The Daily Shot: 25-Mar-24

• Administrative Update

• The United States

• The United Kingdom

• The Eurozone

• Europe

• Japan

• Asia-Pacific

• China

• Emerging Markets

• Commodities

• Energy

• Equities

• Credit

• Rates

• Global Developments

• Food for Thought

Administrative Update

The Daily Shot will not be published this Friday, March 29th.

Back to Index

The United States

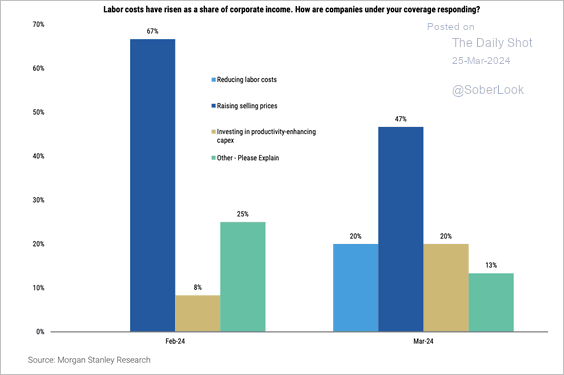

1. Firms are raising their selling prices to offset higher labor costs, according to an analyst survey by Morgan Stanley, …

Source: Morgan Stanley Research

Source: Morgan Stanley Research

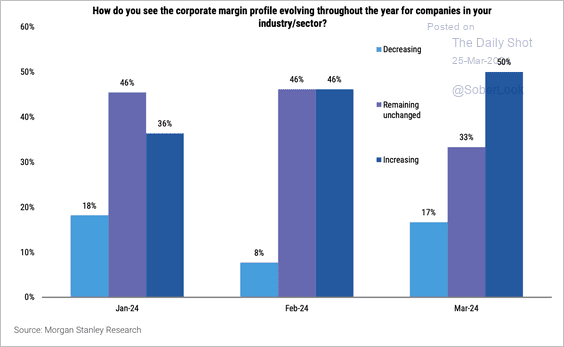

… and the outlook for corporate margins remains solid.

Source: Morgan Stanley Research

Source: Morgan Stanley Research

——————–

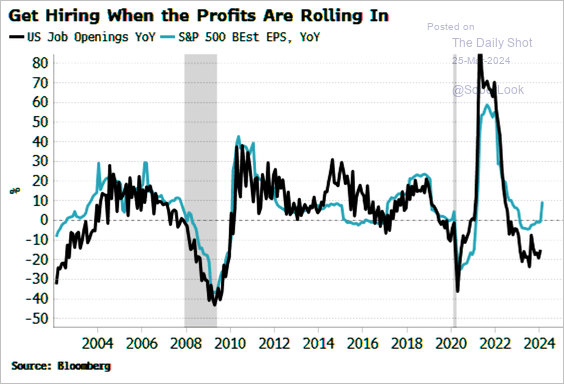

2. Could strong corporate earnings accelerate hiring?

Source: Simon White, Bloomberg Markets Live Blog

Source: Simon White, Bloomberg Markets Live Blog

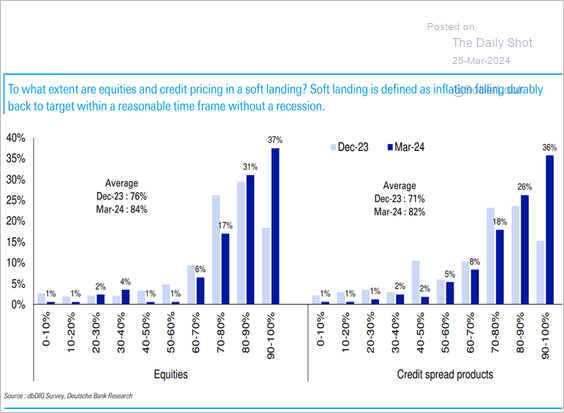

3. According to a Deutsche Bank survey, a growing number of investors think that equity and credit markets have factored in a soft landing. Still, there could be room for further gains if this scenario actually unfolds.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

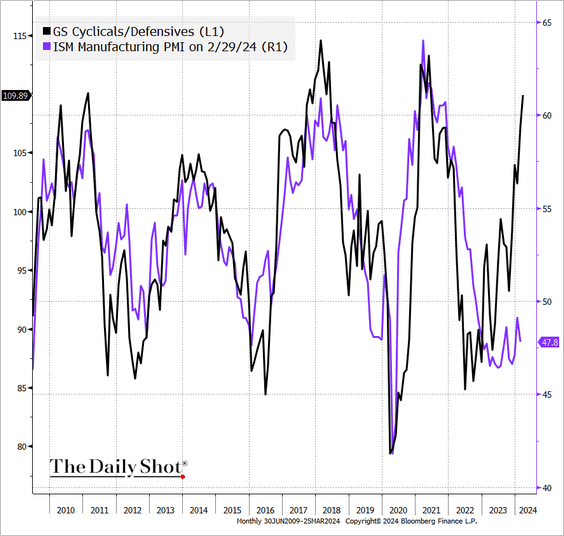

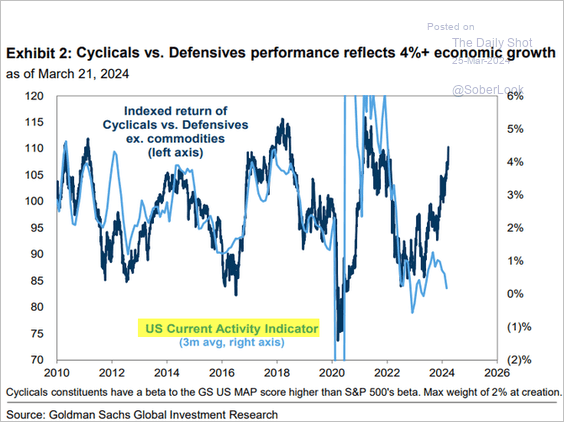

4. The outperformance of cyclical shares signals stronger economic growth ahead (2 charts).

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: Goldman Sachs; @MikeZaccardi

Source: Goldman Sachs; @MikeZaccardi

——————–

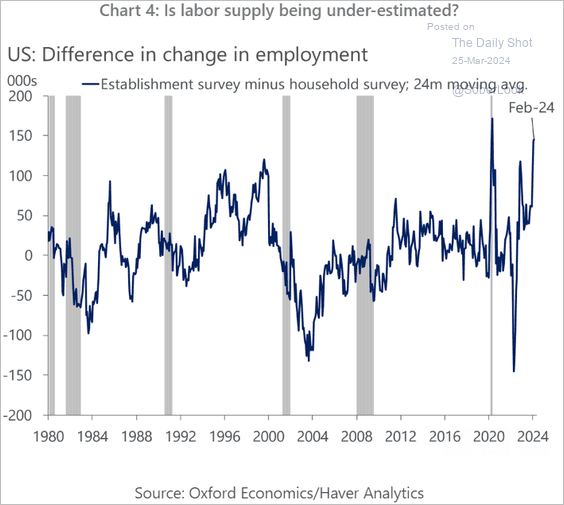

5. The gap between job growth based on the Household and Establishment surveys has reached extreme levels, raising the question of whether the strength in US job gains might be overstated.

Source: Oxford Economics

Source: Oxford Economics

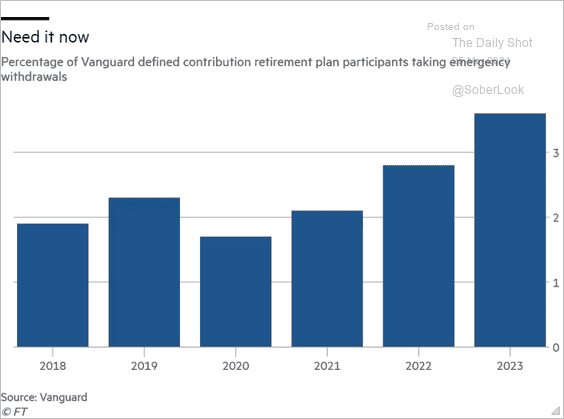

6. US households are increasingly tapping their IRA/401-k accounts.

Source: @financialtimes Read full article

Source: @financialtimes Read full article

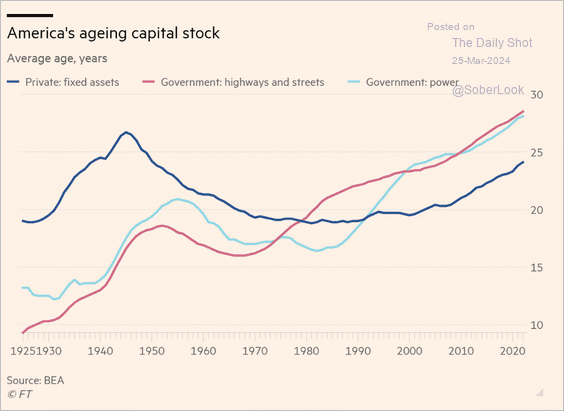

7. This chart illustrates that substantial investment will be required to rejuvenate the nation’s aging infrastructure.

Source: @financialtimes Read full article

Source: @financialtimes Read full article

Back to Index

The United Kingdom

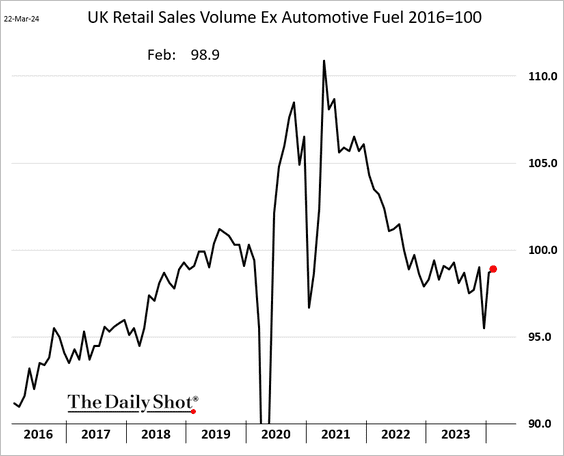

1. UK retail sales experienced a slight increase last month, defying market expectations of a decline.

Source: Reuters Read full article

Source: Reuters Read full article

——————–

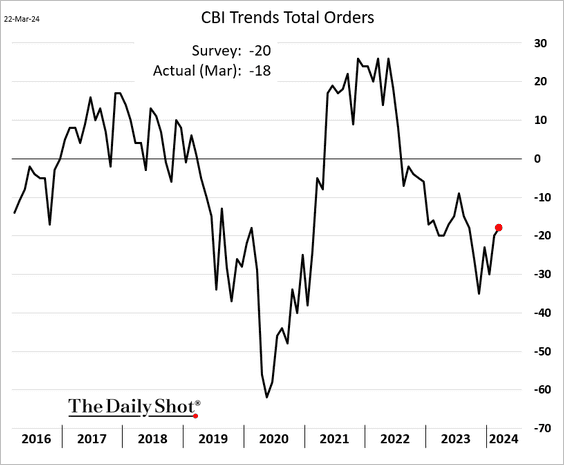

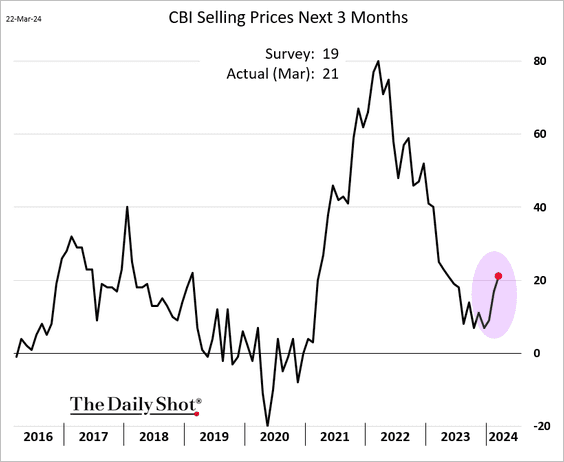

2. The CBI report showed the UK industrial slump easing.

• An increasing number of manufacturing firms plan to boost prices.

Back to Index

The Eurozone

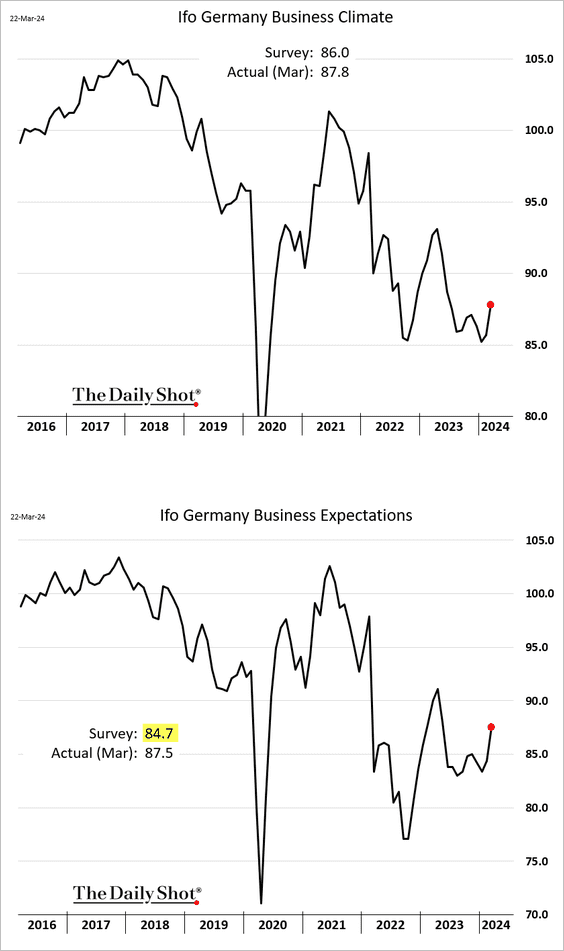

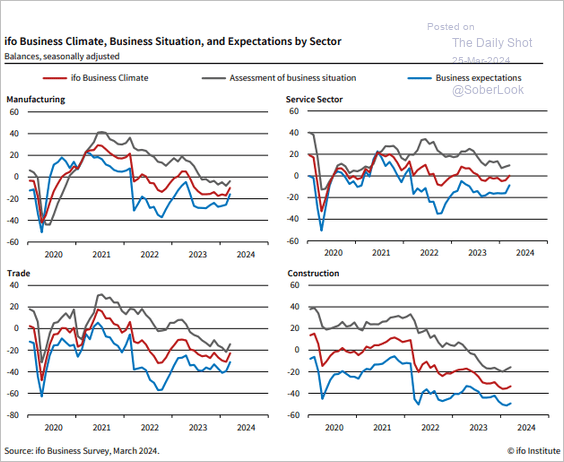

1. Germany’s Ifo business sentiment improved further this month.

Source: ifo Institute

Source: ifo Institute

——————–

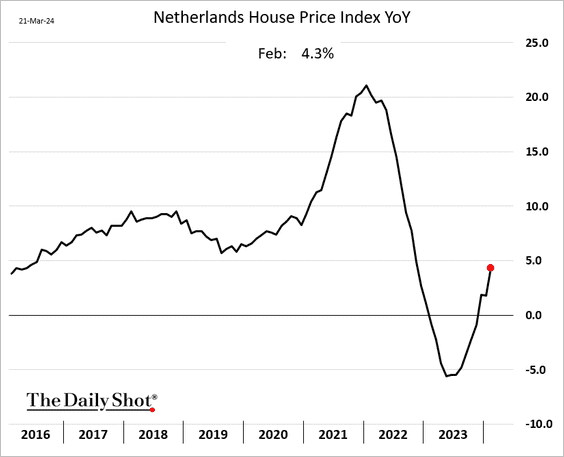

2. Dutch home prices are rebounding.

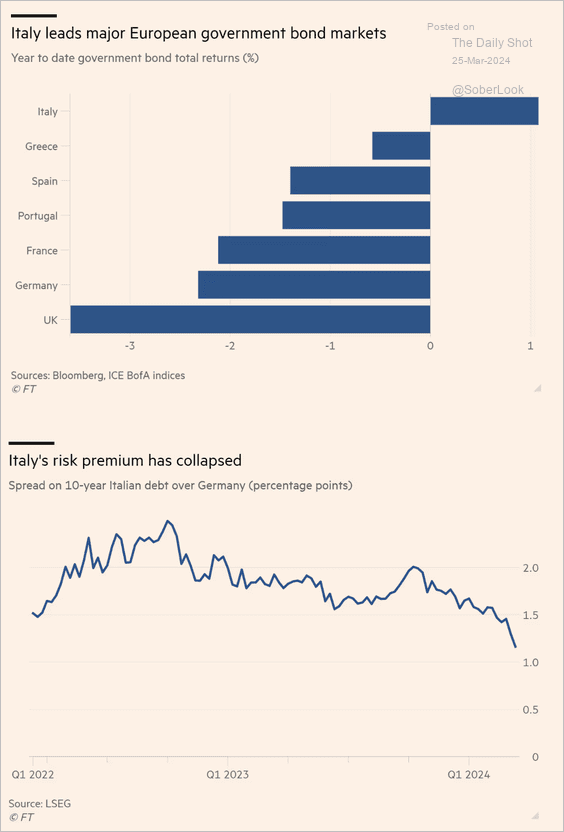

3. Italian bonds have been outperforming.

Source: @financialtimes Read full article

Source: @financialtimes Read full article

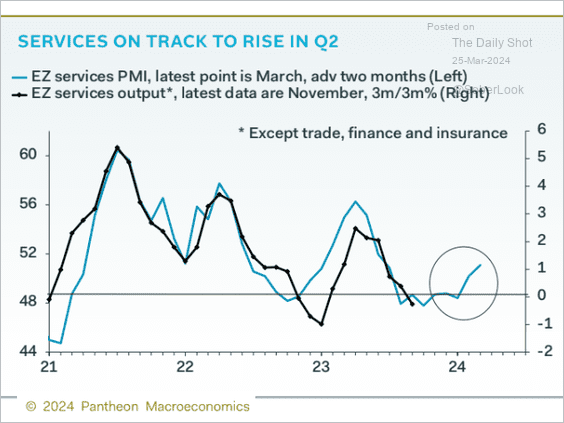

4. The PMI data signal a rebound in euro-area services output.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

Back to Index

Europe

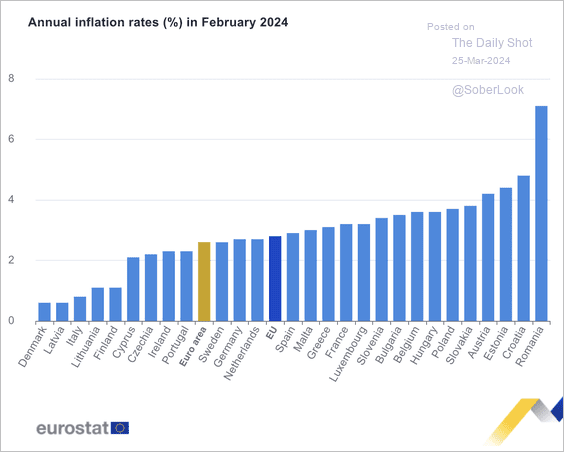

1. Here is a look at inflation rates by country in the EU.

Source: Eurostat Read full article

Source: Eurostat Read full article

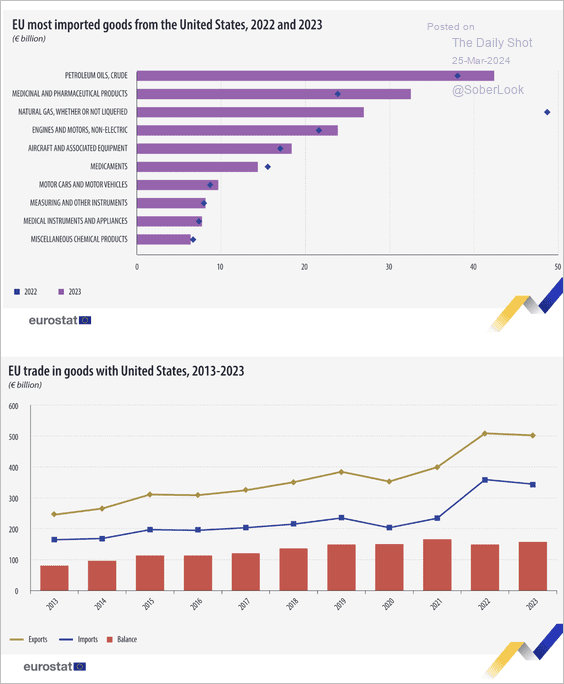

2. The chart below shows the EU’s most imported goods from the US. The second panel depicts the EU-US trade in goods.

Source: Eurostat Read full article

Source: Eurostat Read full article

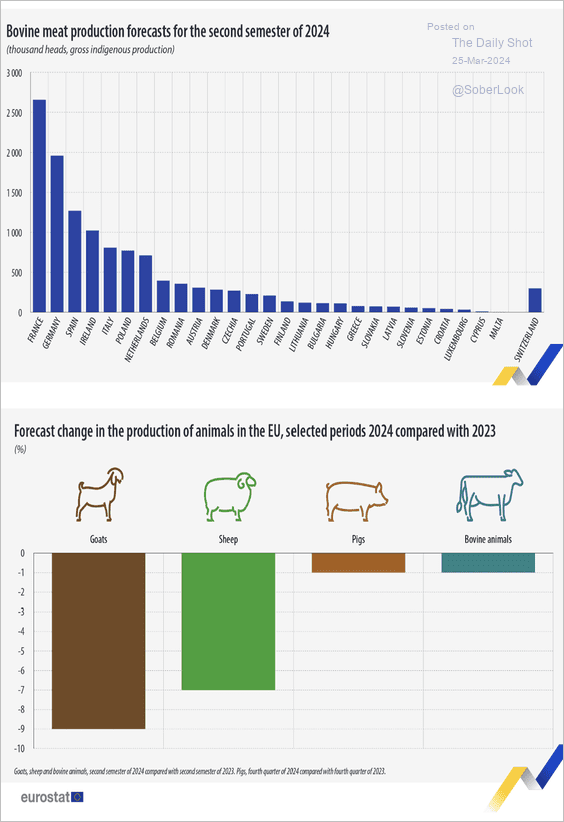

3. Next, we have the bovine meat production forecasts and livestock production changes for 2024.

Source: Eurostat Read full article

Source: Eurostat Read full article

Back to Index

Japan

1. Household spending has been soft.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

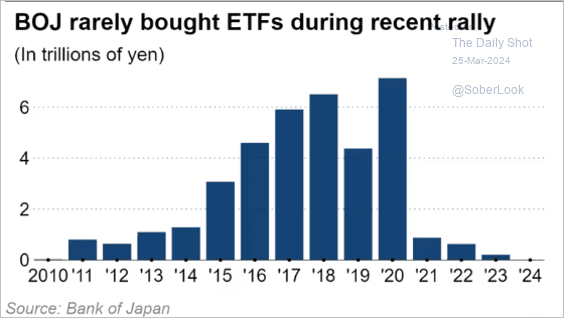

2. The BoJ has made fewer ETF purchases in recent years before officially ending the program last week.

Source: Nikkei Asia Read full article

Source: Nikkei Asia Read full article

Back to Index

Asia-Pacific

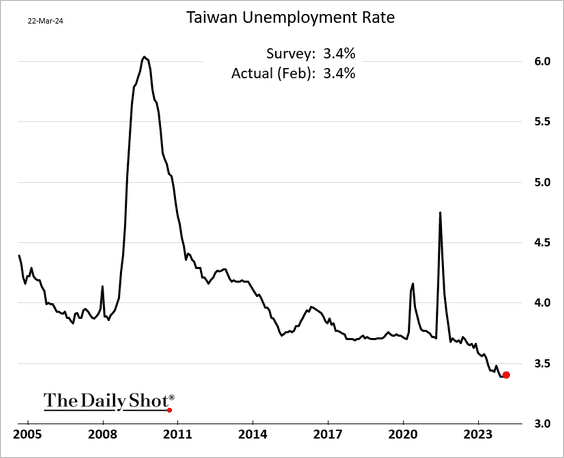

1. Taiwan’s unemployment is holding near record lows.

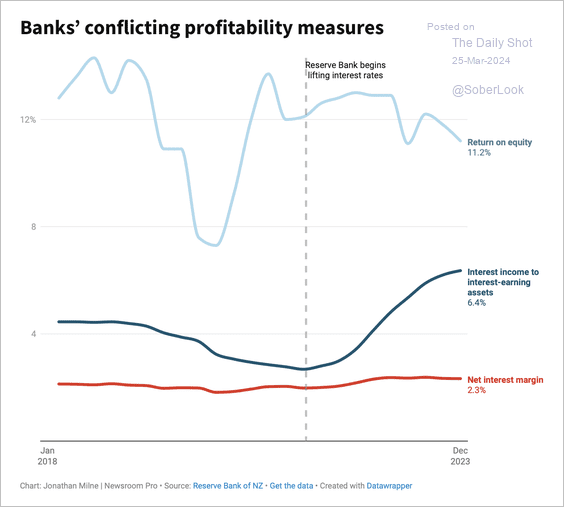

2. New Zealand’s banks have experienced declining returns on equity despite rising interest income.

Source: Newsroom Read full article

Source: Newsroom Read full article

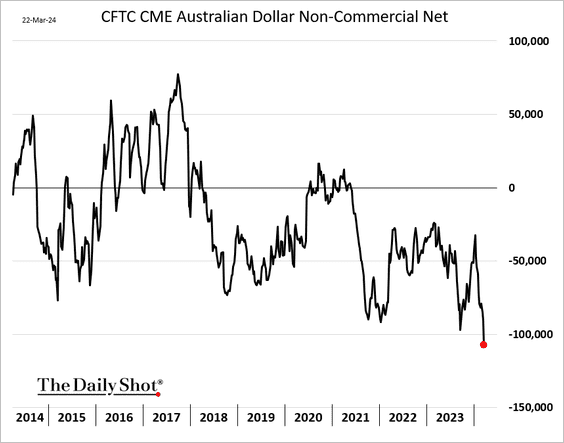

3. Traders are extending their bets against the Aussie dollar.

Back to Index

China

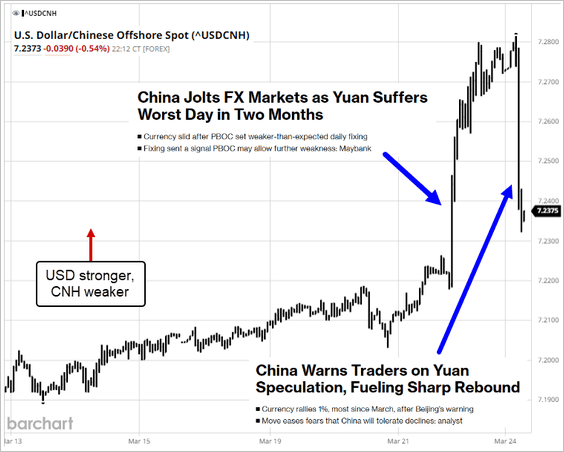

1. The renminbi has rebound after a sharp selloff last week.

Source: @markets Read full article

Source: @markets Read full article

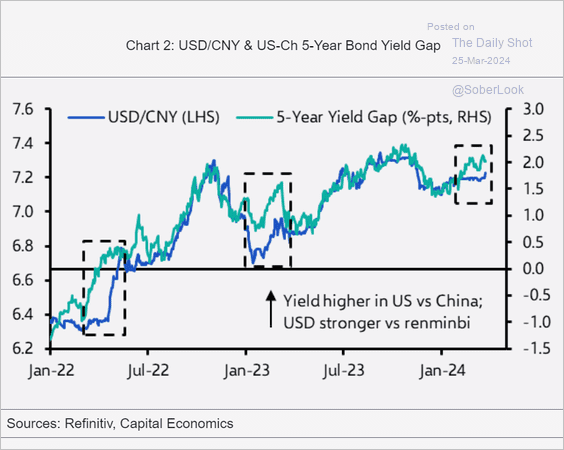

• Yield differentials with the US point to downside risks for the yuan.

Source: Capital Economics

Source: Capital Economics

——————–

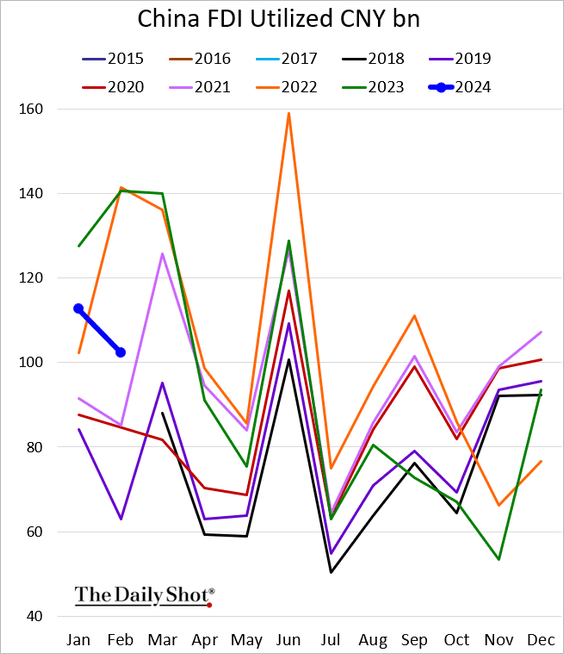

2. Utilization of foreign direct investment was soft last month.

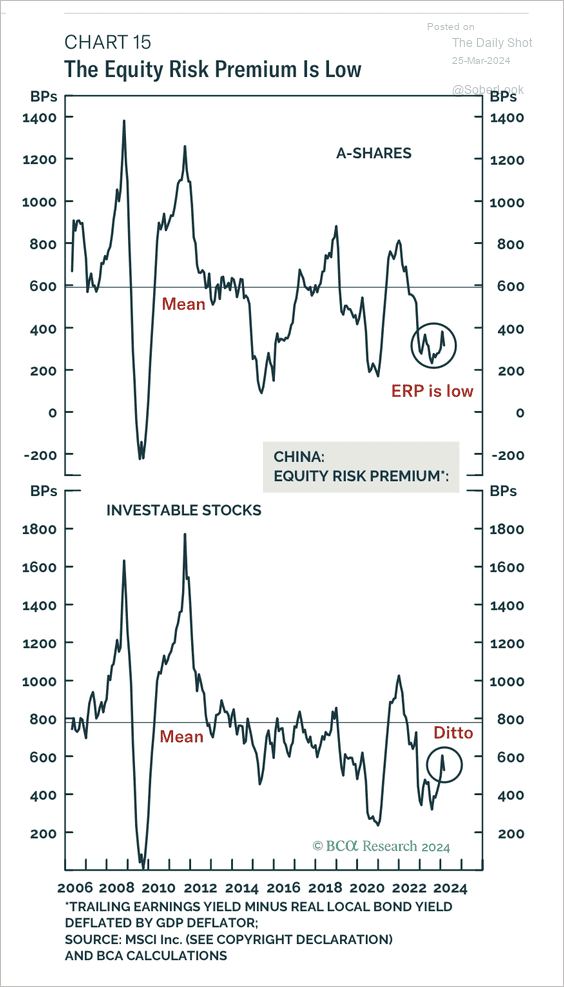

3. Chinese stocks are not necessarily cheap when deflation is incorporated into valuation measures.

Source: BCA Research

Source: BCA Research

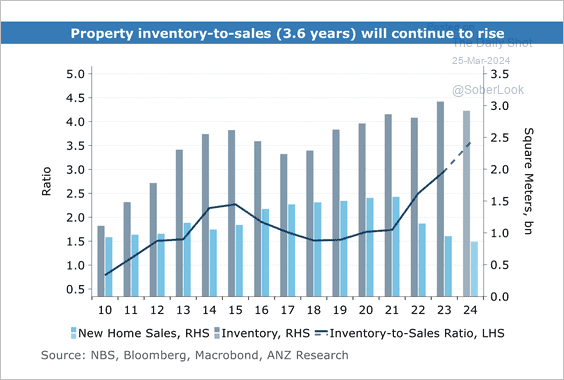

4. Weak housing demand has led to an inventory pile-up, which weighed on prices.

Source: @ANZ_Research

Source: @ANZ_Research

Back to Index

Emerging Markets

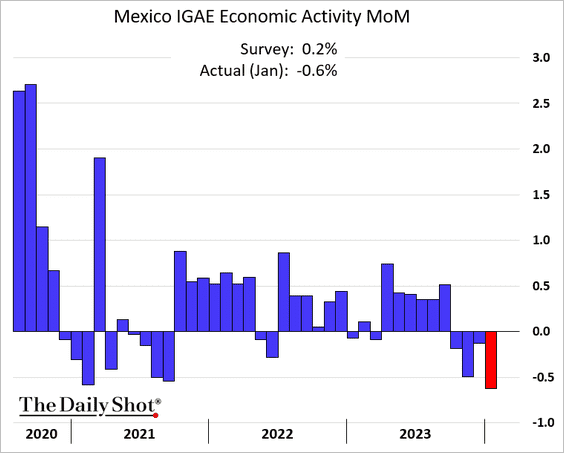

1. Mexico’s economic activity was down for the fourth month in a row in January.

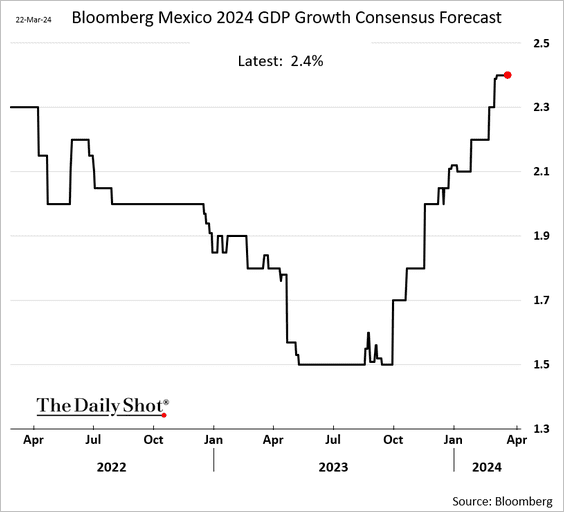

• Nonetheless, economists remain upbeat on this year’s GDP growth.

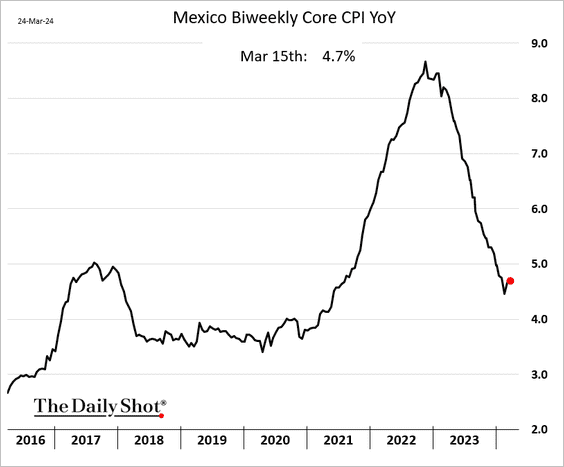

• The declines in core inflation have stalled.

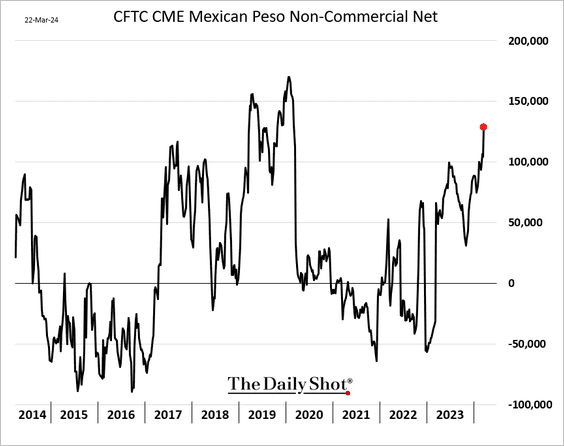

• Traders are boosting their bets on the Mexican peso.

——————–

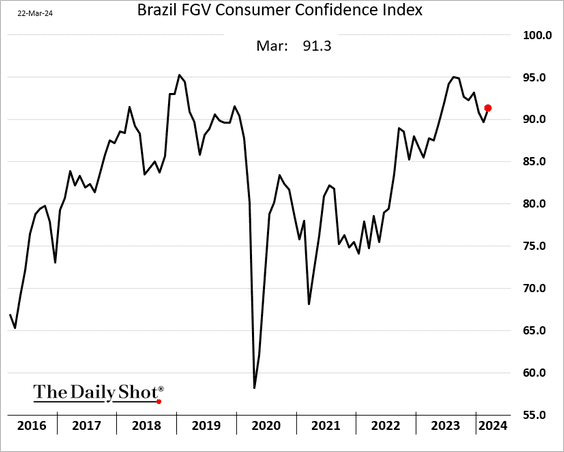

2. Brazil’s consumer confidence improved this month.

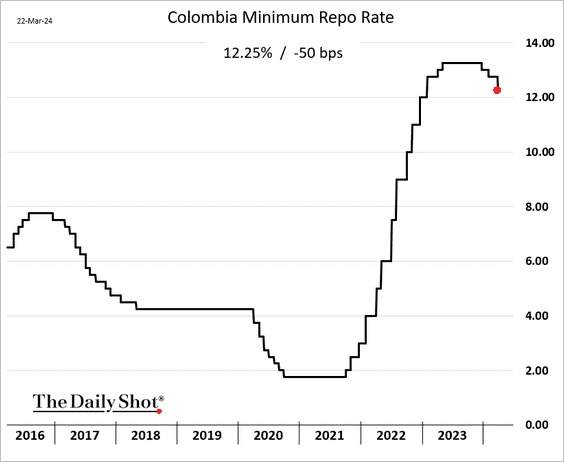

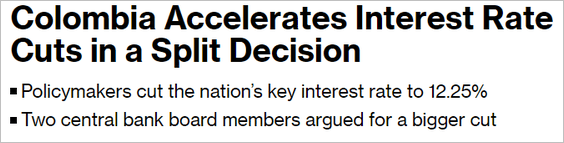

3. Colombia’s central bank cut rates by 50 bps.

Source: @economics Read full article

Source: @economics Read full article

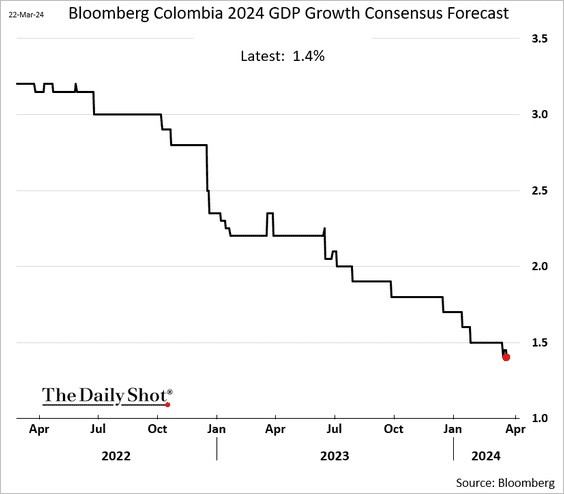

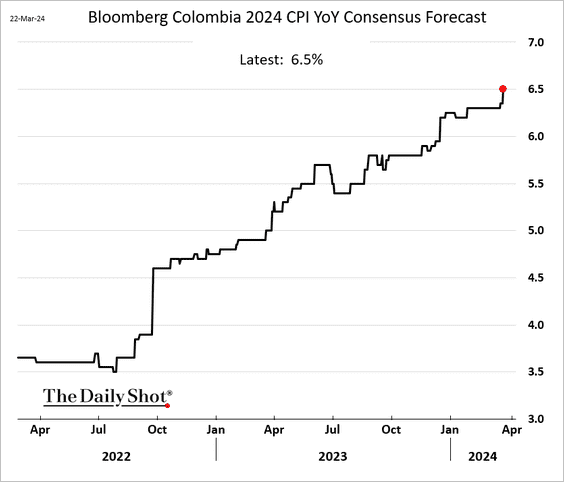

• Economists increasingly see stagflationary trends in Colombia.

– 2024 GDP growth estimates over time:

– 2024 inflation estimates:

Source: Bloomberg

Source: Bloomberg

——————–

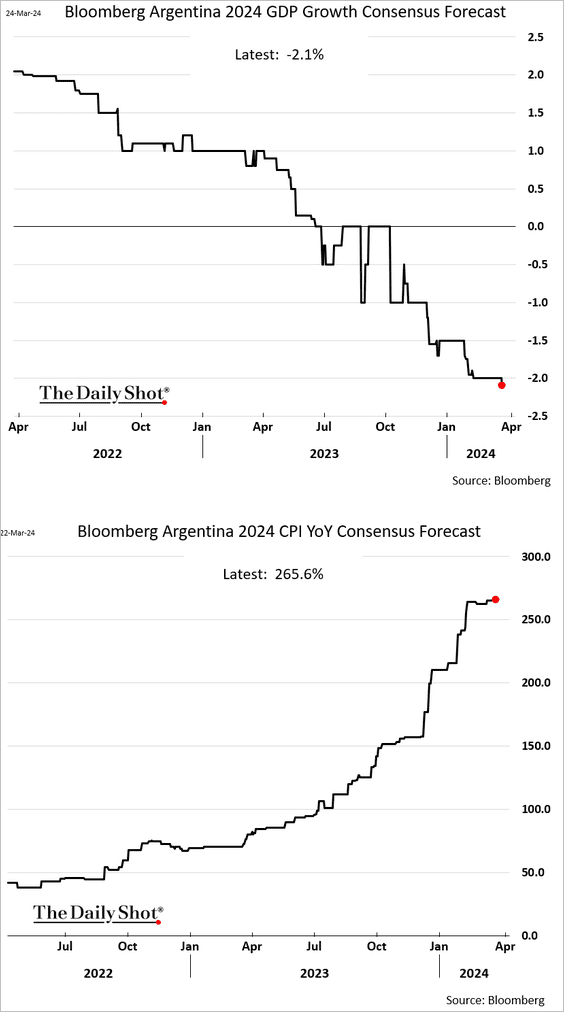

4. Forecasters are not optimistic about Argentina’s economy this year.

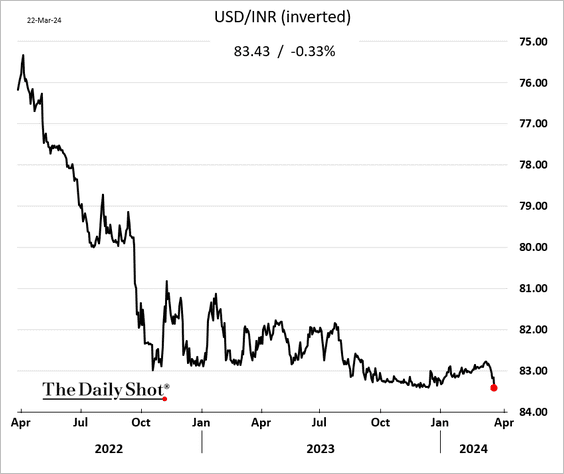

5. The Indian rupee hit a record low against the US dollar.

Source: Reuters Read full article

Source: Reuters Read full article

——————–

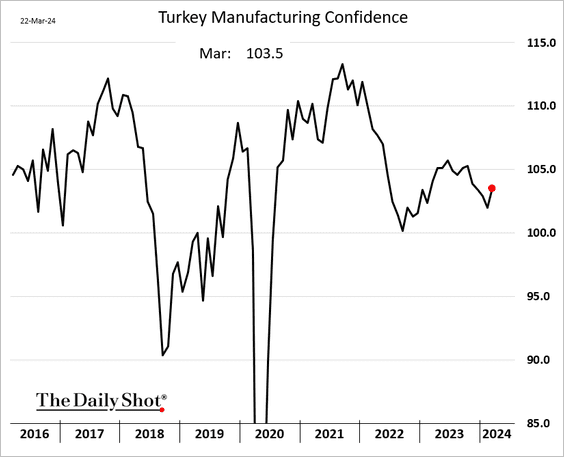

6. Turkey’s manufacturing confidence appears to have stabilized.

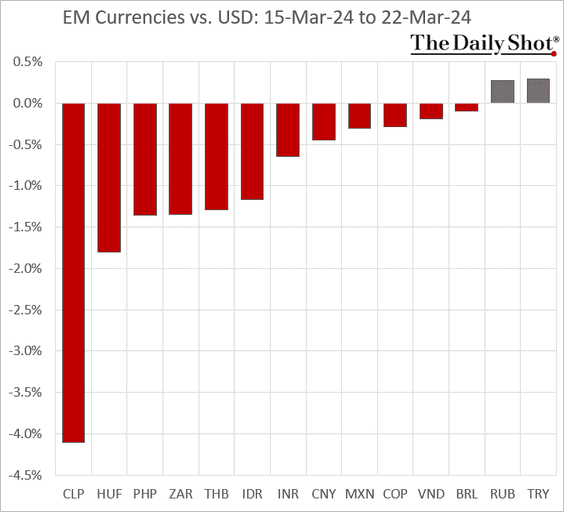

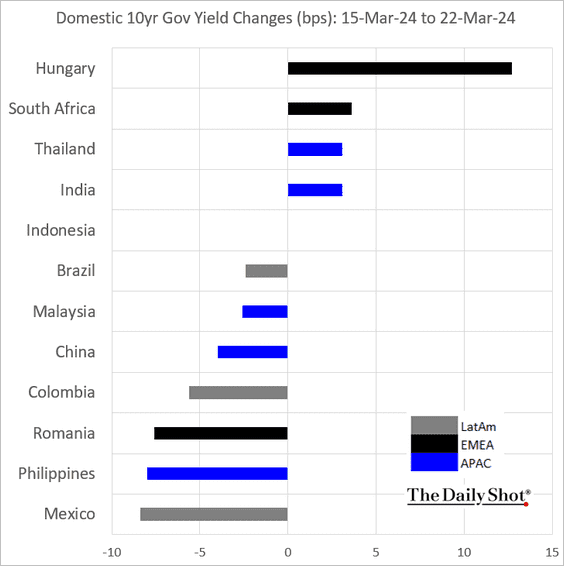

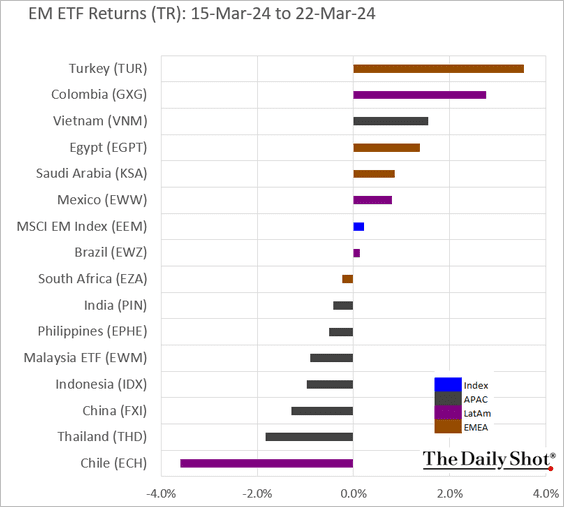

7. Next, we have some performance data from last week.

• Currencies:

• Bond yields:

• Equity ETFs:

Back to Index

Commodities

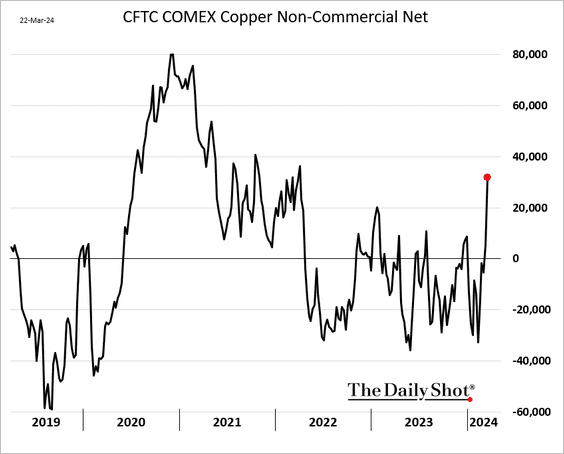

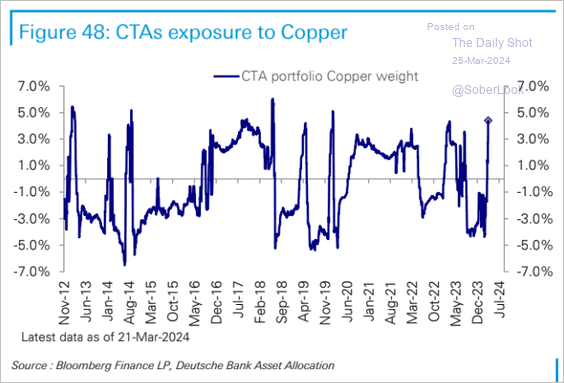

1. Traders are boosting their bets on copper.

Here is CTAs’ copper positioning.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

——————–

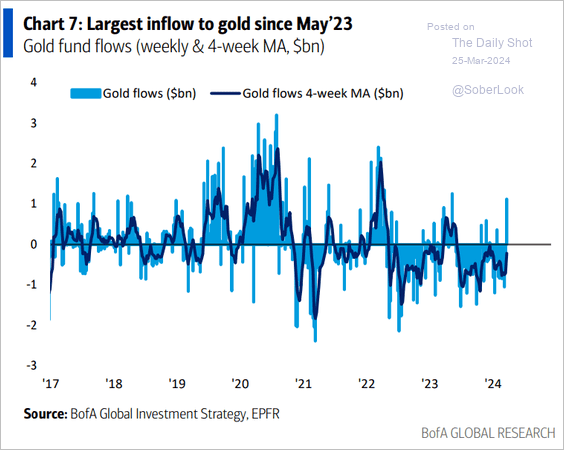

2. Flows into gold funds have picked up.

Source: BofA Global Research

Source: BofA Global Research

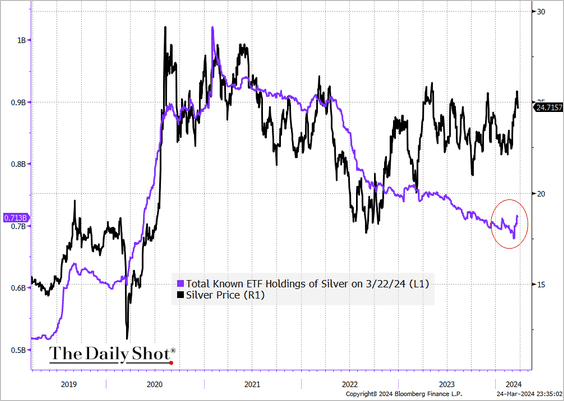

• Silver ETFs are also seeing some inflows.

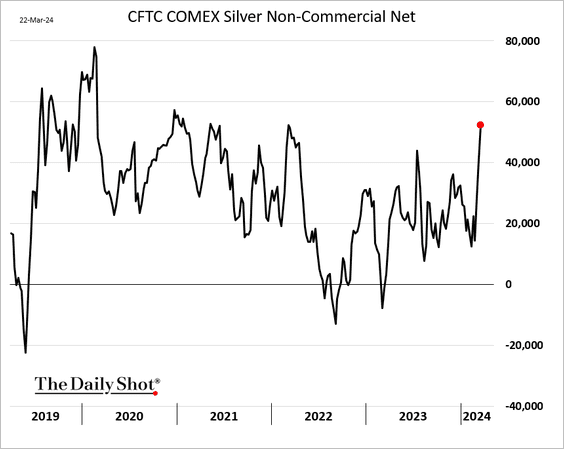

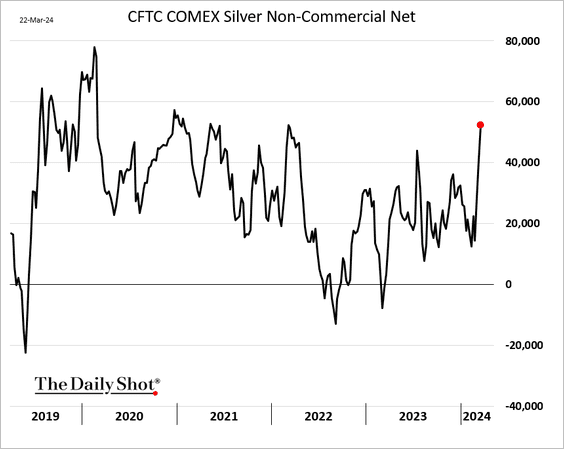

– Speculative accounts are boosting their bets on silver.

——————–

3. Here is a look at last week’s performance.

Back to Index

Energy

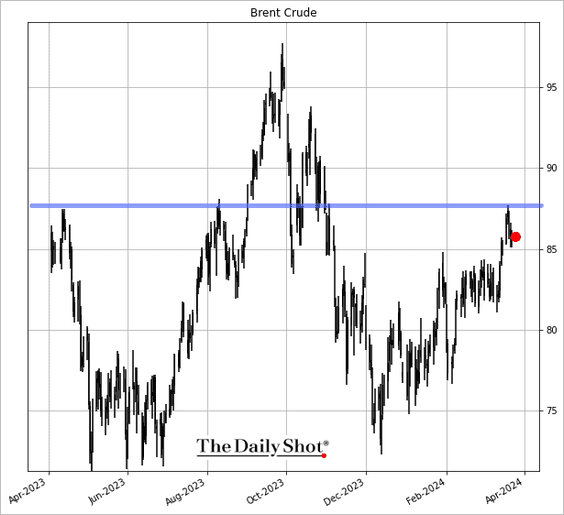

1. Brent crude resistance has been holding.

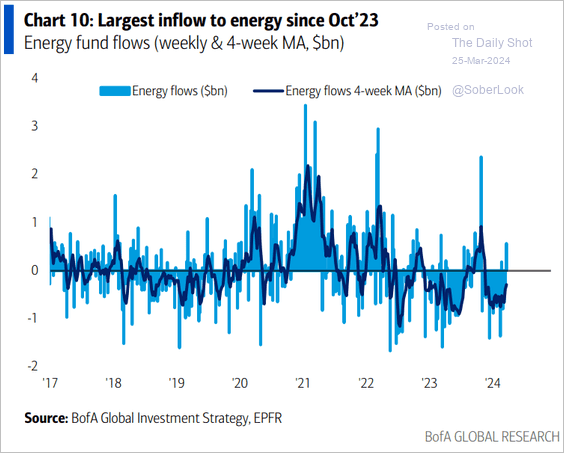

2. Flows into energy funds have picked up.

Source: BofA Global Research

Source: BofA Global Research

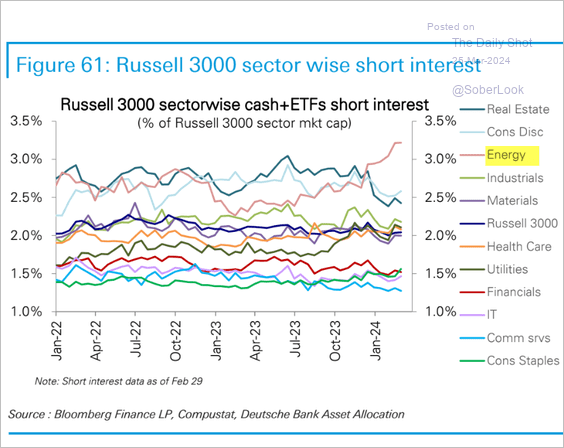

• Short positioning in energy names has been rising.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

——————–

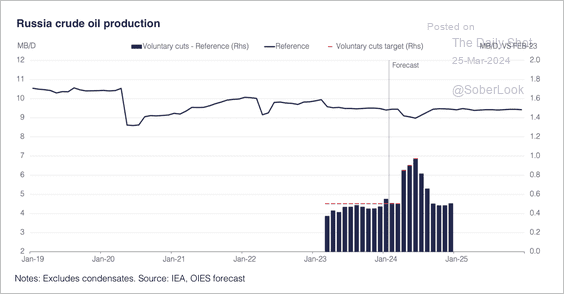

3. Russia’s crude oil production in Q2 is expected to fall to its lowest level since the war started.

Source: OIES

Source: OIES

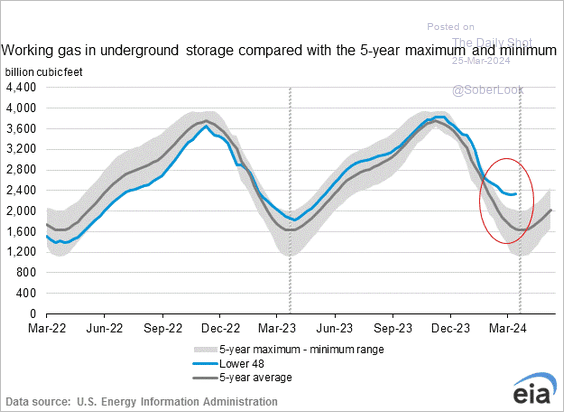

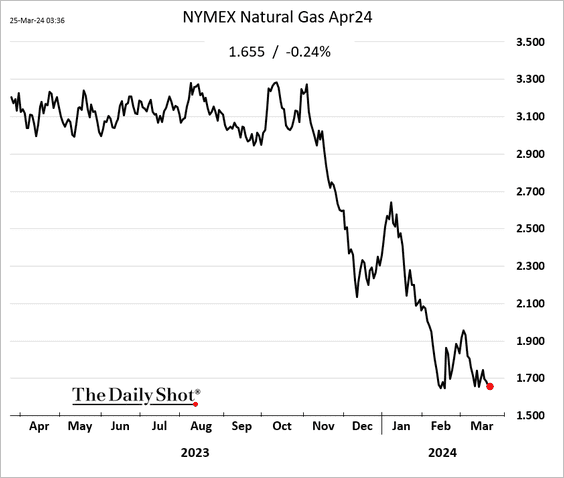

4. The US has a lot of natural gas in storage, …

… which is pressuring prices.

Back to Index

Equities

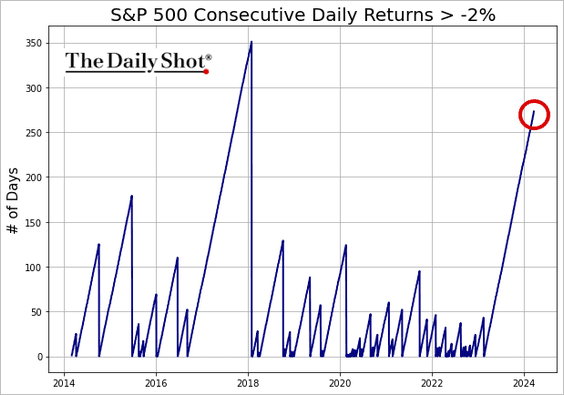

1. It’s been a while (273 consecutive trading sessions) since the S&P 500 had a daily decline of 2% or more.

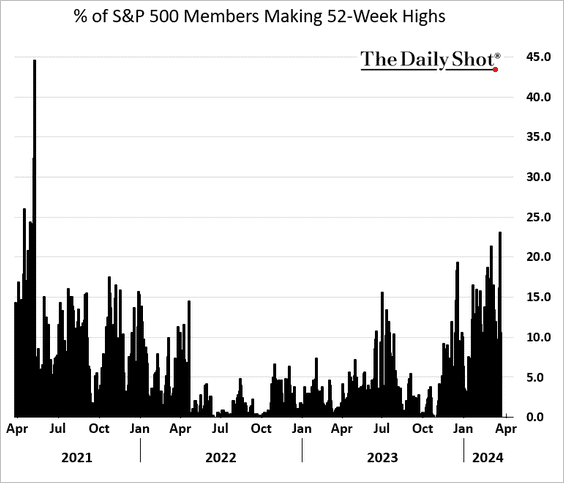

2. Large-cap breadth has been improving.

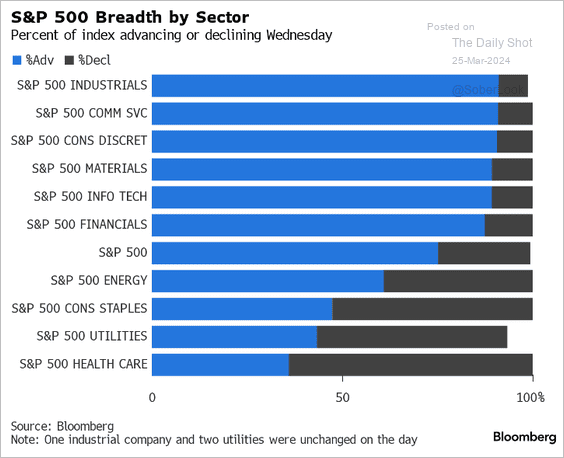

Here is a look at breadth by sector.

Source: @Sebaboyd, @business

Source: @Sebaboyd, @business

——————–

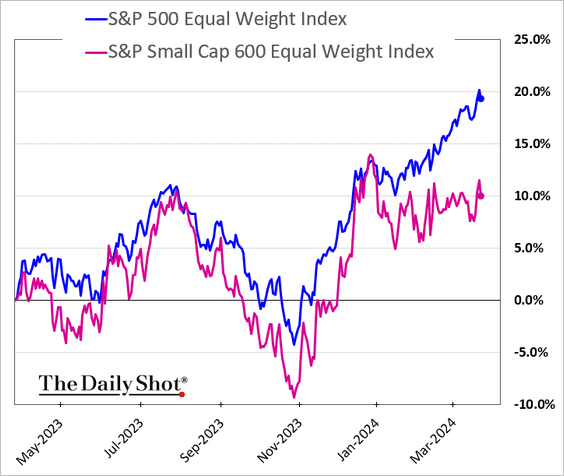

3. The S&P 500 equal-weight index has been outperforming its small-cap counterpart.

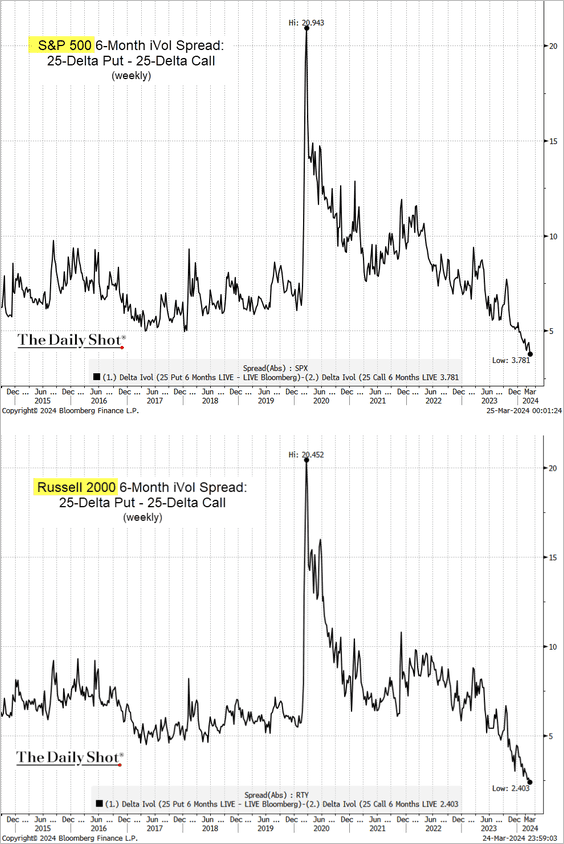

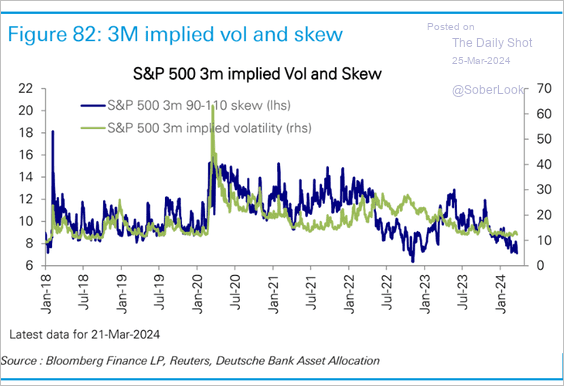

4. Options markets are signaling extreme optimism, as evidenced by the volatility skew being near multi-year lows (2 charts).

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

——————–

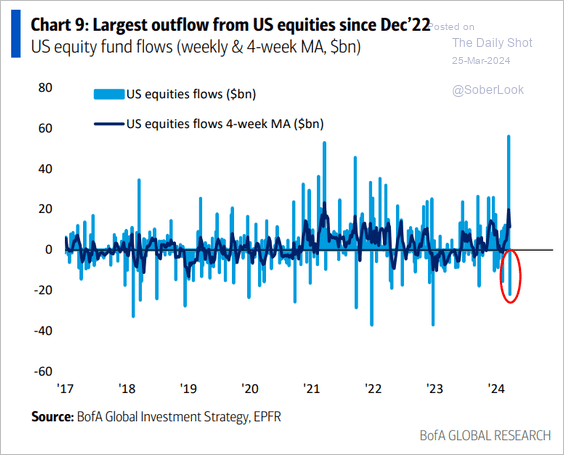

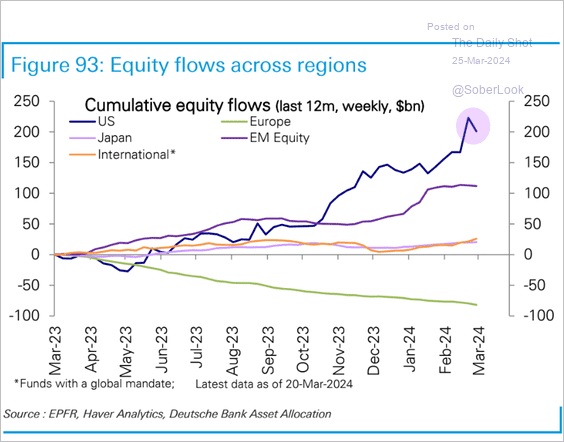

5. Equity funds saw some outflows last week, …

Source: BofA Global Research

Source: BofA Global Research

… driven by US funds.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

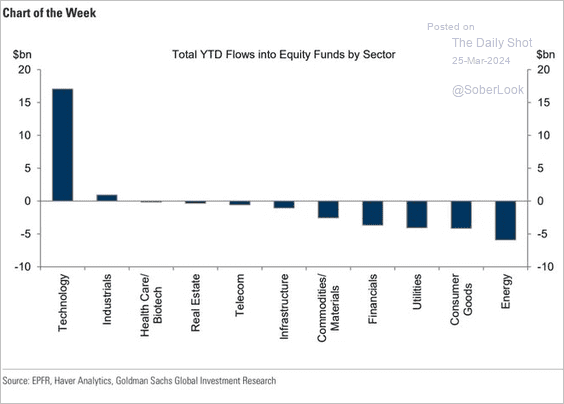

• Below are the year-to-date fund flows by sector.

Source: Goldman Sachs; @Marlin_Capital

Source: Goldman Sachs; @Marlin_Capital

——————–

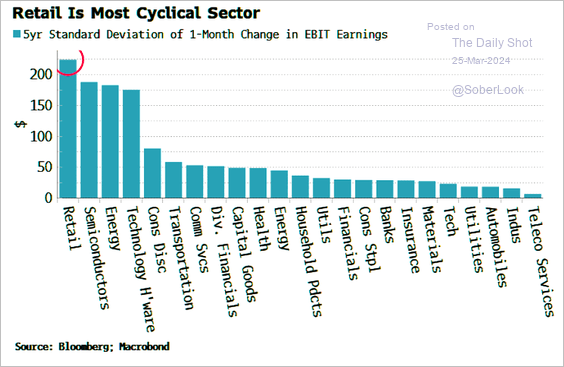

6. This chart displays earnings volatility by sector, with retail companies exhibiting the highest volatility.

Source: Simon White, Bloomberg Markets Live Blog

Source: Simon White, Bloomberg Markets Live Blog

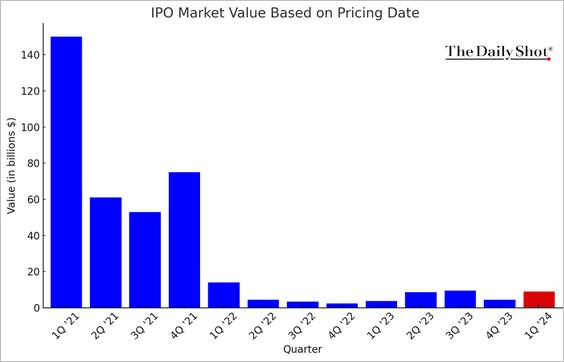

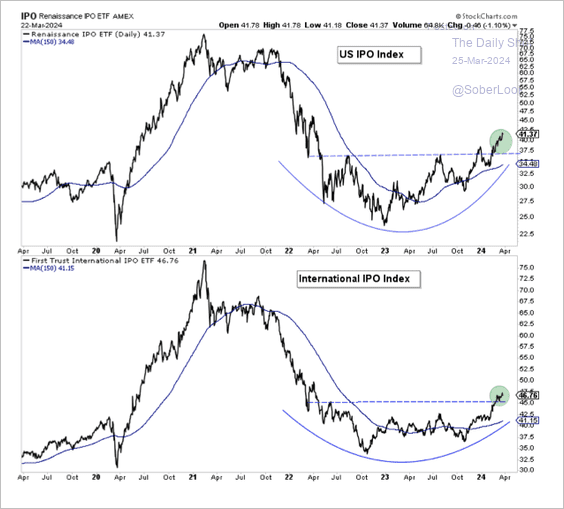

7. US IPO activity has picked up a bit this quarter.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

• US and international IPO baskets are starting to reverse their prior downtrends.

Source: Aazan Habib, Paradigm Capital

Source: Aazan Habib, Paradigm Capital

——————–

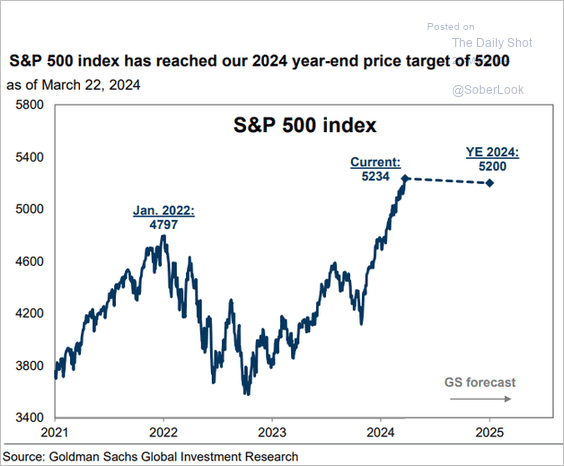

8. OK, now what?

Source: Goldman Sachs; @MikeZaccardi

Source: Goldman Sachs; @MikeZaccardi

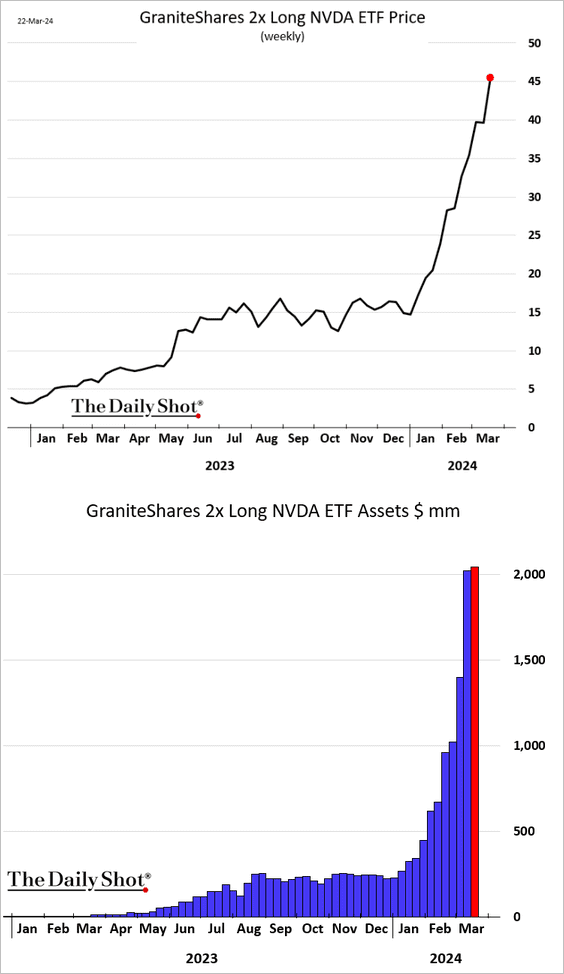

9. The GraniteShares 2x Long NVDA ETF (NVDL) experienced a surge in new assets.

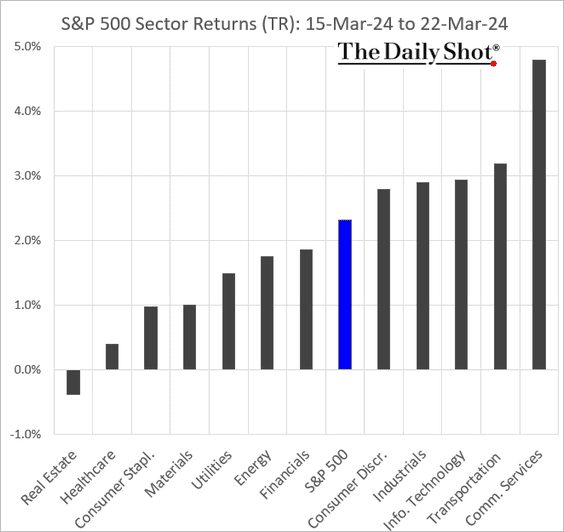

10. Finally, we have some performance data from last week.

• Sectors:

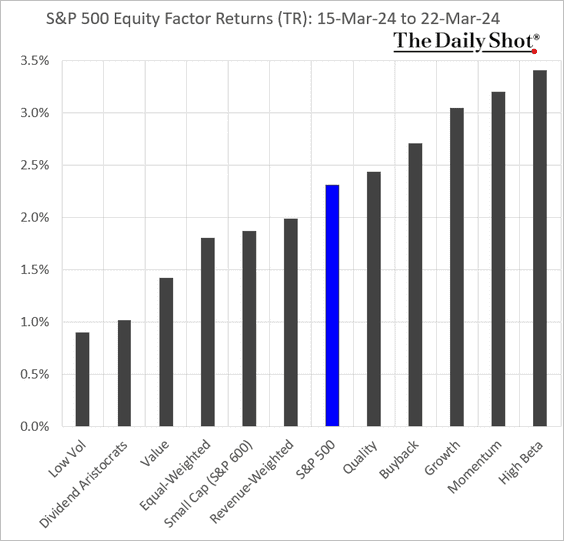

• Equity factors:

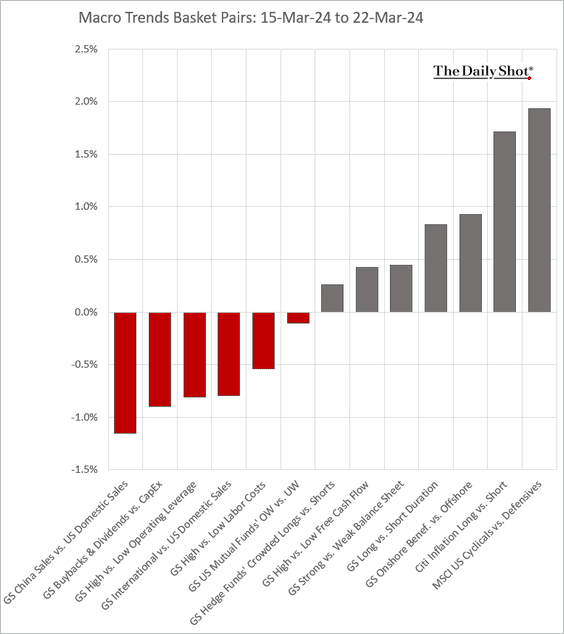

• Macro basket pairs’ relative performance:

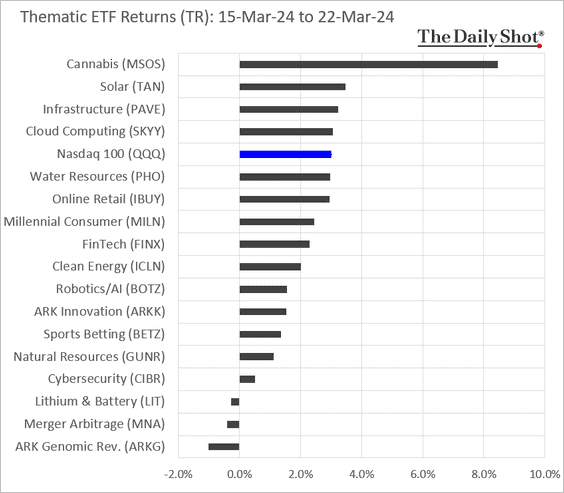

• Thematic ETFs:

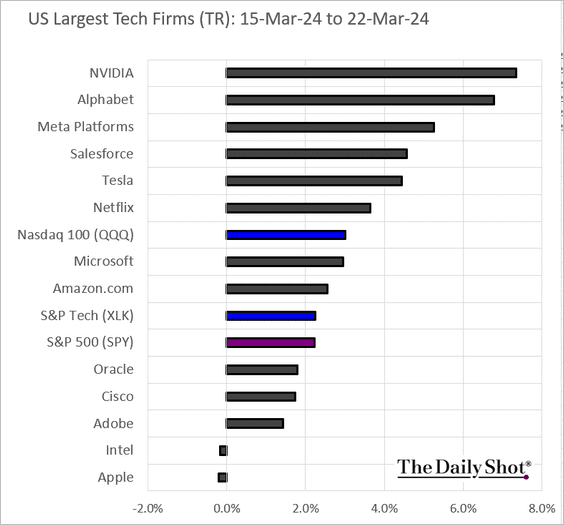

• Largest US tech firms:

Back to Index

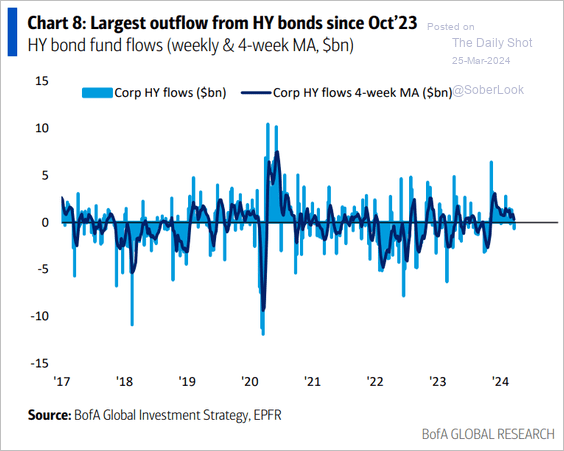

Credit

1. High-yield bond funds are seeing some outflows.

Source: BofA Global Research

Source: BofA Global Research

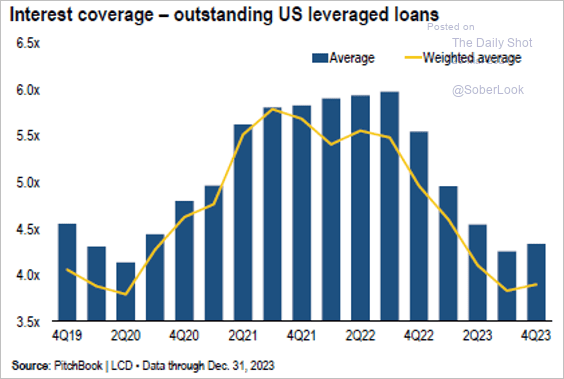

2. Interest coverage on US leveraged loans is finally ticking higher.

Source: PitchBook

Source: PitchBook

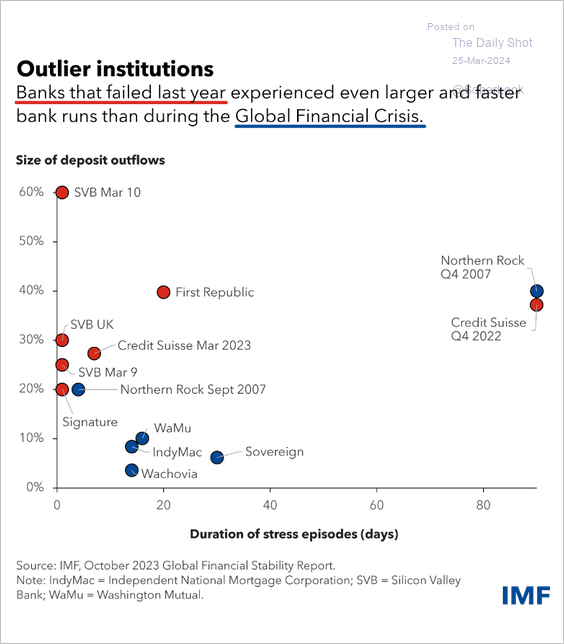

3. This scatterplot compares the scale and speed of recent bank failures to the Global Financial Crisis.

Source: IMF Read full article

Source: IMF Read full article

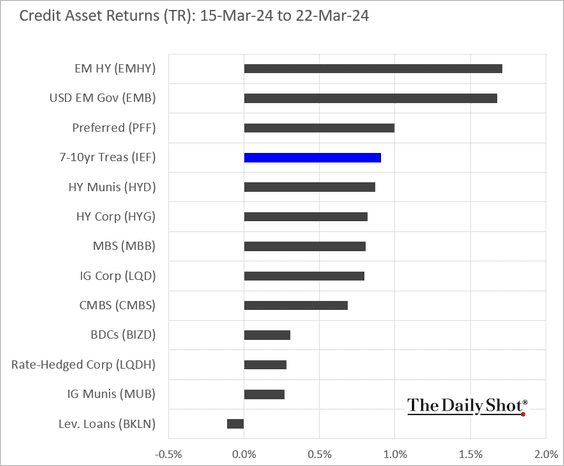

4. Here is last week’s performance data.

Back to Index

Rates

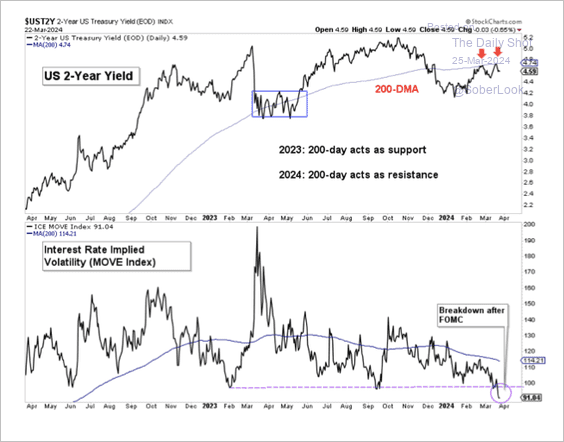

1. The 2-year Treasury yield is trading below its 200-day moving average as interest rate implied vol makes new lows.

Source: Aazan Habib, Paradigm Capital

Source: Aazan Habib, Paradigm Capital

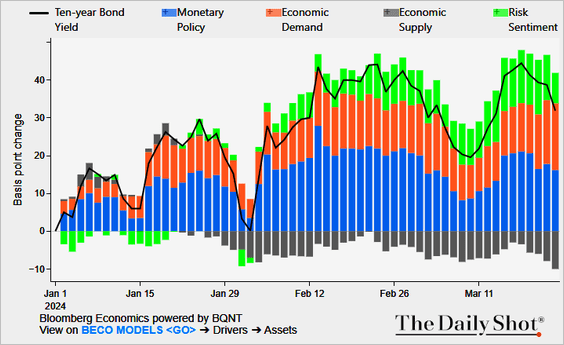

2. This chart, based on Bloomberg’s model, illustrates the factors influencing changes in the 10-year Treasury yield year to date.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

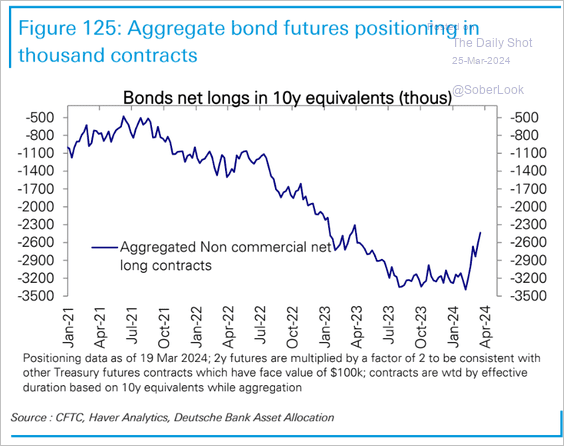

3. Treasury futures short positioning continues to ease.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

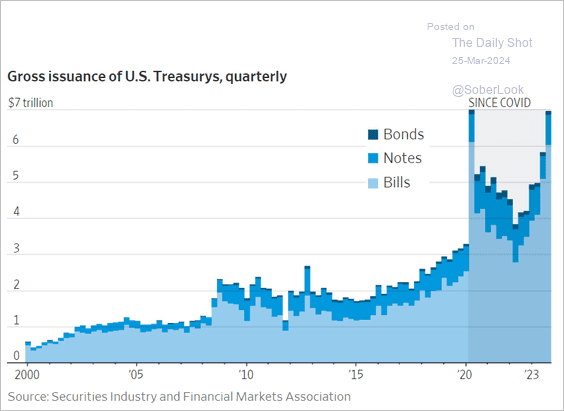

4. US debt issuance keeps climbing

Source: @WSJ Read full article

Source: @WSJ Read full article

Back to Index

Global Developments

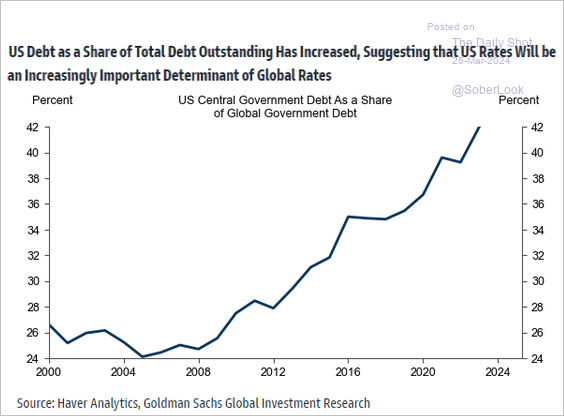

1. As US debt expands relative to global debt, US interest rates will increasingly influence global rates.

Source: Goldman Sachs; @MikeZaccardi

Source: Goldman Sachs; @MikeZaccardi

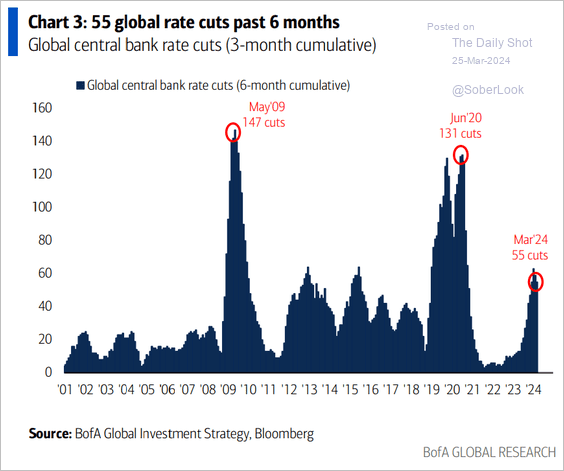

2. An increasing number of central banks have been reducing rates.

Source: BofA Global Research

Source: BofA Global Research

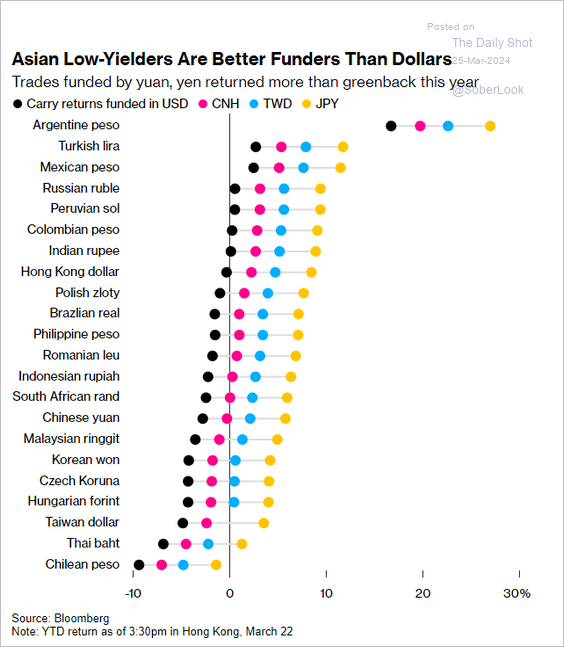

3. What are the best currencies to fund carry trades?

Source: @markets Read full article

Source: @markets Read full article

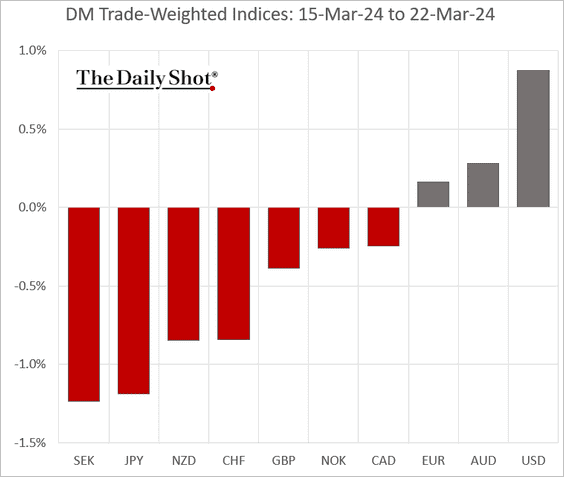

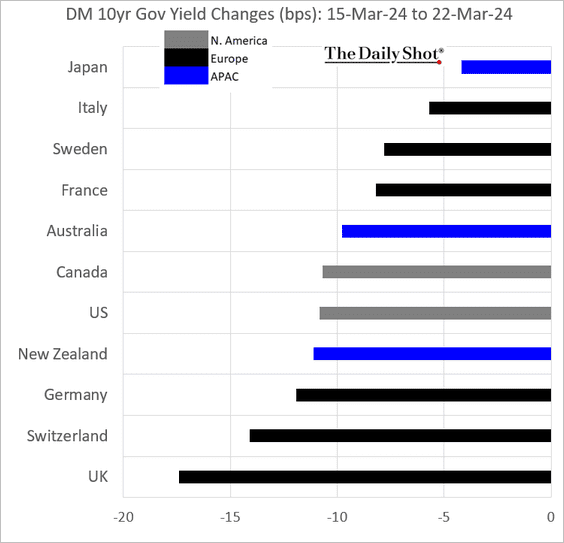

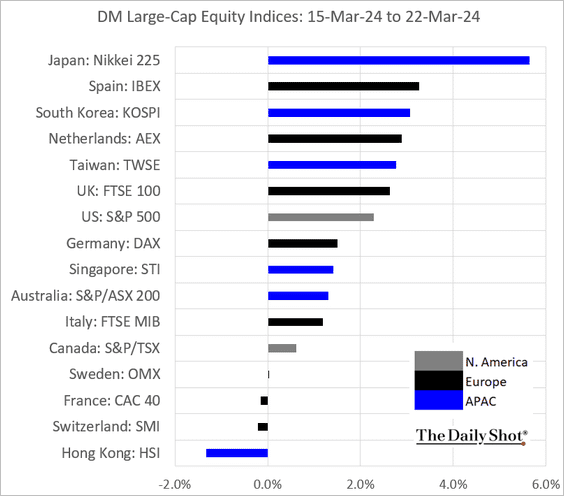

4. Finally, we have some performance data from last week.

• Currencies:

• Bond yields:

• Large-cap equity indices:

——————–

Food for Thought

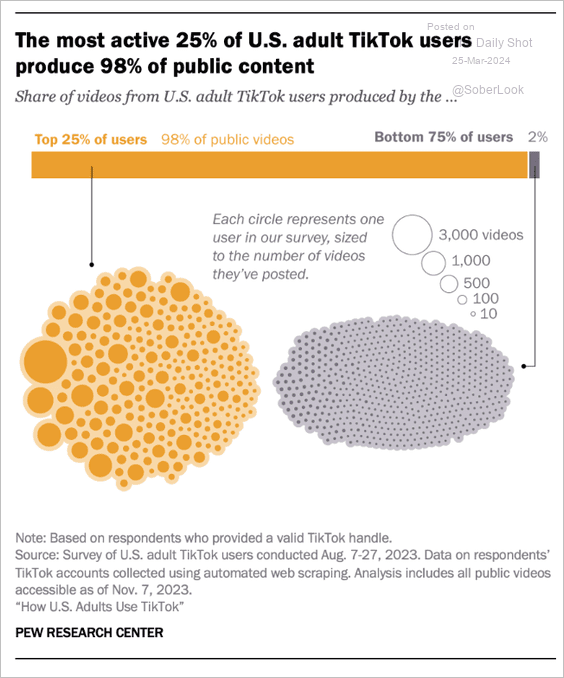

1. Content creation disparity among US TikTok users:

Source: Pew Research Center Read full article

Source: Pew Research Center Read full article

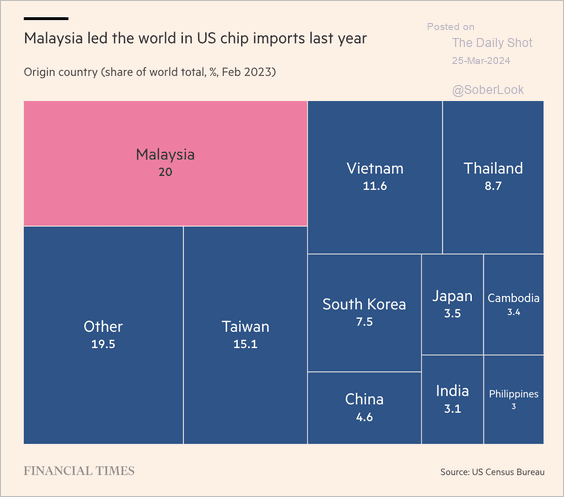

2. US chip imports by country of origin:

Source: @financialtimes Read full article

Source: @financialtimes Read full article

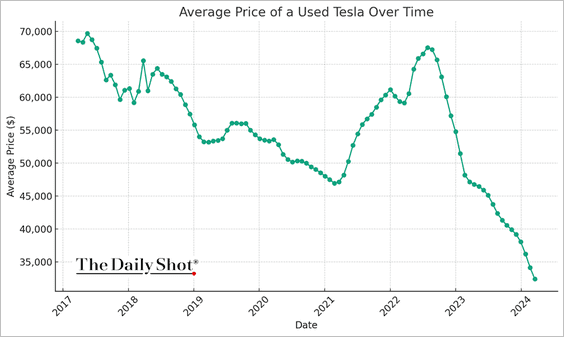

3. Used Tesla price trend:

Source: CarGurus

Source: CarGurus

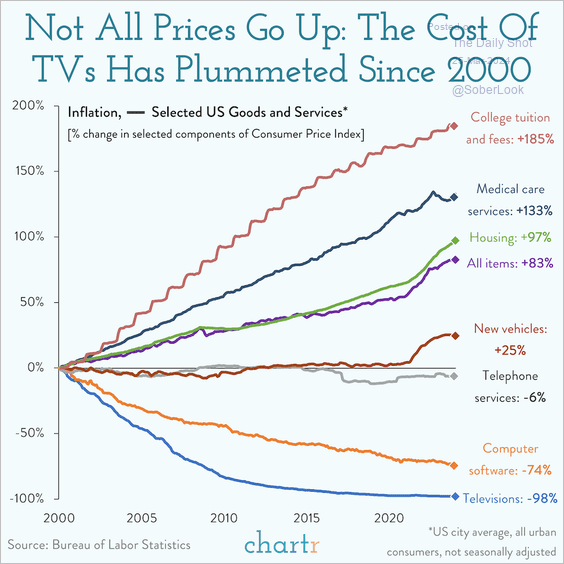

4. Price changes in select US goods and services from 2000 to 2020:

Source: @chartrdaily

Source: @chartrdaily

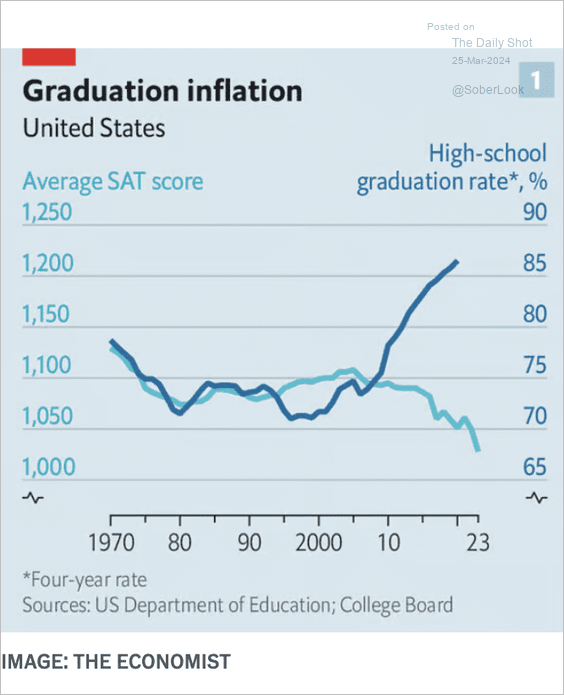

5. Trends in US high school graduation rates and SAT scores over time:

Source: The Economist Read full article

Source: The Economist Read full article

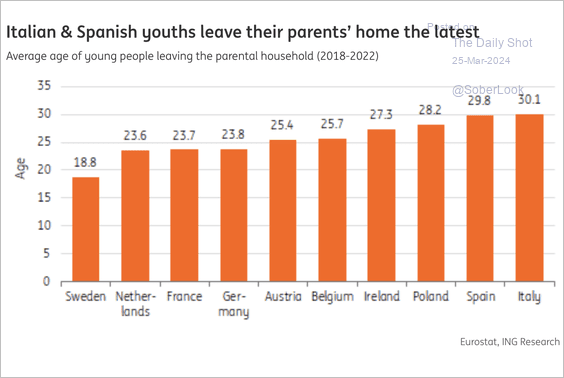

6. Comparative ages of young adults leaving home in Europe:

Source: ING

Source: ING

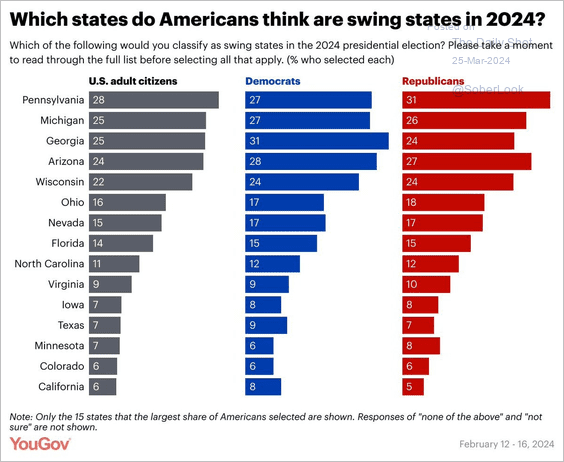

7. Perception of swing states’ importance for the 2024 presidential election:

Source: YouGov Read full article

Source: YouGov Read full article

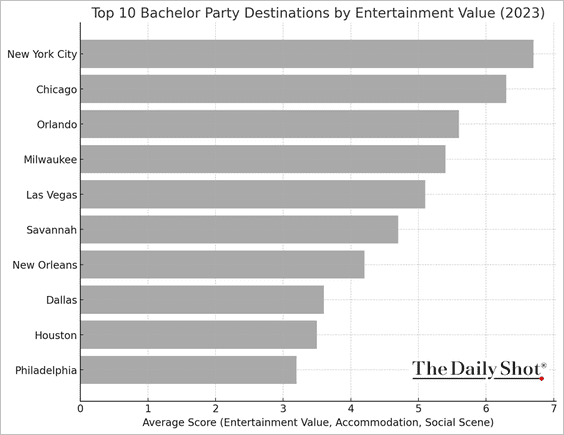

8. The ten best bachelor party destinations:

Source: Searchbloom

Source: Searchbloom

——————–

Back to Index