The Daily Shot: 09-Apr-24

• The United States

• The Eurozone

• Europe

• Asia-Pacific

• Emerging Markets

• Cryptocurrency

• Commodities

• Energy

• Equities

• Credit

• Global Developments

• Food for Thought

The United States

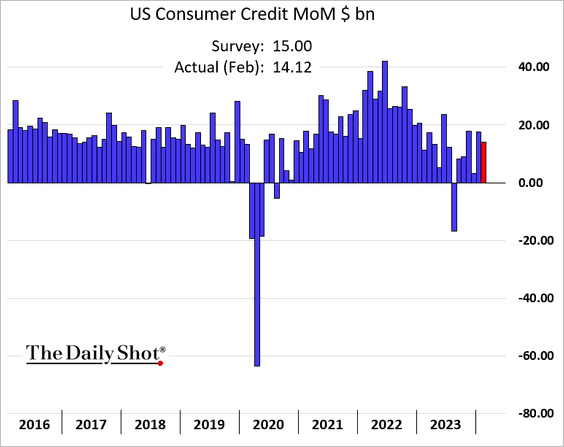

1. The rise in consumer credit for February was slightly below forecasts.

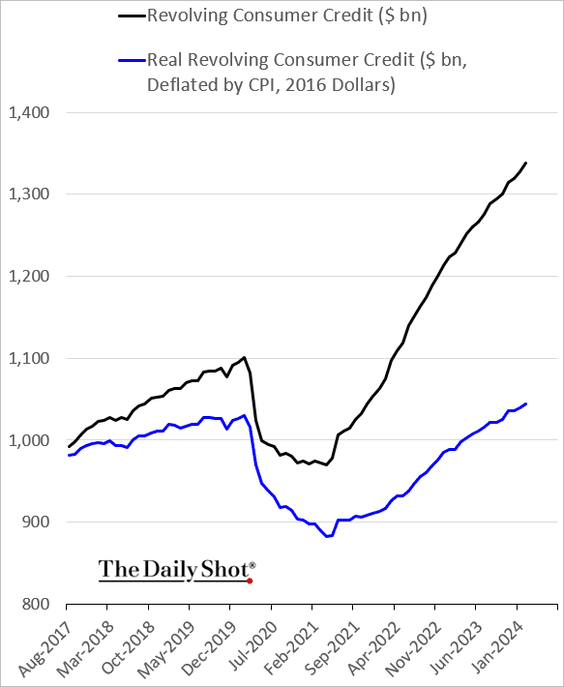

• Credit card debt has continued to climb, …

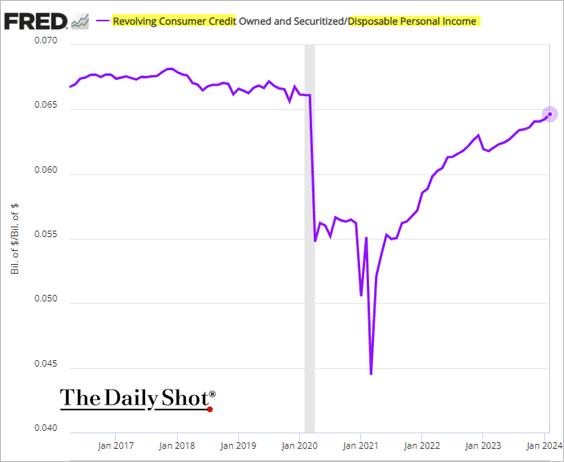

… with its ratio to disposable income approaching pre-COVID levels.

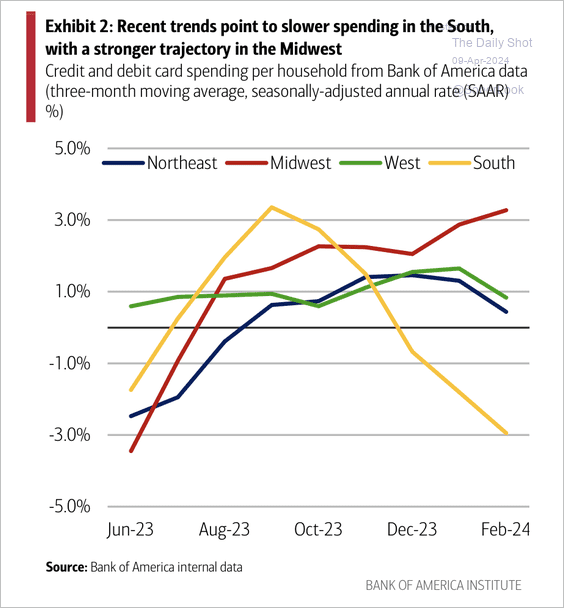

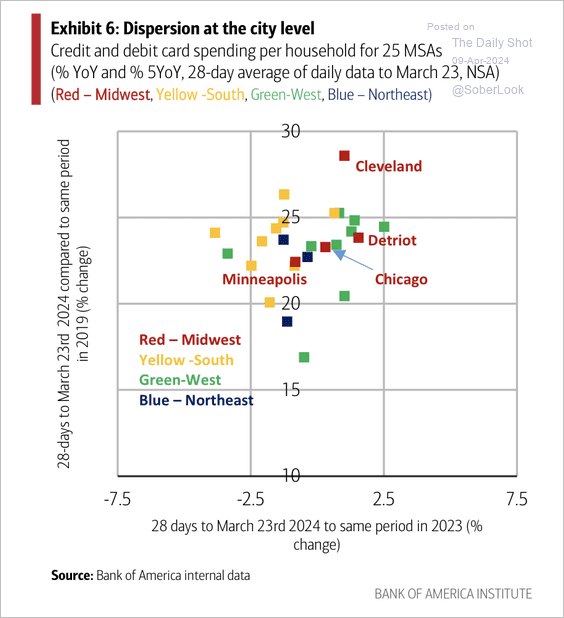

• Household credit/debit card spending has strengthened in the Midwest and weakened considerably in the South. (2 charts)

Source: Bank of America Institute

Source: Bank of America Institute

Source: Bank of America Institute

Source: Bank of America Institute

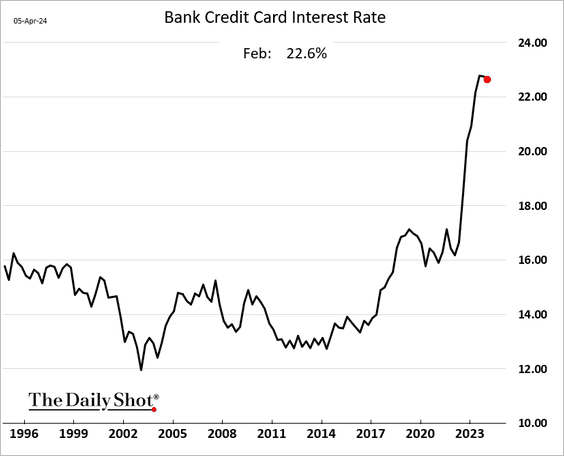

• The average interest rate on credit card accounts remains near 23%.

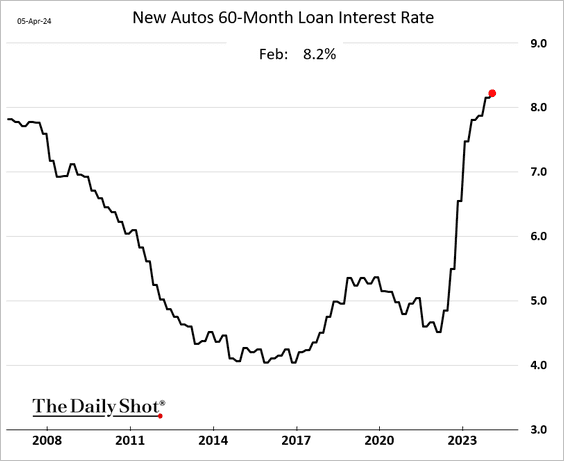

– The average rate for a 5-year auto loan has now surpassed 8%.

——————–

2. Next, we have some updates on the labor market.

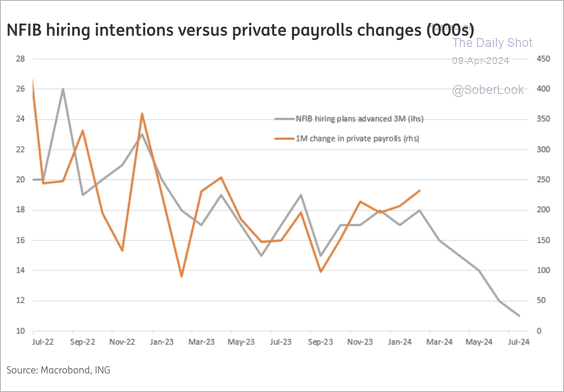

• The NFIB hiring intentions index points to weaker job growth this quarter.

Source: ING

Source: ING

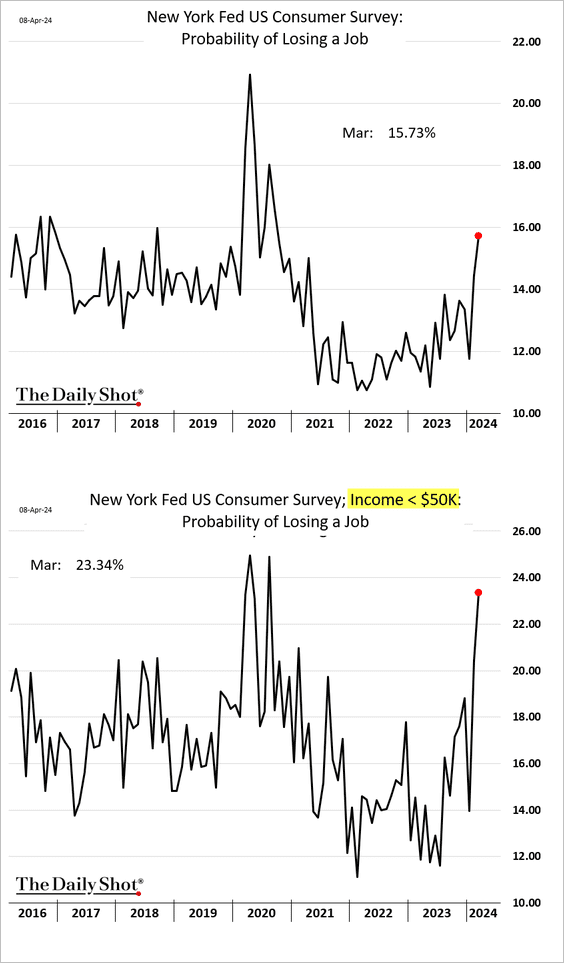

• US households are growing more concerned about the possibility of job loss.

Furthermore, they are less confident about securing alternative employment if needed.

——————–

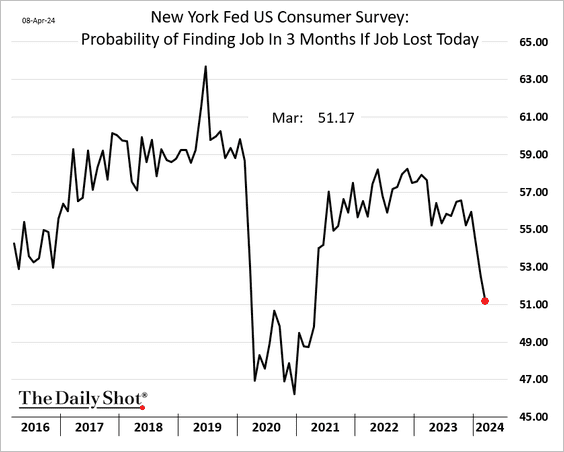

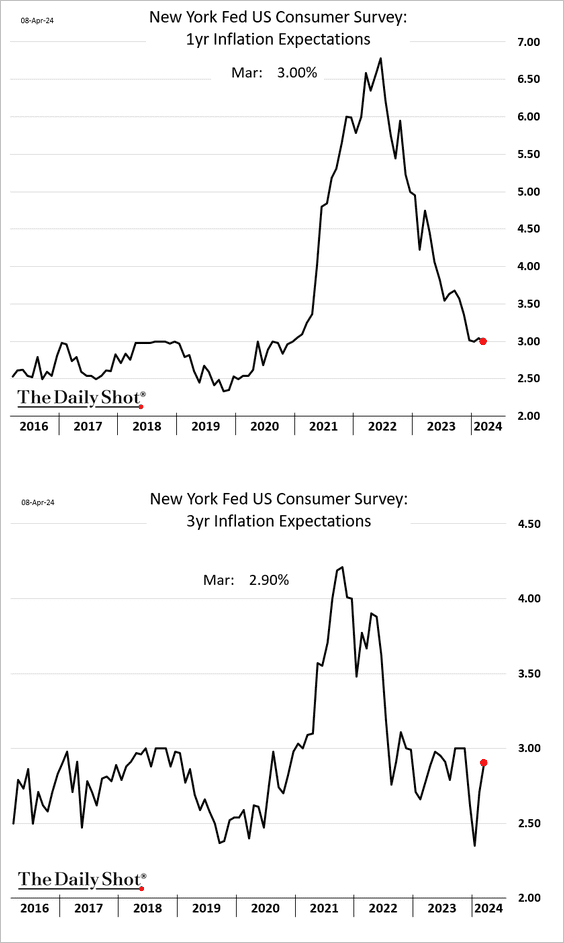

3. The Northeast and Midwest regions have underperformed in terms of GDP.

Source: Bank of America Institute

Source: Bank of America Institute

4. Next, we have some updates on inflation.

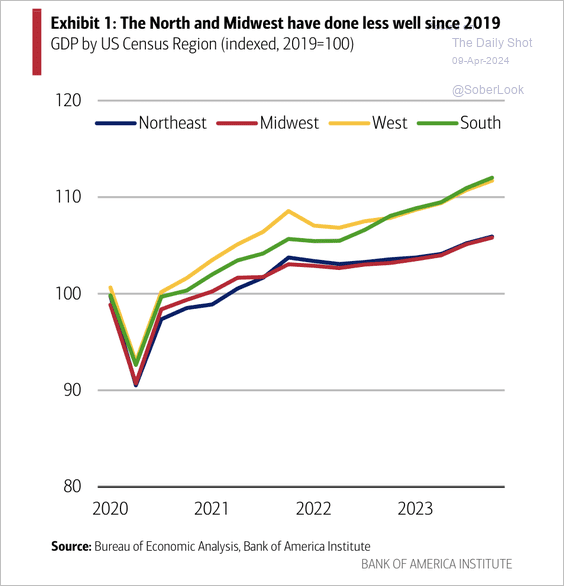

• The New York Fed’s national consumer survey indicated an increase in three-year inflation expectations, …

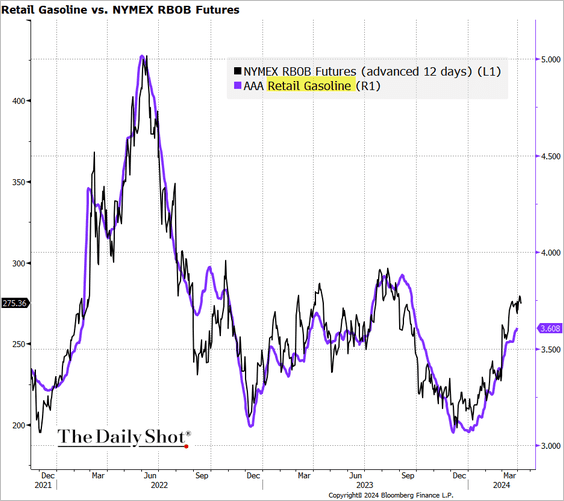

… as gasoline prices rebound.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

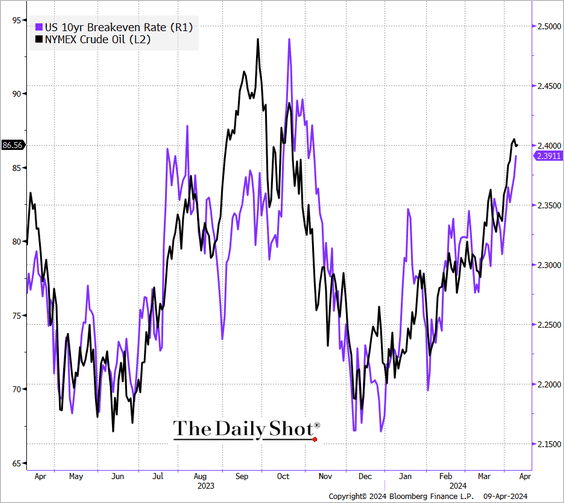

• Higher crude oil prices are also raising market-based inflation expectations.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

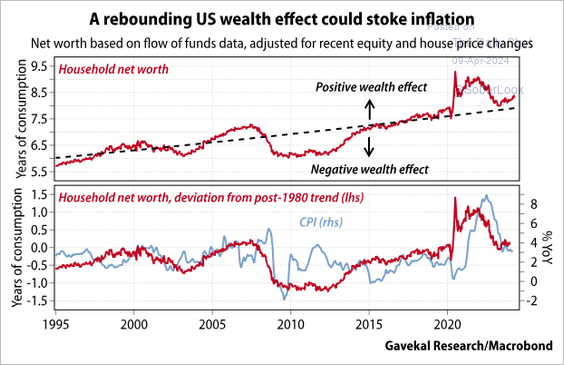

• Could a stronger wealth effect boost inflation?

Source: Gavekal Research

Source: Gavekal Research

Back to Index

The Eurozone

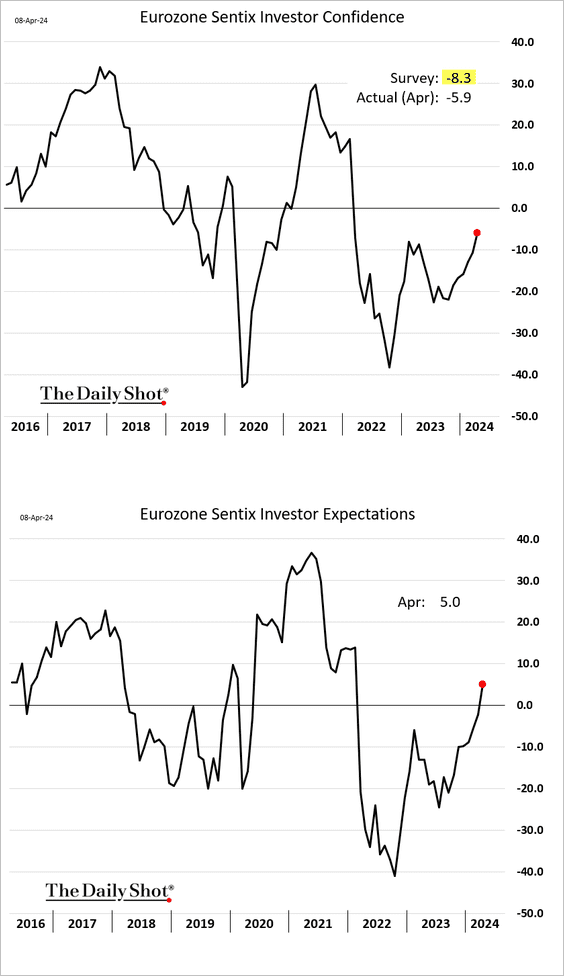

1. Euro-area investor confidence continues to strengthen.

Source: RTT News Read full article

Source: RTT News Read full article

——————–

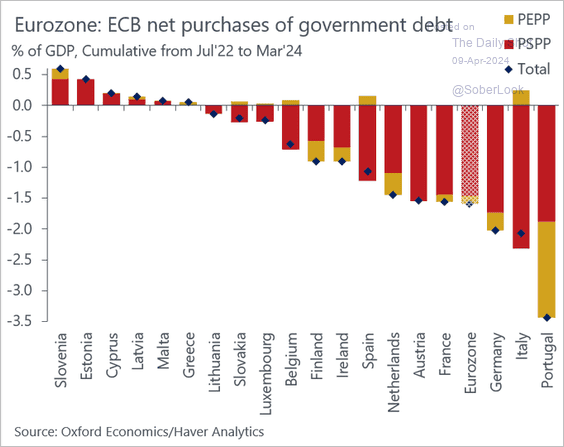

2. Portugal and Italy were impacted the most by the ECB’s contracting balance sheet.

Source: @DanielKral1, @OxfordEconomics

Source: @DanielKral1, @OxfordEconomics

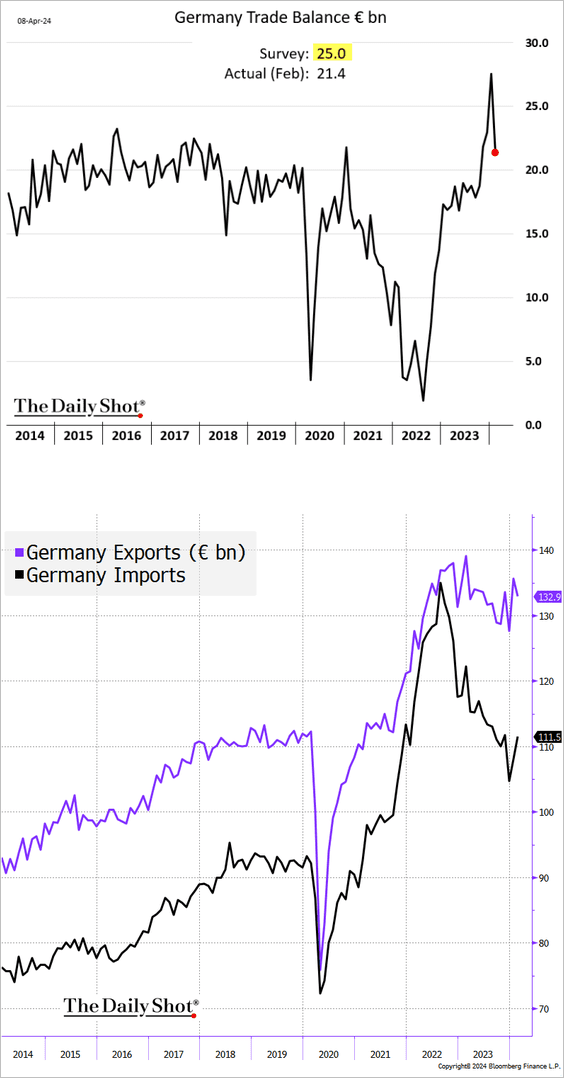

3. Germany’s trade surplus declined sharply in February as imports jumped.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

Back to Index

Europe

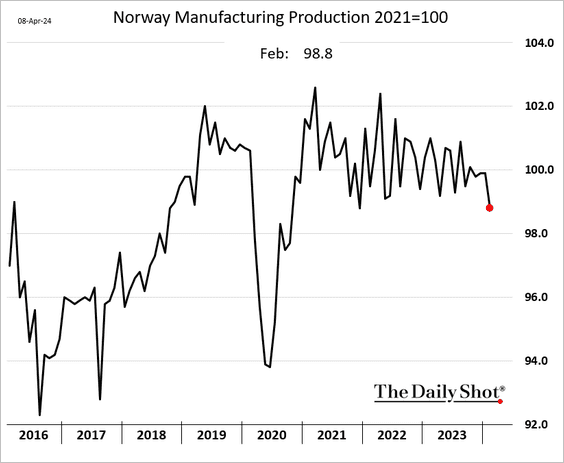

1. Norway’s factory output declined sharply in February.

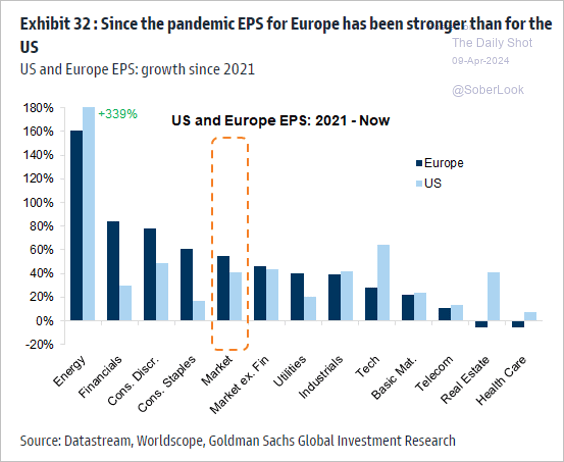

2. Growth in European earnings per share has outpaced that of US counterparts since 2021.

Source: Goldman Sachs; @MikeZaccardi

Source: Goldman Sachs; @MikeZaccardi

Back to Index

Asia-Pacific

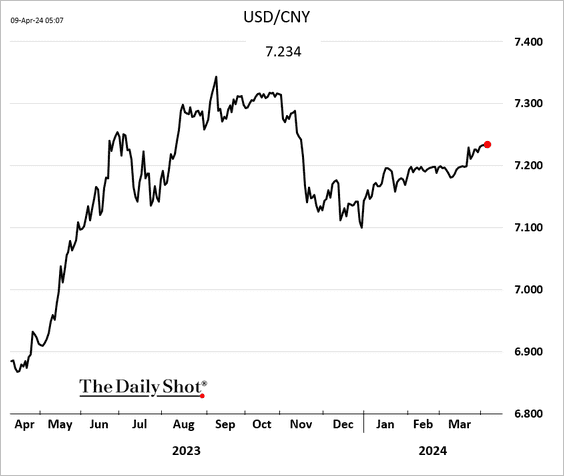

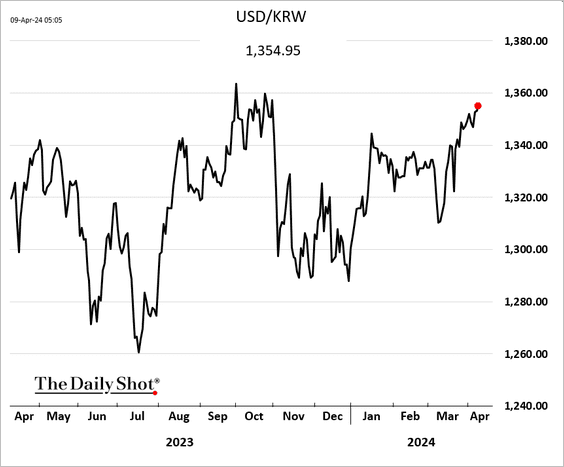

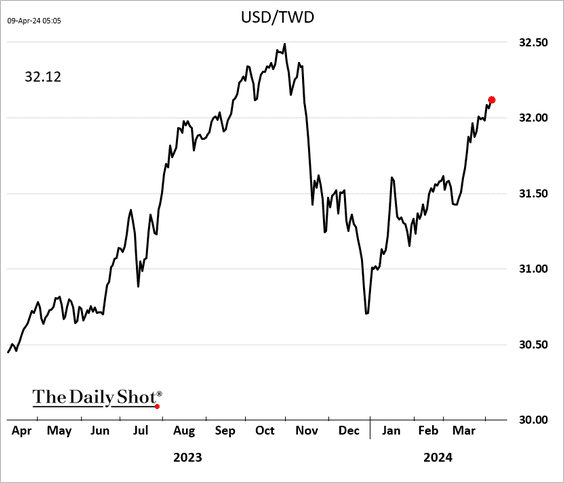

1. Asian currencies are declining against the dollar, influenced by the weakening of the renminbi (below).

• The South Korean won:

• The Tawian dollar:

——————–

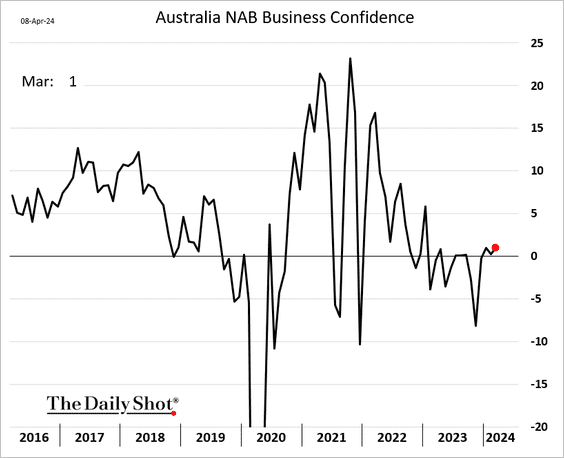

2. Next, we have some updates on Australia.

• Business confidence edge higher in March.

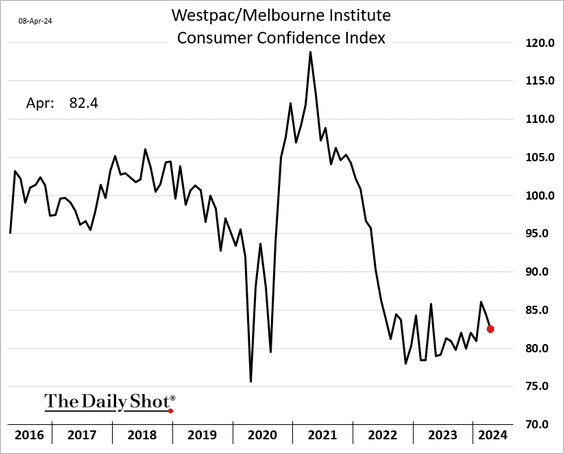

• Consumer confidence declined again this month.

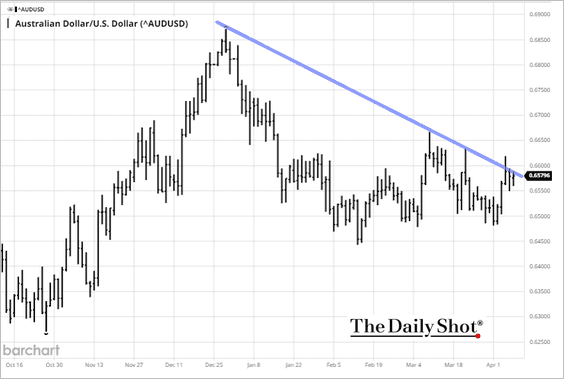

• AUD/USD is testing downtrend resistance.

Back to Index

Emerging Markets

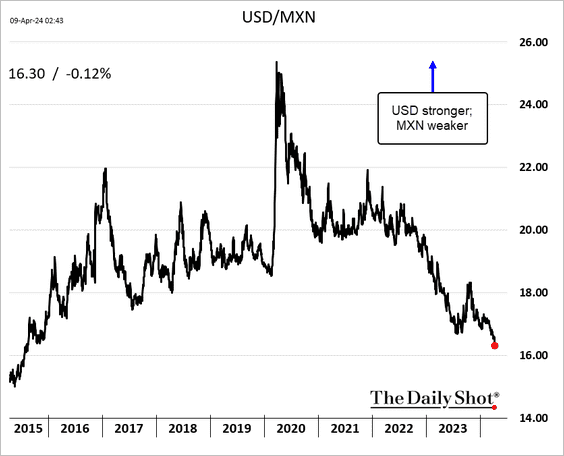

1. The Mexican peso has reached its highest level against the dollar since 2015, a trend that can contribute to inflationary pressures in the US (imports from Mexico become more expensive).

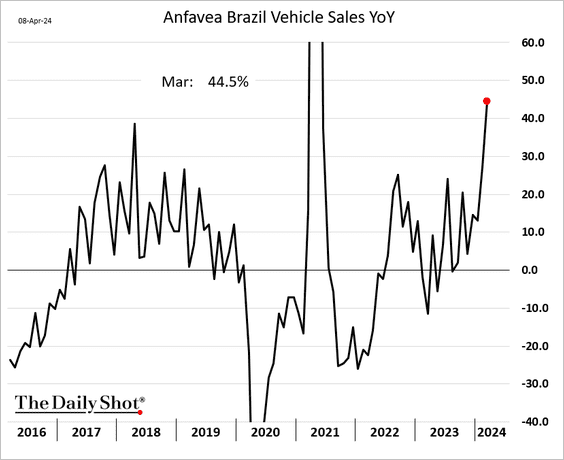

2. Brazil’s vehicle sales were up 44.5% relative to 2023 levels in March.

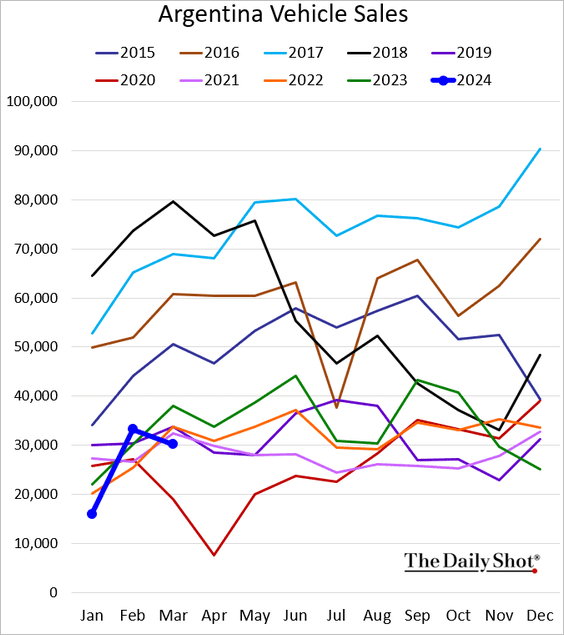

3. Argenitna’s automobile sales remain depressed.

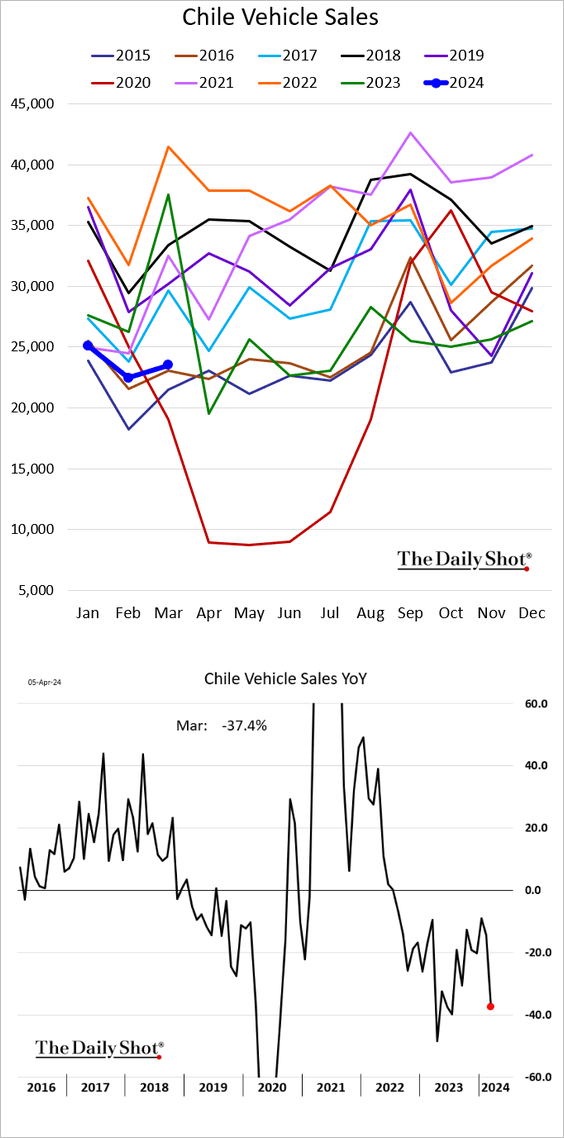

4. Chile’s car sales were well below last year’s levels.

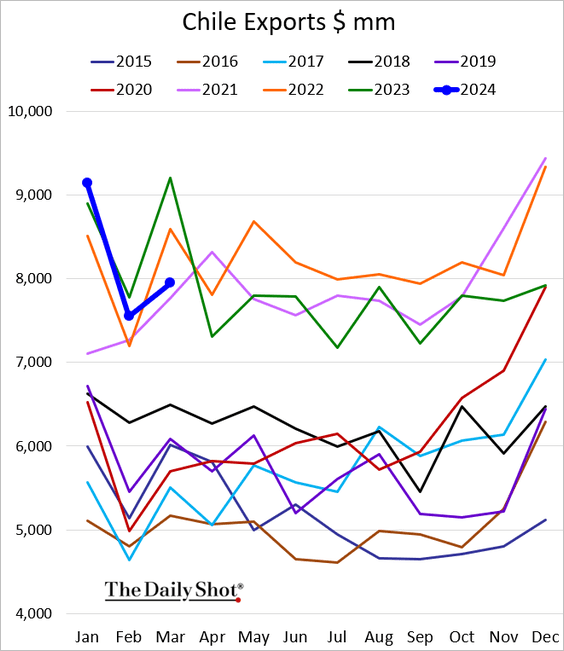

• Chile’s exports were down relative to 2023 levels in March.

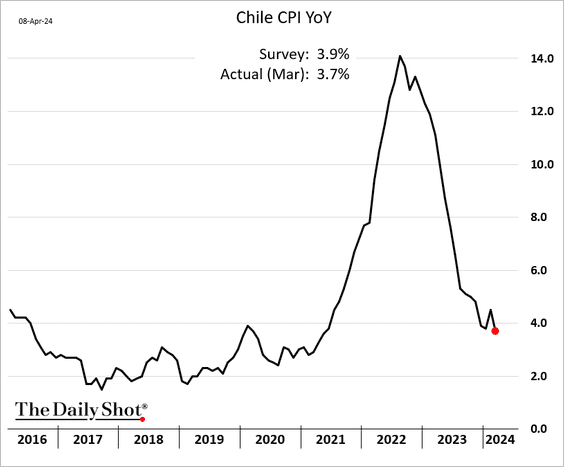

• Chile’s March CPI print was below forecasts. Policymakers’ outlook has been less dovish recently and is likely to remain so despite softer inflation.

——————–

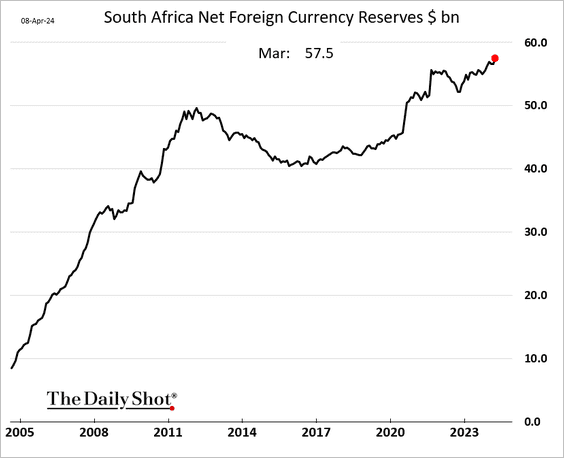

5. South Africa’s F/X reserves are nearing $60 billion.

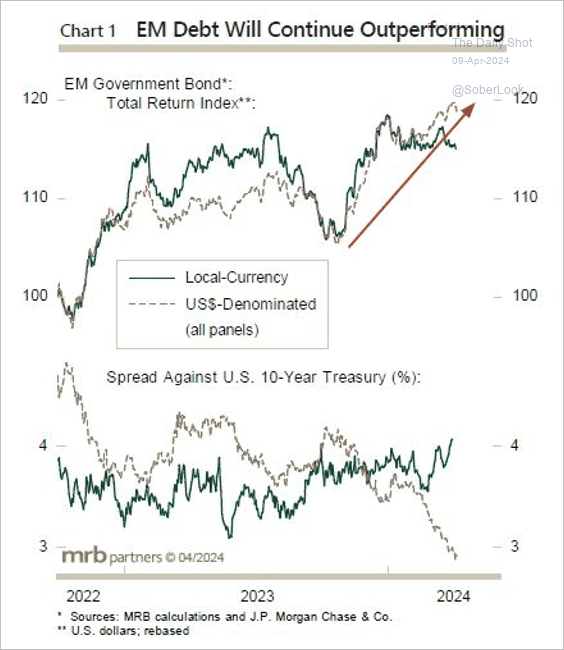

6. Aggregate dollar-denominated EM sovereign bond spreads are near historic lows.

Source: MRB Partners

Source: MRB Partners

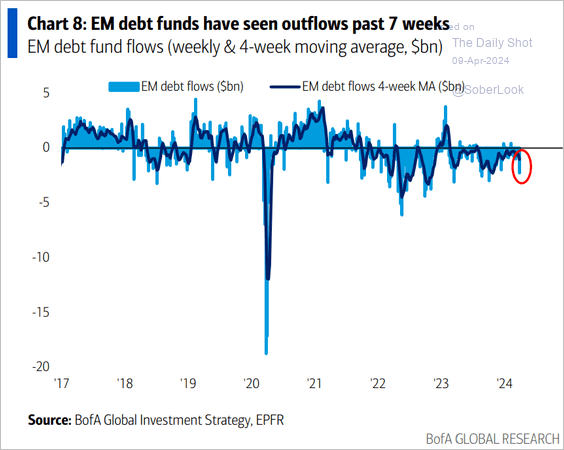

• EM debt funds registered some outflows recently.

Source: BofA Global Research

Source: BofA Global Research

Back to Index

Cryptocurrency

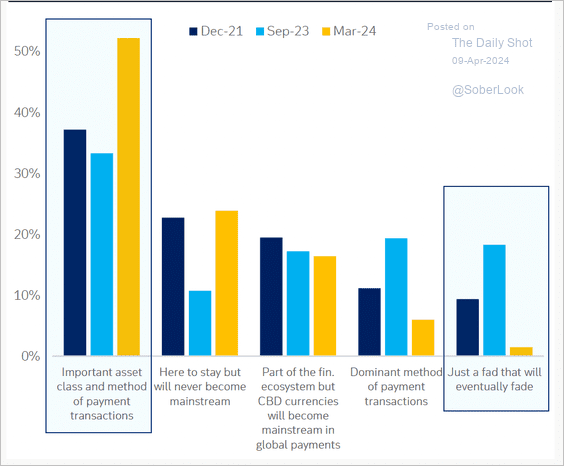

1. Consumers have become more positive on crypto, according to a Deutsche Bank survey.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

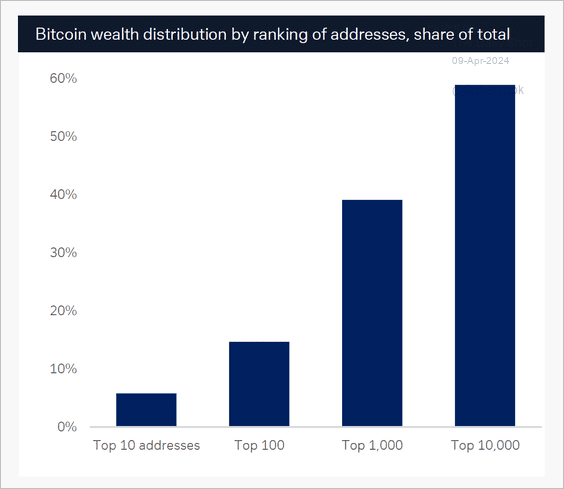

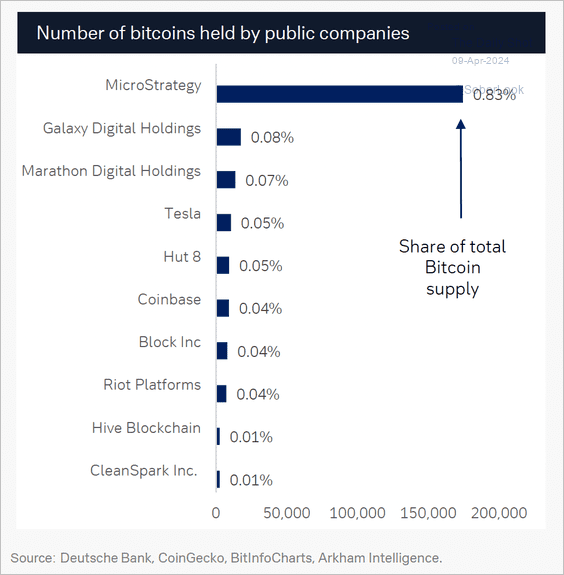

2. Most of Bitcoin’s supply is held by a few addresses, known as “crypto whales.” (2 charts)

Source: Deutsche Bank Research

Source: Deutsche Bank Research

Source: Deutsche Bank Research

Source: Deutsche Bank Research

——————–

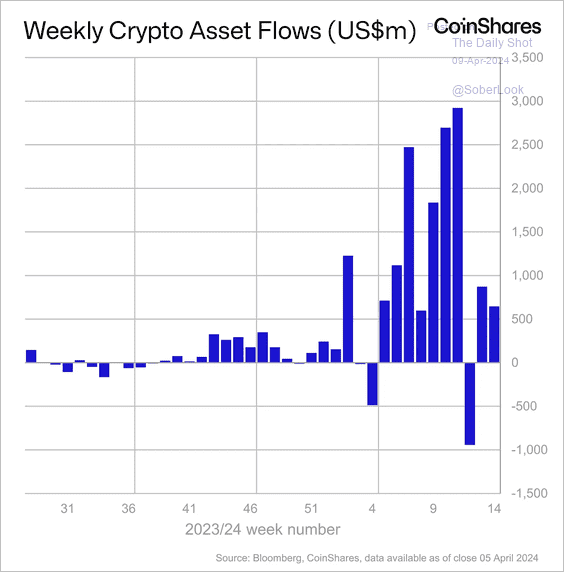

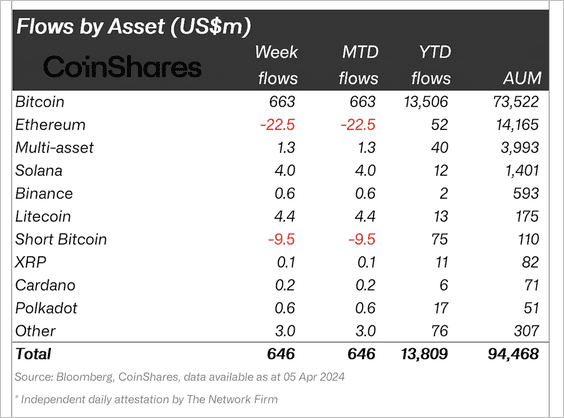

3. Crypto funds saw another week of inflows, led by long-Bitcoin products. However, funds holding Ethereum continued to see outflows. (2 charts)

Source: CoinShares Read full article

Source: CoinShares Read full article

Source: CoinShares Read full article

Source: CoinShares Read full article

Back to Index

Commodities

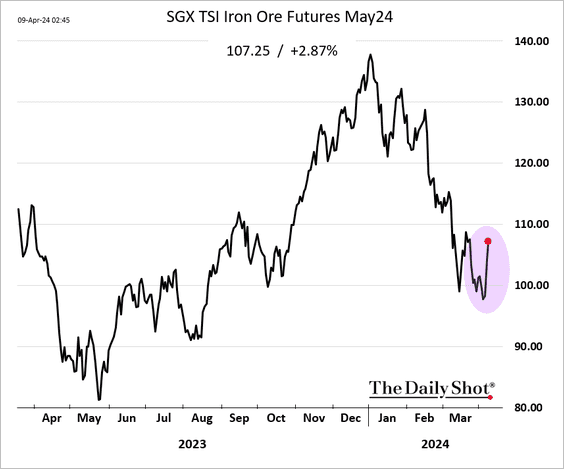

1. Iron ore futures are attempting a rebound.

Source: @markets Read full article

Source: @markets Read full article

——————–

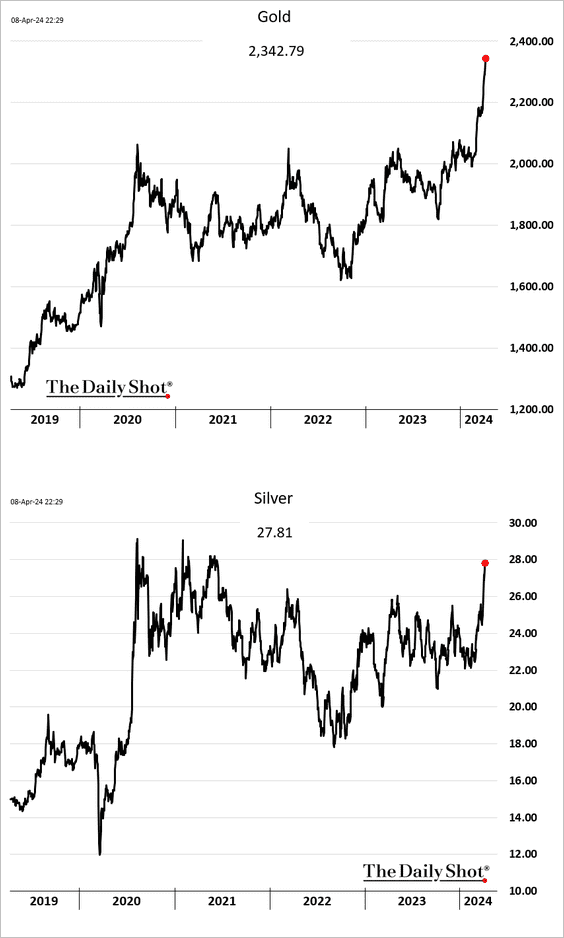

2. Gold prices keep hitting record highs. Silver also continues to rally.

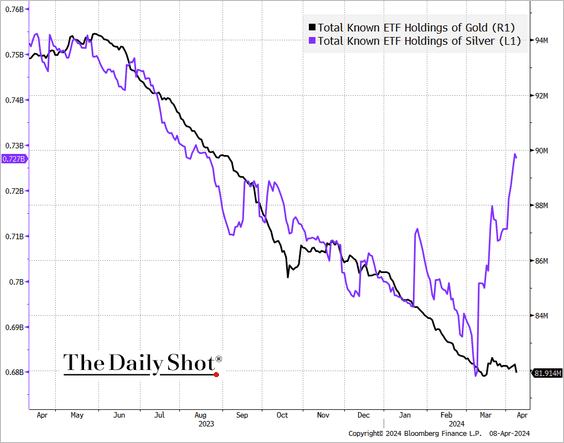

• Holdings of gold and silver ETFs have diverged.

Source: @TheTerminal, Bloomberg Finance L.P. h/t Jake Lloyd-Smith

Source: @TheTerminal, Bloomberg Finance L.P. h/t Jake Lloyd-Smith

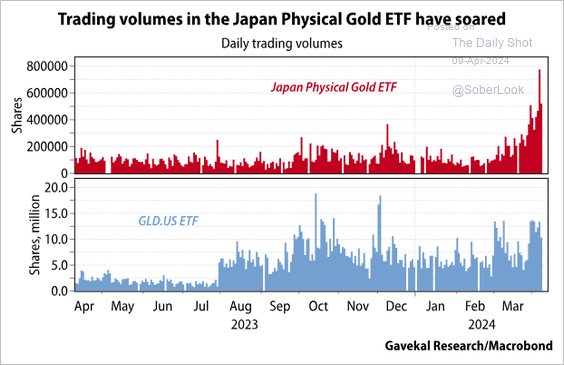

• Investors have been buying Japan Physical Gold ETF.

Source: Goldman Sachs; @dailychartbook; Gavekal Research

Source: Goldman Sachs; @dailychartbook; Gavekal Research

——————–

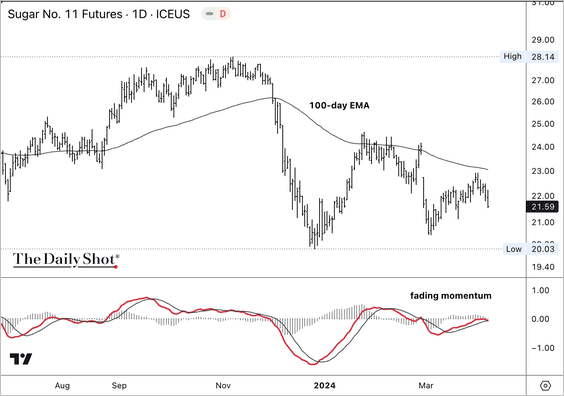

3. Sugar futures remain in a short-term downtrend.

Back to Index

Energy

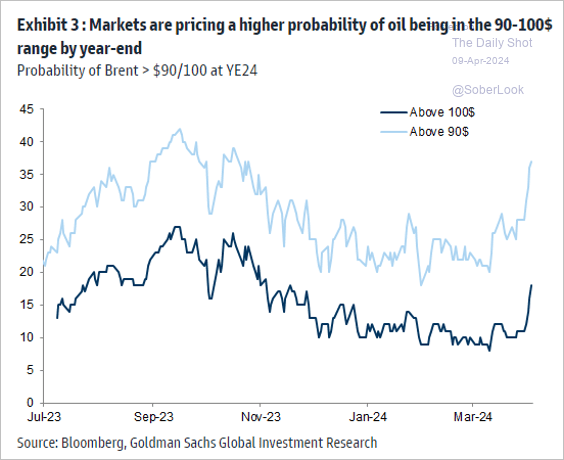

1. The options markets are boosting bets on crude oil prices exceeding $100/bbl.

Source: Goldman Sachs; @MikeZaccardi

Source: Goldman Sachs; @MikeZaccardi

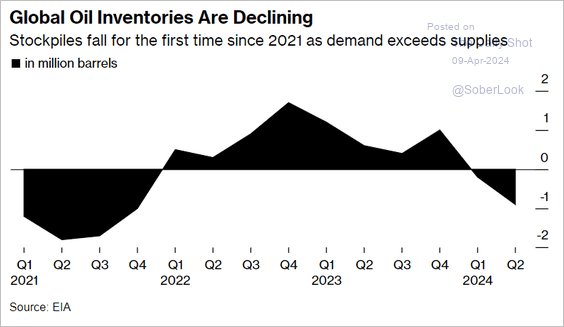

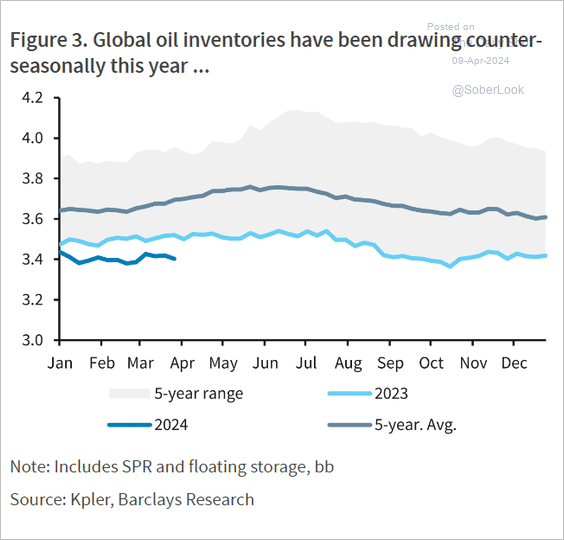

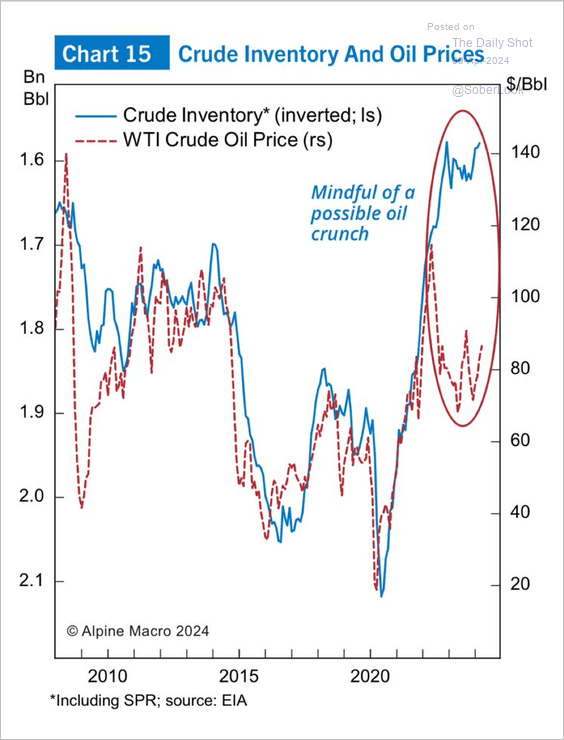

2. Global oil stockpiles have been shrinking (2 charts), …

Source: @markets Read full article

Source: @markets Read full article

Source: Barclays Research

Source: Barclays Research

… which could put upward pressure on prices.

Source: Chen Zhao, Alpine Macro

Source: Chen Zhao, Alpine Macro

——————–

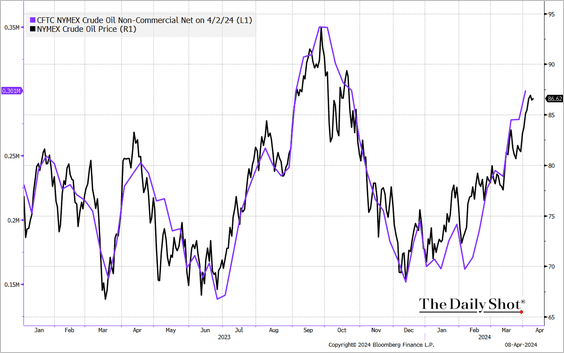

3. Is crude oil positioning becoming stretched?

Source: @TheTerminal, Bloomberg Finance L.P.; h/t Mark Cranfield, Markets Live

Source: @TheTerminal, Bloomberg Finance L.P.; h/t Mark Cranfield, Markets Live

Back to Index

Equities

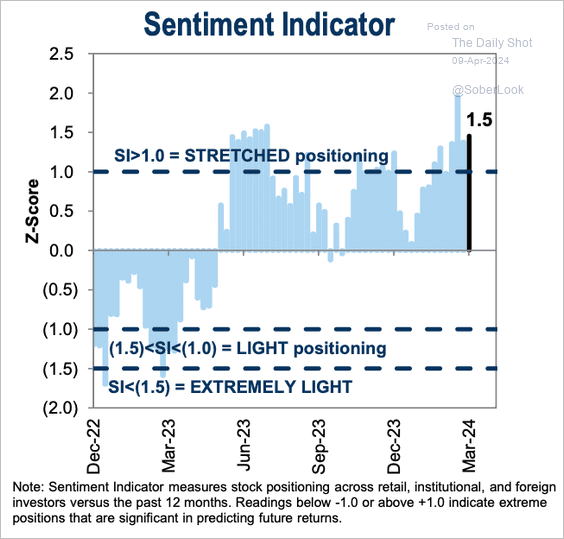

1. Goldman’s positioning indicator remains in “stretched” territory.

Source: Goldman Sachs; @dailychartbook; Gavekal Research

Source: Goldman Sachs; @dailychartbook; Gavekal Research

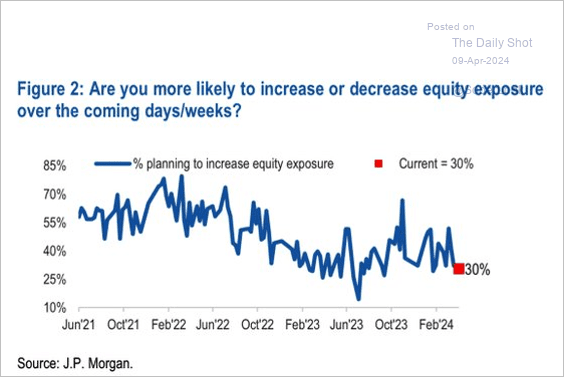

But JP Morgan’s clients have been cautious on stocks.

Source: JP Morgan Research; @WallStJesus

Source: JP Morgan Research; @WallStJesus

——————–

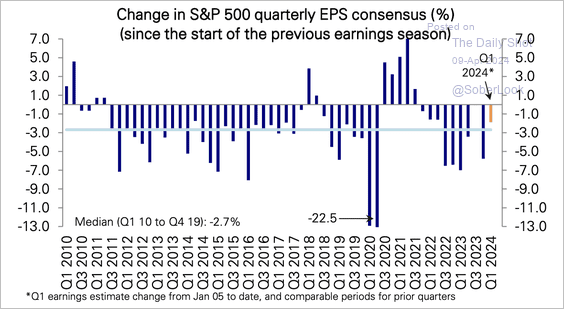

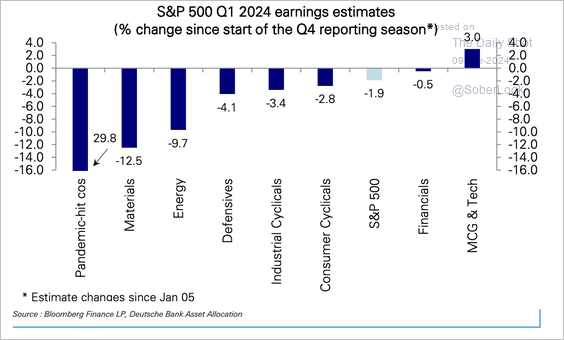

2. Earnings downgrades going into this season have been slightly smaller than usual.

Source: Danske Bank

Source: Danske Bank

• Downgrades have been broad-based outside of tech.

Source: Danske Bank

Source: Danske Bank

——————–

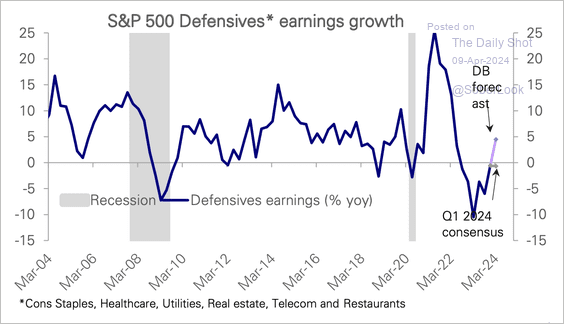

3. Deutsche Bank expects S&P 500 defensive sector earnings growth to turn positive for the first time in six quarters.

Source: Danske Bank

Source: Danske Bank

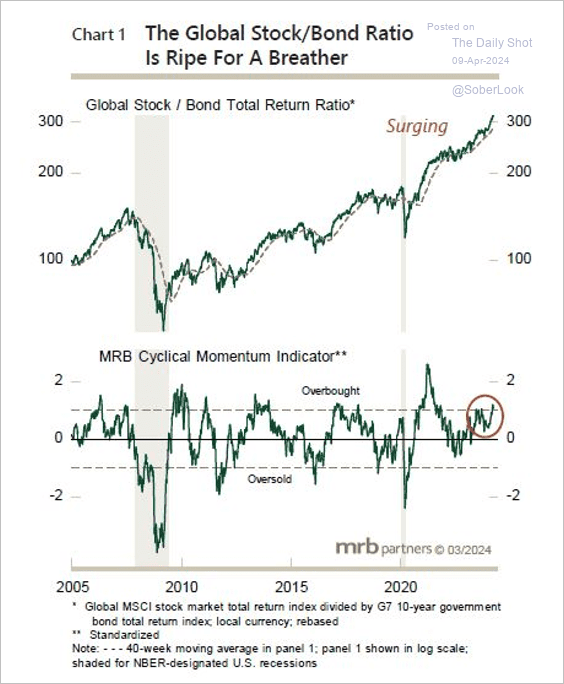

4. The global stock/bond ratio appears overbought, although the long-term uptrend is intact.

Source: MRB Partners

Source: MRB Partners

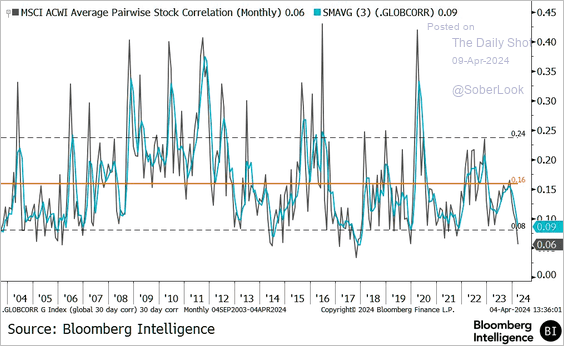

5. Correlations among global stocks hit a multi-year low.

Source: @GinaMartinAdams

Source: @GinaMartinAdams

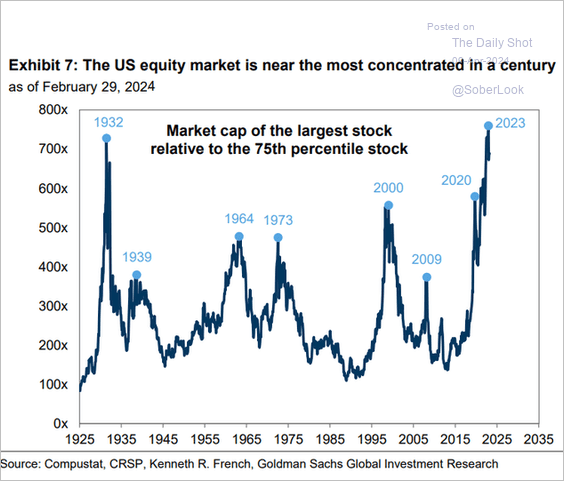

6. US equity market concentration has reached extreme levels.

Source: Goldman Sachs; @MikeZaccardi

Source: Goldman Sachs; @MikeZaccardi

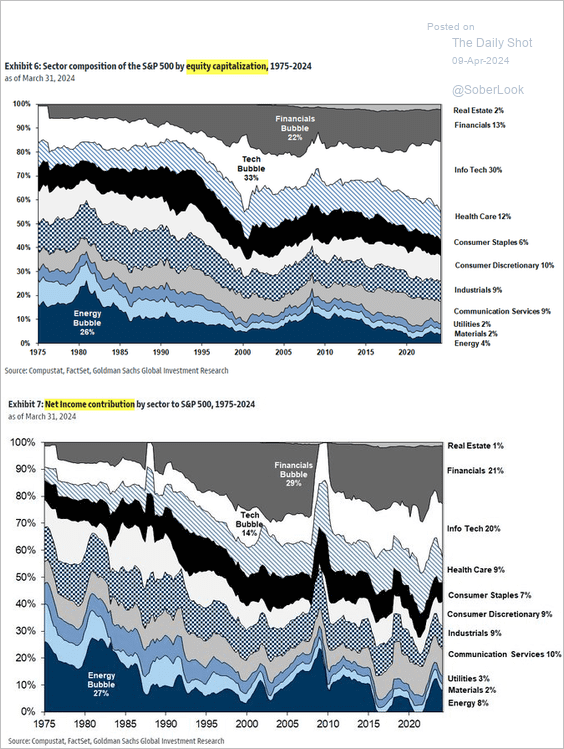

7. Here is a look at the S&P 500 sector breakdown over time by market capitalization and net income.

Source: Goldman Sachs; @MikeZaccardi

Source: Goldman Sachs; @MikeZaccardi

Back to Index

Credit

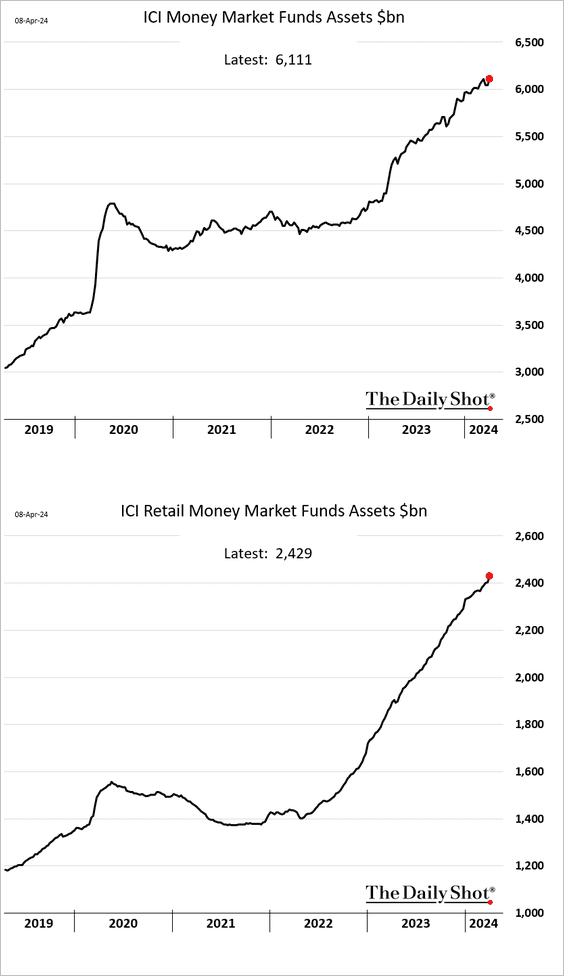

1. Money market funds’ AUM continues to hit record highs.

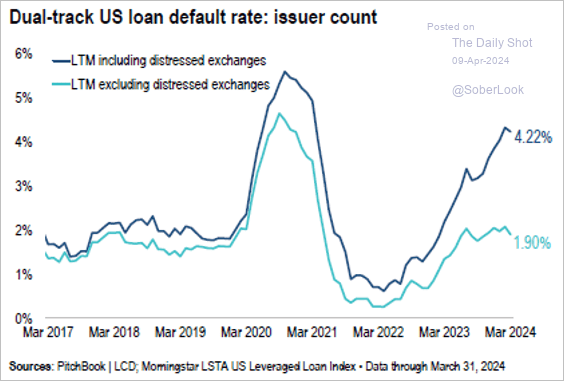

2. Default rates among US syndicated loan issuers eased last month.

Source: PitchBook

Source: PitchBook

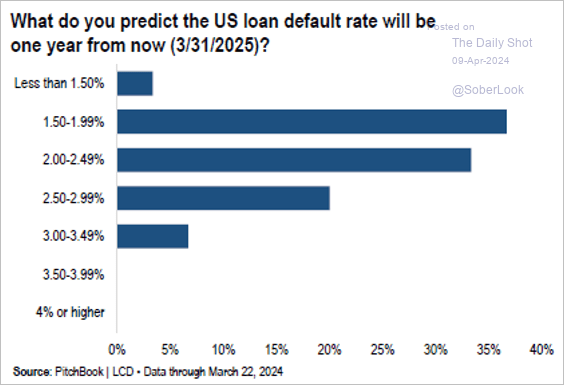

• The US loan default rate is expected to fall in the 1.5%-1.9% range one year from now, which is down from the 2.5%-2.9% prediction in December 2023, according to a survey by PitchBook.

Source: PitchBook

Source: PitchBook

Back to Index

Global Developments

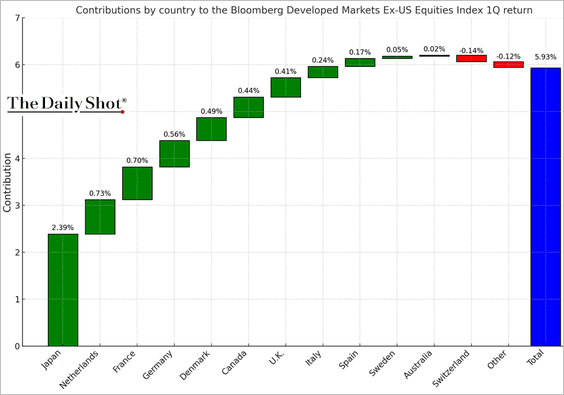

1. This chart shows the contributions to the first quarter’s gain in the Bloomberg Developed Markets Ex-US Equities Index.

h/t Douglas Lytle, Bloomberg Intelligence

h/t Douglas Lytle, Bloomberg Intelligence

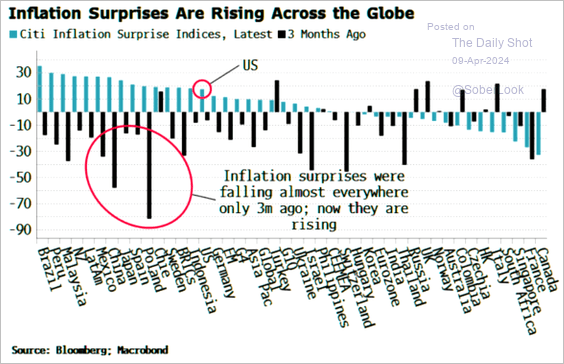

2. Inflation has been surprising to the upside recently.

Source: Simon White, Bloomberg Markets Live Blog

Source: Simon White, Bloomberg Markets Live Blog

——————–

Food for Thought

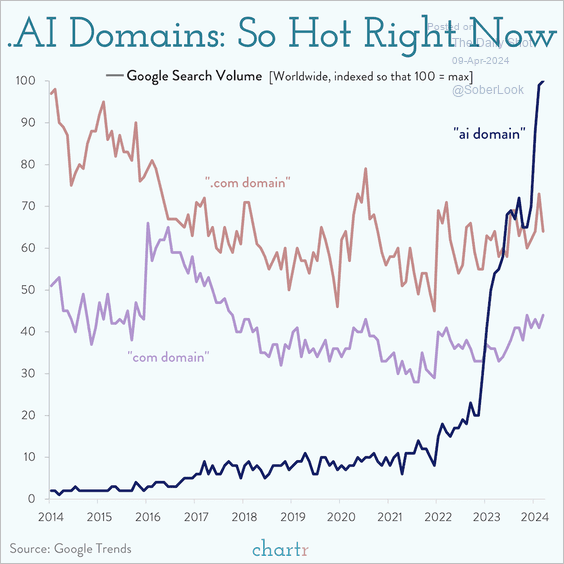

1. Rising popularity of “.AI” domains in search trends compared to “.COM” domains:

Source: @chartrdaily

Source: @chartrdaily

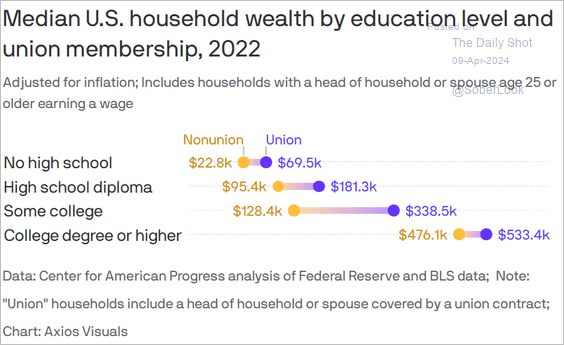

2. Median household wealth in the US by education and union membership:

Source: @axios Read full article

Source: @axios Read full article

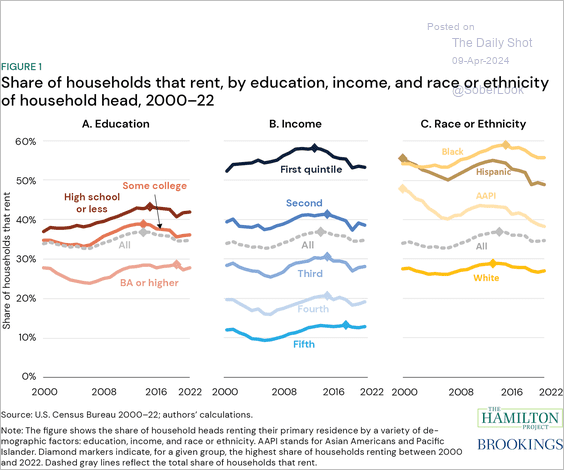

3. Renting trends across education, income, and ethnicity:

Source: Brookings Read full article

Source: Brookings Read full article

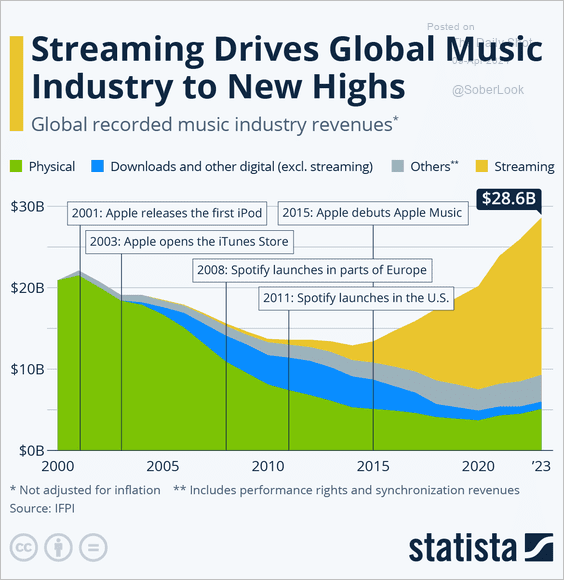

4. Evolution of global music industry revenues by format:

Source: Statista

Source: Statista

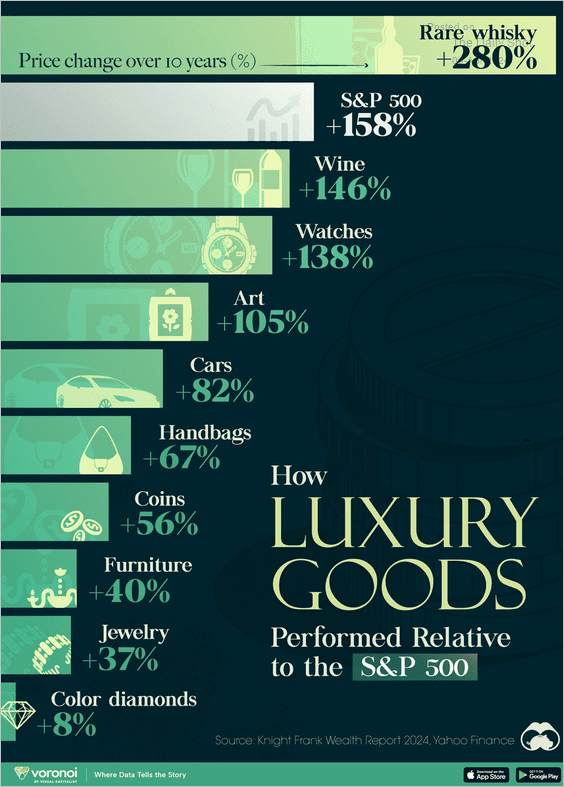

5. Decade-long price performance of luxury goods compared to the S&P 500:

Source: Visual Capitalist Read full article

Source: Visual Capitalist Read full article

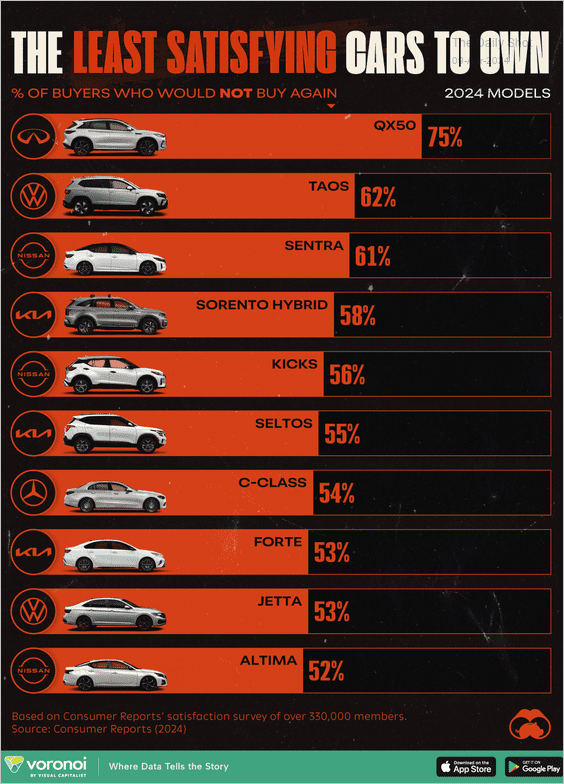

6. 2024 car models with the highest buyers’ remorse rates:

Source: Visual Capitalist Read full article

Source: Visual Capitalist Read full article

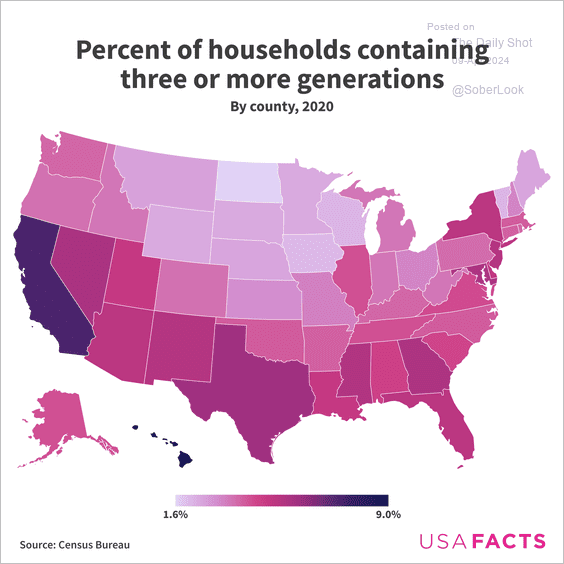

7. Households with three or more generations:

Source: USAFacts

Source: USAFacts

——————–

Back to Index