The Daily Shot: 12-Jun-24

• The United States

• Canada

• The United Kingdom

• The Eurozone

• Europe

• Japan

• China

• Emerging Markts

• Cryptocurrency

• Energy

• Equities

• Credit

• Rates

• Global Developments

• Food for Thought

The United States

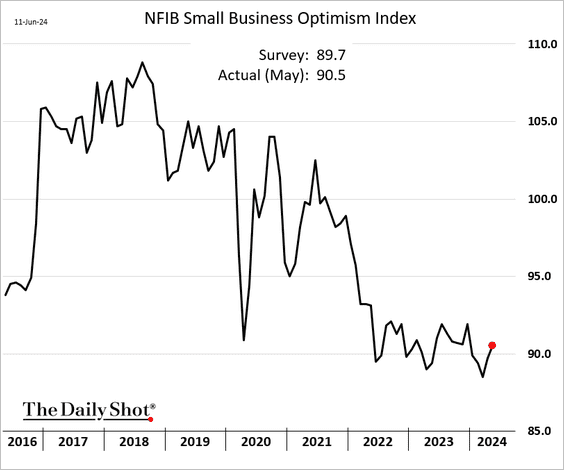

1. The NFIB small business sentiment index increased again in May, …

… while the uncertainty index hit the highest level since 2020.

Source: RTT News Read full article

Source: RTT News Read full article

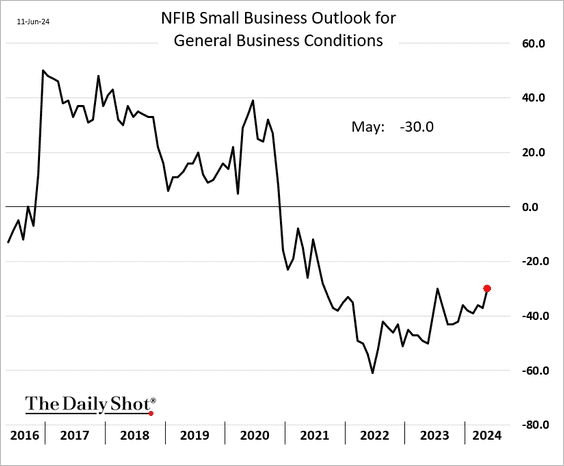

• The outlook was less gloomy last month.

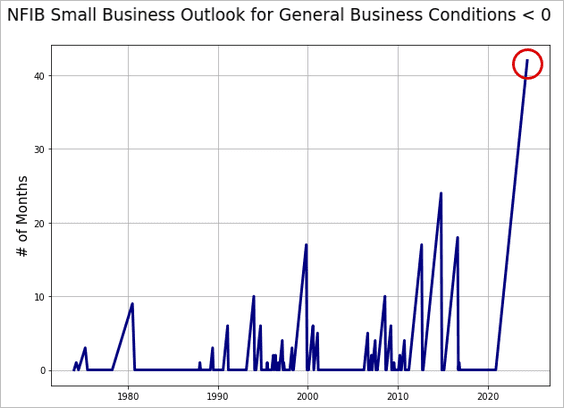

However, the NFIB’s outlook index has been holding in negative territory for 42 consecutive months.

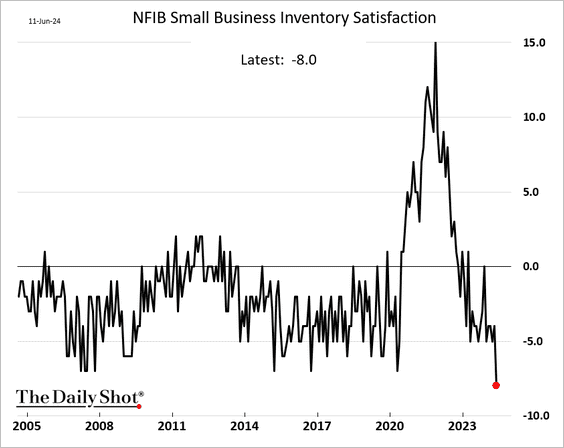

• Sales and earnings indicators remain depressed.

– Small firms see their inventories as too high.

• More companies plan to raise prices.

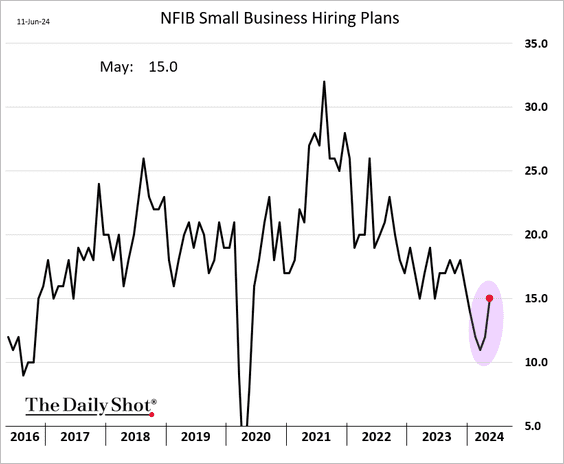

• Labor indicators showed improvement last month.

– Hiring plans:

– Job openings:

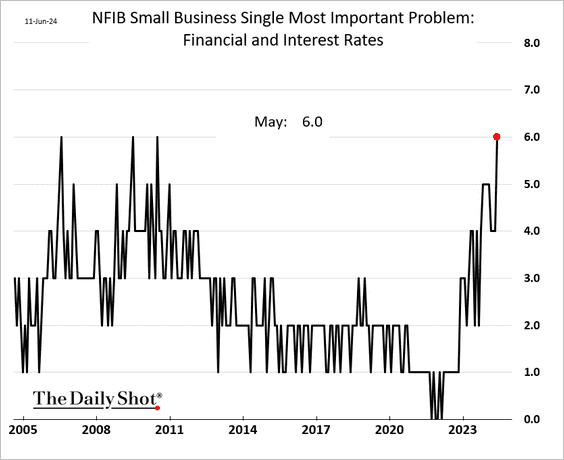

• More small firms are citing elevated interest rates as a major issue, …

… yet an increasing number of companies report that their borrowing needs are being met.

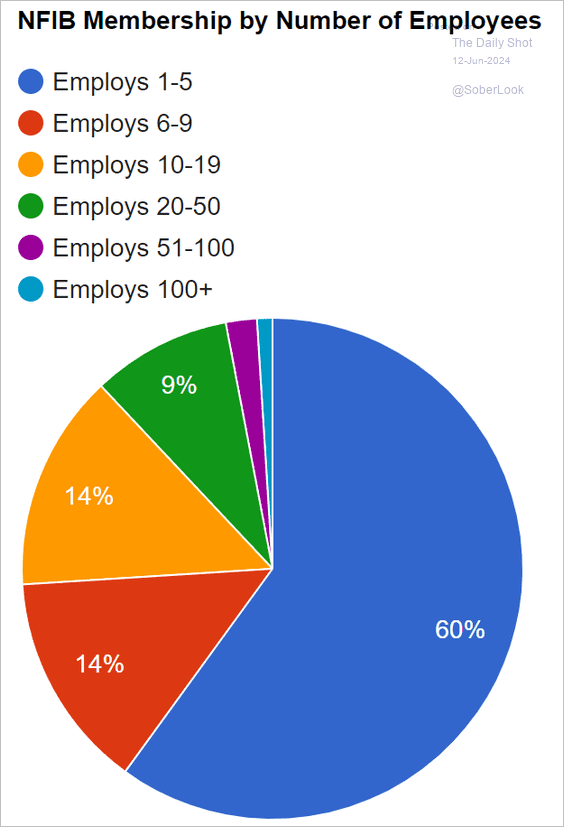

• It’s important to note that NFIB members tend to be very small businesses, with responses provided by their owners. In some ways, the NFIB survey resembles a consumer survey without adjustments for demographics or political leanings.

Source: NFIB

Source: NFIB

——————–

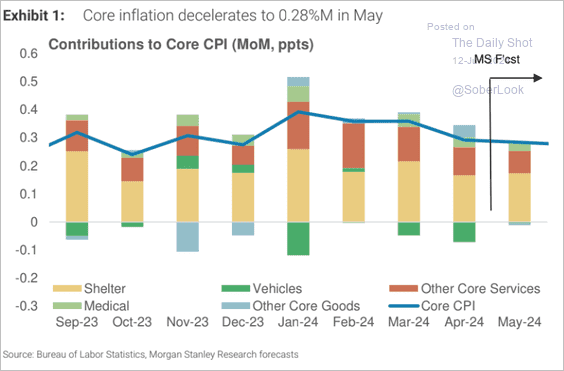

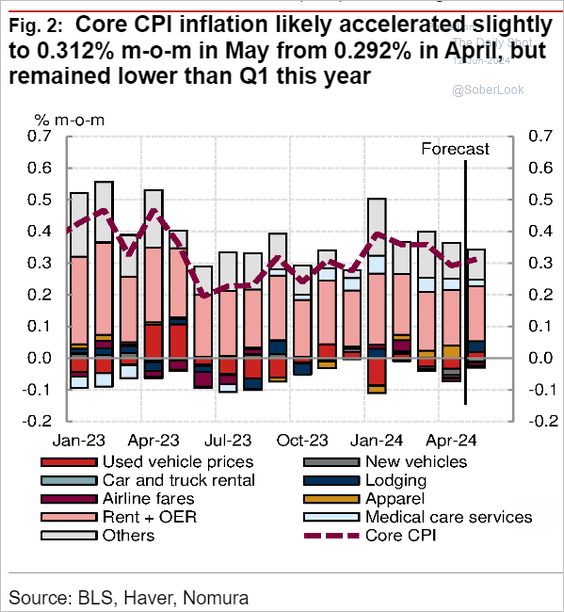

2. What should we expect from today’s CPI report?

• Morgan Stanley’s estimates show the core CPI gains slowing in May.

Source: Morgan Stanley Research

Source: Morgan Stanley Research

• Nomura expects a modest increase.

Source: Nomura Securities

Source: Nomura Securities

——————–

3. The inventory-to-sales ratios for durable and nondurable goods in the wholesale sector are trending in opposite directions (the second panel provides an example).

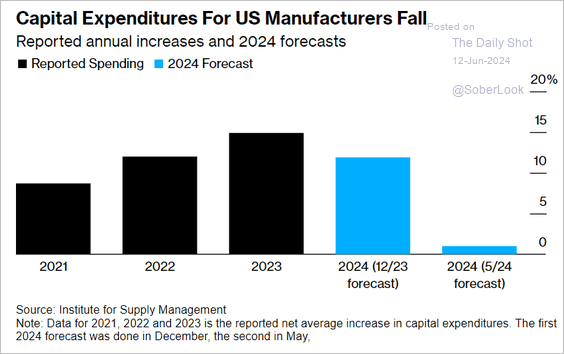

4. US manufacturing CapEx growth is expected to slow sharply this year.

Source: @economics Read full article

Source: @economics Read full article

5. Spending at restaurants has been outpacing grocery spending.

Source: @WSJ Read full article

Source: @WSJ Read full article

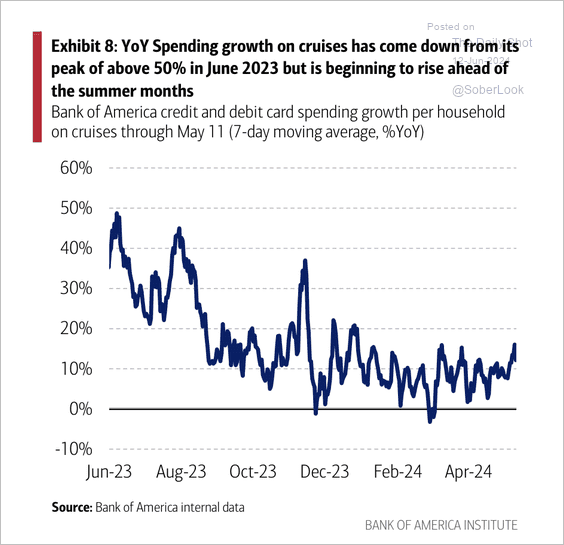

• Consumer travel spending as a share of disposable income remains below 2019 levels, according to BofA credit and debit card data.

Source: Bank of America Institute

Source: Bank of America Institute

– Spending growth on cruises is starting to improve.

Source: Bank of America Institute

Source: Bank of America Institute

Back to Index

Canada

1. Consumer confidence is rebounding.

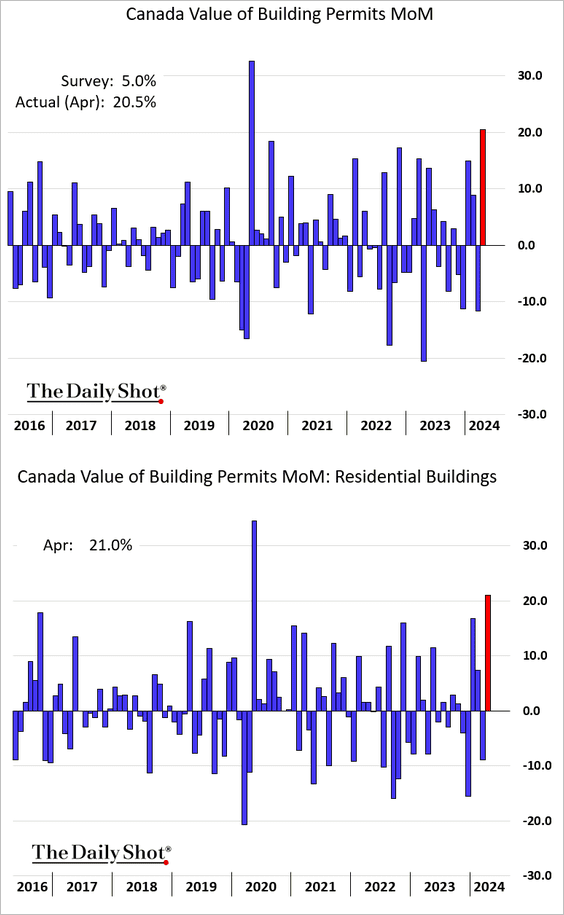

2. Building permits jumped in April.

3. Since March, Canada’s market-based policy rate trajectory has shifted downward, contrasting with upward repricing in other economies.

Source: @johnauthers, @opinion Read full article

Source: @johnauthers, @opinion Read full article

Back to Index

The United Kingdom

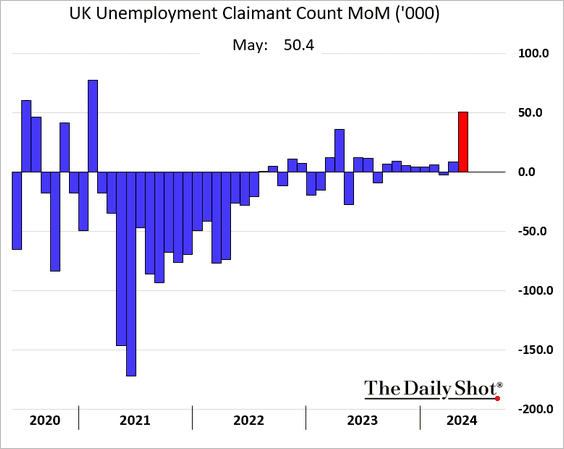

1. The unemployment rate continues to climb, …

… with the claimant count surging last month.

• At the same time, wage growth remains elevated.

Source: @WSJ Read full article

Source: @WSJ Read full article

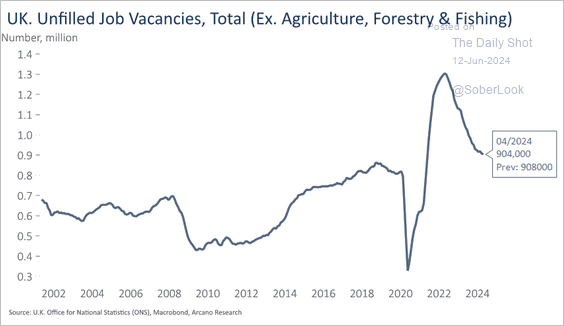

• Job vacancies are still trending lower.

Source: Arcano Economics

Source: Arcano Economics

——————–

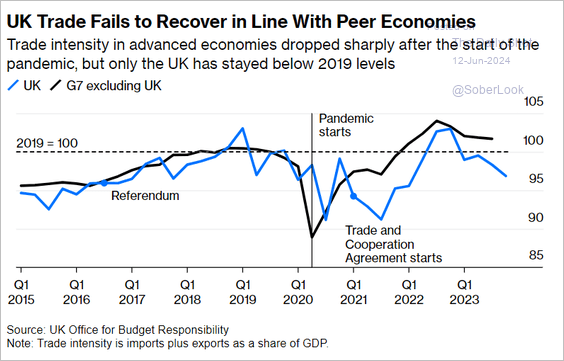

2. UK international trade is below pre-COVID levels.

Source: @adwooldridge, @opinion Read full article

Source: @adwooldridge, @opinion Read full article

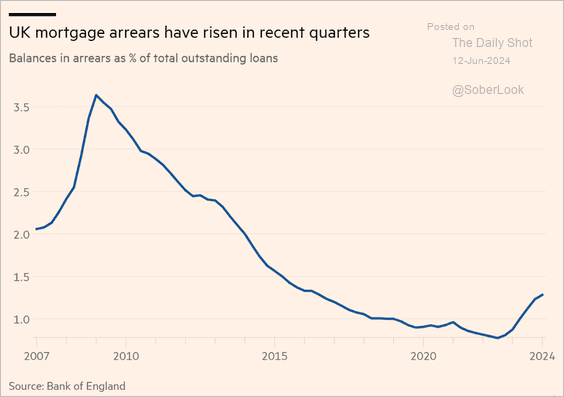

3. More UK mortgages are in arrears.

Source: @financialtimes Read full article

Source: @financialtimes Read full article

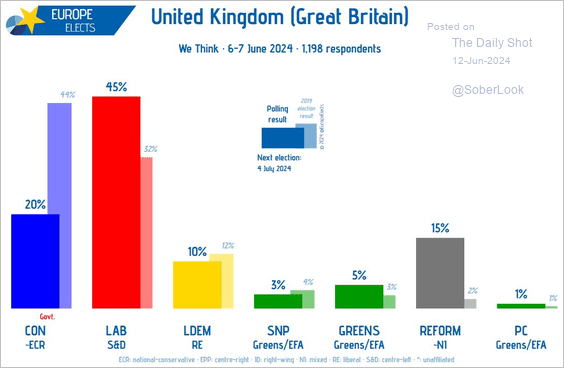

4. Here is the latest poll compared to the 2019 results.

Source: @EuropeElects

Source: @EuropeElects

Back to Index

The Eurozone

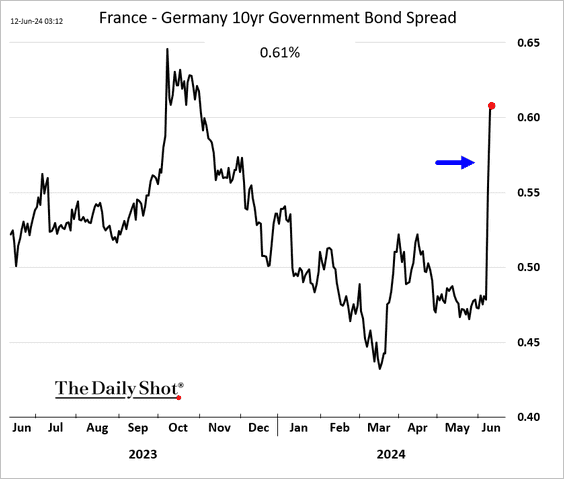

1. French bond spreads to Germany have risen sharply after the snap elections announcement.

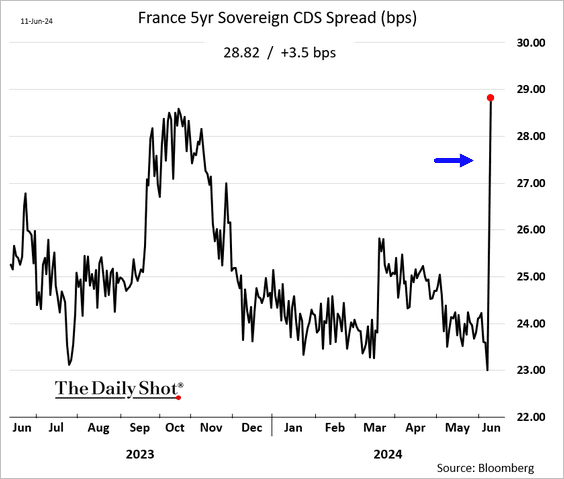

Here is the sovereign CDS spread.

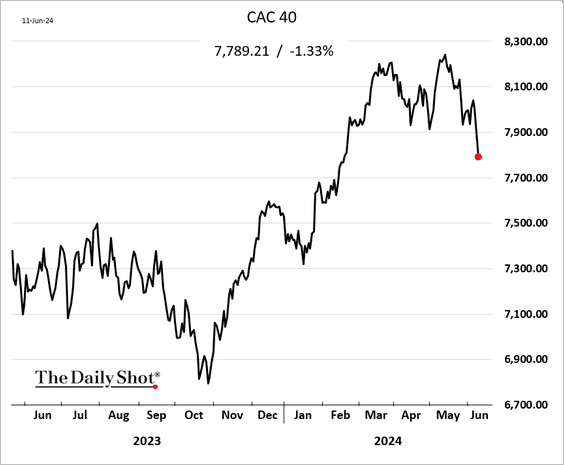

French shares seem to have stabilized this morning after a sharp selloff.

——————–

2. EUR/USD dipped below 1.075.

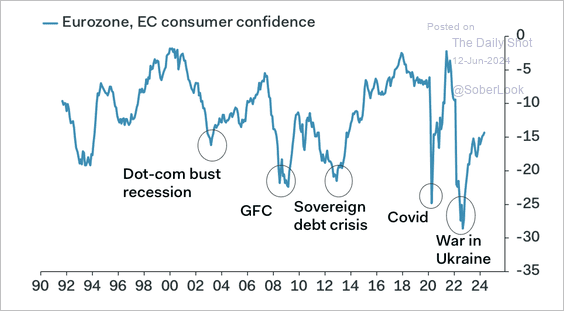

3. The latest increase in Eurozone consumer confidence remains subdued relative to historical highs.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

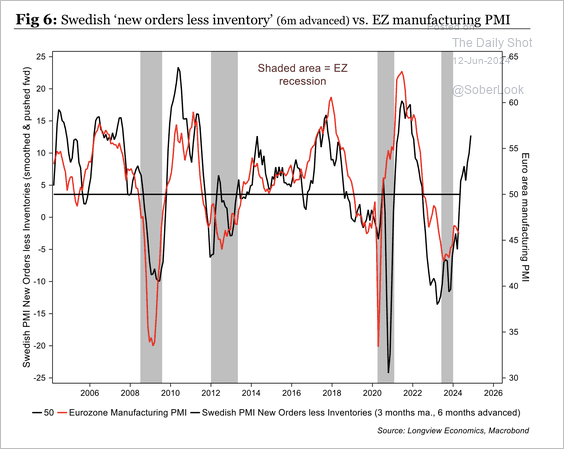

4. The rise in Sweden’s new orders vs. inventories points to an improvement in Eurozone manufacturing PMI.

Source: Longview Economics

Source: Longview Economics

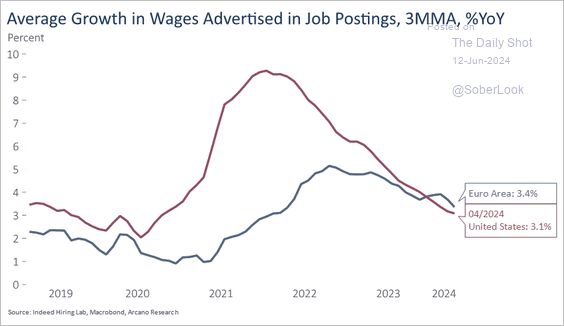

5. Wage pressures persist.

Source: @economics Read full article

Source: @economics Read full article

Wage growth in euro-area job postings is now surpassing that in the US.

Source: Arcano Economics

Source: Arcano Economics

Back to Index

Europe

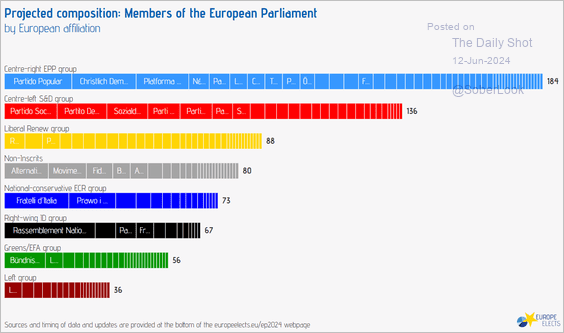

1. Here is the projected composition of the European Parliament.

Source: @EuropeElects

Source: @EuropeElects

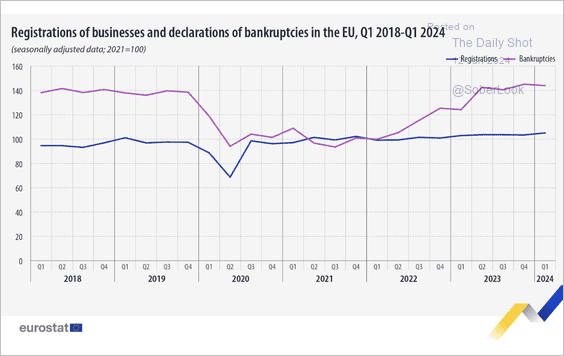

2. This chart shows business registrations and bankruptcies in the EU.

Source: Eurostat Read full article

Source: Eurostat Read full article

Back to Index

Japan

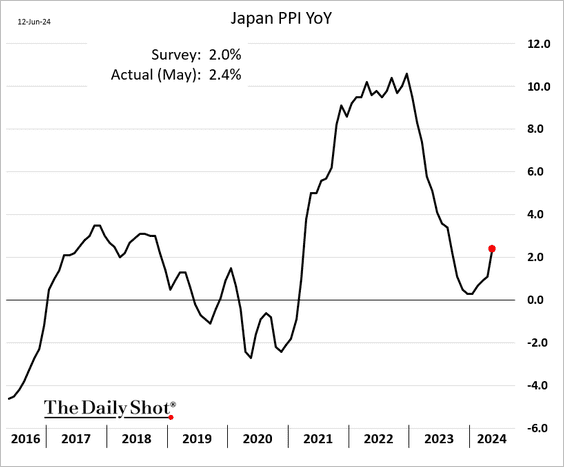

1. Producer prices are accelerating again.

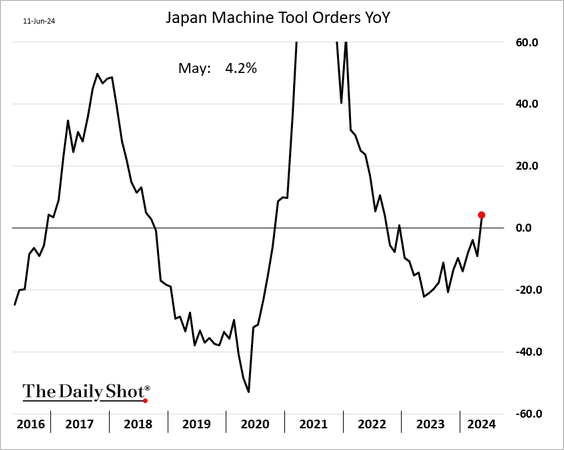

2. Machine tool orders are finally above 2023 levels.

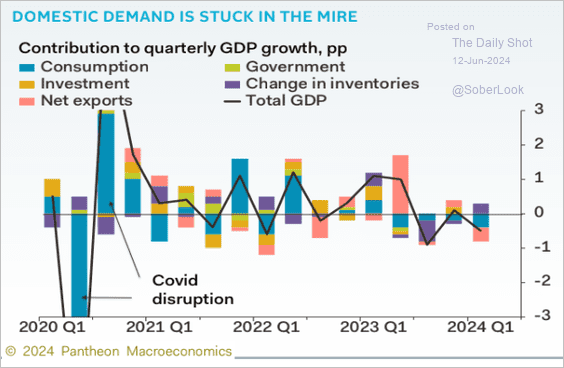

3. Domestic demand has been soft.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

4. The broad money supply growth continues to moderate.

Back to Index

China

1. Consumer inflation remains very low.

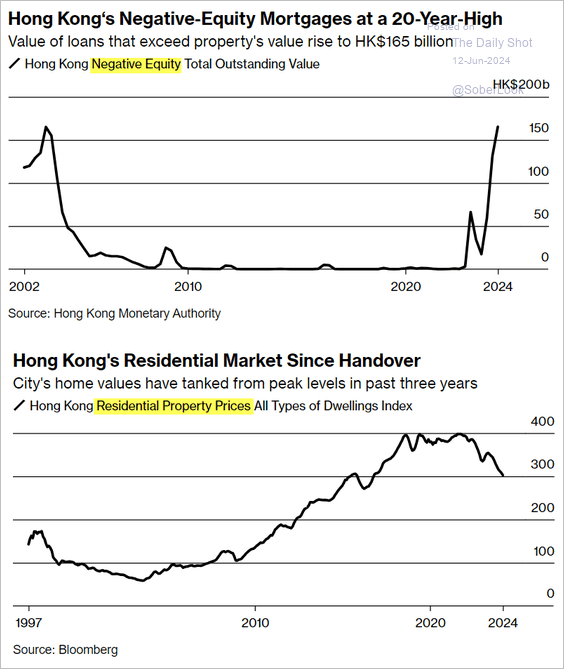

2. More Hong Kong homeowners face negative equity as residential property prices decline.

Source: @wealth Read full article

Source: @wealth Read full article

Back to Index

Emerging Markts

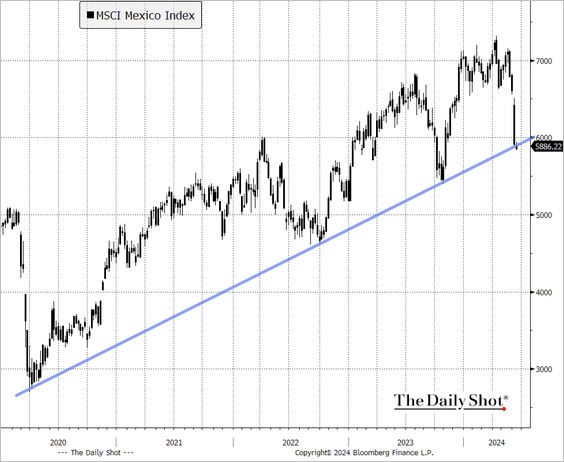

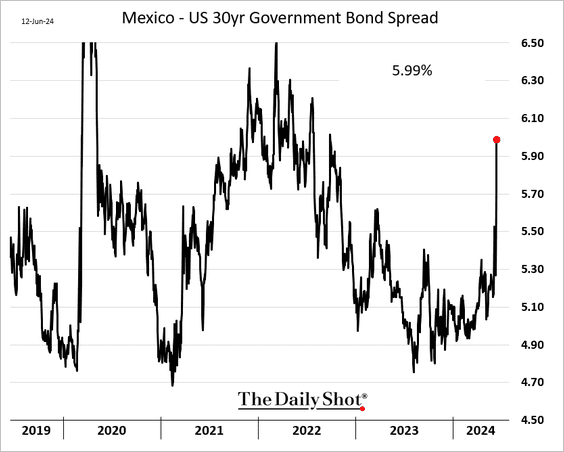

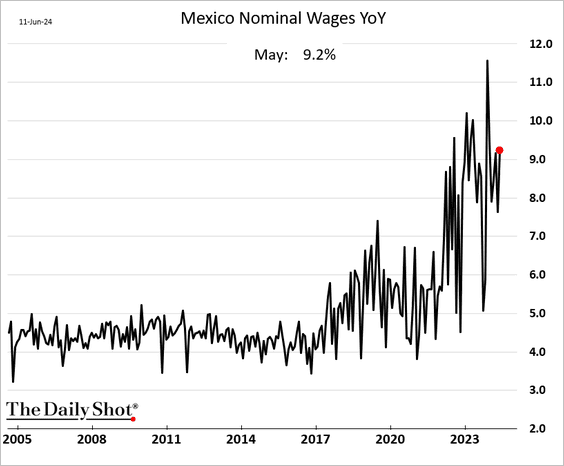

1. Let’s begin with Mexico.

• The MSCI Mexico equity index is testing uptrend support.

• Longer-term bond yields have risen after the election results.

• Manufacturing output took a hit in April.

• Wage growth is holding above 9%.

——————–

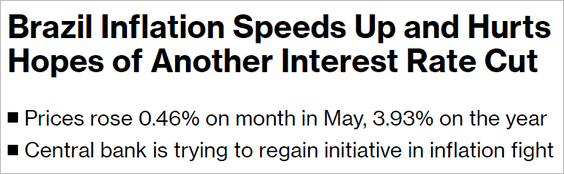

2. Brazil’s inflation report was a bit stronger than expected.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @economics Read full article

Source: @economics Read full article

• Bond yields climbed.

• The Brazilian real continues to weaken.

——————–

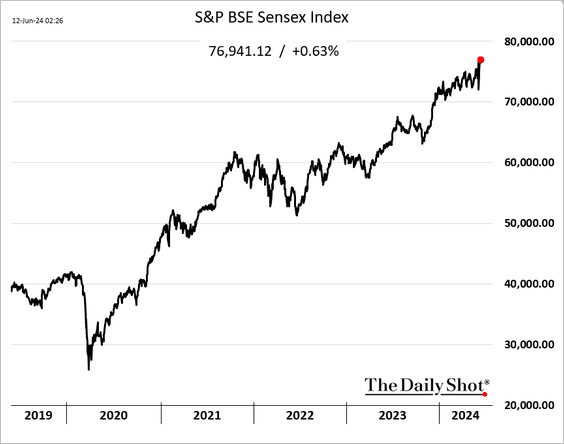

3. Indian stocks are hitting record highs.

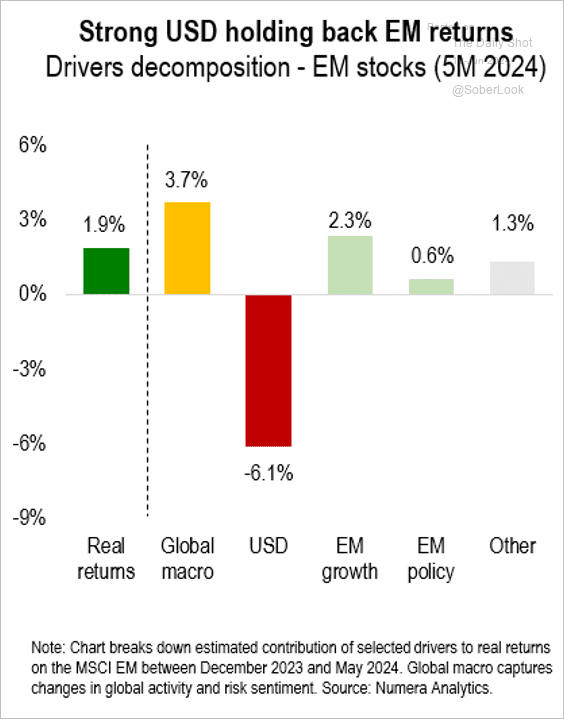

4. EM equities have been weighed down this year by an appreciating dollar, while global macro optimism and stronger economic growth (plus improvement in China) have stabilized returns.

Source: Numera Analytics (@NumeraAnalytics)

Source: Numera Analytics (@NumeraAnalytics)

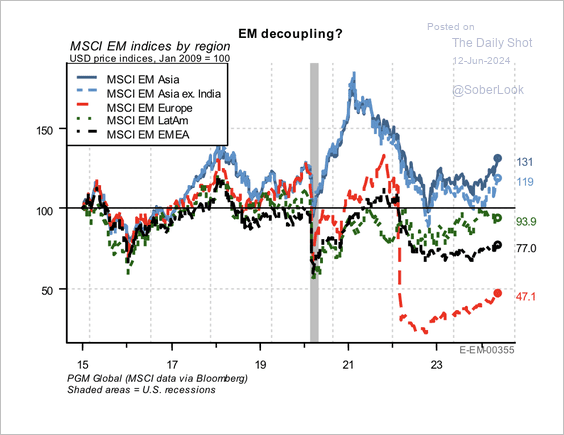

• There has been a wide dispersion across EM regional equity returns.

Source: PGM Global

Source: PGM Global

Back to Index

Cryptocurrency

1. After a sharp pullback, Bitcoin held support at its 50-day moving average.

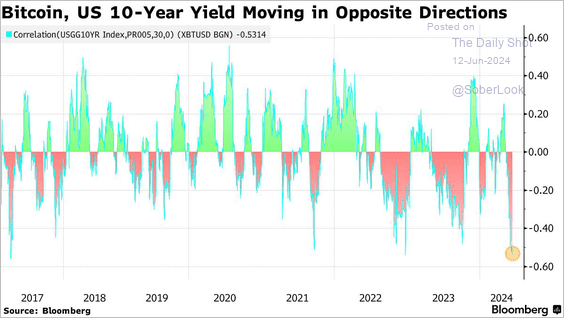

2. Bitcoin has been correlated to Treasuries in recent weeks.

Source: @markets Read full article

Source: @markets Read full article

3. The streak of bitcoin ETF inflows has finally ended.

Source: @markets Read full article

Source: @markets Read full article

Back to Index

Energy

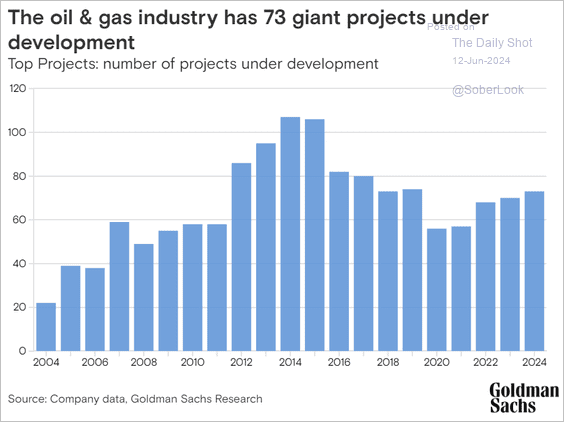

1. Here is a look at oil & gas projects under development over time.

Source: Goldman Sachs

Source: Goldman Sachs

2. Russia reduced its oil production, yet output still exceeds the levels pledged.

Source: @CrowleyKev, @markets Read full article

Source: @CrowleyKev, @markets Read full article

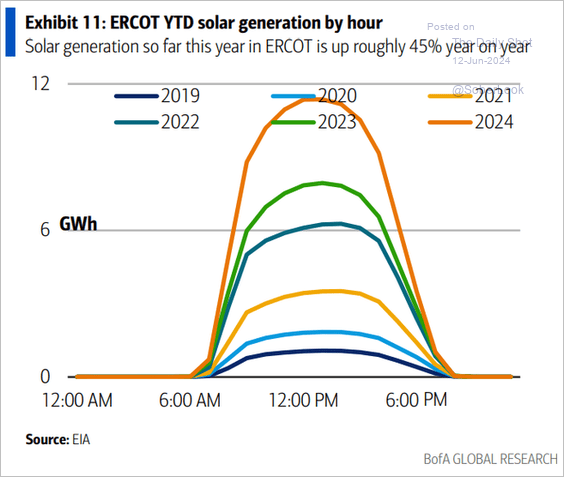

3. Texas continues to boost its solar power usage.

Source: BofA Global Research; @MikeZaccardi

Source: BofA Global Research; @MikeZaccardi

4. US LNG cargo transits surged last week.

Source: BloombergNEF Read full article

Source: BloombergNEF Read full article

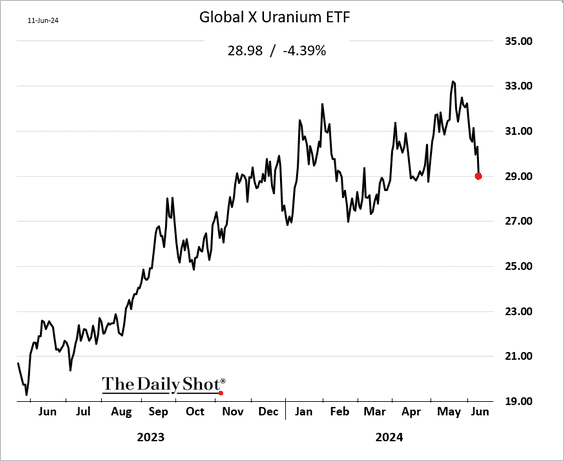

5. Uranium shares are rolling over.

6. European carbon credits have declined following the far-right’s gains in the European Parliament elections.

Back to Index

Equities

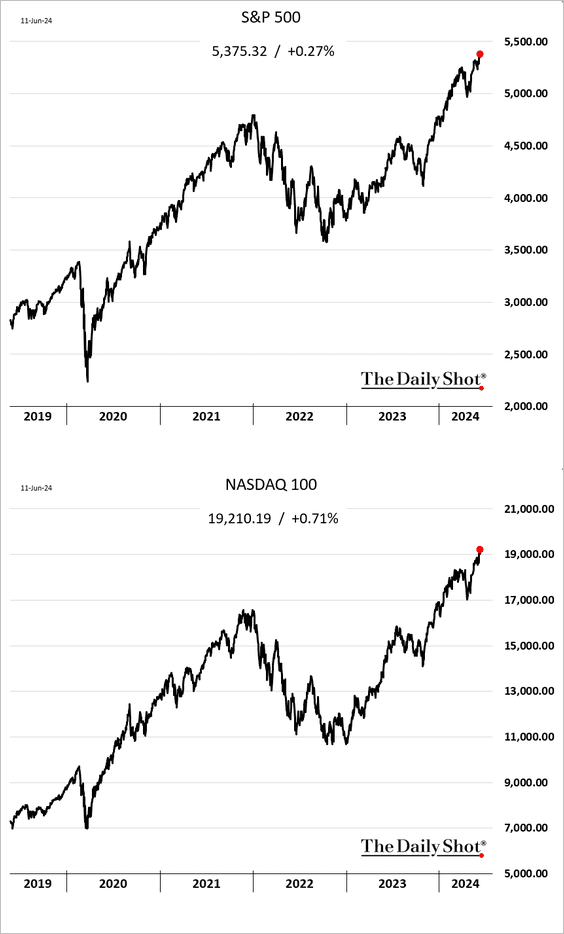

1. US indices hit another record high ahead of the CPI report and the FOMC decision, …

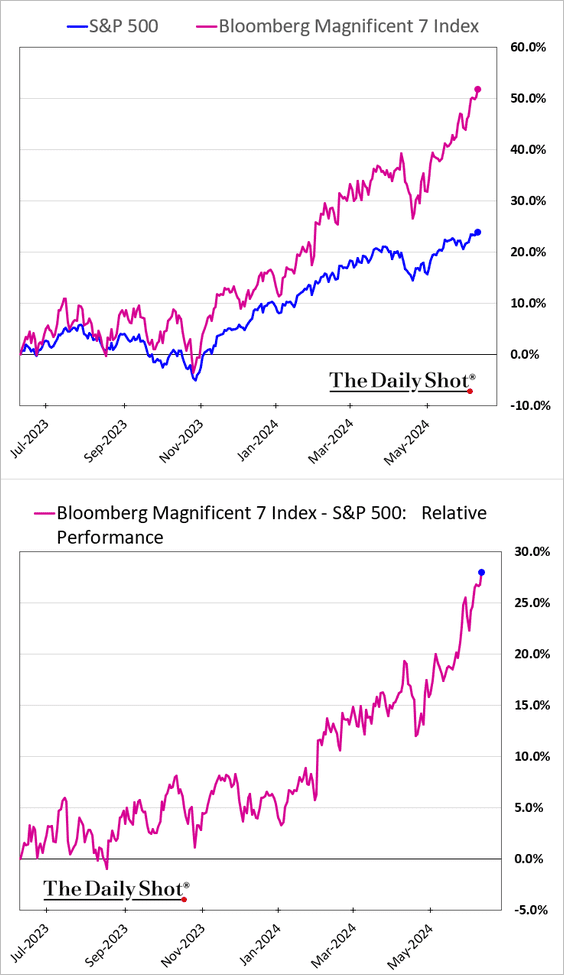

… driven by tech megacaps (on Tuesday it was Apple).

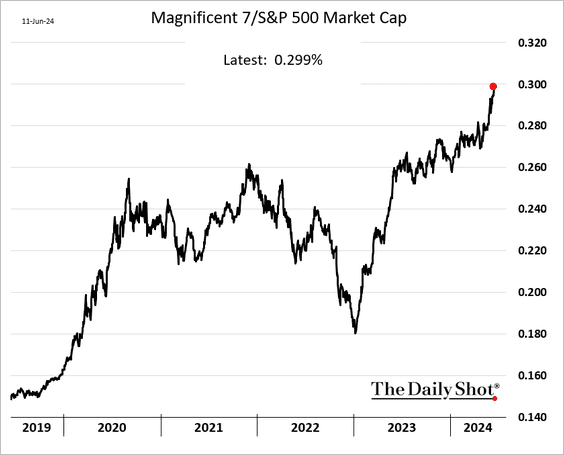

• The Magnificent 7 market cap is now 30% of the S&P 500.

• The average S&P 500 stock has fallen nearly 12% relative to the index over the past 12 months.

There is a similar trend globally.

• US stocks continue to widen their outperformance vs. the rest of the world.

——————–

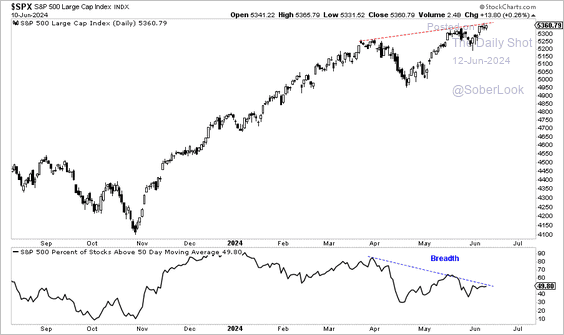

2. S&P 500 breadth has weakened over the past two months despite the market reaching new highs, reflecting narrow leadership.

Source: Aazan Habib, Paradigm Capital

Source: Aazan Habib, Paradigm Capital

3. The Russell 2000 underperformance continues to intensify.

h/t @MikeZaccardi

h/t @MikeZaccardi

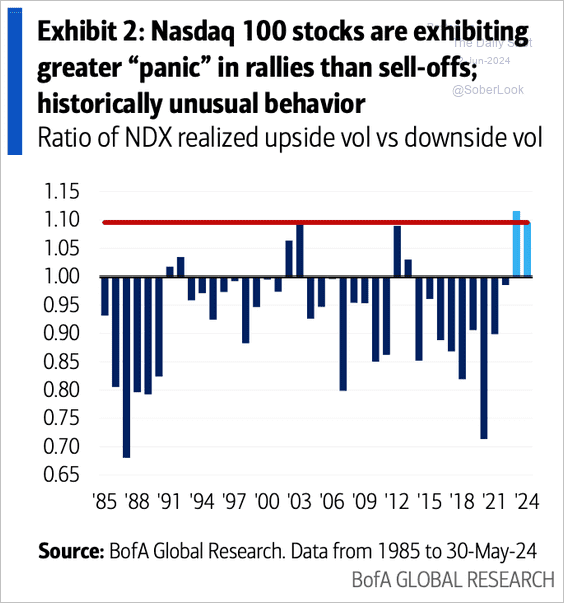

4. Upside volatility for Nasdaq 100 shares has been outpacing downside volatility.

Source: BofA Global Research; @dailychartbook

Source: BofA Global Research; @dailychartbook

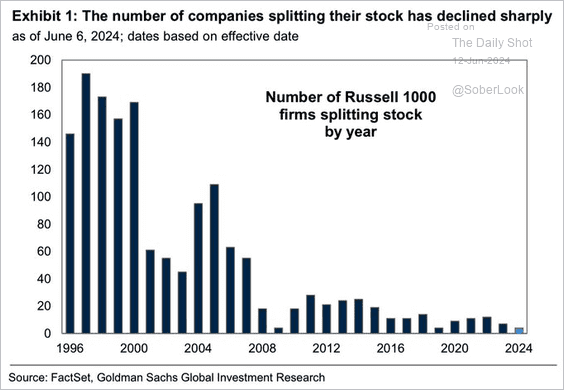

5. Stock splits haven’t been very common in recent years.

Source: Goldman Sachs; @WallStJesus

Source: Goldman Sachs; @WallStJesus

Back to Index

Credit

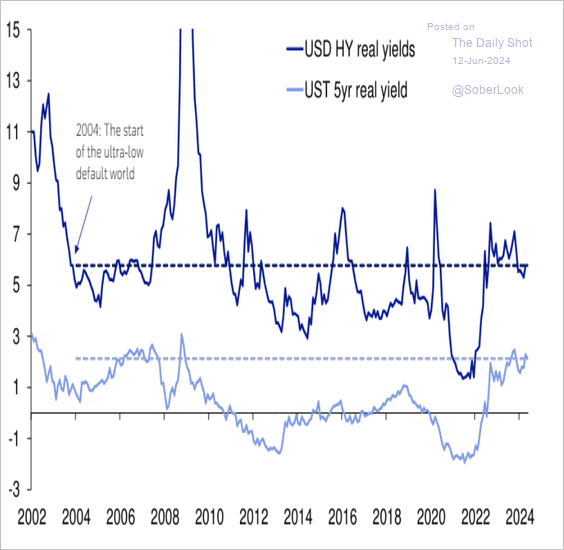

1. US junk bond real yields remain within their 20-year range despite government bond real yields reaching the highest level since the financial crisis.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

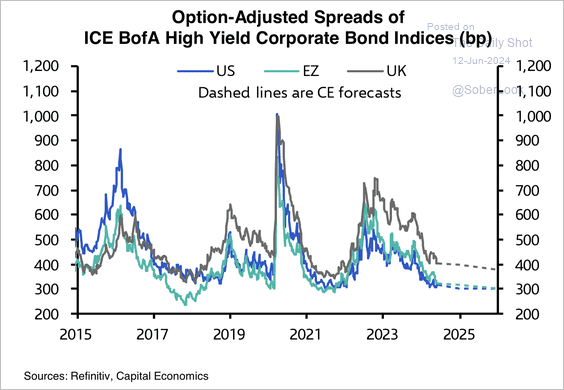

2. Capital Economics expects DM junk bond spreads to remain low for the rest of the year.

Source: Capital Economics

Source: Capital Economics

Back to Index

Rates

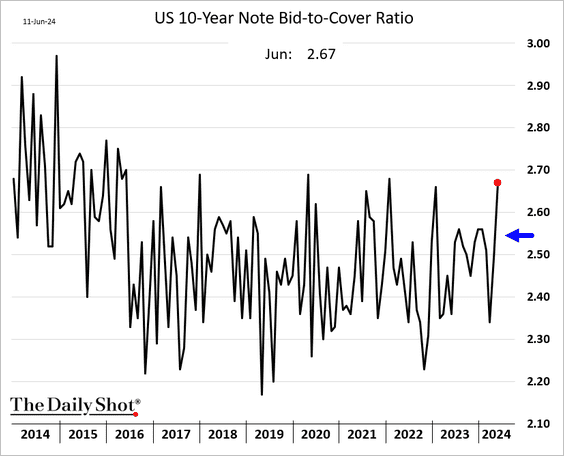

1. The 10-year Treasury yields declined …

… after a relatively strong auction (2 charts).

——————–

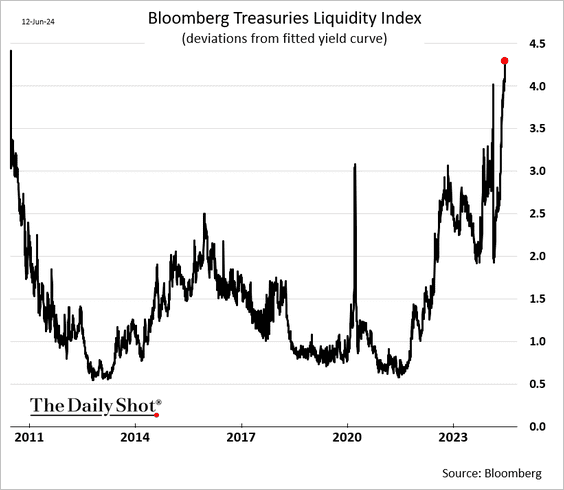

2. The Treasury market liquidity hasn’t been this poor since 2010.

h/t Simon White, Bloomberg Markets Live Blog

h/t Simon White, Bloomberg Markets Live Blog

Back to Index

Global Developments

1. Bloomberg’s US dollar index is at the upper end of the wedge pattern.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

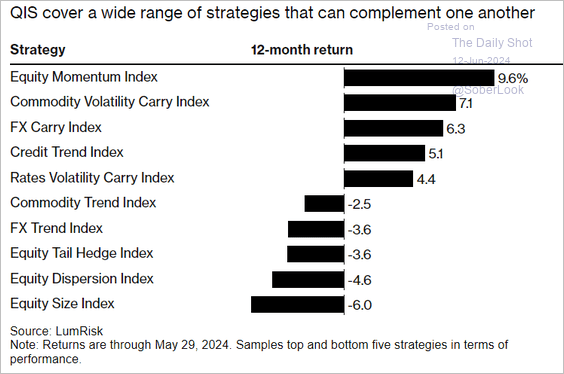

2. Here is a look at some quantitative investment strategies’ performance over the past 12 months.

Source: @markets Read full article

Source: @markets Read full article

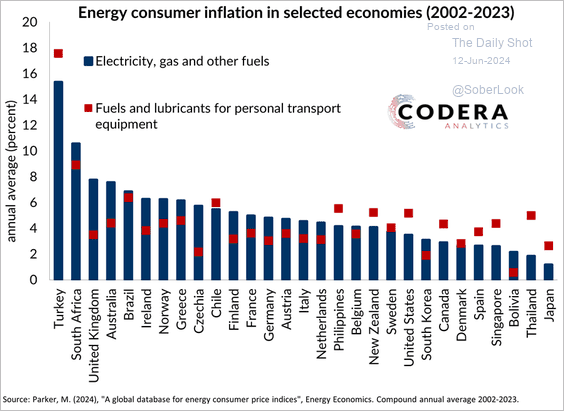

3. Turkey and South Africa have experienced much faster inflation in electricity, gas, and motor fuels since 2002 than other major economies.

Source: Codera Analytics

Source: Codera Analytics

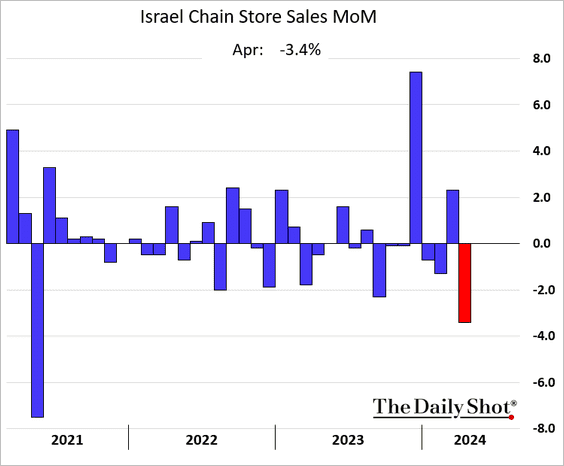

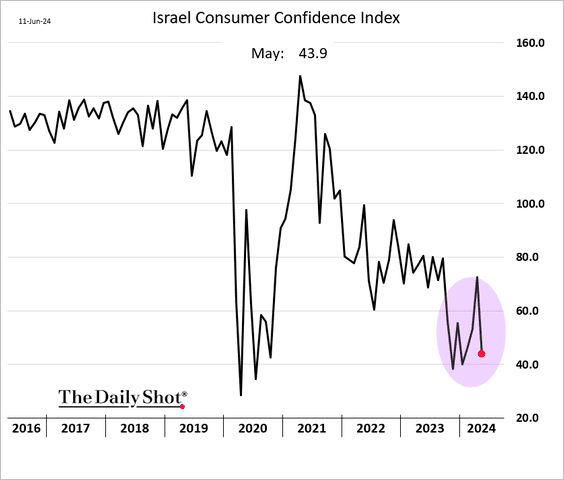

4. The war is taking a toll on Israel’s economy.

• Chain store sales:

• Consumer confidence:

• Consensus GDP growth estimate for 2024:

——————–

Food for Thought

1. Toyota’s vehicle sales:

Source: @chartrdaily

Source: @chartrdaily

2. China’s semiconductor exports to Russia:

![]() Source: The Economist Read full article

Source: The Economist Read full article

3. US tariffs on Chinese goods:

Source: The Economist Read full article

Source: The Economist Read full article

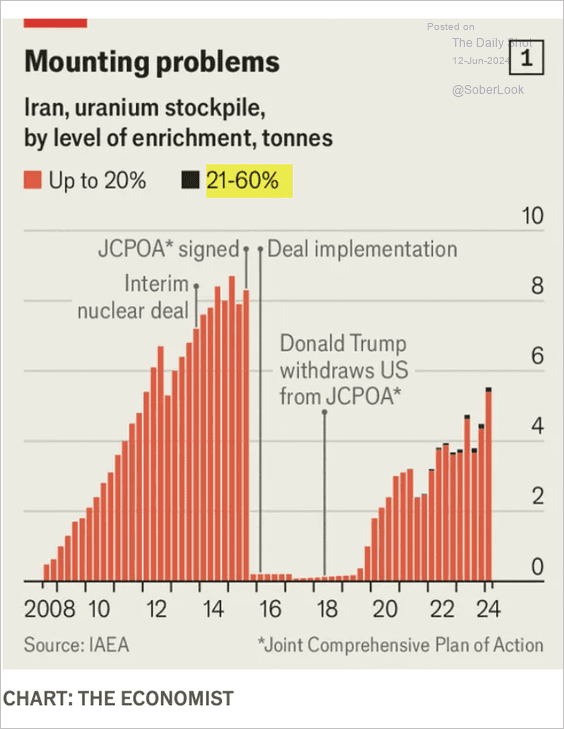

4. Iran’s uranium stockpile:

Source: The Economist Read full article

Source: The Economist Read full article

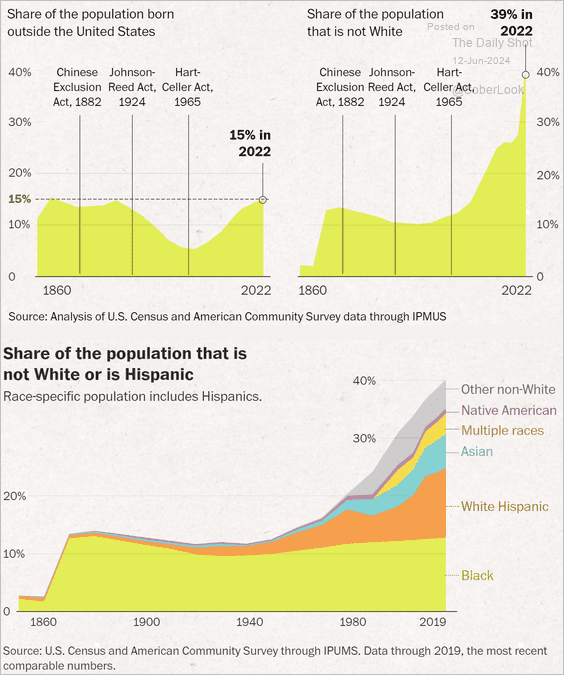

5. Changes in US population demographics since 1860:

Source: The Washington Post Read full article

Source: The Washington Post Read full article

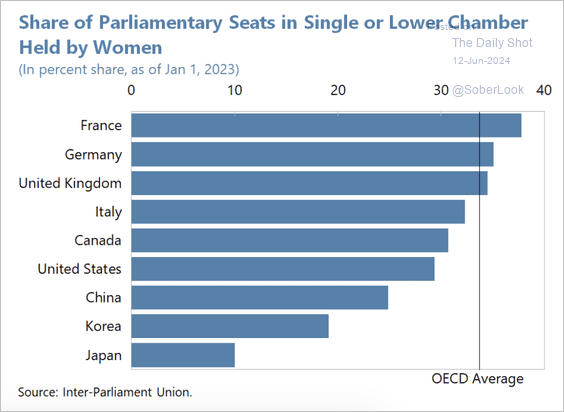

6. Parliamentary seats held by women:

Source: IMF Read full article

Source: IMF Read full article

7. The wettest and driest countries in the world:

Source: Visual Capitalist Read full article

Source: Visual Capitalist Read full article

——————–

Back to Index