The Daily Shot: 27-Mar-24

• The United States

• The United Kingdom

• The Eurozone

• Europe

• Asia-Pacific

• China

• Emerging Markets

• Cryptocurrency

• Commodities

• Energy

• Equities

• Alternatives

• Food for Thought

The United States

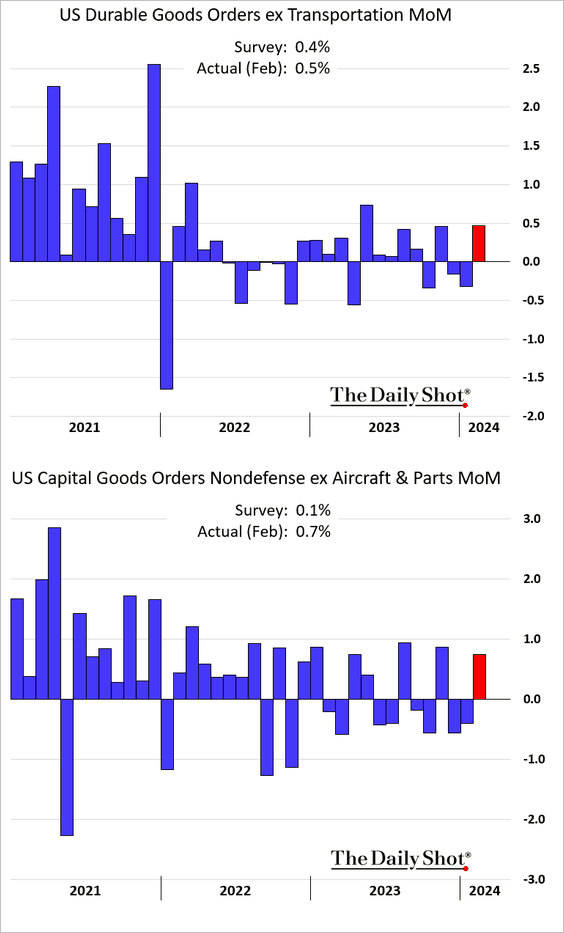

1. Durable goods orders increased last month, topping expectations.

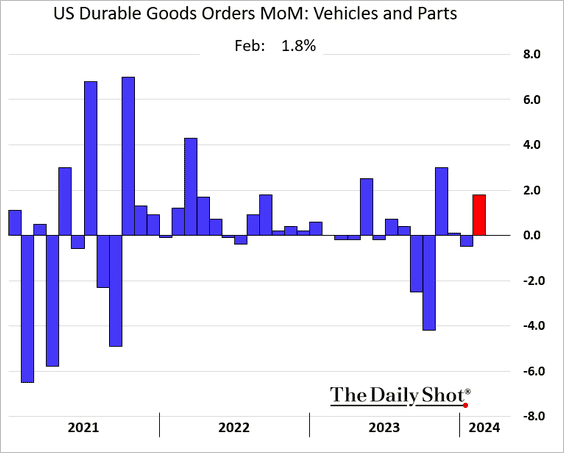

• Here are the monthly changes in vehicle orders.

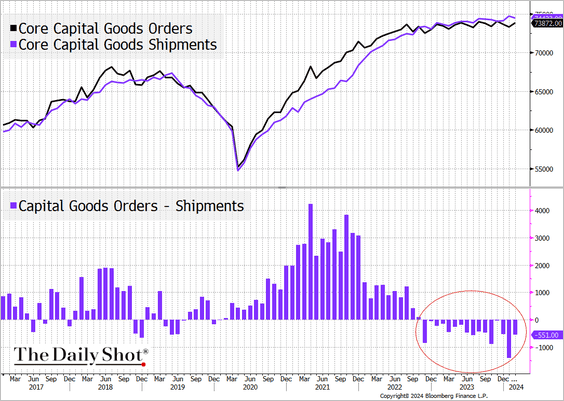

• Capital goods shipments exceeding orders indicate potential downside risks for future demand.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

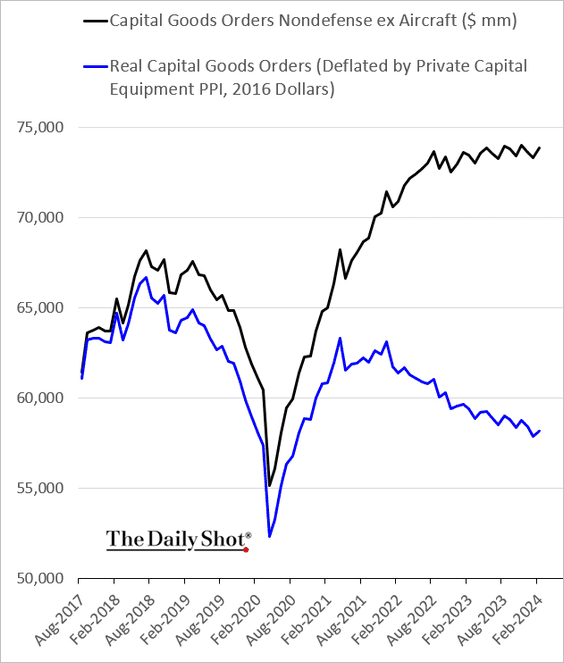

• Adjusted for inflation, capital goods orders have been trending lower for a couple of years now.

——————–

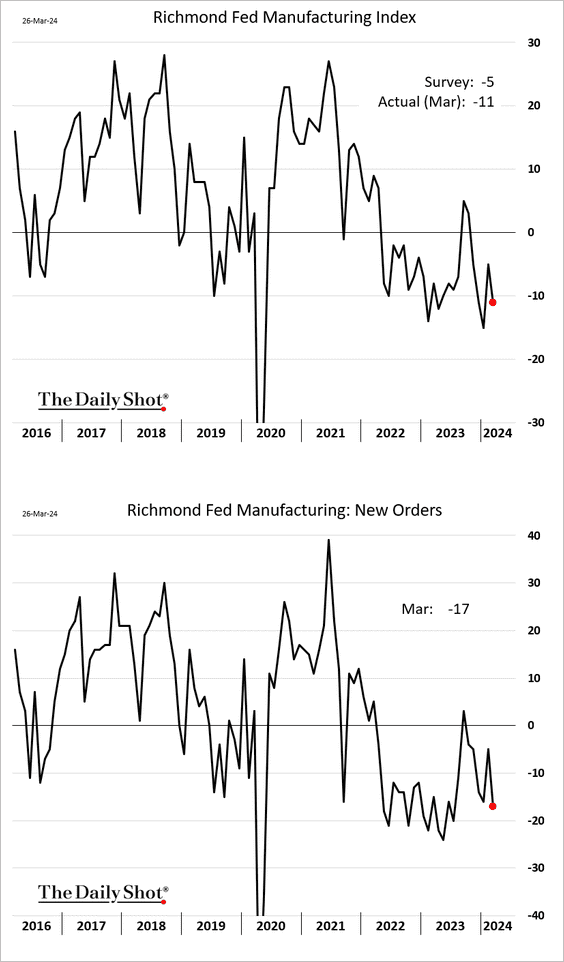

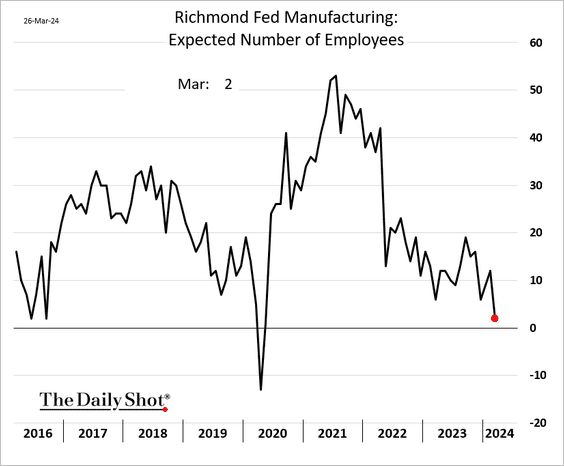

2. The Richmond Fed’s manufacturing index continues to indicate a slump in factory activity in the region.

• Companies plan to reduce hiring.

——————–

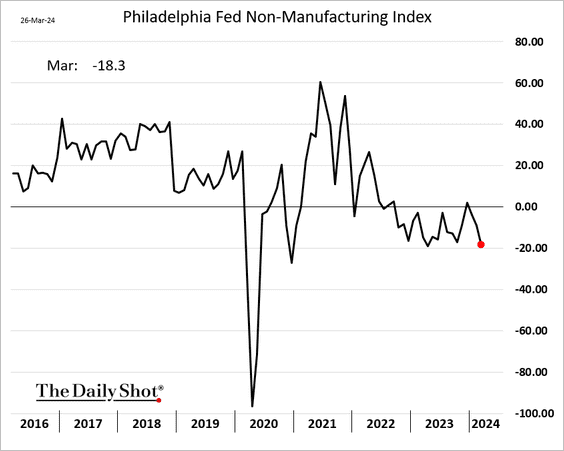

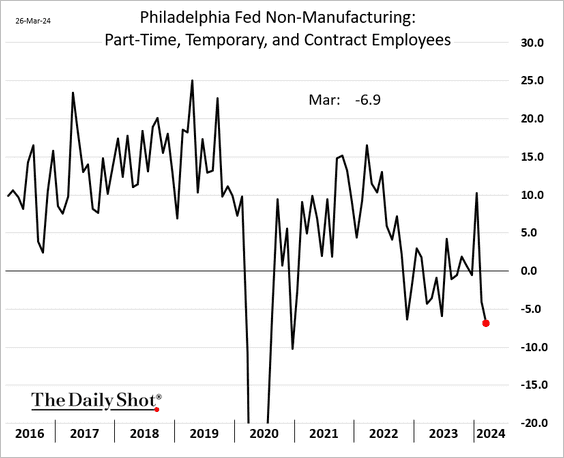

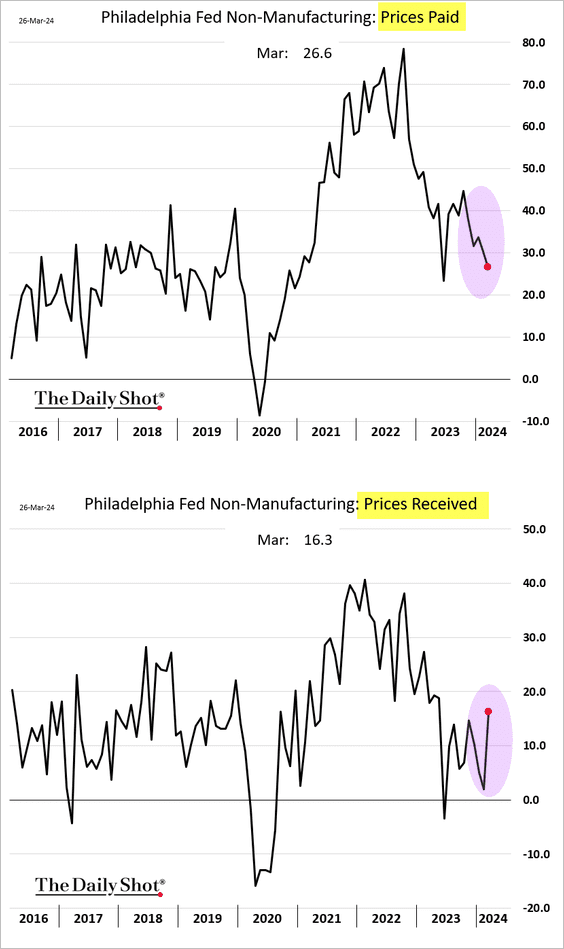

3. The Philly Fed’s service sector activity index moved further into contraction territory this month.

• Companies are reducing part-time and temporary staff.

• A larger number of firms boosted prices this month even as cost pressures ease, suggesting that companies are able to defend their margins.

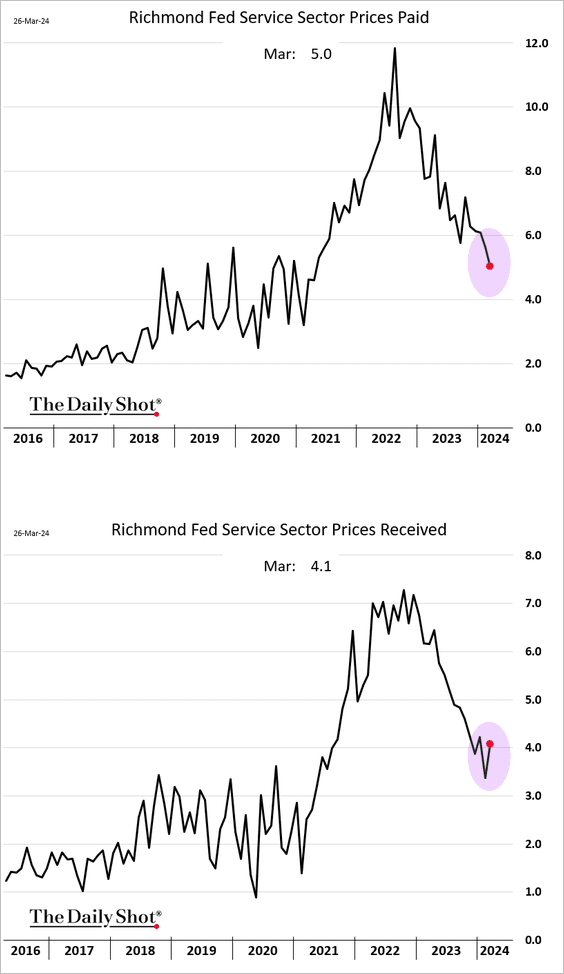

– There was a similar divergence in the Richmond Fed’s services report.

——————–

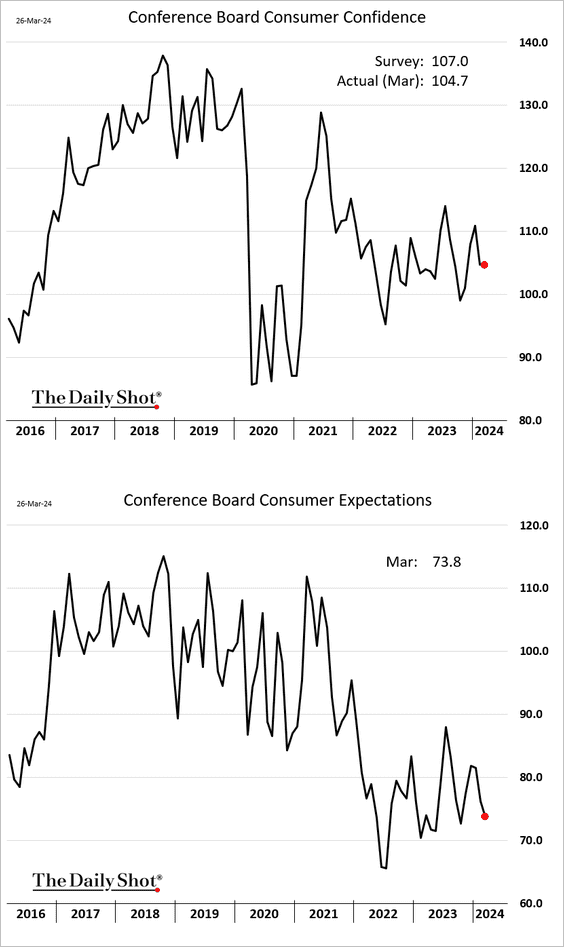

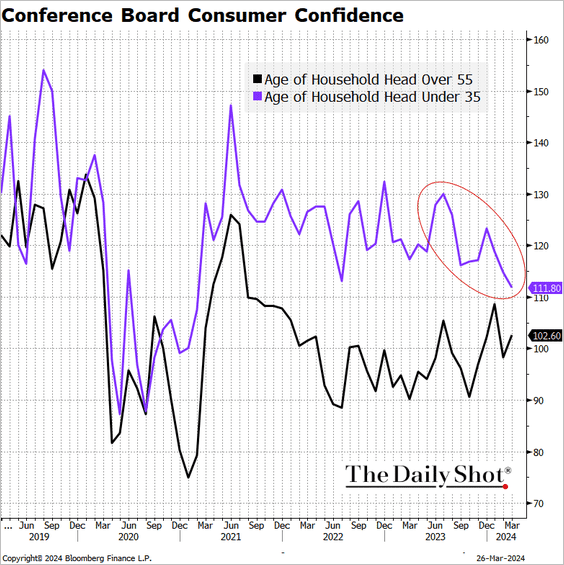

4. The Conference Board’s consumer confidence index was almost unchanged this month, but the expectations component declined.

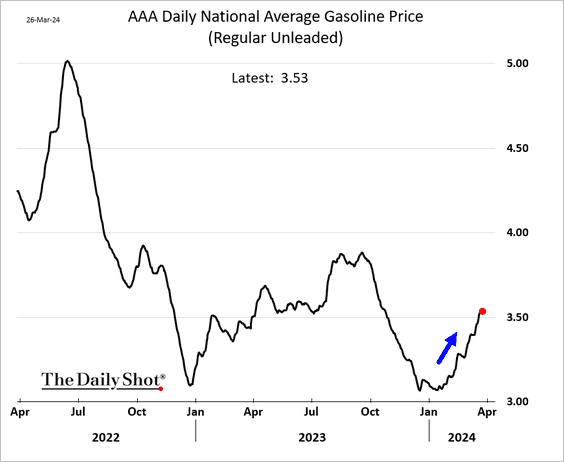

• Higher gasoline prices have been a headwind for sentiment.

• There has been a marked decline in consumer confidence among younger Americans.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

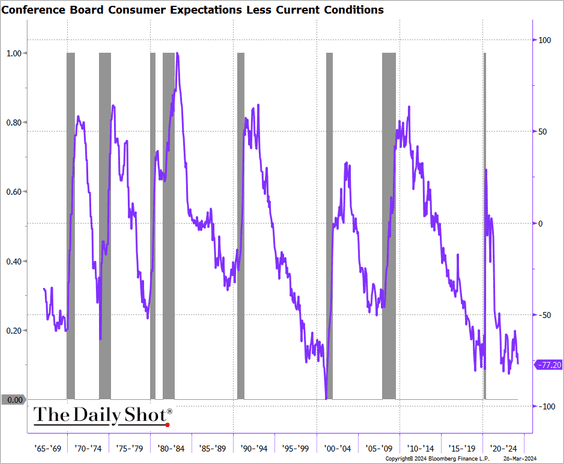

• The spread between expectations and current conditions remains at recessionary levels.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

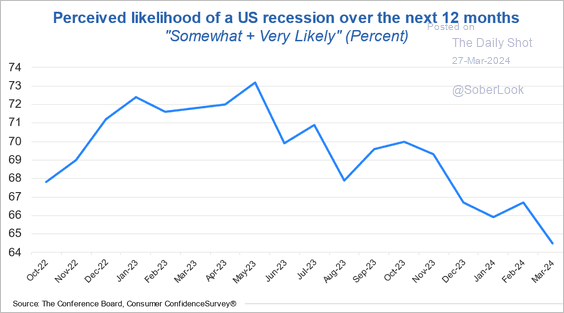

But fewer households expect a recession.

Source: The Conference Board

Source: The Conference Board

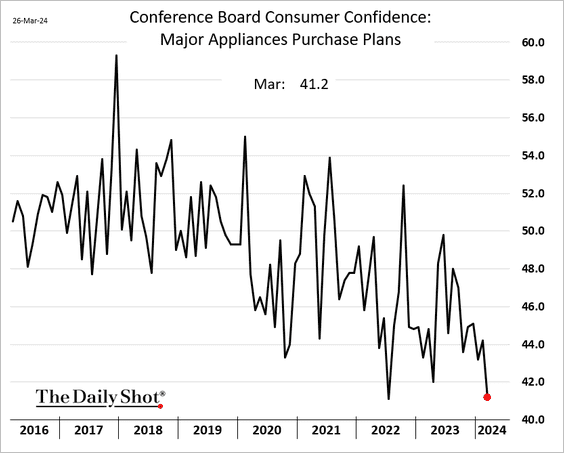

• Consumer interest in buying major appliances tumbled this year.

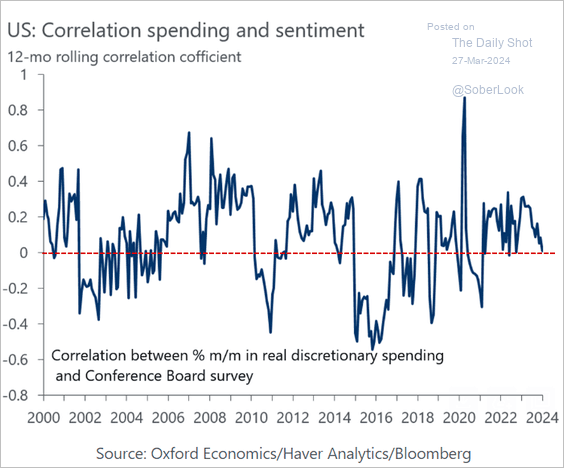

– However, there is little correlation between consumer sentiment and spending.

Source: Oxford Economics

Source: Oxford Economics

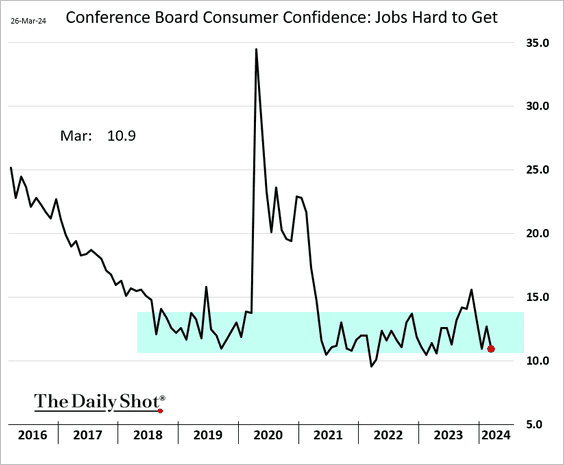

• Fewer Americans say that jobs are hard to get.

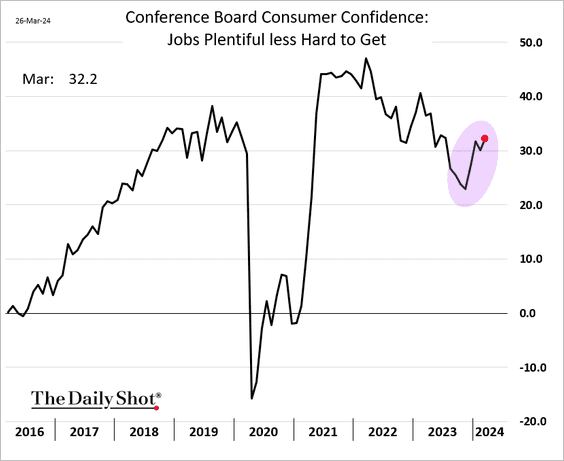

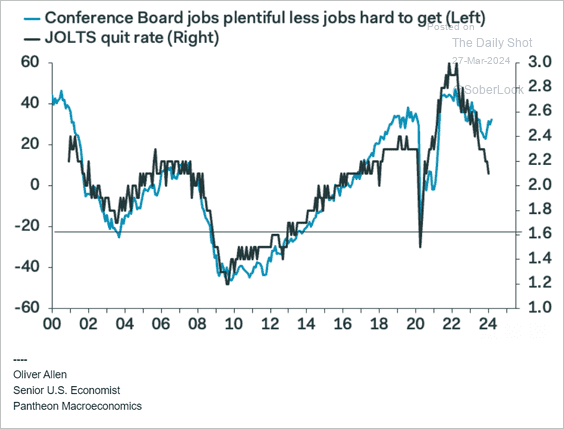

– The labor differential climbed again, indicating growing consumer confidence in the job market.

– This indicator has diverged from the quits rate (voluntary resignations).

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

——————–

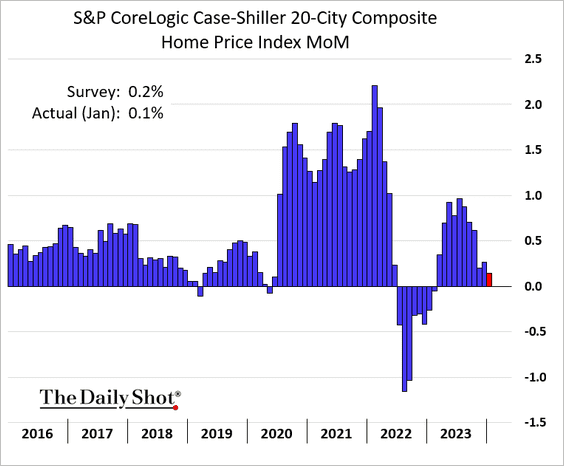

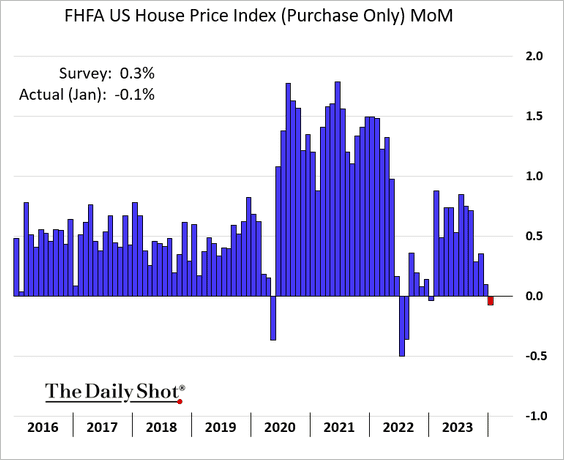

5. Home price appreciation slowed in January.

The Federal Housing Finance Agency’s home price report showed a decline in prices.

——————–

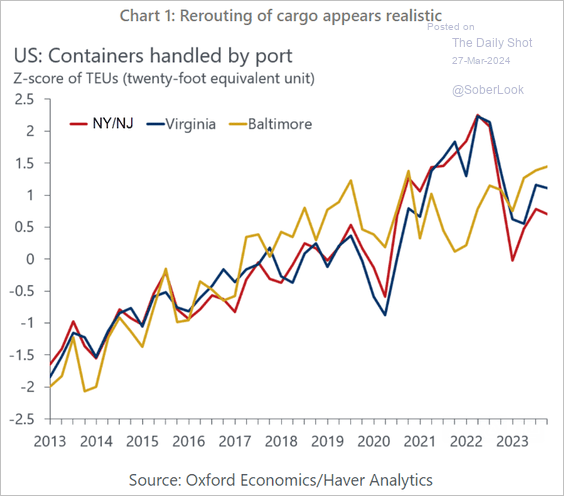

6. According to Oxford Economics, rerouting container shipping from the Port of Baltimore to the Ports of Virginia and New York/New Jersey seems feasible following the Key Bridge tragedy.

Source: Oxford Economics

Source: Oxford Economics

Back to Index

The United Kingdom

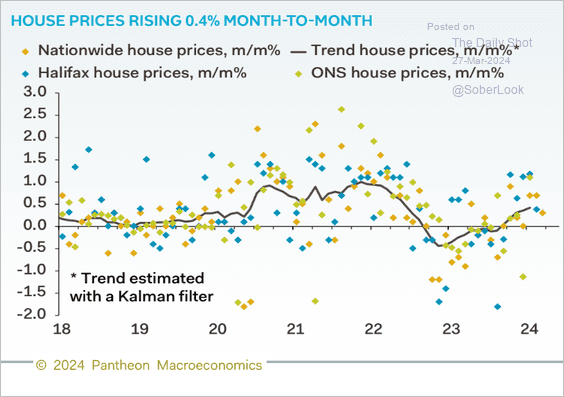

1. Housing indicators continue to signal a rebound in home prices.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

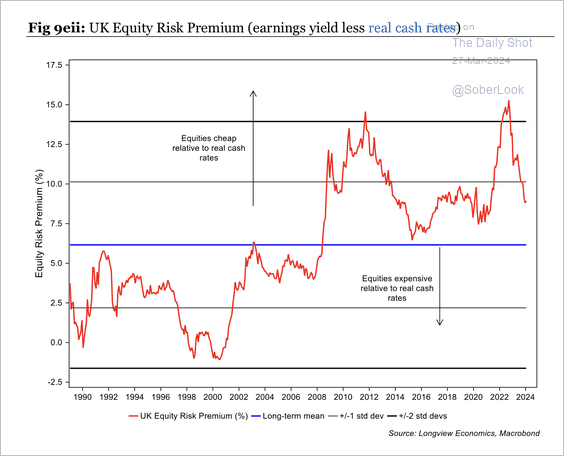

2. The UK equity risk premium remains elevated.

Source: Longview Economics

Source: Longview Economics

Back to Index

The Eurozone

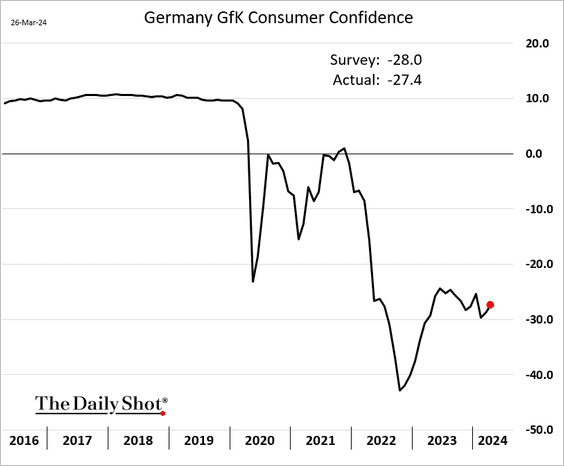

1. Germany’s consumer confidence edged higher this month.

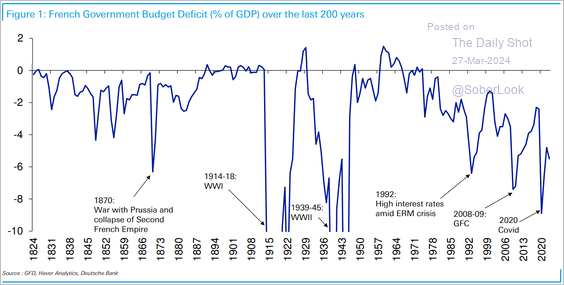

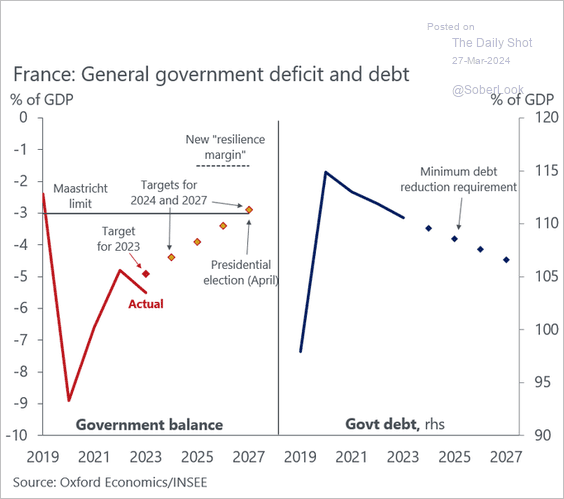

2. France’s budget deficit continues to widen.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

Source: @financialtimes Read full article

Source: @financialtimes Read full article

• To comply with the EU’s new fiscal rules, France will need several years of austerity.

Source: @DanielKral1

Source: @DanielKral1

Back to Index

Europe

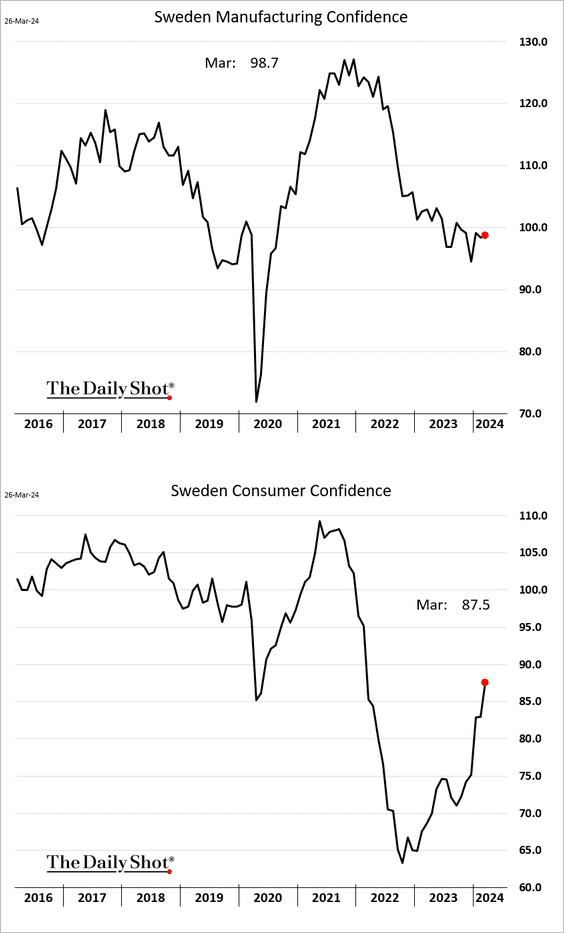

1. Sweden’s manufacturing confidence was roughly flat this month, but consumer sentiment continues to rebound.

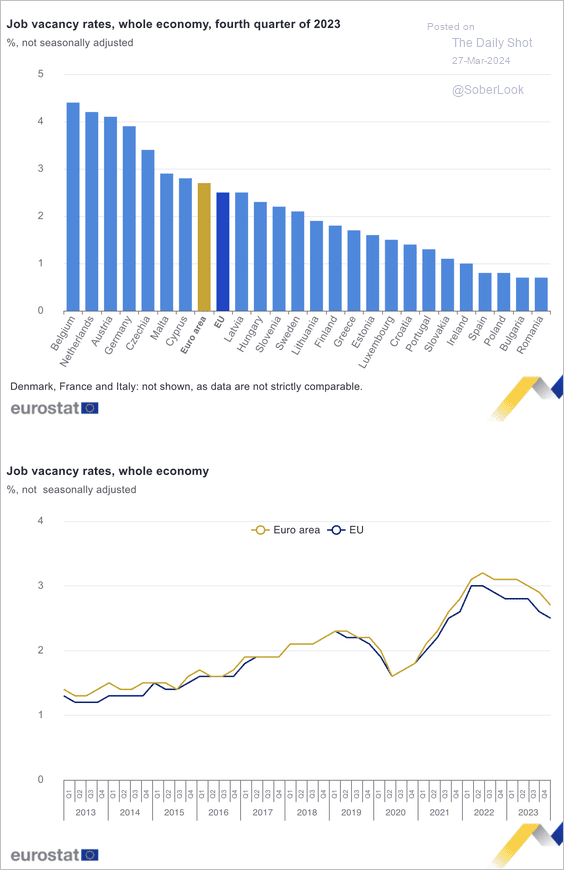

2. Here is a look at job openings across the EU.

Source: Eurostat Read full article

Source: Eurostat Read full article

Back to Index

Asia-Pacific

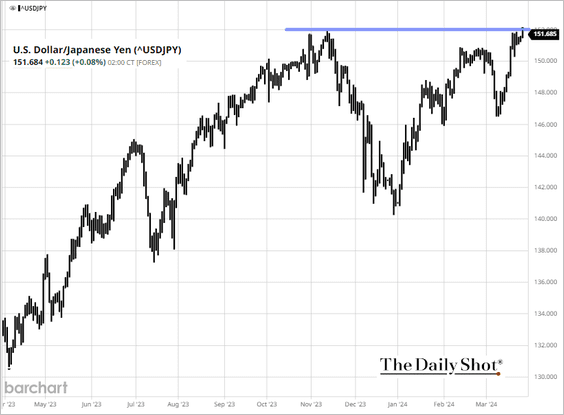

1. Dollar-yen is at resistance.

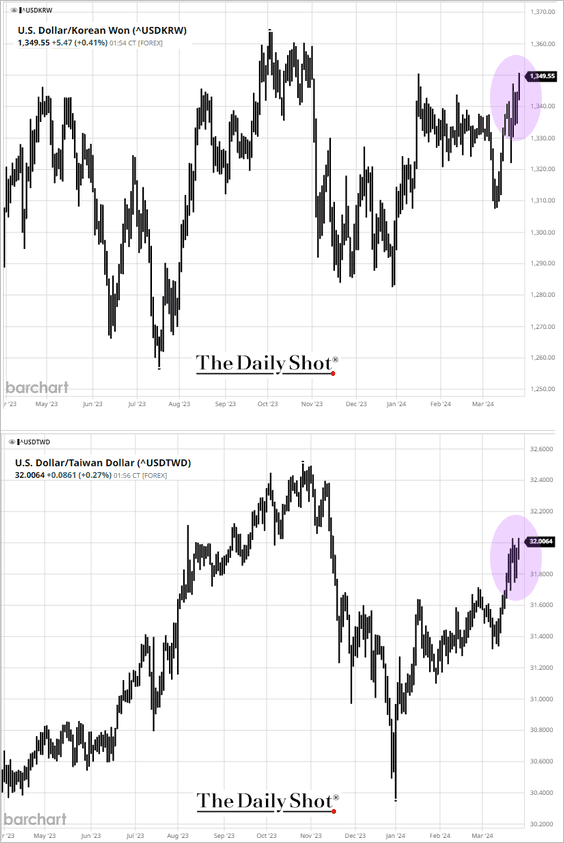

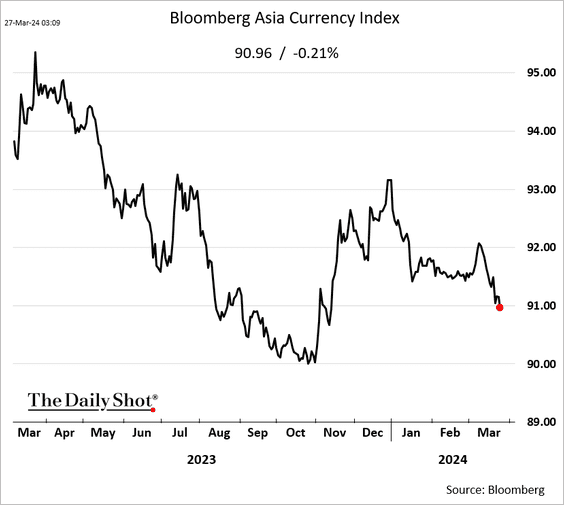

2. Other Asian currencies are also weakening against the dollar.

Here is Bloomberg’s Asia currency index.

——————–

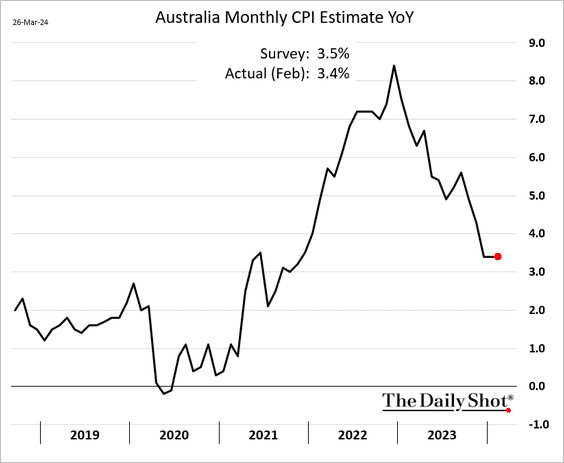

3. Australia’s monthly CPI held steady last month (year-over-year).

Back to Index

China

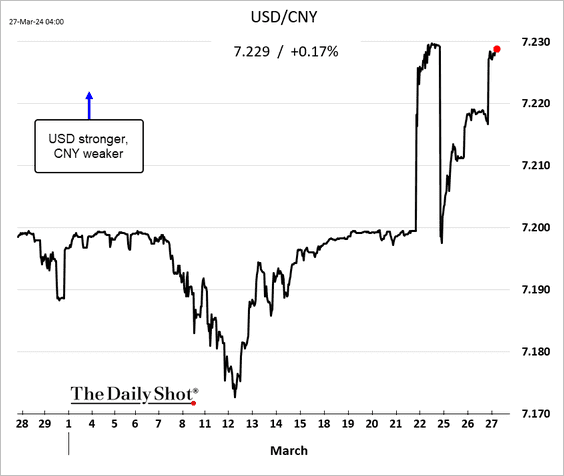

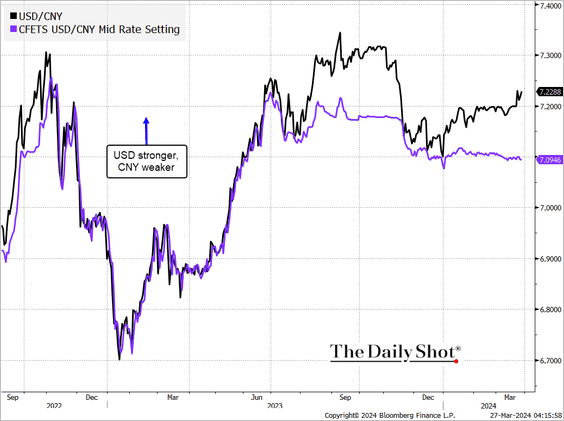

1. The renminbi continues to weaken, …

… once again diverging from the PBoC’s mid-rate fixing.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

——————–

2. The 2-year yield keeps sinking as the market prices in further monetary easing.

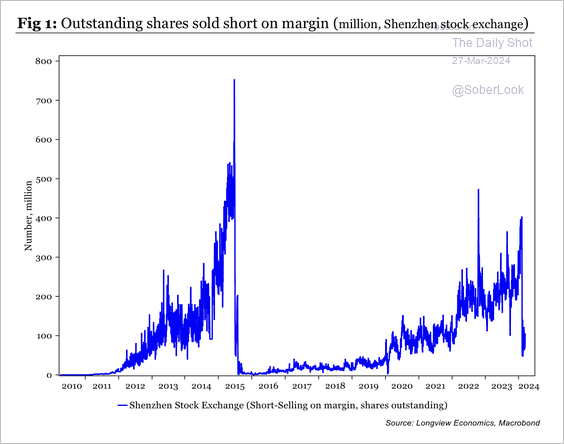

3. The number of outstanding shares sold short on margin has fallen sharply as Beijing targets higher share prices.

Source: Longview Economics

Source: Longview Economics

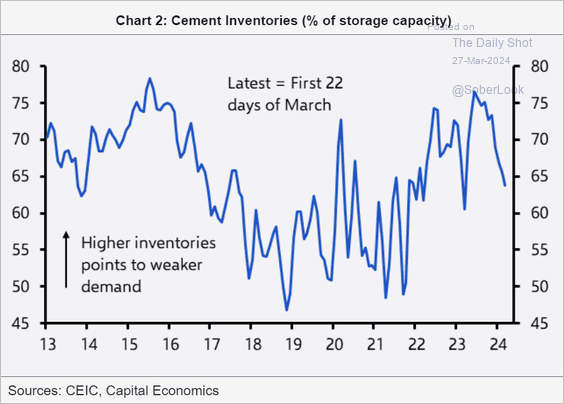

4. Cement inventories have been easing.

Source: Capital Economics

Source: Capital Economics

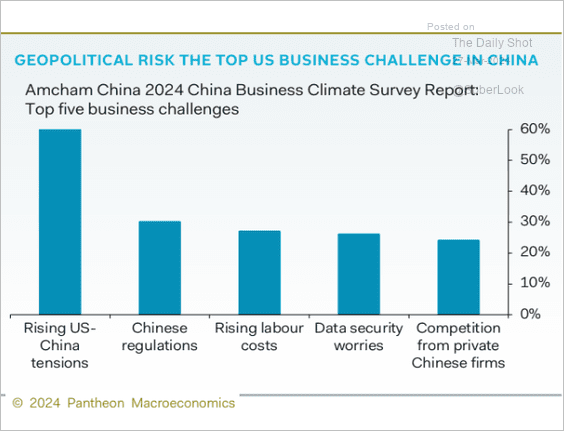

5. US companies trying to do business in China are concerned about geopolitical risks.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

Back to Index

Emerging Markets

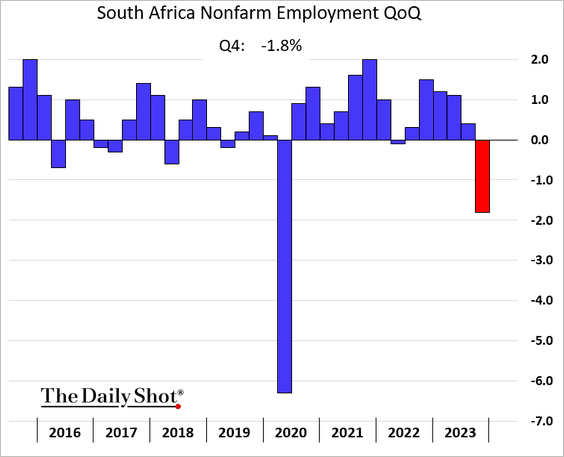

1. South Africa’s employment declined sharply last quarter.

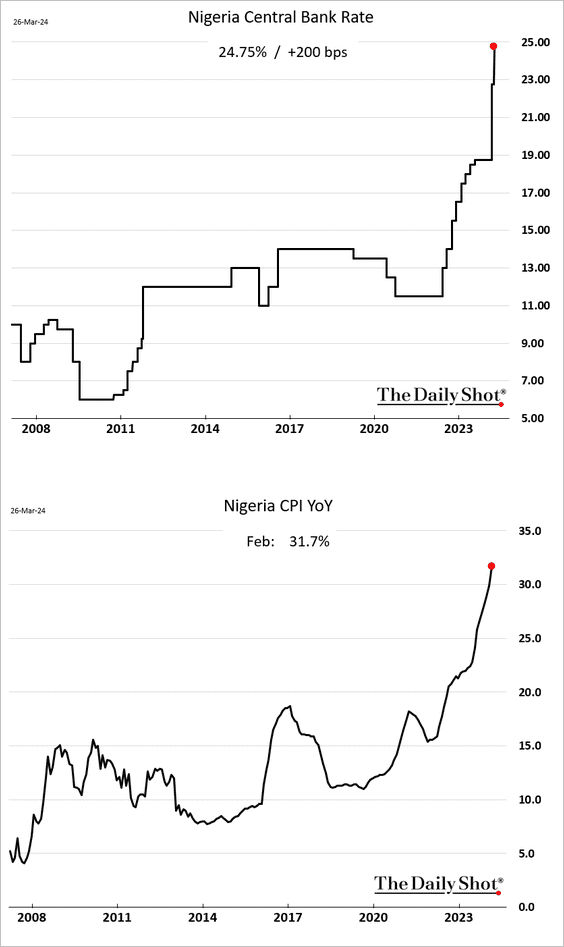

2. Nigeria’s central bank raised interest rates by an additional 200 basis points in response to surging inflation following the recent currency devaluation.

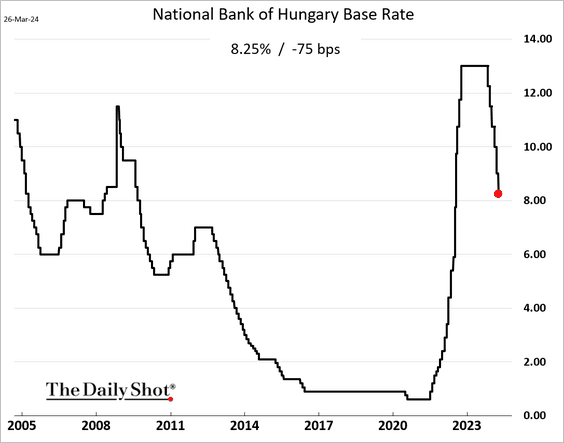

3. The Hungarian central bank cut rates for the sixth time in this cycle.

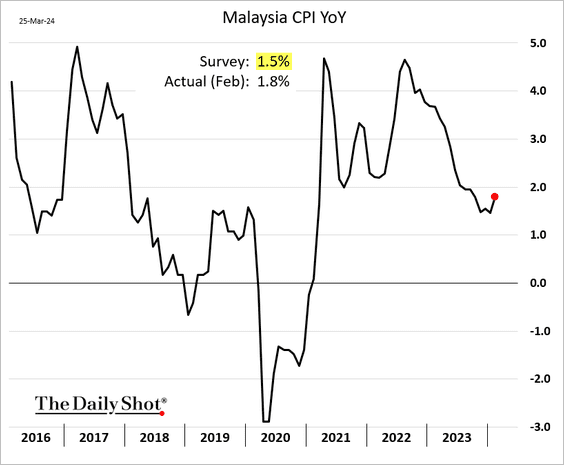

4. Malaysia’s inflation unexpectedly climbed last month.

Source: Reuters Read full article

Source: Reuters Read full article

——————–

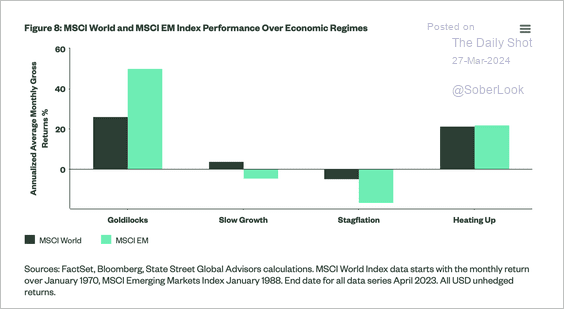

5. EM stocks typically outperform during “goldilocks” environments (positive economic growth and falling inflation), but underperform during stagflation environments (negative growth and rising inflation).

Source: State Street Global Advisors Read full article

Source: State Street Global Advisors Read full article

Back to Index

Cryptocurrency

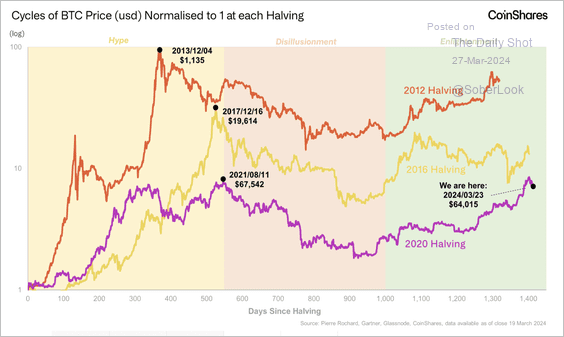

1. Based on previous patterns, the next bitcoin halving event, which is in about a month, could attract additional demand. This time, however, price action is probably well within the “hype” phase as ETF optimism propelled BTC to an all-time high.

Source: CoinShares Read full article

Source: CoinShares Read full article

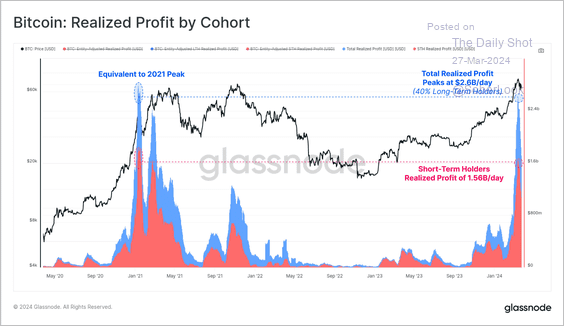

2. Realized profits among long-term bitcoin holders approached peak levels last seen in 2021. This could encourage minor profit-taking around resistance levels.

Source: @glassnode

Source: @glassnode

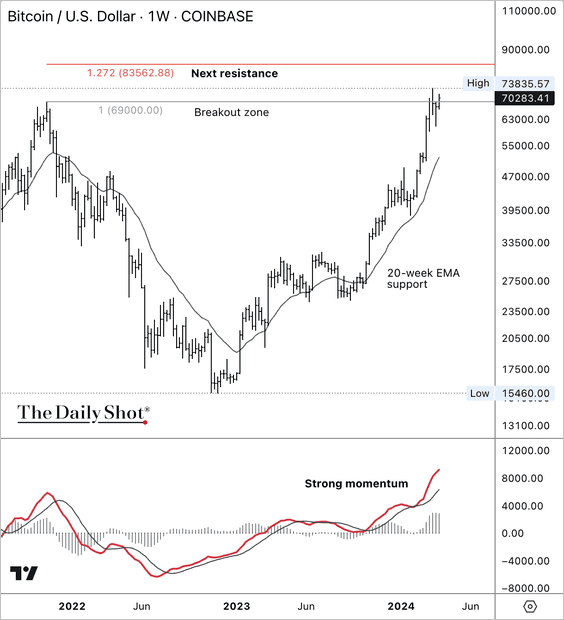

3. Bitcoin remains in an uptrend with strong momentum. Here are some key levels to watch.

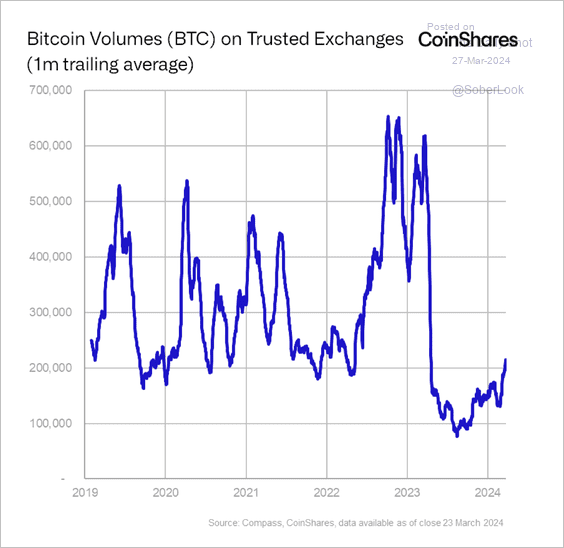

4. Bitcoin’s trading volume is rising but remains well below last year’s highs.

Source: CoinShares Read full article

Source: CoinShares Read full article

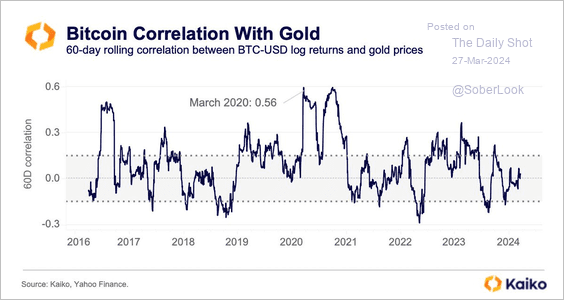

5. Historically, bitcoin has shown little correlation with gold.

Source: @KaikoData

Source: @KaikoData

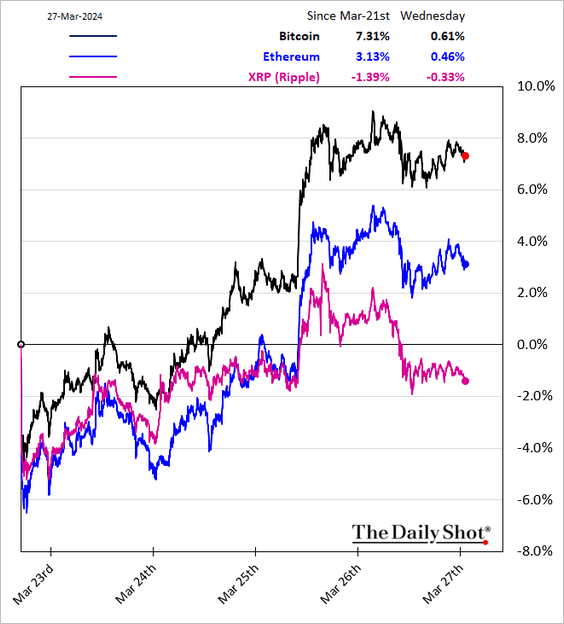

6. XRP is underperforming as the SEC goes after Ripple Labs.

Source: Reuters Read full article

Source: Reuters Read full article

Back to Index

Commodities

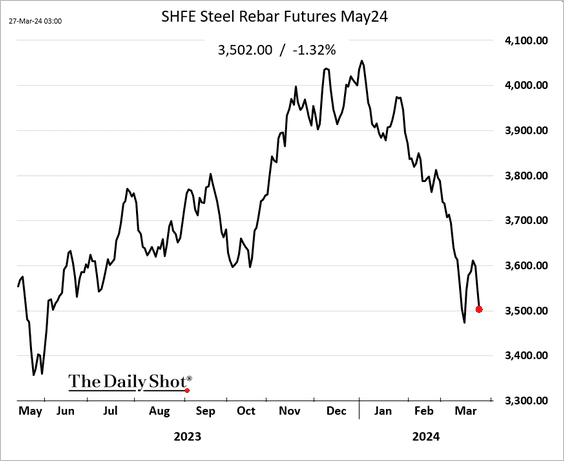

1. The bounce in China’s steel futures didn’t last long.

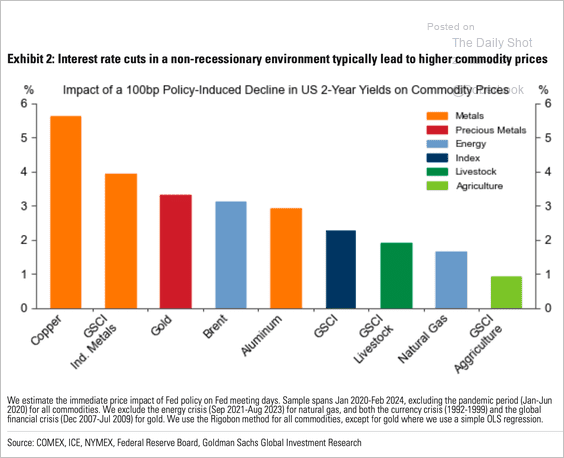

2. Here is a look at how rate cuts impact commodity markets in a nonrecessionary environment.

Source: Goldman Sachs; @dailychartbook

Source: Goldman Sachs; @dailychartbook

Back to Index

Energy

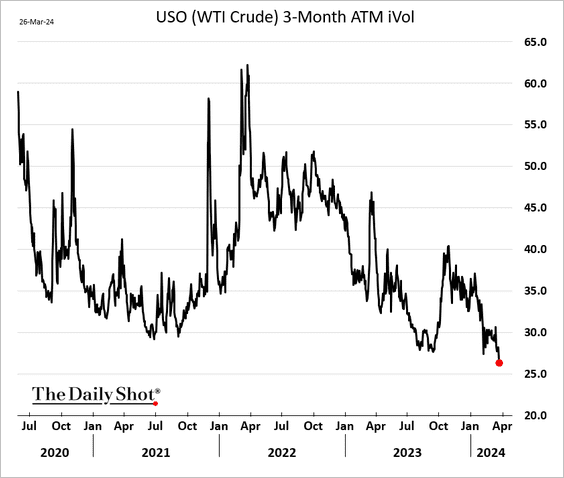

1. Crude oil implied volatility continues to sink.

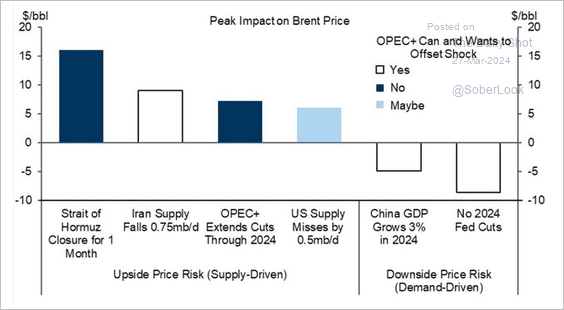

2. What are the primary upside and downside risks for crude oil this year?

Source: Goldman Sachs; @MikeZaccardi

Source: Goldman Sachs; @MikeZaccardi

Back to Index

Equities

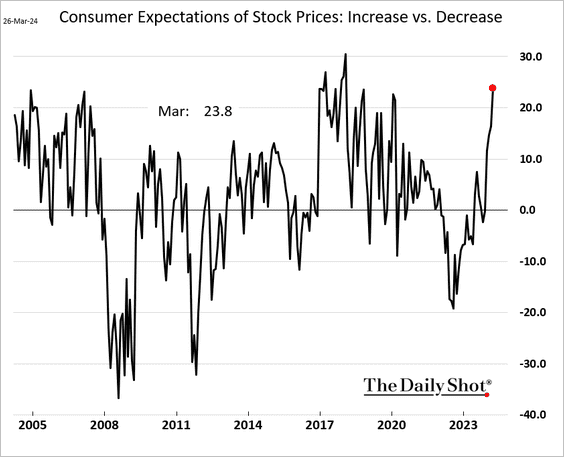

1. The Conference Board’s consumer sentiment report shows households becoming very bullish on stocks.

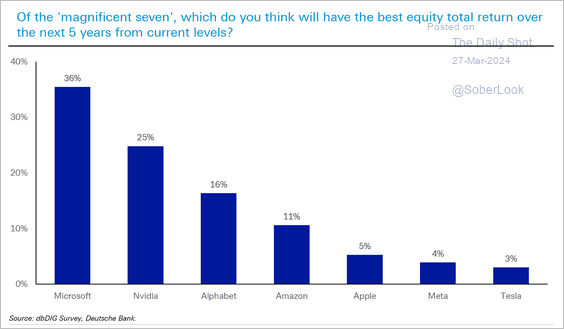

2. Over a third of respondents surveyed by Deutsche Bank believe Microsoft will secure the best total return over the next five years in the “Magnificent Seven.”

Source: Deutsche Bank Research

Source: Deutsche Bank Research

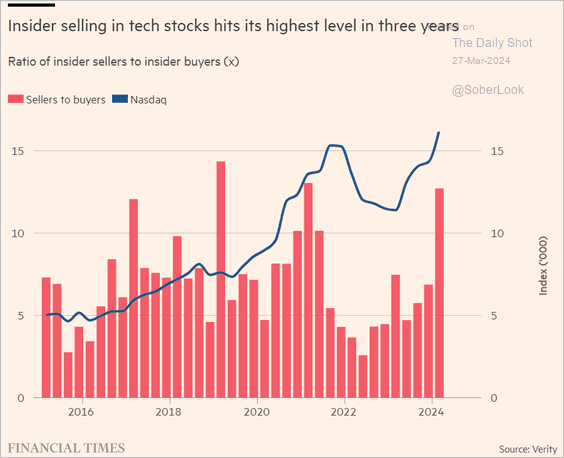

3. Tech insiders have been selling.

Source: @financialtimes Read full article

Source: @financialtimes Read full article

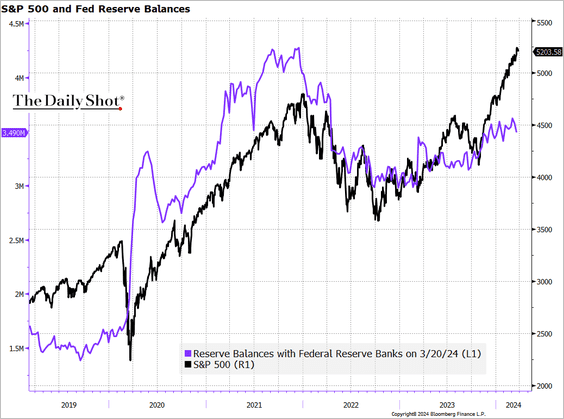

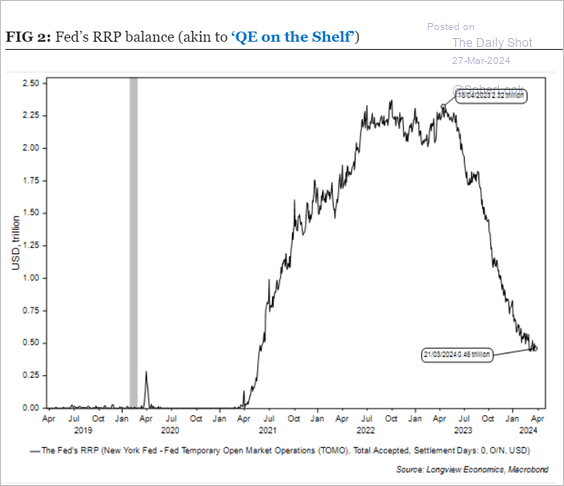

4. Rising reserve balances have been a tailwind for stocks.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

However, once the decline in the Fed’s reverse repo (RRP) facility balance halts, reserves will start to decrease as the US central bank persists in reducing its balance sheet.

Source: Longview Economics

Source: Longview Economics

——————–

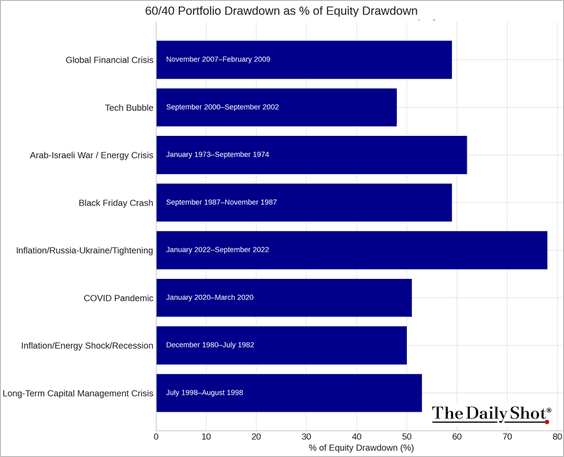

5. This chart shows how the traditional 60% US stocks/40% US bonds portfolio performed during the worst stock market drawdowns.

Source: State Street Global Advisors Read full article

Source: State Street Global Advisors Read full article

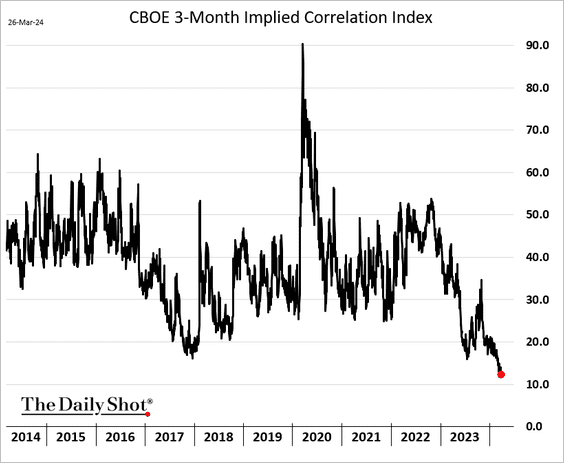

6. Implied correlations among US stocks have been trending lower. Theoretically, lower correlations should enable stock pickers to achieve superior performance.

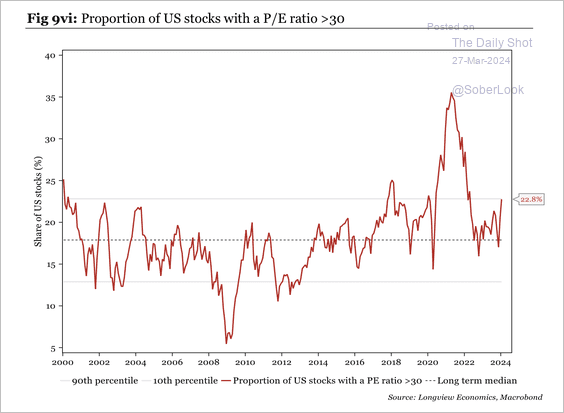

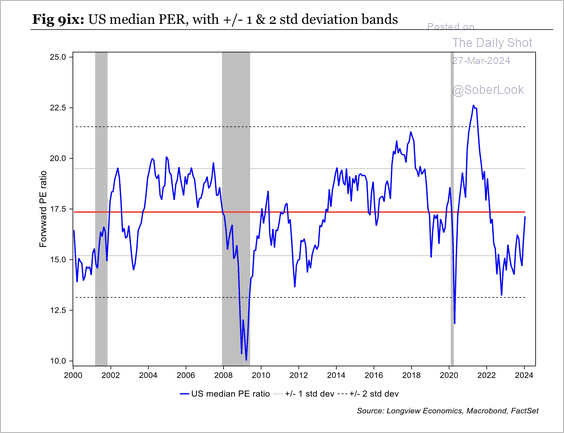

7. The proportion of US stocks with P/E ratios over 30x is high.

Source: Longview Economics

Source: Longview Economics

However, the median US stock P/E ratio is around the historical average.

Source: Longview Economics

Source: Longview Economics

——————–

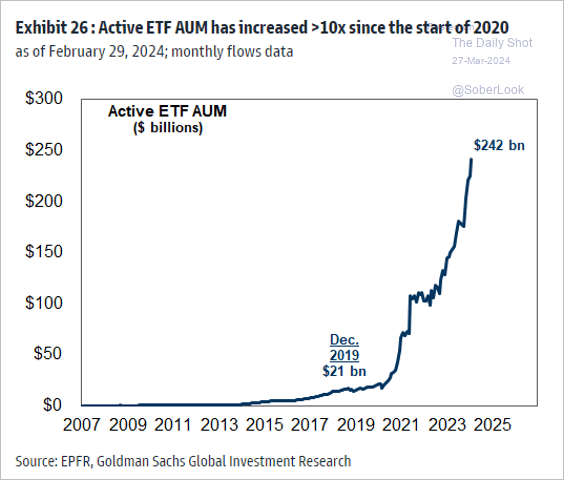

8. Active ETFs have been very popular in the post-COVID era.

Source: Goldman Sachs; @MikeZaccardi

Source: Goldman Sachs; @MikeZaccardi

Back to Index

Alternatives

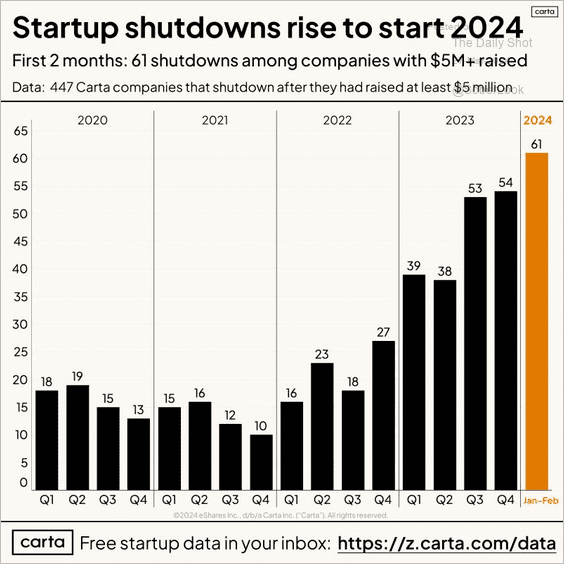

1. Many VC-funded firms shut down this year.

Source: Peter Walker Read full article

Source: Peter Walker Read full article

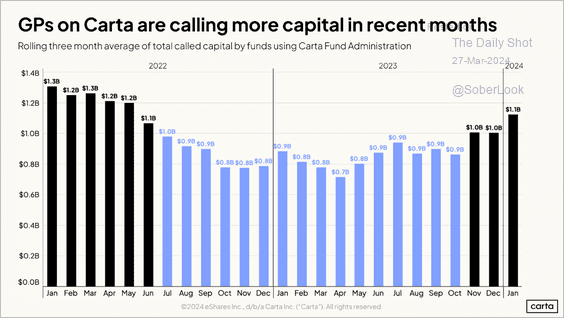

2. Capital calls by US venture capital funds are starting to rise.

Source: Carta

Source: Carta

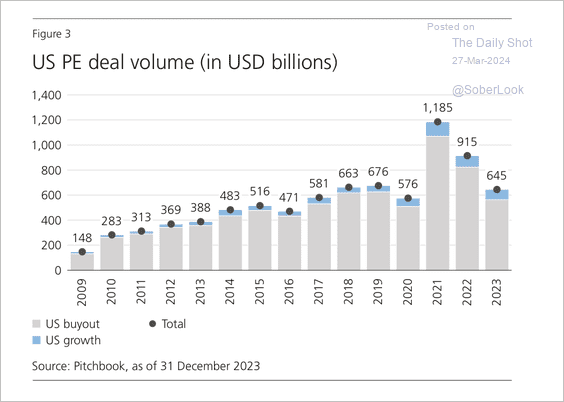

3. US private equity deal activity declined over the past year but was still stronger than in the aftermath of the financial crisis.

Source: UBS Asset Management

Source: UBS Asset Management

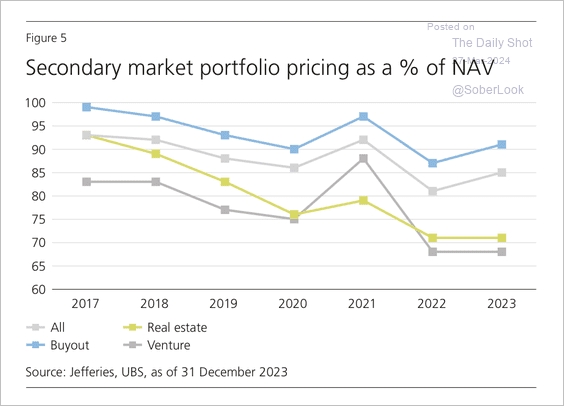

4. The average secondary market pricing for LP portfolios improved during the second half of last year.

Source: UBS Asset Management

Source: UBS Asset Management

——————–

Food for Thought

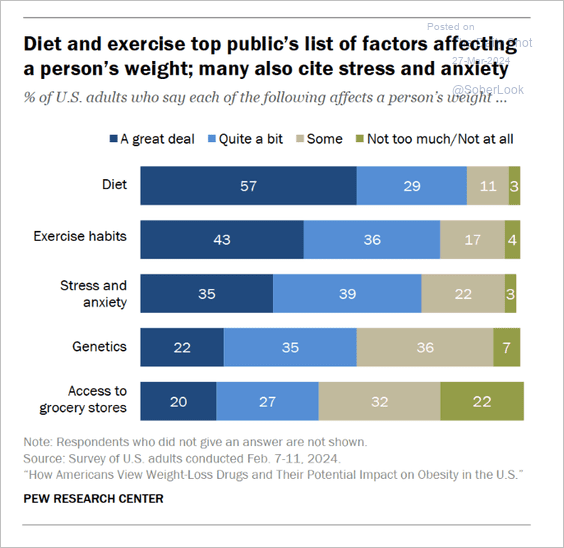

1. Public opinion on factors influencing a person’s weight:

Source: Pew Research Center Read full article

Source: Pew Research Center Read full article

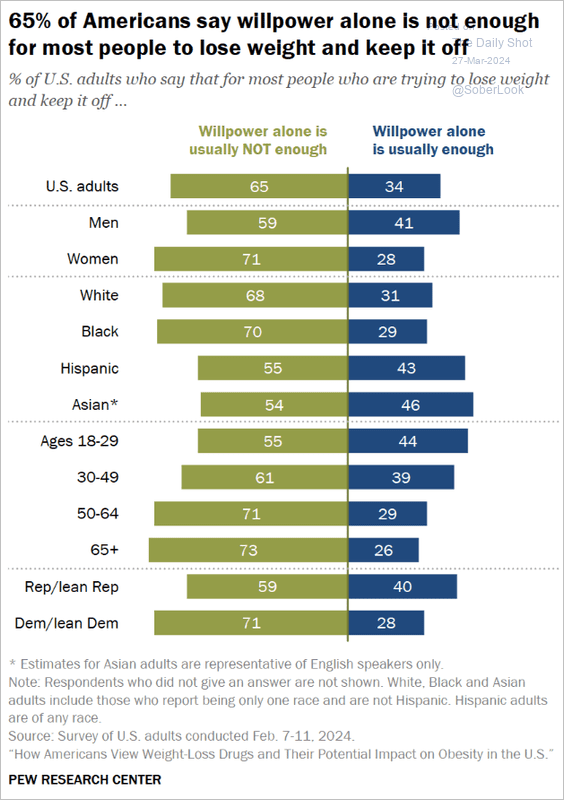

• Views on willpower for weight loss by demographic:

Source: Pew Research Center Read full article

Source: Pew Research Center Read full article

——————–

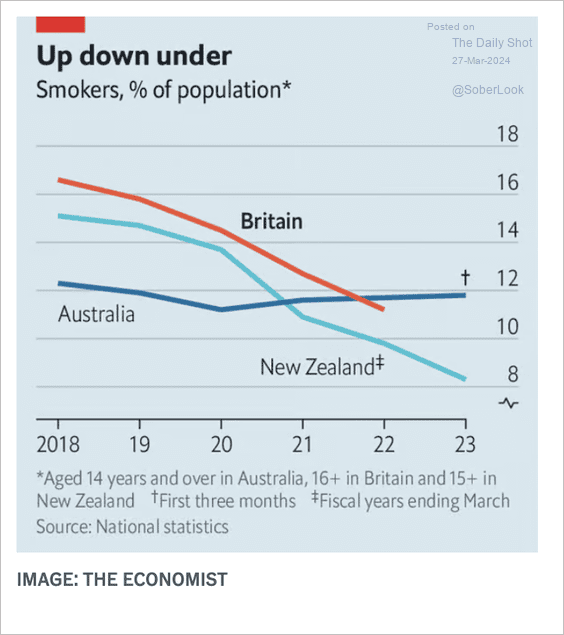

2. Trends in smoking prevalence in Britain, Australia, and New Zealand:

Source: The Economist Read full article

Source: The Economist Read full article

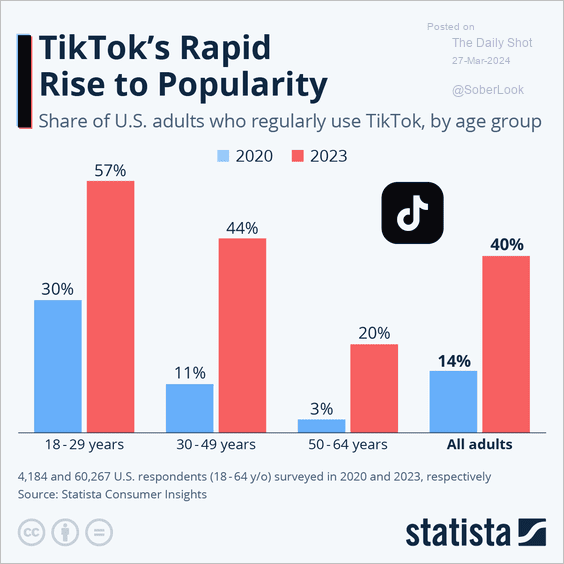

3. Changes in TikTok usage among US adults by age group:

Source: Statista

Source: Statista

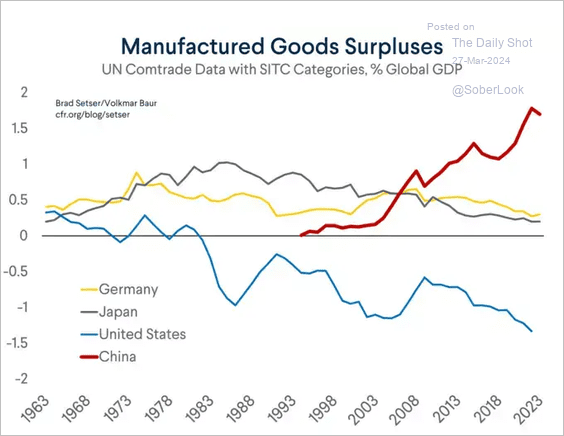

4. Trends in manufactured goods trade balances as a percentage of global GDP:

Source: CFR Read full article

Source: CFR Read full article

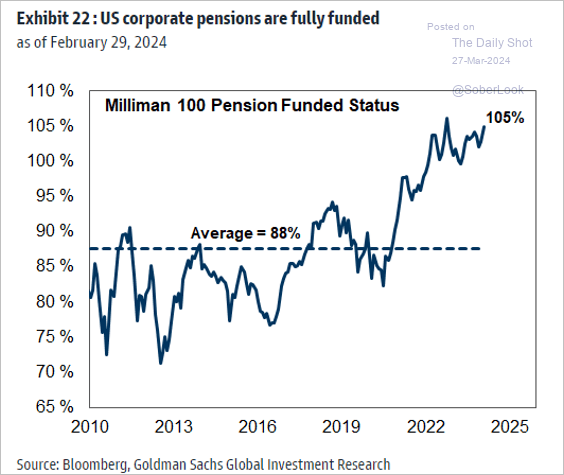

5. US corporate pensions are fully funded.

Source: Goldman Sachs; @MikeZaccardi

Source: Goldman Sachs; @MikeZaccardi

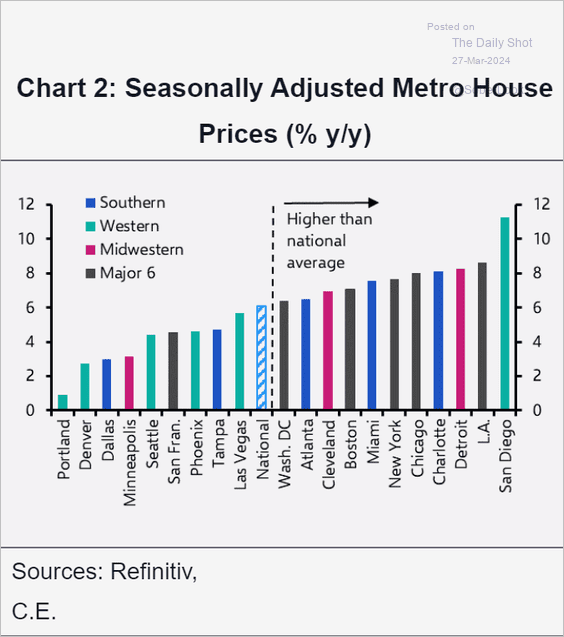

6. House price gains by metro area:

Source: Capital Economics

Source: Capital Economics

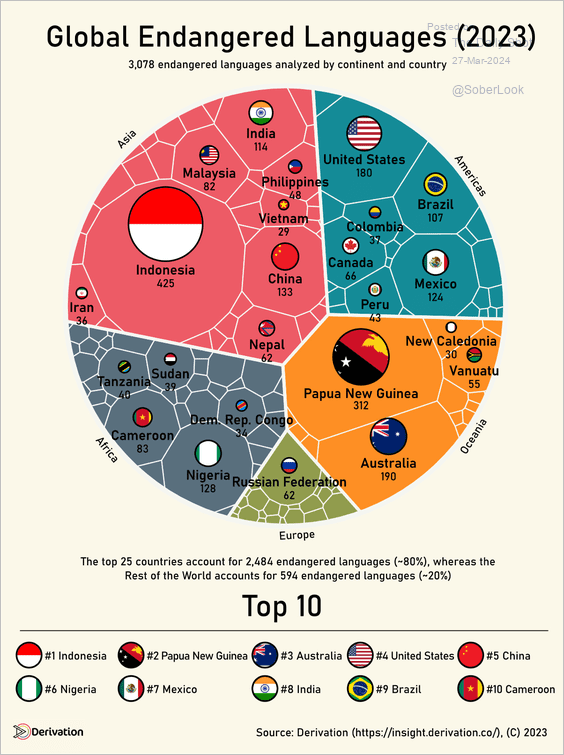

7. Endangered languages around the world:

Source: Visual Capitalist Read full article

Source: Visual Capitalist Read full article

——————–

Back to Index