The Daily Shot: 07-Jun-23

• The United States

• Canada

• The United Kingdom

• The Eurozone

• Asia-Pacific

• China

• Emerging Markets

• Cryptocurrency

• Commodities

• Equities

• Credit

• Food for Thought

The United States

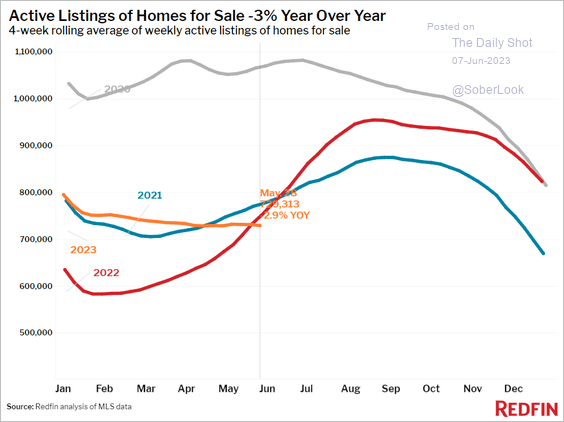

1. Let’s begin with the housing market.

• Active listings dipped below last year’s levels.

Source: Redfin

Source: Redfin

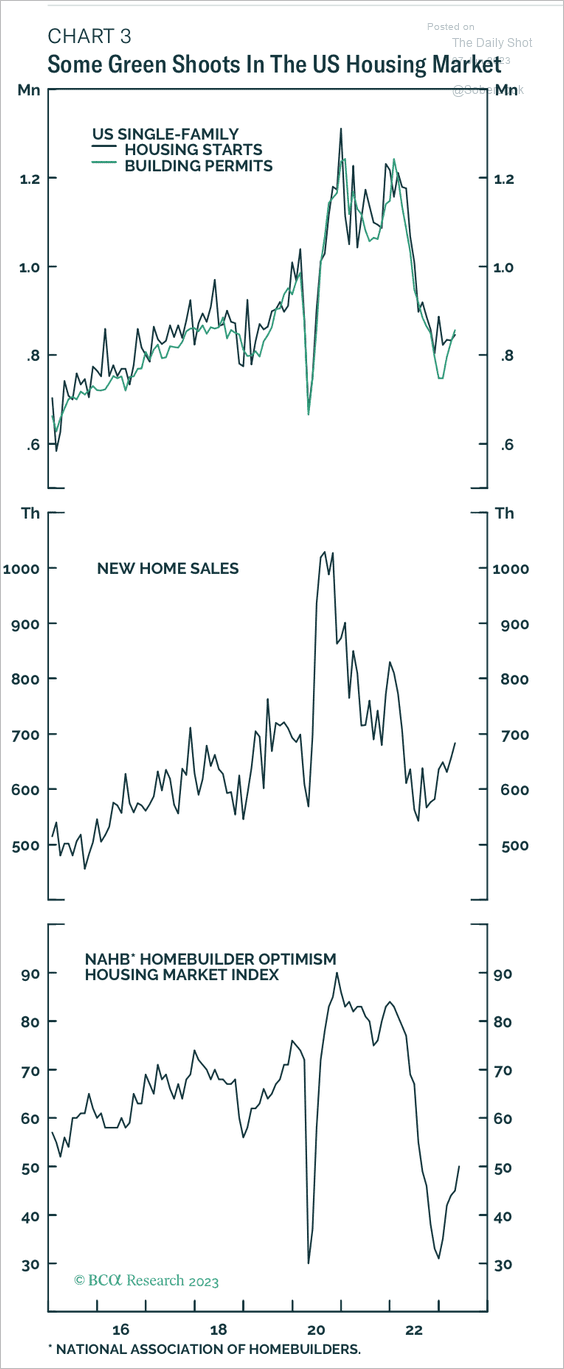

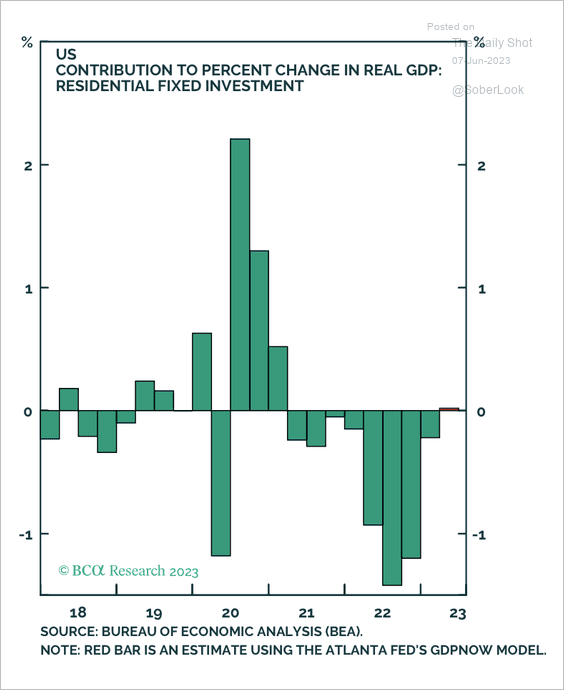

• The housing market has been showing signs of improvement amid tight supplies.

Source: BCA Research

Source: BCA Research

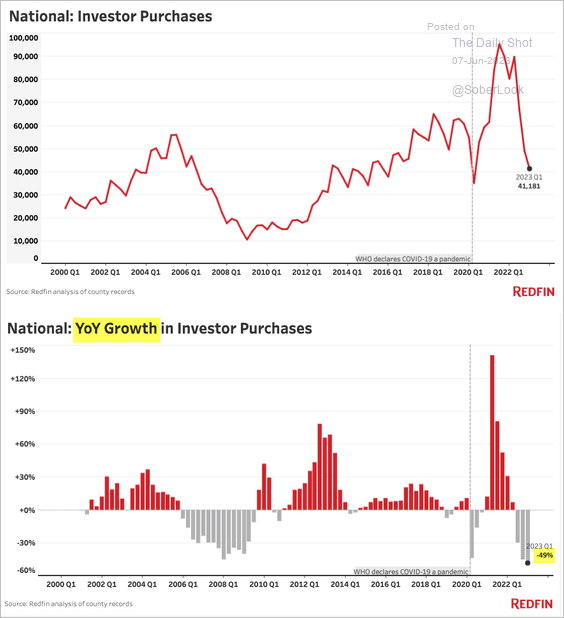

• Investors have been scaling back house purchases, …

Source: Redfin

Source: Redfin

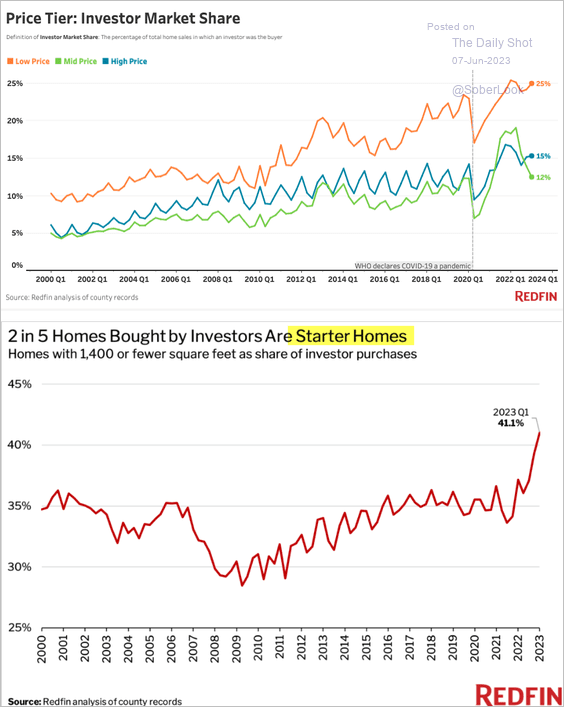

… preferring lower-price properties.

Source: Redfin

Source: Redfin

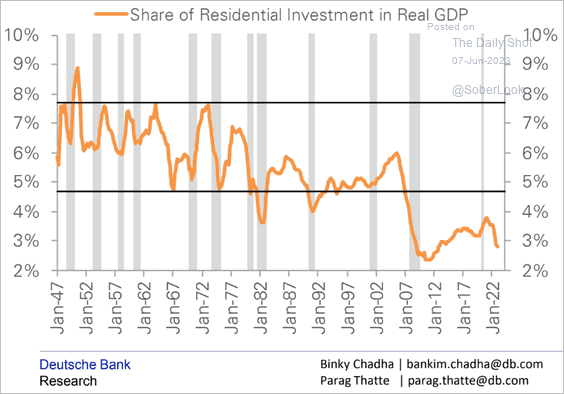

• This chart shows residential investment as a share of GDP since 1947.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

Residential investment is set to make a positive contribution to GDP growth in Q2 for the first time in nine quarters.

Source: BCA Research

Source: BCA Research

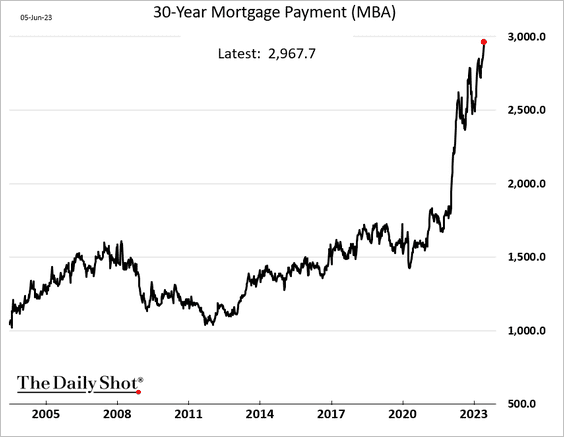

• The average monthly mortgage payment is nearing $3,000.

h/t III Capital Management

h/t III Capital Management

——————–

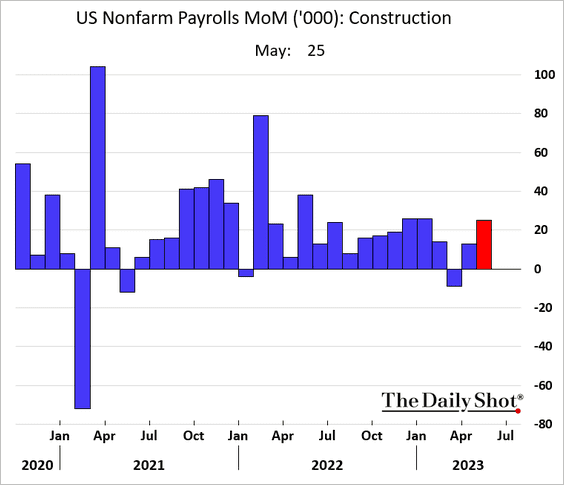

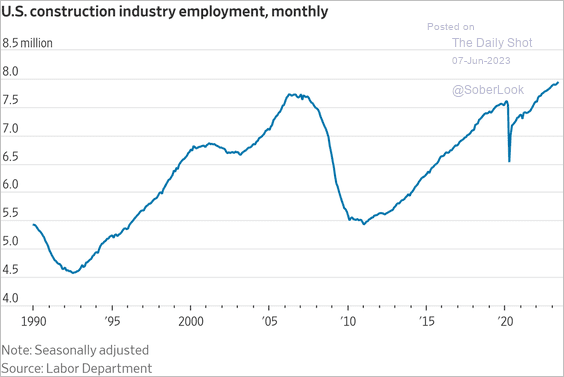

2. Construction employment is holding up.

Source: @jeffsparshott, @greg_ip

Source: @jeffsparshott, @greg_ip

——————–

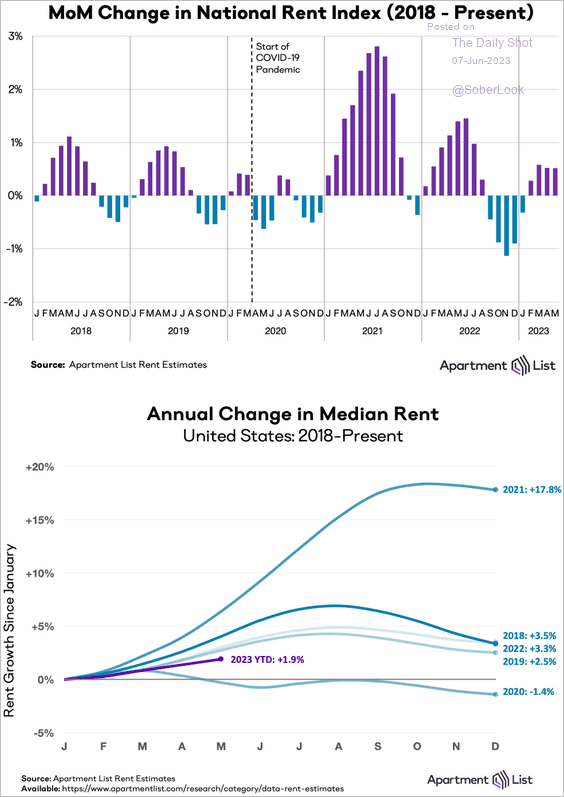

3. Next, we have some updates on inflation.

• US rental costs were up for the fourth month in a row in May, but the increases have been relatively small.

Source: Apartment List

Source: Apartment List

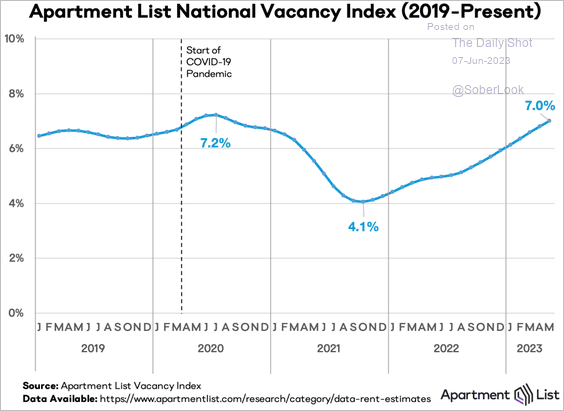

Rental vacancies continue to climb.

Source: Apartment List

Source: Apartment List

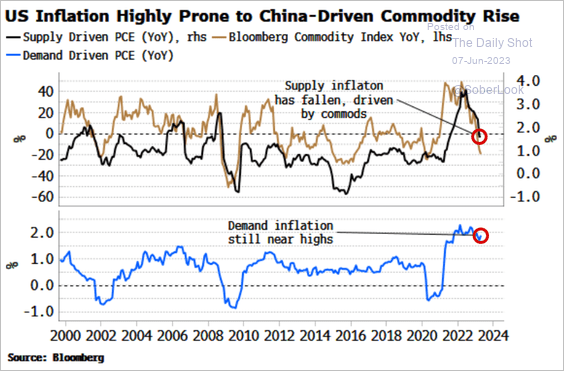

• This chart shows supply- and demand-driven consumer inflation trends.

Source: Simon White, Bloomberg Markets Live Blog

Source: Simon White, Bloomberg Markets Live Blog

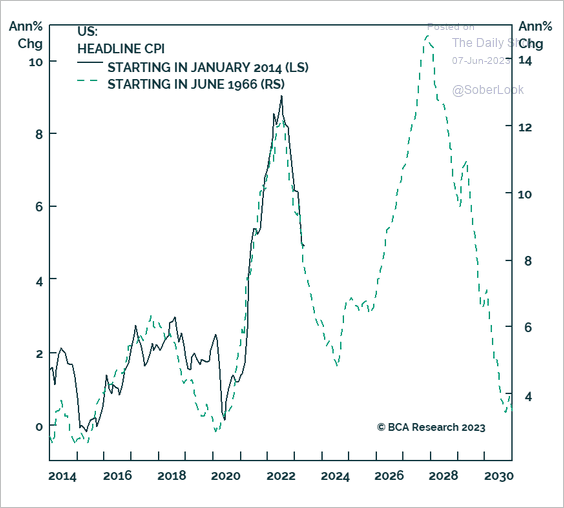

• Some policymakers remain concerned about a potential resurgence of inflation, reminiscent of the 1970s-style second wave.

Source: BCA Research

Source: BCA Research

——————–

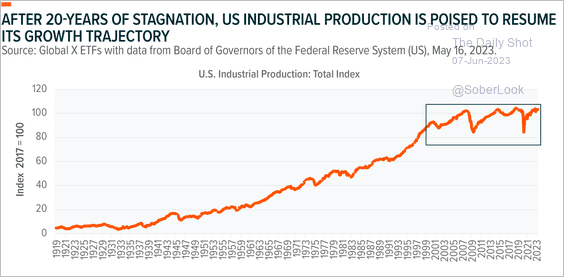

4. Industrial production has been stagnant for nearly two decades.

Source: Global X ETFs Read full article

Source: Global X ETFs Read full article

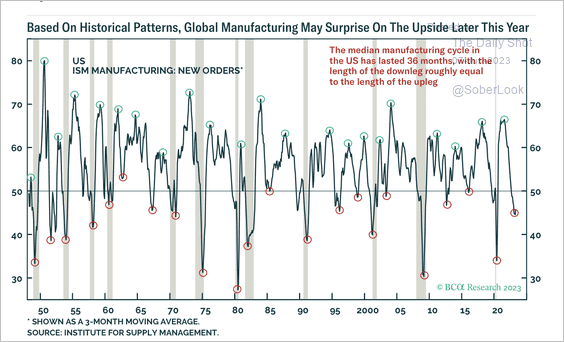

• Could we see an upward surprise in manufacturing activity?

Source: BCA Research

Source: BCA Research

——————–

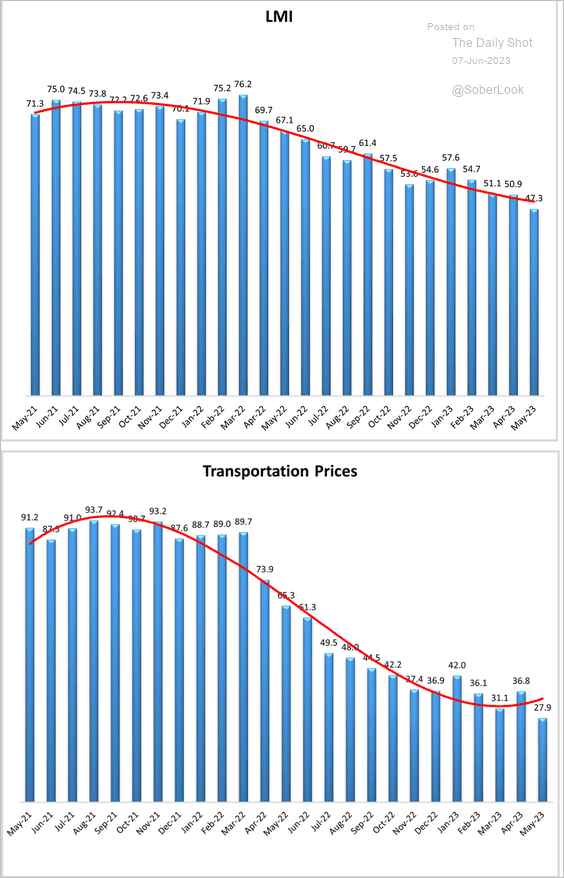

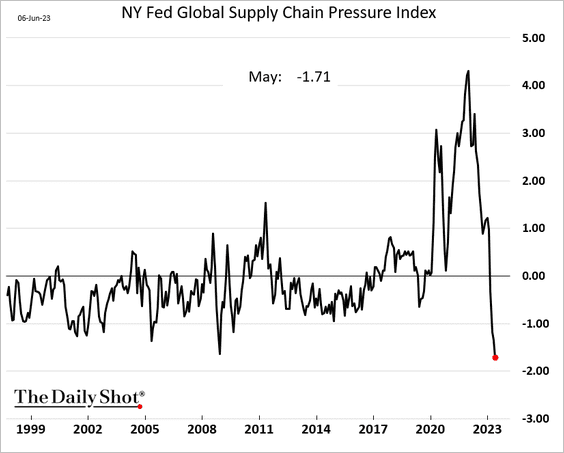

5. The Logistics Manager’s Index continues to fall amid softer demand.

Source: Logistics Managers’ Index

Source: Logistics Managers’ Index

The NY Fed’s Supply Chain Pressure Index saw the largest year-over-year decline on record.

Source: @atanzi, @business Read full article

Source: @atanzi, @business Read full article

——————–

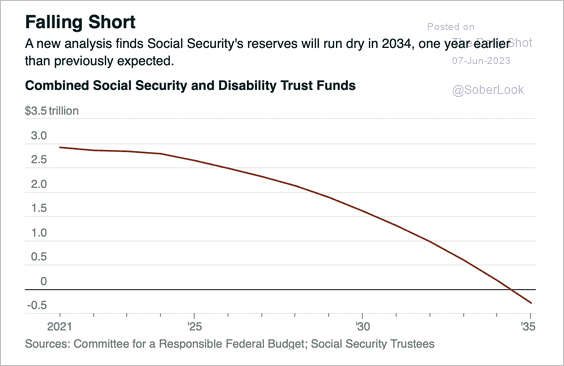

6. Social Security reserves could run dry in 2034.

Source: Barron’s Read full article

Source: Barron’s Read full article

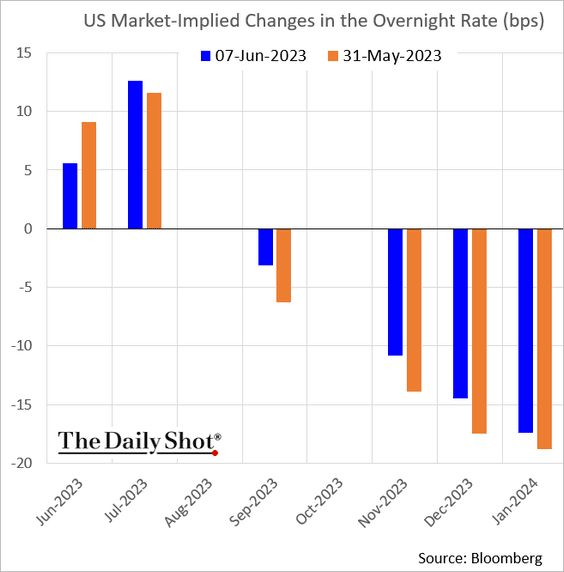

7. Fed rate hike expectations continue to shift to July.

Back to Index

Canada

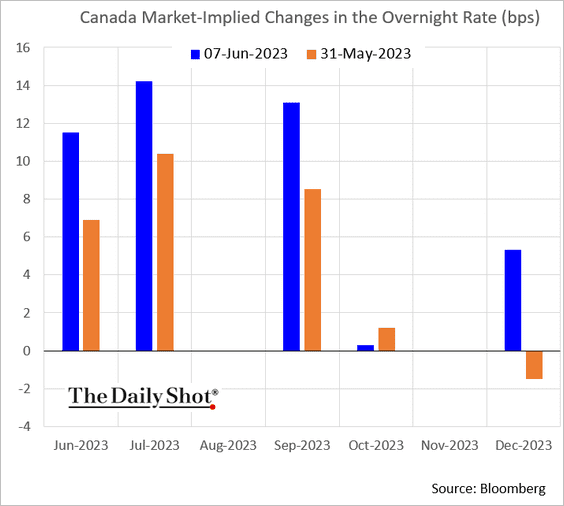

1. Rate hike expectations have risen sharply in June.

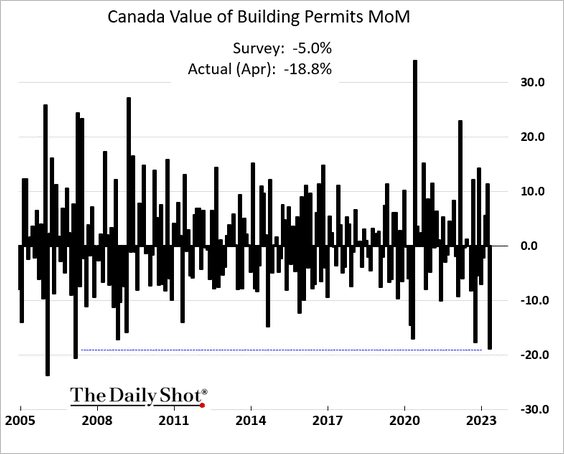

2. Building permits tumbled in April.

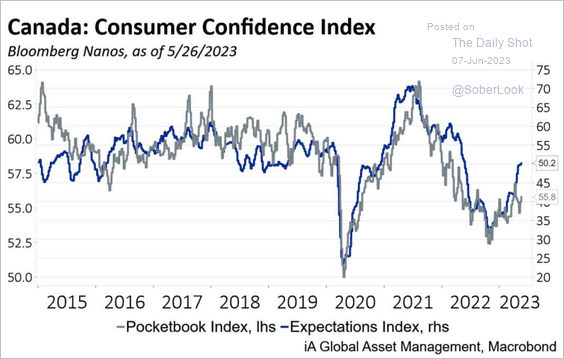

3. Consumers are increasingly confident about the future, while the current conditions index remains depressed.

Source: iA Global Asset Management

Source: iA Global Asset Management

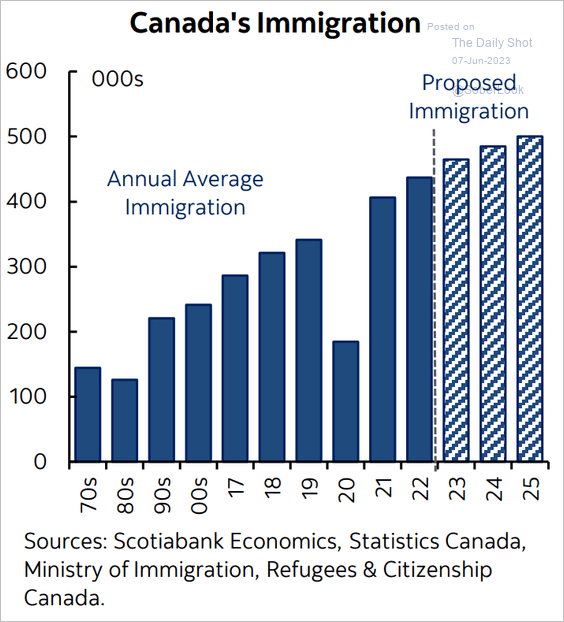

4. Will immigration continue to grow?

Source: Scotiabank Economics

Source: Scotiabank Economics

Back to Index

The United Kingdom

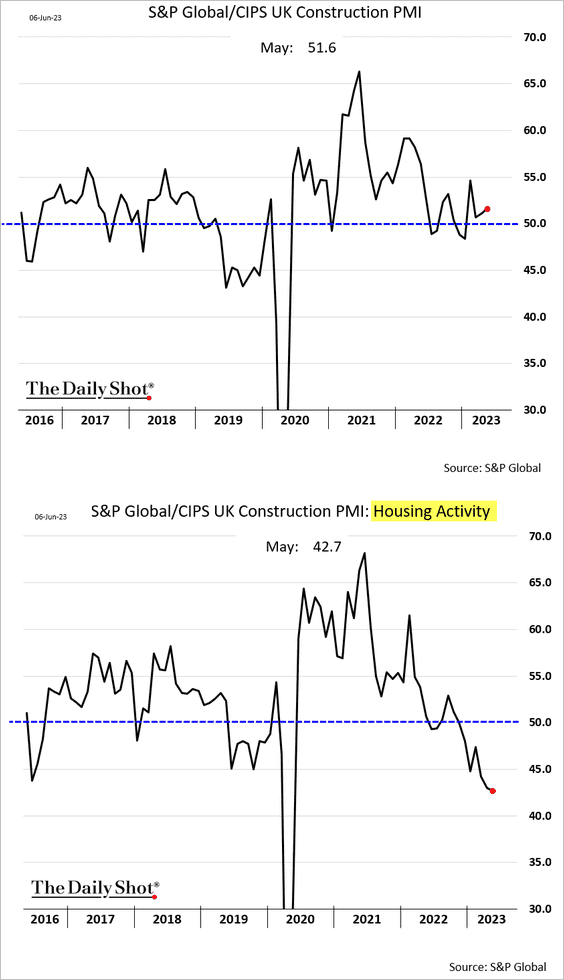

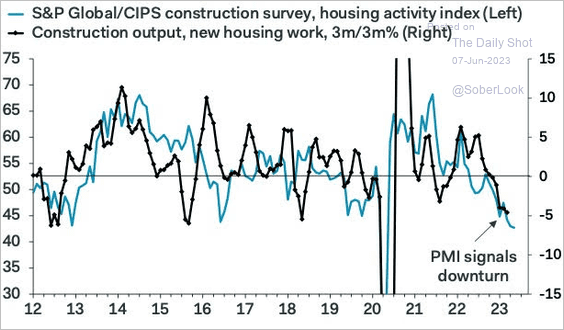

Total construction activity remained in growth mode last month. But housing activity has been crashing.

Construction output is expected to follow.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

Back to Index

The Eurozone

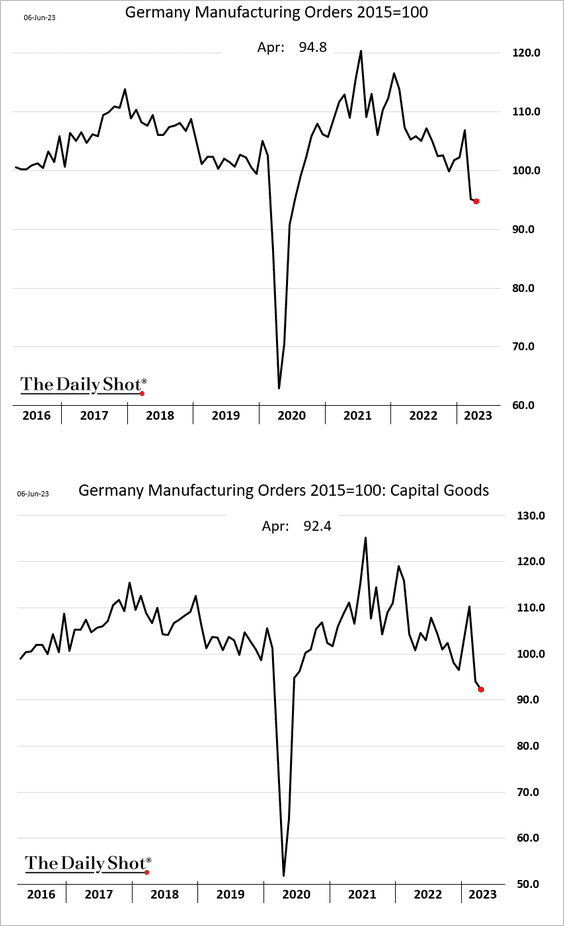

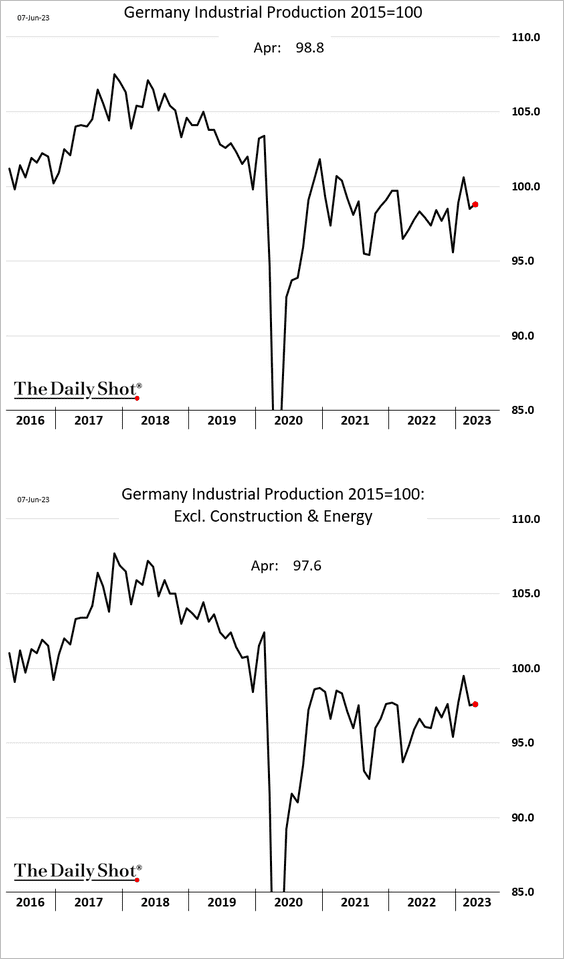

1. Germany’s factory orders declined again in April.

Industrial production edged higher, but manufacturing output (2nd panel) was roughly flat.

——————–

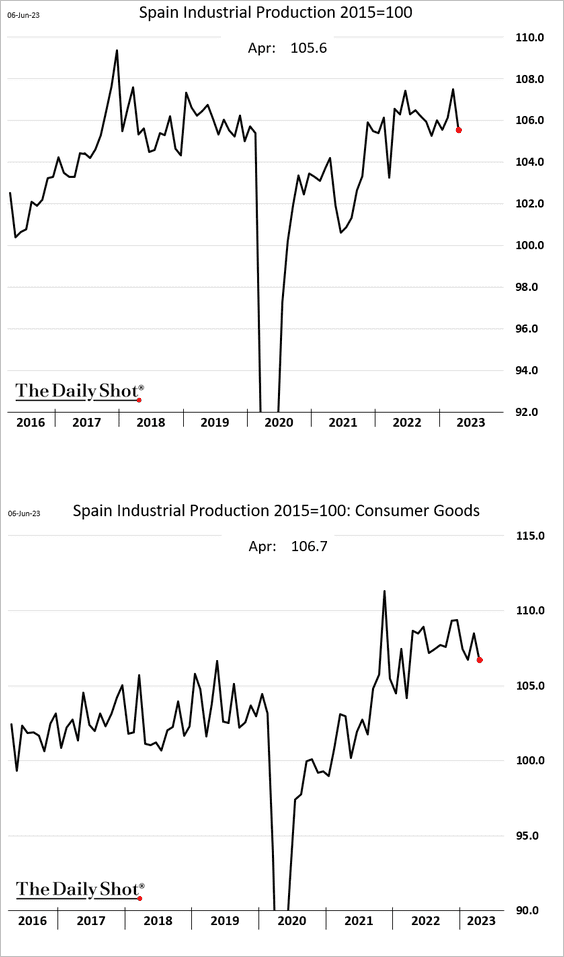

2. Spain’s industrial production declined.

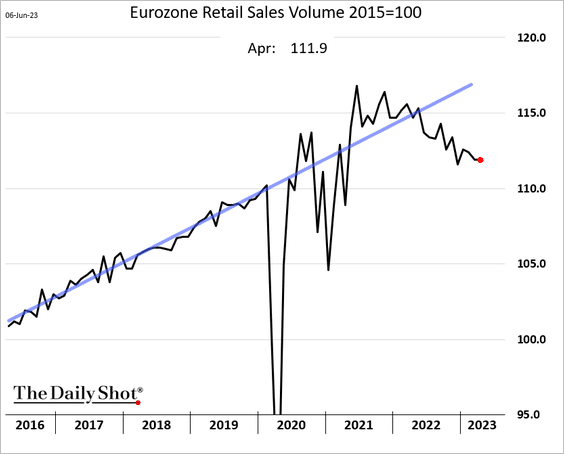

3. Euro-area retail sales held steady in April.

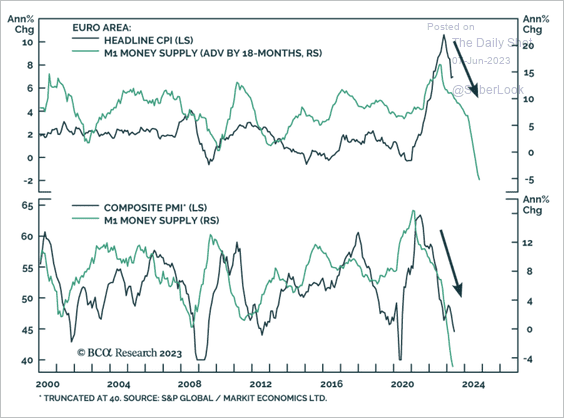

4. The contraction in the euro-area money supply points to lower inflation and weaker PMIs.

Source: BCA Research

Source: BCA Research

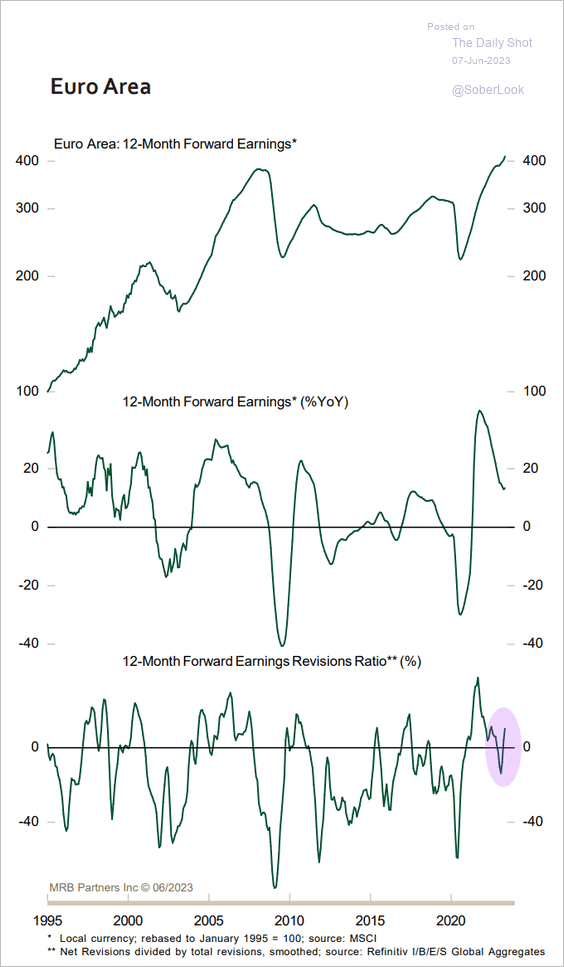

5. Corporate earnings expectations keep climbing, and the revisions ratio has turned positive.

Source: MRB Partners

Source: MRB Partners

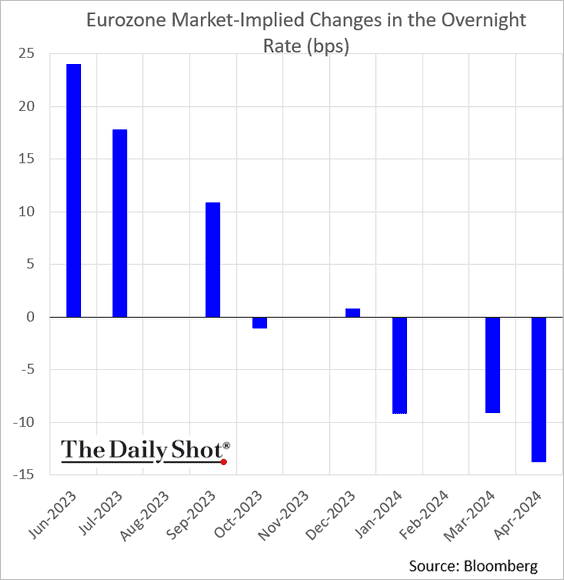

6. The market expects at least another two ECB rate hikes, including one this month.

Back to Index

Asia-Pacific

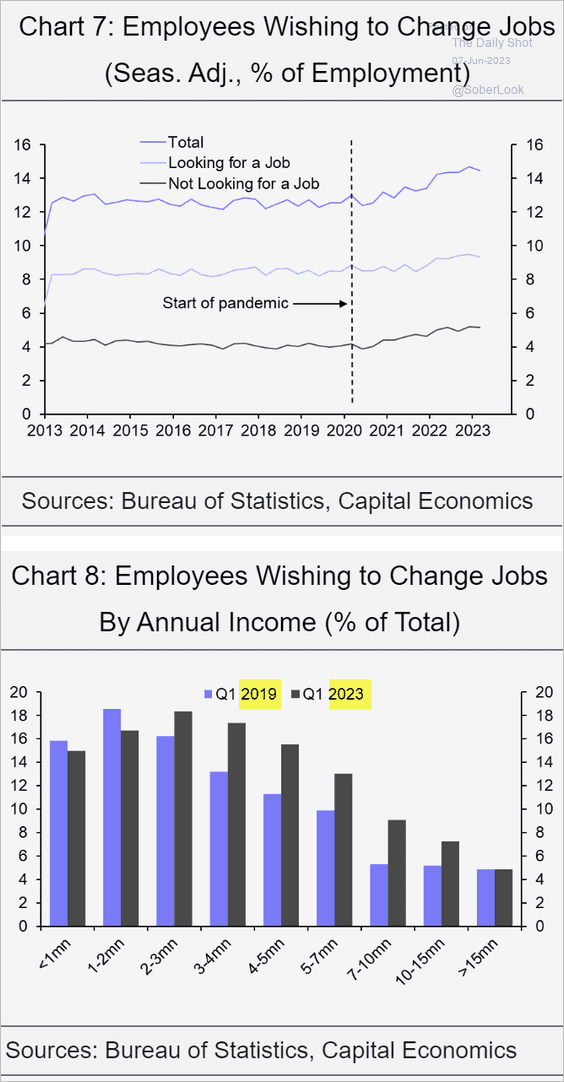

1. The number of employees in Japan expressing a desire to switch jobs has been steadily increasing.

Source: Capital Economics

Source: Capital Economics

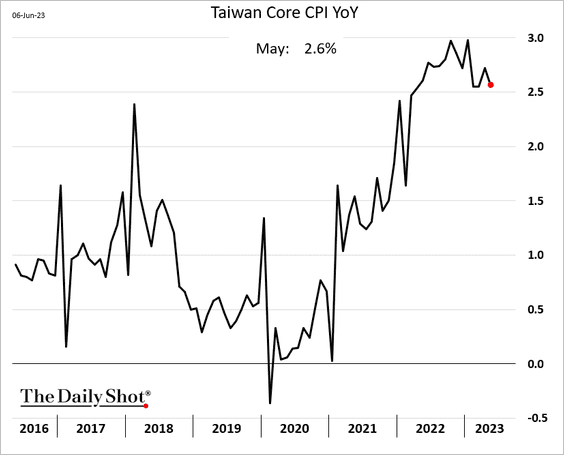

2. Tawian’s core inflation eased in May.

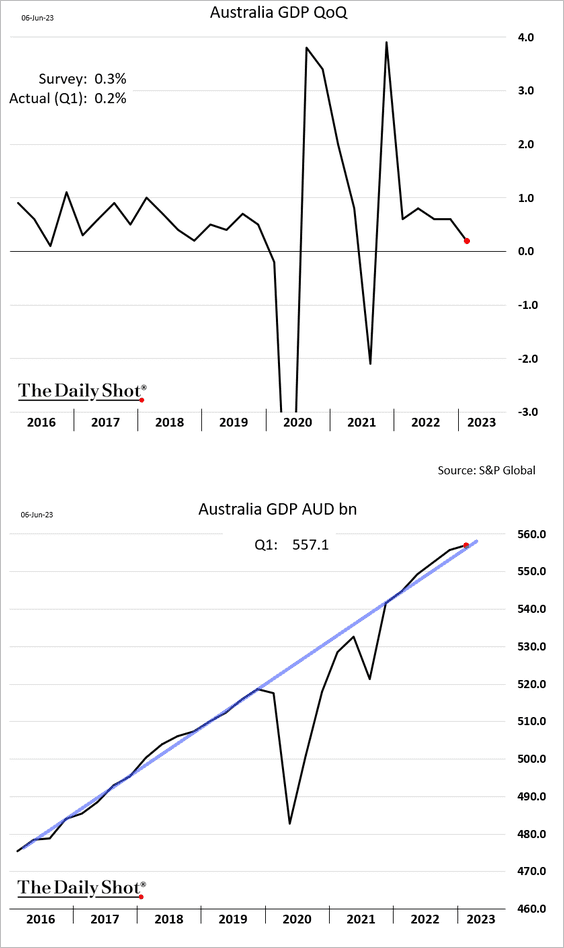

3. Australia’s economic growth slowed in Q1.

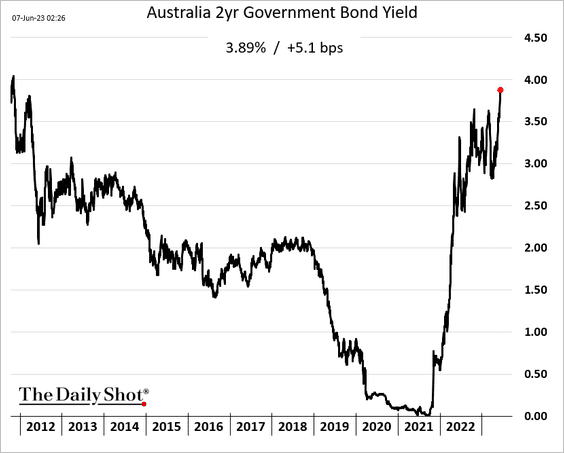

Bond yields continue to climb after the RBA’s surprise hike.

Back to Index

China

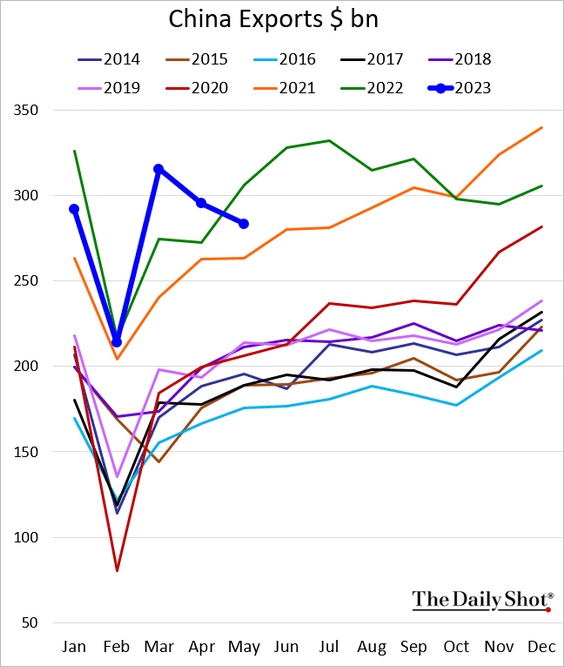

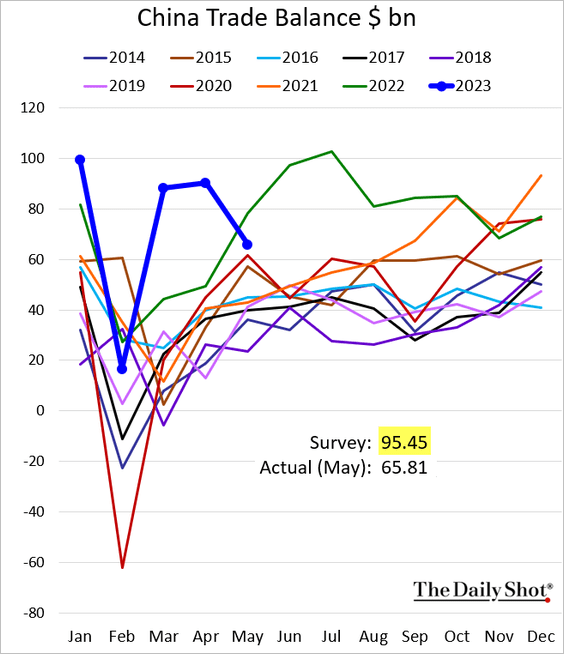

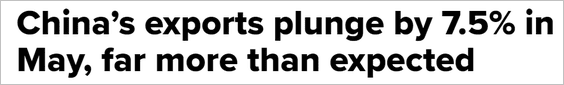

1. Exports and the trade surplus surprised to the downside.

Source: CNBC Read full article

Source: CNBC Read full article

——————–

2. Beijing is implementing easing policies …

Source: Reuters Read full article

Source: Reuters Read full article

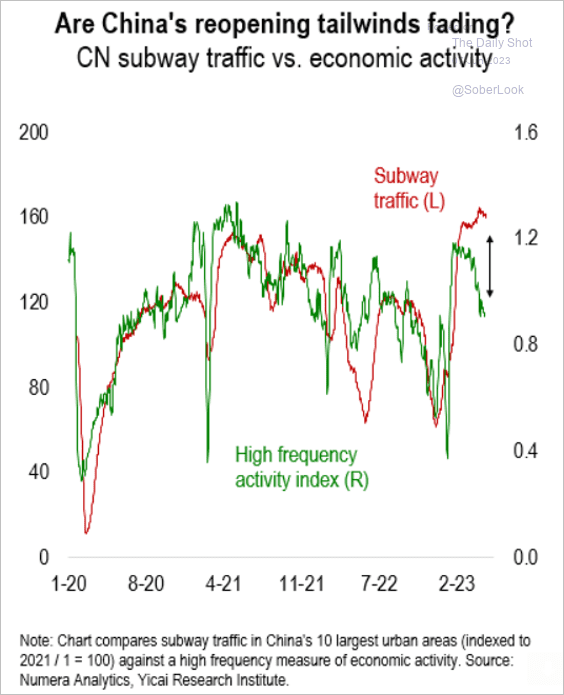

… as the economic rebound sputters.

Source: Numera Analytics (@NumeraAnalytics)

Source: Numera Analytics (@NumeraAnalytics)

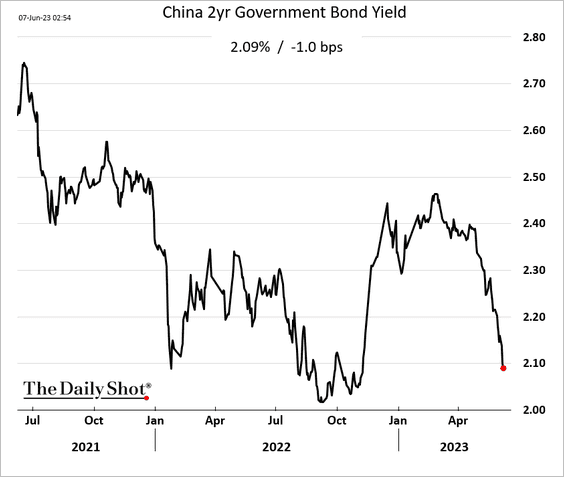

Bond yields are sinking.

——————–

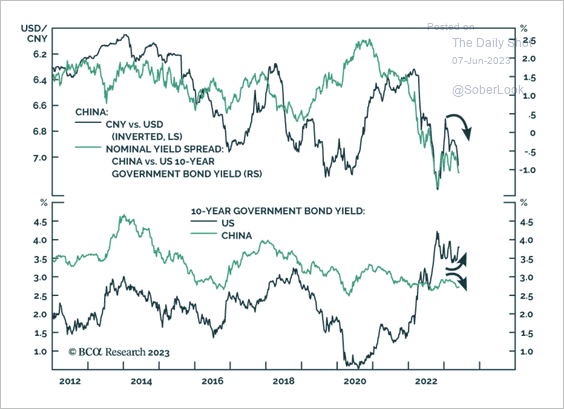

3. Interest rate differentials have moved in favor of USD/CNY.

Source: BCA Research

Source: BCA Research

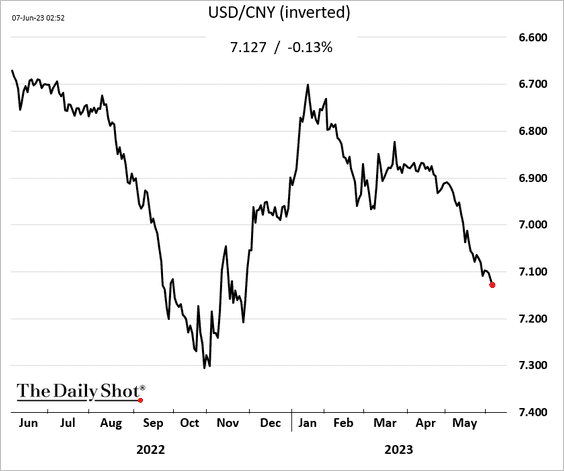

The renminbi continues to fall (vs. USD).

——————–

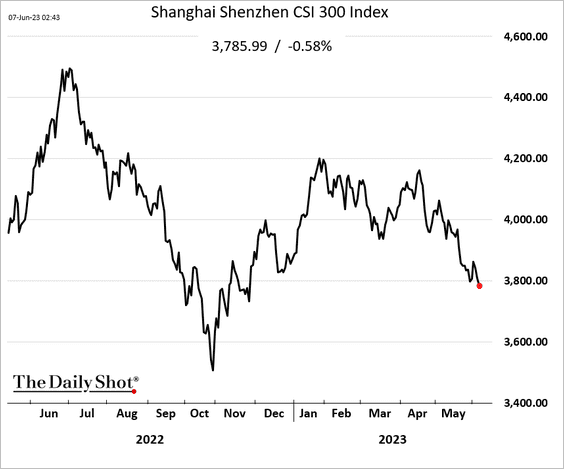

4. The Shanghai Shenzhen CSI 300 stock market index hit its lowest level since last November.

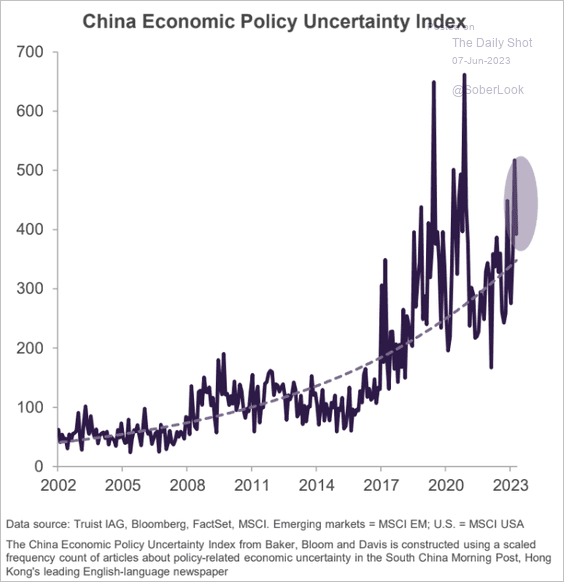

5. The economic uncertainty index remains elevated.

Source: Truist Advisory Services

Source: Truist Advisory Services

Back to Index

Emerging Markets

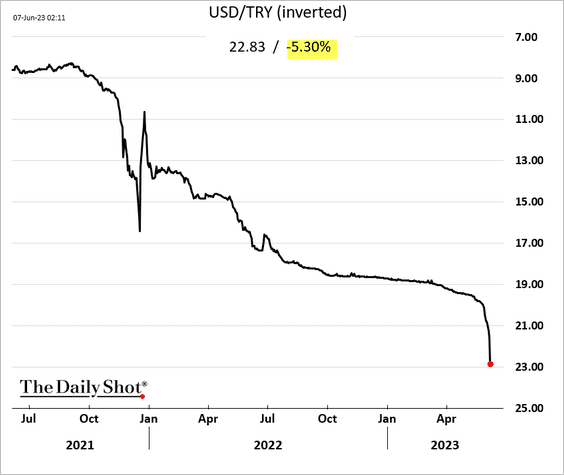

1. The Turkish lira is in freefall amid growing indications that policymakers might be reducing their efforts to bolster the currency.

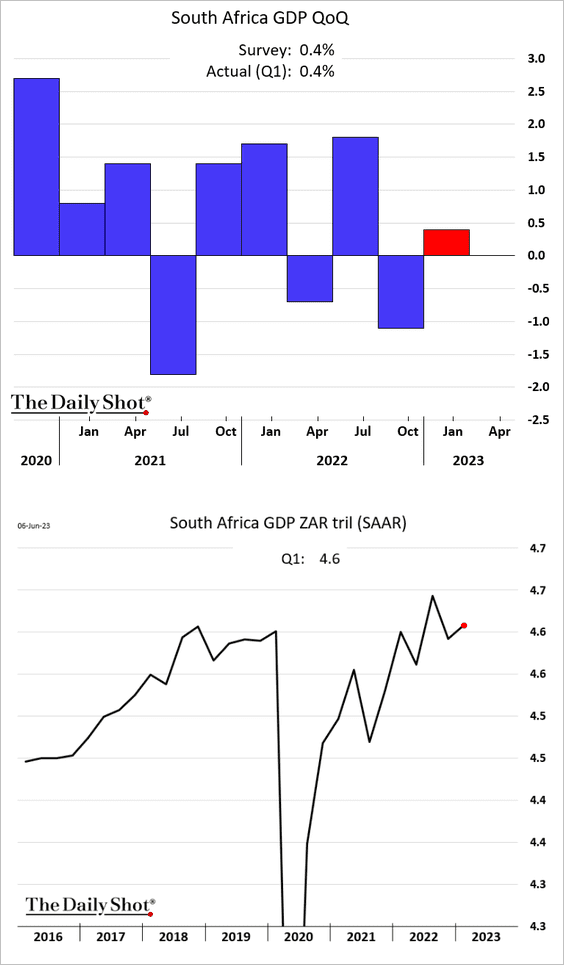

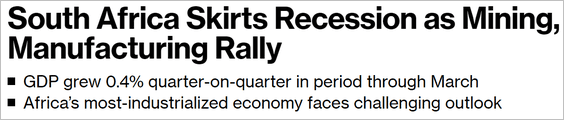

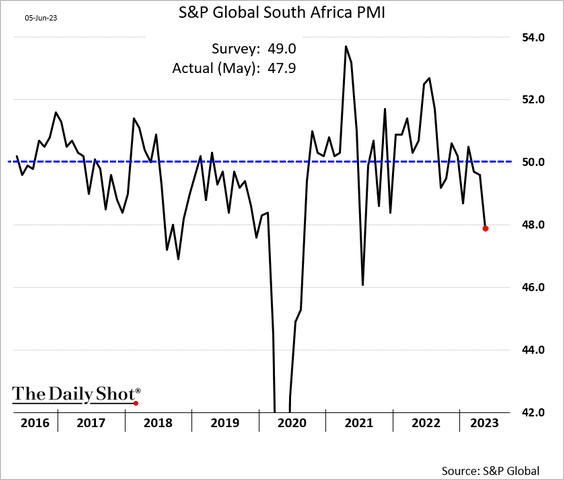

2. South Africa’s economy expanded in Q1.

Source: @MoniqueVanek, @economics Read full article

Source: @MoniqueVanek, @economics Read full article

But business activity moved deeper into contraction territory in May.

——————–

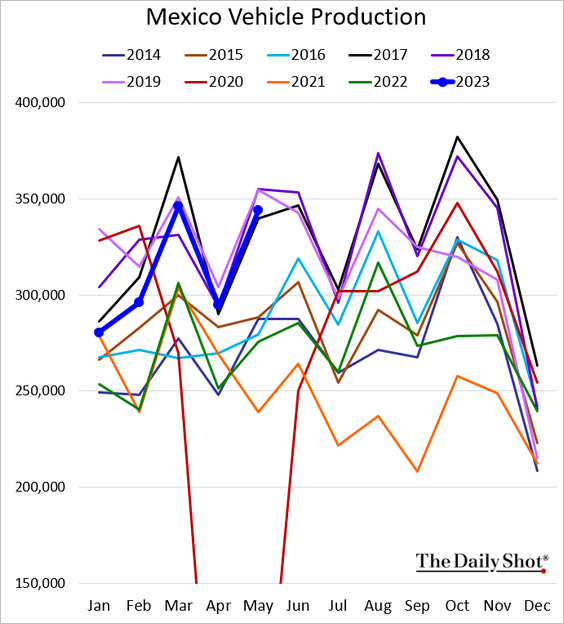

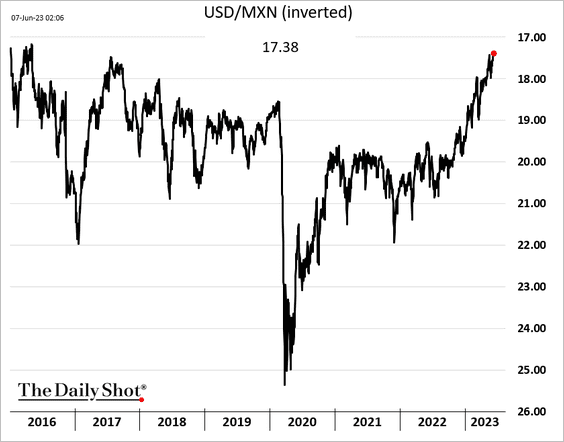

3. Next, we have some updates on Mexico.

• Vehicle production is running at pre-COVID levels.

• The peso hit its highest level since early 2016.

Source: Mexico News Daily Read full article

Source: Mexico News Daily Read full article

——————–

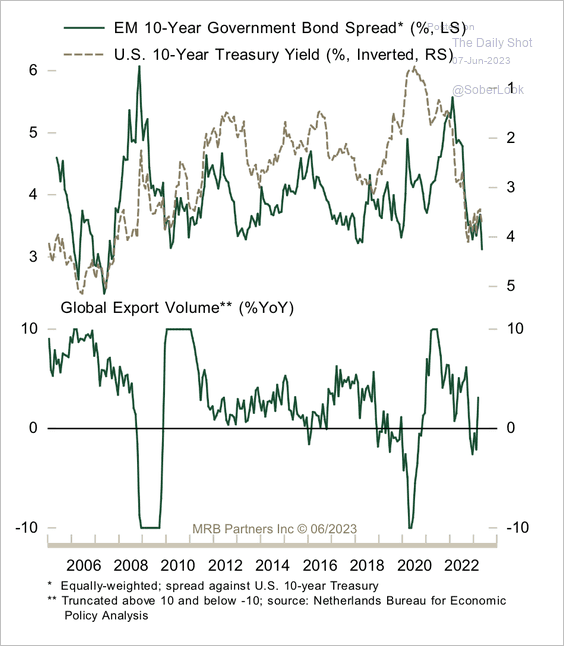

4. Firming global trade could lead to tighter EM bond spreads.

Source: MRB Partners

Source: MRB Partners

Back to Index

Cryptocurrency

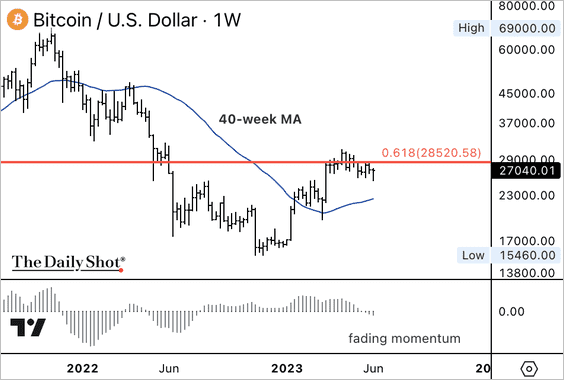

1. Bitcoin declined from a key resistance zone, although the 40-week moving average could stabilize pullbacks.

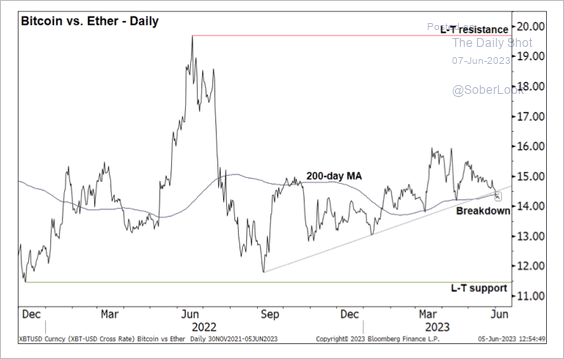

2. The BTC/ETH price ratio is testing support at its 200-day moving average. A confirmed breakdown could signal outperformance for ether, which typically occurs during risk-on markets.

Source: @StocktonKatie

Source: @StocktonKatie

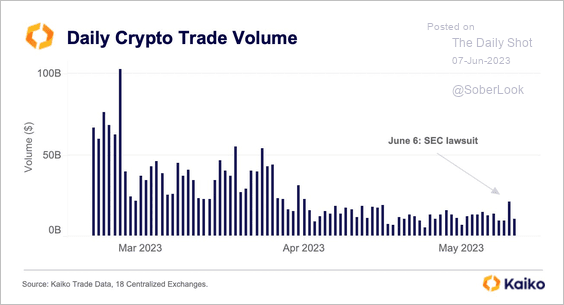

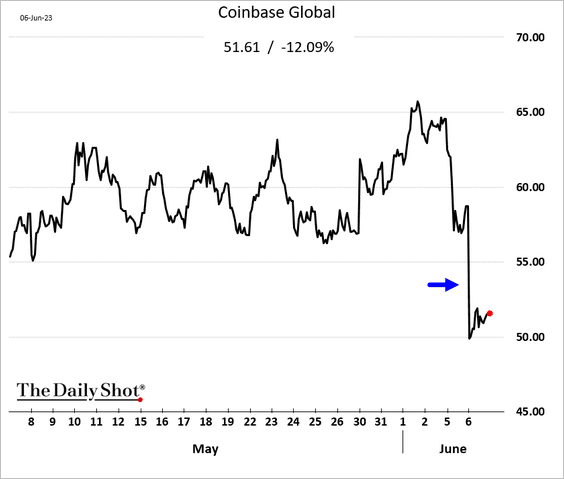

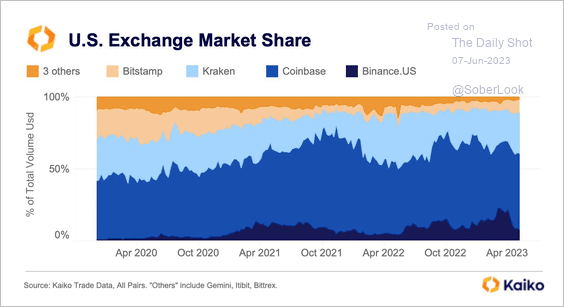

3. Crypto trading volume ticked higher after the SEC’s lawsuit against Coinbase.

Source: @KaikoData

Source: @KaikoData

Source: @WSJ Read full article

Source: @WSJ Read full article

Coinbase accounts for just 6% of global trading volume, but its US market share is 53%, according to Kaiko Data.

Source: @KaikoData

Source: @KaikoData

Back to Index

Commodities

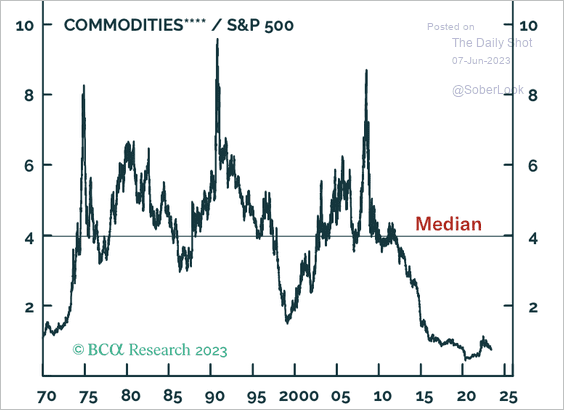

1. Commodities appear deeply oversold relative to the S&P 500.

Source: BCA Research

Source: BCA Research

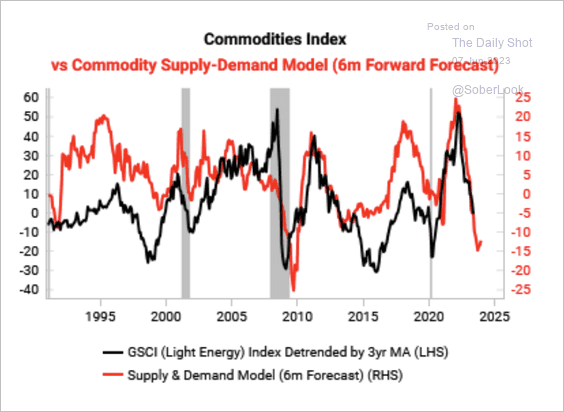

2. Variant Perception’s supply/demand model points to further near-term weakness in commodities, albeit structurally bullish.

Source: Variant Perception

Source: Variant Perception

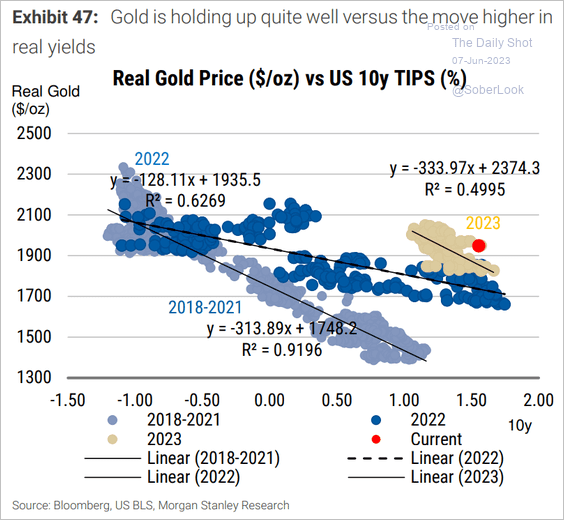

3. Gold has been holding up well despite elevated real yields.

Source: Morgan Stanley Research

Source: Morgan Stanley Research

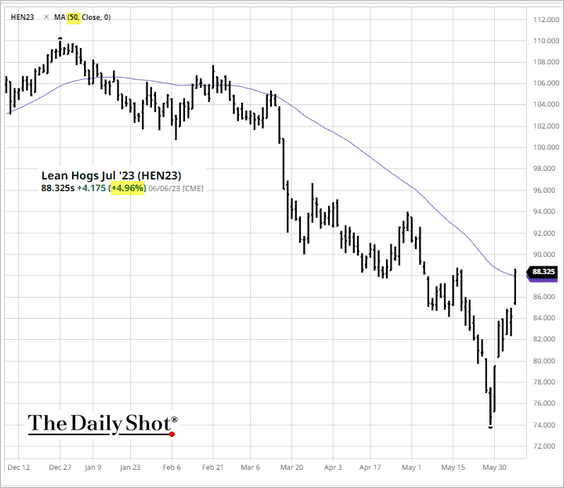

4. Hog futures jumped 5% on Tuesday, supported by stronger spot demand.

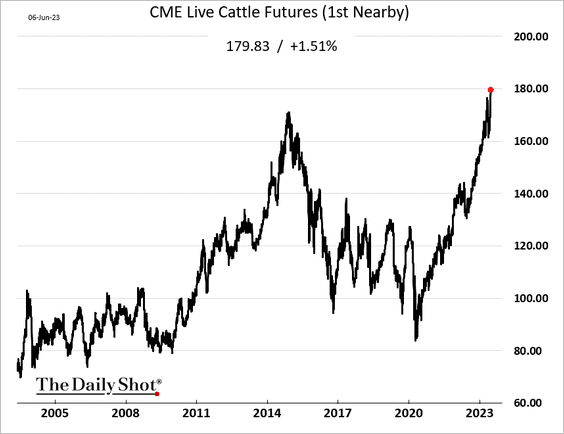

5. Live cattle futures hit a new high.

Back to Index

Equities

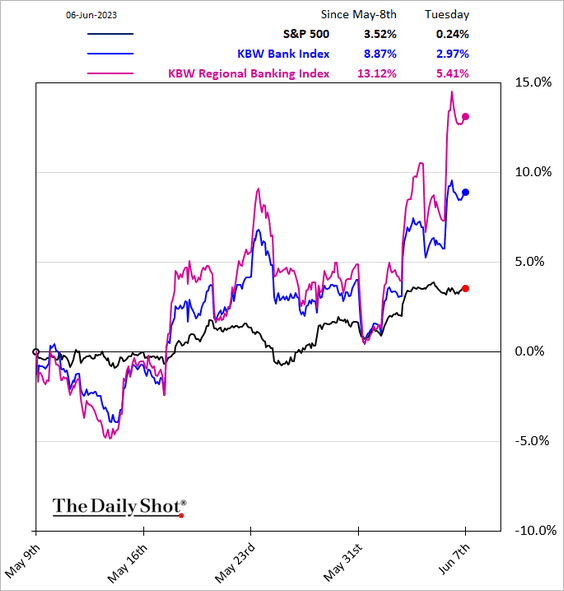

1. Bank shares have been staging a rebound.

Source: Reuters Read full article

Source: Reuters Read full article

——————–

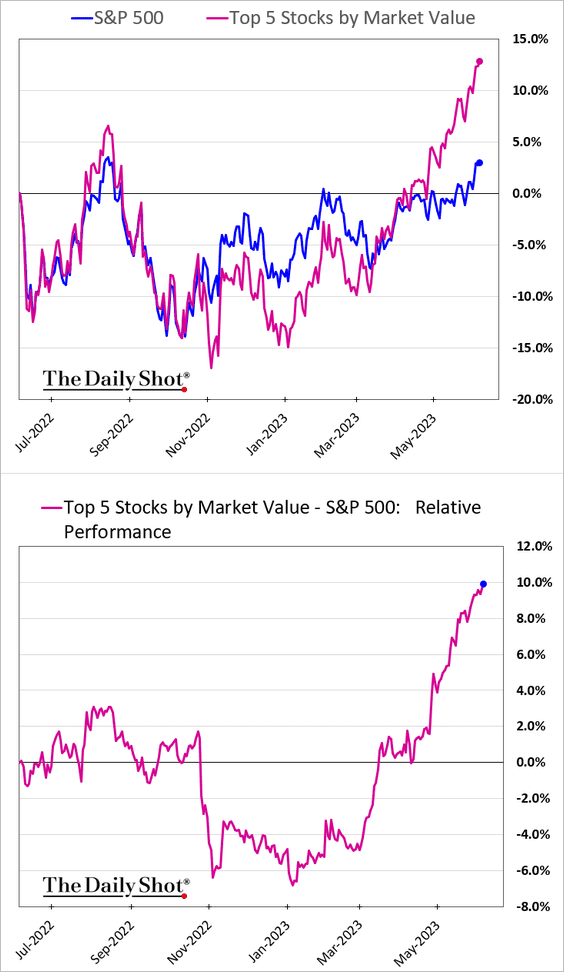

2. The top five stocks continue to outperform the S&P 500.

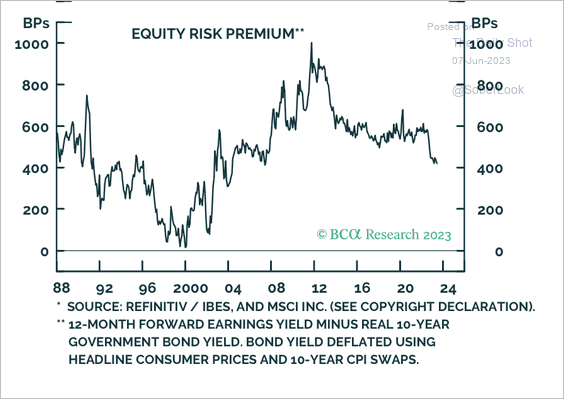

3. The US equity risk premium fell toward zero during the dot-com bubble.

Source: BCA Research

Source: BCA Research

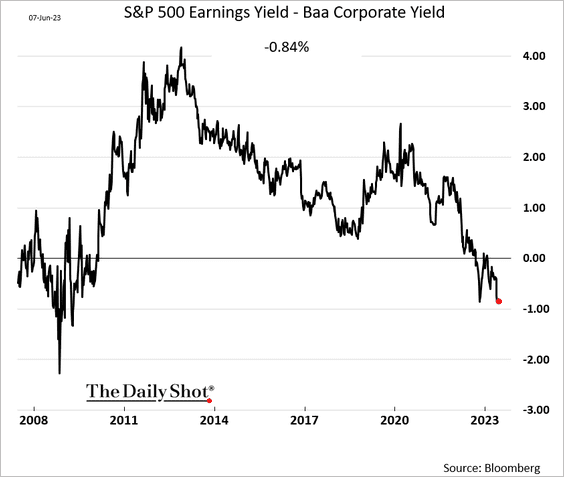

• The S&P 500 earnings yield hit a multi-year low relative to the BBB corporate bond yield.

——————–

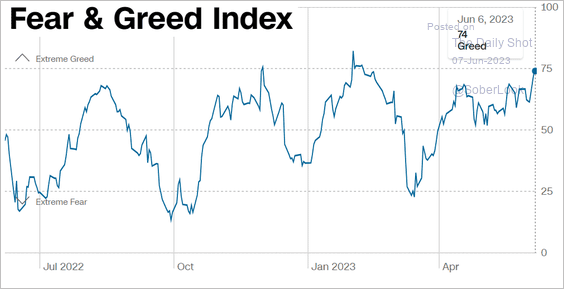

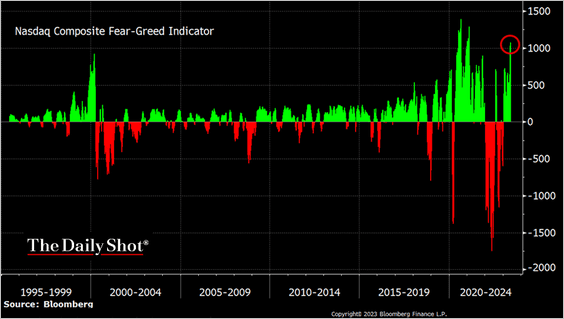

4. Sentiment is now well in “greed” territory (2 charts).

Source: CNN Business

Source: CNN Business

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

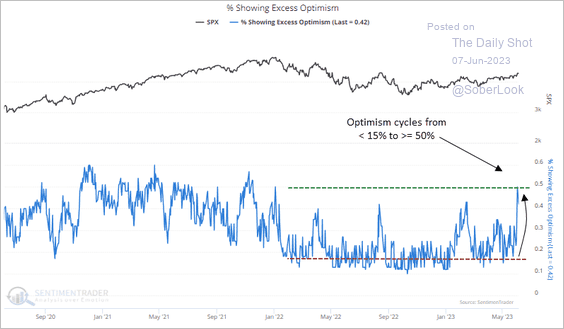

• Here is the share of S&P 500 stocks showing “excess optimism.”

Source: SentimenTrader Read full article

Source: SentimenTrader Read full article

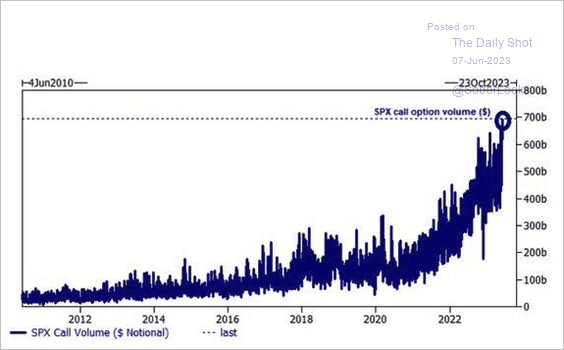

• Demand for S&P 500 call options has been surging.

Source: @Marlin_Capital

Source: @Marlin_Capital

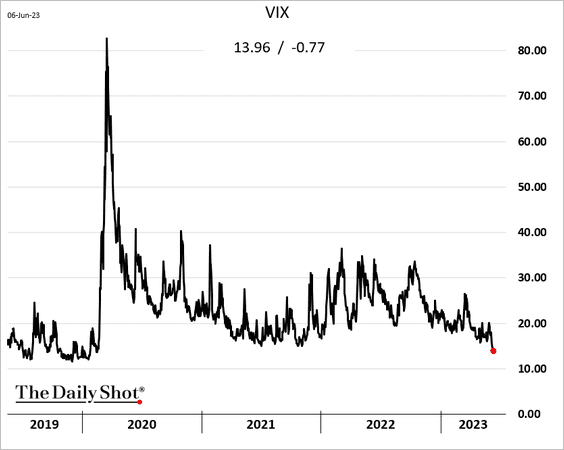

• VIX dipped below 14 for the first time in the COVID era.

——————–

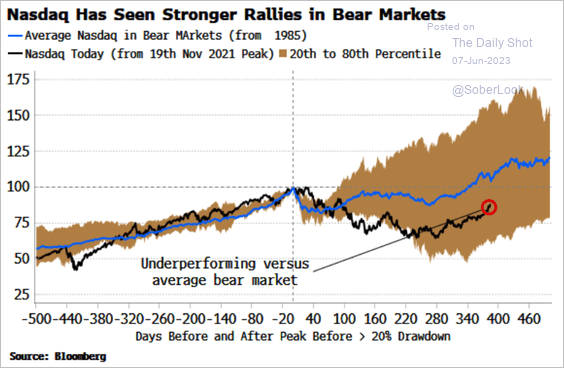

5. Here is the Nasdaq performance during bear markets.

Source: Simon White, Bloomberg Markets Live Blog

Source: Simon White, Bloomberg Markets Live Blog

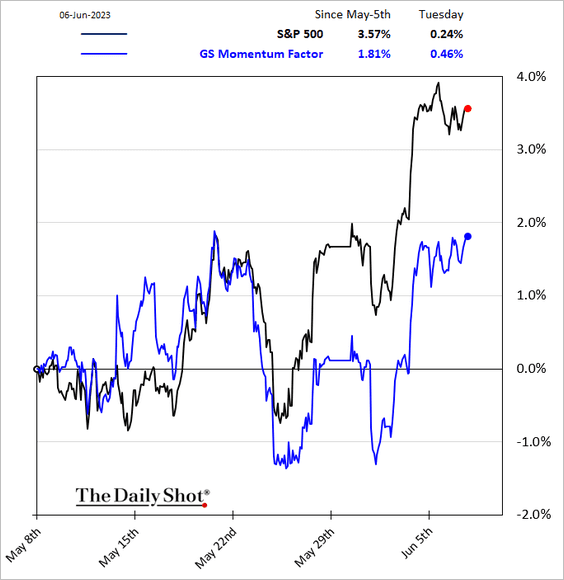

6. The momentum factor has been underperforming.

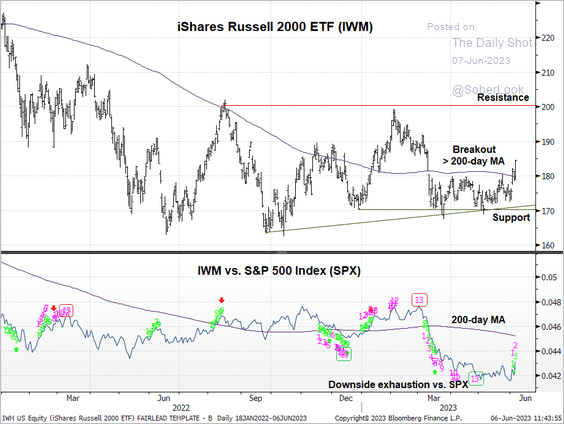

7. The iShares Russell 2000 ETF (IWM) broke above its 200-day moving average with improving momentum relative to the S&P 500.

Source: @StocktonKatie

Source: @StocktonKatie

Back to Index

Credit

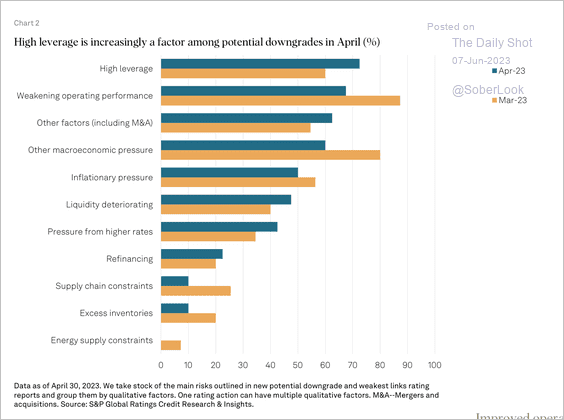

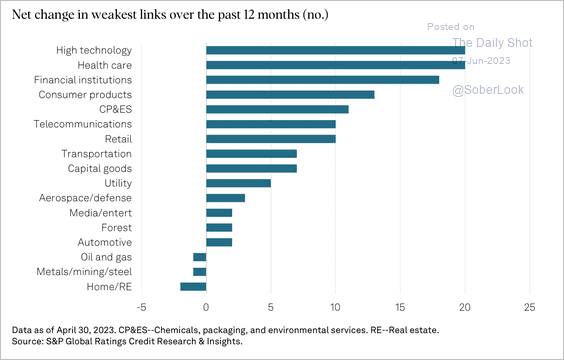

1. High leverage was the main reason behind negative credit outlook revisions in April, mostly in tech and healthcare. (2 charts)

Source: S&P Global Ratings

Source: S&P Global Ratings

Source: S&P Global Ratings

Source: S&P Global Ratings

——————–

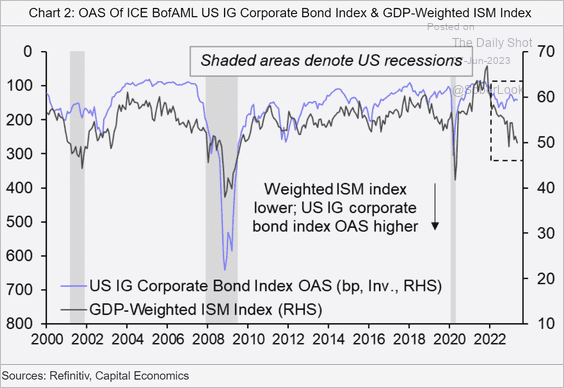

2. Corporate investment-grade spreads should be wider, given the economic backdrop.

Source: Capital Economics

Source: Capital Economics

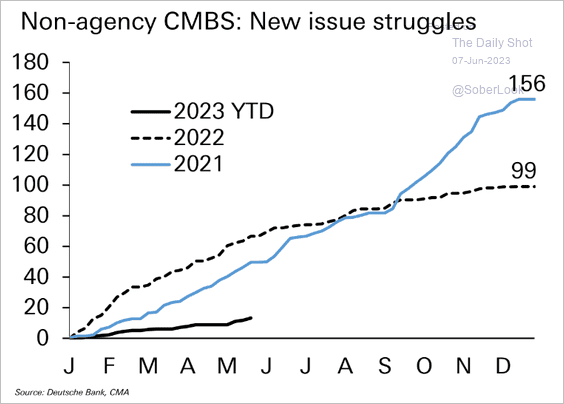

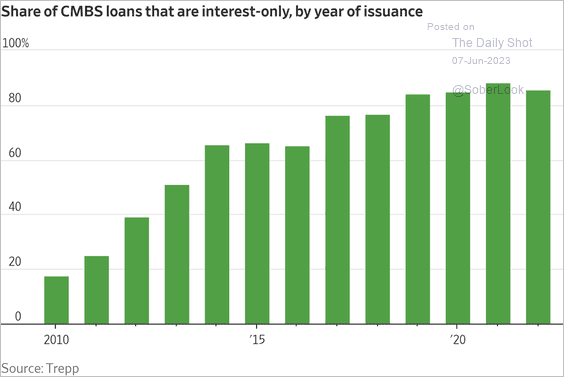

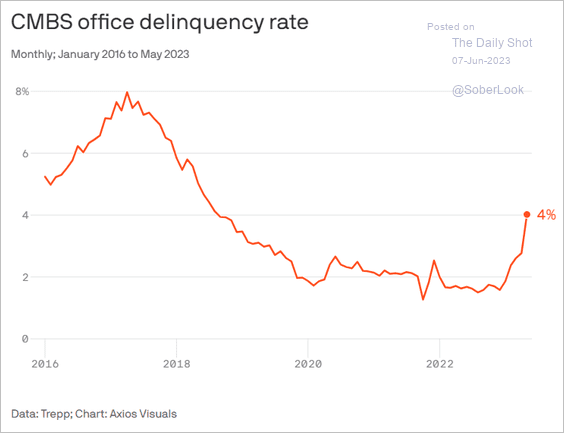

3. Next, we have some updates on the CMBS market.

• Issuance:

Source: Deutsche Bank Research

Source: Deutsche Bank Research

• Interest-only loans:

Source: @WSJ Read full article

Source: @WSJ Read full article

• Office property loan delinquencies:

Source: @axios Read full article

Source: @axios Read full article

——————–

Food for Thought

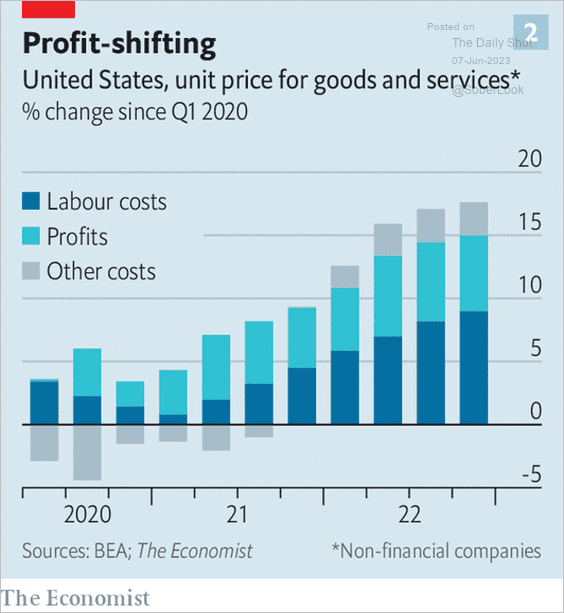

1. Drivers of inflation:

Source: The Economist Read full article

Source: The Economist Read full article

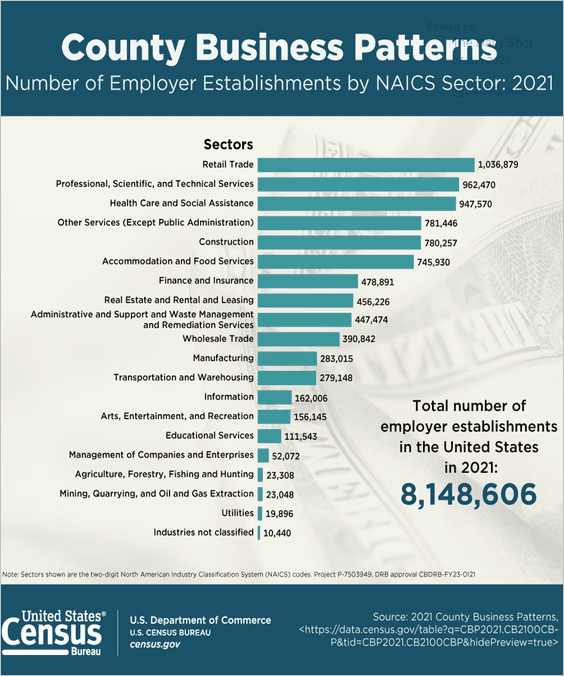

2. Number of employer establishments in the US:

Source: Census Bureau Read full article

Source: Census Bureau Read full article

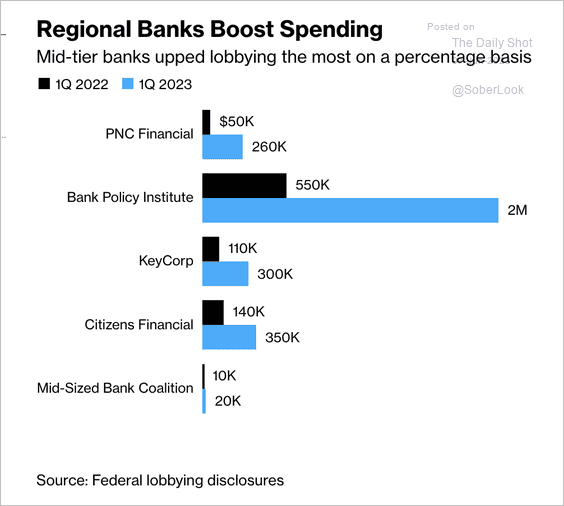

3. Regional banks boosting their lobbying efforts:

Source: @laurapdavison, @bill_allison, @bpolitics Read full article

Source: @laurapdavison, @bill_allison, @bpolitics Read full article

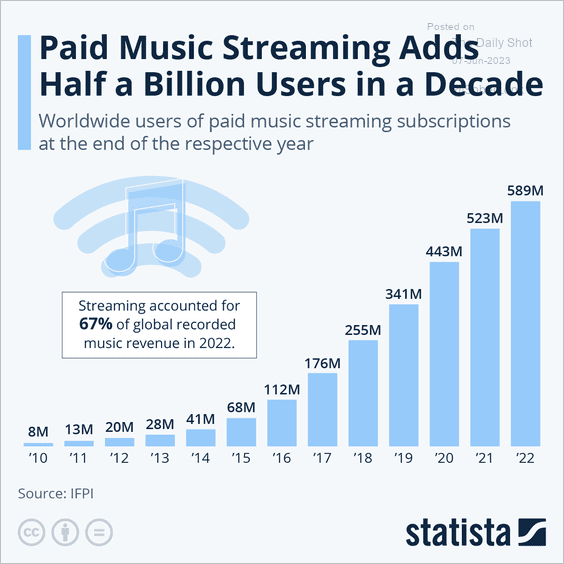

4. Paid music streaming:

Source: Statista

Source: Statista

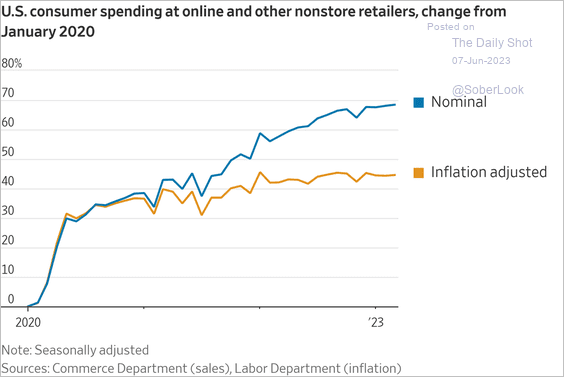

5. Online consumer spending:

Source: @WSJ Read full article

Source: @WSJ Read full article

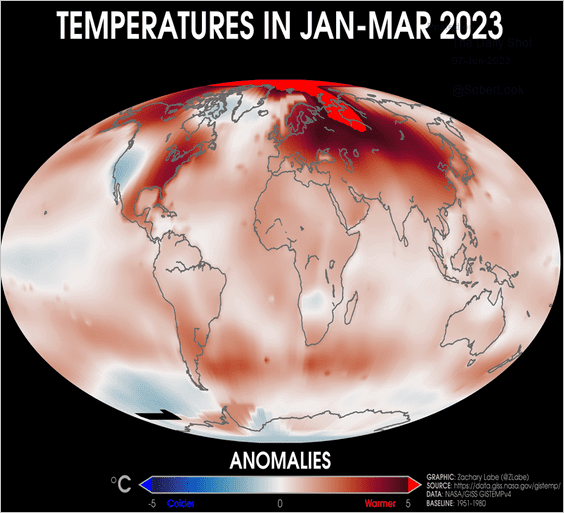

6. 2023 temperature anomalies:

Source: @ZLabe Read full article

Source: @ZLabe Read full article

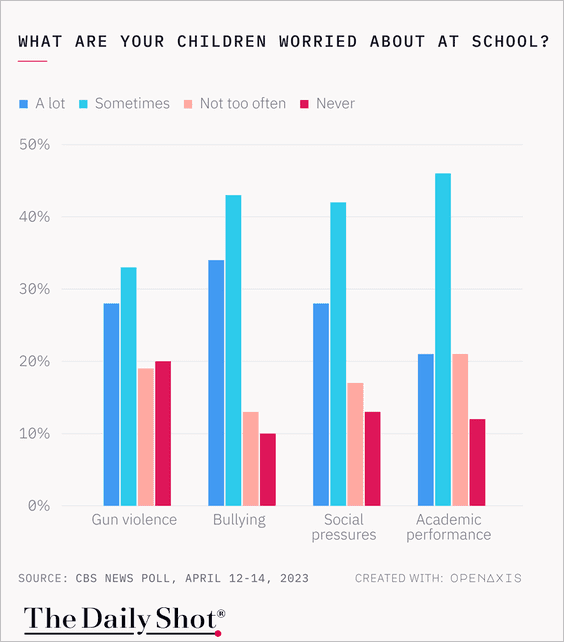

7. What are your children worried about at school?

Source: @TheDailyShot

Source: @TheDailyShot

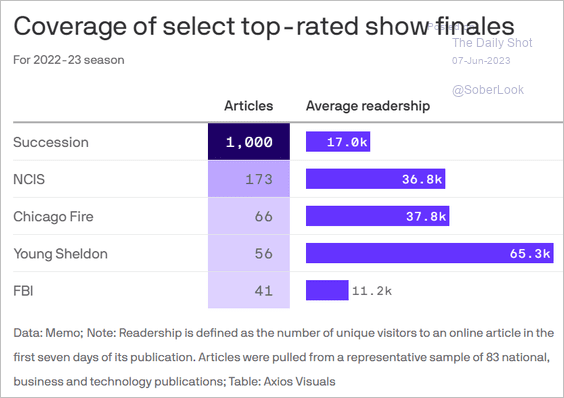

8. News coverage of top-rated show finales:

Source: @axios Read full article

Source: @axios Read full article

——————–

Back to Index