The Daily Shot: 19-Apr-24

• Global Developments

• The United States

• Europe

• Japan

• China

• Emerging Markets

• Cryptocurrency

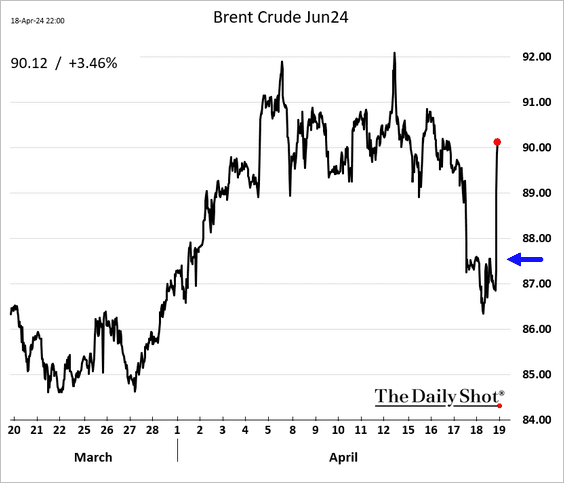

• Commodities

• Equities

• Credit

• Rates

• Food for Thought

Global Developments

1. Israel launched a retaliatory strike against Iran.

Source: @WSJ Read full article

Source: @WSJ Read full article

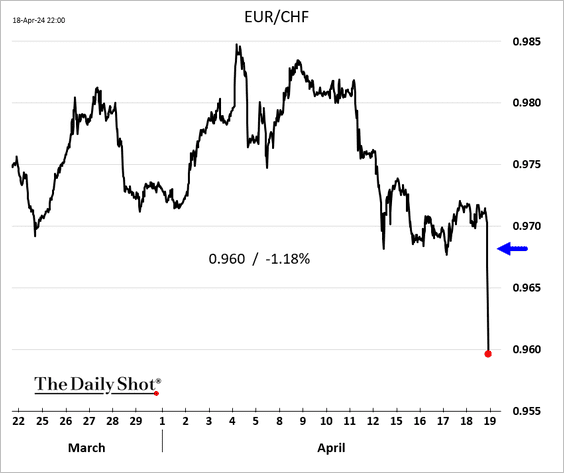

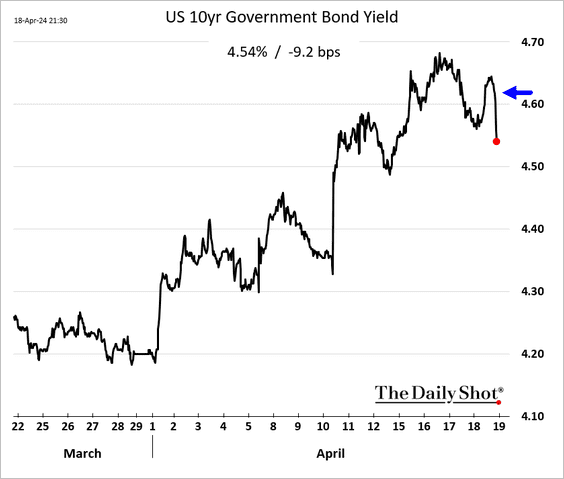

• Crude oil and safe-haven assets surged.

– The Swiss franc climbed by over 1% against the euro.

– Treasury yields declined.

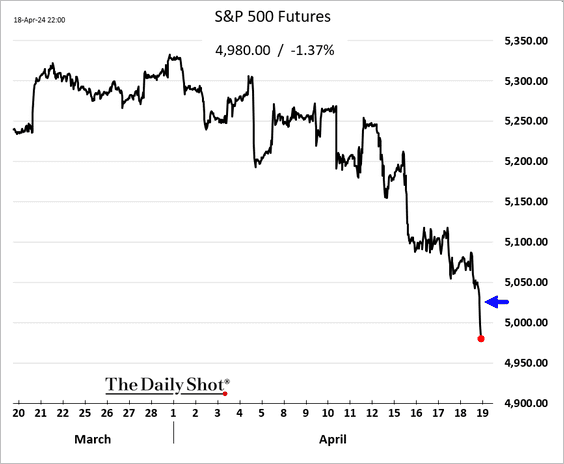

• Asian stocks and US futures dropped sharply.

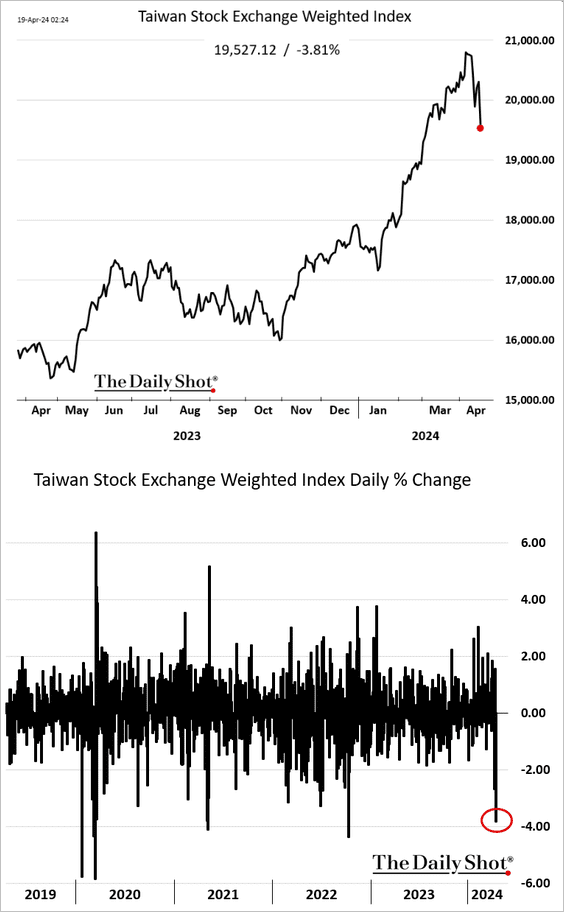

Here is Taiwan’s key equity index.

• However, markets have reversed some of the initial moves this morning as Iran downplayed the attack, with the nation’s nuclear facilities reportedly remaining intact.

Source: The Jerusalem Post Read full article

Source: The Jerusalem Post Read full article

Source: The Independent Read full article

Source: The Independent Read full article

——————–

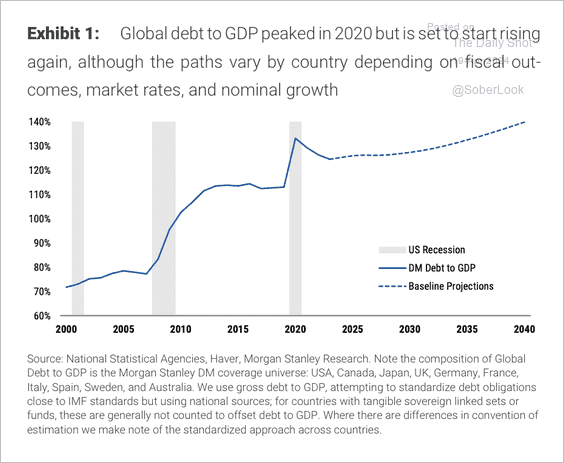

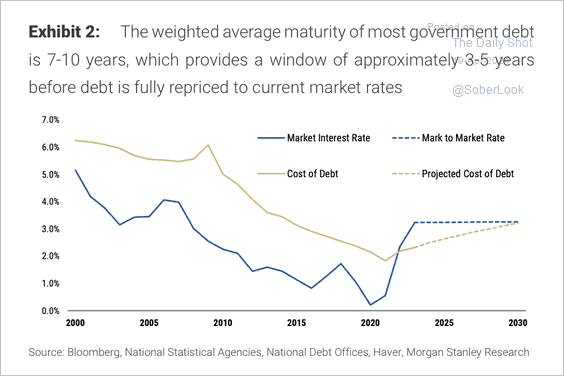

2. Morgan Stanley forecasts a renewed acceleration in global debt-to-GDP alongside rising debt servicing costs. (2 charts)

Source: Morgan Stanley Research

Source: Morgan Stanley Research

Source: Morgan Stanley Research

Source: Morgan Stanley Research

——————–

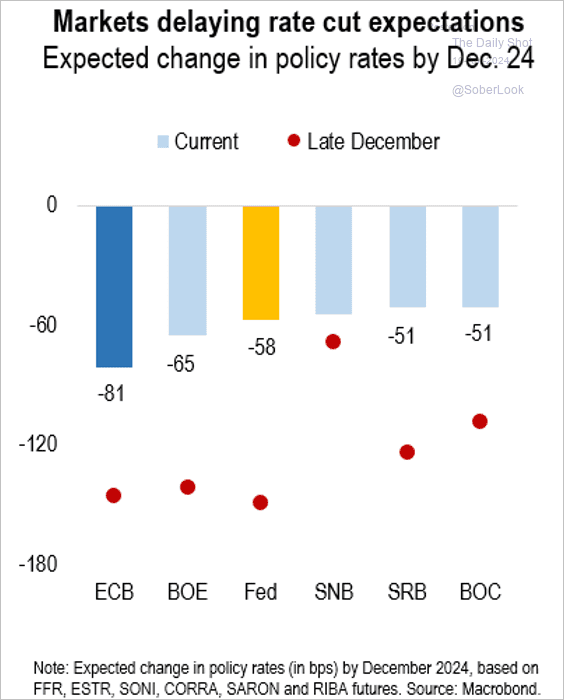

3. Investors have delayed expectations around policy easing across major developed markets.

Source: Numera Analytics (@NumeraAnalytics)

Source: Numera Analytics (@NumeraAnalytics)

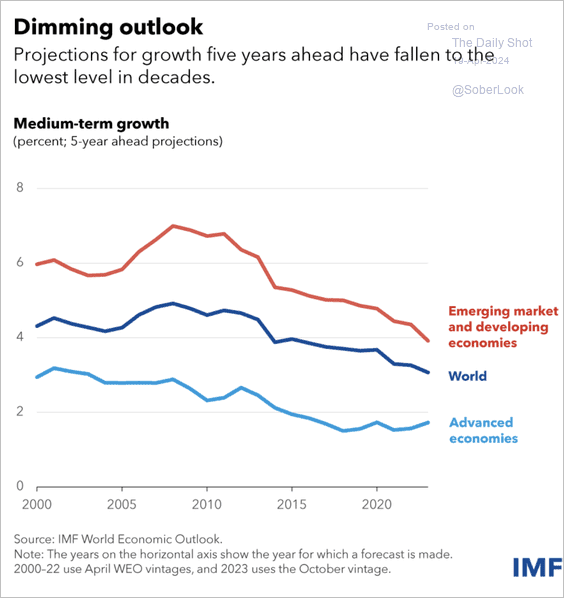

4. The IMF’s projections for growth five years out have been trending lower.

Source: IMF Read full article

Source: IMF Read full article

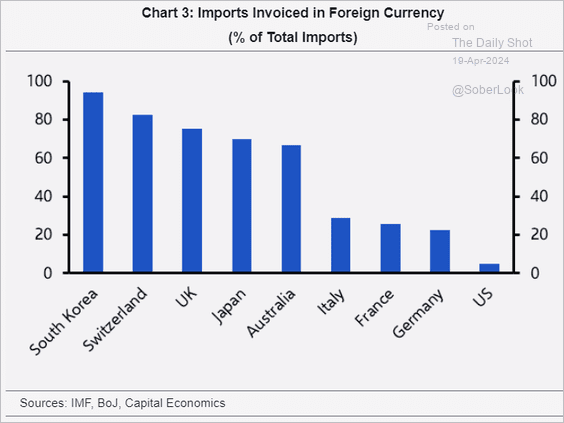

5. This chart shows the percentage of imports billed in foreign currency by country.

Source: Capital Economics

Source: Capital Economics

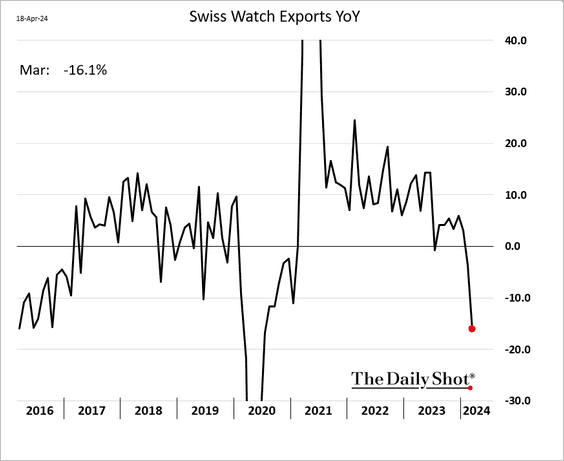

6. Swiss watch exports slumped last month due to weak demand from China.

Source: @wealth Read full article

Source: @wealth Read full article

Back to Index

The United States

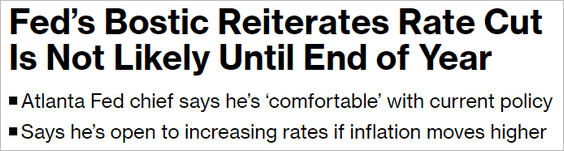

1. Fed officials continue to signal delays in rate cuts.

Source: @economics Read full article

Source: @economics Read full article

Source: @economics Read full article

Source: @economics Read full article

Rate cut expectations for 2024 dipped below 40 bps.

——————–

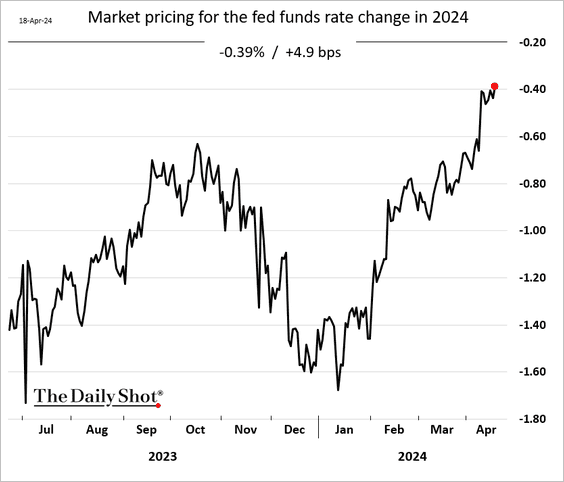

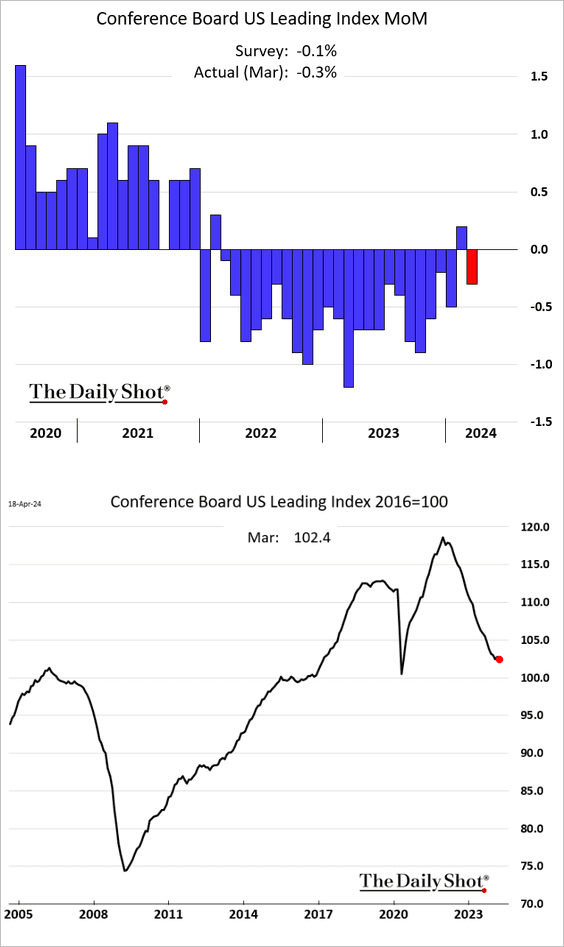

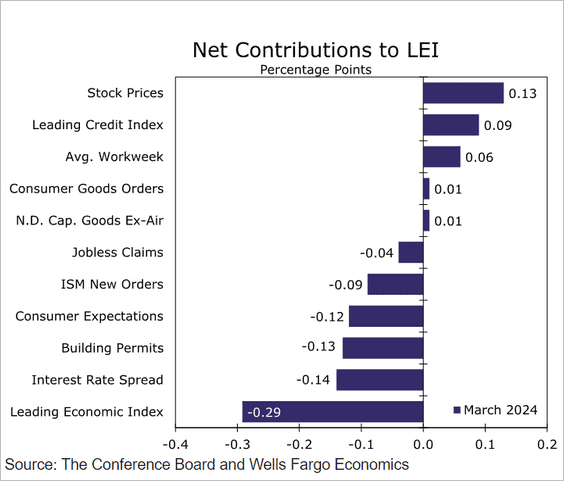

2. The Conference Board’s leading index declined again in March. Some economists argue that in the current environment, this indicator does not effectively measure economic activity.

——————–

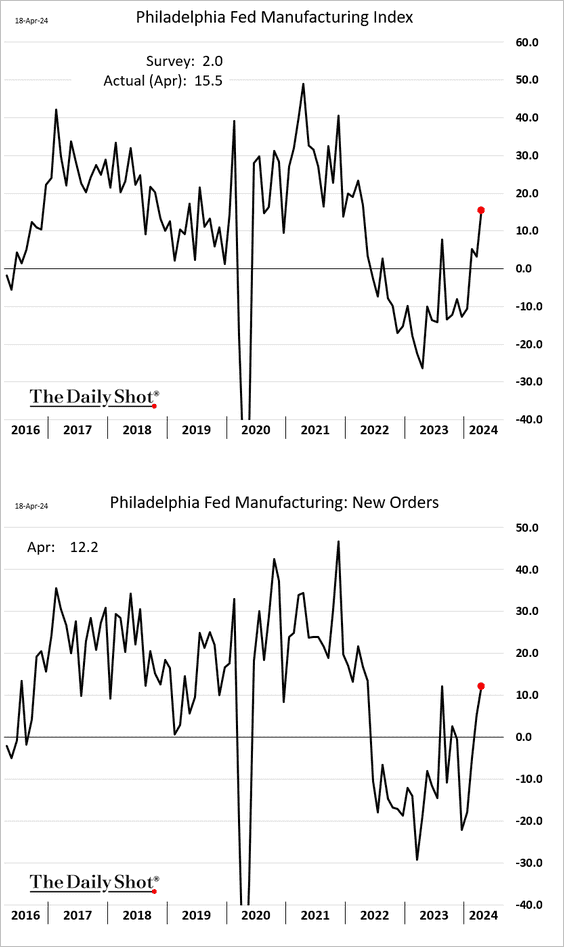

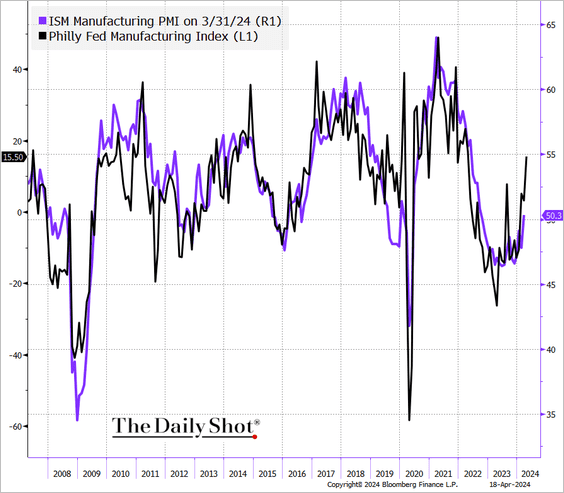

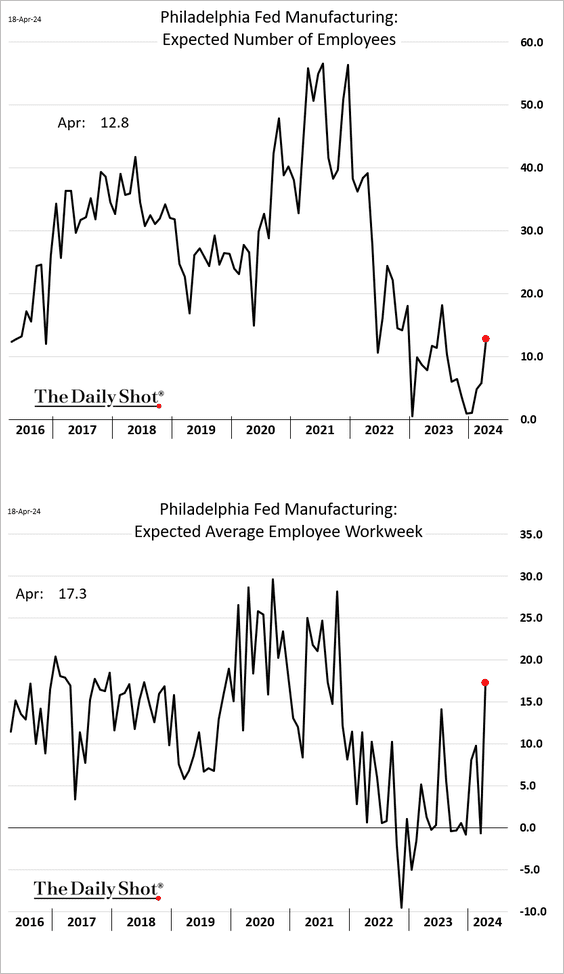

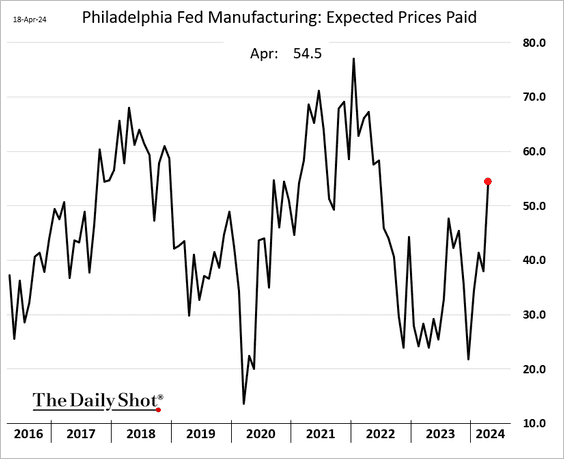

3. The Philly Fed’s regional manufacturing index rose this month, signaling an improvement in US factory activity. This report contrasts with the earlier data from the New York Fed.

• The Philly Fed’s index is consistent with the ISM PMI (at the national level) reaching 55.

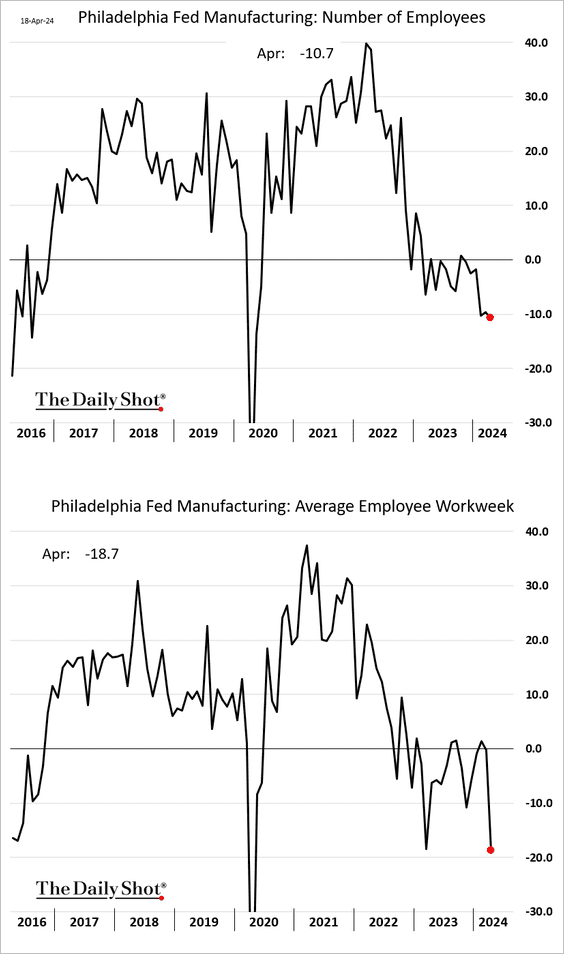

• Although the region’s factories continue to reduce their workforce and employee hours, …

… they are becoming more optimistic about labor demand in the coming months.

• Manufacturers increasingly expect their costs to rise.

——————–

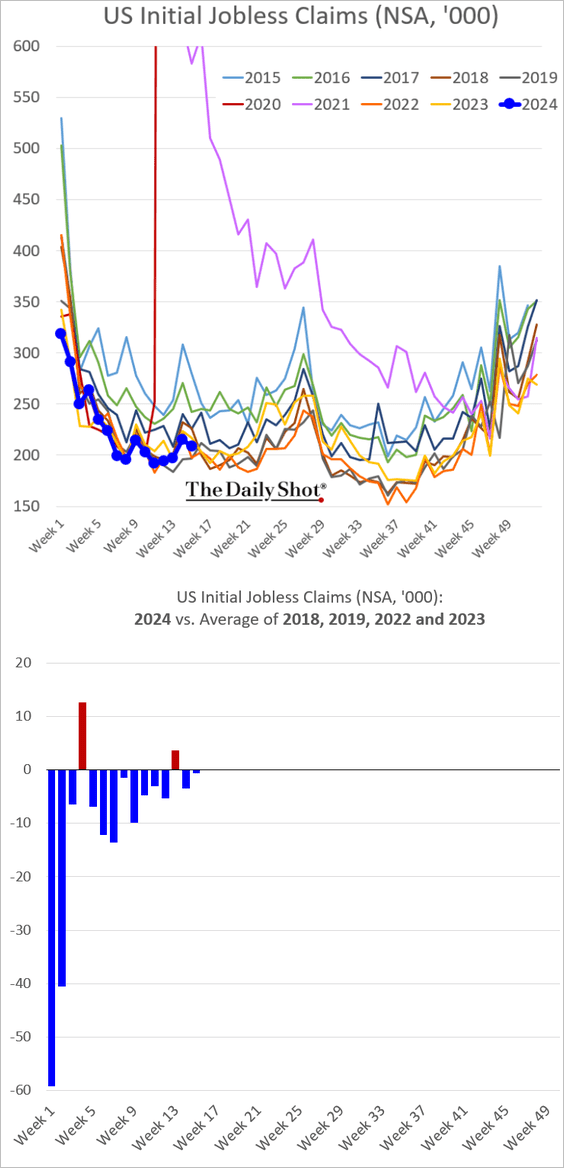

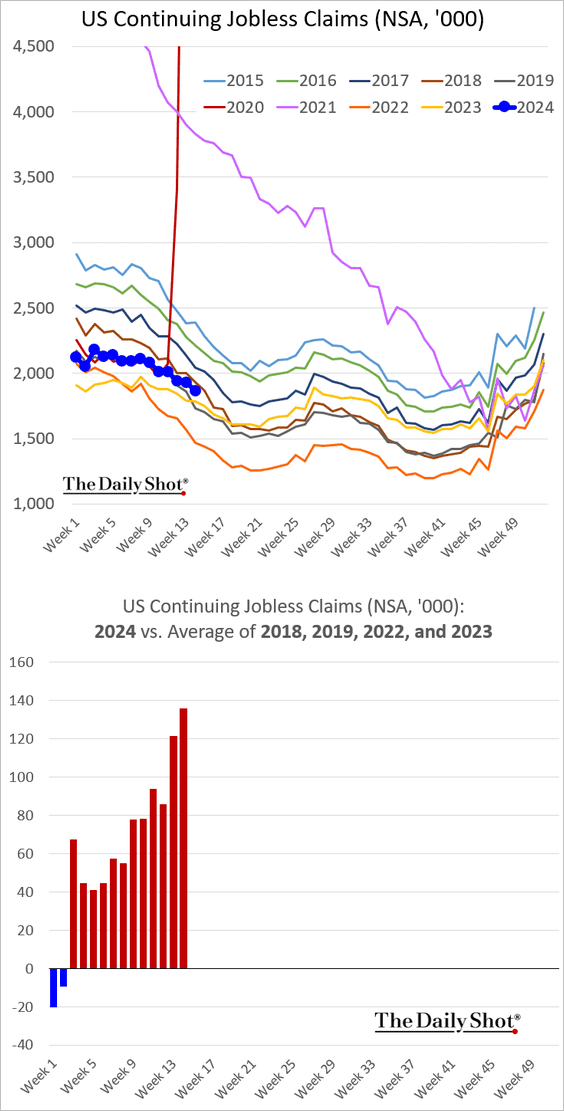

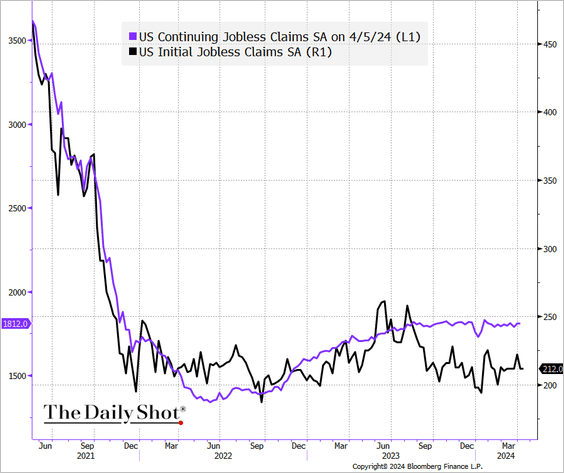

4. Next, we have some updates on the labor market.

• Initial jobless claims remain low, …

… but continuing claims appear to be trending up relative to recent years.

– Here are the seasonally adjusted trends. It is important to note that seasonal adjustments to weekly data may not always be reliable in the short term.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

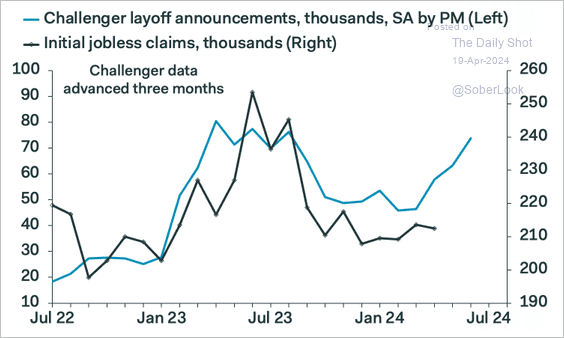

– Layoff data seem to suggest that jobless claims will move higher in the weeks ahead.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

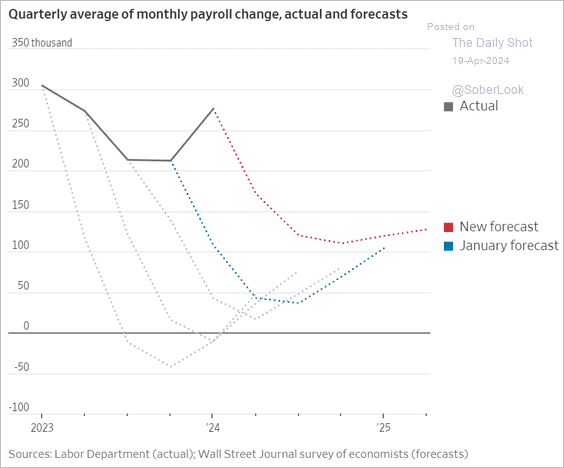

• Economists have been surprised by the strength of the US labor market.

Source: @WSJ Read full article

Source: @WSJ Read full article

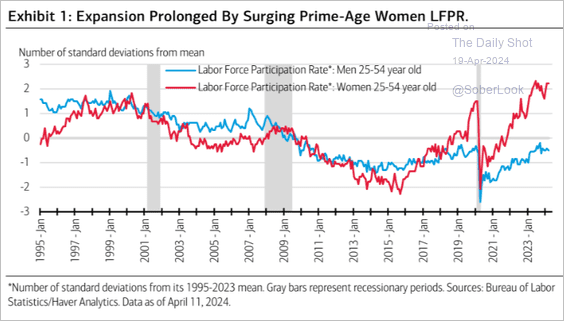

• The entry of more prime-age women into the labor force has extended the expansion of the US labor force.

Source: Merrill Lynch

Source: Merrill Lynch

——————–

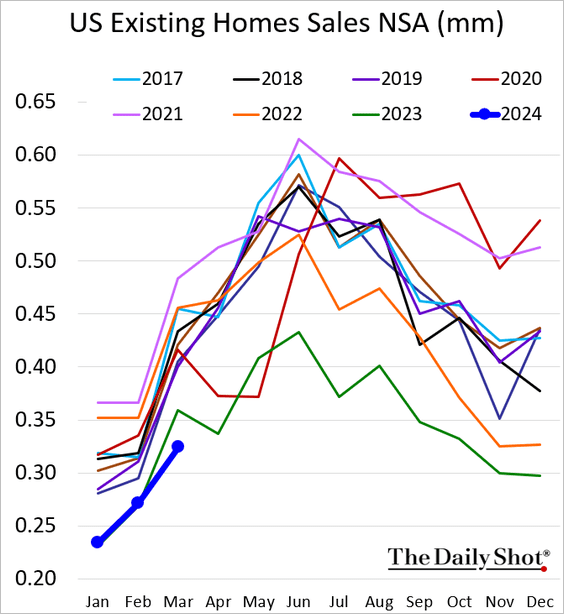

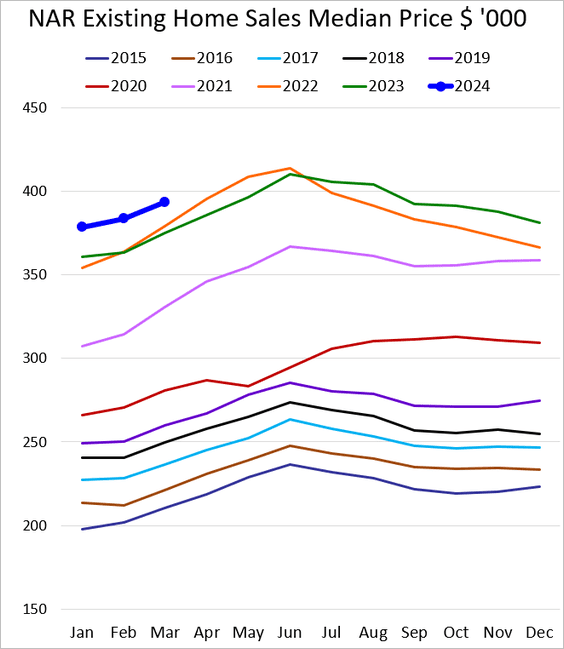

5. Existing home sales dropped below 2023 levels last month, reaching a multi-year low for this time of the year.

Source: @economics Read full article

Source: @economics Read full article

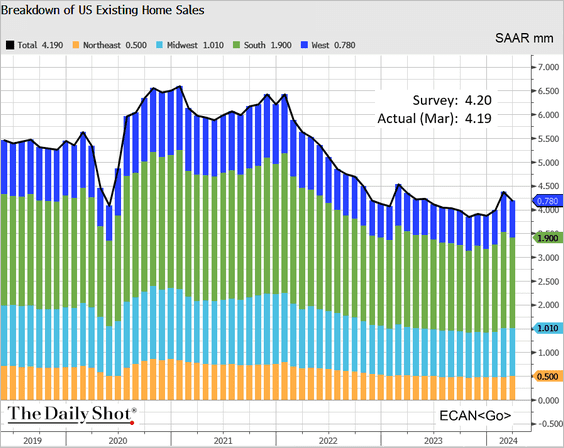

• Here is the regional breakdown (seasonally adjusted).

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

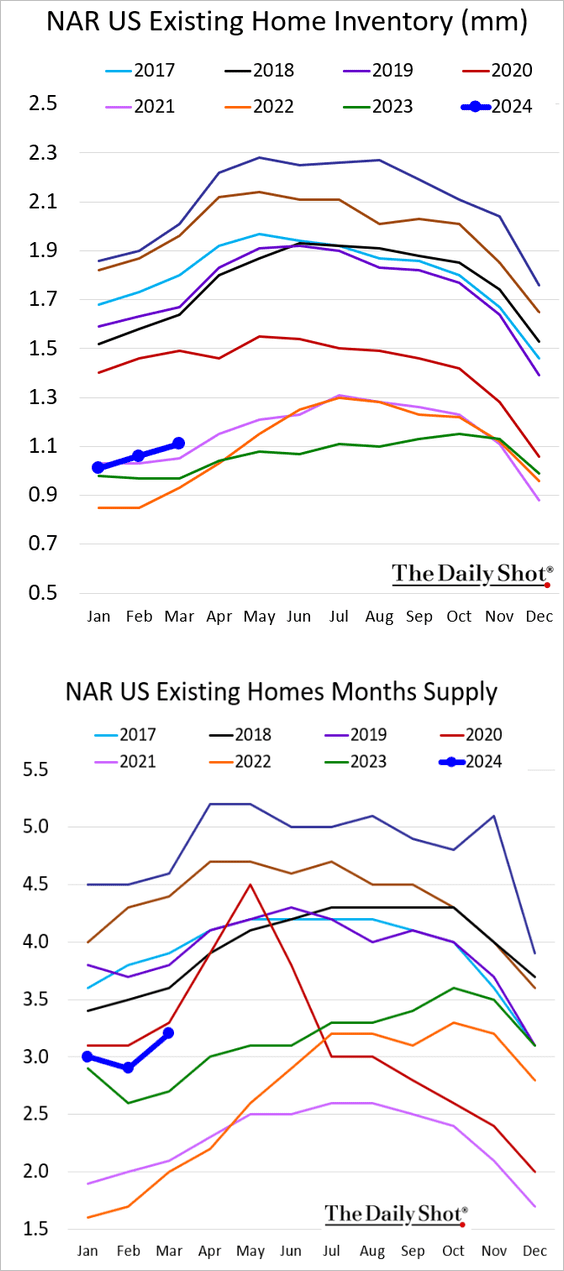

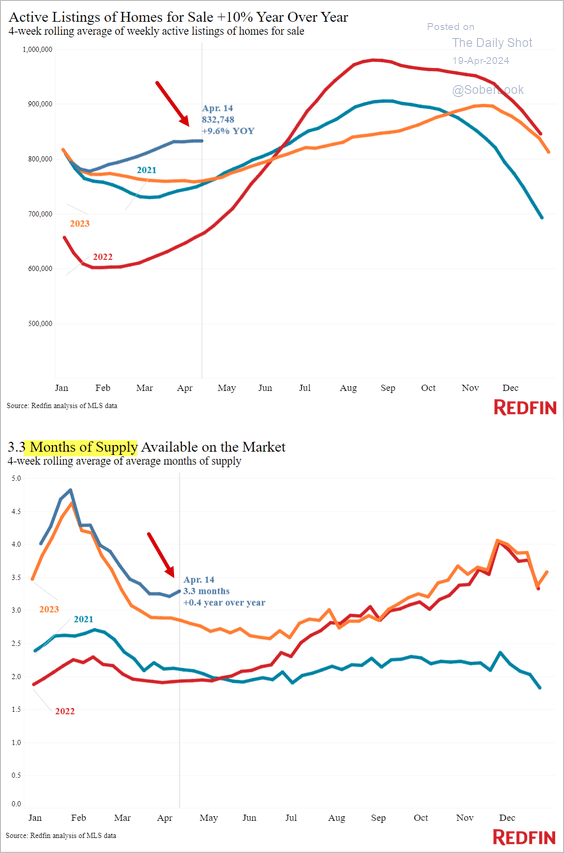

• Inventories of homes for sale have risen well above the 2023 levels, …

… which is confirmed by RedFin’s data.

Source: Redfin

Source: Redfin

• The median sales price was 4.8% above last year’s level.

Back to Index

Europe

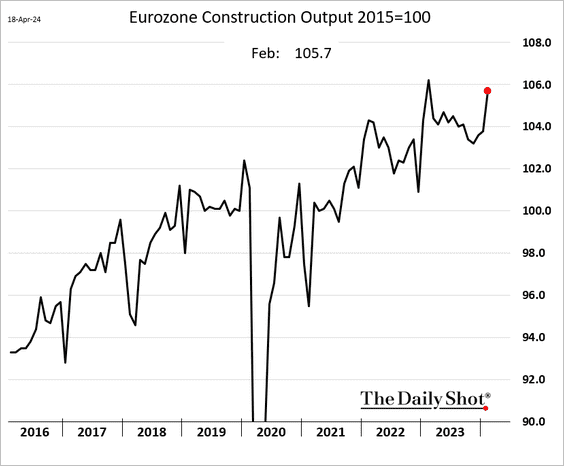

1. The Eurozone’s construction output improved further in February.

Source: RTT News Read full article

Source: RTT News Read full article

——————–

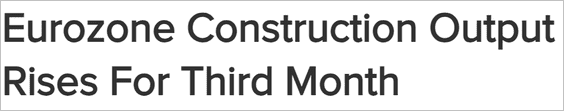

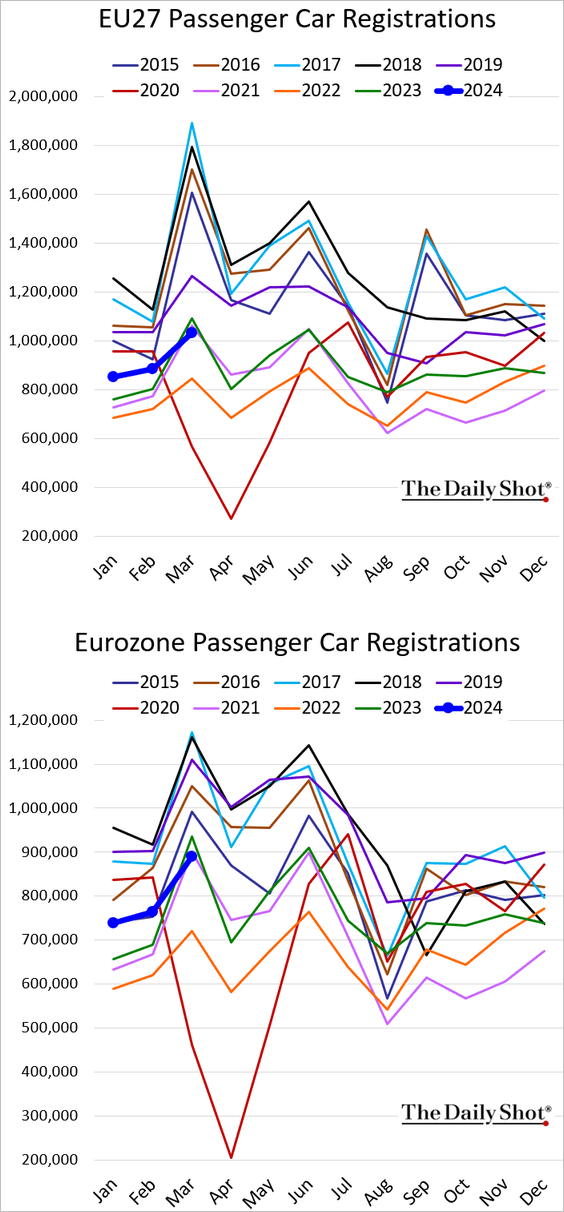

2. EU vehicle registrations dipped below last year’s levels.

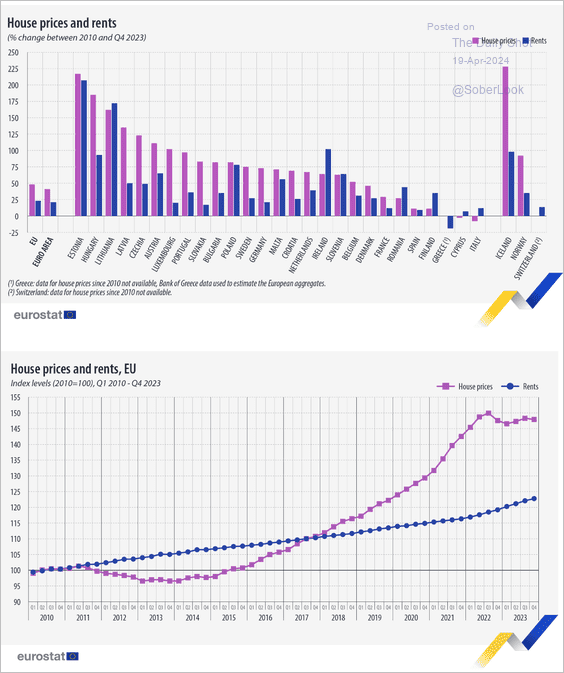

3. Here is a look at the changes in rents and house prices in the EU.

Source: Eurostat Read full article

Source: Eurostat Read full article

Back to Index

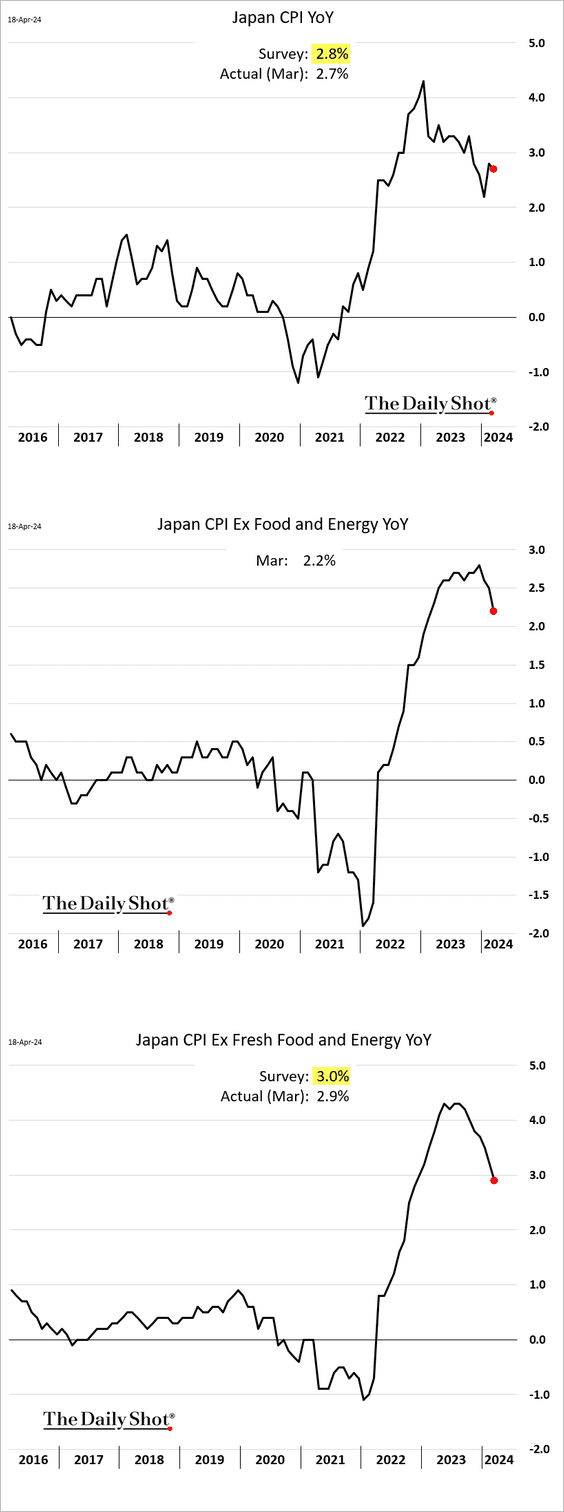

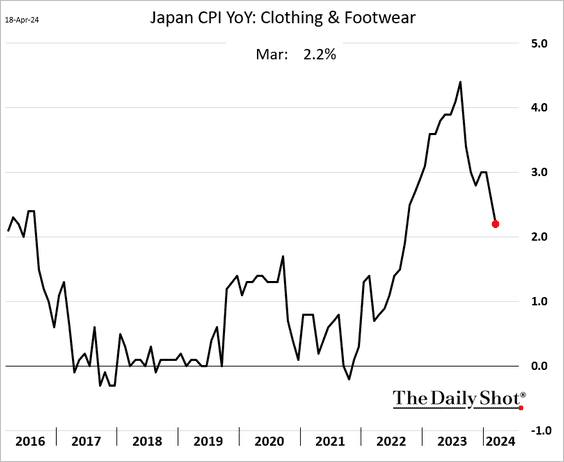

Japan

Inflation eased last month.

Source: Reuters Read full article

Source: Reuters Read full article

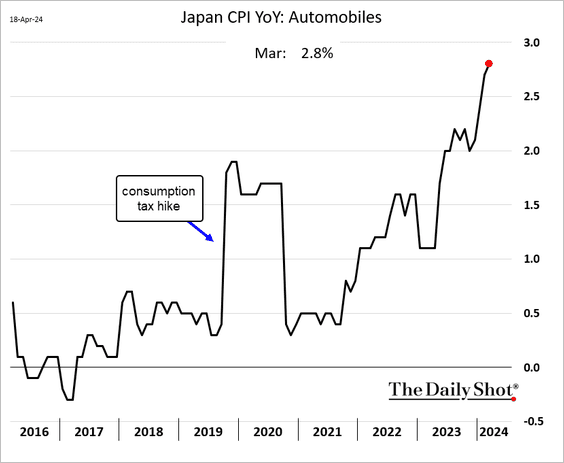

Here are a couple of CPI components.

• Autos:

• Clothing:

Back to Index

China

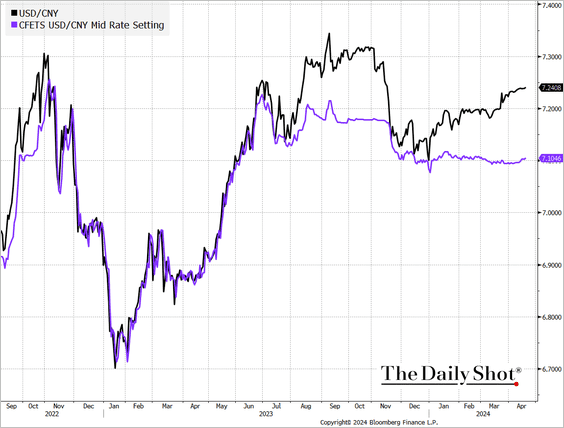

1. The renminbi continues to weaken gradually, diverging from the PBoC’s target midpoint.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

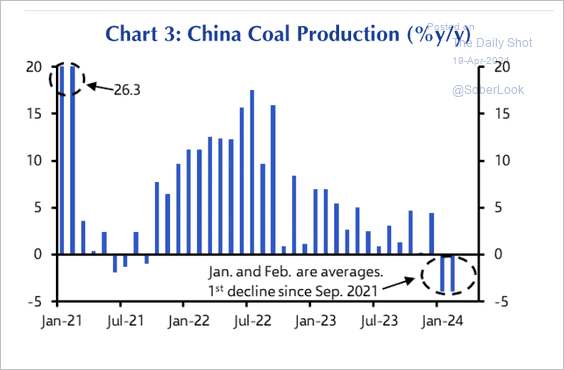

2. Coal production declined for the first time since September 2021. This is partly because of recent accidents leading to a tightening of safety regulations, according to Capital Economics.

Source: Capital Economics

Source: Capital Economics

Back to Index

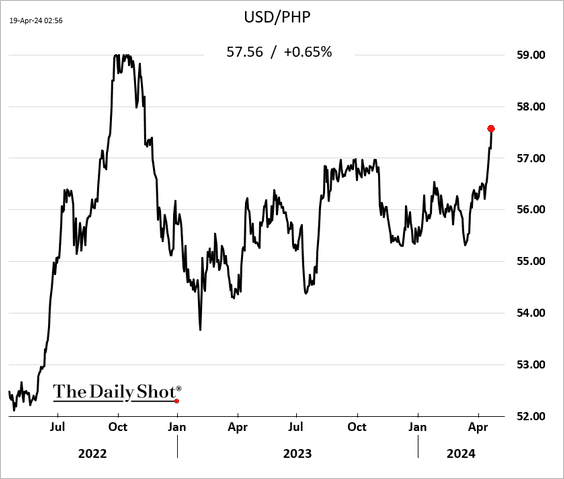

Emerging Markets

1. Asian currencies are weaker after Israel’s retaliatory strike. This chart shows the US dollar gaining against the Philippine peso.

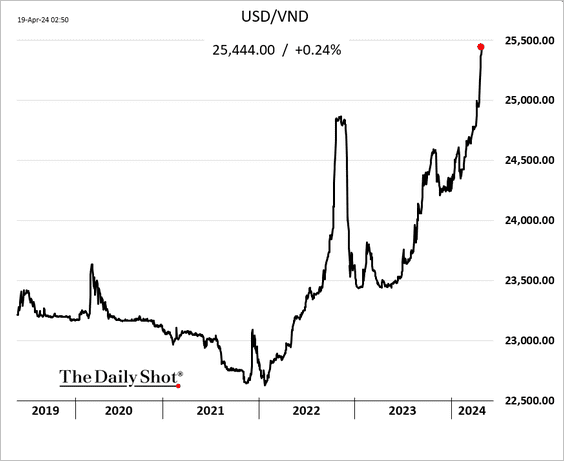

2. The Vietnamese dong reached a new low against the dollar. Will Vietnam’s central bank intervene to avoid being labeled a currency manipulator by the US Treasury?

Source: @markets Read full article

Source: @markets Read full article

——————–

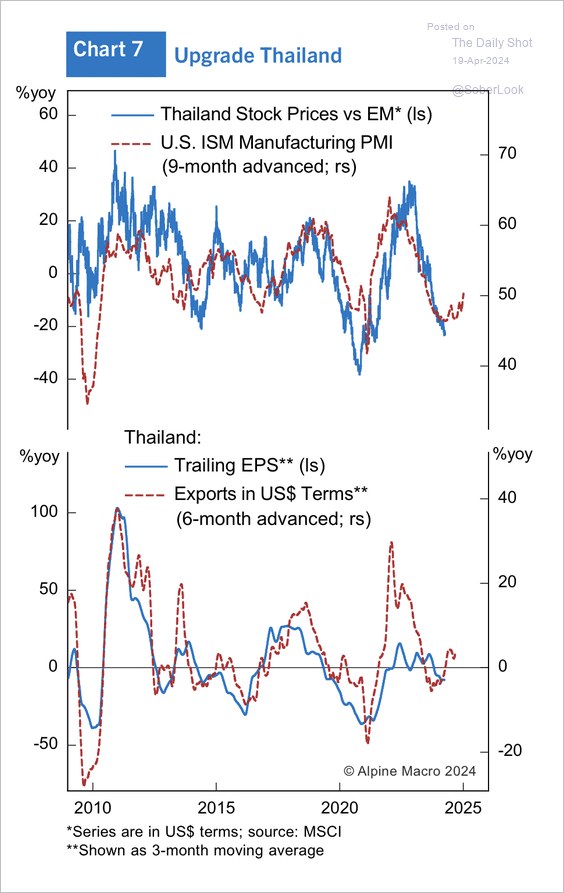

3. The increase in Thailand’s exports could benefit domestic earnings growth.

Source: Alpine Macro

Source: Alpine Macro

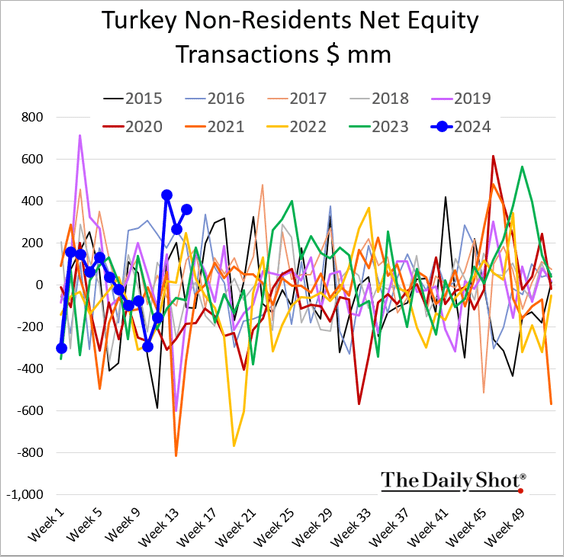

4. Foreigners continue to buy Turkish stocks.

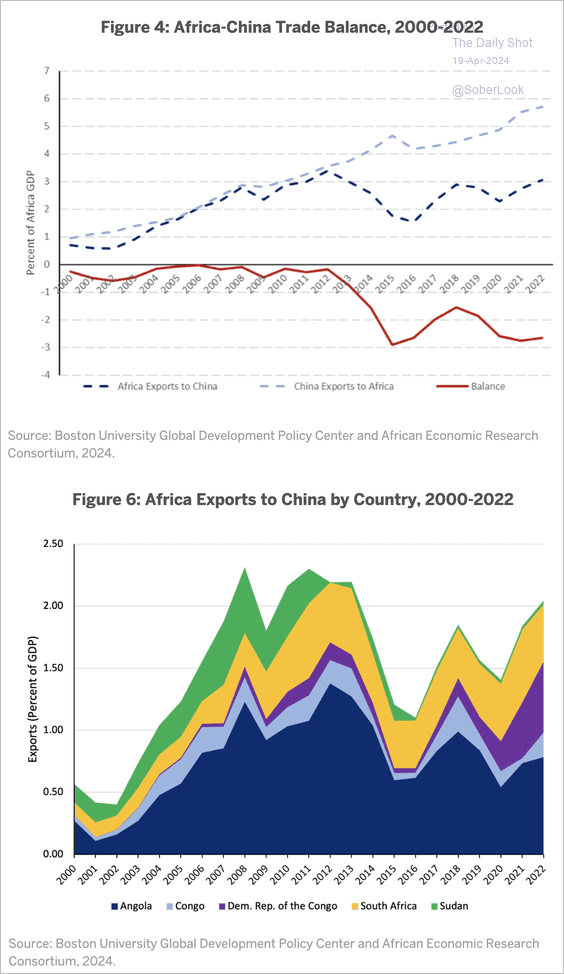

5. Here is a look at the Africa-China trade.

Source: Boston University Global Development Policy Center Read full article

Source: Boston University Global Development Policy Center Read full article

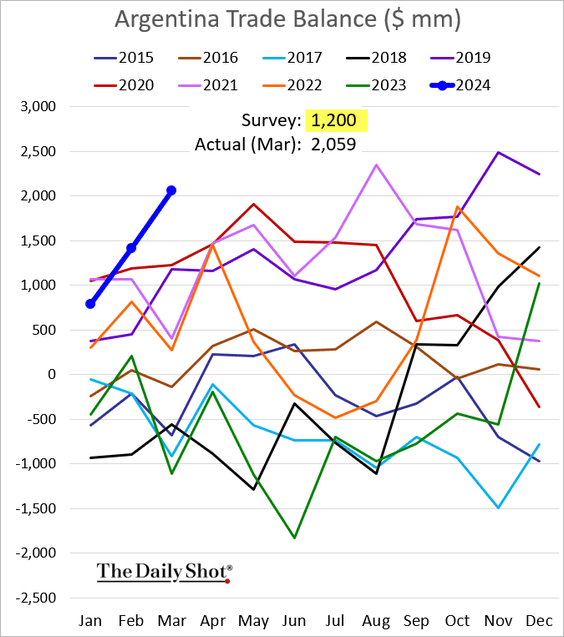

6. Argentina’s trade surplus surprised to the upside as exports firmed while imports slumped last month.

Back to Index

Cryptocurrency

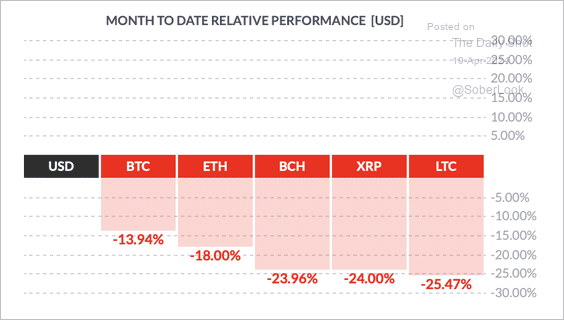

1. It has been a tough month for cryptos, with several altcoins underperforming bitcoin.

Source: FinViz

Source: FinViz

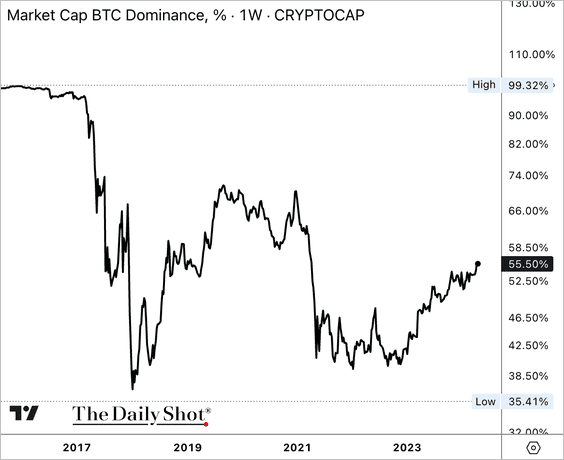

2. Bitcoin’s market cap relative to the total crypto market cap (dominance ratio) continues to rise.

3. Is the bitcoin halving priced in?

Source: CoinDesk Read full article

Source: CoinDesk Read full article

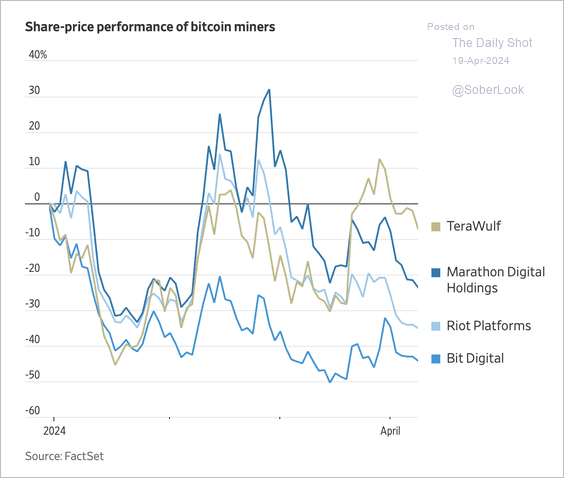

4. The rally in bitcoin mining stocks has faded.

Source: @WSJ Read full article

Source: @WSJ Read full article

Back to Index

Commodities

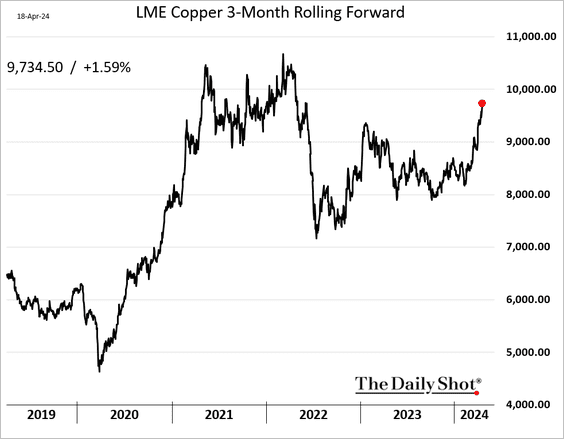

1. The rally in copper remains intact.

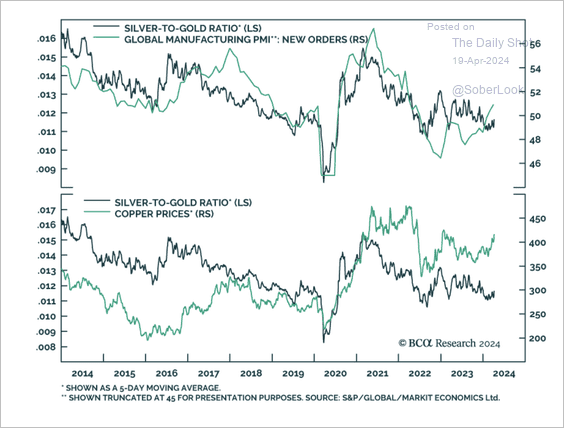

2. The rise in industrial metal prices has been supported by improving global manufacturing PMIs.

Source: BCA Research

Source: BCA Research

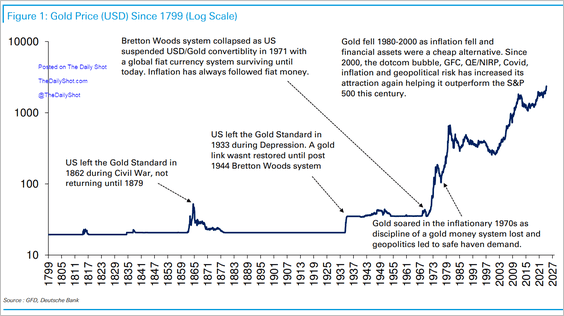

3 Here is an annotated history of gold.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

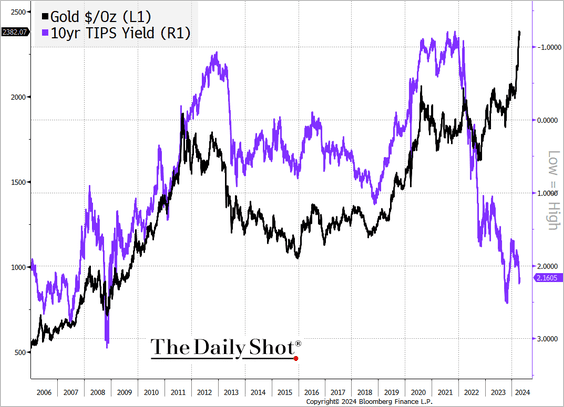

• Gold prices continue to diverge from real rates.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

——————–

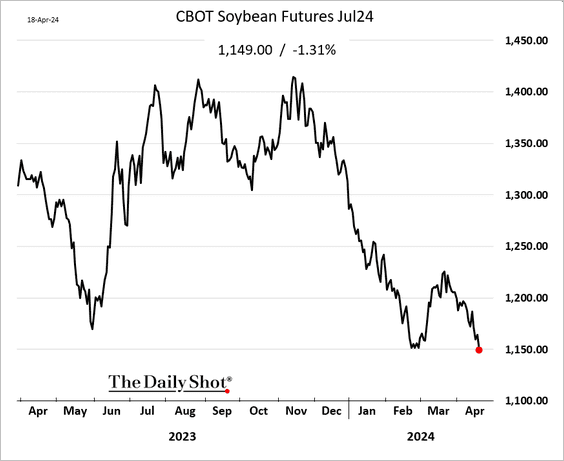

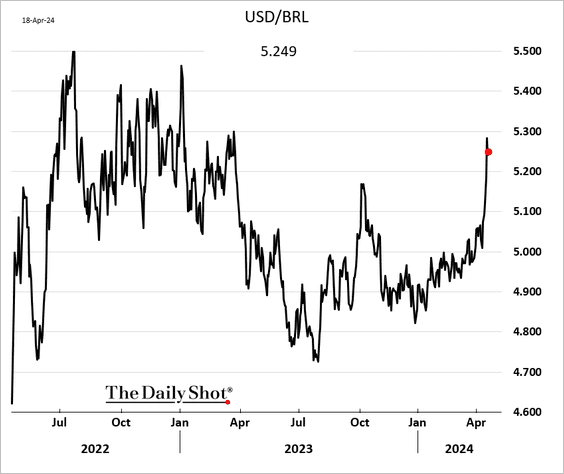

3. The selloff in US soybean futures continues.

A weak Brazilian real and favorable weather conditions have been a headwind for soybeans.

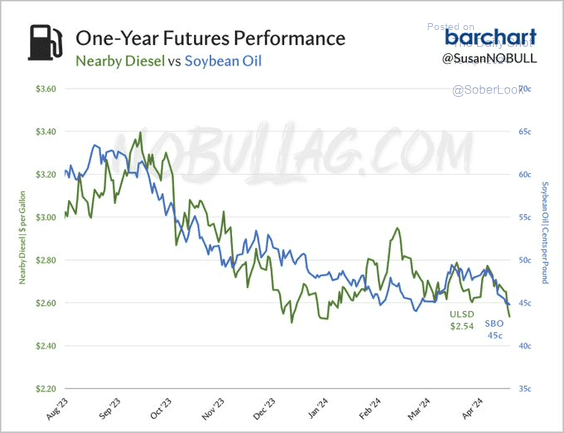

4. With nearly half of US soybean oil being used in biofuels, the commodity now behaves like an energy product.

Source: @SusanNOBULL, @Barchart Read full article

Source: @SusanNOBULL, @Barchart Read full article

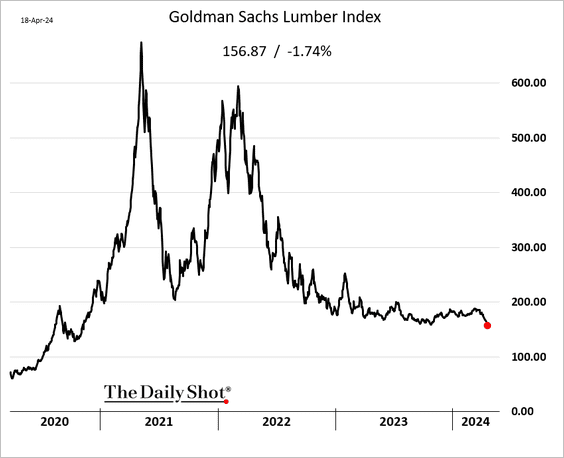

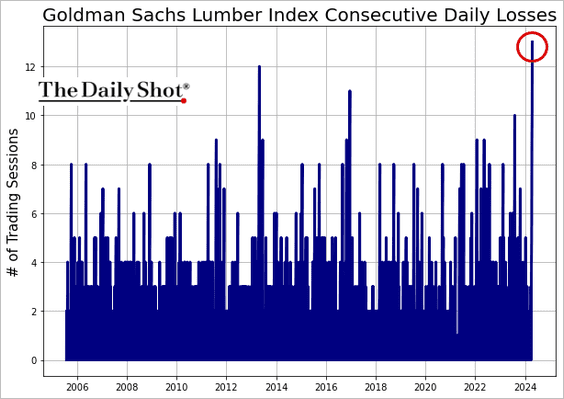

5. Lumber prices have been down for 13 days in a row, reaching the lowest level since 2020 this week. Weak US housing data has weighed on lumber.

——————–

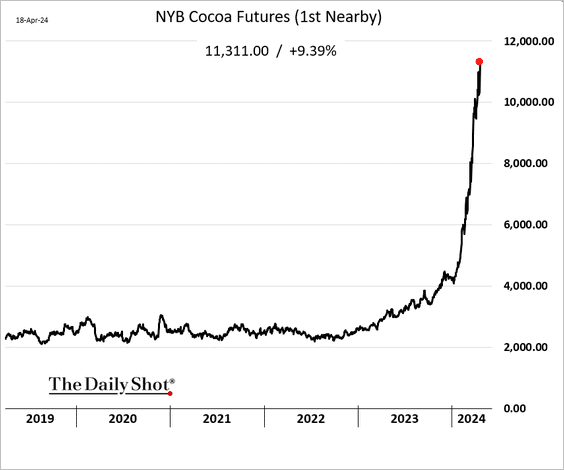

6. Cocoa futures have resumed their unprecedented rally.

Back to Index

Equities

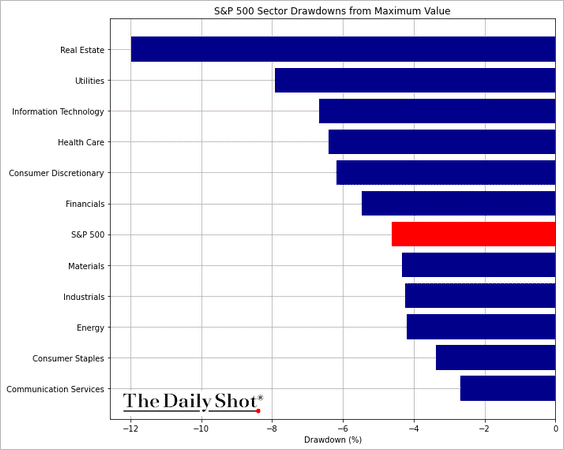

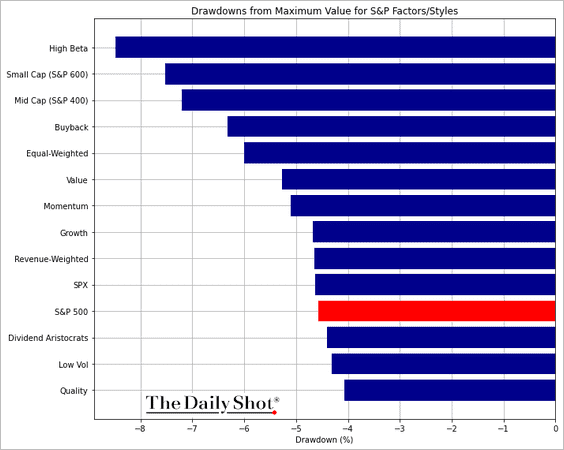

1. Let’s take a look at the market drawdowns in the current selloff.

• Sectors:

• Equity factors/styles:

——————–

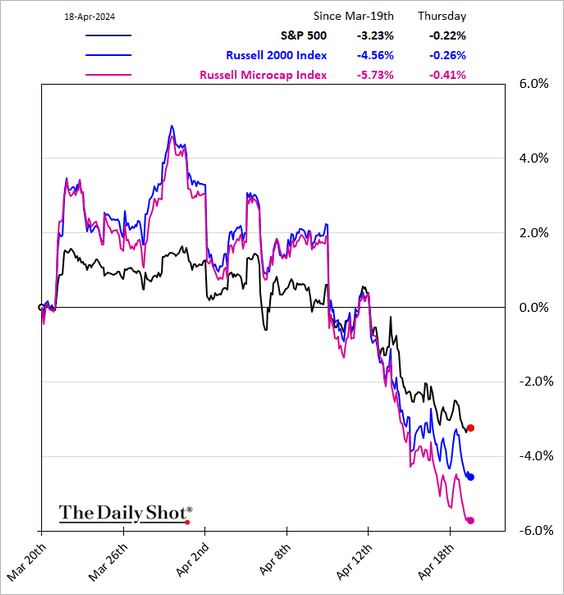

2. Micorcaps’ underperformance worsened this week.

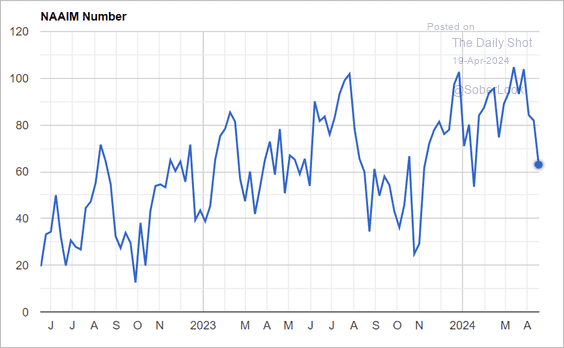

3. Investment managers are trimming equity exposure.

Source: NAAIM

Source: NAAIM

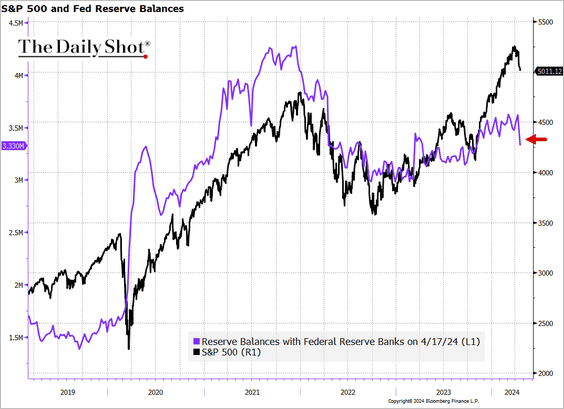

4. Yesterday, we showed a sharp increase in the US Treasury’s balances at the Fed, which reduces liquidity in the private sector and typically acts as a headwind for risk assets.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

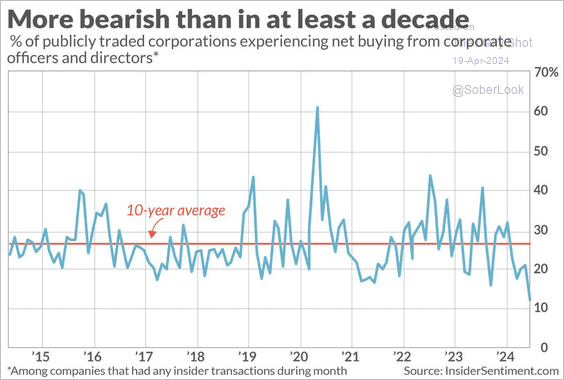

5. Insiders’ net equity buying has been running well below the historical average.

Source: @Mayhem4Markets

Source: @Mayhem4Markets

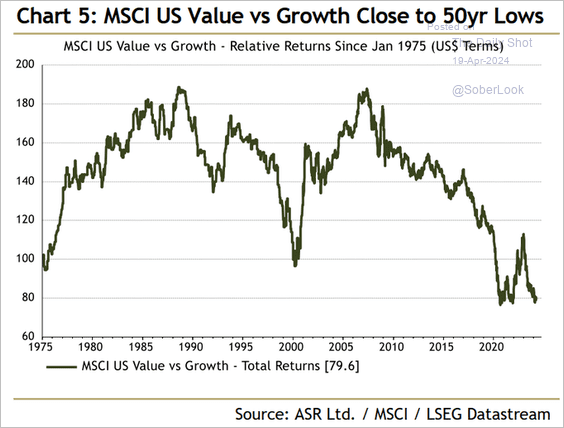

6. The relative performance of value versus growth stocks is approaching its 50-year lows.

Source: @IanRHarnett

Source: @IanRHarnett

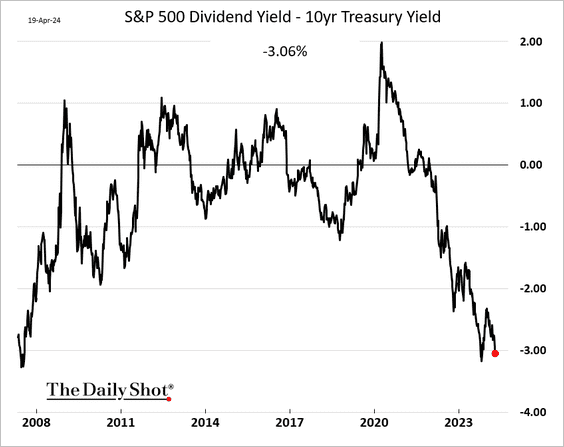

7. The S&P 500 dividend yield is over 3% below the 10-year Treasury yield.

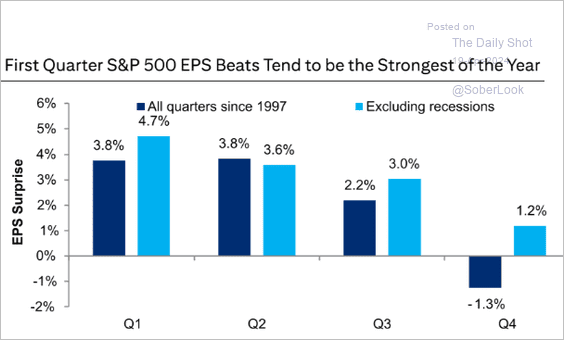

8. First-quarter earnings per share (EPS) beats for the S&P 500 are typically the strongest of the year.

Source: Citi Private Bank

Source: Citi Private Bank

Back to Index

Credit

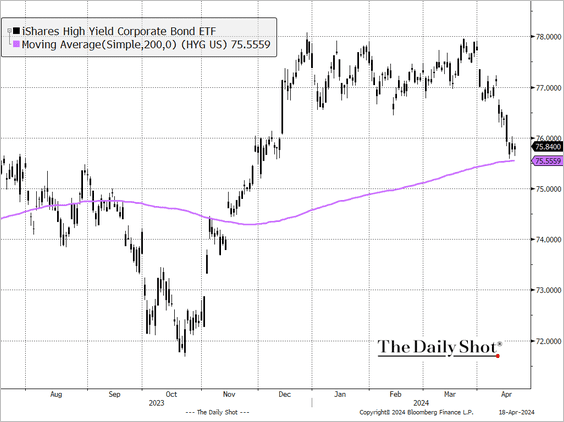

1. HYG, the largest corporate high-yield ETF, is testing support at the 200-day moving average.

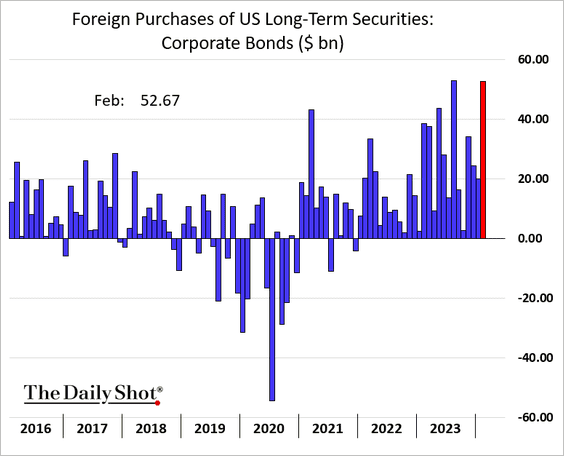

2. Foreigners bought $53 billion worth of US corporate bonds in February.

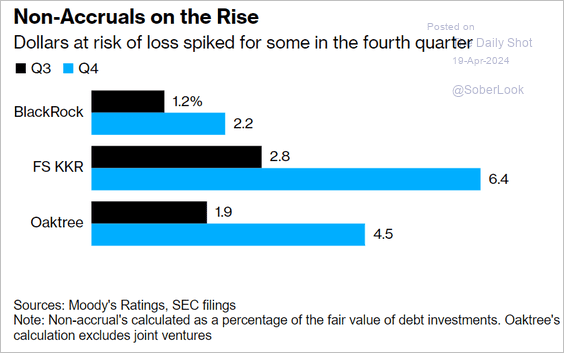

3. Direct lending funds, including BDCs, are reporting an increase in distressed names within their portfolios.

Source: @markets Read full article

Source: @markets Read full article

Back to Index

Rates

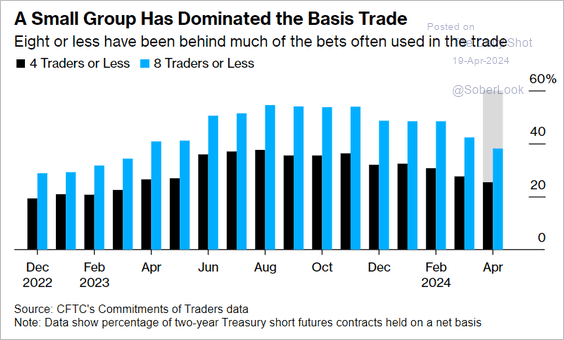

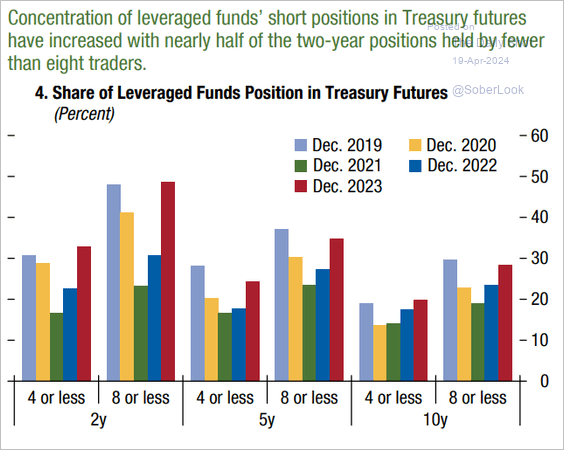

1. A small number of players have been dominating the Treasury futures/cash arb trades (2 charts).

Source: @markets Read full article

Source: @markets Read full article

Source: IMF Read full article

Source: IMF Read full article

——————–

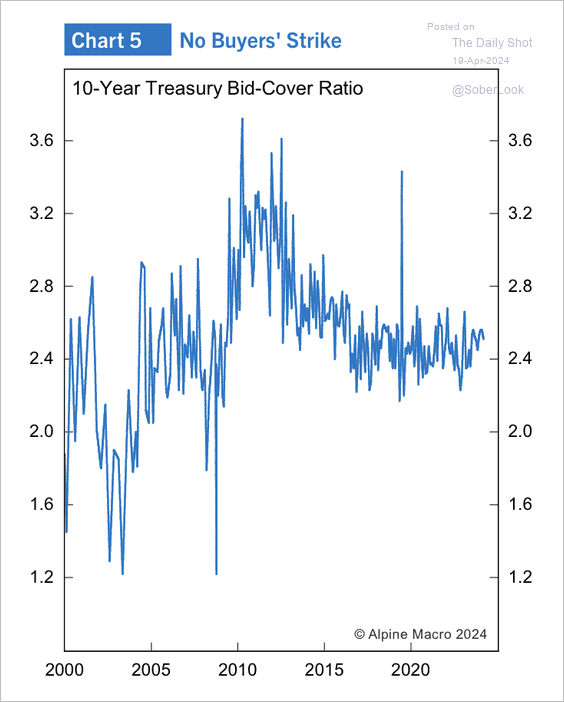

2. The bid-to-cover ratio at 10-year Treasury auctions has been relatively stable.

Source: Alpine Macro

Source: Alpine Macro

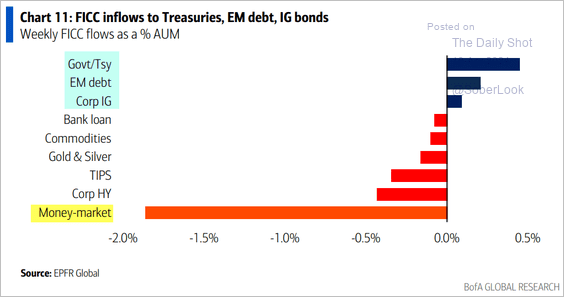

3. Fund flows suggest that investors believe longer-term interest rates have peaked, as evidenced by their rotation from money market funds to longer-term fixed-rate debt.

Source: BofA Global Research

Source: BofA Global Research

——————–

Food for Thought

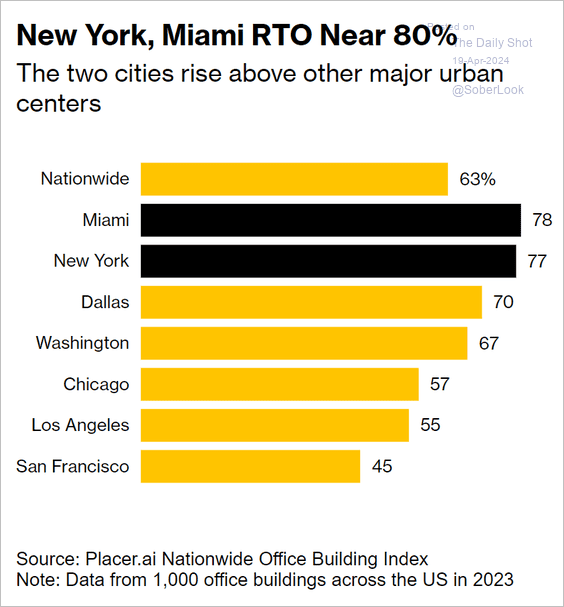

1. Return-to-office rates in major US cities during 2023:

Source: @markets Read full article

Source: @markets Read full article

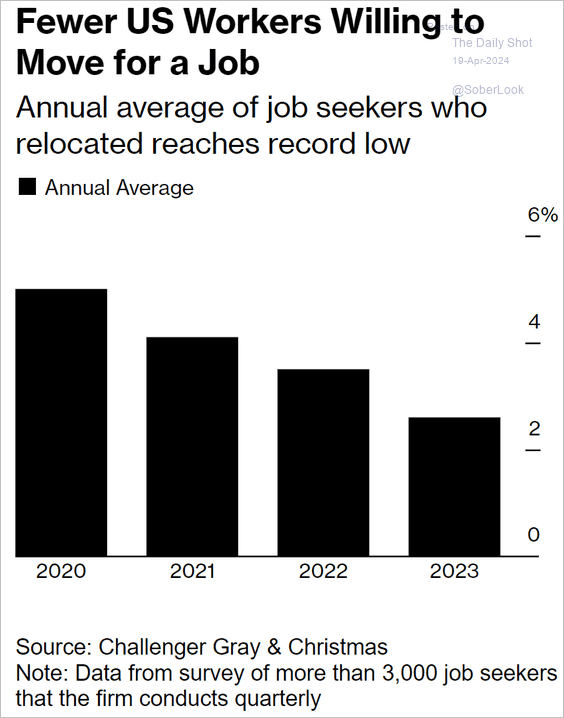

2. Decline in the willingness of US workers to relocate for employment opportunities.

Source: @economics Read full article

Source: @economics Read full article

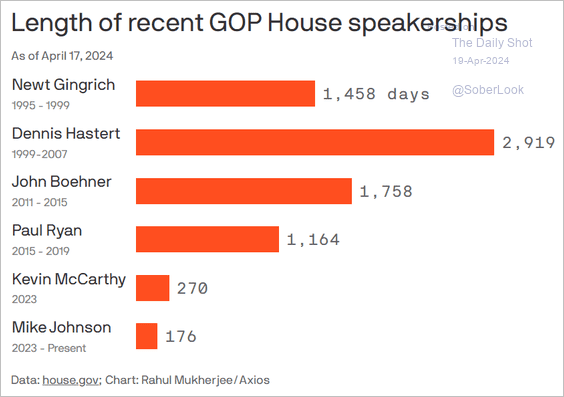

3. Length of House of Representatives GOP speakerships:

Source: @axios Read full article

Source: @axios Read full article

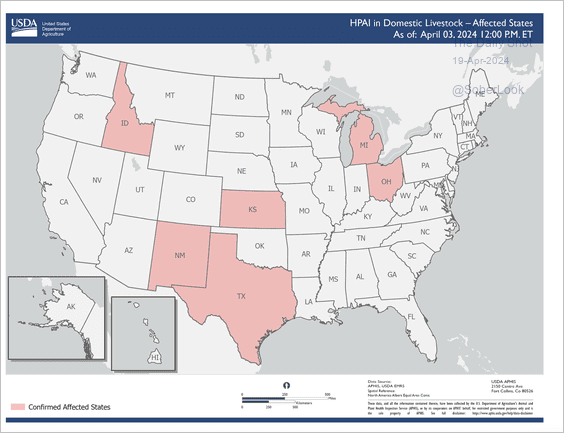

4. Highly Pathogenic Avian Influenza (bird flu) detections in livestock:

Source: USDA Read full article

Source: USDA Read full article

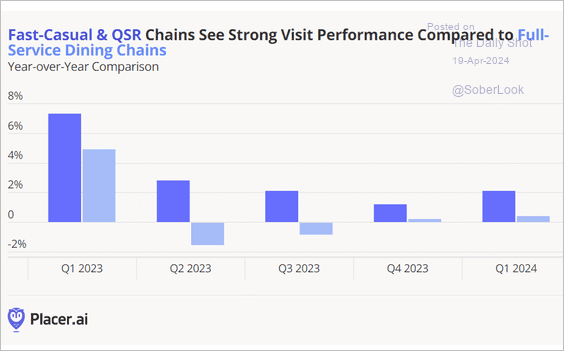

5. Fast-casual and quick-service restaurant chains vs. the full-service dining segment:

Source: Placer.ai

Source: Placer.ai

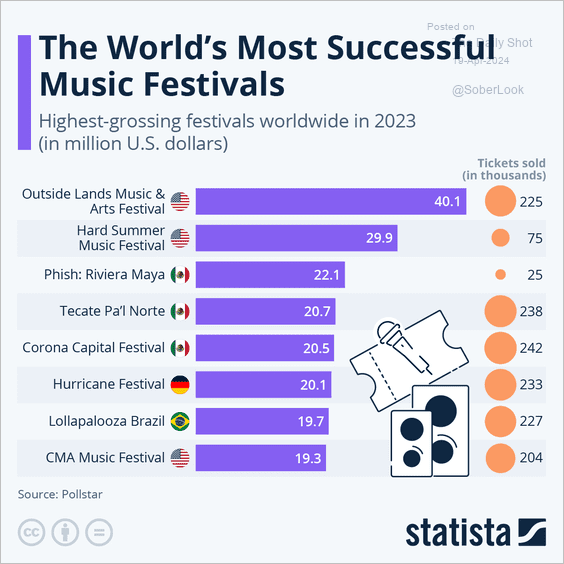

6. Highest-grossing music festivals:

Source: Statista

Source: Statista

——————–

Have a great weekend!

Back to Index