The Daily Shot: 01-Jun-23

• The United States

• Canada

• The Eurozone

• Europe

• Japan

• Asia-Pacific

• China

• Emerging Markets

• Commodities

• Equities

• Credit

• Rates

• Global Developments

• Food for Thought

The United States

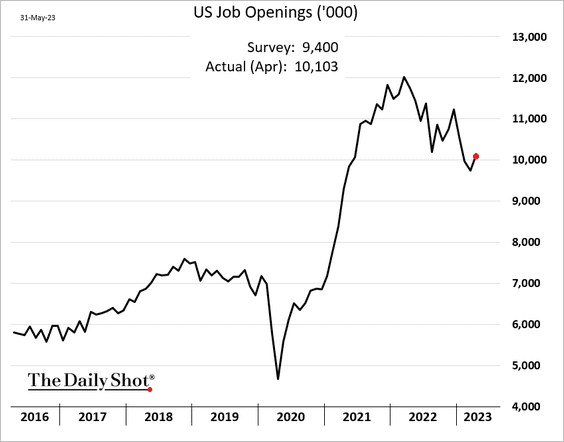

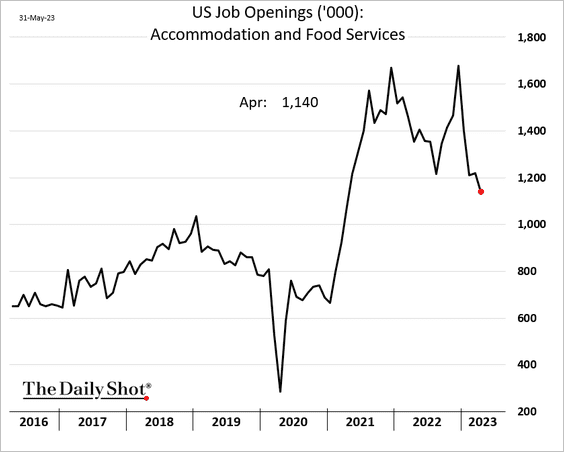

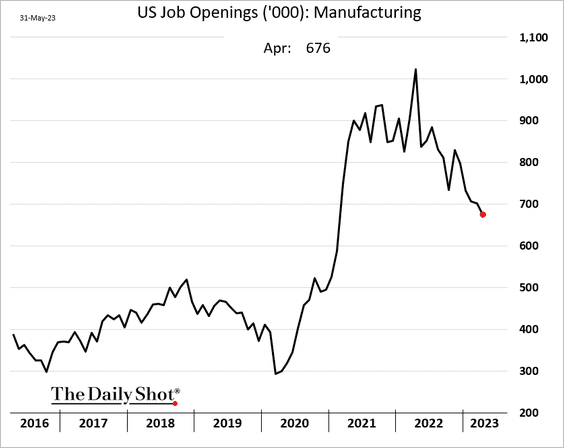

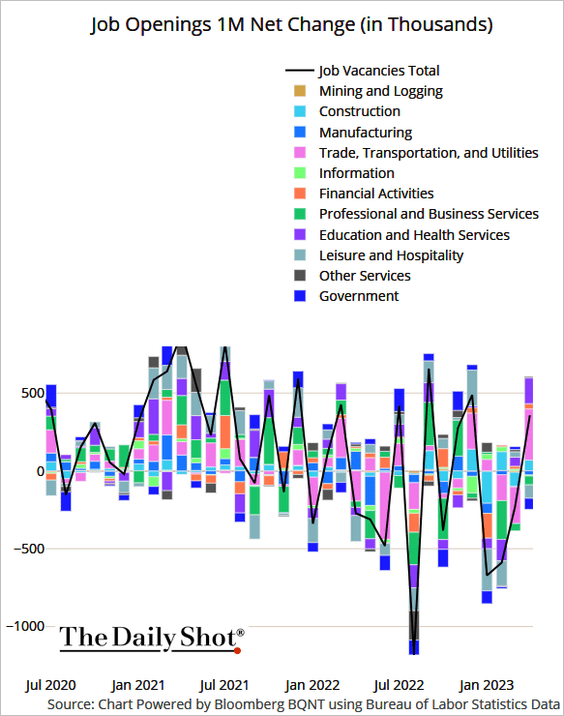

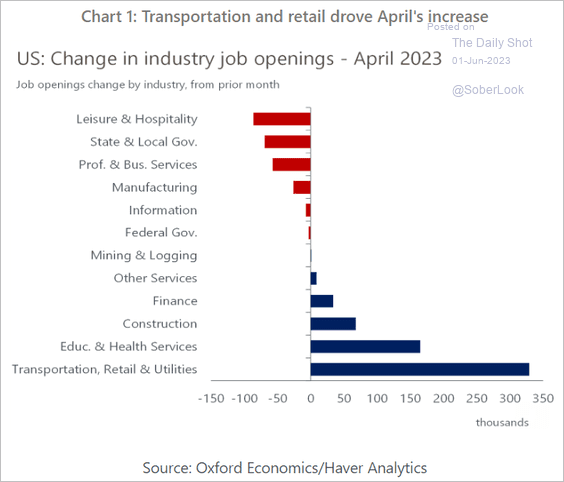

1. US job openings unexpectedly increased in April, climbing above ten million.

Source: @WSJ Read full article

Source: @WSJ Read full article

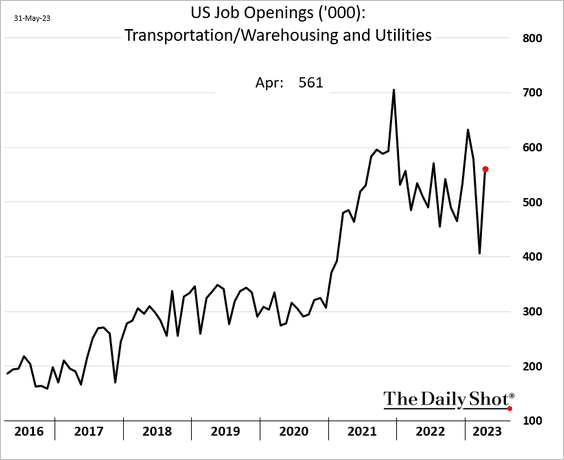

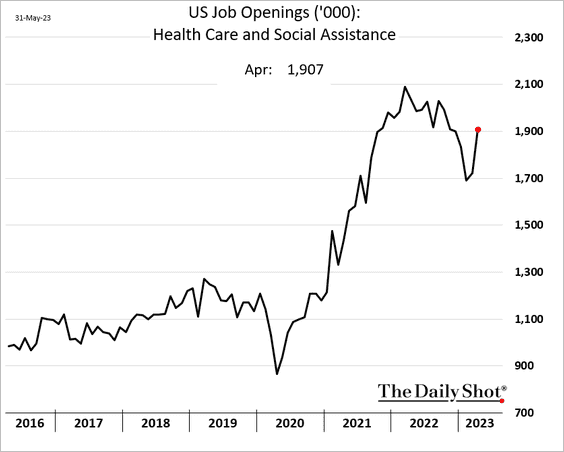

• Logistics (chart below) and healthcare (2nd chart) were the key drivers of the increase.

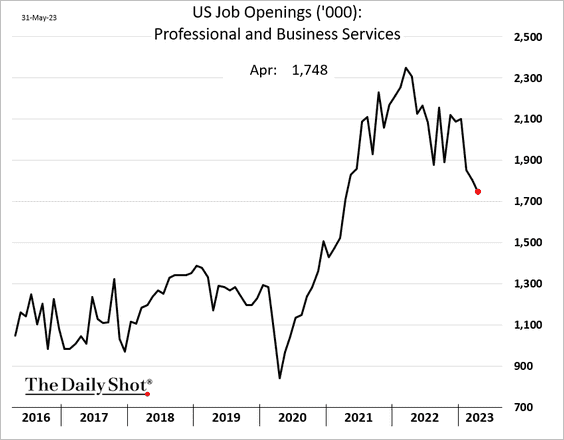

Business services, hotels/restaurants, and manufacturing saw declines.

Here are the contributions (2 charts).

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: Oxford Economics

Source: Oxford Economics

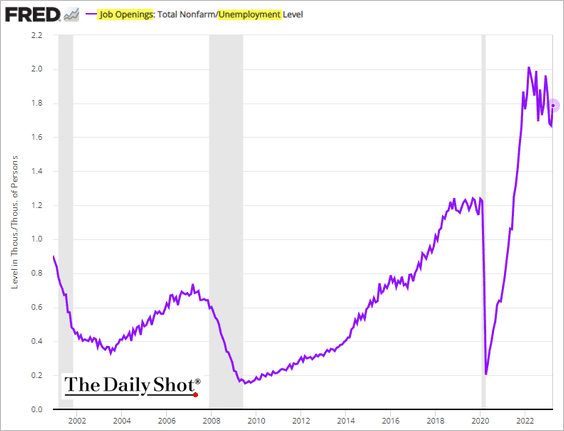

• The ratio of job openings to unemployment remains elevated (1.8 openings per unemployed American), an indication of persistent imbalances in the labor market.

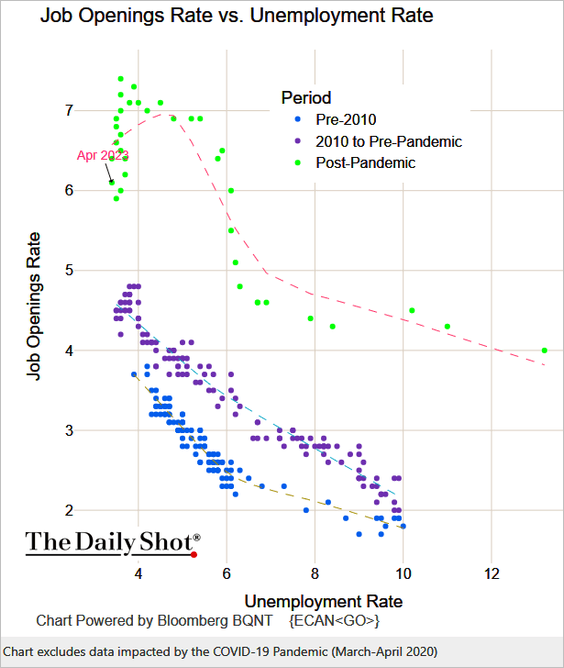

• Here is the Beveridge Curve.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

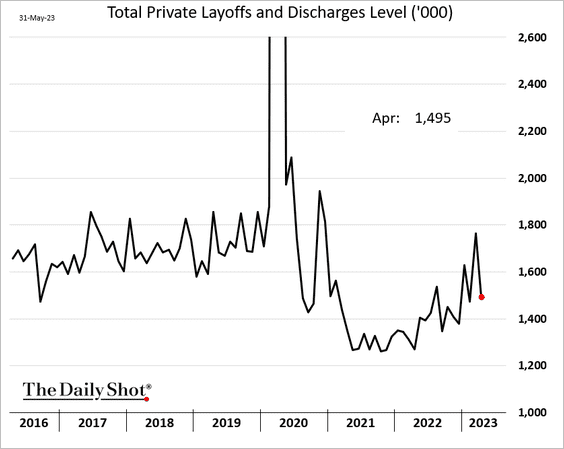

• Layoffs eased in April.

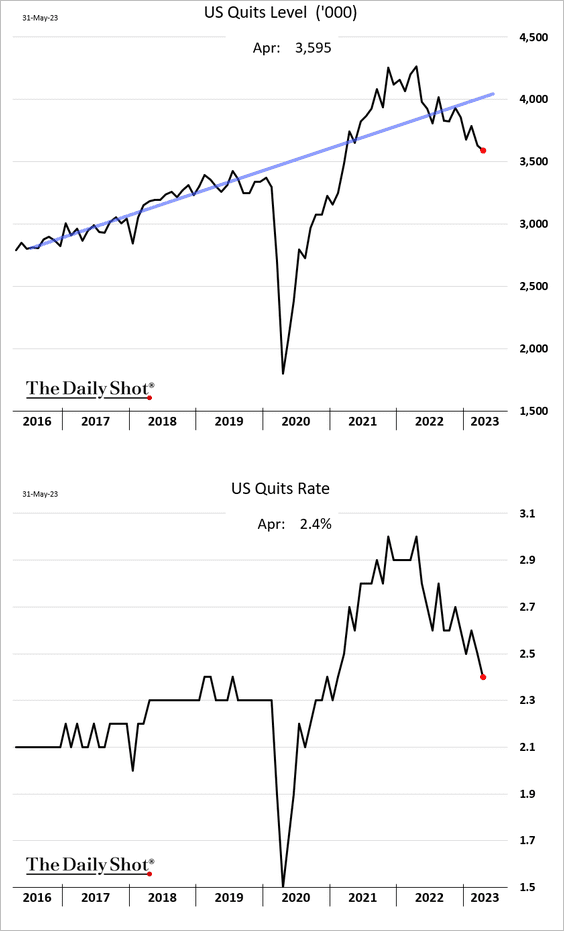

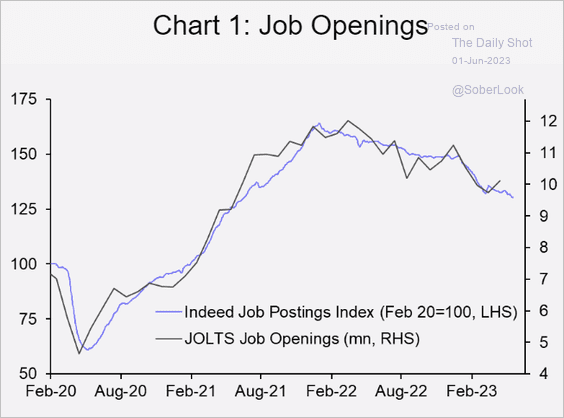

• Voluntary resignations (quits) declined again and are approaching pre-COVID levels. The trend suggests some loosening in the jobs market as the Great Resignation ends.

Falling quits rate signals deceleration in wage growth.

Source: Capital Economics

Source: Capital Economics

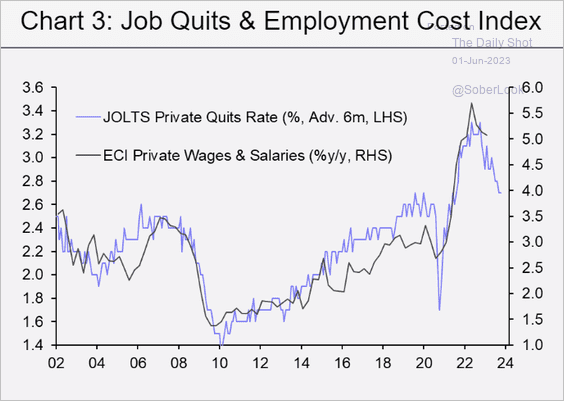

• Postings on Indeed point to lower job openings ahead.

Source: Capital Economics

Source: Capital Economics

——————–

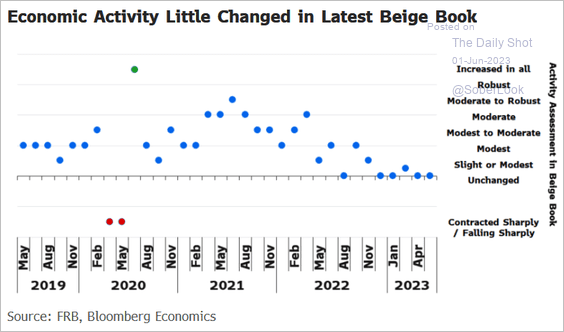

2. The Fed’s Beige Book sentiment was roughly unchanged from April, according to Bloomberg Economics.

Source: @WingerEliza Read full article

Source: @WingerEliza Read full article

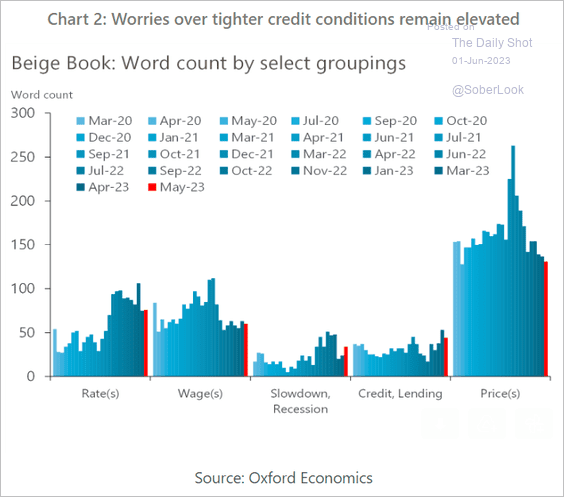

Concerns about tighter credit persist.

Source: Oxford Economics

Source: Oxford Economics

——————–

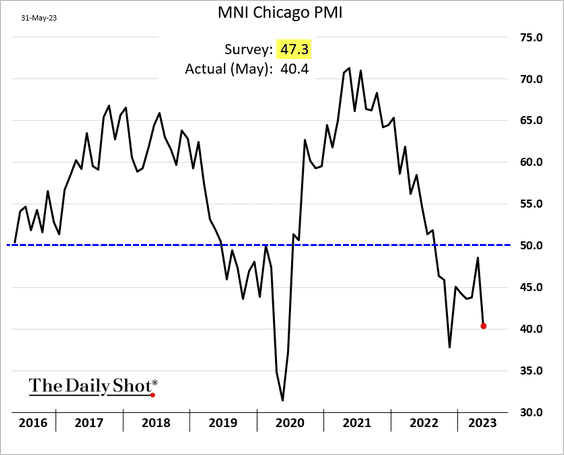

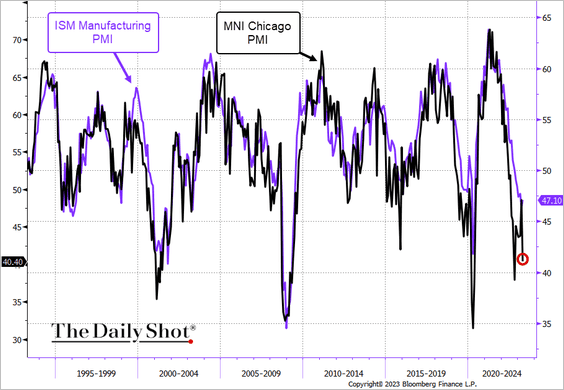

3. The MNI Chicago PMI surprised to the downside, moving deeper into contraction territory.

The index points to downside risks for manufacturing activity at the national level.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

——————–

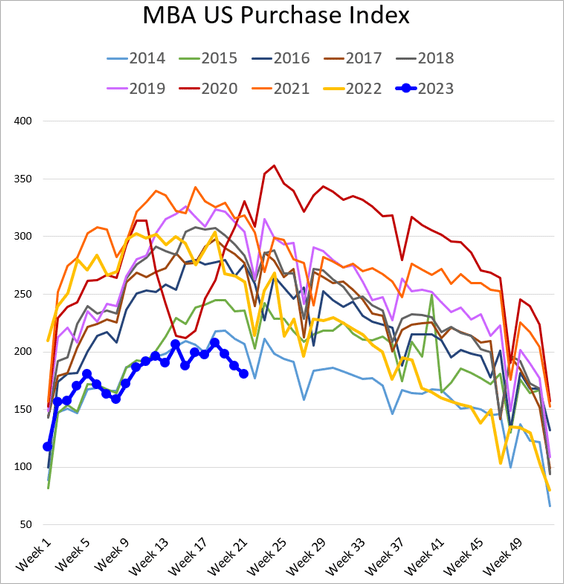

4. Mortgage applications remain at multi-year lows, …

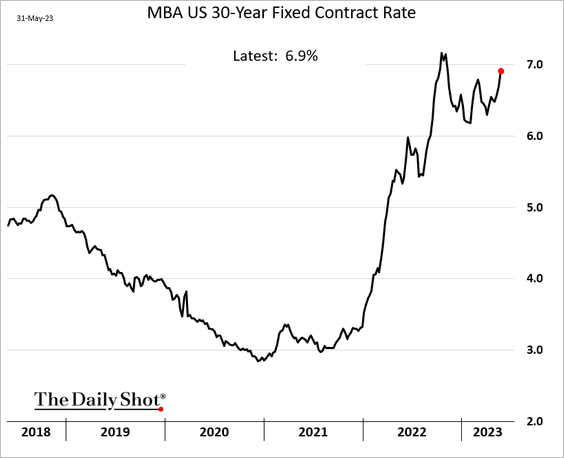

… as mortgage rates climb.

——————–

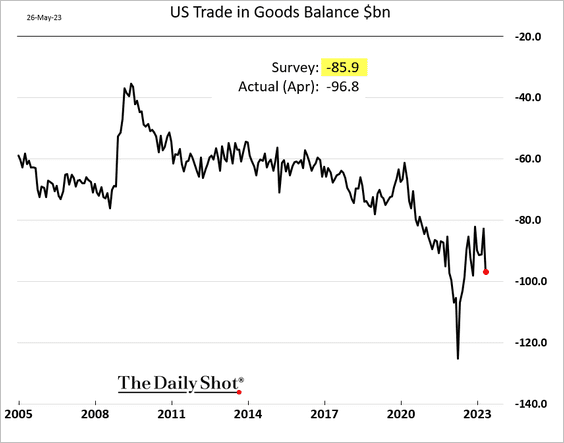

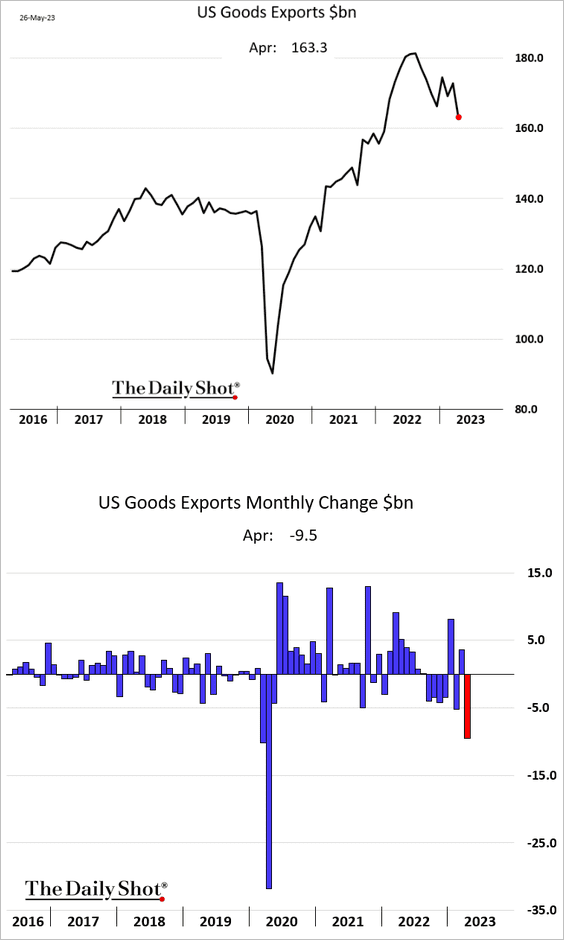

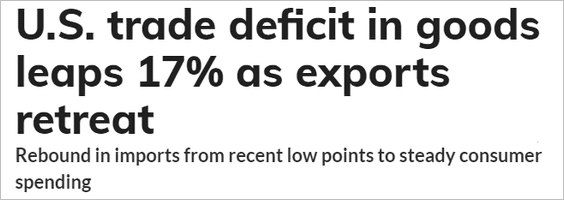

5. US trade in goods deficit widened in April.

Exports declined.

Source: MarketWatch Read full article

Source: MarketWatch Read full article

——————–

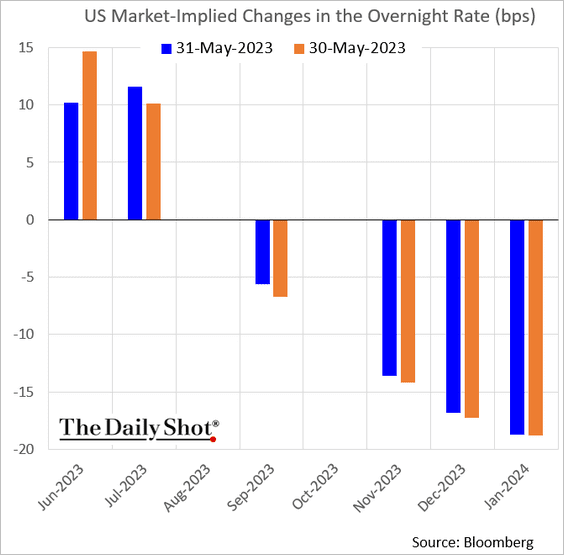

6. Fed officials are hinting at a “pause” in June, with rate hikes continuing in July.

Source: @WSJ Read full article

Source: @WSJ Read full article

Here are the changes in market expectations between Tuesday and Wednesday.

——————–

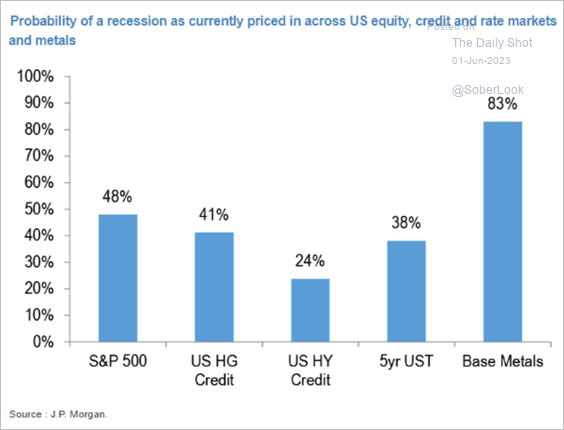

7. This chart shows recession probabilities priced by different asset classes.

Source: JP Morgan Research; III Capital Management

Source: JP Morgan Research; III Capital Management

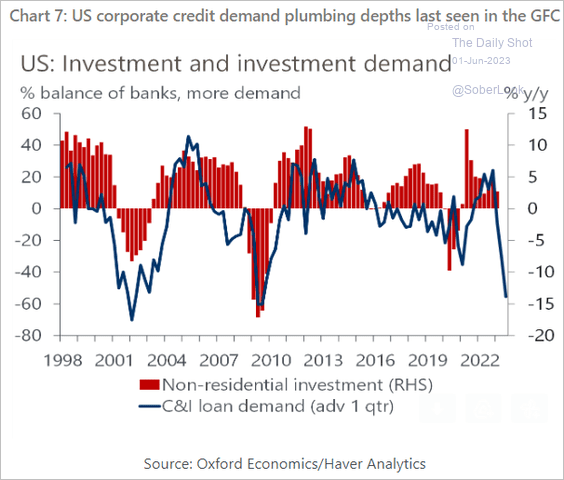

8. Weak credit demand signals slowing CapEx ahead.

Source: Oxford Economics

Source: Oxford Economics

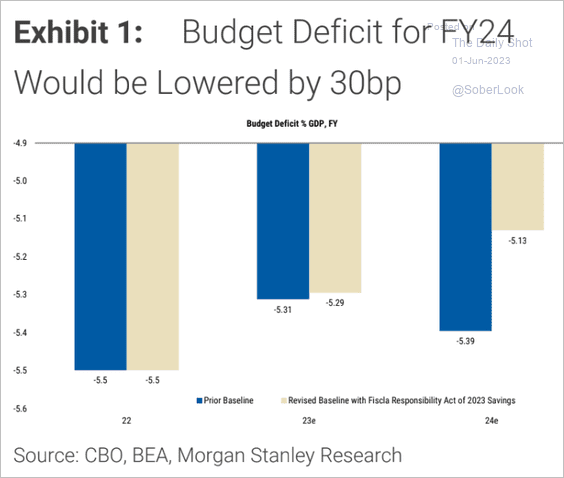

9. The House passed the debt ceiling legislation.

Source: @WSJ Read full article

Source: @WSJ Read full article

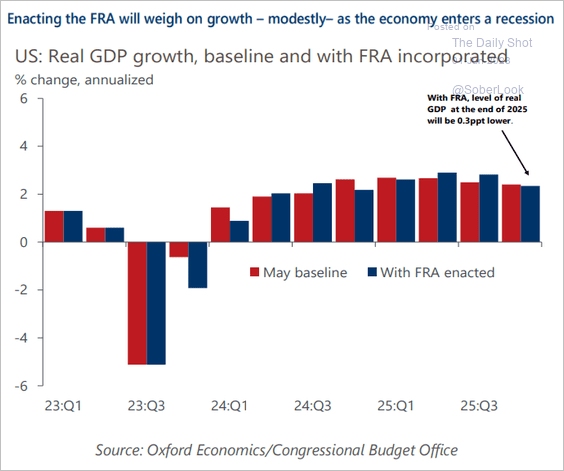

How will the bill impact the budget deficit and economic growth?

Source: Morgan Stanley Research

Source: Morgan Stanley Research

Source: Oxford Economics

Source: Oxford Economics

Back to Index

Canada

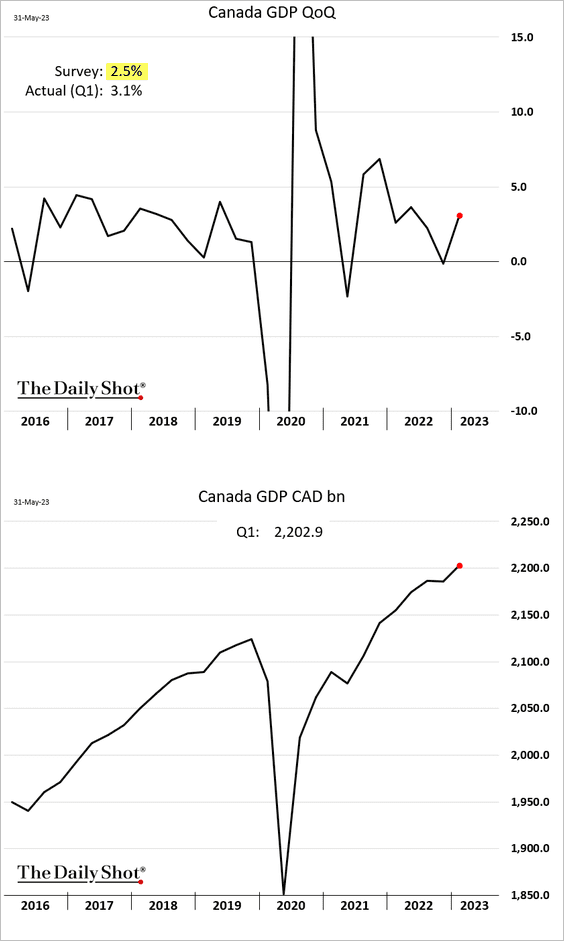

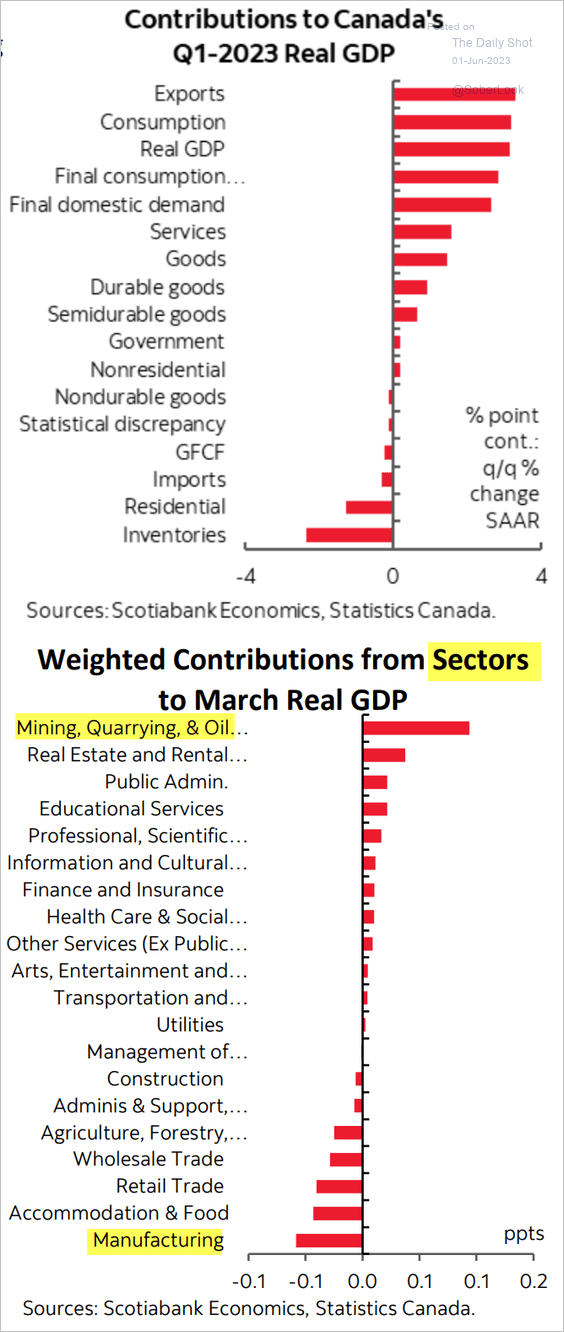

1. The Q1 GDP growth topped expectations.

Here are the contributions.

Source: Scotiabank Economics

Source: Scotiabank Economics

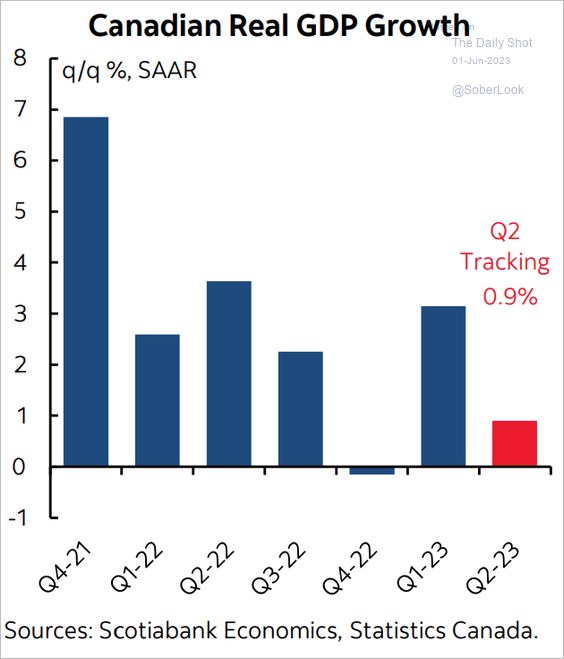

Scotia Economics’ GDP tracker has the Q2 growth running at 0.9%.

Source: Scotiabank Economics

Source: Scotiabank Economics

——————–

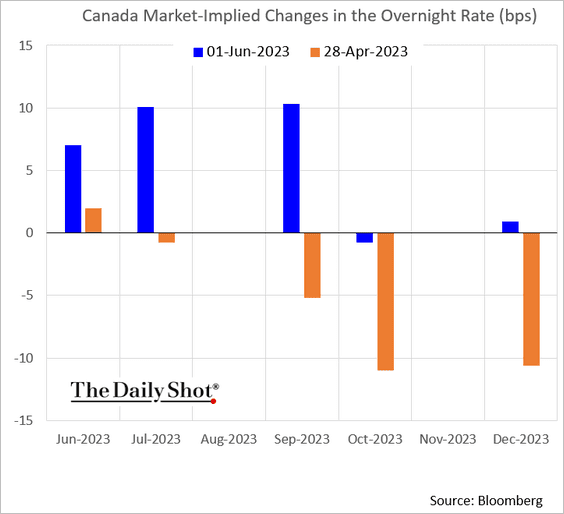

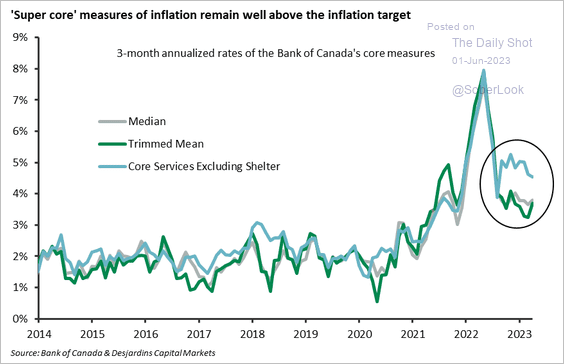

2. A BoC rate hike is now fully priced in, …

… as core inflation remains elevated.

Source: Desjardins

Source: Desjardins

——————–

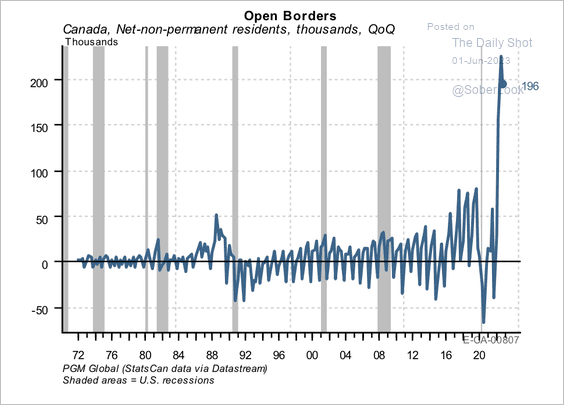

3. Soaring immigration is spurring demand for housing.

Source: PGM Global

Source: PGM Global

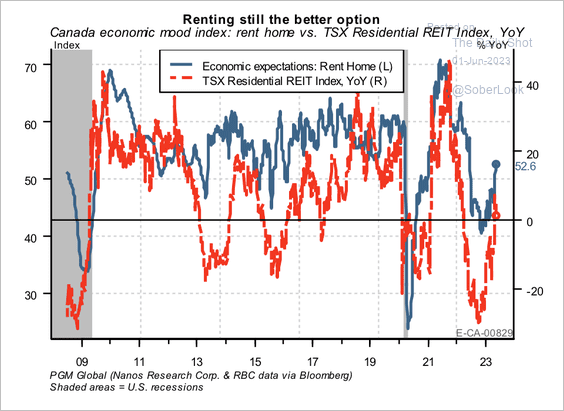

4. Residential REITs could benefit from higher rental prices.

Source: PGM Global

Source: PGM Global

Back to Index

The Eurozone

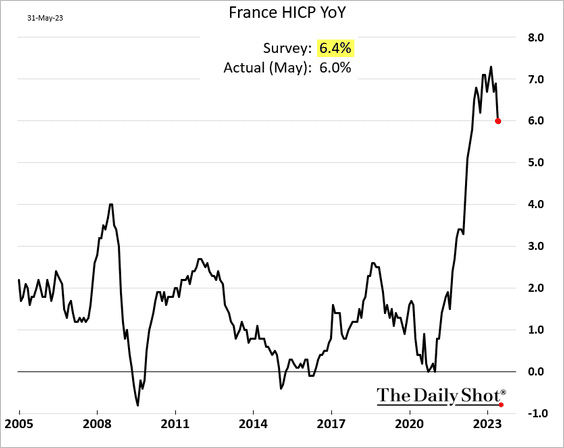

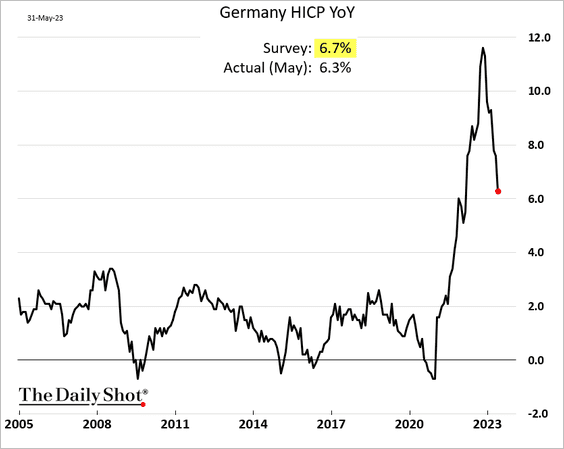

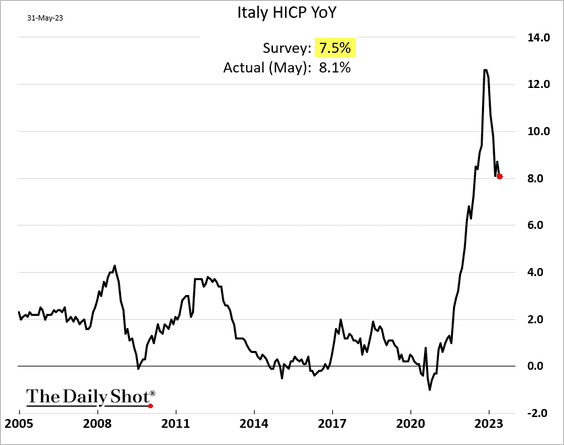

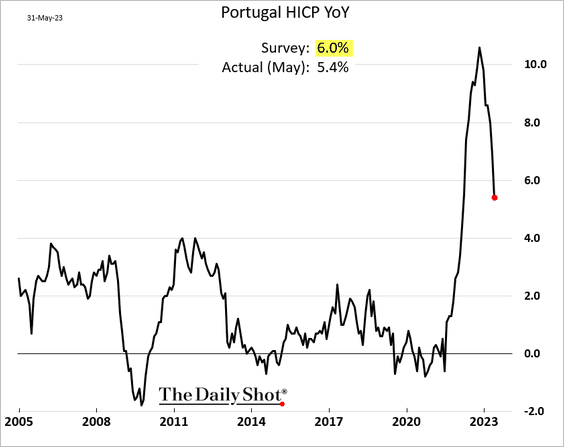

1. The May inflation figures were lower than expected, except for Italy.

• Spain: see the chart from yesterday.

• France:

• Germany:

• Italy:

• Portugal:

——————–

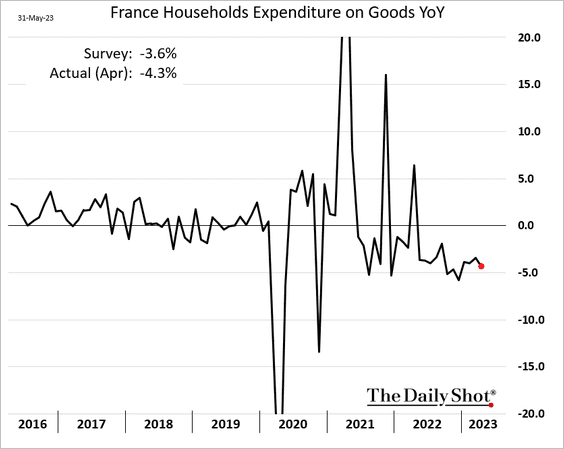

2. French household spending on goods declined in April.

Source: ING Read full article

Source: ING Read full article

——————–

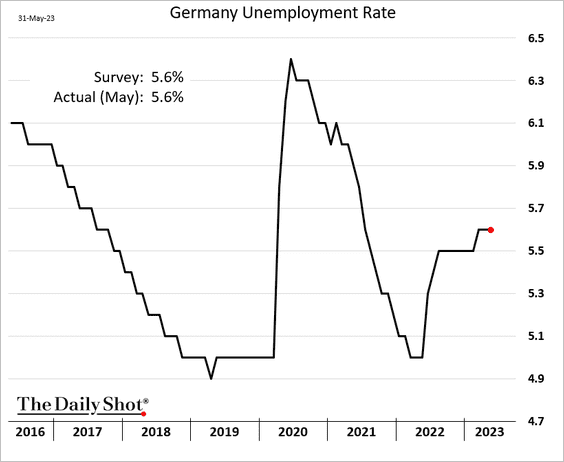

3. Germany’s unemployment held steady in May.

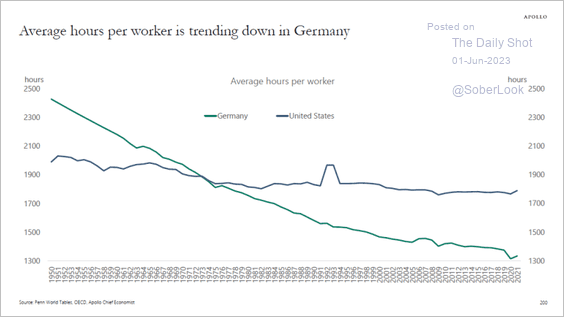

This chart shows Germany’s average hours per worker (over time).

Source: Torsten Slok, Apollo

Source: Torsten Slok, Apollo

Back to Index

Europe

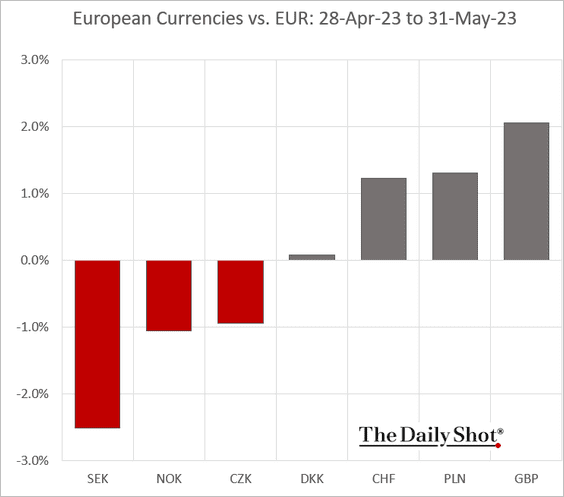

1. Let’s start with the May performance of select currencies against the euro.

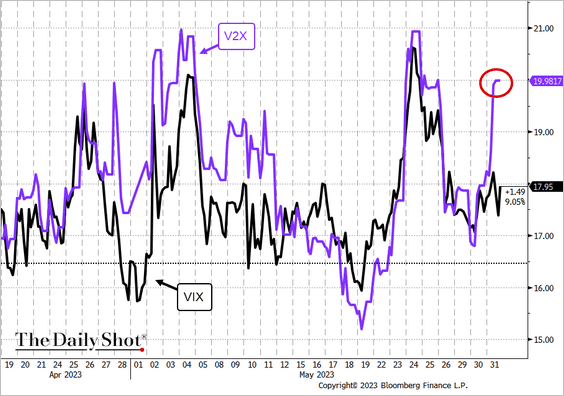

2. European equity-market implied vol index (V2X) jumped this week, outpacing VIX.

Source: @TheTerminal, Bloomberg Finance L.P.; h/t @themarketear

Source: @TheTerminal, Bloomberg Finance L.P.; h/t @themarketear

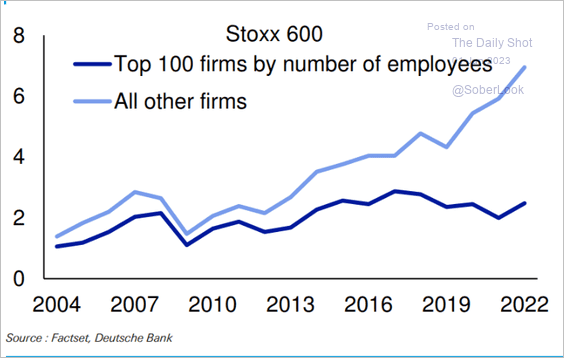

3. Large employers have been underperforming in the equity market.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

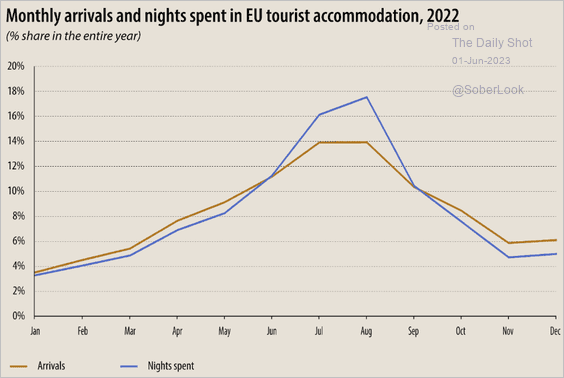

4. This chart shows the seasonality of tourism activity in the EU.

Source: Eurostat Read full article

Source: Eurostat Read full article

Back to Index

Japan

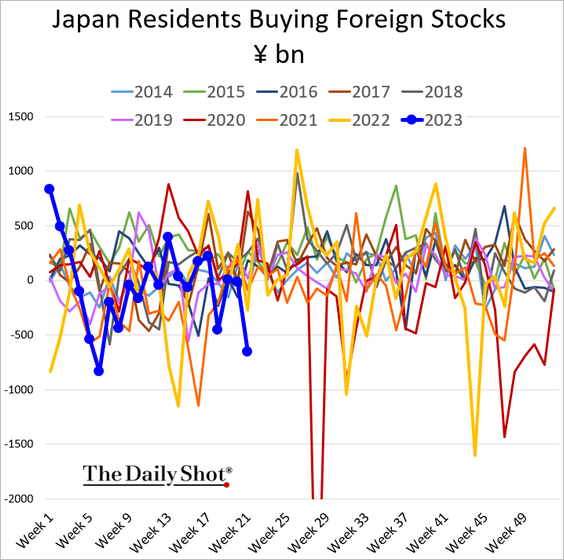

1. Japanese investors have been dumping foreign stocks as domestic shares surge.

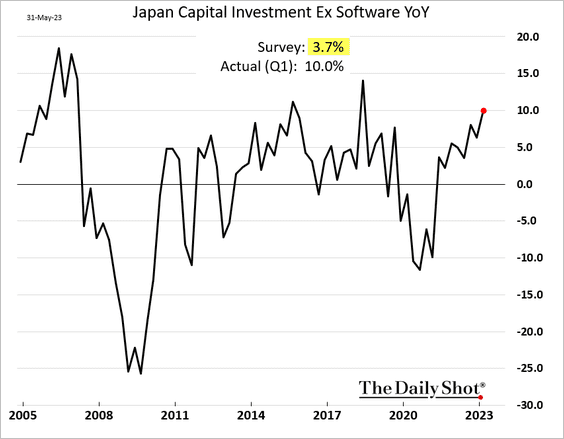

2. CapEx growth has been strong.

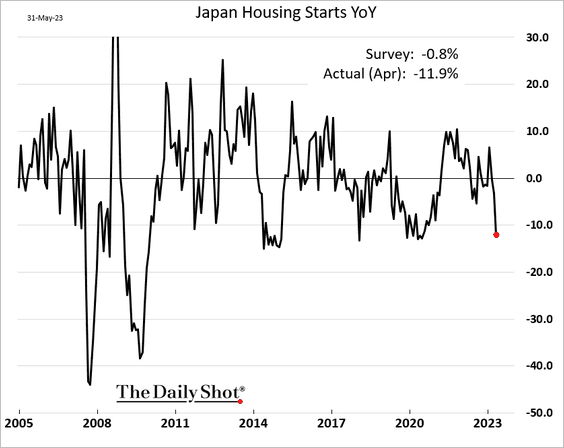

3. Housing starts deteriorated in April.

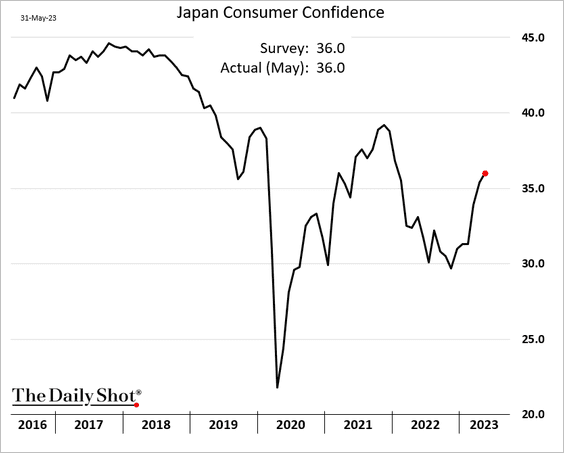

4. Consumer confidence edged higher in May.

Back to Index

Asia-Pacific

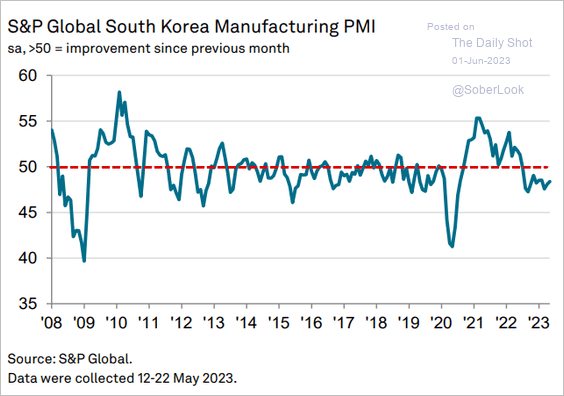

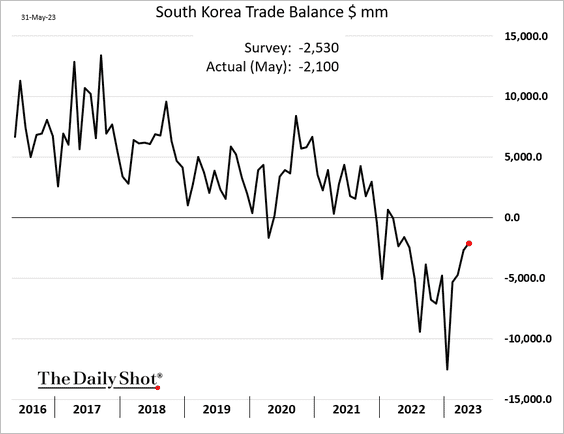

1. South Korea’s manufacturing activity remains in contraction territory.

Source: S&P Global PMI

Source: S&P Global PMI

The nation’s trade deficit continues to narrow.

——————–

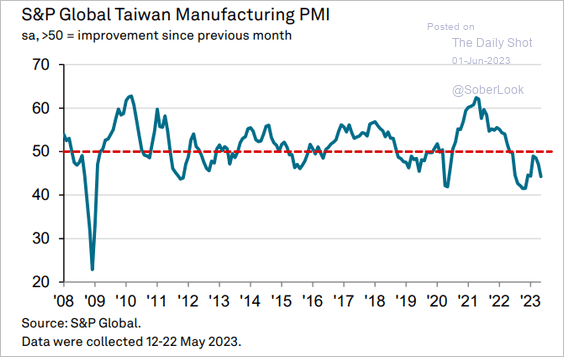

2. Taiwan’s manufacturing contraction accelerated last month.

Source: S&P Global PMI

Source: S&P Global PMI

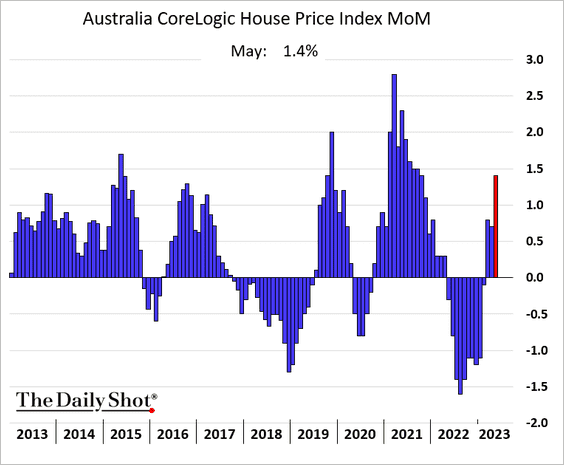

3. Australia’s home prices jumped in May.

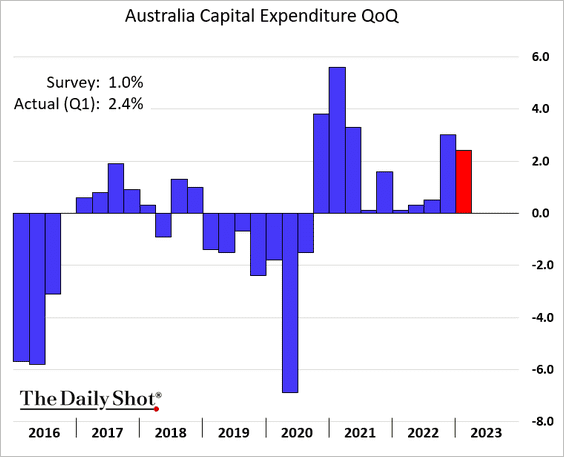

Separately, the country’s Q1 CapEx growth topped expectations.

Back to Index

China

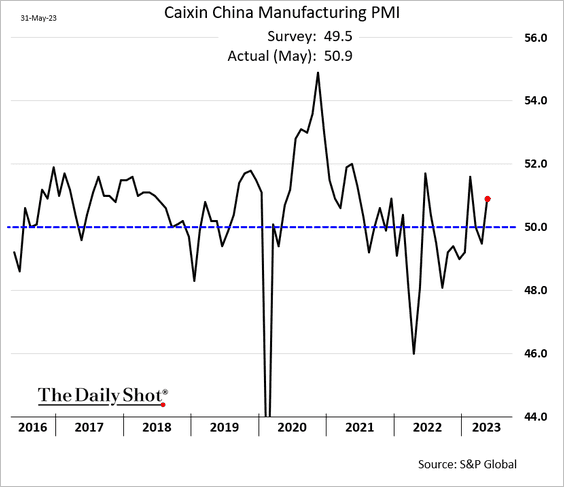

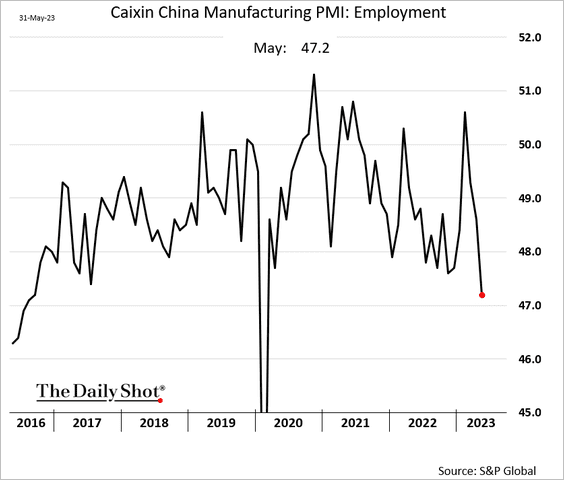

1. Unlike the official PMI, the manufacturing index from S&P Global showed factory activity growing in May.

But factory employment is shrinking.

——————–

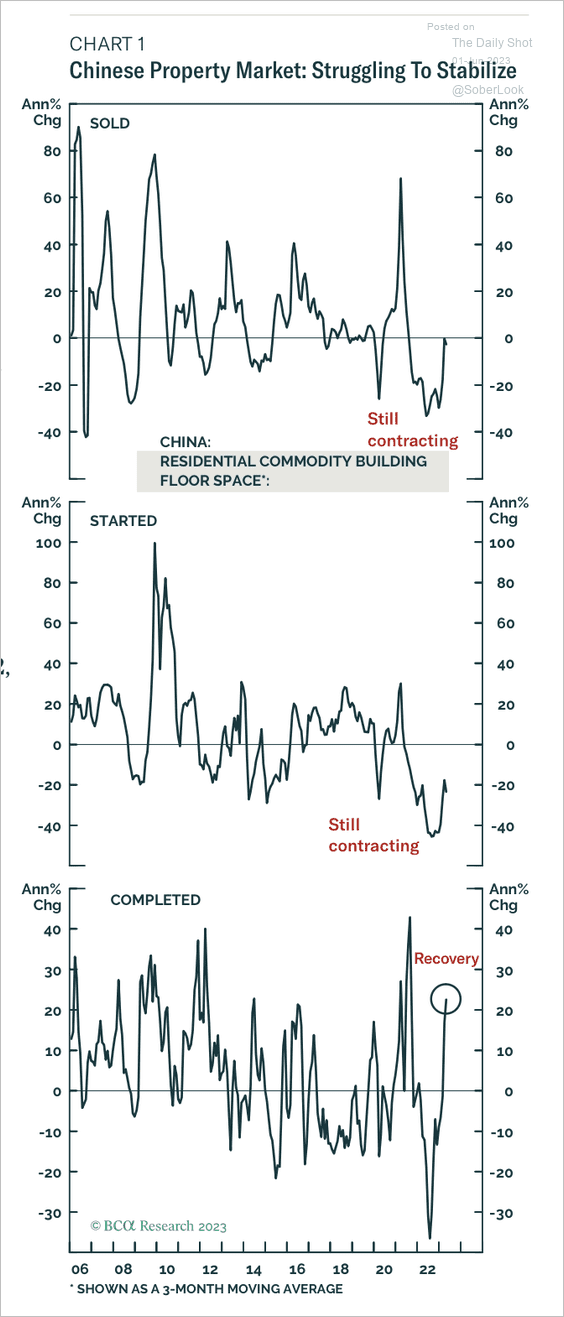

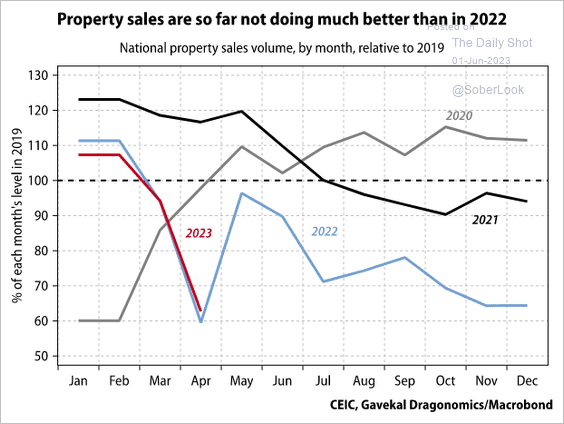

2. While property completions have rebounded, sales and starts remain weak.

Source: BCA Research

Source: BCA Research

Source: Gavekal Research

Source: Gavekal Research

——————–

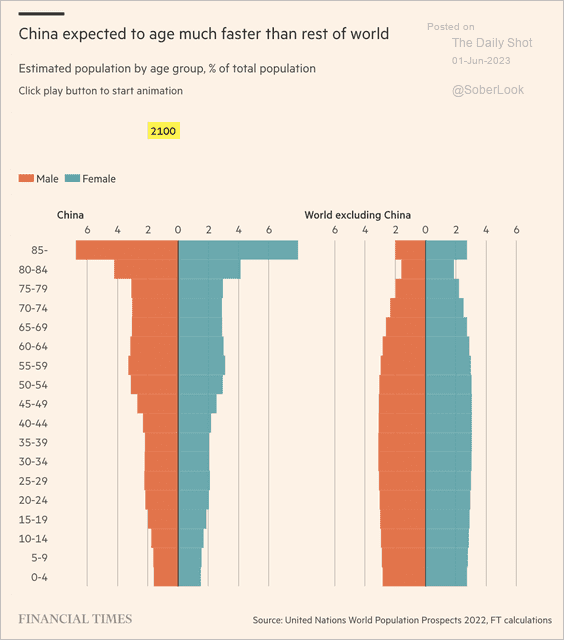

3. China faces demographic headwinds in the decades ahead.

Source: @financialtimes Read full article

Source: @financialtimes Read full article

Back to Index

Emerging Markets

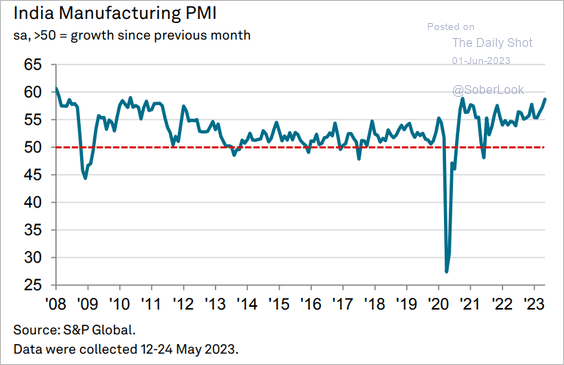

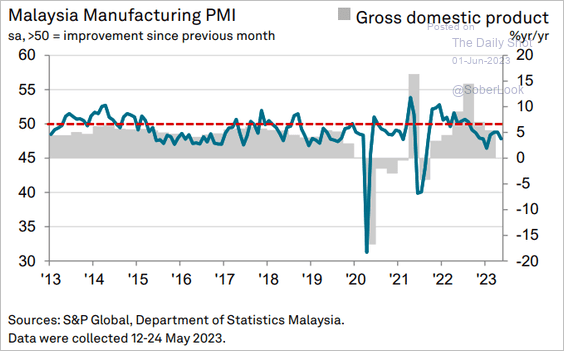

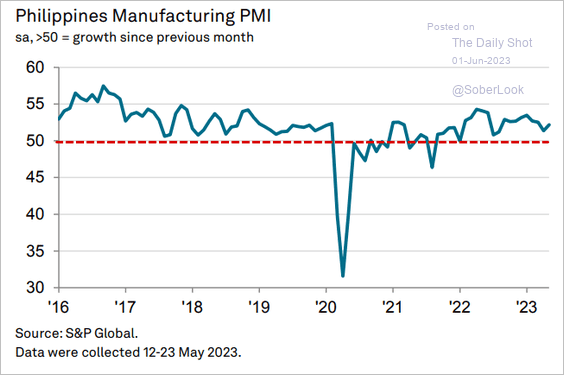

1. Let’s run through Asian manufacturing PMIs.

• India (remarkably strong growth):

Source: S&P Global PMI

Source: S&P Global PMI

• Malaysia (contraction continues):

Source: S&P Global PMI

Source: S&P Global PMI

• The Philippines (faster growth in May):

Source: S&P Global PMI

Source: S&P Global PMI

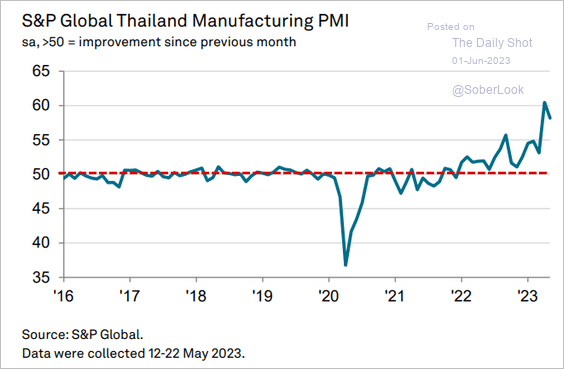

• Thailand (exceptionally strong growth):

Source: S&P Global PMI

Source: S&P Global PMI

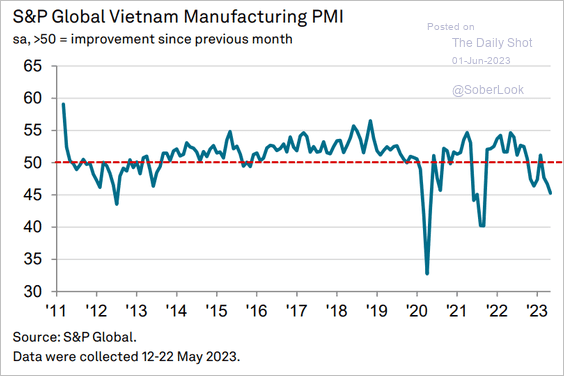

• Vietnam (contraction deepens):

Source: S&P Global PMI

Source: S&P Global PMI

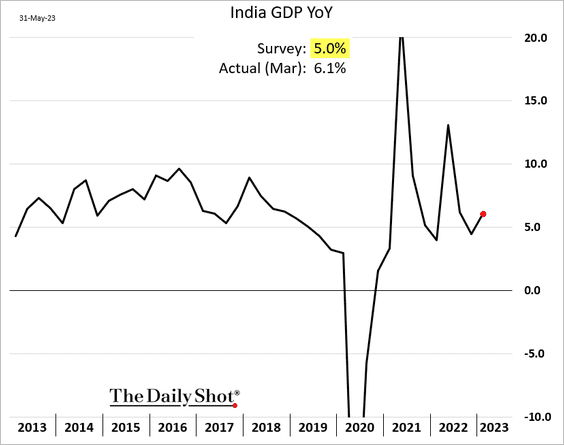

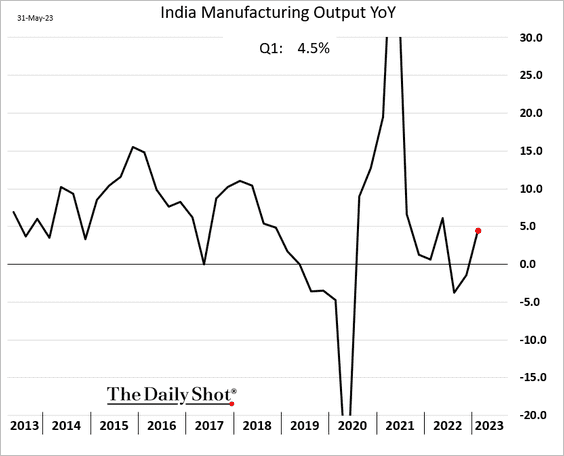

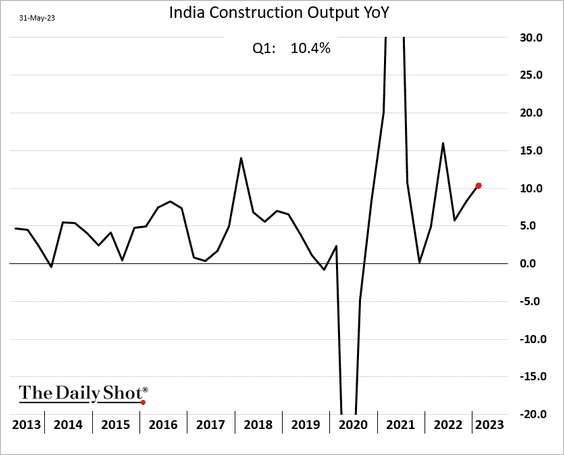

2. India’s GDP topped expectations.

Source: Reuters Read full article

Source: Reuters Read full article Manufacturing and construction output strengthened.

——————–

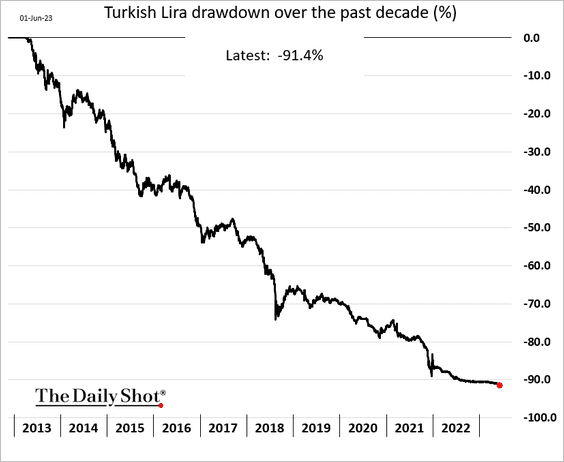

3. Here is the Turkish lira’s drawdown (vs. USD) over the past ten years.

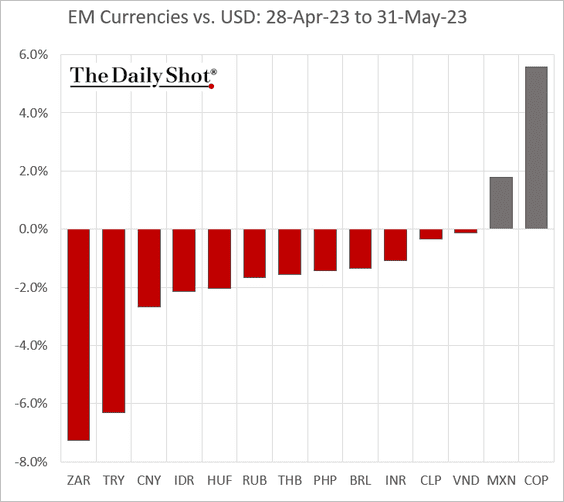

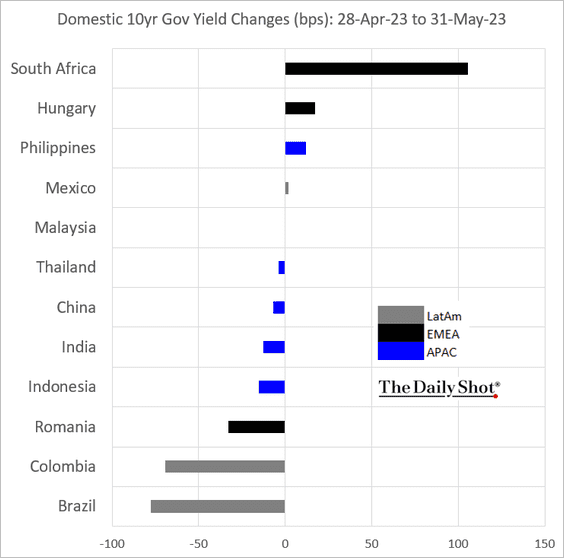

4. Next, we have some performance data for May.

• Currencies:

• Bond yields:

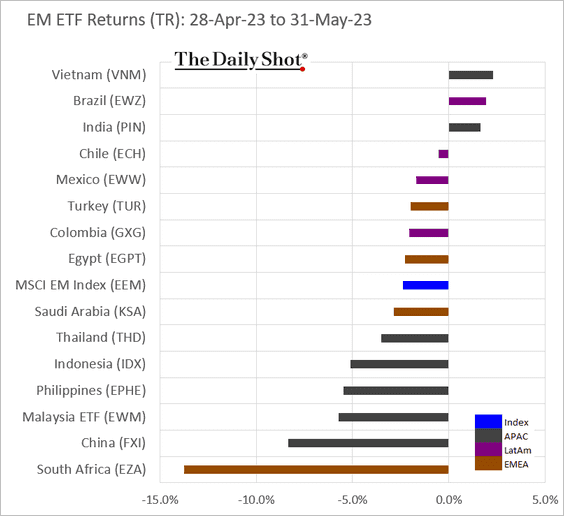

• Equity ETFs:

Back to Index

Commodities

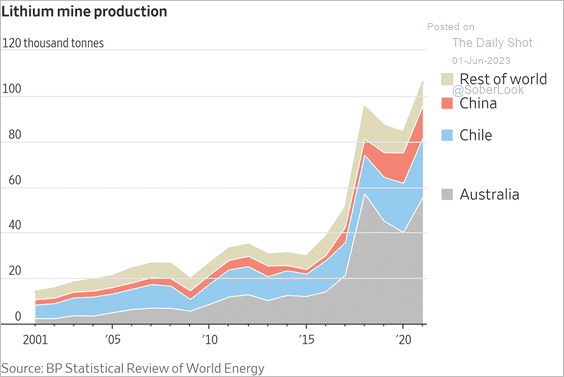

1. This chart shows the contributions to global lithium production.

Source: @WSJ Read full article

Source: @WSJ Read full article

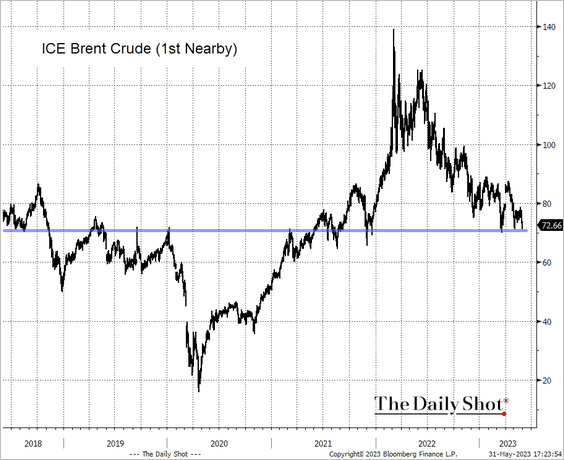

2. Brent crude is at support.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

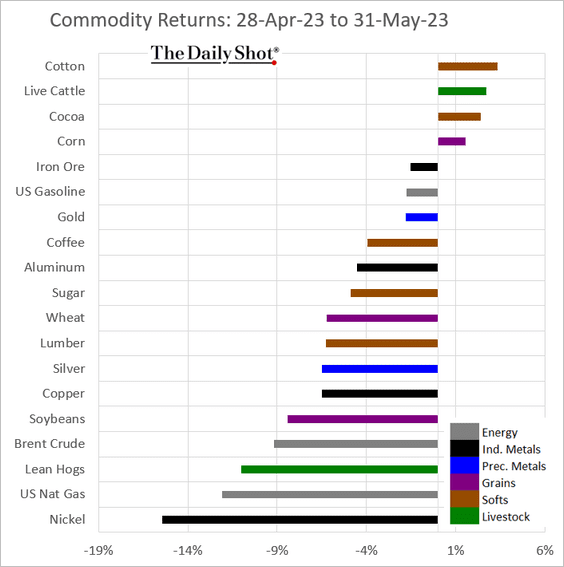

3. Here is last month’s performance across key commodity markets.

Back to Index

Equities

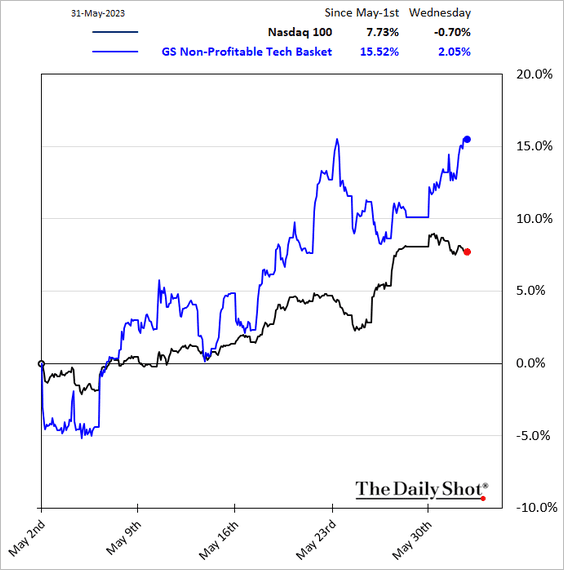

1. Speculative tech stocks are outperforming again.

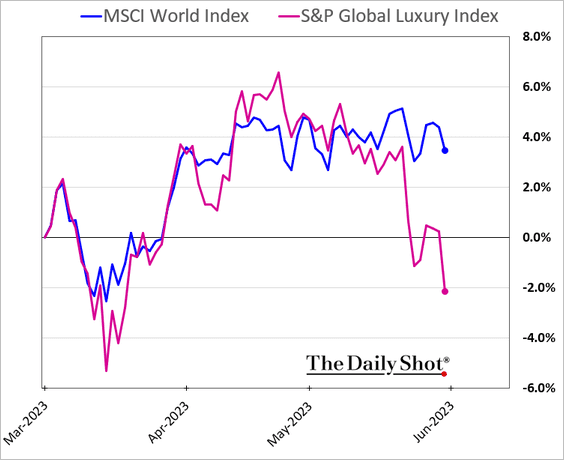

2. Luxury stocks are rolling over as China’s recovery disappoints.

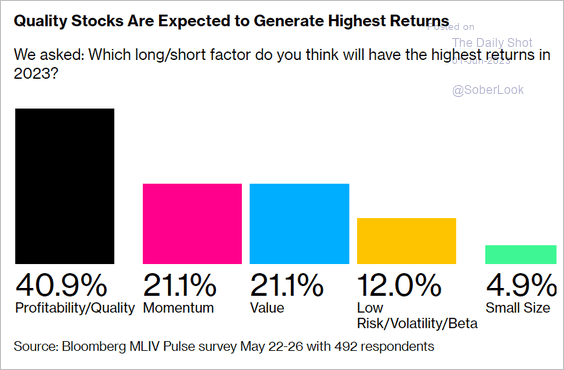

3. How will equity factors perform in 2023?

Source: @markets Read full article

Source: @markets Read full article

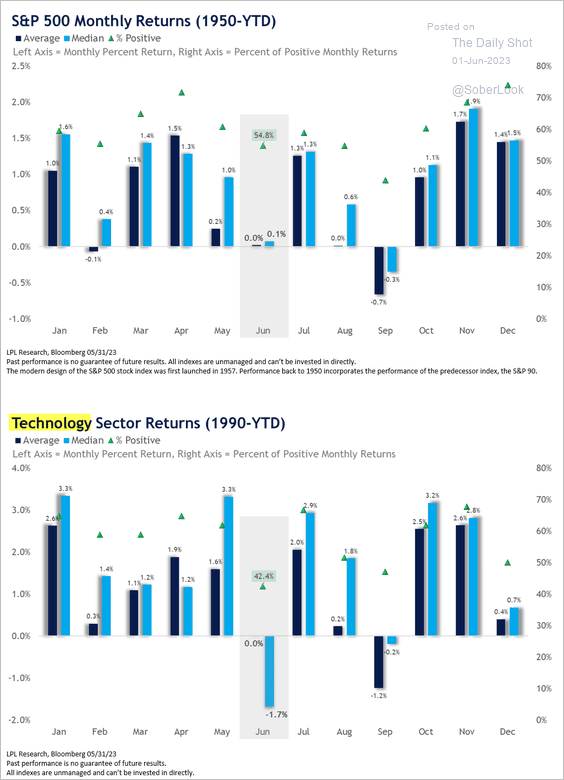

4. There are no seasonal tailwinds in June.

Source: LPL Research

Source: LPL Research

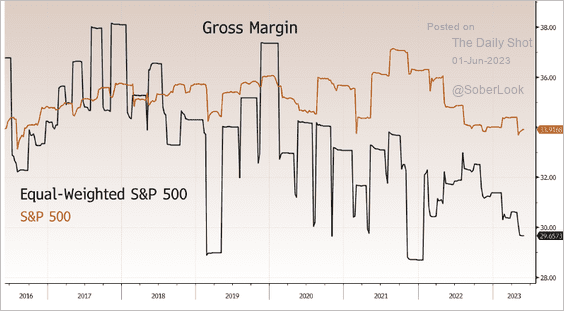

5. Margins for the S&P 500 equal-weight index have been deteriorating.

Source: Simon White, Bloomberg Markets Live Blog

Source: Simon White, Bloomberg Markets Live Blog

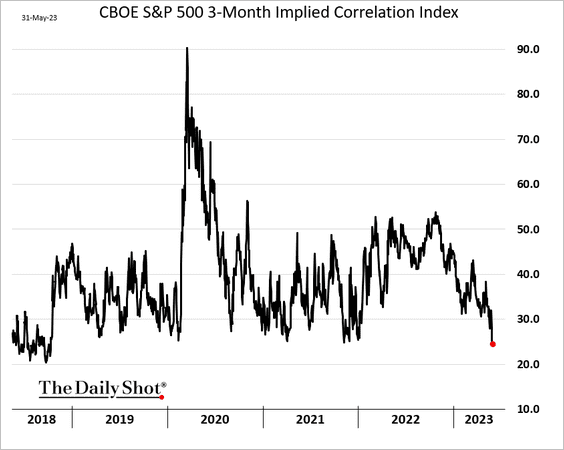

6. S&P 500 implied correlation has been sinking.

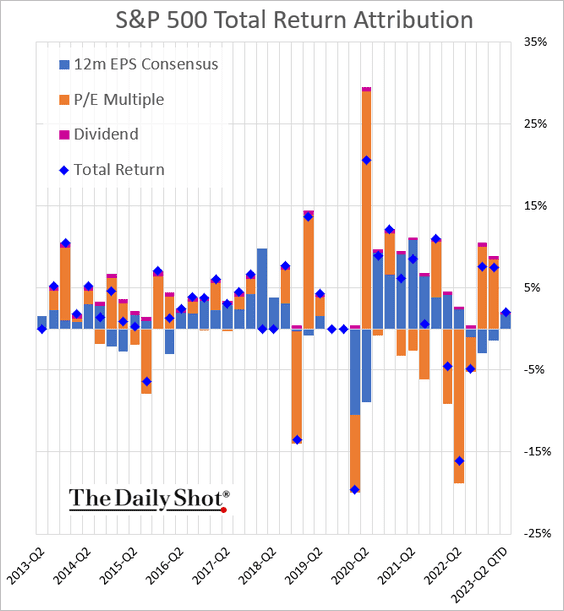

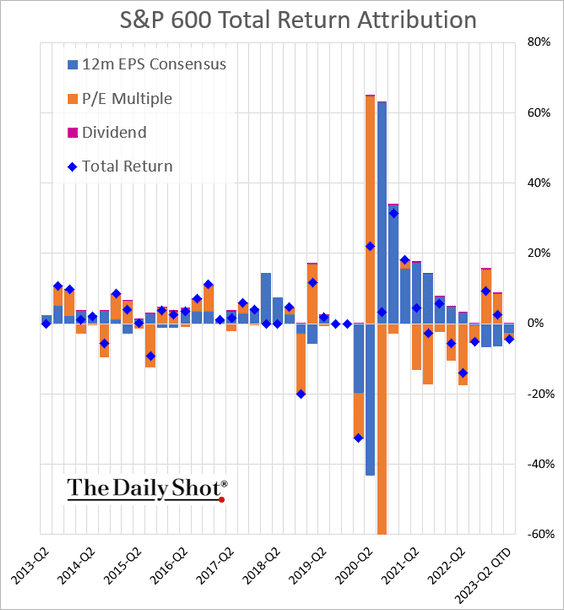

7. Next, let’s take a look at quarterly return attributions.

• S&P 500:

• S&P 600 (small caps):

——————–

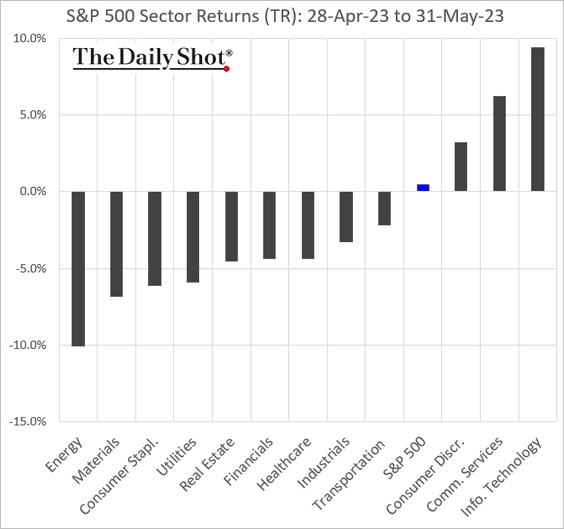

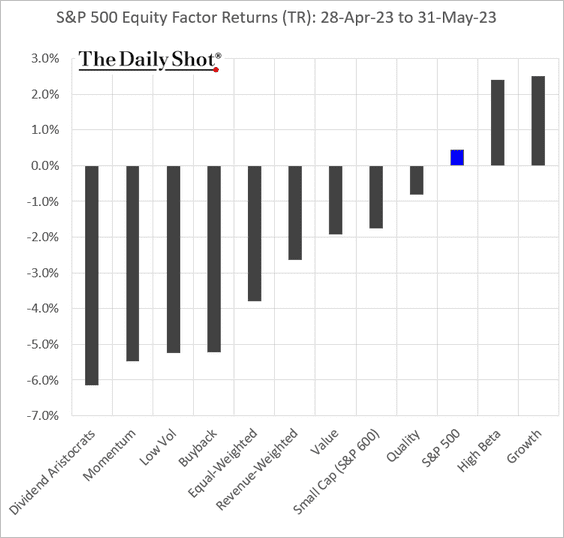

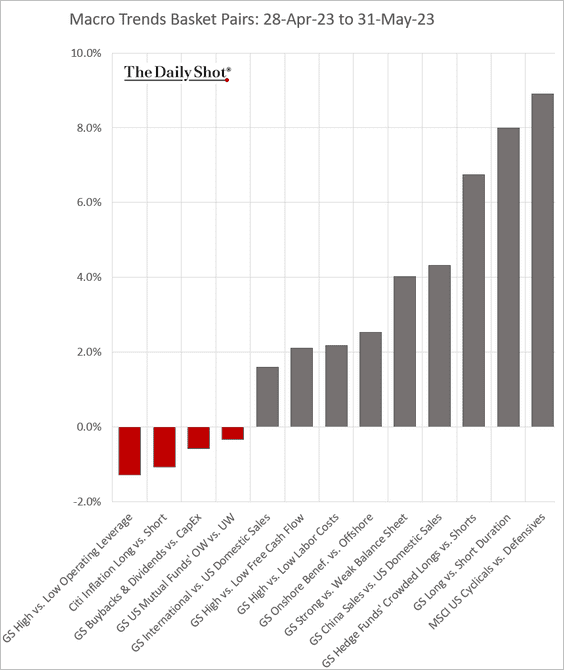

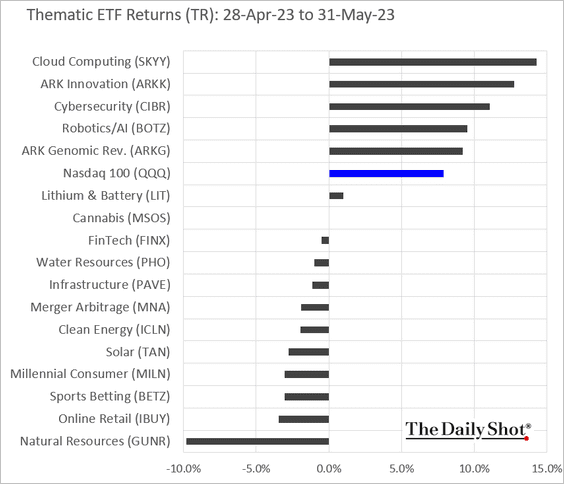

8. Finally, here is a look at performance data for May.

• Sectors:

• Equity factors:

• Macro basket pairs’ relative performance:

• Thematic ETFs:

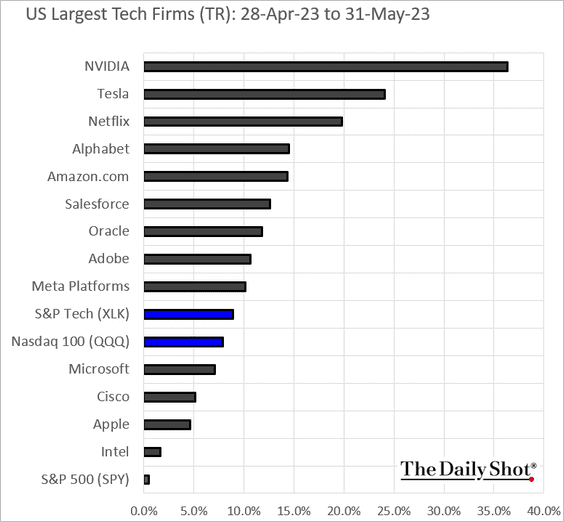

• Largest US tech firms:

Back to Index

Credit

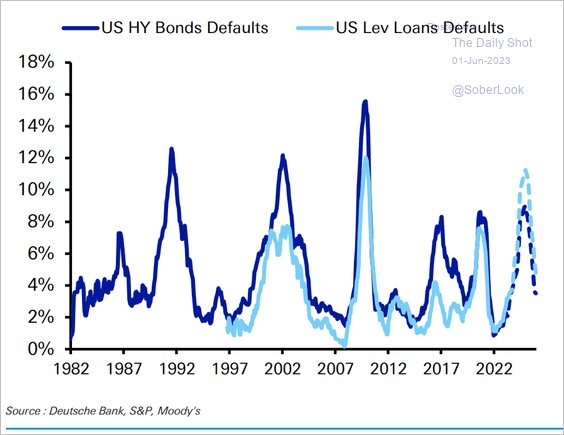

1. Deutsche Bank sees the leveraged loan default rate reaching the highest level since the GFC.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

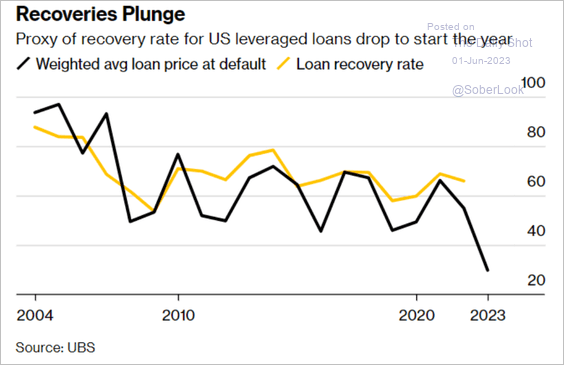

Leveraged loan recovery rates have been worsening.

Source: UBS Research; Variant Perception

Source: UBS Research; Variant Perception

——————–

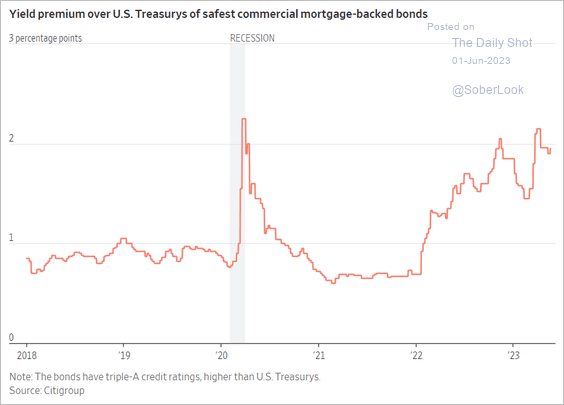

2. CMBS spreads remain elevated.

Source: @WSJ Read full article

Source: @WSJ Read full article

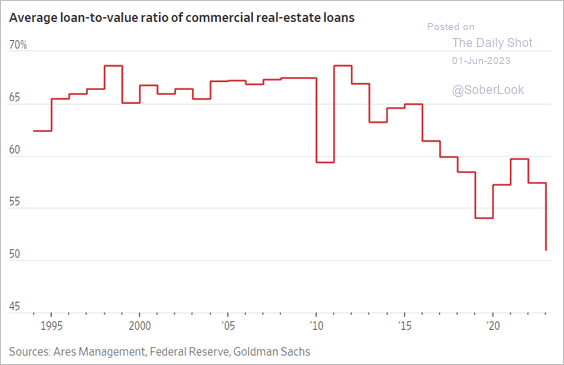

3. Banks have become much more cautious in extending credit backed by commercial real estate.

Source: @WSJ Read full article

Source: @WSJ Read full article

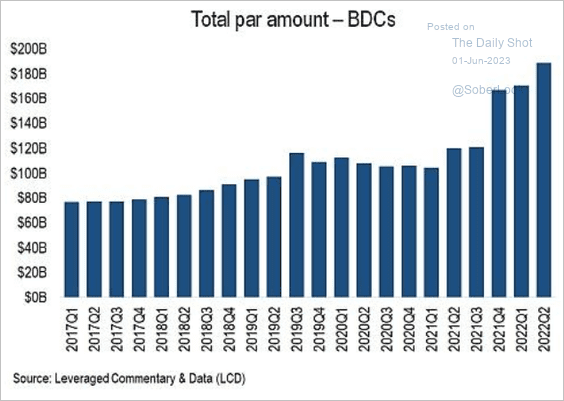

4. BDCs are becoming a key source of capital for private companies.

Source: @lcdnews; Variant Perception

Source: @lcdnews; Variant Perception

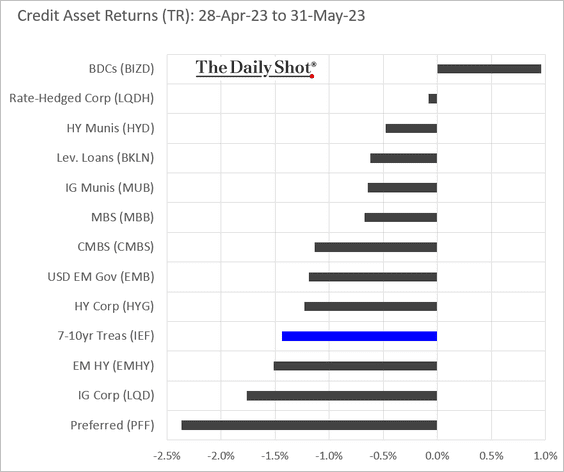

5. Next, we have some performance data for May.

Back to Index

Rates

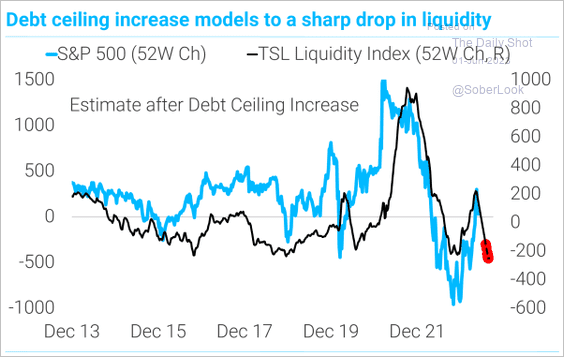

1. Once the debt ceiling is lifted, rebuilding the US Treasury’s account at the Fed will drain liquidity from the banking system.

Source: TS Lombard

Source: TS Lombard

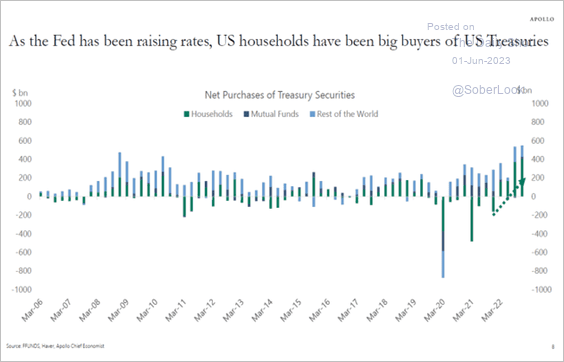

2. Households have been buying Treasuries.

Source: Torsten Slok, Apollo

Source: Torsten Slok, Apollo

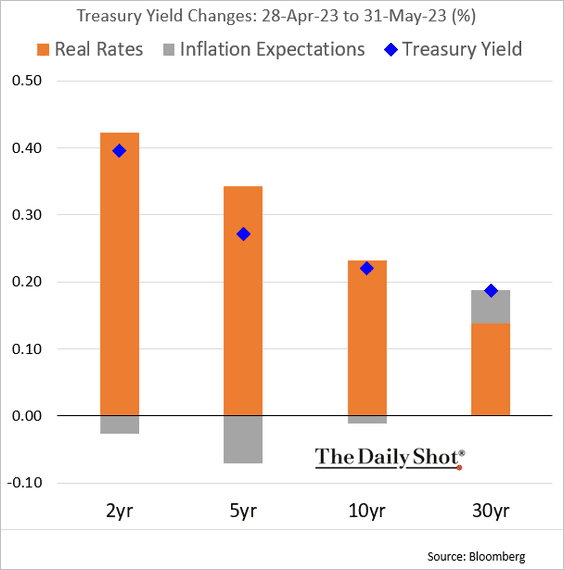

3. Here is the attribution of Treasury yield changes in May.

Back to Index

Global Developments

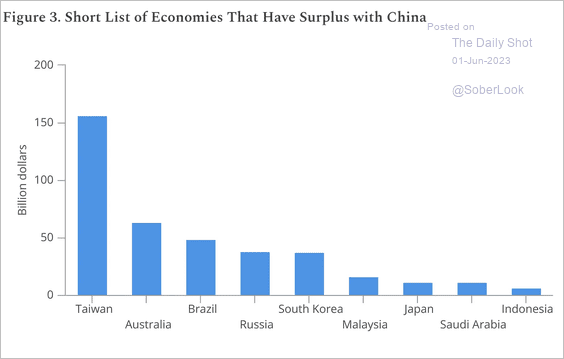

1. This chart shows the countries running a trade surplus with China.

Source: MacroPolo Read full article

Source: MacroPolo Read full article

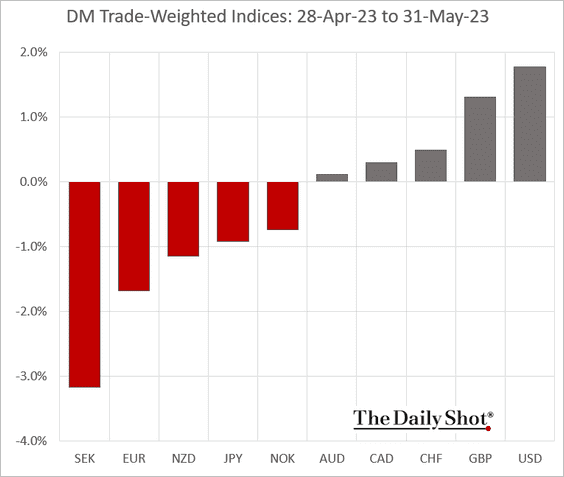

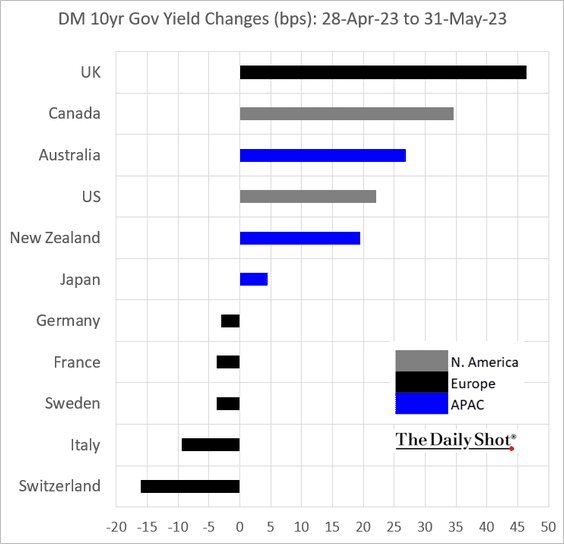

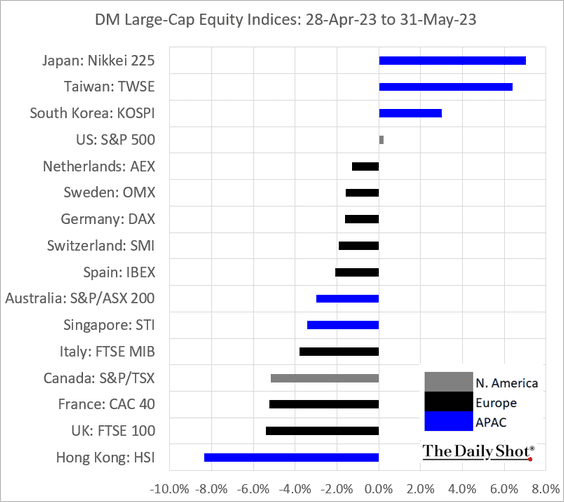

2. Next, we have some DM performance data for May.

• Trade-weighted currency indices:

• Bond yields:

• Large-cap equity indices:

——————–

Food for Thought

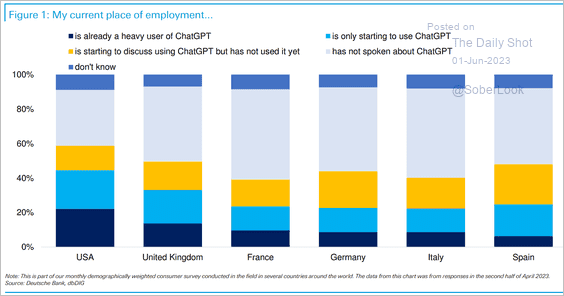

1. The use of ChatGPT in the US and Europe:

Source: Deutsche Bank Research

Source: Deutsche Bank Research

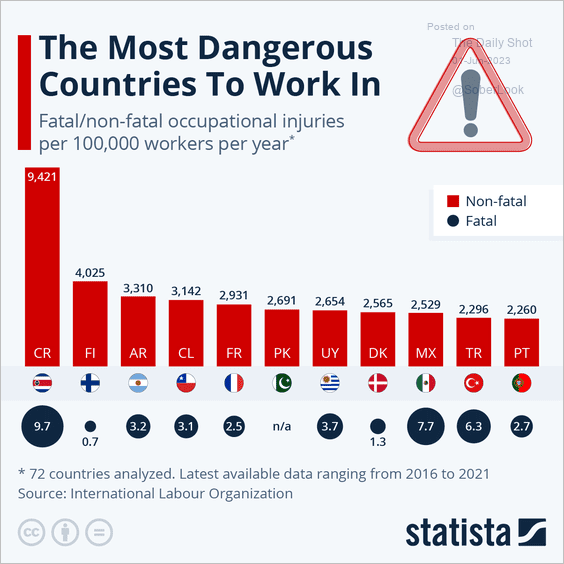

2. Occupational injuries:

Source: Statista

Source: Statista

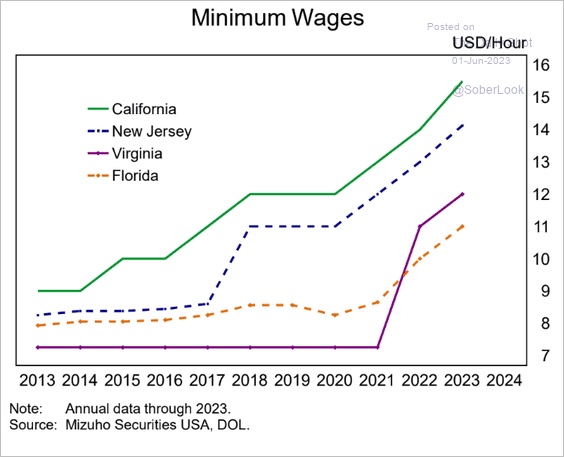

3. The minimum wage in select states:

Source: Mizuho Securities USA

Source: Mizuho Securities USA

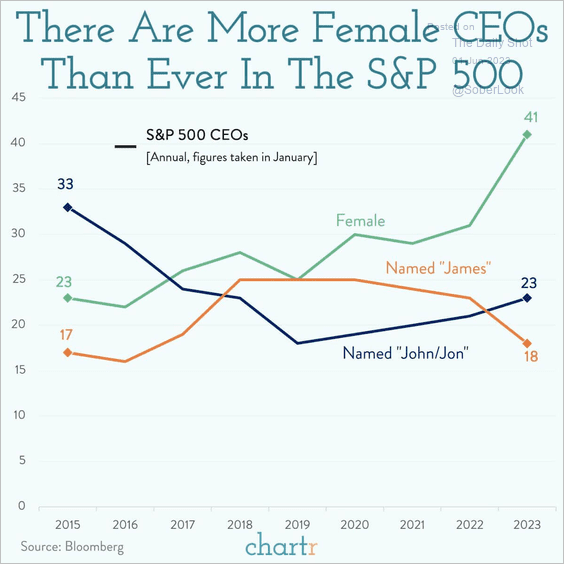

4. S&P 500 female CEOs:

Source: @chartrdaily

Source: @chartrdaily

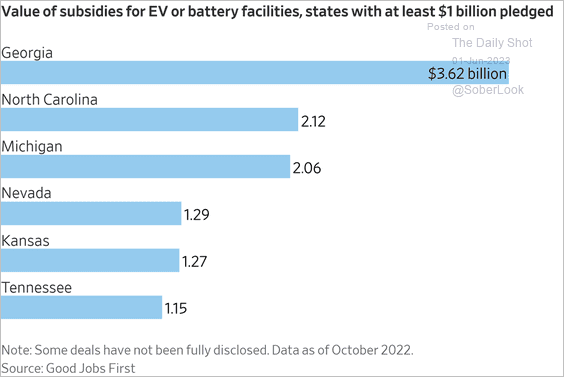

5. Subsidies for EV and battery facilities:

Source: @WSJ Read full article

Source: @WSJ Read full article

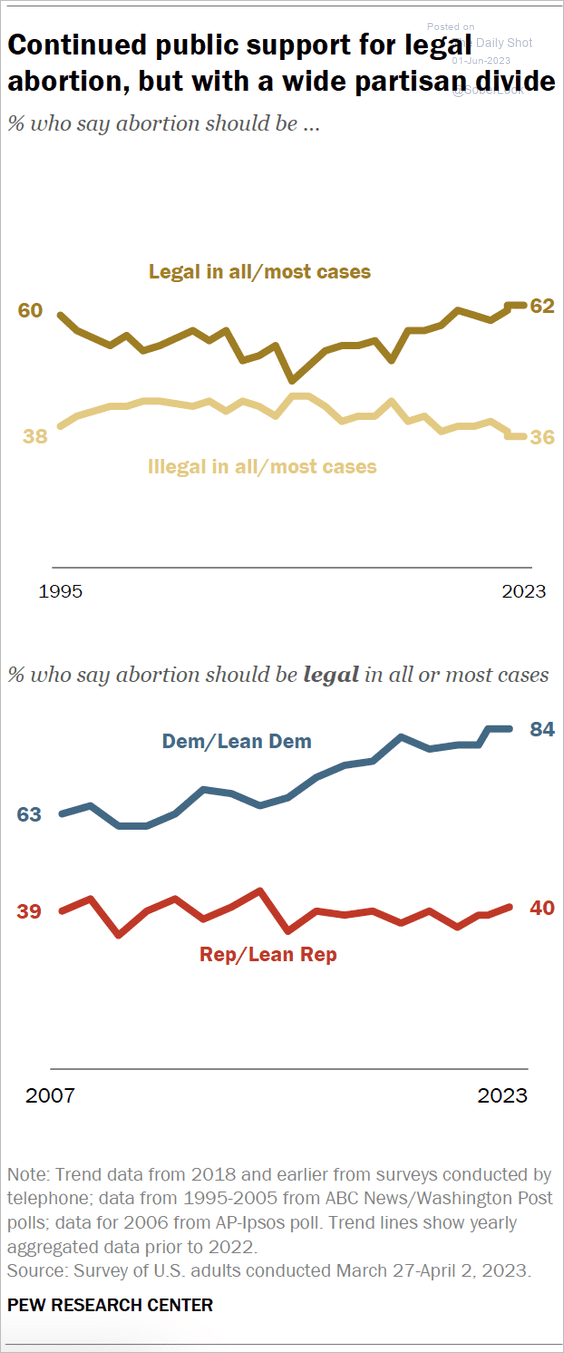

6. Public support for legal abortion:

Source: Pew Research Center Read full article

Source: Pew Research Center Read full article

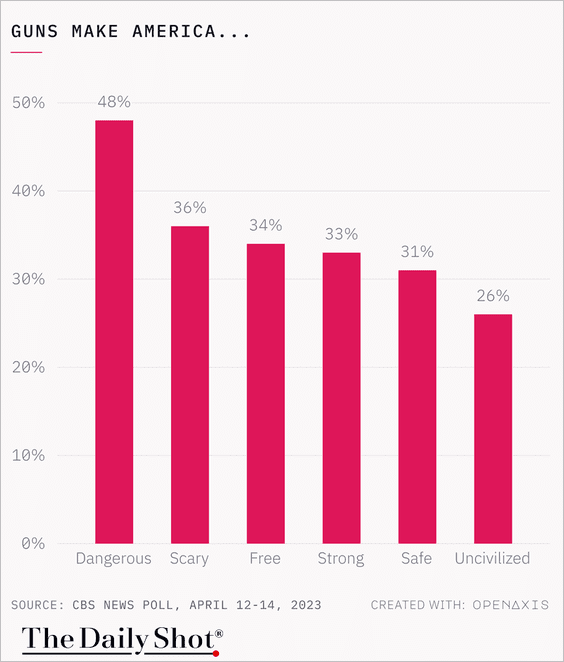

7. How Americans view guns:

Source: @TheDailyShot

Source: @TheDailyShot

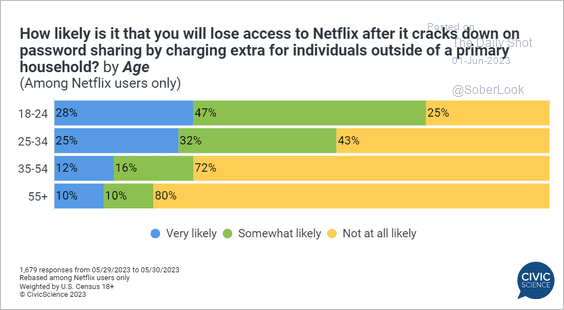

8. Losing access to parents’ Netflix account:

Source: @CivicScience Read full article

Source: @CivicScience Read full article

——————–

Back to Index