The Daily Shot: 26-Mar-24

• The United States

• Canada

• The United Kingdom

• Europe

• Asia-Pacific

• China

• Cryptocurrency

• Commodities

• Energy

• Equities

• Credit

• Global Developments

• Food for Thought

The United States

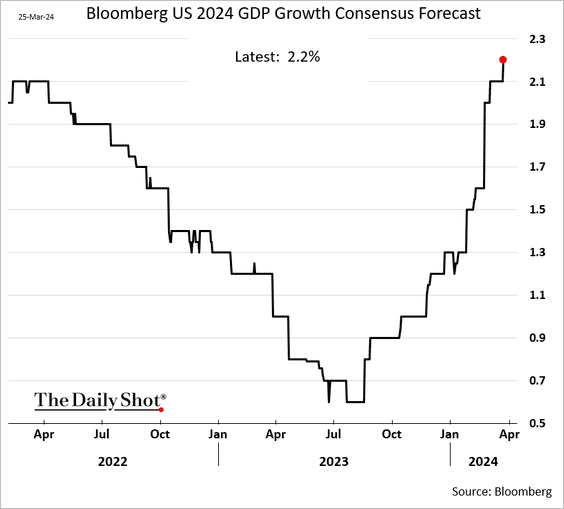

1. Economists continue to boost their estimates for this year’s GDP growth.

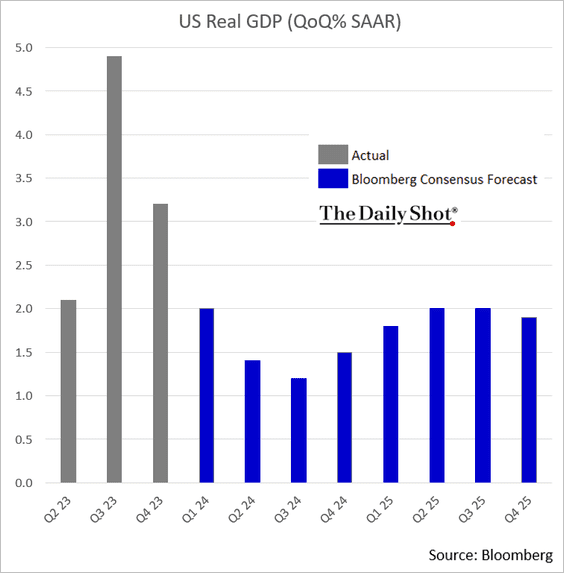

Here are the quarterly projections (median).

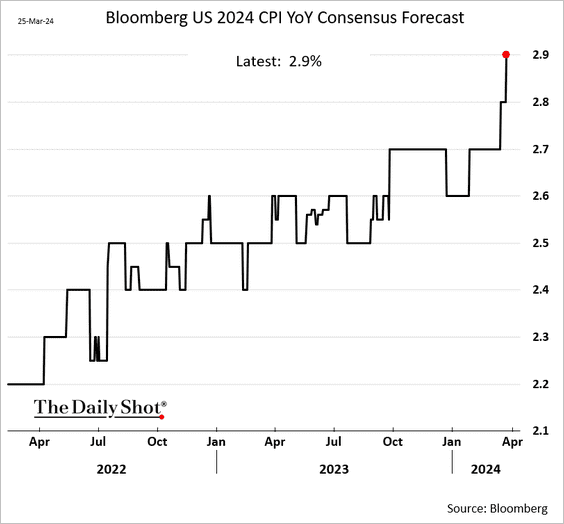

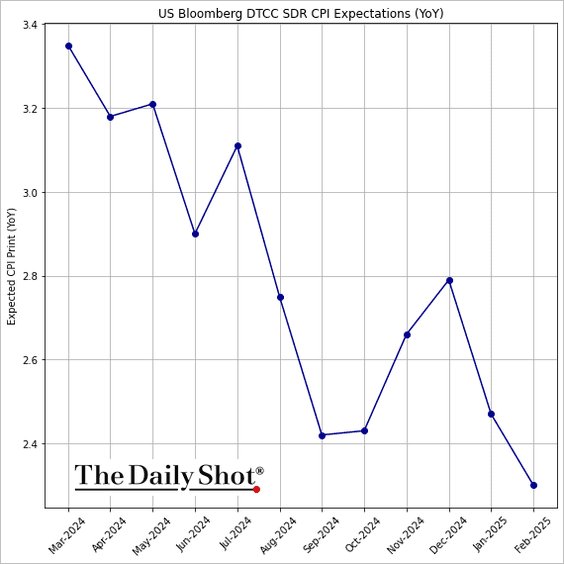

2. Next, we have some updates on inflation.

• Forecasters have increased their projections for the 2024 year-over-year CPI, partly due to rising energy prices.

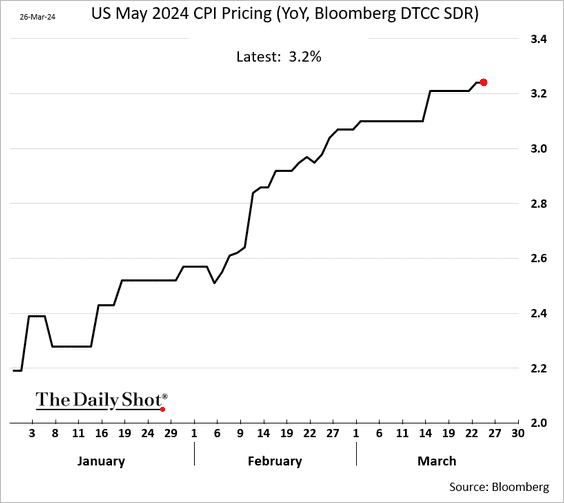

• The markets are also pricing in higher inflation this year. Here is the projection for the May CPI print.

– This chart depicts market expectations for the year-over-year CPI figures over the next 12 months.

h/t Simon White, Bloomberg Markets Live Blog Further reading

h/t Simon White, Bloomberg Markets Live Blog Further reading

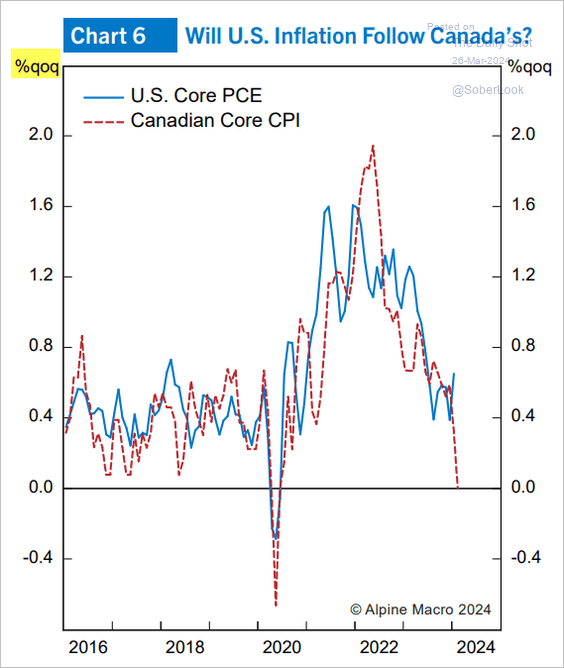

• Will US inflation follow Canada’s CPI lower?

Source: Alpine Macro

Source: Alpine Macro

——————–

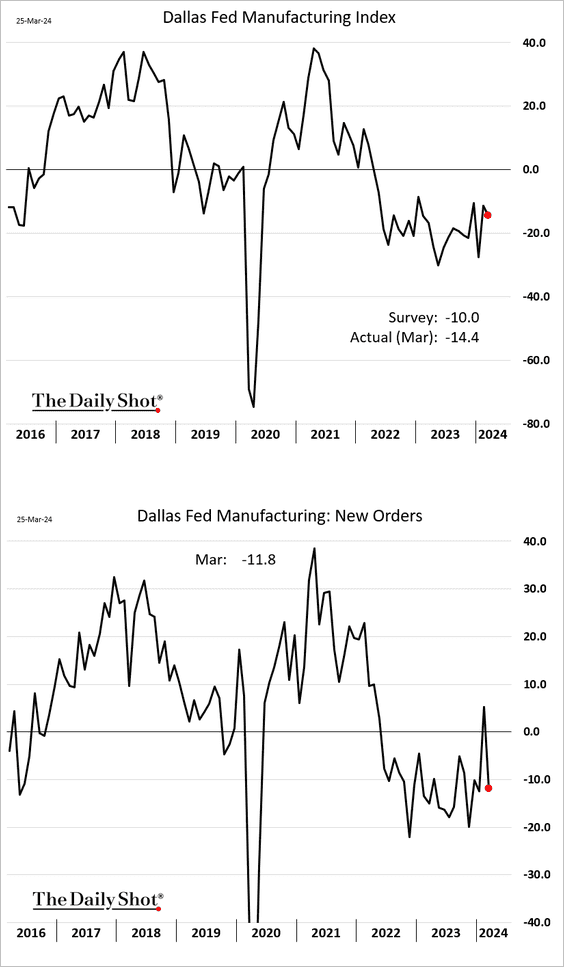

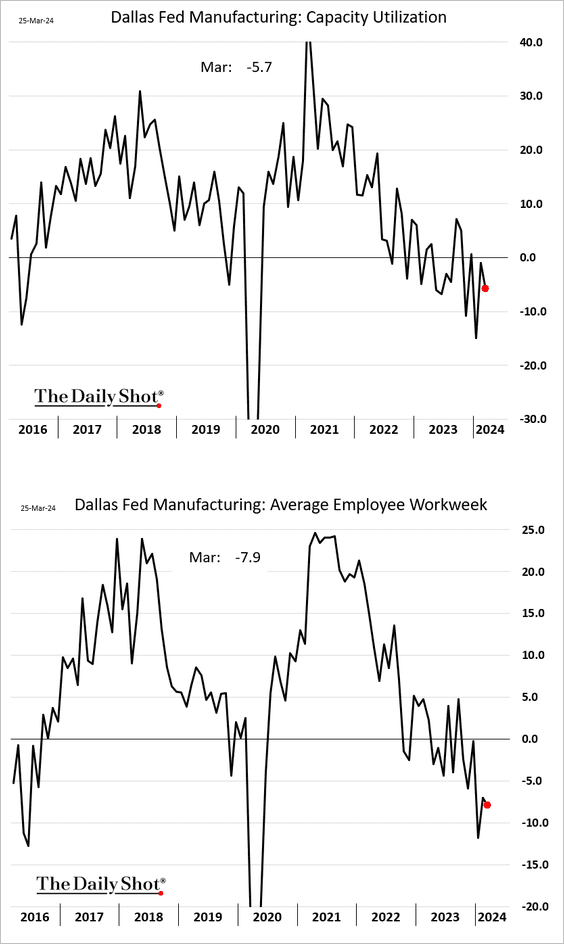

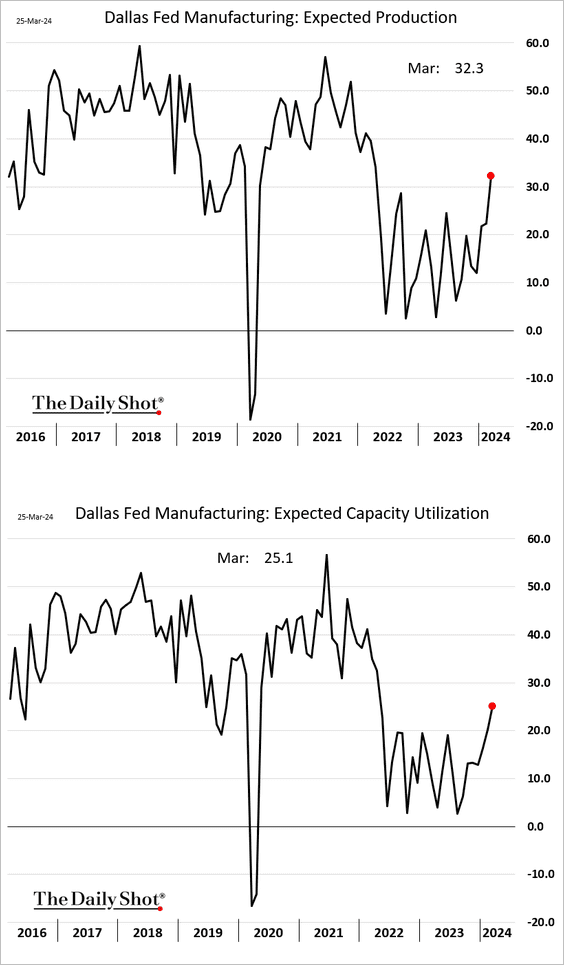

3. The Dallas Fed’s manufacturing index indicated subdued factory activity in the region.

• Indices of capacity utilization and workers’ hours have been trending lower.

• However, manufacturers’ outlook is more upbeat.

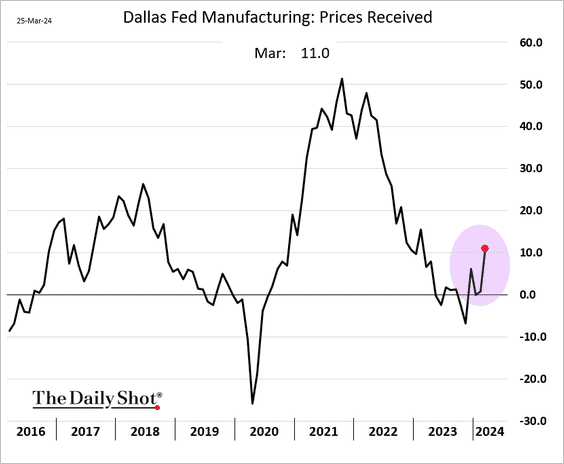

• An increasing number of factories are raising prices, a trend observed nationwide.

——————–

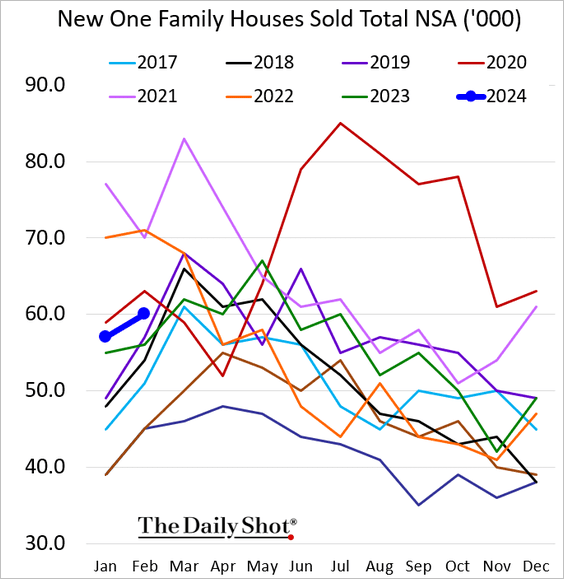

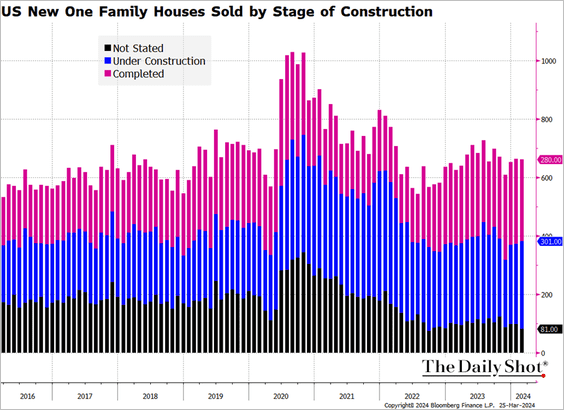

4. New home sales in February surpassed last year’s levels but fell short of forecasts.

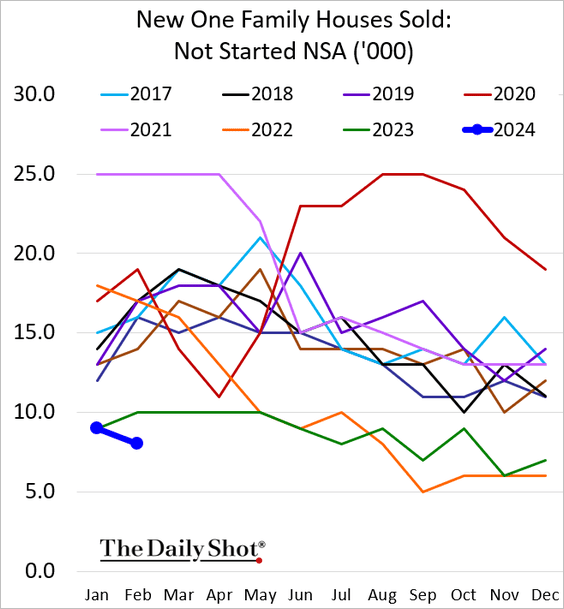

• Buyers are showing less interest in purchasing homes that have yet to be constructed.

– This chart shows seasonally adjusted new home sales by stage of construction.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

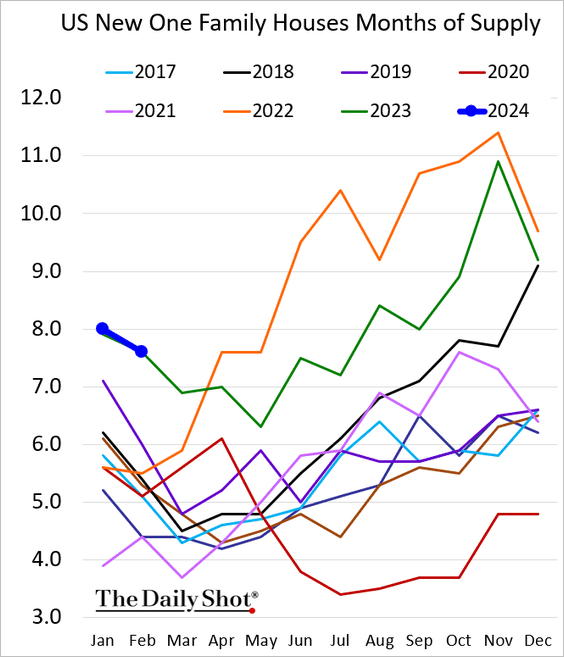

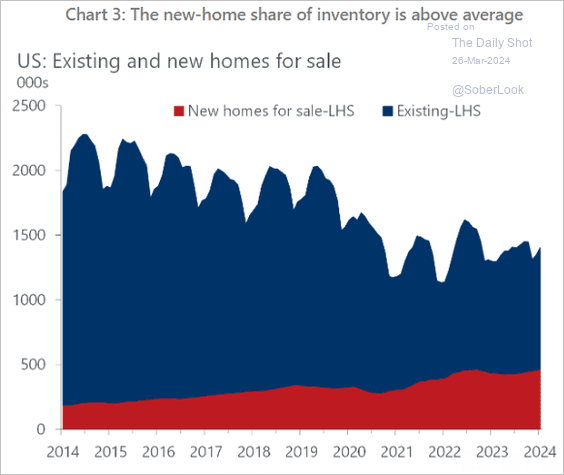

• Measured in months of supply, inventories are following last year’s trajectory.

– The share of new homes in total housing inventories has been increasing.

Source: Oxford Economics

Source: Oxford Economics

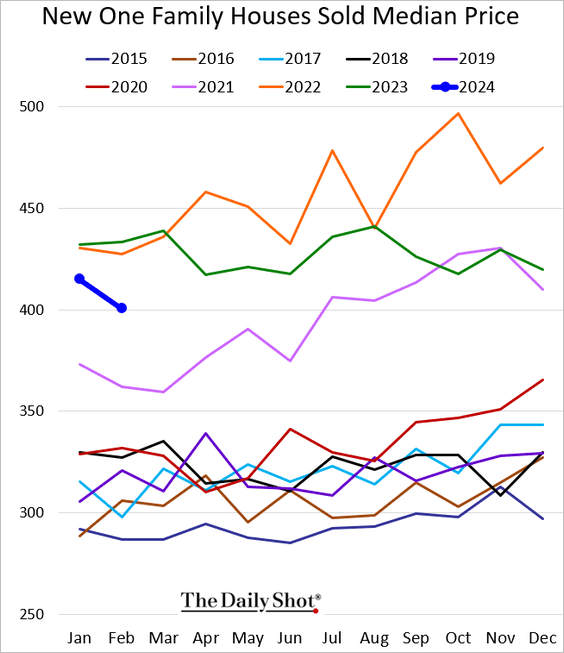

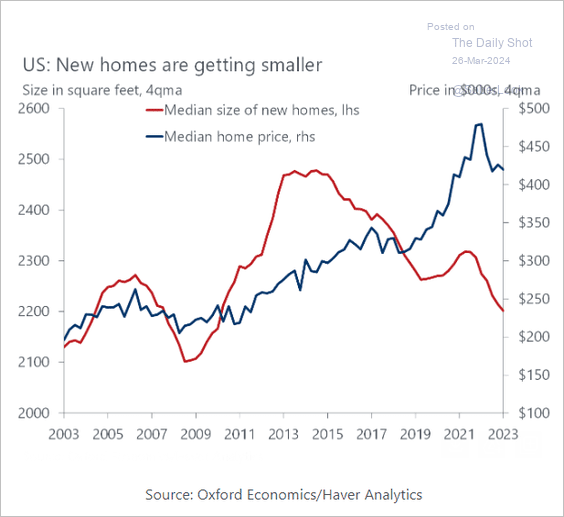

• The median price of new homes sold is well below last year’s levels, …

… as builders focus on smaller homes.

Source: Oxford Economics

Source: Oxford Economics

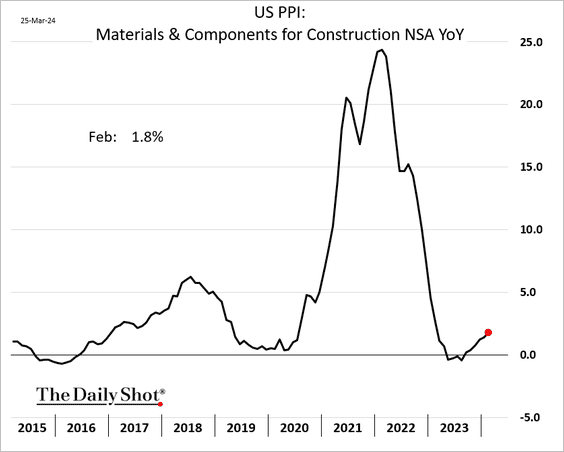

• Separately, price increases for wholesale construction materials are beginning to accelerate again.

Back to Index

Canada

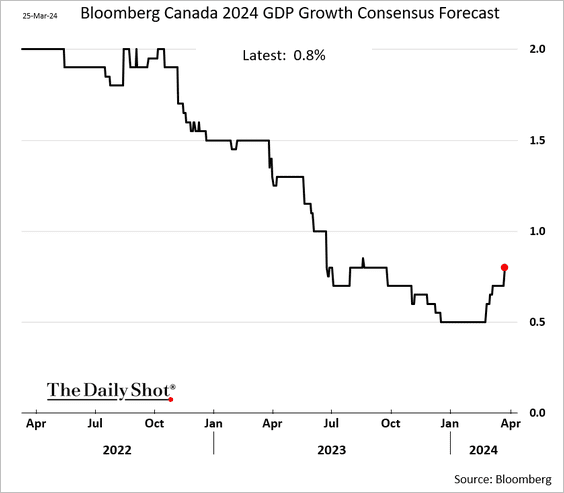

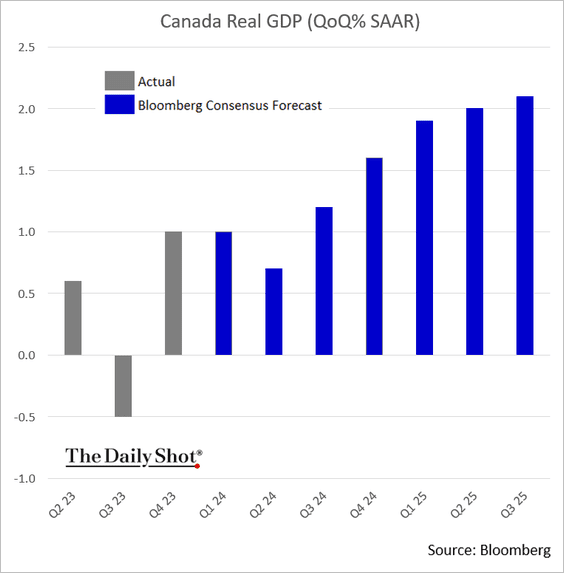

1. Economists are becoming more upbeat about Canada’s economic growth this year, …

… no longer expecting a recession.

——————–

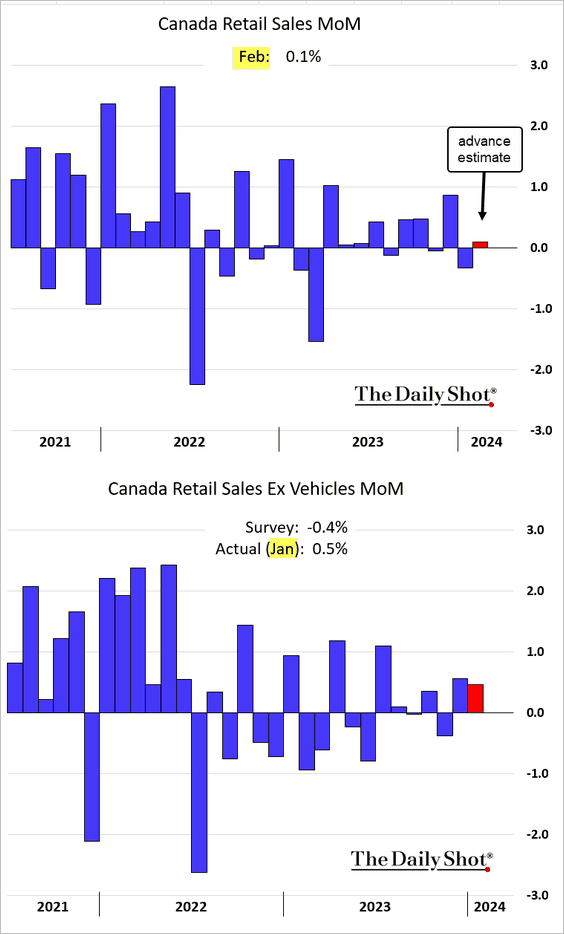

2. The advance estimate of retail sales showed a small gain last month. Excluding vehicles, retail sales were up in January (2nd panel).

Source: @economics Read full article

Source: @economics Read full article

Back to Index

The United Kingdom

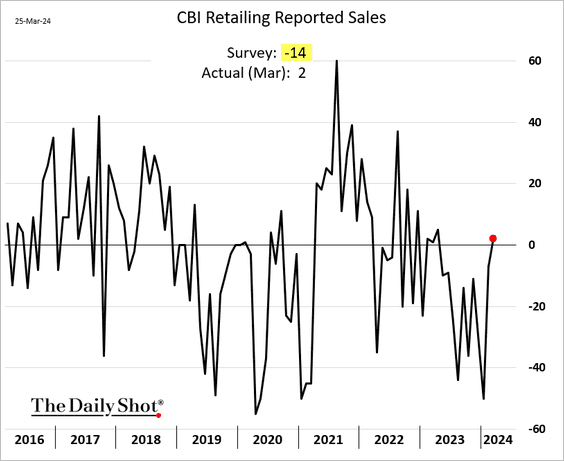

1. Retail sales stabilized in March.

Source: Reuters Read full article

Source: Reuters Read full article

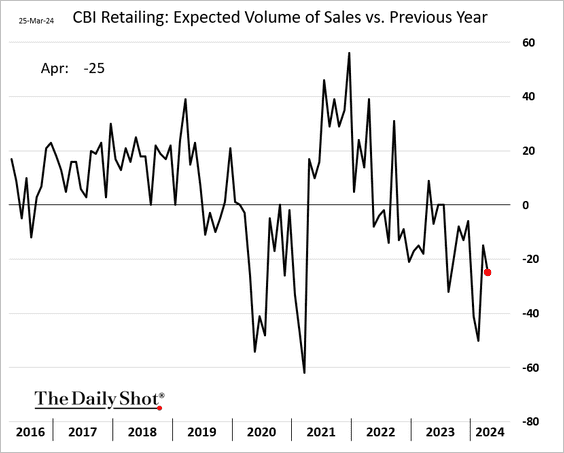

But retailers are not optimistic about next month.

Source: RTT News Read full article

Source: RTT News Read full article

——————–

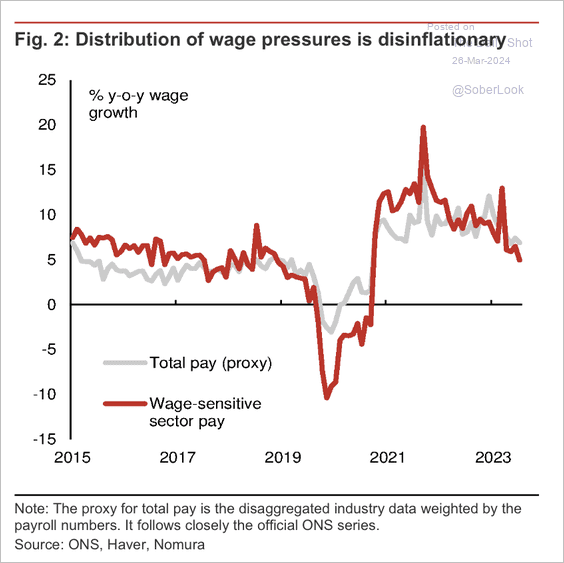

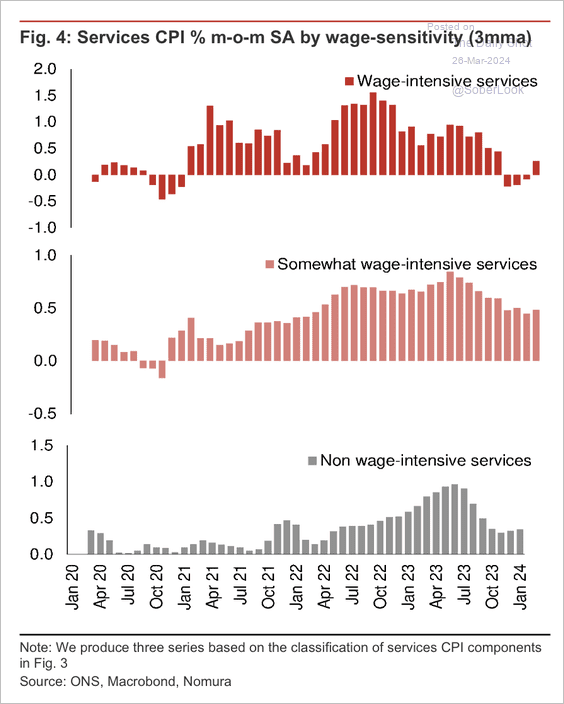

2. Wage pressures are easing.

Source: Nomura Securities

Source: Nomura Securities

• There has been a significant slowdown in services price momentum across both wage-sensitive and non-wage-sensitive sectors. This suggests that a low unemployment rate is unable to keep inflationary pressures alive, according to Nomura.

Source: Nomura Securities

Source: Nomura Securities

Back to Index

Europe

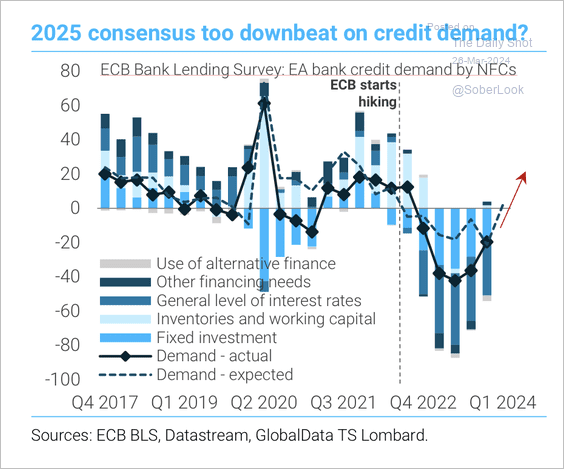

1. Euro area credit demand is expected to turn around.

Source: TS Lombard

Source: TS Lombard

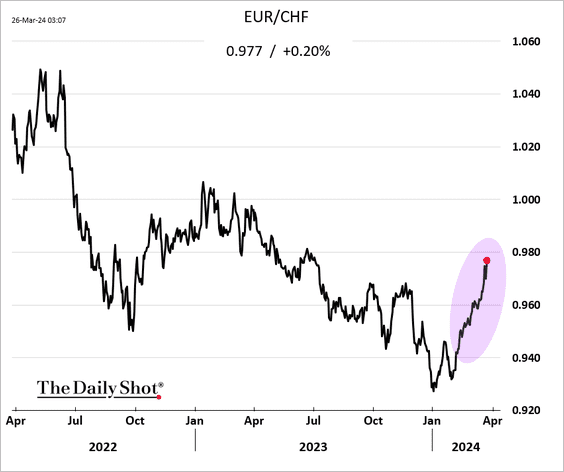

2. The Swiss franc continues to weaken after the SNB’s surprise rate cut.

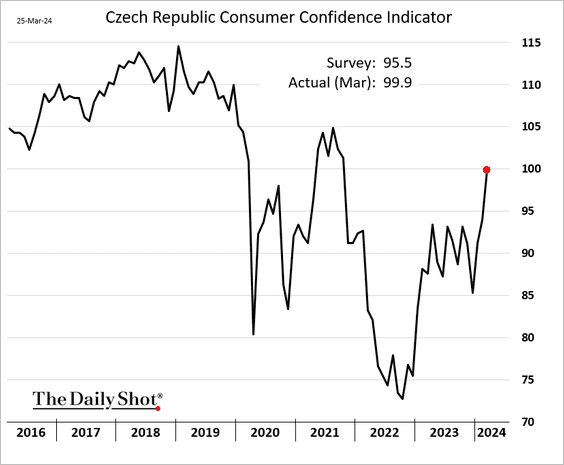

3. Consumer sentiment in the Czech Republic is rebounding.

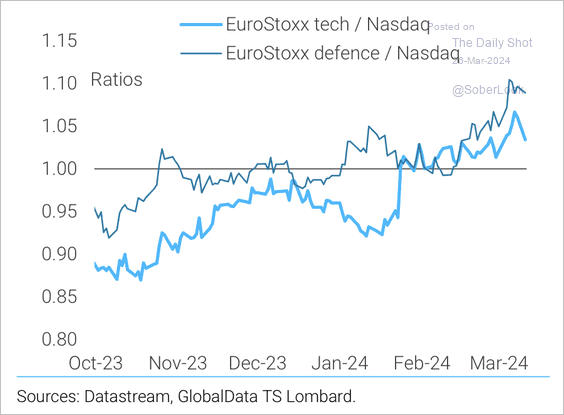

4. European tech and defense sectors have started to outperform the Nasdaq.

Source: TS Lombard

Source: TS Lombard

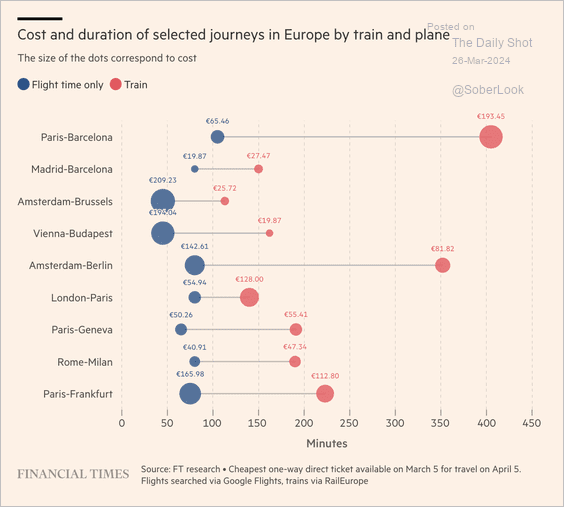

5. Below is a comparison of train and flight costs and durations for key European routes.

Source: @financialtimes Read full article

Source: @financialtimes Read full article

Back to Index

Asia-Pacific

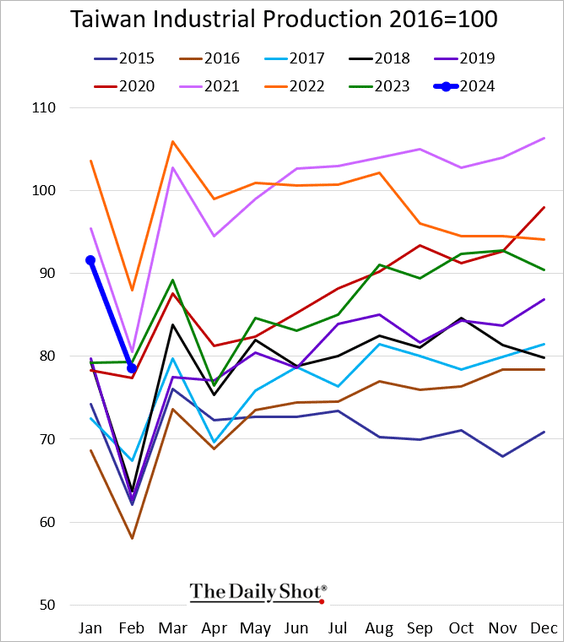

1. Taiwan’s industrial production dipped below last year’s levels in February.

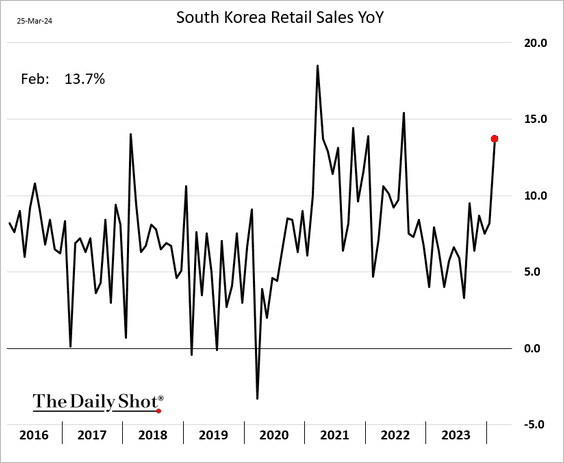

2. South Korea’s retail sales surged last month.

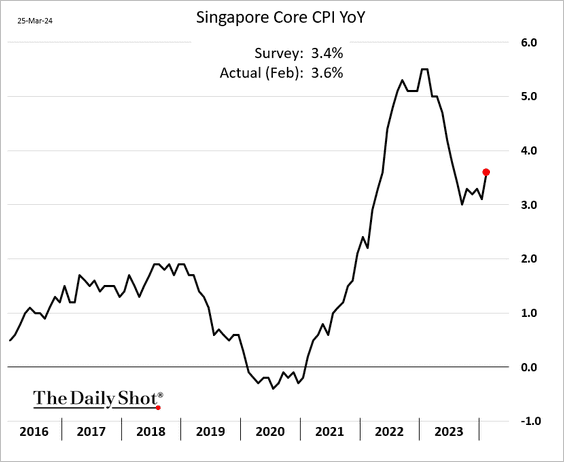

3. Singapore’s inflation climbed last month, which we are starting to see elsewhere in Asia.

Back to Index

China

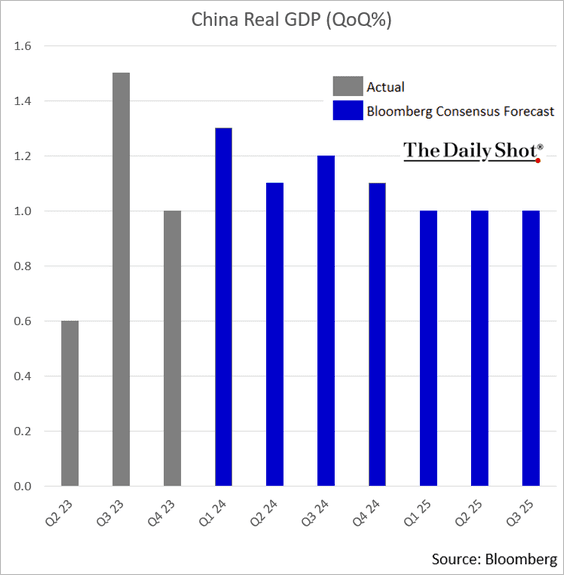

1. Here is a look at consensus estimates for China’s quarterly GDP growth.

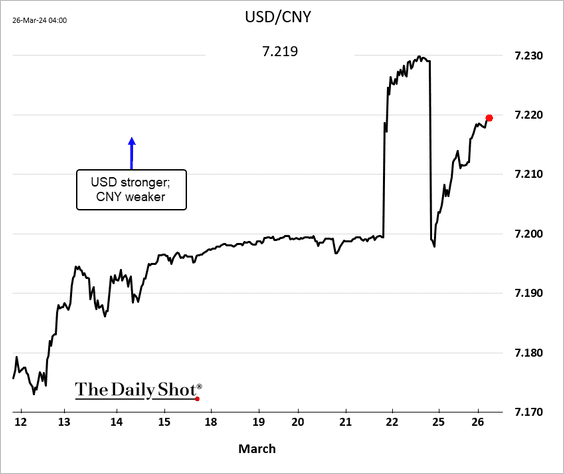

2. The renminbi is weakening again. Will Bejing step in once more?

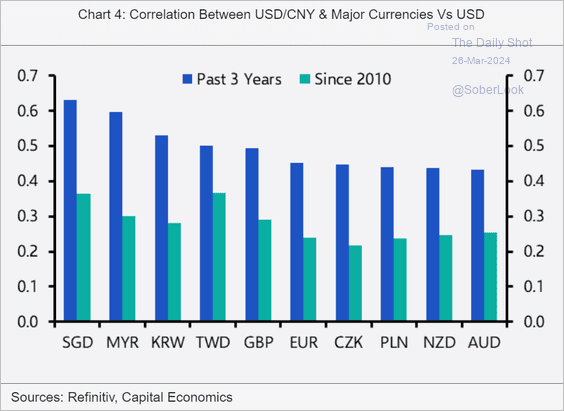

• How correlated is the USD/CNY exchange rate to other major currencies?

Source: Capital Economics

Source: Capital Economics

Back to Index

Cryptocurrency

1. Bitcoin is back above $70k.

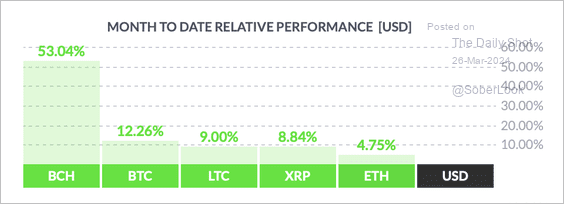

• So far, bitcoin cash (BCH) has outperformed top cryptos this month, while ether (ETH) has lagged.

Source: FinViz

Source: FinViz

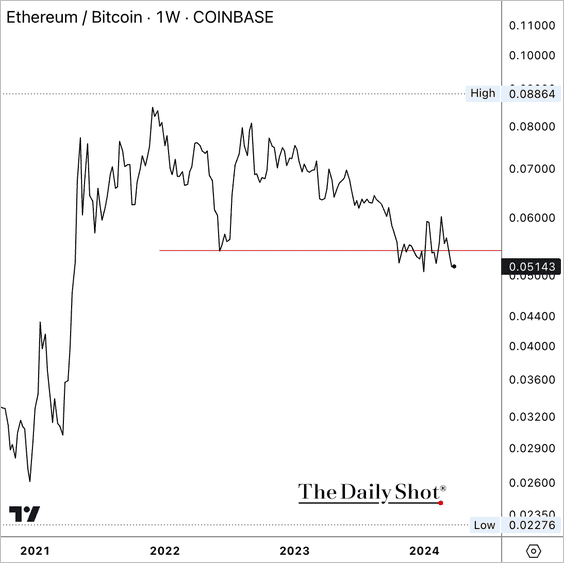

• The ETH/BTC ratio broke below support.

——————–

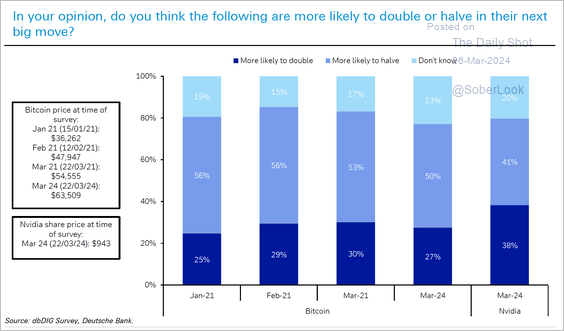

2. There has been persistent bearishness among market participants throughout bitcoin’s latest price rally, according to a survey by Deutsche Bank.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

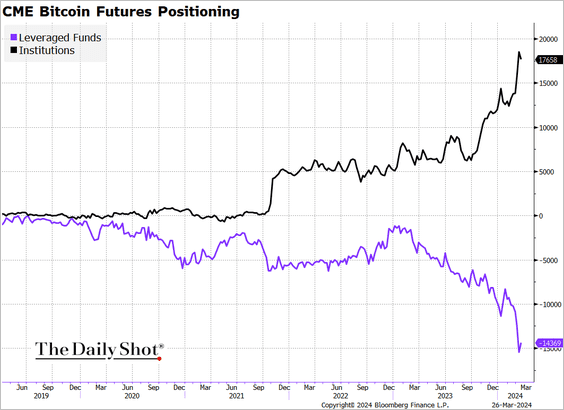

3. Bitcoin futures positioning reveals contrasting strategies between institutional investors, with their longer-term outlooks, and hedge funds.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

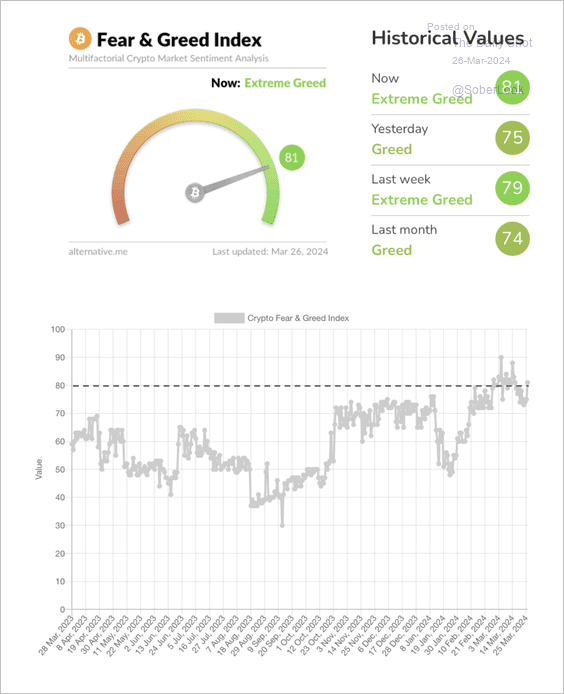

4. The Crypto Fear & Greed Index entered “extreme greed” territory.

Source: Alternative.me

Source: Alternative.me

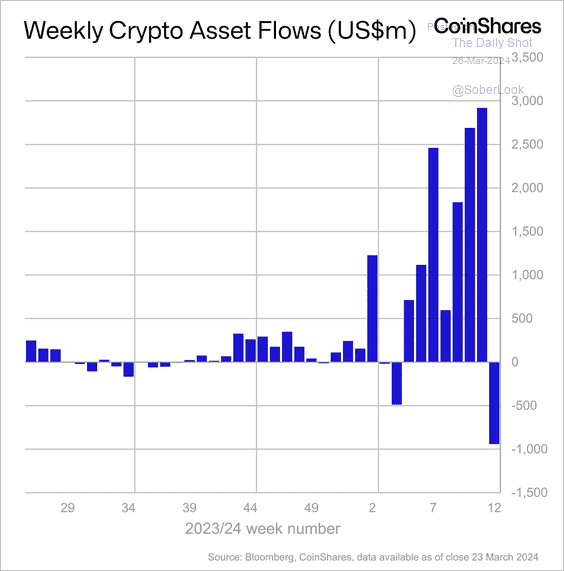

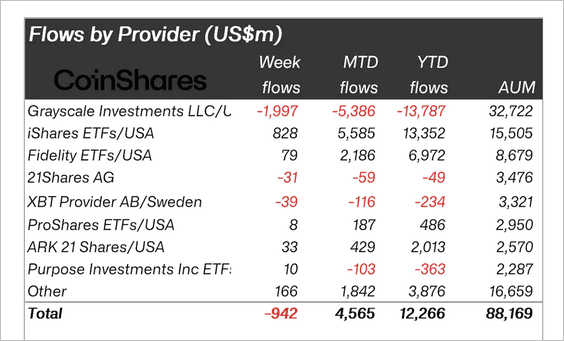

5. Crypto funds saw significant outflows last week.

Source: CoinShares Read full article

Source: CoinShares Read full article

• New ETF issuers in the US saw inflows, which partially offset large outflows from incumbent Grayscale.

Source: CoinShares Read full article

Source: CoinShares Read full article

——————–

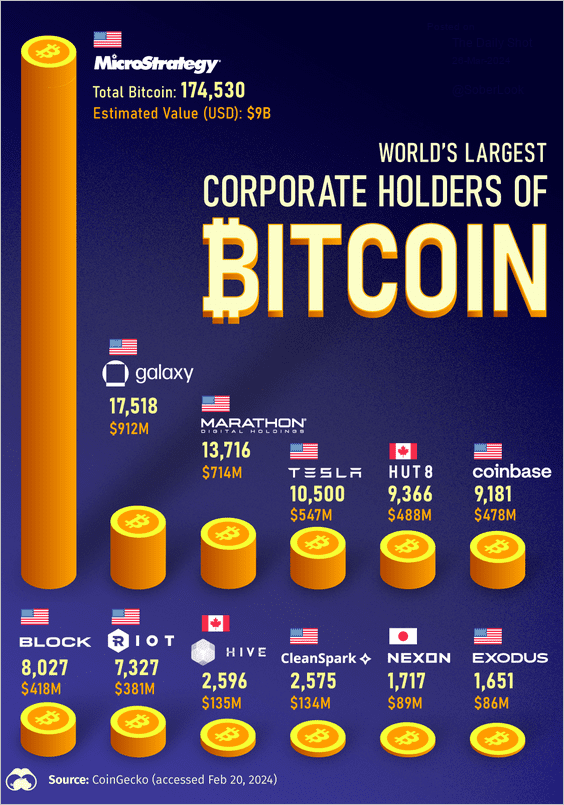

6. Here is a look at the largest corporate holders of bitcoin.

Source: Visual Capitalist Read full article

Source: Visual Capitalist Read full article

Back to Index

Commodities

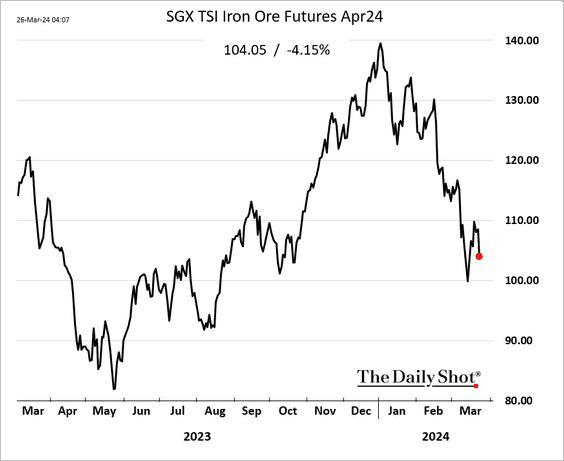

1. Iron ore futures are under pressure again.

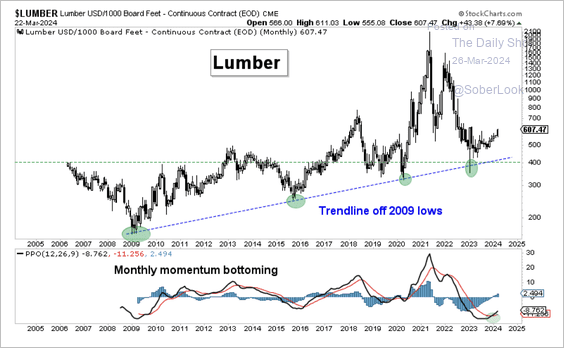

2. Lumber futures held long-term support with improving momentum.

Source: Aazan Habib, Paradigm Capital

Source: Aazan Habib, Paradigm Capital

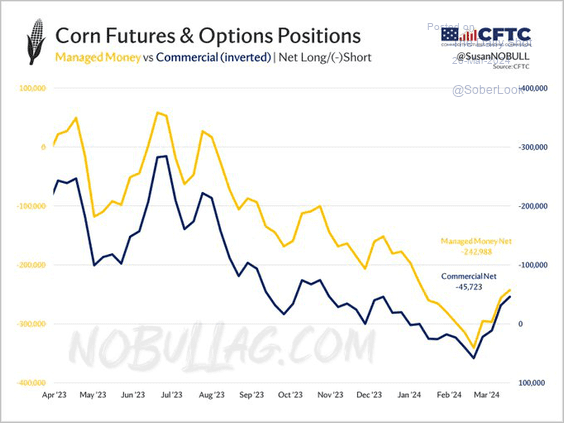

3. Fund managers are growing more optimistic about corn.

Source: @SusanNOBULL, @Barchart Read full article

Source: @SusanNOBULL, @Barchart Read full article

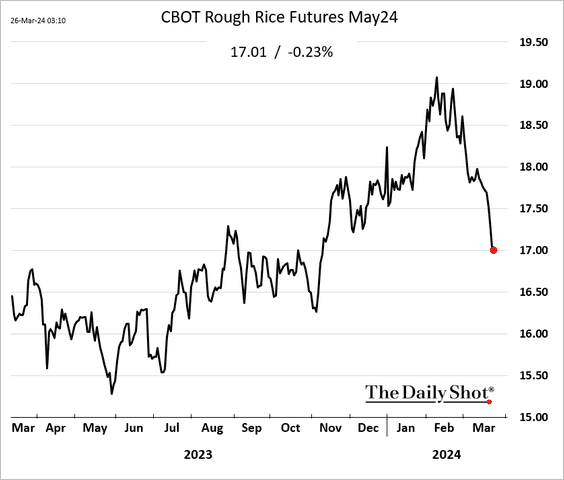

4. Rice futures have been selling off.

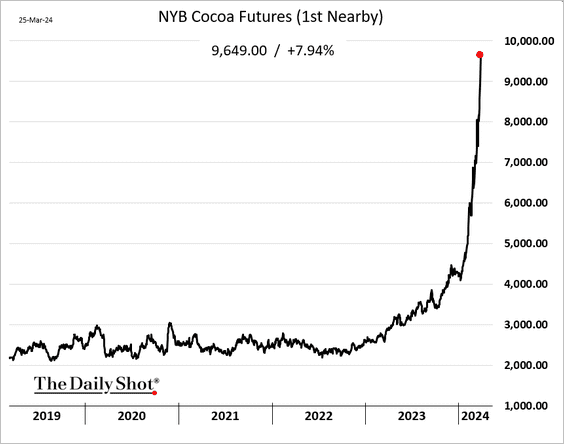

5. Cocoa futures keep surging, …

… leading to chaotic conditions in the market.

Source: @markets Read full article

Source: @markets Read full article

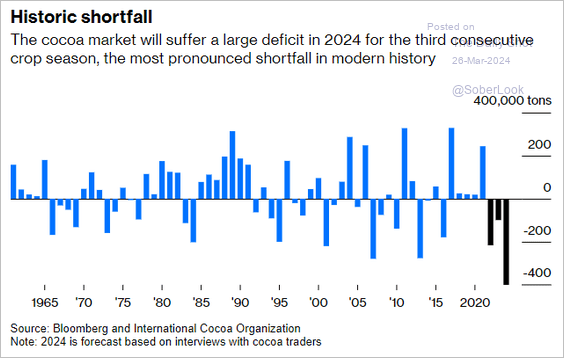

The cocoa market deficit is massive.

Source: @JavierBlas, @opinion Read full article

Source: @JavierBlas, @opinion Read full article

Back to Index

Energy

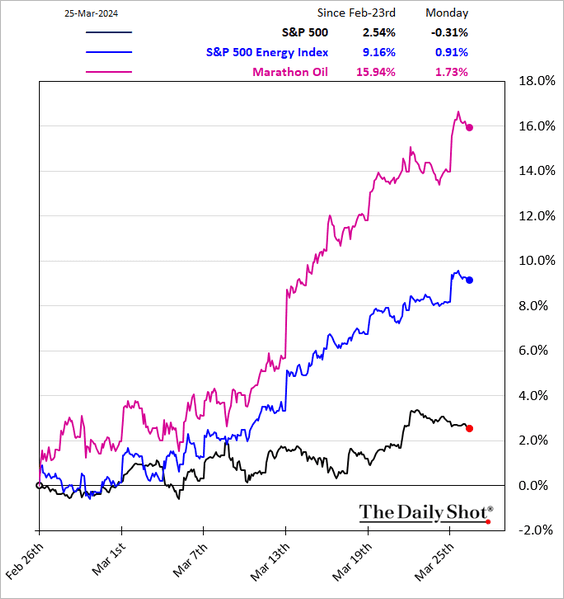

1. Energy shares have been outperforming.

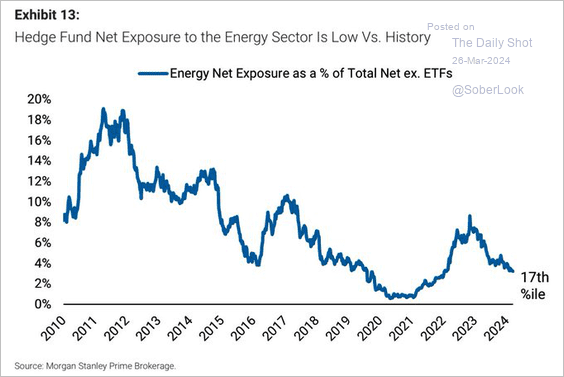

2. Hedge funds’ exposure to the energy sector has been relatively low.

Source: Morgan Stanley Research; @WallStJesus

Source: Morgan Stanley Research; @WallStJesus

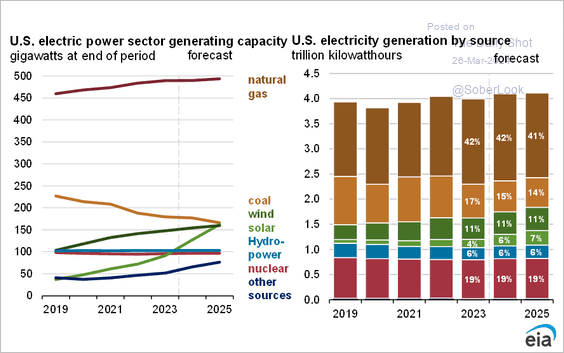

3. Here is a look at growth in US renewable capacity and shifts in the electricity generation mix (2019-2025).

Source: @EIAgov Read full article

Source: @EIAgov Read full article

Back to Index

Equities

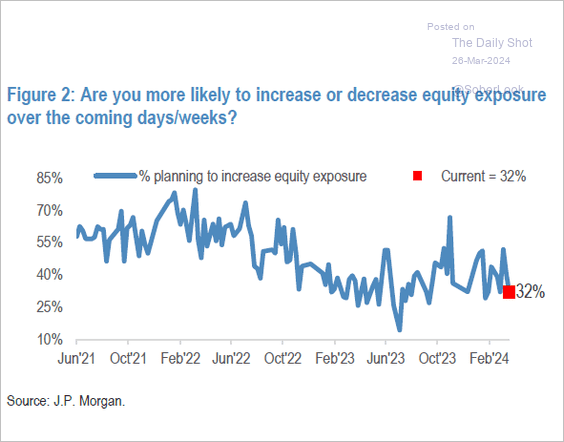

1. JP Morgan’s clients have recently shown less optimism about the market.

Source: JP Morgan Research

Source: JP Morgan Research

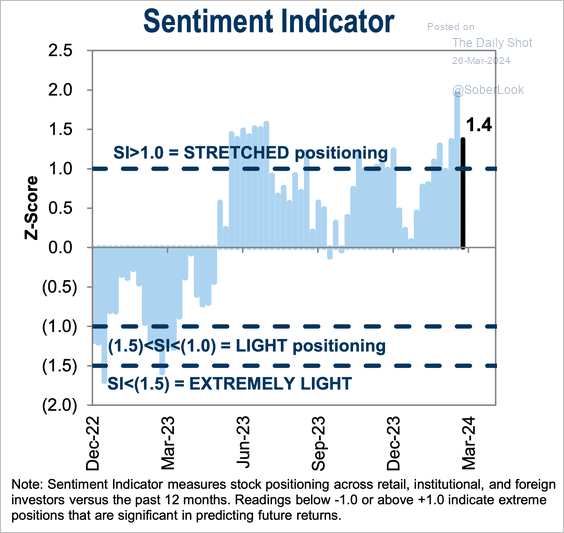

But Goldman’s sentiment indicator remains in “stretched” territory.

Source: Goldman Sachs; @dailychartbook

Source: Goldman Sachs; @dailychartbook

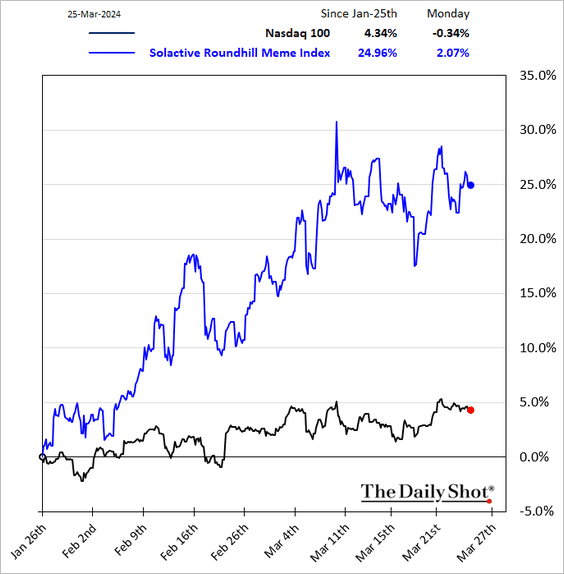

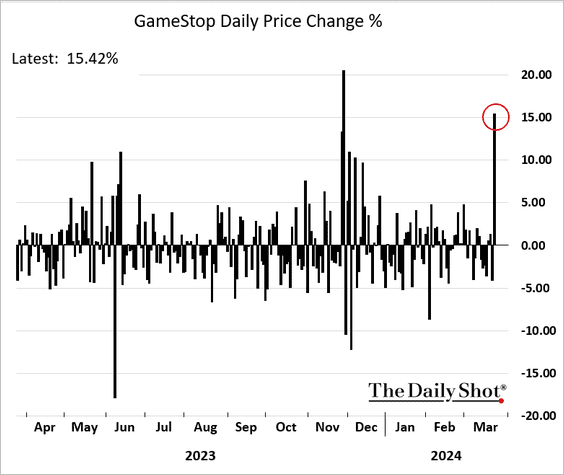

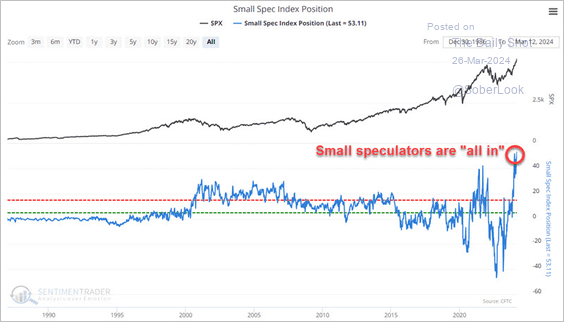

• Meme stocks continue to show increased risk appetite among retail investors (2 charts).

• Smaller players in US stock index futures have reached their most bullish net position ever.

Source: SentimenTrader

Source: SentimenTrader

——————–

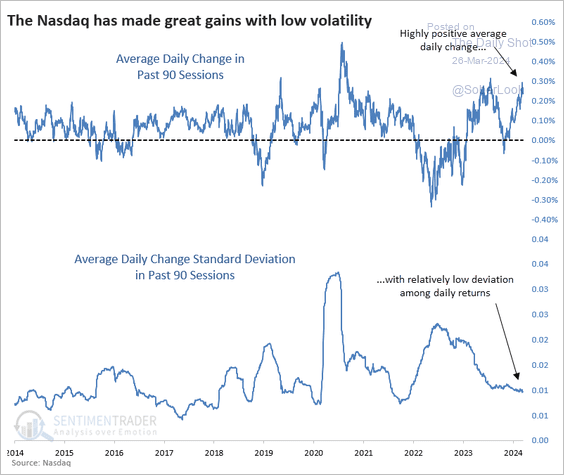

2. The Nasdaq 100’s recent average daily gain occurred with low volatility.

Source: SentimenTrader

Source: SentimenTrader

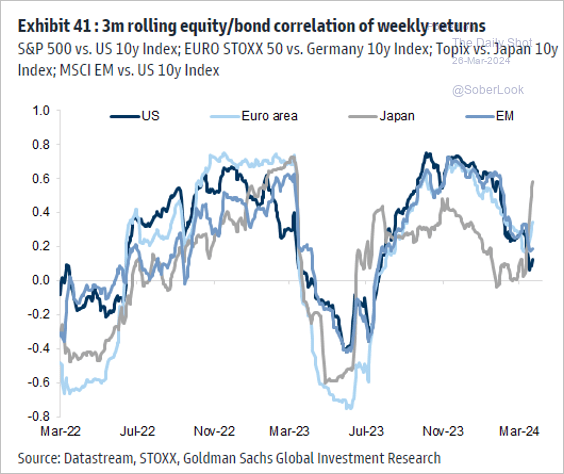

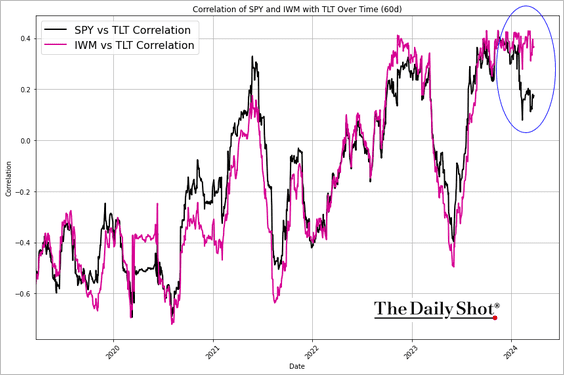

3. Large-cap market correlation to government bonds has been trending lower except in Japan.

Source: Goldman Sachs; @MikeZaccardi

Source: Goldman Sachs; @MikeZaccardi

• US small caps remain more correlated to Treasuries than large caps.

——————–

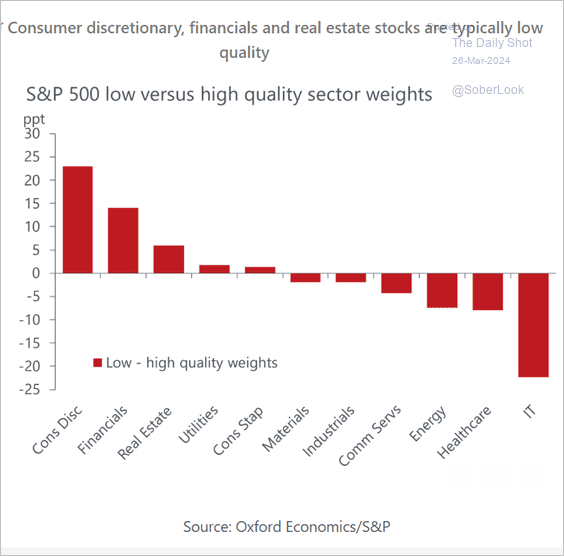

4. Which sectors include the most “low-quality” stocks?

Source: Oxford Economics

Source: Oxford Economics

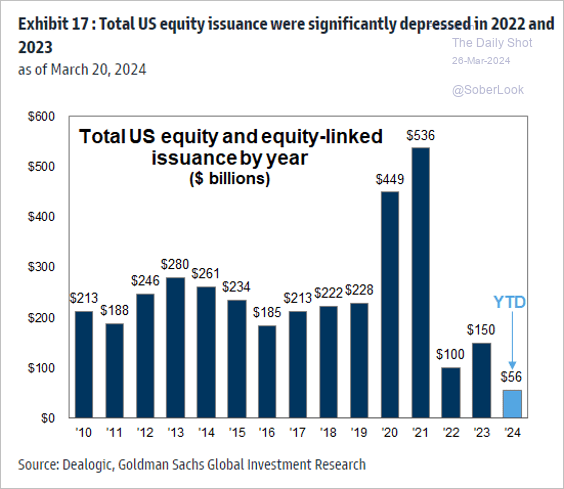

5. Total equity issuance has been relatively soft.

Source: Goldman Sachs; @MikeZaccardi

Source: Goldman Sachs; @MikeZaccardi

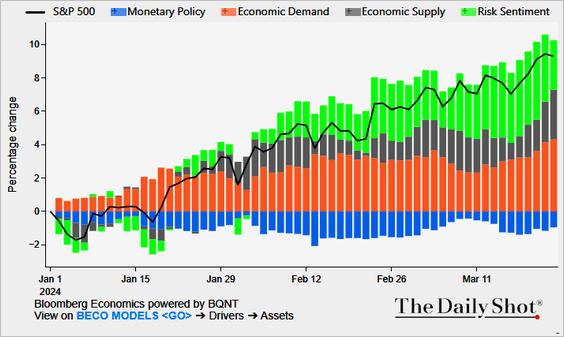

6. This chart from Bloomberg shows the attribution of the S&P 500 year-to-date performance.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

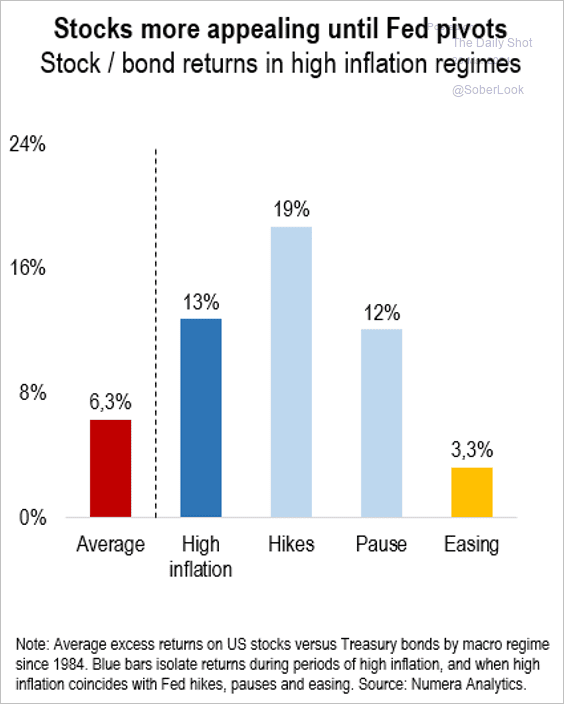

7. The US stock/bond premium typically doubles in high-inflation regimes, especially when the Fed is hiking. The premium narrows below average once the Fed pivots as bonds become more attractive.

Source: Numera Analytics (@NumeraAnalytics)

Source: Numera Analytics (@NumeraAnalytics)

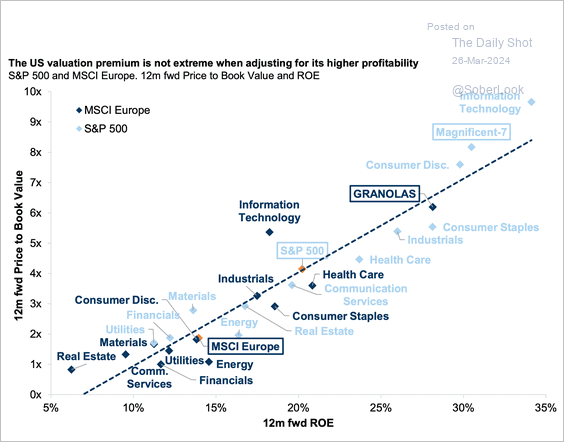

8. When adjusted for profitability, the valuation premium of US shares over Europe is not excessive.

Source: Goldman Sachs; @dailychartbook

Source: Goldman Sachs; @dailychartbook

Back to Index

Credit

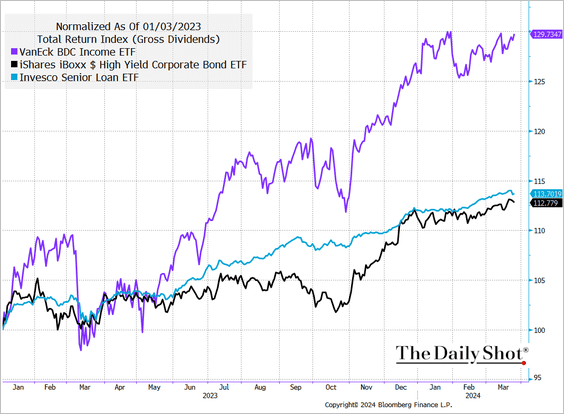

1. BDCs have outperformed both the high-yield bond and leveraged loan markets.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

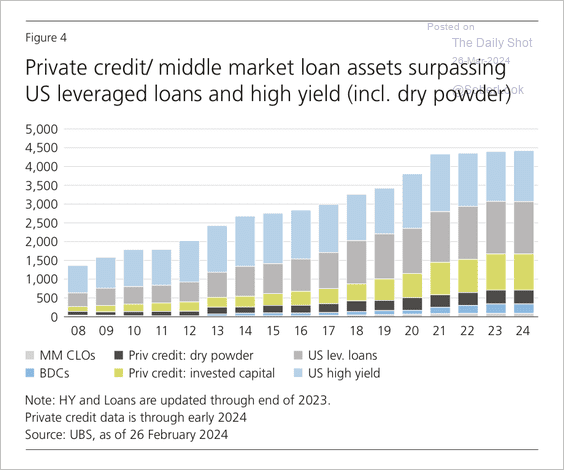

2. Given the abundance of dry powder, the private credit market (middle-market loans) remains a significant source of funding.

Source: UBS Asset Management

Source: UBS Asset Management

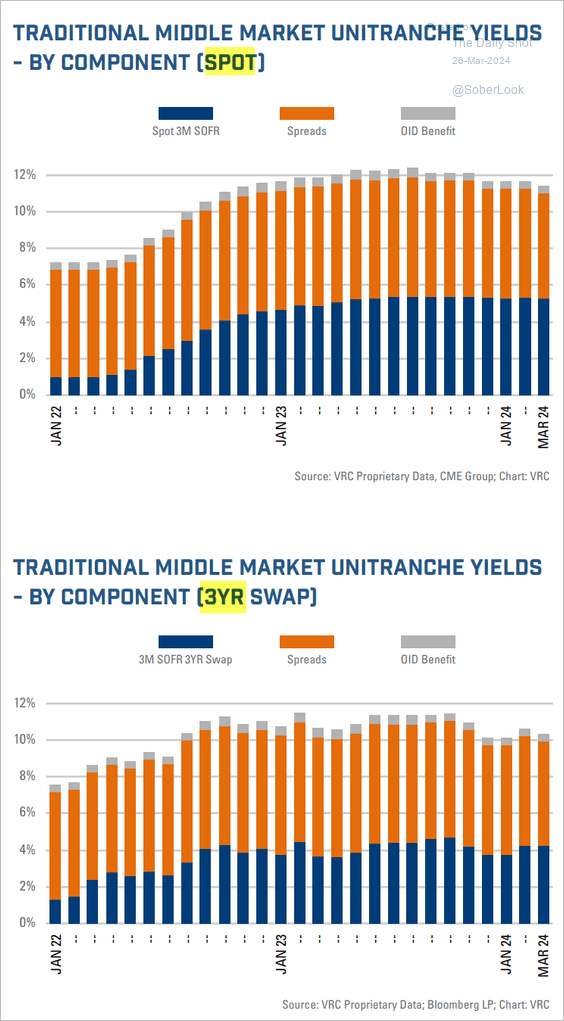

• This chart presents middle-market loan yields, with the first panel displaying the current yield and the second panel showing the fixed yield achievable by swapping to a fixed rate for three years.

Source: VRC

Source: VRC

——————–

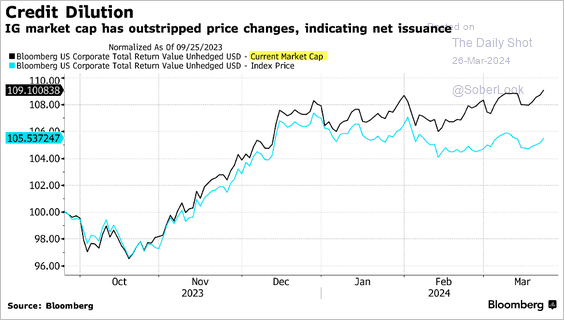

3. The US corporate bond supply has been rising.

Source: Cameron Crise, Macro Man Columns (Bloomberg) Read full article

Source: Cameron Crise, Macro Man Columns (Bloomberg) Read full article

Back to Index

Global Developments

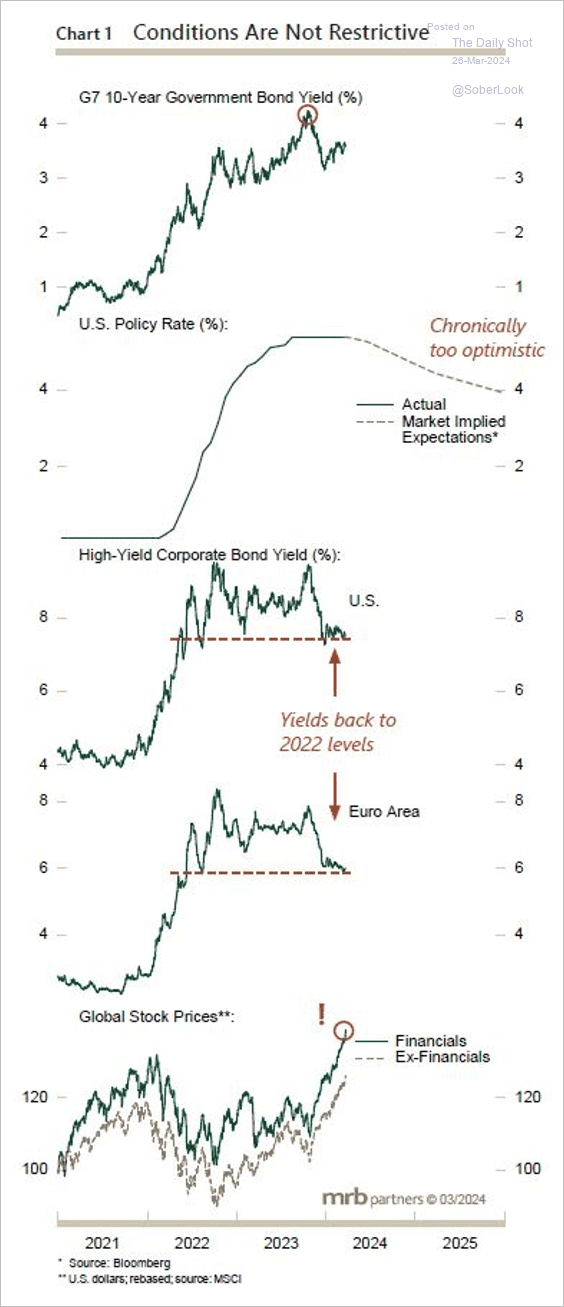

1. So far, market conditions are not restrictive.

Source: MRB Partners

Source: MRB Partners

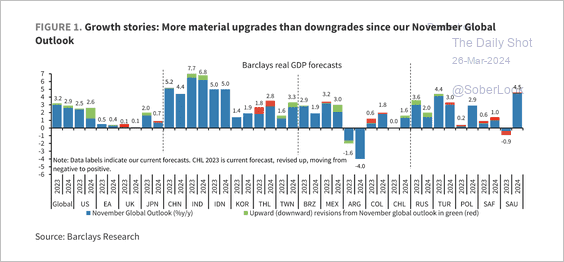

2. Barclays revised their global real GDP estimates higher.

Source: Barclays Research

Source: Barclays Research

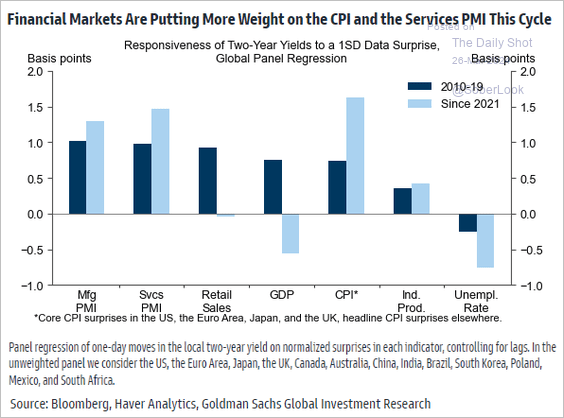

3. Here is a look at how global short-term bond yields respond to data surprises (pre- and post-COVID).

Source: Goldman Sachs; @MikeZaccardi

Source: Goldman Sachs; @MikeZaccardi

——————–

Food for Thought

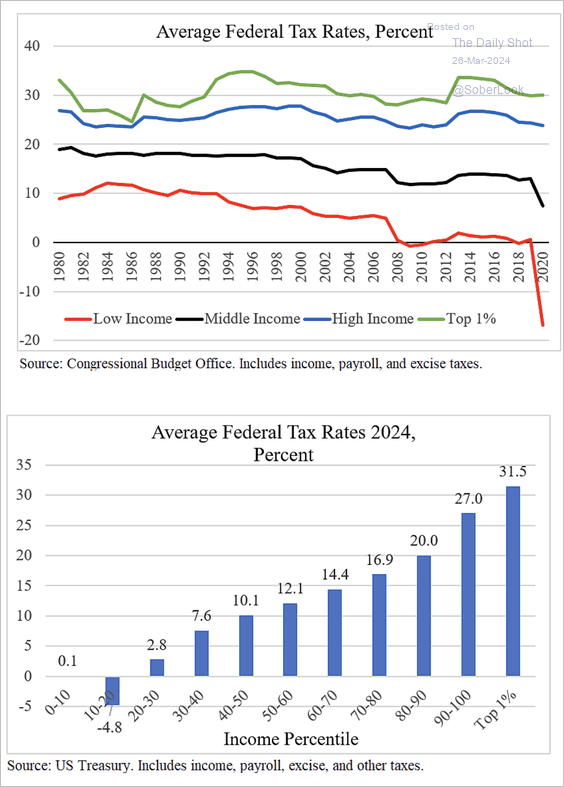

1. Historical and current average federal tax rates by income percentile in the US:

Source: Cato Institute Read full article

Source: Cato Institute Read full article

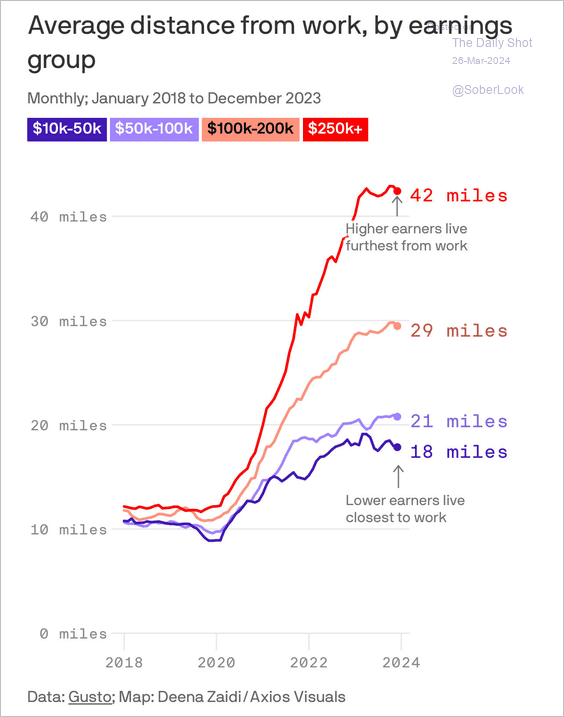

2. Americans living further away from work:

Source: @axios Read full article

Source: @axios Read full article

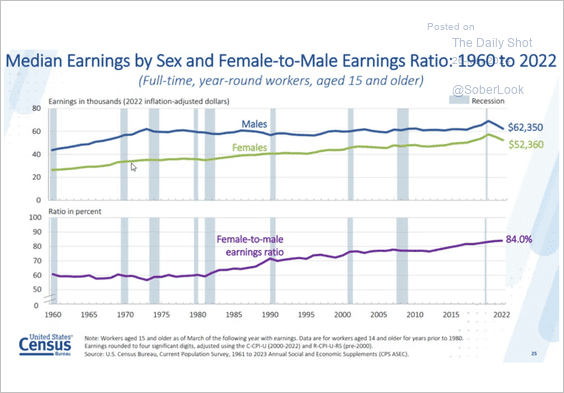

3. Female-to-male earnings ratio:

Source: The US Census Bureau Read full article

Source: The US Census Bureau Read full article

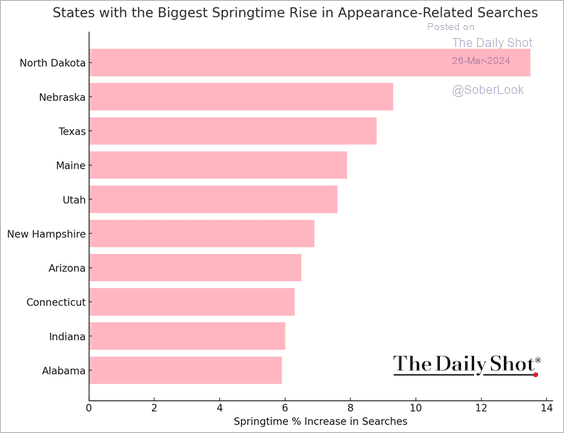

4. States most at risk of body image issues:

Source: MindWings

Source: MindWings

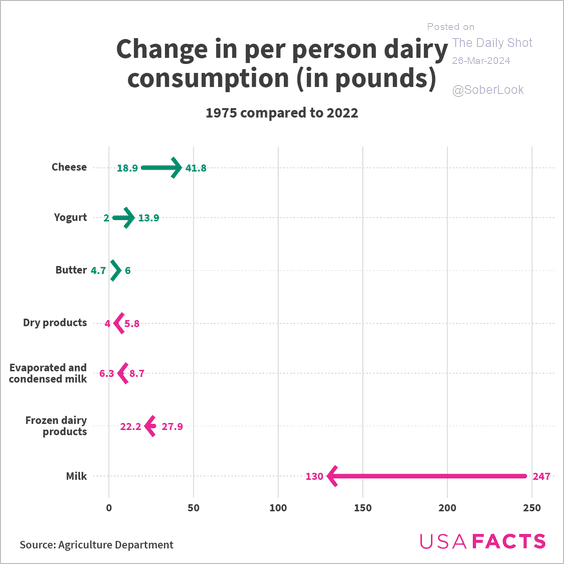

5. Dairy consumption changes by product:

Source: USAFacts

Source: USAFacts

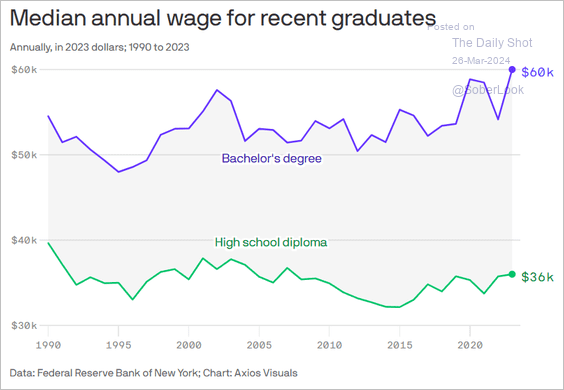

6. Wage comparison for recent graduates with a bachelor’s degree vs. high school diploma:

Source: @axios Read full article

Source: @axios Read full article

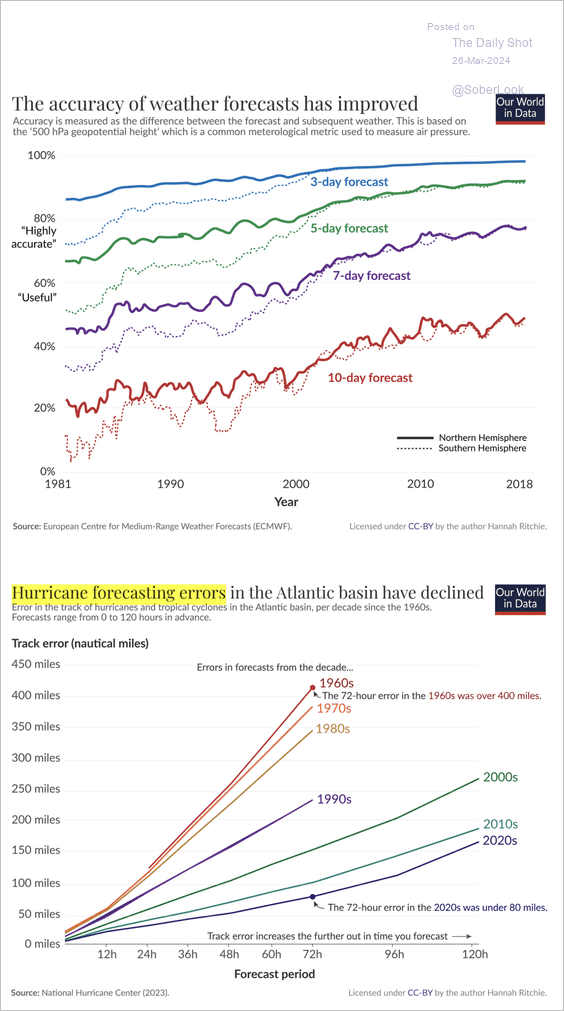

7. Weather forecast accuracy:

Source: Our World in Data Read full article

Source: Our World in Data Read full article

——————–

Back to Index