The Daily Shot: 03-Apr-24

• The United States

• The United Kingdom

• The Eurozone

• Europe

• Japan

• China

• Emerging Markets

• Cryptocurrency

• Commodities

• Energy

• Equities

• Credit

• Rates

• Global Developments

• Food for Thought

The United States

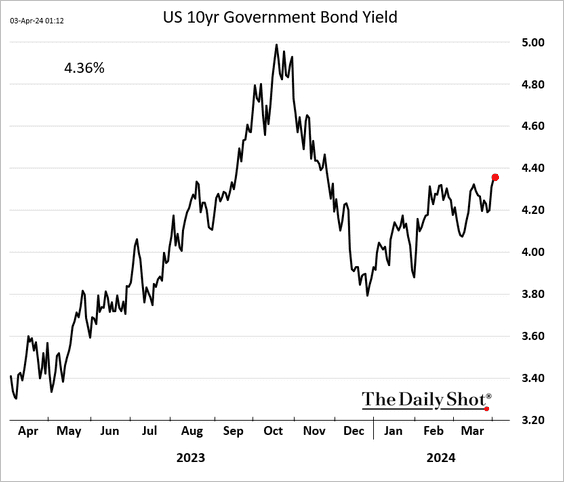

1. Treasury yields have been trending higher.

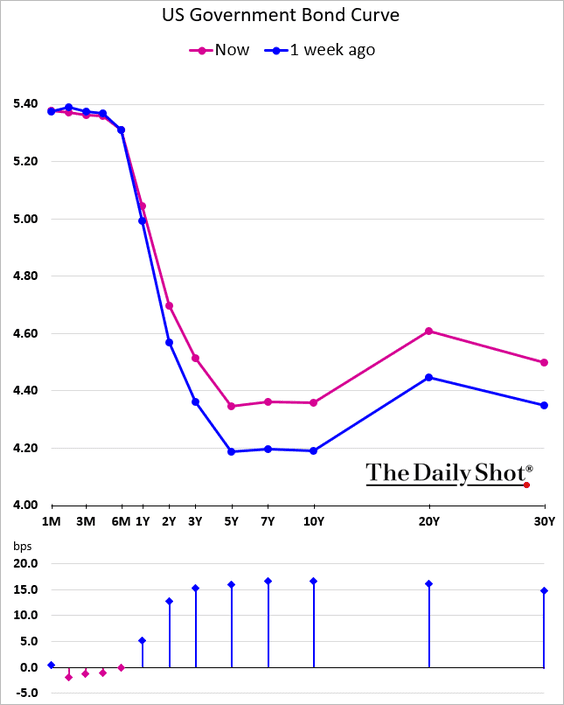

Here is the yield curve.

——————–

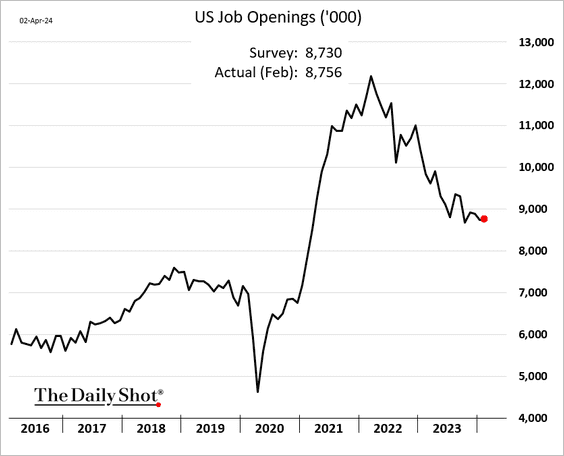

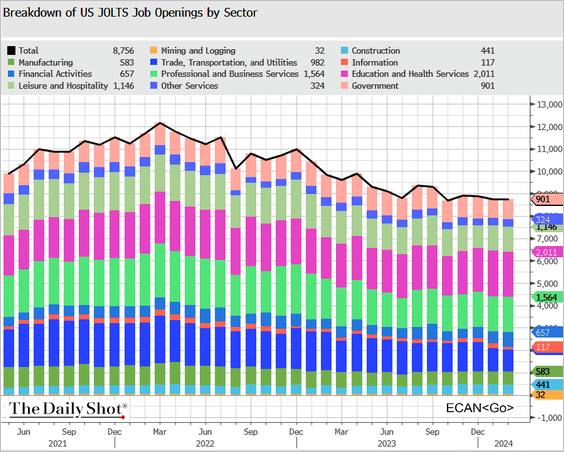

2. US job openings were almost unchanged in February, …

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

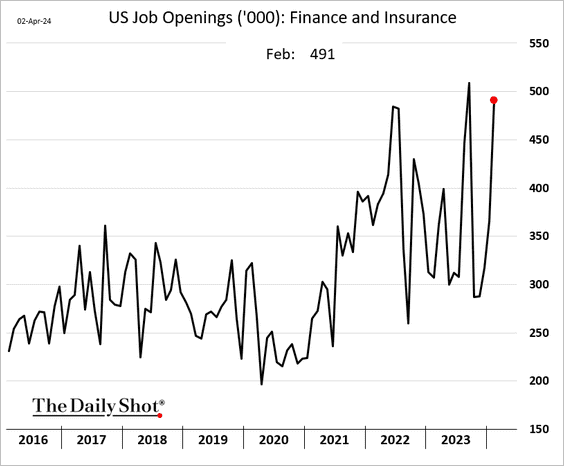

… held up by vacancies in financial services (which tend to be volatile).

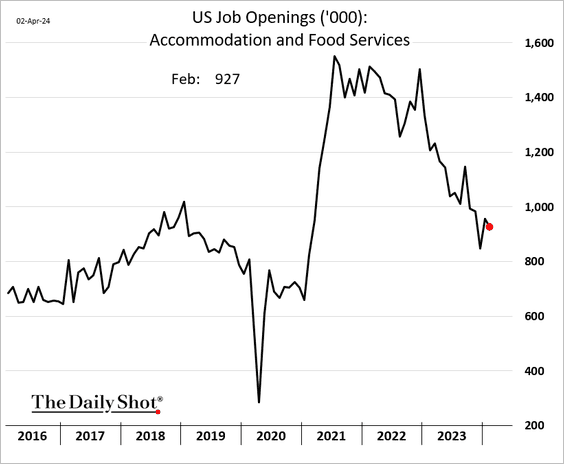

On the other hand, the number of openings at hotels, restaurants, and bars continues to trend lower.

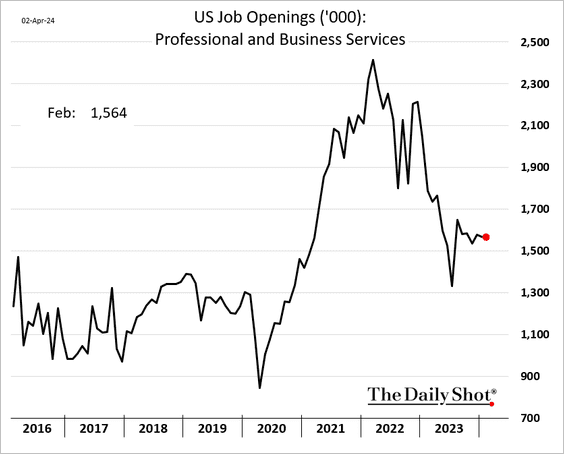

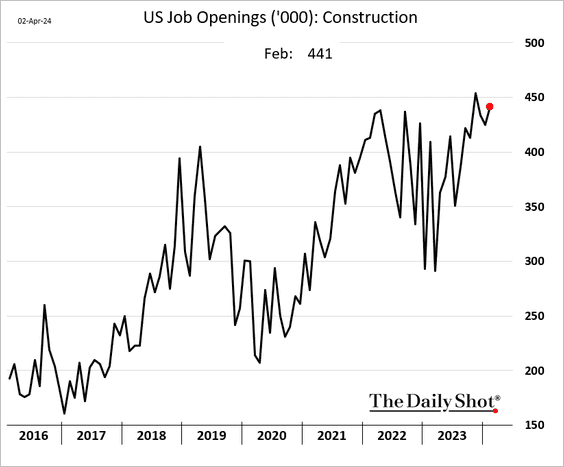

Below are some additional sector trends.

– Professional and business services (steady):

– Construction (surprisingly strong):

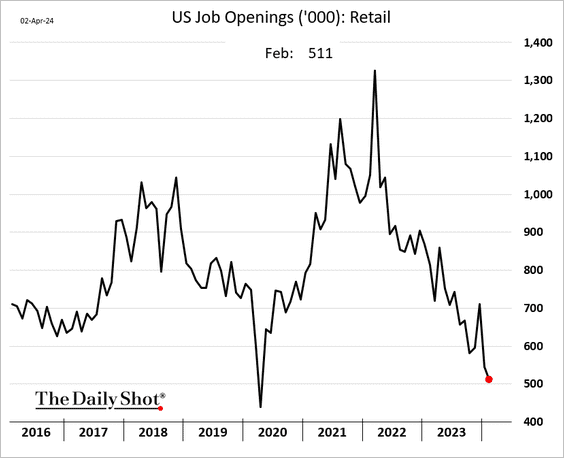

– Retail (lowest since the COVID shock):

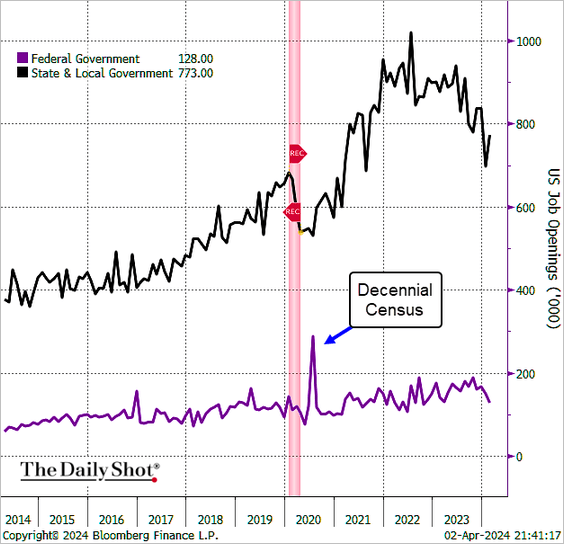

– Government:

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

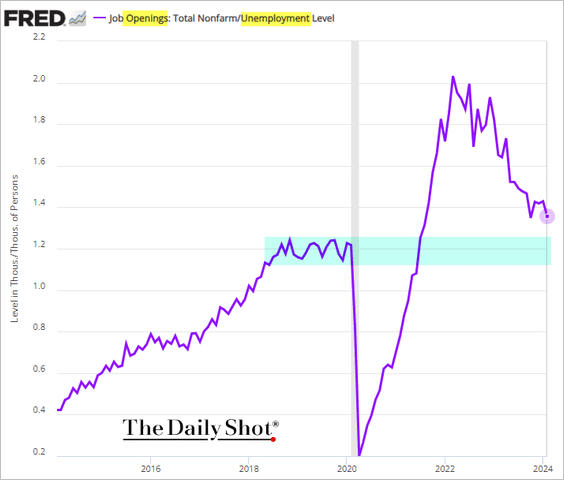

• The ratio of job openings to unemployed individuals is trending downward but remains above pre-COVID levels.

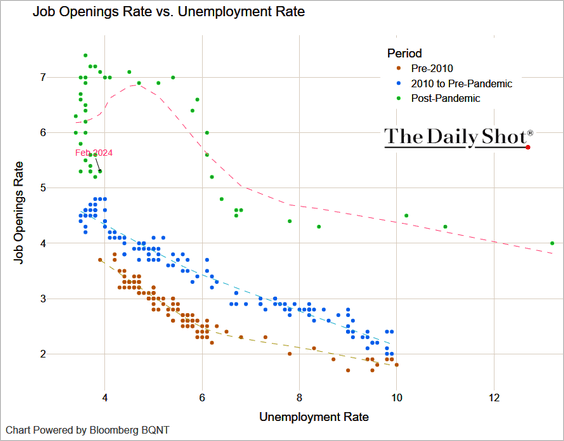

– Here is the Beveridge Curve.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

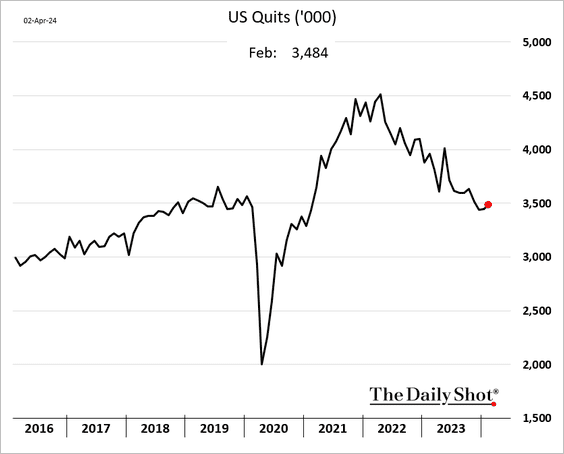

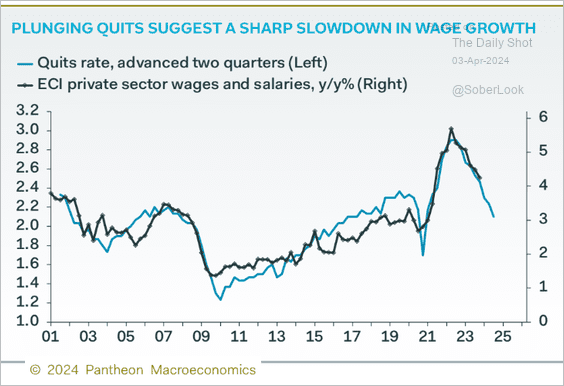

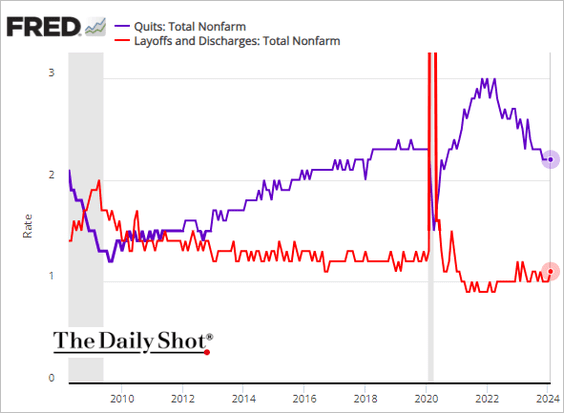

• Quits (voluntary resignations) edged higher in February.

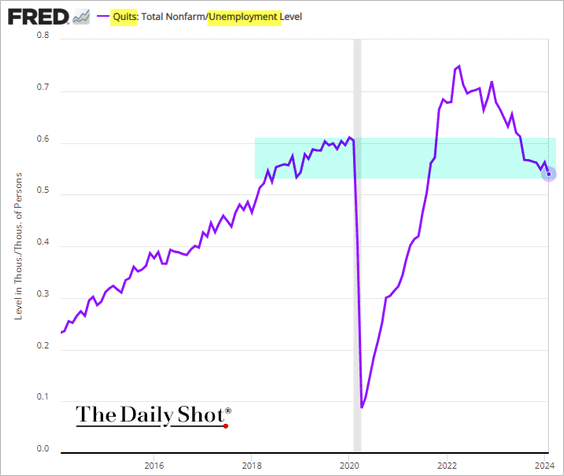

– The ratio of quits to unemployed individuals is now well below pre-COVID levels. The Great Resignation is over.

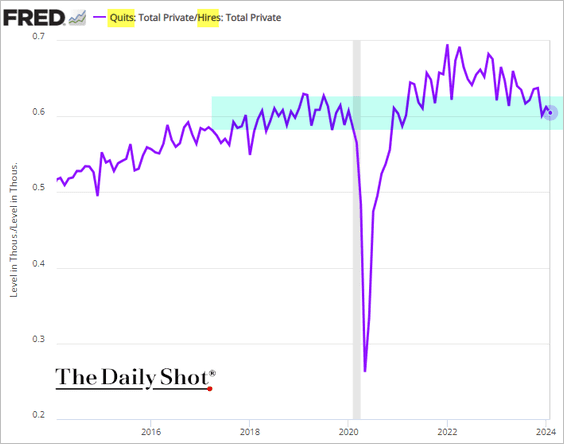

Below is the quits-to-hires ratio.

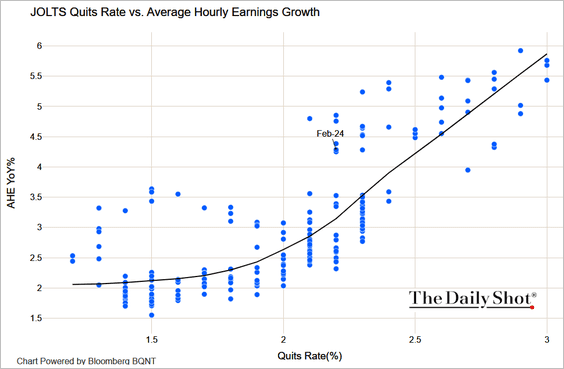

– Given the current quits rate, wage growth should be lower, …

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

… which is what economists expect this year.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

– Layoffs remain below pre-COVID levels.

——————–

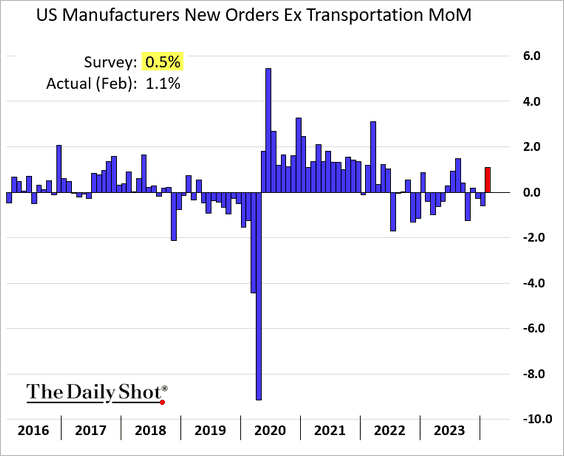

3. Factory orders in February exceeded expectations.

Source: MarketWatch Read full article

Source: MarketWatch Read full article

——————–

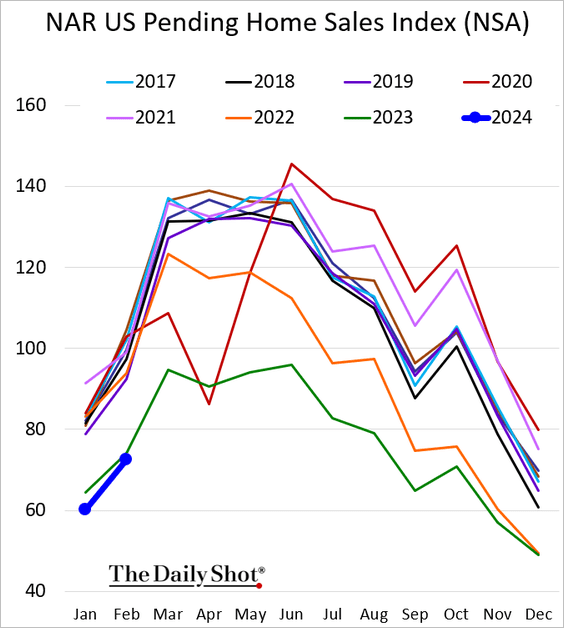

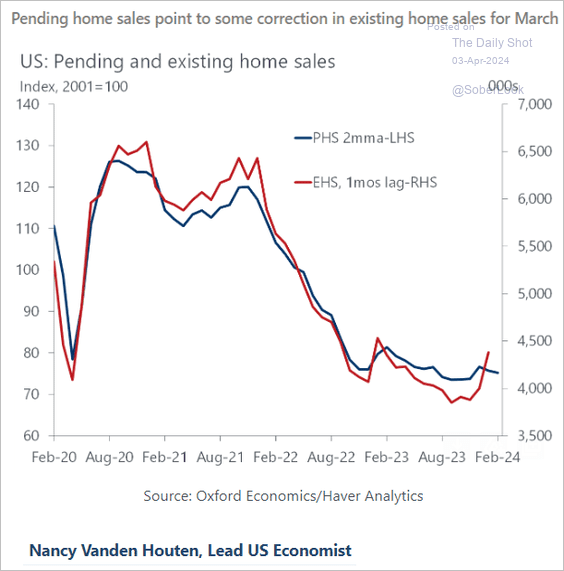

4. Pending home sales remained at multi-year lows in February, …

… suggesting a pullback in existing home sales in March.

Source: Oxford Economics

Source: Oxford Economics

——————–

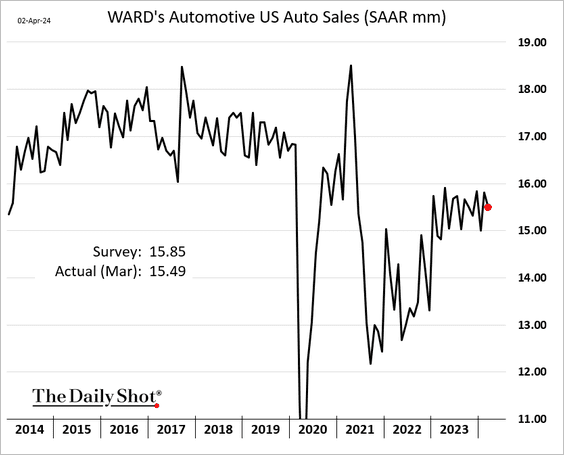

5. Automobile sales edged lower in March.

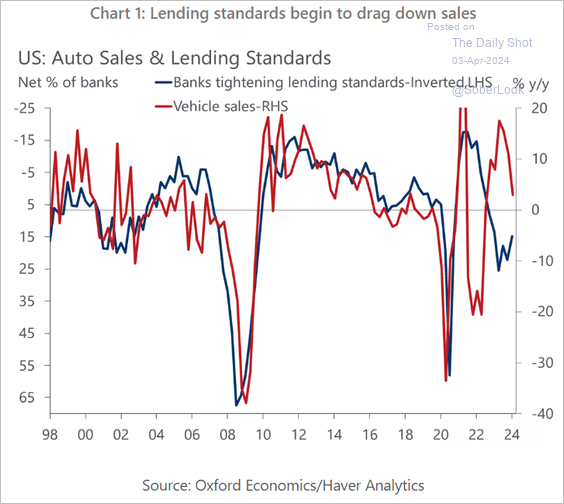

• Tighter credit is now a drag on auto sales.

Source: Oxford Economics

Source: Oxford Economics

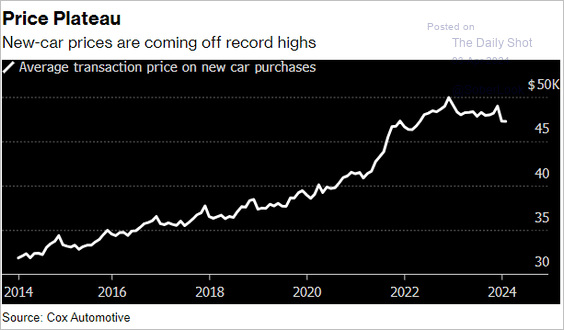

• Tight credit and high financing costs are forcing Americans to buy cheaper vehicles.

Source: @business Read full article

Source: @business Read full article

Back to Index

The United Kingdom

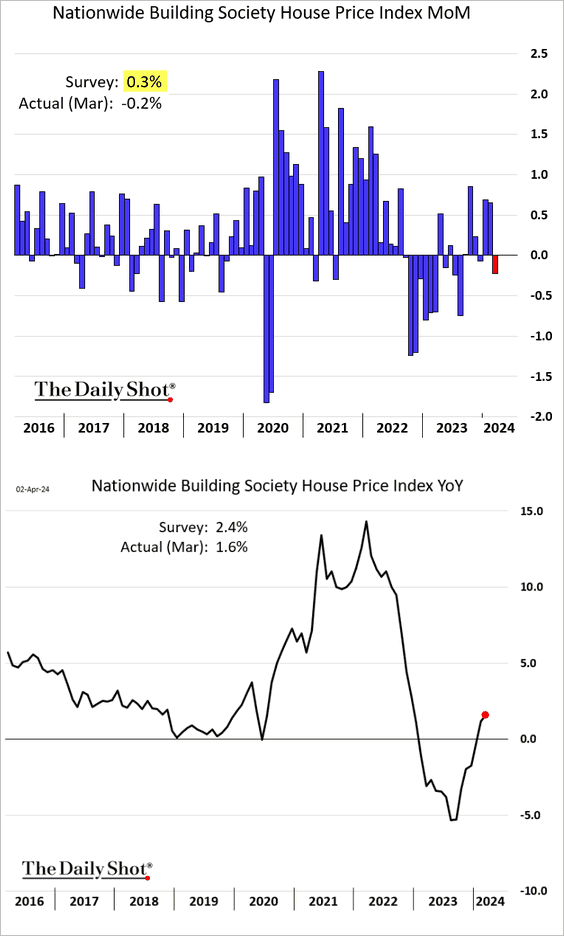

1. Home prices declined in March, …

Source: @economics Read full article

Source: @economics Read full article

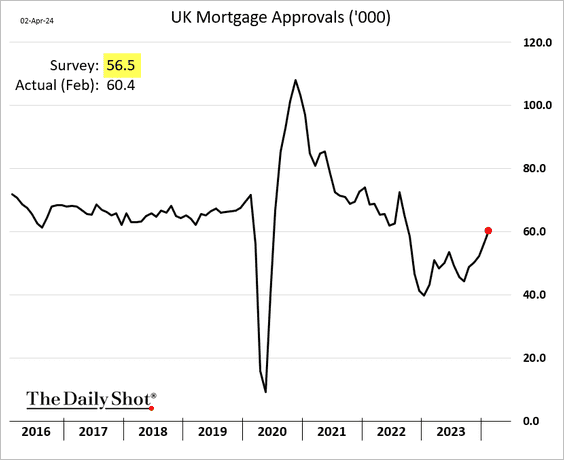

… but mortgage approvals continue to climb.

Source: @financialtimes Read full article

Source: @financialtimes Read full article

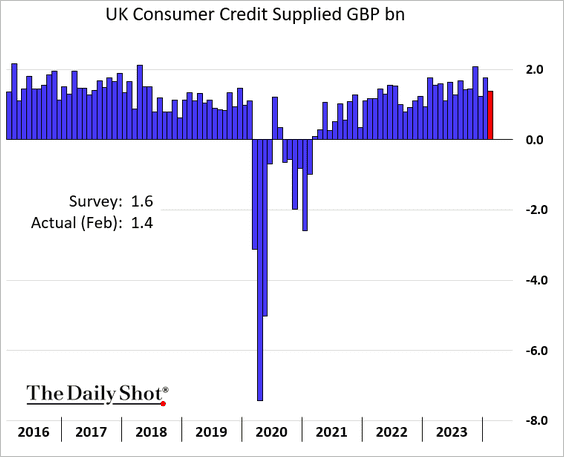

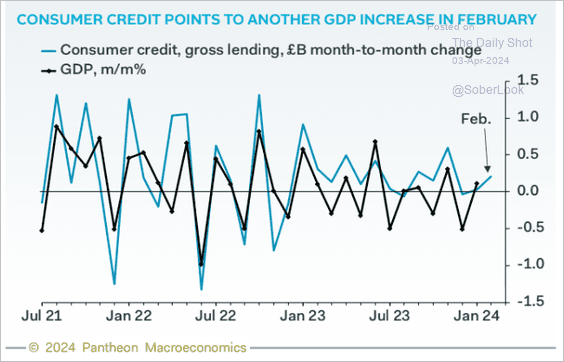

2. Consumer credit growth remains relatively strong, …

… which should support economic activity.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

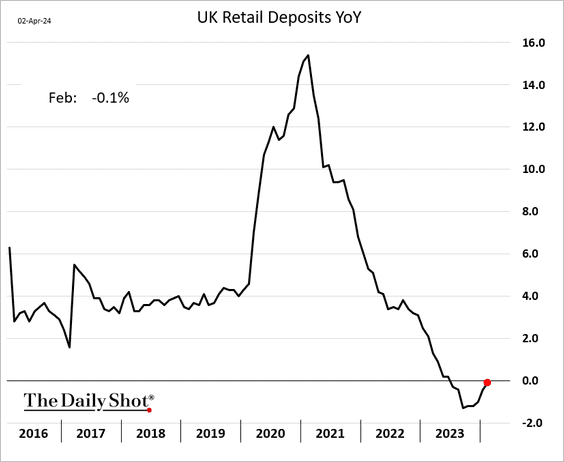

3. Retail deposits are stabilizing.

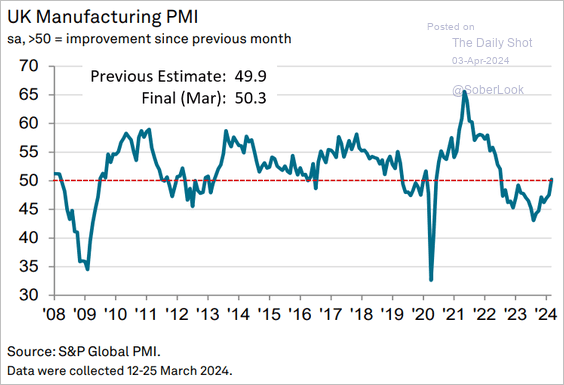

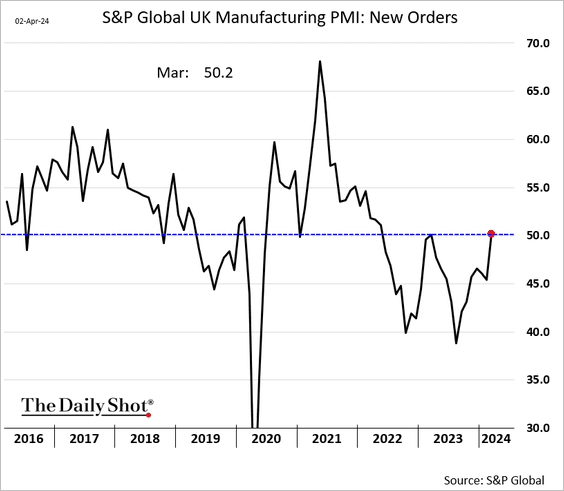

4. The manufacturing PMI shifts to growth mode (2 charts).

Source: S&P Global PMI

Source: S&P Global PMI

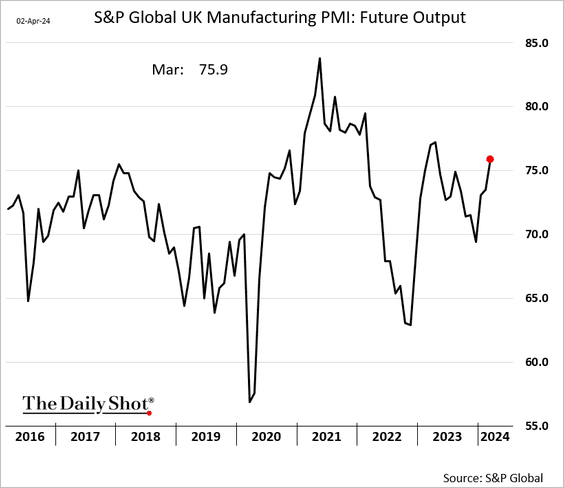

The outlook is improving.

Back to Index

The Eurozone

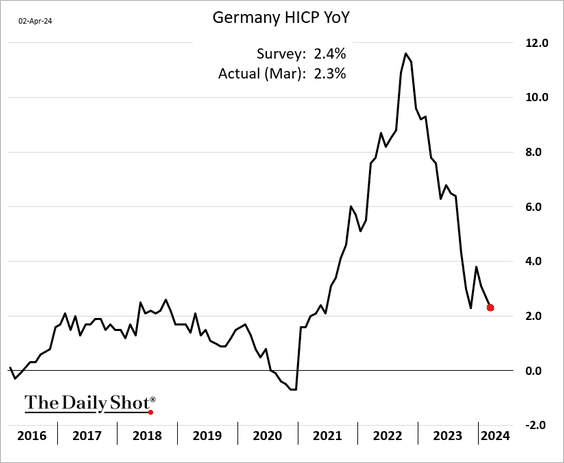

1. Germany’s inflation continues to ease.

Source: Reuters Read full article

Source: Reuters Read full article

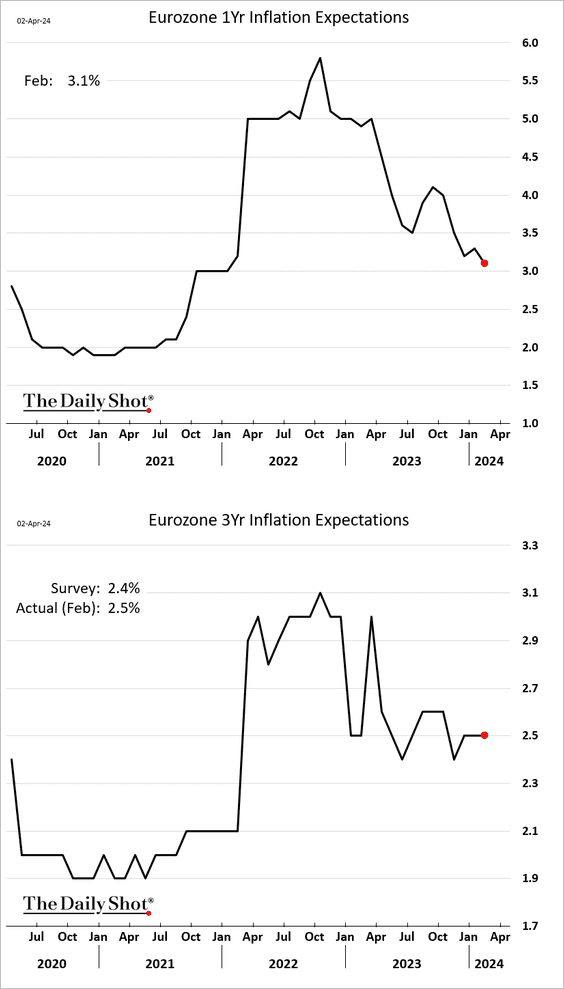

2. Euro-area near-term inflation expectations are trending lower.

Source: @economics Read full article

Source: @economics Read full article

——————–

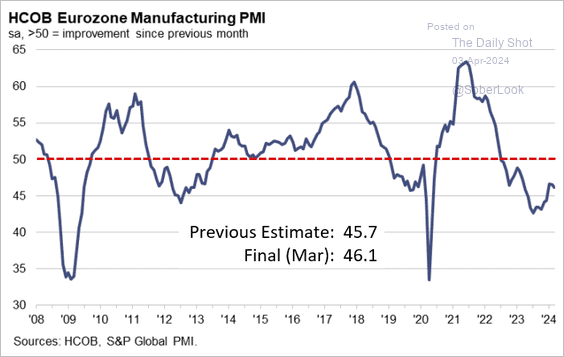

3. The euro-area manufacturing contraction was a bit less severe last month than the flash figures showed.

Source: S&P Global PMI

Source: S&P Global PMI

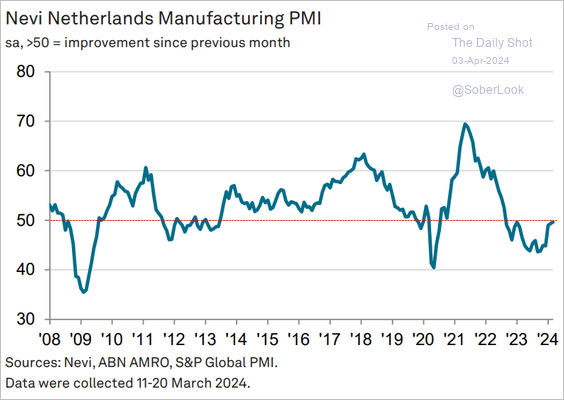

• Dutch manufacturing is stabilizing.

Source: S&P Global PMI

Source: S&P Global PMI

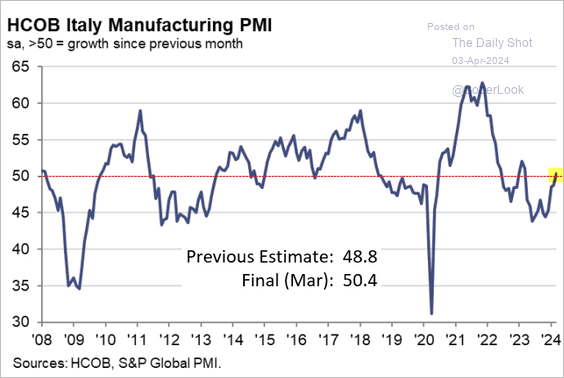

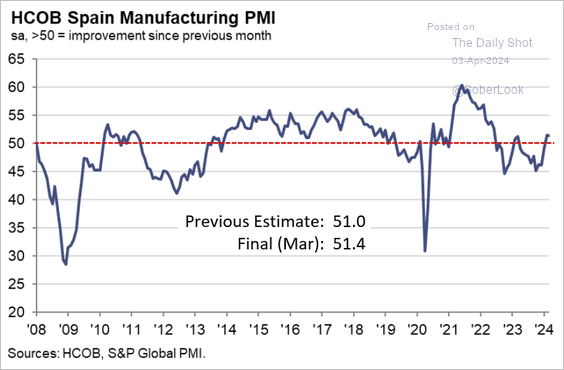

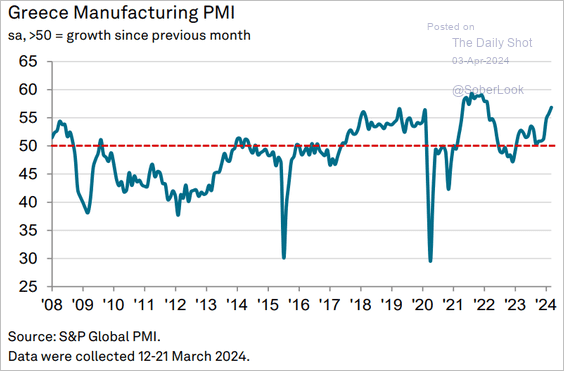

• Southern Europe’s factory activity is now in growth territory.

– Italy:

Source: S&P Global PMI

Source: S&P Global PMI

– Spain:

Source: S&P Global PMI

Source: S&P Global PMI

– Greece:

Source: S&P Global PMI

Source: S&P Global PMI

Back to Index

Europe

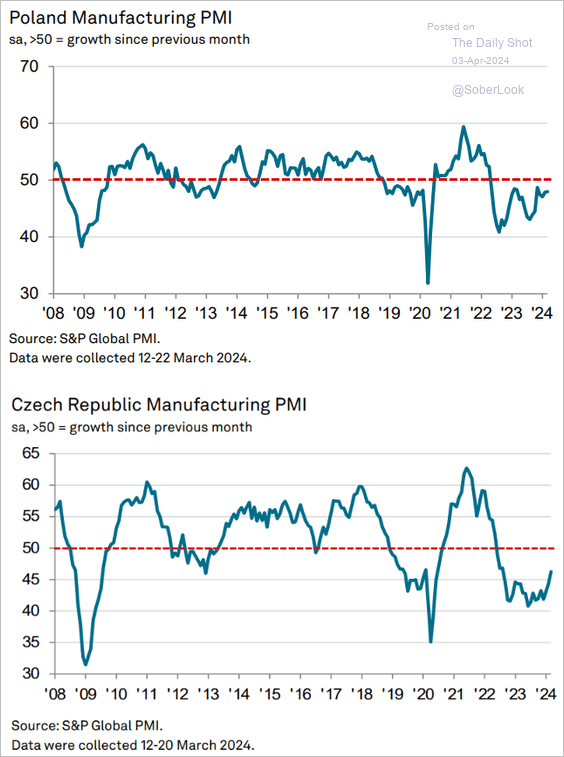

1. Factory activity in central Europe is still contracting, but the Czech Republic’s slump eased significantly this year.

Source: S&P Global PMI

Source: S&P Global PMI

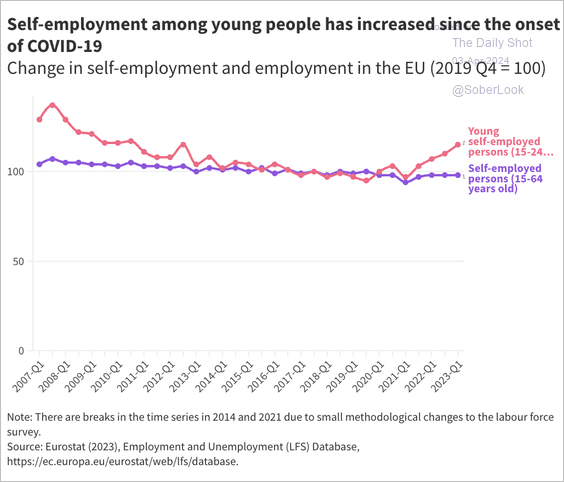

2. Here is a look at self-employment among young people vs. total self-employment in the EU.

Source: OECD Read full article

Source: OECD Read full article

Back to Index

Japan

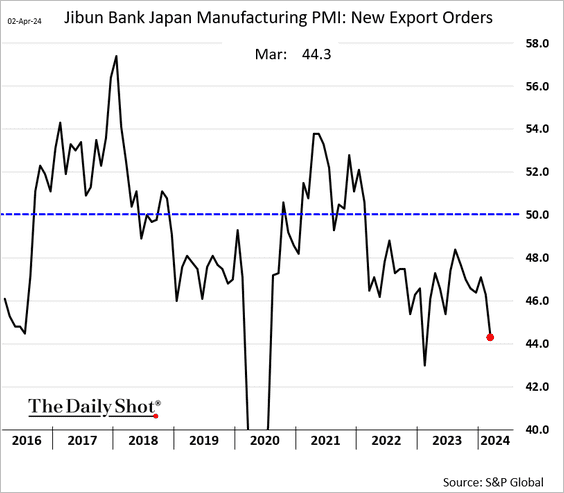

1. The March PMI report indicated a deepening slump in Japan’s manufacturing export orders.

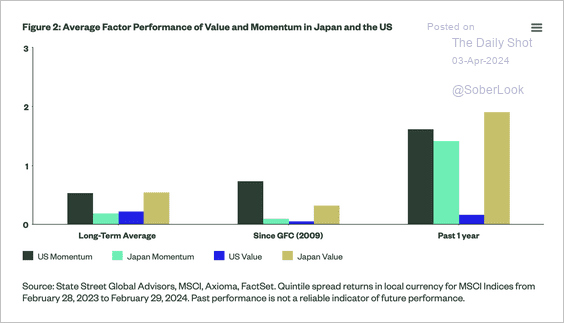

2. Over the long-term, the momentum factor has delivered a positive return, but has recently been dwarfed by value.

Source: State Street Global Advisors Read full article

Source: State Street Global Advisors Read full article

Back to Index

China

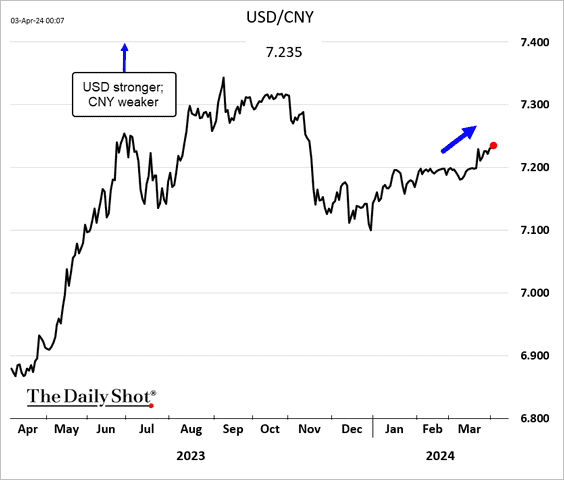

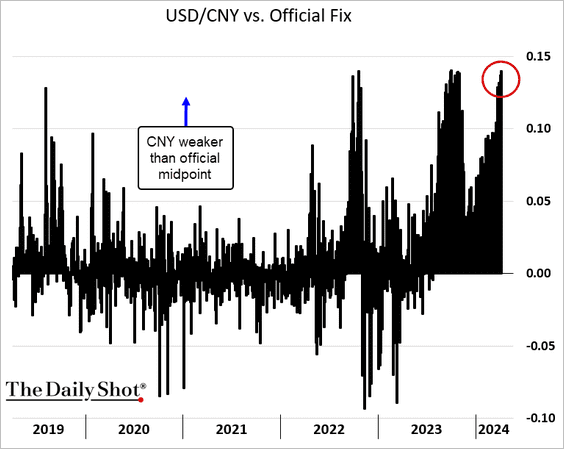

1. The renminbi continues to weaken versus the US dollar, …

Source: @markets Read full article

Source: @markets Read full article

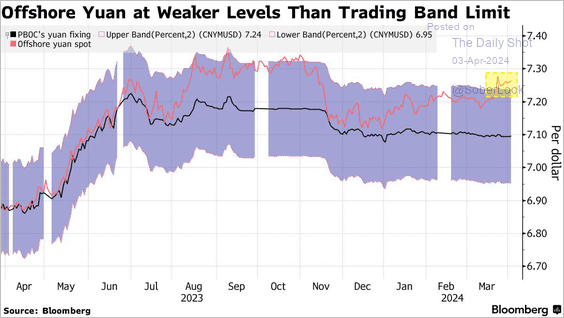

… even as Bejing tries to stem the declines (2 charts).

Source: @markets Read full article

Source: @markets Read full article

——————–

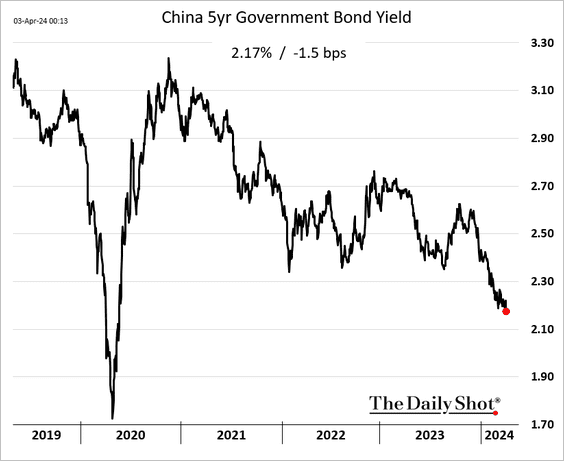

2. Bond yields are trending lower.

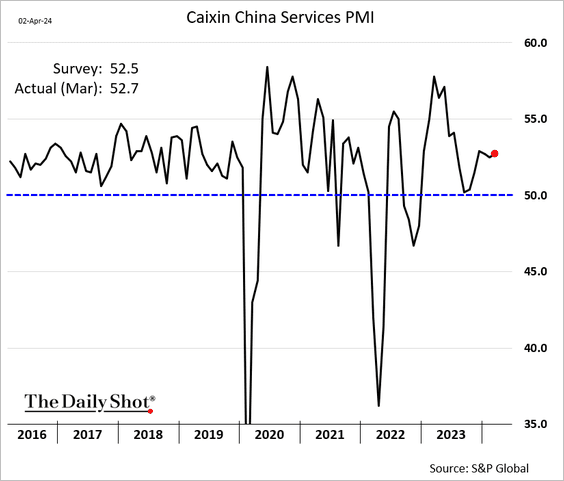

3. Service sector growth is holding up.

Back to Index

Emerging Markets

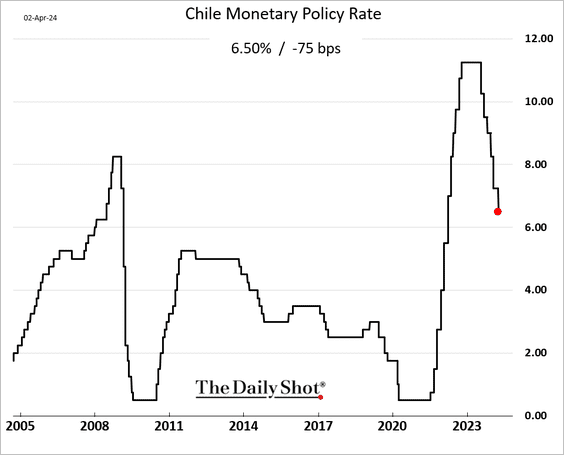

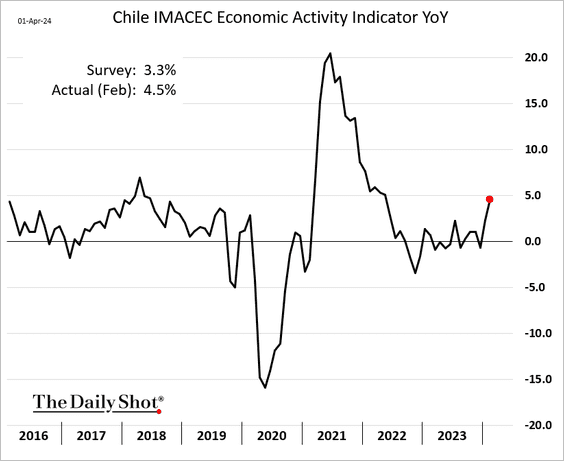

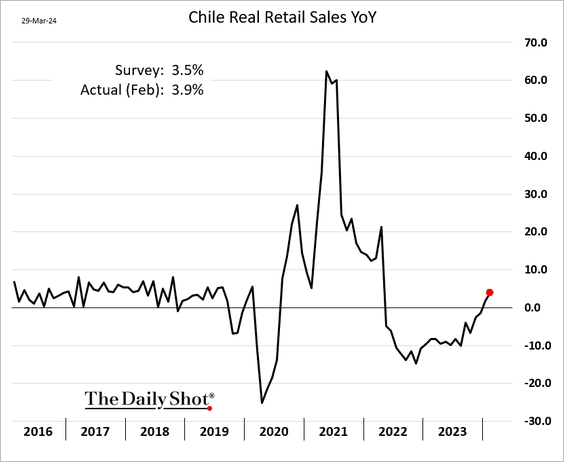

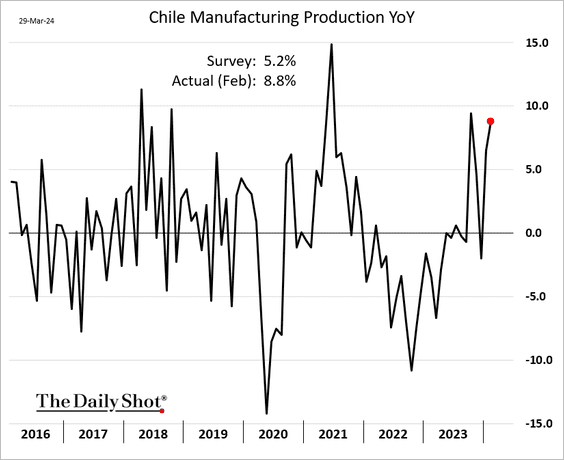

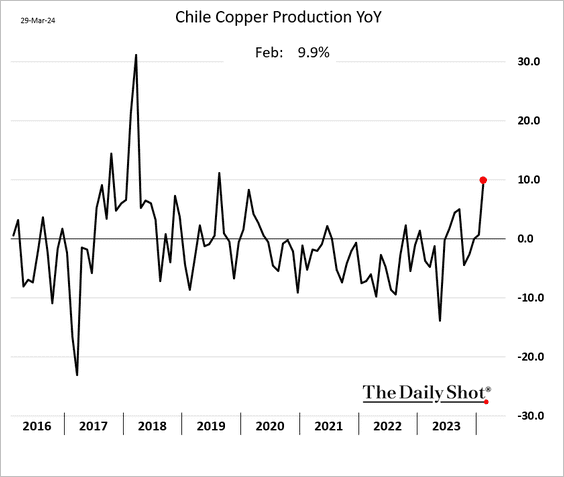

1. Let’s begin with Chile.

• The central bank delivered a 75 bps rate cut and signaled more is on the way.

Source: Reuters Read full article

Source: Reuters Read full article

• Economic activity surprised to the upside.

– Retail sales:

– Industrial production:

– Copper production:

——————–

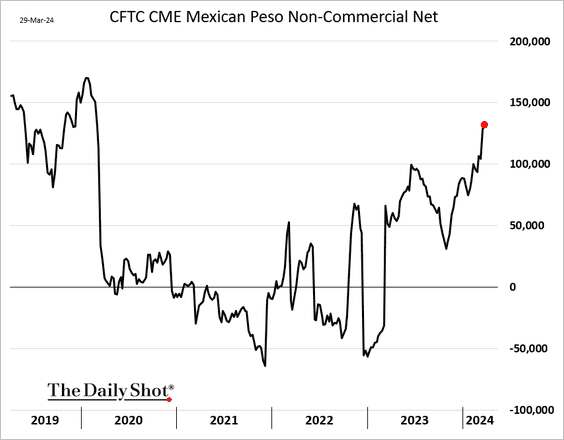

2. Traders have been boosting their bets on the Mexican peso.

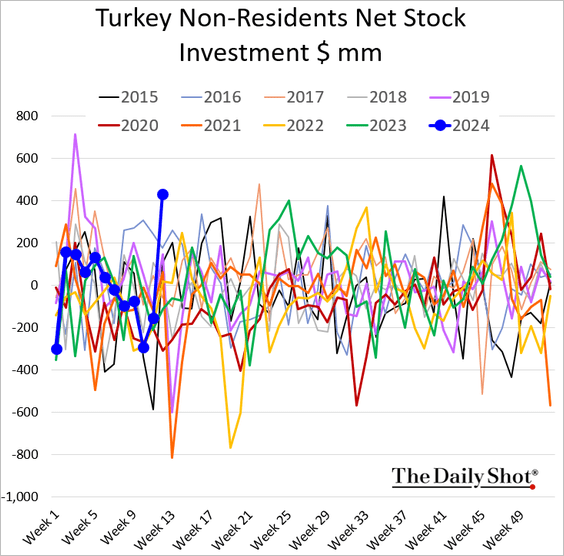

3. Foreign investors have been buying Turkish stocks.

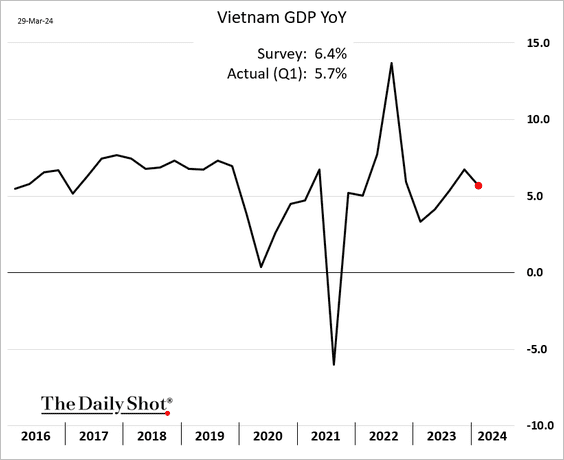

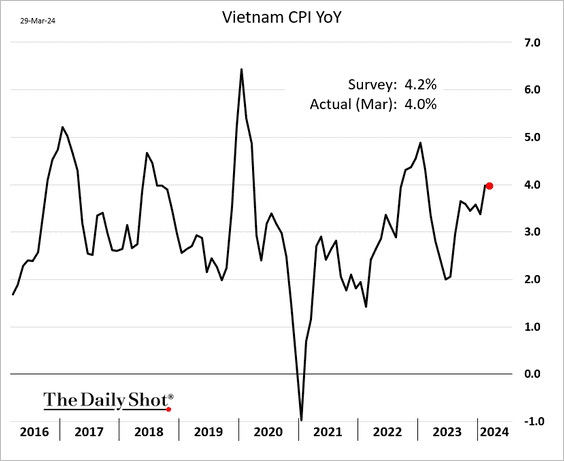

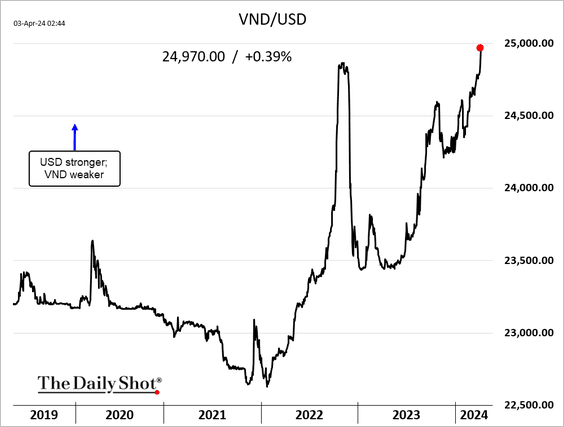

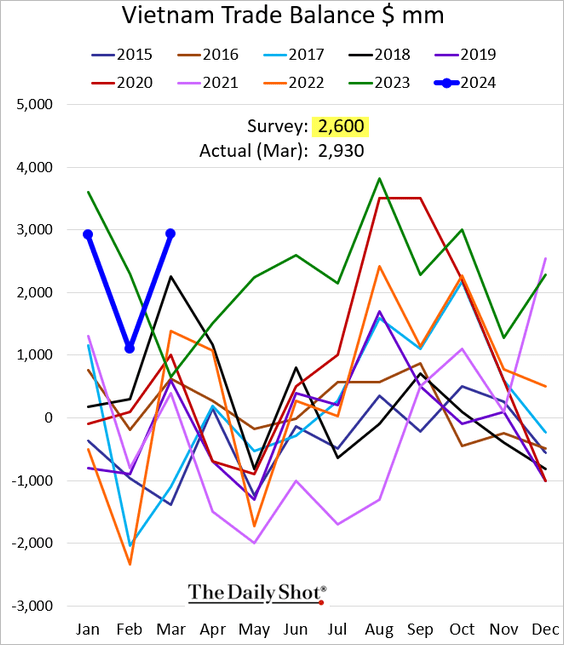

4. Next, we have some updates on Vietnam.

• The Q1 GDP growth was below forecasts.

• Inflation is holding at 4%.

• The Vietnamese dong hit the lowest level on record versus the US dollar.

• Vietnam’s trade surplus surprised to the upside.

——————–

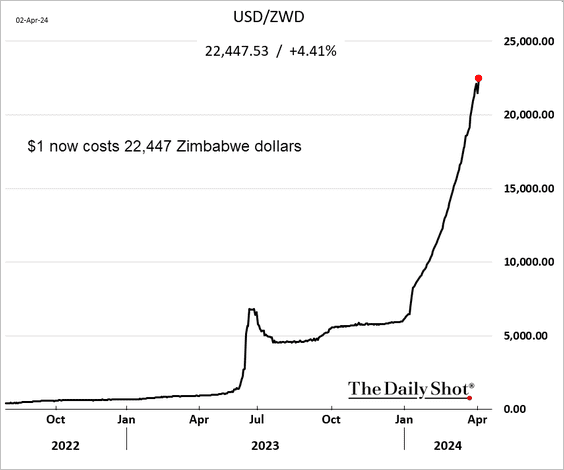

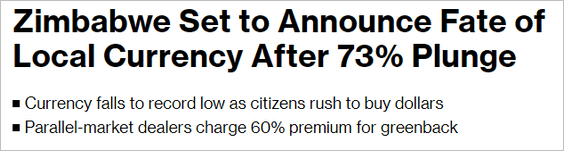

5. The Zimbabwe dollar has collapsed.

Source: @markets Read full article

Source: @markets Read full article

——————–

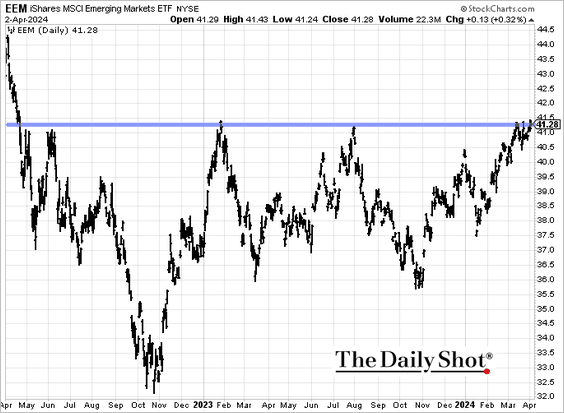

6. The iShares MSCI Emerging Markets ETF is at resistance.

Back to Index

Cryptocurrency

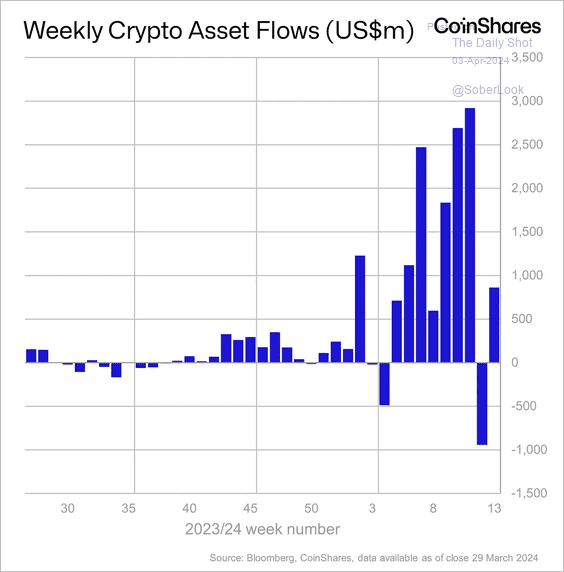

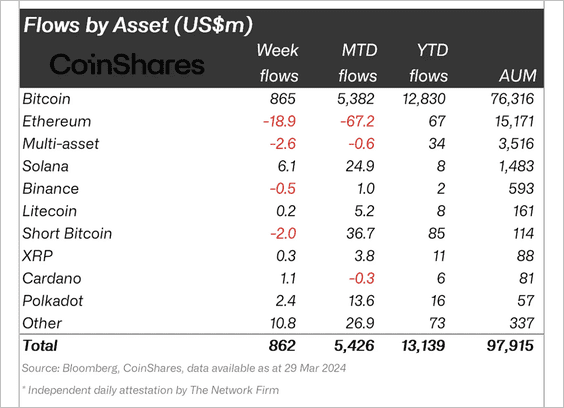

1. Crypto fund flows rebounded last week, led by US bitcoin products, while ethereum-focused and multi-asset funds continued to see outflows. (2 charts)

Source: CoinShares Read full article

Source: CoinShares Read full article

Source: CoinShares Read full article

Source: CoinShares Read full article

——————–

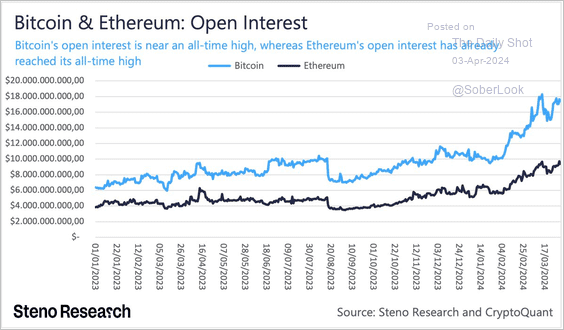

2. Open interest in the Bitcoin and Ethereum futures markets continues to rise.

Source: @MadsEberhardt

Source: @MadsEberhardt

Back to Index

Commodities

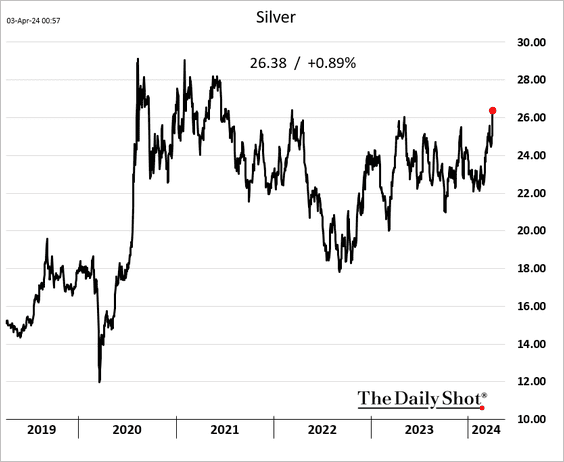

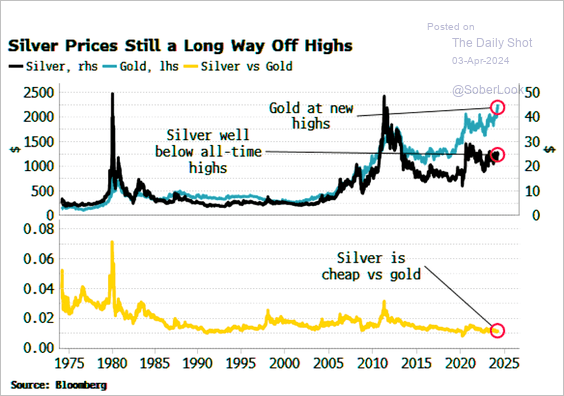

1. Silver hit a 2-year high, …

… but it continues to underperform gold.

Source: Simon White, Bloomberg Markets Live Blog

Source: Simon White, Bloomberg Markets Live Blog

——————–

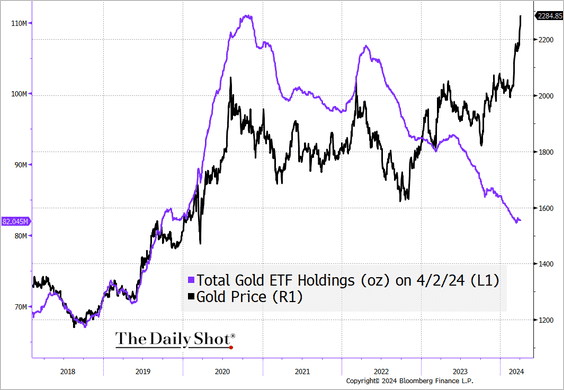

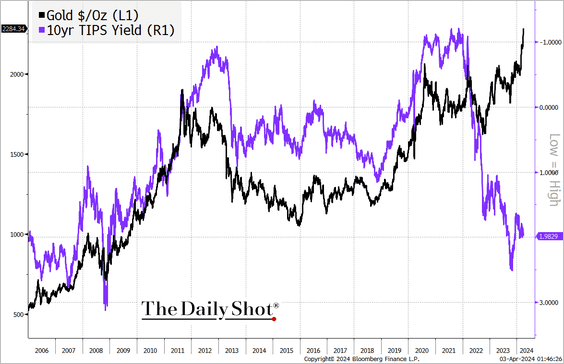

2. Gold continues to diverge from ETFs’ total gold holdings …

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

… and from real rates.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

——————–

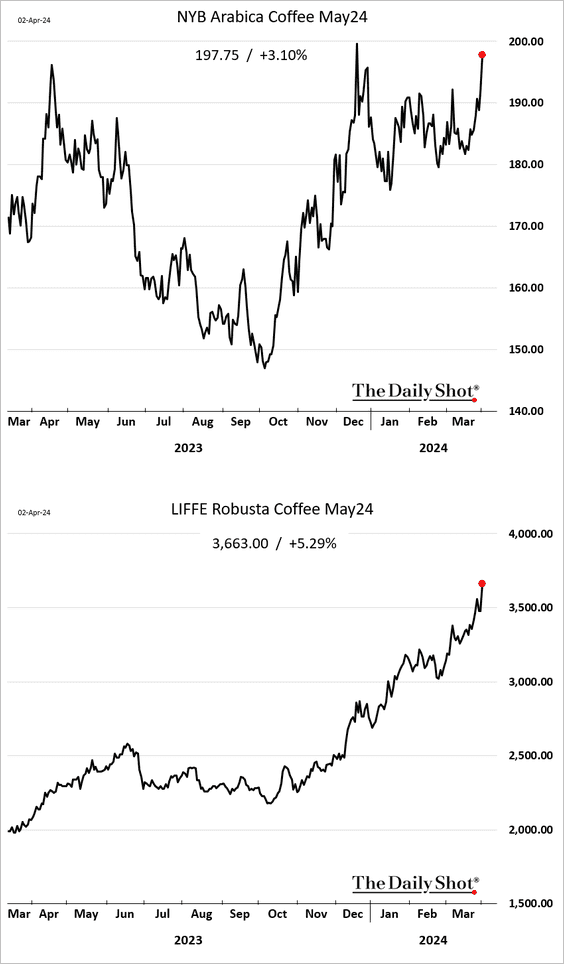

3. Coffee futures are surging.

Source: barchart.com Read full article

Source: barchart.com Read full article

——————–

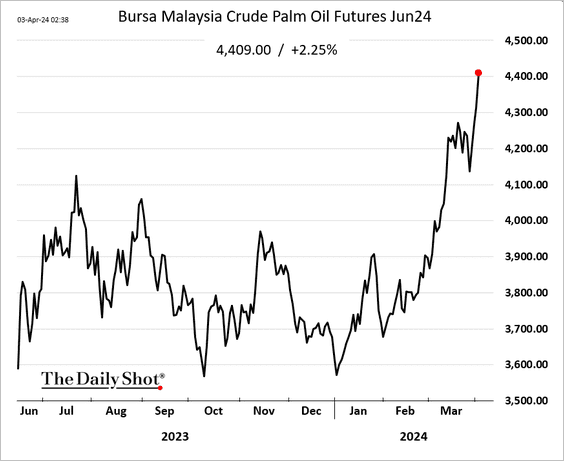

4. Palm oil has been rallying.

Source: Reuters Read full article

Source: Reuters Read full article

Back to Index

Energy

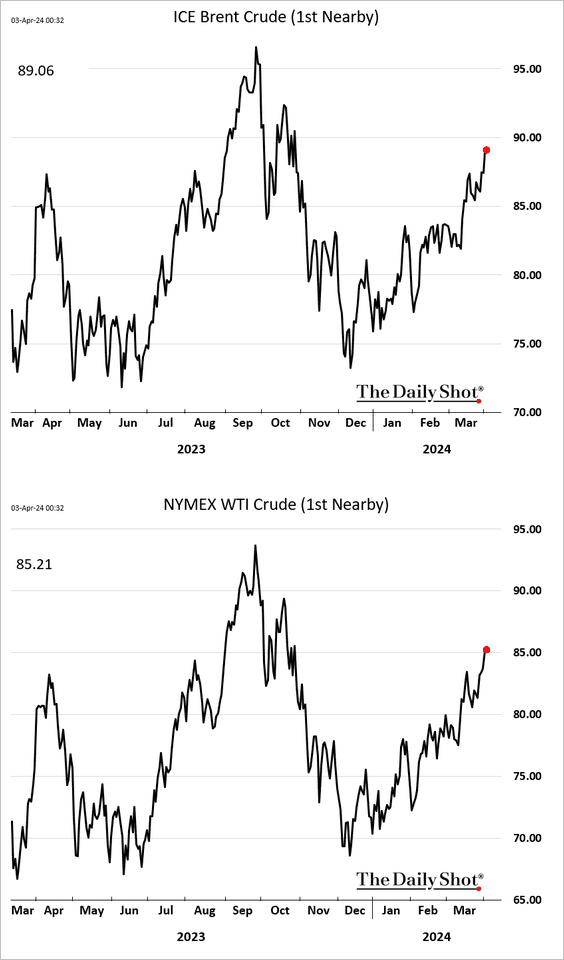

1. US crude oil is trading above $85/bbl, and Brent is nearing $90/bbl amid rising geopolitical tensions.

Source: NBC News Read full article

Source: NBC News Read full article

——————–

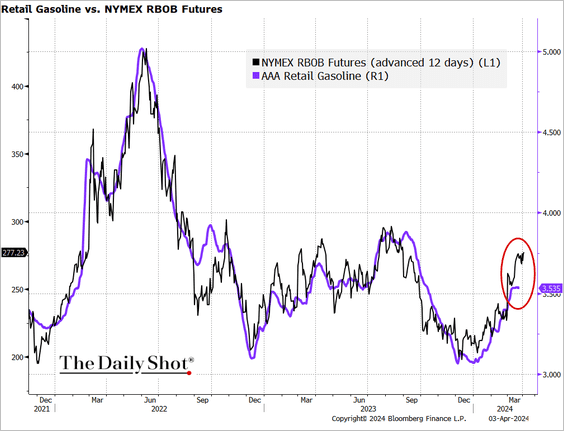

2. US prices at the pump are headed higher.

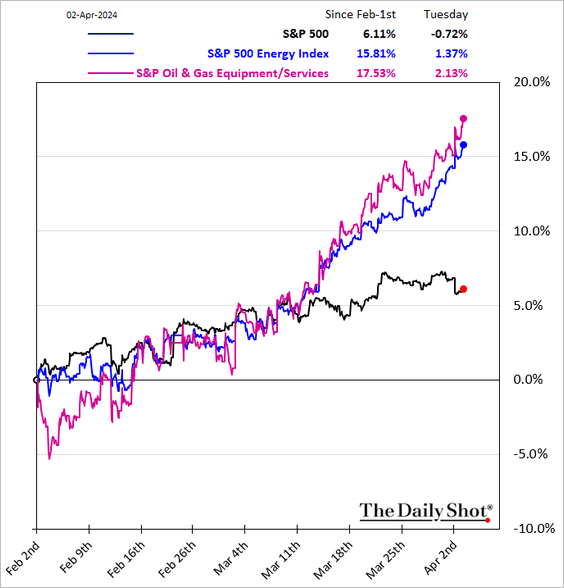

3. Energy shares continue to outperform.

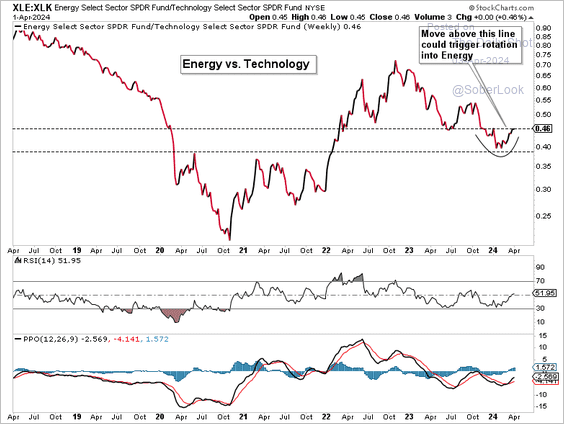

• The US energy sector is improving relative to tech.

Source: Aazan Habib, Paradigm Capital

Source: Aazan Habib, Paradigm Capital

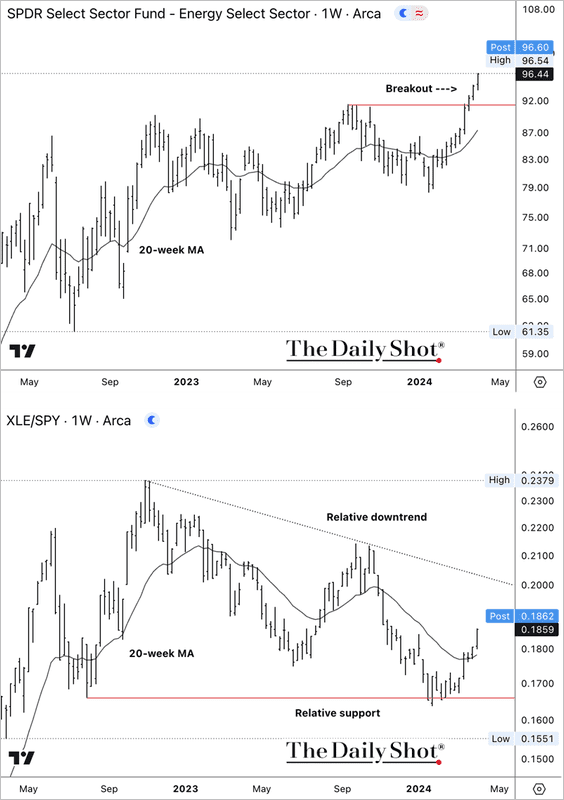

• The SPDR Energy Sector ETF (XLE) reached a new high but remains in a short-term downtrend relative to the S&P 500.

Back to Index

Equities

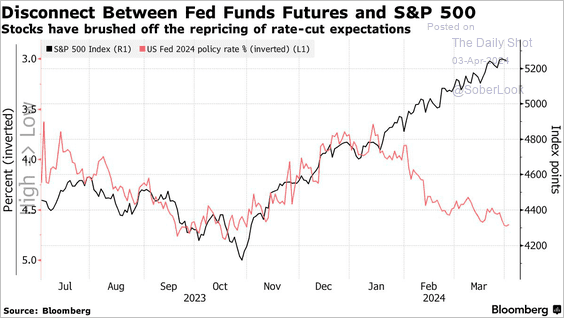

1. The equity market is ignoring the recent sharp repricing in Fed rate cut expectations.

Source: @markets Read full article

Source: @markets Read full article

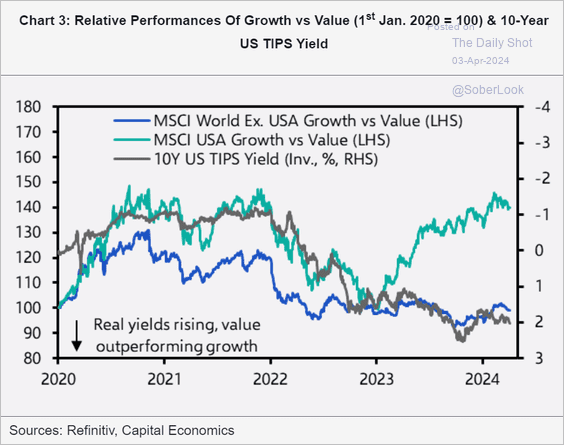

• The performance of US growth stocks relative to value has diverged from Treasury yields, a trend not mirrored in the non-US growth-to-value ratio.

Source: Capital Economics

Source: Capital Economics

——————–

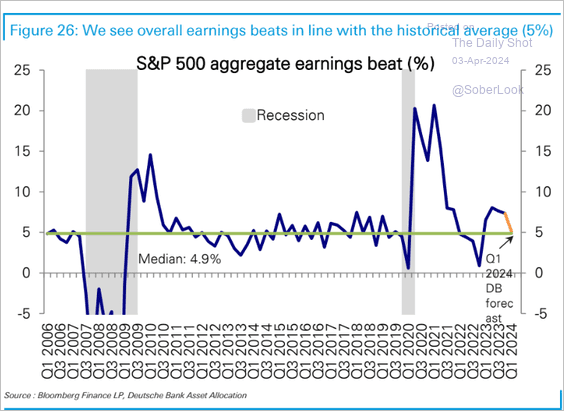

2. The Q1 earnings beats are expected to be close to their historical average, according to Deutsche Bank.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

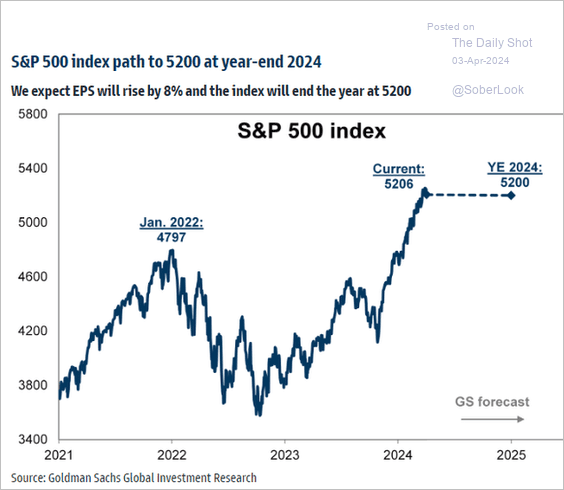

3. Goldman says the S&P 500 will end the year roughly where it is now.

Source: Goldman Sachs; @MikeZaccardi

Source: Goldman Sachs; @MikeZaccardi

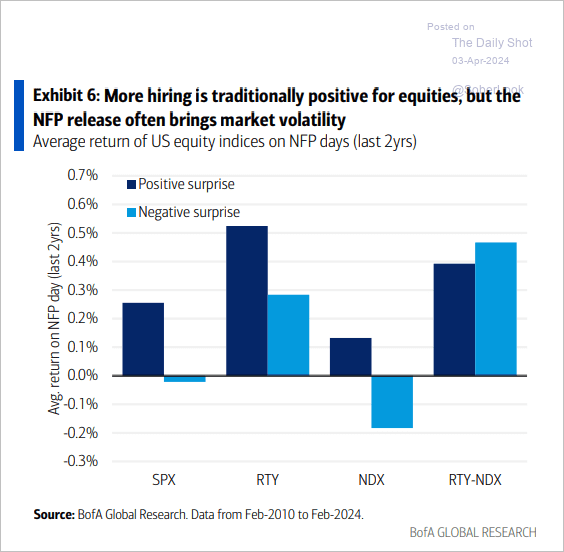

4. How do US indices react to surprises in the jobs report?

Source: BofA Global Research

Source: BofA Global Research

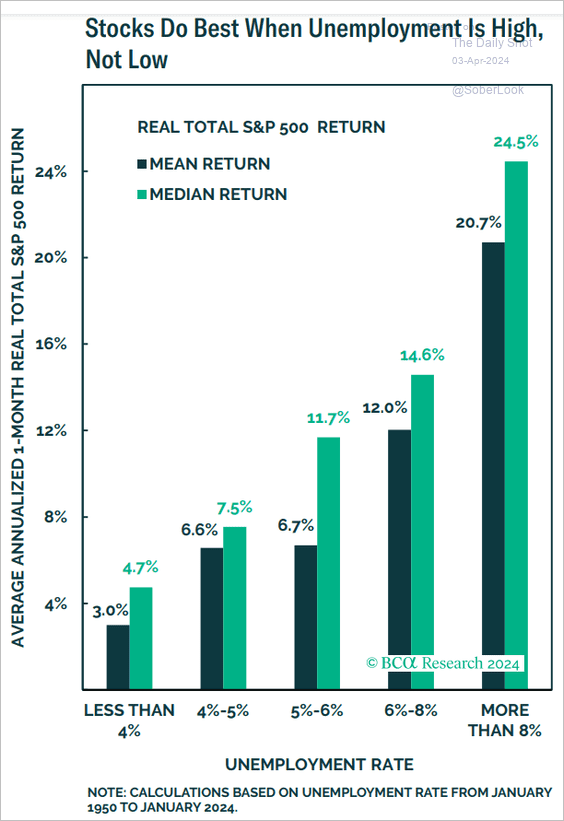

• The S&P 500 typically performs well during periods of high US unemployment, as the Federal Reserve often lowers interest rates in response.

Source: BCA Research

Source: BCA Research

——————–

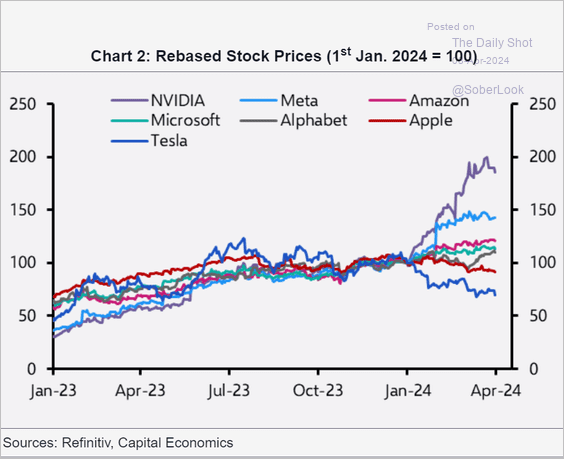

5. The dispersion in the “Magnificent 7” performance continues to widen.

Source: Capital Economics

Source: Capital Economics

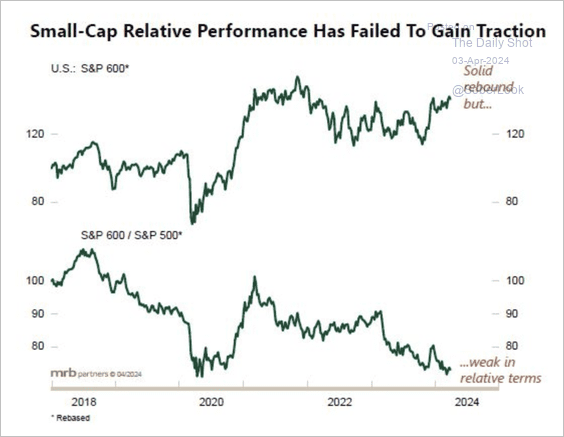

6. US small caps have rebounded but remain in a downtrend relative to the S&P 500.

Source: MRB Partners

Source: MRB Partners

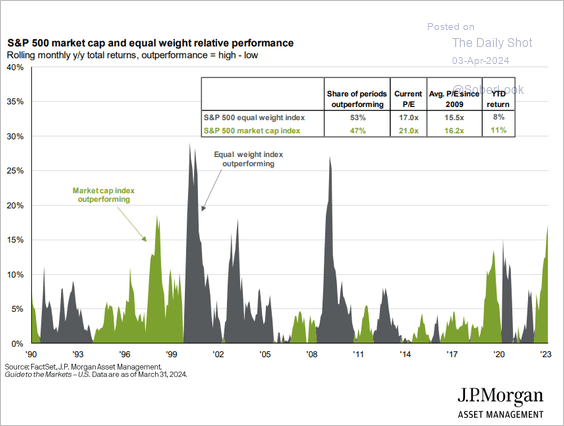

7. Will the equal-weight S&P 500 index underperformance persist?

Source: J.P. Morgan Asset Management

Source: J.P. Morgan Asset Management

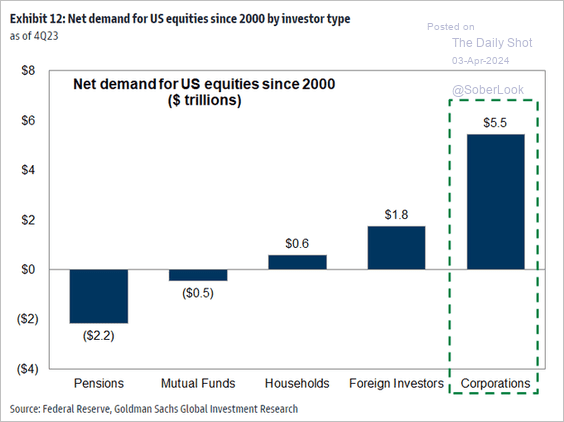

8. Share buybacks have been the key driver of equity demand this century.

Source: Goldman Sachs; @MikeZaccardi

Source: Goldman Sachs; @MikeZaccardi

Back to Index

Credit

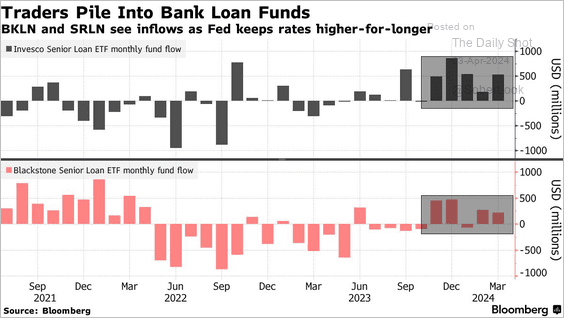

1. Leveraged loan ETFs continue to see inflows as short-term rates remain elevated (leveraged loans are predominantly floating-rate debt).

Source: @markets Read full article

Source: @markets Read full article

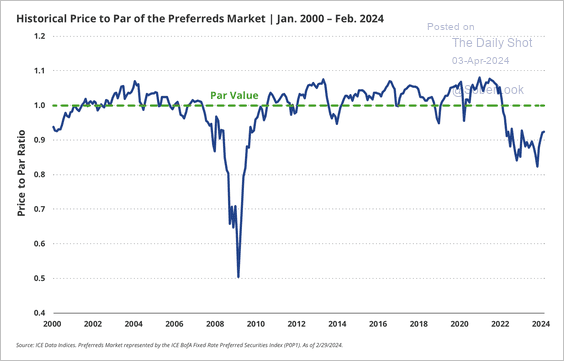

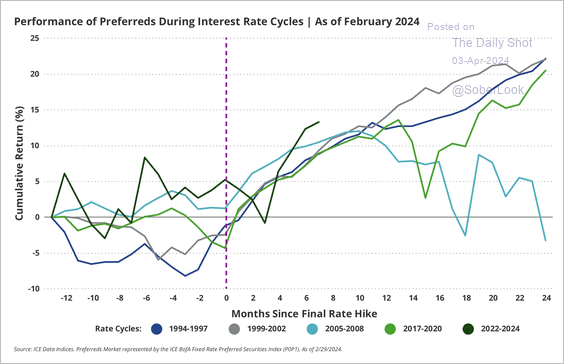

2. US fixed-rate preferreds are trading at discounts to par value not seen since the financial crisis.

Source: VanEck Read full article

Source: VanEck Read full article

• Fixed-rate preferreds have historically been strong performers after the final rate hike.

Source: VanEck Read full article

Source: VanEck Read full article

——————–

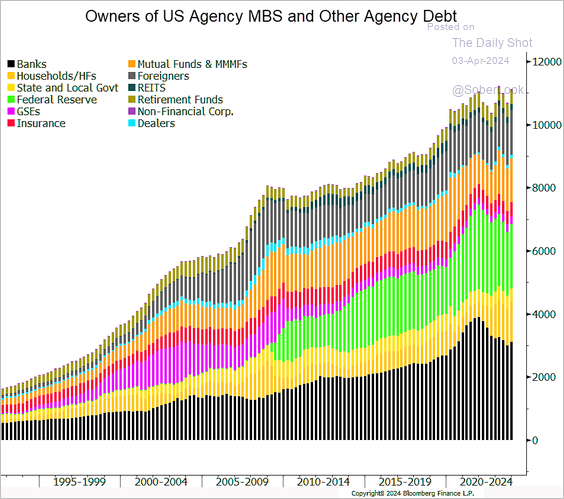

3. Who owns US agency MBS and other agency debt?

Source: Erica Adelberg Read full article

Source: Erica Adelberg Read full article

Back to Index

Rates

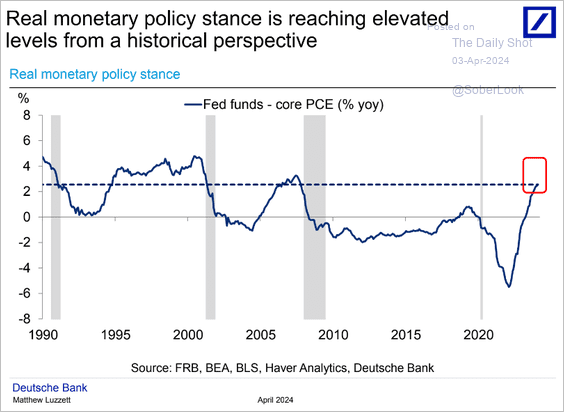

1. The real fed funds rate points to an increasingly tight monetary policy in the US.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

2. TLT is below its short-term support level.

Back to Index

Global Developments

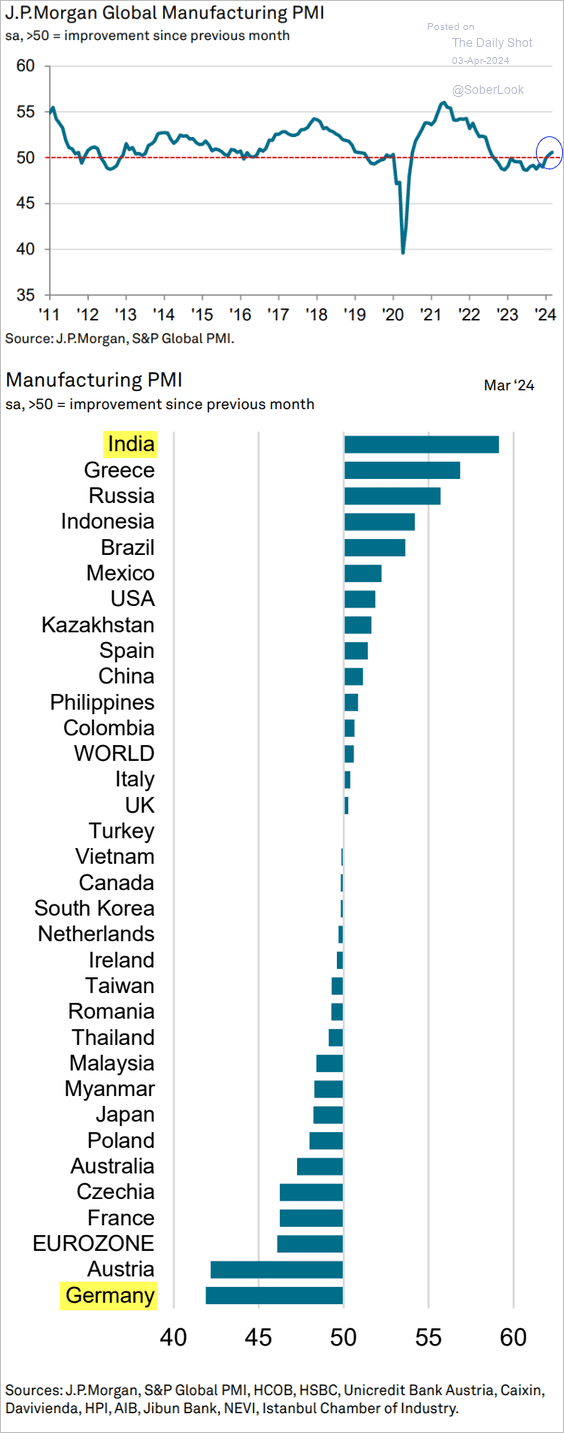

1. Global manufacturing activity is growing again.

Source: S&P Global PMI

Source: S&P Global PMI

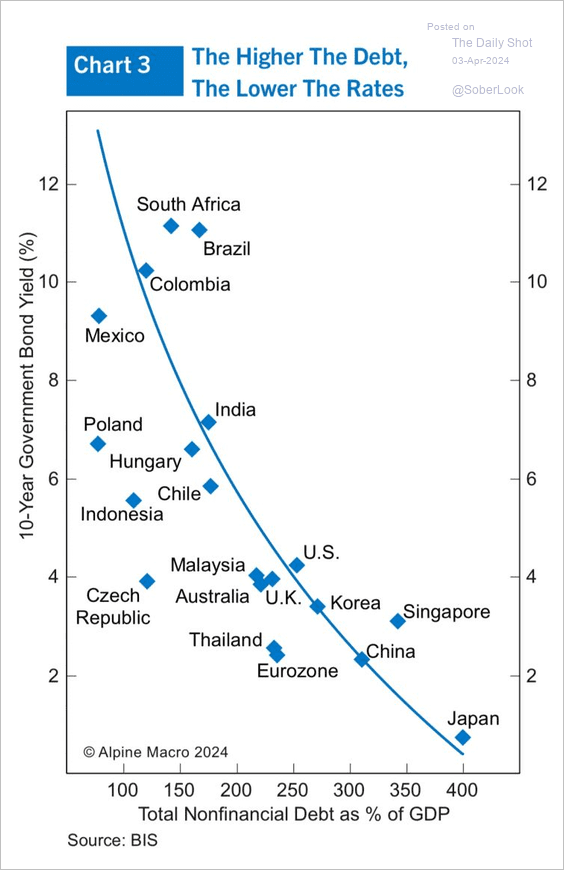

2. High sovereign debt levels don’t necessarily translate into higher rates.

Source: Chen Zhao, Alpine Macro

Source: Chen Zhao, Alpine Macro

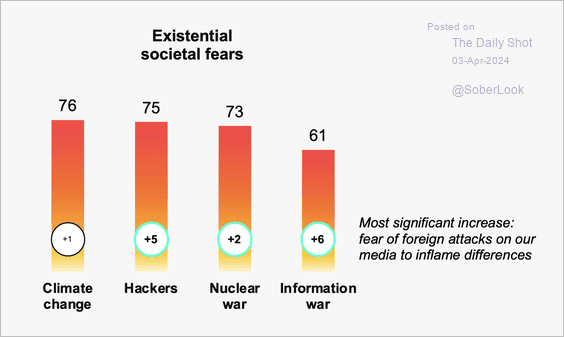

3. There is growing concern about an information war, according to a global survey by Edelman.

Source: Edelman Read full article

Source: Edelman Read full article

——————–

Food for Thought

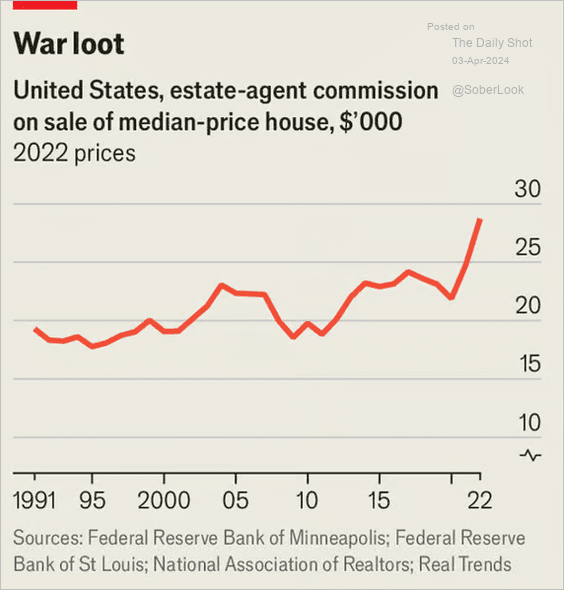

1. The cost of selling homes in the US:

Source: The Economist Read full article

Source: The Economist Read full article

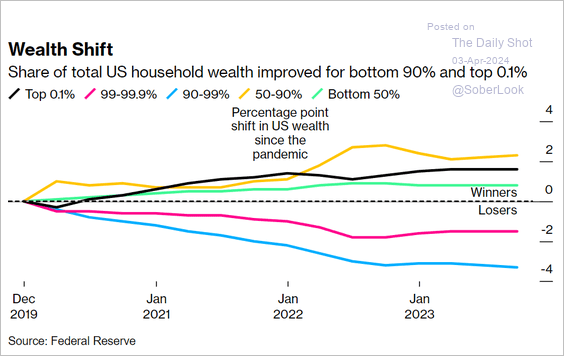

2. Changes in the share of total US household wealth by wealth tier:

Source: @wealth Read full article

Source: @wealth Read full article

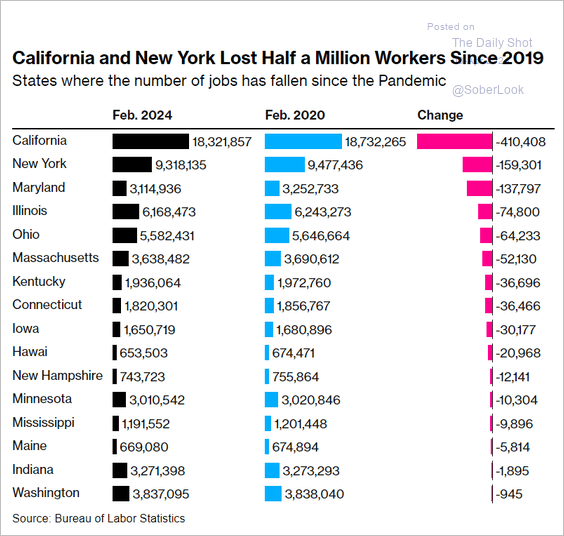

3. Job market shifts in the post-pandemic era for select states:

Source: @economics Read full article

Source: @economics Read full article

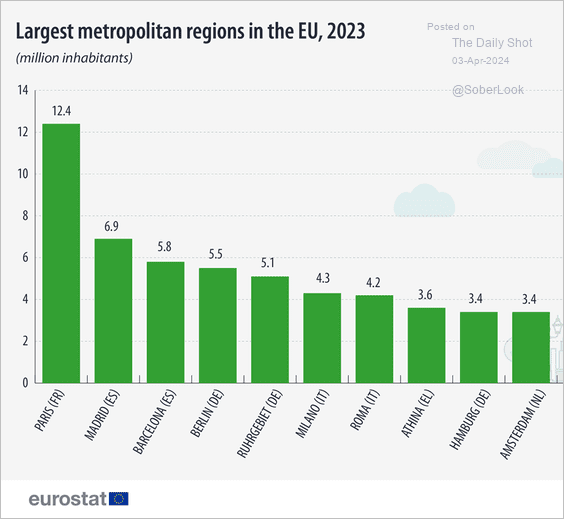

4. The EU’s largest cities by number of inhabitants:

Source: Eurostat Read full article

Source: Eurostat Read full article

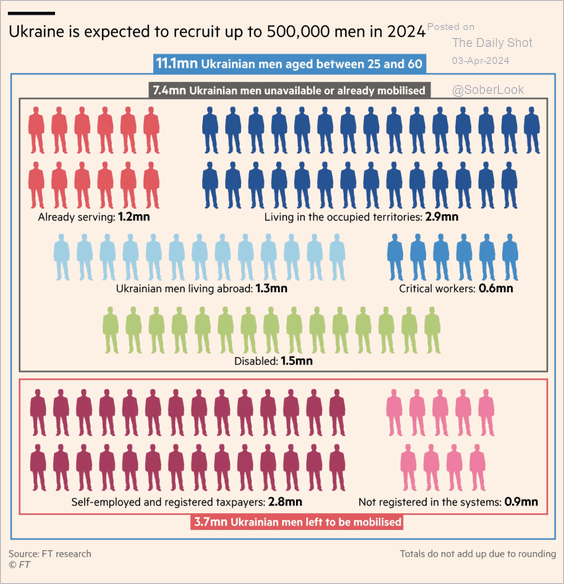

5. Projected mobilization potential of Ukrainian men:

Source: @financialtimes Read full article

Source: @financialtimes Read full article

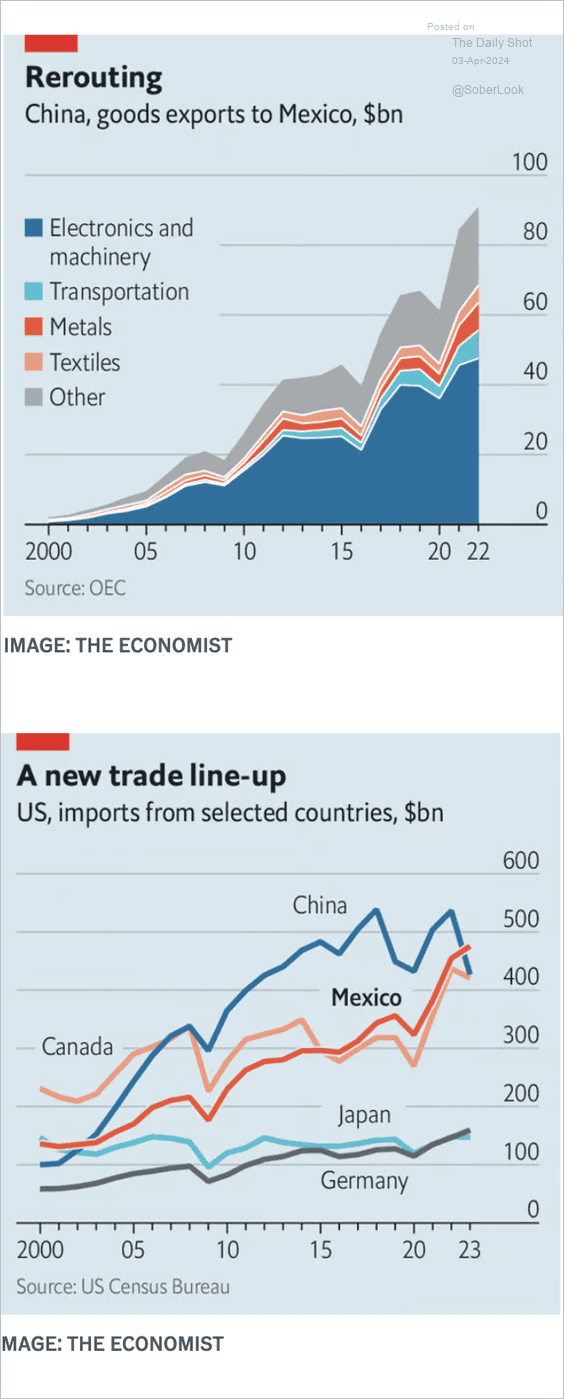

6. Rerouting Chinese imports via Mexico:

Source: The Economist Read full article

Source: The Economist Read full article

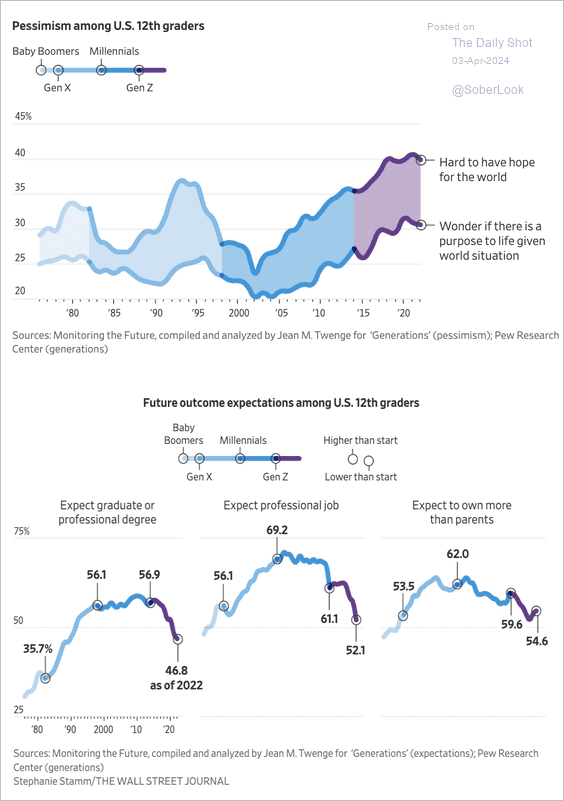

7. The evolving mindset of US 12th graders:

Source: @WSJ Read full article

Source: @WSJ Read full article

——————–

Back to Index