The Daily Shot: 10-Jun-24

• The United States

• Canada

• The Eurozone

• Europe

• Japan

• Emerging Markets

• Cryptocurrency

• Commodities

• Energy

• Equities

• Credit

• Rates

• Global Developments

• Food for Thought

The United States

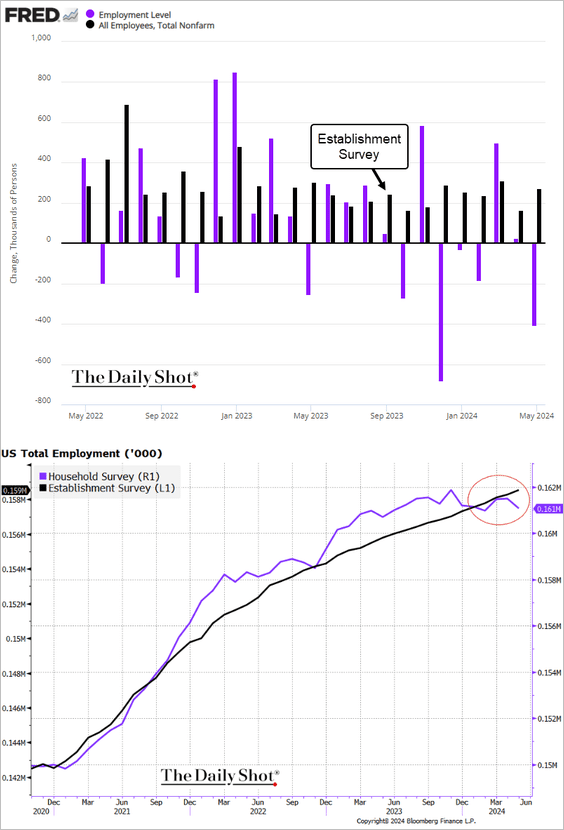

1. The employment report exceeded expectations, with 272k jobs added in May.

• Conversely, the Household Survey data indicated a sharp decline in employment, suggesting that the official figures from the Establishment Survey may be subject to downward revisions.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

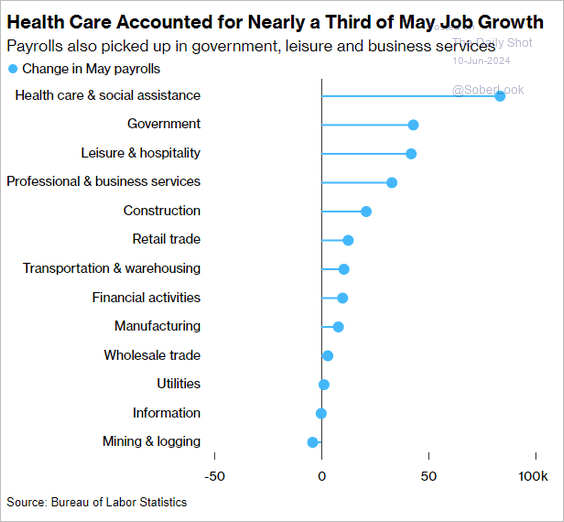

• Job gains were still concentrated in the healthcare, leisure and hospitality, and government sectors (mostly local government).

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @economics Read full article

Source: @economics Read full article

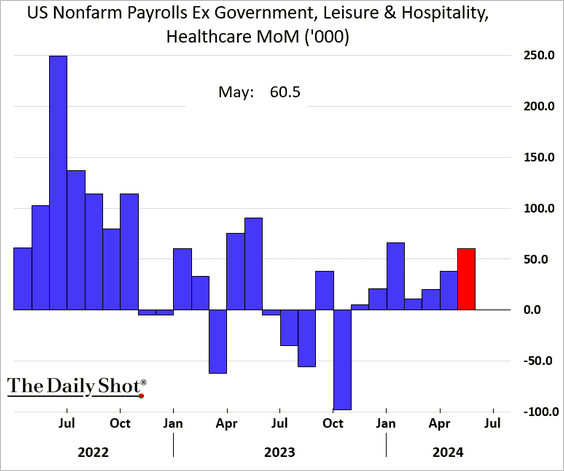

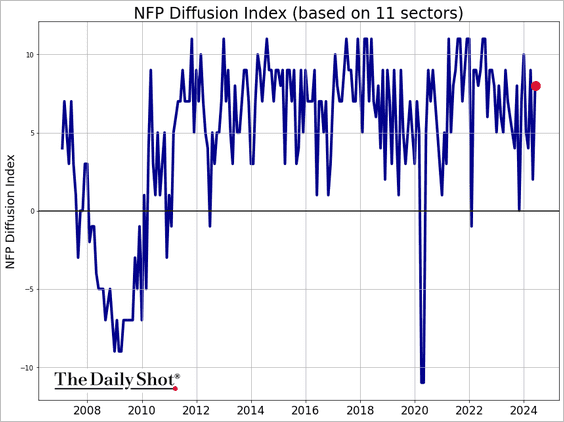

However, job gains have been broadening beyond those sectors.

Here is the diffusion index.

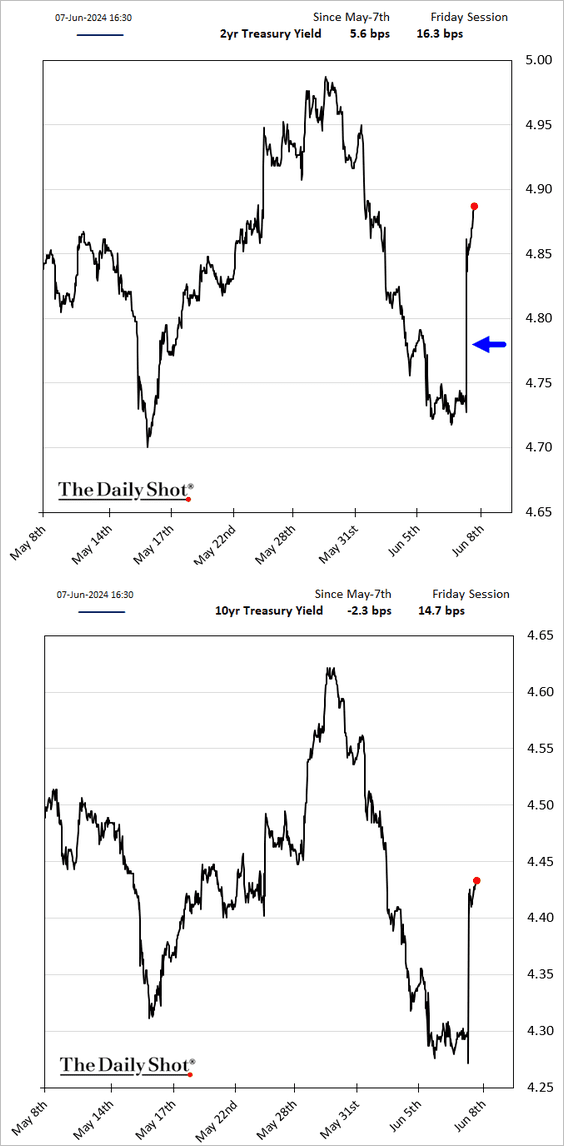

• Wage growth surprised to the upside, spooking the bond markets.

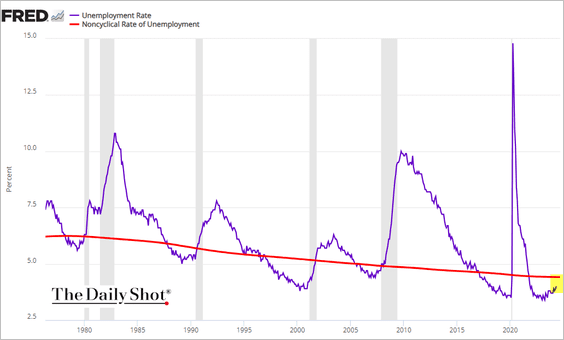

• The unemployment rate inched higher, …

… narrowing the gap with the “natural” rate of unemployment (NAIRU).

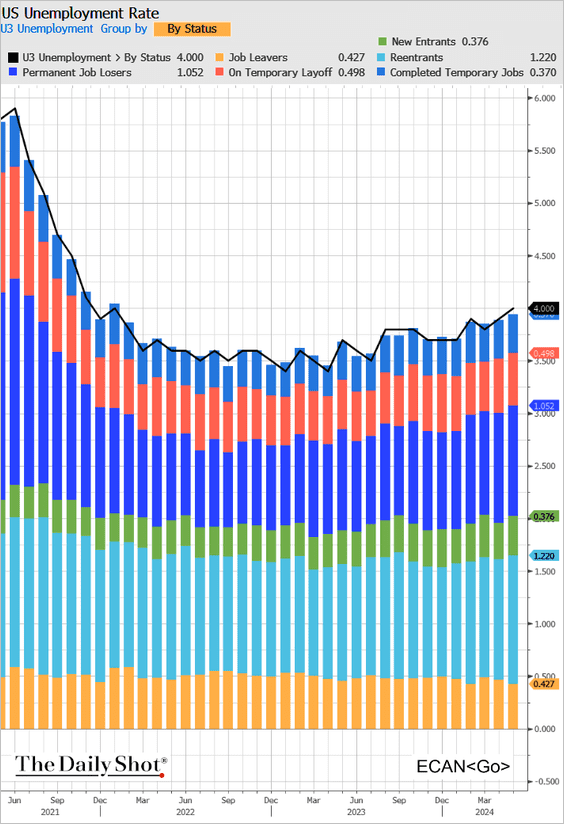

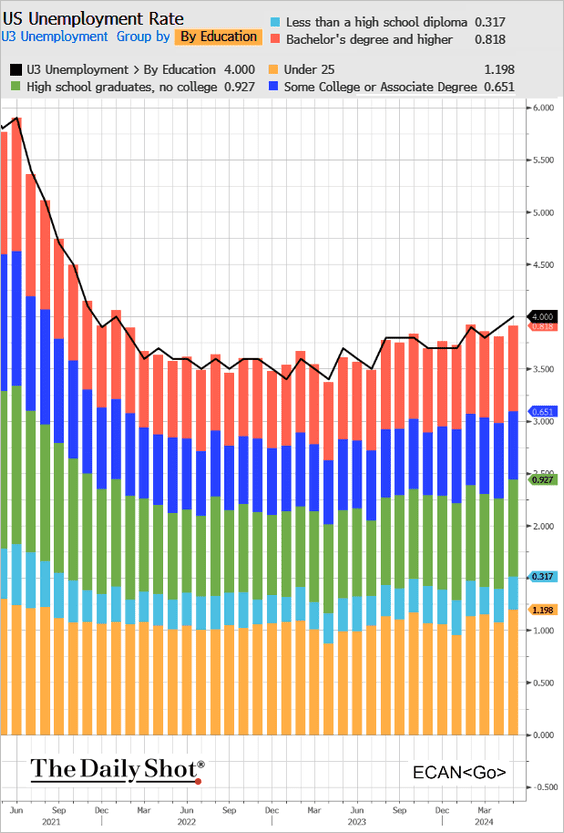

Below is the breakdown of the unemployment rate by different groupings.

– Status:

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

– Age:

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

– Education:

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

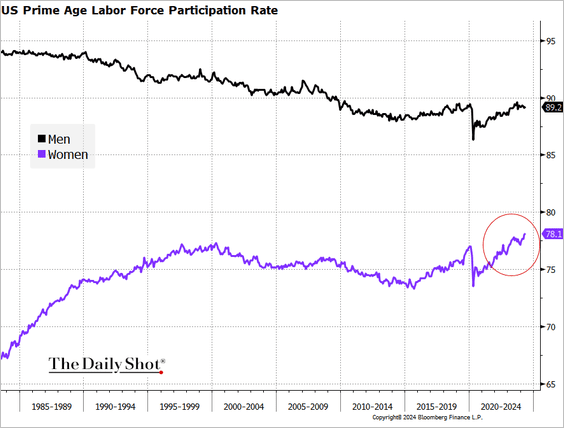

• While the overall labor force participation rate declined, participation among prime-age individuals reached a multi-year high, …

… driven by record-high participation among prime-age women.

Source: @axios Read full article

Source: @axios Read full article

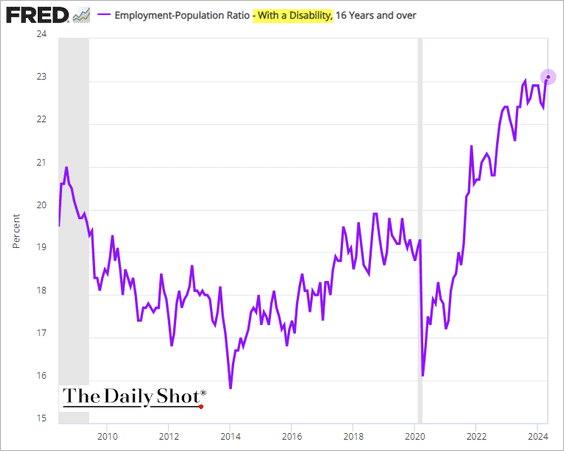

• The employment-to-population ratio for Americans with disabilities continues to hit new highs.

——————–

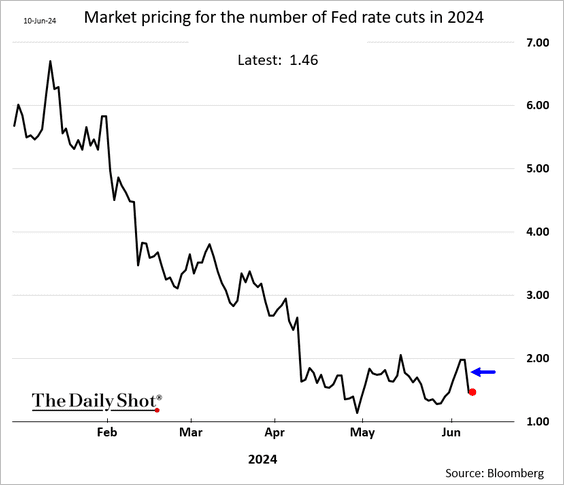

2. The expected number of Fed rate cuts this year dropped below 1.5, …

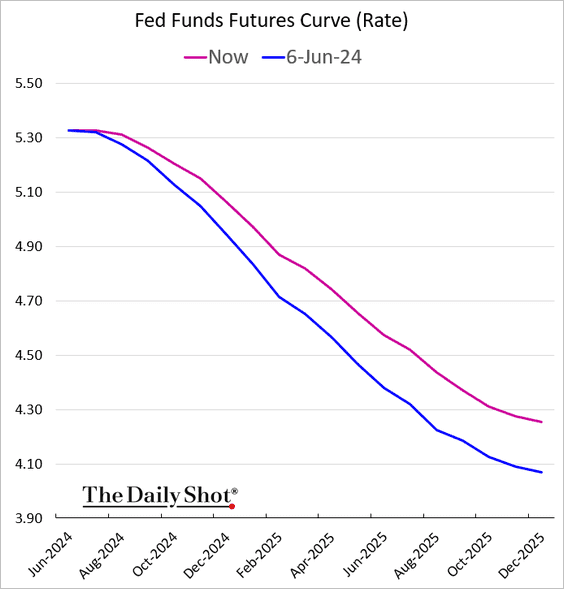

… as the rate trajectory repriced sharply higher.

• Treasury yields and the US dollar jumped.

——————–

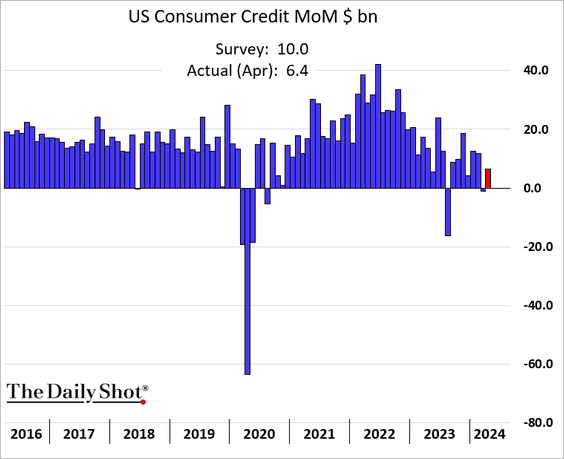

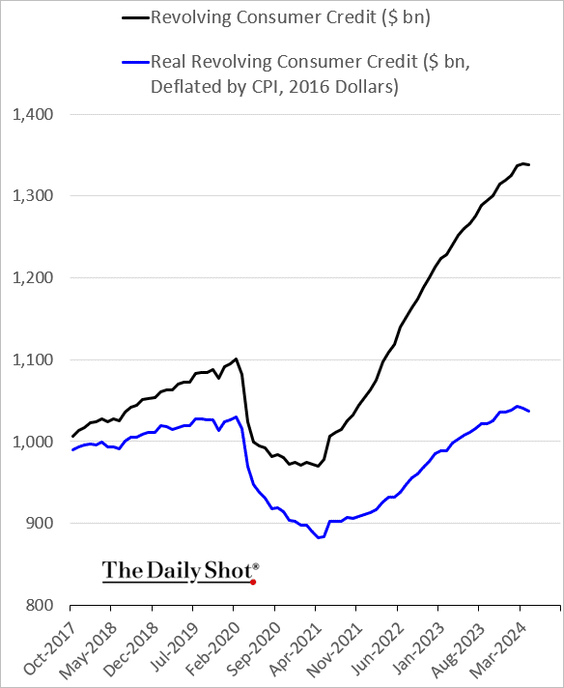

3. Consumer credit increased less than expected in April.

Credit card balances declined, …

… and remain below pre-COVID levels as a share of disposable income.

——————–

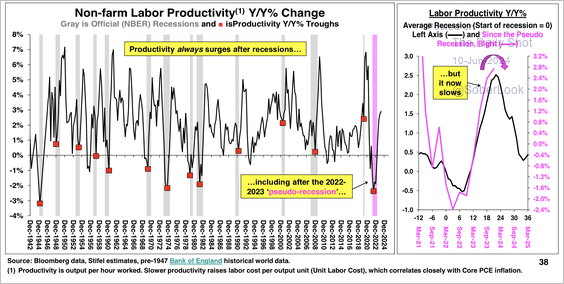

4. The rebound in labor productivity could slow, in line with previous post-recession paths (assuming a 2002-2003 pseudo-recession).

Source: Stifel

Source: Stifel

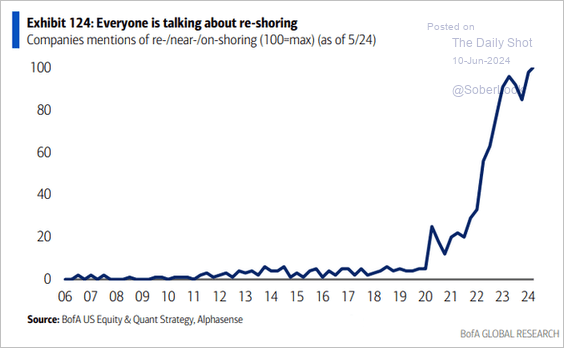

5. Companies increasingly mention re-shoring or near-shoring on earnings calls.

Source: BofA Global Research; @MikeZaccardi

Source: BofA Global Research; @MikeZaccardi

Back to Index

Canada

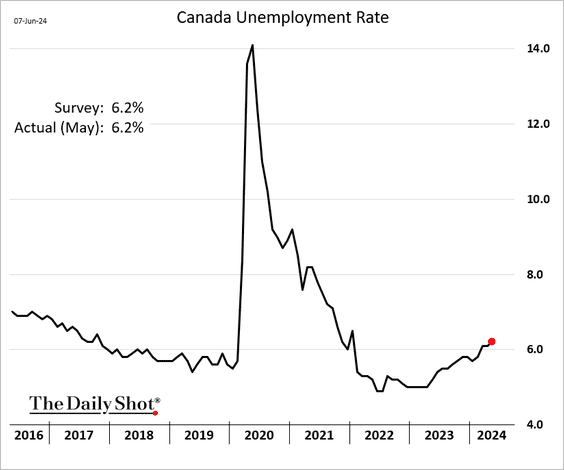

1. Canada’s employment report was stronger than expected, though the gains were in part-time positions. Full-time employment, on the other hand, declined significantly.

• Just like in the US, wage growth surprised to the upside.

Source: @economics Read full article

Source: @economics Read full article

• The unemployment rate has been trending higher.

• Labor force participation was unchanged.

——————–

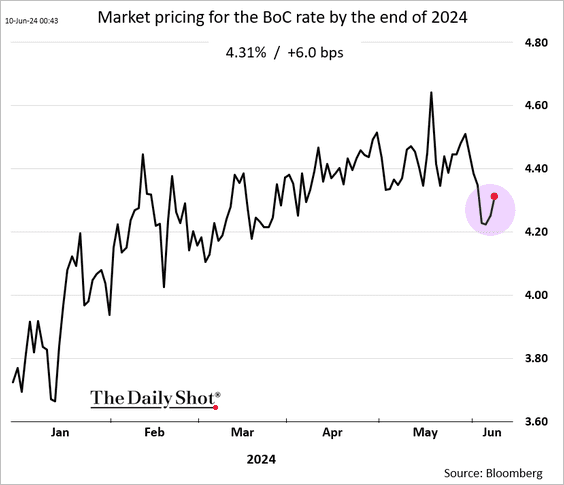

2. Market expectations for Bank of Canada rate cuts this year were scaled back after wage growth exceeded forecasts.

• Bond yields jumped.

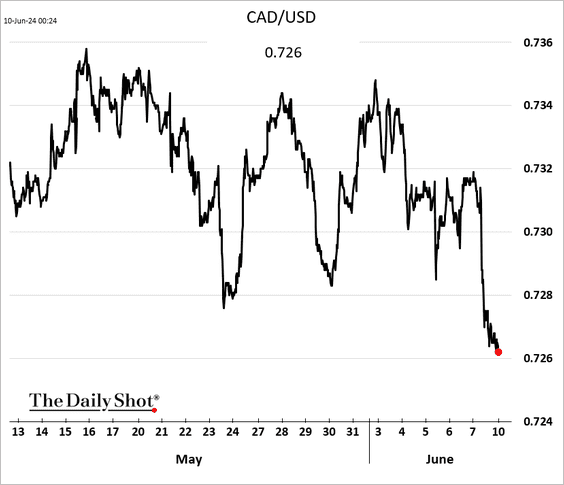

• The loonie dropped vs. USD after the US employment report.

– Speculative accounts continue to boost their bets against Canada’s currency.

——————–

3. The Q1 industrial capacity utilization surprised to the downside.

Back to Index

The Eurozone

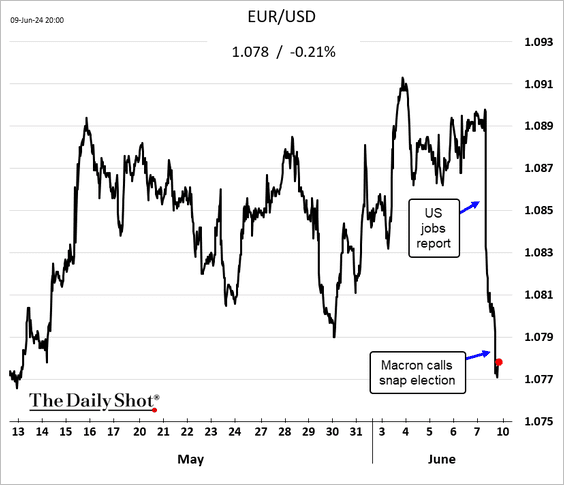

1. The euro fell sharply following the US employment report, with declines intensifying after Macron announced snap elections.

Source: Reuters Read full article

Source: Reuters Read full article

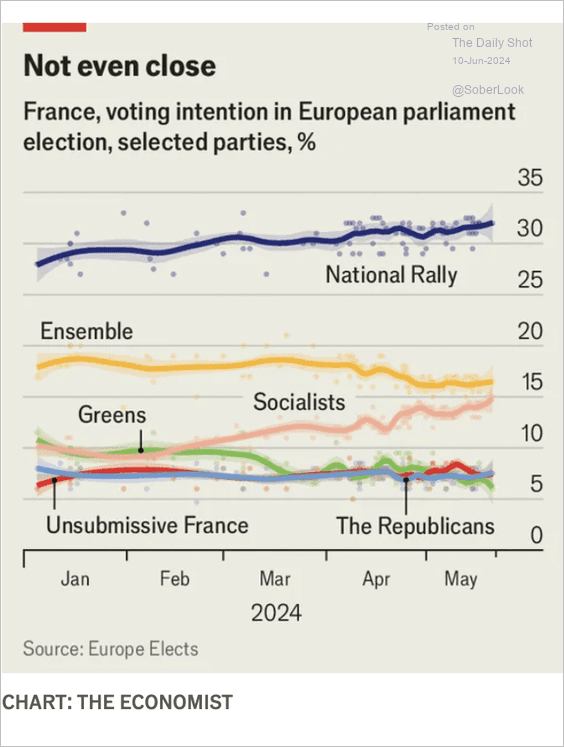

Le Pen’s far-right party appears poised to defeat Macron’s centrist group.

Source: The Economist Read full article

Source: The Economist Read full article

——————–

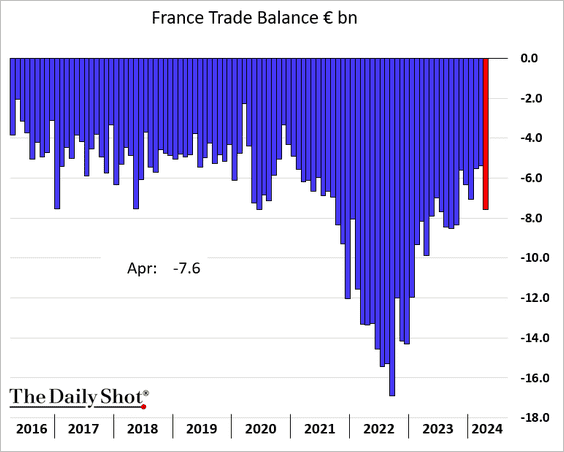

2. The French trade deficit expanded more than anticipated in April.

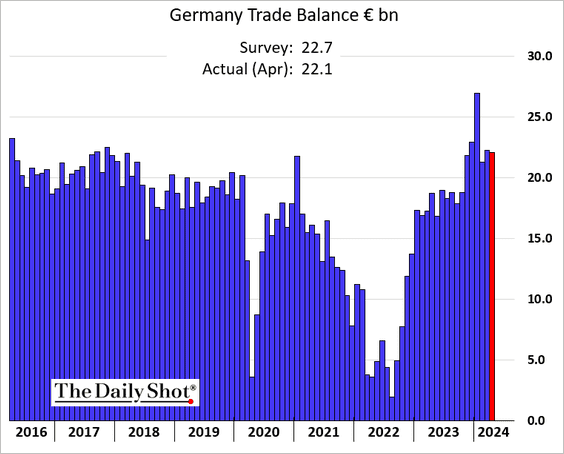

3. Germany’s trade surplus was lower than expected.

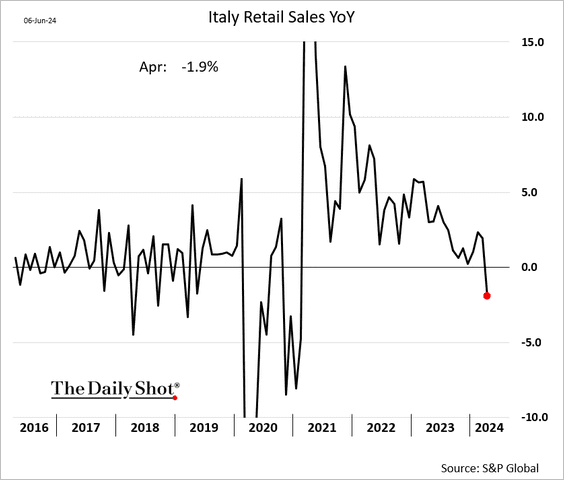

4. Euro-area retail sales eased in April.

This chart shows the year-over-year changes in Italian retail sales.

——————–

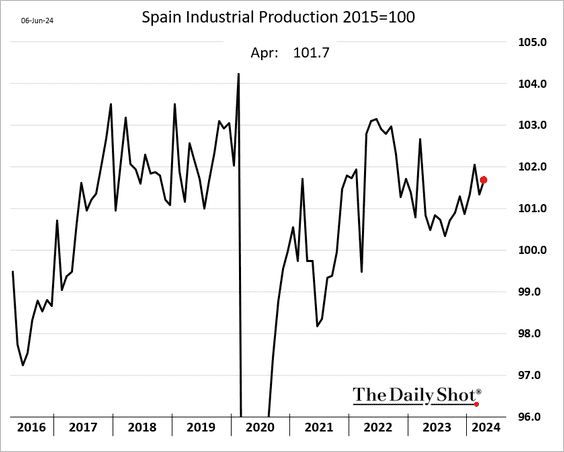

5. Spain’s industrial production has been trending higher.

6. Numera Analytics expects a less aggressive ECB easing cycle than markets are pricing in, mainly due to improving economic activity and sticky wage inflation.

Source: Numera Analytics (@NumeraAnalytics)

Source: Numera Analytics (@NumeraAnalytics)

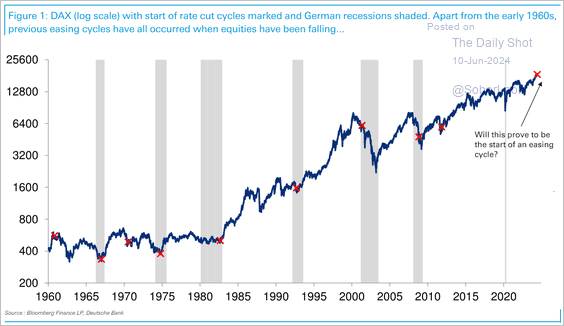

7. Historically, the start of an ECB/Bundesbank easing cycle has always happened when the DAX has been falling in the preceding six months, typically during recessions.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

Back to Index

Europe

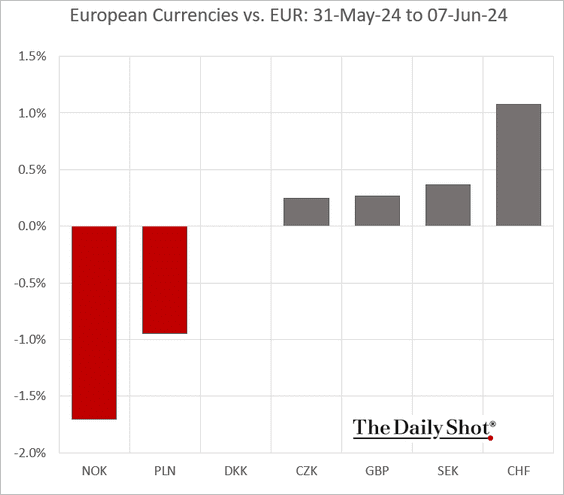

1. The Swiss franc has been strengthening against the euro.

——————–

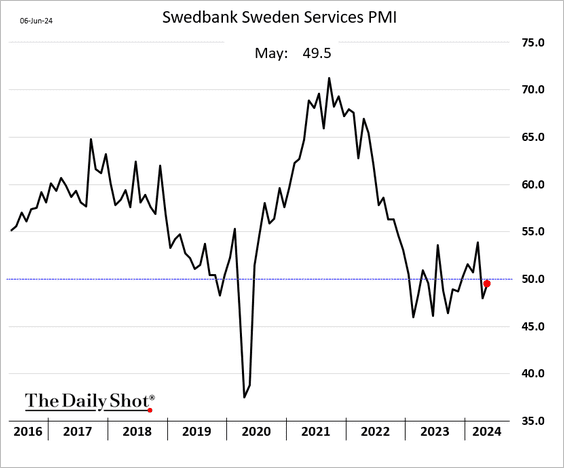

2. Sweden’s service activity is treading water.

3. Czech industrial production remains range-bound.

• The nation’s trade surplus is at record highs for this time of the year.

Back to Index

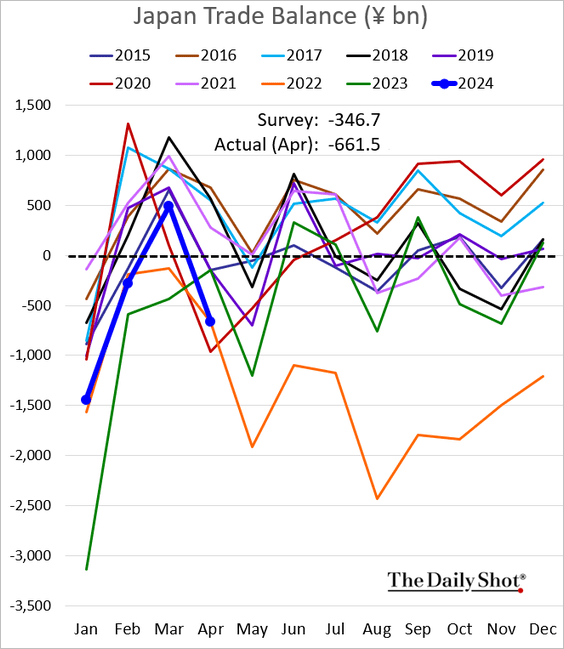

Japan

1. The Economy Watchers Survey Expectations Index continues to tumble.

2. The trade deficit was wider than expected in April.

Back to Index

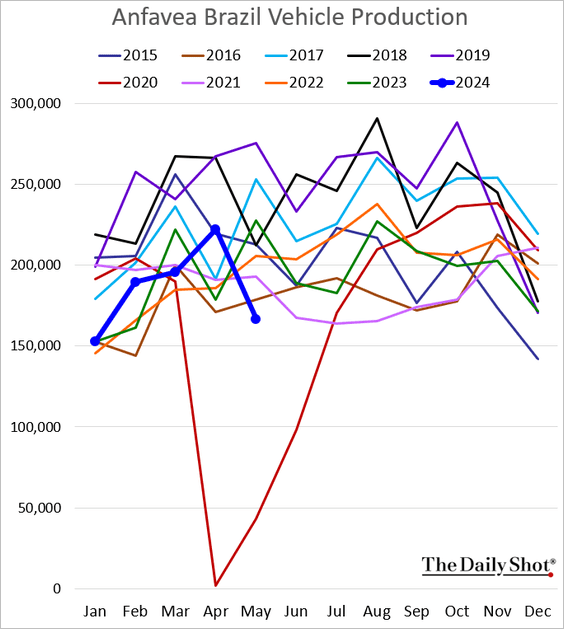

Emerging Markets

1. Brazil’s vehicle production hit the lowest level since the COVID shock.

2. Chile’s trade surplus was higher than expected last month.

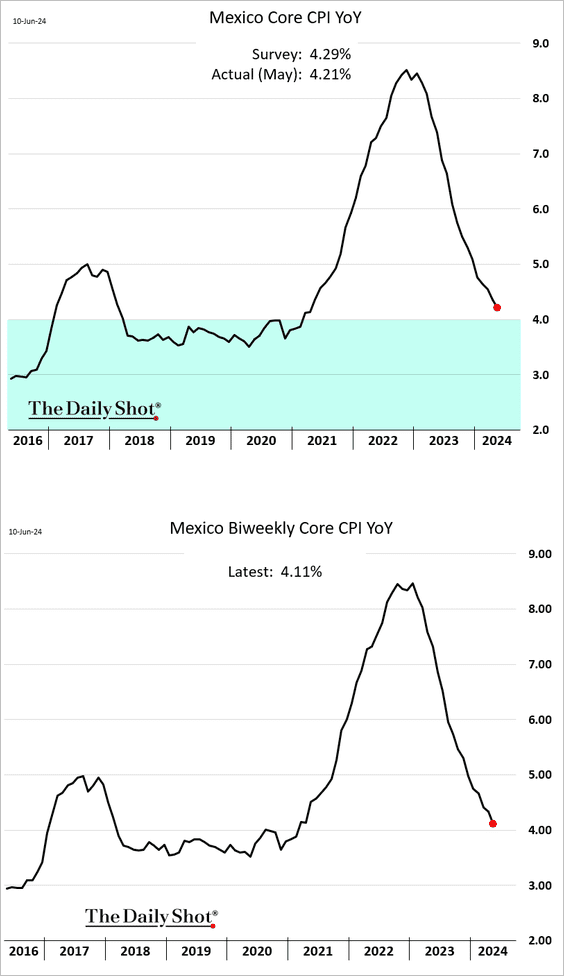

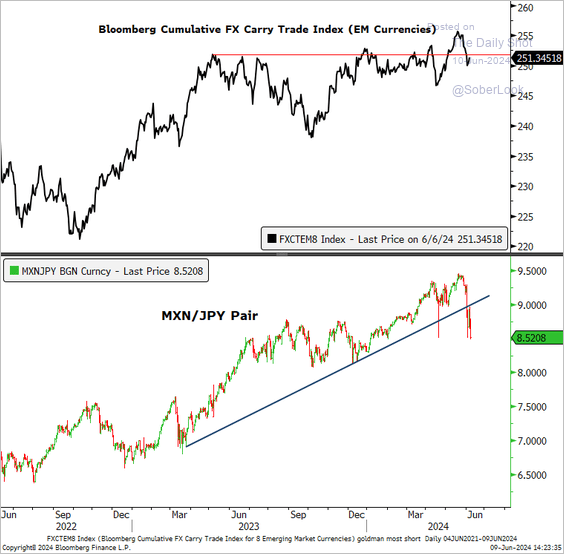

3. Next, we have some updates on Mexico.

• Core inflation is nearing Banxico’s target range.

• Investors jumped into Mexican equity funds after the post-election selloff.

Source: BofA Global Research

Source: BofA Global Research

• The MXN/JPY pair has broken below a year-long uptrend as popular carry trades unwind.

Source: Aazan Habib, Paradigm Capital

Source: Aazan Habib, Paradigm Capital

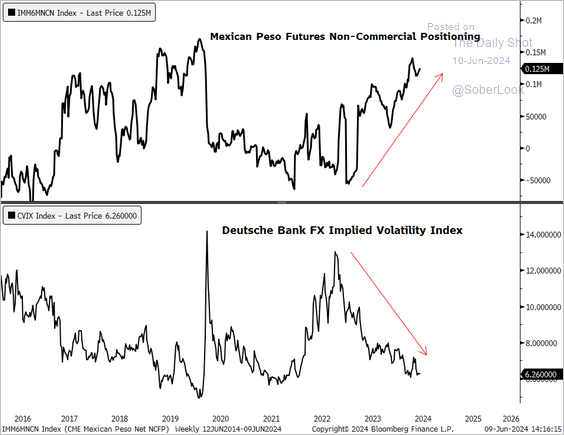

– Speculative positioning in Mexican Peso futures has risen to multi-year highs, which typically occurs when FX vol is falling.

Source: Aazan Habib, Paradigm Capital

Source: Aazan Habib, Paradigm Capital

——————–

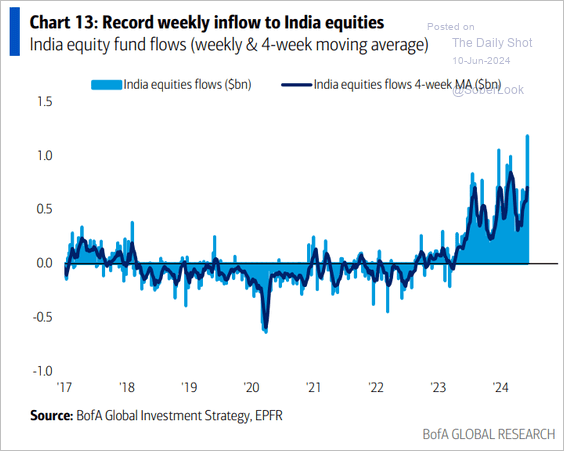

4. Fund flows into India-focused funds surged last week.

Source: BofA Global Research

Source: BofA Global Research

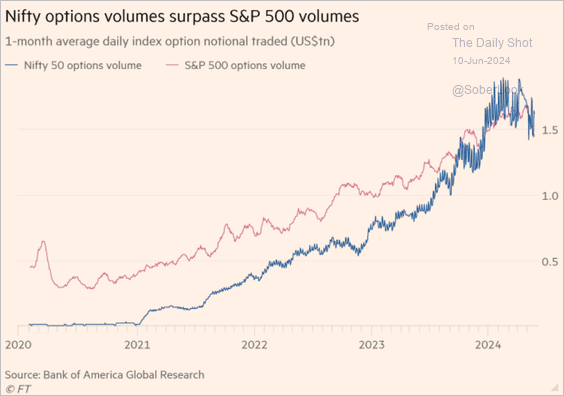

• India’s retail investors are increasingly involved in the options market.

Source: @financialtimes Read full article

Source: @financialtimes Read full article

——————–

5. Here is a look at some performance data from last week.

• Currencies:

• Bond yields:

• Equity ETFs:

Back to Index

Cryptocurrency

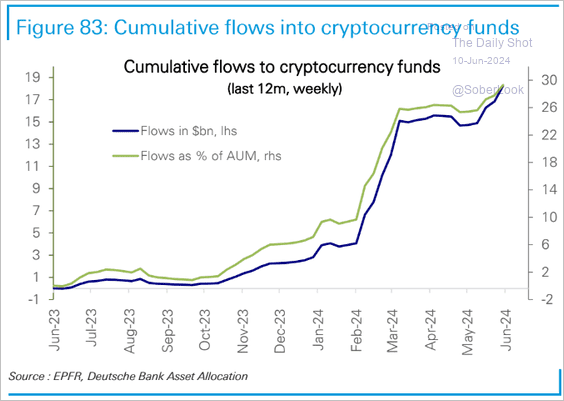

1. Flows into crypto funds remain robust.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

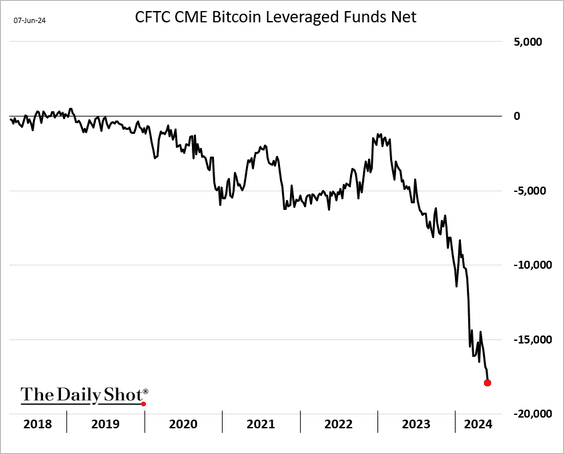

2. Hedge funds have built a substantial short position in bitcoin futures. Note that some of these positions may be against cash or ETF holsings.

Back to Index

Commodities

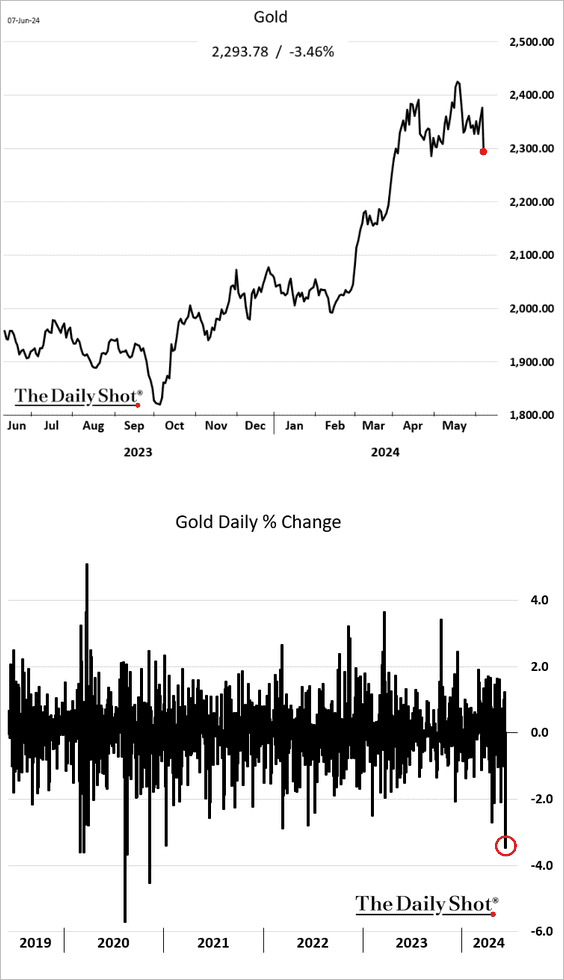

1. Gold took a hit on Friday as the US employment report sent the dollar sharply higher, …

… and China’s central bank paused gold purchases.

Source: MarketWatch Read full article

Source: MarketWatch Read full article

——————–

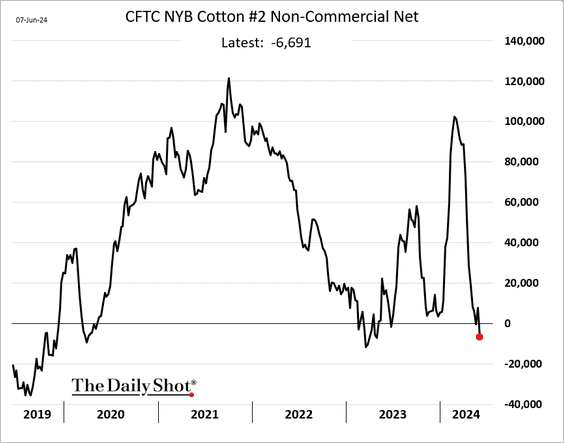

2. US cotton futures have faced downward pressure, …

… with speculators shifting to a net short position last week.

——————–

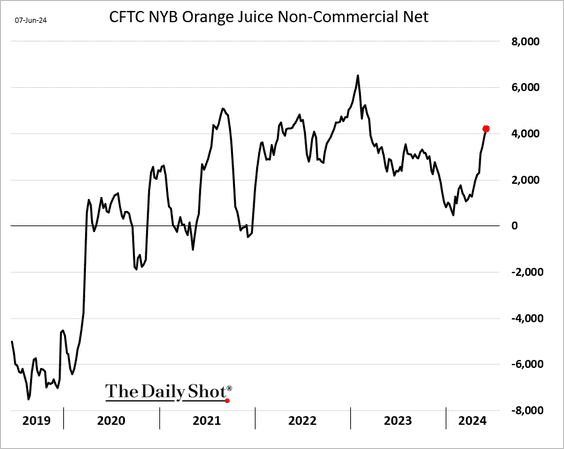

3. The rally in orange juice is fading, …

… but speculative accounts continue to boost their bets.

——————–

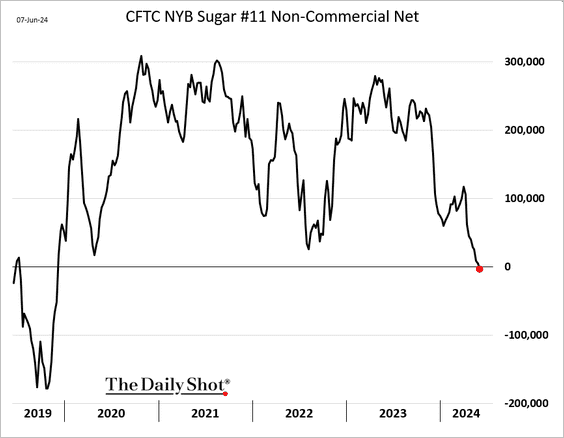

4. Speculative accounts are now net short sugar futures.

5. Finally, we have last week’s performance data.

Back to Index

Energy

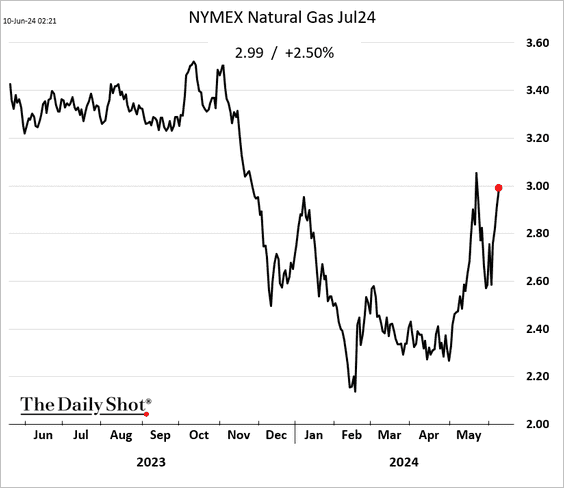

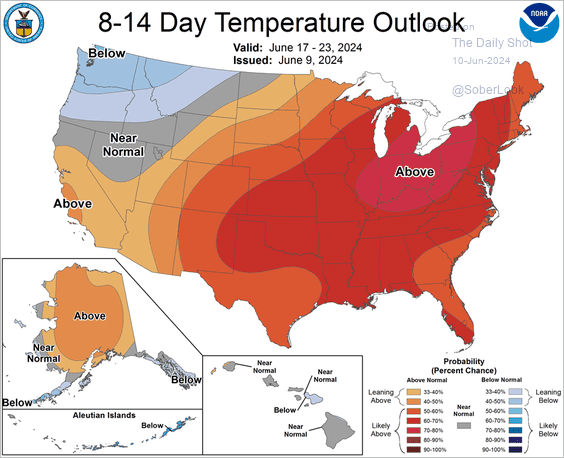

1. US natural gas futures are trading near $3/mmbtu again amid forecasts for warm weather.

Source: NOAA

Source: NOAA

——————–

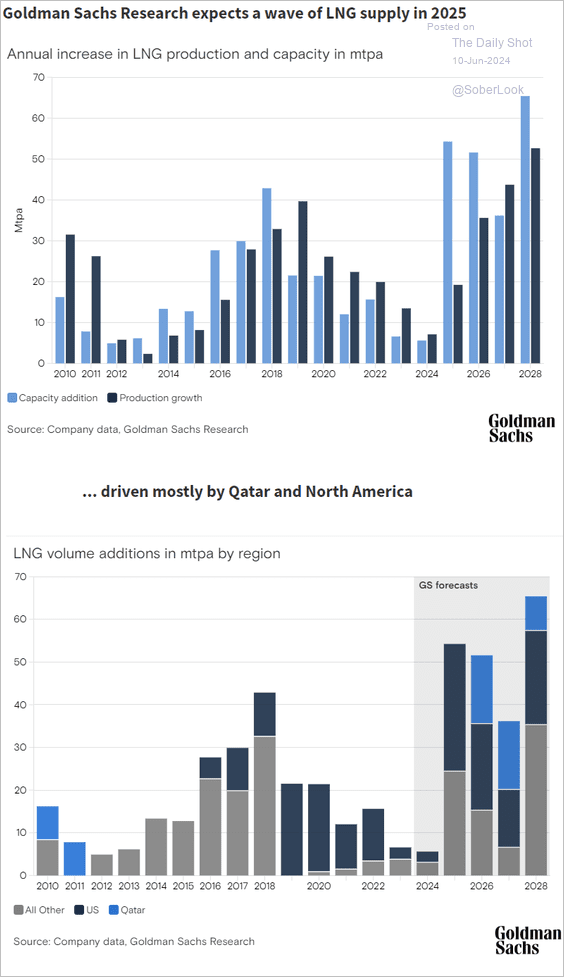

2. LNG supply is expected to rise sharply next year.

Source: Goldman Sachs

Source: Goldman Sachs

Back to Index

Equities

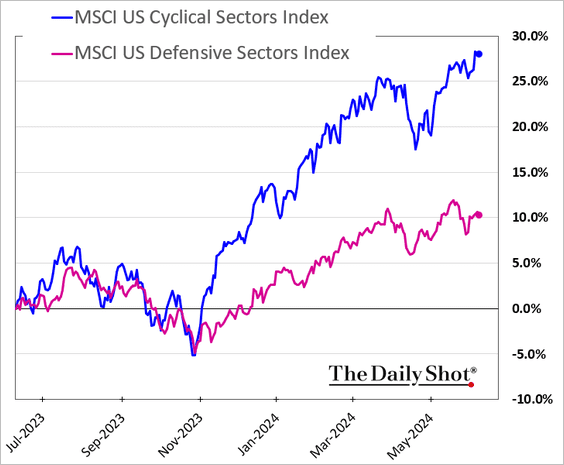

1. Cyclical sectors keep outperforming.

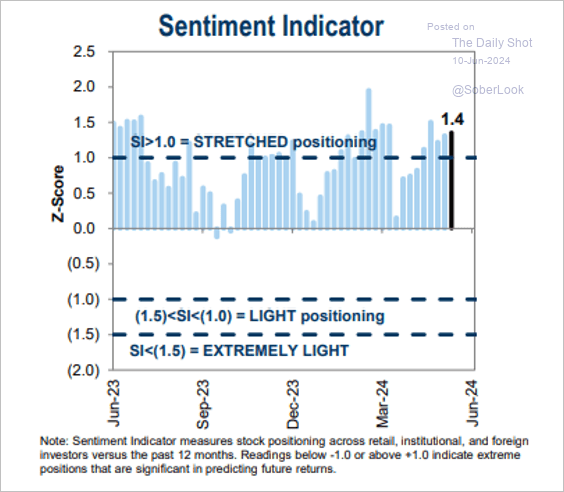

2. Investor sentiment continues to be upbeat, according to positioning data.

Source: Goldman Sachs; @MikeZaccardi

Source: Goldman Sachs; @MikeZaccardi

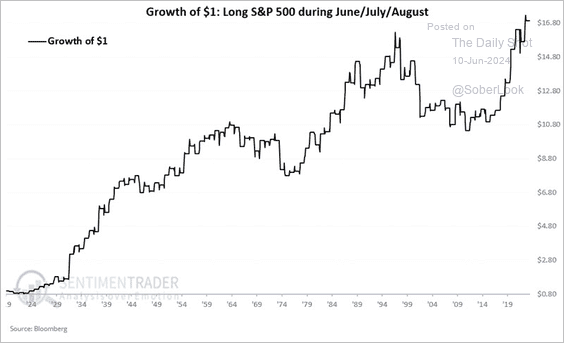

3. Hypothetically, investing in the S&P 500 during the June-August period has resulted in a gain going back to 1920.

Source: SentimenTrader

Source: SentimenTrader

4. Mentions of “lower income” have increased in US company earnings calls.

Source: Stifel

Source: Stifel

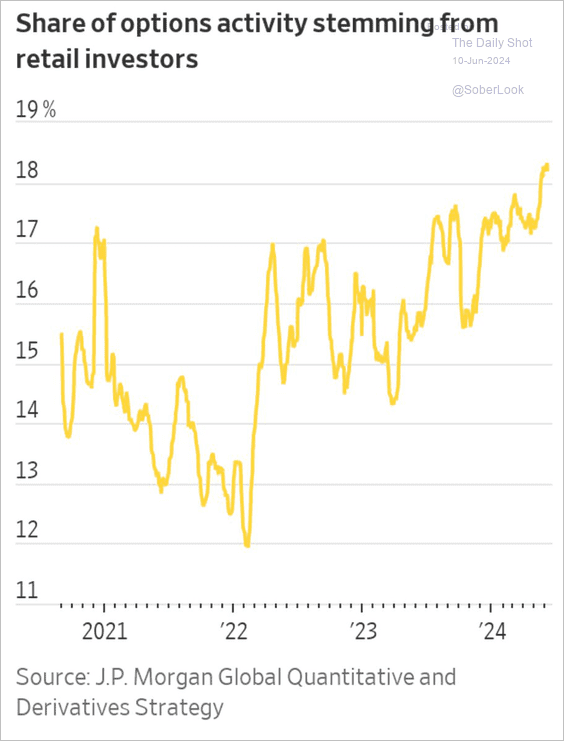

5. Retail investors are progressively expanding their share of the overall options market.

Source: @GunjanJS, @WSJmarkets

Source: @GunjanJS, @WSJmarkets

6. Buy-the-dip trends have been strong over the past couple of decades.

Source: BofA Global Research; @MikeZaccardi

Source: BofA Global Research; @MikeZaccardi

7. The ARK Innovation ETF continues to mirror the trajectory of the Nasdaq during the dot-com era.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

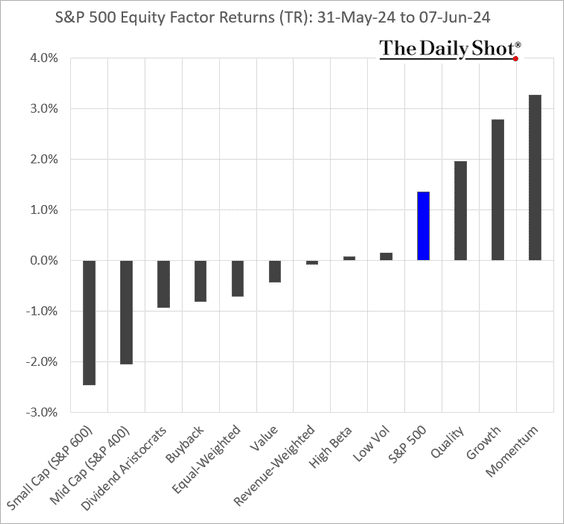

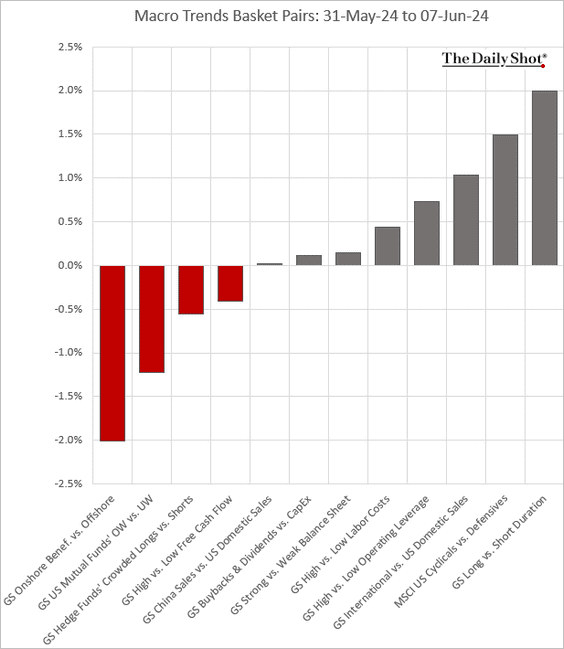

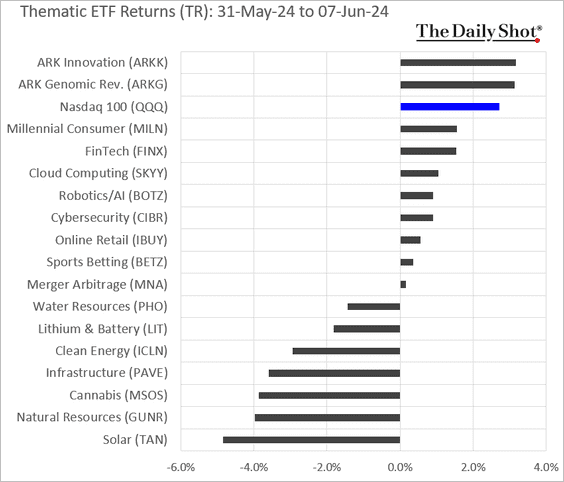

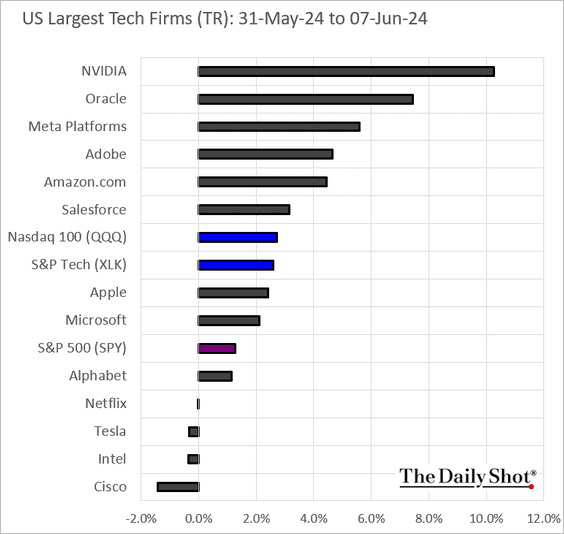

8. Next, we have some performance data from last week.

• Sectors:

• Equity factors/styles:

• Macro basket pairs’ relative performance:

• Thematic ETFs:

• Largest US tech firms:

Back to Index

Credit

1. The US leveraged loan default rate hit the lowest level in 15 months. However, some issuers continue to employ out-of-court liability management exercises to help skirt potential Chapter 11 bankruptcy filings, according to PitchBook.

Source: PitchBook

Source: PitchBook

• Investors are consistently directing capital into leveraged loan funds.

Source: BofA Global Research

Source: BofA Global Research

——————–

2. Here is last week’s performance.

Back to Index

Rates

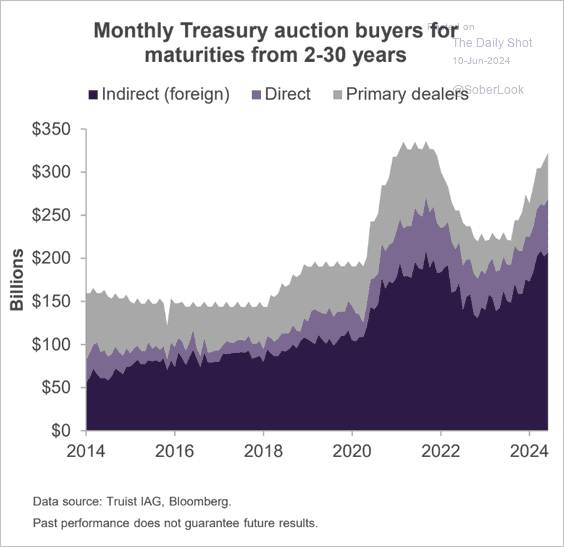

1. Here is a look at coupon Treasury issuance.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

2. The Treasury curve has been inverted for 484 trading sessions.

Back to Index

Global Developments

1. The global stock/bond ratio appears overbought within a strong uptrend.

Source: MRB Partners

Source: MRB Partners

• Upside momentum has slowed over the past few months in the global stock/bond ratio, which typically preceded short-term pullbacks.

——————–

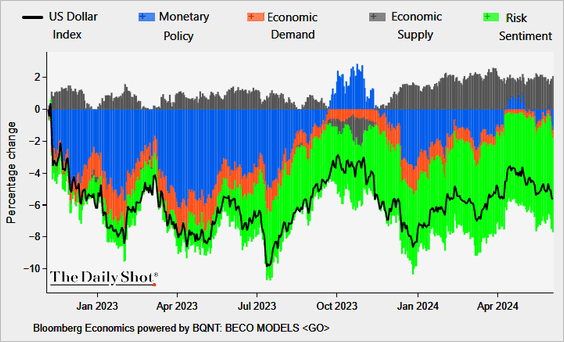

2. Here is Bloomberg’s model explaining the factors influencing changes in the US dollar index.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

3. South Korea’s exports signal a rebound in global trade.

Source: @JeffreyKleintop

Source: @JeffreyKleintop

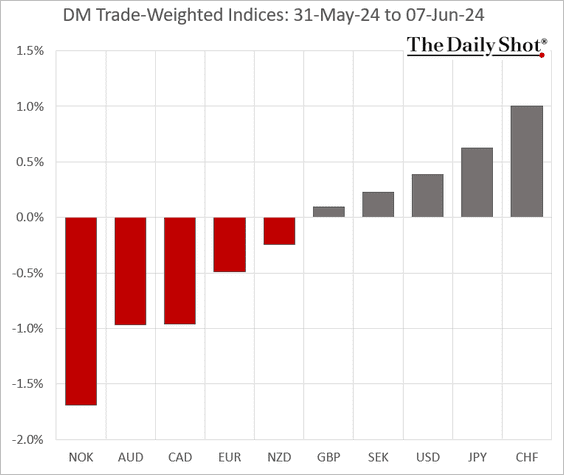

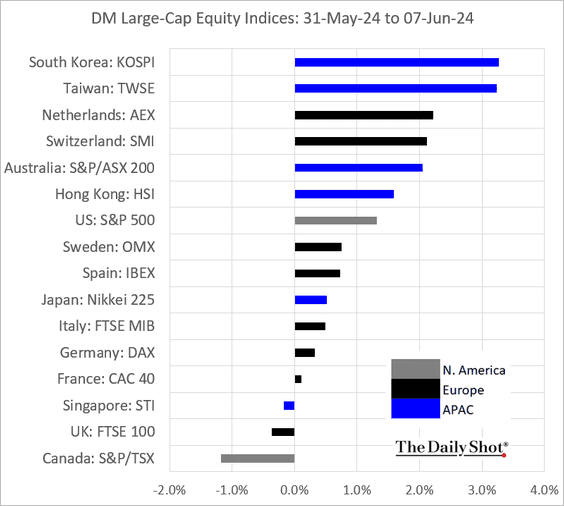

4. Finally, we have last week’s performance data.

• Currencies:

• Equities:

——————–

Food for Thought

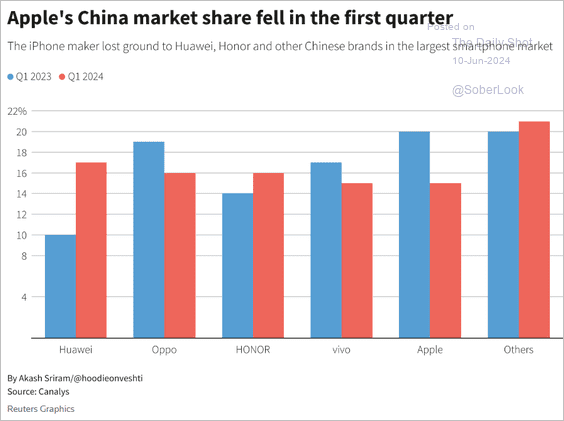

1. Apple’s China market share:

Source: Reuters Read full article

Source: Reuters Read full article

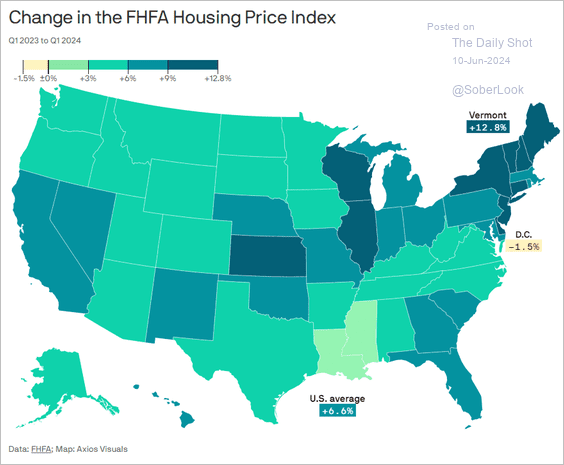

2. Year-over-year changes in house prices:

Source: @axios Read full article

Source: @axios Read full article

3. Life expectancy:

Source: @financialtimes Read full article

Source: @financialtimes Read full article

4. Student-to-school counselor ratio:

Source: @axios Read full article

Source: @axios Read full article

5. United Nations Security Council vetoes by country:

Source: The Economist Read full article

Source: The Economist Read full article

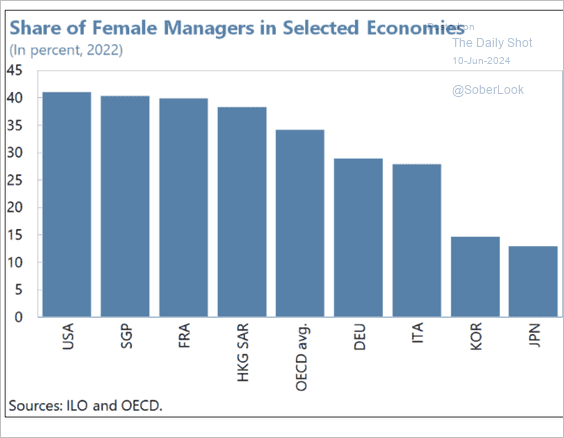

6. Female managers:

Source: IMF Read full article

Source: IMF Read full article

7. Most-visited museums:

Source: Statista Read full article

Source: Statista Read full article

——————–

Back to Index