The Daily Shot: 08-Apr-24

• The United States

• Canada

• The United Kingdom

• The Eurozone

• Europe

• Japan

• China

• Emerging Markets

• Commodities

• Energy

• Equities

• Credit

• Rates

• Global Developments

• Food for Thought

The United States

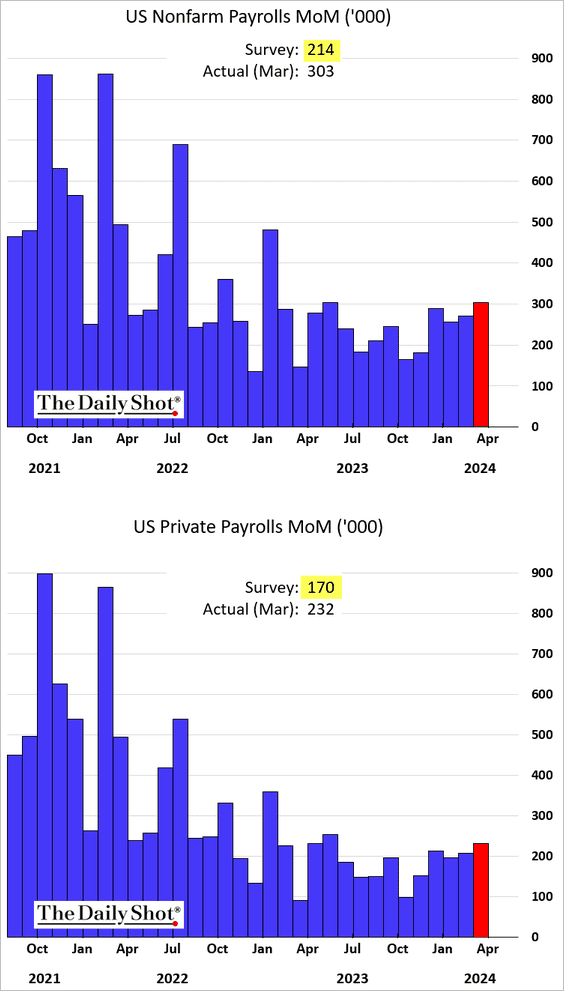

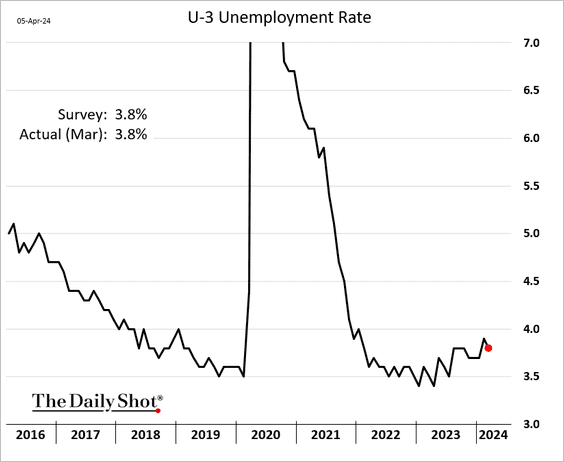

1. The employment report topped economists’ projections once again.

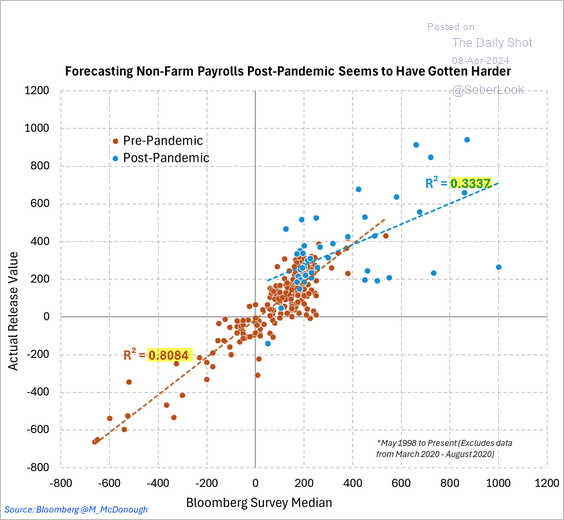

• Forecasters have faced challenges in accurately estimating job gains during the COVID era.

Source: @M_McDonough

Source: @M_McDonough

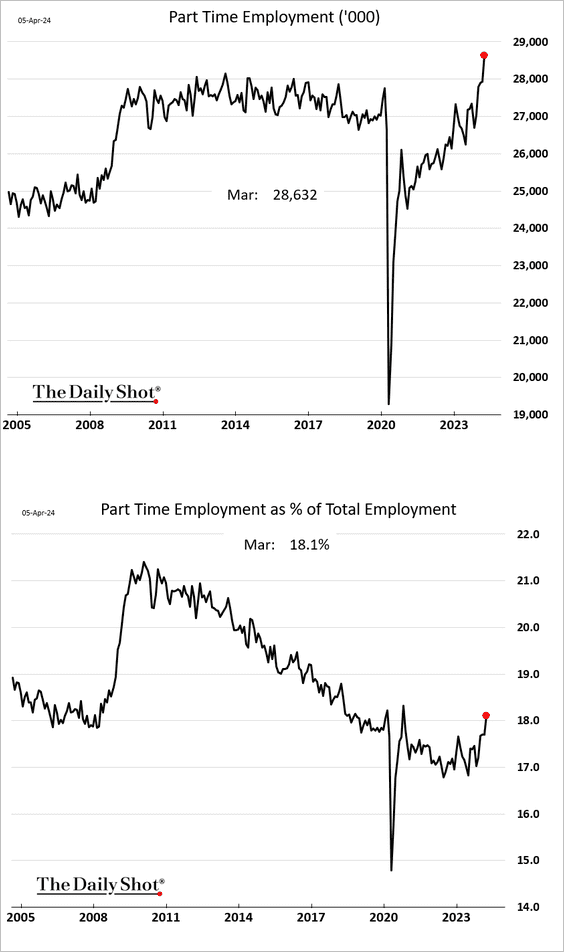

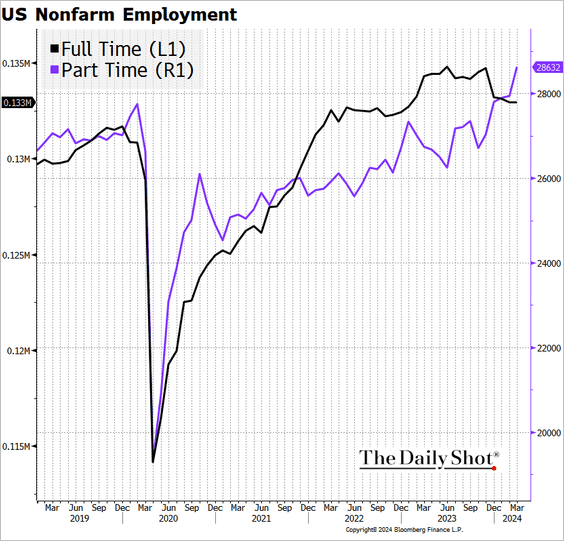

• Part-time employment has surged, …

… while full-time employment has declined in recent months.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

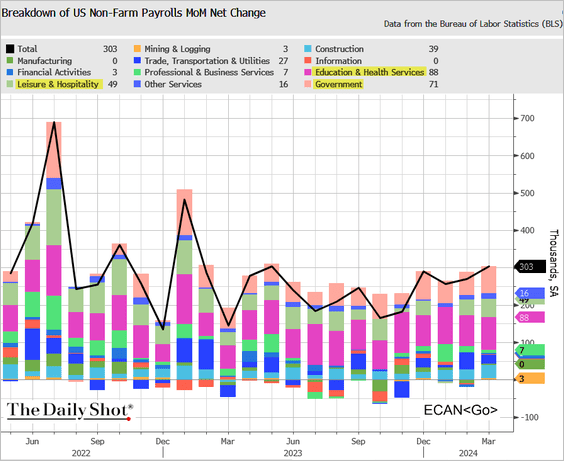

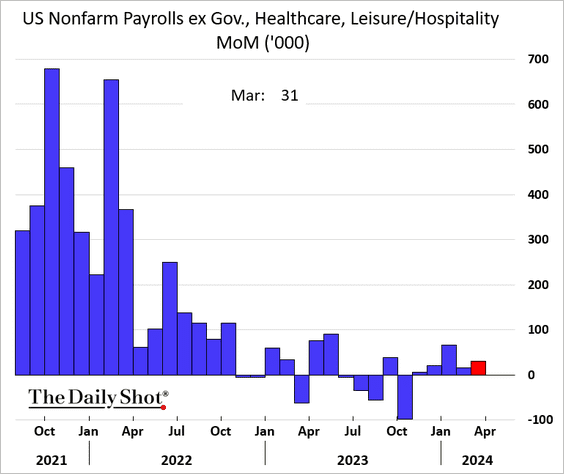

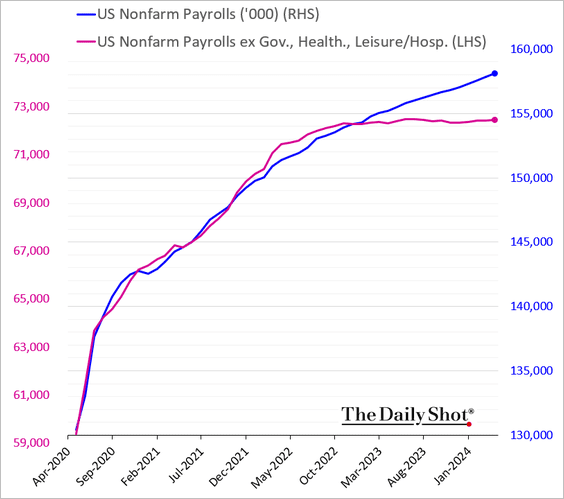

• Job gains continue to be concentrated in three sectors: Leisure and Hospitality, Healthcare, and Government (mostly state and local government).

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

Excluding these sectors, job growth has been tepid.

This chart employs dual y-axis scales to illustrate the divergence between the overall jobs trend and the trend excluding these three sectors.

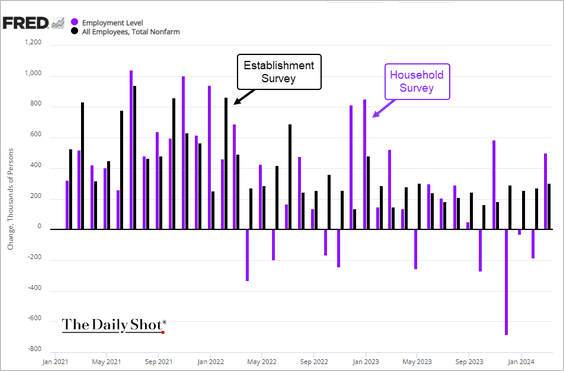

• The Household Survey also showed job gains last month.

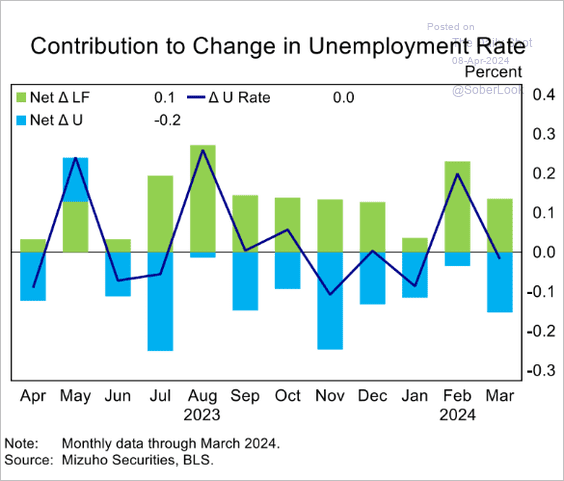

• The unemployment rate declined.

Below are the contributions to changes in the unemployment rate (Delta LF = change in the labor force; Delta U = change in unemployment).

Source: Mizuho Securities USA

Source: Mizuho Securities USA

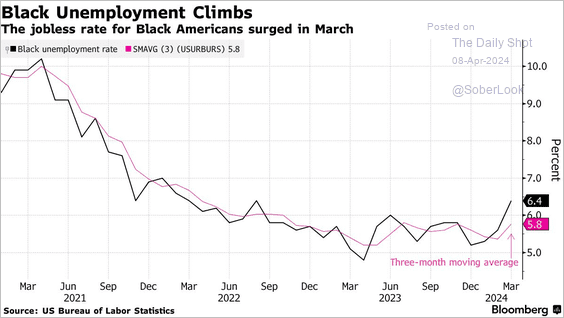

– The unemployment rate among African Americans rose sharply.

Source: @economics Read full article

Source: @economics Read full article

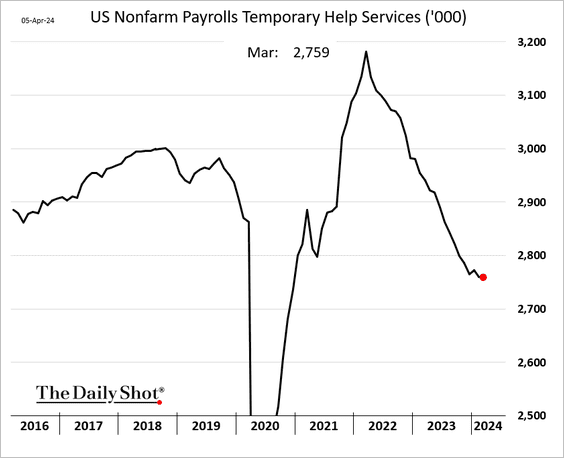

• After rapid declines, temp help service employment was roughly unchanged last month.

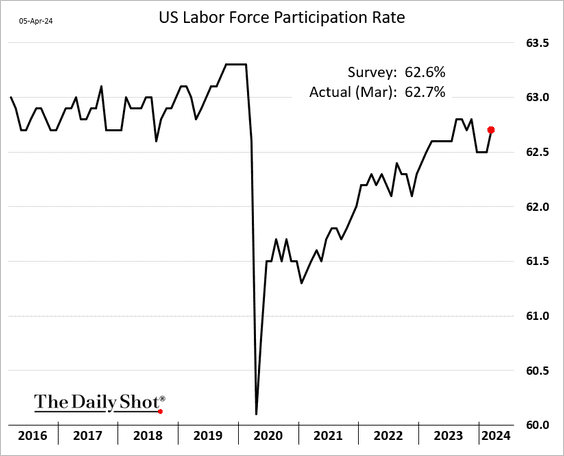

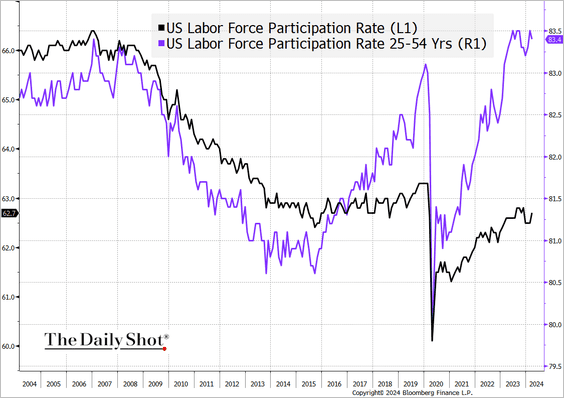

• The labor force participation rate increased.

But prime-age participation edged lower.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

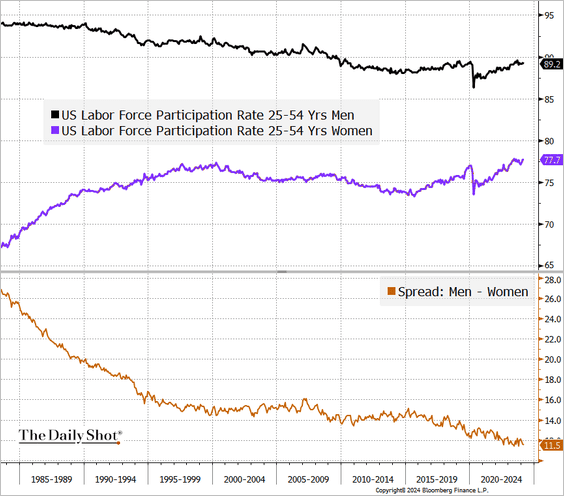

Here are the trends among women and men.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

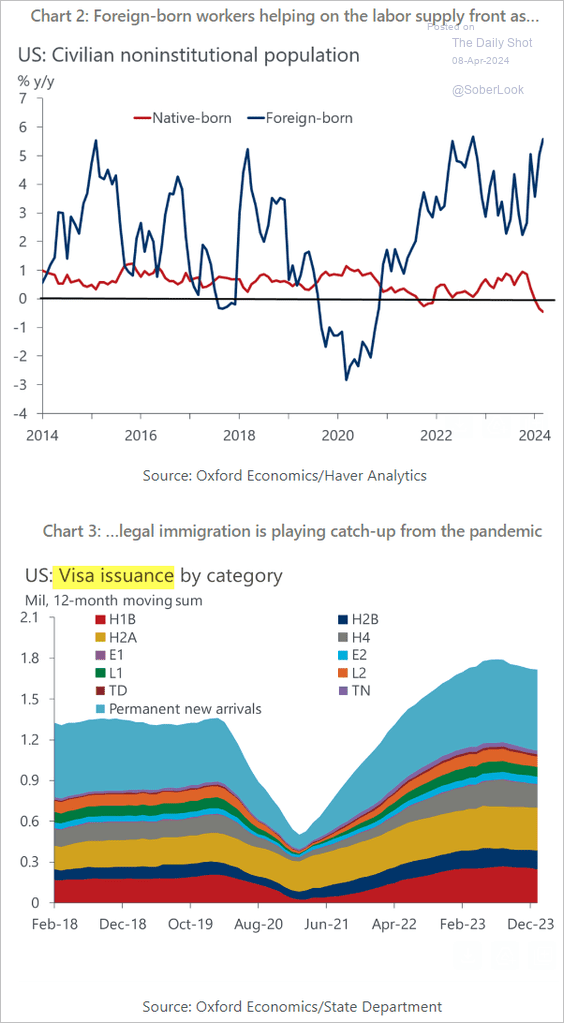

• There is talk of rising immigration driving job growth without hastening inflation. While growth in foreign-born population has rebounded, …

Source: Oxford Economics

Source: Oxford Economics

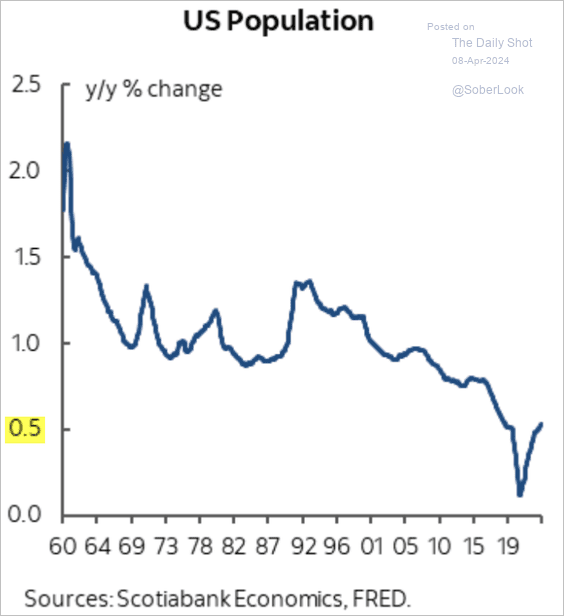

… the overall population is still growing at only 0.5% per year. The rebound in the chart below was driven by increased immigration as well as fewer people dying from COVID.

Source: Scotiabank Economics

Source: Scotiabank Economics

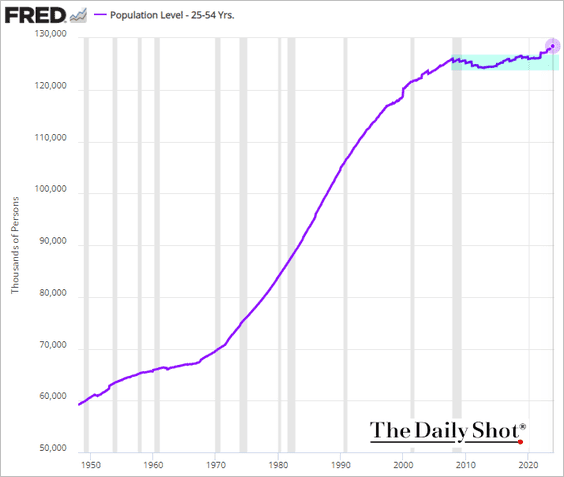

– Moreover, the prime-age population has grown by only 2% (in total) since the end of 2007, while the US GDP has increased by 34% over the same period.

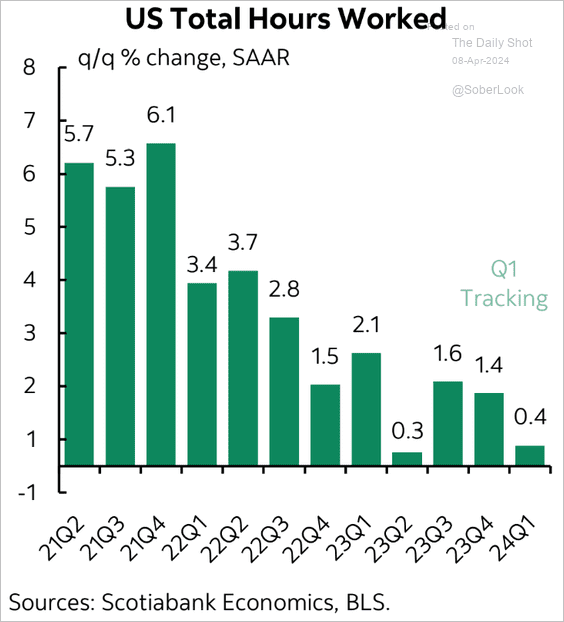

– Growth in hours worked was only 0.4% in the first quarter.

Source: Scotiabank Economics

Source: Scotiabank Economics

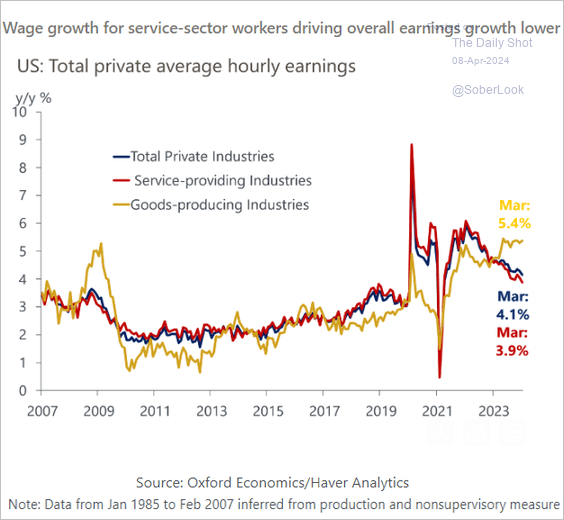

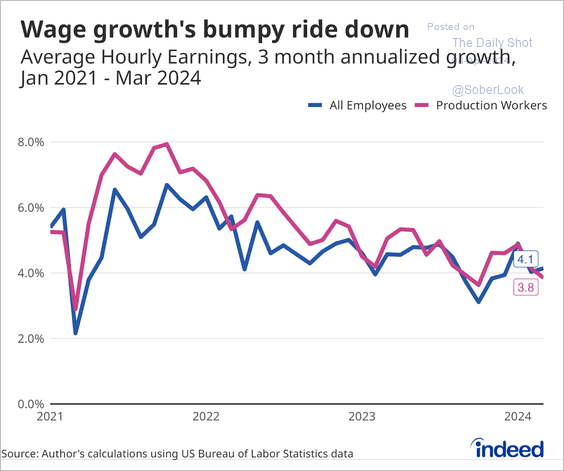

• Wage growth has been slowing.

Source: Oxford Economics

Source: Oxford Economics

Here are the 3-month changes.

Source: Indeed Read full article

Source: Indeed Read full article

——————–

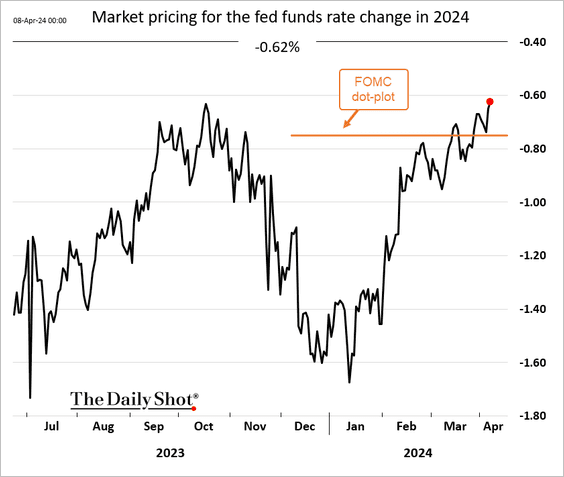

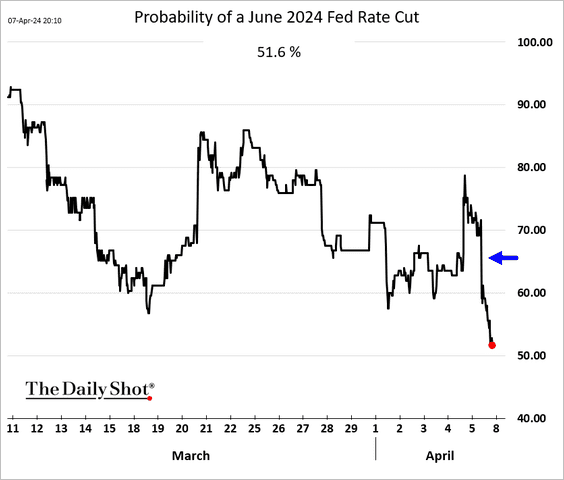

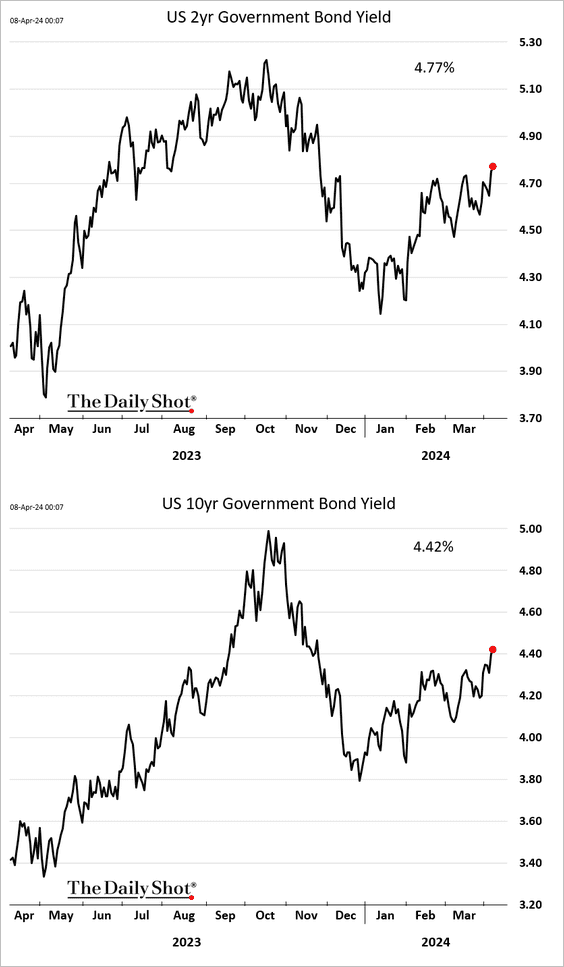

2. The market no longer sees three Fed rate reductions this year, …

… with the probability of a June rate cut tumbling after the jobs report.

Treasury yield moved higher.

——————–

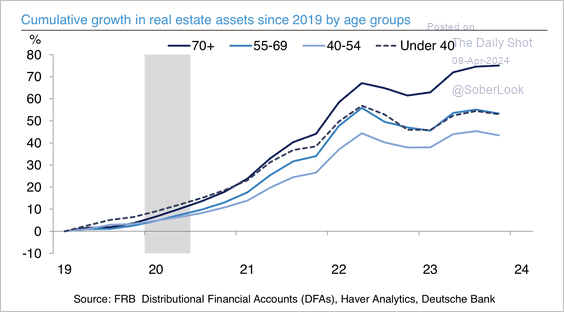

3. The oldest age group has experienced the largest rise in real estate assets over the past five years.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

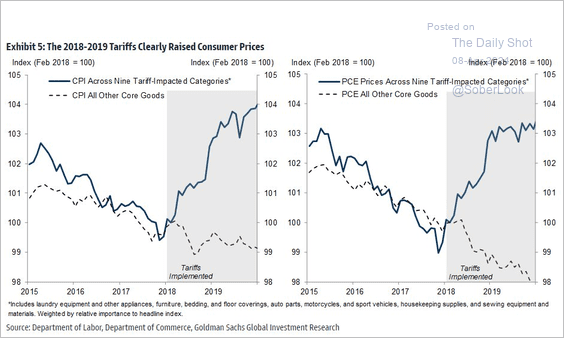

4. Here is a look at how tariffs impact prices.

Source: Goldman Sachs; @MikeZaccardi

Source: Goldman Sachs; @MikeZaccardi

Back to Index

Canada

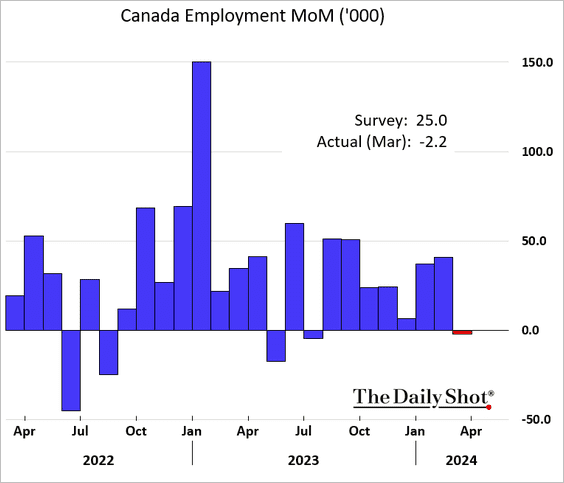

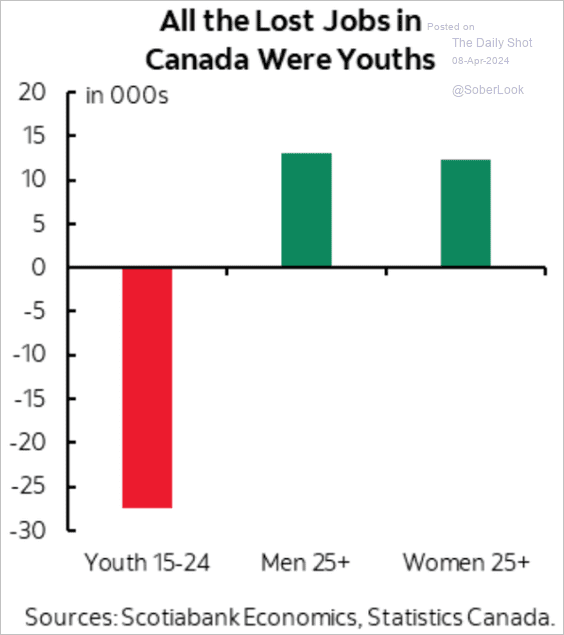

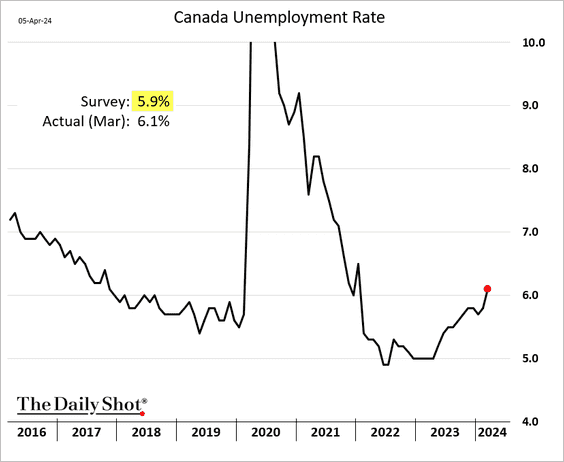

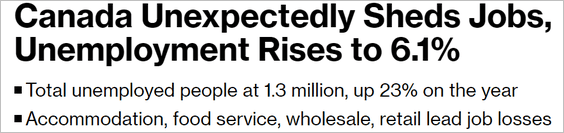

1. The economy shed jobs for the first time in eight months, …

… with declines driven by younger workers.

Source: Scotiabank Economics

Source: Scotiabank Economics

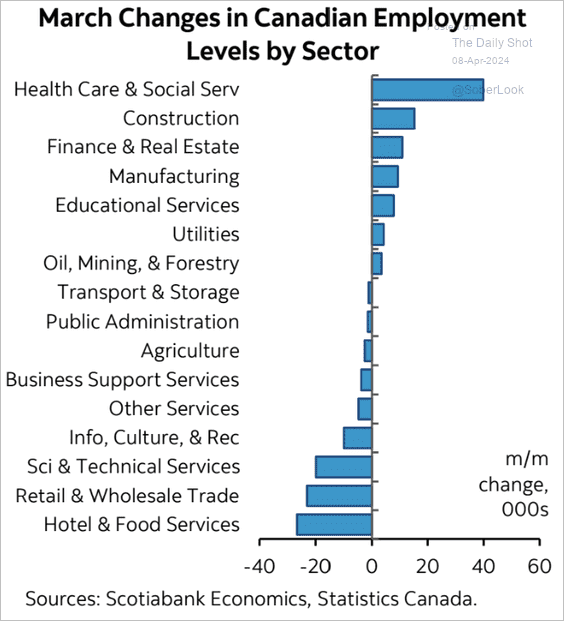

– Here is the breakdown by sector.

Source: Scotiabank Economics

Source: Scotiabank Economics

• The unemployment rate rose.

Source: @economics Read full article

Source: @economics Read full article

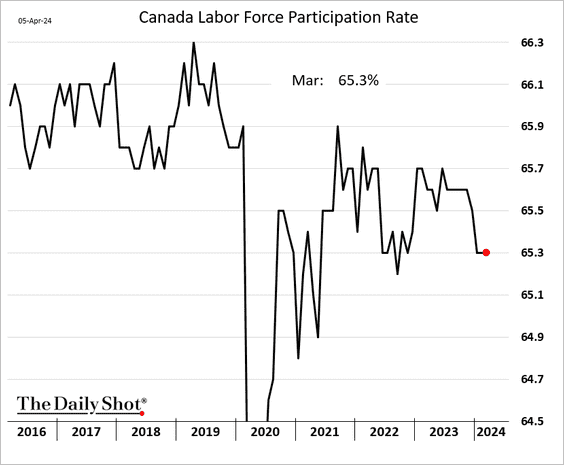

• The labor force participation rate held steady.

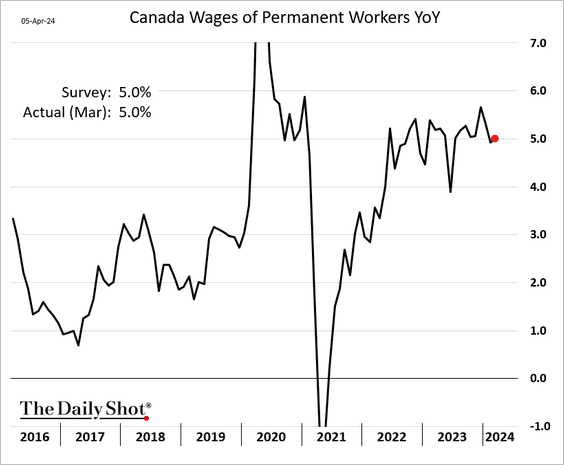

• Wage growth edged higher, …

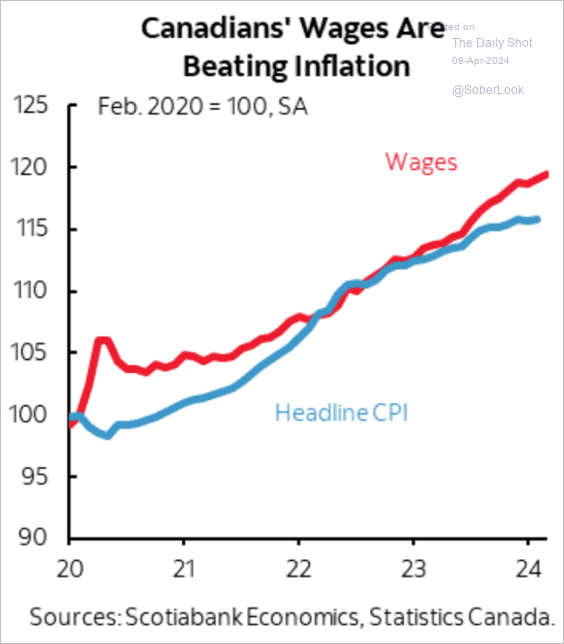

.. with wages outpacing inflation.

Source: Scotiabank Economics

Source: Scotiabank Economics

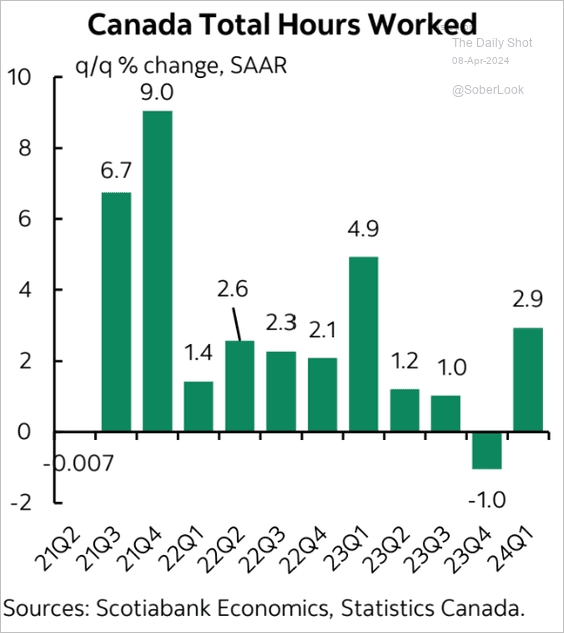

• Total hours worked jumped in the first quarter.

Source: Scotiabank Economics

Source: Scotiabank Economics

——————–

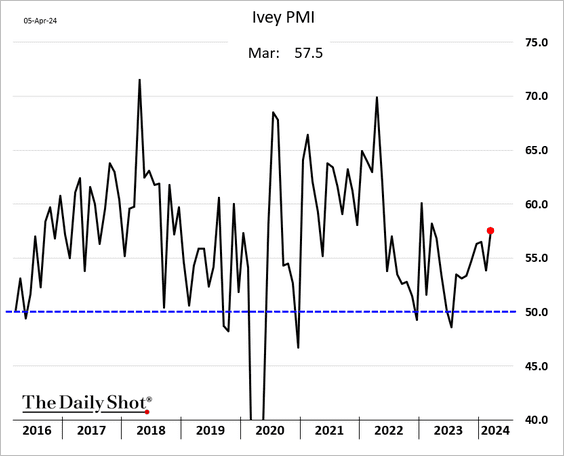

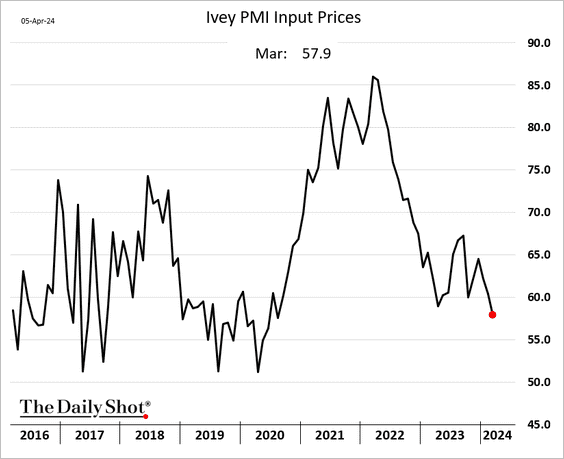

2. The Ivey PMI showed accelerating economic activity.

Price pressures are moderating.

——————–

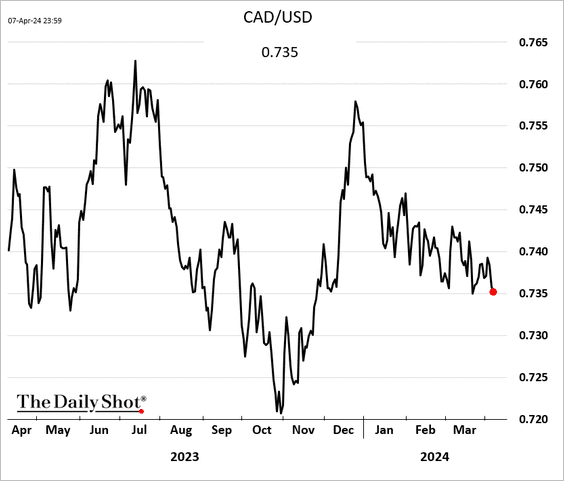

3. The Canadian dollar has been trending lower vs. USD.

Back to Index

The United Kingdom

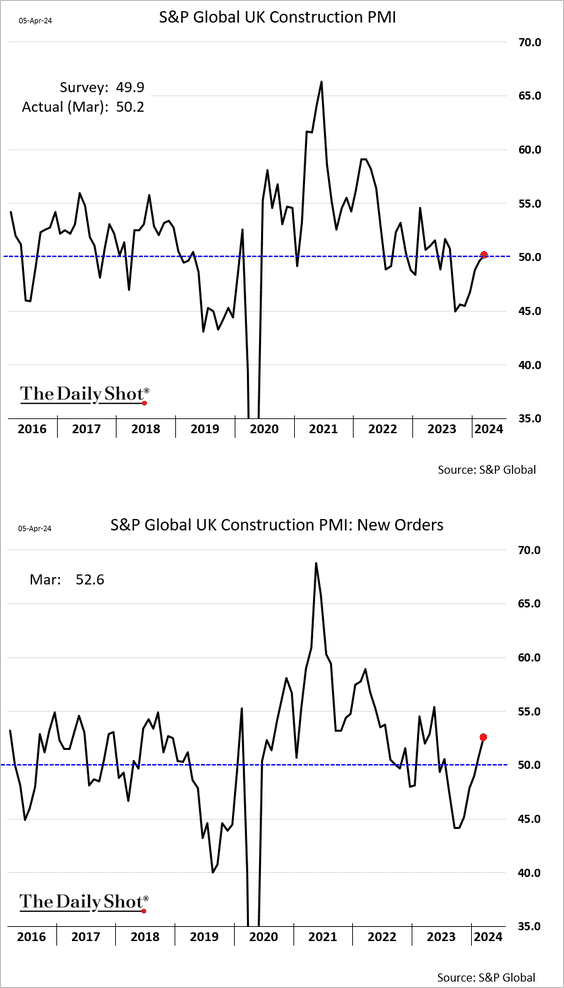

1. Construction activity is back in growth territory.

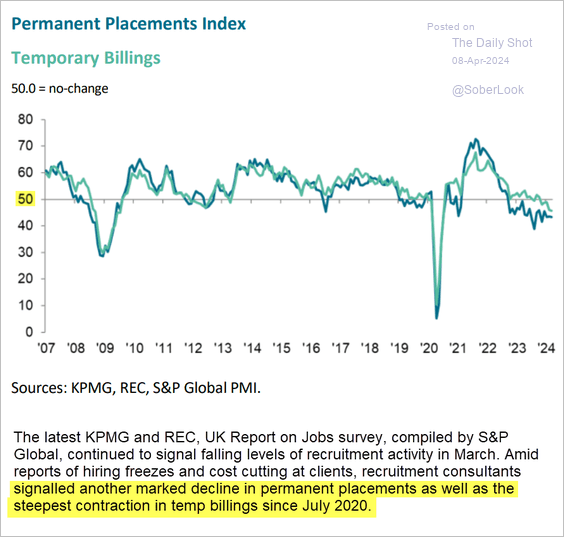

2. Hiring continues to slow.

Source: S&P Global PMI

Source: S&P Global PMI

Back to Index

The Eurozone

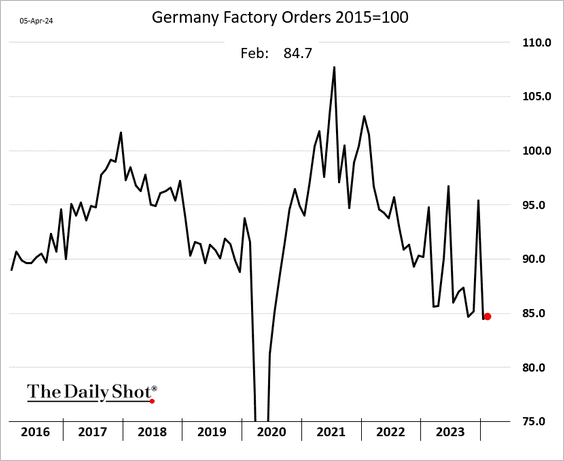

1. Germany’s factory orders edged higher in February.

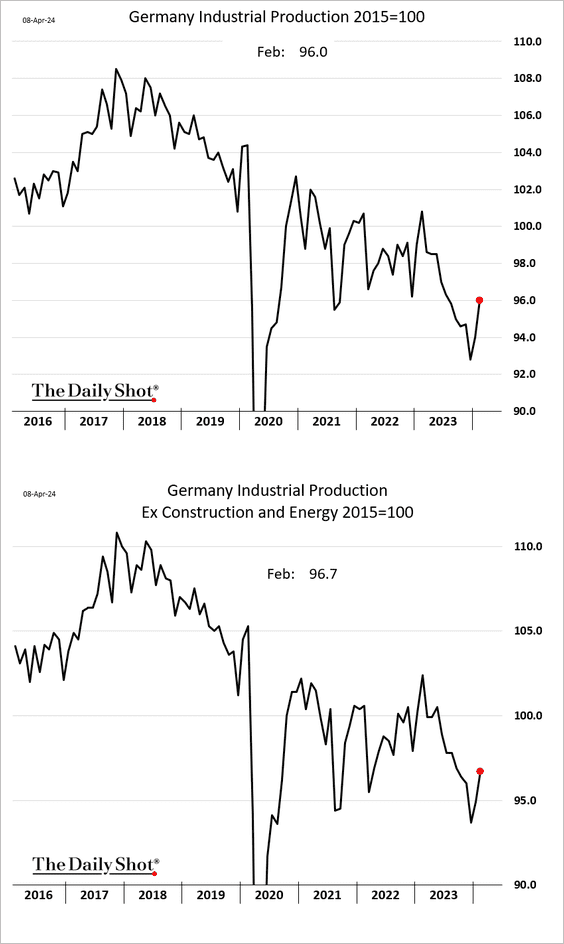

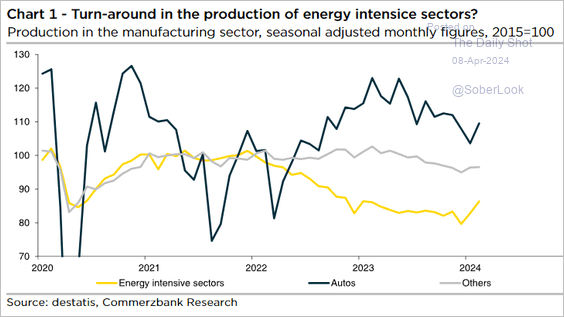

Industrial production increased again.

Source: Commerzbank Research

Source: Commerzbank Research

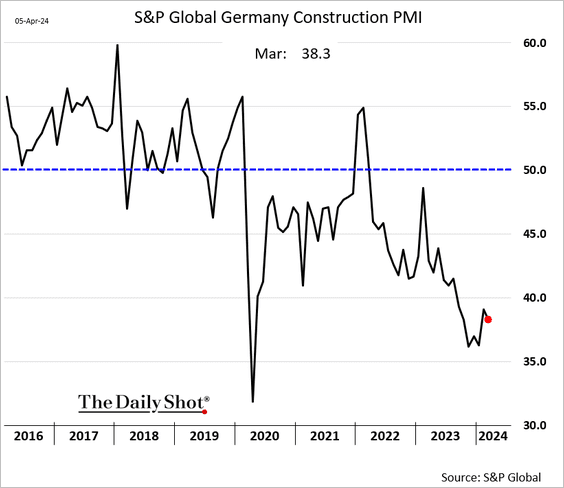

• Germany’s construction activity continues to decline (PMI < 50).

——————–

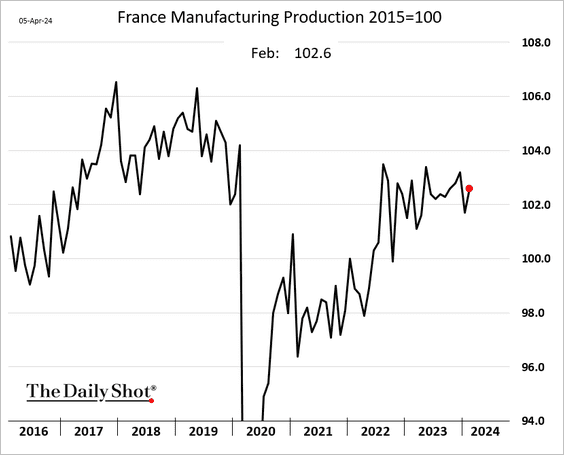

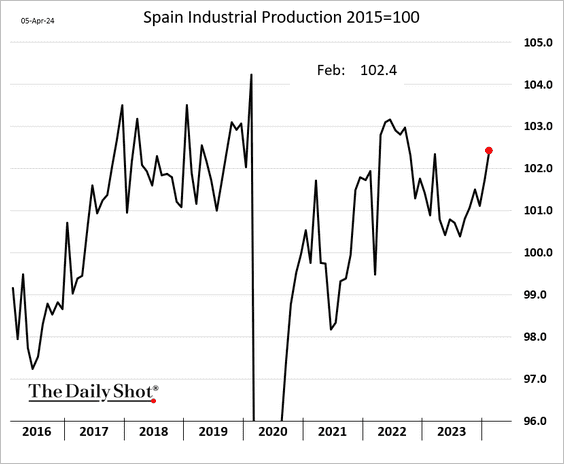

2. Industrial production also improved in other euro-area economies.

• France:

• Spain:

——————–

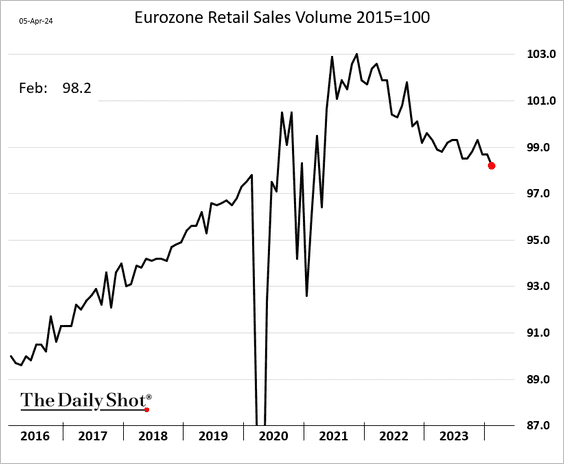

3. Eurozone real retail sales continue to trend lower.

Source: MarketWatch Read full article

Source: MarketWatch Read full article

——————–

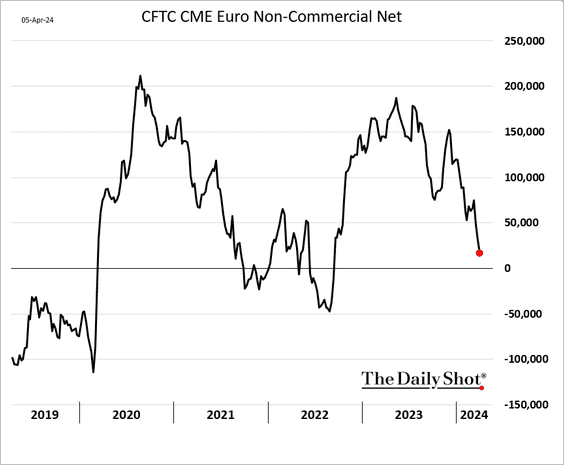

4. Traders keep trimming their bets on the euro.

Back to Index

Europe

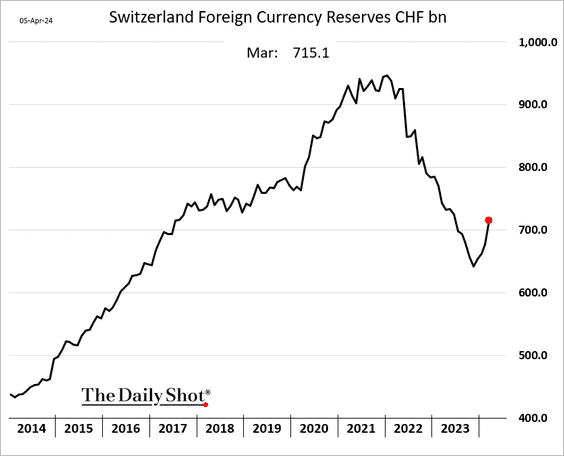

1. The Swiss central bank is growing its balance sheet again.

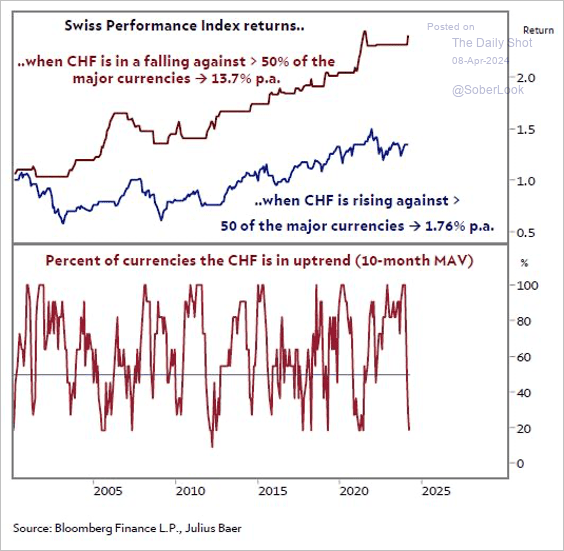

• Historically, Swiss equities have benefited from a falling franc.

Source: Mensur Pocinci; Julius Baer

Source: Mensur Pocinci; Julius Baer

——————–

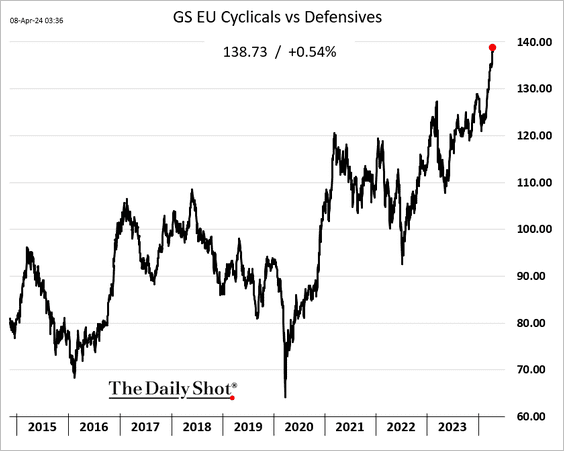

2. European cyclicals continue to surge relative to defensives.

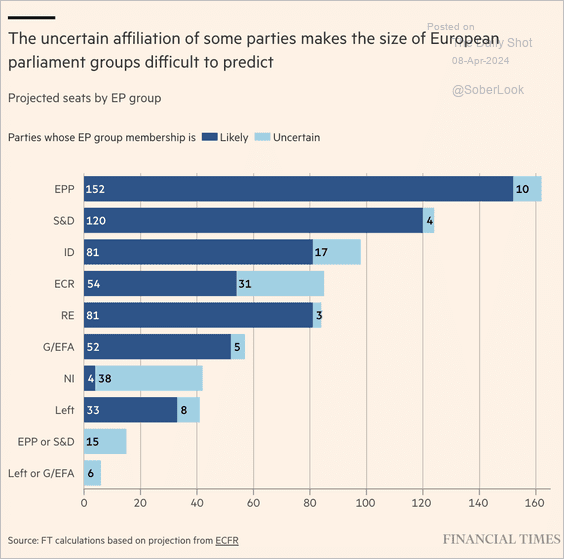

3. Here is a look at projected European parliament group sizes with potential membership variability in 2024.

Source: @financialtimes Read full article

Source: @financialtimes Read full article

Back to Index

Japan

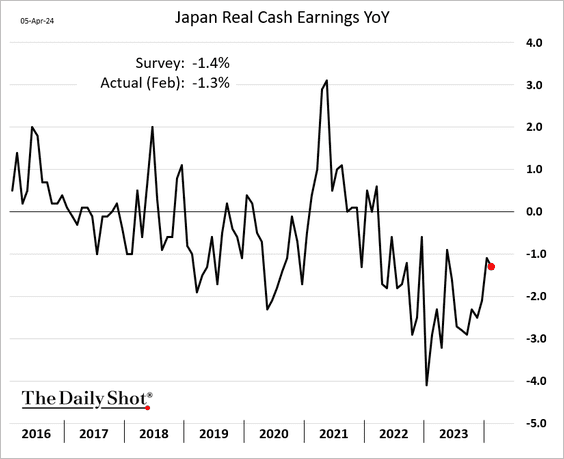

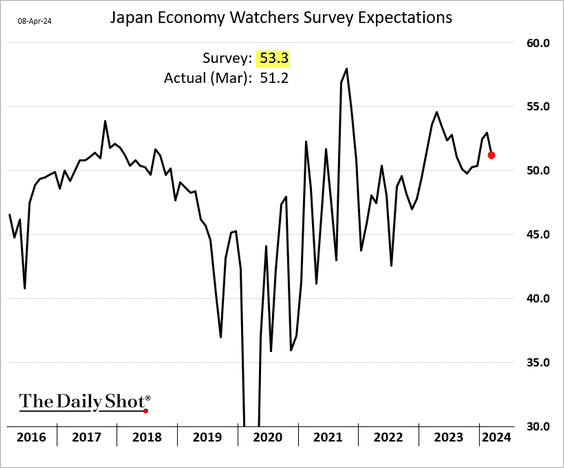

1. Real wage growth remains negative.

Source: @economics Read full article

Source: @economics Read full article

——————–

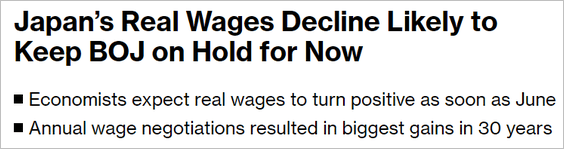

2. The trade deficit was wider than expected in February.

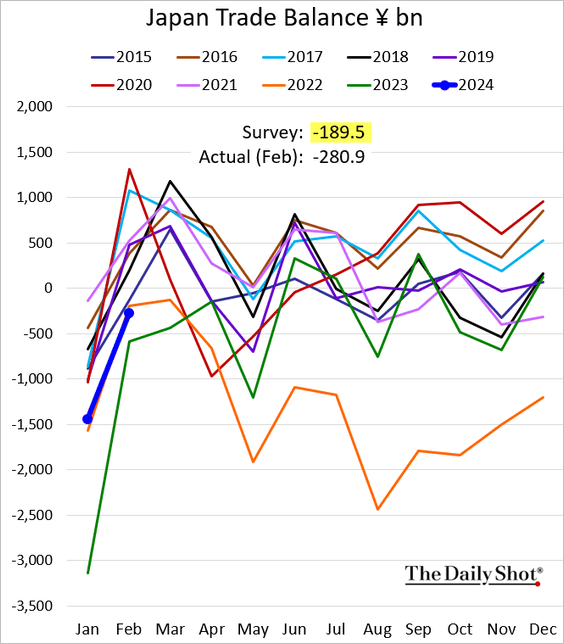

3. The Economy Watchers Survey outlook index declined in March.

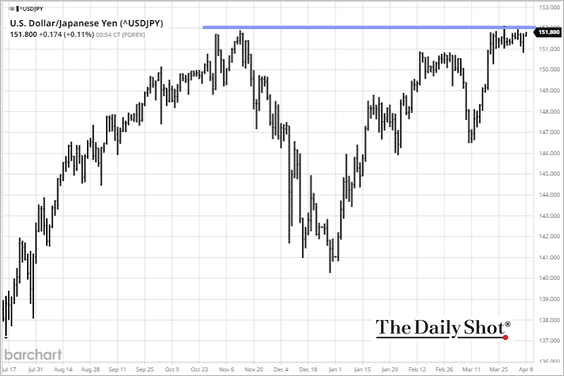

4. Dollar-yen is holding resistance at 152.

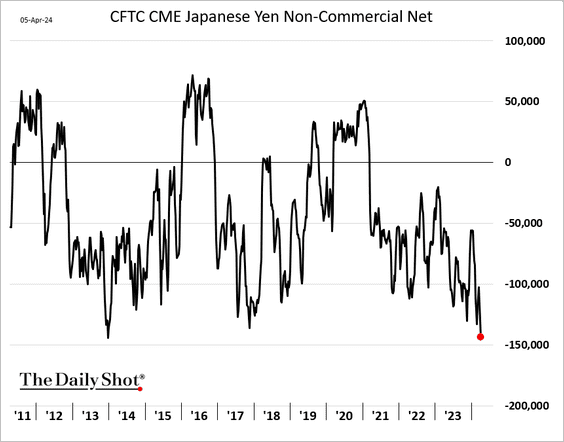

• Have bets against the yen become overextended?

——————–

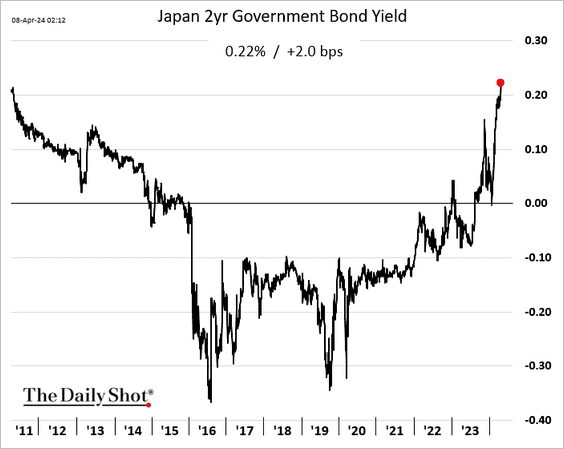

5. Short-term bond yields continue to climb.

Source: Reuters Read full article

Source: Reuters Read full article

Back to Index

China

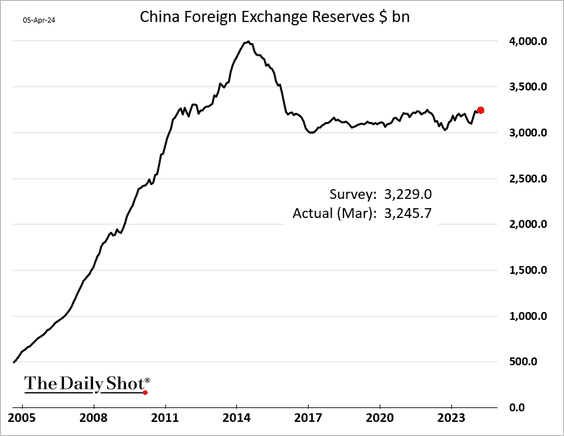

1. F/X reserves edged higher last month.

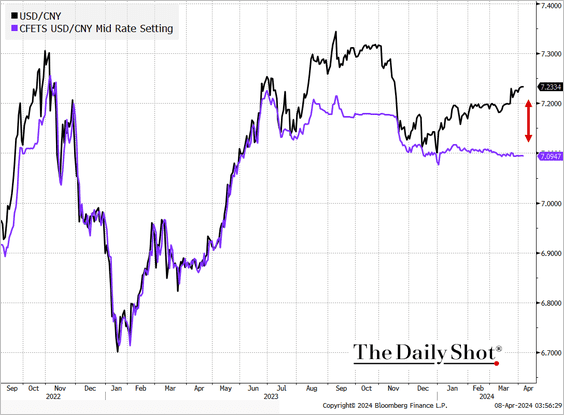

2. Beijing continues its attempts to halt the renminbi’s slide.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @markets Read full article

Source: @markets Read full article

——————–

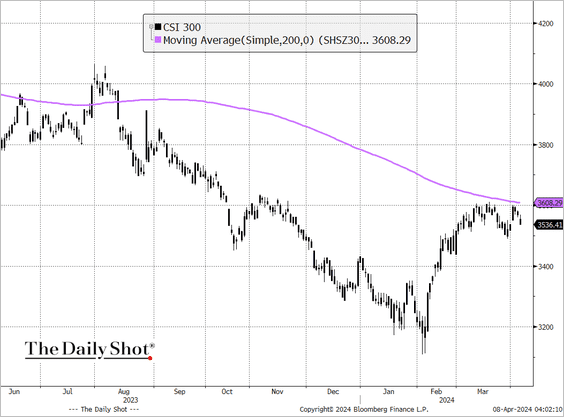

3. The CSI 300 equity index is holding resistance at the 200-day moving average.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

Back to Index

Emerging Markets

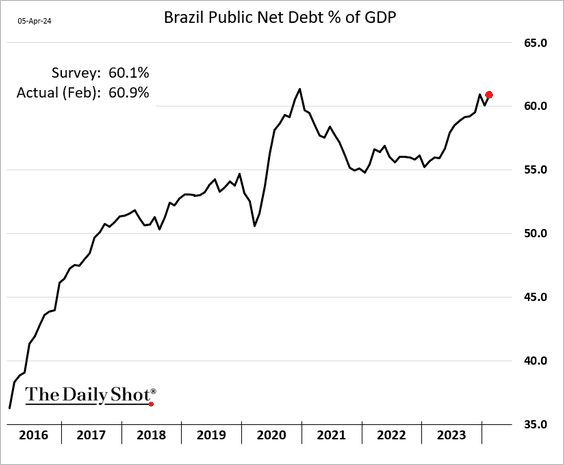

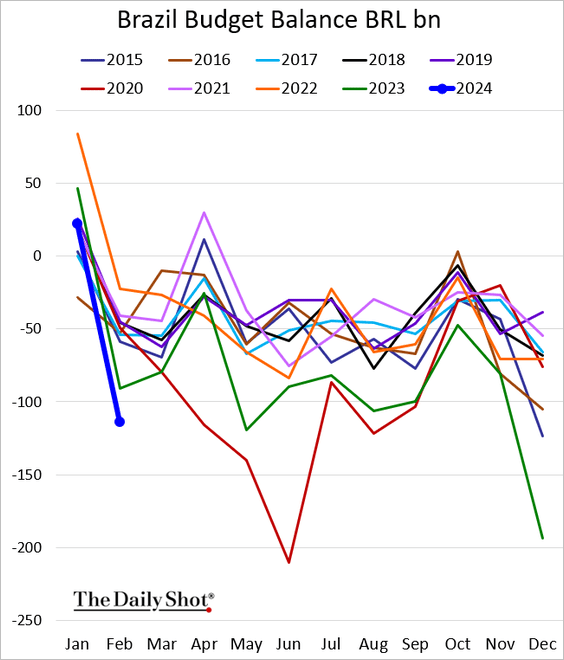

1. Breazil’s debt-to-GDP ratio increased in February as spending accelerated.

——————–

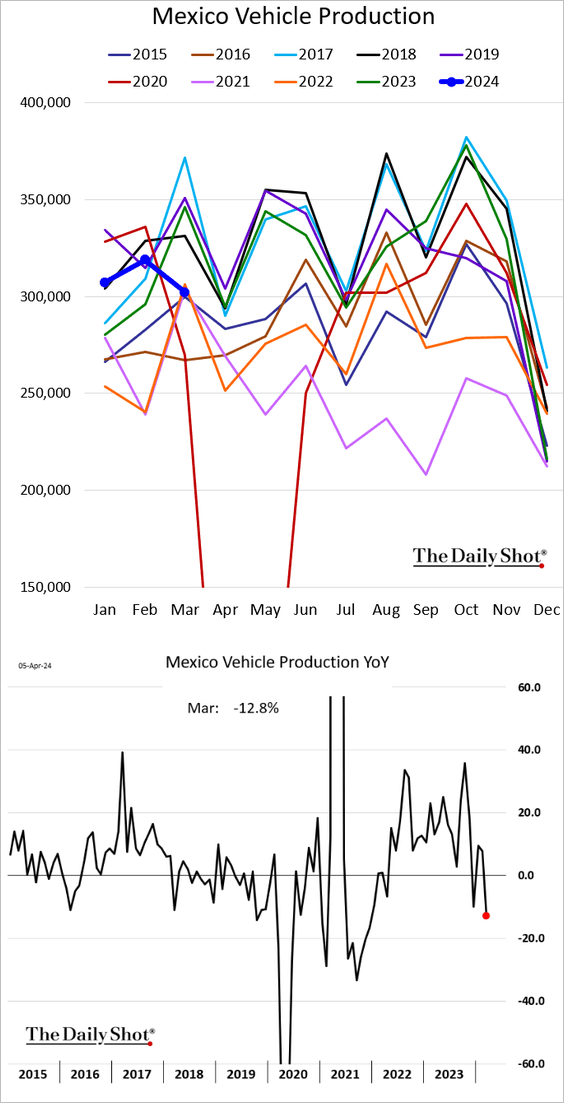

2. Mexico’s vehicle production declined last month.

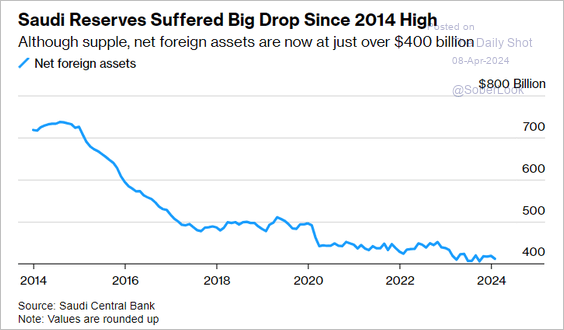

3. Here is a look at Saudi FX reserves.

Source: @economics Read full article

Source: @economics Read full article

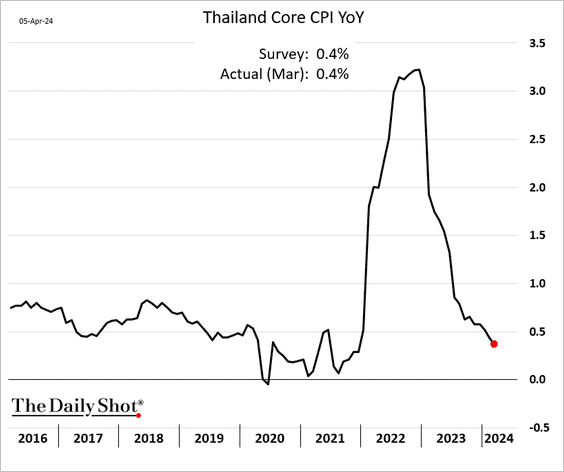

4. Thai inflation continues to ease.

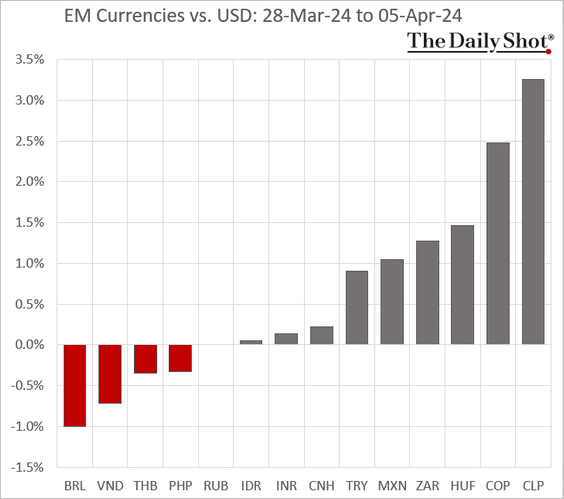

5. Next, we have some performance data from last week.

• Currencies:

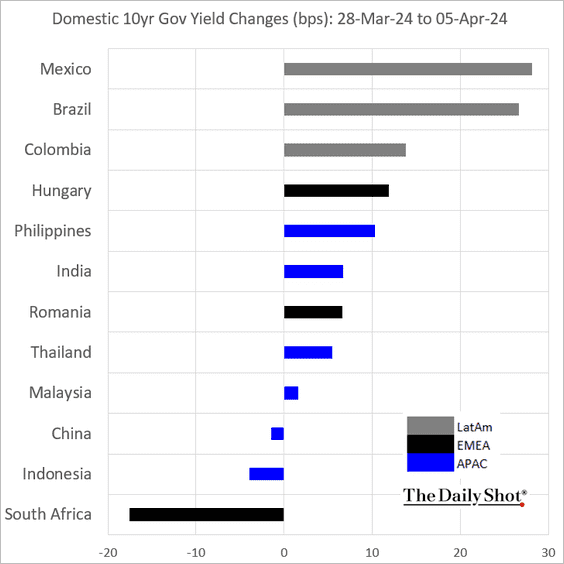

• Bond yields:

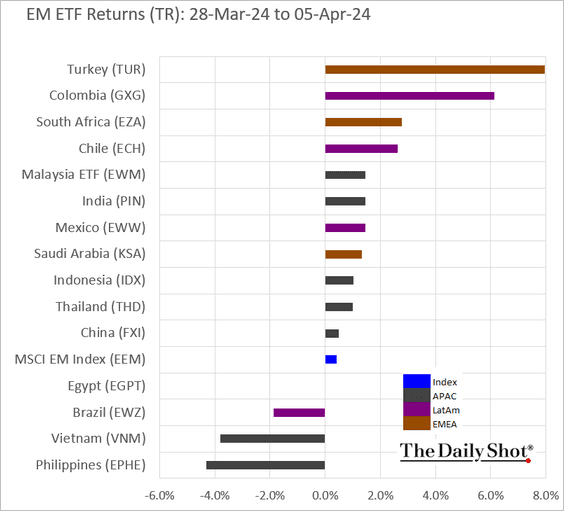

• Equity ETFs:

Back to Index

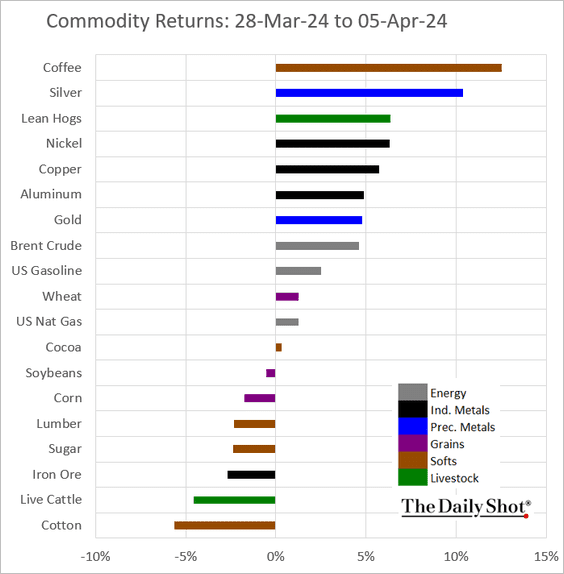

Commodities

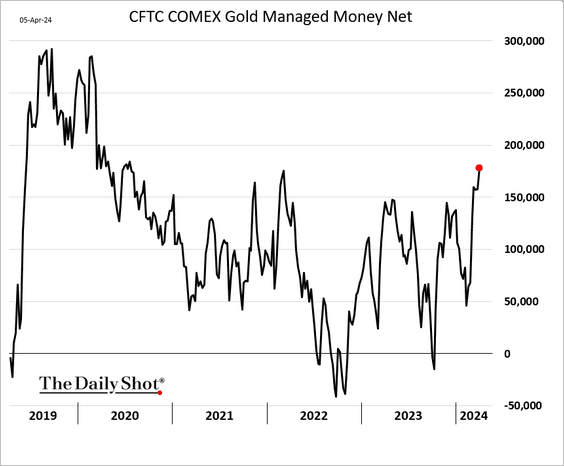

1. Hedge funds have been boosting their bets on gold.

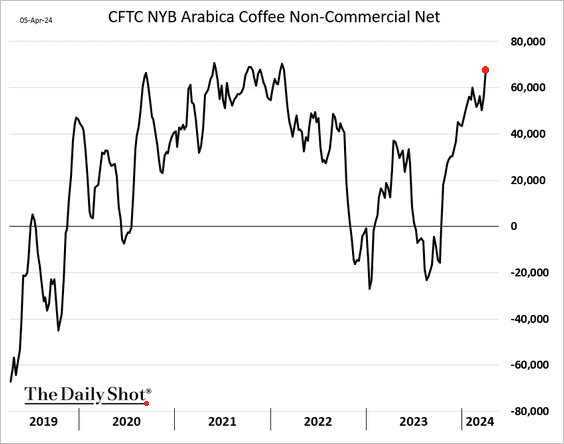

2. Bets on coffee futures continue to climb.

3. Here is a look at last week’s performance.

Back to Index

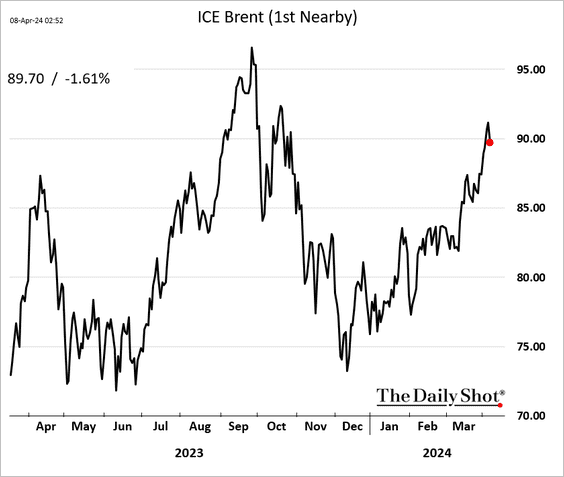

Energy

1. The oil price rally has paused.

Source: NPR Read full article

Source: NPR Read full article

——————–

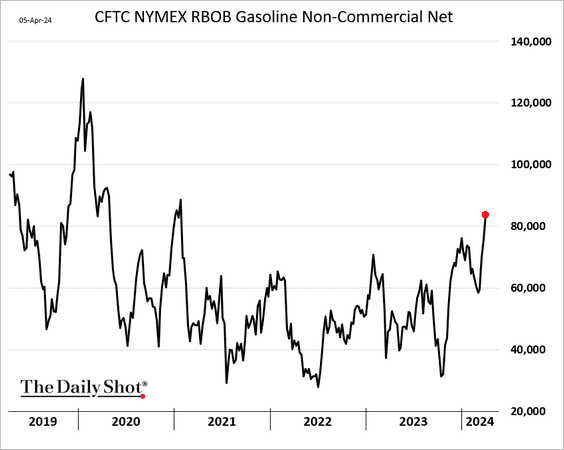

2. Traders are boosting their bets on US gasoline futures.

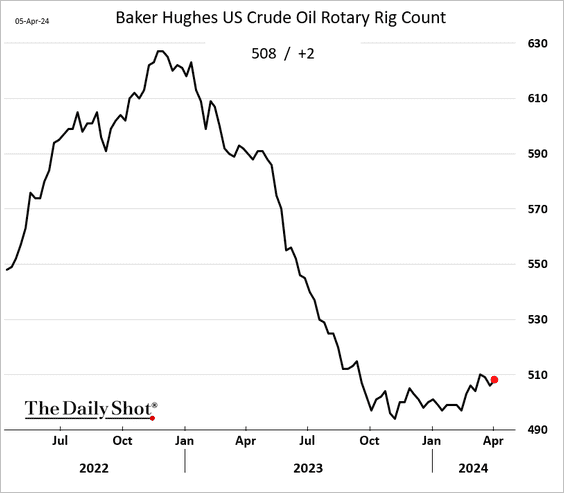

3. The US rig count increased last week.

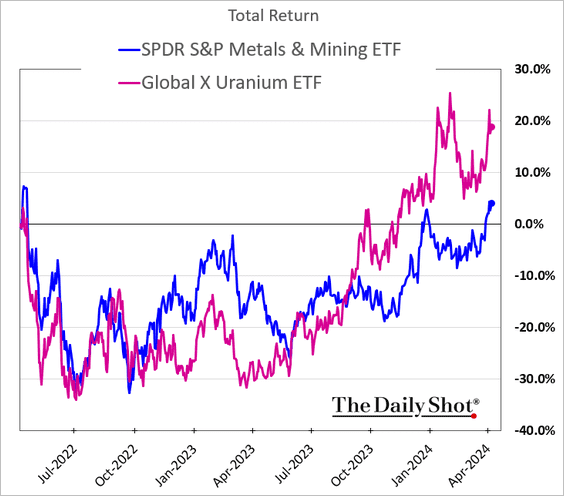

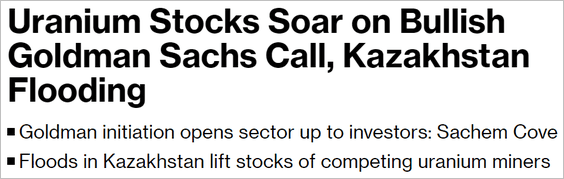

4. Uranium miners’ shares have been outperforming.

Source: @markets Read full article

Source: @markets Read full article

Back to Index

Equities

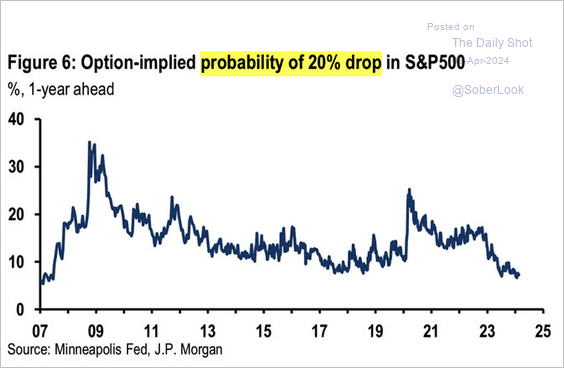

1. The options market signals rising complacency.

Source: JP Morgan Research; @WallStJesus

Source: JP Morgan Research; @WallStJesus

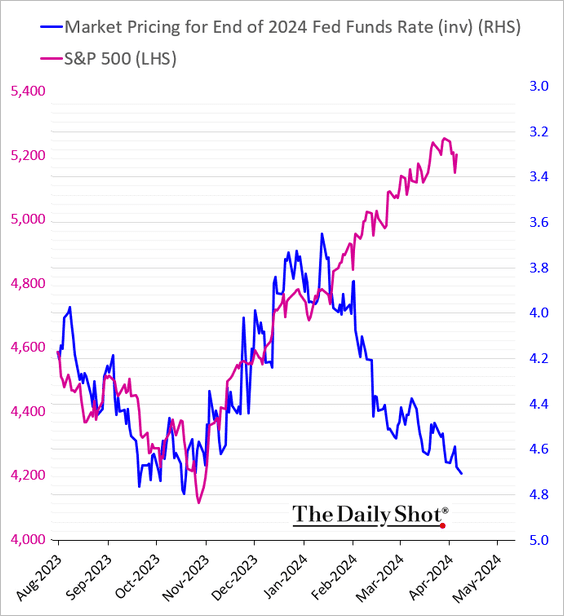

• The stock market continues to ignore the ongoing pullback in rate cut expectations.

——————–

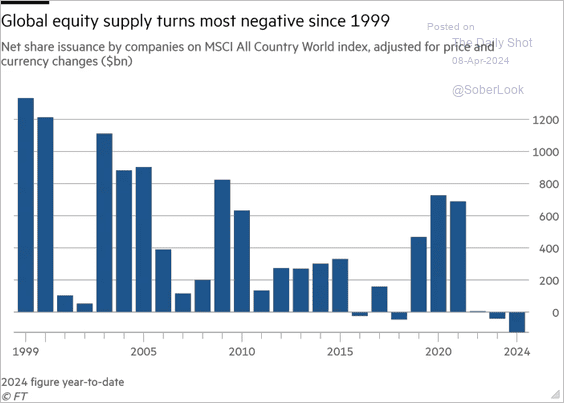

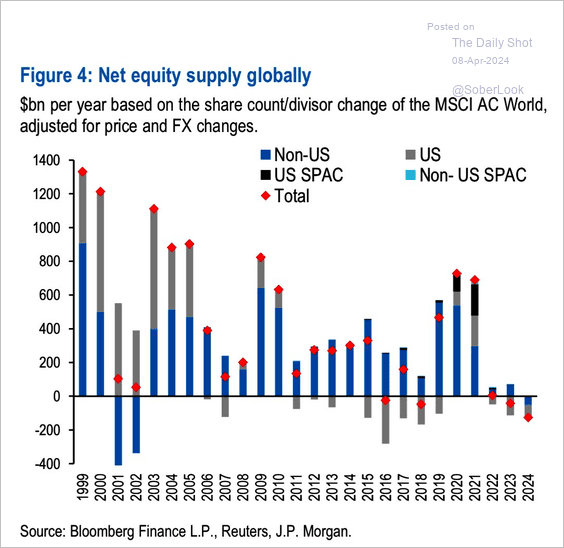

2. The global supply of equities is shrinking, …

Source: @financialtimes Read full article

Source: @financialtimes Read full article

Source: JP Morgan Research; @WallStJesus

Source: JP Morgan Research; @WallStJesus

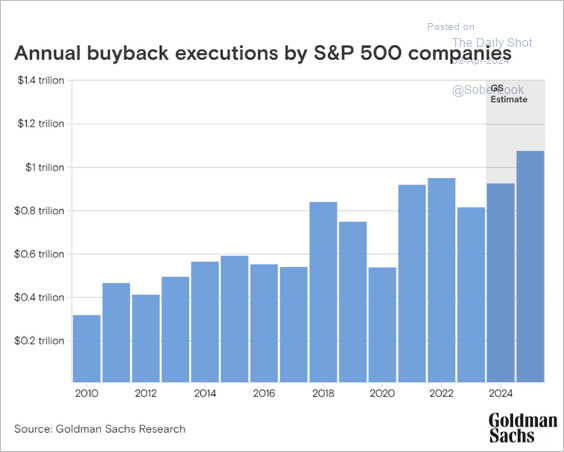

… as share buybacks outpace equity offerings.

Source: Goldman Sachs

Source: Goldman Sachs

——————–

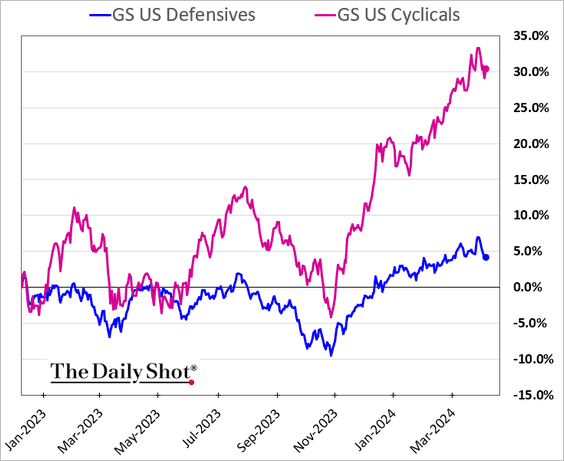

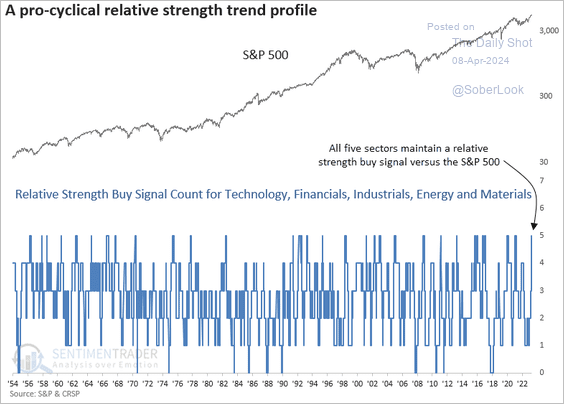

3. Cyclical sectors keep outperforming …

… and displaying positive trends relative to the S&P 500.

Source: SentimenTrader

Source: SentimenTrader

——————–

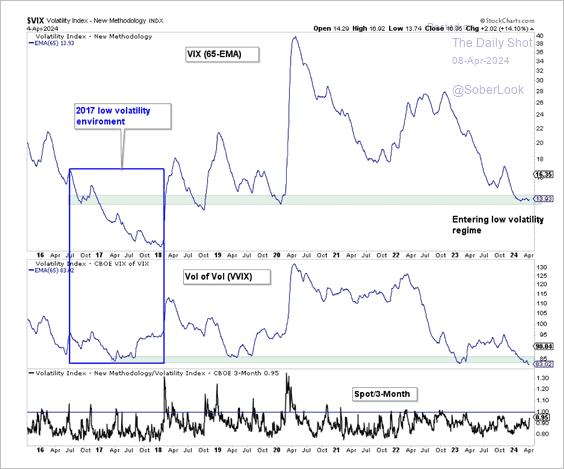

4. The S&P 500 remains in a low-vol regime, similar to what occurred during the 2017 market uptrend.

Source: Aazan Habib, Paradigm Capital

Source: Aazan Habib, Paradigm Capital

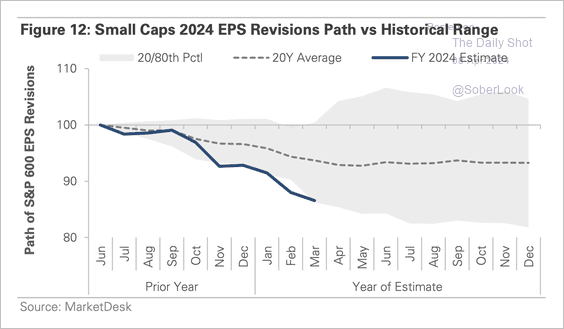

5. Are investors too pessimistic on small-cap earnings?

Source: MarketDesk Research

Source: MarketDesk Research

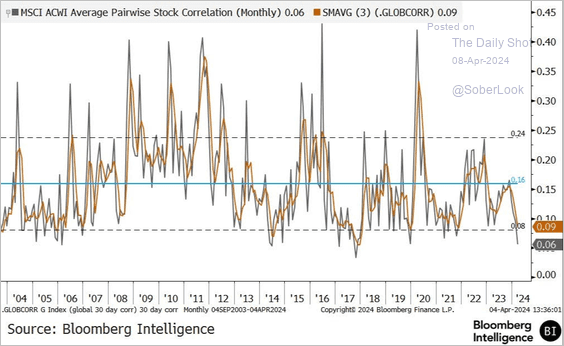

6. Global stock correlations reached a four-year low in March, which typically precedes market pullbacks.

Source: @GinaMartinAdams

Source: @GinaMartinAdams

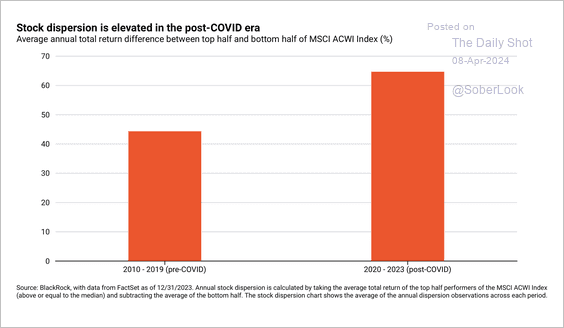

7. Return dispersion has been elevated within the MSCI ACWI Index.

Source: BlackRock Investment Institute Read full article

Source: BlackRock Investment Institute Read full article

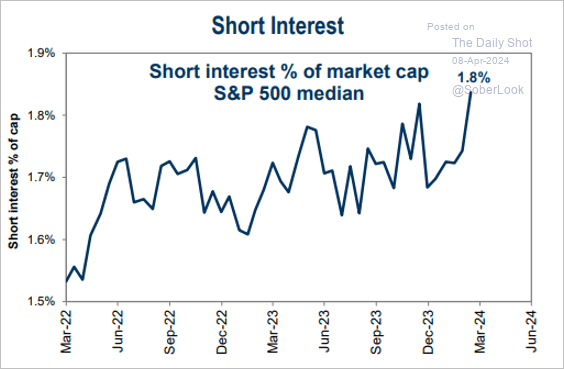

8. Short interest in S&P 500 stocks has been rising.

Source: Goldman Sachs; @MikeZaccardi

Source: Goldman Sachs; @MikeZaccardi

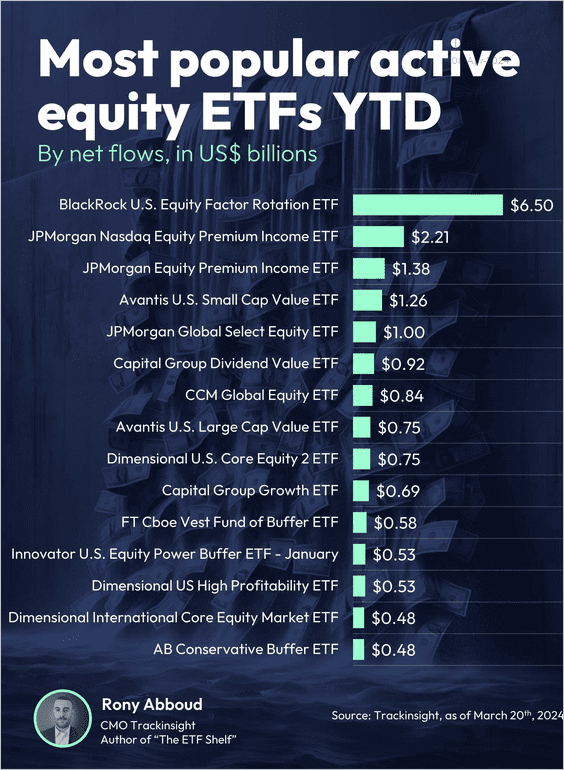

9. Here are the most popular active equity ETFs this year.

Source: The ETF Shelf

Source: The ETF Shelf

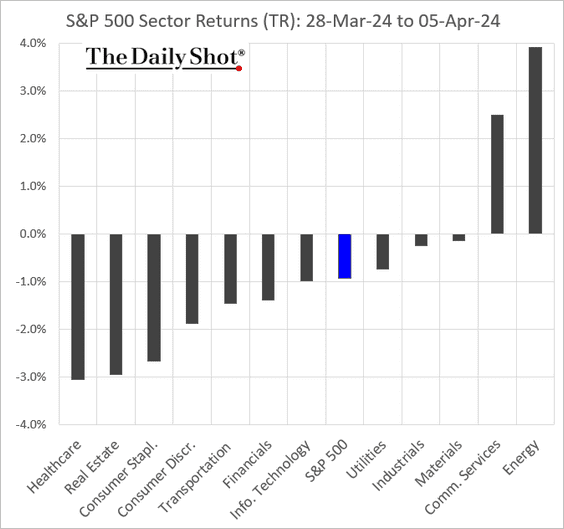

10. Finally, we have some performance data from last week.

• Sectors:

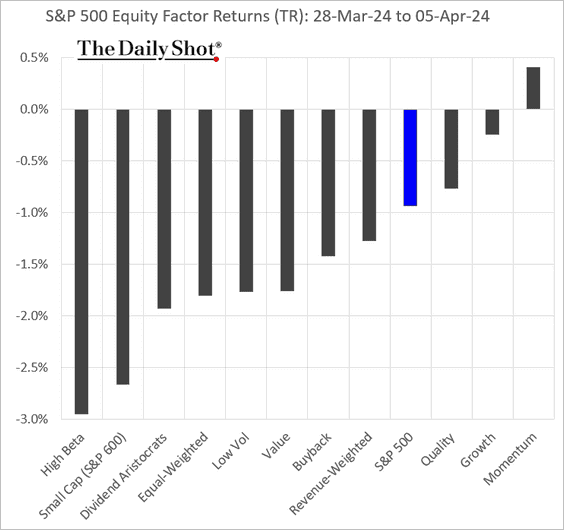

• Equity factors/styles:

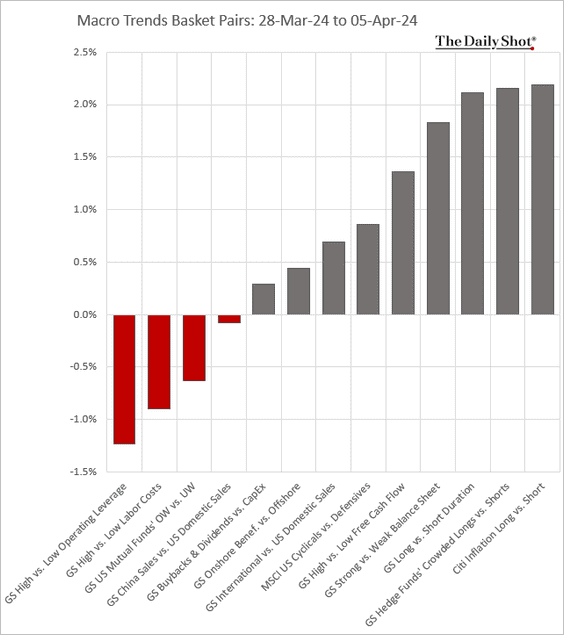

• Macro basket pairs’ relative performance:

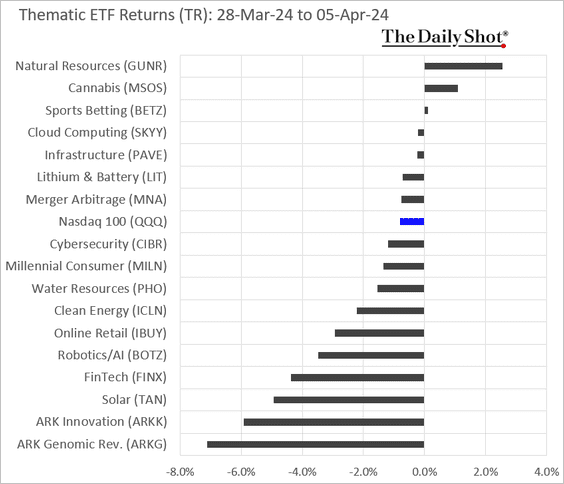

• Thematic ETFs:

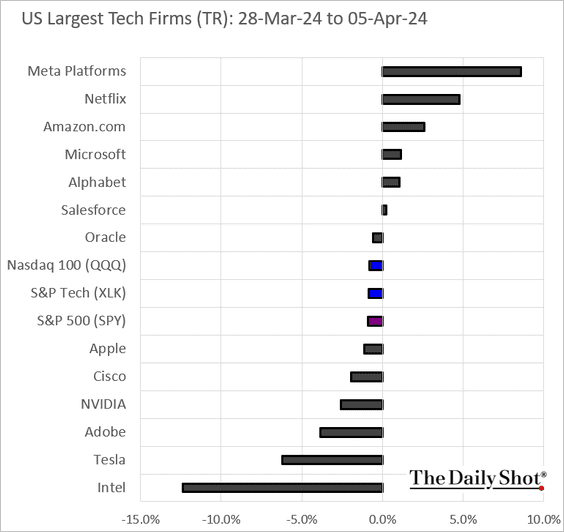

• The largest US tech firms:

Back to Index

Credit

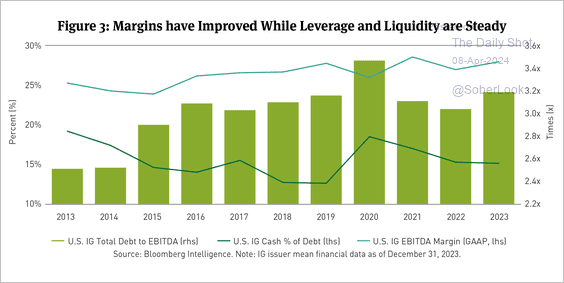

1. US investment-grade credit fundamentals are broadly stable.

Source: Breckinridge Read full article

Source: Breckinridge Read full article

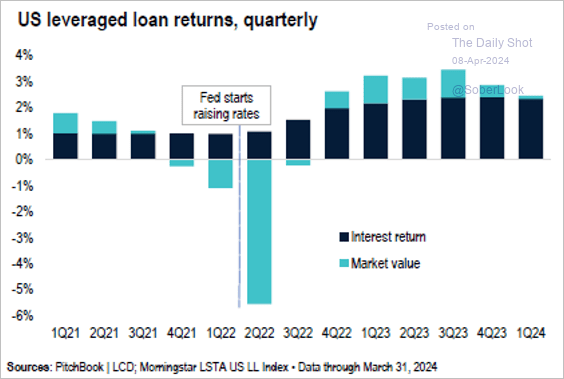

2. US leveraged loan returns are holding up.

Source: PitchBook

Source: PitchBook

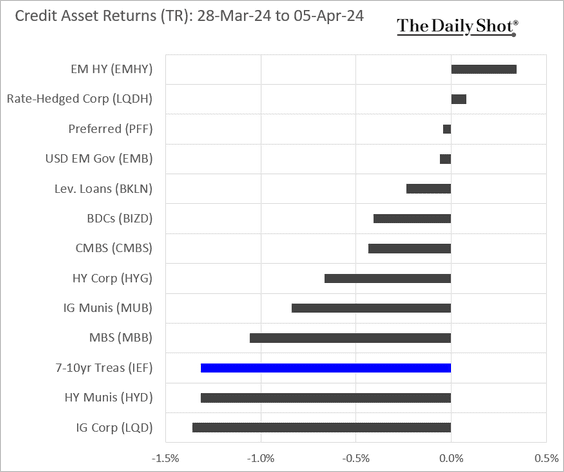

3. Here is a look at last week’s performance.

Back to Index

Rates

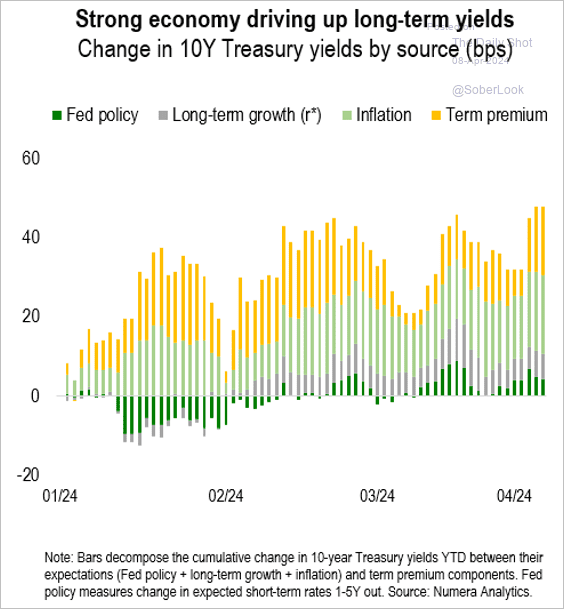

1. A combination of stronger growth optimism, rising inflation expectations, and a delayed outlook on Fed rate cuts have driven the rise in Treasury yields.

Source: Numera Analytics (@NumeraAnalytics)

Source: Numera Analytics (@NumeraAnalytics)

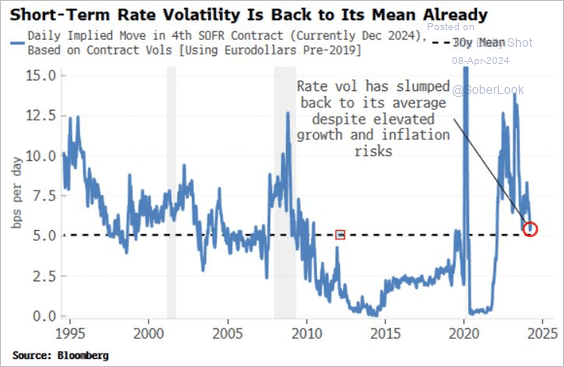

2. Short-term rate volatility is back to its long-term average.

Source: Simon White, Bloomberg Markets Live Blog

Source: Simon White, Bloomberg Markets Live Blog

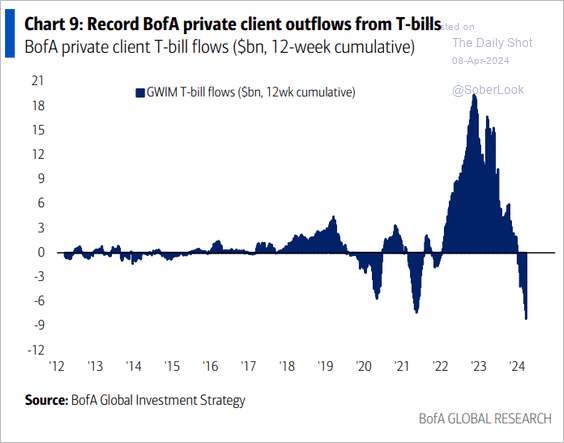

3. BofA’s private clients have been rotating out of Treasury bills.

Source: BofA Global Research

Source: BofA Global Research

Back to Index

Global Developments

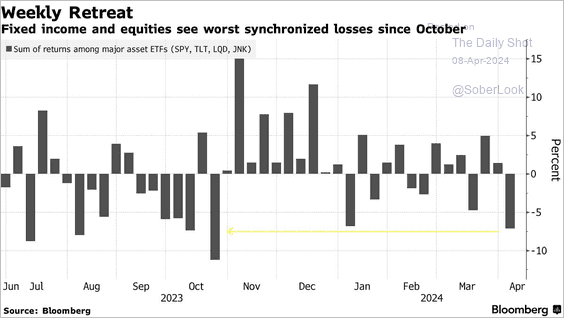

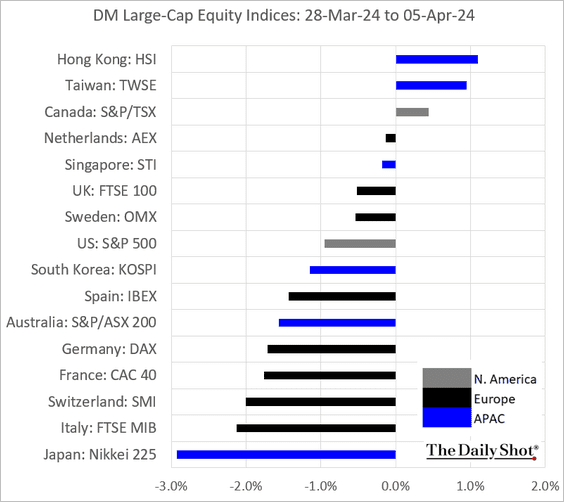

Stocks and bonds declined last week.

Source: @markets Read full article

Source: @markets Read full article

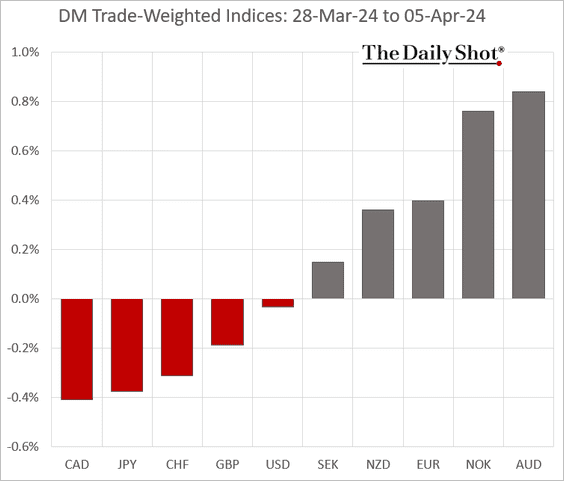

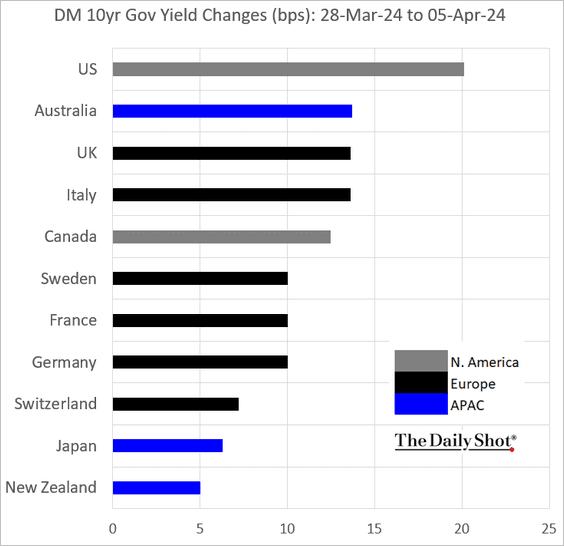

Here is a look at market performance in advanced economies.

• Currencies:

• Bond yields:

• Large-cap equities:

——————–

Food for Thought

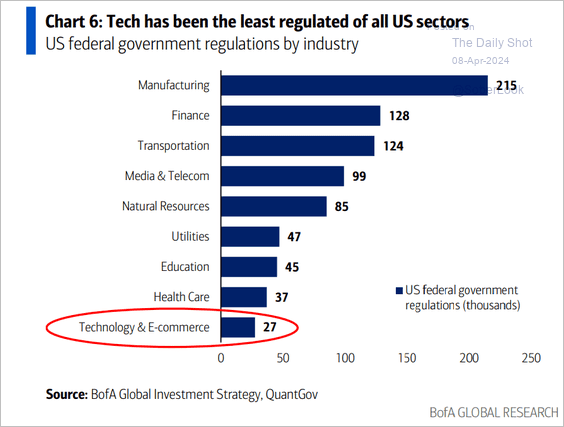

1. Federal government regulations by industry:

Source: BofA Global Research

Source: BofA Global Research

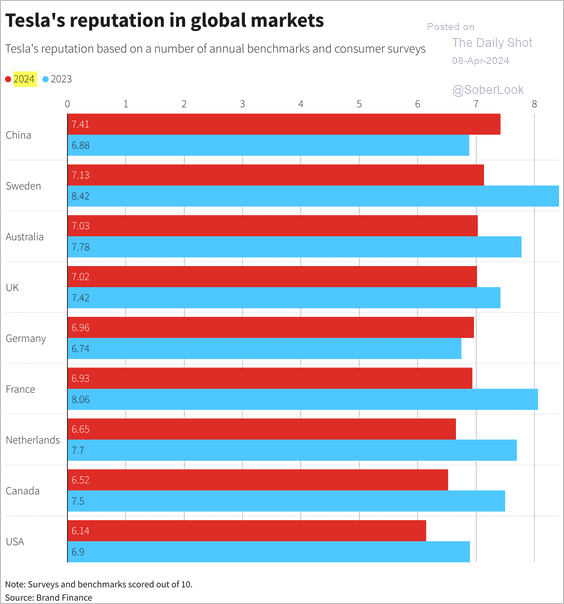

2. Tesla’s reputation:

Source: Reuters Read full article

Source: Reuters Read full article

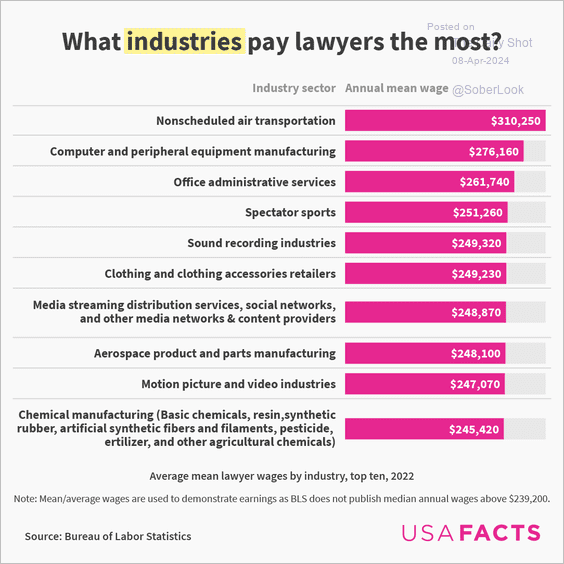

3. Top-paying industries for lawyers:

Source: USAFacts

Source: USAFacts

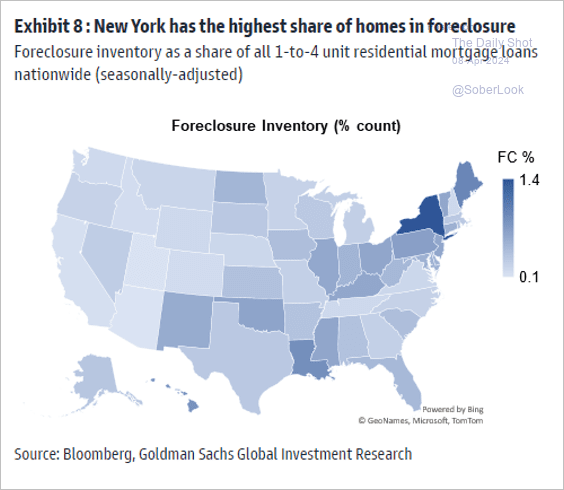

4. Housing foreclosure rates by state:

Source: Goldman Sachs; @MikeZaccardi

Source: Goldman Sachs; @MikeZaccardi

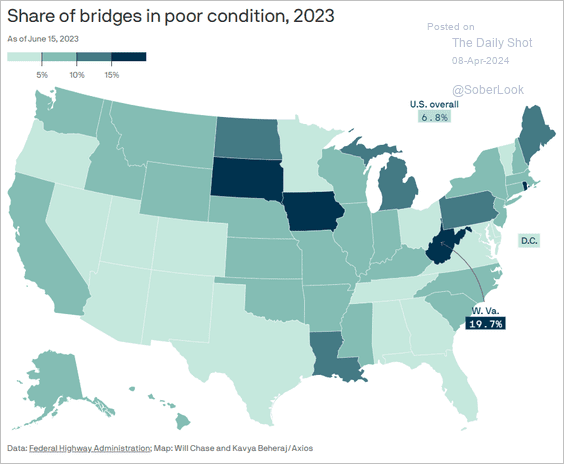

5. Bridges in poor condition:

Source: @axios Read full article

Source: @axios Read full article

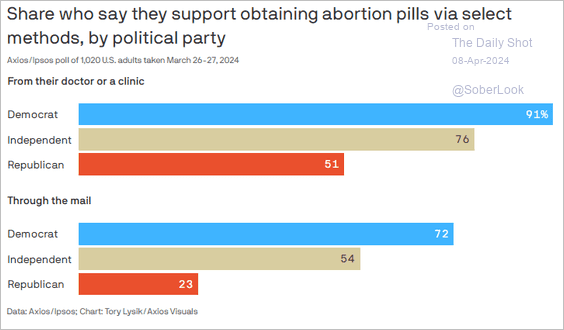

6. Political party differences in support for abortion pill access methods:

Source: @axios Read full article

Source: @axios Read full article

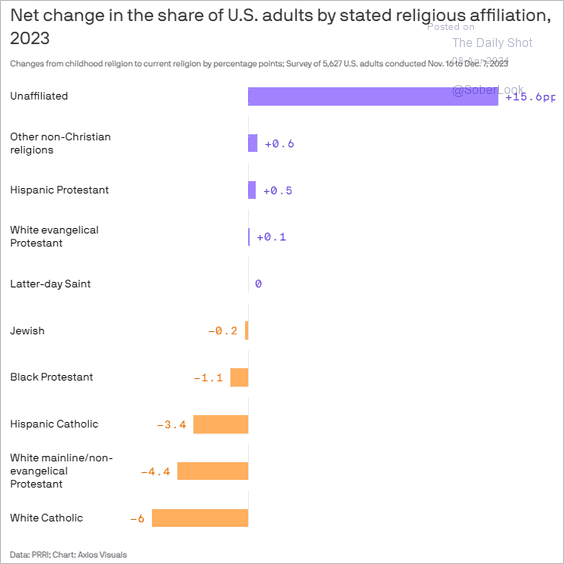

7. Shifts in religious affiliation among US adults since childhood:

Source: @axios Read full article

Source: @axios Read full article

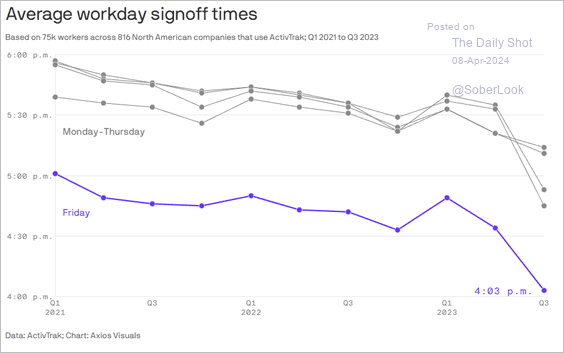

8. Signoff times:

Source: @axios Read full article

Source: @axios Read full article

——————–

Back to Index