The Daily Shot: 26-Apr-24

• The United States

• Canada

• The United Kingdom

• The Eurozone

• Europe

• Japan

• China

• Emerging Markets

• Cryptocurrency

• Commodities

• Energy

• Equities

• Credit

• Rates

• Food for Thought

The United States

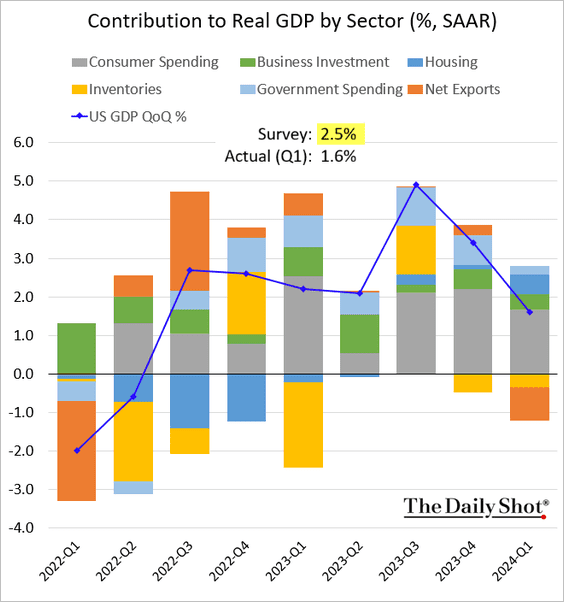

1. The Q1 GDP report surprised to the downside, …

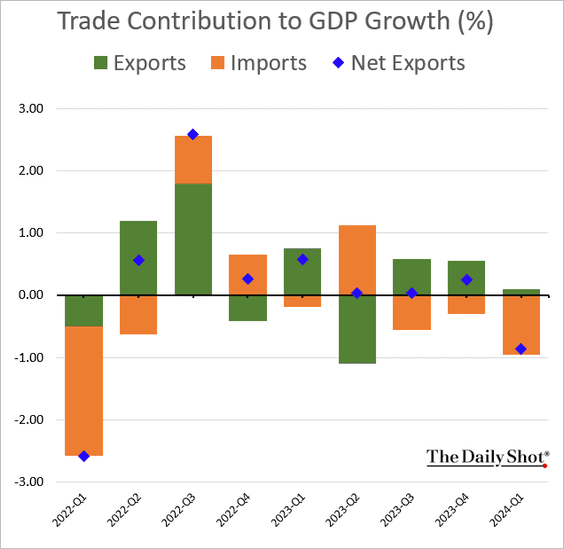

… with weakness coming from strong imports (which decrease net exports) …

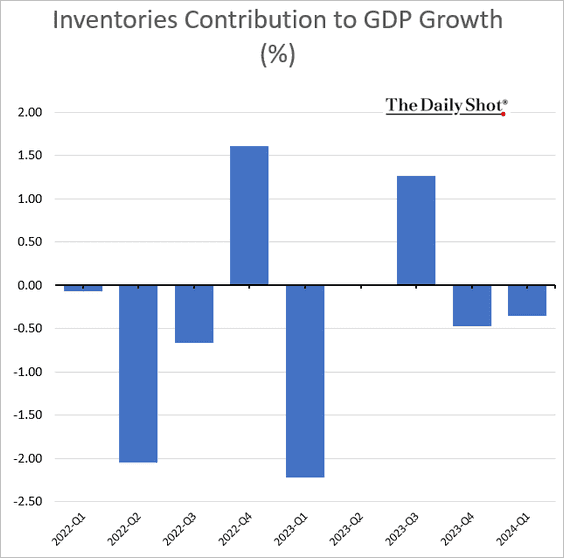

… and contracting inventories.

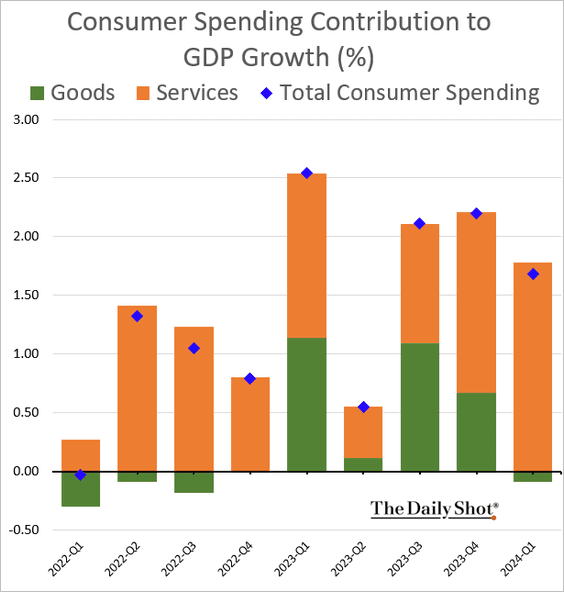

– Consumer spending growth was robust, driven by services.

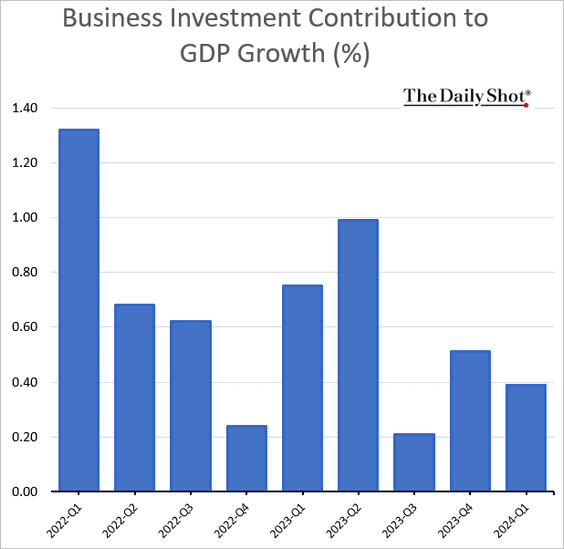

– Business investment expanded again.

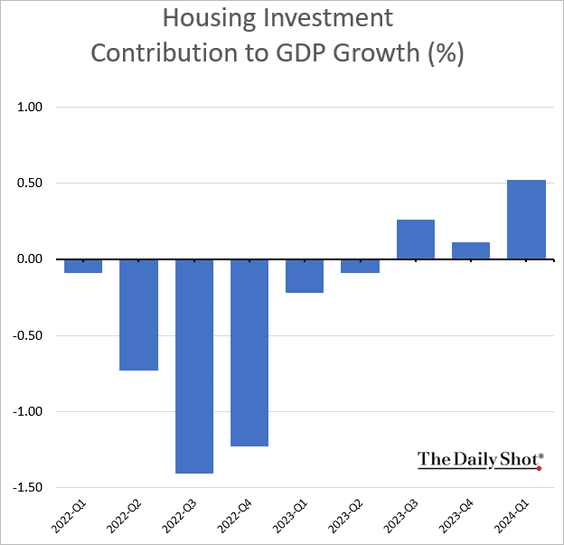

– Housing investment also registered growth.

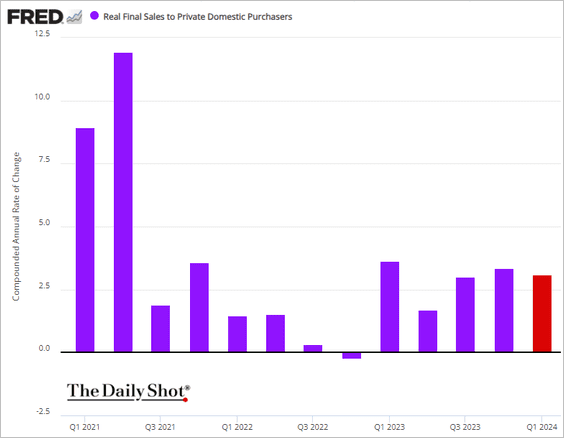

• Due to strong domestic demand, real final sales to private domestic purchasers (“core GDP”) expanded by more than 3% (annualized).

Source: @economics Read full article

Source: @economics Read full article

——————–

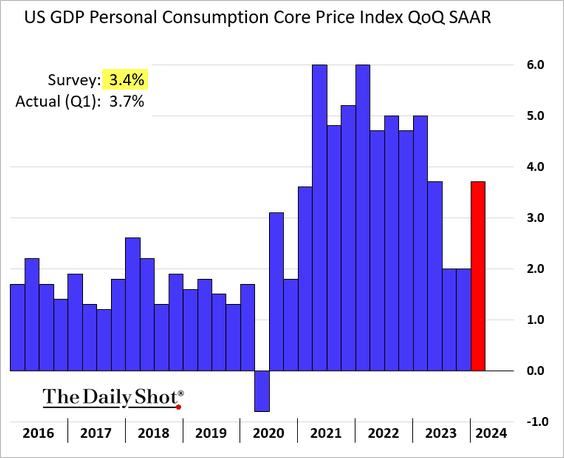

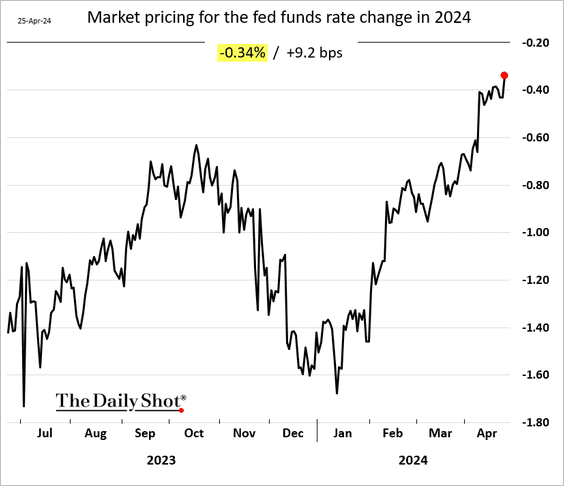

2. The GDP report’s troubling aspect was the surge in core PCE inflation in the first quarter.

• The market now sees only 34 basis points of Fed rate cuts this year.

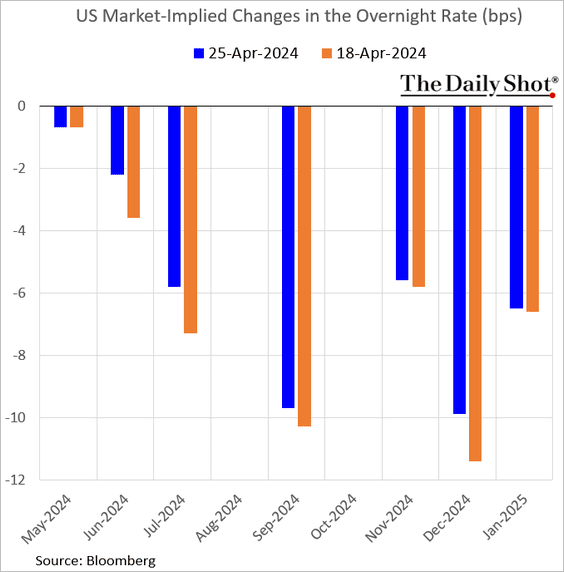

Here is what the market is pricing for each of the FOMC meetings through January of next year.

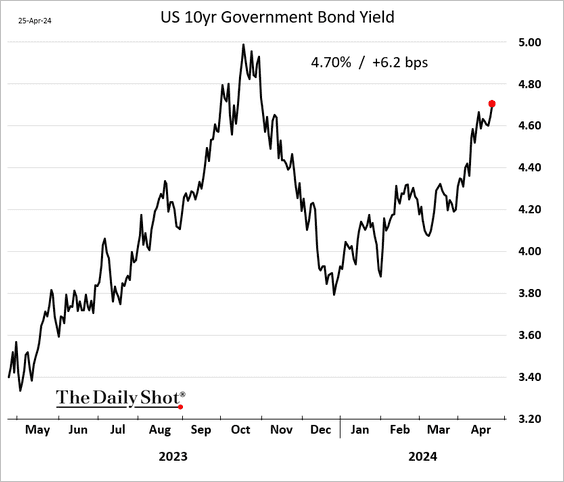

• Treasury yields jumped.

——————–

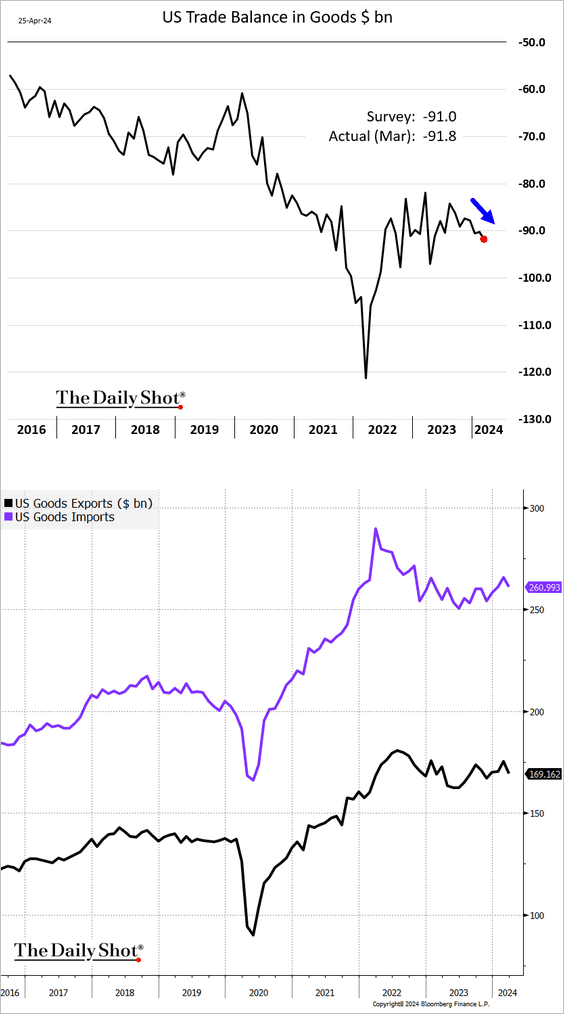

3. The trade deficit in goods continues to widen amid robust imports.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

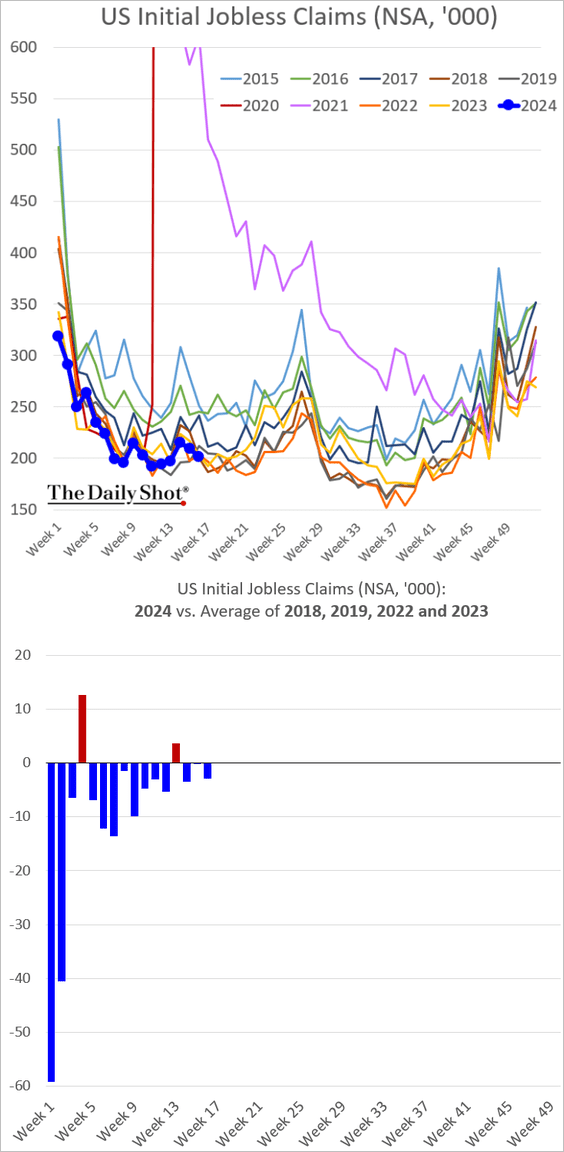

4. Initial jobless claims are holding neat multi-year lows.

Continuing claims are telling a somewhat different story.

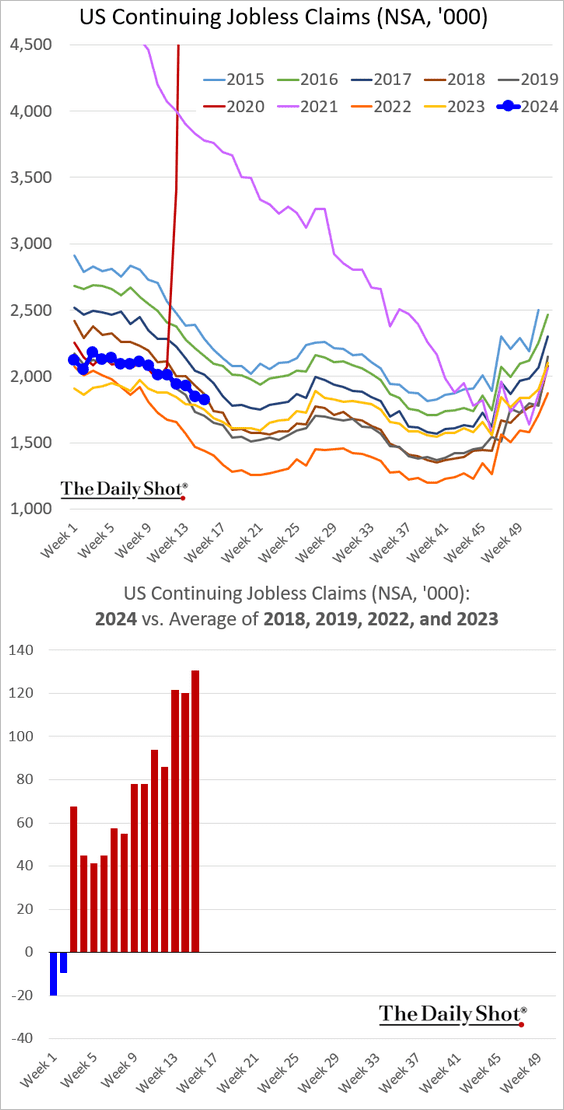

Here are the seasonally adjusted indices.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

——————–

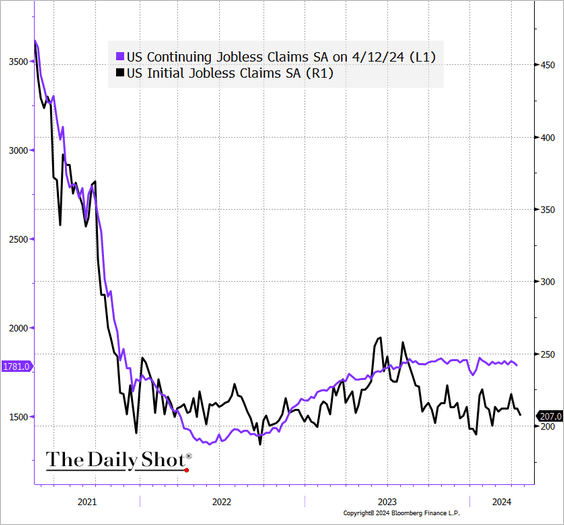

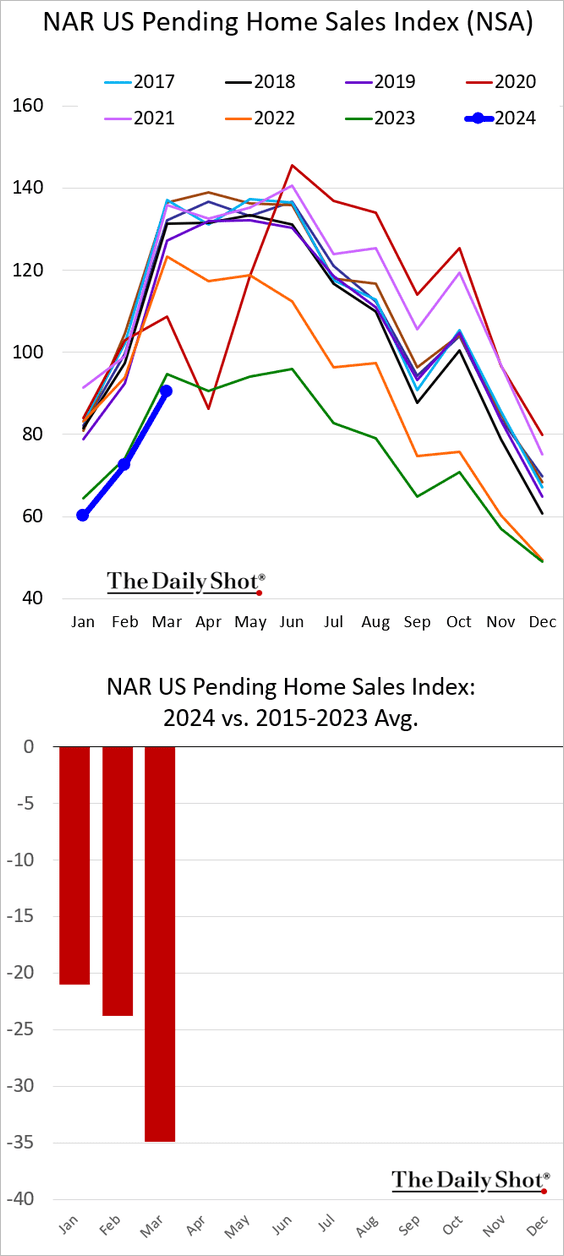

5. Pending home sales continue to run below last year’s levels.

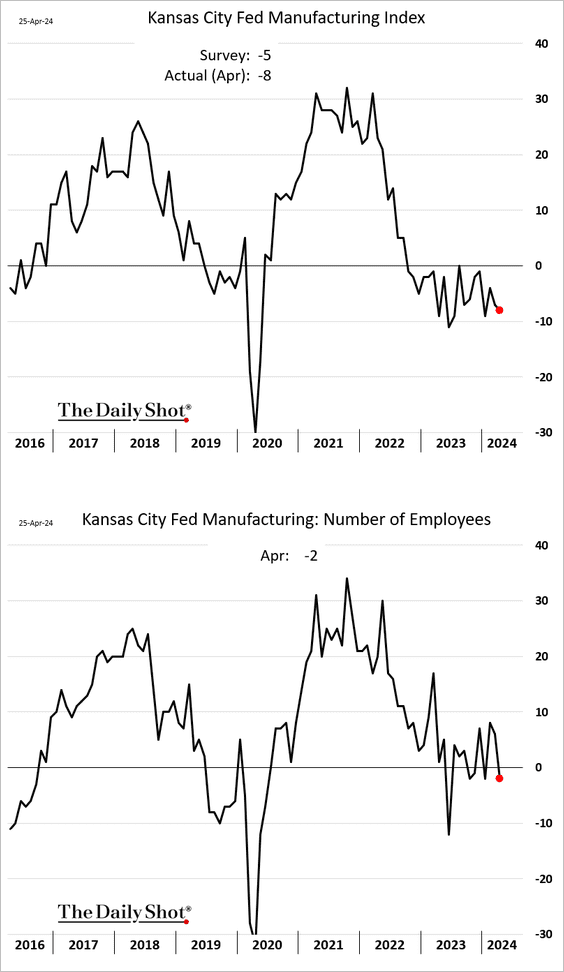

6. The Kansas City Fed’s manufacturing index signals soft factory activity in the region.

Back to Index

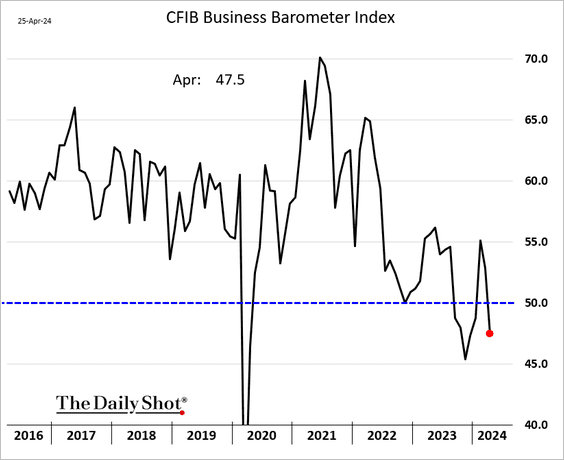

Canada

The CFIB small/medium-size business sentiment index shifted into contraction territory this month.

Source: CFIB Read full article

Source: CFIB Read full article

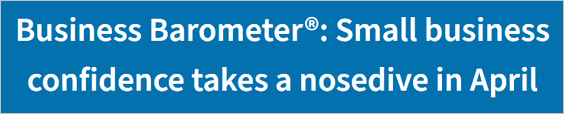

Here is a look at the CFIB index by sector and province.

Back to Index

The United Kingdom

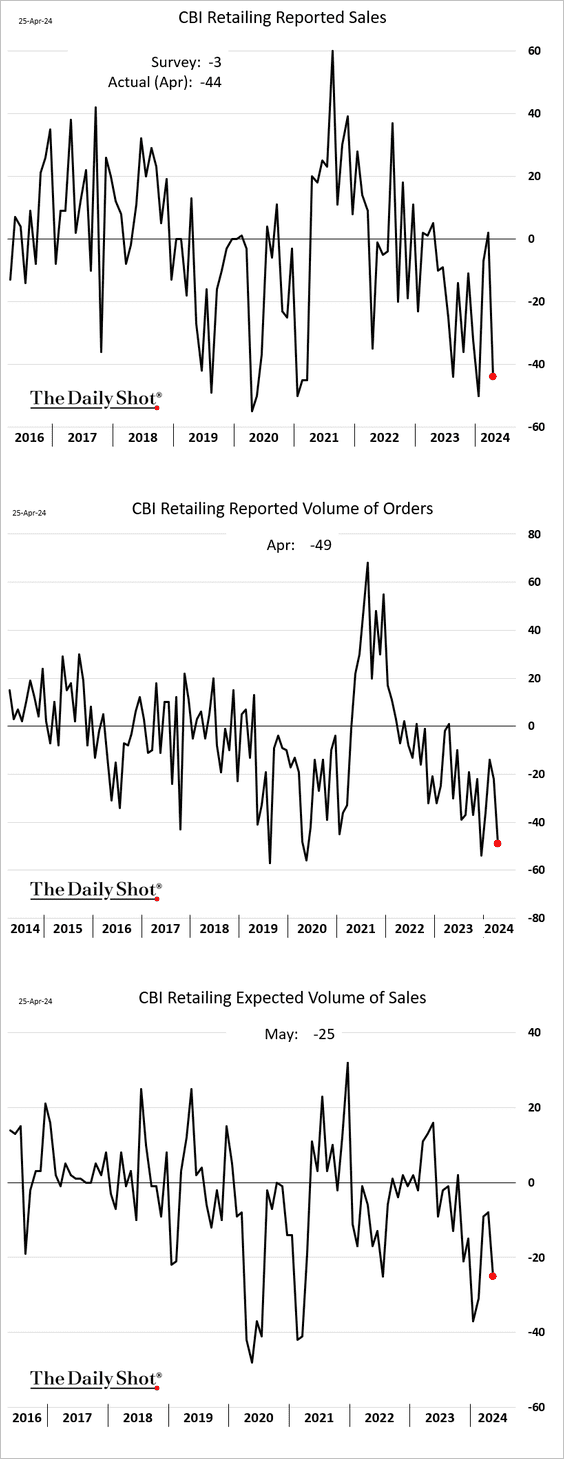

1. According to the latest CBI report, retail sales plummeted this month. Retailers are reducing orders in anticipation of slower future sales.

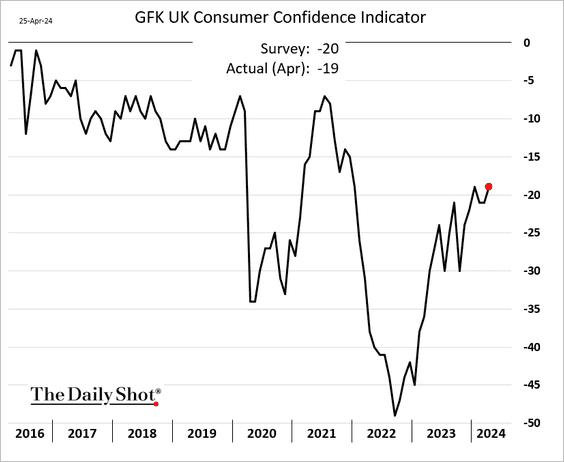

2. UK consumer confidence improved this month.

Back to Index

The Eurozone

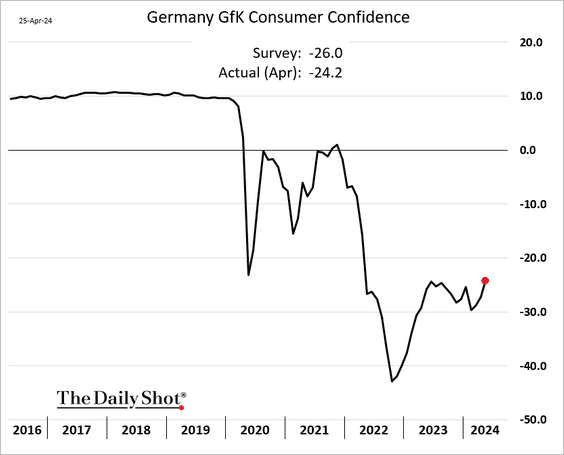

1. Germany’s consumer confidence increased again in April.

Source: @WSJ Read full article

Source: @WSJ Read full article

——————–

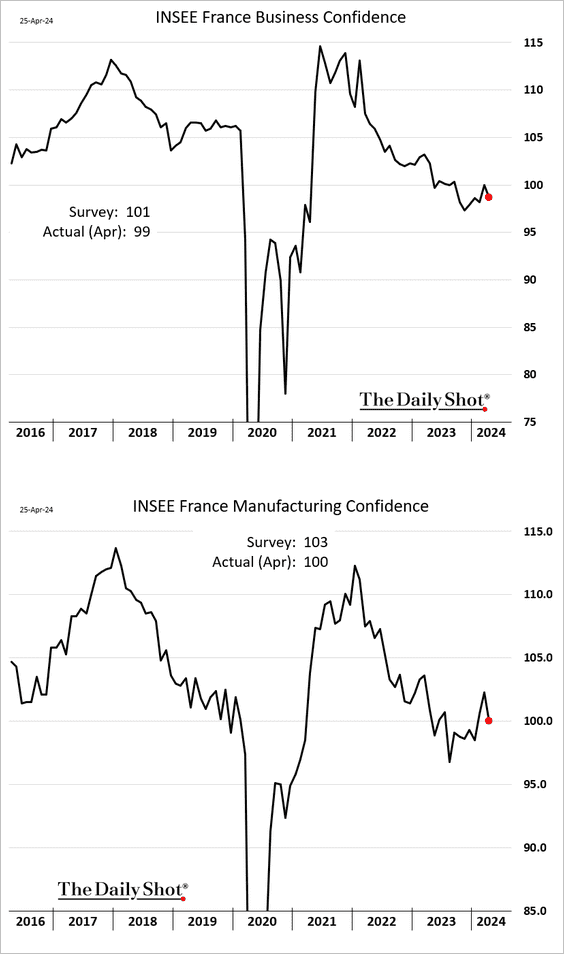

2. French business sentiment fell this month.

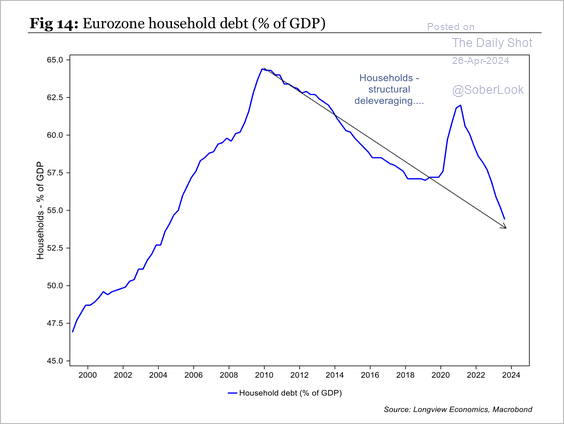

3. Eurozone household debt is trending lower as a share of GDP.

Source: Longview Economics

Source: Longview Economics

Back to Index

Europe

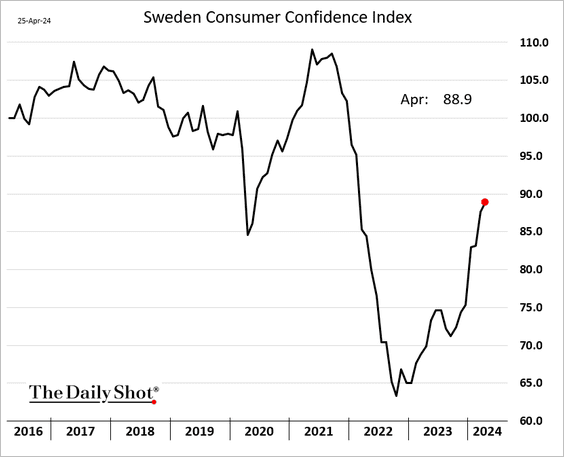

1. Sweden’s consumer confidence continues to rise.

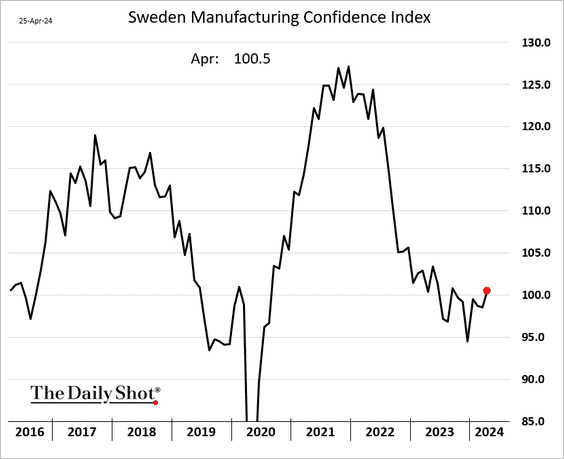

– Business confidence also improved this month.

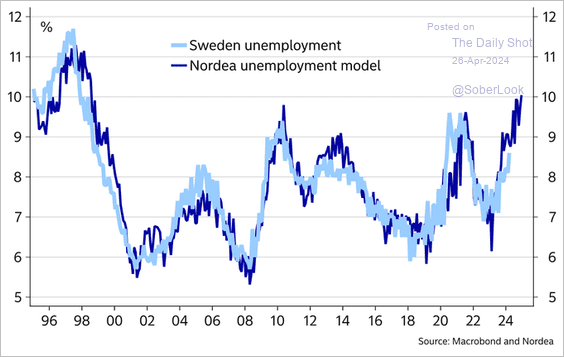

• Nordea’s model indicates a sharp increase in the unemployment rate in the coming months.

Source: @MikaelSarwe

Source: @MikaelSarwe

——————–

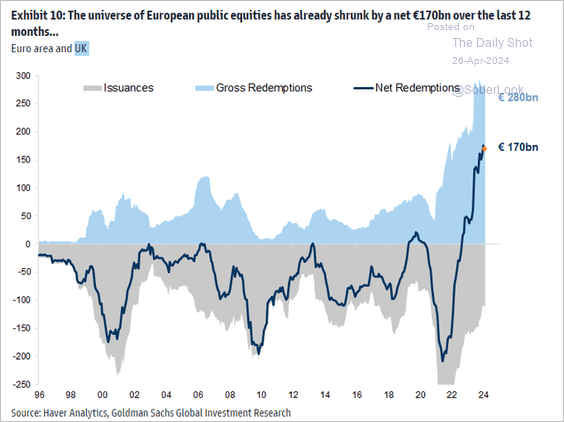

2. The outstanding volume of European public equities is shrinking as buybacks exceed new issuance.

Source: Goldman Sachs; @MikeZaccardi

Source: Goldman Sachs; @MikeZaccardi

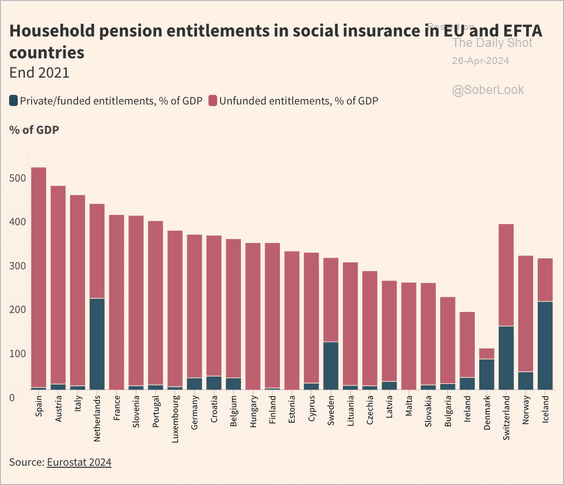

3. Here is a look at household pension entitlements.

Source: @financialtimes Read full article

Source: @financialtimes Read full article

Back to Index

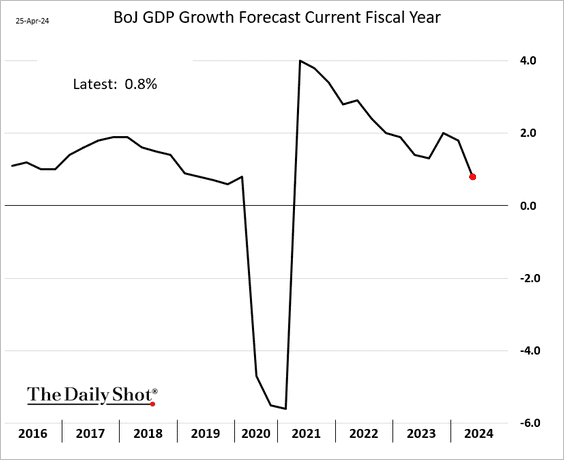

Japan

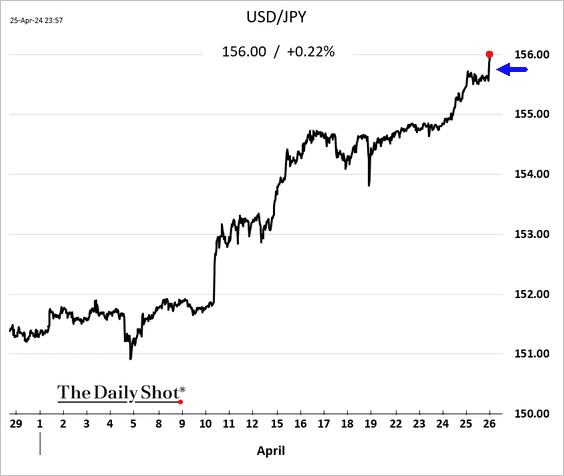

1. The Bank of Japan left interest rates unchanged despite the market pricing in some probability of a rate hike. The yen weakened to 156 to the dollar (the weakest level in decades).

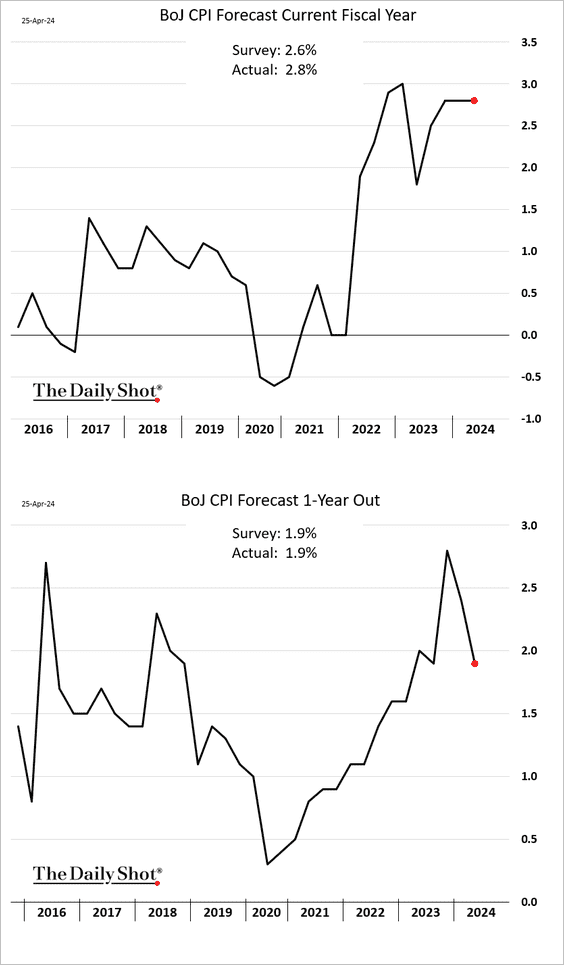

• The BoJ held its CPI forecast for the current year but lowered it for the year ahead.

The central bank reduced its estimate for this year’s GDP growth.

——————–

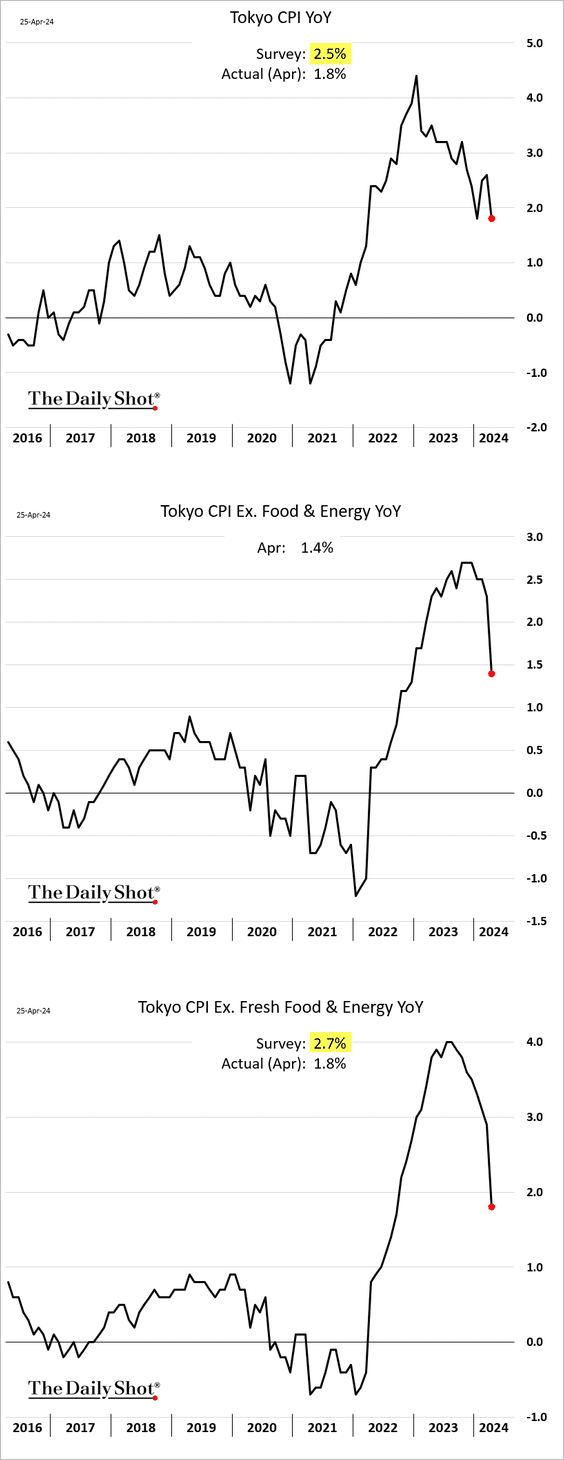

2. The April Tokyo CPI plummeted, …

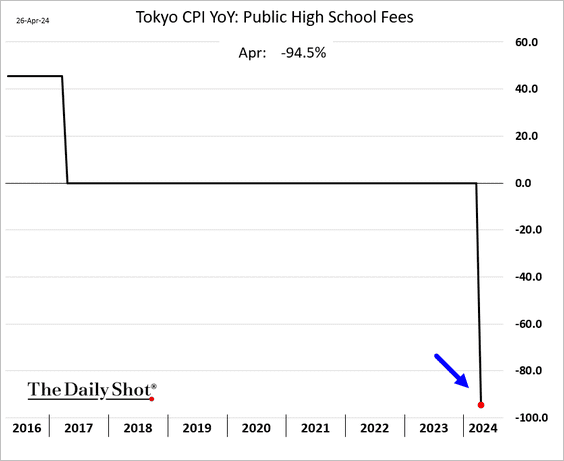

… largely due to the effective elimination of high school tuition in Tokyo.

——————–

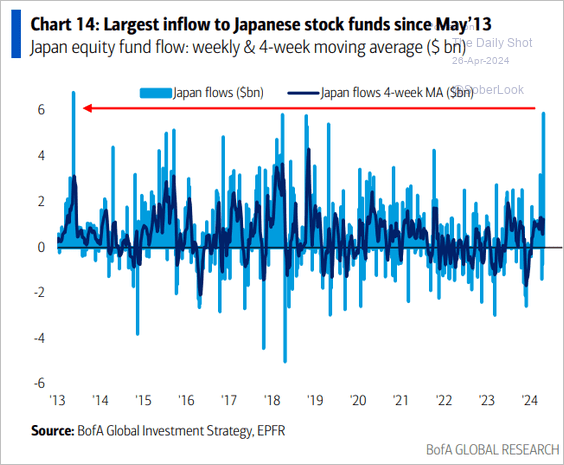

3. Flows into Japan-focused equity funds have surged in recent days.

Source: BofA Global Research

Source: BofA Global Research

Back to Index

China

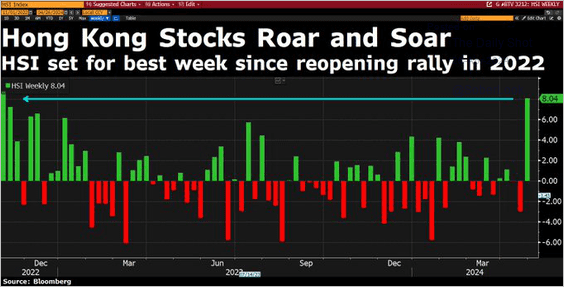

1. Stocks in Hong Kong are surging, …

Source: @DavidInglesTV

Source: @DavidInglesTV

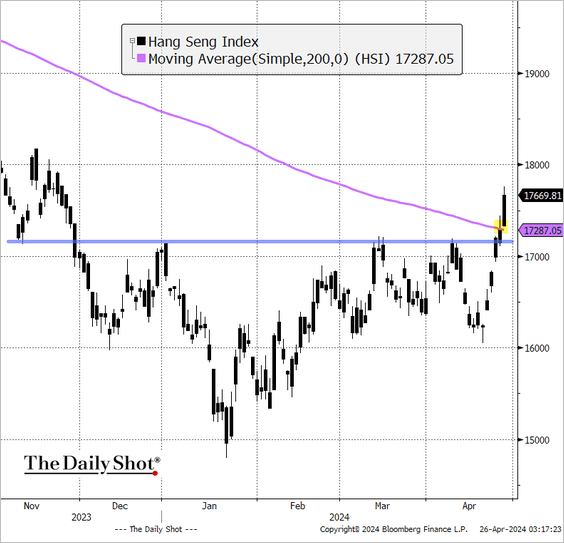

… as the Hang Seng Index breaks above resistance.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

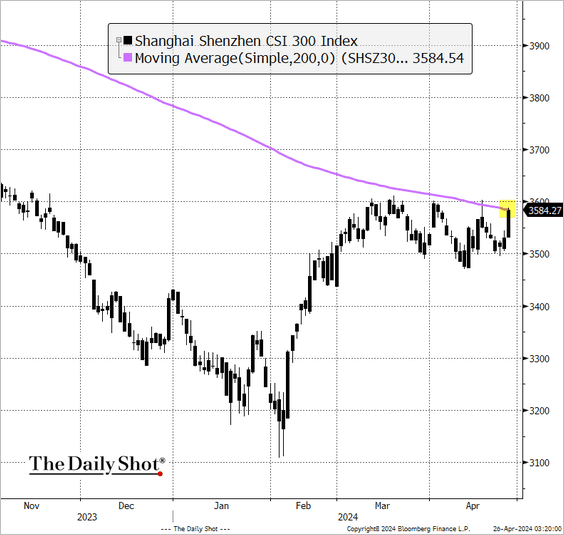

• Mainland stocks are also higher, with the Shanghai Shenzhen CSI 300 testing resistance at the 200-day moving average.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

——————–

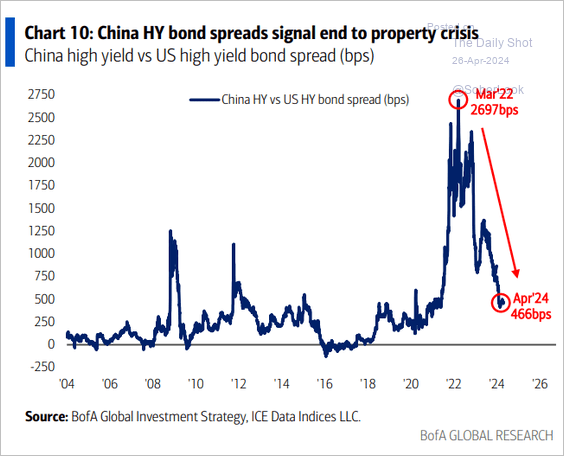

2. Are we near the end of China’s property crisis?

Source: BofA Global Research

Source: BofA Global Research

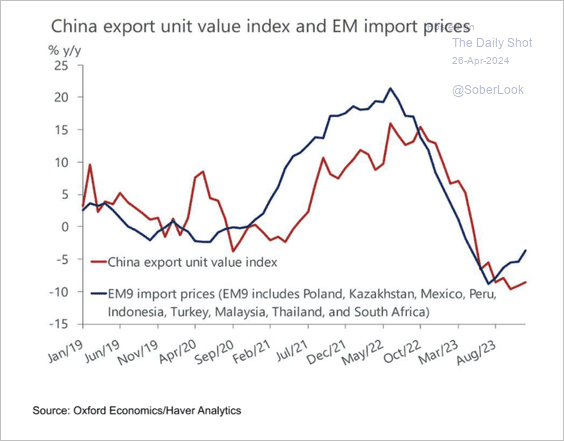

3. The uptick in EM import prices could point to higher China export prices.

Source: Oxford Economics

Source: Oxford Economics

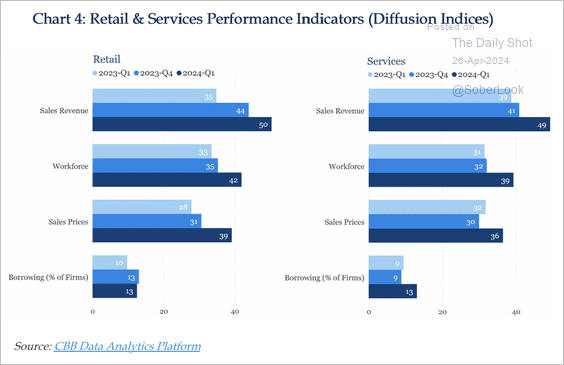

4. Retail and service sectors have improved in terms of revenue, profit, and hiring despite domestic deflation.

Source: China Beige Book

Source: China Beige Book

Back to Index

Emerging Markets

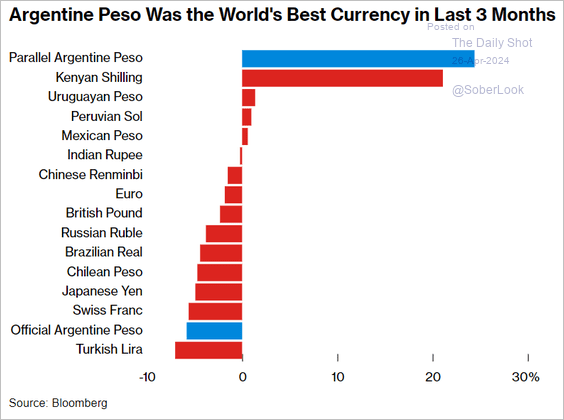

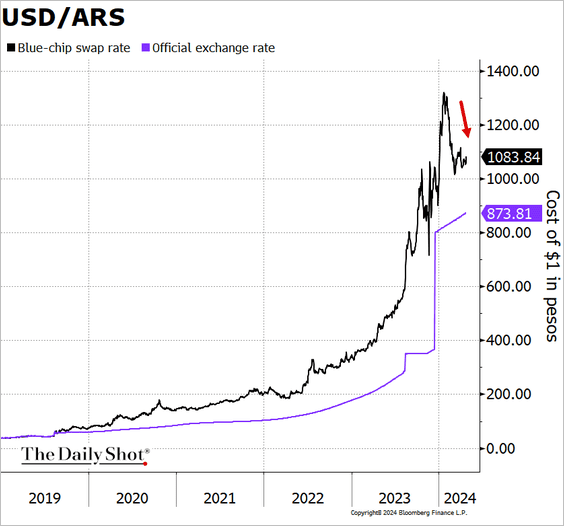

1. The Argentine peso rebounded sharply in the unofficial market (2 charts).

Source: @markets Read full article

Source: @markets Read full article

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

——————–

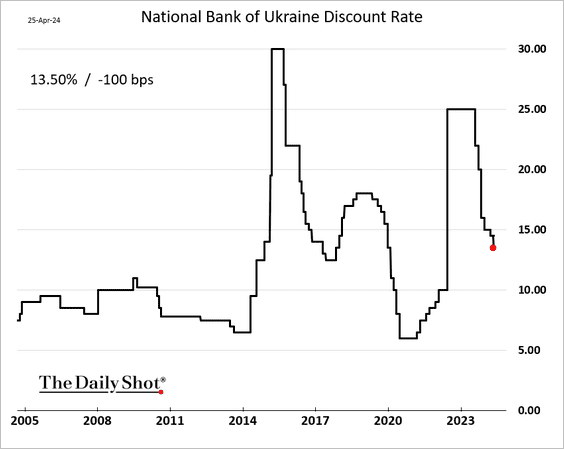

2. Ukraine’s central bank delivered an aggressive rate cut as inflation eases.

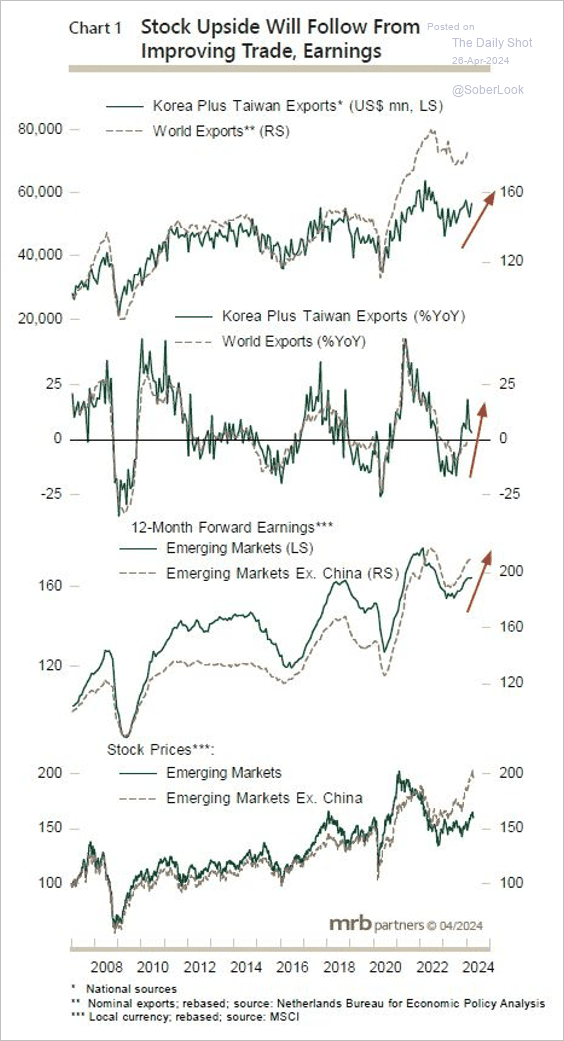

3. EM stocks could benefit from improving trade and earnings.

Source: MRB Partners

Source: MRB Partners

Back to Index

Cryptocurrency

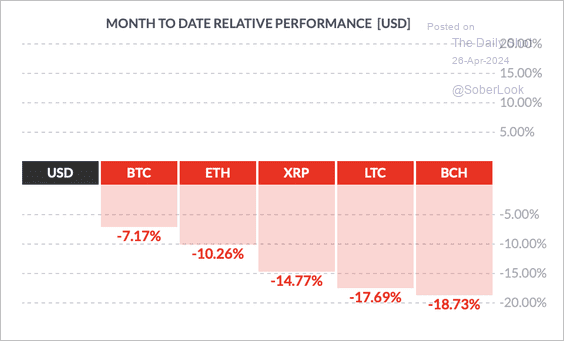

1. Major cryptos are down month-to-date, with Bitcoin Cash (BCH) underperforming top peers.

Source: FinViz

Source: FinViz

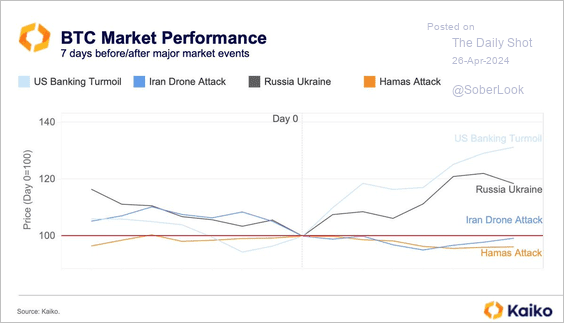

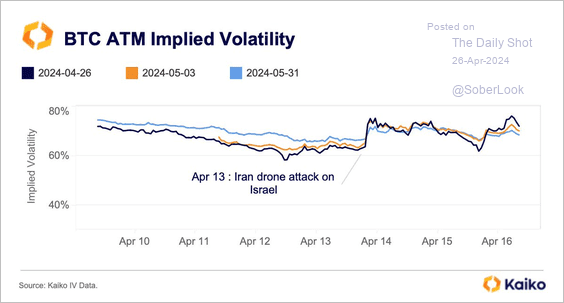

2. There has been limited demand for BTC as a safe haven during recent geopolitical events …

Source: @KaikoData

Source: @KaikoData

… although implied volatility picked up.

Source: @KaikoData

Source: @KaikoData

——————–

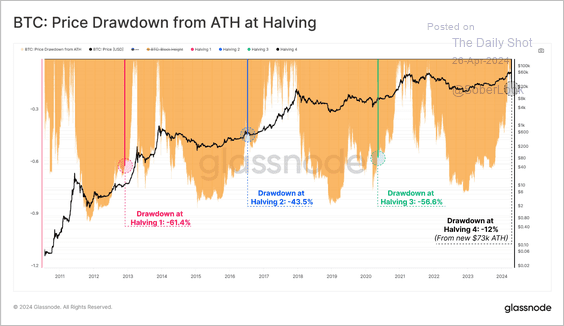

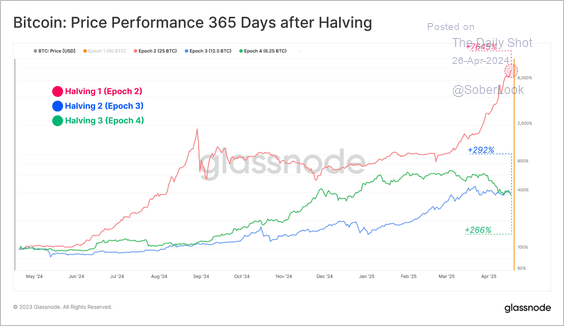

3. Here is a look at BTC’s previous drawdowns at price halvings and forward performance. (2 charts)

Source: @glassnode

Source: @glassnode

Source: @glassnode

Source: @glassnode

Back to Index

Commodities

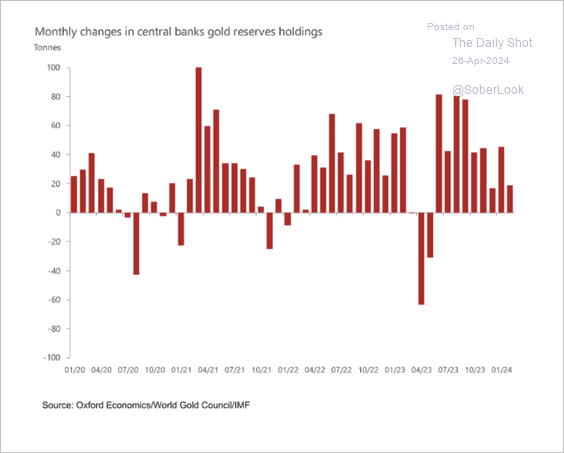

1. Monthly central bank net purchases of gold have slowed but remain positive.

Source: Oxford Economics

Source: Oxford Economics

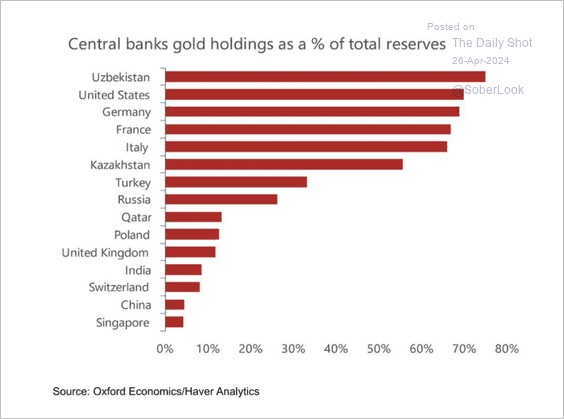

Here is a look at central bank gold holdings as a percentage of total reserves.

Source: Oxford Economics

Source: Oxford Economics

——————–

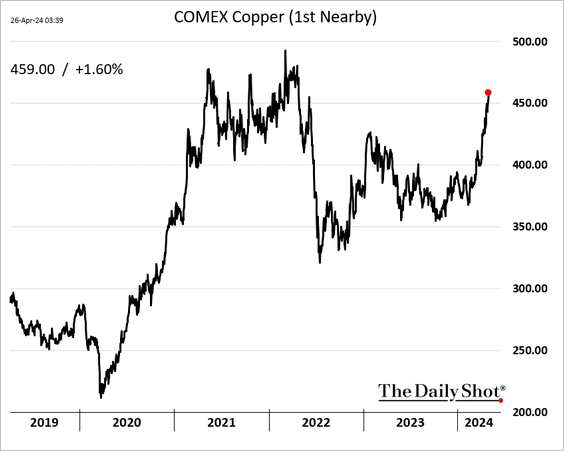

2. Copper futures continue to surge.

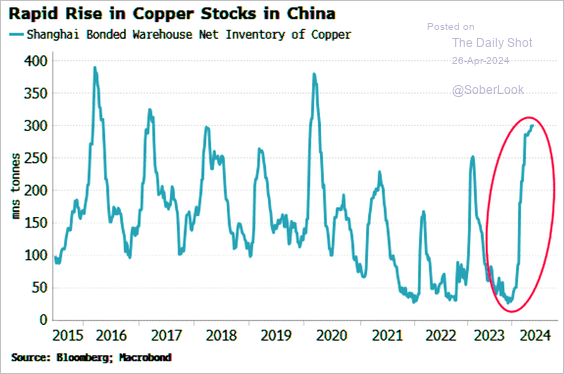

China has been stockpiling copper.

Source: Simon White, Bloomberg Markets Live Blog

Source: Simon White, Bloomberg Markets Live Blog

——————–

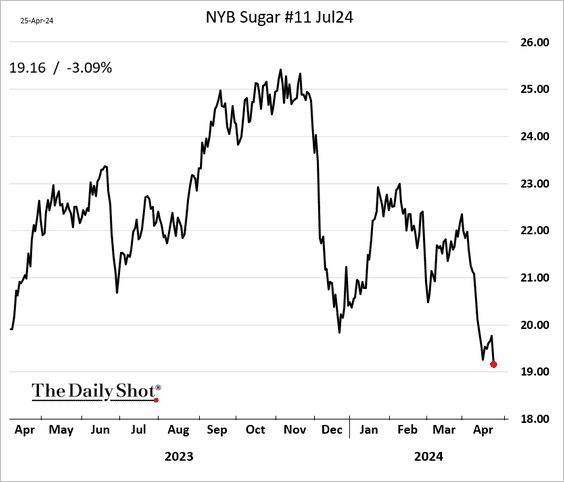

3. US sugar futures are under pressure.

Back to Index

Energy

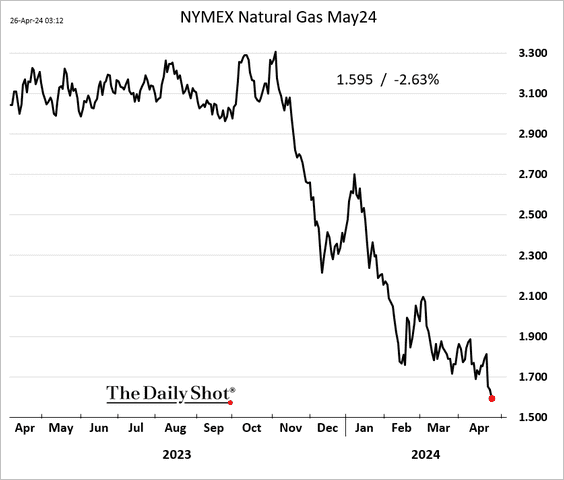

1. The May US natural gas contract dipped below $1.60/MMBtu, …

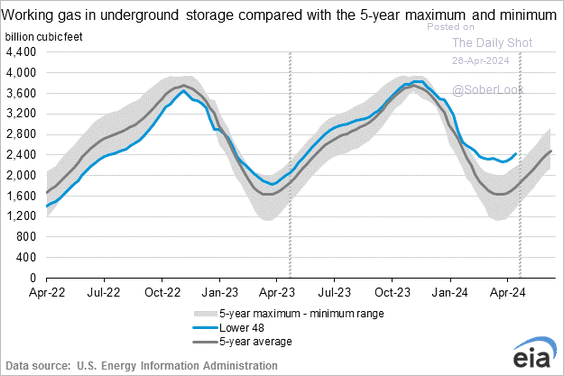

… amid elevated inventories.

——————–

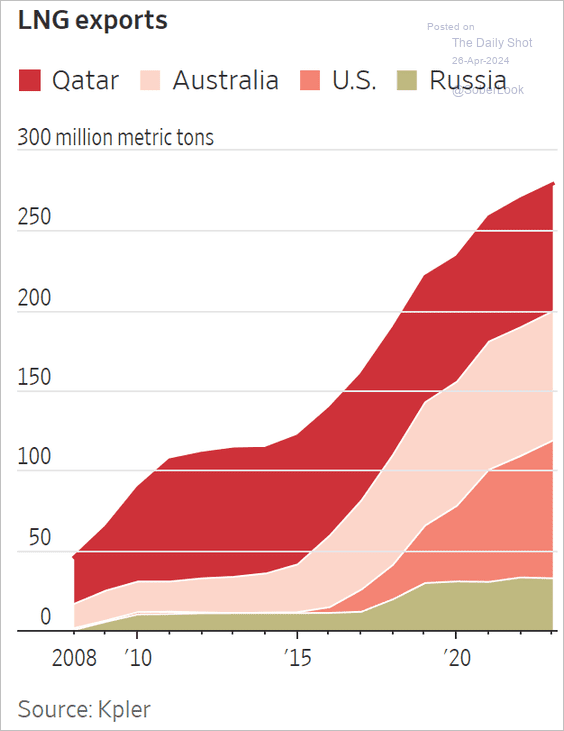

2. Here is a look at global LNG exports.

Source: @WSJ Read full article

Source: @WSJ Read full article

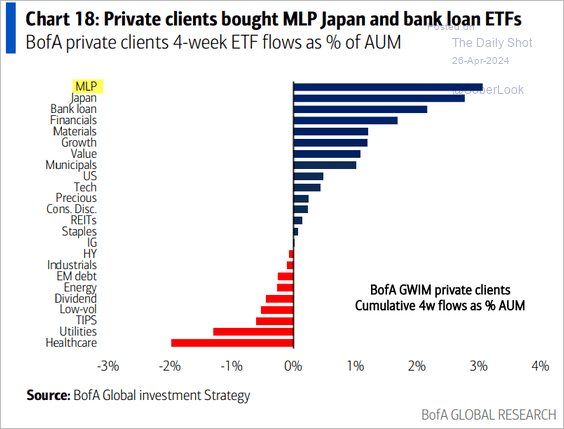

3. BofA’s private clients have been buying MLPs (pipeline companies).

Source: BofA Global Research

Source: BofA Global Research

Back to Index

Equities

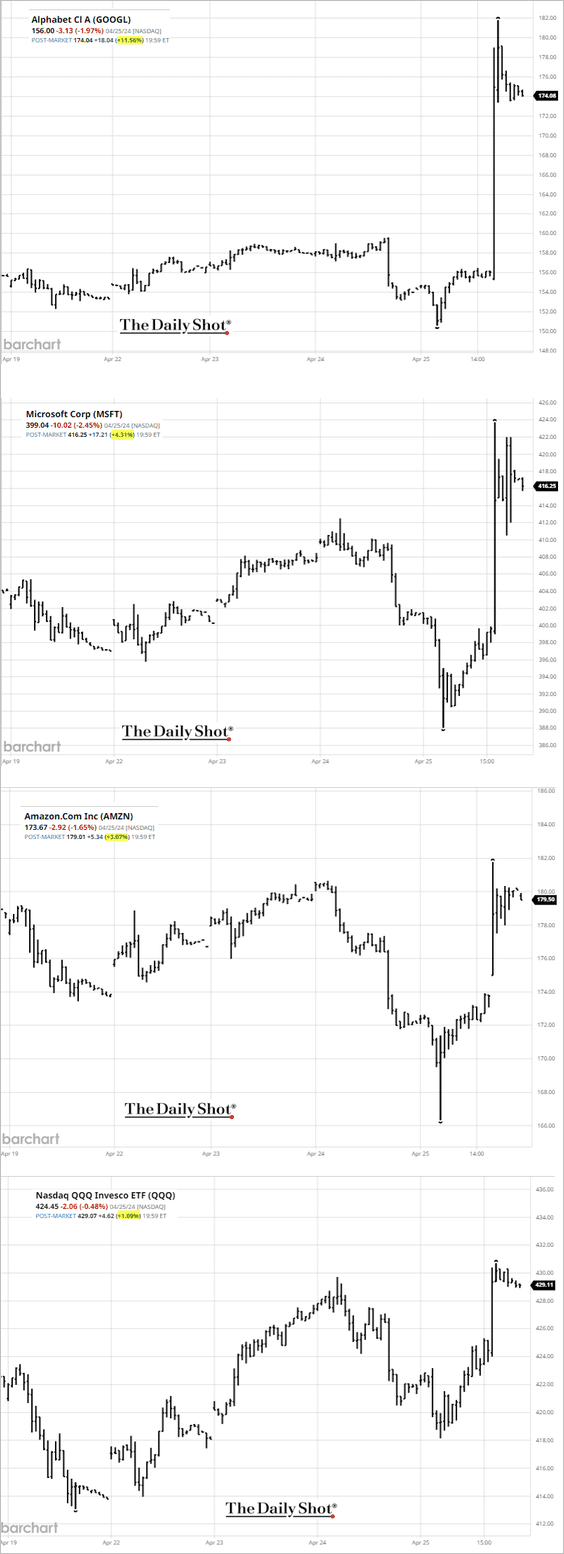

1. Shares of tech giants surged in after-hours trading as the market responded positively to announcements from Alphabet and other major players.

Source: CNBC Read full article

Source: CNBC Read full article

——————–

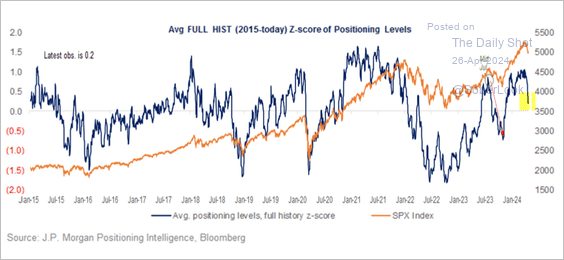

2. Positioning is near neutral levels now, according to JP Morgan.

Source: JP Morgan Research; @dailychartbook

Source: JP Morgan Research; @dailychartbook

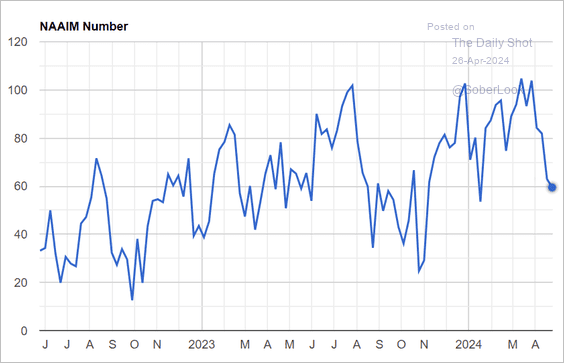

Investment managers have cut back exposure significantly.

Source: NAAIM

Source: NAAIM

——————–

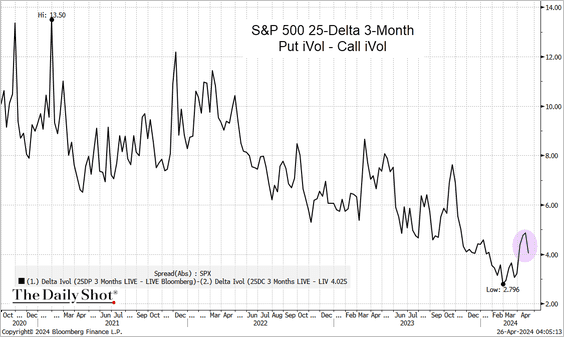

3. The S&P 500 volatility skew has risen only modestly during the recent selloff.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

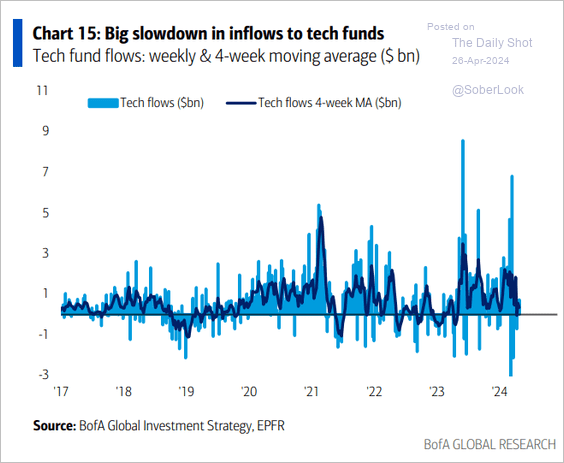

4. Flows into tech funds have slowed.

Source: BofA Global Research

Source: BofA Global Research

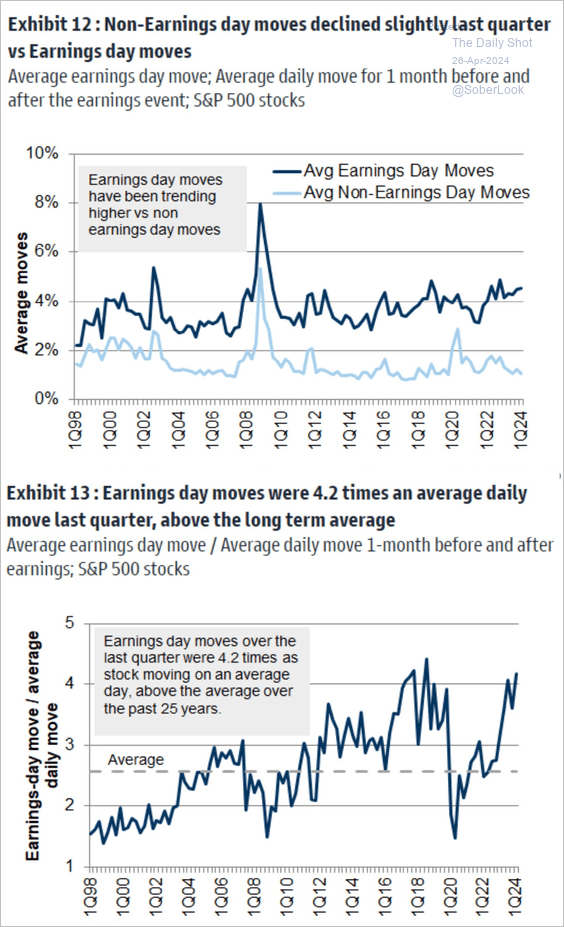

5. Here’s a comparison of stock price movements on earnings days versus non-earnings days.

Source: Goldman Sachs; @dailychartbook

Source: Goldman Sachs; @dailychartbook

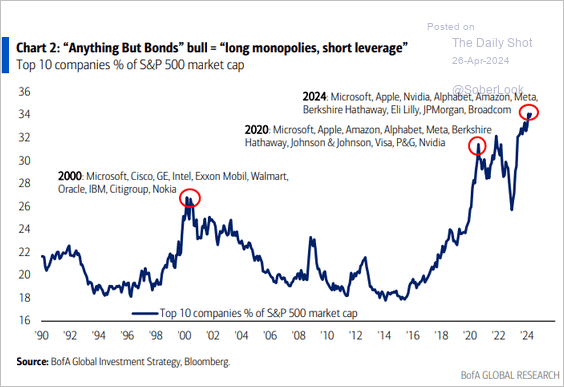

6. The US market remains very concentrated.

Source: BofA Global Research

Source: BofA Global Research

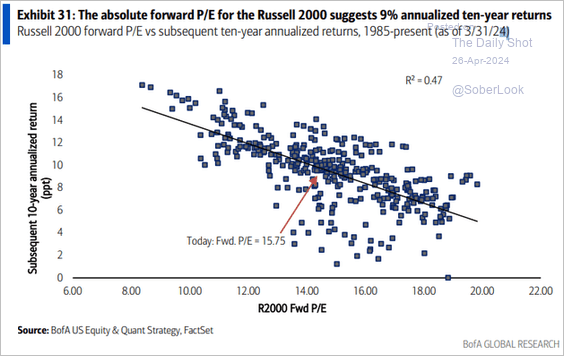

7. Given current valuations, the Russell 2000 could gain 9% annualized over the next decade.

Source: BofA Global Research; @MikeZaccardi

Source: BofA Global Research; @MikeZaccardi

Back to Index

Credit

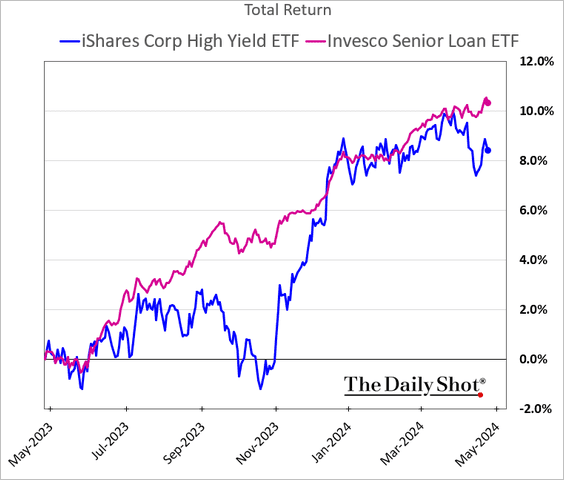

1. Leveraged loans have been outperforming high-yield bonds in recent weeks as Treasury yields rose.

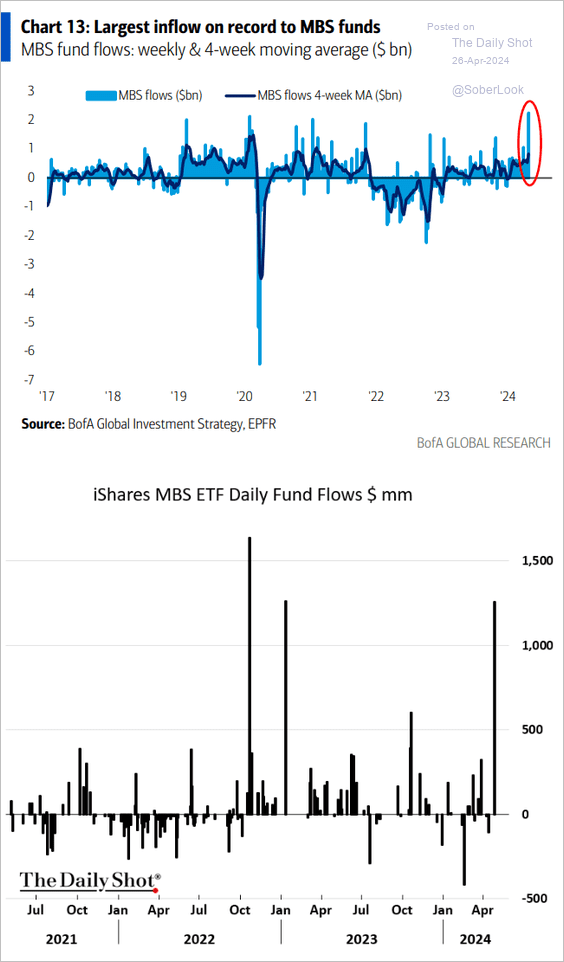

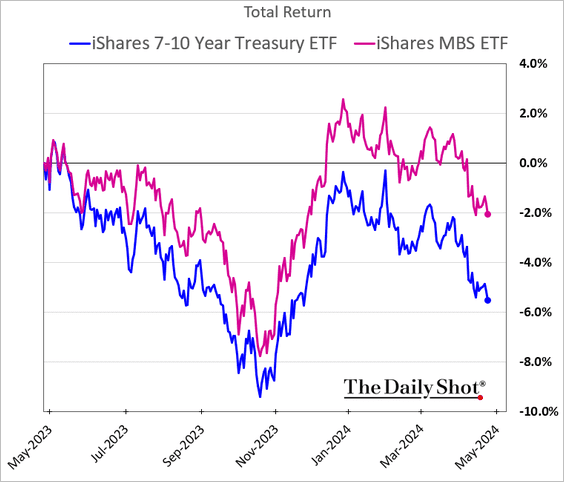

2. MBS funds are seeing robust inflows, …

Source: BofA Global Research

Source: BofA Global Research

… as the asset class outperforms Treasuries.

——————–

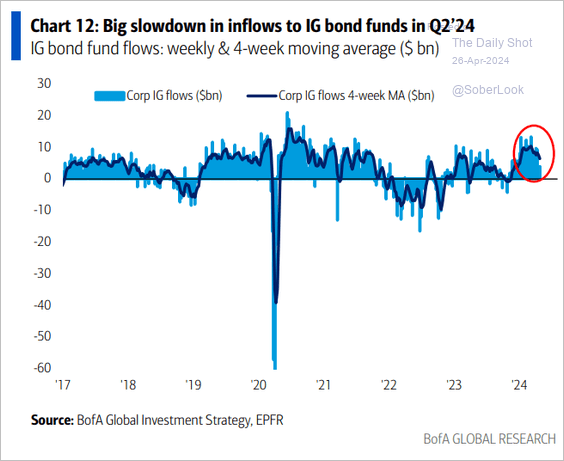

3. Investment-grade corporate bond fund inflows have slowed.

Source: BofA Global Research

Source: BofA Global Research

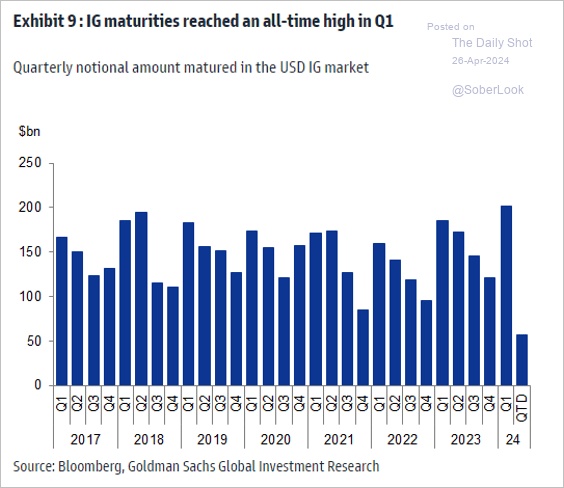

• A significant number of investment-grade bonds matured last quarter.

Source: Goldman Sachs; @MikeZaccardi

Source: Goldman Sachs; @MikeZaccardi

——————–

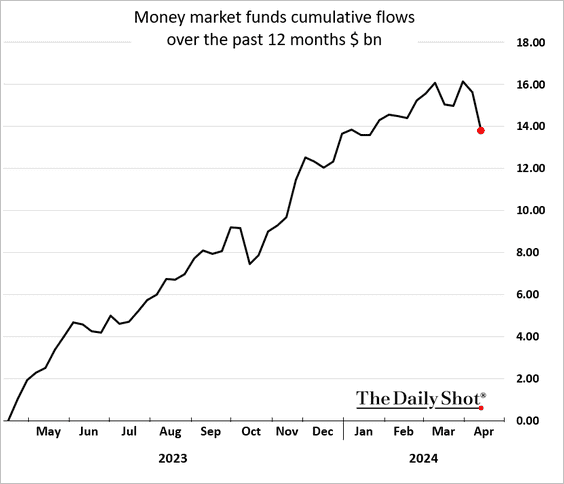

4. Money market funds are seeing redemptions.

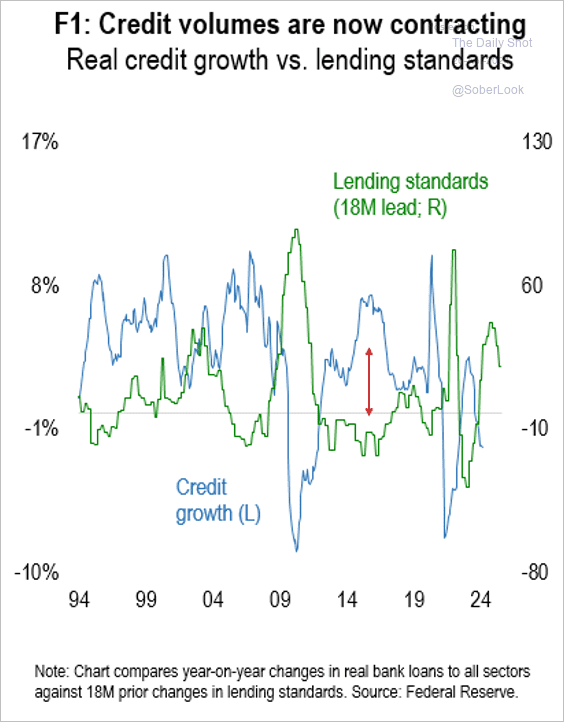

5. High rates and tighter lending standards have weighed on US credit volumes.

Source: Numera Analytics (@NumeraAnalytics)

Source: Numera Analytics (@NumeraAnalytics)

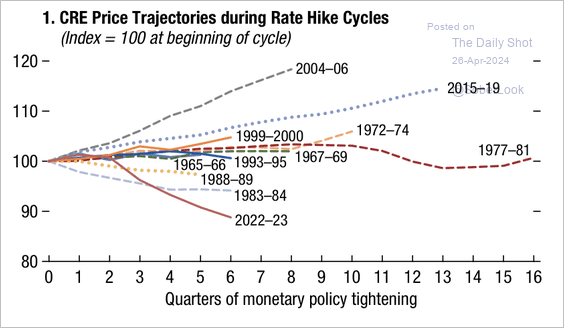

6. Commercial real estate valuations have plummeted more in the present monetary policy cycle than in previous episodes.

Source: IMF

Source: IMF

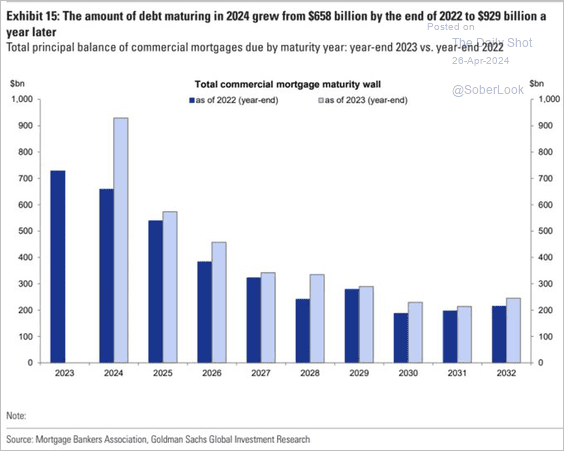

The CRE debt maturity wall looks challenging.

Source: Goldman Sachs; @AyeshaTariq

Source: Goldman Sachs; @AyeshaTariq

Back to Index

Rates

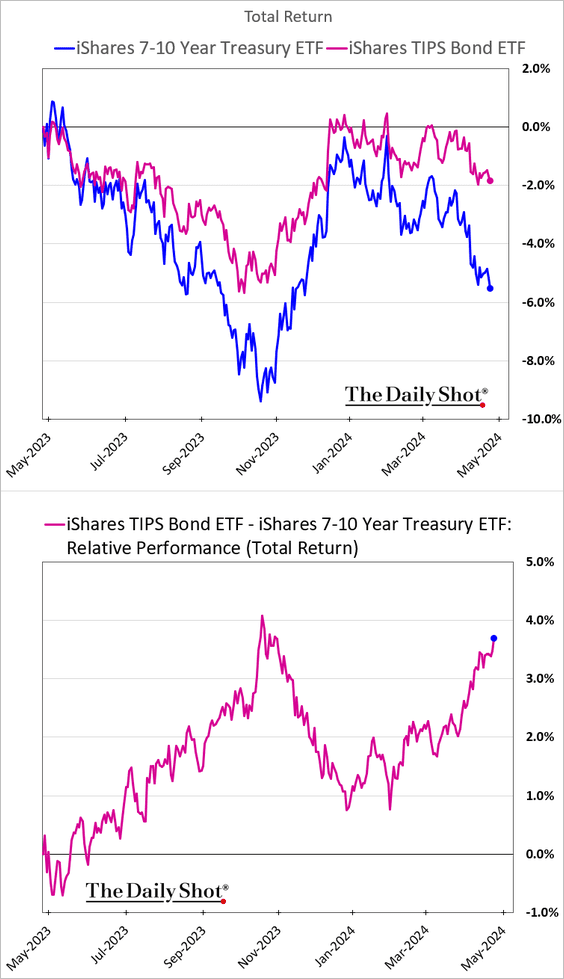

1. TIPS have been outperforming Treasuries as inflation jitters return.

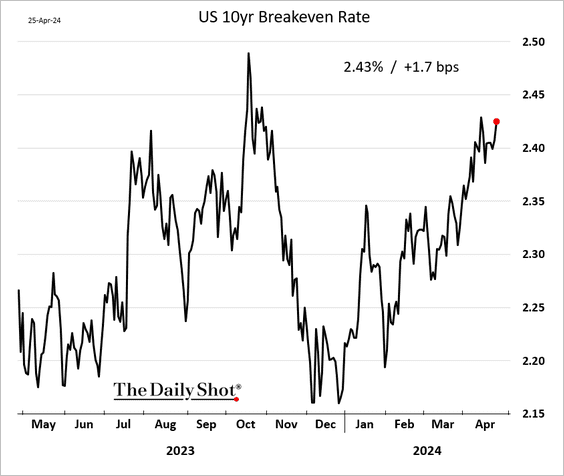

As a result, US breakeven rates (market-based inflation expectations) are climbing.

——————–

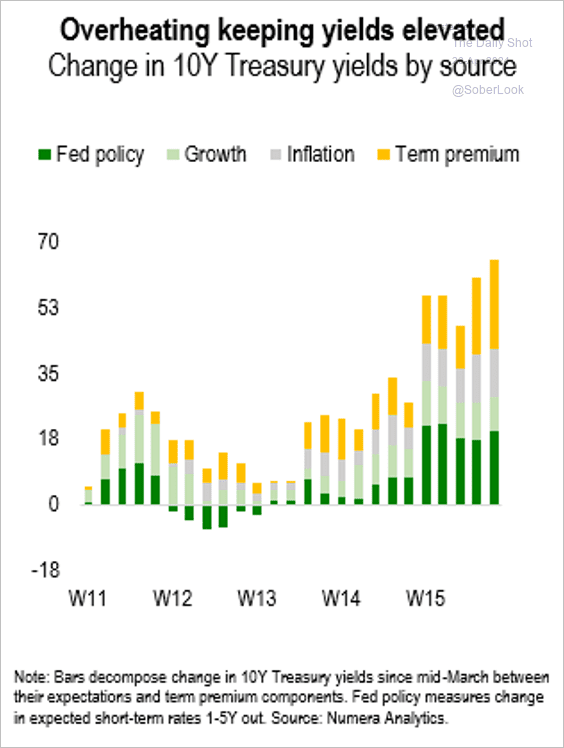

2. A rising term premium and reduced expectations of a Fed pivot have kept Treasury yields elevated.

Source: Numera Analytics (@NumeraAnalytics)

Source: Numera Analytics (@NumeraAnalytics)

——————–

Food for Thought

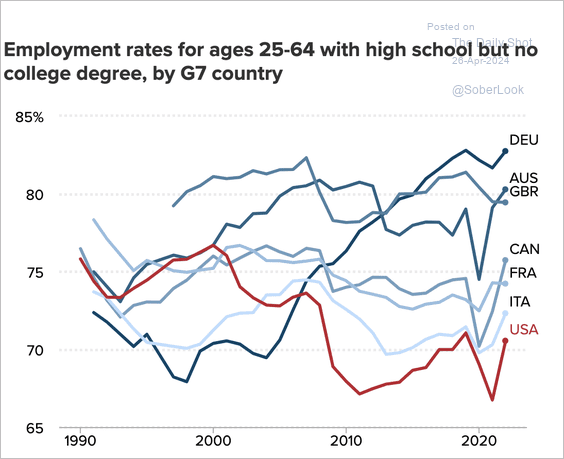

1. Prime-age employment rates:

Source: EPI Read full article

Source: EPI Read full article

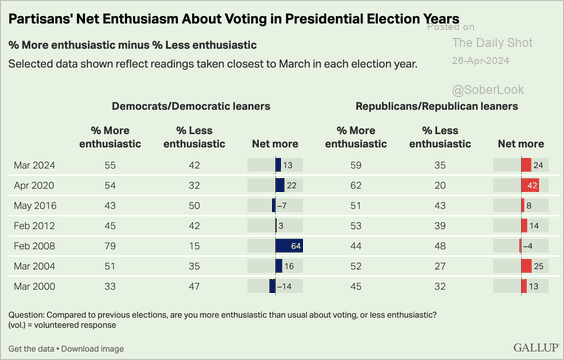

2. Voter enthusiasm trends in US presidential election years:

Source: Gallup Read full article

Source: Gallup Read full article

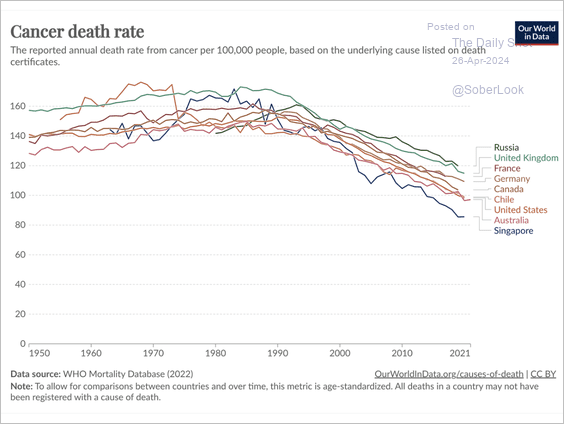

3. Cancer mortality rates:

Source: Our World in Data Read full article

Source: Our World in Data Read full article

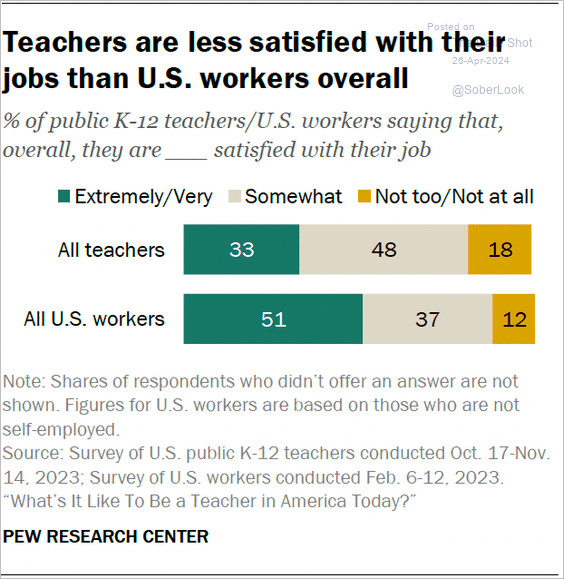

4. Job satisfaction comparison between K-12 teachers and the overall US workforce:

Source: Pew Research Center Read full article

Source: Pew Research Center Read full article

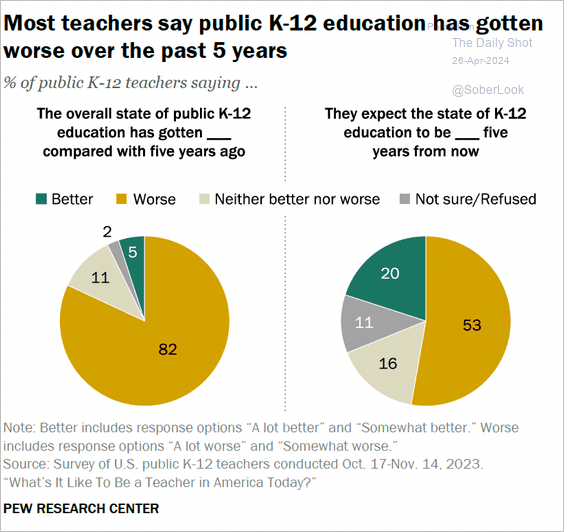

• Teachers’ perspectives on the recent and future state of public K-12 education:

Source: Pew Research Center Read full article

Source: Pew Research Center Read full article

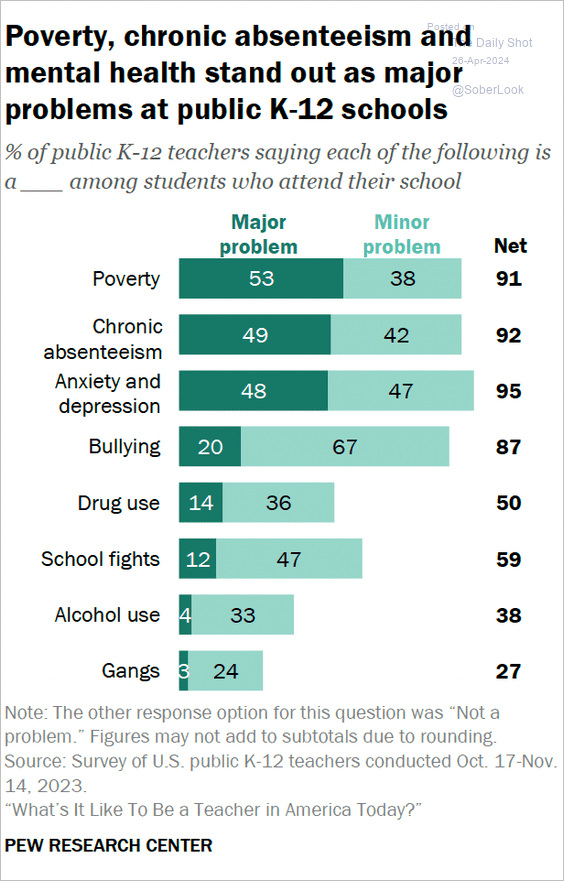

• Key issues in public K-12 schools according to teachers:

Source: Pew Research Center Read full article

Source: Pew Research Center Read full article

——————–

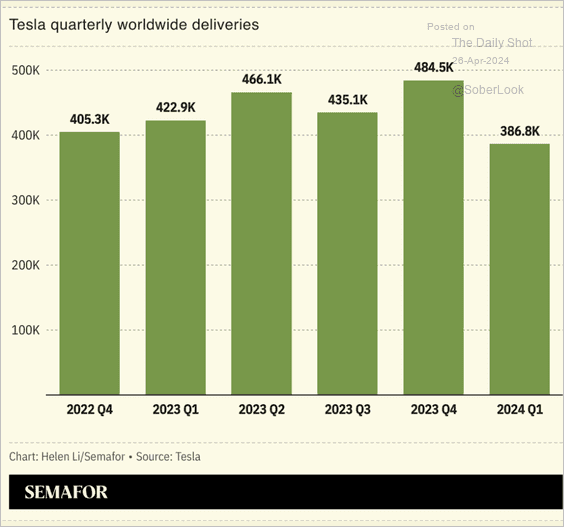

5. Tesla’s quarterly deliveries:

Source: Semafor

Source: Semafor

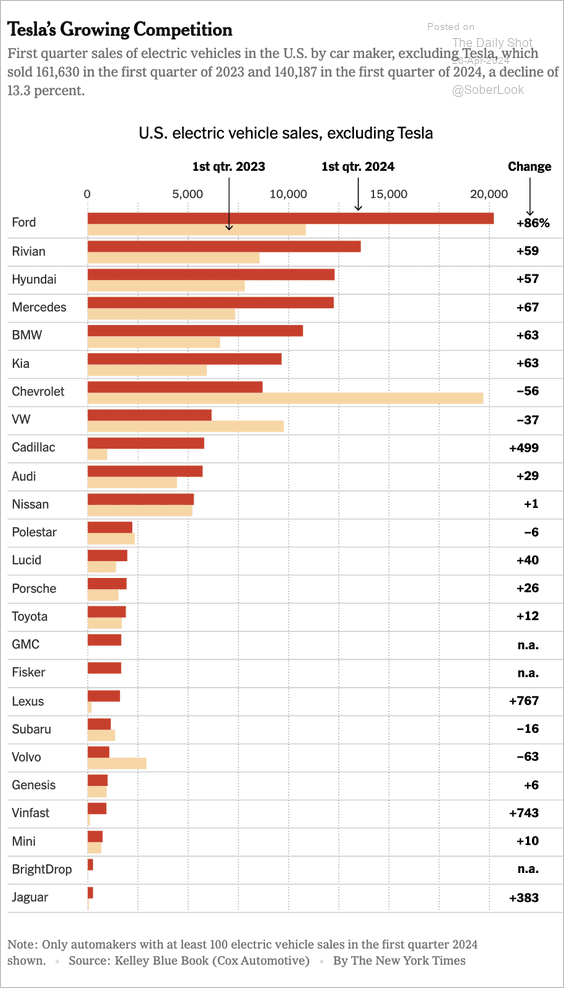

• Tesla’s competition:

Source: The New York Times Read full article

Source: The New York Times Read full article

——————–

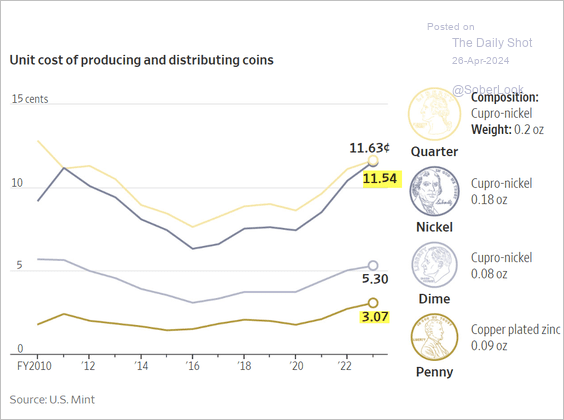

6. The cost of producing and distributing US coins:

Source: @WSJ Read full article

Source: @WSJ Read full article

——————–

Have a great weekend!

Back to Index