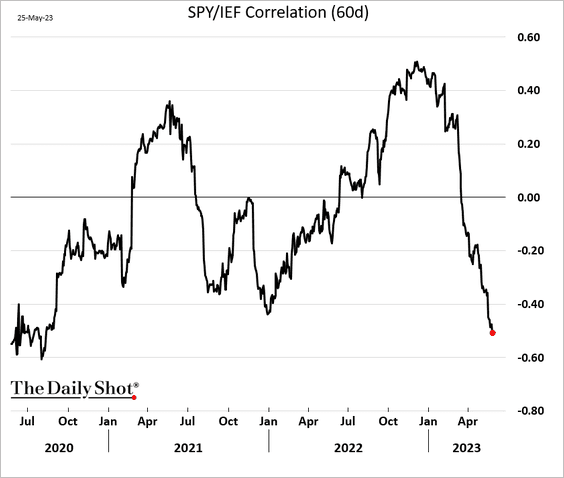

4. The stock-bond correlation continues to move deeper into negative territory.

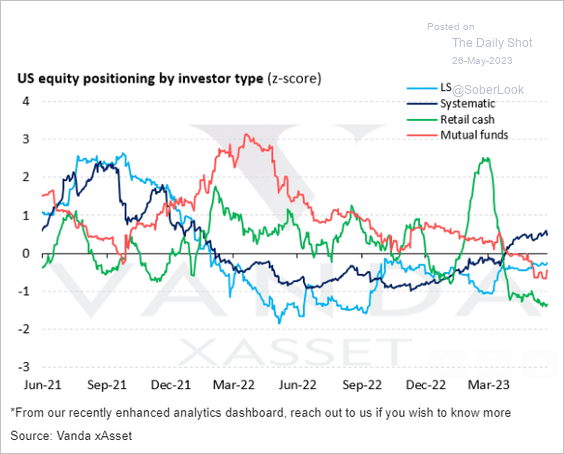

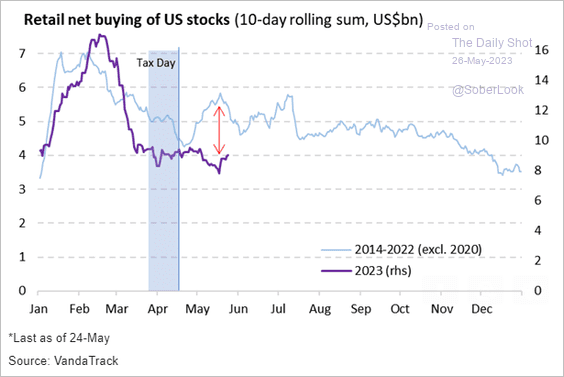

5. Retail investor positioning remains light.

Source: Vanda Research

Source: Vanda Research

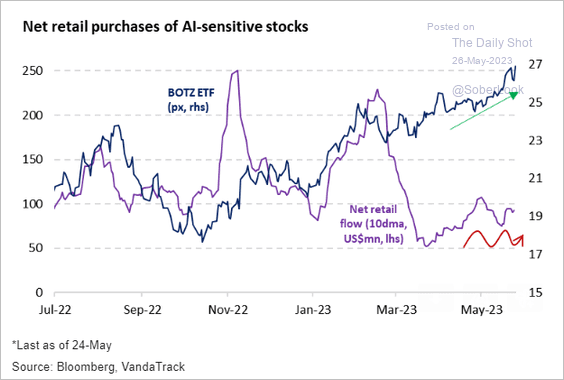

• Retail investors are not chasing the AI-fuelled rally.

Source: Vanda Research

Source: Vanda Research

• Tax refunds have not been driving retail stock purchasing this year.

Source: Vanda Research

Source: Vanda Research

——————–

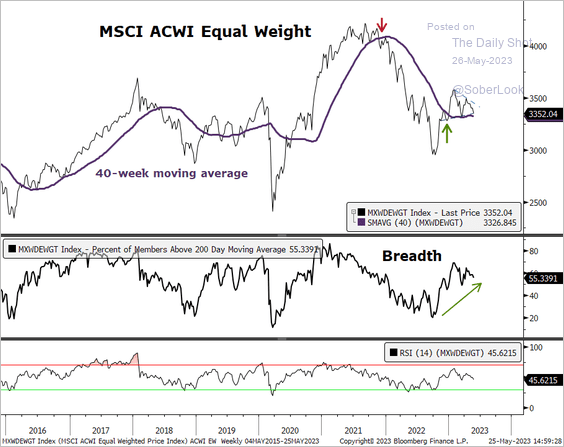

6. The MSCI ACWI Equal Weight Index (global stock index) is holding support with improving breadth.

Source: Aazan Habib, Paradigm Capital

Source: Aazan Habib, Paradigm Capital

Back to Index

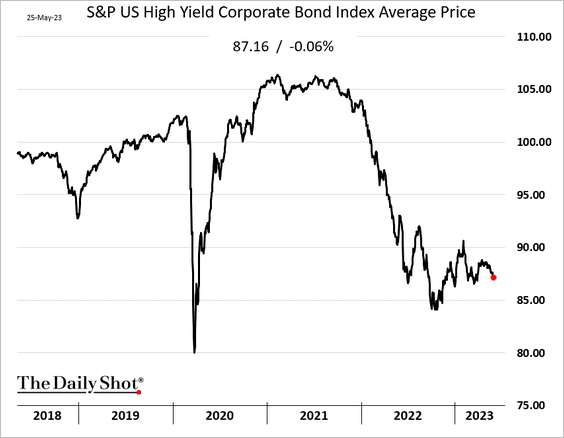

Credit

1. The average HY bond trades at 13% below par.

h/t BofA Global Research

h/t BofA Global Research

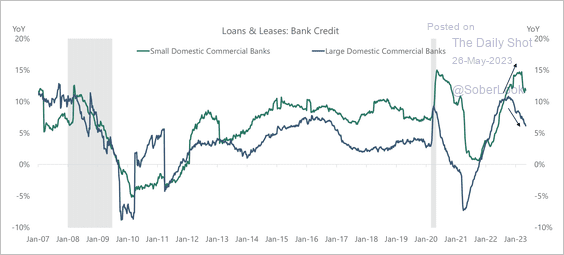

2. Small banks have driven lending growth over the past year.

Source: Torsten Slok, Apollo

Source: Torsten Slok, Apollo

Back to Index

Rates

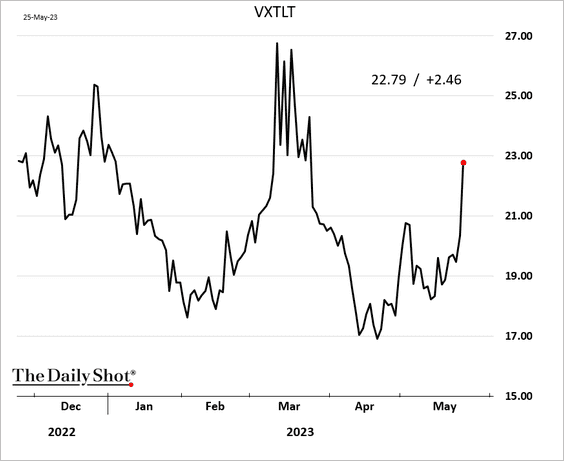

1. Longer-term Treasuries’ implied volatility rose sharply this week.

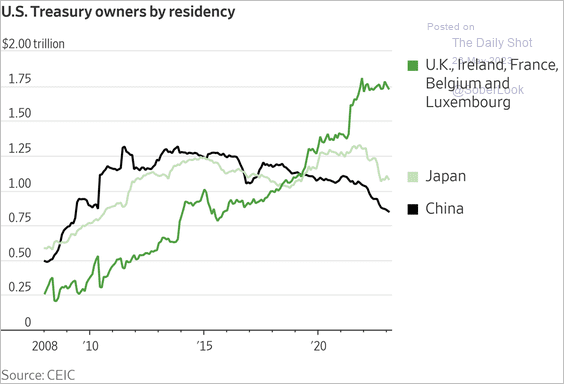

2. This chart shows selected foreign owners of US Treasury securities.

Source: @WSJ Read full article

Source: @WSJ Read full article

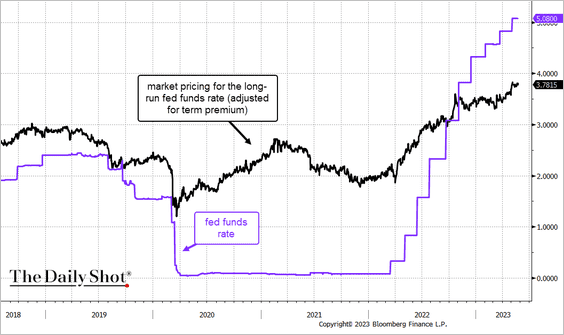

3. The US policy rate is about 130 bps above the market expectations for the long-run fed funds rate.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

Back to Index

Global Developments

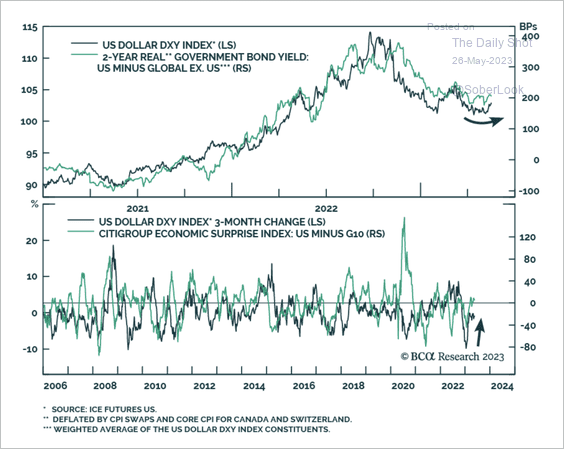

1. The dollar’s recent bounce occurred alongside positive US economic surprises relative to other G10 nations. Slightly wider interest rate differentials also helped.

Source: BCA Research

Source: BCA Research

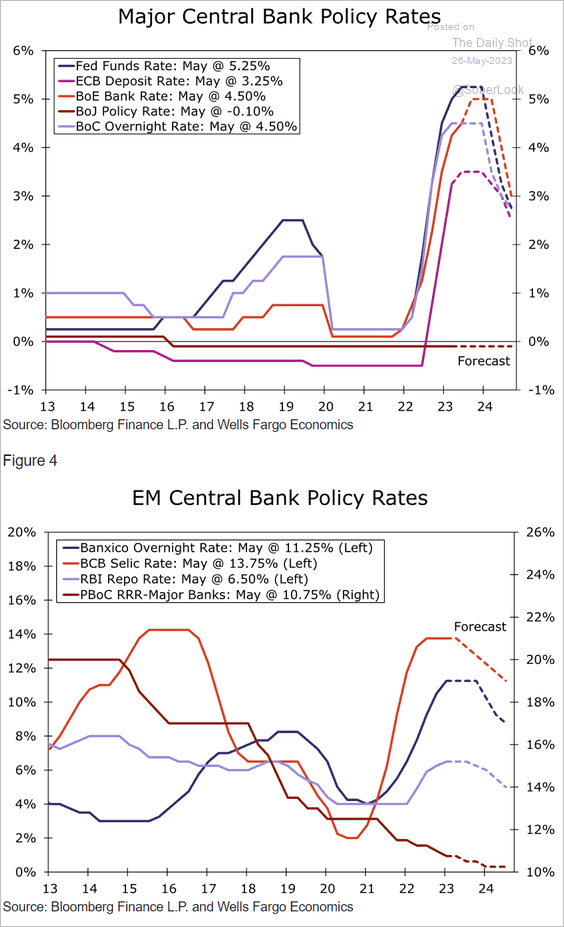

2. This chart shows Wells Fargo’s projections for key policy rates.

Source: Wells Fargo Securities

Source: Wells Fargo Securities

——————–

Food for Thought

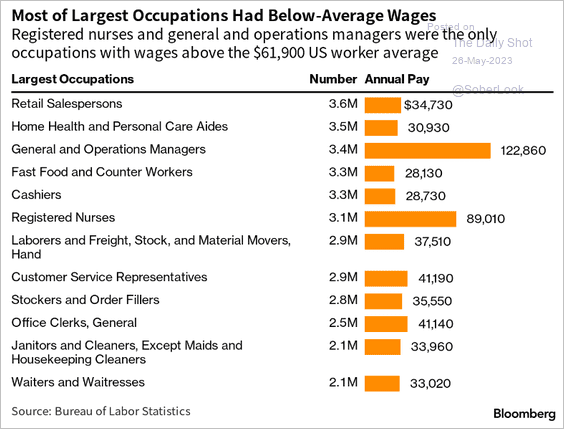

1. US wage data from the Bureau of Labor Statistics:

Source: Bloomberg Law Read full article

Source: Bloomberg Law Read full article

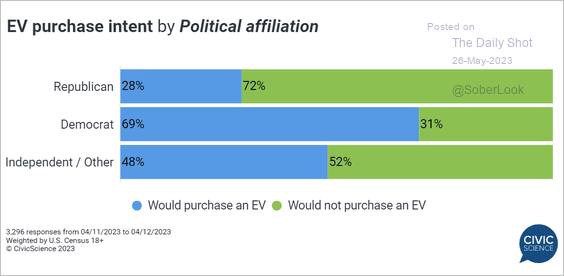

2. Who intends to buy an EV?

Source: @CivicScience Read full article

Source: @CivicScience Read full article

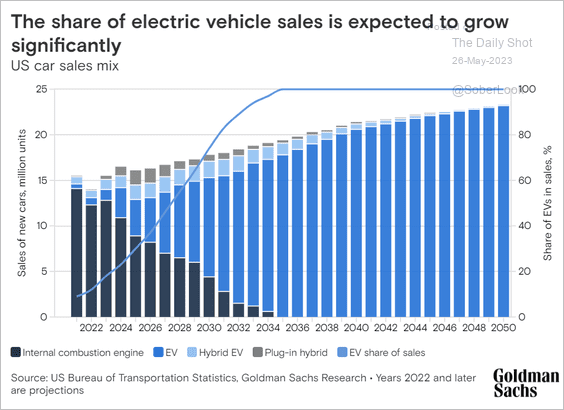

3. EV sales projections:

Source: Goldman Sachs

Source: Goldman Sachs

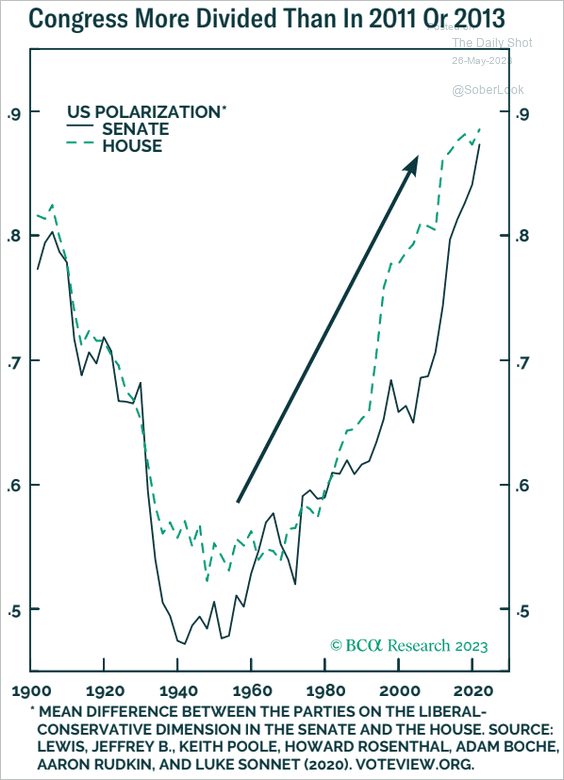

4. Polarization in the US Congress:

Source: BCA Research

Source: BCA Research

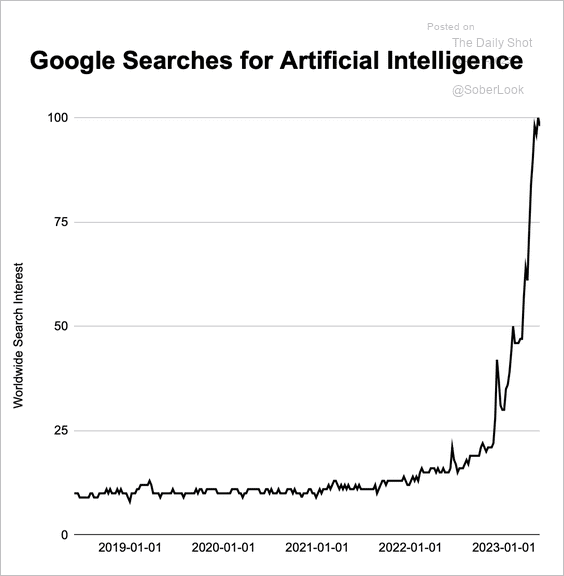

5. Google search frequency for “artificial intelligence”:

Source: Google Trends

Source: Google Trends

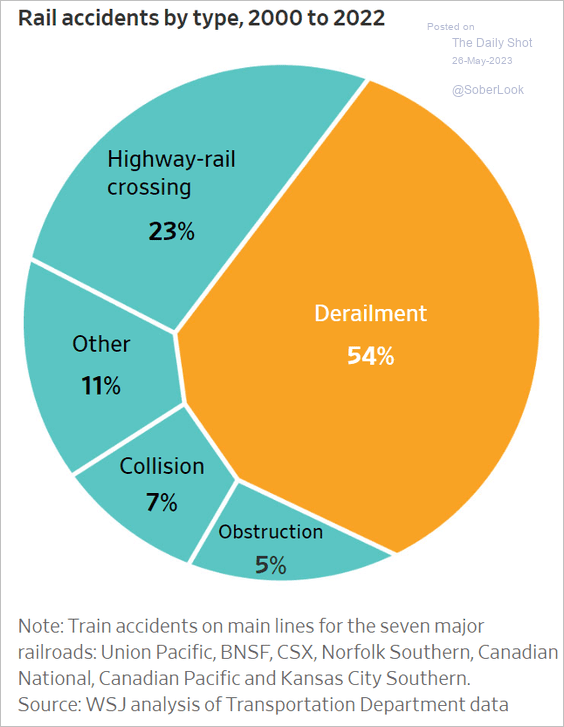

6. US rail accidents:

Source: @WSJ Read full article

Source: @WSJ Read full article

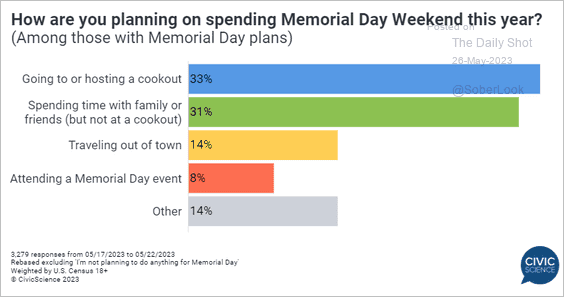

7. Memorial Day plans:

Source: @CivicScience Read full article

Source: @CivicScience Read full article

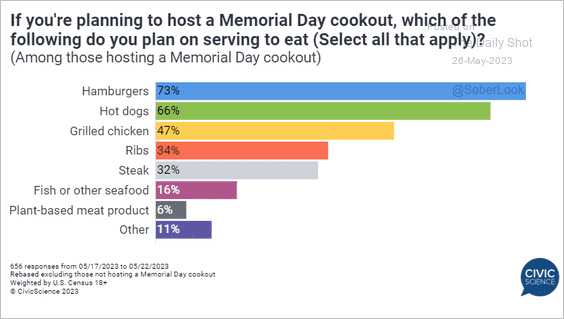

• Memorial Day cookout:

Source: @CivicScience Read full article

Source: @CivicScience Read full article

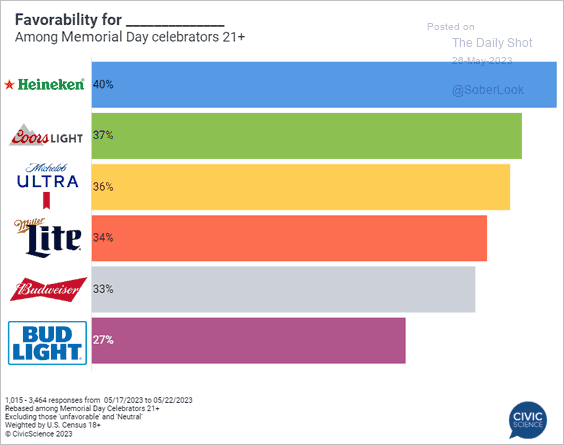

• Memorial Day preferred beer brands:

Source: @CivicScience Read full article

Source: @CivicScience Read full article

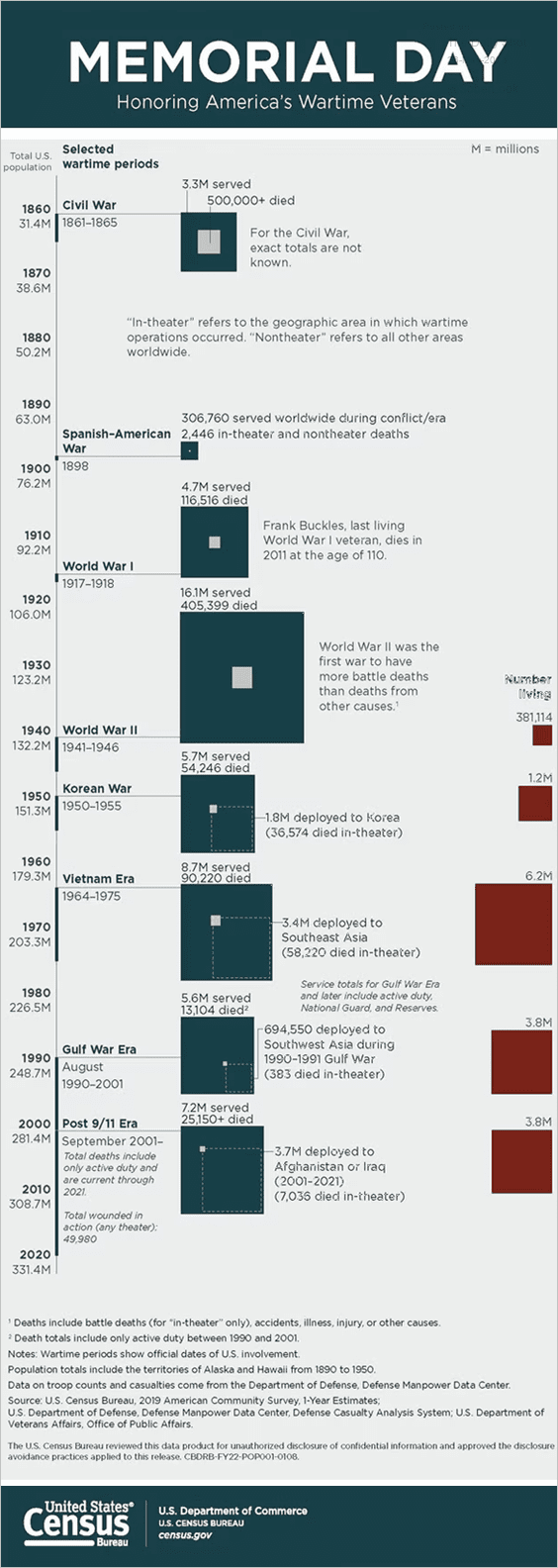

8. The number of Americans who served and died in each of the US wars:

Source: U.S. Census Bureau Read full article

Source: U.S. Census Bureau Read full article

——————–

The next Daily Shot will be out on Tuesday, May 30th.

Have a great weekend!

Back to Index