The Daily Shot: 20-Mar-24

• The United States

• Canada

• The United Kingdom

• The Eurozone

• Europe

• Japan

• Emerging Markets

• Cryptocurrency

• Equities

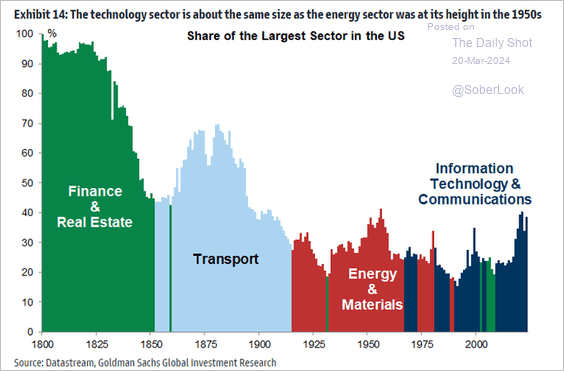

• Credit

• Rates

• Global Developments

• Food for Thought

The United States

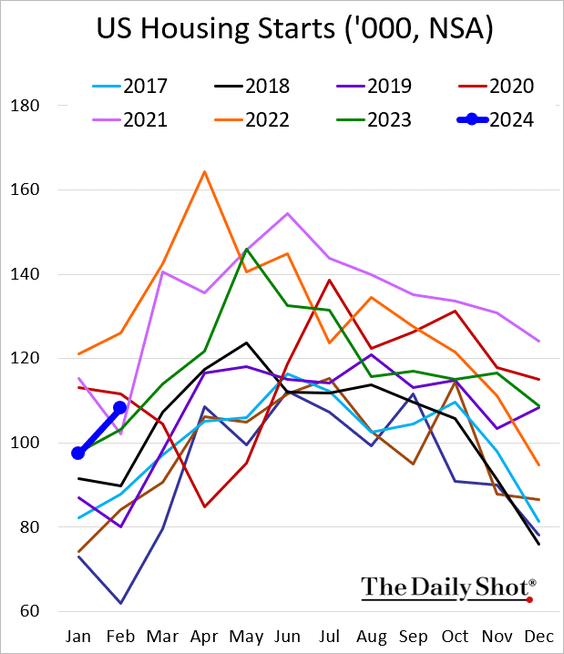

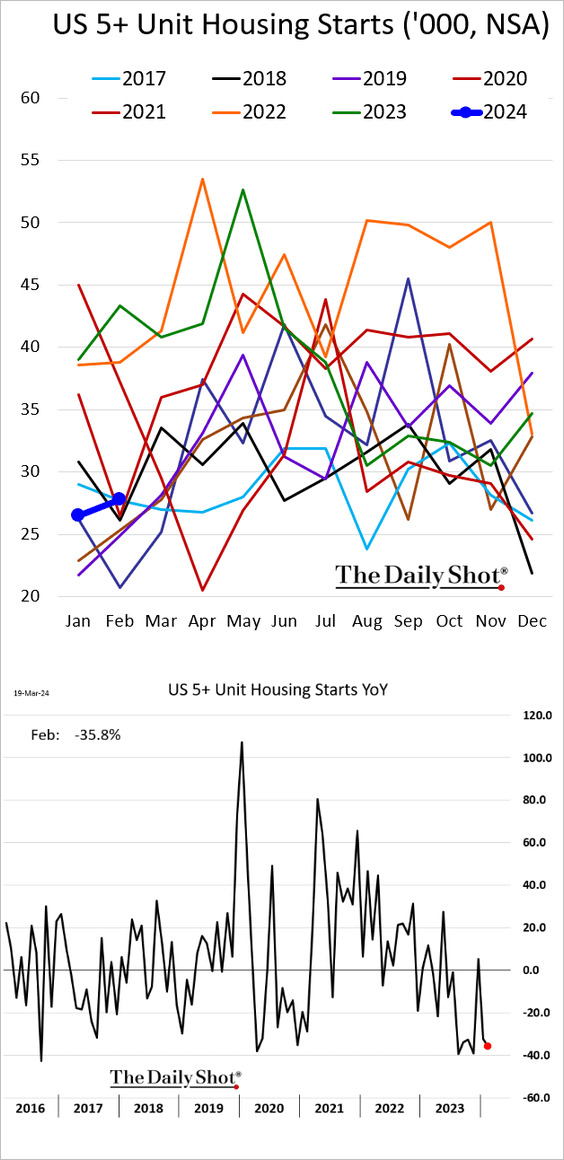

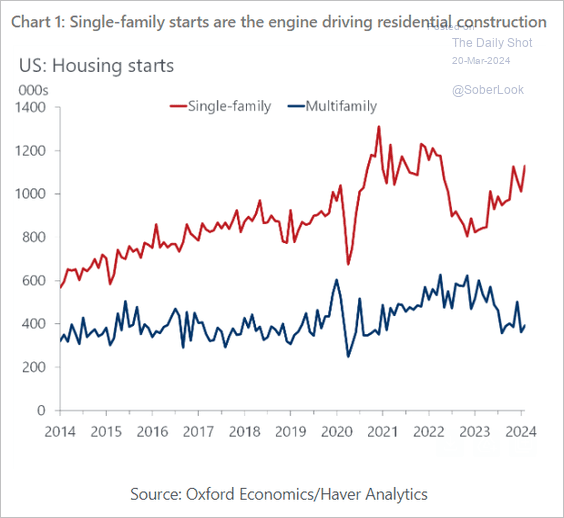

1. Housing starts rebounded from the weather-related weakness in January, …

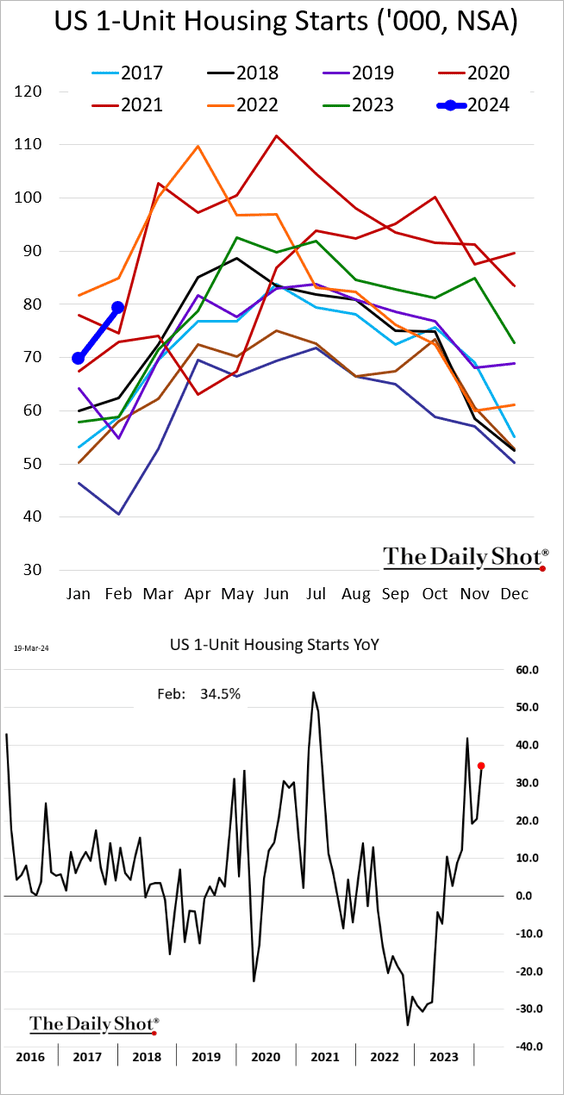

… boosted by single-family construction.

Source: @economics Read full article

Source: @economics Read full article

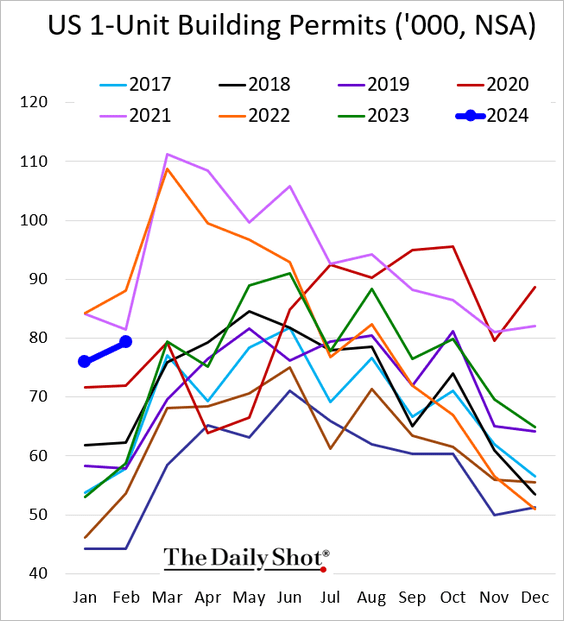

• Single-family building permits were well above last year’s levels.

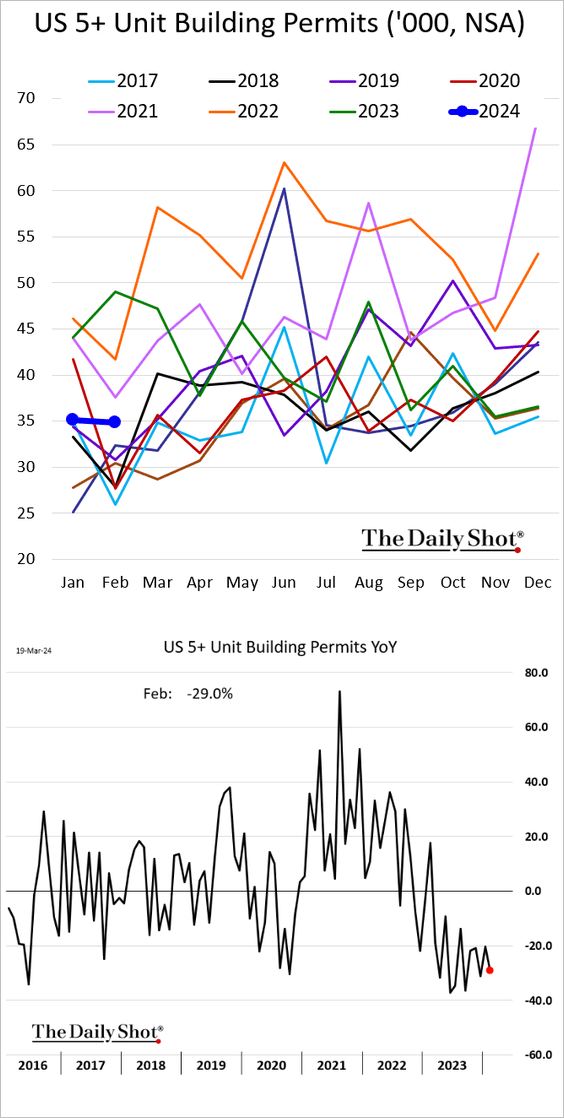

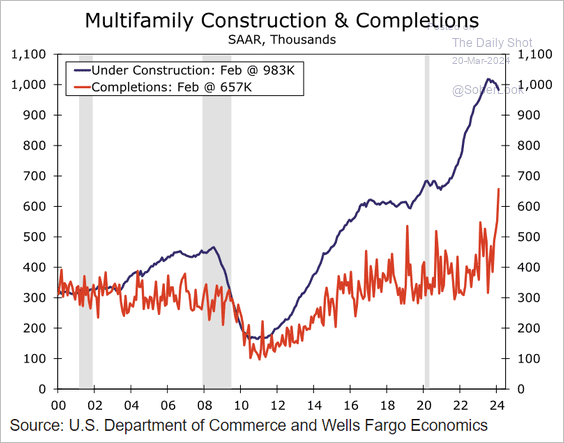

• Multifamily activity remains soft, …

• Permits:

• Starts:

… as a surge of new inventory hits the market, …

Source: Wells Fargo Securities

Source: Wells Fargo Securities

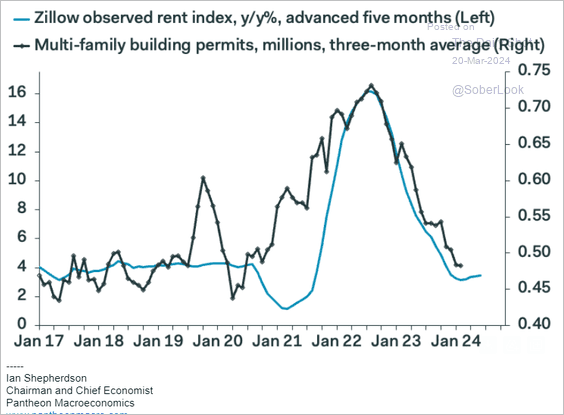

… and rent growth slows.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

• This seasonally-adjusted chart of housing starts illustrates the divergence between single-family and multi-family construction activity.

Source: Oxford Economics

Source: Oxford Economics

——————–

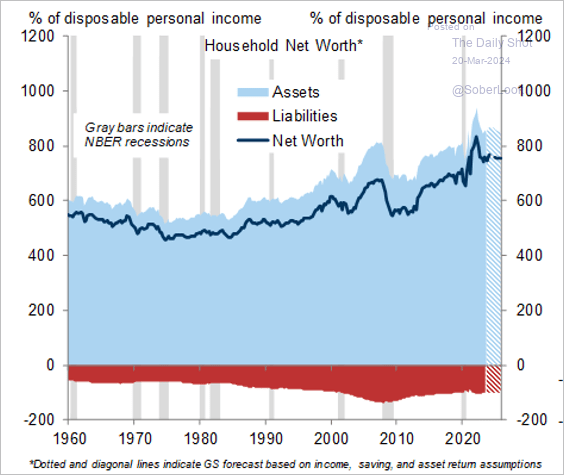

2. Next, let’s take a look at some trends in US household finances.

• Household balance sheets, as a percentage of disposable income, remain robust relative to historical levels.

Source: Goldman Sachs; @MikeZaccardi

Source: Goldman Sachs; @MikeZaccardi

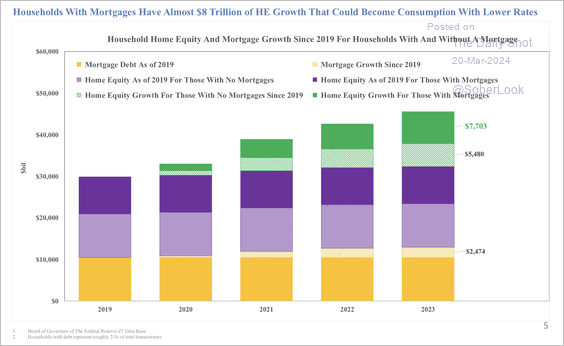

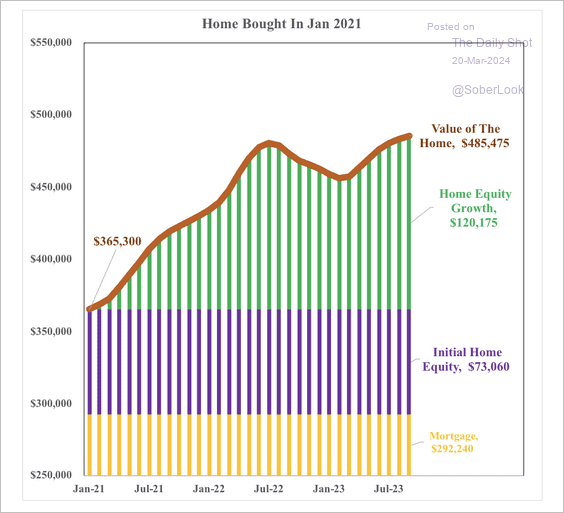

• Households with mortgages have experienced a rise in home equity, especially for those who purchased a home in early 2021. (2 charts)

Source: SOM Macro Strategies

Source: SOM Macro Strategies

Source: SOM Macro Strategies

Source: SOM Macro Strategies

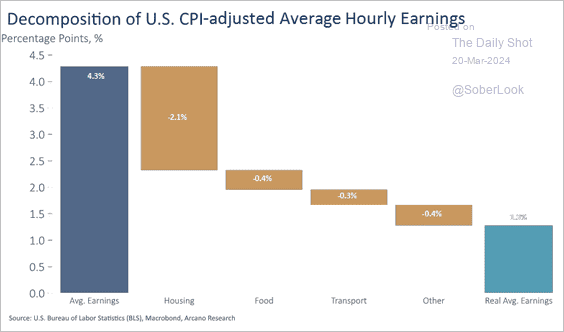

• This diagram bridges nominal and real wage growth.

Source: Arcano Economics

Source: Arcano Economics

——————–

3. Below are some trends in the US labor market.

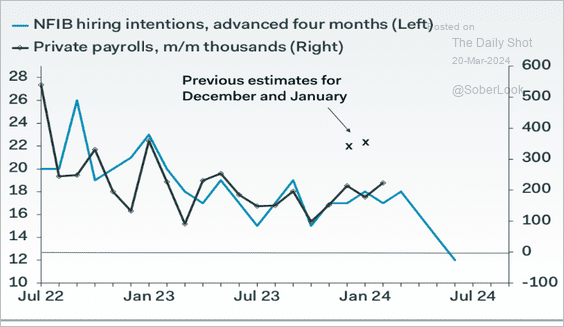

• The NFIB small business survey signals slower job growth ahead.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

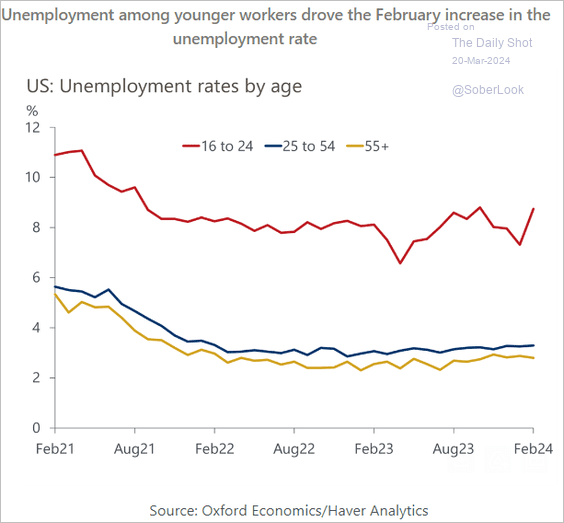

• Last month’s rise in the unemployment rate was attributed to younger workers.

Source: Oxford Economics

Source: Oxford Economics

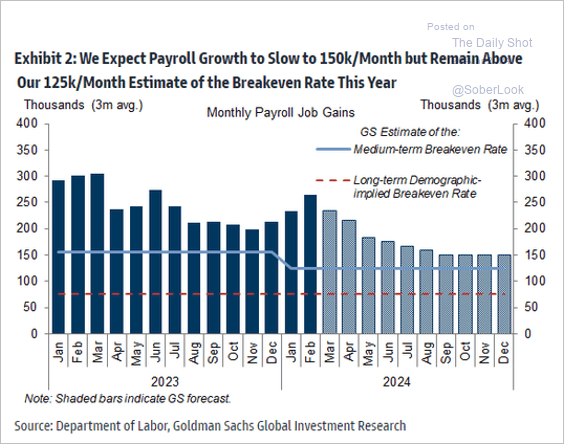

• Goldman anticipates that job growth will slightly exceed the medium-term breakeven rate (the rate necessary to replace retiring workers) later this year.

Source: Goldman Sachs; @MikeZaccardi

Source: Goldman Sachs; @MikeZaccardi

Back to Index

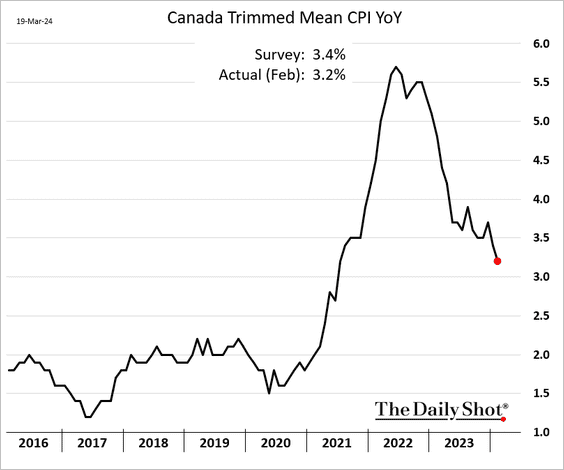

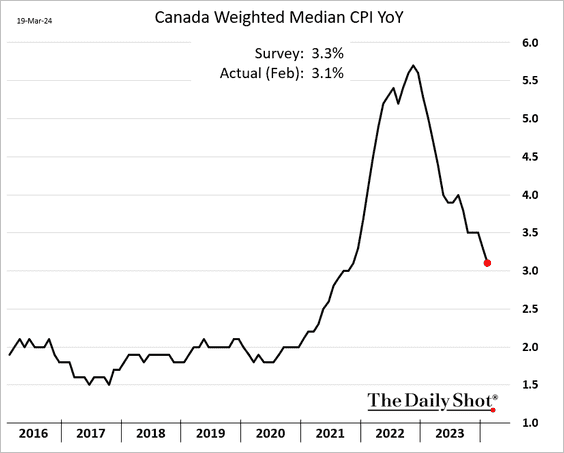

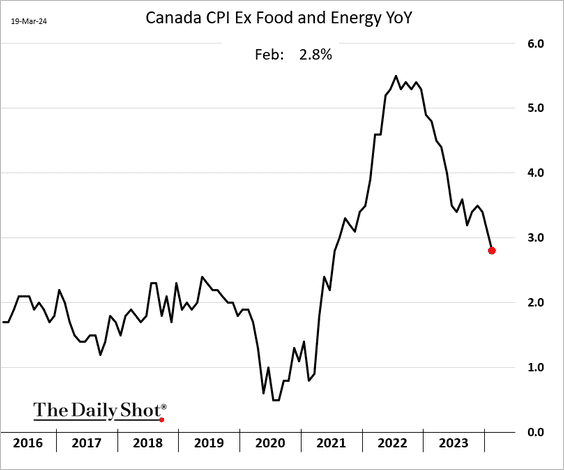

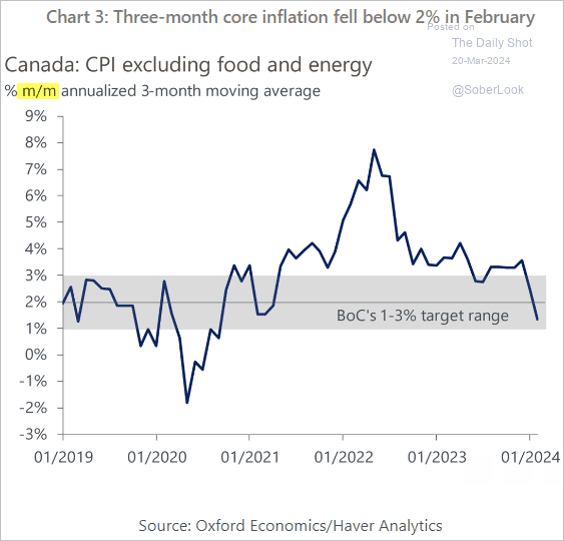

Canada

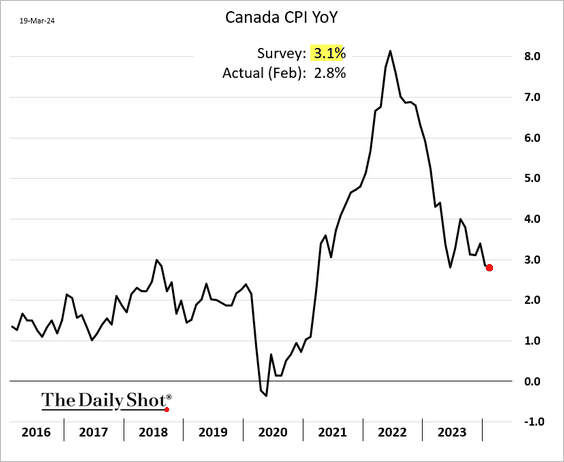

1. Inflation surprised to the downside.

• Headline:

• Core CPI measures (3 charts):

– Month-over-month core inflation changes are now at the lower end of the BoC’s target range.

Source: Oxford Economics

Source: Oxford Economics

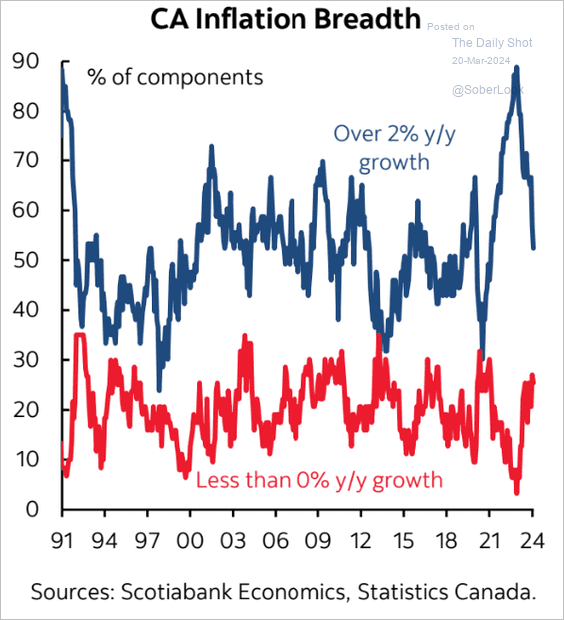

• Inflation breadth is falling.

Source: Scotiabank Economics

Source: Scotiabank Economics

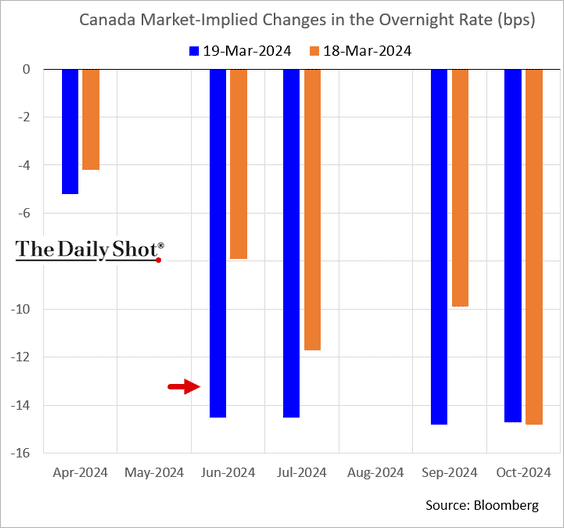

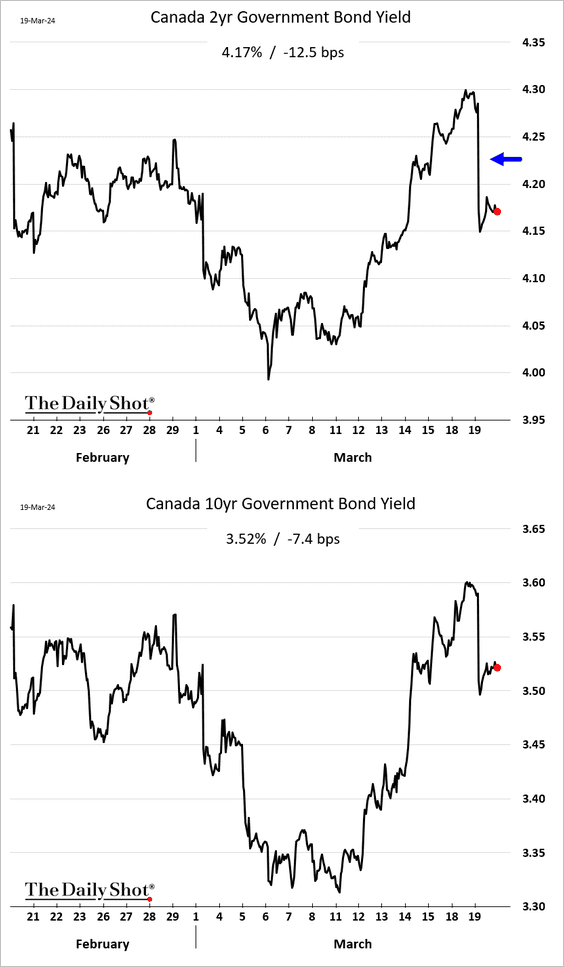

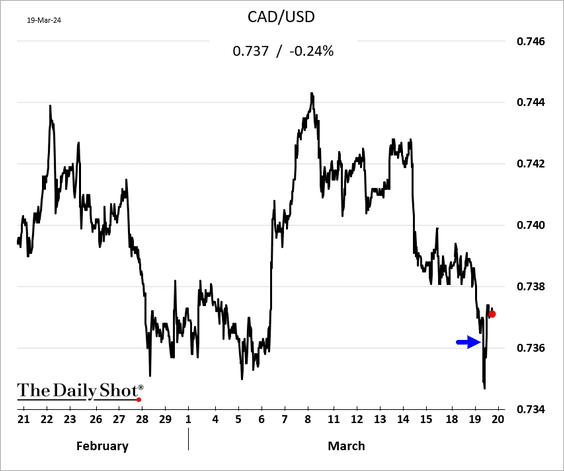

2. Expectations for a Bank of Canada rate cut rose following the CPI report, with the first reduction anticipated in June.

Source: Reuters Read full article

Source: Reuters Read full article

• Bond yields dropped.

• The loonie initially declined following the CPI report but rebounded shortly thereafter.

Back to Index

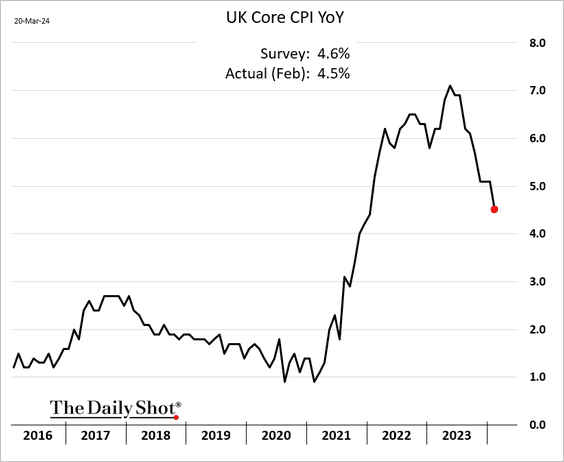

The United Kingdom

1. The February CPI figures came in slightly below expectations, indicating a continued moderation in inflation. We will have more on the UK inflation report tomorrow.

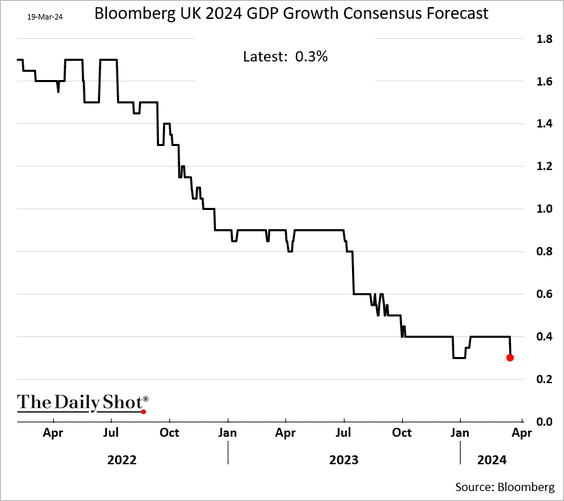

2. Economists still hold a bleak outlook for UK growth this year.

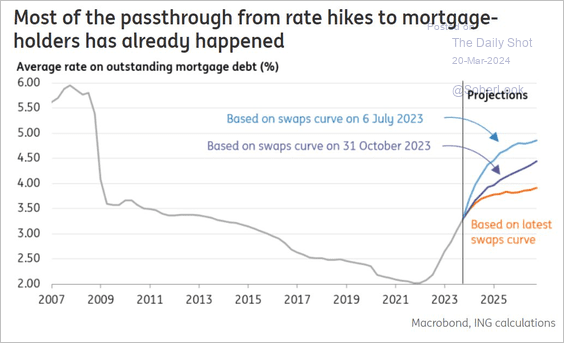

3. Most of the BoE rate hikes have already been factored into existing mortgages.

Source: ING Read full article

Source: ING Read full article

Back to Index

The Eurozone

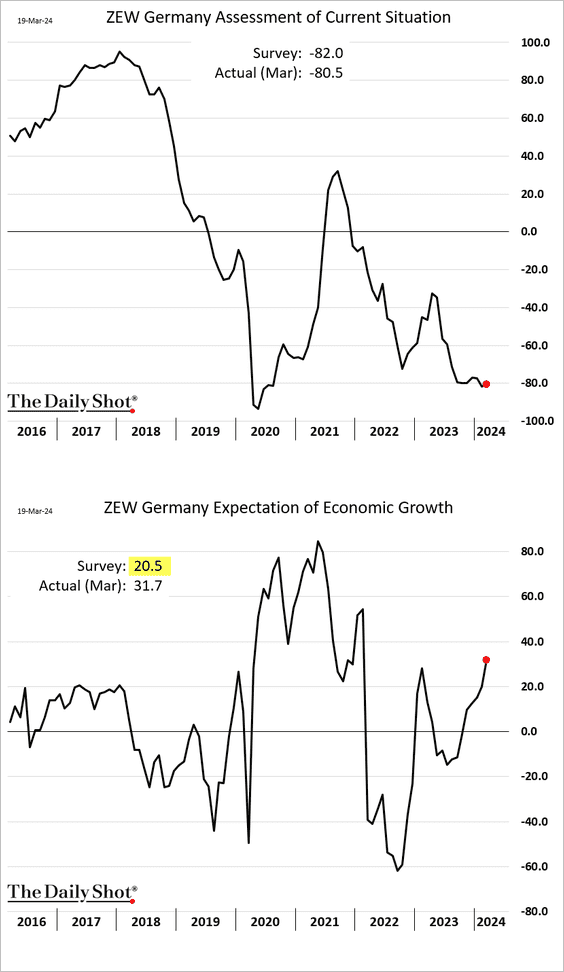

1. Germany’s ZEW index of expected economic growth topped forecasts this month.

Source: Reuters Read full article

Source: Reuters Read full article

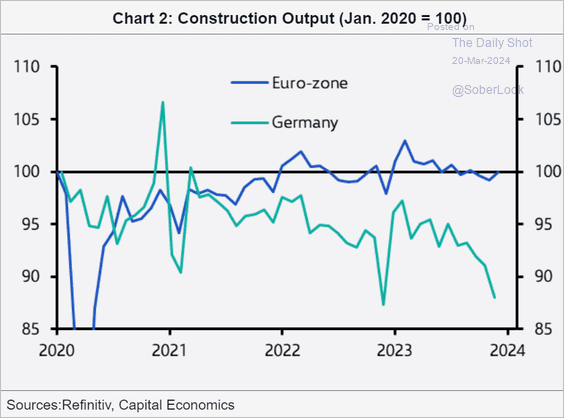

• Germany’s construction slump has been severe.

Source: Capital Economics

Source: Capital Economics

——————–

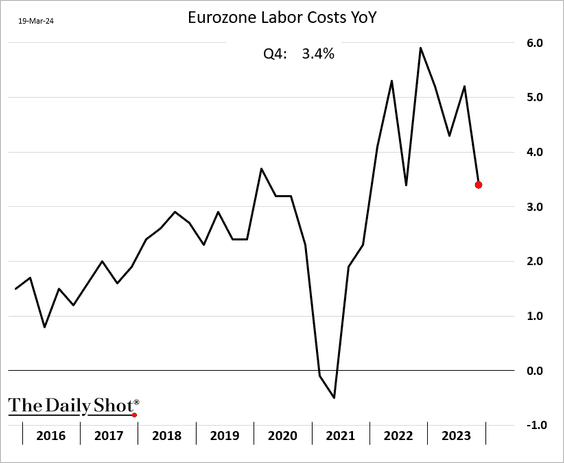

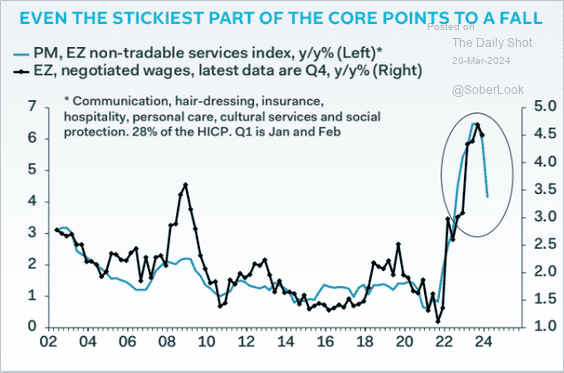

2. Growth in euro-area labor costs slowed last quarter.

Source: @economics Read full article

Source: @economics Read full article

Slower wage growth should further ease inflationary pressures.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

——————–

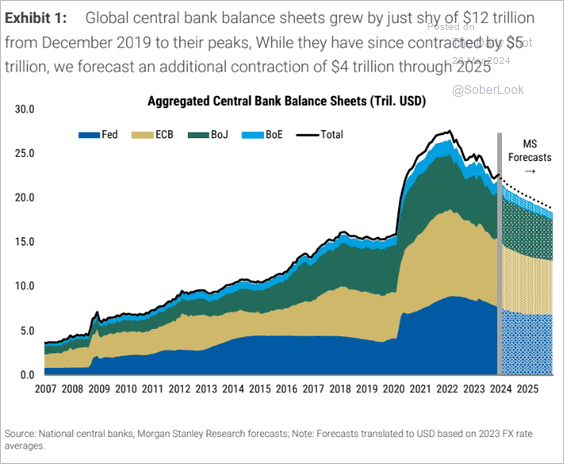

3. The ECB will be driving major central banks’ balance sheet reduction after the Fed tapers its QT.

Source: Morgan Stanley Research

Source: Morgan Stanley Research

Back to Index

Europe

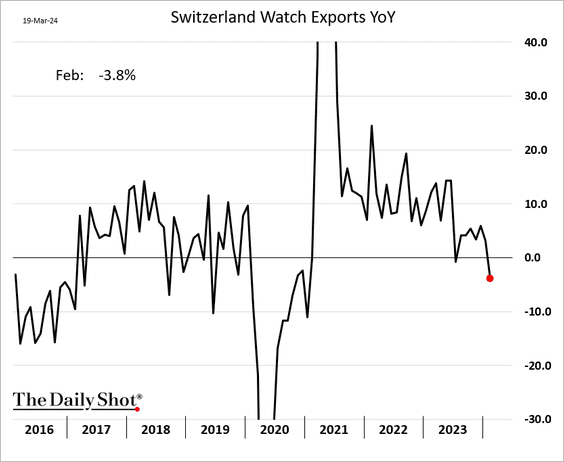

1. Swiss watch exports softened last month amid weak demand from China.

Source: @markets Read full article

Source: @markets Read full article

——————–

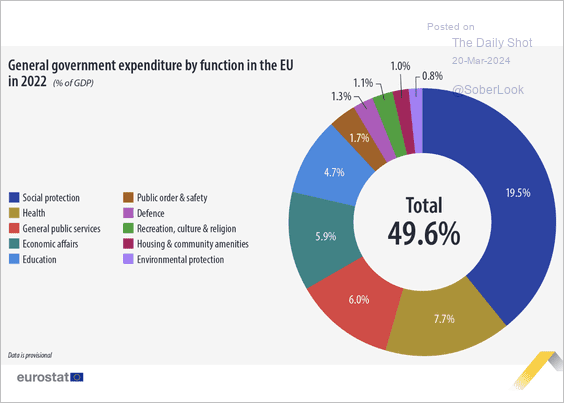

2. Here is a look at the EU government expenditures by function as a percentage of GDP.

Source: Eurostat Read full article

Source: Eurostat Read full article

Back to Index

Japan

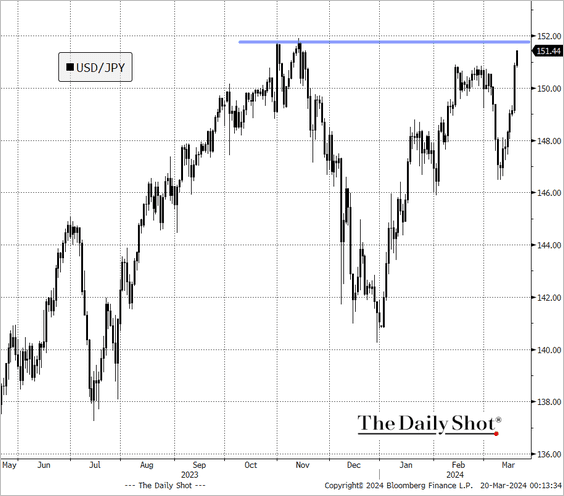

1. Dollar-yen is nearing the November peak after the BoJ’s dovish rate hike.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

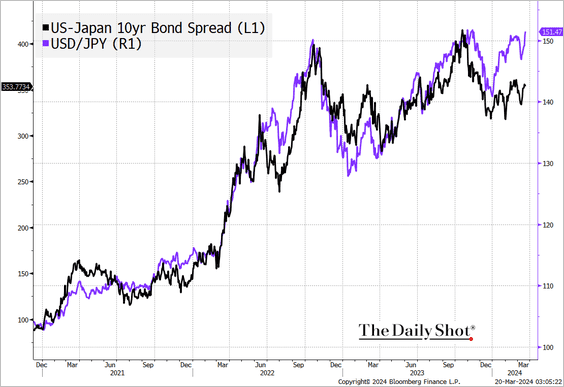

• The rate differential with the US favors a stronger yen.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

——————–

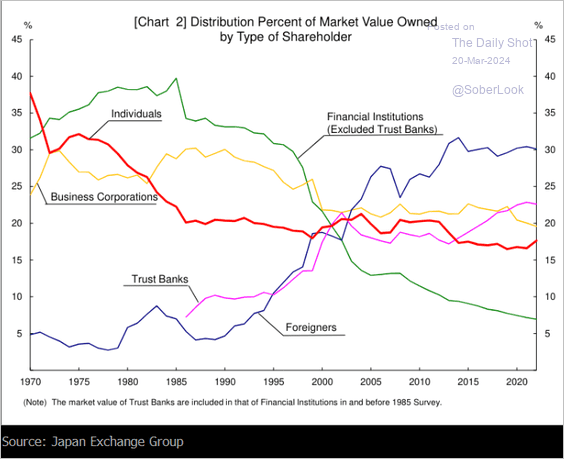

2. Who owns Japan’s stocks?

Source: Simon White, Bloomberg Markets Live Blog

Source: Simon White, Bloomberg Markets Live Blog

Back to Index

Emerging Markets

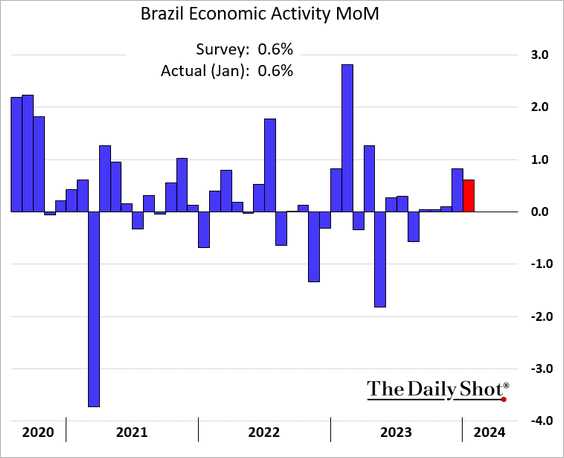

1. Brazil’s economy expanded in January.

Source: @economics Read full article

Source: @economics Read full article

——————–

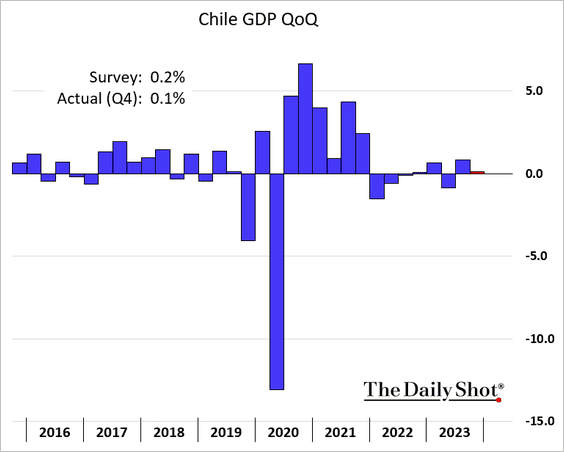

2. Chile’s economic growth was lower than expected last quarter.

Source: @economics Read full article

Source: @economics Read full article

——————–

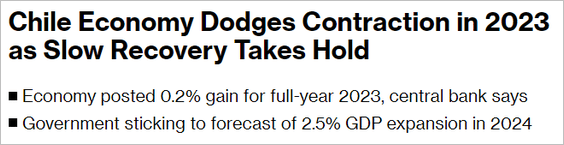

3. Argentina’s trade surplus increased in February as imports slumped.

Back to Index

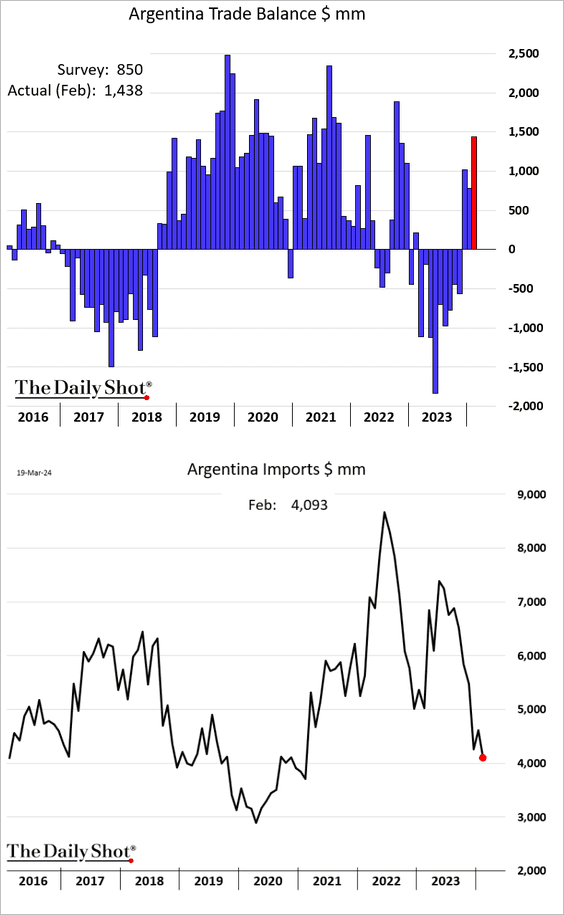

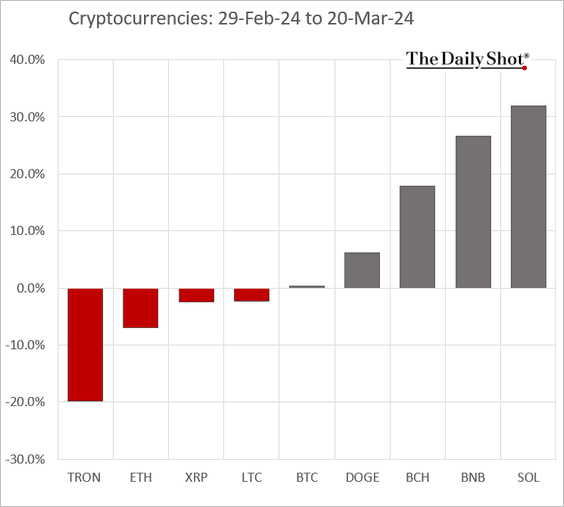

Cryptocurrency

The crypto correction continues.

Bitcoin is now almost flat month-to-date.

Back to Index

Equities

1. Semiconductors have been giving up some of the recent outperformance.

![]()

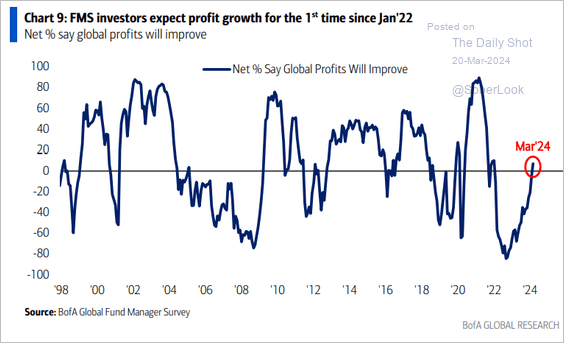

2. Fund managers now see global corporate profits improving.

Source: BofA Global Research

Source: BofA Global Research

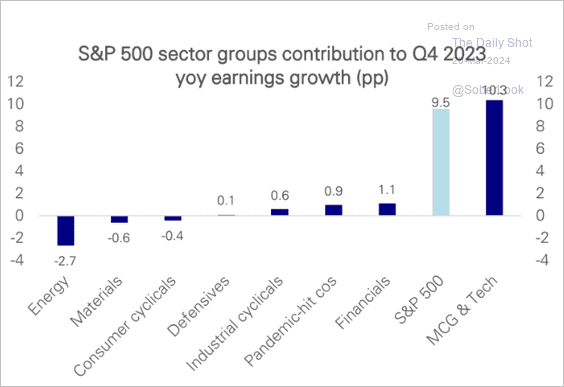

3. Megacaps and tech drove most of the year-over-year earnings growth last quarter.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

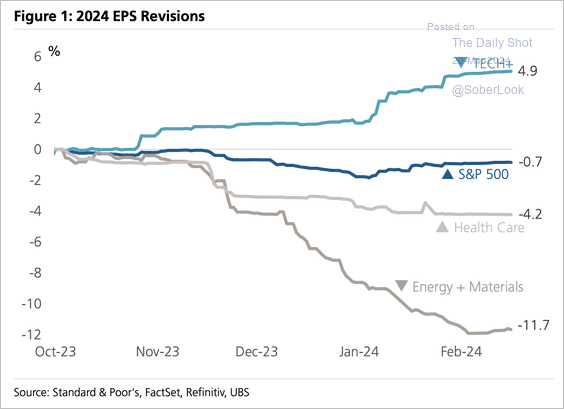

4. Here is a look at the earnings revision divergence between tech and the rest of the market.

Source: UBS Research; @dailychartbook

Source: UBS Research; @dailychartbook

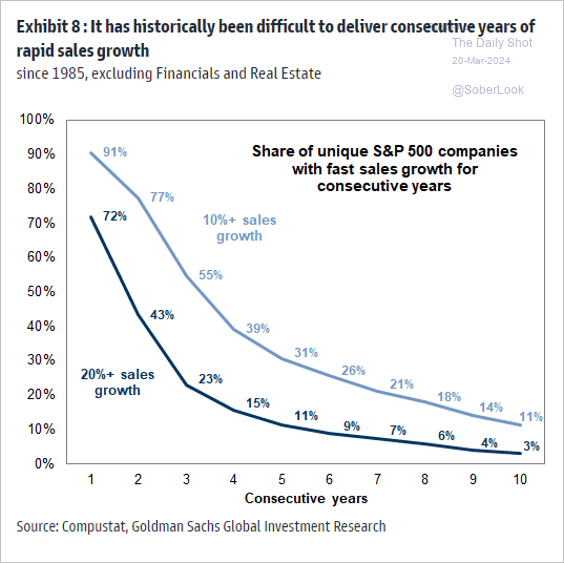

5. Few companies can deliver consistently high sales growth rates.

Source: Goldman Sachs; @MikeZaccardi

Source: Goldman Sachs; @MikeZaccardi

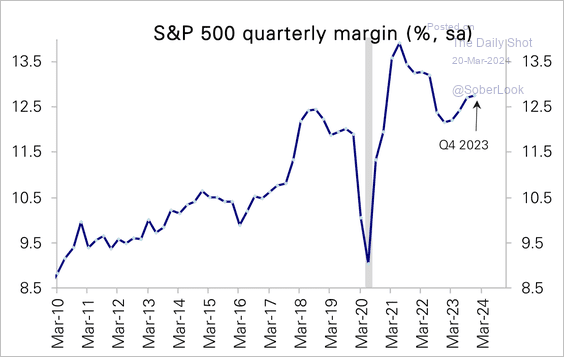

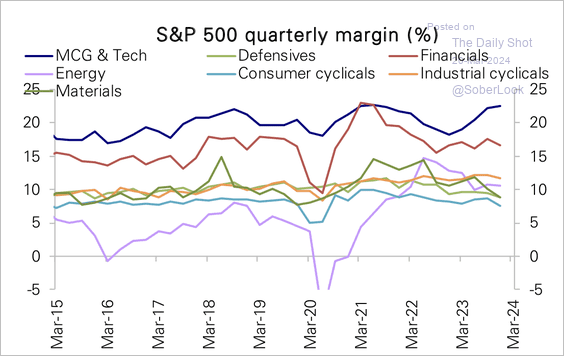

6. S&P 500 margins are rebounding, almost entirely in mega-cap growth (MCG) and tech. (2 charts)

Source: Deutsche Bank Research

Source: Deutsche Bank Research

Source: Deutsche Bank Research

Source: Deutsche Bank Research

——————–

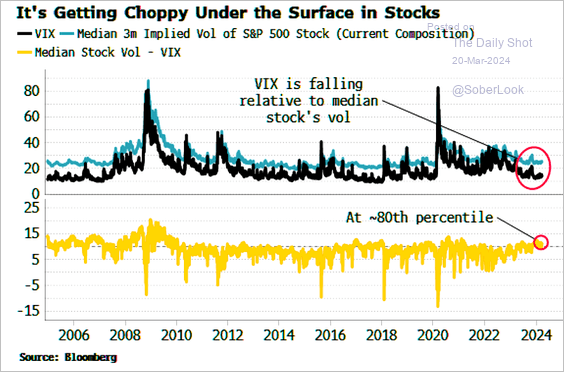

7. The market is factoring in greater volatility for individual stocks compared to the index.

Source: Simon White, Bloomberg Markets Live Blog

Source: Simon White, Bloomberg Markets Live Blog

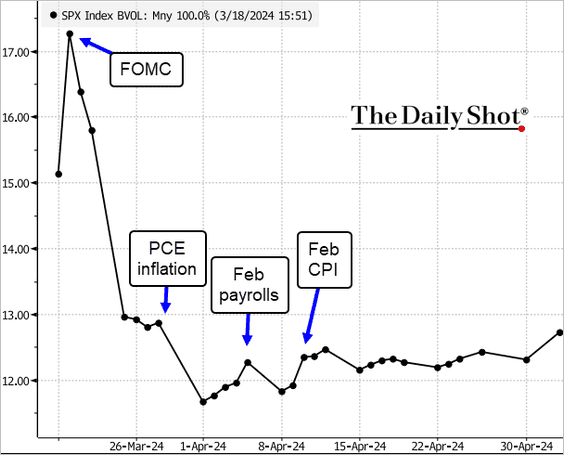

8. Here is the near-term S&P 500 implied vol curve.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

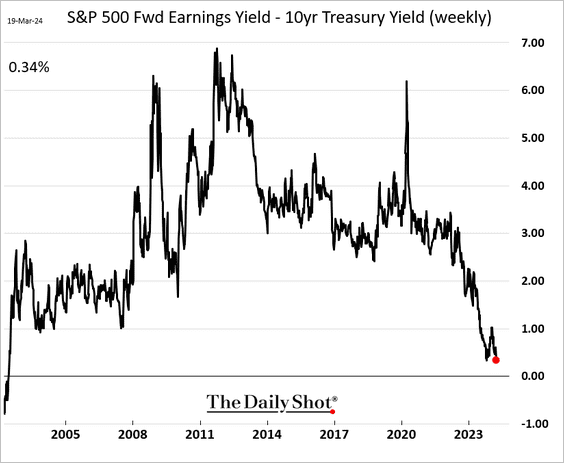

9. Equity risk premium continues to trend lower.

10. This chart shows the share of the largest sector in the US over time.

Source: Goldman Sachs; @MikeZaccardi

Source: Goldman Sachs; @MikeZaccardi

Back to Index

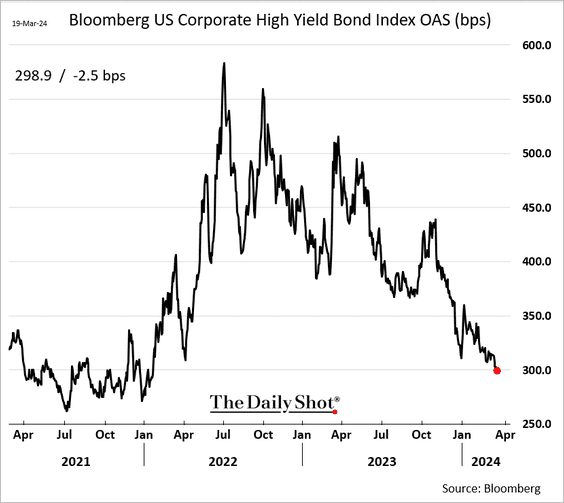

Credit

1. Bloomberg’s high-yield index average spread dipped below 300 bps.

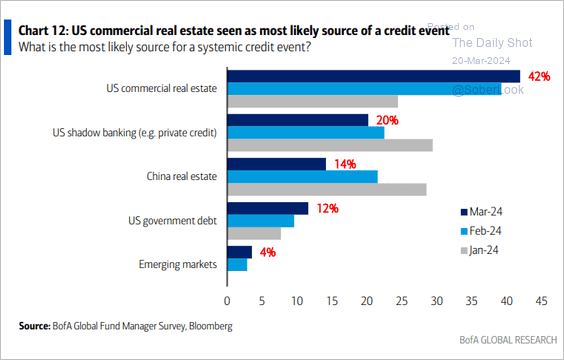

2. Investors remain concerned about commercial real estate (CRE).

Source: BofA Global Research

Source: BofA Global Research

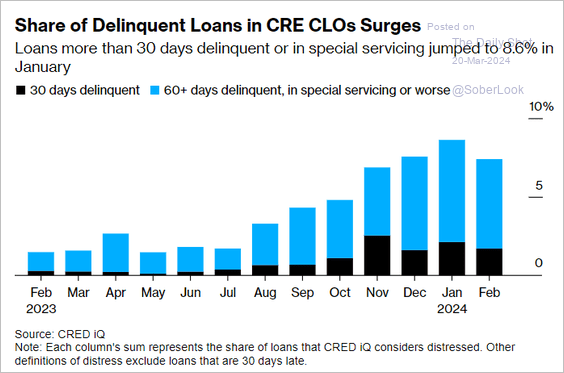

• CRE delinquency rates remain elevated.

Source: @markets Read full article

Source: @markets Read full article

Back to Index

Rates

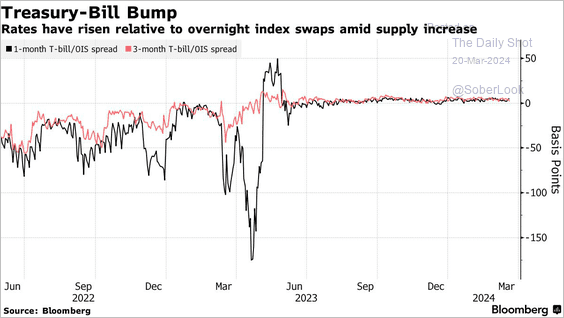

1. T-bills trade above OIS, reflecting increased supply.

Source: @markets Read full article

Source: @markets Read full article

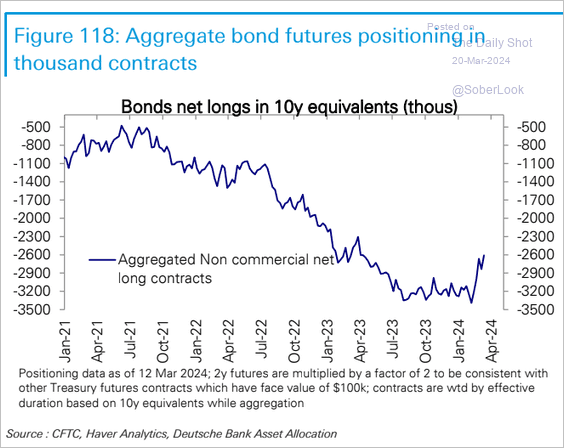

2. Speculative accounts continue to unwind the futures-cash arb trade.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

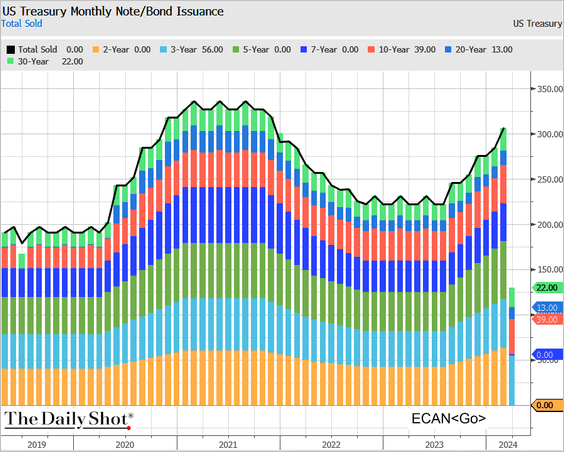

3. Treasury coupon issuance is ramping up.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

Back to Index

Global Developments

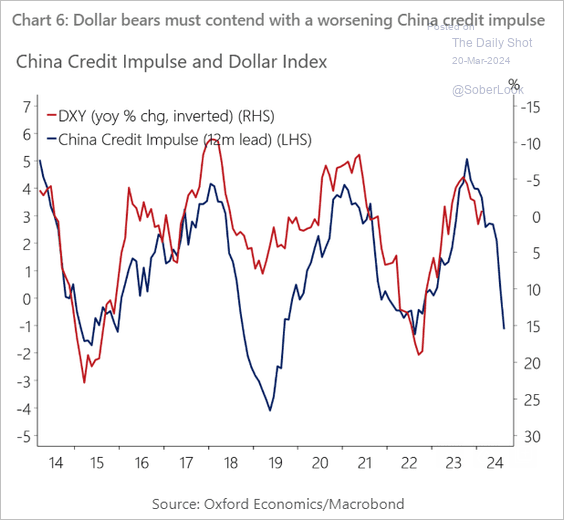

1. China’s worsening credit impulse is a tailwind for the US dollar.

Source: Oxford Economics

Source: Oxford Economics

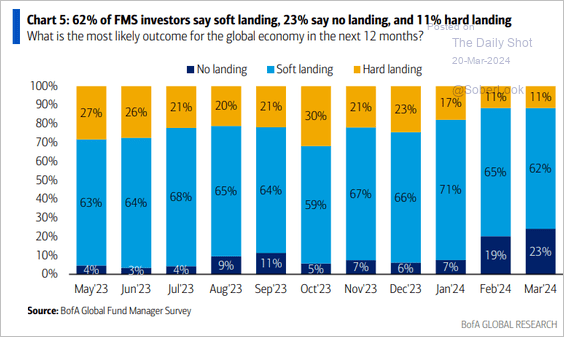

2. Only a relatively small percentage of fund managers now anticipate a global recession.

Source: BofA Global Research

Source: BofA Global Research

——————–

Food for Thought

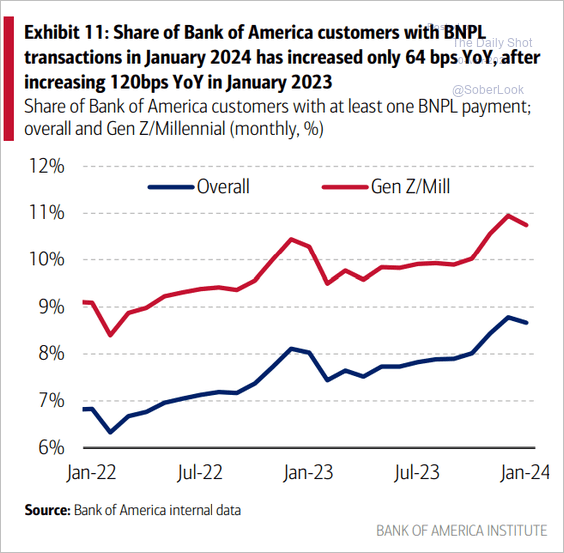

1. BNPL (buy now, pay later) usage over time:

Source: Bank of America Institute

Source: Bank of America Institute

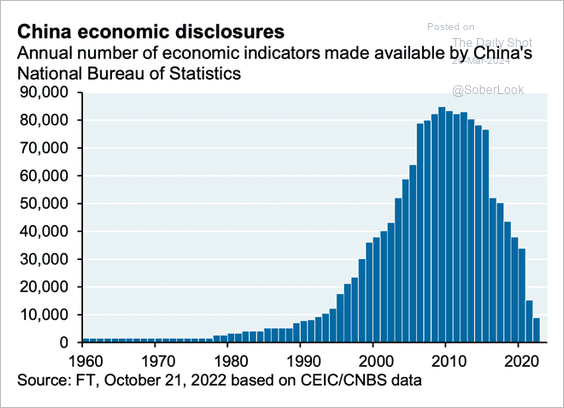

2. China’s rapidly fading economic transparency:

Source: J.P. Morgan Asset Management

Source: J.P. Morgan Asset Management

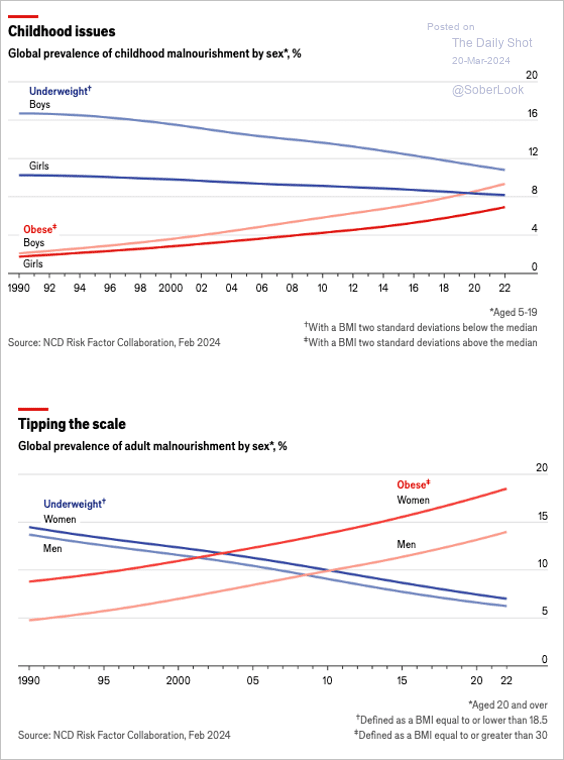

3. Global trends in childhood and adult malnourishment and obesity by gender:

Source: The Economist Read full article

Source: The Economist Read full article

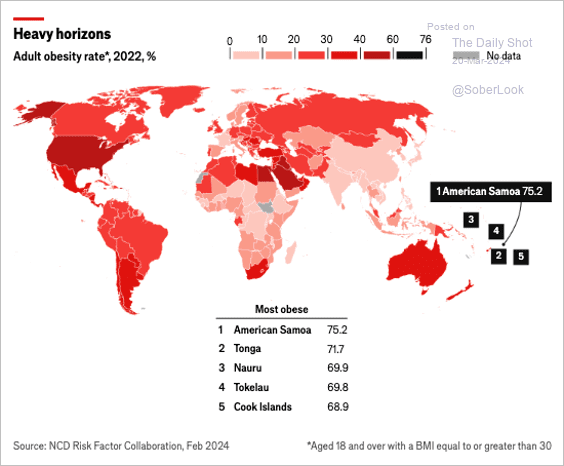

• Adult obesity rates:

Source: The Economist Read full article

Source: The Economist Read full article

——————–

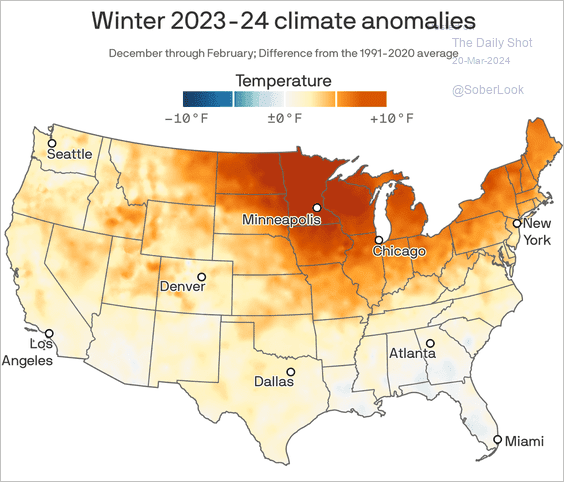

4. A warm winter:

Source: @axios Read full article

Source: @axios Read full article

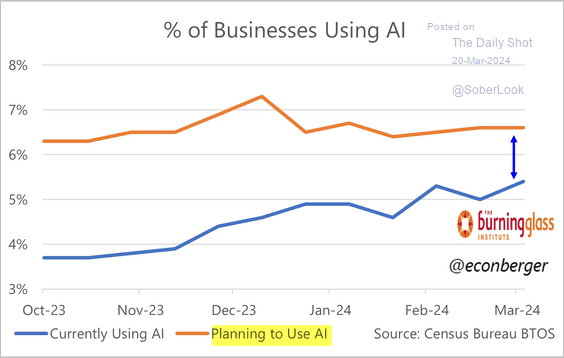

5. AI usage saturation?

Source: @EconBerger, @uscensusbureau

Source: @EconBerger, @uscensusbureau

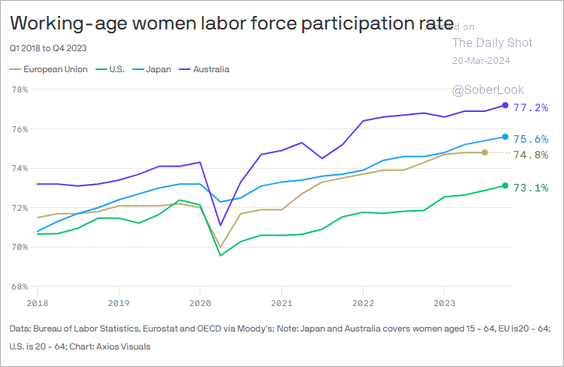

6. Working-age women labor force participation rates:

Source: @axios Read full article

Source: @axios Read full article

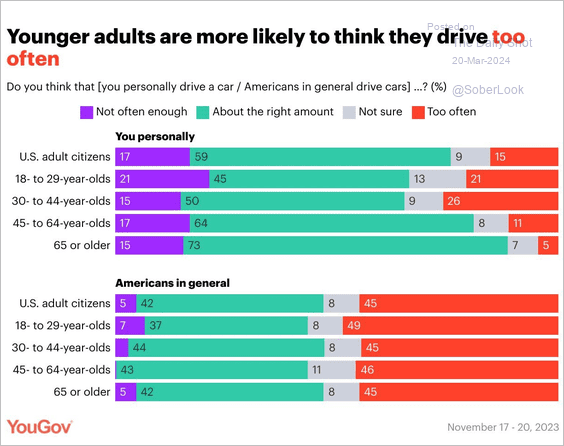

7. Perceptions on driving frequency by age group in the US:

Source: @YouGovAmerica Read full article

Source: @YouGovAmerica Read full article

——————–

Back to Index