The Daily Shot: 15-Mar-24

• The United States

• Europe

• Japan

• China

• Emerging Markets

• Cryptocurrency

• Commodities

• Energy

• Equities

• Credit

• Global Developments

• Food for Thought

The United States

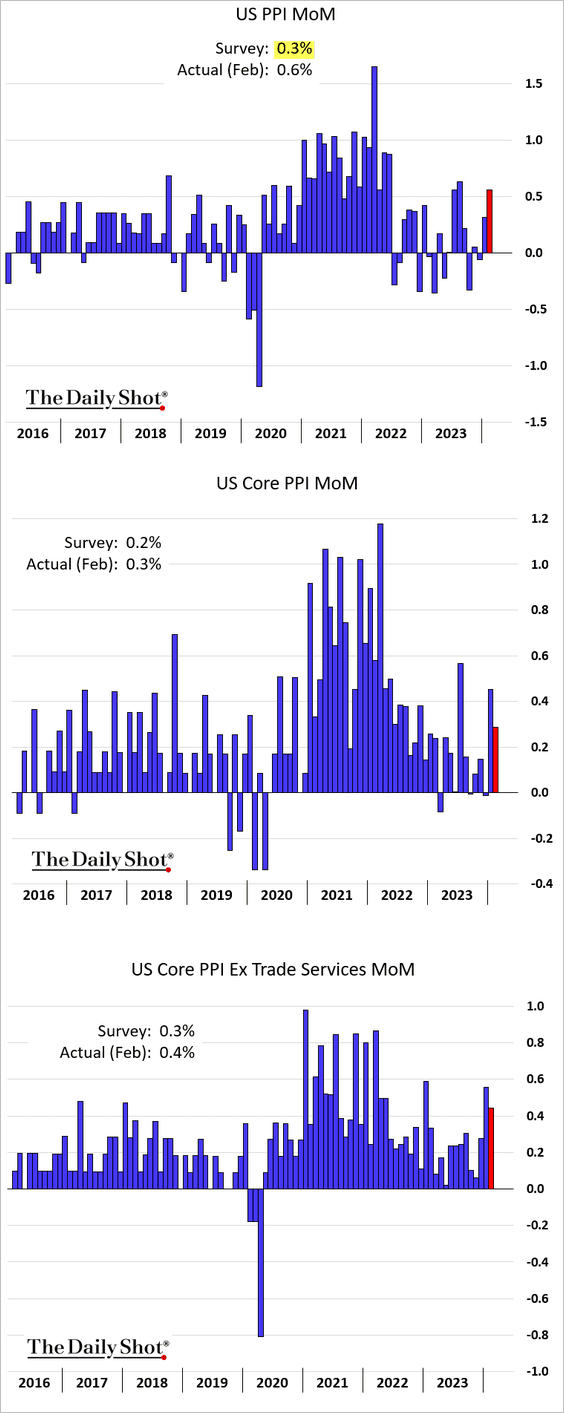

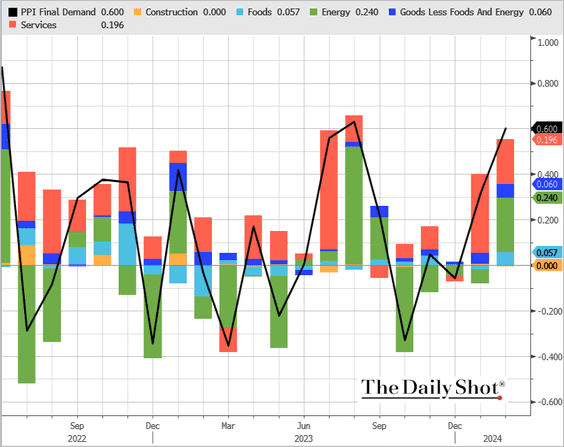

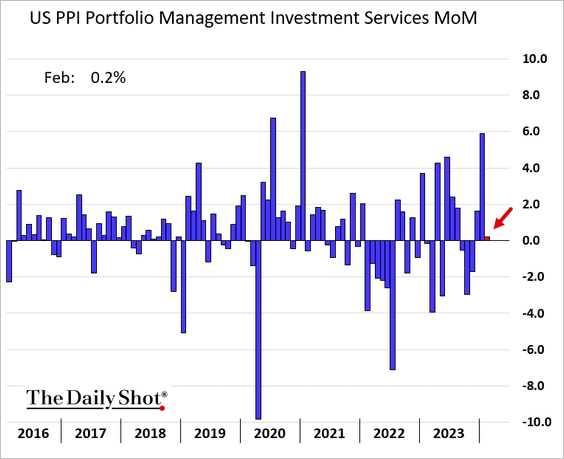

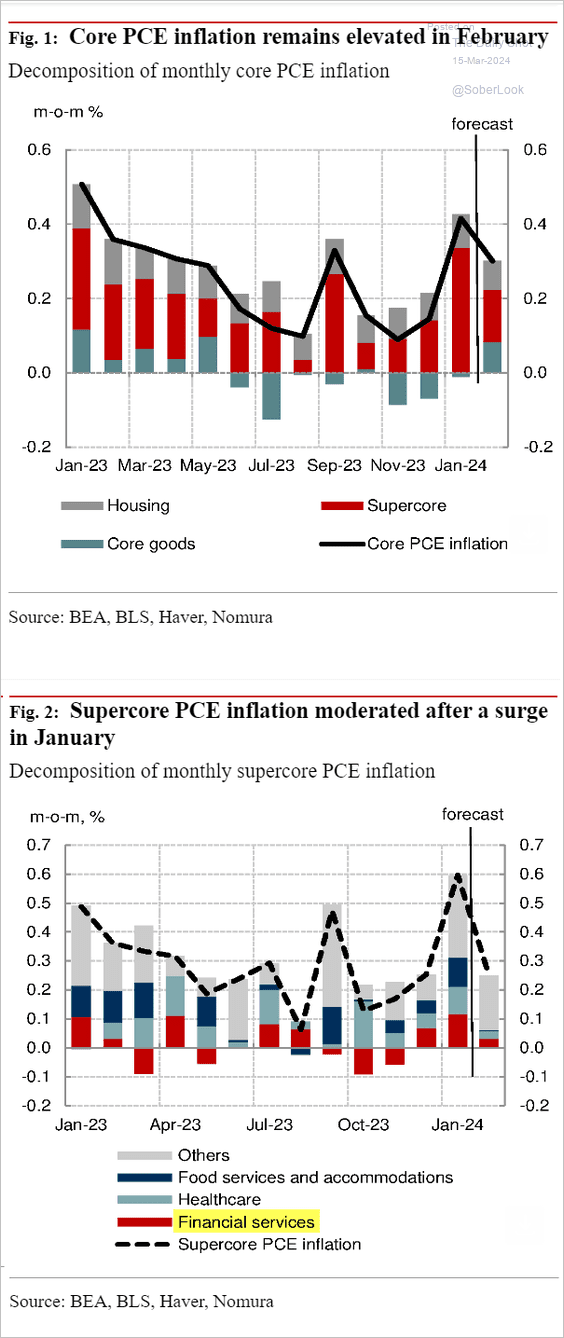

1. Last month’s producer prices topped expectations, reflecting persistent inflationary pressures.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: CNBC Read full article

Source: CNBC Read full article

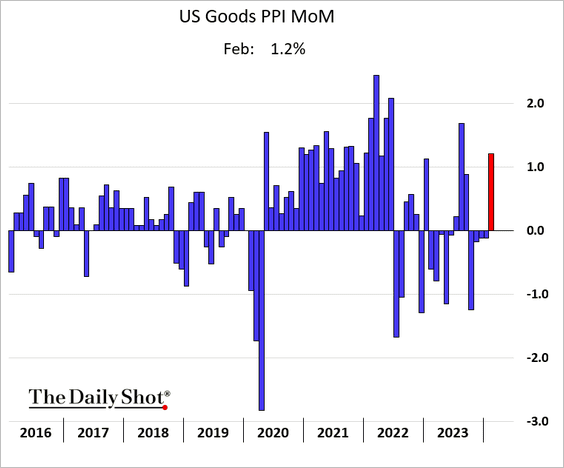

• Following four months of declines, the goods PPI rebounded strongly.

• Financial services PPI didn’t climb as much as expected despite robust stock market gains.

As a result, Nomura sees a softer February supercore PCE print (reported later this month).

Source: Nomura Securities

Source: Nomura Securities

——————–

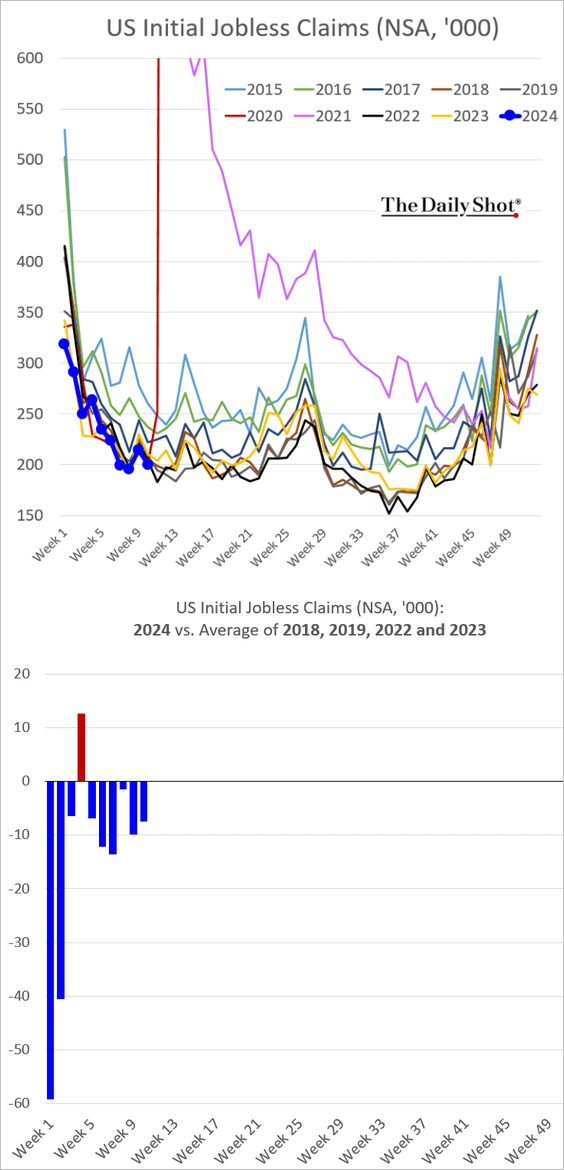

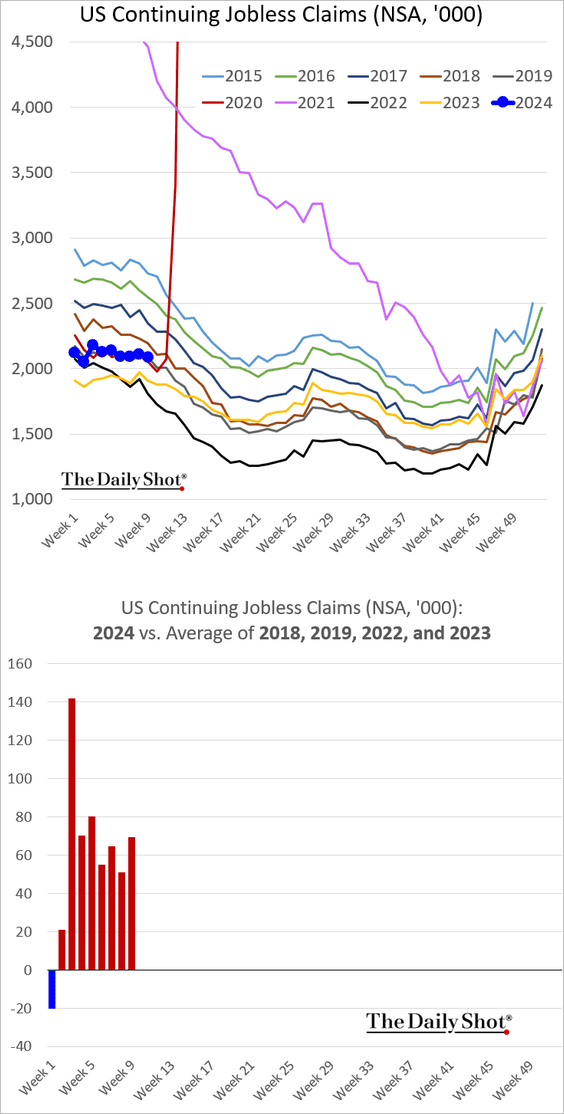

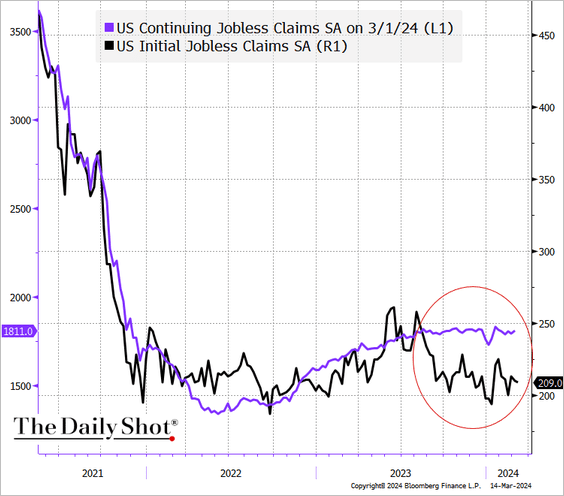

2. Even with the rise in WARN notices, initial jobless claims remained close to multi-year lows last week, suggesting that the labor market is still tight.

• Initial unemployment applications have diverged from continuing claims, which have been elevated relative to recent years.

Here are the seasonally adjusted indices.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

——————–

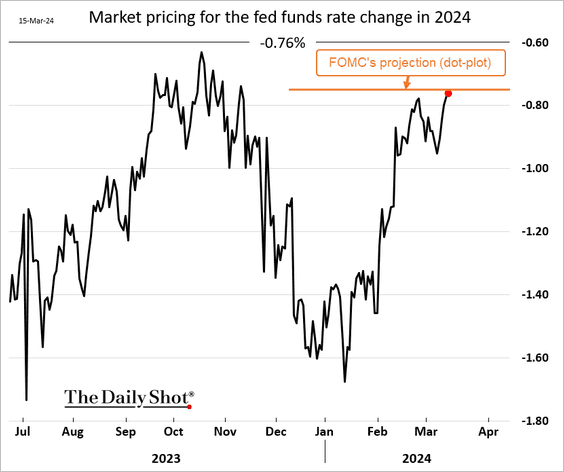

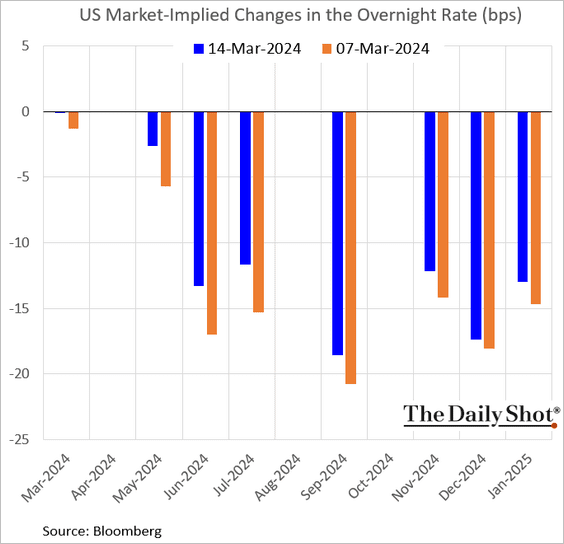

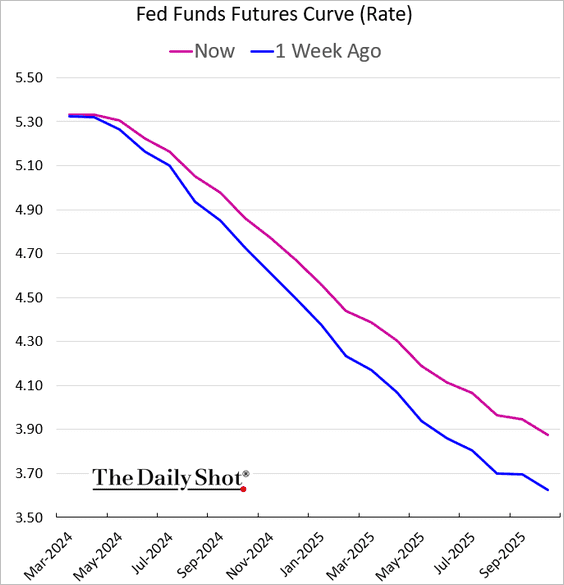

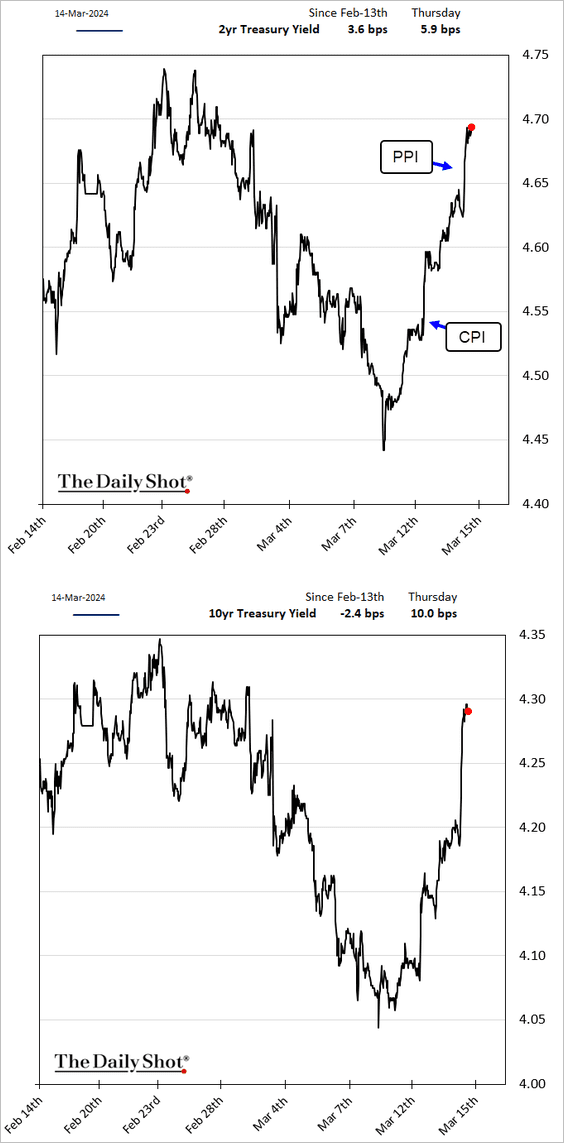

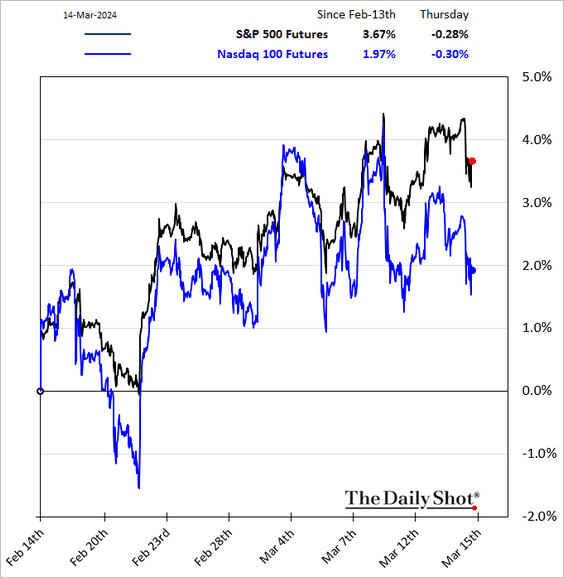

3. Markets reacted sharply to the hot PPI report and low jobless claims, leading to further reductions in projections for Fed rate cuts this year. Expectations are now in line with the last FOMC’s dot plot.

However, market participants are concerned that the dot plot will shift higher at next week’s FOMC meeting.

Source: MarketWatch Read full article

Source: MarketWatch Read full article

The implied rate trajectory has been repriced higher.

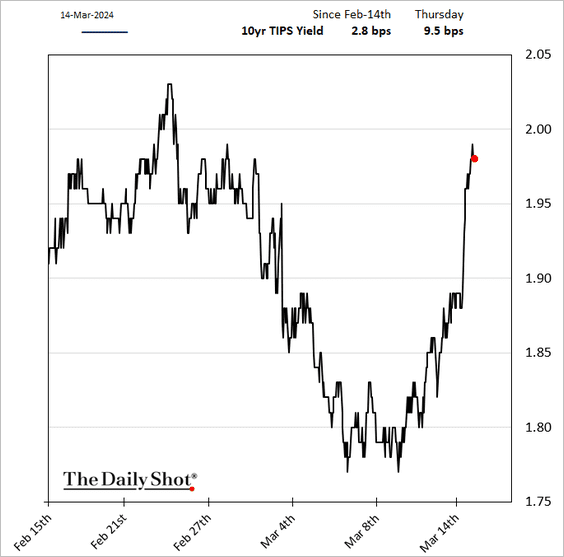

• Treasury yields jumped in response to the PPI report and low jobless claims, …

… driven by higher real yields.

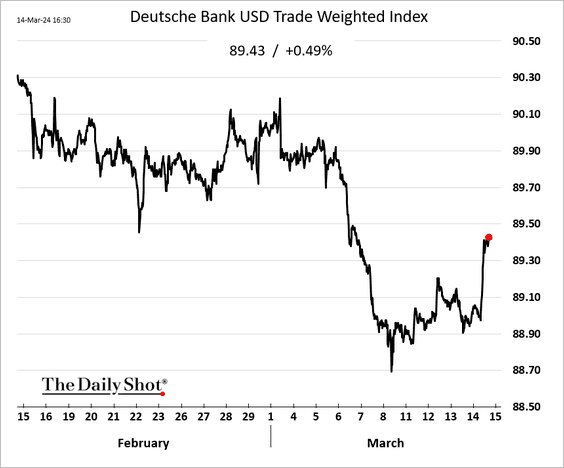

• The dollar climbed.

• Stocks sold off.

——————–

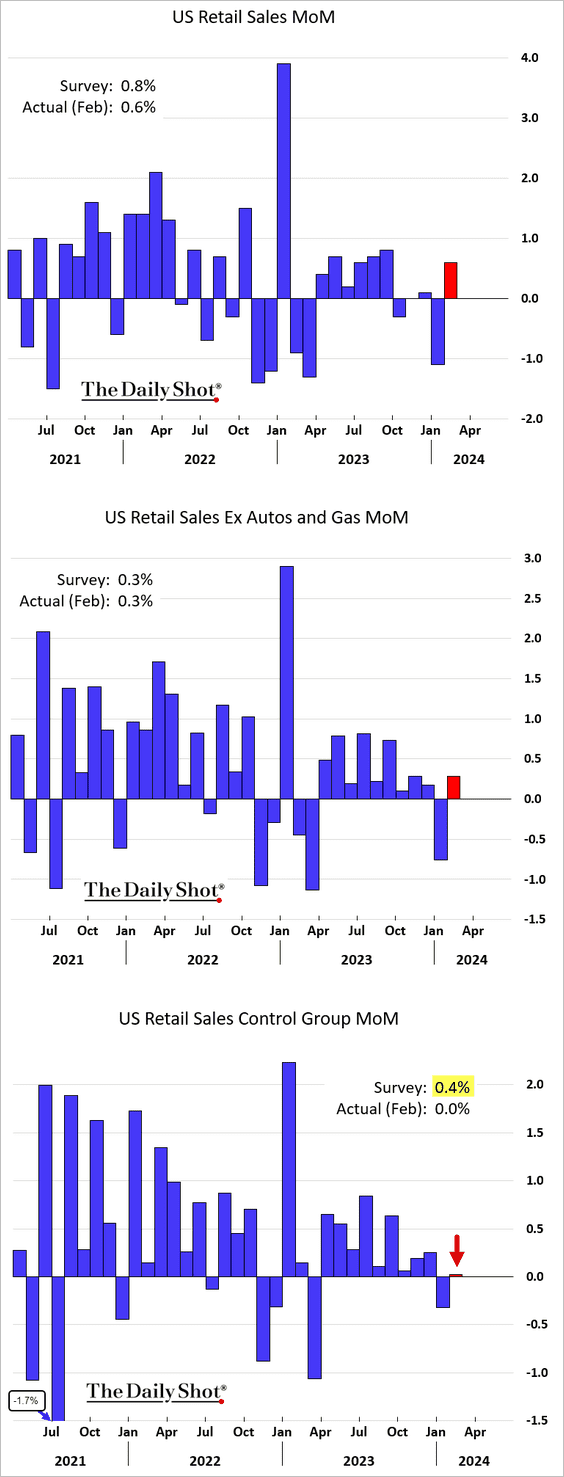

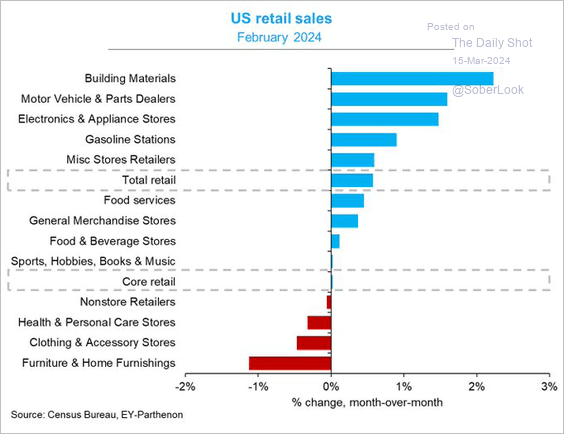

4. Retail sales fell short of forecasts, as the market anticipated a more significant recovery from January’s weather-related weakness. Core retail sales were flat (3rd panel).

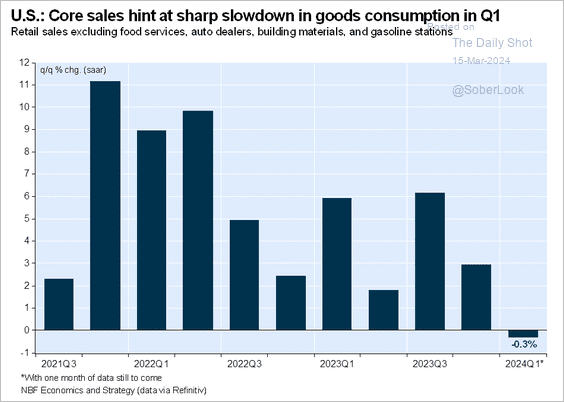

Core retail sales are now down quarter-to-date, …

Source: Economics and Strategy Group, National Bank of Canada

Source: Economics and Strategy Group, National Bank of Canada

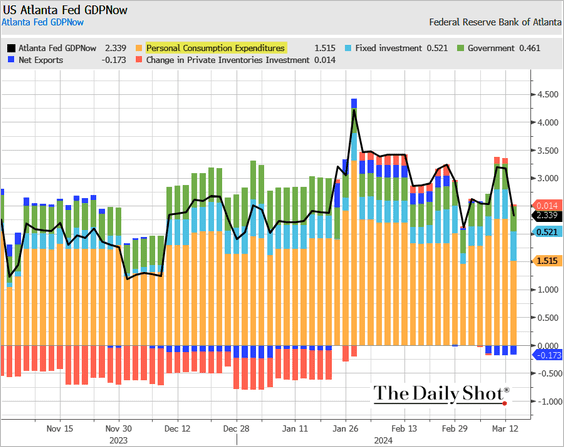

… pushing the Atlanta Fed’s GDPNow Q1 estimate lower.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

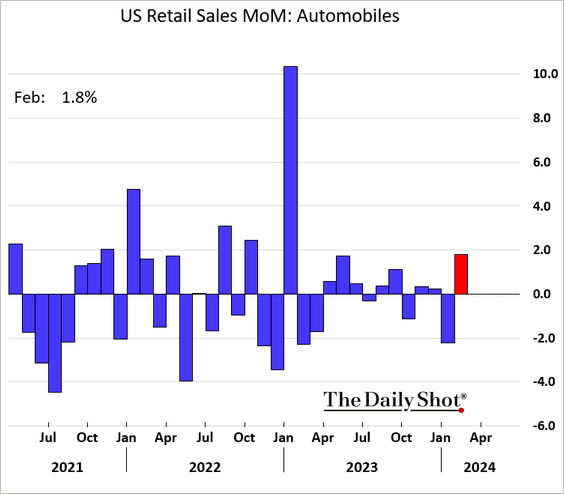

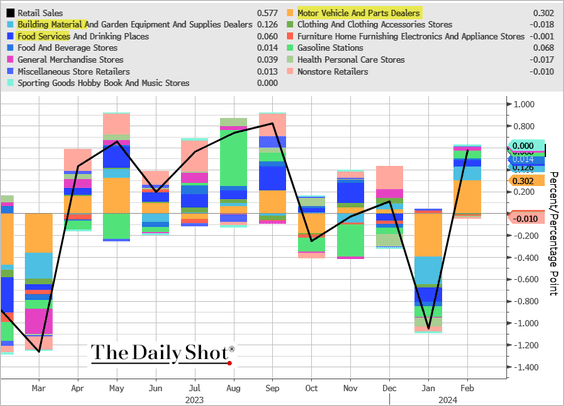

• Vehicle sales increased, …

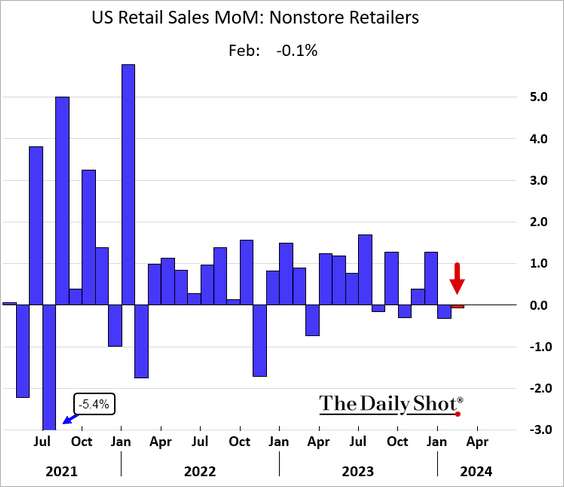

… but online sales declined for the second month in a row.

• Here is the breakdown by sector (2 charts).

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @GregDaco

Source: @GregDaco

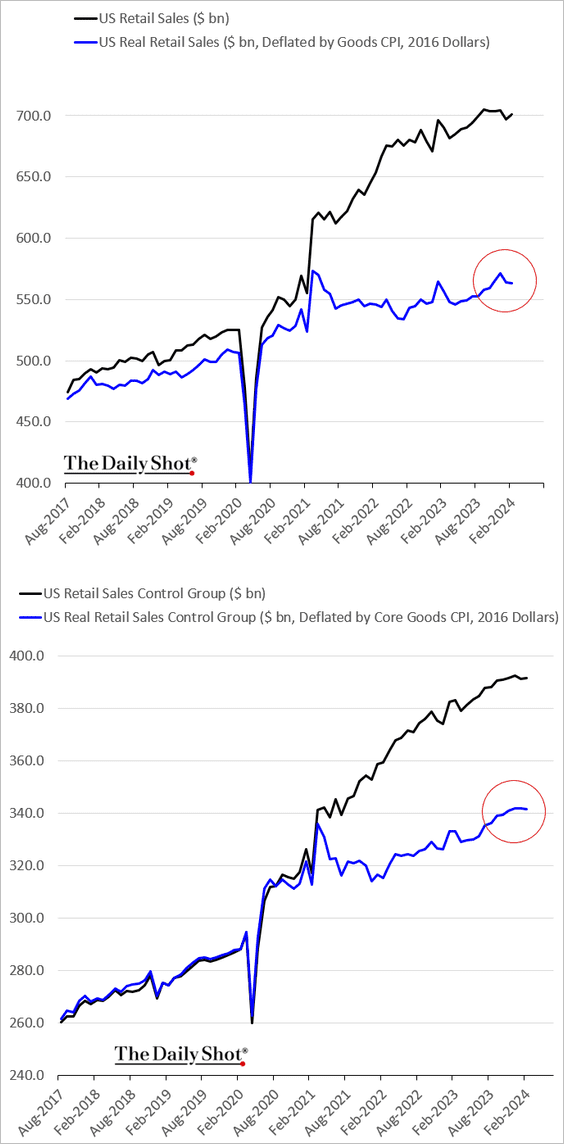

• Real retail sales declined last month.

——————–

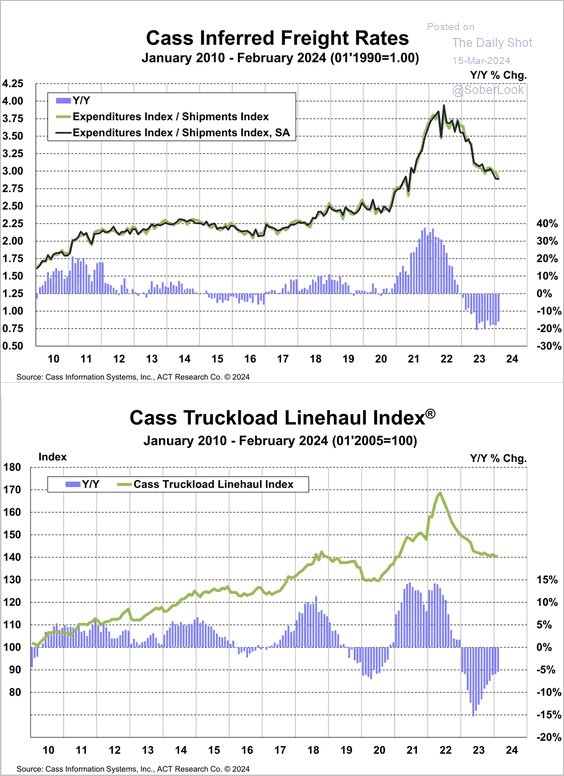

5. Freight rates continue to ease.

Source: Cass Information Systems

Source: Cass Information Systems

Back to Index

Europe

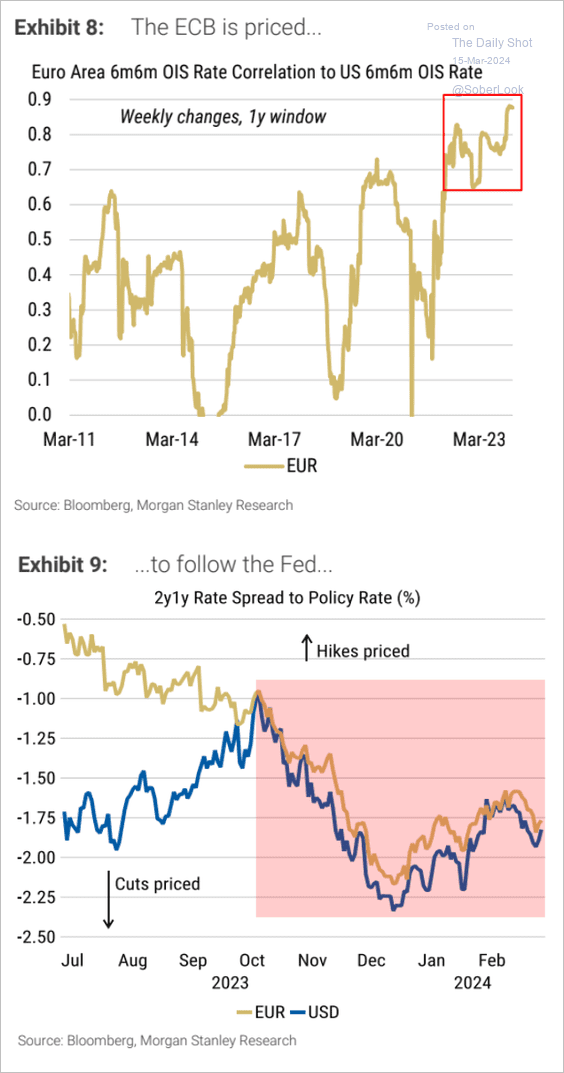

1. The market’s expectations for the ECB policy rate have been tracking those for the Fed, …

Source: Morgan Stanley Research

Source: Morgan Stanley Research

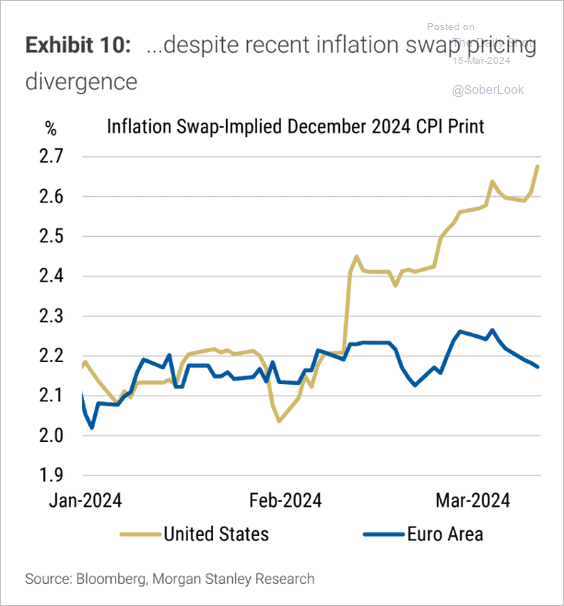

… even as inflation expectations diverge.

Source: Morgan Stanley Research

Source: Morgan Stanley Research

——————–

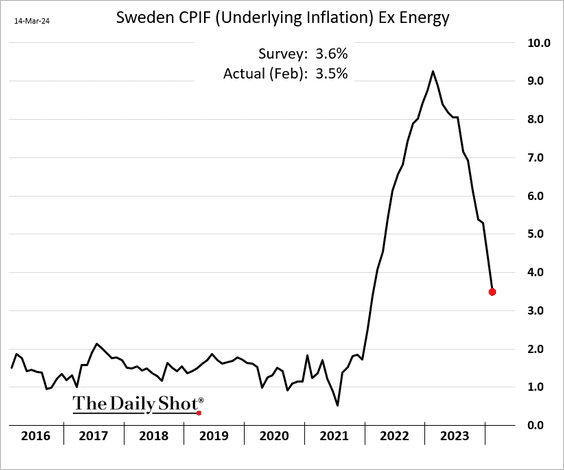

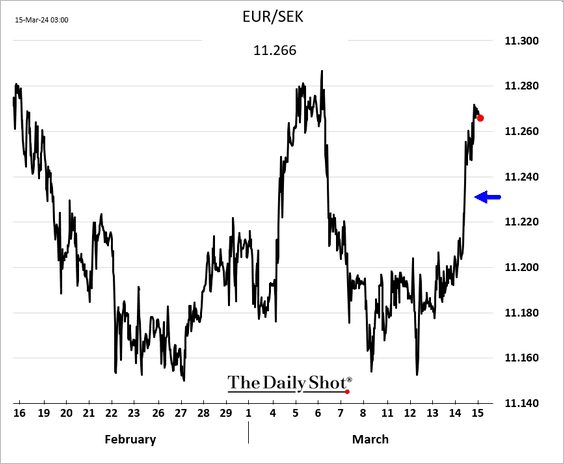

2. Sweden’s CPI report was softer than expected as inflation moderates rapidly.

The Swedish krona declined in response to the CPI data.

——————–

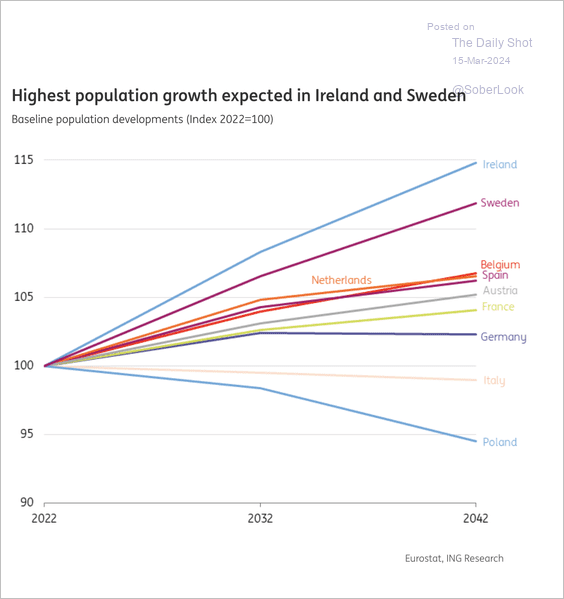

3. This graph illustrates projections for population growth from 2022 to 2042 in various European countries.

Source: ING

Source: ING

Back to Index

Japan

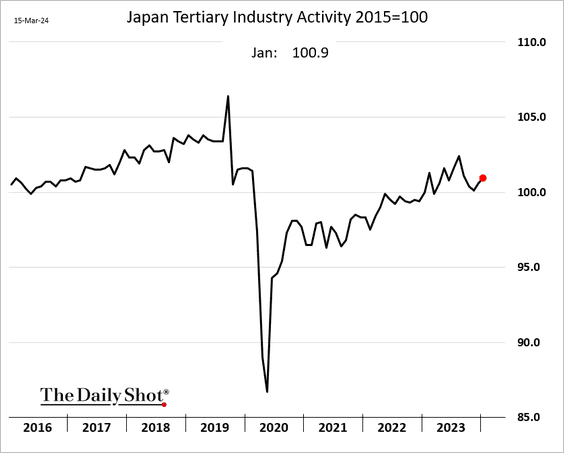

1. Services output improved in January.

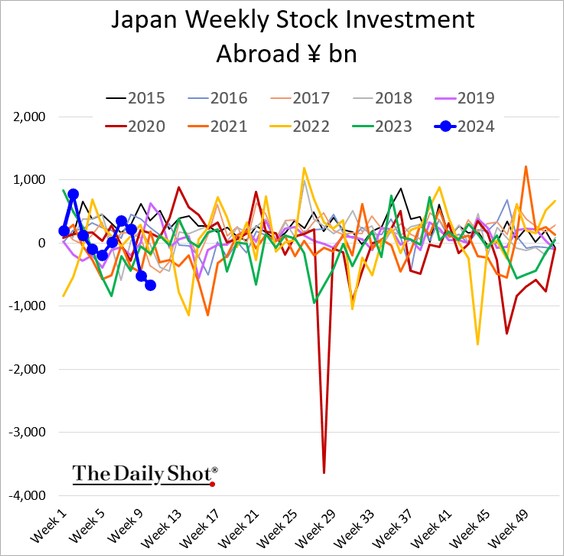

2. Japanese investors have been dumping foreign stocks.

Back to Index

China

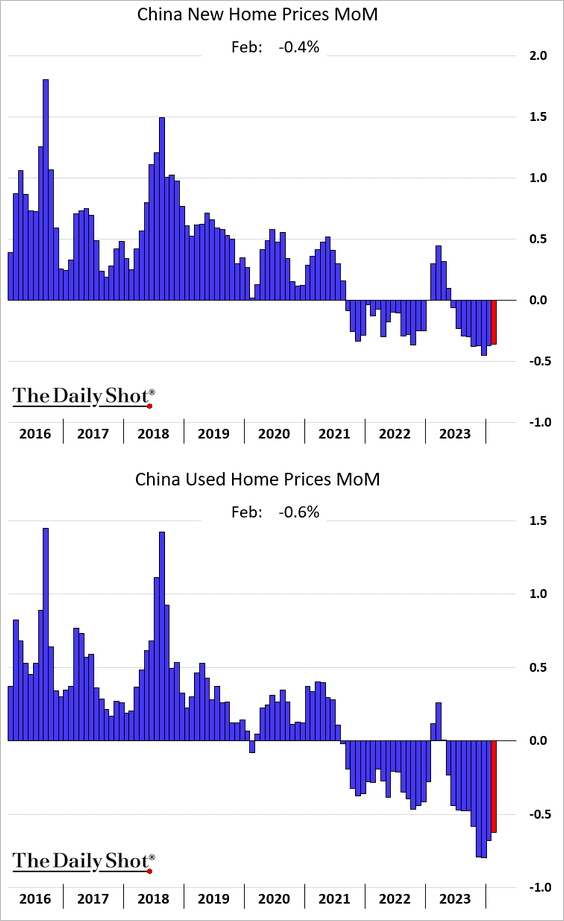

1. Home prices continue to sink.

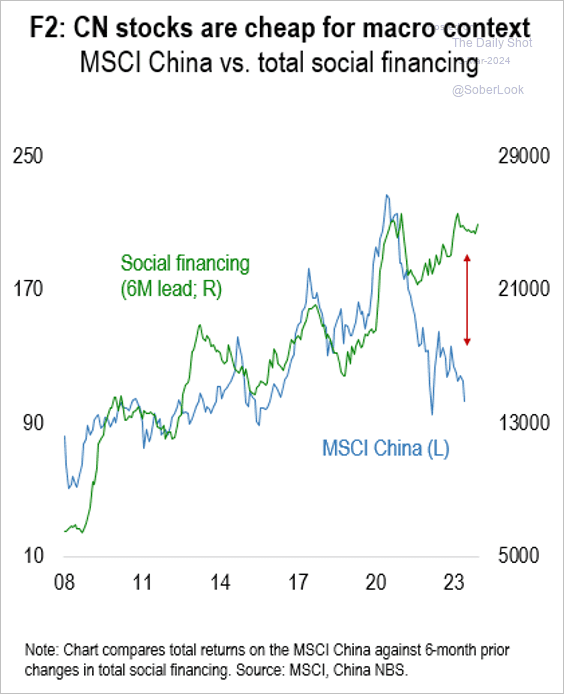

2. The MSCI China Index sharply diverged from the rise in social financing.

Source: Numera Analytics (@NumeraAnalytics)

Source: Numera Analytics (@NumeraAnalytics)

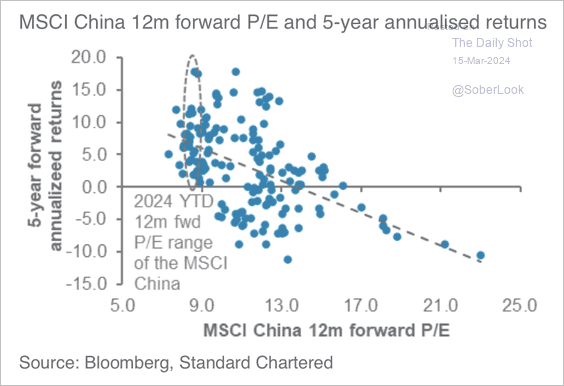

• At current valuation levels, the MSCI China Index has historically produced average annualized returns of 6.8%.

Source: Standard Chartered

Source: Standard Chartered

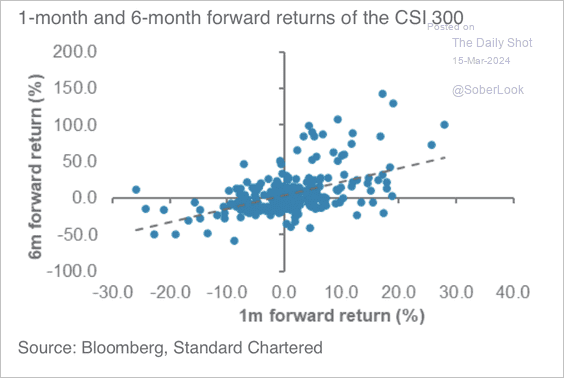

– Momentum has been a better guide to near-term performance. Rapid short-term gains typically lead to even greater returns in the subsequent six months.

Source: Standard Chartered

Source: Standard Chartered

——————–

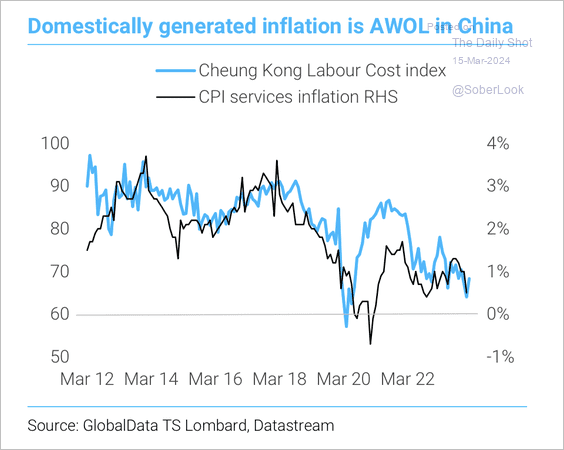

3. Services inflation has been weak, although there was a recent uptick in labor costs.

Source: TS Lombard

Source: TS Lombard

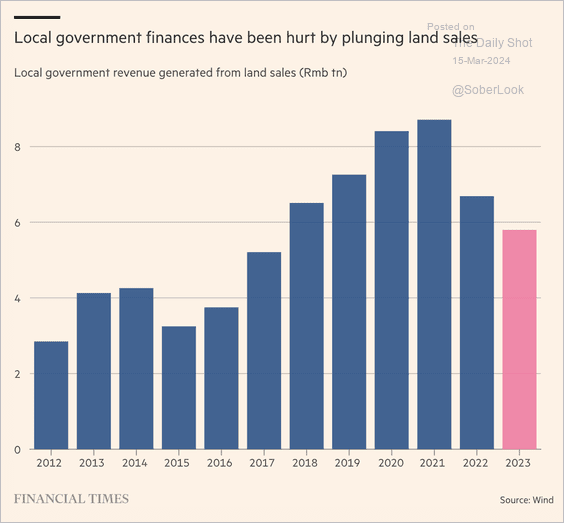

4. Here is a look at local governments’ revenue from land sales.

Source: @financialtimes Read full article

Source: @financialtimes Read full article

Back to Index

Emerging Markets

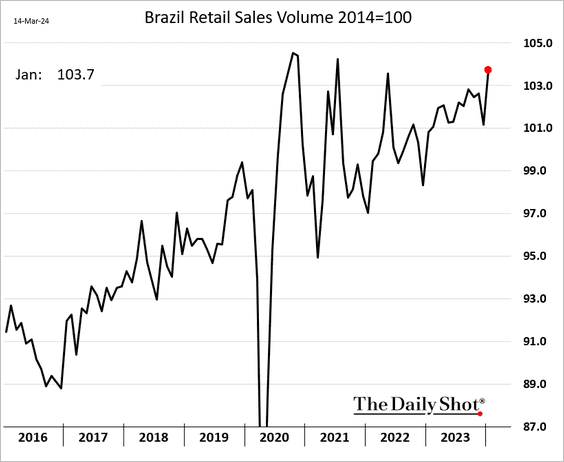

1. Brazil’s retail sales bounced in January.

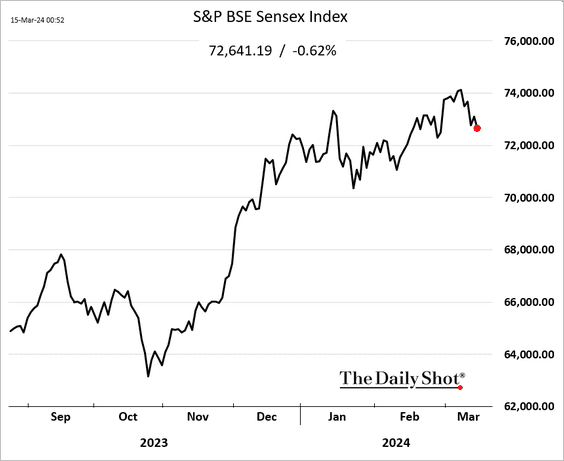

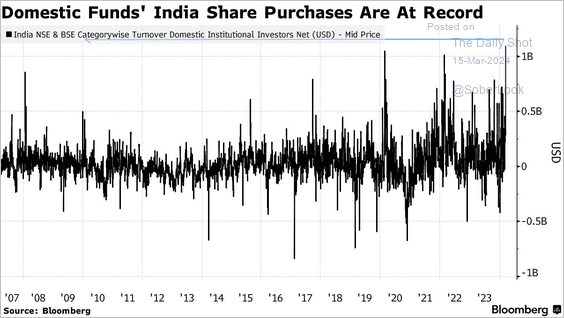

2. Indian funds have used the recent market pullback to buy a record amount of stocks.

Source: @markets Read full article

Source: @markets Read full article

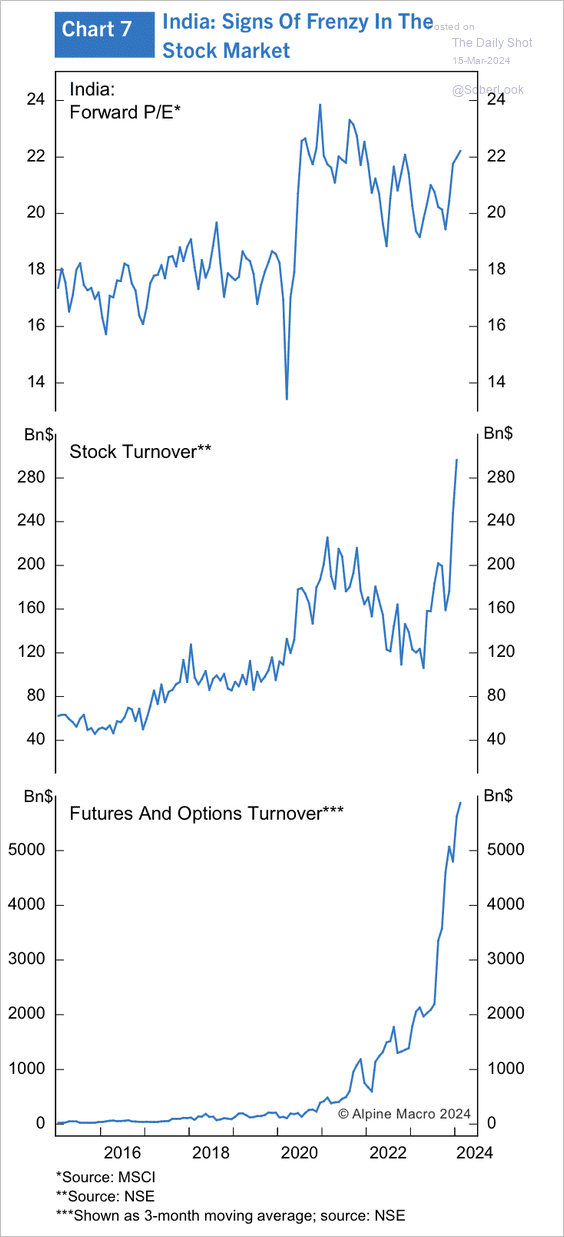

There are signs of a retail-driven frenzy in India’s stock market.

Source: Alpine Macro

Source: Alpine Macro

——————–

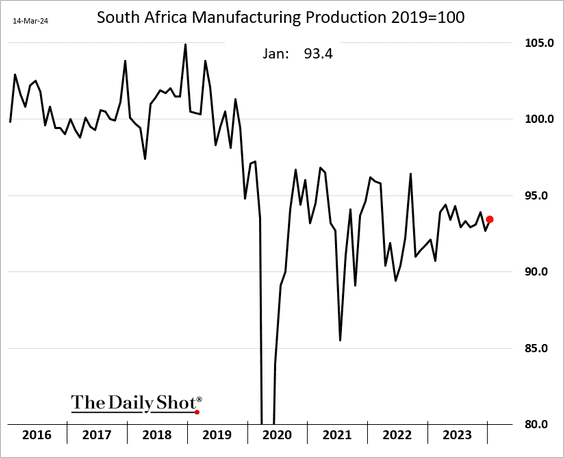

3. South Africa’s factory production climbed in January, …

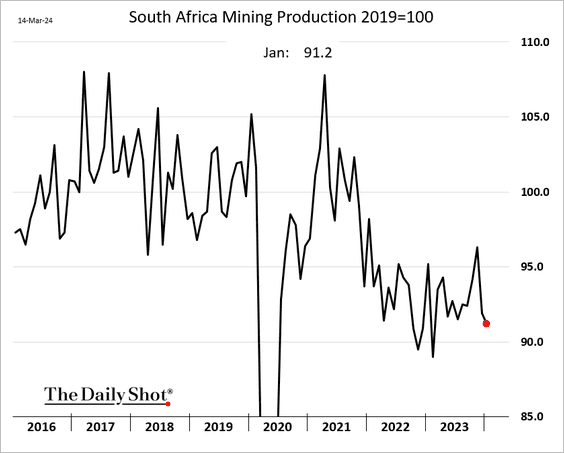

… but mining output declined again.

——————–

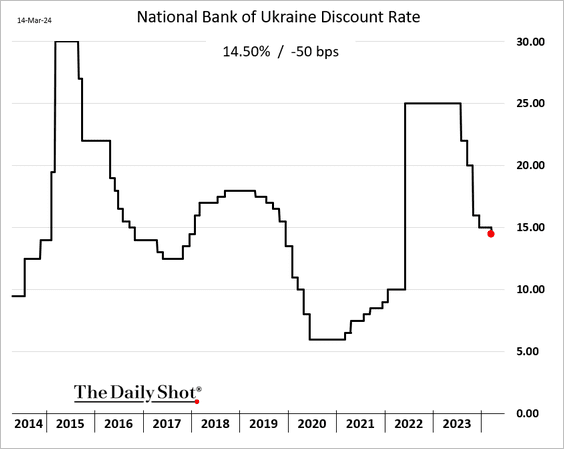

4. Ukraine’s central bank unexpectedly cut rates as inflation moderates.

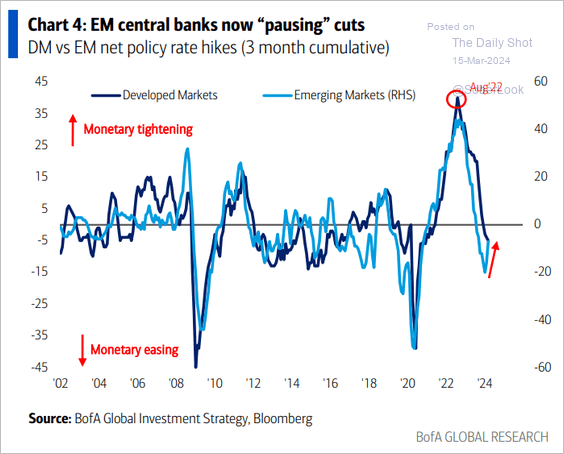

5. Some EM central banks are pausing rate cuts.

Source: BofA Global Research

Source: BofA Global Research

Back to Index

Cryptocurrency

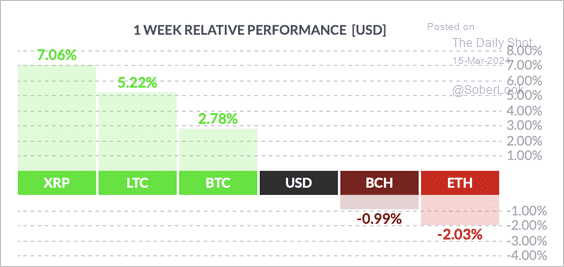

1. It has been a mixed week for cryptos, with XRP outperforming and ether (ETH) underperforming top peers.

Source: FinViz

Source: FinViz

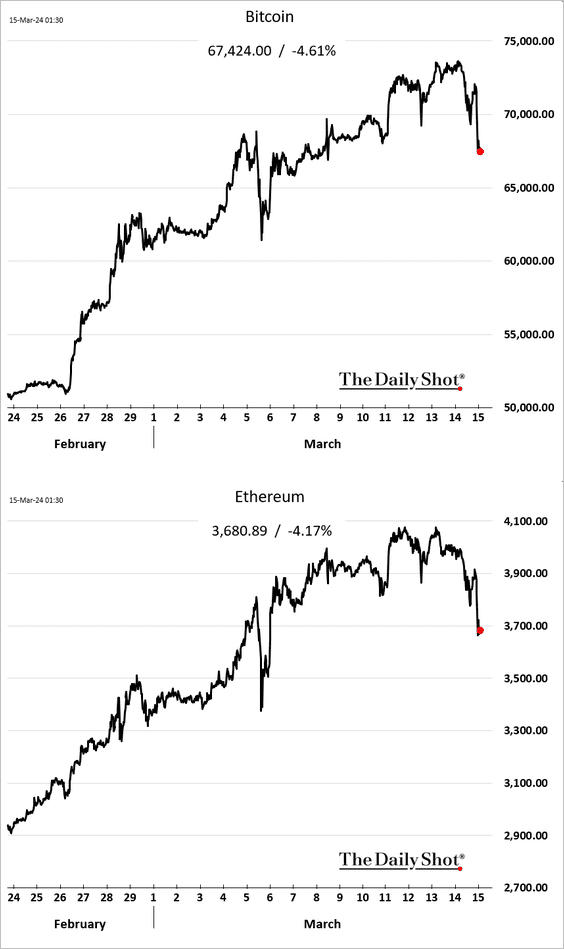

But cryptos are rolling over today as the market trims Fed rate cut expectations.

——————–

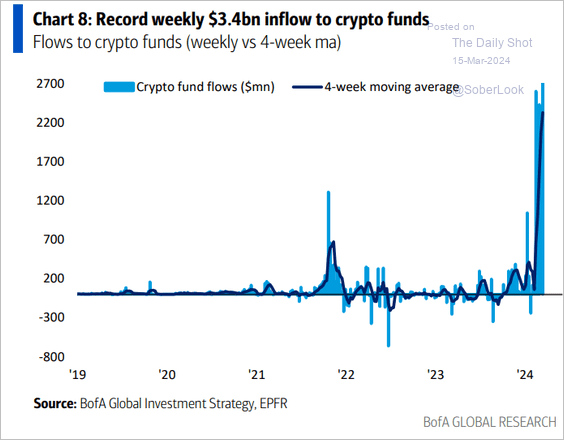

2. Crypto fund inflows hit a record high.

Source: BofA Global Research

Source: BofA Global Research

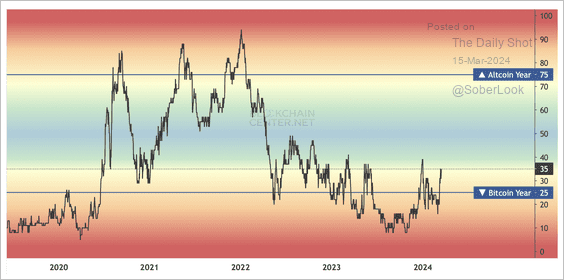

3. Only 35% of top altcoins have outperformed bitcoin over the past year. Typically altcoins outperform in a bull market. However, this time traders flocked to bitcoin leading up to the US spot ETF approval.

Source: Blockchain Center

Source: Blockchain Center

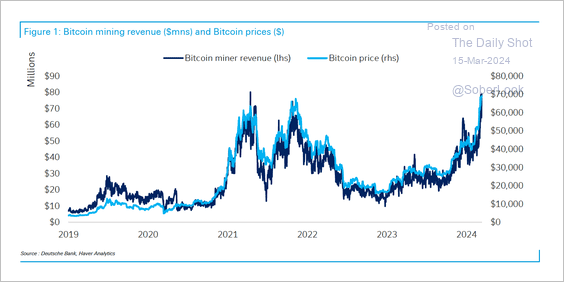

4. Bitcoin mining revenue has surged alongside price.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

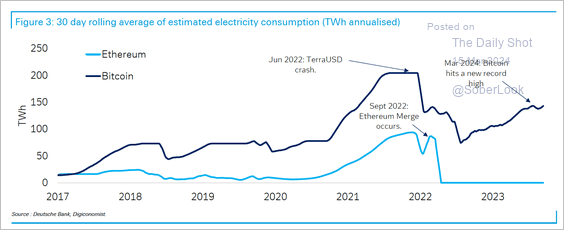

• The increase in mining activity has led to a rise in energy consumption.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

Back to Index

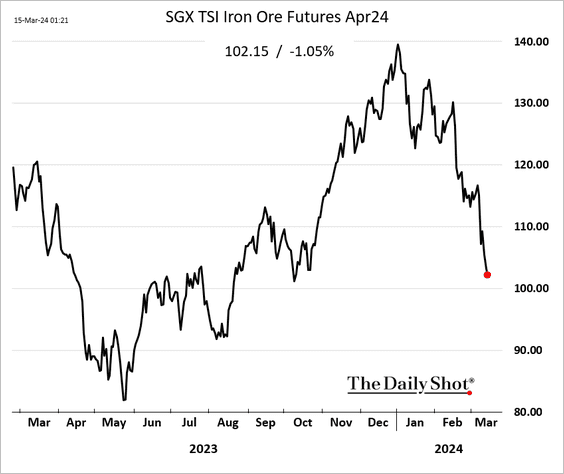

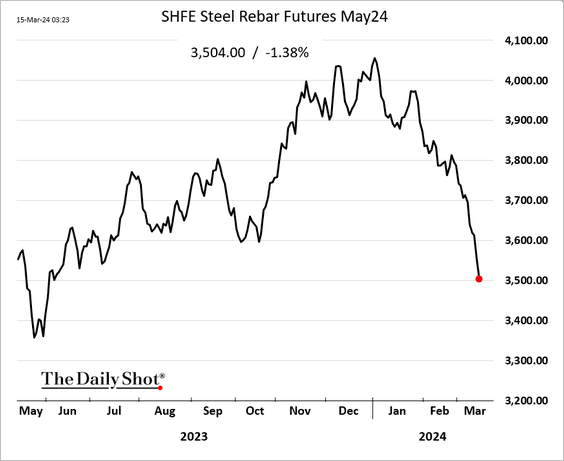

Commodities

Iron ore futures continue to sink, …

… amid soft demand from China. Here are the steel rebar futures in Shanghai.

Back to Index

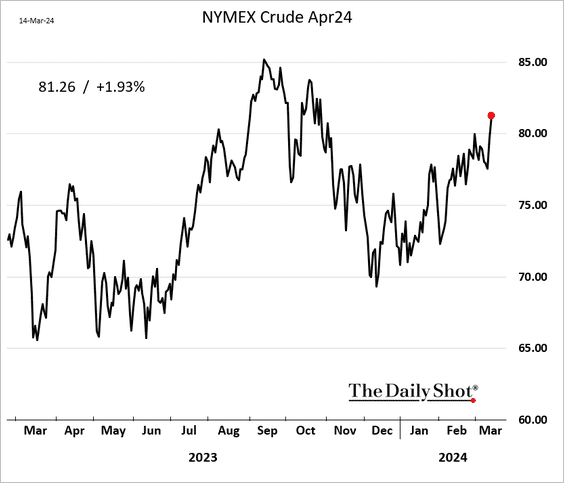

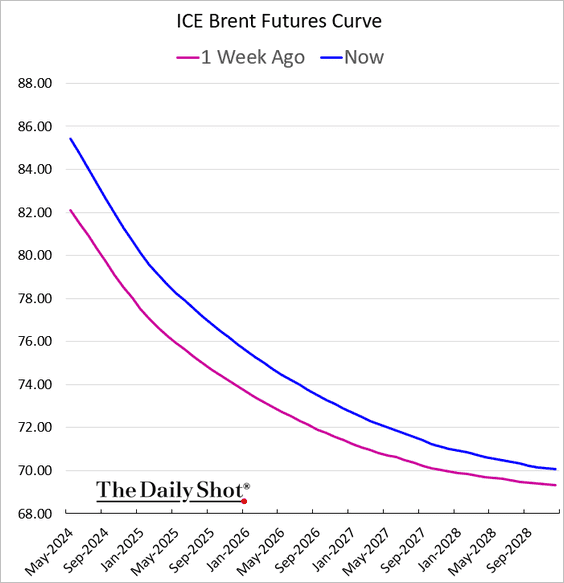

Energy

1. WTI crude climbed above $80/bbl.

• Crude oil backwardation is strengthening.

——————–

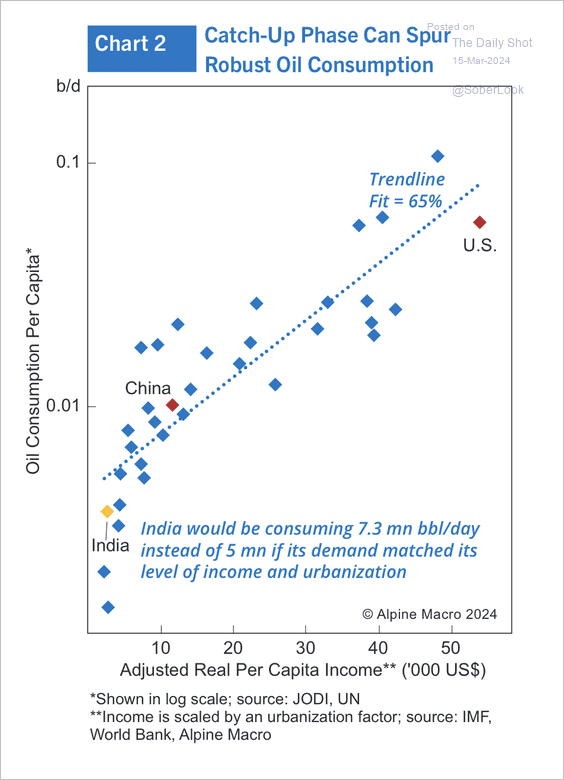

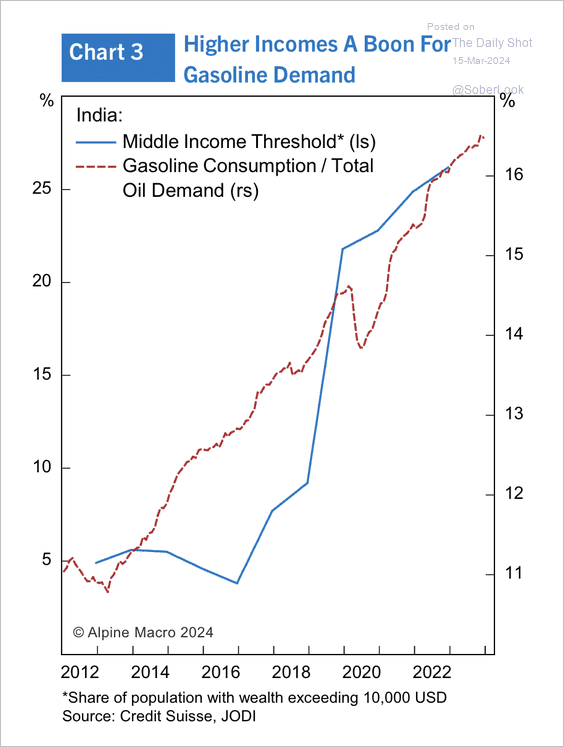

2. India’s oil demand could rise as income levels and urbanization improve. (2 charts)

Source: Alpine Macro

Source: Alpine Macro

Source: Alpine Macro

Source: Alpine Macro

——————–

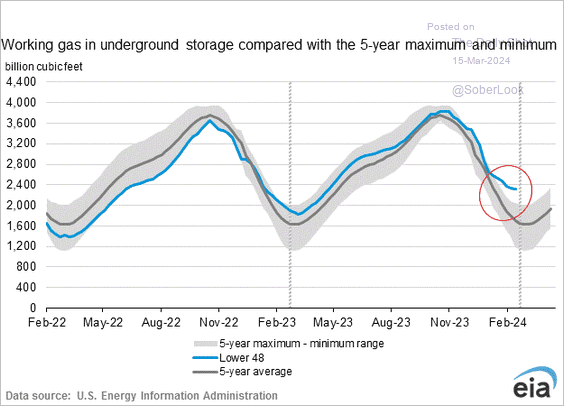

3. US natural gas in storage is exceptionally high for this time of the year.

Back to Index

Equities

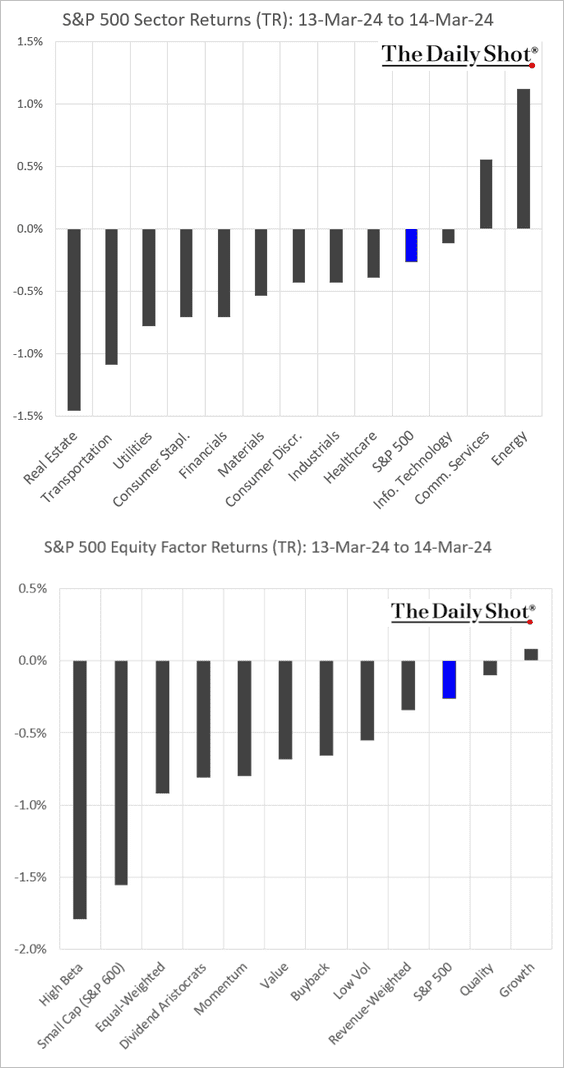

1. How did US sectors and equity factors fare during the sell-off driven by the hot PPI report?

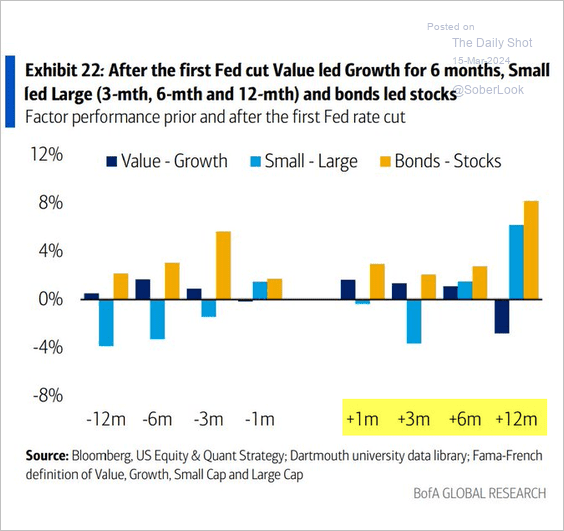

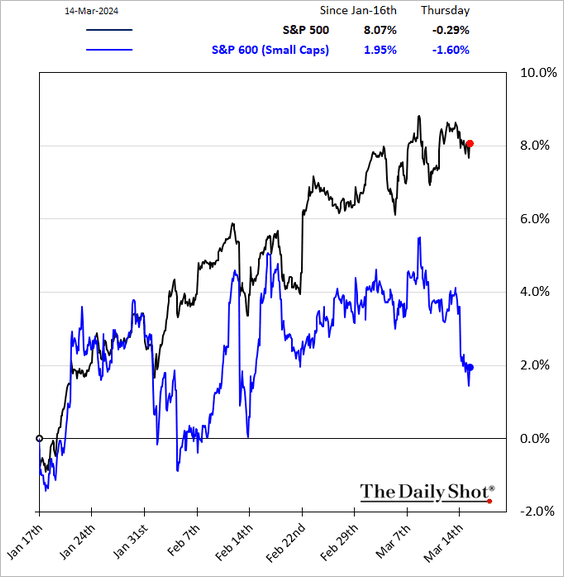

2. Small caps tend to outperform after the Fed starts cutting rates, …

Source: BofA Global Research

Source: BofA Global Research

… but the PPI report signaled that the Fed’s easing will not be coming for a while. Small caps slumped.

——————–

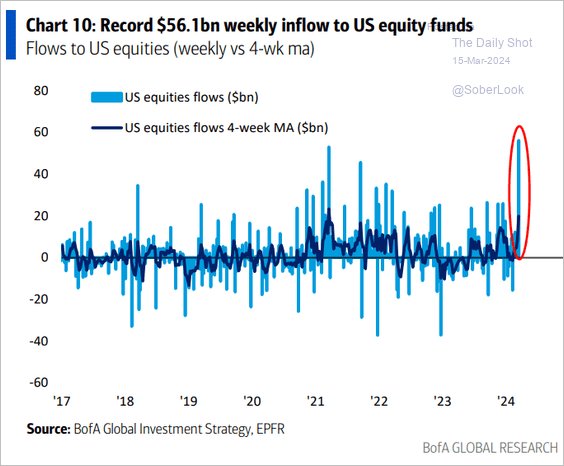

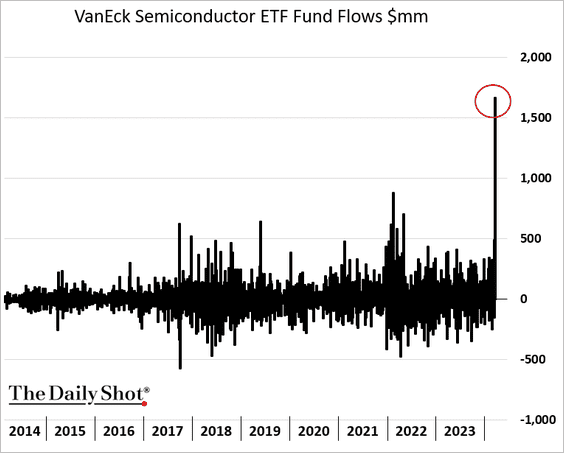

2. Equity fund inflows have been exceptionally strong, …

Source: BofA Global Research

Source: BofA Global Research

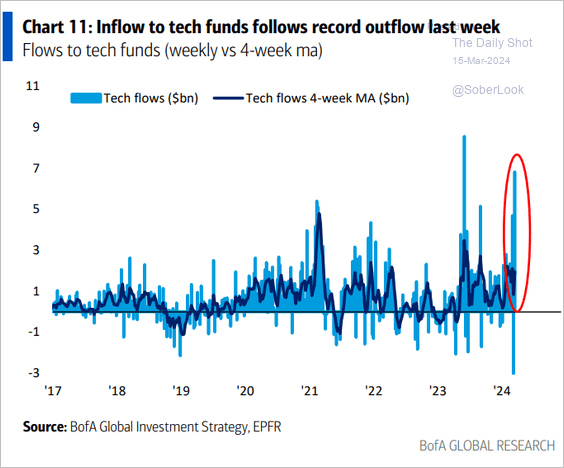

… with tech flows rebounding.

Source: BofA Global Research

Source: BofA Global Research

Capital is flowing into the semiconductor sector.

——————–

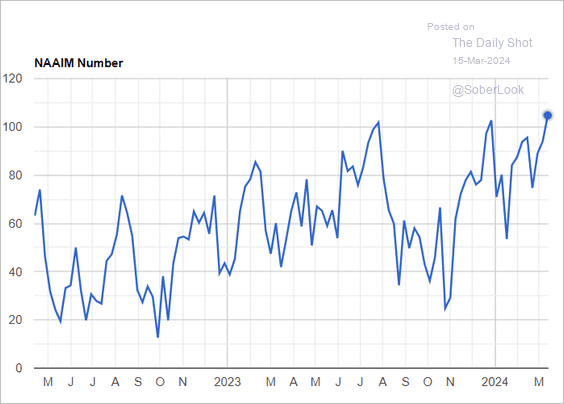

3. Investment managers are extremely bullish.

Source: NAAIM

Source: NAAIM

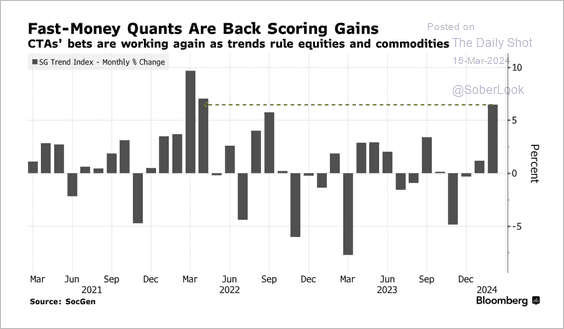

4. CTAs posted strong performance last month.

Source: @markets Read full article

Source: @markets Read full article

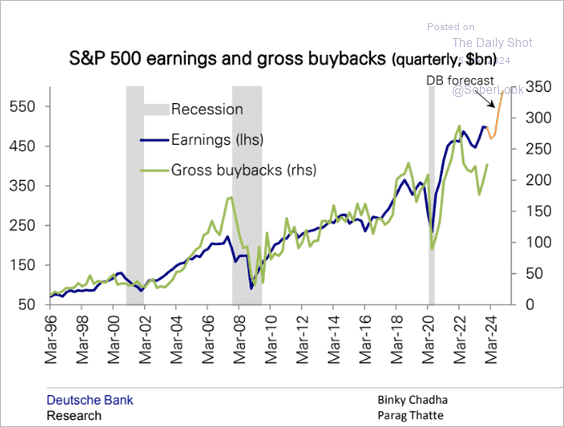

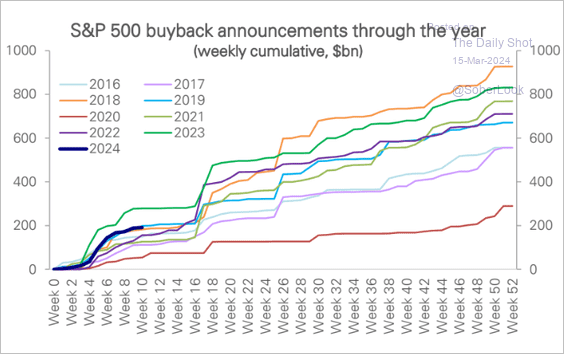

5. Share buybacks should strengthen with earnings, according to Deutsche Bank.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

• This chart shows S&P 500 share buyback announcements by year.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

——————–

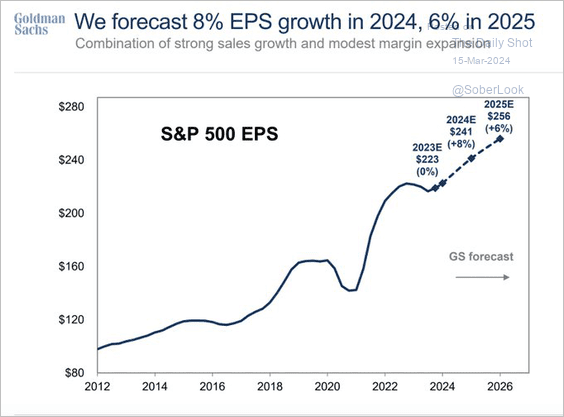

6. Goldman’s forecast for the S&P 500 2024 EPS growth is lower than the 11% consensus estimate.

Source: Goldman Sachs; @AyeshaTariq

Source: Goldman Sachs; @AyeshaTariq

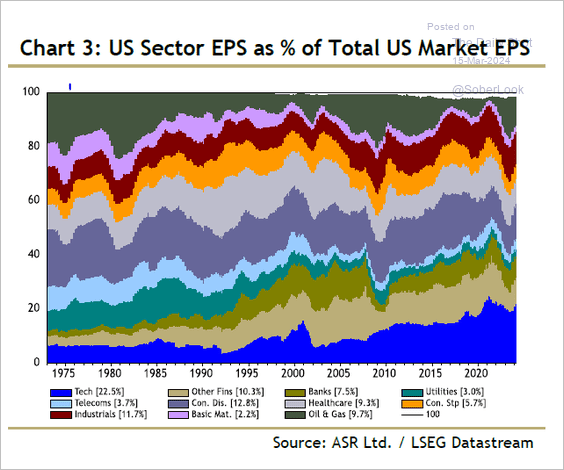

7. Here is a look at the US market EPS distribution by sector over time.

Source: @IanRHarnett; @johnauthers, @opinion Read full article

Source: @IanRHarnett; @johnauthers, @opinion Read full article

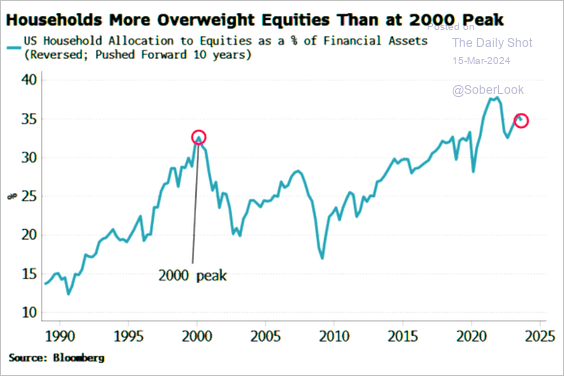

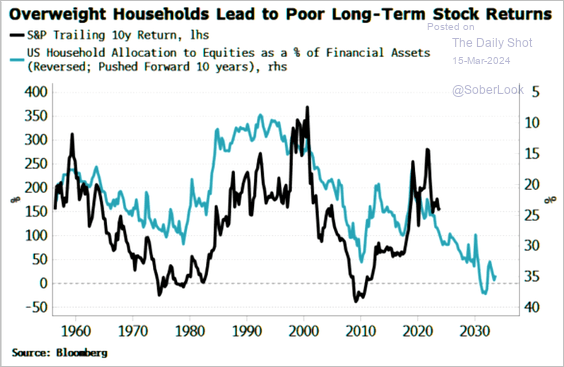

8. Households are increasingly overweight in equities, …

Source: Simon White, Bloomberg Markets Live Blog

Source: Simon White, Bloomberg Markets Live Blog

… suggesting weaker long-term returns.

Source: Simon White, Bloomberg Markets Live Blog

Source: Simon White, Bloomberg Markets Live Blog

Back to Index

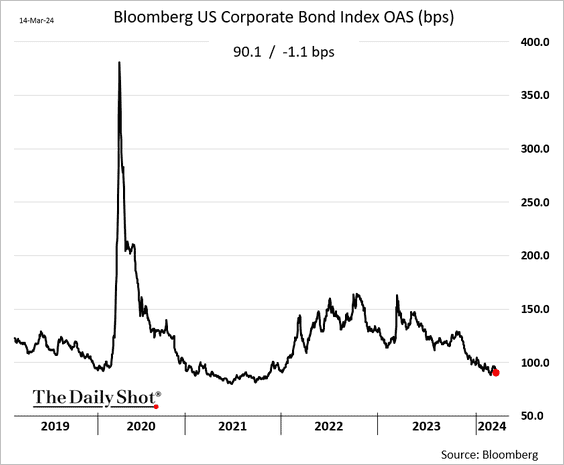

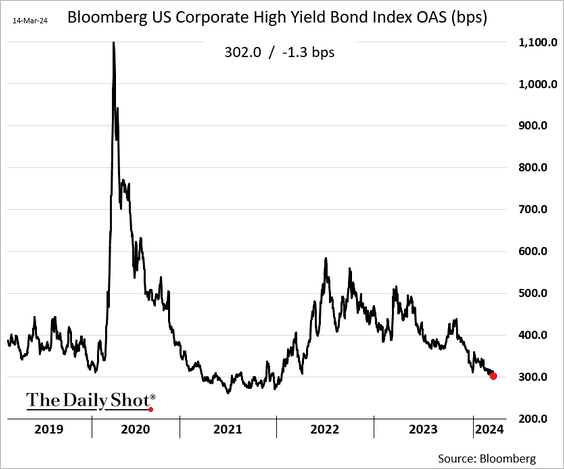

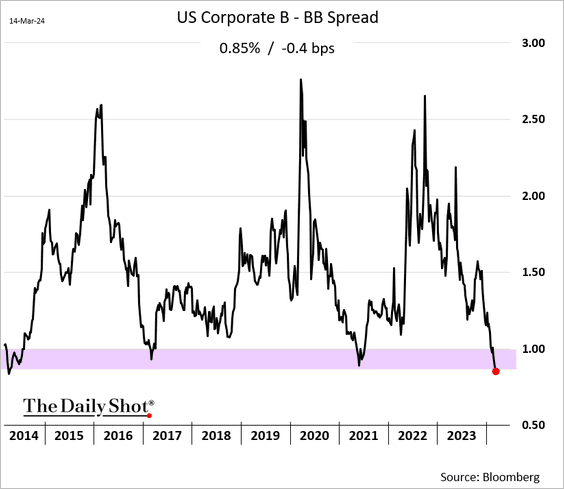

Credit

1. Bond spreads continue to trend lower even as Treasury yields climb.

– IG:

– HY:

• The single-B/BB spread is at multi-year lows.

——————–

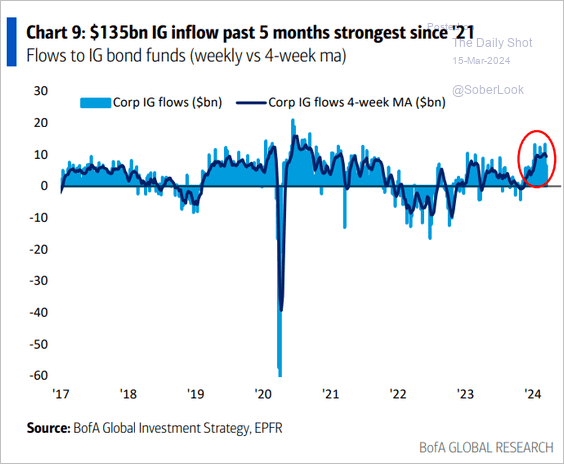

2. Investment-grade bond fund inflows remain strong.

Source: BofA Global Research

Source: BofA Global Research

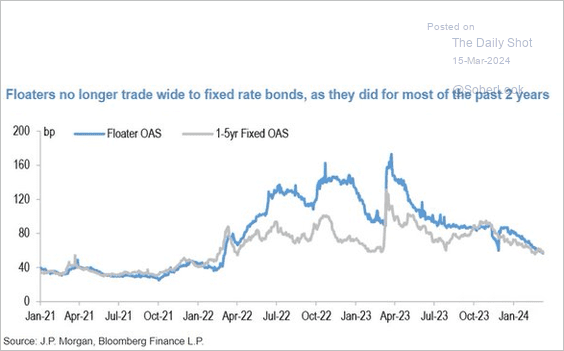

3. Fewer borrowers are issuing floating-rate debt, suggesting that companies see rates remaining higher for longer.

Source: JP Morgan Research; @GunjanJS

Source: JP Morgan Research; @GunjanJS

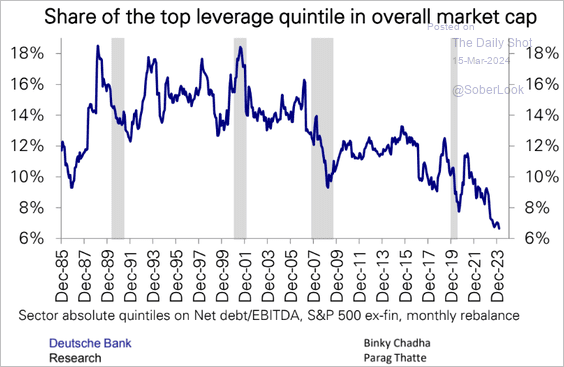

4. The most leveraged companies represent a shrinking portion of the equity market capitalization.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

Back to Index

Global Developments

1. Inflation has been tracking its 1970s path in many G7 economies.

![]() Source: @JeffreyKleintop

Source: @JeffreyKleintop

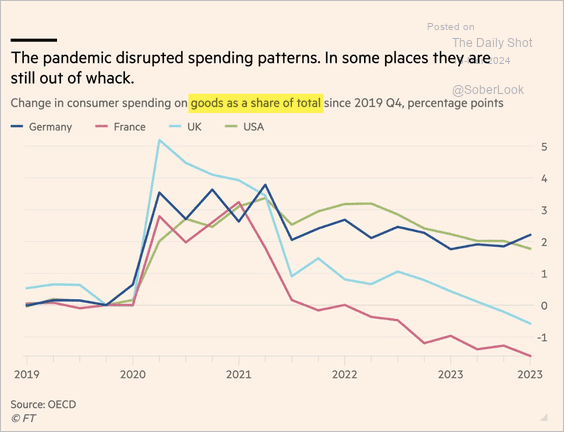

2. Here is a look at the impact of the pandemic on consumer spending patterns in major economies.

Source: @financialtimes Read full article

Source: @financialtimes Read full article

Back to Index

Food for Thought

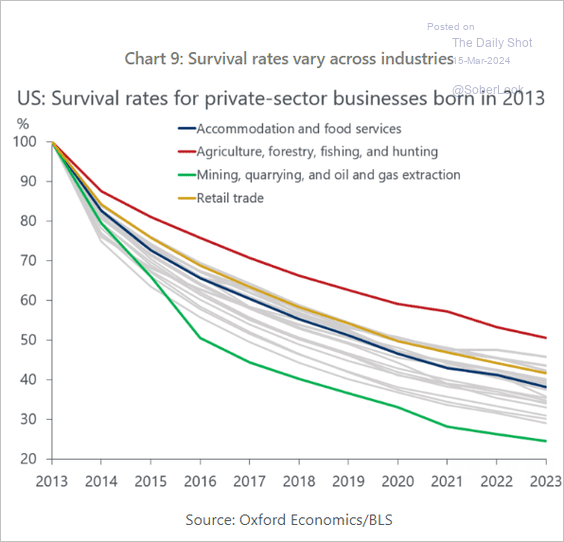

1. Survival rates of newly established businesses.

Source: Oxford Economics

Source: Oxford Economics

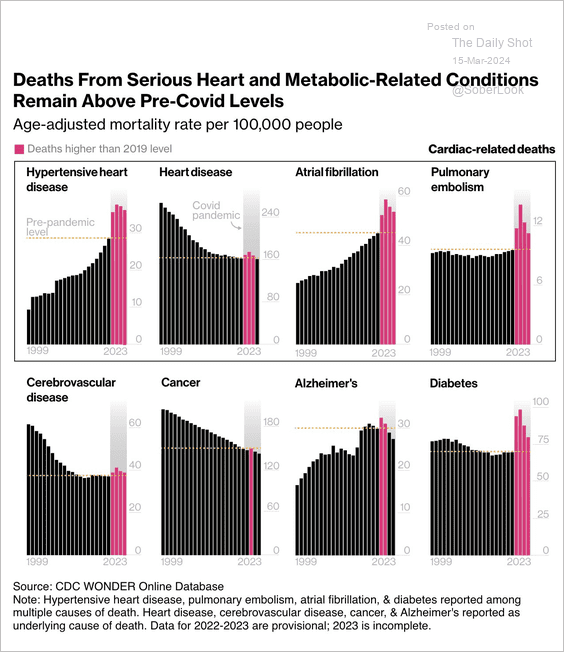

2. A spike in heart disease deaths since Covid:

Source: @business Read full article

Source: @business Read full article

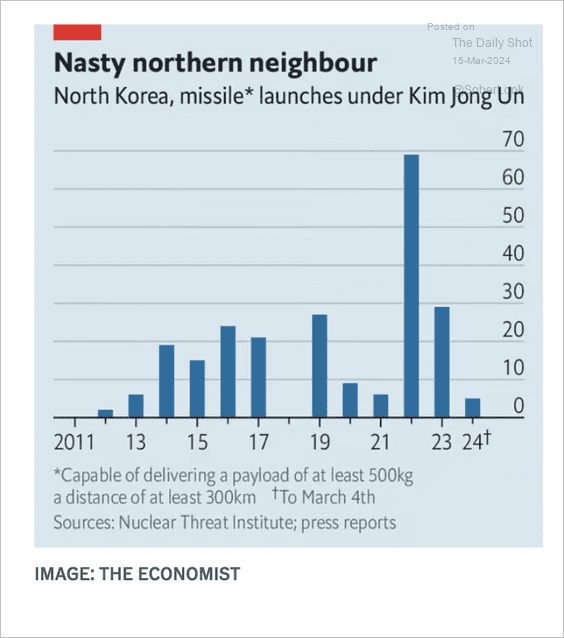

3. North Korea’s missile launches:

Source: The Economist Read full article

Source: The Economist Read full article

4. China avoiding US tariffs by moving product via Vietnam:

Source: The Economist Read full article

Source: The Economist Read full article

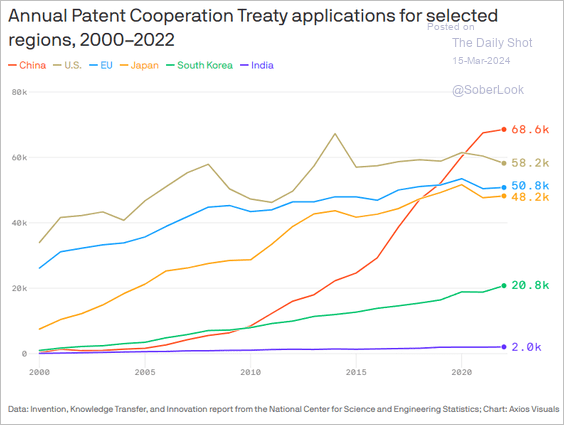

5. Patent applications:

Source: @axios Read full article

Source: @axios Read full article

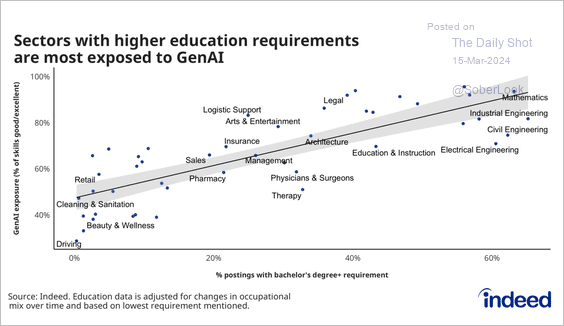

6. Sector vulnerability to AI disruption:

Source: Indeed Read full article

Source: Indeed Read full article

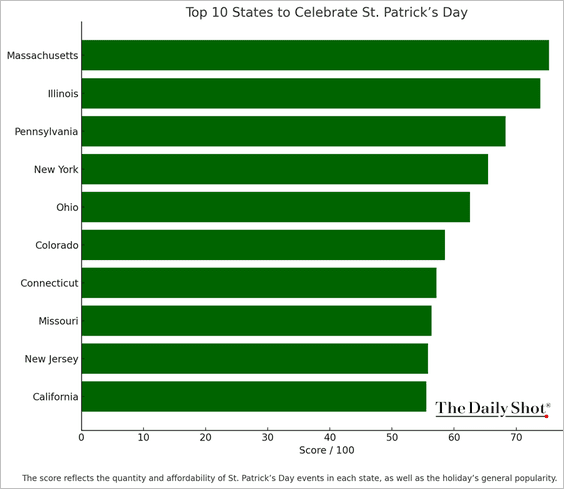

7. The top ten states to celebrate St. Patrick’s Day:

Source: Chummy Tees

Source: Chummy Tees

——————–

Have a great weekend!

Back to Index