The Daily Shot: 21-Mar-24

• The United States

• The United Kingdom

• Europe

• Japan

• Asia-Pacific

• China

• Emerging Markets

• Cryptocurrency

• Commodities

• Energy

• Equities

• Credit

• Global Developments

• Food for Thought

The United States

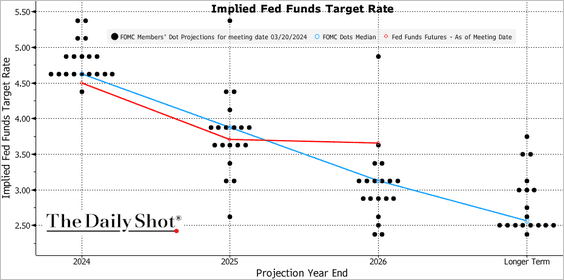

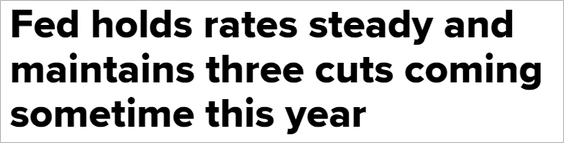

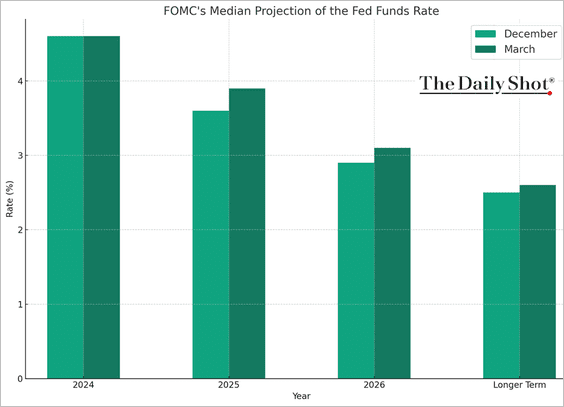

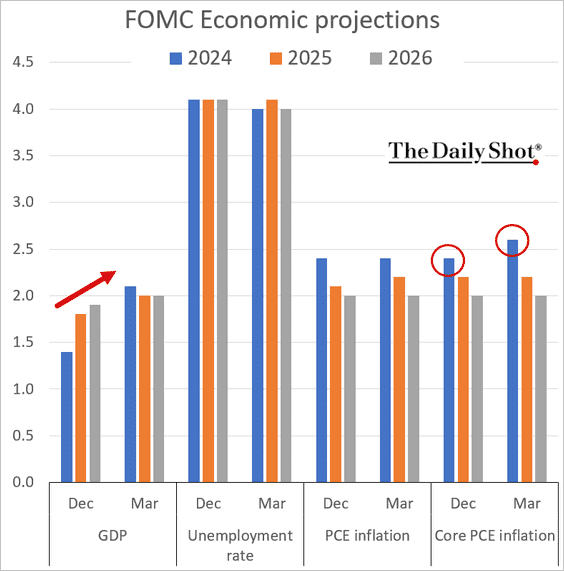

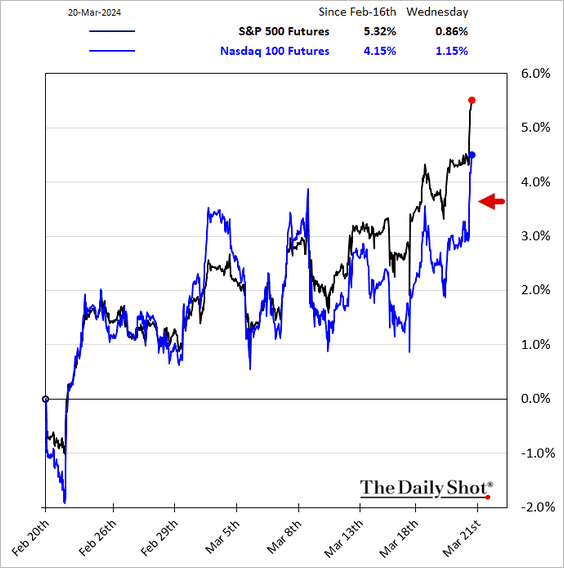

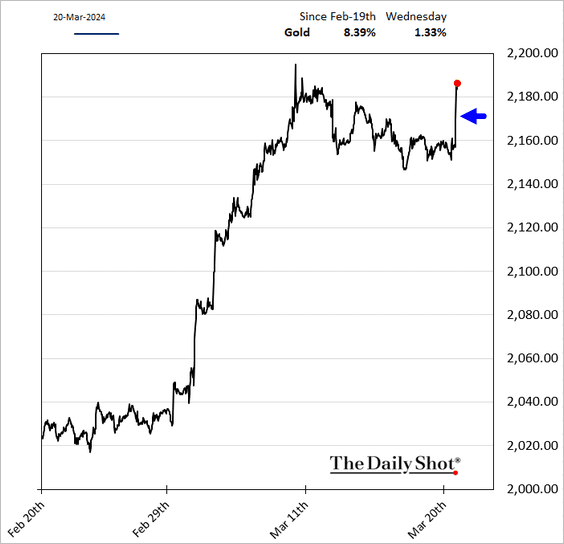

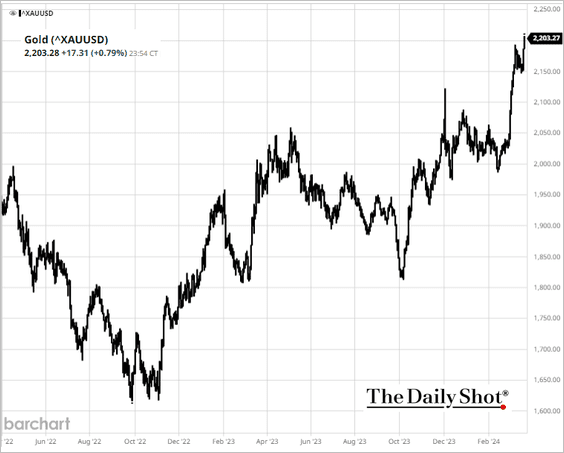

1. Despite data indicating persistent inflation, the FOMC maintained its projection for three rate cuts this year. The markets interpreted the decision as dovish, sending the S&P 500 and gold to record highs.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: CNBC Read full article

Source: CNBC Read full article

• However, the FOMC’s dot plot shifted higher beyond 2024.

Here is the evolution of the projections by year.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

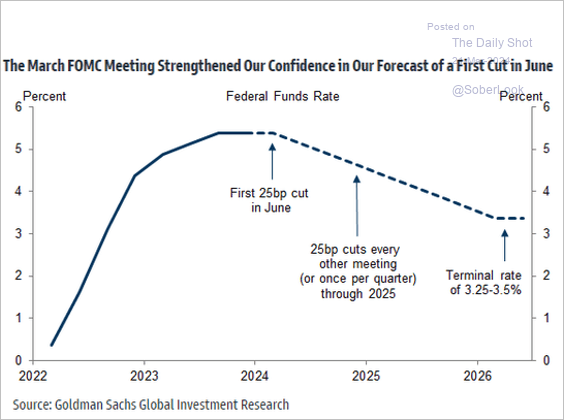

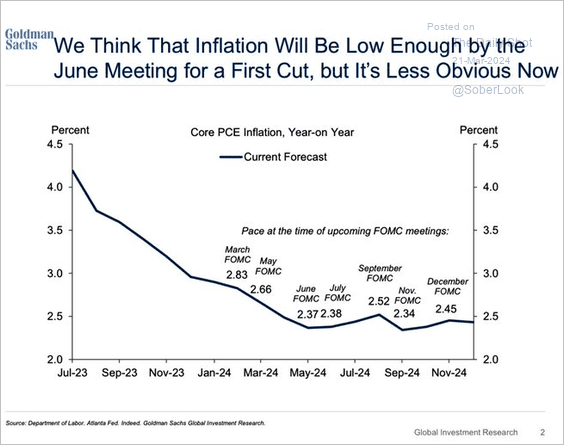

• Goldman expects the first rate cut in June (2 charts).

Source: Goldman Sachs; @MikeZaccardi

Source: Goldman Sachs; @MikeZaccardi

Source: Goldman Sachs; @WallStJesus

Source: Goldman Sachs; @WallStJesus

• The FOMC raised its GDP projections and adjusted its forecast for this year’s core inflation upward.

——————–

2. Let’s take a look at market reactions.

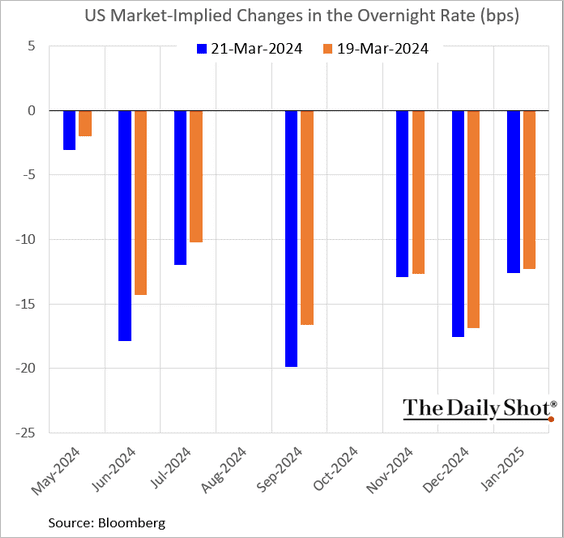

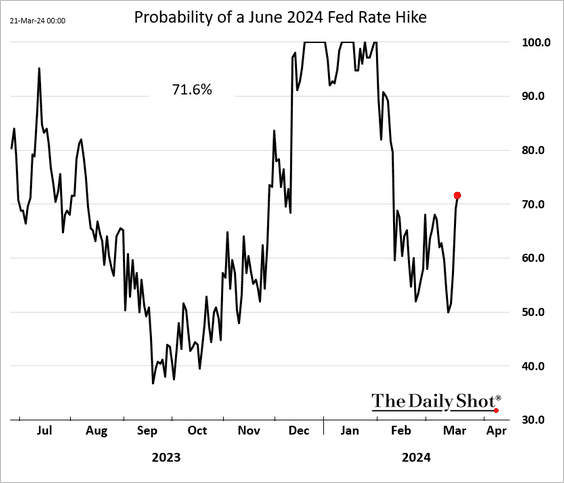

• Markets are now viewing a rate cut in June as more likely (2 charts).

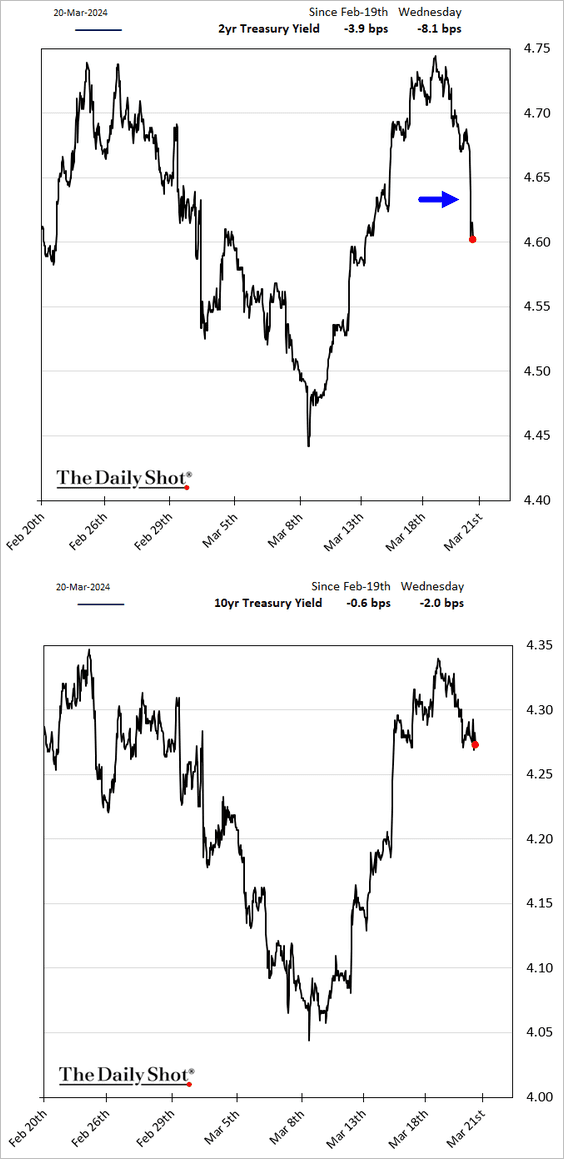

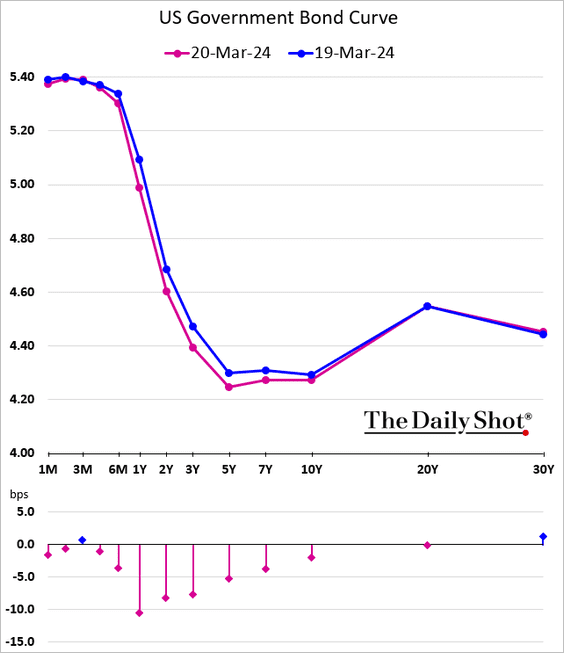

• Short-term Treasuries rallied, while the FOMC’s decision had less impact on longer-dated bonds.

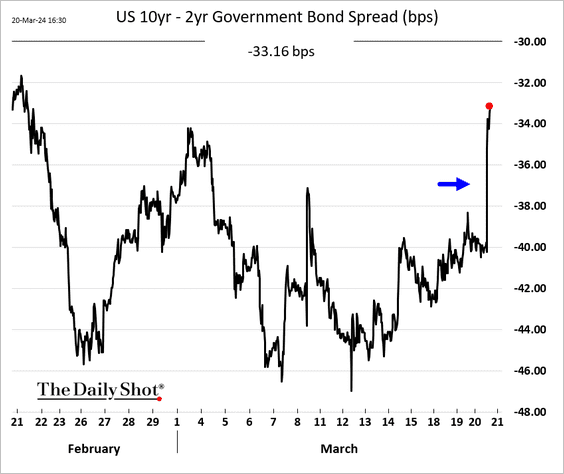

– The yield curve steepened (2 charts).

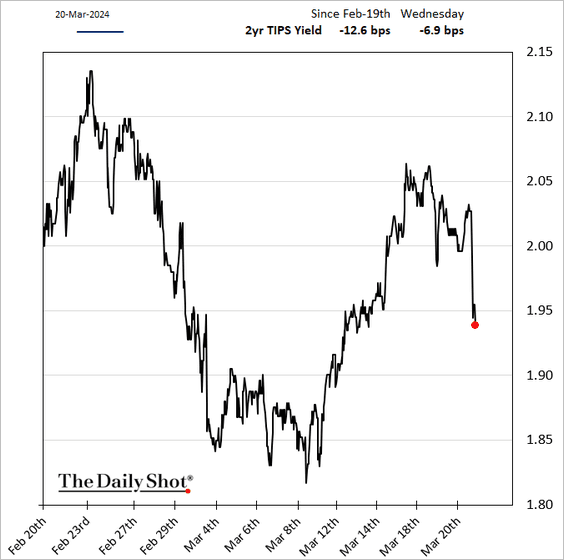

– Short-term real yields also declined.

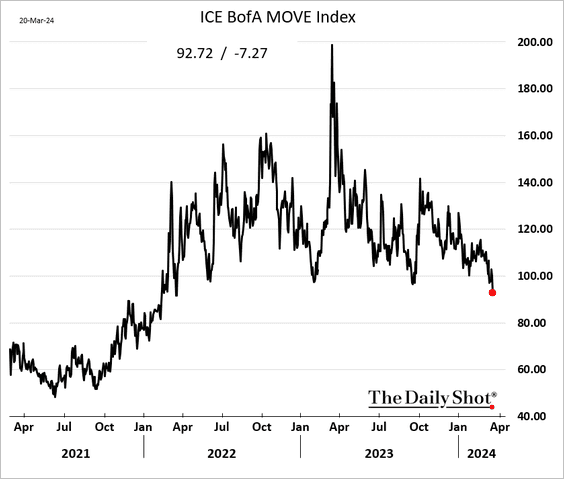

– Treasury market implied volatility dipped to the lowest level in two years.

• Stocks surged.

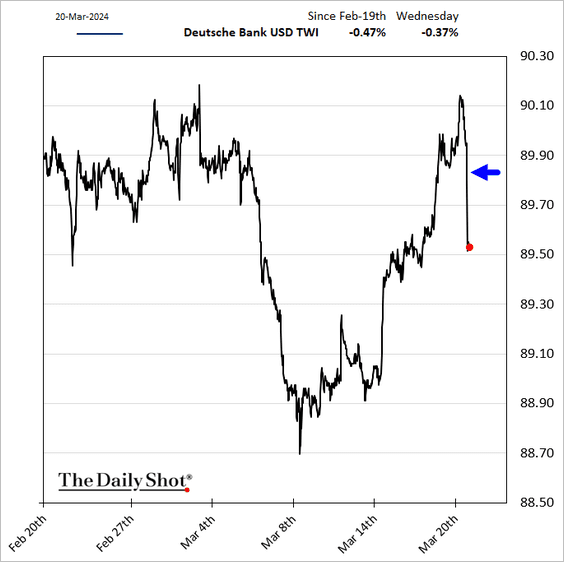

• The US dollar slipped.

• Gold climbed.

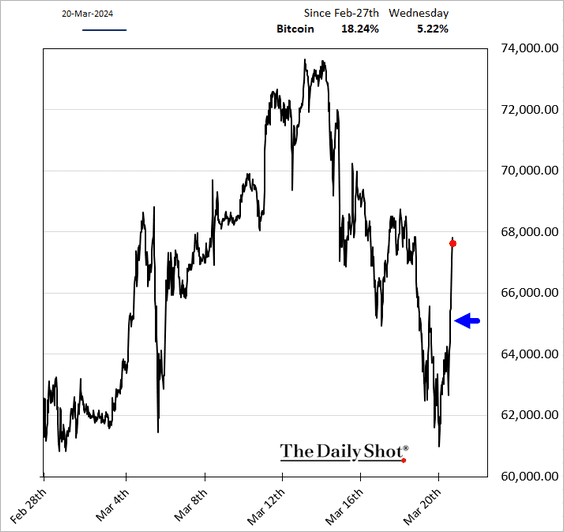

• Cryptos rebounded.

——————–

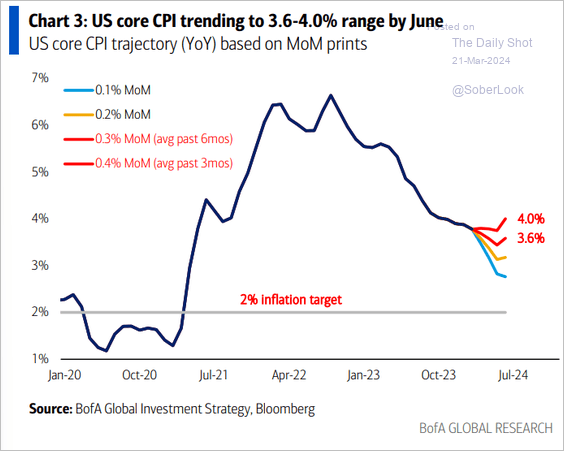

3. Is there a risk that core inflation could remain persistently above 2%?

Source: BofA Global Research

Source: BofA Global Research

——————–

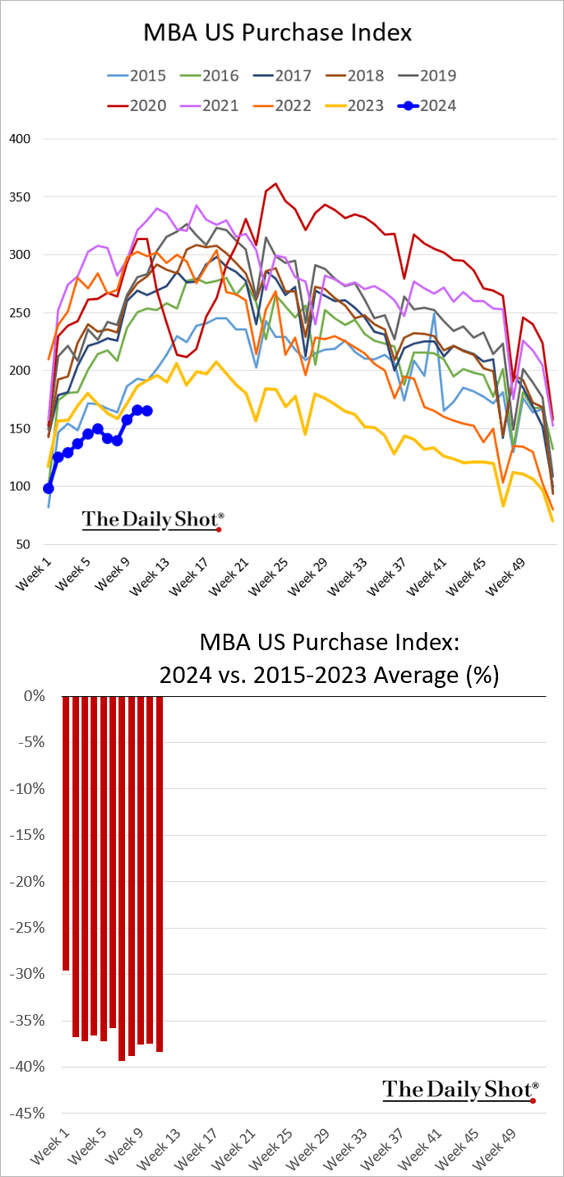

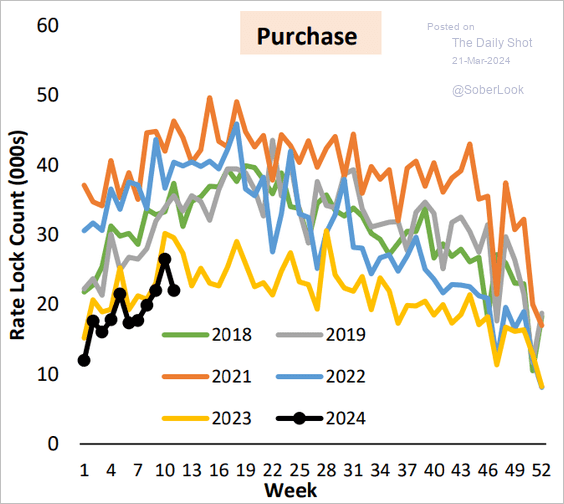

4. Mortgage applications are holding below last year’s levels.

Here is the rate lock count.

Source: AEI Housing Center

Source: AEI Housing Center

Back to Index

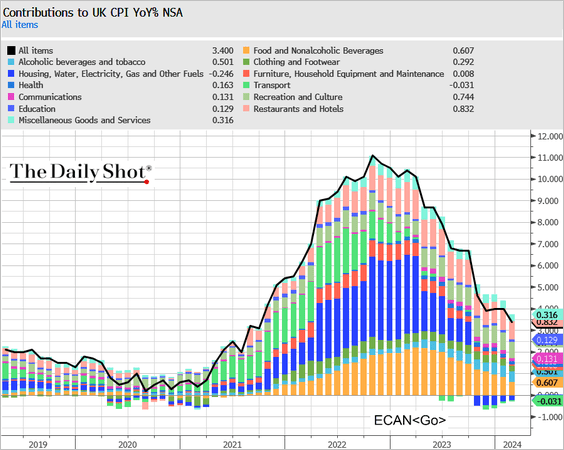

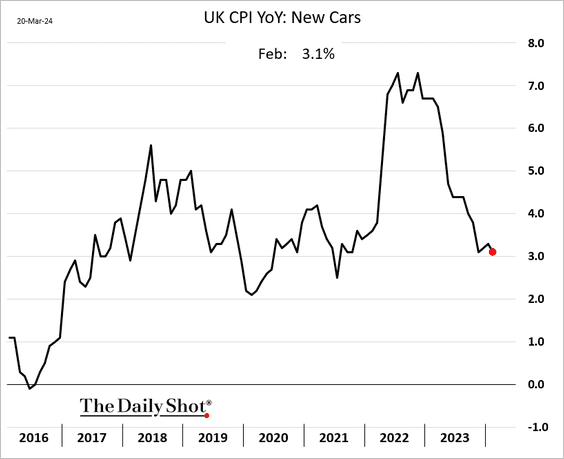

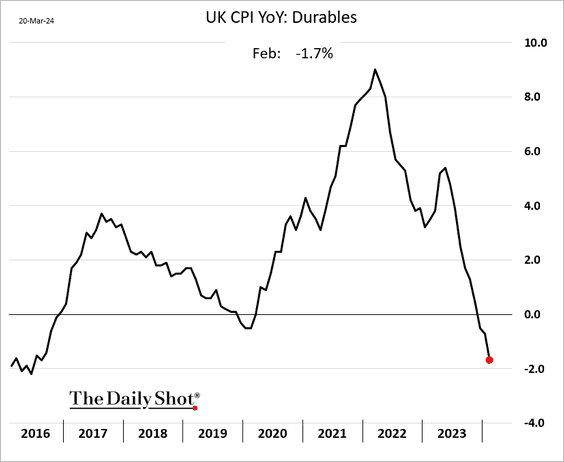

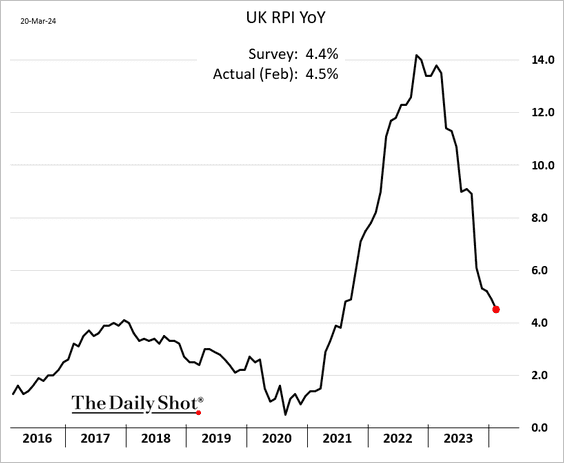

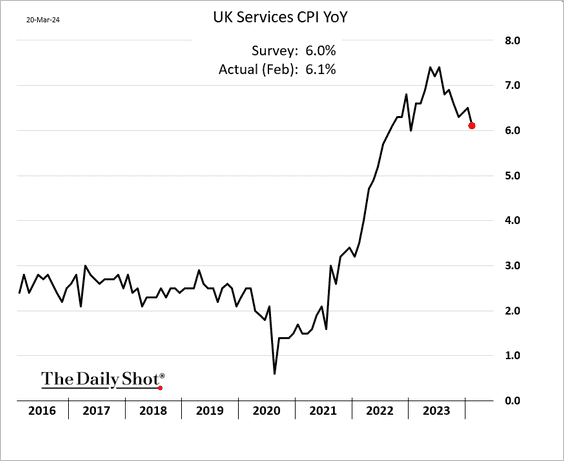

The United Kingdom

1. As we saw yesterday (chart), UK CPI data came in below expectations, indicating a moderation in inflation.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: CNBC Read full article

Source: CNBC Read full article

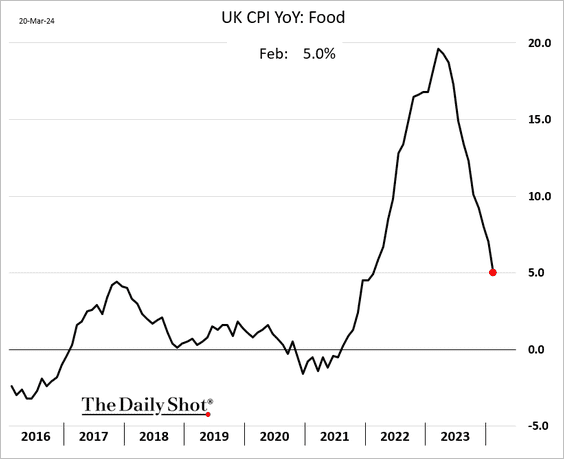

• Goods inflation is slowing rapidly.

– Food:

– Cars:

– Durables:

– Shop prices:

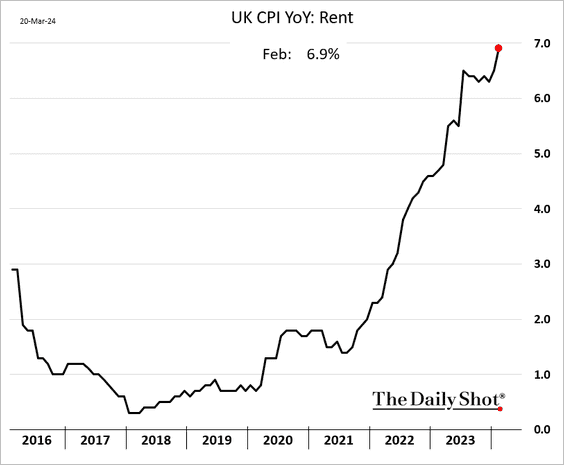

• However, services inflation remains sticky, …

… driven by accelerating gains in rental costs.

——————–

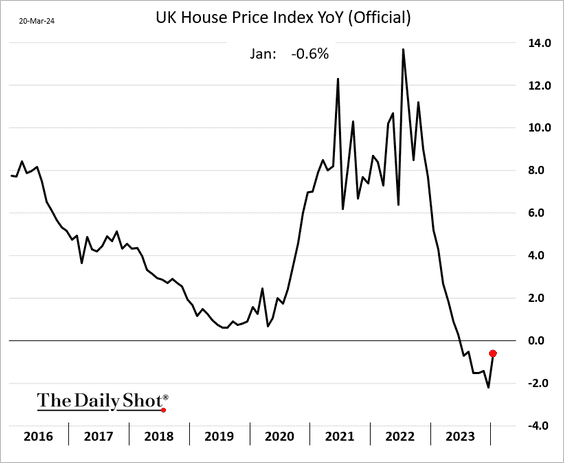

2. The official index of house price appreciation showed improvement in January.

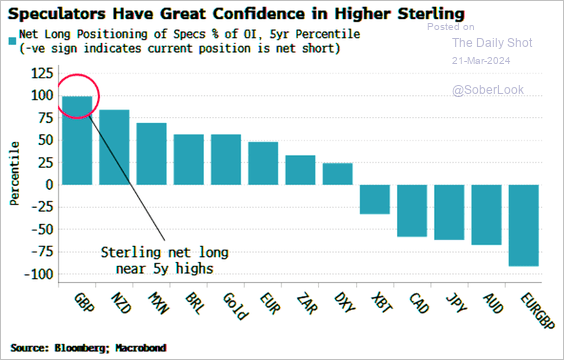

3. As we mentioned previously (chart), speculators have been very bullish on the pound, …

Source: Simon White, Bloomberg Markets Live Blog

Source: Simon White, Bloomberg Markets Live Blog

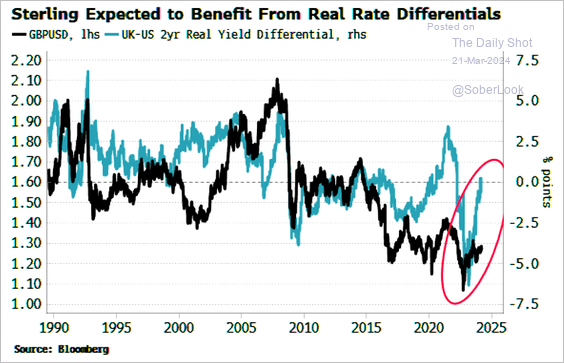

… amid rising UK-US rate differentials.

Source: Simon White, Bloomberg Markets Live Blog

Source: Simon White, Bloomberg Markets Live Blog

Back to Index

Europe

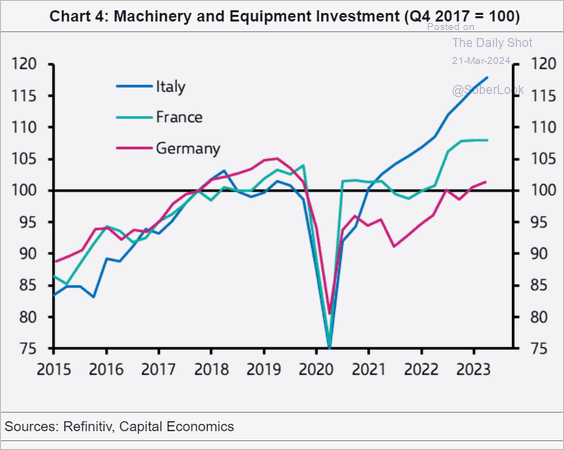

1. Germany’s CapEx has been lagging.

Source: Capital Economics

Source: Capital Economics

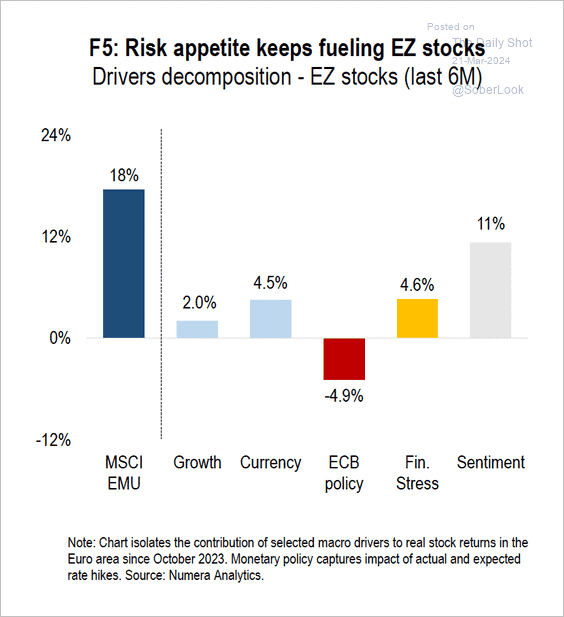

2. Eurozone stocks have been supported by higher risk appetite.

Source: Numera Analytics

Source: Numera Analytics

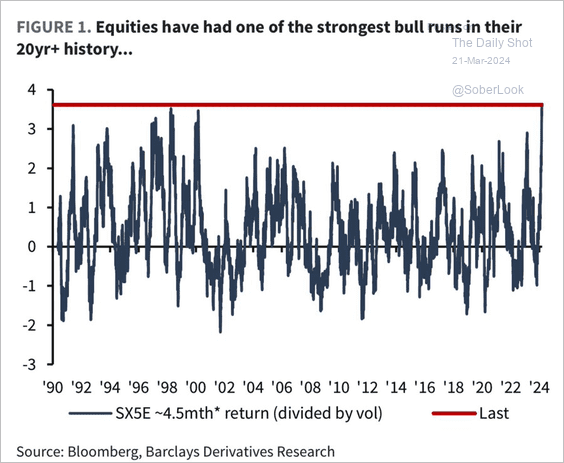

• The recent large-cap rally has been impressive.

Source: Barclays Research; @WallStJesus

Source: Barclays Research; @WallStJesus

——————–

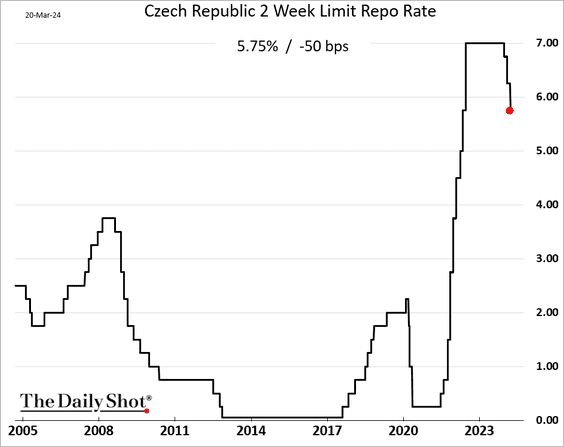

3. The Czech central bank delivered another 50 bps rate cut.

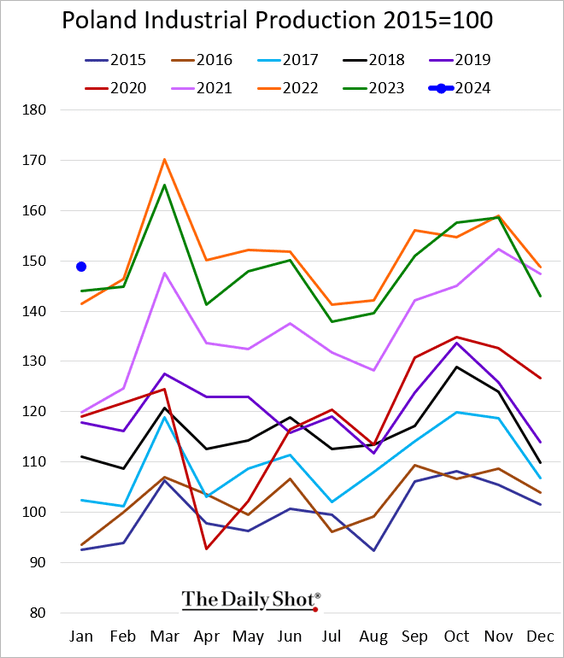

4. Poland’s industrial sales were off to a strong start at the beginning of the year.

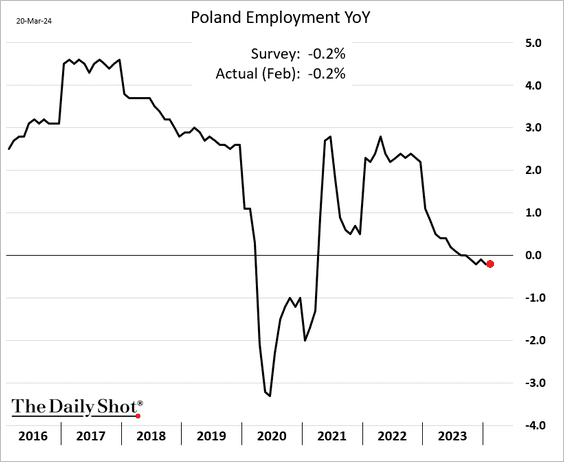

• Employment remains below last year’s levels.

——————–

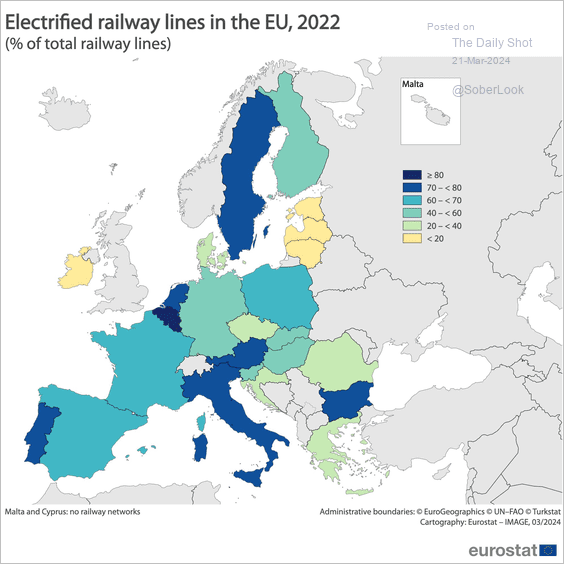

5. Here is a look at the concentration of electrified railway lines in the EU.

Source: Eurostat Read full article

Source: Eurostat Read full article

Back to Index

Japan

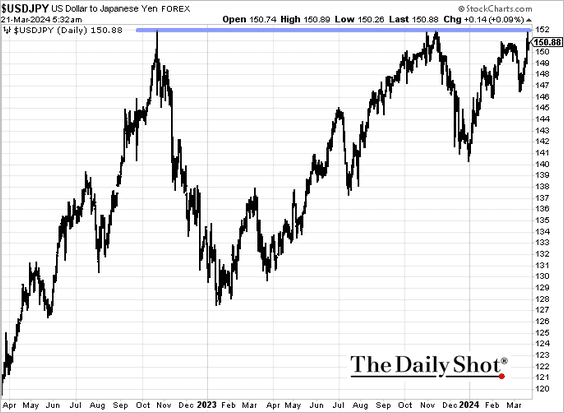

1. Dollar-yen is holding resistance at 152.

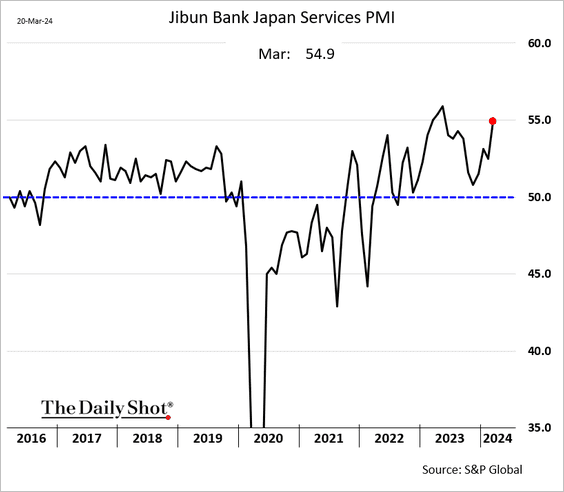

2. Japan’s services activity accelerated this month.

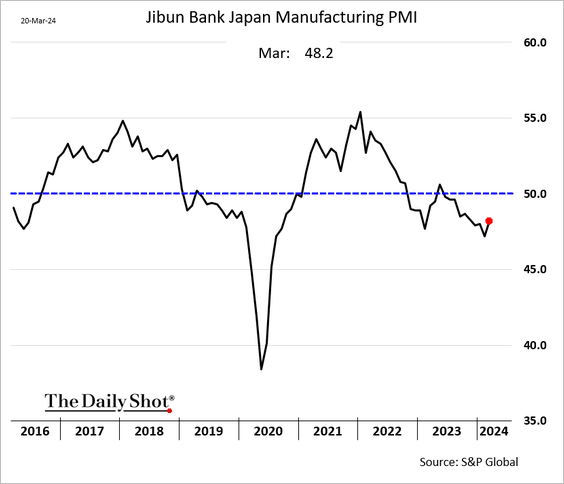

The manufacturing slump eased somewhat.

——————–

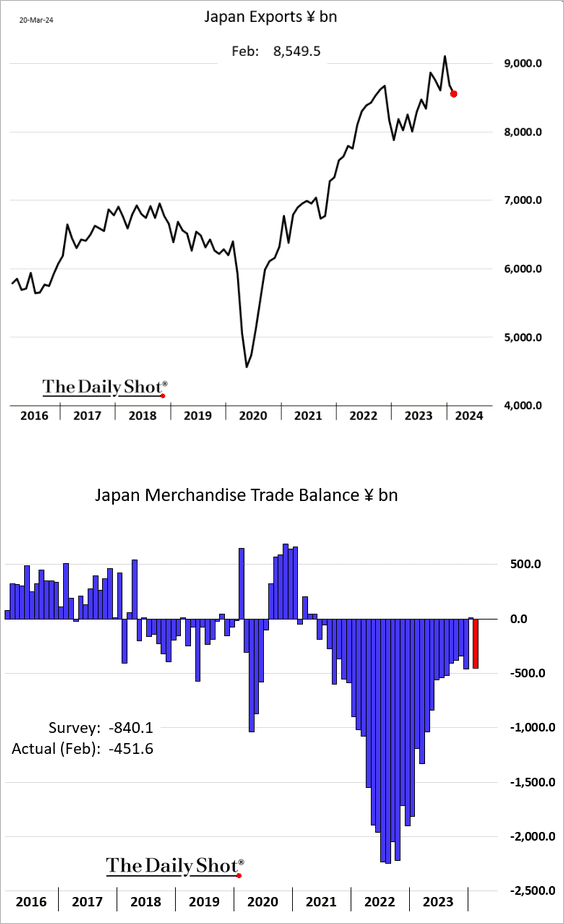

3. Exports slowed in February, but the trade gap was narrower than expected.

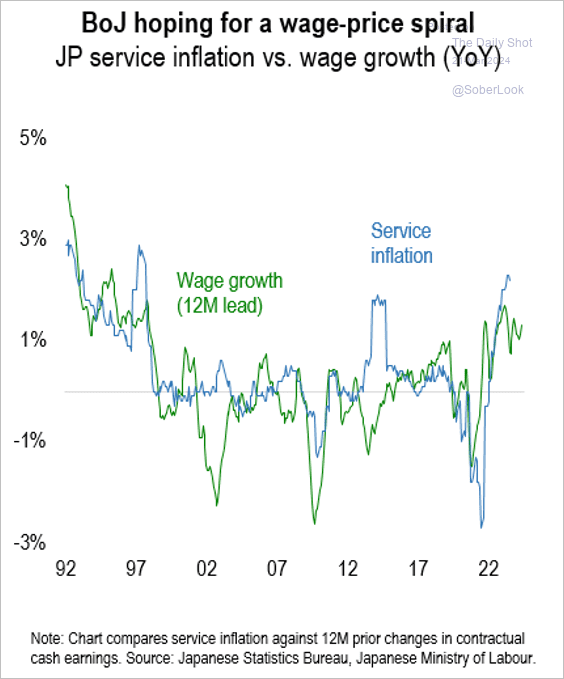

4. Service inflation remains elevated alongside wage increases, which could support further rate hikes.

Source: Numera Analytics

Source: Numera Analytics

Back to Index

Asia-Pacific

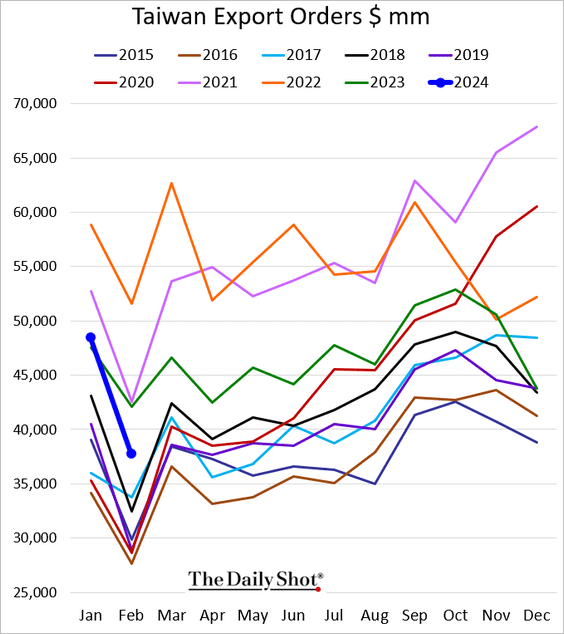

1. Taiwan’s export orders were soft in February.

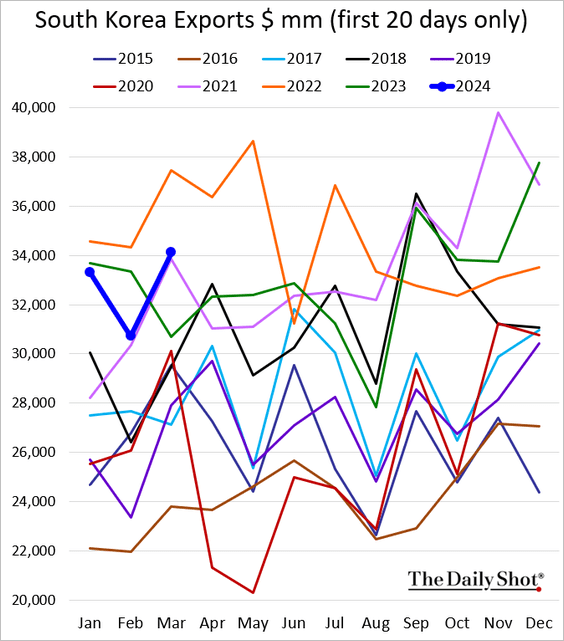

2. South Korea’s exports climbed well above last year’s levels this month.

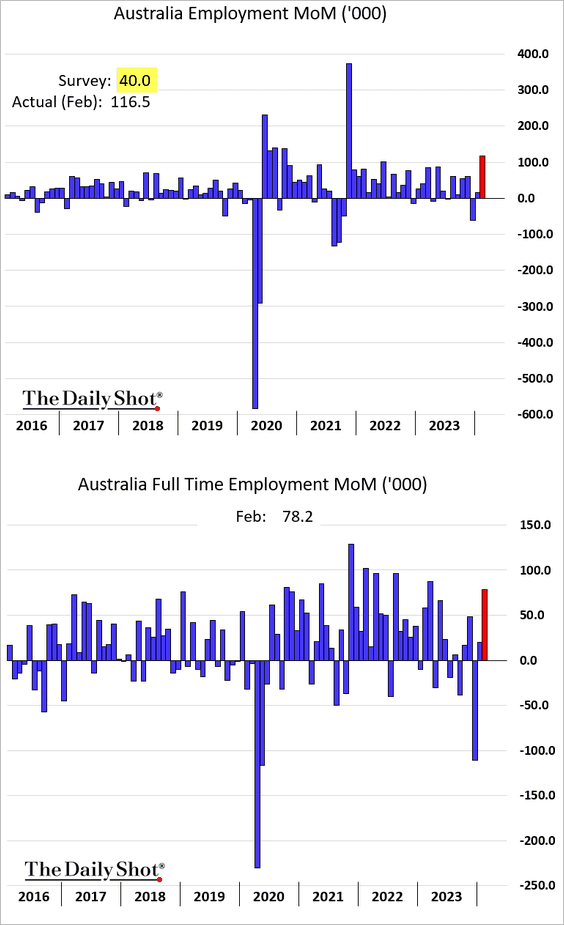

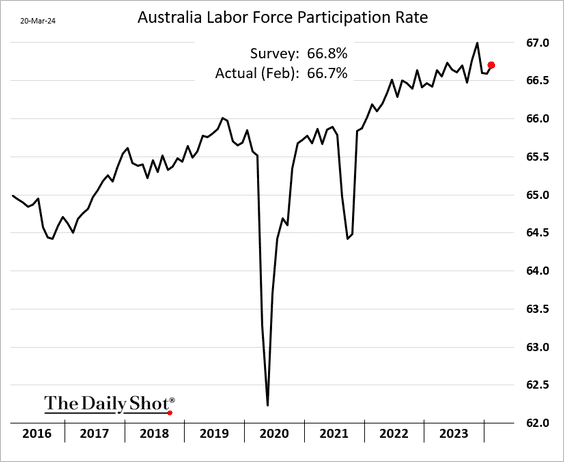

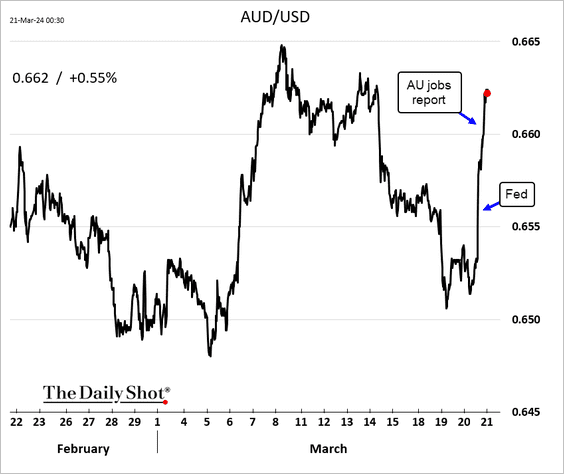

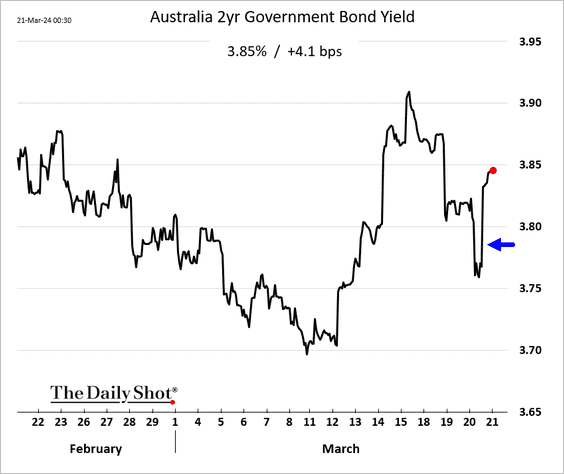

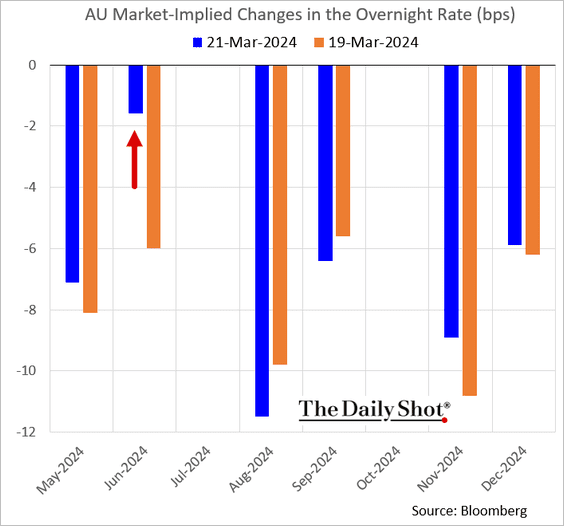

3. Australia’s February employment report was much stronger than expected.

Source: @WSJ Read full article

Source: @WSJ Read full article

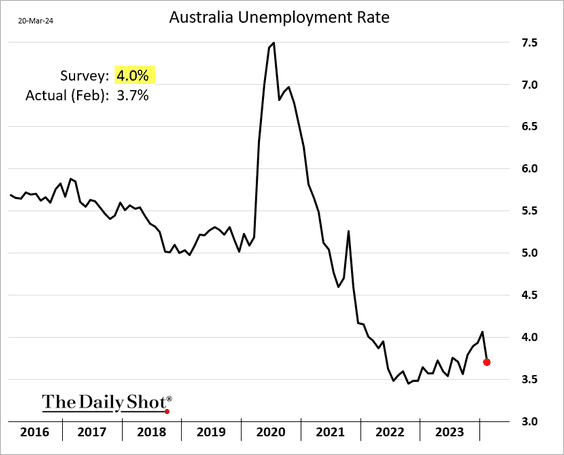

– The unemployment rate dropped to 3.7%.

– Labor force participation edged higher.

• The Aussie dollar and bond yields jumped.

– A June rate cut now looks very unlikely.

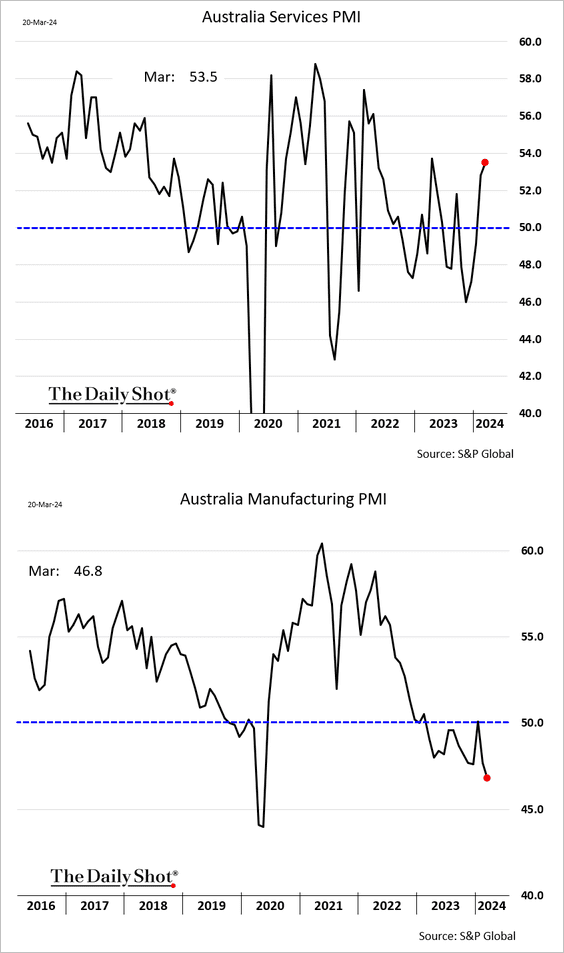

• Separately, Australia’s services and manufacturing growth trends diverged further this month.

——————–

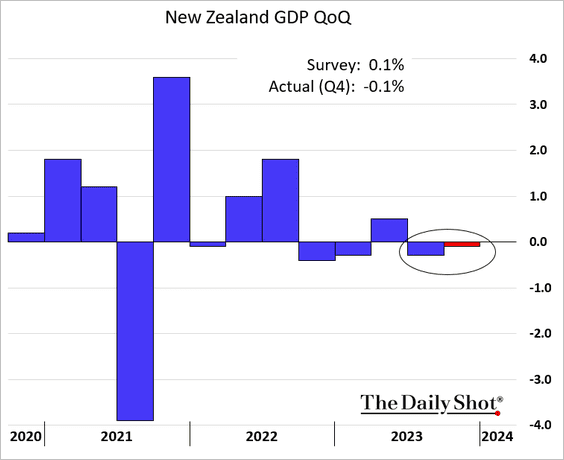

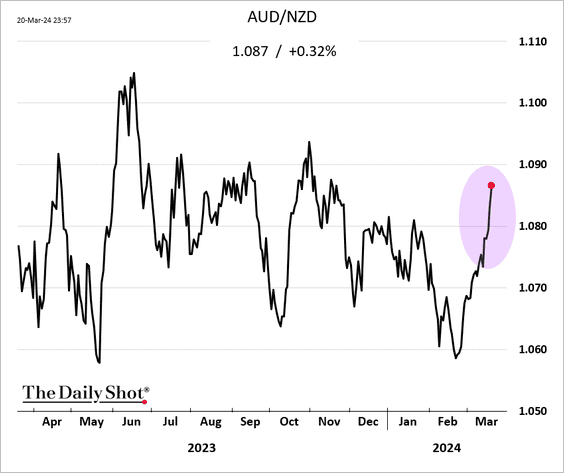

4. New Zealand unexpectedly reported another technical recession.

Source: @WSJ Read full article

Source: @WSJ Read full article

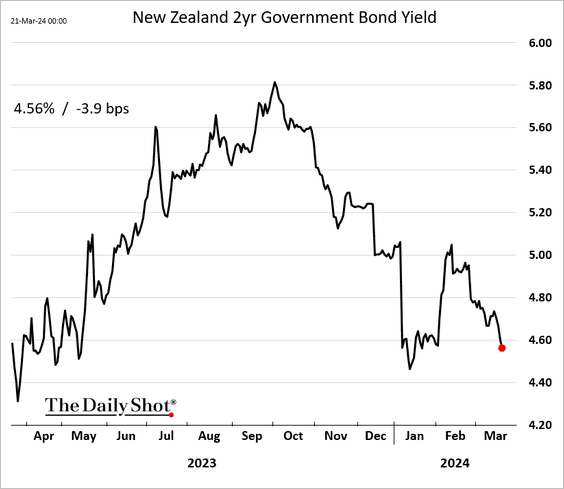

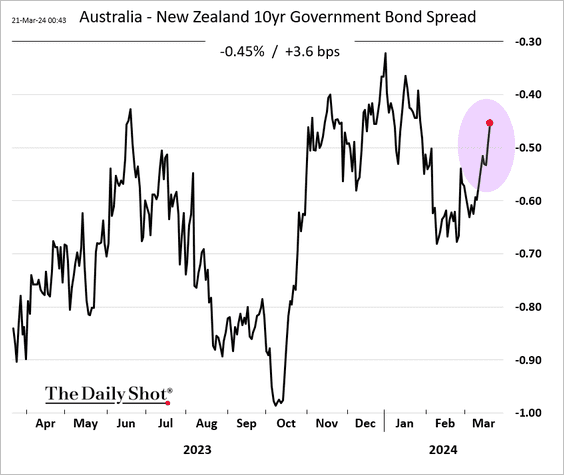

Bond yields declined, …

… diverging from Australia’s rates.

Here is AUD/NZD.

Back to Index

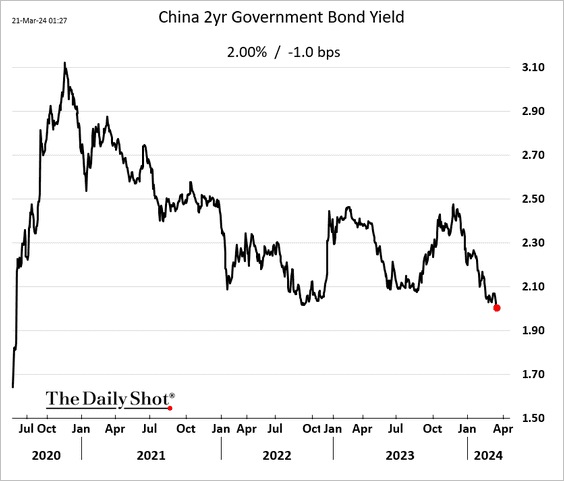

China

1. The market expects further monetary easing ahead.

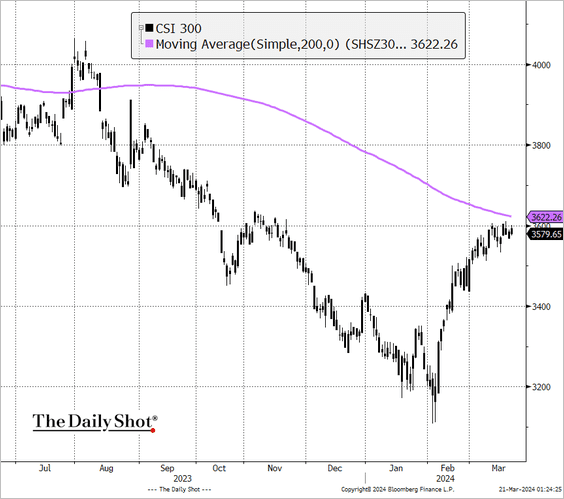

2. The equity rally has paused.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

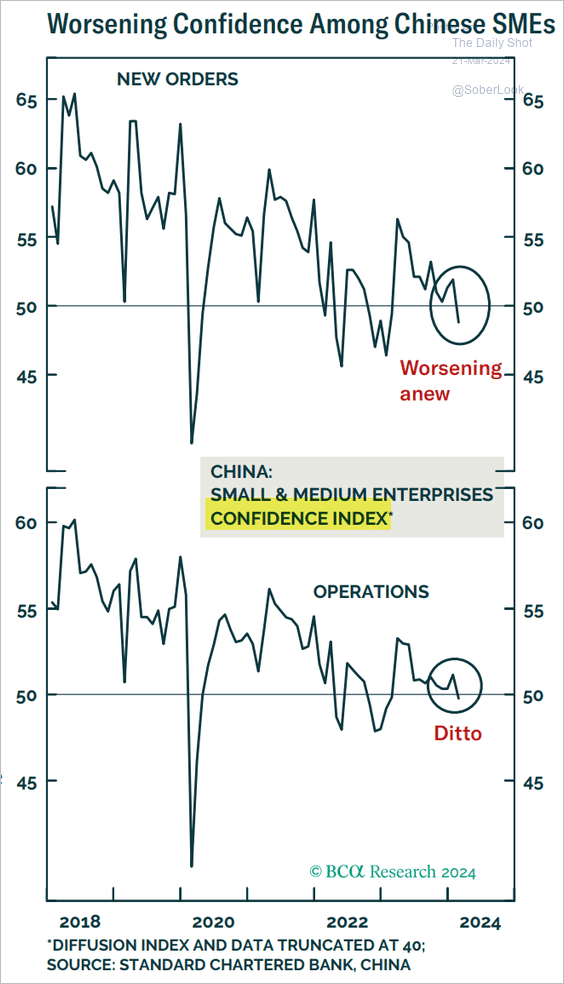

3. Small- and medium-size companies’ sentiment has deteriorated.

Source: BCA Research

Source: BCA Research

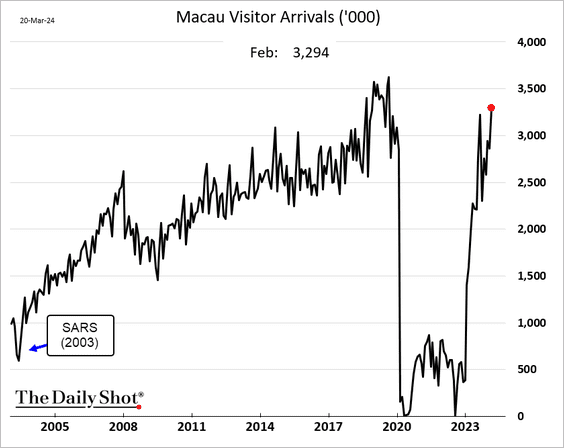

4. Gamblers return to Macau.

Back to Index

Emerging Markets

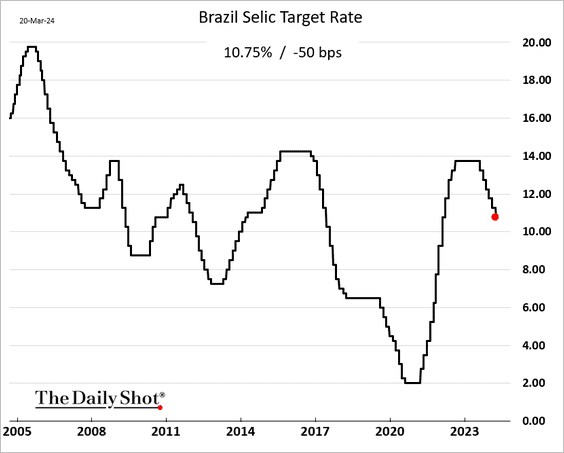

1. Brazil’s central bank cut rates again.

Source: @economics Read full article

Source: @economics Read full article

——————–

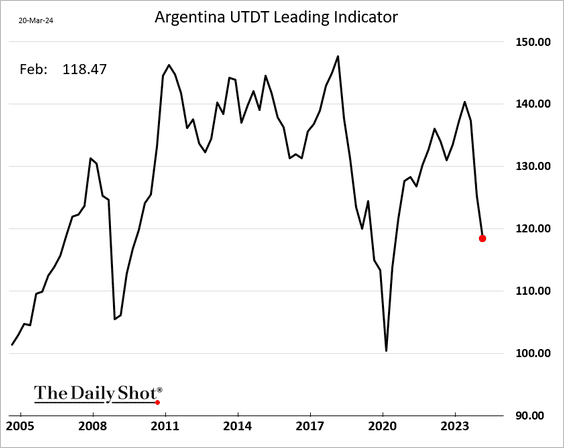

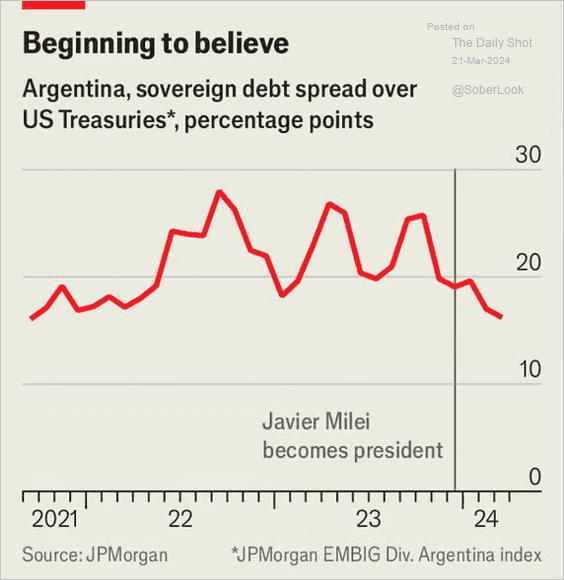

2. Argentina’s leading indicator has declined sharply this year.

But bond spreads are tightening.

Source: The Economist Read full article

Source: The Economist Read full article

——————–

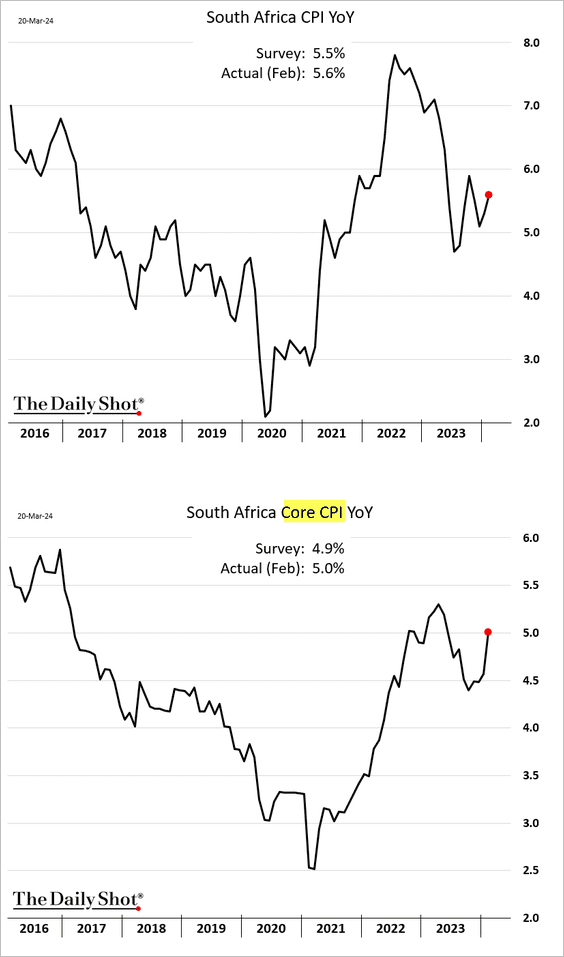

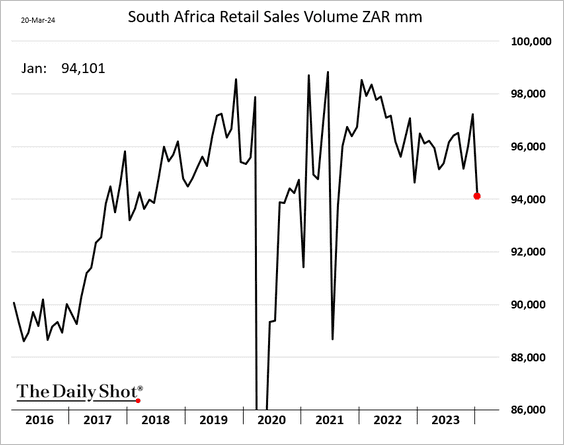

3. South Africa’s inflation accelerated last month.

Source: @economics Read full article

Source: @economics Read full article

• Retail sales dropped sharply in January.

Back to Index

Cryptocurrency

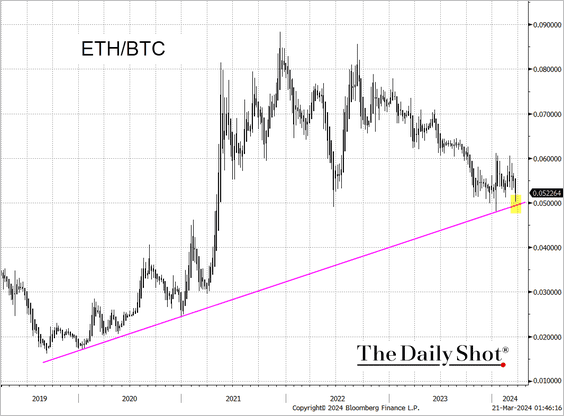

1. The ether-bitcoin cross is holding its uptrend support.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

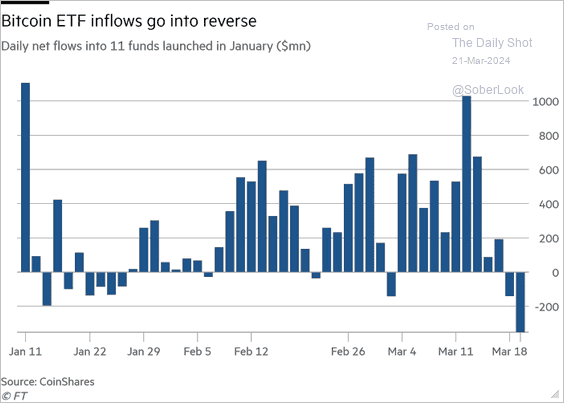

2. Bitcoin funds are seeing some outflows.

Source: @financialtimes Read full article

Source: @financialtimes Read full article

Back to Index

Commodities

1. Gold hit a record high.

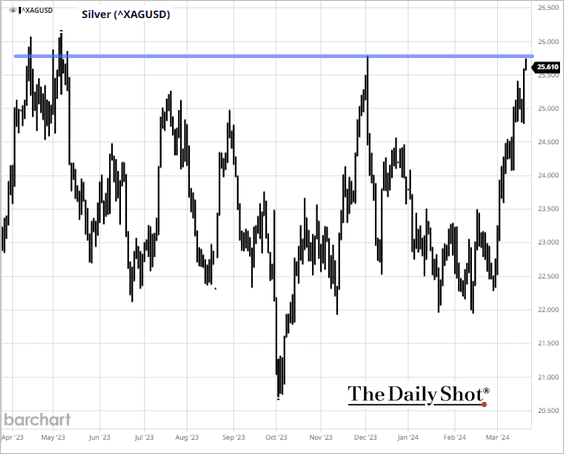

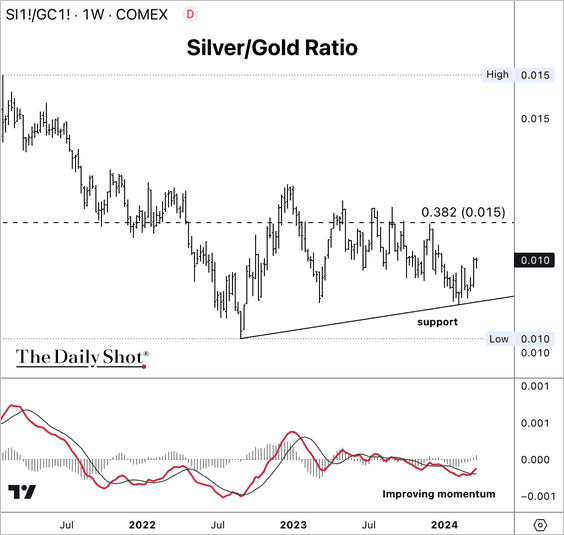

• Will silver breach the January peak?

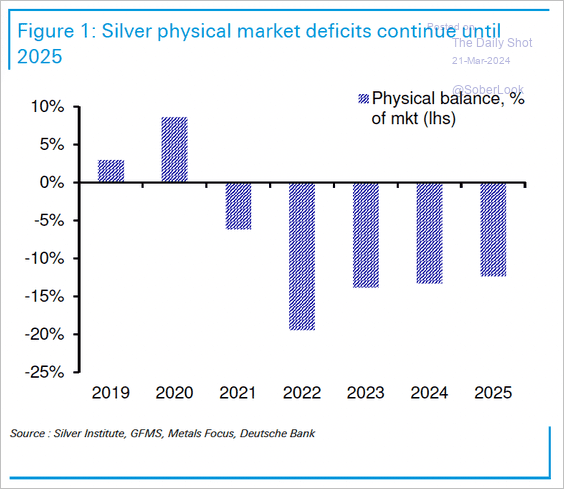

• Deutsche Bank forecasts silver market deficits to continue through 2025.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

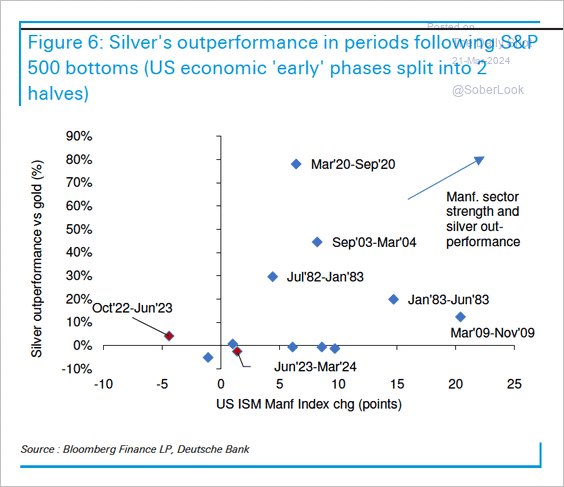

• Silver typically outperforms gold during periods of US manufacturing expansions, which also coincides with equity market strength.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

• The silver/gold ratio is improving.

——————–

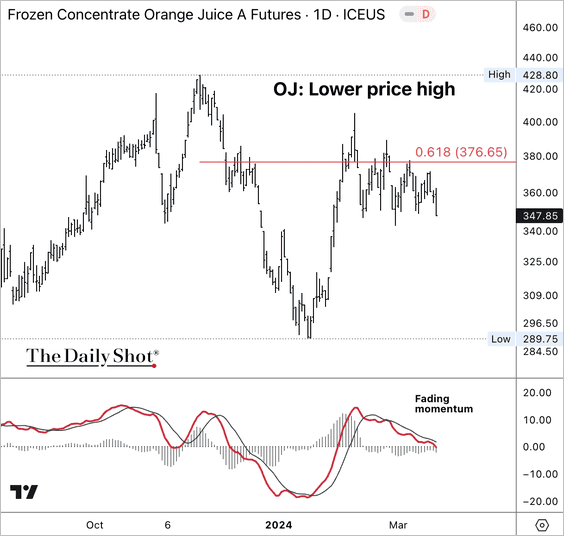

2. The rally in orange juice futures is fading below strong resistance.

Back to Index

Energy

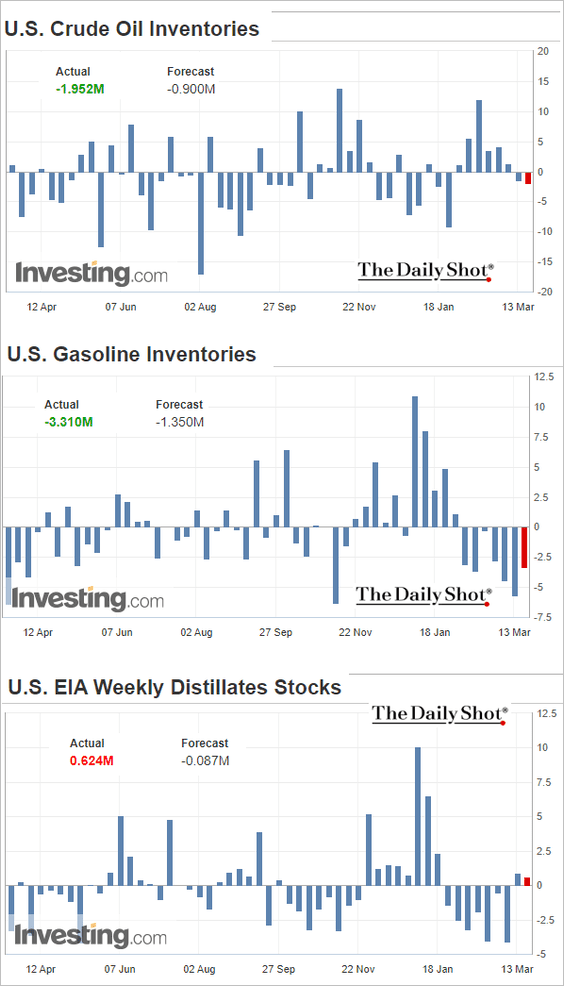

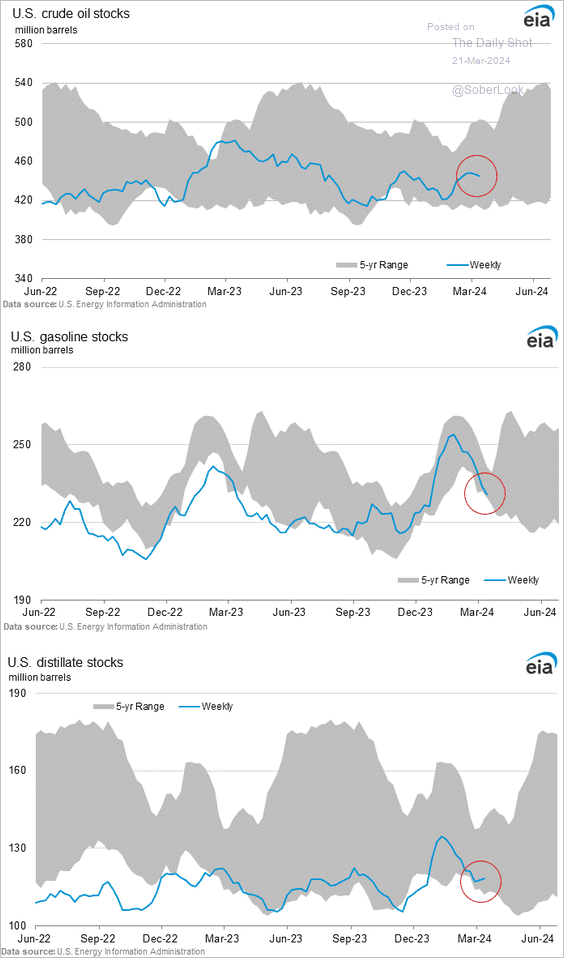

1. US crude oil and gasoline inventories declined more than expected last week. Distilate stockpiles climbed.

– Weekly changes:

– Barrels:

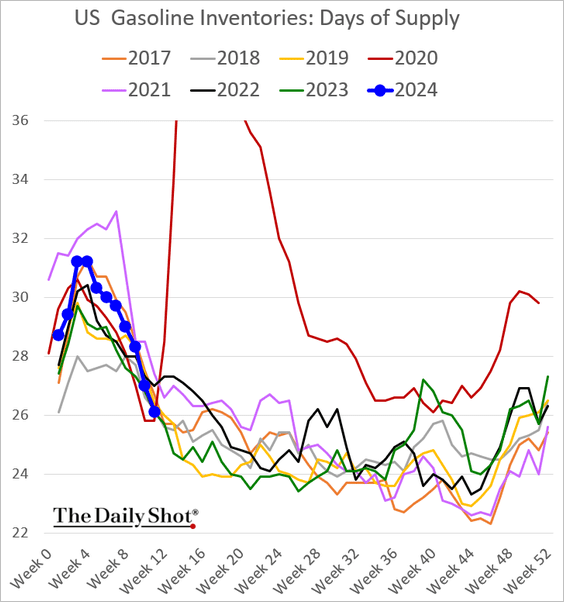

– Gasoline days of supply:

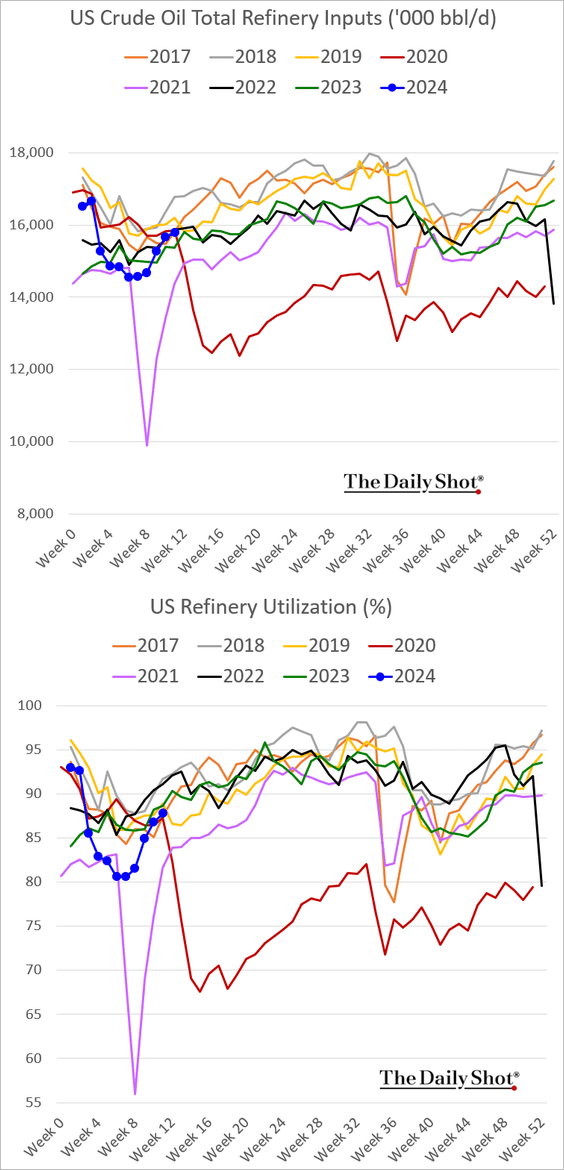

2. Refinery inputs are running above last year’s levels.

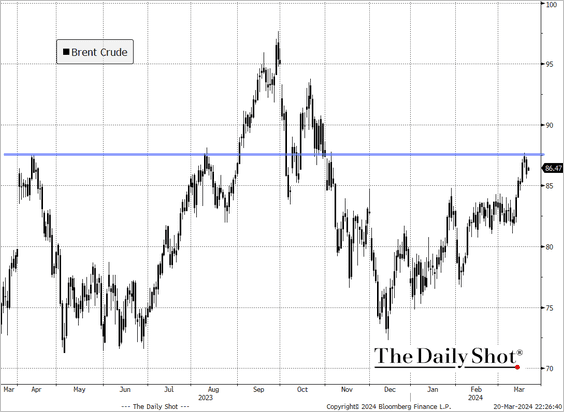

3. Brent crude held resistance near $87.50/bbl.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

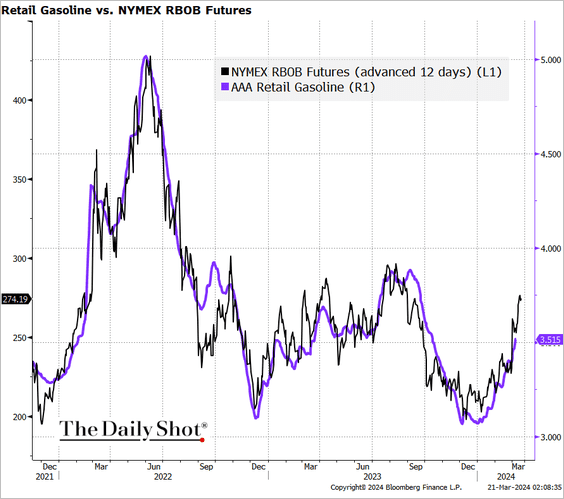

4. US prices at the pump keep moving higher.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

Back to Index

Equities

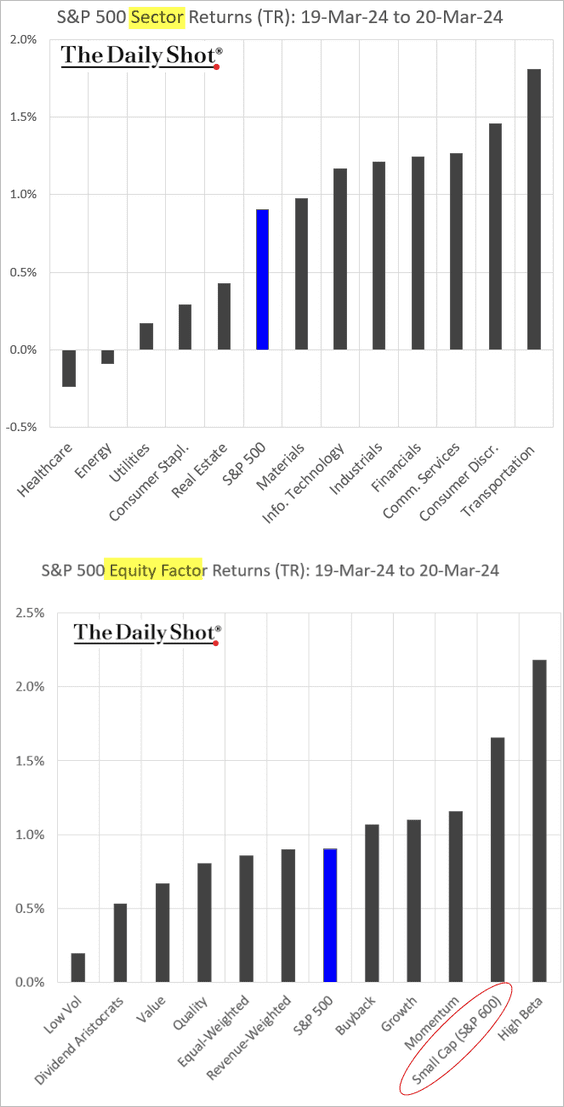

1. How did various sectors and equity factors react to the FOMC maintaining its forecast for three rate cuts? Highly correlated to Treasury prices, small caps had a good day.

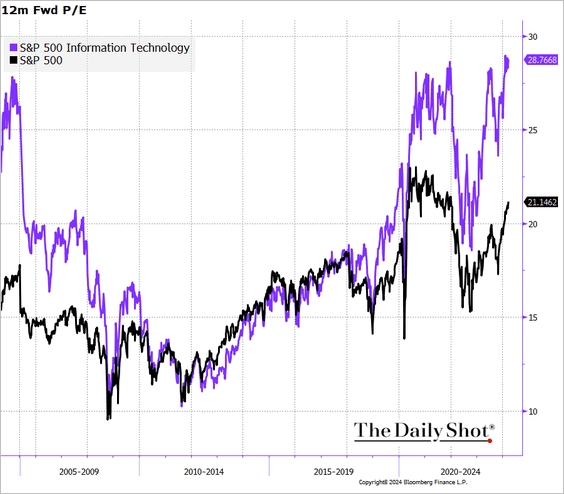

2. The S&P 500 12-month forward P/E is now above 21x. The S&P 500 tech sector is nearing 29x.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

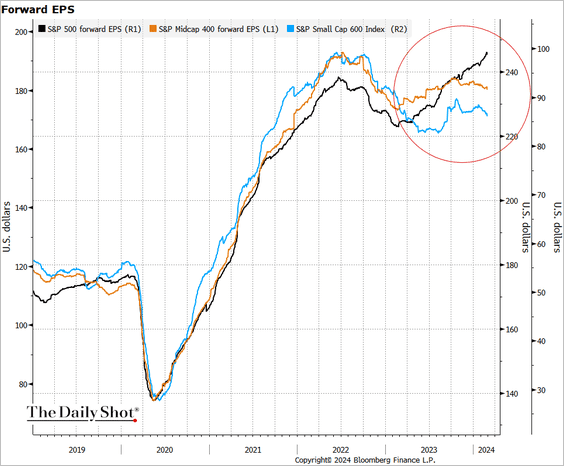

3. The trajectory of earnings expectations for the S&P 500 has diverged from that of mid- and small-caps.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

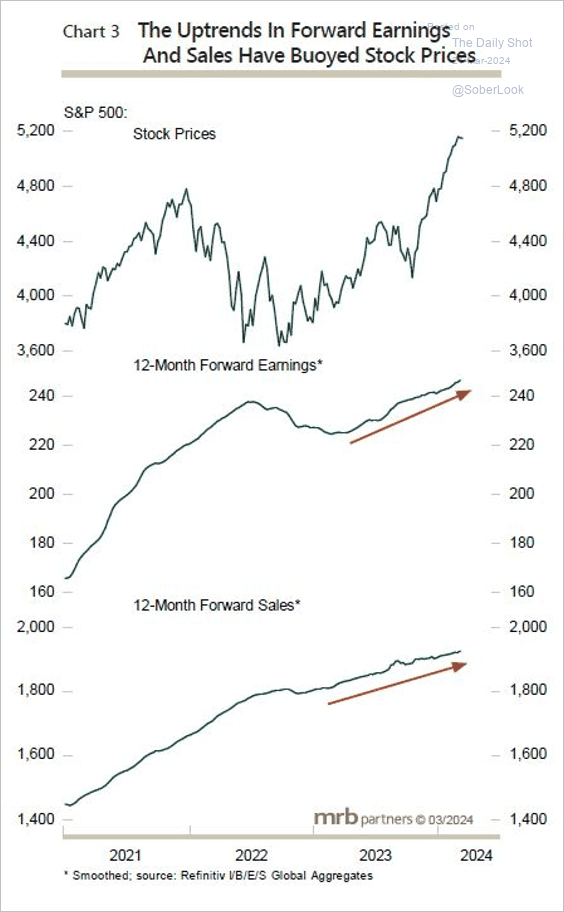

4. The S&P 500 has been supported by uptrends in forward earnings and sales.

Source: MRB Partners

Source: MRB Partners

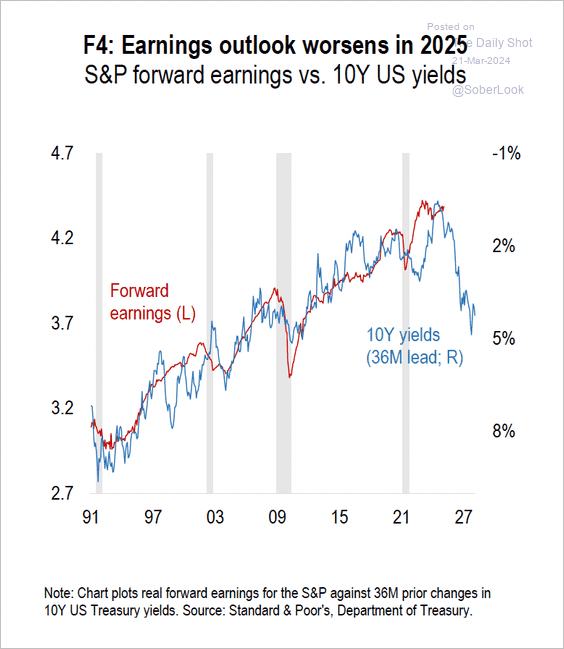

However, earnings remain vulnerable to higher yields.

Source: Numera Analytics

Source: Numera Analytics

——————–

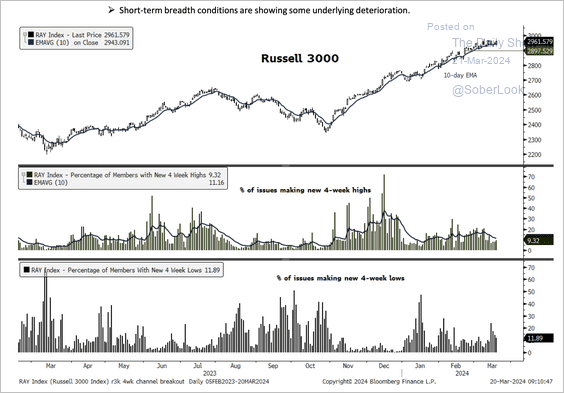

5. The Russell 3,000 Index’s (broad market index) short-term breadth is starting to deteriorate.

Source: Aazan Habib, Paradigm Capital

Source: Aazan Habib, Paradigm Capital

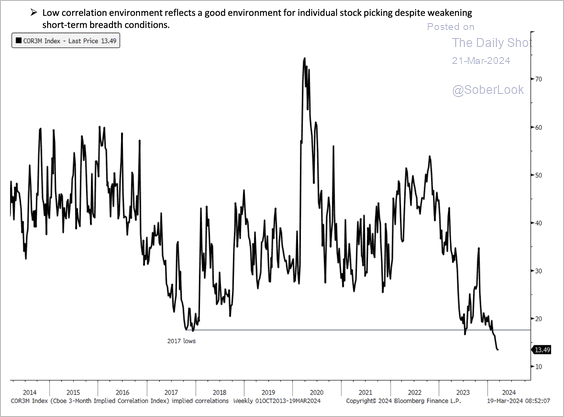

6. The CBOE Implied Correlation Index made a new low, which could benefit stock picking.

Source: Aazan Habib, Paradigm Capital

Source: Aazan Habib, Paradigm Capital

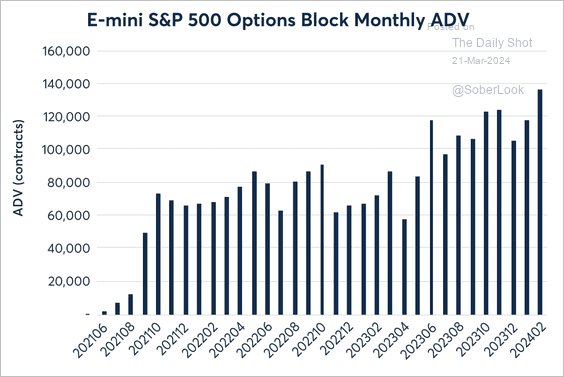

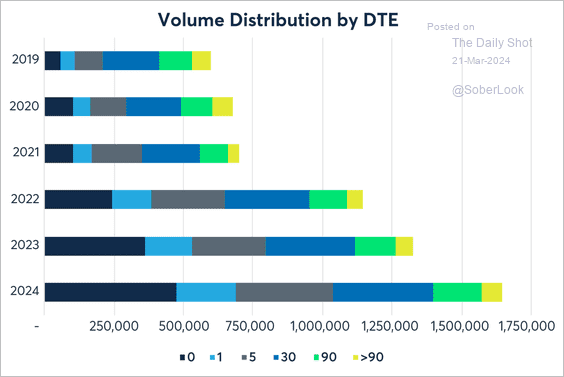

7. Average E-Mini S&P 500 option daily volume (ADV) continues to rise across the maturity spectrum. (2 charts)

Source: CME Group

Source: CME Group

Source: CME Group

Source: CME Group

Back to Index

Credit

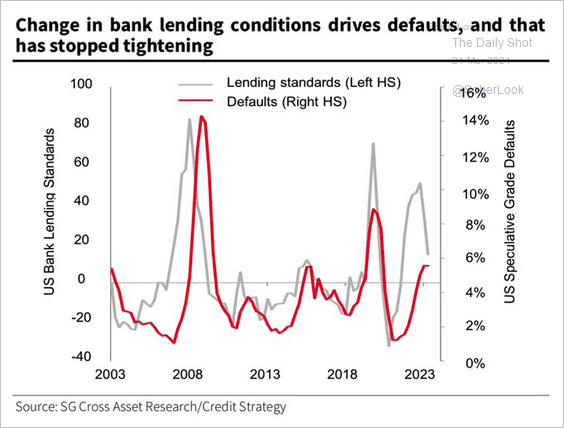

1. Will we see a decline in corporate defaults as fewer banks tighten lending conditions?

Source: SG Cross Asset Research; @WallStJesus

Source: SG Cross Asset Research; @WallStJesus

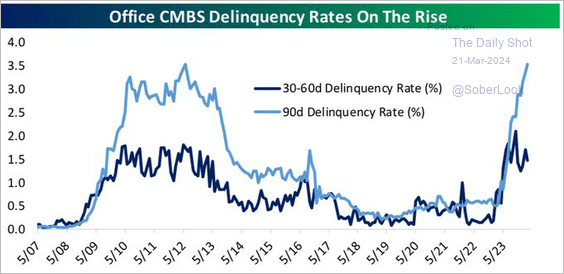

2. CMBS portfolios (commercial real estate debt) are experiencing higher delinquency rates.

Source: @bespokeinvest

Source: @bespokeinvest

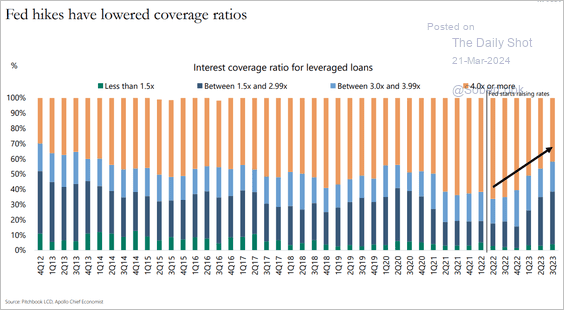

3. More firms are reporting lower coverage ratios.

Source: Torsten Slok, Apollo

Source: Torsten Slok, Apollo

Back to Index

Global Developments

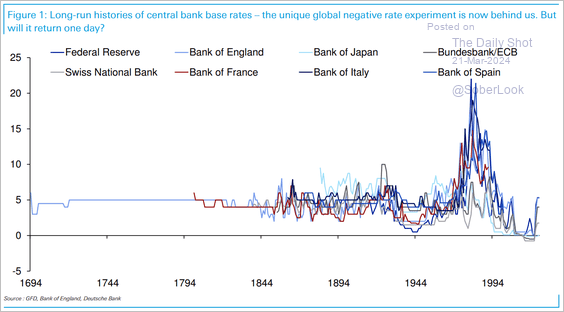

1. Globally, the negative rate regime has ended after the BoJ (the final holdout) hiked rates for the first time in 17 years.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

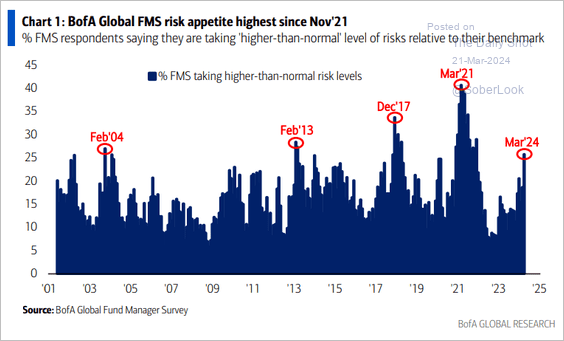

2. Fund managers’ risk appetite is growing.

Source: BofA Global Research

Source: BofA Global Research

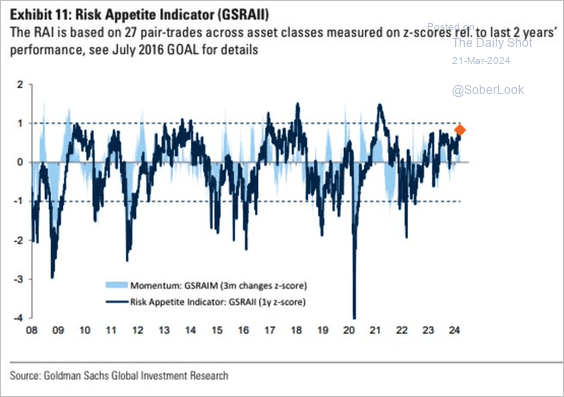

• Here is Goldman’s risk appetite index.

Source: Goldman Sachs

Source: Goldman Sachs

——————–

Food for Thought

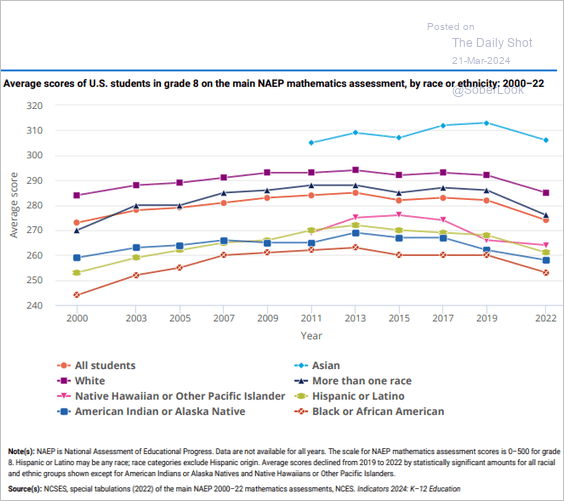

1. Math assessment scores by race and ethnicity for US 8th-grade students:

Source: National Science Foundation

Source: National Science Foundation

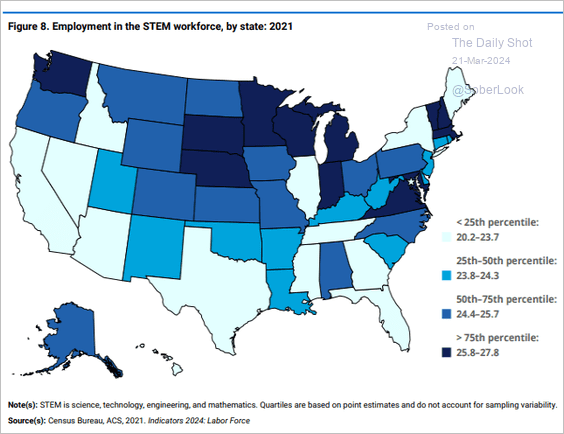

2. STEM employment:

Source: National Science Foundation

Source: National Science Foundation

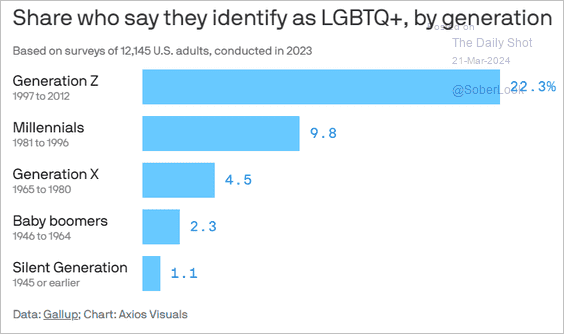

3. LGBTQ+ identification rates by generation in the US:

Source: @axios Read full article

Source: @axios Read full article

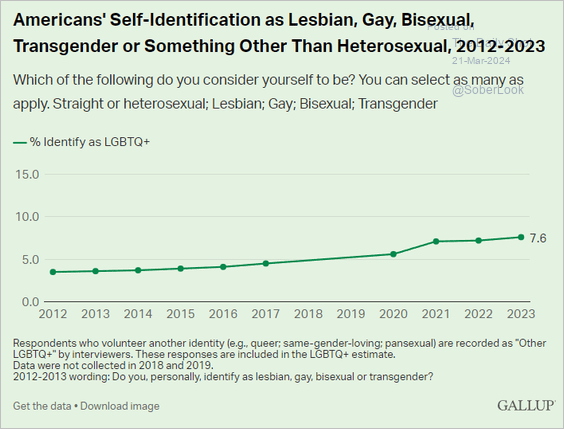

• Trend in LGBTQ+ self-identification:

Source: Gallup Read full article

Source: Gallup Read full article

——————–

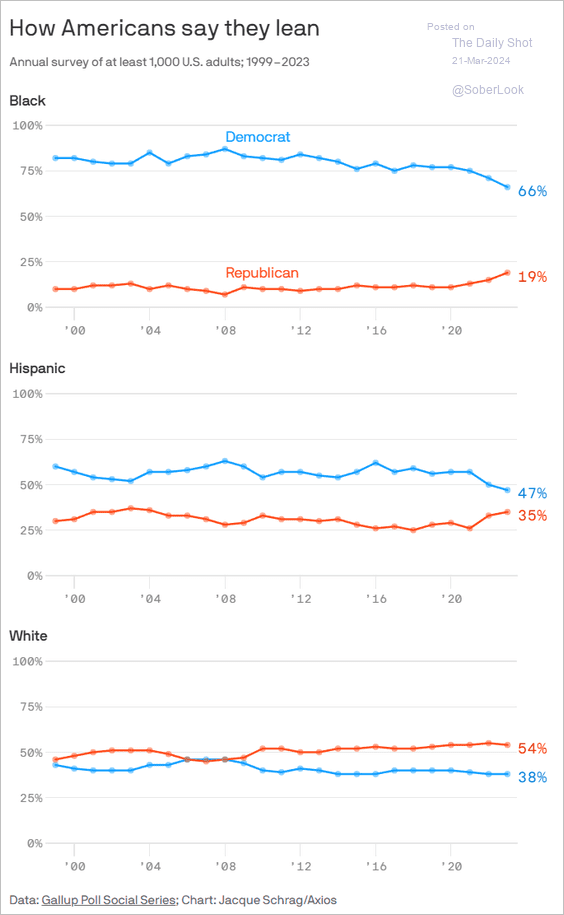

4. Political party affiliation over time:

Source: @axios Read full article

Source: @axios Read full article

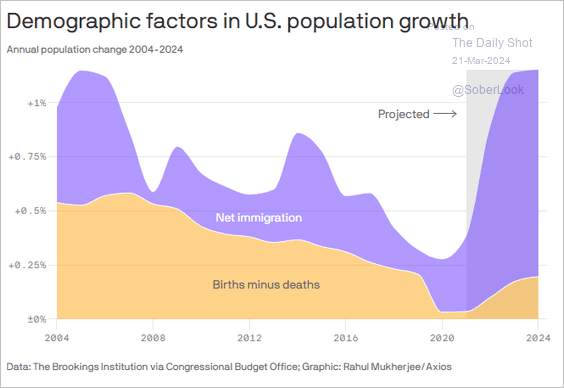

5. Contributors to US population growth:

Source: @axios Read full article

Source: @axios Read full article

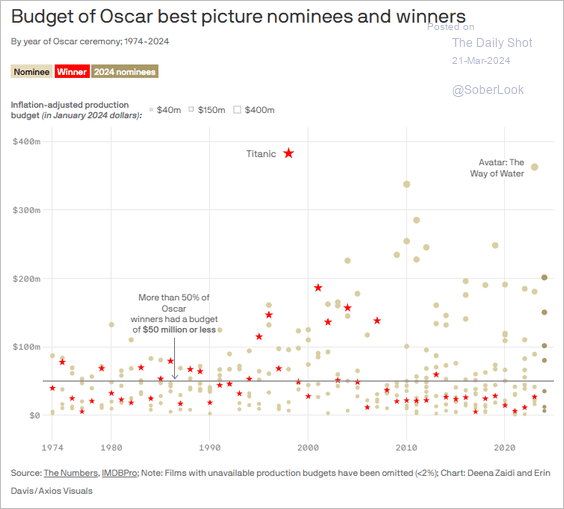

6. Budgets of Oscar-nominated and winning films:

Source: @axios Read full article

Source: @axios Read full article

——————–

Back to Index