The Daily Shot: 16-May-24

• The United States

• Canada

• The Eurozone

• Europe

• Japan

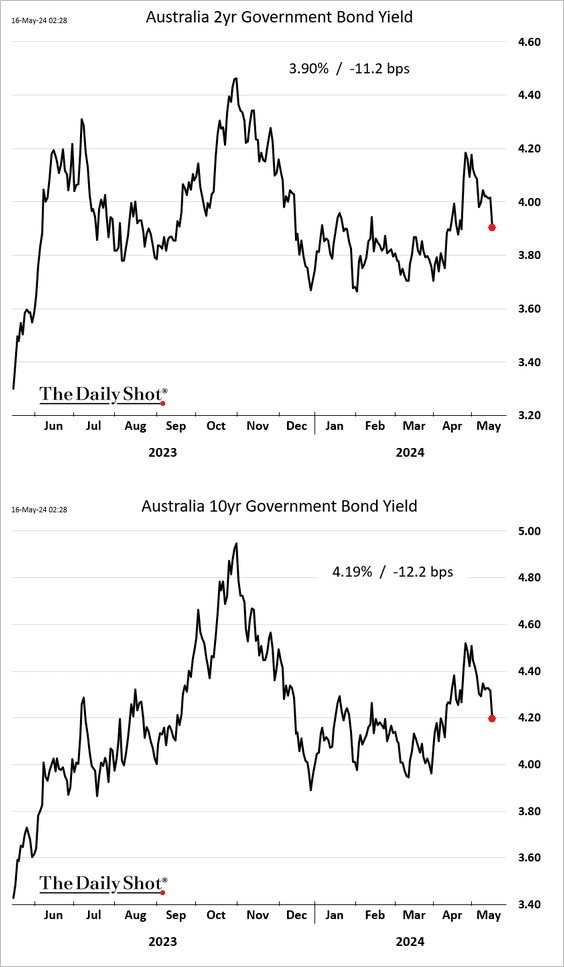

• Asia-Pacific

• Emerging Markets

• Cryptocurrency

• Commodities

• Energy

• Equities

• Credit

• Food for Thought

The United States

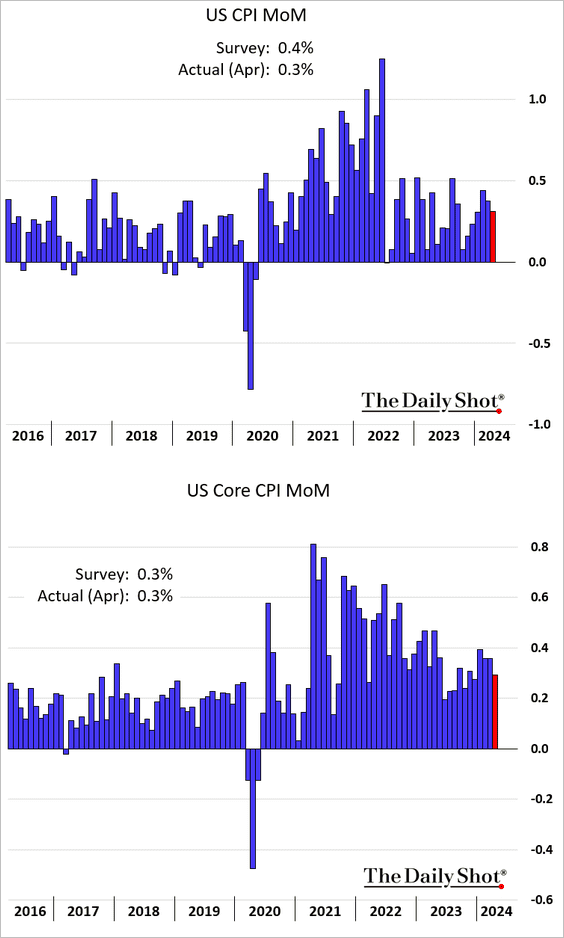

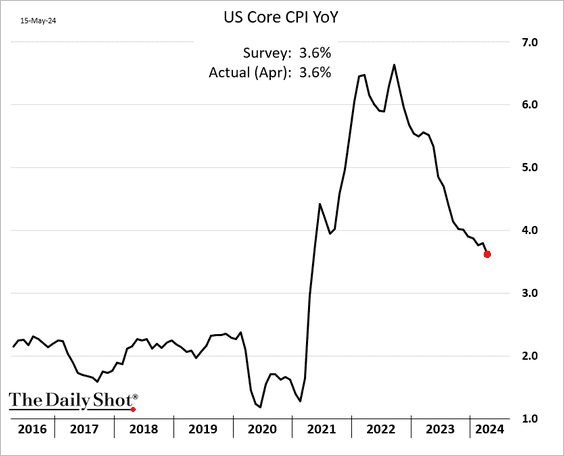

1. The April core CPI print met expectations, easing concerns about a potential acceleration in inflation.

The year-over-year changes in the core CPI resumed their downward trend.

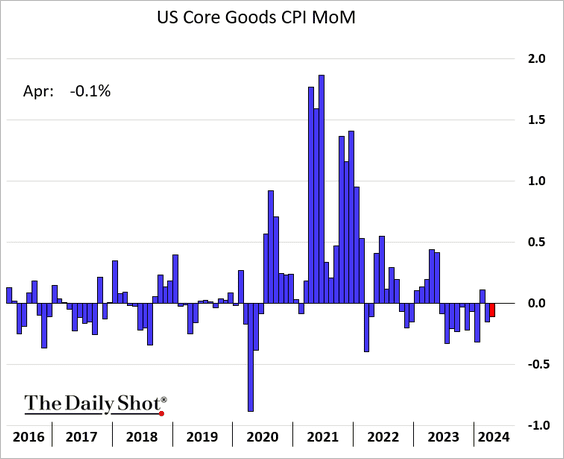

• The core goods CPI declined again, …

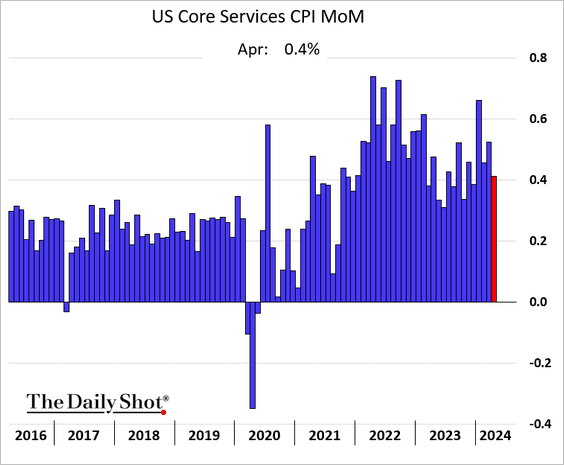

… but core services inflation remains elevated.

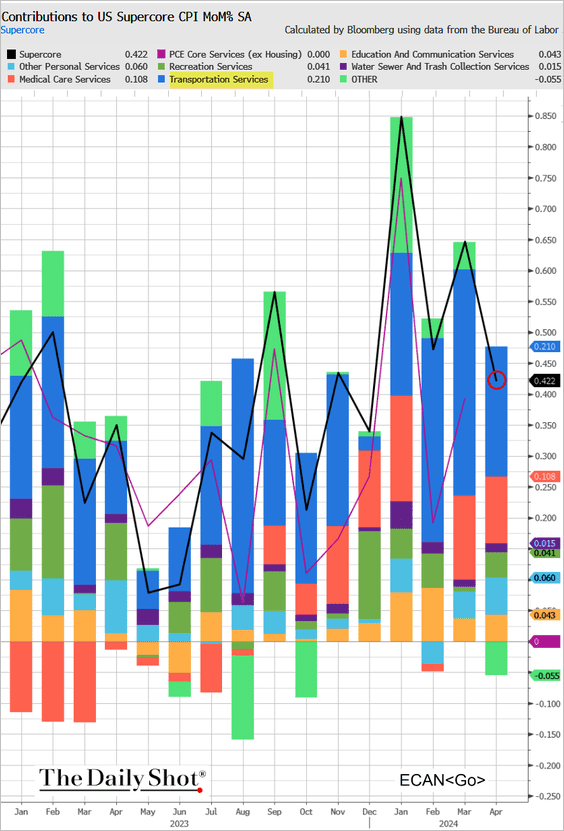

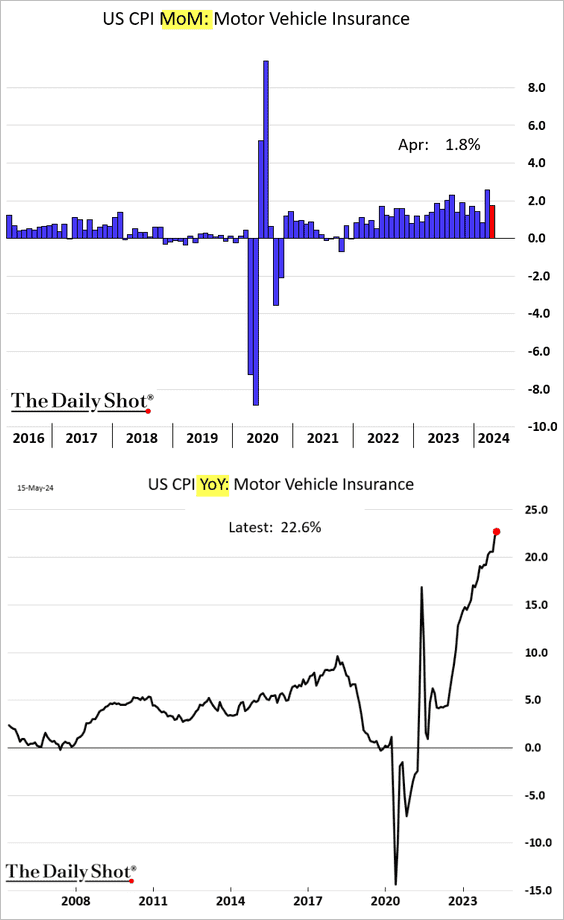

• Supercore CPI growth slowed but still recorded an almost 0.5% monthly gain. The surge in car insurance costs (2nd chart) continues to dominate this indicator, which makes it less useful as a broad measure.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

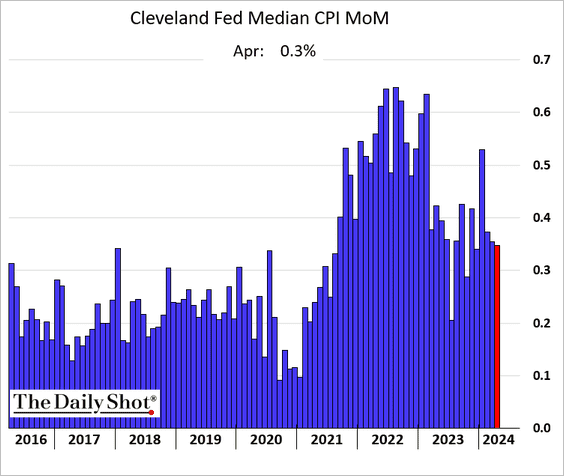

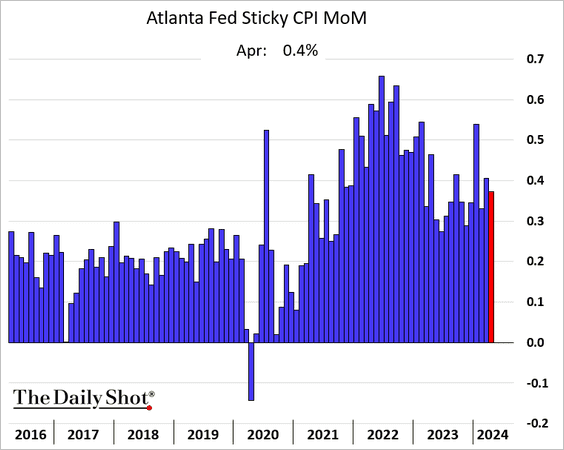

• Alternative measures of core inflation remain elevated.

– Median CPI:

– Sticky CPI:

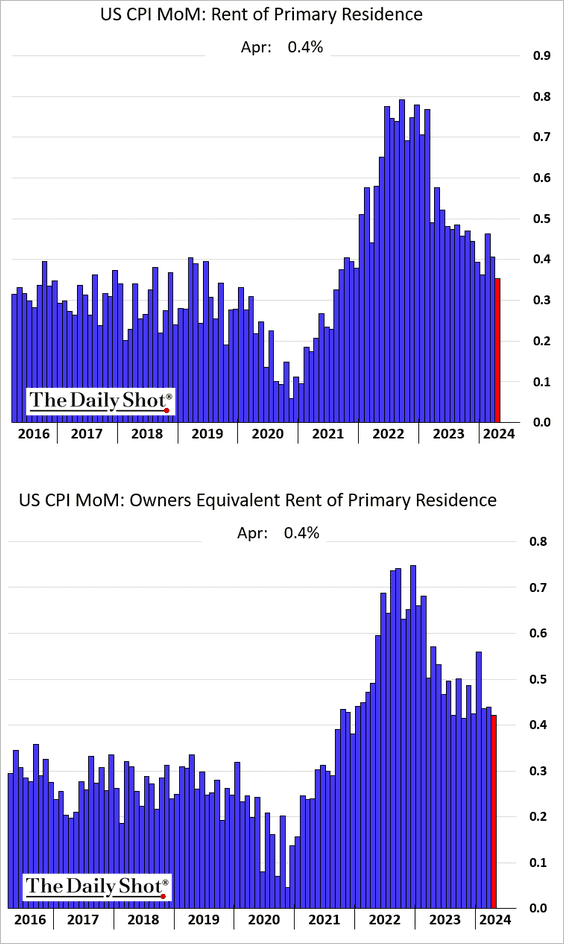

• Housing inflation slowed somewhat last month.

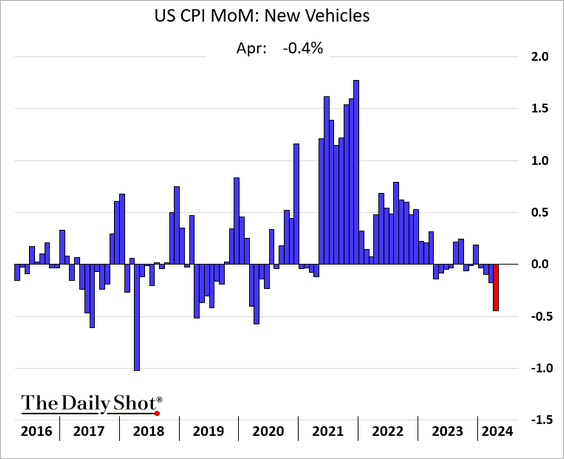

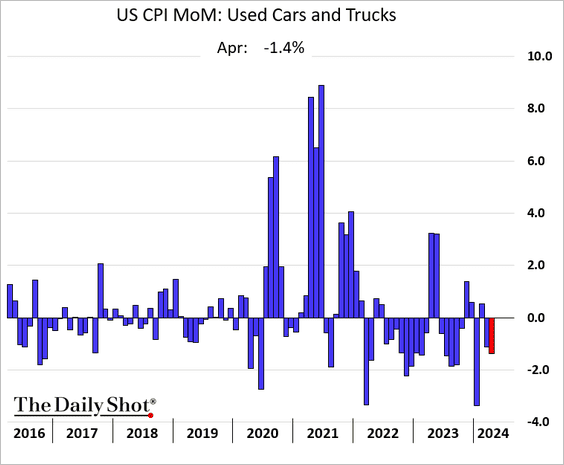

• Vehicle prices declined again.

– New:

– Used:

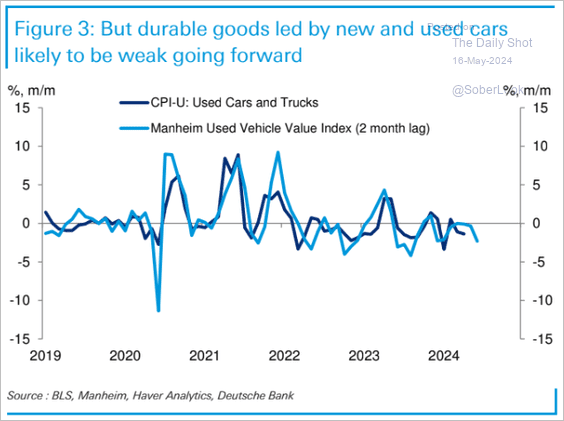

Used vehicle inflation is expected to stay soft.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

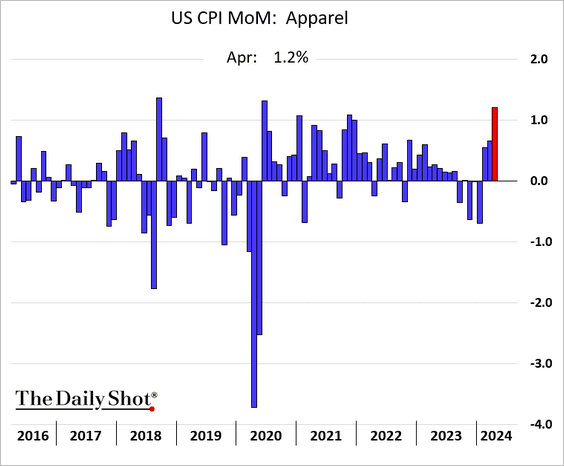

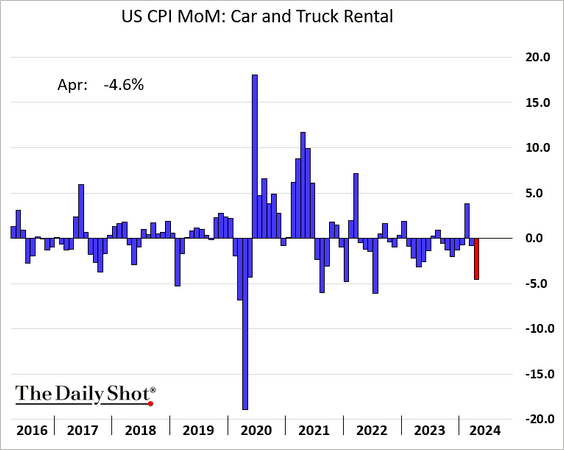

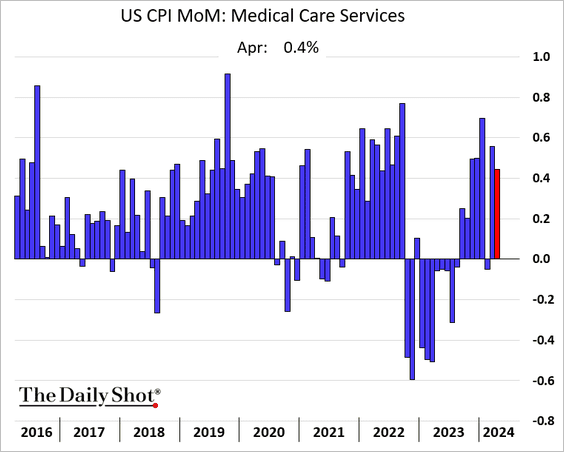

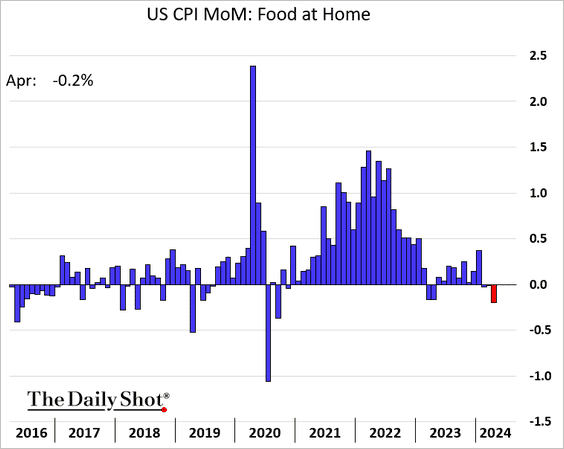

• Here are a few other components of the CPI index (monthly changes).

– Airline fares:

– Apparel:

– Car rentals:

– Medical services:

– Groceries:

We will have more on the CPI report tomorrow.

——————–

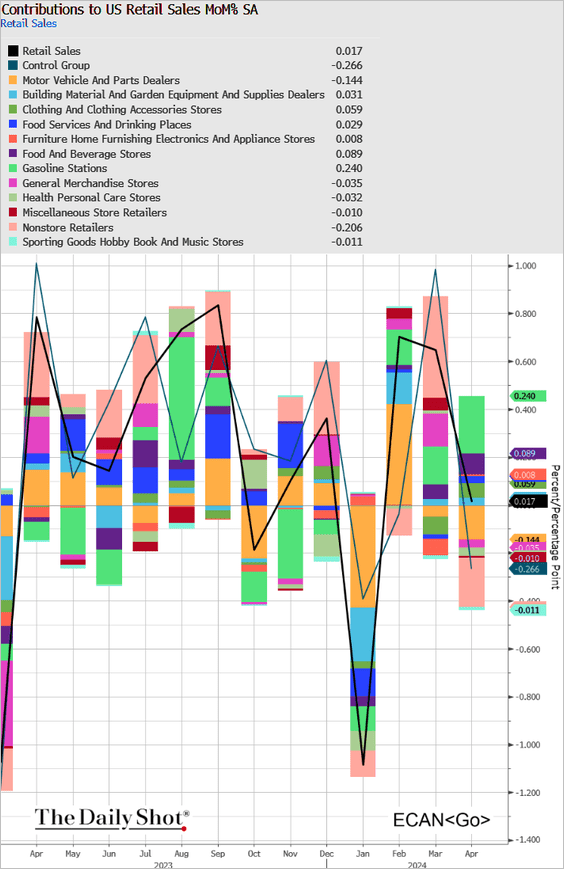

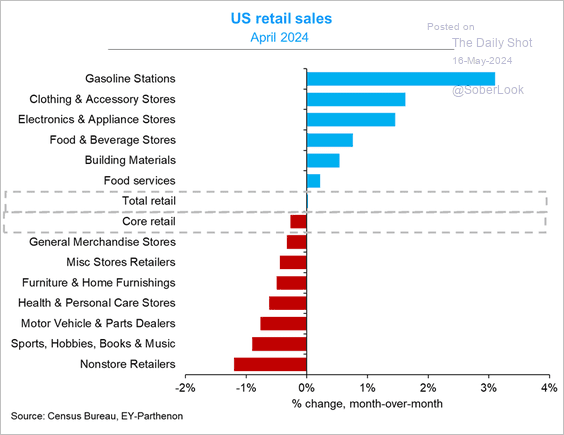

2. Retail sales were weaker than expected last month, with the “core” measures unexpectedly declining. Consumers are becoming more discerning, which should help slow price increases.

Source: @economics Read full article

Source: @economics Read full article

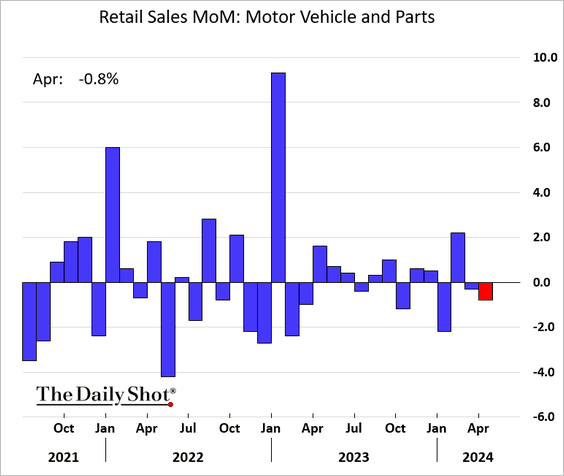

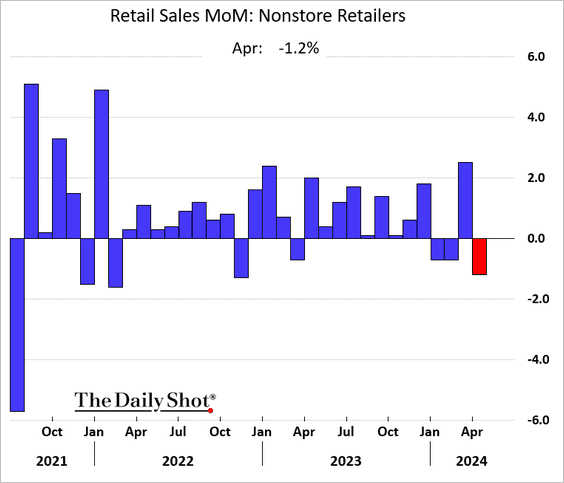

• Consumers reduced discretionary purchases (2 charts).

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @GregDaco

Source: @GregDaco

– Vehicle sales and online sales declined.

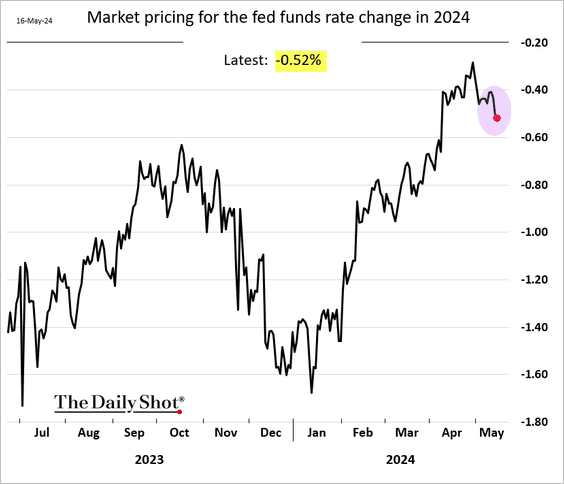

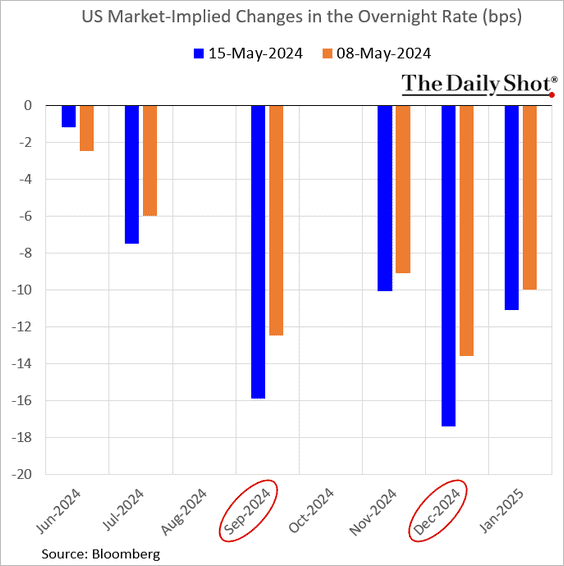

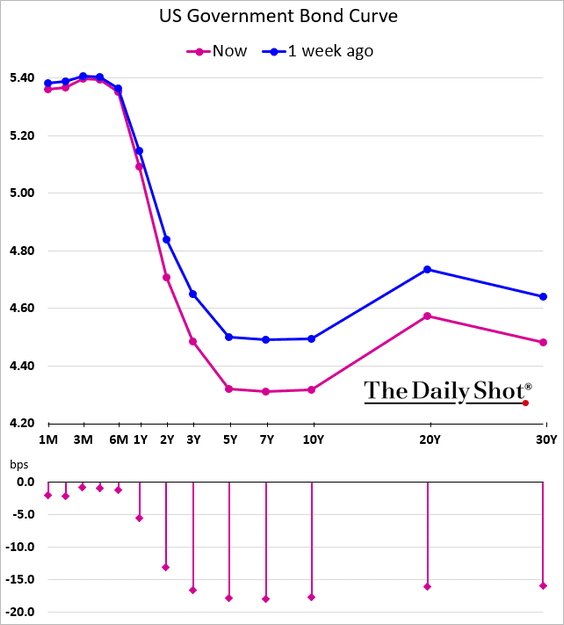

3. After the “benign” CPI report and weak retail sales data, the market fully priced in two Fed rate cuts this year, …

… perhaps in September and December.

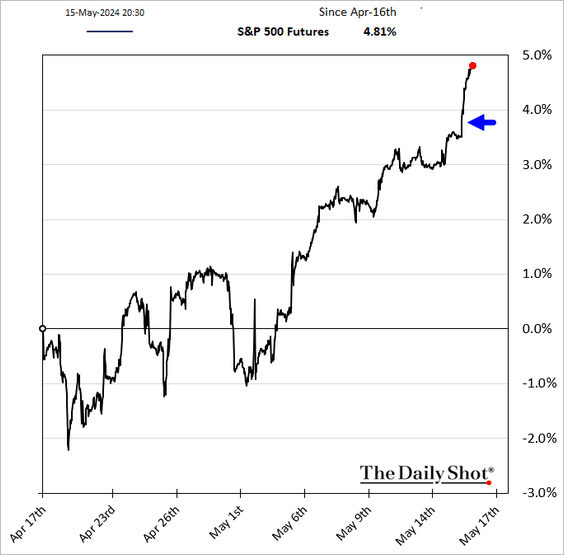

• Stocks surged as the market was relieved to avoid another upside inflation surprise.

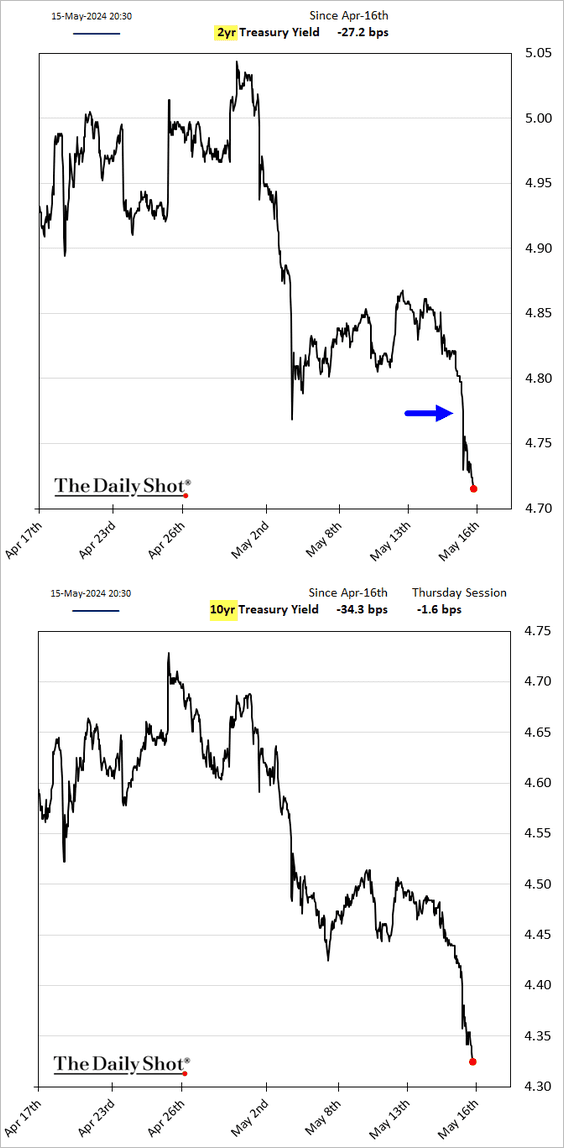

• Treasury yields declined.

Here is the yield curve.

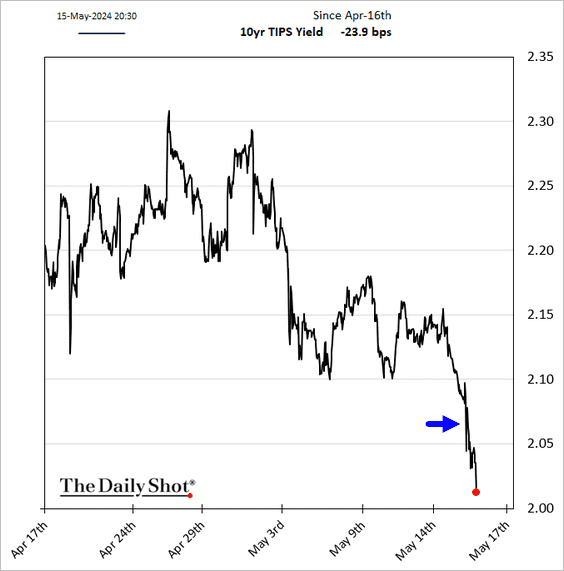

– TIPS yields (real rates) were lower as well.

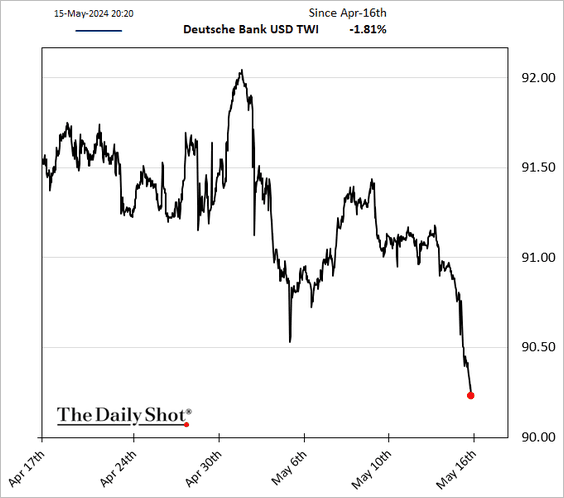

• The dollar declined.

——————–

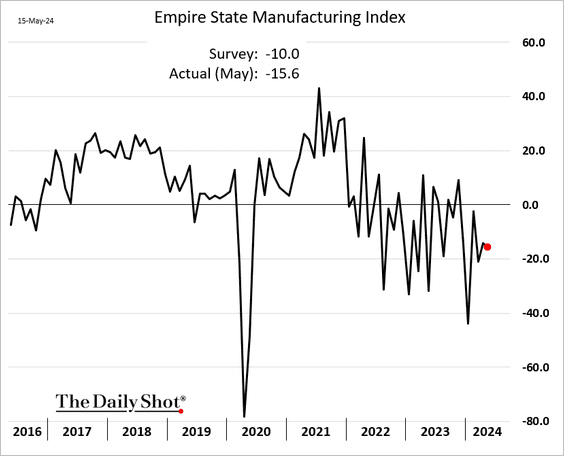

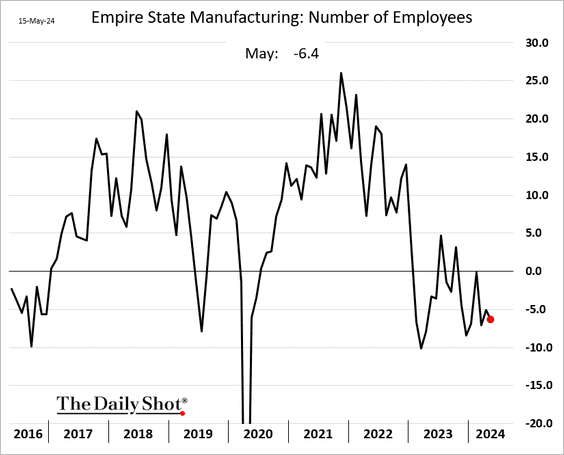

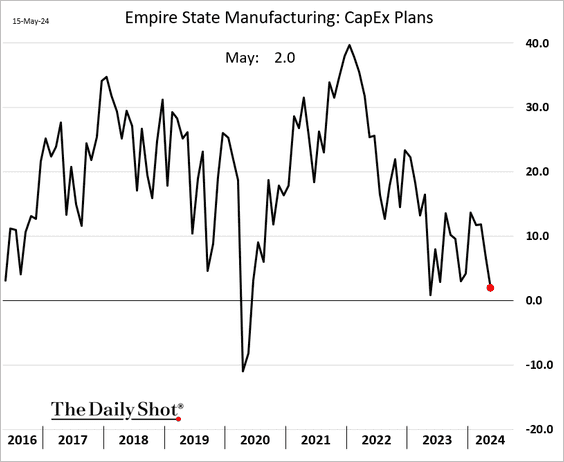

4. The first regional manufacturing report of the month (from the NY Fed) was disappointing.

• The region’s manufacturers are not hiring.

• Cost pressures eased.

• CapEx plans softened again.

Back to Index

Canada

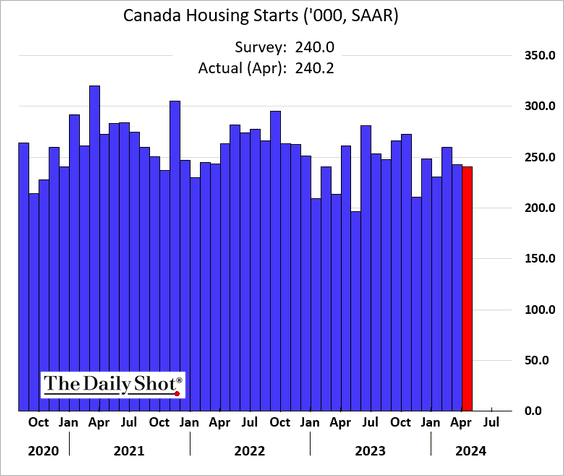

1. Last month’s housing starts were in line with forecasts.

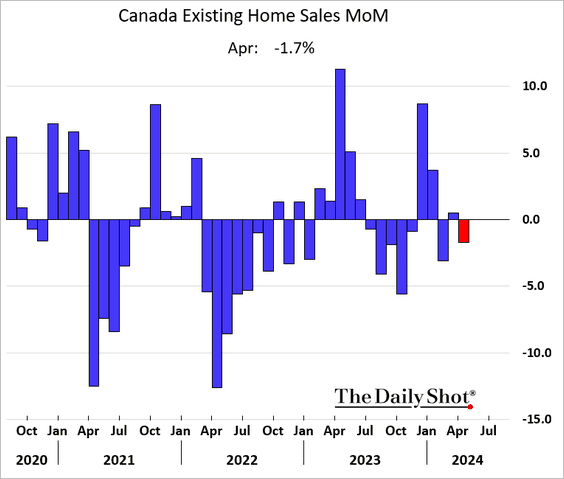

2. Existing home sales declined.

Source: Reuters Read full article

Source: Reuters Read full article

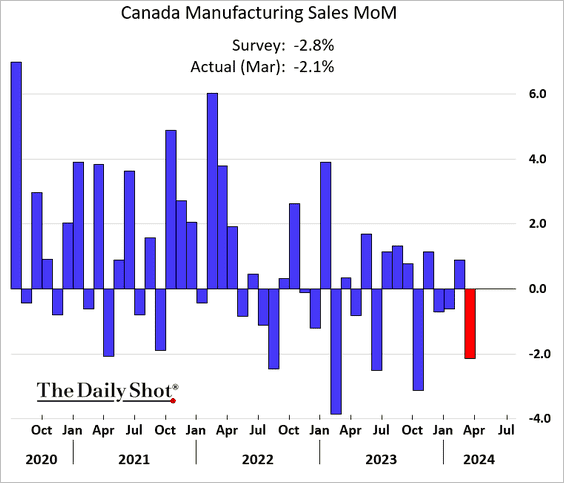

3. Manufacturing sales slowed in March.

Back to Index

The Eurozone

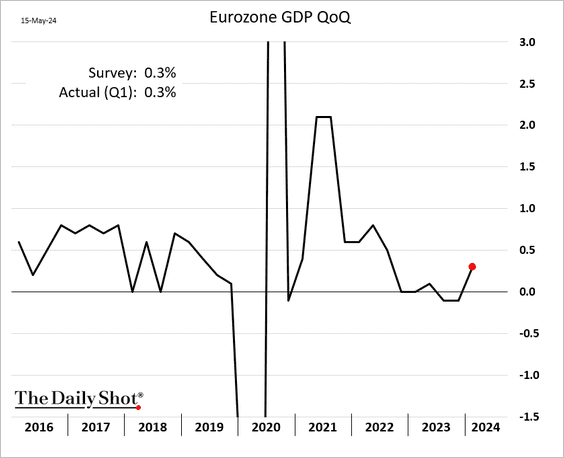

1. Euro-area GDP bounced in Q1.

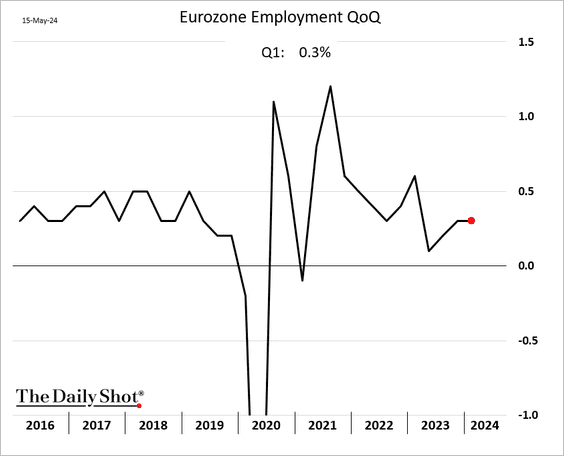

Employment increased again.

Source: EC Read full article

Source: EC Read full article

——————–

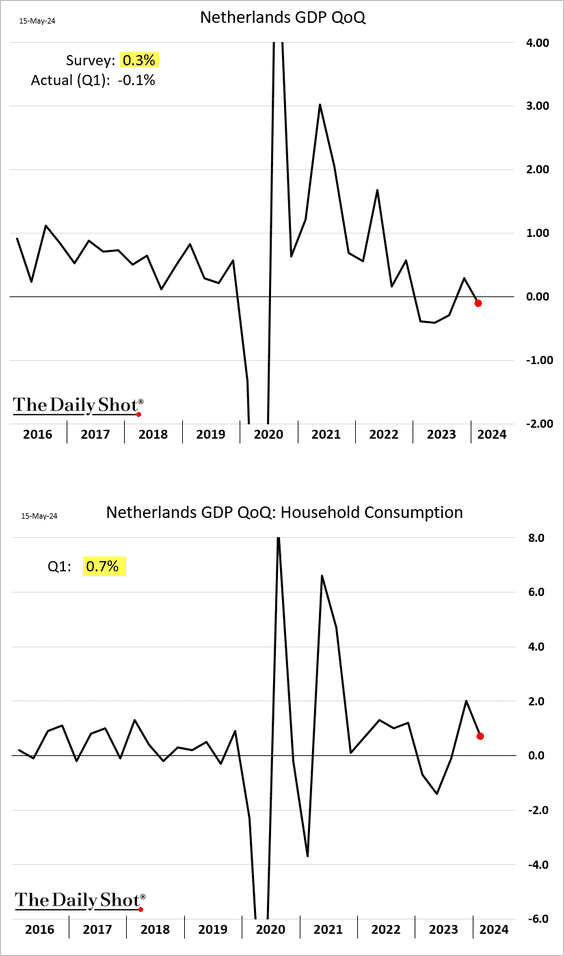

2. The Dutch GDP unexpectedly declined in Q1, but some of the weakness was “noise.” Domestic demand continues to grow (2nd panel).

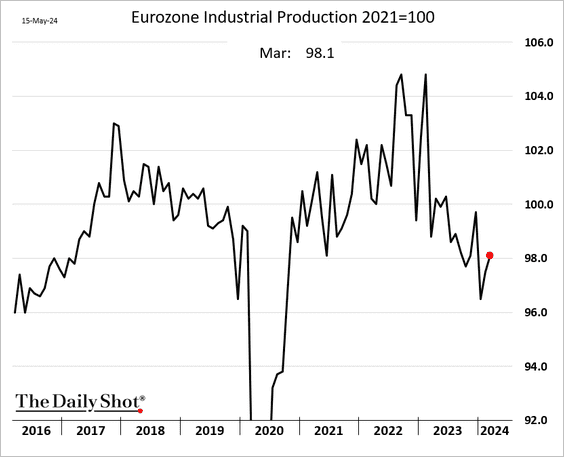

3. Euro-area industrial production increased further in March.

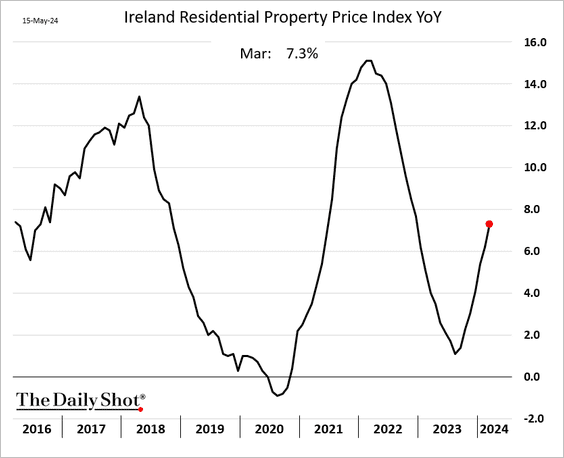

4. Ireland’s property prices are accelerating again.

5. European stocks are climbing.

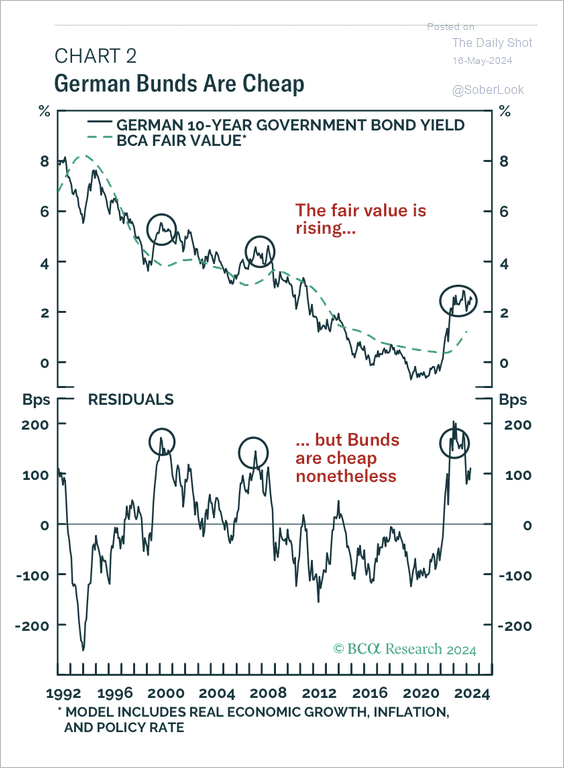

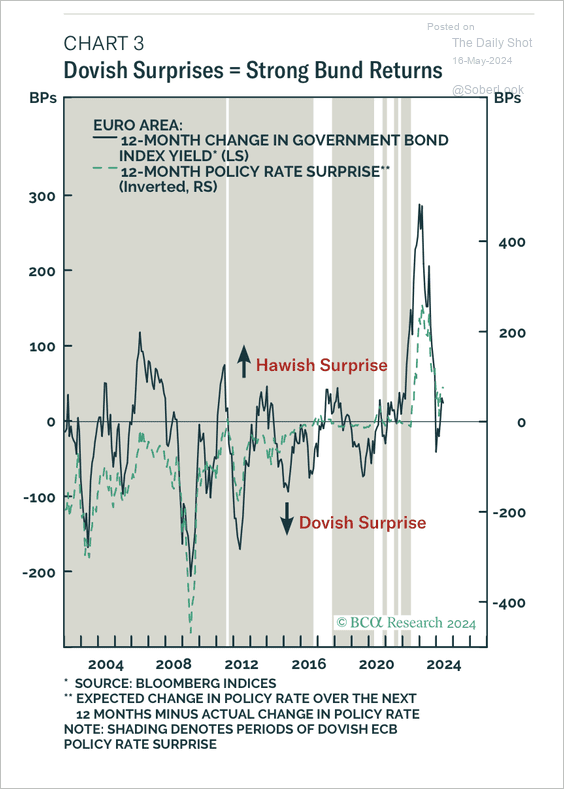

6. Bund yields are trading roughly 113 basis points above their fair value, according to BCA Research.

Source: BCA Research

Source: BCA Research

• Dovish ECB surprises typically coincide with positive German bund returns (lower yields).

Source: BCA Research

Source: BCA Research

Back to Index

Europe

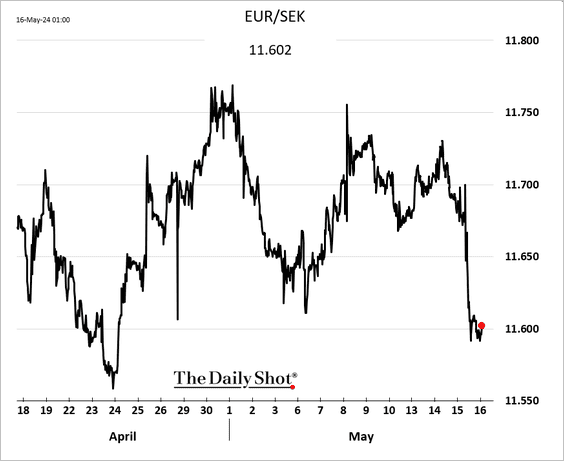

1. The Swedish krona unexpectedly strengthened after a soft CPI report.

Riksbank’s Breman: … it is important to continue to monitor the krona exchange rate if we see that it affects the outlook for inflation in Sweden.

——————–

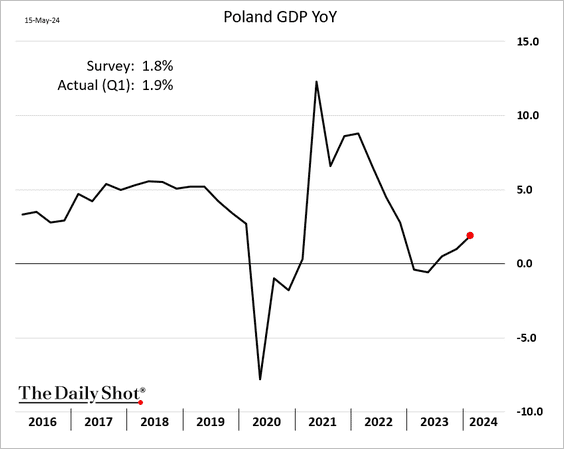

2. Poland’s GDP growth is strengthening.

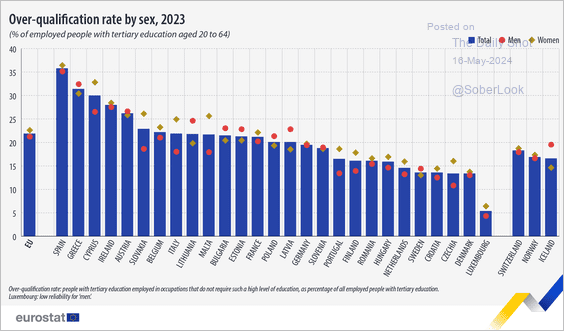

3. Here is a look at overqualification rates in the EU.

Source: Eurostat Read full article

Source: Eurostat Read full article

Back to Index

Japan

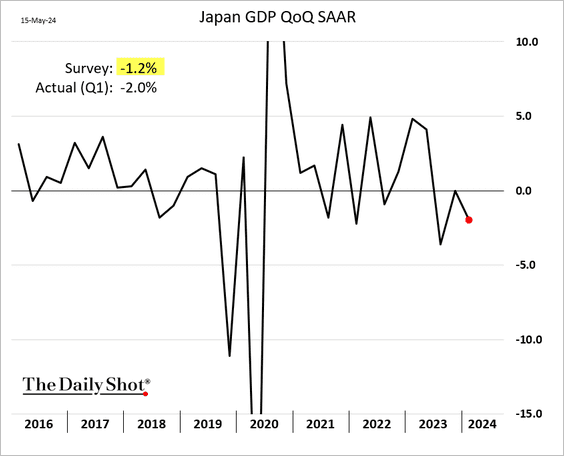

1. The GDP declined more than expected last quarter.

Source: Reuters Read full article

Source: Reuters Read full article

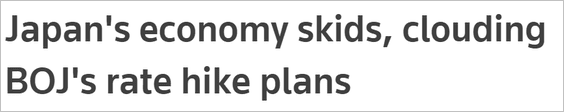

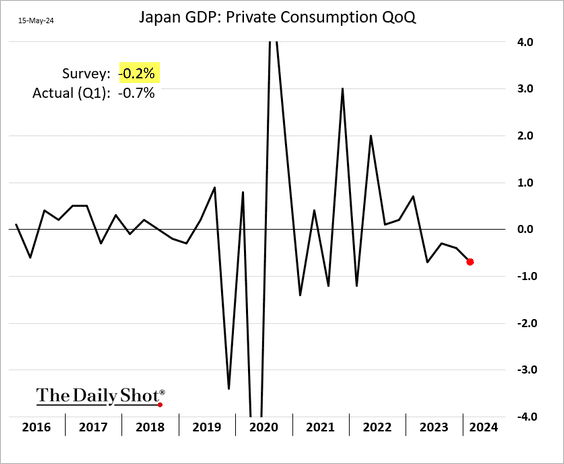

• Domestic demand softened (2 charts).

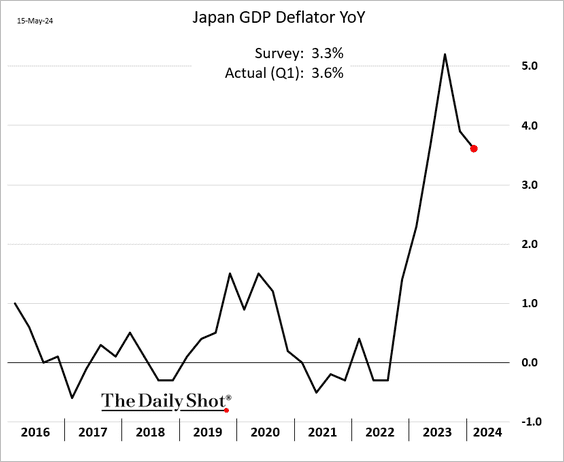

However, the BoJ is unlikely to deviate from its tightening plans amid robust inflation. The Q1 GDP deflator was well above forecasts.

——————–

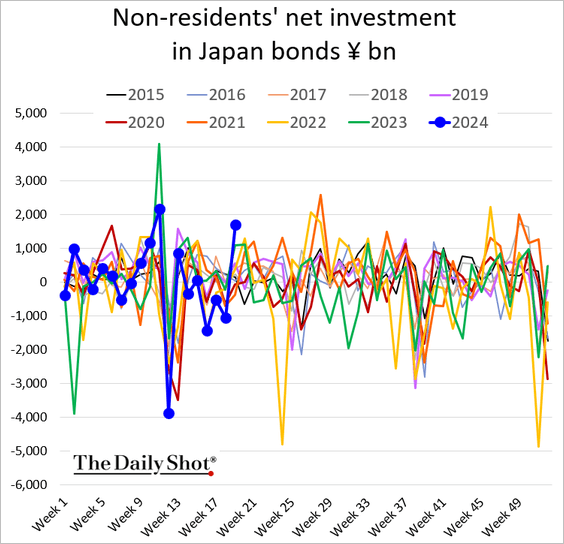

2. Foreigners have been buying JGBs as yields climbed.

Back to Index

Asia-Pacific

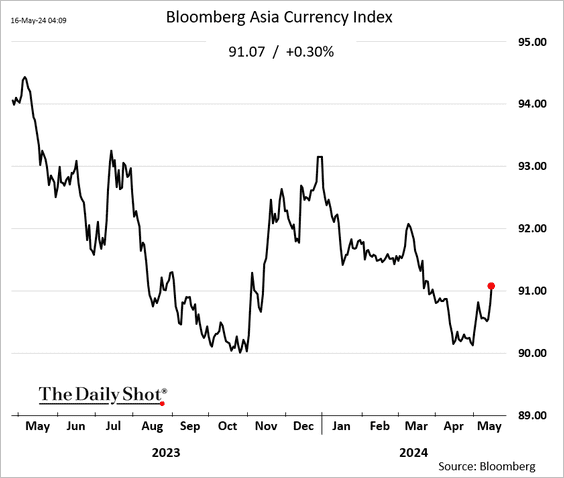

1. Asian currencies jumped against the US dollar following the benign US CPI report.

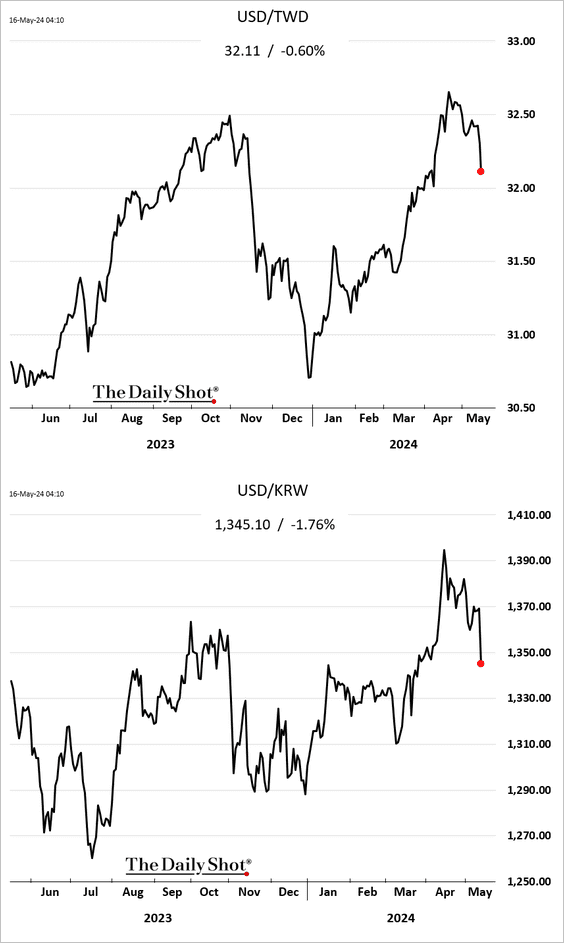

This chart shows the US dollar declining against the Taiwan dollar and the South Korean won.

——————–

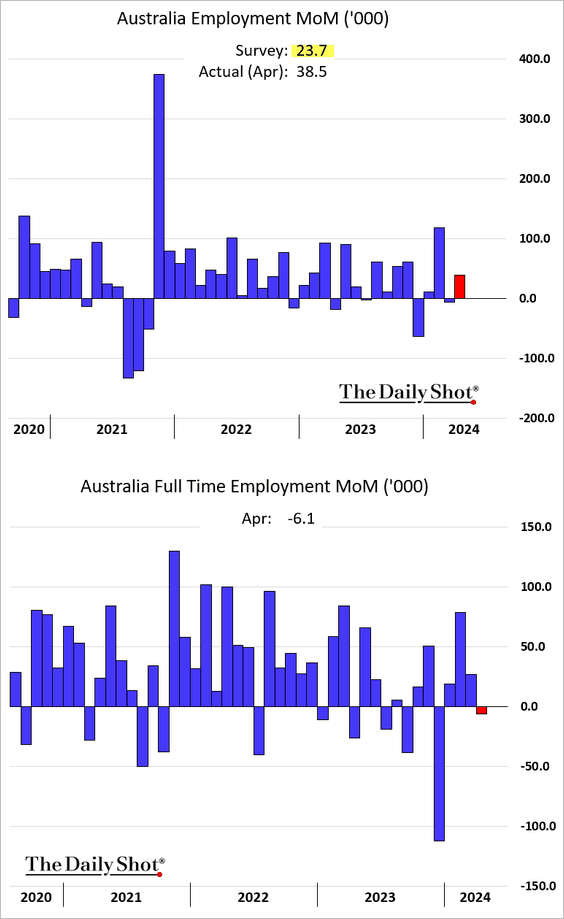

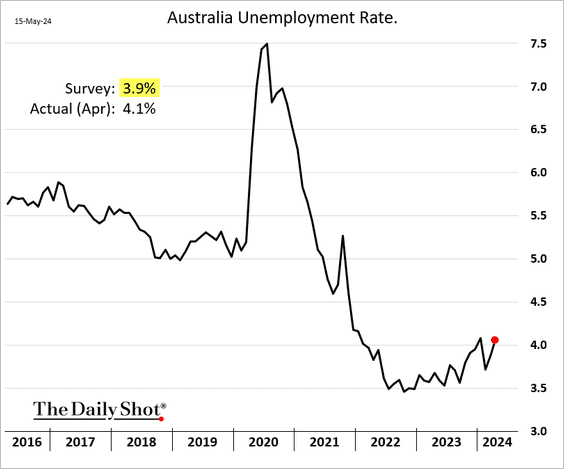

2. Australia’s employment report was mixed. Job gains exceeded forecasts, but full-time employment declined.

– The unemployment rate increased more than expected.

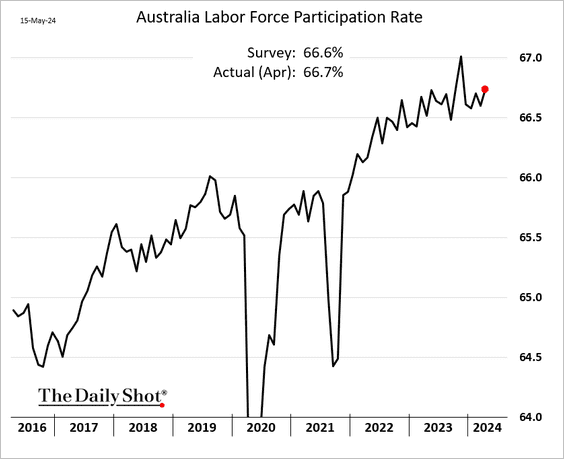

– The participation rate was higher.

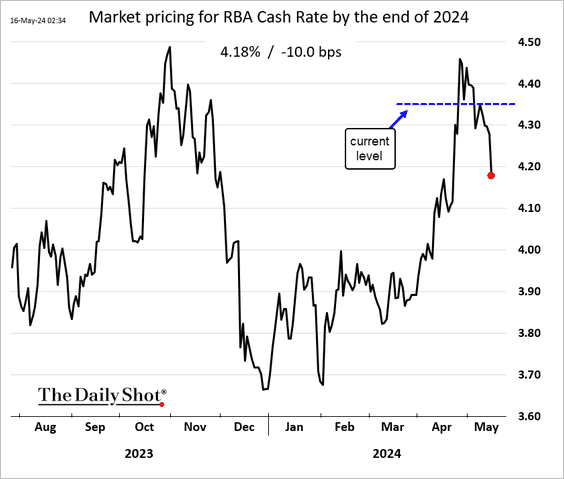

• The market is no longer concerned about an RBA rate hike this year.

Source: @WSJ Read full article

Source: @WSJ Read full article

Bond yields declined.

Back to Index

Emerging Markets

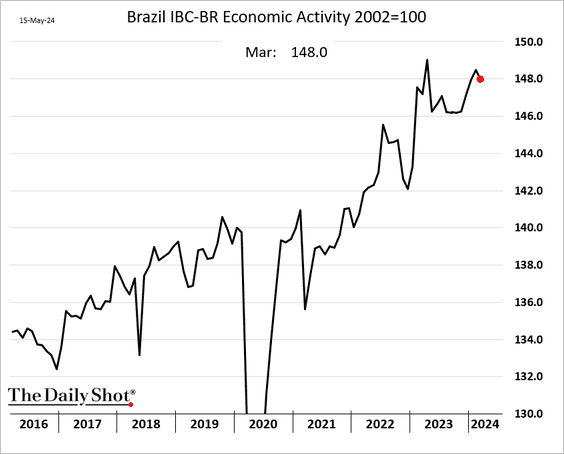

1. Brazil’s economic activity declined in March but remained robust.

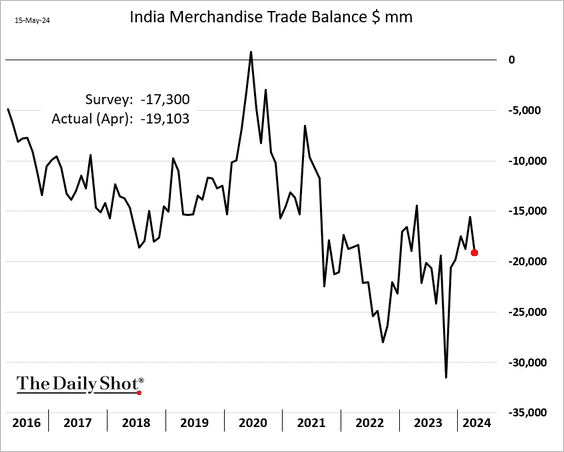

2. India’s trade deficit widened more than expected last month.

3. Foreign net purchases of EM equities and bonds dropped to the lowest level in six months amid a strengthening dollar.

Source: Capital Economics

Source: Capital Economics

Back to Index

Cryptocurrency

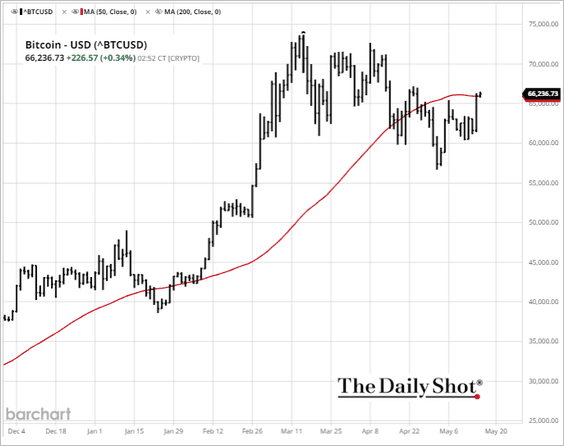

1. Bitcoin is trading above its 50-day moving average following the benign US CPI report.

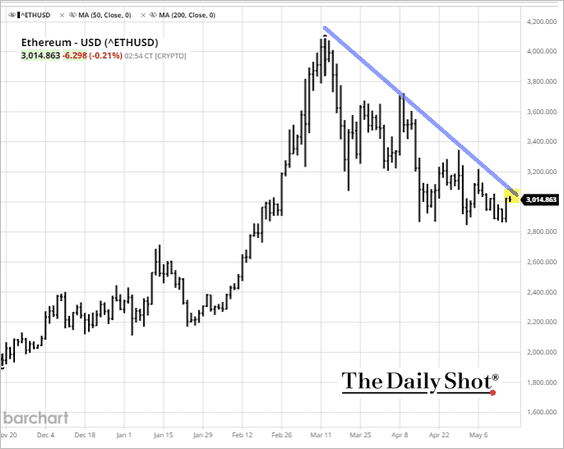

2. Ether is testing the downtrend resistance.

Back to Index

Commodities

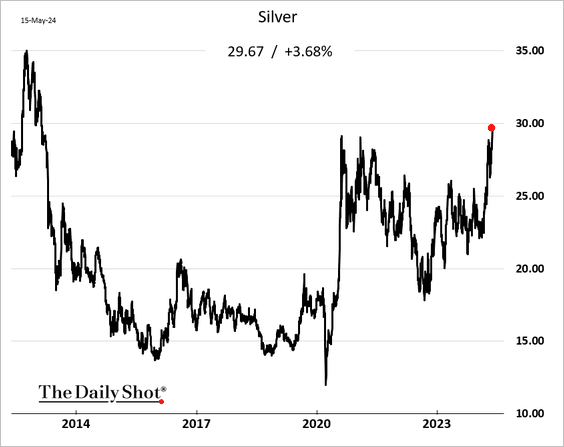

1. Silver surged to multi-year highs after the US dollar weakened following the US CPI report.

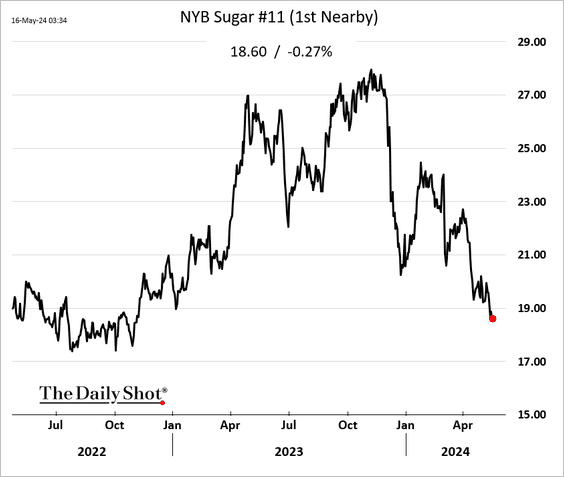

2. Sugar futures continue to sink.

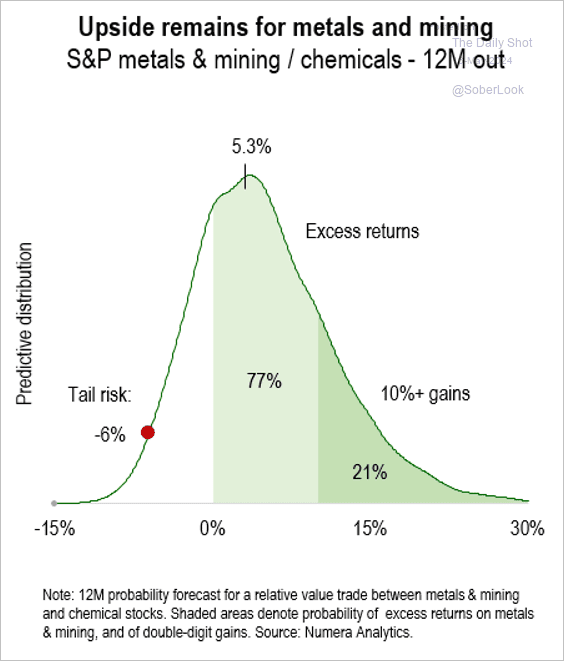

3. Numera Analytics expects rising commodity prices to benefit mining profits but hurt chemical producers’ margins over the next 6-12 months, which could impact relative returns.

Source: Numera Analytics (@NumeraAnalytics)

Source: Numera Analytics (@NumeraAnalytics)

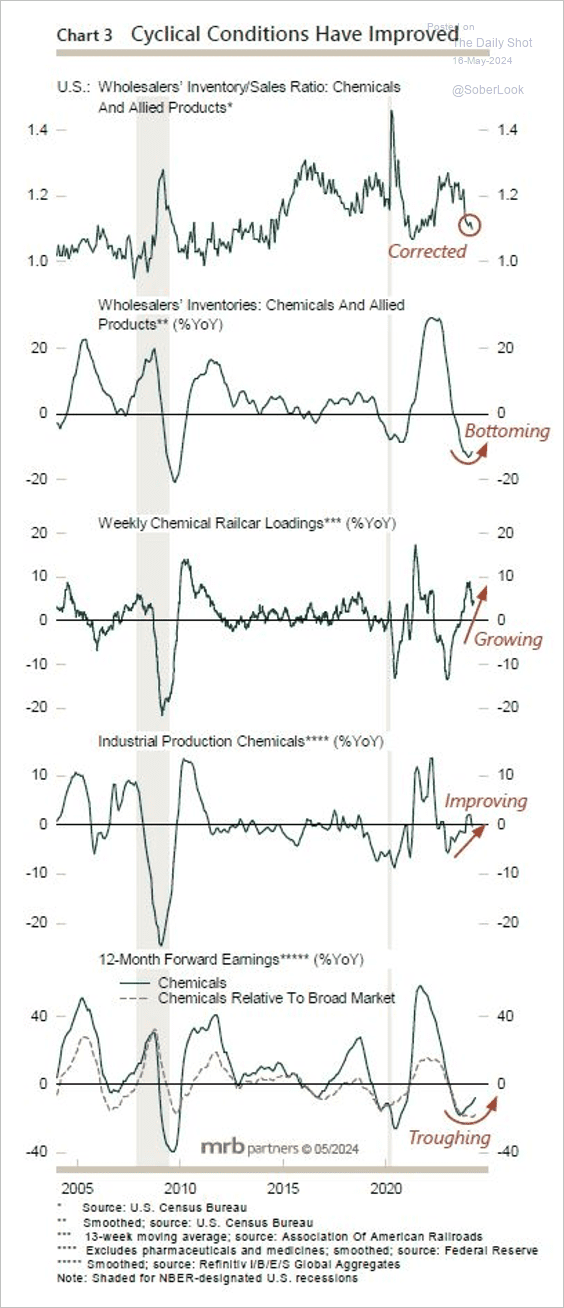

• Generally, cyclical conditions are improving for the chemicals sector after a weak period of significant inventory destocking.

Source: MRB Partners

Source: MRB Partners

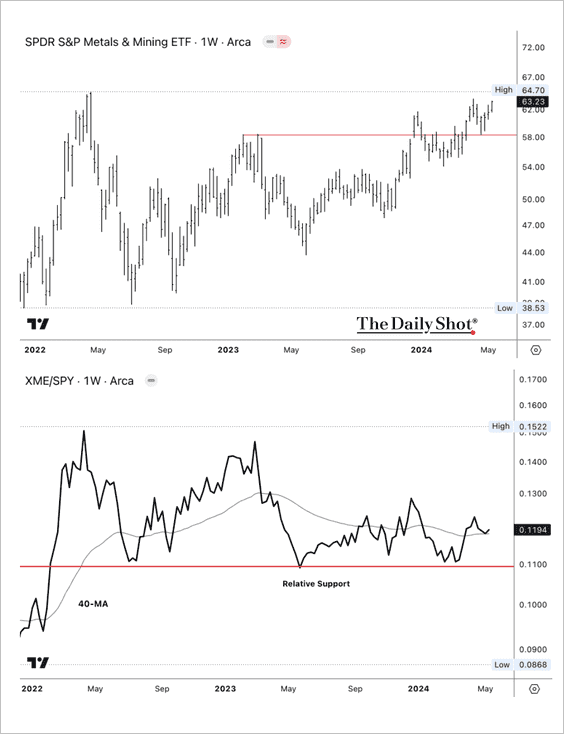

5. The SPDR Metals & Mining ETF (XME) is holding uptrend support, while its weakness relative to the S&P 500 is starting to stabilize.

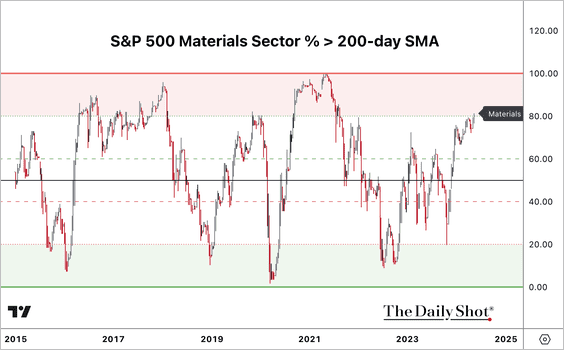

• Breadth is improving within the S&P 500 materials sector and is not yet extreme.

Back to Index

Energy

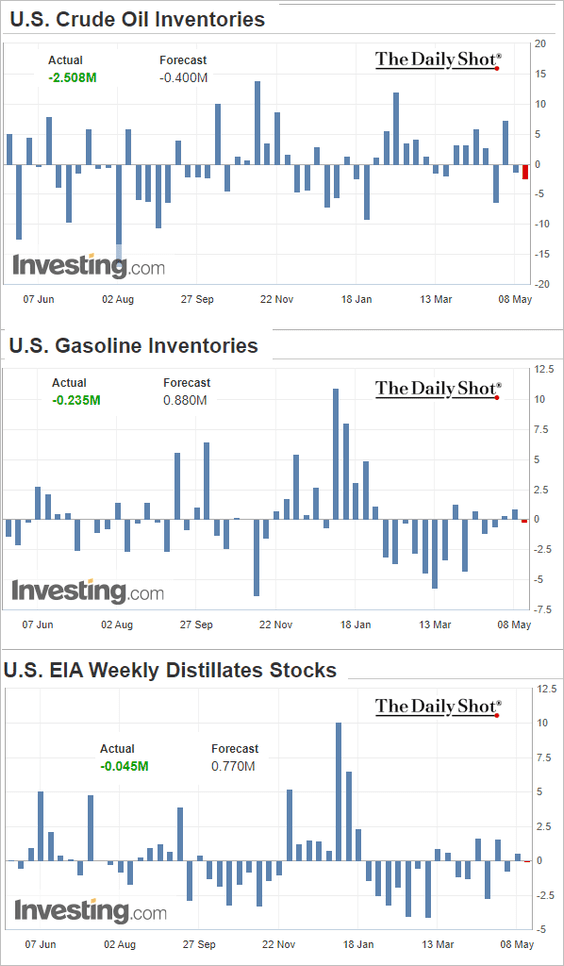

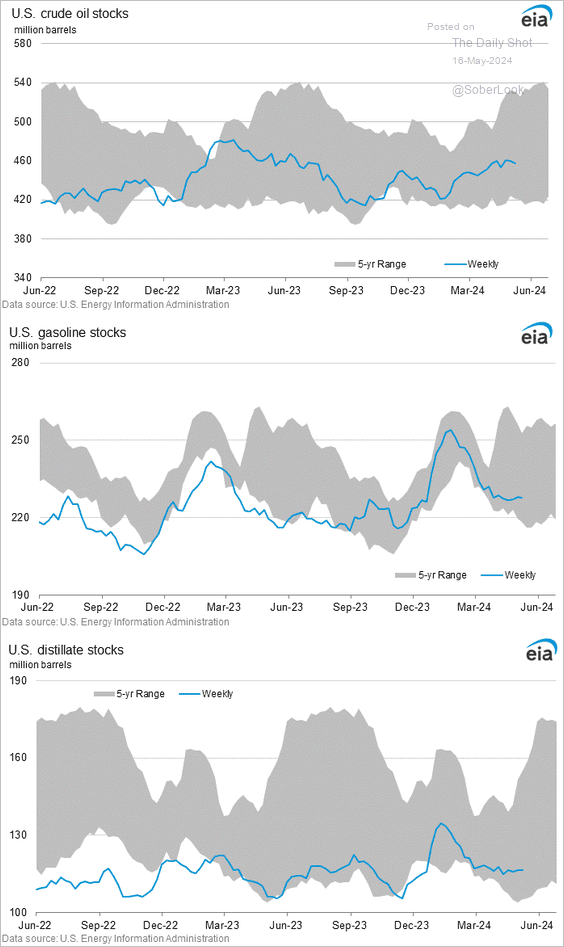

1. US oil inventories declined again last week. Refined product stockpiles edged lower as well.

• Here are the inventory levels.

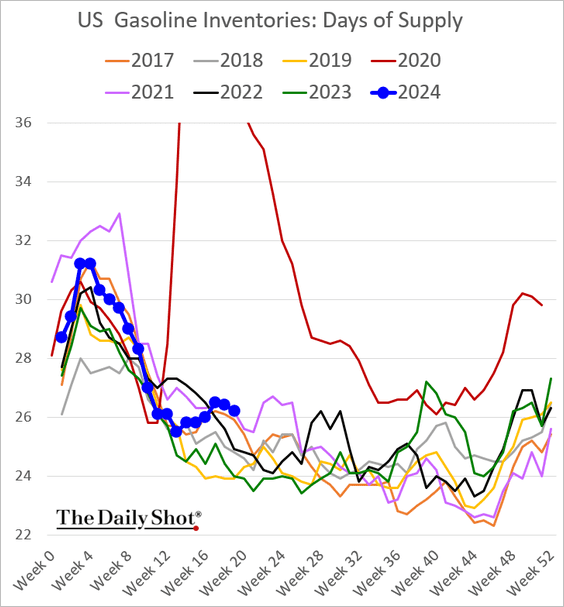

• Measured in days of supply, US gasoline inventories remain elevated.

——————–

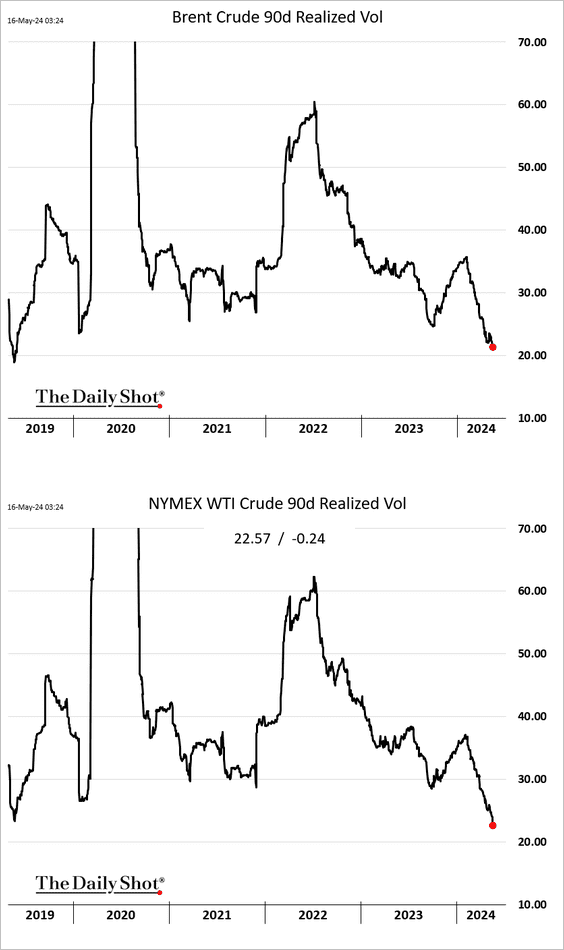

2. Crude oil volatility is collapsing.

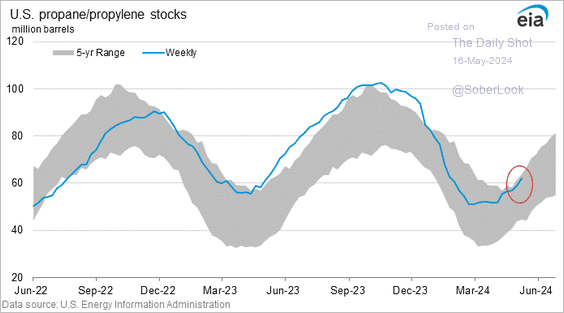

3. US propane inventories are nearing the upper end of their five-year range.

Back to Index

Equities

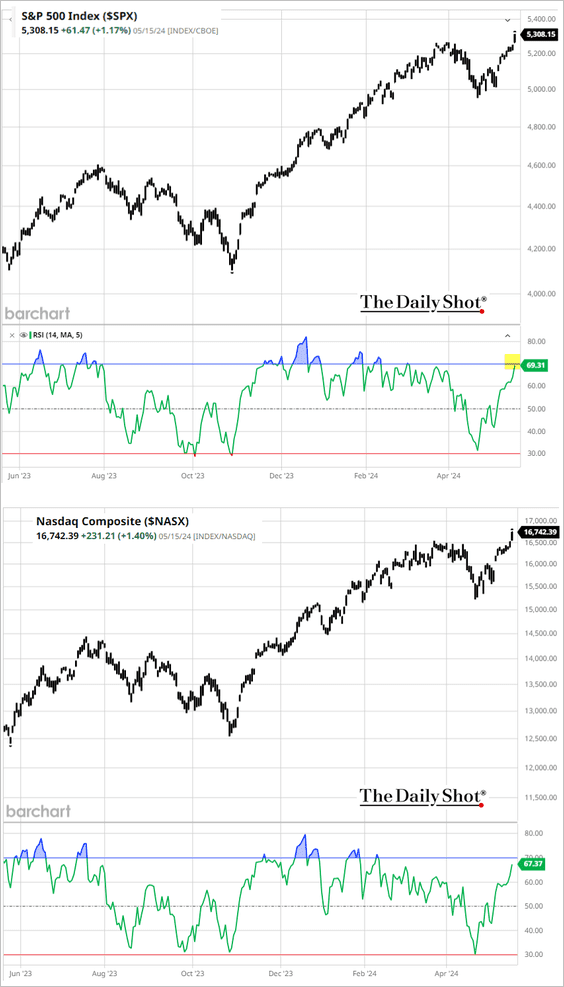

1. US indices hit record highs and are nearing overbought territory.

2. The S&P 500 average stock’s discount to the overall index continues to widen.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

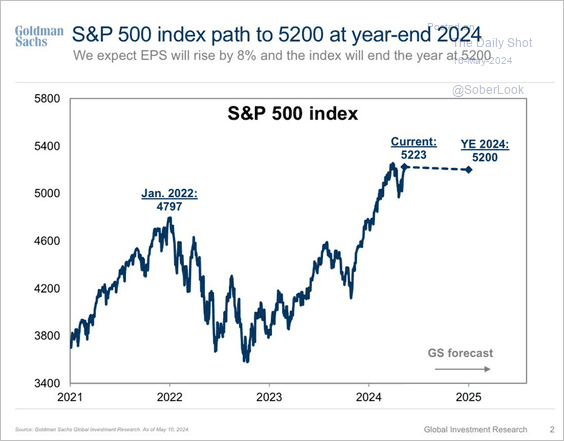

3. Goldman expects the S&P 500 to end the year at 5200 (currently at 5308).

Source: Goldman Sachs; @carlquintanilla

Source: Goldman Sachs; @carlquintanilla

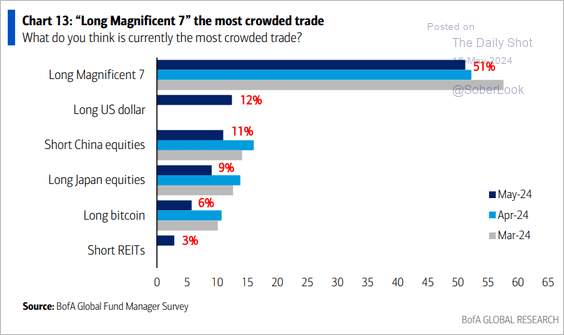

4. Investors still see the Magnificent 7 as the most crowded trade.

Source: BofA Global Research

Source: BofA Global Research

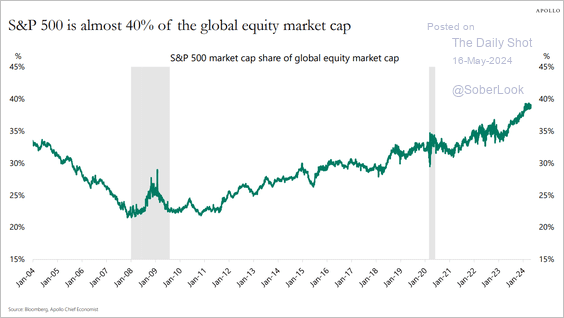

5. The S&P 500 represents 40% of the global market capitalization.

Source: Truist Advisory Services

Source: Truist Advisory Services

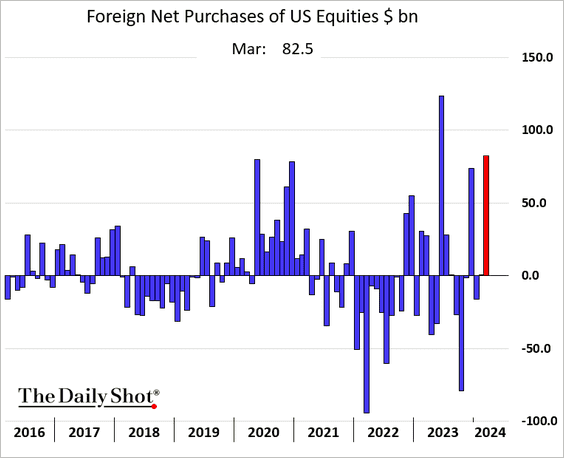

6. Foreigners bought over $82 billion worth of US shares in March.

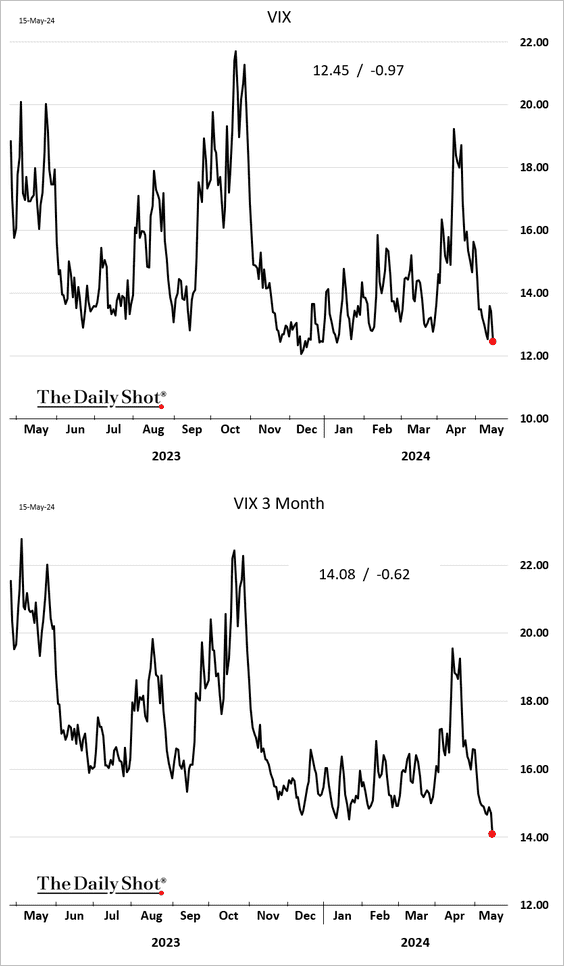

7. Implied volatility indicators continue to sink.

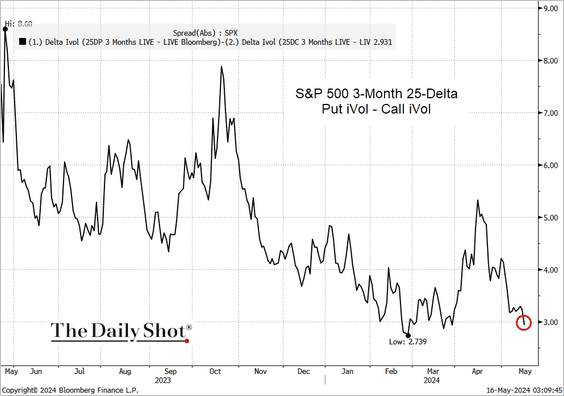

The S&P 500 3-month skew is nearing multi-year lows.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

Back to Index

Credit

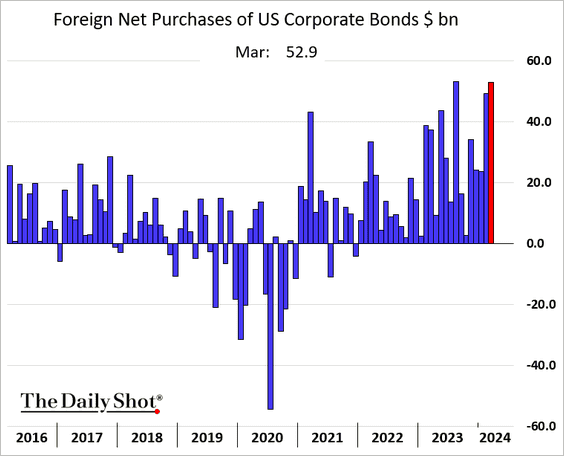

1. Foreigners love US corporate bonds.

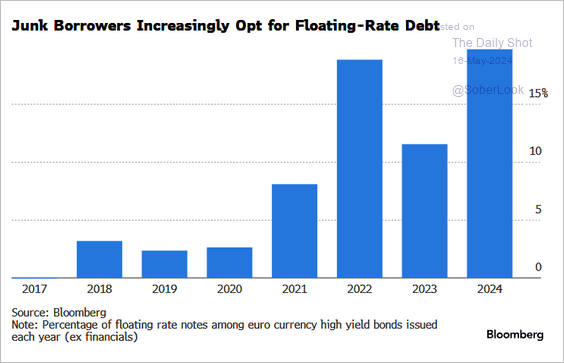

2. High-yield borrowers are increasingly opting for floating-rate loans, betting on Fed rate cuts and favorable terms from CLO managers.

Source: Bloomberg Law Read full article

Source: Bloomberg Law Read full article

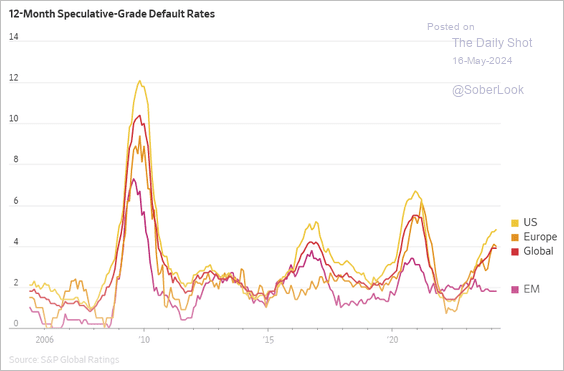

3. Global high-yield default rates have been climbing.

Source: @GunjanJS, @SPGlobal Read full article

Source: @GunjanJS, @SPGlobal Read full article

——————–

Food for Thought

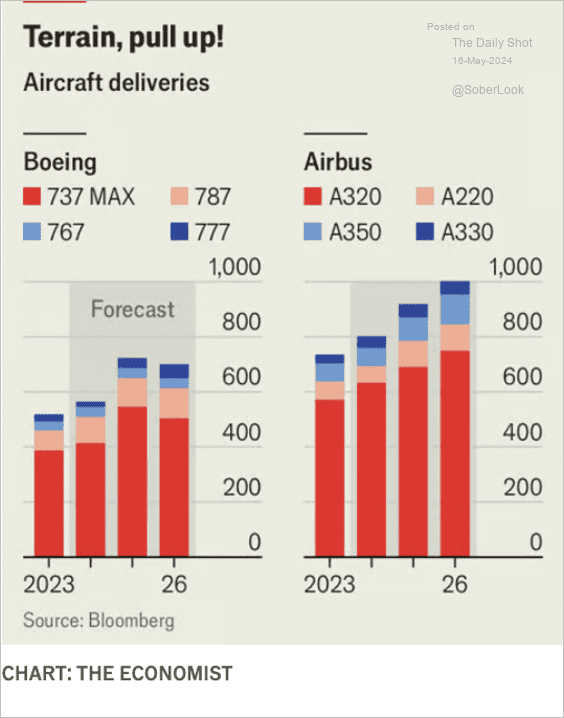

1. Aircraft deliveries:

Source: The Economist Read full article

Source: The Economist Read full article

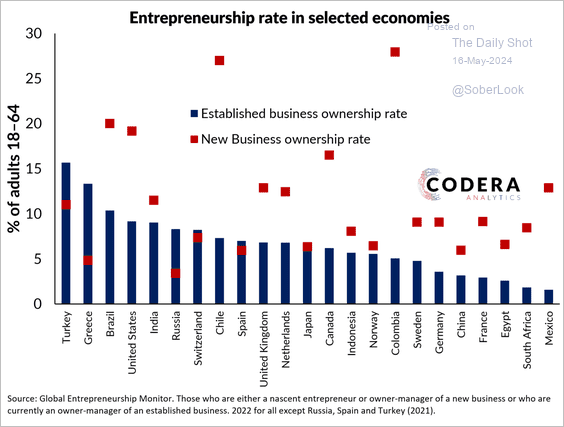

2. A comparison of entrepreneurship rates around the world:

Source: Codera Analytics Read full article

Source: Codera Analytics Read full article

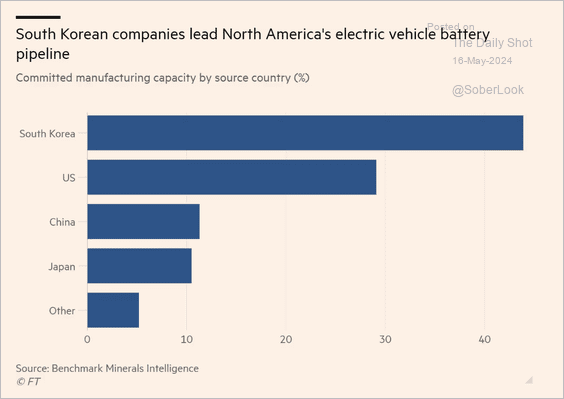

3. EV battery manufacturing capacity for North America:

Source: @financialtimes Read full article

Source: @financialtimes Read full article

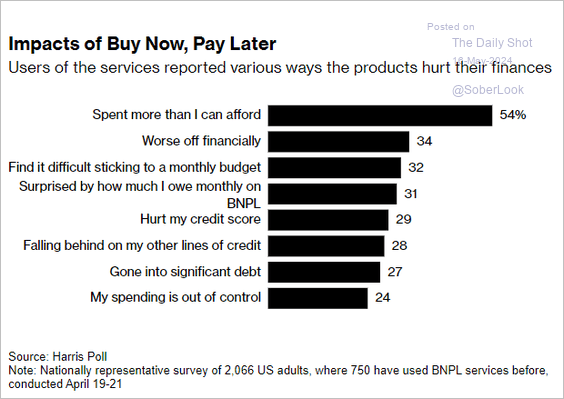

4. The impact of BNPL:

Source: @wealth Read full article

Source: @wealth Read full article

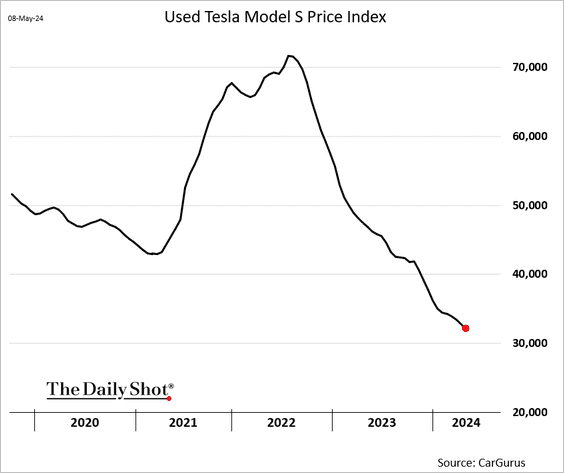

5. Used Tesla prices:

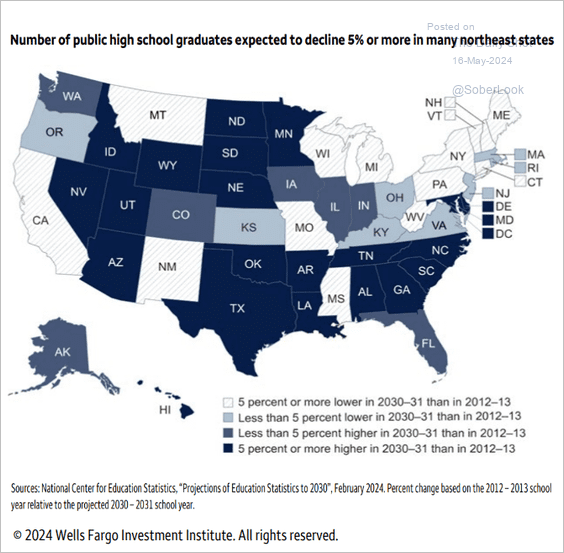

6. Projected changes in high school graduate numbers by state:

Source: Wells Fargo Investment Institute

Source: Wells Fargo Investment Institute

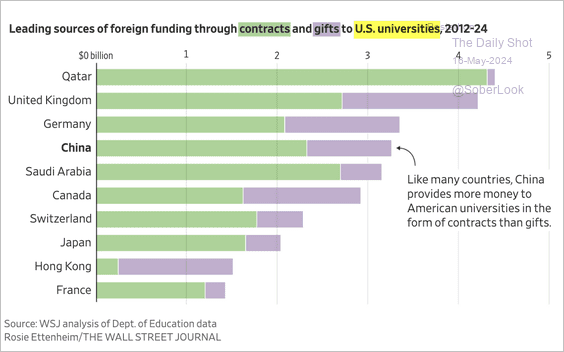

7. Research for sale:

Source: @WSJ Read full article

Source: @WSJ Read full article

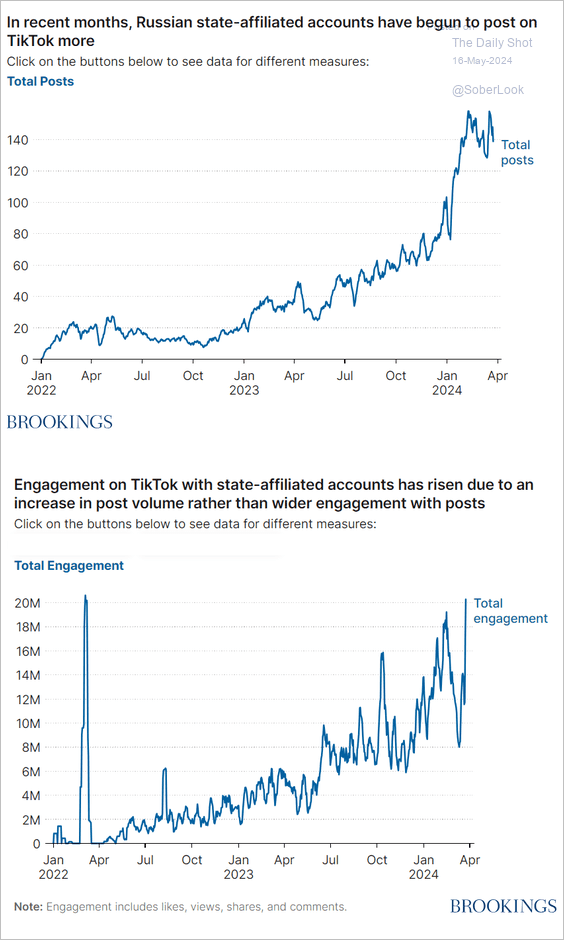

8. The Russian state propaganda machine sets its sights on TikTok.

Source: Brookings Read full article

Source: Brookings Read full article

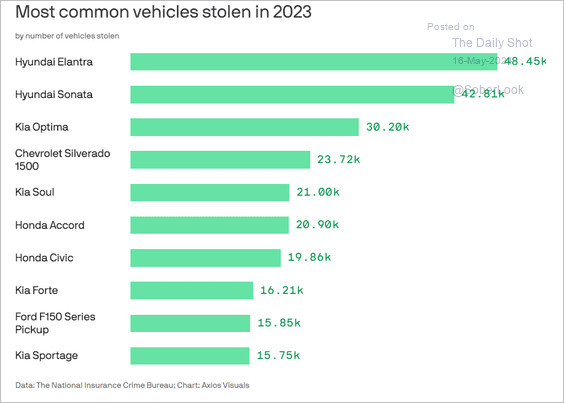

9. Most common vehicles stolen in 2023:

Source: @axios Read full article

Source: @axios Read full article

——————–

Back to Index