The Daily Shot: 31-May-24

• The United States

• Canada

• The United Kingdom

• The Eurozone

• Europe

• Japan

• Asia-Pacific

• China

• Emerging Markets

• Cryptocurrency

• Commodities

• Energy

• Equities

• Rates

• Global Developments

• Food for Thought

The United States

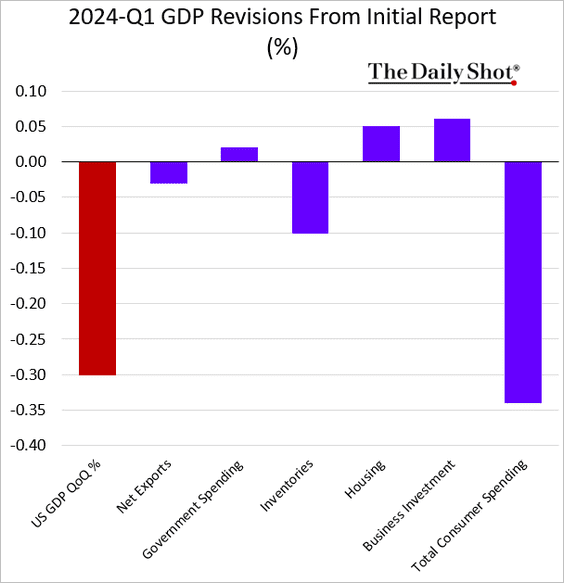

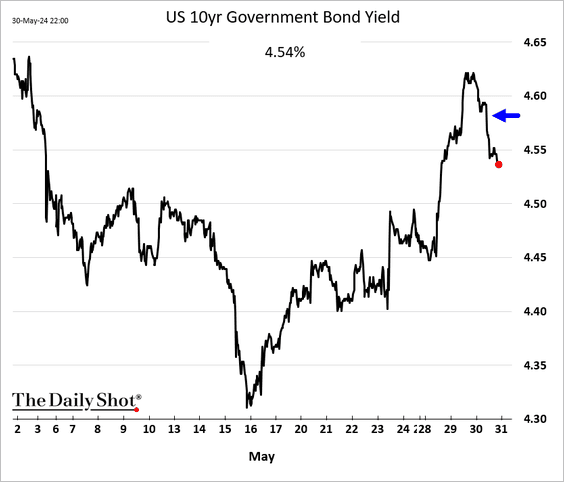

1. The Q1 GDP growth was revised downward, primarily due to softer consumer spending, …

Source: @economics Read full article

Source: @economics Read full article

… especially in goods.

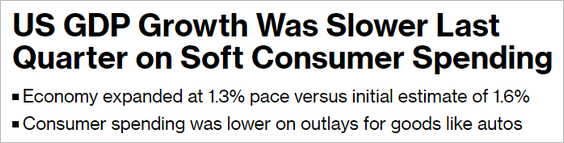

Here are the updated GDP growth contributions.

• US real final sales to private domestic purchasers, sometimes referred to as “core GDP,” remain robust.

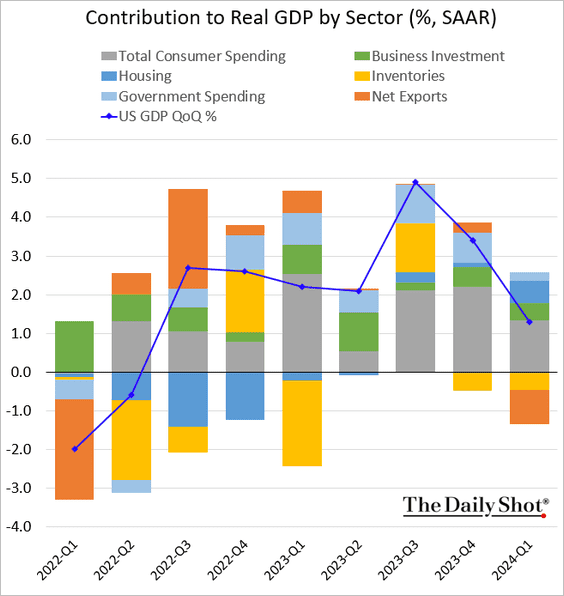

• Treasury yields declined in response to the GDP revision.

——————–

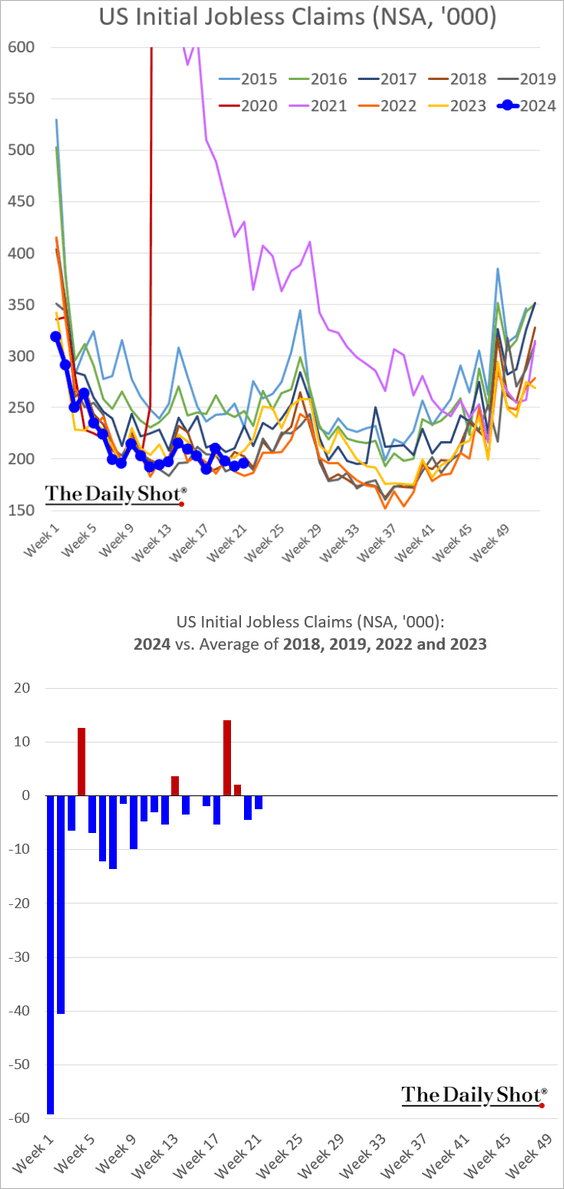

2. Below are some updates on the labor market.

• Initial jobless claims continue to signal labor market strength.

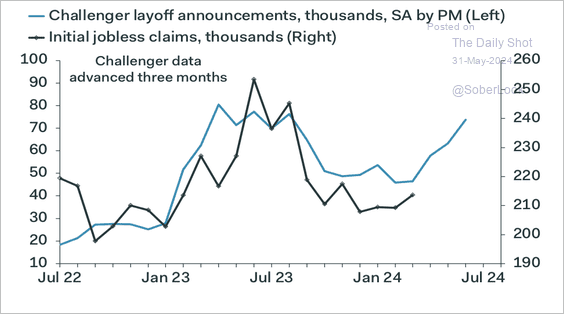

However, rising layoff announcements point to higher unemployment claims ahead.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

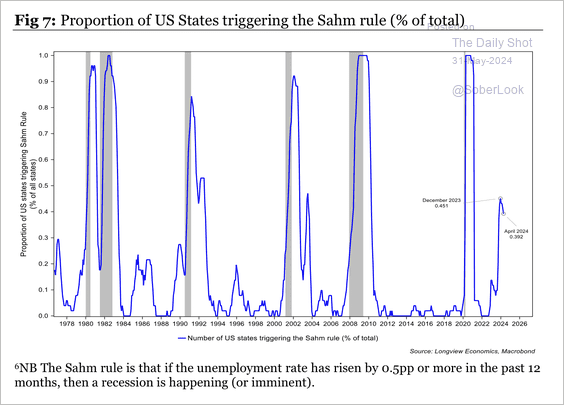

• More states are experiencing deteriorating labor market conditions, which is typically consistent with a recession.

Source: Longview Economics

Source: Longview Economics

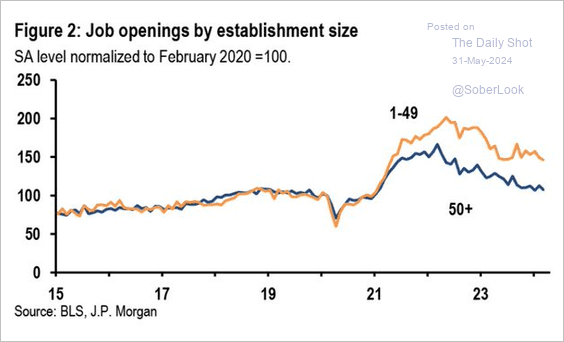

• This chart shows job openings by company size.

Source: JP Morgan Research; @carlquintanilla

Source: JP Morgan Research; @carlquintanilla

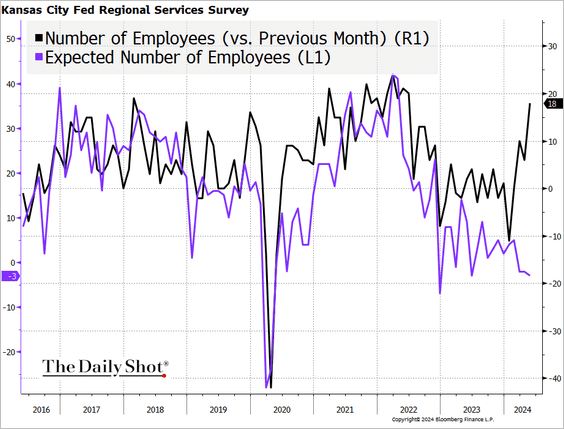

• The Kansas City Fed reports diverging trends in regional services employment: while current hiring has strengthened, businesses remain pessimistic about future hiring prospects.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

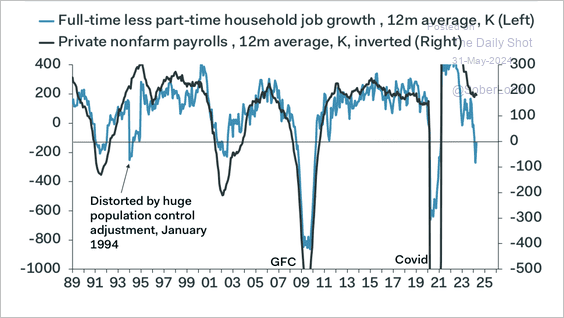

• Full-time employment has been declining relative to part-time employment.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

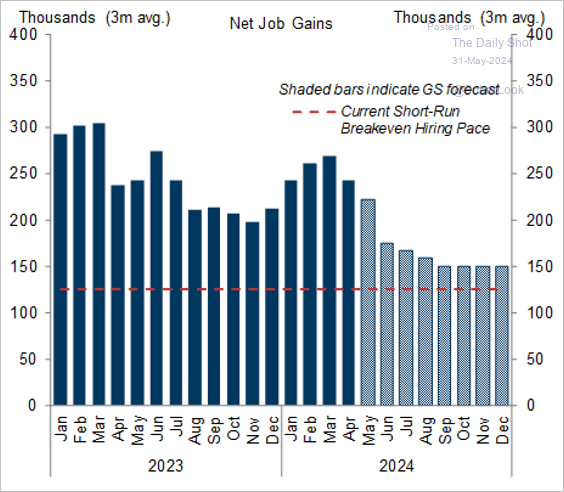

• Here is Goldman’s projection for job growth.

Source: Goldman Sachs; @MikeZaccardi

Source: Goldman Sachs; @MikeZaccardi

• Non-residential construction employment growth remains robust despite the slowdown in housing starts.

Source: PGM Global

Source: PGM Global

——————–

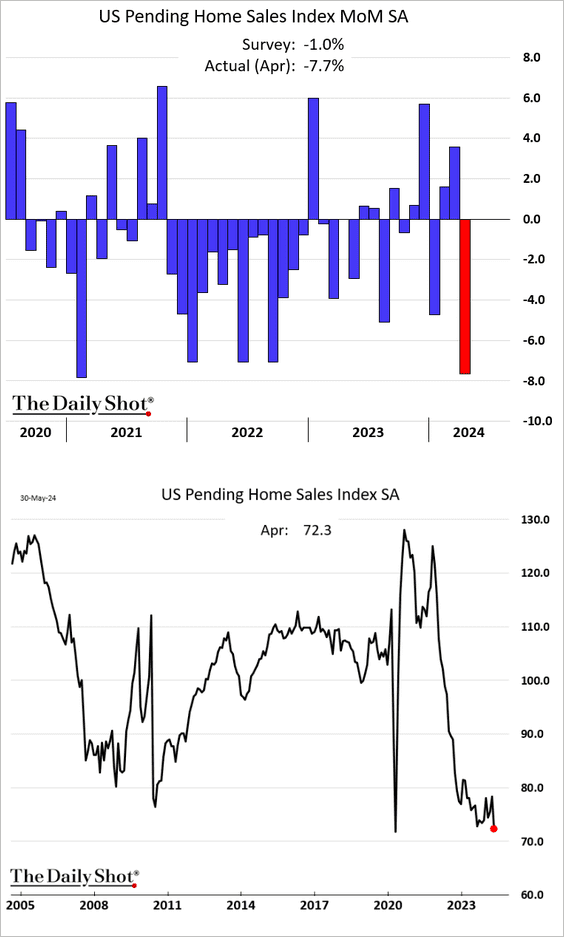

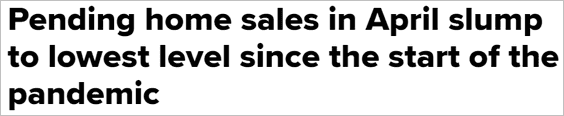

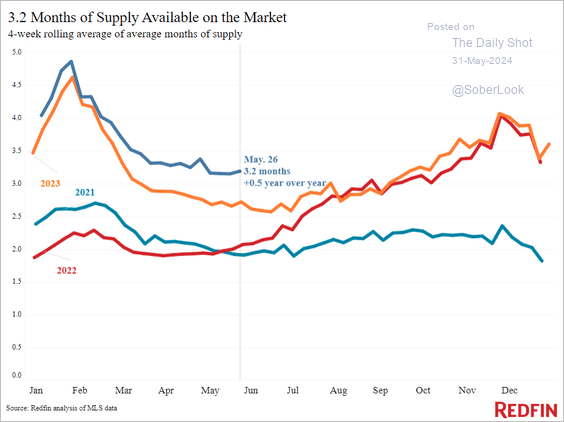

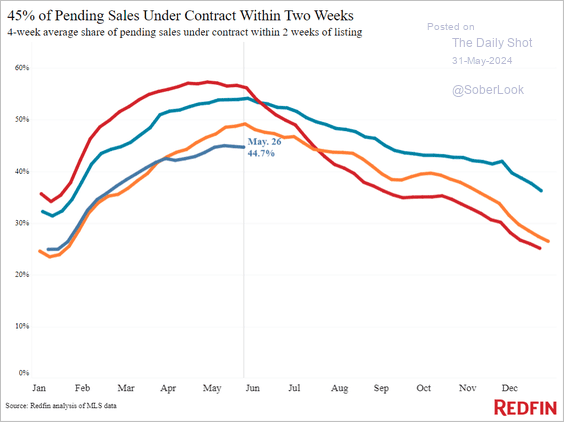

3. Next, we have some updates on the housing market.

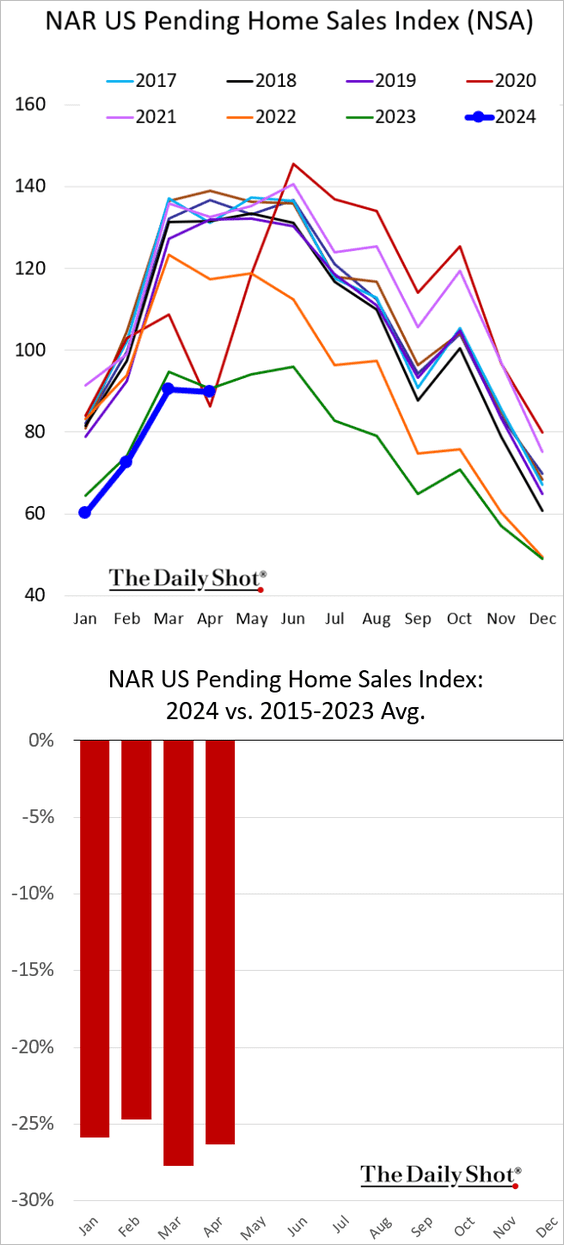

• Pending home sales remained soft last month.

– Home sales registered their biggest decline since early 2021 on a seasonally adjusted basis.

Source: CNBC Read full article

Source: CNBC Read full article

• Housing inventories have risen (2 charts).

Source: Redfin

Source: Redfin

Source: Redfin

Source: Redfin

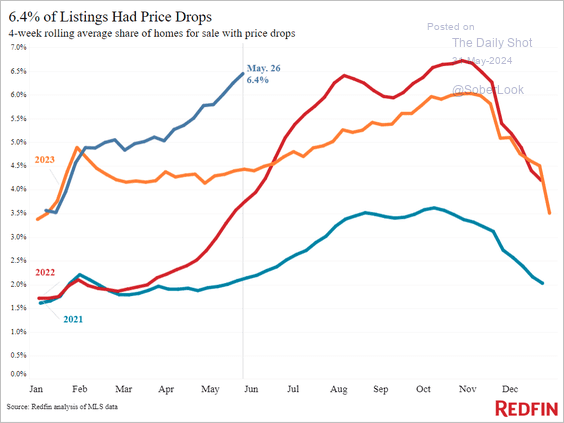

• A higher proportion of sellers have been forced to drop prices, …

Source: Redfin

Source: Redfin

… as homes take longer to sell.

Source: Redfin

Source: Redfin

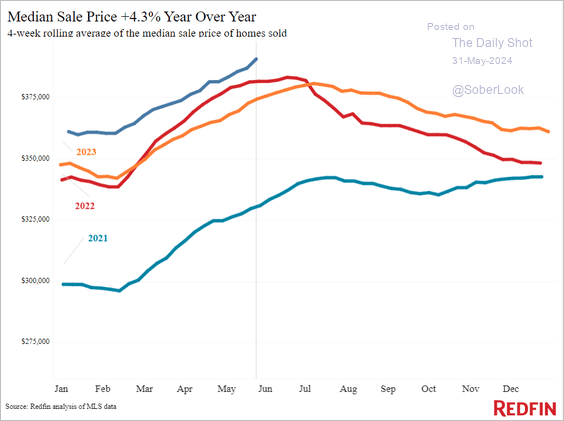

But sale prices remain well above last year’s levels.

Source: Redfin

Source: Redfin

• Redfin’s homebuyer demand index has weakened.

Source: Redfin

Source: Redfin

——————–

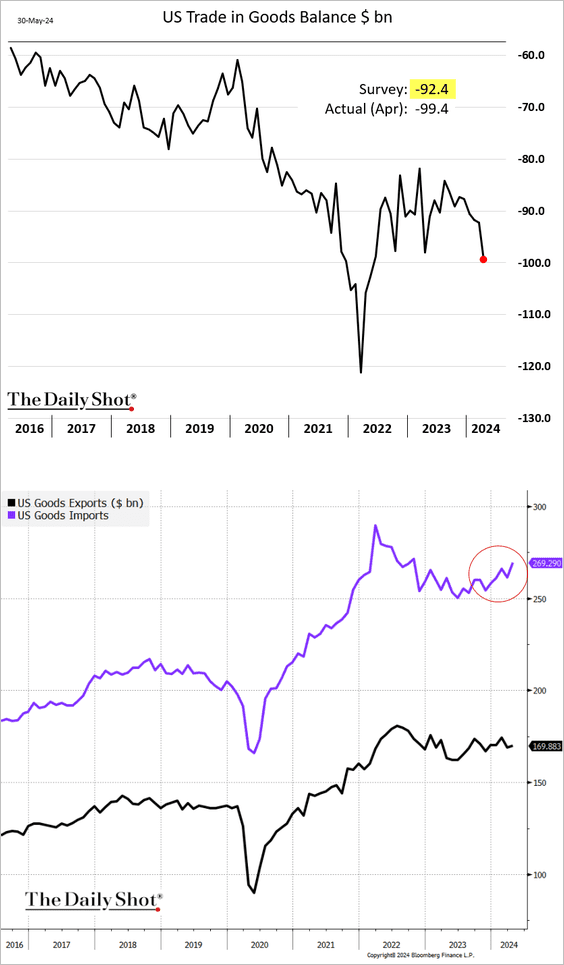

4. The US trade deficit in goods widened sharply last month as imports surged.

Back to Index

Canada

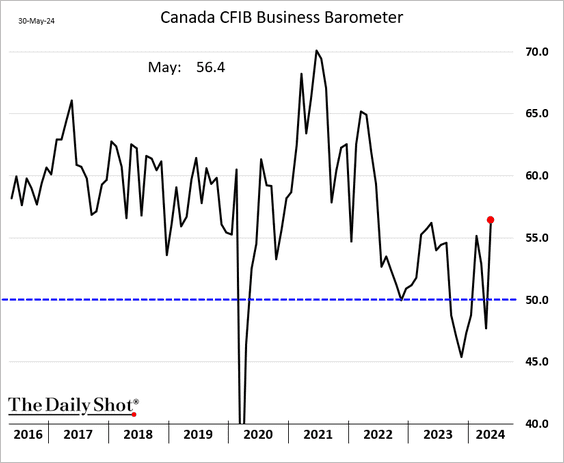

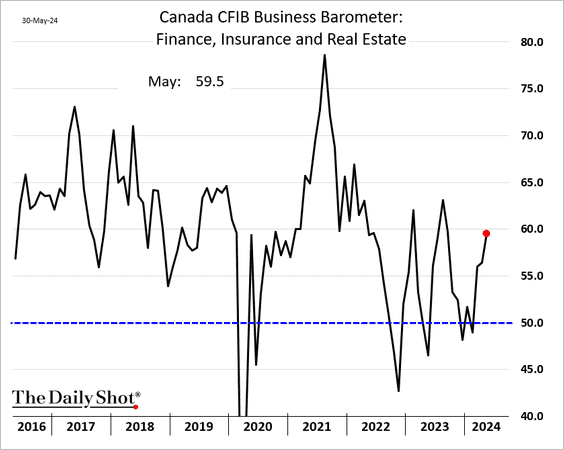

1. The CFIB index of medium-sized and small companies’ sentiment returned to growth in May.

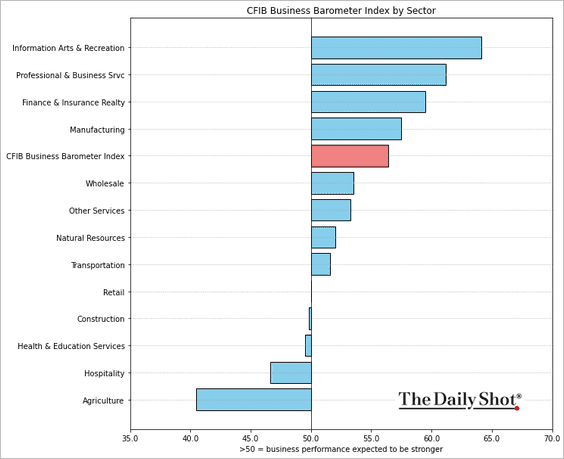

Here is the CFIB index by sector.

——————–

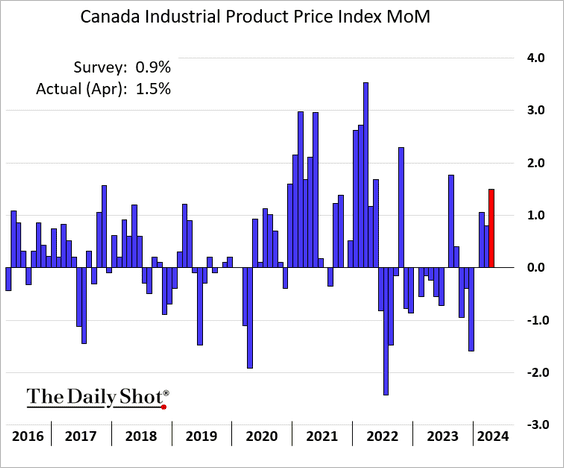

2. Industrial producer prices jumped more than expected in April.

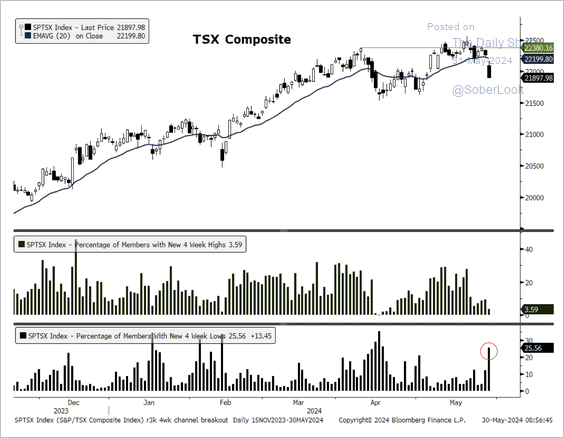

3. There has been an uptick in new four-week lows within the TSX Composite, reflecting weak short-term breadth.

Source: Aazan Habib, Paradigm Capital

Source: Aazan Habib, Paradigm Capital

Back to Index

The United Kingdom

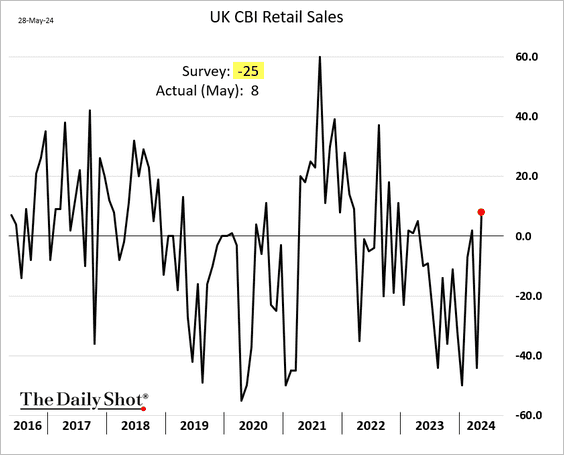

1. According to the CBI, UK retail sales unexpectedly rebounded in May.

Source: The Guardian Read full article

Source: The Guardian Read full article

Outlook improved.

——————–

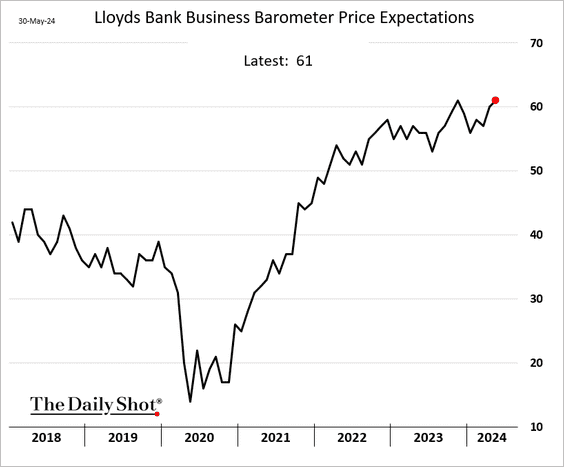

2. The Lloyds Bank Business Barometer surged in May.

More firms plan to boost prices.

Back to Index

The Eurozone

1. The euro-area unemployment rate hit a record low in April.

Source: @WSJ Read full article

Source: @WSJ Read full article

Here is Italy’s unemployment rate.

——————–

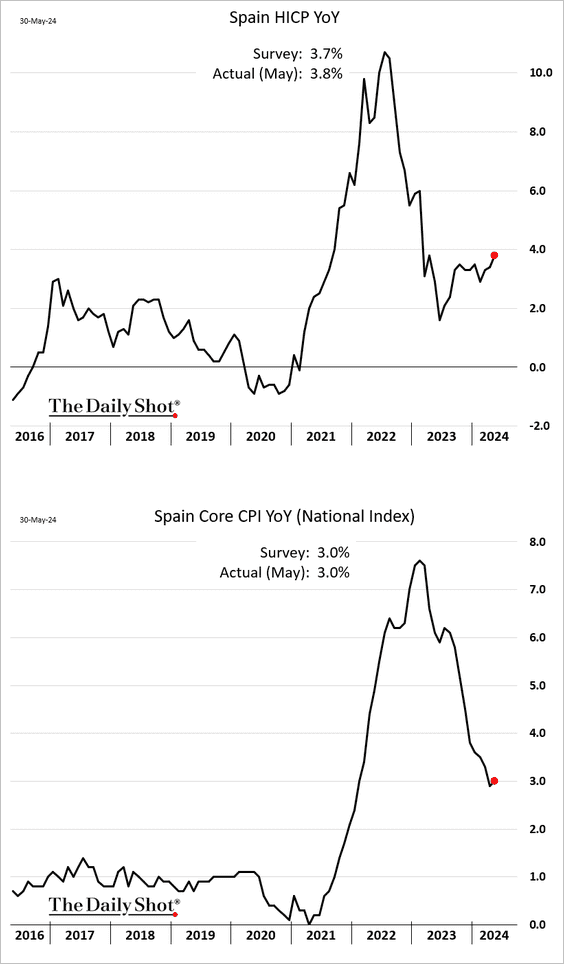

2. Spain’s CPI increased in May.

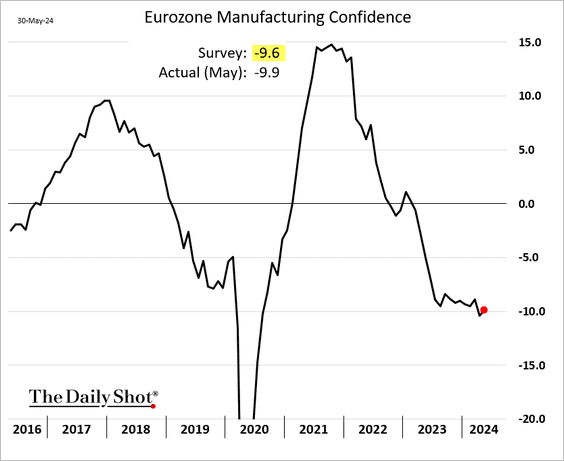

3. Euro-area manufacturing confidence edged higher but was below forecasts.

Services confidence also inched up.

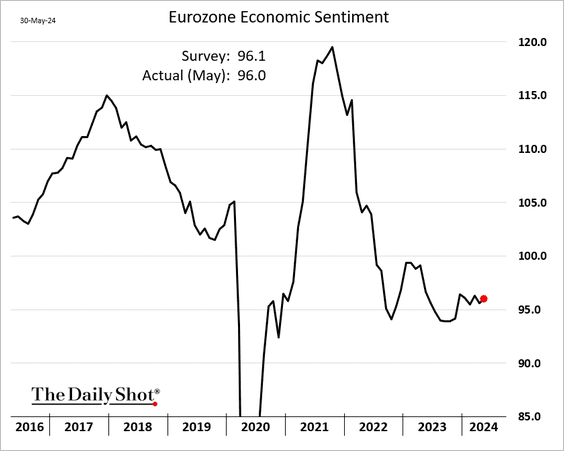

Here is the economic sentiment index, which includes consumer confidence.

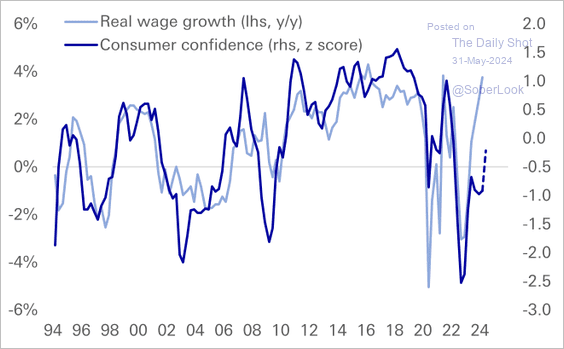

• German consumer confidence is starting to catch up to the rise in real wage growth.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

Back to Index

Europe

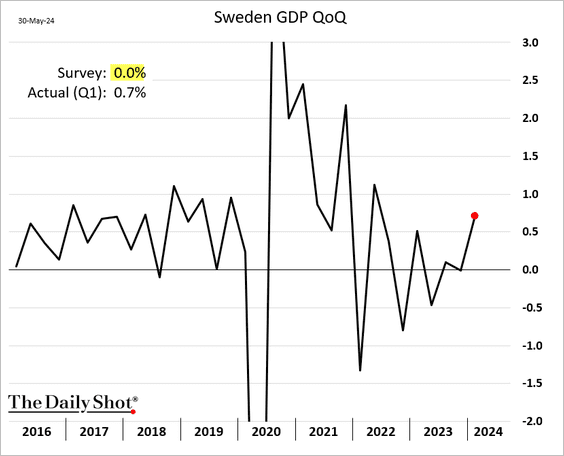

1. Sweden’s Q1 GDP growth topped expectations.

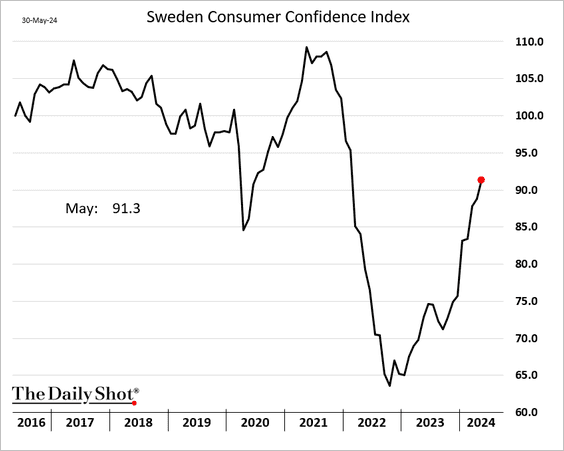

• Consumer confidence continues to climb, …

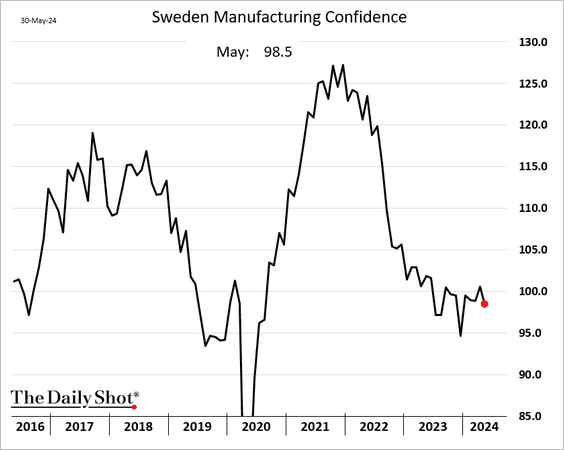

… but manufacturing sentiment dropped in May.

——————–

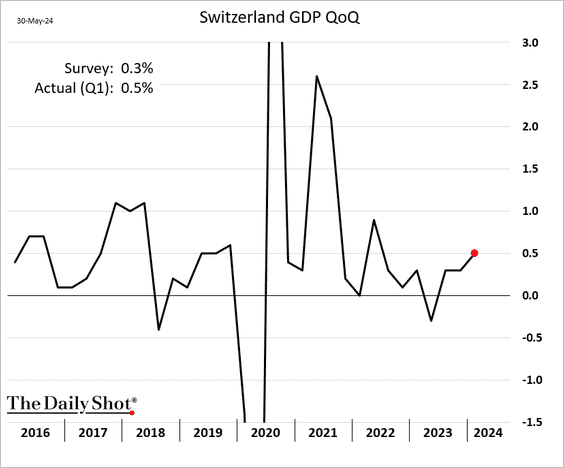

2. Swiss GDP growth was also stronger than expected.

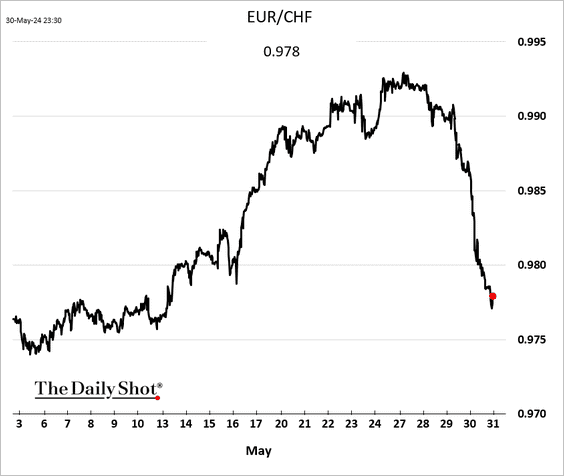

The Swiss franc strengthened this week.

——————–

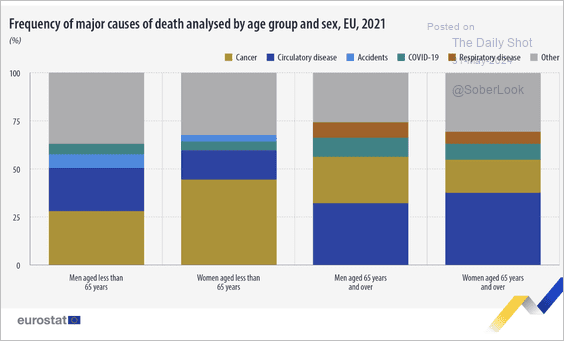

3. Here is a look at major causes of death by age group and sex in the EU.

Source: Eurostat Read full article

Source: Eurostat Read full article

Back to Index

Japan

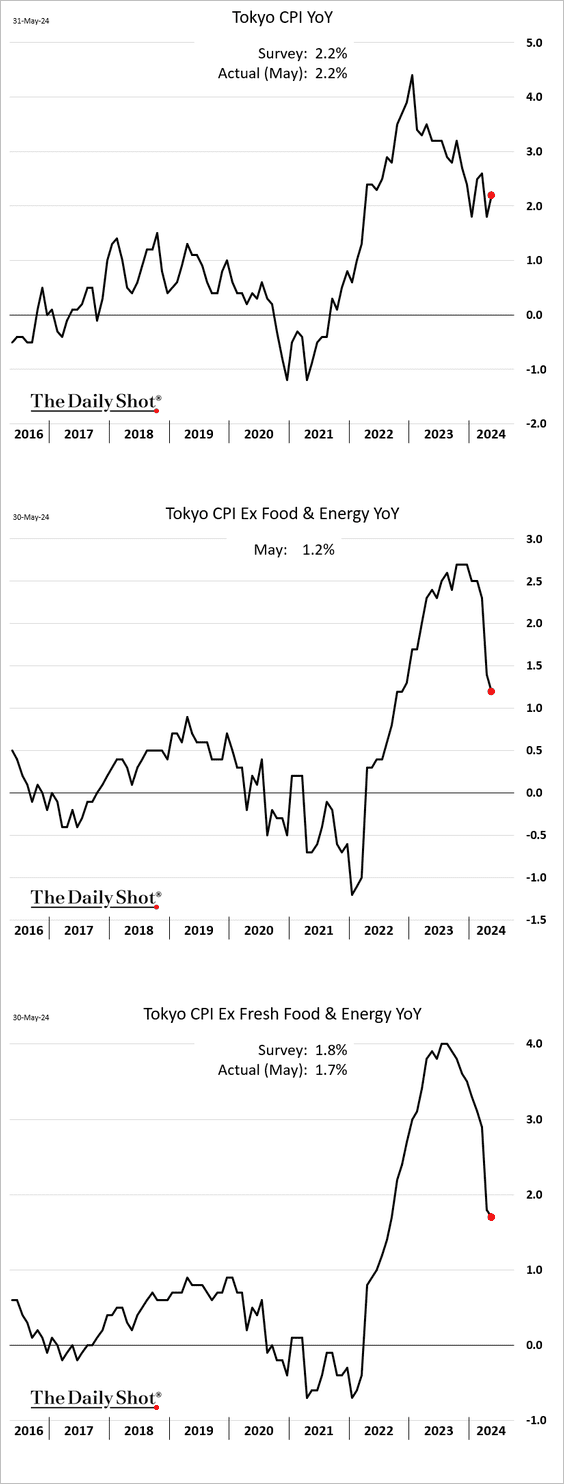

1. The Tokyo CPI increased in May, but core inflation continues to moderate.

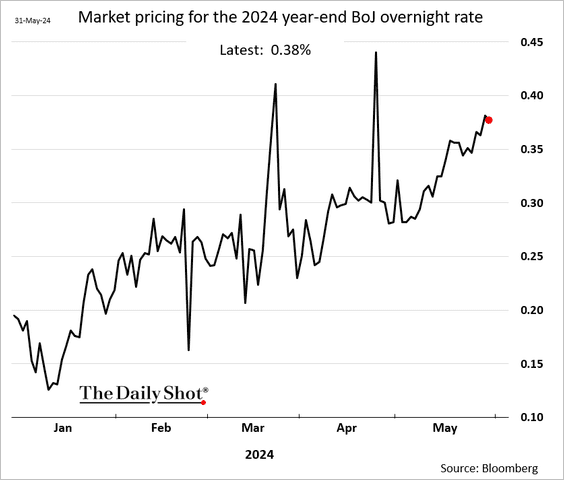

2. The market is pricing in about three 10 bps rate hikes this year (the current BoJ rate is 10 bps).

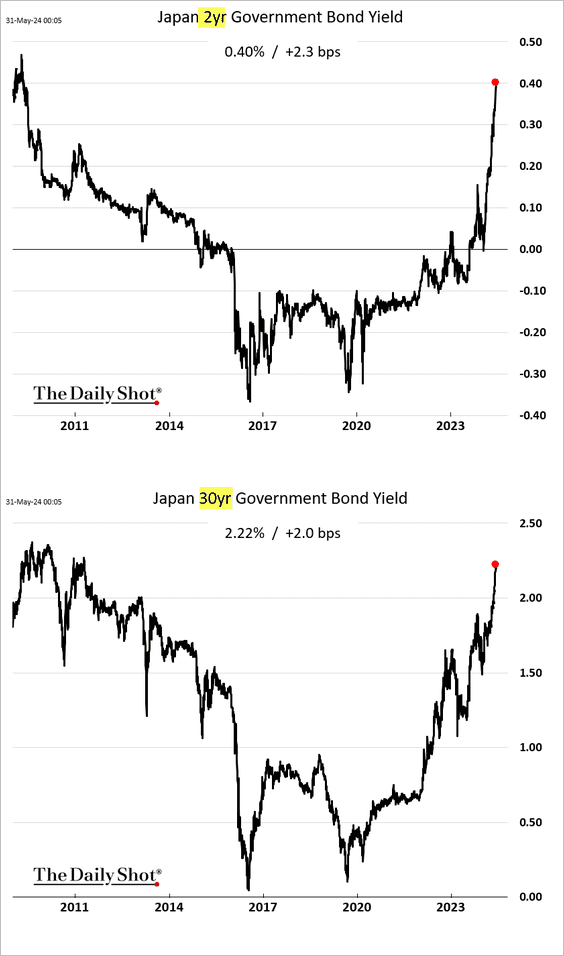

• JGB yields continue to surge.

——————–

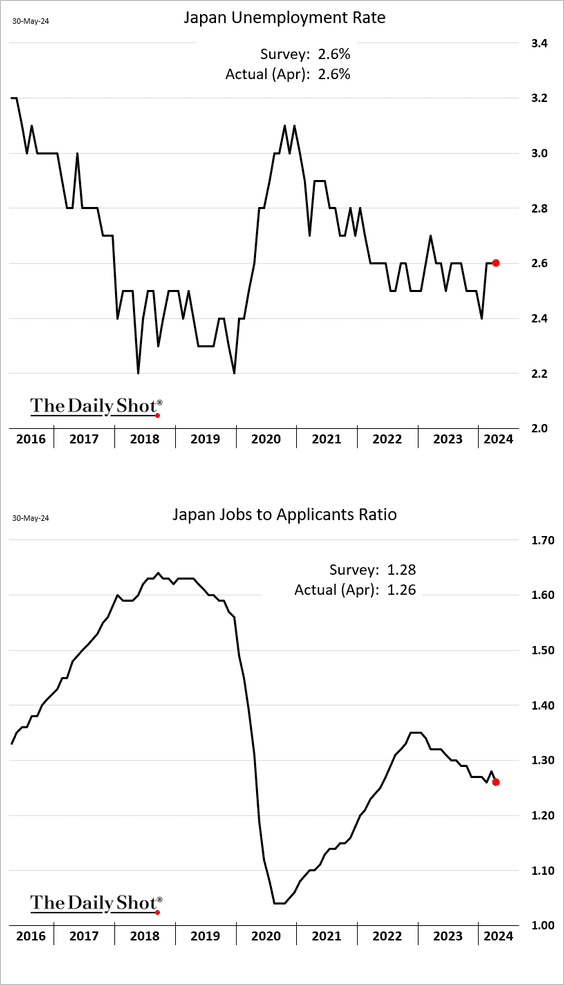

3. The unemployment rate held steady in April, but the jobs-to-applicants ratio continues to trend lower.

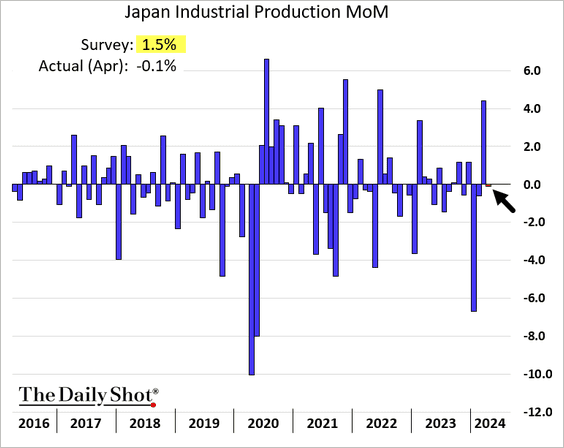

4. Industrial production unexpectedly declined in April, …

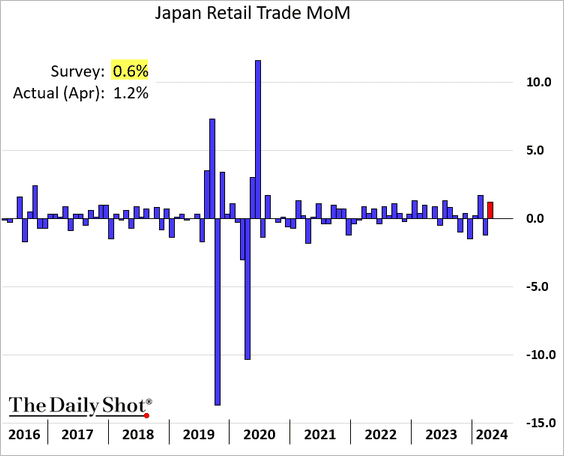

… but retail sales topped forecasts.

Back to Index

Asia-Pacific

1. South Korea’s industrial production strengthened in April.

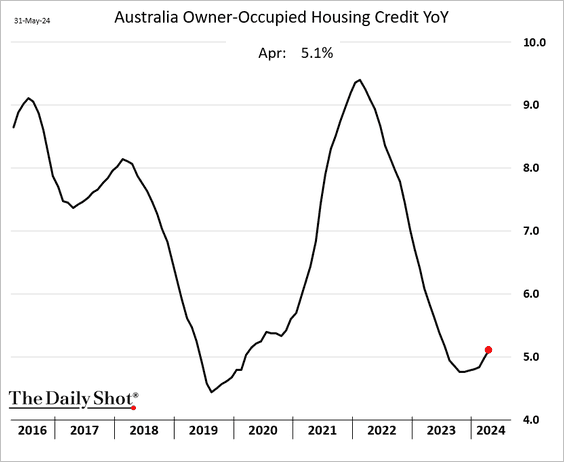

2. Australia’s mortgage lending growth is starting to improve.

Back to Index

China

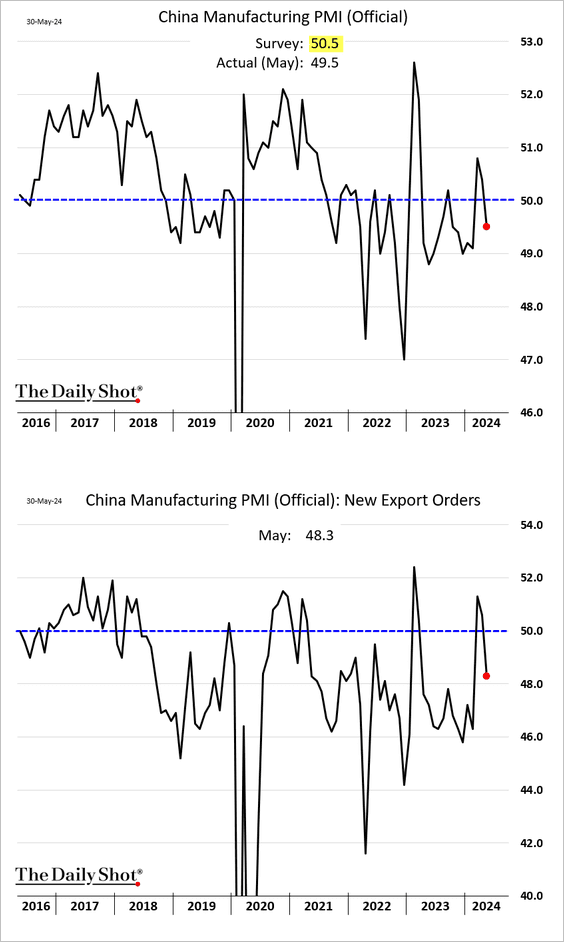

1. The official manufacturing PMI unexpectedly dipped into contraction territory in May as demand eased.

Source: @WSJ Read full article

Source: @WSJ Read full article

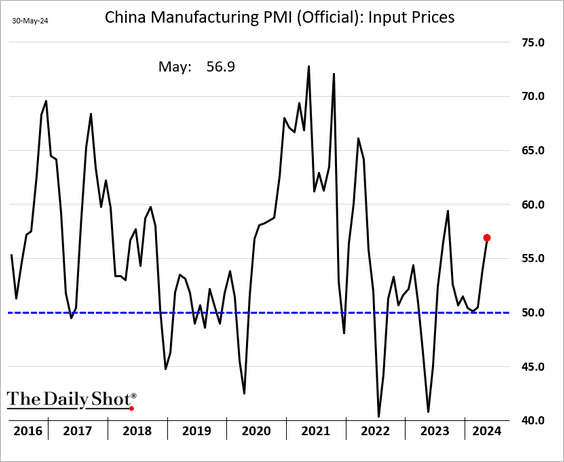

Costs are rising.

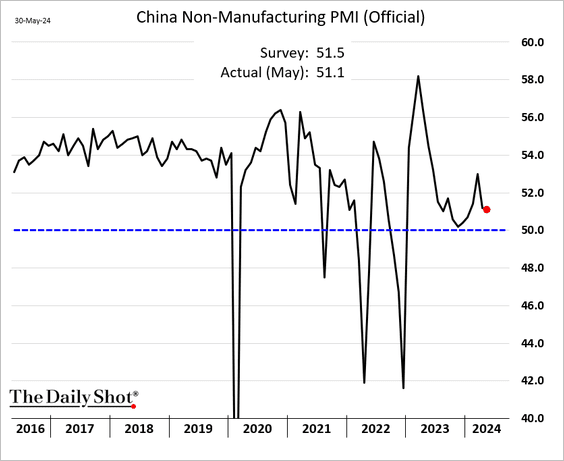

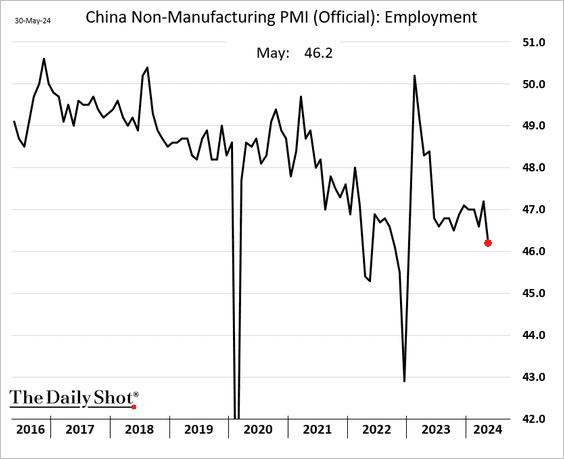

• China’s non-manufacturing activity continues to grow, …

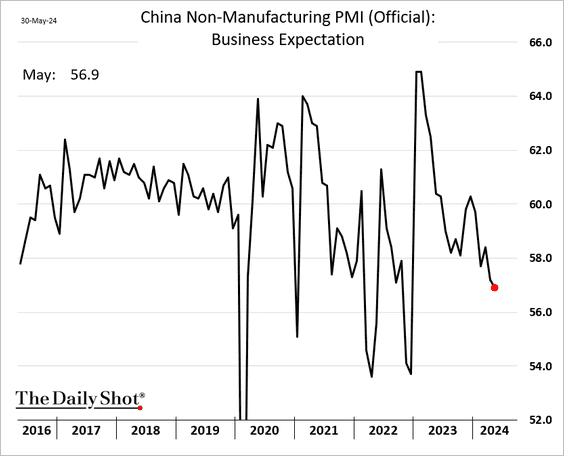

… although fewer firms hold a positive outlook.

Non-manufacturing employment keeps softening.

——————–

2. The 2-year yield continues to sink as the market prices in PBoC easing.

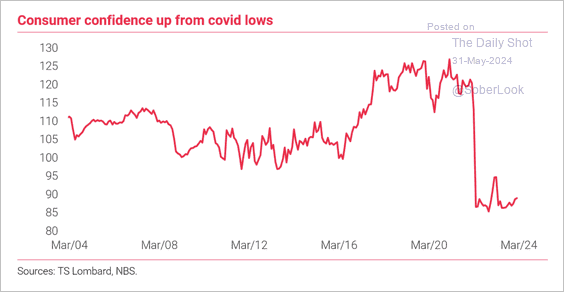

3. The collapse in consumer confidence has stabilized.

Source: TS Lombard

Source: TS Lombard

Back to Index

Emerging Markets

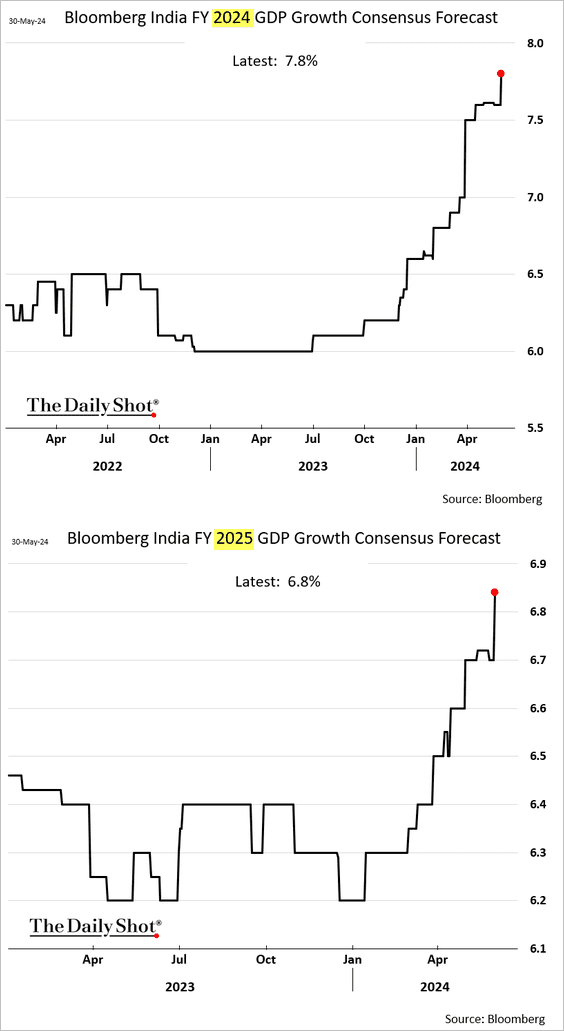

1. Economists continue to boost estimates for India’s GDP growth.

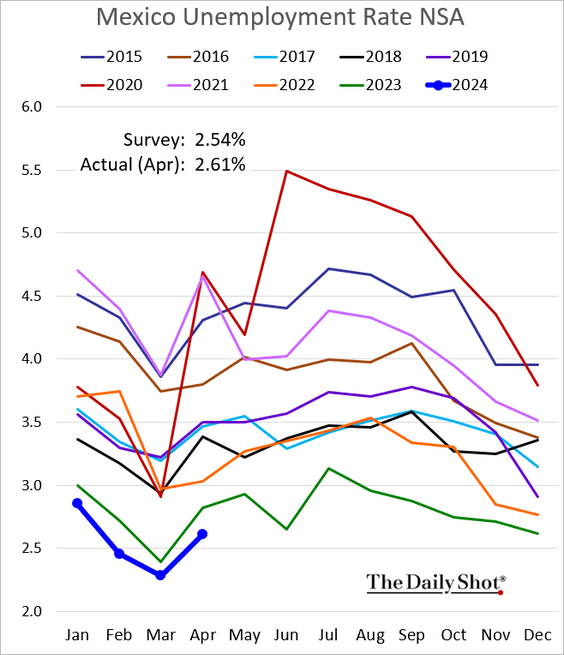

2. Mexico’s April unemployment rate was a bit higher than expected, but it remains at multi-year lows.

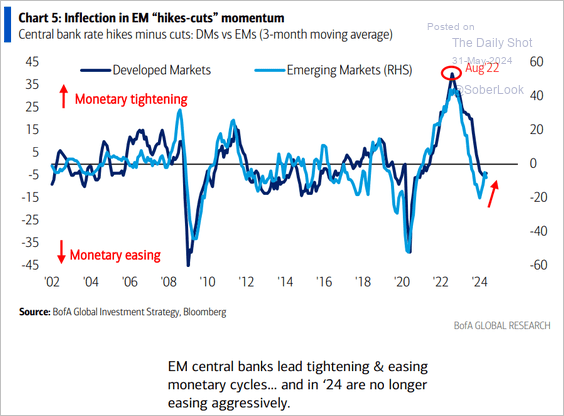

3. Monetary policy easing momentum has slowed.

Source: BofA Global Research

Source: BofA Global Research

Back to Index

Cryptocurrency

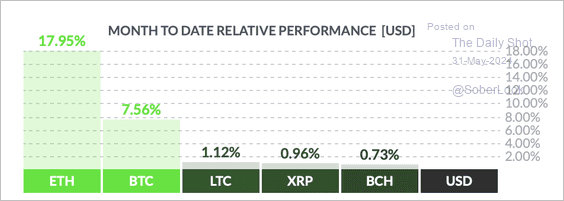

1. Ether outperformed major cryptos this month on ETF hopes.

Source: FinViz

Source: FinViz

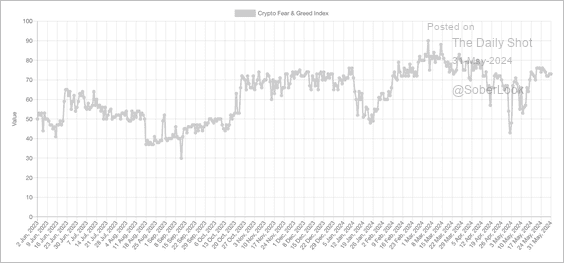

2. The Crypto Fear & Greed Indicator remained in “greed” territory over the past week.

Source: Alternative.me

Source: Alternative.me

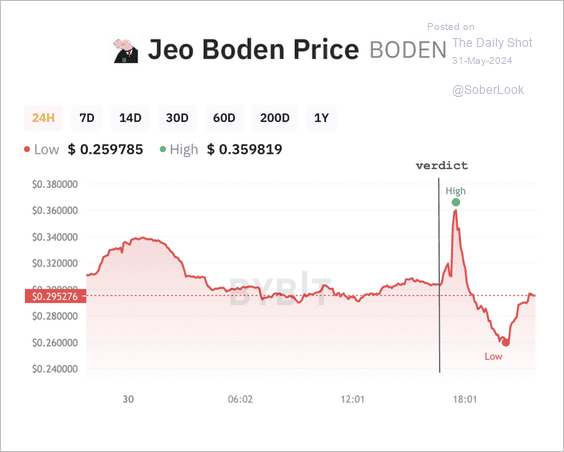

3. Presidential meme coins experienced sharp price swings on Thursday.

Source: BYBIT

Source: BYBIT

Source: BYBIT

Source: BYBIT

Back to Index

Commodities

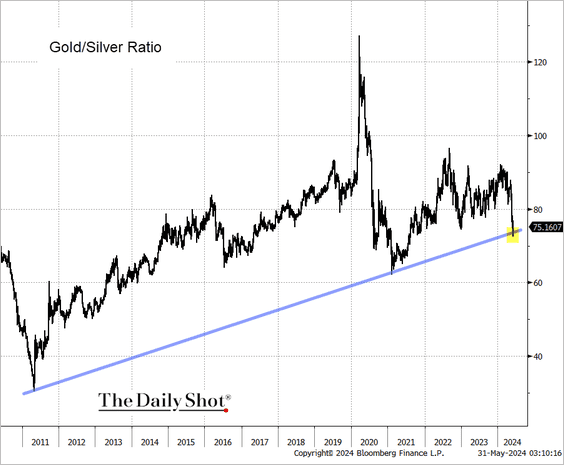

1. The gold-silver ratio is breaking below its long-term uptrend support.

Source: @TheTerminal, Bloomberg Finance L.P.; h/t @TaviCosta

Source: @TheTerminal, Bloomberg Finance L.P.; h/t @TaviCosta

2. Forecasts continue to indicate that wheat stockpiles will remain low

Source: @markets Read full article

Source: @markets Read full article

Back to Index

Energy

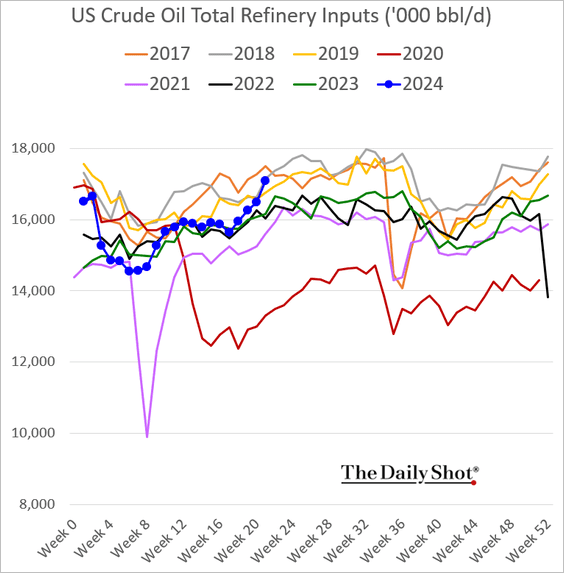

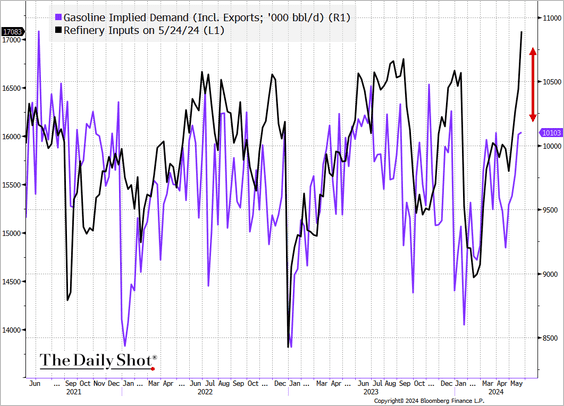

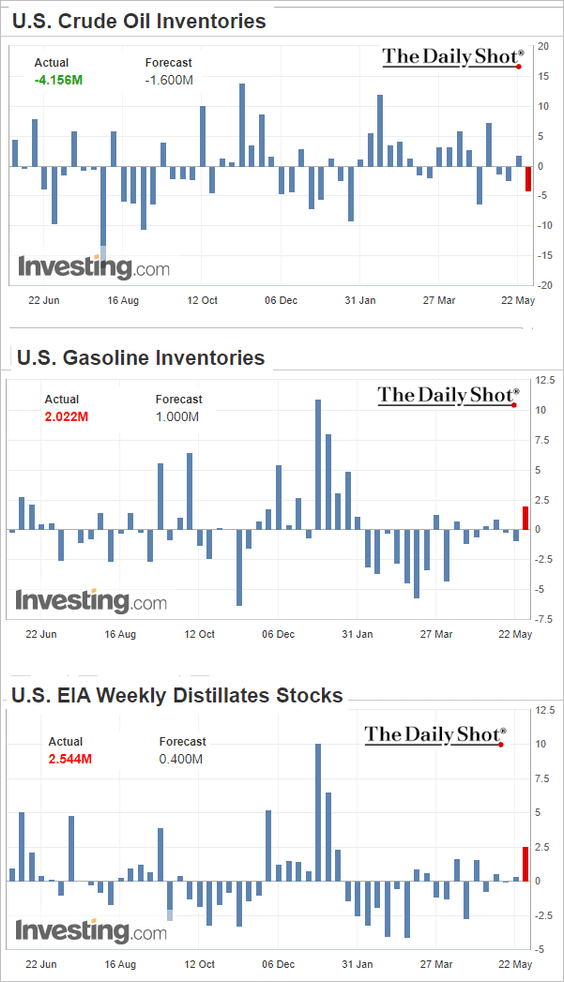

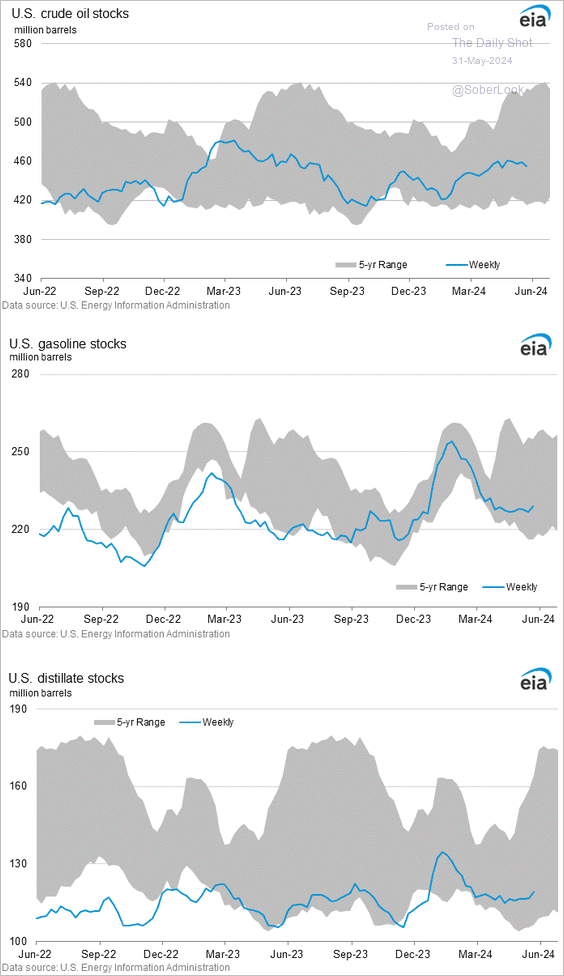

1. US refineries increased output ahead of the Memorial Day holiday, yet gasoline demand remained relatively subdued.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

• Consequently, the reduction in crude oil inventories was offset by a rise in refined product stockpiles.

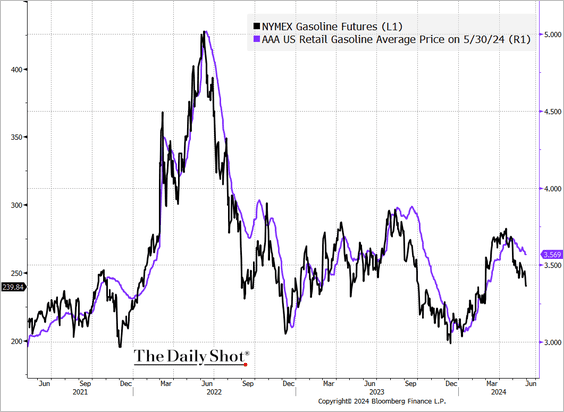

• Crude oil and gasoline futures declined.

Source: Reuters Read full article

Source: Reuters Read full article

Source: Reuters Read full article

Source: Reuters Read full article

Prices at the pump should be moving lower.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

——————–

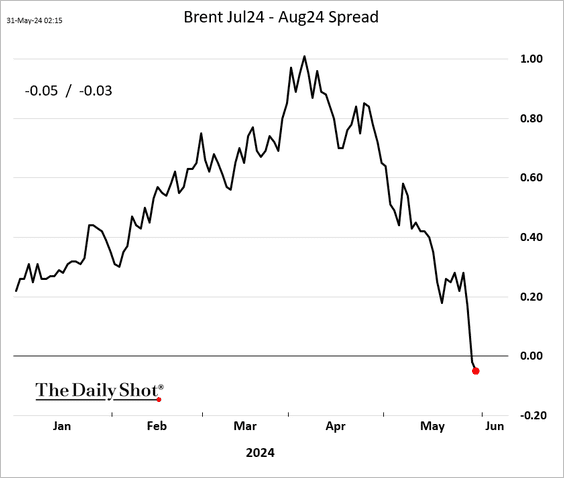

2. The Brent crude curve shifted into contango.

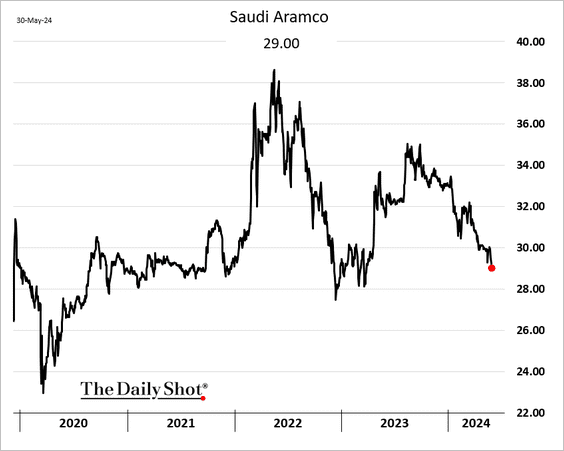

3. Shares of Saudi Aramco have been declining in anticipation of a massive secondary sale.

Source: @markets Read full article

Source: @markets Read full article

Back to Index

Equities

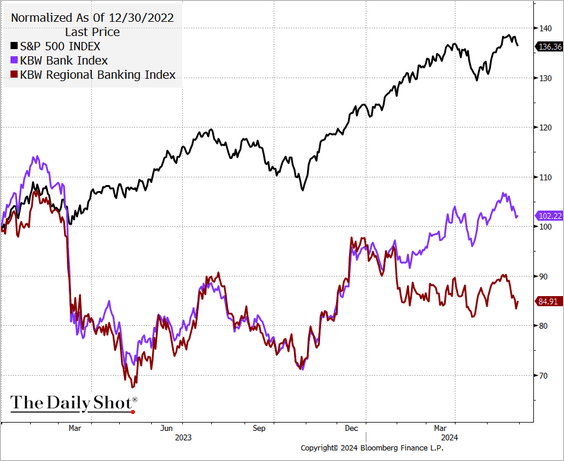

1. Regional banks continue to underperform.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

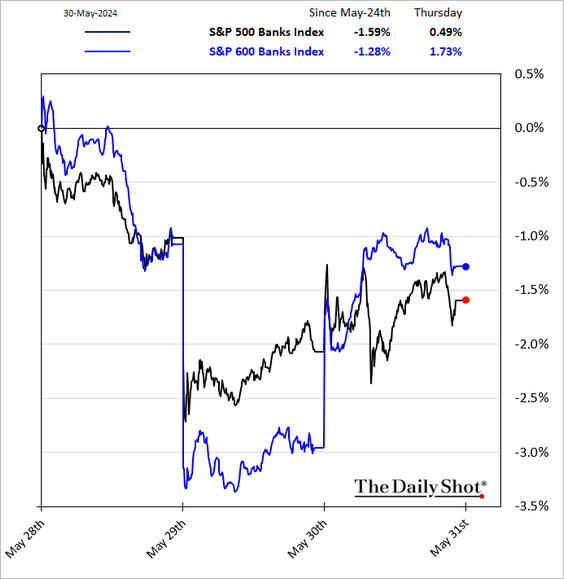

However, there was a bounce on Thursday, …

… which boosted the S&P 600 small-cap index.

——————–

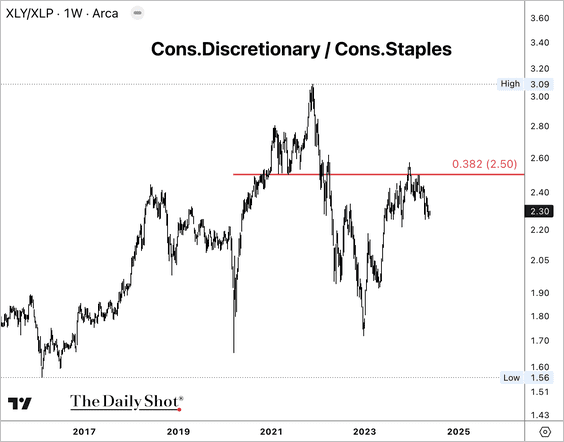

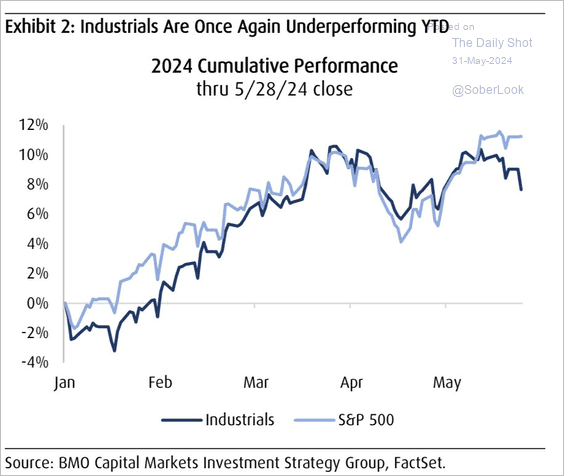

2. Here are a couple of additional sector trends.

• The recovery in US consumer discretionary stocks has stalled relative to consumer staples stocks.

• Industrials have been underperforming.

Source: BMO Capital Markets; @carlquintanilla

Source: BMO Capital Markets; @carlquintanilla

——————–

3. CTAs remain bullish on stocks.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

4. Stocks have been shrugging off the decline in the US economic surprise index.

Source: Longview Economics

Source: Longview Economics

5. Share buybacks have been rising.

Source: @markets Read full article

Source: @markets Read full article

6. Capex among S&P 500 companies typically lags earnings by about three quarters.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

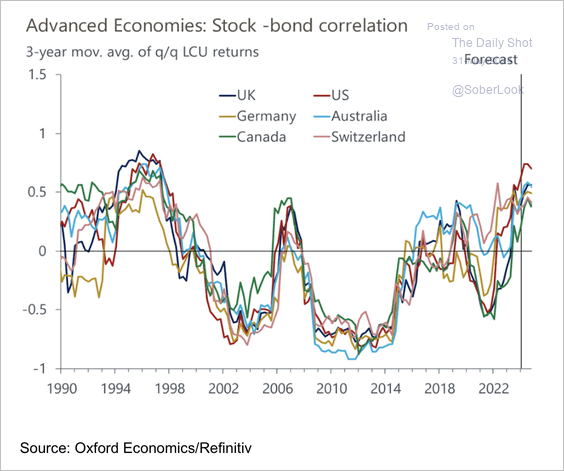

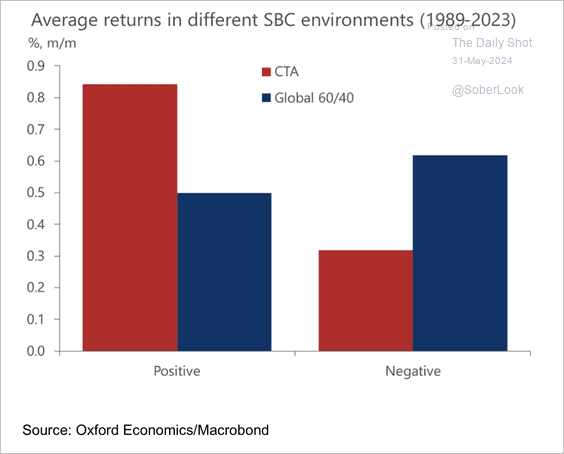

7. Oxford Economics expects DM stock/bond correlations to remain positive and elevated, which typically aligns with CTA outperformance. (2 charts)

Source: Oxford Economics

Source: Oxford Economics

Source: Oxford Economics

Source: Oxford Economics

——————–

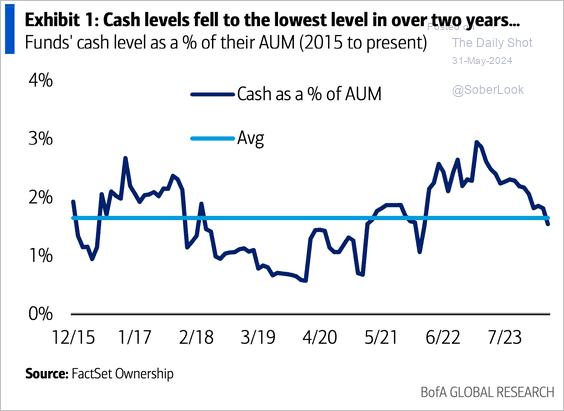

8. Funds’ cash levels are now below their longer-term average.

Source: BofA Global Research; @dailychartbook

Source: BofA Global Research; @dailychartbook

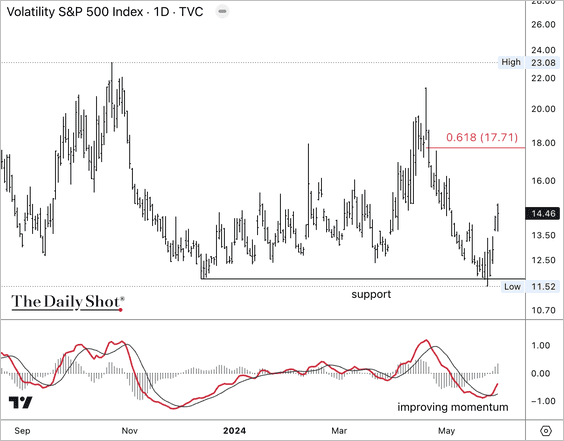

9. VIX held support this week. The next major resistance level is near 17.

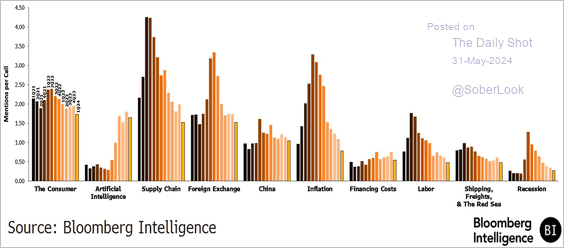

10. S&P 500 company mentions of macro issues continue to dwindle.

Source: @GinaMartinAdams

Source: @GinaMartinAdams

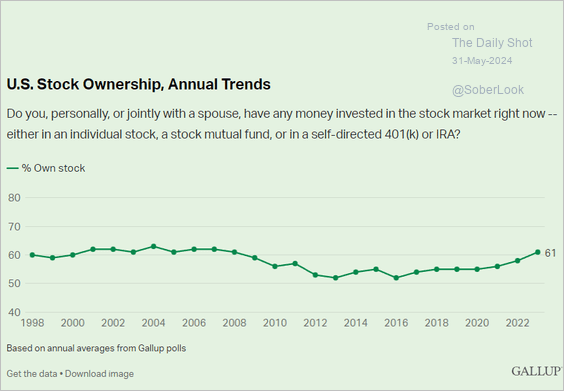

11. Households’ stock ownership has been rising.

Source: Gallup Read full article

Source: Gallup Read full article

Back to Index

Rates

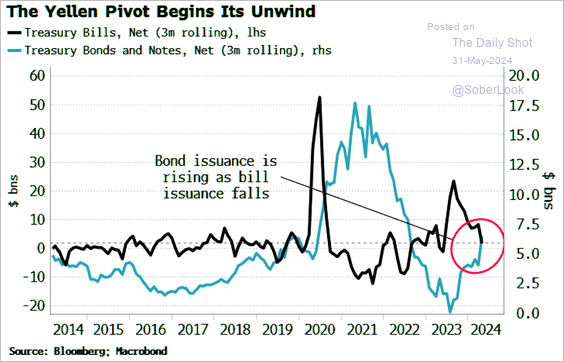

Issuance of coupon Treasury securities is rising as bill sales slow.

Source: Simon White, Bloomberg Markets Live Blog

Source: Simon White, Bloomberg Markets Live Blog

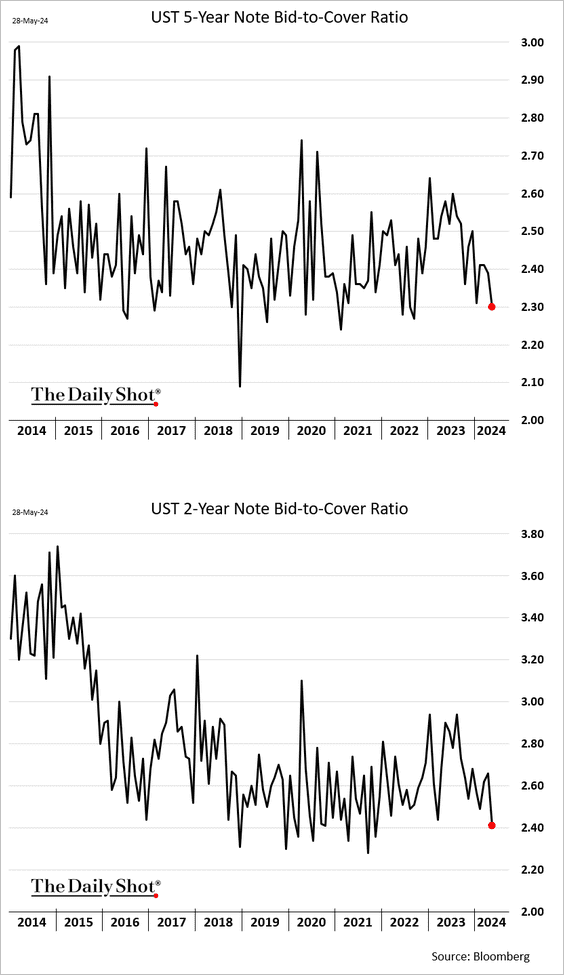

The latest auctions for Treasury notes show softer demand.

Back to Index

Global Developments

1. Financial conditions in advanced economies are easing more rapidly than in emerging markets.

Source: Goldman Sachs; @AyeshaTariq

Source: Goldman Sachs; @AyeshaTariq

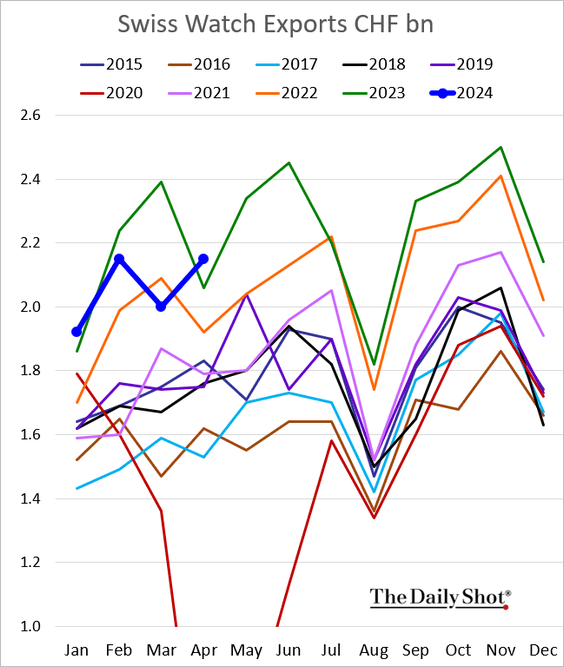

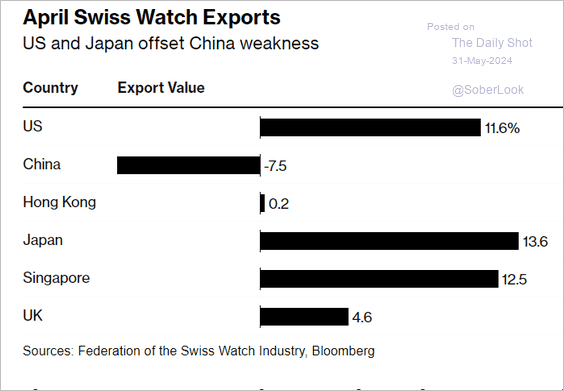

2. Swiss watch exports rebounded in April, …

… boosted by US buyers.

Source: @luxury Read full article

Source: @luxury Read full article

——————–

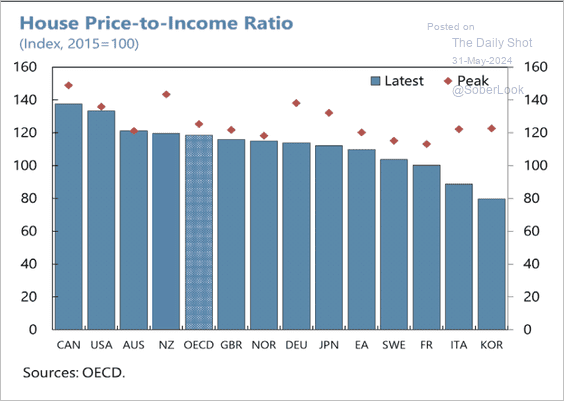

3. Here is a look at house price-to-income ratios.

Source: IMF Read full article

Source: IMF Read full article

——————–

Food for Thought

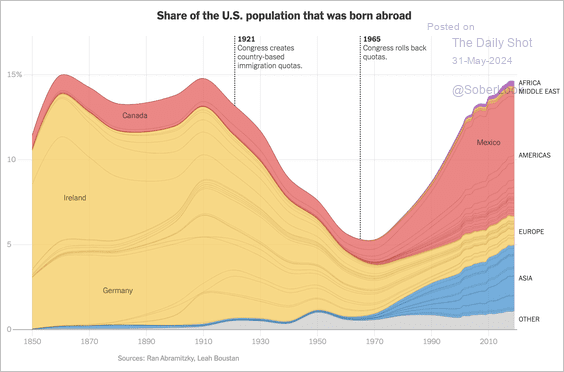

1. Share of the US population born abroad:

Source: The New York Times Read full article

Source: The New York Times Read full article

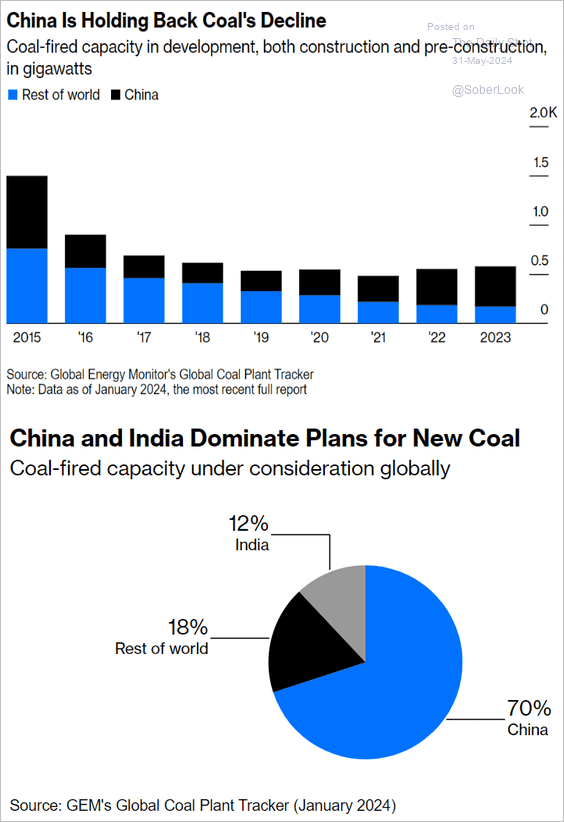

2. Coal-fired capacity in development:

Source: @opinion Read full article

Source: @opinion Read full article

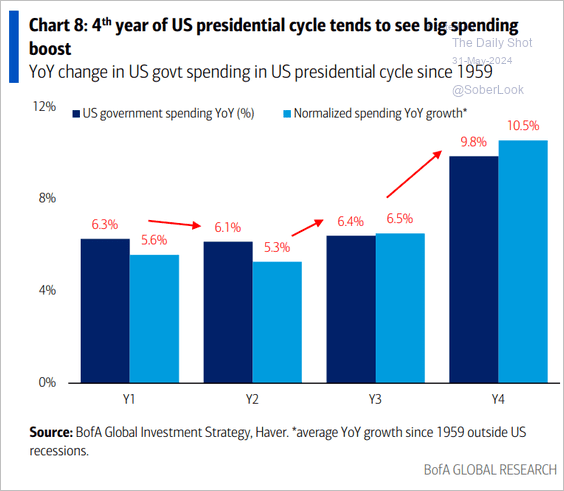

3. Yearly change in US government spending across presidential cycles:

Source: BofA Global Research

Source: BofA Global Research

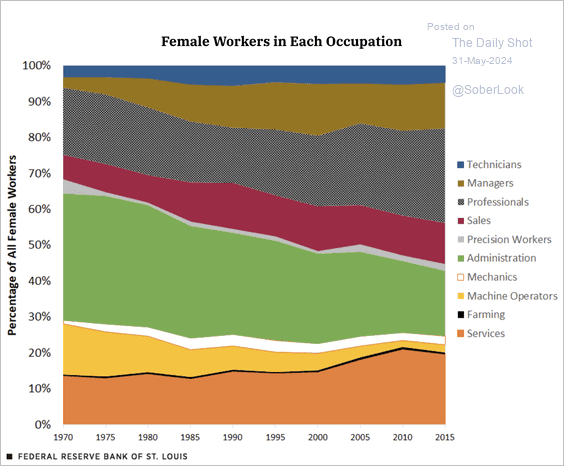

4. Distribution of female workers across occupations:

Source: Federal Reserve Bank of St. Louis Read full article

Source: Federal Reserve Bank of St. Louis Read full article

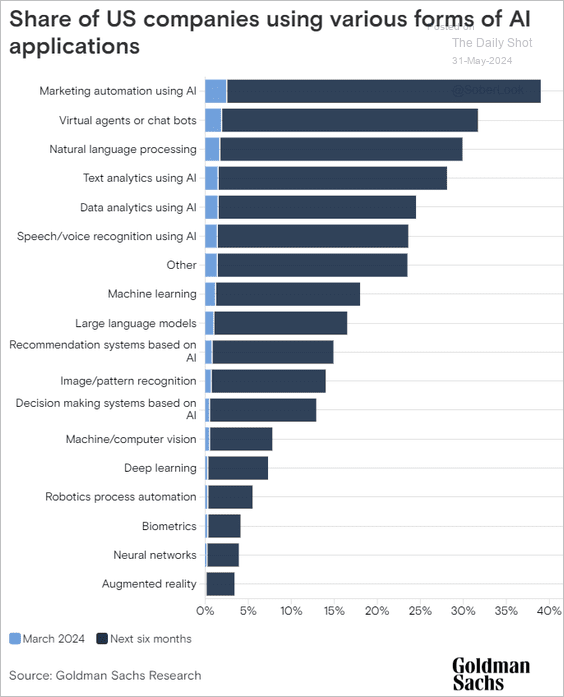

5. Share of US companies using various AI applications:

Source: Goldman Sachs

Source: Goldman Sachs

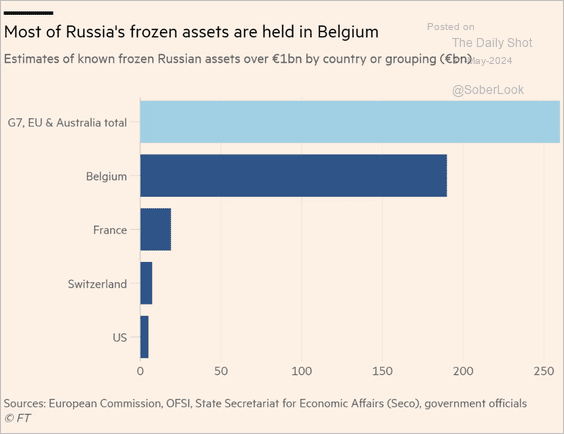

6. Frozen Russian assets:

Source: @financialtimes Read full article

Source: @financialtimes Read full article

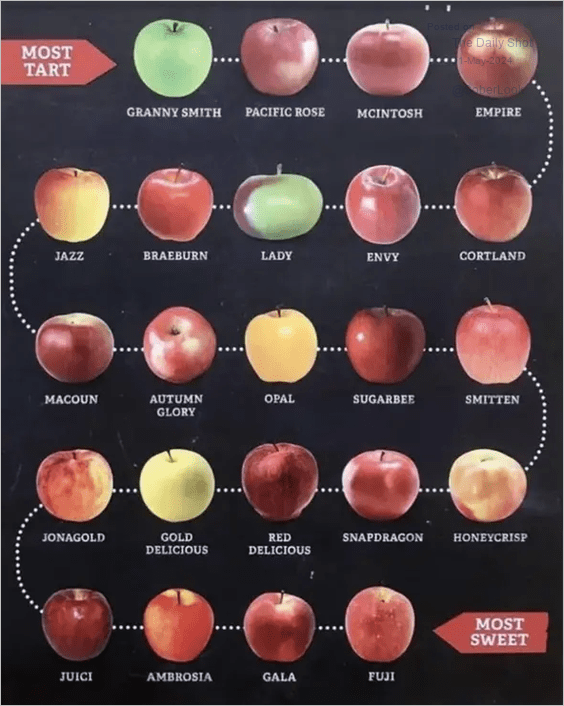

7. Spectrum of apple varieties from tart to sweet:

Source: BuzzFeed

Source: BuzzFeed

——————–

Have a great weekend!

Back to Index