The Daily Shot: 02-Apr-24

• The United States

• Canada

• The United Kingdom

• The Eurozone

• Japan

• Asia-Pacific

• China

• Emerging Markets

• Cryptocurrency

• Commodities

• Energy

• Equities

• Credit

• Global Developments

• Food for Thought

The United States

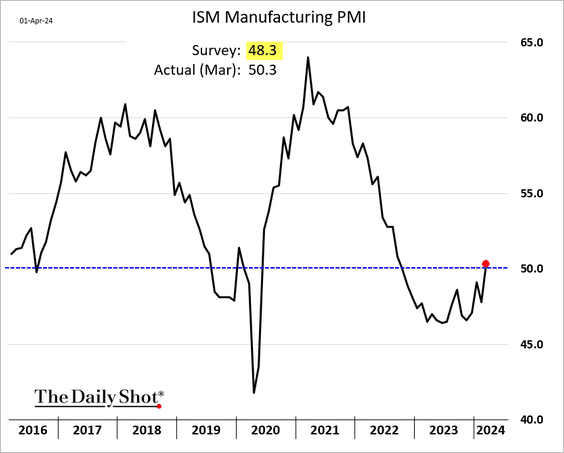

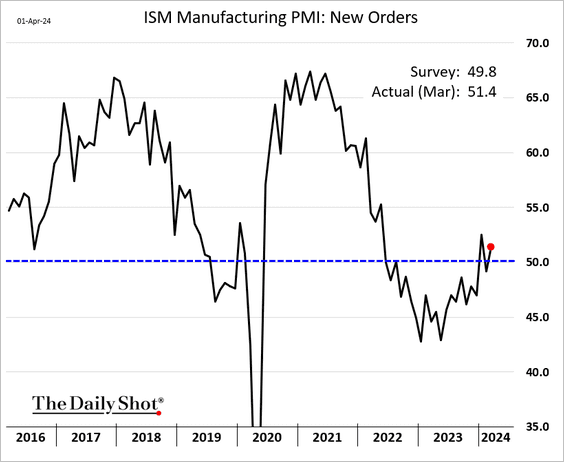

1. The ISM Manufacturing PMI finally returned to growth in March, topping expectations.

Source: @economics Read full article

Source: @economics Read full article

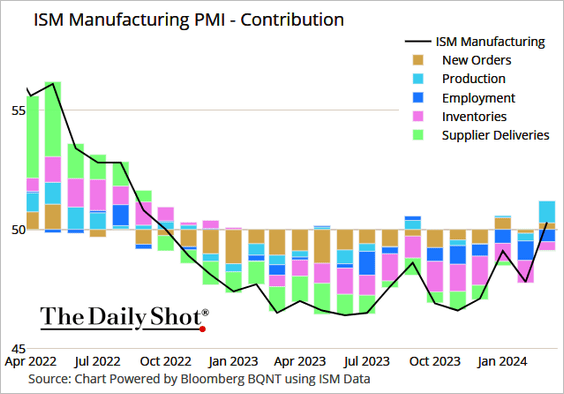

– Here are the contributions to the PMI.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

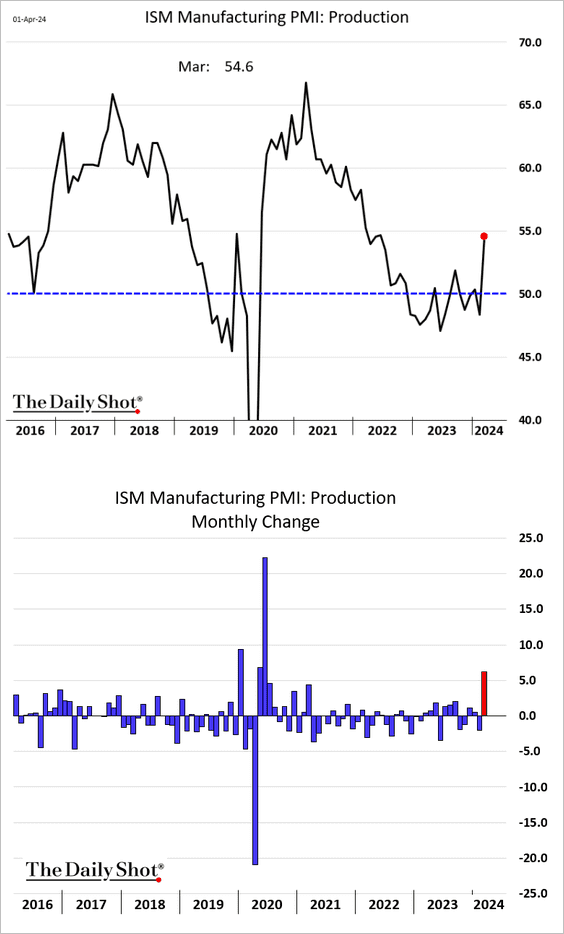

• The index of production surged, …

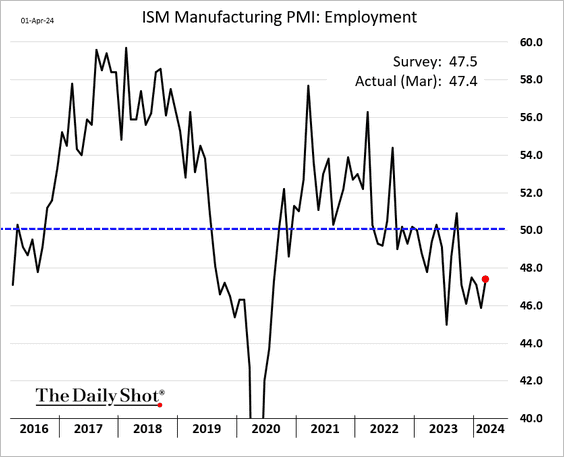

… but employment remained soft.

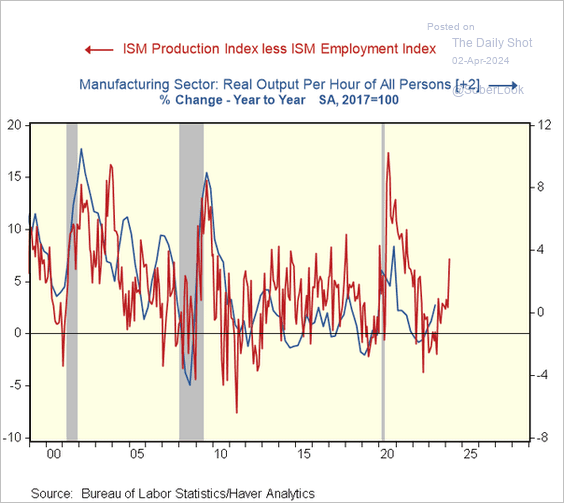

As a result, we could see improvements in labor productivity.

Source: @RenMacLLC

Source: @RenMacLLC

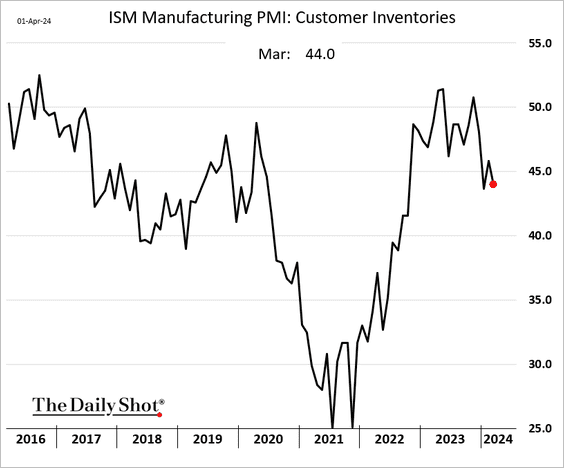

• Companies increasingly see customers’ inventories as too low.

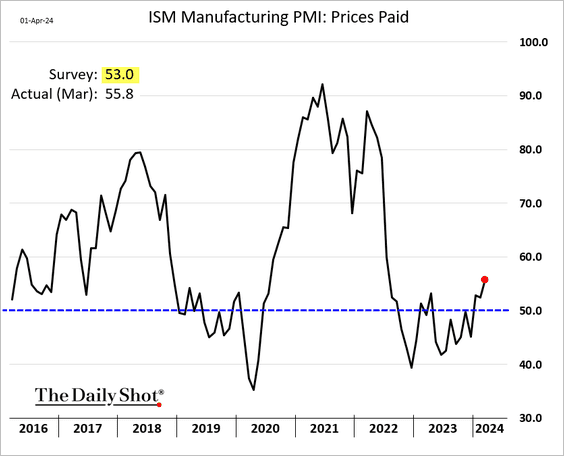

• Input prices are rising again.

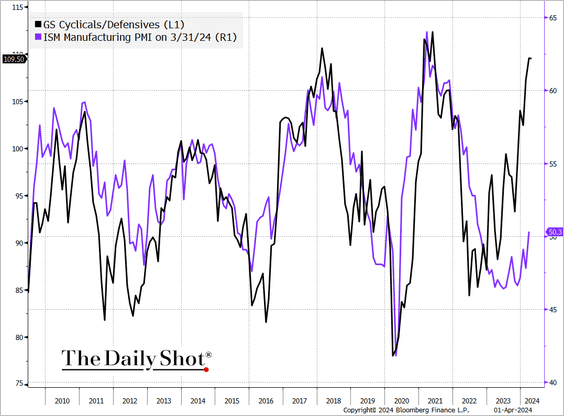

• The ratio of cyclical-to-defensive equity sectors continues to signal stronger factory activity ahead.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

——————–

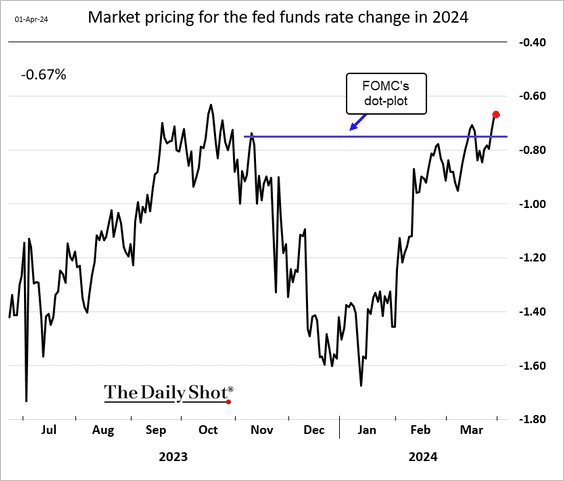

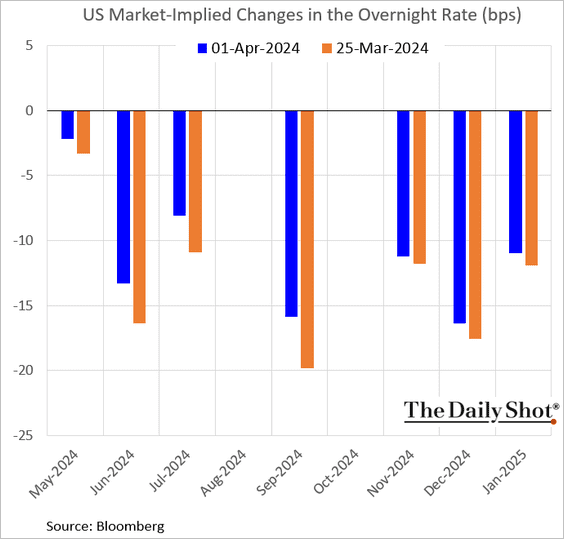

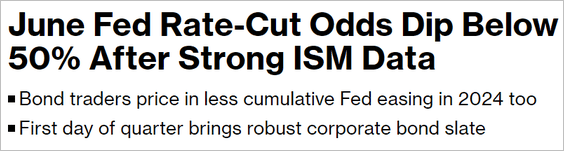

2. In response to the robust ISM PMI report, the market scaled back the anticipated Fed rate cuts for this year (2 charts).

Source: @markets Read full article

Source: @markets Read full article

——————–

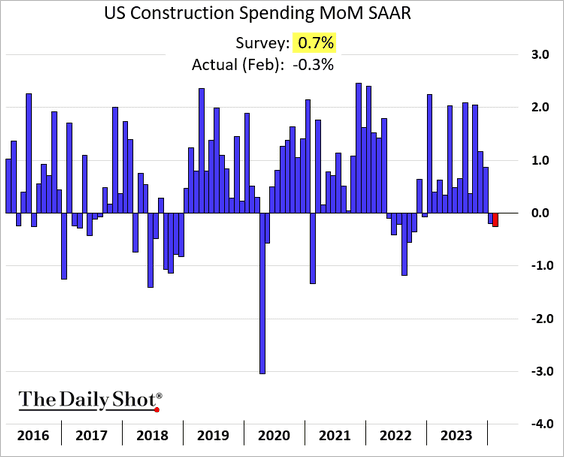

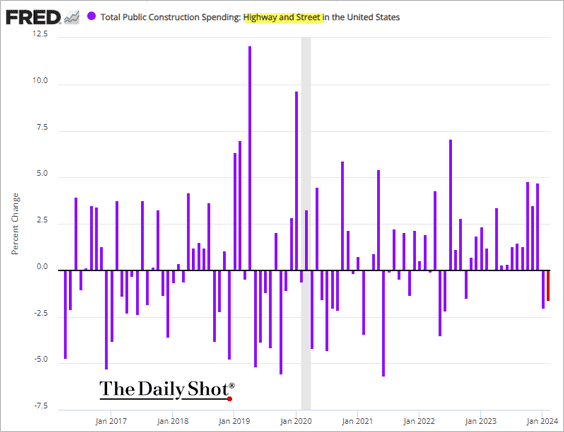

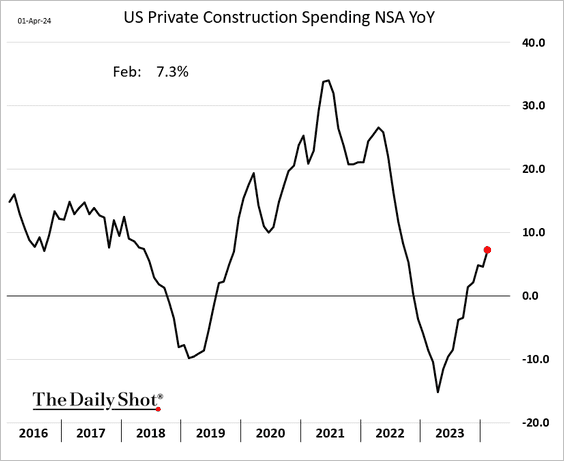

3. Construction spending unexpectedly declined in February, …

Source: Reuters Read full article

Source: Reuters Read full article

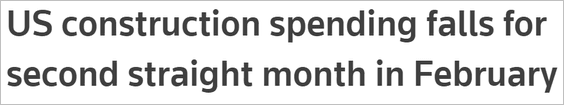

… amid softer private nonresidential construction …

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

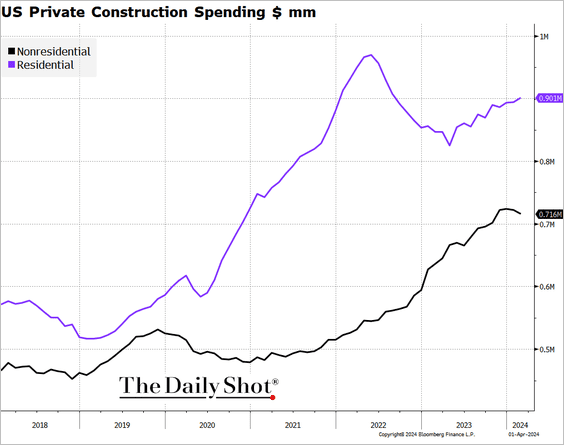

… and weaker public construction expenditures.

Year-over-year, total private construction spending has increased.

——————–

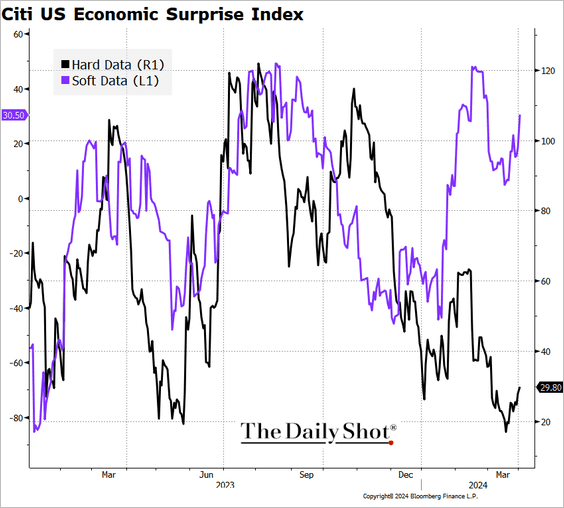

4. This year’s gains in the Citi Economic Surprise Index have been driven by soft data (surveys).

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

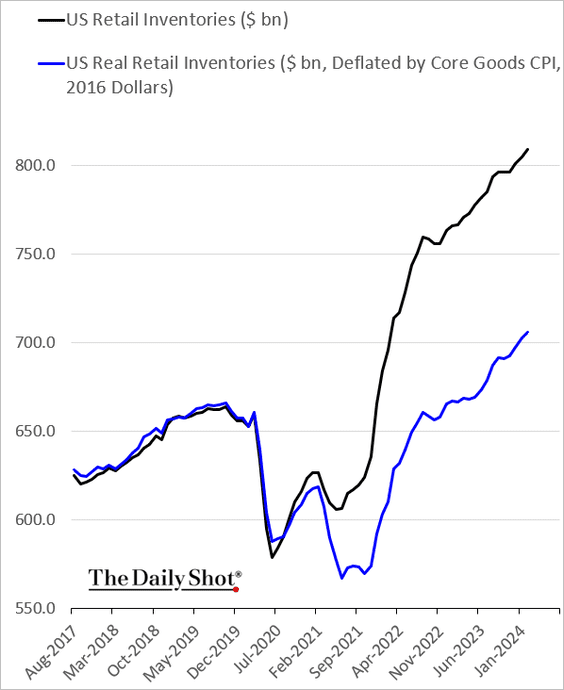

5. Retail inventories continue to climb.

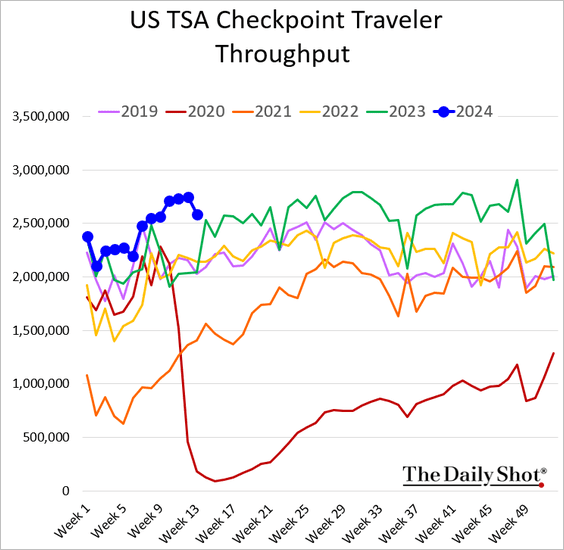

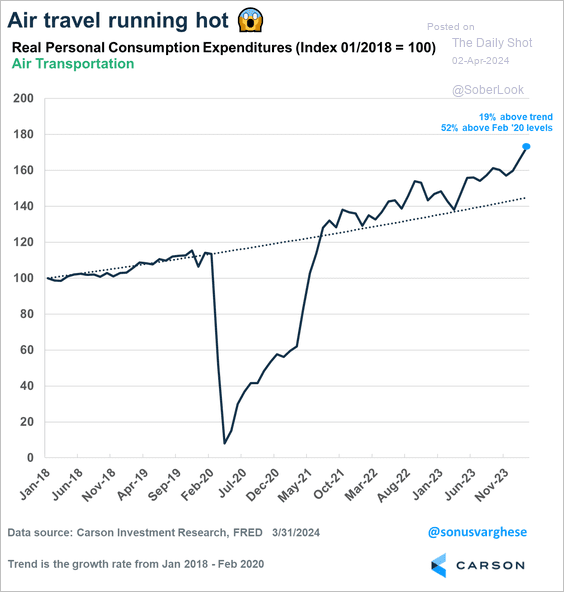

6. More Americans are flying this year (2 charts).

Source: @sonusvarghese

Source: @sonusvarghese

Back to Index

Canada

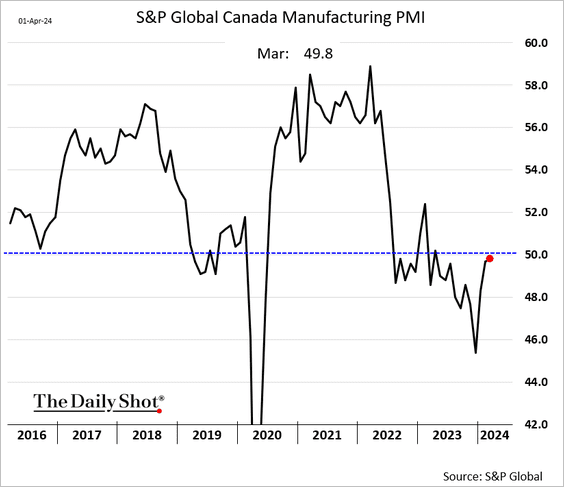

1. The manufacturing PMI shows factory activity stabilizing, but growth remains elusive.

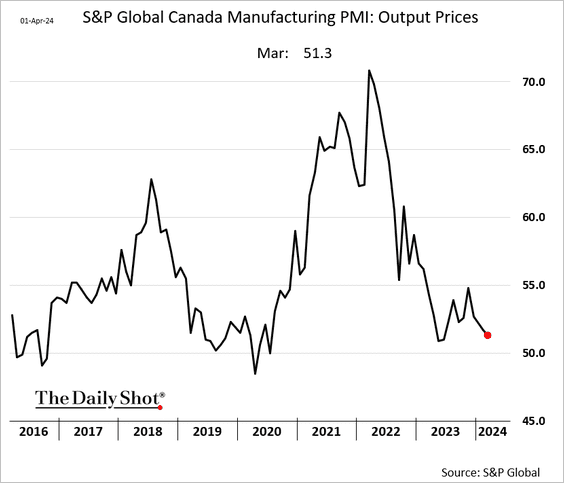

• Fewer factories are boosting prices.

——————–

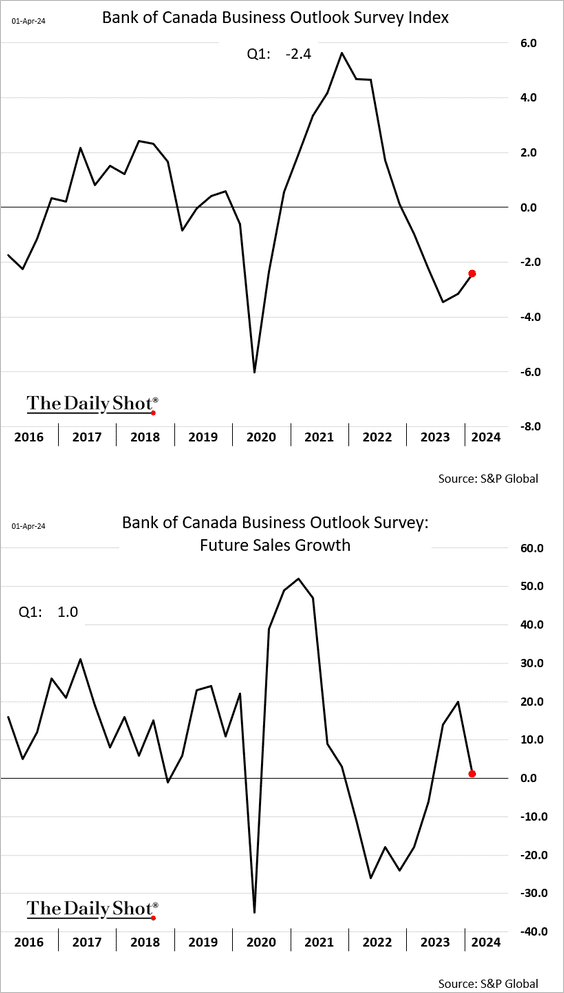

2. The BoC’s first-quarter business survey report was lackluster, with sales growth expectations stalling.

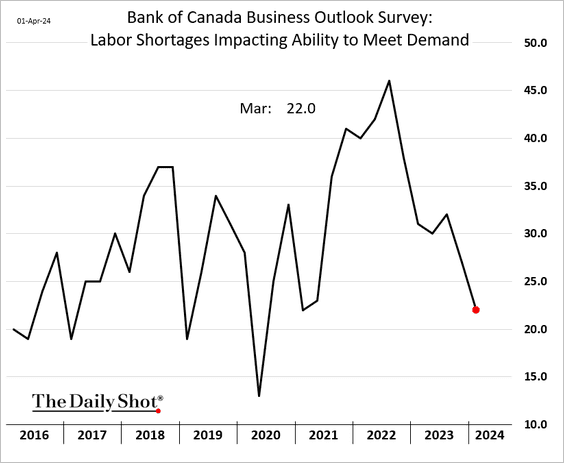

• Labor shortages are less of a problem.

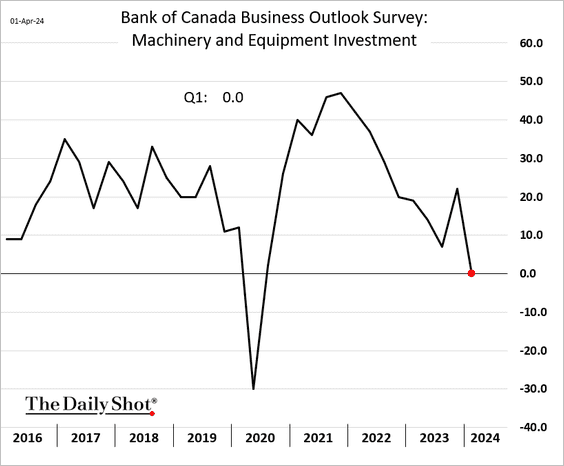

• The CapEx index deteriorated.

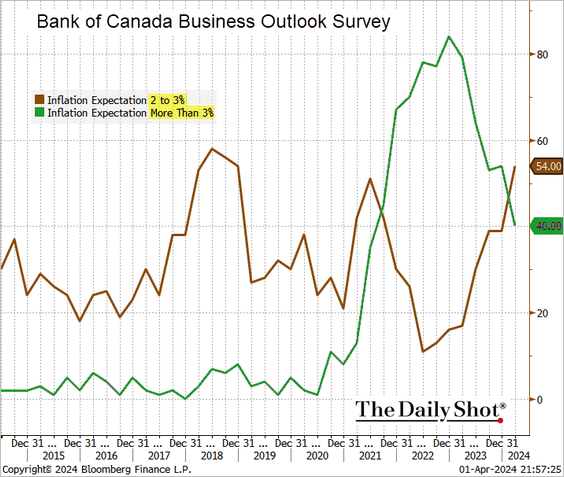

• Fewer firms expect high inflation ahead.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

——————–

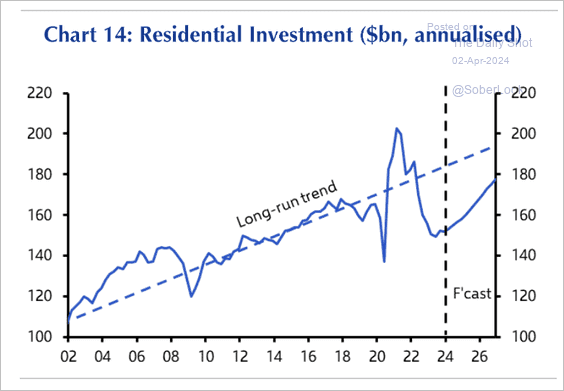

3. Capital Economics expects an increase in residential investment, although it will be below the historical trend.

Source: Capital Economics

Source: Capital Economics

Back to Index

The United Kingdom

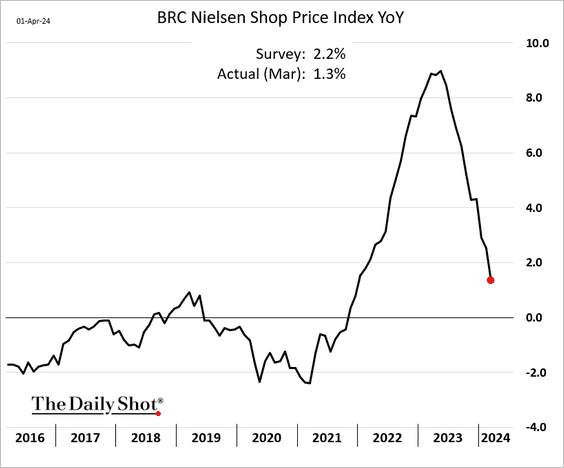

1. Shop price gains continue to slow.

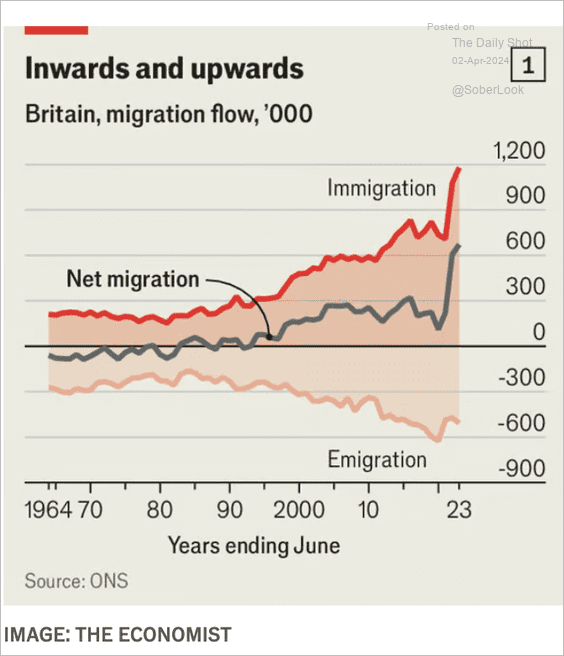

2. Here is a look at Britain’s migration trends.

Source: The Economist Read full article

Source: The Economist Read full article

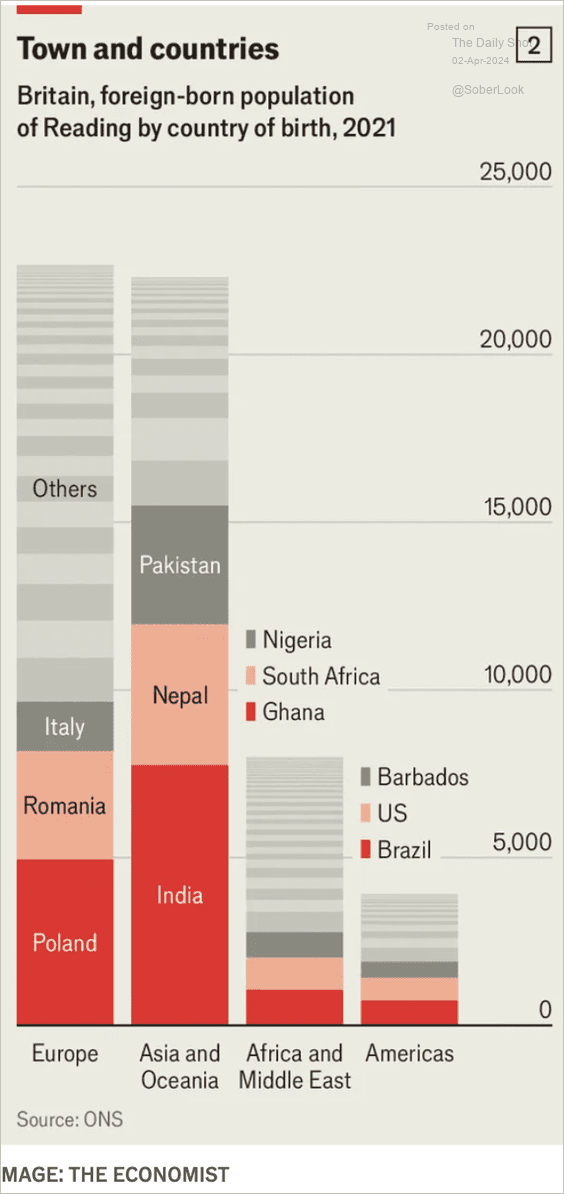

This chart shows the foreign-born population by country of birth.

Source: The Economist Read full article

Source: The Economist Read full article

Back to Index

The Eurozone

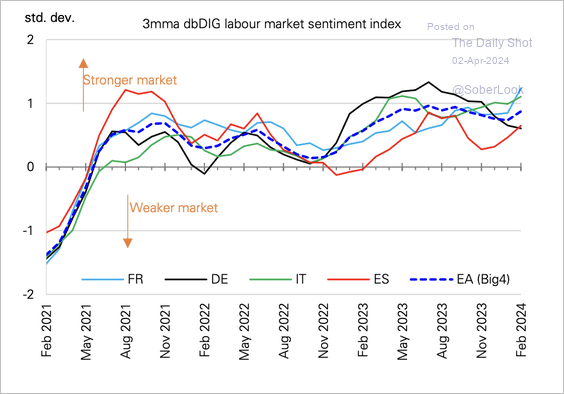

1. Household perceptions of the labor market remain robust, except in Germany.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

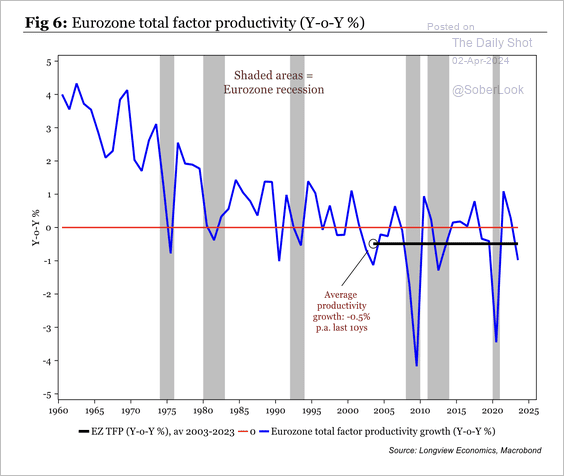

2. Eurozone total factor productivity remains weak.

Source: Longview Economics

Source: Longview Economics

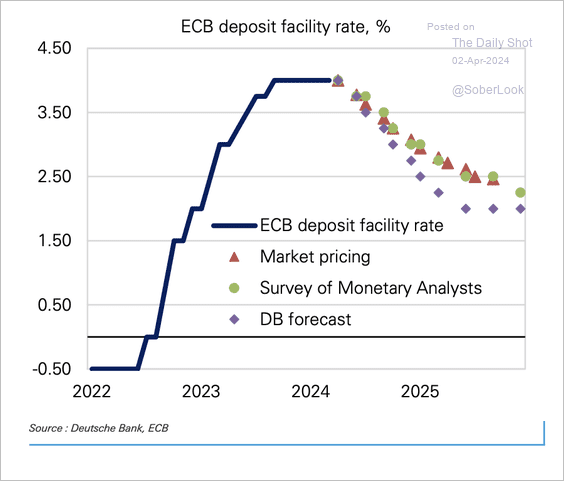

3. Deutsche Bank expects the ECB policy rate to drop to 2% by mid-2025.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

Back to Index

Japan

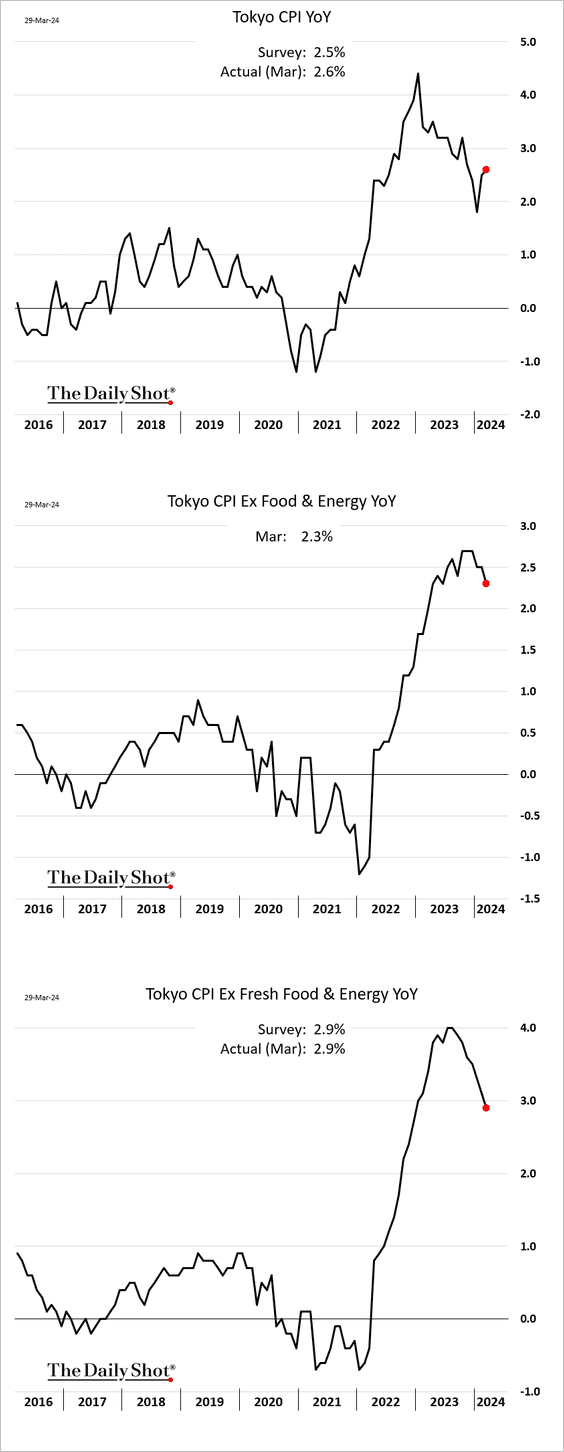

1. The year-over-year headline CPI figure for Tokyo increased slightly in March, while core inflation shows signs of deceleration.

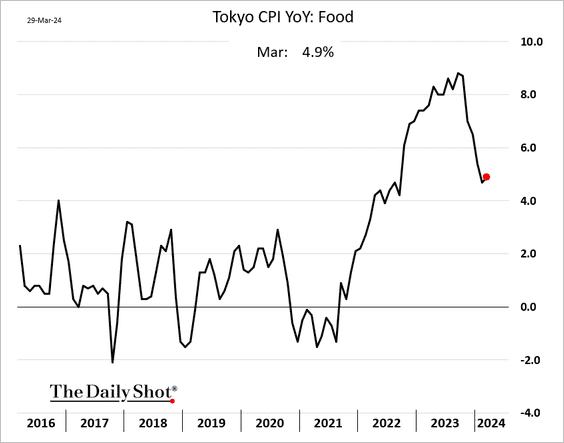

Here is food inflation.

——————–

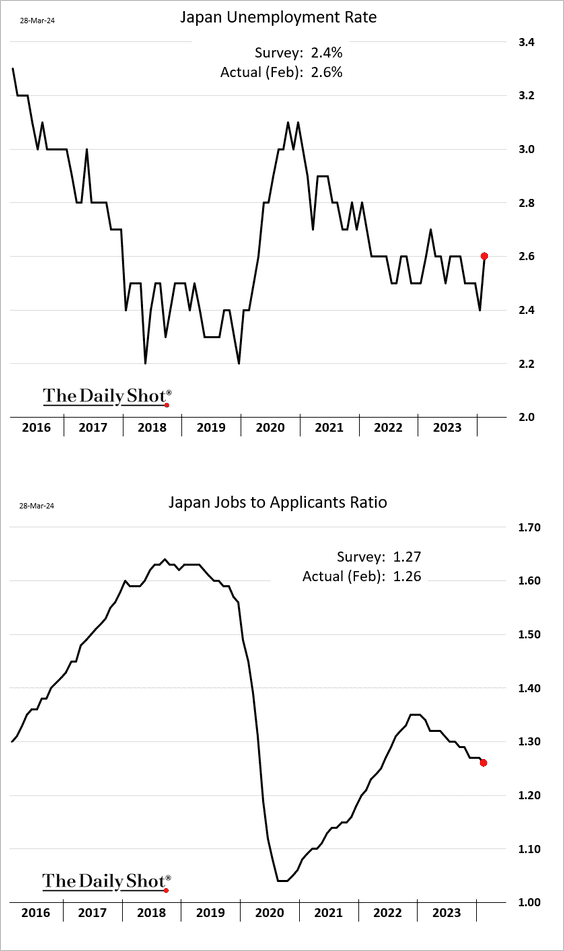

2. The unemployment rate increased in February, while the jobs-to-applicants ratio continues to trend lower.

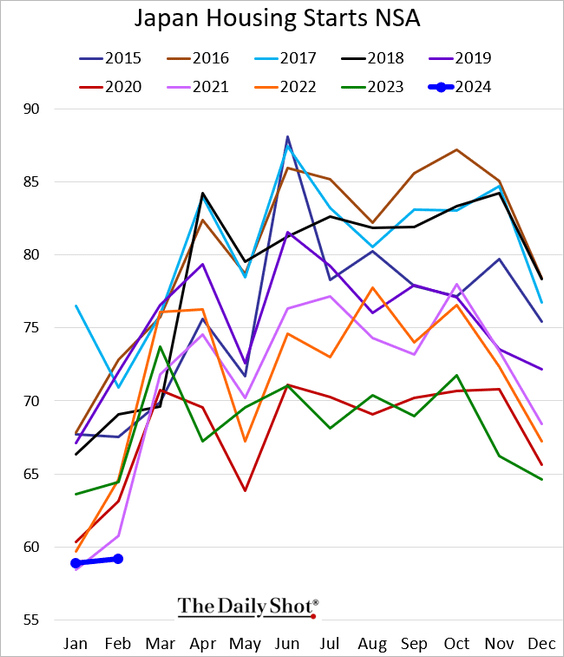

3. Housing starts are at multi-year lows.

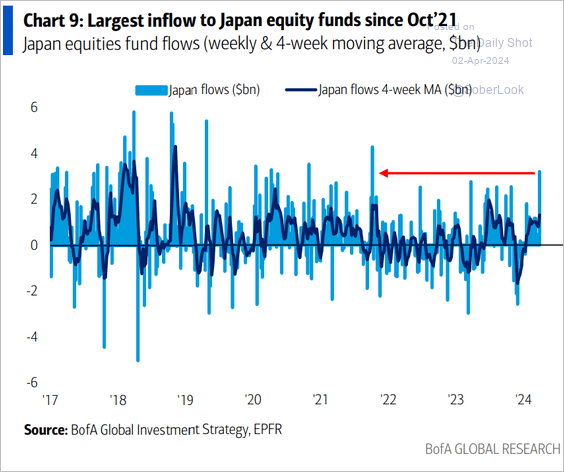

4. Investors continue channeling capital into Japan-focused equity funds.

Source: BofA Global Research

Source: BofA Global Research

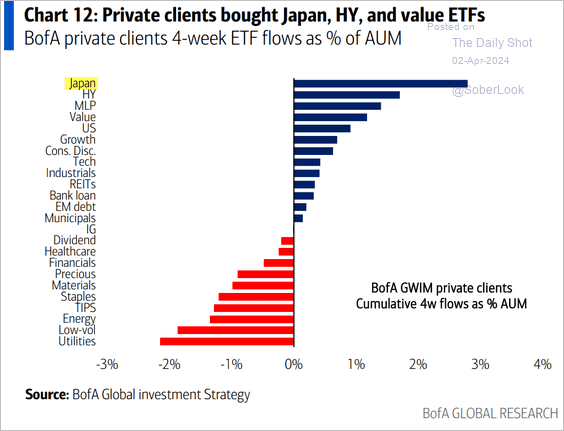

BofA’s private clients also love Japanese stocks.

Source: BofA Global Research

Source: BofA Global Research

——————–

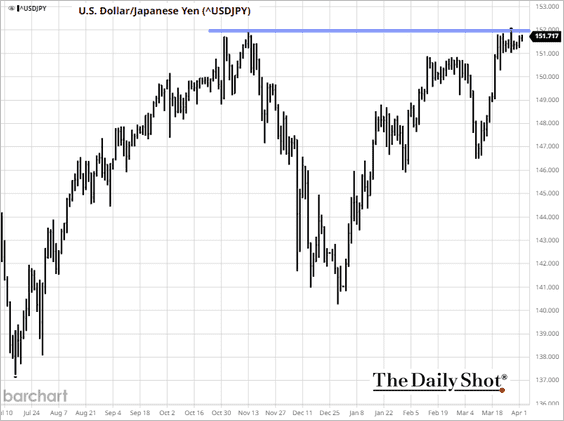

5. Resistance is holding.

Back to Index

Asia-Pacific

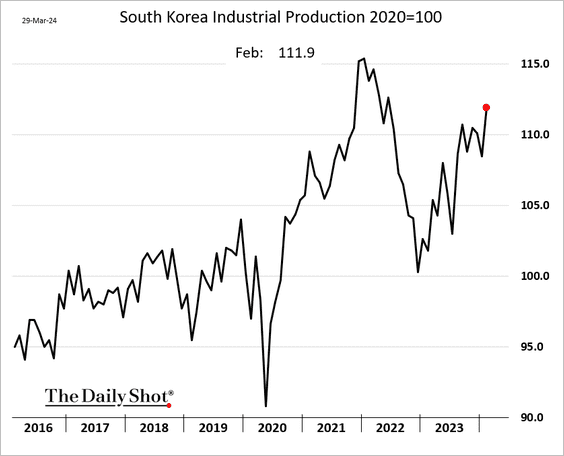

1. South Korea’s industrial production picked up momentum in February.

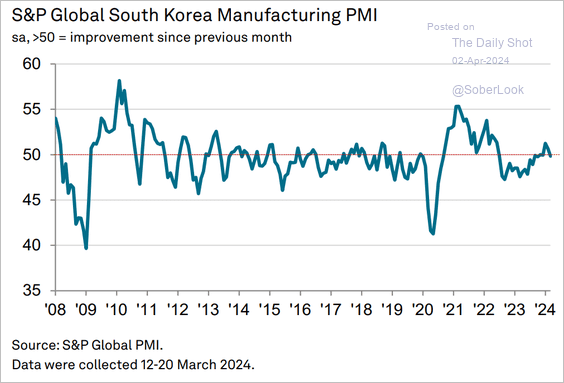

However, the manufacturing PMI is back in contraction territory.

Source: S&P Global PMI

Source: S&P Global PMI

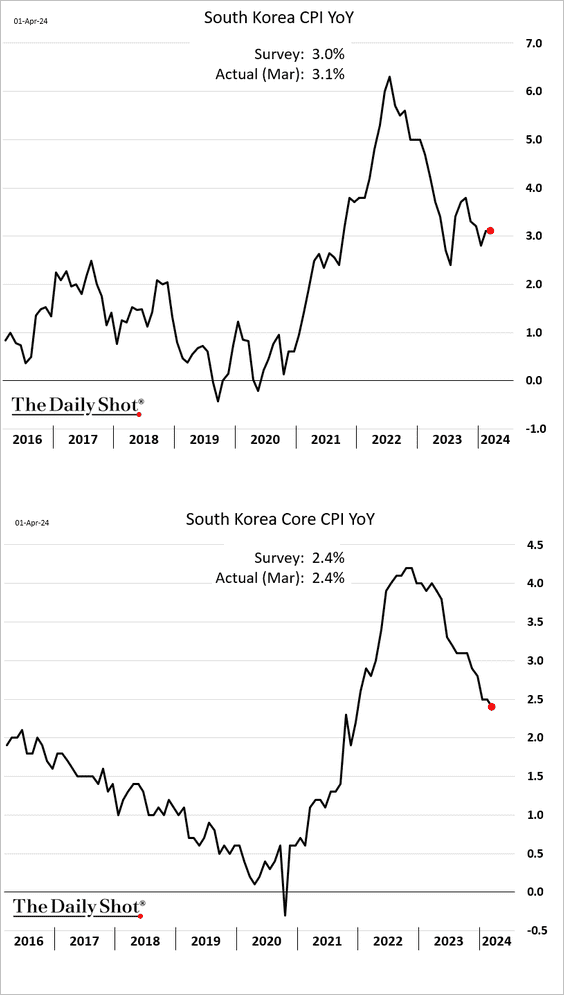

• The headline inflation is holding above 3%, but the core CPI continues to moderate.

——————–

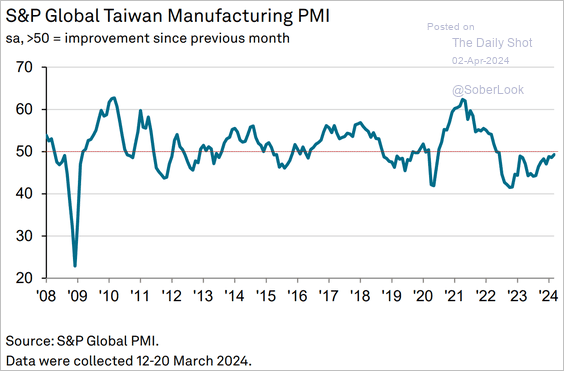

2. Taiwan’s factory activity is stabilizing.

Source: S&P Global PMI

Source: S&P Global PMI

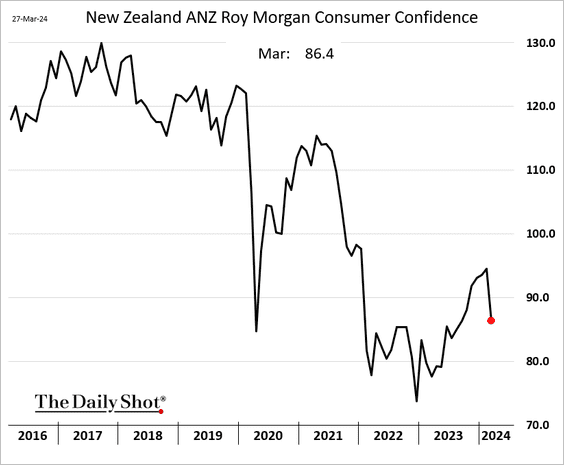

3. New Zealand’s consumer confidence declined sharply in March.

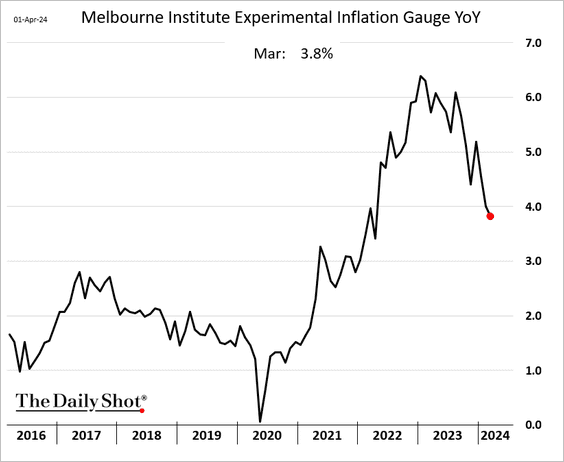

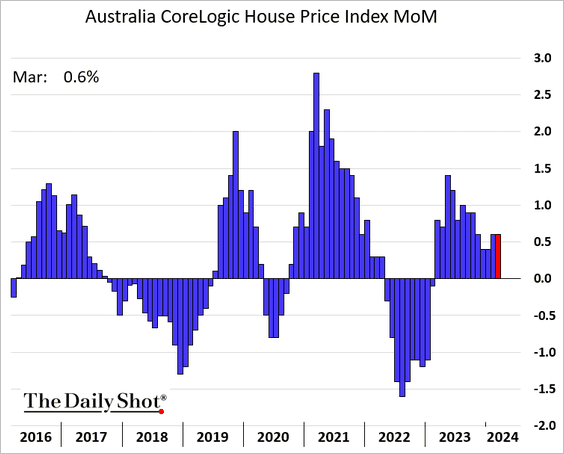

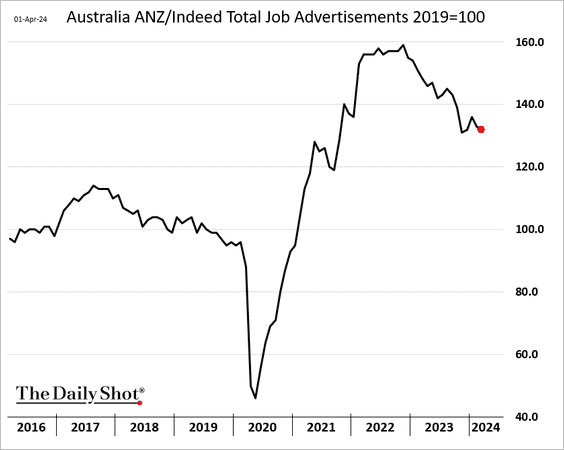

4. Next, we have some updates on Australia.

• The Melbourne Institute inflation tracker continues to ease.

• Home prices keep rising.

• Job openings remain elevated relative to pre-COVID levels.

Back to Index

China

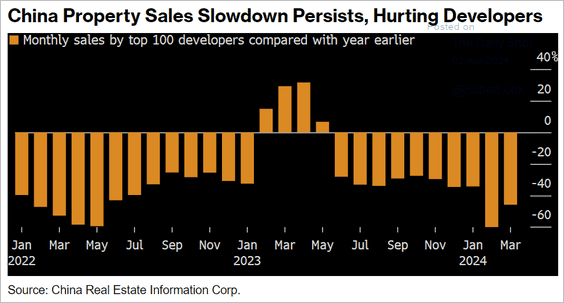

1. Property sales continue to soften.

Source: @economics Read full article

Source: @economics Read full article

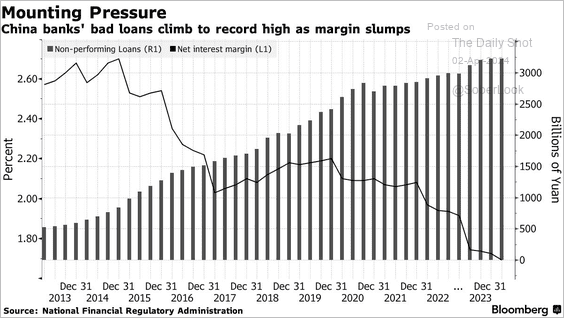

2. Banks are experiencing shrinking margins as nonperforming loans continue to rise.

Source: @markets Read full article

Source: @markets Read full article

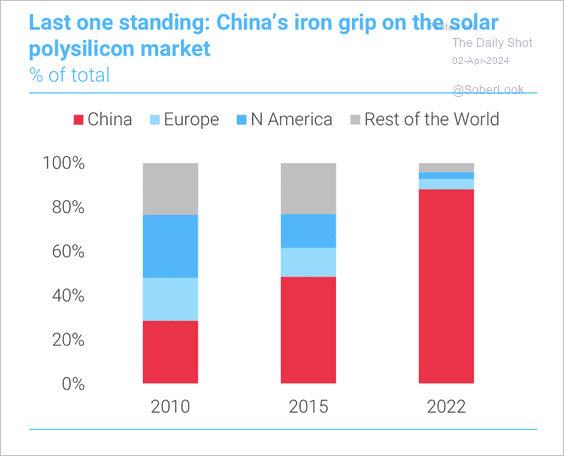

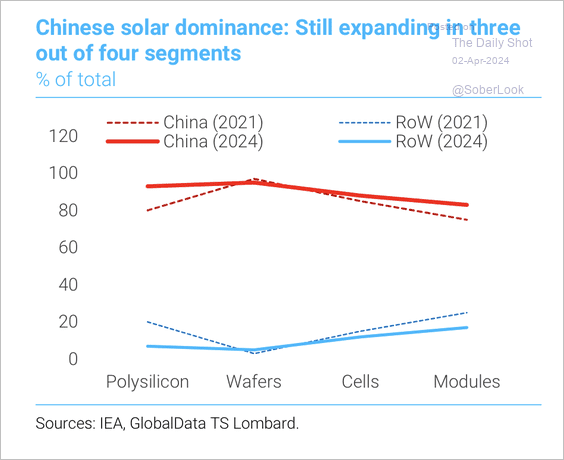

3. China is a dominant player in the global solar power supply chain. (2 charts)

Source: TS Lombard

Source: TS Lombard

Source: TS Lombard

Source: TS Lombard

——————–

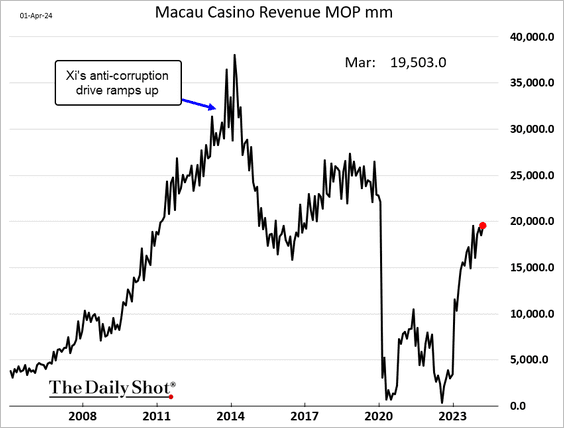

4. Here is a look at Macau casino revenues.

Back to Index

Emerging Markets

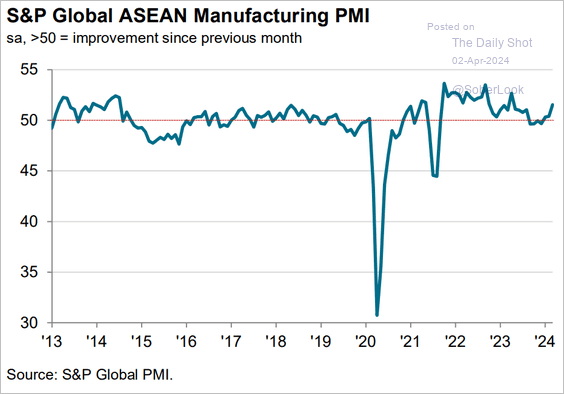

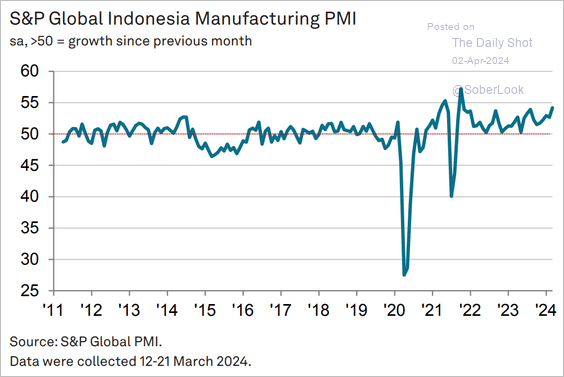

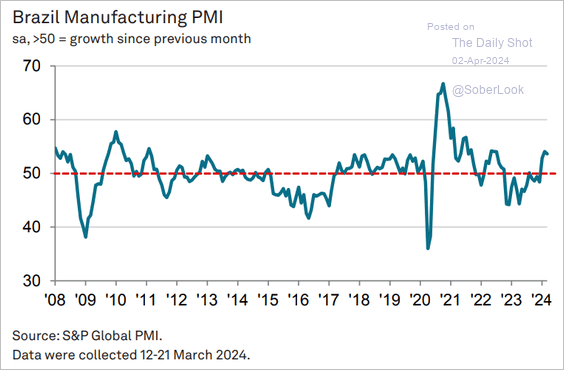

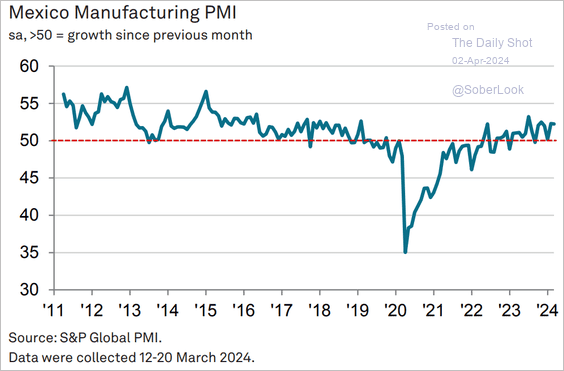

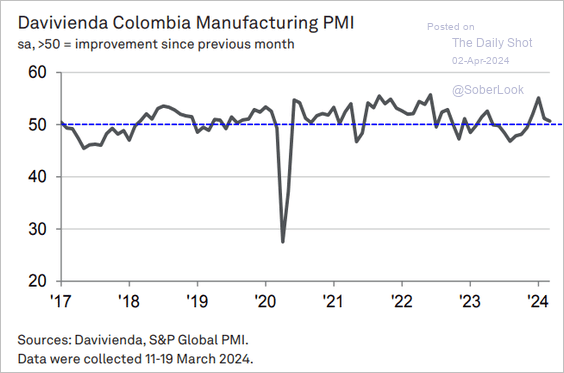

1. Let’s run through the March manufacturing PMI data.

{*) Asia:

– ASEAN (accelerating):

Source: S&P Global PMI

Source: S&P Global PMI

– Indonesia (very strong):

Source: S&P Global PMI

Source: S&P Global PMI

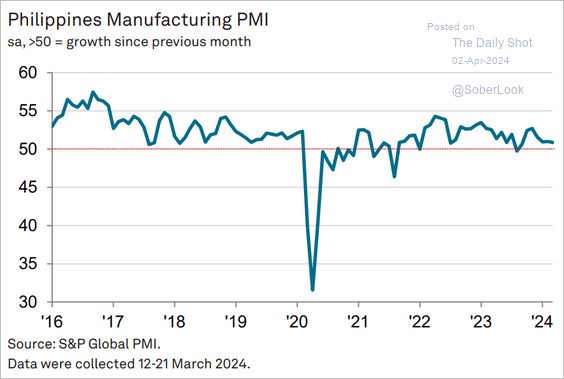

– The Philippines (modest growth):

Source: S&P Global PMI

Source: S&P Global PMI

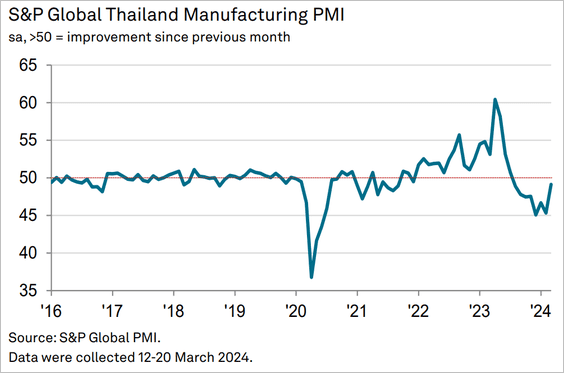

– Thailand (stabilizing):

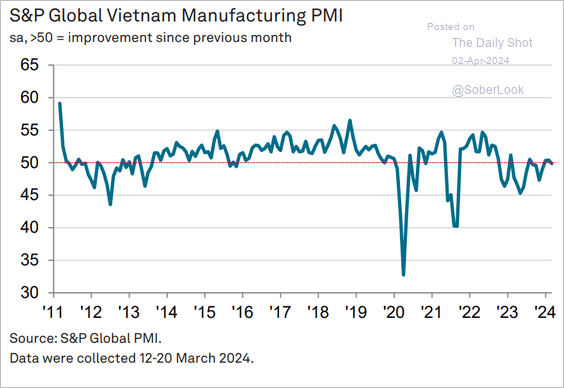

– Vietnam (growth stalled):

Source: S&P Global PMI

Source: S&P Global PMI

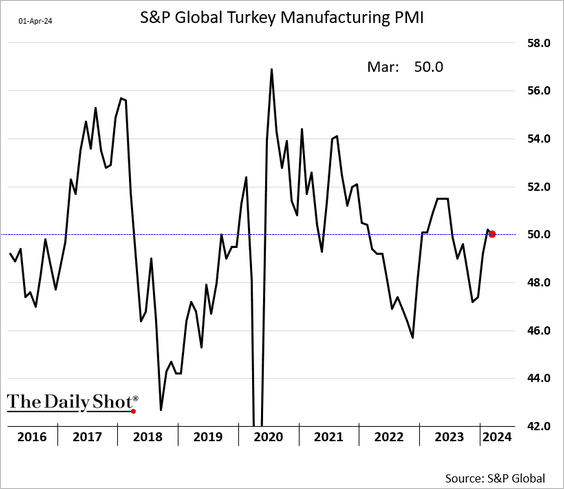

• Turkey (no growth):

• LatAm:

– Brazil (strong expansion):

Source: S&P Global PMI

Source: S&P Global PMI

– Mexico (holding up well):

Source: S&P Global PMI

Source: S&P Global PMI

– Colombia (growth stalling):

Source: S&P Global PMI

Source: S&P Global PMI

——————–

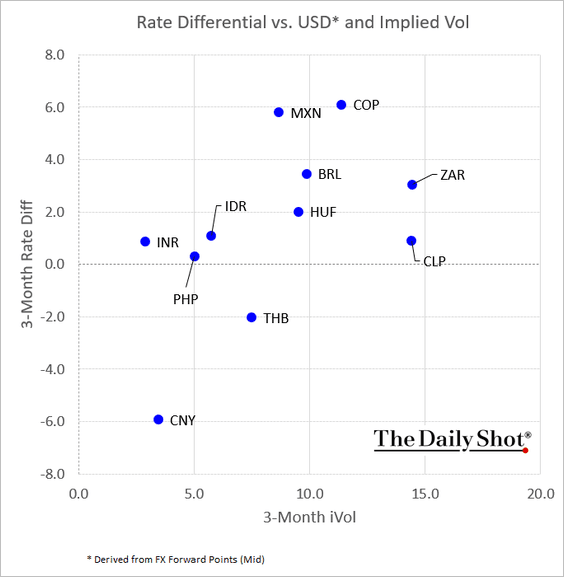

2. This chart shows the rate differentials (vs. USD) and implied volatility for select EM currencies.

3. Next, we have some market performance data for Q1.

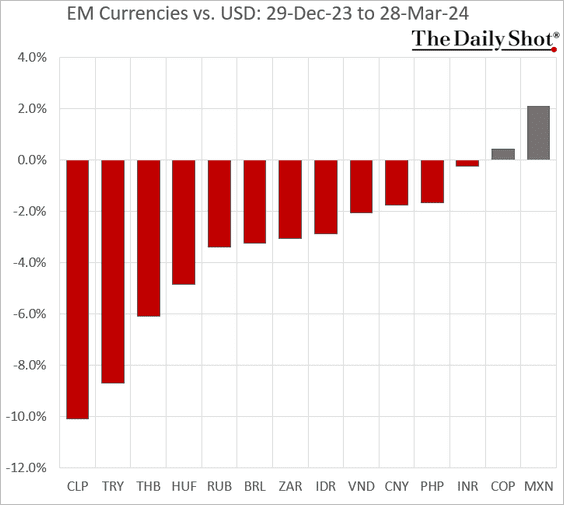

• Currencies:

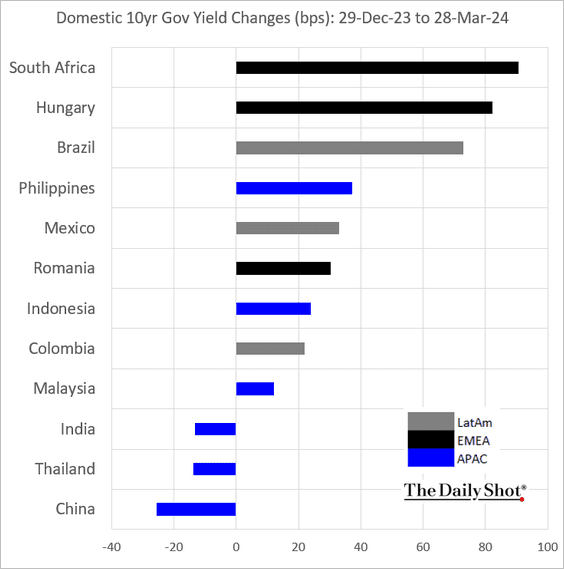

• Bond yields:

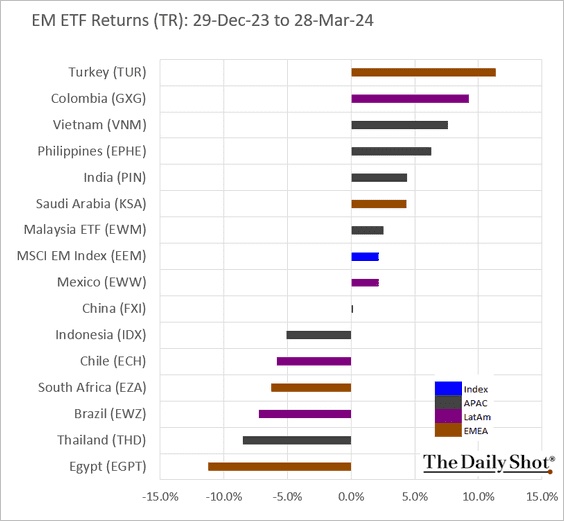

• Equity ETFs:

Back to Index

Cryptocurrency

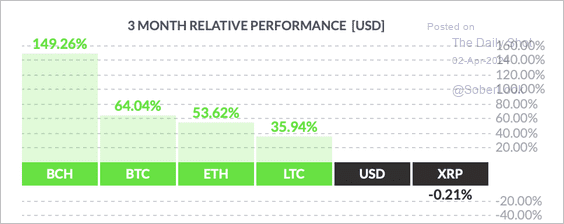

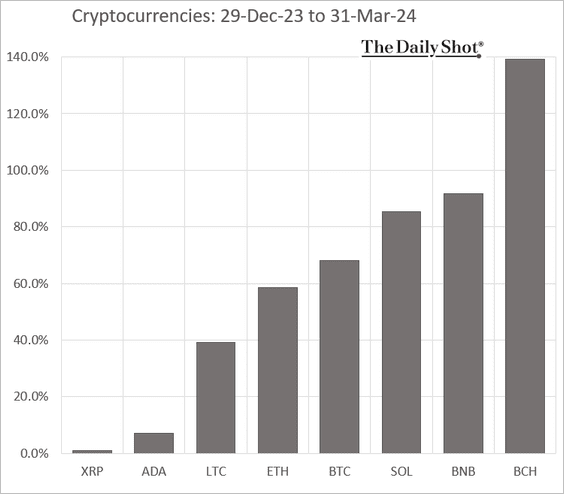

1. Cryptos had a solid Q1 with Bitcoin Cash (BCH – a modified version of bitcoin that runs on its own blockchain), significantly outperforming while XRP lagged top peers.

Source: FinViz

Source: FinViz

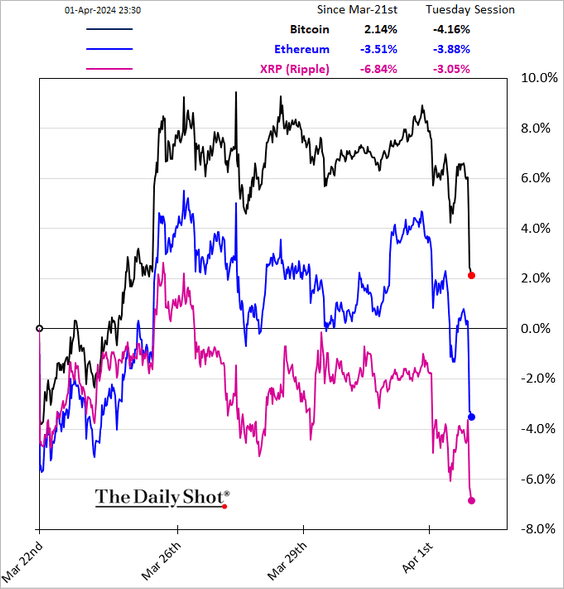

• But cryptos are under pressure this morning, …

… with bitcoin testing the uptrend support.

——————–

2. Bitcoin cash’s halving has contributed to bullish sentiment.

Source: Decrypt Read full article

Source: Decrypt Read full article

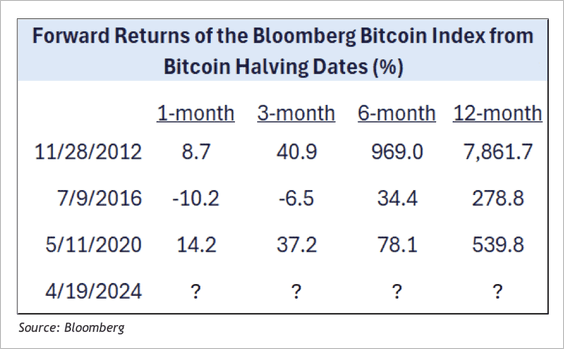

• Separately, this table shows bitcoin’s forward returns after previous halving events.

Source: @StocktonKatie

Source: @StocktonKatie

——————–

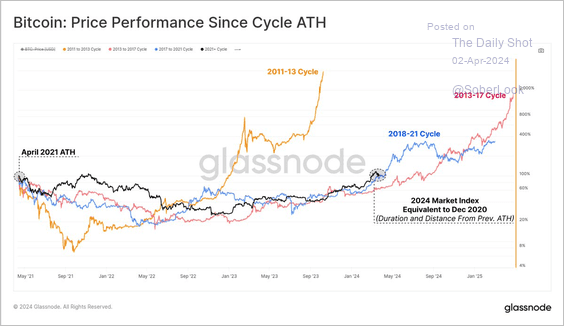

3. BTC/USD is closely tracking the 2018-2021 cycle.

Source: @glassnode

Source: @glassnode

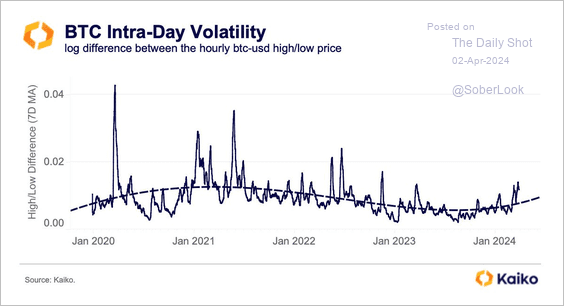

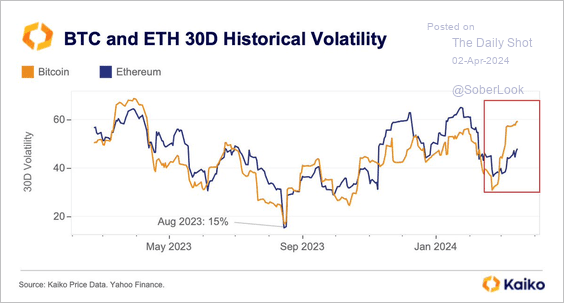

4. Bitcoin’s intraday price volatility is advancing from historically low levels.

Source: @KaikoData

Source: @KaikoData

Bitcoin’s realized volatility has surpassed ether’s since February.

Source: @KaikoData

Source: @KaikoData

Back to Index

Commodities

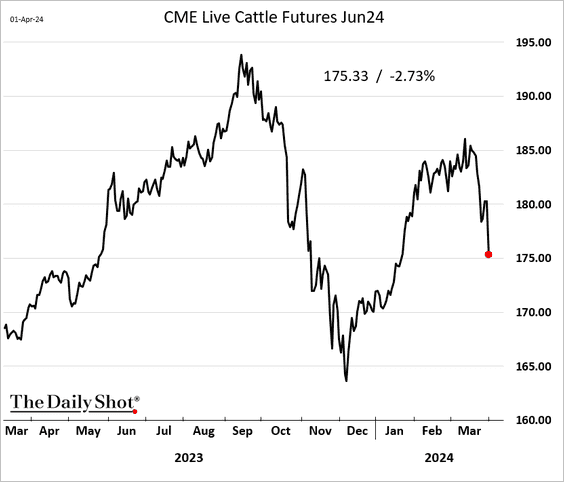

1. Chicago cattle futures are selling off.

Source: Drovers Read full article

Source: Drovers Read full article

——————–

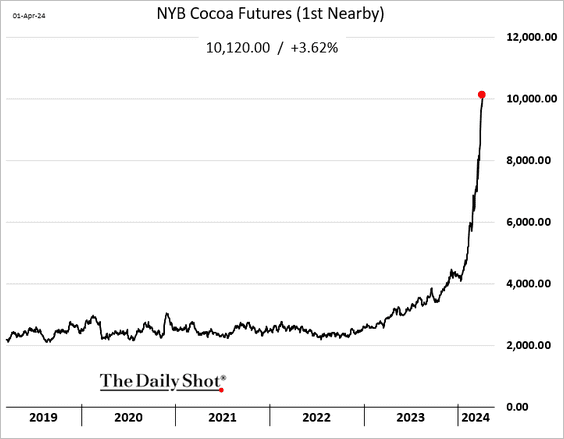

2. Cocoa futures are trading above $10k per ton.

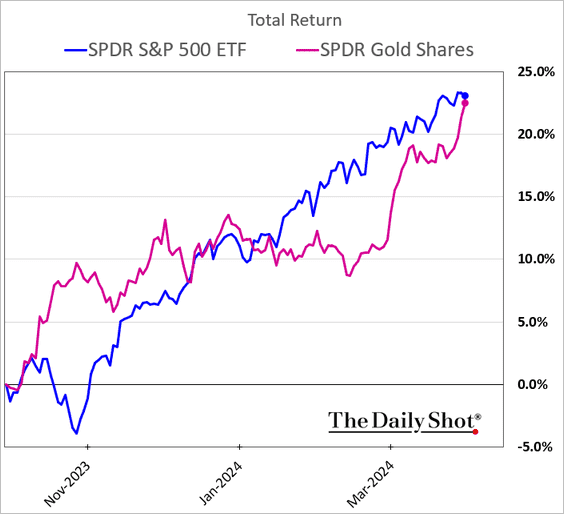

3. Here is gold vs. the S&P 500 over the past six months (relative performance).

Back to Index

Energy

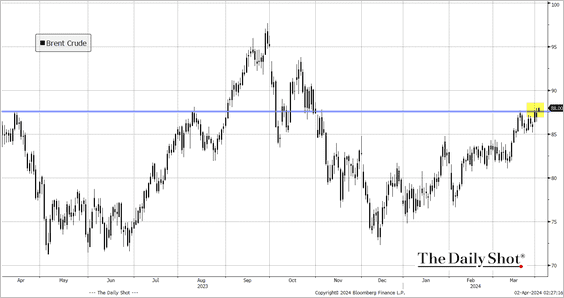

1. Brent crude is testing resistance.

Source: @markets Read full article

Source: @markets Read full article

——————–

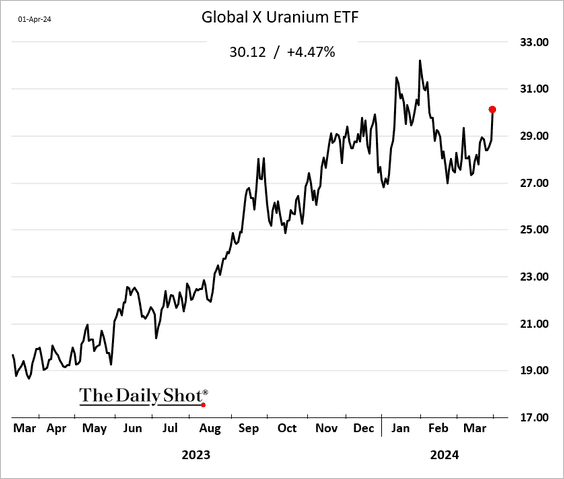

2. Uranium mining shares are climbing again.

Back to Index

Equities

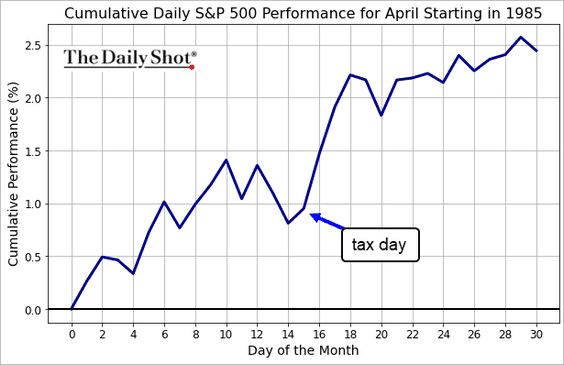

1. Stocks tend to rise following the tax filing deadline.

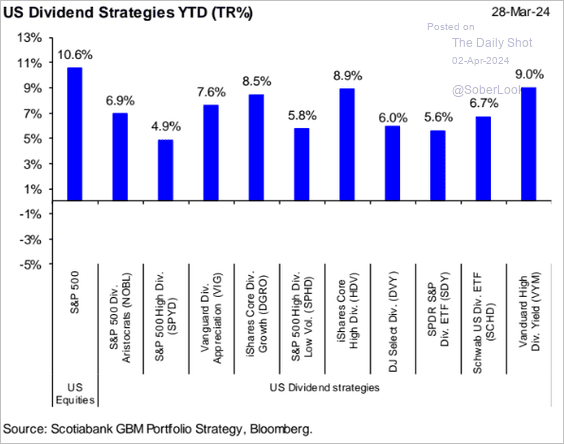

2. Here is a look at the year-to-date performance across dividend strategies.

Source: Hugo Ste-Marie, Portfolio & Quantitative Strategy Global Equity Research, Scotia Capital

Source: Hugo Ste-Marie, Portfolio & Quantitative Strategy Global Equity Research, Scotia Capital

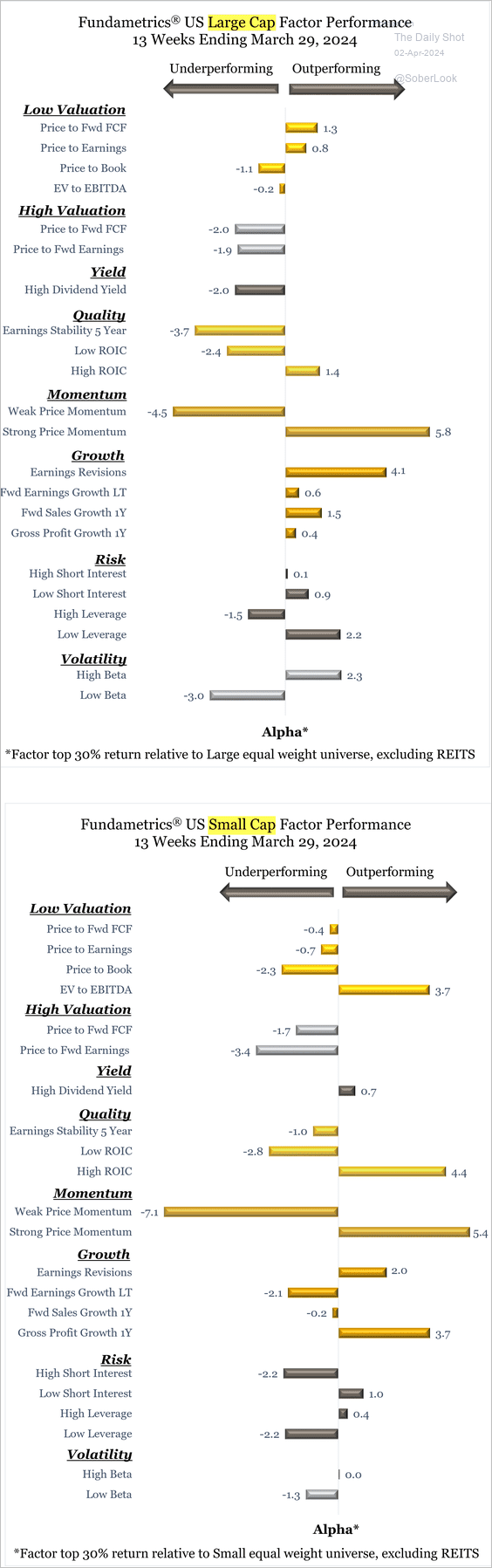

3. Below, we have detailed year-to-date performance across equity factors.

Source: CornerCap Institutional

Source: CornerCap Institutional

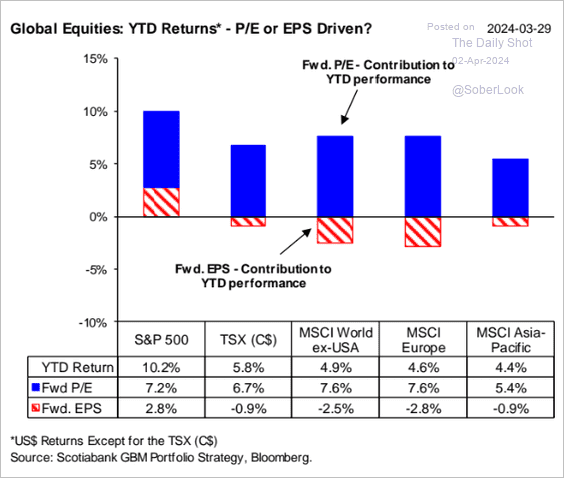

4. Outside of the US, multiple expansion has been driving stock gains year-to-date.

Source: Hugo Ste-Marie, Portfolio & Quantitative Strategy Global Equity Research, Scotia Capital

Source: Hugo Ste-Marie, Portfolio & Quantitative Strategy Global Equity Research, Scotia Capital

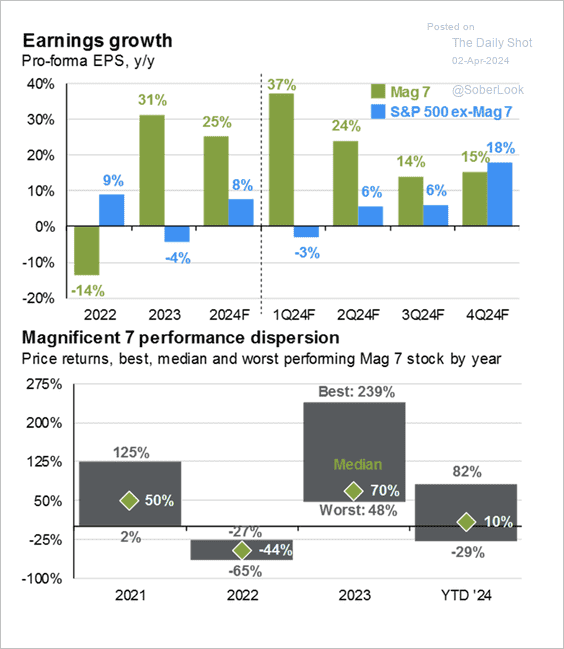

5. Earnings growth for the “Magnificent 7” is expected to slow coming off a period of high performance dispersion within the group.

Source: J.P. Morgan Asset Management

Source: J.P. Morgan Asset Management

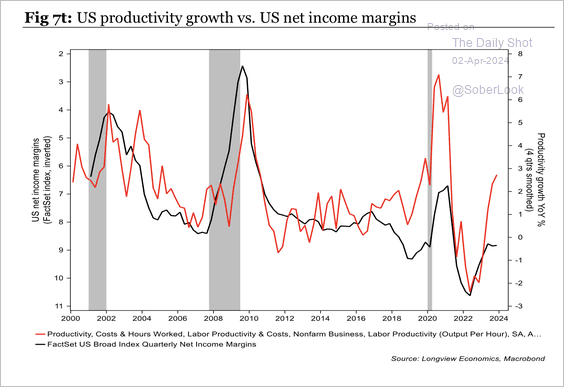

6. Productivity growth is improving, which is supporting margins.

Source: Longview Economics

Source: Longview Economics

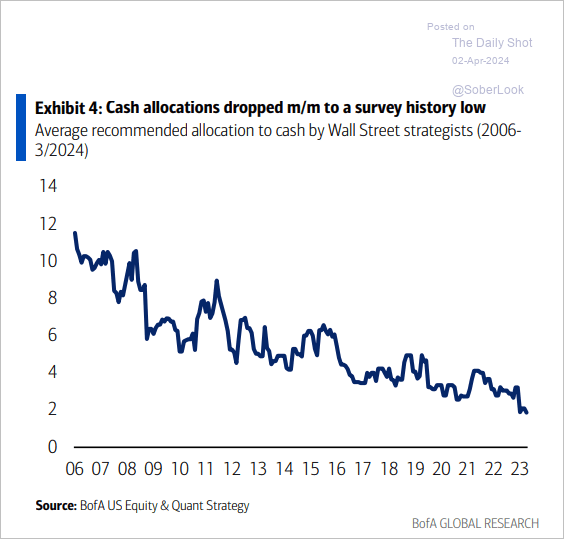

7. Investment advisors say go all in …

Source: BofA Global Research

Source: BofA Global Research

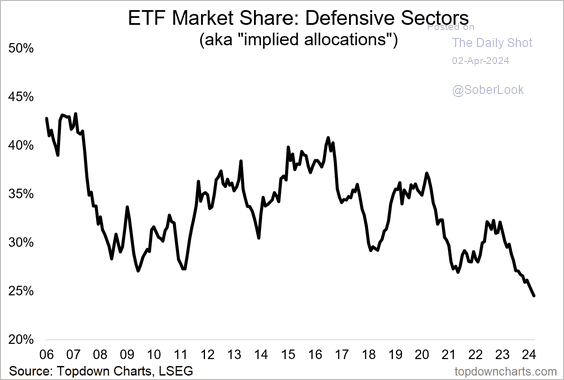

… and don’t bother with defensive sectors.

Source: @topdowncharts Read full article

Source: @topdowncharts Read full article

——————–

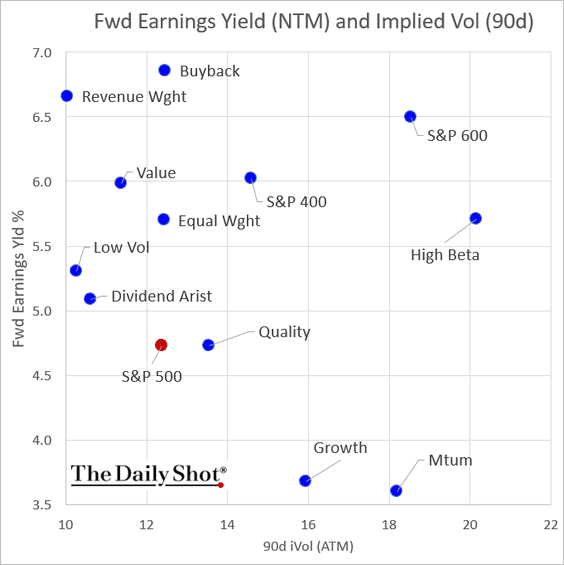

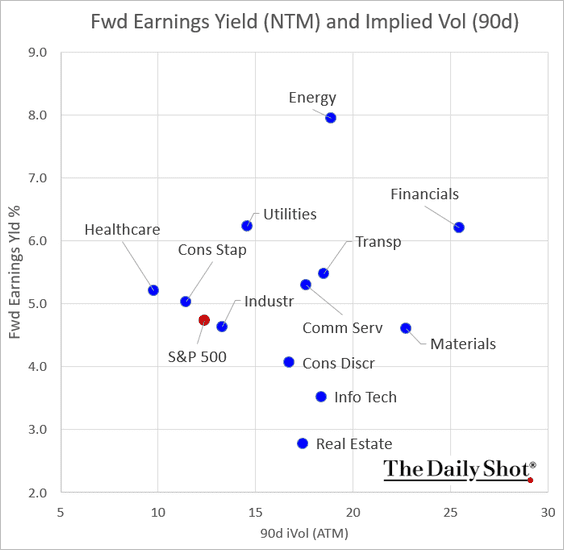

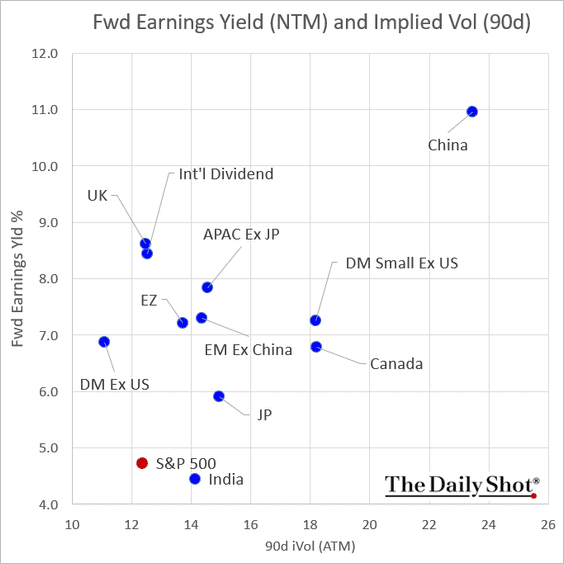

8. Next, we have forward earnings yields and implied volatility (“expected performance” vs. “perceived risk”).

• Factors:

• Sectors:

• International indices:

Back to Index

Credit

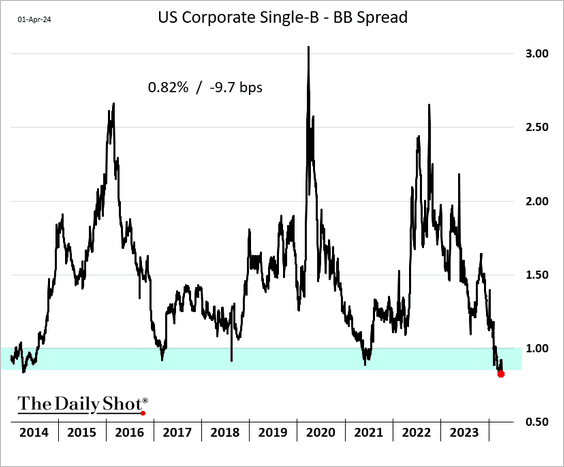

1. The single-B – BB corporate spreads continue to tighten, singling increased risk appetite.

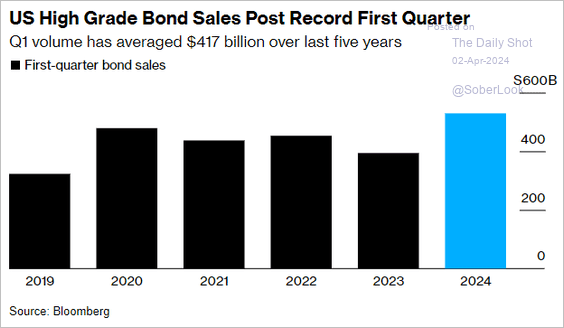

2. It was a good quarter for IG bond sales.

Source: @markets Read full article

Source: @markets Read full article

Back to Index

Global Developments

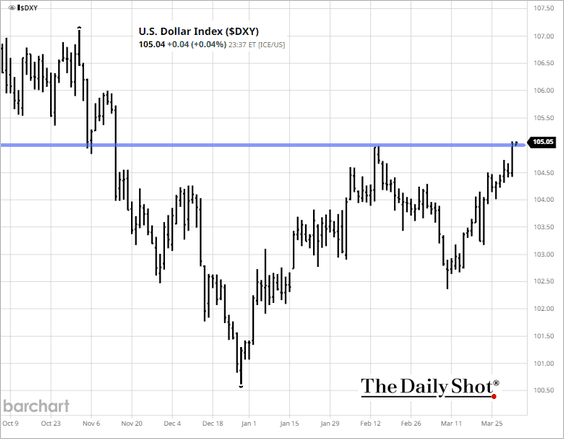

1. The dollar index (DXY) is testing resistance at 105.

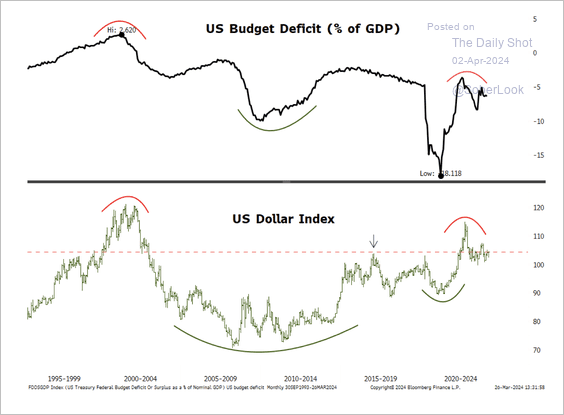

• A wider US budget deficit could be a catalyst for weakness in the dollar.

Source: Aazan Habib, Paradigm Capital

Source: Aazan Habib, Paradigm Capital

——————–

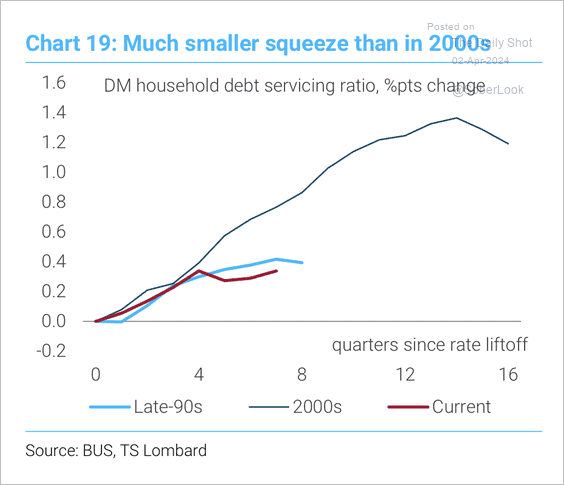

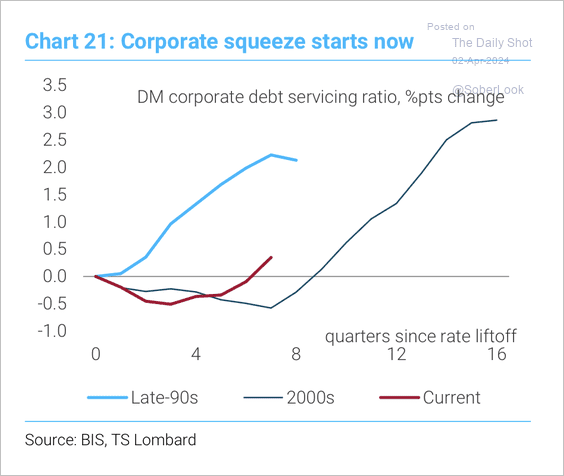

2. Debt servicing ratios in developed markets have remained low compared with past cycles. (2 charts)

Source: TS Lombard

Source: TS Lombard

Source: TS Lombard

Source: TS Lombard

——————–

Food for Thought

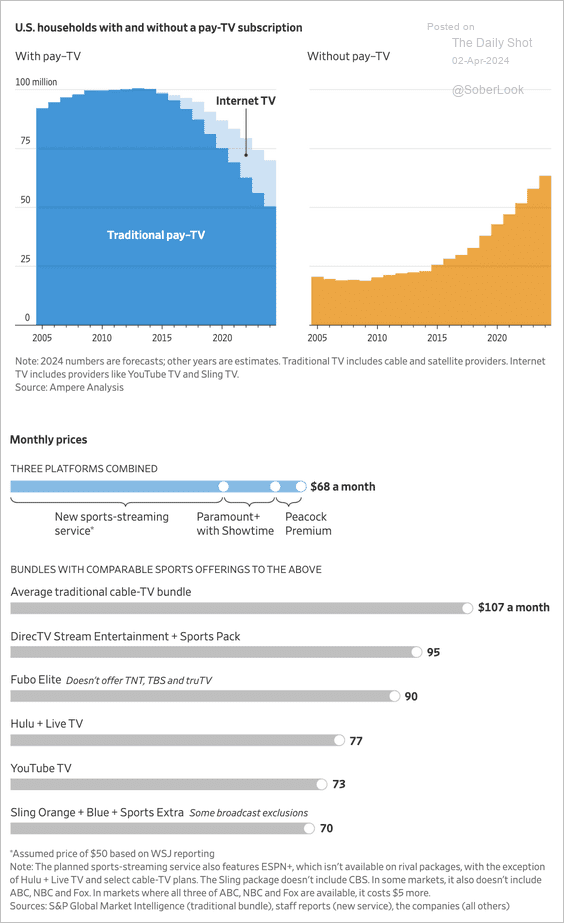

1. The evolution of US TV consumption and current costs:

Source: @WSJ Read full article

Source: @WSJ Read full article

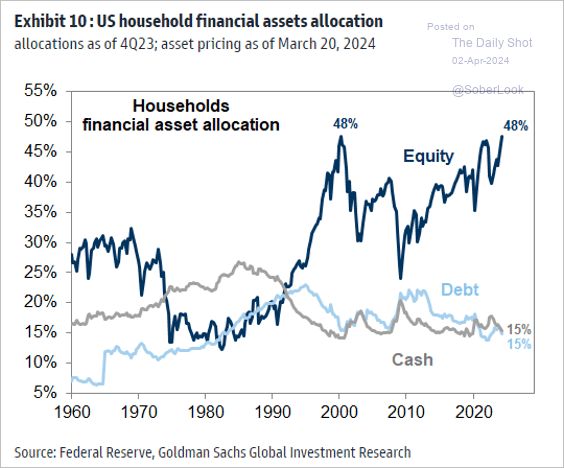

2. US households’ financial asset allocation:

Source: Goldman Sachs; @MikeZaccardi

Source: Goldman Sachs; @MikeZaccardi

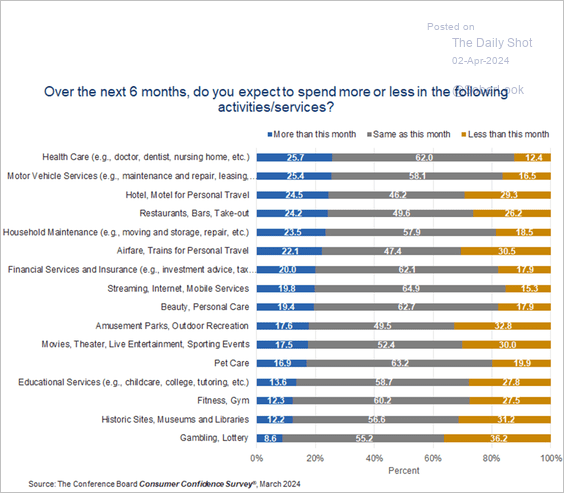

3. US consumer spending expectations across various services over the next six months:

Source: The Conference Board

Source: The Conference Board

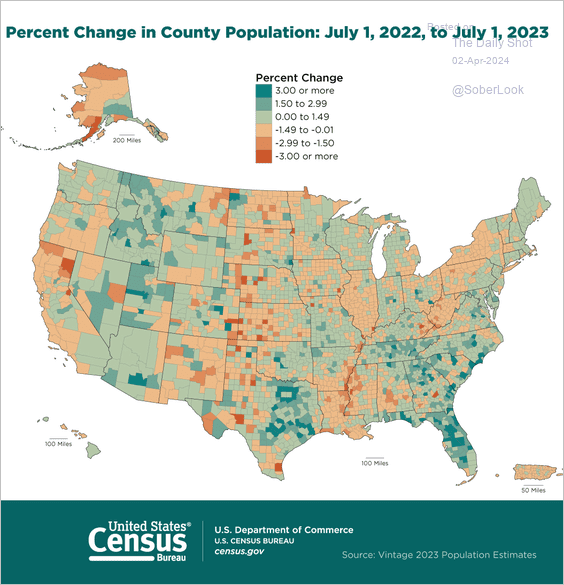

4. Population changes by county:

Source: Census Bureau Read full article

Source: Census Bureau Read full article

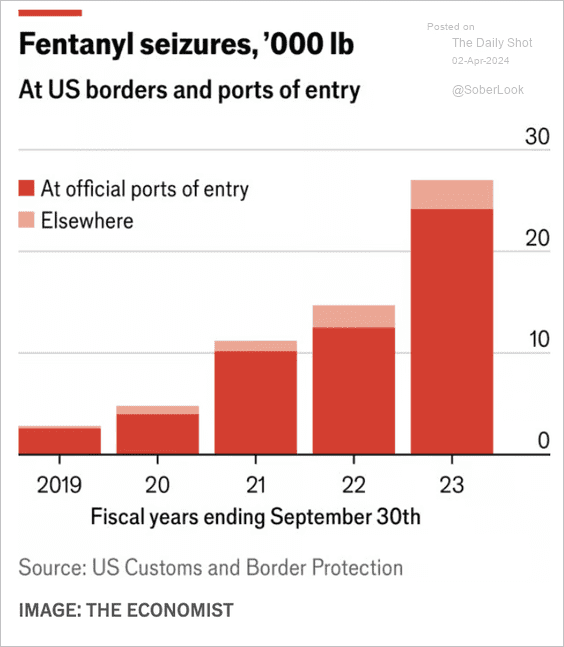

5. Fentanyl seizures:

Source: The Economist Read full article

Source: The Economist Read full article

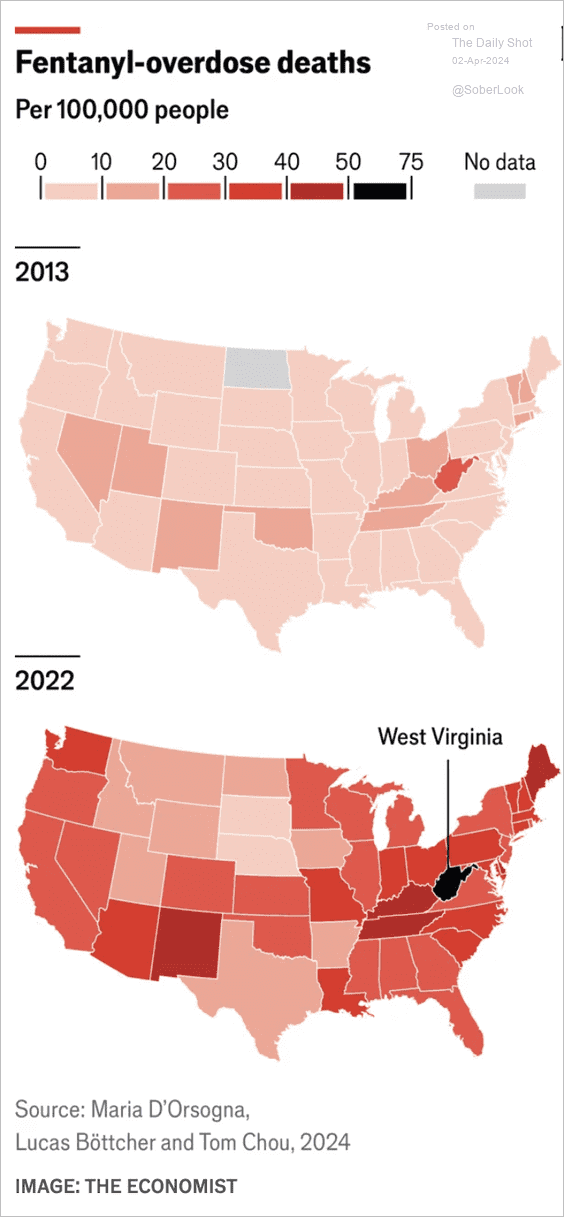

• Fentanyl overdose deaths:

Source: The Economist Read full article

Source: The Economist Read full article

——————–

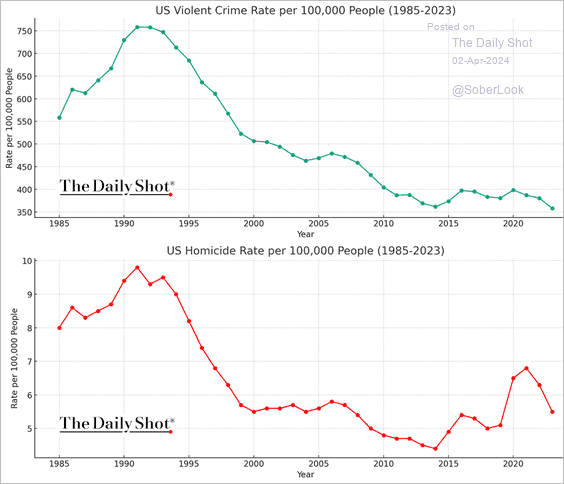

6. Violent crime in the US:

Source: FBI Further reading

Source: FBI Further reading

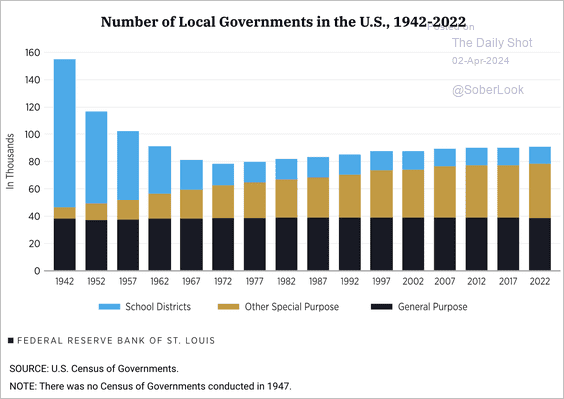

7. Changes in the number of local governments:

Source: Federal Reserve Bank of St. Louis Read full article

Source: Federal Reserve Bank of St. Louis Read full article

——————–

Back to Index