The Daily Shot: 03-Jul-24

• The United States

• Canada

• The Eurozone

• Asia-Pacific

• China

• Emerging Markets

• Commodities

• Equities

• Credit

• Rates

• Food for Thought

As a reminder, The Daily Shot will not be published this Thursday and Friday (July 4th and 5th).

The United States

1. Job openings unexpectedly increased in May, …

Source: @economics Read full article

Source: @economics Read full article

… with most of the gains driven by government job vacancies (2 charts).

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

• Below are some job openings trends by sector.

– Hotels and restaurants/bars:

– Retail:

– Durable goods manufacturing:

– Real estate:

• Here is the job openings diffusion index.

• Job openings per unemployed person held at pre-pandemic levels.

– The Beveridge Curve suggests that the labor market imbalances are nearly gone.

• Job openings figures have been revised downward for most months over the past year and a half.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

• Quits (voluntary resignations) held steady in May.

– Here is the ratio of quits to the number of unemployed persons.

• The quits rate points to slower wage growth ahead.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

• Layoffs remain subdued.

——————–

2. US vehicle sales declined more than expected in June, …

… which is a drag on the Q2 GDP growth.

Source: Estelle Ou Read full article

Source: Estelle Ou Read full article

——————–

3. Next, we have some updates on the housing market.

• With housing affordability at its worst levels in decades (2 charts) …

Source: Goldman Sachs; @MikeZaccardi

Source: Goldman Sachs; @MikeZaccardi

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

… and supply limited, the market is increasingly favoring buyers with strong credit scores, as evidenced by the rising average FICO scores for purchase loans. According to the AEI Housing Center, the average borrower FICO score for purchase loans was 738, the highest level in the 11-year history of their series.

Source: AEI Housing Center

Source: AEI Housing Center

• Home equity levels continue to rise.

Source: Goldman Sachs; @MikeZaccardi

Source: Goldman Sachs; @MikeZaccardi

• More home sellers have been reducing their asking prices., …

Source: Redfin

Source: Redfin

… but the median sale price is still at record highs.

Source: Redfin

Source: Redfin

• Inventories are rising.

Source: Redfin

Source: Redfin

• Here is the Architecture Billings Index.

Source: Wells Fargo Securities

Source: Wells Fargo Securities

——————–

4. Most forecasters estimate that job growth slowed in June.

• Nomura (225k):

Source: Nomura Securities

Source: Nomura Securities

• Bloomberg Economics (188k):

Source: @economics Read full article

Source: @economics Read full article

• Oxford Economics (215k):

Source: Oxford Economics

Source: Oxford Economics

• Morgan Stanley (210k):

Source: Morgan Stanley Research

Source: Morgan Stanley Research

Back to Index

Canada

1. The manufacturing PMI remains in contraction territory.

Below is the employment index.

——————–

2. Here is a look at productivity in Canada and the US.

Source: Economics and Strategy Group, National Bank of Canada

Source: Economics and Strategy Group, National Bank of Canada

Back to Index

The Eurozone

1. The June euro area core CPI was slightly stronger than expected, …

… with services inflation remaining elevated.

But the ECB isn’t too concerned.

Source: @economics Read full article

Source: @economics Read full article

• Food inflation continues to slow.

——————–

2. The unemployment rate remains at record lows.

3. Here is a look at the euro-area trade balance and international trade trends.

Source: Eurostat Read full article

Source: Eurostat Read full article

Back to Index

Asia-Pacific

1. USD/JPY keeps grinding higher.

Sentiment is so negative that we could see a rebound in the yen.

——————–

2. South Korea’s core CPI is approaching 2%.

3. Australian building approvals improved in May.

Back to Index

China

1. The renminbi continues to weaken.

Could the yuan weaken beyond 7.5? Here are the options-implied probabilities of such an outcome 3 and 6 months from now.

——————–

2. Bond yields are still trending lower.

3. Growth in services activity slowed sharply in June, …

… with business outlook trending lower.

Back to Index

Emerging Markets

1. The Brazilian real keeps weakening.

• Brazil’s unemployment rate continues to decline.

• Here is the debt-to-GDP ratio.

——————–

2. Colombia’s central bank delivered another 50 bps rate cut.

3. South Africa’s trade balance improved substantially in May.

• Vehicle sales remain soft.

——————–

4. Forward earnings in some EM ex-China markets are improving relative to the US.

Source: MRB Partners

Source: MRB Partners

Back to Index

Commodities

1. Speculative accounts continue to boost their bets on gold.

2. Sugar futures are rebounding.

3. Here is a look at top export products by country in Latin America.

Source: The Economist Read full article

Source: The Economist Read full article

Back to Index

Equities

1. The S&P 500 reached a record high, surpassing 5500.

Source: MarketWatch Read full article

Source: MarketWatch Read full article

The options market indicates a 19% probability of the index exceeding 6000 by year-end.

——————–

2. Market concentration is hitting extreme levels (2 charts)

Source: Truist Advisory Services

Source: Truist Advisory Services

Source: Goldman Sachs; @WallStJesus

Source: Goldman Sachs; @WallStJesus

——————–

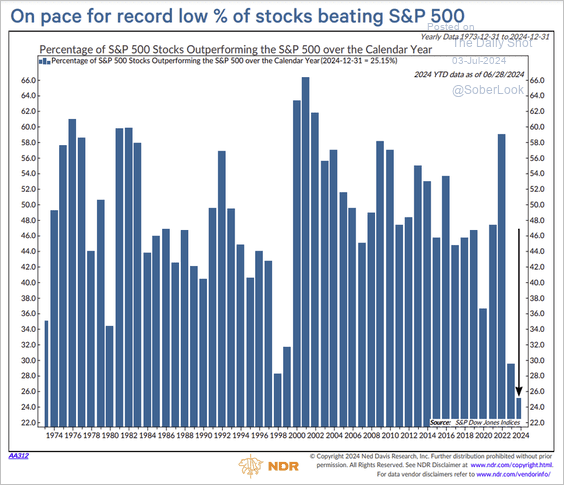

3. The percentage of S&P 500 members beating the index is extraordinarily low.

Source: @WillieDelwiche

Source: @WillieDelwiche

4. The underperformance of the S&P 500 equal-weight index is not solely due to tech megacaps. Here is the S&P 500 ex Tech and Communication Services.

• Despite the underperformance, the equal weight index is no longer cheap relative to its longer-term average.

Source: Truist Advisory Services

Source: Truist Advisory Services

——————–

5. Share buyback activity remains robust.

Source: BofA Global Research

Source: BofA Global Research

6. The call-put ratio for 0dte options is nearing its 2023 peak.

Source: Citi Research; @GunjanJS

Source: Citi Research; @GunjanJS

7. Here is the relative performance of S&P 500 stocks with the highest and lowest 10-year median tax rates.

8. The Bloomberg Billionaires Investment Select Index, which tracks the performance of the top 50 US-listed companies held by US billionaires, posted solid returns over the past three years, even beating the performance of the largest cryptos.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

Back to Index

Credit

1. Liquidity (trading volume as a fraction of total outstanding debt or turnover) in the US investment-grade credit market has improved in recent years.

Source: Torsten Slok, Apollo

Source: Torsten Slok, Apollo

The increase in turnover has been driven almost entirely by on-the-run bonds (issued in the prior six months).

Source: Torsten Slok, Apollo

Source: Torsten Slok, Apollo

——————–

2. Here is a look at broadly syndicated and direct lending loan takeouts.

Source: VRC

Source: VRC

3. This chart shows commercial real estate loan modification rates.

Source: Scott Carpenter Read full article

Source: Scott Carpenter Read full article

Back to Index

Rates

1. Three Fed rate cuts this year?

Source: CNBC Read full article

Source: CNBC Read full article

The probability of this outcome (target range = 4.5%-4.75%) has risen in recent months as the likelihood of the Fed keeping rates unchanged diminishes, according to the CME model.

——————–

2. The repo market showed some stress at quarter end, …

Source: @markets Read full article

Source: @markets Read full article

… as reserve balances declined. Should the Fed accelerate the QT taper?

Here is the Fed’s RRP facility balance.

——————–

Food for Thought

1. World’s top 20 retailers by revenue:

Source: Visual Capitalist Read full article

Source: Visual Capitalist Read full article

2. AI-powered smartphone shipments and market share growth:

Source: @financialtimes Read full article

Source: @financialtimes Read full article

3. The world’s largest exporters and importers of arms (2 charts):

Source: Visual Capitalist; BofA Global Research

Source: Visual Capitalist; BofA Global Research

Source: Visual Capitalist; BofA Global Research

Source: Visual Capitalist; BofA Global Research

——————–

4. Permanent contraception procedures:

Source: The Economist Read full article

Source: The Economist Read full article

5. US presidential election probabilities in the betting markets:

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

6. Trends in substance use frequency among US adults:

Source: The Economist Read full article

Source: The Economist Read full article

7. The number of signers of the Declaration of Independence from each colony (in 1776):

Source: US Census Bureau Read full article

Source: US Census Bureau Read full article

Estimated population of each colony at that time:

Source: US Census Bureau Read full article

Source: US Census Bureau Read full article

——————–

As a reminder, The Daily Shot will not be published this Thursday and Friday (July 4th and 5th).

Have a great weekend!

Back to Index