The Daily Shot: 28-Jun-24

• Administrative Update

• The United States

• Canada

• The United Kingdom

• The Eurozone

• Europe

• Japan

• Emerging Markets

• Cryptocurrency

• Commodities

• Energy

• Equities

• Rates

• Global Developments

• Food for Thought

Administrative Update

The Daily Shot will not be published next Thursday and Friday (July 4th and 5th).

Back to Index

The United States

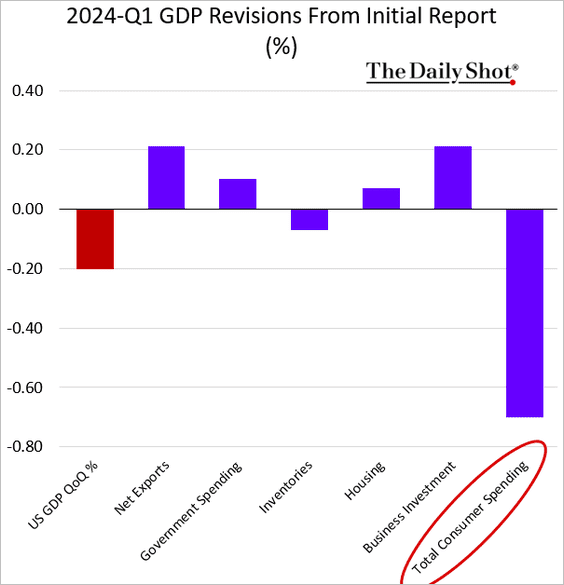

1. The final GDP revision showed further downward adjustments to Q1 consumer spending growth.

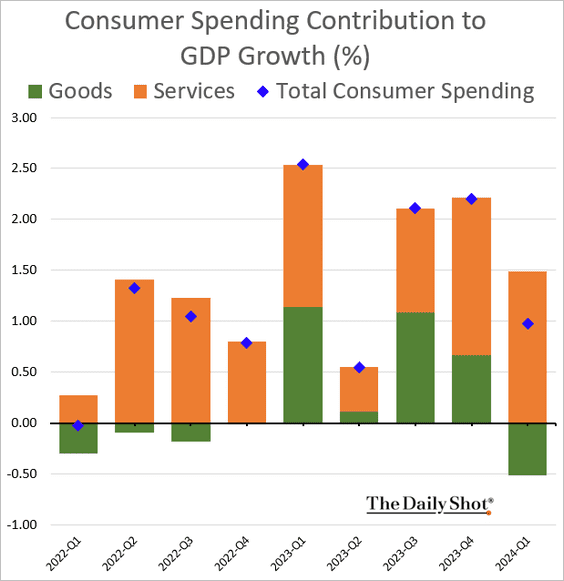

Here is the breakdown of the consumer spending contribution to GDP.

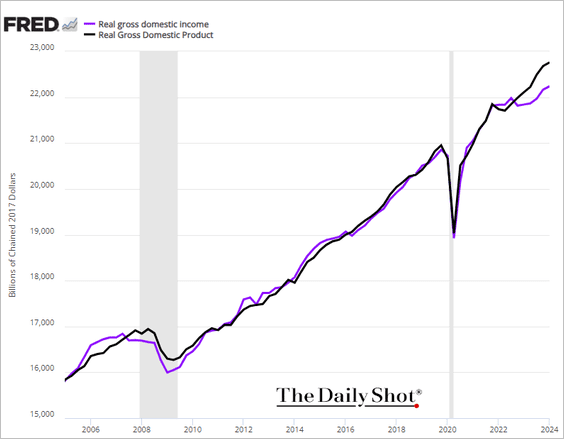

• One way or another, the GDP-GDI divergence must resolve itself.

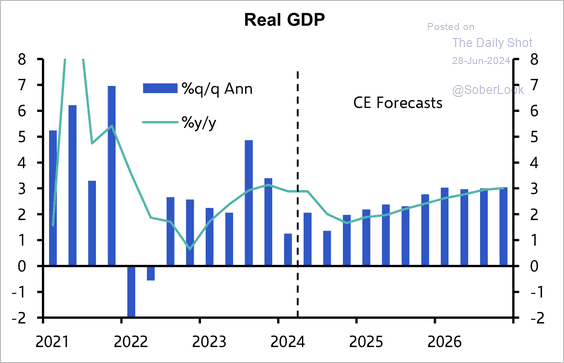

• Capital Economics expects a slowdown in real GDP during the second half of this year.

Source: Capital Economics

Source: Capital Economics

——————–

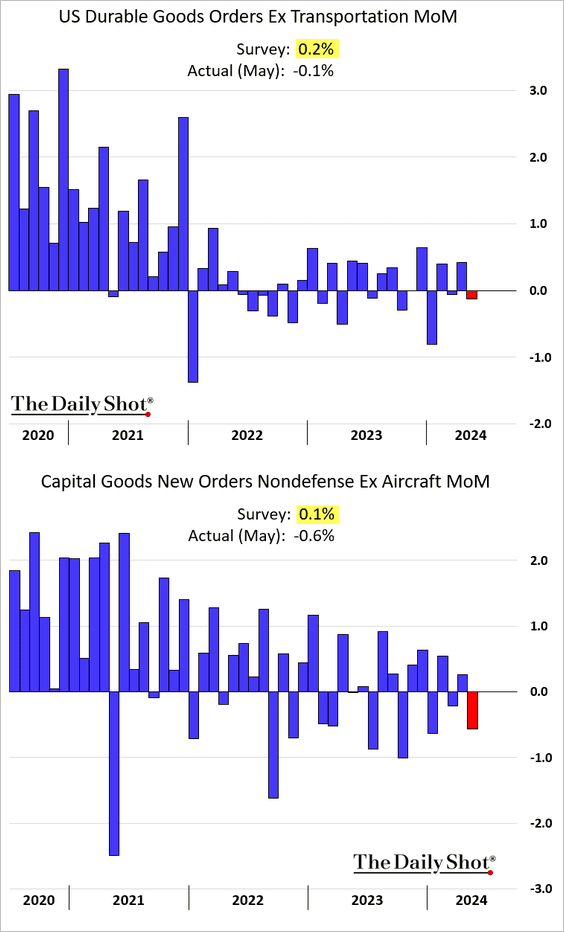

2. Durable goods orders surprised to the downside in May, with capital goods purchases being particularly weak.

Source: MarketWatch Read full article

Source: MarketWatch Read full article

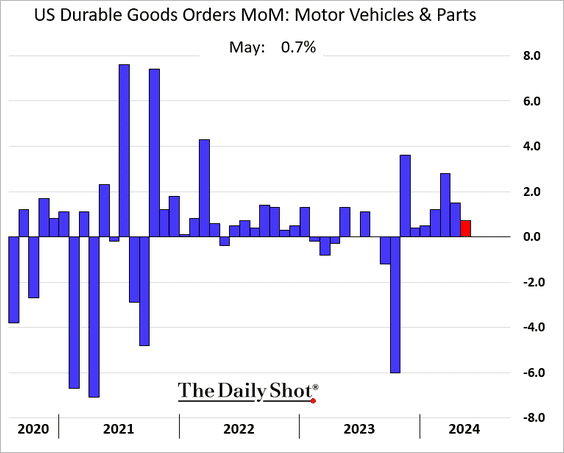

• Vehicle orders have increased for seven months in a row.

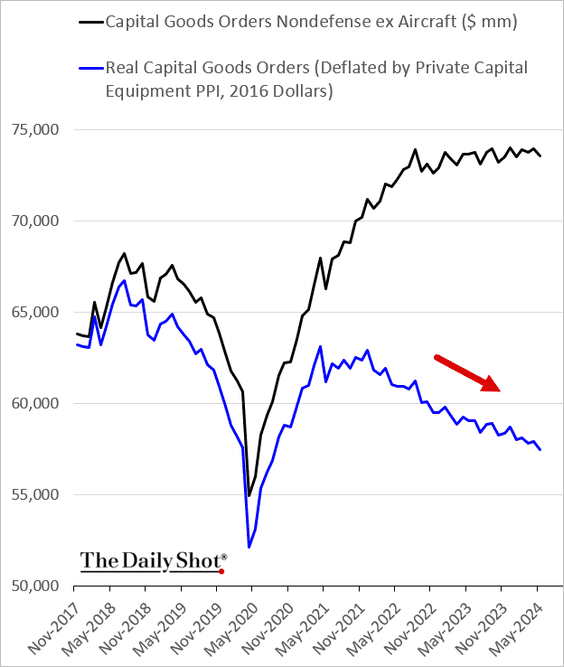

• Real capital goods orders have been steadily trending lower, indicating weak capital expenditures.

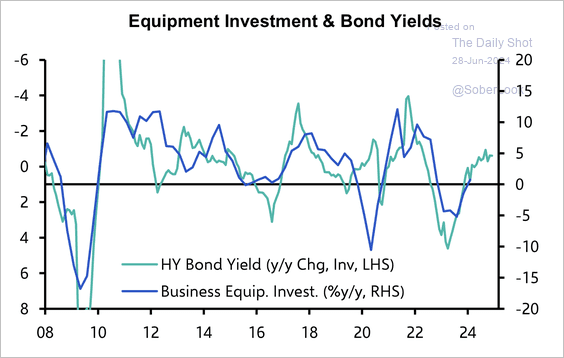

• The manufacturing sector could benefit from the recent drop in high-yield borrowing costs – a potential boost to equipment investment growth.

Source: Capital Economics

Source: Capital Economics

——————–

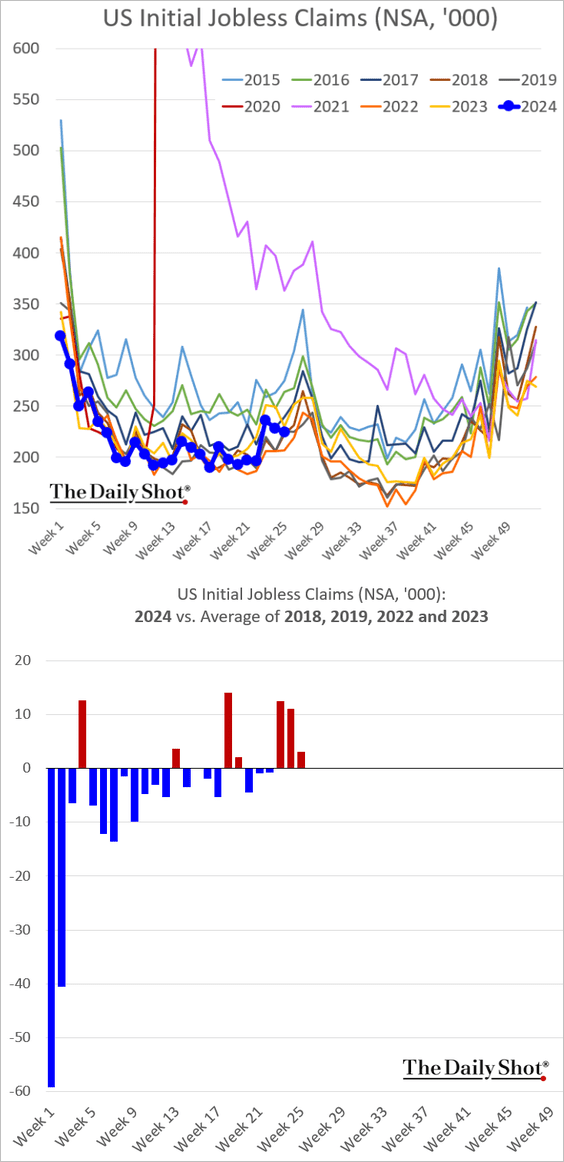

2. Initial jobless claims eased last week, …

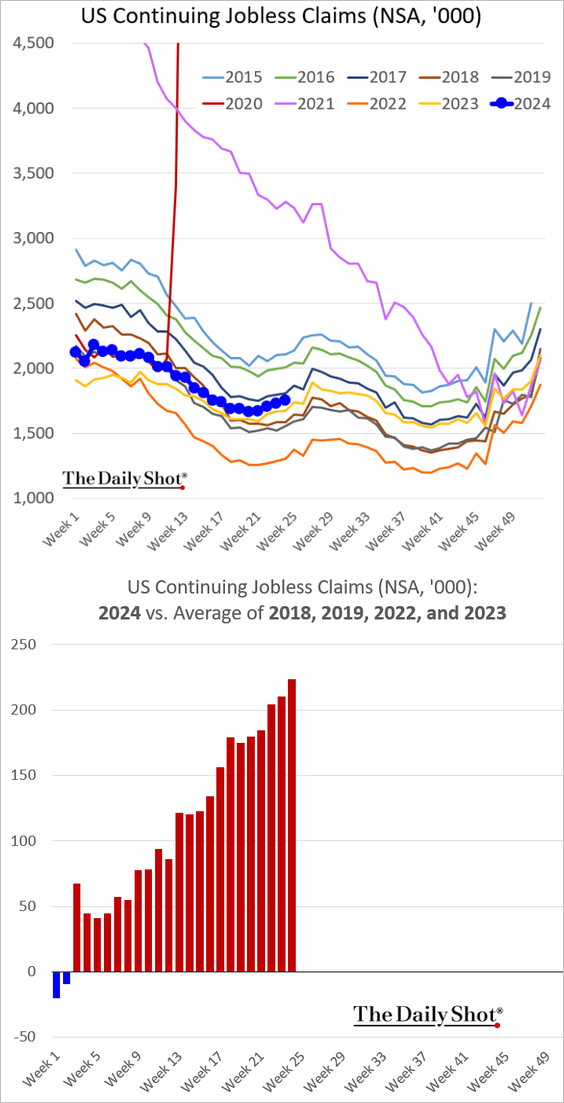

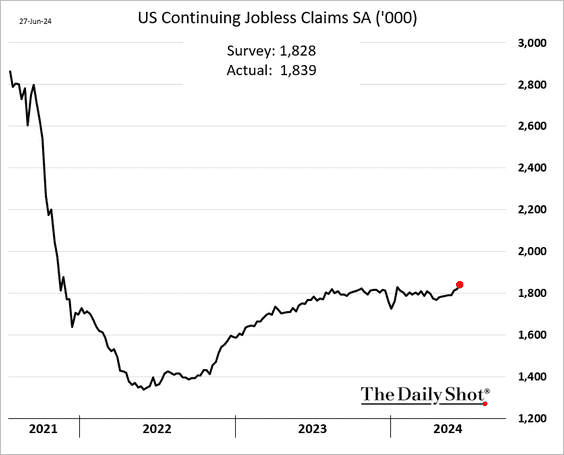

… but continuing claims keep moving higher.

Here is the seasonally adjusted index.

Source: AP News Read full article

Source: AP News Read full article

——————–

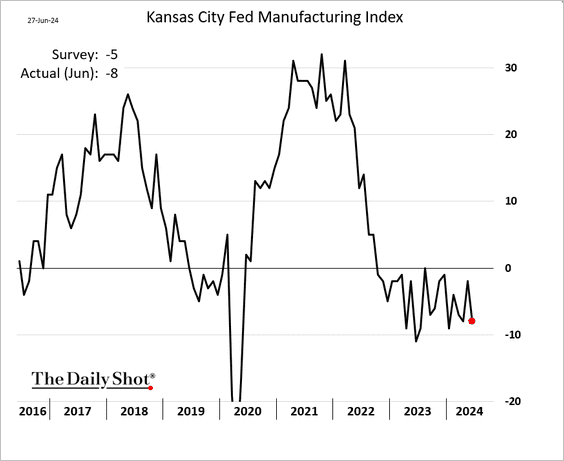

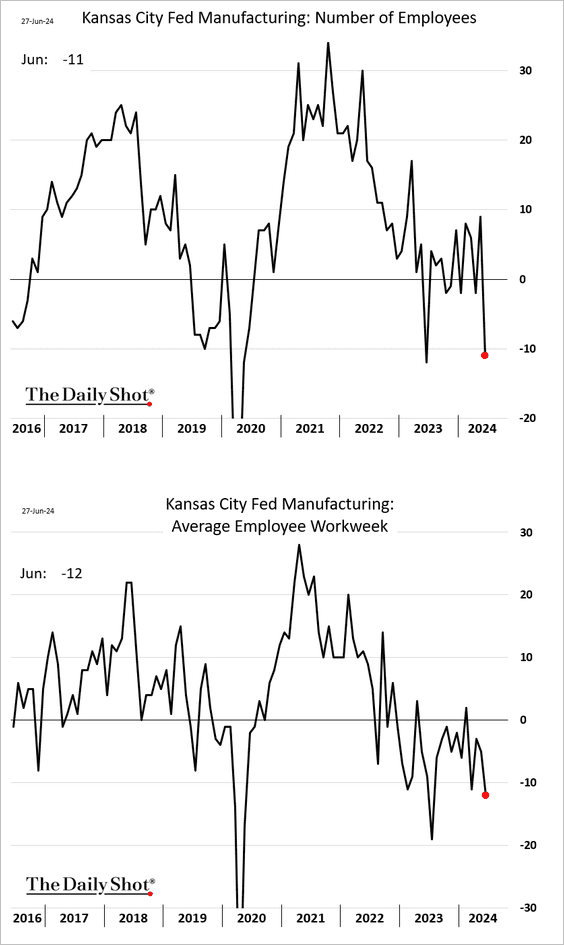

3. The Kansas City Fed manufacturing index continues to indicate a slump in the region’s factory activity.

• Employment indicators were down sharply.

——————–

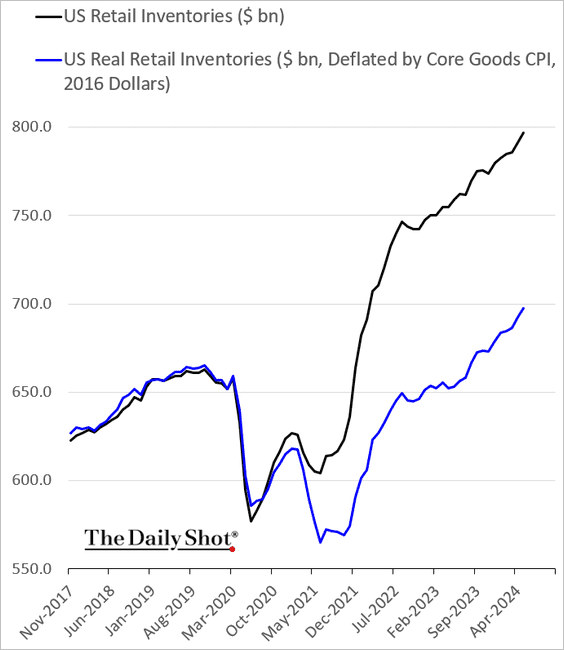

4. Real retail inventories are rising quickly.

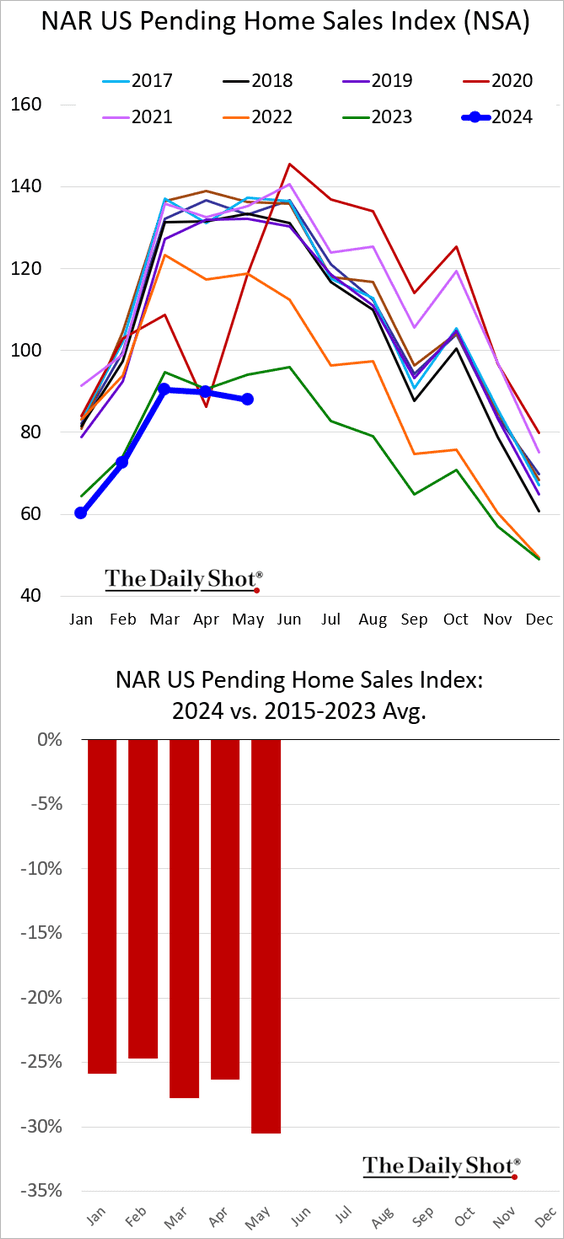

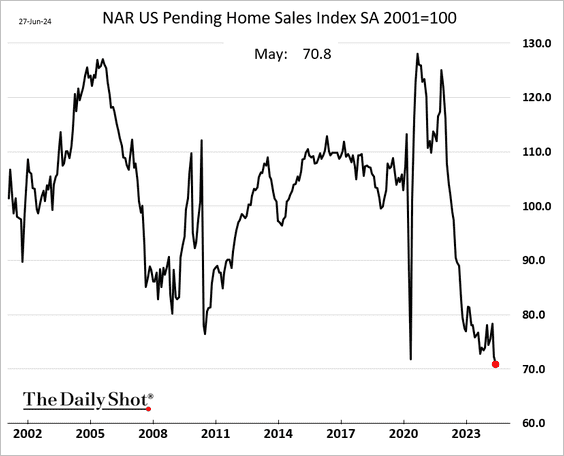

5. Pending home sales deteriorated further last month.

Here is the seasonally adjusted index.

Source: MarketWatch Read full article

Source: MarketWatch Read full article

——————–

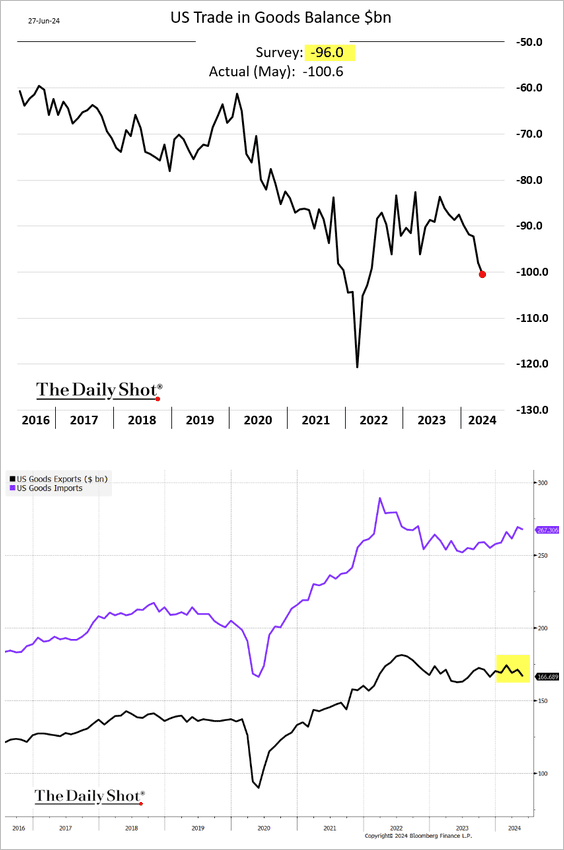

6. The trade gap in goods widened more than expected last month as exports declined more than imports.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

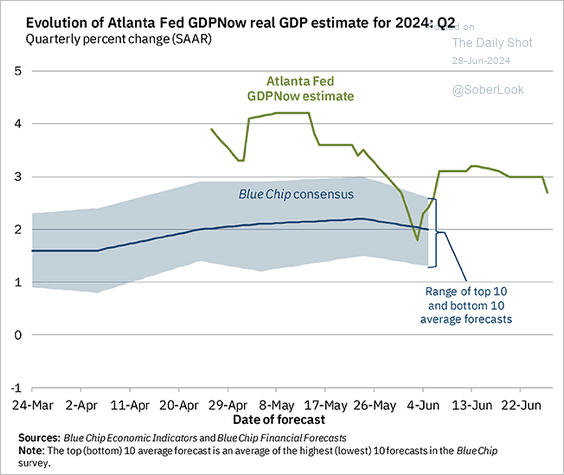

• The widening trade gap has caused the Atlanta Fed’s GDPNow Q2 growth estimate to drop below 3% (annualized).

Source: Federal Reserve Bank of Atlanta

Source: Federal Reserve Bank of Atlanta

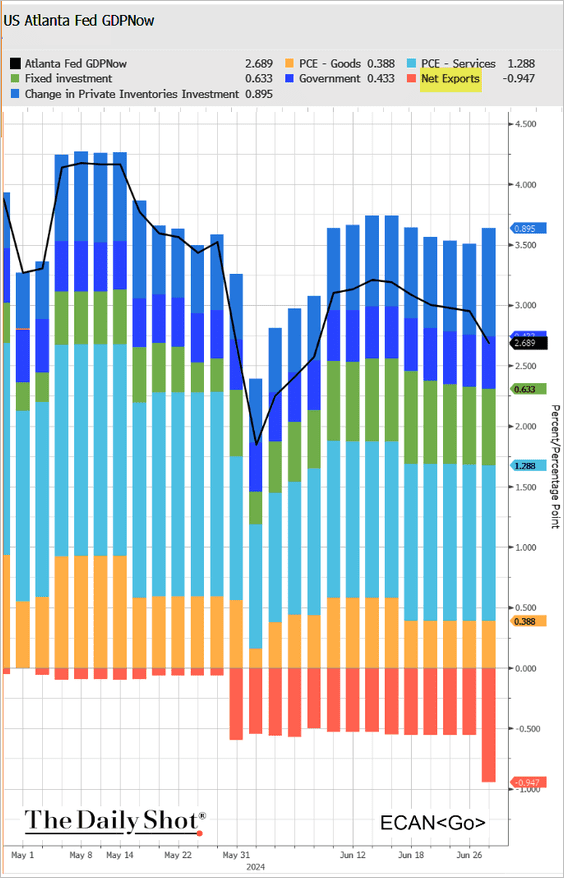

Here is the attribution.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

——————–

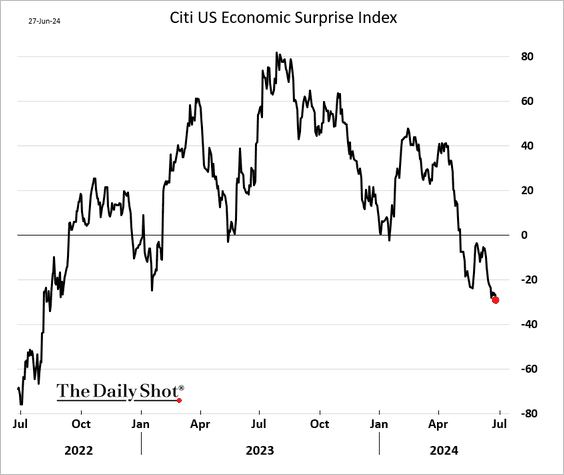

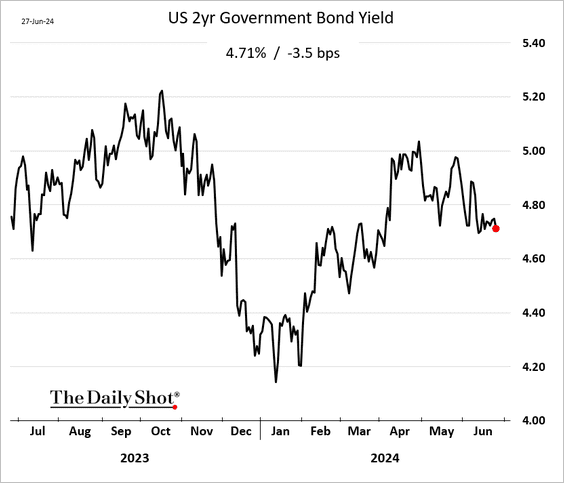

7. The Citi Economic Surprise Index declined further as economic reports continue to disappoint.

Treasury yields moved lower.

Back to Index

Canada

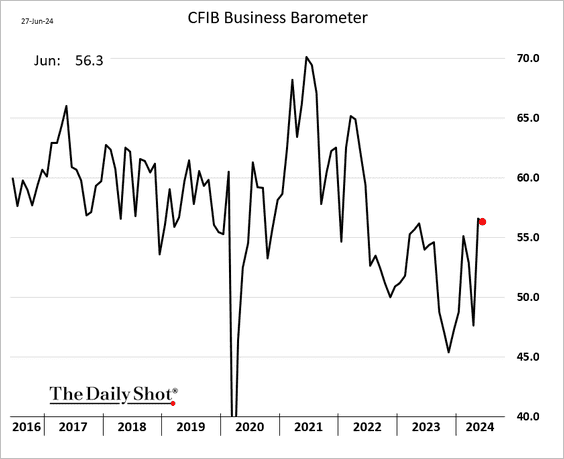

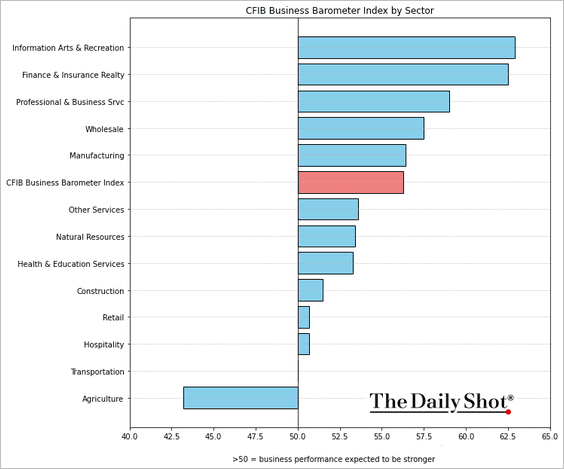

1. The CFIB small/medium-size business outlook index was roughly unchanged this month.

• Here is the index by sector.

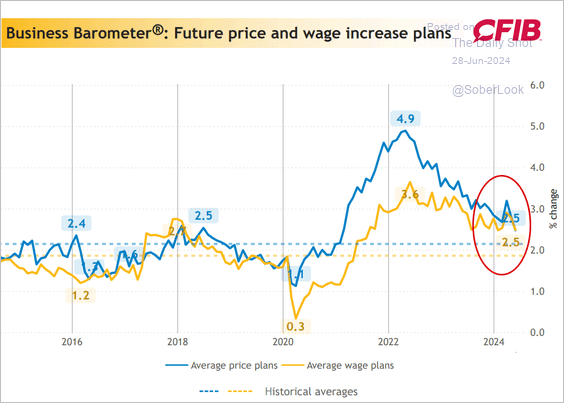

• Businesses report easing price and wage pressures.

Source: CFIB

Source: CFIB

——————–

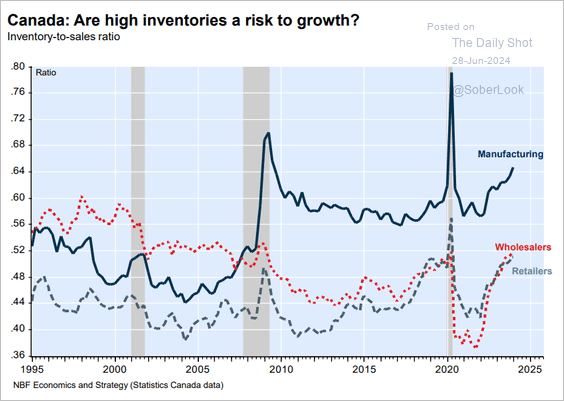

2. Inventory-to-sales ratios are elevated.

Source: Economics and Strategy Group, National Bank of Canada

Source: Economics and Strategy Group, National Bank of Canada

Back to Index

The United Kingdom

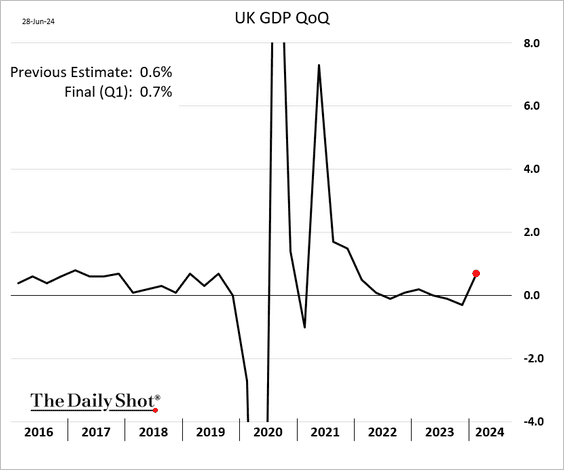

1. The Q1 GDP growth was revised higher.

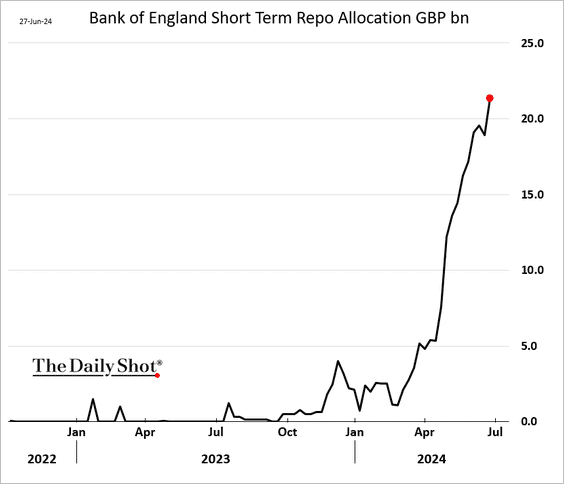

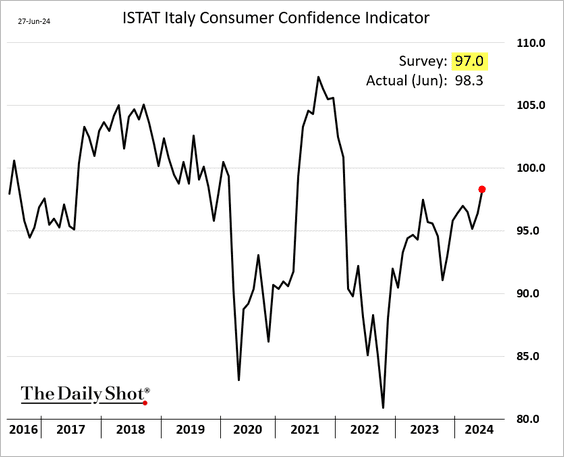

2. Banks are increasingly relying on the BoE for funding, suggesting that reserves may be too low.

Source: Reuters Read full article

Source: Reuters Read full article

Back to Index

The Eurozone

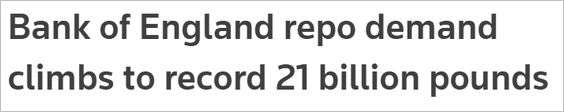

1. Manufacturing confidence edged lower this month.

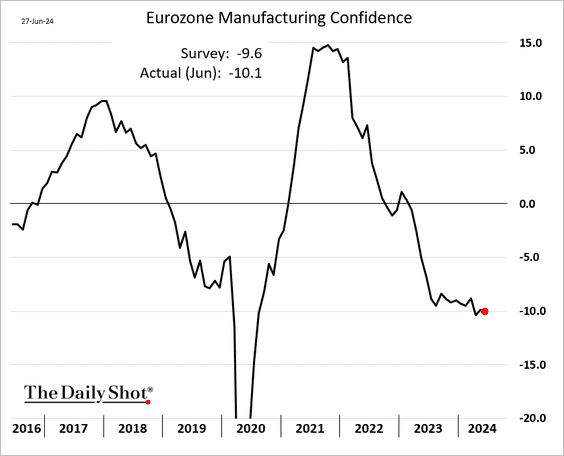

• Services sentiment held steady.

——————–

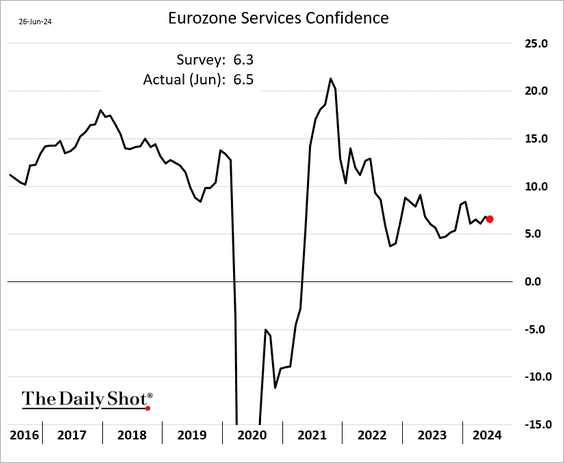

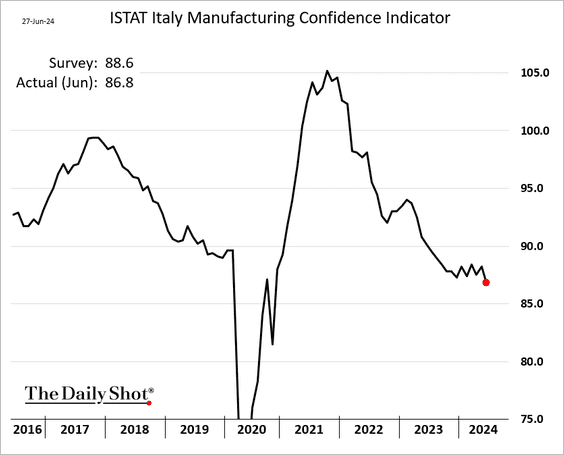

2. Italy’s consumer confidence continues to strengthen.

But manufacturing sentiment is deteriorating.

——————–

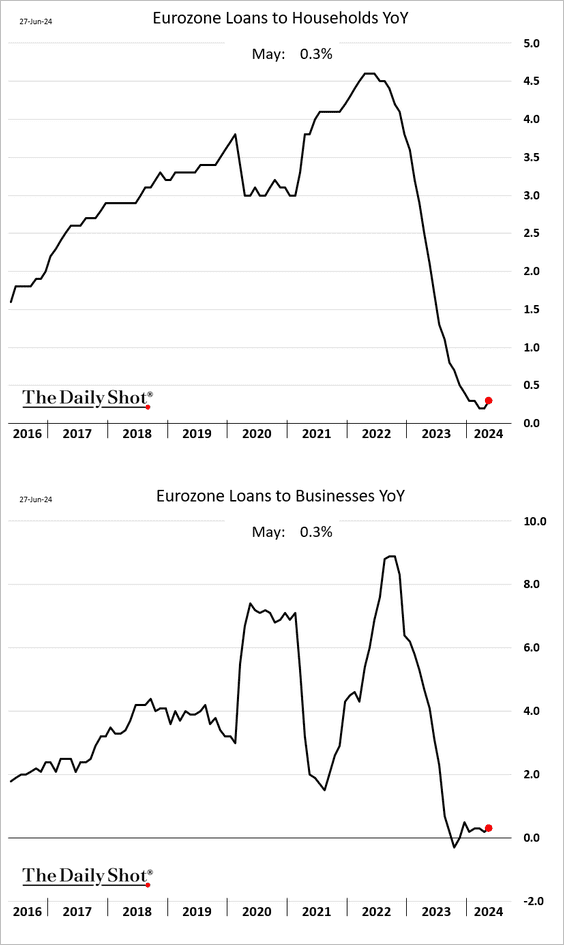

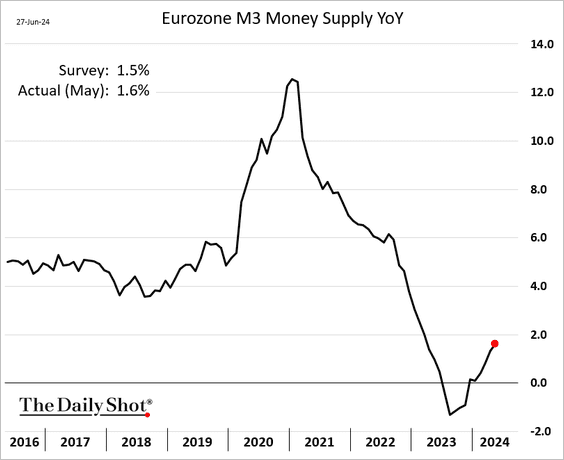

3. Euro-area loan growth edged higher last month but remains depressed.

The broad money supply growth has picked up momentum.

——————–

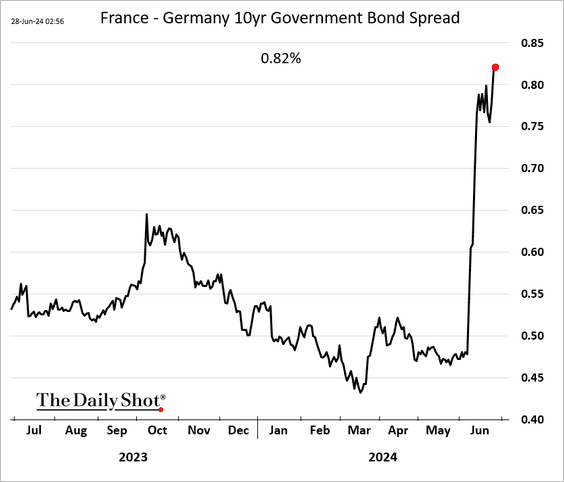

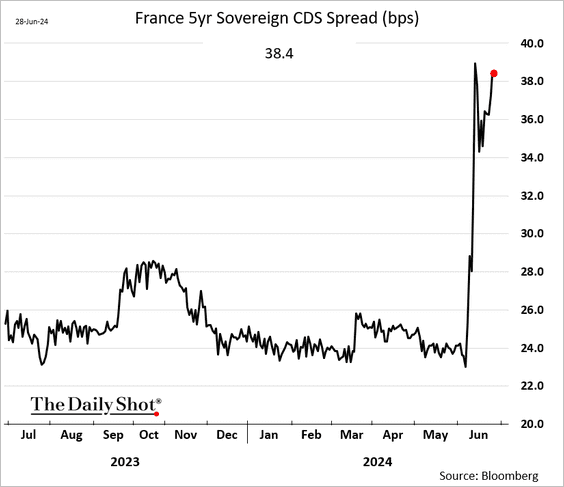

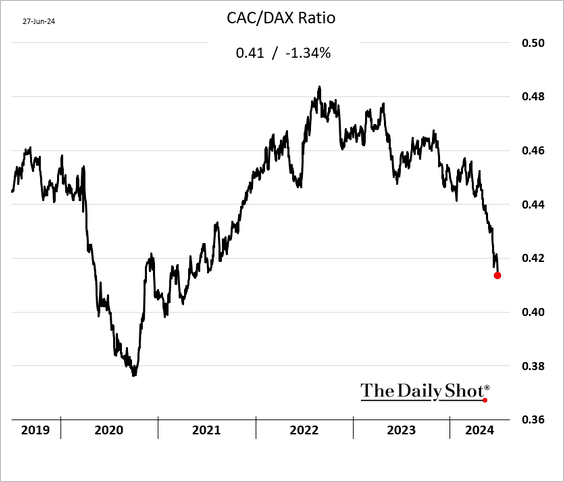

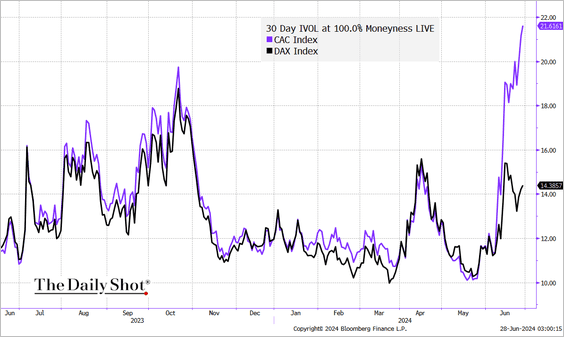

4. The markets remain nervous about the upcoming French elections.

• France – Germany 10-year bond spread:

• French sovereign CDS spread:

• The CAC/DAX ratio:

• The CAC and DAX implied volatility divergence:

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

Back to Index

Europe

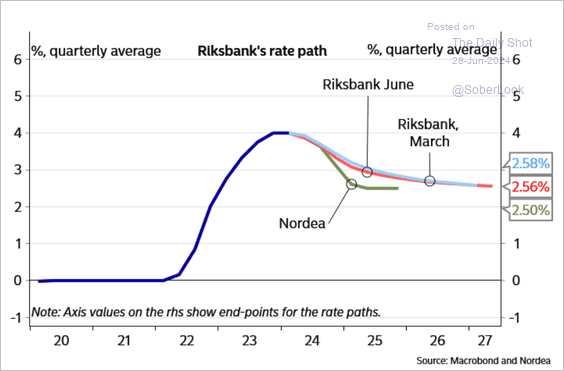

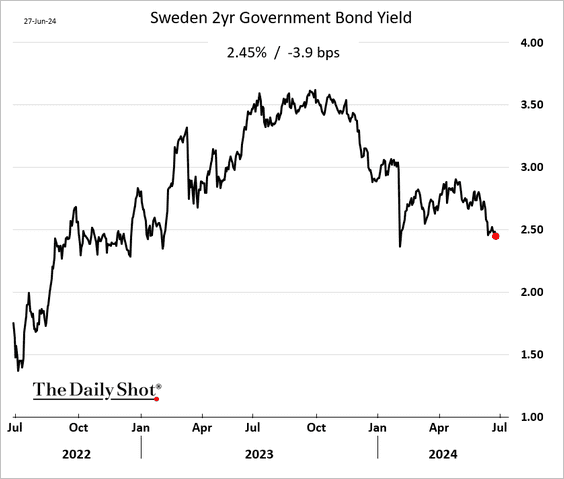

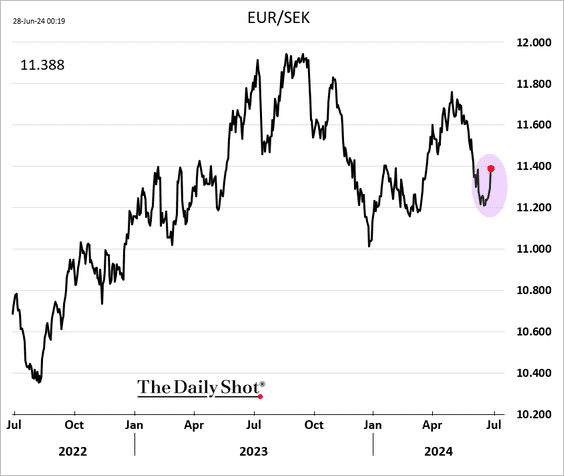

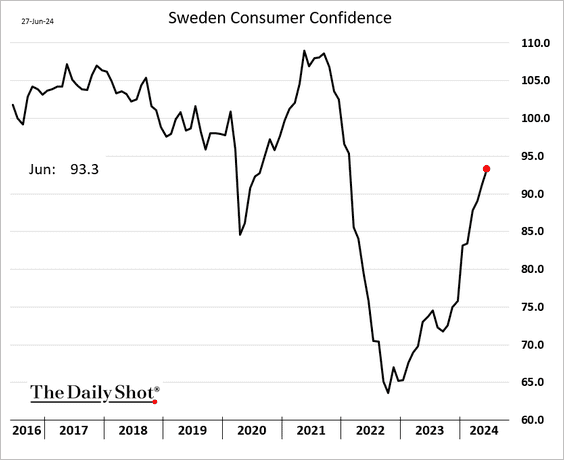

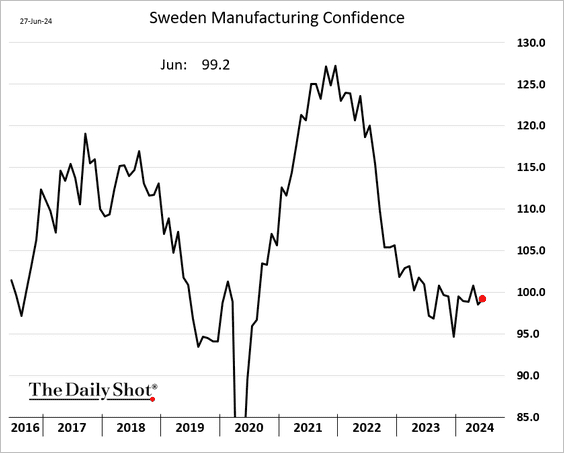

1. Riksbank held rates unchanged but expects two or three cuts later this year.

Source: Nordea Markets

Source: Nordea Markets

– Bond yields and the krona moved lower.

– Sweden’s consumer confidence continues to rise.

Manufacturing sentiment edged higher this month.

——————–

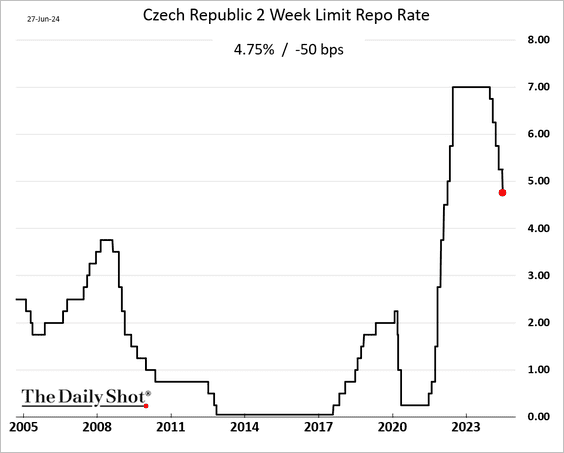

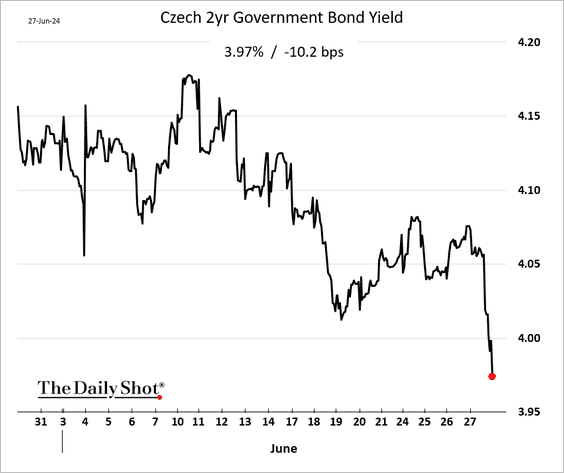

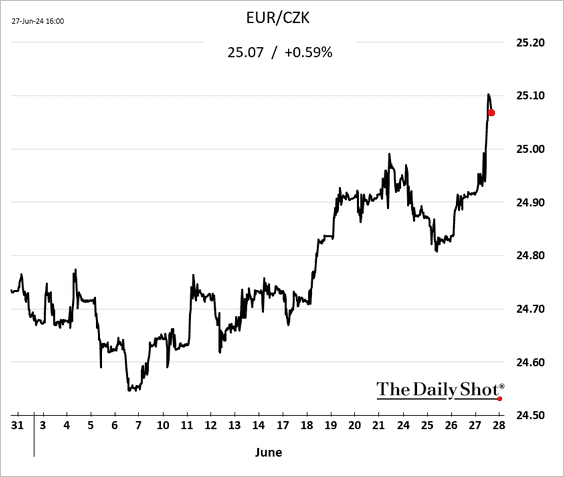

2. The Czech central bank unexpectedly cut rates by 50 bps again.

Bond yields and the koruna were down sharply.

——————–

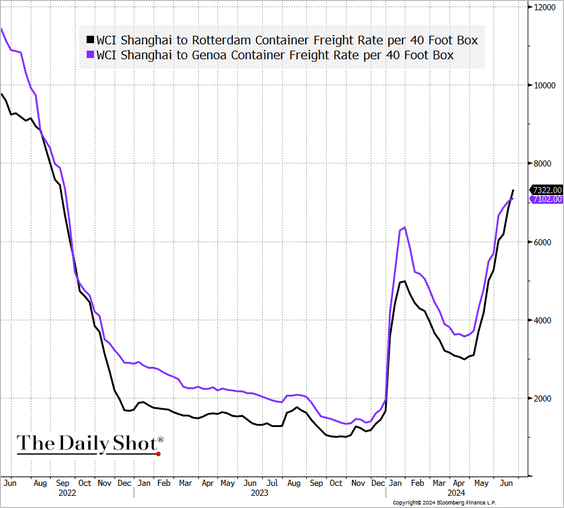

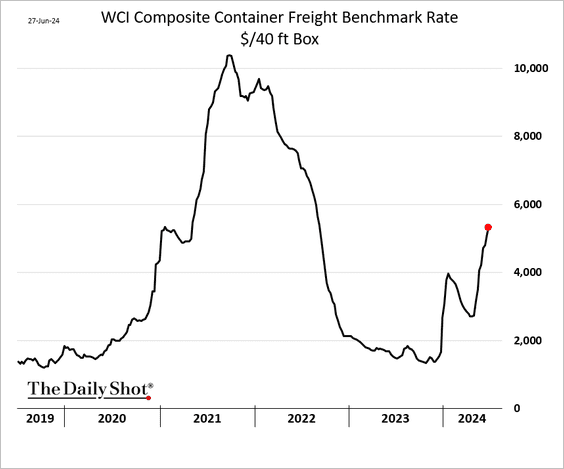

3. Container shipping costs from Asia to Europe continue to climb.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

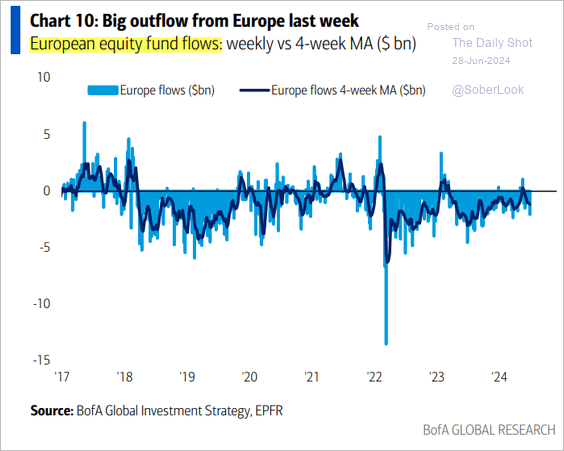

4. Europe-focused equity funds keep seeing outflows.

Source: BofA Global Research

Source: BofA Global Research

Back to Index

Japan

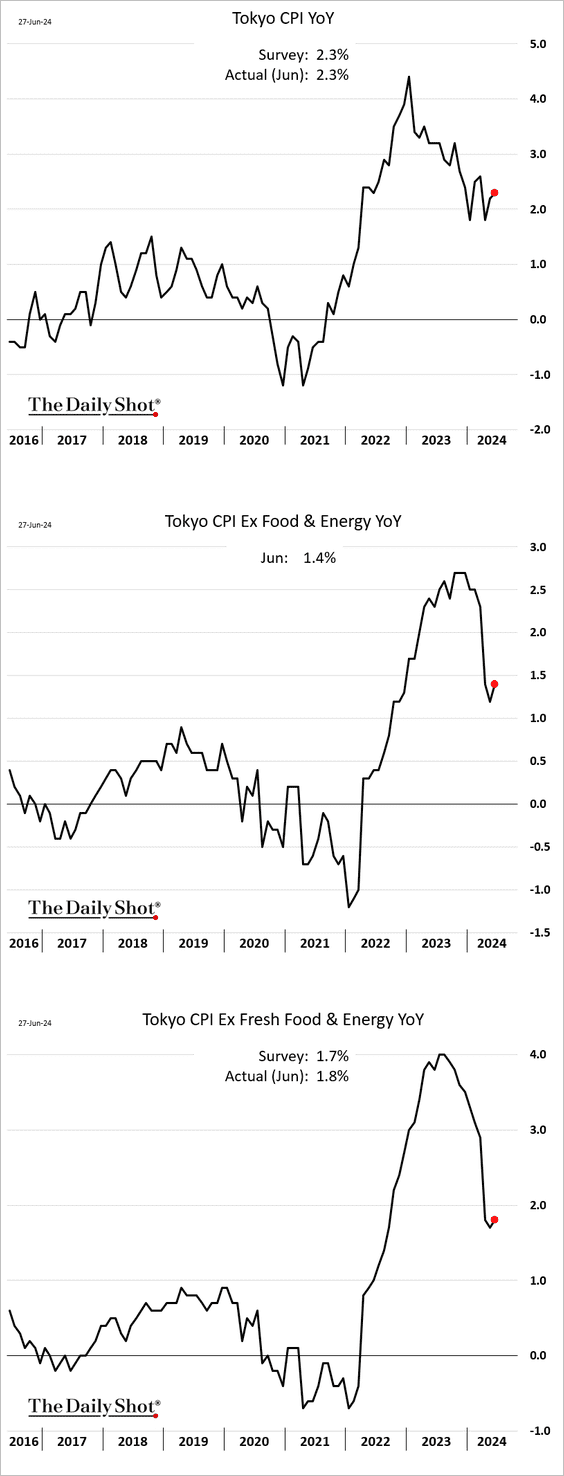

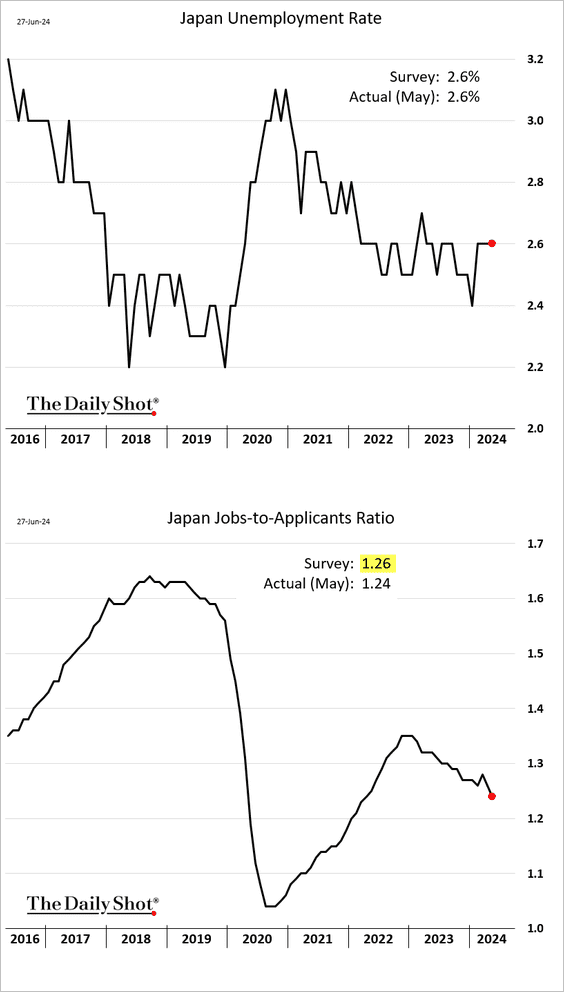

1. Tokyo’s core inflation climbed this month.

Source: @economics Read full article

Source: @economics Read full article

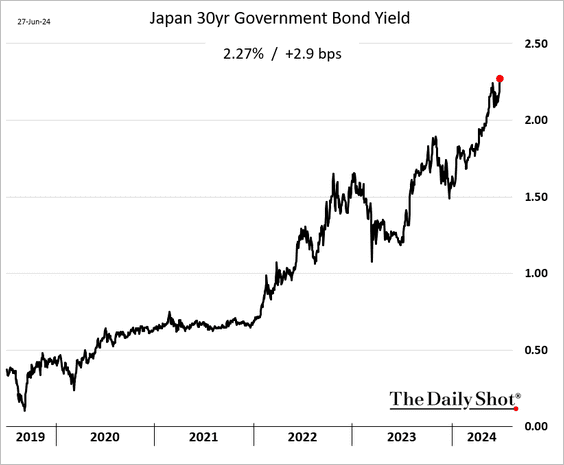

• Bond yields moved higher.

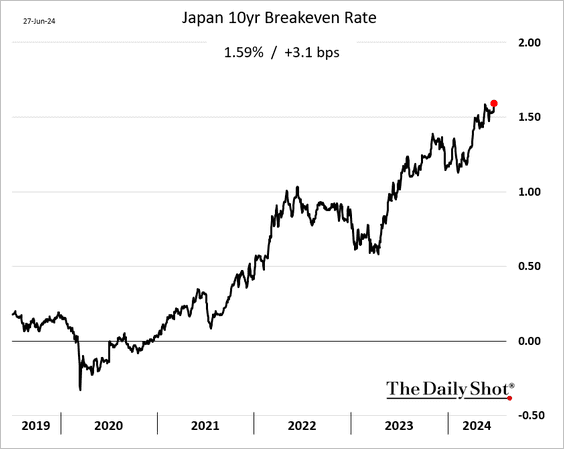

• Japan’s market-based inflation expectations continue to rise.

Source: @markets Read full article

Source: @markets Read full article

——————–

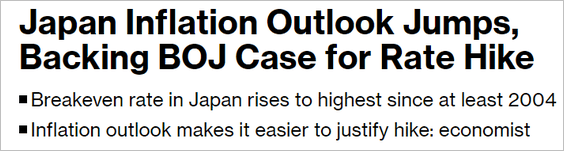

2. Dollar-yen is trading above 161.

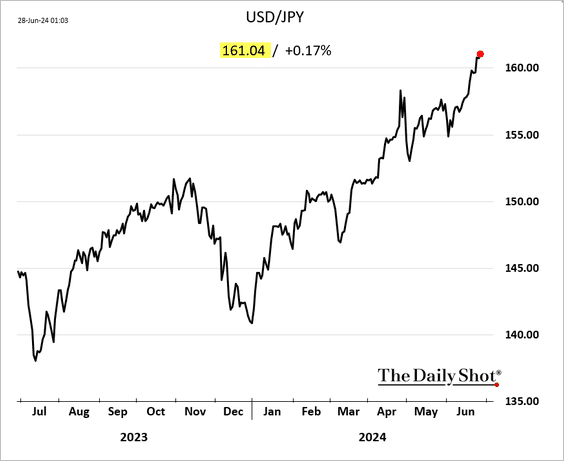

3. Industrial production strengthened in May.

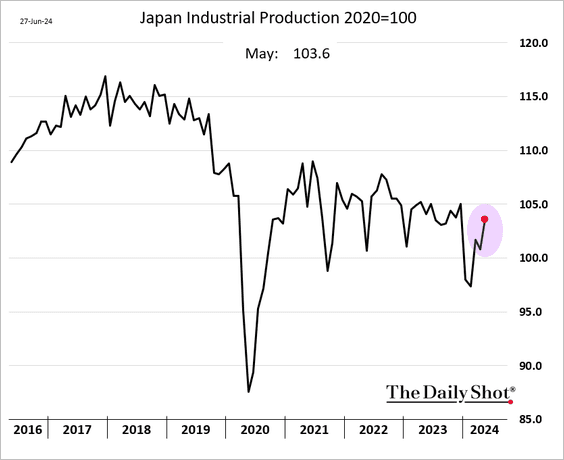

4. The unemployment rate held steady, but the jobs-to-applicants ratio declined further.

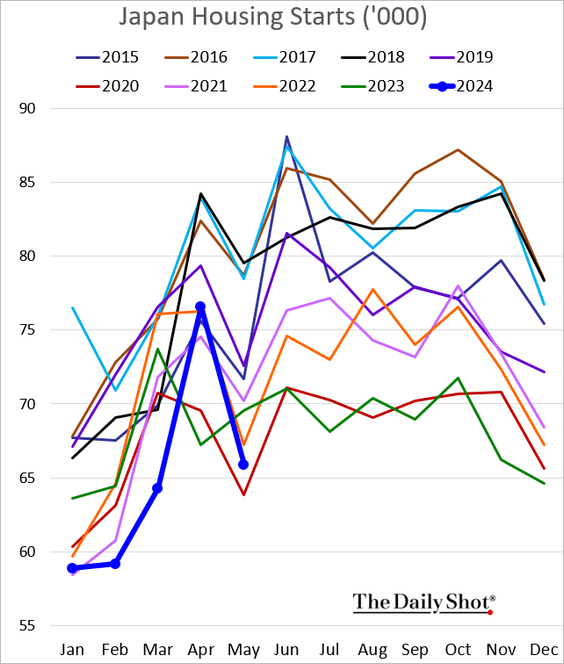

5. Housing starts have been soft.

Back to Index

Emerging Markets

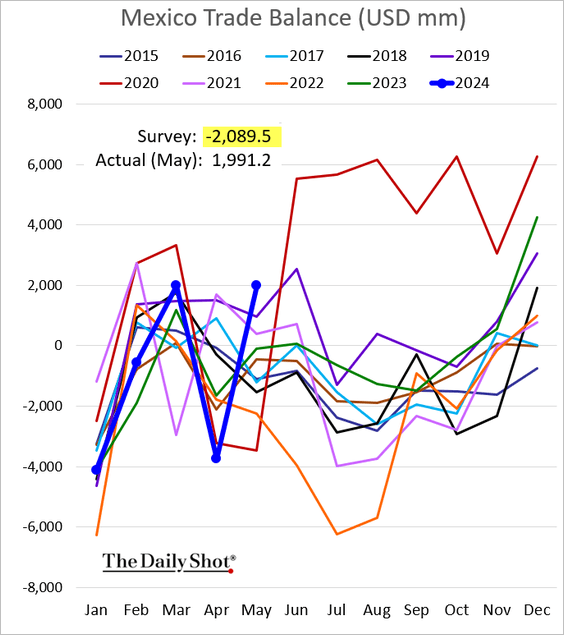

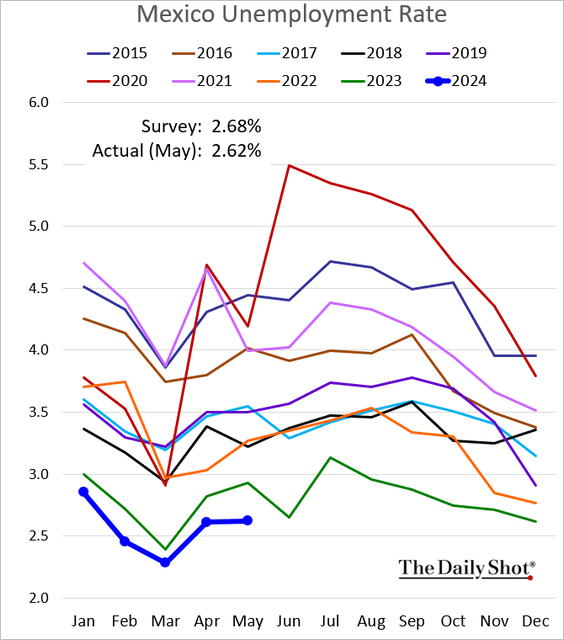

1. Let’s begin with Mexico.

• Banxico left rates unchanged.

Source: @economics Read full article

Source: @economics Read full article

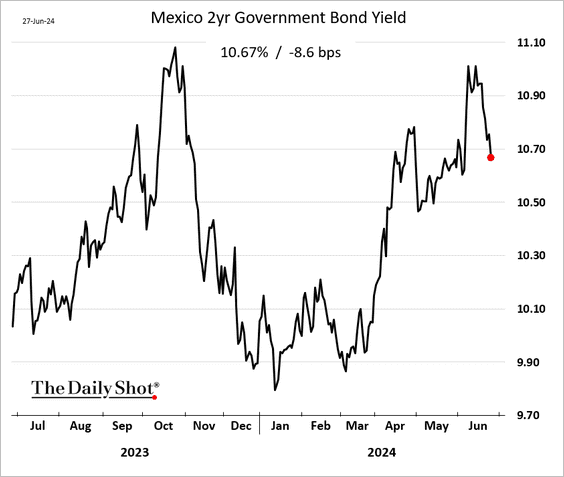

– Bond yields have been moving lower.

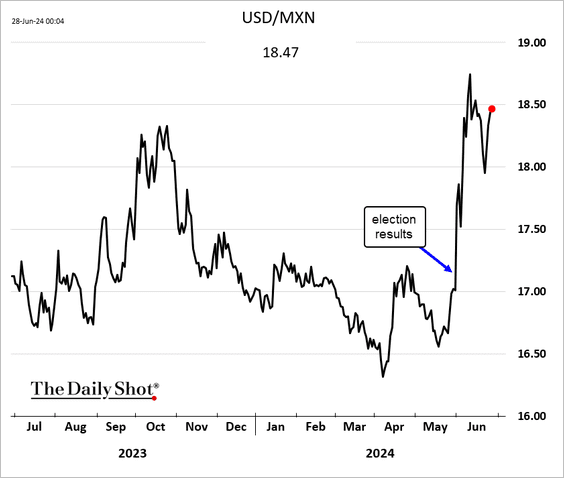

– The peso has not rebounded after the post-election selloff.

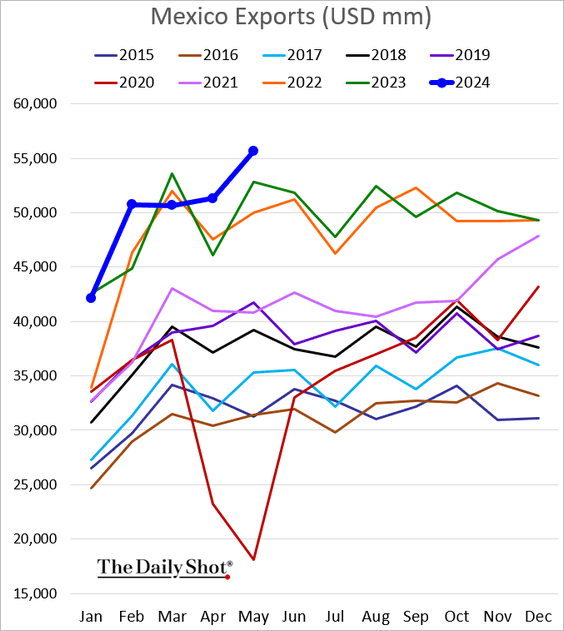

• Exports hit a record high.

• The unemployment rate is at multi-year lows.

——————–

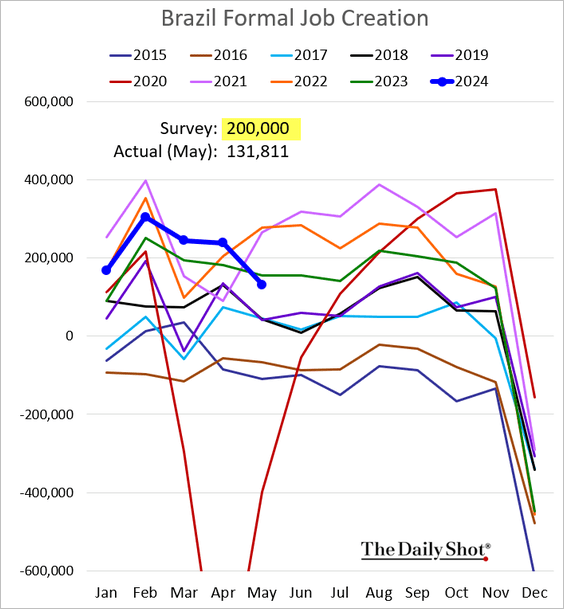

2. Brazil’s formal job creation dipped below last year’s levels in May.

.

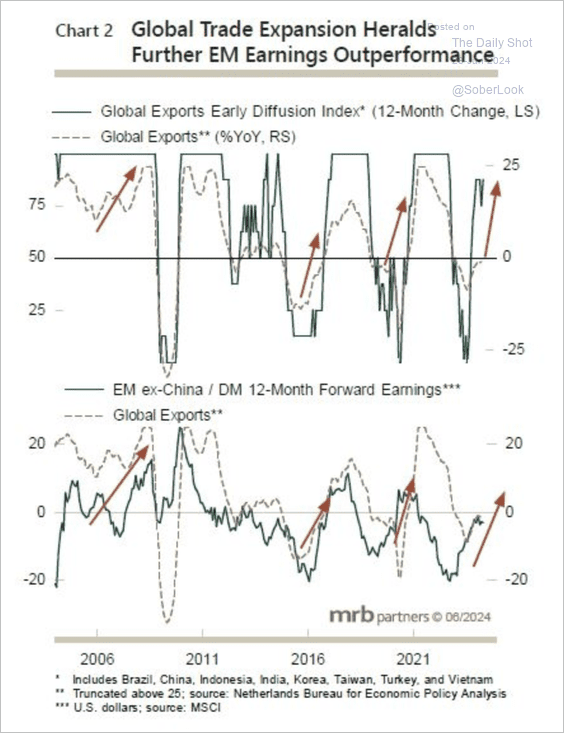

3. The upswing in global trade has boosted EM earnings.

Source: MRB Partners

Source: MRB Partners

Back to Index

Cryptocurrency

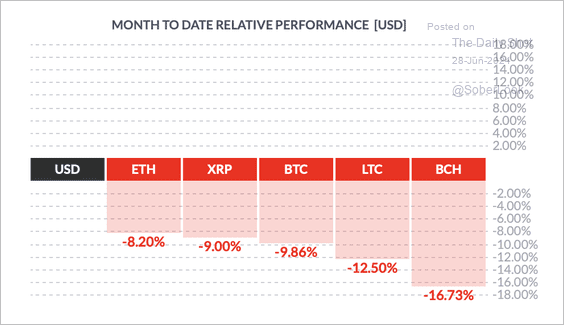

1. It has been a tough month for cryptos, with Bitcoin Cash underperforming and Ether posting a slightly lower decline versus top peers.

Source: FinViz

Source: FinViz

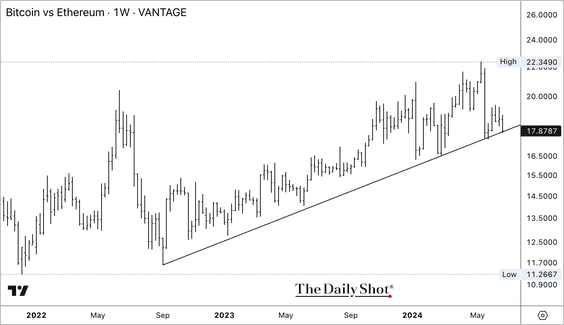

2. The BTC/ETH price ratio is testing uptrend support.

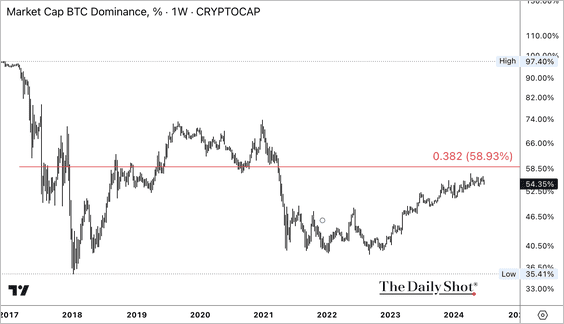

3. Bitcoin’s market cap relative to the total crypto market cap (dominance ratio) is near a long-term resistance.

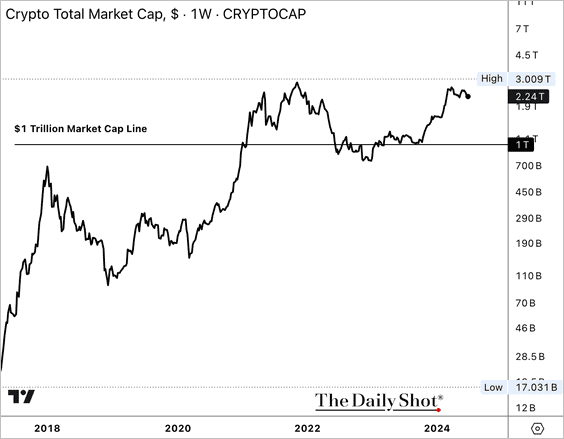

4. The total crypto market cap declined from its peak of around $3 trillion.

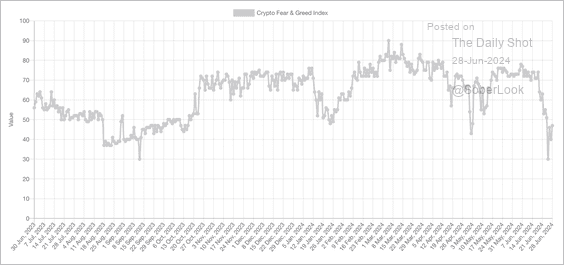

5. The Crypto Fear & Greed Index is back to “neutral” territory after a sharp decline to “fear” levels earlier this week.

Source: Alternative.me

Source: Alternative.me

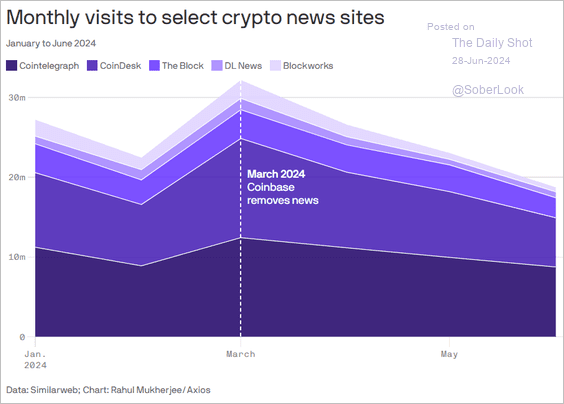

6. Visits to crypto news sites have been trending lower.

Source: @axios Read full article

Source: @axios Read full article

Back to Index

Commodities

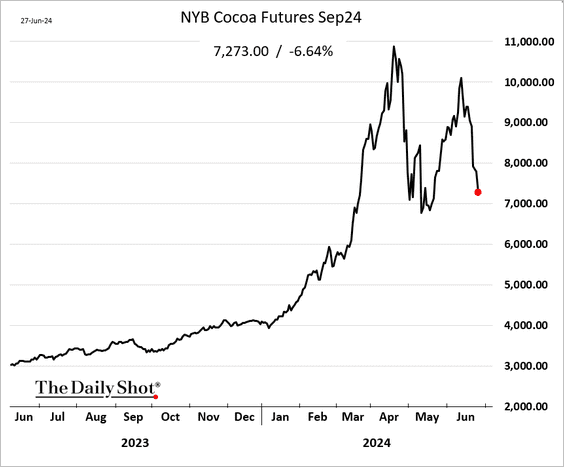

1. Cocoa futures are tumbling again.

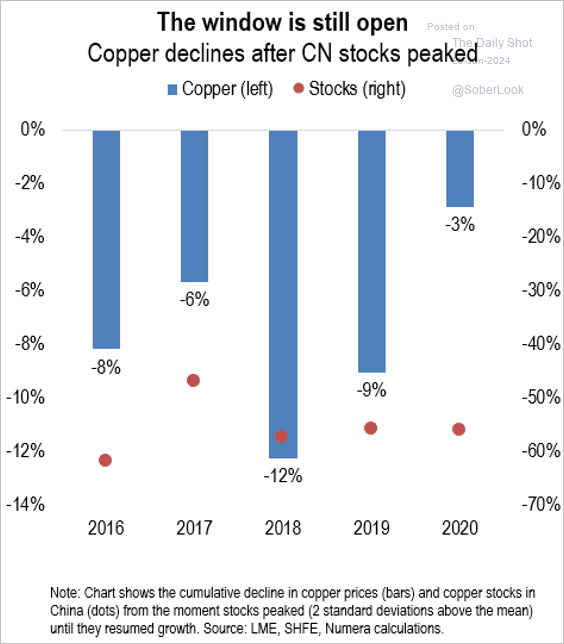

2. Historically, copper prices have declined alongside peaks in Chinese equities.

Source: Numera Analytics (@NumeraAnalytics)

Source: Numera Analytics (@NumeraAnalytics)

Back to Index

Energy

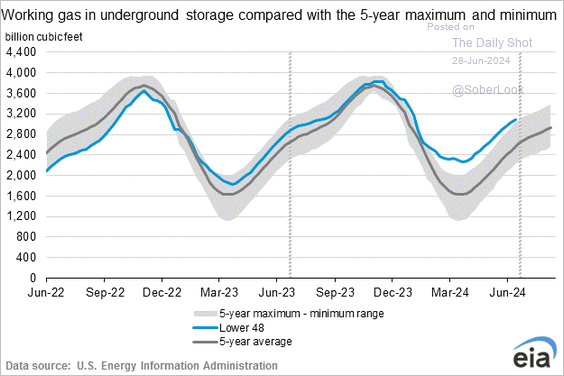

1. US natural gas in storage is approaching its five-year range.

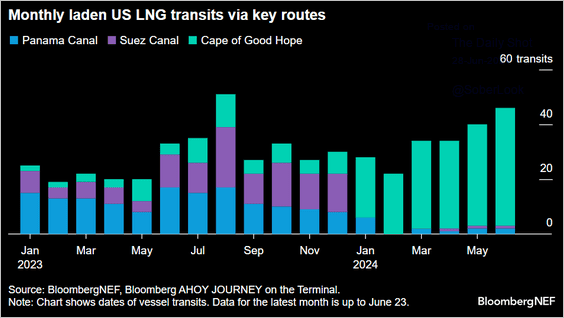

2. Here is a look at the routes taken by US LNG exporters.

Source: Han Wei, BloombergNEF Read full article

Source: Han Wei, BloombergNEF Read full article

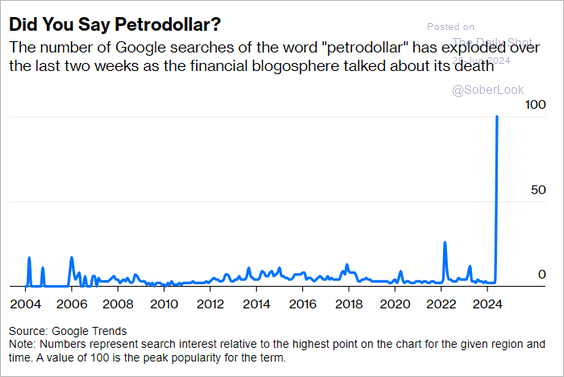

3. There’s a lot of discussion about more energy markets being priced in currencies other than the US dollar. However, for now, it’s mostly just talk.

Source: @JavierBlas, @opinion Read full article

Source: @JavierBlas, @opinion Read full article

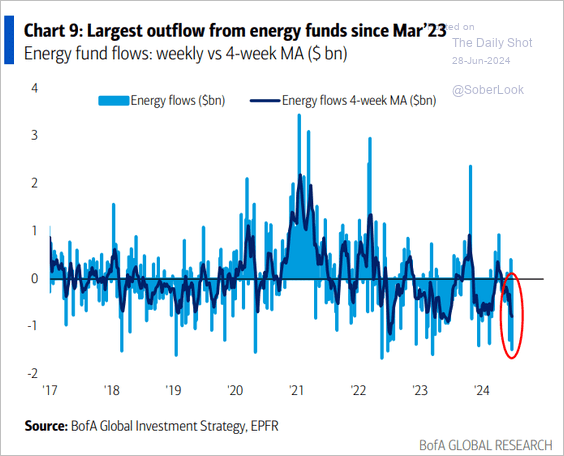

4. Energy funds are seeing outflows.

Source: BofA Global Research

Source: BofA Global Research

Back to Index

Equities

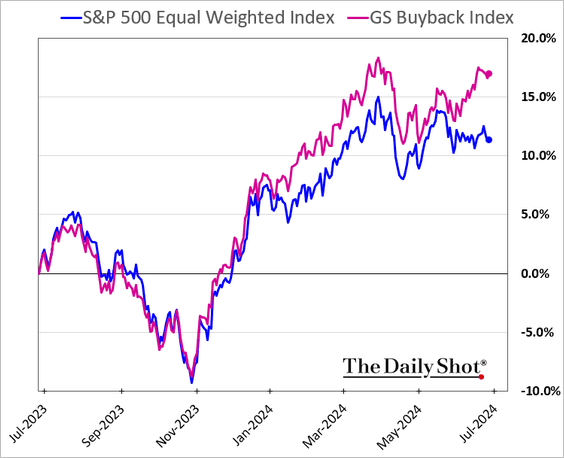

1. Shares of companies known for share buybacks have been outperforming the S&P 500 equal-weight index, which is now a more appropriate benchmark.

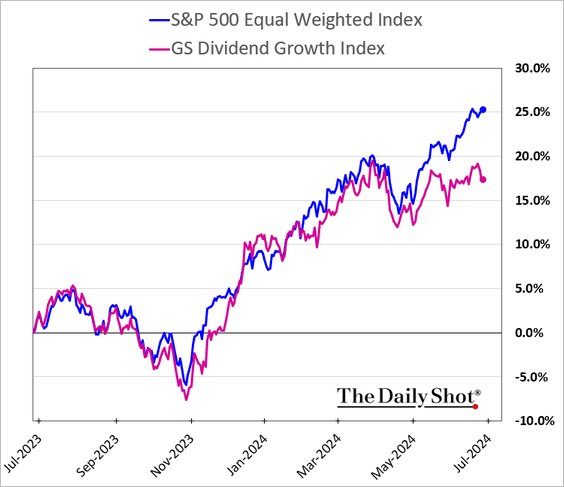

But dividend growers have been underperforming.

——————–

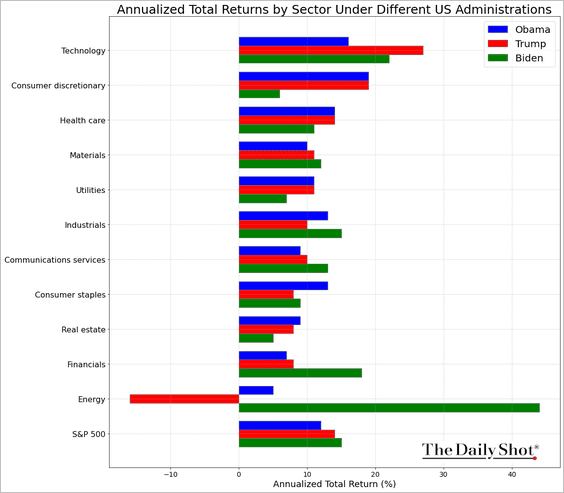

2. How have different S&P 500 sectors performed under the past three administrations?

Source: Truist Advisory Services

Source: Truist Advisory Services

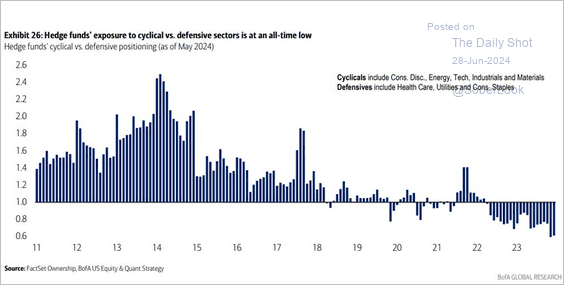

3. Here is a look at hedge funds’ exposure to cyclicals vs. defensives.

Source: BofA Global Research; @MikeZaccardi

Source: BofA Global Research; @MikeZaccardi

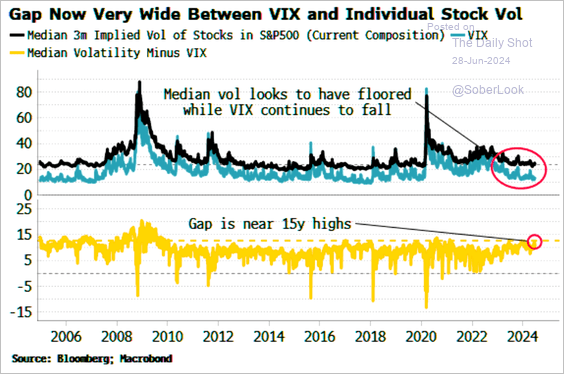

4. The implied volatility of individual stocks has been diverging from the volatility of the index, …

Source: Simon White, Bloomberg Markets Live Blog

Source: Simon White, Bloomberg Markets Live Blog

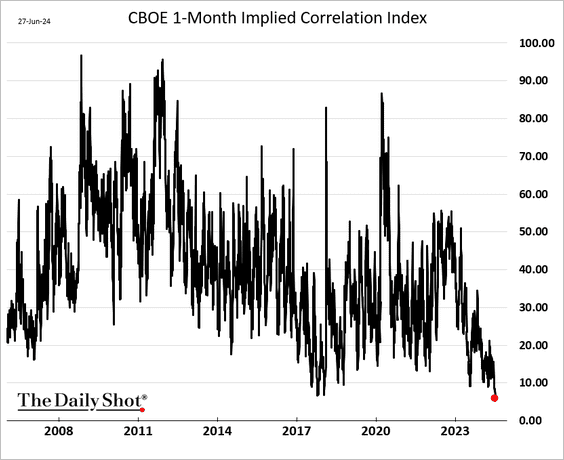

… as correlations among stocks hit multi-year lows.

——————–

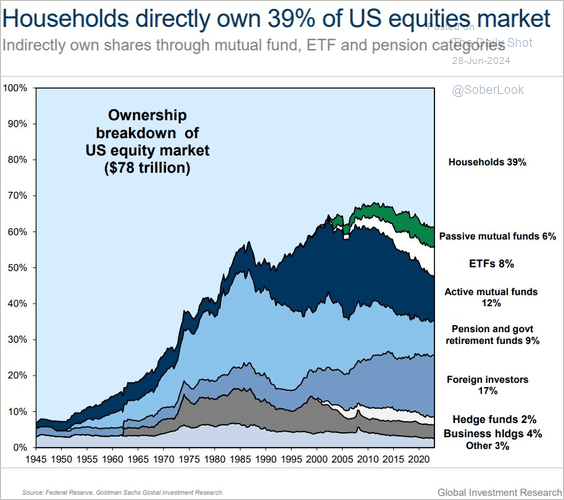

5. This chart displays the breakdown of US equity ownership.

Source: Goldman Sachs; @MikeZaccardi

Source: Goldman Sachs; @MikeZaccardi

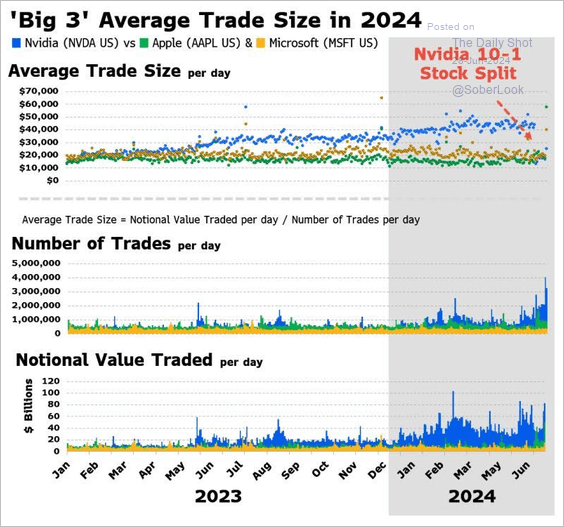

6. Nvidia has registered larger trade sizes this year, far exceeding Apple and Microsoft. This could erode the notion that Nvidia’s performance was due to passive influences, according to Bloomberg Intelligence.

Source: @psarofagis

Source: @psarofagis

Back to Index

Rates

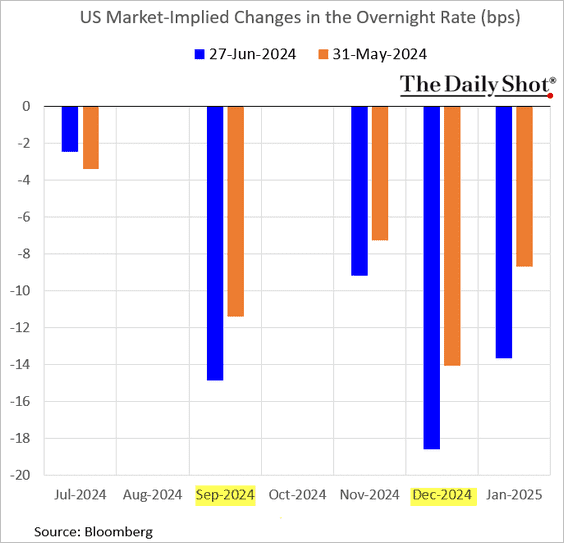

1. A Fed rate cut in September and December remains in play.

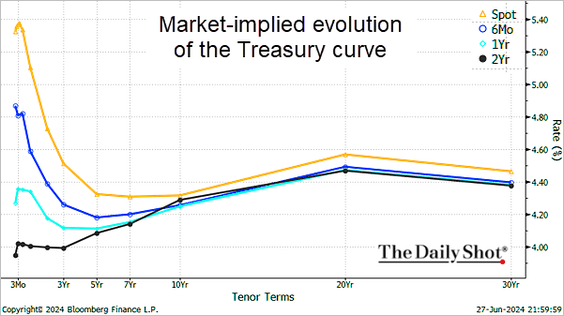

2. The market expects the Treasury curve to remain inverted for a while.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

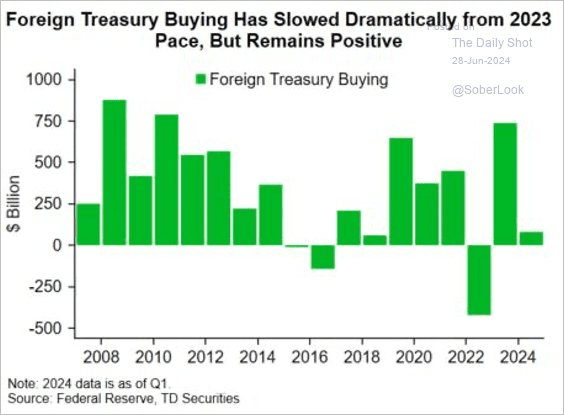

3. Foreign Treasury buying has slowed.

Source: Gennadiy Goldberg; TD Securities

Source: Gennadiy Goldberg; TD Securities

Back to Index

Global Developments

1. Container shipping costs continue to climb.

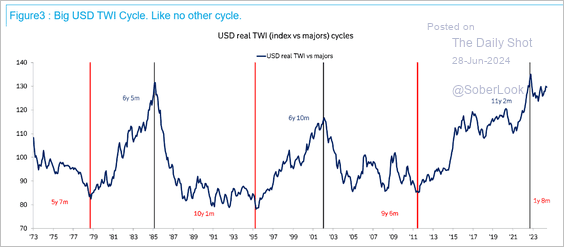

2. This chart shows dollar cycles throughout history.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

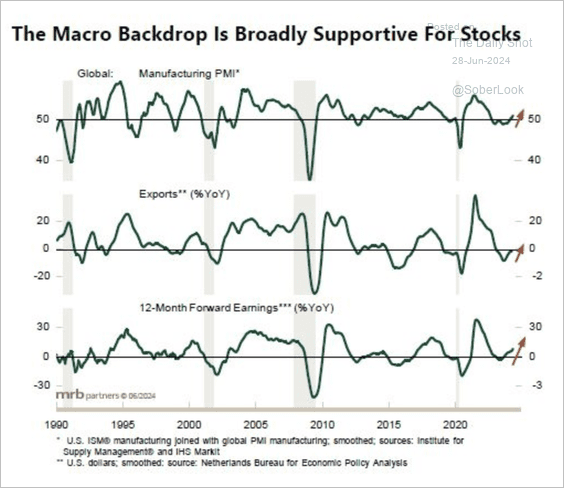

3. Generally, global macro conditions have improved, which has benefitted equities.

Source: MRB Partners

Source: MRB Partners

——————–

Food for Thought

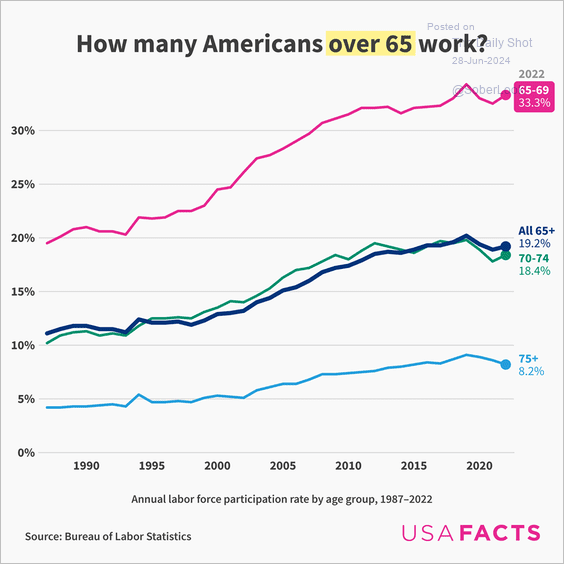

1. Labor force participation among Americans aged 65 and older:

Source: USAFacts

Source: USAFacts

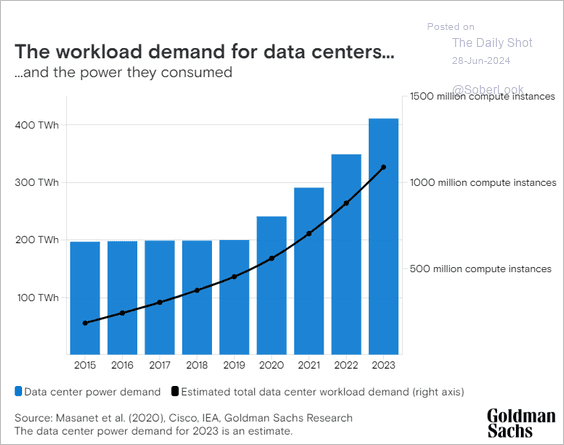

2. Data centers’ power consumption:

Source: Goldman Sachs

Source: Goldman Sachs

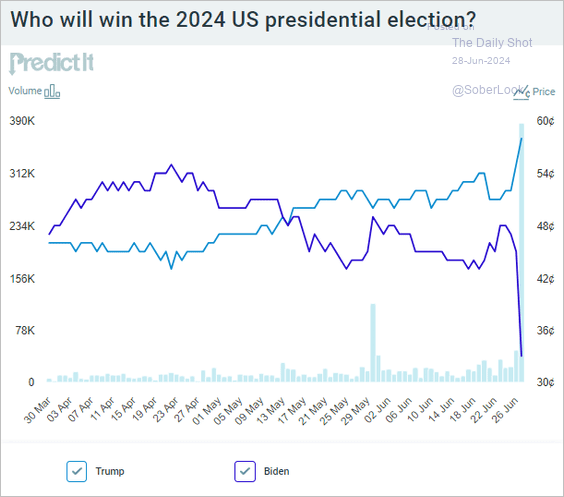

3. Betting market odds for the US 2024 presidential election:

Source: @PredictIt

Source: @PredictIt

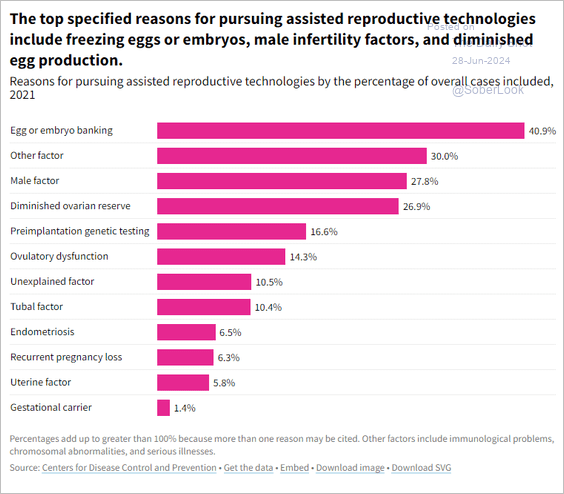

4. Reasons for pursuing assisted reproductive technologies:

Source: USAFacts Read full article

Source: USAFacts Read full article

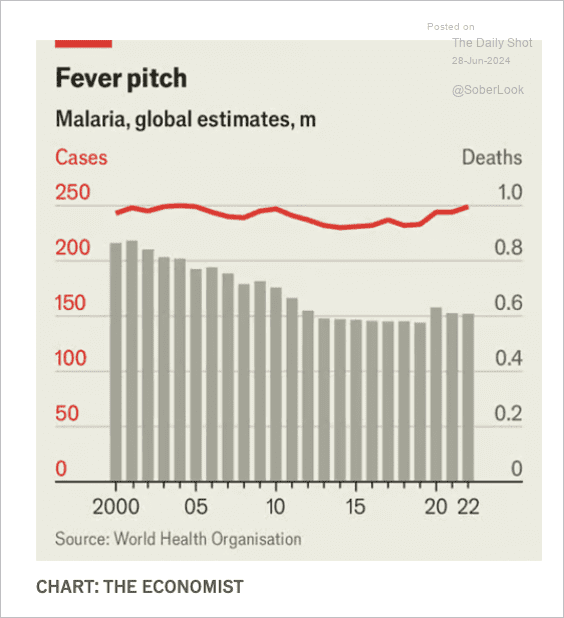

5. Global estimates of malaria cases and deaths:

Source: The Economist Read full article

Source: The Economist Read full article

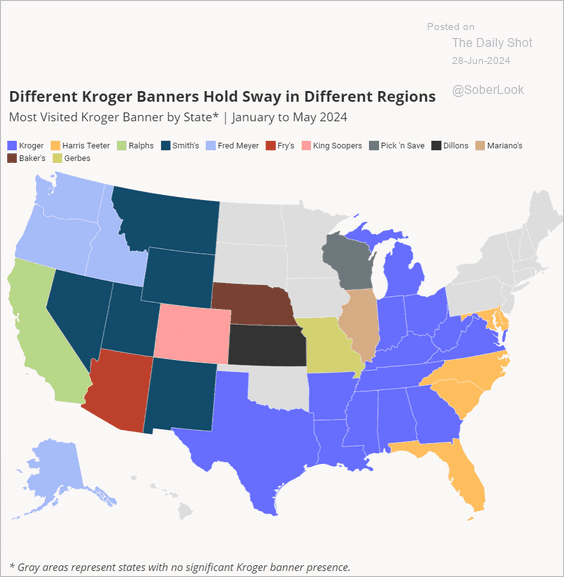

6. The most visited Kroger-owned stores by state:

Source: Placer.ai

Source: Placer.ai

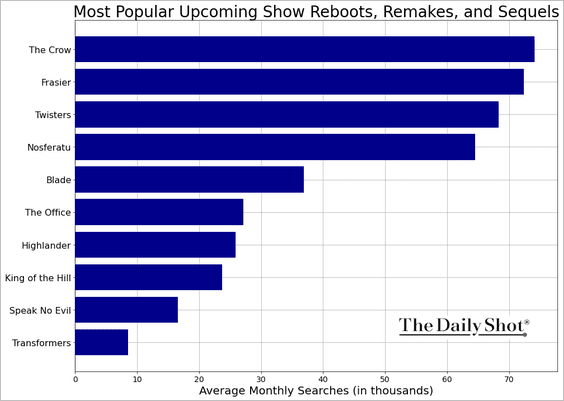

7. The most popular upcoming show reboots, remakes, and sequels:

Source: Hearts.co

Source: Hearts.co

——————–

Have a great weekend!

Back to Index