The Daily Shot: 14-Mar-24

• The United States

• The United Kingdom

• The Eurozone

• China

• Emerging Markets

• Commodities

• Energy

• Equities

• Global Developments

• Food for Thought

The United States

1. Let’s begin with some updates on the US consumer.

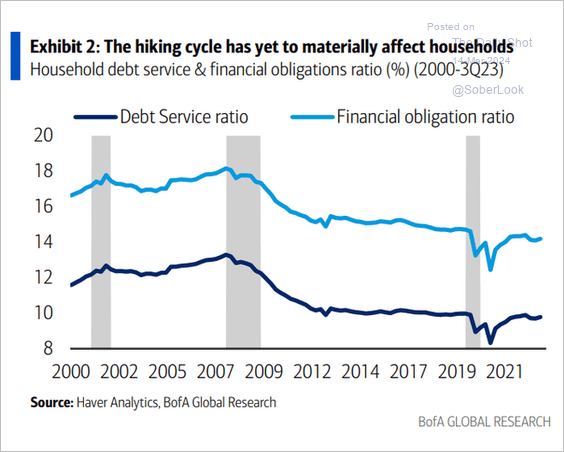

• So far, Fed rate hikes have had a limited impact on households’ financial burdens.

Source: Bank of America Institute

Source: Bank of America Institute

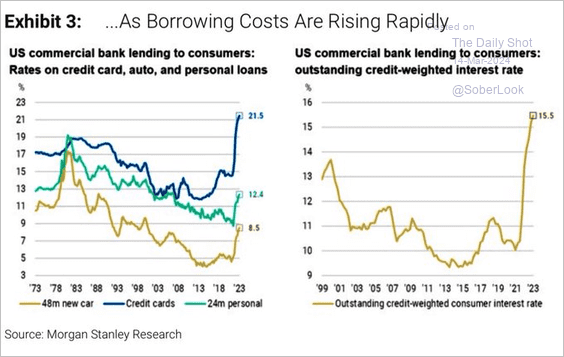

But higher borrowing costs are making their way through the economy.

Source: Morgan Stanley Research; @WallStJesus

Source: Morgan Stanley Research; @WallStJesus

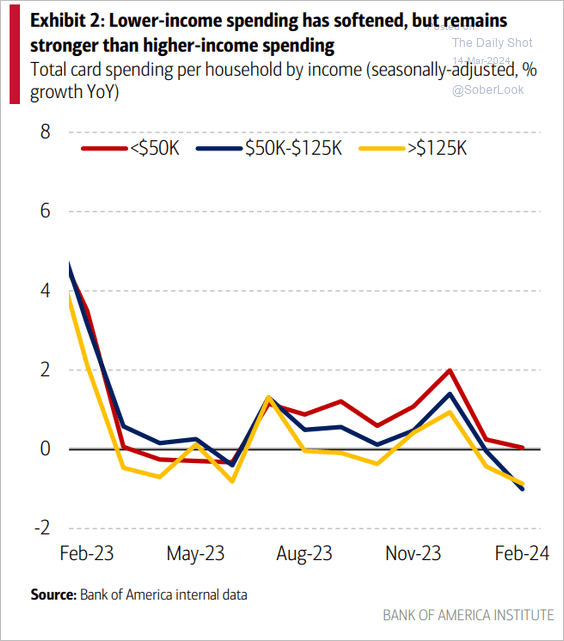

• Debit/credit card spending declined in February year-over-year for higher-income households, …

Source: Bank of America Institute

Source: Bank of America Institute

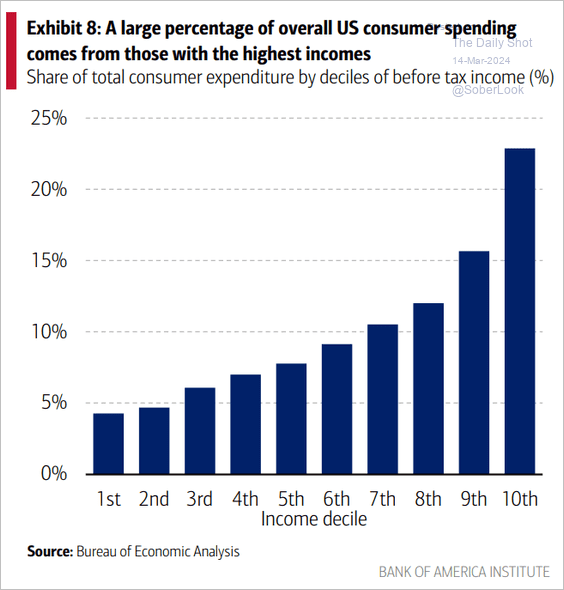

… who drive much of the consumer spending in the US.

Source: Bank of America Institute

Source: Bank of America Institute

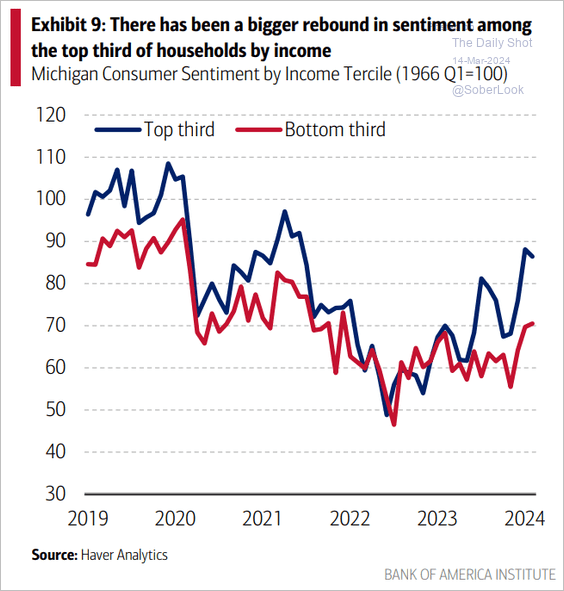

• Consumer sentiment is more robust among higher-income brackets.

Source: Bank of America Institute

Source: Bank of America Institute

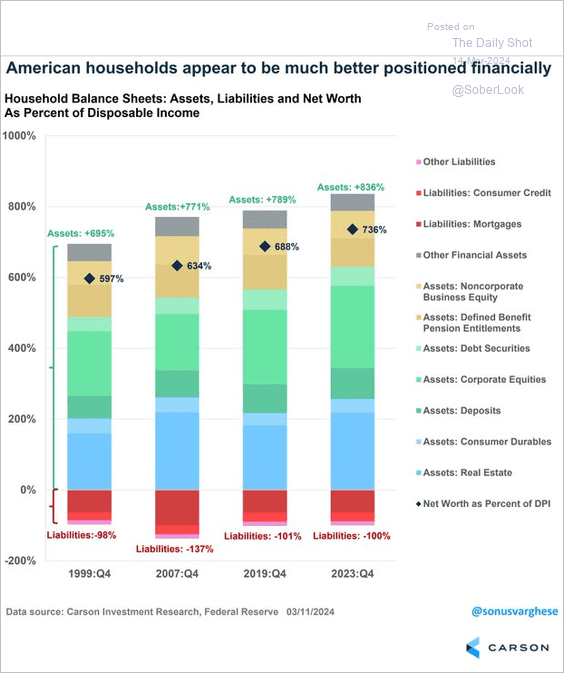

• Household balance sheets remain strong.

Source: @sonusvarghese

Source: @sonusvarghese

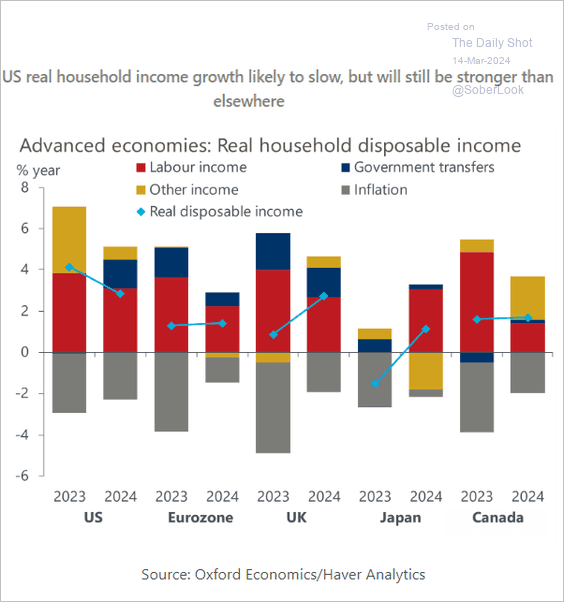

• US households’ disposable income growth is expected to slow this year but still outpace other advanced economies.

Source: Oxford Economics

Source: Oxford Economics

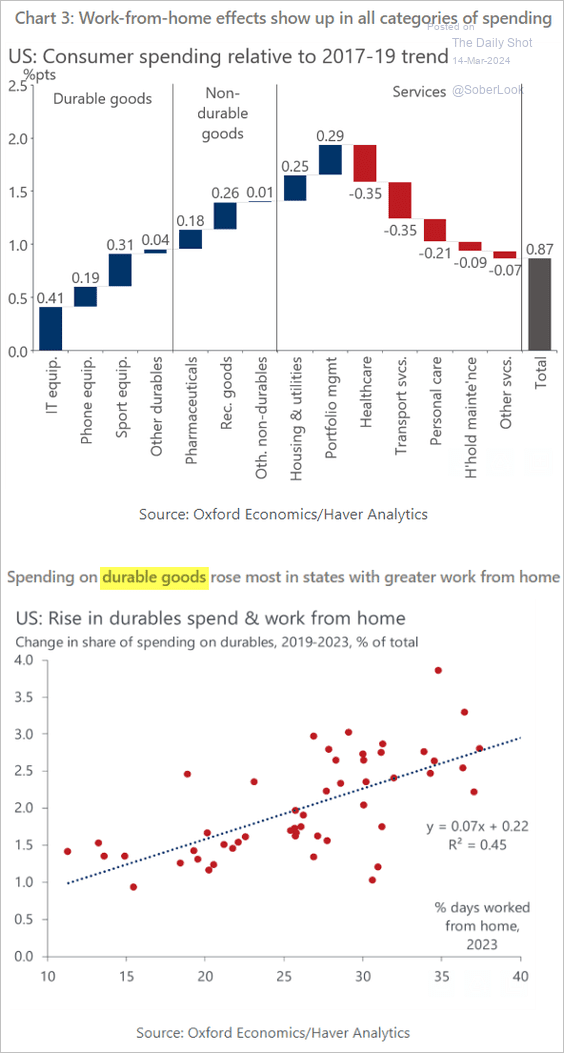

• Work-from-home continues to impact consumer spending patterns.

Source: Oxford Economics

Source: Oxford Economics

——————–

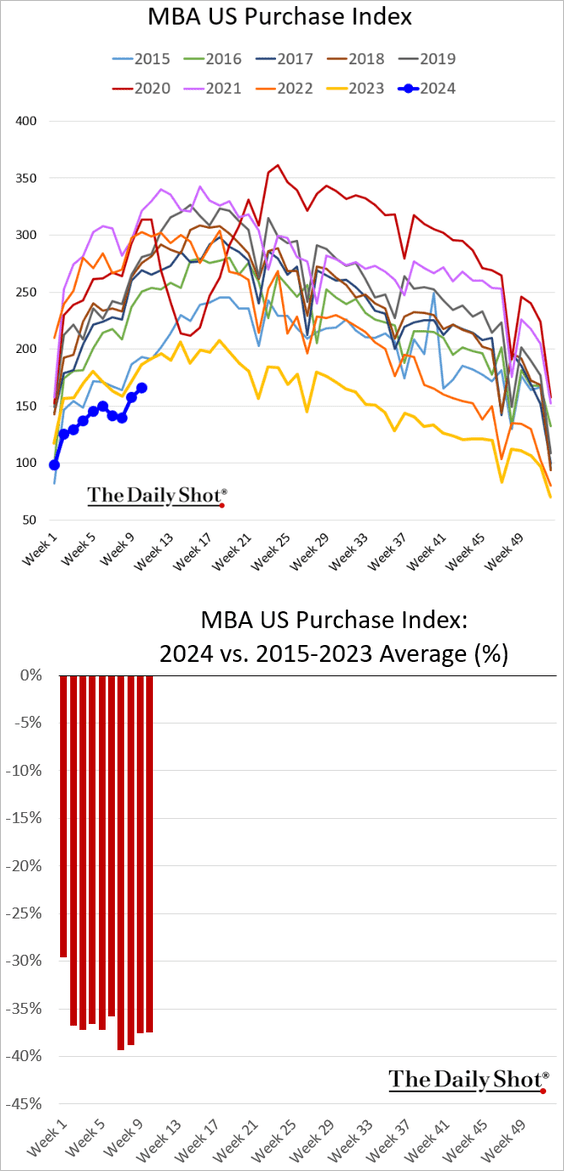

2. Mortgage applications are still running below last year’s levels.

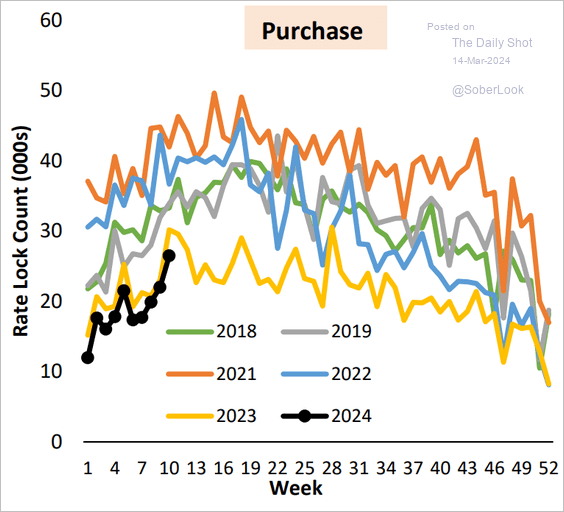

Here is the trend for rate locks.

Source: AEI Housing Center

Source: AEI Housing Center

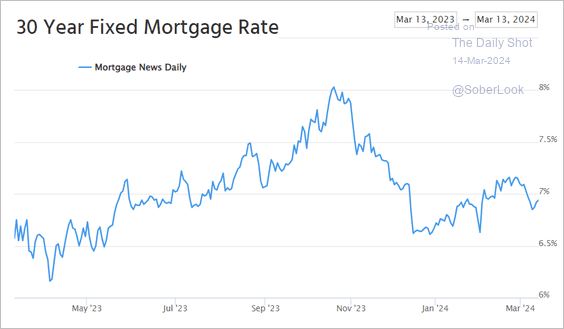

• The mortgage rate is holding below 7%.

Source: Mortgage News Daily

Source: Mortgage News Daily

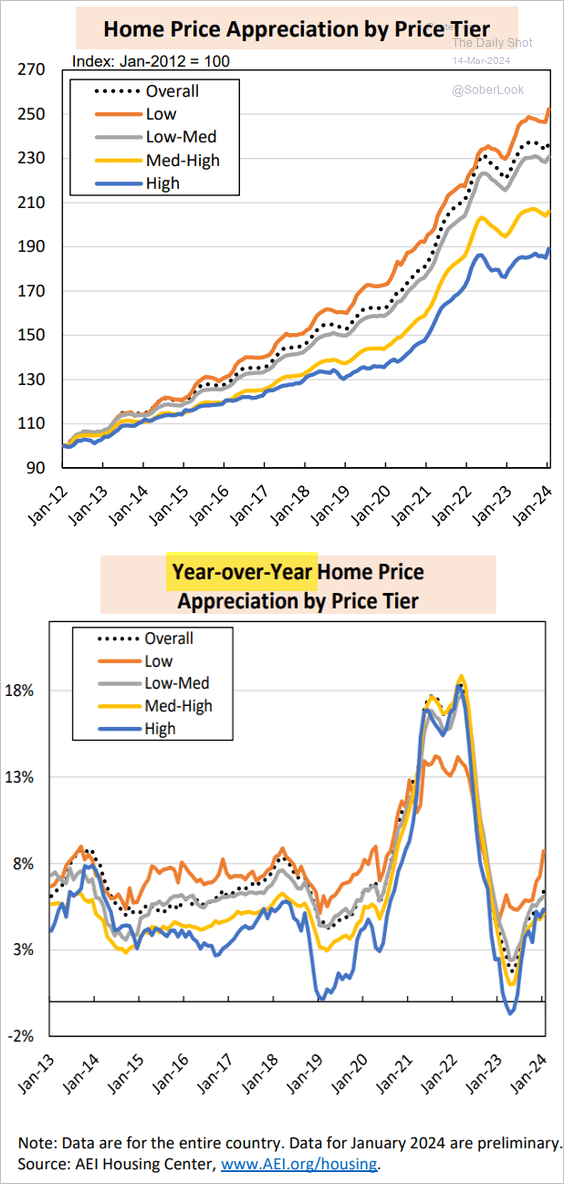

• This chart shows home price appreciation by price tier.

Source: AEI Housing Center

Source: AEI Housing Center

——————–

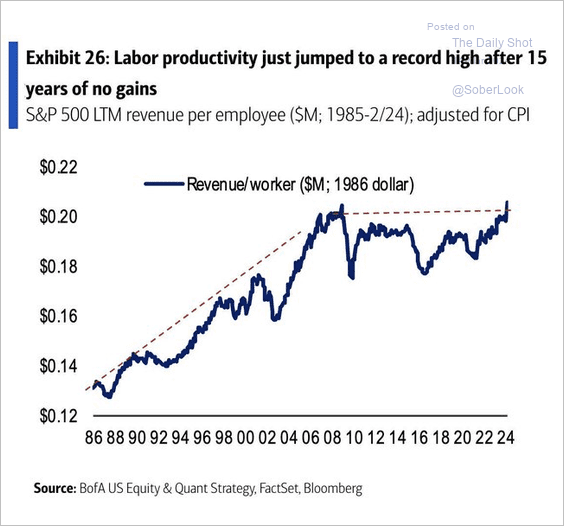

3. Labor productivity at large US firms is rising again.

Source: BofA Global Research

Source: BofA Global Research

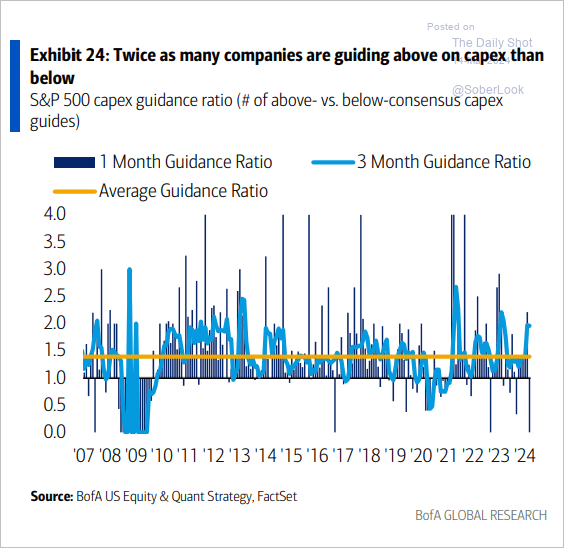

4. Companies are more upbeat about CapEx than the market had been expecting.

Source: BofA Global Research

Source: BofA Global Research

Back to Index

The United Kingdom

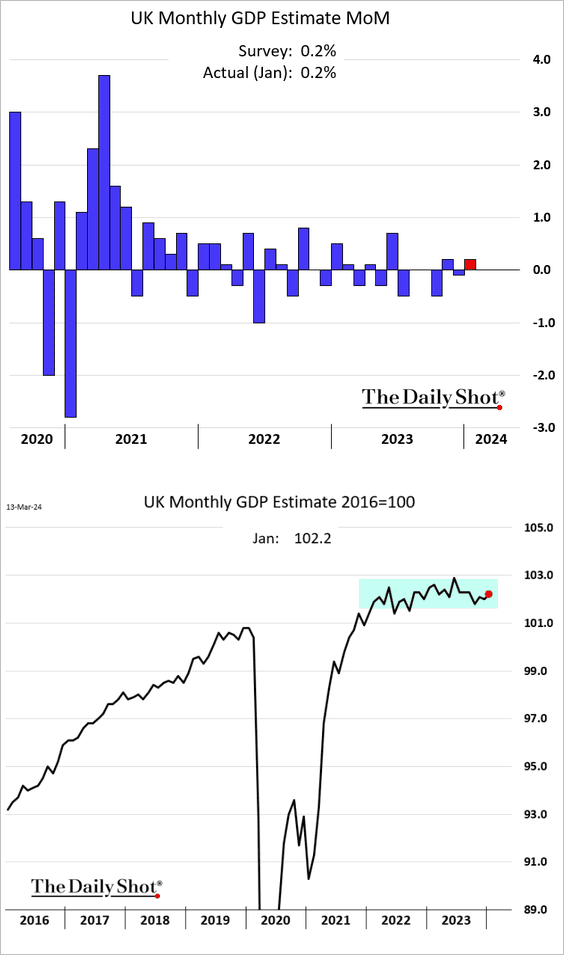

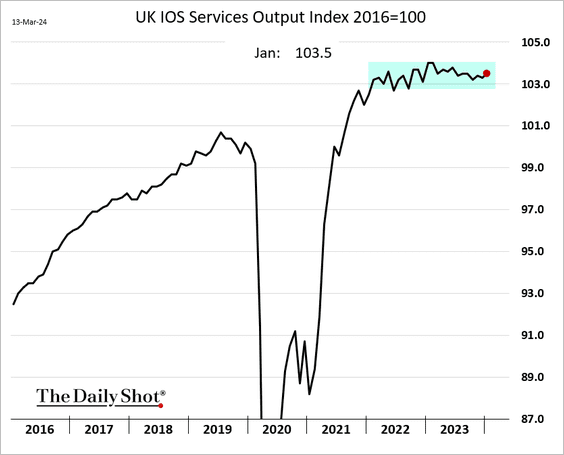

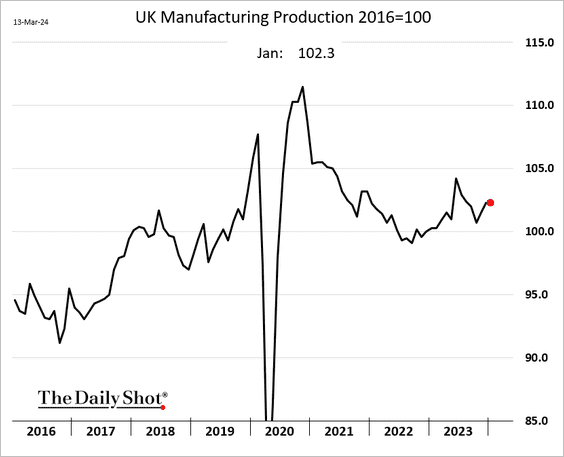

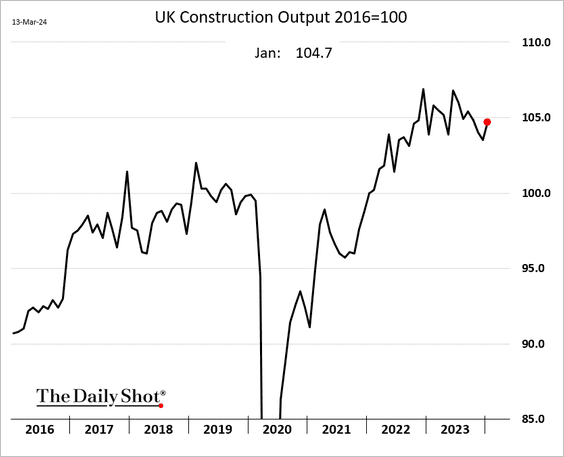

1. The monthly GDP estimate edged higher in January. The GDP level has been relatively static over the past two years.

Source: @financialtimes Read full article

Source: @financialtimes Read full article

– Services:

– Manufacturing (unchanged from December):

– Construction output:

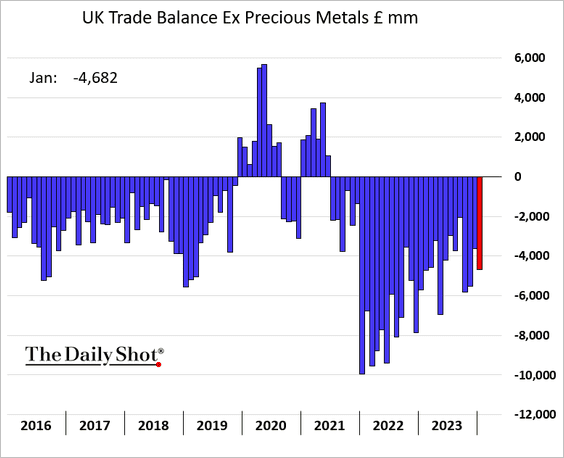

• The trade deficit widened.

——————–

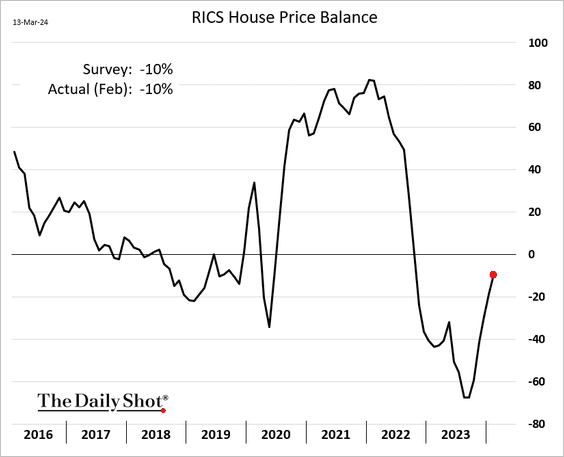

2. The housing market continues to strengthen.

Source: Reuters Read full article

Source: Reuters Read full article

——————–

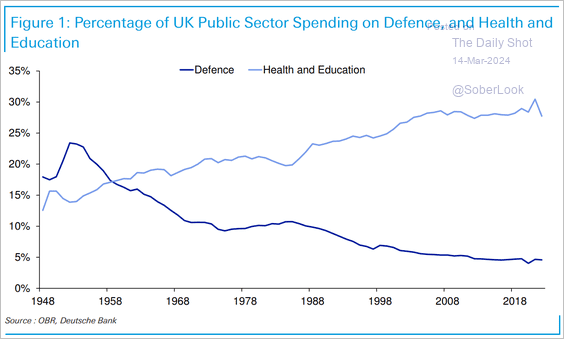

3. Health and education have accounted for a greater share of public spending than defense in the post-WWII era.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

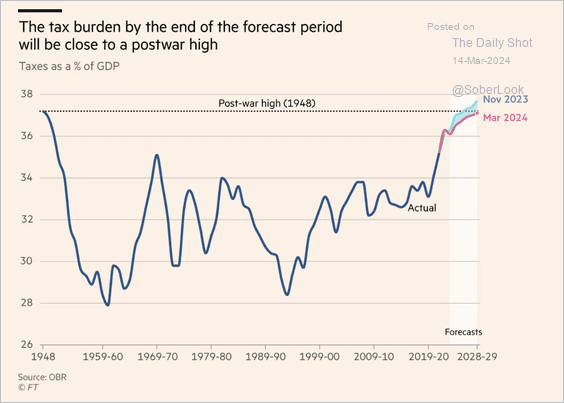

4. The UK tax burden has been rising.

Source: @financialtimes Read full article

Source: @financialtimes Read full article

Back to Index

The Eurozone

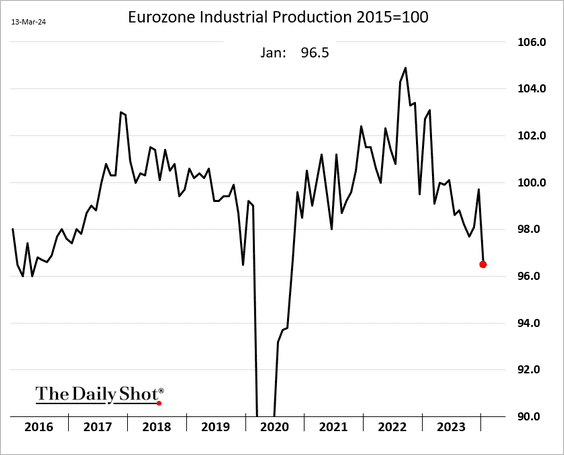

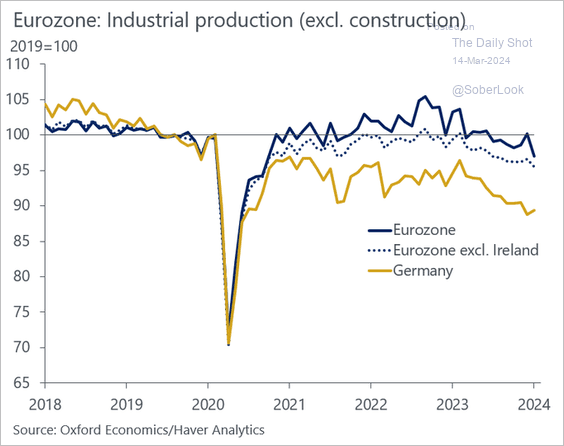

1. Industrial output declined sharply in January, more than reversing the Ireland-driven December surge.

Source: @DanielKral1, @OxfordEconomics

Source: @DanielKral1, @OxfordEconomics

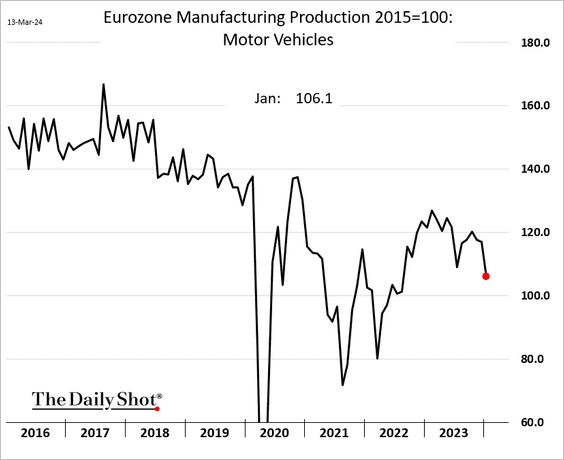

• Vehicle production slowed.

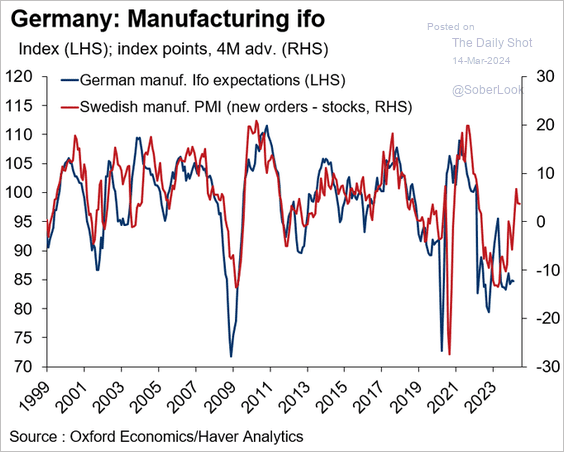

• Stronger factory activity in Sweden signals a rebound in Germany’s manufacturing production.

Source: @DanielKral1, @OliverRakau

Source: @DanielKral1, @OliverRakau

——————–

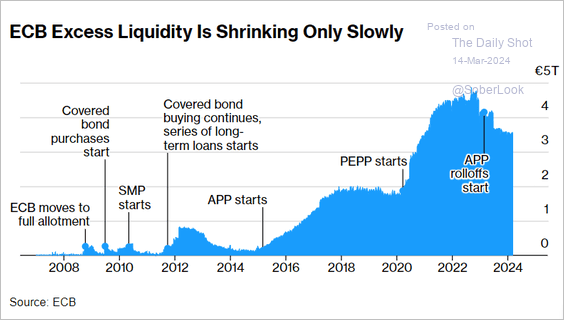

2. Excess liquidity in the Eurozone’s banking system remains elevated.

Source: @economics Read full article

Source: @economics Read full article

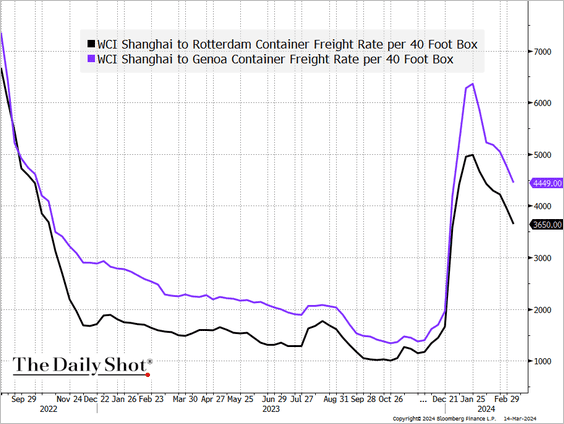

3. Container shipping costs from Asia are gradually moderating.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

Back to Index

China

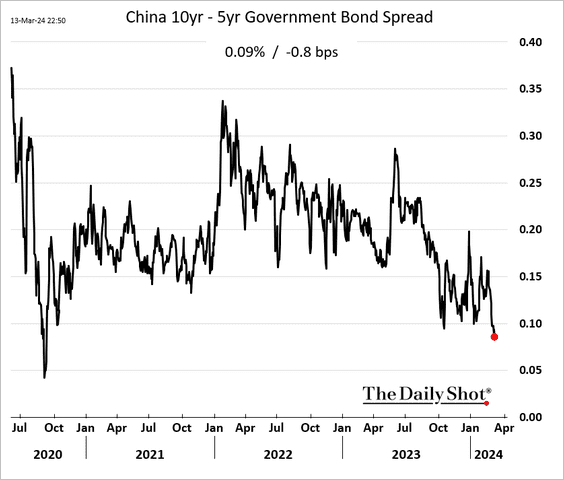

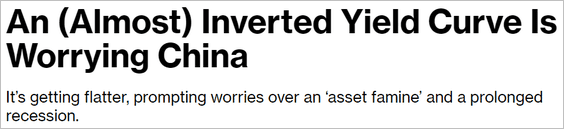

1. The yield curve has been flattening.

Source: @shuli_ren, @opinion Read full article

Source: @shuli_ren, @opinion Read full article

——————–

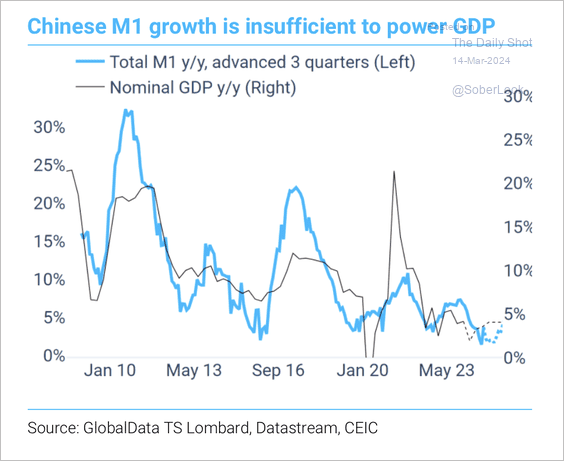

2. Money supply growth has slowed considerably alongside weaker GDP in recent years.

Source: TS Lombard

Source: TS Lombard

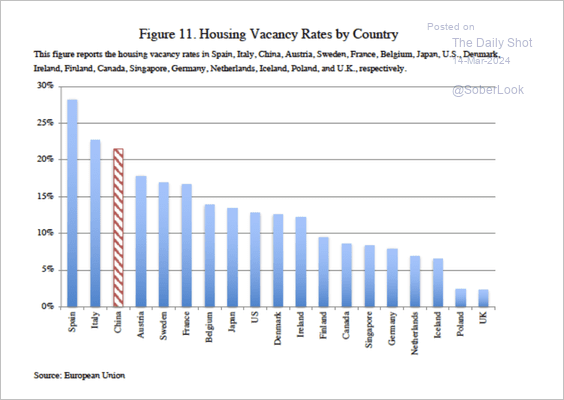

3. China’s housing vacancy rate is among the highest in the world.

Source: SOM Macro Strategies

Source: SOM Macro Strategies

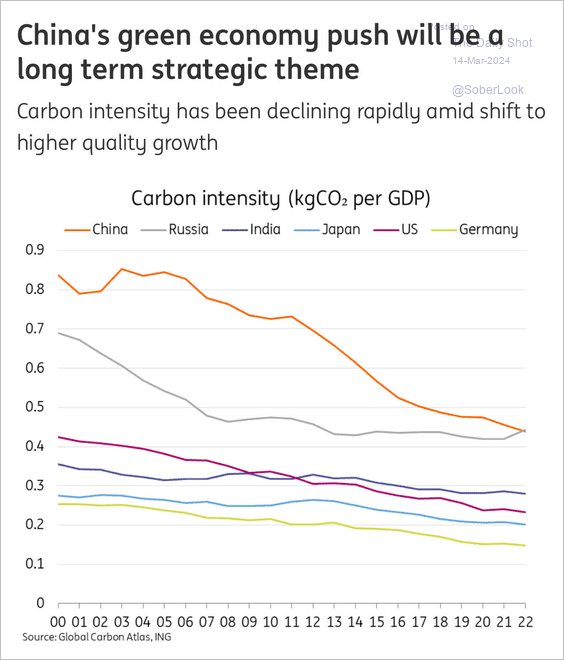

4. China’s carbon intensity has been declining rapidly.

Source: ING

Source: ING

Back to Index

Emerging Markets

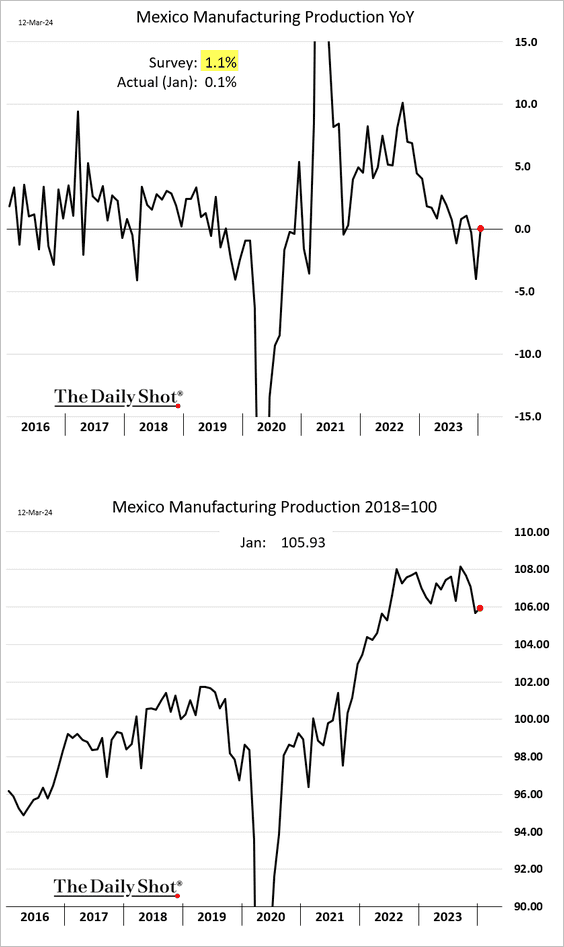

1. Mexico’s manufacturing output was softer than expected in January.

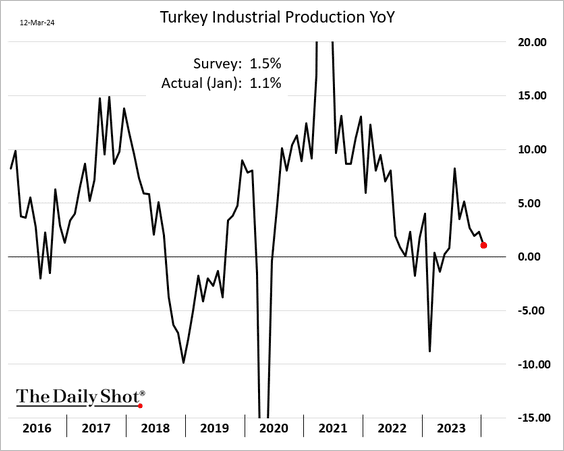

2. Growth in Turkey’s industrial production continues to slow.

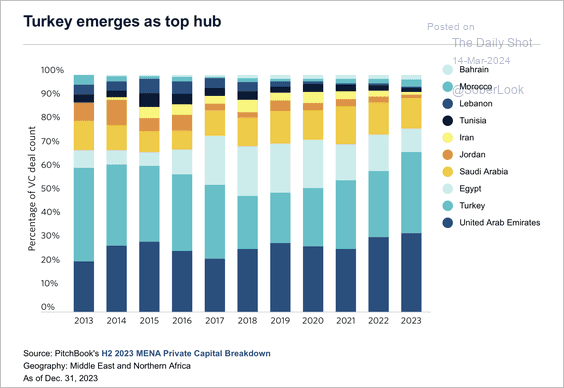

3. Turkey has accounted for a growing share of venture capital deal activity in the MENA region.

Source: PitchBook

Source: PitchBook

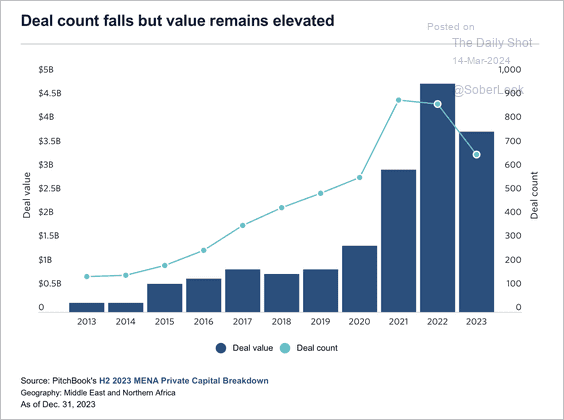

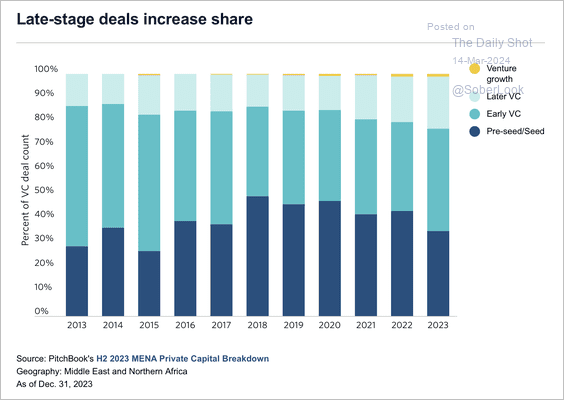

• Overall, deal activity has softened in the MENA region, while early-stage ventures have gained market share. (2 charts)

Source: PitchBook

Source: PitchBook

Source: PitchBook

Source: PitchBook

——————–

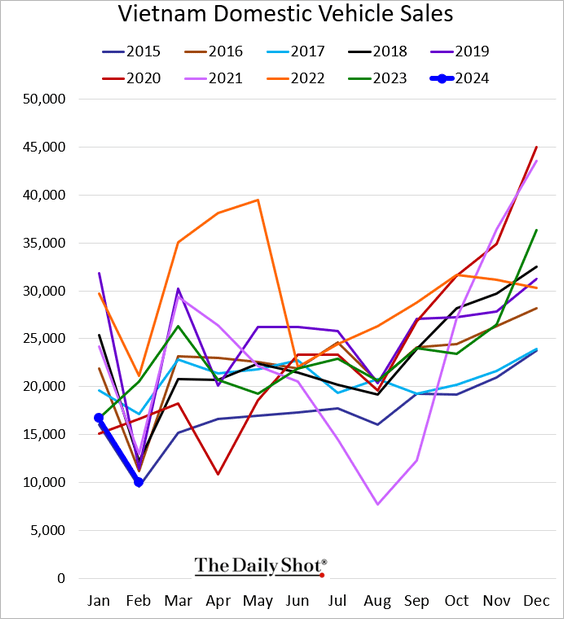

4. Vietnam’s vehicle sales have been very soft.

Back to Index

Commodities

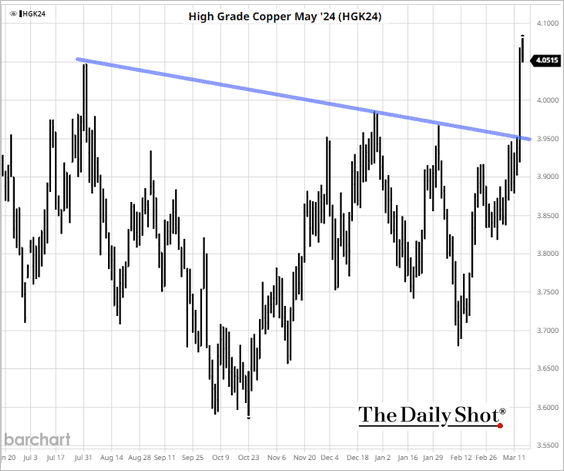

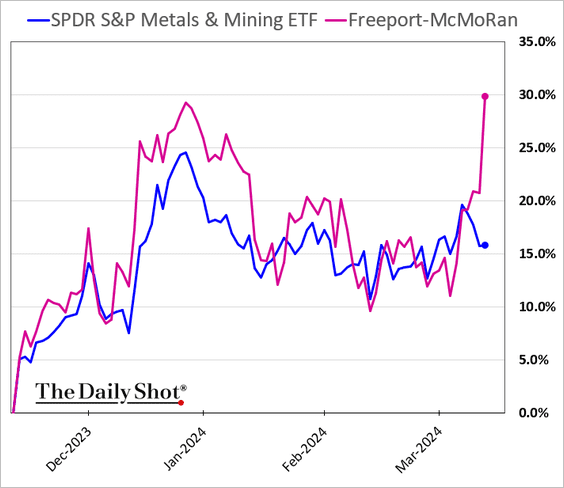

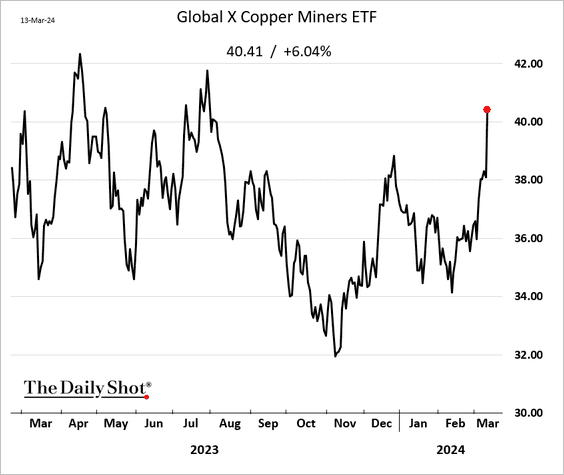

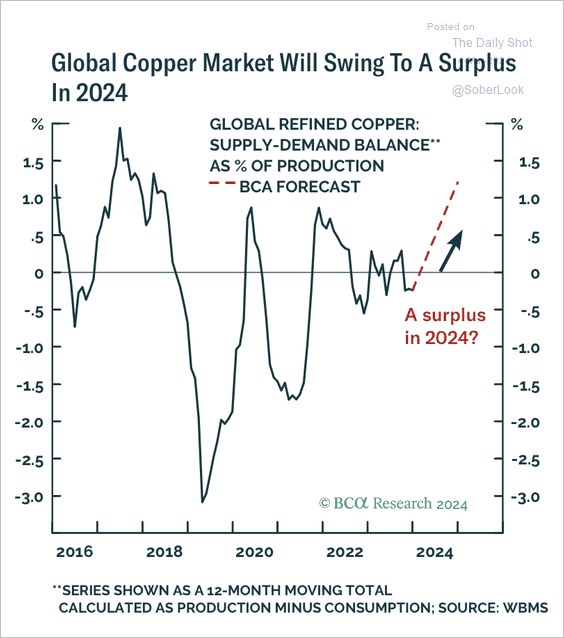

1. Copper surged on Wednesday, …

Source: Reuters Read full article

Source: Reuters Read full article

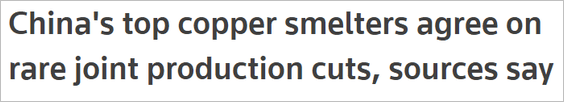

… boosting copper miners’ share prices (2 charts).

• BCA Research expects the copper market to swing to a small surplus this year, which could weigh on prices.

Source: BCA Research

Source: BCA Research

——————–

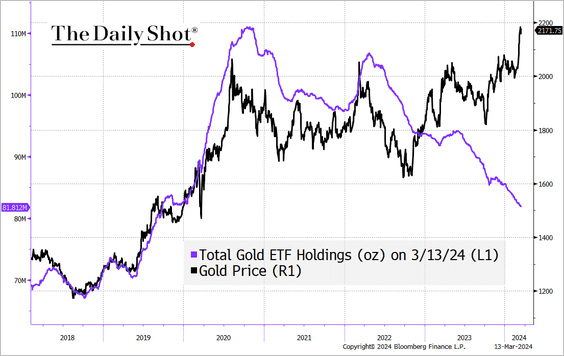

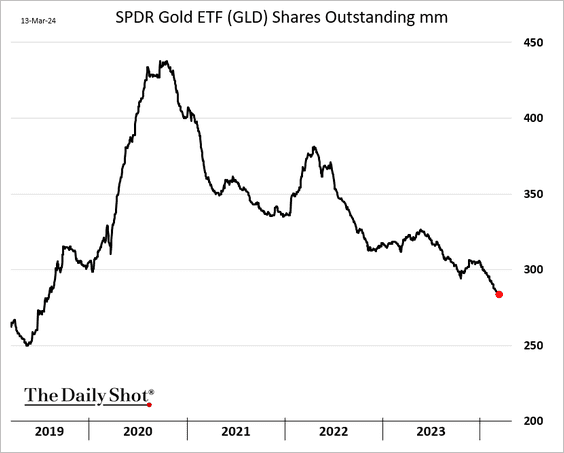

2. Gold ETFs’ holdings continue to sink (2 charts).

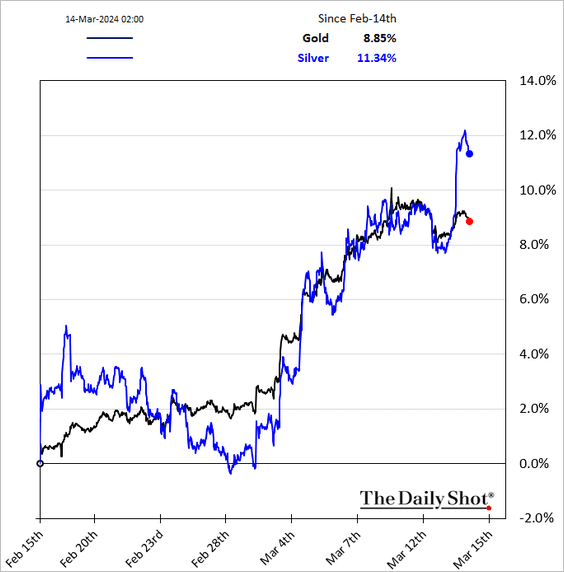

• Silver is outperforming gold this week.

——————–

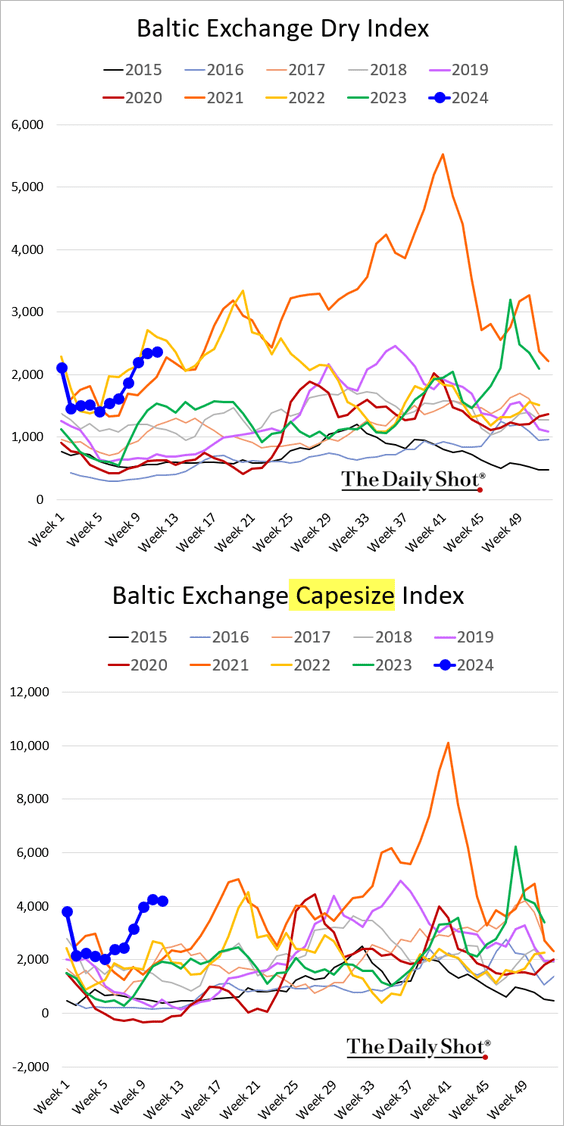

3. Dry bulk shipping costs are running well above last year’s levels.

Back to Index

Energy

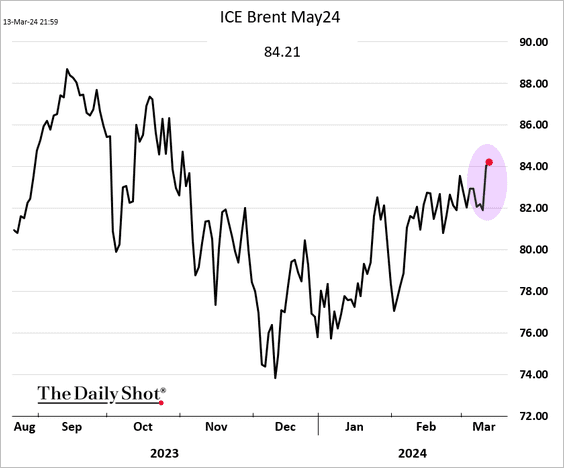

1. Crude oil futures advanced on Wednesday.

Source: @markets Read full article

Source: @markets Read full article

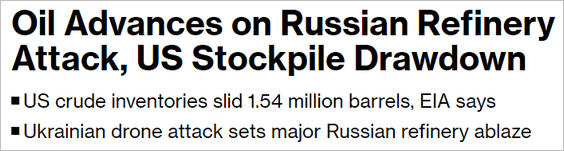

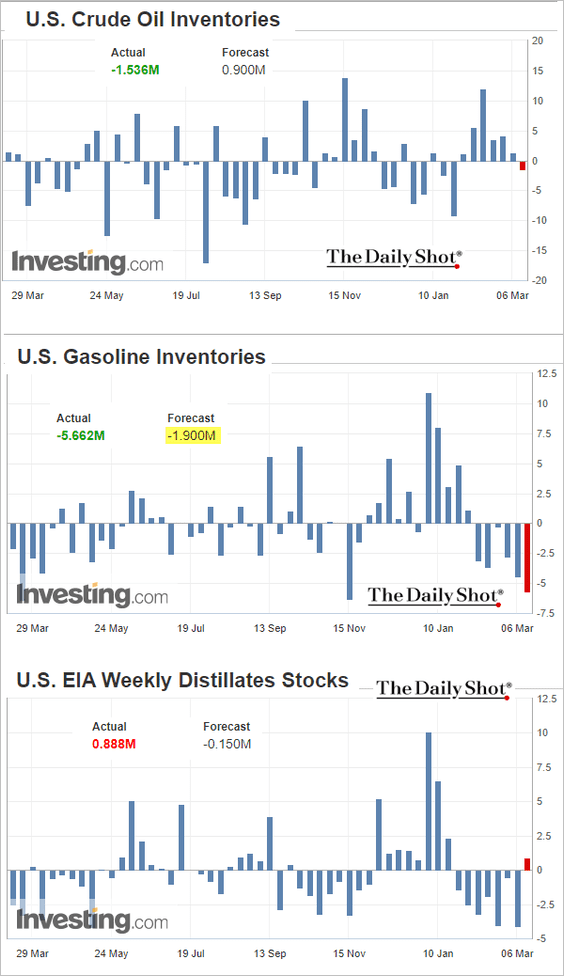

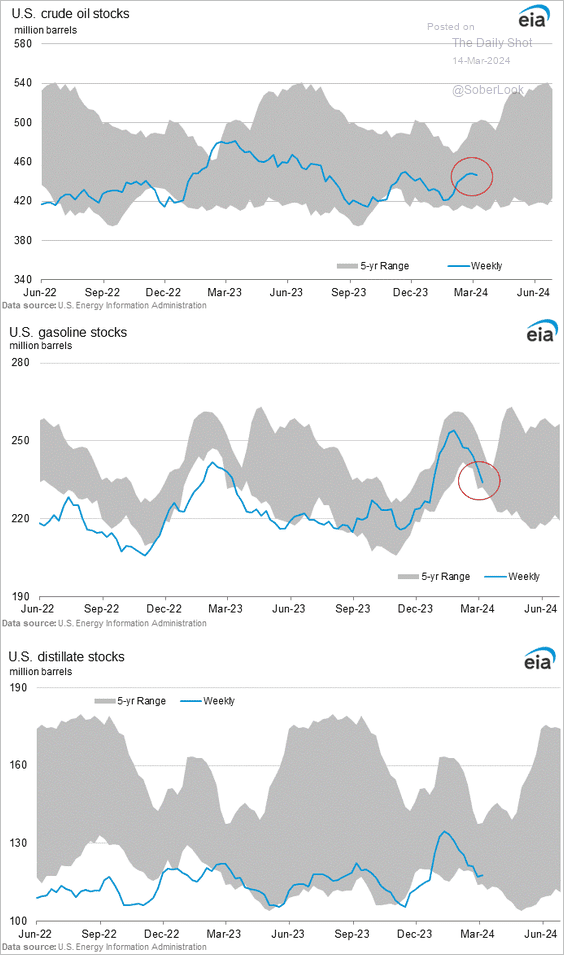

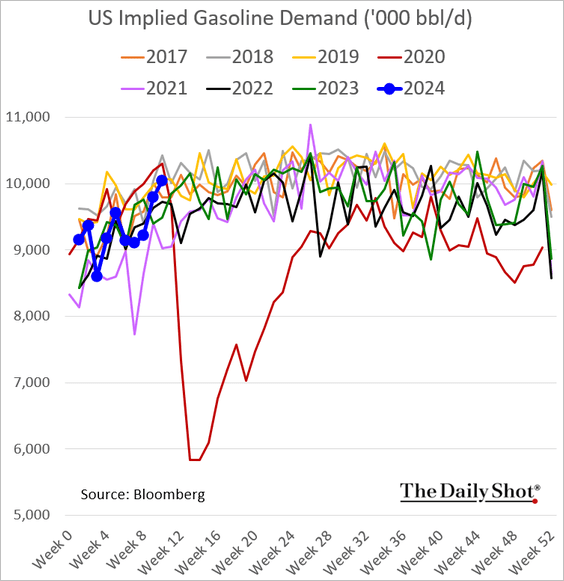

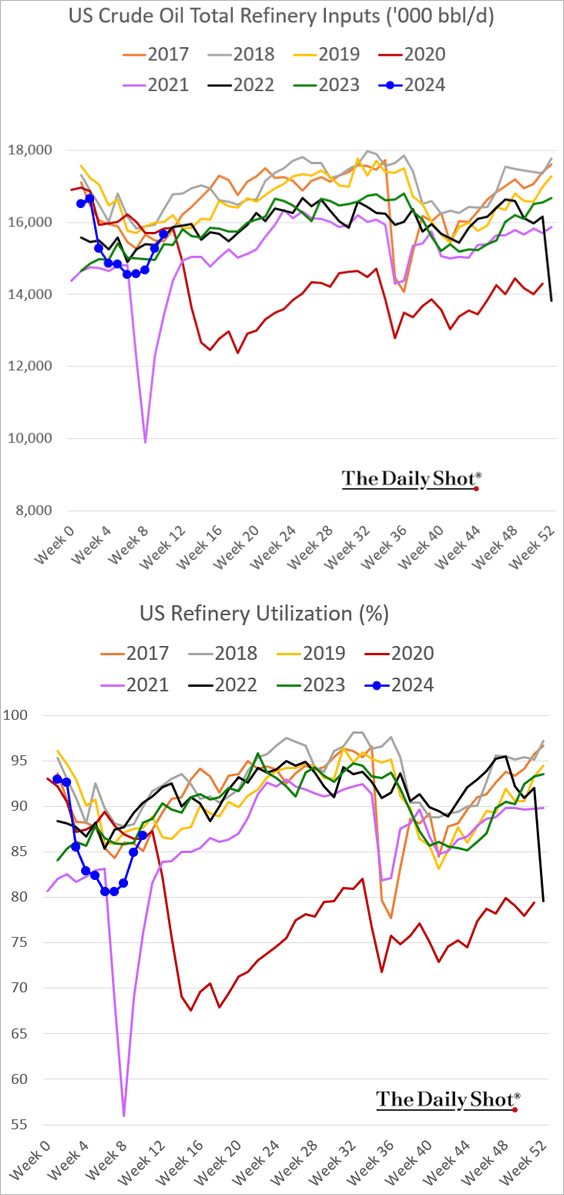

2. US crude oil inventories unexpectedly dropped last week, accompanied by a significant reduction in gasoline stockpiles.

– Weekly changes:

– Levels:

• Gasoline demand strengthened.

• Refinery inputs and utilization improved further.

——————–

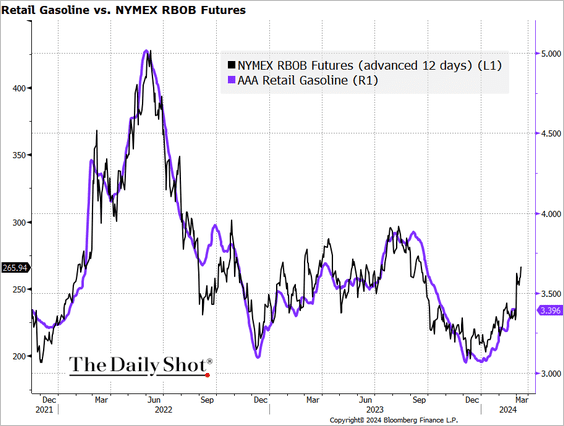

3. US gasoline prices at the pump are headed higher.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

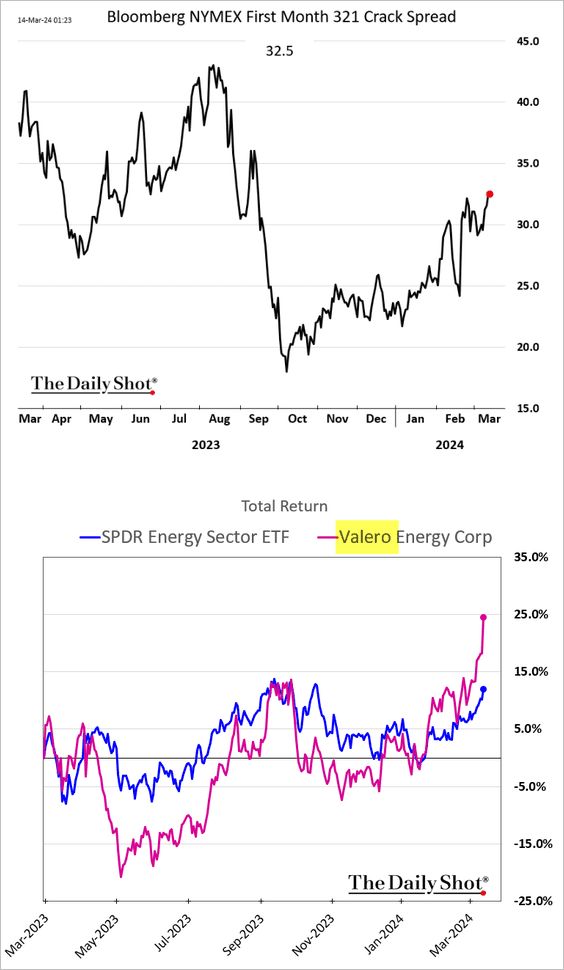

4. Crack spreads are rising, which has been a tailwind for refinery businesses.

Back to Index

Equities

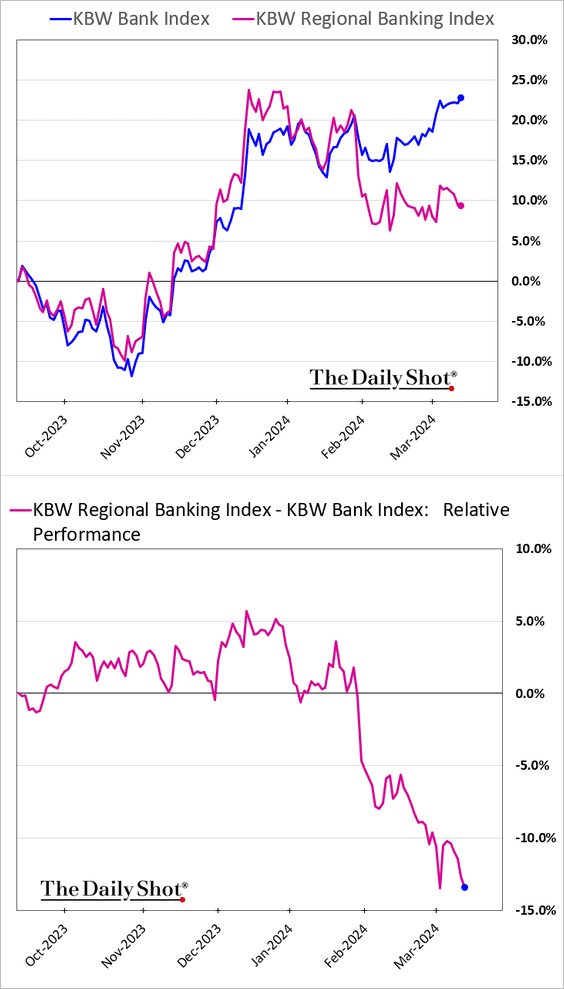

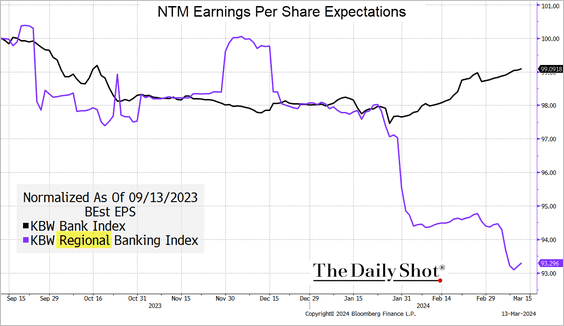

1. Regional banks continue to widen their underperformance, …

… as earnings expectations deteriorate.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

——————–

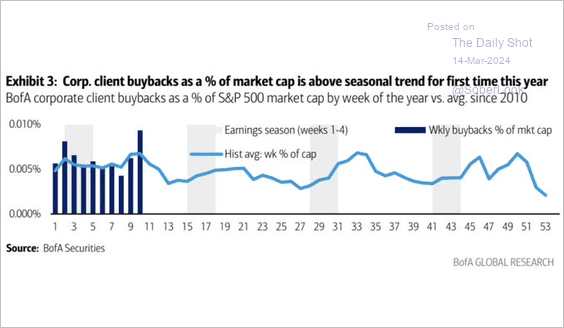

2. Share buybacks are now running above their seasonal trend.

Source: BofA Global Research

Source: BofA Global Research

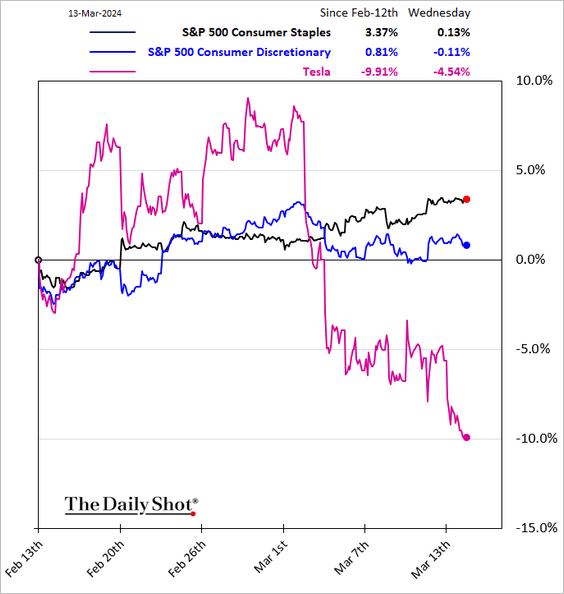

3. Tesla continues to weigh on the consumer discretionary sector.

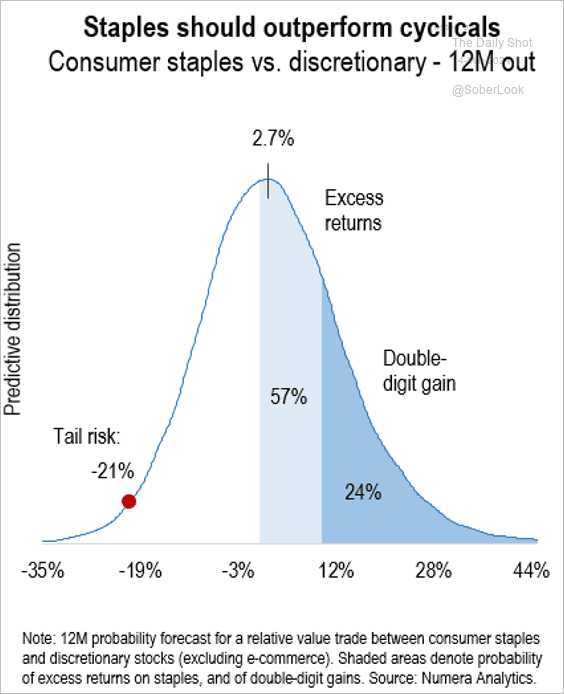

• Numera Analytics sees a greater chance of consumer staples outperforming consumer discretionary over the next six to 12 months.

Source: Numera Analytics (@NumeraAnalytics)

Source: Numera Analytics (@NumeraAnalytics)

——————–

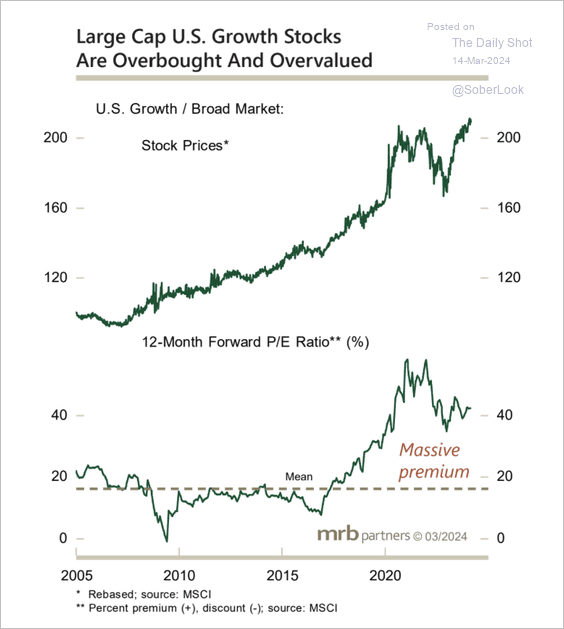

4. US large-cap growth stocks are trading at a significant valuation premium relative to the broader market.

Source: MRB Partners

Source: MRB Partners

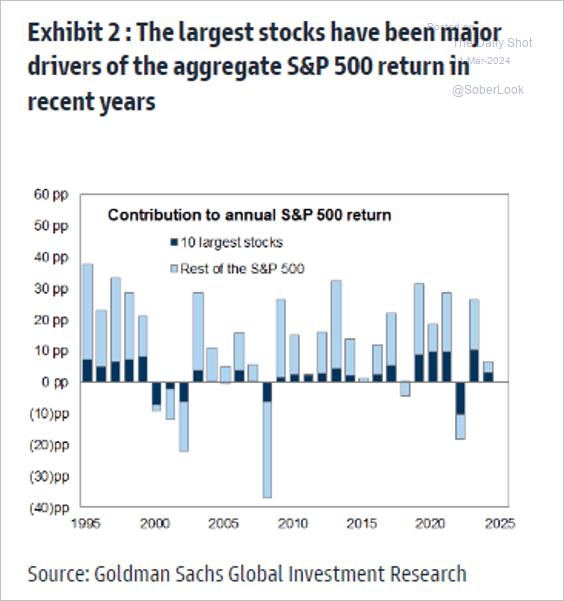

5. The top ten stocks have played a major role in driving S&P 500 returns.

Source: Goldman Sachs; @MikeZaccardi

Source: Goldman Sachs; @MikeZaccardi

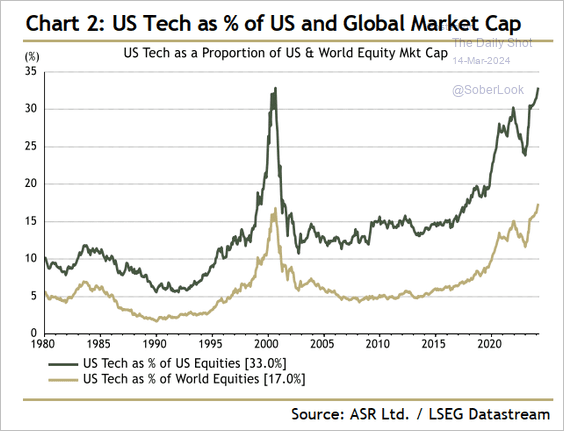

6. Here is a look at the tech sector’s share of the overall market cap.

Source: @IanRHarnett, @asr_london

Source: @IanRHarnett, @asr_london

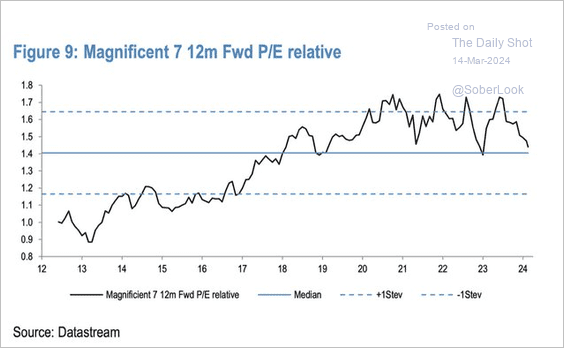

7. The Magnificent 7 valuations are not extreme relative to the rest of the market.

Source: JP Morgan Research; @dailychartbook

Source: JP Morgan Research; @dailychartbook

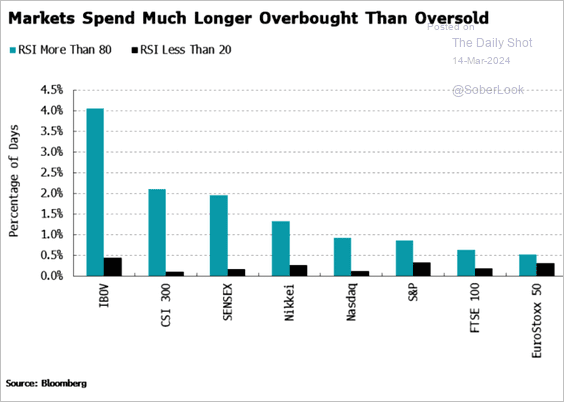

8. Markets often remain in overbought territory significantly longer than in oversold conditions.

Source: Simon White, Bloomberg Markets Live Blog

Source: Simon White, Bloomberg Markets Live Blog

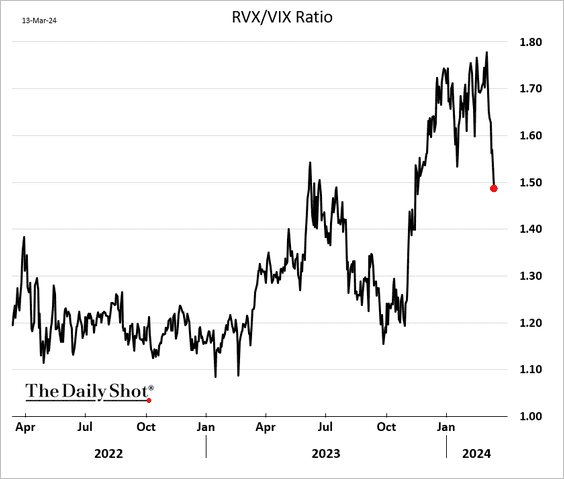

9. Small-cap implied volatility premium over large caps is narrowing.

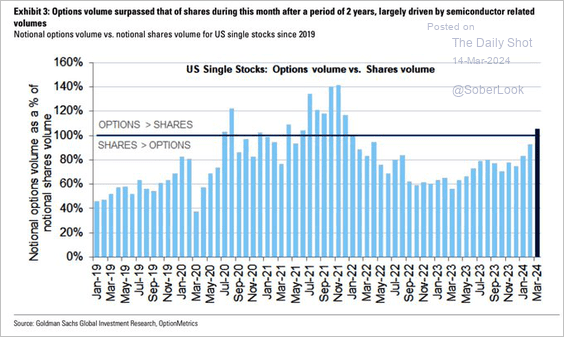

10. Single-stock options volume is once again above shares’ volume.

Source: Goldman Sachs; @WallStJesus

Source: Goldman Sachs; @WallStJesus

Back to Index

Global Developments

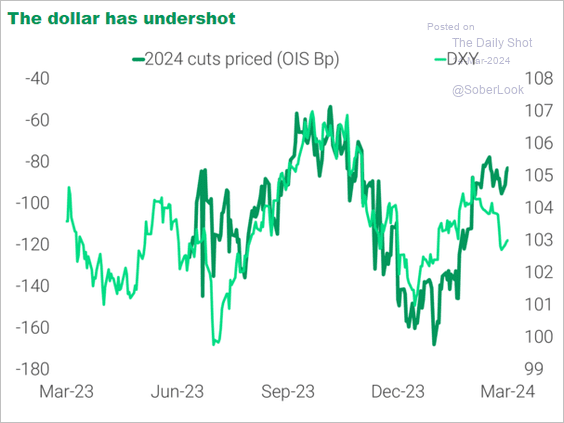

1. The dollar has corrected too far, given reduced US rate cut expectations.

Source: TS Lombard

Source: TS Lombard

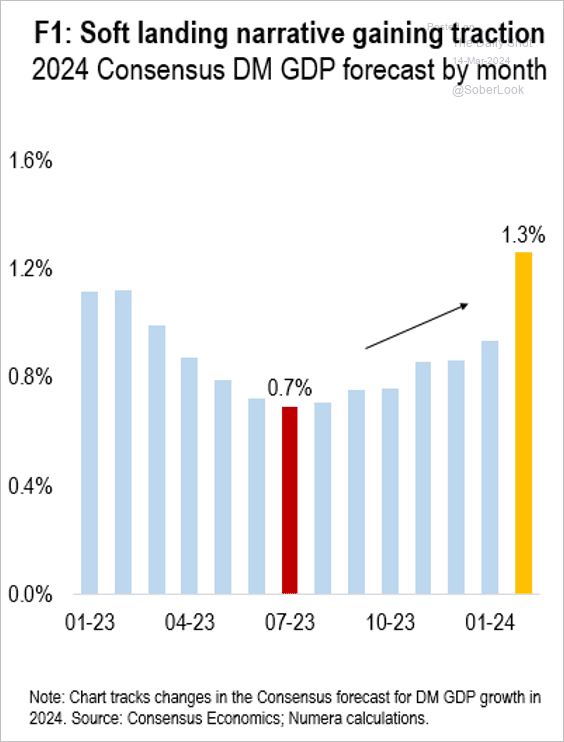

2. Consensus GDP estimates for developed markets have risen.

Source: Numera Analytics (@NumeraAnalytics)

Source: Numera Analytics (@NumeraAnalytics)

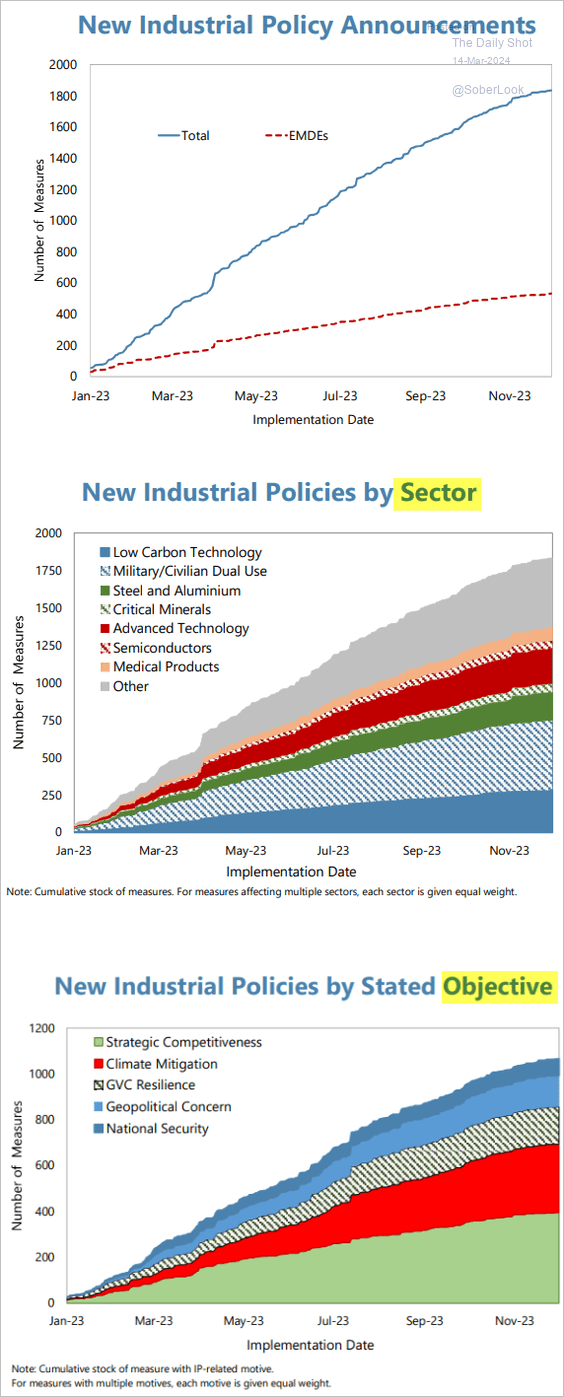

3. Here is a look at the resurgence of national industrial policies.

Source: International Monetary Fund

Source: International Monetary Fund

——————–

Food for Thought

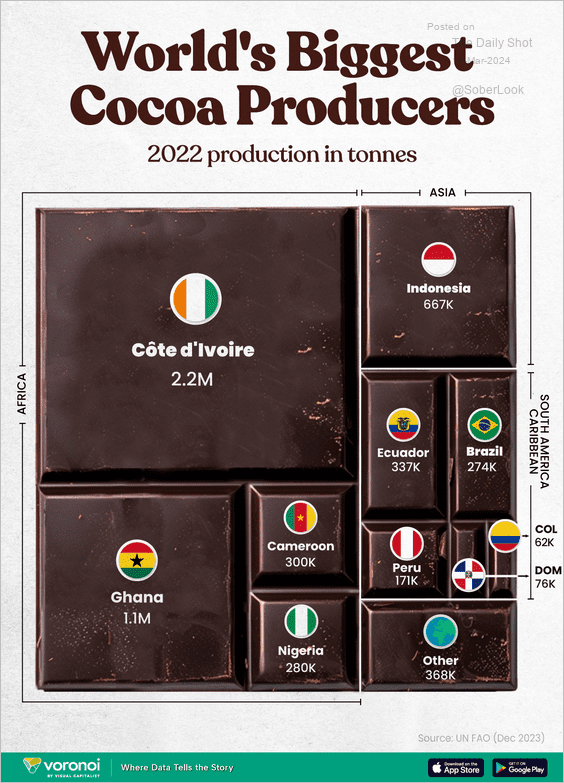

1. Biggest cocoa producers:

Source: Visual Capitalist Read full article

Source: Visual Capitalist Read full article

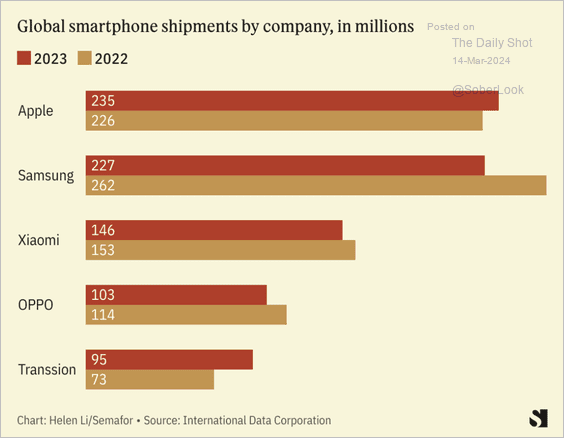

2. Global smartphone shipments:

Source: semafor

Source: semafor

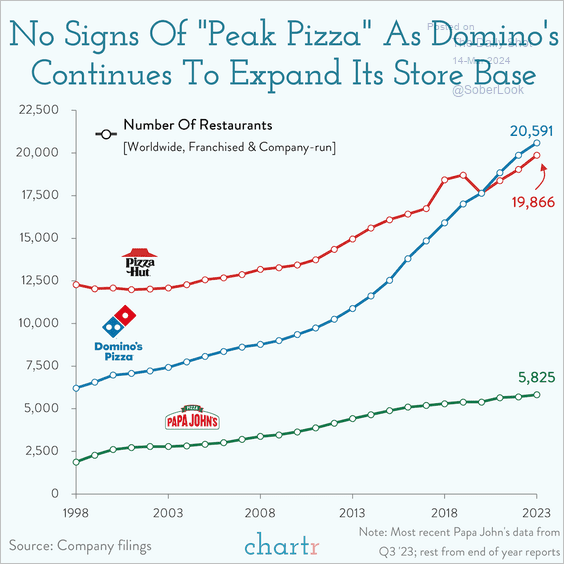

3. Pizza chains:

Source: @chartrdaily

Source: @chartrdaily

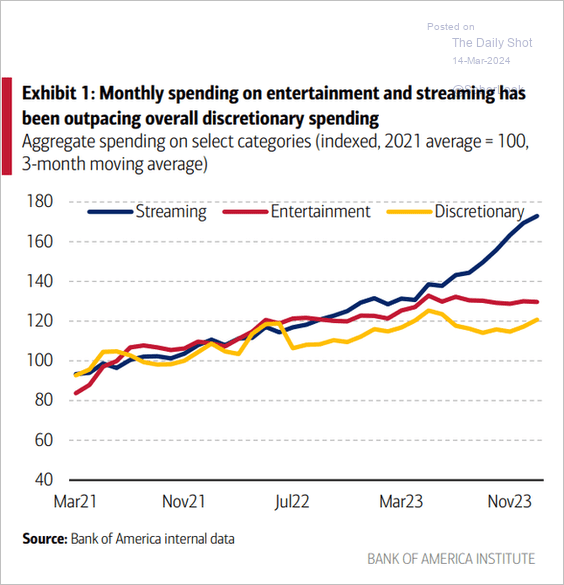

4. Spending on streaming services:

Source: BofA Global Research

Source: BofA Global Research

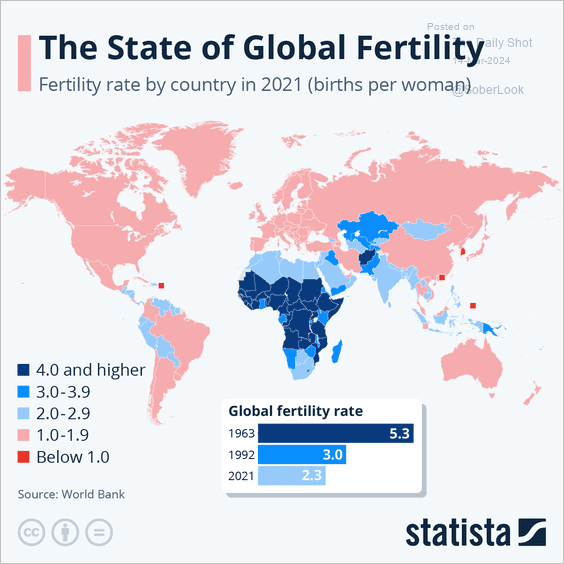

5. Fertility rates:

Source: Statista

Source: Statista

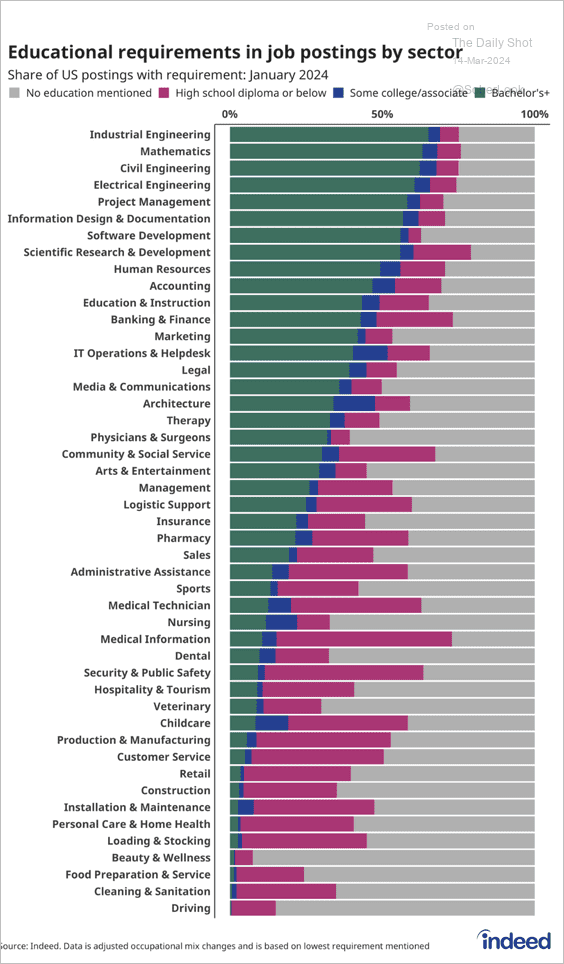

6. Educational requirements in job postings by sector:

Source: Indeed Read full article

Source: Indeed Read full article

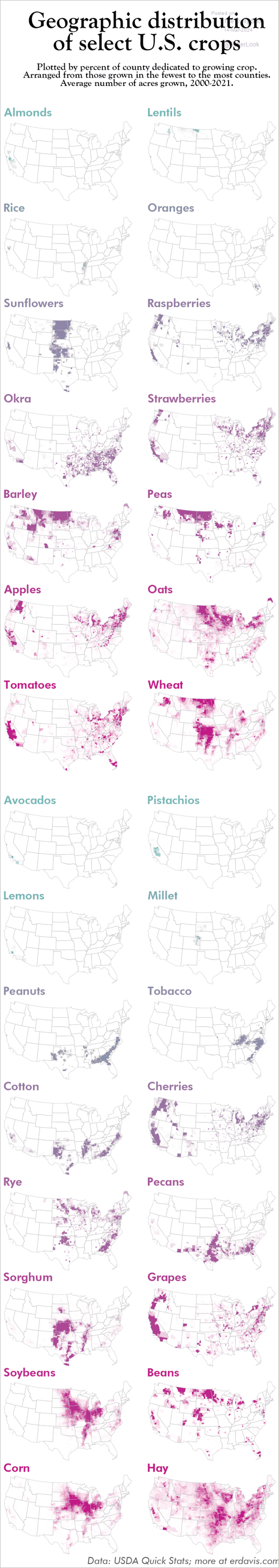

7. Geographic distribution of US crops:

Source: Data Stuff Read full article

Source: Data Stuff Read full article

——————–

Back to Index