The Daily Shot: 18-Apr-24

• The United States

• The United Kingdom

• Europe

• Asia-Pacific

• China

• Emerging Markets

• Cryptocurrency

• Commodities

• Energy

• Equities

• Rates

• Global Developments

• Food for Thought

The United States

1. The Fed’s latest Beige Book report indicates that US economic activity has picked up. Below is the Oxford Economics Beige Book Activity Index.

Source: Oxford Economics

Source: Oxford Economics

• The report showed a decrease in interest-rate-related commentary.

• There was more discussion of the housing markets.

• Commercial real estate concerns appear to have eased.

• Inflation concerns persist.

Source: Oxford Economics

Source: Oxford Economics

Source: MarketWatch Read full article

Source: MarketWatch Read full article

——————–

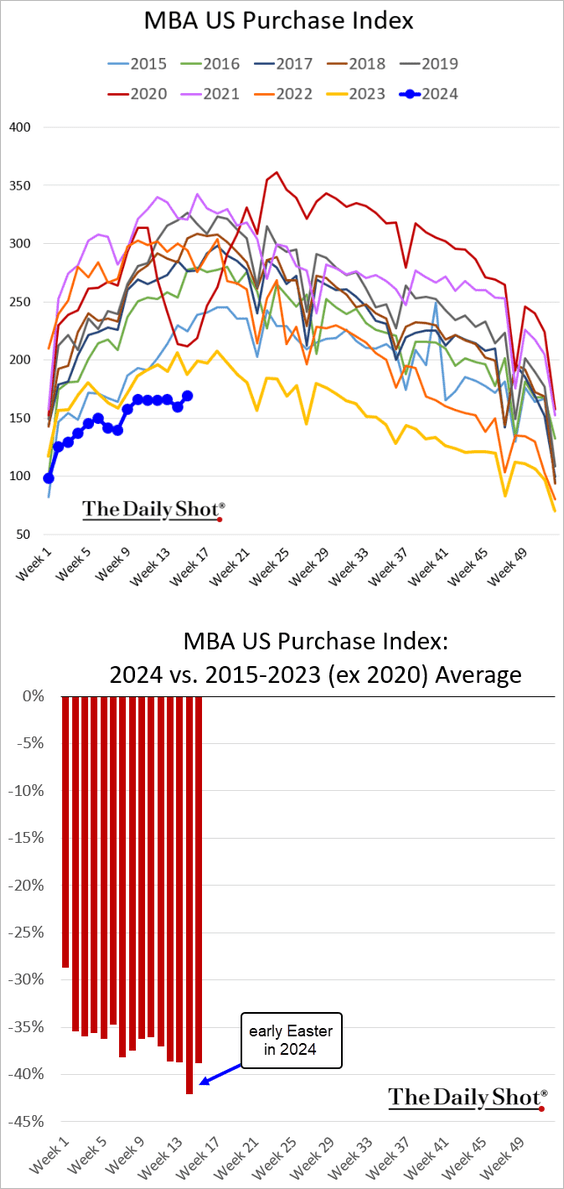

2. Next, we have some updates on the housing market.

• Mortgage applications remain well below last year’s levels.

Here is the rate lock count.

Source: AEI Housing Center

Source: AEI Housing Center

• Delinquencies on FHA loans due to unemployment are increasing.

Source: Quill Intelligence

Source: Quill Intelligence

• The number of housing units authorized but not yet started remains high, particularly in the multifamily sector

Source: Arcano Economics

Source: Arcano Economics

• Builders are increasingly constructing single-family homes intended for rental purposes.

Source: Apartment List

Source: Apartment List

——————–

3. The slump in the annual growth rate of temporary employment suggests permanent employment growth may weaken.

Source: Capital Economics

Source: Capital Economics

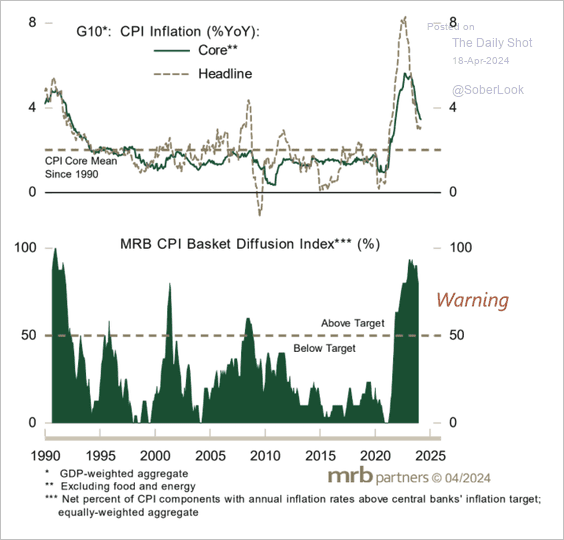

4. Cyclical pressures have been driving inflation.

Source: MRB Partners

Source: MRB Partners

5. The share of equities and real estate held by those over 55 years old is at record levels and has significantly diverged from younger cohorts. (2 charts)

Source: Deutsche Bank Research

Source: Deutsche Bank Research

Source: Deutsche Bank Research

Source: Deutsche Bank Research

Back to Index

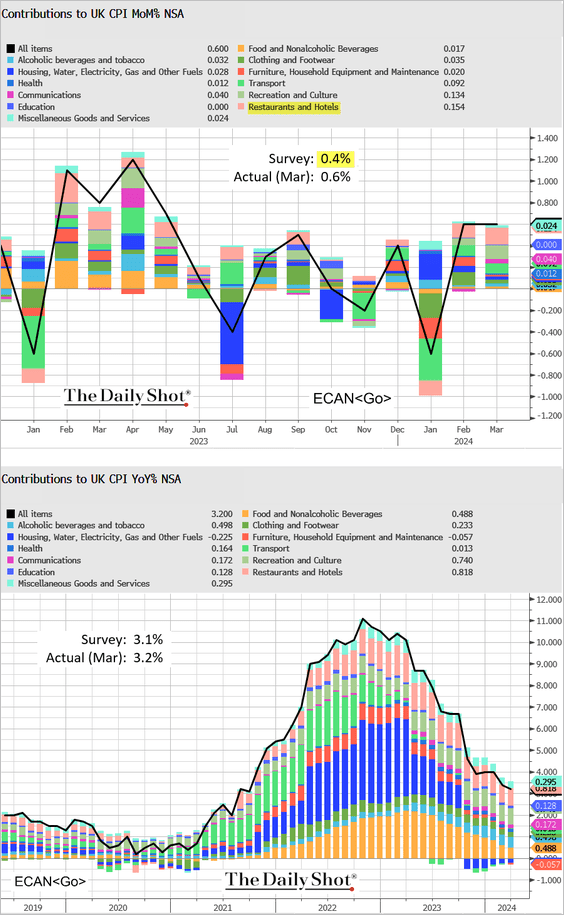

The United Kingdom

1. The UK CPI figures for March were a bit higher than anticipated.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: CNBC Read full article

Source: CNBC Read full article

• Here is the core CPI.

• Goods inflation continues to moderate.

But services CPI remains sticky, as rent inflation surges.

• Below is the retail price index.

——————–

2. The official index of house prices showed almost no change year over year in February as the housing market strengthened.

Back to Index

Europe

1. The monthly CPI increase in the Eurozone received a substantial boost from higher clothing prices. The second panel shows the contributions to the year-over-year CPI changes.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

2. Here is a look at labor costs across the EU.

Source: Eurostat Read full article

Source: Eurostat Read full article

3. What are the main causes of death in the EU?

Source: Eurostat Read full article

Source: Eurostat Read full article

Back to Index

Asia-Pacific

1. Japan’s services sector output surged in February, …

… with PMI data continuing to indicate robust activity in the nation’s services sector.

——————–

2. Australia’s employment contracted in March, but full-time employment gained for the third month in a row.

Source: @WSJ Read full article

Source: @WSJ Read full article

• The unemployment rate remains very low.

• The labor force participation rate edged lower.

• Here is the Beveridge curve.

Source: Capital Economics

Source: Capital Economics

Back to Index

China

1. Bond yields continue to sink.

——————–

2. The share of SWIFT payments made in yuan is nearing 5%.

3. China’s IPO activity has collapsed.

Source: Reuters Read full article

Source: Reuters Read full article

4. Industrial product demand and capacity utilization have been weakening.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

5. With domestic demand remaining relatively soft, China’s economy continues to rely on government investment and exports.

Source: Capital Economics

Source: Capital Economics

Back to Index

Emerging Markets

1. Brazil’s economic activity kept strengthening in February.

Source: TradingView Read full article

Source: TradingView Read full article

——————–

2. Inflation in South Africa declined slightly in March, …

… while retail sales experienced a modest increase.

——————–

4. Here is a look at EM currencies’ performance since April 10th (US CPI report).

Source: Capital Economics

Source: Capital Economics

5. Numera Analytics expects EM stocks to outperform DM stocks 12 months out, mainly due to differences in terms of trade as commodity prices gain momentum.

Source: Numera Analytics (@NumeraAnalytics)

Source: Numera Analytics (@NumeraAnalytics)

Back to Index

Cryptocurrency

1. Cryptos are down substantially over the past few days.

2. Bitcoin is tetsting support at $60k.

Back to Index

Commodities

1. Iron ore futures are rebounding.

• China’s steel prices are also climbing.

——————–

2. Coffee futures in New York and London are surging.

3. US cotton futures have given up most of their 2024 gains.

4. The slump in US wheat prices persists.

Source: Reuters Read full article

Source: Reuters Read full article

Back to Index

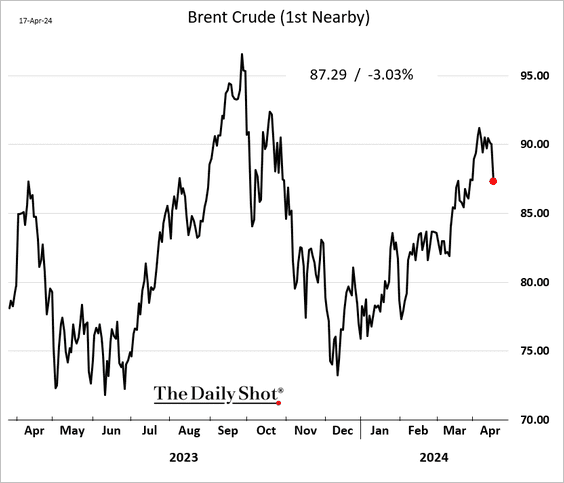

Energy

Crude oil prices declined on Wednesday as traders unwound some of the geopolitical risk premium, …

Source: CNBC Read full article

Source: CNBC Read full article

… while US stockpiles continue to grow.

Source: BNN Read full article

Source: BNN Read full article

– Weekly US inventory changes:

– Inventory levels:

– US gasoline days of supply:

• US gasoline demand has softened in recent weeks.

Back to Index

Equities

1. The average S&P 500 stock (equal weight index) has been down for five days in a row.

• The average stock’s 5-day drawdown has been substantial. Small caps also took a significant hit (2nd panel)

• The S&P 500 Equal Weight Index is nearing oversold territory.

——————–

2. The percentage of S&P 500 members trading above their 20-day moving average has fallen below 10%, a level typically followed by a bounce, though not necessarily a sustained one.

3. The S&P 500 is almost 2% below its 50-day moving average.

4. The AAII bull-bear spread (retail investor sentiment) dropped this week but remains in positive territory.

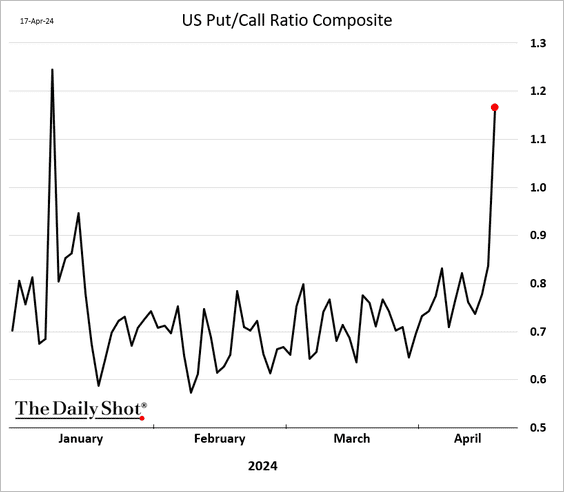

5. The put/call ratio surged this week.

6. The S&P 500 implied correlation is starting to rise as volatility returns.

Source: Aazan Habib, Paradigm Capital

Source: Aazan Habib, Paradigm Capital

7. Unlike the average stock in the S&P 500, tech shares are no longer correlated with Treasuries.

8. The gap between S&P 500 valuations and real rates keeps widening.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

9. Mutual fund families that offer ETFs have seen more inflows than fund families that do not offer ETFs.

Source: @BBGIntelligence

Source: @BBGIntelligence

Back to Index

Rates

1. Foreigners bought almost $90 billion of coupon Treasuries in February.

2. Fund managers have been unloading their bond holdings.

Source: BofA Global Research

Source: BofA Global Research

3. Some traders are betting that the economy and inflation will weaken significantly in the months ahead, forcing the Fed to deliver three rate cuts.

Source: @markets Read full article

Source: @markets Read full article

4. The US Treasury’s cash holdings at the Fed hit the highest level in two years, which will put downward pressure on reserves (reducing liquidity in the private sector).

Back to Index

Global Developments

1. Global inflation is much stickier than in the past.

Source: MRB Partners

Source: MRB Partners

2. Major central banks continue to shrink their balance sheets.

Source: Arcano Economics

Source: Arcano Economics

——————–

Food for Thought

1. Wage growth comparison of 1979-2019 and 2019-2023 periods:

Source: EPI Read full article

Source: EPI Read full article

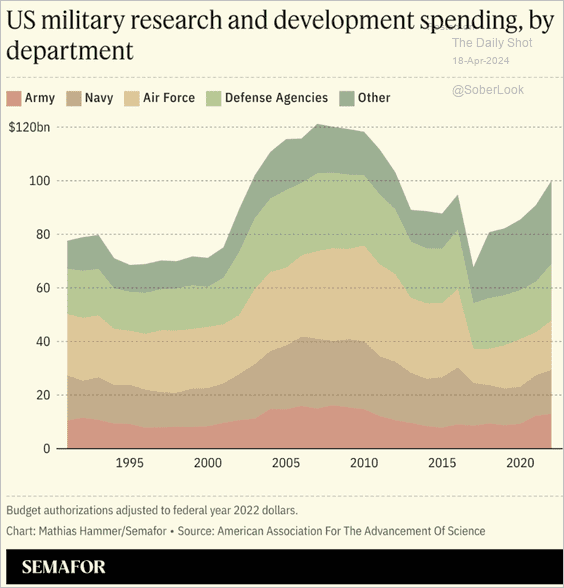

2. US military’s R&D expenditure by department:

Source: Semafor

Source: Semafor

3. Americans planning to vacation abroad:

4. Home insurance rates:

Source: Insurify

Source: Insurify

5. Population projections for select countries:

Source: Visual Capitalist Read full article

Source: Visual Capitalist Read full article

6. Children’s sports participation rates:

Source: USAFacts

Source: USAFacts

——————–

Back to Index