The Daily Shot: 14-Jun-24

• The United States

• The Eurozone

• Europe

• Japan

• China

• Emerging Markets

• Commodities

• Energy

• Equities

• Alternatives

• Global Developments

• Food for Thought

The United States

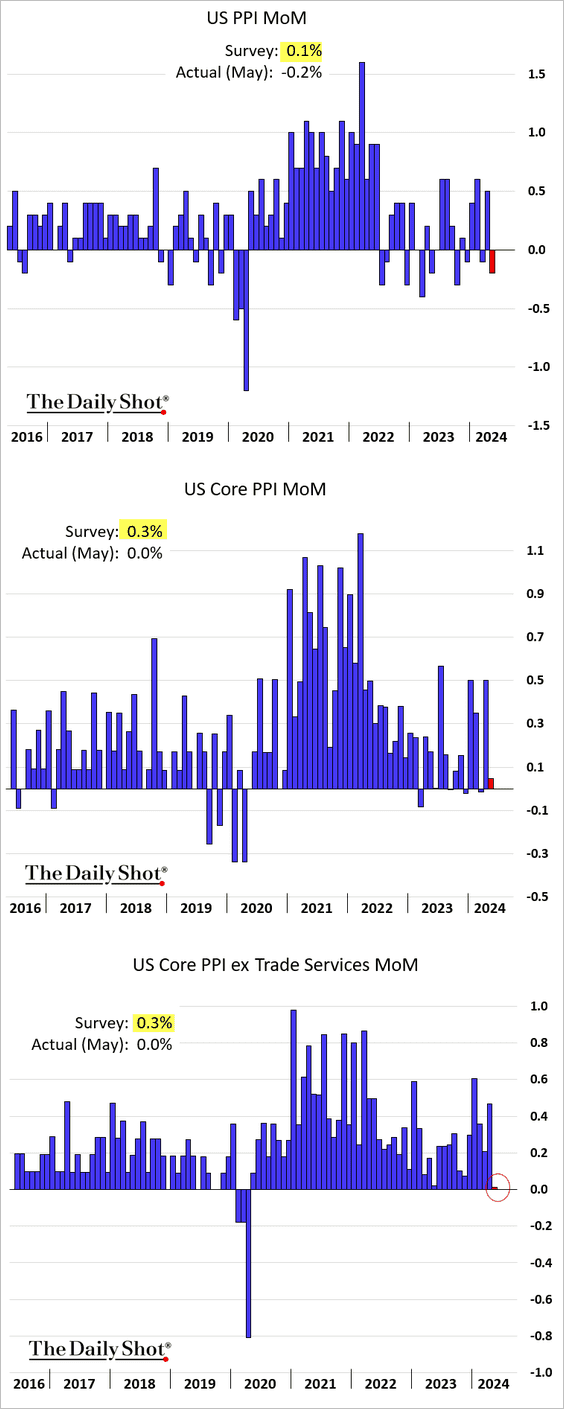

1. Producer prices unexpectedly fell in May, while the core PPI remained unchanged.

Source: CNBC Read full article

Source: CNBC Read full article

• Part of the reason for the downside surprise was the decline in logistics services prices.

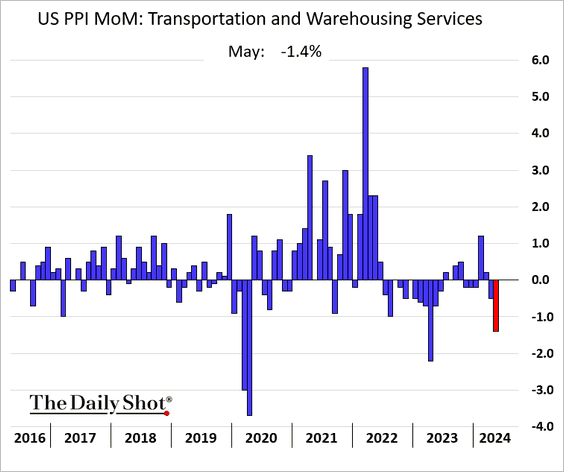

Here are the contributions to the PPI changes.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

• The trade services PPI (business markups) suggests that corporate margins have stopped rising.

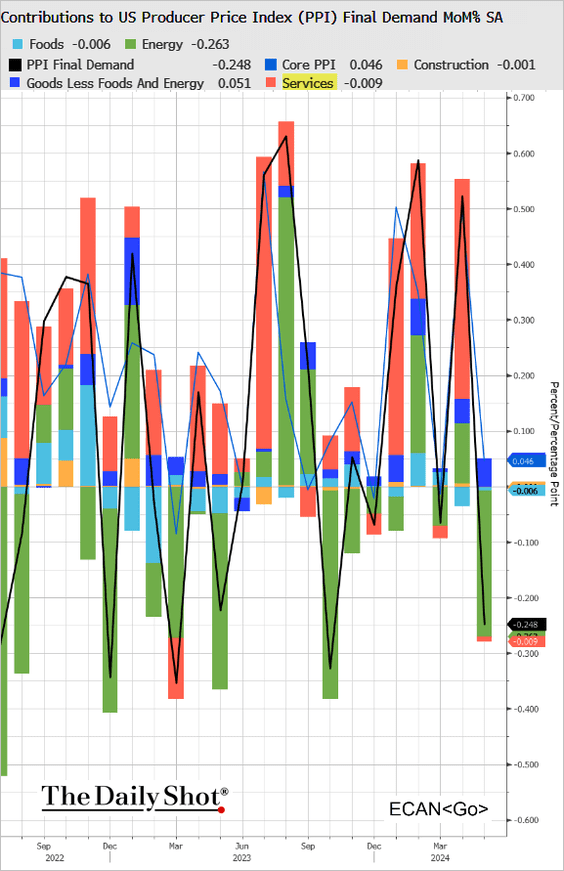

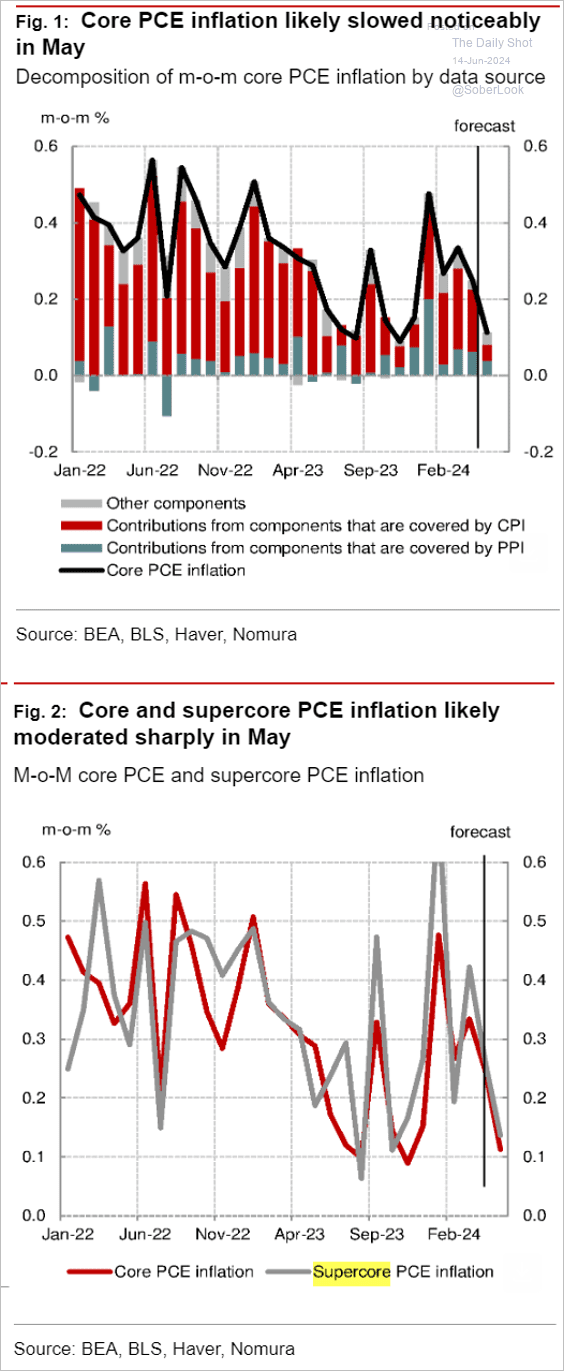

• Softer PPI and CPI reports signal a significant slowdown in the core PCE measure.

Source: Nomura Securities

Source: Nomura Securities

• The market is now pricing in two rate cuts this year, deviating from the June dot plot that projected only one.

——————–

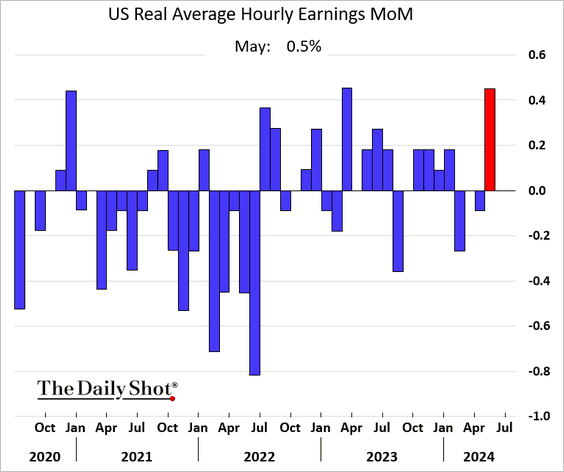

2. Real wages jumped in May as consumer inflation slowed.

3. Initial jobless claims moved higher last week.

• Continuing claims keep diverging from the levels seen in recent years.

——————–

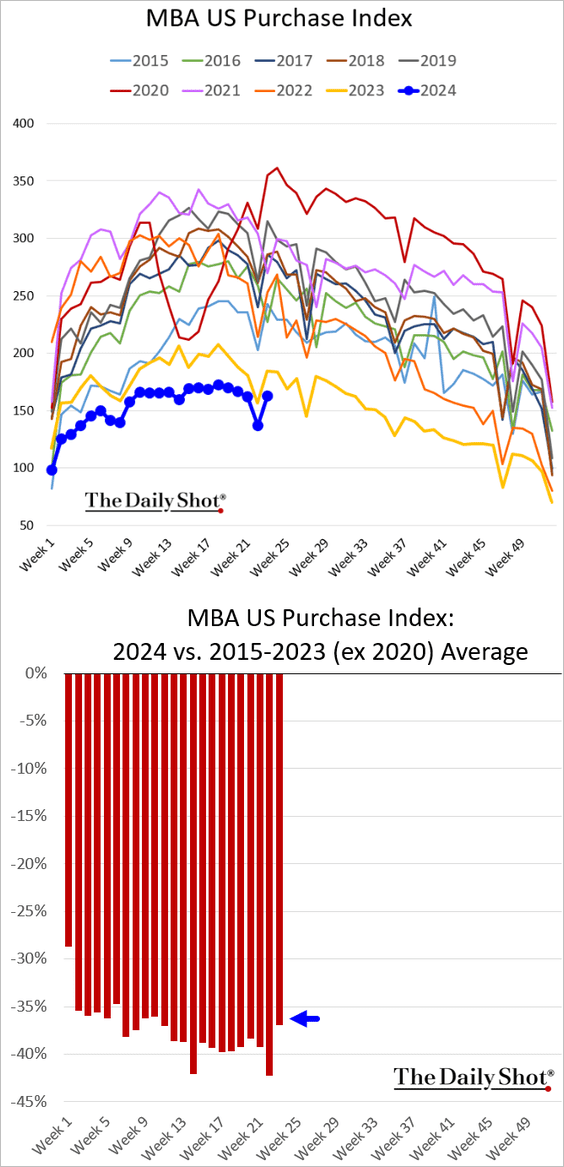

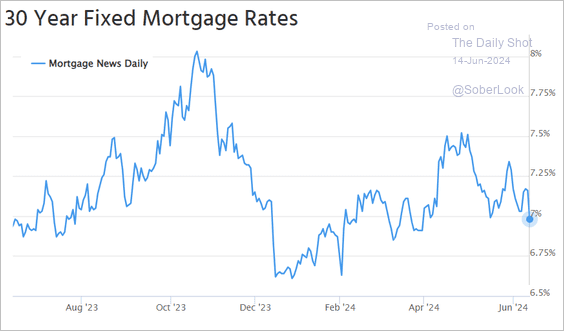

4. Next, we have some updates on the housing market.

• Mortgage applications were firmer last week.

Here is the rate lock count.

Source: AEI Housing Center

Source: AEI Housing Center

• Mortgage rates have been moving lower.

Source: Mortgage News Daily

Source: Mortgage News Daily

• Housing inventories have been running well above last year’s levels (3 charts).

Source: AEI Housing Center

Source: AEI Housing Center

Source: Redfin

Source: Redfin

Source: Redfin

Source: Redfin

• More home sellers have been dropping prices, …

Source: Redfin

Source: Redfin

… yet sales prices continue to climb.

Source: Redfin

Source: Redfin

Back to Index

The Eurozone

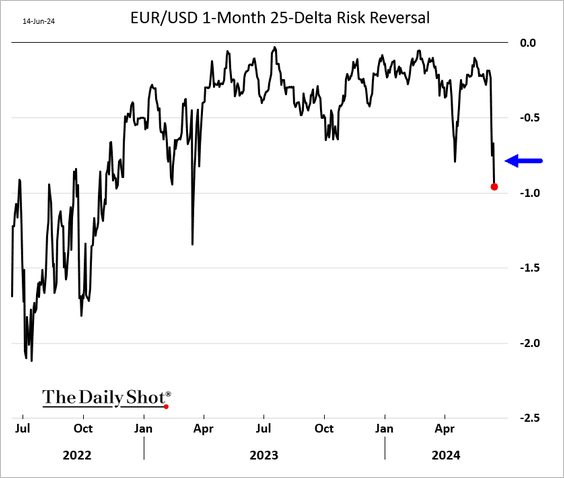

1. EUR/USD risk reversals continue to show increased downside bias ahead of the French elections.

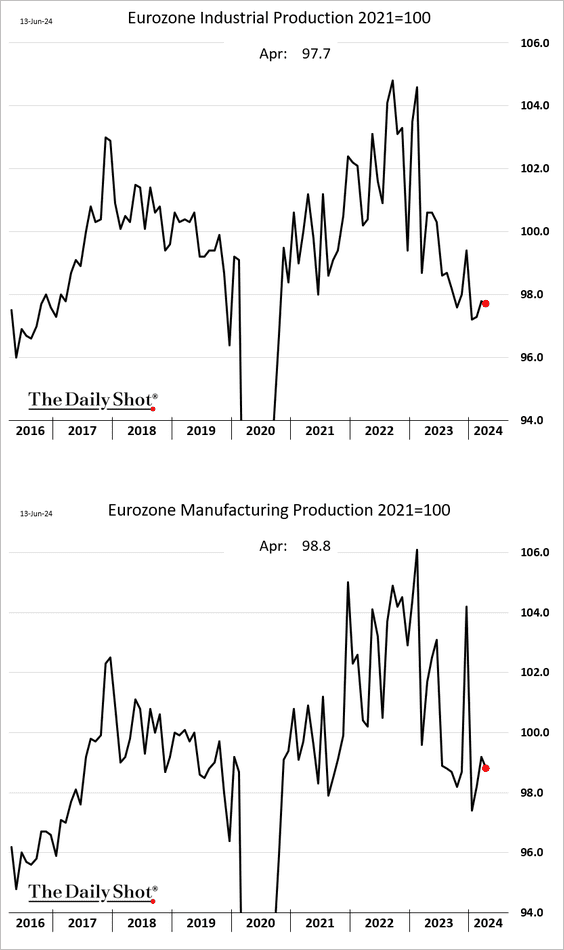

2. Eurozone industrial production inched lower in April.

Source: @economics Read full article

Source: @economics Read full article

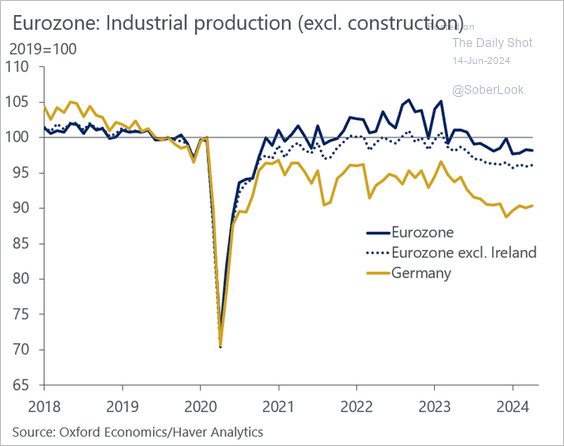

Here is the industrial production trend excluding Ireland (dotted line).

Source: @DanielKral1, @OxfordEconomics

Source: @DanielKral1, @OxfordEconomics

Back to Index

Europe

1. The Swiss franc continues to strengthen vs. the euro amid jitters about France.

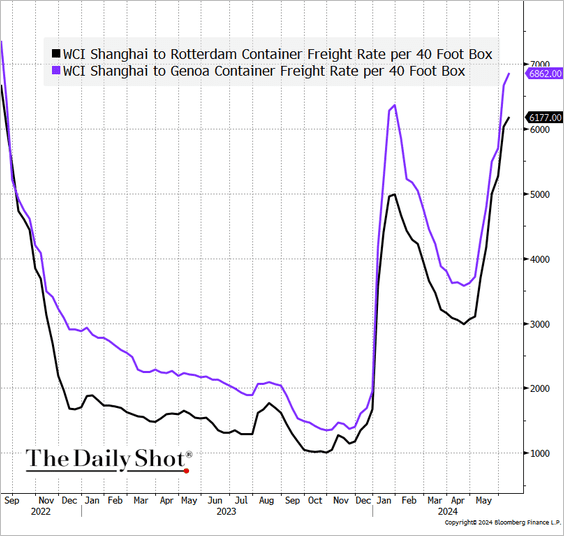

2. Container shipping costs from Asia keep rising.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

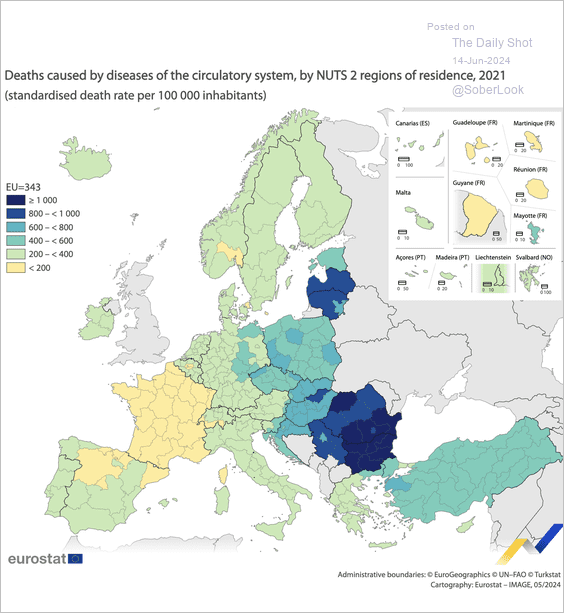

3. Here is a look at European death rates due to diseases of the circulatory system.

Source: Eurostat Read full article

Source: Eurostat Read full article

Back to Index

Japan

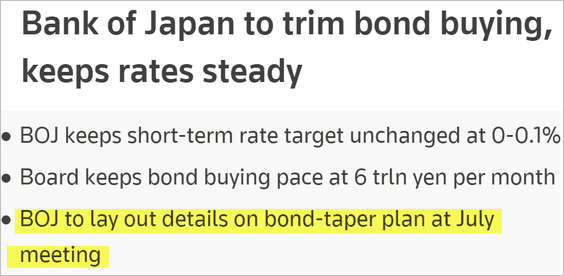

1. The Bank of Japan will keep the market in suspense until the July meeting regarding the specifics of its bond purchasing taper. A rate hike in July is also being considered.

Source: Reuters Read full article

Source: Reuters Read full article

Bond buying has already slowed this year.

Source: @economics Read full article

Source: @economics Read full article

• The yen tumbled following comments from the Bank of Japan.

• JGB yields declined.

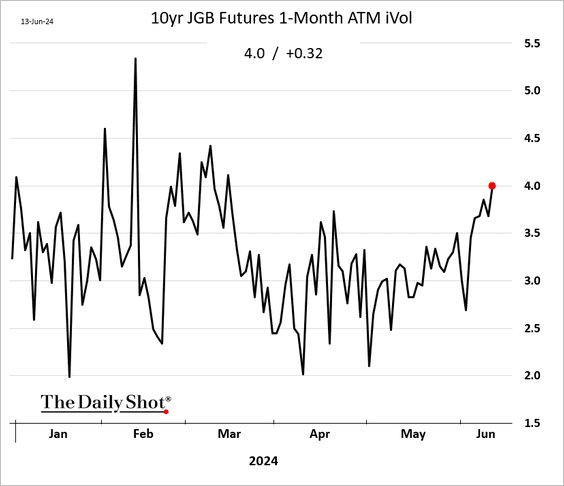

• JGB implied volatility has been rising.

h/t Masaki Kondo FX/Rates Strategist, Bloomberg

h/t Masaki Kondo FX/Rates Strategist, Bloomberg

——————–

2. The BoJ owns about 60% of JGBs outstanding.

Source: Torsten Slok, Apollo

Source: Torsten Slok, Apollo

Back to Index

China

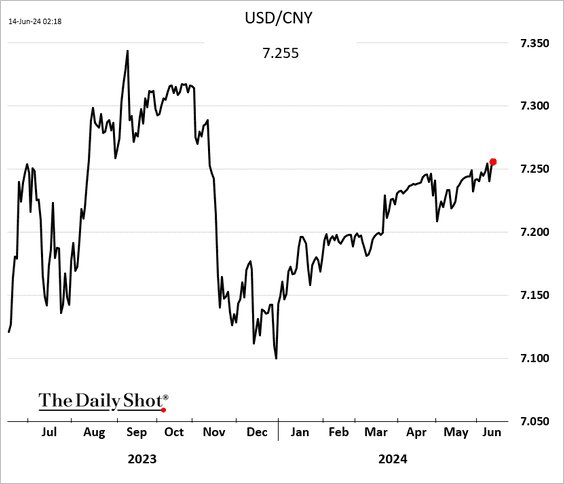

1. The renminbi continues to weaken vs. USD.

2. China’s credit impulse (change in new credit issued as a percentage of GDP) has been weakening, which doesn’t bode well for economic growth.

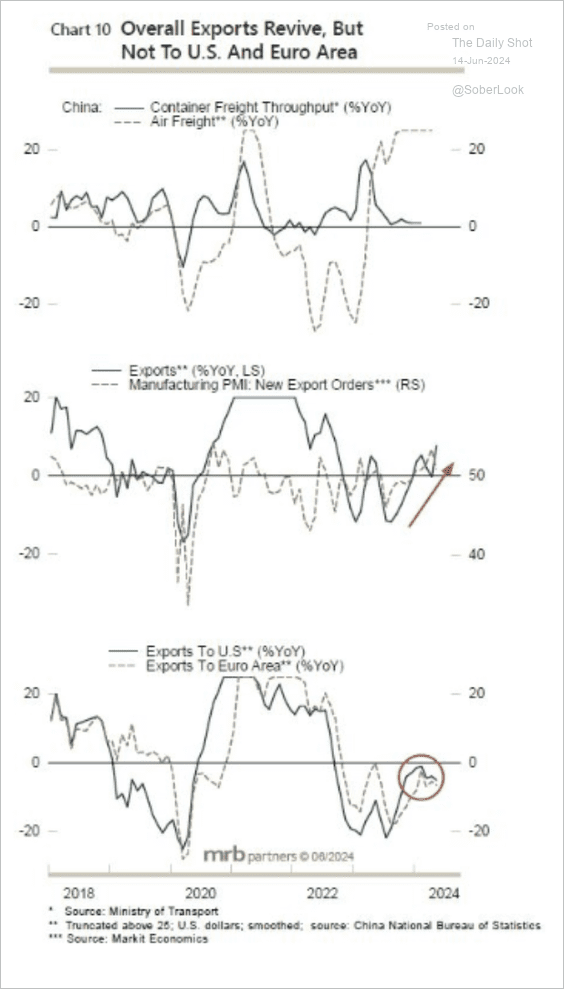

3. Exports are recovering outside of the US and euro area.

Source: MRB Partners

Source: MRB Partners

Back to Index

Emerging Markets

1. LatAm equity ETFs have underperformed sharply this week after Mexico’s election results (2 charts).

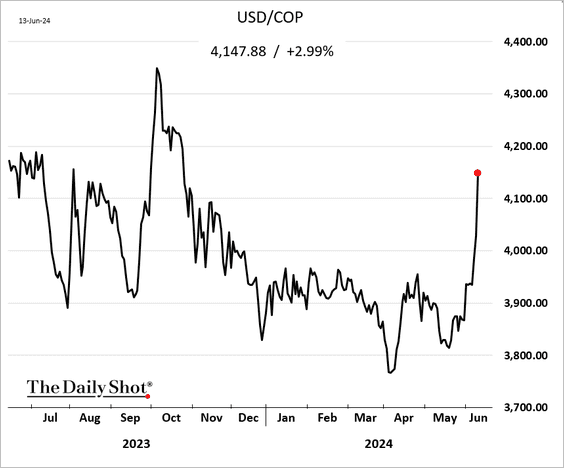

2. The Colombian peso has been tumbling.

• Colombia’s core inflation continues to moderate.

——————–

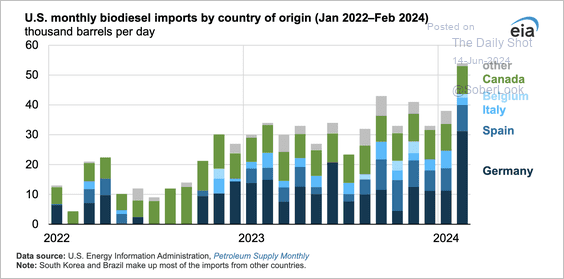

3. The Indonesian rupiah remains under pressure.

4. Stock trading activity in India has been surging.

Source: @markets Read full article

Source: @markets Read full article

5. Next, we have some updates on South Africa.

• Business confidence (lower in May):

• Manufacturing production (a rebound in April):

• Mining output:

• Real GDP per capita:

Source: ING

Source: ING

• Government debt-to-GDP-ratio:

Source: ING

Source: ING

Back to Index

Commodities

1. Speculative gold bets have been rising.

Source: @bespokeinvest

Source: @bespokeinvest

• Gold ETF outflows appear to have stopped.

——————–

2. ANZ expects a gradual reduction in global platinum supply.

Source: @ANZ_Research

Source: @ANZ_Research

Platinum has recently diverged from gold.

Source: @ANZ_Research

Source: @ANZ_Research

Back to Index

Energy

1. Crude oil implied volatility continues to trend lower.

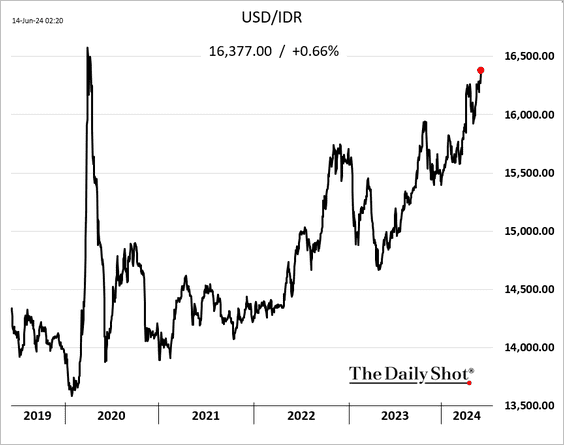

2. What is the market-implied probability of Brent futures trading above $90/bbl or below $70/bbl? The charts below show the results for late July and the end of the year.

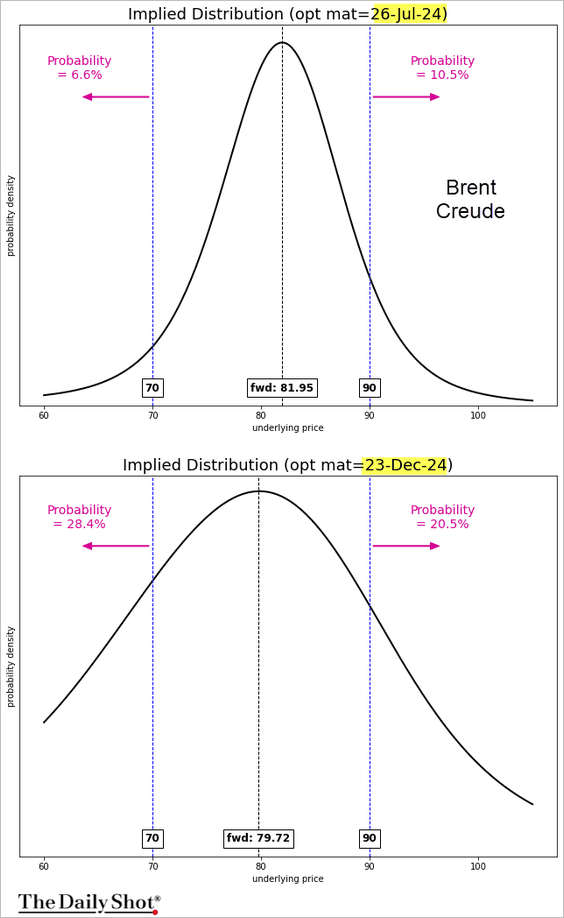

3. US biodiesel imports have doubled since 2022 due to low prices in Europe.

Source: @EIAgov Read full article

Source: @EIAgov Read full article

Back to Index

Equities

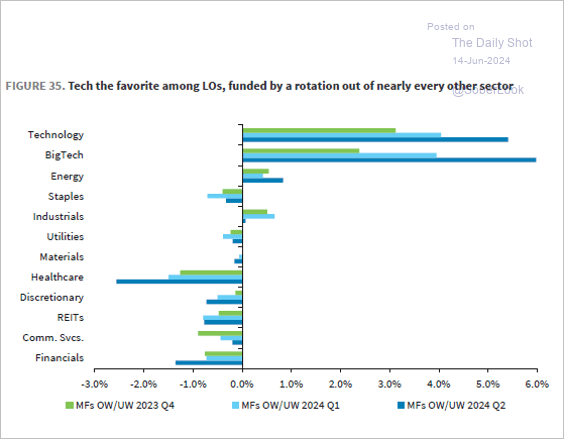

1. Investors have been rotating into tech stocks, shifting away from nearly all other sectors (“LOs” = long-only investors).

Source: Barclays Research; @markets Read full article

Source: Barclays Research; @markets Read full article

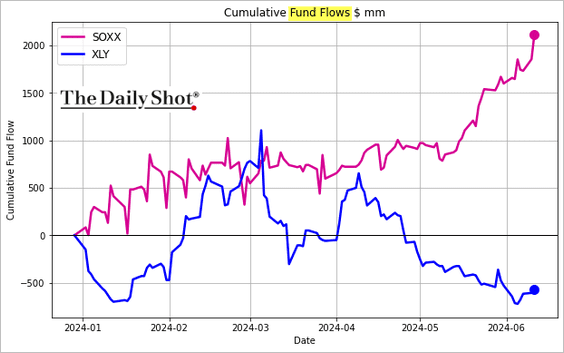

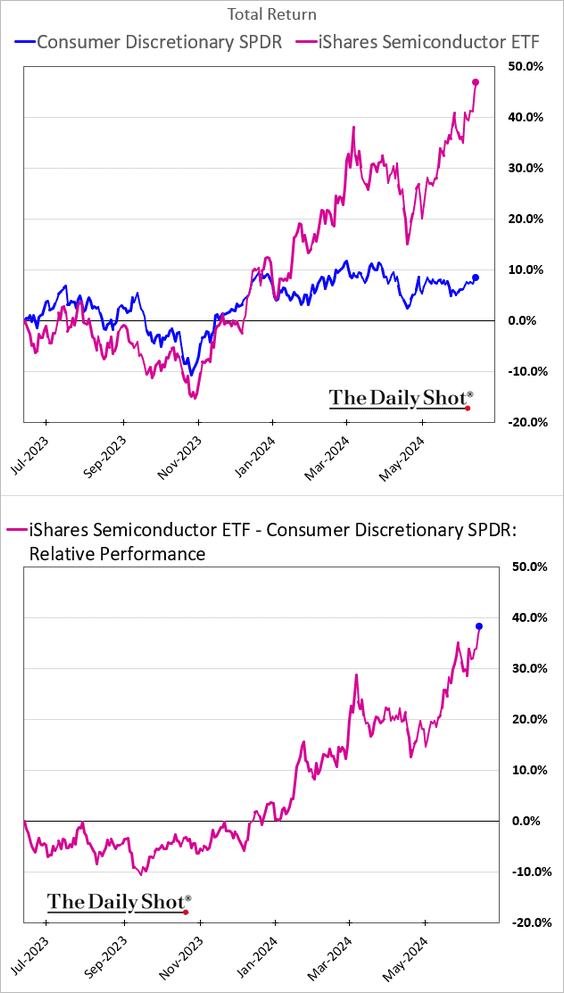

• For example, this chart shows cumulative year-to-date flows for SOXX (semiconductor ETF) and XLY (consumer discretionary ETF).

And here is the price action.

——————–

2. Related to the above, industrials have been underperforming.

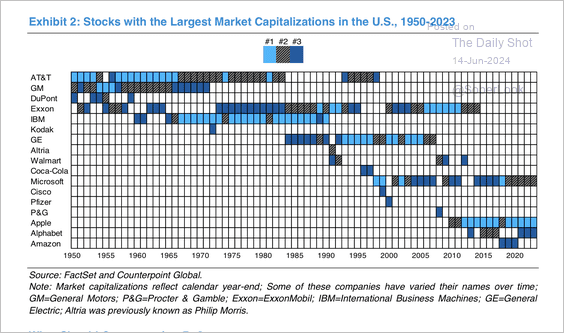

3. Stock market concentration in the US is at the highest levels since the 1960s.

Source: Counterpoint Global; Morgan Stanley Research

Source: Counterpoint Global; Morgan Stanley Research

• This figure shows the stocks of US companies that have been among the top three in market cap at the end of the year from 1950-2023.

Source: Counterpoint Global; Morgan Stanley Research

Source: Counterpoint Global; Morgan Stanley Research

——————–

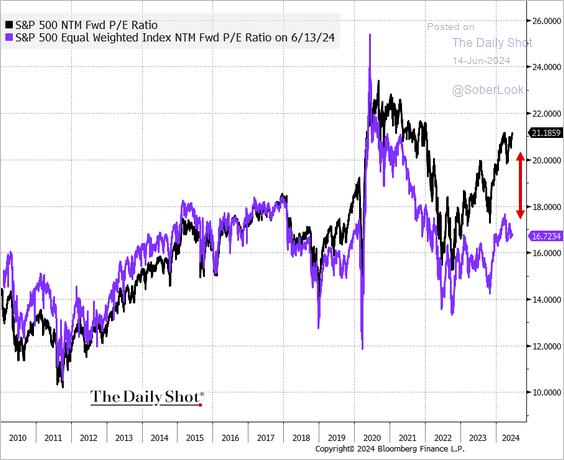

4. The average S&P 500 stock is trading at an increasing discount to the index.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

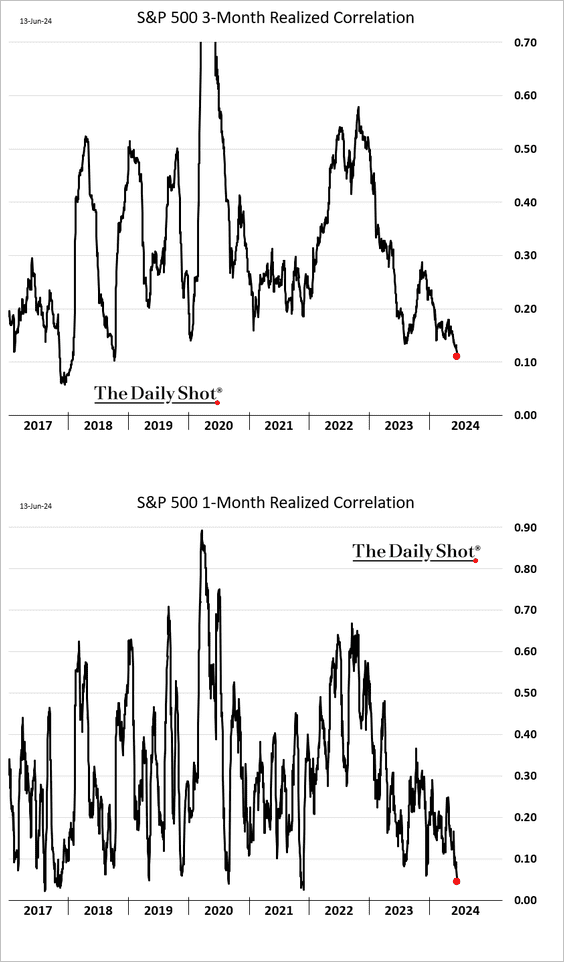

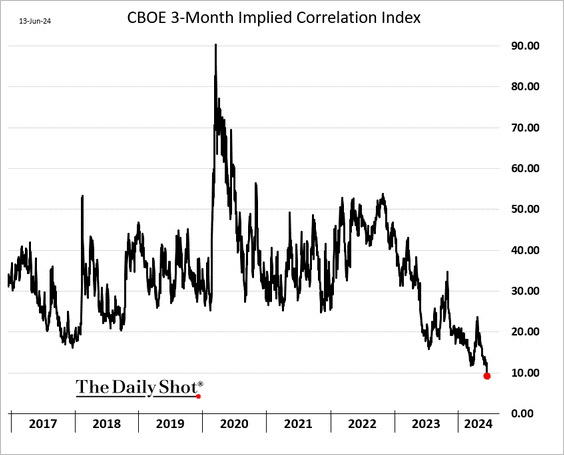

5. Correlations among S&P 500 stocks continue to sink. In theory, this trend is good news for stock prickers (actively-managed funds).

• Realized correlations:

• Impleid correlations:

——————–

6. The market expects over 30% of Russell 2000 members to remain unprofitable.

Source: Goldman Sachs; @AyeshaTariq

Source: Goldman Sachs; @AyeshaTariq

7. Fed liquidity is no longer a tailwind for stocks.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

8. Investors are sitting on a lot of cash.

Back to Index

Alternatives

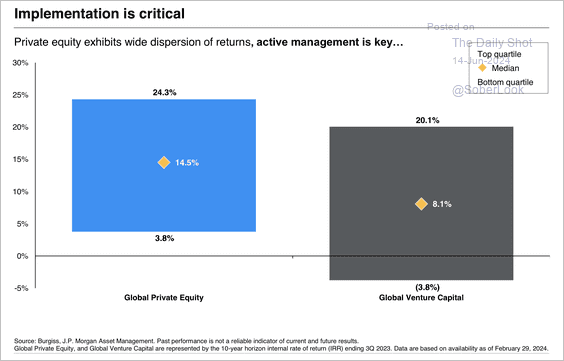

1. There is a wide dispersion of returns in private equity.

Source: J.P. Morgan Asset Management

Source: J.P. Morgan Asset Management

2. Exit values in Australia and New Zealand have declined in recent years, although hopes of the next wave of growth are pinned to Canva at a roughly $40 billion valuation.

Source: PitchBook

Source: PitchBook

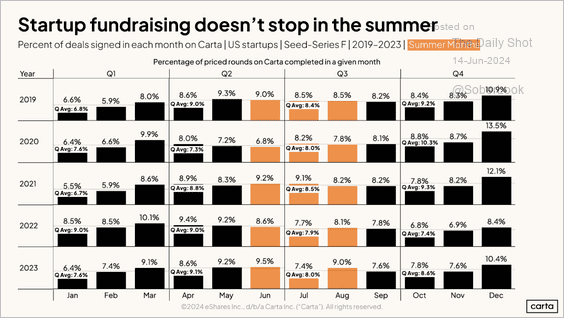

3. Startup fundraising typically holds up during the summer months.

Source: Carta

Source: Carta

4. Here is a look at private/public market correlations.

Source: J.P. Morgan Asset Management

Source: J.P. Morgan Asset Management

Back to Index

Global Developments

1. Container shipping costs continue to climb.

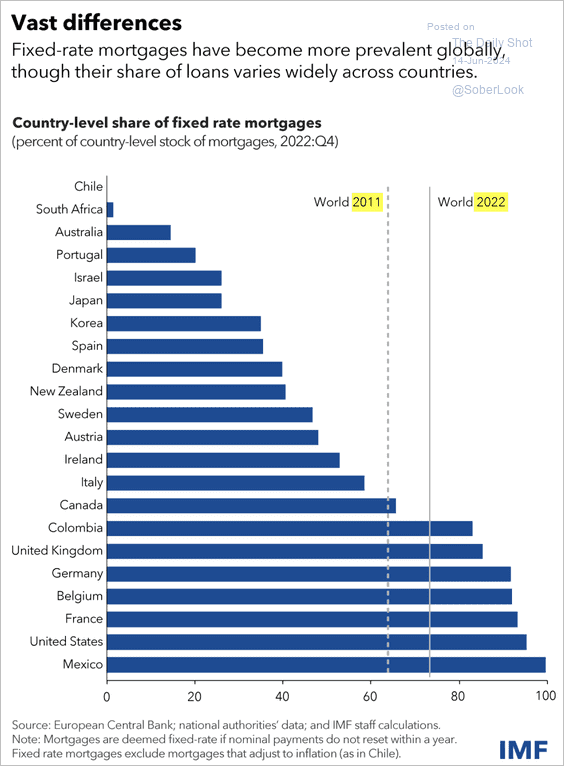

2. Here is a look at the country-level share of fixed-rate mortgages.

Source: IMF Read full article

Source: IMF Read full article

3. Finally, we have seaborne trade over time.

Source: J.P. Morgan Asset Management

Source: J.P. Morgan Asset Management

——————–

Food for Thought

1. The distribution of S&P 500 CEO pay in 2023:

Source: @WSJ Read full article

Source: @WSJ Read full article

2. Share of US TV-viewing time by platform:

Source: @WSJ Read full article

Source: @WSJ Read full article

3. Increasing Chinese incursions into Taiwan’s air-defense identification zone:

Source: The Economist Read full article

Source: The Economist Read full article

4. Mexico’s drug cartels:

Source: @financialtimes Read full article

Source: @financialtimes Read full article

5. Number of abortions in the US:

Source: Brookings Read full article

Source: Brookings Read full article

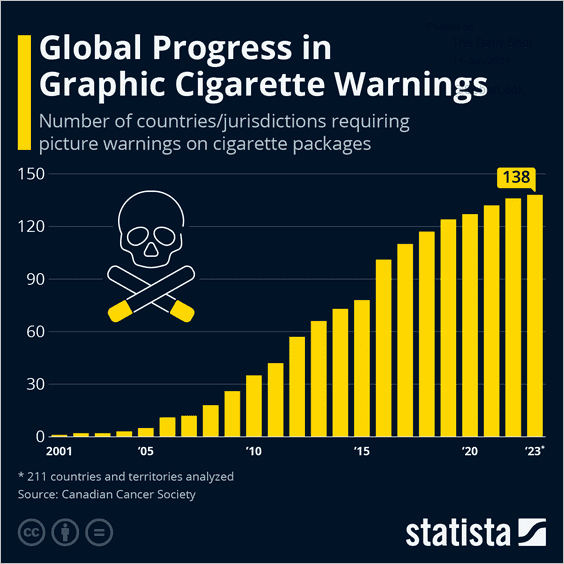

6. Global adoption of graphic warnings on cigarette packages:

Source: Statista

Source: Statista

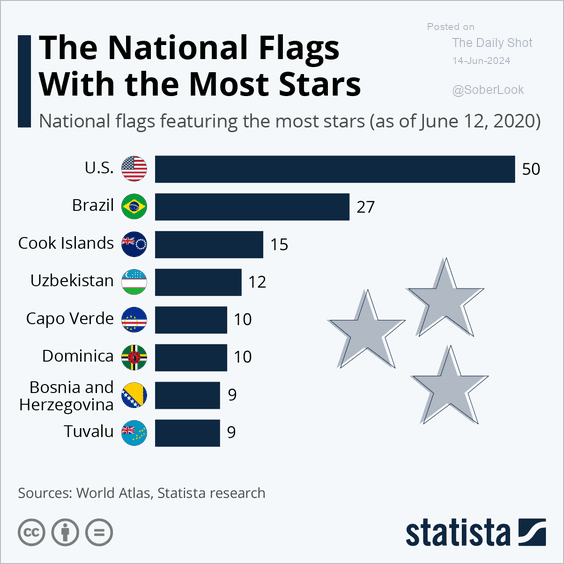

7. National flags featuring the most stars:

Source: Statista

Source: Statista

• Versions of US flags used over time:

Source: Quarterhouse

Source: Quarterhouse

——————–

Have a great weekend!

Back to Index