The Daily Shot: 24-May-24

• The United States

• The United Kingdom

• The Eurozone

• Japan

• Asia-Pacific

• China

• Emerging Markets

• Cryptocurrency

• Commodities

• Equities

• Food for Thought

Please note that The Daily Shot will not be published on Monday, May 27th.

The United States

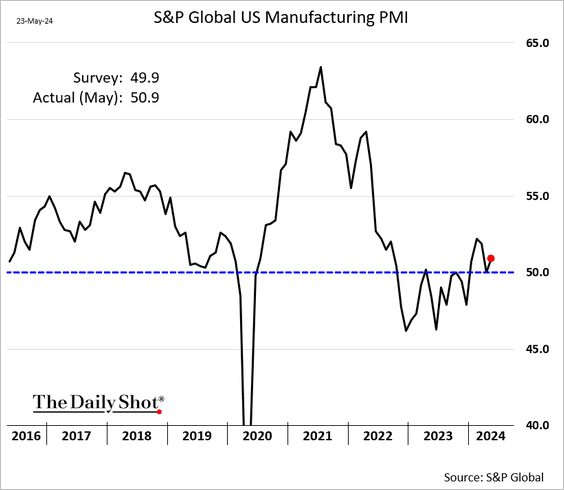

1. The May flash PMI report from S&P Global topped expectations, suggesting firmer growth in business activity this month.

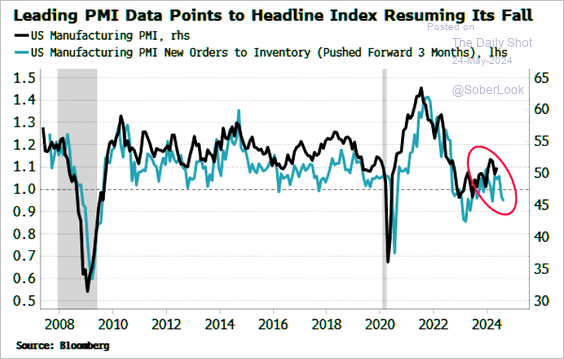

• Manufacturing now shows modest expansion.

– However, the orders-to-inventories ratio points to downside risks.

Source: Simon White, Bloomberg Markets Live Blog

Source: Simon White, Bloomberg Markets Live Blog

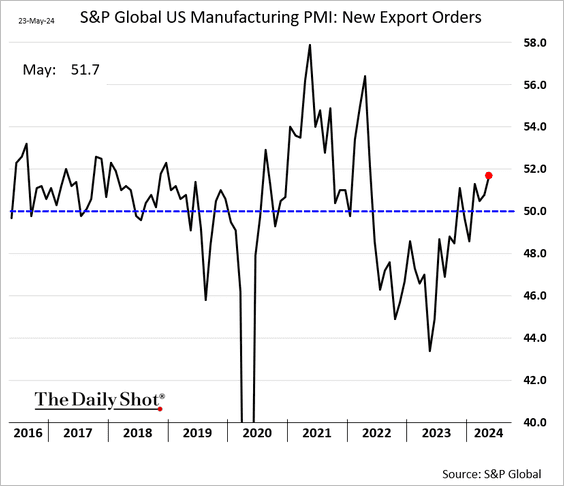

– Export orders are growing faster.

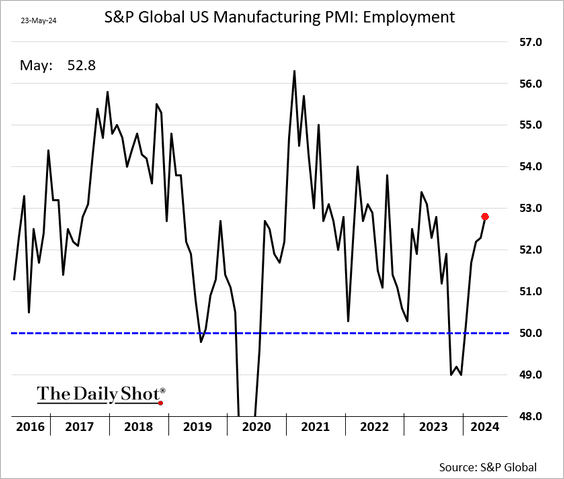

– Hiring has picked up momentum.

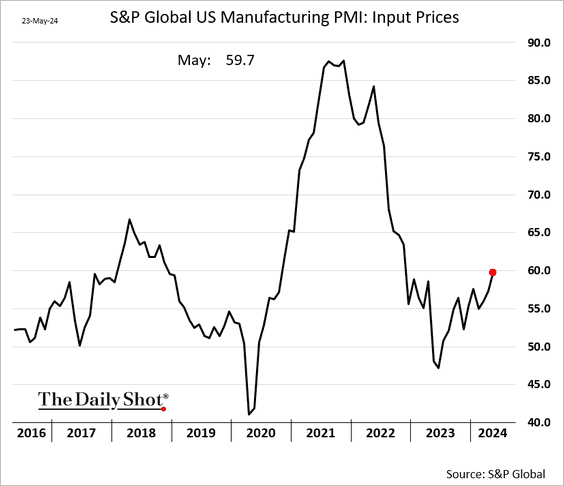

– Businesses reported increased input costs, which rattled the stock market.

——————–

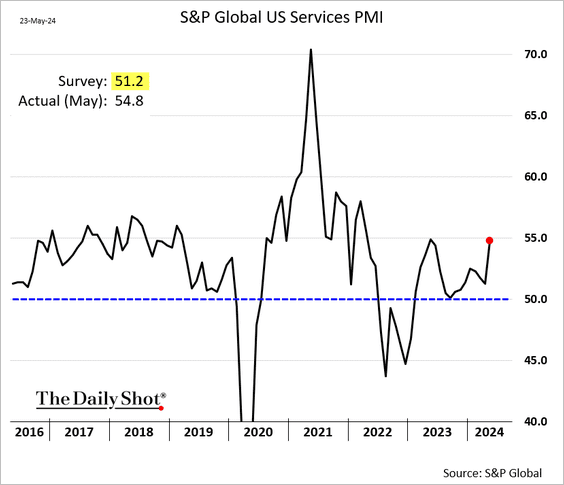

• Service sector growth accelerated.

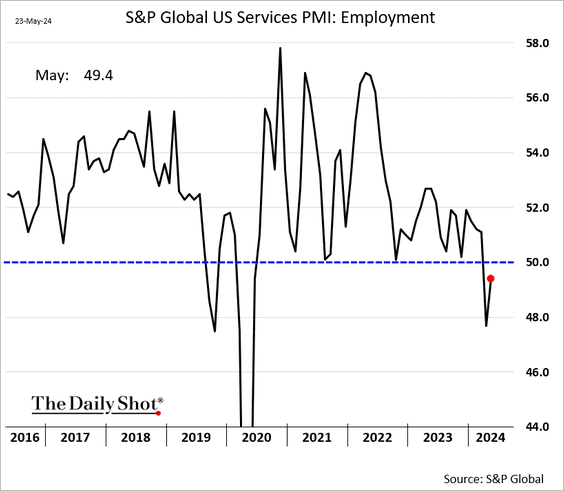

– The downturn in services employment seems to be easing.

——————–

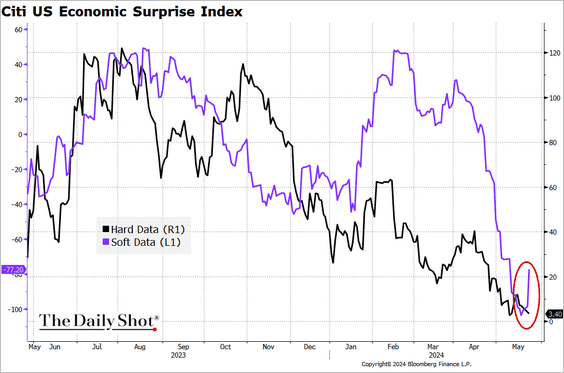

2. The soft-data component of the Citi Economic Surprise Index rose following the PMI report.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

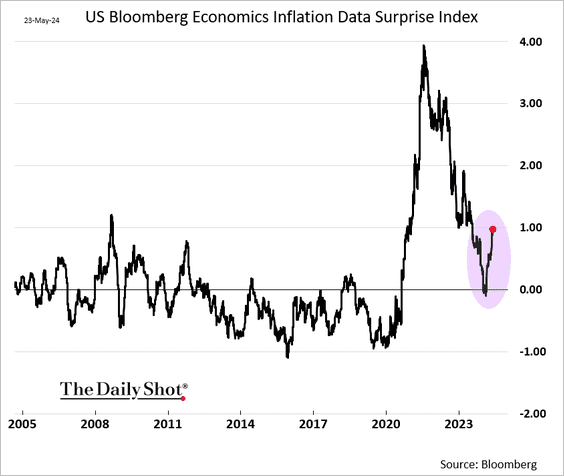

3. Bloomberg’s inflation data surprise index has been rebounding.

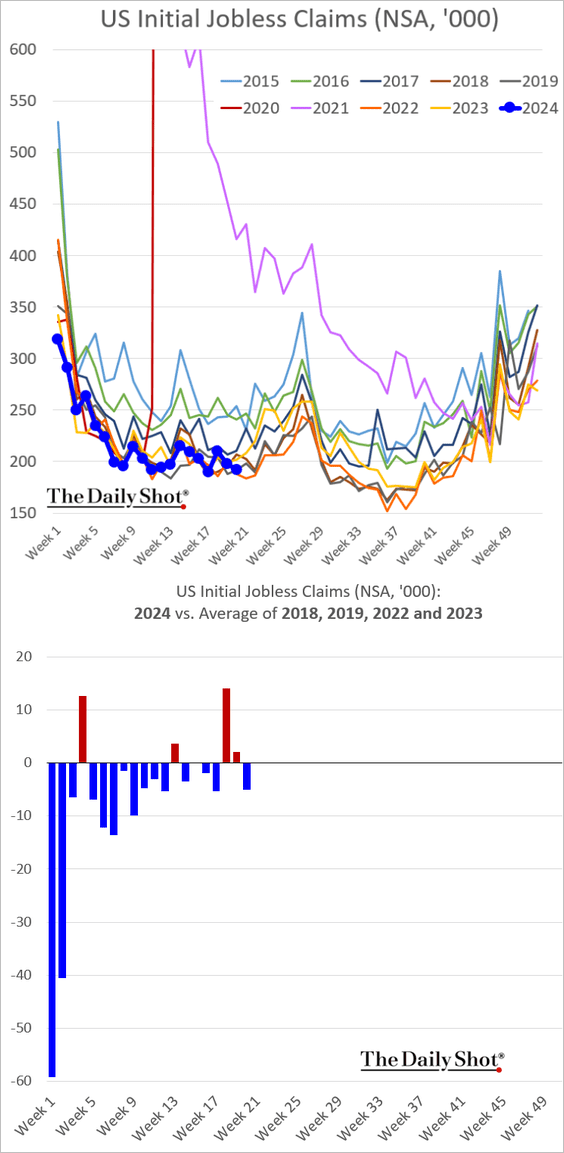

4. Jobless claims show no signs of a downturn in the labor market.

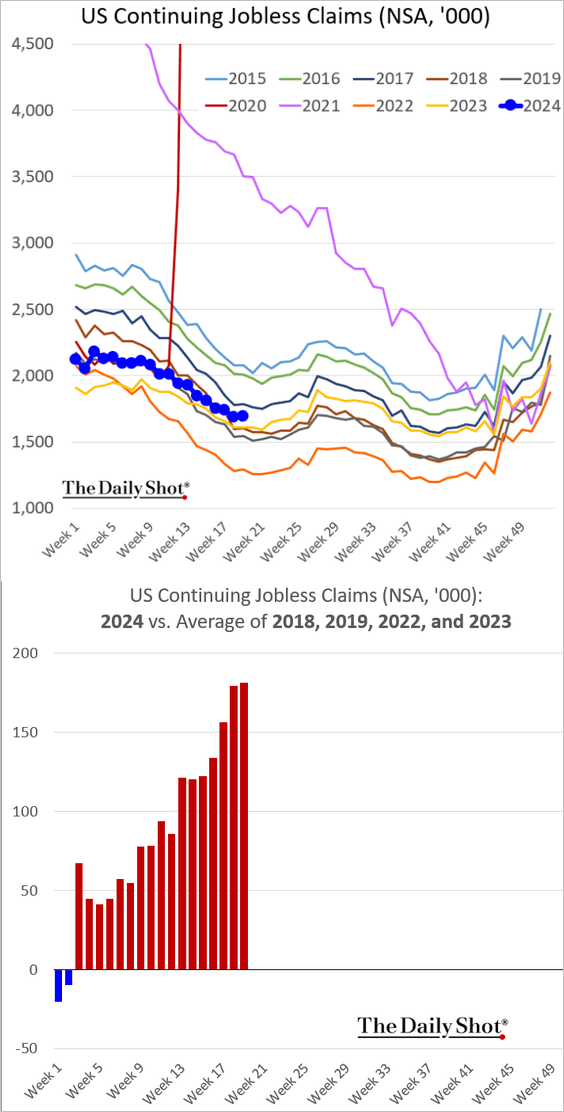

However, the continuing claims indicator has been trending higher than levels observed in recent years.

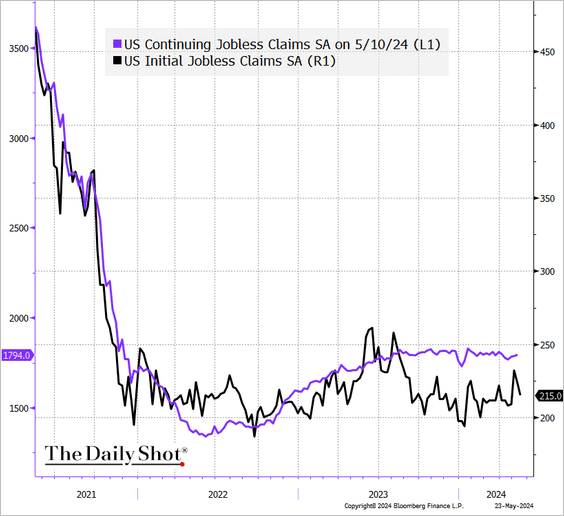

Here are the seasonally adjusted trends.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

——————–

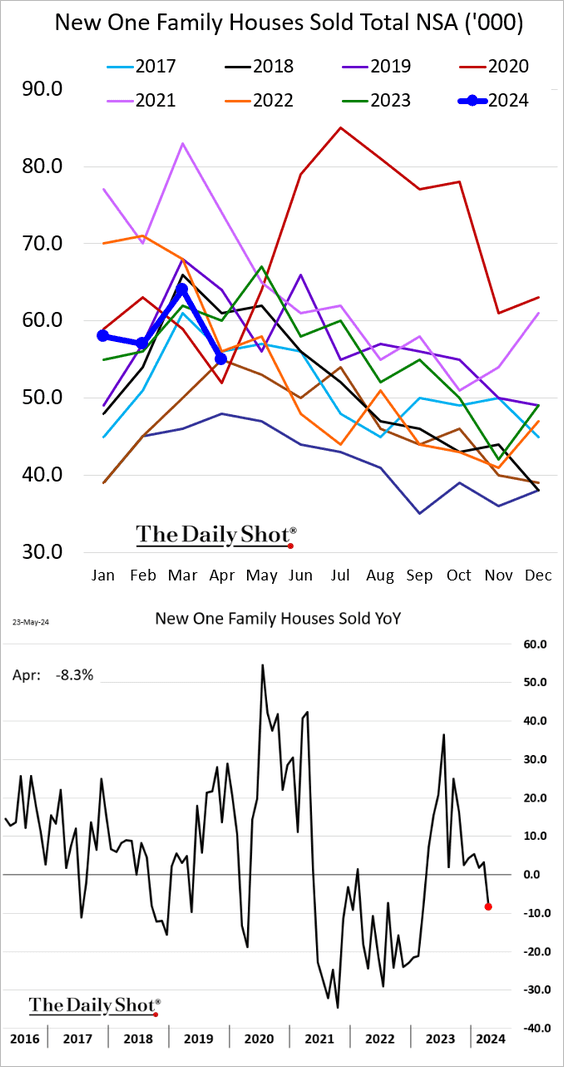

5. New home sales dipped below last year’s levels in April.

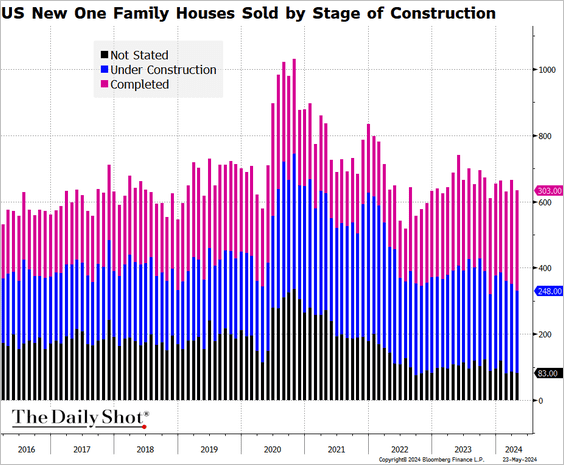

• The number of new housing pre-sales, represented in black below, continues to show a downward trend.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

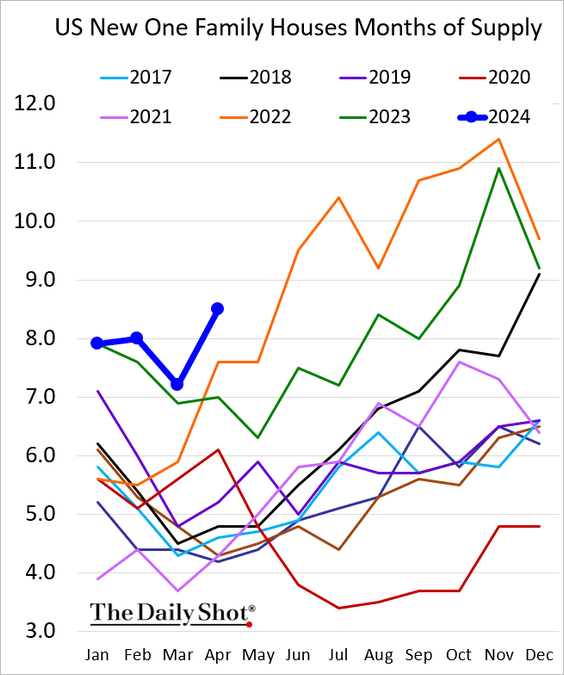

• Measured in months of supply, new home inventories are at a multi-year high.

——————–

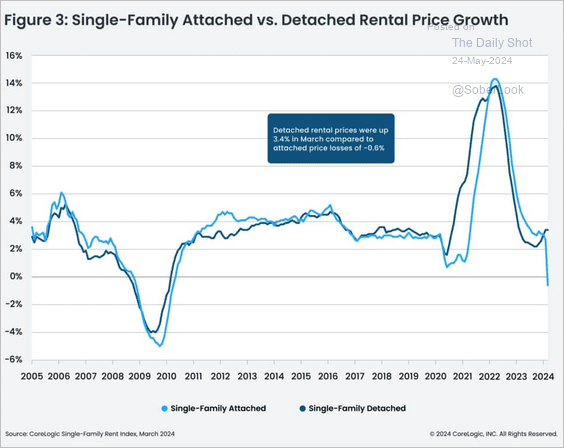

6. For the first time since 2010, rental costs for single-family attached homes have decreased year over year, diverging from the rents of detached units.

Source: CoreLogic

Source: CoreLogic

Back to Index

The United Kingdom

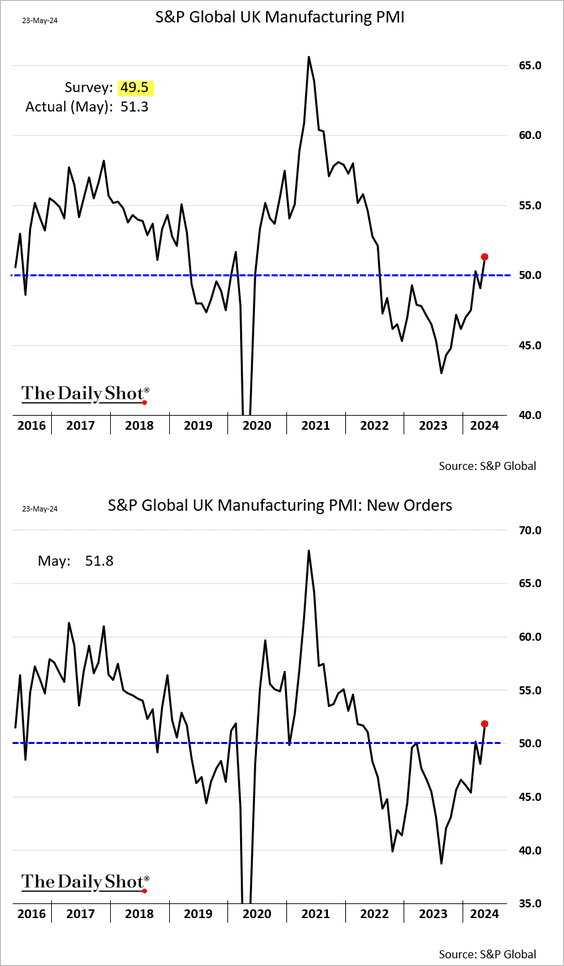

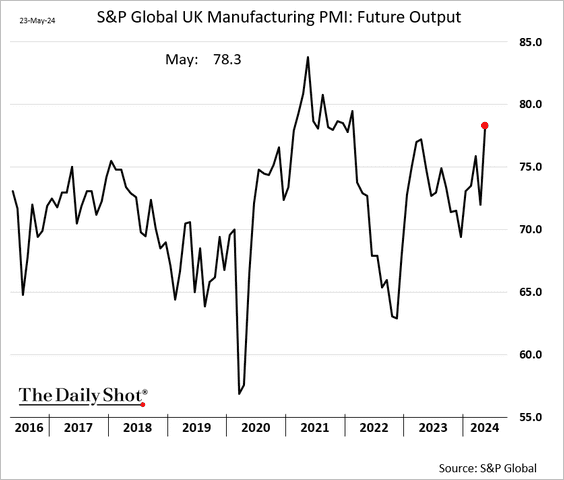

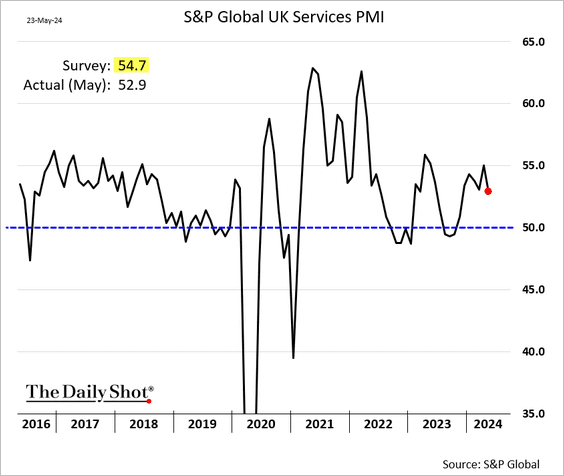

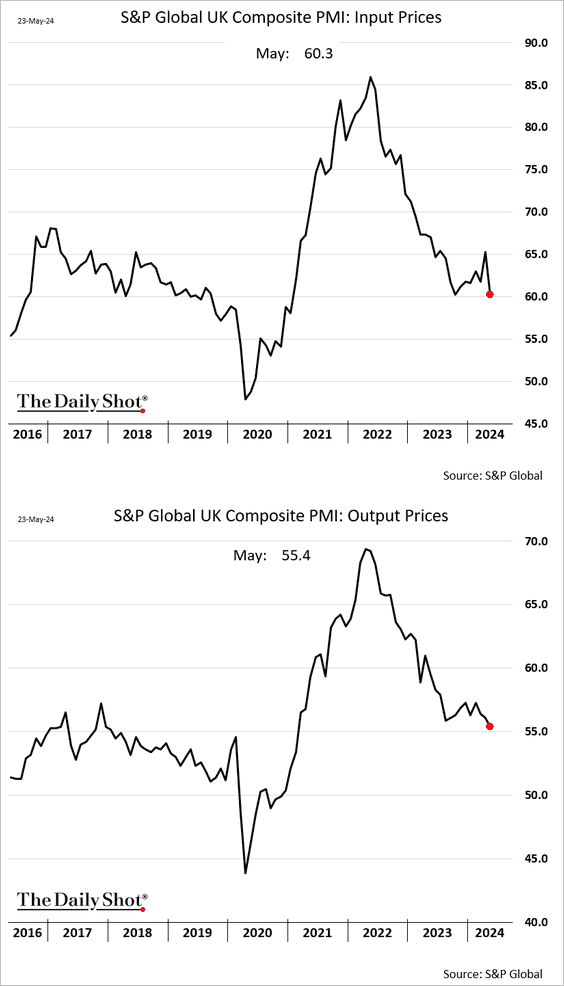

1. The May PMI report was mixed.

• Manufacturing unexpectedly returned to growth, …

… with outlook improving.

• But services expansion slowed.

• Price gains continue to moderate.

——————–

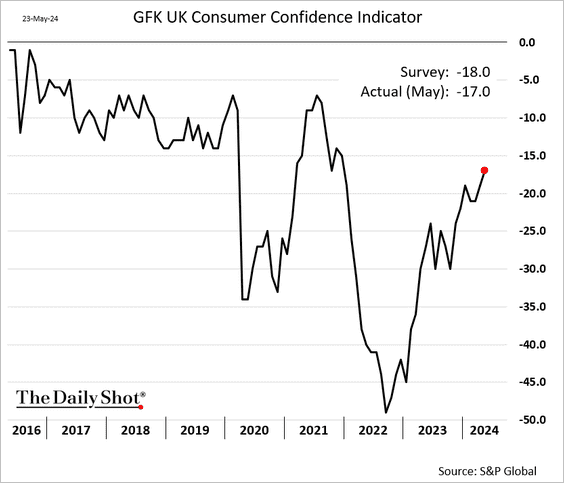

2. Consumer confidence is strengthening.

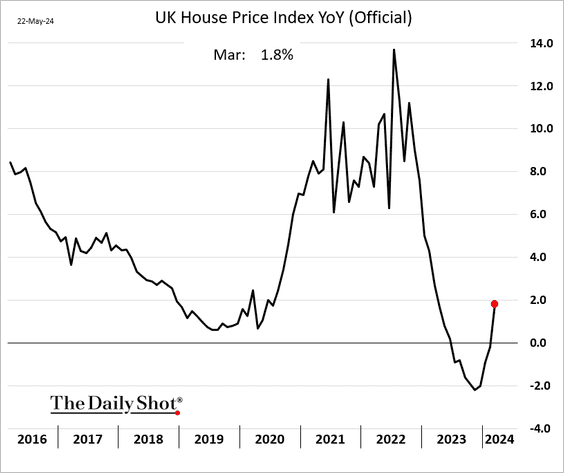

3. The official index of home price appreciation shows gains.

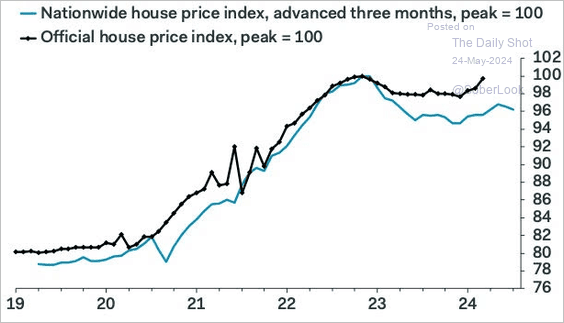

But the Nationwide Building Society data has been less upbeat.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

——————–

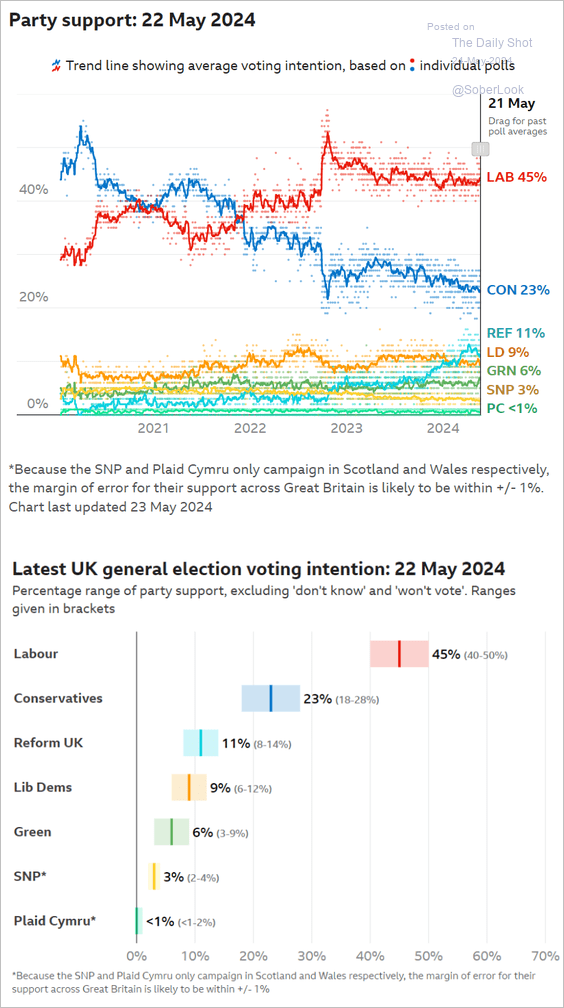

4. Here are the latest voting intention polls.

Source: BBC Read full article

Source: BBC Read full article

Back to Index

The Eurozone

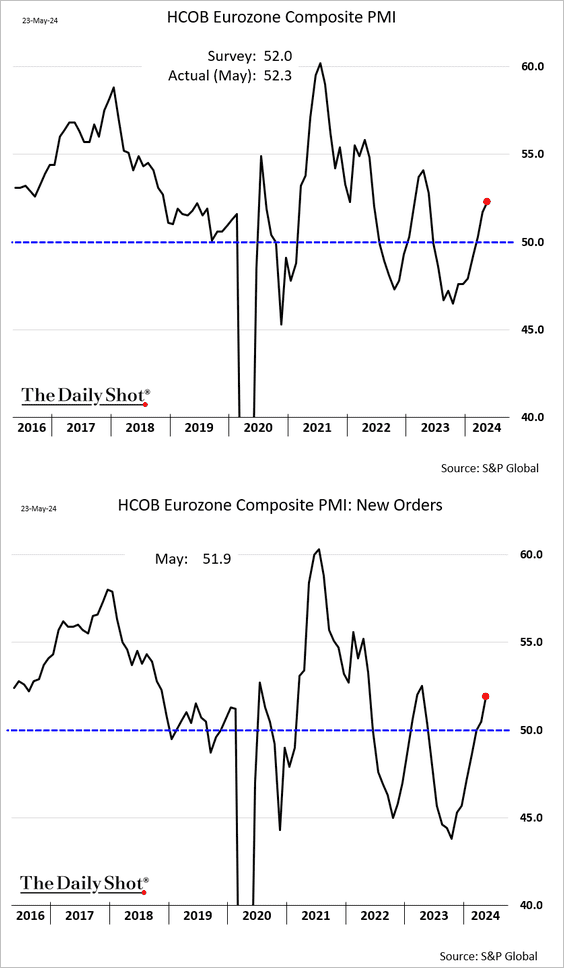

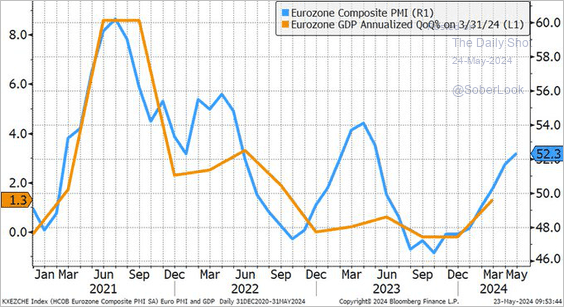

1. The May flash PMI report showed growth in business activity accelerating, …

… pointing to stronger economic expansion.

Source: @JeffreyKleintop

Source: @JeffreyKleintop

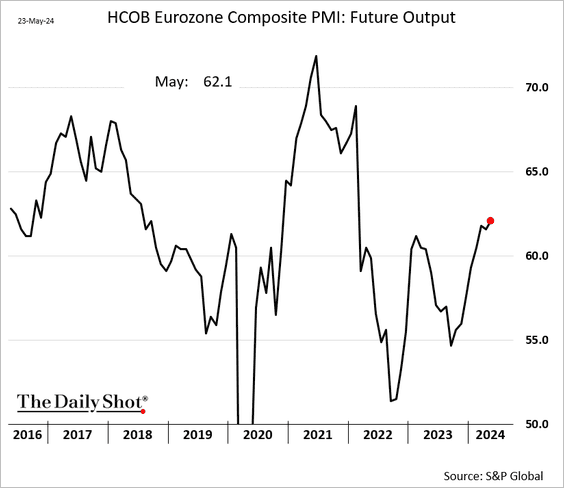

– Busines outlook is improving.

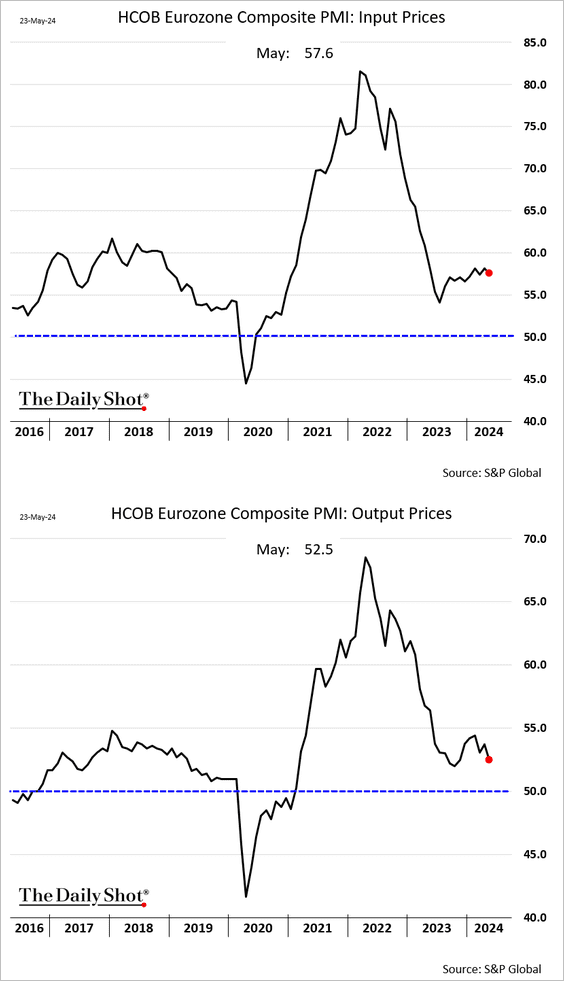

– Price pressures are lessening.

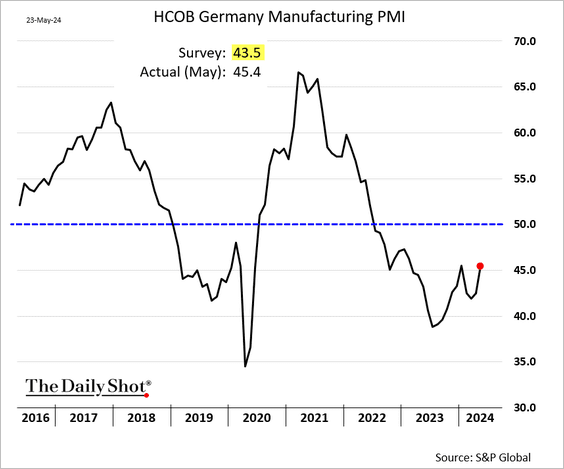

• Germany’s manufacturing slump is easing, …

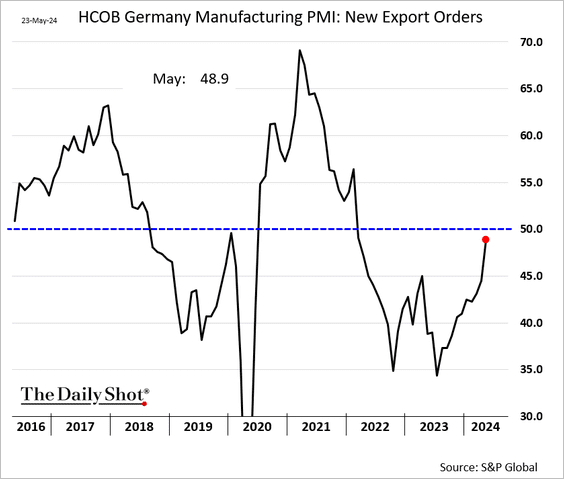

… as exports stabilize.

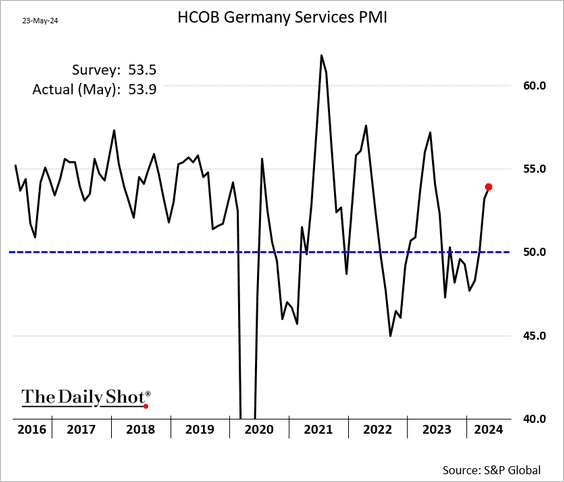

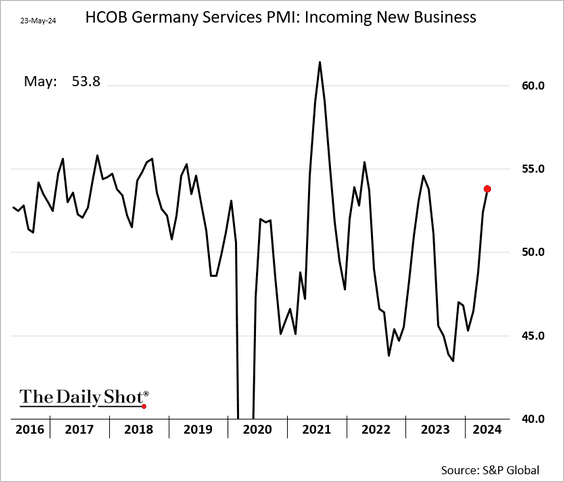

– Service sector growth strengthened further.

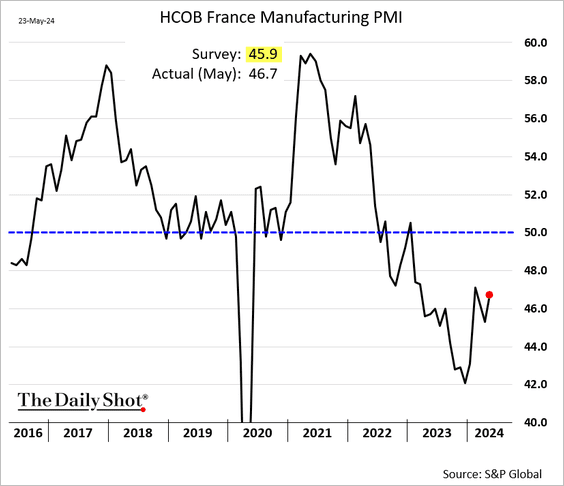

• The declines in French manufacturing activity eased somewhat.

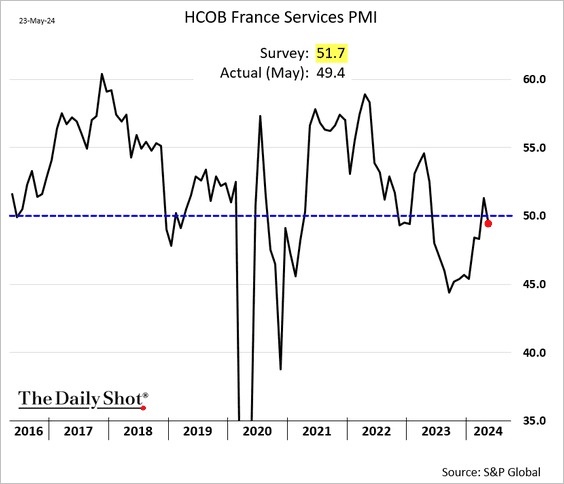

– The French service sector is back in contraction mode.

——————–

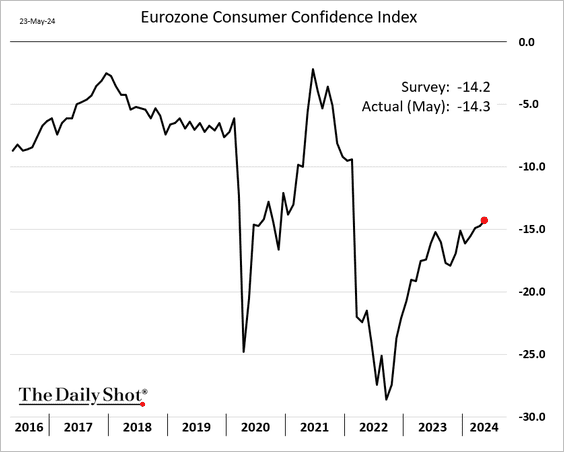

2. Euro-area consumer confidence edged higher in May.

Back to Index

Japan

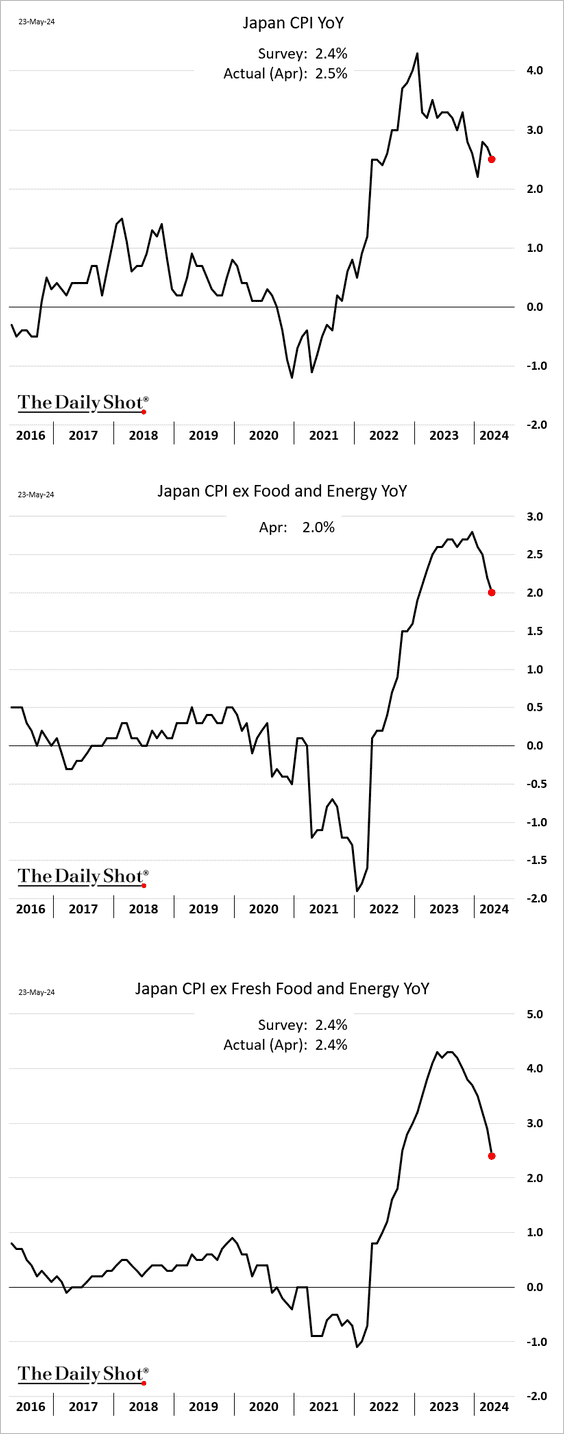

1. Inflation keeps slowing.

Source: Reuters Read full article

Source: Reuters Read full article

——————–

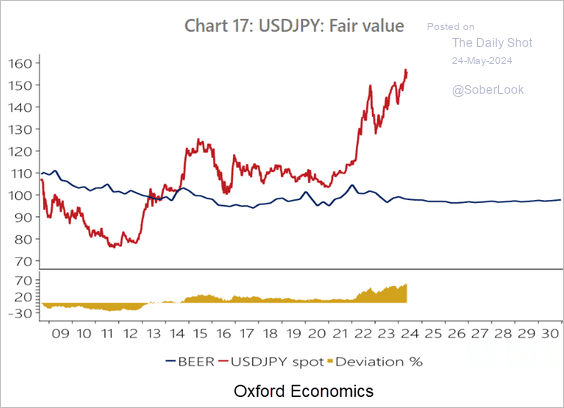

2. The yen appears oversold.

Source: Oxford Economics

Source: Oxford Economics

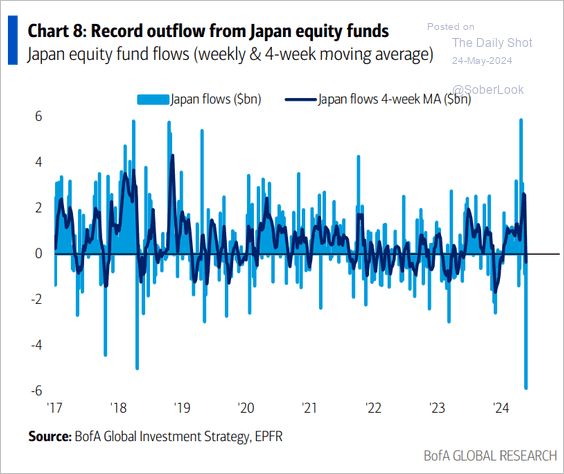

3. Japan-focused equity funds are seeing some outflows.

Source: BofA Global Research

Source: BofA Global Research

Back to Index

Asia-Pacific

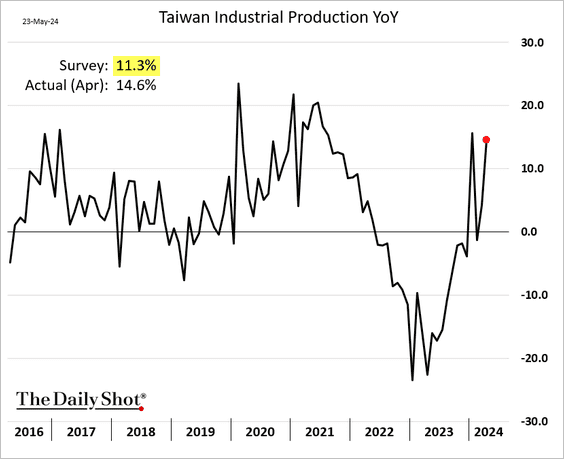

1. Taiwan’s industrial production is up almost 15% from a year ago.

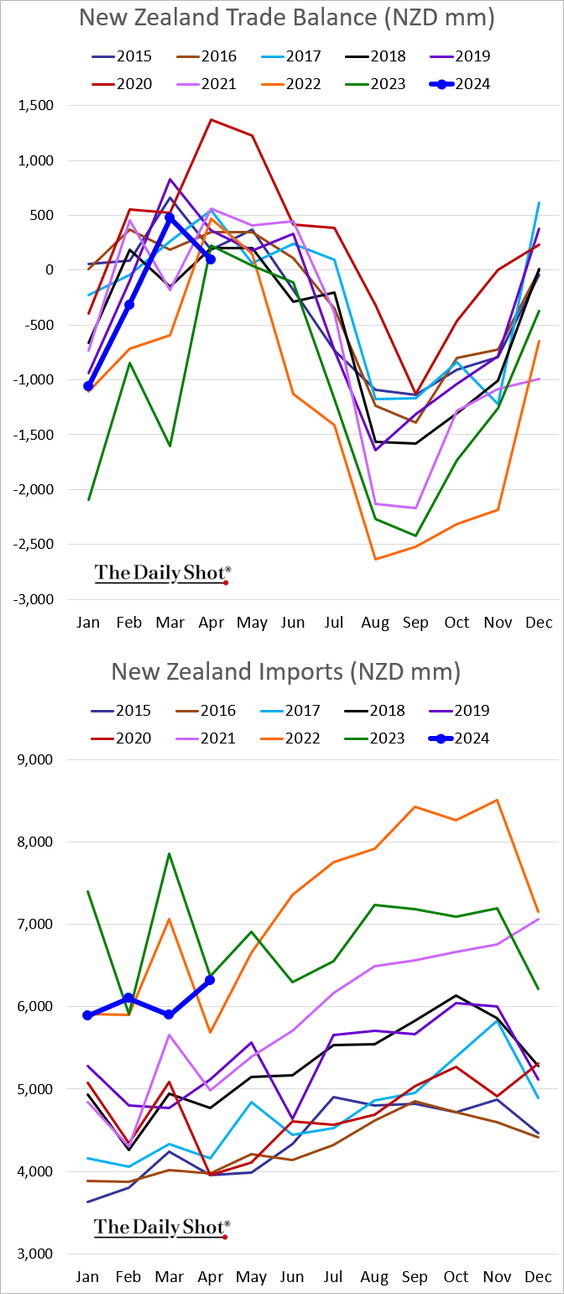

2. New Zealand’s trade balance hit a multi-year low in April as imports surged.

Back to Index

China

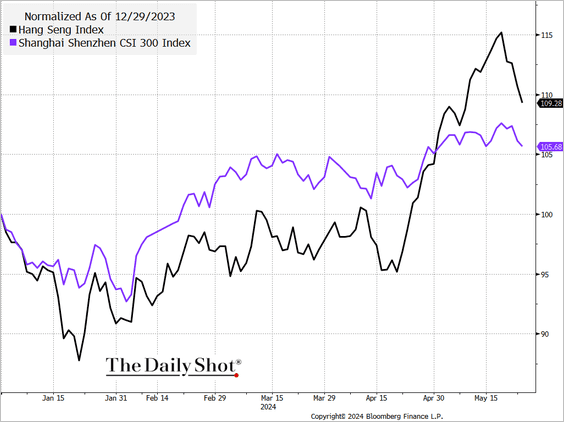

1. The stock market rally is fading.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

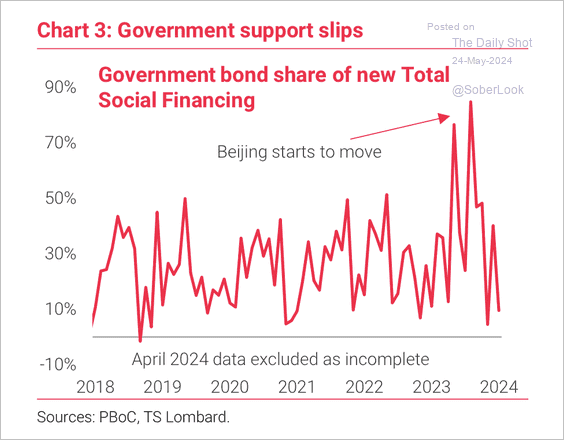

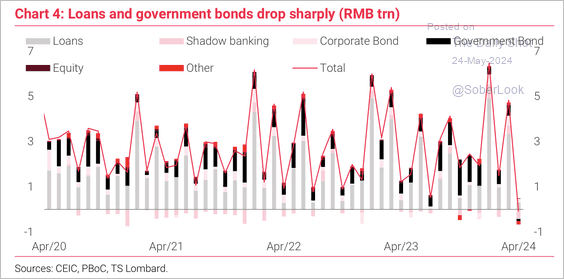

2. There has been a sharp decline in government-driven credit creation. (2 charts)

Source: TS Lombard

Source: TS Lombard

Source: TS Lombard

Source: TS Lombard

——————–

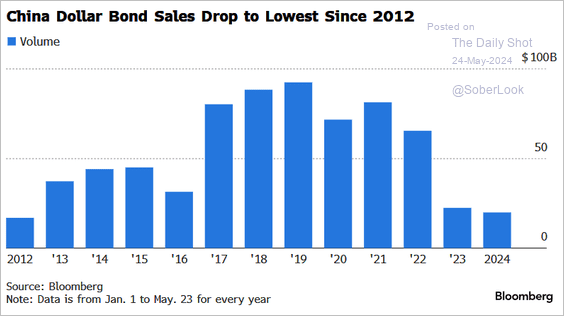

3. US dollar bond issuance has slumped due to foreign disinterest in China’s corporate debt, driven by defaulting developers.

Source: Bloomberg Law Read full article

Source: Bloomberg Law Read full article

Back to Index

Emerging Markets

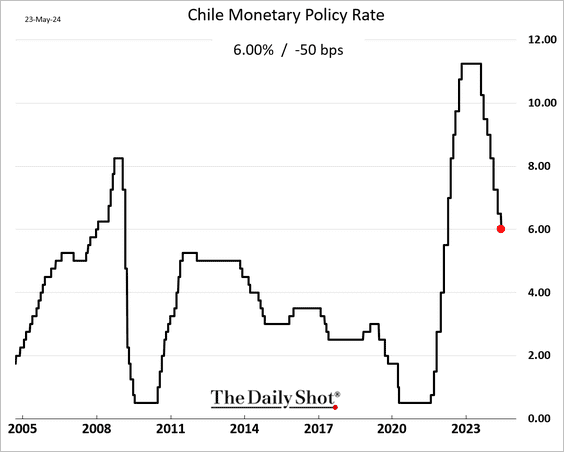

1. Chile’s central bank slowed the pace of rate cuts to 50 bps.

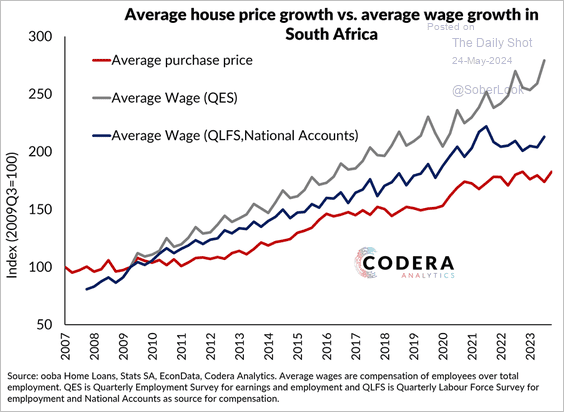

2. South Africa’s home prices have been rising slower than wages.

Source: Codera Analytics

Source: Codera Analytics

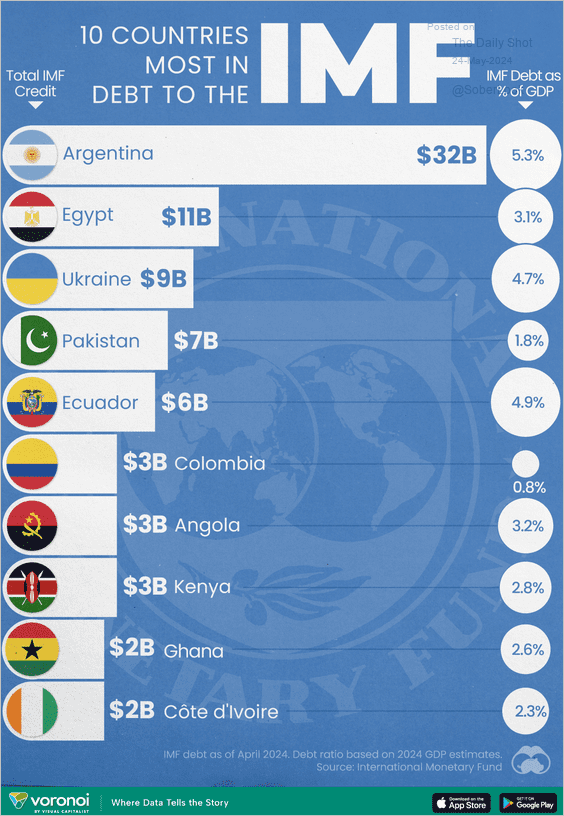

3. Here is a look at IMF debt.

Source: Visual Capitalist Read full article

Source: Visual Capitalist Read full article

Back to Index

Cryptocurrency

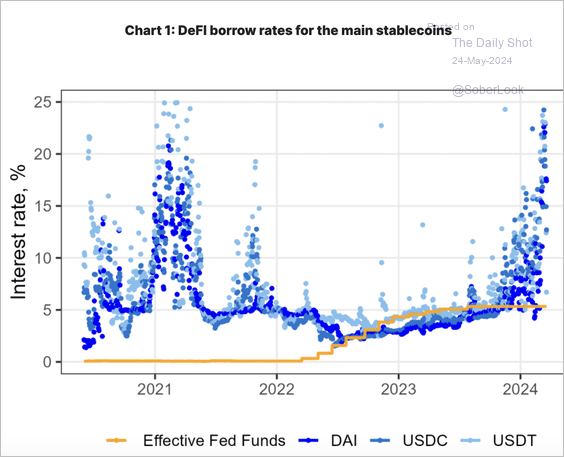

1. Interest rates on decentralized finance (DeFi) lending and deposit platforms exhibit high volatility and seem notably uncorrelated with traditional finance interest rates.

Source: Banque de France Read full article

Source: Banque de France Read full article

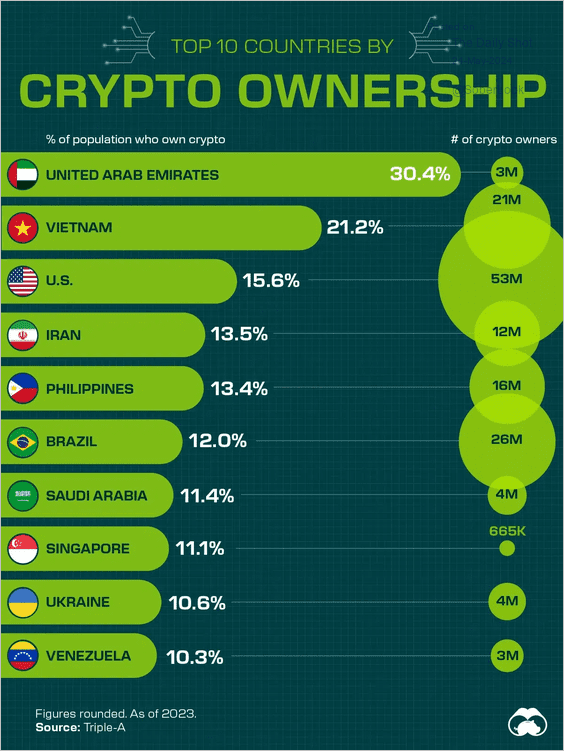

2. Here are the top ten countries by crypto ownership in 2023.

Source: Visual Capitalist Read full article

Source: Visual Capitalist Read full article

Back to Index

Commodities

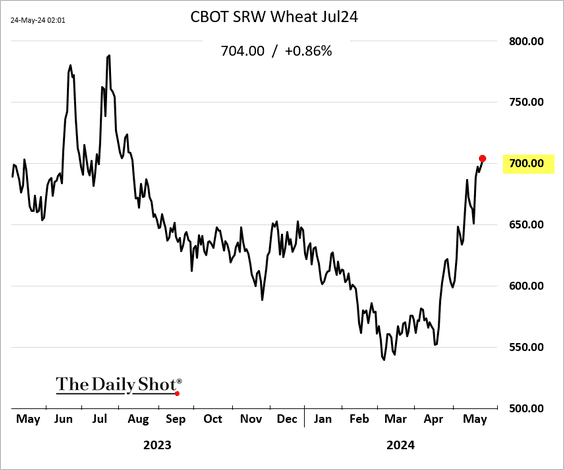

1. US wheat prices continue to surge.

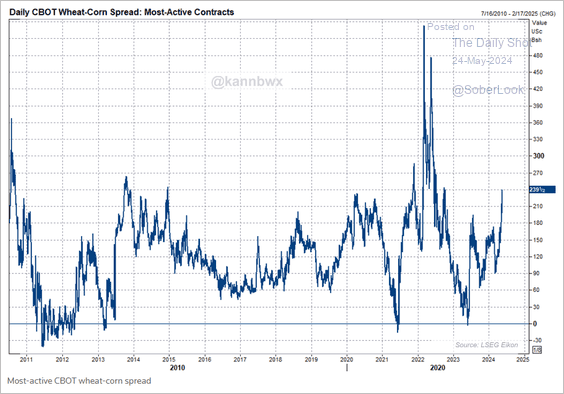

• The wheat-corn spread has been widening.

Source: Reuters Read full article

Source: Reuters Read full article

——————–

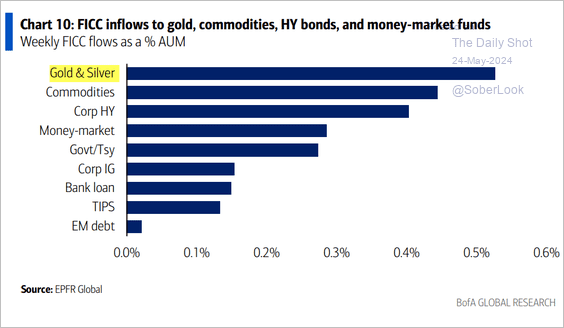

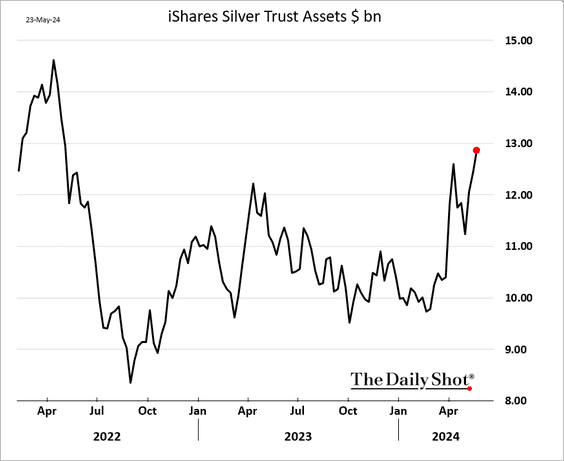

2. Gold and silver fund inflows have strengthened in recent days.

Source: BofA Global Research

Source: BofA Global Research

——————–

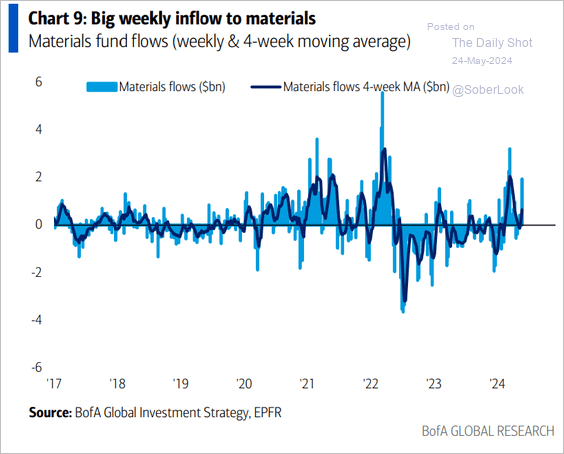

3. Materials funds are seeing some inflows.

Source: BofA Global Research

Source: BofA Global Research

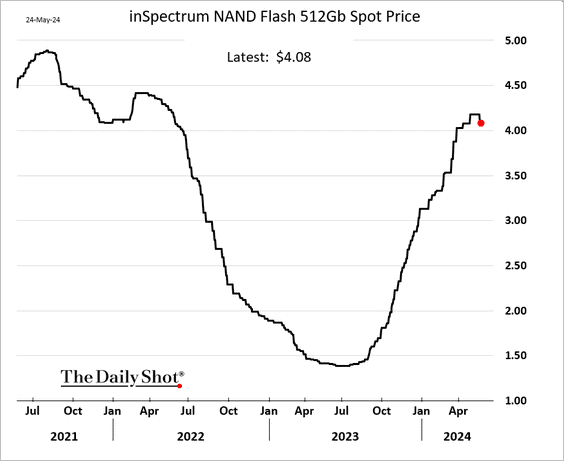

4. Is the rebound in flash memory prices stalling?

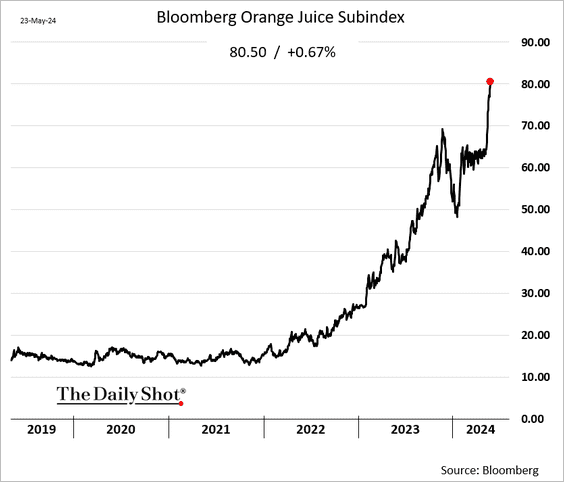

5. Orange juice prices continue to climb.

Back to Index

Equities

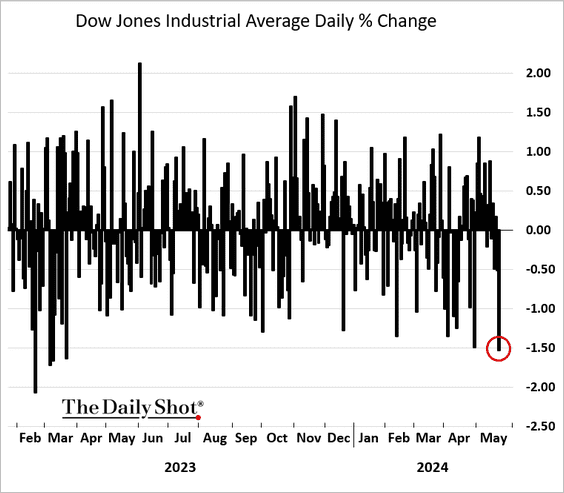

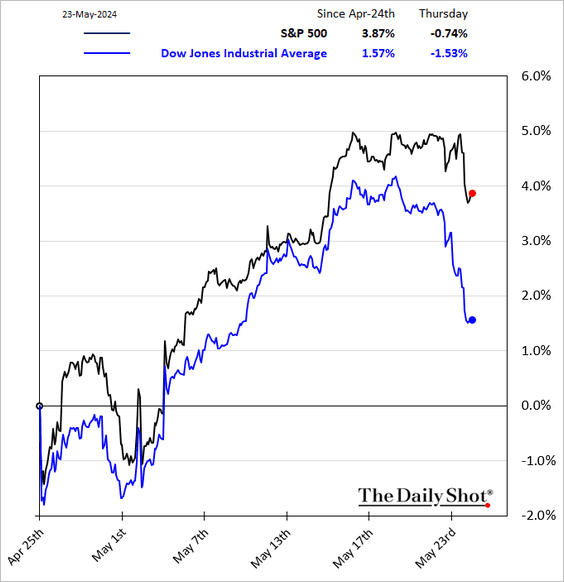

1. The Dow declined sharply on Thursday, …

… underperforming the S&P 500.

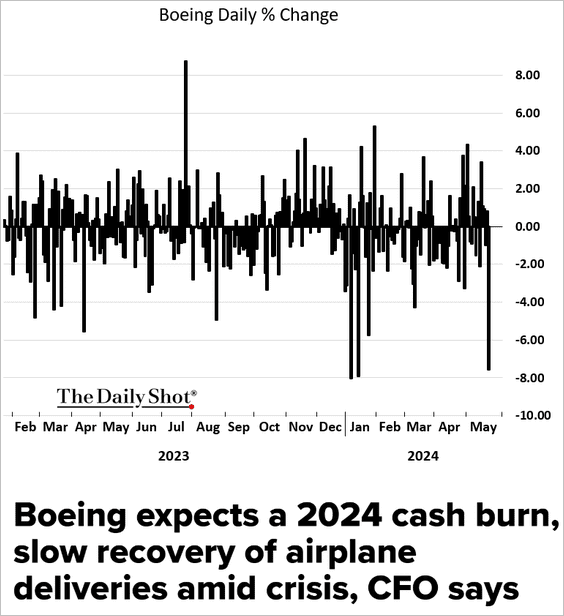

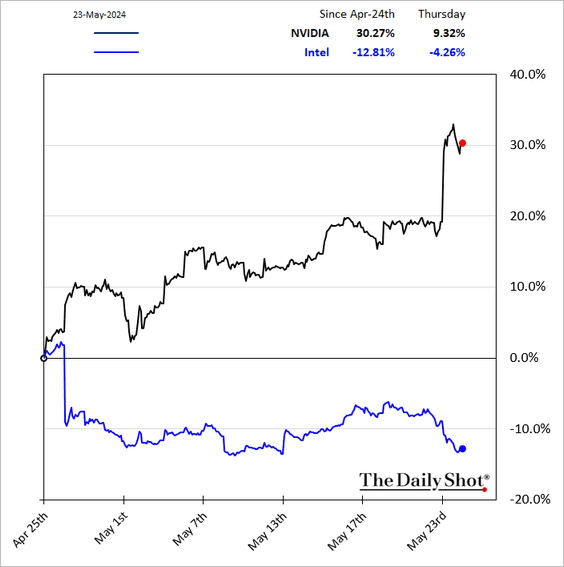

Here are a couple of events contributing to the divergence.

• Boeing:

Source: CNBC Read full article

Source: CNBC Read full article

• NVIDIA vs. Intel:

——————–

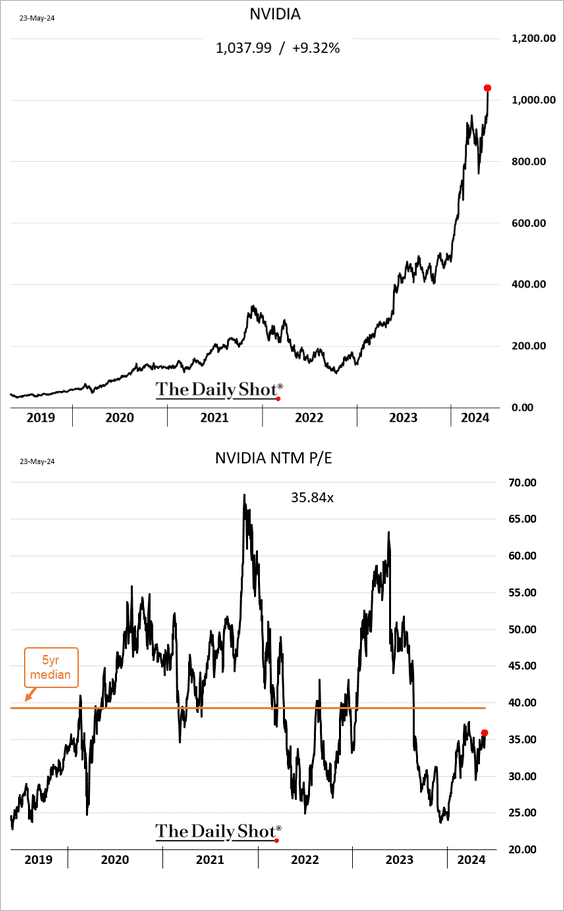

2. Despite NVIDIA’s surge, the stock’s valuation is still well below the 5-year median.

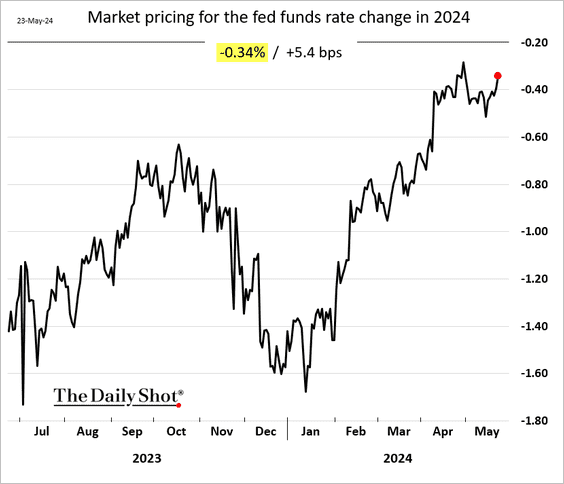

3. The market is now pricing only 34 bps of Fed rate cuts this year, weighing on stocks.

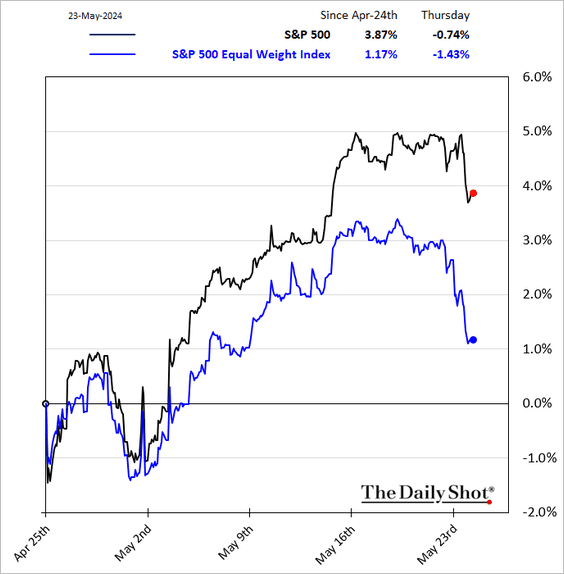

• NVIDIA contributed to the S&P 500’s outperformance relative to the broader market.

– The equal-weight index:

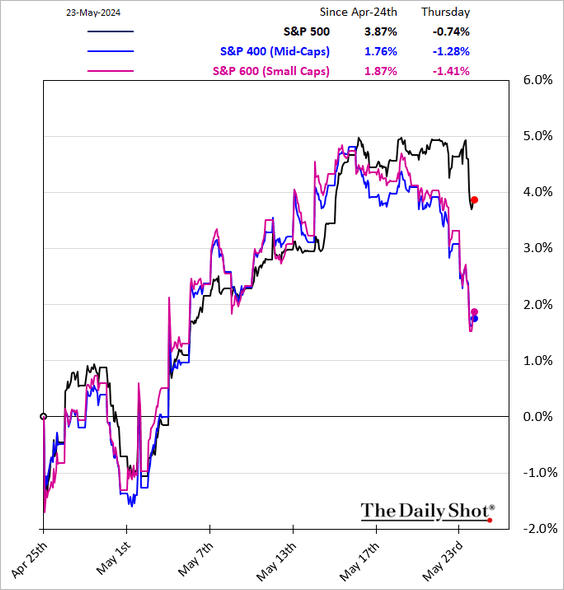

– Mid-caps and small caps:

——————–

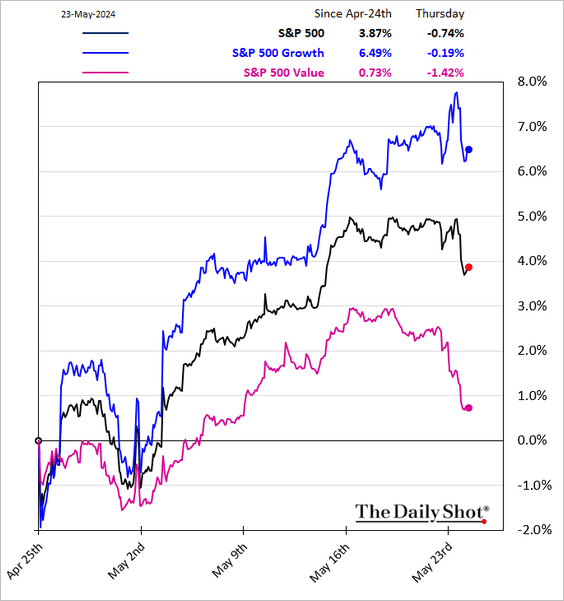

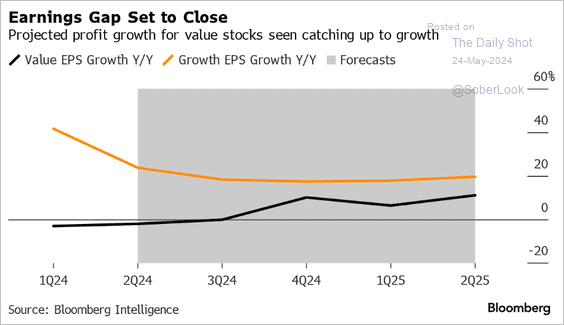

4. Value stocks have widened their underperformance vs. growth.

The gap in earnings growth rates between value and growth stocks is projected to narrow over the next few quarters, with value stocks expected to significantly improve their year-over-year EPS growth, while growth stocks maintain a steady, albeit lower, growth trajectory.

Source: Simon White, Bloomberg Markets Live Blog

Source: Simon White, Bloomberg Markets Live Blog

——————–

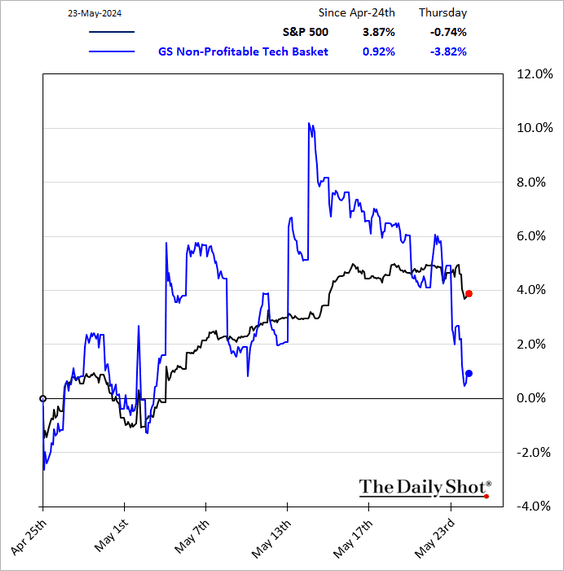

5. Speculative stocks saw a pullback on Thursday.

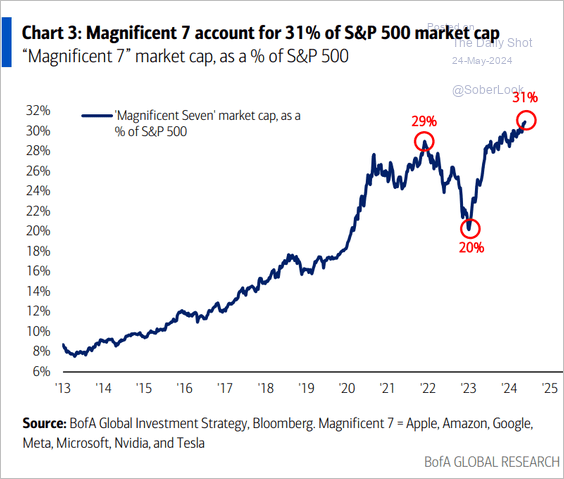

6. The Magnificent 7 concentration continues to rise.

Source: BofA Global Research

Source: BofA Global Research

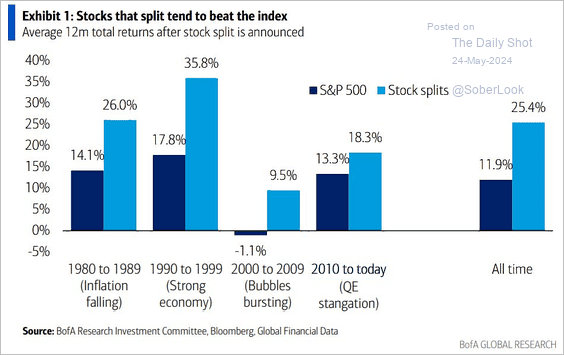

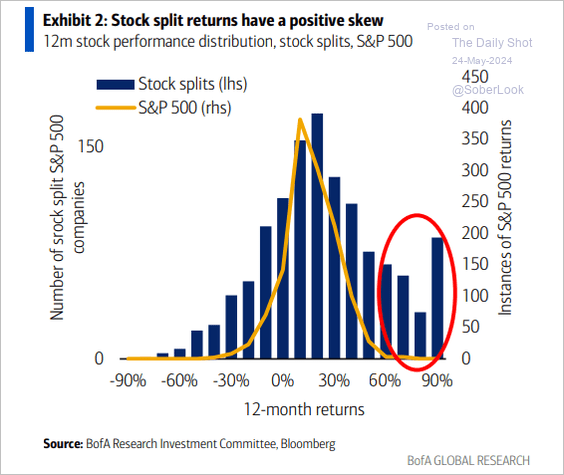

7. Stock splits tend to predict outperformance (2 charts).

Source: BofA Global Research; @MikeZaccardi

Source: BofA Global Research; @MikeZaccardi

Source: BofA Global Research; @MikeZaccardi

Source: BofA Global Research; @MikeZaccardi

——————–

Food for Thought

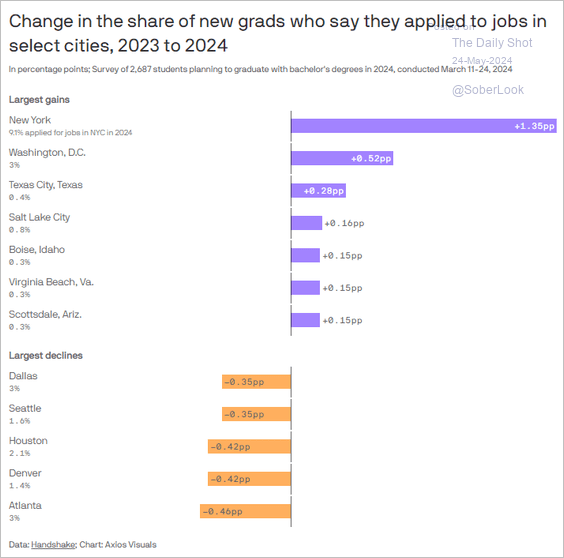

1. Best cities to work in, according to the class of 2024:

Source: @axios Read full article

Source: @axios Read full article

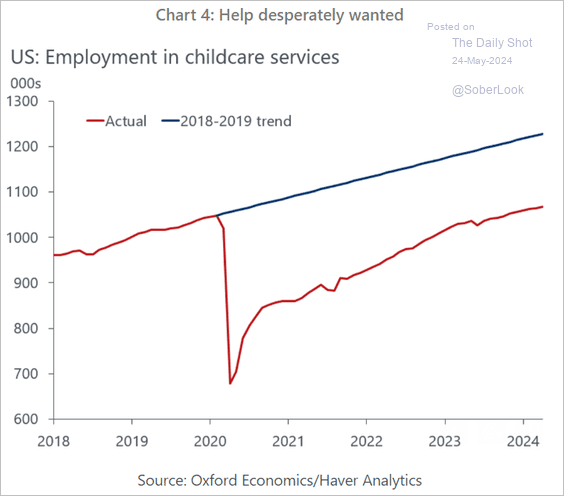

2. Daycare employment vs. the pre-pandemic trend:

Source: Oxford Economics

Source: Oxford Economics

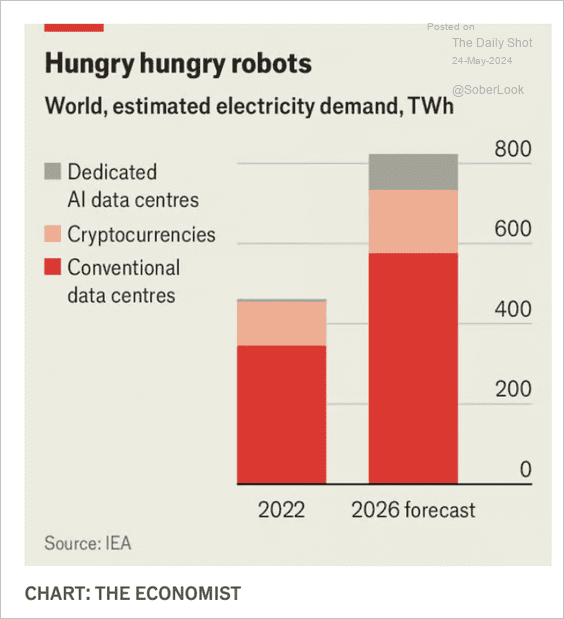

3. Estimated global electricity demand by data centers:

Source: The Economist Read full article

Source: The Economist Read full article

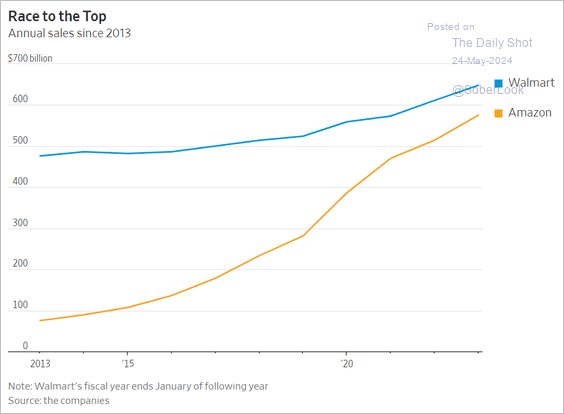

4. Walmart vs. Amazon annual sales:

Source: @WSJ Read full article

Source: @WSJ Read full article

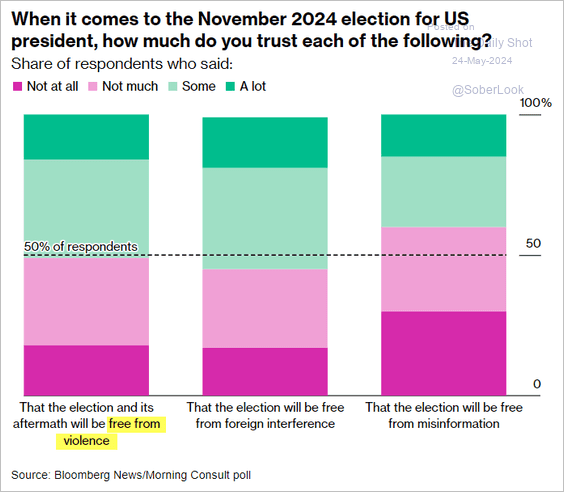

5. Trust in aspects of the 2024 US presidential election:

Source: @bpolitics Read full article

Source: @bpolitics Read full article

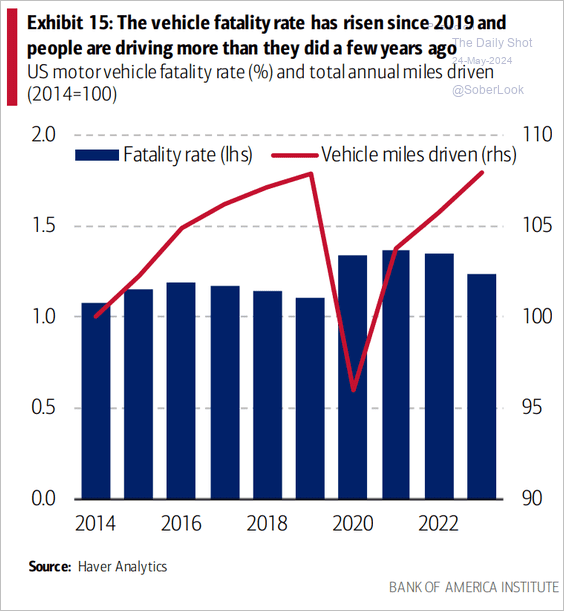

6. The US vehicle fatality rate:

Source: Bank of America Institute

Source: Bank of America Institute

7. Who is supplying Russia’s arms industry?

Source: The Economist Read full article

Source: The Economist Read full article

8. Memorial Day facts:

Source: WalletHub Read full article

Source: WalletHub Read full article

——————–

Have a great weekend!

Back to Index