The Daily Shot: 30-May-24

• The United States

• The Eurozone

• Asia-Pacific

• China

• Emerging Markets

• Cryptocurrency

• Commodities

• Equities

• Credit

• Global Developments

• Food for Thought

The United States

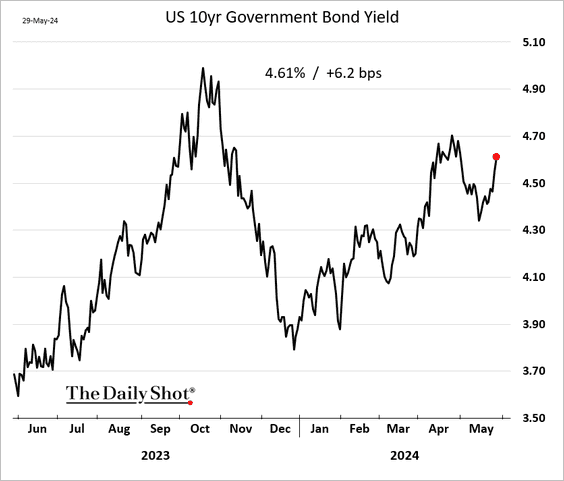

1. Treasury yields have been rising, exerting pressure on risk assets.

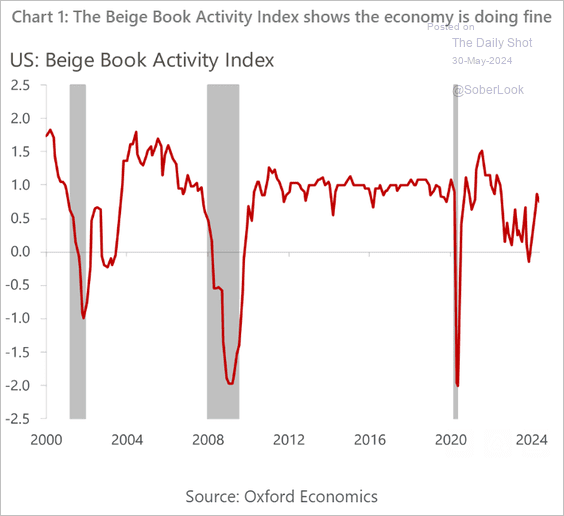

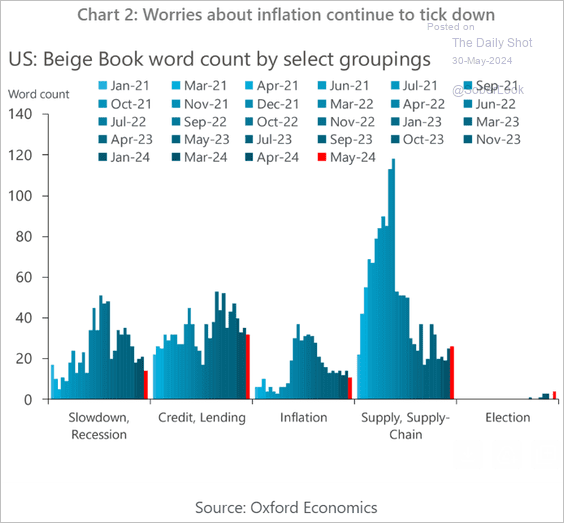

2. The Fed’s Beige Book points to modest growth, with softer demand limiting price increases.

Source: @economics Read full article

Source: @economics Read full article

Here is the Oxford Economics Beige Book Activity Index.

Source: Oxford Economics

Source: Oxford Economics

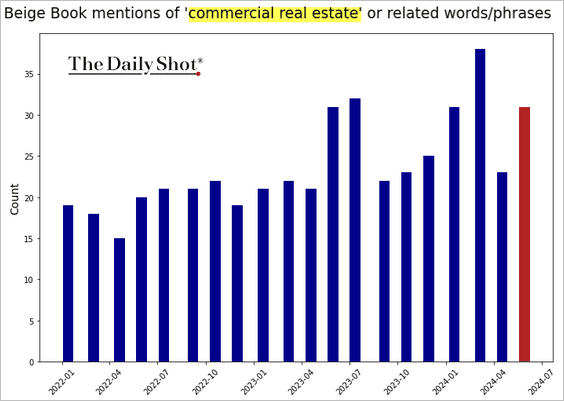

• Concerns about commercial real estate remain elevated.

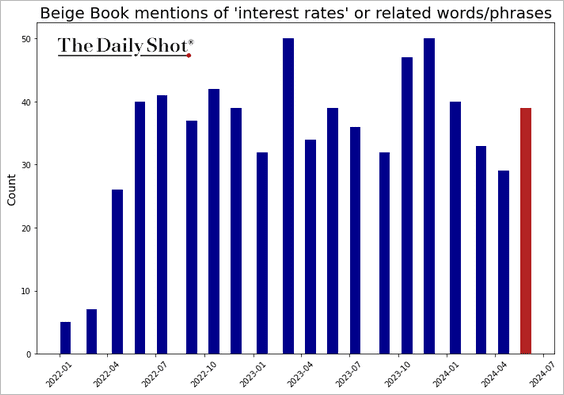

• There was more discussion about interest rates.

• Here are some additional Beige Book trends.

Source: Oxford Economics

Source: Oxford Economics

——————–

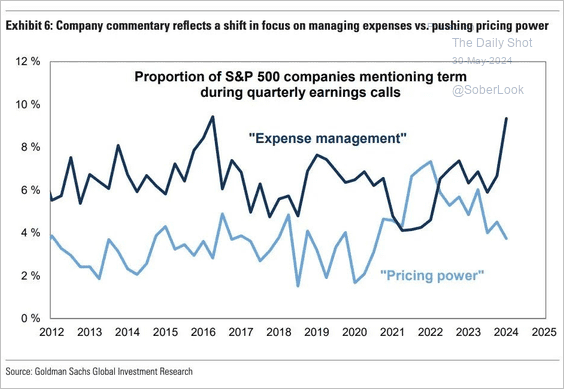

2. Consistent with the Fed’s Beige Book observations, large companies are shifting their focus from pricing power to expense management in response to softening demand.

Source: Goldman Sachs; @topdowncharts

Source: Goldman Sachs; @topdowncharts

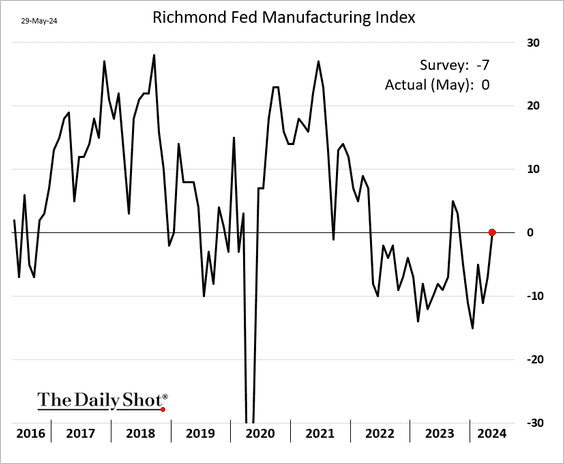

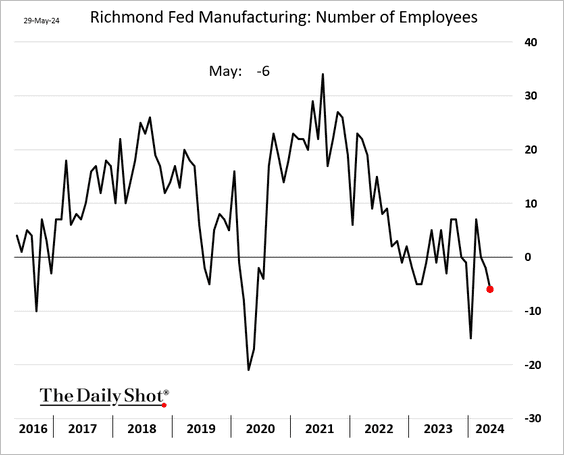

3. The Richmond Fed’s manufacturing index showed some stabilization in the region’s factory activity.

• Factories are reducing headcount.

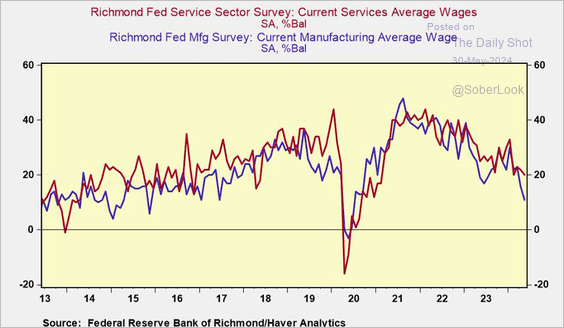

• Wage growth in the region’s manufacturing and services sectors is slowing.

Source: @RenMacLLC

Source: @RenMacLLC

——————–

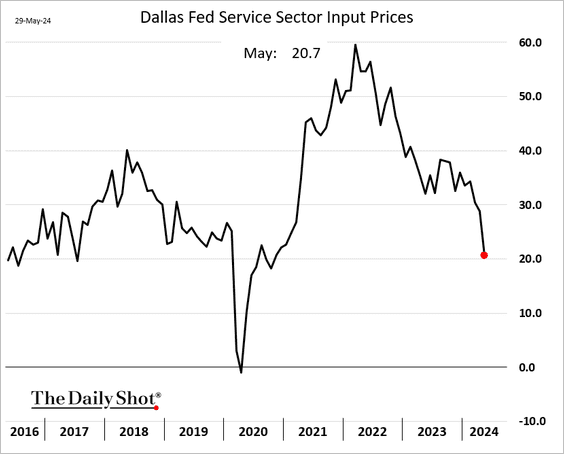

4. The Dallas Fed’s services survey shows moderating cost pressures.

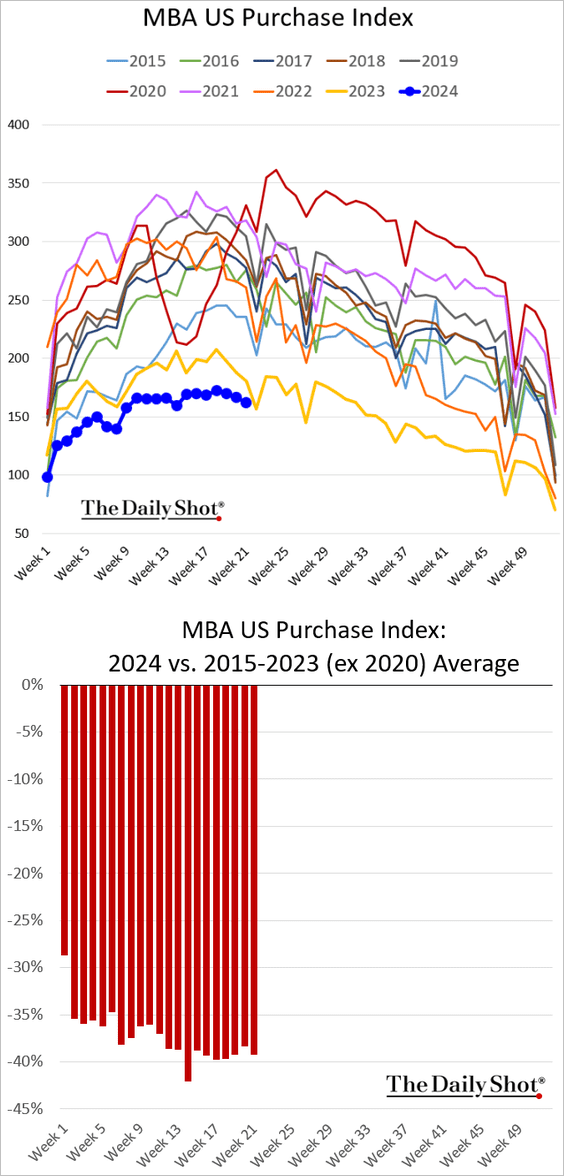

5. Next, we have some updates on the housing market.

• The recent modest improvement in mortgage applications did not extend into last week.

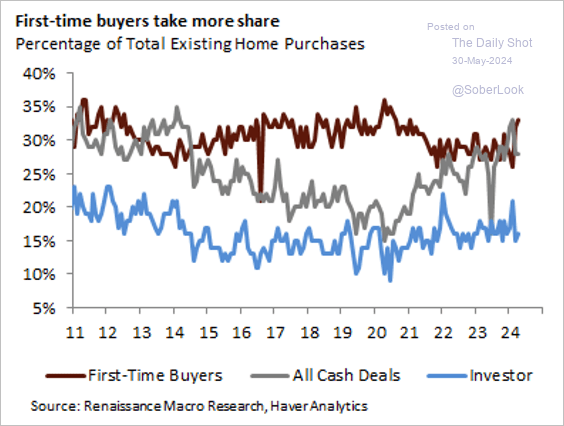

• First-time homebuyers’ share of home purchases increased in recent months.

Source: @RenMacLLC

Source: @RenMacLLC

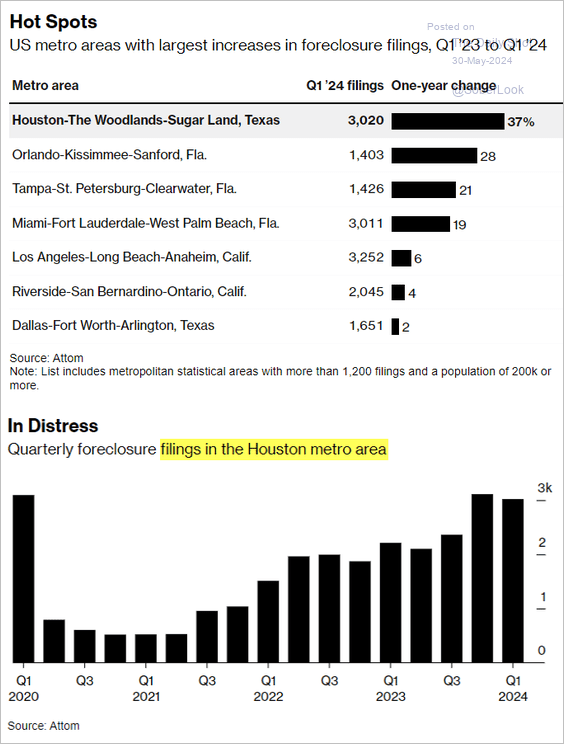

• Some metro areas are seeing higher foreclosure rates.

Source: @business Read full article

Source: @business Read full article

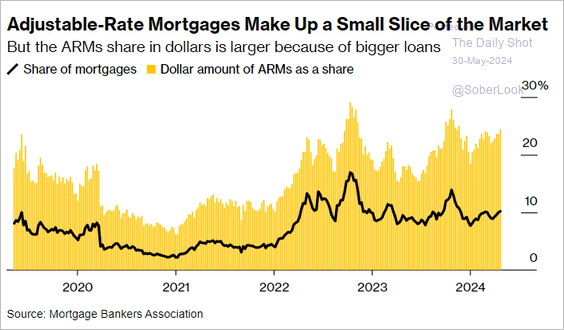

• Here is a look at ARMs’ share of the mortgage market.

Source: @economics Read full article

Source: @economics Read full article

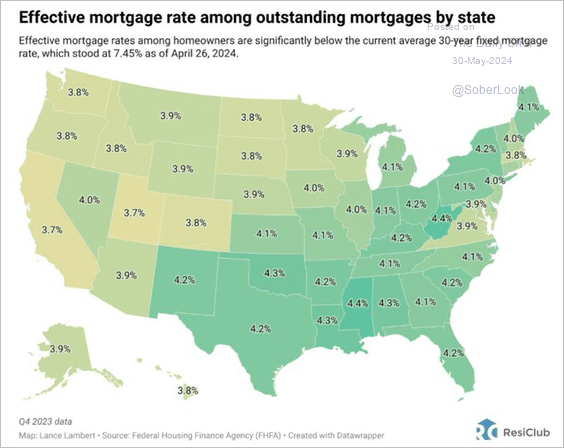

• This map shows the effective mortgage rates (outstanding mortgages) by state.

Source: @EricSoda

Source: @EricSoda

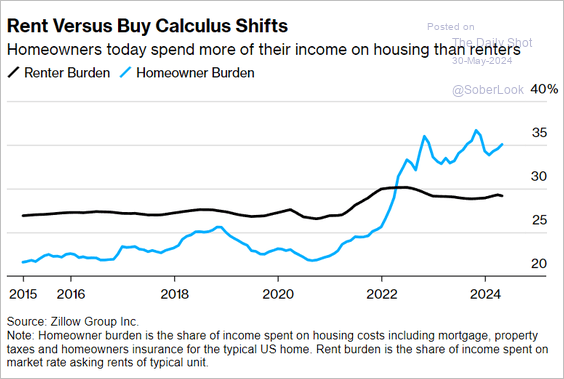

• These days, renting is more practical than buying for many households.

Source: @economics Read full article

Source: @economics Read full article

——————–

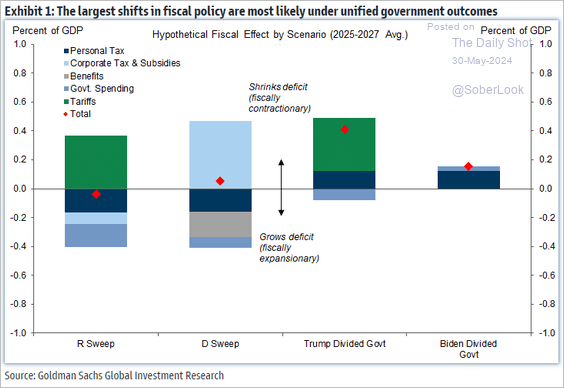

6. Finally, we have fiscal policy shifts under different post-election government scenarios.

Source: Goldman Sachs; @MikeZaccardi

Source: Goldman Sachs; @MikeZaccardi

Back to Index

The Eurozone

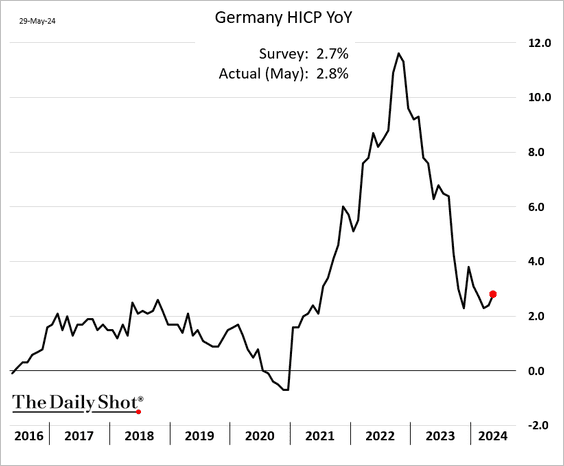

1. As expected, Germany’s CPI registered an uptick this month.

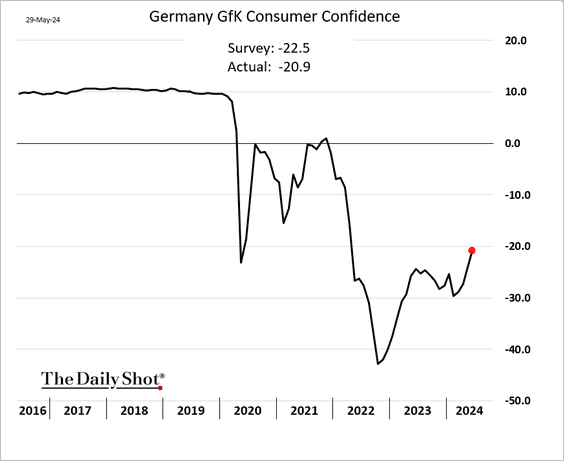

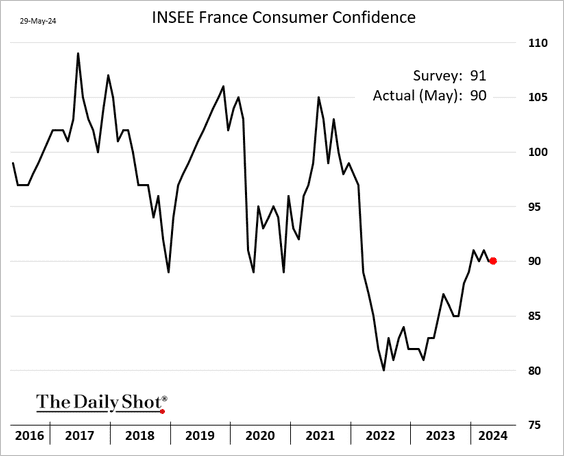

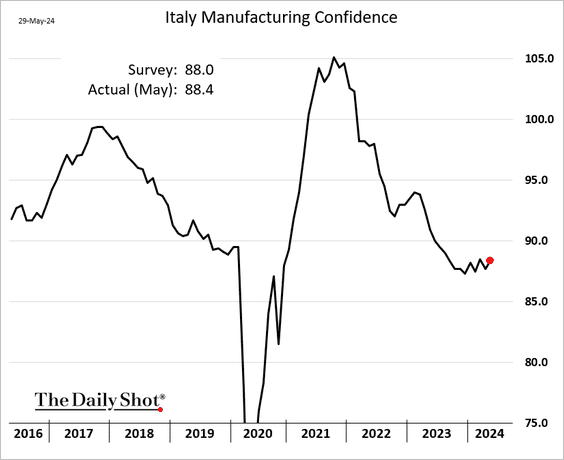

2. Consumer confidence improved in Germany and Italy in May.

French sentiment was flat.

• Italian manufacturing confidence edged higher.

——————–

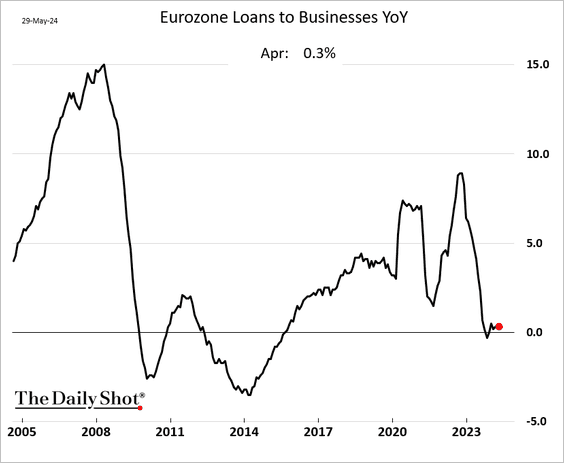

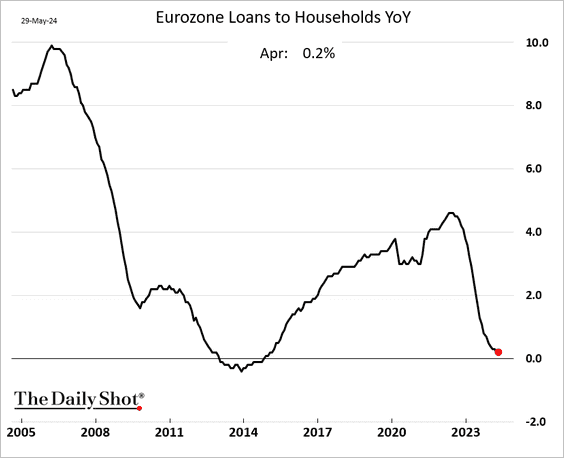

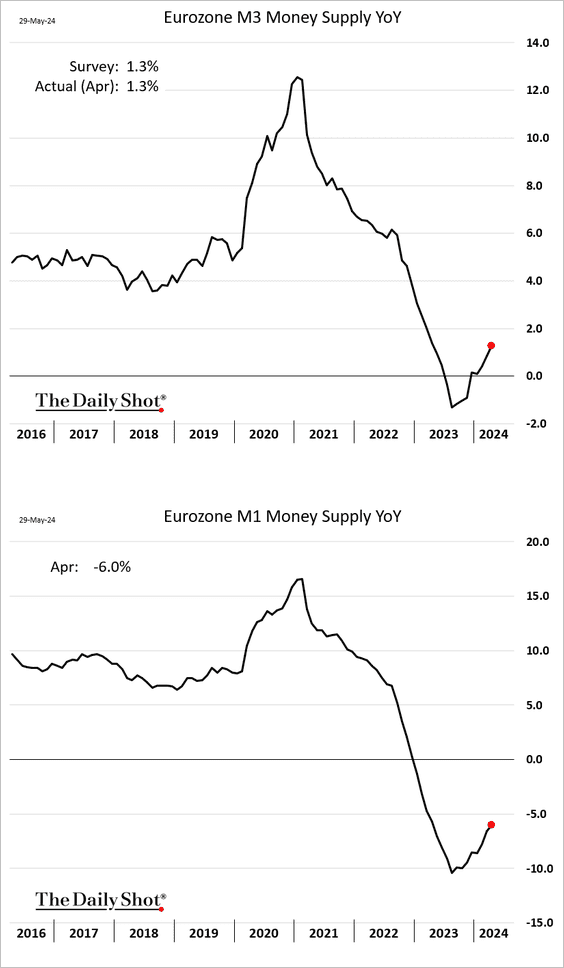

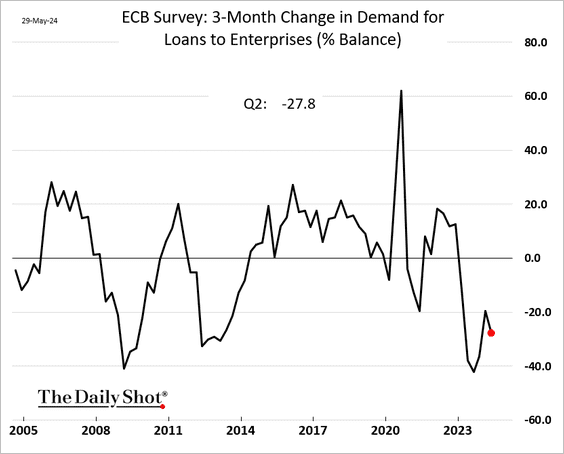

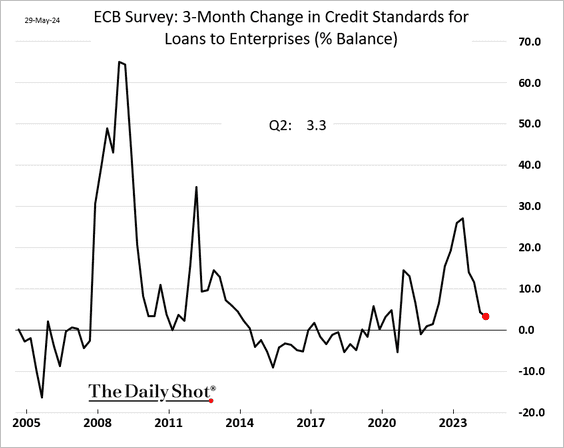

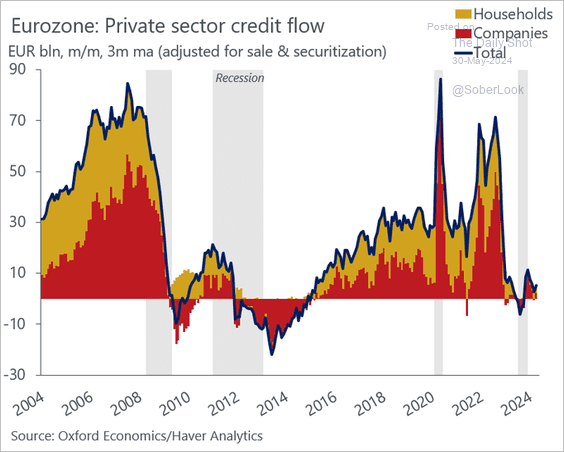

3. Next, we have some updates on euro-area credit trends.

• Loan growth remains depressed (2 charts).

• The broad money supply is starting to rebound.

• Demand for business loans has been soft.

– Fewer banks have been tightening credit standards.

• Aggregate credit extended to the non-financial sector has fallen significantly.

Source: Alpine Macro

Source: Alpine Macro

• This chart shows private sector credit flow.

Source: @DanielKral1, @OxfordEconomics

Source: @DanielKral1, @OxfordEconomics

Back to Index

Asia-Pacific

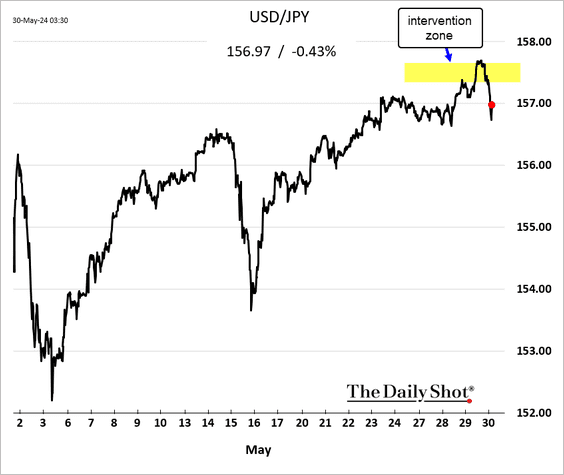

1. The yen bounced after reaching the lows seen during interventions.

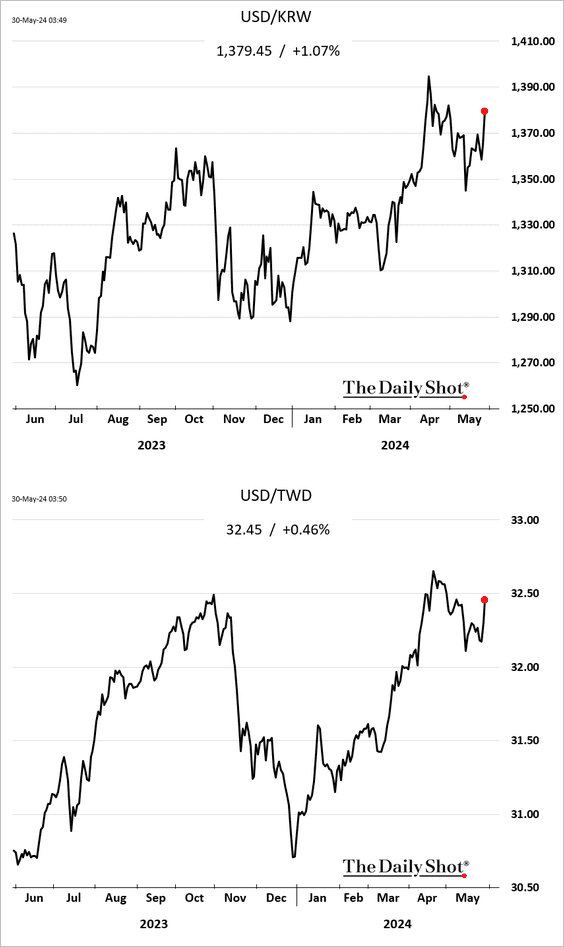

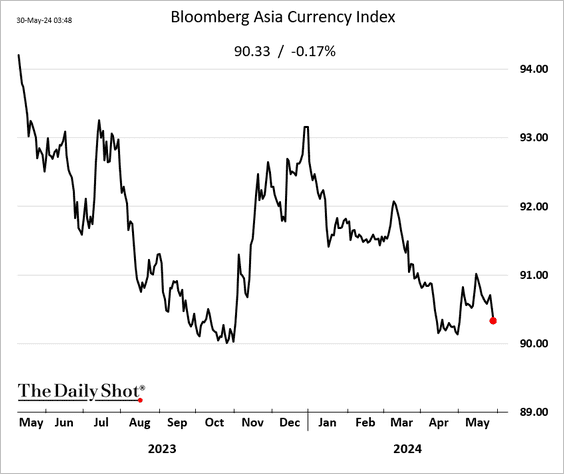

2. The South Korean won and the Taiwan dollar have been selling off as higher US yields propel the dollar.

——————–

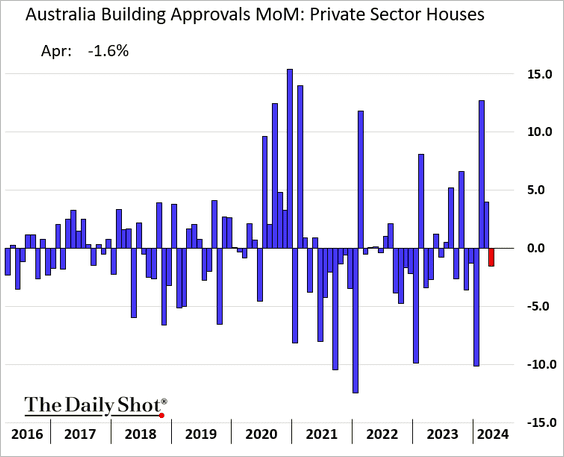

3. Australian building approvals declined in April.

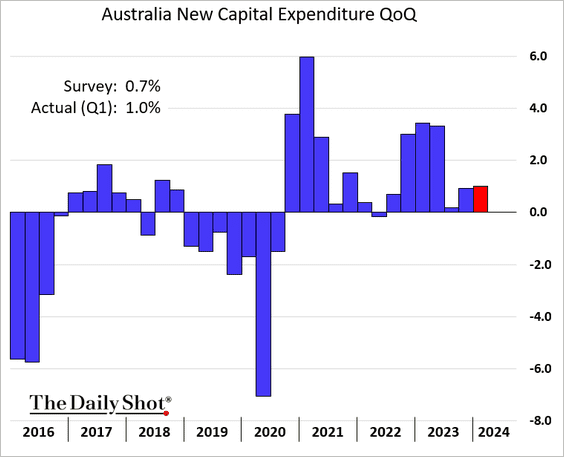

• CapEx has been up for seven quarters in a row.

Back to Index

China

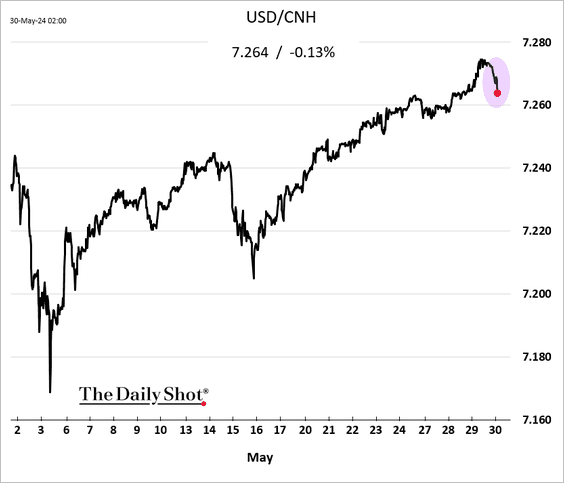

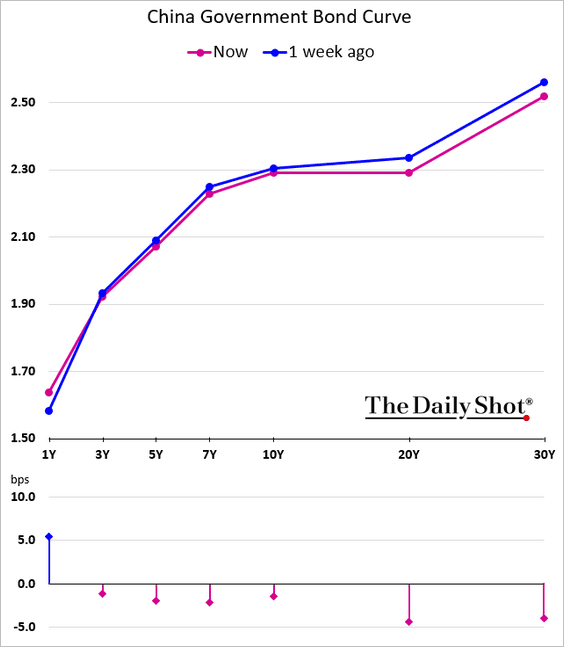

1. China’s currency strengthened today as Beijing aims to halt the decline.

Source: @markets Read full article

Source: @markets Read full article

——————–

2. The equity rally is fading.

Tech and property stocks listed in Hong Kong are relinquishing the gains made in the first half of May.

——————–

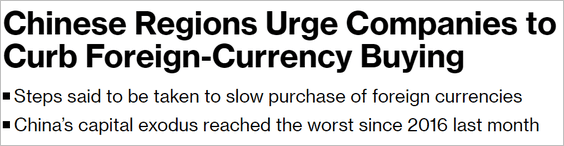

3. The yield curve has been flattening.

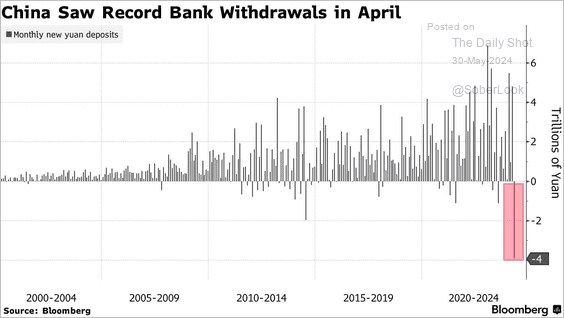

4. Last month, depositors withdrew a significant amount of capital from China’s banks.

Source: @markets Read full article

Source: @markets Read full article

Back to Index

Emerging Markets

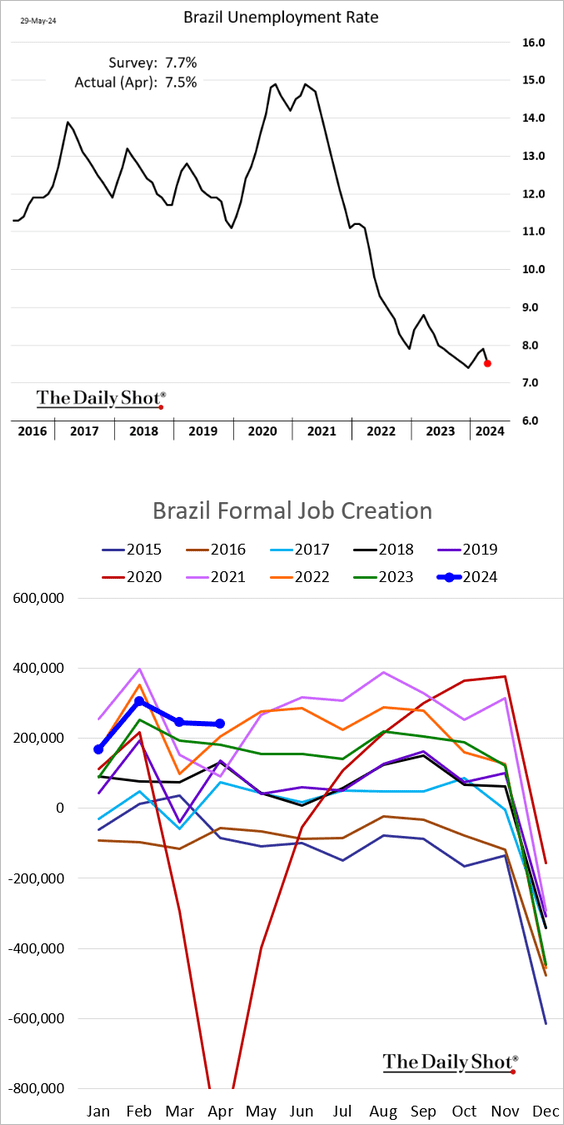

1. Brazil’s labor market remains robust.

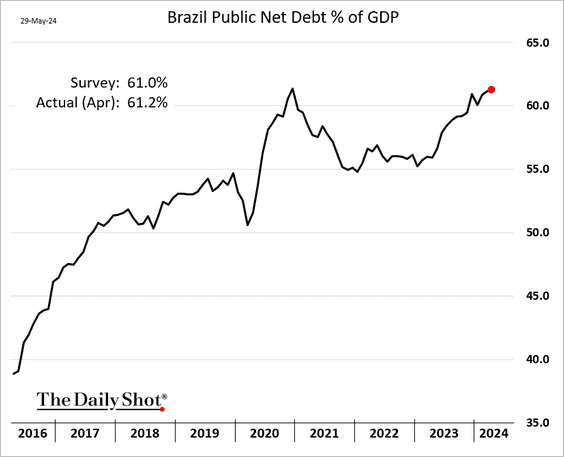

• The debt-to-GDP ratio continues to grind higher.

——————–

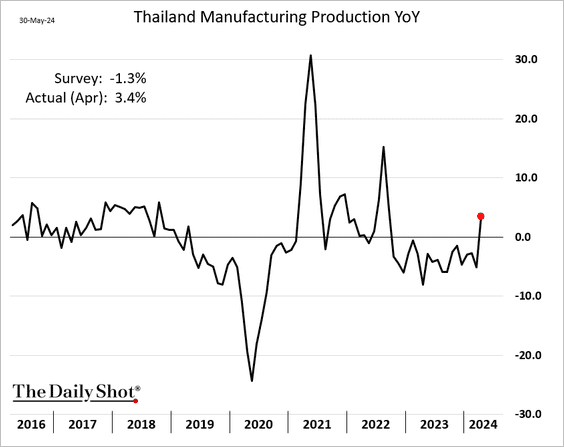

2. Thailand’s April factory output topped expectations.

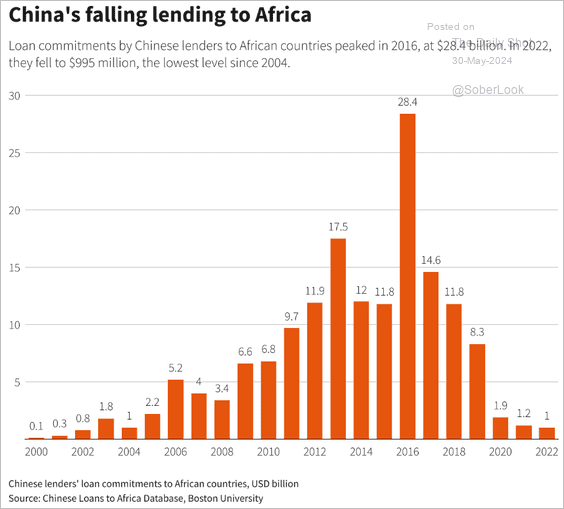

3. Here is a look at China’s lending to African nations.

Source: Reuters Read full article

Source: Reuters Read full article

Back to Index

Cryptocurrency

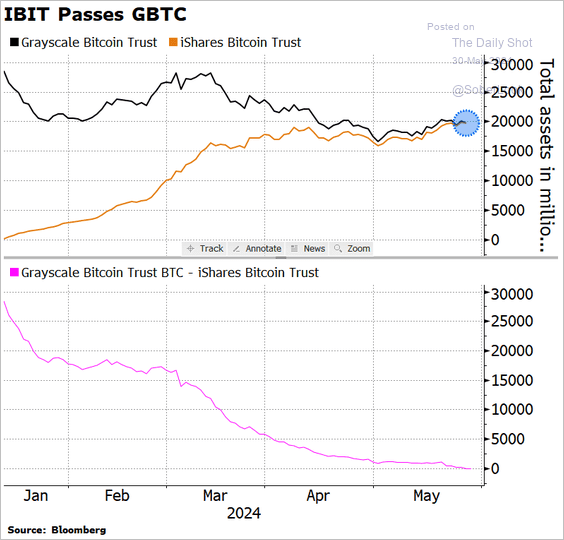

1. BlackRock is now home to the world’s largest bitcoin fund, overtaking Grayscale.

Source: @kgeifeld

Source: @kgeifeld

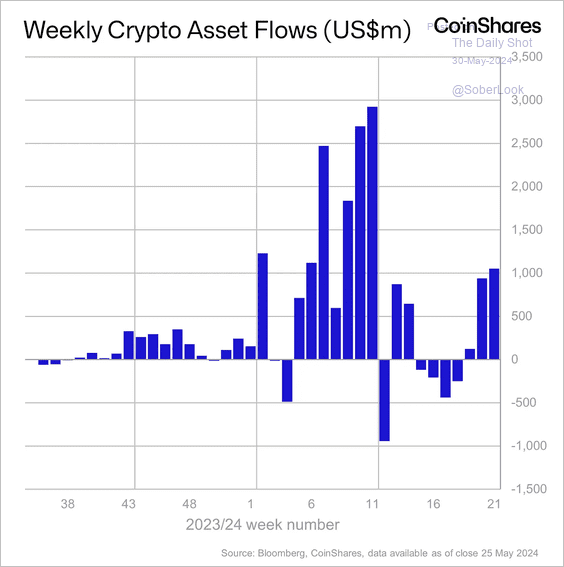

2. Crypto funds saw inflows for the third consecutive week.

Source: CoinShares Read full article

Source: CoinShares Read full article

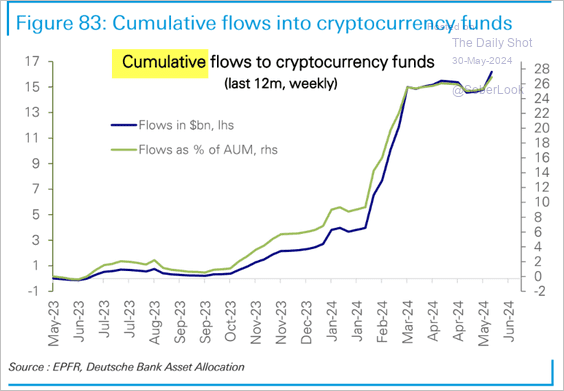

• Here are the cumulative flows.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

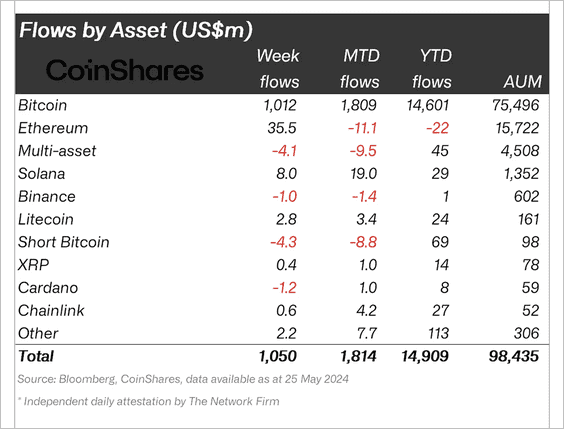

• Bitcoin-focused funds accounted for most inflows last week. Ethereum-focused funds also saw fresh inflows on ETF hopes.

Source: CoinShares Read full article

Source: CoinShares Read full article

Back to Index

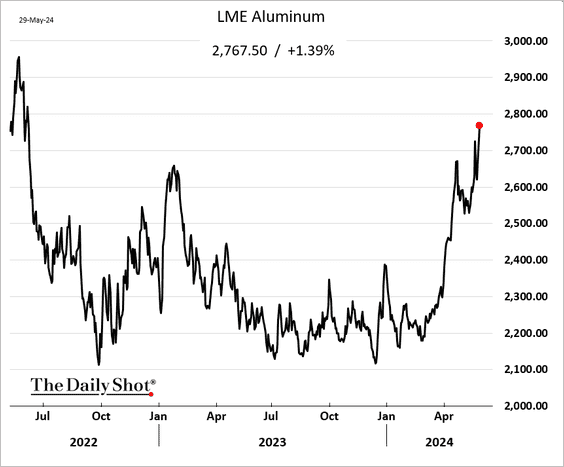

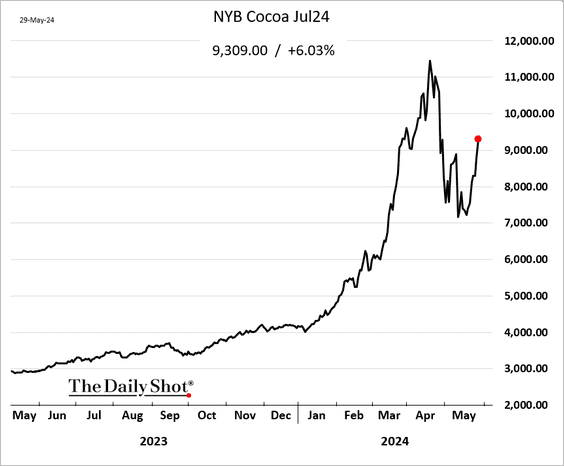

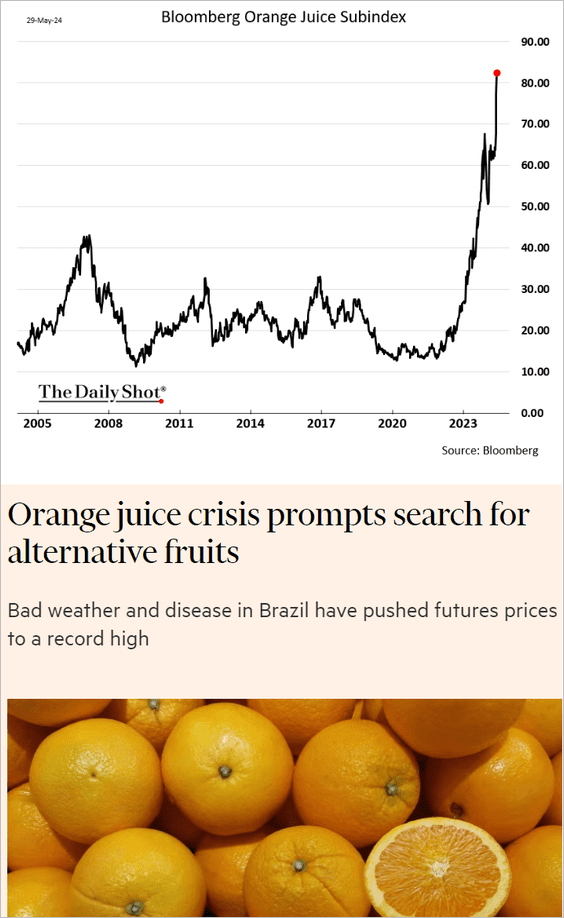

Commodities

1. Aluminum prices are climbing.

2. Cocoa futures are experiencing another surge as sparse rainfall in West Africa threatens the output for the upcoming season.

3. Alternative fruits?

Source: @financialtimes Read full article

Source: @financialtimes Read full article

Back to Index

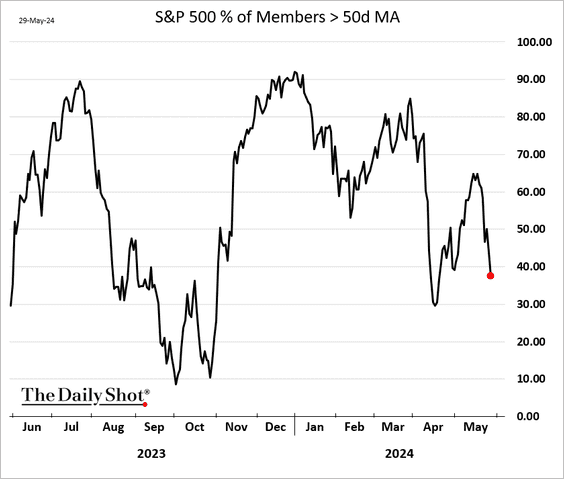

Equities

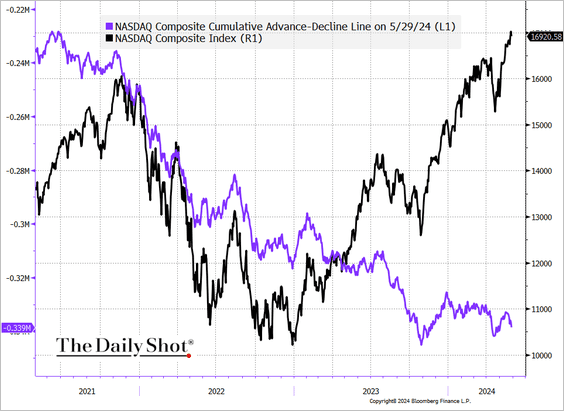

1. Market breadth has been deteriorating.

Here is the Nasdaq advance/decline line.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

——————–

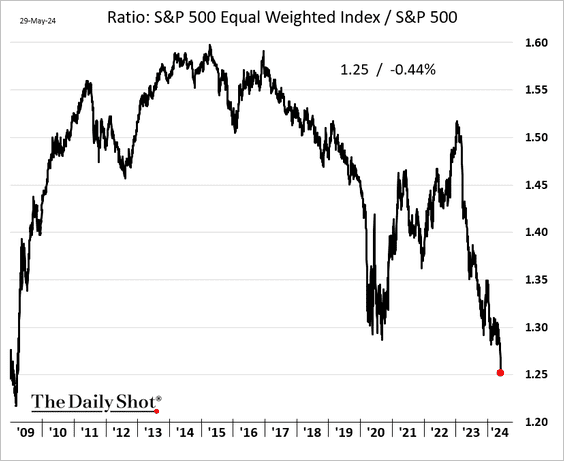

2. The S&P 500 equal-weight index has reached its lowest level relative to the S&P 500 since 2009.

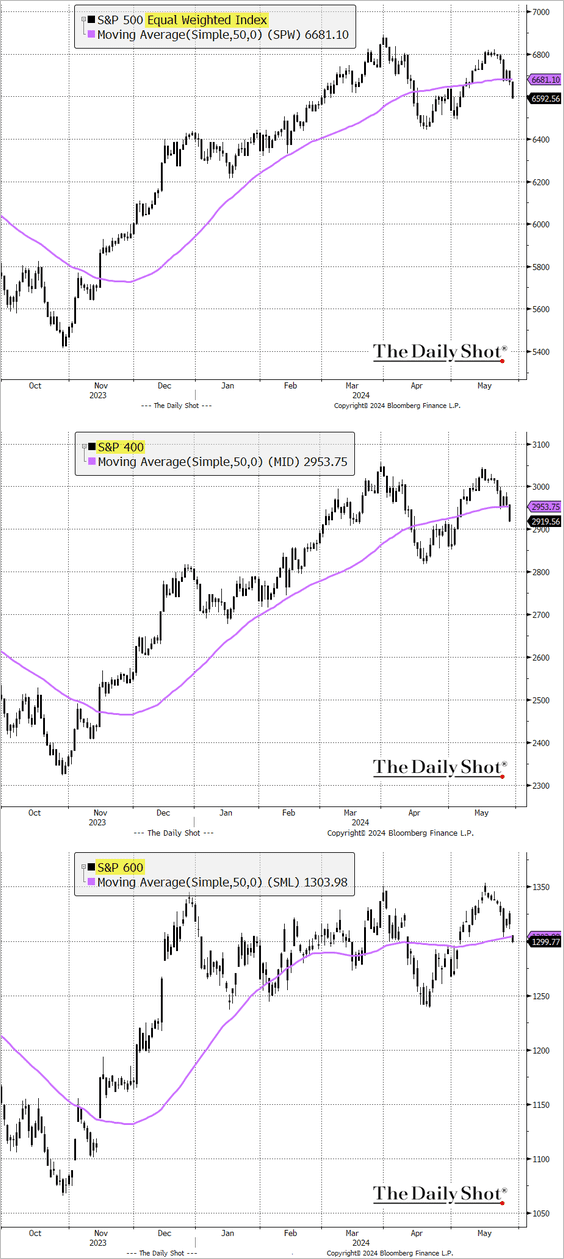

3. Major indices, excluding those driven by tech megacaps, have now fallen below their 50-day moving averages.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

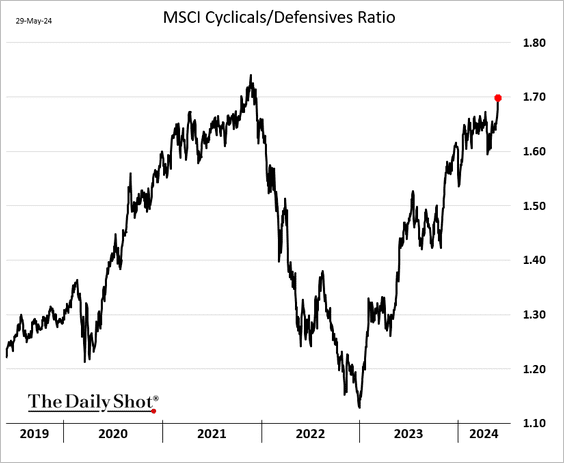

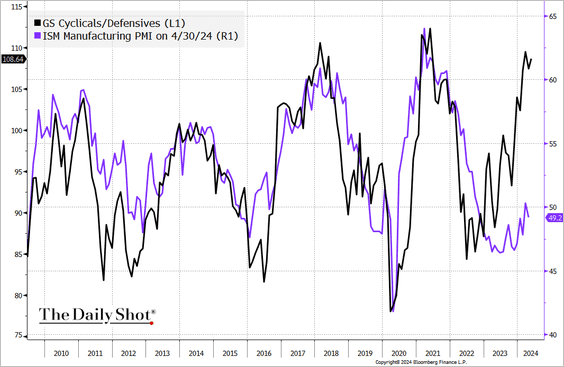

4. Cyclicals continue to outperform defensives, …

… suggesting confidence in economic growth. Too much optimism?

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

——————–

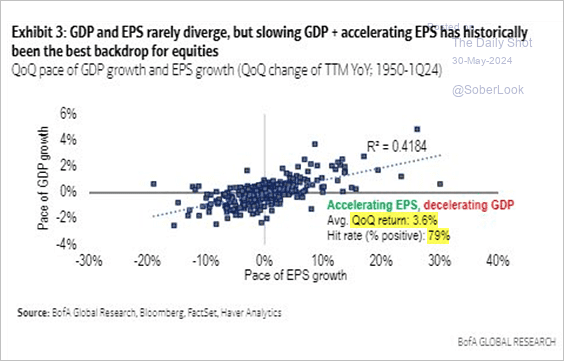

5. Accelerating earnings growth combined with slower GDP expansion typically creates a favorable environment for stocks.

Source: BofA Global Research; @carlquintanilla

Source: BofA Global Research; @carlquintanilla

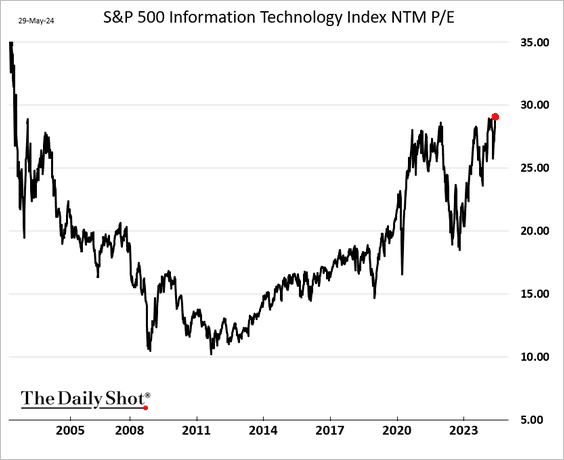

6. Tech stocks are trading at the highest multiple since the dot-com era.

7. Hedge funds have been bullish on semiconductors.

![]() Source: Goldman Sachs; @WallStJesus

Source: Goldman Sachs; @WallStJesus

• The SOX index could not breach the March peak relative to the S&P 500.

![]()

——————–

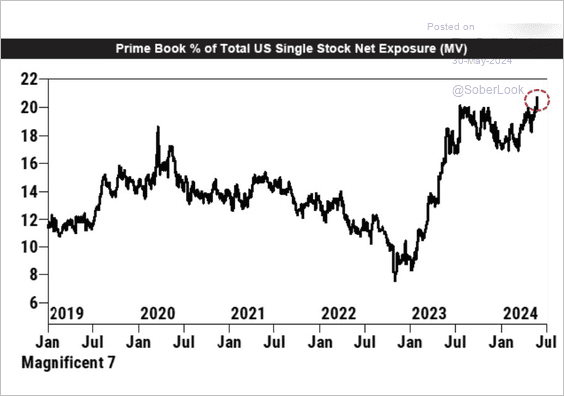

8. Hedge funds love the Magnificent 7 stocks.

Source: Goldman Sachs; @carlquintanilla

Source: Goldman Sachs; @carlquintanilla

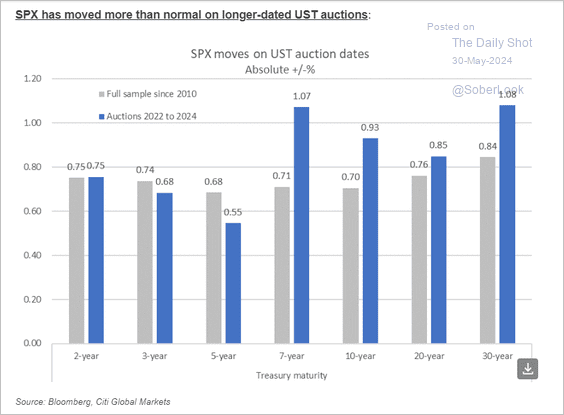

9. Stocks have been more sensitive to Treasury auctions.

Source: @GunjanJS

Source: @GunjanJS

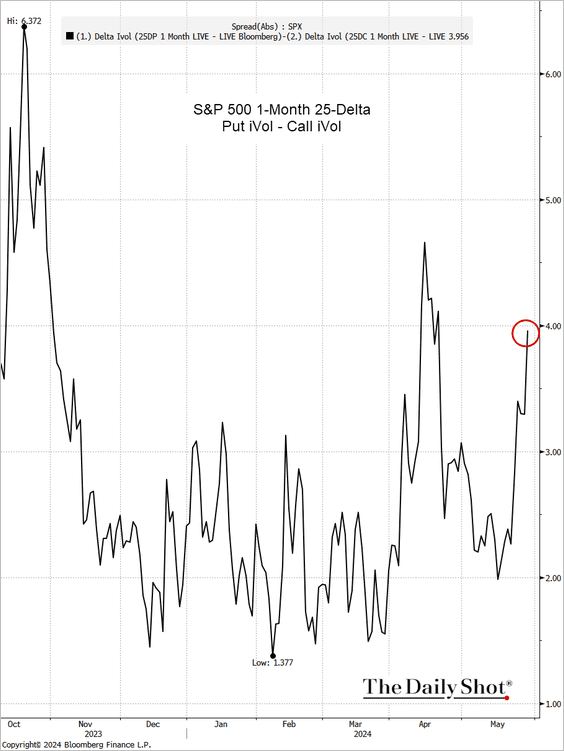

10. The S&P 500 volatility skew has been rising with Treasury yields.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

Back to Index

Credit

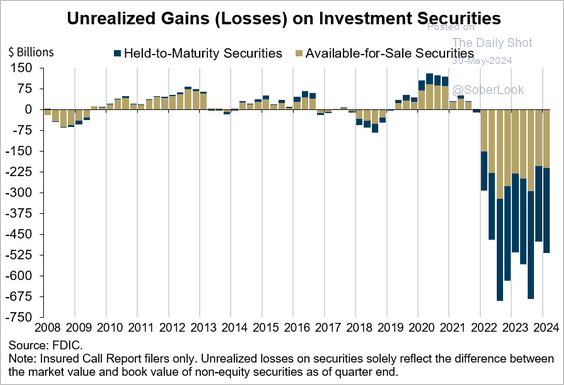

1. US banks continue to carry substantial unrealized mark-to-market losses on their bond holdings.

Source: FDIC

Source: FDIC

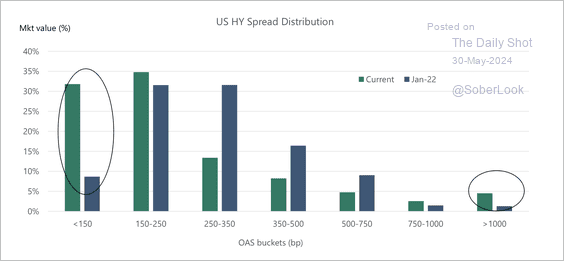

2. There is a high amount of spread dispersion within high-yield debt.

Source: Torsten Slok, Apollo

Source: Torsten Slok, Apollo

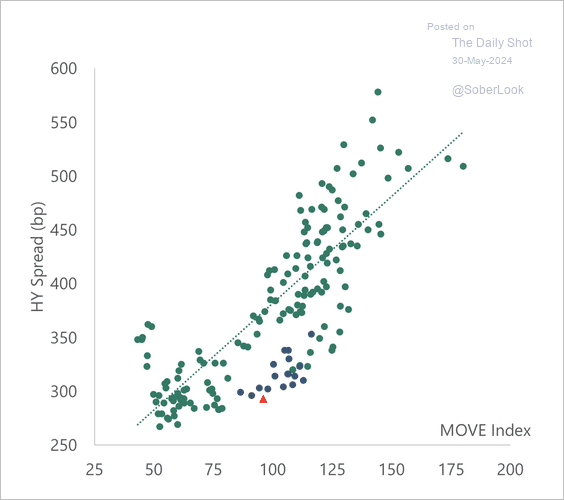

3. The pickup in interest rate volatility could weigh on credit spreads in the near term.

Source: Torsten Slok, Apollo

Source: Torsten Slok, Apollo

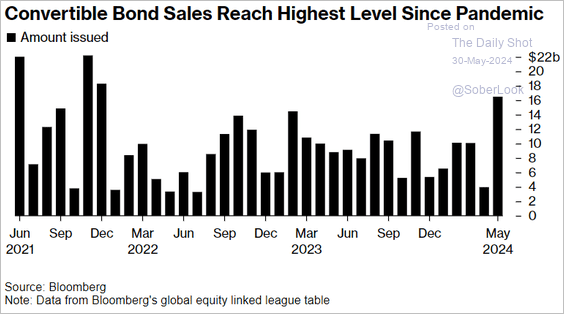

4. Convertibles sales have surged in recent weeks.

Source: @markets Read full article

Source: @markets Read full article

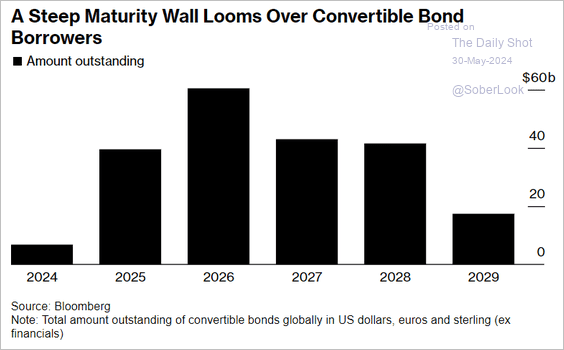

Here is the maturity wall.

Source: @markets Read full article

Source: @markets Read full article

Back to Index

Global Developments

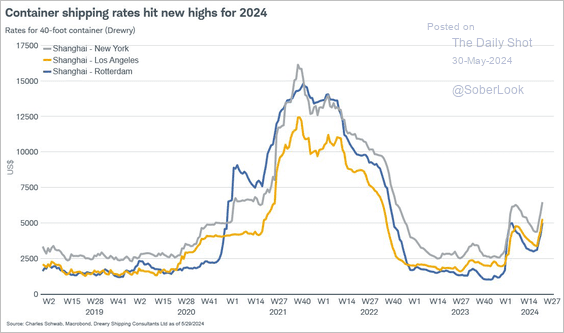

1. Container shipping costs are rising.

Source: @JeffreyKleintop

Source: @JeffreyKleintop

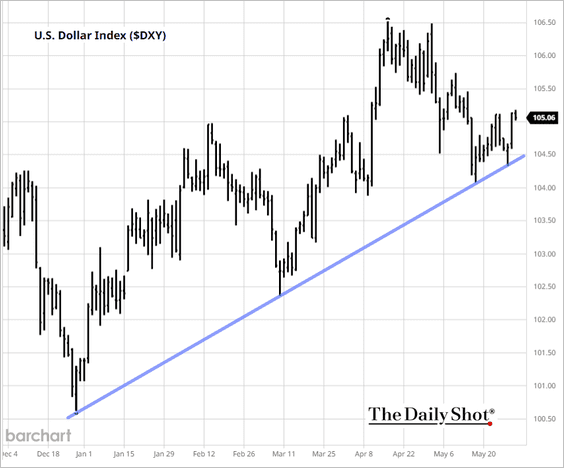

2. The US dollar index (DXY) has been holding the short-term uptrend support.

——————–

Food for Thought

1. Unemployment benefits in OECD countries:

Source: The Economist Read full article

Source: The Economist Read full article

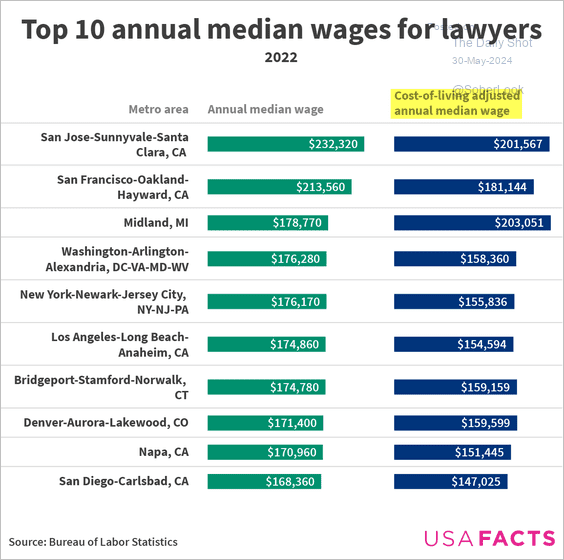

2. Top ten annual median wages for US lawyers:

Source: USAFacts

Source: USAFacts

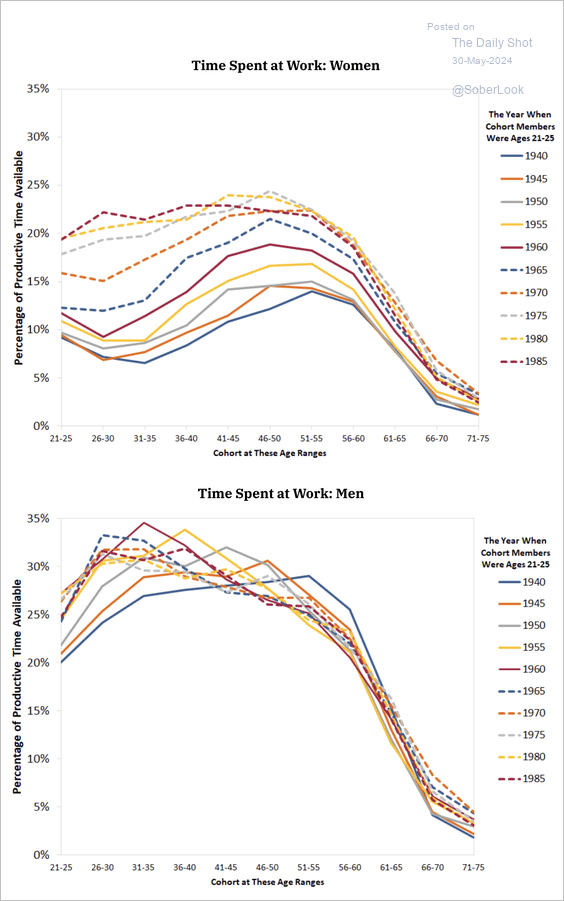

3. Time spent at work by age cohorts for women and men:

Source: Federal Reserve Bank of St. Louis Read full article

Source: Federal Reserve Bank of St. Louis Read full article

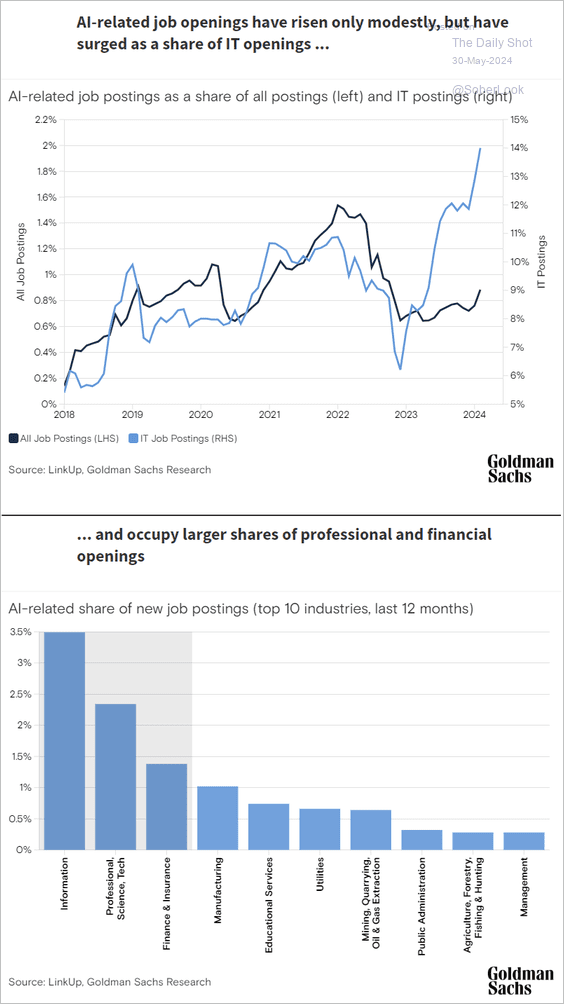

4. AI-related job openings:

Source: Goldman Sachs

Source: Goldman Sachs

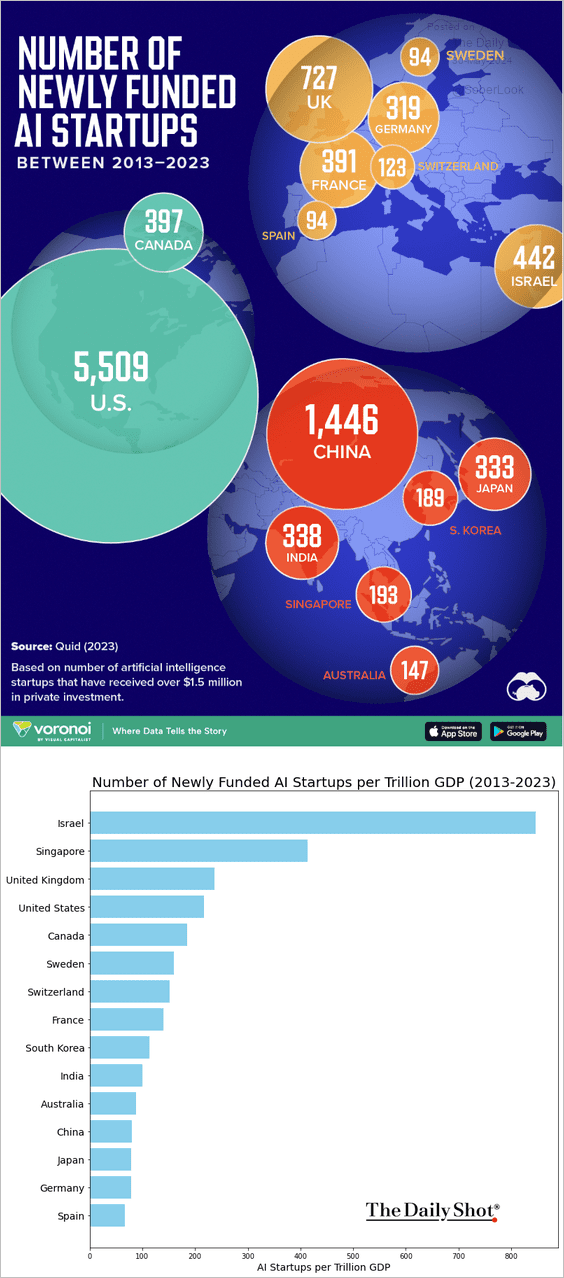

5. Newly funded AI startups (the second panel shows the same data adjusted for GDP):

Source: Visual Capitalist Read full article

Source: Visual Capitalist Read full article

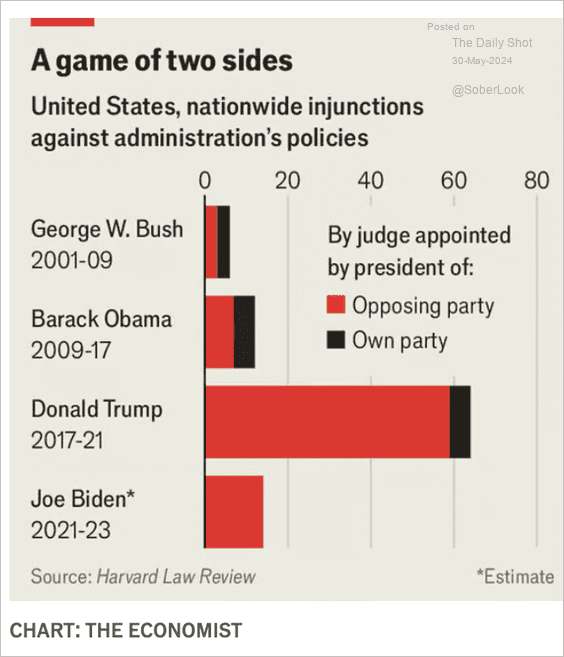

6. Nationwide injunctions against US administration policies by presidential term:

Source: The Economist Read full article

Source: The Economist Read full article

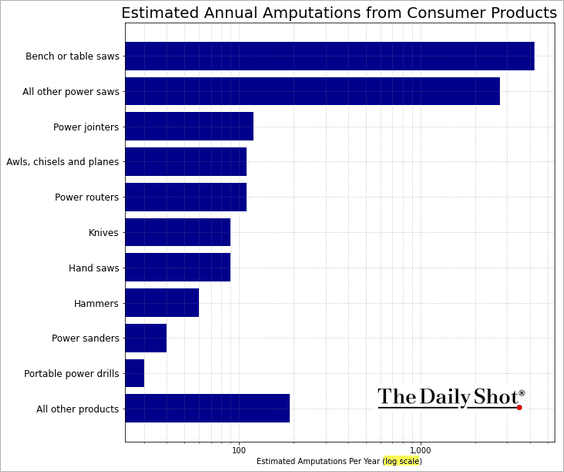

7. Amputations from consumer products:

Source: The New York Times Read full article

Source: The New York Times Read full article

——————–

Back to Index