The Daily Shot: 13-Mar-24

• The United States

• The Eurozone

• Asia-Pacific

• China

• Emerging Markets

• Cryptocurrency

• Commodities

• Energy

• Equities

• Alternatives

• Credit

• Global Developments

• Food for Thought

The United States

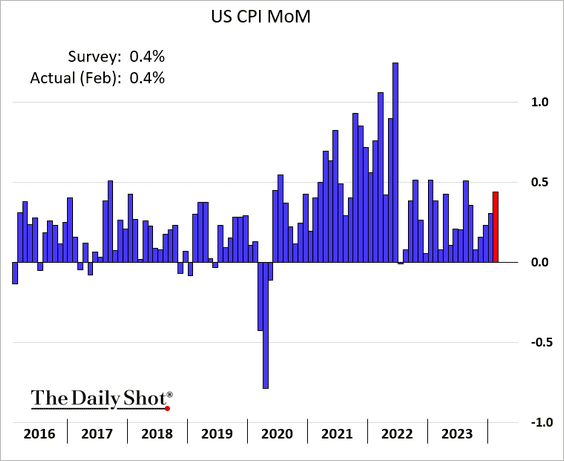

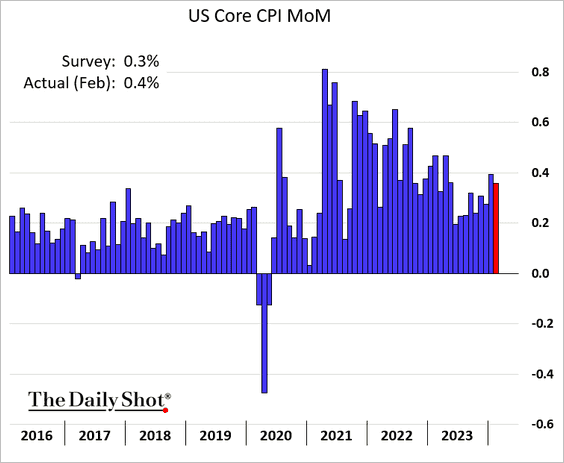

1. Inflation strengthened in February, …

… with the core CPI topping expectations again.

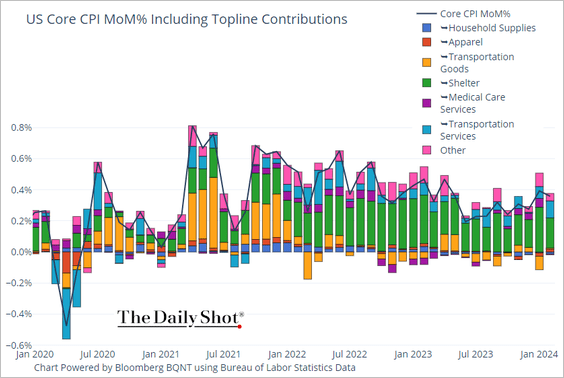

This chart outlines the components contributing to the monthly changes in core CPI.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

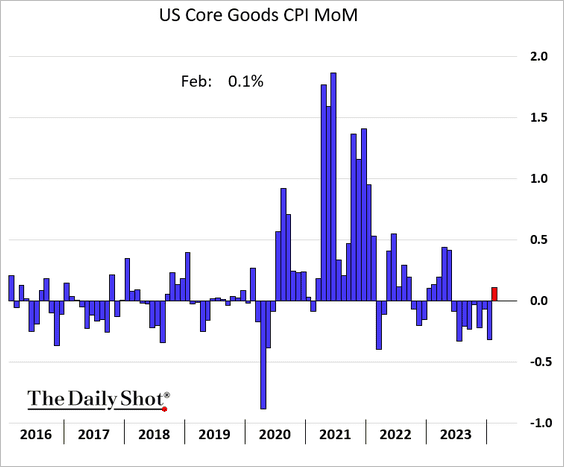

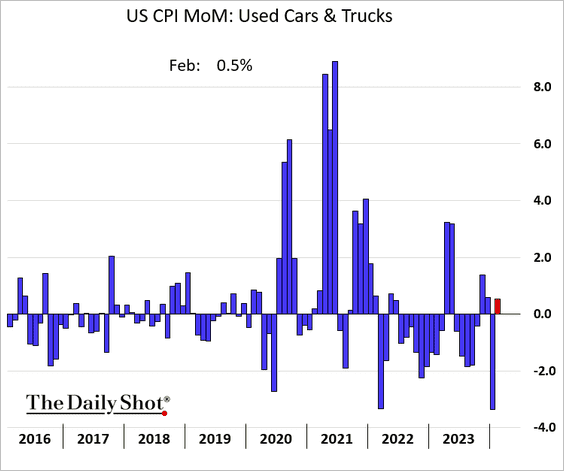

• Following eight months of declines, the core goods CPI registered an increase, …

… boosted by a gain in used vehicle prices.

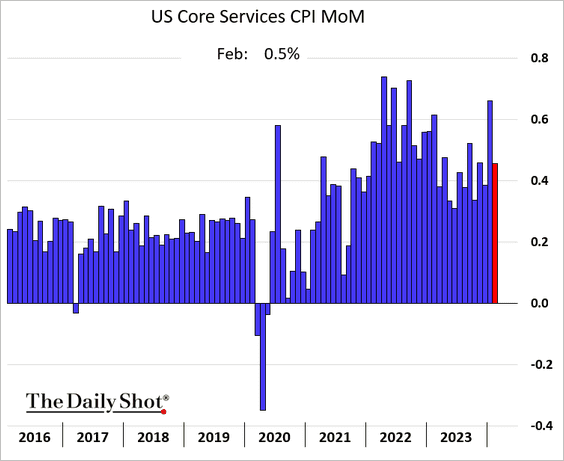

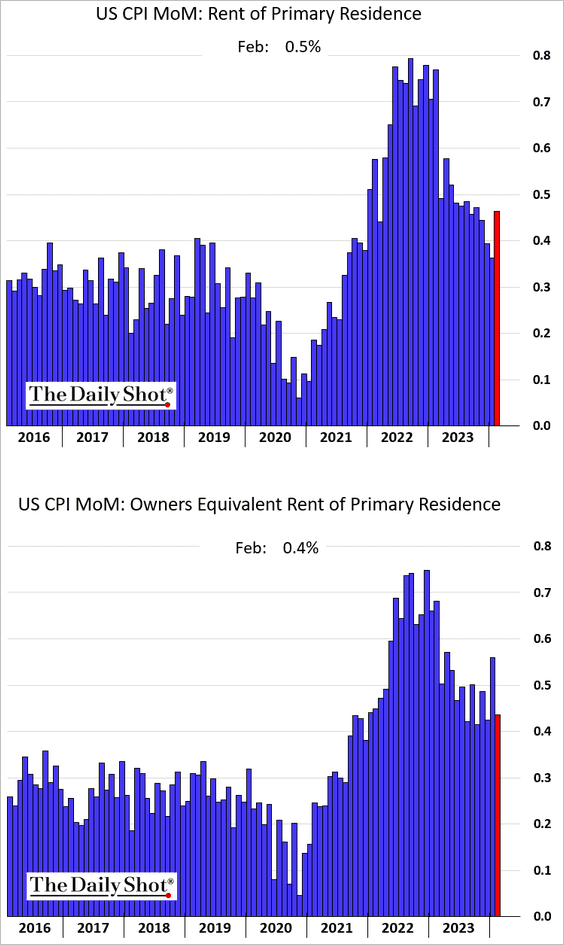

• The core services inflation continues to run hot, …

… as rent inflation accelerated. The Owner’s Equivalent Rent CPI (second panel) moderated from January’s spike but remains elevated.

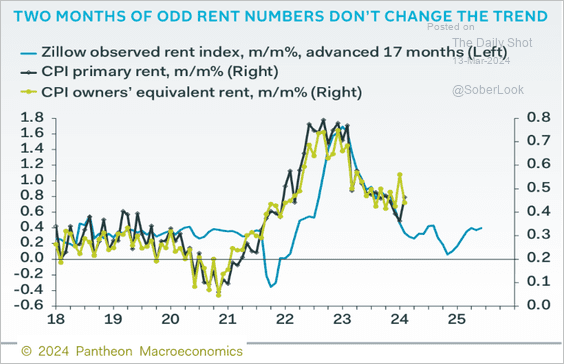

– Leading indicators continue to signal softer housing inflation ahead.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

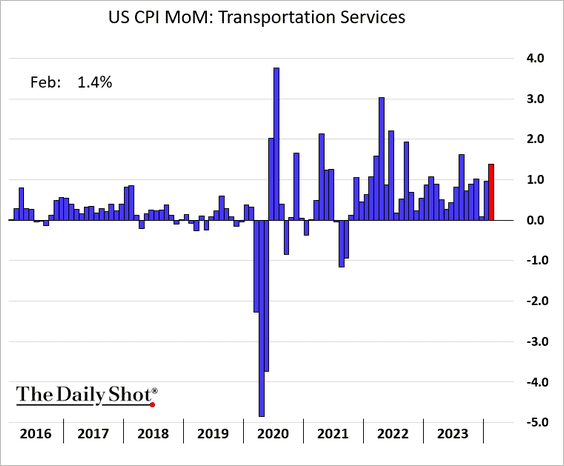

– The CPI for transportation services, which encompasses auto insurance, has also been persistently high.

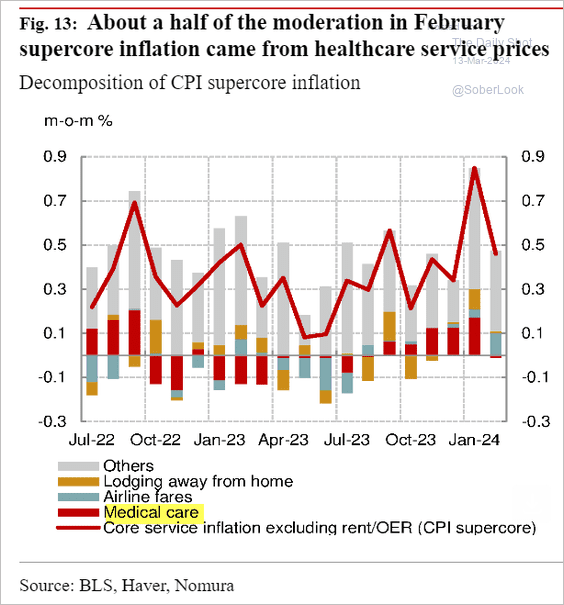

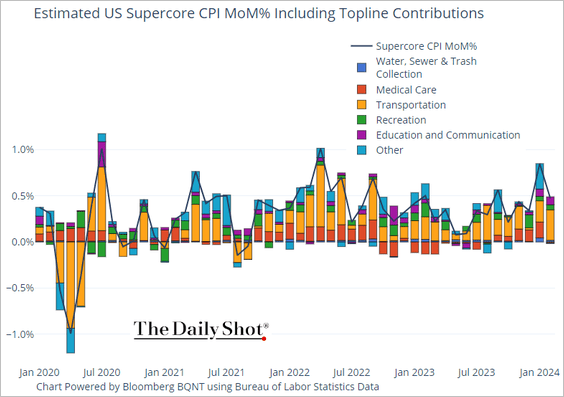

• Supercore inflation receded from January’s peak yet remains elevated (2 charts).

Source: Nomura Securities

Source: Nomura Securities

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

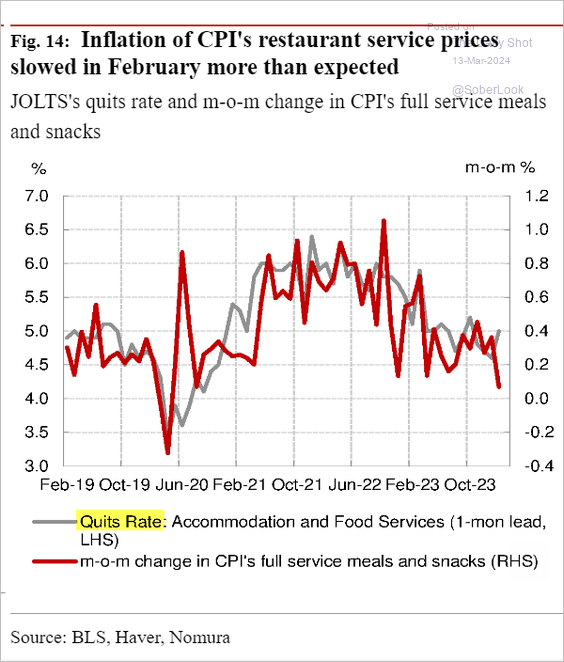

• Restaurant services inflation eased last month despite a persistently high quits rate within the sector.

Source: Nomura Securities

Source: Nomura Securities

——————–

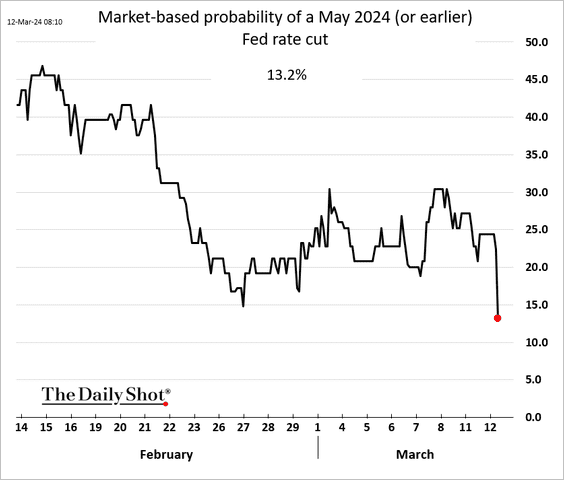

2. The probability of a Fed rate cut in May tumbled in response to the hot CPI print.

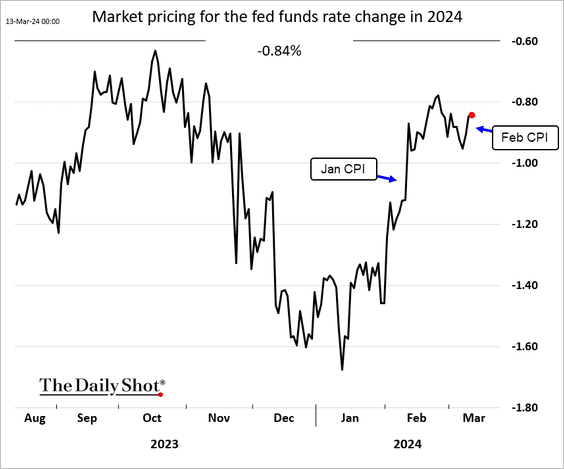

Here are the market’s expectations for Fed rate cuts in 2024.

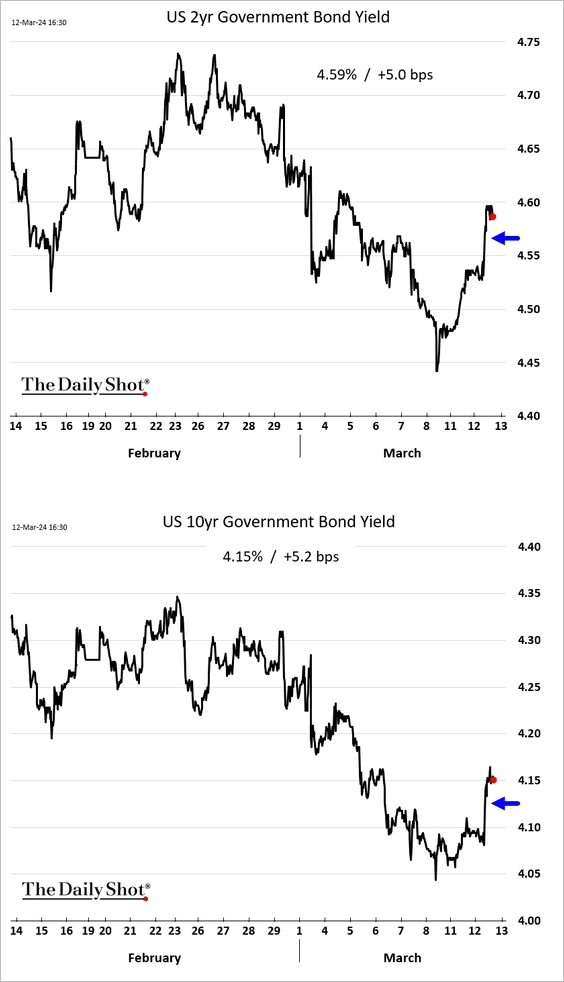

• Bond yields climbed.

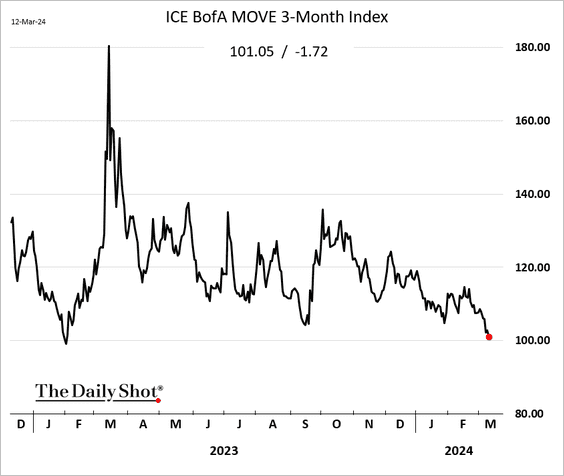

However, the Treasury market implied volatility (the 3-month index) declined further.

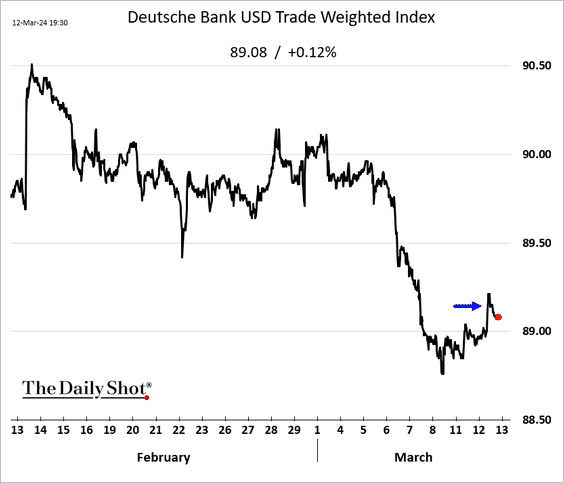

• The dollar edged higher.

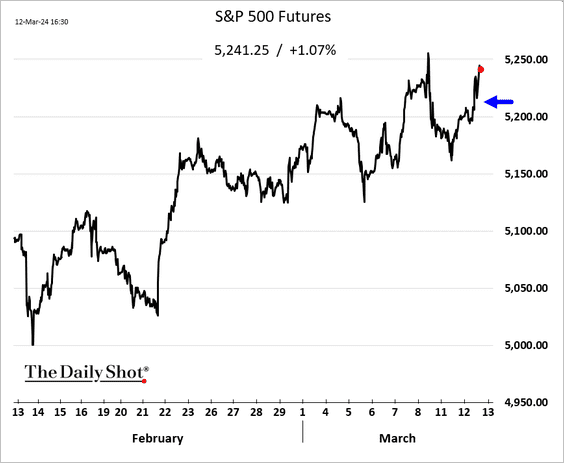

• Stocks shrugged off the CPI report and kept on rallying.

——————–

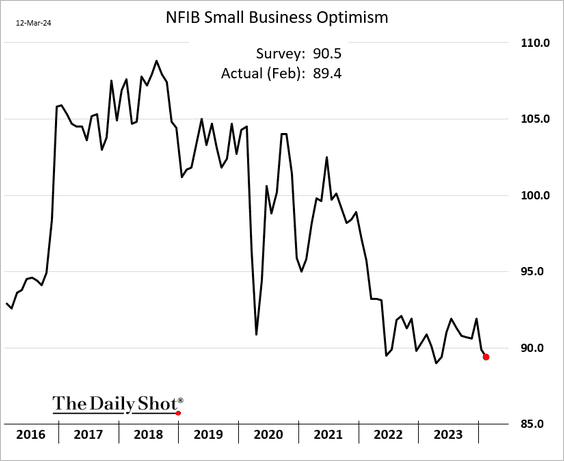

3. The NFIB small business sentiment index declined again last month.

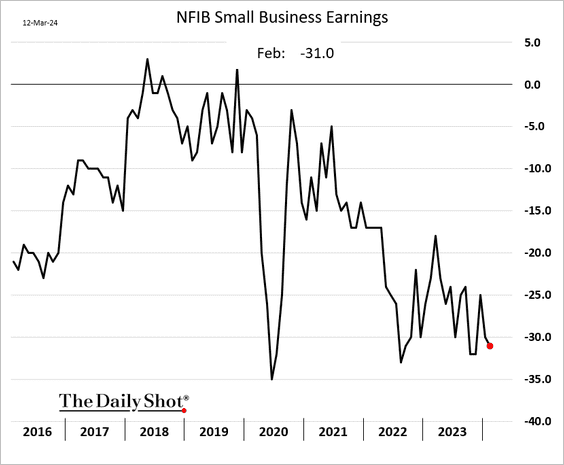

• Businesses continue to report soft earnings.

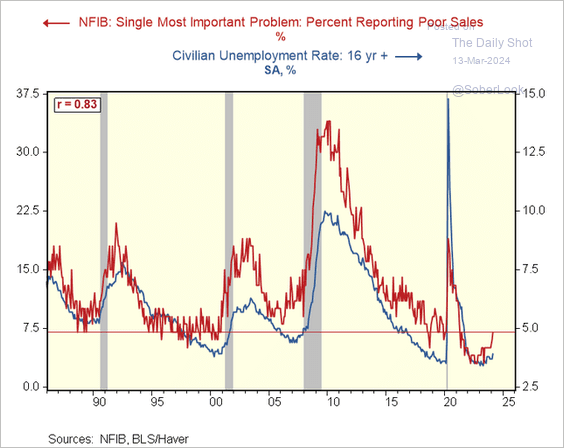

• More firms reported “poor sales” as the most important problem, which could indicate higher unemployment ahead.

Source: @RenMacLLC

Source: @RenMacLLC

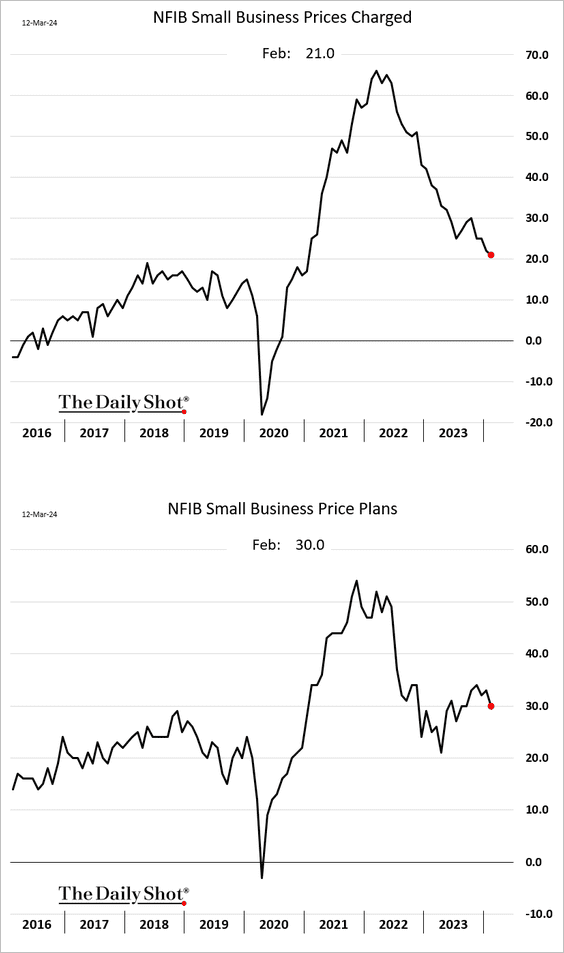

• Price indicators eased last month but remained above pre-COVID levels.

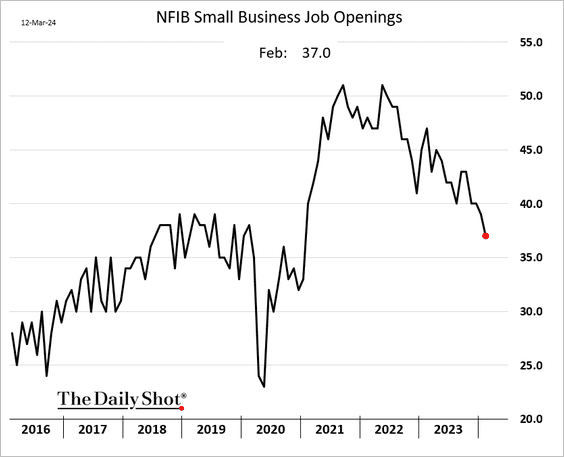

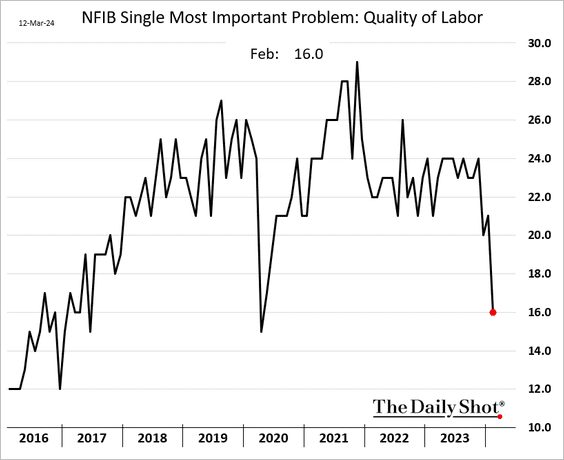

• In another sign of a softening US labor market, the NFIB’s job openings and quality of labor indicators declined sharply.

——————–

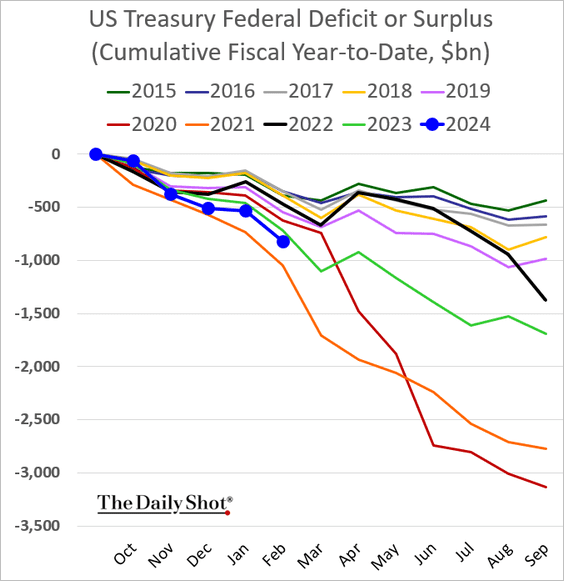

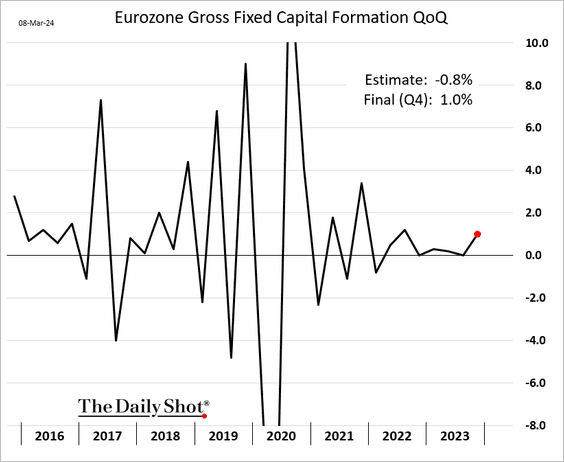

4. The budget deficit continues to run above last year’s levels.

Source: @economics Read full article

Source: @economics Read full article

Back to Index

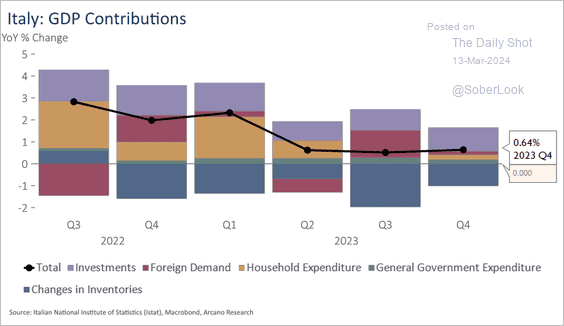

The Eurozone

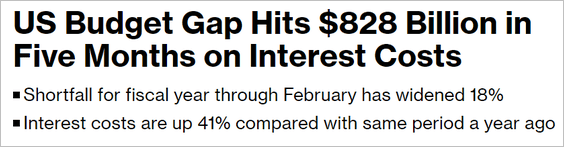

1. The euro-area labor market remains tight.

Source: Nomura Securities

Source: Nomura Securities

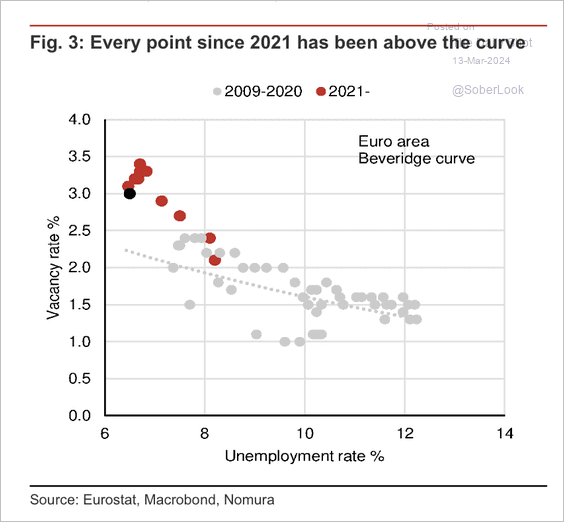

2. Last quarter’s growth in euro-area business investment surprised to the upside.

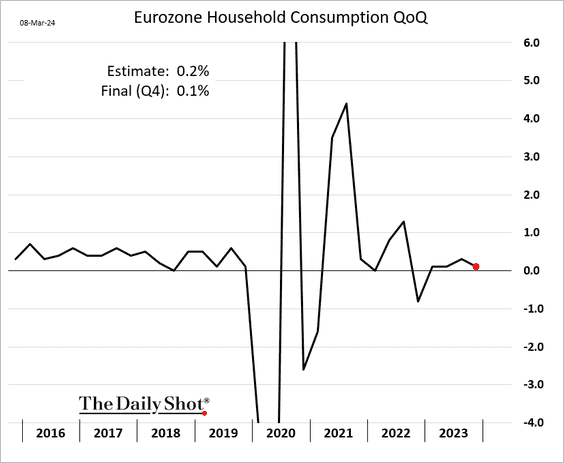

But growth in consumer spending was soft.

As an example, here are Italy’s GDP growth contributions.

Source: Arcano Economics

Source: Arcano Economics

——————–

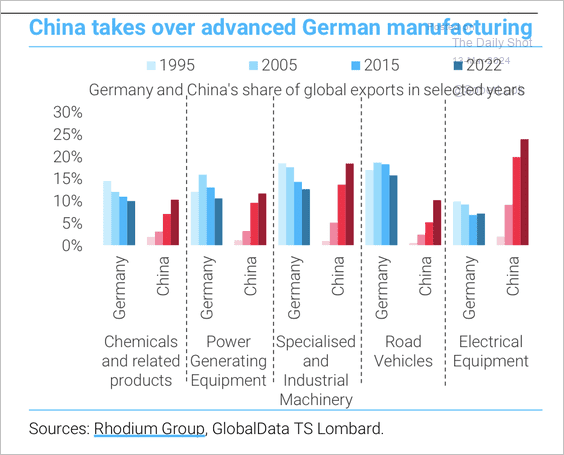

3. China has emerged as a top competitor to Germany’s manufacturing industry.

Source: TS Lombard

Source: TS Lombard

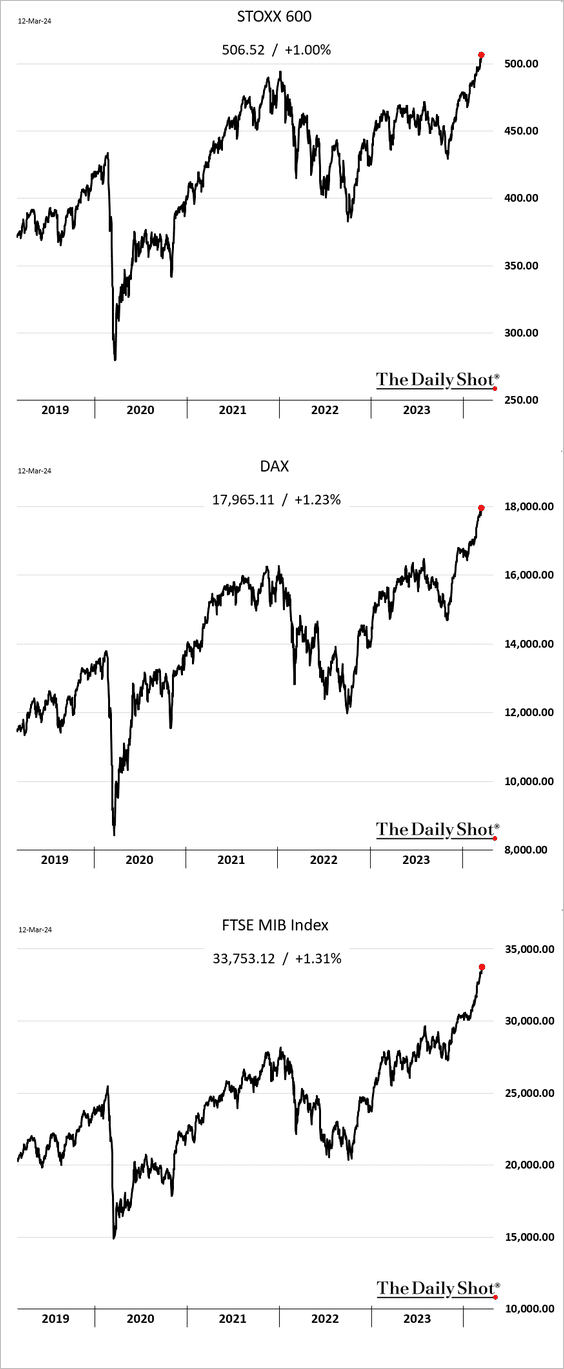

4. European shares continue to surge.

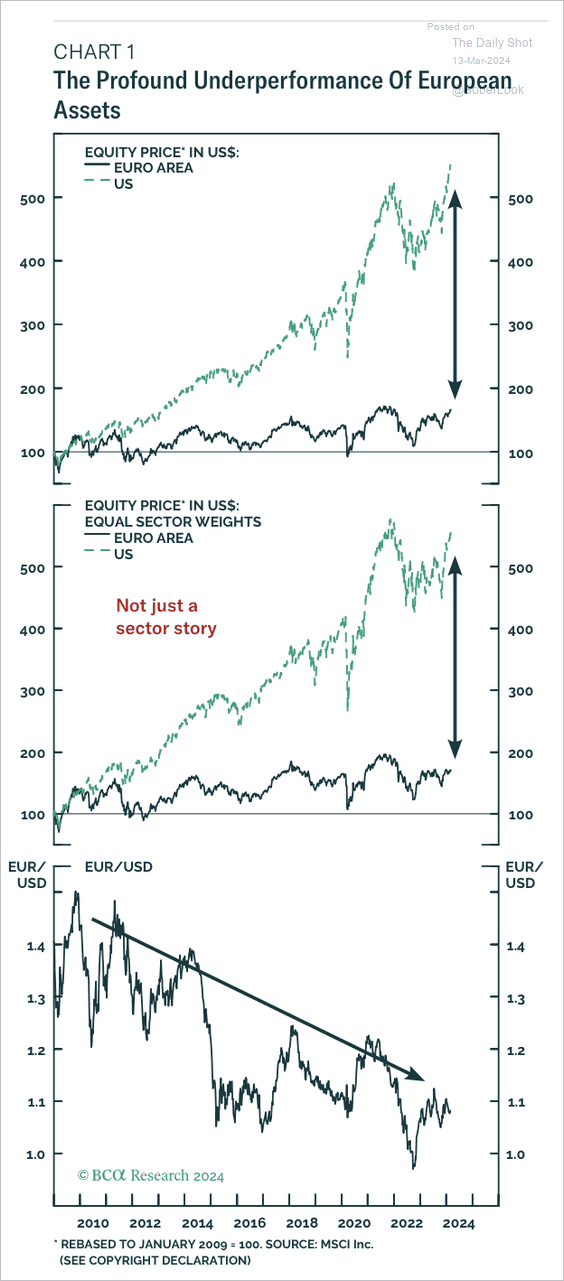

• European assets have significantly underperformed the US, …

Source: BCA Research

Source: BCA Research

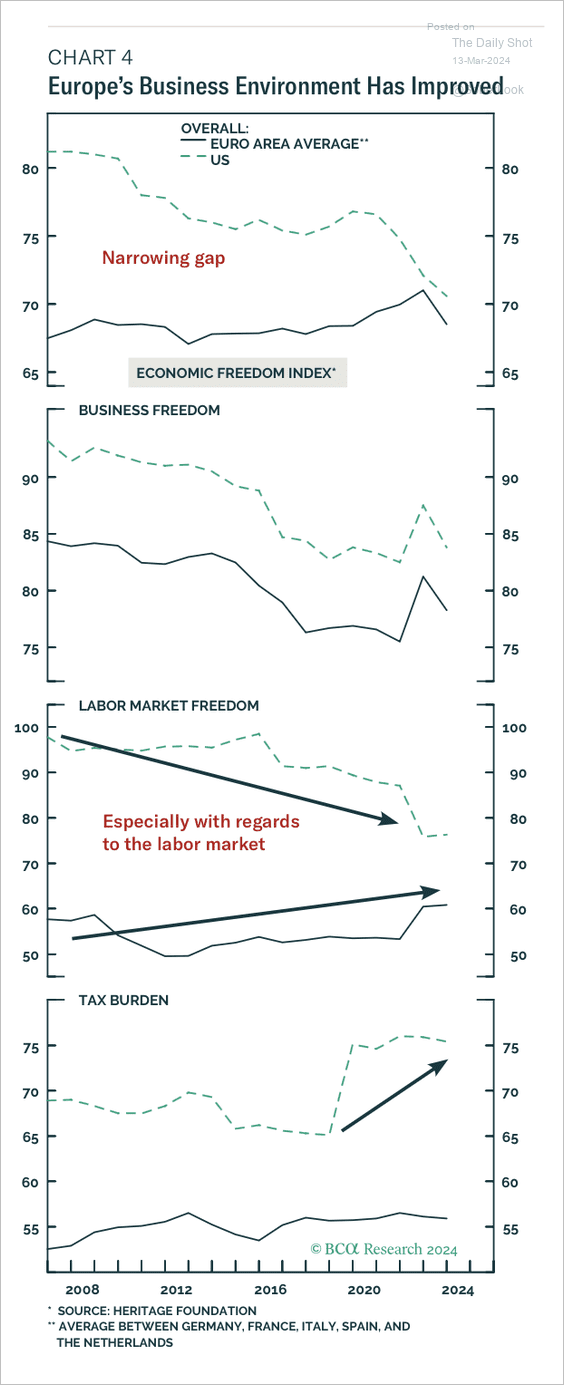

… but the euro area’s business environment has improved relative to the US.

Source: BCA Research

Source: BCA Research

Back to Index

Asia-Pacific

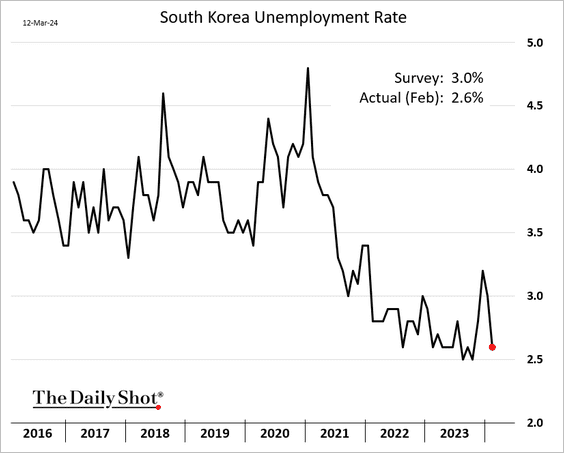

1. Unemployment in South Korea is exceptionally low.

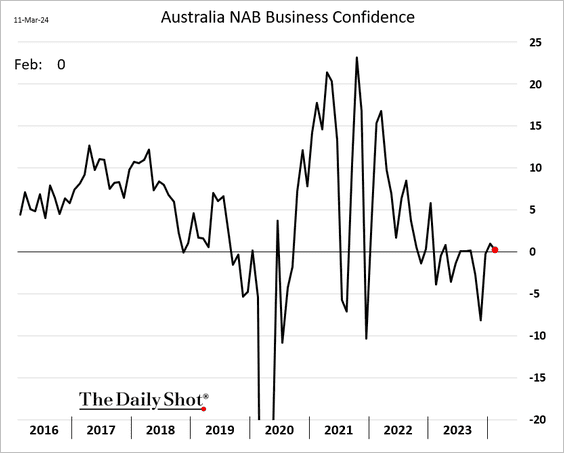

2. Australian business confidence remains lackluster.

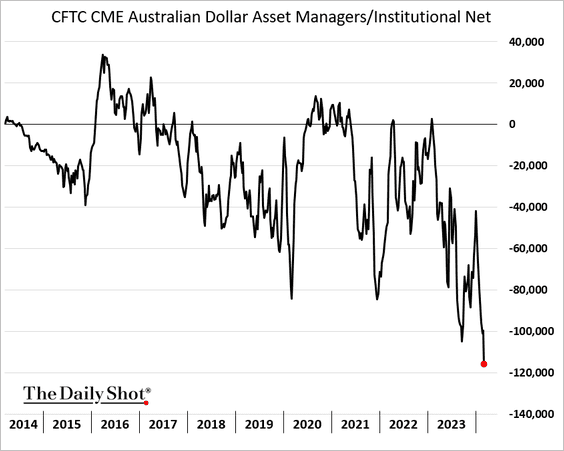

• Asset managers have been boosting their bets against the Aussie dollar.

Back to Index

China

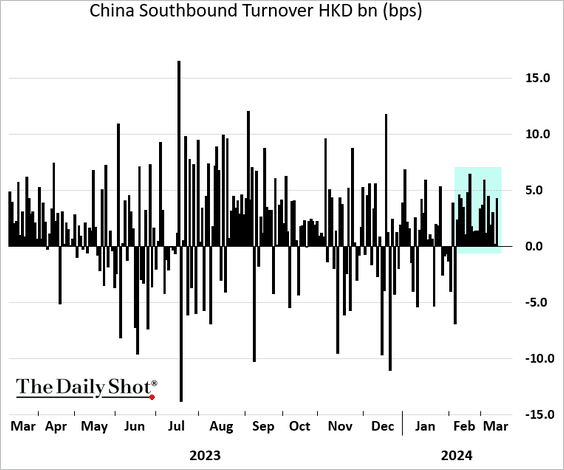

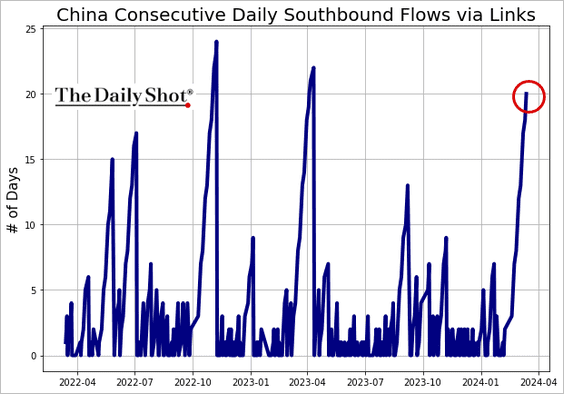

1. Mainland investors have been buying up Hong Kong stocks (southbound flows).

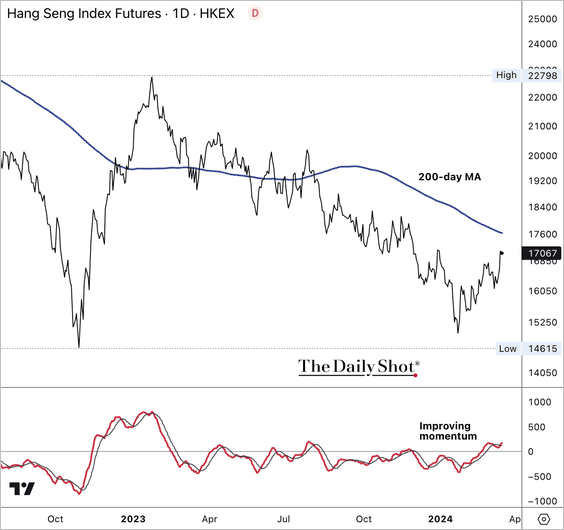

• The Hang Seng Index is approaching initial resistance at its 200-day moving average, although momentum is improving.

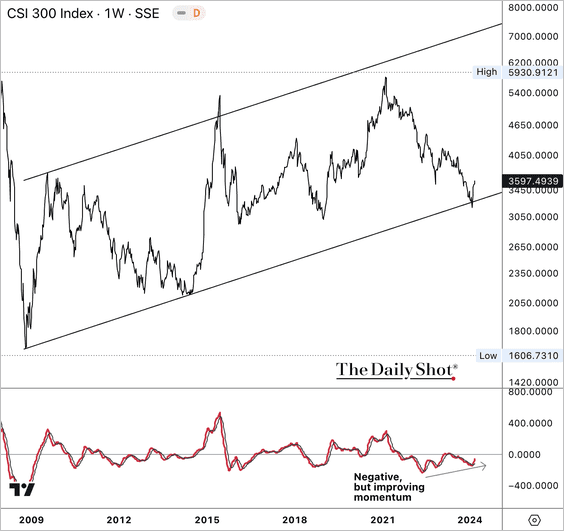

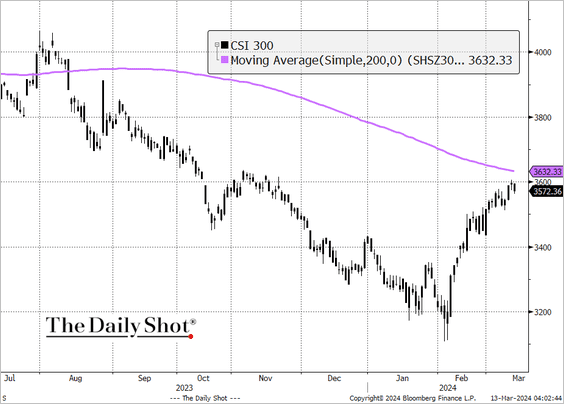

• The CSI 300 Index held long-term support, …

… and is nearing its 200-day moving average.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

——————–

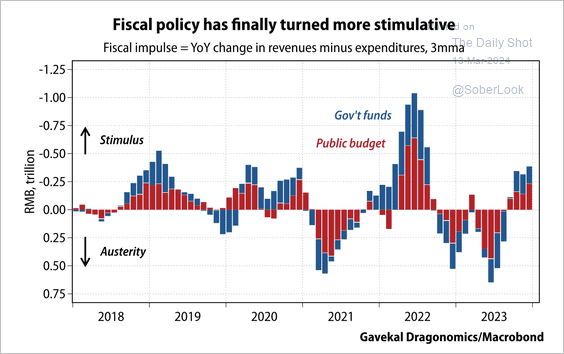

2. Fiscal policy is now stimulative, which could support economic growth and market sentiment.

Source: Gavekal Research

Source: Gavekal Research

Back to Index

Emerging Markets

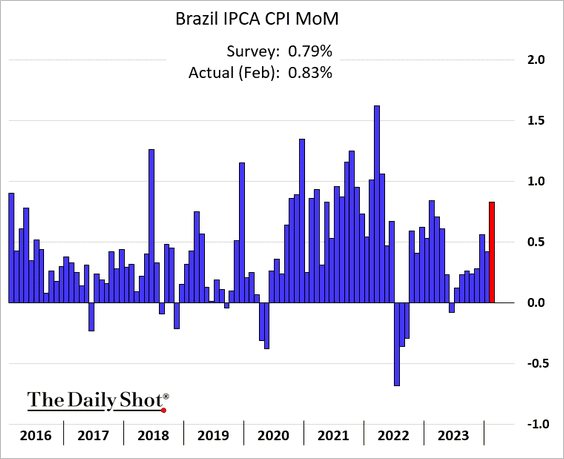

1. Brazil’s inflation was a bit stronger than expected last month.

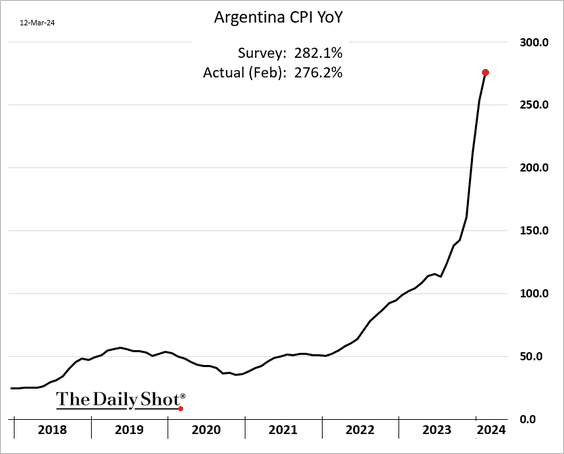

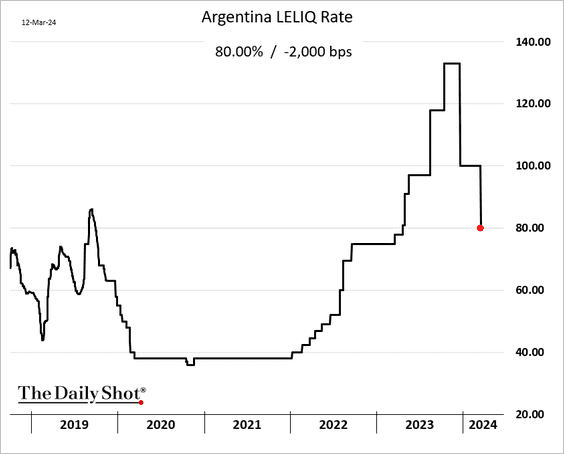

2. Argentina’s CPI continues to climb, …

… but the central bank decided to cut rates by 20%.

Source: @economics Read full article

Source: @economics Read full article

——————–

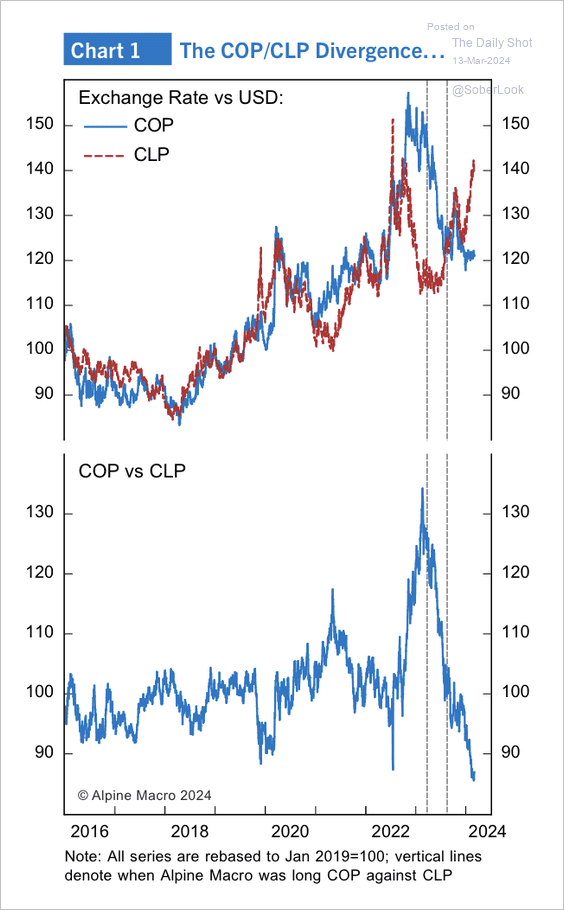

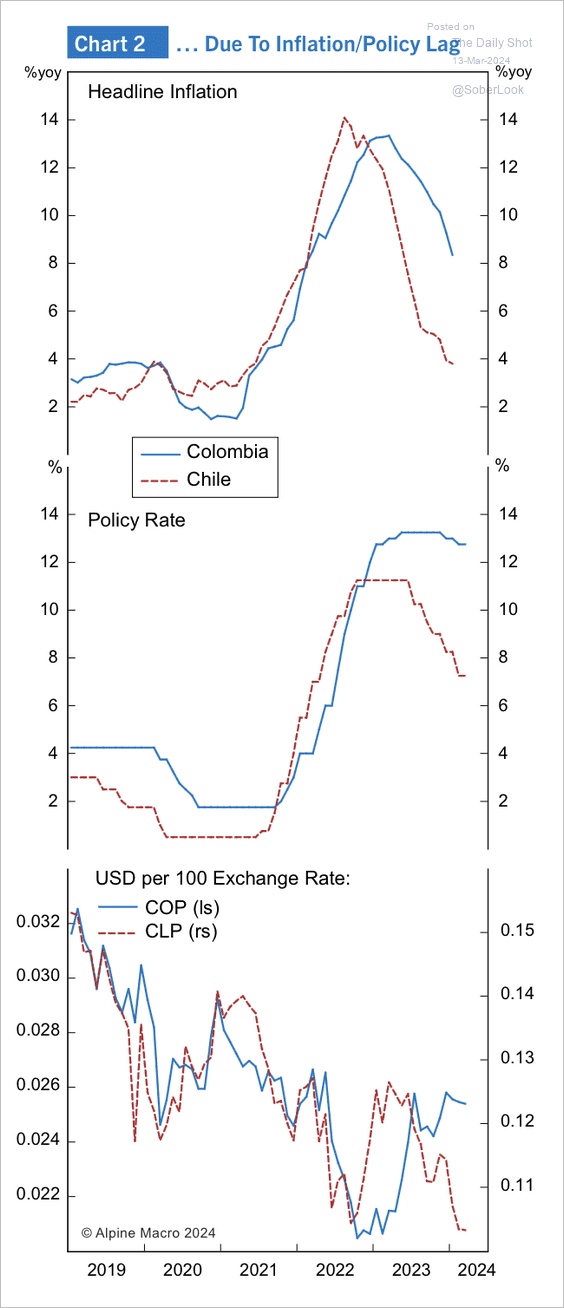

3. The Colombian peso and Chilean peso have diverged vs. the dollar alongside wider inflation and rate differentials. (2 charts)

Source: Alpine Macro

Source: Alpine Macro

Source: Alpine Macro

Source: Alpine Macro

——————–

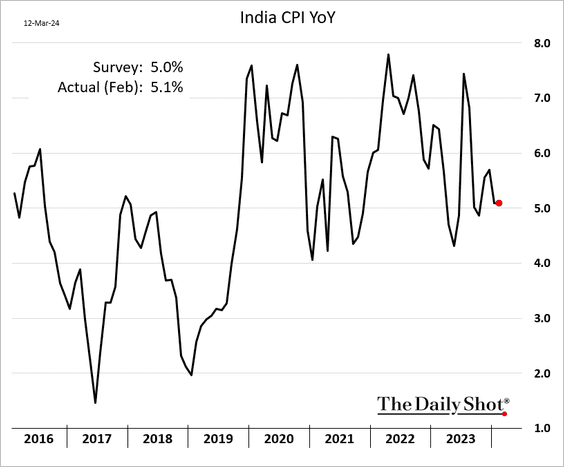

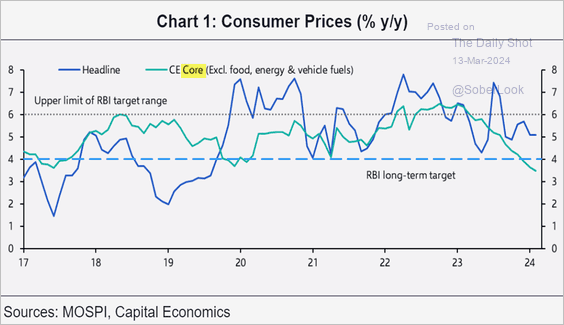

4. India’s CPI held steady in February, …

… but core inflation continues to ease.

Source: Capital Economics

Source: Capital Economics

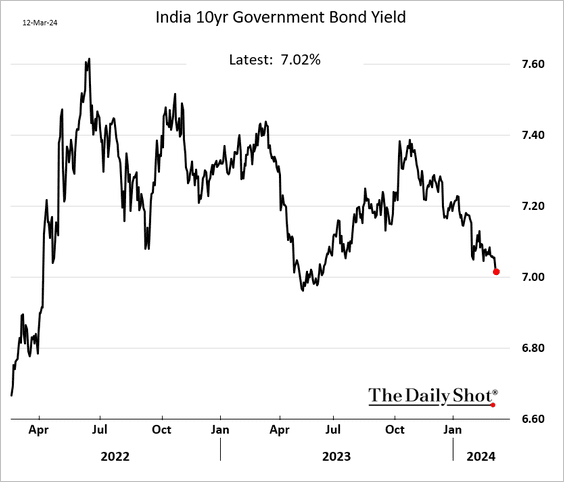

• India’s bond yields are moving lower.

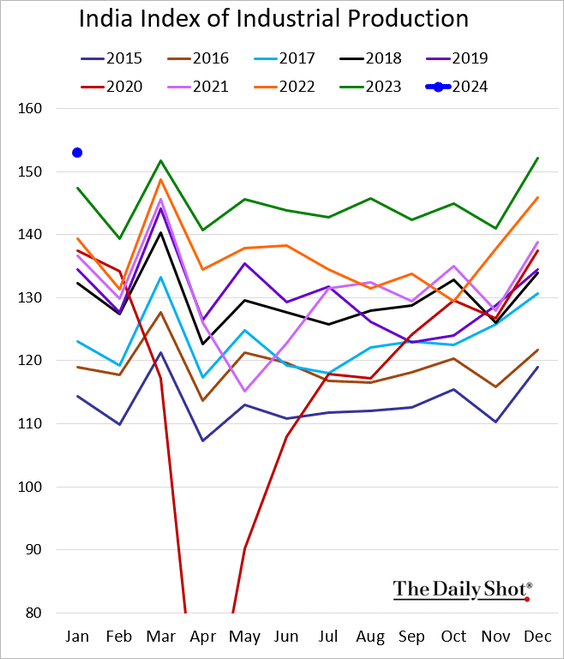

• India’s industrial production was above last year’s levels in January.

——————–

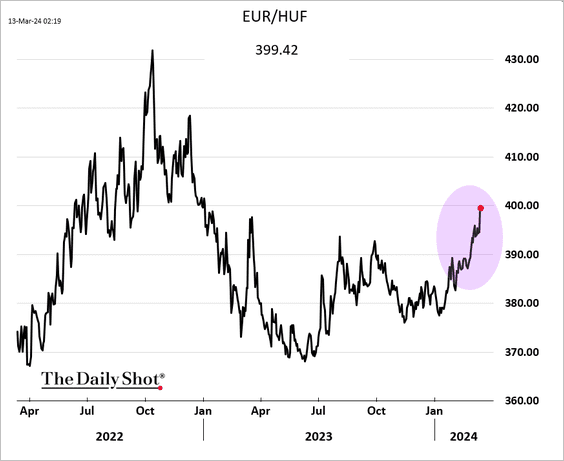

5. The Hungarian forint is under pressure amid threats to the central bank’s independence.

Source: @business Read full article

Source: @business Read full article

——————–

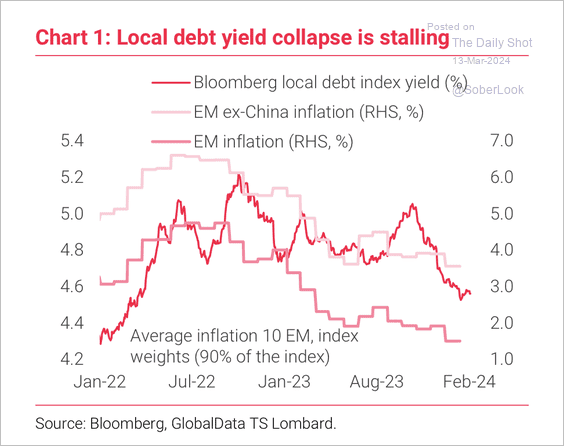

6. Despite the recent decline in EM average inflation (local debt index weighted), the collapse in yields has stalled. External conditions facing local debt markets have deteriorated because of the delay in Fed easing, according to TS Lombard.

Source: TS Lombard

Source: TS Lombard

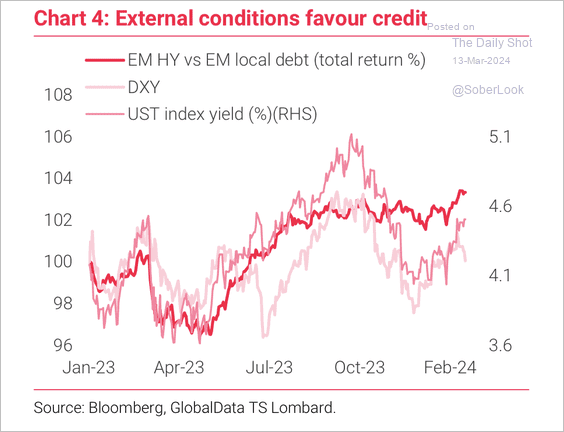

• The combination of higher Treasury yields and dollar appreciation has historically favored EM high-yield credit over local-currency government debt.

Source: TS Lombard

Source: TS Lombard

Back to Index

Cryptocurrency

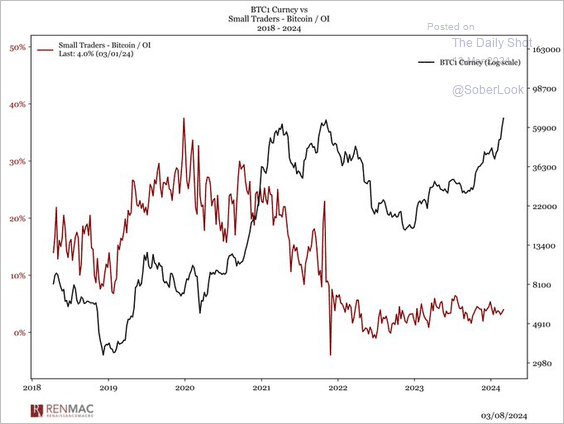

1. Retail traders are not driving the bitcoin rally.

Source: @RenMacLLC

Source: @RenMacLLC

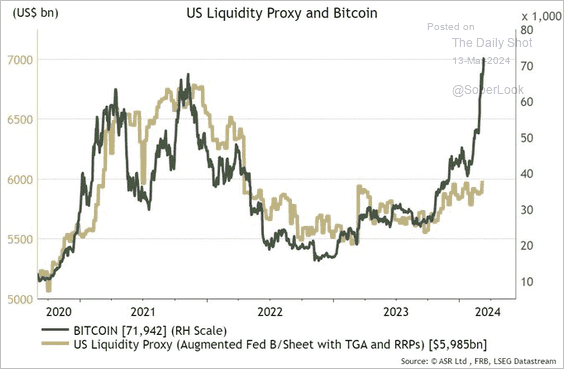

2. Bitcoin’s price has diverged from US liquidity.

Source: @IanRHarnett

Source: @IanRHarnett

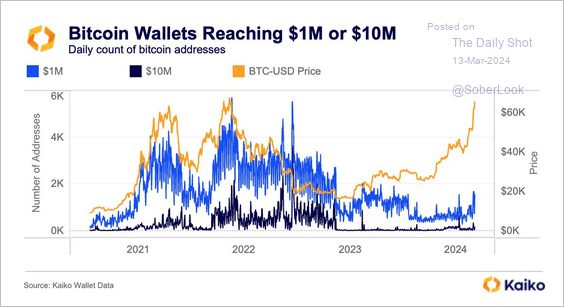

3. The number of millionaire bitcoin wallets is significantly low compared to prior bull markets.

Source: @KaikoData

Source: @KaikoData

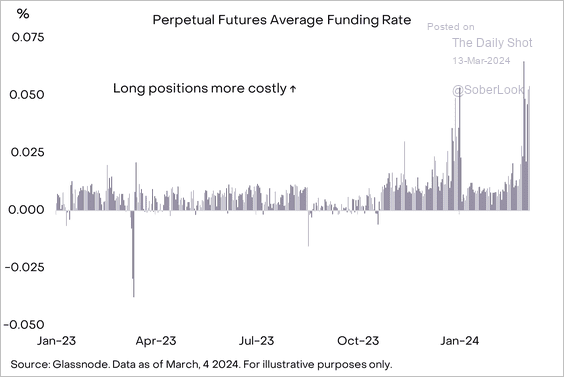

4. The average funding rate in bitcoin’s perpetual futures market spiked, which reflects growing speculative interest.

Source: Grayscale Read full article

Source: Grayscale Read full article

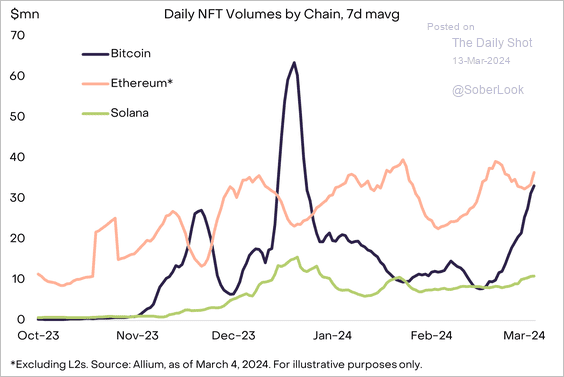

5. Bitcoin NFTs are becoming more popular.

Source: Grayscale Read full article

Source: Grayscale Read full article

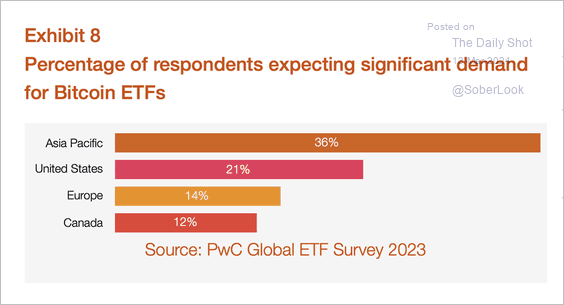

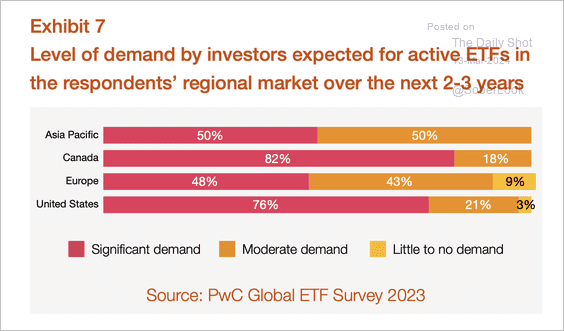

6. The Asia-Pacific region is expected to see greater demand for bitcoin ETFs over the next two to three years.

Source: PwC Read full article

Source: PwC Read full article

Back to Index

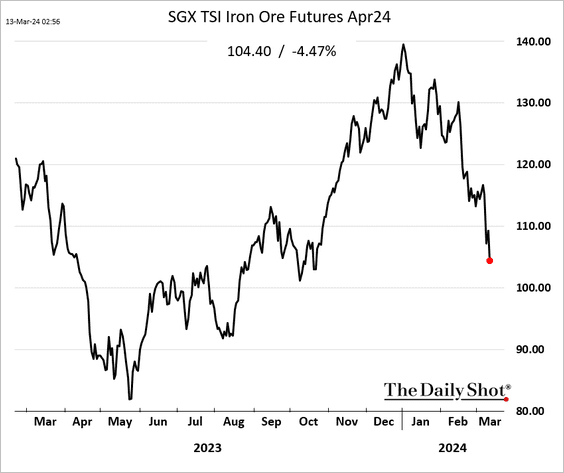

Commodities

1. Iron ore prices are under pressure.

Source: @markets Read full article

Source: @markets Read full article

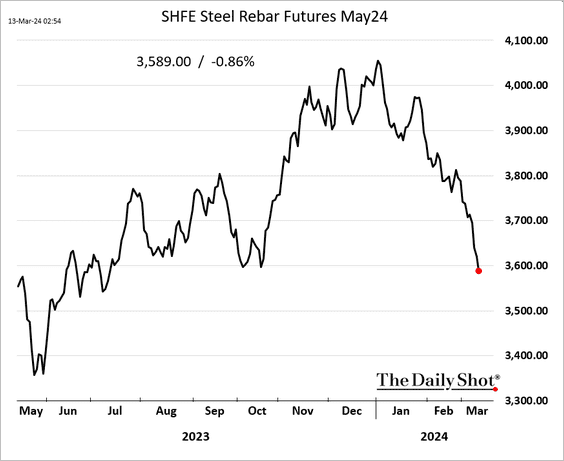

• China’s steel prices are falling as well.

——————–

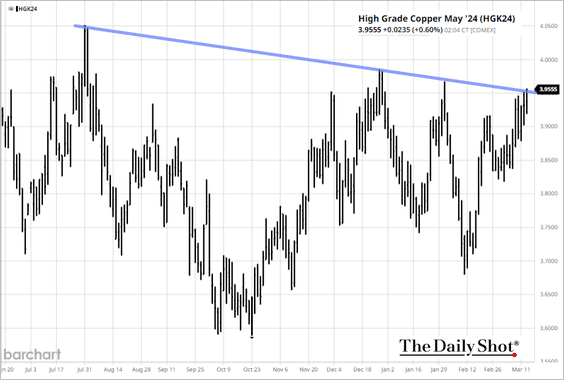

2. Copper is at resistance.

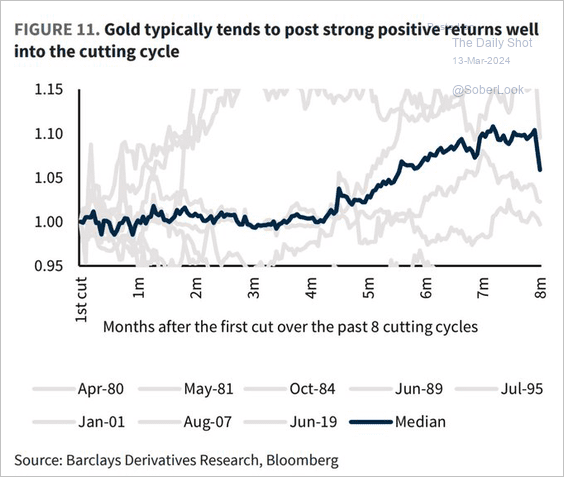

3. Gold performs well in a rate-cutting cycle.

Source: Barclays Research; @WallStJesus

Source: Barclays Research; @WallStJesus

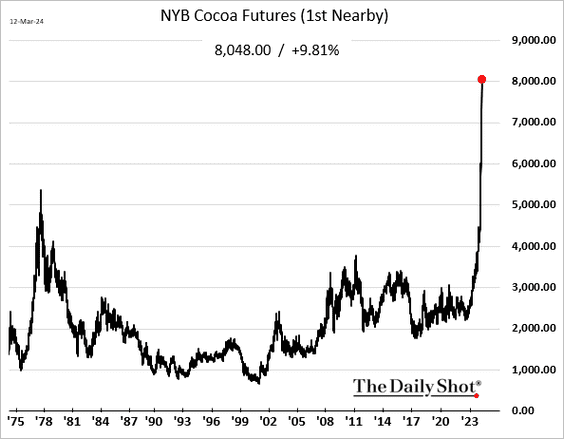

4. Cocoa futures blasted past $8000/ton.

Source: @markets Read full article

Source: @markets Read full article

——————–

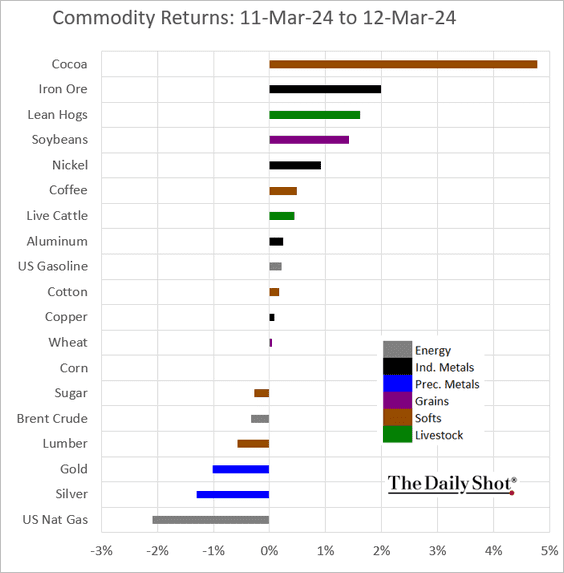

5. How did commodities perform on the day of the US (hot) CPI report?

Back to Index

Energy

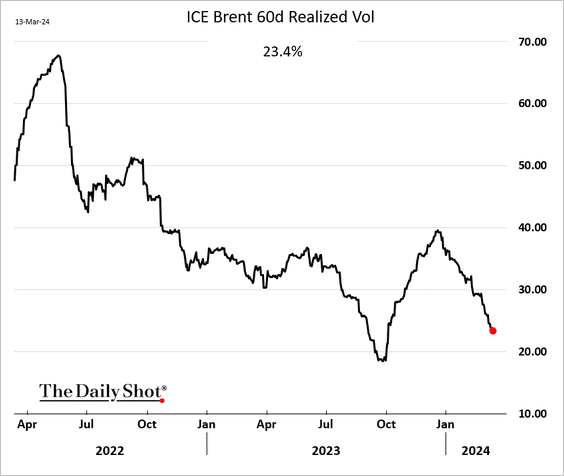

1. Crude oil volatility continues to ease.

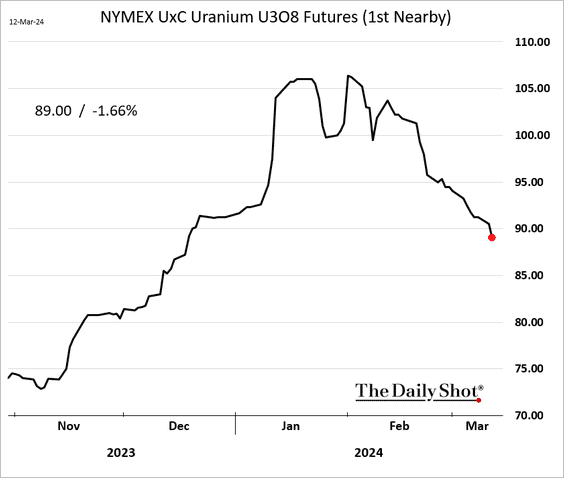

2. The uranium rally is reversing.

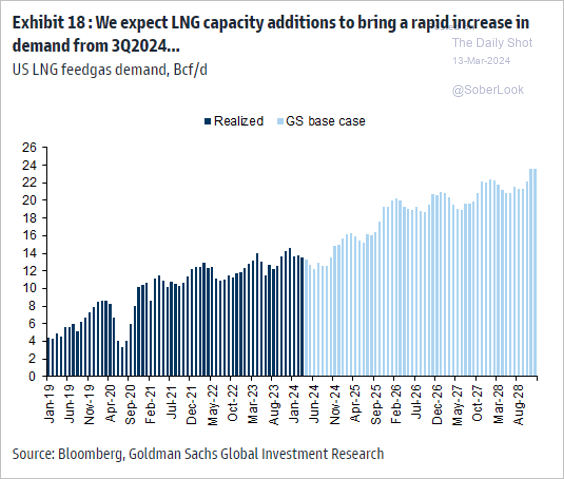

3. Here is Goldman’s forecast for US natural gas demand from LNG producers.

Source: Goldman Sachs; @MikeZaccardi

Source: Goldman Sachs; @MikeZaccardi

Back to Index

Equities

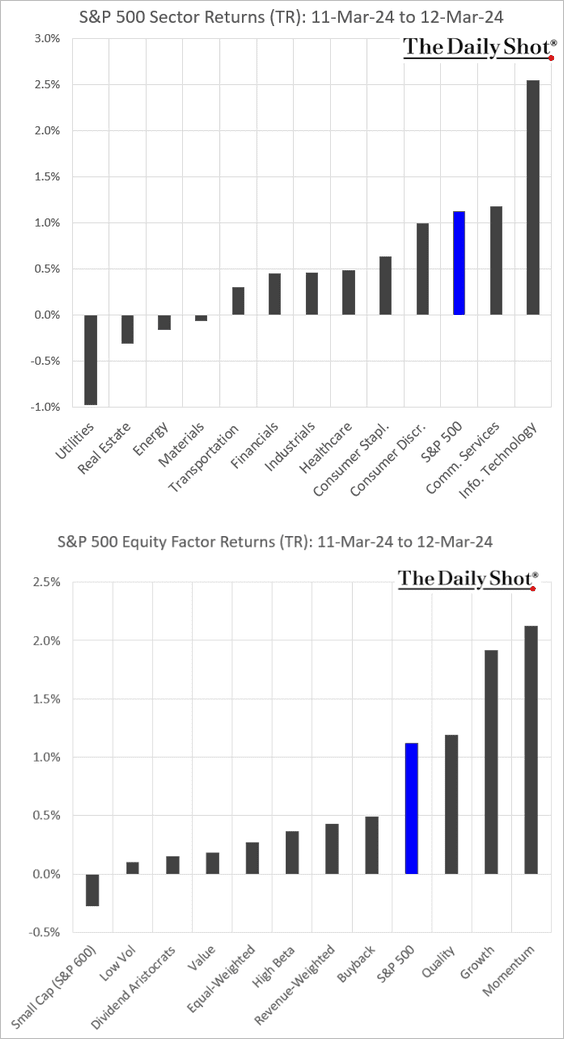

1. Which sectors and equity factors contributed to market gains on the day the core CPI exceeded expectations?

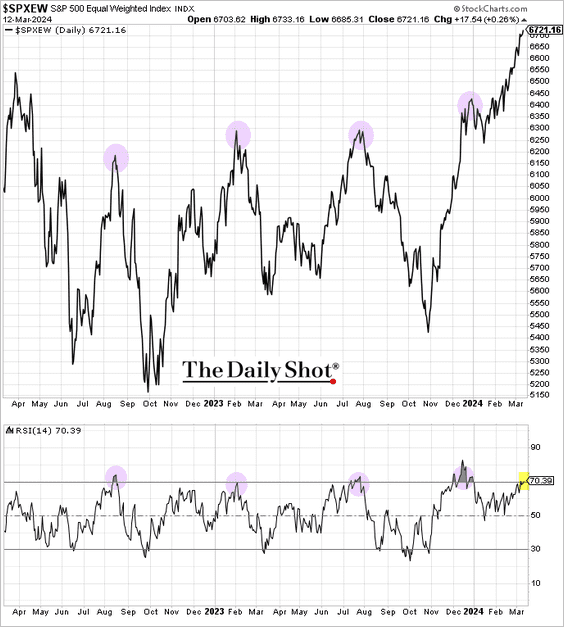

2. The S&P 500 equal weight index hit a record high and is now in overbought territory.

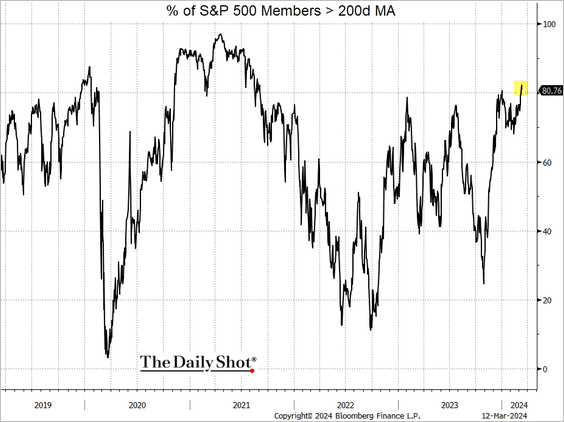

3. This chart shows the proportion of S&P 500 members trading above their 200-day moving average.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

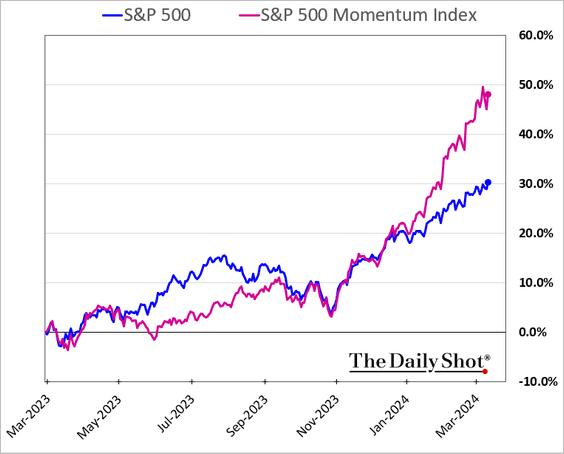

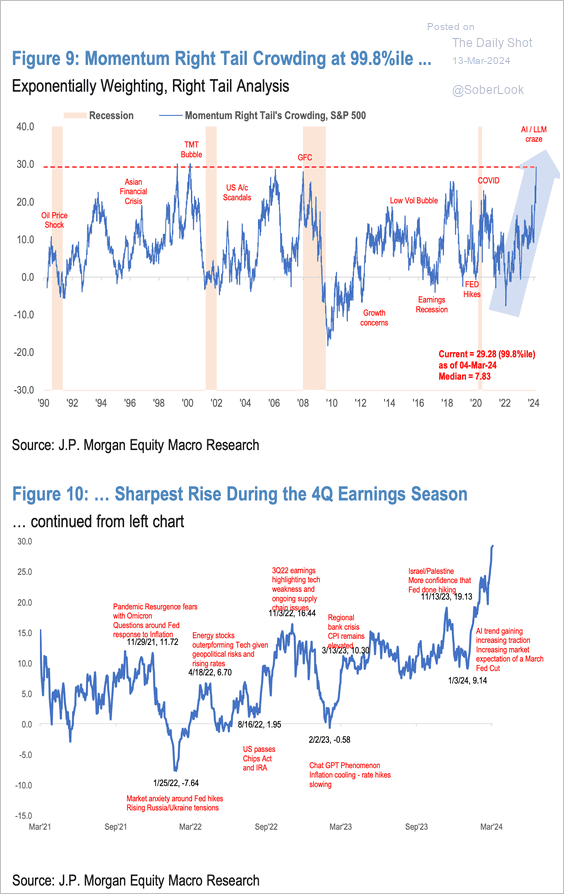

4. Momentum stocks have been outperforming, …

… but it has become a crowded trade.

Source: JP Morgan Research; @dailychartbook

Source: JP Morgan Research; @dailychartbook

——————–

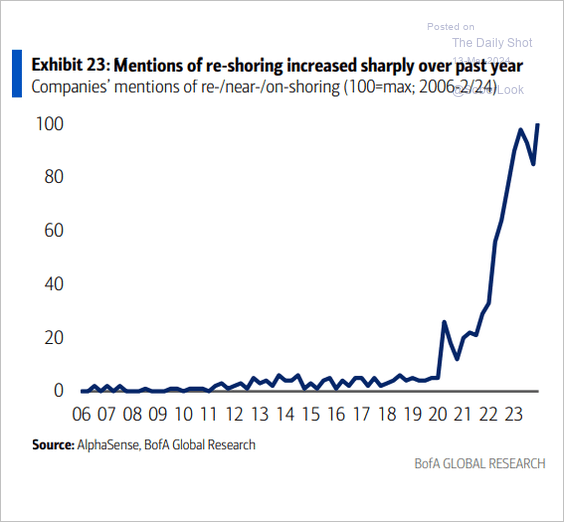

5. Many companies continue to focus on re-shoring, …

Source: BofA Global Research

Source: BofA Global Research

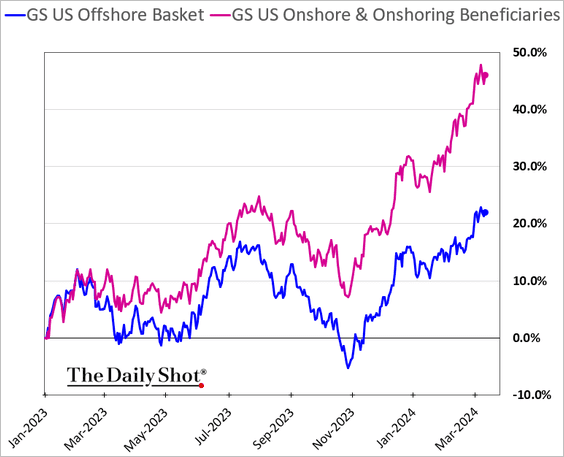

… and the market is rewarding them for doing so.

——————–

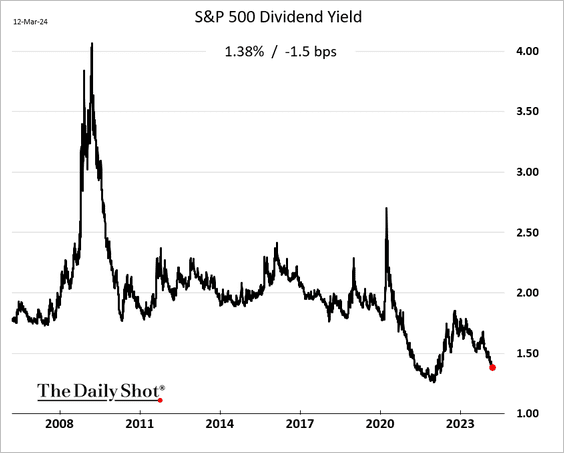

6. The S&P 500 dividend yield is nearing historic lows as corporations increasingly favor share buybacks over dividends to distribute cash to investors.

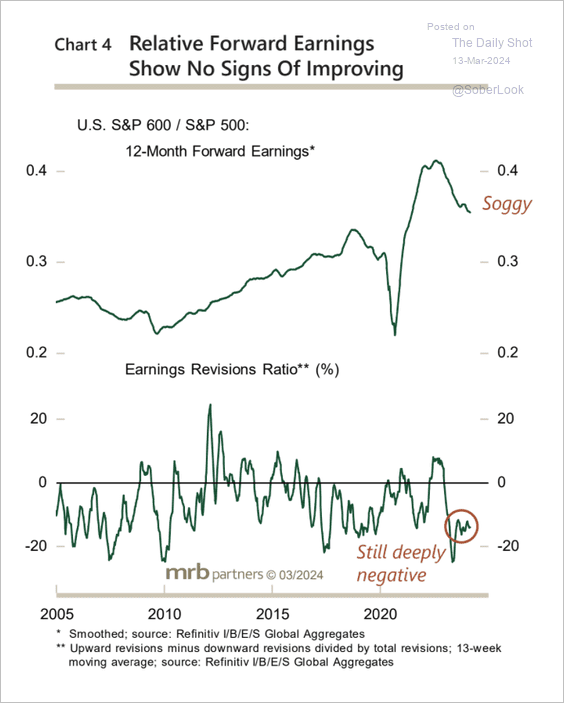

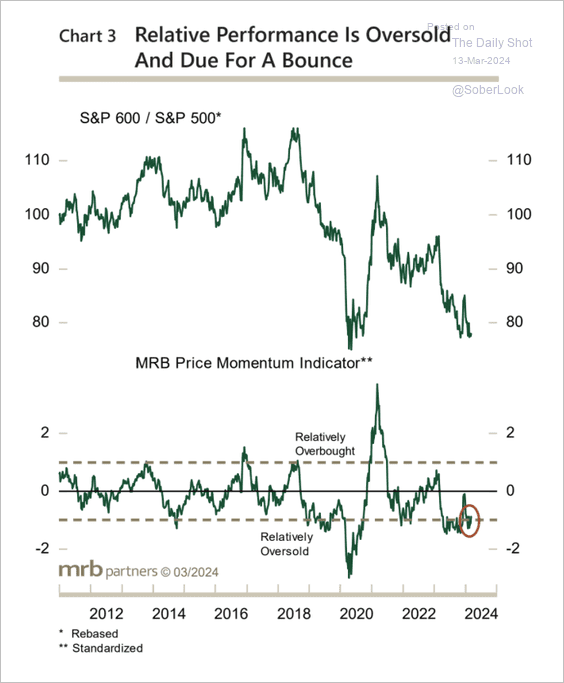

7. The earnings outlook for US small-caps remains weak relative to large-caps …

Source: MRB Partners

Source: MRB Partners

…although relative underperformance appears stretched.

Source: MRB Partners

Source: MRB Partners

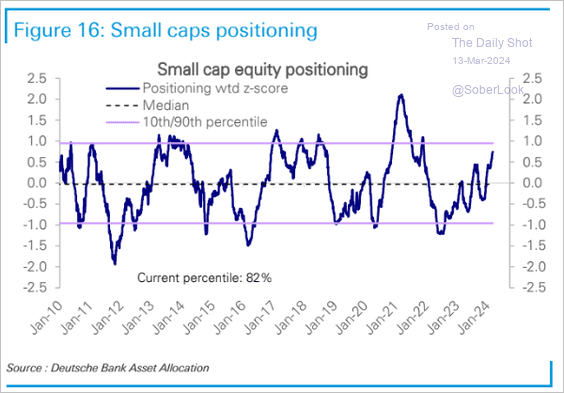

• Investor positioning in small caps has been rising.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

——————–

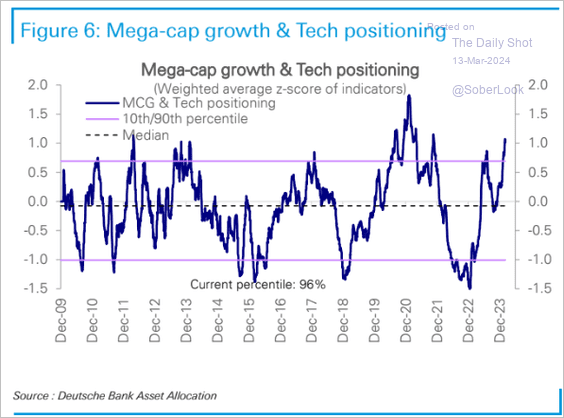

8. Tech positioning looks stretched.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

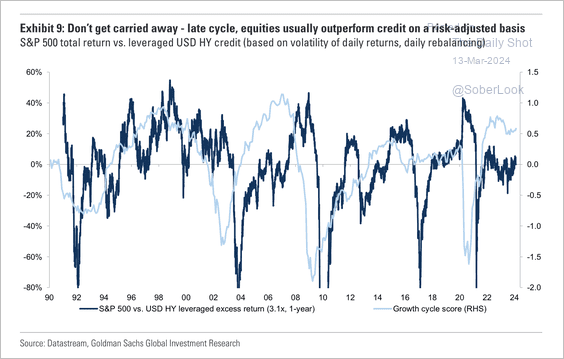

9. Equities tend to outperform credit when the economic cycle is elevated and peaking.

Source: Goldman Sachs

Source: Goldman Sachs

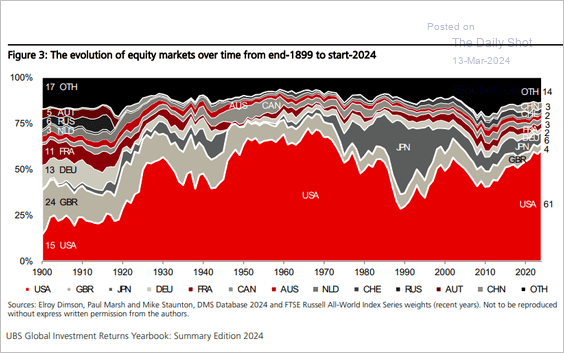

10. This chart depicts the historical progression of the global equity market share distribution from 1899 to 2024.

Source: UBS Asset Management

Source: UBS Asset Management

Back to Index

Alternatives

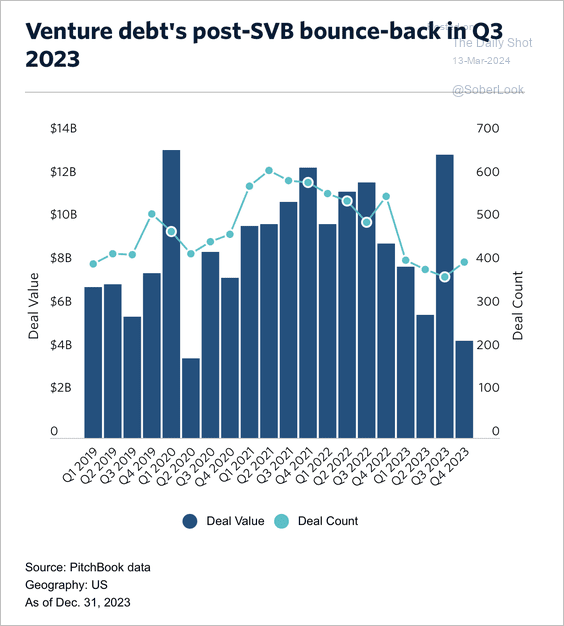

1. US venture-debt activity is picking up again as private companies return to banks, which typically offer less expensive loans than non-bank lenders like BDCs, according to PitchBook.

Source: PitchBook

Source: PitchBook

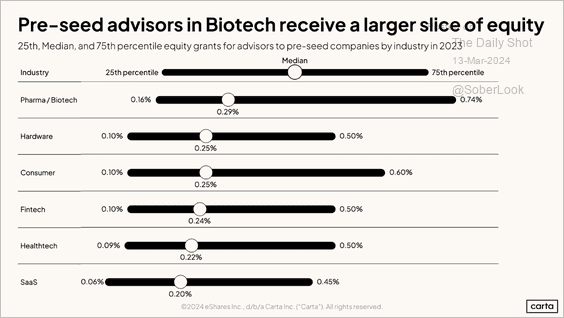

2. Advisors to early-stage biotech firms received higher grants than other industries last year.

Source: Carta

Source: Carta

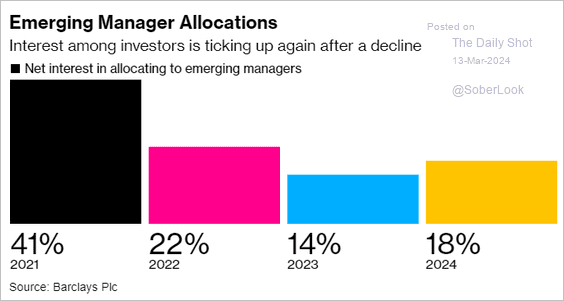

3. Investor interest in allocating to emerging hedge fund managers has increased this year.

Source: @markets Read full article

Source: @markets Read full article

Back to Index

Credit

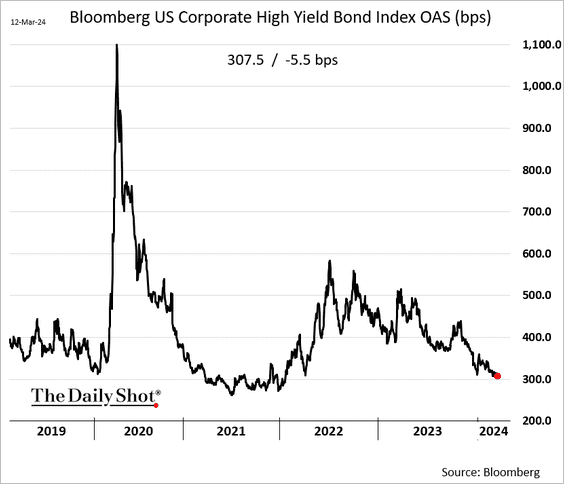

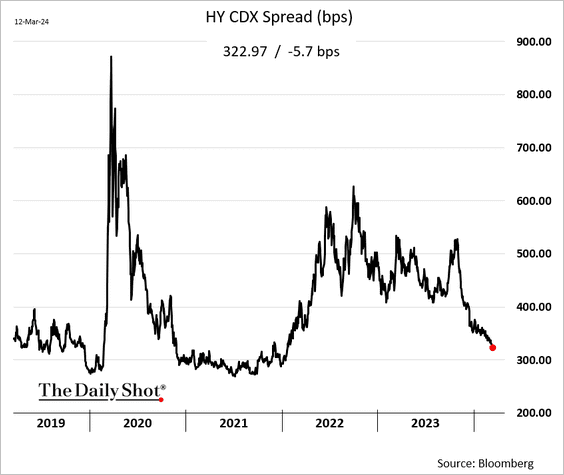

1. Corporate high-yield spreads continue to tighten.

• Bond spreads:

• Credit default swaps:

——————–

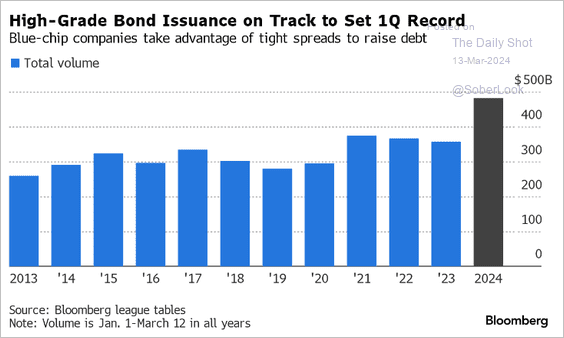

2. Investment-grade bond issuance already hit a record this quarter.

Source: @jtcrombie, @business

Source: @jtcrombie, @business

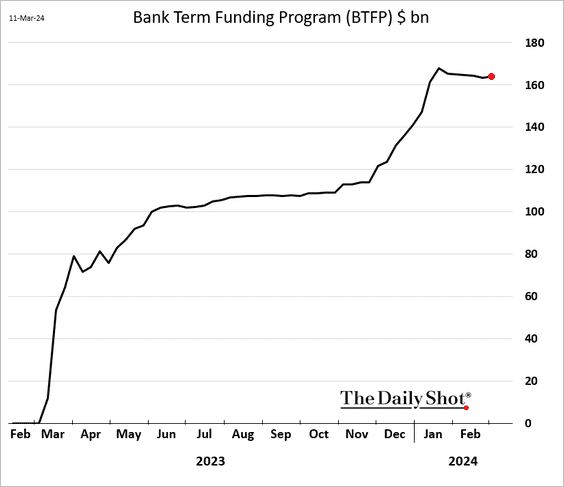

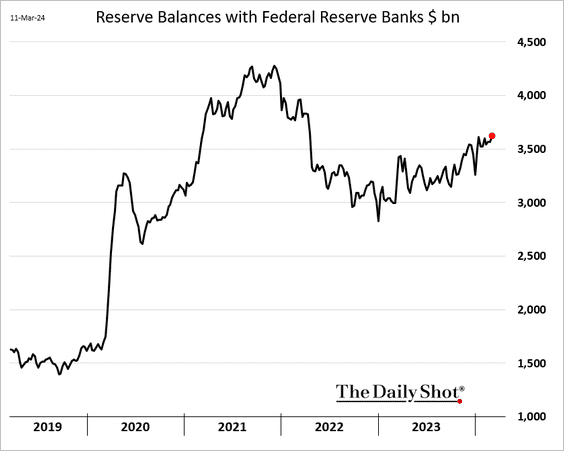

3. The Fed’s Term Funding Program, an emergency facility for banks, is nearing its expiration.

As banks repay their loans to the Federal Reserve, it is expected that reserve levels will decline.

Back to Index

Global Developments

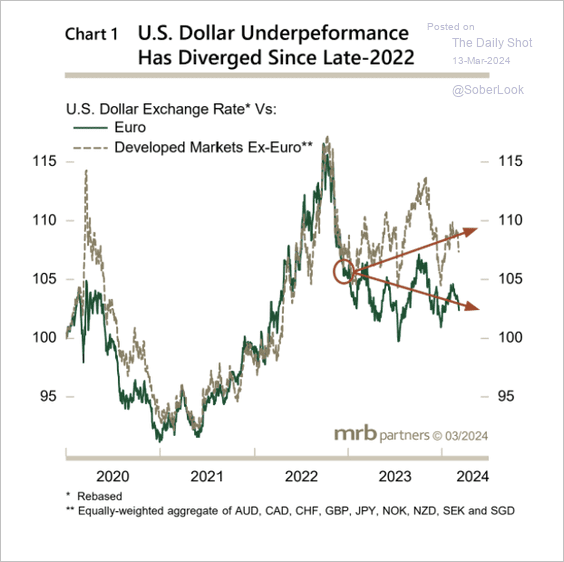

1. The dollar’s movement versus the euro diverged from its performance against other developed market currencies.

Source: MRB Partners

Source: MRB Partners

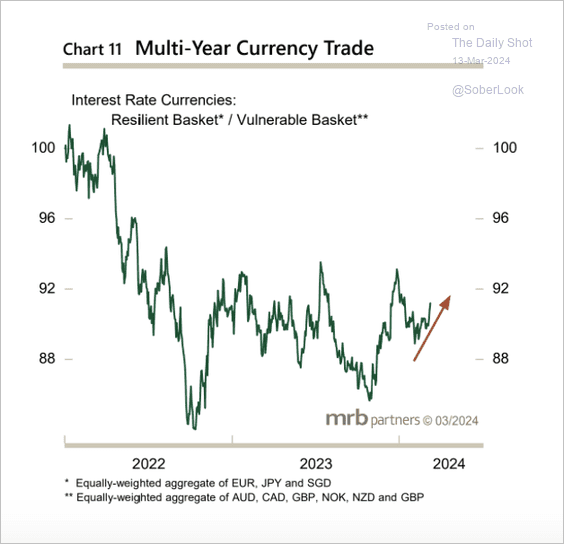

• A higher-for-longer interest rate environment could benefit “resilient” currencies relative to “vulnerable” (rate sensitive) currencies, according to MRB Partners.

Source: MRB Partners

Source: MRB Partners

——————–

2. The US and Canada are expected to see higher demand for active ETFs.

Source: PwC Read full article

Source: PwC Read full article

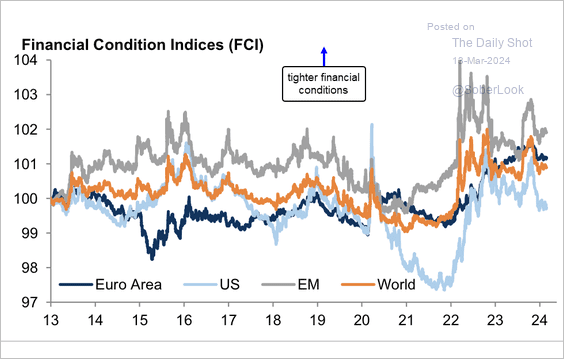

3. The US has led the recent easing in financial conditions relative to the rest of the world.

Source: Goldman Sachs

Source: Goldman Sachs

Back to Index

Food for Thought

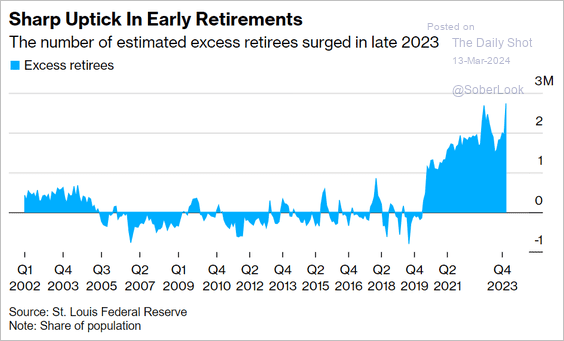

1. High levels of early retirements in the US:

Source: @economics Read full article

Source: @economics Read full article

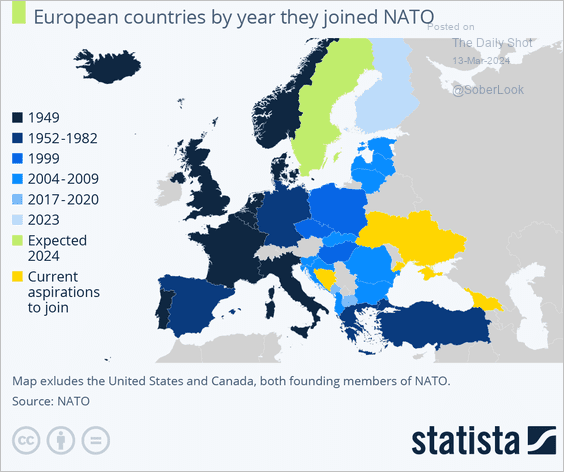

2. The timeline of European countries joining NATO:

Source: Statista

Source: Statista

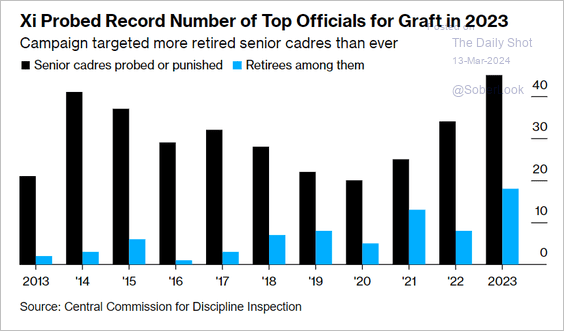

3. Xi’s scrutiny of top Chinese officials in anti-corruption drive:

Source: @business Read full article

Source: @business Read full article

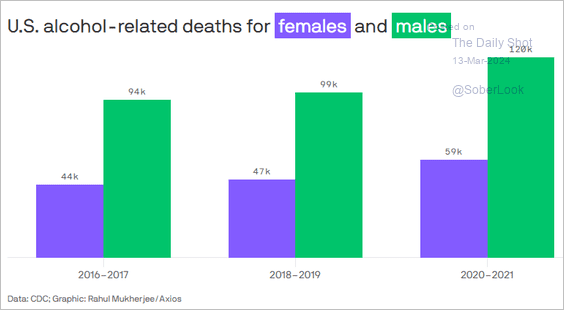

4. Alcohol-related deaths:

Source: @axios Read full article

Source: @axios Read full article

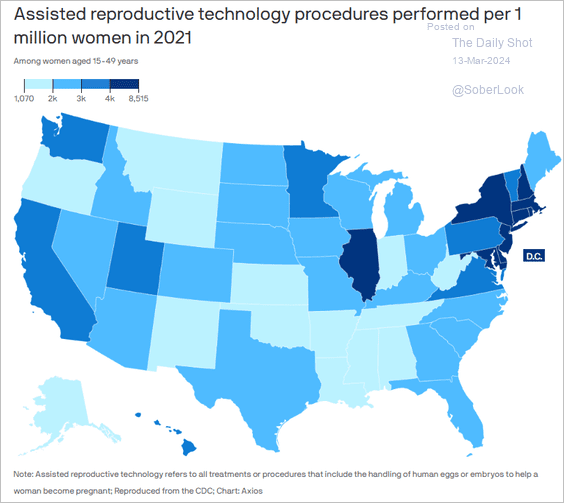

5. IVF procedures:

Source: @axios Read full article

Source: @axios Read full article

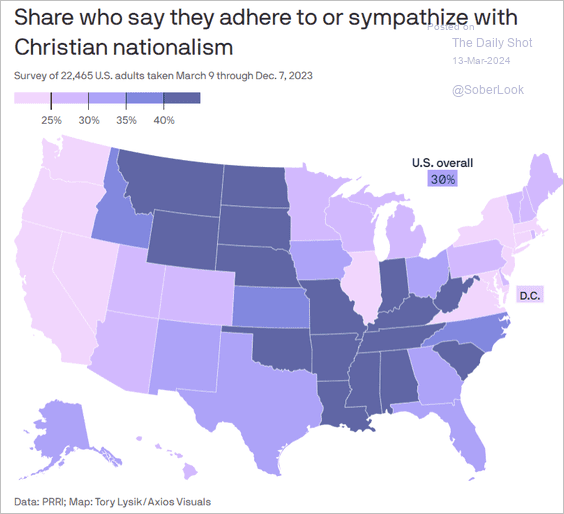

6. Christian nationalism:

Source: @axios Read full article

Source: @axios Read full article

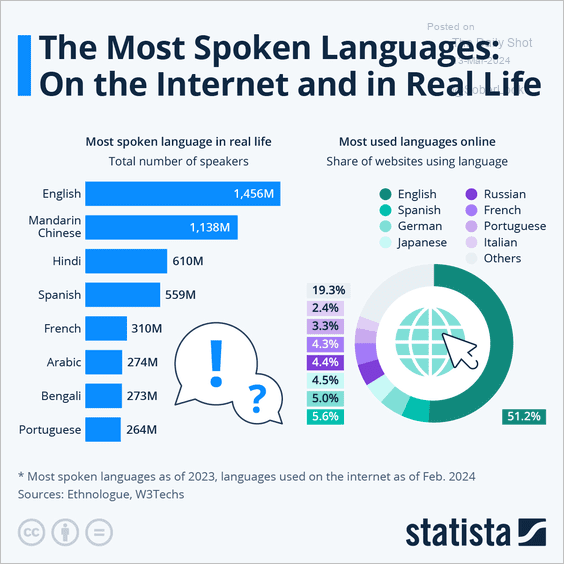

7. Most widely spoken languages vs. the most frequently used languages online:

Source: Statista

Source: Statista

——————–

Back to Index