The Daily Shot: 05-Apr-24

• The United States

• Canada

• The United Kingdom

• The Eurozone

• Europe

• Asia-Pacific

• Emerging Markets

• Commodities

• Energy

• Equities

• Credit

• Global Developments

• Food for Thought

The United States

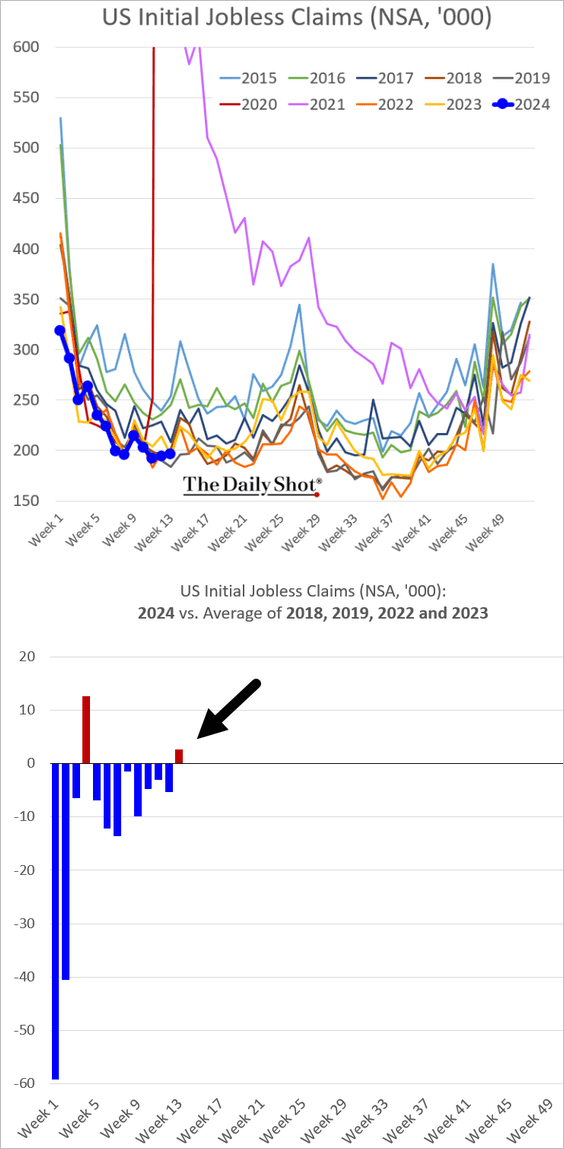

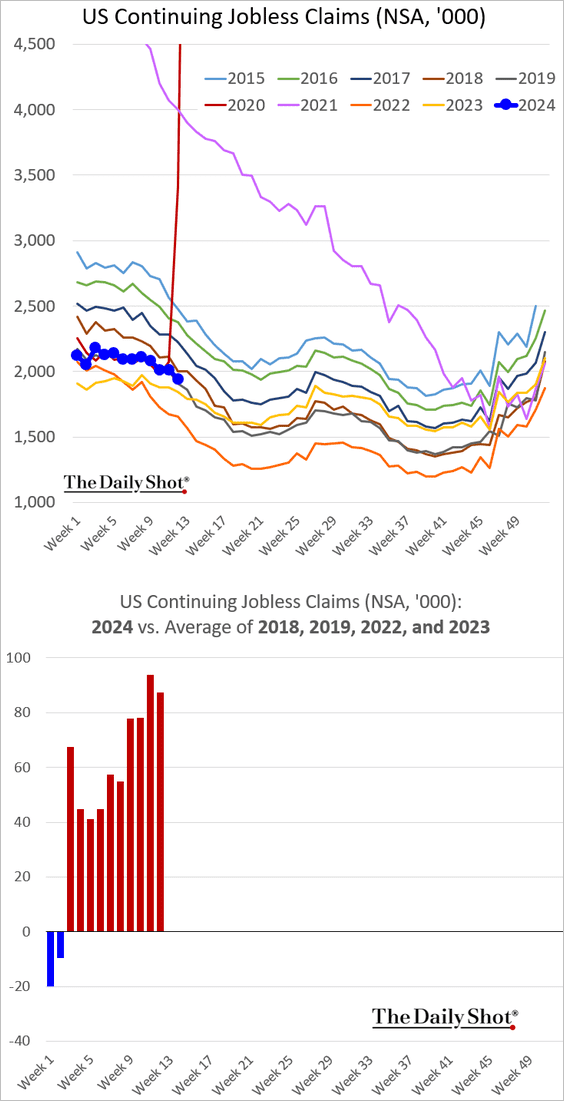

1. Let’s begin with the labor market.

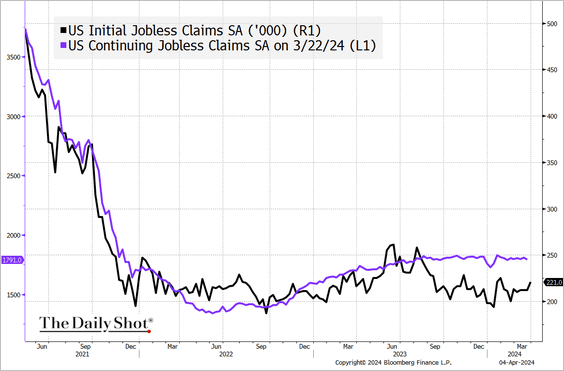

• Initial unemployment applications moved higher last week.

– Continuing claims are still running above 2022 and 2023 levels.

– This seasonally adjusted chart illustrates the divergence between initial and continuing claims.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

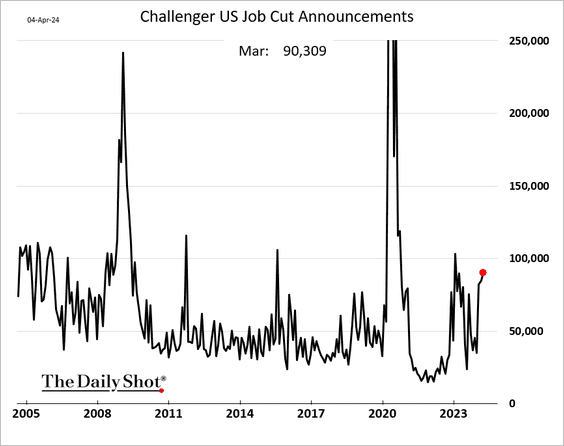

• The Challenger index of layoff announcements increased again last month.

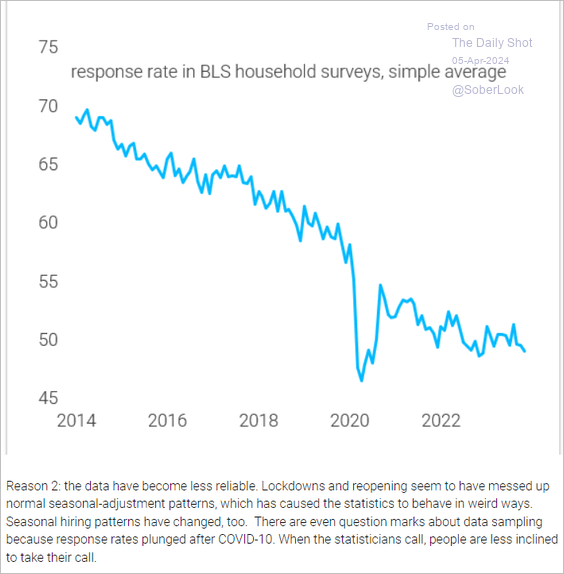

• The Bureau of Labor Statistics’ response rate to the Household Survey has been trending lower, resulting in more volatility in the employment data.

Source: TS Lombard

Source: TS Lombard

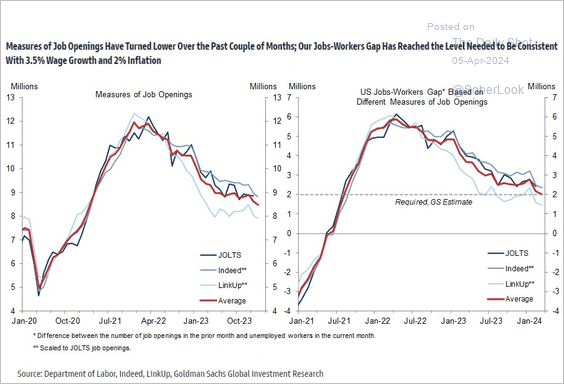

• Leading indicators point to further declines in job openings.

Source: Goldman Sachs; @MikeZaccardi

Source: Goldman Sachs; @MikeZaccardi

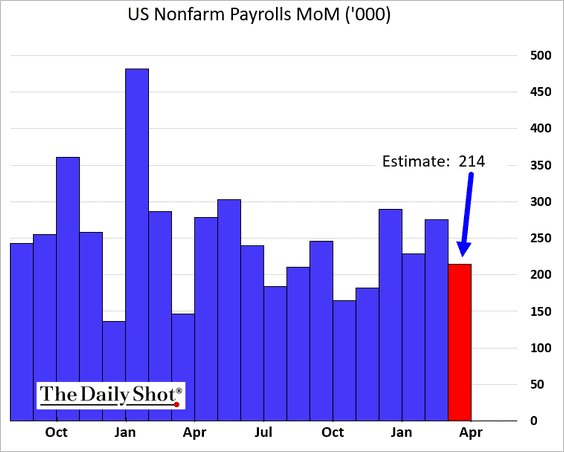

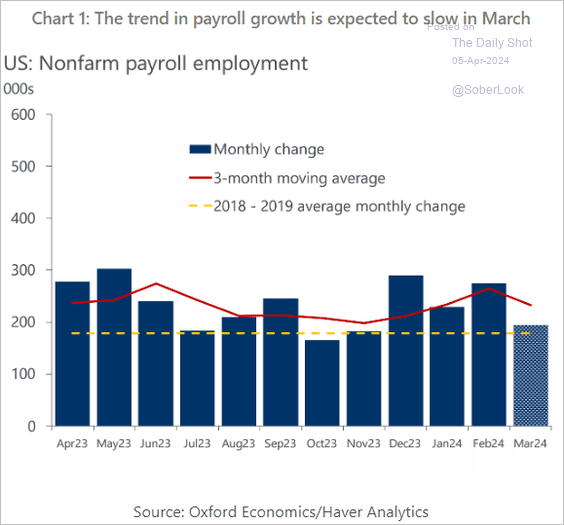

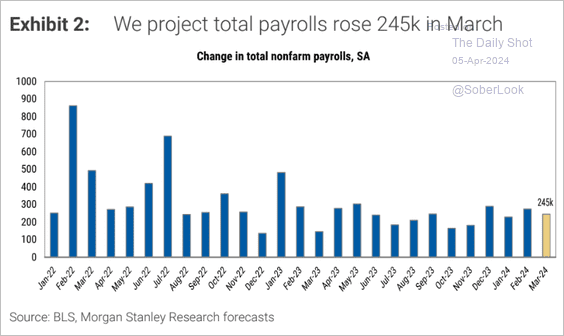

• What should we expect from today’s employment report? Estimates suggest that job growth held up well last month.

– Consensus (214k):

– Oxford Economics (195k):

Source: Oxford Economics

Source: Oxford Economics

– Morgan Stanley (245k):

Source: Morgan Stanley Research

Source: Morgan Stanley Research

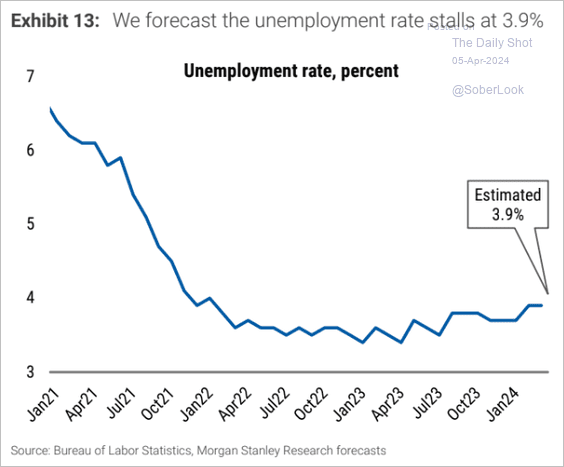

Morgan Stanley estimates that the unemployment rate remained unchanged in March.

Source: Morgan Stanley Research

Source: Morgan Stanley Research

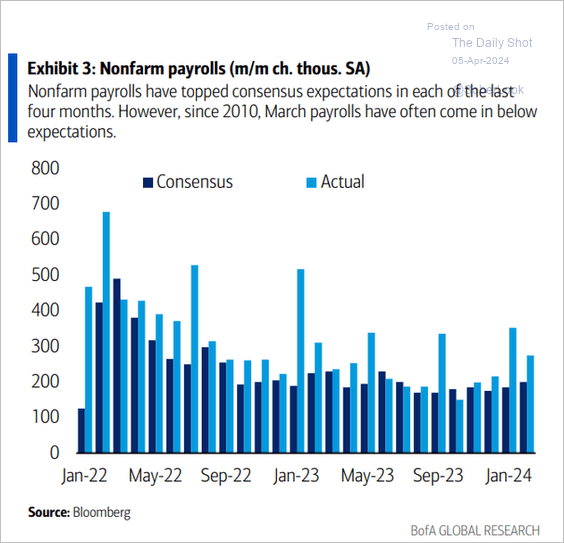

• The payrolls figures have been surprising to the upside.

Source: BofA Global Research

Source: BofA Global Research

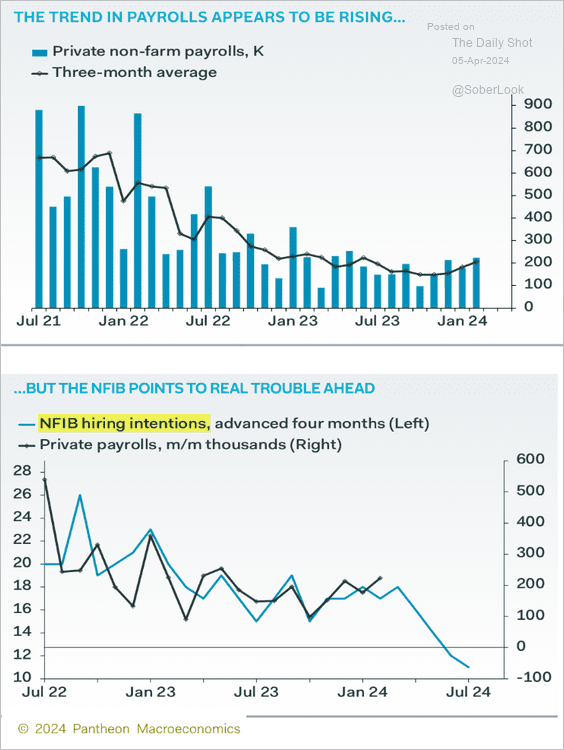

• The NFIB’s small business hiring intentions suggest potential challenges for the labor market in the months ahead.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

——————–

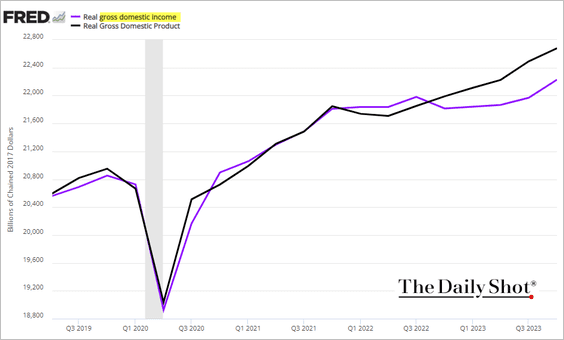

2. The GDP-GDI divergence persists.

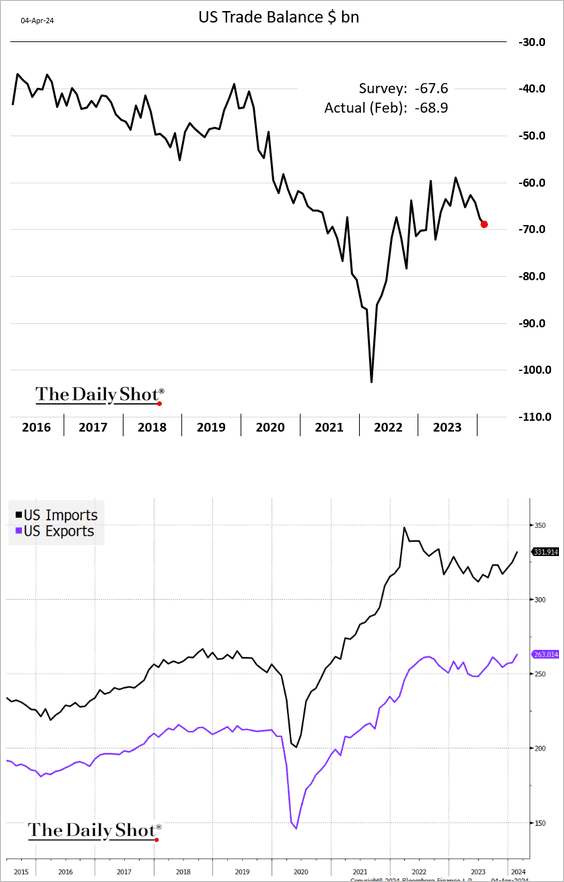

3. The US trade deficit widened further in February as imports strengthened.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

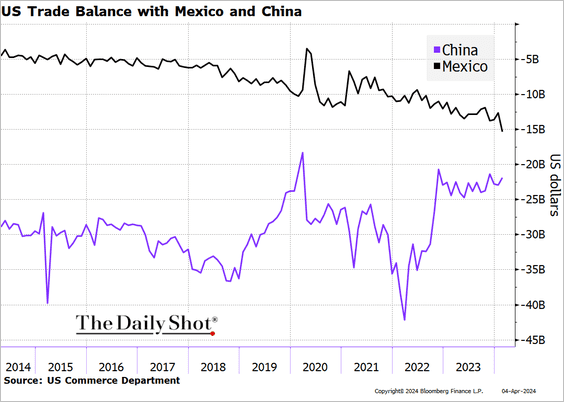

• The trade deficit with Mexico reached a record high, whereas the trade gap with China decreased.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

——————–

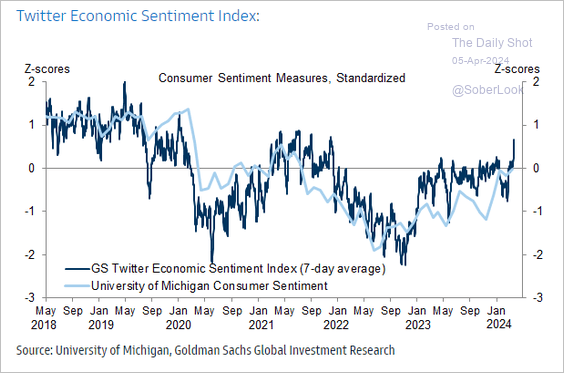

4. Twitter-based economic sentiment has diverged from the University of Michigan’s consumer sentiment.

Source: Goldman Sachs; @MikeZaccardi

Source: Goldman Sachs; @MikeZaccardi

Back to Index

Canada

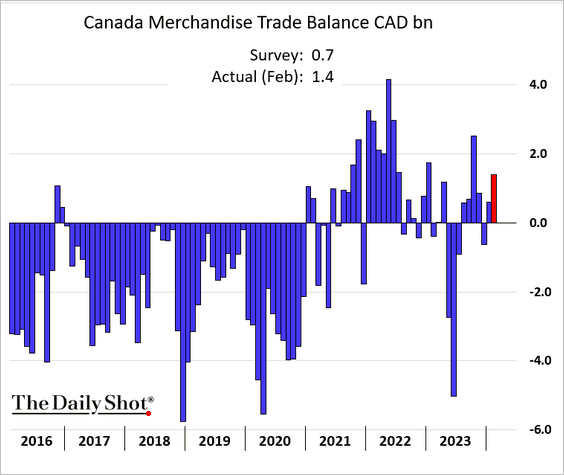

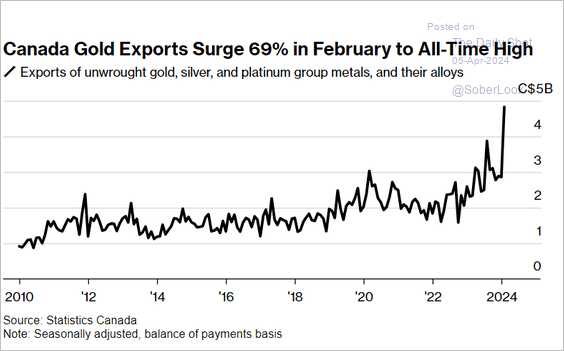

1. The trade surplus surprised to the upside, …

… boosted by gold exports.

Source: @economics Read full article

Source: @economics Read full article

——————–

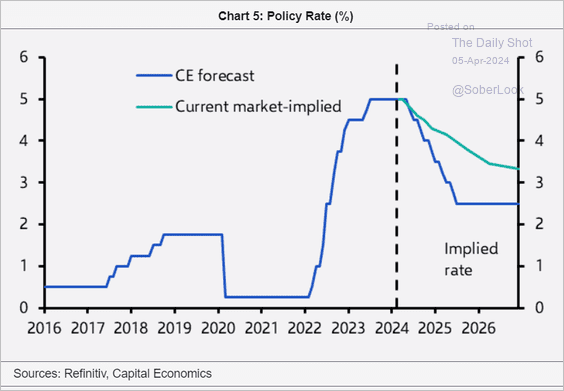

2. Capital Economics sees a much steeper pace of BoC rate cuts than the market.

Source: Capital Economics

Source: Capital Economics

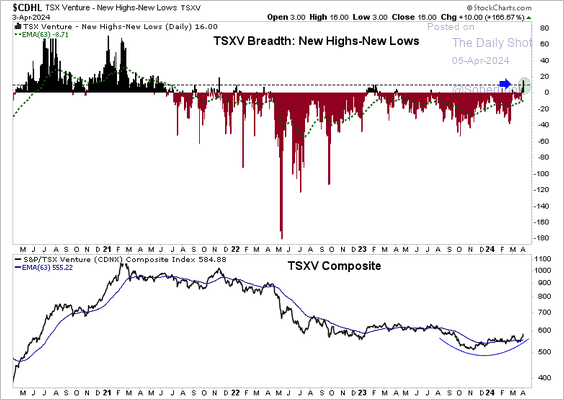

3. The TSX Venture Index’s (microcaps) breadth is expanding alongside improving relative performance.

Source: Aazan Habib, Paradigm Capital

Source: Aazan Habib, Paradigm Capital

Back to Index

The United Kingdom

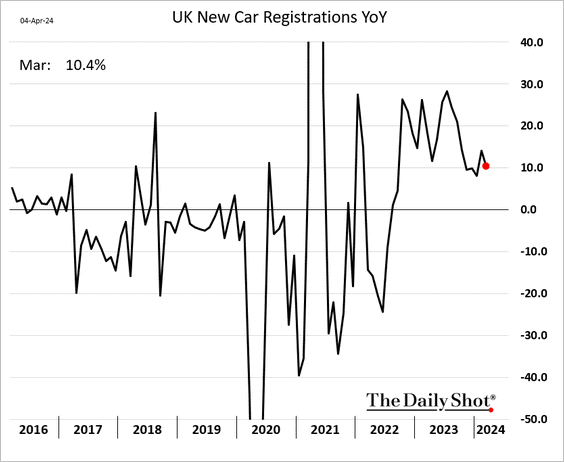

1. New vehicle sales continue to run above last year’s levels.

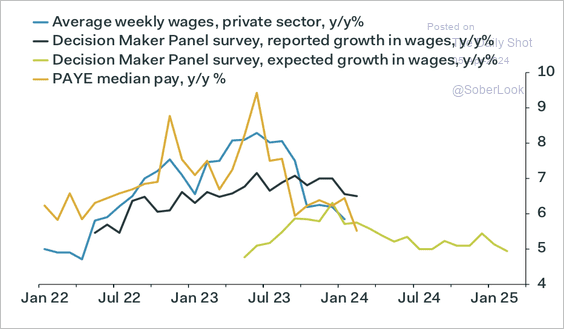

2. Wage growth is slowing.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

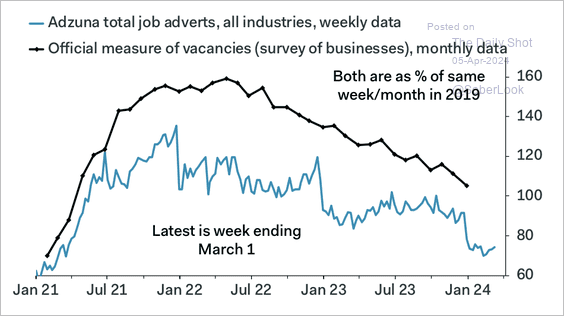

• Job vacancy numbers have been dropping.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

——————–

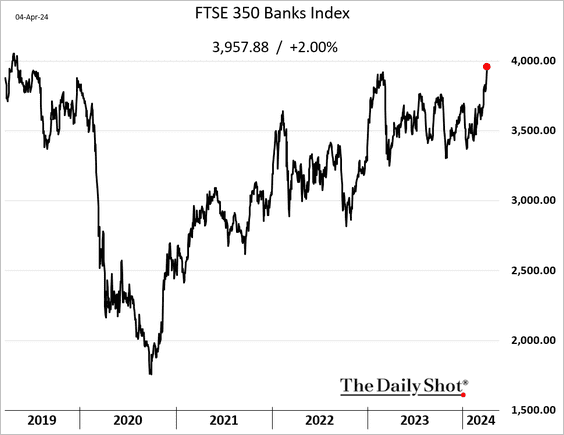

3. Bank shares reached a multi-year high.

Back to Index

The Eurozone

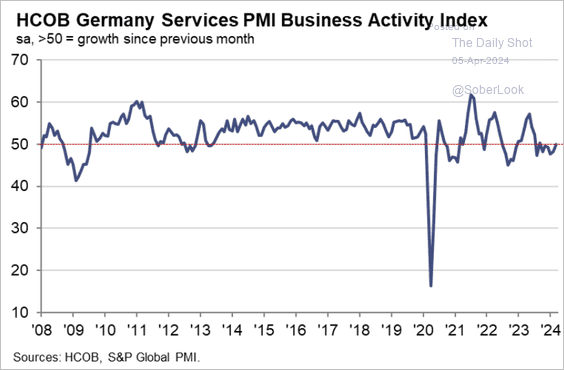

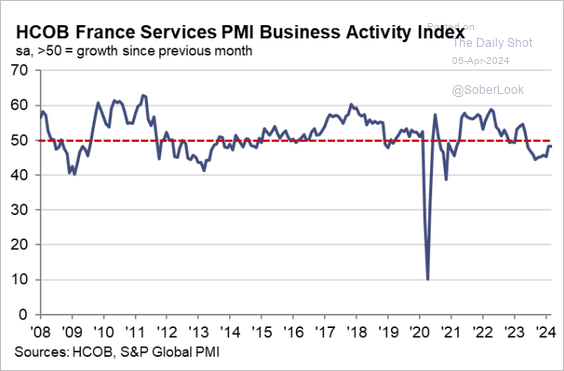

1. The services PMI figures for France and Germany were adjusted higher.

– Germany (stabilized):

Source: S&P Global PMI

Source: S&P Global PMI

– France (slowing declines):

Source: S&P Global PMI

Source: S&P Global PMI

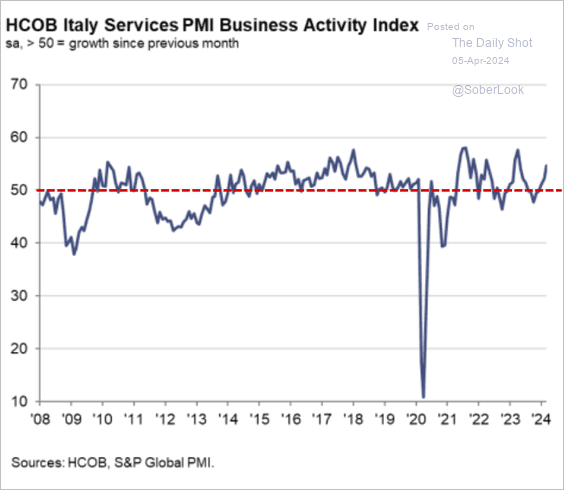

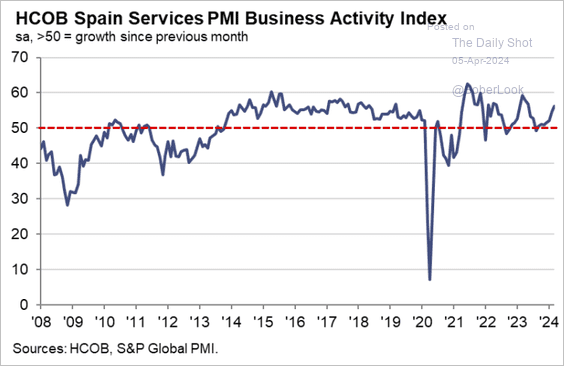

• Service firms in Italy and Spain are reporting accelerating growth.

Source: S&P Global PMI

Source: S&P Global PMI

Source: S&P Global PMI

Source: S&P Global PMI

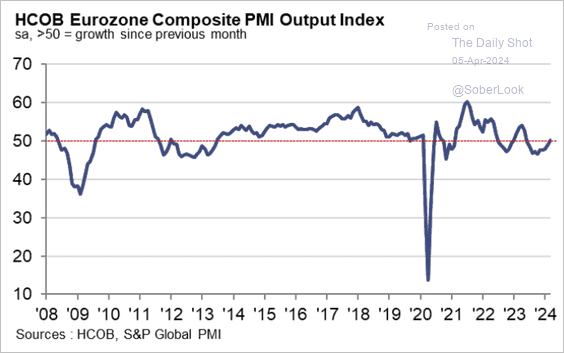

• The Eurozone Composite PMI is now in growth territory.

Source: S&P Global PMI

Source: S&P Global PMI

——————–

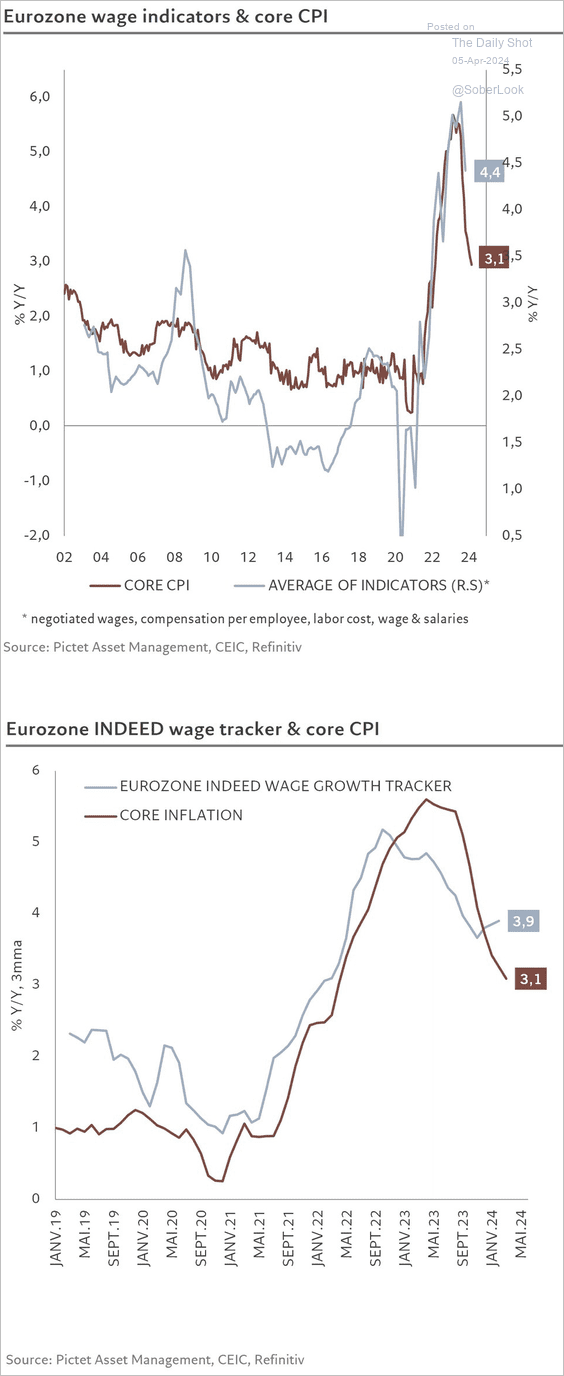

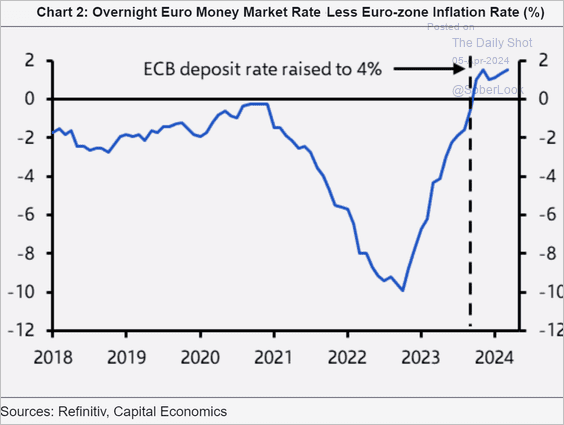

2. The ECB is preparing to lower interest rates.

• Wage growth is moving lower.

Source: @skhanniche

Source: @skhanniche

• The real policy rate is increasingly restrictive.

Source: Capital Economics

Source: Capital Economics

Back to Index

Europe

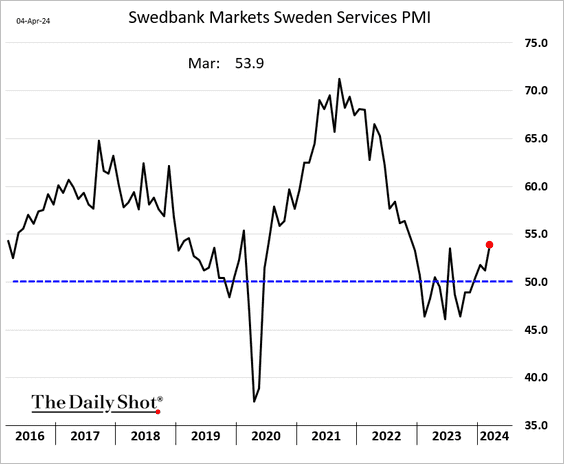

1. Sweden’s services activity is picking up momentum.

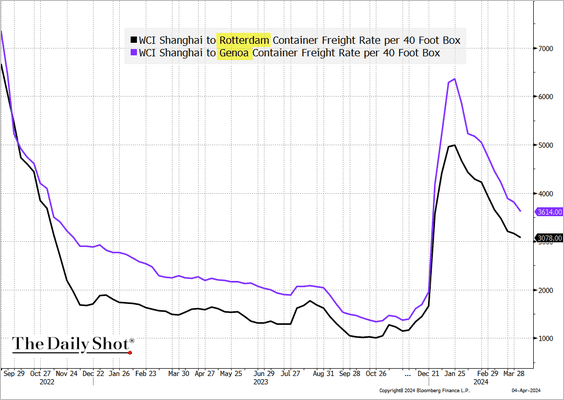

2. Container shipping costs from Asia continue to trend lower.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

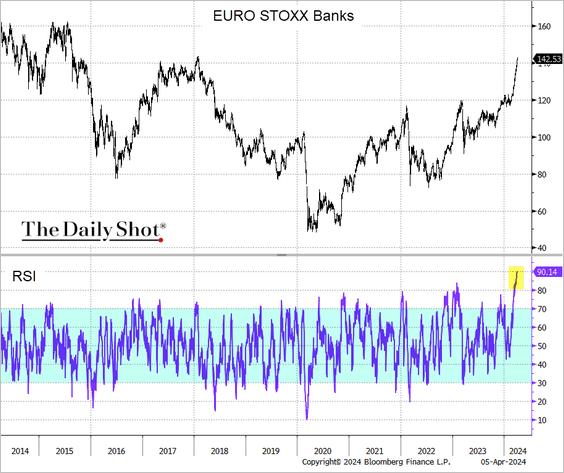

3. European banks are overbought.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

Back to Index

Asia-Pacific

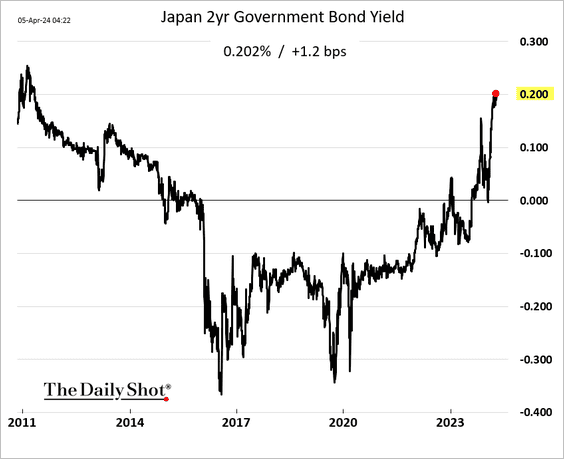

1. The 2-year JGB yield breached 0.2% for the first time since 2011 as the market prices in BoJ rate hikes.

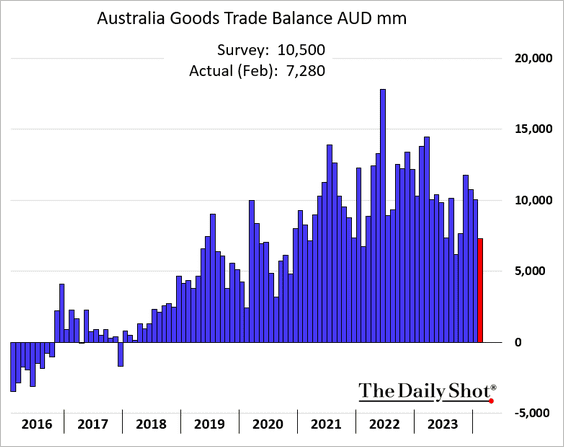

2. Australia’s trade surplus surprised to the downside.

Back to Index

Emerging Markets

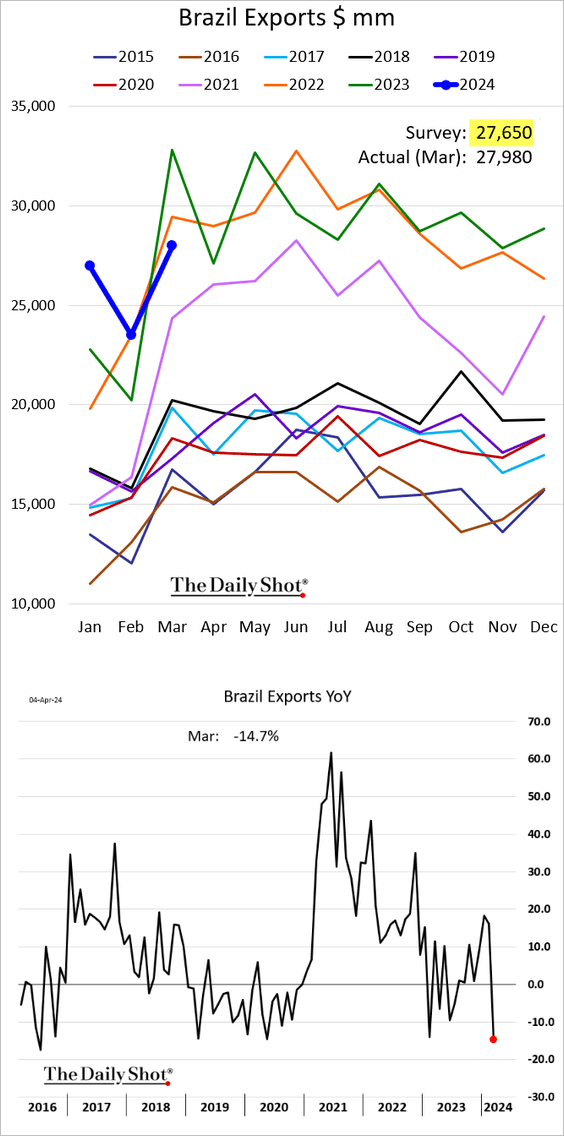

1. Brazil’s exports in March fell below 2023 levels but exceeded expectations.

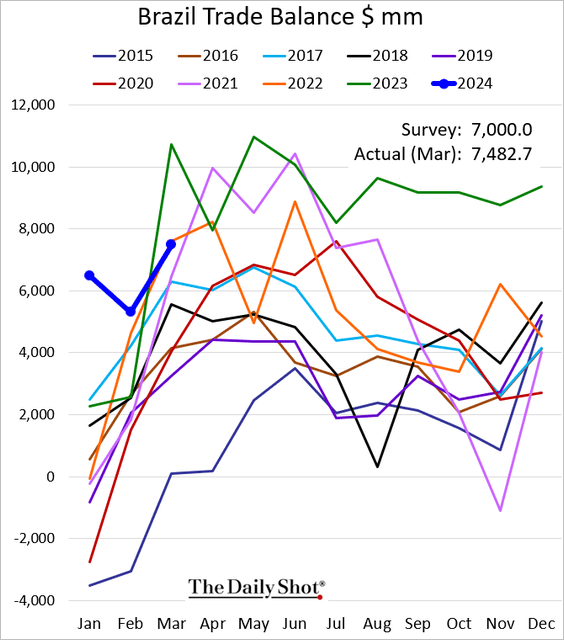

Here is the trade balance.

——————–

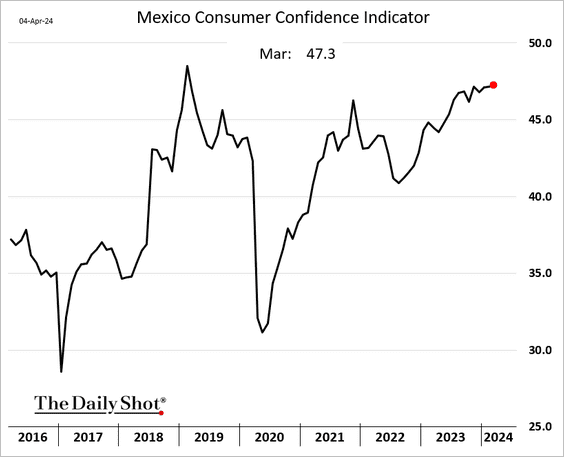

2. Mexico’s consumer sentiment remains strong.

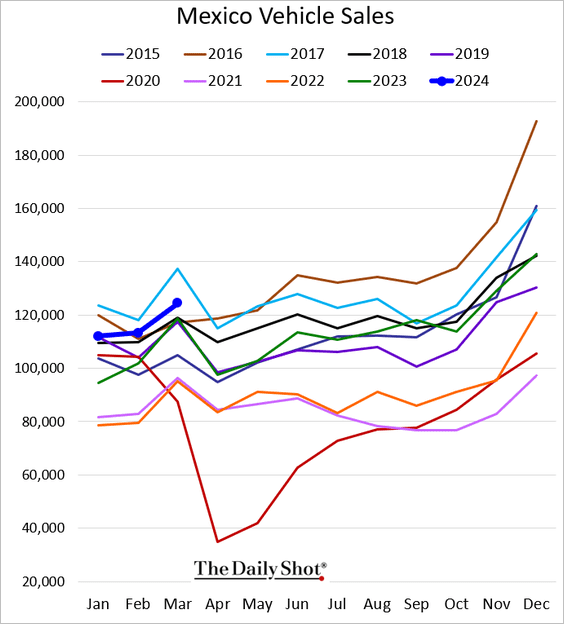

• Vehicle sales held above last year’s levels.

——————–

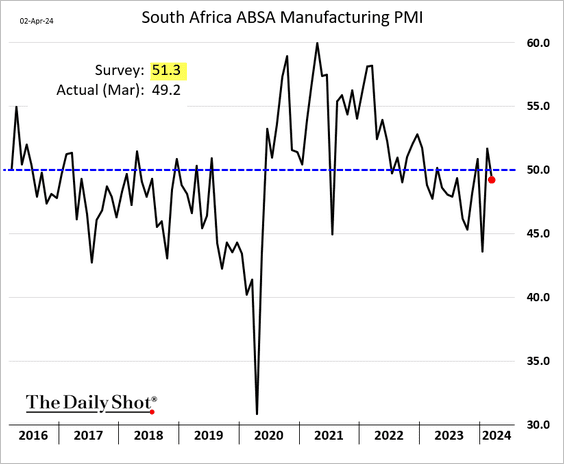

3. South Africa’s manufacturing activity shifted into contraction territory last month.

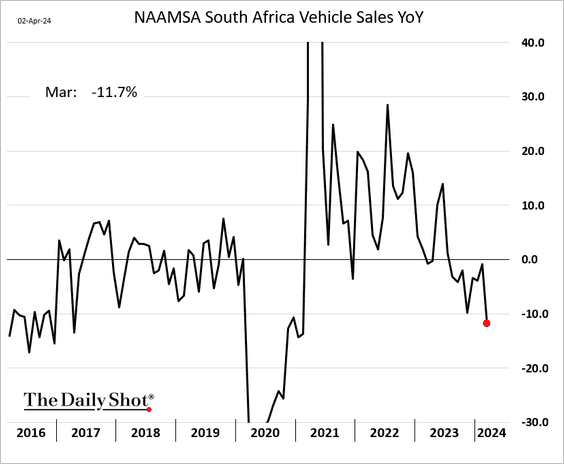

• Vehicle sales deteriorated.

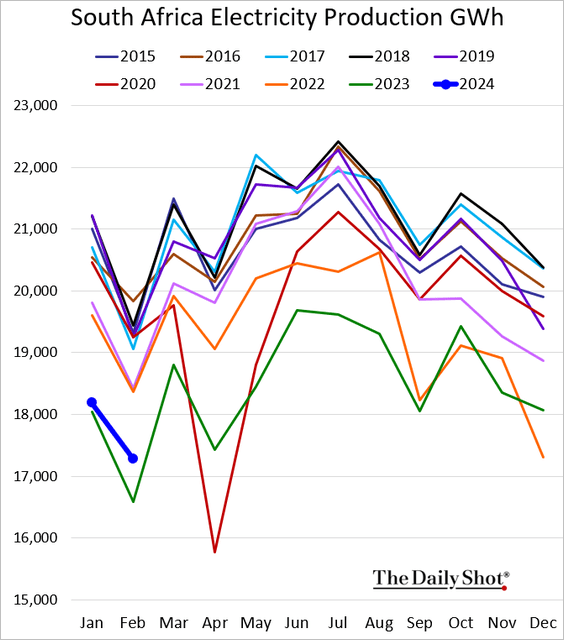

• The nation’s electricity output is above last year’s levels but still depressed.

——————–

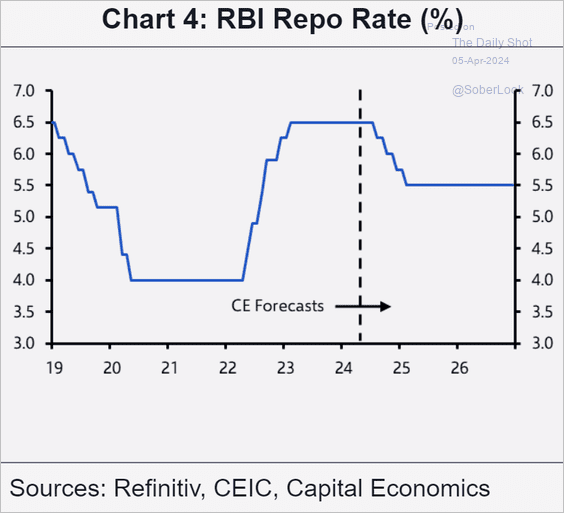

4. India’s RBI kept rates steady, yet Capital Economics anticipates rate cuts in the near future.

Source: Capital Economics

Source: Capital Economics

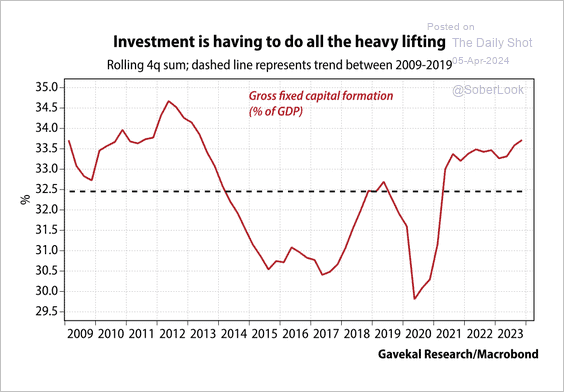

• The investment share of India’s GDP has risen to levels last seen in more than a decade.

Source: Gavekal Research

Source: Gavekal Research

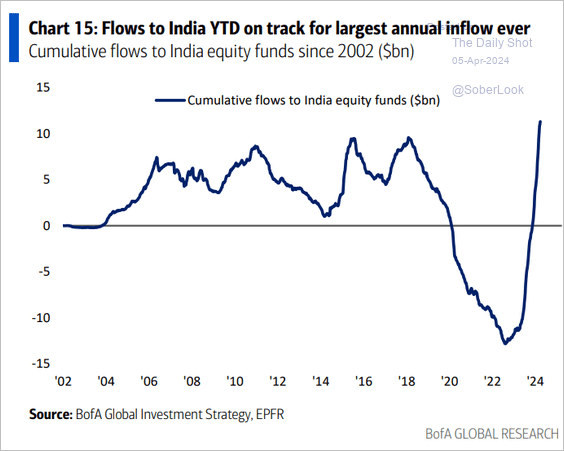

• Capital flows into India-focused equity funds are surging.

Source: BofA Global Research

Source: BofA Global Research

Back to Index

Commodities

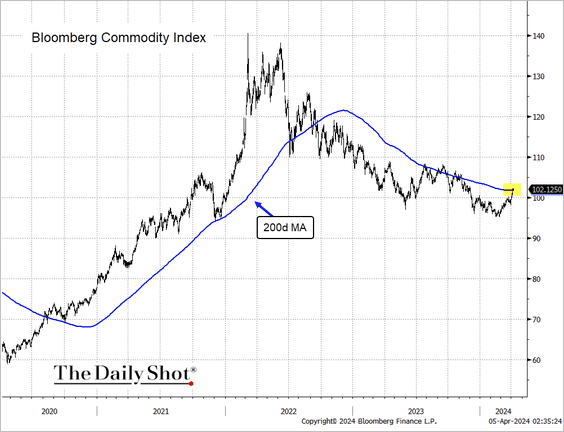

1. Bloomberg’s broad commodity index is above its 200-day moving average.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

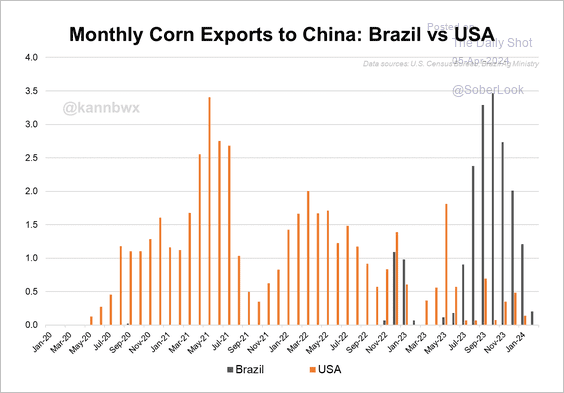

2. This chart compares corn exports from the US and Brazil to China.

Source: @kannbwx

Source: @kannbwx

Back to Index

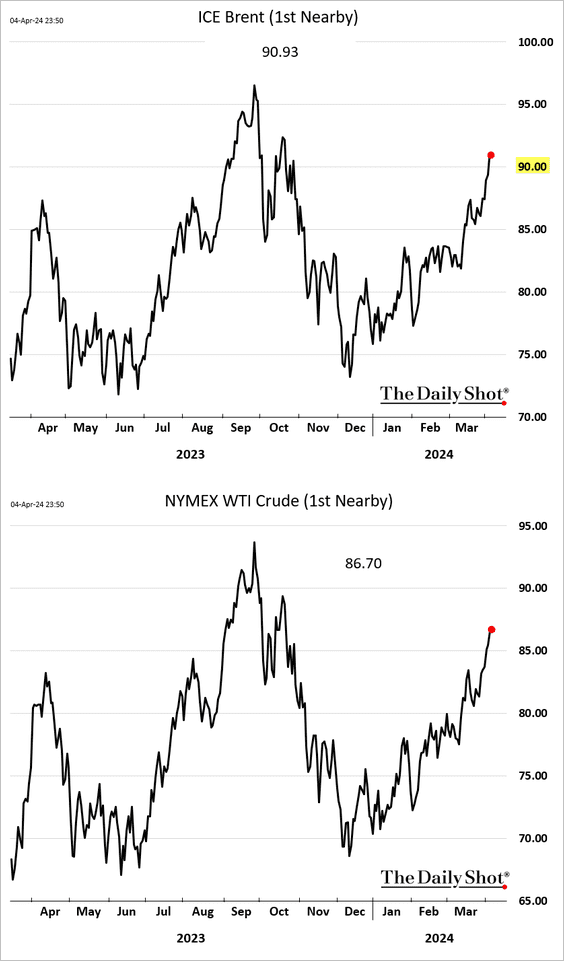

Energy

1. Brent crude breached $90/bbl amid geopolitical tensions.

Source: Reuters Read full article

Source: Reuters Read full article

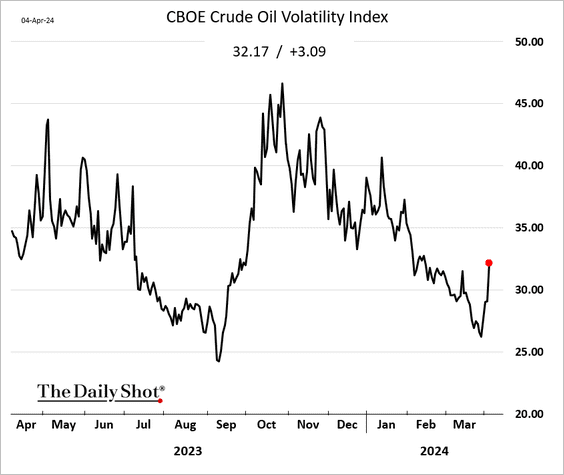

2. Implied volatility in crude oil jumped this week from recent lows.

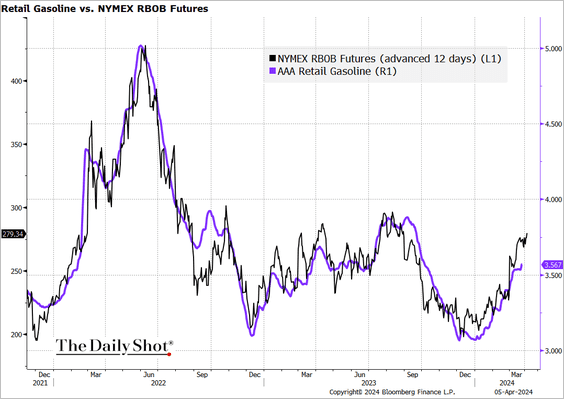

3. US gasoline prices are climbing, which could impact US inflation expectations and consumer sentiment.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

Back to Index

Equities

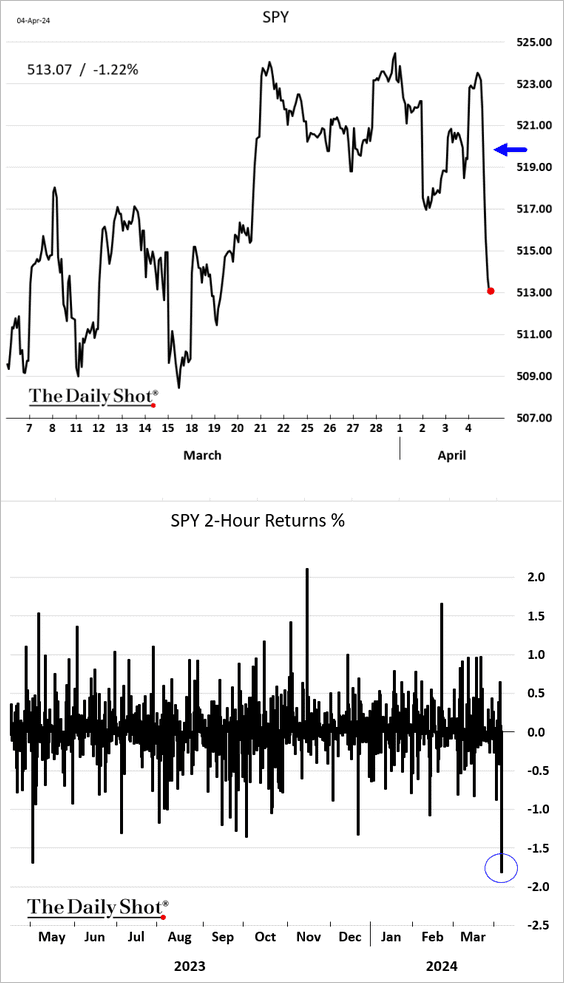

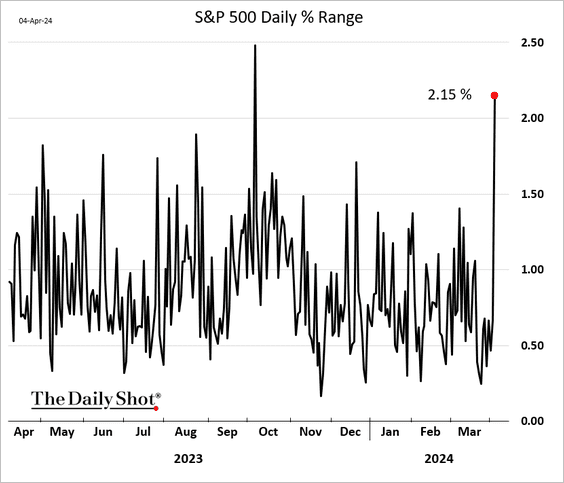

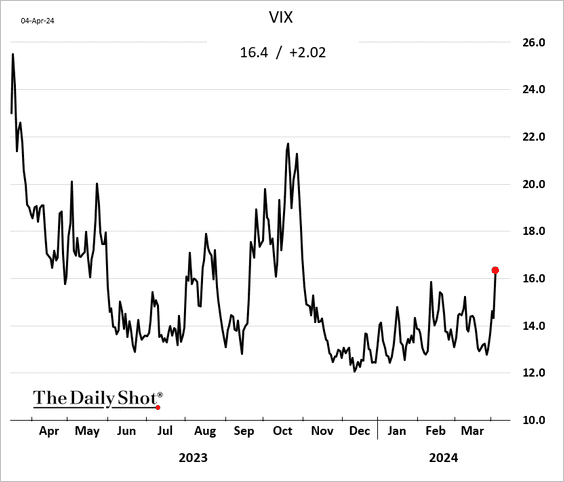

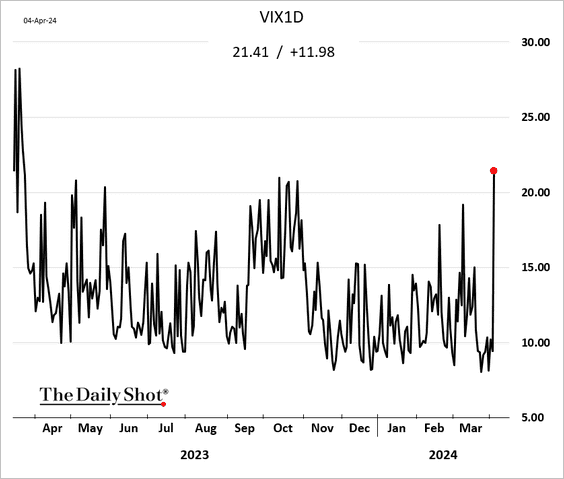

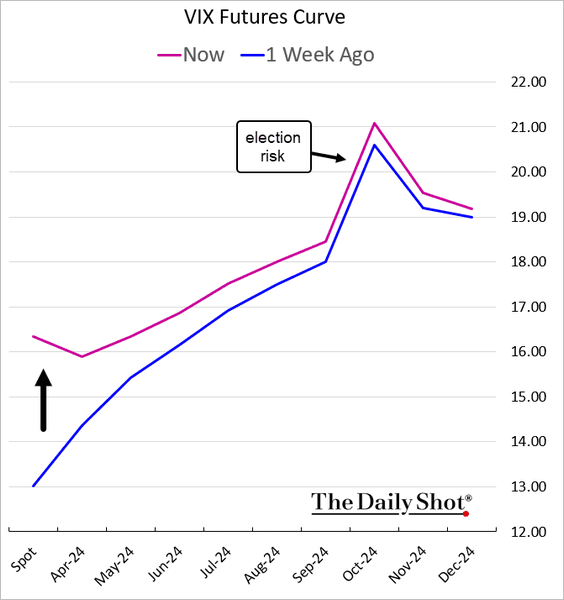

1. Volatility is back.

• Stocks saw a sharp intraday drop ahead of the jobs report.

Here is the intraday trading range.

• VIX climbed above 16 for the first time in months.

Below is the 1-day VIX.

• The front end of the VIX curve moved into backwardation.

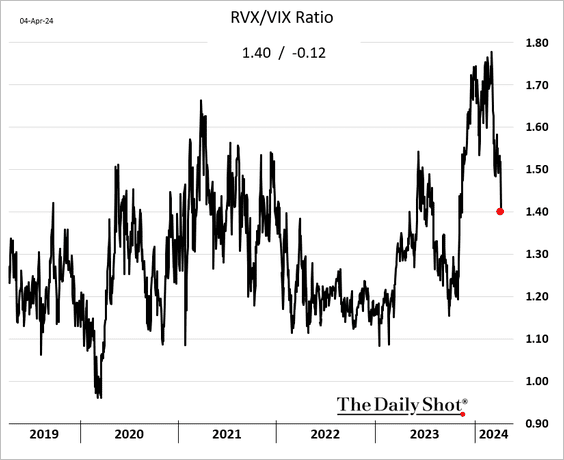

• The ratio of RVX (Russell 2000 VIX-equivalent) to VIX is returning to more typical levels.

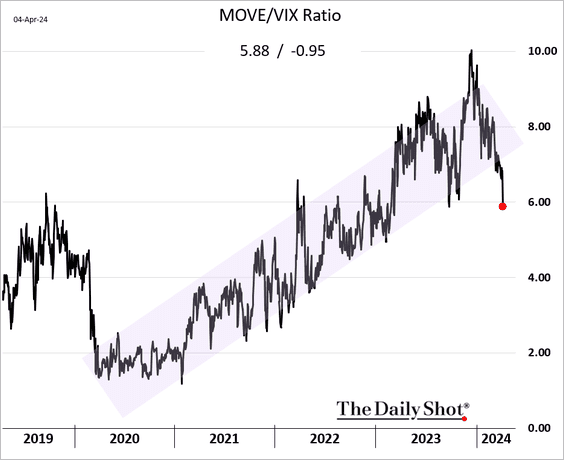

• The MOVE/VIX ratio broke below its uptrend channel (MOVE is the VIX-equivalent for Treasuries).

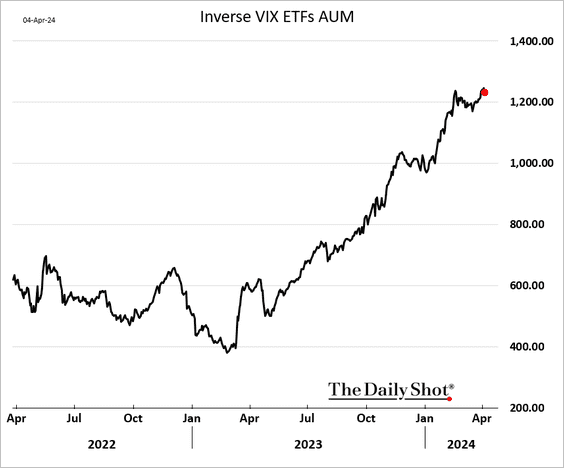

• This has got to hurt. Retail investors have been loading up on short-vol ETFs over the past 12 months (riding the Theta decay).

——————–

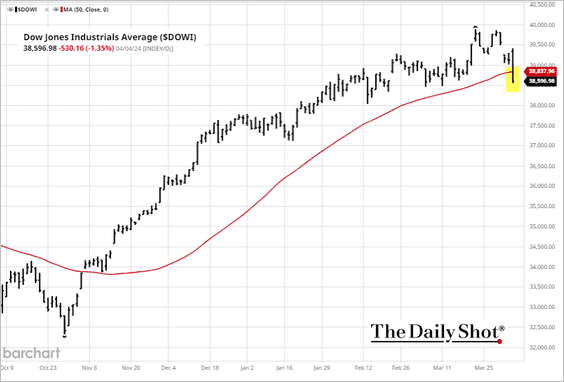

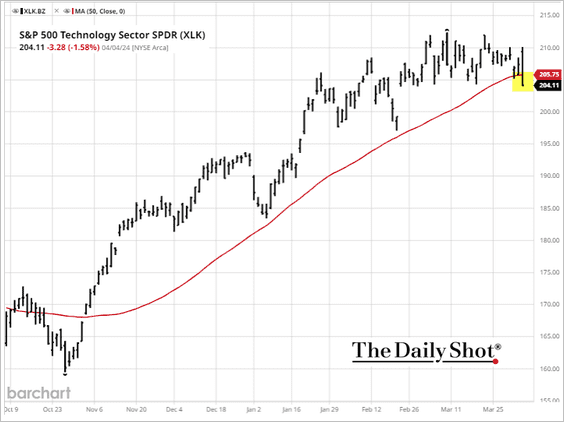

2. The Dow dipped below its 50-day moving average, …

… and so did the tech index.

——————–

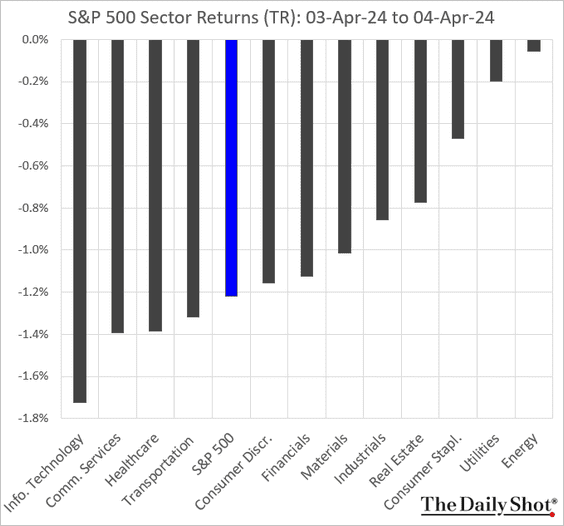

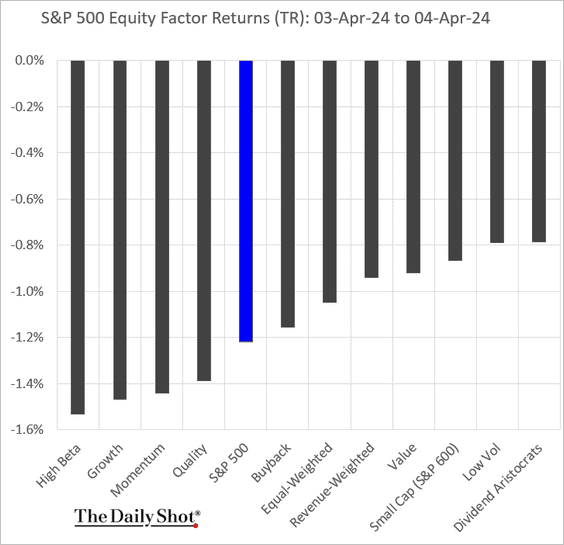

3. Here is a look at market performance on Thursday.

• Sectors:

• Equity factors/styles:

——————–

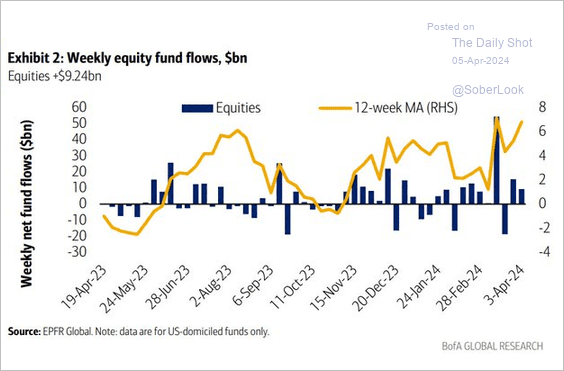

4. Equity funds registered another weekly inflow.

Source: BofA Global Research

Source: BofA Global Research

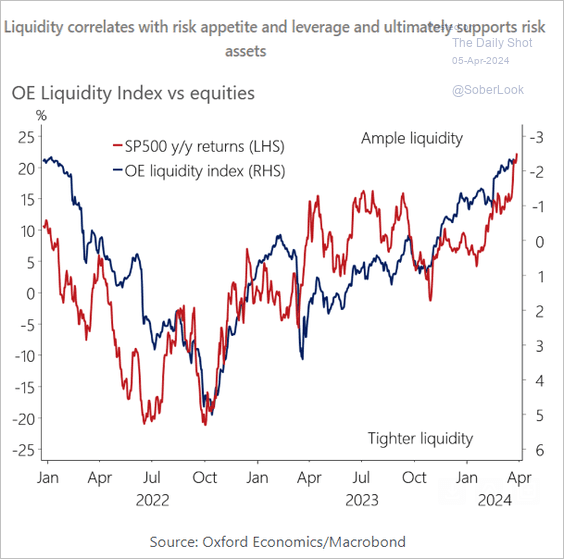

5. Rising liquidity (boosted by higher bank reserves at the Fed) has been a tailwind for stocks.

Source: Oxford Economics

Source: Oxford Economics

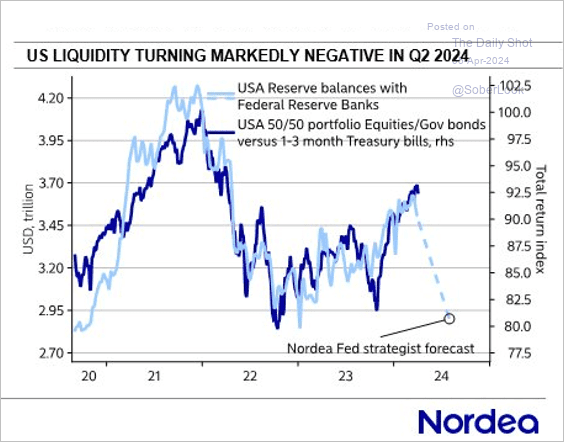

But that support is expected to end this quarter.

Source: Nordea Markets

Source: Nordea Markets

——————–

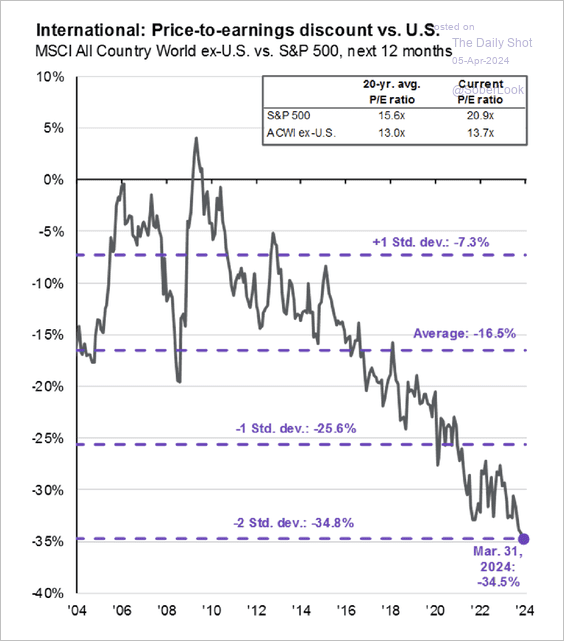

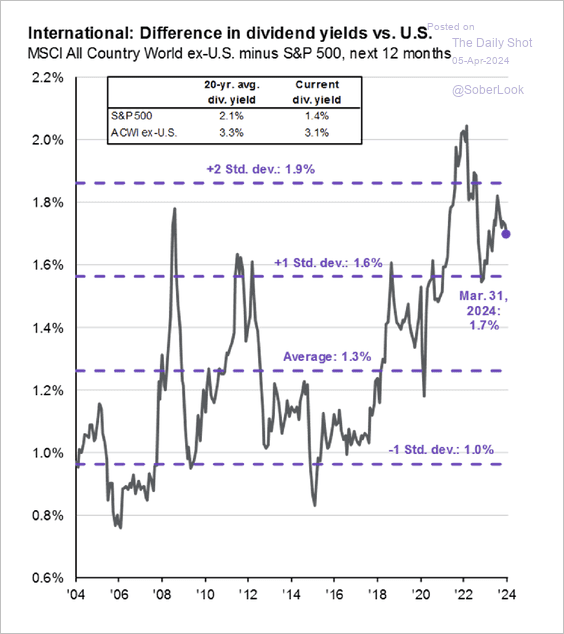

6. Non-US equities continue to trade a deep valuation discount with higher dividend yields than the US. (2 charts)

Source: J.P. Morgan Asset Management

Source: J.P. Morgan Asset Management

Source: J.P. Morgan Asset Management

Source: J.P. Morgan Asset Management

——————–

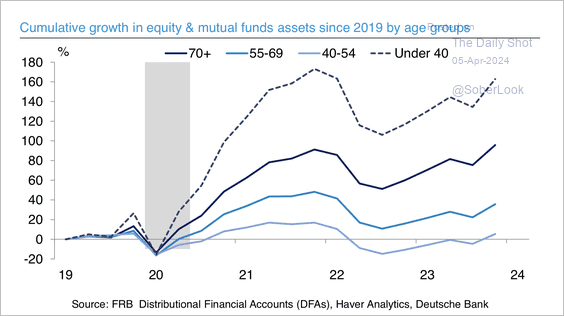

7. The youngest US age group has experienced the largest growth in equity and mutual fund assets over the past five years.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

Back to Index

Credit

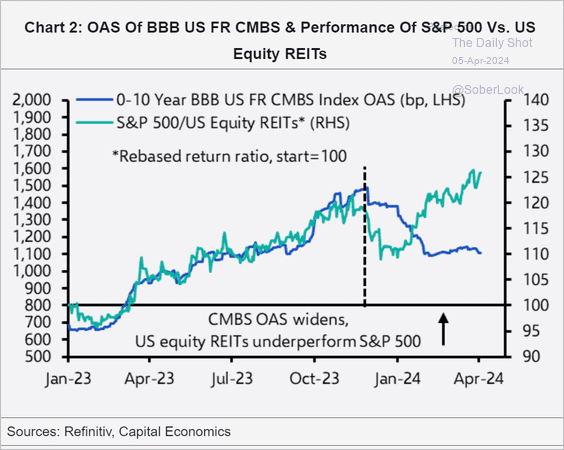

1. Are property operators (REITs) too cheap, given tighter CMBS spreads?

Source: Capital Economics

Source: Capital Economics

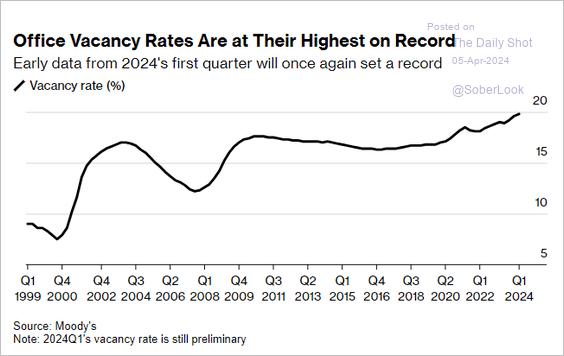

2. Office vacancies keep rising.

Source: @business Read full article

Source: @business Read full article

Back to Index

Global Developments

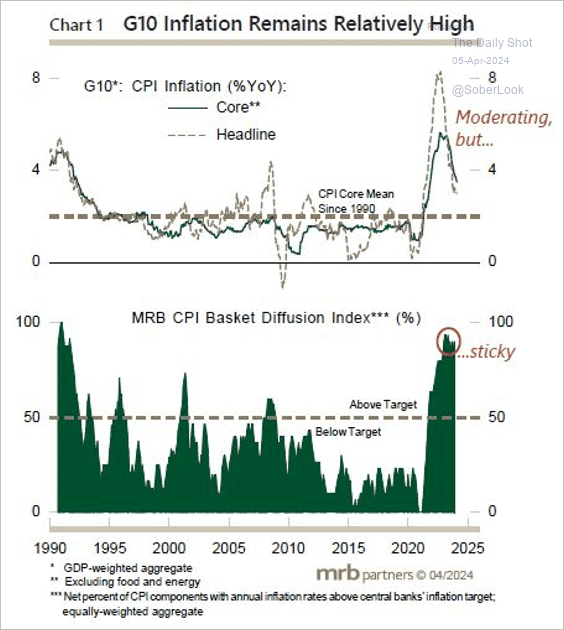

1. Inflation across G10 nations is moderating but remains sticky.

Source: MRB Partners

Source: MRB Partners

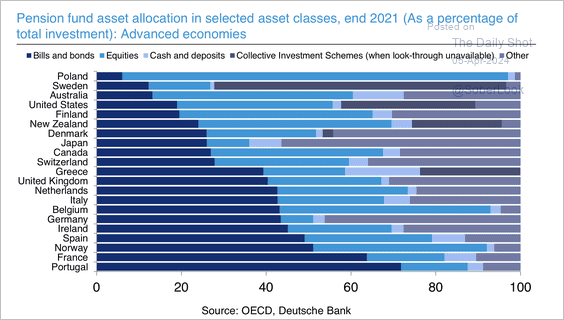

2. This chart shows pension fund allocations across different countries.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

——————–

Food for Thought

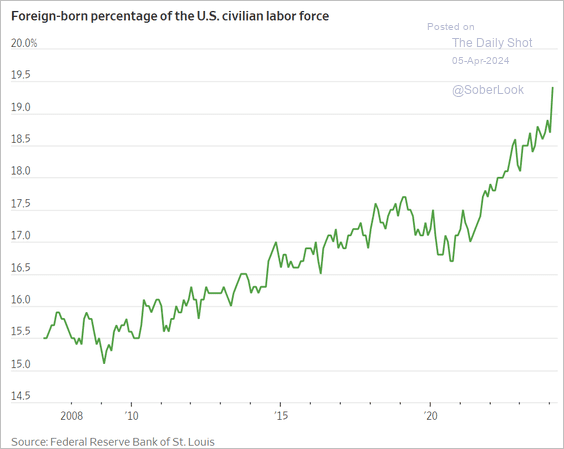

1. Foreign-born share of the US labor force:

Source: @WSJ Read full article

Source: @WSJ Read full article

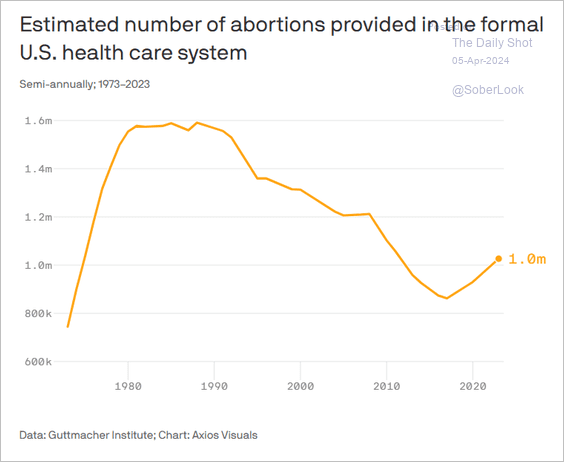

2. Historical trend in abortion rates in formal healthcare settings:

Source: @axios Read full article

Source: @axios Read full article

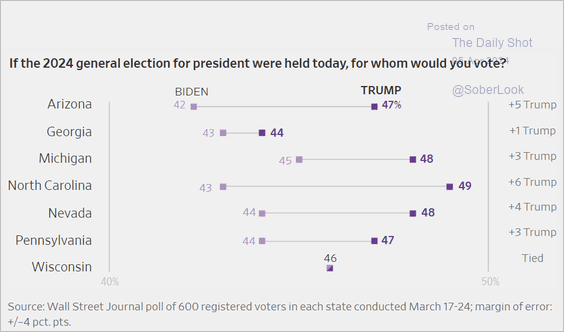

3. 2024 US presidential election polling in key states:

Source: @WSJ Read full article

Source: @WSJ Read full article

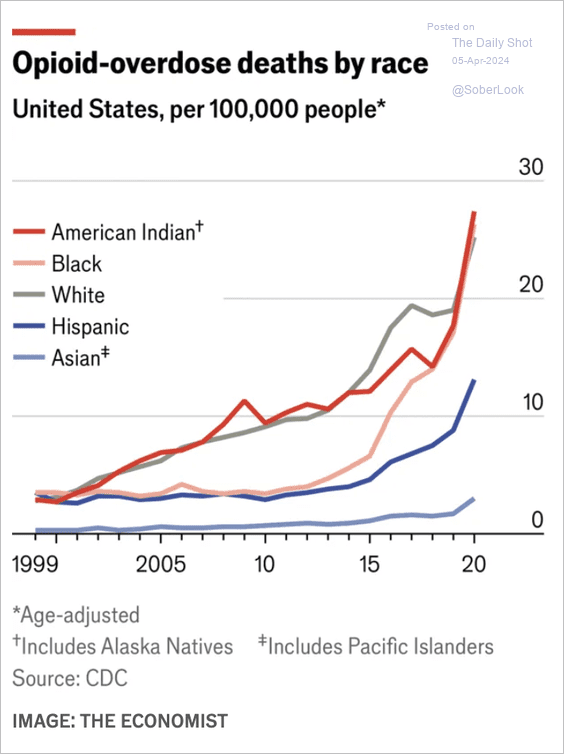

4. Opioid overdose deaths by race/ethnicity:

Source: The Economist Read full article

Source: The Economist Read full article

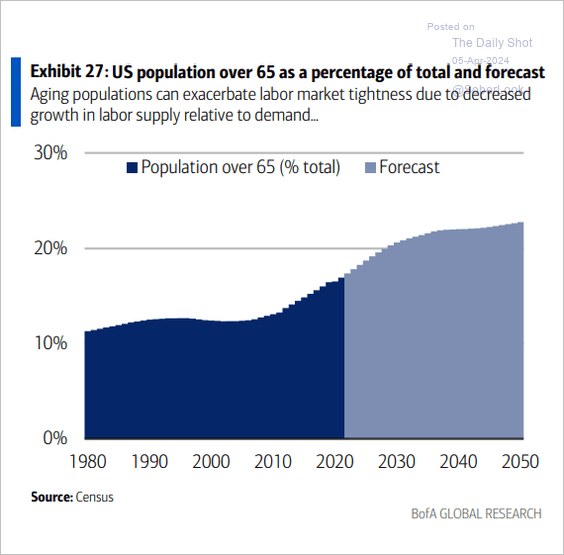

5. Projected increase in the elderly population’s share of the total US population:

Source: BofA Global Research

Source: BofA Global Research

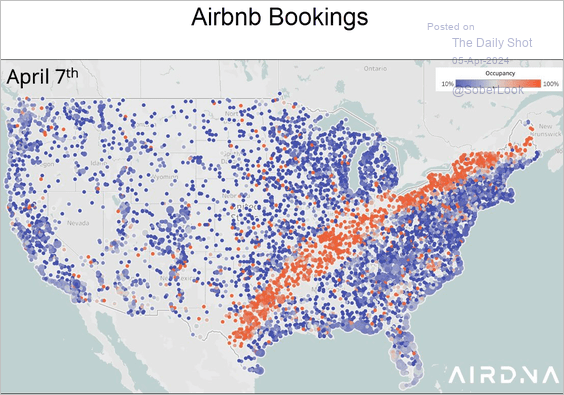

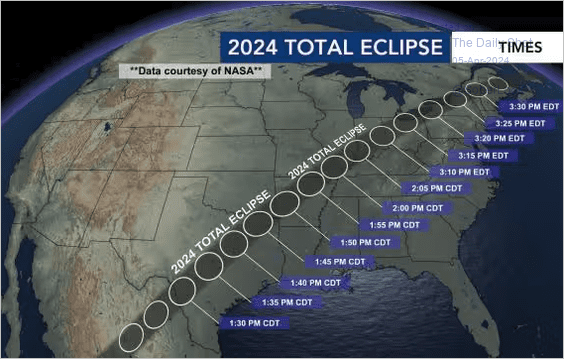

6. Getting ready for the eclipse (2 charts):

Source: @Jamie_Lane, @airdna

Source: @Jamie_Lane, @airdna

Source: WRAL-TV Read full article

Source: WRAL-TV Read full article

——————–

Have a great weekend!

Back to Index