The Daily Shot: 04-Apr-24

• The United States

• Canada

• The Eurozone

• Europe

• Asia-Pacific

• Emerging Markets

• Commodities

• Energy

• Equities

• Alternatives

• Rates

• Food for Thought

The United States

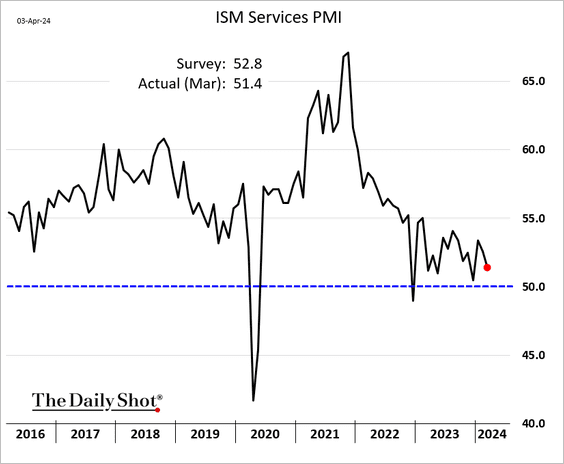

1. The ISM Services PMI fell short of expectations, …

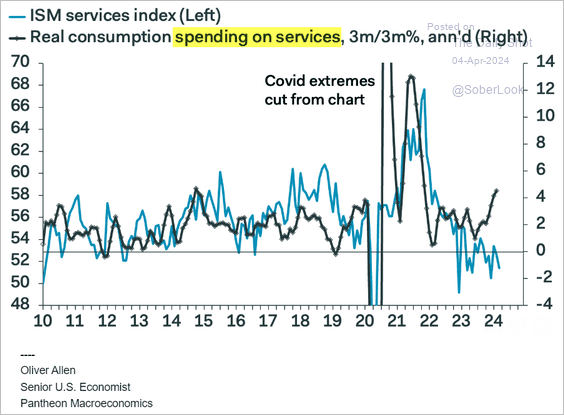

… indicating slower consumer spending …

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

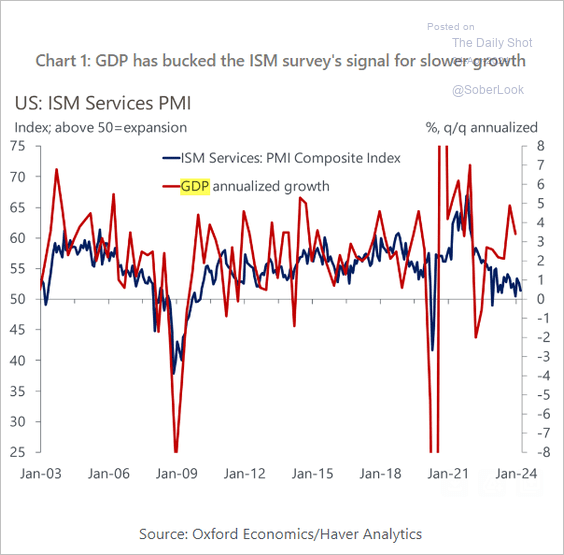

… and weaker economic growth.

Source: Oxford Economics

Source: Oxford Economics

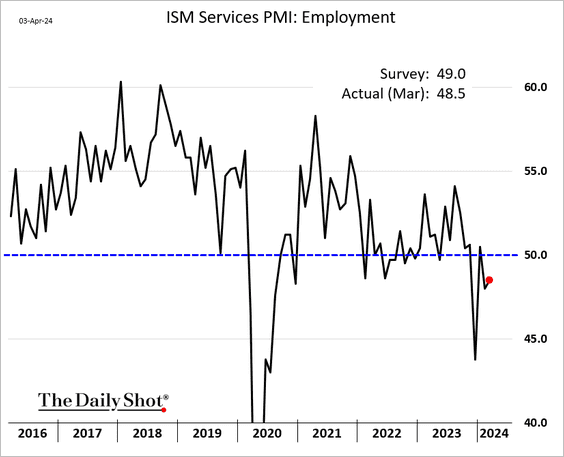

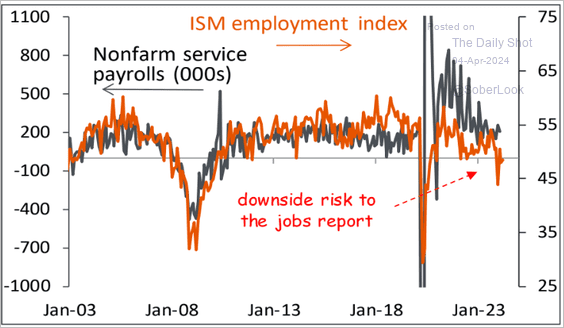

• The employment index remains in contraction territory, …

… which could indicate slower job growth.

Source: Piper Sandler

Source: Piper Sandler

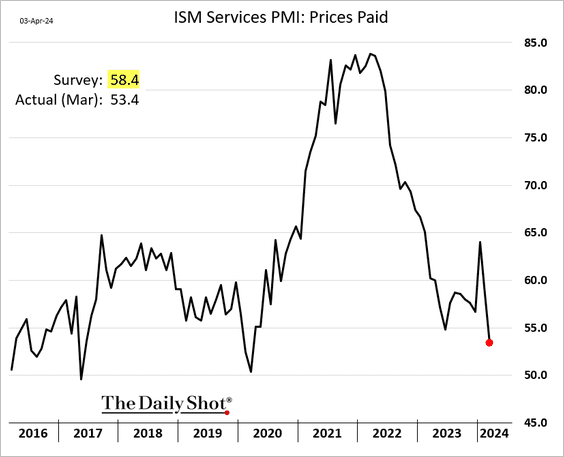

• Fewer service firms are reporting rising costs, …

Source: @economics Read full article

Source: @economics Read full article

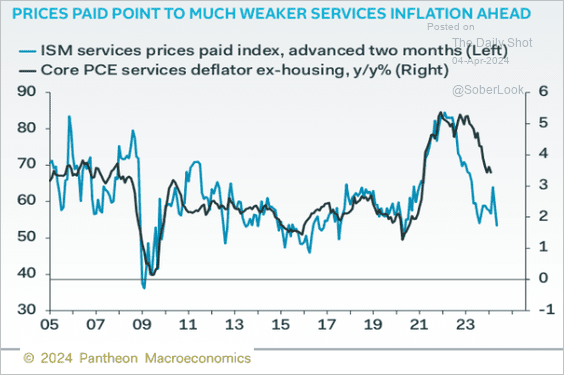

… signaling slower supercore inflation.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

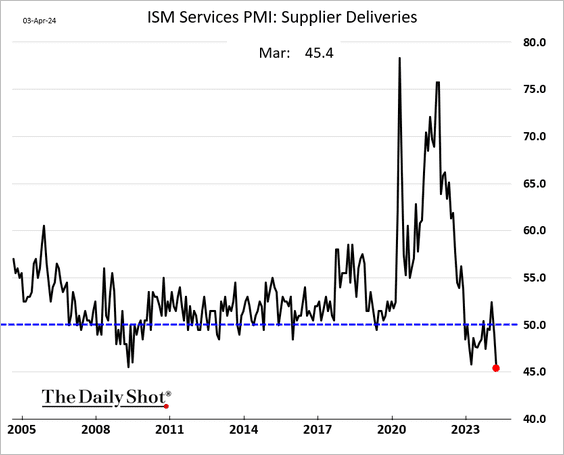

• Supplier delivery times are falling at the fastest pace on record, suggesting softer demand.

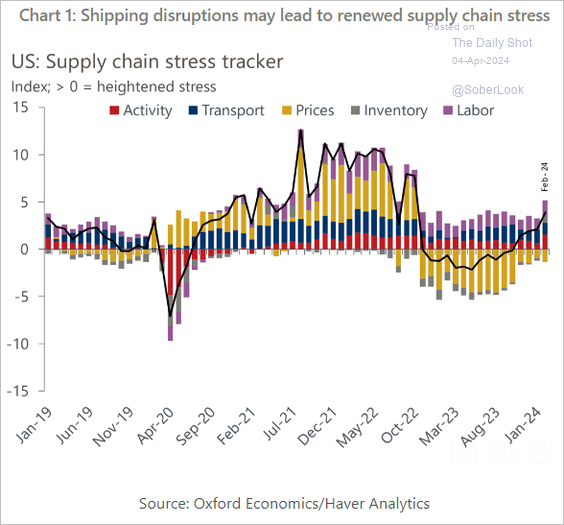

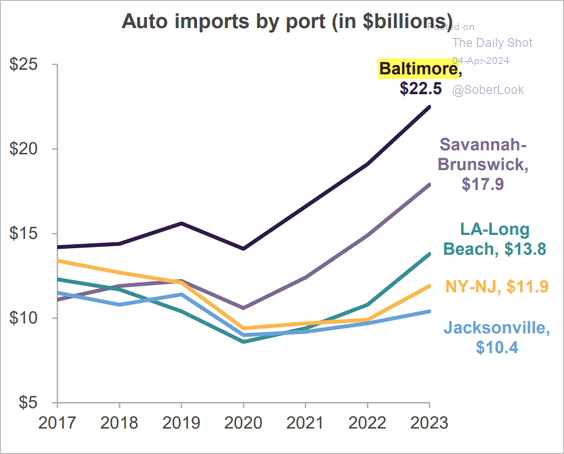

– Will supply chain stress bring back delivery delays in the months ahead (2 charts)?

Source: Oxford Economics

Source: Oxford Economics

Source: Truist Advisory Services

Source: Truist Advisory Services

——————–

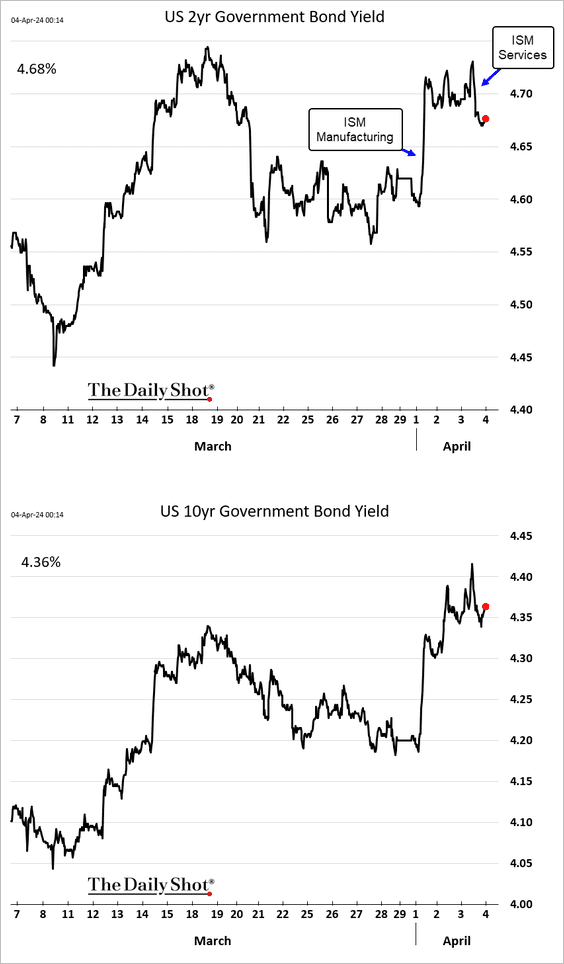

2. Short-term Treasury yields fell following the ISM Services report, while longer-dated yields continue to climb.

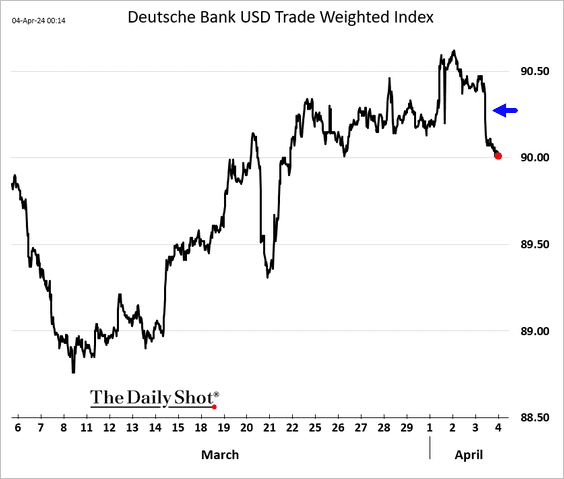

The dollar dropped, boosting commodity prices.

——————–

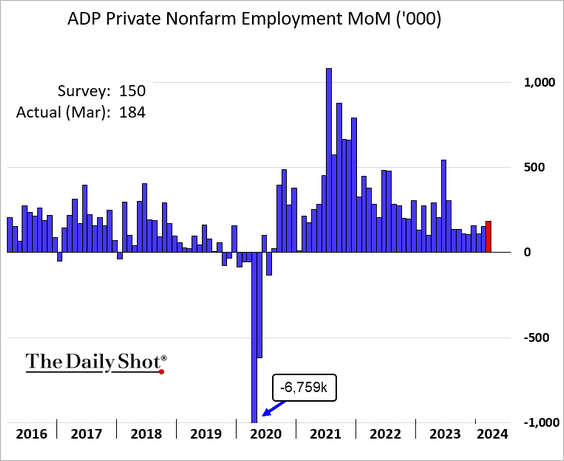

3. The ADP private payrolls index exceeded forecasts …

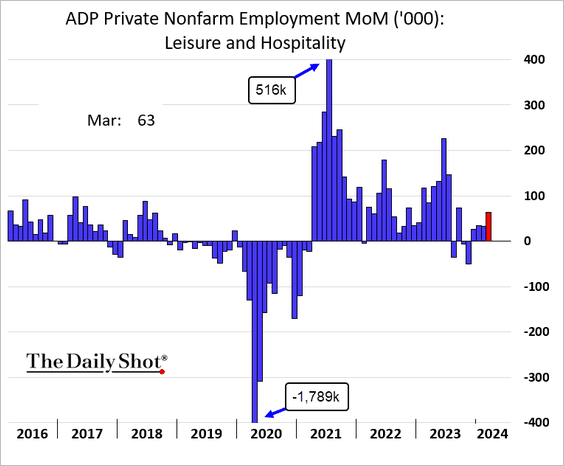

… supported by the Leisure and Hospitality sector.

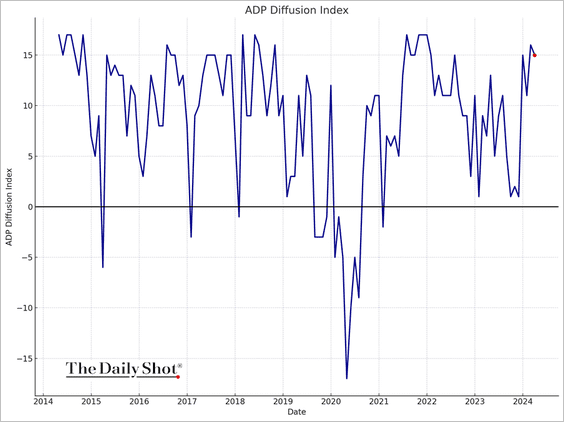

• This ADP diffusion index incorporates job gains vs. losses by sector, region, and company size and suggests that the labor market remains robust.

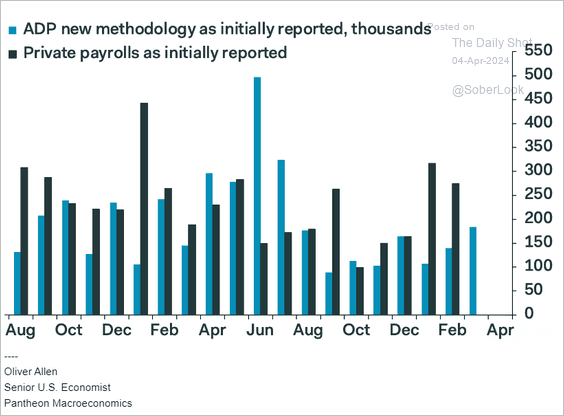

• The ADP report has been a poor predictor of the official employment data.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

——————–

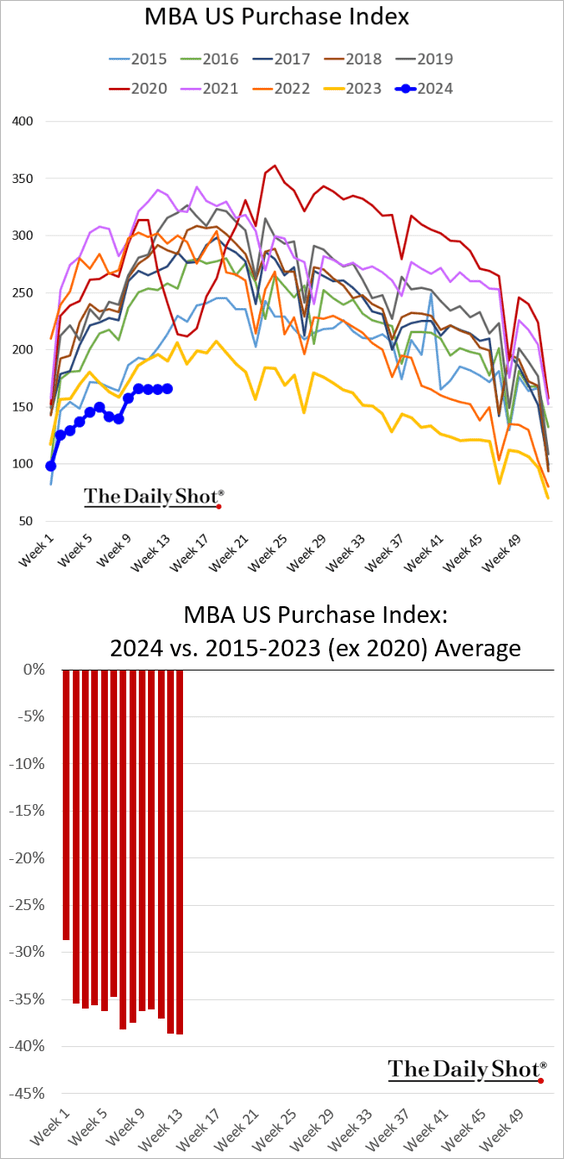

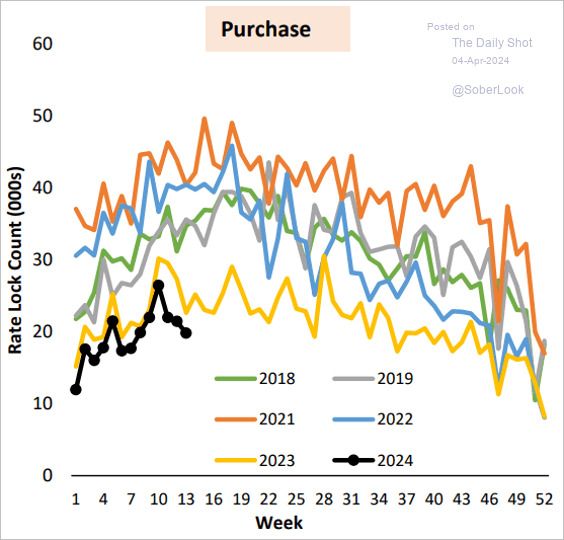

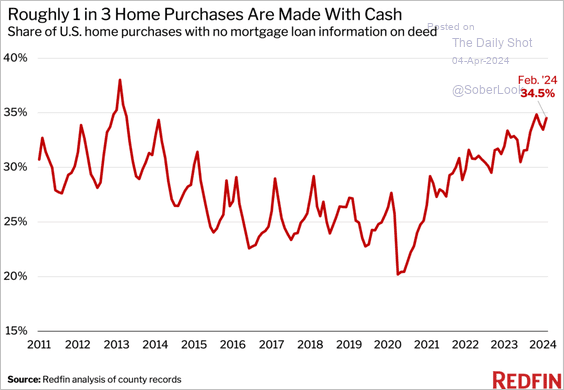

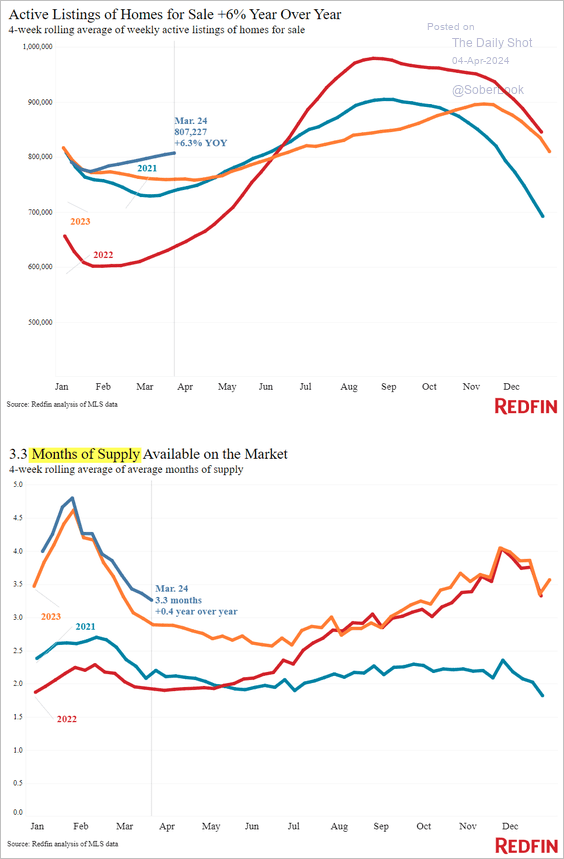

4. Next, we have some updates on the housing market.

• Mortgage applications are running well below last year’s levels.

This chart shows the rate lock count.

Source: AEI Housing Center

Source: AEI Housing Center

• Home purchases are increasingly made with cash.

Source: Redfin

Source: Redfin

• Existing home inventories are rising relative to 2023.

Source: Redfin

Source: Redfin

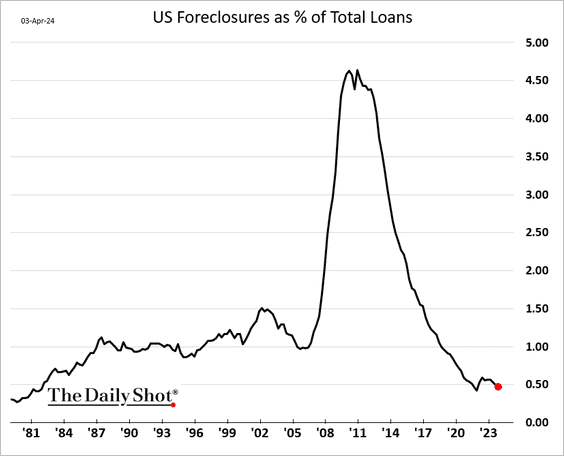

• Foreclosures remain very low.

——————–

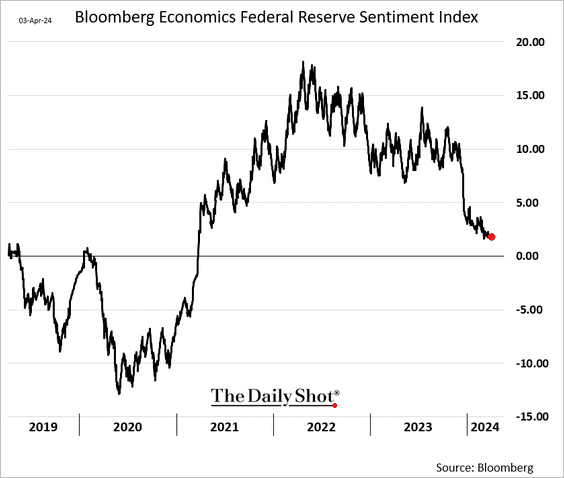

5. Based on the language in Fed officials’ speeches and statements, the central bank’s stance is becoming less hawkish.

Back to Index

Canada

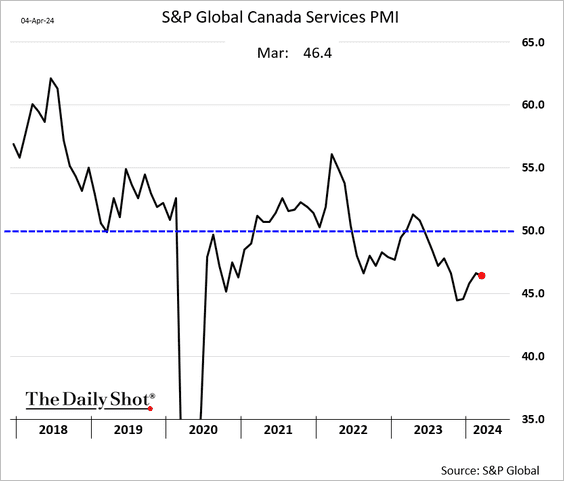

1. The Services PMI remains deep in contraction territory.

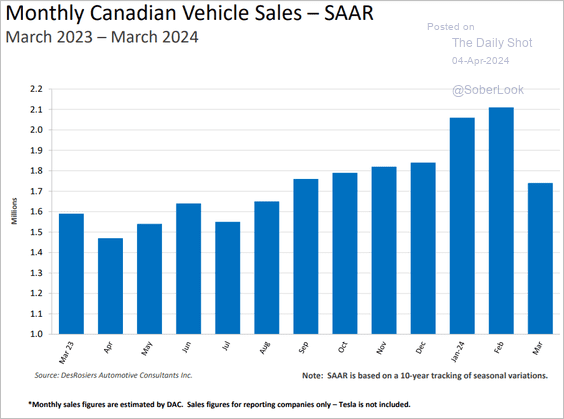

2. Vehicle sales declined last month.

Source: DAC

Source: DAC

Back to Index

The Eurozone

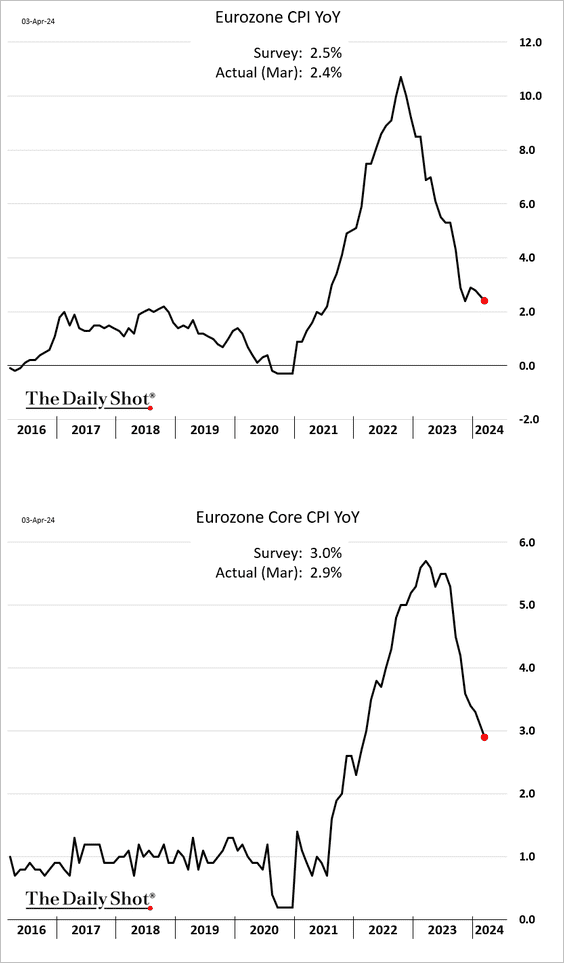

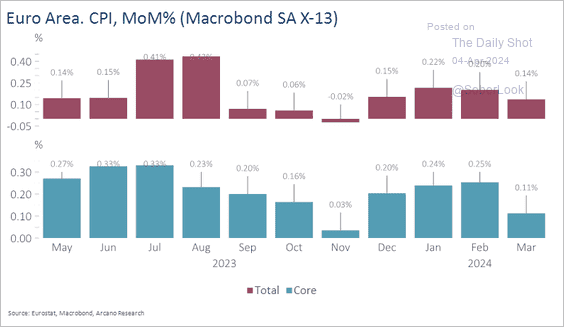

1. The euro-area CPI report was a bit softer than expected as inflation continues to moderate (2 charts).

Source: Arcano Economics

Source: Arcano Economics

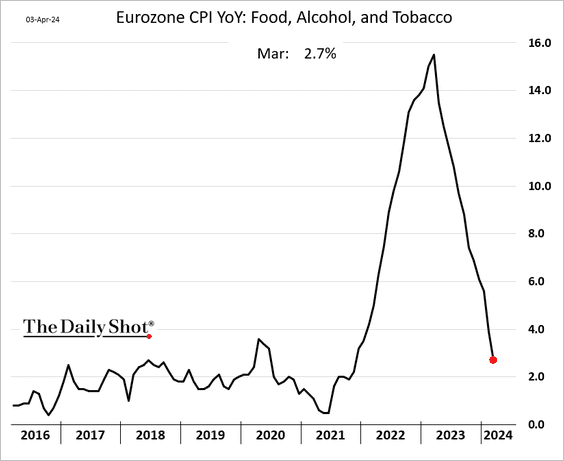

Food inflation is falling rapidly.

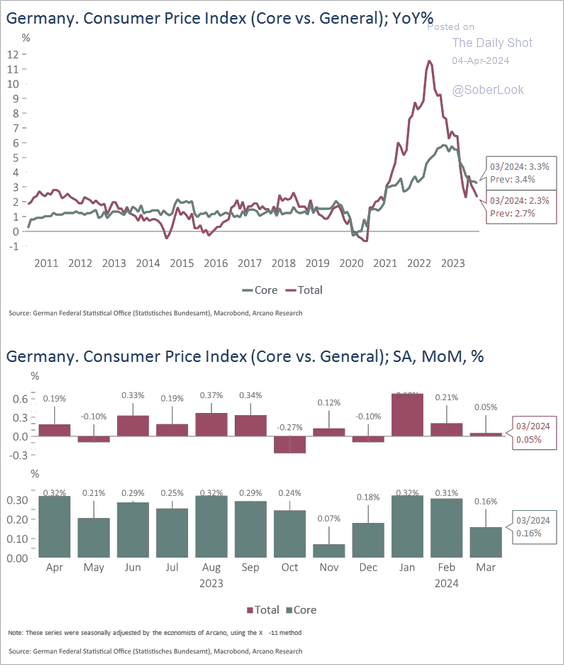

• Here is a look at Germany’s headline and core CPI

Source: Arcano Economics

Source: Arcano Economics

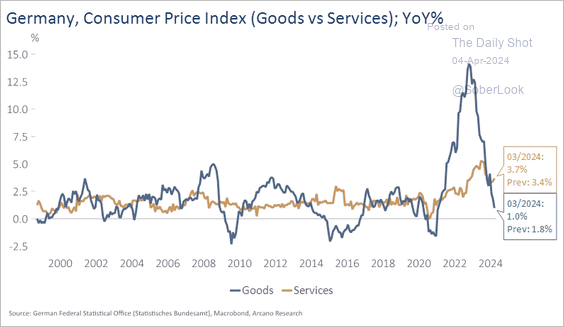

And this chart shows Germany’s goods and services inflation.

Source: Arcano Economics

Source: Arcano Economics

——————–

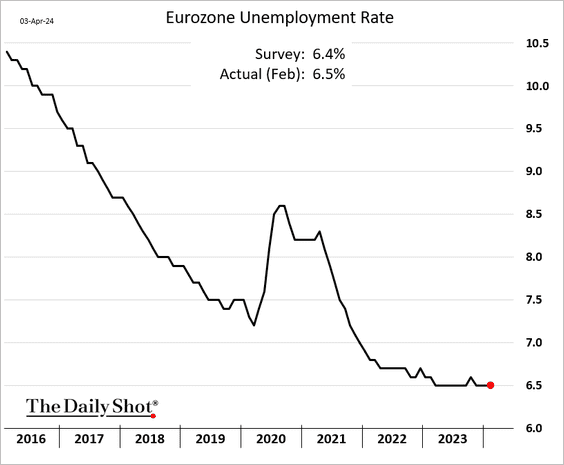

2. The unemployment rate held steady in February.

Back to Index

Europe

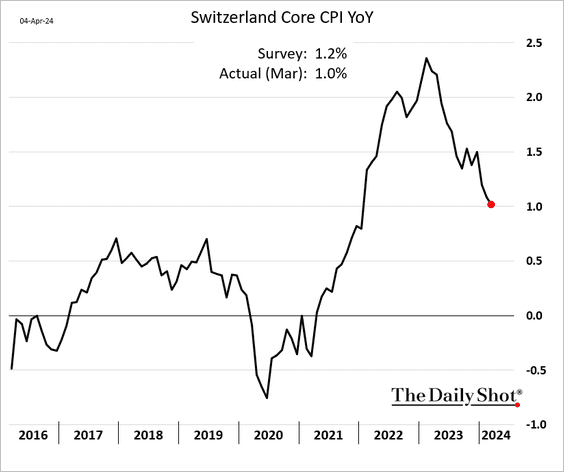

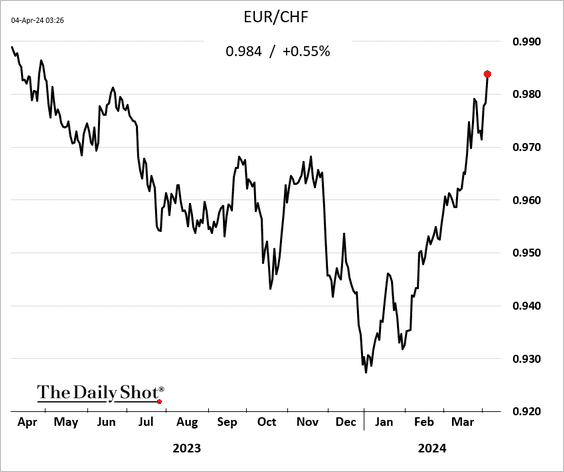

1. Swiss inflation surprised to the downside, with the core CPI back at 1%.

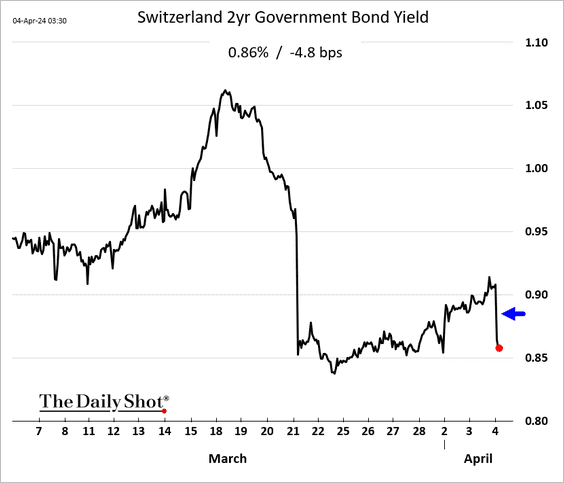

• Swiss bond yields dropped as the market prices in more SNB rate cuts.

• The Swiss franc continues to tumble vs. the euro.

——————–

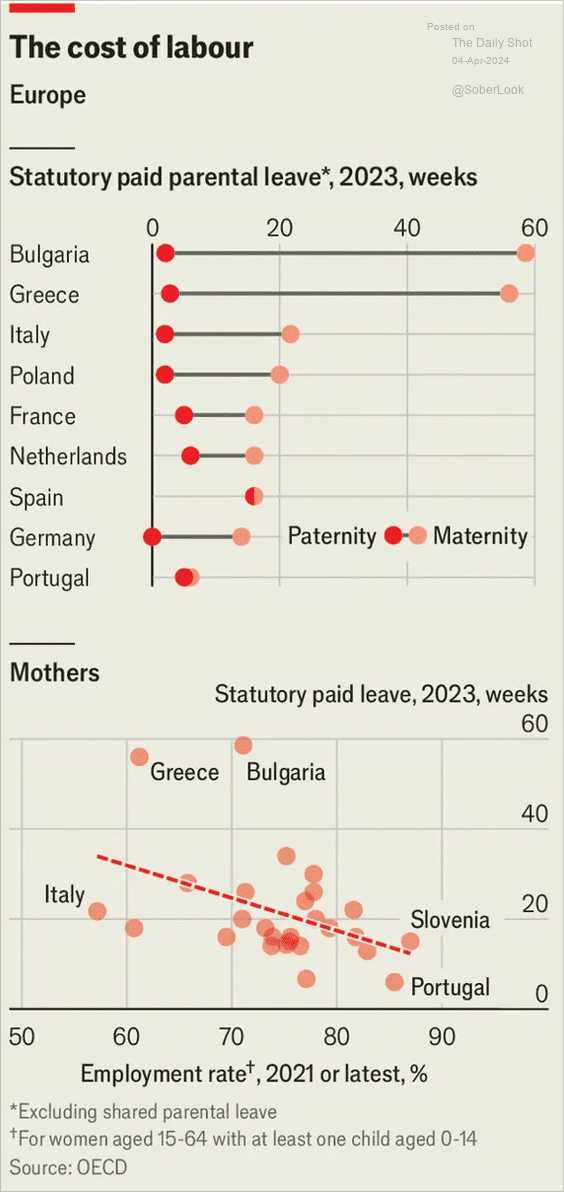

2. Here is a look at parental leave and employment rates in Europe in 2023.

Source: The Economist Read full article

Source: The Economist Read full article

Back to Index

Asia-Pacific

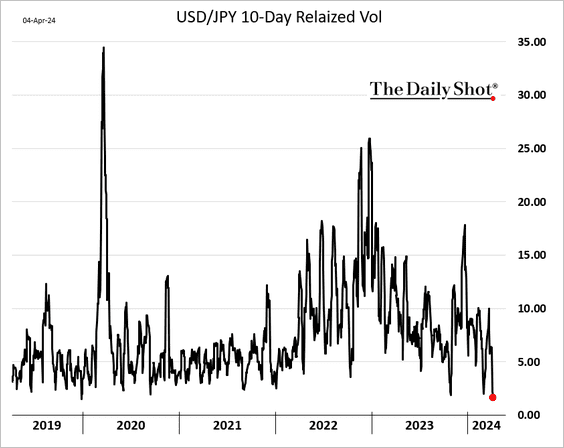

1. Short-term realized volatility for dollar-yen has plummeted, with the exchange rate stabilizing just below 152.

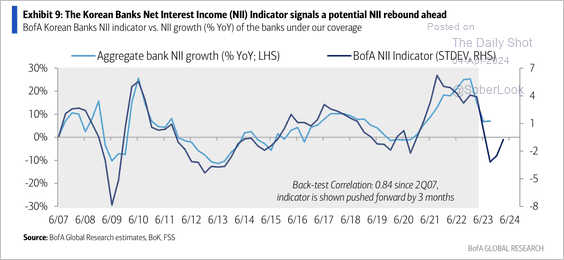

2. South Korean banks could see a rebound in net interest income.

Source: BofA Global Research

Source: BofA Global Research

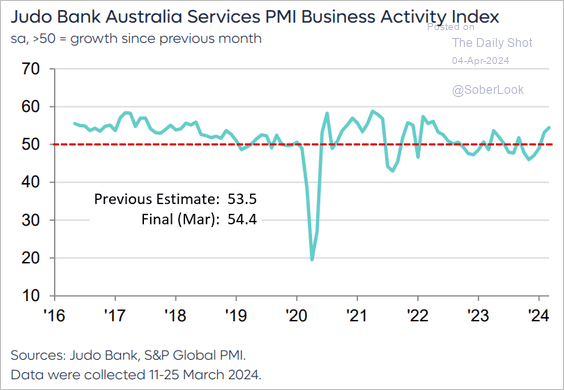

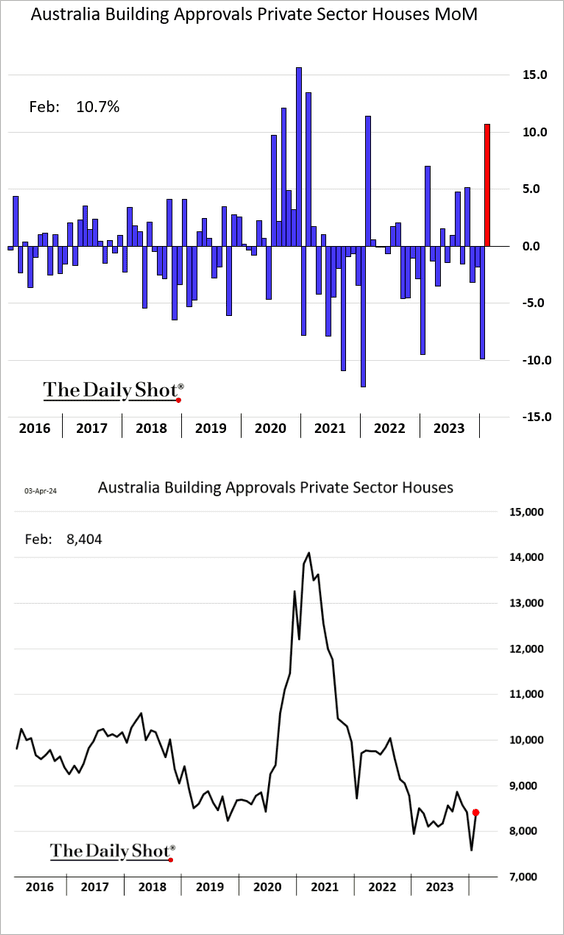

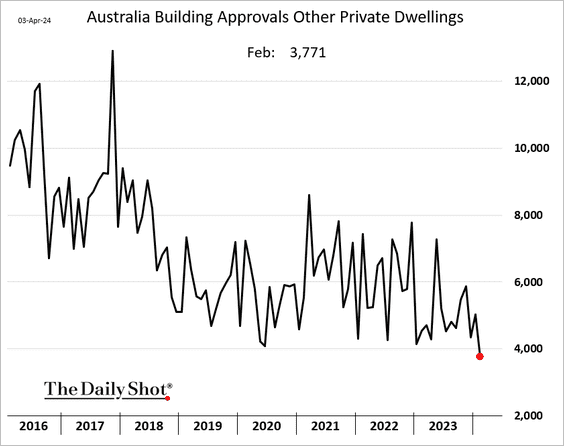

3. Next, we have some updates on Australia.

• The revised services PMI was higher than the initial flash estimate.

Source: S&P Global PMI

Source: S&P Global PMI

• Building approvals for houses bounced from the recent lows.

But apartment permits hit a 12-year low.

Source: @economics Read full article

Source: @economics Read full article

Back to Index

Emerging Markets

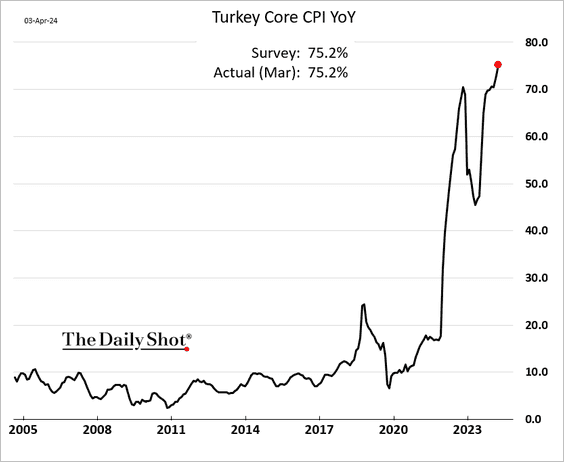

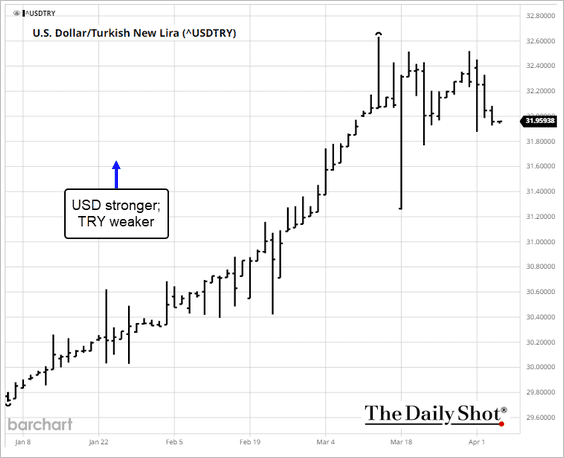

1. Turkey’s core inflation exceeded 75% in March, leading to increased support for Erdogan’s opposition.

Source: Reuters Read full article

Source: Reuters Read full article

The lira has stabilized.

——————–

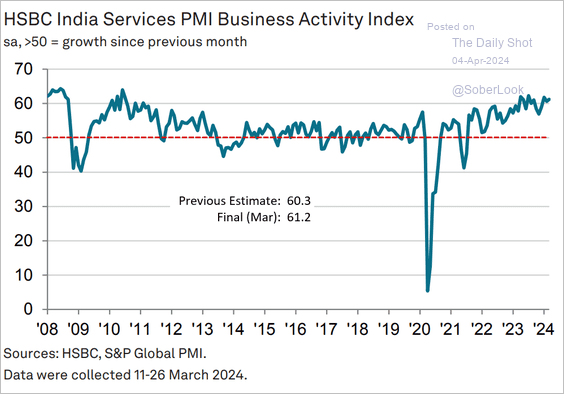

2. Next, we have some updates on India.

• The revised services PMI was even higher than the flash estimate.

Source: S&P Global PMI

Source: S&P Global PMI

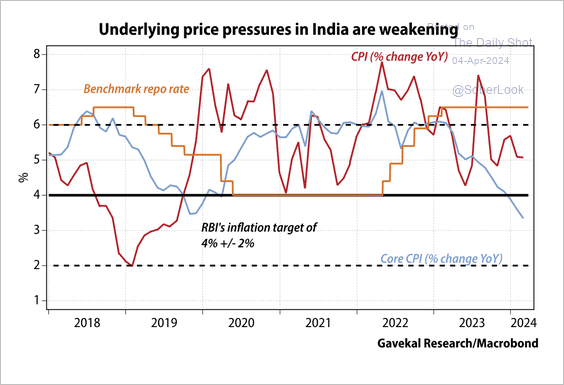

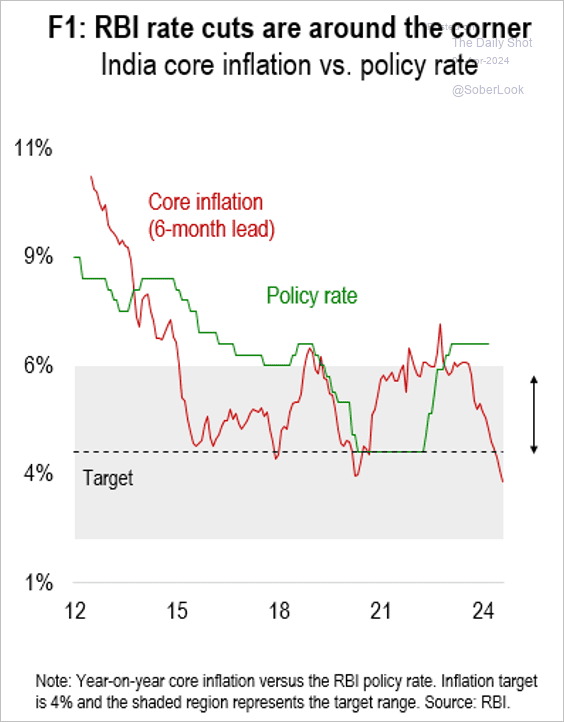

• Lower inflation could pressure the Reserve Bank of India to cut rates.

Source: Gavekal Research

Source: Gavekal Research

The central bank has room to cut rates, given the rapid decline in inflation.

Source: Numera Analytics (@NumeraAnalytics)

Source: Numera Analytics (@NumeraAnalytics)

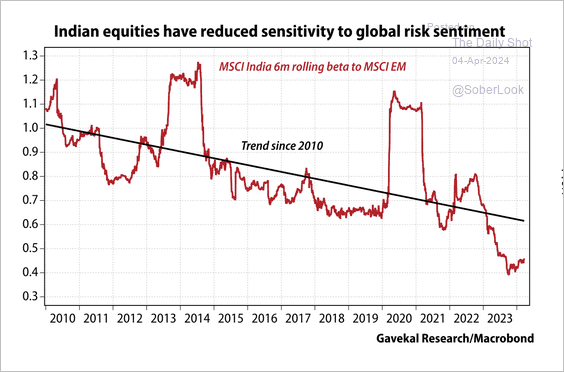

• Indian equities have declining sensitivity to the MSCI EM Index.

Source: Gavekal Research

Source: Gavekal Research

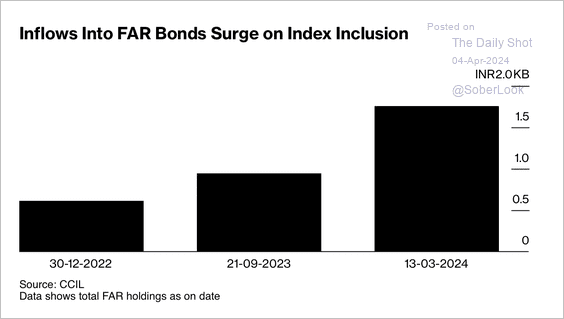

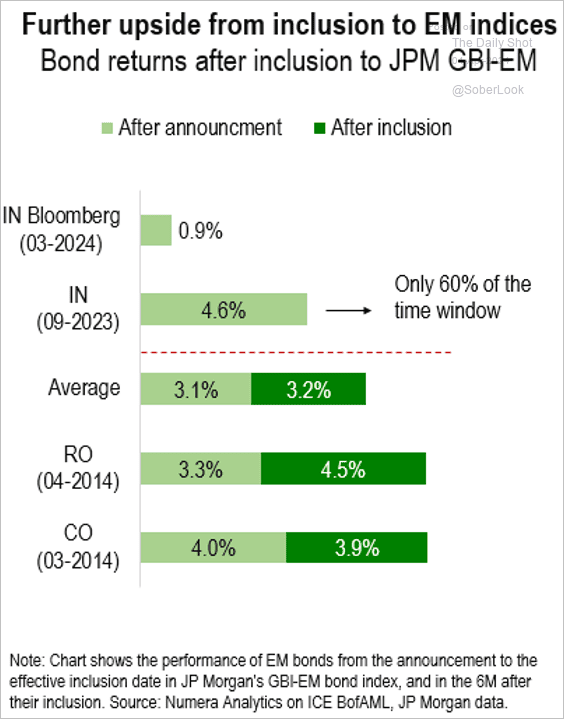

• Inflows into index-eligible (fully accessible route, FAR) India bonds surged ahead of its upcoming inclusion in JP Morgan and Bloomberg’s EM local currency bond indices.

Source: @markets Read full article

Source: @markets Read full article

——————–

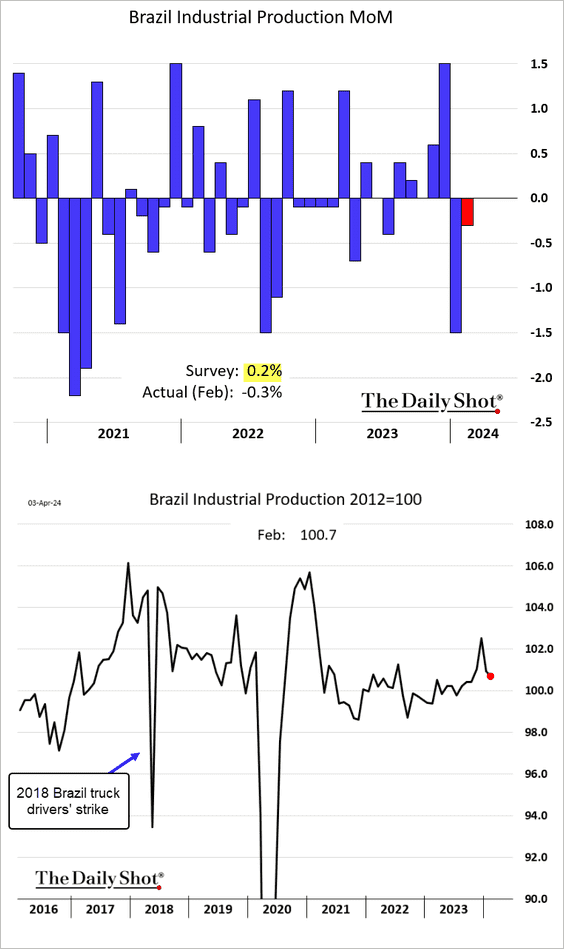

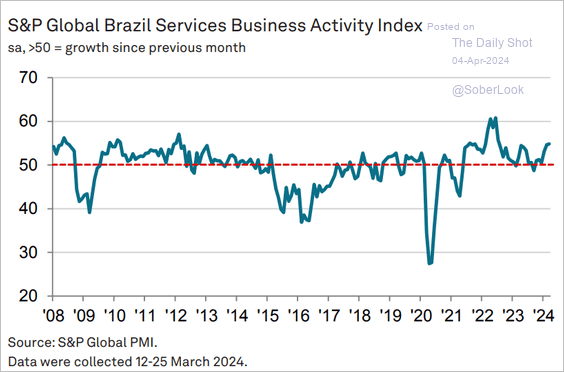

3. Brazil’s industrial production declined again in February.

• Services growth remains robust.

Source: S&P Global PMI

Source: S&P Global PMI

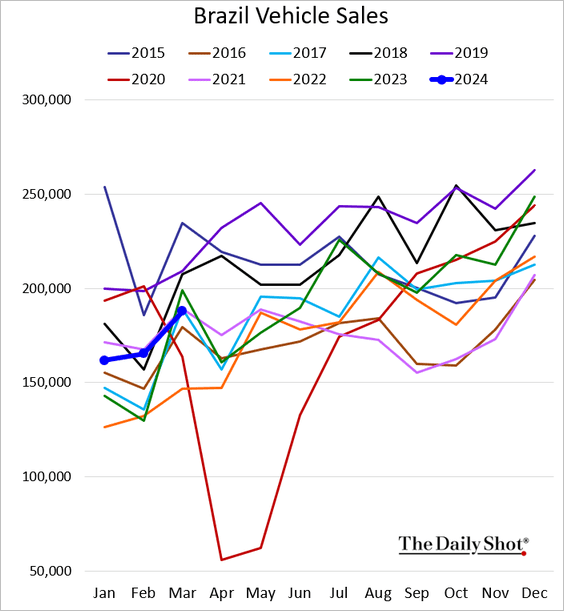

• Vehicle sales dipped below the 2023 level.

——————–

4. Indian, Colombian, and Romanian sovereign bonds have reacted favorably to index inclusion announcements.

Source: Numera Analytics (@NumeraAnalytics)

Source: Numera Analytics (@NumeraAnalytics)

Back to Index

Commodities

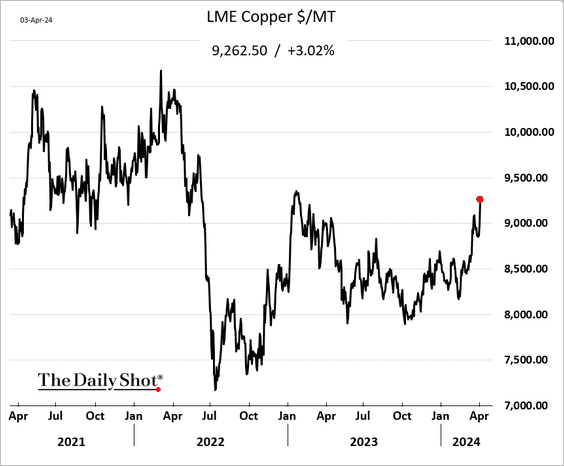

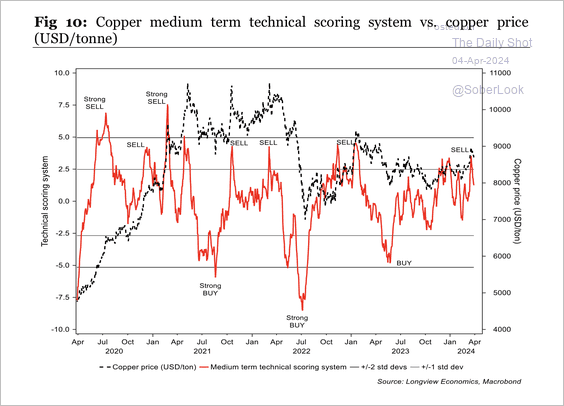

1. Copper prices jumped on Wednesday as the dollar weakened.

Technicals suggest copper is overbought over the medium term.

Source: Longview Economics

Source: Longview Economics

——————–

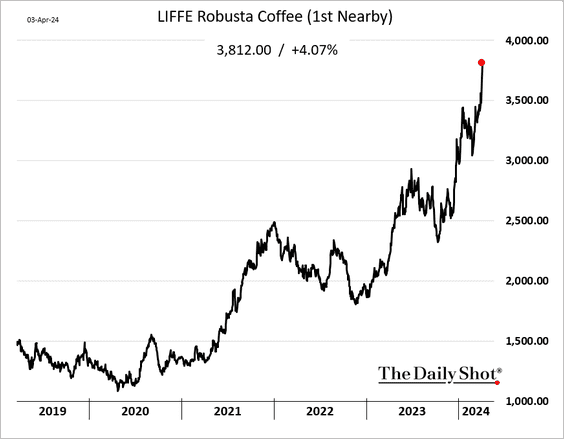

2. Robusta coffee is hitting new highs.

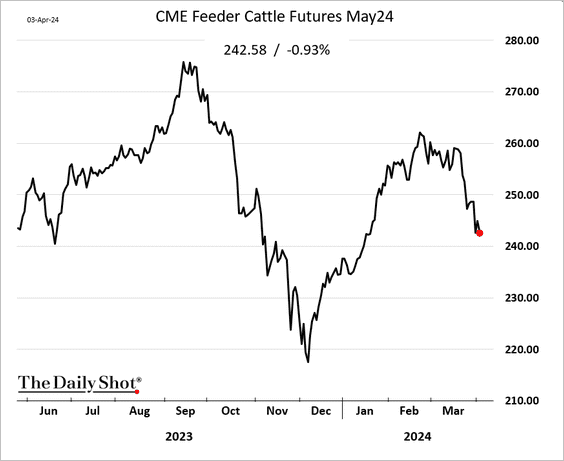

3. US cattle futures remain under pressure.

Source: @markets Read full article

Source: @markets Read full article

——————–

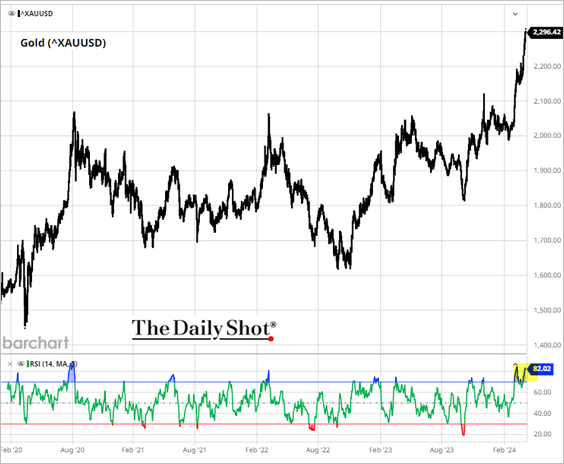

4. Gold appears to be overbought.

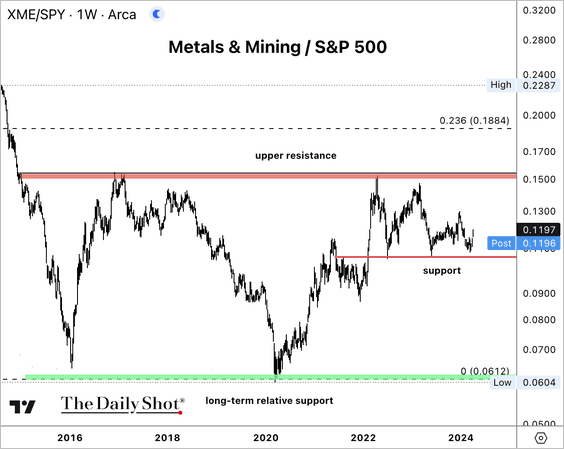

5. The SPDR Metals & Mining ETF (XME) is holding support relative to the S&P 500.

Back to Index

Energy

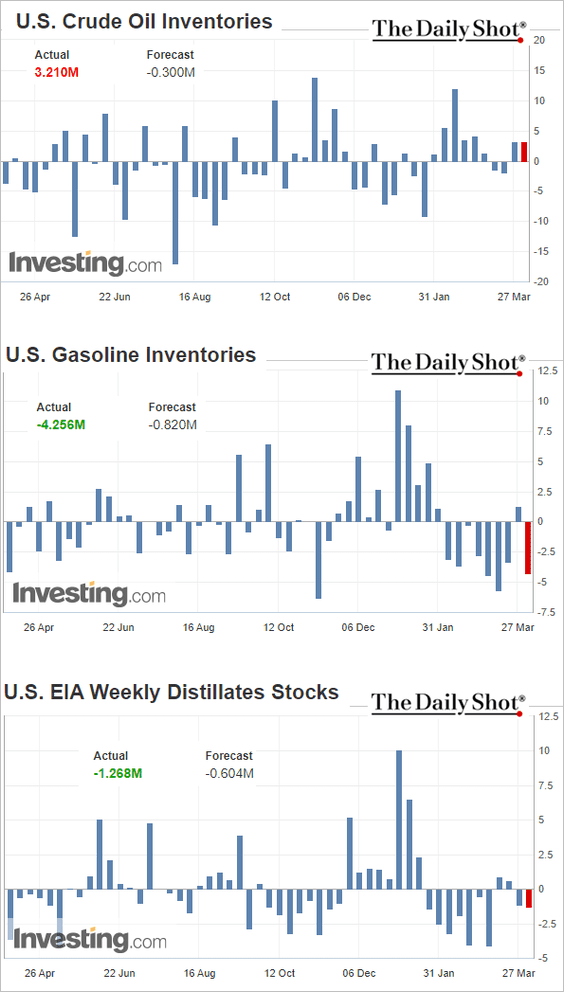

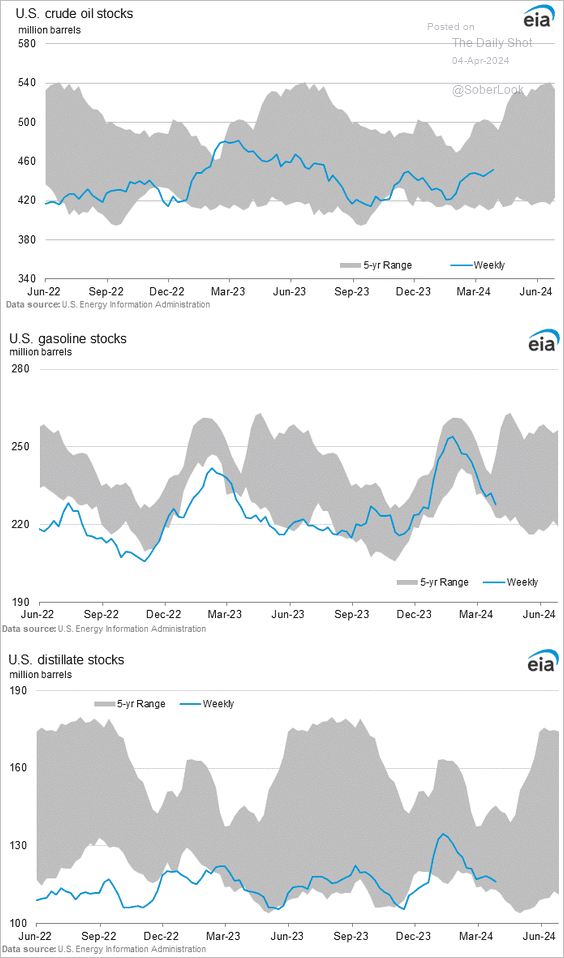

1. US oil inventories rose again last week, but stockpiles of refined products declined more than expected.

• Weekly changes:

• Levels:

——————–

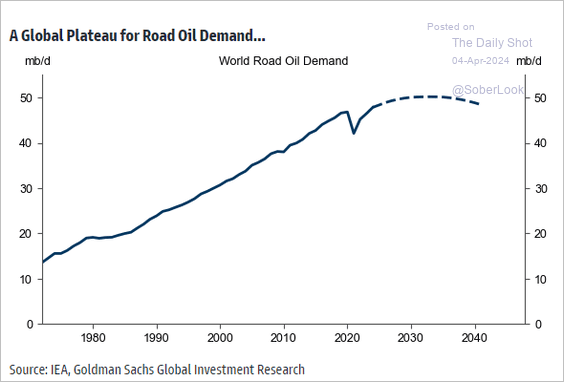

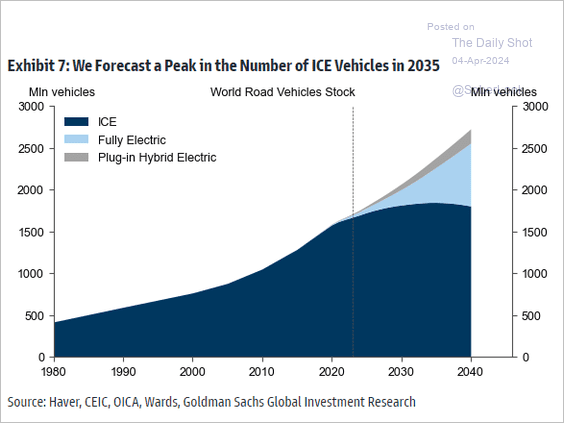

2. Will oil demand peak over the next decade (2 charts)?

Source: Goldman Sachs; @MikeZaccardi

Source: Goldman Sachs; @MikeZaccardi

Source: Goldman Sachs; @MikeZaccardi

Source: Goldman Sachs; @MikeZaccardi

Back to Index

Equities

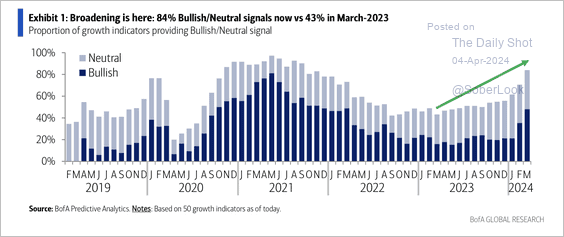

1. BofA’s bullish signals are at a 30-month high, implying an almost synchronized global growth upturn.

Source: BofA Global Research

Source: BofA Global Research

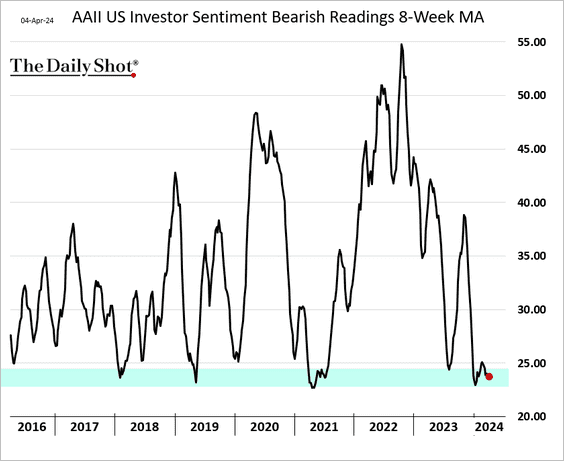

• The number of bearish US investors has dwindled

——————–

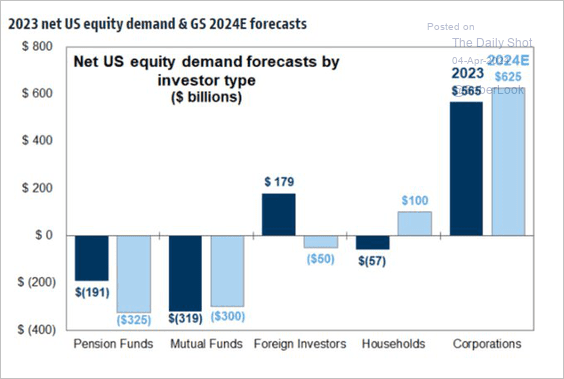

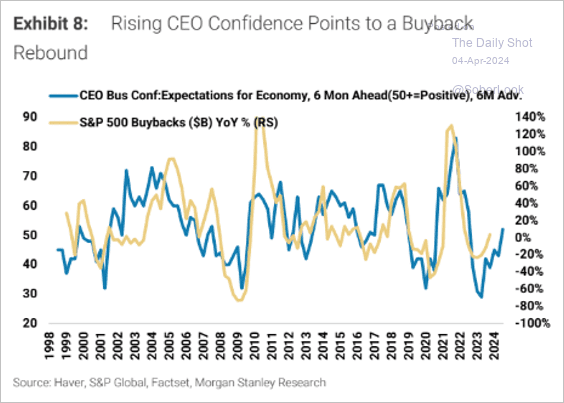

2. Goldman sees share buybacks driving demand for stocks this year, …

Source: Goldman Sachs; @WallStJesus

Source: Goldman Sachs; @WallStJesus

… as CEO confidence improves.

Source: Morgan Stanley Research; @AyeshaTariq

Source: Morgan Stanley Research; @AyeshaTariq

——————–

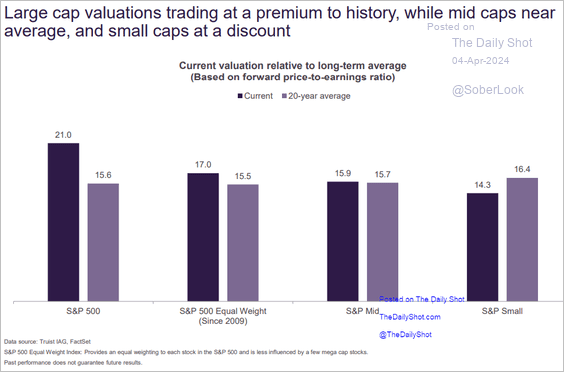

3. This chart shows US index valuations relative to the 20-year average.

Source: Truist Advisory Services

Source: Truist Advisory Services

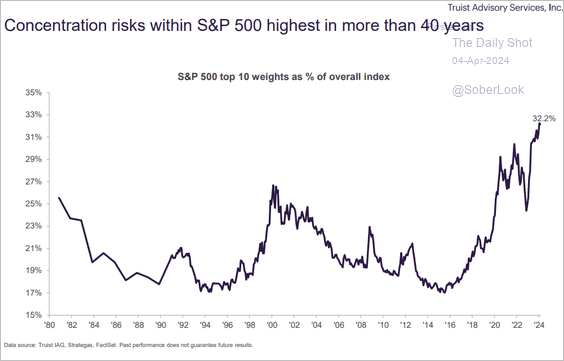

4. Concentration risks remain extreme.

Source: Truist Advisory Services

Source: Truist Advisory Services

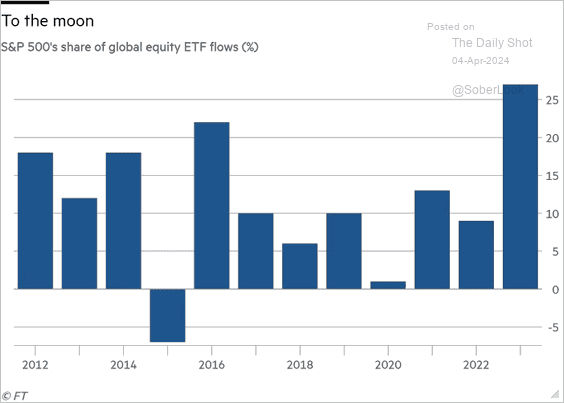

5. S&P 500 index funds accounted for a record 27% of global equity ETF flows in 2023.

Source: @financialtimes Read full article

Source: @financialtimes Read full article

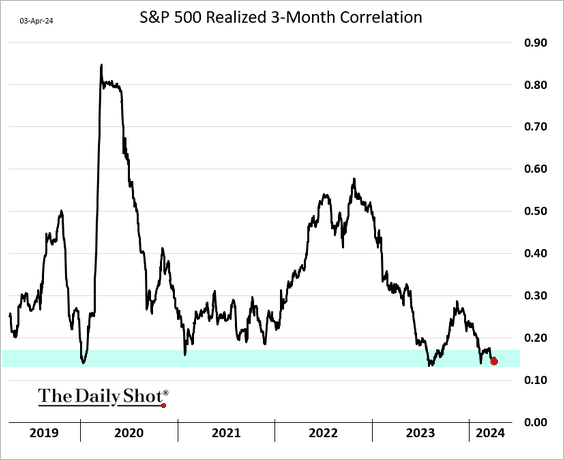

6. The S&P 500 realized correlation is holding near multi-year lows.

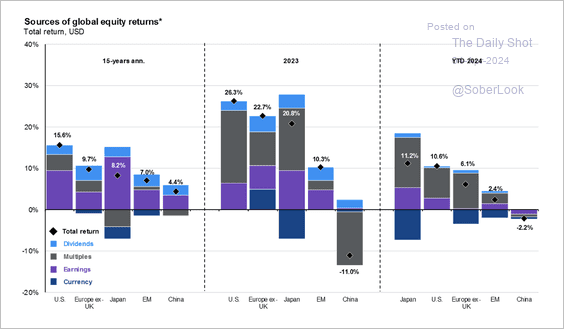

7. Here is a look at global equity return composition.

Source: J.P. Morgan Asset Management

Source: J.P. Morgan Asset Management

Back to Index

Alternatives

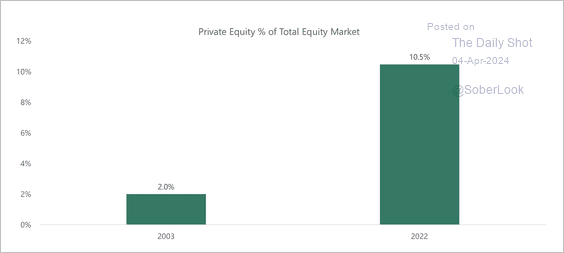

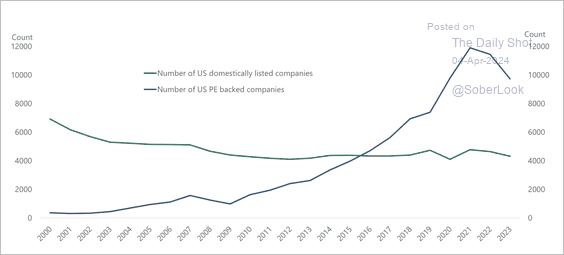

1. US private equity has grown massively as a percentage of the total equity market.

Source: Torsten Slok, Apollo

Source: Torsten Slok, Apollo

However, the number of private equity-backed companies has declined in recent years.

Source: Torsten Slok, Apollo

Source: Torsten Slok, Apollo

——————–

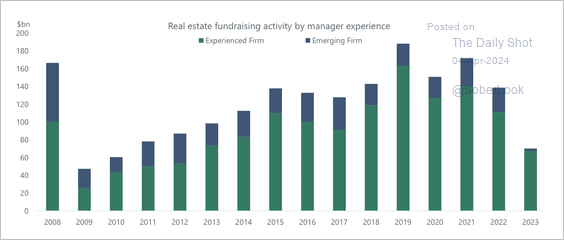

2. Real estate fundraising has been led by more established firms recently.

Source: Torsten Slok, Apollo

Source: Torsten Slok, Apollo

Back to Index

Rates

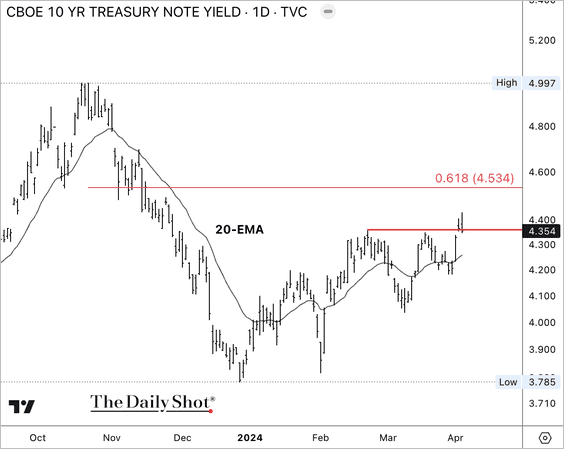

The 10-year Treasury yield attempted a minor breakout on Tuesday and could face resistance around 4.53%

.

——————–

Food for Thought

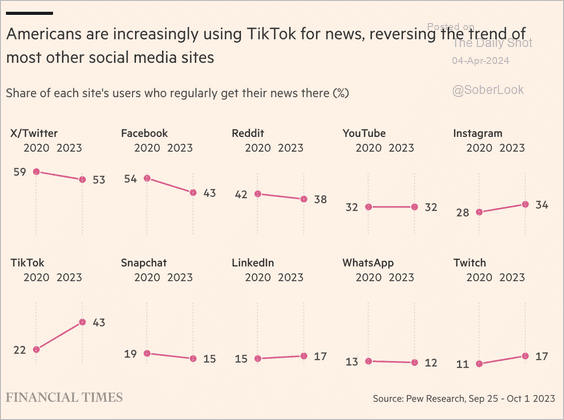

1. The rise of TikTok for news:

Source: @financialtimes Read full article

Source: @financialtimes Read full article

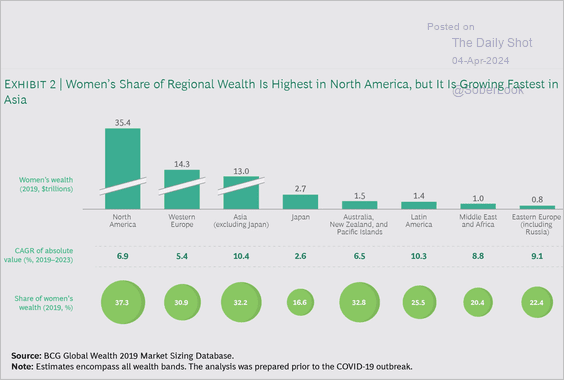

2. Women’s share of regional wealth:

Source: BCG Read full article

Source: BCG Read full article

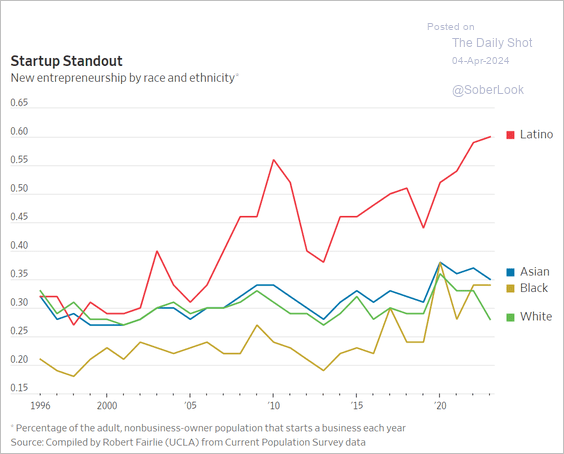

3. Entrepreneurial trends by race/ethnicity:

Source: @WSJ Read full article

Source: @WSJ Read full article

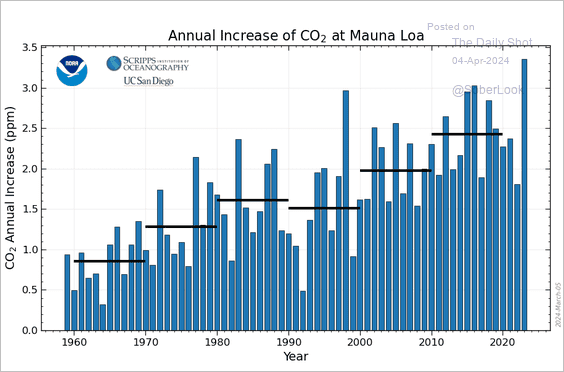

4. The rise in annual carbon dioxide levels as measured at the Mauna Loa Observatory:

Source: NOAA Read full article

Source: NOAA Read full article

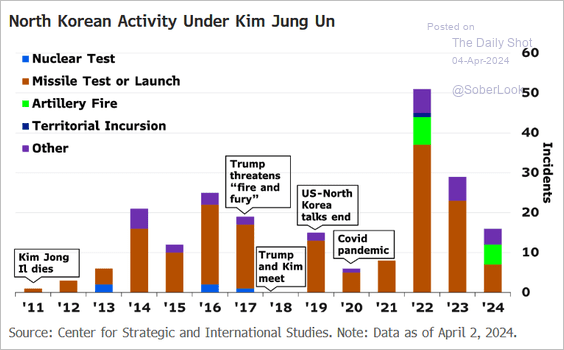

5. North Korean provocations since 2011:

Source: @ThatJennieWelch, @economics Read full article

Source: @ThatJennieWelch, @economics Read full article

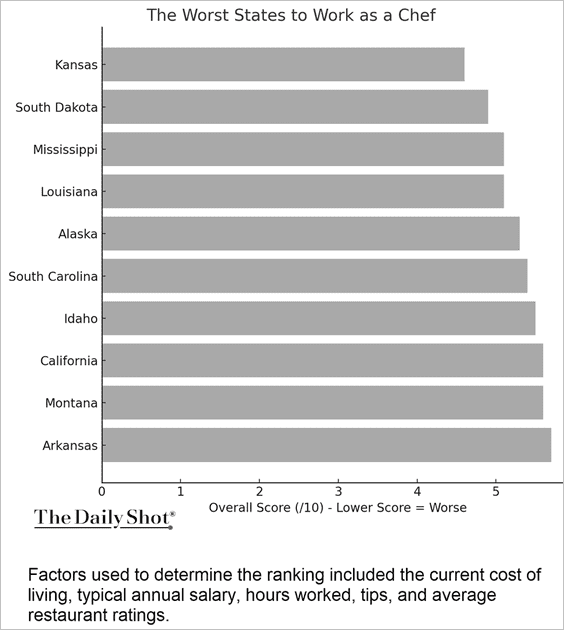

6. The worst states to work as a chef:

Source: Affordable Seating

Source: Affordable Seating

——————–

Back to Index