The Daily Shot: 19-Mar-24

• The United States

• Canada

• The Eurozone

• Japan

• Australia

• China

• Cryptocurrency

• Commodities

• Energy

• Equities

• Credit

• Global Developments

• Food for Thought

The United States

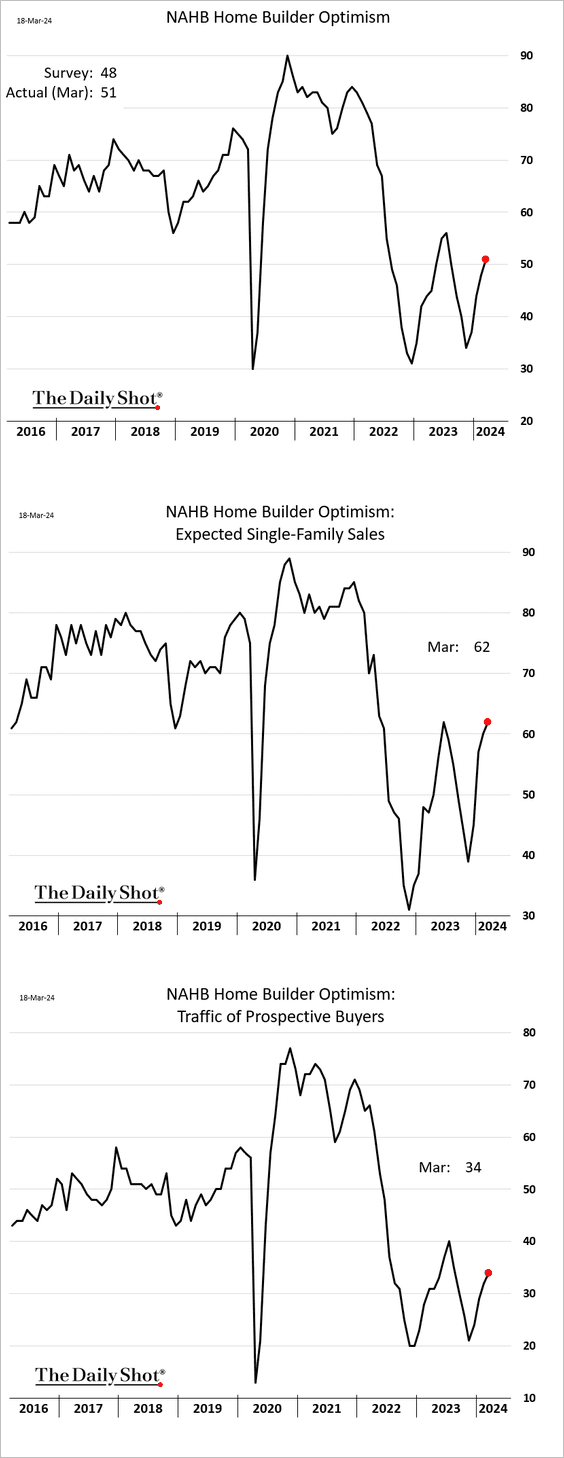

1. Let’s begin with the housing market.

• Sentiment among homebuilders is on the rise.

Source: Reuters Read full article

Source: Reuters Read full article

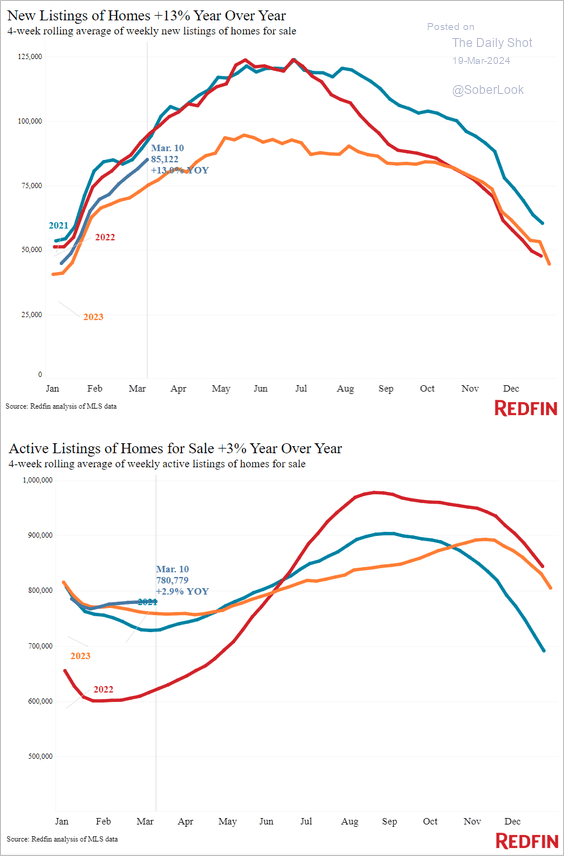

• Property listings are above last year’s levels, …

Source: Redfin

Source: Redfin

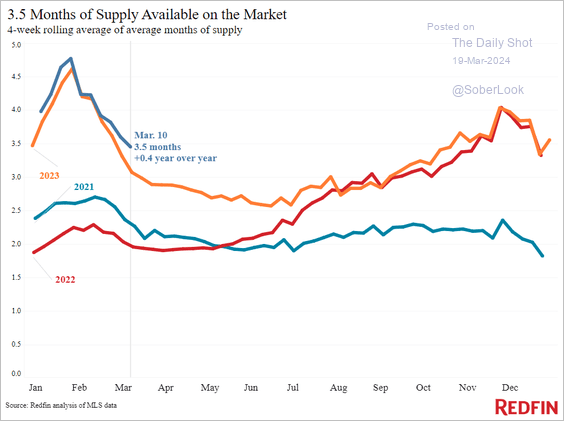

… with the supply duration (measured in months) reaching multi-year highs.

Source: Redfin

Source: Redfin

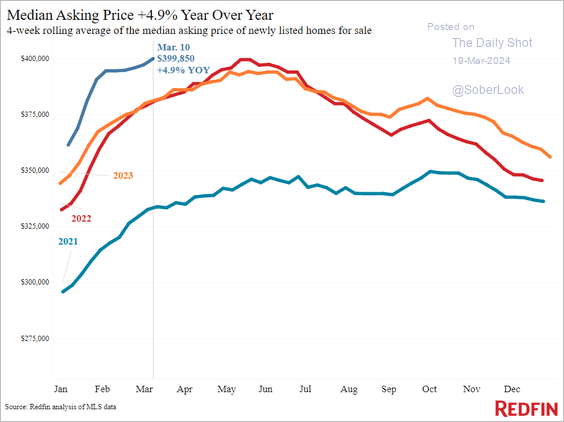

– But asking prices are at record levels for this time of the year.

Source: Redfin

Source: Redfin

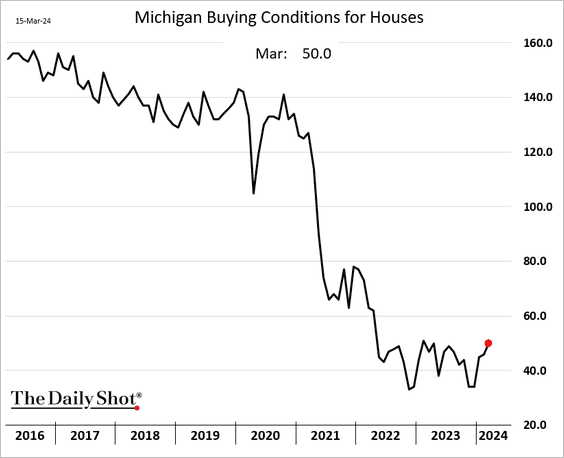

• The University of Michigan consumer sentiment survey indicates that households are becoming marginally more positive about the home-buying conditions, up from record lows.

——————–

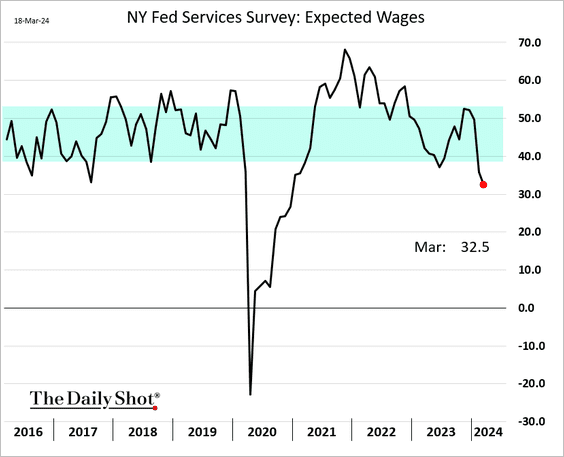

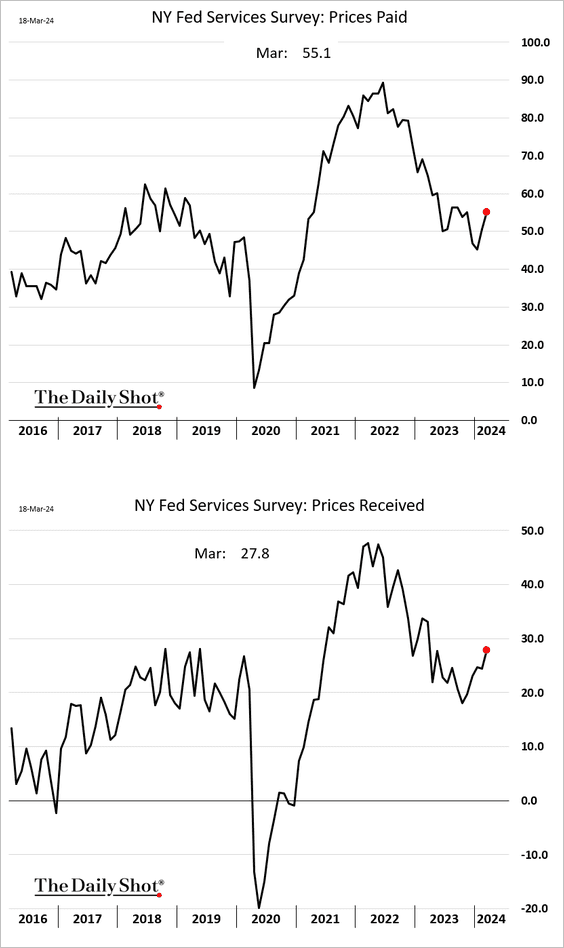

2. Fewer service firms based in the NY Fed’s district (which includes New York State, northern New Jersey, and southwestern Connecticut) plan to raise wages.

But more firms report rising costs and plans to boost prices.

——————–

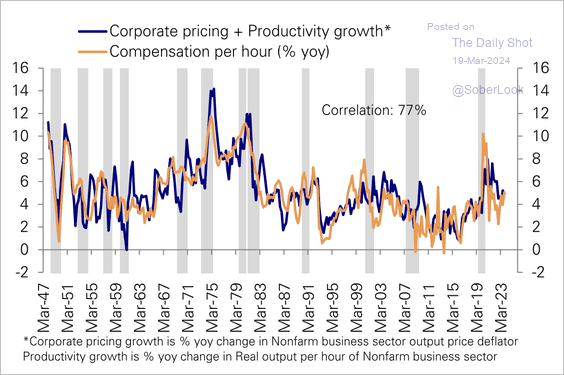

3. Companies have been able to offset labor cost growth by a combination of raising productivity and prices.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

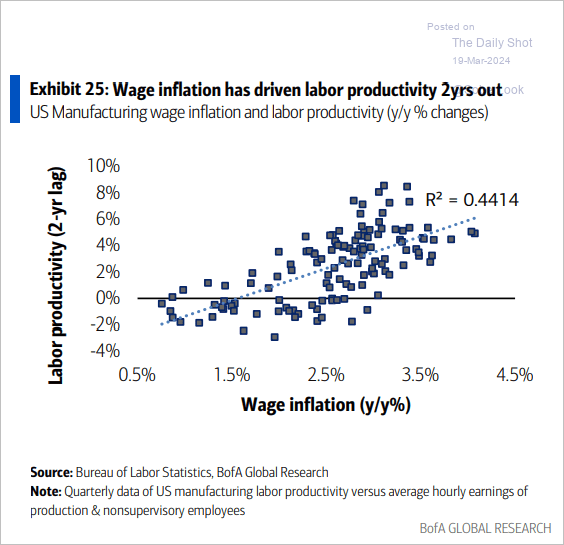

• Wage inflation tends to drive labor productivity.

Source: BofA; @MikeZaccardi

Source: BofA; @MikeZaccardi

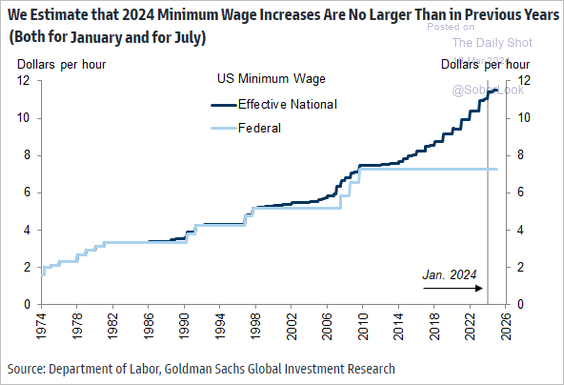

• This chart shows the effective minimum wage.

Source: Goldman Sachs; @MikeZaccardi

Source: Goldman Sachs; @MikeZaccardi

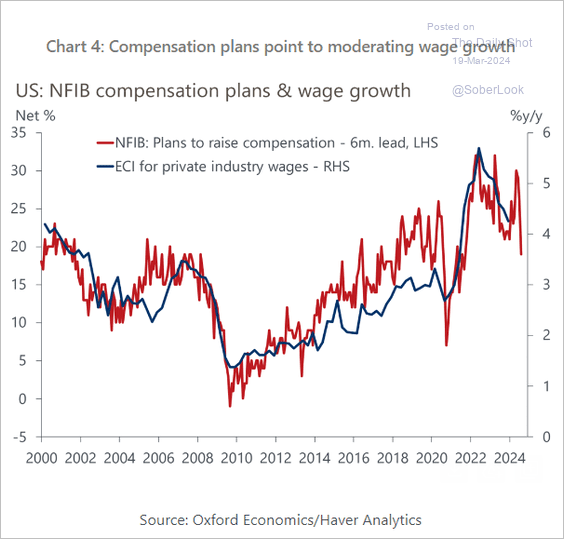

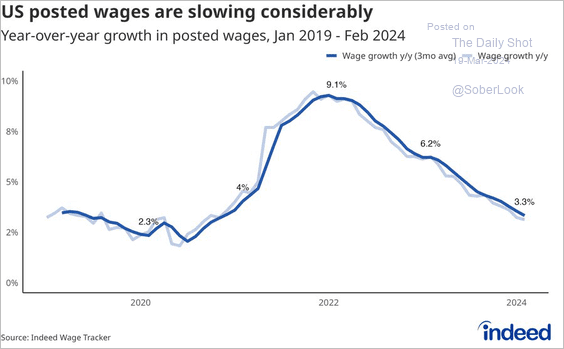

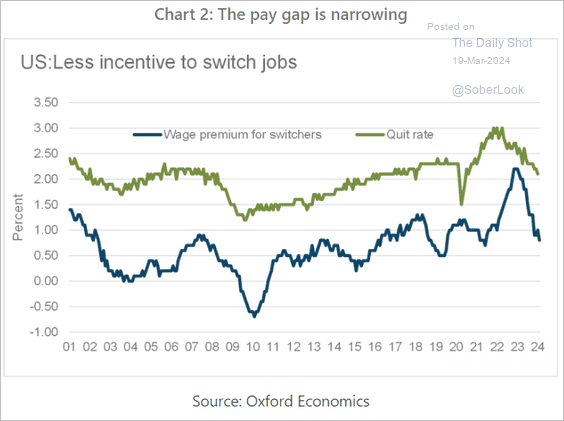

• Leading indicators continue to suggest that wage growth is moderating (2 charts).

Source: Oxford Economics

Source: Oxford Economics

Source: @nick_bunker Read full article

Source: @nick_bunker Read full article

• Job switching has become less lucrative.

Source: Oxford Economics

Source: Oxford Economics

——————–

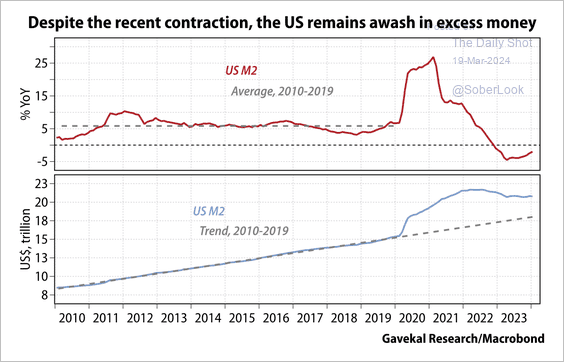

4. M2 money supply has been contracting, but the level remains above trend.

Source: Gavekal Research

Source: Gavekal Research

Back to Index

Canada

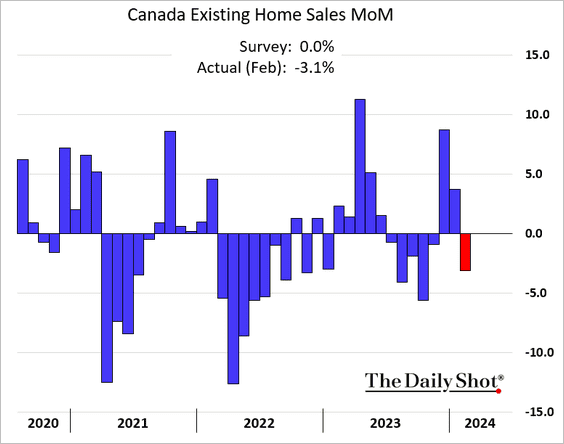

1. Existing home sales unexpectedly declined last month.

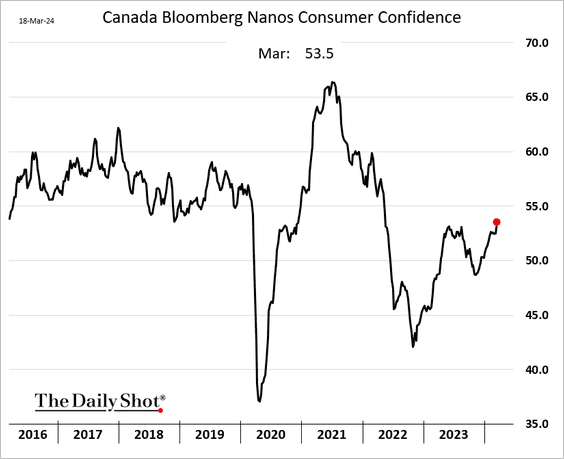

2. Consumer sentiment continues to recover.

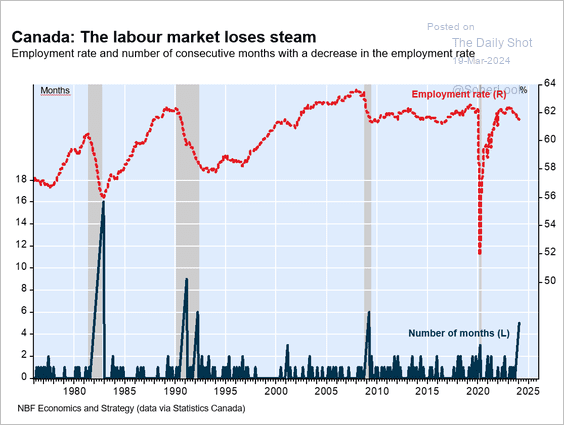

3. The labor market is losing steam.

Source: Economics and Strategy Group, National Bank of Canada

Source: Economics and Strategy Group, National Bank of Canada

Back to Index

The Eurozone

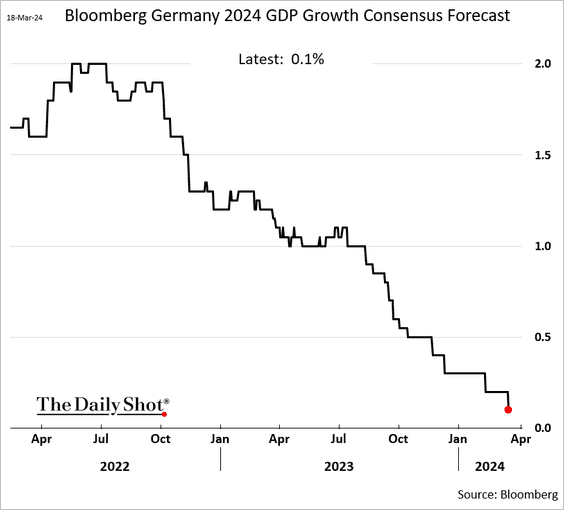

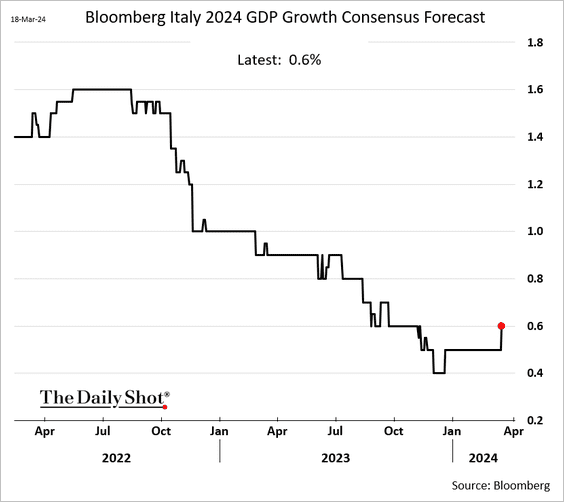

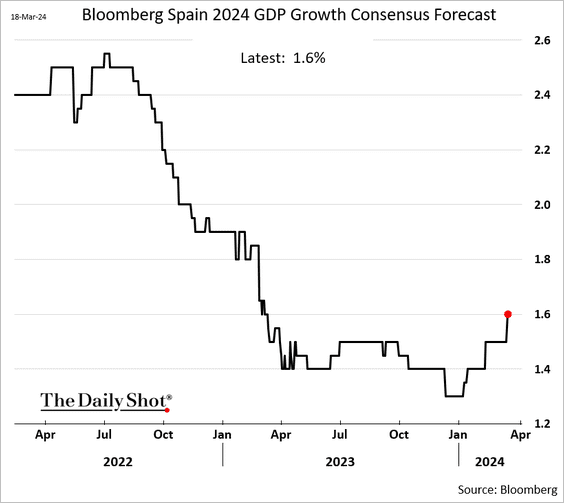

1. Economists have further reduced their 2024 growth forecasts for Germany to a mere 0.1%.

However, growth forecasts for Italy and Spain have been revised upward.

——————–

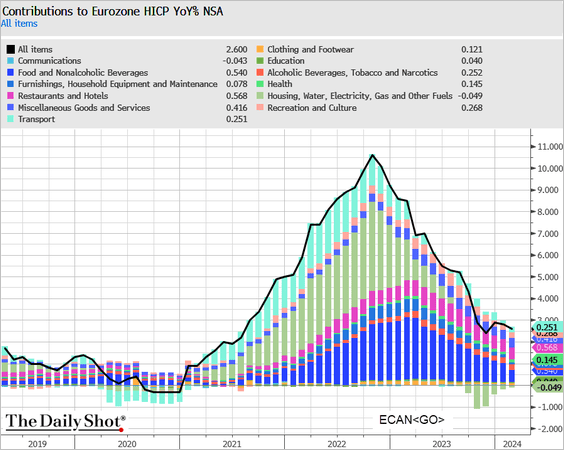

2. Here is a look at the euro-area CPI contributions (year-over-year).

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

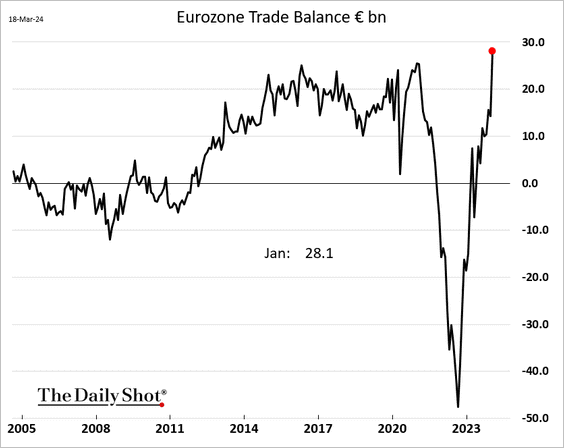

3. The euro-area trade surplus hit a record high.

Source: @financialtimes Read full article

Source: @financialtimes Read full article

——————–

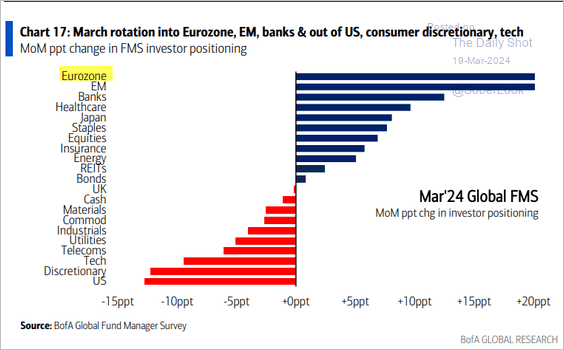

4. Fund managers have been increasing their allocations to Eurozone equities.

Source: BofA Global Research

Source: BofA Global Research

Back to Index

Japan

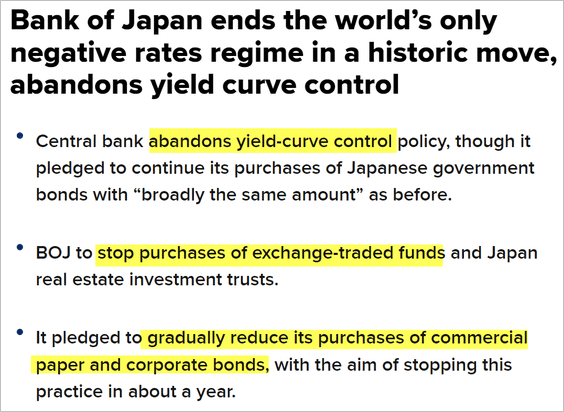

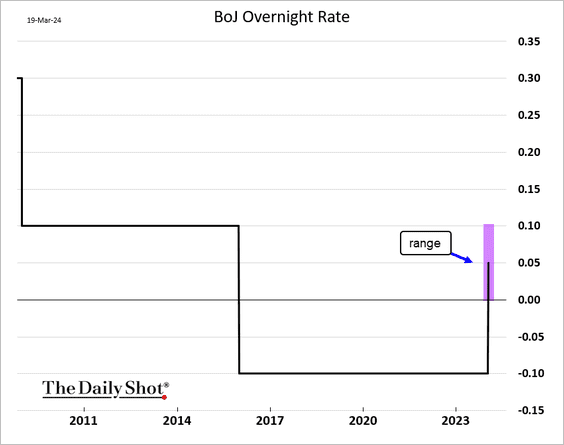

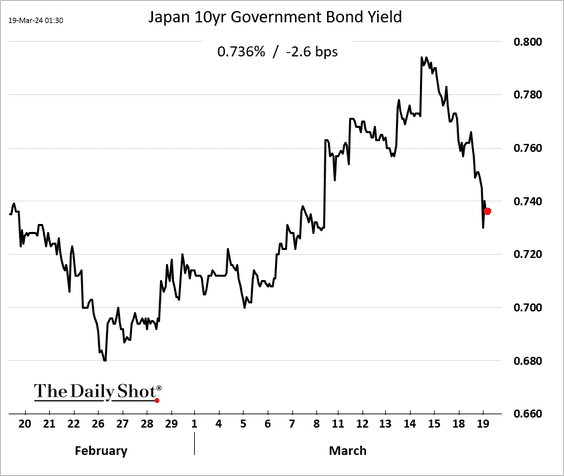

1. The BoJ finally exited its negative-rate policy and abandoned yield curve control, …

Source: CNBC Read full article

Source: CNBC Read full article

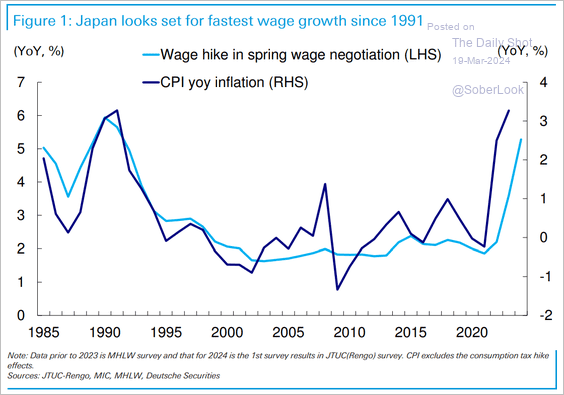

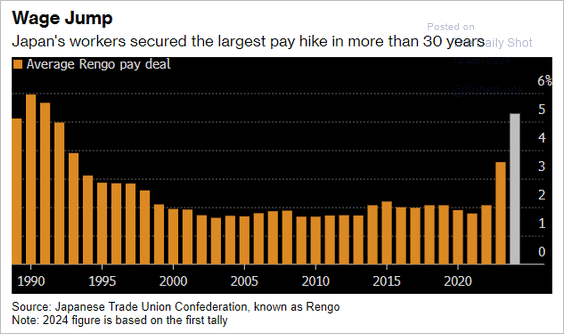

… as wage growth accelerated (2 charts).

Source: Deutsche Bank Research

Source: Deutsche Bank Research

Source: @economics Read full article

Source: @economics Read full article

Source: @financialtimes Read full article

Source: @financialtimes Read full article

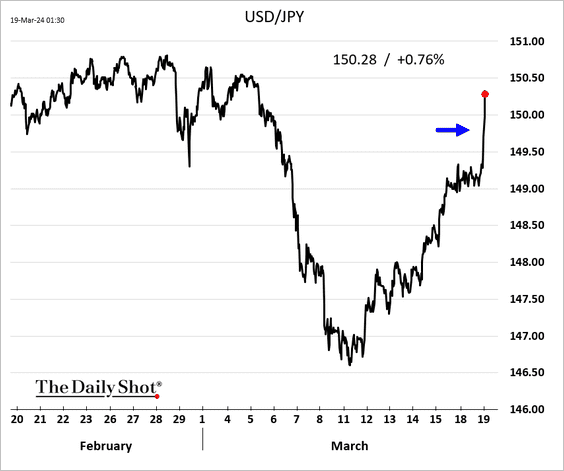

Nevertheless, the Bank of Japan’s rate hike was offset by its dovish tone.

• The yen and JGB yields declined.

——————–

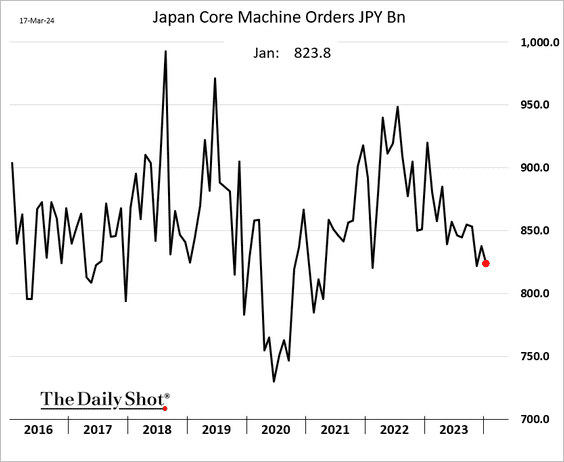

2. Machinery orders have been trending lower.

Source: Reuters Read full article

Source: Reuters Read full article

Back to Index

Australia

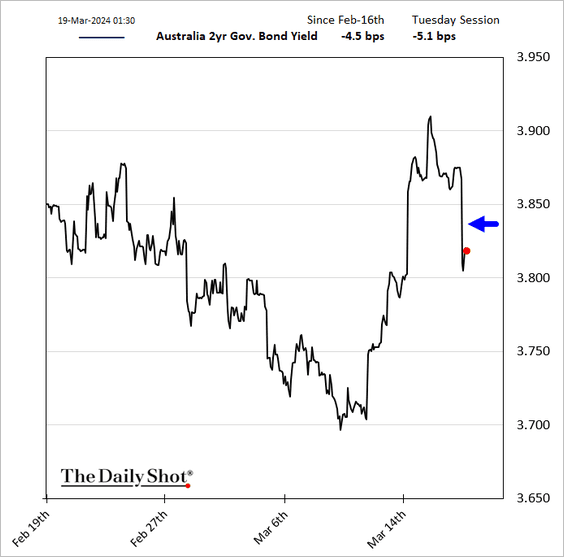

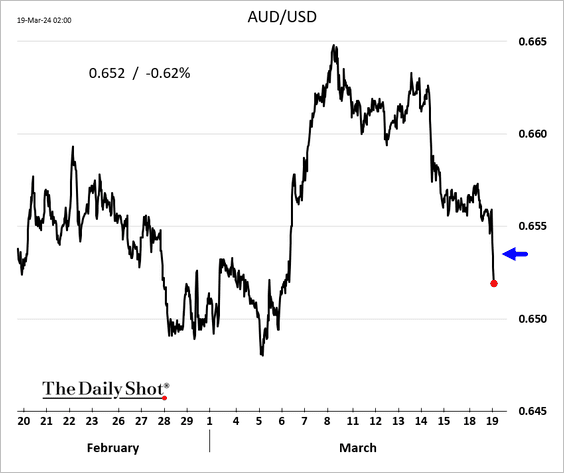

The RBA dropped its tightening bias.

Source: @economics Read full article

Source: @economics Read full article

Bond yields and the Aussie dollar declined.

Back to Index

China

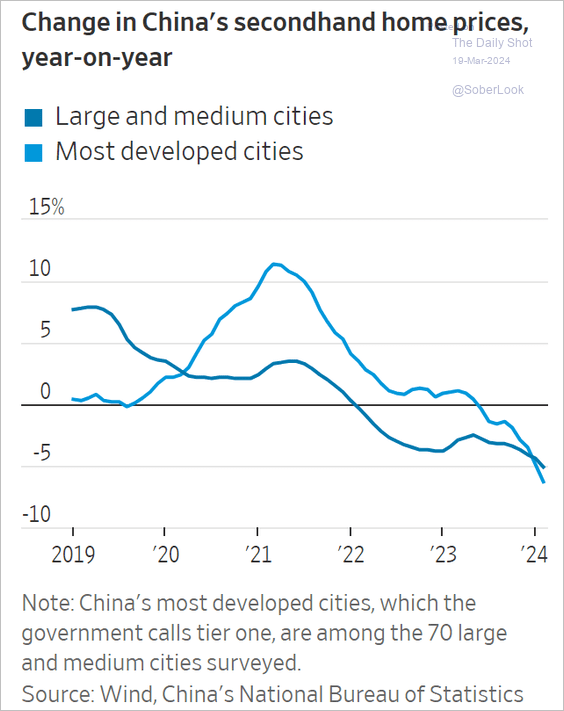

1. Existing home prices remain under pressure.

Source: @WSJ Read full article

Source: @WSJ Read full article

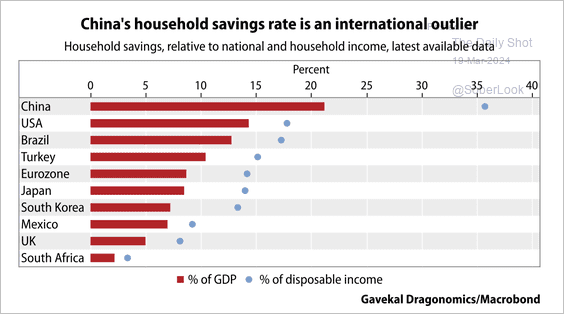

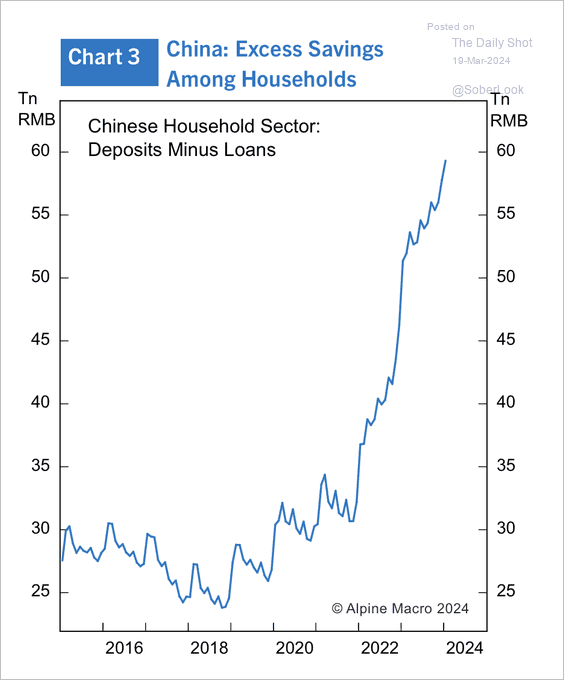

2. Household savings are very high relative to other large nations.

Source: Gavekal Research

Source: Gavekal Research

Source: Alpine Macro

Source: Alpine Macro

——————–

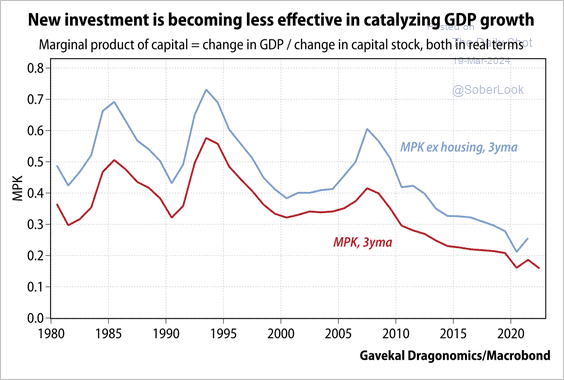

3. The result of China’s investment boom has been an extended decline in the marginal product of capital.

Source: Gavekal Research

Source: Gavekal Research

Back to Index

Cryptocurrency

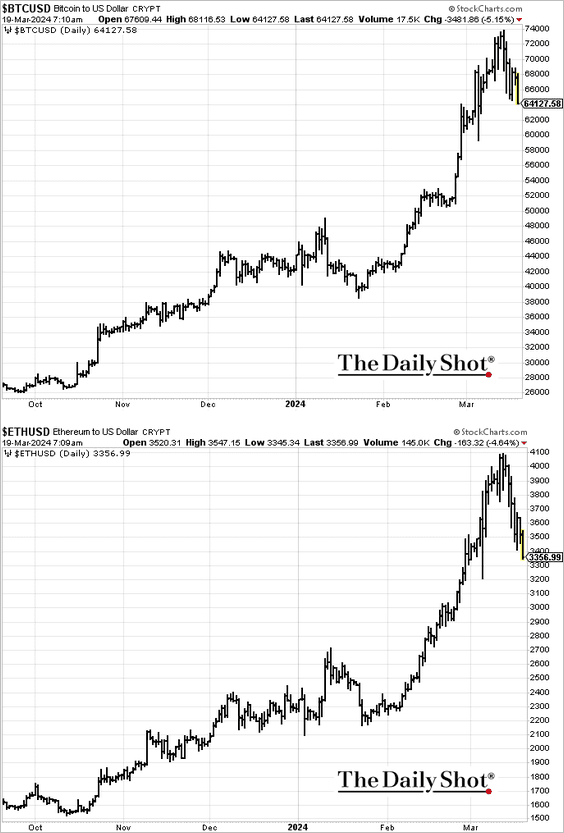

1. The crypto rally is fading, with bitcoin dipping below $65k.

• The pullback is putting pressure on memecoins, …

… which have surged in recent weeks.

Source: CoinTelegraph Read full article

Source: CoinTelegraph Read full article

——————–

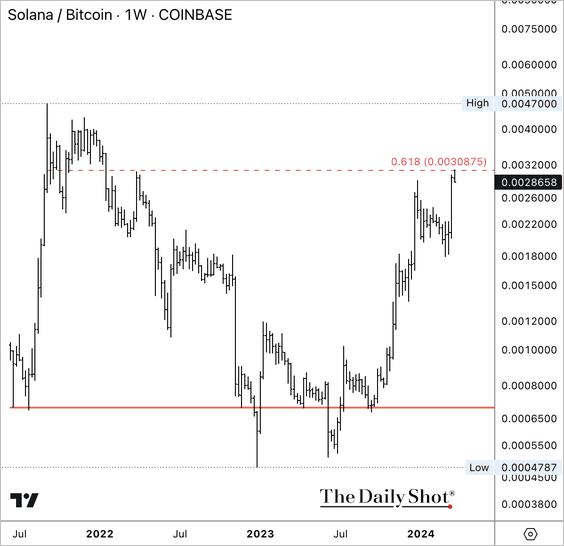

2. The SOL/BTC ratio has retraced roughly 60% of its 2022 decline.

Source: @crypto Read full article

Source: @crypto Read full article

——————–

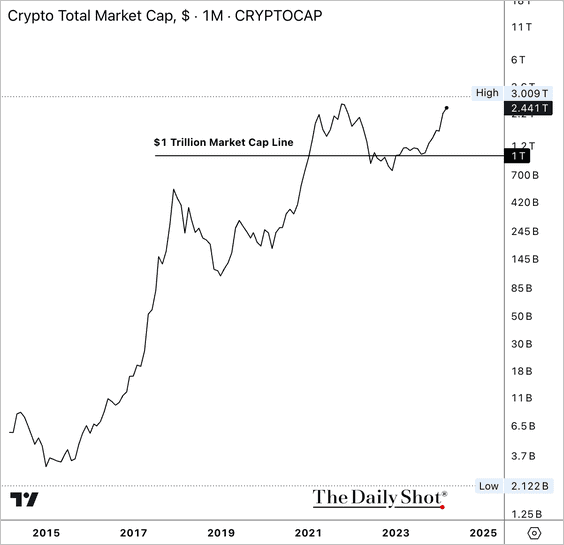

3. The total crypto market cap has been approaching its all-time high.

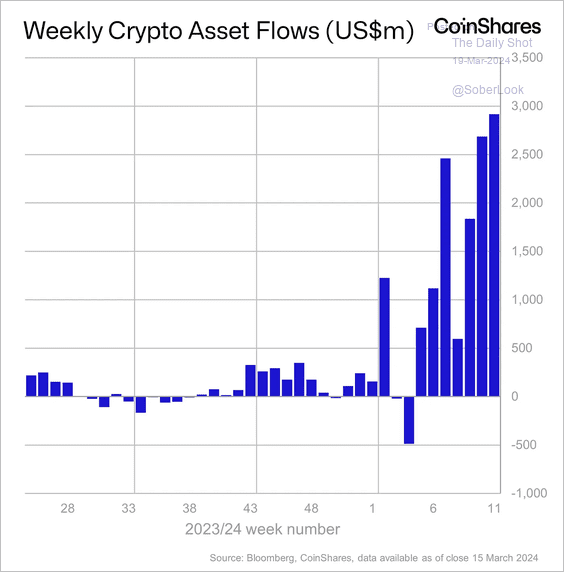

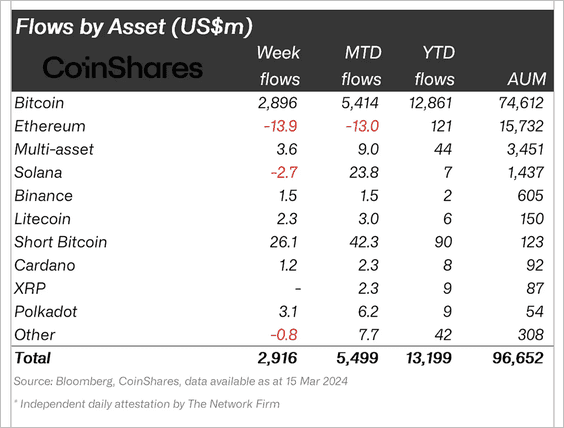

4. Crypto funds saw another record week of inflows.

Source: CoinShares Read full article

Source: CoinShares Read full article

Bitcoin-focused funds accounted for most inflows last week, while smart-contract funds holding Ethereum and Solana experienced outflows.

Source: CoinShares Read full article

Source: CoinShares Read full article

Back to Index

Commodities

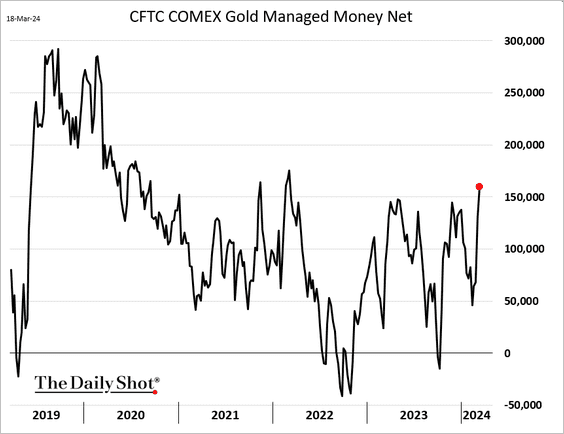

1. Money managers have been boosting their positions in gold futures.

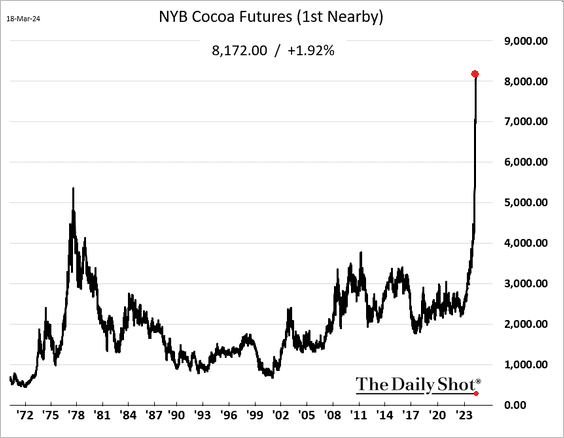

2. Cocoa prices continue to hit record highs.

Back to Index

Energy

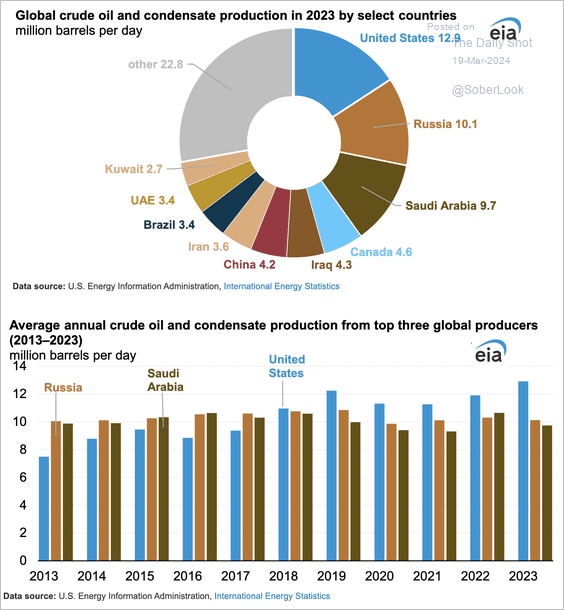

1. This chart shows the 2023 global crude oil and condensate production by country with a decade trend for the top three producers.

Source: @EIAgov Read full article

Source: @EIAgov Read full article

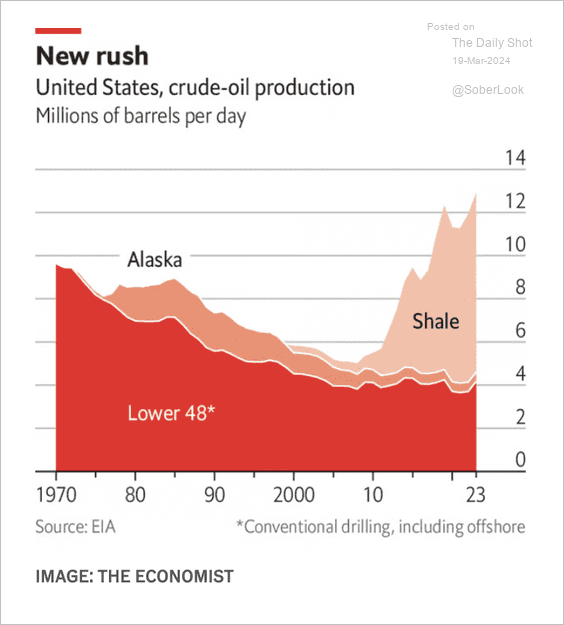

• Here is the evolution of crude oil production in the US by source.

Source: The Economist Read full article

Source: The Economist Read full article

——————–

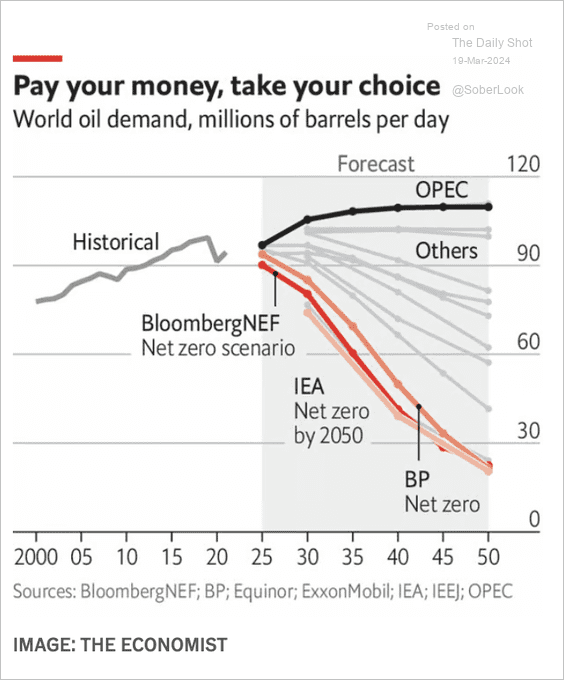

2. Global oil demand projections have diverged. Are the “net zero” forecasts a fantasy?

Source: The Economist Read full article

Source: The Economist Read full article

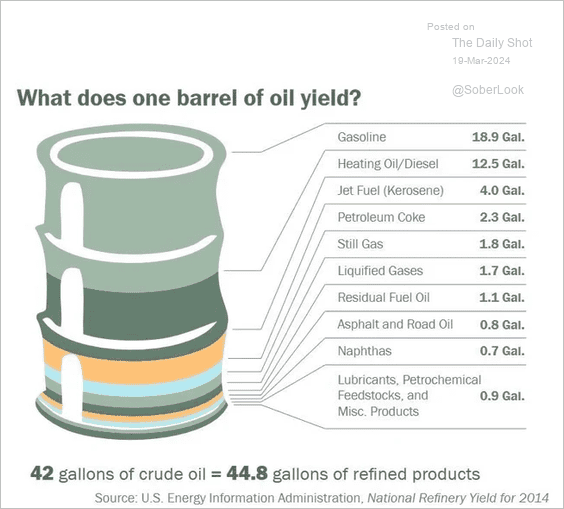

3. Below is the breakdown of products derived from a barrel of oil.

Source: @EIAgov

Source: @EIAgov

Back to Index

Equities

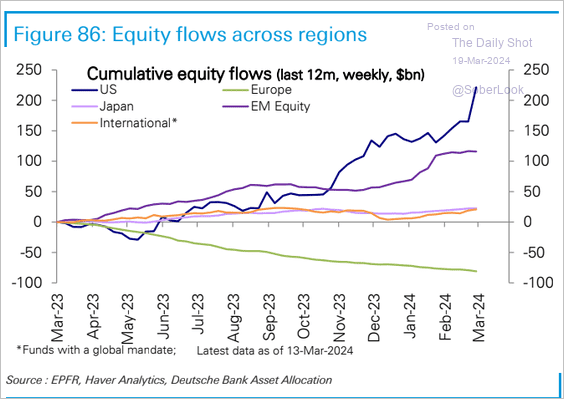

1. Flows into US equity funds have been outpacing other markets.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

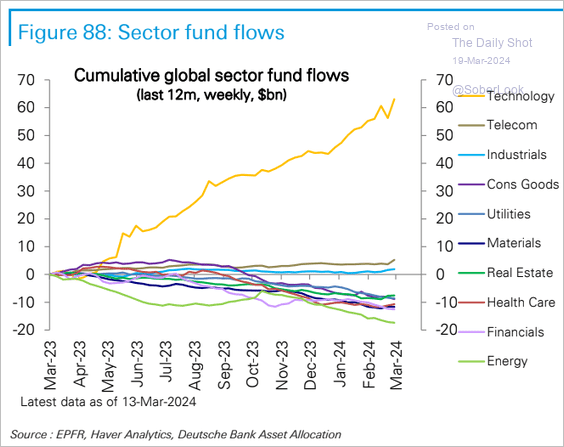

Tech funds have been the largest beneficiary.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

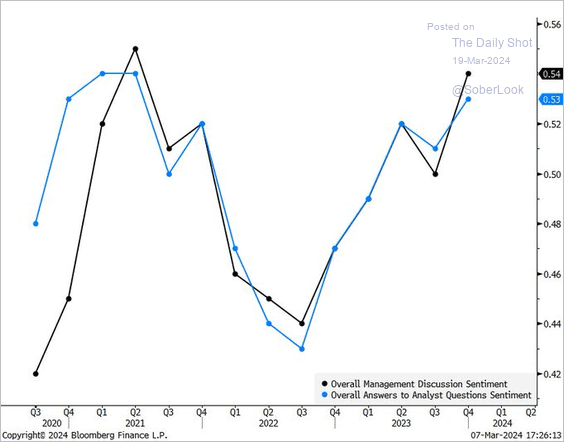

2. Earnings call sentiment has been improving.

Source: @GinaMartinAdams

Source: @GinaMartinAdams

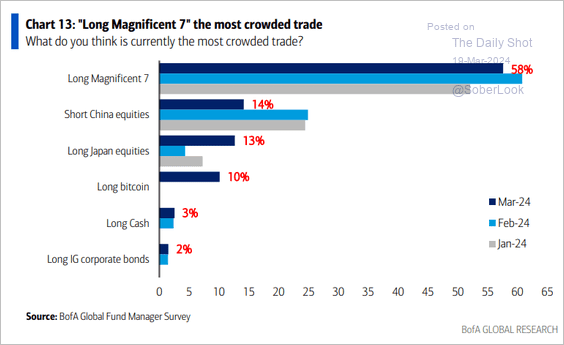

3. Fund managers still see “long Magnificent 7” as the most crowded trade.

Source: BofA Global Research

Source: BofA Global Research

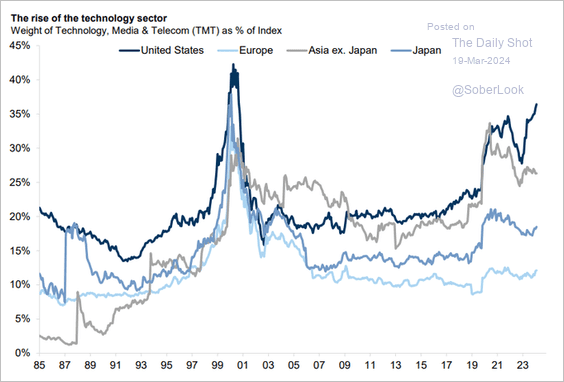

4. Here is a look at tech sector concentrations globally.

Source: Goldman Sachs; @MikeZaccardi

Source: Goldman Sachs; @MikeZaccardi

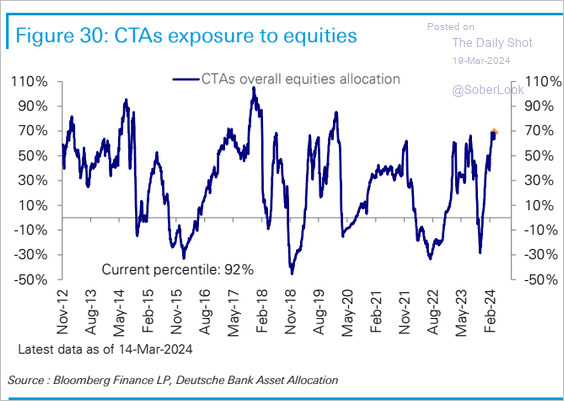

5. CTAs have been increasingly bullish on stocks.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

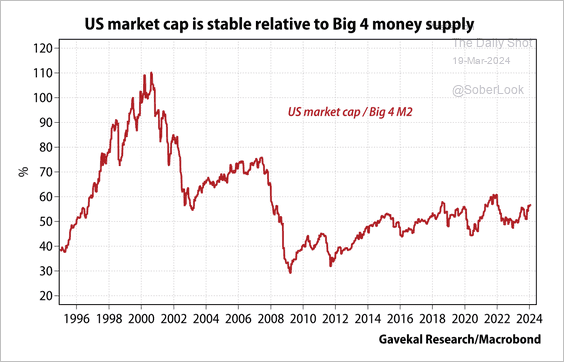

6. The US equity market cap does not look excessive when compared with the global money supply. (Big four: US, China, Eurozone, Japan).

Source: Gavekal Research

Source: Gavekal Research

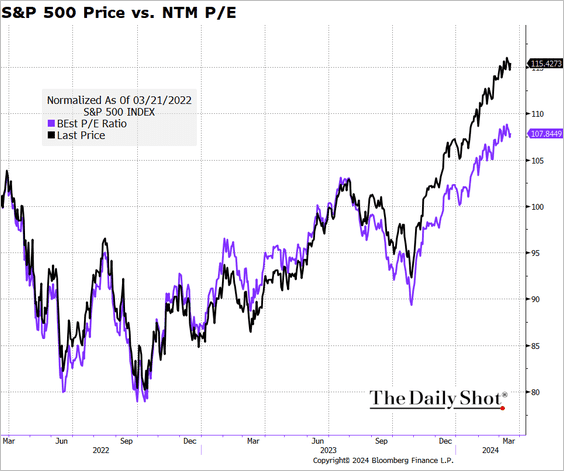

7. The S&P 500 price has been outpacing valuations (forward P/E ratio).

Source: @TheTerminal, Bloomberg Finance L.P.; h/t Morgan Stanley

Source: @TheTerminal, Bloomberg Finance L.P.; h/t Morgan Stanley

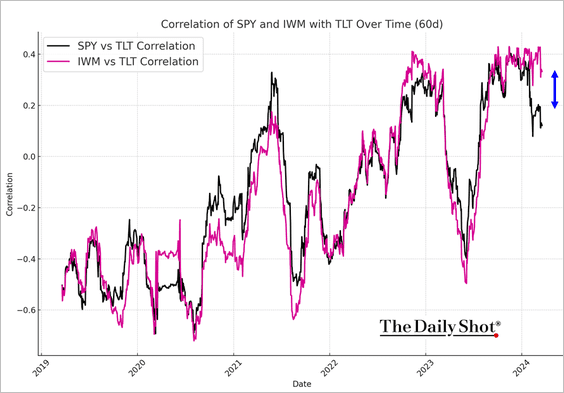

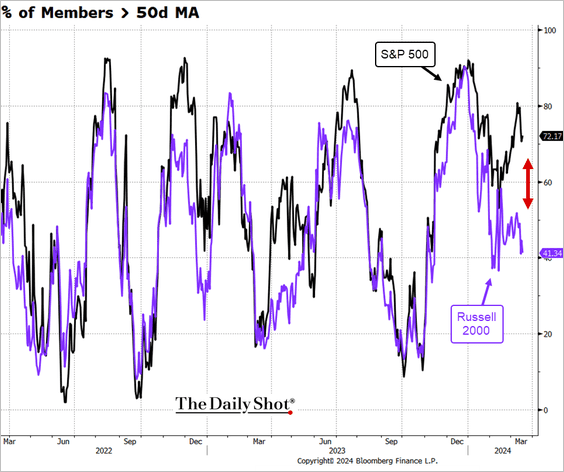

8. Small caps have been more correlated to Treasury prices than the S&P 500.

As bond yields have risen recently, the market breadth of the Russell 2000 has lagged behind that of the S&P 500.

Source: @TheTerminal, Bloomberg Finance L.P.; h/t Morgan Stanley

Source: @TheTerminal, Bloomberg Finance L.P.; h/t Morgan Stanley

——————–

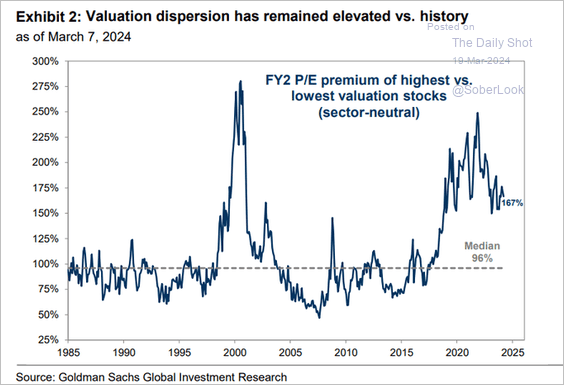

9. Valuation dispersion has remained elevated since the start of the pandemic.

Source: Goldman Sachs; @MikeZaccardi

Source: Goldman Sachs; @MikeZaccardi

Back to Index

Credit

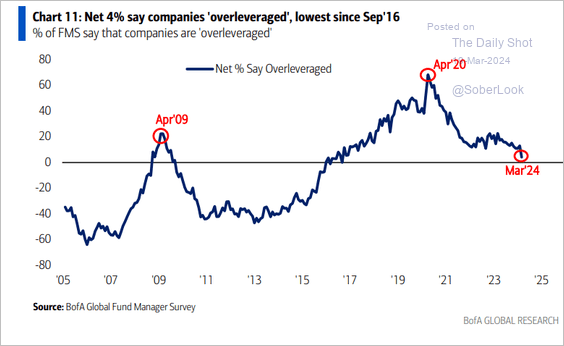

1. Fewer fund managers see companies as being overleveraged.

Source: BofA Global Research

Source: BofA Global Research

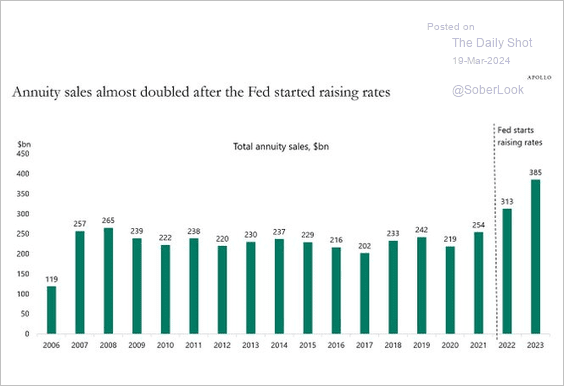

2. Strong annuity sales continue to drive the insurance industry’s demand for credit products.

Source: Torsten Slok, Apollo

Source: Torsten Slok, Apollo

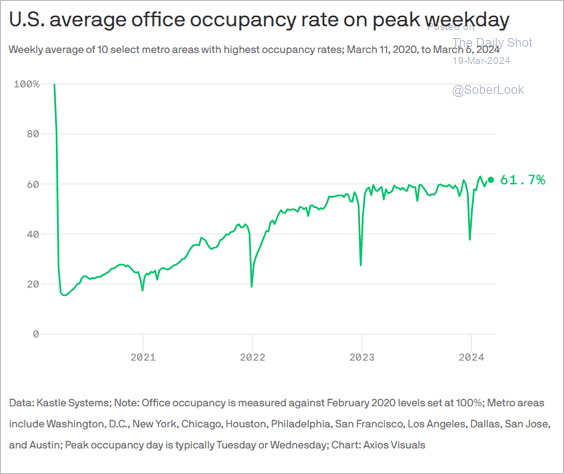

3. Office occupancy is holding near 60% of its pre-COVID levels.

Source: @axios Read full article

Source: @axios Read full article

Back to Index

Global Developments

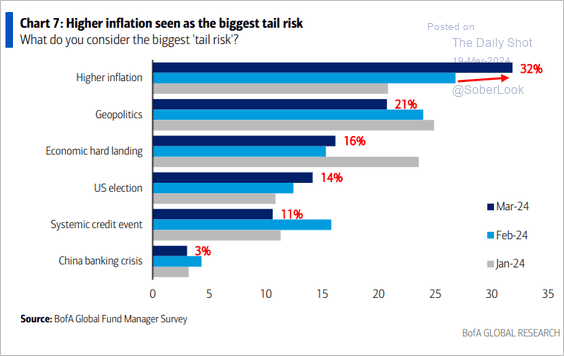

1. Investors increasingly see inflation as the key tail risk.

Source: BofA Global Research

Source: BofA Global Research

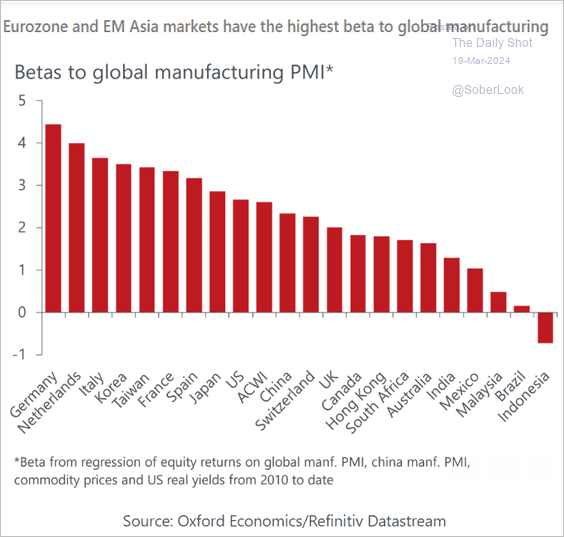

2. Here is a look at equity markets’ beta to global manufacturing activity.

Source: Oxford Economics

Source: Oxford Economics

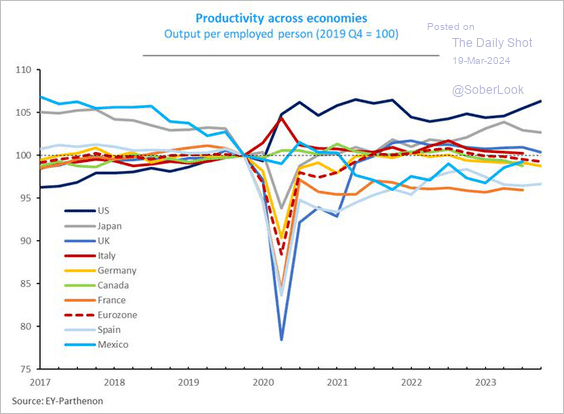

3. Finally, we have productivity trends in select economies.

Source: @GregDaco

Source: @GregDaco

——————–

Food for Thought

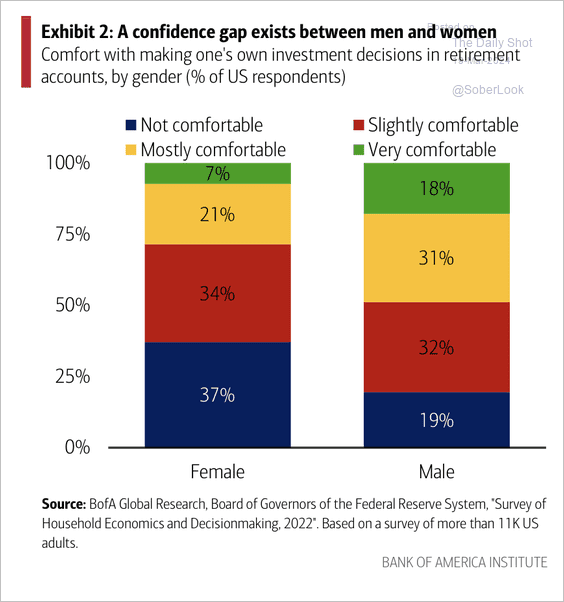

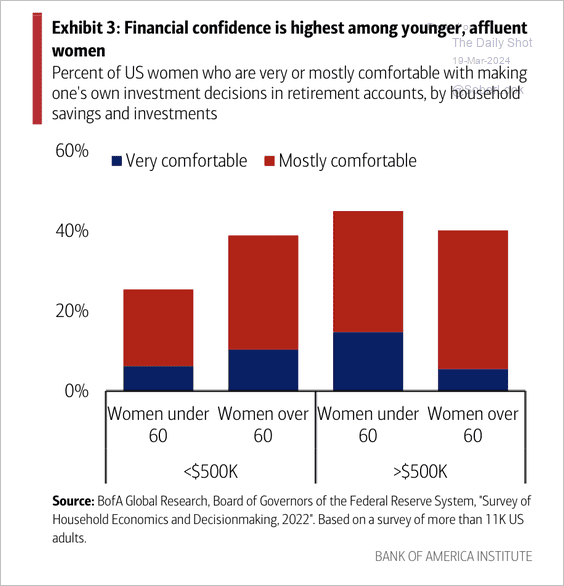

1. Households’ financial confidence (2 charts):

Source: Bank of America Institute

Source: Bank of America Institute

Source: Bank of America Institute

Source: Bank of America Institute

——————–

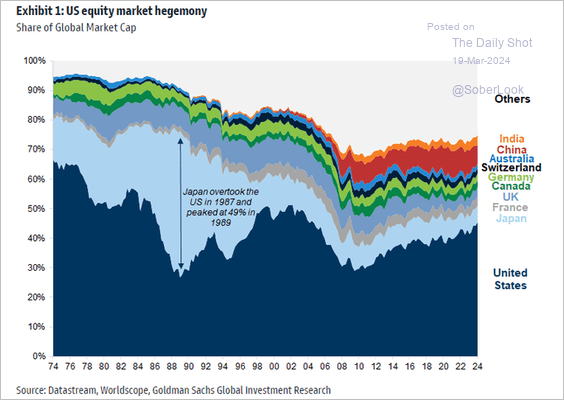

2. Share of global stock market capitalization by country over the past 50 years:

Source: Goldman Sachs; @MikeZaccardi

Source: Goldman Sachs; @MikeZaccardi

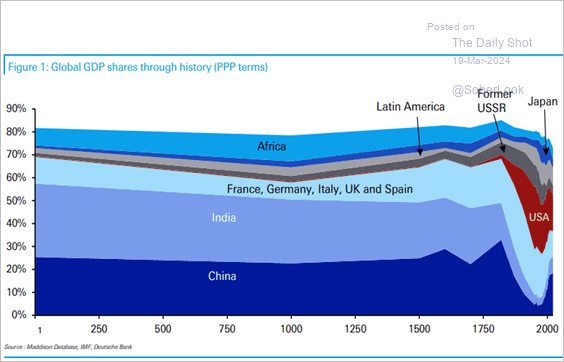

3. Global GDP shares by region over the past two millennia:

Source: Deutsche Bank Research

Source: Deutsche Bank Research

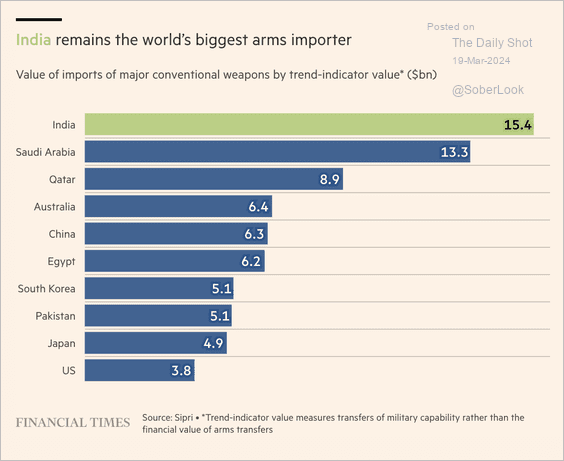

4. Biggest arms importers:

Source: @financialtimes Read full article

Source: @financialtimes Read full article

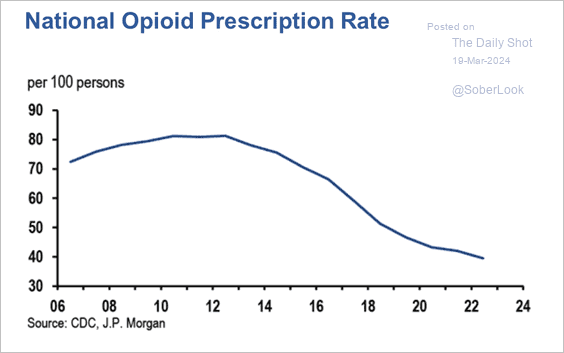

5. US opioid prescription rate over time:

Source: JP Morgan Research; III Capital Management

Source: JP Morgan Research; III Capital Management

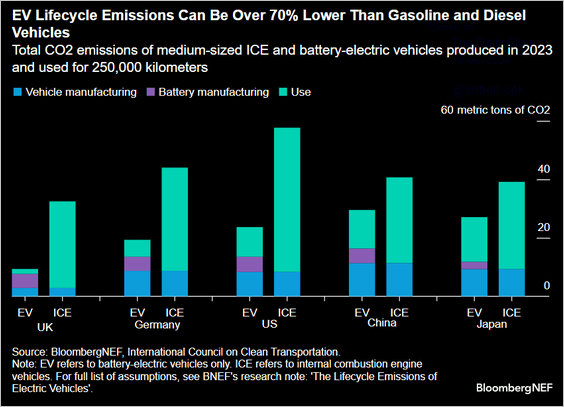

6. Lifecycle CO2 emissions of EV vs. ICE vehicles:

Source: @BloombergNEF Read full article

Source: @BloombergNEF Read full article

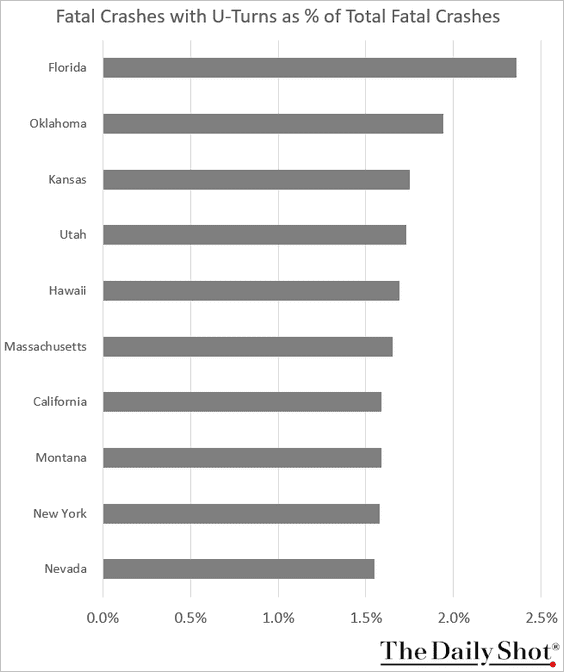

7. Most dangerous states to make a U-turn:

Source: Stone Injury Lawyers

Source: Stone Injury Lawyers

——————–

Back to Index