The Daily Shot: 15-Apr-24

• The United States

• The United Kingdom

• The Eurozone

• Europe

• Japan

• Asia-Pacific

• China

• Emerging Markets

• Cryptocurrency

• Commodities

• Energy

• Equities

• Credit

• Global Developments

• Food for Thought

The United States

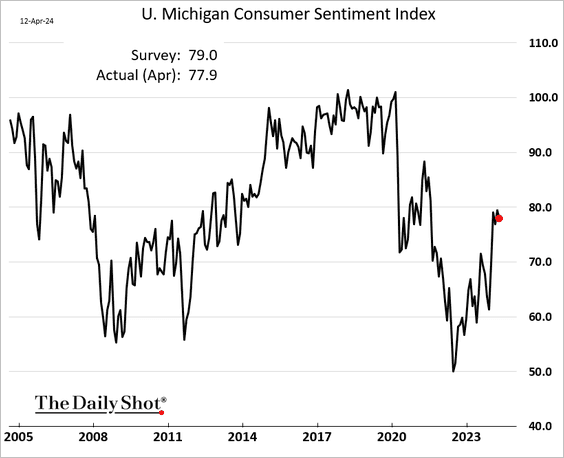

1. The University of Michigan’s consumer sentiment index edged lower this month.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

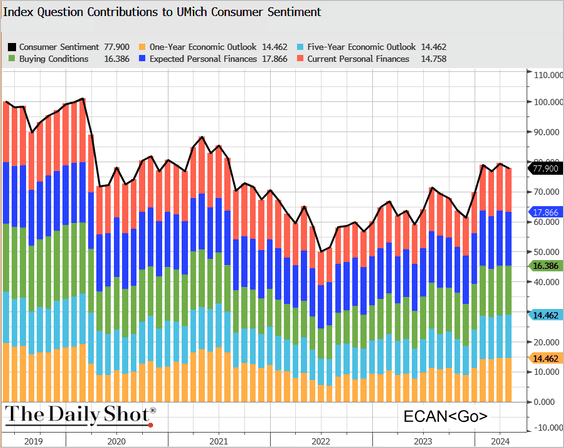

Here is the consumer expectations index.

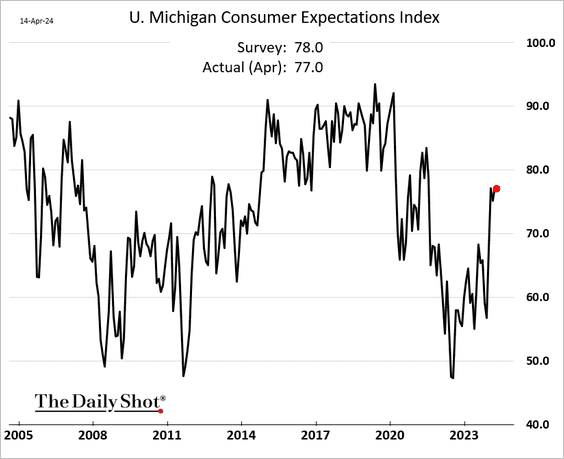

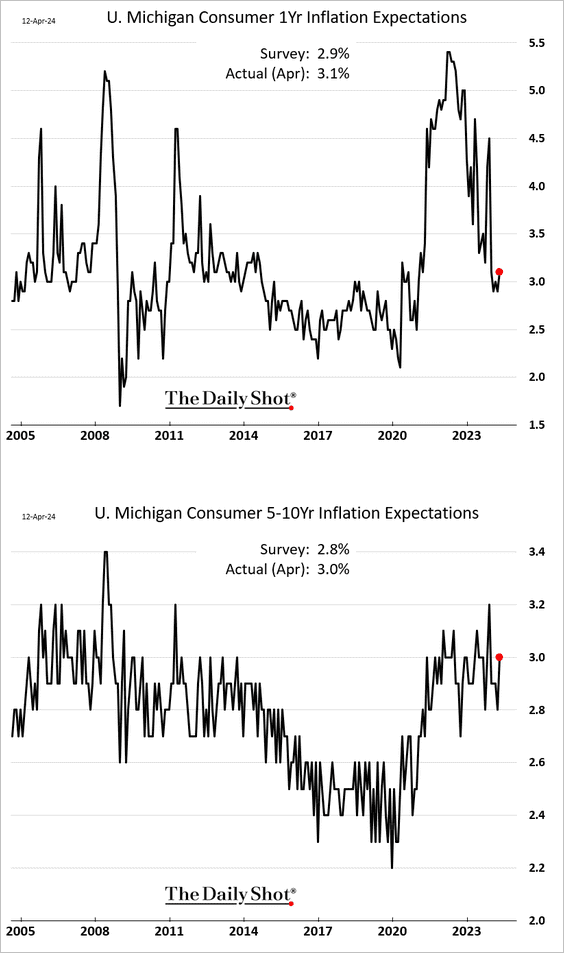

• Inflation expectations moved higher as gasoline prices increased.

Source: Reuters Read full article

Source: Reuters Read full article

——————–

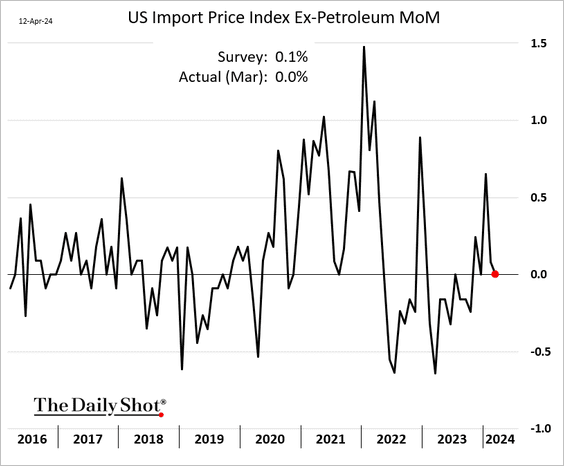

2. Next, we have some updates on inflation.

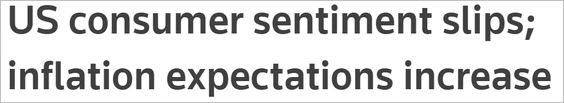

• The import price index (excluding petroleum) was flat last month.

• Inflation remains sticky.

Source: MRB Partners

Source: MRB Partners

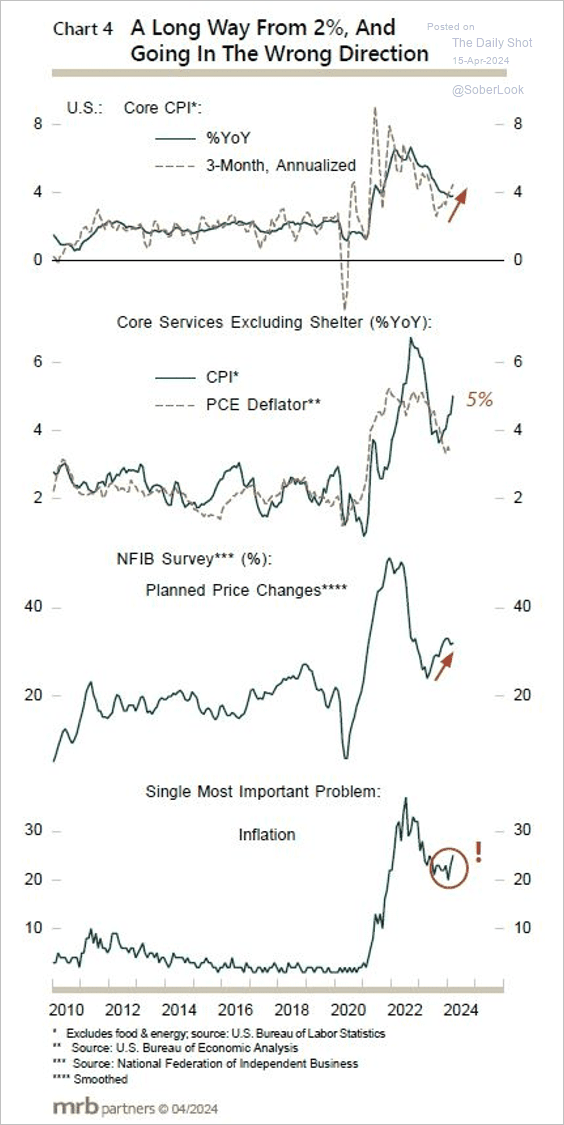

• The latest US upside inflation surprise stands out among advanced economies.

Source: @WallStJesus

Source: @WallStJesus

——————–

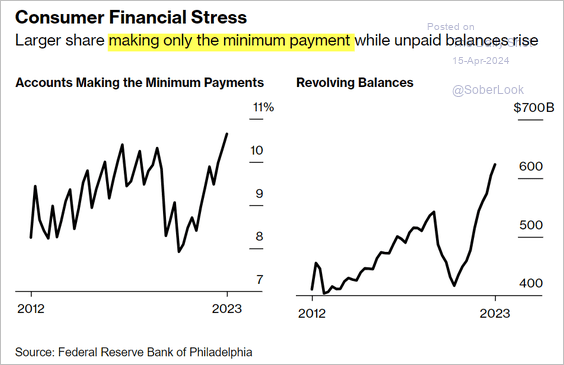

3. An increasing percentage of Americans are making only the minimum payment on their credit card debt.

Source: @economics Read full article

Source: @economics Read full article

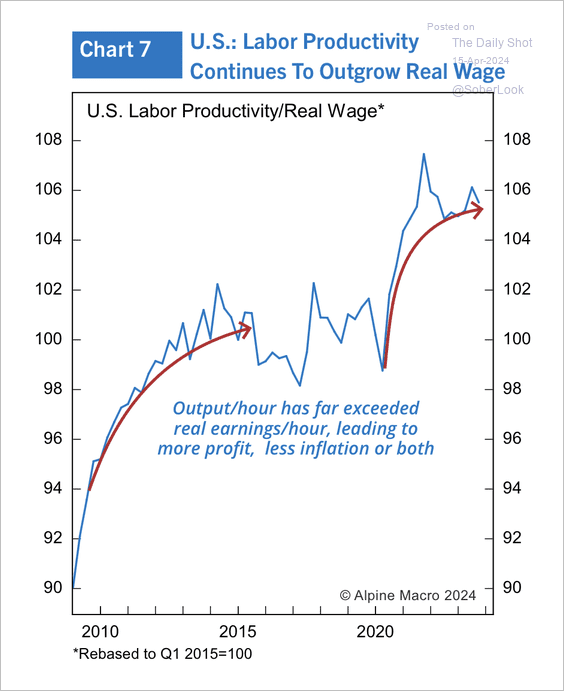

4. Labor productivity has persistently outpaced real wage growth in recent years.

Source: Alpine Macro

Source: Alpine Macro

Back to Index

The United Kingdom

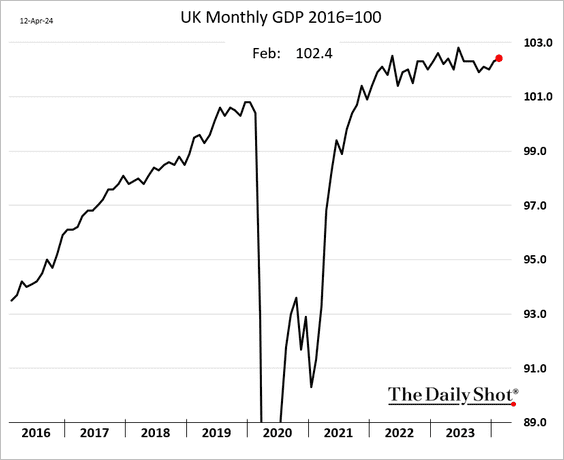

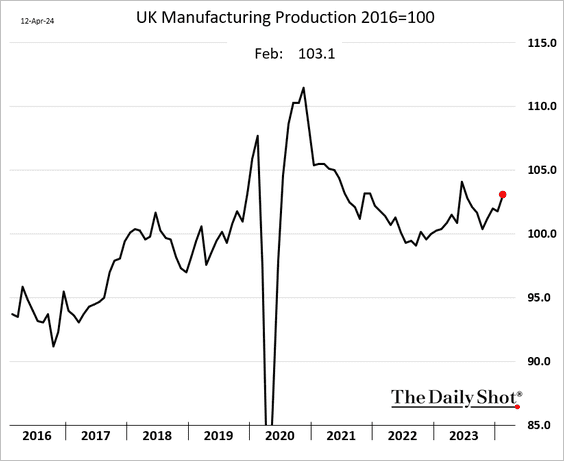

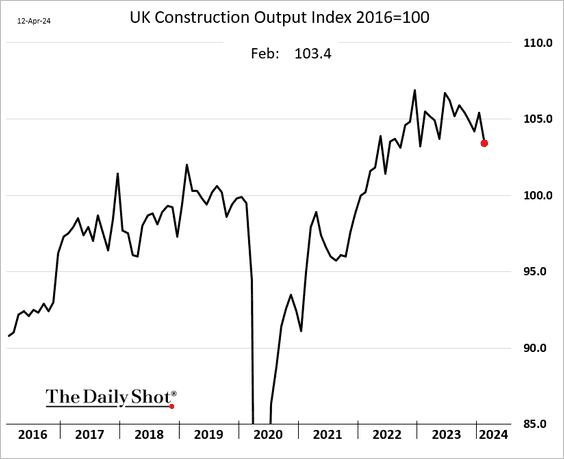

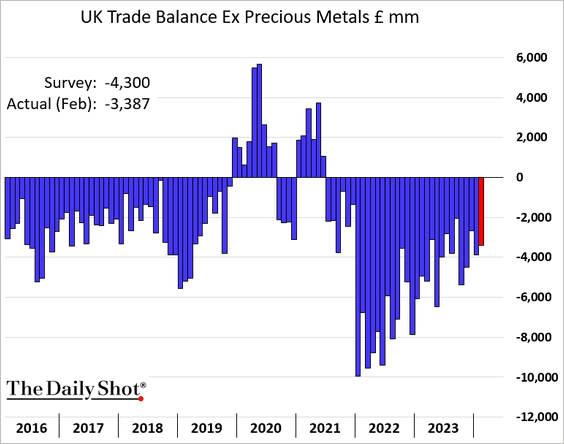

The economy is growing again.

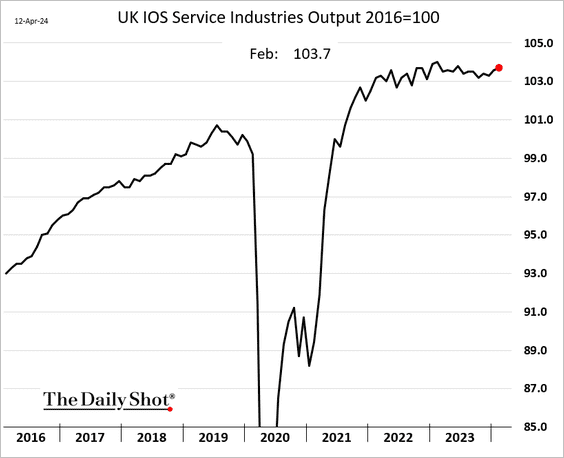

• Service sector output edged higher in February.

• Factory output is rebounding.

• The construction sector output registered a sharp decline.

• The trade deficit was narrower than expected.

Back to Index

The Eurozone

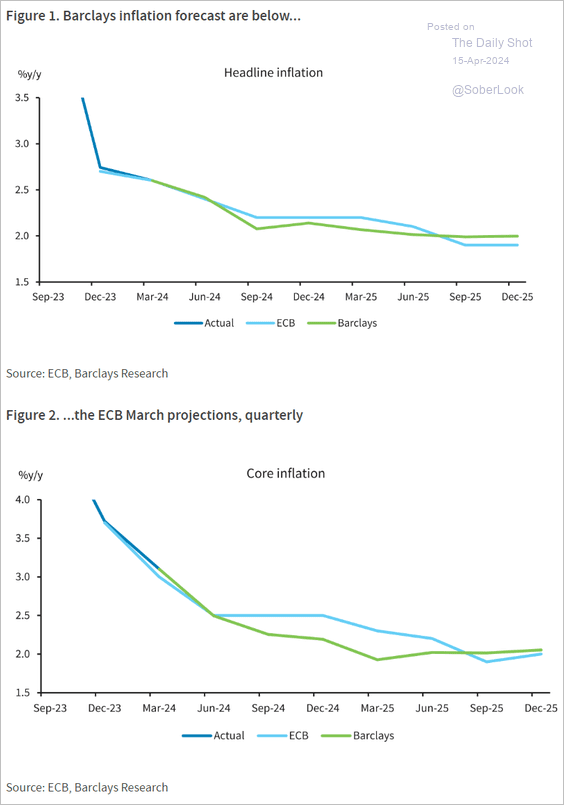

1. Barclays projects the euro-area core inflation to reach 2% in the first quarter of next year.

Source: Barclays Research

Source: Barclays Research

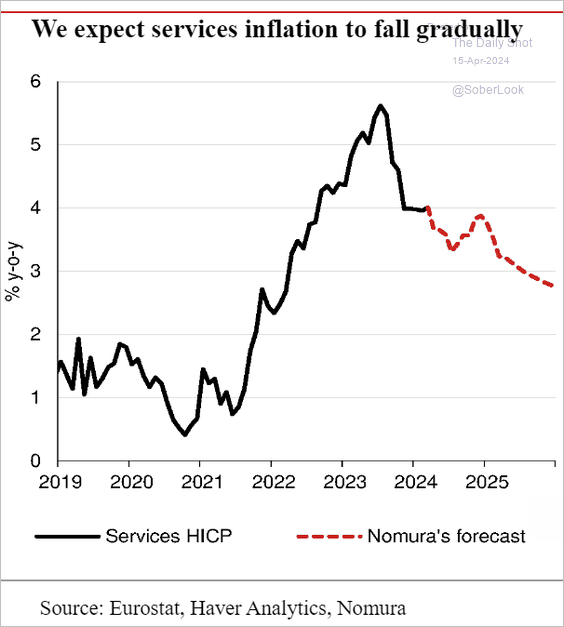

2. Services inflation has been sticky.

Source: Nomura Securities

Source: Nomura Securities

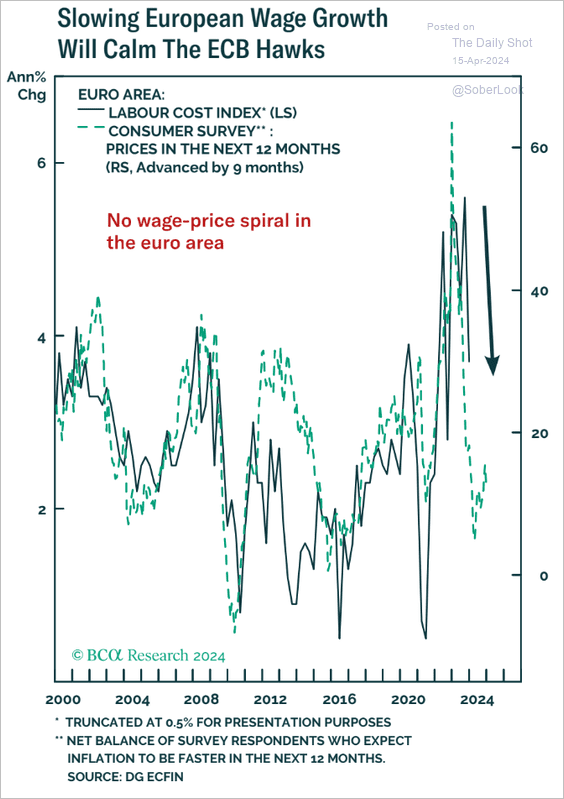

3. Wage growth is expected to slow later this year.

Source: BCA Research

Source: BCA Research

——————–

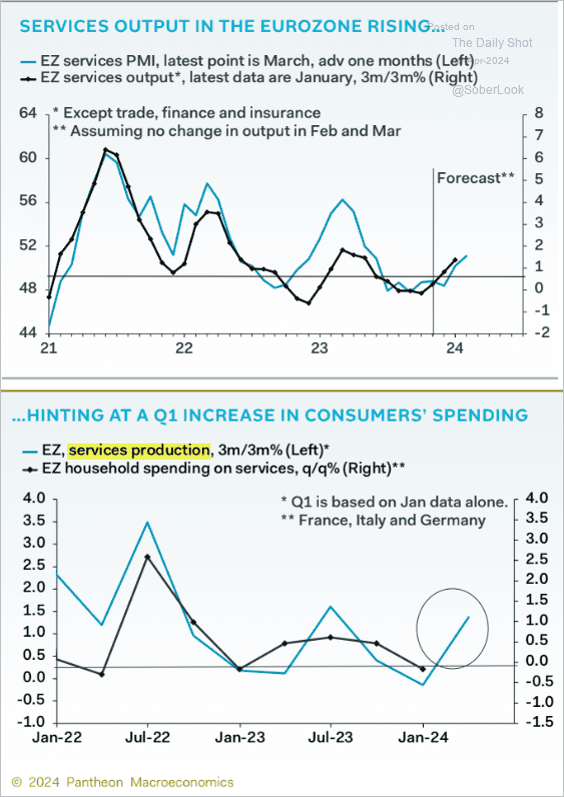

4. The Eurozone’s services output improvement points to a rebound in consumer spending.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

Back to Index

Europe

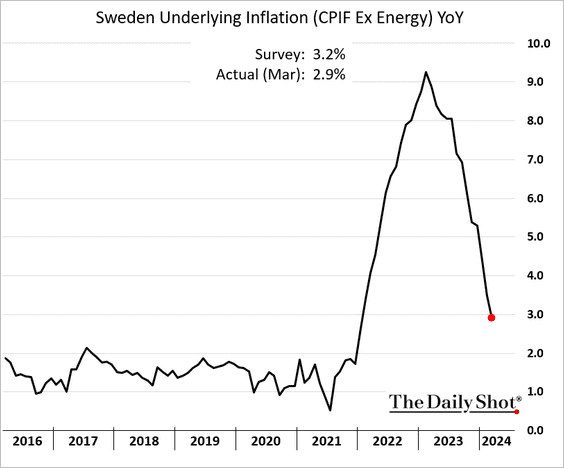

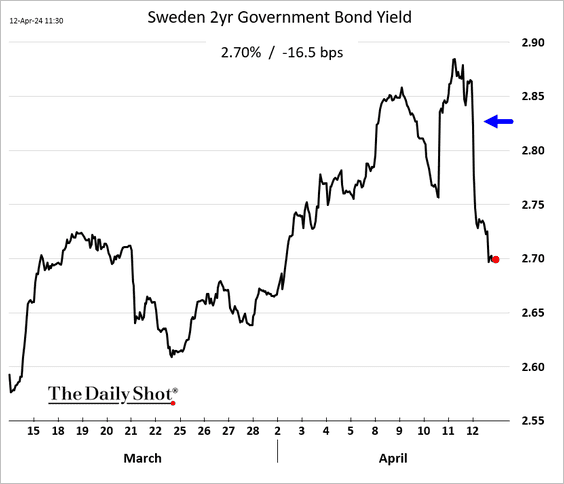

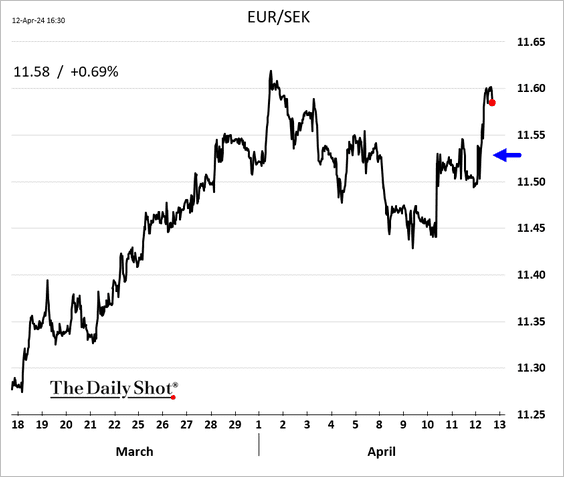

1. Sweden’s inflation surprised to the downside.

Source: @economics Read full article

Source: @economics Read full article

Bond yields and the krona dropped on expectations of a rate cut next month.

——————–

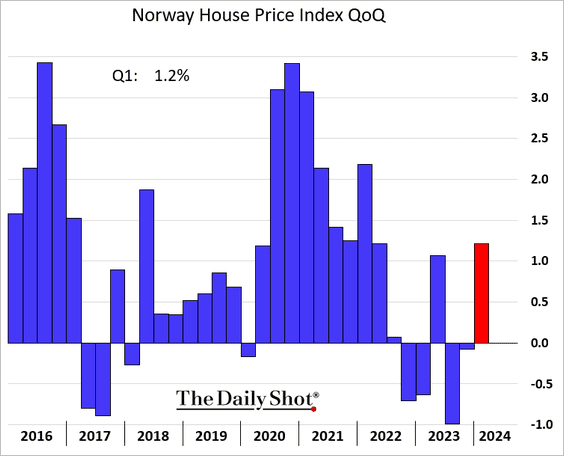

2. Norway’s home prices climbed in the first quarter.

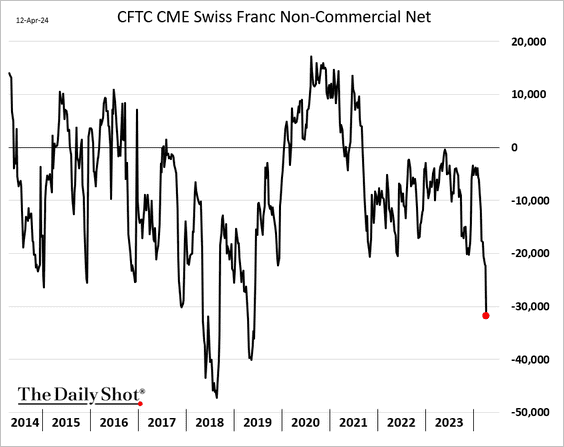

3. Speculative accounts are increasing their bets against the Swiss franc in anticipation of further rate cuts by the SNB.

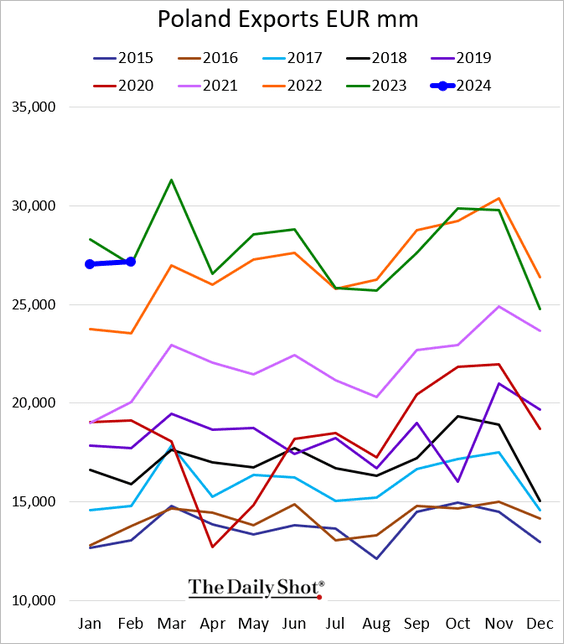

4. Poland’s exports remain strong.

Back to Index

Japan

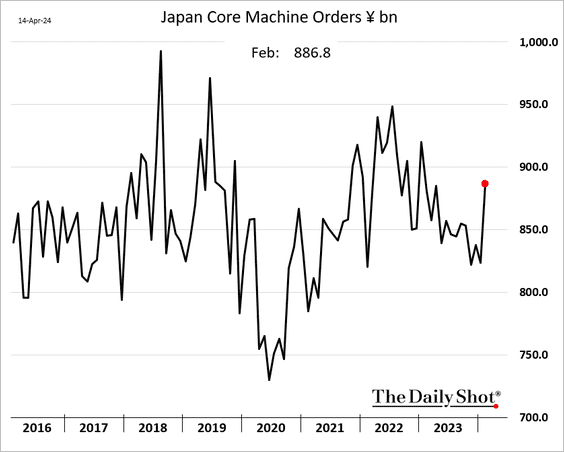

1. Machinery orders jumped in February,

Source: Reuters Read full article

Source: Reuters Read full article

——————–

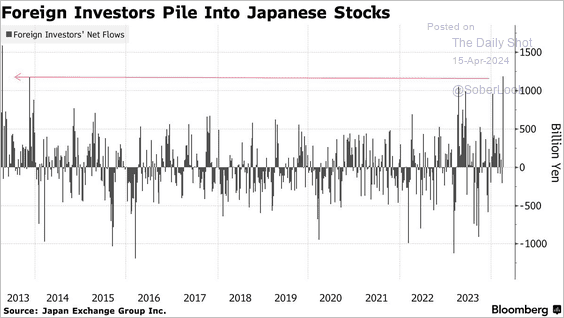

2. Foreigners continue buying Japanese stocks.

Source: @markets Read full article

Source: @markets Read full article

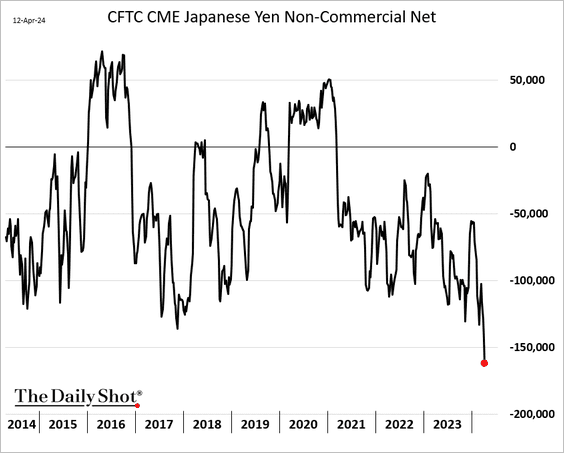

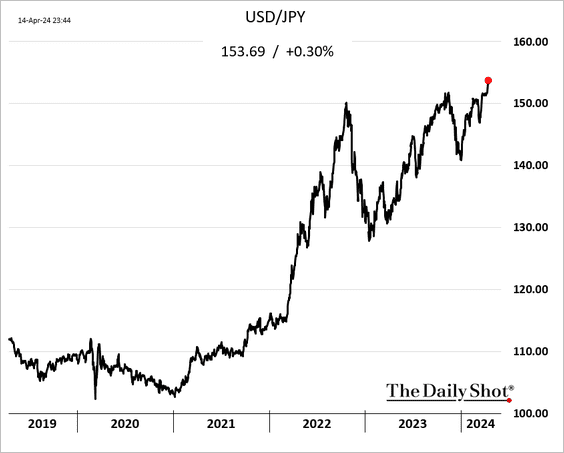

3. Speculative accounts keep pressing their bets against the yen, …

… as the currency hits multi-decade lows against the dollar.

Back to Index

Asia-Pacific

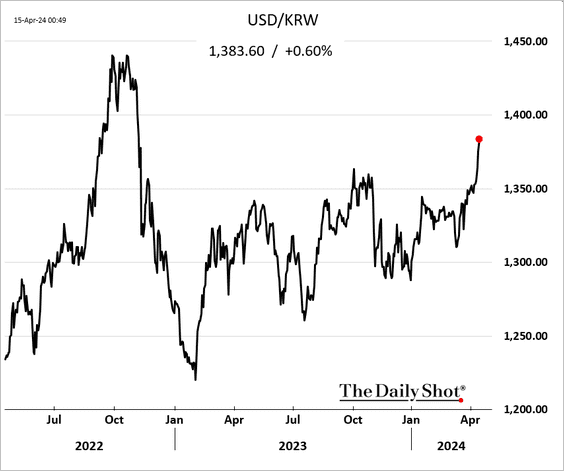

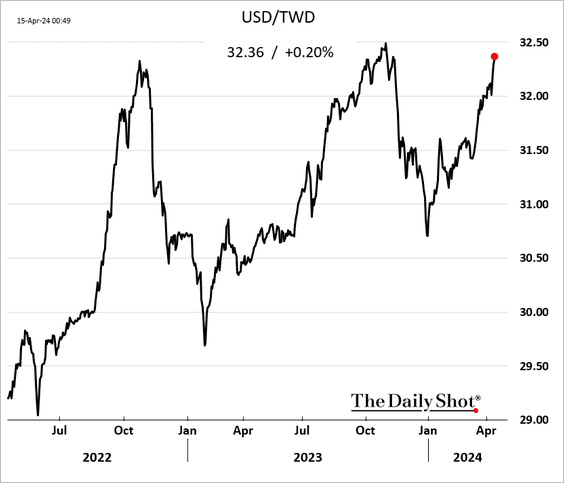

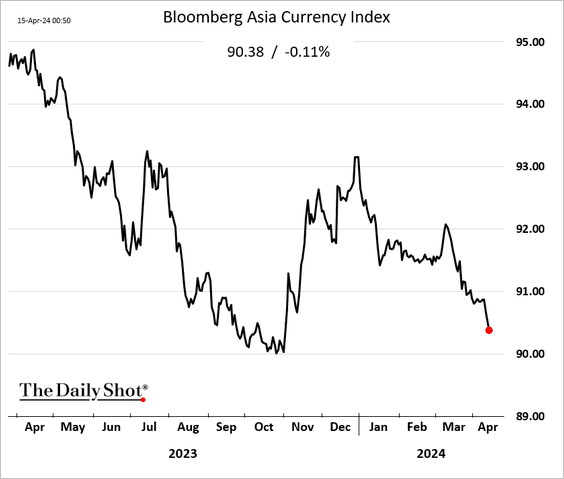

1. Asian currencies remain under pressure.

• The South Korean won:

• The Taiwan dollar:

• Bloomberg’s index of Asian currencies:

——————–

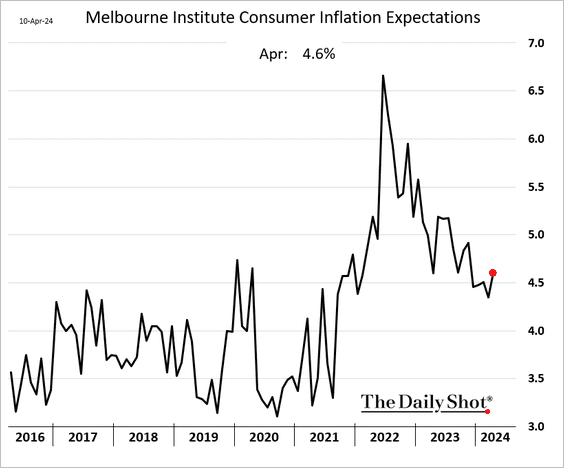

2. Australian inflation expectations moved higher this month.

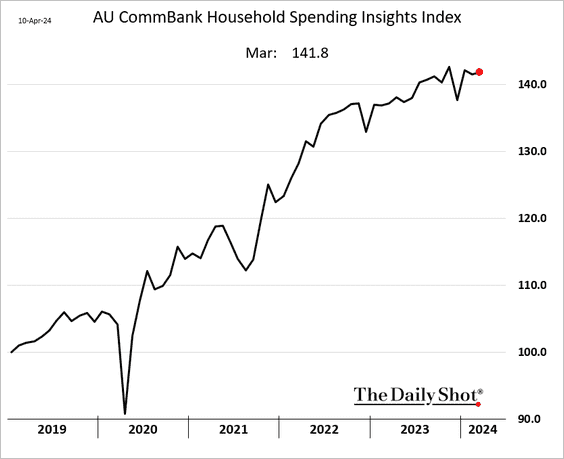

• Household spending edged higher last month.

——————–

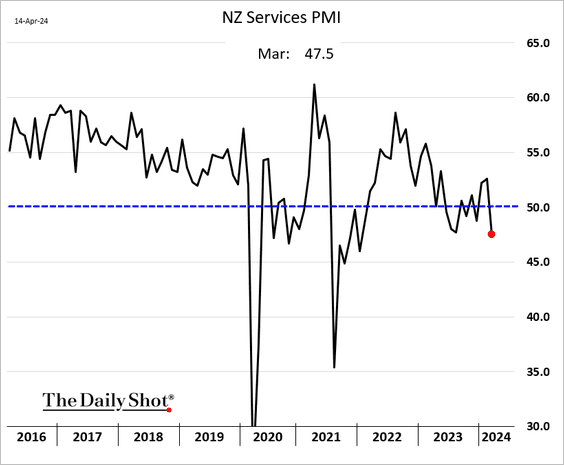

3. New Zealand’s service sector is contracting again.

Back to Index

China

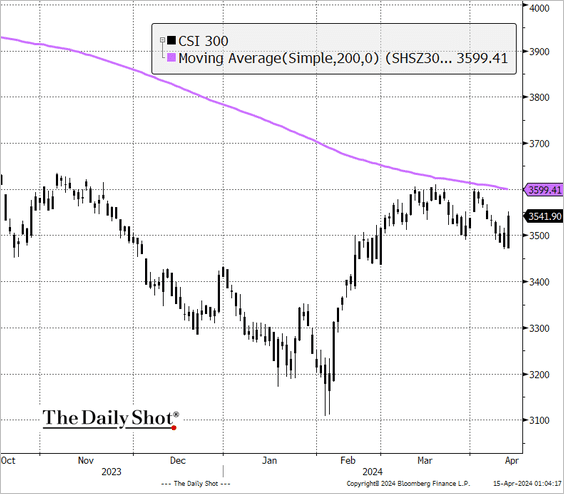

1. Beijing announced more measures to support the equity market, sending stocks higher.

Source: @markets Read full article

Source: @markets Read full article

• Separately, Beijing’s strategy has been to “hide” data that might cast China in an unfavorable light.

Bloomberg: – China will soon cease displaying real-time data for flows into the world’s second-largest stock market through Hong Kong, shielding a closely-watched indicator of foreign sentiment.

Live trading data for flows from Hong Kong into Shanghai and Shenzhen via the connect programs will no longer be available in about a month, according to statements by the two mainland stock exchanges late Friday. Instead, they will provide the turnover details after the daily session.

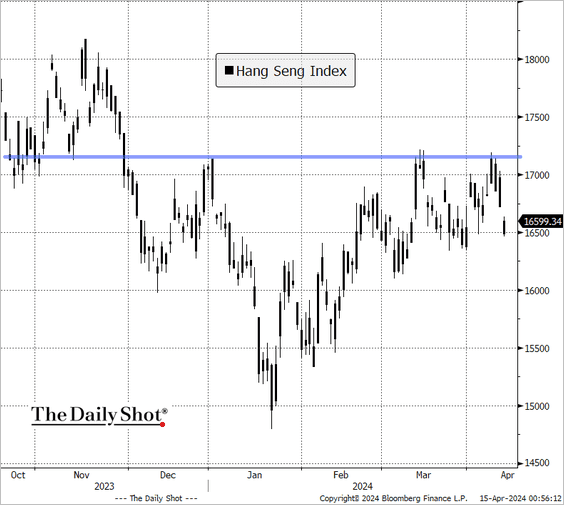

• The Hang Sent Index (Hong Kong) has been unable to break resistance.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

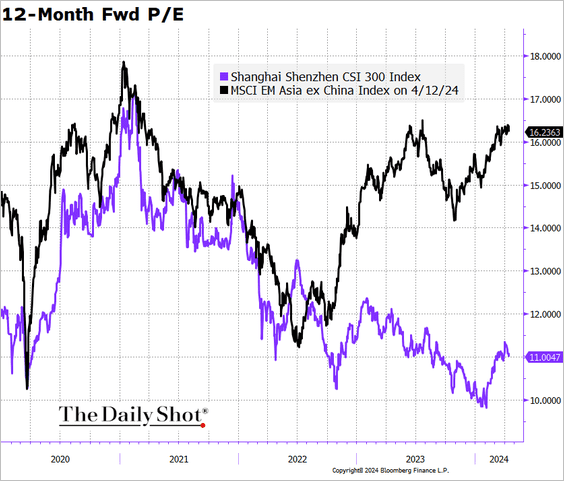

• China’s equities continue to trade at a deep discount to Asian peers.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

——————–

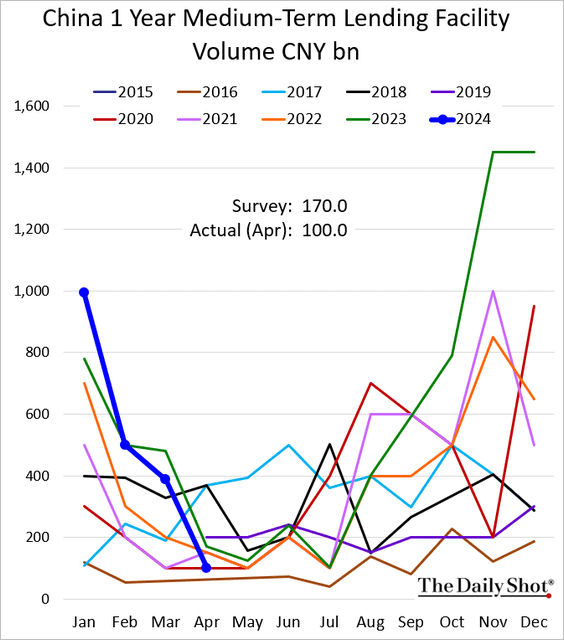

2. The PBoC left its 1-year benchmark rate unchanged but provided less liquidity than expected, as Beijing remains concerned about the weak yuan.

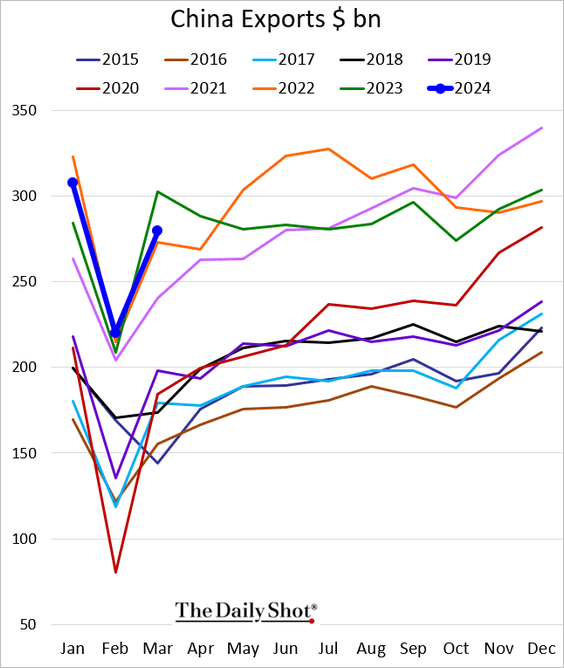

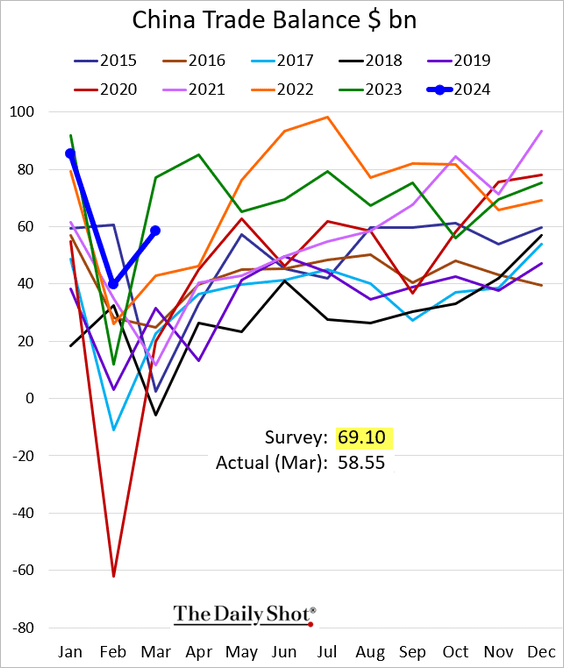

3. Exports surprised to the downside, …

… with the trade surplus dipping well below last year’s level.

Source: @economics Read full article

Source: @economics Read full article

——————–

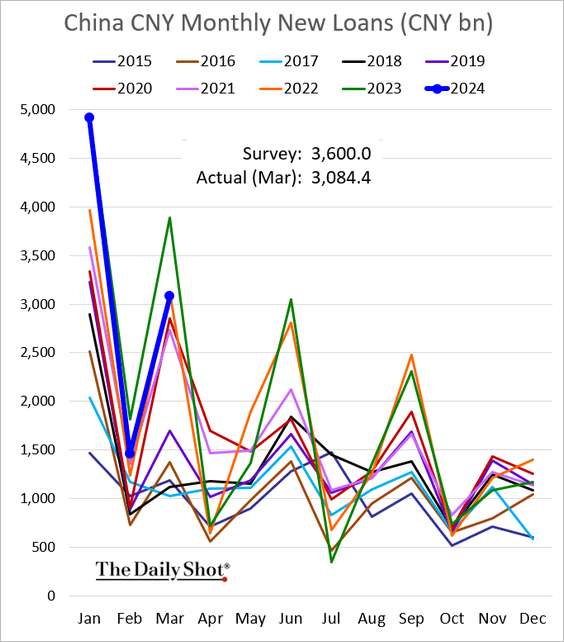

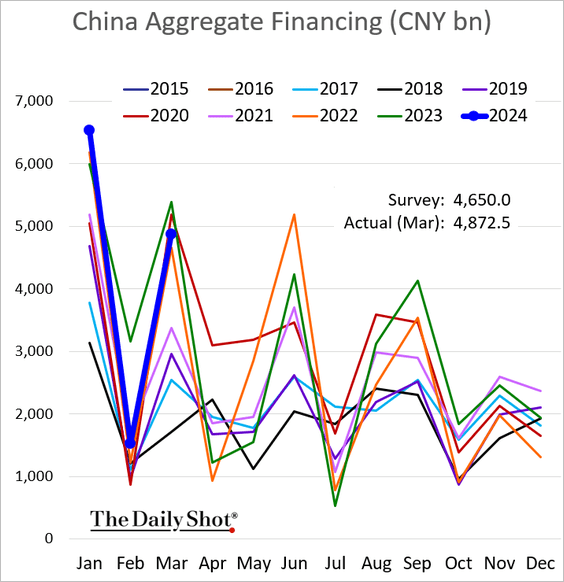

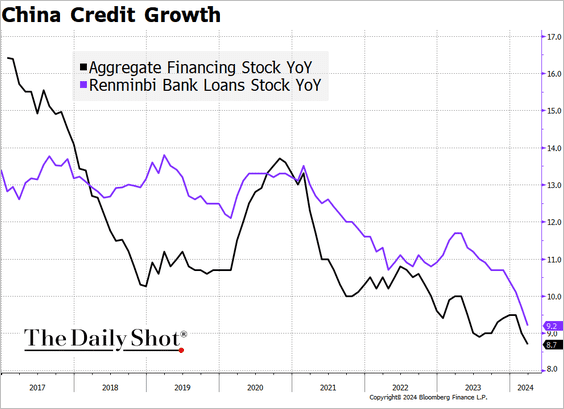

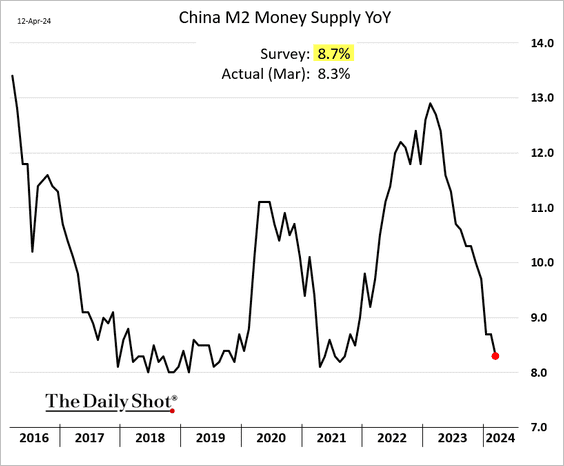

4. Credit growth also surprised to the downside.

• Monthly changes:

• Year of year changes in total loan balances:

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

• The broad money supply growth:

Source: @markets Read full article

Source: @markets Read full article

——————–

5. Fitch followed Moody’s in cutting its outlook on China’s debt.

Source: Reuters Read full article

Source: Reuters Read full article

Back to Index

Emerging Markets

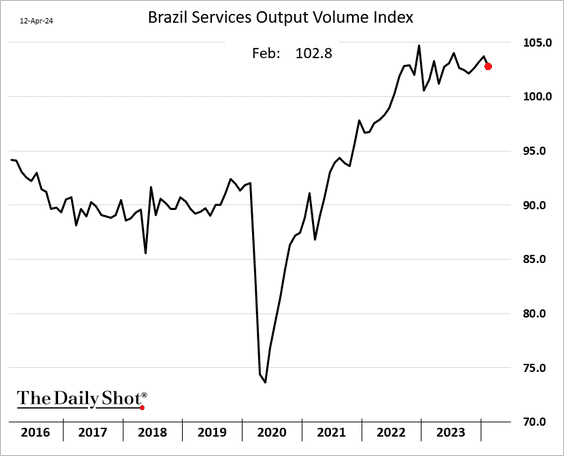

1. Brazil’s services output declined in February.

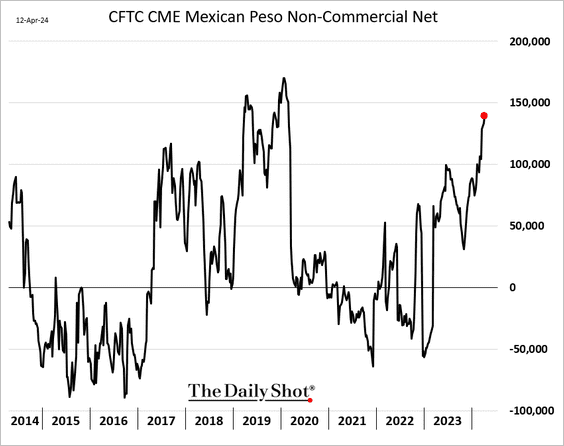

2. Traders continue to increase their bets on the Mexican peso.

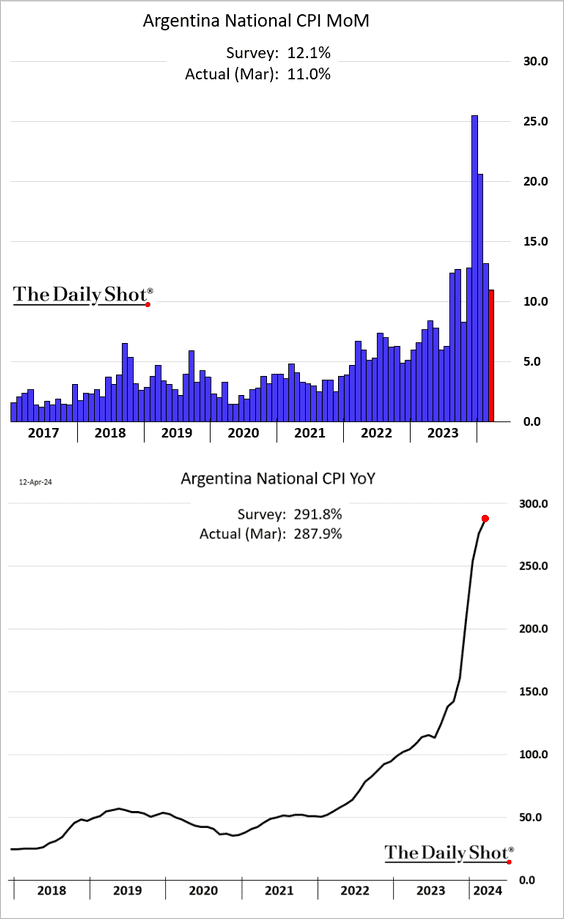

3. Argentina’s inflation has slowed but is still near 300% year over year.

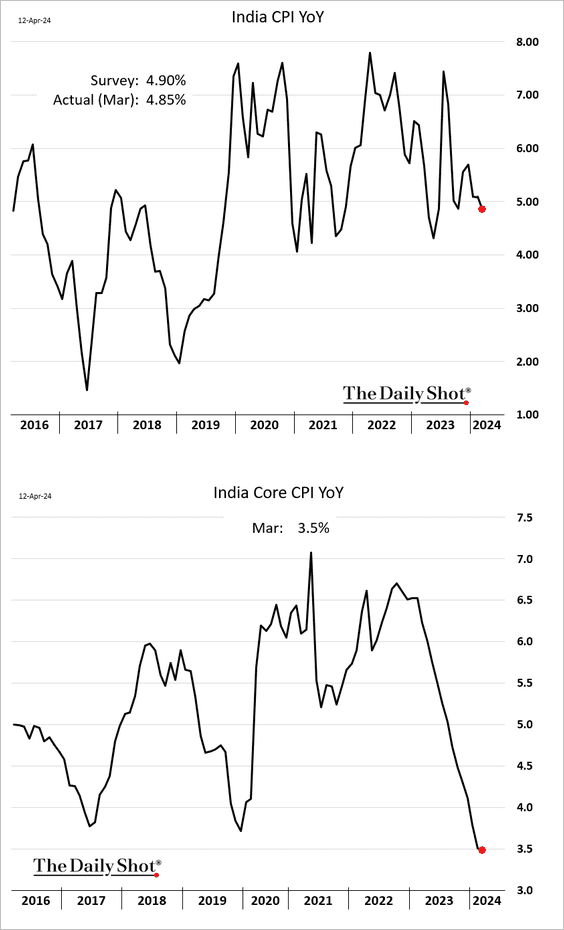

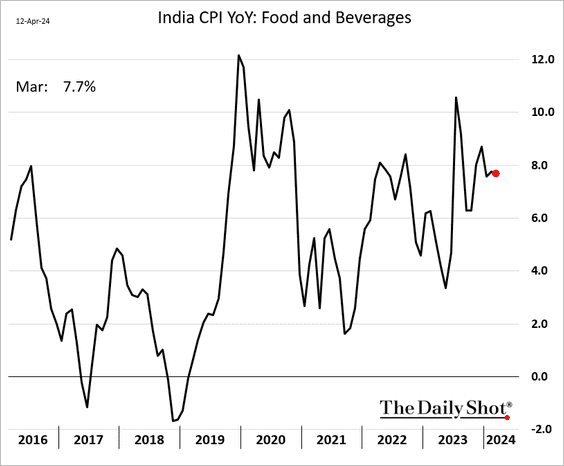

4. India’s inflation continues to ease.

Source: The Economic Times Read full article

Source: The Economic Times Read full article

Food inflation remains elevated.

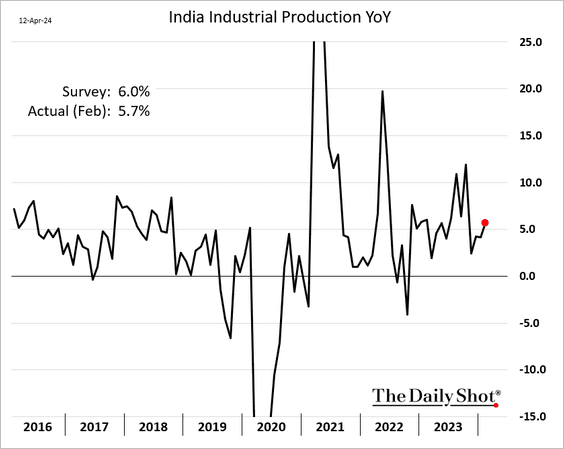

• India’s industrial production growth has been robust.

——————–

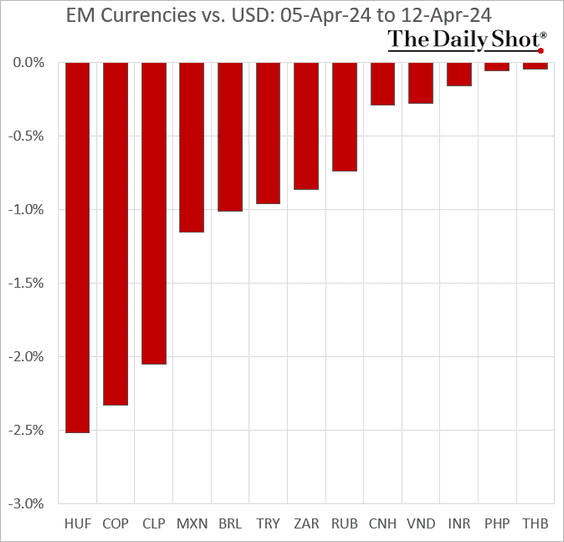

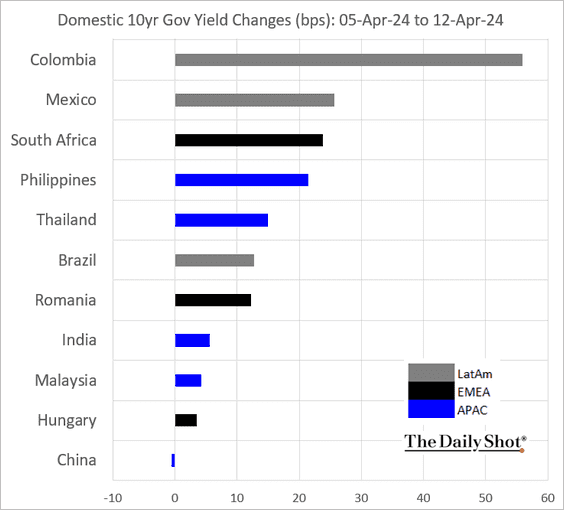

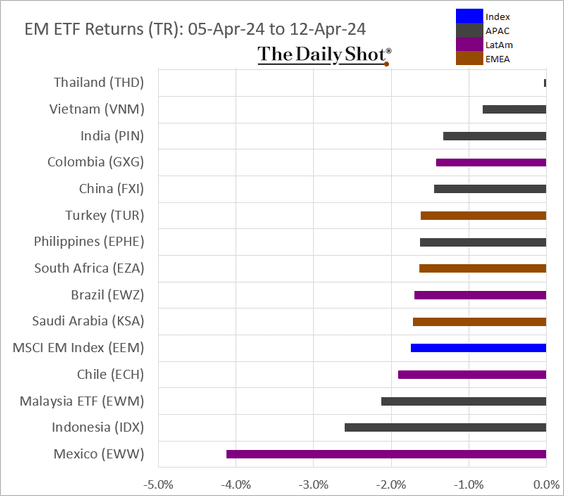

5. Next, we have some performance data from last week.

• Currencies:

• Bond yields:

• Equity ETFs:

Back to Index

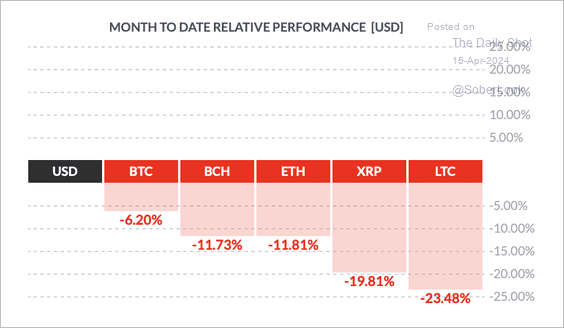

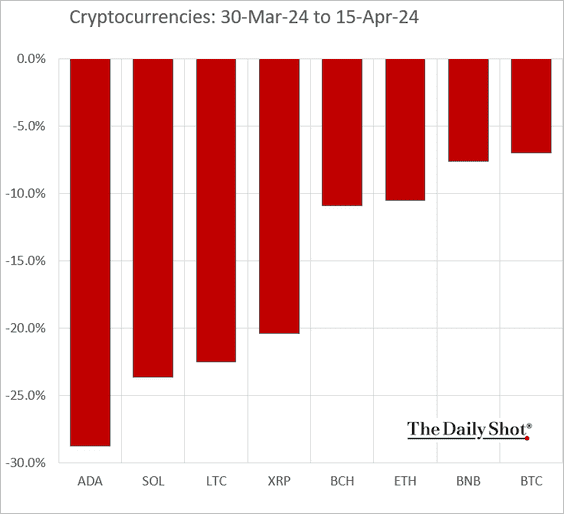

Cryptocurrency

1. Litecoin (LTC) has been underperforming top crypto peers this month.

Source: FinViz

Source: FinViz

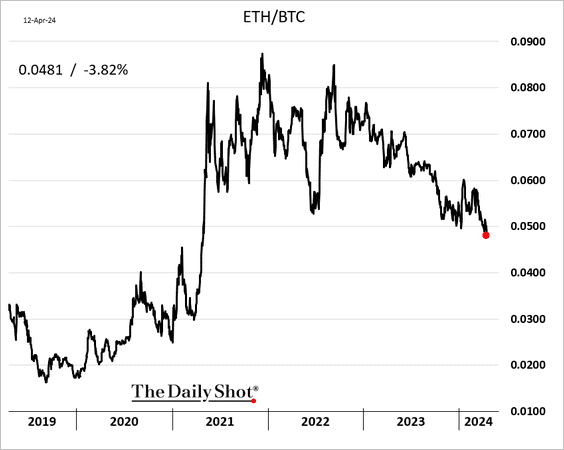

2. Ether continues to underperform bitcoin.

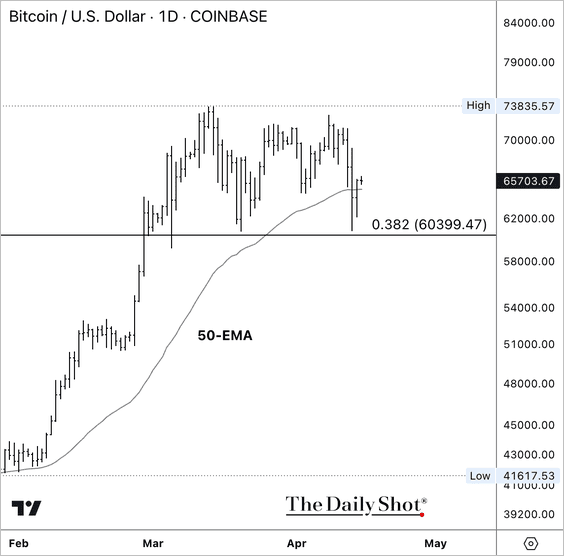

3. So far, BTC/USD is holding short-term support, which helped stabilize the recent price correction.

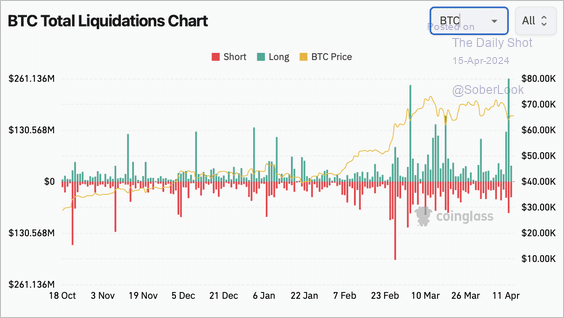

4. Bitcoin’s weekend price drop saw a spike in long liquidations.

Source: Coinglass

Source: Coinglass

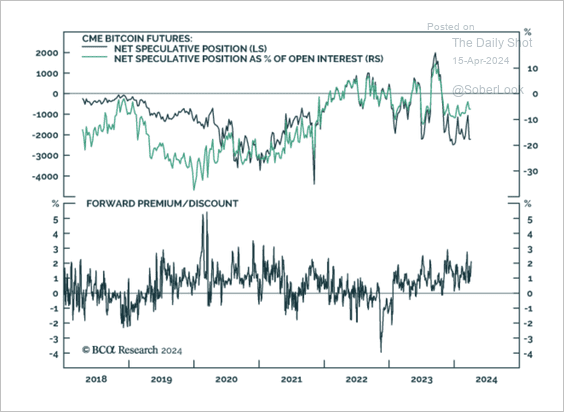

5. Speculators are net-short bitcoin futures, although some positioning could reflect arbitrage activity.

Source: BCA Research

Source: BCA Research

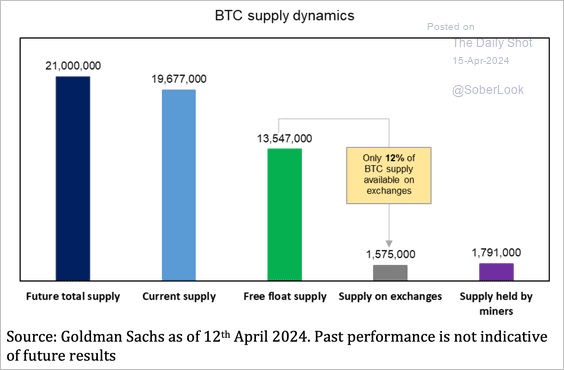

6. Currently, only 12% of bitcoin supply is available for purchase on exchanges.

Source: Goldman Sachs; @dailychartbook

Source: Goldman Sachs; @dailychartbook

Back to Index

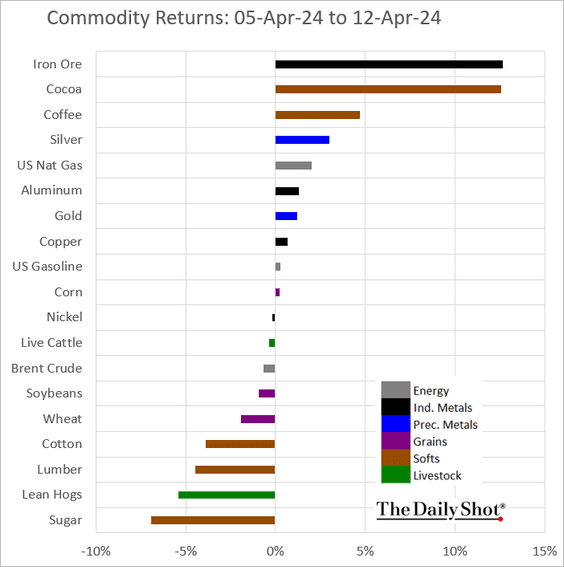

Commodities

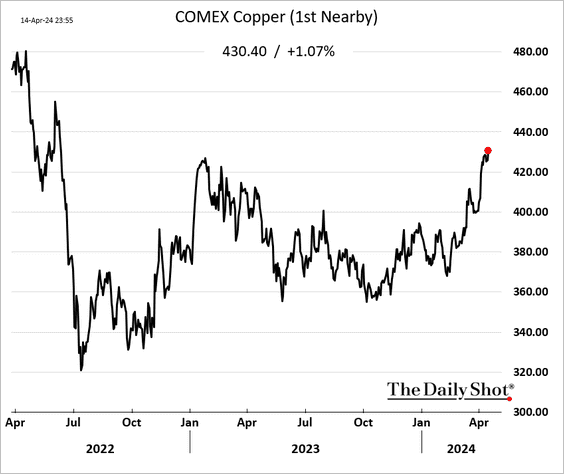

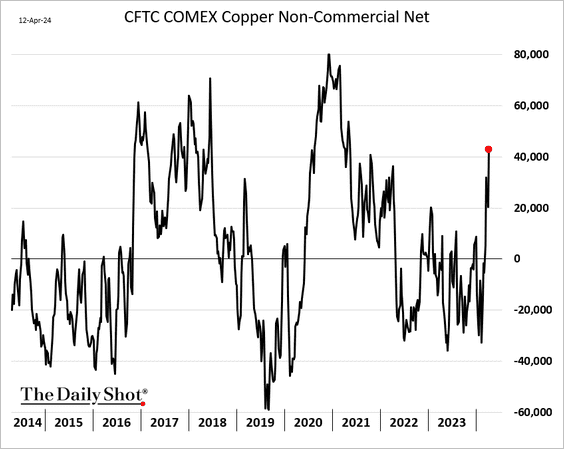

1. Copper continues to climb.

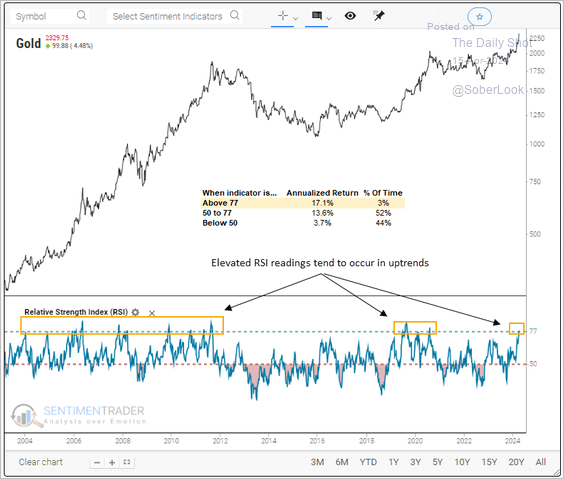

2. Gold is overbought within an uptrend, which is typically a positive signal during bull markets.

Source: SentimenTrader

Source: SentimenTrader

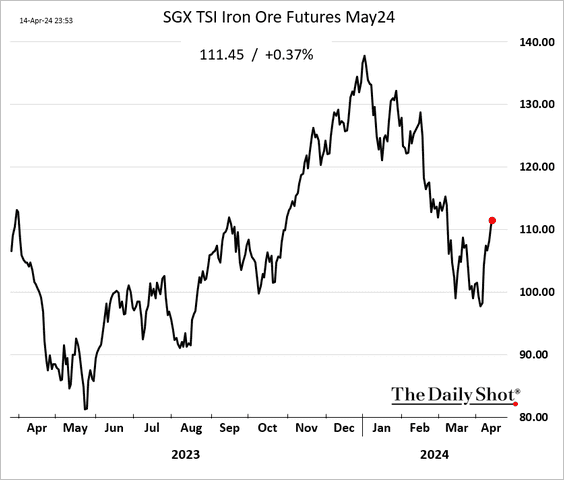

3. Iron ore is rebounding.

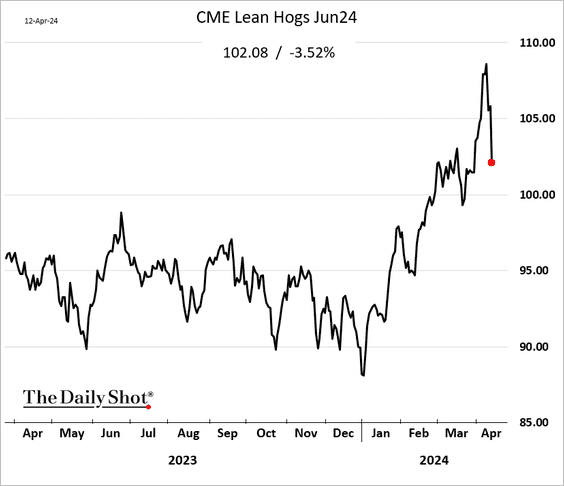

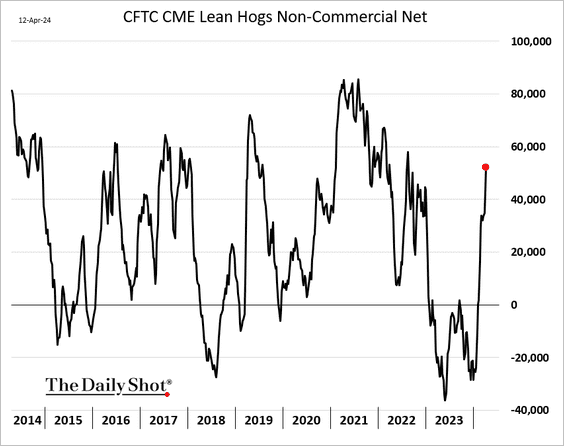

4. The Chicago hog futures rally is fading.

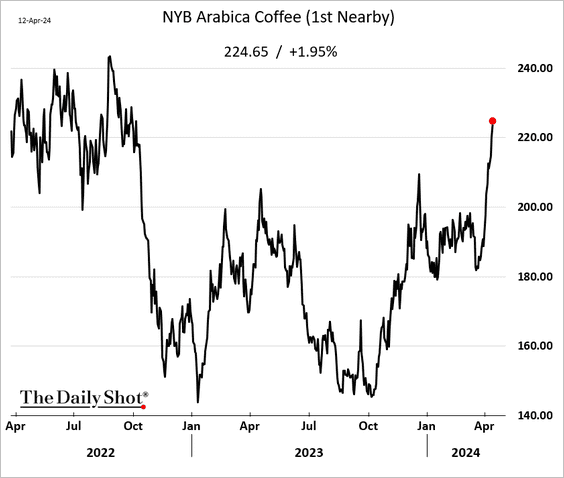

5. Coffee continues to surge.

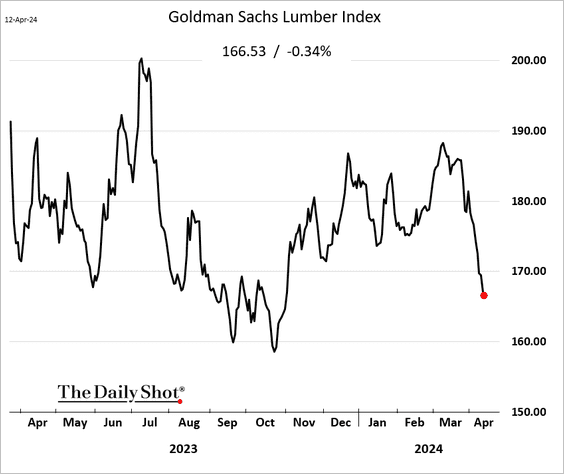

6. Lumber has been under pressure.

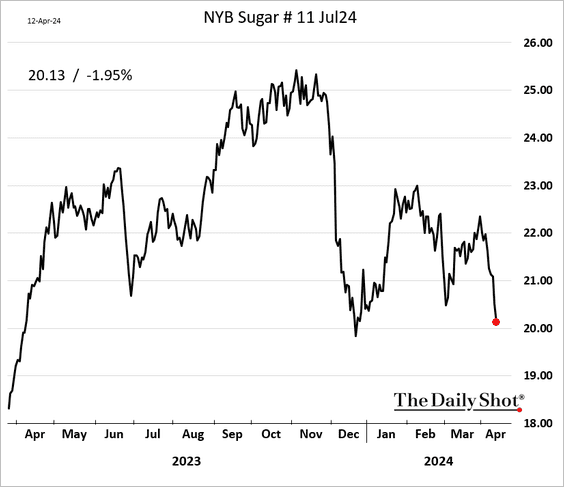

7. Sugar futures have been selling off.

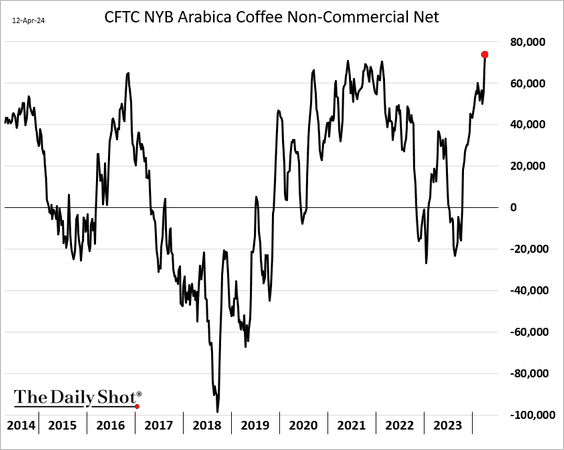

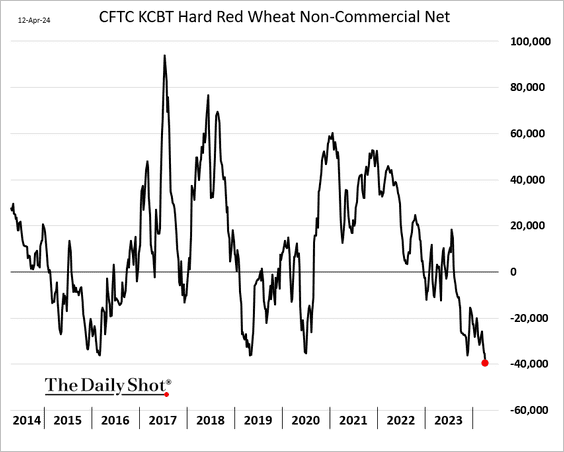

8. Next, we have some positioning data.

• Copper:

• Coffee:

• Hard red wheat:

• Hogs:

——————–

9. Finally, here is last week’s performance.

Back to Index

Energy

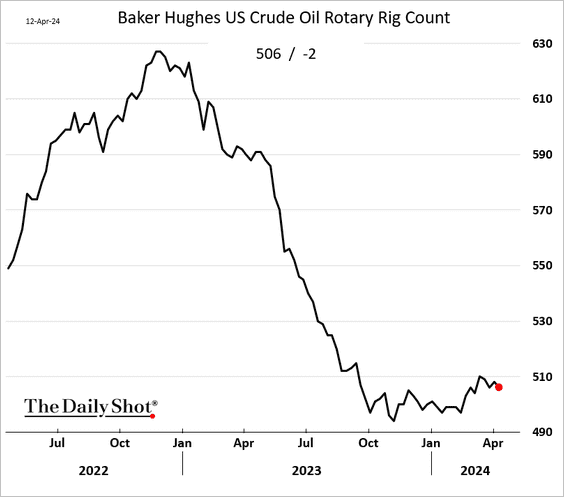

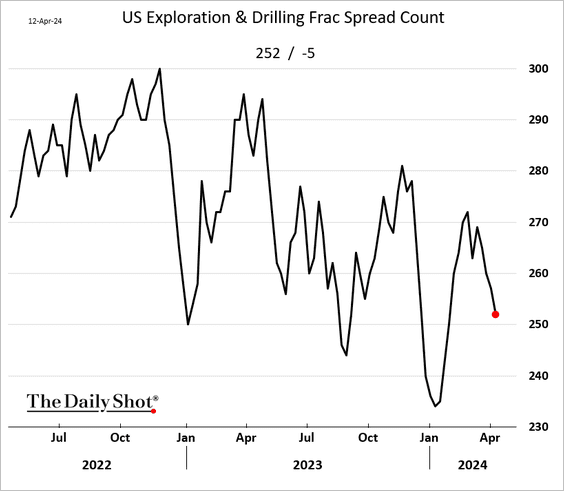

1. The rebound in US drilling activity is fading.

• Rigs:

• Frac spread:

——————–

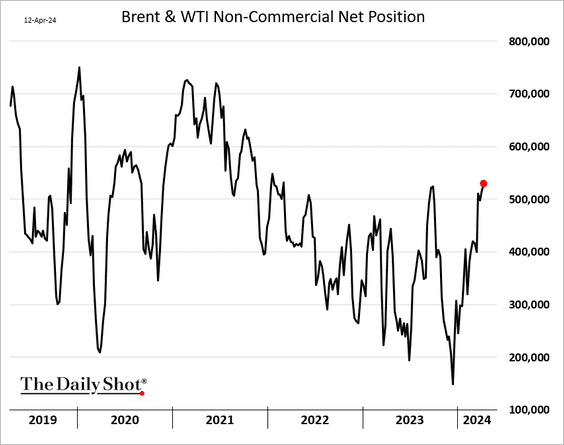

2. Speculative accounts are boosting their bets on crude oil futures.

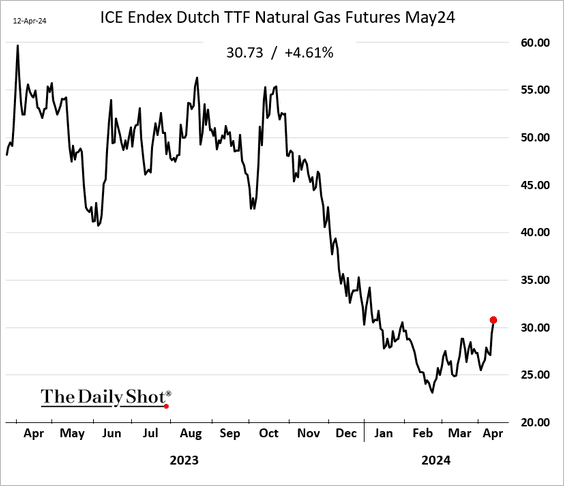

3. European natural gas futures continue to rally on Ukraine concerns.

Back to Index

Equities

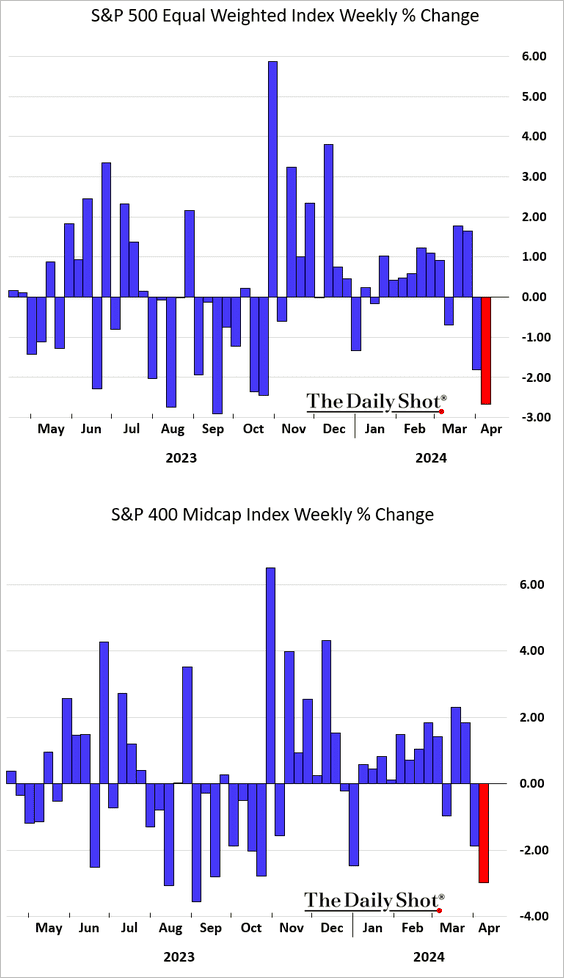

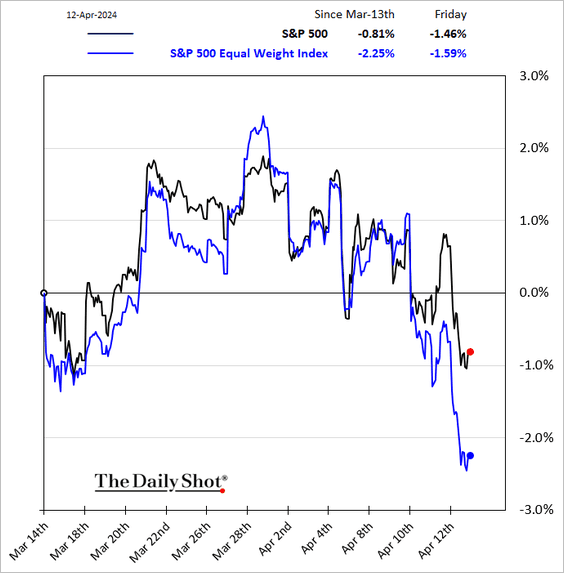

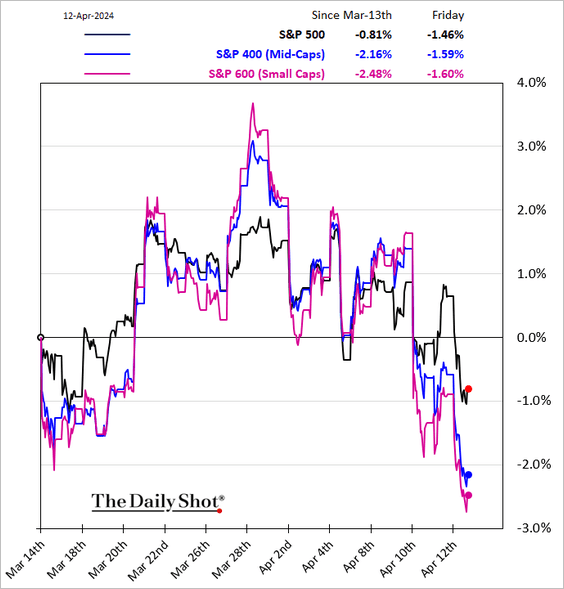

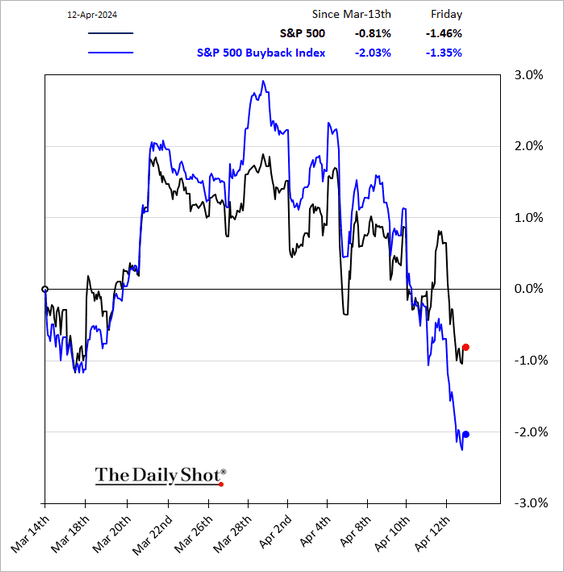

1. The average stock in the S&P 500 (equal-weight index) took a hit last week. So did small caps and mid-caps.

• Here is the relative performance over the past month.

——————–

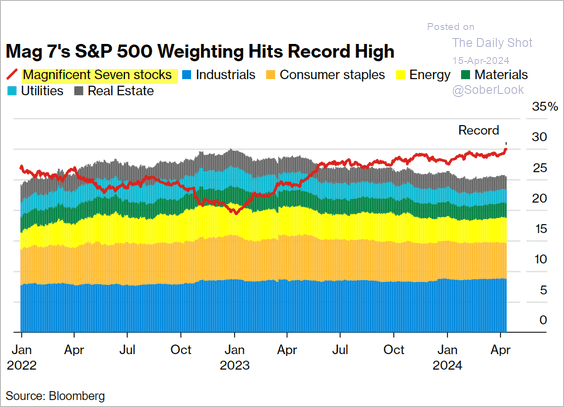

2. The “Mag 7” concentration keeps rising.

Source: @markets Read full article

Source: @markets Read full article

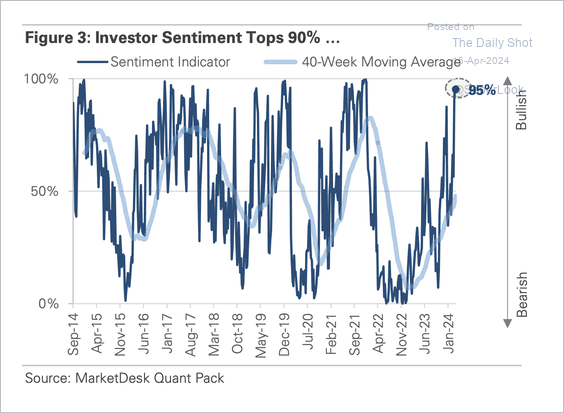

3. Bullish sentiment has been stretched.

Source: MarketDesk Research

Source: MarketDesk Research

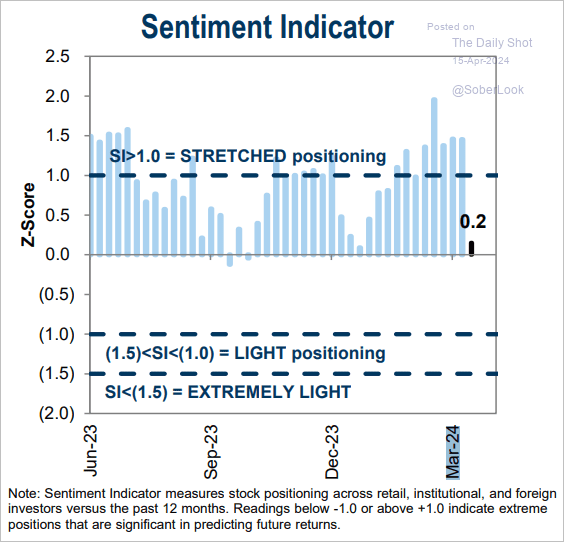

Goldman’s sentiment indicator retreated last week.

Source: Goldman Sachs; @MikeZaccardi

Source: Goldman Sachs; @MikeZaccardi

——————–

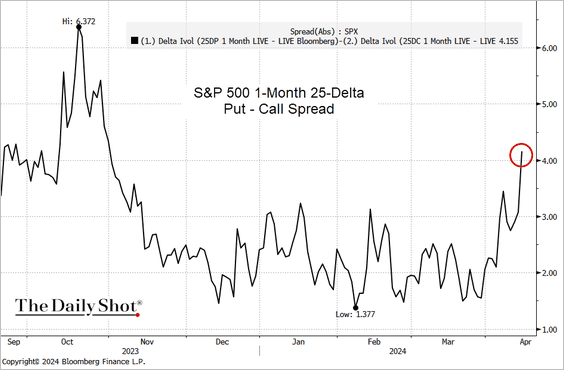

4. Volatility skew jumped on Friday amid market jitters.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

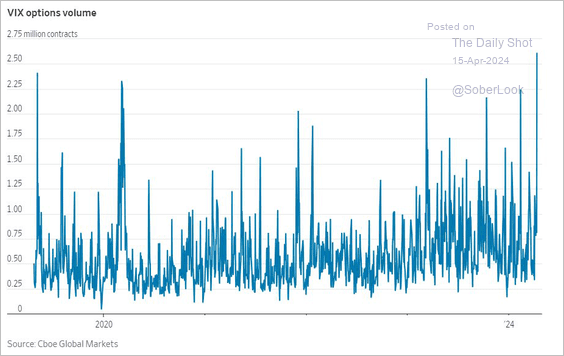

Demand for VIX options surged.

Source: @GunjanJS

Source: @GunjanJS

——————–

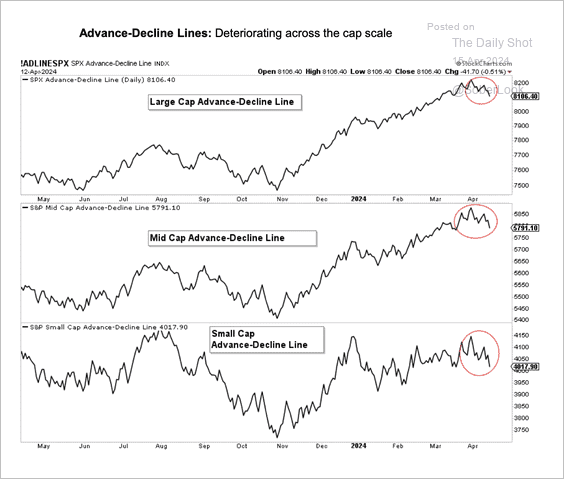

5. US market breadth is starting to weaken.

Source: Aazan Habib, Paradigm Capital

Source: Aazan Habib, Paradigm Capital

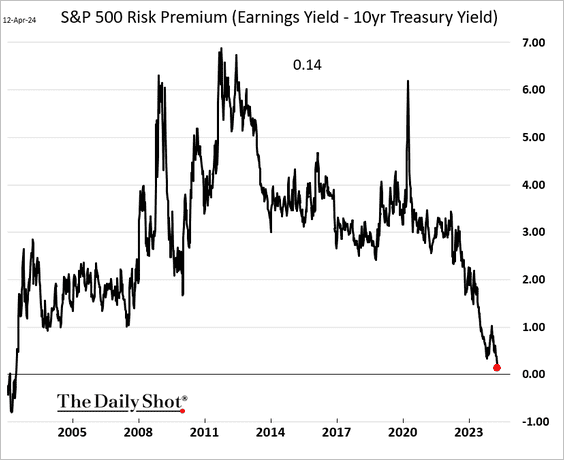

6. The S&P 500 equity risk premium is nearing zero.

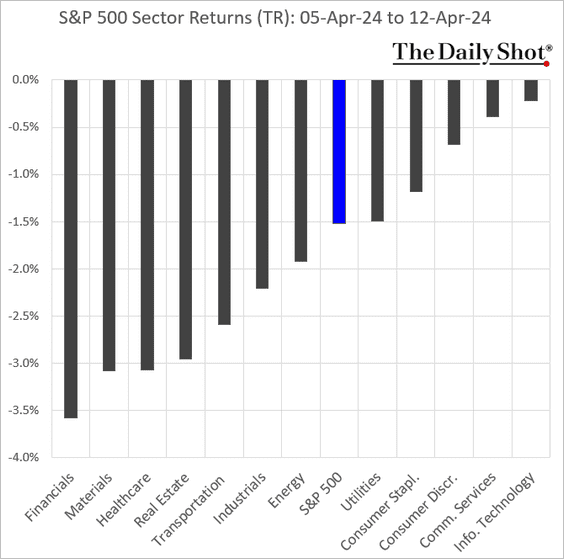

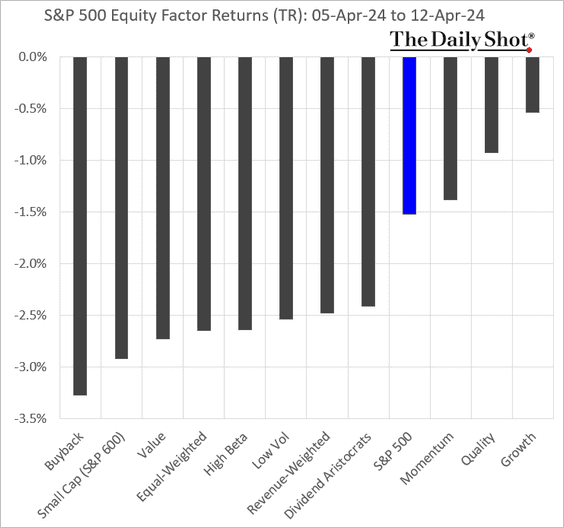

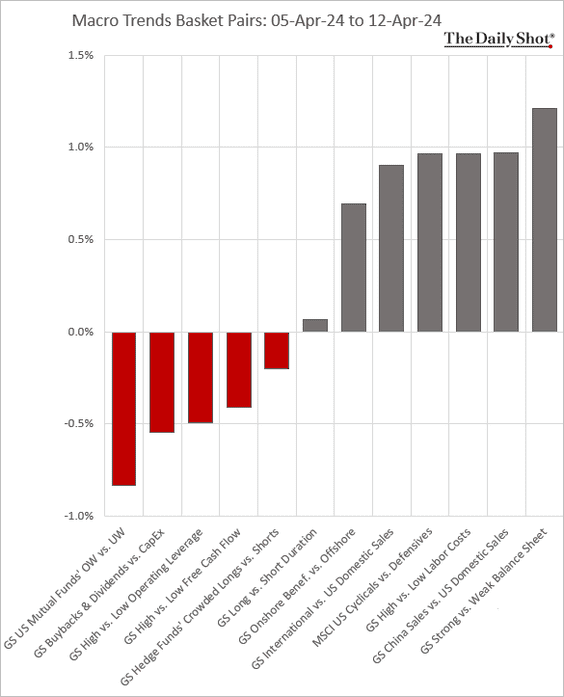

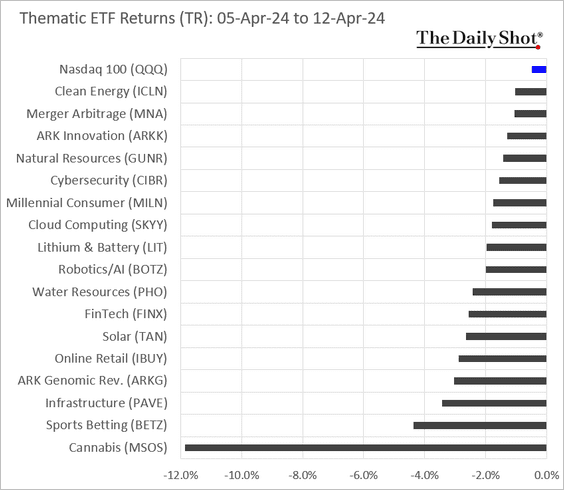

7. Next, we have some performance data from last week.

• Sectors:

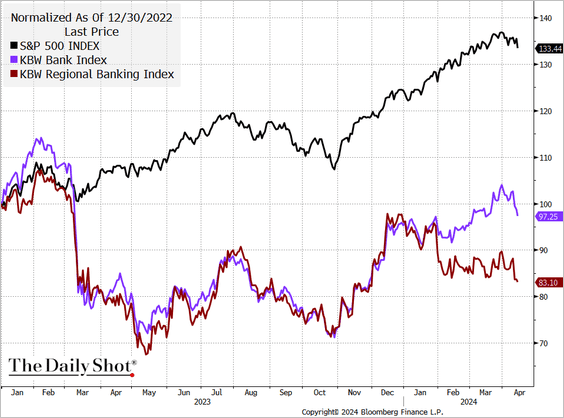

– Banks are widening their underperformance.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

• Equity factors (2 charts):

• Macro basket pairs’ relative performance:

• Thematic ETFs:

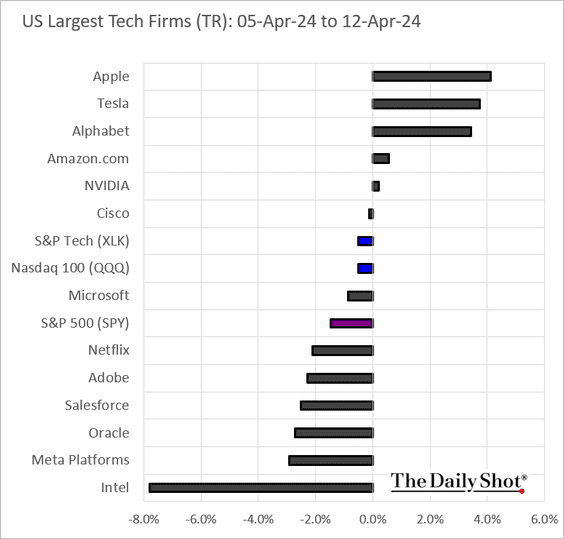

• Largest US tech firms:

Back to Index

Credit

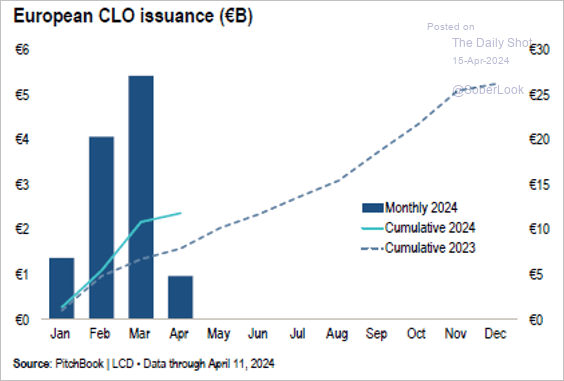

1. European CLO issuance has been robust.

Source: PitchBook

Source: PitchBook

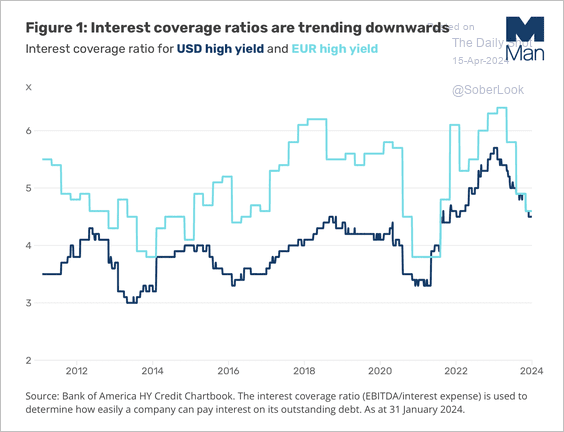

2. Interest coverage ratios have declined, although this has not yet translated to a significant rise in defaults.

Source: Man Group Read full article

Source: Man Group Read full article

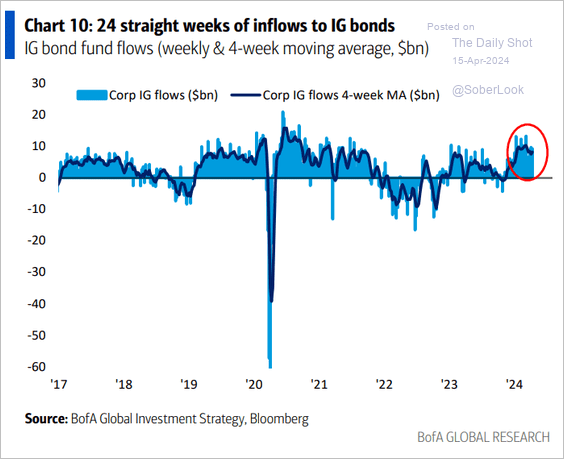

3. IG bond inflows are holding up.

Source: BofA Global Research

Source: BofA Global Research

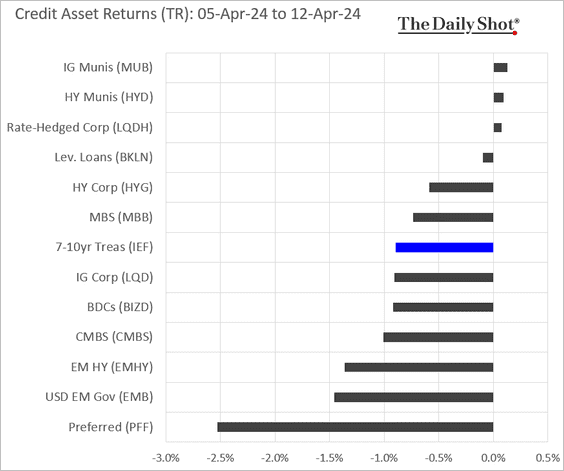

4. Here is last week’s performance.

Back to Index

Global Developments

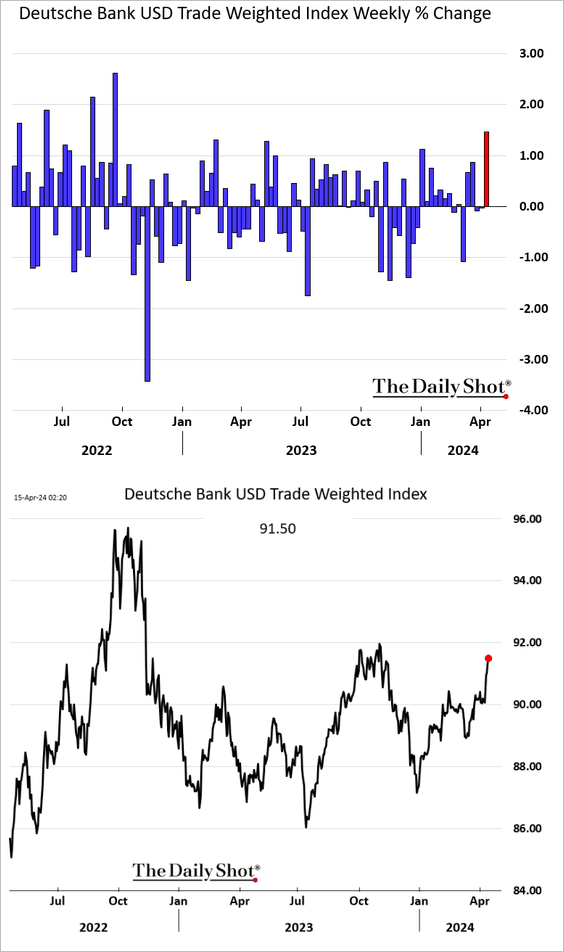

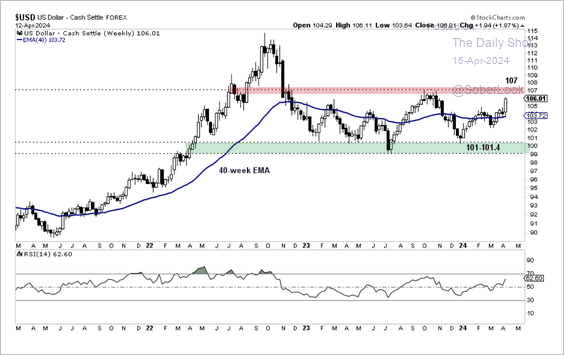

1. The US dollar had a good week, bolstered by a higher-than-expected US CPI report and heightened geopolitical tensions.

• The dollar is approaching resistance within a sideways range.

Source: Aazan Habib, Paradigm Capital

Source: Aazan Habib, Paradigm Capital

——————–

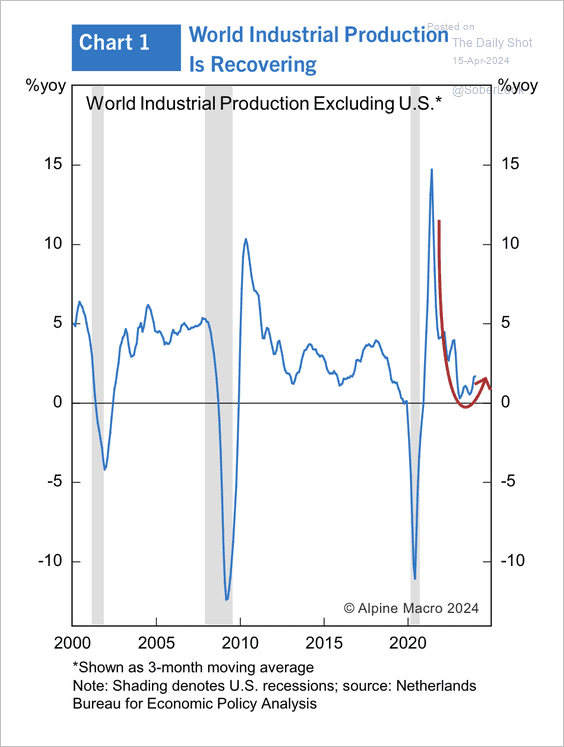

2. Global ex-US industrial production is starting to improve.

Source: Alpine Macro

Source: Alpine Macro

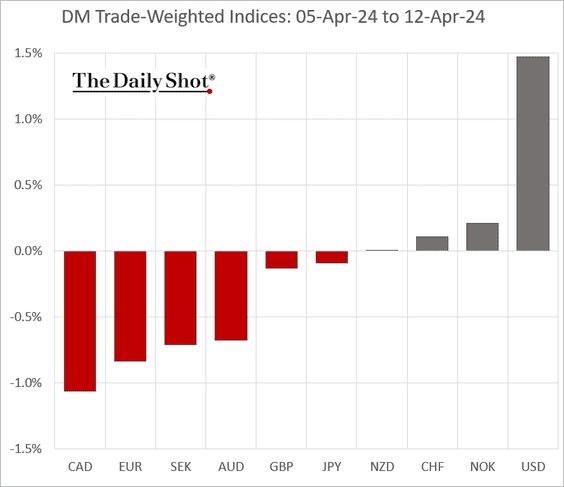

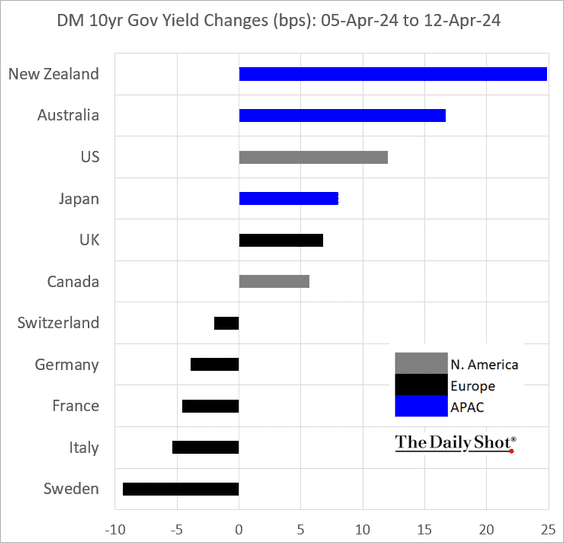

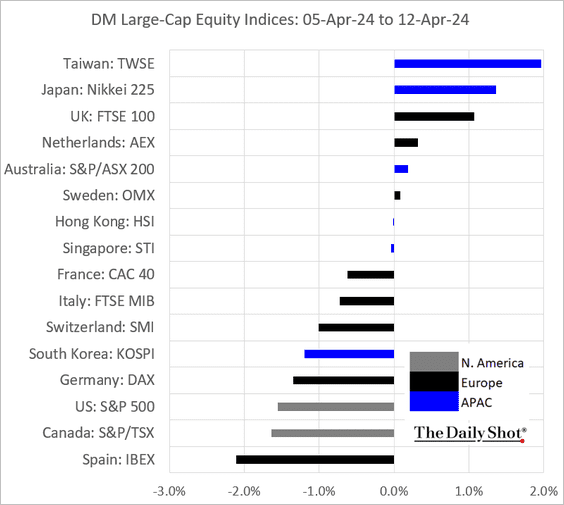

3. Finally, we have last week’s performance data for advanced economies.

• Currencies:

• Bond yields:

• Equities:

——————–

Food for Thought

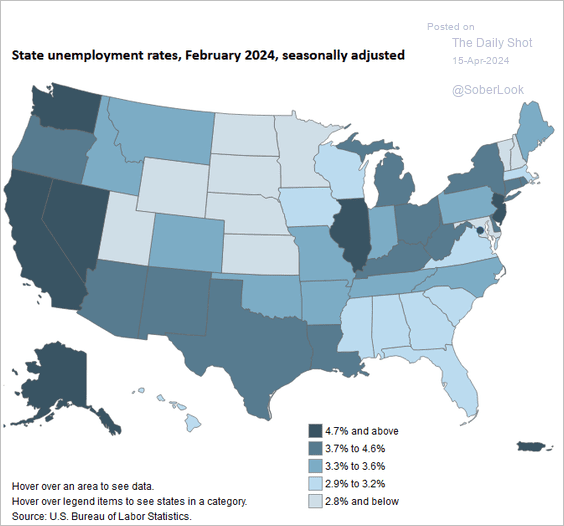

1. Unemployment rates by state:

Source: BLS

Source: BLS

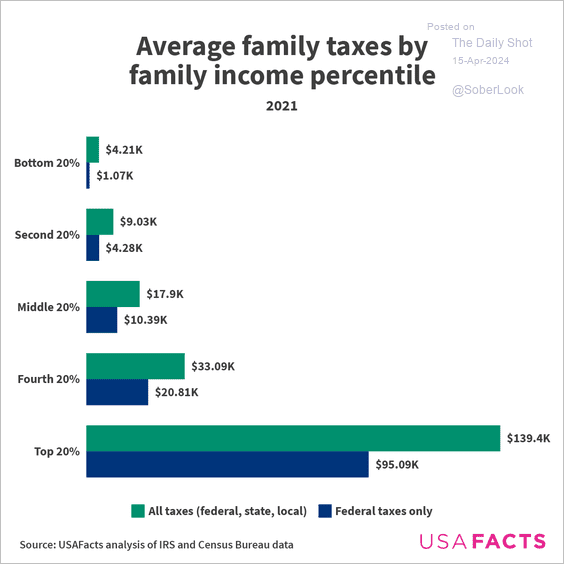

2. Tax burden by income percentiles in the US:

Source: USAFacts

Source: USAFacts

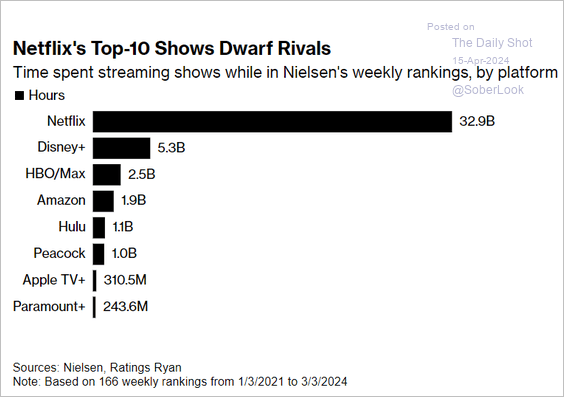

3. Streaming hours comparison across platforms from 2021 to 2024:

Source: @technology Read full article

Source: @technology Read full article

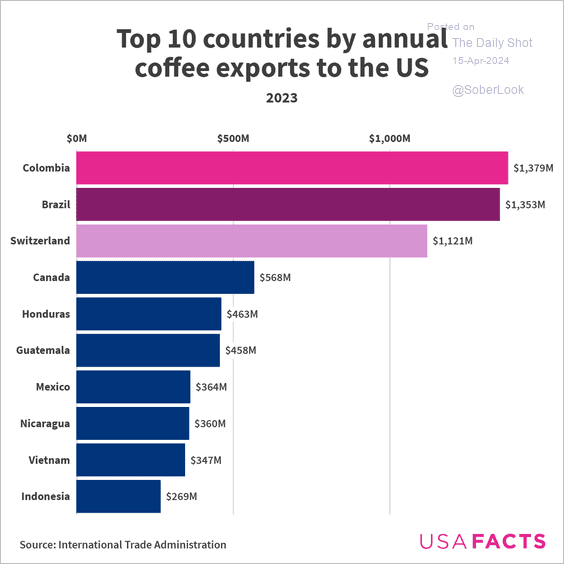

4. Leading coffee exporting countries to the US:

Source: USAFacts

Source: USAFacts

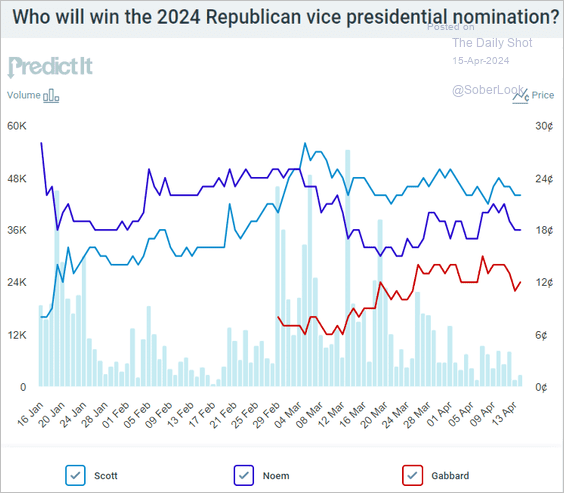

5. GOP VP nomination odds in the betting markets:

Source: @PredictIt

Source: @PredictIt

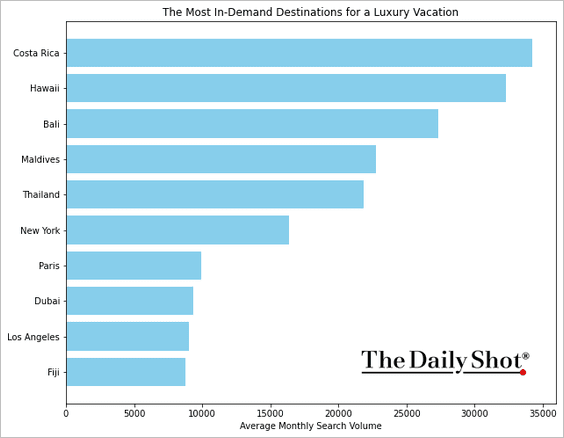

6. Popular destinations for luxury vacation:

Source: Renty

Source: Renty

——————–

Back to Index