The Daily Shot: 06-May-24

• The United States

• Canada

• The Eurozone

• Europe

• Emerging Markets

• Commodities

• Energy

• Equities

• Credit

• Rates

• Global Developments

• Food for Thought

The United States

1. The April jobs report was weaker than anticipated, raising expectations for a Fed rate cut by September.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

Nonetheless, hiring continues to be robust, with April marking the 40th consecutive month of job gains exceeding 100k.

– A significant factor in the downside surprise of the jobs report was the absence of local government hiring last month.

The number of local government jobs, driven in large part by public education employment, remains near record highs, but growth appears to have stalled.

– Healthcare jobs continue to surge, becoming a key contributor to total job gains.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

– Leisure & Hospitality jobs have rebounded to pre-pandemic levels, although gains have slowed in recent quarters.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

• The April employment survey had the lowest percentage of participants in years, making it particularly susceptible to noise.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

– The Household Survey showed almost no job growth last month.

• The unemployment rate edged higher.

Underemployment increased (2 charts).

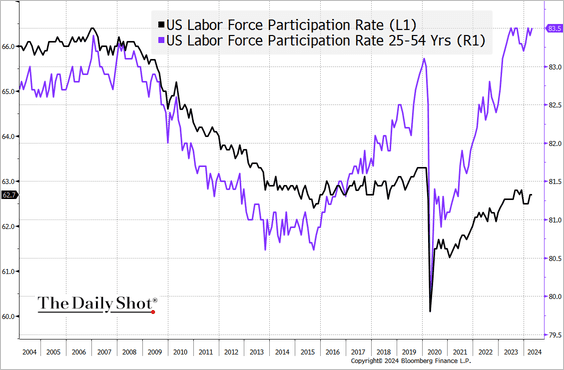

• Labor force participation held steady, with prime-age participation increasing slightly.

Labor force participation among prime-age women reached a record high.

• Markets were particularly impressed by slowing wage growth, which could indicate slower inflation ahead (2 charts).

Source: @RenMacLLC

Source: @RenMacLLC

• The NFIB small business survey indicates that job gains will likely slow in the future.

Source: ING

Source: ING

——————–

2. The markets boosted the odds of rate cuts in 2024 in response to the employment report, …

… now pricing in a 90% chance of a Fed rate cut in September or earlier.

• Treasury yields declined, …

… and stocks rallied.

——————–

3. The ISM Services PMI index dipped into contraction territory for the first time since 2022.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

• Order growth slowed.

• Service firms are reporting job cuts.

• Price pressures increased in April.

——————–

4. Following the jobs and ISM Services PMI reports, the Citi Economic Surprise Index dipped below zero.

Back to Index

Canada

1. Service sector activity has almost stabilized, according to the latest PMI report.

2. The trade balance unexpectedly dipped into deficit in March, …

… due to a pullback in precious metals exports.

Source: Economics and Strategy Group, National Bank of Canada

Source: Economics and Strategy Group, National Bank of Canada

Source: Reuters Read full article

Source: Reuters Read full article

• Goods trade was a drag on Q1 GDP growth.

Source: Economics and Strategy Group, National Bank of Canada

Source: Economics and Strategy Group, National Bank of Canada

——————–

The Eurozone

1. The euro-area unemployment rate held steady in March.

• Italian unemployment hit the lowest level since the beginning of 2009.

——————–

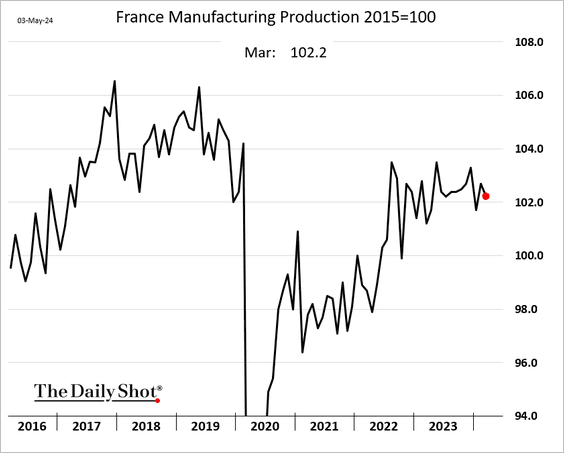

2. French factory output declined in March.

3. Deutsche Bank forecasts positive growth rates for Germany over the next two years.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

However, Germany’s real GDP is expected to remain significantly smaller than its pre-pandemic trend.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

——————–

4. Here is a look at price levels relative to trends for the US and the Eurozone.

Source: @financialtimes Read full article

Source: @financialtimes Read full article

And these charts compare the contributions to the price changes since December 2019.

Source: @financialtimes Read full article

Source: @financialtimes Read full article

Back to Index

Europe

1. Norges Bank’s comments were a bit hawkish, …

Source: @economics Read full article

Source: @economics Read full article

… sending the krone sharply higher vs. the euro.

——————–

2. Here is a look at the aggregate government deficit in the EU.

Source: Eurostat Read full article

Source: Eurostat Read full article

3. Finally, this chart shows migrant deaths in the Mediterranean Sea.

Source: @financialtimes Read full article

Source: @financialtimes Read full article

Back to Index

Emerging Markets

1. Brazil’s industrial output climbed in March, but the increase was lower than expected.

• Vehicle sales surged in April.

• Consumer loan delinquencies have been trending lower.

——————–

2. Chile’s car sales showed improvement last month.

3. Mexico’s vehicle sales remain well above 2023 levels.

4. Turkey’s core inflation remains above 75%.

5. India’s investors love equity options.

Source: The Economist Read full article

Source: The Economist Read full article

6. The Philippines leads its Asian peers in remittances as a percentage of GDP.

Source: The Economist Read full article

Source: The Economist Read full article

7. Finally, we have some performance data from last week.

• Currencies:

• Bond yields:

• Equity ETFs:

Back to Index

Commodities

1. Grains’ overall positioning has been depressed.

Source: @kannbwx

Source: @kannbwx

2. Traders have increased their bets against soybean oil, …

… as its use in biomass-based diesel production declines

Source: @SusanNOBULL, @Barchart Read full article

Source: @SusanNOBULL, @Barchart Read full article

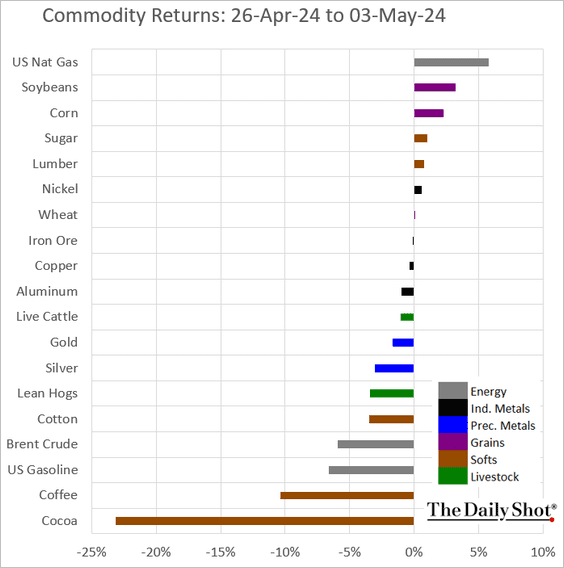

3. Here is a look at last week’s performance data.

Back to Index

Energy

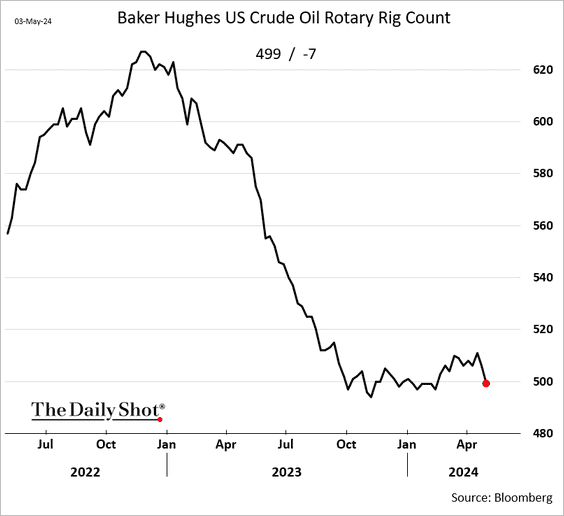

1. The US oil rig count dipped below 500 again.

2. Next, we have some updates on natural gas.

• US natural gas futures have bounced from recent lows.

• This chart shows Goldman’s forecast for US LNG export demand.

Source: Goldman Sachs; @MikeZaccardi

Source: Goldman Sachs; @MikeZaccardi

• European gas demand continues to fall this year.

Source: Greg Molnár; IEA

Source: Greg Molnár; IEA

• Russia’s Gazprom registered a loss last year partly driven by lower export volumes to Europe.

Source: Greg Molnár; IEA

Source: Greg Molnár; IEA

Back to Index

Equities

1. Key US indices are testing resistance at the 50-day moving average.

2. Only 15% of S&P 500 companies provided guidance that exceeded estimates. Solid earnings beats might not suffice to sustain the stock market rally as the focus shifts toward profit forecasts.

Source: @markets Read full article

Source: @markets Read full article

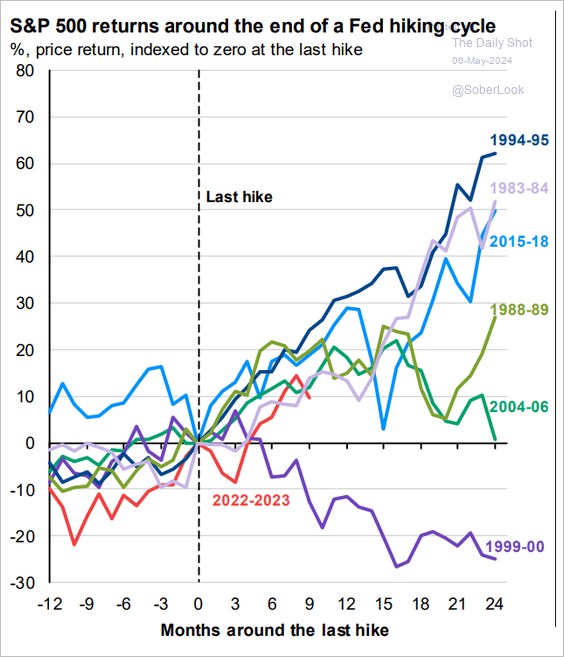

3. This chart shows the S&P 500 performance around the Fed’s last rate hike.

Source: J.P. Morgan Asset Management

Source: J.P. Morgan Asset Management

4. Regional banks continue to struggle despite some positive news from NYCB in recent days.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

5. Share buyback activity is picking up, …

Source: Deutsche Bank Research

Source: Deutsche Bank Research

… as more companies exit their blackout periods.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

——————–

6. The percentage of active large-cap funds outperforming their benchmark hit a multi-year high this year.

Source: BofA Global Research; @MikeZaccardi

Source: BofA Global Research; @MikeZaccardi

7. Earnings of the largest firms have significantly outpaced smaller peers.

Source: Simon White, Bloomberg Markets Live Blog

Source: Simon White, Bloomberg Markets Live Blog

8. Sustainable funds have lost their luster.

Source: @axios Read full article

Source: @axios Read full article

9. Next, we have some updates on the options markets.

• Net-bullish options volume has been sinking.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

• VIX registered a “golden cross” last week, which could point to choppy trading conditions ahead.

• The VIX curve contango intensified last week.

• Options-based ETFs, such as covered call and collar strategies, experienced significant AUM growth in recent years.

Source: TheETFShelf

Source: TheETFShelf

——————–

10. Finally, we have some performance data from last week.

• Sectors:

• Equity factors/styles:

• Macro basket pairs’ relative performance:

• Thematic ETFs:

• Largest US tech firms:

Back to Index

Credit

1. Spreads continue to tighten.

2. US high-yield funds experienced inflows for the second straight week.

Source: PitchBook

Source: PitchBook

3. Flows into leveraged loan funds have been strong.

Source: BofA Global Research

Source: BofA Global Research

4. Flows into investment-grade bond funds are holding up.

Source: BofA Global Research

Source: BofA Global Research

5. Here is last week’s performance data.

Back to Index

Rates

1. Traders have soured on SOFR futures as Fed rate cut expectations get pushed forward.

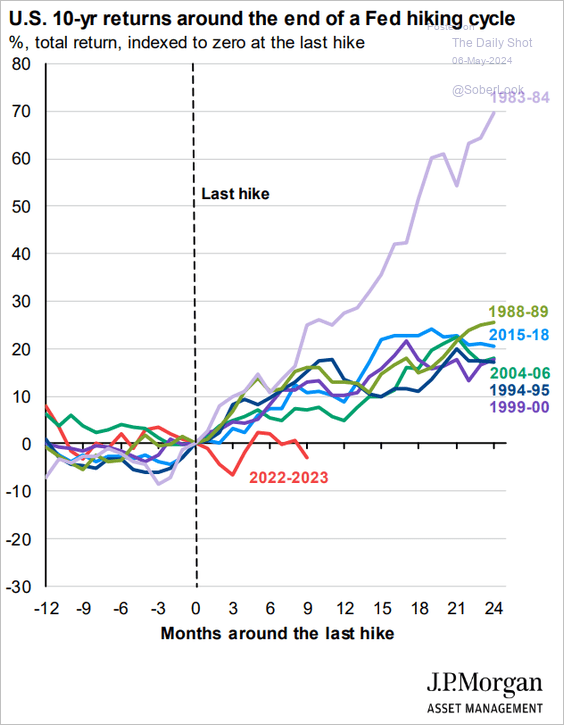

2. The 10-year Treasury note has been underperforming relative to previous trends around the Fed’s last rate hike.

Source: J.P. Morgan Asset Management

Source: J.P. Morgan Asset Management

Back to Index

Global Developments

1. This chart illustrates cross-asset fund flows relative to the past one-year average.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

2. Growth in global manufacturing activity slowed in April. The second panel shows the PMIs by country/region.

Source: S&P Global PMI

Source: S&P Global PMI

3. Finally, we have some performance data from last week.

• Currency indices:

• Bond yields:

• Equities:

——————–

Food for Thought

1. Airline incidents:

Source: NTSB Further reading

Source: NTSB Further reading

2. Convenience stores outperforming overall US retail:

Source: Placer.ai

Source: Placer.ai

3. Berkshire Hathaway’s cash pile:

Source: @financialtimes Read full article

Source: @financialtimes Read full article

4. Historical and projected population trajectories:

Source: Goldman Sachs

Source: Goldman Sachs

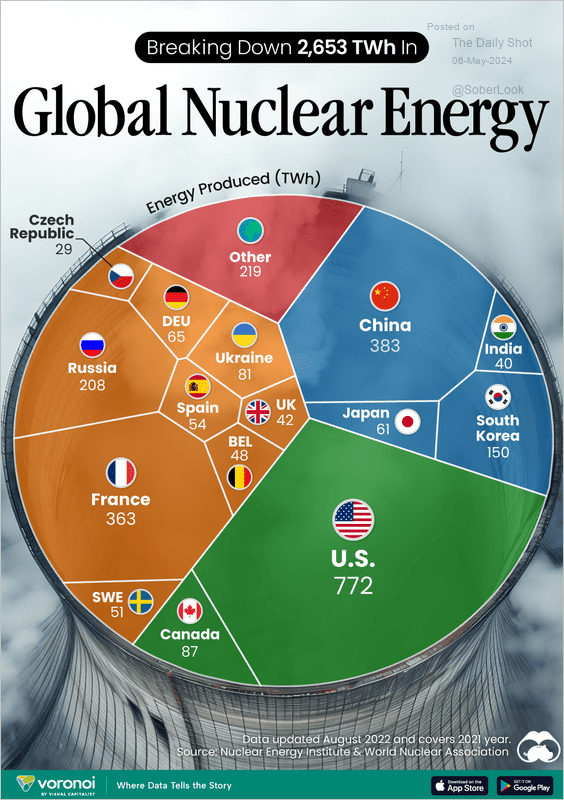

5. Global nuclear energy output:

Source: Visual Capitalist Read full article

Source: Visual Capitalist Read full article

6. Impact of recycled materials on lifecycle CO2 emissions of electric vehicles:

Source: @climate Read full article

Source: @climate Read full article

7. Growing educational divide in GOP affiliation among white voters:

Source: The New York Times Read full article

Source: The New York Times Read full article

8. States with the highest concentration of law students:

Source: Hennessey.com

Source: Hennessey.com

——————–

Back to Index