The Daily Shot: 14-May-24

• The United States

• Canada

• The Eurozone

• Europe

• Japan

• Asia-Pacific

• China

• Emerging Markets

• Cryptocurrency

• Commodities

• Energy

• Equities

• Credit

• Food for Thought

The United States

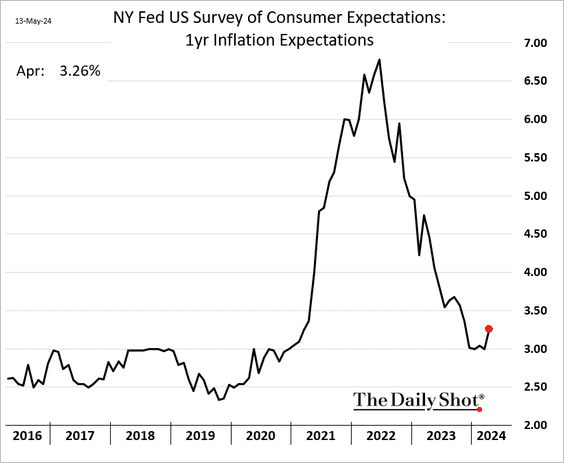

1. The New York Fed’s US consumer survey indicated rising short-term inflation expectations in April, …

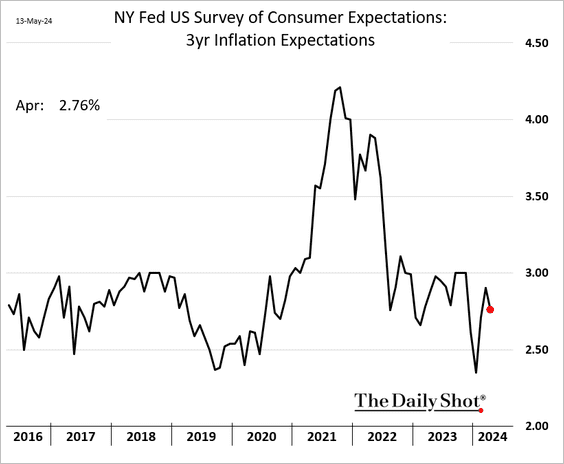

… while longer-term expectations have eased.

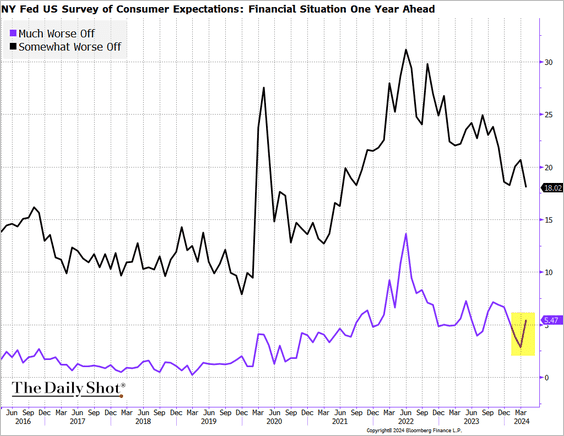

• More households expect to be “much worse off” in a year.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

• Lower-income Americans are increasingly worried about finding work if they lose their job.

Source: Federal Reserve Bank of New York

Source: Federal Reserve Bank of New York

——————–

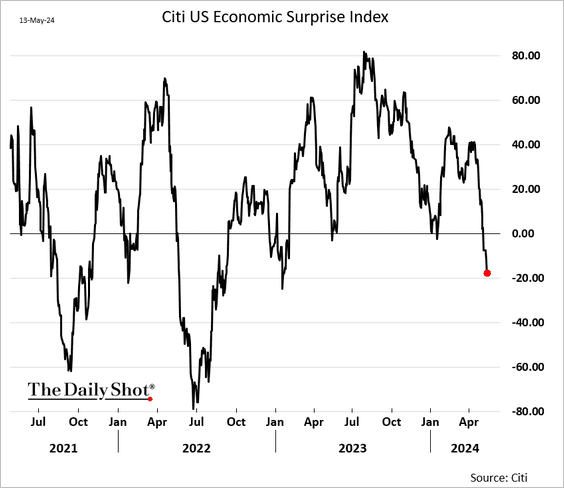

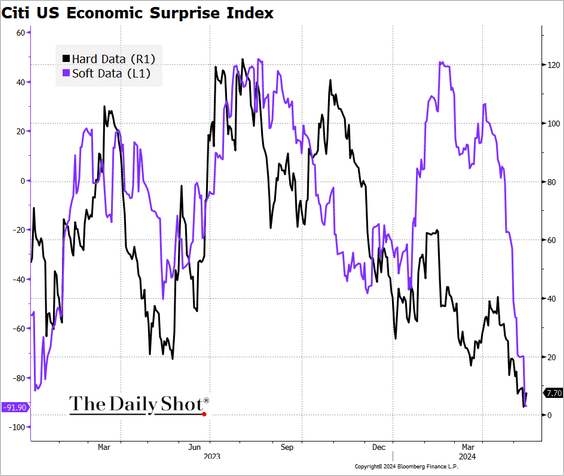

2. The Citi Economic Surprise Index continues to trend lower, …

… with the soft-data indicator (surveys) converging with hard data.

Source: Citi; @TheTerminal, Bloomberg Finance L.P.

Source: Citi; @TheTerminal, Bloomberg Finance L.P.

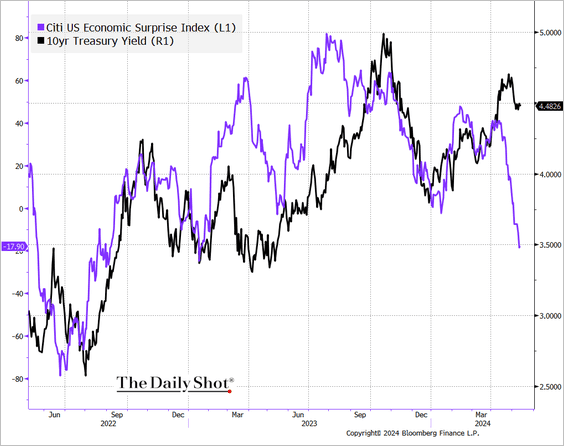

• Negative economic surprises signal lower Treasury yields ahead.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

——————–

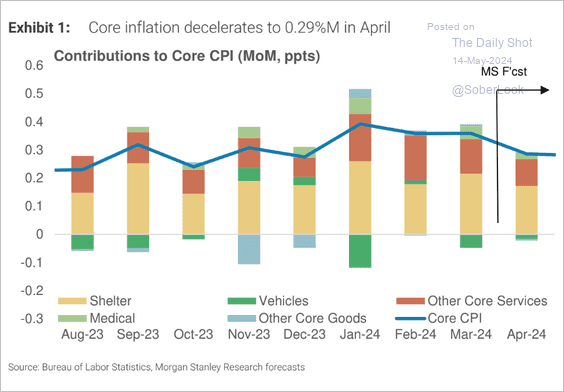

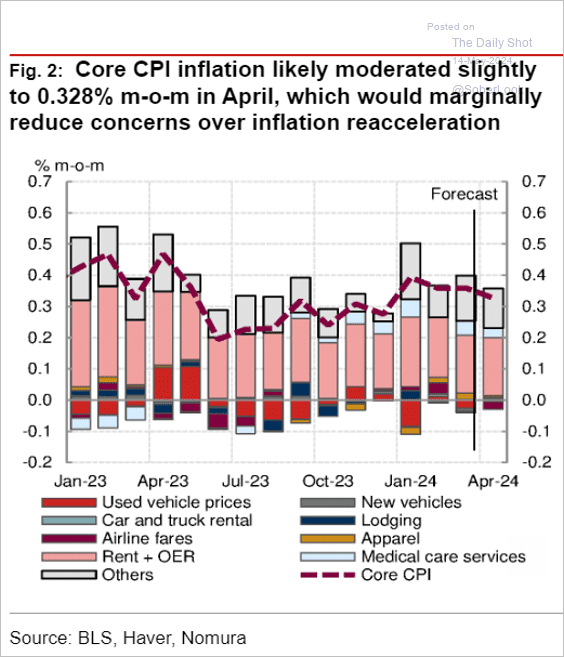

3. Next, we have some updates on inflation.

• What should we expect from the CPI report this week? Here are some estimates for the April core CPI (monthly changes).

– Wells Fargo (0.29%):

Source: Wells Fargo Securities

Source: Wells Fargo Securities

– Morgan Stanley (0.29%):

Source: Morgan Stanley Research

Source: Morgan Stanley Research

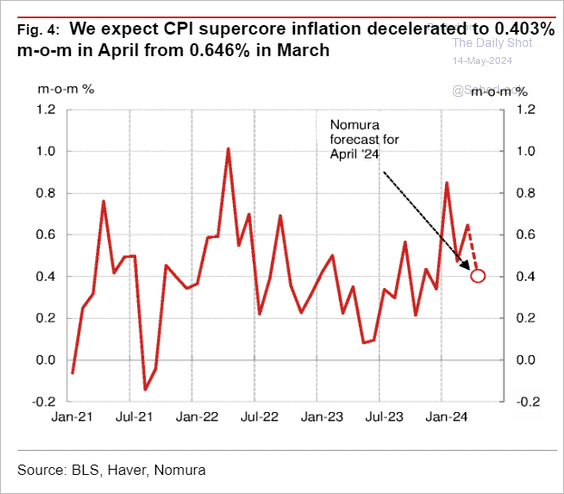

– Nomura (0.33%):

Source: Nomura Securities

Source: Nomura Securities

Nomura projects the supercore CPI to slow to 0.40%, which remains too high for the Fed’s comfort.

Source: Nomura Securities

Source: Nomura Securities

• Elevated vehicle repair costs have propelled car insurance inflation higher.

Source: Morgan Stanley Research

Source: Morgan Stanley Research

• There has been a sizable gap between healthcare prices and costs.

Source: BCA Research

Source: BCA Research

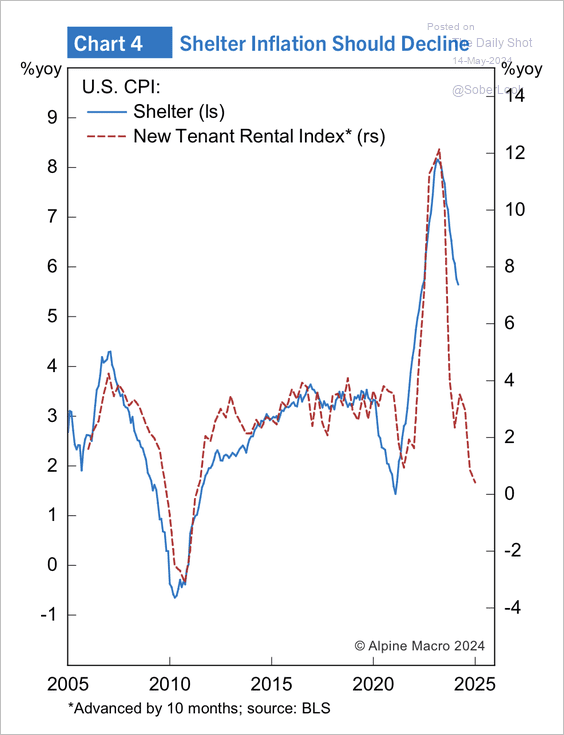

• The sharp deceleration in new rents indicates weaker shelter inflation ahead.

Source: Alpine Macro

Source: Alpine Macro

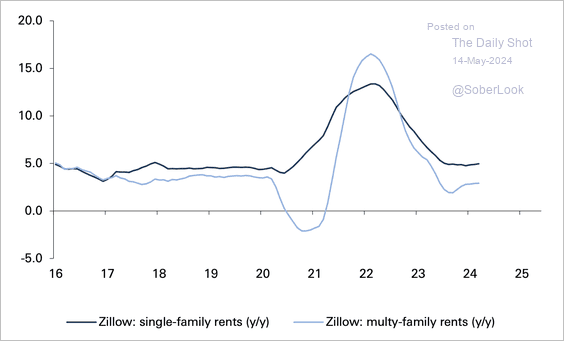

Single-family rent inflation is running stronger than multi-family.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

——————–

4. Will households start tapping into their substantial home equity?

Source: Deutsche Bank Research

Source: Deutsche Bank Research

Back to Index

Canada

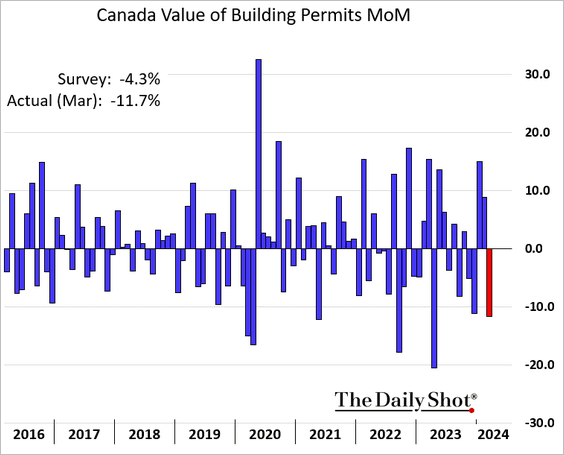

1. Building permits declined more than expected in March.

2. Consumer sentiment continues to drift lower.

Back to Index

The Eurozone

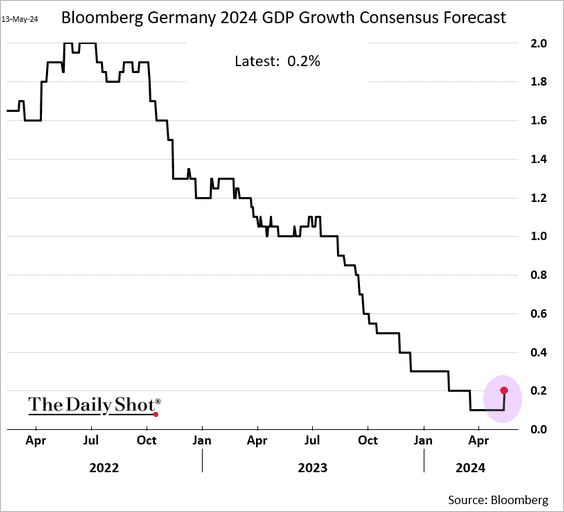

1. After months of persistent downgrades, economists have upgraded Germany’s GDP growth forecasts for this year (slightly).

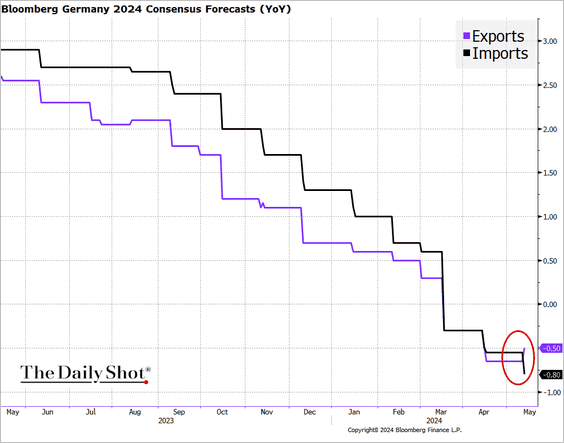

This year, the decline in German exports is expected to be less severe than the decline in imports.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

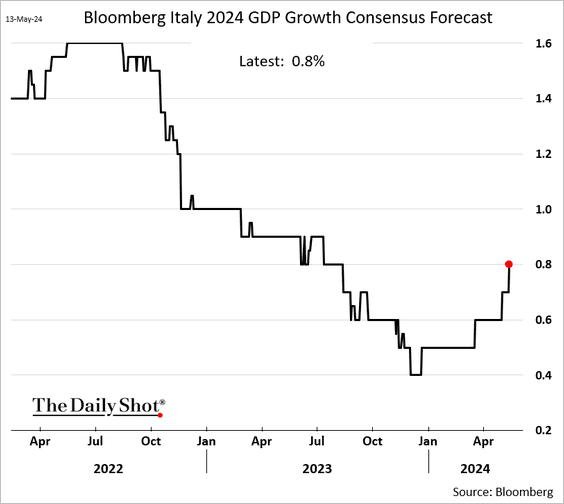

2. Economists continue to upgrade their GDP forecasts for Italy and Spain.

Back to Index

Europe

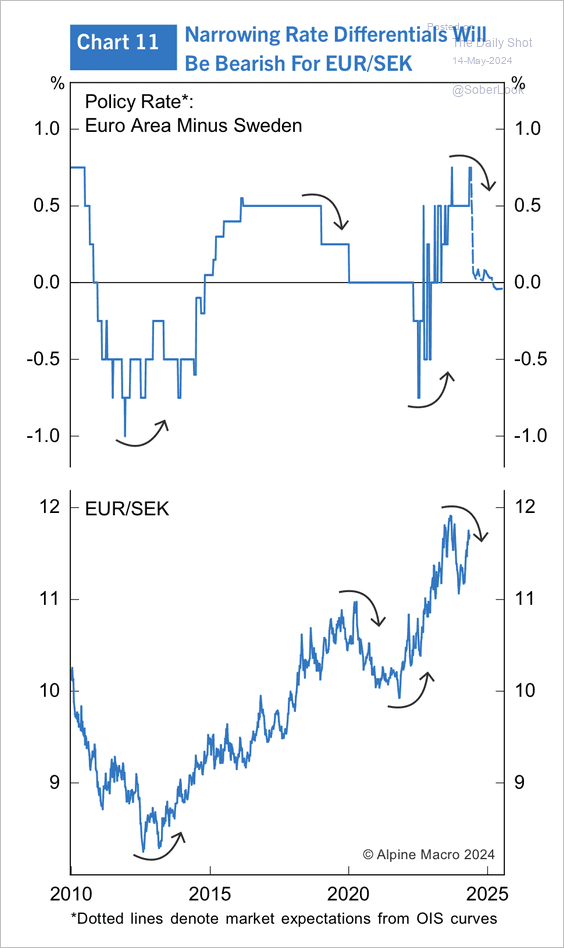

1. Narrower interest rate differentials could weigh on EUR/SEK.

Source: Alpine Macro

Source: Alpine Macro

2. The Czech CPI report topped expectations, …

… further supporting the Czech koruna.

——————–

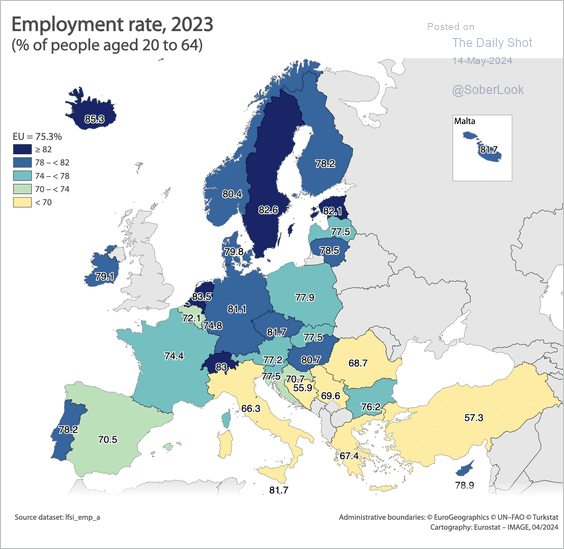

3. Here is a look at employment rates across the EU.

Source: Eurostat Read full article

Source: Eurostat Read full article

Back to Index

Japan

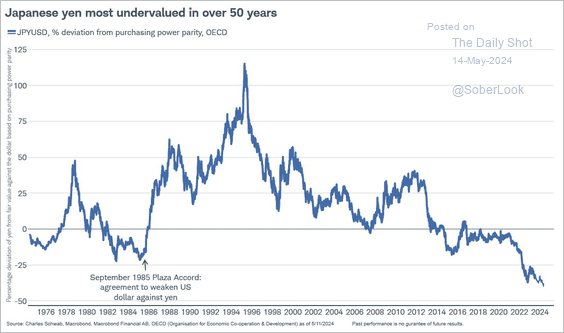

1. The yen continues to weaken, …

… and is now massively undervalued.

Source: @JeffreyKleinto

Source: @JeffreyKleinto

——————–

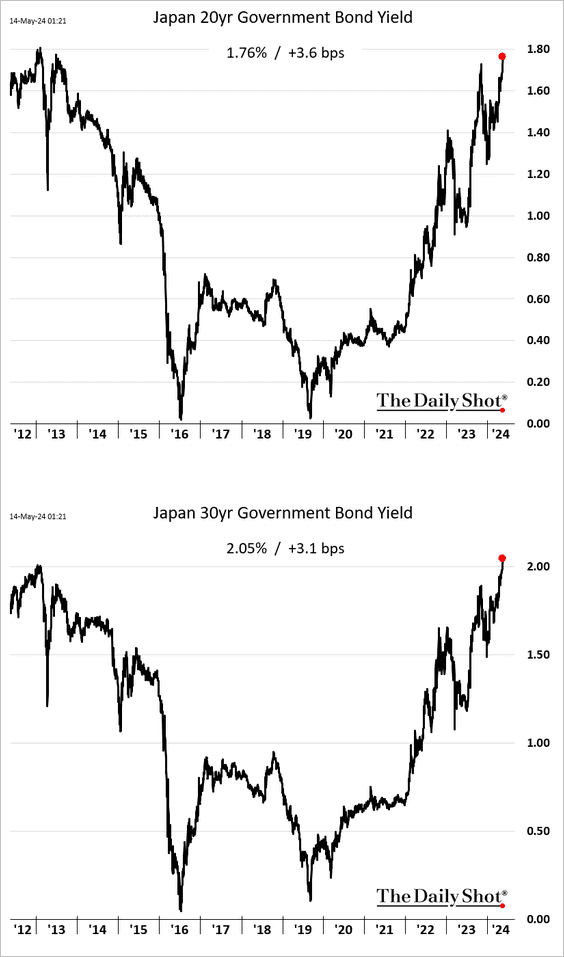

2. JGB yields are surging, with the 30-year rate climbing above 2%.

Source: @economics Read full article

Source: @economics Read full article

Source: @markets Read full article

Source: @markets Read full article

——————–

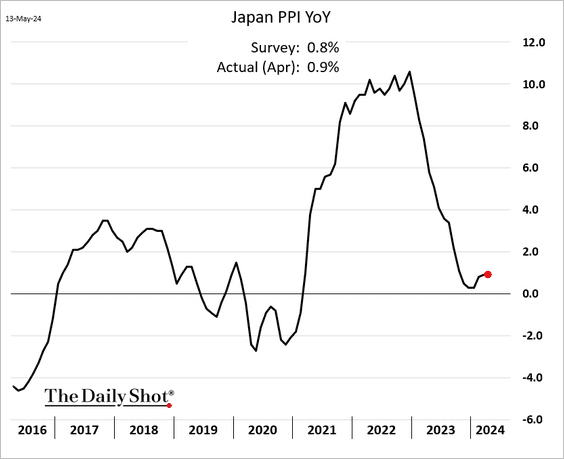

3. The April PPI was a bit higher than expected.

Back to Index

Asia-Pacific

1. South Korea’s export price gains have been accelerating.

2. Australian households cut back on spending in April.

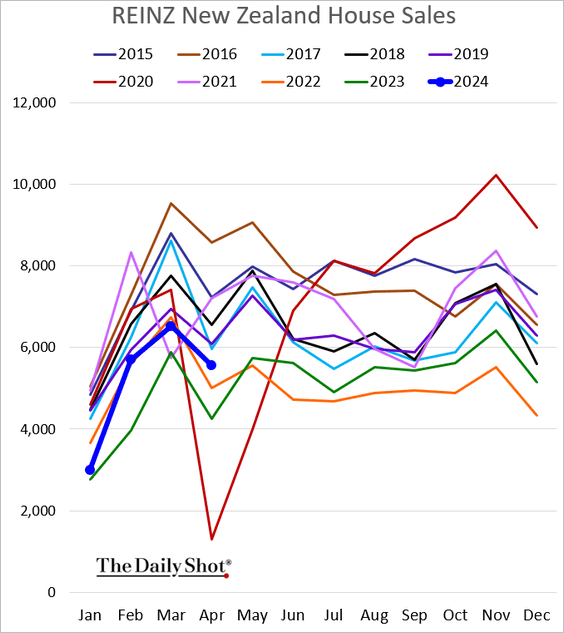

3. New Zealand’s house sales are holding above last year’s levels.

Back to Index

China

1. Weak liquidity conditions will be a drag on economic activity.

Source: Simon White, Bloomberg Markets Live Blog

Source: Simon White, Bloomberg Markets Live Blog

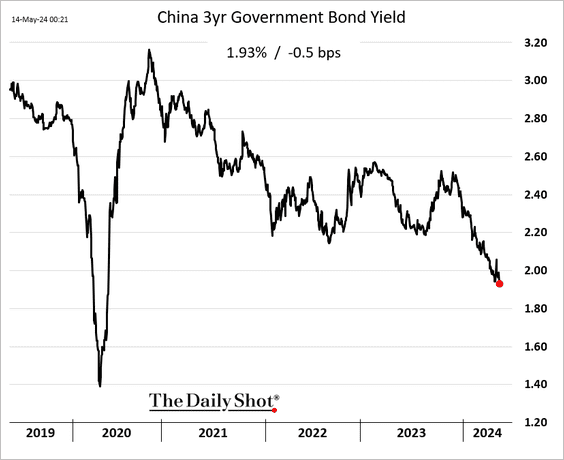

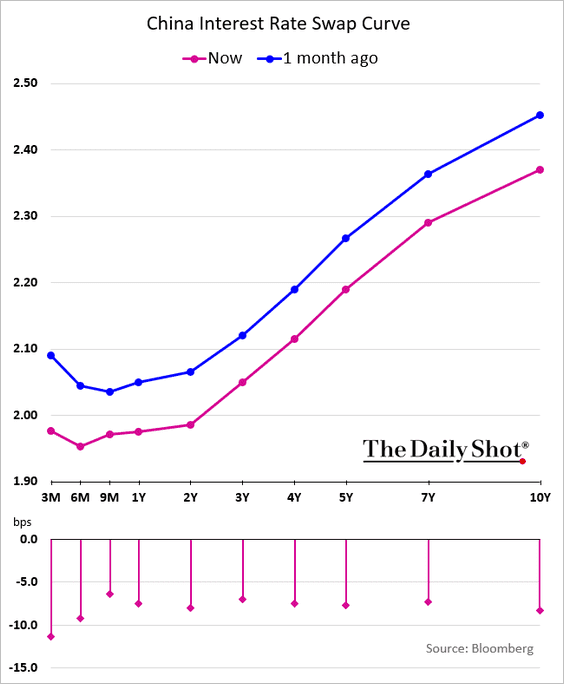

2. Markets are betting on PBoC rate cuts in the months ahead.

• 3-year bond yield:

• One-year swap rate:

• The swap curve:

——————–

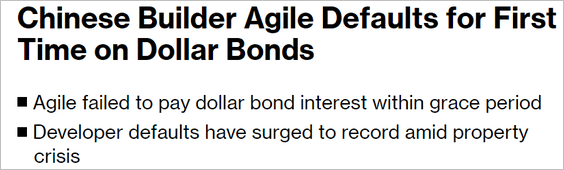

3. The credit crunch among Chinese developers continues to fester as Agile defaults on dollar bonds.

Source: @markets Read full article

Source: @markets Read full article

——————–

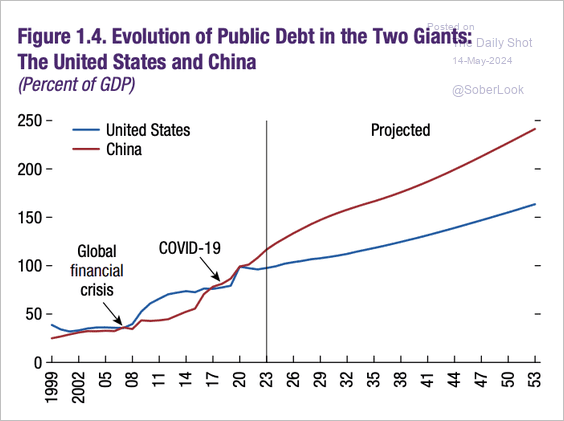

4. This chart displays projections for the public debt-to-GDP ratios of the US and China.

Source: IMF Read full article

Source: IMF Read full article

Back to Index

Emerging Markets

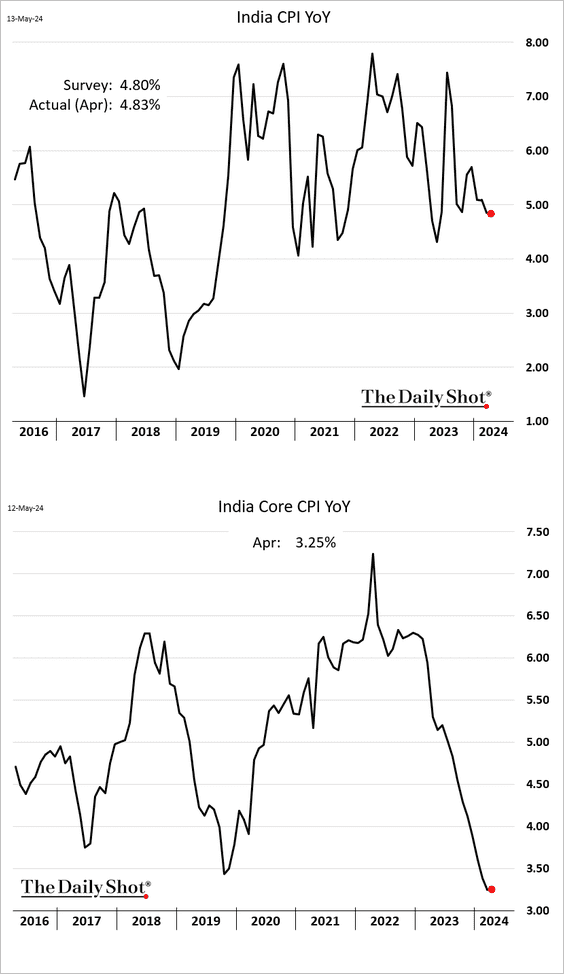

1. India’s year-over-year CPI growth was roughly unchanged from March.

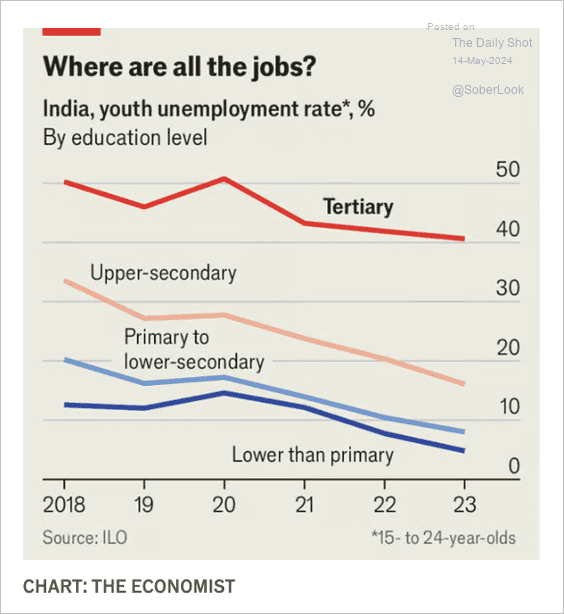

• Separately, here are India’s youth unemployment rates by education levels.

Source: The Economist Read full article

Source: The Economist Read full article

——————–

2. Turkey’s industrial production declined in March.

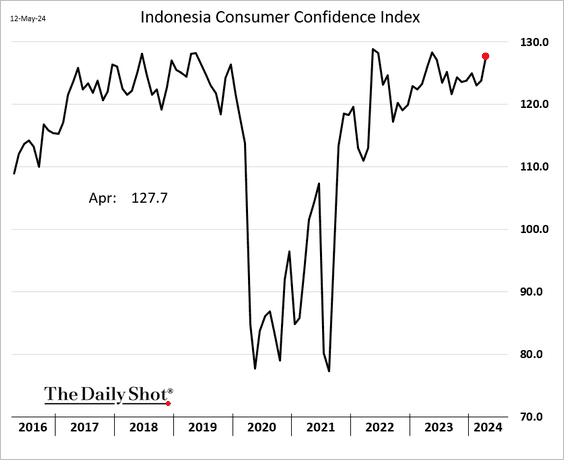

3. Indonesia’s consumer sentiment is nearing multi-year highs.

4. Ukraine’s CPI was lower than expected in April.

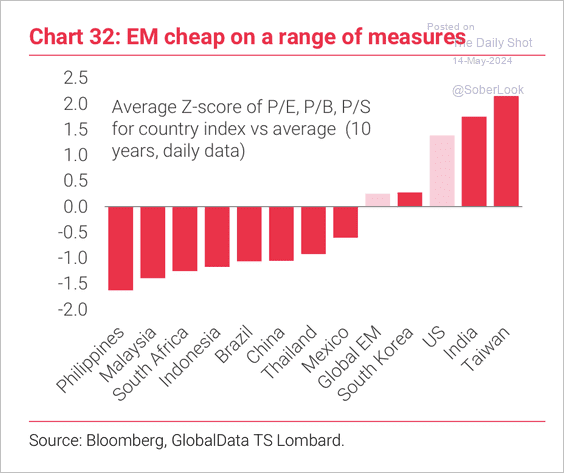

5. Many EM equity markets trade at historical valuation lows.

Source: TS Lombard

Source: TS Lombard

Back to Index

Cryptocurrency

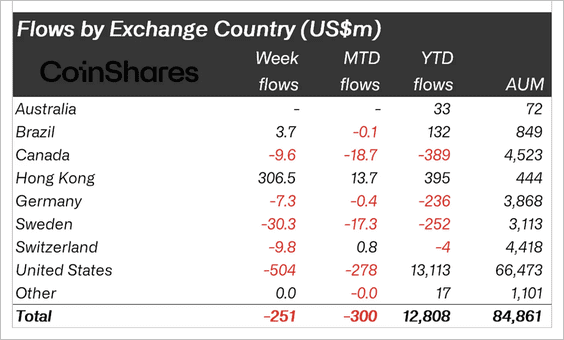

1. Crypto funds saw the fourth straight week of outflows.

Source: CoinShares Read full article

Source: CoinShares Read full article

US funds experienced the most outflows last week, which overshadowed inflows in Hong Kong following recent crypto ETF approvals, …

Source: CoinShares Read full article

Source: CoinShares Read full article

…but the initial wave of inflows did not last long.

Source: CoinDesk Read full article

Source: CoinDesk Read full article

——————–

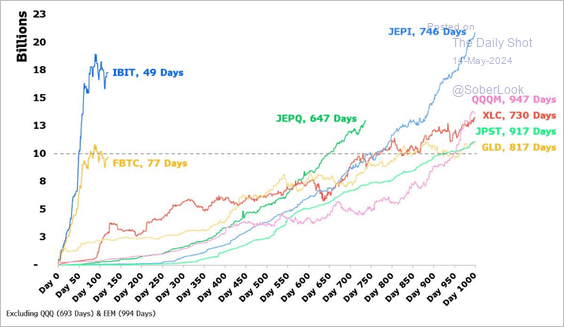

2. This chart compares the record speed of IBIT’s AUM growth (before recent outflows) versus other top ETFs.

Source: @thetrinianalyst

Source: @thetrinianalyst

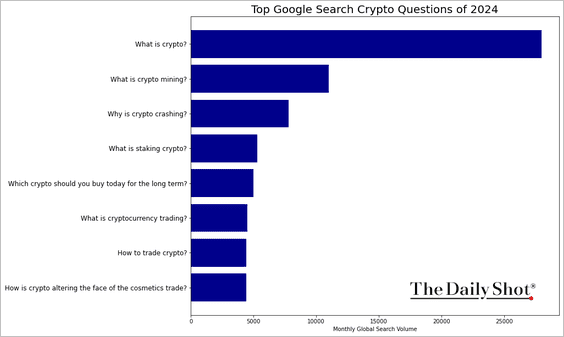

3. Here is a look at the most frequently asked crypto-related questions on Google.

Source: CoinLedger

Source: CoinLedger

Back to Index

Commodities

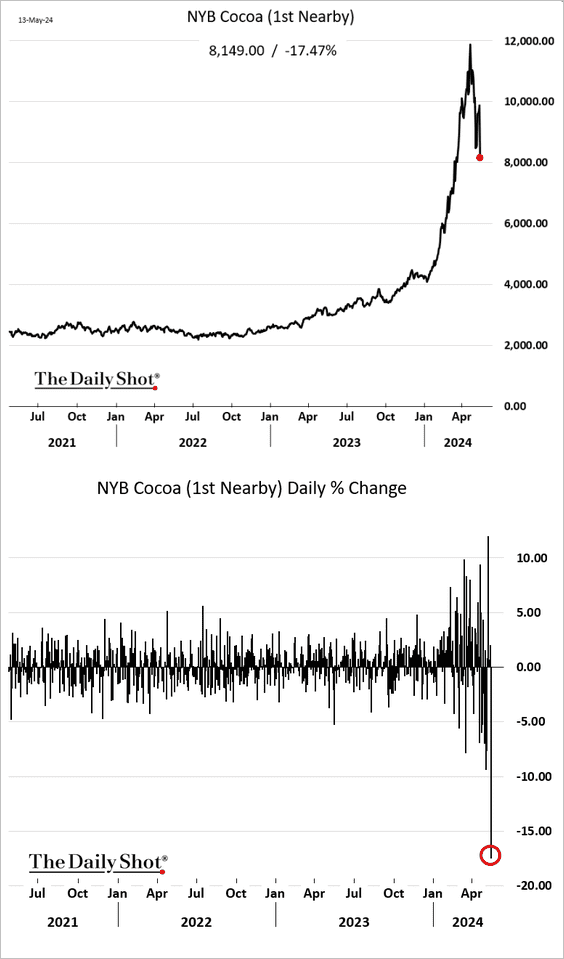

1. Cocoa futures took a massive hit on Monday.

Source: The Spokesman-Review Read full article

Source: The Spokesman-Review Read full article

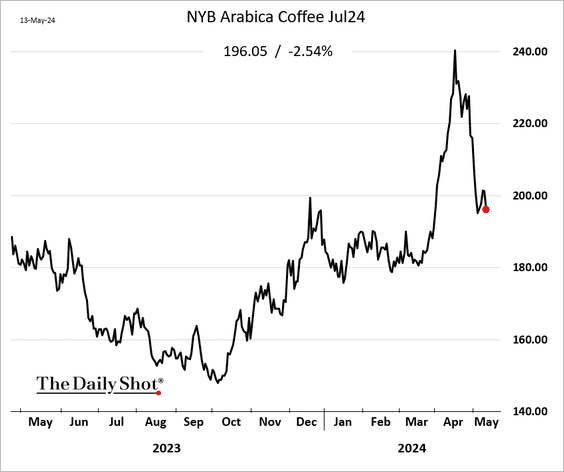

2. The selloff in coffee futures resumed.

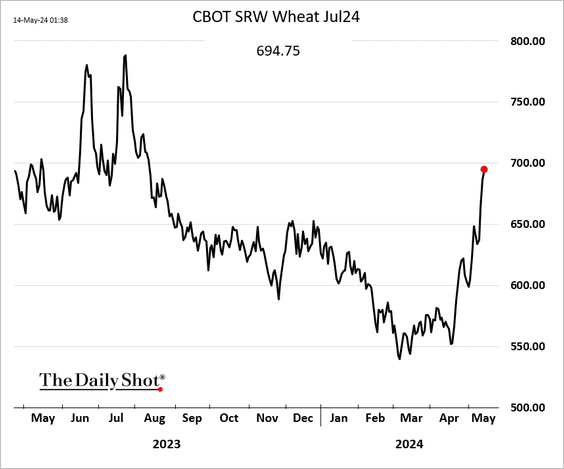

3. Soft red winter wheat is approaching $7 per bushel as funds rotate out of cocoa and coffee into grains.

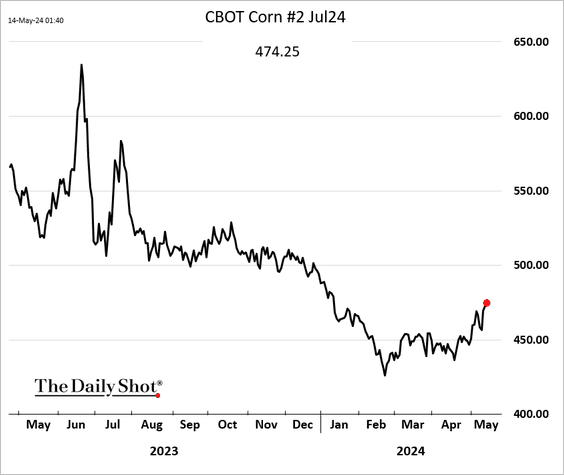

Corn futures are grinding higher as well.

——————–

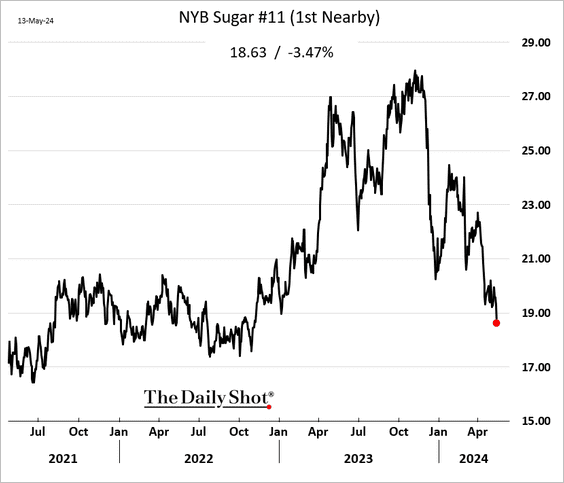

4. Sugar remains under pressure.

Source: barchart.com Read full article

Source: barchart.com Read full article

——————–

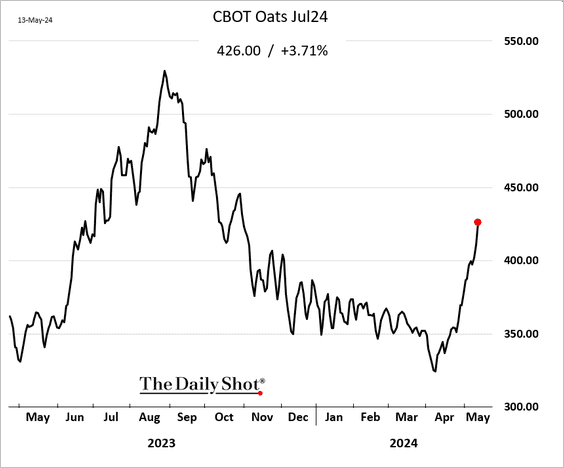

5. Oats futures continue to rally.

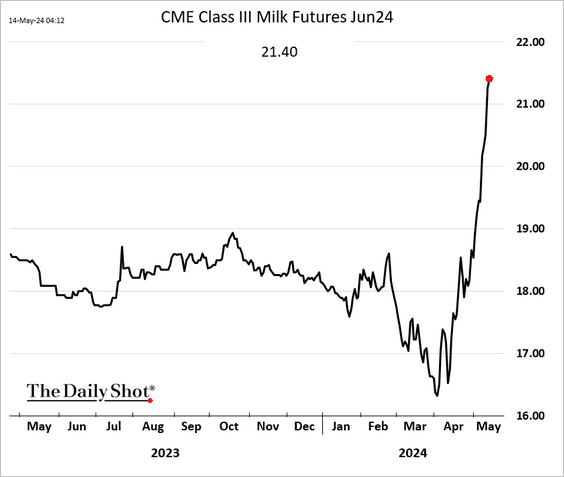

6. It’s been a good month for milk futures.

——————–

7. Copper prices are soaring.

Source: @WSJ Read full article

Source: @WSJ Read full article

Back to Index

Energy

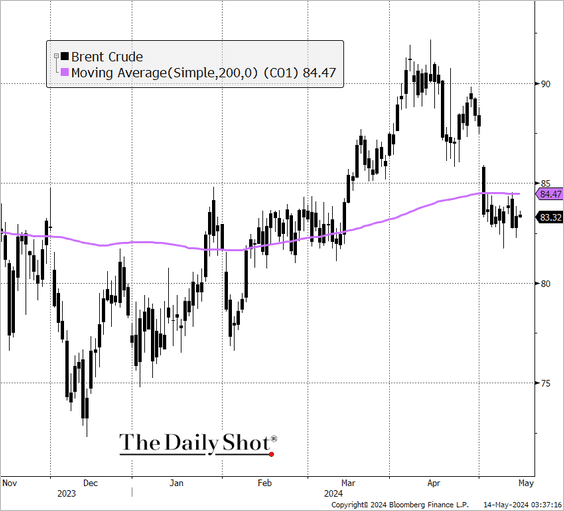

1. Brent crude remains below its 200-day moving average.

Source: Bloomberg

Source: Bloomberg

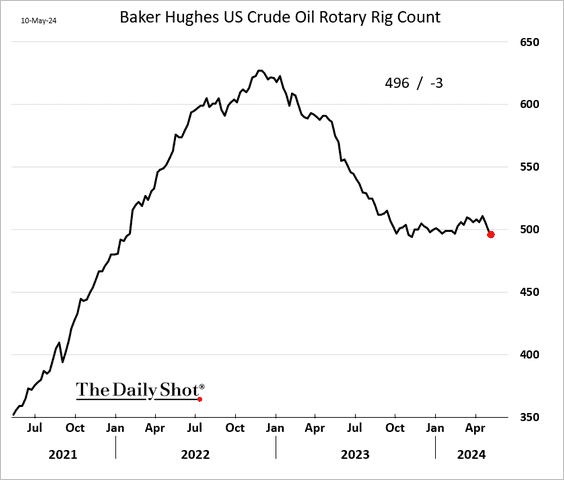

2. The US oil rig count declined again last week.

Source: Reuters Read full article

Source: Reuters Read full article

——————–

3. Capital Economics expects OPEC+ production cuts will start to be unwound from July.

Source: Capital Economics

Source: Capital Economics

4. The US natural gas price is testing initial resistance at its 40-week moving average, although momentum is improving.

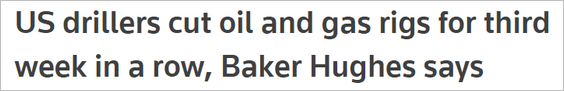

• Gas flows to the US Freeport LNG export terminal have recovered following outages last month. The unwind of a substantial surplus in gas storage helped to stabilize natural gas prices over the past week.

Source: Capital Economics

Source: Capital Economics

——————–

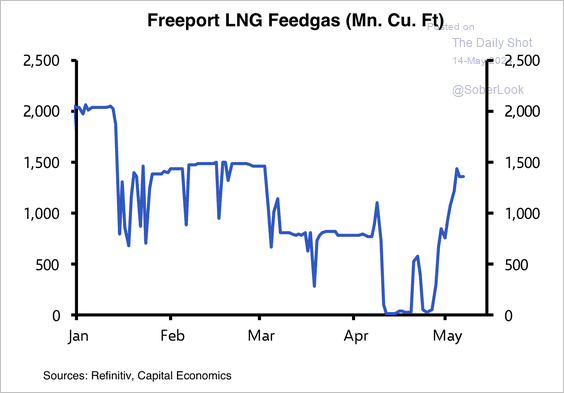

5. Nuclear energy ETFs have experienced strong inflows.

Source: The ETF Shelf

Source: The ETF Shelf

6. Short interest in energy companies continues to rise.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

Back to Index

Equities

1. The Reddit crowd’s “pump ‘n dump” activity is back.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: ABC News Read full article

Source: ABC News Read full article

• The meme share bid triggered a short squeeze in a number of names,…

… giving many hedge funds a headache.

——————–

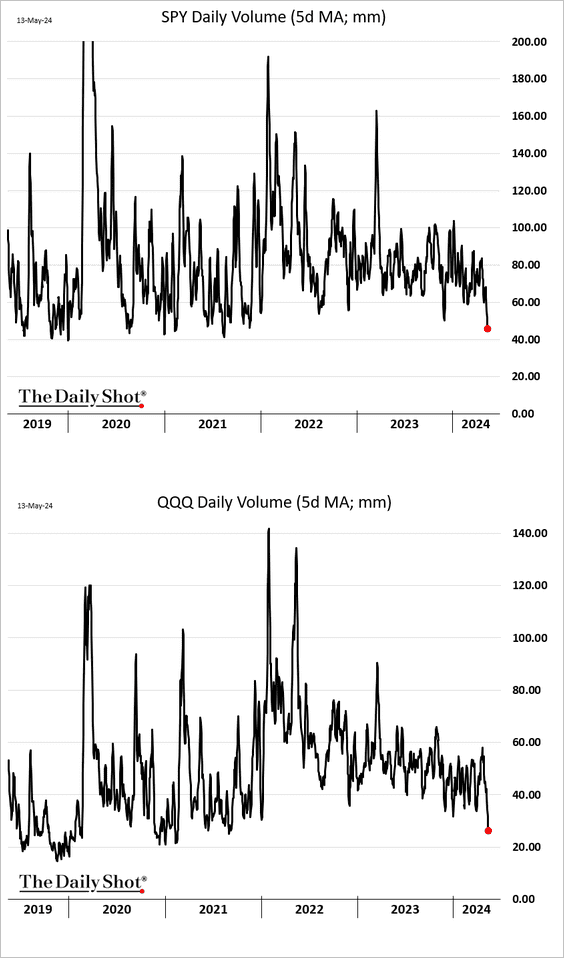

2. Trading volumes in the most liquid US equity securities, SPY and QQQ, continue to fall.

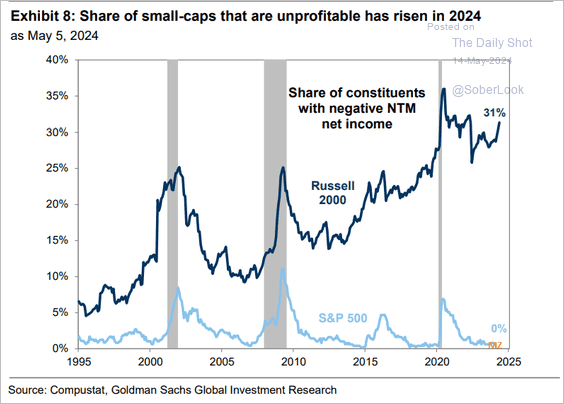

3. The percentage of unprofitable small caps remains elevated.

Source: Goldman Sachs; @MikeZaccardi

Source: Goldman Sachs; @MikeZaccardi

4. The largest global equity market ETF hit a record high.

Source: @GunjanJS, @WSJmarkets, @jackpitcher20

Source: @GunjanJS, @WSJmarkets, @jackpitcher20

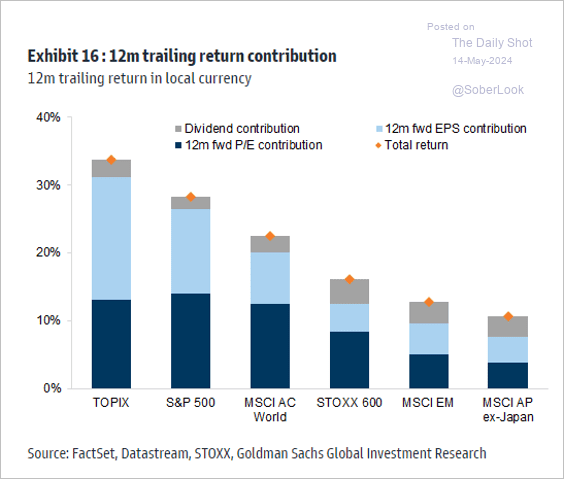

5. Here is the performance attribution across key global markets over the past 12 months.

Source: Goldman Sachs; @MikeZaccardi

Source: Goldman Sachs; @MikeZaccardi

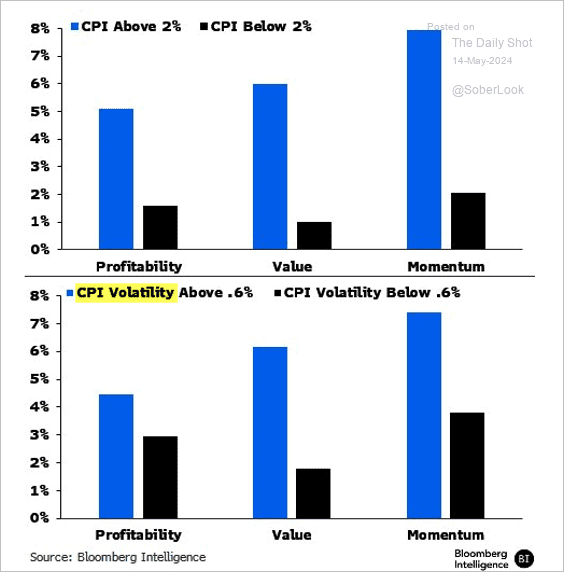

6. This chart illustrates the performance of select factors under various CPI levels and CPI volatility environments.

Source: @GinaMartinAdams

Source: @GinaMartinAdams

Back to Index

Credit

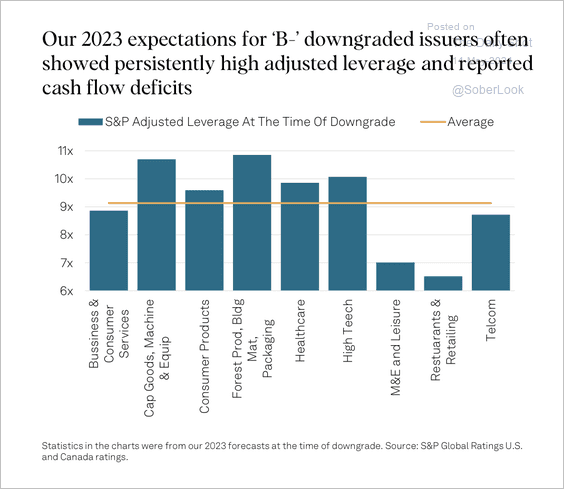

1. B- downgrades in the US and Canada rose last year amid high leverage and cash flow deficits. S&P expects the share of downgrades to remain elevated this year. (2 charts)

Source: S&P Global Ratings

Source: S&P Global Ratings

Source: S&P Global Ratings

Source: S&P Global Ratings

——————–

2. Corporate bonds have massively outperformed Treasuries since the onset of the pandemic.

Source: BofA Global Research

Source: BofA Global Research

——————–

Food for Thought

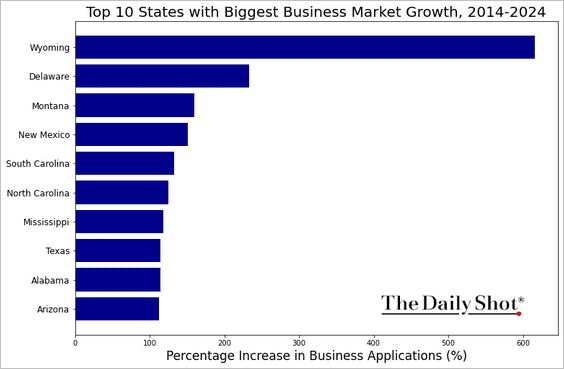

1. Growth in business applications:

Source: CreditDonkey; SBA

Source: CreditDonkey; SBA

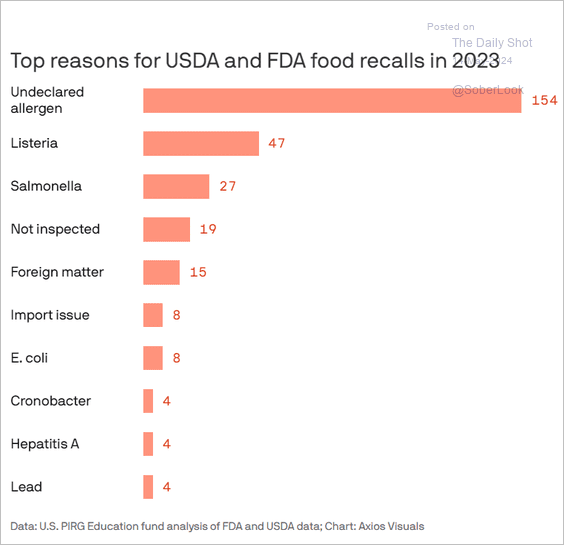

2. Food recalls:

Source: @axios Read full article

Source: @axios Read full article

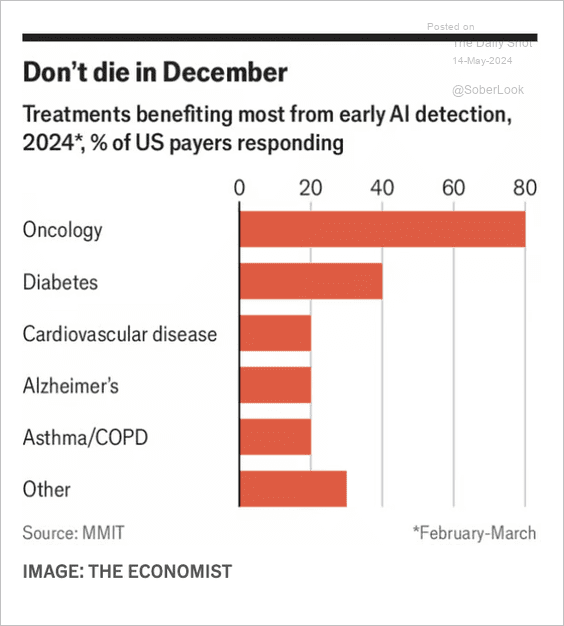

3. Impact of early AI detection on treatment outcomes across medical specialties:

Source: The Economist Read full article

Source: The Economist Read full article

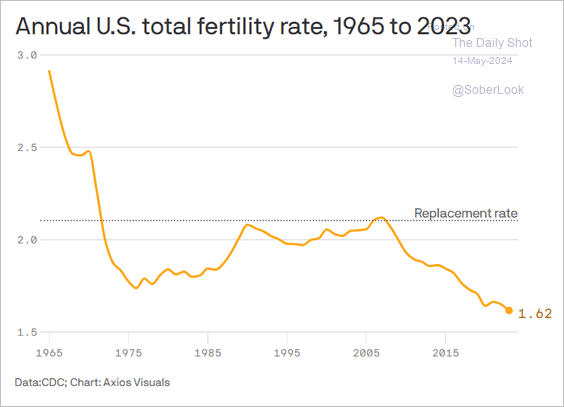

4. The US fertility rate since 1965:

Source: @axios Read full article

Source: @axios Read full article

5. Israel’s budget deficit:

Source: @bpolitics Read full article

Source: @bpolitics Read full article

6. A warm April:

Source: @axios Read full article

Source: @axios Read full article

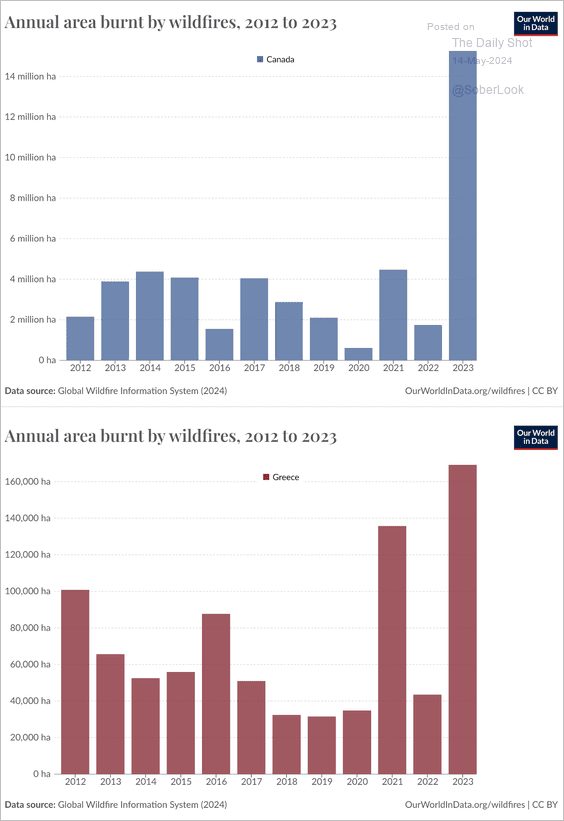

7. Wildfires in Canada and Greece:

Source: Our World in Data Read full article

Source: Our World in Data Read full article

8. Ticket sales for stand-up comedy:

Source: @technology Read full article

Source: @technology Read full article

——————–

Back to Index