The Daily Shot: 16-Apr-24

• The United States

• Canada

• The United Kingdom

• The Eurozone

• Europe

• Asia-Pacific

• China

• Emerging Markets

• Cryptocurrency

• Commodities

• Energy

• Equities

• Rates

• Food for Thought

The United States

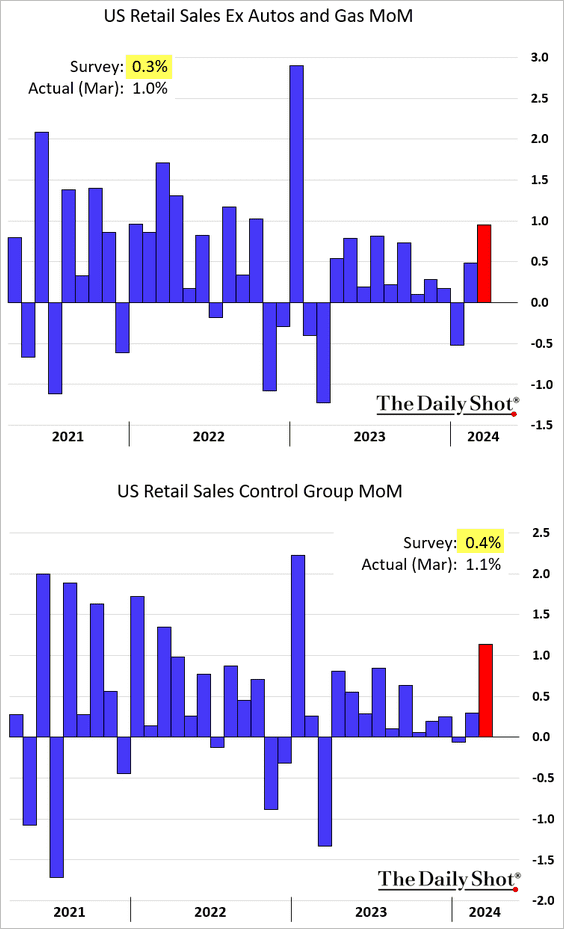

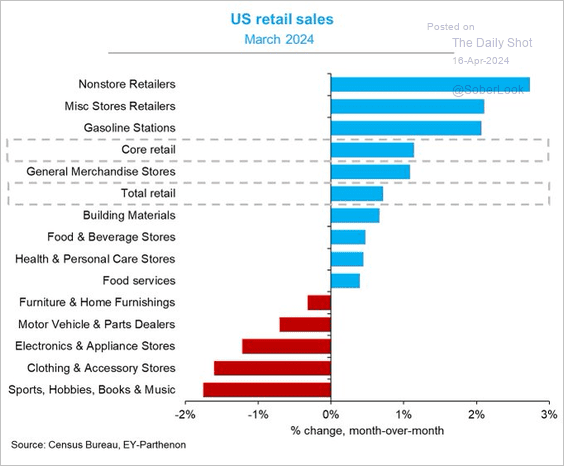

1. Retail sales surged last month, topping expectations.

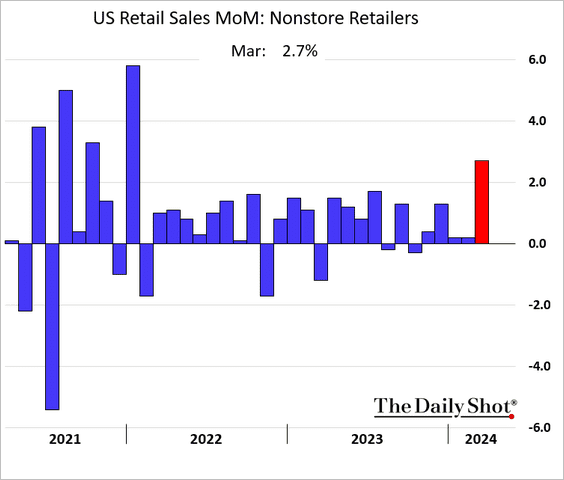

• Online sales registered their largest increase since January 2022.

• Vehicle sales declined.

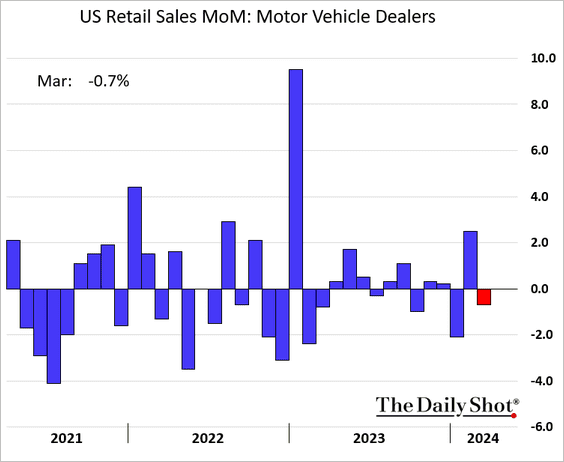

• Here are the March changes in retail sales by sector.

Source: @GregDaco

Source: @GregDaco

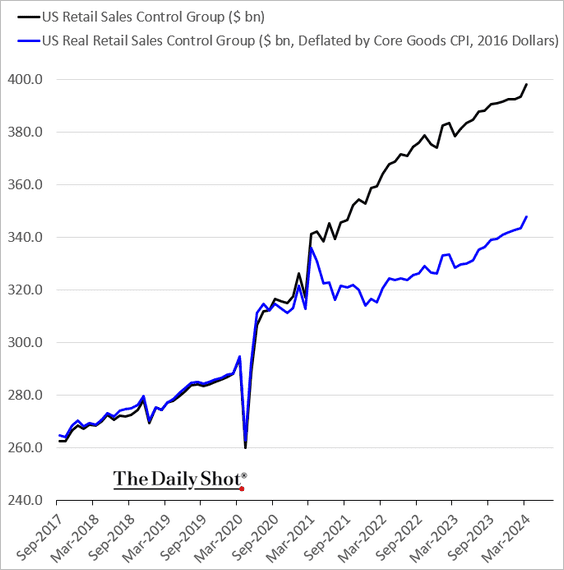

• This chart shows nominal and real core retail sales.

——————–

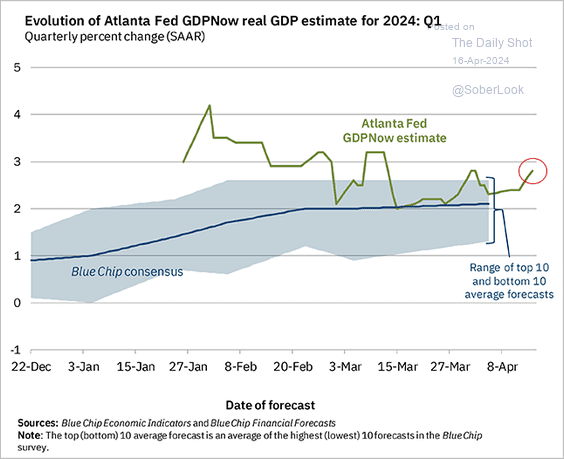

2. The Atlanta Fed’s GDPNow estimate for Q1 GDP growth jumped after the retail sales surprise.

Source: Federal Reserve Bank of Atlanta

Source: Federal Reserve Bank of Atlanta

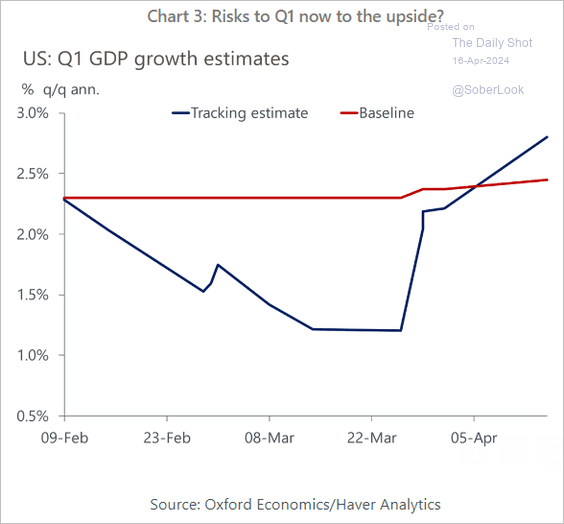

• Here is the Oxford Economics’ GDP tracker.

Source: Oxford Economics

Source: Oxford Economics

——————–

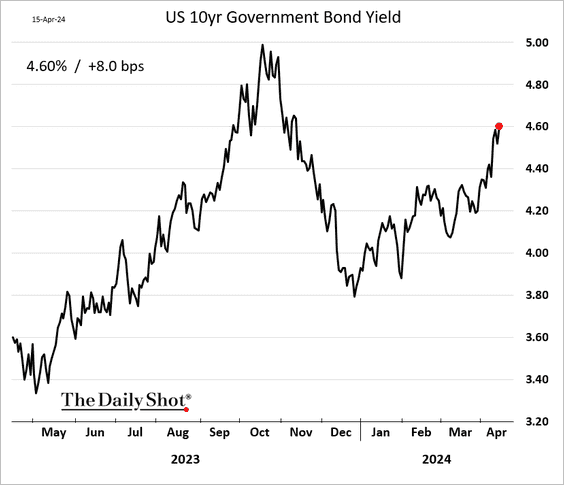

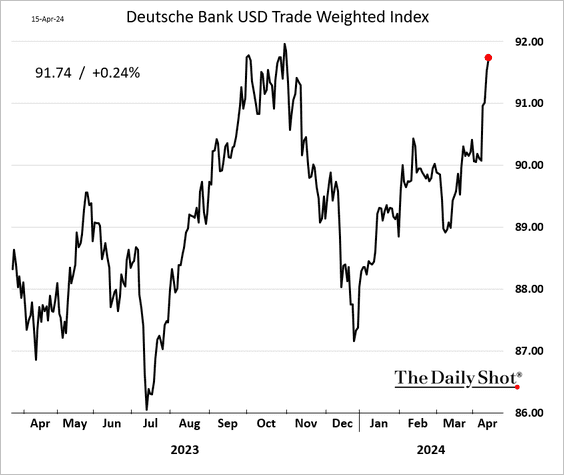

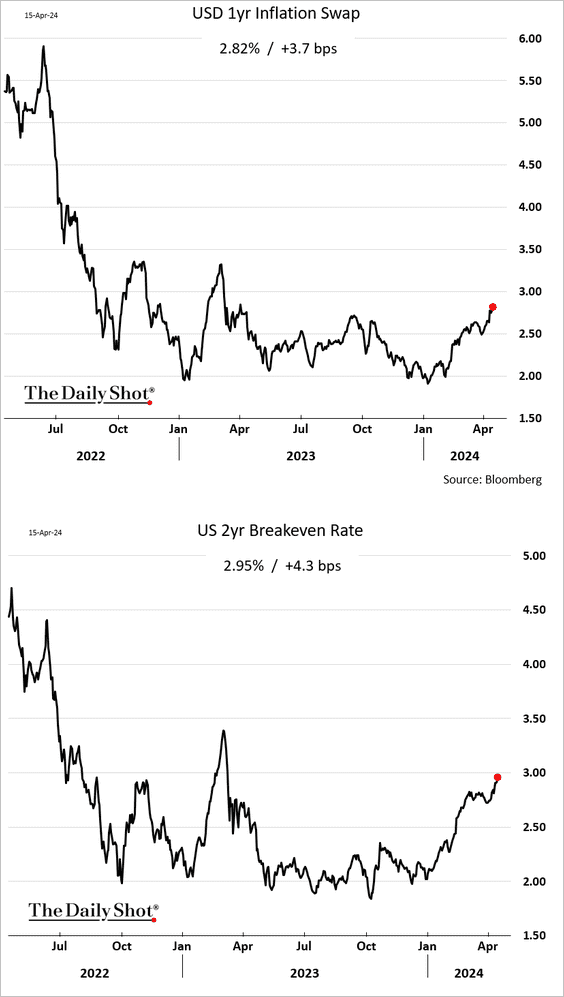

3. Following the robust retail sales report, Treasury yields and the US dollar rose further. Robust US consumption may sustain elevated inflation levels.

Source: @financialtimes Read full article

Source: @financialtimes Read full article

• Short-term market-based inflation expectations are rebounding

——————–

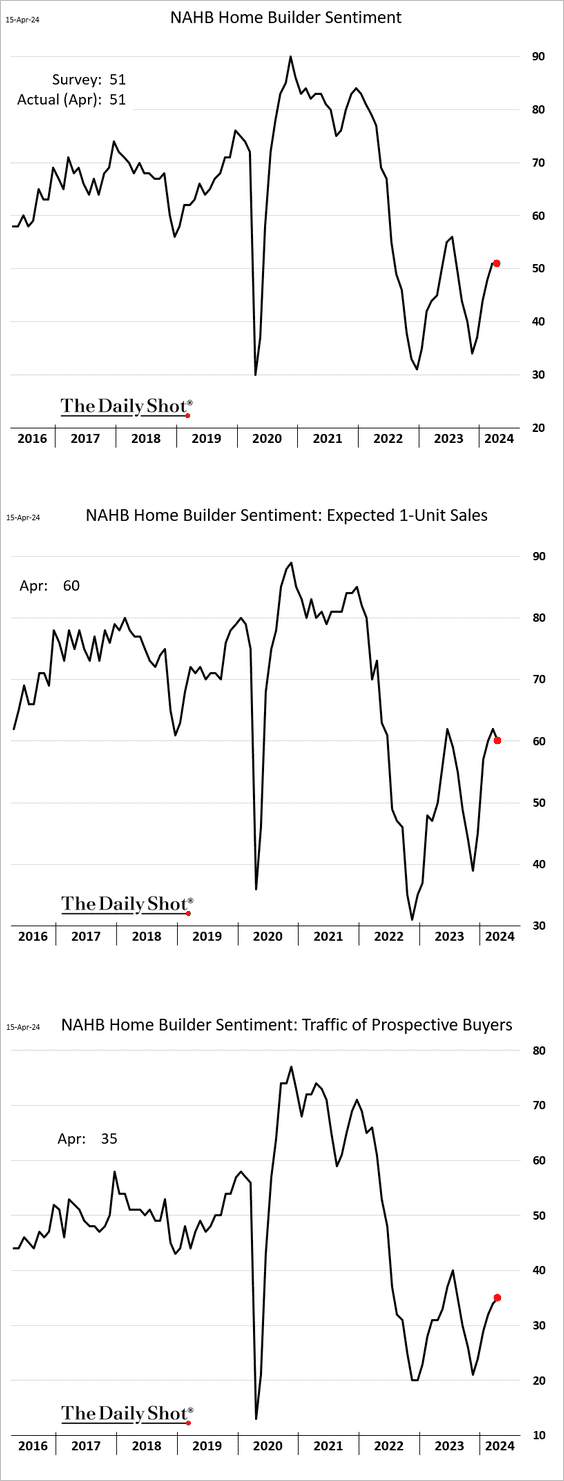

4. The NAHB index of homebuilder sentiment was roughly unchanged. The measure of expected new home sales edged lower (2nd panel), …

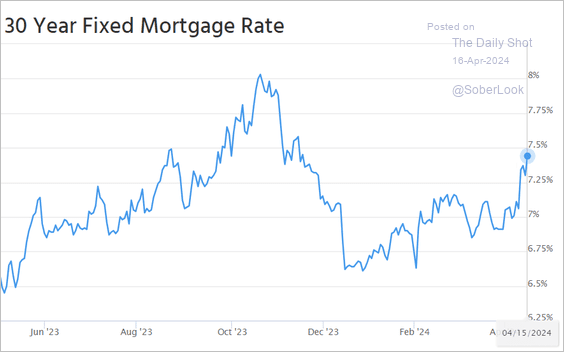

… as mortgage rates climb.

Source: Mortgage News Daily

Source: Mortgage News Daily

——————–

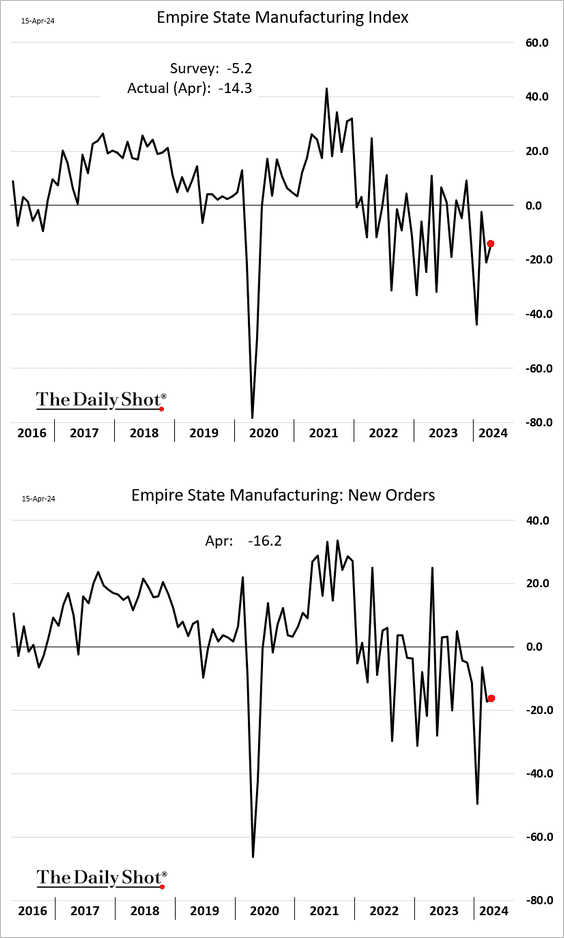

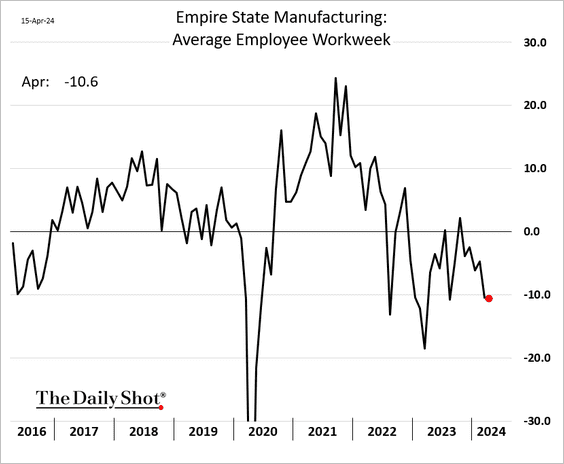

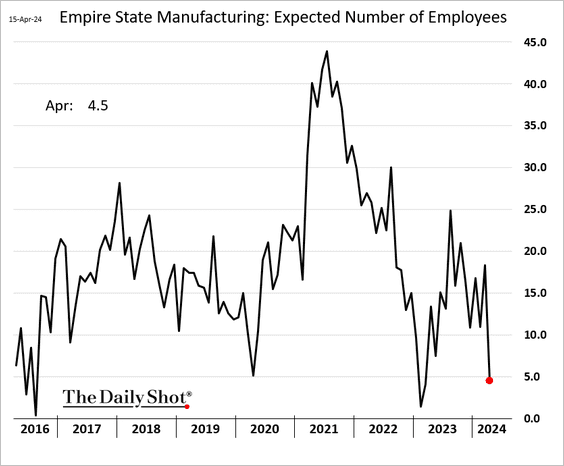

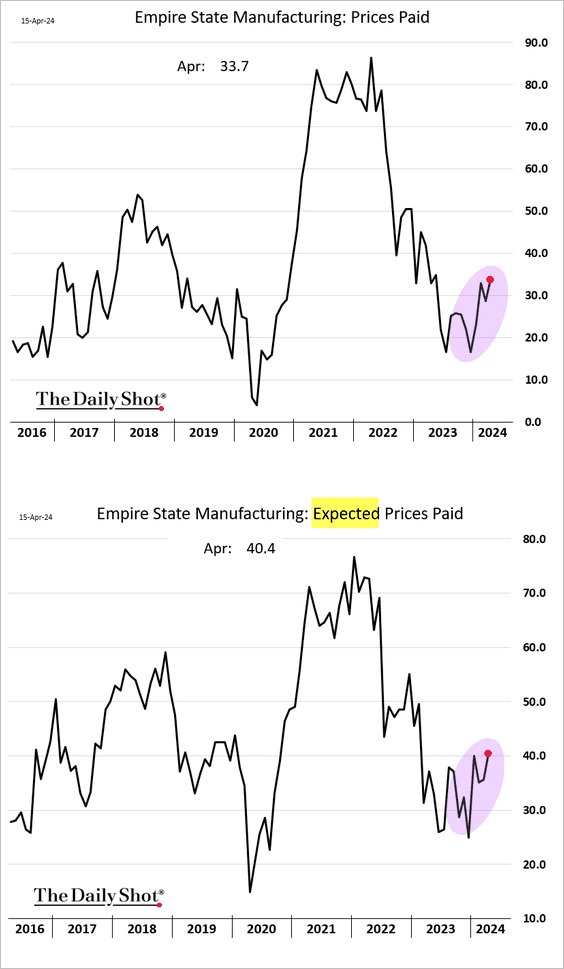

5. The first regional manufacturing survey of the month (from the New York Fed) showed no signs of recovery.

• Factories continue to reduce workers’ hours, …

… and fewer companies expect to be hiring in the months ahead.

• More firms are reporting rising costs.

——————–

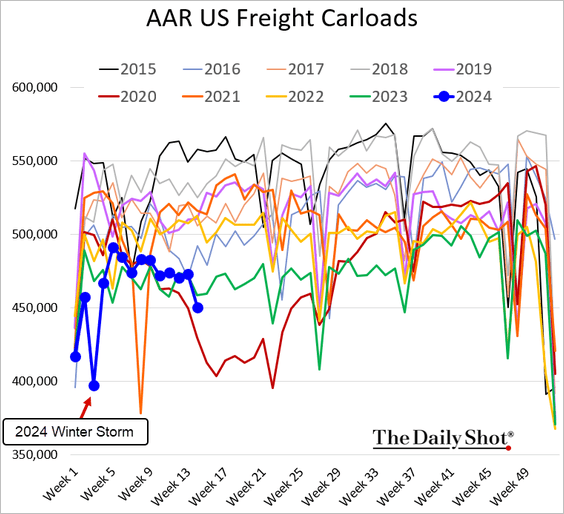

6. Rail freight activity slowed in recent days, dipping below last year’s levels.

Back to Index

Canada

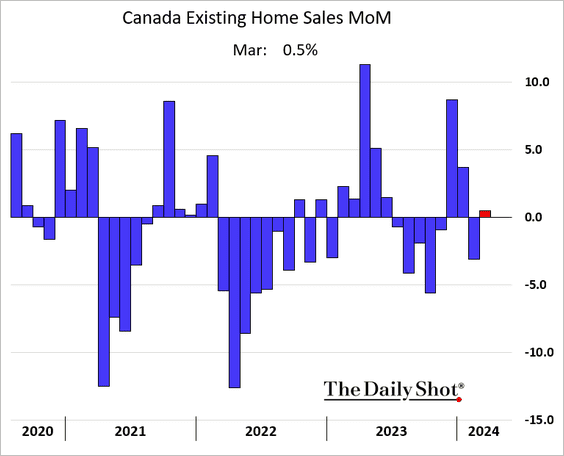

1. Existing home sales edged higher last month.

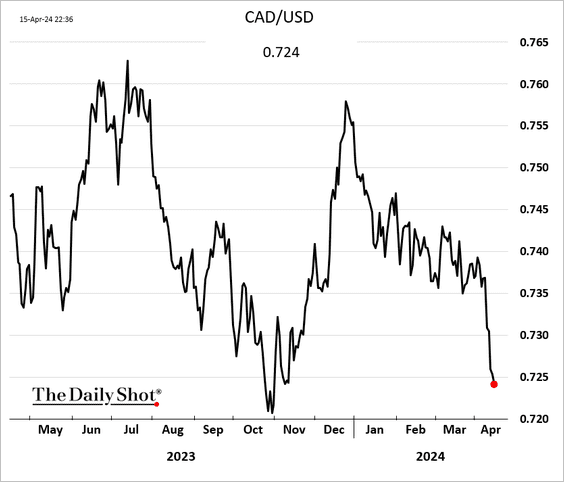

2. The loonie has faced downward pressure as US inflation and corresponding rate hike expectations surpass those in Canada.

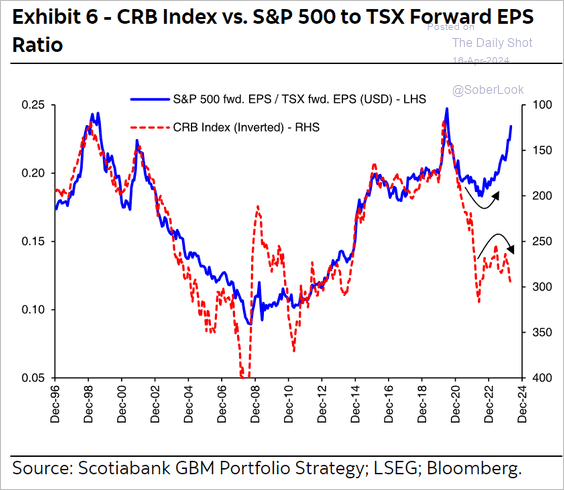

3. Higher commodity prices could boost Canadian corporate earnings relative to the US.

Source: Hugo Ste-Marie, Portfolio & Quantitative Strategy Global Equity Research, Scotia Capital

Source: Hugo Ste-Marie, Portfolio & Quantitative Strategy Global Equity Research, Scotia Capital

Back to Index

The United Kingdom

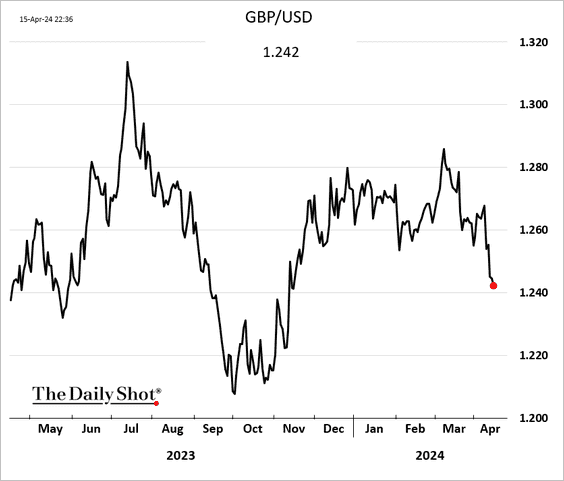

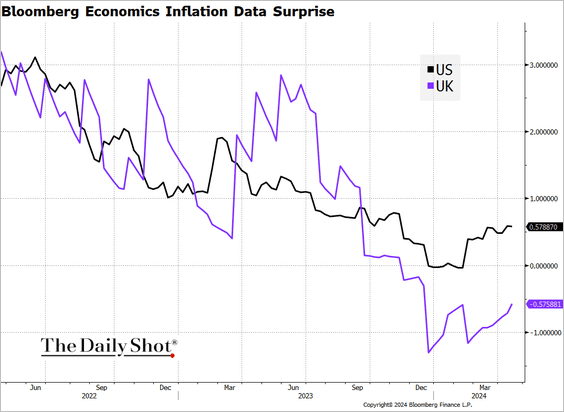

1. The pound has weakened against the US dollar as indicators of inflation surprises diverge.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

——————–

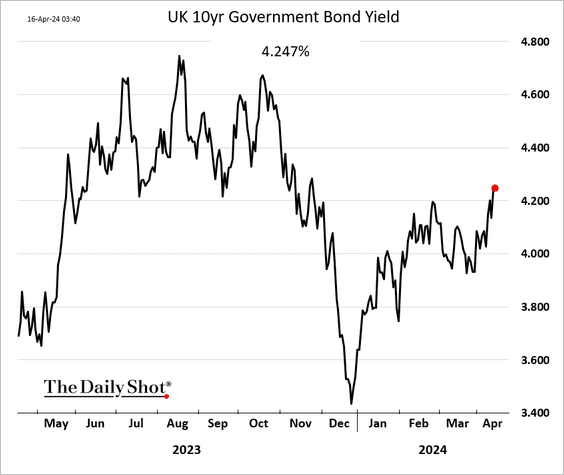

2. Gilt yields continue to rise amid a global sell-off in bonds.

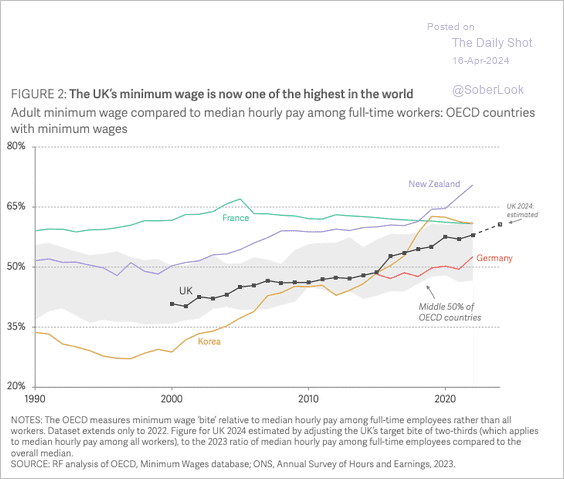

3. The minimum wage in the UK is now one of the highest in the world.

Source: Resolution Foundation Read full article

Source: Resolution Foundation Read full article

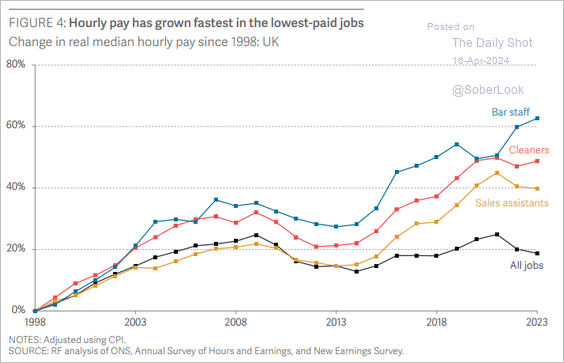

• Lowest-paid jobs have seen the fastest wage growth in recent years.

Source: Resolution Foundation Read full article

Source: Resolution Foundation Read full article

——————–

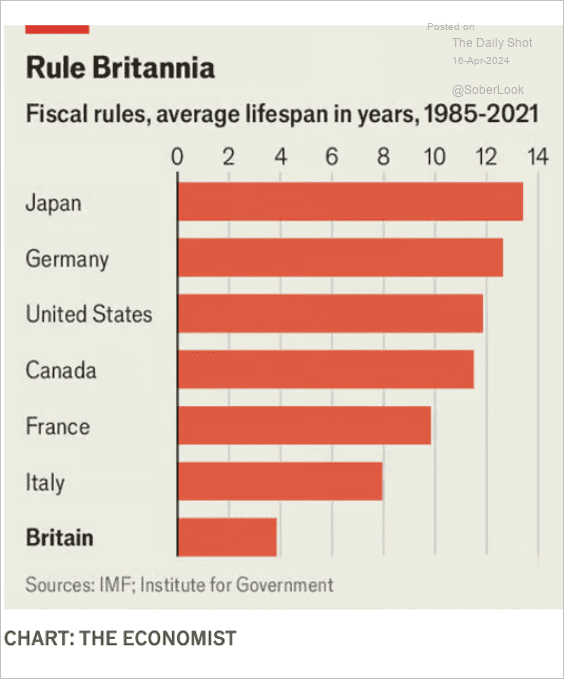

4. Frequent changes to UK fiscal rules are increasing market uncertainty, potentially keeping bond yields elevated.

Source: The Economist Read full article

Source: The Economist Read full article

Back to Index

The Eurozone

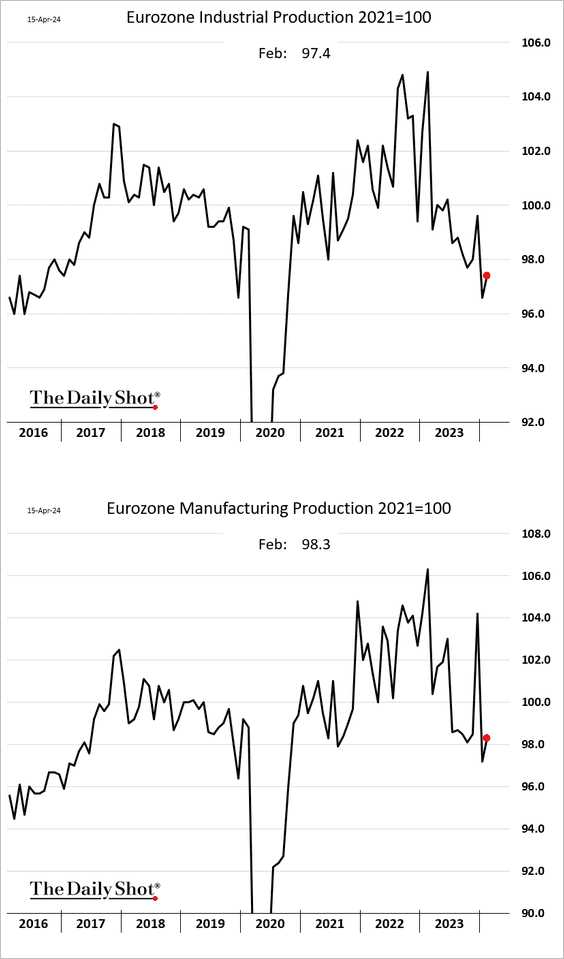

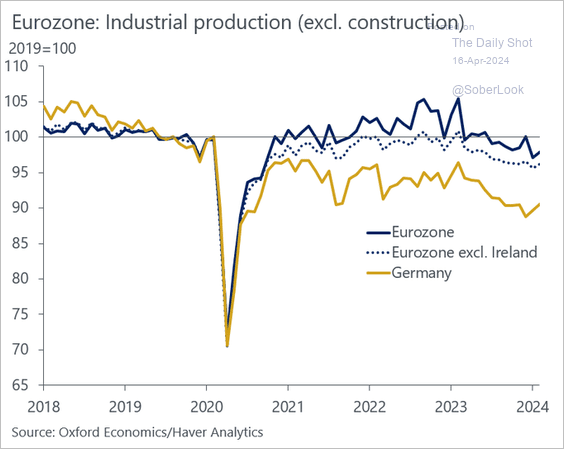

1. Euro-area industrial production increased in February from the lowest level since the 2020 COVID shock.

The currency bloc’s industrial production is less volatile when Ireland is excluded.

Source: @DanielKral1, @OxfordEconomics

Source: @DanielKral1, @OxfordEconomics

——————–

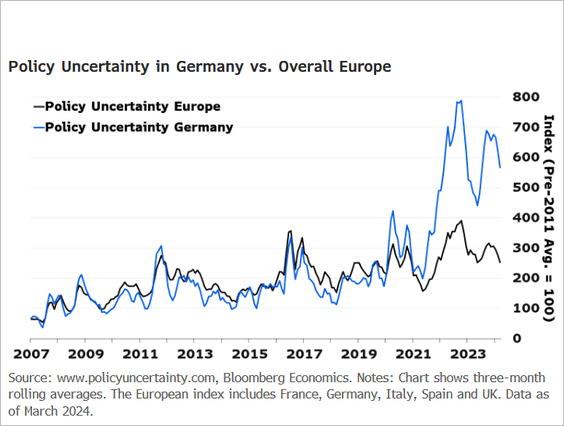

2. German policy uncertainty is well above that of Europe.

Source: Martin Ademmer, Bloomberg Economics Read full article

Source: Martin Ademmer, Bloomberg Economics Read full article

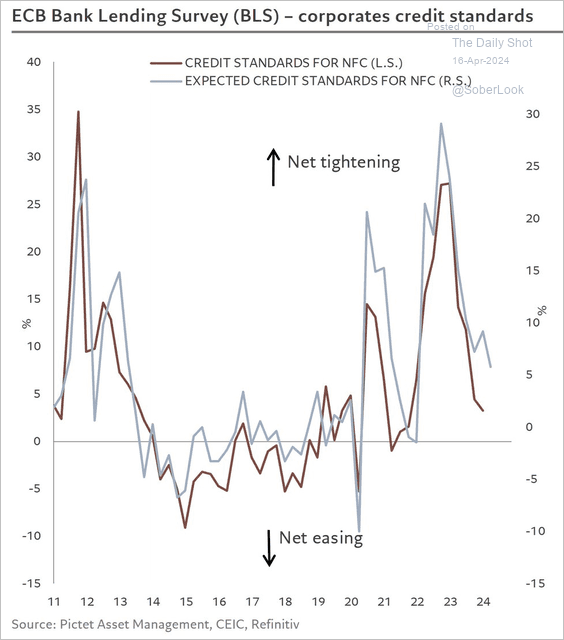

3. Fewer euro-area banks are tightening lending standards.

Source: @skhanniche

Source: @skhanniche

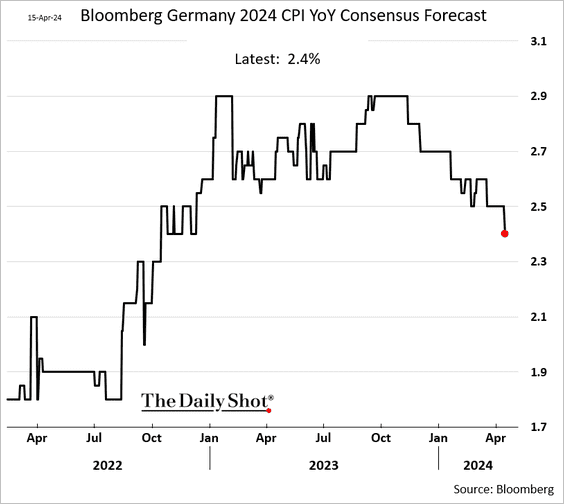

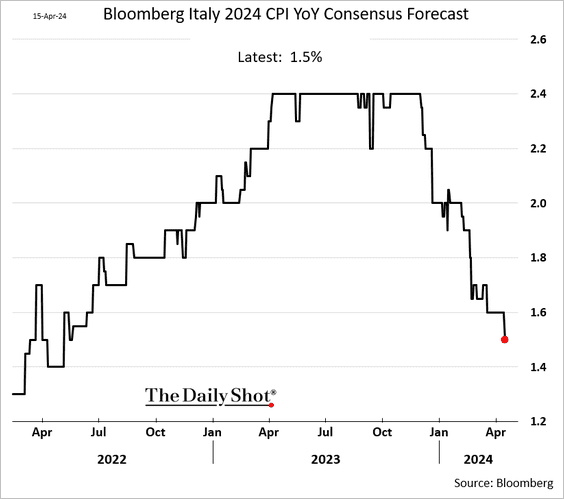

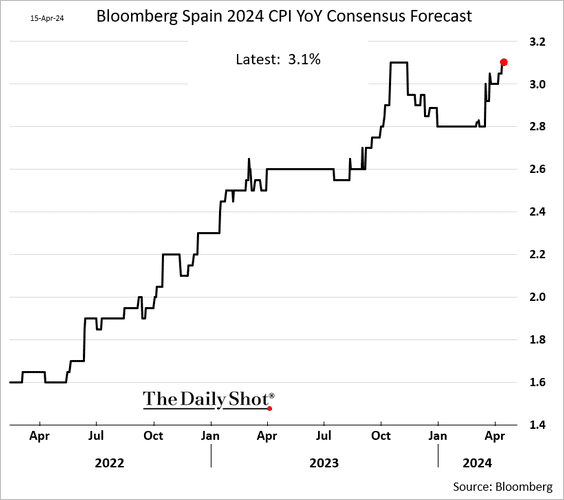

4. Economists downgraded their forecasts for this year’s CPI in Germany and Italy, …

… but increased their estimates for Spain’s inflation.

——————–

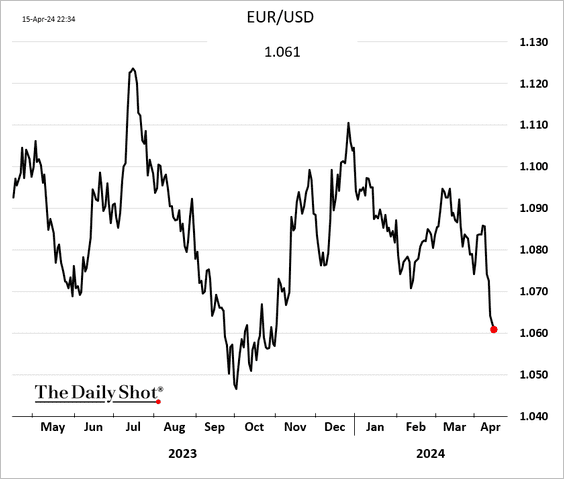

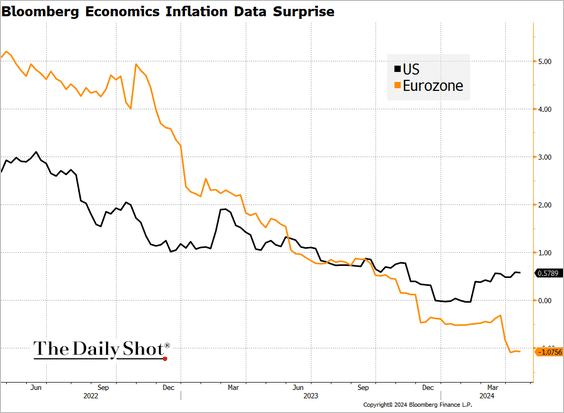

5. The euro continues to move lower relative to the US dollar, …

… as indicators of inflation surprises diverge.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

——————–

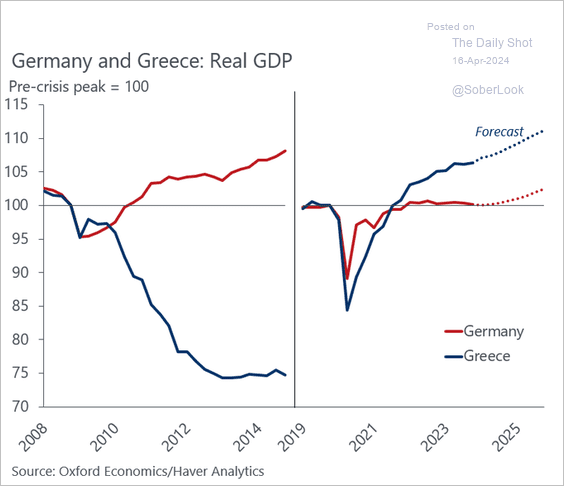

6. The Greek economy has been outpacing that of Germany.

Source: @DanielKral1, @OxfordEconomics

Source: @DanielKral1, @OxfordEconomics

Back to Index

Europe

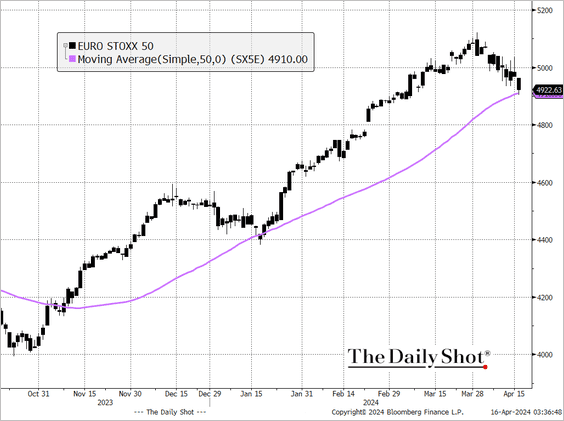

1. The STOXX 50 is testing support at its 50-day moving average.

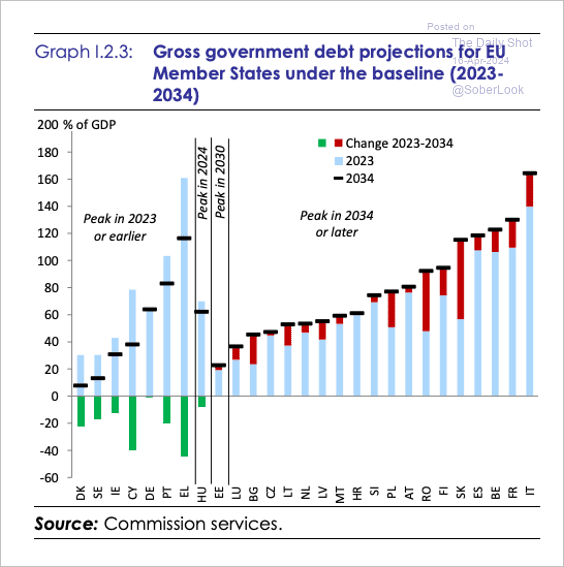

2. Here is a look at EU member states’ government debt projections for 2034 vs. 2023.

Source: EC Read full article

Source: EC Read full article

Back to Index

Asia-Pacific

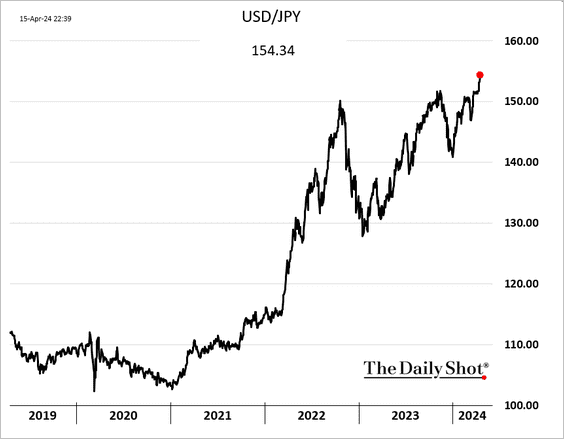

1. The yen continues to hit multi-decade lows vs.USD.

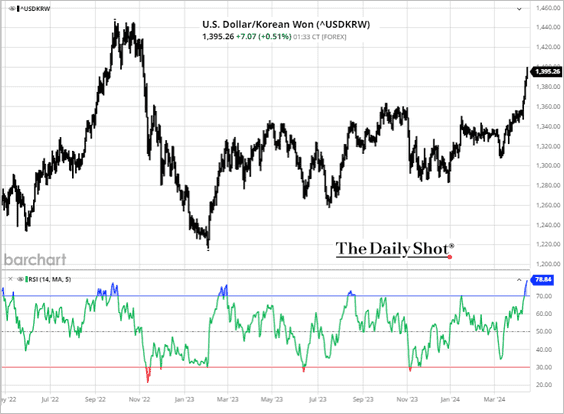

2. The South Korean won is oversold relative to the US dollar.

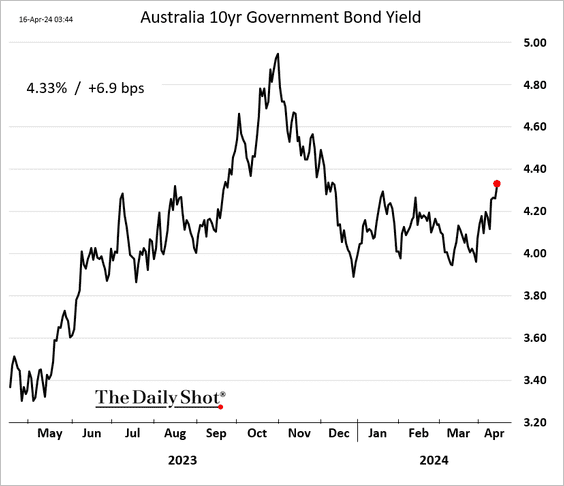

3. Australian bond yields are climbing.

Back to Index

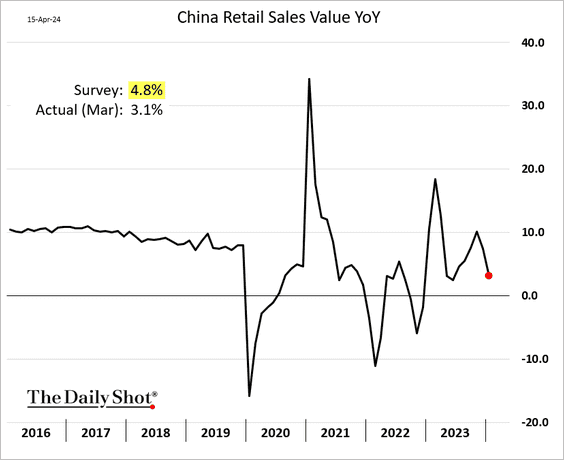

China

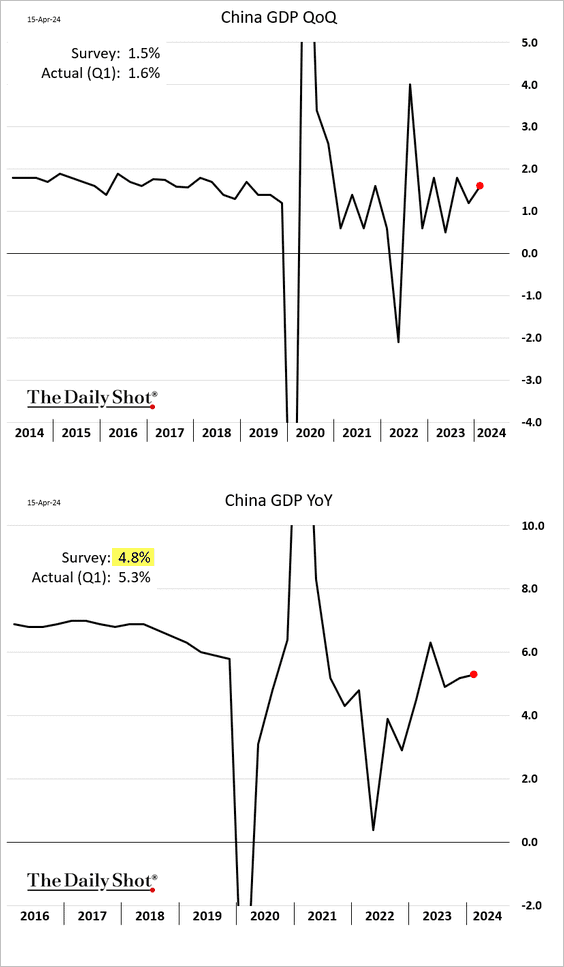

1. China’s Q1 GDP report topped expectations.

Source: Reuters Read full article

Source: Reuters Read full article

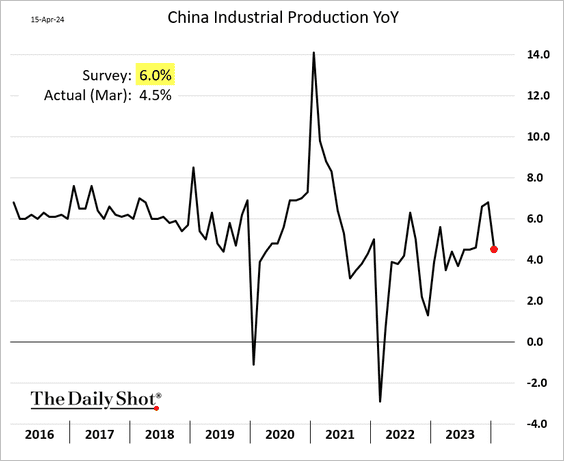

2. Growth rates in industrial production and retail sales were softer than expected last month.

——————–

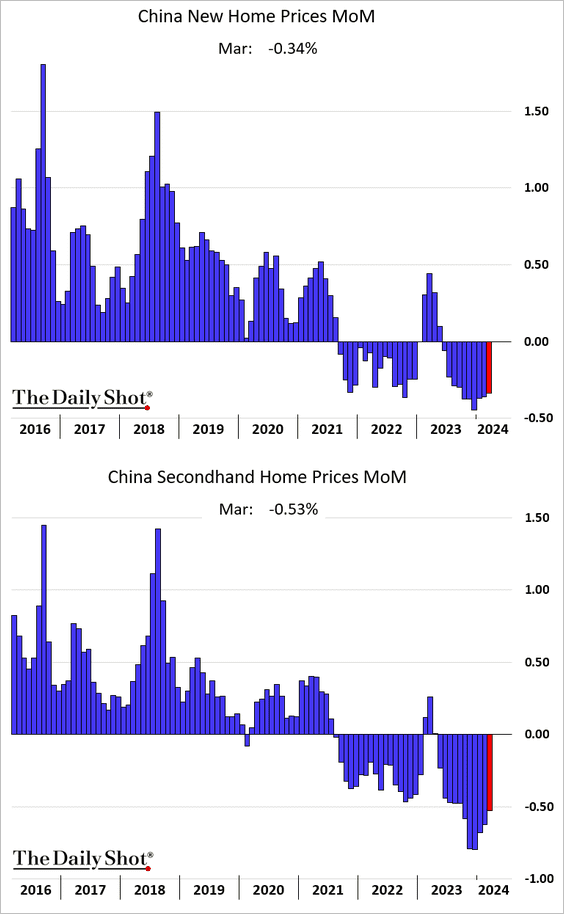

3. Home prices continue to fall.

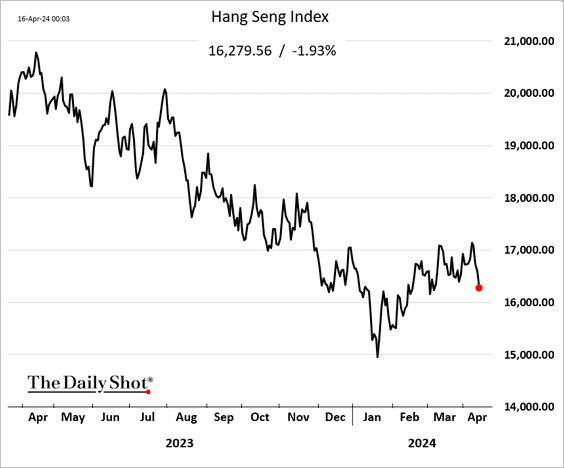

4. Hong Kong-listed stocks are down this week.

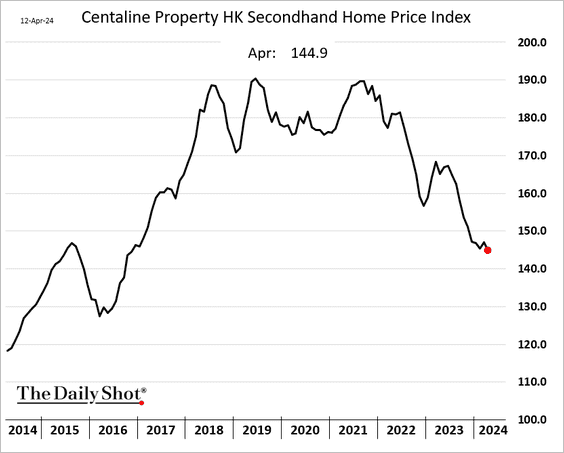

5. Hong Kong’s existing home prices continue to sink.

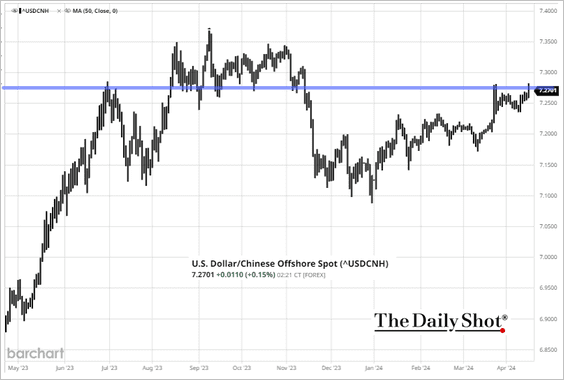

6. USD/CNH (offshore yuan) is at resistance.

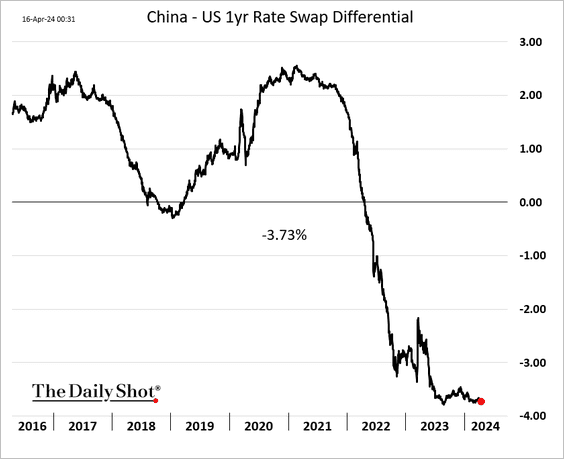

7. The US-China short-term rate differential continues to widen.

Back to Index

Emerging Markets

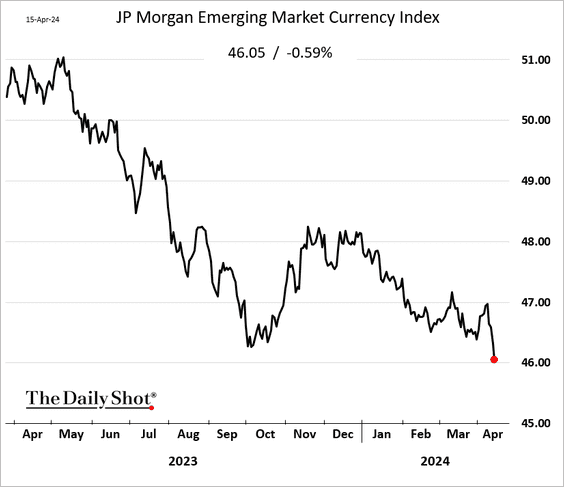

1. EM currencies have been struggling in recent days.

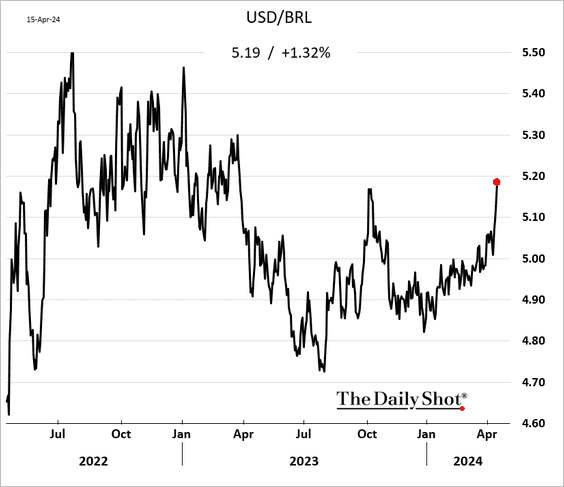

• The Brazilian real (a sharp selloff):

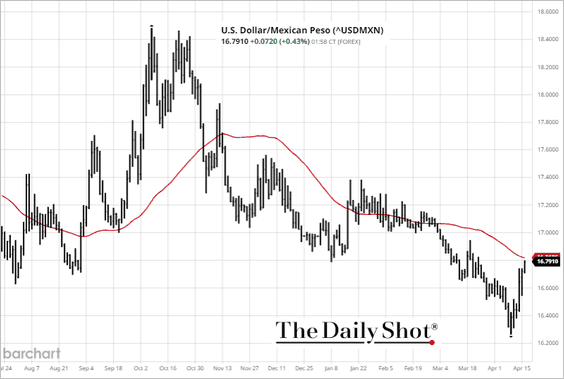

• The Mexican peso rally is reversing, with USD/MXN now at its 50-day moving average.

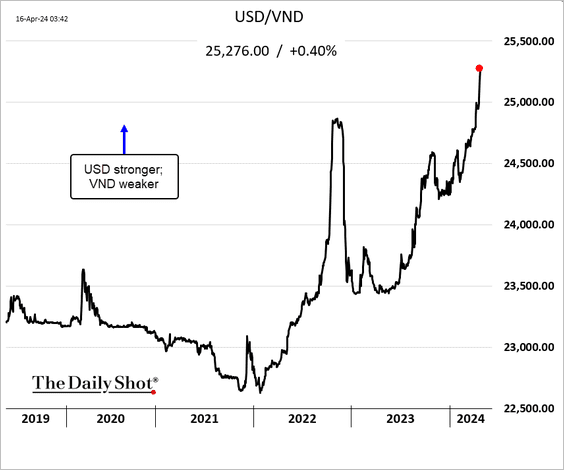

• The Vietnamese dong continues to decline.

——————–

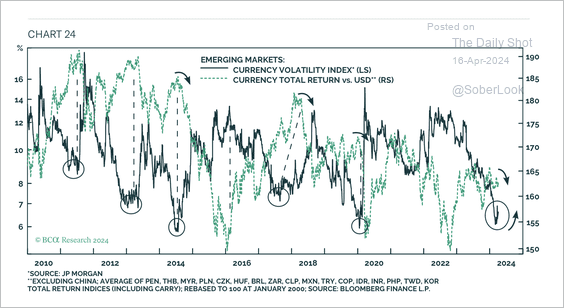

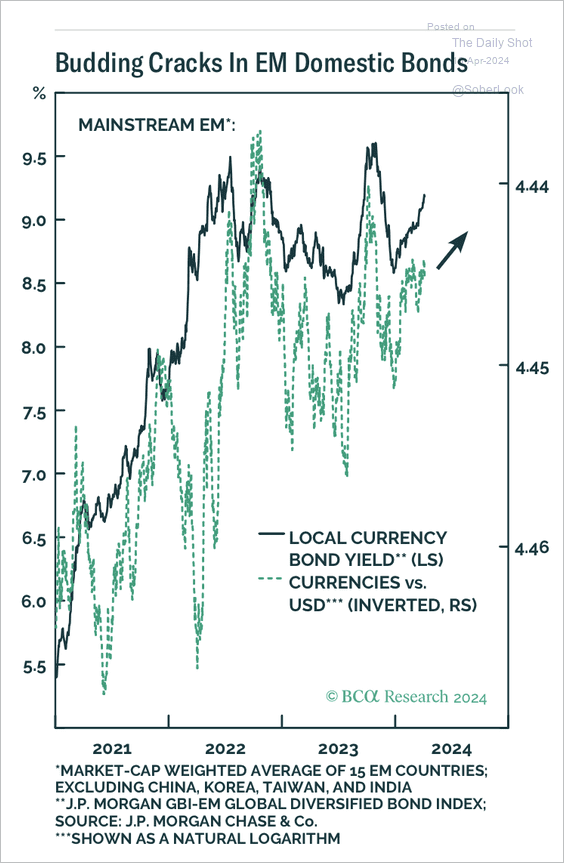

2. Rising currency volatility could weigh on EM currencies and boost domestic bond yields. (2 charts)

Source: BCA Research

Source: BCA Research

Source: BCA Research

Source: BCA Research

——————–

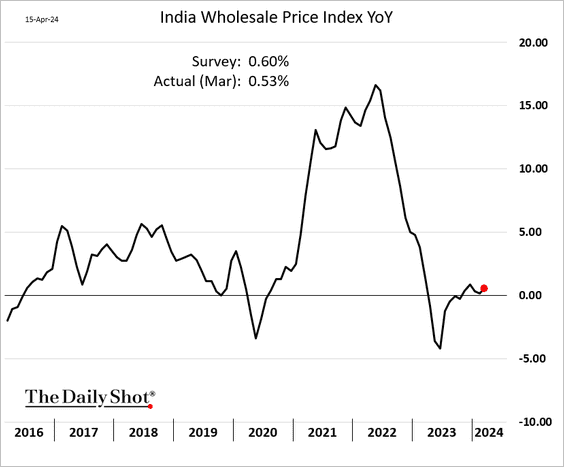

3. India’s wholesale price inflation edged higher last month.

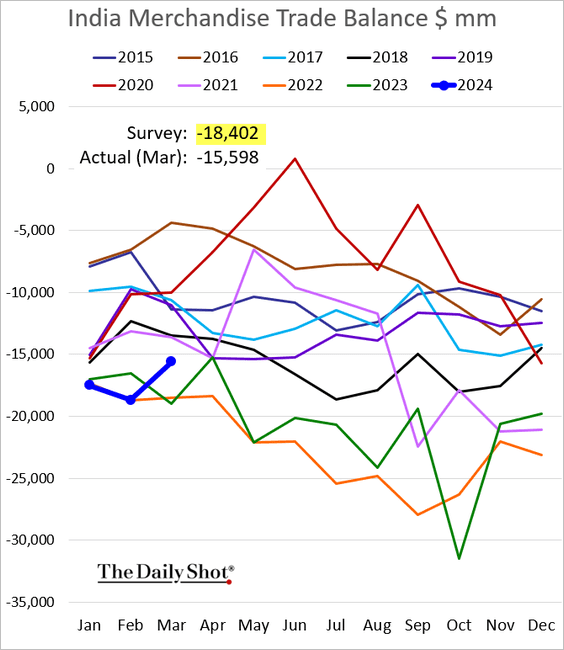

• The trade deficit narrowed more than expected as imports dropped.

——————–

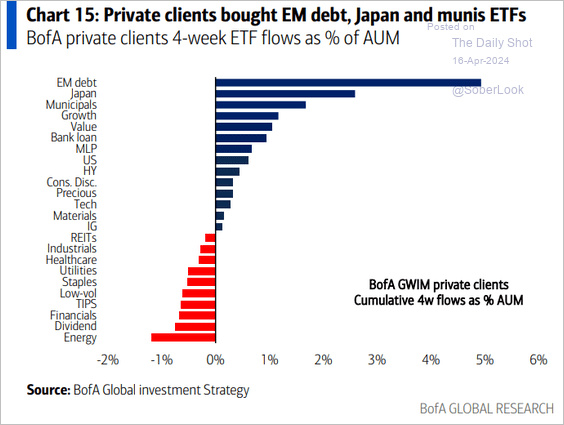

4. BofA’s private clients continue to buy EM debt.

Source: BofA Global Research

Source: BofA Global Research

Back to Index

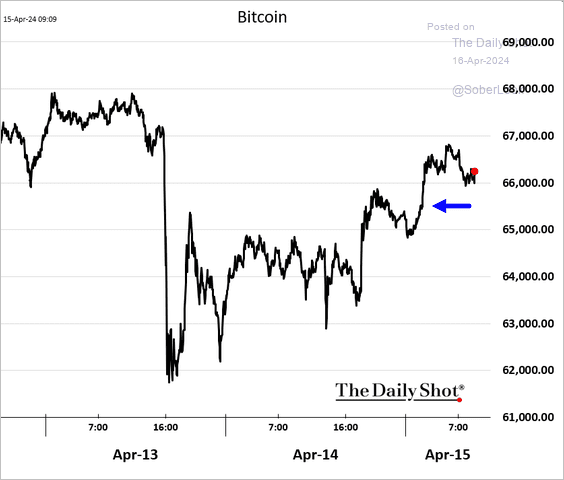

Cryptocurrency

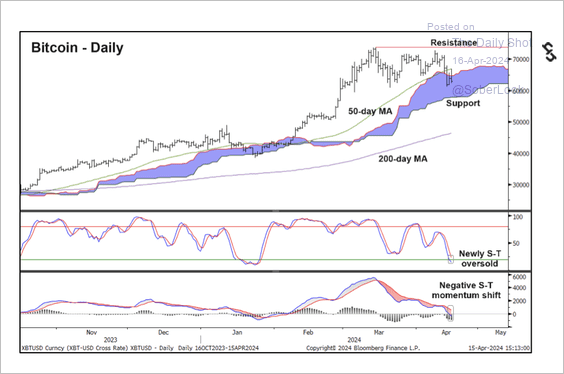

1. BTC/USD is oversold with support around $57.8K, although upside momentum has weakened.

Source: @StocktonKatie

Source: @StocktonKatie

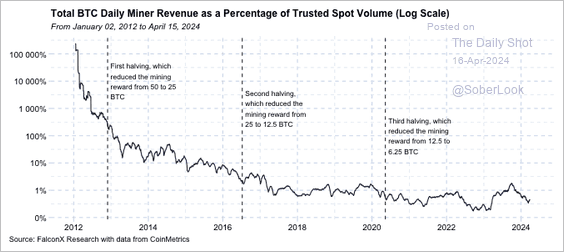

2. The proportion of total bitcoin mining revenue compared to BTC trading volume has persistently declined after prior halvings. This may suggest that miner influence on price action has waned.

Source: @dlawant

Source: @dlawant

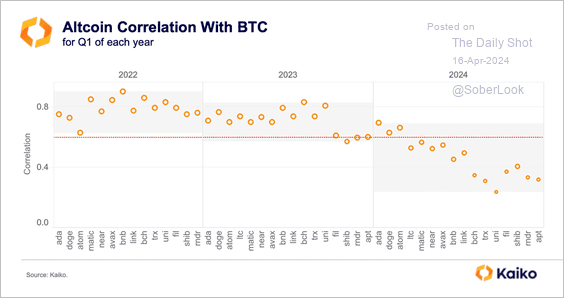

3. Bitcoin’s correlation with select altcoins has fallen to historic lows in Q1, relative to the same period in the prior two years.

Source: @KaikoData

Source: @KaikoData

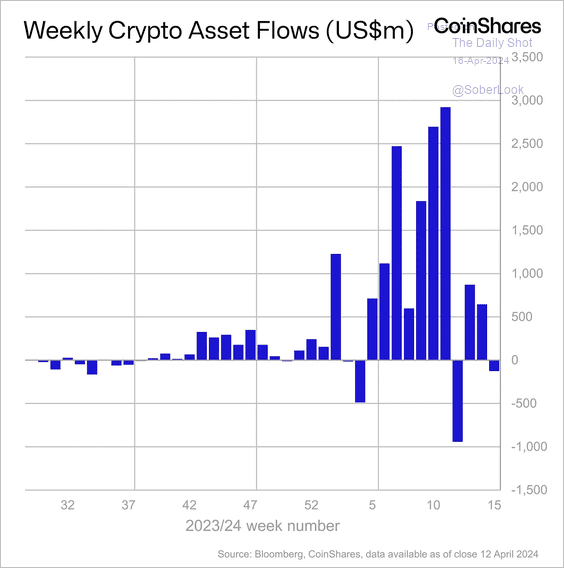

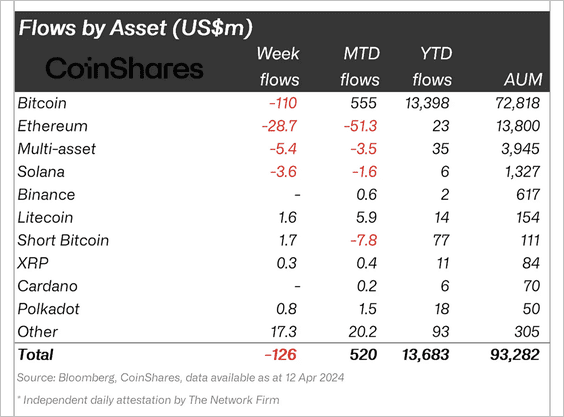

4. Crypto funds saw minor outflows last week led by Ethereum-focused products. (2 charts)

Source: CoinShares Read full article

Source: CoinShares Read full article

Source: CoinShares Read full article

Source: CoinShares Read full article

——————–

5. Hong Kong conditionally approved its first spot bitcoin and ether ETFs, …

Source: @crypto Read full article

Source: @crypto Read full article

… giving bitcoin a temporary boost.

Source: Oxford Economics

Source: Oxford Economics

Back to Index

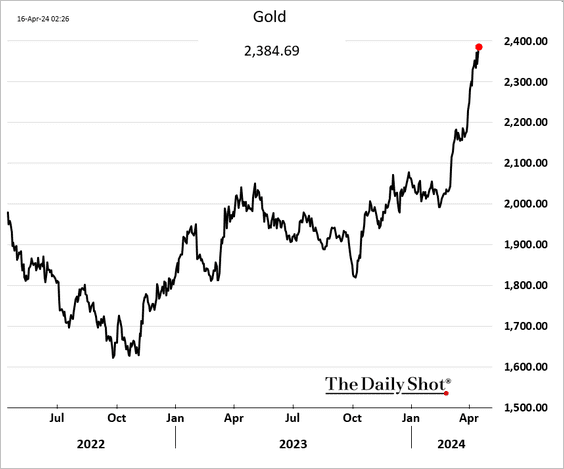

Commodities

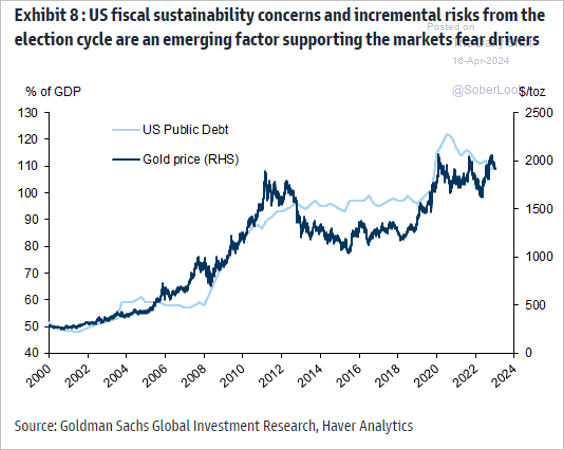

1. Gold continues to surge.

• Gold has been supported by US fiscal concerns.

Source: Goldman Sachs; @MikeZaccardi

Source: Goldman Sachs; @MikeZaccardi

——————–

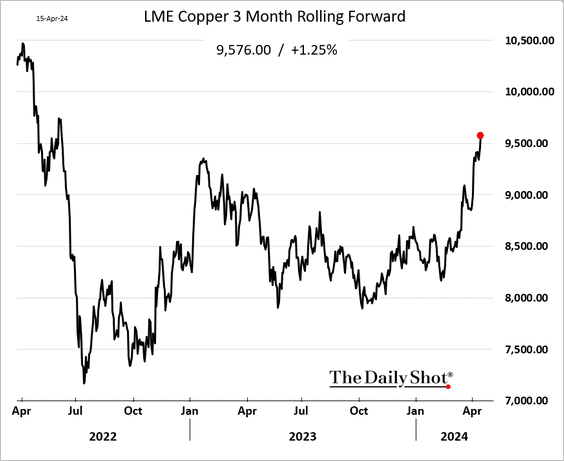

2. Copper keeps rising as well.

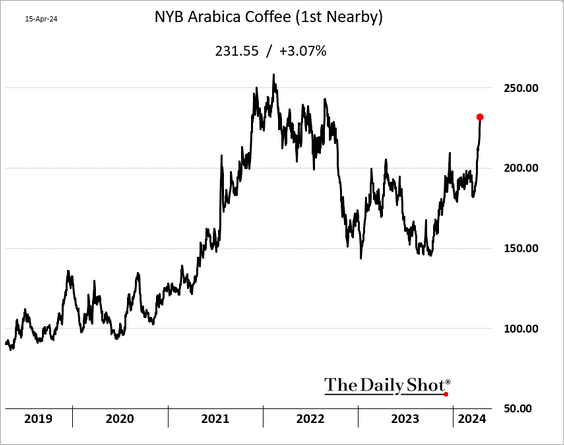

3. The rally in coffee futures continues.

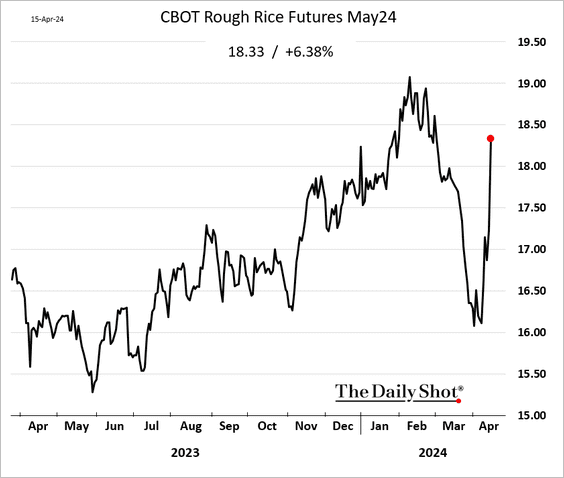

4. Rice futures surged as Indian rice exporters expressed concerns about their ability to transport the commodity.

Source: The Economic Times Read full article

Source: The Economic Times Read full article

Back to Index

Energy

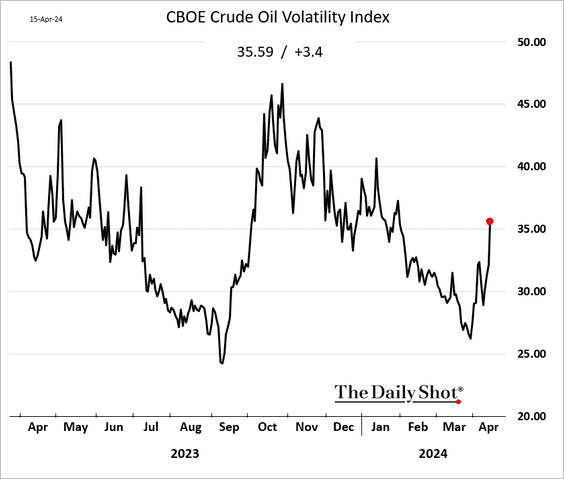

1. Oil implied volatility is rising, …

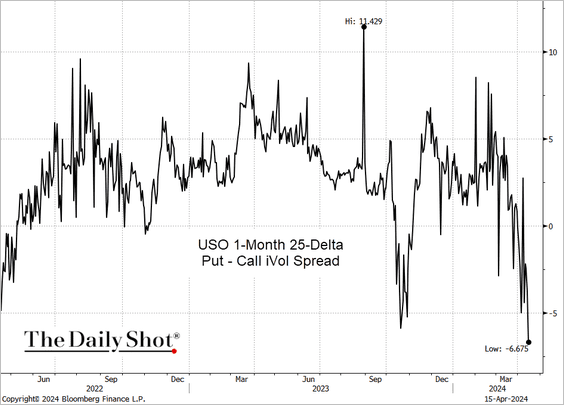

… with risk bias to the downside.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

——————–

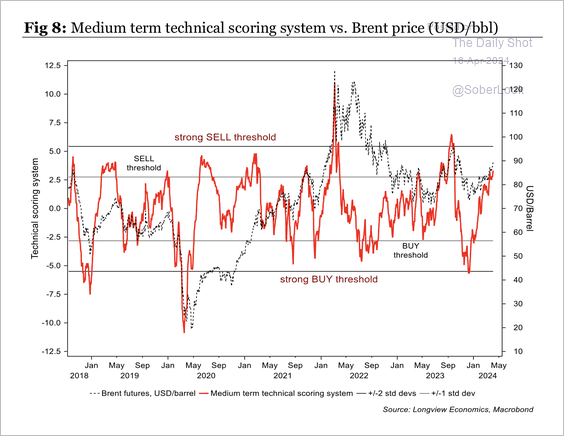

2. Technicals suggest Brent oil is overbought, although not yet extreme compared to prior peaks.

Source: Longview Economics

Source: Longview Economics

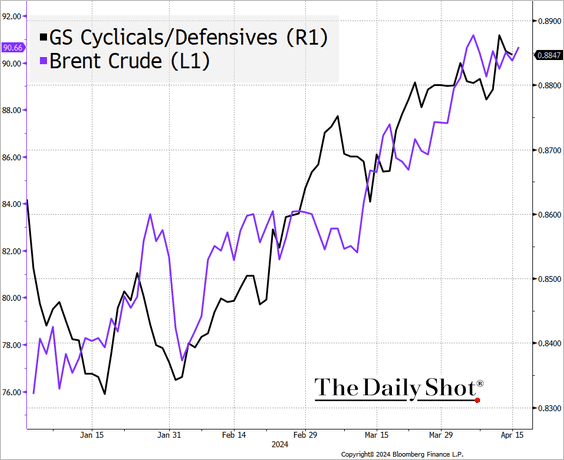

3. According to Goldman, the crude oil rally has been driven in part by improved global economic growth.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

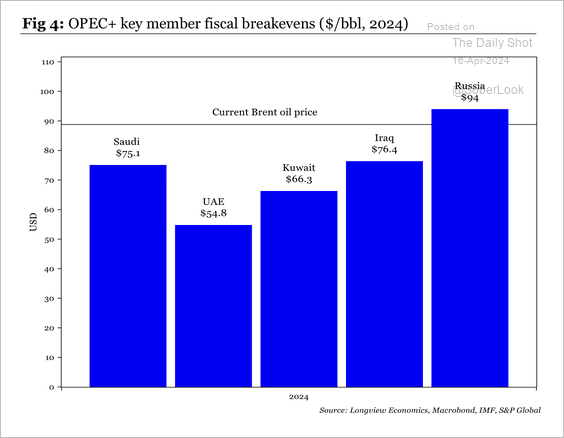

4. This chart shows OPEC+ fiscal breakeven oil prices by country.

Source: Longview Economics

Source: Longview Economics

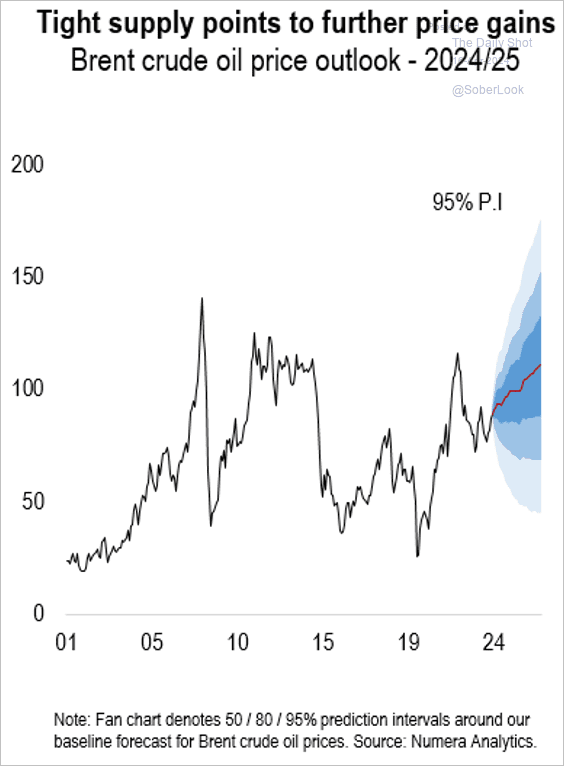

5. Numera Analytics expects oil prices to remain supported by an extension of voluntary OPEC cuts and weak shale supply growth.

Source: Numera Analytics (@NumeraAnalytics)

Source: Numera Analytics (@NumeraAnalytics)

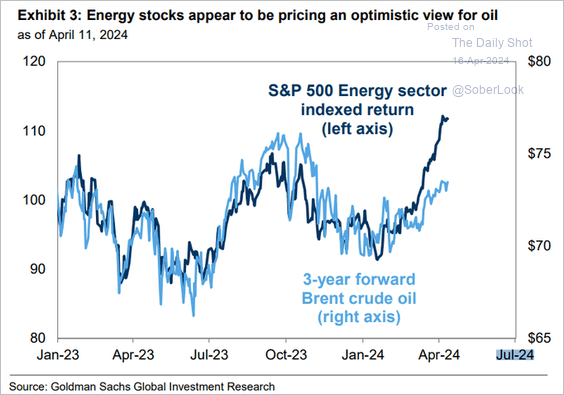

6. Equity investors are more upbeat about oil prices than the oil market.

Source: Goldman Sachs; @MikeZaccardi

Source: Goldman Sachs; @MikeZaccardi

Back to Index

Equities

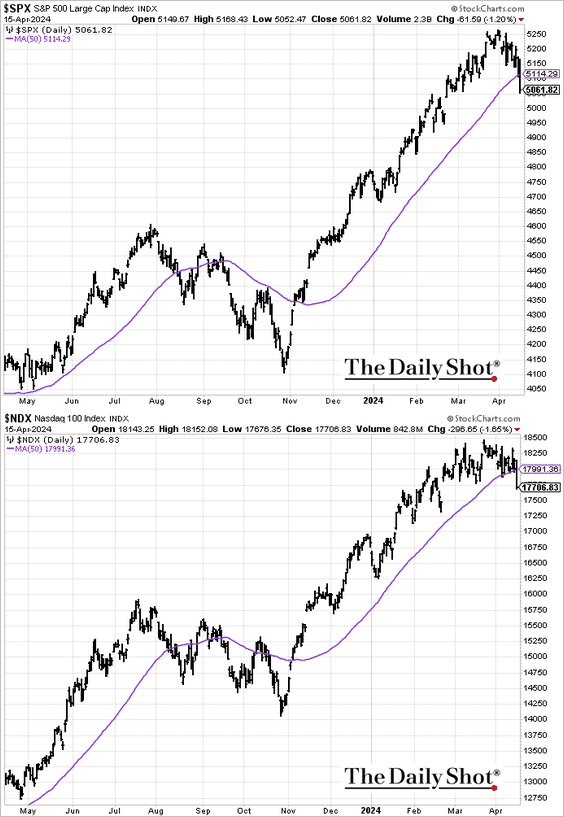

1. Key US indices dipped below their 50-day moving averages after the strong US retail sales report sent Treasury yields higher.

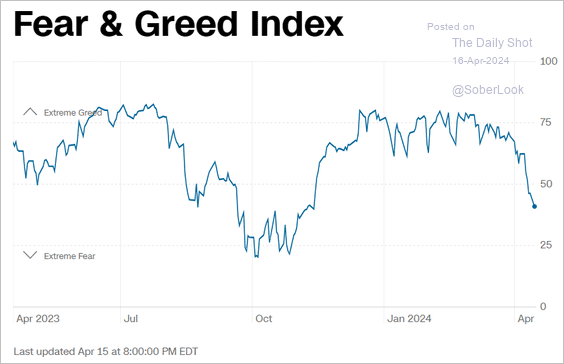

2. Sentiment has deteriorated sharply.

Source: CNN Business

Source: CNN Business

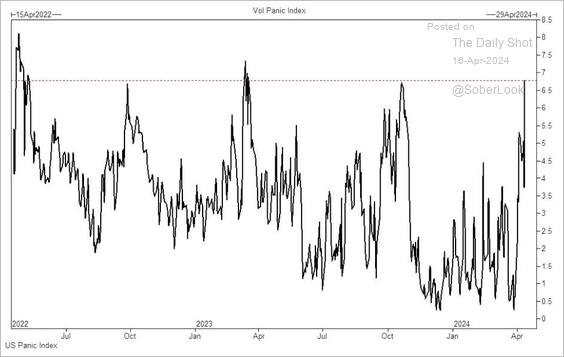

Here is Goldman’s “panic index.”

Source: Goldman Sachs; @dailychartbook

Source: Goldman Sachs; @dailychartbook

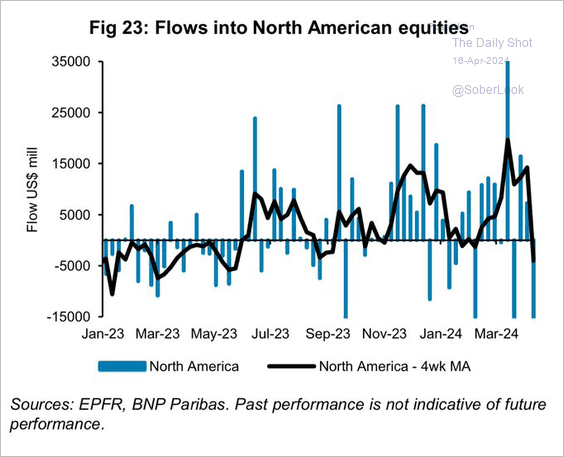

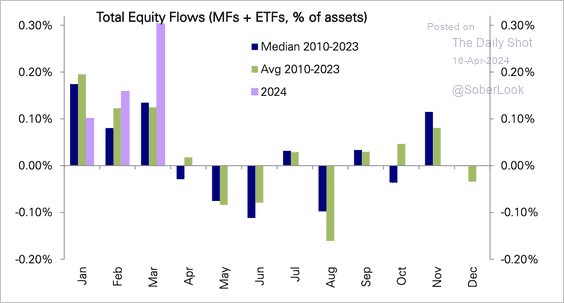

3. Fund flows also show unease.

Source: BNP Paribas; @WallStJesus

Source: BNP Paribas; @WallStJesus

Equity flows are entering a seasonally weak period.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

——————–

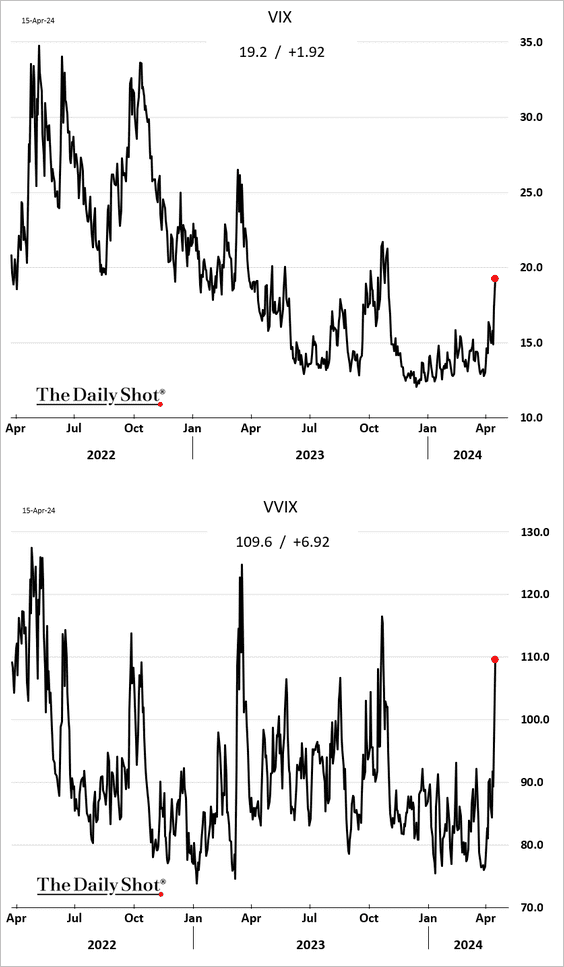

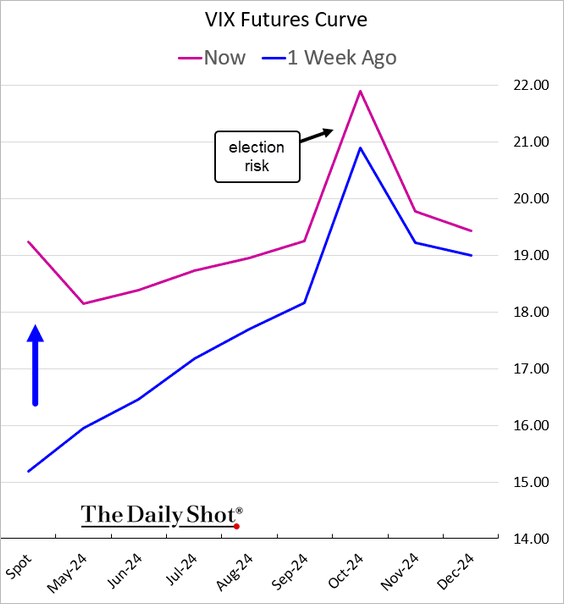

4. VIX and VVIX (vol of vol) surged in recent days.

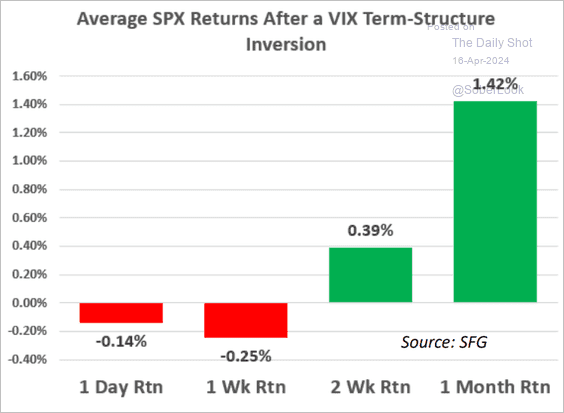

• The VIX curve inverted.

• Here is how the S&P 500 performs after the VIX curve inverts.

Source: Chris Murphy, Susquehanna International Group

Source: Chris Murphy, Susquehanna International Group

——————–

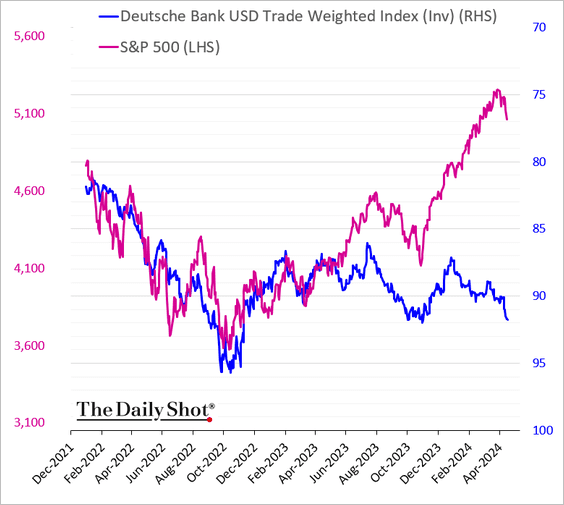

5. This chart shows how the negative correlation between stocks and the dollar reversed last year.

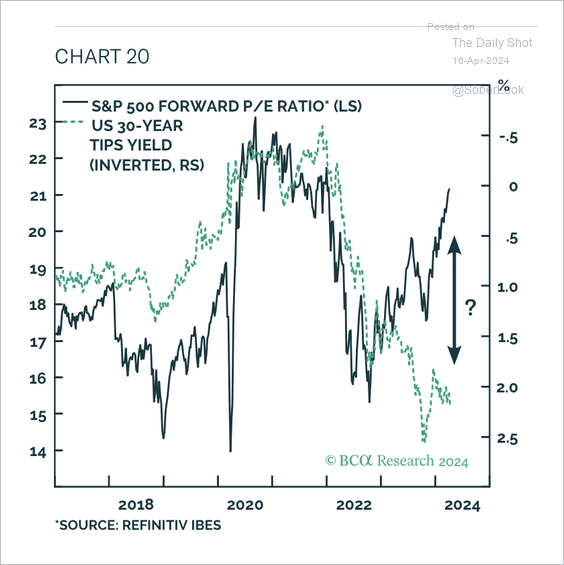

6. The S&P 500 has experienced multiple expansion despite high real bond yields.

Source: BCA Research

Source: BCA Research

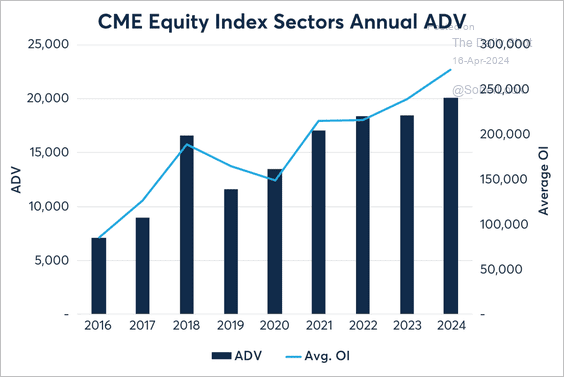

7. Sector index futures’ average daily volume (ADV) on the CME Exchange remains robust.

Source: CME Group

Source: CME Group

Back to Index

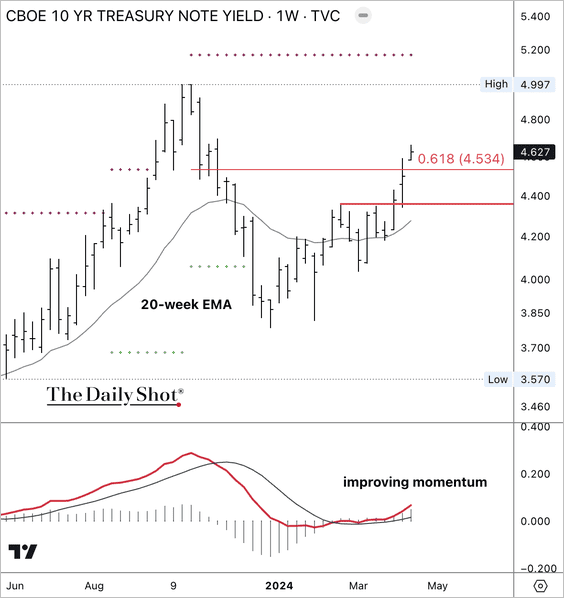

Rates

1. The 10-year Treasury yield is holding support with improving momentum.

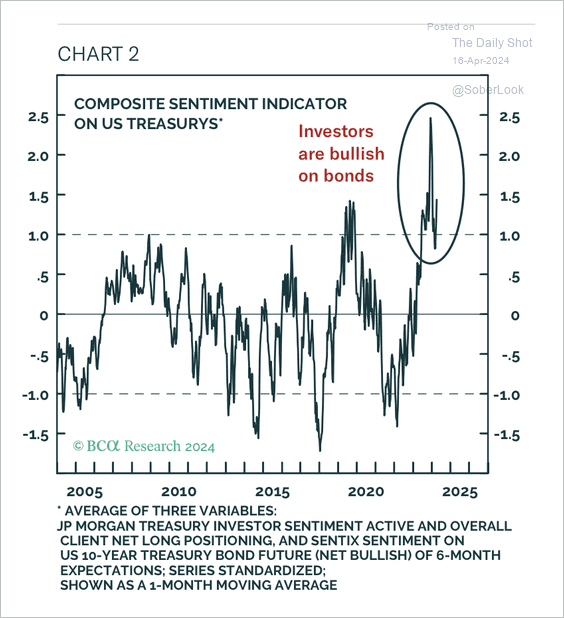

2. Investor sentiment on Treasuries remains very bullish.

Source: BCA Research

Source: BCA Research

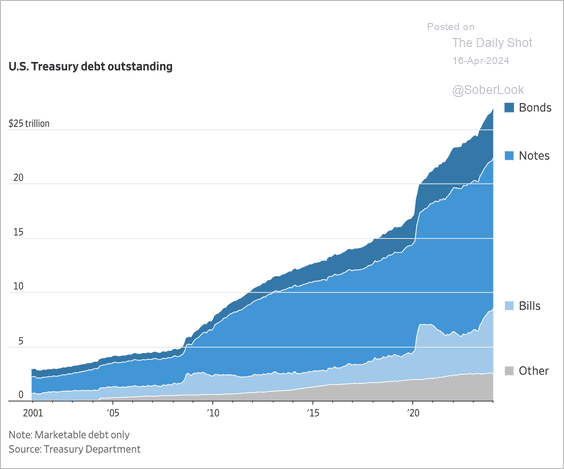

3. This chart shows the composition of Treasury debt outstanding.

Source: @WSJ Read full article

Source: @WSJ Read full article

Back to Index

Food for Thought

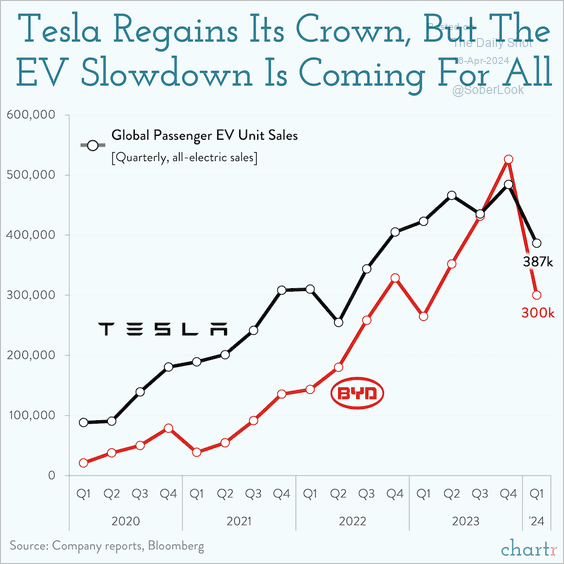

1. Tesla and BYD EV sales:

Source: @chartrdaily

Source: @chartrdaily

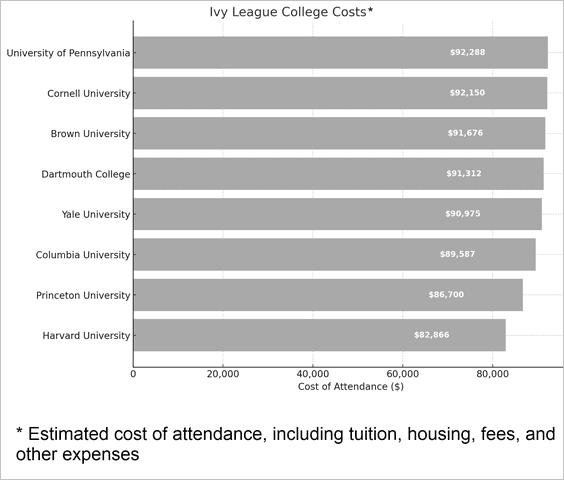

2. Ivy League college costs:

Source: @wealth Read full article

Source: @wealth Read full article

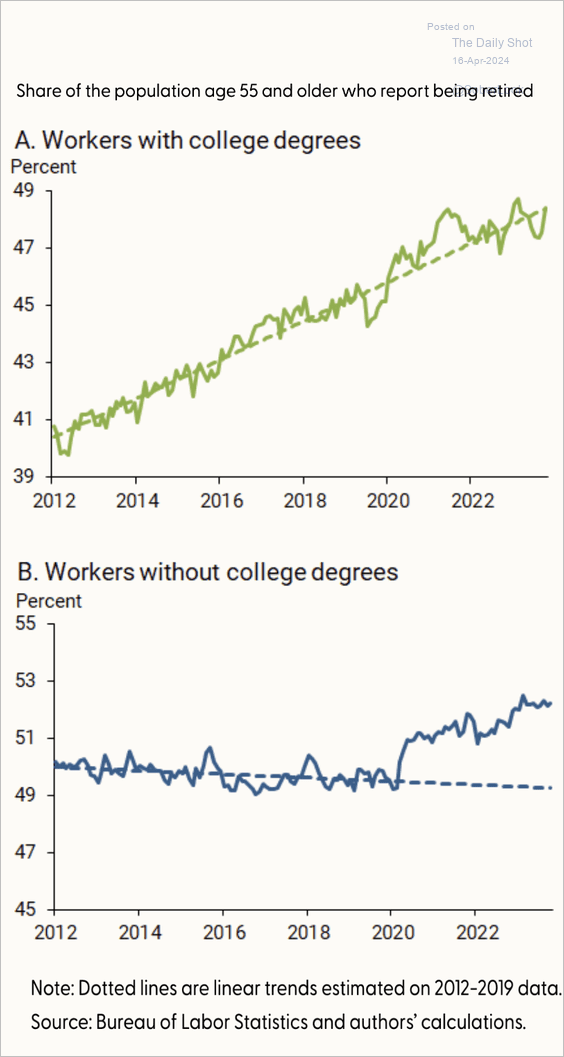

3. Retirement trends in the US by education level:

Source: Federal Reserve Bank of San Francisco Read full article

Source: Federal Reserve Bank of San Francisco Read full article

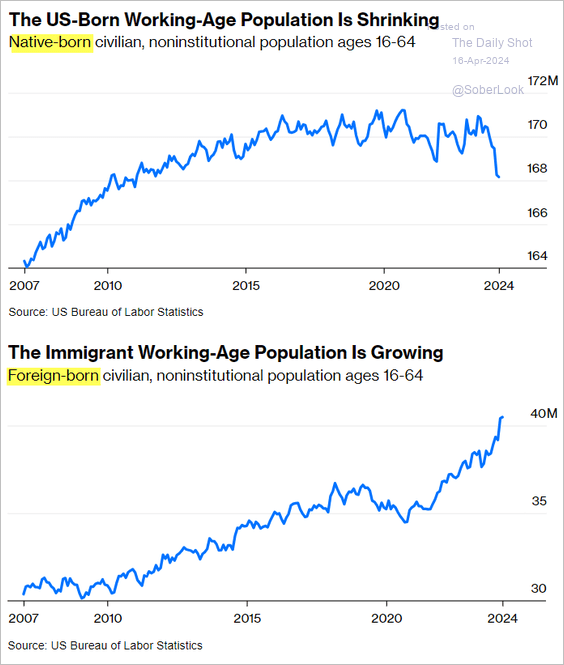

4. The US increasingly relies on immigrants to grow its labor force.

Source: @foxjust, @opinion Read full article

Source: @foxjust, @opinion Read full article

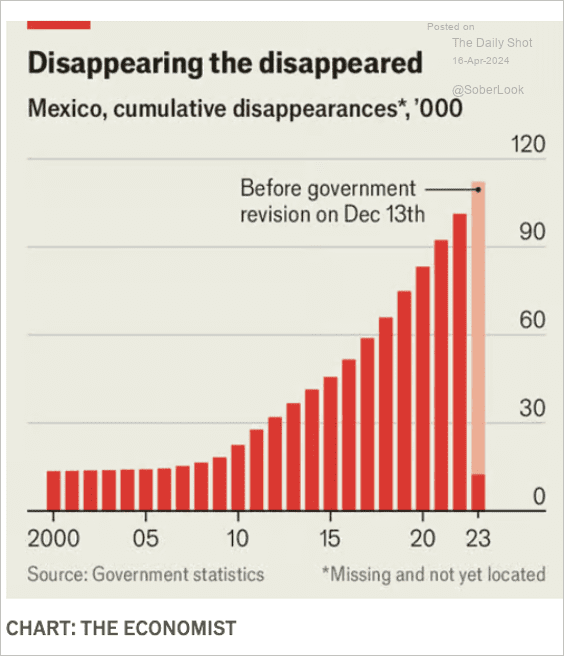

5. Timeline of reported disappearances in Mexico:

Source: The Economist Read full article

Source: The Economist Read full article

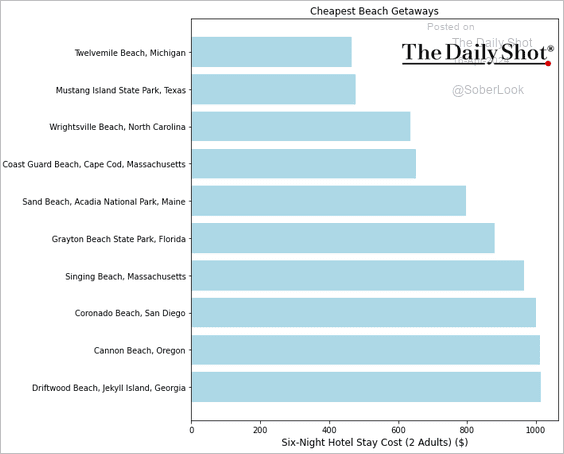

6. Cheapest beach getaways in the US:

Source: DIVEIN Travel

Source: DIVEIN Travel

——————–

Back to Index