The Daily Shot: 23-May-24

• Administrative Update

• The United States

• The United Kingdom

• Japan

• Asia-Pacific

• Emerging Markets

• Commodities

• Energy

• Equities

• Credit

• Rates

• Global Developments

• Food for Thought

Administrative Update

Please note that The Daily Shot will not be published on Monday, May 27th.

Back to Index

The United States

1. Bloomberg’s latest Fed Minutes Sentiment Indicator was roughly neutral, …

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

… but some language in the minutes is hawkish, as seen in the broader Fed sentiment index.

• The FOMC shows unease over the inadequate progress in controlling inflation.

Participants observed that while inflation had eased over the past year, in recent months there had been a lack of further progress toward the Committee’s 2 percent objective. The recent monthly data had showed significant increases in components of both goods and services price inflation. In particular, inflation for core services excluding housing had moved up in the first quarter compared with the fourth quarter of last year, and prices of core goods posted their first three-month increase in several months.

• Some FOMC members remain concerned that current high interest rates may not be sufficiently restrictive. The possibility of higher long-run equilibrium interest rates and lower potential output suggests that more aggressive policy measures may be required to control inflation.

These participants saw this uncertainty as coming from the possibility that high interest rates may be having smaller effects than in the past, that longer-run equilibrium interest rates may be higher than previously thought, or that the level of potential output may be lower than estimated.

• FOMC members continue to communicate their willingness to keep rates ‘higher for longer’ or even raise rates if inflation worsens. It should be noted that these statements were made before the release of the April CPI report, which was more ‘benign’ than the market had feared.

Participants discussed maintaining the current restrictive policy stance for longer should inflation not show signs of moving sustainably toward 2 percent or reducing policy restraint in the event of an unexpected weakening in labor market conditions. Various participants mentioned a willingness to tighten policy further should risks to inflation materialize in a way that such an action became appropriate.

——————–

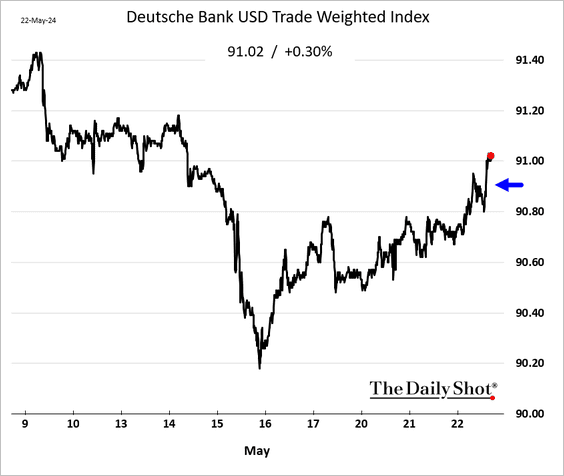

2. The US dollar jumped in response to the FOMC minutes.

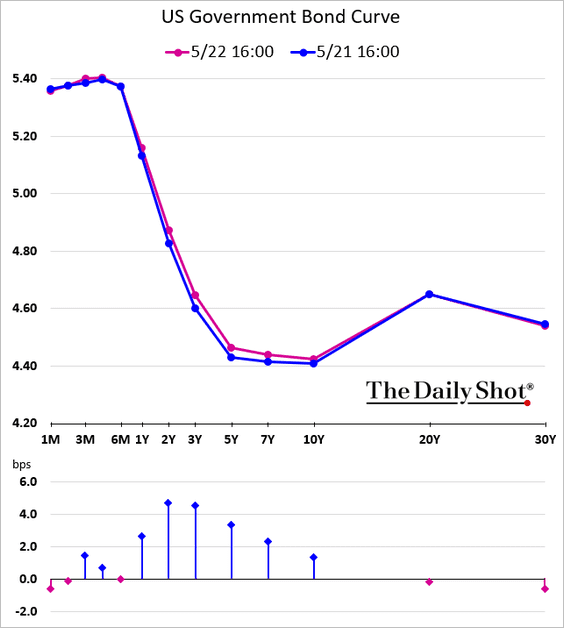

• The Treasury curve inversion increased slightly.

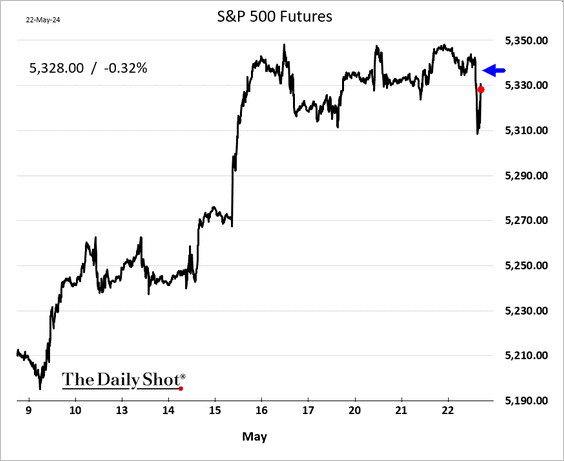

• Stocks declined, but futures are higher this morning on the NVIDIA news.

——————–

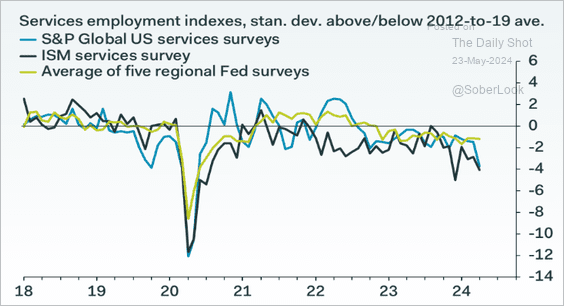

3. Surveys of service firms signal a slowdown in hiring.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

• Small business payments toward loans have risen while payments toward payrolls have declined as hiring moderated, according to BofA’s transaction data.

Source: Bank of America Institute

Source: Bank of America Institute

——————–

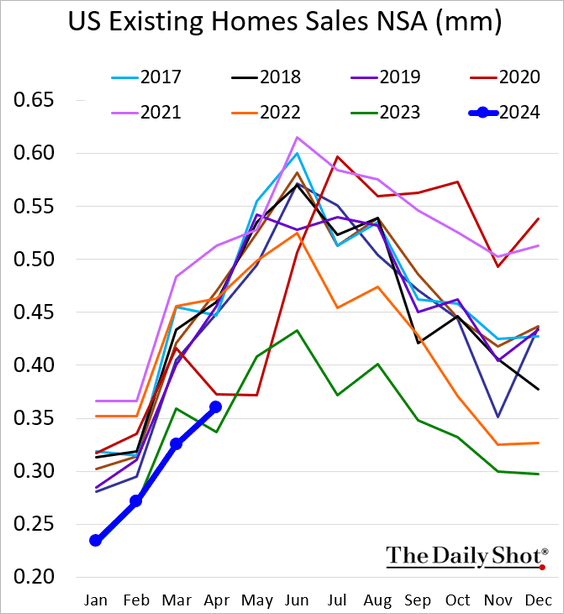

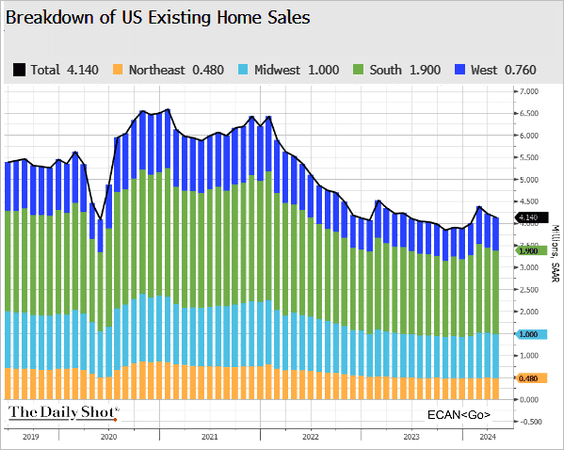

4. Existing home sales climbed above last year’s level in April but were lower than expected.

Here is the seasonally adjusted index of home sales.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: CNBC Read full article

Source: CNBC Read full article

– The median price held at record highs for this time of the year.

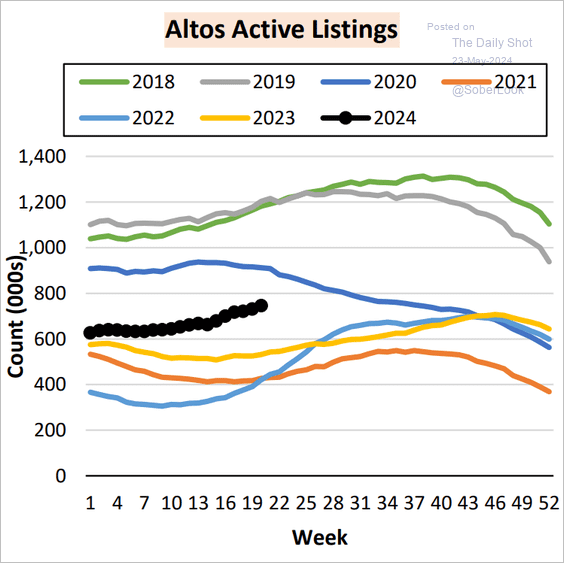

– Inventories are turning higher.

Here is the Altos Active Listings index.

Source: AEI Housing Center

Source: AEI Housing Center

• But there is help on the way. Mortgage rates are down substantially this month.

.

.

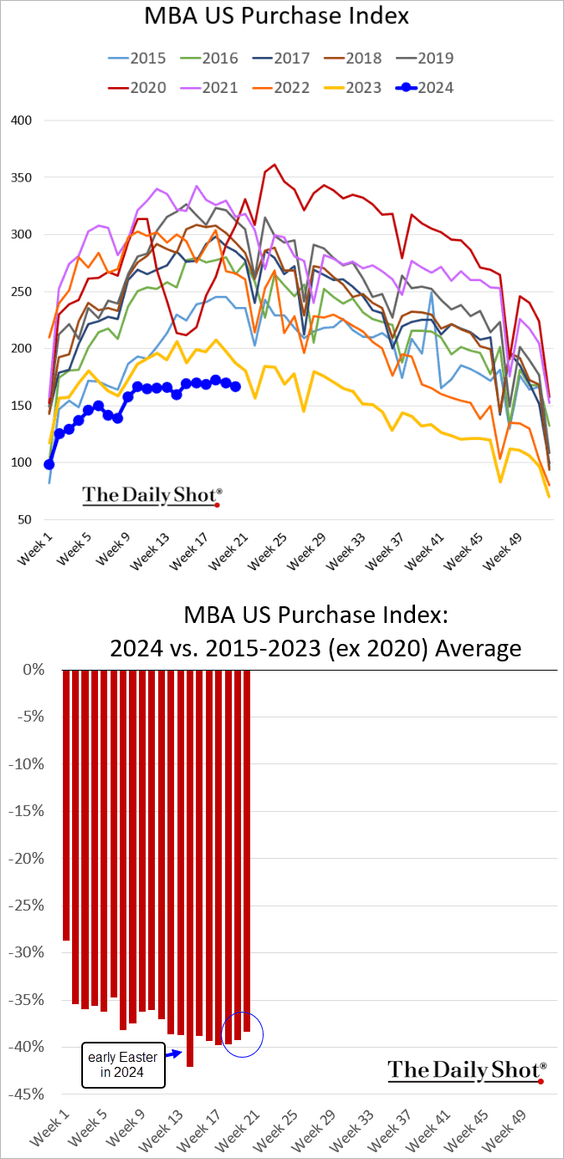

– Mortgage applications are still at multi-year lows, but there has been a modest improvement.

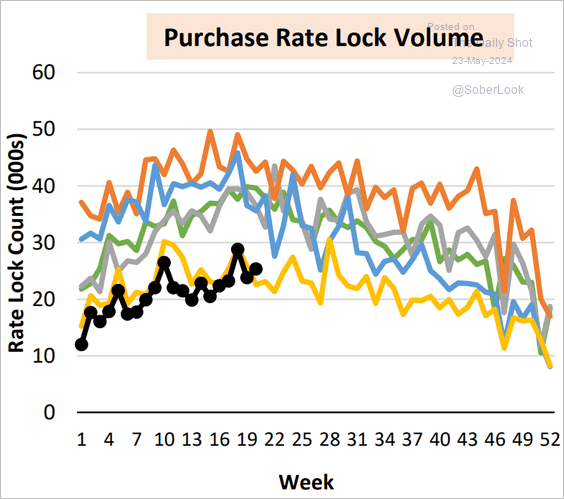

The rate lock count climbed above last year’s levels.

Source: AEI Housing Center

Source: AEI Housing Center

Back to Index

The United Kingdom

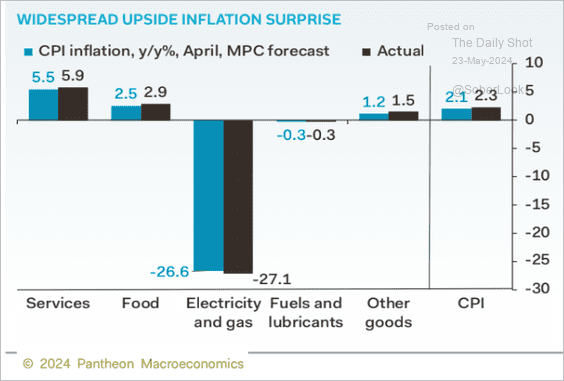

1. As we mentioned yesterday, the UK CPI report topped expectations.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

Source: @economics Read full article

Source: @economics Read full article

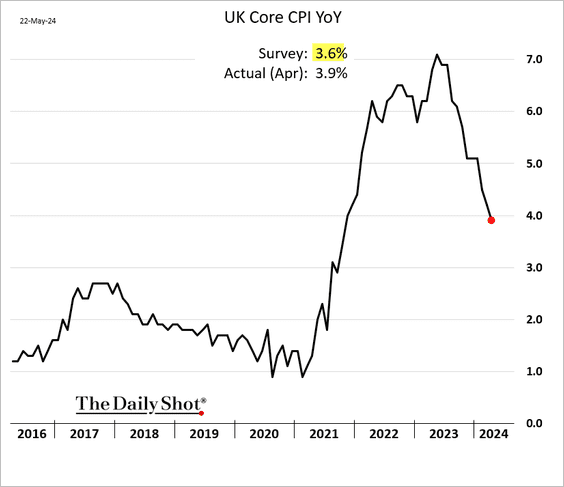

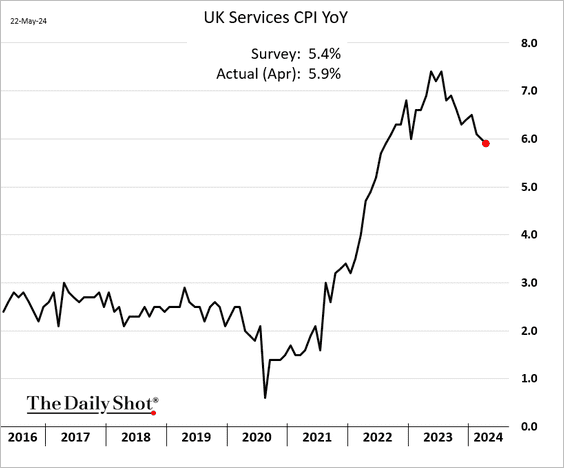

• The core CPI remains sticky, …

… held up by services inflation.

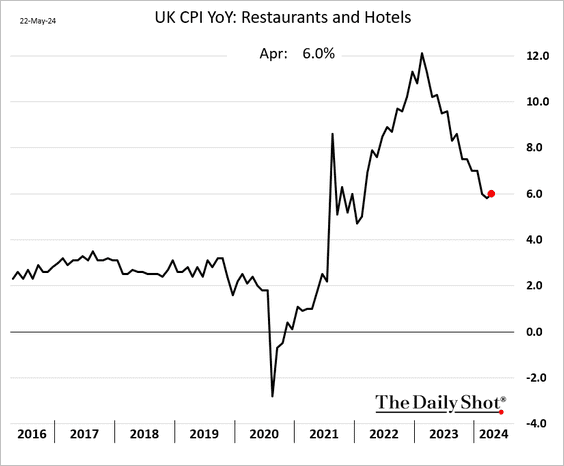

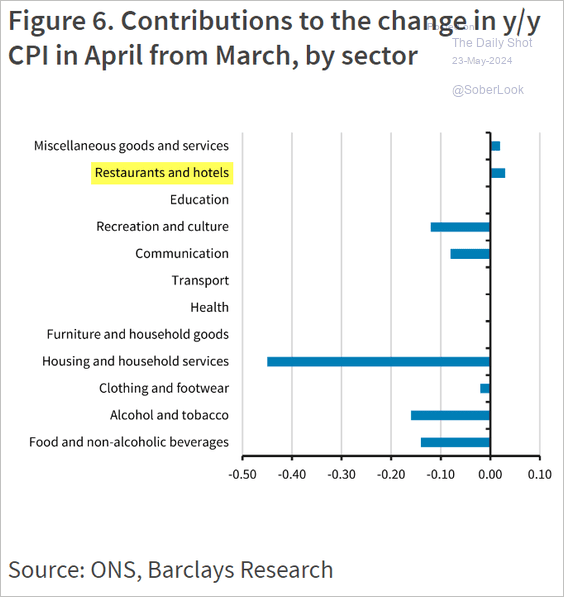

• The decrease in inflation for restaurants and hotels is losing momentum.

Source: Barclays Research

Source: Barclays Research

• After peaking at 14%, retail price increases continue to ease.

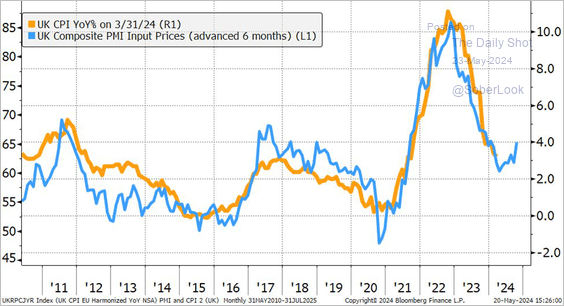

• The PMI index signals risks to the upside for inflation.

Source: @JeffreyKleintop

Source: @JeffreyKleintop

——————–

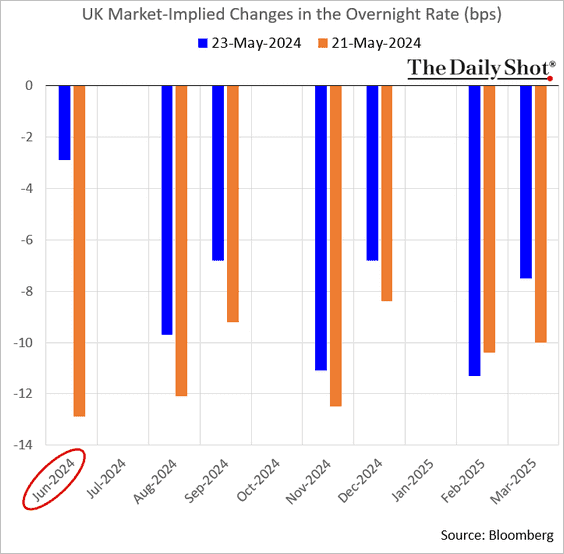

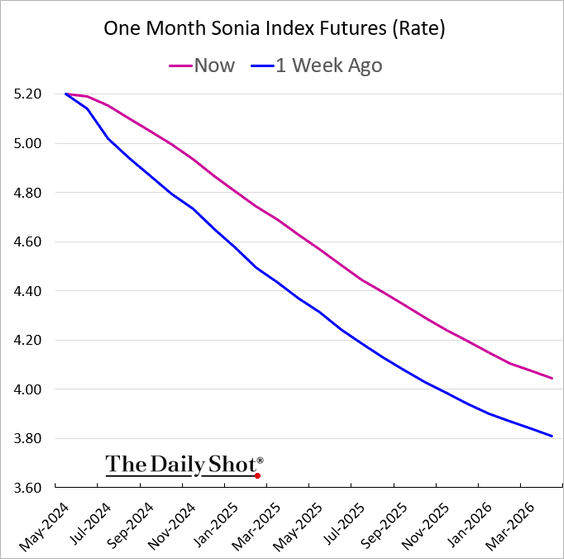

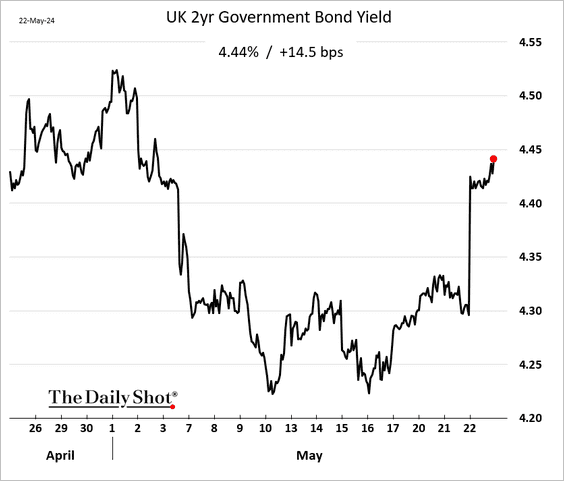

2. A June BoE rate cut is off the table after the hot CPI report, …

… as the market reprices the rate trajectory higher.

• Gilt yields jumped.

Here is the yield curve.

• The pound strengthened.

——————–

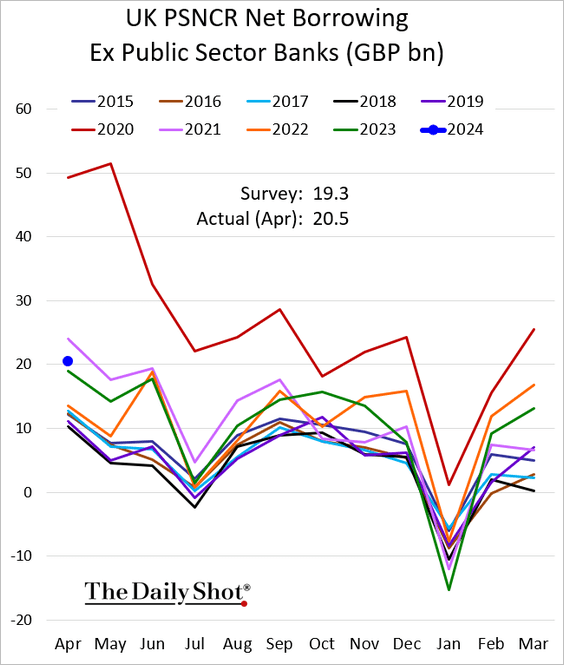

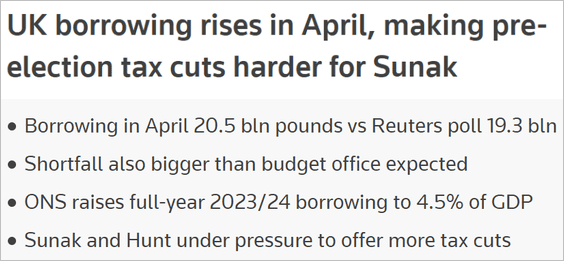

3. UK government borrowing was higher than expected last month.

Source: Reuters Read full article

Source: Reuters Read full article

Back to Index

Japan

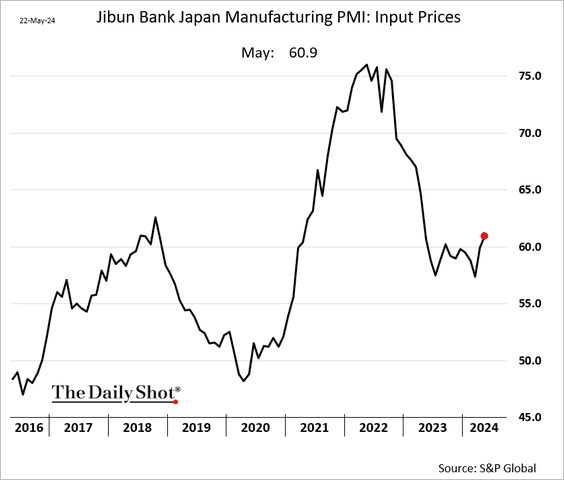

1. Manufacturing is back in growth territory, …

Source: Reuters Read full article

Source: Reuters Read full article

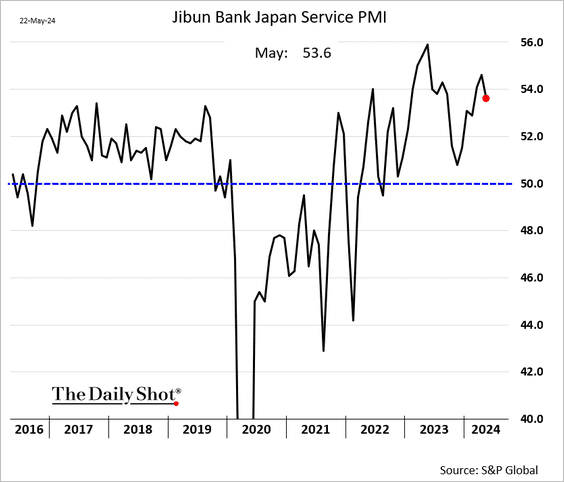

… while services expansion persists.

• Factories are reporting ongoing price pressures, …

… as the yen continues to weaken.

——————–

2. The economy is expected to grow by 0.6% this year.

Back to Index

Asia-Pacific

1. Taiwan’s unemployment remains near multi-year lows.

2. New Zealand’s real retail sales climbed for the first time in nine quarters.

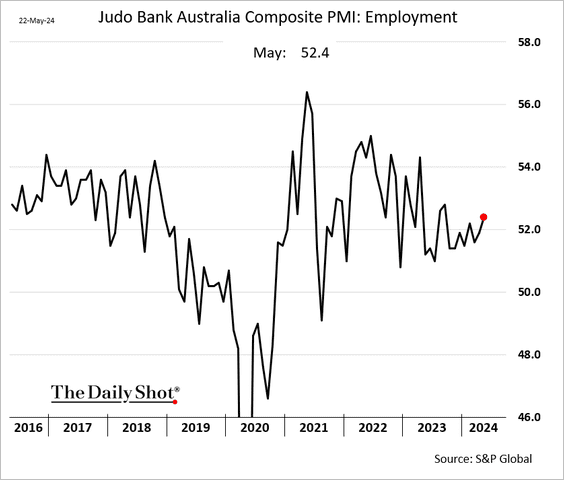

3. Next, we have some updates on Australia.

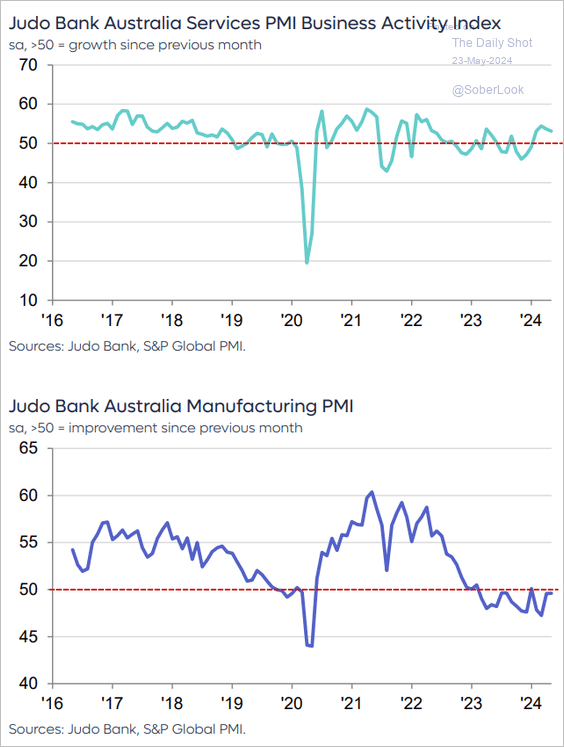

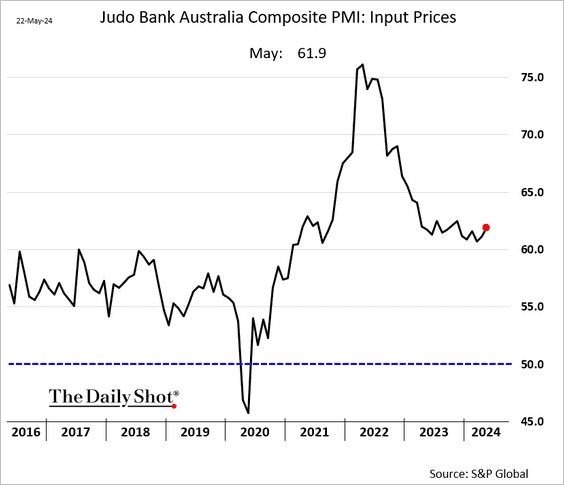

• Service companies continue to report expansion while manufacturing growth remains stalled.

Source: S&P Global PMI

Source: S&P Global PMI

– Cost pressures worsened this month.

– Hiring accelerated.

Source: @WSJ Read full article

Source: @WSJ Read full article

• Consumer inflation expectations are falling rapidly.

Back to Index

Emerging Markets

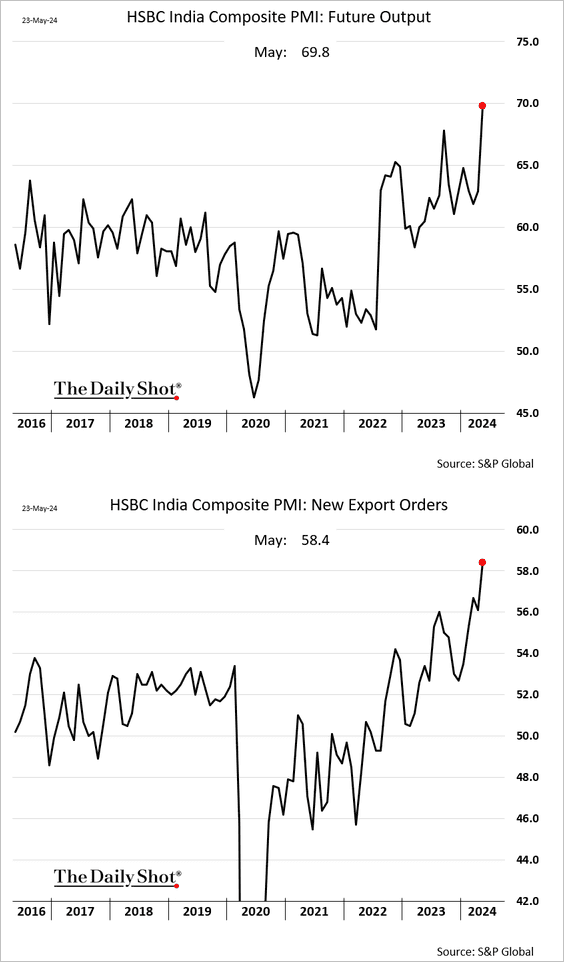

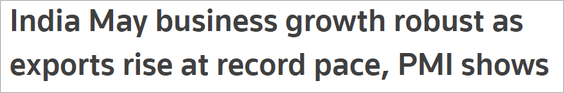

1. India’s business sector is showing remarkable strength, …

… amid growing demand.

Source: Reuters Read full article

Source: Reuters Read full article

——————–

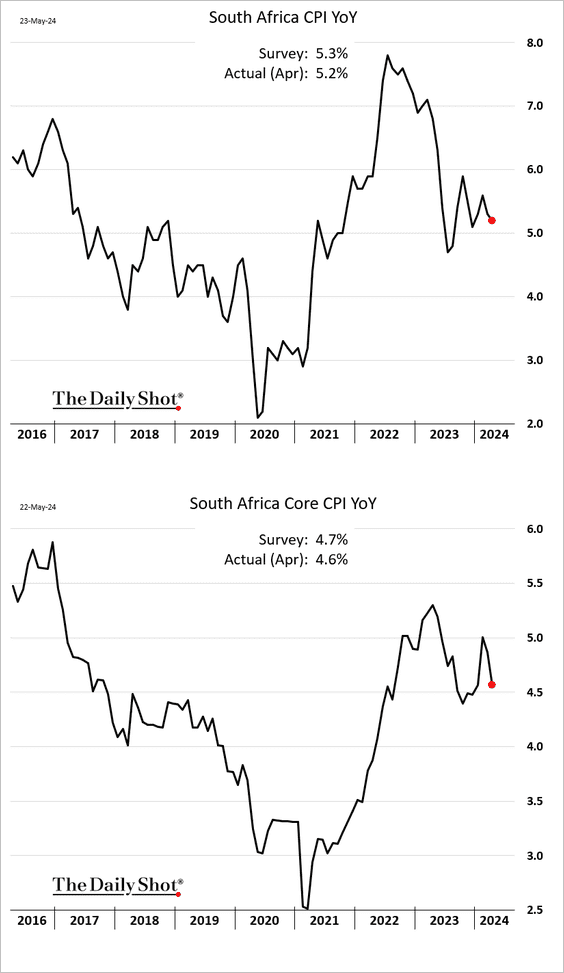

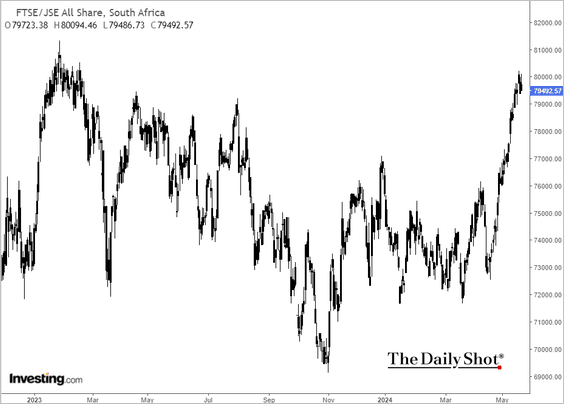

2. South Africa’s CPI report was slightly below expectations.

This month, the nation’s stock market experienced a robust rally, boosted by surging commodity prices.

——————–

3. Thailand’s vehicle sales slumped due to tight lending conditions.

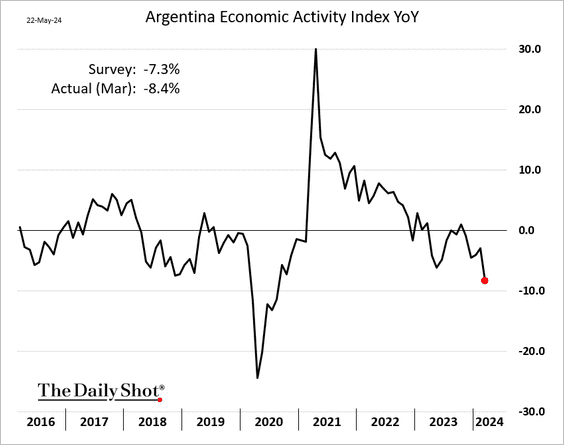

4. Argentina’s economic activity deteriorated further in March, …

Source: Reuters Read full article

Source: Reuters Read full article

… but the leading index showed improvement in April.

Back to Index

Commodities

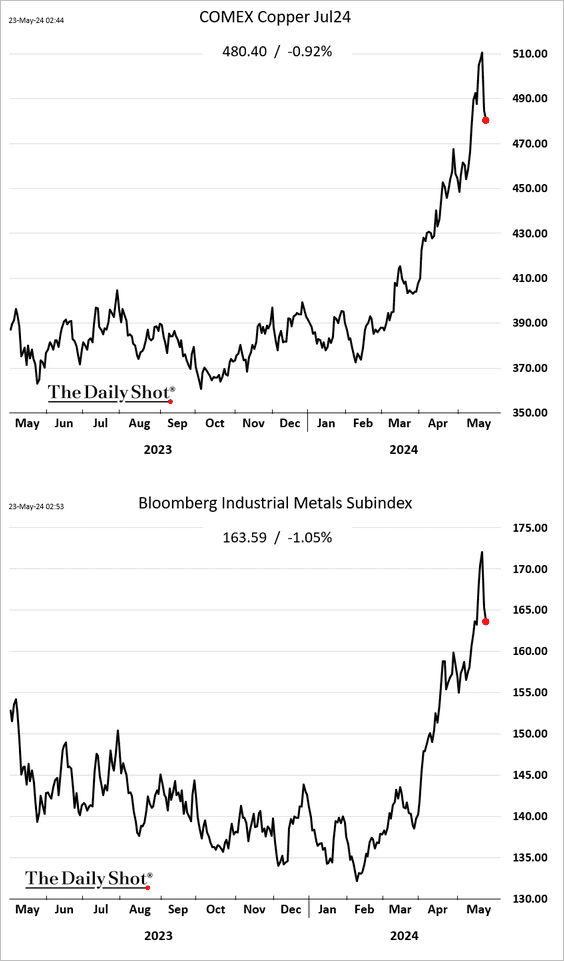

1. The metals rally is fading.

2. The dollar has strengthened alongside commodities in recent years.

Source: Alpine Macro

Source: Alpine Macro

Back to Index

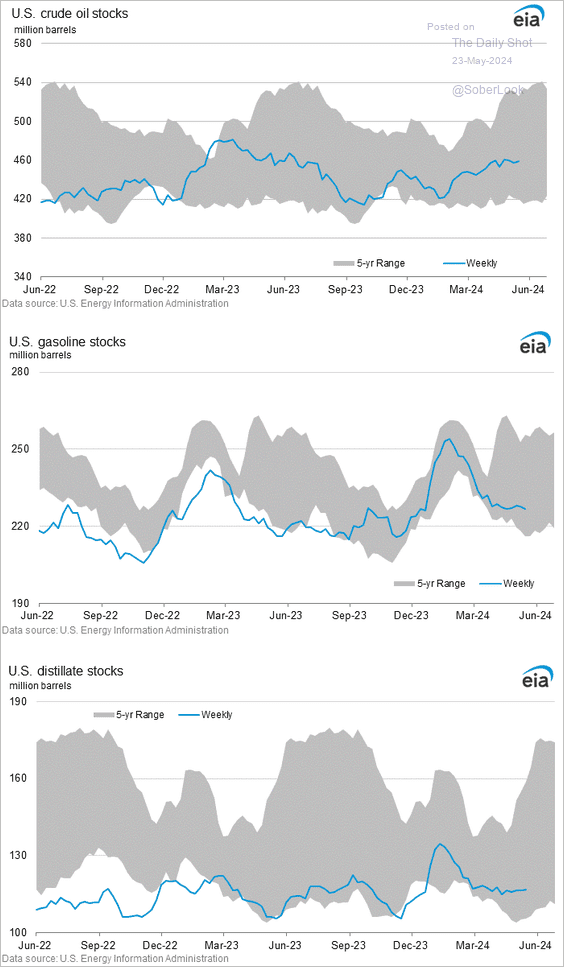

Energy

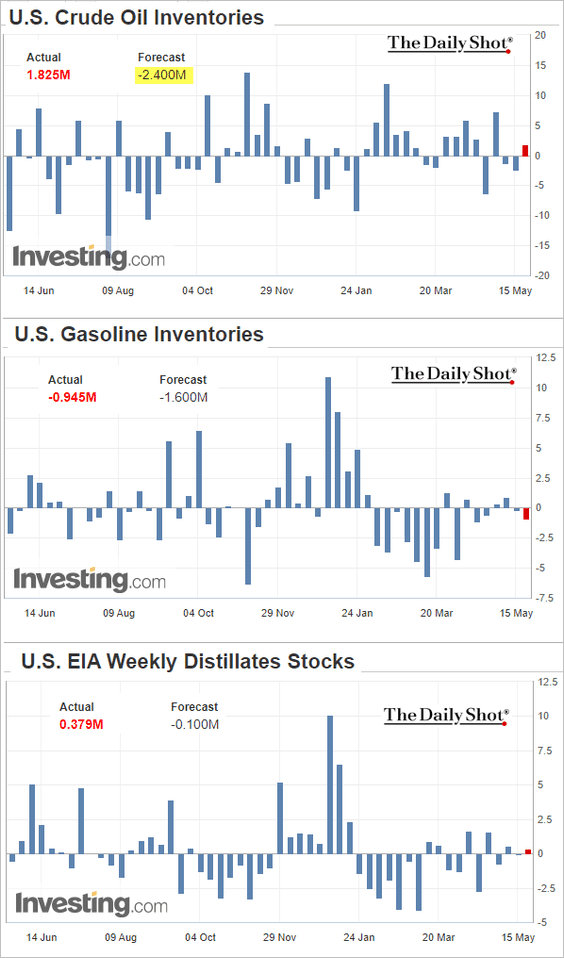

1. US crude oil inventories unexpectedly increased last week.

Source: Reuters Read full article

Source: Reuters Read full article

• Brent crude dipped below $82/bbl.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

• Here are the inventory levels.

• Refinery runs have picked up momentum, …

… as gasoline demand strengthens.

——————–

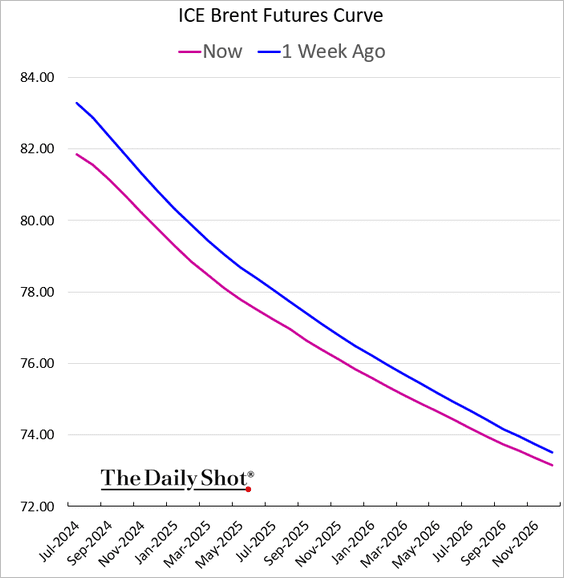

2. The Brent backwardation has been easing.

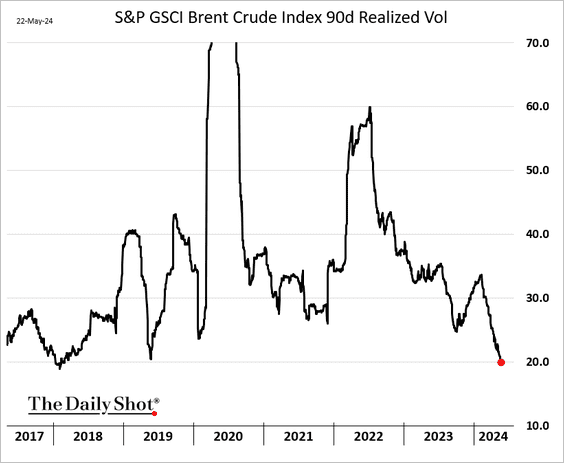

3. Oil volatility remains at multi-year lows.

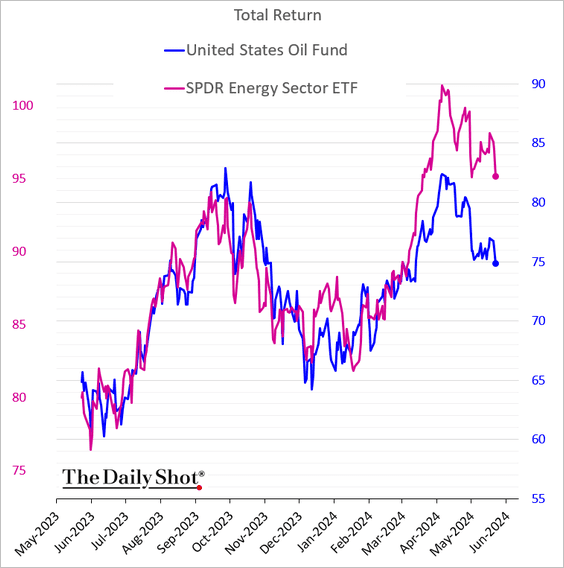

4. Energy shares have been underperforming, …

… dragged lower by soft oil prices.

——————–

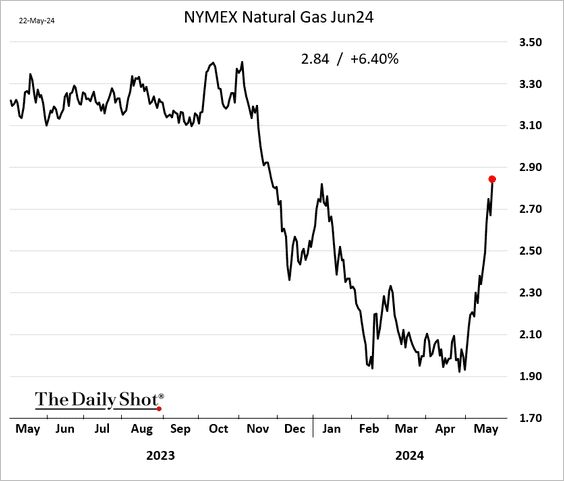

5. US natural gas futures continue to surge.

Back to Index

Equities

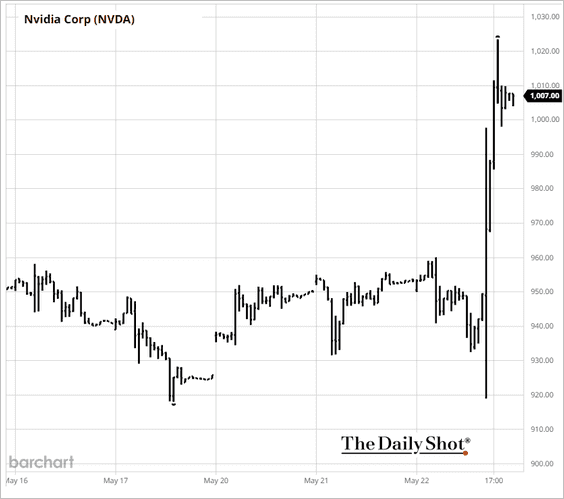

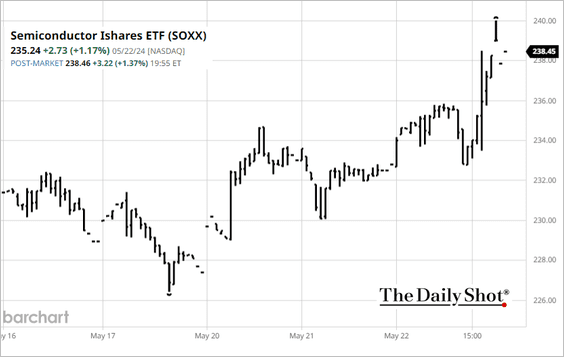

1. The market liked what it heard from NVIDIA, suggesting that the AI momentum remains intact.

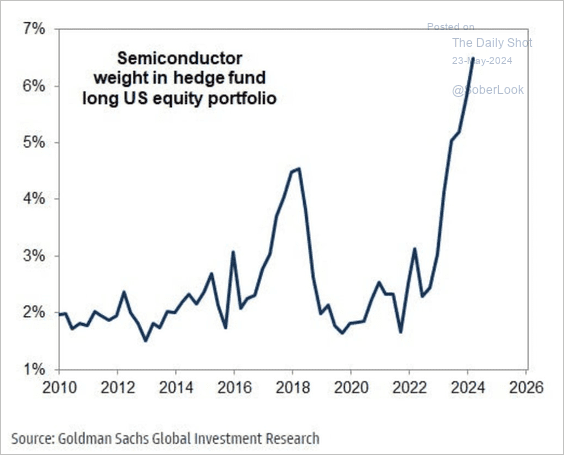

• Some hedge funds will be celebrating.

Source: Goldman Sachs

Source: Goldman Sachs

——————–

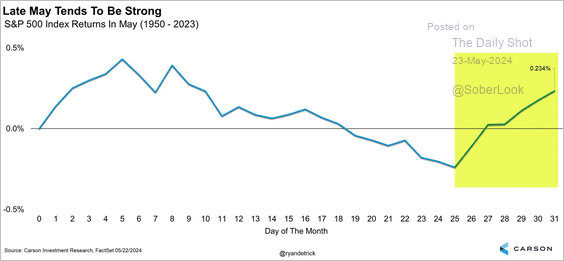

2. The last week of May is typically bullish for the S&P 500.

Source: @RyanDetrick

Source: @RyanDetrick

3. Retail investors are increasingly upbeat.

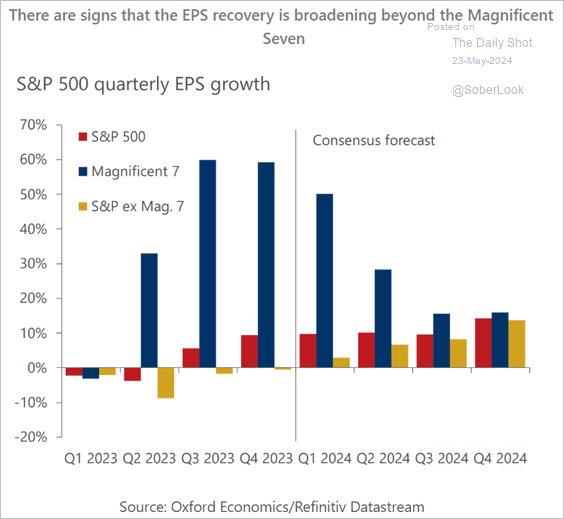

4. The earnings recovery is widening beyond the tech megacaps.

Source: Oxford Economics

Source: Oxford Economics

5. Here is the percentage of fund managers beating their benchmarks.

Source: Morgan Stanley Research; @dailychartbook

Source: Morgan Stanley Research; @dailychartbook

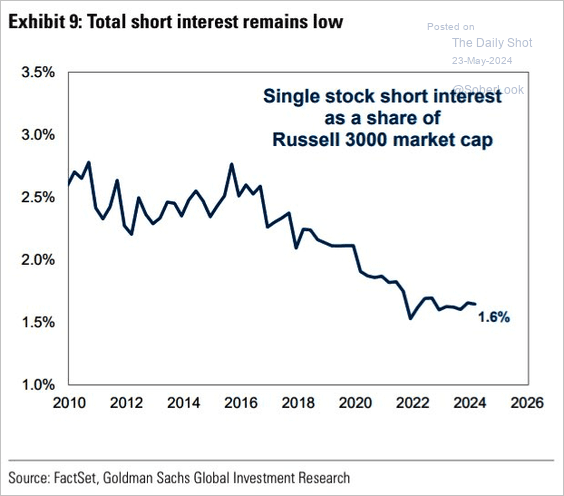

6. Short interest across the broad US market continues to be notably low.

Source: Goldman Sachs; @WallStJesus

Source: Goldman Sachs; @WallStJesus

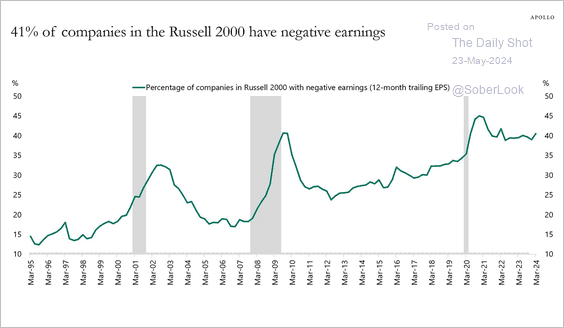

7. The percentage of small caps with negative earnings remains elevated.

Source: Torsten Slok, Apollo

Source: Torsten Slok, Apollo

Back to Index

Credit

1. We could see some fallen angels in the months ahead.

Source: BofA Global Research; @MikeZaccardi

Source: BofA Global Research; @MikeZaccardi

2. Here is a comparison of US corporate debt outstanding by type (2019 and 2023).

h/t Torsten Slok, Apollo

h/t Torsten Slok, Apollo

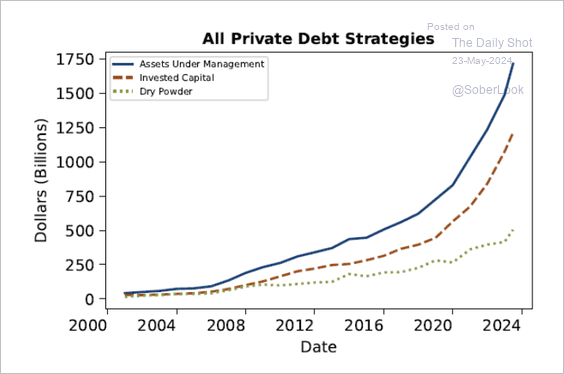

3. Total US private credit AUM has grown exponentially in recent years. The growing amount of dry powder suggests the supply of private credit funding is outstripping demand for private loans.

Source: Federal Reserve Board Read full article

Source: Federal Reserve Board Read full article

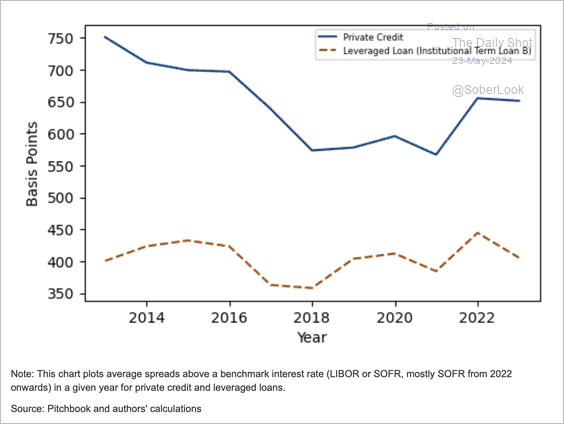

• The average private credit loan spread increased during the latest rate hike cycle, and recently widened its gap with leveraged loans (Term B, less risky senior debt).

Source: Federal Reserve Board Read full article

Source: Federal Reserve Board Read full article

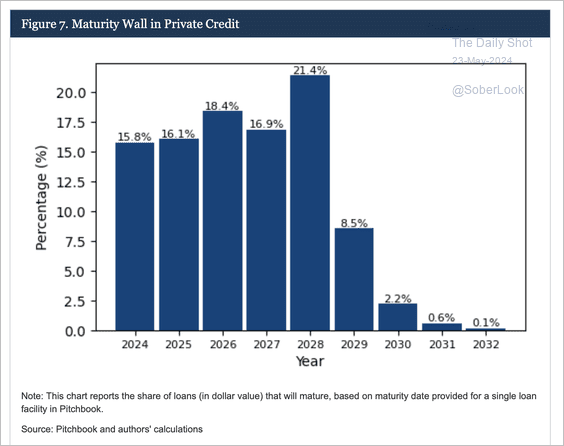

• Private credit debt maturities are spread out evenly over the coming years.

Source: Federal Reserve Board Read full article

Source: Federal Reserve Board Read full article

Back to Index

Rates

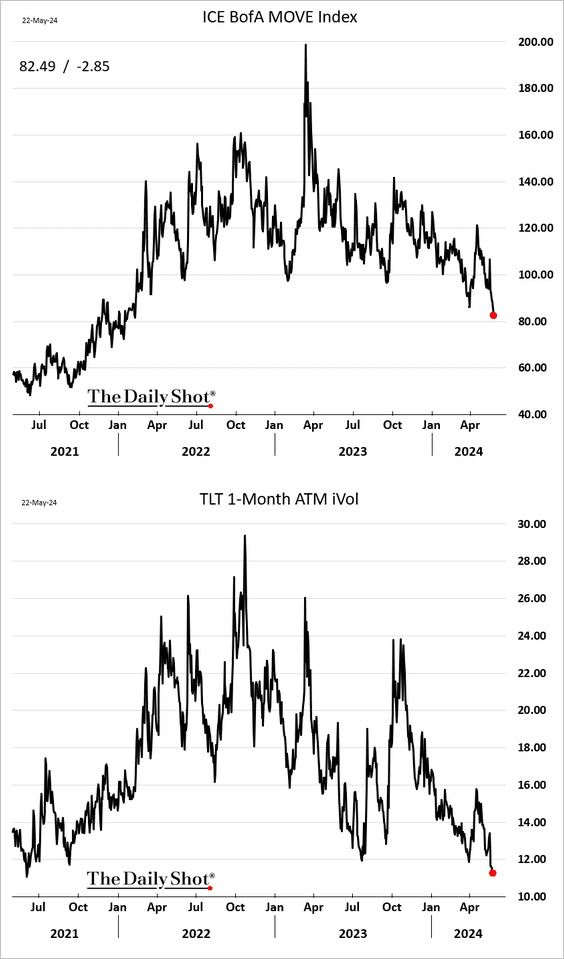

1. Treasury market implied volatility is hitting multi-year lows.

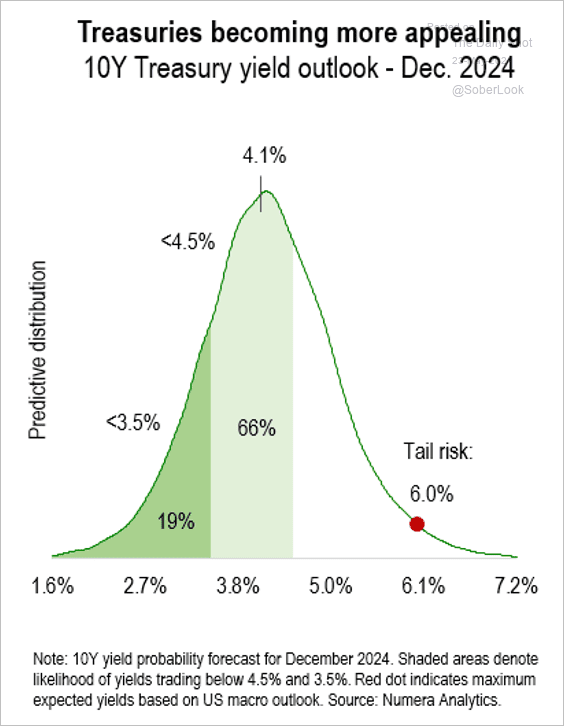

2. Numera Analytics sees a 66% chance that the 10-year Treasury yield will decline below current levels by year-end.

Source: Numera Analytics (@NumeraAnalytics)

Source: Numera Analytics (@NumeraAnalytics)

Back to Index

Global Developments

1. Implied volatility in currency markets has trended lower, reflecting a decrease in policy uncertainty from central banks.

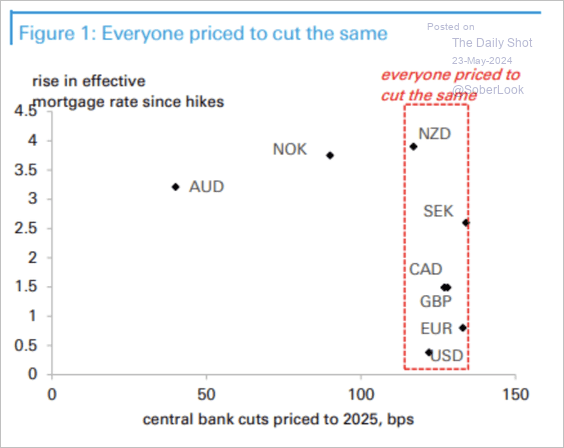

2. Many advanced economies’ central banks are expected to cut rates by similar magnitudes. This is despite varying effective policy tightening, measured by the pass-through of rate hikes to mortgage markets.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

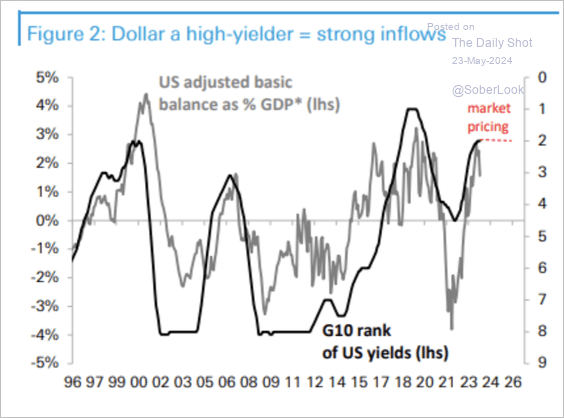

3. The US dollar is set to remain the second-highest-yielding currency in the developed world, which could support inflows and dollar outperformance.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

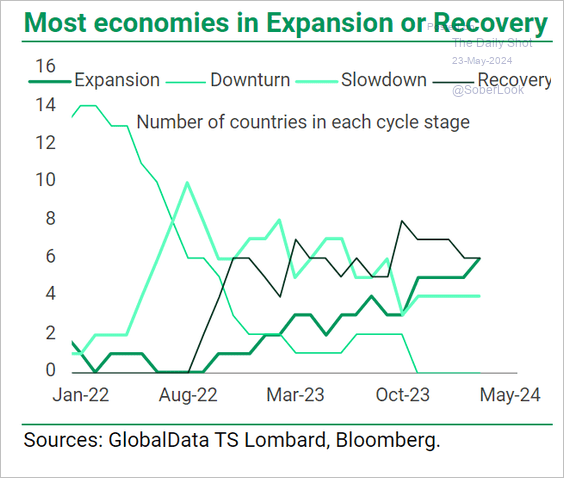

4. This chart displays the trends in stages of the economic growth cycle.

Source: TS Lombard

Source: TS Lombard

——————–

Food for Thought

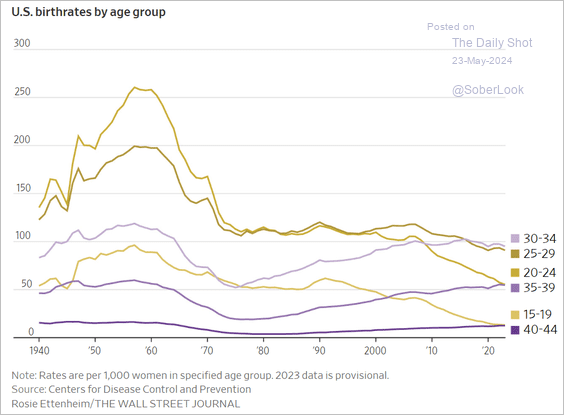

1. Birthrates by age group in the US:

Source: @WSJ Read full article

Source: @WSJ Read full article

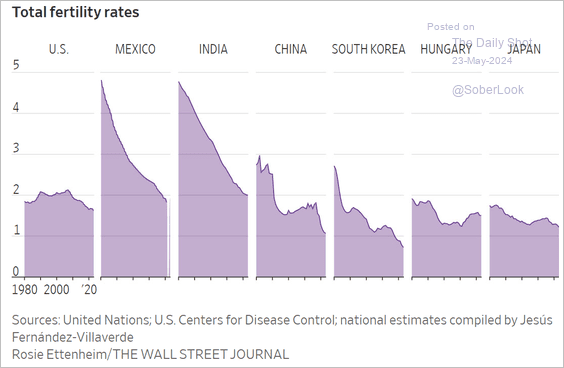

2. Fertility rates in select economies:

Source: @WSJ Read full article

Source: @WSJ Read full article

3. Preferences and plans for proximity to maternal figures:

Source: Realtor.com Read full article

Source: Realtor.com Read full article

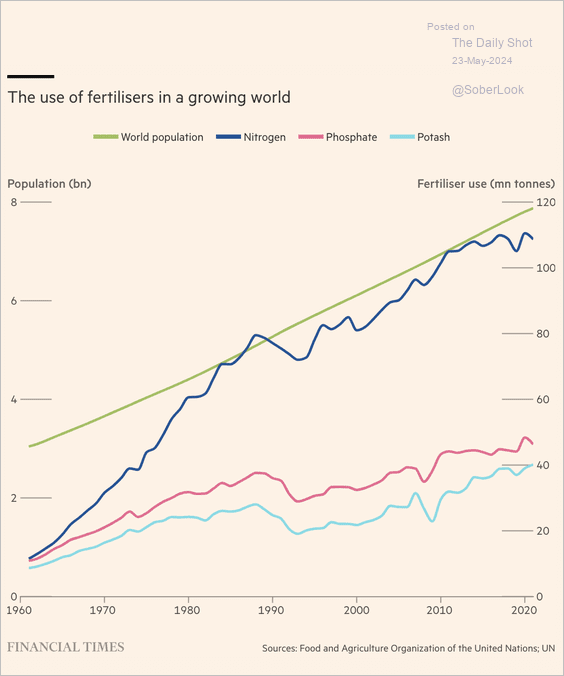

4. Fertilizer use globally:

Source: @financialtimes Read full article

Source: @financialtimes Read full article

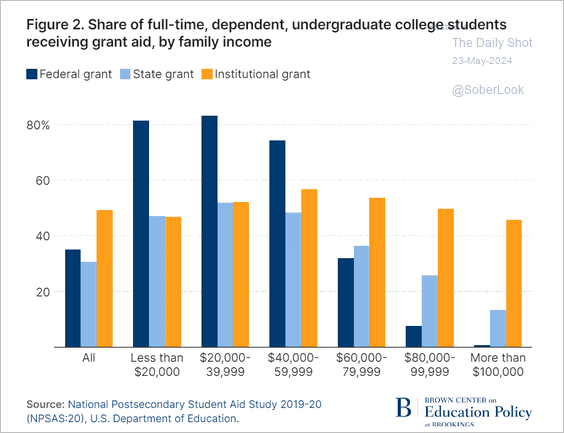

5. Undergraduate students receiving grant aid:

Source: Brookings Read full article

Source: Brookings Read full article

6. Road rage shooting incidents:

Source: @axios Read full article

Source: @axios Read full article

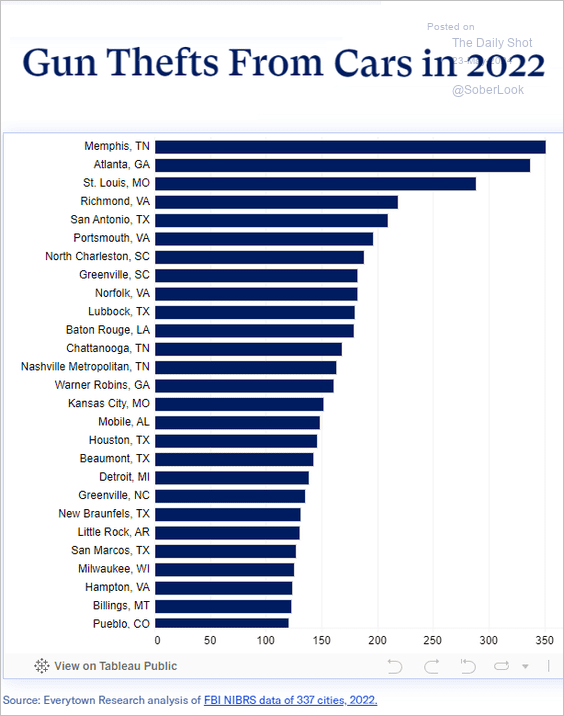

7. Gun thefts (2 charts):

Source: Everytown Read full article

Source: Everytown Read full article

Source: Everytown Read full article

Source: Everytown Read full article

——————–

Back to Index