The Daily Shot: 23-Apr-24

• The United States

• Canada

• The United Kingdom

• The Eurozone

• Europe

• Japan

• China

• Emerging Markets

• Cryptocurrency

• Commodities

• Energy

• Equities

• Credit

• Global Developments

• Food for Thought

The United States

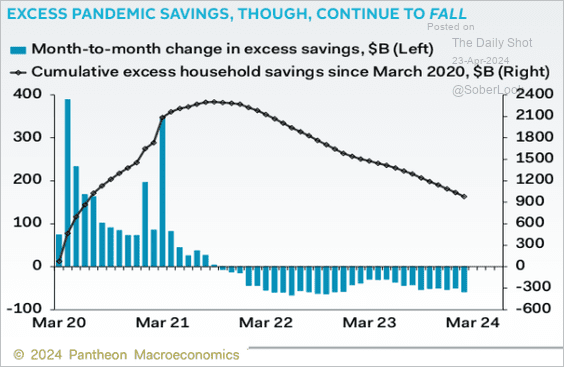

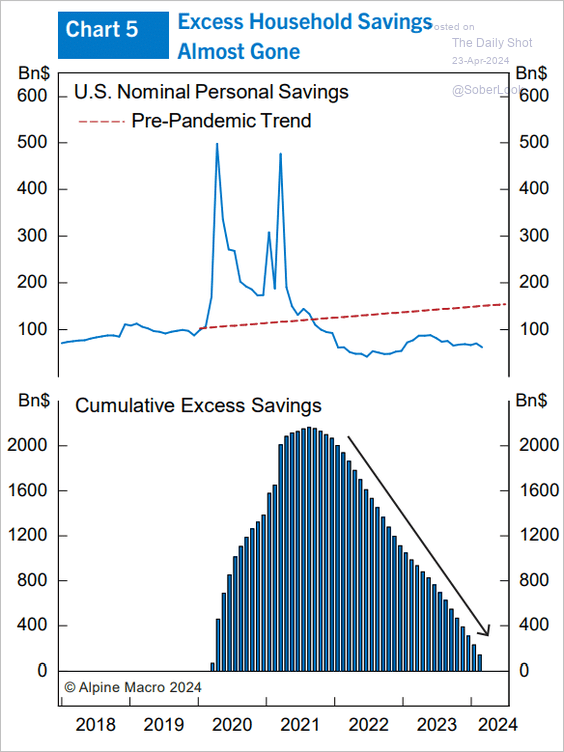

1. Let’s begin with some data on the US consumer.

• How close are US households to depleting their pandemic-era excess savings? Estimates vary significantly.

– Pantheon Macroeconomics:

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

– Alpine Macro:

Source: Alpine Macro

Source: Alpine Macro

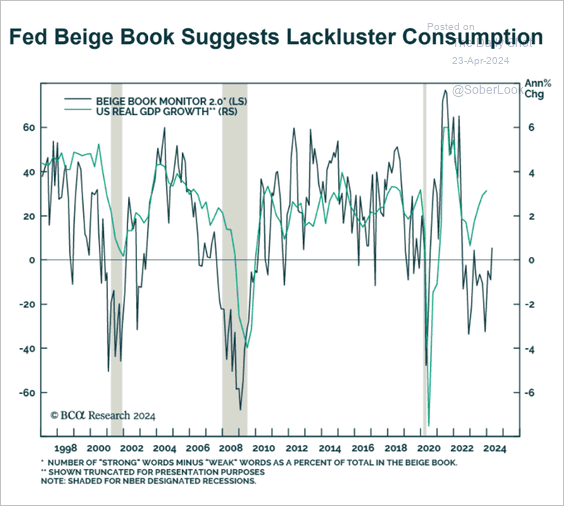

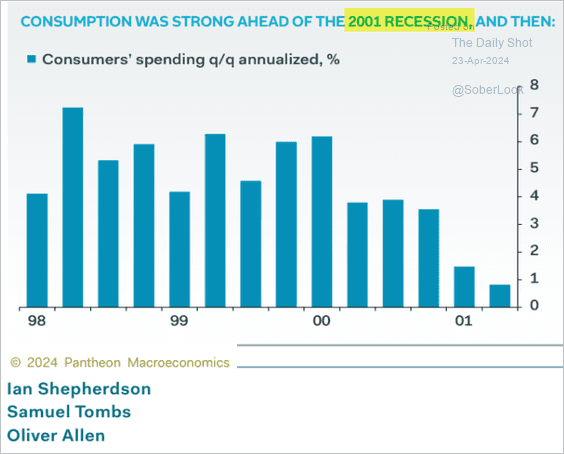

• There are downside risks to consumer spending, …

Source: BCA Research

Source: BCA Research

… which could deteriorate rapidly.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

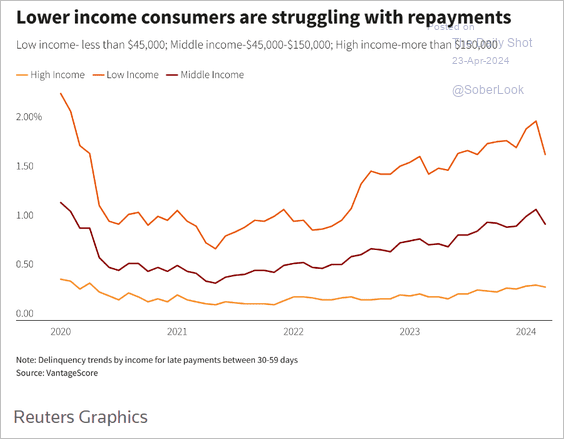

• Consumer loan delinquency rates have risen, especially for lower-income households.

Source: Reuters Read full article

Source: Reuters Read full article

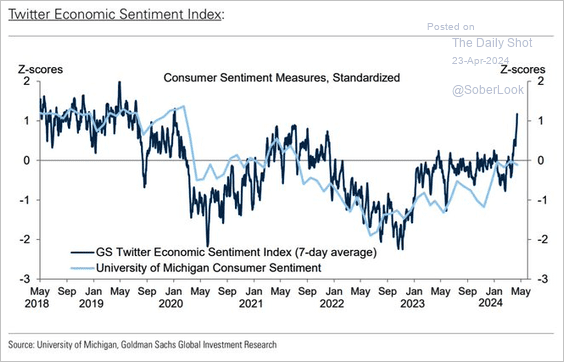

• Goldman’s Twitter Economic Sentiment Index points to improvements in consumer confidence.

Source: Goldman Sachs; @WallStJesus

Source: Goldman Sachs; @WallStJesus

——————–

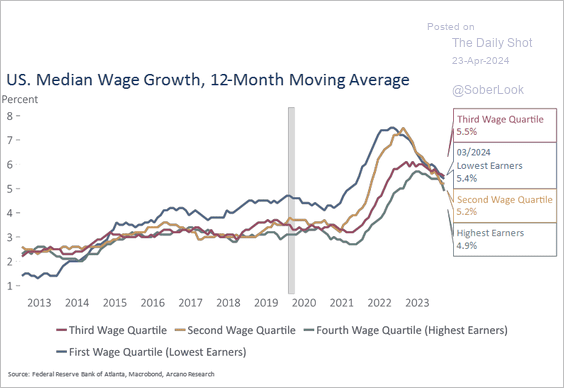

2. Next, let’s look at some trends in wages and inflation.

• This chart shows wage growth by income tier.

Source: Arcano Economics

Source: Arcano Economics

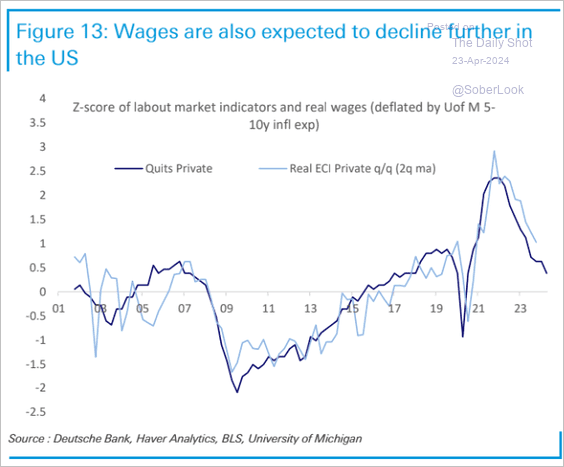

• Leading indicators continue to signal slower wage growth ahead.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

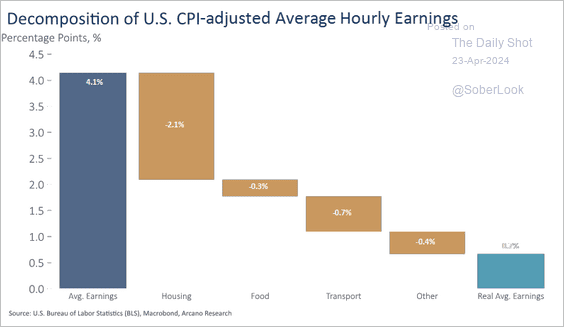

• This bridge diagram shows the transition from nominal to real wage growth.

Source: Arcano Economics

Source: Arcano Economics

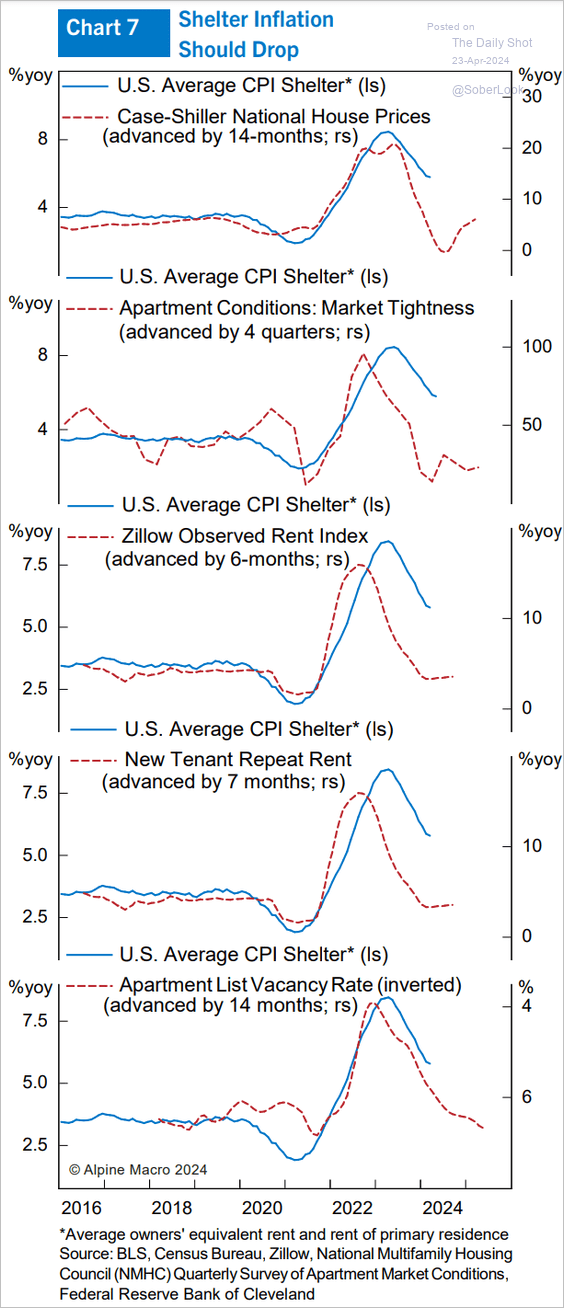

• Housing inflation has been running hotter than leading indicators suggest.

Source: Alpine Macro

Source: Alpine Macro

——————–

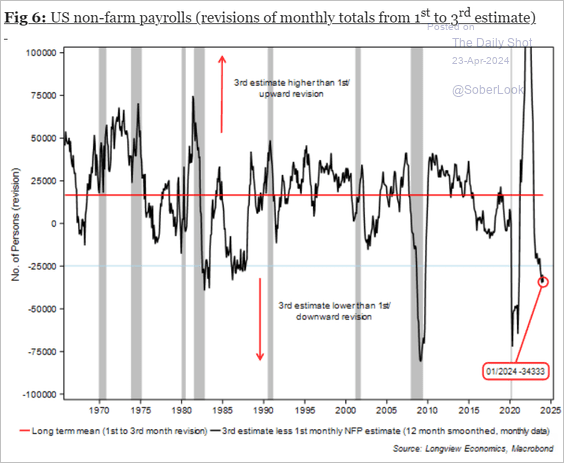

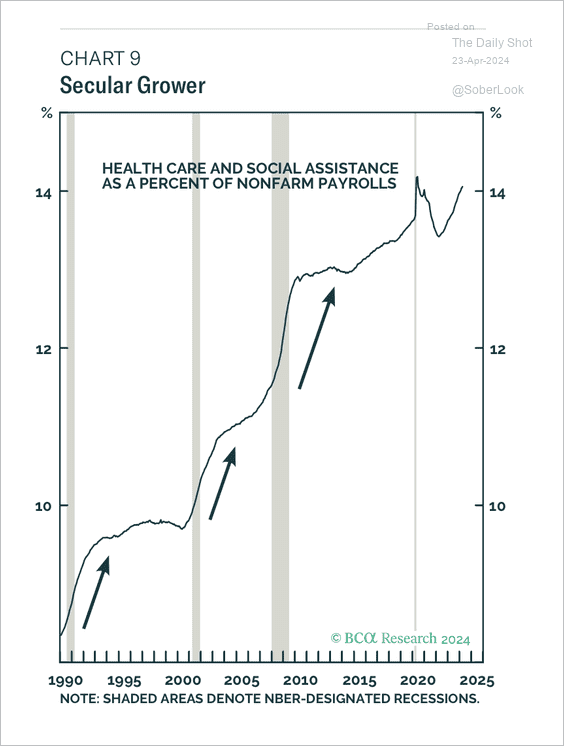

3. Finally, we have some updates on the labor market.

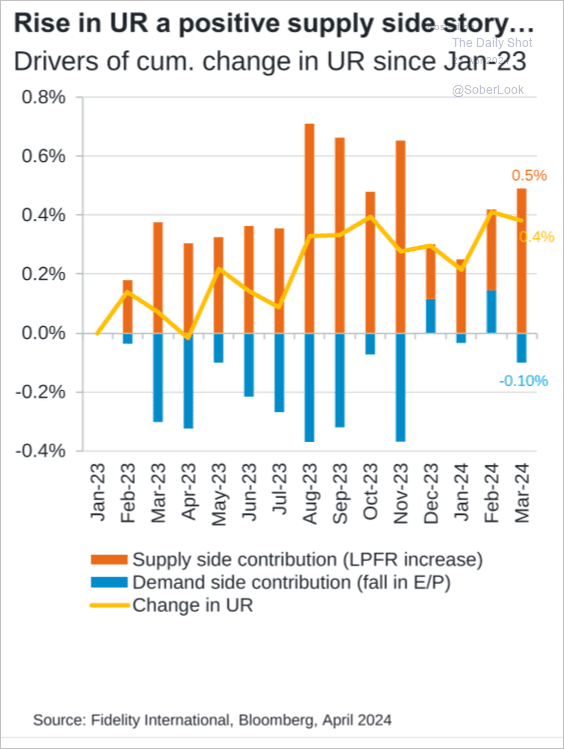

• This year’s increase in the unemployment rate was driven by a rise in labor supply rather than a decrease in demand.

Source: Fidelity International

Source: Fidelity International

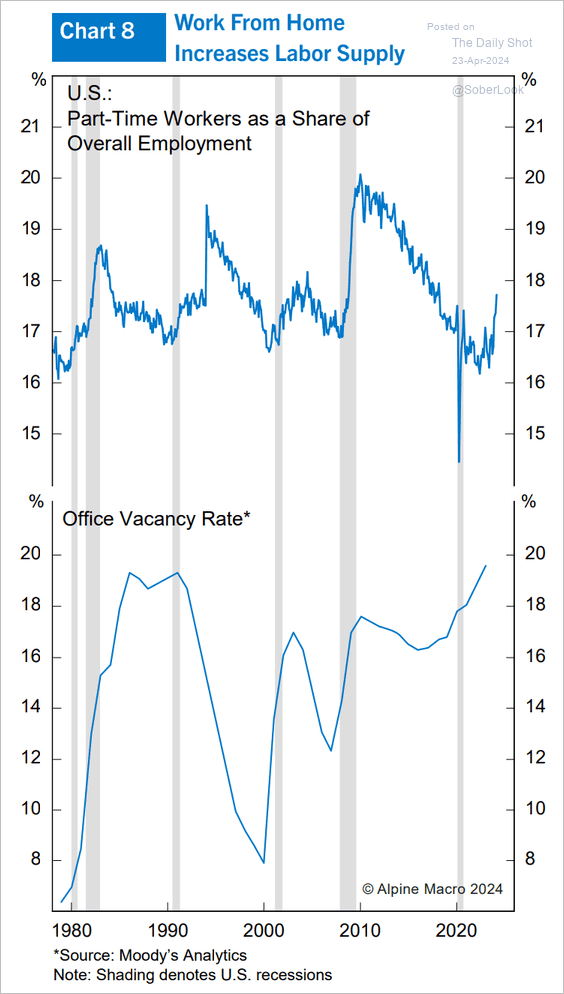

• The work-from-home phenomenon has expanded the labor supply.

Source: Alpine Macro

Source: Alpine Macro

• Revisions to payrolls have been negative in recent months.

Source: Longview Economics

Source: Longview Economics

• Healthcare workers have accounted for a small but steadily rising share of total employment.

Source: BCA Research

Source: BCA Research

Back to Index

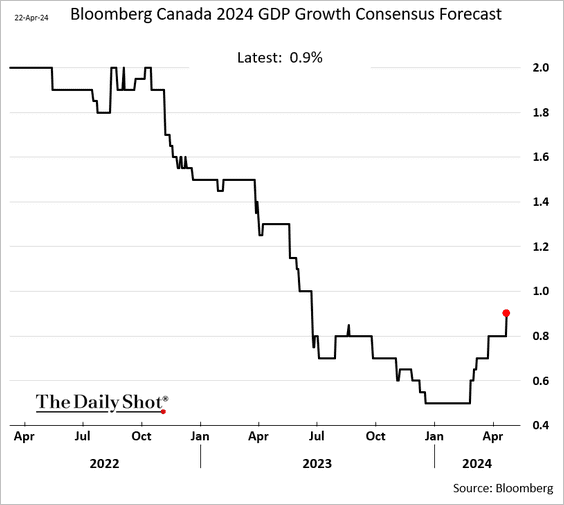

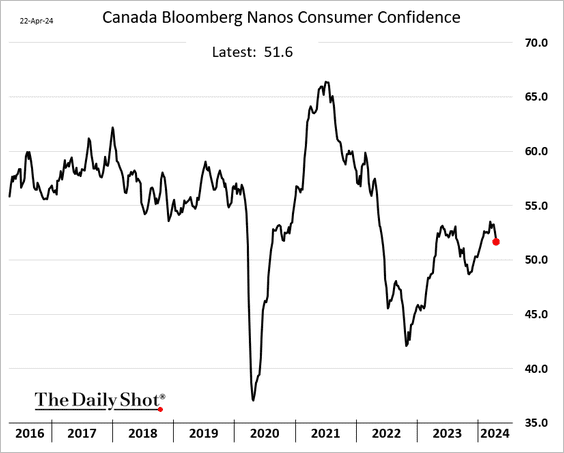

Canada

1. Economists have been upgrading their forecasts for Canada’s 2024 GDP growth.

2. Consumer confidence has turned lower again.

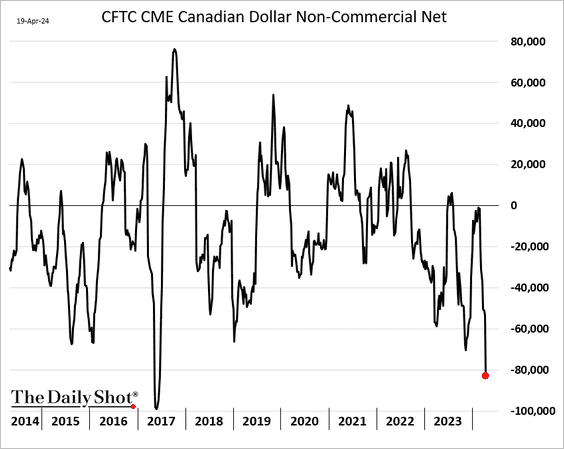

3. Hedge funds have been boosting their bets against the Canadian dollar.

Back to Index

The United Kingdom

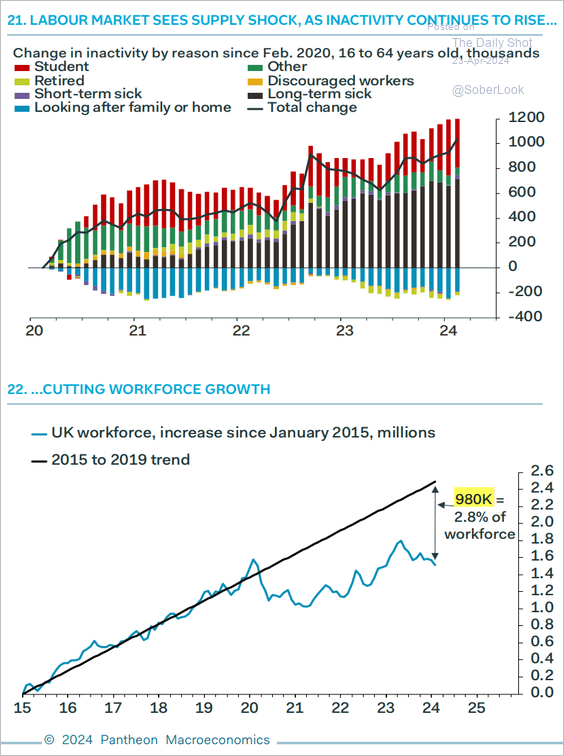

1. The labor supply has been shrinking as inactivity climbs.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

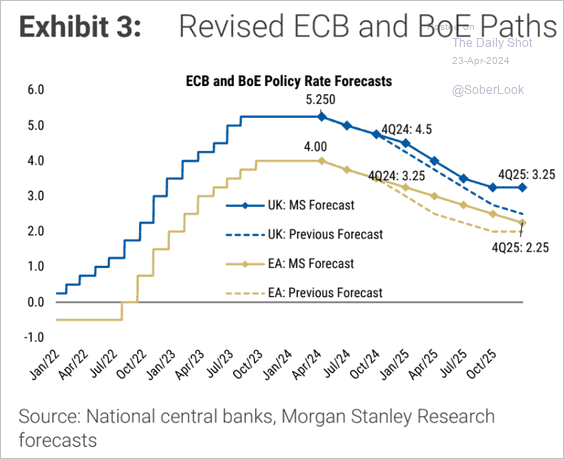

2. Morgan Stanley revised its projected rate paths upward for both the BoE and the ECB.

Source: Morgan Stanley Research

Source: Morgan Stanley Research

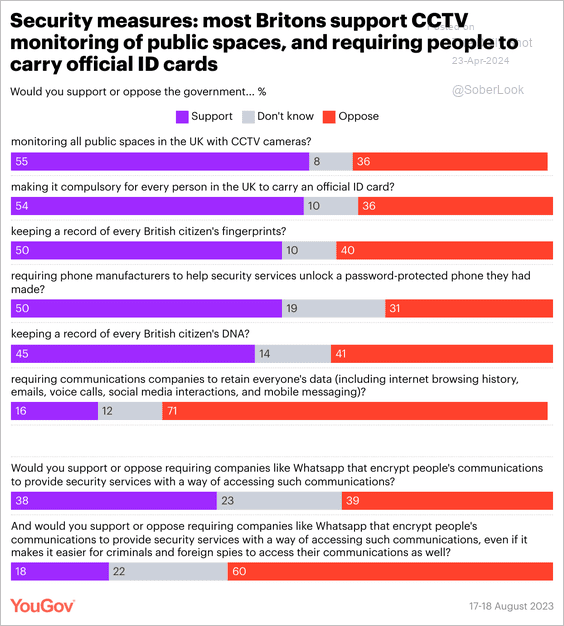

3. This chart shows Britons’ views on various security measures.

Source: @YouGov

Source: @YouGov

Back to Index

The Eurozone

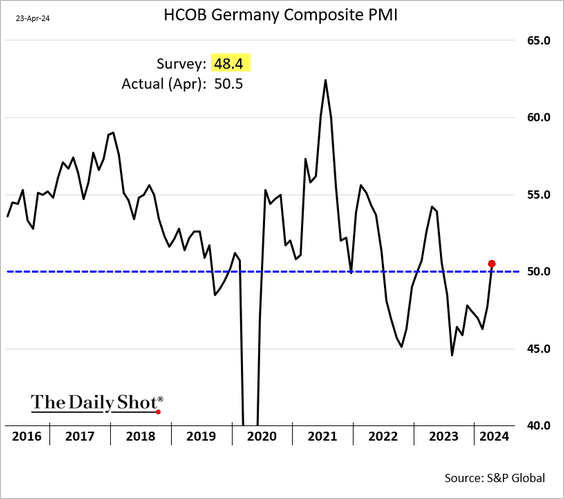

1. Germany’s composite PMI is back in growth mode, topping expectations. The improvement was driven by services, with the manufacturing slump persisting this month. We will have more on the Eurozone PMI report tomorrow.

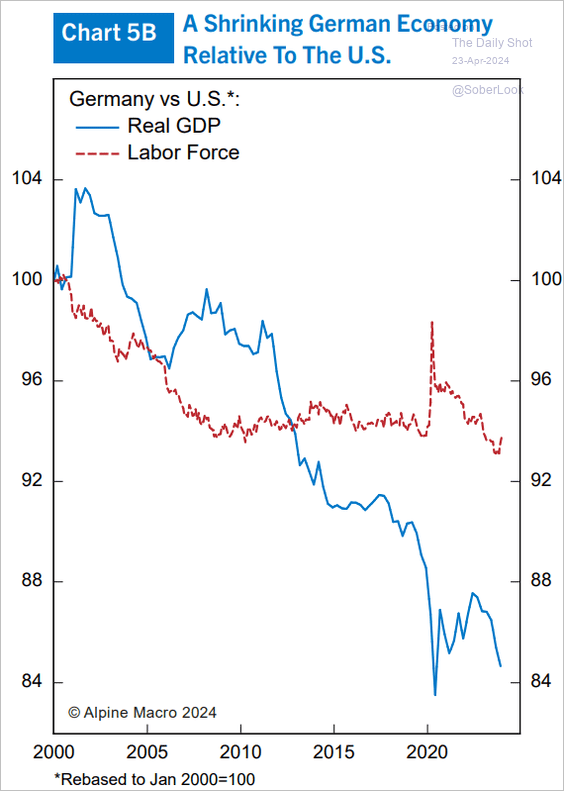

• Germany’s economy has been underperforming the US.

Source: Alpine Macro

Source: Alpine Macro

——————–

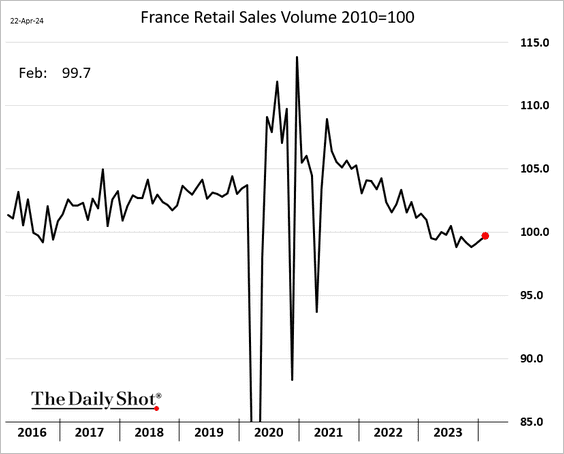

2. French retail sales improved again in February.

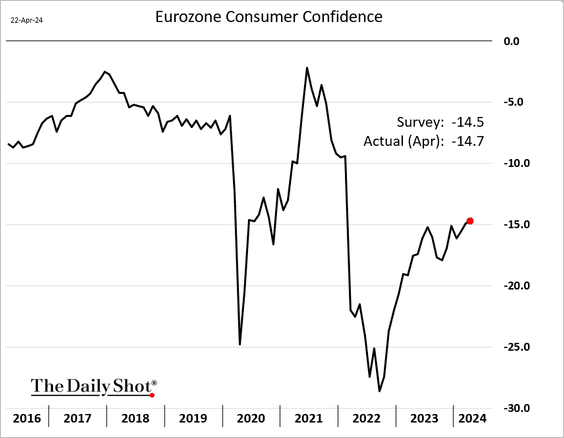

3. Euro-area consumer confidence improved marginally this month.

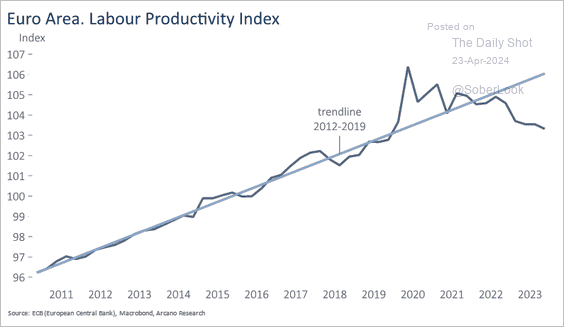

4. Productivity has dropped below trend.

Source: Arcano Economics

Source: Arcano Economics

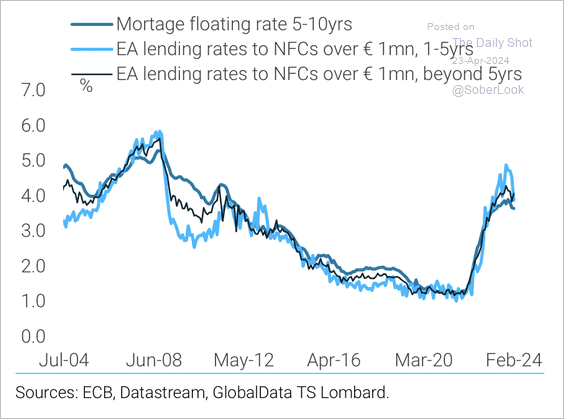

5. ECB rate cut expectations have filtered into lending rates.

Source: TS Lombard

Source: TS Lombard

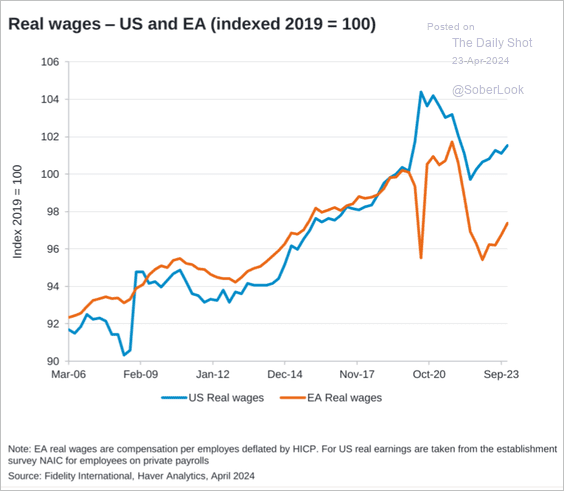

6. This chart compares the US and Eurozone real wage trajectories.

Source: Fidelity International

Source: Fidelity International

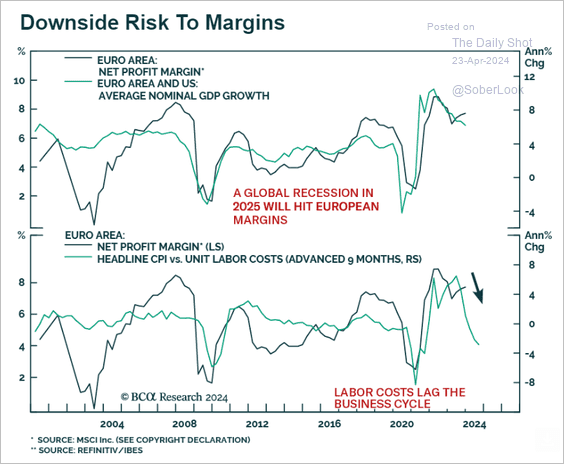

7. Corporate margins could come under pressure.

Source: BCA Research

Source: BCA Research

Back to Index

Europe

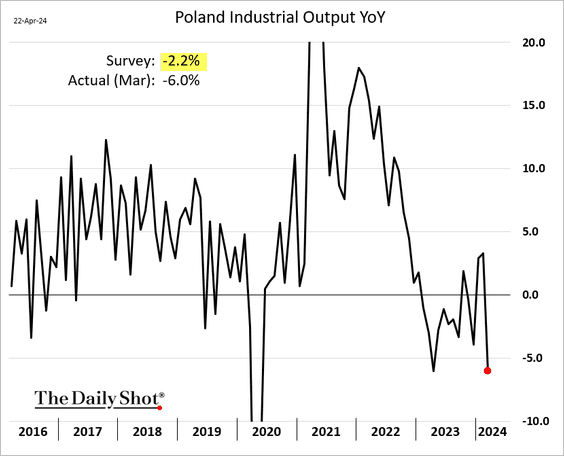

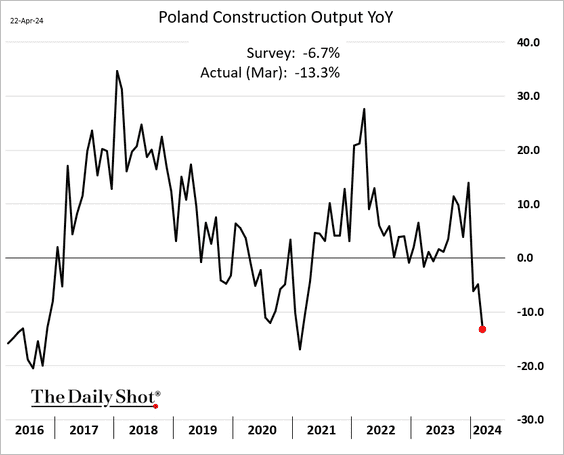

1. Poland’s industrial and construction output deteriorated in March relative to 2023.

——————–

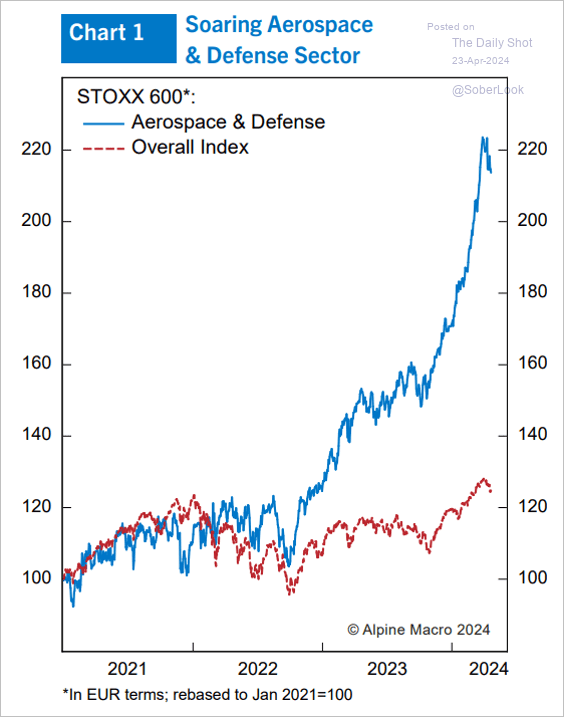

2. It’s been a good run for European defense companies.

Source: Alpine Macro

Source: Alpine Macro

Back to Index

Japan

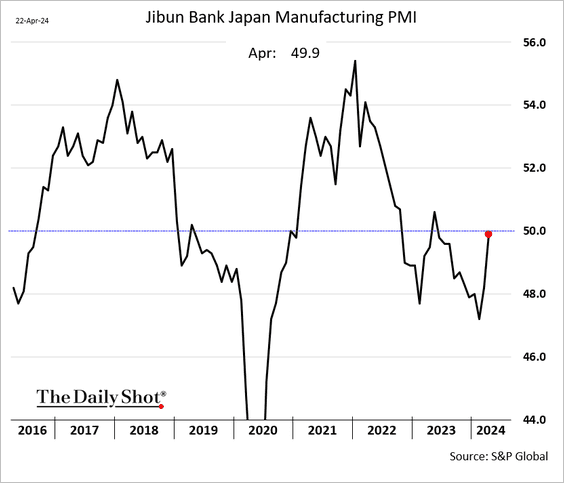

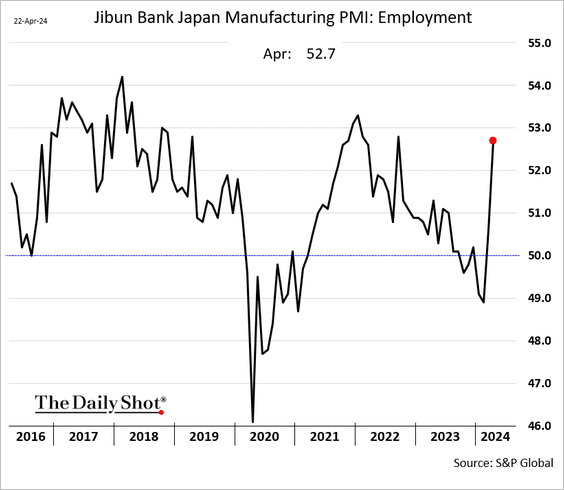

1. The manufacturing PMI has nearly stabilized, …

… as factory hiring accelerates.

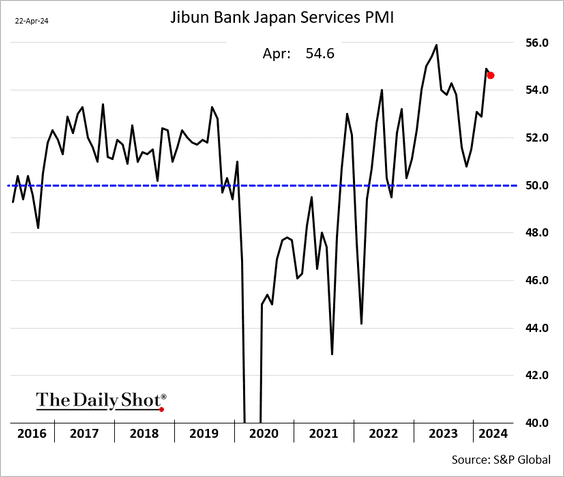

• Services growth remains robust, …

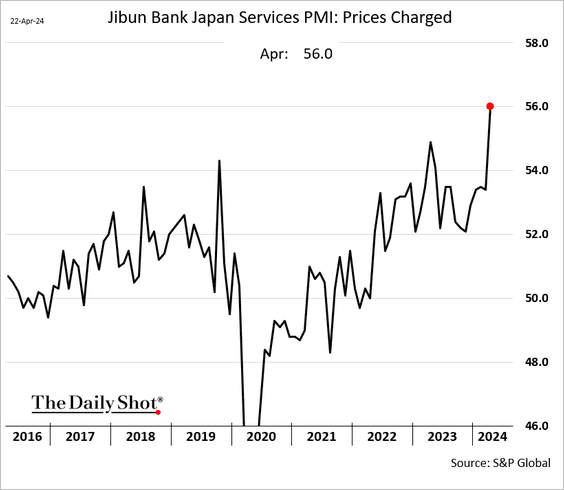

… but service-sector inflation is gaining momentum.

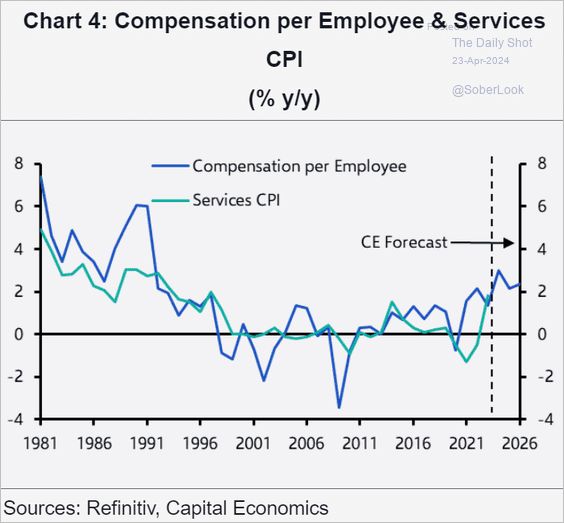

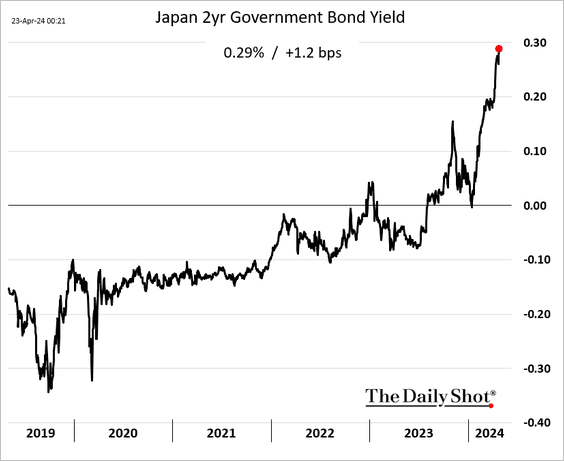

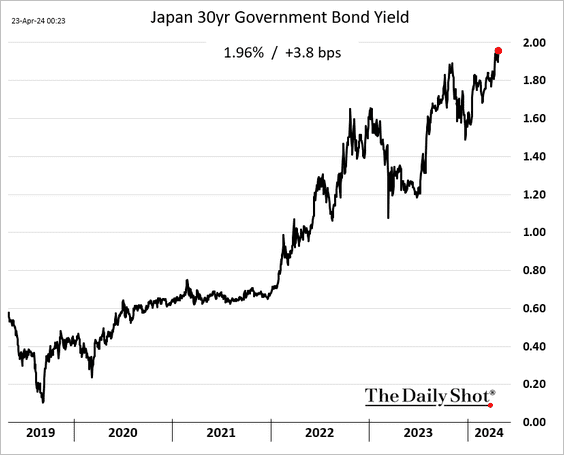

2. Services CPI could climb further, forcing the BoJ to deliver another rate hike.

Source: Capital Economics

Source: Capital Economics

Source: @WSJ Read full article

Source: @WSJ Read full article

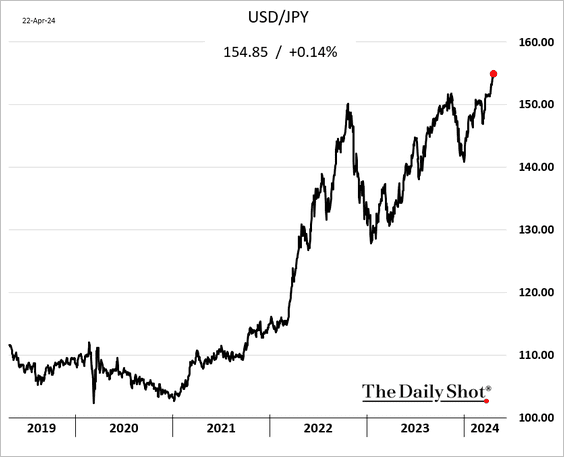

3. The yen continues to sink, which could exacerbate inflationary pressures.

4. JGB yields are climbing across the curve.

Back to Index

China

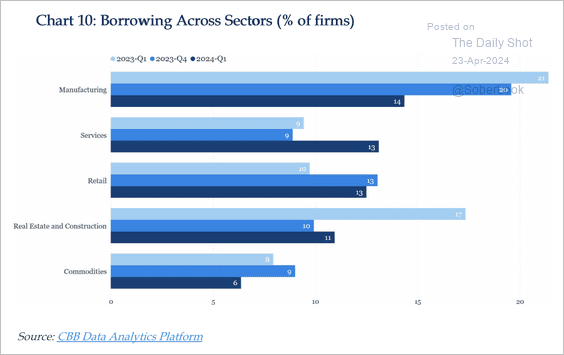

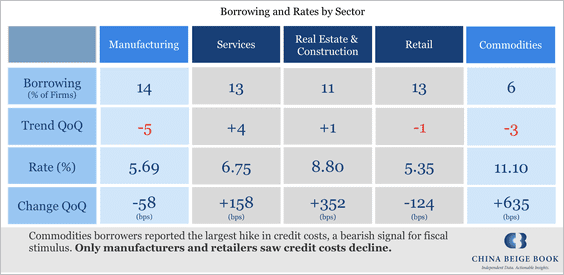

1. Corporate borrowing remains weak.

Source: China Beige Book

Source: China Beige Book

• Services borrowing expanded the most while manufacturing pulled back.

Source: China Beige Book

Source: China Beige Book

——————–

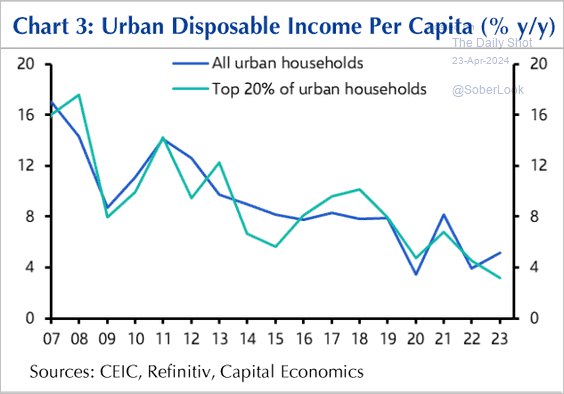

2. Disposable income growth remains soft.

Source: Capital Economics

Source: Capital Economics

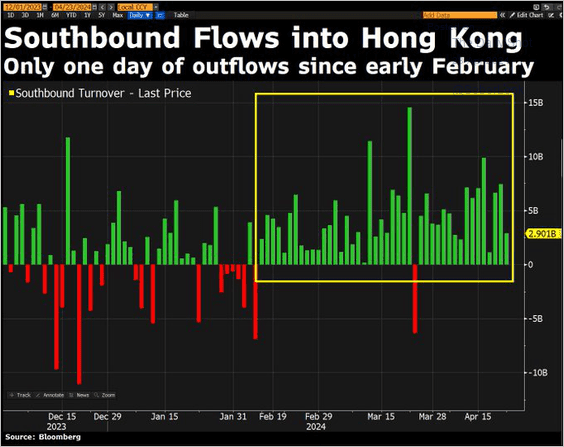

3. Mainland investors have been buying Hong Kong-listed stocks.

Source: @DavidInglesTV

Source: @DavidInglesTV

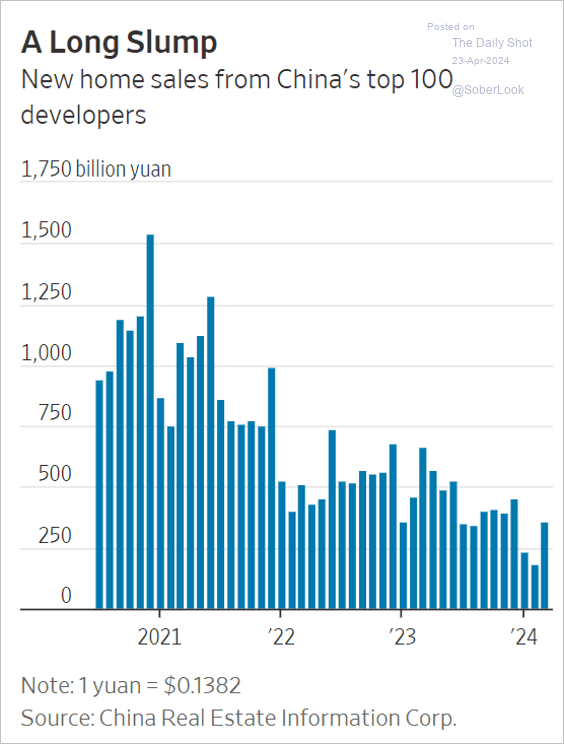

4. New home sales have been trending lower.

Source: @WSJ Read full article

Source: @WSJ Read full article

Back to Index

Emerging Markets

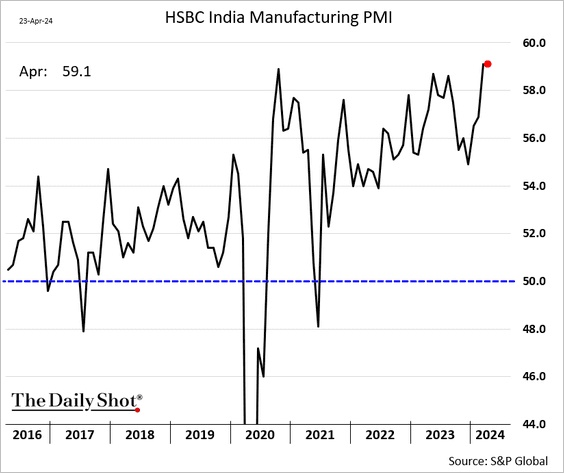

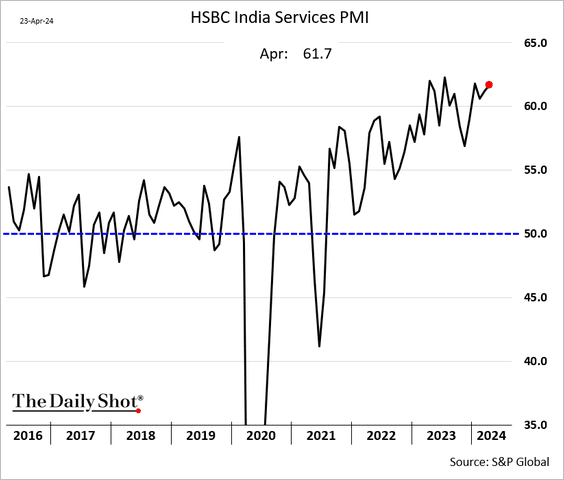

1. India’s business activity remained exceptinally strong this month.

– Manufacturing PMI:

– Services PMI:

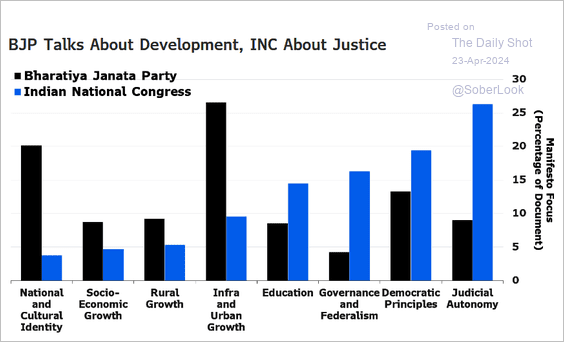

• Separately, this chart illustrates India’s thematic focus in party discourse: a comparison of BJP and INC.

Source: Abhishek Gupta, Bloomberg Economics Read full article

Source: Abhishek Gupta, Bloomberg Economics Read full article

——————–

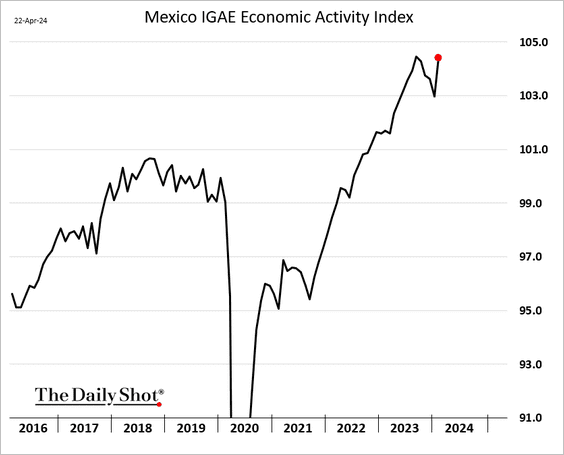

2. Mexico’s economic activity jumped in February.

Back to Index

Cryptocurrency

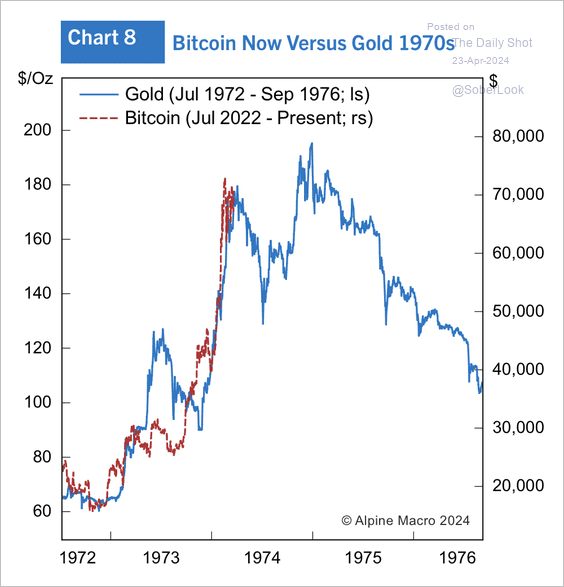

1. BTC/USD has closely tracked the 1970s gold price analog.

Source: Alpine Macro

Source: Alpine Macro

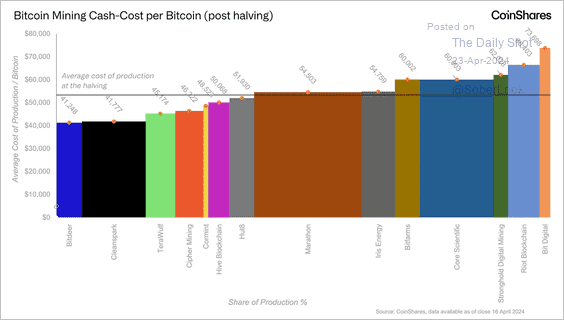

2. The production cost per bitcoin among listed mining companies is now approximately $53K, according to CoinShares.

Source: CoinShares Read full article

Source: CoinShares Read full article

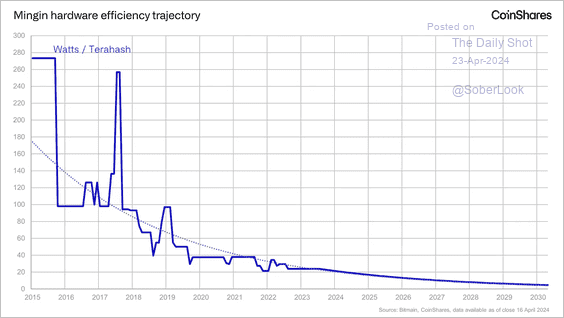

• CoinShares expects mining hardware efficiency to follow a downward trend over the next few years, which could make mining more competitive and boost hash rates.

Source: CoinShares Read full article

Source: CoinShares Read full article

• Bitcoin transaction fees (also used to quantify miner earnings) experienced a sharp spike and fall around the halving event.

Source: CoinShares Read full article

Source: CoinShares Read full article

Source: Hashrate Index

Source: Hashrate Index

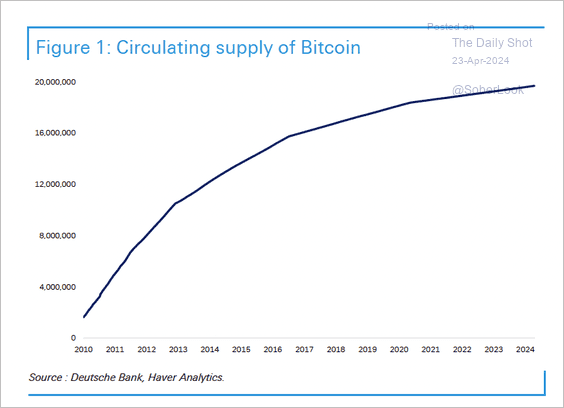

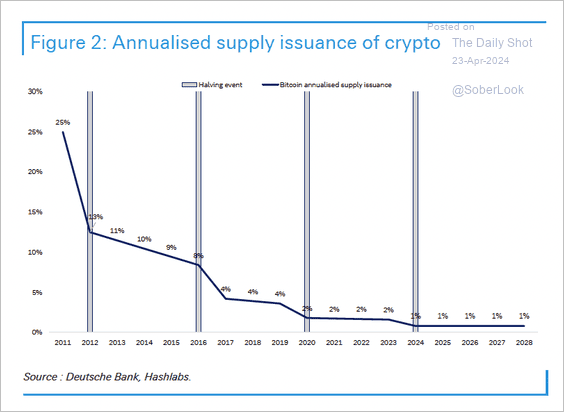

• Bitcoin’s halving process will conclude once the number of BTC in circulation reaches its programmed limit of 21 million. The last halving took place in May 2020, which significantly reduced miner rewards and negatively impacted profits. (2 charts)

Source: Deutsche Bank Research

Source: Deutsche Bank Research

Source: Deutsche Bank Research

Source: Deutsche Bank Research

• Miners are focused on increasing efficiency and reducing cost.

Source: CNBC Read full article

Source: CNBC Read full article

——————–

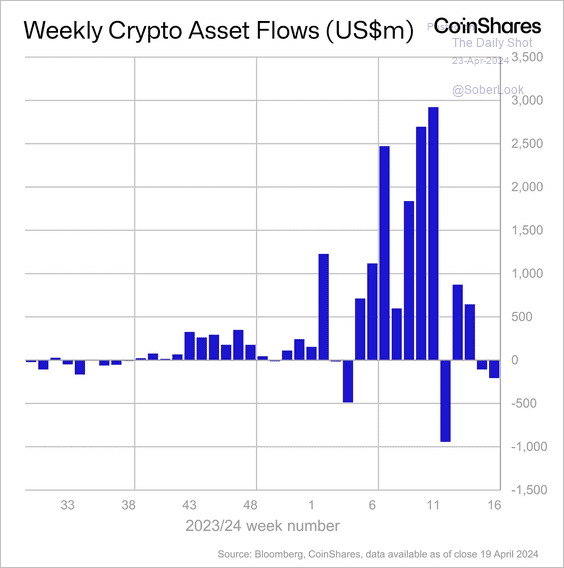

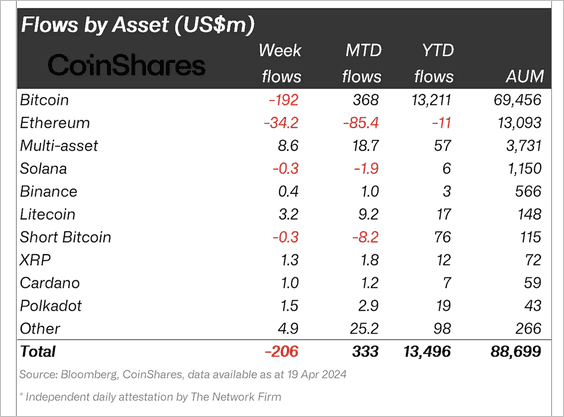

3. Crypto funds saw another week of outflows led by Ethereum and Bitcoin-focused products. (2 charts)

Source: CoinShares Read full article

Source: CoinShares Read full article

Source: CoinShares Read full article

Source: CoinShares Read full article

Back to Index

Commodities

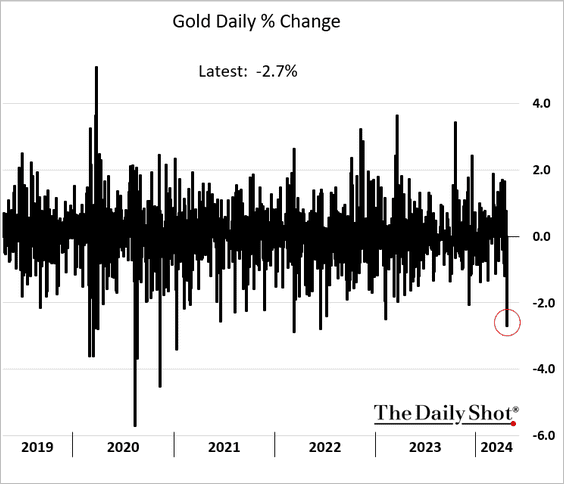

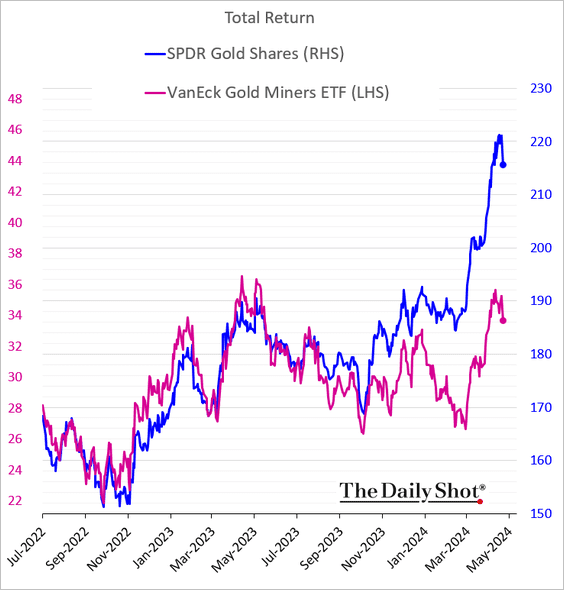

1. Gold declined sharply on Monday as geopolitical tensions appear to have eased.

• Gold mining shares have lagged the recent gains in gold prices.

——————–

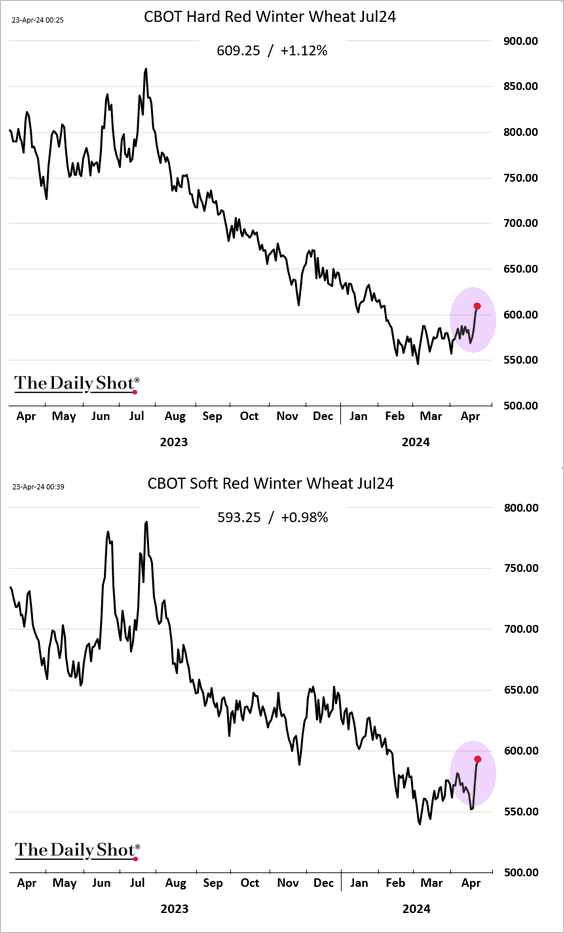

2. US wheat futures are rebounding amid extremely bearish sentiment.

Back to Index

Energy

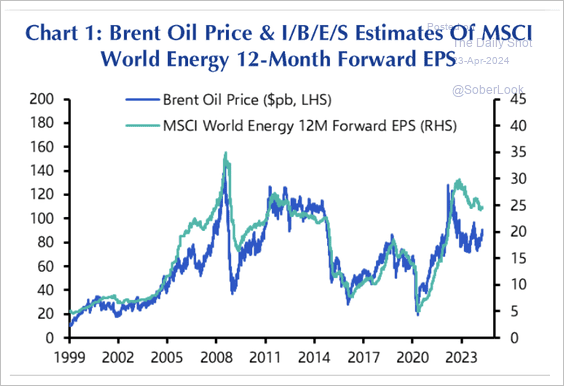

1. So far, higher oil prices have not boosted the expected earnings of global energy firms.

Source: Capital Economics

Source: Capital Economics

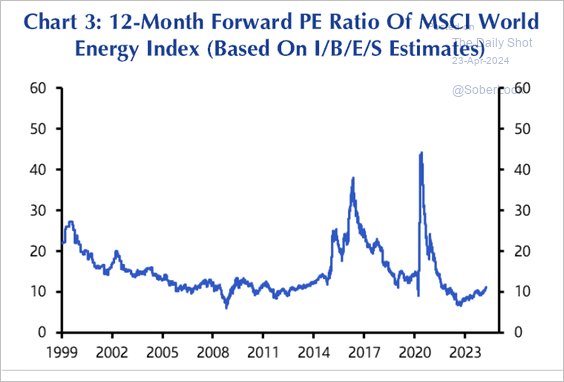

• Global energy stocks are trading at historically low valuations.

Source: Capital Economics

Source: Capital Economics

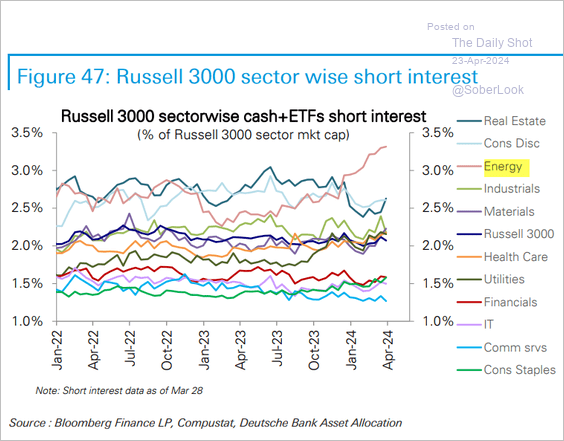

• Short interest in energy stocks and ETFs has been rising.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

——————–

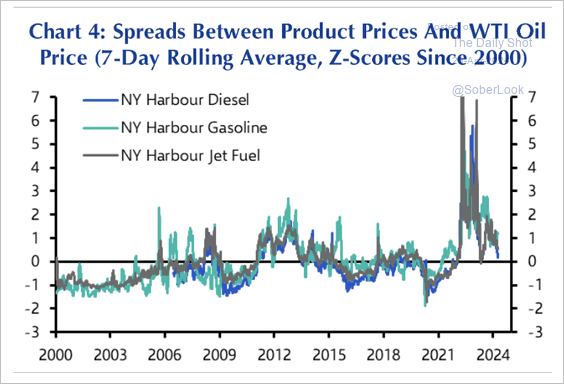

2. Crack spreads have fallen.

Source: Capital Economics

Source: Capital Economics

Back to Index

Equities

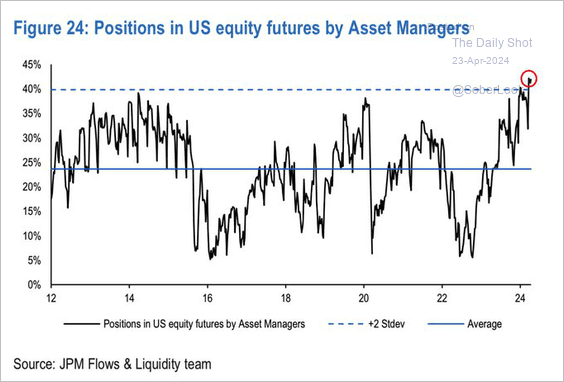

1. Asset managers’ equity futures positioning has been very bullish.

Source: JP Morgan Research; @WallStJesus

Source: JP Morgan Research; @WallStJesus

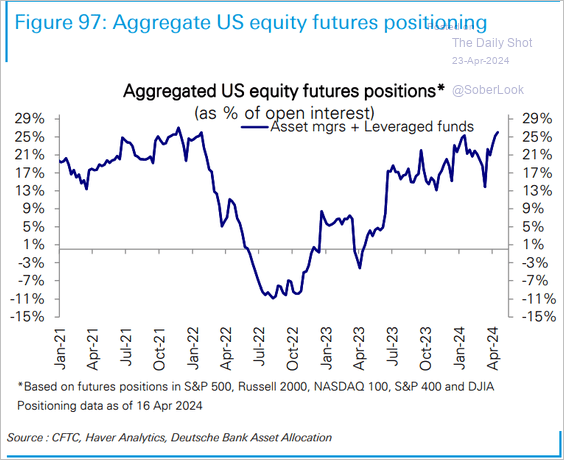

• This chart shows equity futures positioning for asset managers and leveraged funds.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

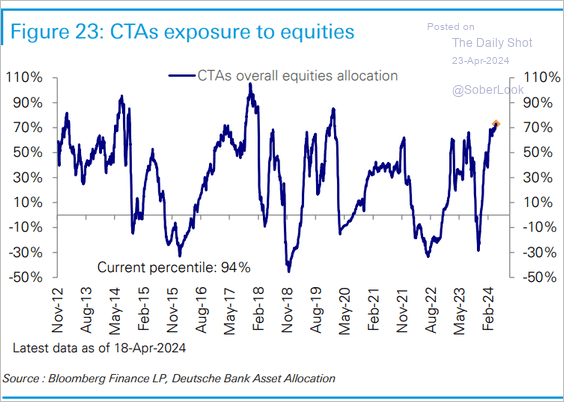

• CTAs have also been sticking with their bullish positioning.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

——————–

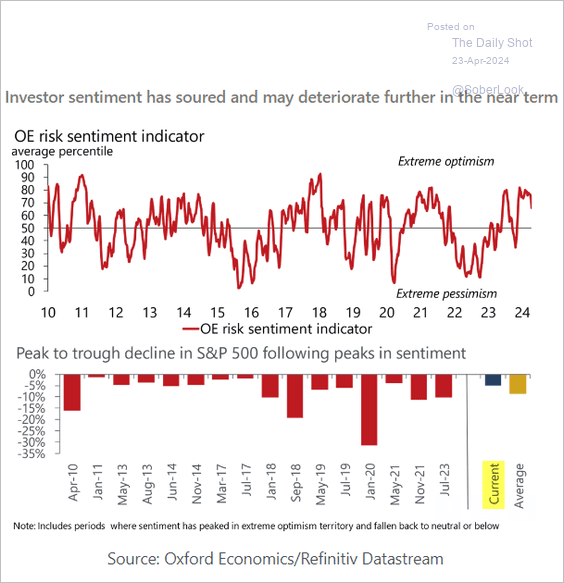

2. Does the market pullback have further to go? The Oxford Economics Risk Sentiment Indicator signals more pain.

Source: Oxford Economics

Source: Oxford Economics

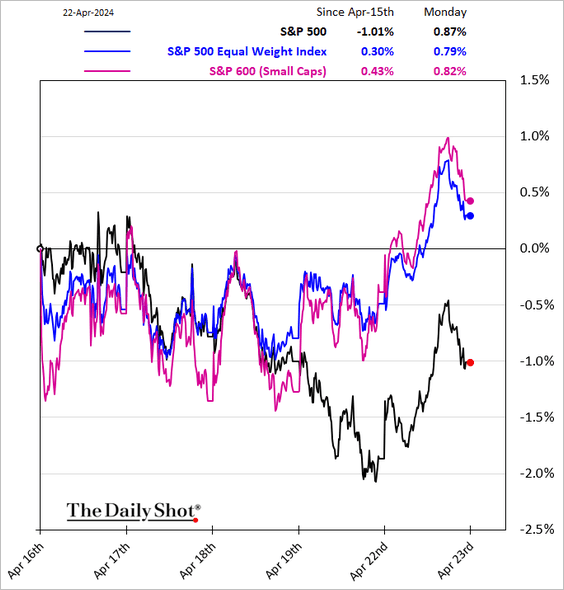

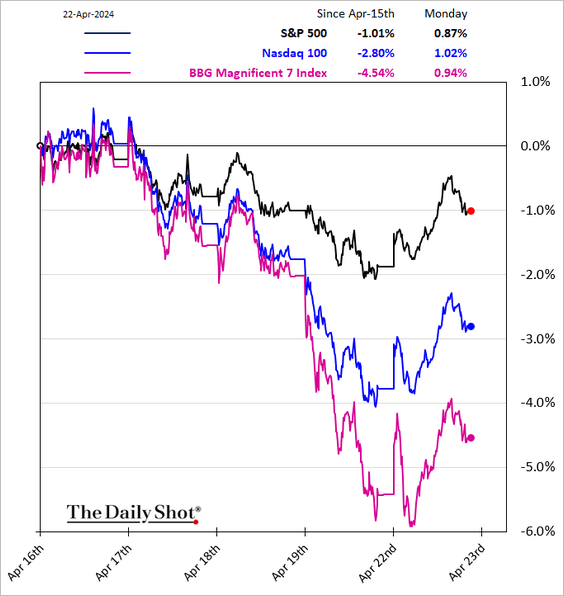

3. Smaller firms outperformed in recent days, …

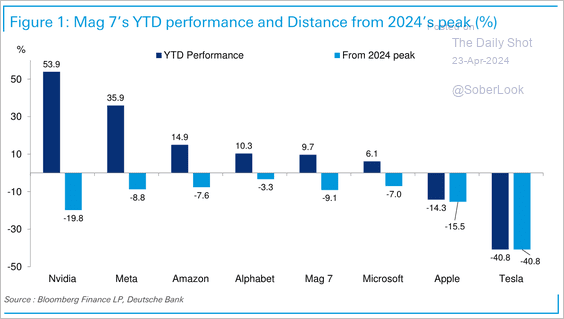

… as tech mega-caps struggled (2 charts).

Source: Deutsche Bank Research

Source: Deutsche Bank Research

——————–

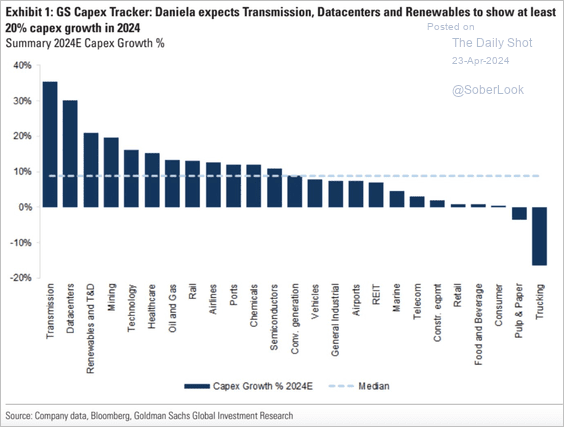

4. Here is a look at Goldman’s CapEx growth estimate for this year.

Source: Goldman Sachs; @AyeshaTariq

Source: Goldman Sachs; @AyeshaTariq

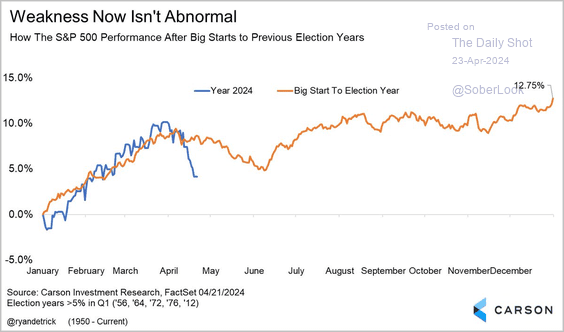

5. Previous election years that started off strong tended to weaken into early June.

Source: @RyanDetrick

Source: @RyanDetrick

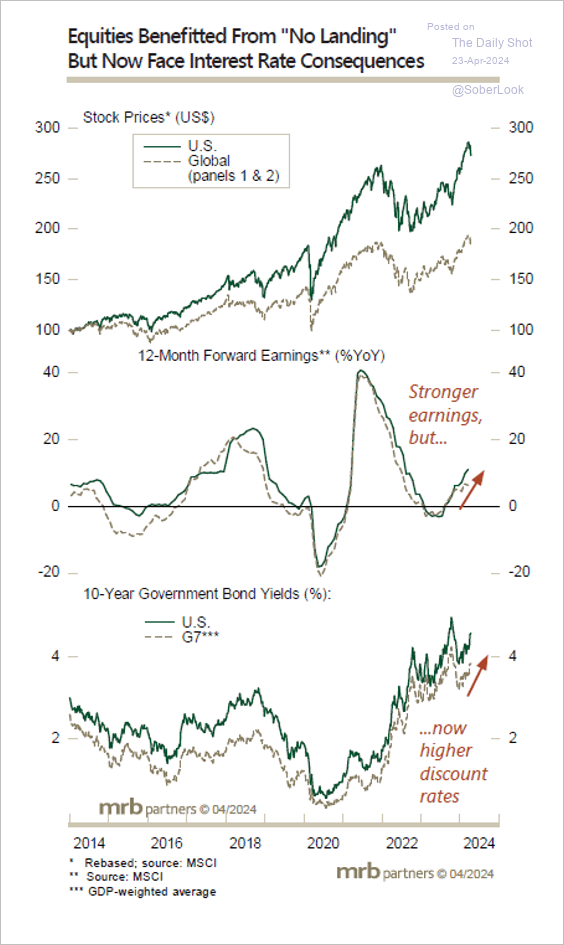

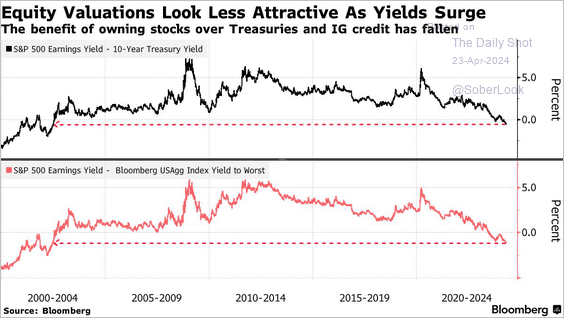

6. Higher yields have partly offset stronger earnings in the S&P 500.

Source: MRB Partners

Source: MRB Partners

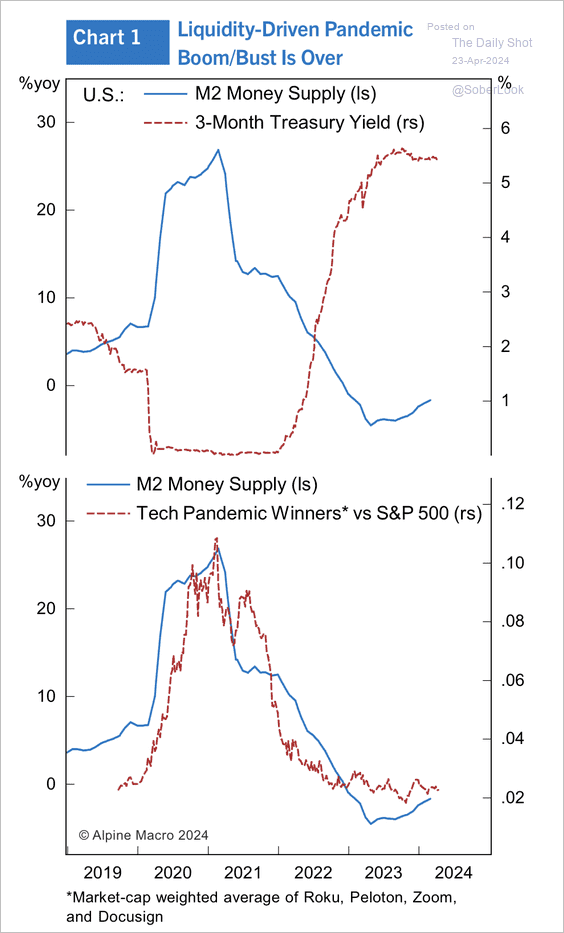

7. A rebound in liquidity could support a turnaround in tech pandemic winners.

Source: Alpine Macro

Source: Alpine Macro

8. Equity risk premium remains very low.

Source: @markets Read full article

Source: @markets Read full article

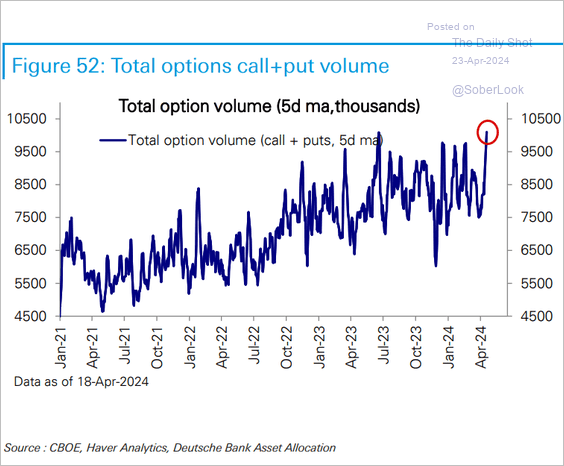

9. Options volume surged in the latest market selloff.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

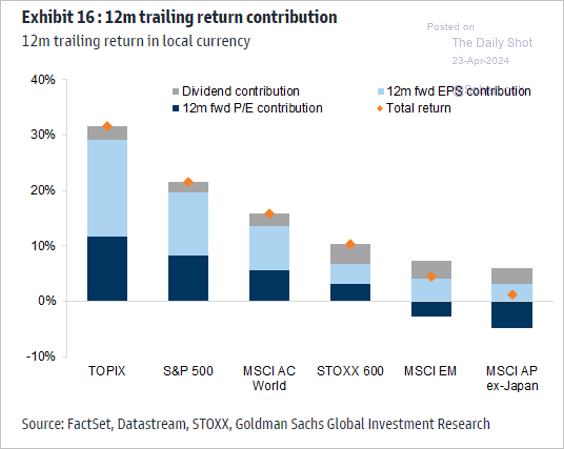

10. This chart shows the 12-month return attribution across global markets.

Source: Goldman Sachs; @MikeZaccardi

Source: Goldman Sachs; @MikeZaccardi

Back to Index

Credit

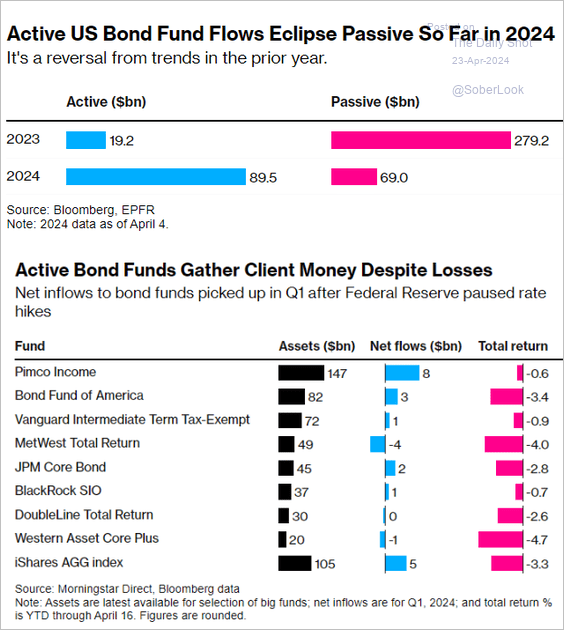

1. Active bond funds have been attracting more capital.

Source: @wealth Read full article

Source: @wealth Read full article

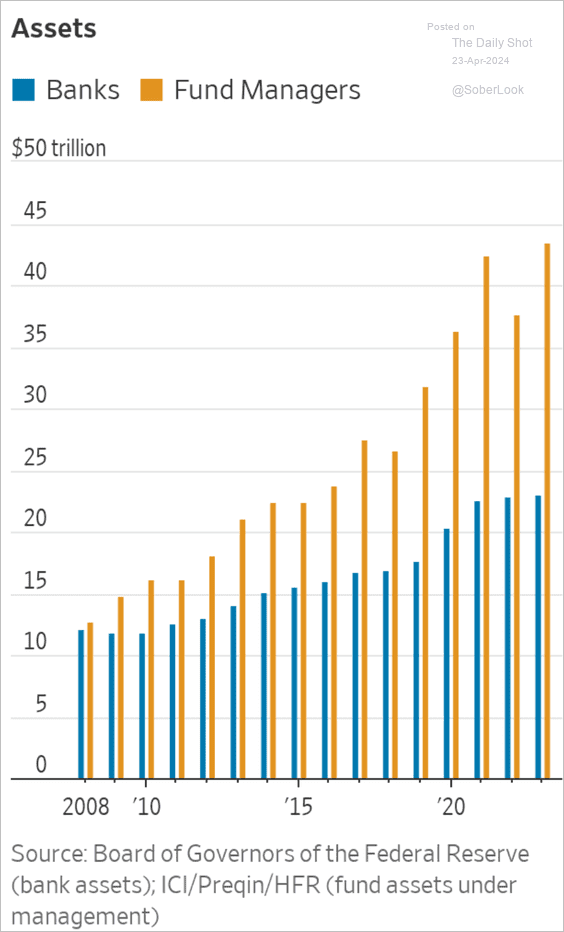

2. US fund managers’ ability to provide capital is rapidly outpacing that of banks.

Source: @WSJ Read full article

Source: @WSJ Read full article

Back to Index

Global Developments

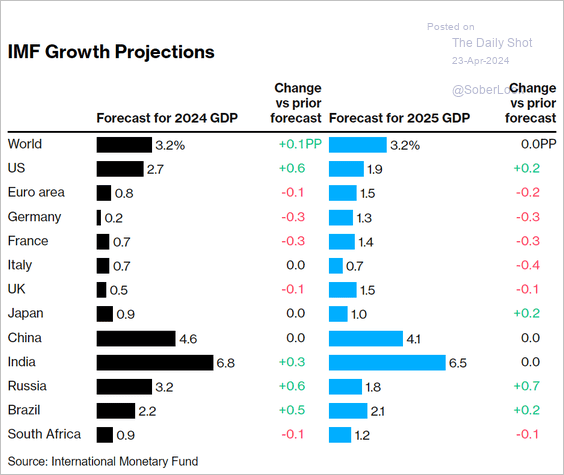

1. Here is a look at the IMF’s growth projections for 2024 and 2025.

Source: @economics Read full article

Source: @economics Read full article

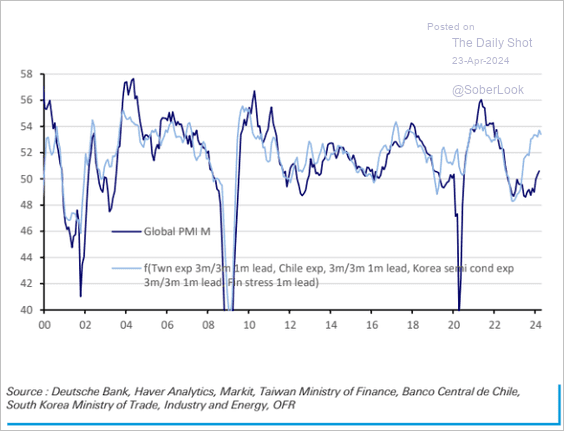

2. Leading indicators point to further strength in global manufacturing activity.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

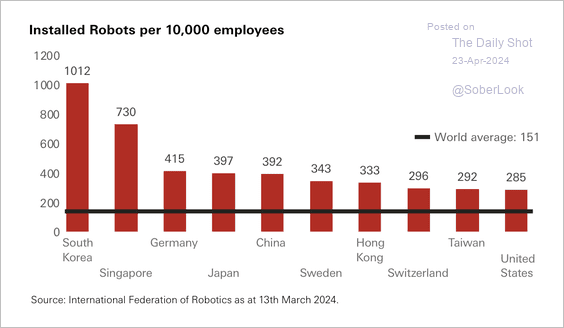

3. Businesses are embracing disruptive technology, which could boost productivity.

Source: HSBC Global Research

Source: HSBC Global Research

——————–

Food for Thought

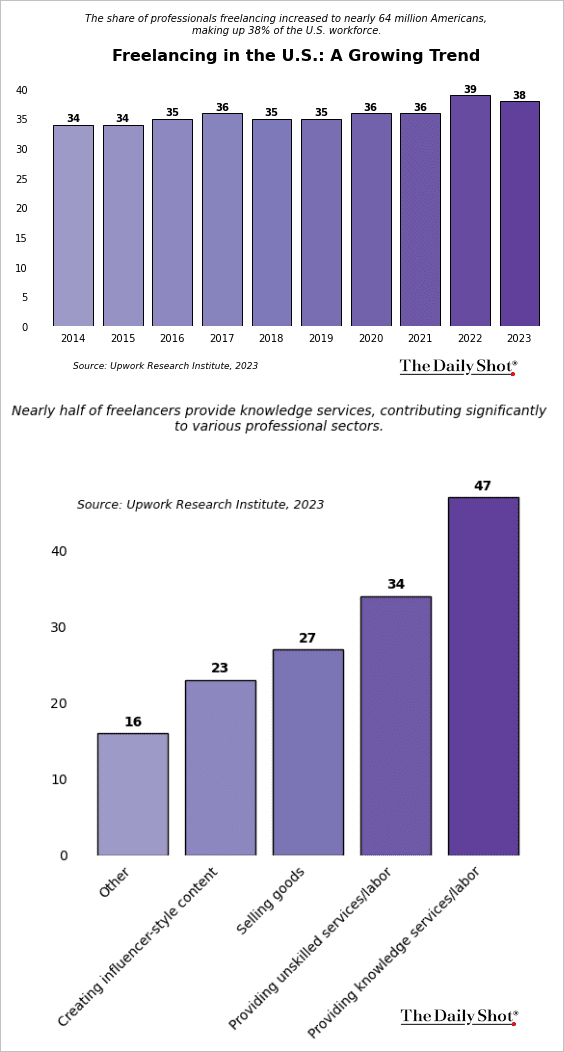

1. Freelancing in the US:

Source: Upwork Read full article

Source: Upwork Read full article

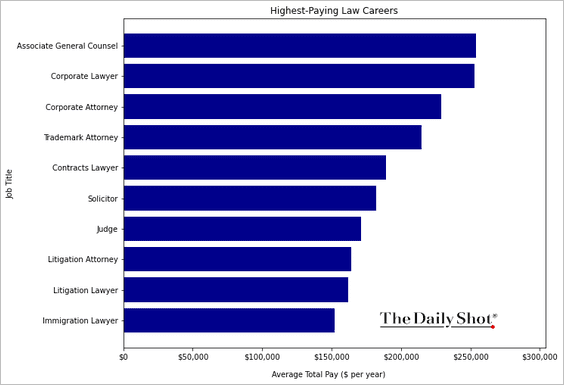

2. Highest-paying law careers:

Source: Hennessey.com

Source: Hennessey.com

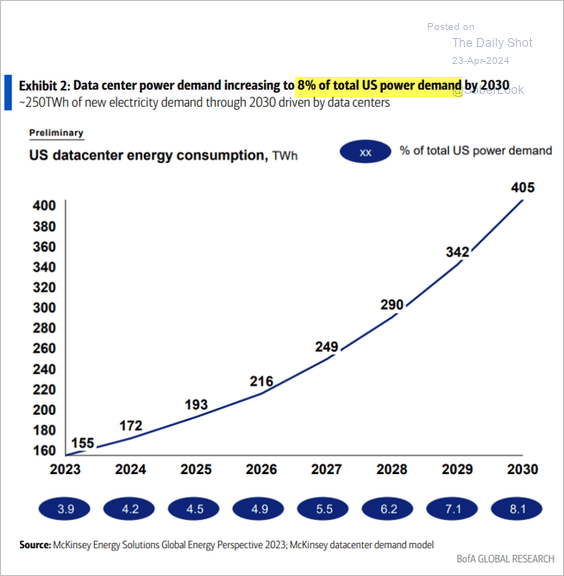

3. Data centers’ power demand projection:

Source: BofA Global Research

Source: BofA Global Research

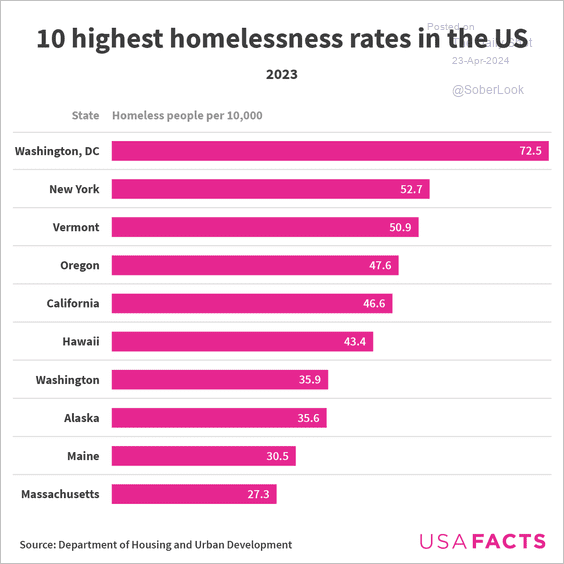

4. Homelessness rates:

Source: USAFacts

Source: USAFacts

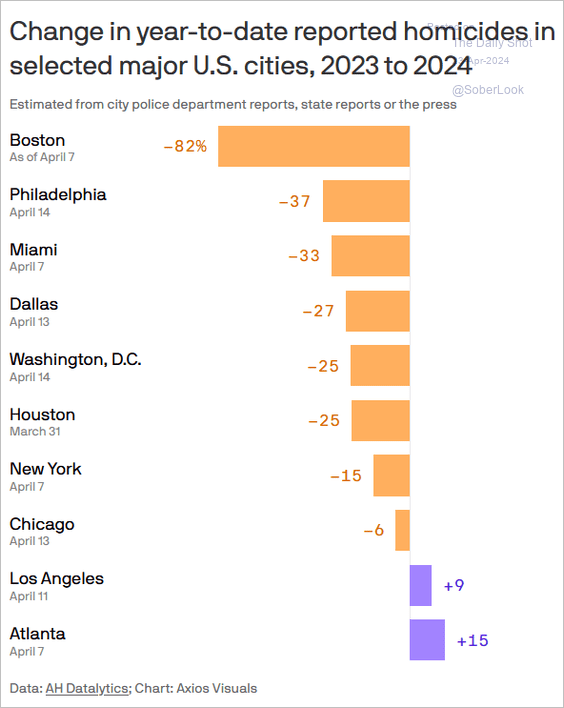

5. Changes in the year-to-date homicide numbers relative to 2023:

Source: @axios Read full article

Source: @axios Read full article

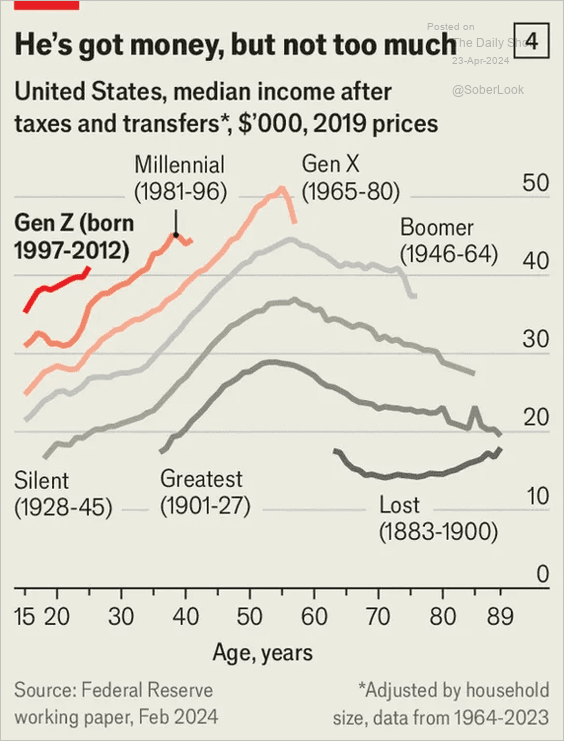

6. Inflation-adjusted median income by generation and age:

Source: The Economist Read full article

Source: The Economist Read full article

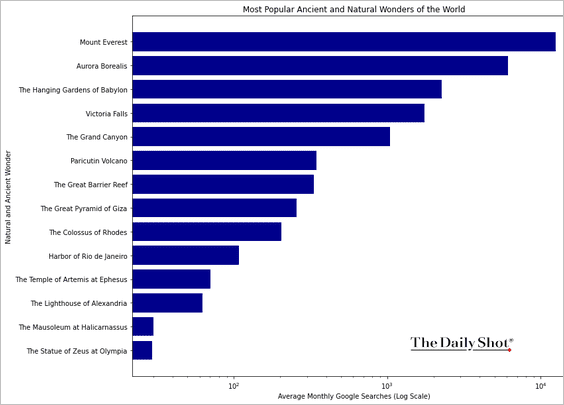

7. Most popular wonders of the world:

Source: Rustic Pathways

Source: Rustic Pathways

——————–

Back to Index