The Daily Shot: 31-May-23

• The United States

• The Eurozone

• Europe

• Japan

• Asia-Pacific

• China

• Emerging Markets

• Cryptocurrency

• Commodities

• Energy

• Equities

• Alternatives

• Credit

• Global Developments

• Food for Thought

The United States

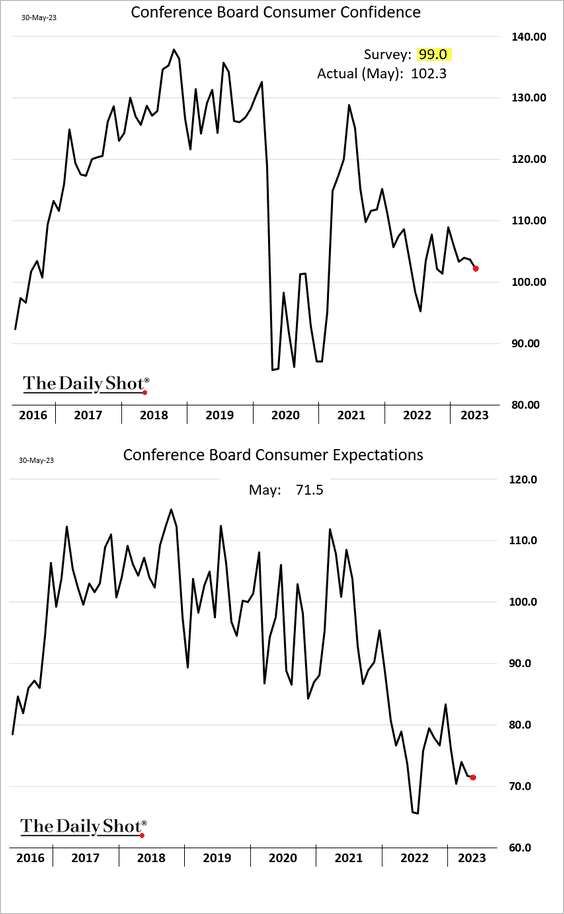

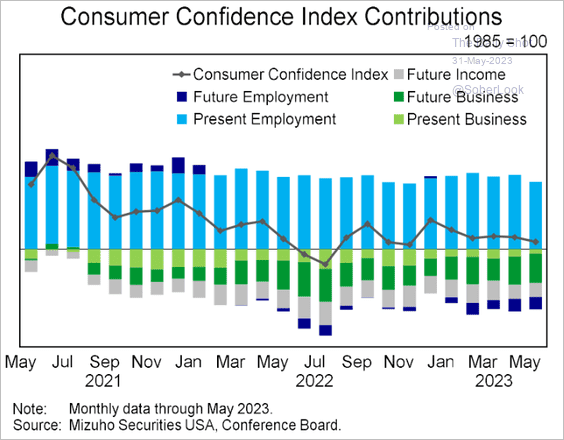

1. The Conference Board’s consumer confidence index declined in May but still topped expectations.

Source: Mizuho Securities USA

Source: Mizuho Securities USA

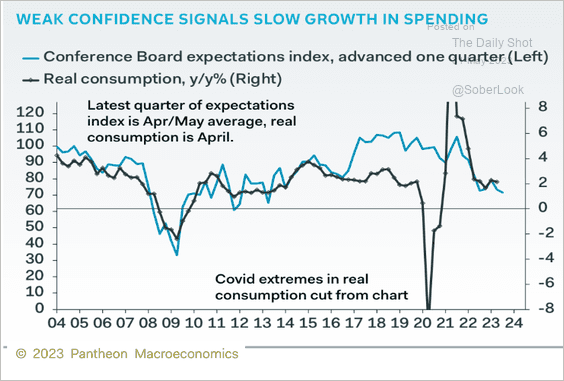

• Softer consumer expectations point to downside risks for household spending.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

• Households are becoming less upbeat about the labor market. The labor differential dropped.

Source: Reuters Read full article

Source: Reuters Read full article

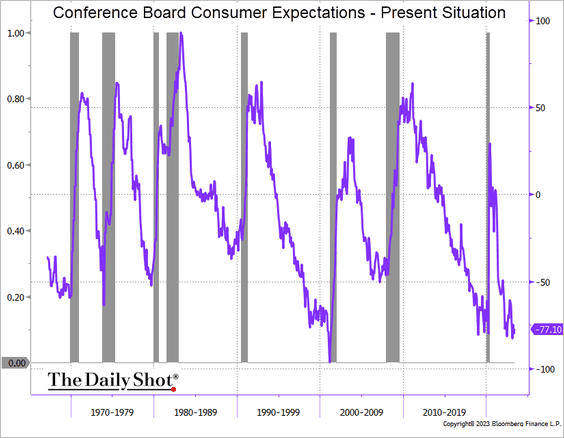

• The spread between expectations and current conditions remains in “pre-recession” territory.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

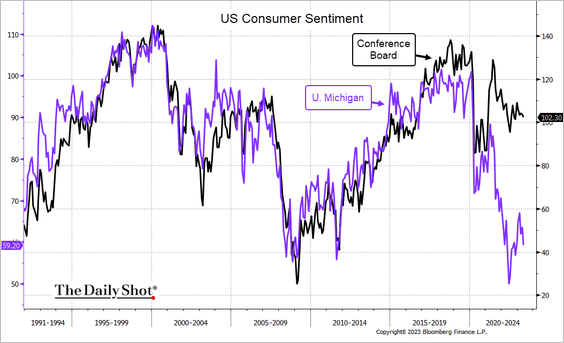

• The divergence between the two key sentiment indicators persists.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

——————–

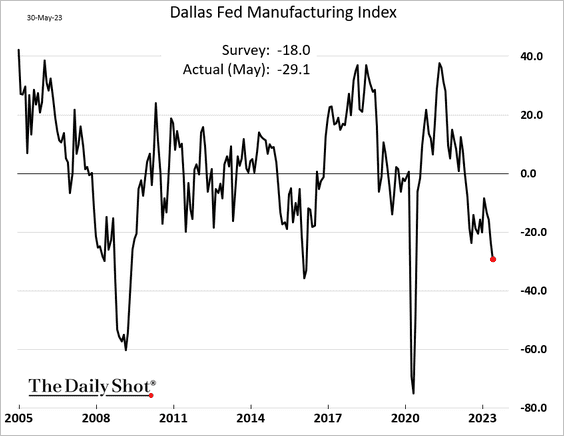

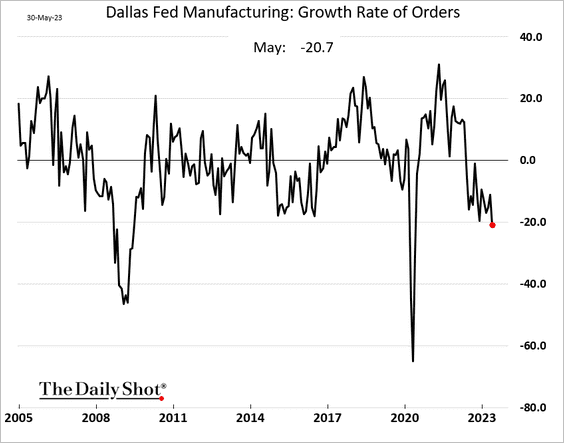

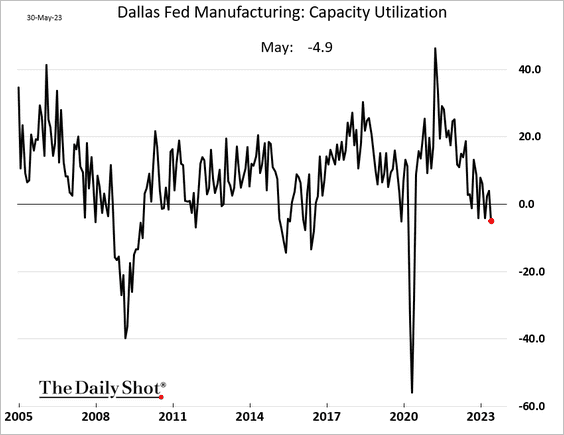

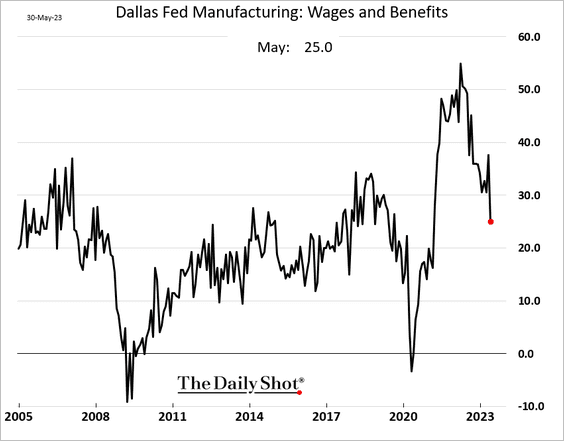

2. The Dallas Fed’s manufacturing index showed further deterioration in the region’s factory activity.

Here are some trends.

• Order growth:

• Capacity utilization:

• Wages:

• Prices:

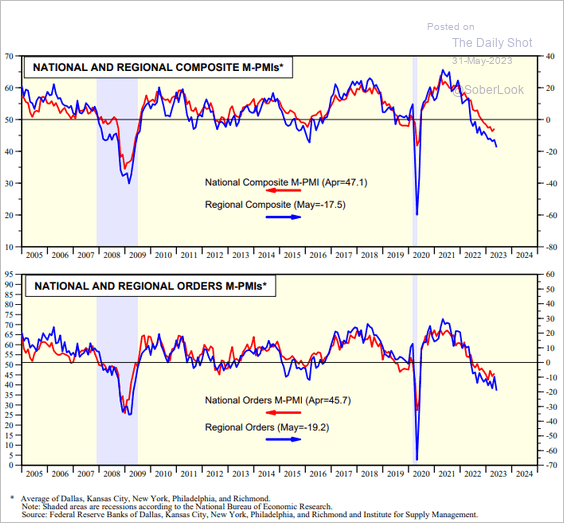

3. The regional Fed indices point to downside risks for factory activity at the national level (ISM).

Source: Yardeni Research

Source: Yardeni Research

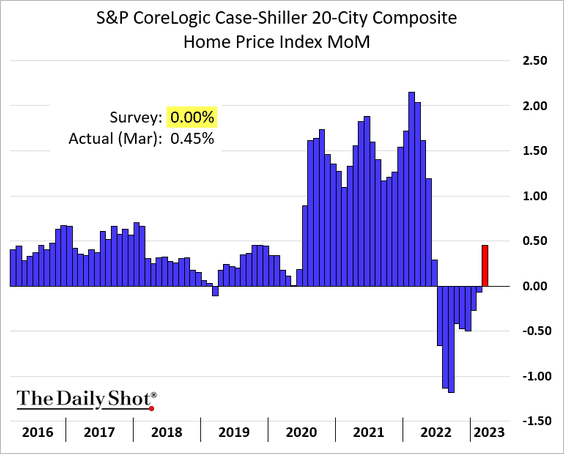

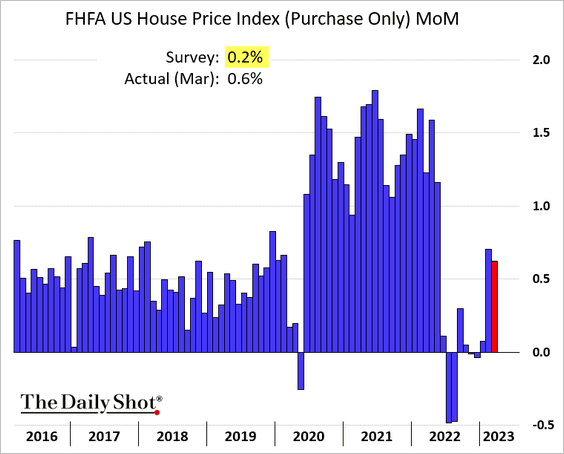

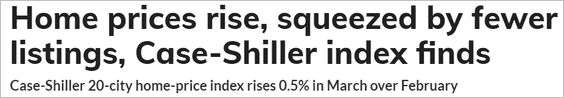

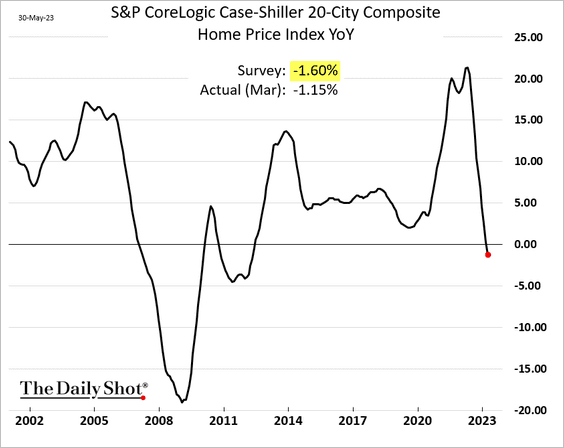

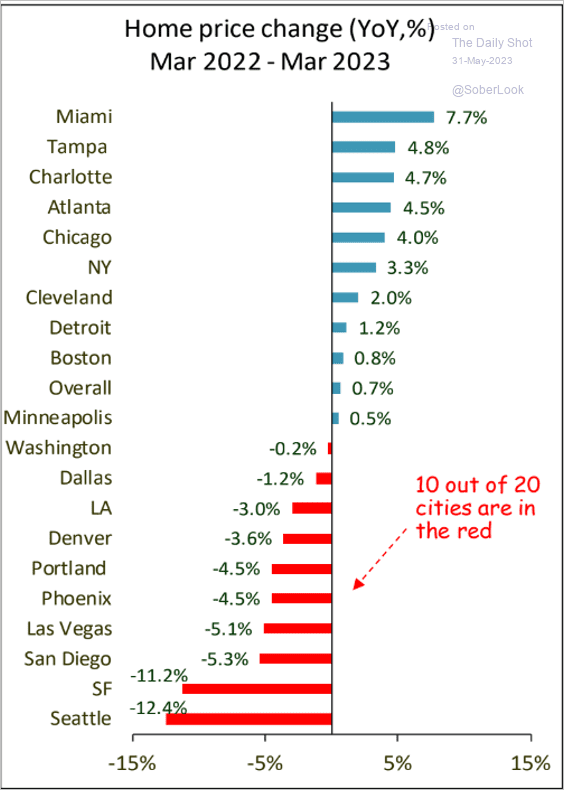

4. Next, we have some updates on the housing market.

• Home prices jumped in March.

Source: MarketWatch Read full article

Source: MarketWatch Read full article

– The Case Shiller 20-city index was down on a year-over-year basis.

Here are the changes by metro area (year-over-year).

Source: Piper Sandler

Source: Piper Sandler

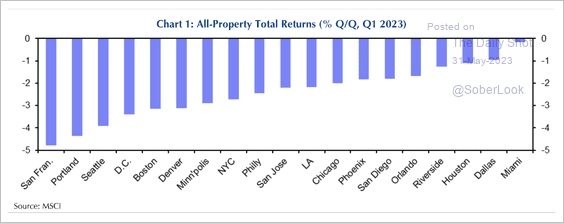

Property values declined in Q1, particularly in West Coast metro areas.

Source: Capital Economics

Source: Capital Economics

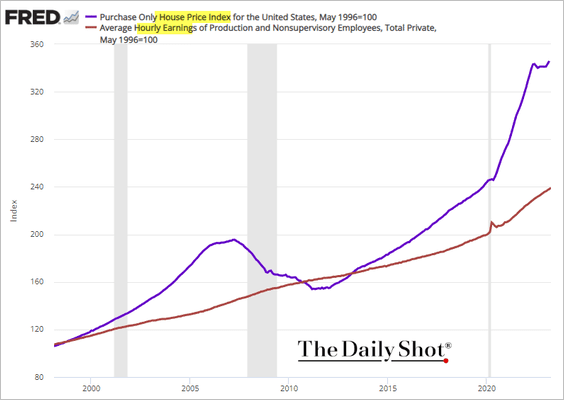

– The gap between home prices and wages widened further.

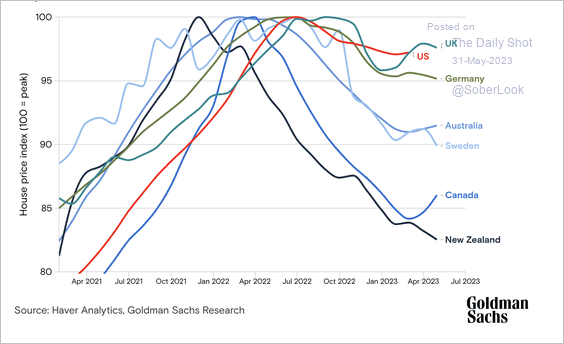

• US home prices are holding up well relative to other advanced economies.

Source: Goldman Sachs

Source: Goldman Sachs

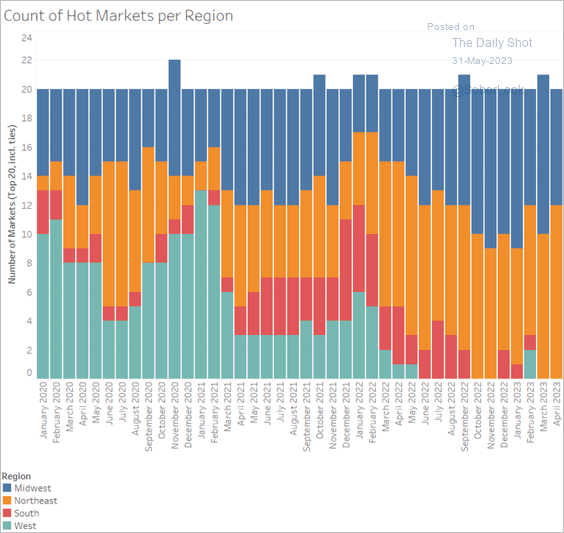

• Here is a look at hot housing markets by region.

Source: Realtor.com

Source: Realtor.com

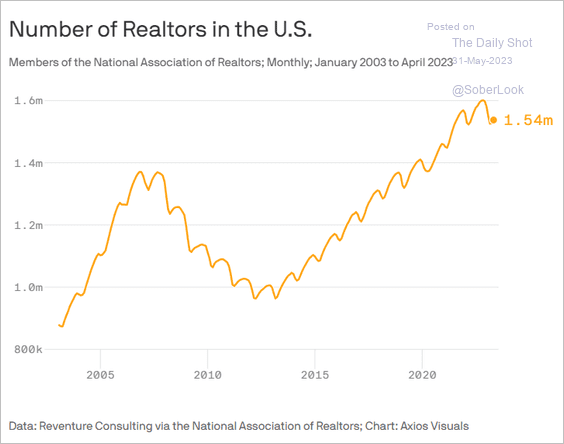

• The number of US realtors is rolling over.

Source: @axios Read full article

Source: @axios Read full article

——————–

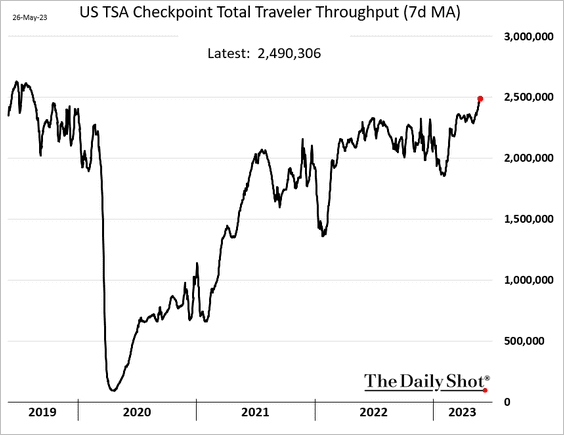

5. Air travel has fully recovered.

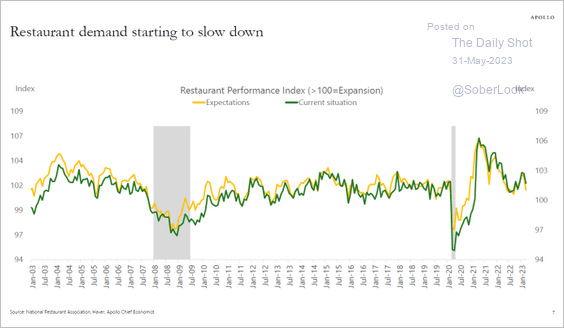

But restaurant activity is slowing.

Source: Torsten Slok, Apollo

Source: Torsten Slok, Apollo

——————–

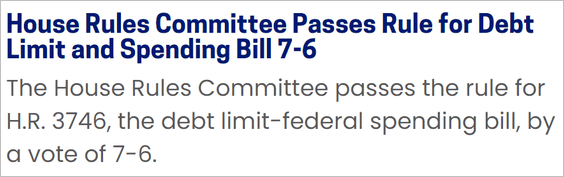

6. The debt limit legislation is now proceeding to the full House of Representatives, where it is set to undergo deliberation, followed by a projected vote on Wednesday.

Source: CSPAN Read full article

Source: CSPAN Read full article

US sovereign CDS spreads tightened sharply.

——————–

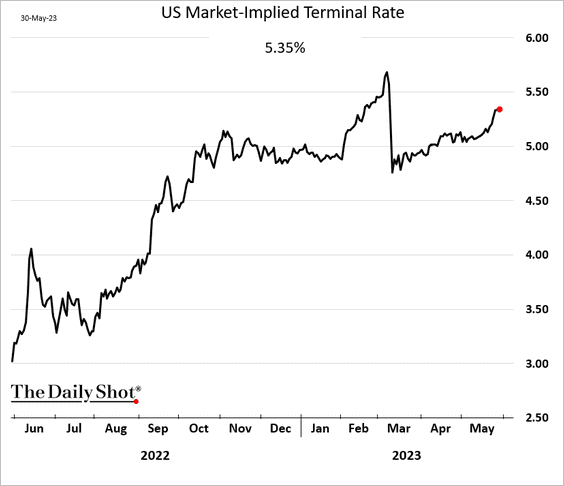

7. With the debt ceiling resolution on the horizon, some Fed officials are gunning for more rate hikes.

Source: @financialtimes Read full article

Source: @financialtimes Read full article

The implied terminal rate hit 5.35% (27 bps above the current fed funds rate).

Back to Index

The Eurozone

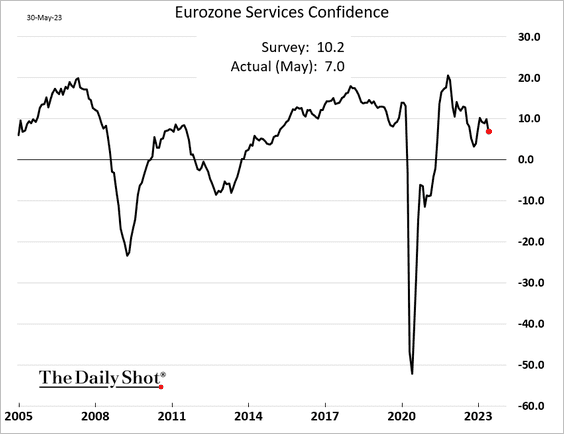

1. Business confidence among service firms declined in May.

Manufacturing sentiment deteriorated further.

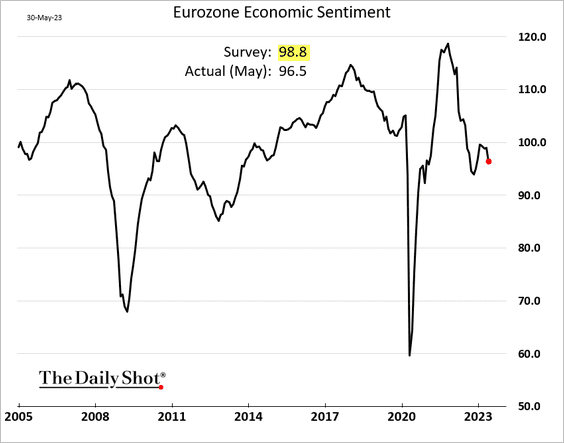

Here is the economic sentiment, which includes consumer confidence.

——————–

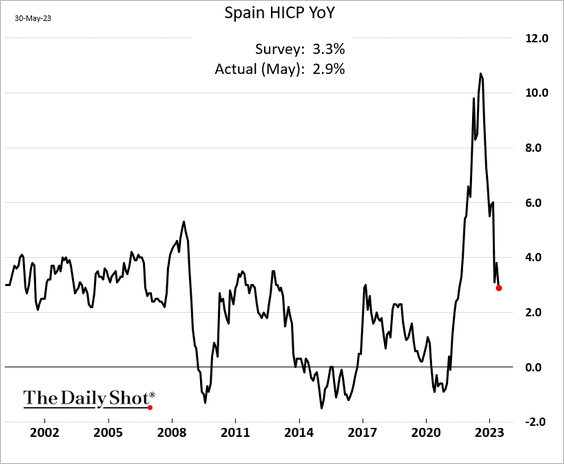

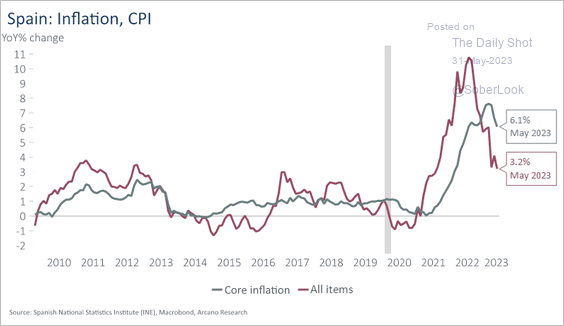

2. Spanish consumer inflation slowed more than expected.

This chart shows the national CPI, with core inflation still elevated.

Source: Arcano Economics

Source: Arcano Economics

——————–

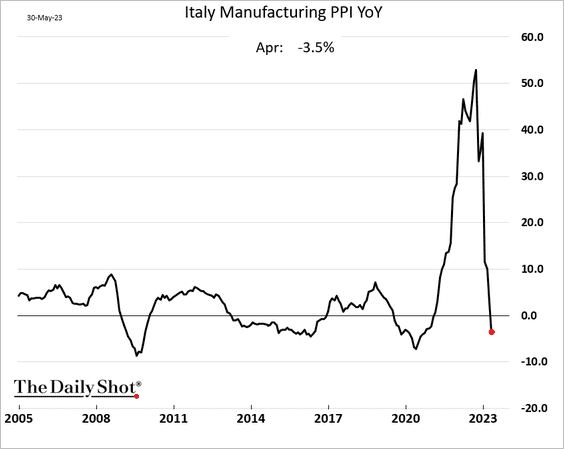

3. Italy’s PPI is in negative territory.

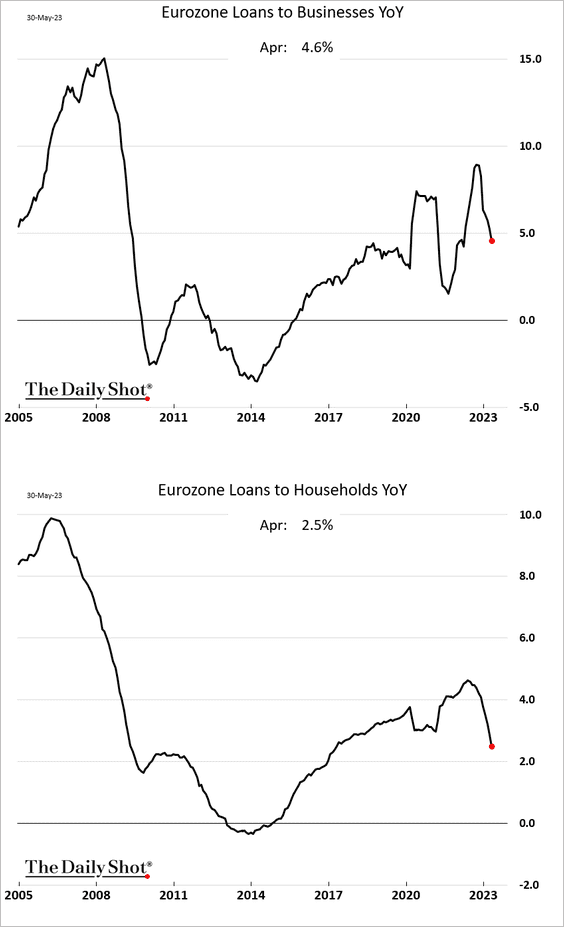

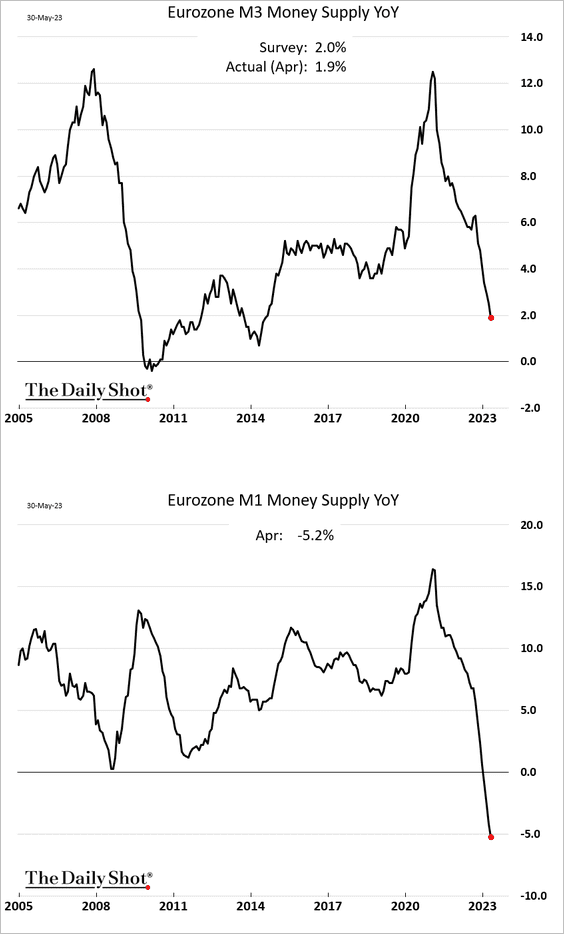

4. Loan growth keeps slowing.

Liquidity conditions continue to tighten, …

… which poses downside risks for economic activity.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

Back to Index

Europe

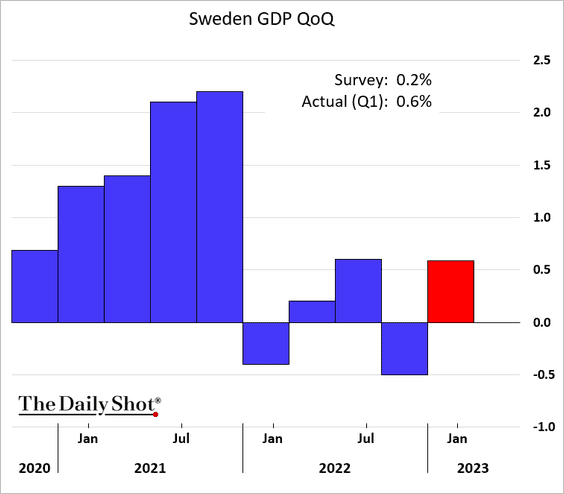

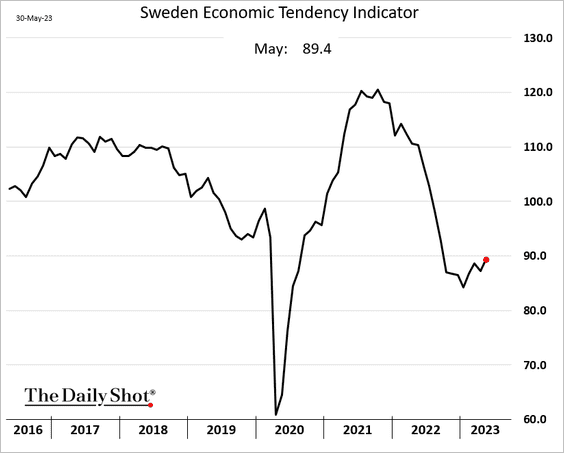

1. Sweden’s Q1 GDP growth topped expectations.

Sentiment indicators are starting to move higher.

——————–

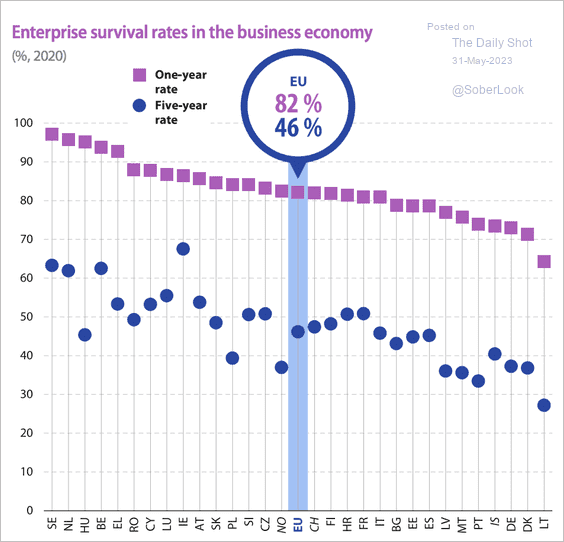

2. This chart shows enterprise survival rates.

Source: Eurostat Read full article

Source: Eurostat Read full article

Back to Index

Japan

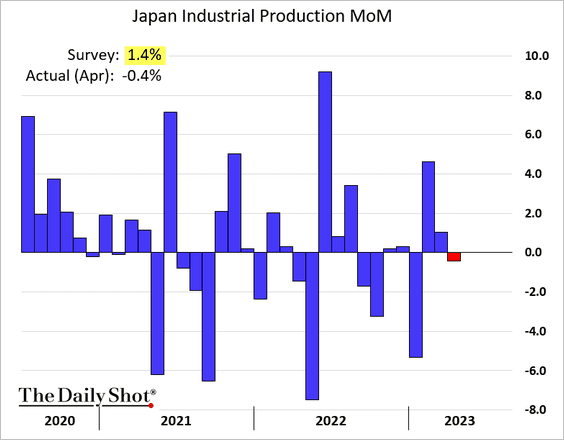

1. Industrial production unexpectedly declined, although capital goods sales were higher.

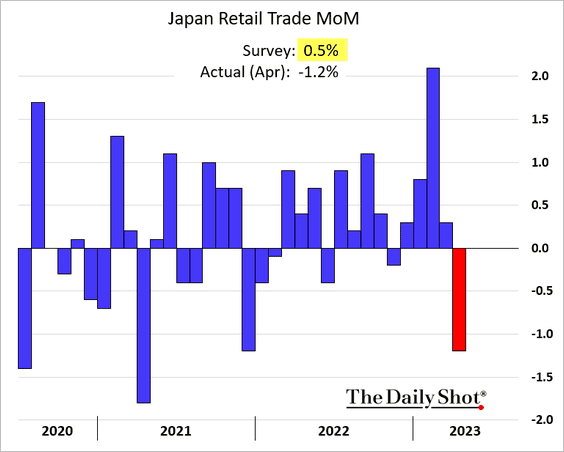

2. Retail sales also surprised to the downside.

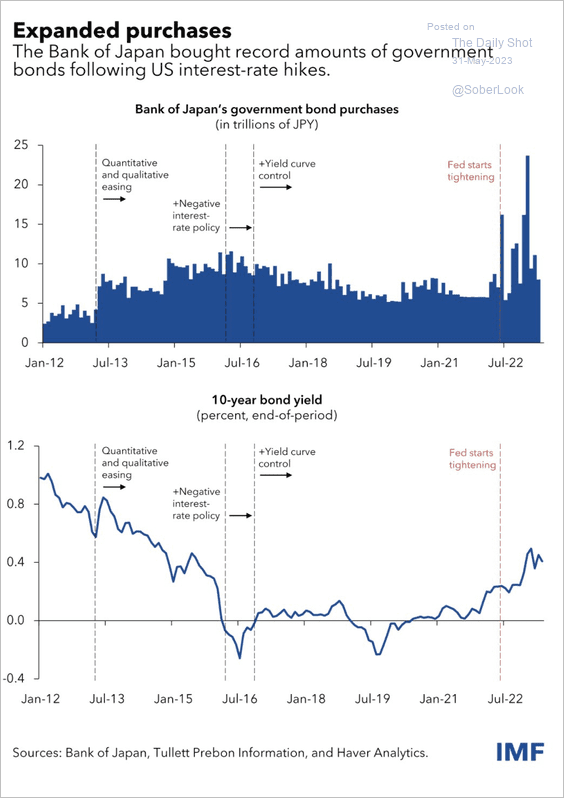

3. This chart shows the BoJ’s debt purchases over time.

Source: IMF Read full article

Source: IMF Read full article

Back to Index

Asia-Pacific

1. South Korea’s industrial production declined in April.

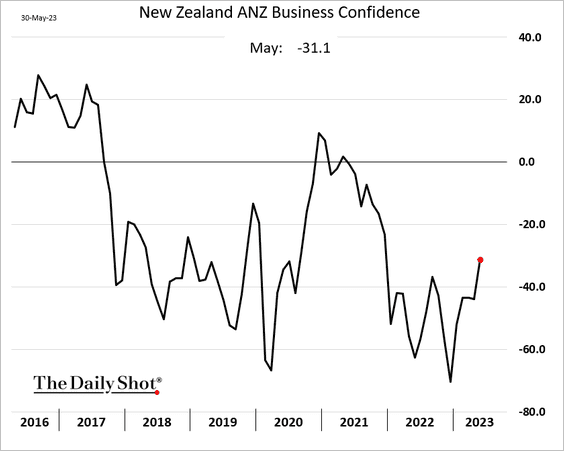

2. New Zealand’s business confidence is starting to rebound.

3. Next, we have some updates on Australia.

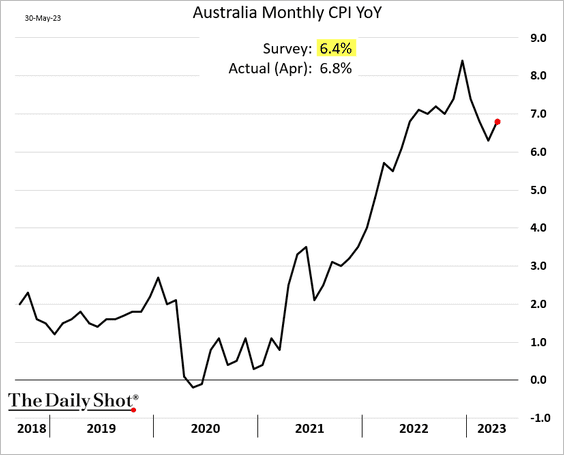

• The monthly CPI surprised to the upside.

– A 25 bps RBA rate hike this summer is nearly fully priced in.

– The yield curve inverted further.

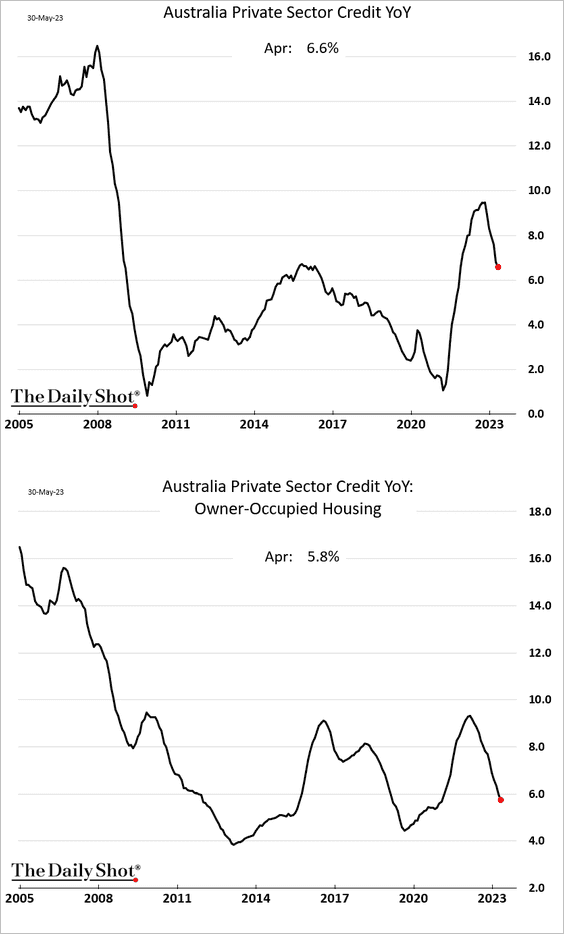

• Credit growth continues to slow.

• Consumer sentiment remains depressed.

Source: @ANZ_Research

Source: @ANZ_Research

Back to Index

China

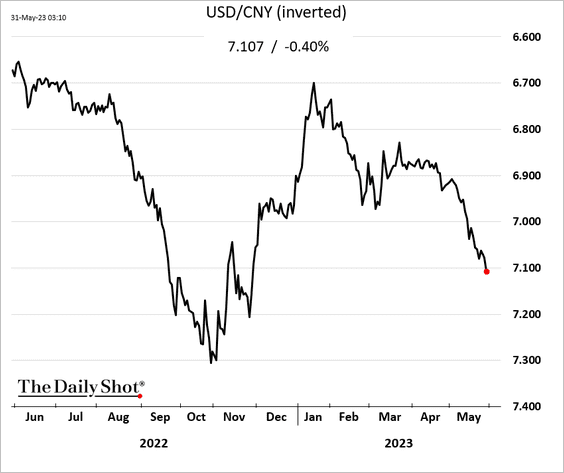

1. China’s currency remains under pressure.

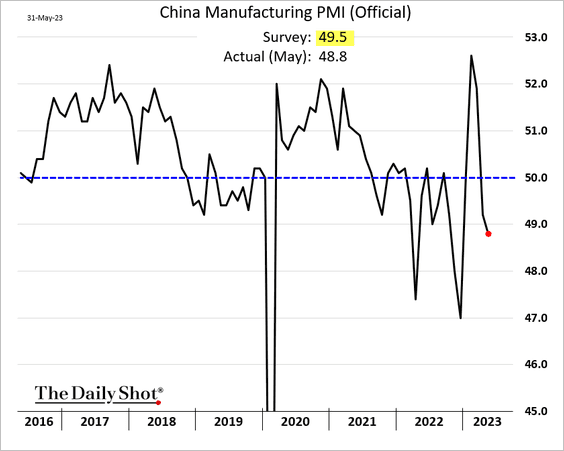

2. The official manufacturing PMI showed a faster rate of contraction in May.

Source: Reuters Read full article

Source: Reuters Read full article

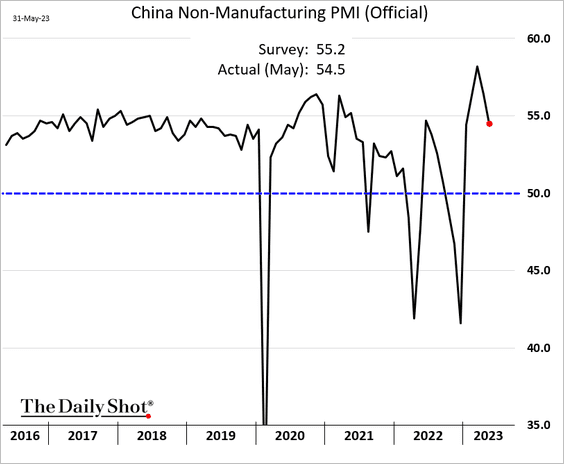

Non-manufacturing sectors continue to see strong growth.

——————–

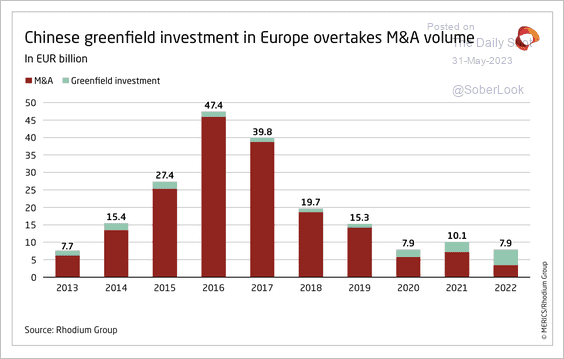

3. Chinese greenfield investment in Europe overtook M&A transactions for the first time in 20 years. This is mainly due to a few large-scale auto projects as Chinese battery giants built plants in Germany, according to MERICS.

Source: Mercator Institute for China Studies

Source: Mercator Institute for China Studies

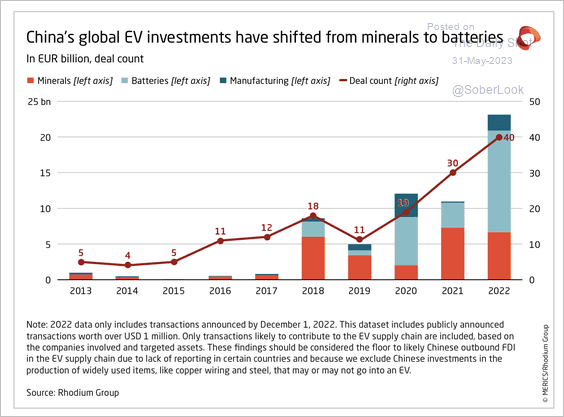

Investment abroad has accelerated, particularly for electric vehicle battery production, which is concentrated in Europe. (2 charts)

Source: Mercator Institute for China Studies

Source: Mercator Institute for China Studies

Source: Mercator Institute for China Studies

Source: Mercator Institute for China Studies

——————–

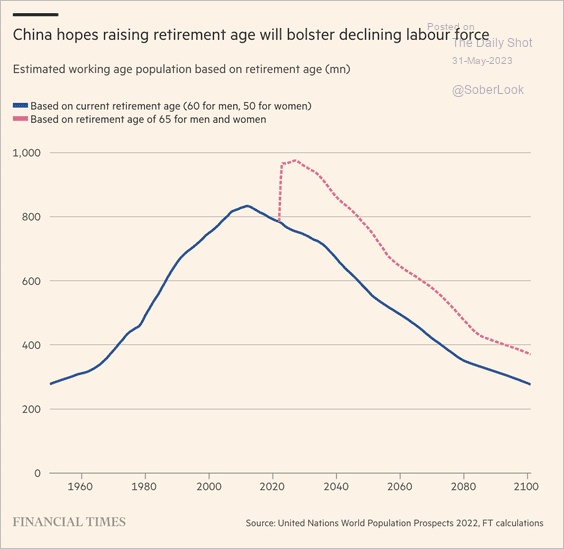

4. China’s retirement age is moving up.

Source: @financialtimes Read full article

Source: @financialtimes Read full article

Back to Index

Emerging Markets

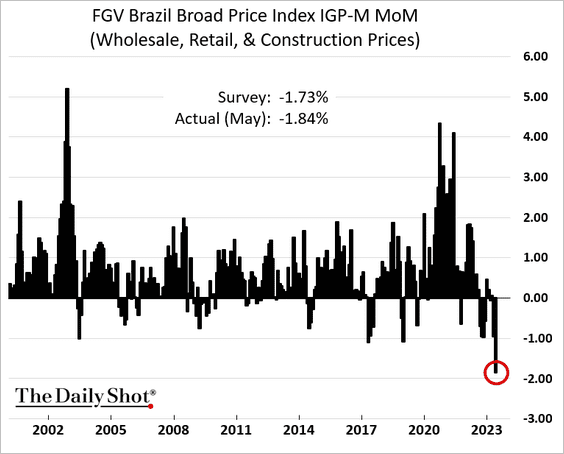

1. Brazil’s broad price index saw the biggest decline in decades.

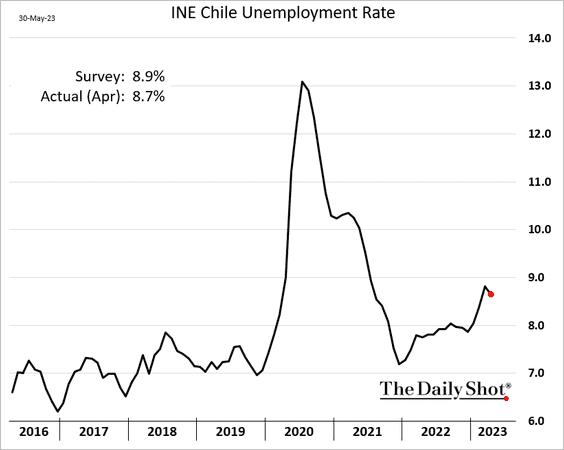

2. Chile’s unemployment unexpectedly declined during the February-April period.

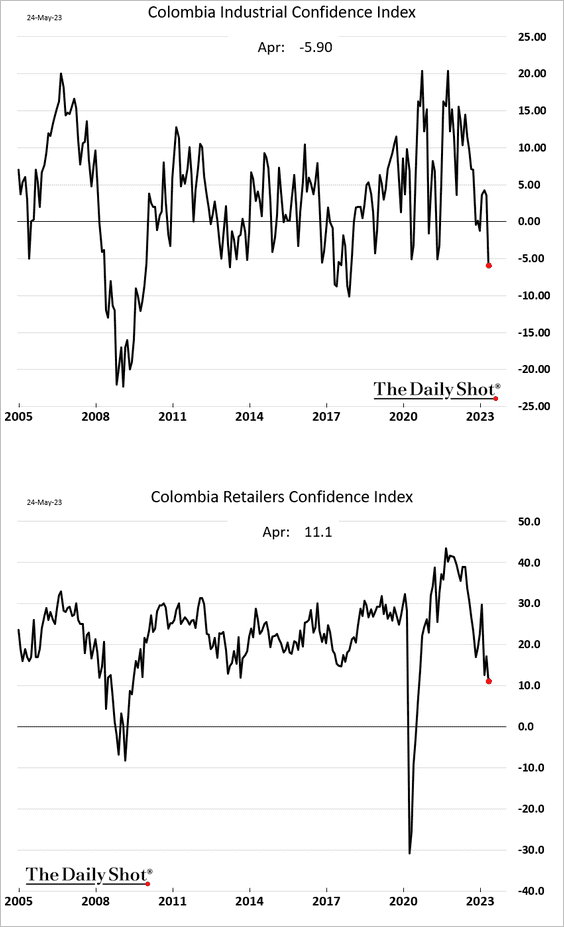

3. Colombia’s business confidence deteriorated last month.

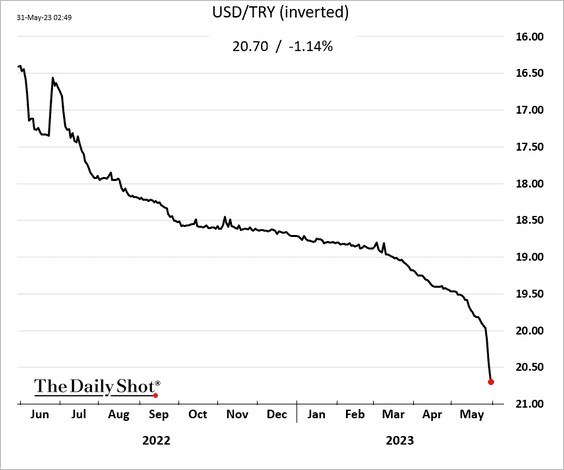

4. The Turkish lira selloff has accelerated.

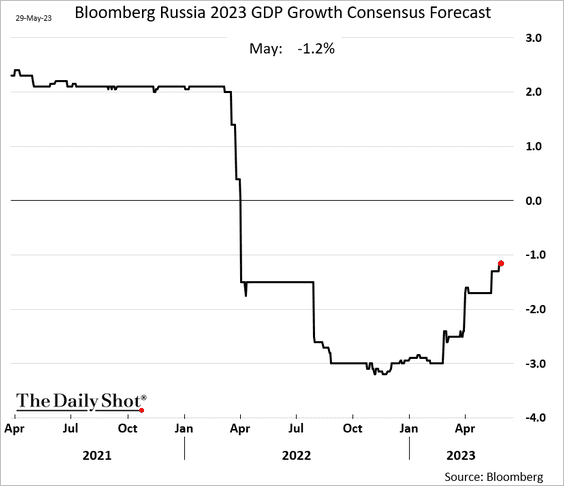

5. Economists have been revising Russian GDP growth higher.

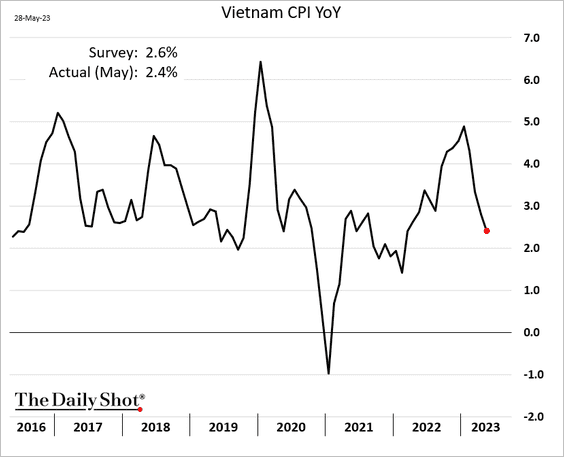

6. Vietnam’s inflation is slowing.

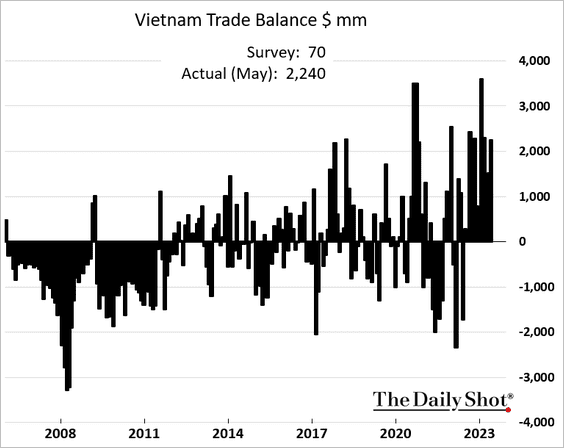

The trade surplus was stronger than expected in May.

——————–

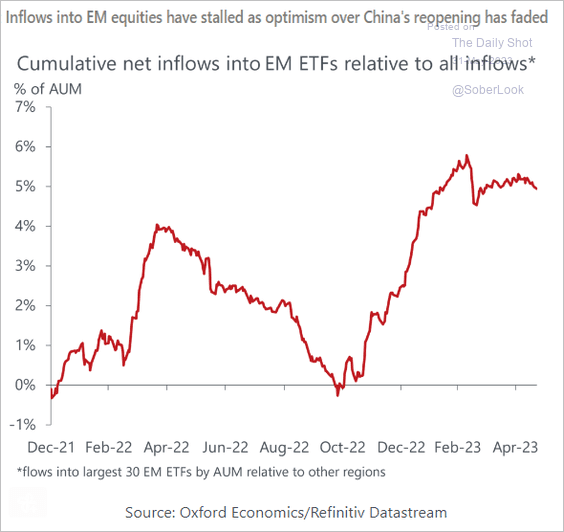

7. Equity ETF inflows are slowing.

Source: Oxford Economics

Source: Oxford Economics

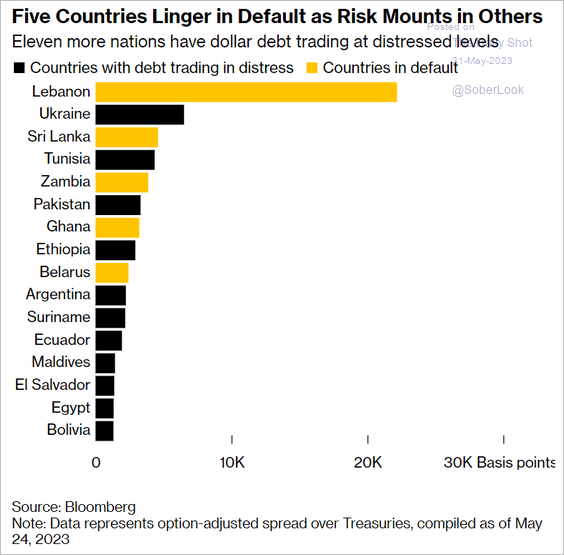

8. Here is a look at distressed and defaulted sovereign debt.

Source: @ezrafieser, @song_eleanor, @markets Read full article

Source: @ezrafieser, @song_eleanor, @markets Read full article

Back to Index

Cryptocurrency

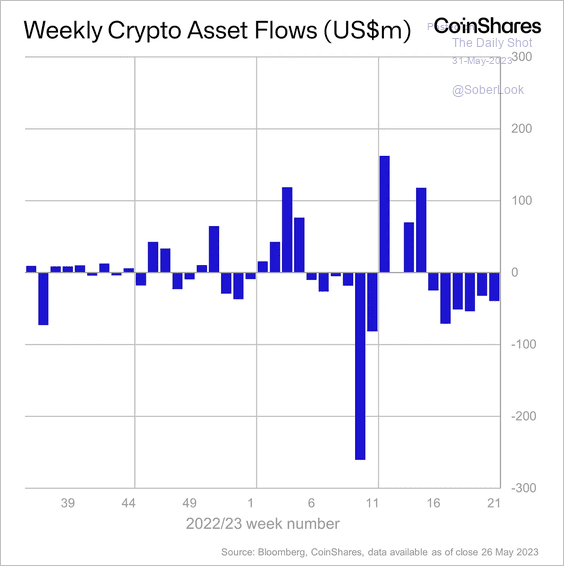

1. Crypto funds saw the sixth consecutive week of outflows.

Source: CoinShares Read full article

Source: CoinShares Read full article

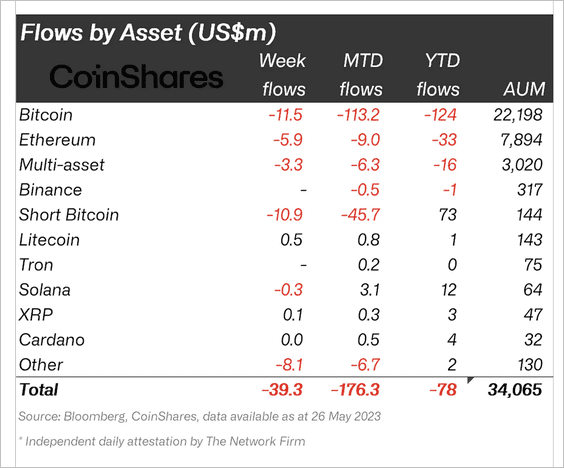

Bitcoin-focused funds accounted for most outflows last week.

Source: CoinShares Read full article

Source: CoinShares Read full article

——————–

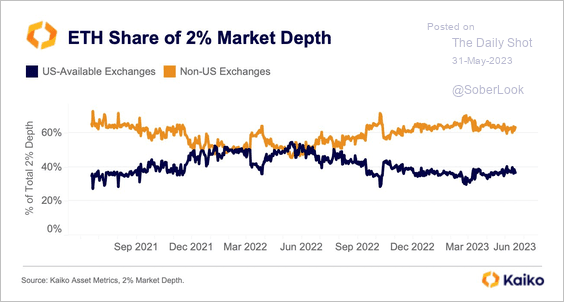

2. Over the past year, ETH liquidity has been moving away from US exchanges.

Source: @KaikoData

Source: @KaikoData

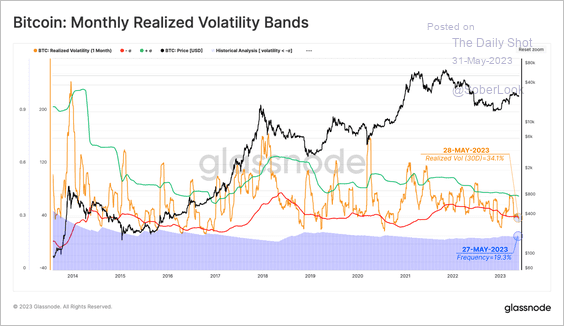

3. Bitcoin’s realized volatility has dropped significantly. Such low-vol regimes only account for 19% of BTC’s market history, according to Glassnode.

Source: Glassnode Read full article

Source: Glassnode Read full article

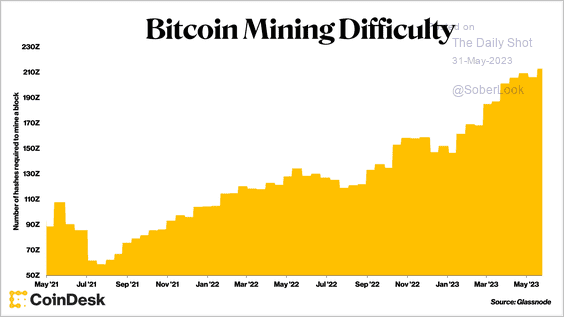

4. Bitcoin mining difficulty reached an all-time high, which could signal a decline in miner profitability.

Source: CoinDesk Read full article

Source: CoinDesk Read full article

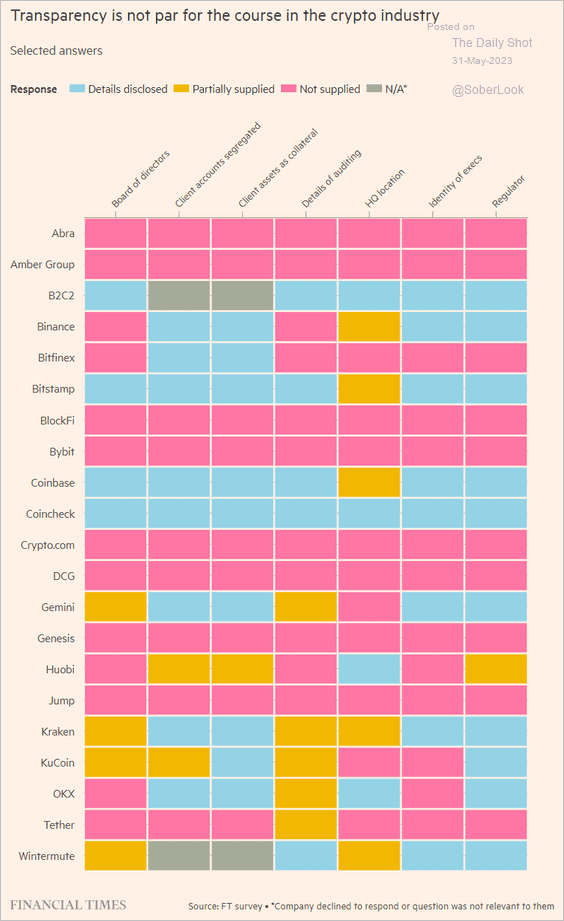

5. The crypto industry has a transparency problem.

Source: @financialtimes Read full article

Source: @financialtimes Read full article

Back to Index

Commodities

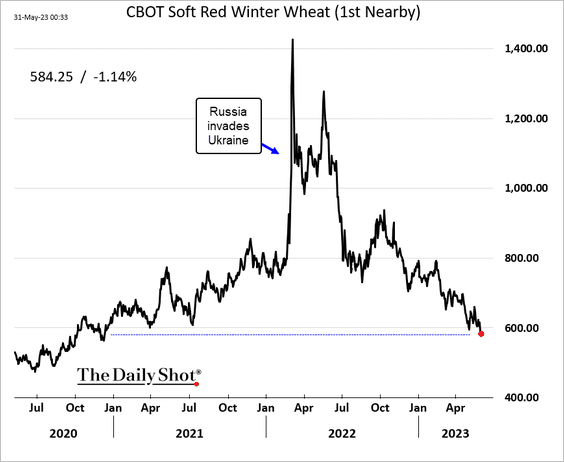

1. Wheat futures have reached their lowest point since December 2020, as US exports look too costly to be competitive in the global market.

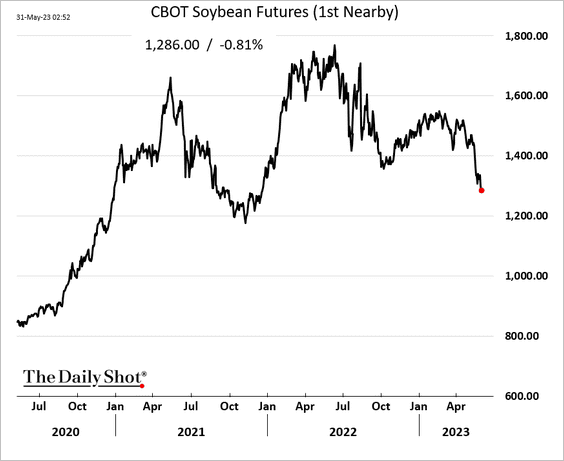

2. Soybean futures continue to sink.

Source: Reuters Read full article

Source: Reuters Read full article

——————–

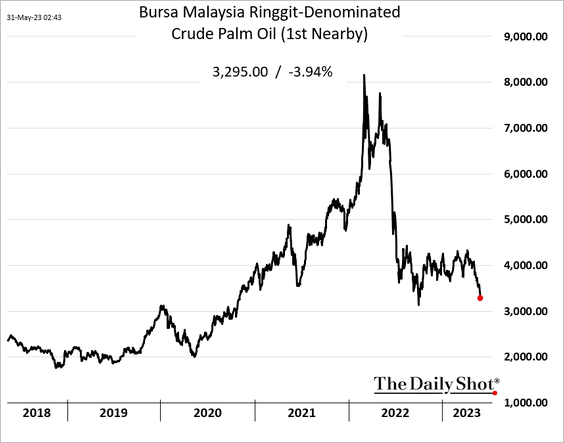

3. Vegetable oils have been under pressure.

• Soybean oil:

• Palm oil:

——————–

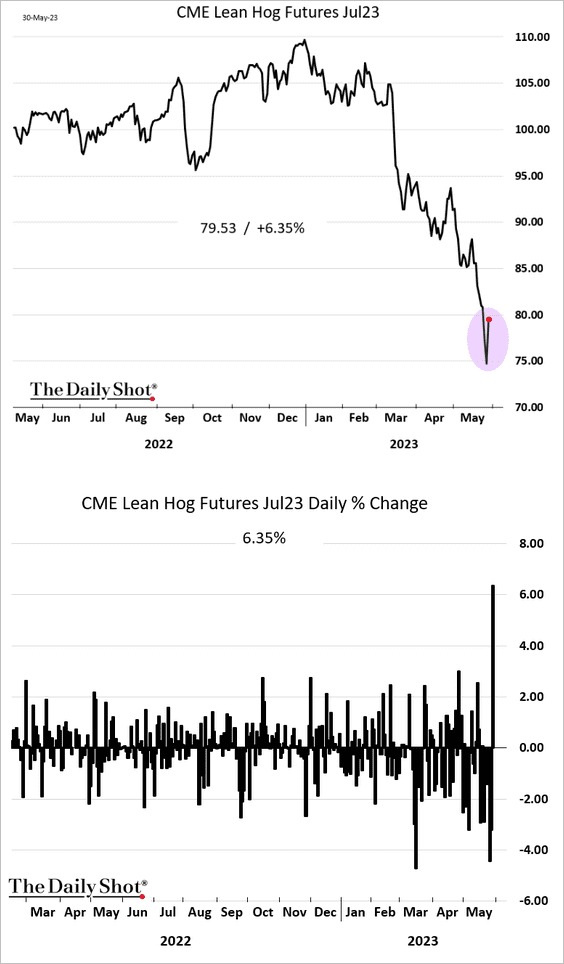

4. CME hog futures rebounded sharply from the recent lows

Source: Reuters Read full article

Source: Reuters Read full article

——————–

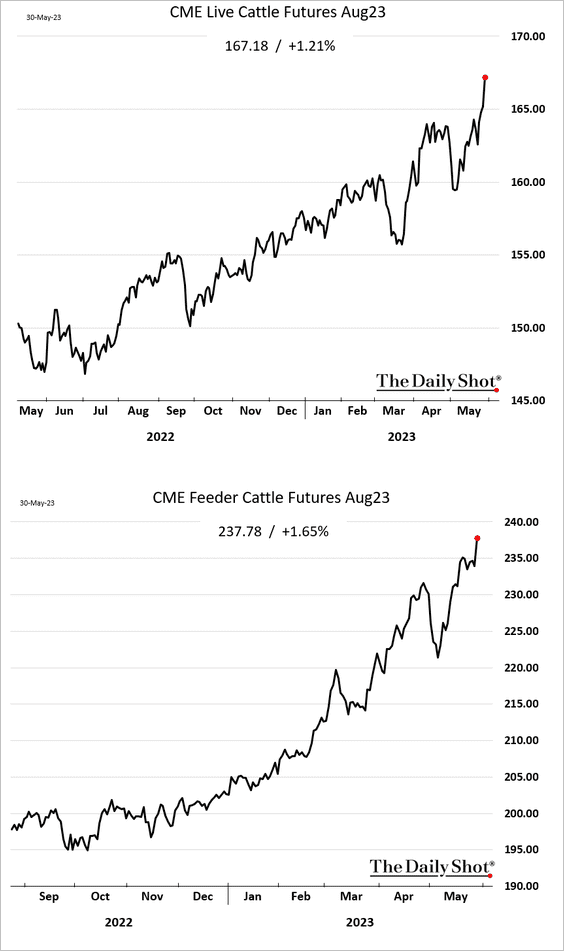

5. Chicago cattle futures are surging.

6. Class III milk futures continue to sink.

Back to Index

Energy

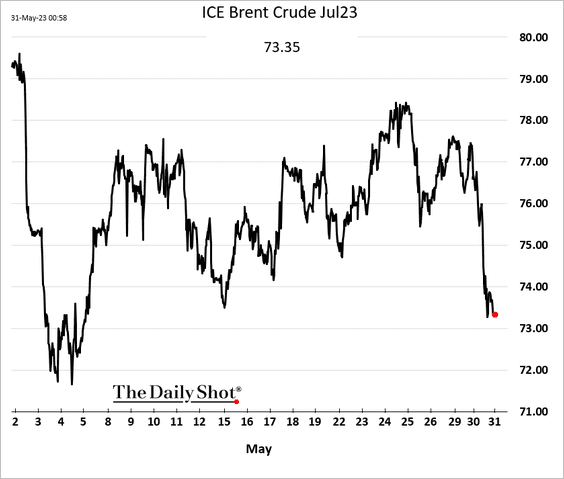

1. Crude oil declined on Tuesday.

Source: Reuters Read full article

Source: Reuters Read full article

——————–

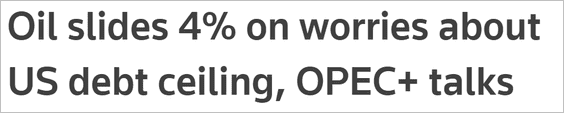

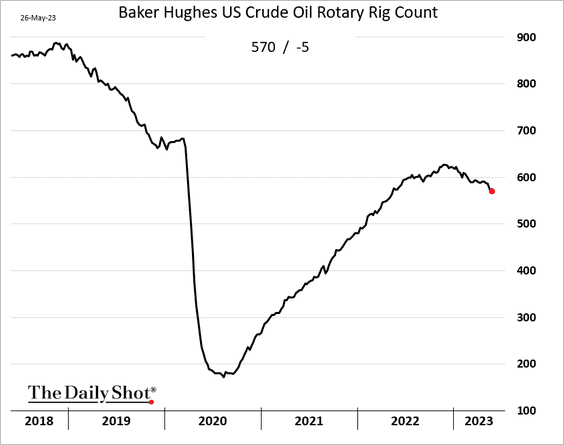

2. US oil and gas rig count has been falling.

Source: Reuters Read full article

Source: Reuters Read full article

——————–

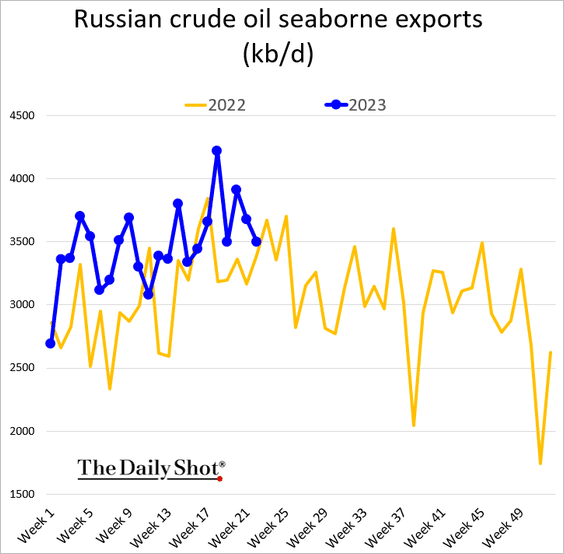

3. Russian oil exports remain elevated.

Source: @WSJ Read full article

Source: @WSJ Read full article

——————–

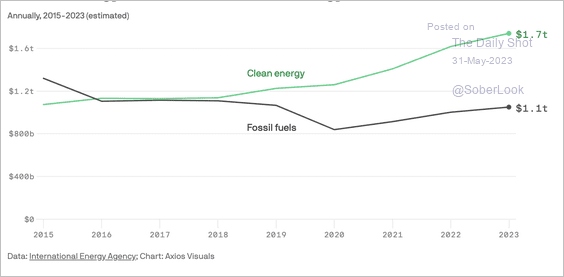

4. Clean energy investment continues to outpace fossil fuels.

Source: @axios Read full article

Source: @axios Read full article

Back to Index

Equities

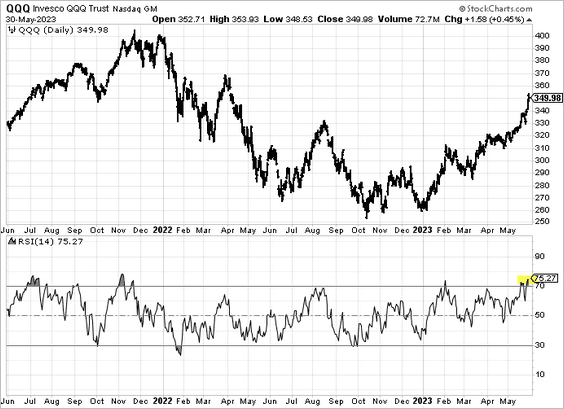

1. Technicals suggest that the Nasdaq 100 is overbought.

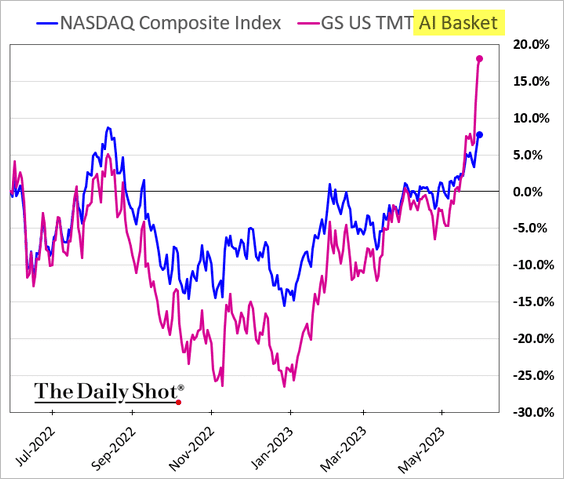

2. Goldman’s AI basket of stocks has been surging.

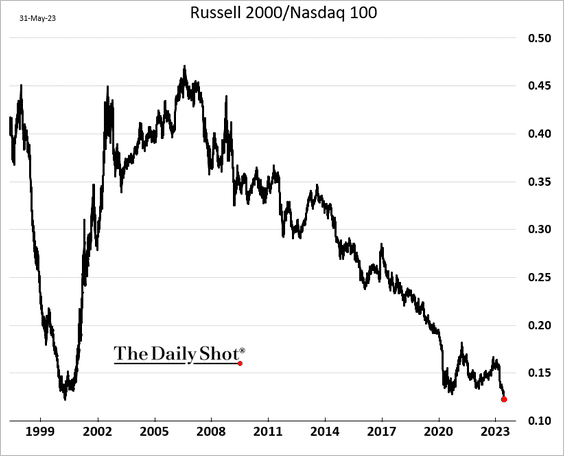

3. The Russell 2000 index is nearing the dot-com low vs. the Nasdaq 100.

4. S&P 500 operating earnings bottomed in Q4 2022.

Source: Alpine Macro

Source: Alpine Macro

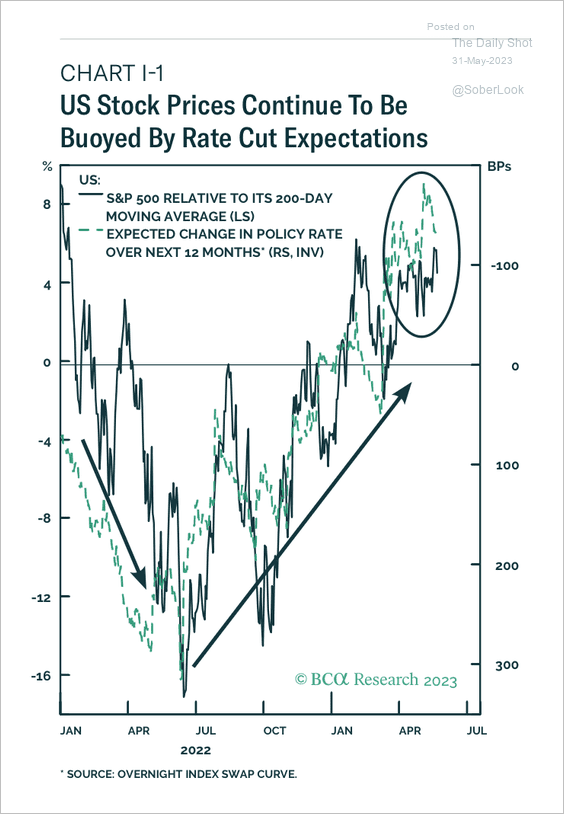

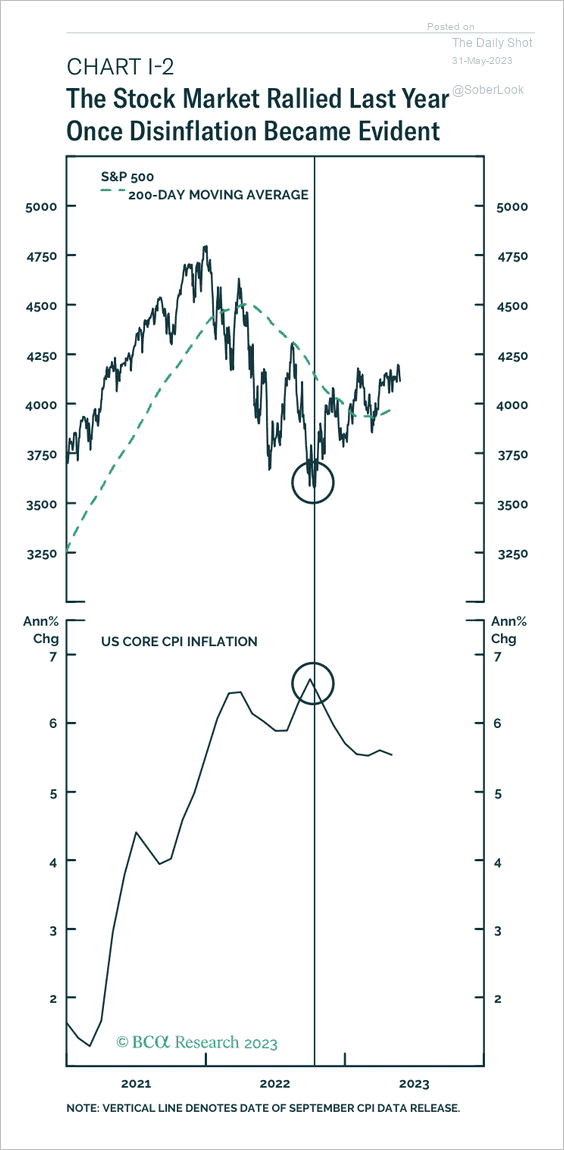

5. The S&P 500’s rally has been supported by rate-cut expectations and signs of cooler inflation. (2 charts)

Source: BCA Research

Source: BCA Research

Source: BCA Research

Source: BCA Research

——————–

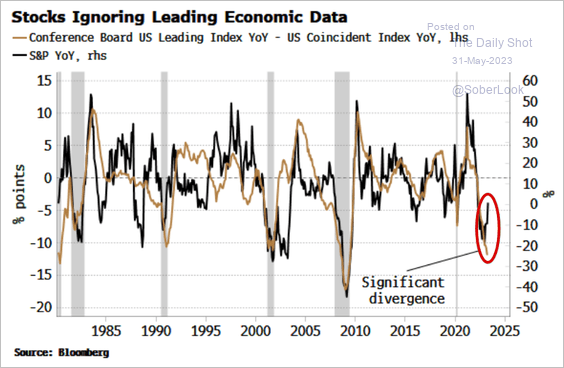

6. The market is ignoring recession warning signs.

Source: Simon White, Bloomberg Markets Live Blog

Source: Simon White, Bloomberg Markets Live Blog

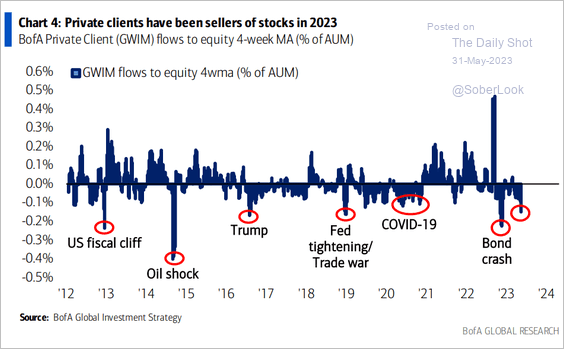

7. BofA’s private clients have been selling stocks.

Source: BofA Global Research

Source: BofA Global Research

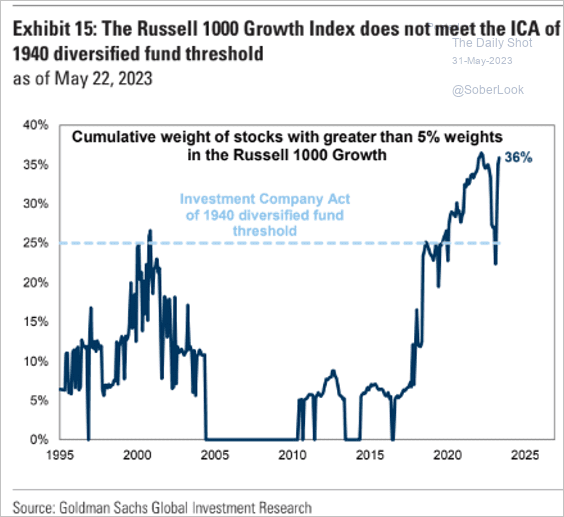

8. The Russell 1000 index is very concentrated.

Source: Goldman Sachs; @MikeZaccardi

Source: Goldman Sachs; @MikeZaccardi

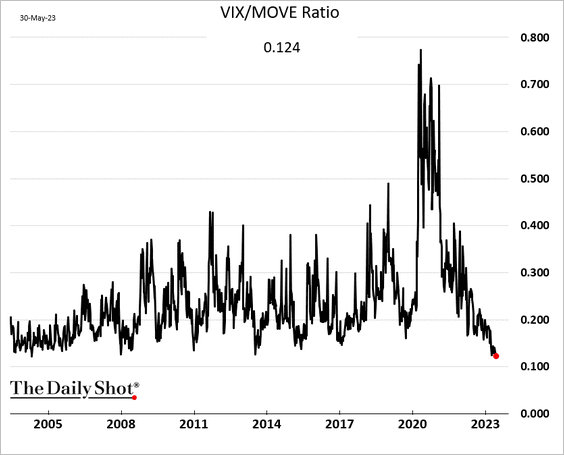

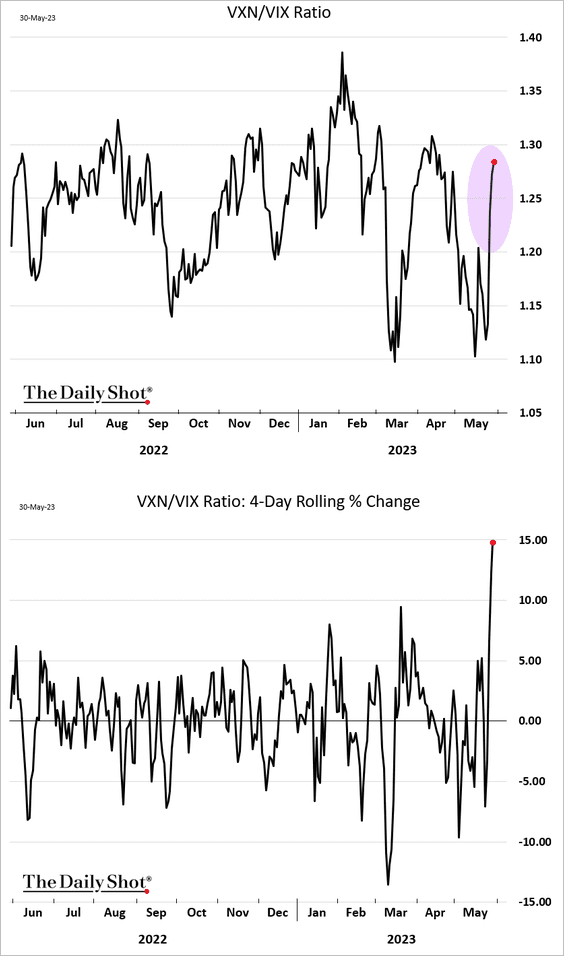

9. Finally, we have some updates on volatility markets.

• Equity implied vol (VIX) is at multi-year lows relative to rates vol (MOVE).

• The Nasdaq 100 volatility index (VXN) has experienced a notable surge in recent days compared to the VIX, reflecting growing investor caution toward the tech rally.

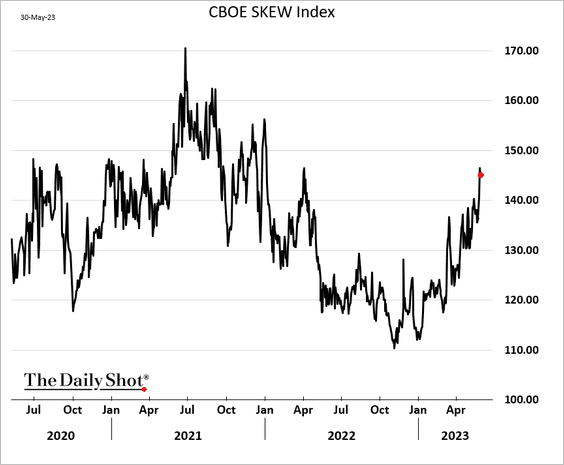

• The S&P 500 skew has been rising, signaling increased demand for downside protection.

Back to Index

Alternatives

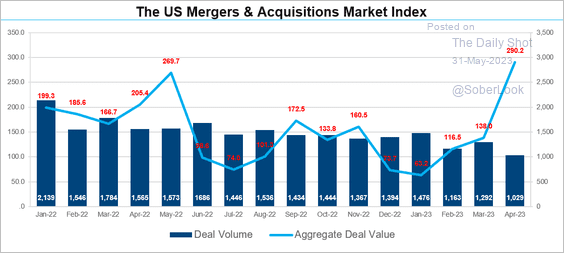

1. There were fewer M&A transactions in April, but the deals were much larger.

Source: @FactSet Read full article

Source: @FactSet Read full article

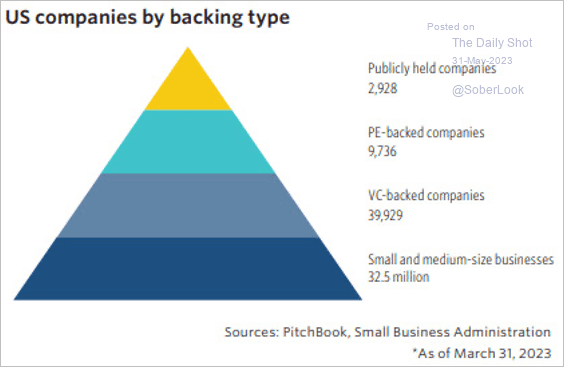

2. There is a vast number of non-backed private companies, providing an abundance of supply for corporate and sponsor buyers, according to PitchBook.

Source: PitchBook

Source: PitchBook

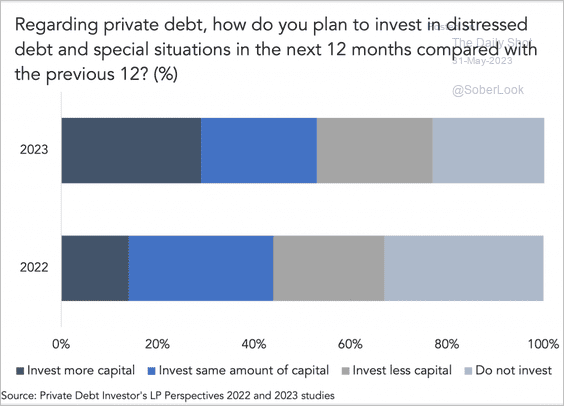

3. Investors plan to allocate more capital toward distressed debt.

Source: @theleadleft

Source: @theleadleft

Back to Index

Credit

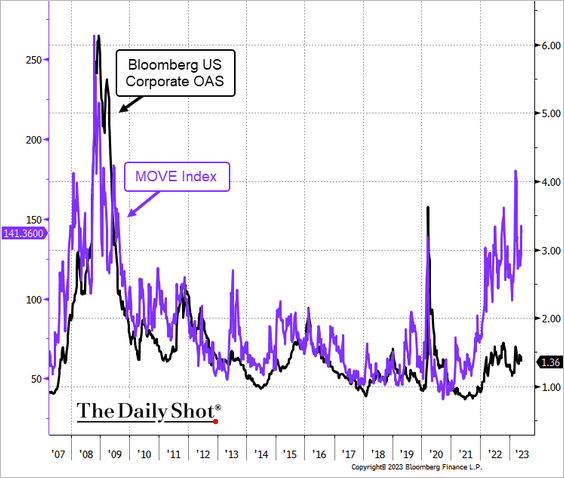

1. Rates market implied vol suggests that credit spreads should be wider.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

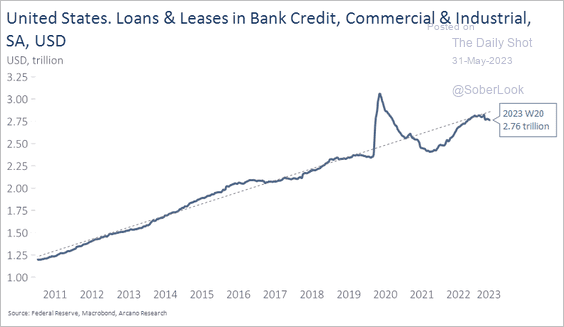

2. Business loan balances in the banking system have been declining.

Source: Arcano Economics

Source: Arcano Economics

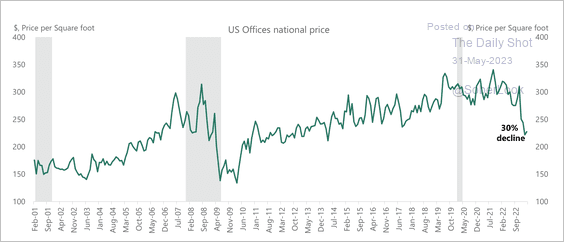

3. Office prices continue to fall.

Source: Torsten Slok, Apollo

Source: Torsten Slok, Apollo

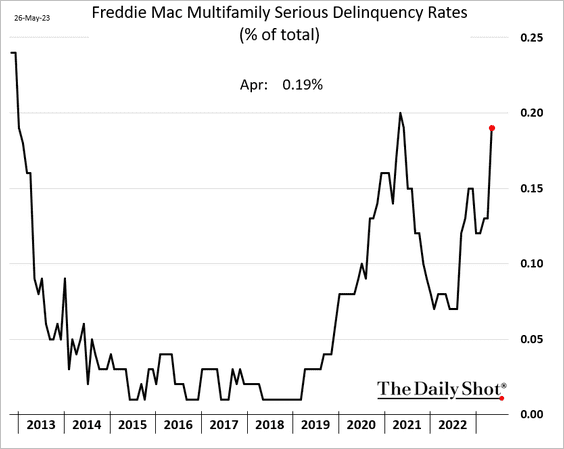

4. Multifamily property delinquency rates are climbing.

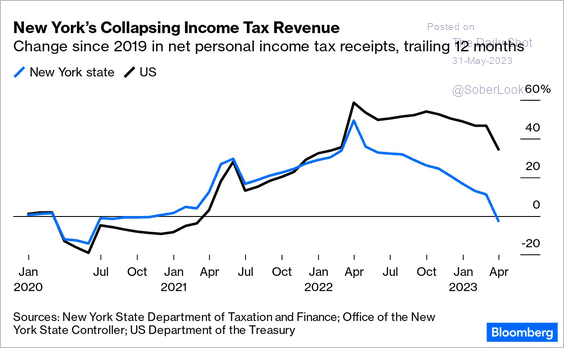

5. New York State’s income-tax revenue has been deteriorating.

Source: @foxjust, @opinion Read full article

Source: @foxjust, @opinion Read full article

Back to Index

Global Developments

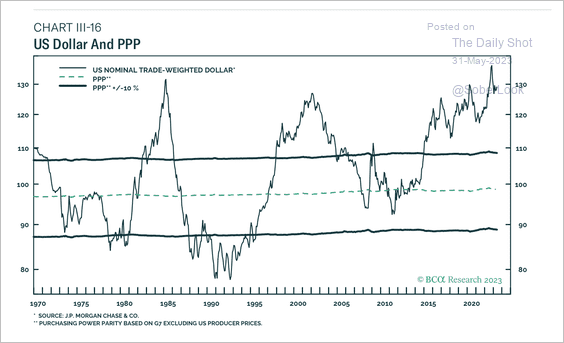

1. The dollar appears extended based on purchasing power parity.

Source: BCA Research

Source: BCA Research

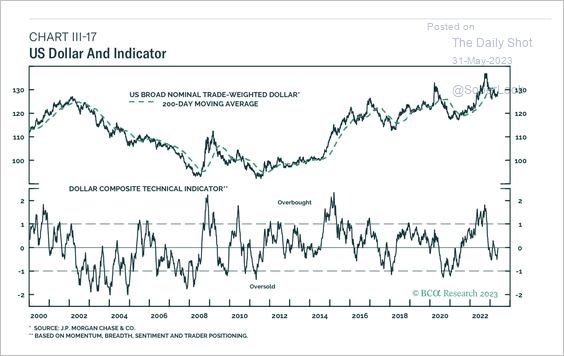

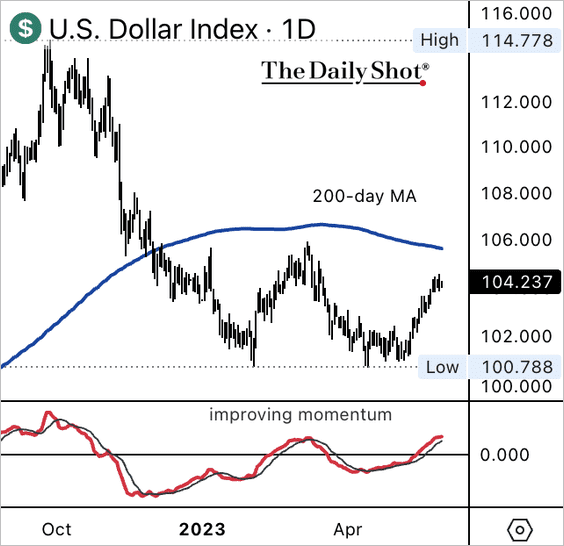

• Technical indicators are neutral, albeit with the dollar capped below its 200-day moving average at the 105 level. (2 charts)

Source: BCA Research

Source: BCA Research

——————–

2. MRB Partners forecasts lower real returns on balanced portfolios of 60% global equities and 40% G7 government bonds over the next decade compared with recent years.

Source: MRB Partners

Source: MRB Partners

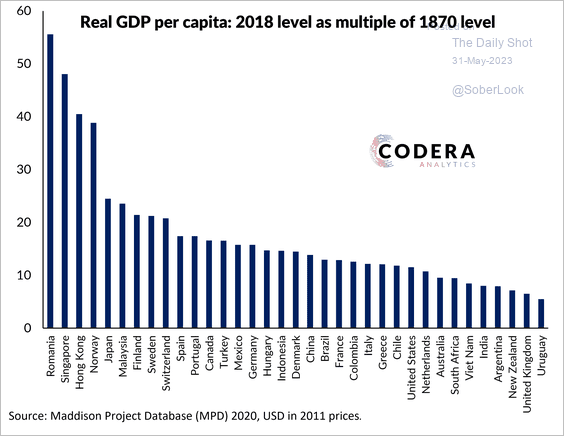

3. Over the last 150 years or so, per capita income has risen most in areas like Romania, Singapore, Hong Kong, and Norway.

Source: Codera Analytics Read full article

Source: Codera Analytics Read full article

——————–

Food for Thought

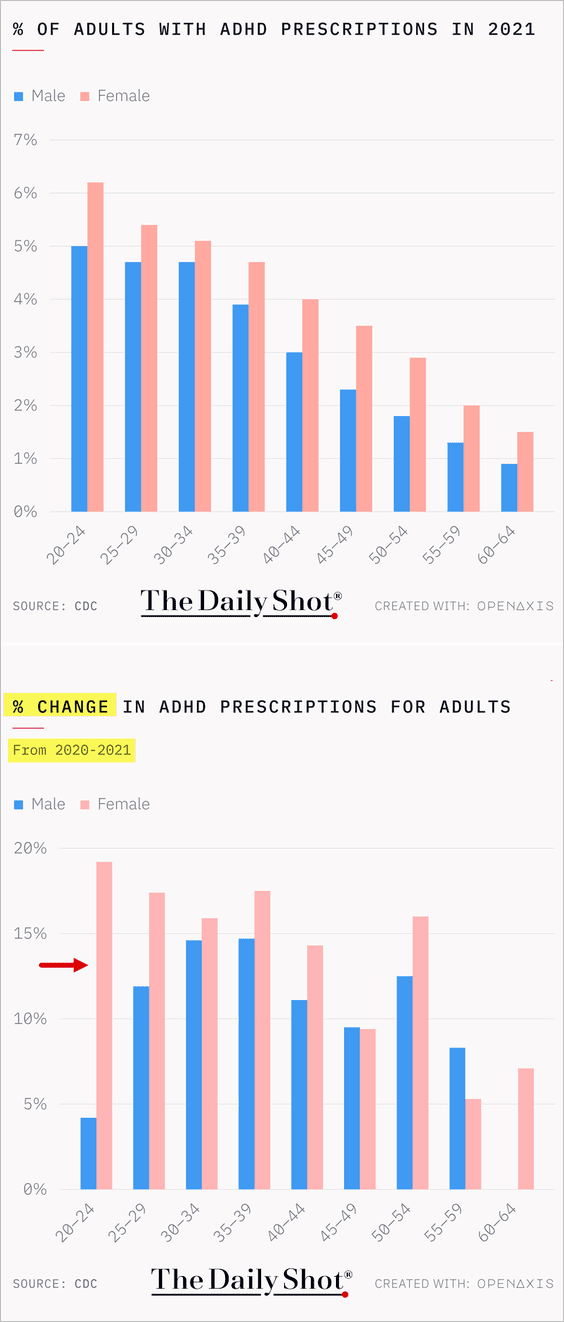

1. Adults with ADHD prescriptions:

Source: @TheDailyShot

Source: @TheDailyShot

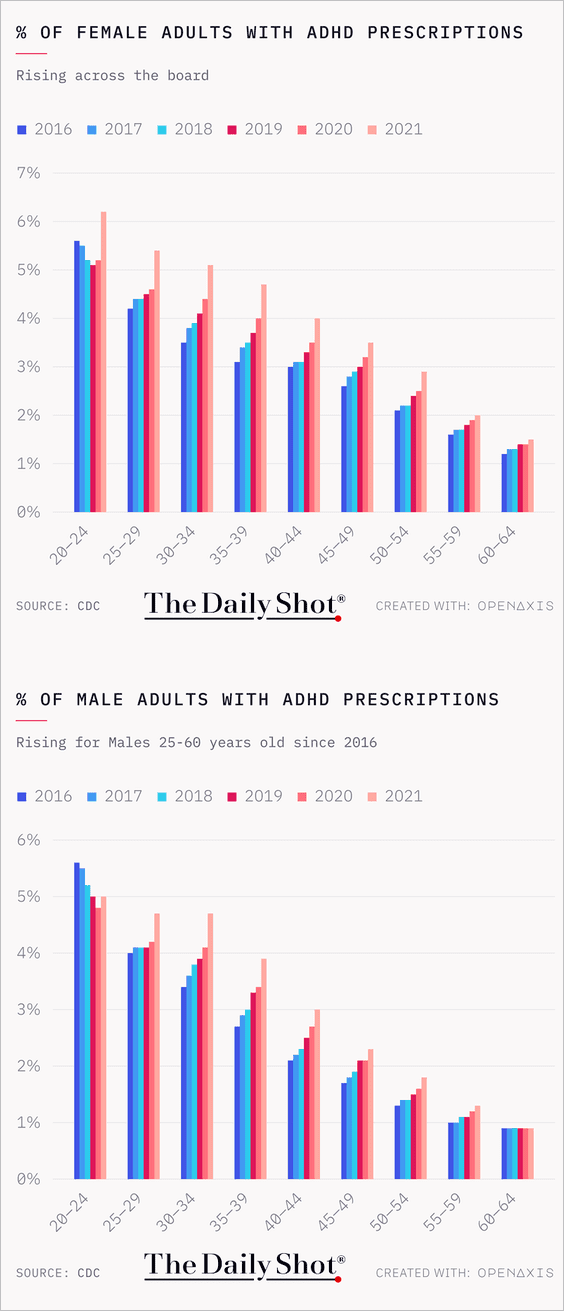

• Adults with ADHD prescriptions, over time:

Source: @TheDailyShot

Source: @TheDailyShot

——————–

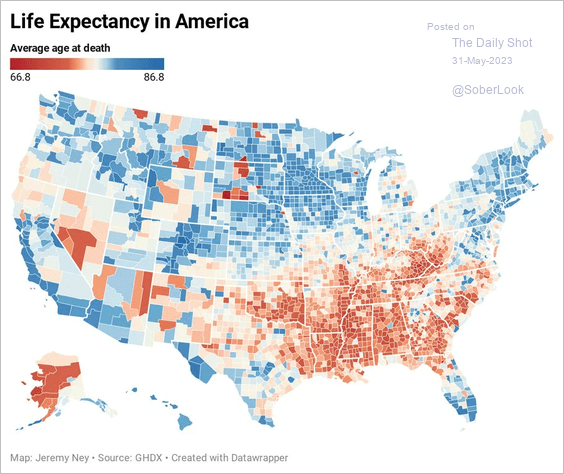

2. Life expectancy in the US:

Source: @jeremybney

Source: @jeremybney

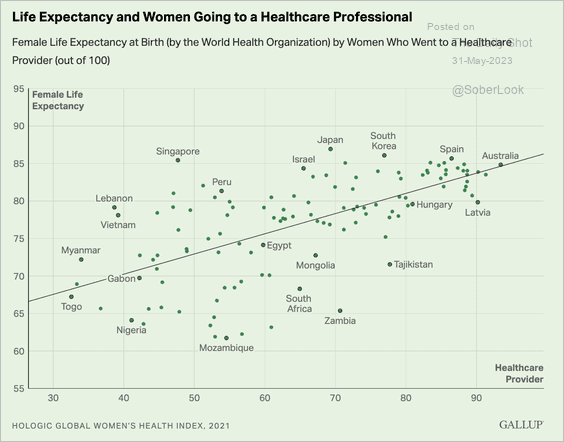

3. Life expectancy and women going to the doctor:

Source: Gallup Read full article

Source: Gallup Read full article

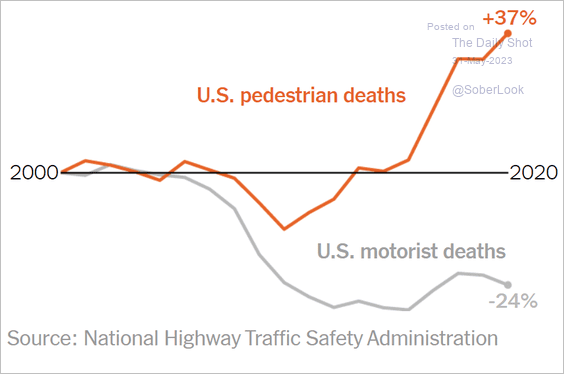

3. Changes in pedestrian and motorist deaths:

Source: The New York Times Read full article

Source: The New York Times Read full article

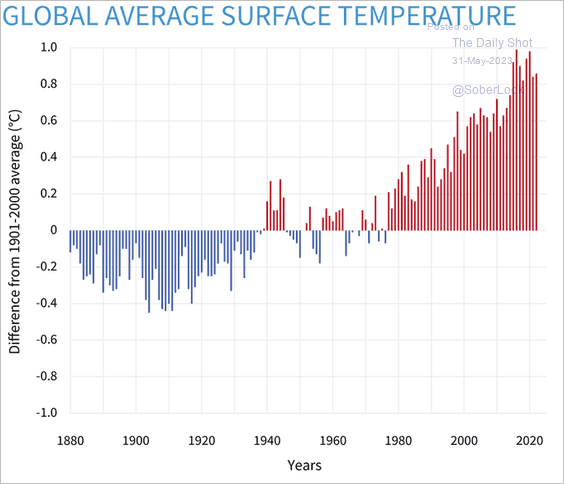

4. Global surface temperature continues to trend higher:

Source: @NOAAResearch Read full article

Source: @NOAAResearch Read full article

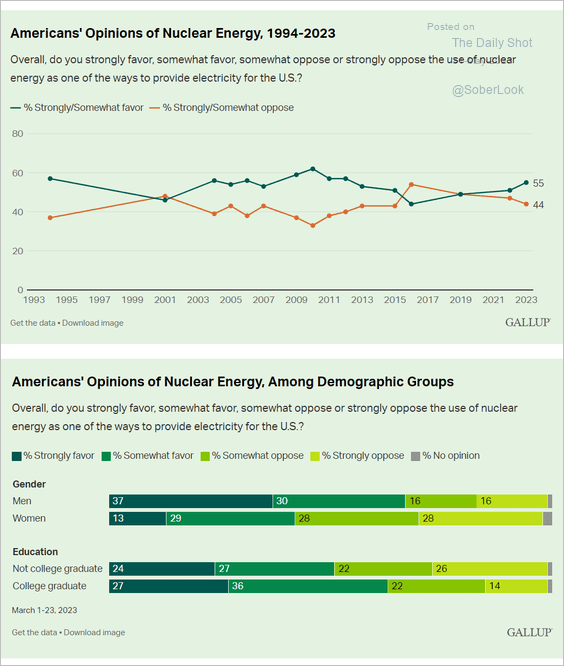

5. Support for nuclear energy:

Source: Gallup Read full article

Source: Gallup Read full article

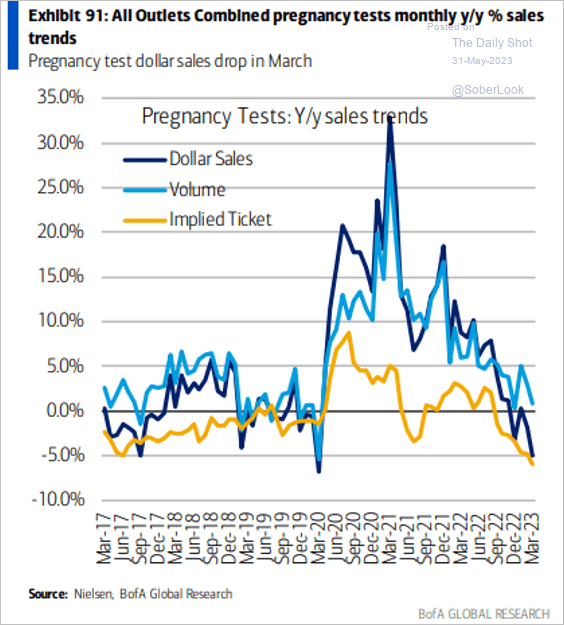

6. Pregnancy test sales (year-over-year changes):

Source: BofA Global Research; @MikeZaccardi

Source: BofA Global Research; @MikeZaccardi

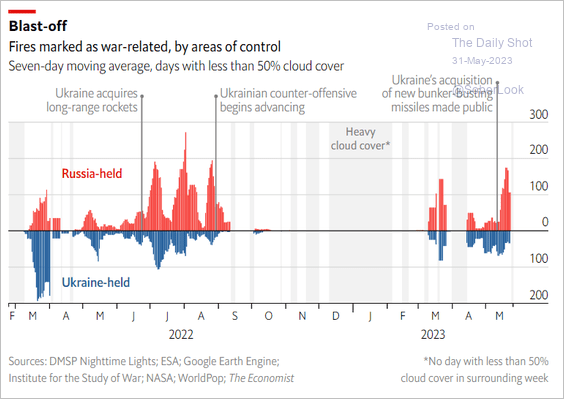

7. War-related fires show Ukraine testing Russian defenses.

Source: The Economist Read full article

Source: The Economist Read full article

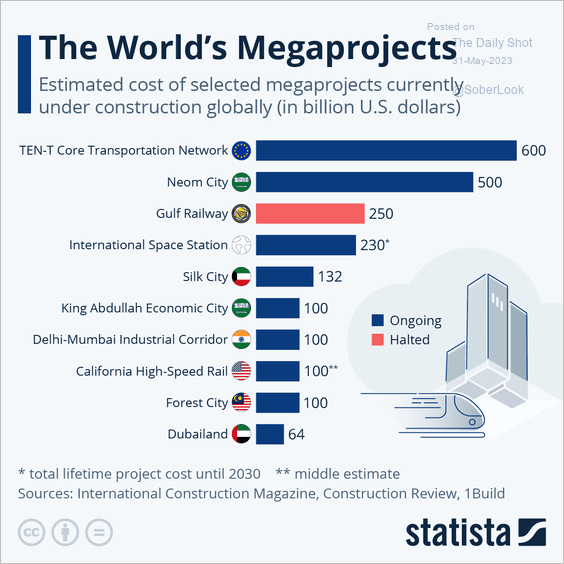

8. Megaprojects under construction:

Source: Statista

Source: Statista

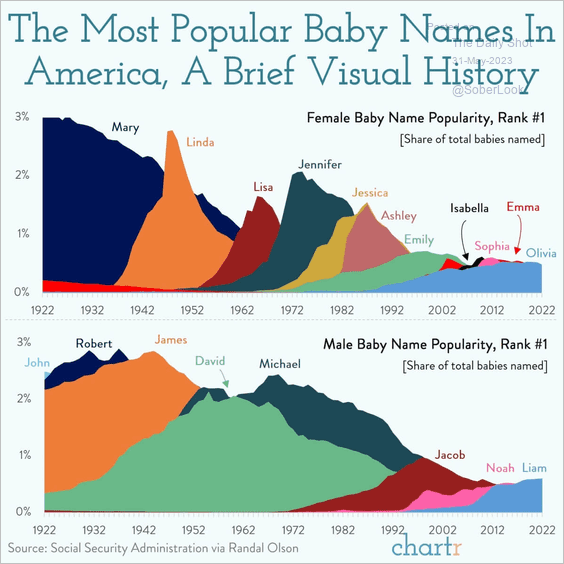

9. Most popular US baby names over time:

Source: @chartrdaily

Source: @chartrdaily

——————–

Back to Index