The Daily Shot: 18-Mar-24

• The United States

• Canada

• The United Kingdom

• The Eurozone

• Europe

• China

• Emerging Markets

• Cryptocurrency

• Commodities

• Energy

• Equities

• Credit

• Global Developments

• Food for Thought

The United States

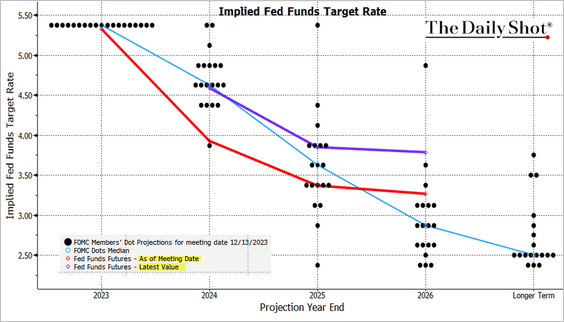

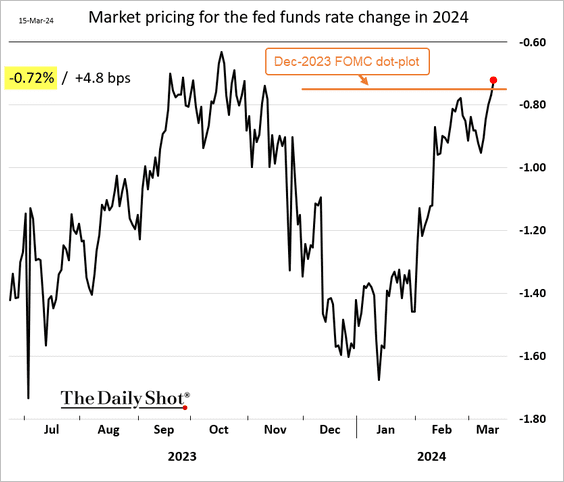

1. Market expectations for the Fed’s policy rate trajectory have moved up substantially since the last projections were published in December. Will the Fed’s new dot plot shift higher?

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

• The market now expects a smaller rate cut this year than the FOMC’s last dot plot.

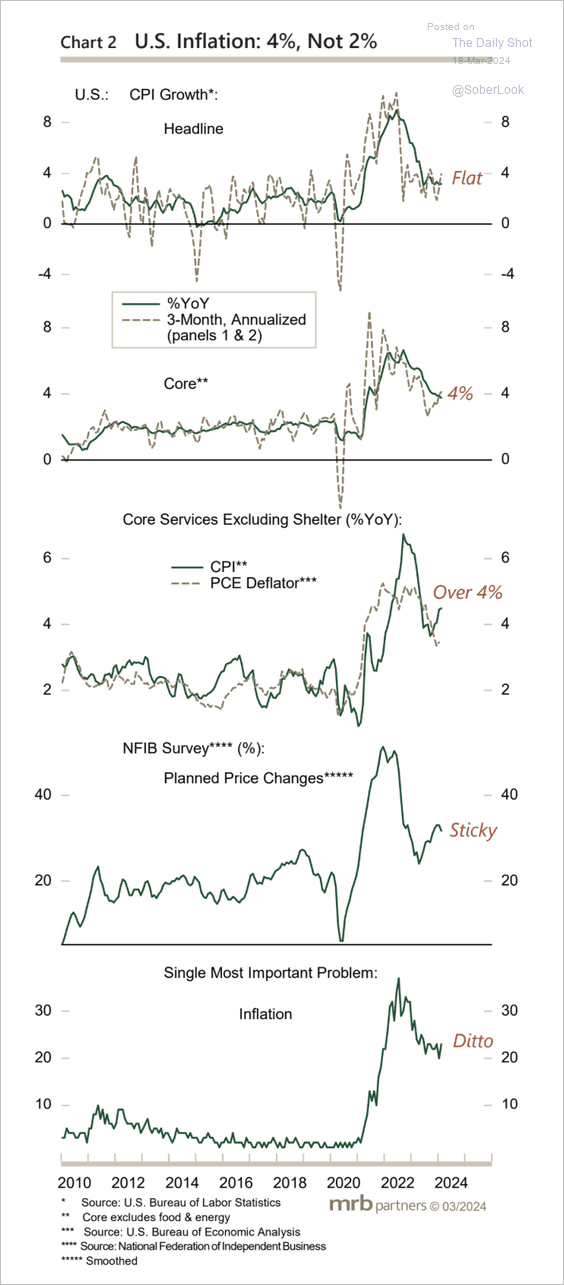

• Underlying inflation measures remain sticky, which could delay rate cuts.

Source: MRB Partners

Source: MRB Partners

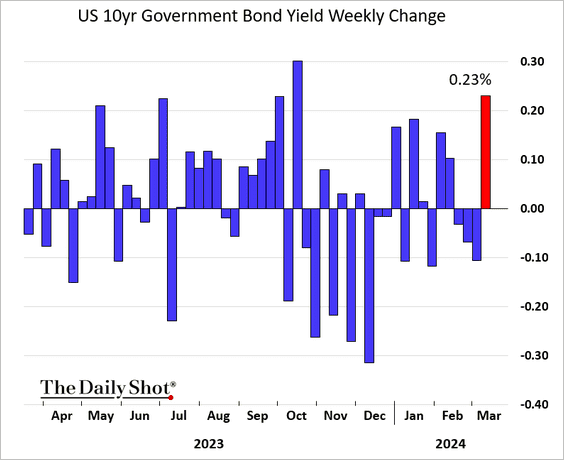

• Treasury yields surged last week, reflecting a growing ‘higher for longer’ interest rate sentiment.

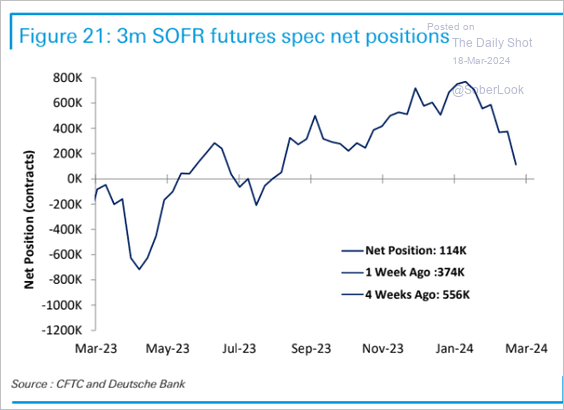

• Traders are trimming their bets on rate cuts.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

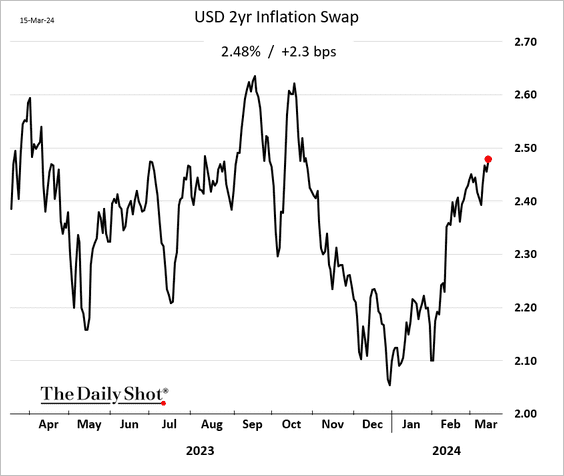

• Market-based inflation expectations have been rising with crude oil prices.

——————–

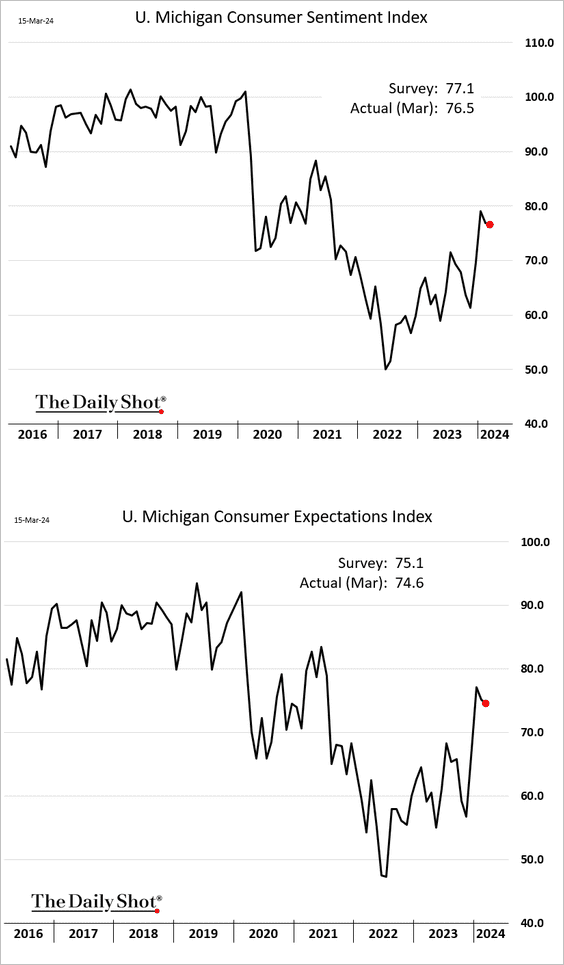

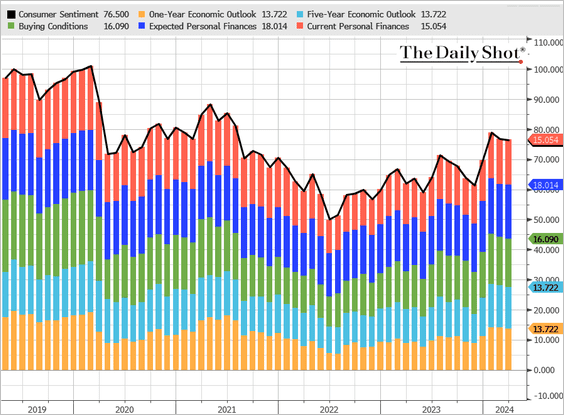

2. The U. Michigan consumer sentiment index edged lower this month.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

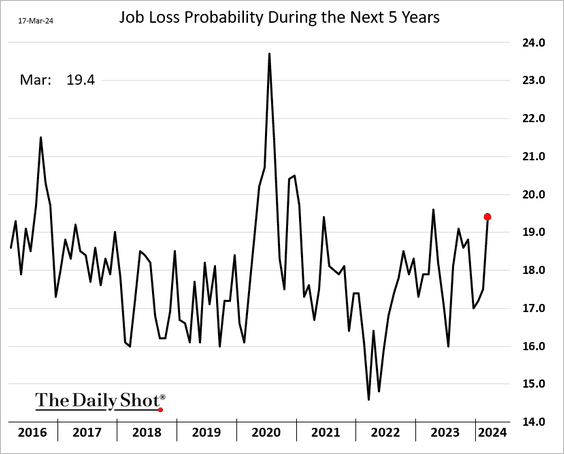

• Concerns over potential job loss in the next five years have intensified.

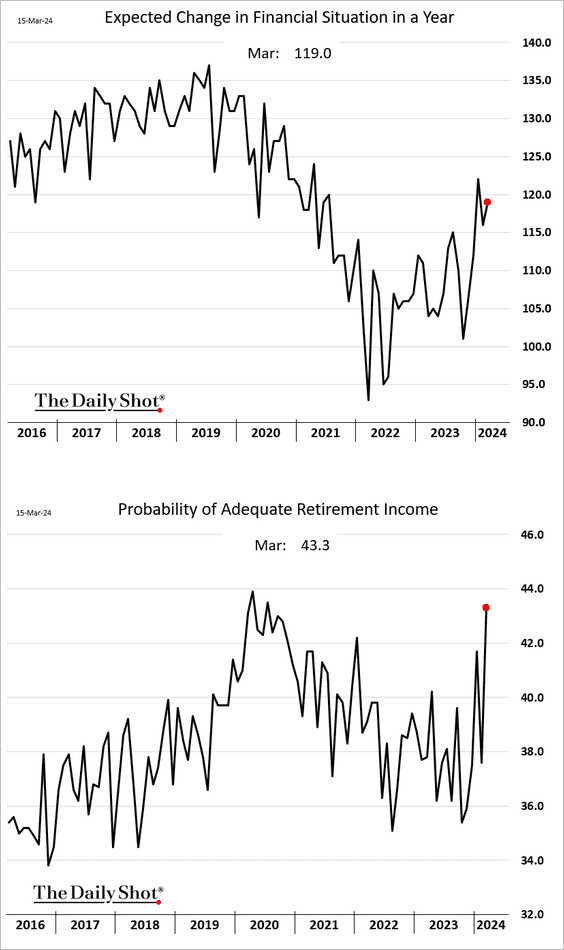

• However, expectations of households’ financial situation improved as stocks surged.

• Buying conditions for vehicles continue to move higher.

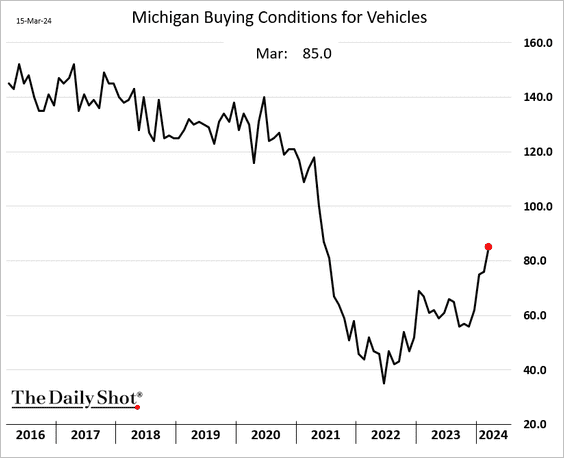

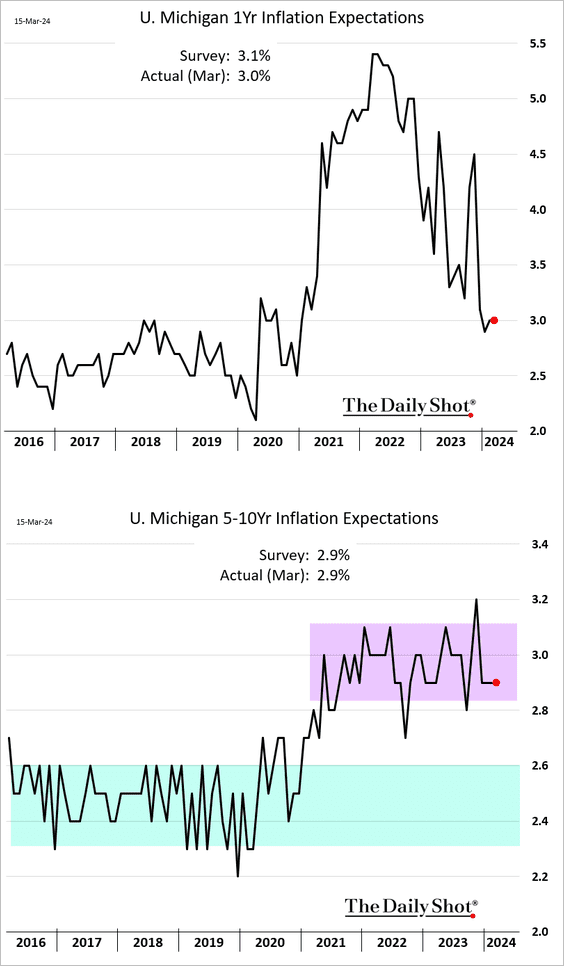

• Inflation expectations were roughly unchanged.

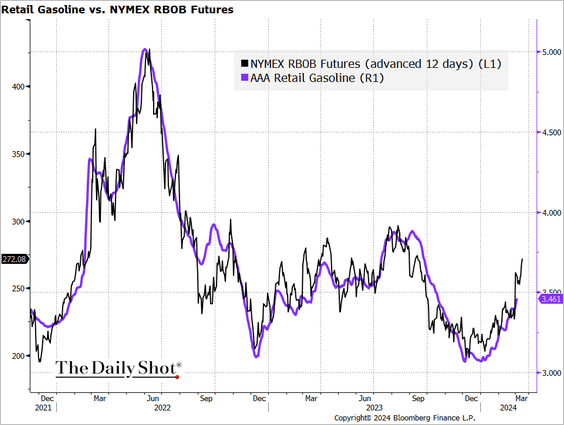

Inflation expectations could be revised upwards later this month due to rising gasoline prices. Futures indicate an increase in pump prices in the coming days.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

——————–

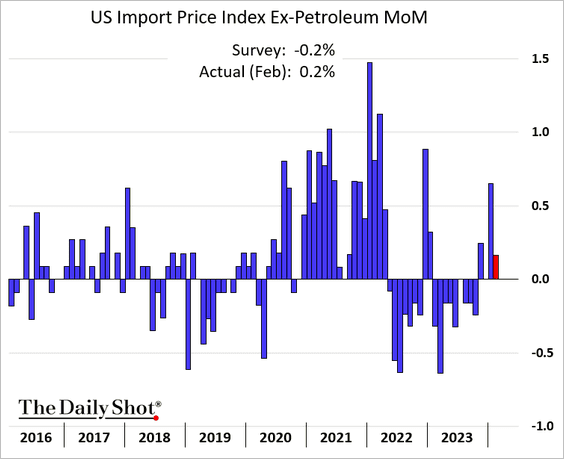

3. US import prices (ex petroleum) unexpectedly climbed last month.

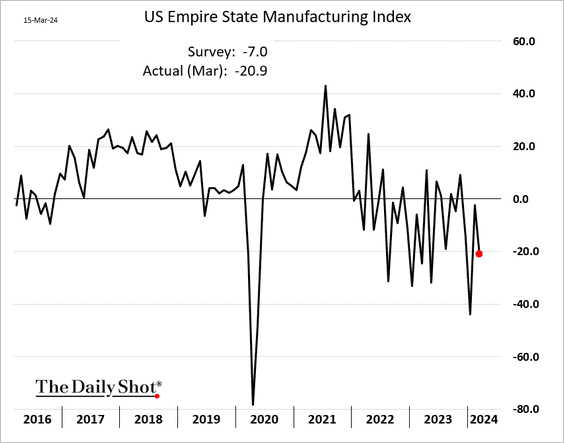

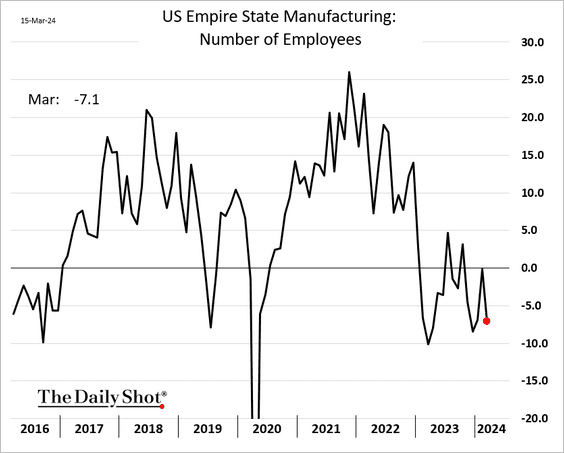

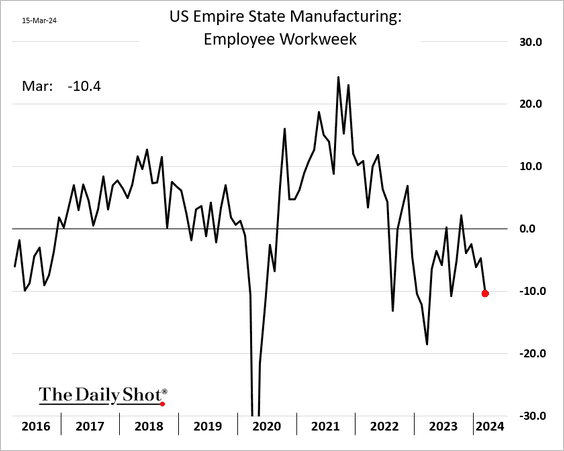

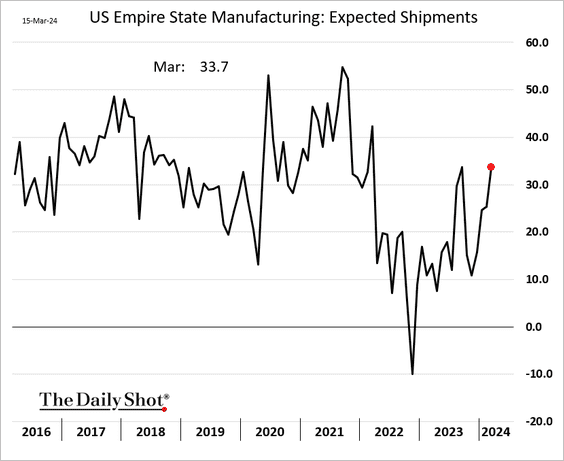

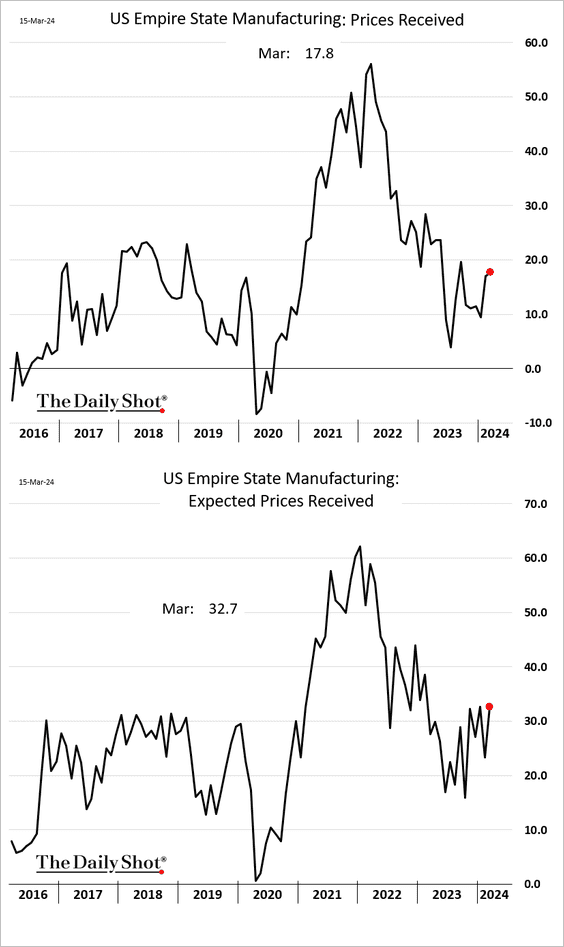

4. The NY Fed’s manufacturing index (Empire Manufacturing) moved deeper into contraction territory this month.

• Employment and workers’ hours declined.

• However, forward-looking indicators were more upbeat.

• Price indices have been trending higher.

——————–

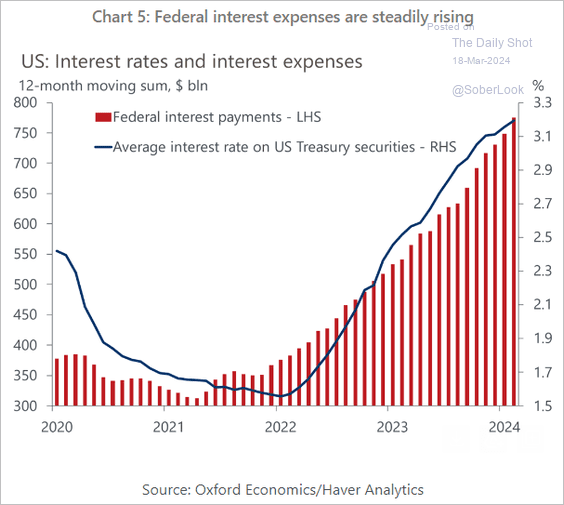

5. The federal government’s interest expenses continue to climb.

Source: Oxford Economics

Source: Oxford Economics

Back to Index

Canada

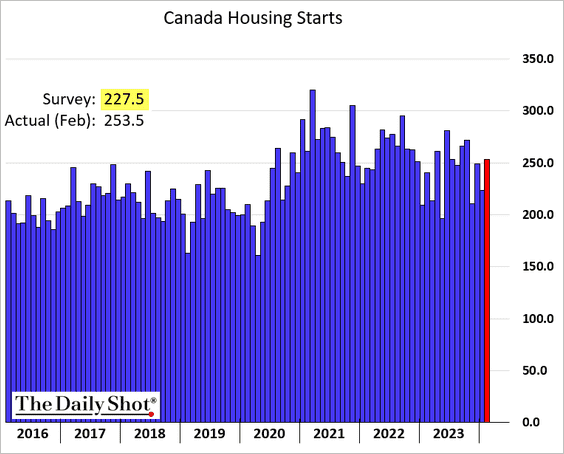

1. Housing starts were stronger than expected last month.

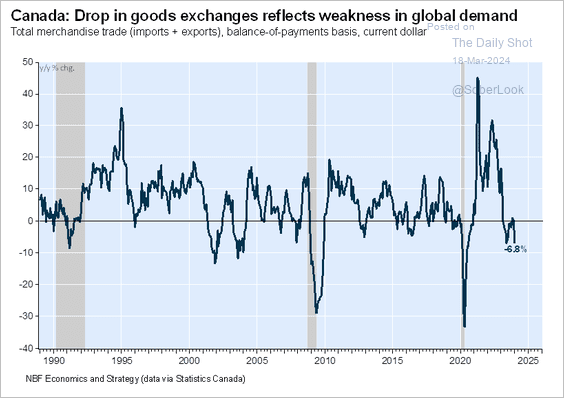

2. Canada’s goods trade is well below last year’s levels.

Source: Economics and Strategy Group, National Bank of Canada

Source: Economics and Strategy Group, National Bank of Canada

Back to Index

The United Kingdom

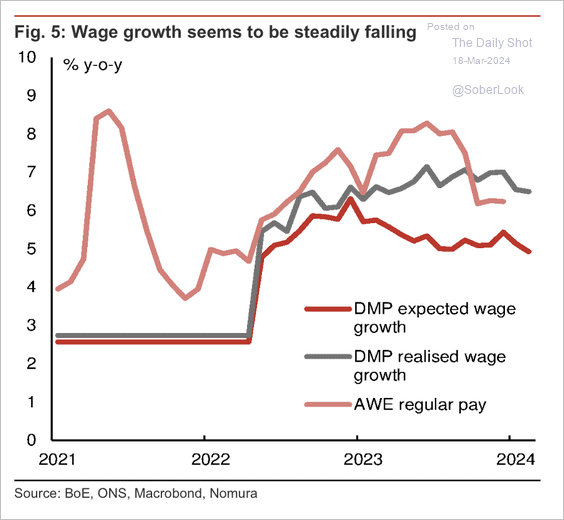

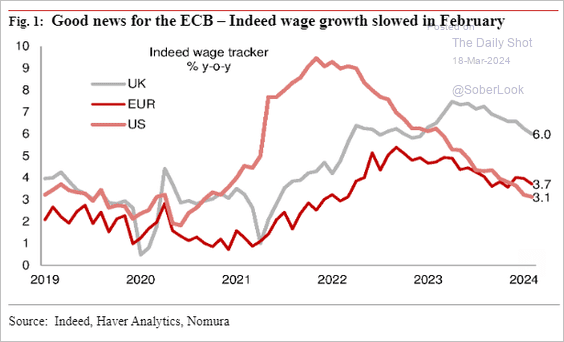

1. Wage growth is drifting lower.

Source: Nomura Securities

Source: Nomura Securities

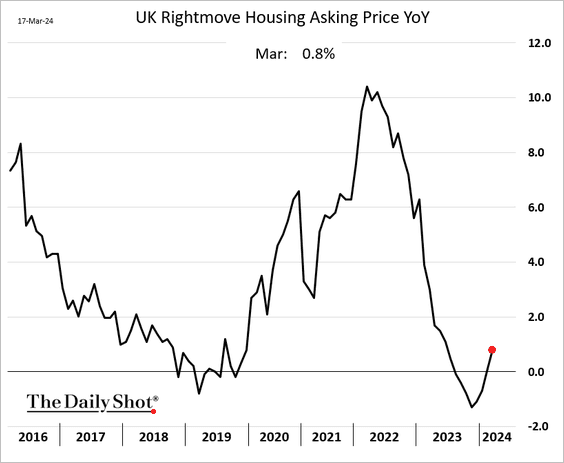

2. House prices are rebounding.

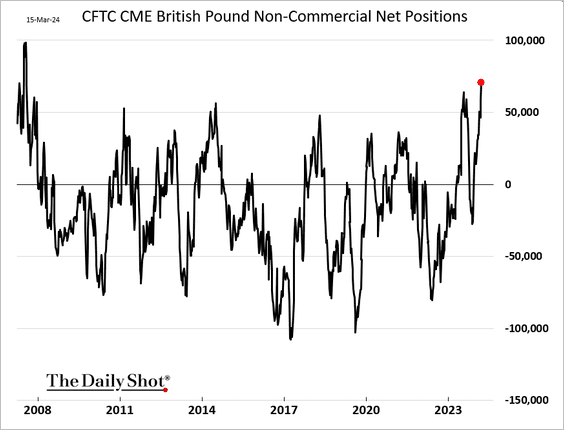

3. Traders haven’t been this bullish on the British pound (vs. USD) in a long time.

Back to Index

The Eurozone

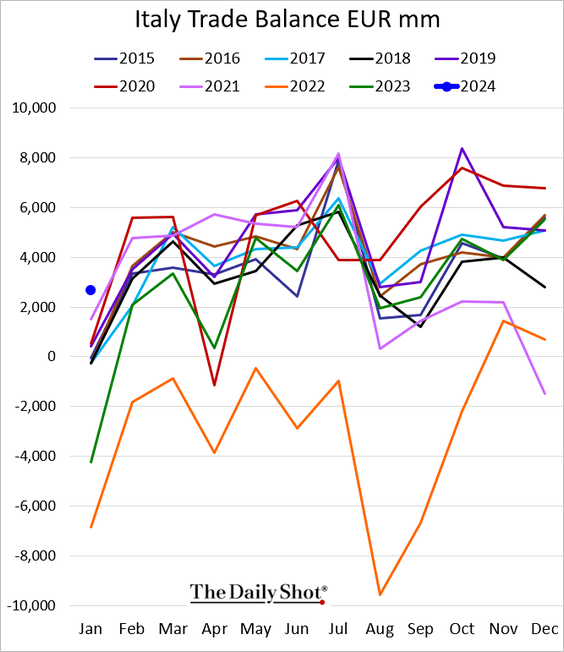

1. Italy was running a trade surplus in January.

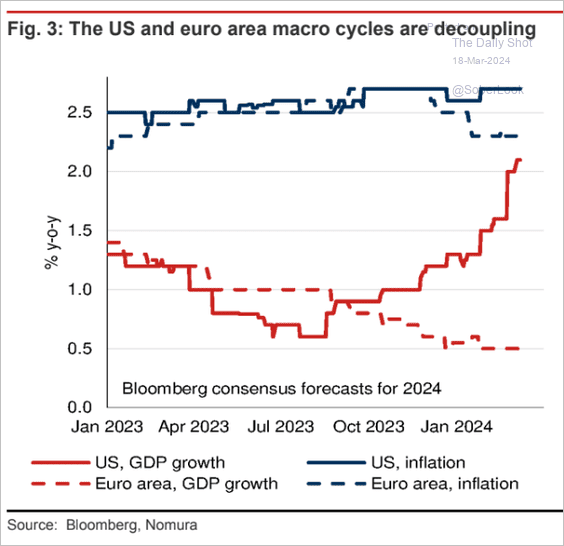

2. Here is a look at the consensus estimates for GDP and inflation over time in the Eurozone and the US.

Source: Nomura Securities

Source: Nomura Securities

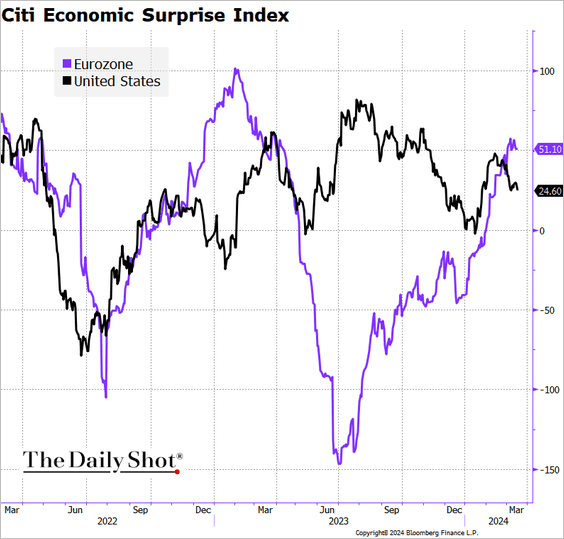

• Euro-area/US economic surprises continue to diverge.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

——————–

3. Wage growth is moderating.

Source: Nomura Securities

Source: Nomura Securities

Back to Index

Europe

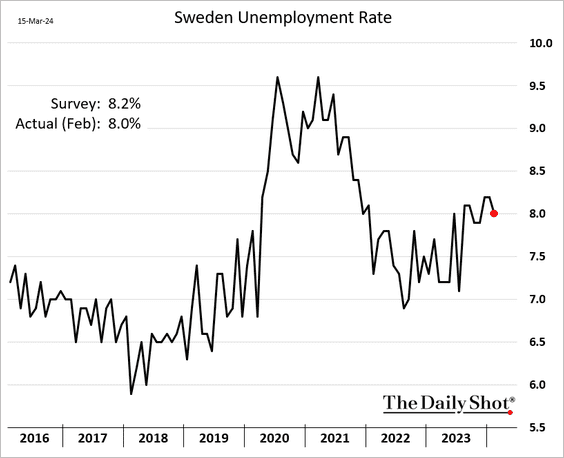

1. Sweden’s unemployment rate, which has been trending higher, declined last month.

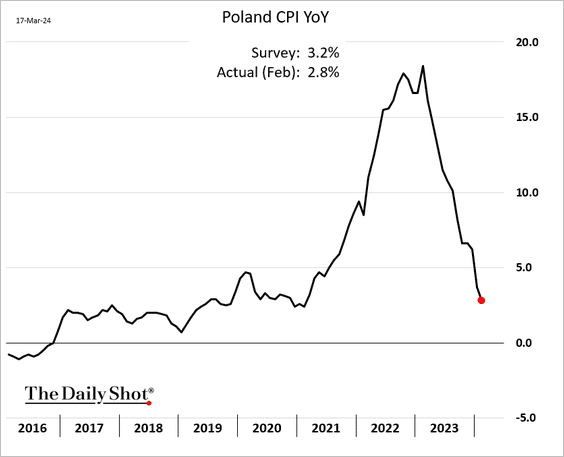

2. Poland’s inflation continues to sink.

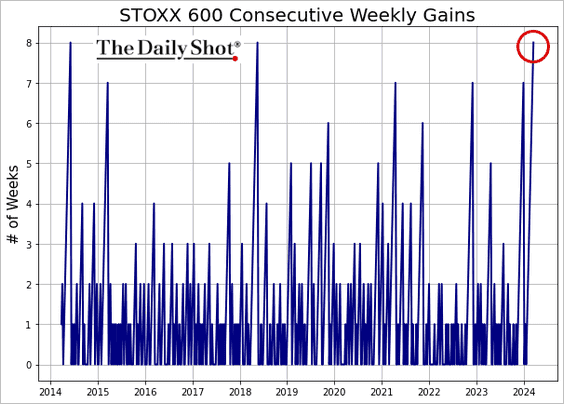

3. STOXX 600 has been up for eight weeks in a row.

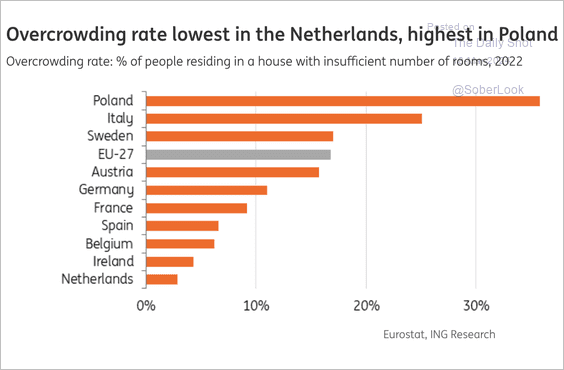

4. Here is a look at overcrowding rates in European homes by country.

Source: ING

Source: ING

Back to Index

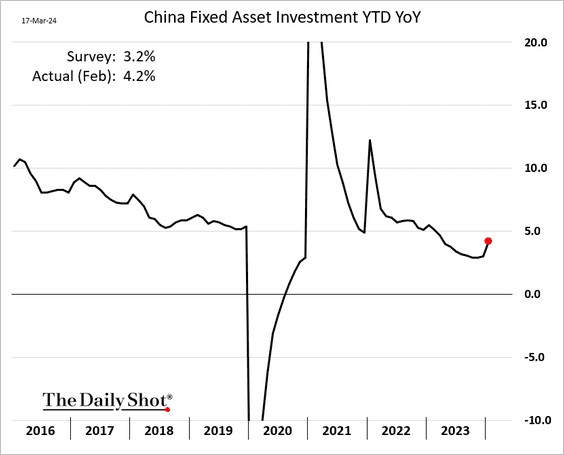

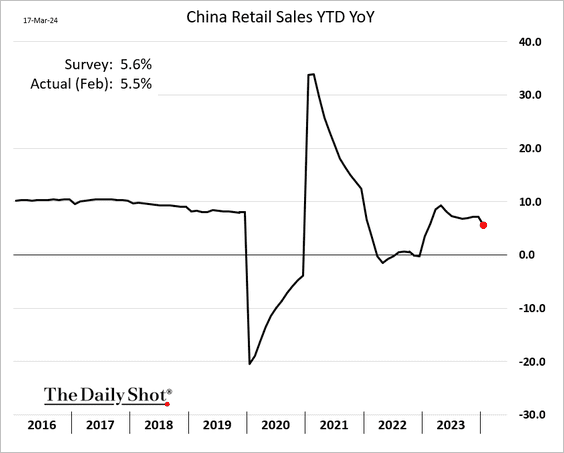

China

1. Industrial output surprised to the upside.

Source: Reuters Read full article

Source: Reuters Read full article

• Fixed-asset investment was also robust in the first two months of the year.

• Retail sales were roughly in line with expectations.

Source: @economics Read full article

Source: @economics Read full article

——————–

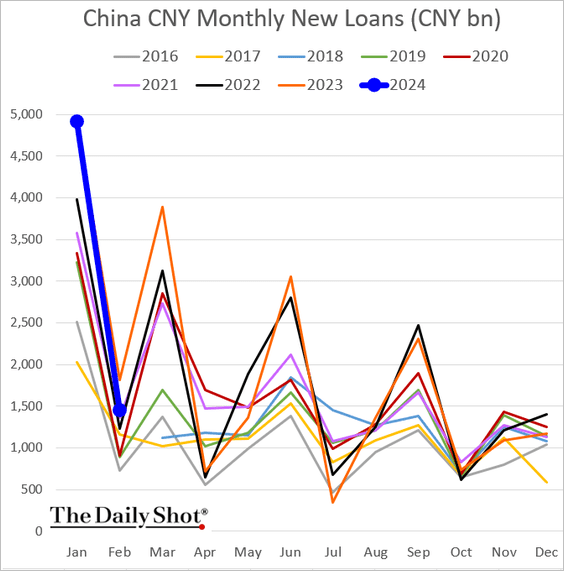

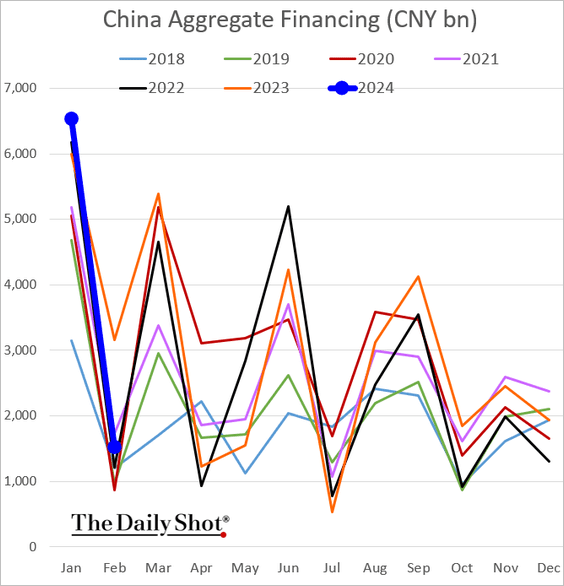

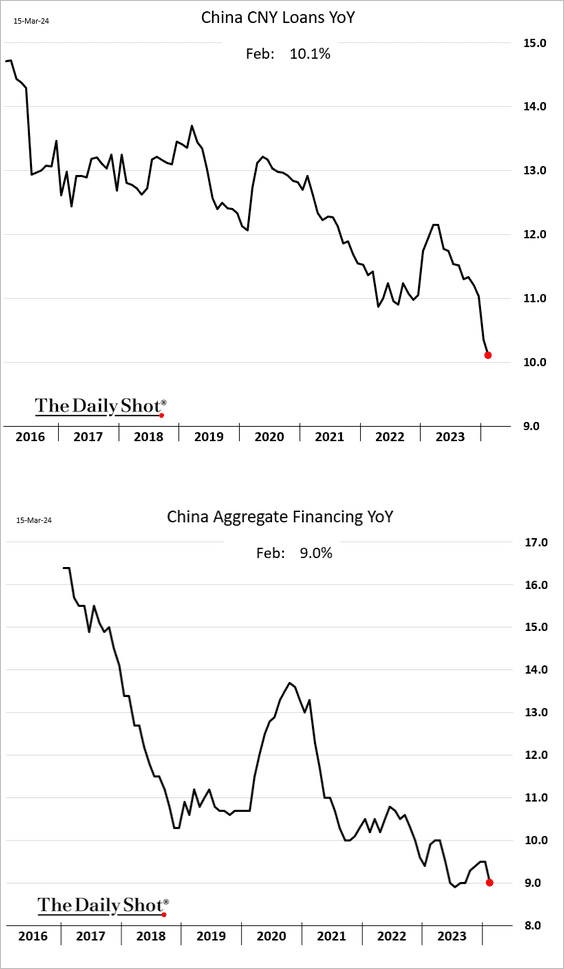

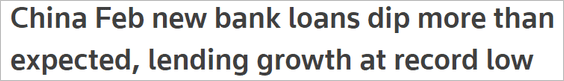

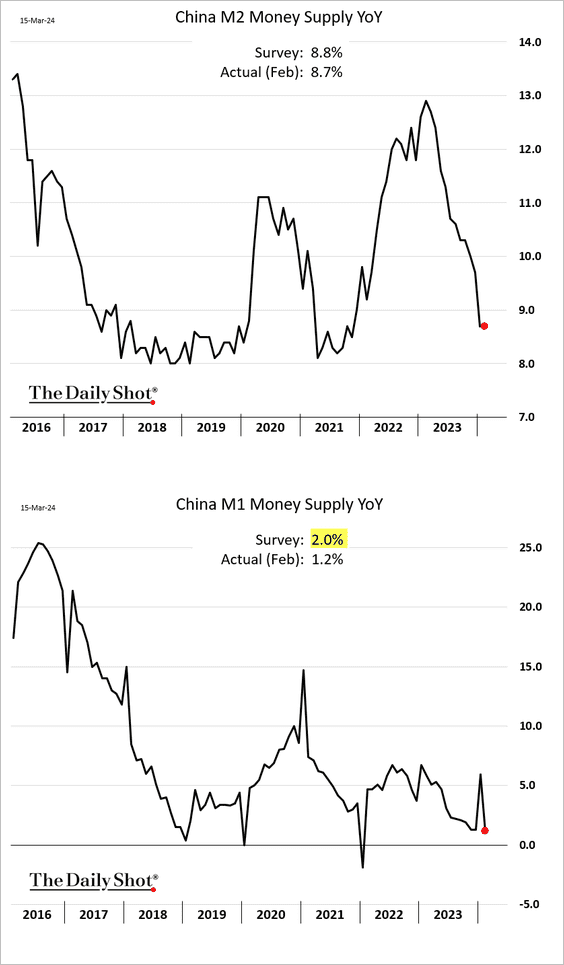

2. Credit growth slowed last month.

– Bank loans:

– Total financing:

– Year-over-year changes:

Source: Reuters Read full article

Source: Reuters Read full article

• The money supply growth has been trending lower.

——————–

3. The CSI 300 index is nearing its 200-day moving average.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

Back to Index

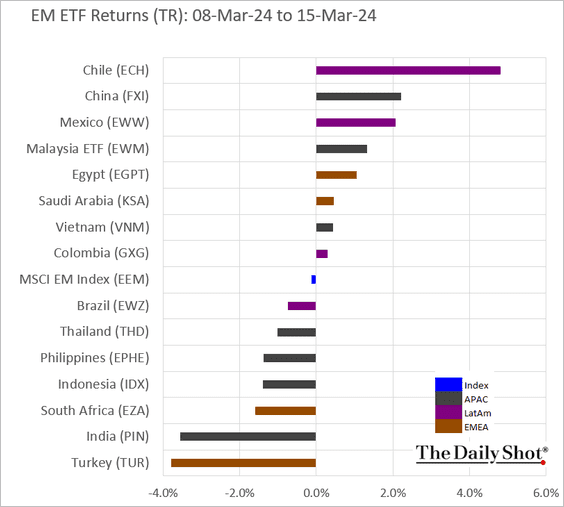

Emerging Markets

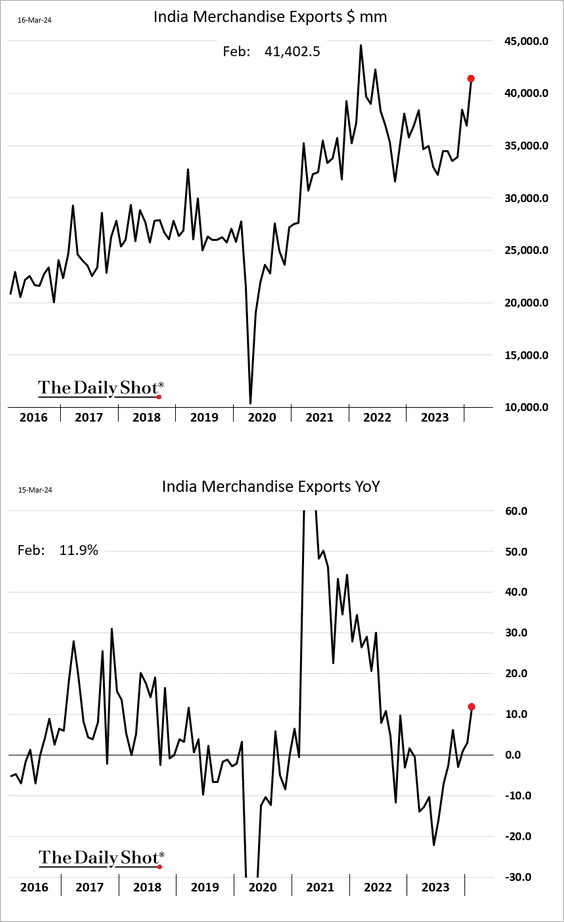

1. India’s exports jumped last month.

Source: The Indian Express Read full article

Source: The Indian Express Read full article

——————–

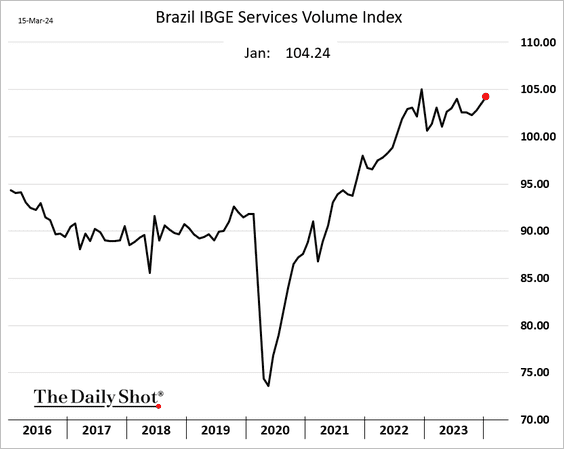

2. Brazil’s service sector output strengthened in January.

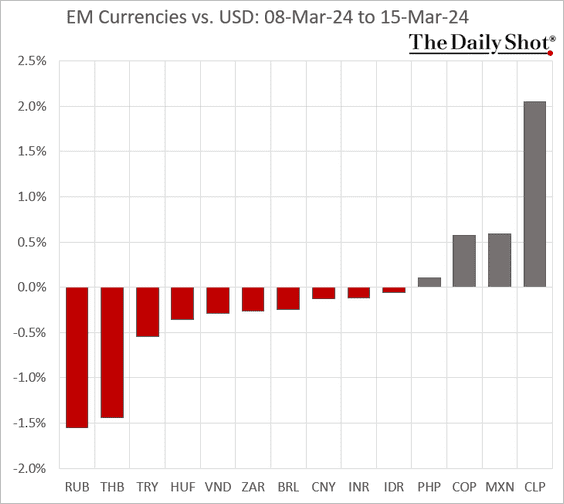

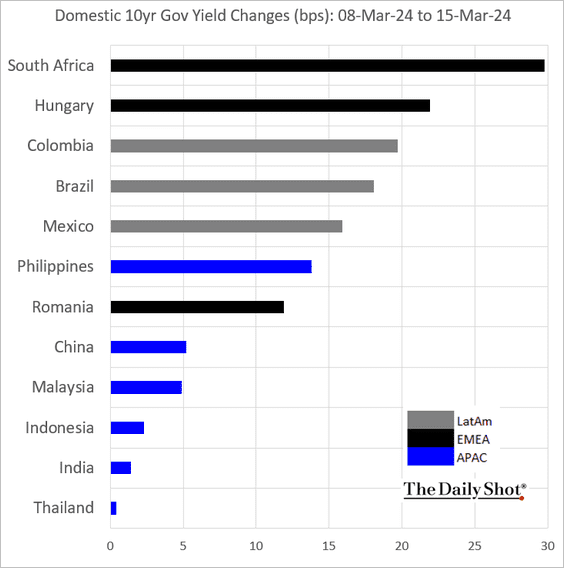

3. Here is a look at last week’s performance.

• Currencies:

• Bond yields:

• Equity ETFs:

Back to Index

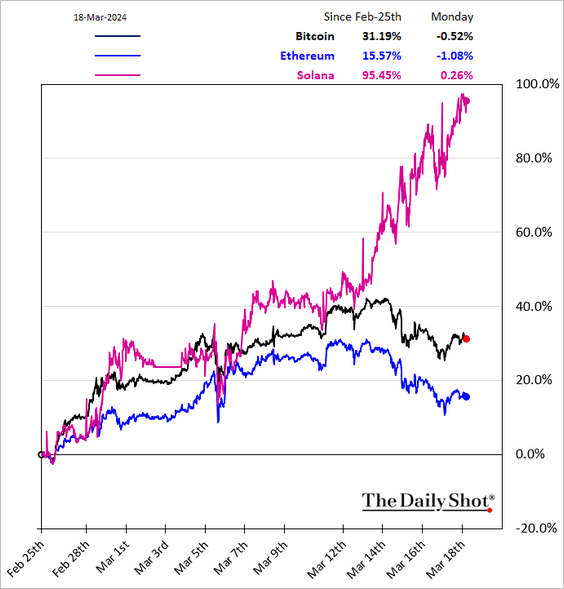

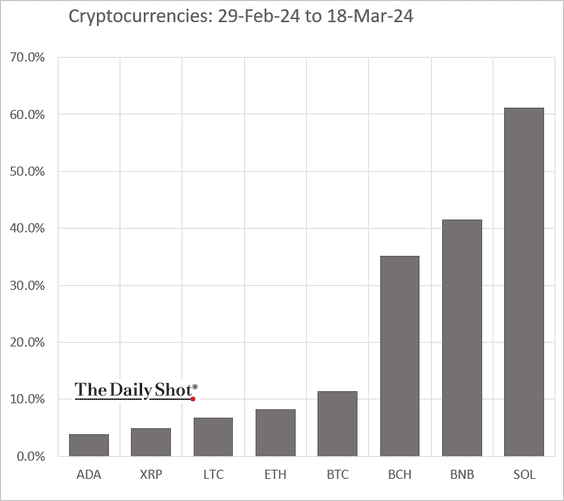

Cryptocurrency

1. Solana has been surging.

Source: crypto.news Read full article

Source: crypto.news Read full article

Here is the month-to-date performance.

——————–

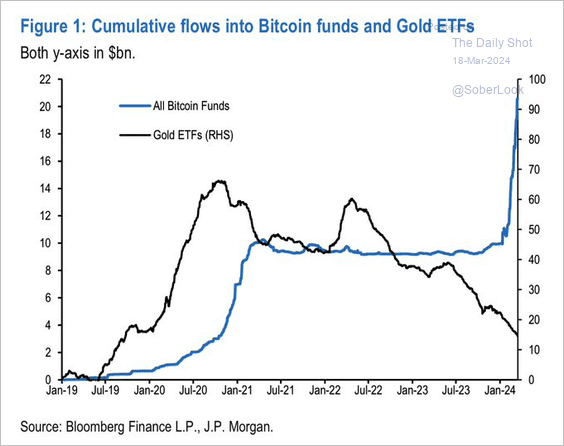

2. Bitcoin fund flows have diverged from gold.

Source: JP Morgan Research; @WallStJesus

Source: JP Morgan Research; @WallStJesus

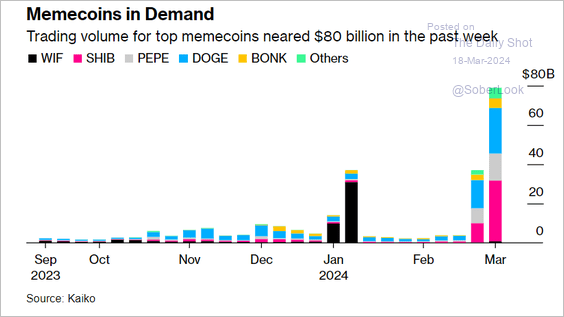

3. The trading volume in memecoins soared this month.

Source: @wealth Read full article

Source: @wealth Read full article

Back to Index

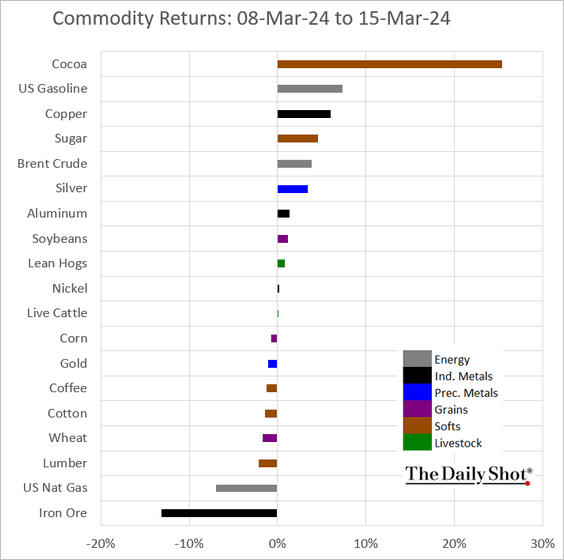

Commodities

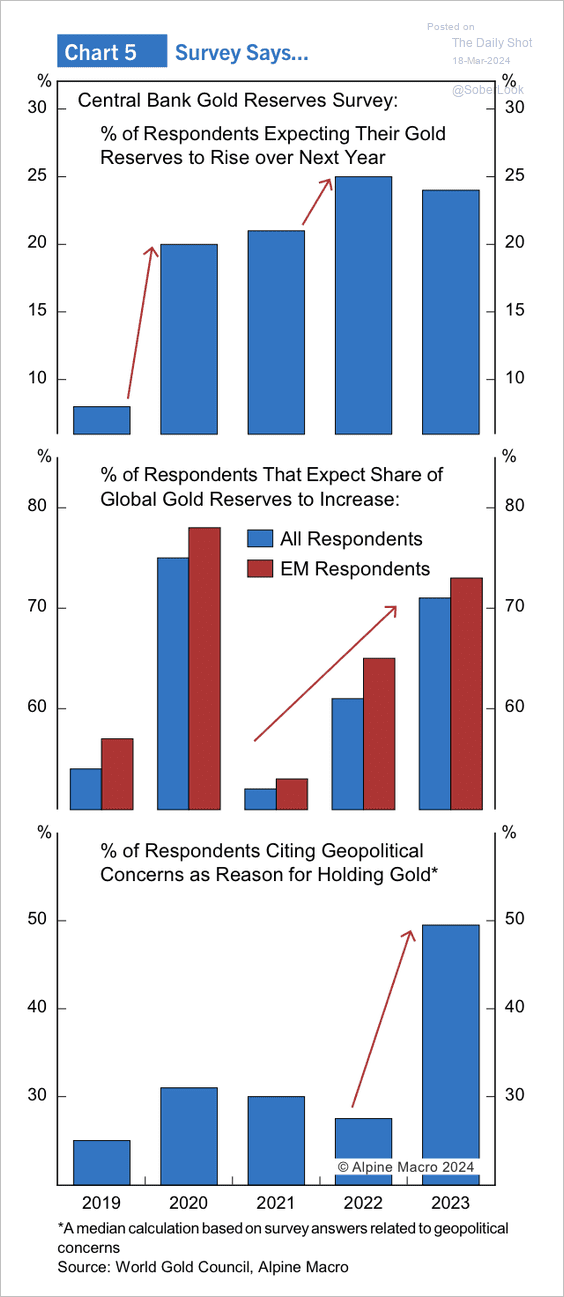

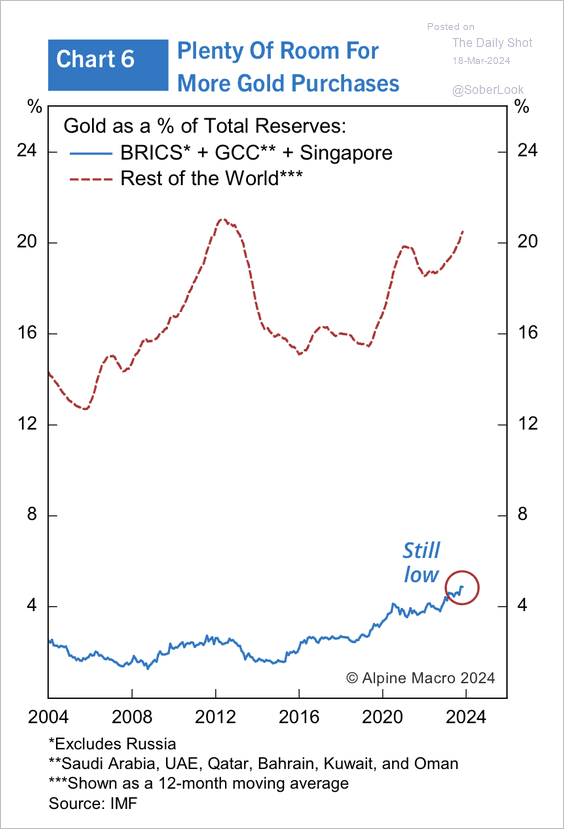

1. Central banks have room to acquire more gold reserves. (2 charts)

Source: Alpine Macro

Source: Alpine Macro

Source: Alpine Macro

Source: Alpine Macro

——————–

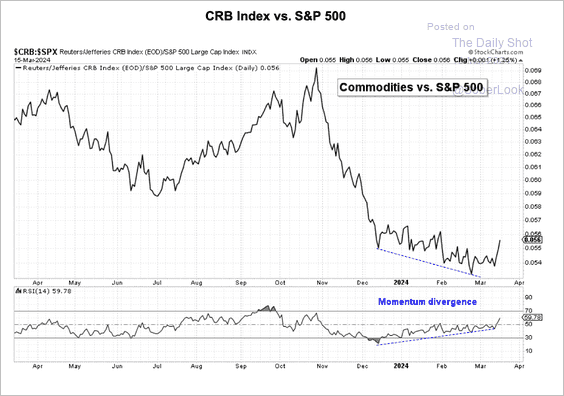

2. Commodities are starting to improve relative to the S&P 500.

Source: Aazan Habib, Paradigm Capital

Source: Aazan Habib, Paradigm Capital

3. This chart shows last week’s performance across key commodity markets.

Back to Index

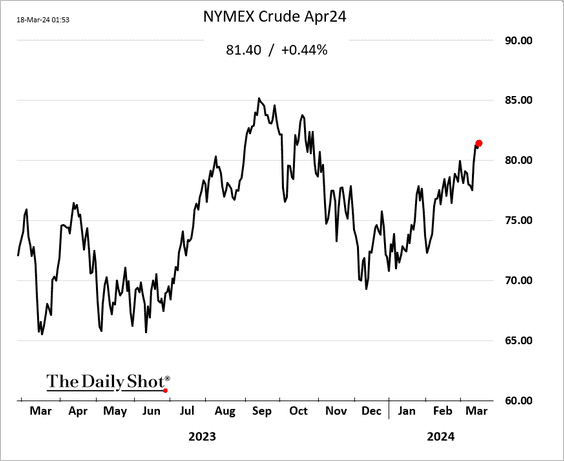

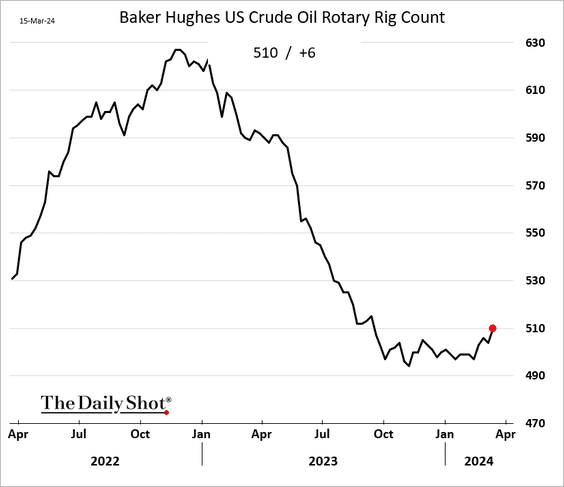

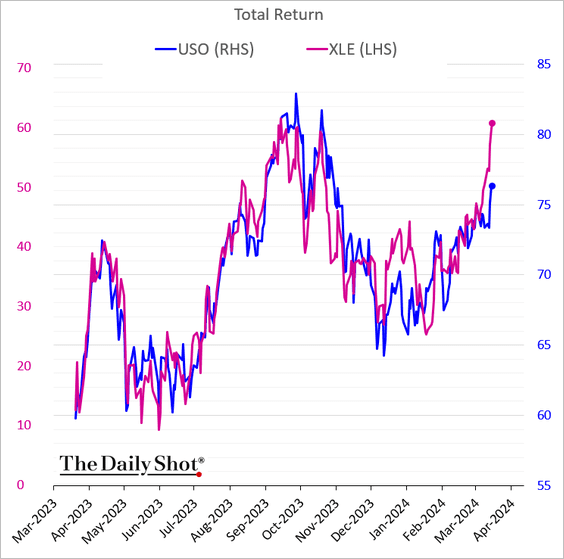

Energy

1. Crude oil futures continue to climb.

2. The US rig count is rebounding with prices.

3. Energy shares have been outperforming crude oil.

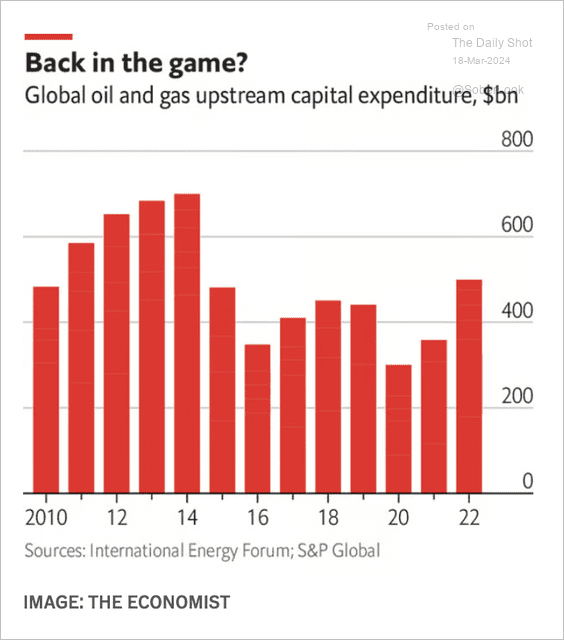

4. Here is a look at the trend in global oil and gas upstream investment.

Source: The Economist Read full article

Source: The Economist Read full article

Back to Index

Equities

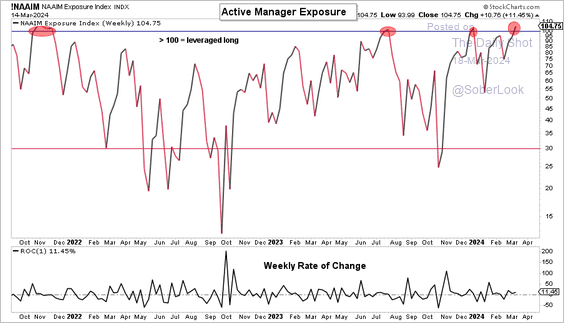

1. Bullish positioning in US equities is getting crowded.

Source: Aazan Habib, Paradigm Capital

Source: Aazan Habib, Paradigm Capital

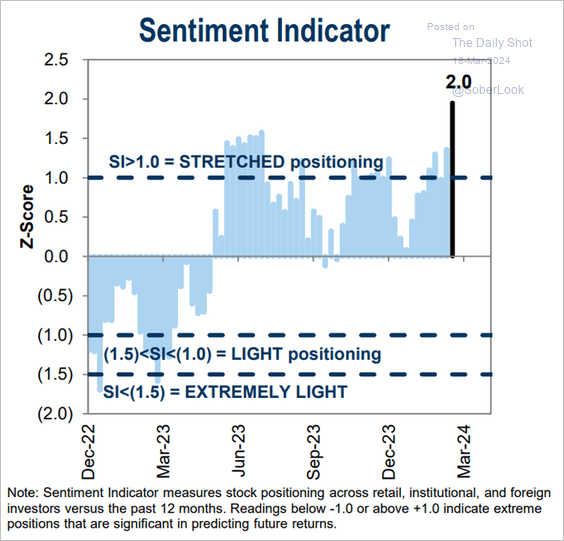

• Here is Goldman’s sentiment indicator.

Source: Goldman Sachs; @MikeZaccardi

Source: Goldman Sachs; @MikeZaccardi

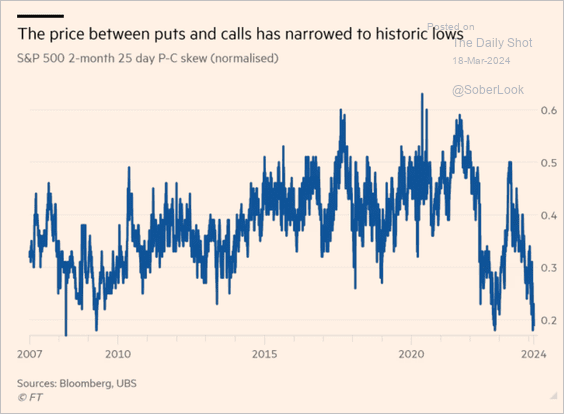

• The volatility skew points to market complacency setting in (the title is supposed to say “25 delta”).

Source: @financialtimes Read full article

Source: @financialtimes Read full article

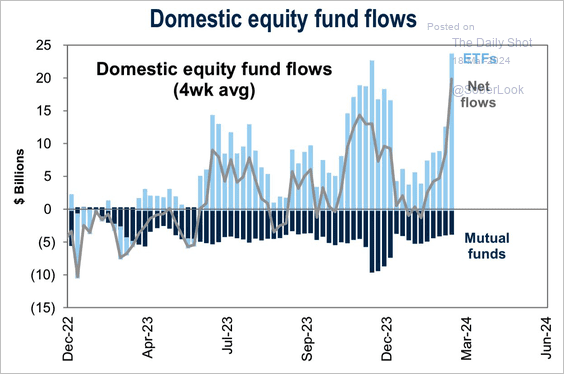

• Fund inflows have been surging.

Source: Goldman Sachs; @WallStJesus

Source: Goldman Sachs; @WallStJesus

——————–

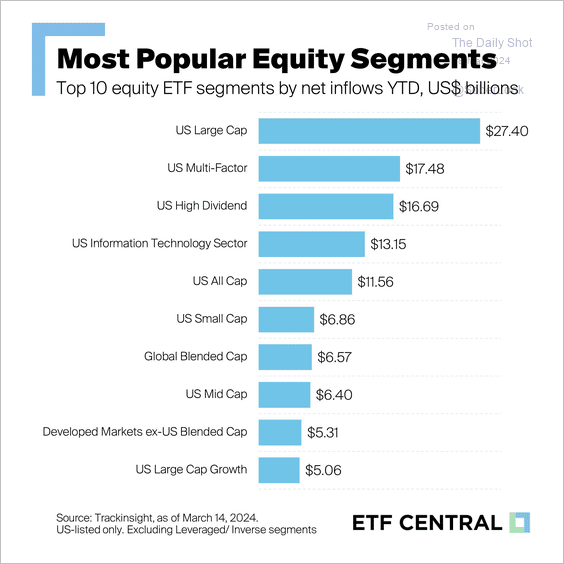

2. The following ETF segments have attracted the most funds year-to-date.

Source: The ETF Shelf

Source: The ETF Shelf

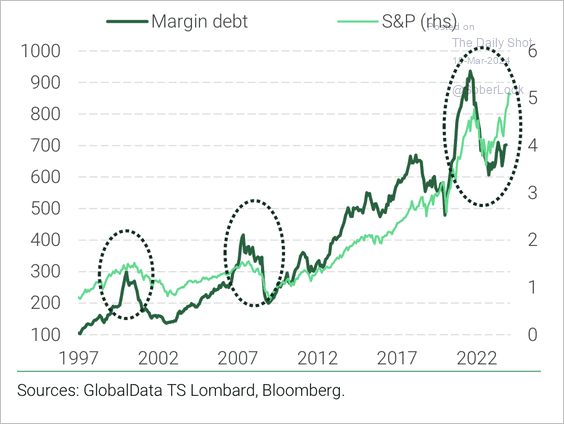

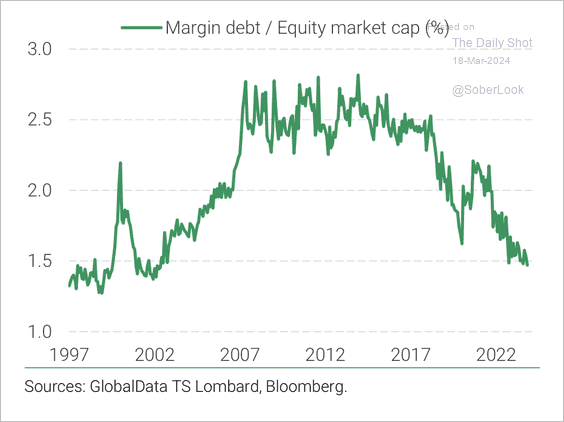

3. Unlike in 2020, margin debt has risen modestly and has declined relative to the S&P 500 market cap. (2 charts)

Source: TS Lombard

Source: TS Lombard

Source: TS Lombard

Source: TS Lombard

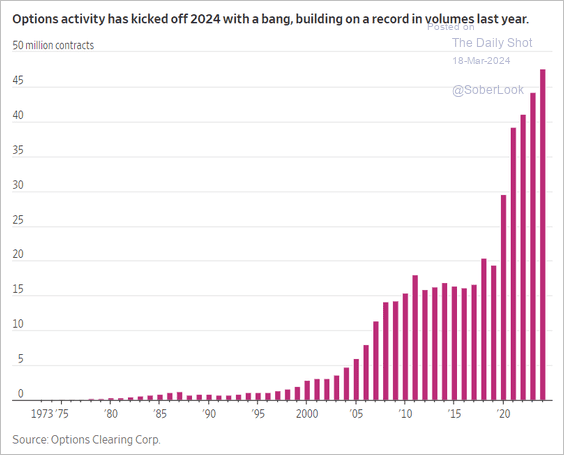

Market leverage has shifted from margin borrowing to options.

Source: @WSJ Read full article

Source: @WSJ Read full article

——————–

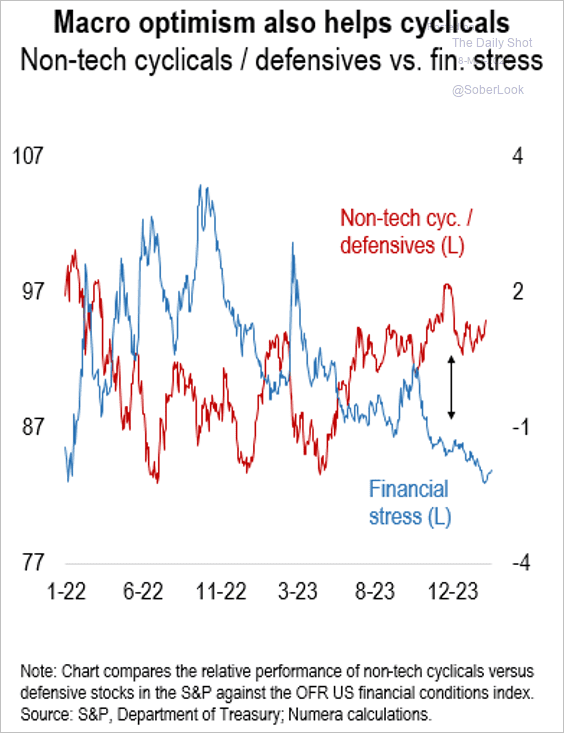

4. US non-tech cyclicals have benefited from low financial stress.

Source: Numera Analytics (@NumeraAnalytics)

Source: Numera Analytics (@NumeraAnalytics)

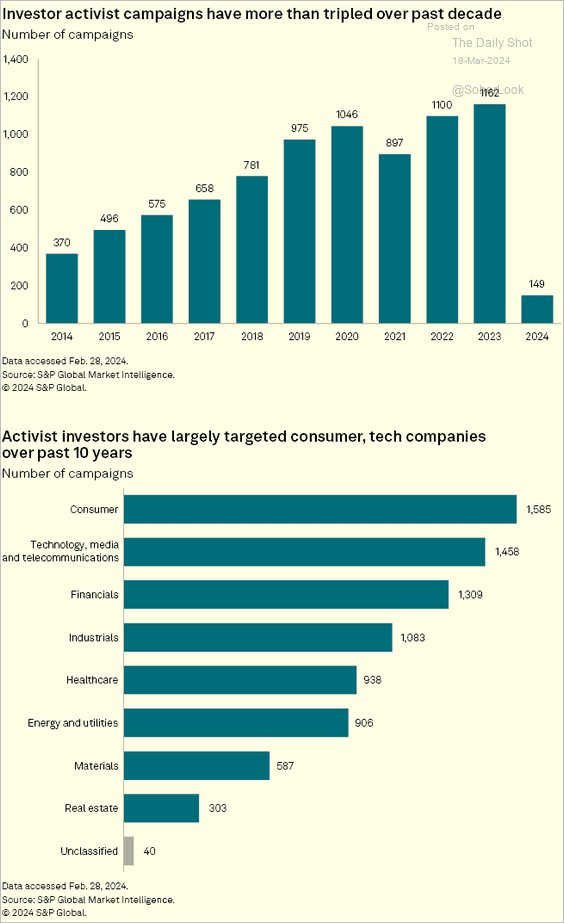

5. Here is a look at activist campaigns.

Source: S&P Global Market Intelligence

Source: S&P Global Market Intelligence

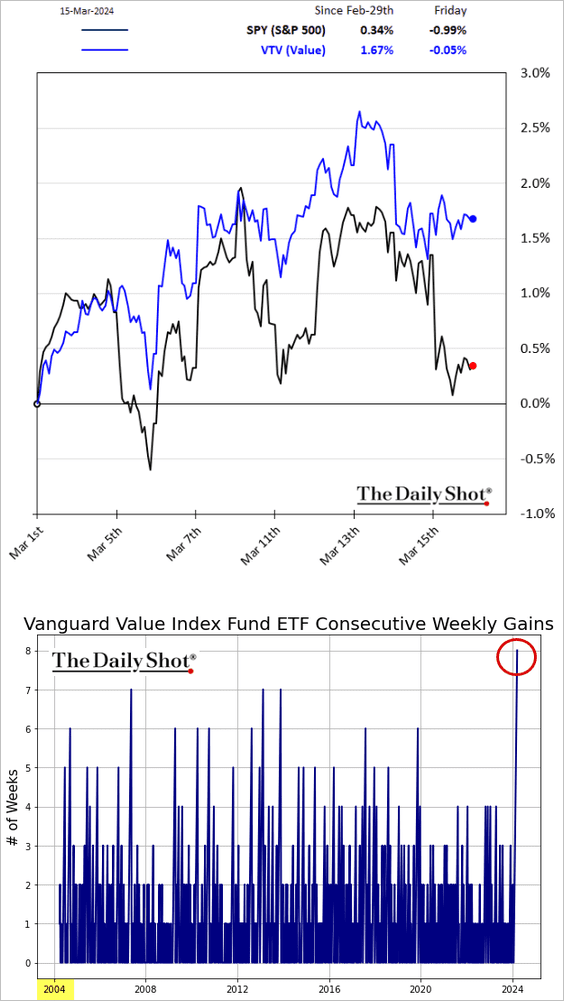

6. Value stocks have been outperforming in recent days. Vanguard’s value ETF has been up for eight weeks in a row.

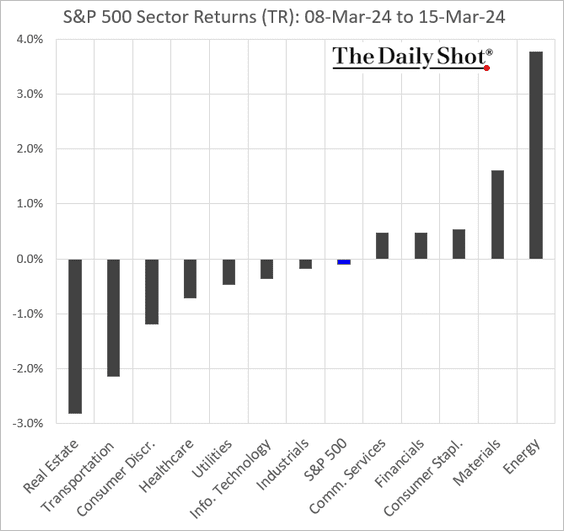

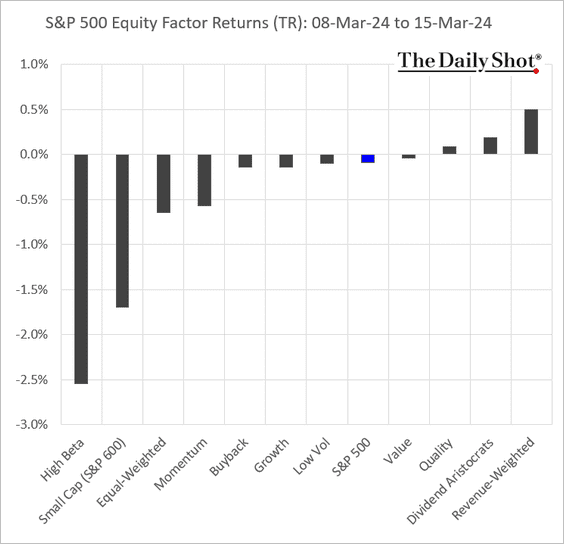

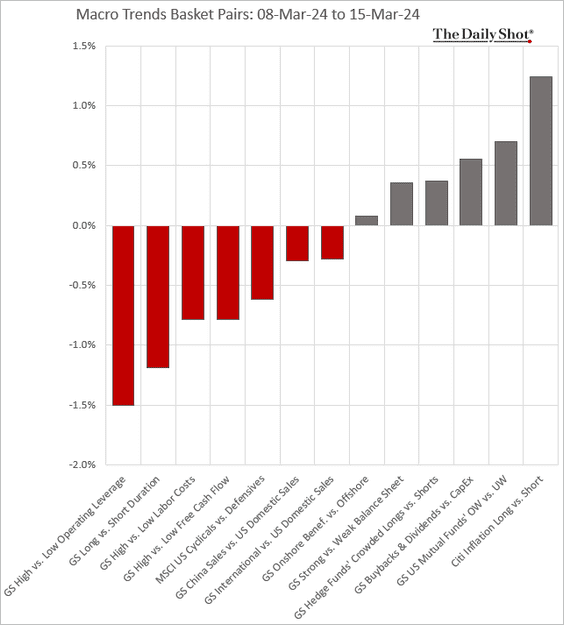

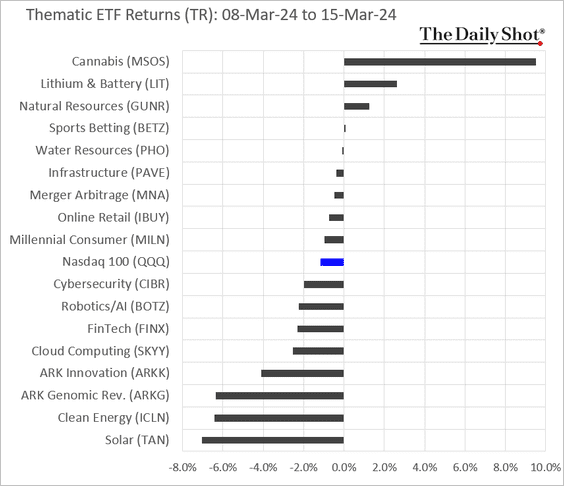

7. Next, let’s take a look at last week’s performance data.

• Sectors:

• Equity factors:

• Macro basket pairs’ relative performance:

• Thematic ETFs:

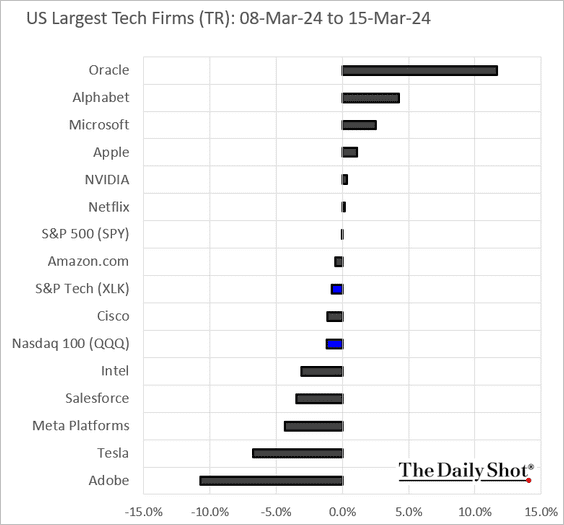

• Largest US tech firms:

Back to Index

Credit

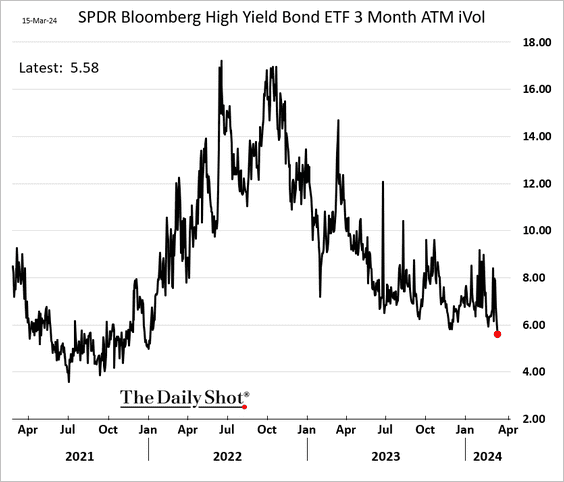

1. The implied volatility in high-yield bonds has been trending lower.

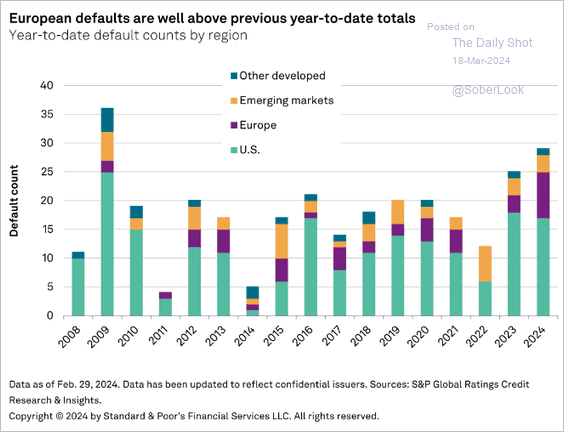

2. Global corporate defaults are at the highest level since 2009.

Source: S&P Global Ratings

Source: S&P Global Ratings

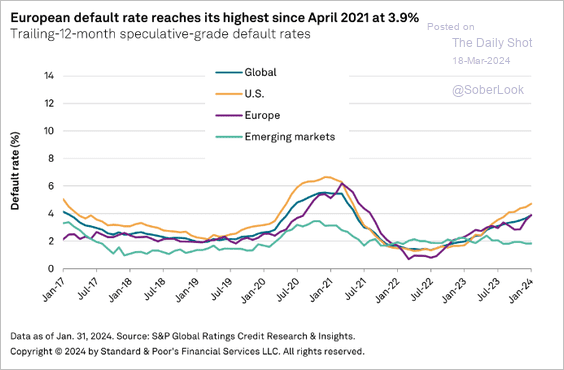

• US and European default rates are climbing.

Source: S&P Global Ratings

Source: S&P Global Ratings

——————–

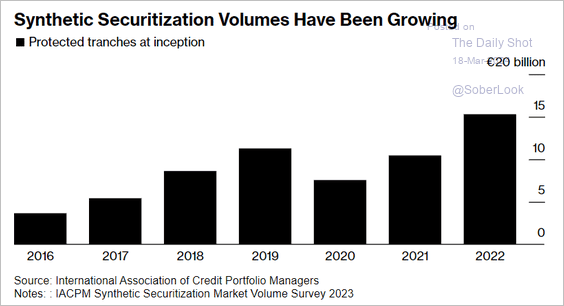

3. Synthetic risk transfers have been increasingly popular.

Source: @markets Read full article

Source: @markets Read full article

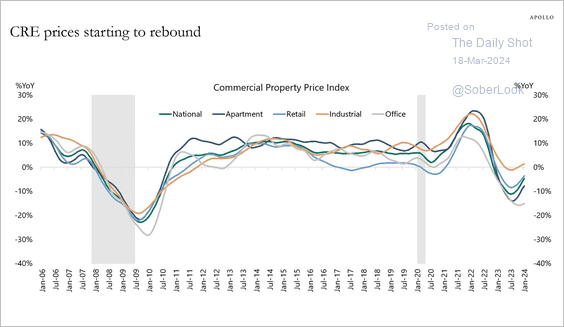

4. Commercial real estate prices are starting to rebound.

Source: Torsten Slok, Apollo

Source: Torsten Slok, Apollo

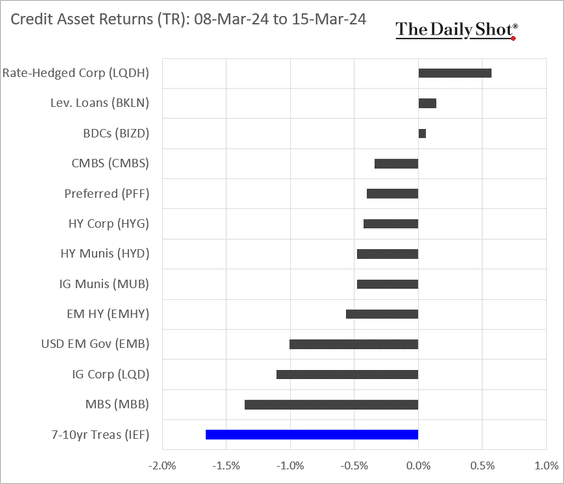

5. Here is a look at last week’s performance (price weakness driven by Treasuries).

Back to Index

Global Developments

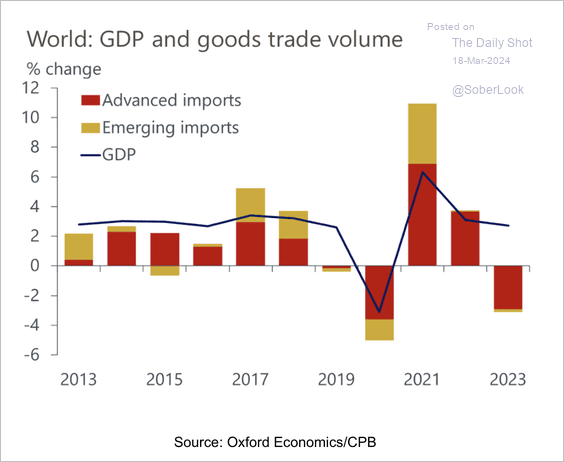

1. World goods trade declined last year.

Source: Oxford Economics

Source: Oxford Economics

2. The combined performance of ETFs tracking stocks, Treasuries, and credit hit a multi-year high this month.

![]() Source: @markets Read full article

Source: @markets Read full article

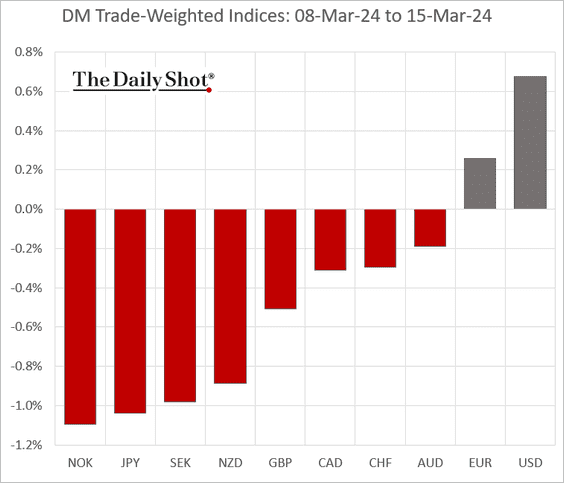

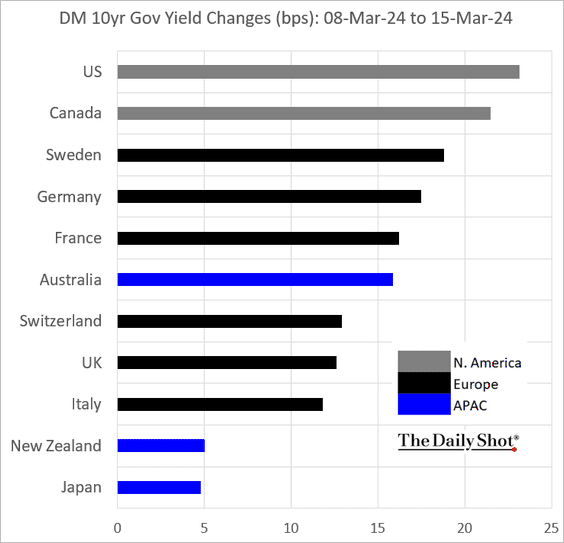

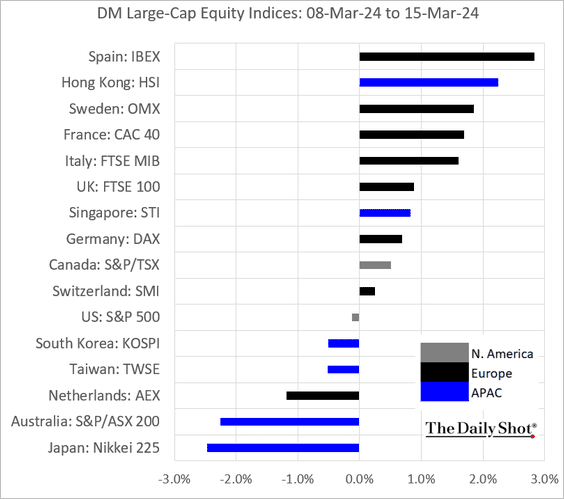

3. Here is last week’s performance across advanced economies.

• Currencies:

• Bond yields:

• Large-cap equities:

——————–

Food for Thought

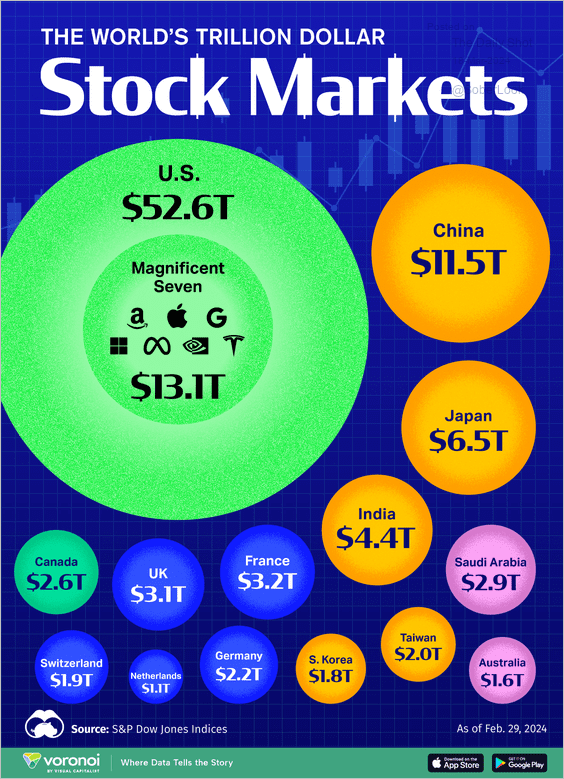

1. The scale of the world’s largest stock markets by country:

Source: Visual Capitalist Read full article

Source: Visual Capitalist Read full article

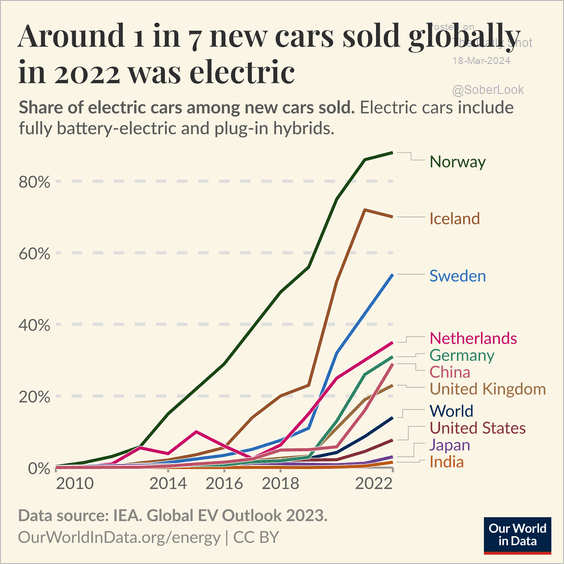

2. Global adoption of electric vehicles in new car sales:

Source: @OurWorldInData

Source: @OurWorldInData

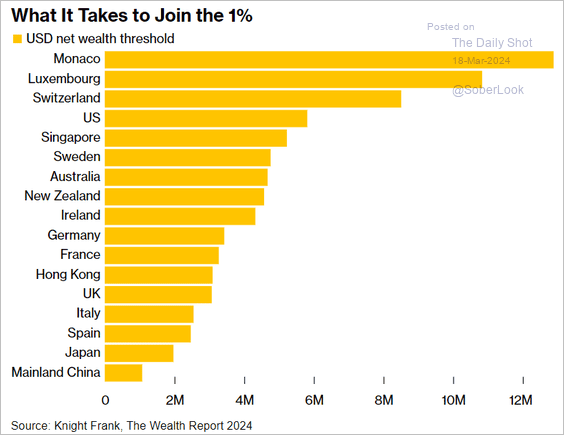

3. What it takes to join the 1%:

Source: @economics Read full article

Source: @economics Read full article

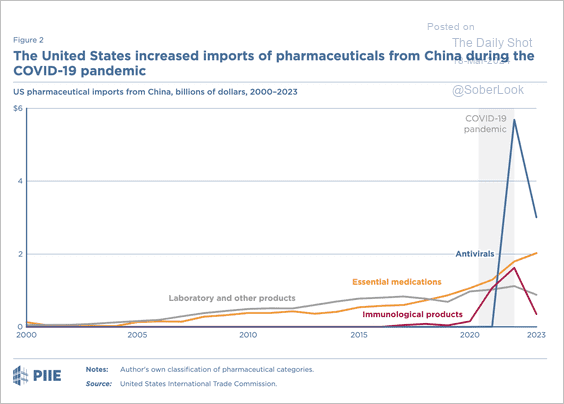

4. US pharmaceutical imports from China:

Source: PIIE Read full article

Source: PIIE Read full article

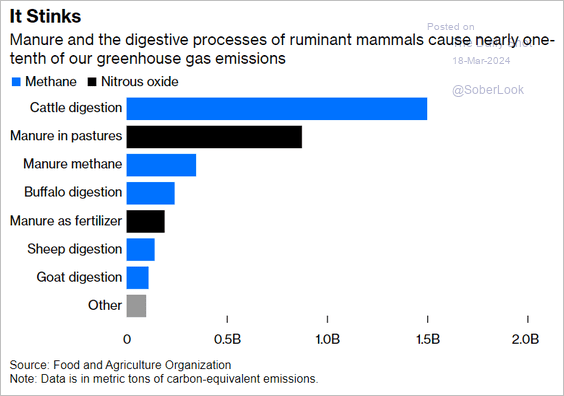

5. Ruminant livestock emissions:

Source: @davidfickling, @opinion Read full article

Source: @davidfickling, @opinion Read full article

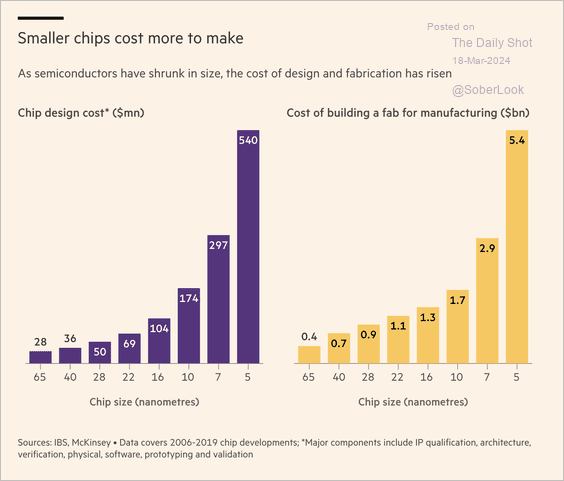

6. Chip design and fabrication costs:

Source: @financialtimes Read full article

Source: @financialtimes Read full article

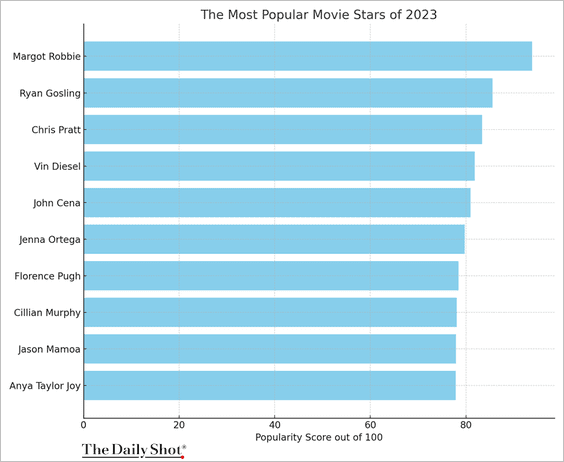

7. The most popular movie stars of 2023:

Source: NoDepositRewards.com

Source: NoDepositRewards.com

——————–

Back to Index