The Daily Shot: 28-Mar-24

• The United States

• The Eurozone

• Europe

• Japan

• Australia

• China

• Emerging Markets

• Energy

• Equities

• Credit

• Rates

• Food for Thought

Please note that the next issue of The Daily Shot will be published on Monday, April 1st.

The United States

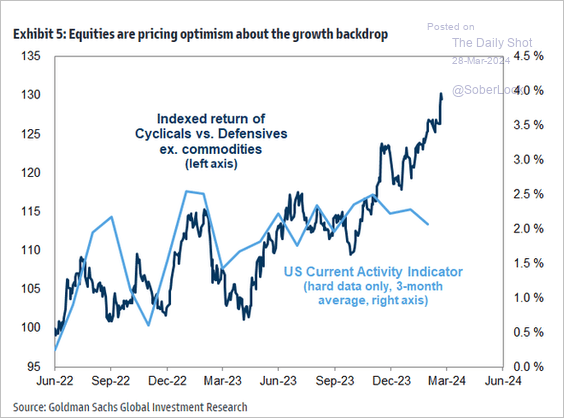

1. The equity market anticipates accelerated US growth, …

Source: Goldman Sachs; @MikeZaccardi

Source: Goldman Sachs; @MikeZaccardi

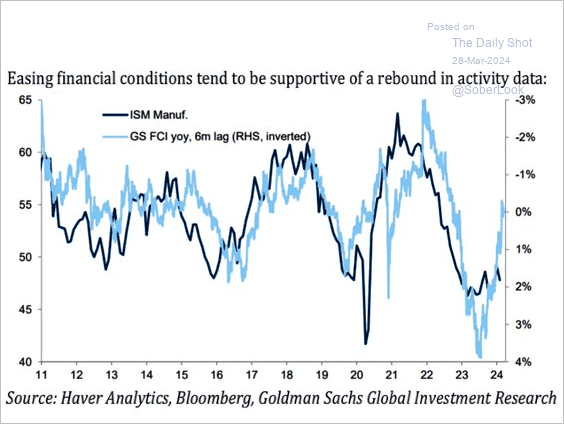

… with easing financial conditions also signaling heightened economic activity.

Source: Goldman Sachs; @AyeshaTariq

Source: Goldman Sachs; @AyeshaTariq

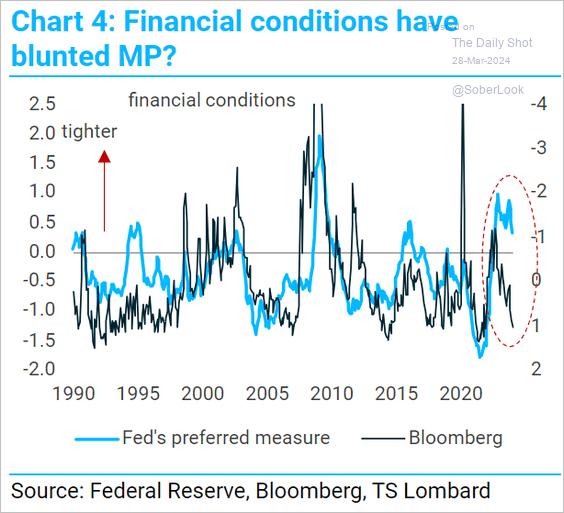

• However, the Fed may perceive financial conditions as significantly tighter than the market’s assessment.

Source: TS Lombard

Source: TS Lombard

——————–

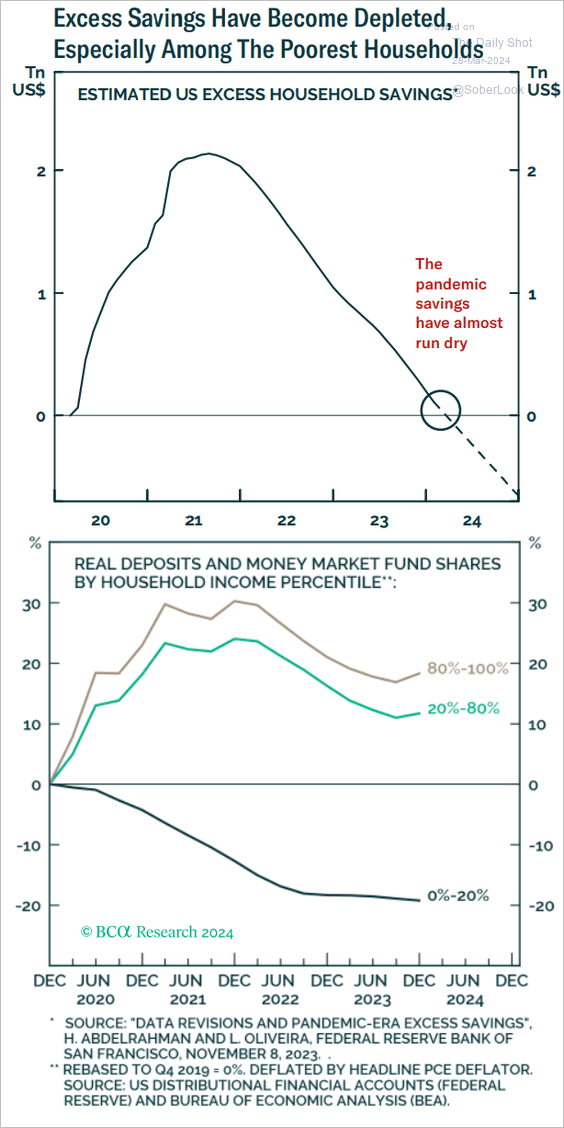

2. Are households’ excess savings running out?

Source: BCA Research

Source: BCA Research

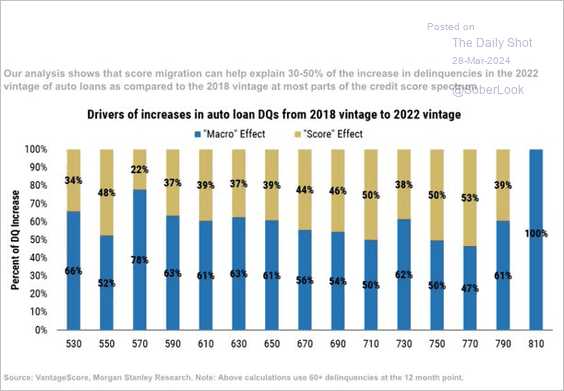

3. Due to upward credit score migration in recent years, individuals who previously may not have qualified for an auto loan are now obtaining one. This shift has weakened the borrower pool, leading to an increase in delinquencies.

Source: Morgan Stanley Research; @carlquintanilla

Source: Morgan Stanley Research; @carlquintanilla

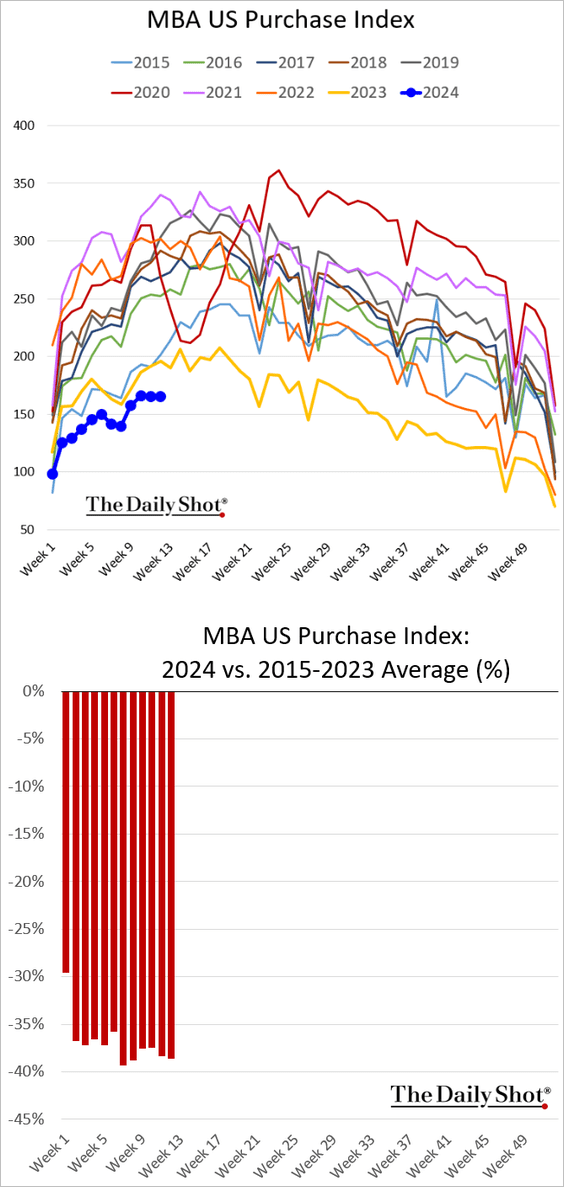

4. Mortgage applications are holding at multi-year lows.

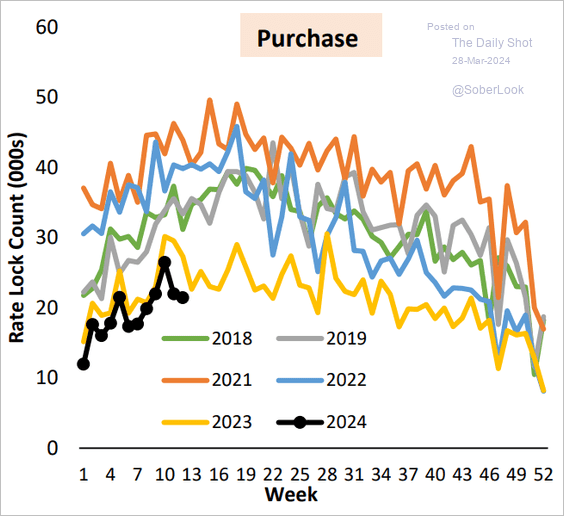

Here is the rate lock count.

Source: AEI Housing Center

Source: AEI Housing Center

——————–

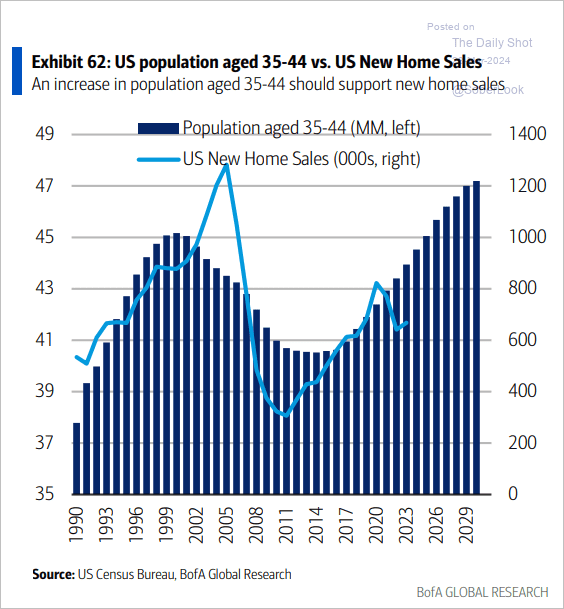

5. Demographic trends are favorable for stronger new home sales in the coming years.

Source: BofA Global Research

Source: BofA Global Research

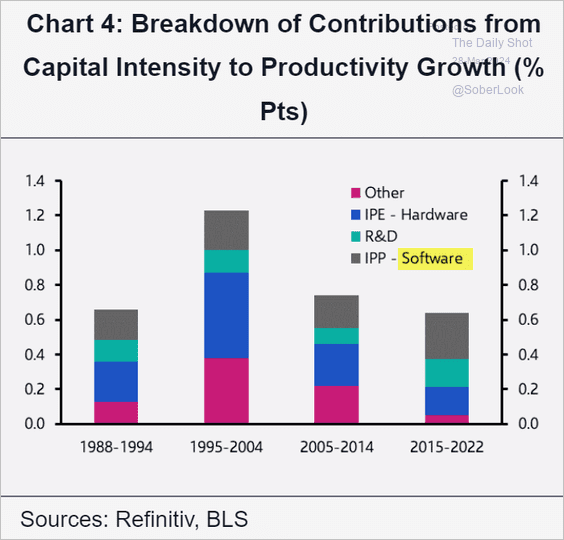

6. Software is becoming a key driver of productivity improvements. Could AI provide a significant boost to US productivity?

Source: Capital Economics

Source: Capital Economics

Back to Index

The Eurozone

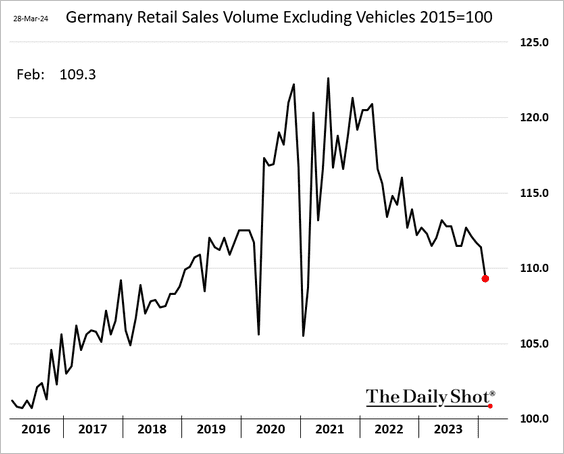

1. Germany’s retail sales deteriorated sharply last month, continuing the downward trend.

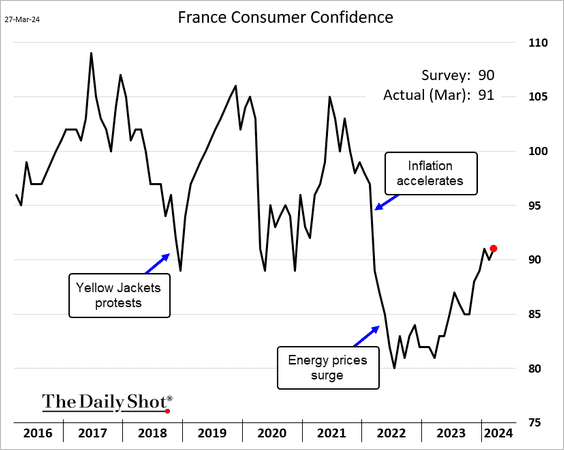

2. French consumer sentiment improved in March.

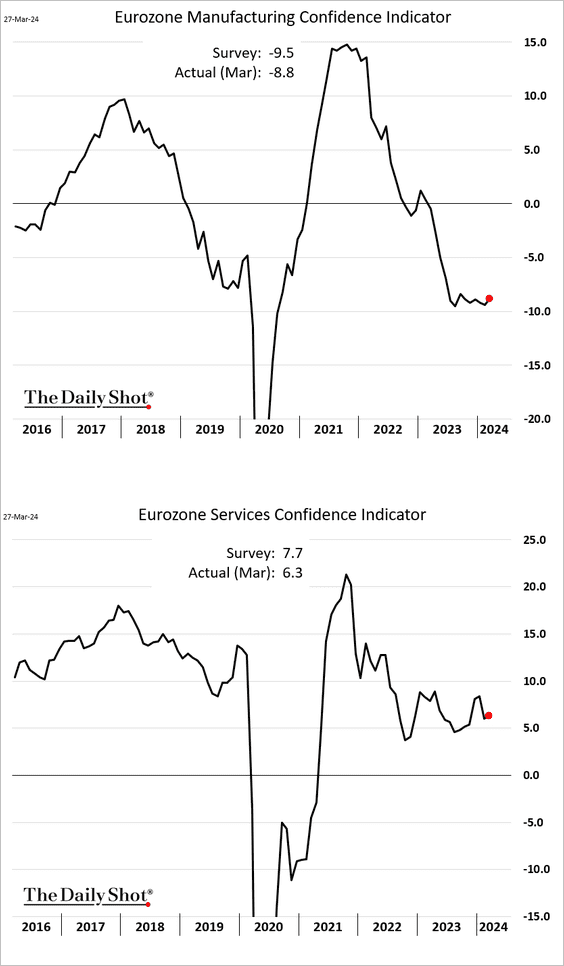

3. Business sentiment in the euro area improved slightly this month, although confidence in the manufacturing sector remains depressed.

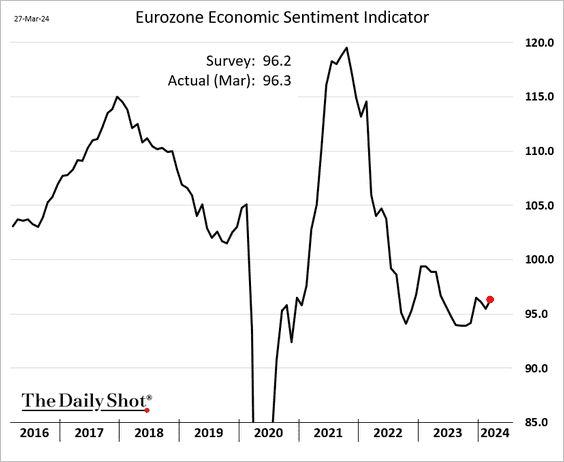

Here is the economic sentiment index, which includes consumer sentiment.

——————–

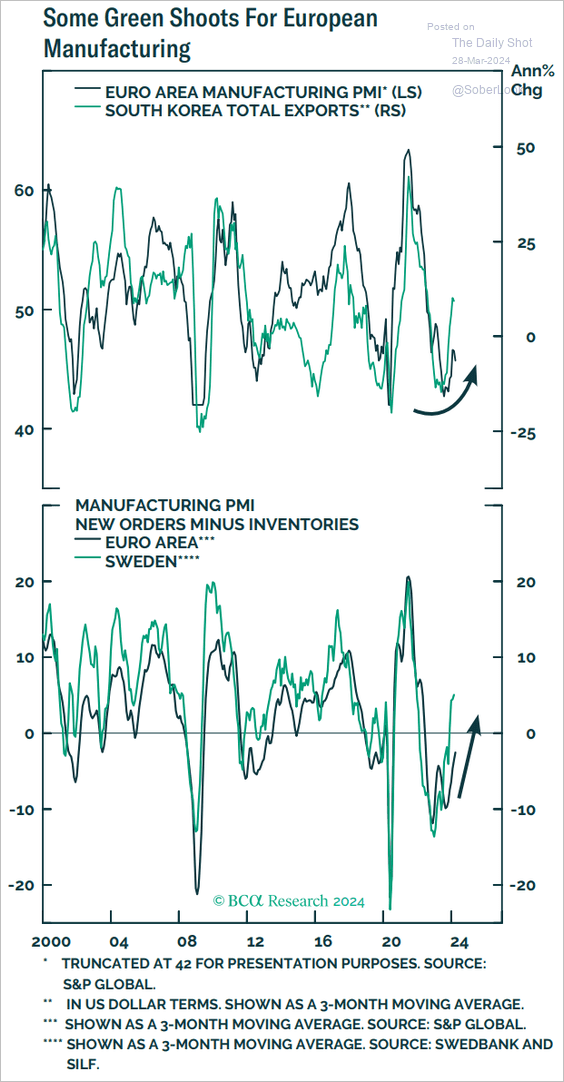

4. Leading indicates point to a rebound in euro-area manufacturing activity.

Source: BCA Research

Source: BCA Research

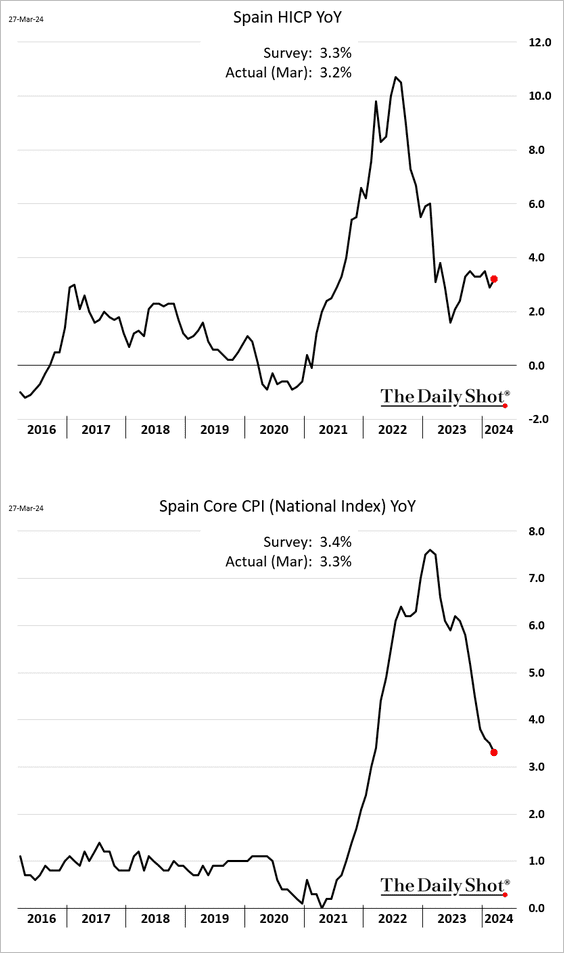

5. Spain’s headline CPI increased this month, but core inflation continues to moderate.

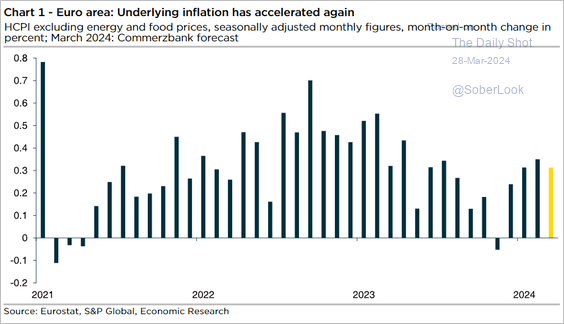

• Inflation in the Eurozone has accelerated. The following chart presents Commerzbank’s month-over-month inflation estimate for March.

Source: Commerzbank Research

Source: Commerzbank Research

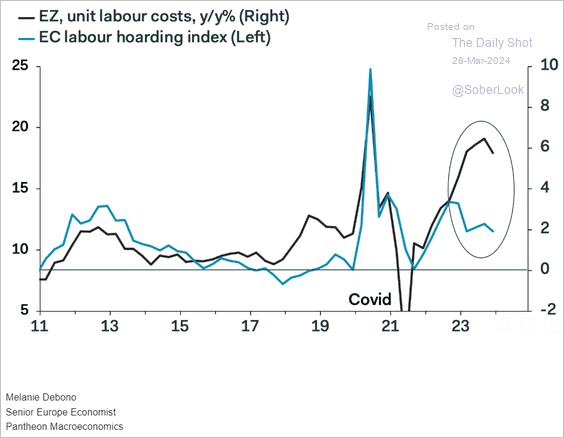

• The labor hoarding index suggests that unit labor costs should ease in the months ahead.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

Back to Index

Europe

1. Let’s start with some updates on Sweden.

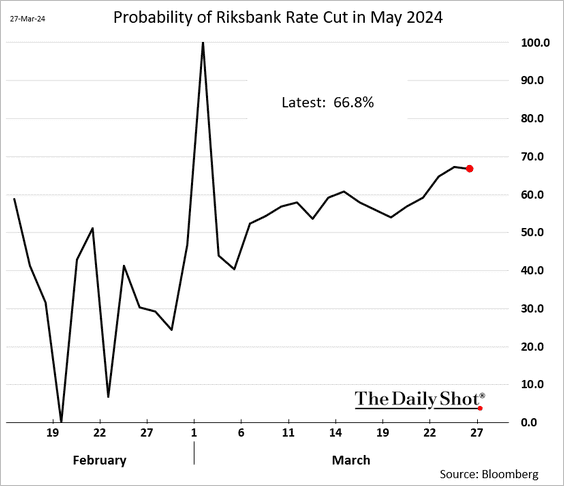

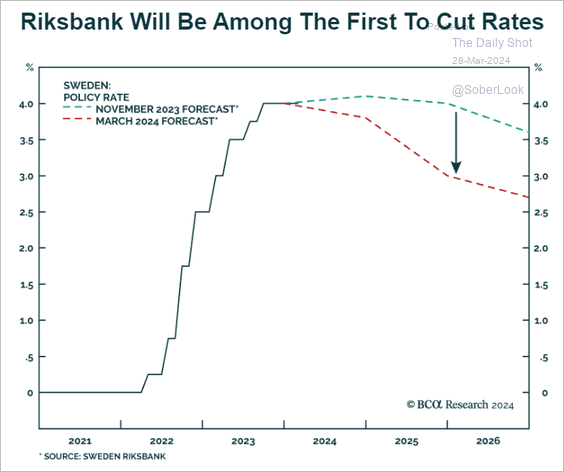

• Sweden’s Riksbank held rates steady but indicated potential cuts in May or June, …

Source: @WSJ Read full article

Source: @WSJ Read full article

… with the market assigning a two-thirds probability to a cut in May.

– Below is a forecast from BCA Research.

Source: BCA Research

Source: BCA Research

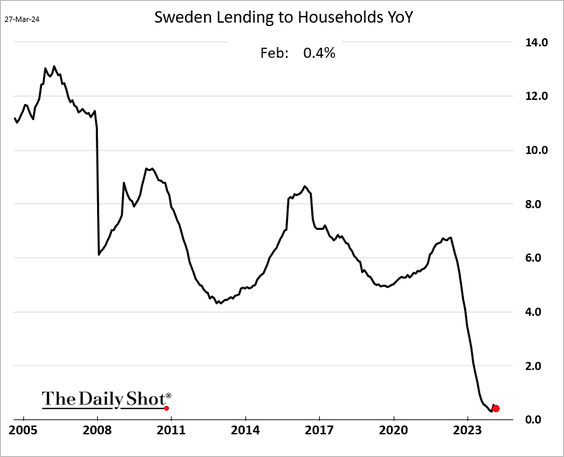

• Loan growth to Swedish households remains subdued.

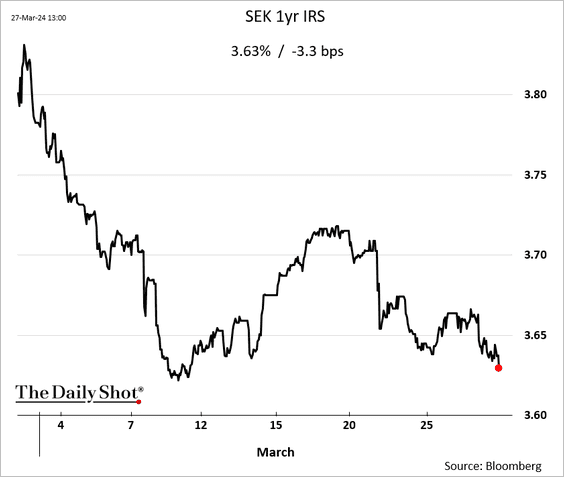

• Short-term rates have been moving lower. Here is the 1-year interest rate swap.

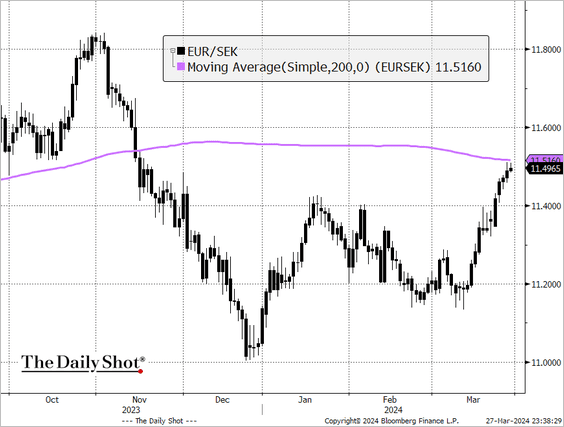

– The Swedish krona continues to weaken, with EUR/SEK testing the 200-day moving average.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

——————–

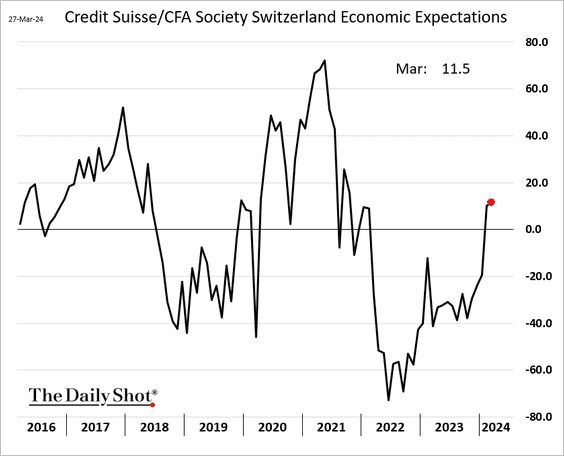

2. Swiss economic expectations are improving.

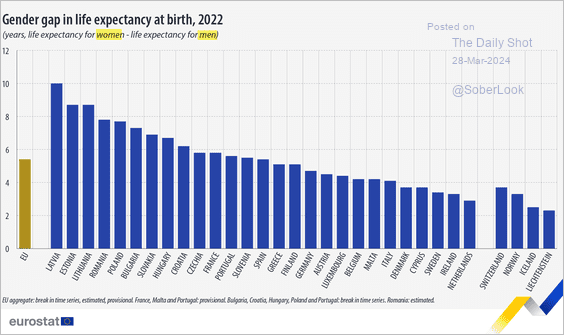

3. Next, we have a comparative analysis of gender disparities in life expectancy across European nations.

Source: Eurostat Read full article

Source: Eurostat Read full article

Back to Index

Japan

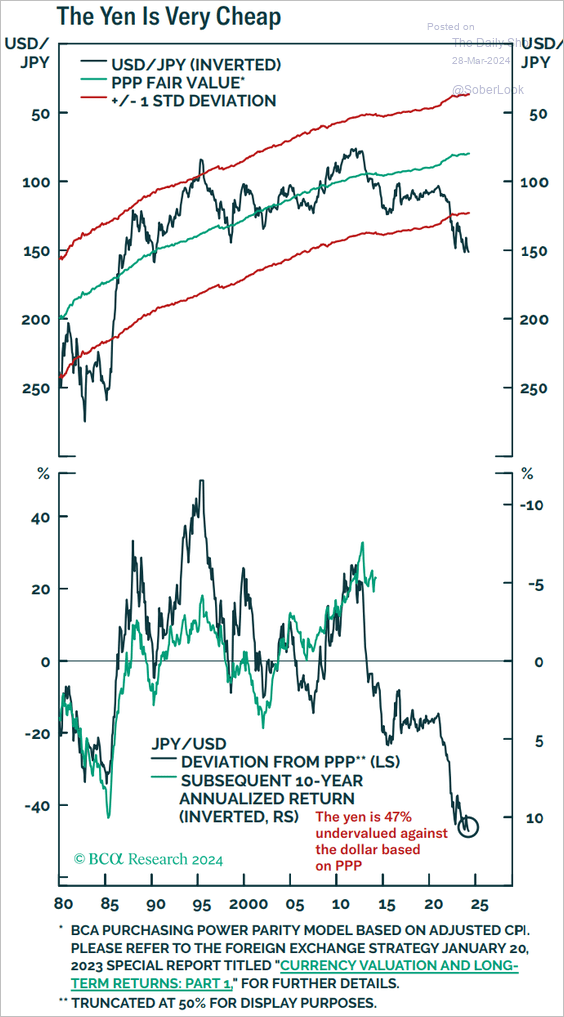

1. Fundamentals point to gains ahead for the yen.

Source: BCA Research

Source: BCA Research

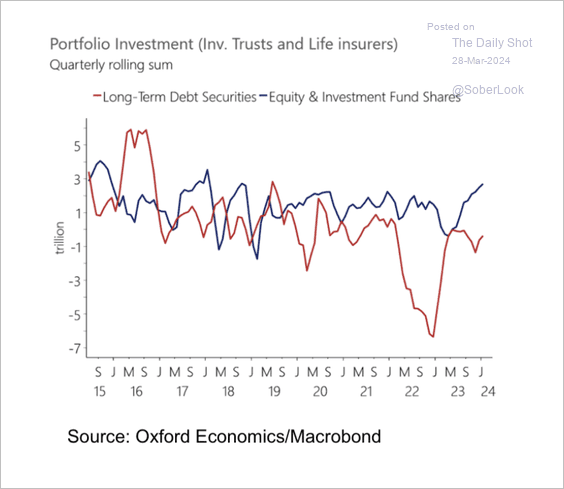

2. There has been an increasing shift toward domestic equities among local investors, …

Source: Oxford Economics

Source: Oxford Economics

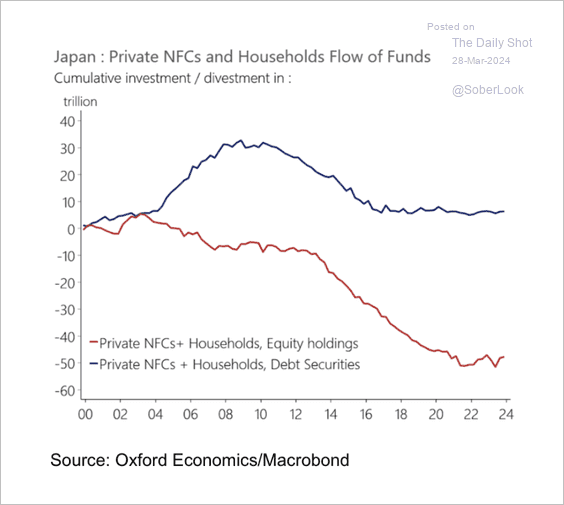

… and there is room for more domestic inflows.

Source: Oxford Economics

Source: Oxford Economics

Back to Index

Australia

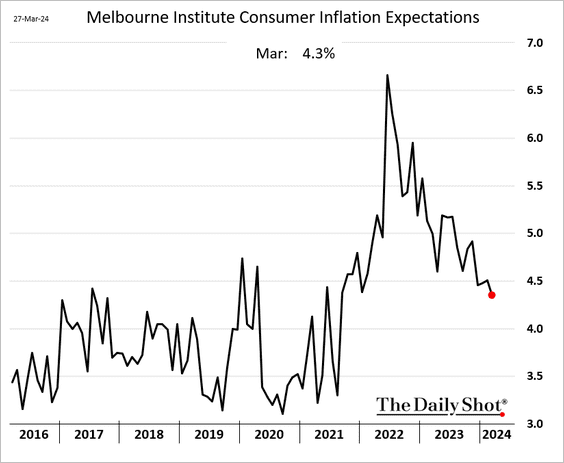

1. Inflation expectations are easing.

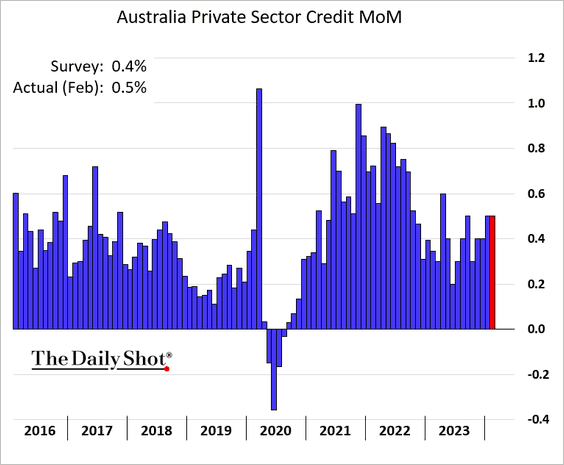

2. Credit growth is holding up.

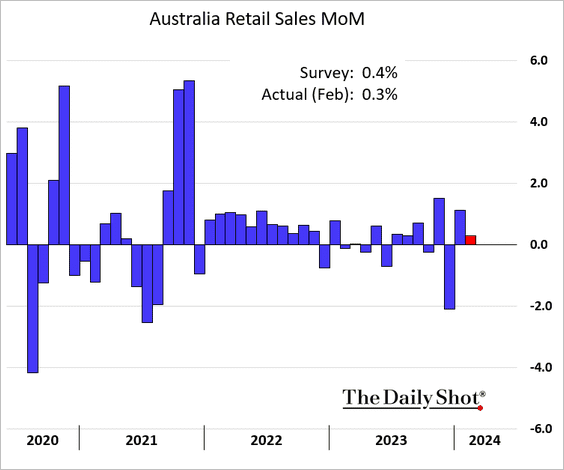

3. Retail sales increased modestly last month.

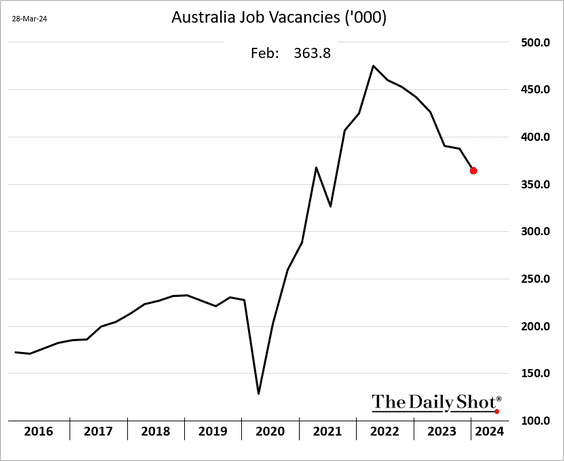

4. Job vacancies are easing but remain elevated.

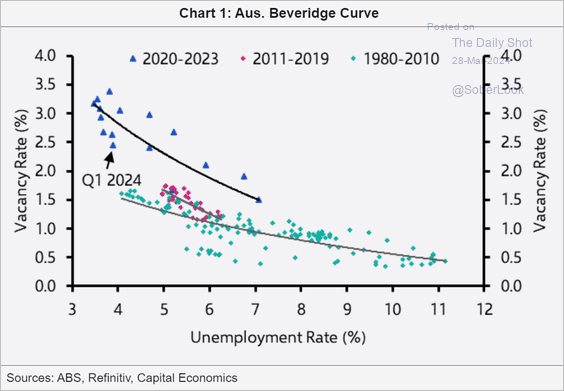

• The Beveridge curve continues to signal persistent labor market imbalance.

Source: Capital Economics

Source: Capital Economics

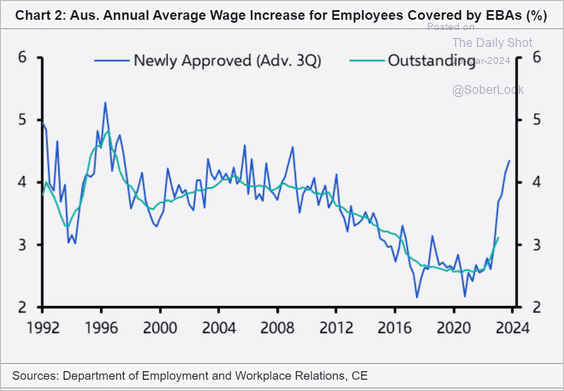

• Wage growth is accelerating, suggesting that the RBA is on hold for some time.

Source: Capital Economics

Source: Capital Economics

Back to Index

China

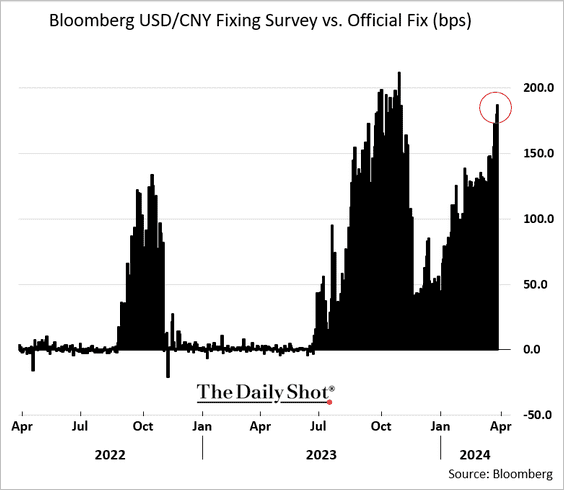

1. Beijing continues its efforts to boost the renminbi.

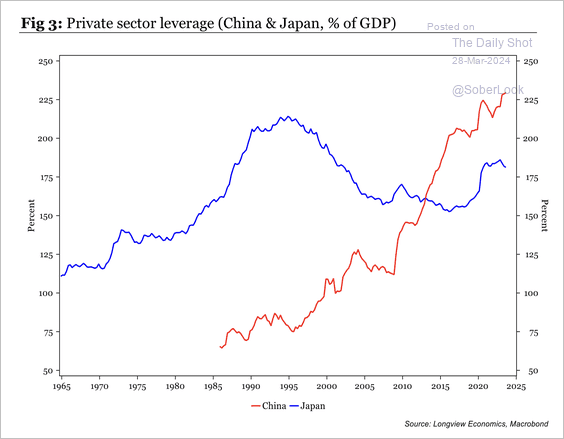

2. Private sector leverage surged past Japan in recent years.

Source: Longview Economics

Source: Longview Economics

Back to Index

Emerging Markets

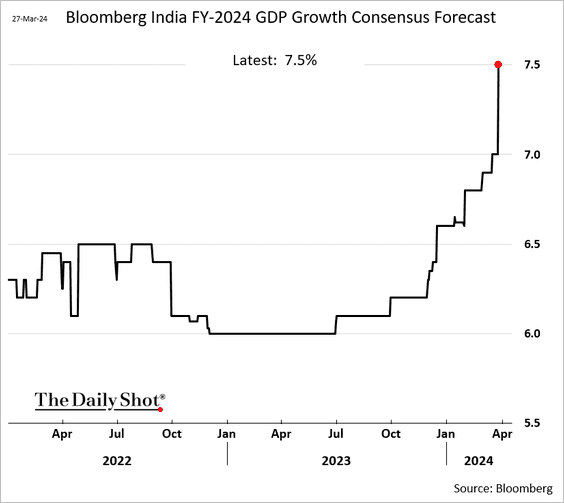

1. Economists keep boosting forecasts for India’s GDP growth.

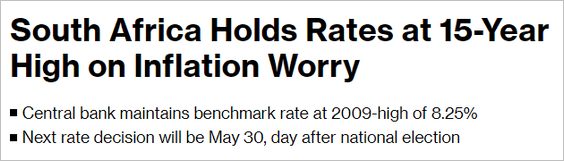

2. South Africa’s central bank left rates unchanged, …

Source: @economics Read full article

Source: @economics Read full article

… amid rising inflation expectations.

——————–

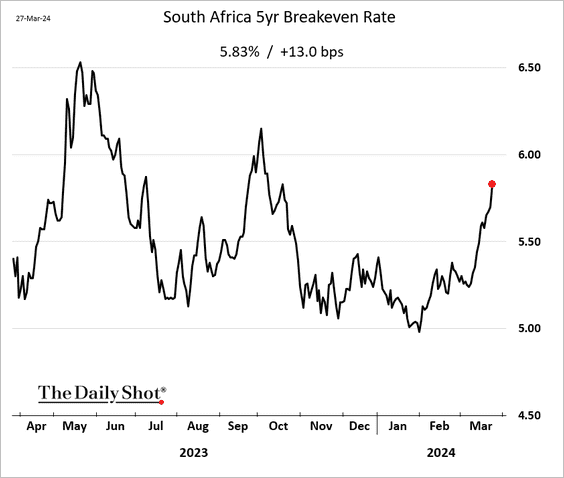

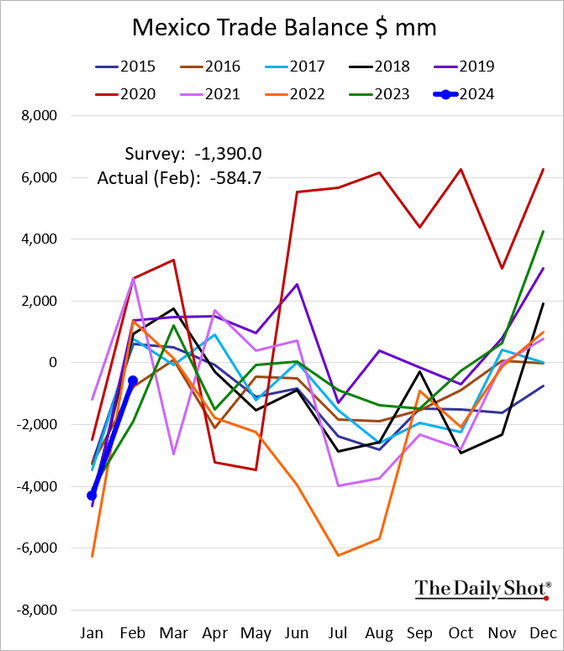

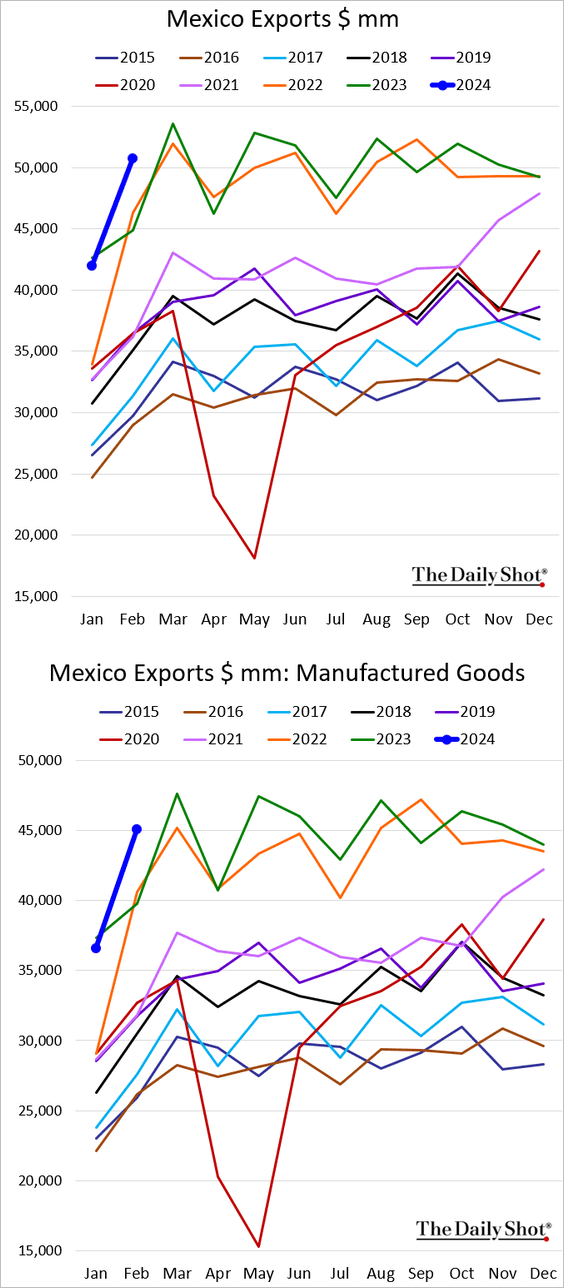

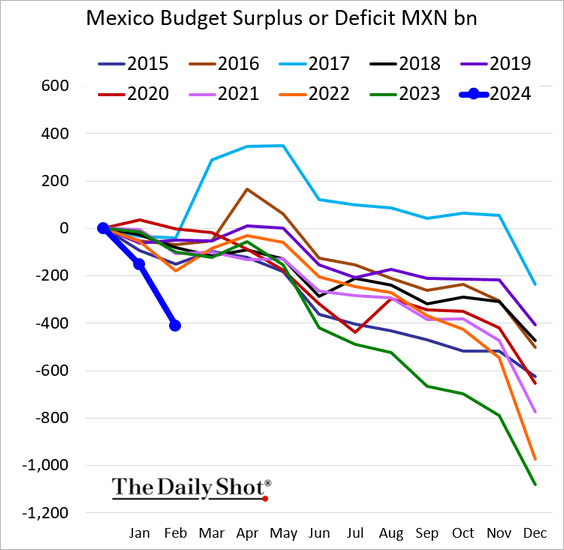

3. Next, we have some updates on Mexico.

• The trade deficit was narrower than expected last month, …

… as exports hit a record high.

• The Mexican government has ramped up spending in the lead-up to the elections.

Source: @economics Read full article

Source: @economics Read full article

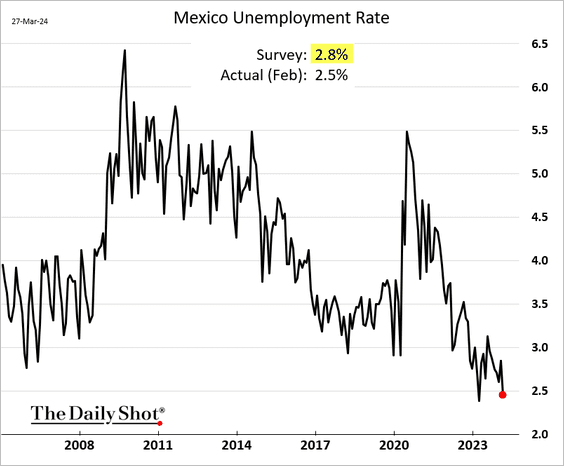

• The unemployment rate surprised to the downside.

Back to Index

Energy

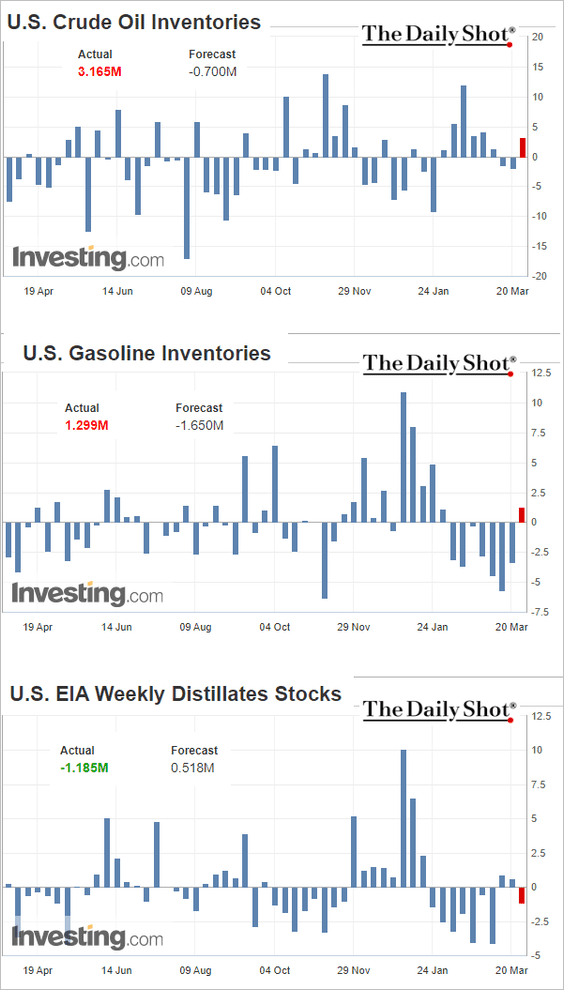

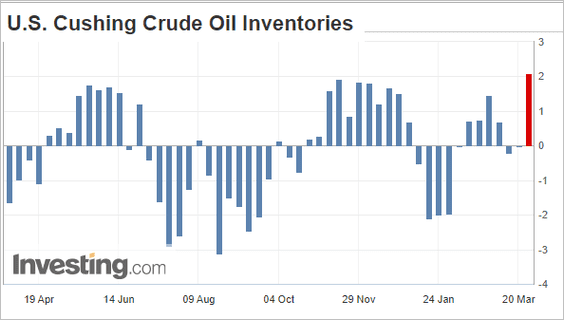

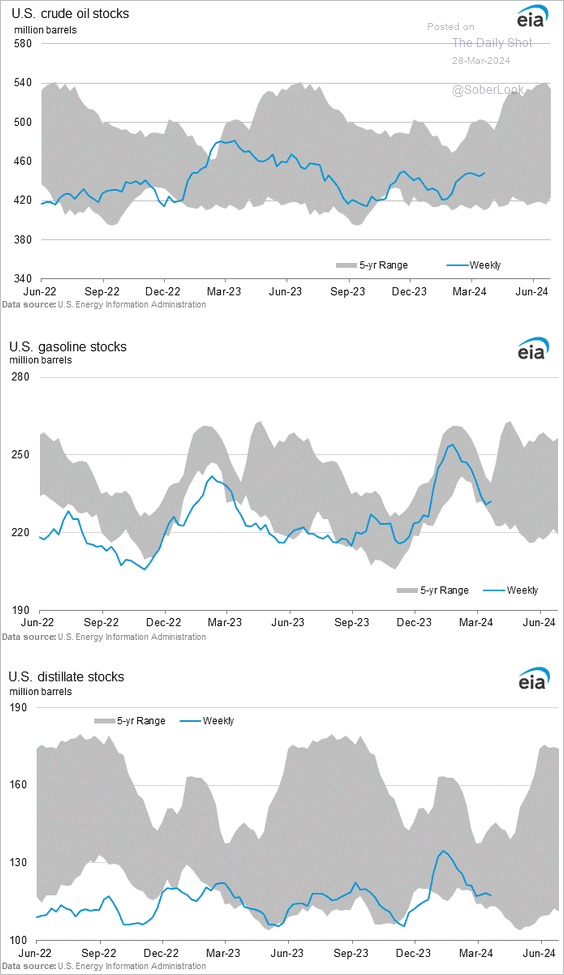

1. The US inventory report was bearish, with crude and gasoline inventories unexpectedly rising last week.

• Oil stockpiles jumped at Cushing, OK (the settlement hub for WTI futures).

Here are the inventory levels.

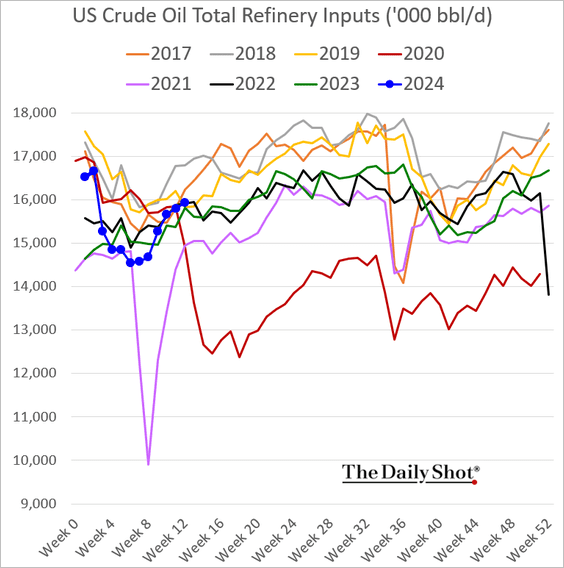

• Refinery runs edged higher.

——————–

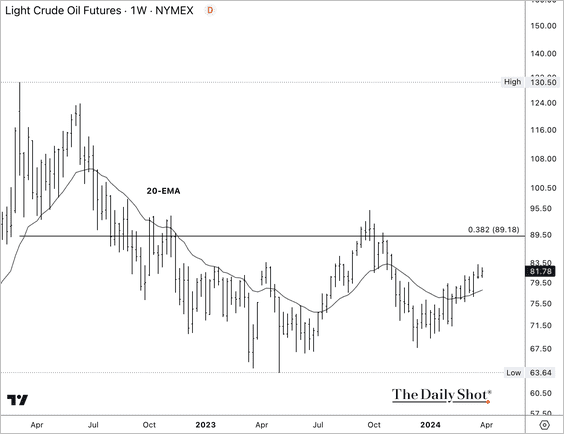

2. The front-month WTI Crude Oil futures contract is attempting to reverse a prior downtrend with resistance at $89/bbl.

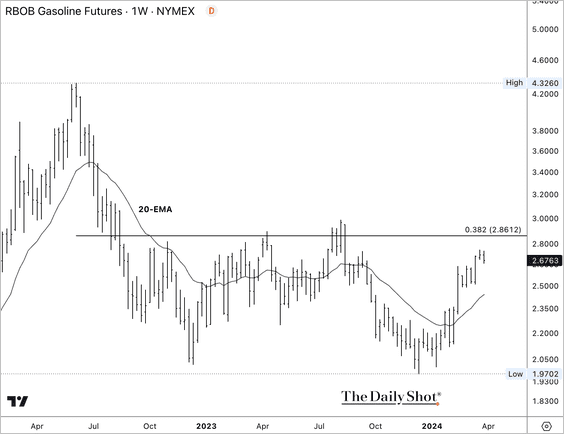

The front-month RBOB Gasoline futures contract is approaching strong resistance.

——————–

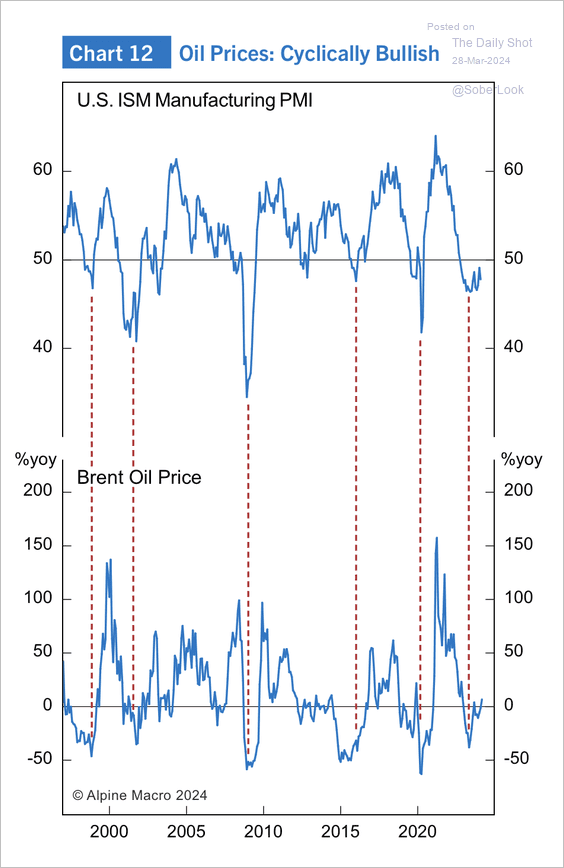

3. The improvement in US manufacturing conditions could be supportive for oil prices.

Source: Alpine Macro

Source: Alpine Macro

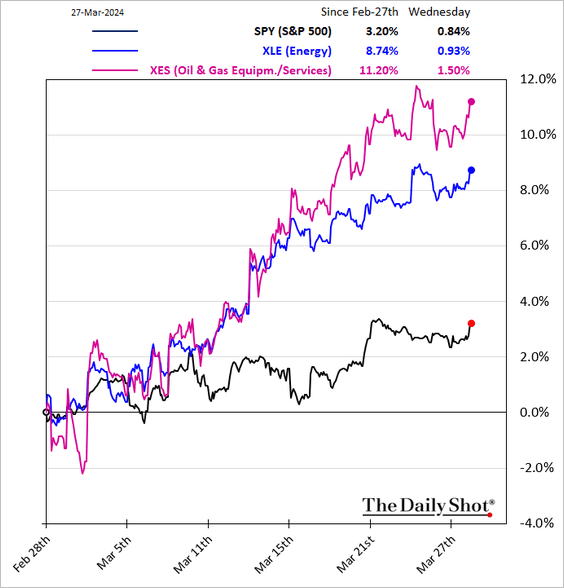

4. US energy shares have been outperforming.

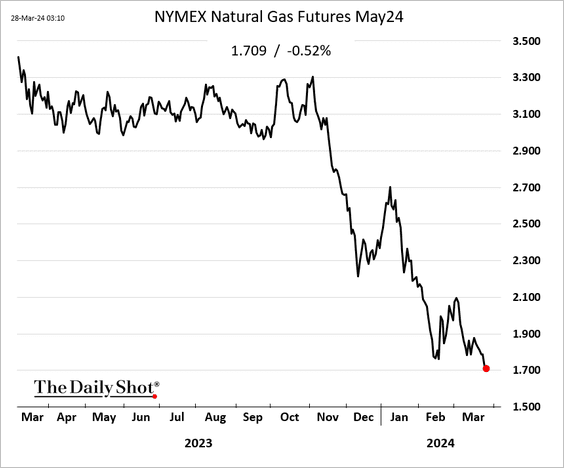

5. US natural gas futures continue to struggle.

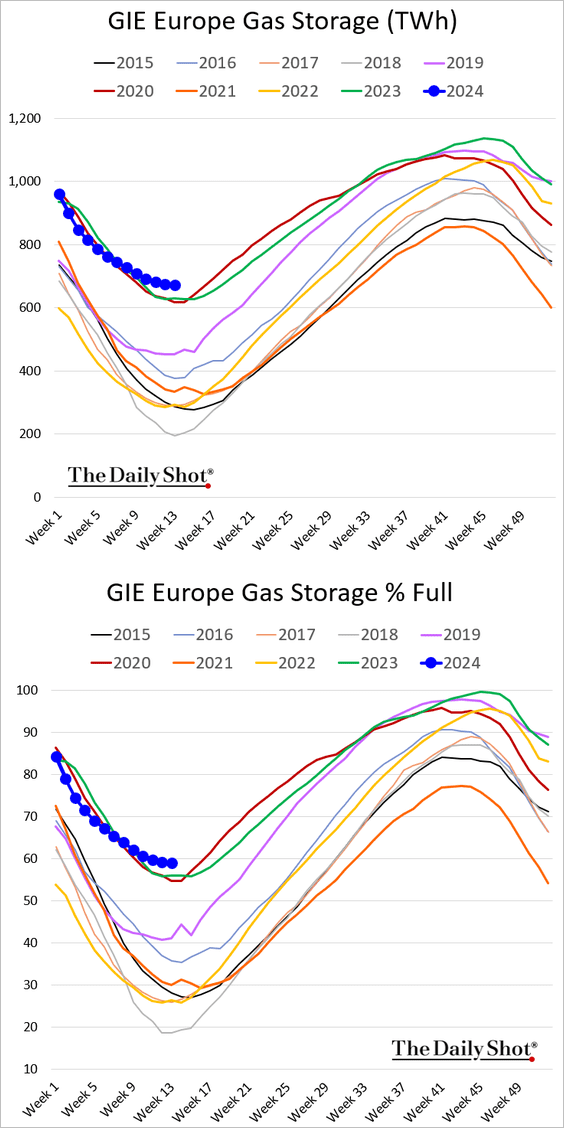

6. European natural gas inventories have reached their highest levels in years (for this time of the year).

Back to Index

Equities

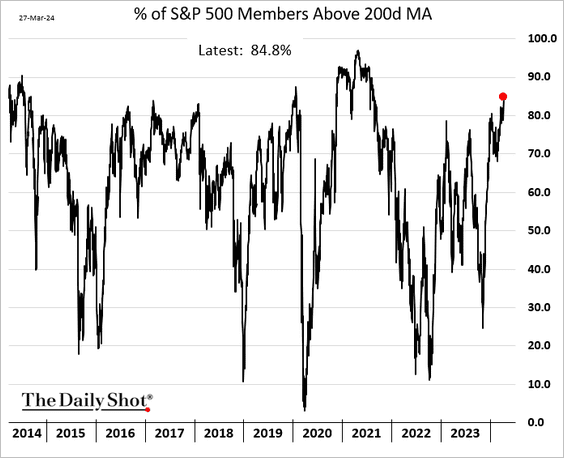

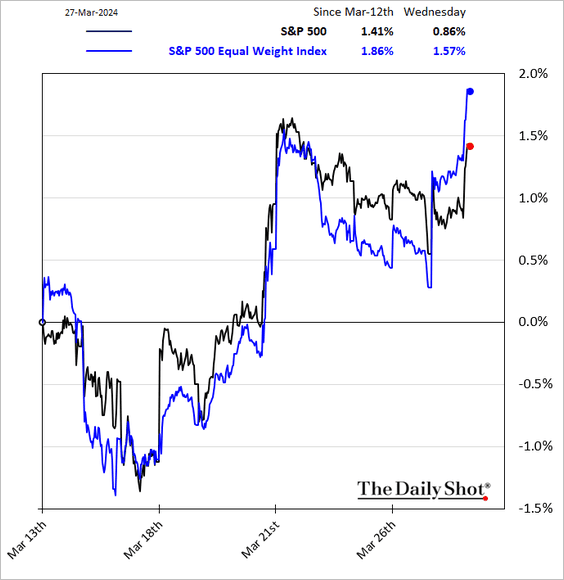

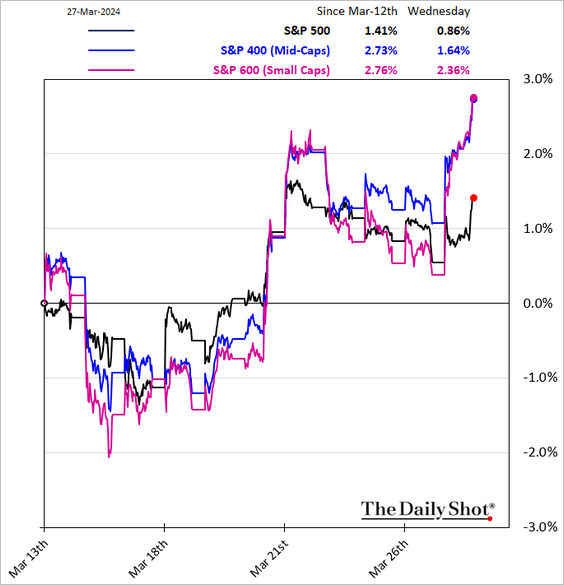

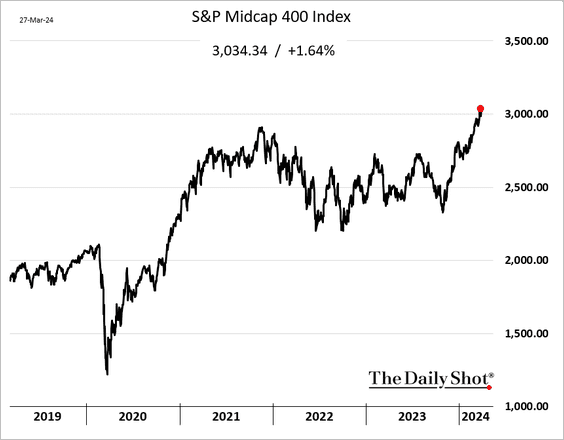

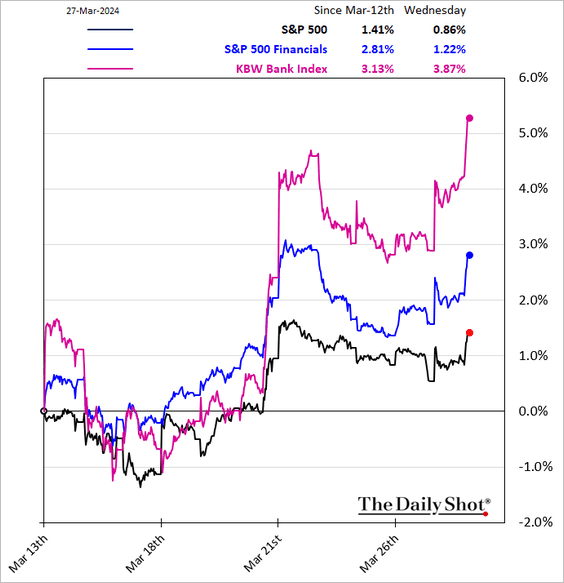

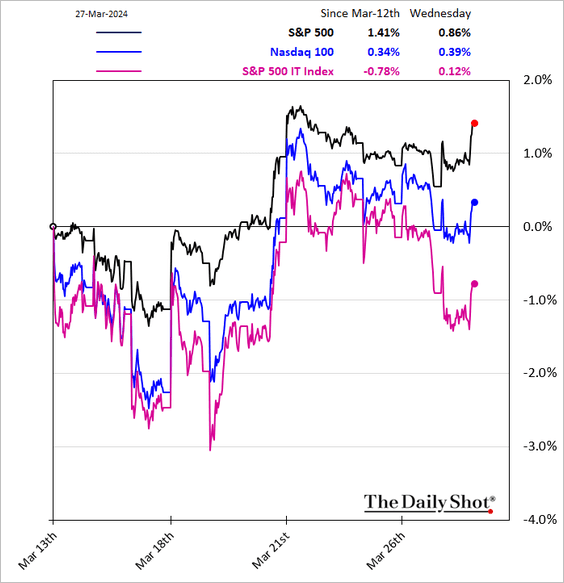

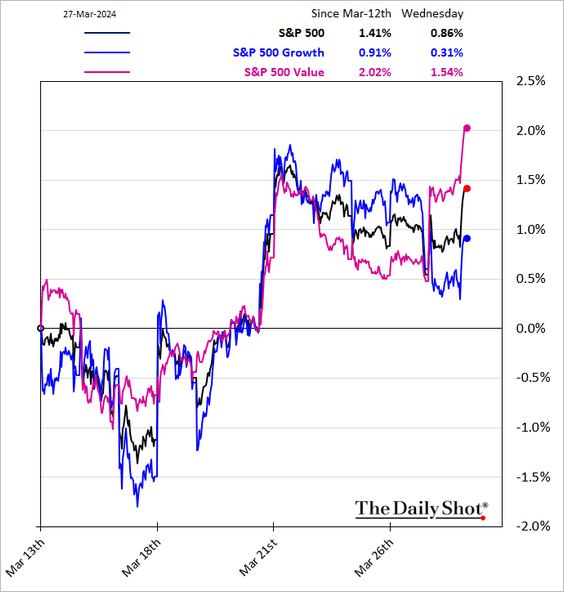

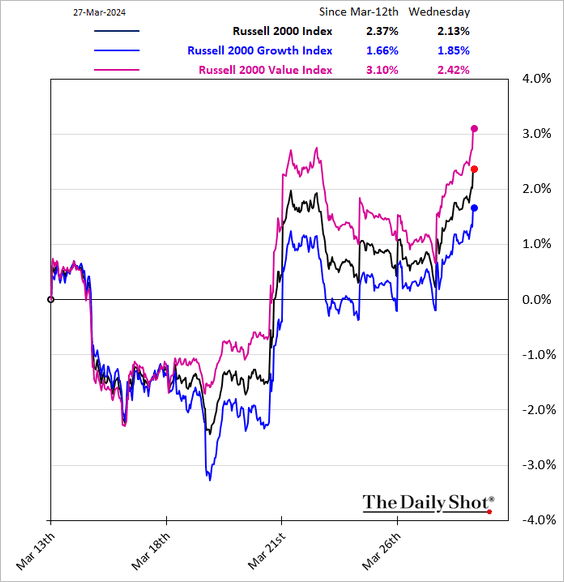

1. The stock market rally has broadened out.

• The equal weight index outperformed on Wednesday, …

… and so did mid and small caps.

– The S&P 400 mid-cap index hit another record.

• Bank shares surged.

• Tech underperformed.

• Value outperformed growth, …

… including for small caps.

——————–

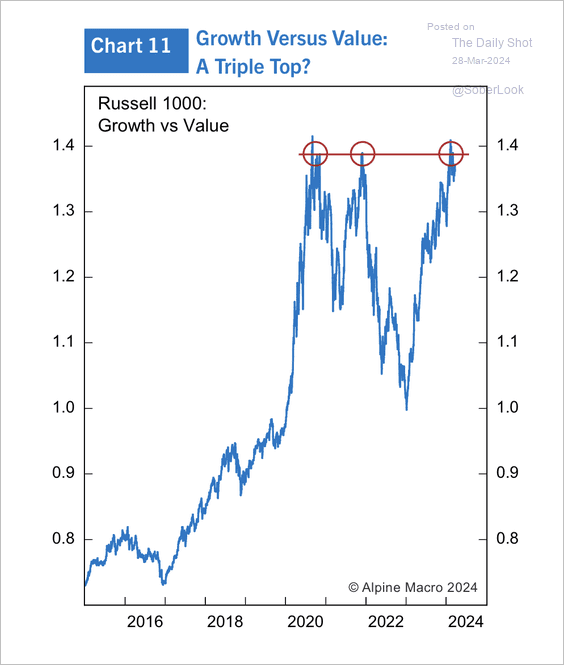

2. The US growth/value ratio is testing long-term resistance.

Source: Alpine Macro

Source: Alpine Macro

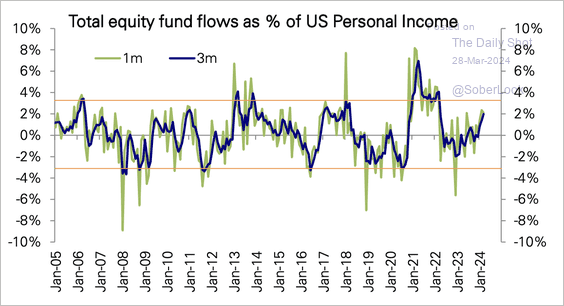

3. US equity flows as a percentage of personal income are well into the upper half of their historical range.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

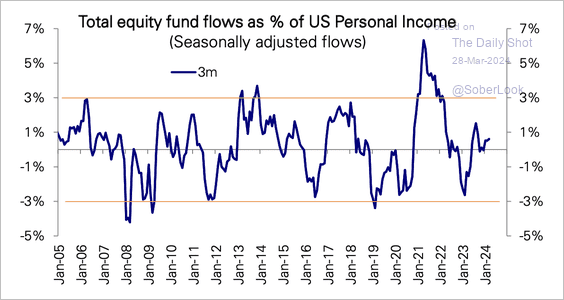

Still, inflows are just about average when scaled by personal income and adjusted for seasonality.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

——————–

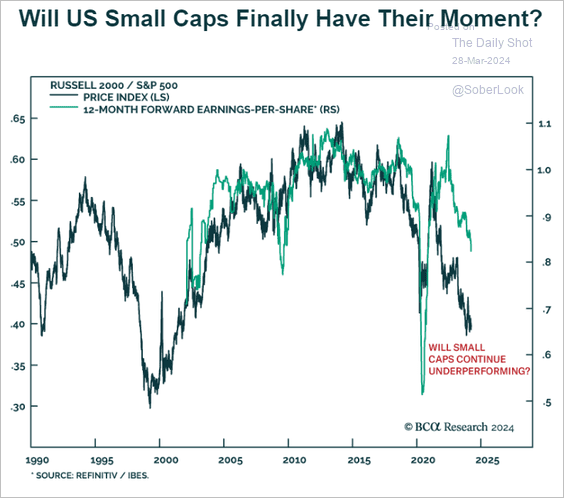

4. The Russell 2000 price performance has been lagging behind its relative EPS expectations.

Source: BCA Research

Source: BCA Research

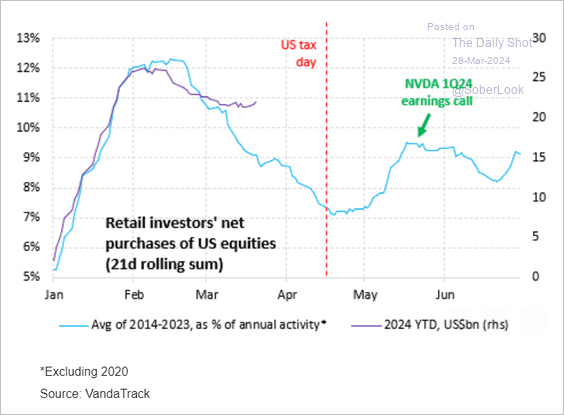

5. Retail investors have been more active than usual this month, …

Source: Vanda Research

Source: Vanda Research

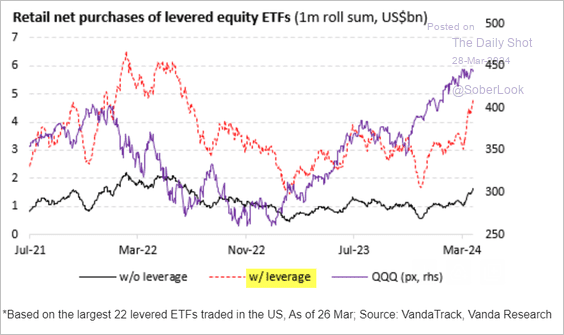

… placing more leveraged bets via ETFs.

Source: Vanda Research

Source: Vanda Research

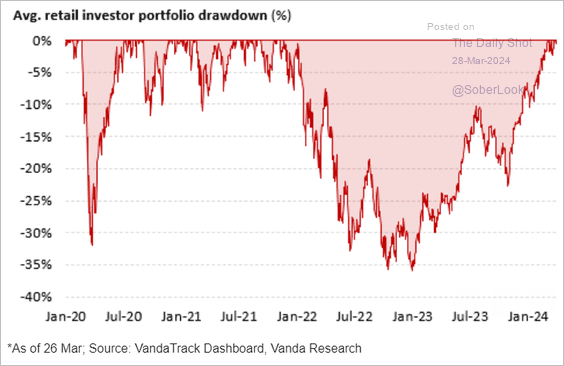

Retail portfolios are no longer underwater.

Source: Vanda Research

Source: Vanda Research

——————–

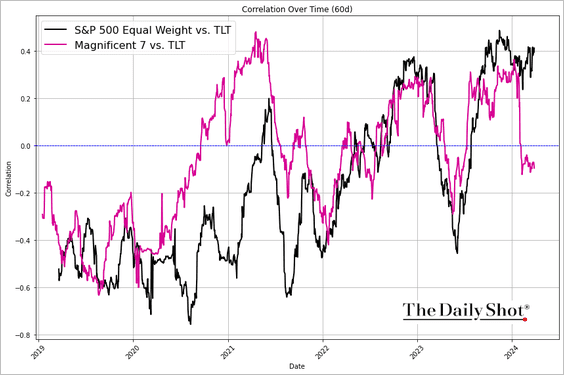

6. The Magnificent Seven shares have decoupled from rates recently, whereas the average S&P 500 stock remains correlated to Treasuries.

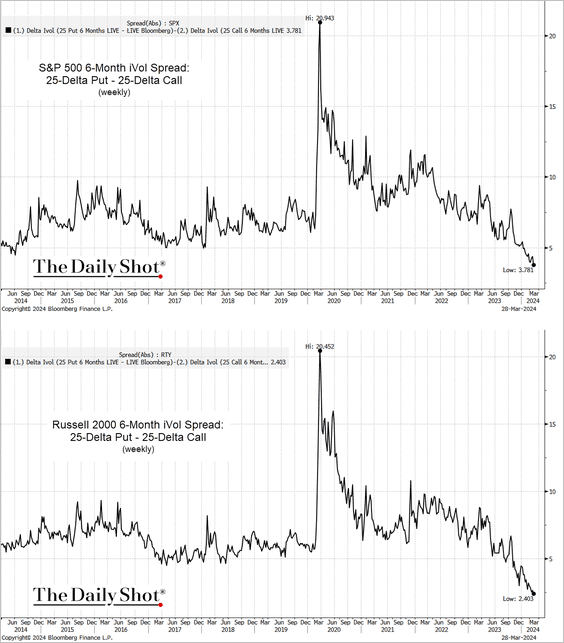

7. Volatility skew measures point to extreme bullishness in the options markets.

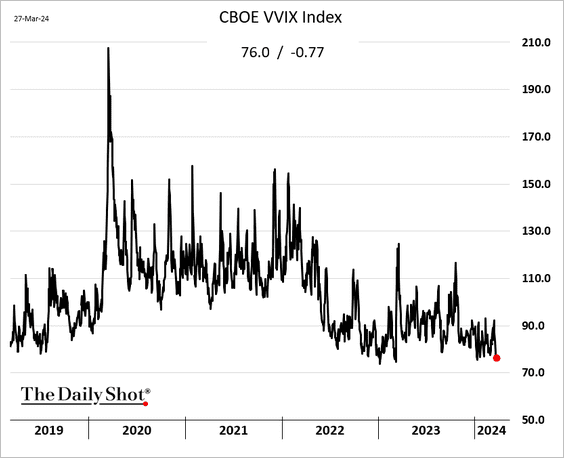

• Demand for VIX calls (a hedge against market correction) has been trending lower. VVIX is the implied volatility index on VIX.

Back to Index

Credit

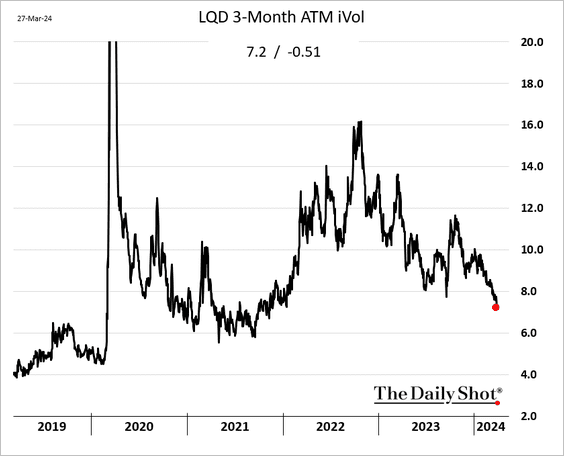

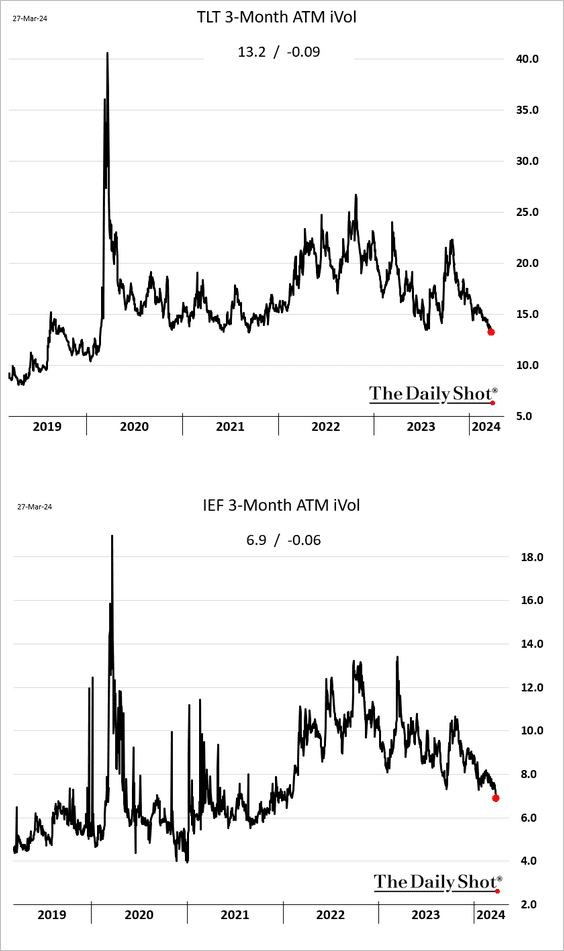

1. Implied volatility on investment-grade bonds is falling.

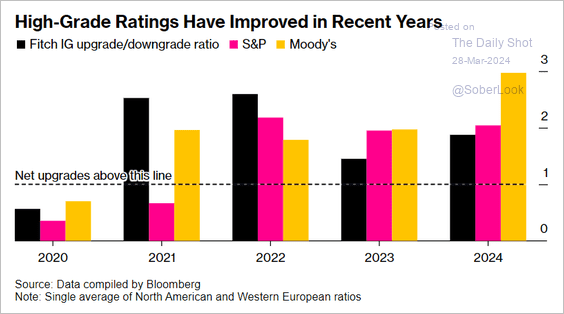

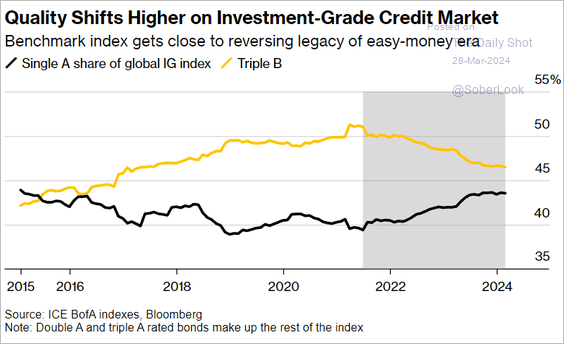

2. The quality of the US investment-grade bond universe has been improving (2 charts).

Source: @markets Read full article

Source: @markets Read full article

Source: @markets Read full article

Source: @markets Read full article

Back to Index

Rates

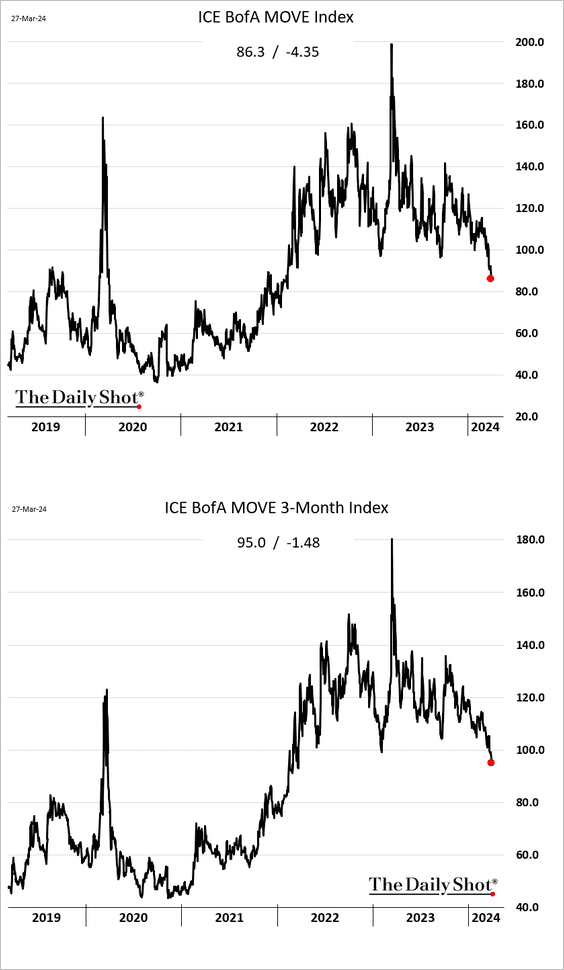

Treasury market implied volatility continues to sink.

Here is the implied vol on Treasury ETFs.

——————–

Food for Thought

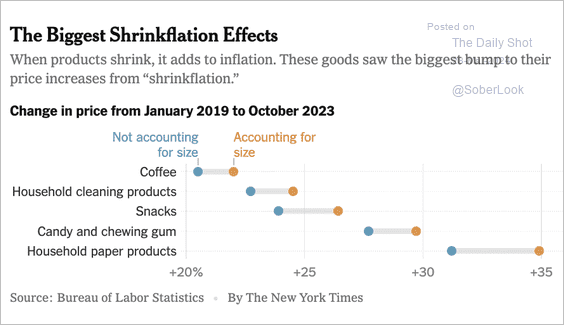

1. The impact of shrinkflation on consumer goods prices:

Source: The New York Times Read full article

Source: The New York Times Read full article

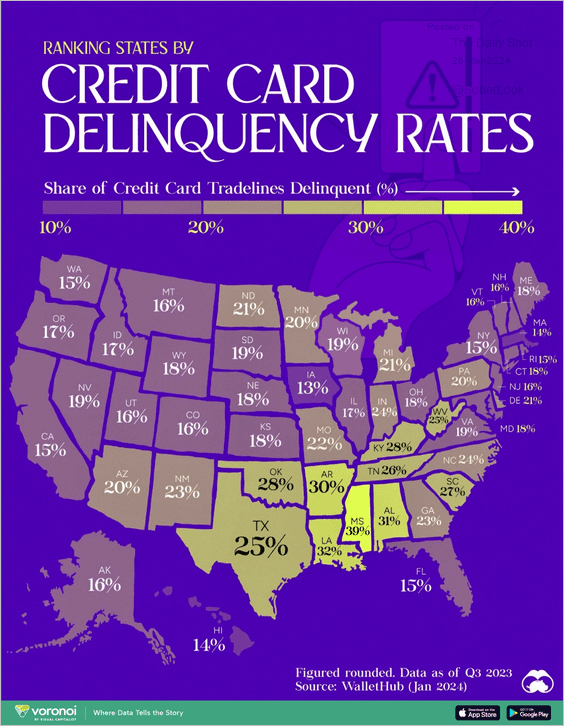

2. State rankings by credit card delinquency rates:

Source: Visual Capitalist Read full article

Source: Visual Capitalist Read full article

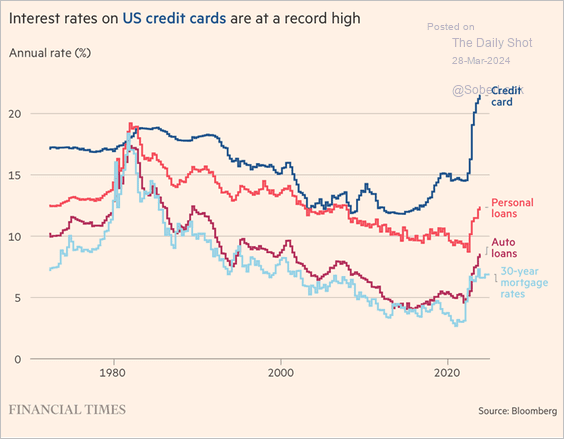

3. The spike in credit card and other consumer loan rates:

Source: @financialtimes Read full article

Source: @financialtimes Read full article

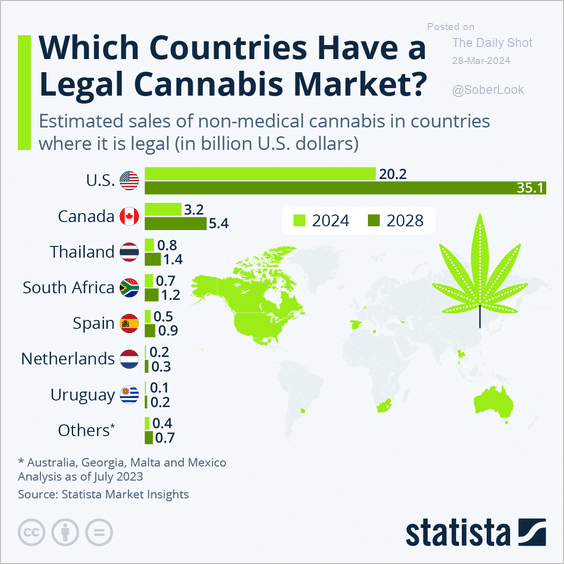

4. Forecasted growth of legal non-medical cannabis markets by country:

Source: Statista

Source: Statista

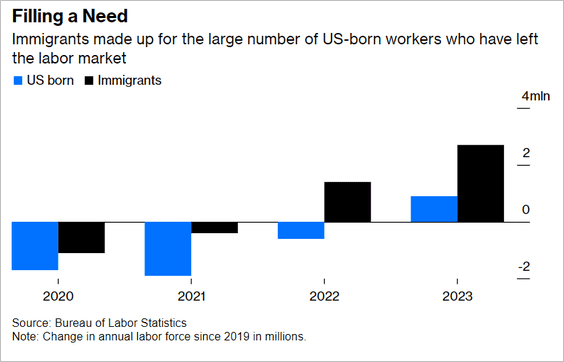

5. Labor market contributions by US-born and immigrant workers since 2019:

Source: @Claudia_Sahm, @opinion Read full article

Source: @Claudia_Sahm, @opinion Read full article

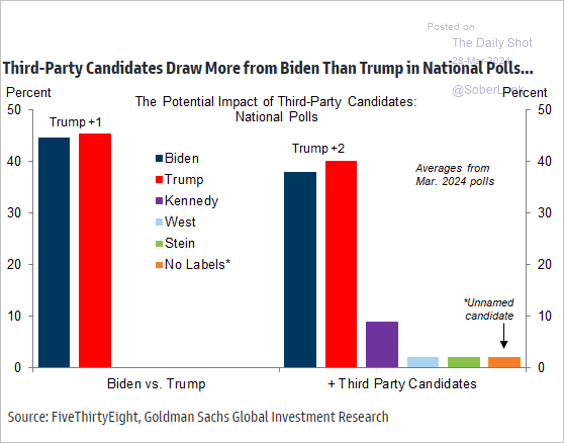

6. The potential impact of third-party candidates on the US 2024 presidential election:

Source: Goldman Sachs; @MikeZaccardi

Source: Goldman Sachs; @MikeZaccardi

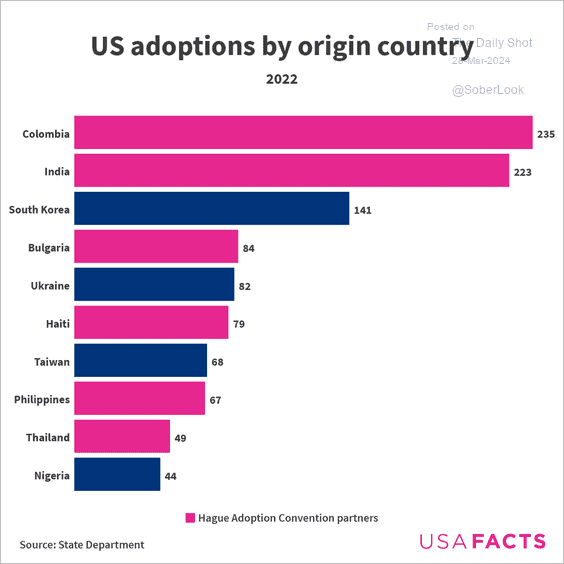

7. International adoptions in the US by country of origin:

Source: USAFacts

Source: USAFacts

——————–

Please note that the next issue of The Daily Shot will be published on Monday, April 1st.

Have a great weekend!

Back to Index