The Daily Shot: 12-Mar-24

• The United States

• The United Kingdom

• Europe

• Japan

• China

• Cryptocurrency

• Commodities

• Energy

• Equities

• Credit

• Rates

• Food for Thought

The United States

1. Let’s begin with some updates on inflation.

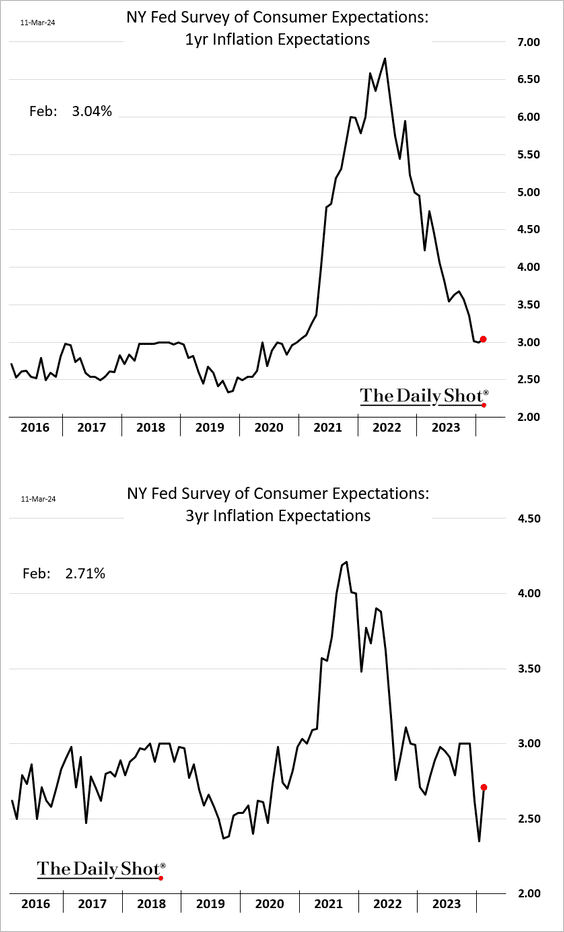

• The NY Fed’s consumer survey showed inflation expectations moving up last month, …

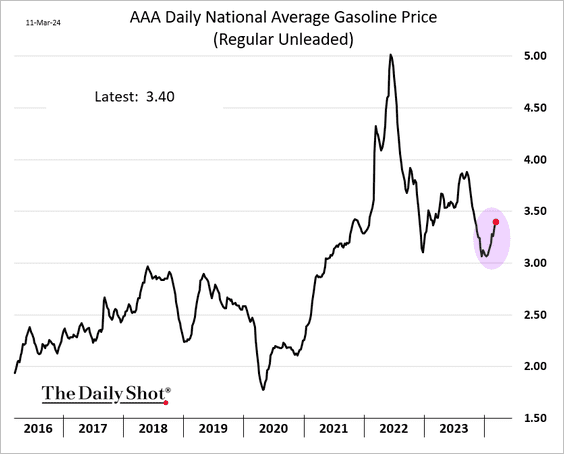

… as gasoline prices climbed.

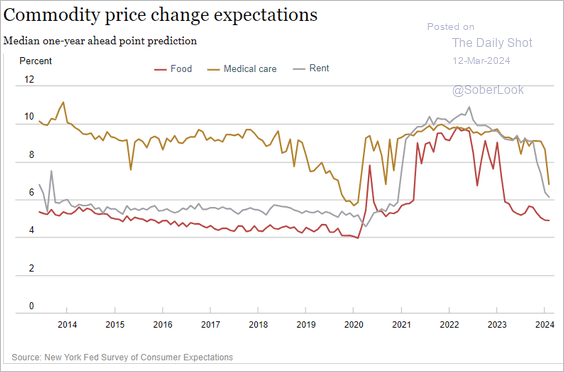

– Households expect slower inflation in food, medical care, and rent.

Source: Federal Reserve Bank of New York

Source: Federal Reserve Bank of New York

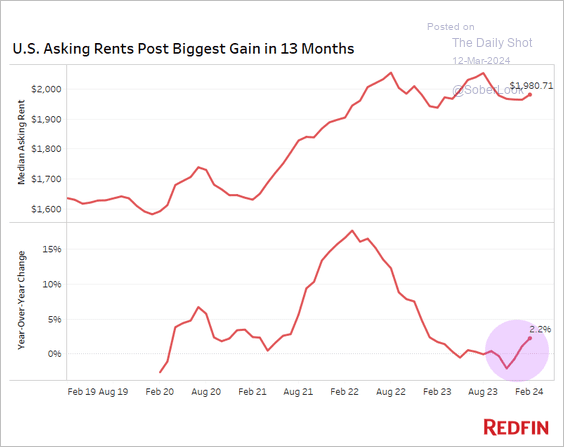

• But rent inflation is picking up again.

Source: Redfin

Source: Redfin

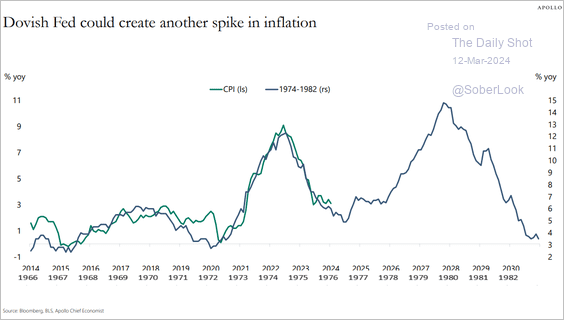

• While most economists don’t expect such an outcome, concerns about reacceleration persist.

Source: Torsten Slok, Apollo

Source: Torsten Slok, Apollo

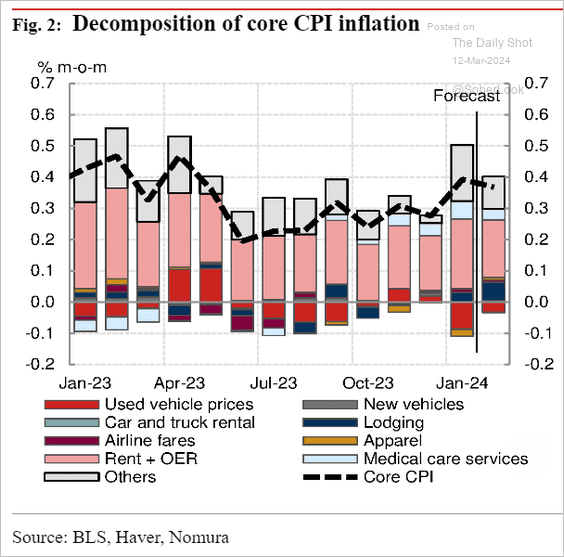

• What should we expect from today’s inflation report?

– Nomura sees the core CPI gains slowing slightly (consensus estimate is 0.3%).

Source: Nomura Securities

Source: Nomura Securities

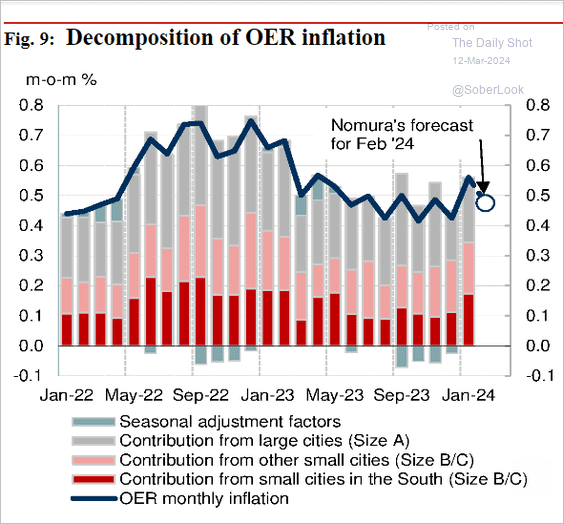

– The January surge in owners’ equivalent rent (OER) inflation probably moderated in February but remained above the December lows.

Source: Nomura Securities

Source: Nomura Securities

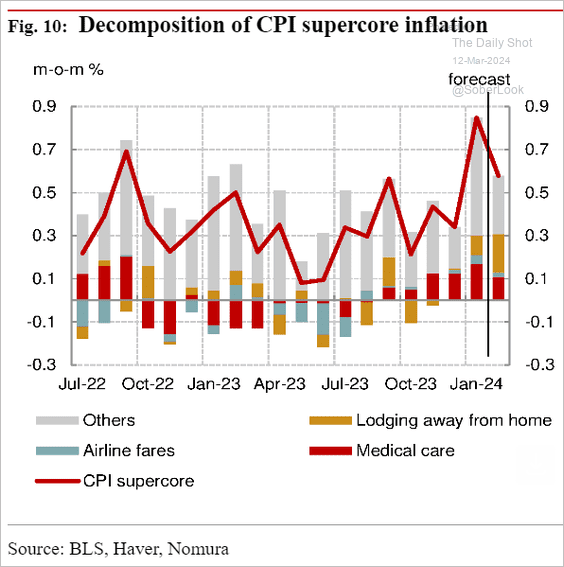

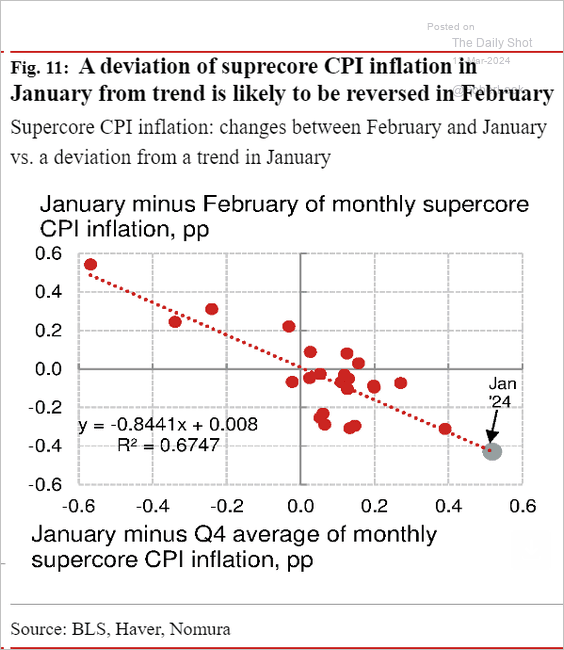

– Supercore inflation likely eased.

Source: Nomura Securities

Source: Nomura Securities

Supercore inflation tends to mean revert in February, but Nomura doesn’t see it reverting fully.

Source: Nomura Securities

Source: Nomura Securities

——————–

2. Next, we have some updates on the labor market.

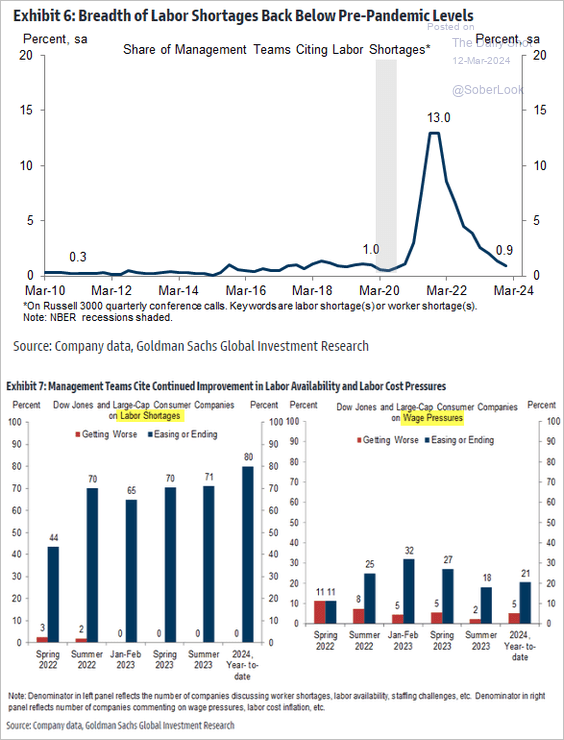

• Companies report that labor shortages are easing.

Source: Goldman Sachs; @MikeZaccardi

Source: Goldman Sachs; @MikeZaccardi

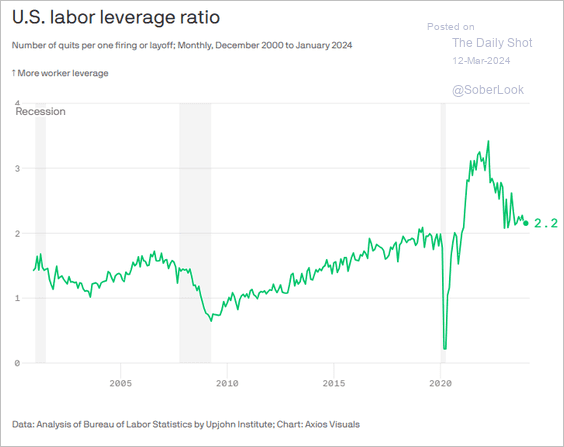

• The labor leverage ratio (quits over layoffs) remains elevated.

Source: @axios Read full article

Source: @axios Read full article

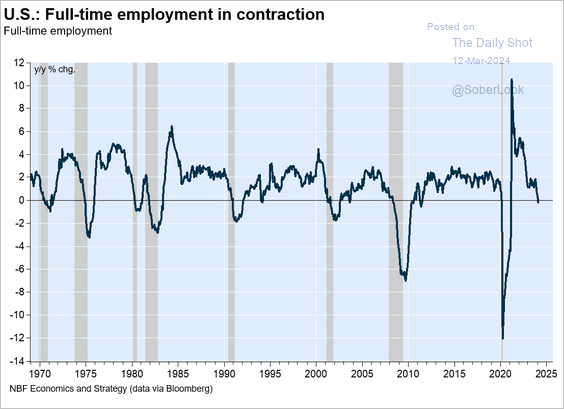

• Full-time employment is now down on a year-over-year basis.

Source: Economics and Strategy Group, National Bank of Canada

Source: Economics and Strategy Group, National Bank of Canada

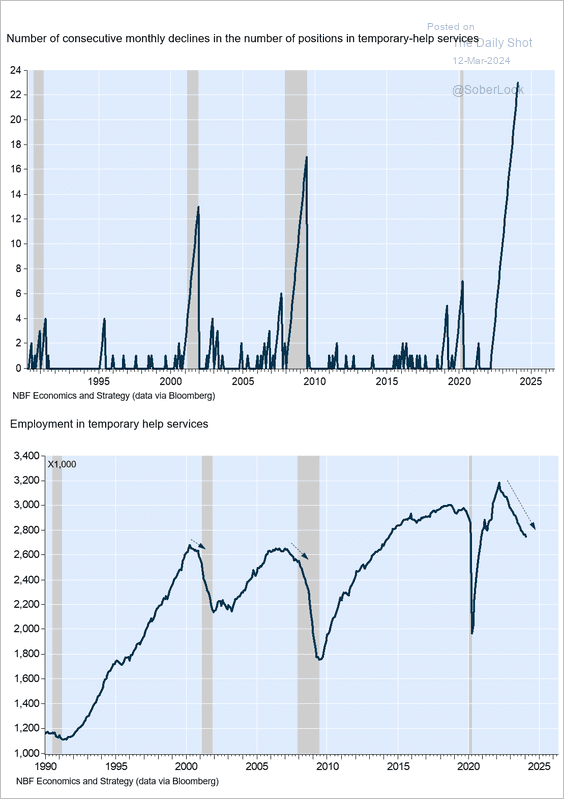

• Employment in temporary help services has decreased monthly for the last 23 months.

Source: Economics and Strategy Group, National Bank of Canada

Source: Economics and Strategy Group, National Bank of Canada

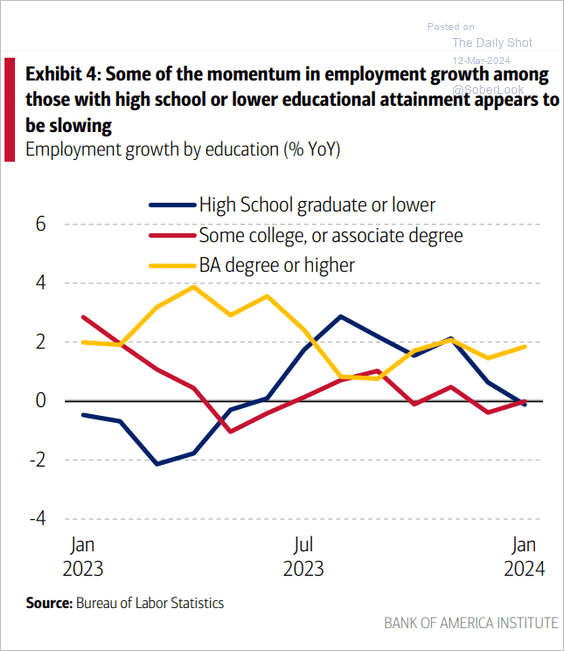

• Here is a look at employment growth by education.

Source: Bank of America Institute

Source: Bank of America Institute

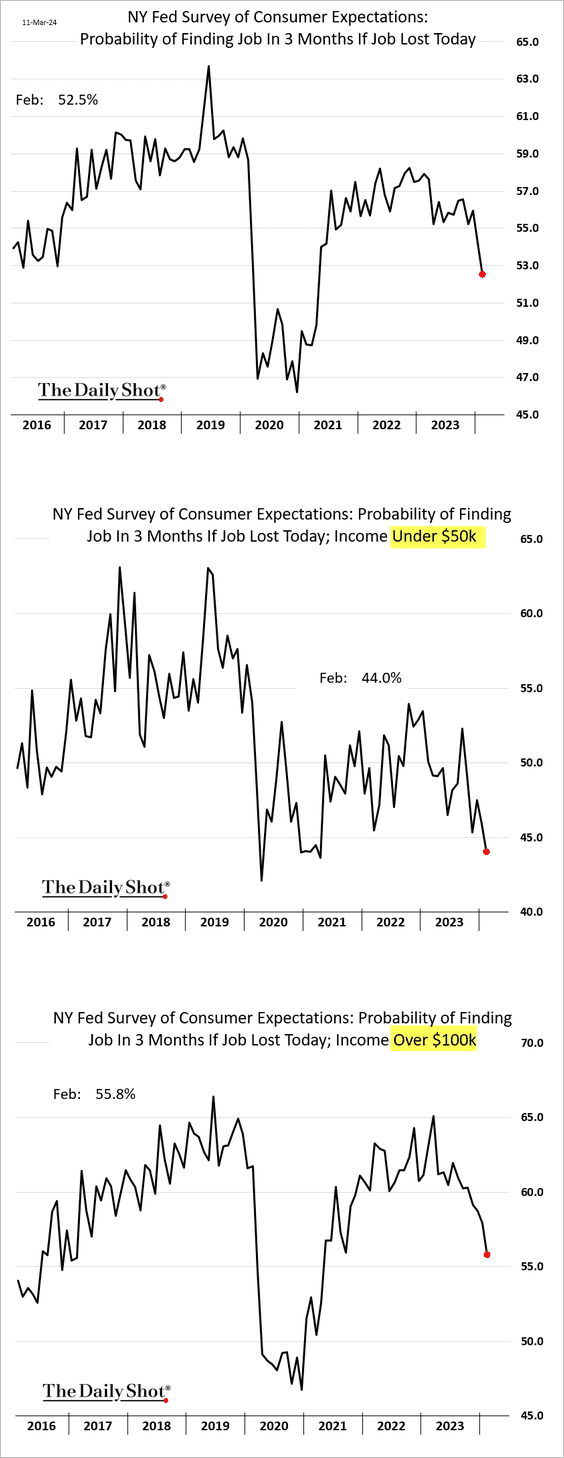

• Consumers across income categories are growing more concerned about their ability to secure new employment should they lose their current job.

——————–

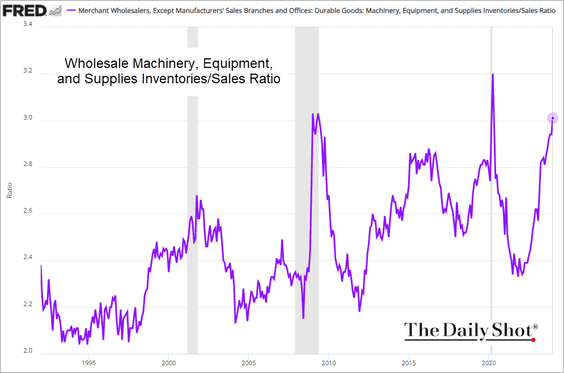

3. The wholesale capital equipment inventories-to-sales ratio keeps rising, suggesting soft demand.

Back to Index

The United Kingdom

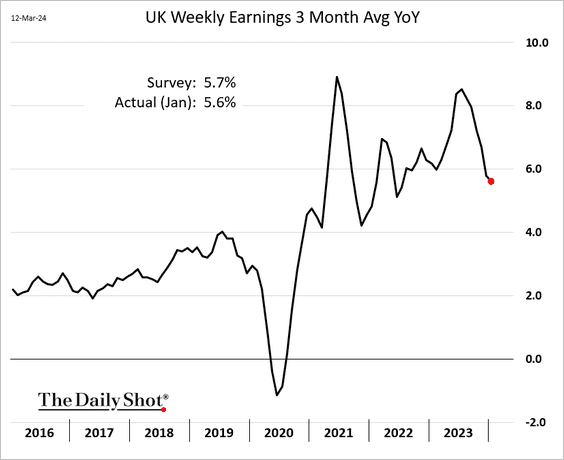

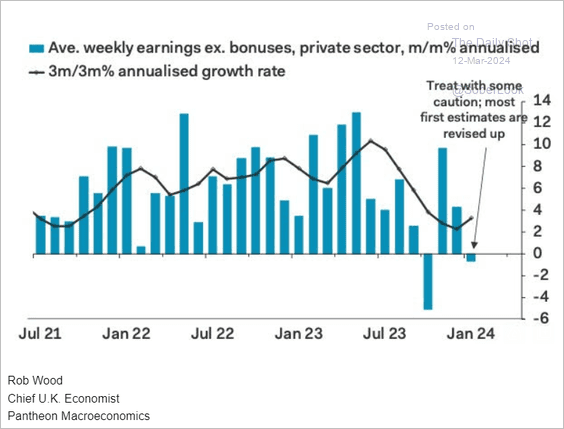

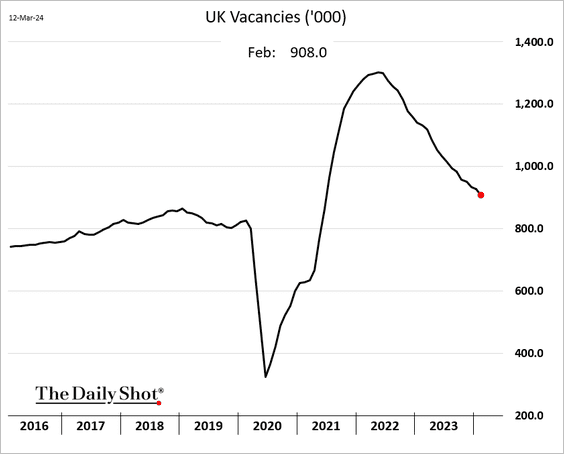

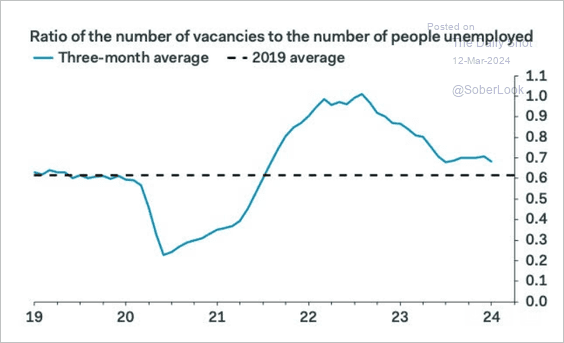

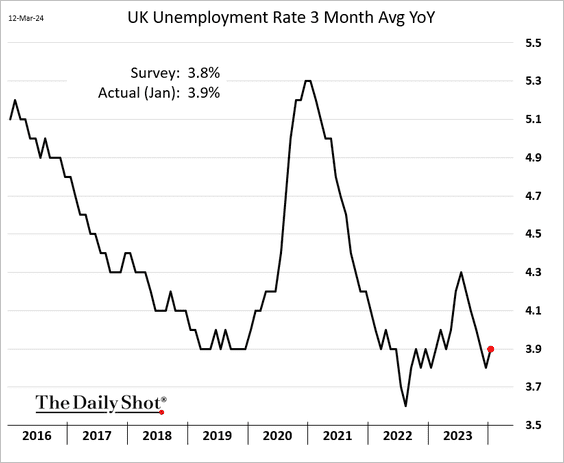

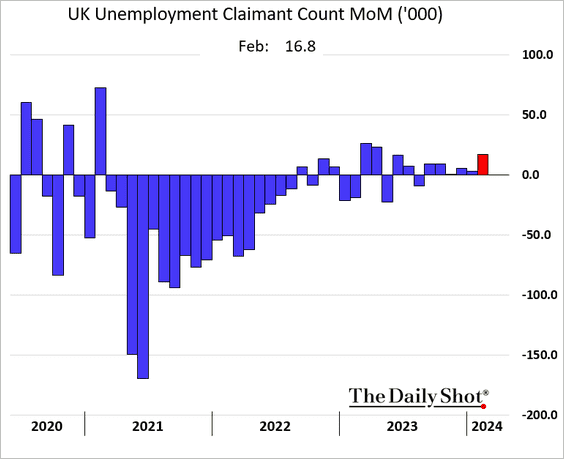

1. Evidence of a softening UK labor market continues to emerge.

• Wage growth is slowing.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

• Job vacancies continue to fall.

Source: Econostrum.info Read full article

Source: Econostrum.info Read full article

– This chart shows the ratio of job openings to the number of unemployed.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

• The unemployment rate edged higher.

• Claimant count increased last month.

——————–

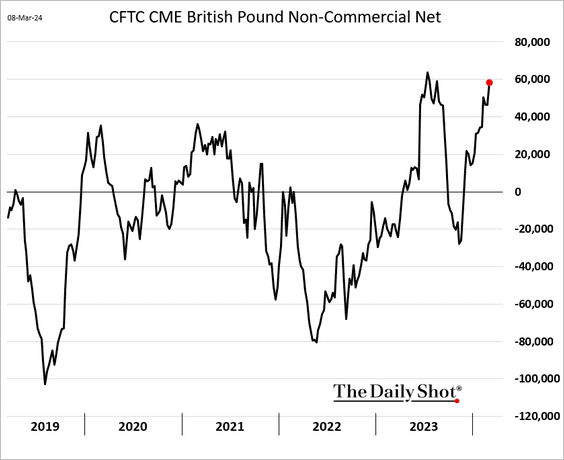

2. Traders are boosting their bets on the pound.

Back to Index

Europe

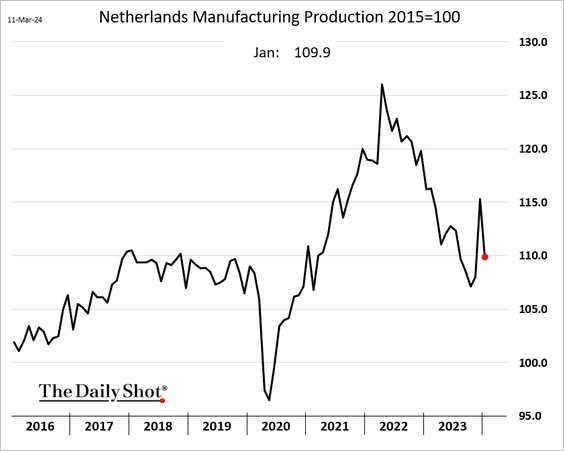

1. Dutch manufacturing production reversed much of the December surge, which was driven by one-off items.

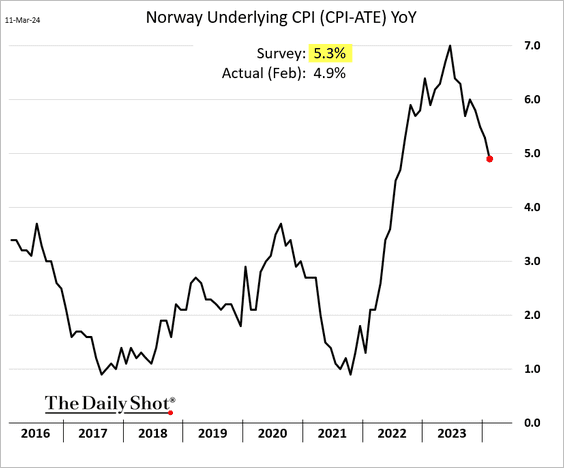

2. Norway’s underlying CPI surprised to the downside.

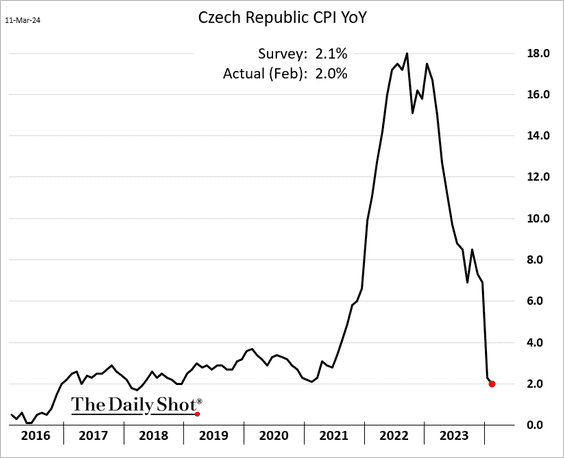

3. Czech inflation is back at 2%.

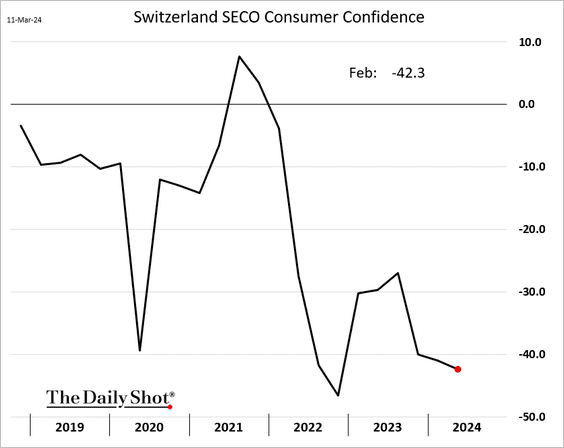

4. Swiss consumer confidence remains depressed.

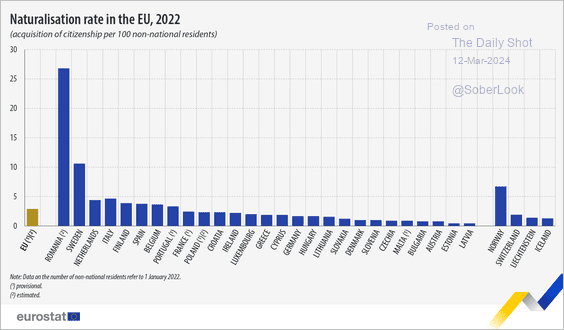

5. In 2022, the EU granted citizenship to nearly one million individuals.

Source: Eurostat Read full article

Source: Eurostat Read full article

Back to Index

Japan

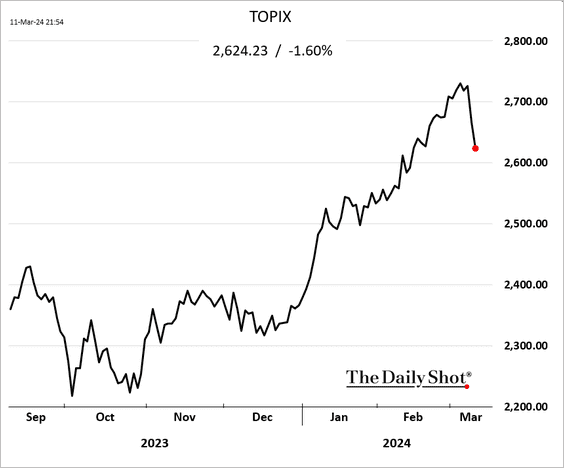

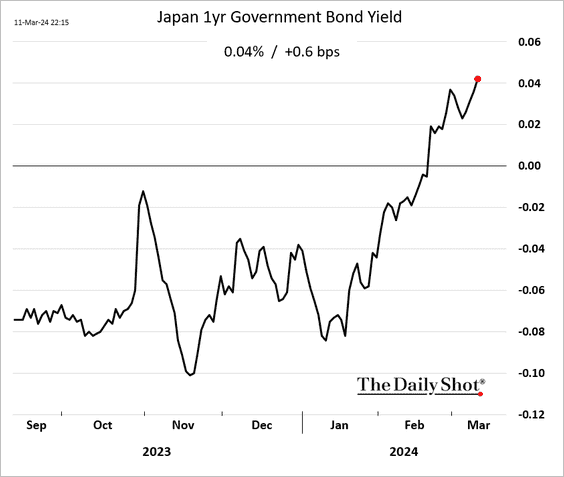

1. The stock rally has been fading …

… amid growing expectations for the BoJ tightening policy this spring.

——————–

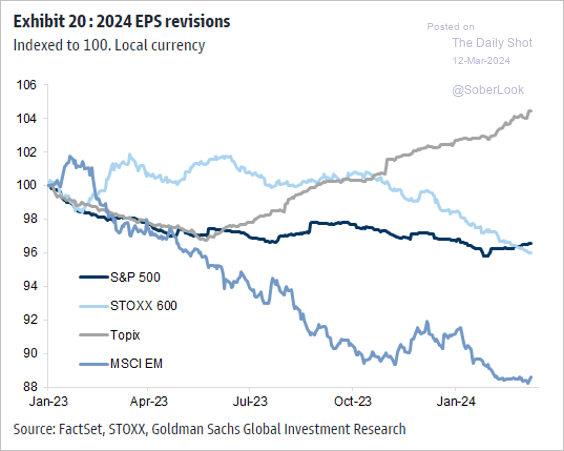

2. Earnings revisions in Japan remain predominantly positive.

Source: Goldman Sachs; @MikeZaccardi

Source: Goldman Sachs; @MikeZaccardi

Back to Index

China

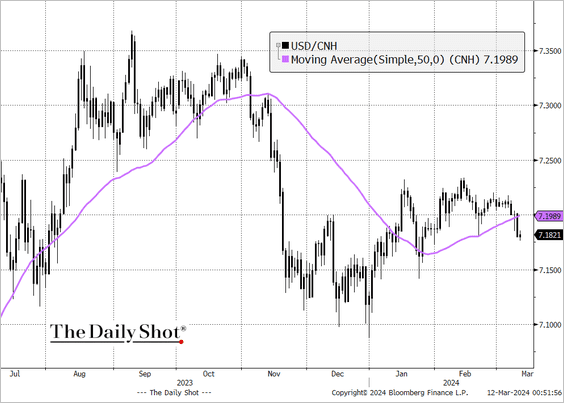

1. The renminbi has been strengthening, with USD/CNH (offshore yuan) dropping below its 50-day moving average.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

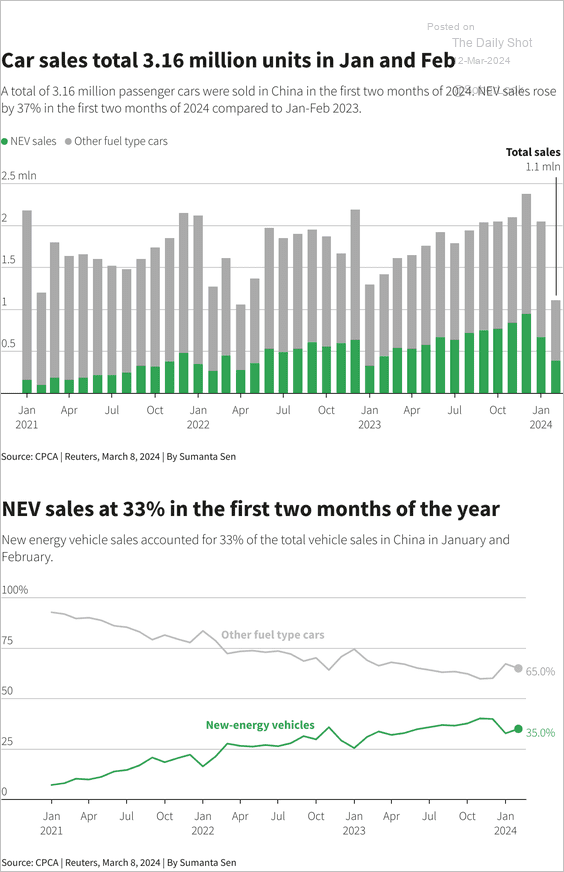

2. Here is a look at China’s EV sales.

Source: Reuters Read full article

Source: Reuters Read full article

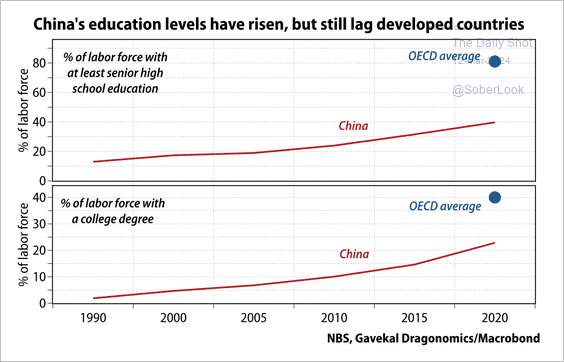

3. Higher education levels still lag developed countries, but recent investments by the Chinese government could narrow the gap.

Source: Gavekal Research

Source: Gavekal Research

Back to Index

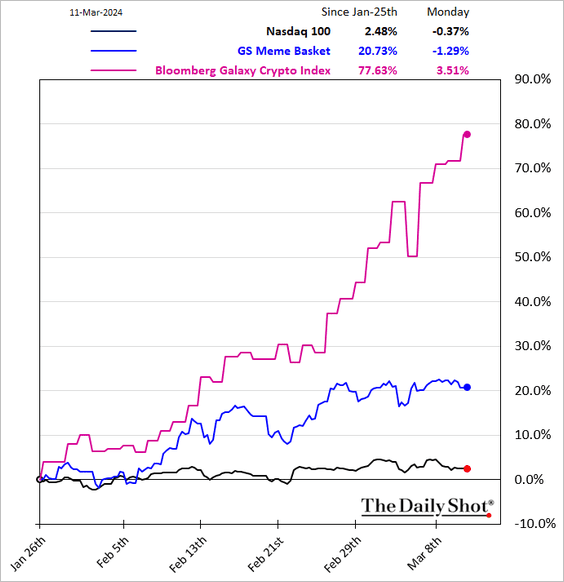

Cryptocurrency

1. Bitcoin blasted past $70k, hitting a record high, …

… while ether breached $4k.

——————–

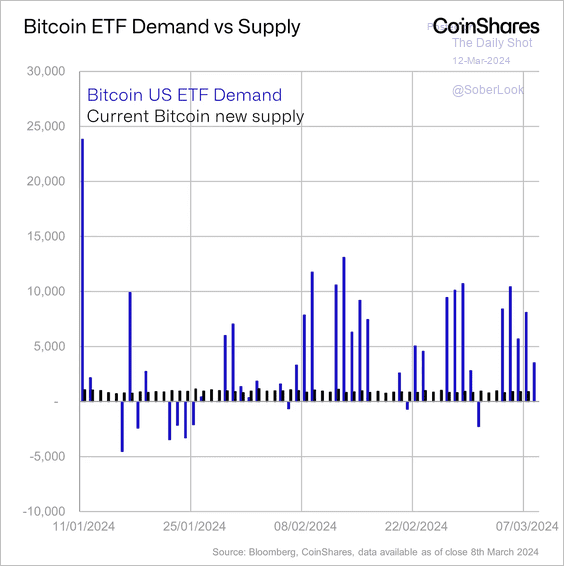

2. On average, daily bitcoin US ETF demand has outstripped new supply.

Source: CoinShares Read full article

Source: CoinShares Read full article

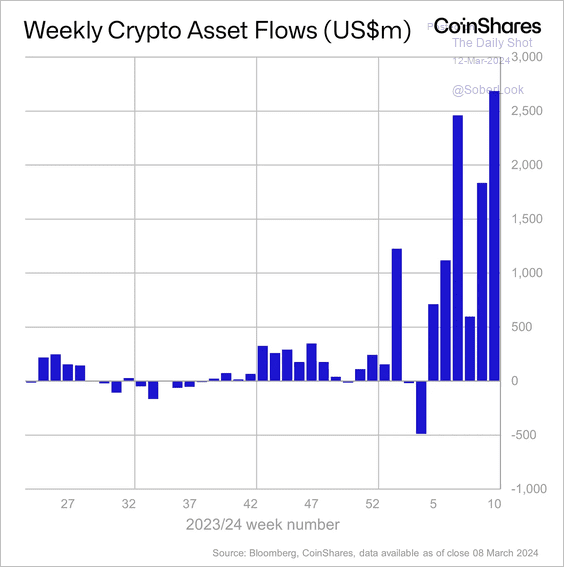

3. Crypto funds saw record inflows last week.

Source: CoinShares Read full article

Source: CoinShares Read full article

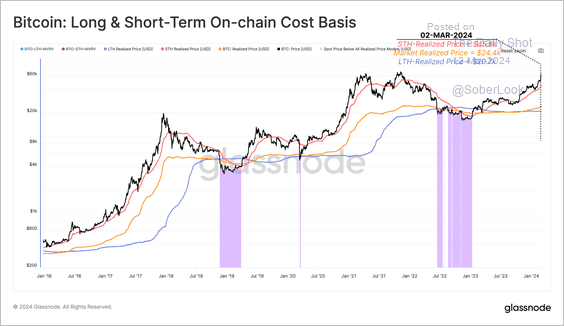

4. BTC is trading above the average cost basis of short-term and long-term holders.

Source: Glassnode Read full article

Source: Glassnode Read full article

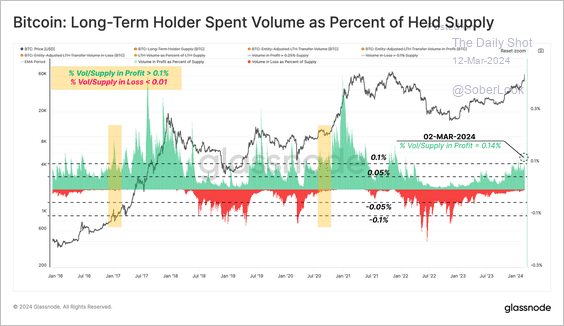

• The magnitude of realized profit locked in by long-term BTC holders increased during the recent price rally.

Source: Glassnode Read full article

Source: Glassnode Read full article

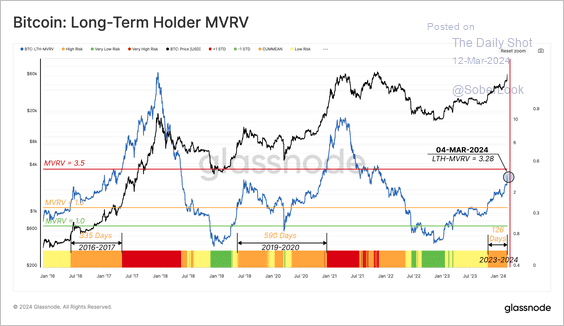

• Some measures, such as the market value vs. realized value (MVRV), suggest bitcoin is entering a euphoric state, although not as extreme compared with prior cycle peaks.

Source: Glassnode Read full article

Source: Glassnode Read full article

——————–

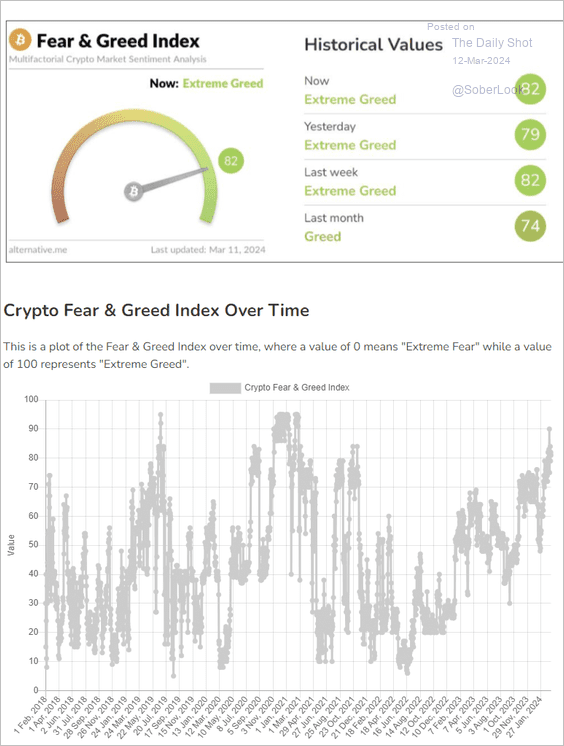

5. The Crypto Fear & Greed Index remains in “extreme greed” territory – the highest level since November 2020.

Source: Alternative.me

Source: Alternative.me

Back to Index

Commodities

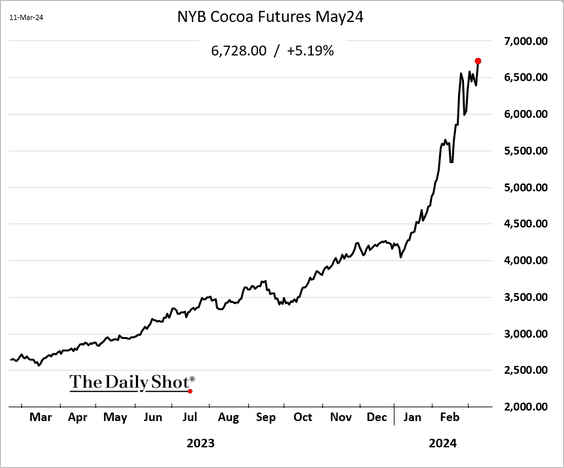

1. Cocoa futures have resumed their record-breaking rally.

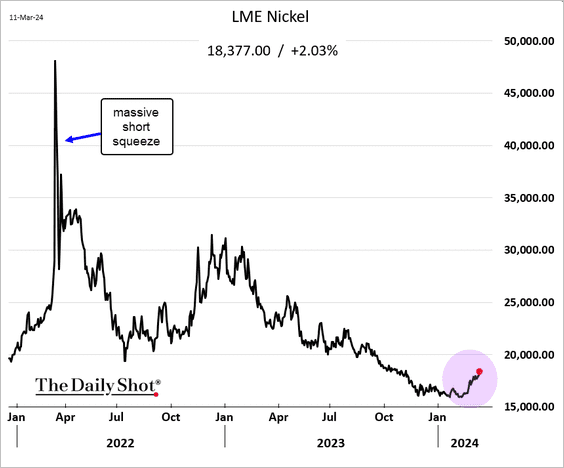

2. Nickel continues to rebound.

Back to Index

Energy

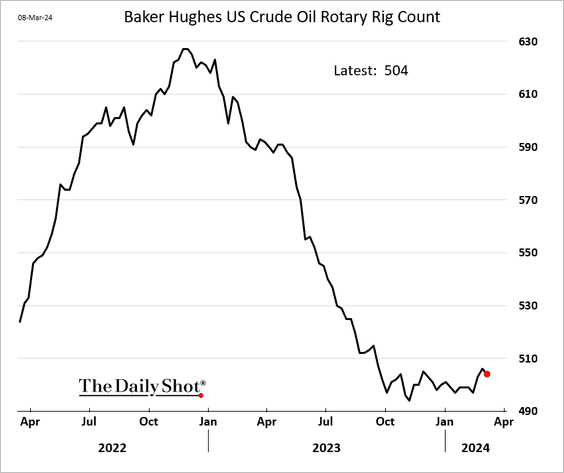

1. The US rig count declined last week.

Source: Reuters Read full article

Source: Reuters Read full article

——————–

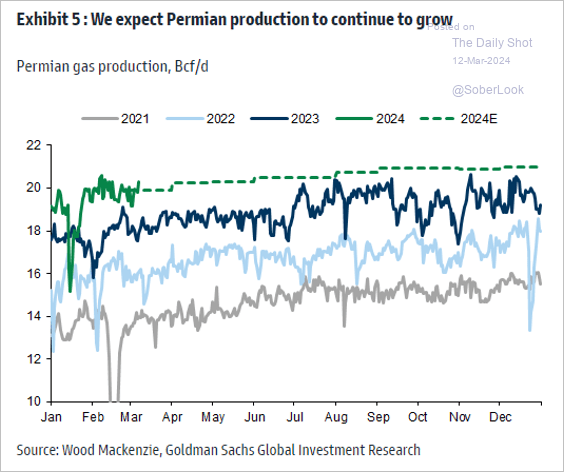

2. Goldman anticipates continued growth in output from the Permian Basin.

Source: Goldman Sachs; @MikeZaccardi

Source: Goldman Sachs; @MikeZaccardi

Back to Index

Equities

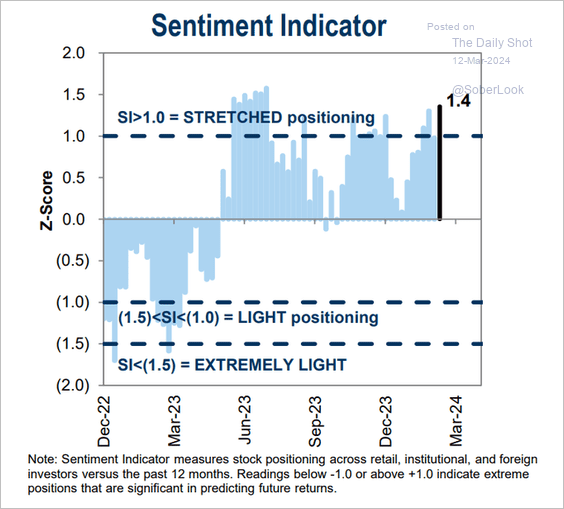

1. Goldman’s sentiment index is in “stretched” territory.

Source: Goldman Sachs; @MikeZaccardi

Source: Goldman Sachs; @MikeZaccardi

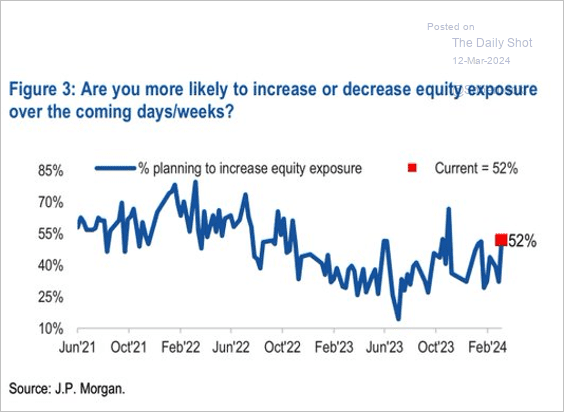

• A higher share of JP Morgan’s clients plan to boost their equity exposure.

Source: JP Morgan Research; @WallStJesus

Source: JP Morgan Research; @WallStJesus

2. There are hints of increased speculative activity.

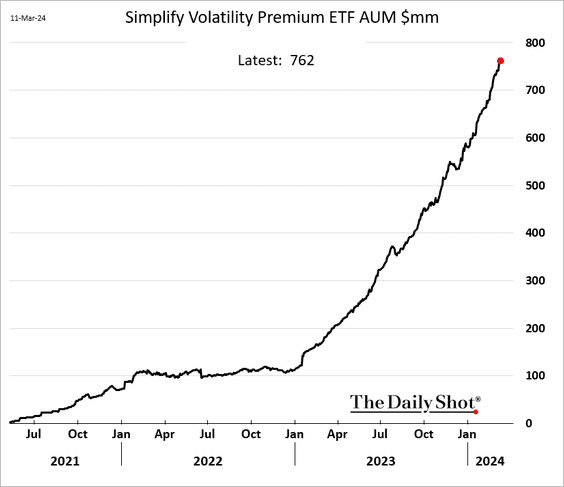

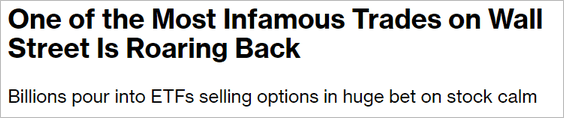

• Shorting vol has become popular again as investors flood into short-VIX products.

Source: @markets Read full article

Source: @markets Read full article

——————–

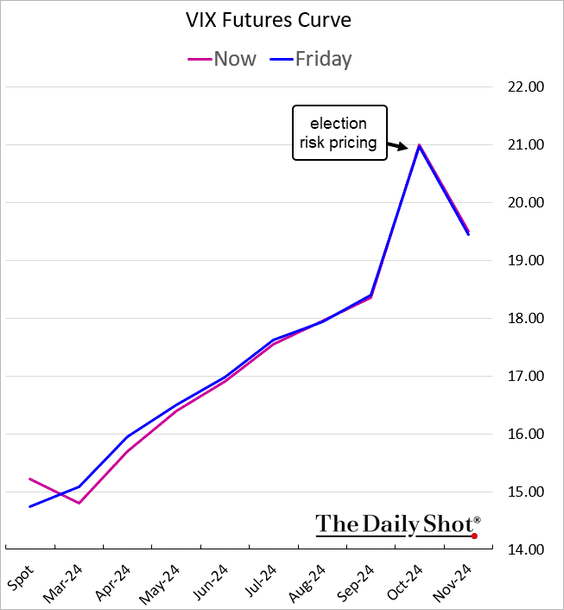

3. VIX climbed above the front VIX futures ahead of the CPI report.

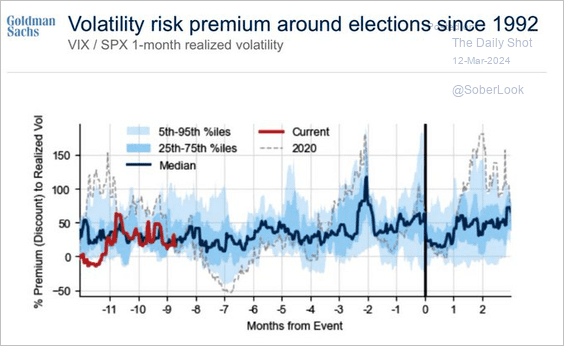

• This chart shows the volatility risk premium (implied vs. realized) around elections.

Source: Goldman Sachs; @WallStJesus

Source: Goldman Sachs; @WallStJesus

——————–

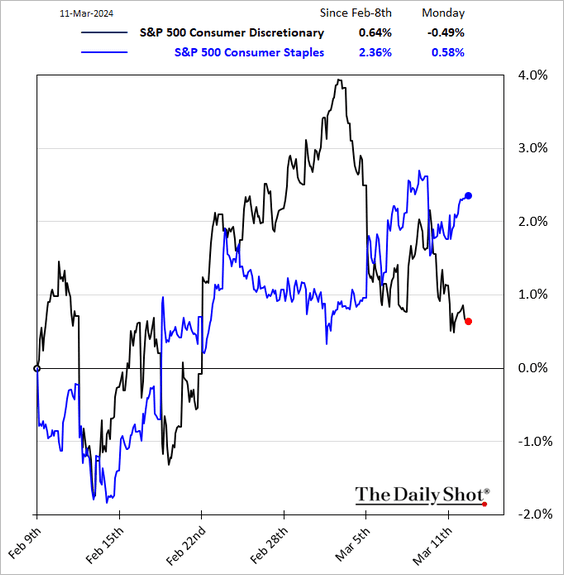

4. Consumer staples are outperforming the consumer discretionary sector, with Tesla contributing to the drag.

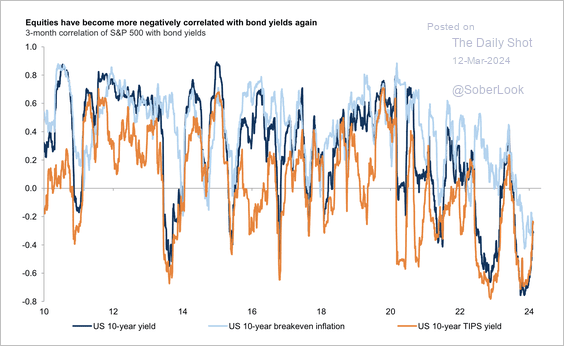

5. So far, US equity/bond yield correlations have turned less negative this year.

Source: Goldman Sachs

Source: Goldman Sachs

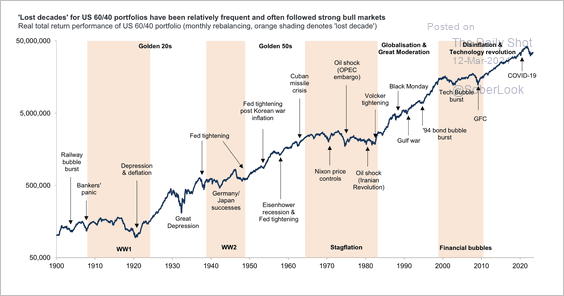

• This chart shows the historical real total return performance of a US 60% equity/40% bond portfolio with shaded “lost decades.”

Source: Goldman Sachs

Source: Goldman Sachs

——————–

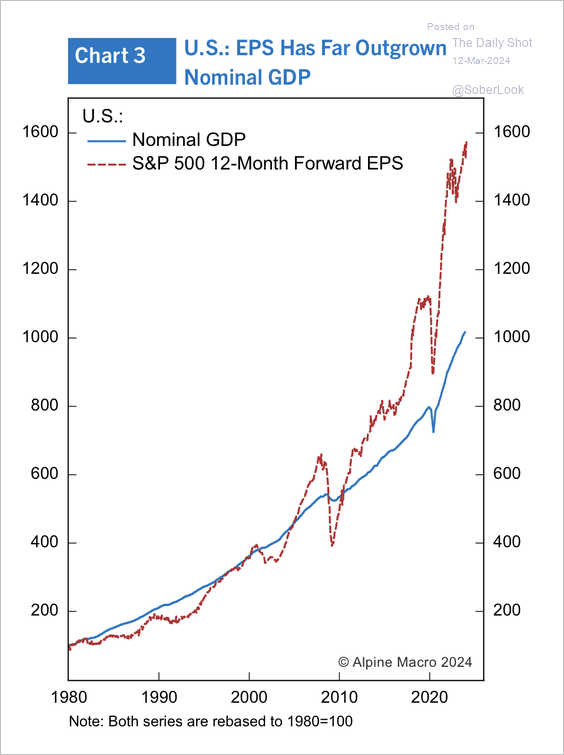

6. S&P 500 earnings have outgrown nominal GDP by a large margin over the past decade (partially reflecting US companies’ global operations).

Source: Alpine Macro

Source: Alpine Macro

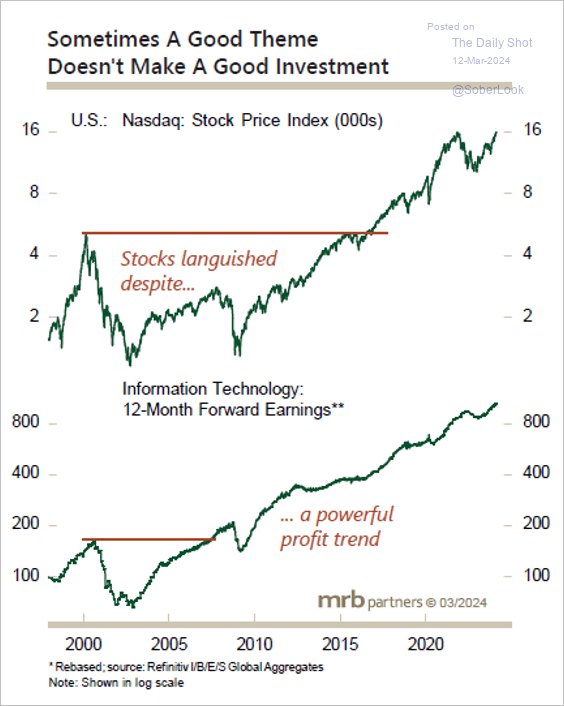

7. The Nasdaq Index’s recovery from the dot-com selloff significantly lagged the strong turnaround in forward earnings.

Source: MRB Partners

Source: MRB Partners

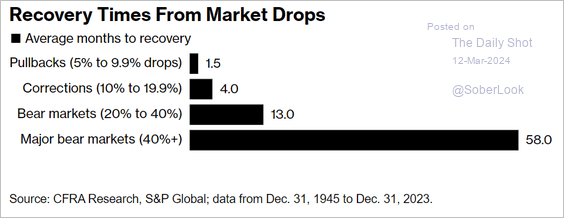

8. Here is a look at recovery times after market declines.

Source: @wealth Read full article

Source: @wealth Read full article

Back to Index

Credit

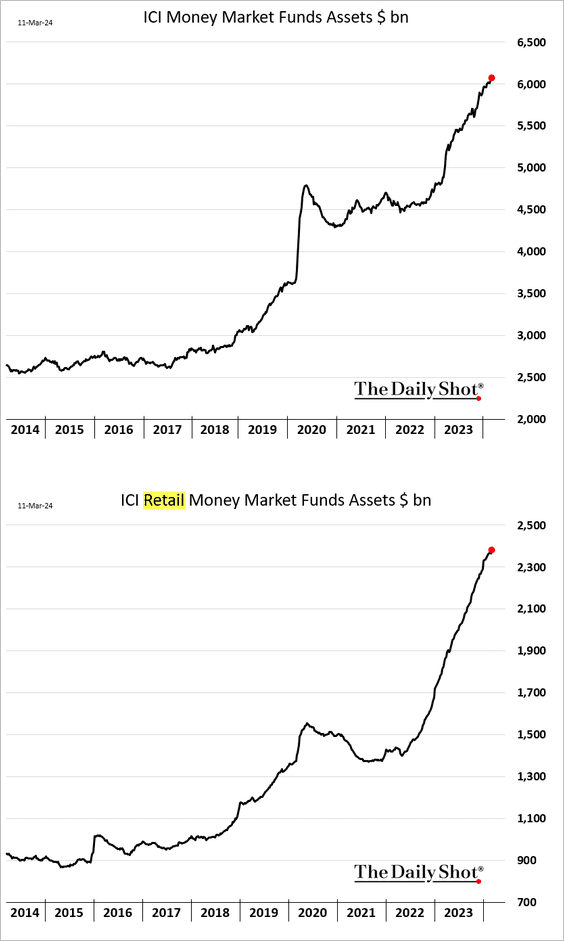

1. Money market funds’ assets hit another record high.

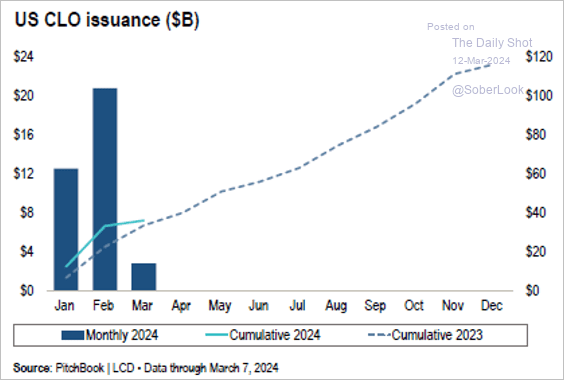

2. CLO issuance remains robust.

Source: PitchBook

Source: PitchBook

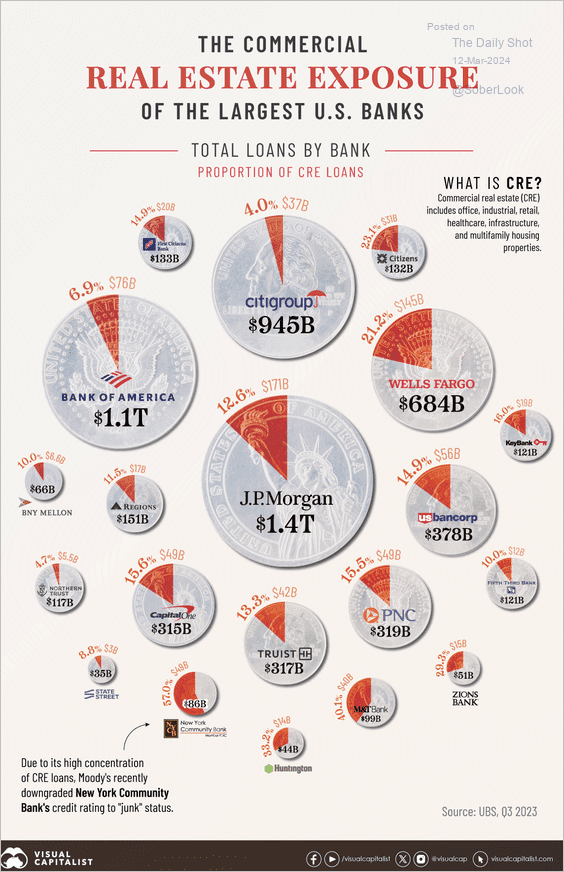

3. Here is a look at US banks’ commercial real estate exposure.

Source: Visual Capitalist Read full article

Source: Visual Capitalist Read full article

Back to Index

Rates

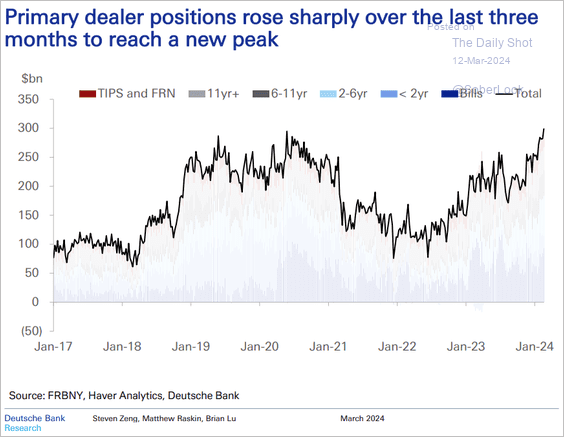

1. Primary dealers have been boosting their holdings of Treasuries.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

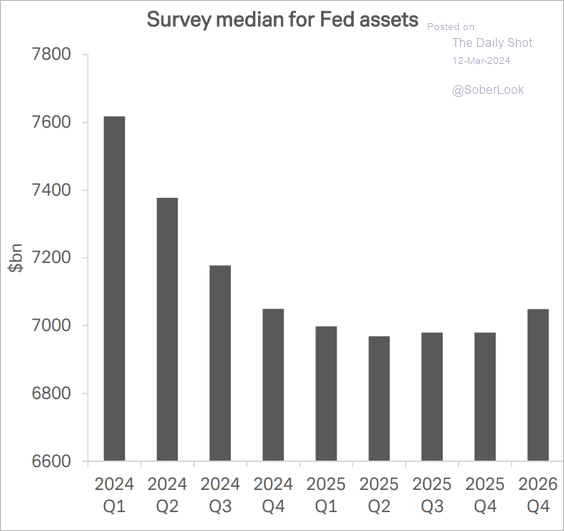

2. Surveys point to the Fed’s balance sheet bottoming next year.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

——————–

Food for Thought

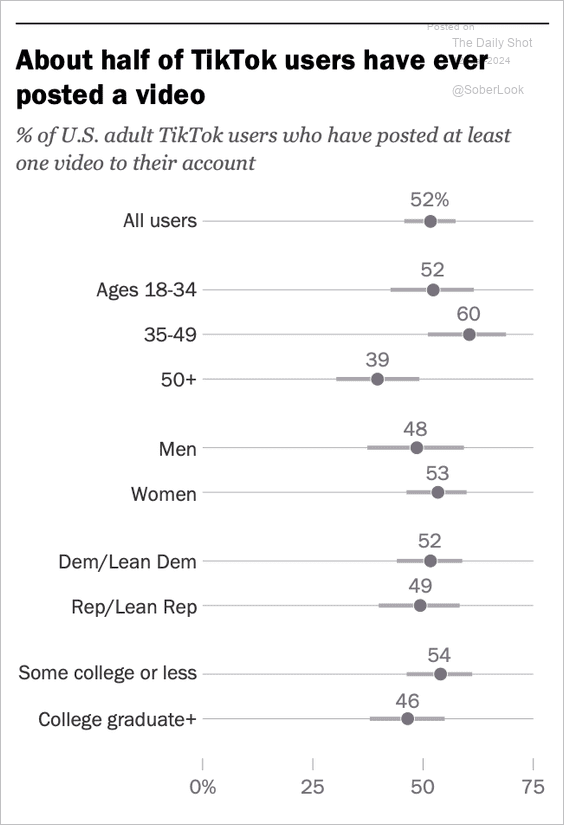

1. Posting videos on TikTok:

Source: Pew Research Center Read full article

Source: Pew Research Center Read full article

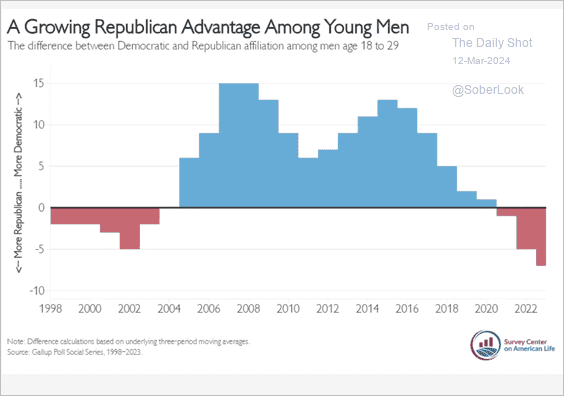

2. Shift in political affiliation among US men aged 18-29:

Source: American Storylines Read full article

Source: American Storylines Read full article

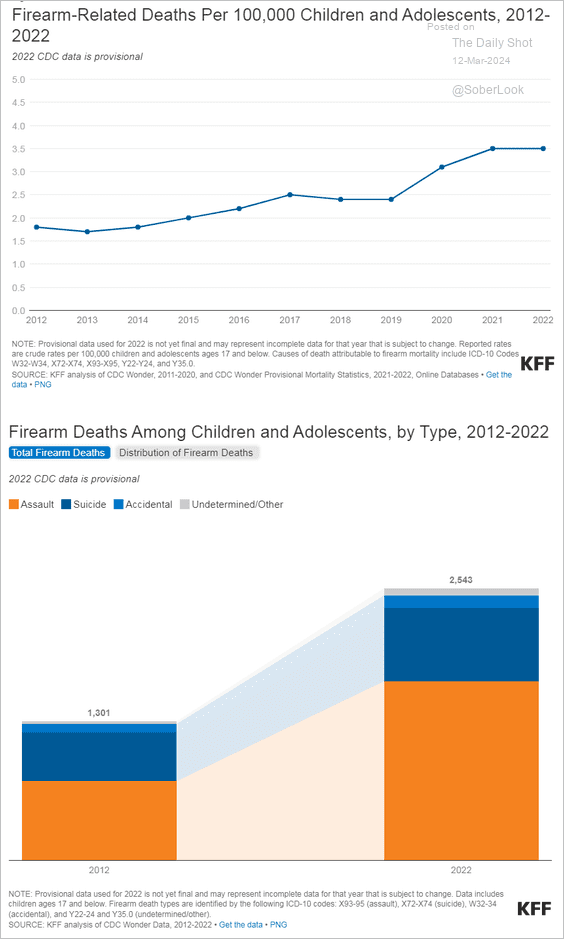

3. US firearm-related deaths among children and adolescents:

Source: KFF Read full article

Source: KFF Read full article

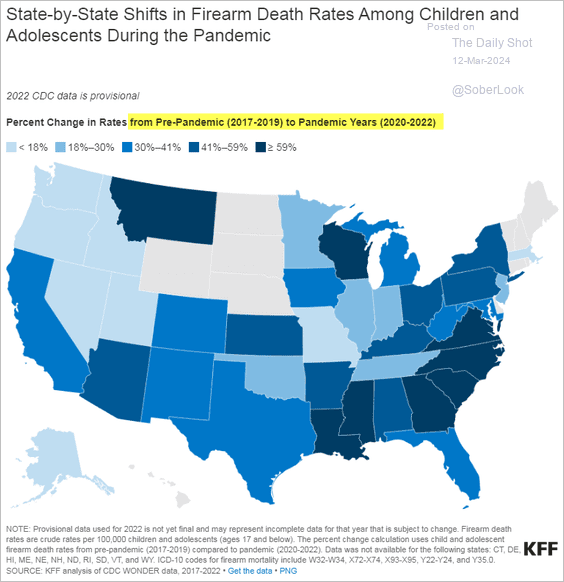

• Changes by state:

Source: KFF Read full article

Source: KFF Read full article

——————–

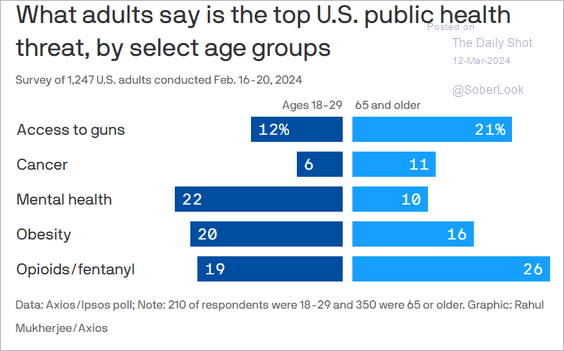

4. Top US public health threats:

Source: @axios Read full article

Source: @axios Read full article

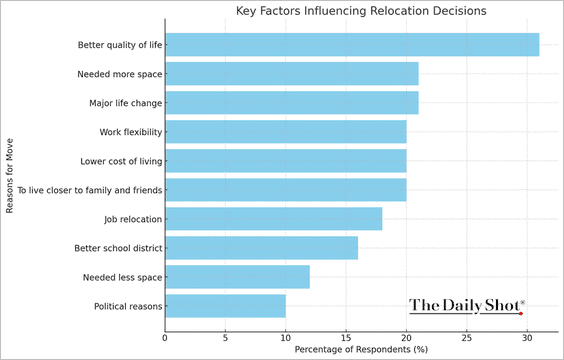

5. Key factors influencing relocation decisions:

Source: Home Bay

Source: Home Bay

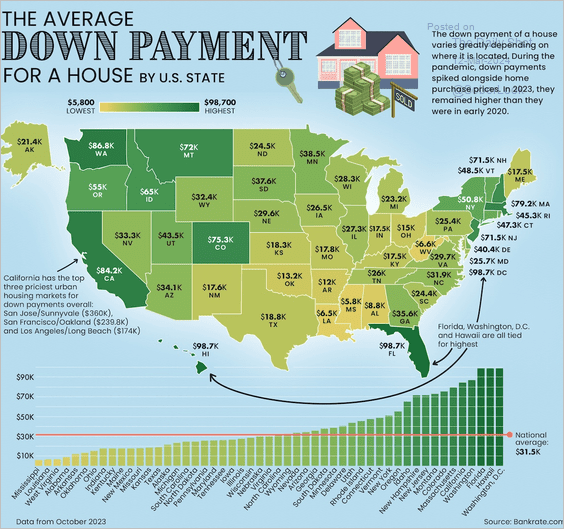

6. The median down payment on a house:

Source: Visual Capitalist Read full article

Source: Visual Capitalist Read full article

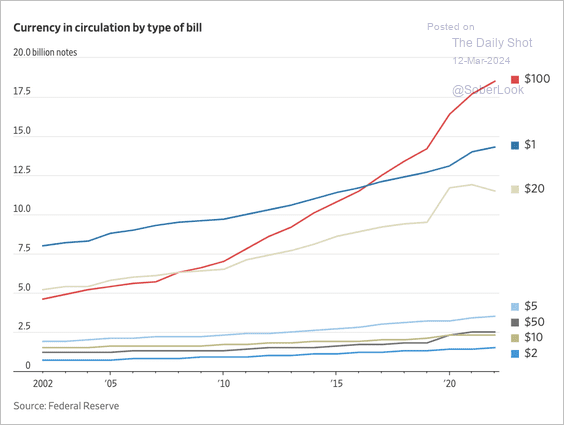

7. US bills in circulation:

Source: @WSJ Read full article

Source: @WSJ Read full article

——————–

Back to Index