The Daily Shot: 25-Apr-24

• The United States

• Canada

• The United Kingdom

• The Eurozone

• Europe

• Japan

• South Korea

• China

• Emerging Markets

• Commodities

• Energy

• Equities

• Alternatives

• Rates

• Food for Thought

The United States

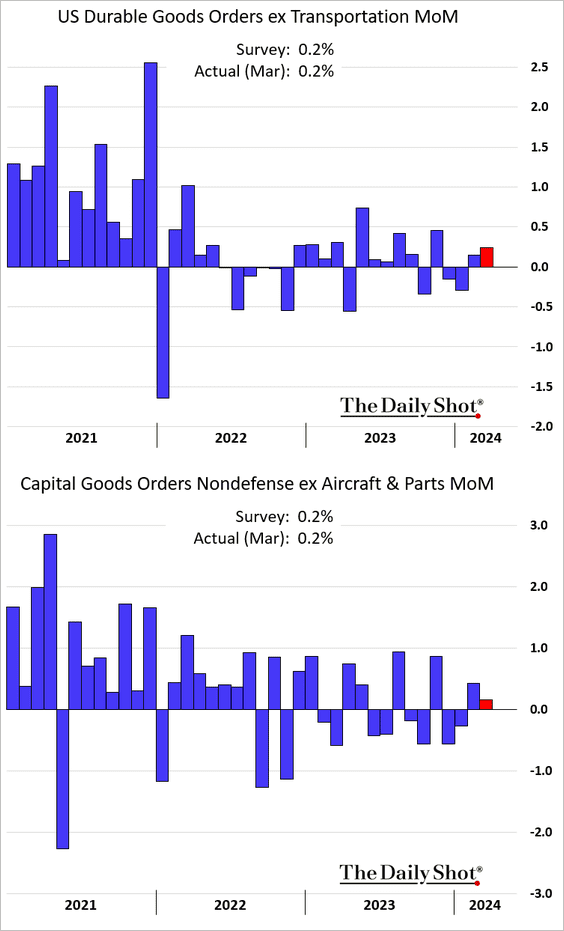

1. Durable goods orders saw a modest increase in March.

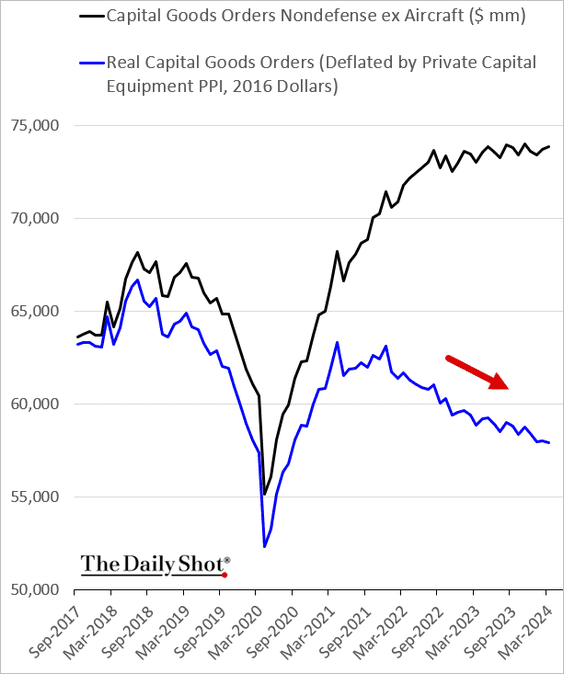

• When adjusted for inflation, capital goods orders continue to decline, suggesting that business investment remains soft. It should be noted that while capital goods orders provide insights into physical investment in machinery and equipment, they do not comprehensively capture the full scope of modern business investments, particularly in technology-driven areas like software and data center development.

Source: Reuters Read full article

Source: Reuters Read full article

——————–

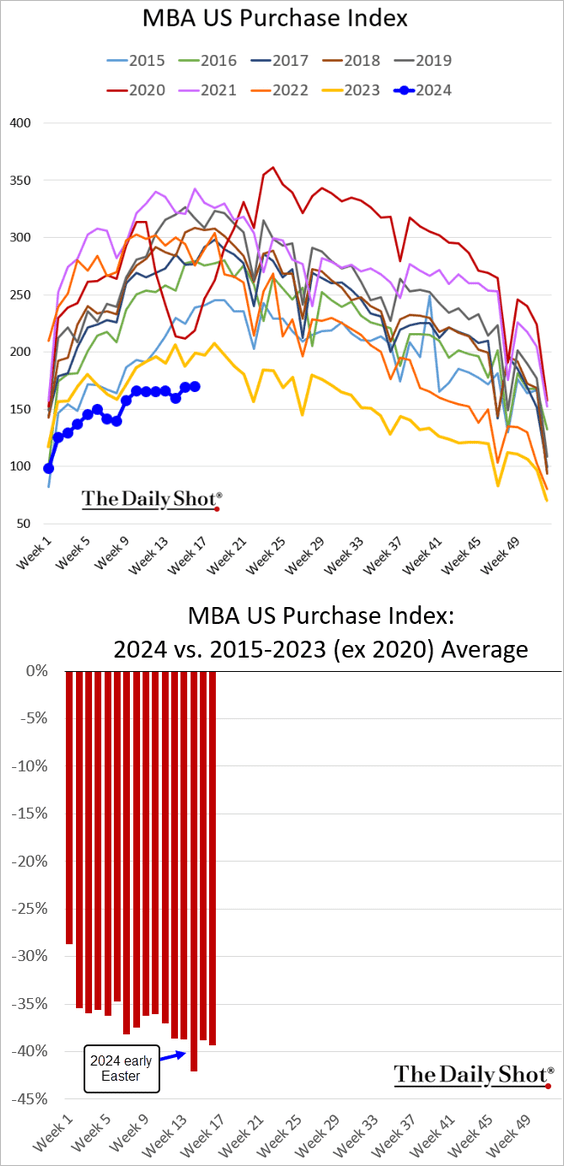

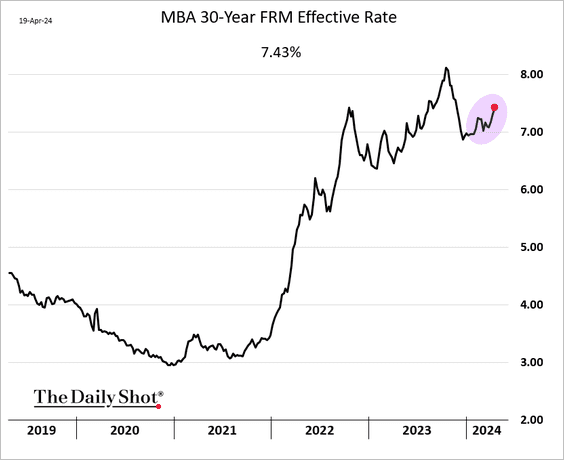

2. Next, we have some updates on the housing market.

• Mortgage applications continue to run at multi-year lows, …

… as rates surge.

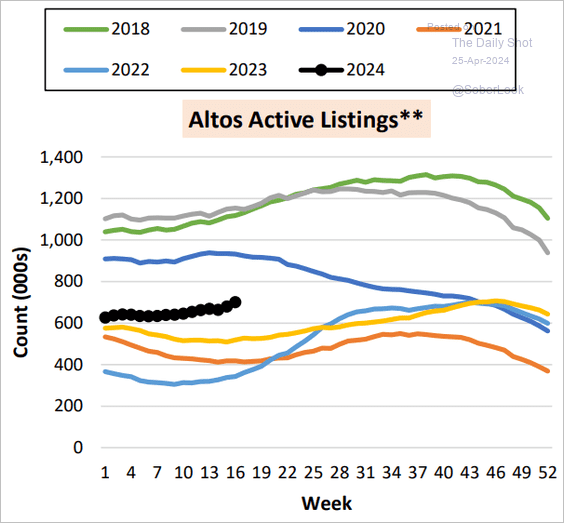

• Active listings keep outpacing last year’s trajectory.

Source: AEI Housing Center

Source: AEI Housing Center

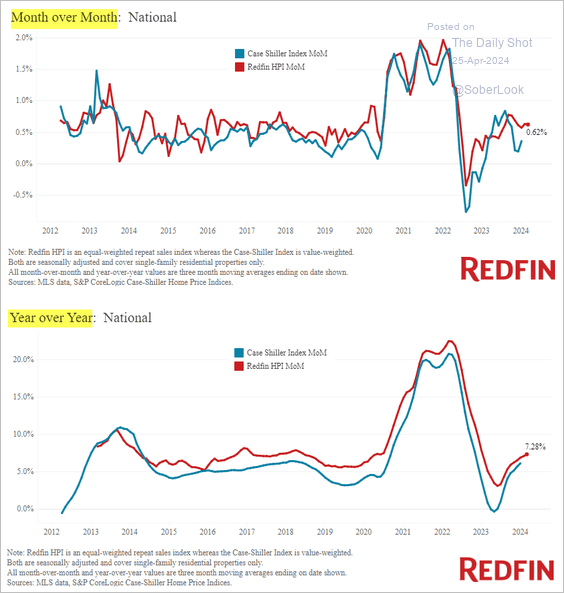

• Home price appreciation remained strong last month, according to Redfin.

Source: Redfin

Source: Redfin

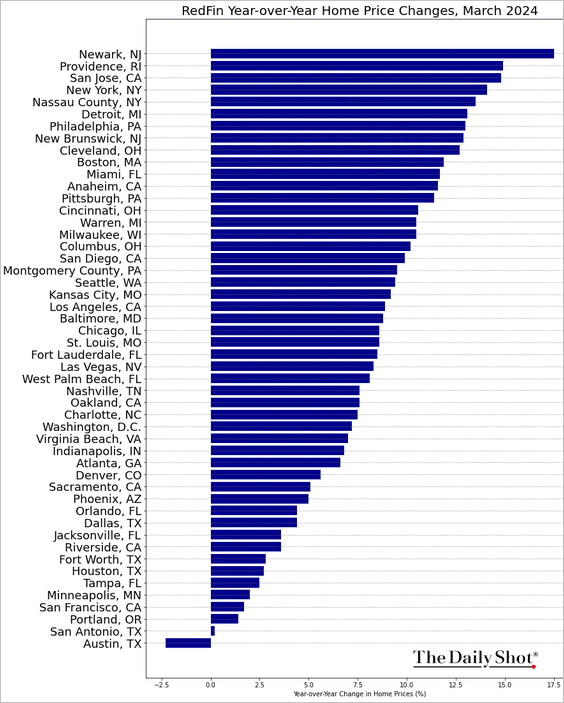

– Here is a look at year-over-year home price changes by metro area.

Source: Redfin

Source: Redfin

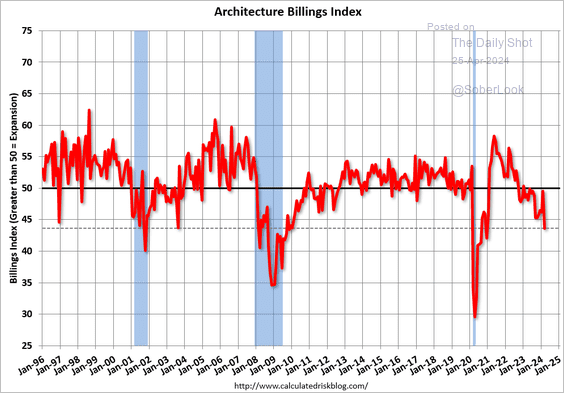

• Architecture billings have been on the decline, indicating a softening in residential construction.

Source: Calculated Risk Read full article

Source: Calculated Risk Read full article

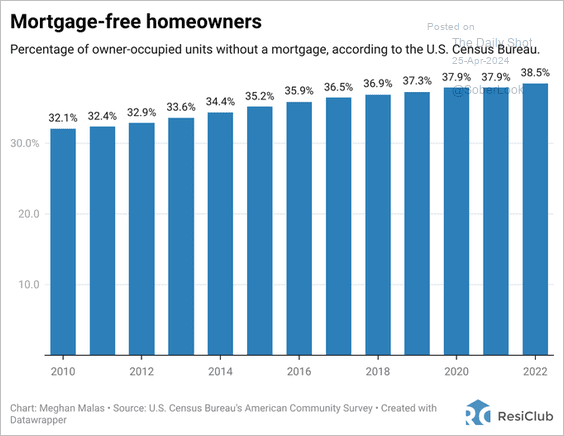

• This chart shows the percentage of owner-occupied properties without a mortgage.

Source: @ResidentialClub Read full article

Source: @ResidentialClub Read full article

——————–

3. Next, we have some updates on inflation.

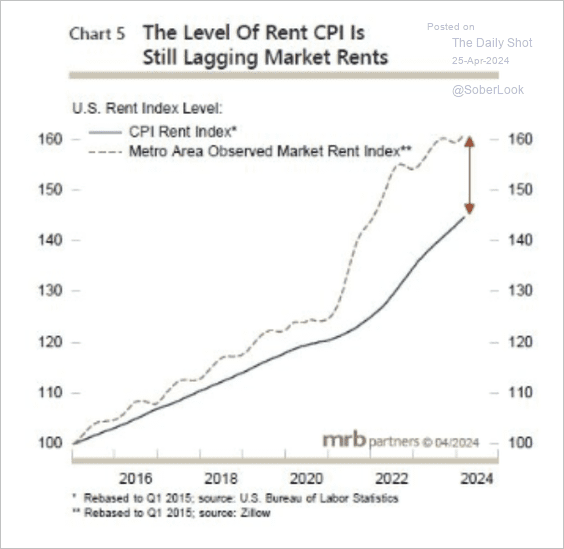

• Market rent levels have been outpacing the rent CPI.

Source: MRB Partners

Source: MRB Partners

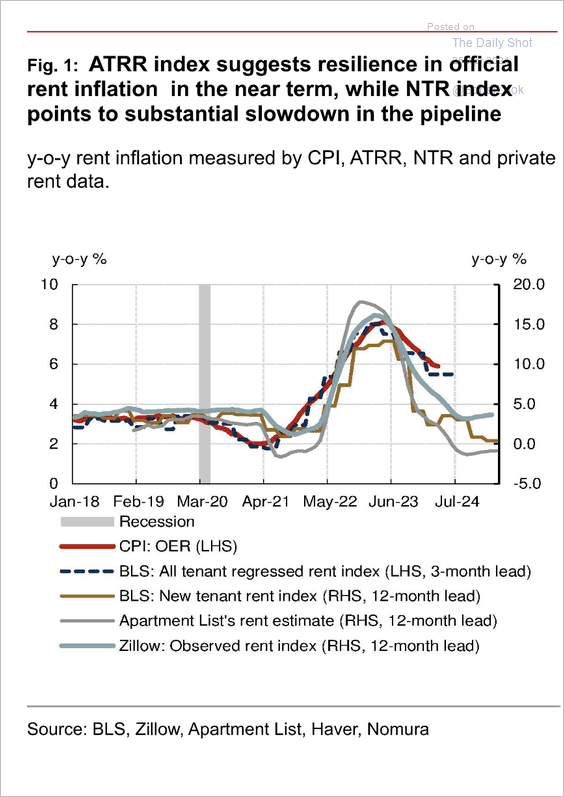

– Nomura’s estimates continue to point to an impending slowdown in rent inflation.

Source: Nomura Securities

Source: Nomura Securities

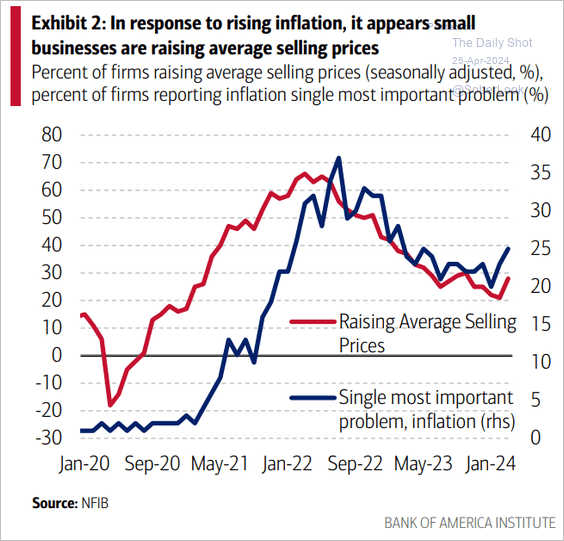

• Small businesses have been raising prices.

Source: Bank of America Institute

Source: Bank of America Institute

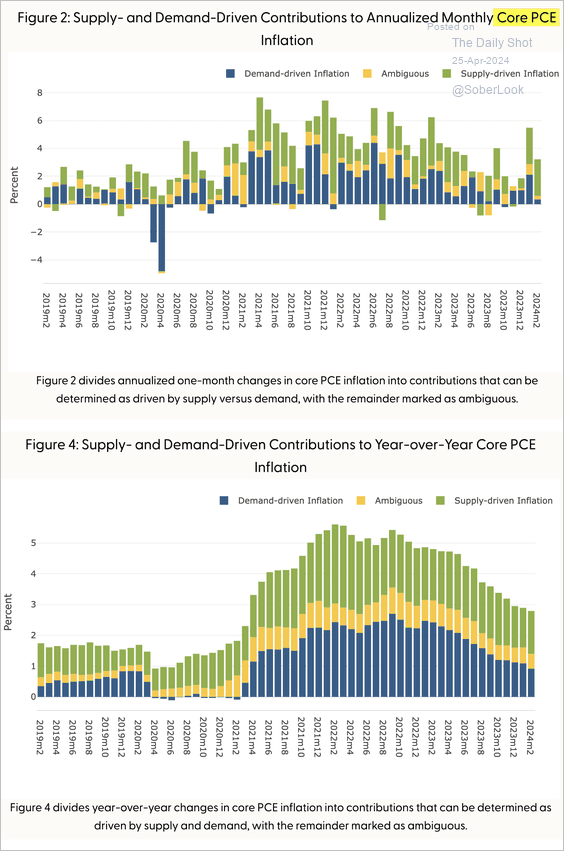

• What proportion of core PCE inflation can be attributed to demand-driven versus supply-driven factors?

Source: Federal Reserve Bank of San Francisco Read full article

Source: Federal Reserve Bank of San Francisco Read full article

Back to Index

Canada

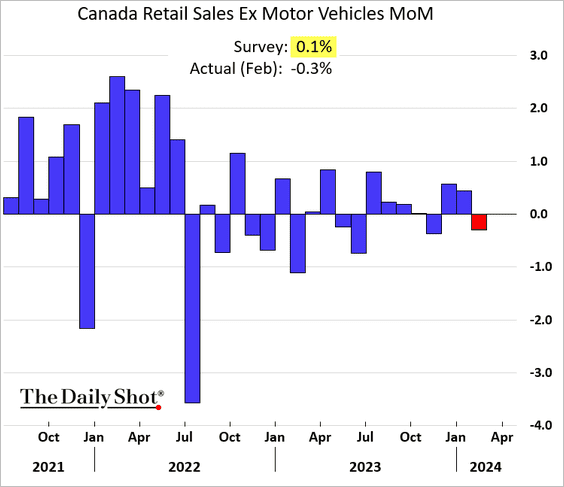

1. Retail sales unexpectedly declined in February.

Source: Reuters Read full article

Source: Reuters Read full article

——————–

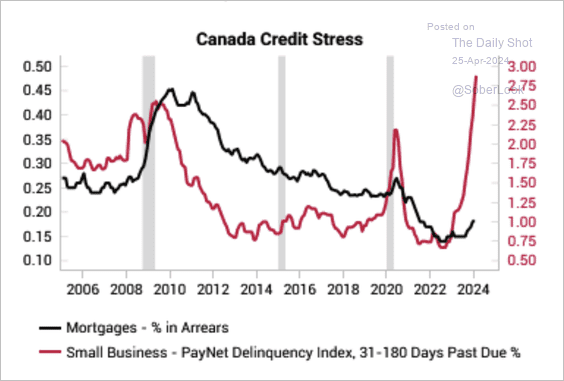

2. Small business delinquencies have surged while mortgages in arrears have troughed.

Source: Variant Perception

Source: Variant Perception

Back to Index

The United Kingdom

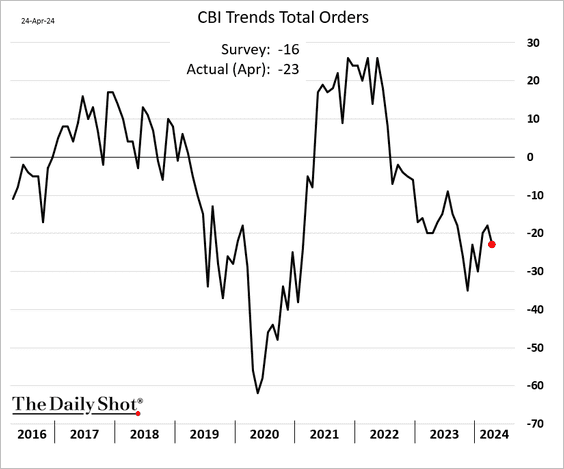

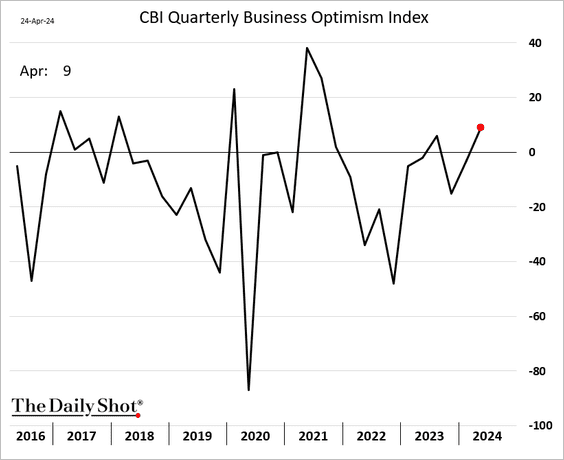

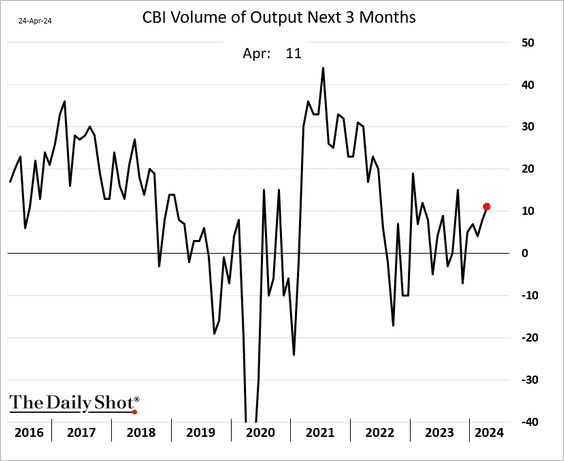

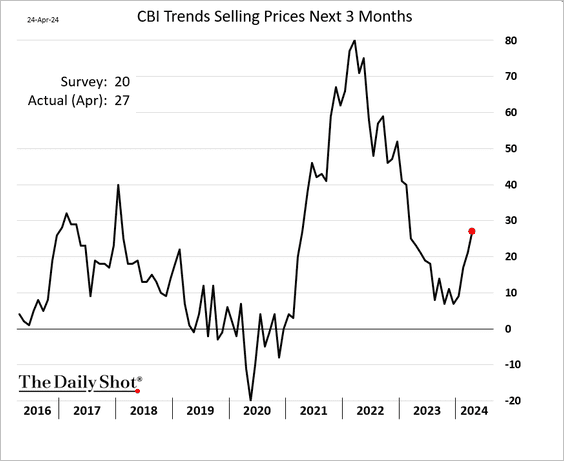

1. The CBI report shows further weakness in industrial orders.

However, there are signs of optimism (2 charts)

Source: Reuters Read full article

Source: Reuters Read full article

• More firms have been boosting prices.

——————–

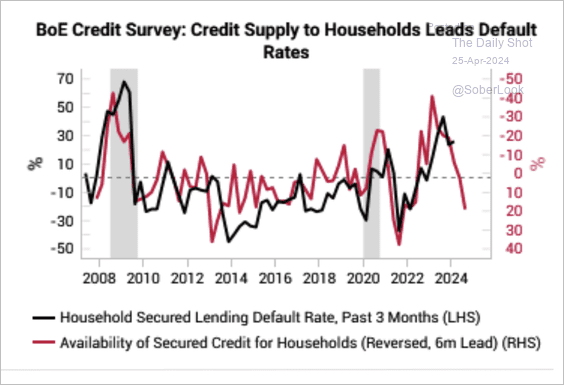

2. Credit conditions are improving, which could lead to lower defaults.

Source: Variant Perception

Source: Variant Perception

Back to Index

The Eurozone

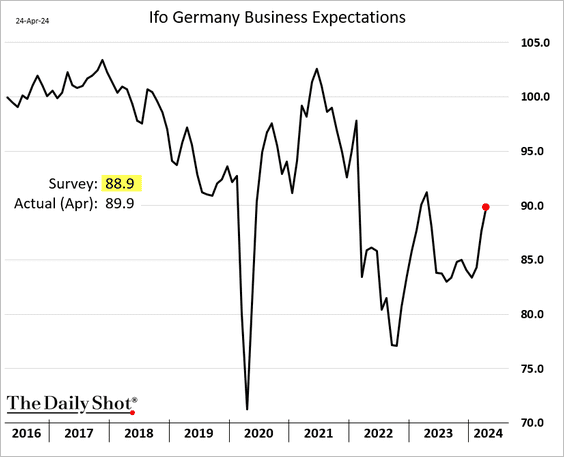

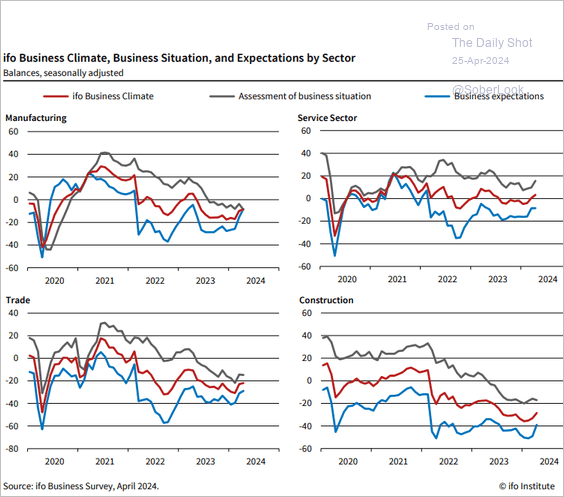

1. Germany’s business expectations continued to rebound this month, topping expectations (2 charts).

Source: ifo Institute

Source: ifo Institute

Source: Reuters Read full article

Source: Reuters Read full article

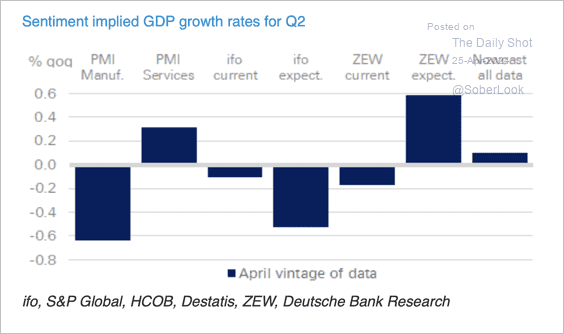

• Sentiment indicators for April suggest improvements in Germany’s Q2 GDP.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

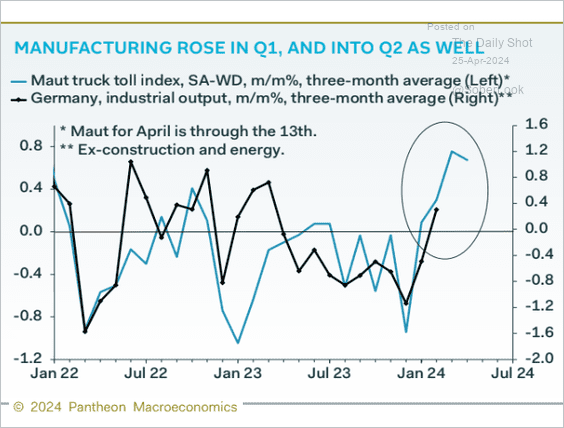

Here is the truck toll index.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

——————–

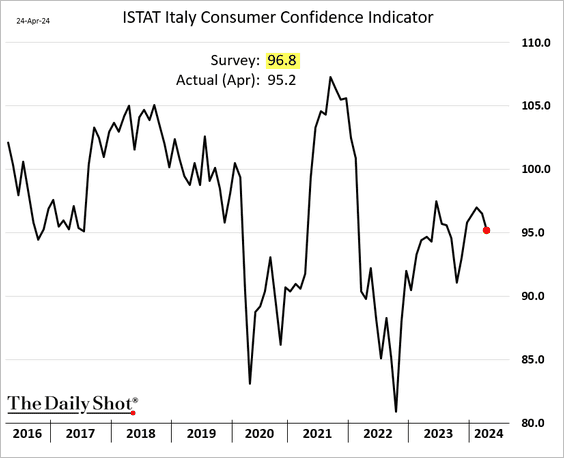

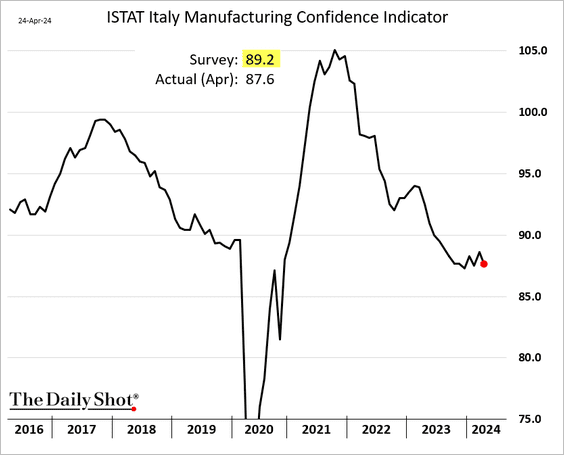

2. Italy’s sentiment indicators declined in April.

• Consumer:

• Manufacturing:

——————–

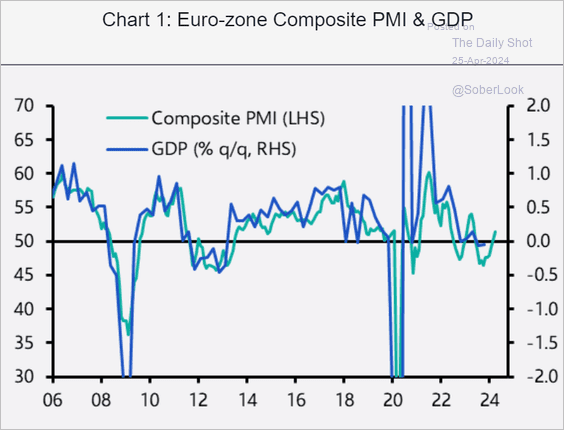

3. Euro-area PMIs signal improvements in economic growth.

Source: Capital Economics

Source: Capital Economics

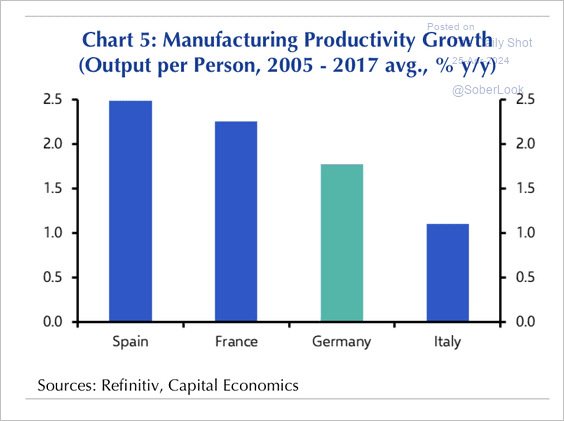

4. Manufacturing productivity growth has been slightly higher in Spain and France than in Germany.

Source: Capital Economics

Source: Capital Economics

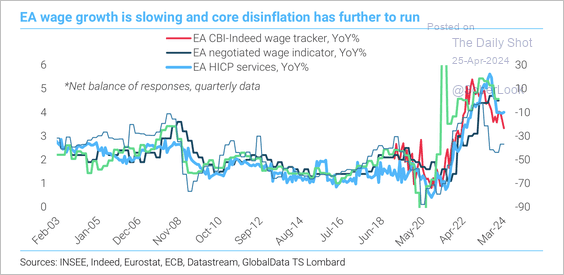

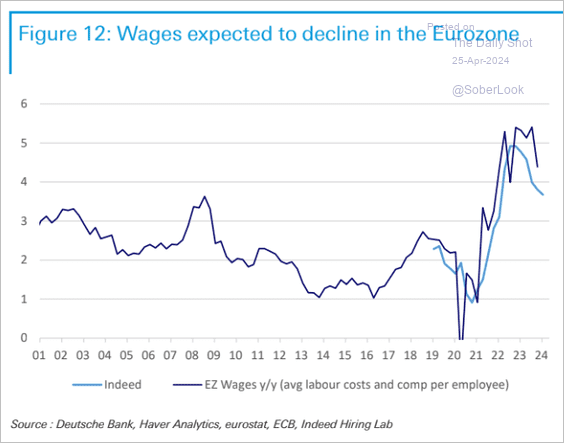

5. Euro-area wage growth is slowing (2 charts).

Source: TS Lombard

Source: TS Lombard

Source: Deutsche Bank Research

Source: Deutsche Bank Research

Back to Index

Europe

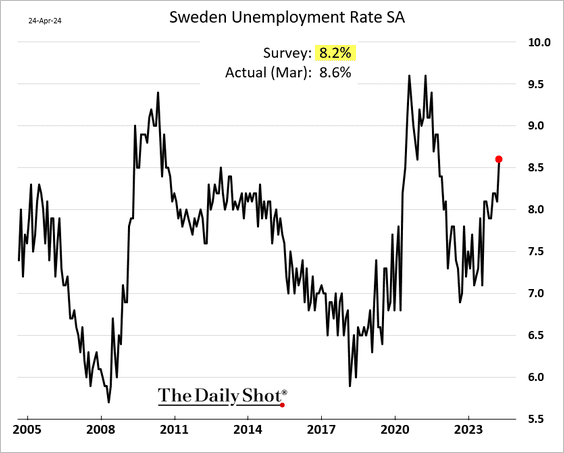

1. Sweden’s unemployment rate unexpectedly jumped in March.

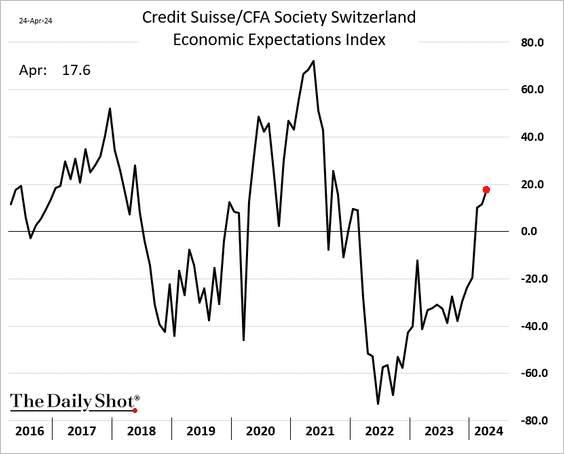

2. The UBS Swiss economic expectations index continues to climb.

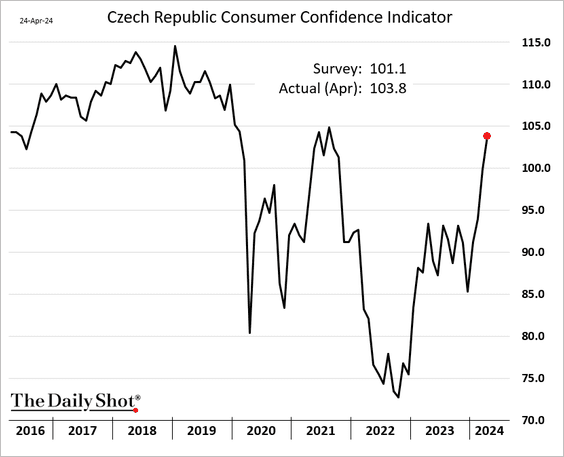

3. Czech consumer confidence is surging.

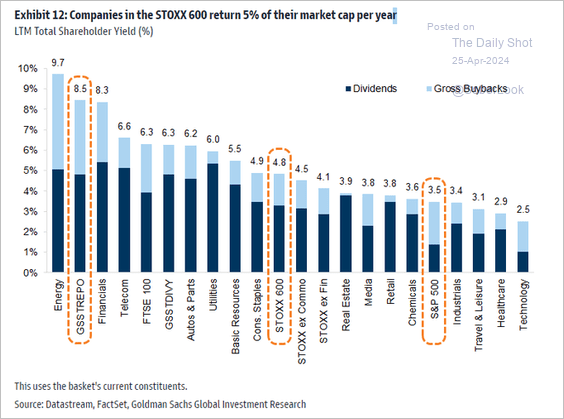

4. Here is a look at European companies returning cash to investors via dividends and share buybacks.

Source: Goldman Sachs; @MikeZaccardi

Source: Goldman Sachs; @MikeZaccardi

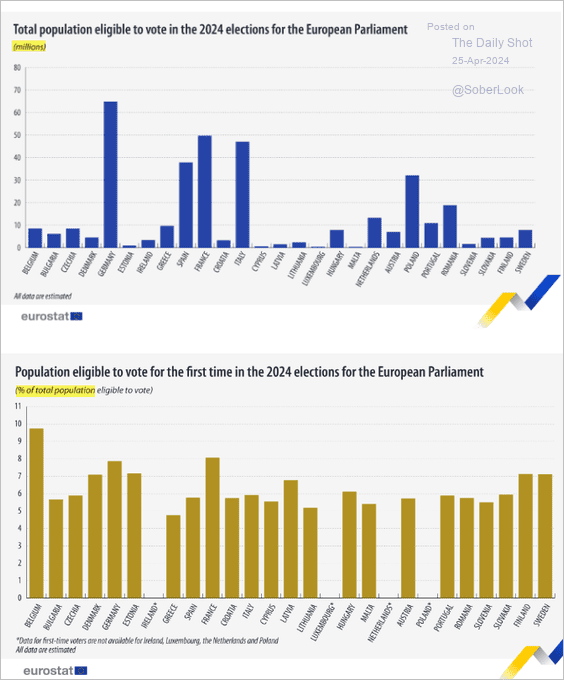

5. Finally, here is a look at eligible voters in the 2024 European Parliament elections by country.

Source: Eurostat Read full article

Source: Eurostat Read full article

Back to Index

Japan

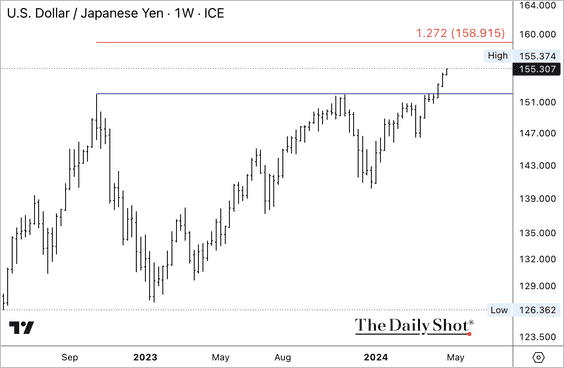

1. USD/JPY continues to rise above 155, maintaining its long-term breakout.

• Intervention ahead?

Source: @markets Read full article

Source: @markets Read full article

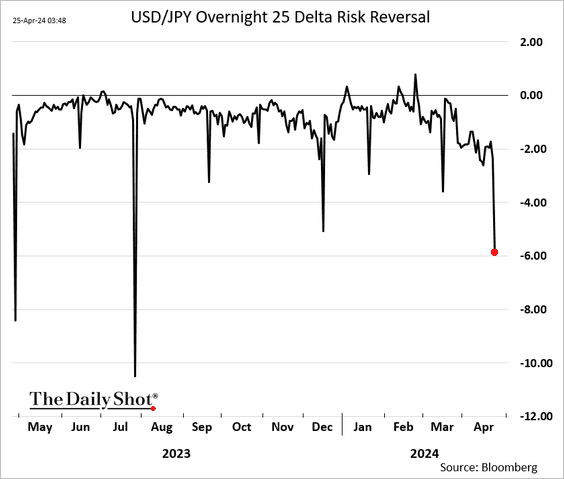

• USD/JPY risk reversals declined sharply ahead of the BoJ meeting.

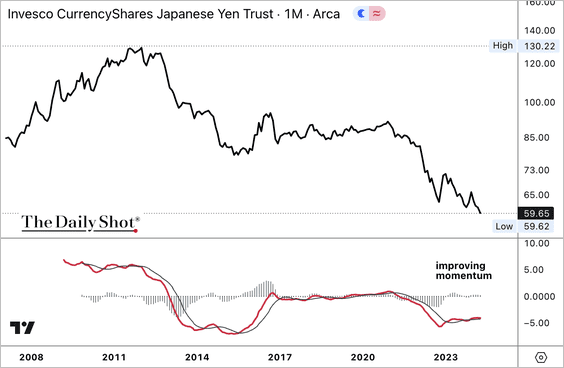

• The Invesco Japanese Yen ETF (FXY) remains in a downtrend, although momentum is starting to improve.

——————–

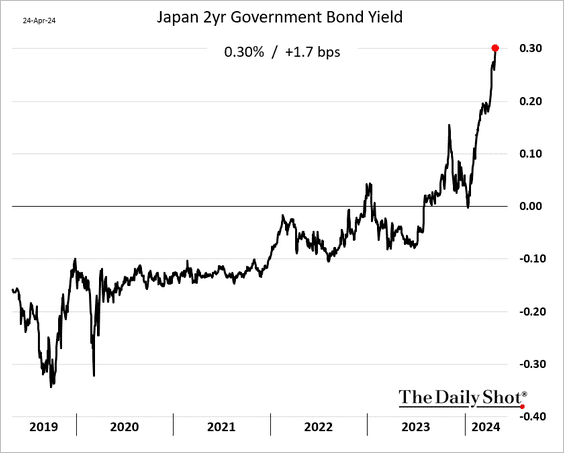

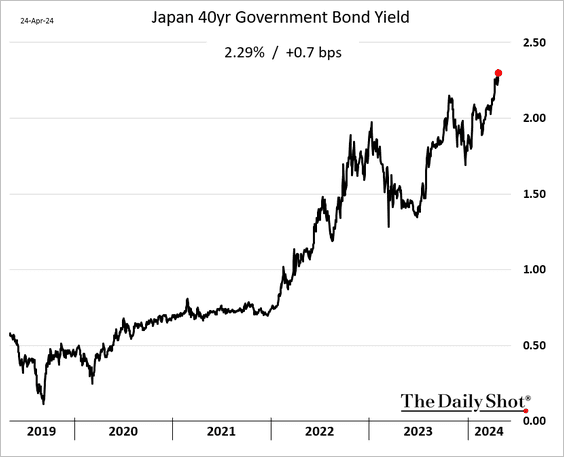

2. JGB yields continue to climb.

——————–

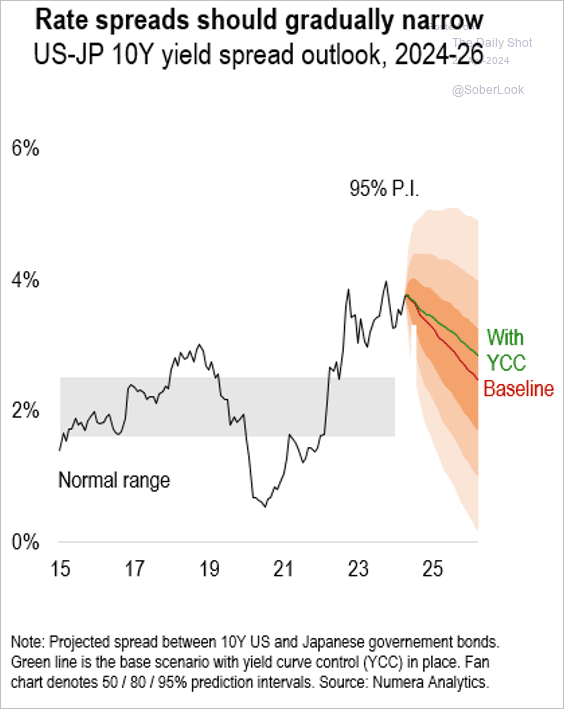

3. Numera Analytics expects the US-Japan 10-year yield spread to gradually narrow, which could benefit the yen later this year.

Source: Numera Analytics (@NumeraAnalytics)

Source: Numera Analytics (@NumeraAnalytics)

Back to Index

South Korea

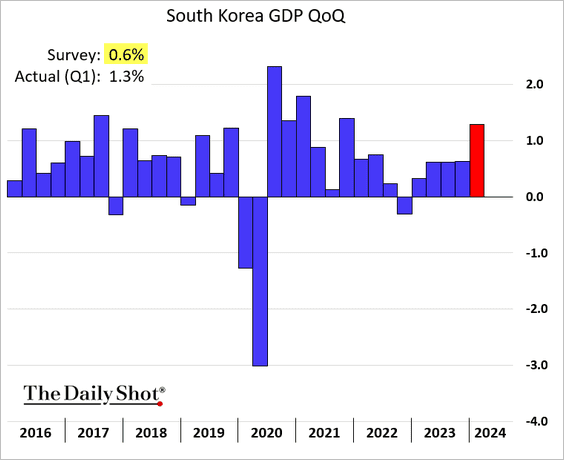

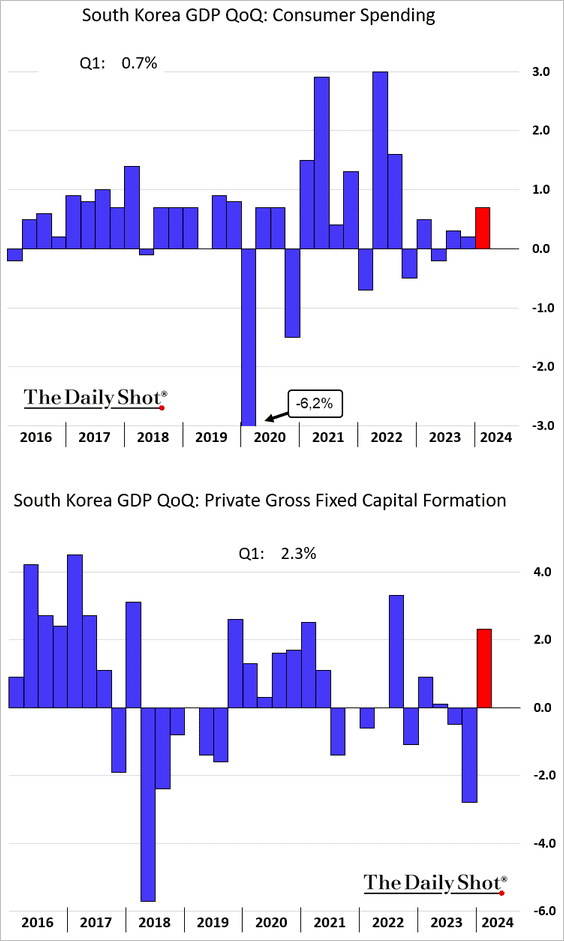

The first-quarter GDP growth exceeded expectations, …

… boosted by consumer spending and construction.

Source: Nikkei Asia Read full article

Source: Nikkei Asia Read full article

Back to Index

China

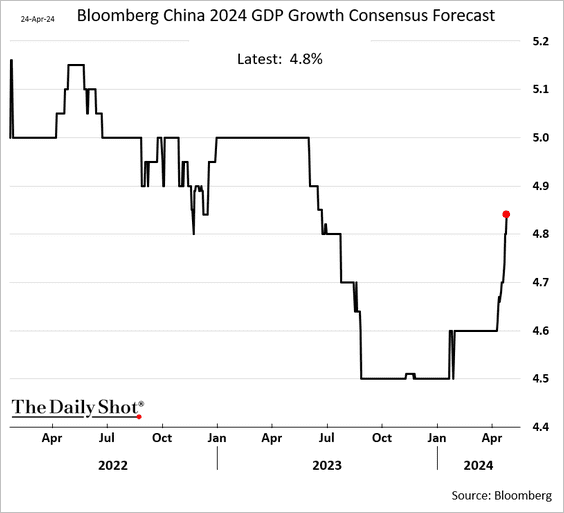

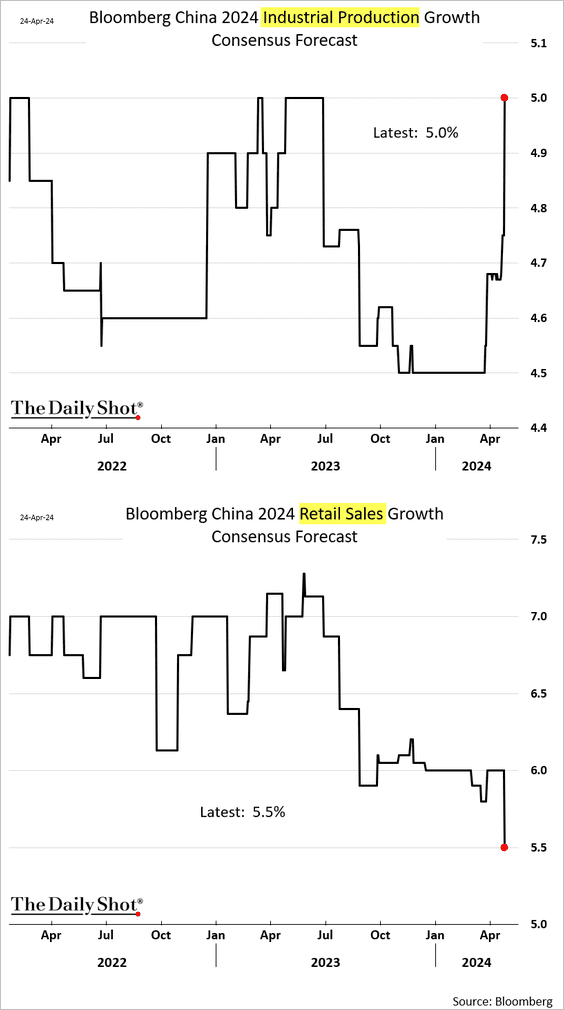

1. Economists have been raising their GDP projections for 2024.

Growth is anticipated to be driven primarily by investment and exports, with consumption expected to remain lackluster.

——————–

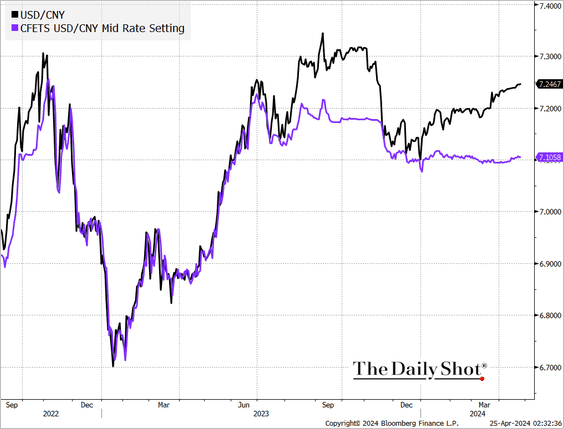

2. The renminbi has been gradually weakening against the US dollar.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

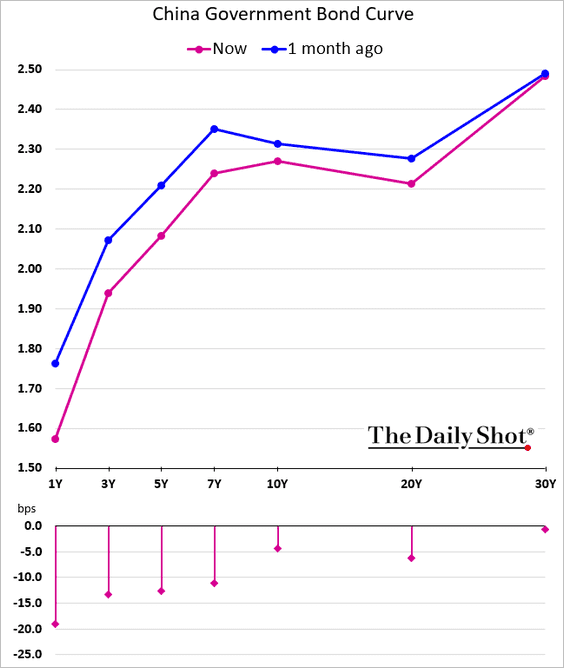

3. China’s yield curve has been (bull) steepening.

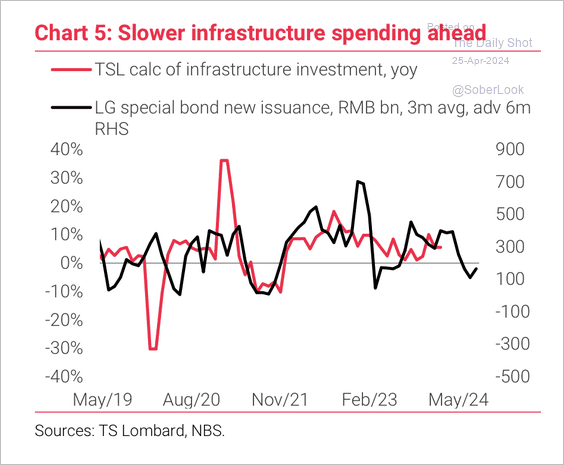

4. The decline in local government bond issuance points to weaker infrastructure spending ahead.

Source: TS Lombard

Source: TS Lombard

Back to Index

Emerging Markets

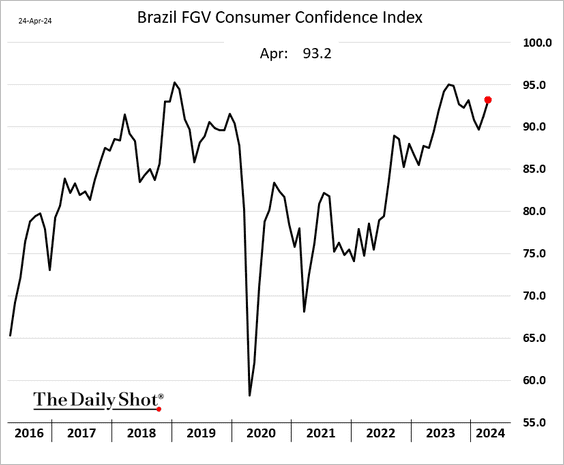

1. Brazil’s consumer confidence improved again this month.

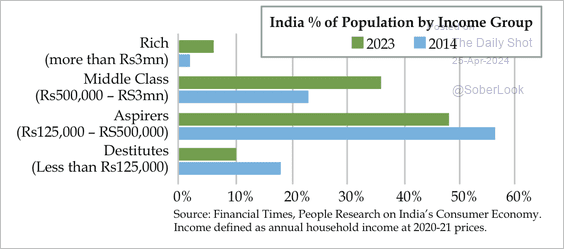

2. India has experienced a growing middle-class and rich population over the past decade.

Source: Quill Intelligence

Source: Quill Intelligence

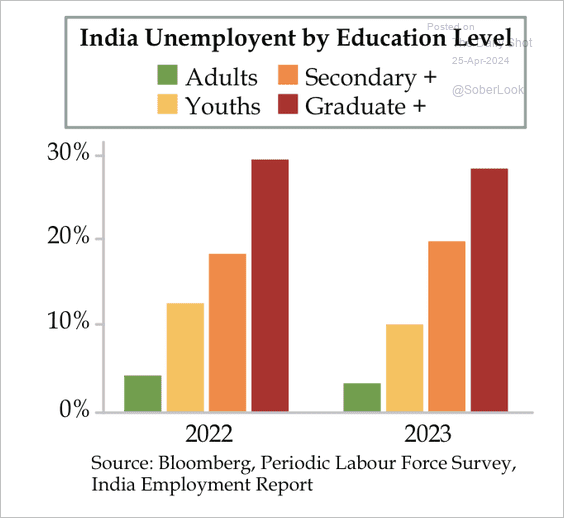

• India’s youth unemployment remains high, especially among the educated.

Source: Quill Intelligence

Source: Quill Intelligence

——————–

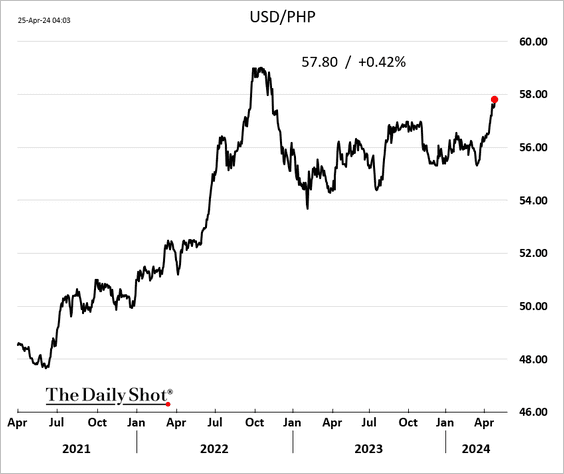

3. The Philippine peso has been under pressure.

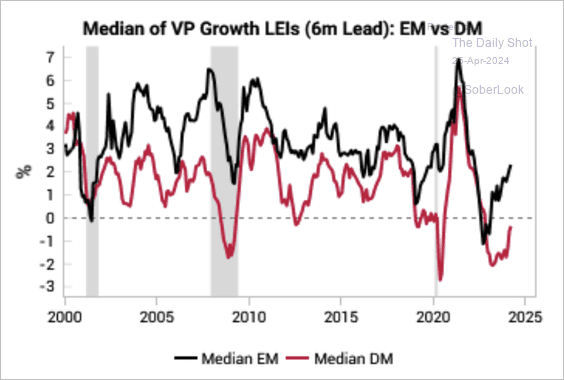

4. Leading indicators are improving for EM vs. DM.

Source: Variant Perception

Source: Variant Perception

Back to Index

Commodities

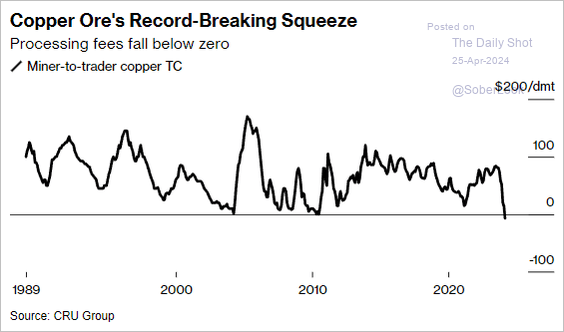

1. The market for semi-processed copper ore is currently facing exceptional scarcity, as traders and smelters are paying prices for copper ore that nearly match its processed value, suggesting a lack of readily available supplies.

Source: @markets Read full article

Source: @markets Read full article

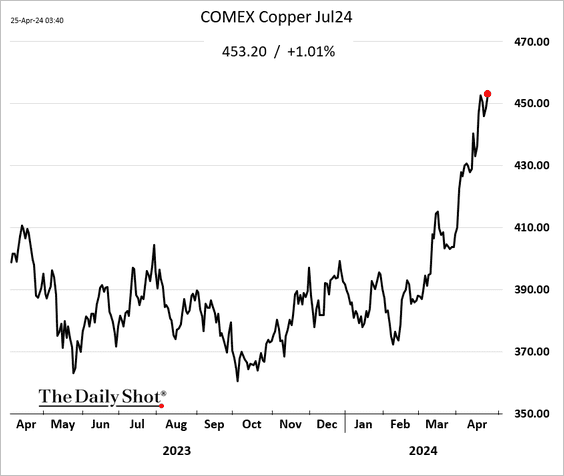

Copper futures continue to surge.

——————–

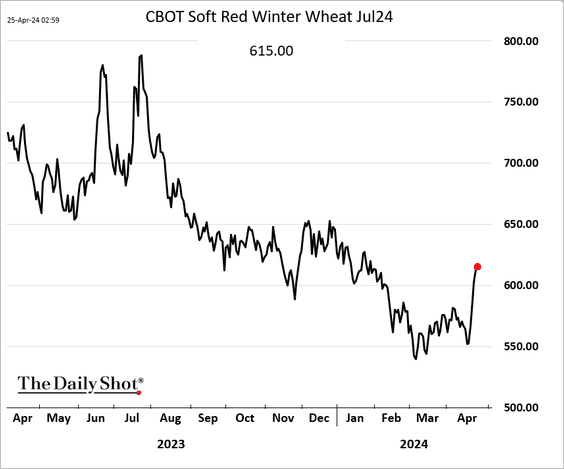

2. The rebound in US wheat futures persists.

Back to Index

Energy

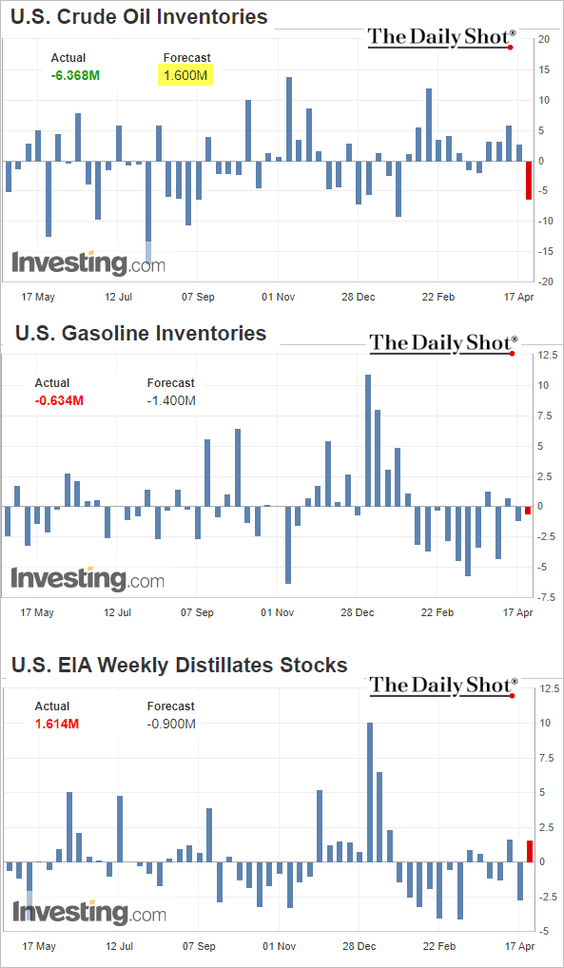

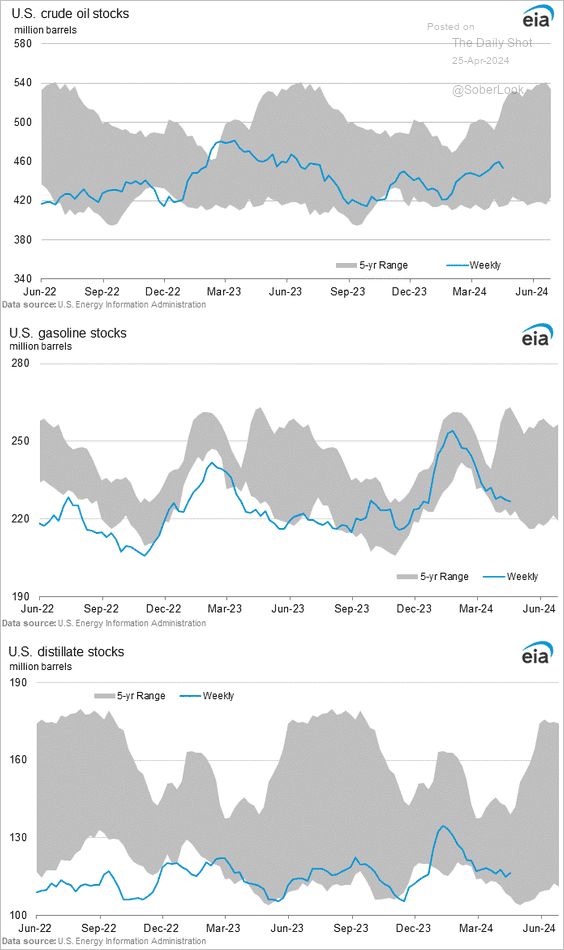

1. US crude oil stockpiles declined sharply last week (the market expected an increase). Inventory data for refined products was less bullish.

Source: @WSJ Read full article

Source: @WSJ Read full article

– Weekly changes:

– Levels:

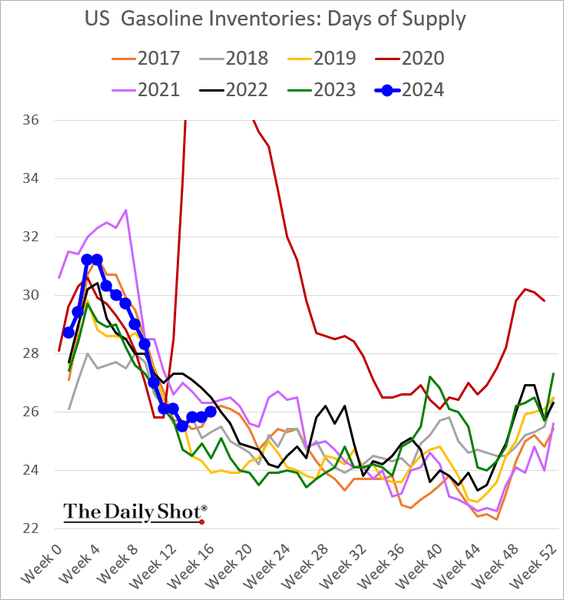

• Gasoline inventories, measured in days of supply, are well above last year’s levels, …

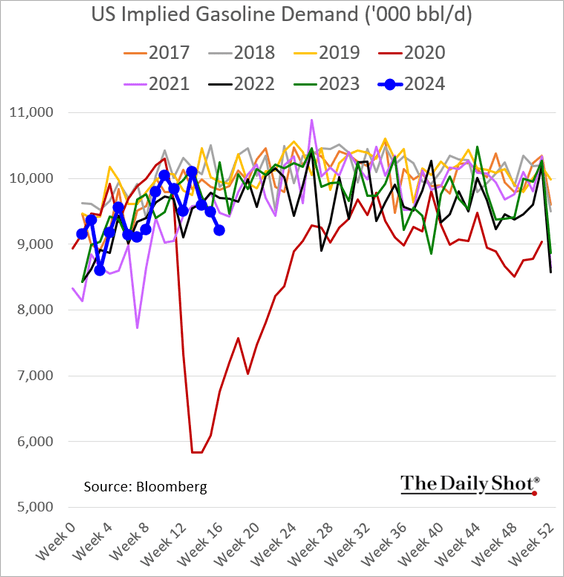

… as demand hits the lowest level since the COVID shock.

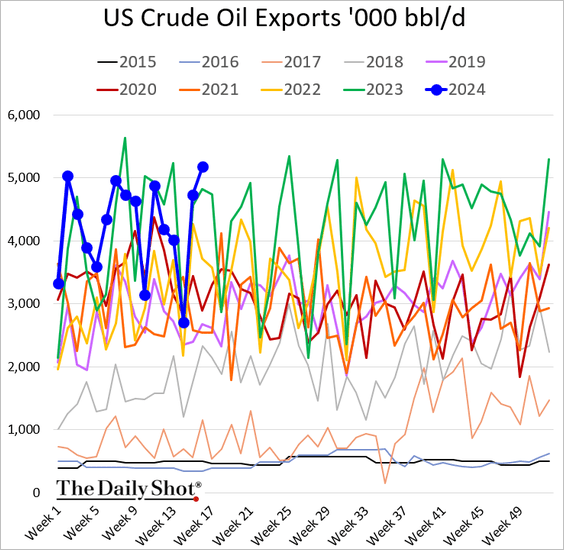

2. US gross exports of crude oil have been strong.

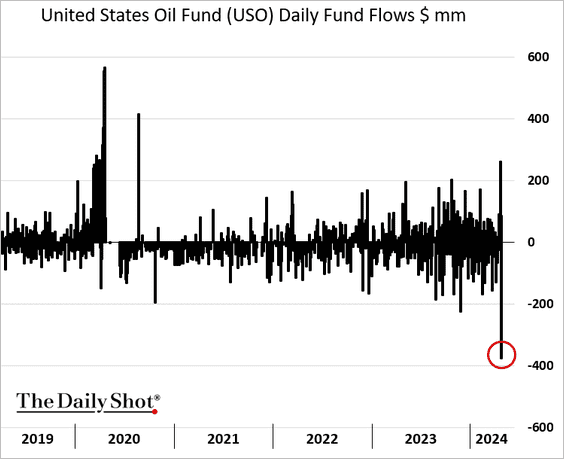

3. The largest oil ETF saw record outflows this week.

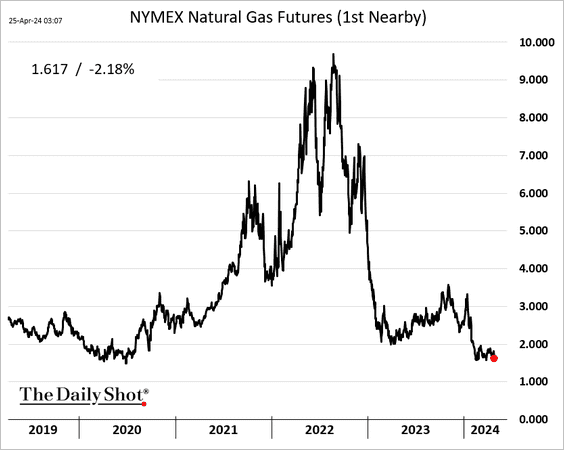

4. US natural gas prices remain depressed amid elevated inventories.

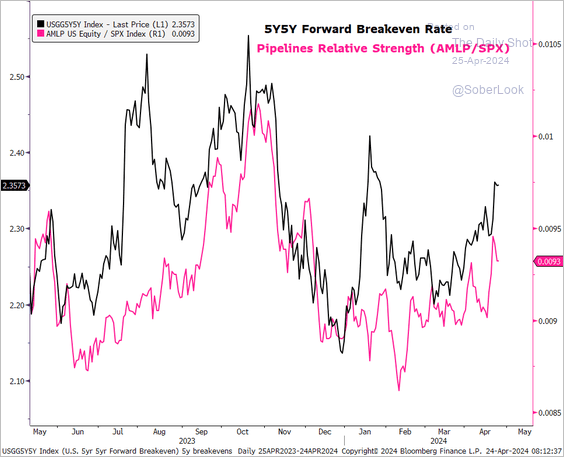

5. The relative performance of MLPs has traded alongside breakeven rates (inflation expectations).

Source: Aazan Habib, Paradigm Capital

Source: Aazan Habib, Paradigm Capital

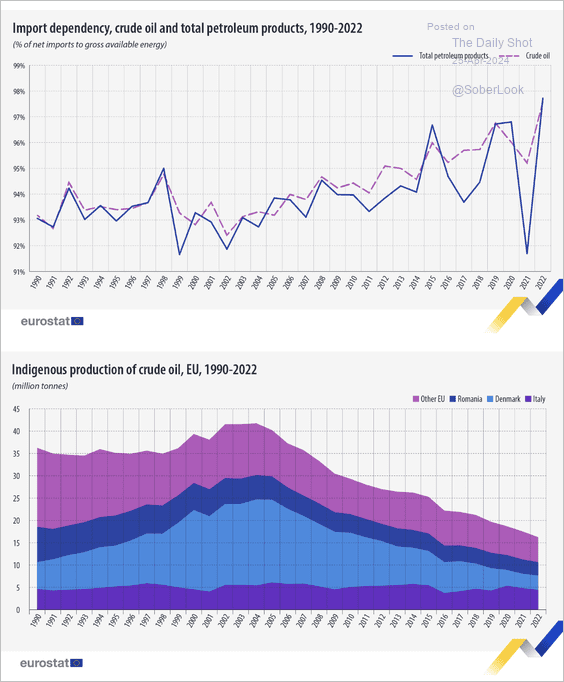

6. Here is a look at the EU’s dependency on crude oil and petroleum product imports.

Source: Eurostat Read full article

Source: Eurostat Read full article

Back to Index

Equities

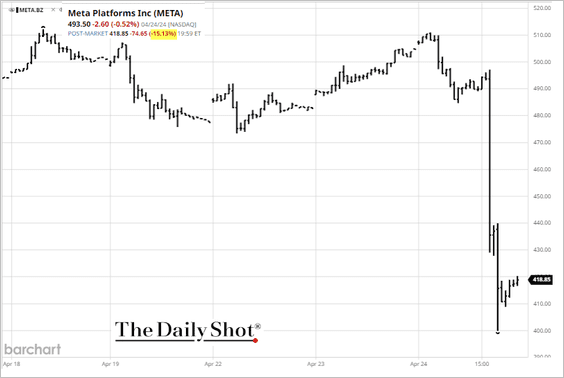

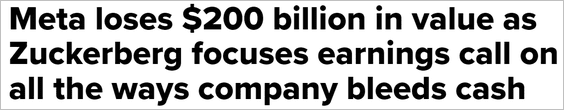

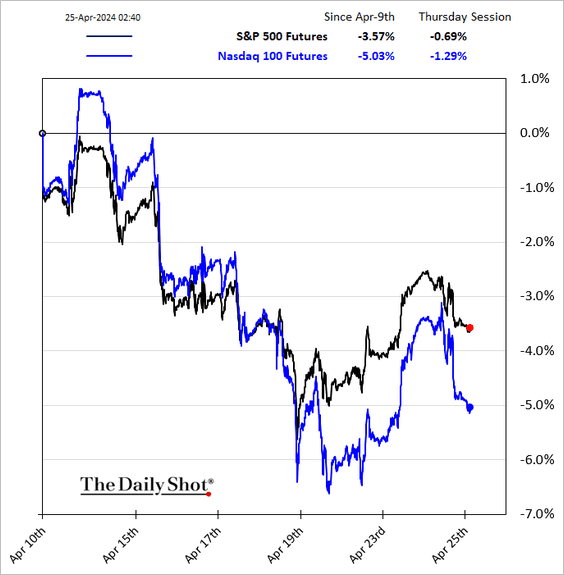

1. The market didn’t like what it heard from Meta after the close.

Source: CNBC Read full article

Source: CNBC Read full article

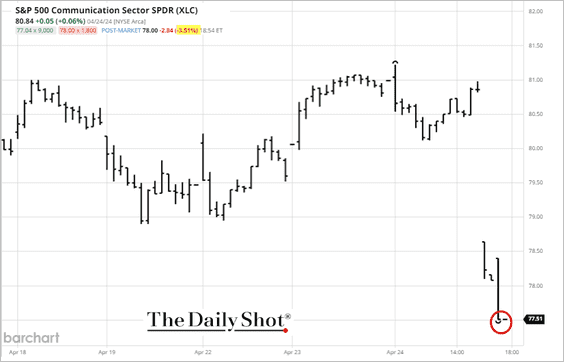

• As a result, the SPDR Communications ETF (XLC) is down sharply.

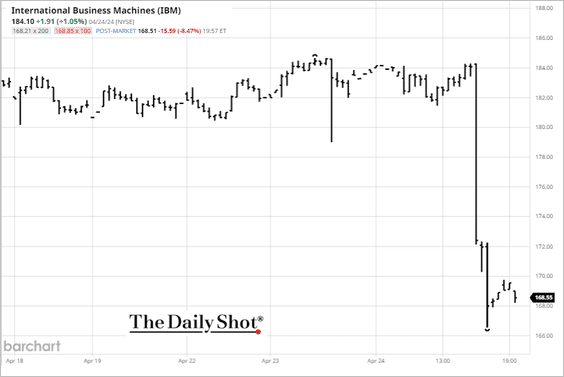

• IBM is also under pressure due to weak consulting revenue.

• Futures are down this morning.

——————–

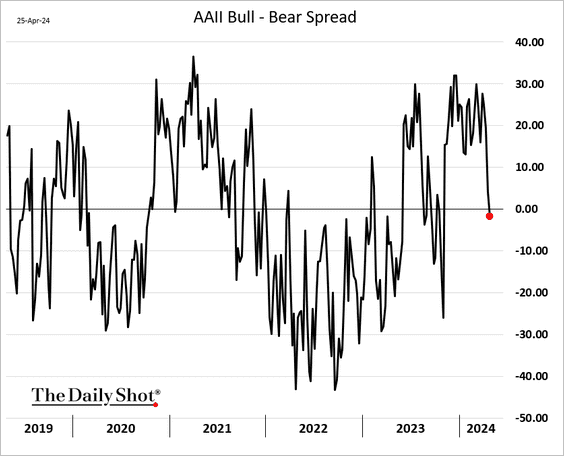

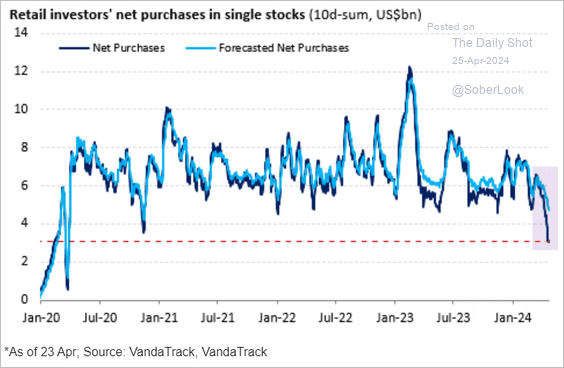

2. Retail investors are turning bearish, with the AAII bull-bear spread dipping into negative territory for the first time this year.

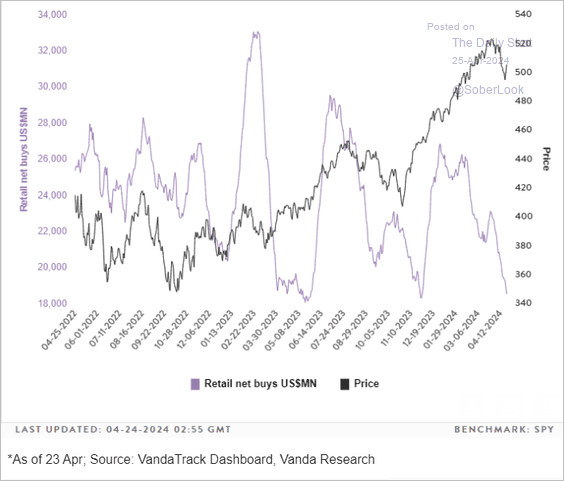

• Retail investors’ net purchases have sharply decreased, …

Source: Vanda Research

Source: Vanda Research

… with a more significant decline than expected in single-stock purchases.

Source: Vanda Research

Source: Vanda Research

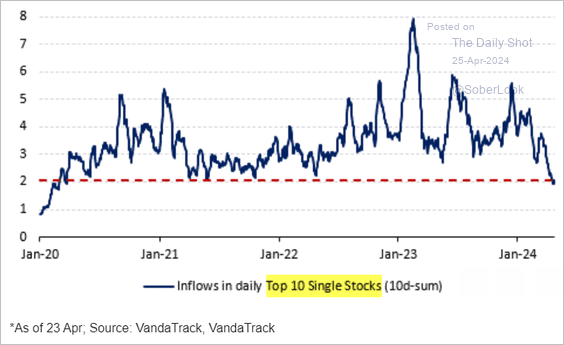

– Purchases have been particularly weak in the most popular stocks.

Source: Vanda Research

Source: Vanda Research

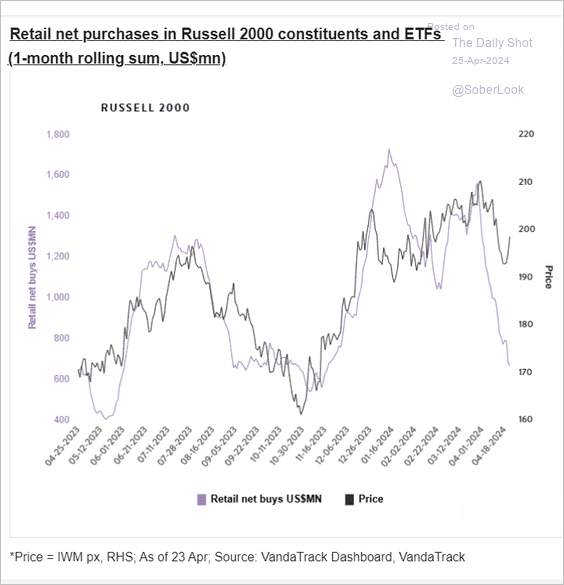

– Small-cap buying has also slowed.

Source: Vanda Research

Source: Vanda Research

——————–

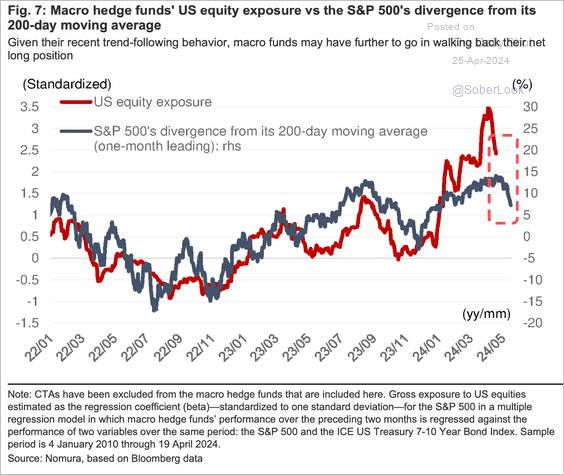

3. Given macro hedge funds’ trend-following in recent years, they might increase their selling going forward.

Source: Nomura Securities; @dailychartbook

Source: Nomura Securities; @dailychartbook

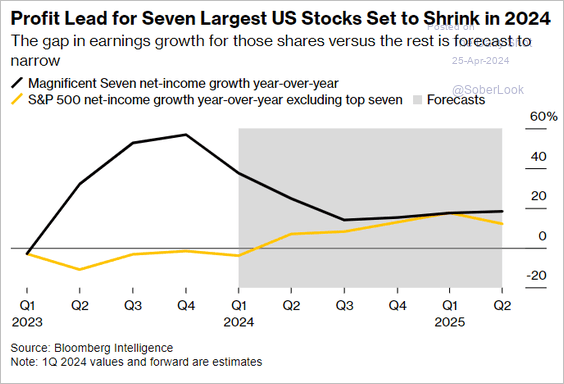

4. The earnings growth of the “Magnificent 7” is expected to cease outperforming the rest of the S&P 500 later this year.

Source: @technology Read full article

Source: @technology Read full article

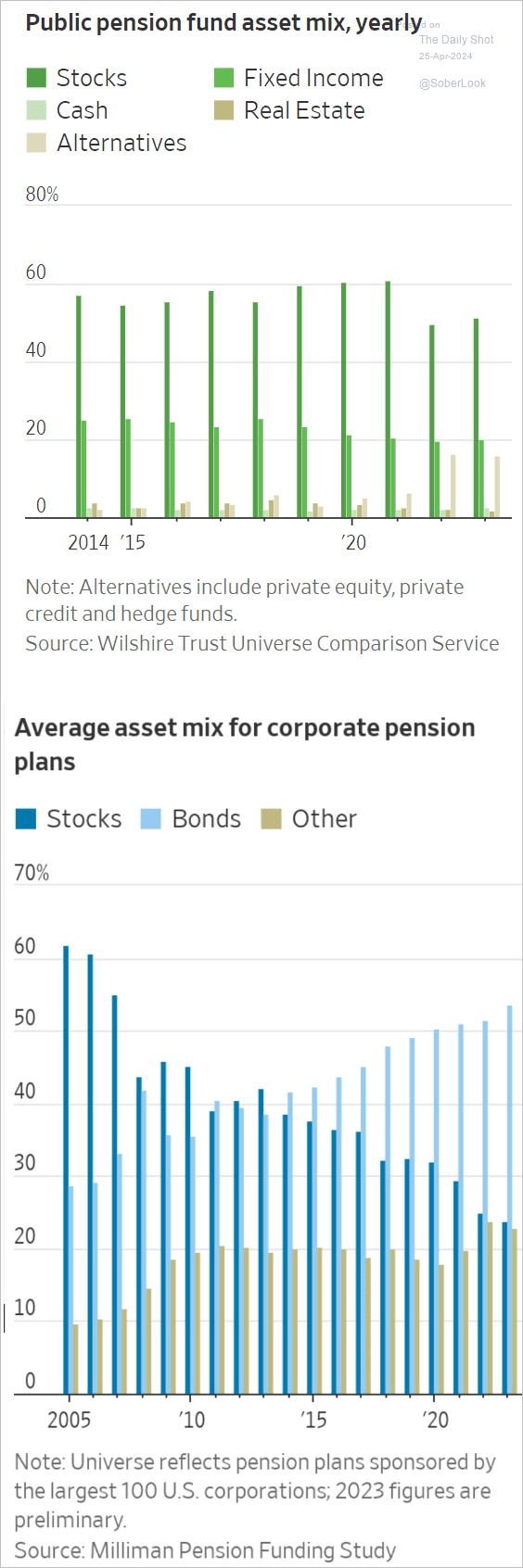

5. Public pensions have been cutting back on stock exposure.

Source: @WSJ Read full article

Source: @WSJ Read full article

Back to Index

Alternatives

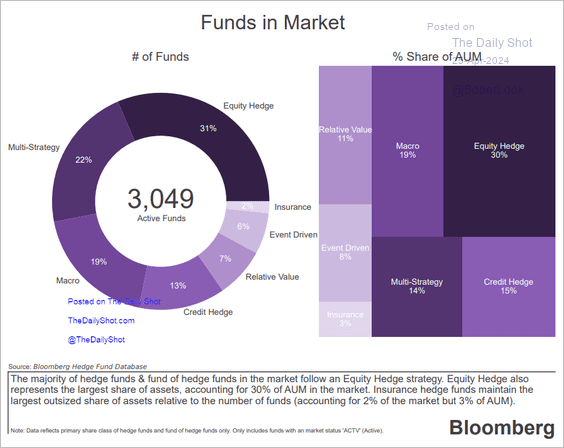

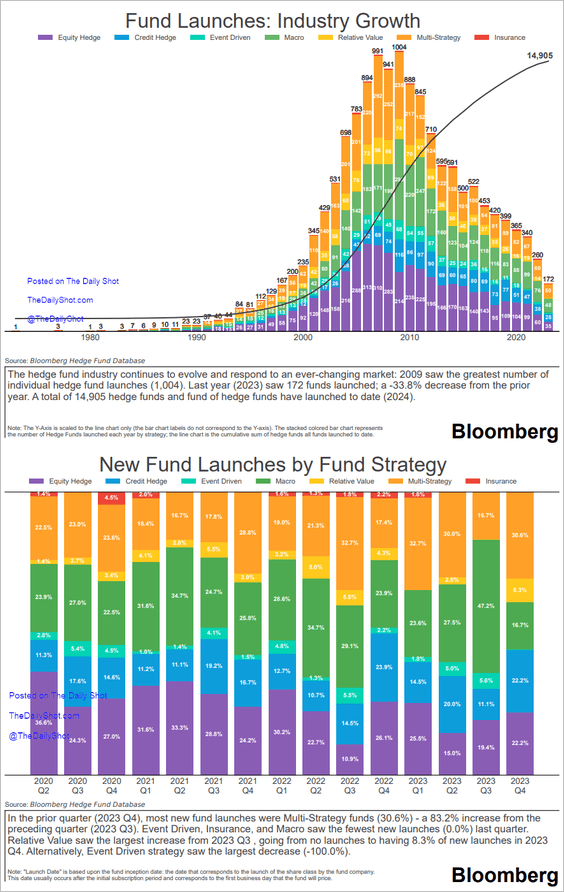

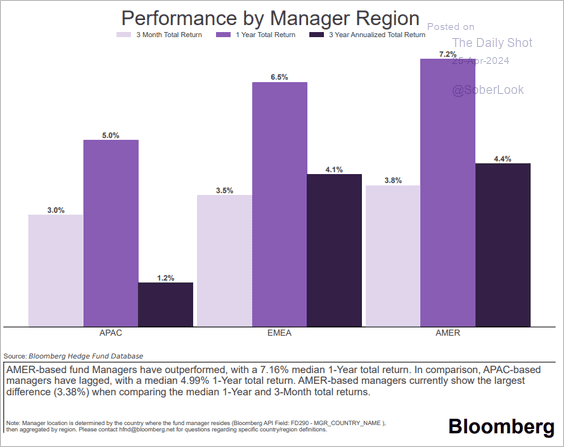

1. Let’s take a look at some hedge fund data from Bloomberg.

• Active hedge funds:

Source: HFND

Source: HFND

• Hedge fund launches by strategy:

Source: HFND

Source: HFND

• Performance by region:

Source: HFND

Source: HFND

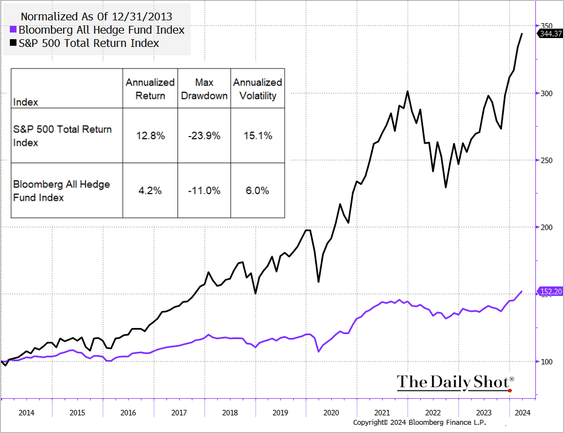

2. Bloomberg’s aggregate hedge fund index tends to underperform the S&P 500 significantly but is much less volatile.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

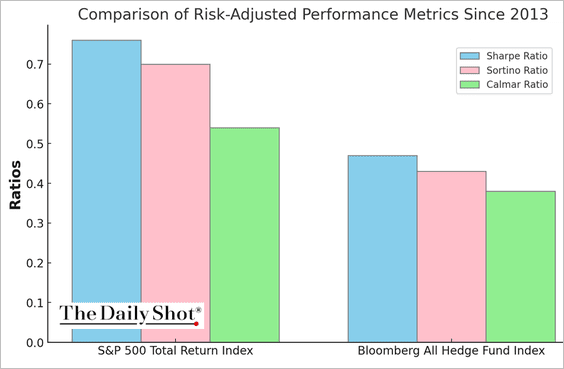

Some in the industry argue that hedge funds tend to outperform on a risk-adjusted basis. In aggregate, that’s simply not true.

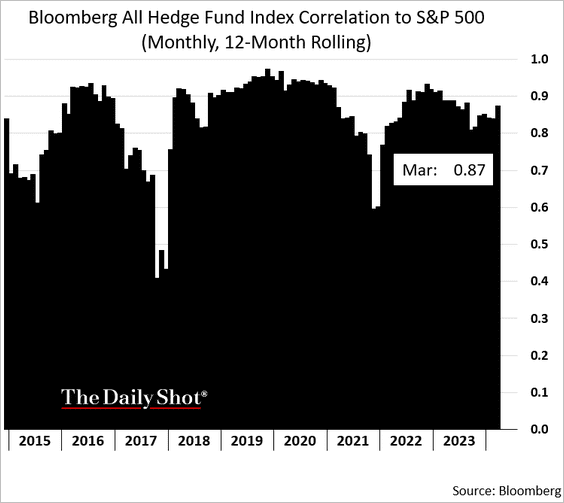

Moreover, hedge funds remain highly correlated to the US stock market (on average).

——————–

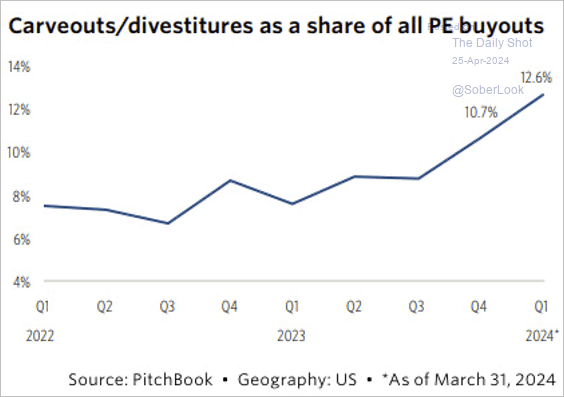

3. Private equity-led acquisitions of corporate divestitures have been rising steadily as a share of all buyouts.

Source: PitchBook

Source: PitchBook

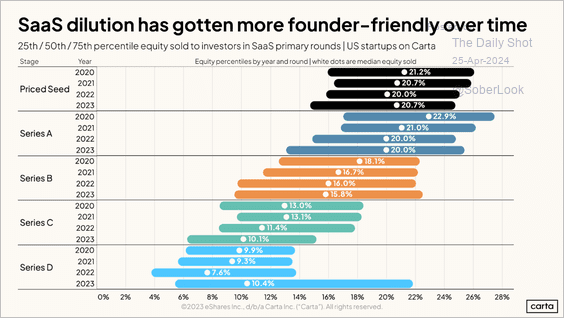

4. Founders in the software industry have been selling less equity to investors in recent years.

Source: Carta

Source: Carta

Back to Index

Rates

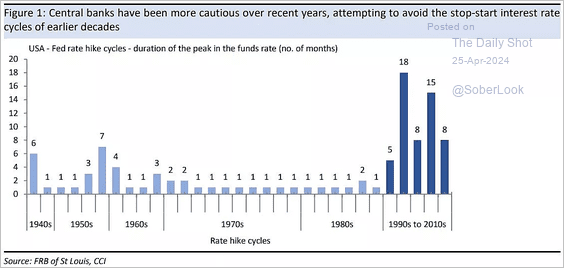

1. The Fed has been more cautious in recent years by holding rates steady for long periods.

Source: Coolabah Capital Read full article

Source: Coolabah Capital Read full article

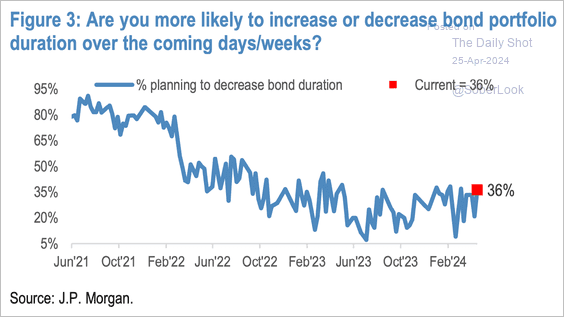

2. A larger proportion of JP Morgan’s clients are extending the duration of their portfolios.

Source: JP Morgan Research; @dailychartbook

Source: JP Morgan Research; @dailychartbook

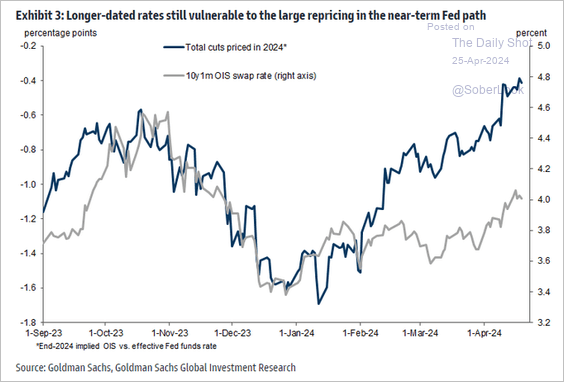

3. Longer-term rates are vulnerable to the Fed’s “higher for longer” policy.

Source: Goldman Sachs; @MikeZaccardi

Source: Goldman Sachs; @MikeZaccardi

——————–

Food for Thought

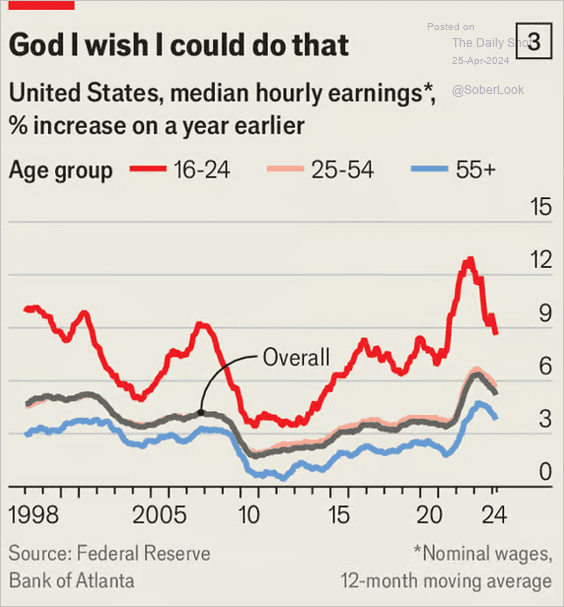

1. Wage growth by age:

Source: The Economist Read full article

Source: The Economist Read full article

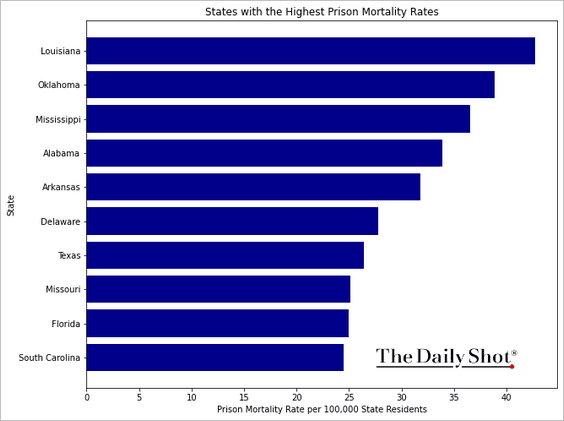

2. States with the highest prison mortality rates:

Source: Connecticut Trial Firm, Bureau of Justice Statistics

Source: Connecticut Trial Firm, Bureau of Justice Statistics

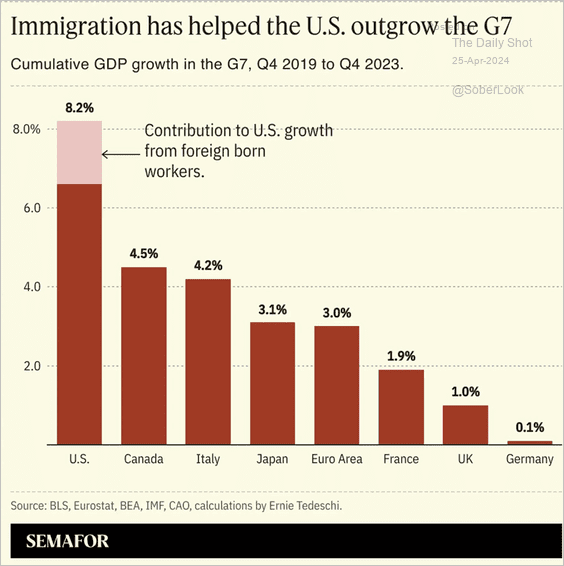

3. The impact of immigration on US GDP growth:

Source: Semafor

Source: Semafor

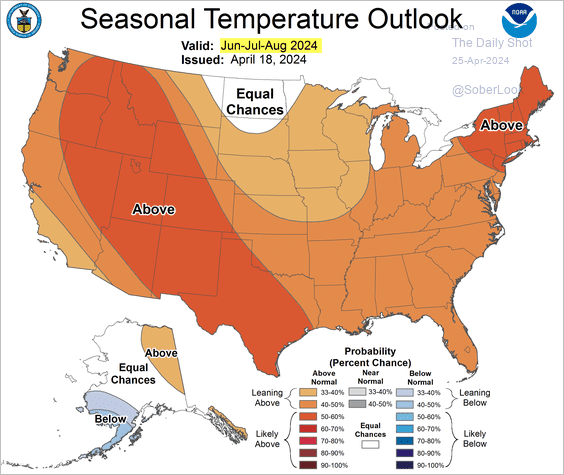

4. It’s going to be a warm summer:

Source: NOAA

Source: NOAA

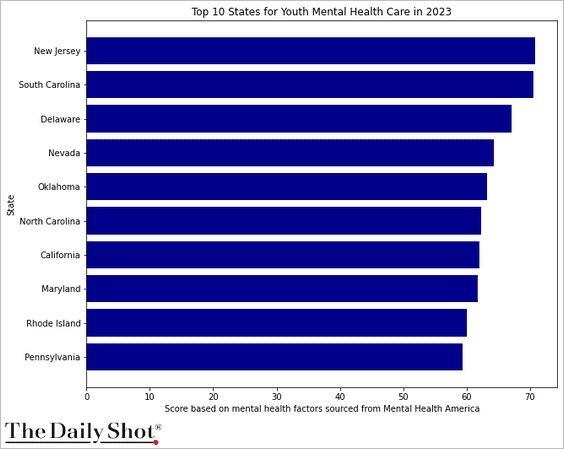

5. States with the best mental health care for young people:

Source: Onyx Behavioral Health

Source: Onyx Behavioral Health

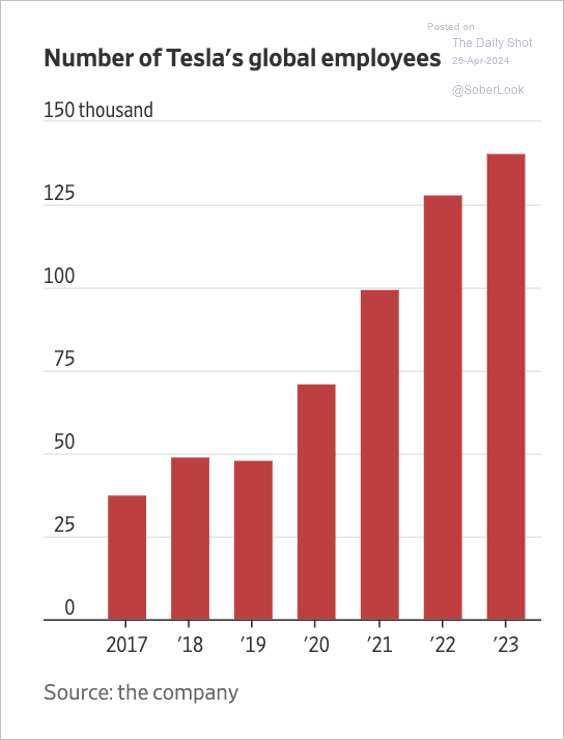

6. Tesla’s workforce:

Source: @WSJ Read full article

Source: @WSJ Read full article

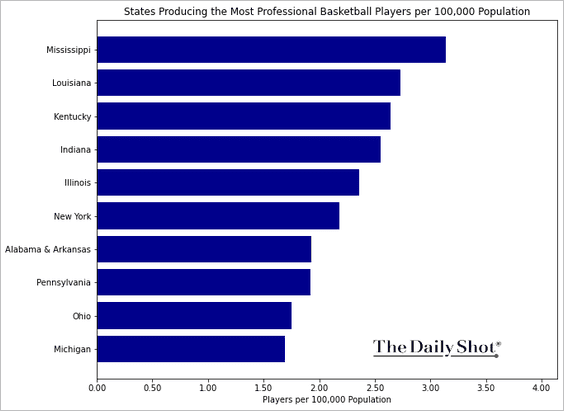

7. The states that have produced the most professional basketball players:

Source: Casino Alpha NZ

Source: Casino Alpha NZ

——————–

Back to Index