The Daily Shot: 12-Apr-24

• The United States

• Canada

• The United Kingdom

• The Eurozone

• Asia-Pacific

• China

• Emerging Markets

• Cryptocurrency

• Commodities

• Energy

• Equities

• Rates

• Global Developments

• Food for Thought

The United States

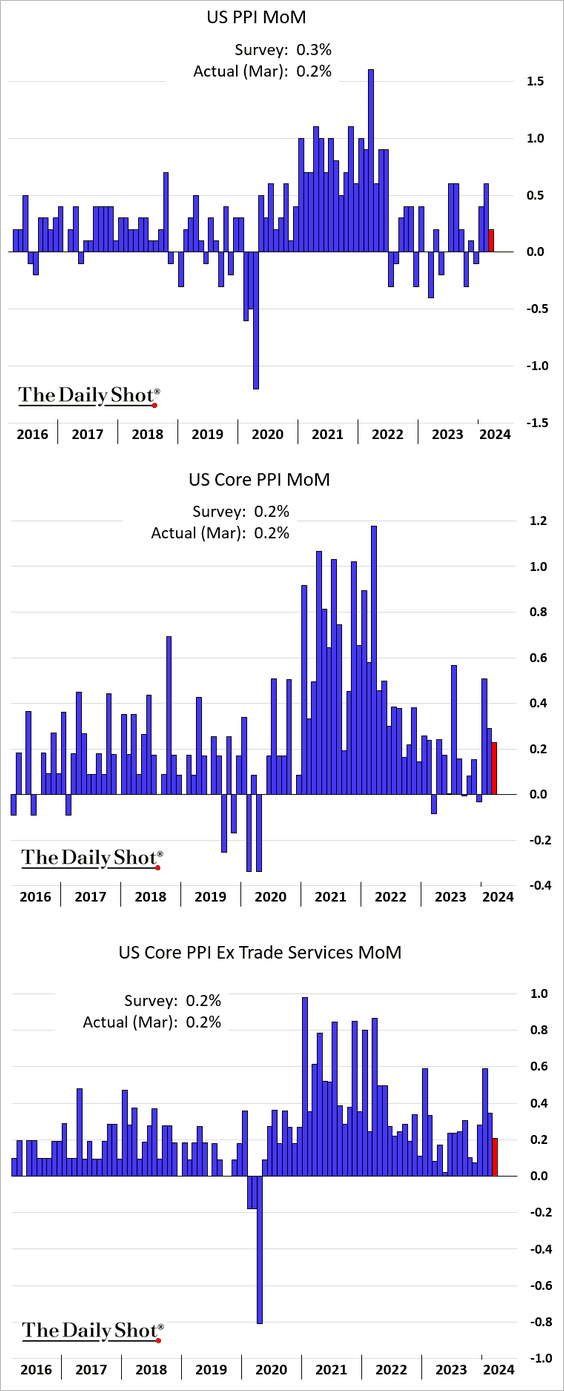

1. Let’s begin with some updates on inflation.

• The PPI report showed some cooling in wholesale price gains.

Source: CNBC Read full article

Source: CNBC Read full article

– The trade services PPI, which generally reflects business markups, showed an increase in March, indicating that companies are successfully maintaining their profit margins.

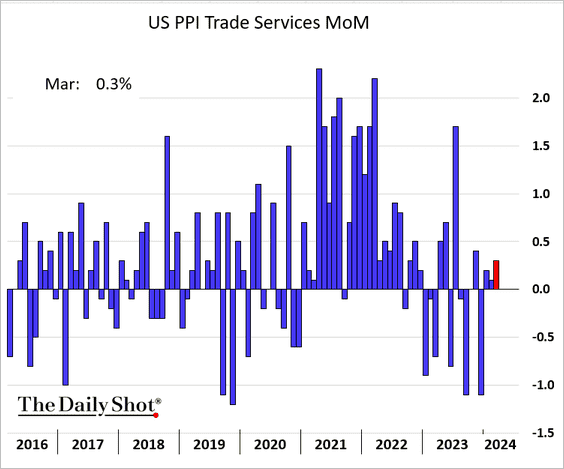

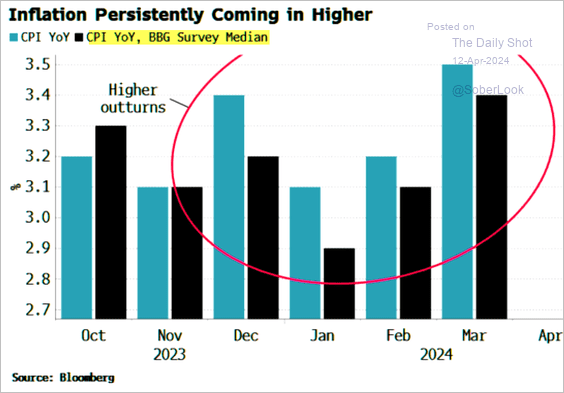

– A milder PPI report led Nomura to revise down their estimate for the March core PCE inflation. Nonetheless, the Fed’s preferred indicator is expected to show an increase from February.

Source: Nomura Securities

Source: Nomura Securities

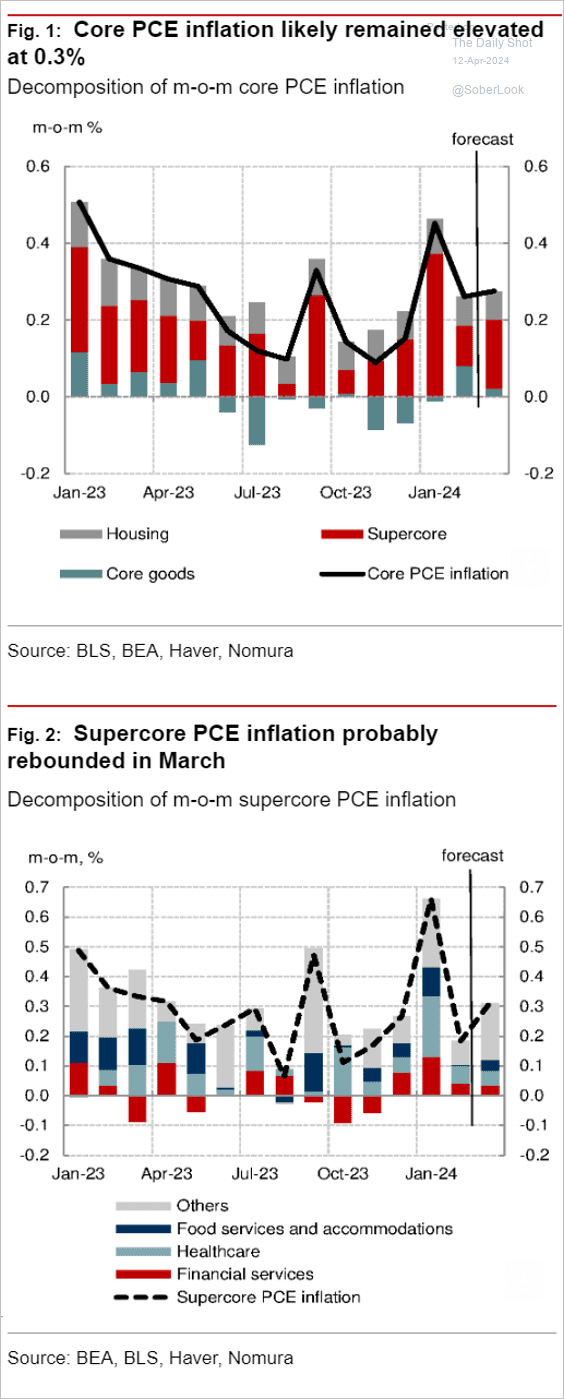

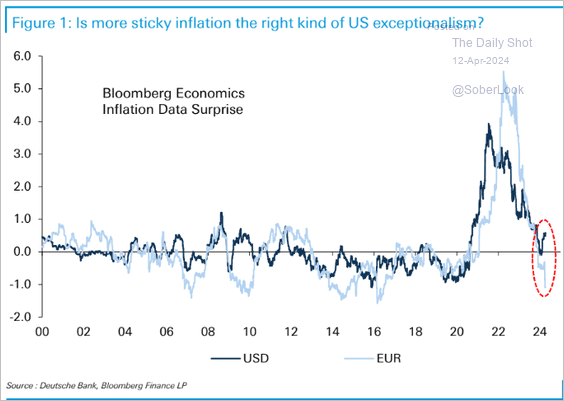

• US inflation has been surprising to the upside in recent months.

Source: Simon White, Bloomberg Markets Live Blog

Source: Simon White, Bloomberg Markets Live Blog

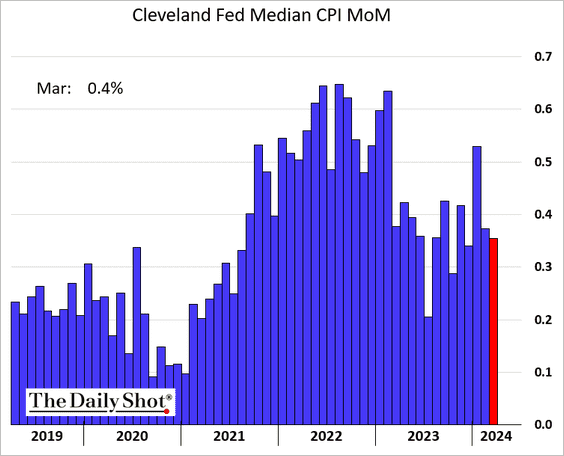

• The median CPI gains remain elevated.

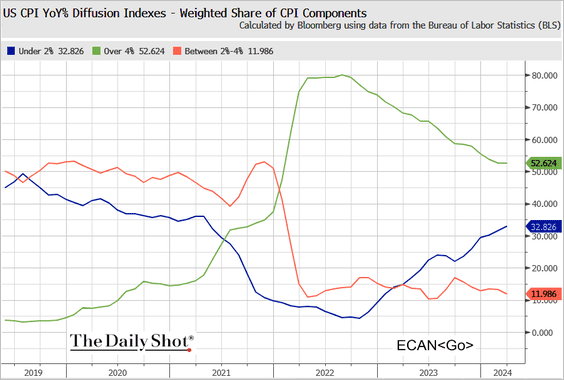

• This chart shows the CPI diffusion indices.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

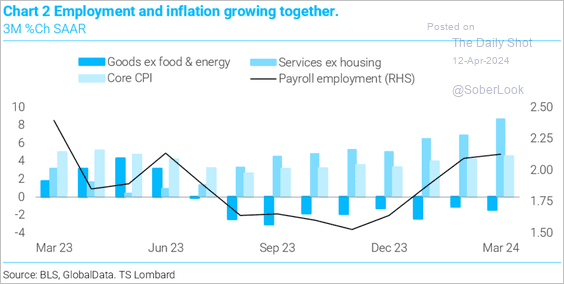

• Robust employment is contributing to persistent inflation.

Source: TS Lombard

Source: TS Lombard

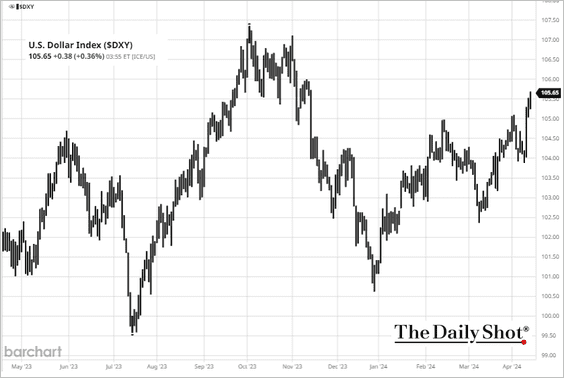

• The US dollar continues to strengthen, exerting some downward pressure on inflation.

——————–

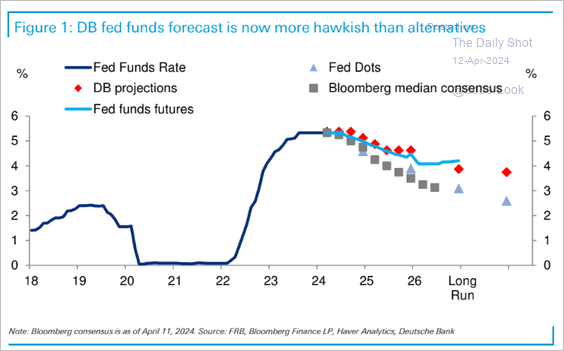

2. Elevated consumer inflation has led Deutsche Bank to shift their forecast for the first Fed rate cut to December.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

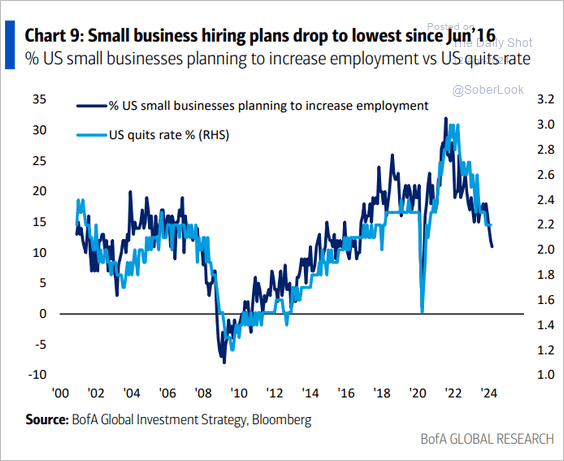

3. The quits rate is expected to keep falling, which will likely exert downward pressure on wage growth.

Source: BofA Global Research

Source: BofA Global Research

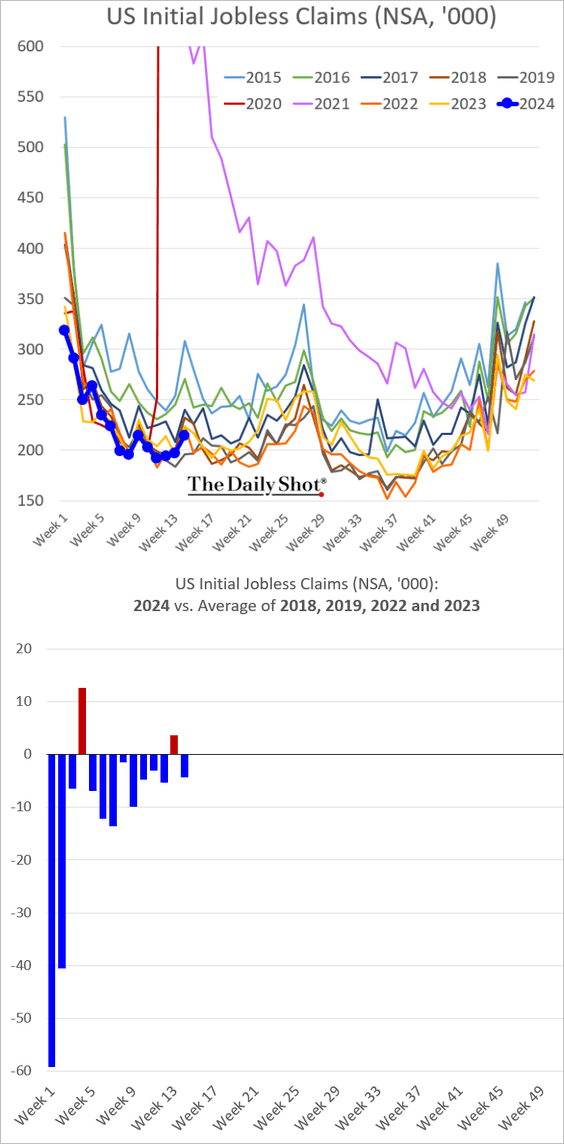

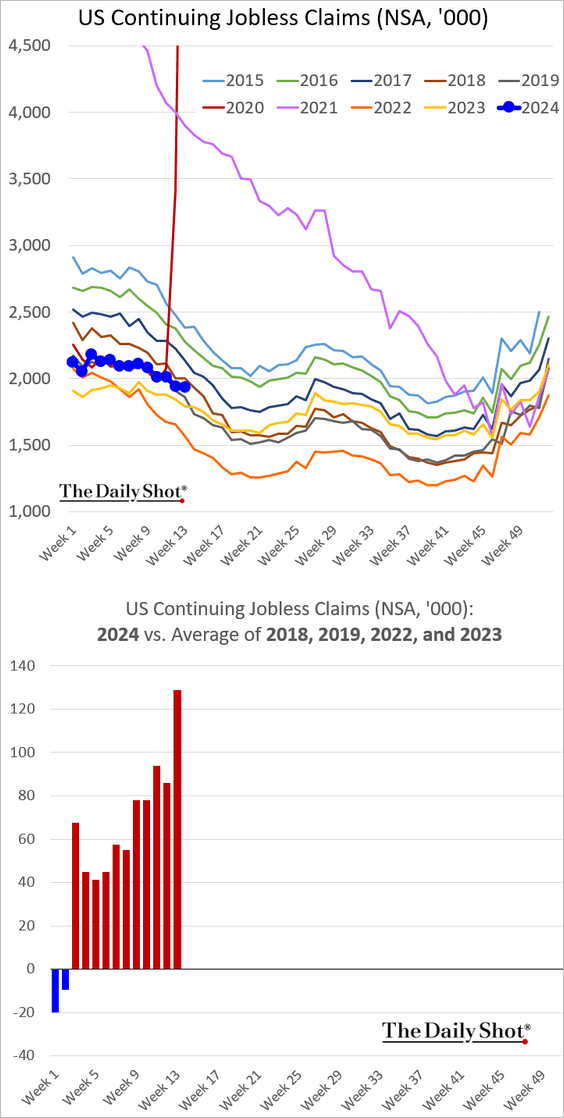

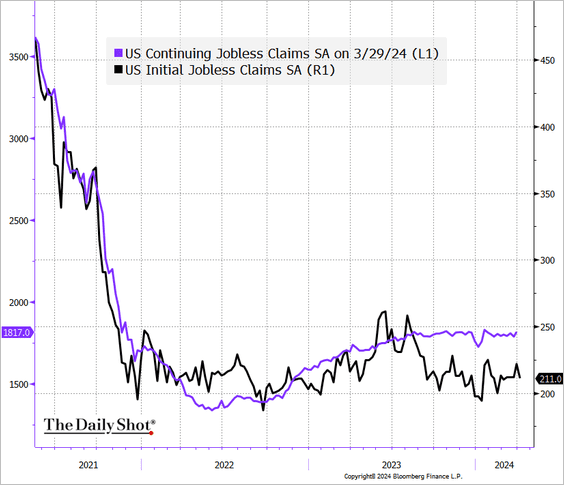

4. Initial jobless claims were slightly below 2023 levels last week.

• Continuing claims remain elevated relative to recent years.

• This seasonally adjusted chart illustrates the trends in initial and continuing jobless claims.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

——————–

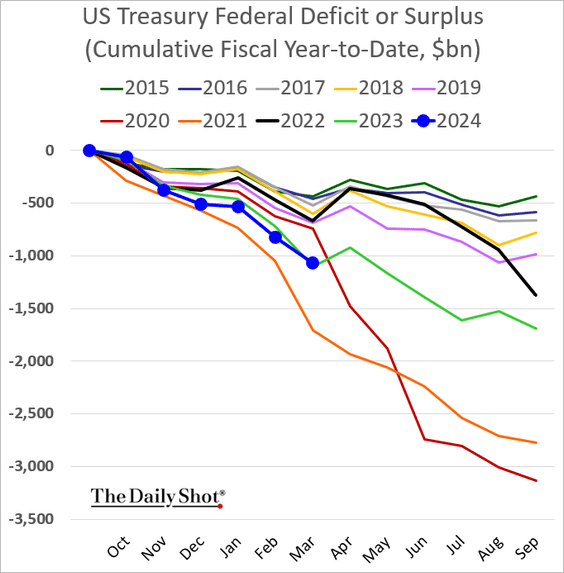

5. The cumulative federal budget deficit is roughly in line with 2023 levels for this time of the (fiscal) year.

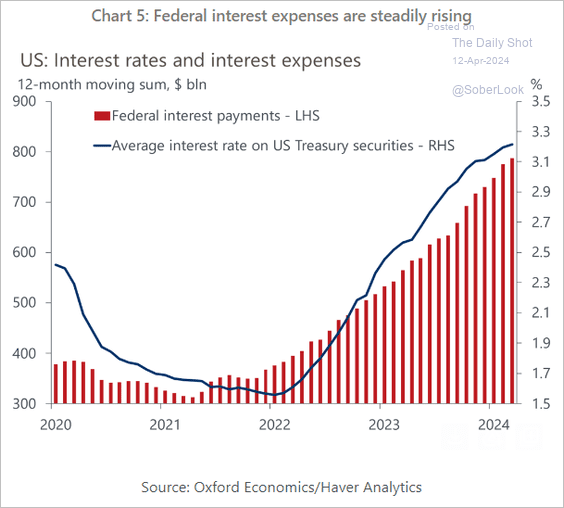

Interest expenses continue to climb.

Source: Oxford Economics

Source: Oxford Economics

——————–

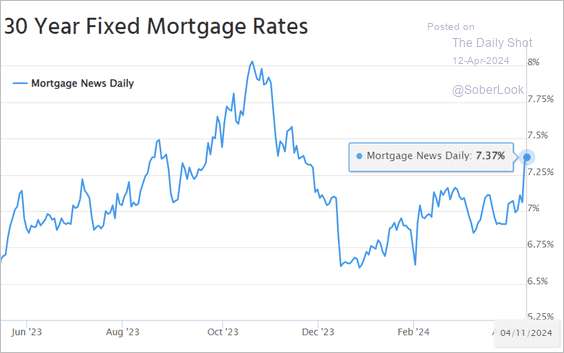

6. US mortgage rates hit the highest level since November.

Source: Mortgage News Daily

Source: Mortgage News Daily

Back to Index

Canada

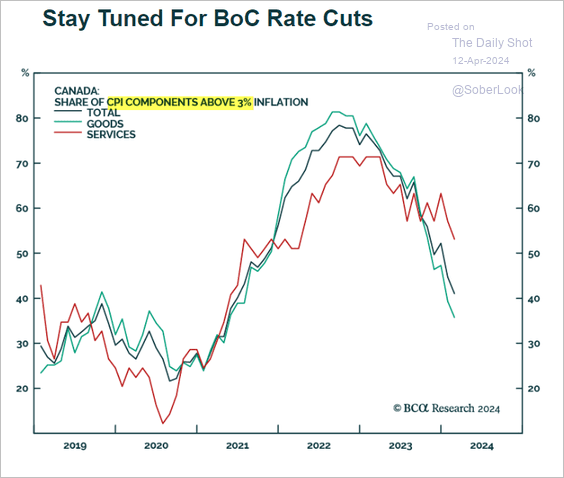

1. Moderating inflation points to rate cuts this summer.

Source: BCA Research

Source: BCA Research

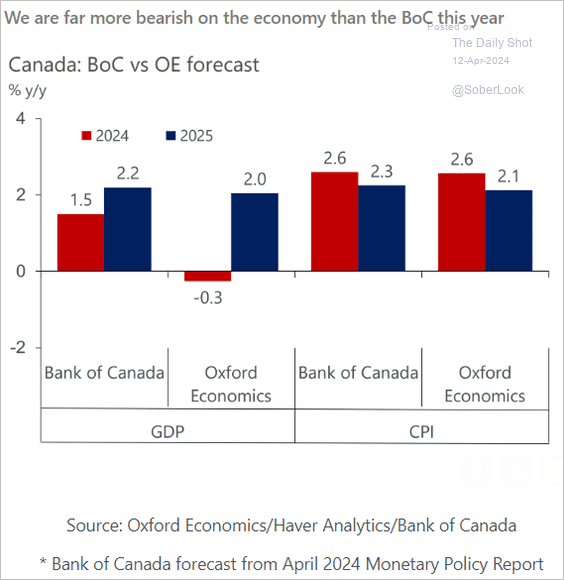

2. Oxford Economics sees Canada’s economy contracting this year.

Source: Oxford Economics

Source: Oxford Economics

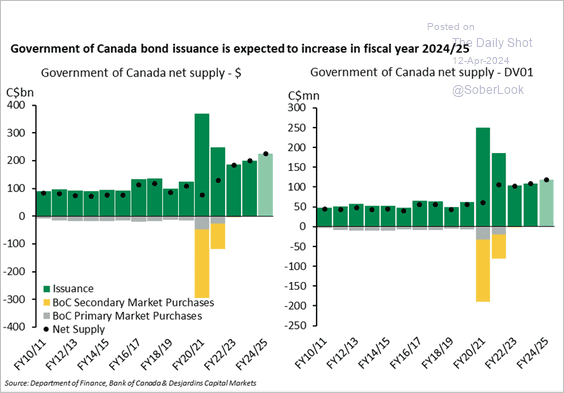

3. Debt issuance is projected to increase in the 2024/25 fiscal year. The chart on the right shows DV01, which represents the P&L impact of a one-basis-point parallel shift, effectively illustrating a duration-adjusted trend in debt issuance.

Source: Desjardins

Source: Desjardins

Back to Index

The United Kingdom

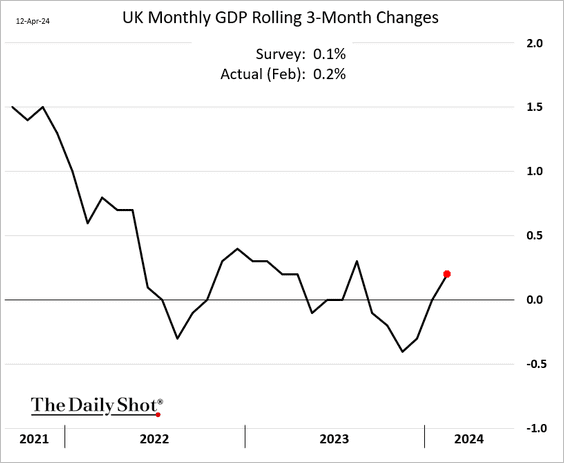

1. The economy shows signs of recovery. We will have more on the monthly GDP report next week.

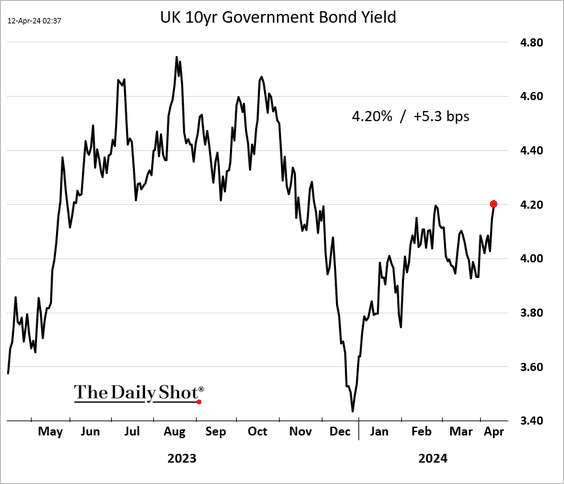

2. The 10-year gilt yield hit the highest level since November.

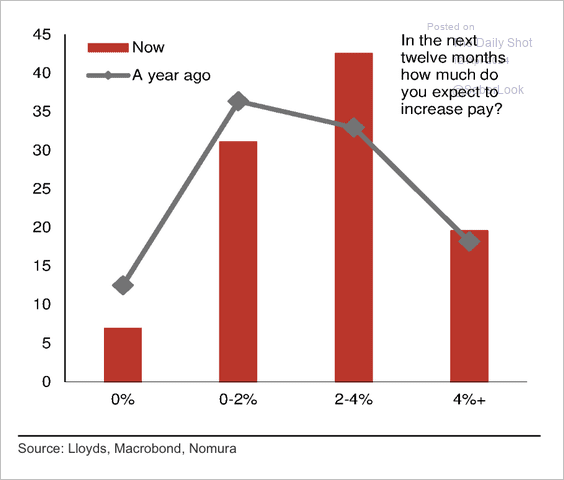

3. Wage pressure remains strong, according to business surveys.

Source: Nomura Securities

Source: Nomura Securities

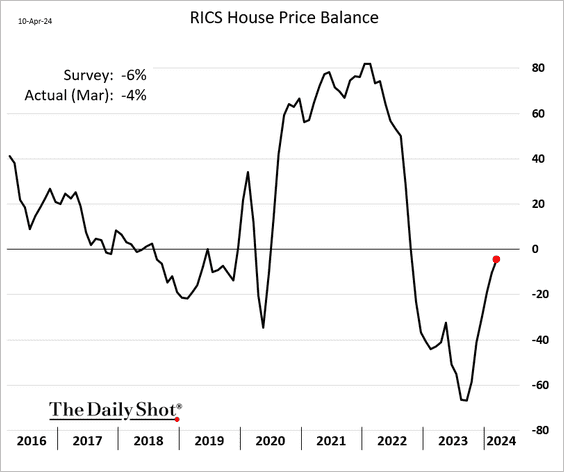

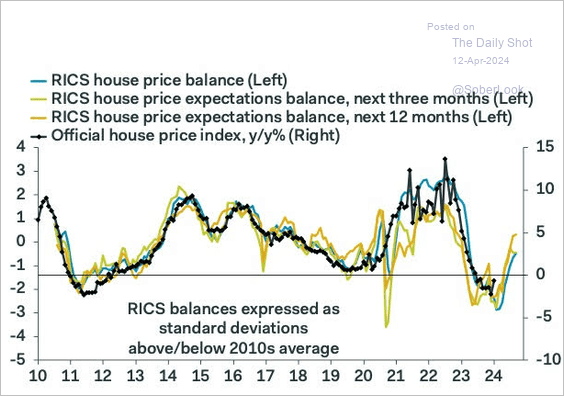

4. The RICS index signals increased optimism in the housing market.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

Source: @markets Read full article

Source: @markets Read full article

——————–

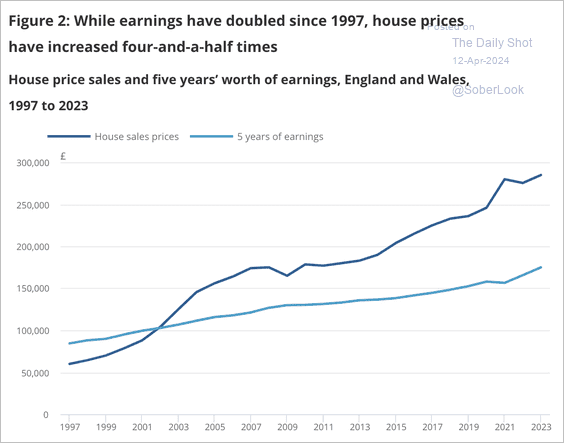

5. Housing affordability continues to deteriorate.

Source: ONS Read full article

Source: ONS Read full article

Back to Index

The Eurozone

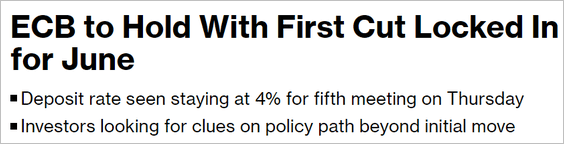

1. The ECB is expected to maintain its current policy stance until June, potentially cutting rates well before the Fed.

Source: @economics Read full article

Source: @economics Read full article

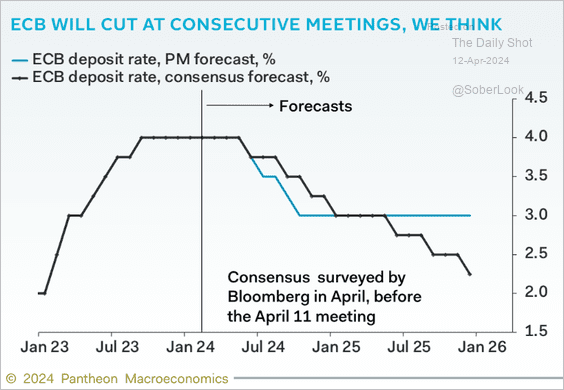

• Many economists see rate cuts continuing after June.

– Pantheon Macroeconomics:

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

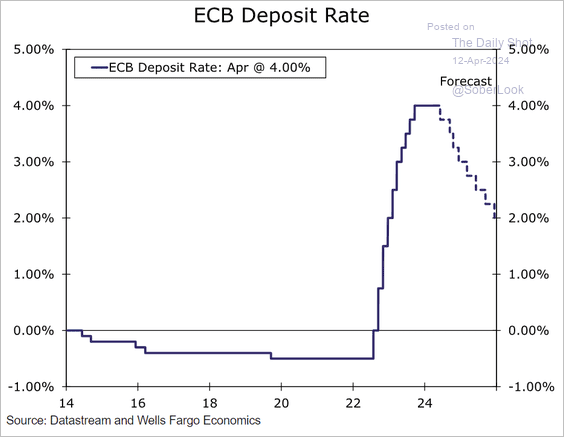

– Wells Fargo:

Source: Wells Fargo Securities

Source: Wells Fargo Securities

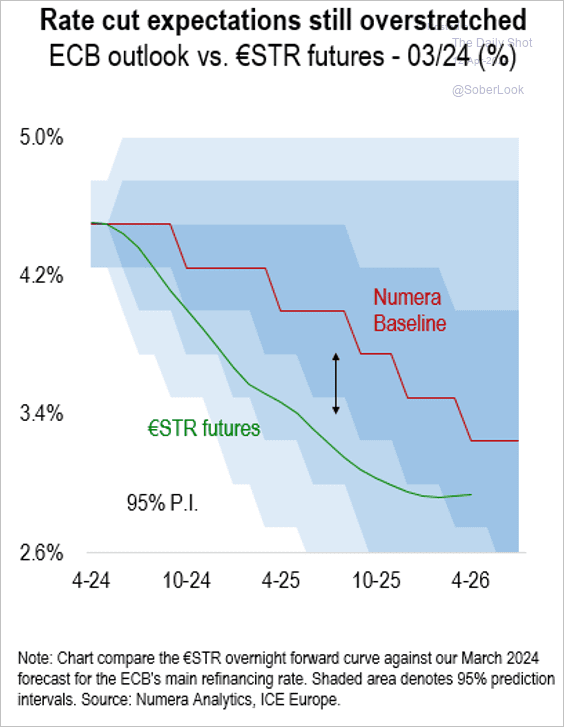

– However, Numera Analytics sees a low probability of ECB rate cuts before Q4.

Source: Numera Analytics (@NumeraAnalytics)

Source: Numera Analytics (@NumeraAnalytics)

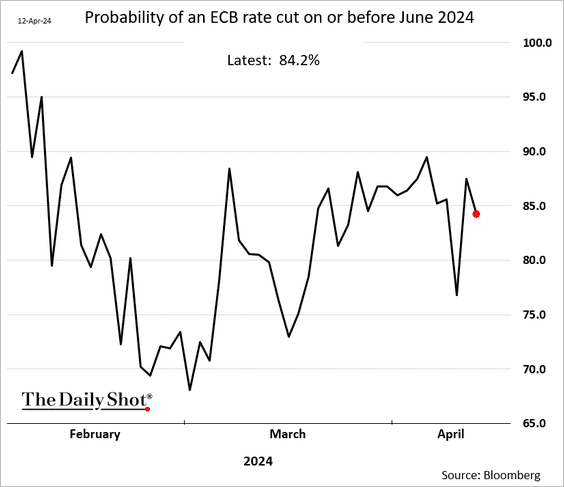

• Here is the market-based probability of a rate cut on or before June.

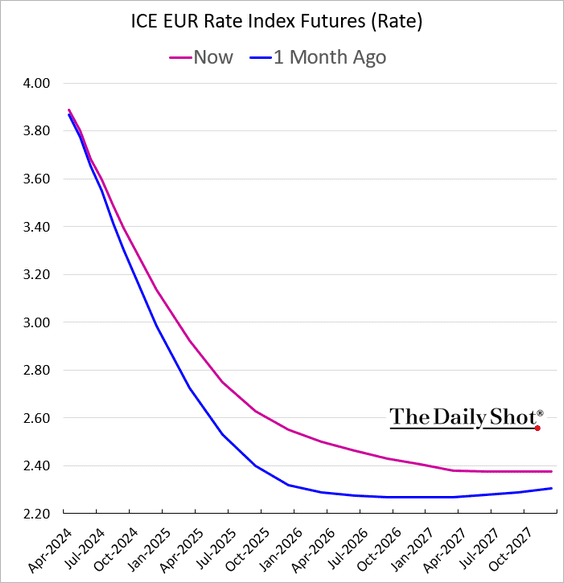

• The market is pricing in slightly less than three rate reductions this year.

• The market-based policy rate trajectory shifted higher over the past 30 days, especially for 2025 and 2026.

——————–

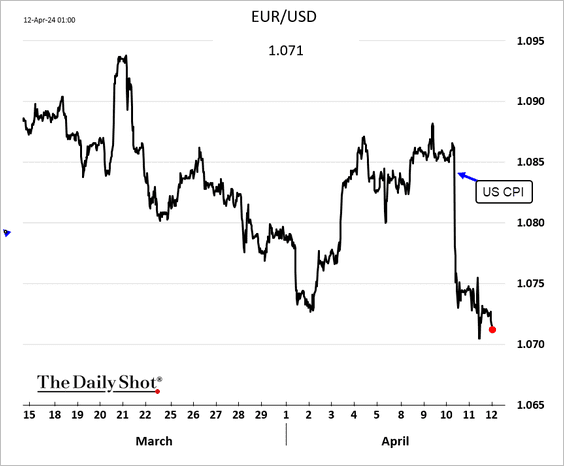

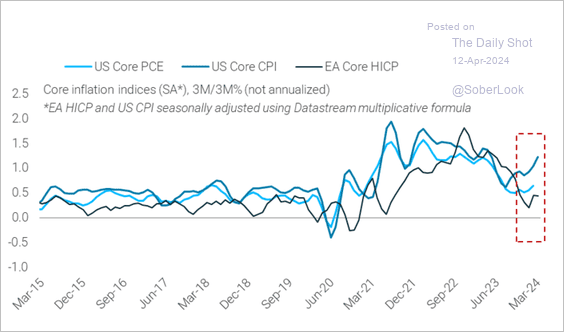

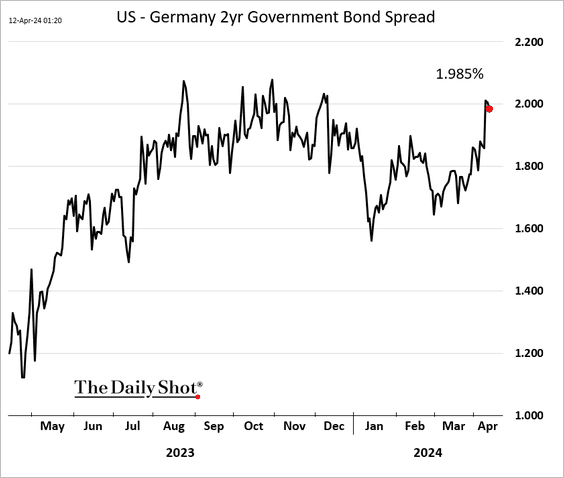

2. The euro has been trading lower vs. USD after the hot US CPI report, …

… as inflation trends diverge (2 charts).

Source: TS Lombard

Source: TS Lombard

Source: Deutsche Bank Research

Source: Deutsche Bank Research

Here is the spread between the 2-year US and German bond yields.

Back to Index

Asia-Pacific

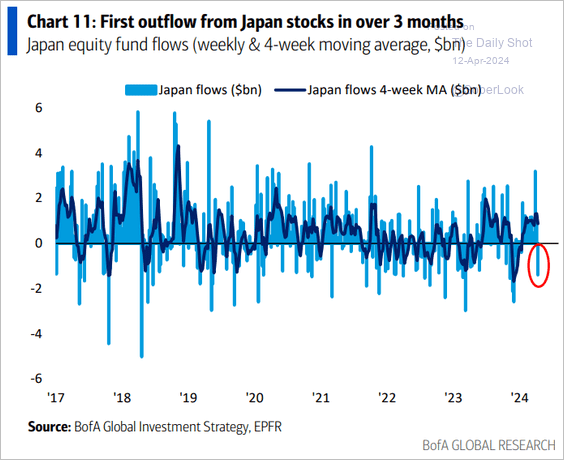

1. Japan-focused equity funds see some outflows.

Source: BofA Global Research

Source: BofA Global Research

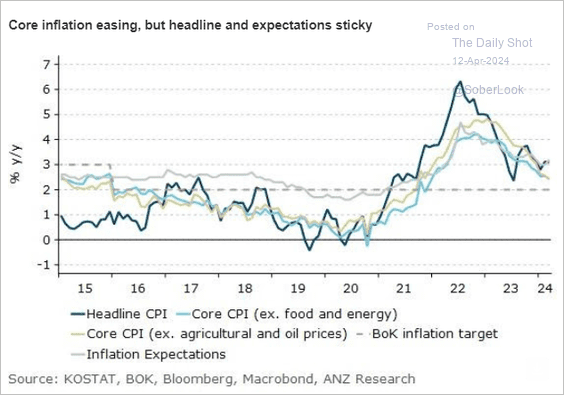

2. South Korea’s headline inflation has been sticky, which is why the BoK is in no hurry to ease policy.

Source: @ANZ_Research

Source: @ANZ_Research

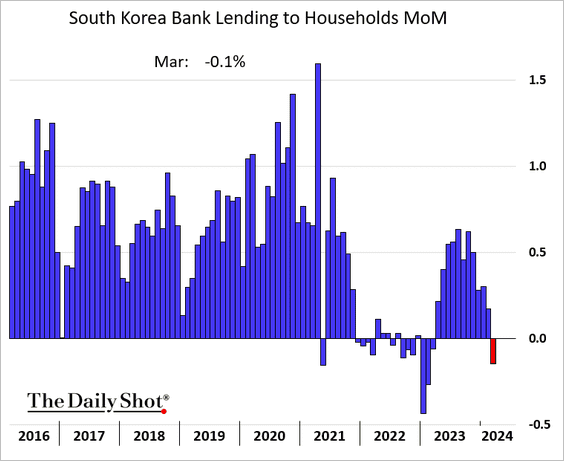

• Bank lending to households declined last month.

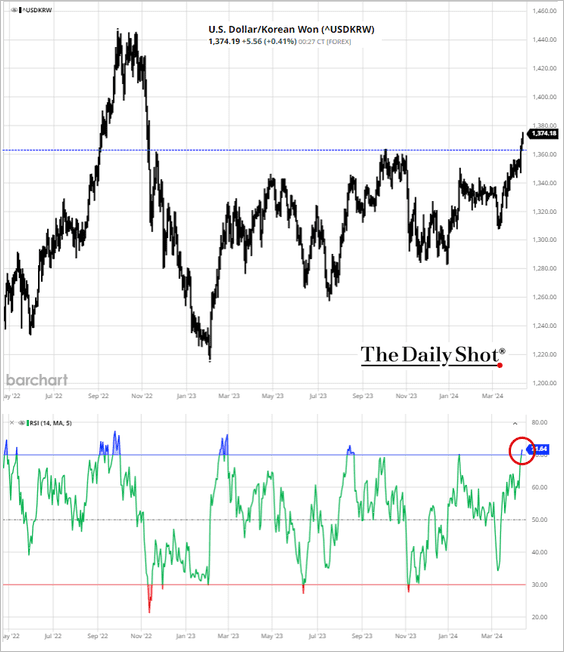

• The won continues to sink vs. the US dollar.

——————–

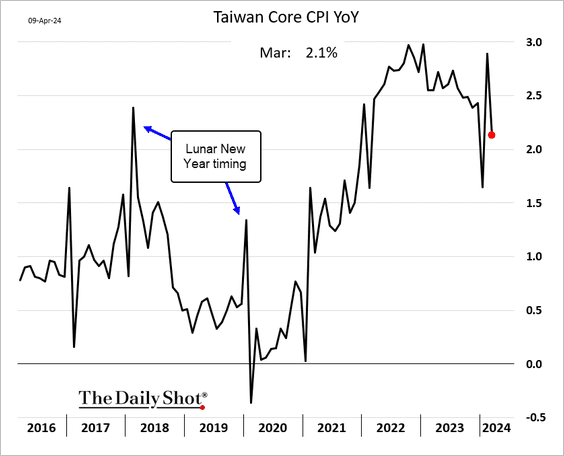

3. Taiwan’s core inflation remains above 2%.

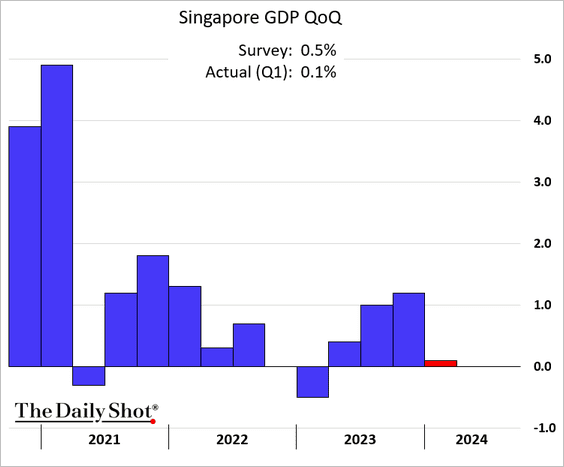

4. Singapore’s economy barely grew in the first quarter.

Back to Index

China

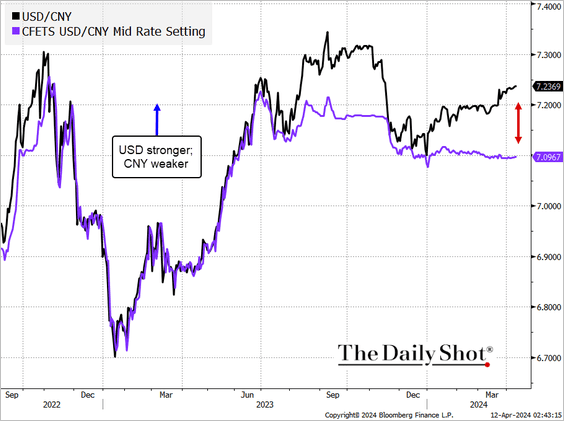

1. This is not the trend Beijing wants to see.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

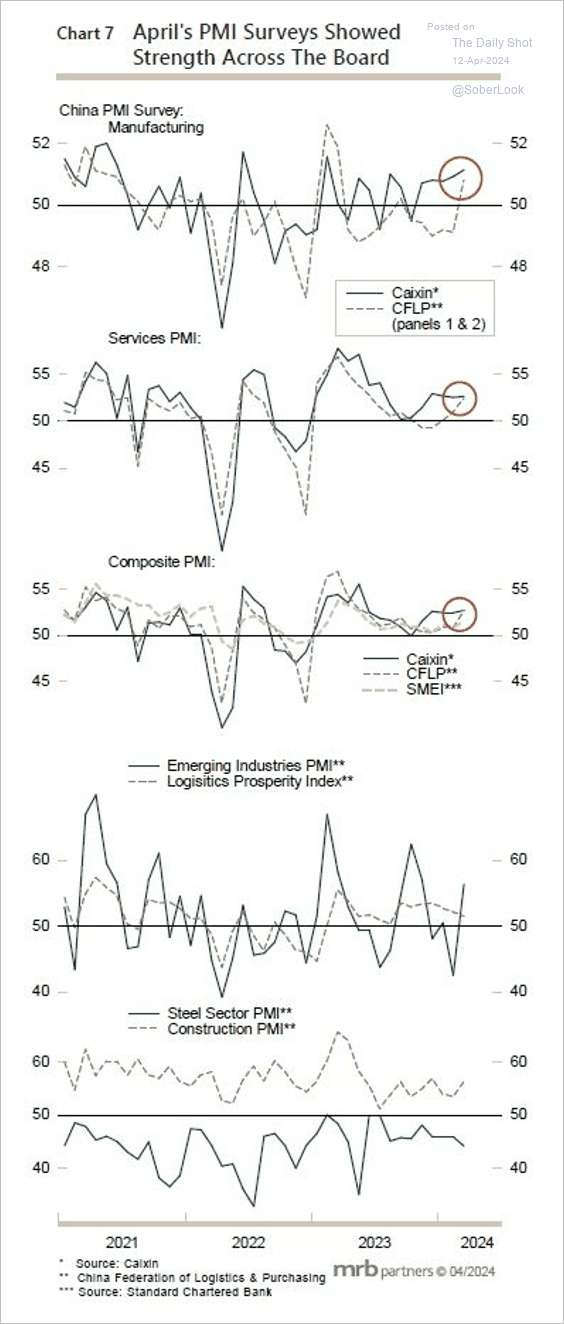

2. Economic growth is improving.

Source: MRB Partners

Source: MRB Partners

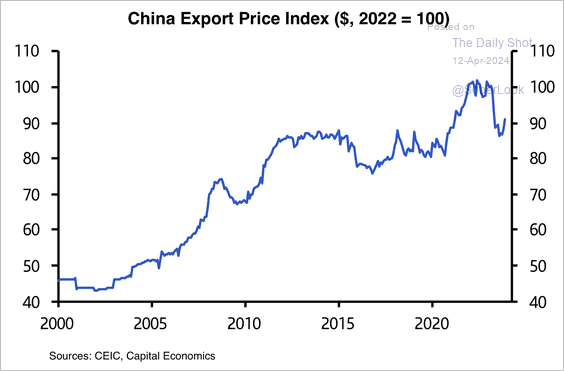

3. The previous correction in export prices boosted Chinese exports, although prices are starting to rise again, possibly due to narrowing profit margins.

Source: Capital Economics

Source: Capital Economics

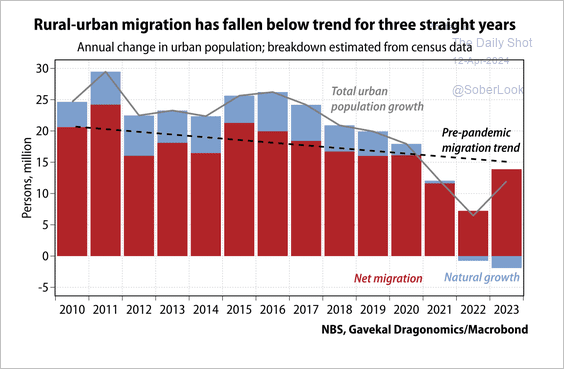

4. Net migration to urban areas is running below its pre-pandemic trend amid negative natural growth.

Source: Gavekal Research

Source: Gavekal Research

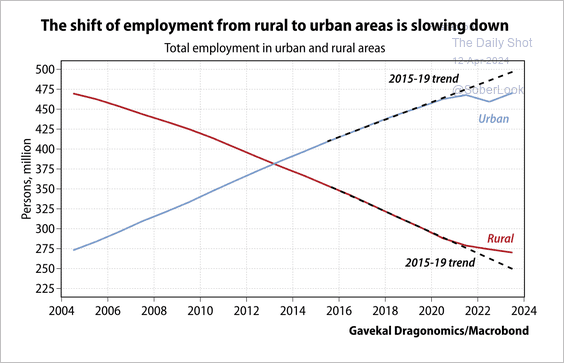

• Urban employment dipped below trend since the pandemic as rural jobs experienced a smaller decrease.

Source: Gavekal Research

Source: Gavekal Research

——————–

Emerging Markets

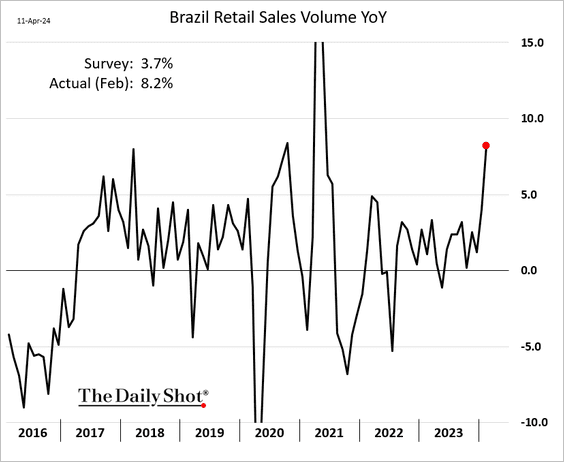

1. Brazil’s retail sales strengthened in February.

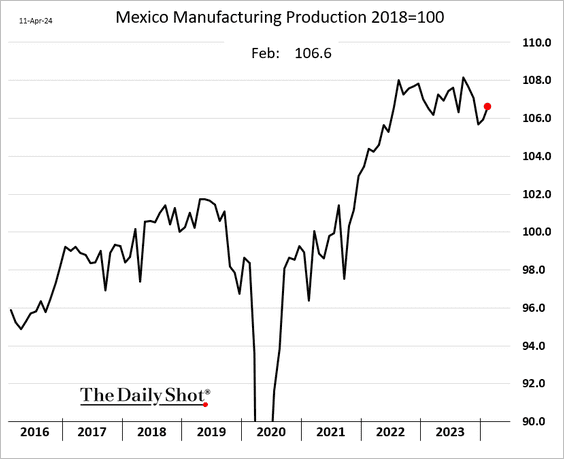

2. Mexico’s factory output has been moving higher.

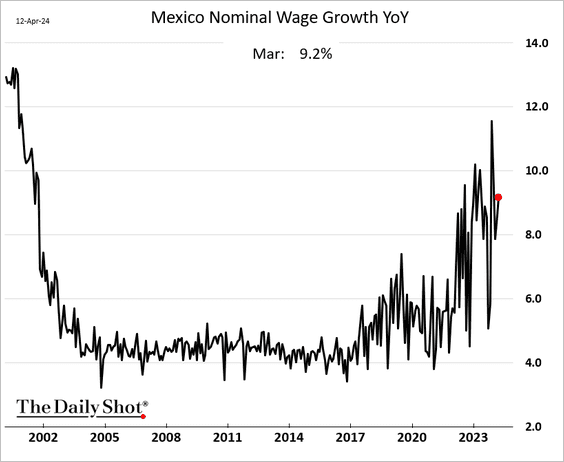

• Wage growth remains elevated, which has been a concern for Banxico.

——————–

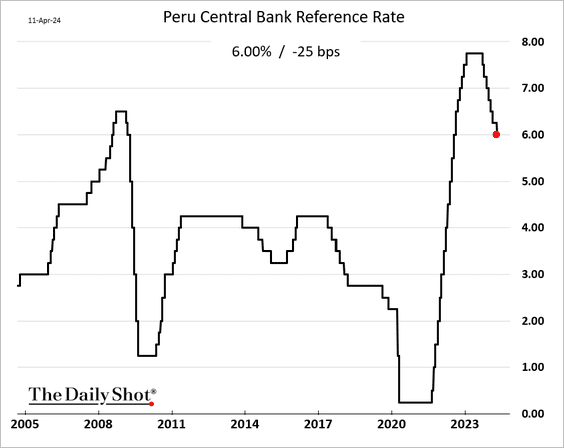

3. Peru’s central bank unexpectedly cut rates again.

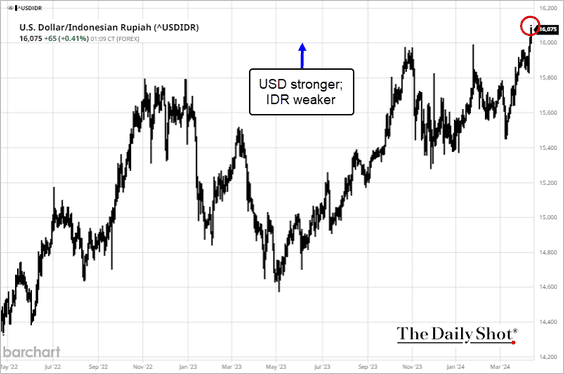

4. The Indonesian rupiah hit a multi-year low against the US dollar.

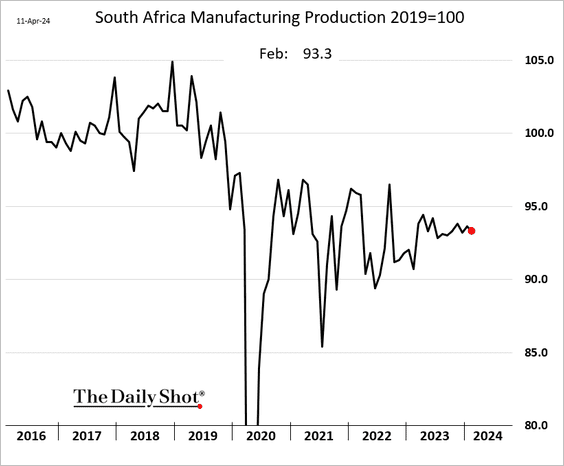

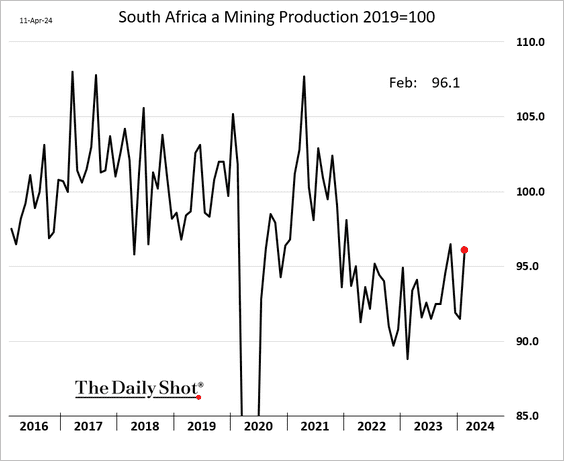

5. South Africa’s factory output edged lower in February.

But mining production rebounded.

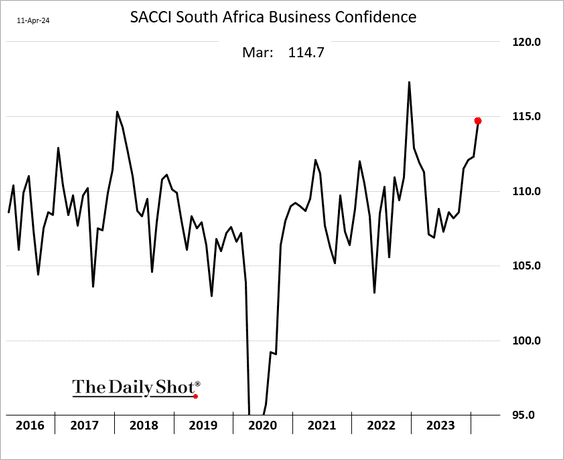

• Business sentiment has been on the rise.

Back to Index

Cryptocurrency

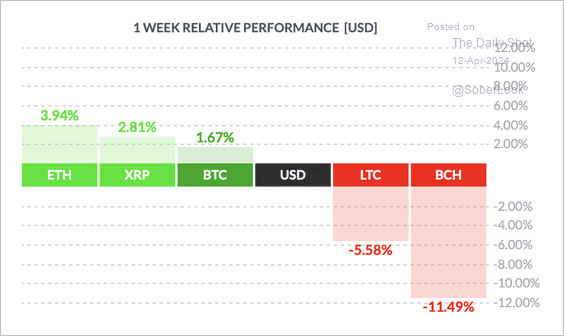

1. It was a mixed week for cryptos, with ether (ETH) outperforming and bitcoin cash (BCH) paring back previous gains.

Source: FinViz

Source: FinViz

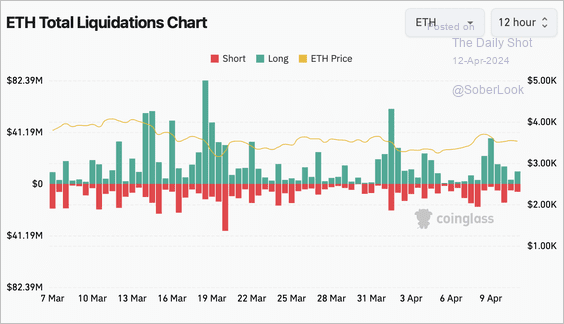

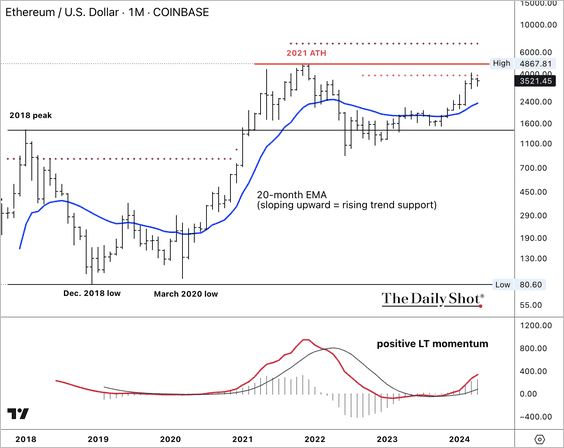

2. There has been a cluster of long ETH liquidations over the past month as the crypto failed to decisively break above the $4K resistance level.

Source: Coinglass

Source: Coinglass

However, ETH/USD is holding long-term support with stronger resistance at its 2021 price high.

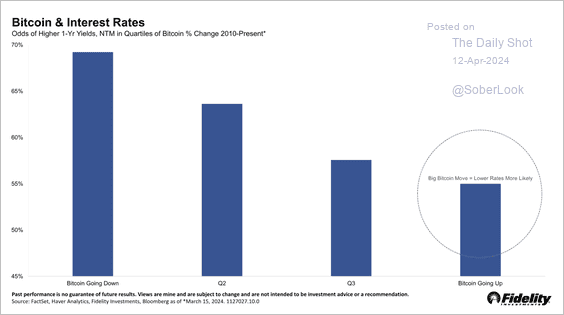

3. Previous bitcoin price rallies were associated with lower odds of rising interest rates.

Source: Denise Chisholm; Fidelity Investments

Source: Denise Chisholm; Fidelity Investments

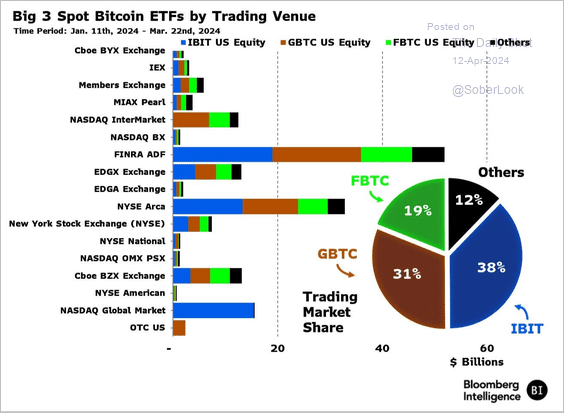

4. Large over-the-counter transactions are taking place off-exchanges in US spot-bitcoin ETFs, which could help boost liquidity.

Source: @thetrinianalyst; Bloomberg Intelligence

Source: @thetrinianalyst; Bloomberg Intelligence

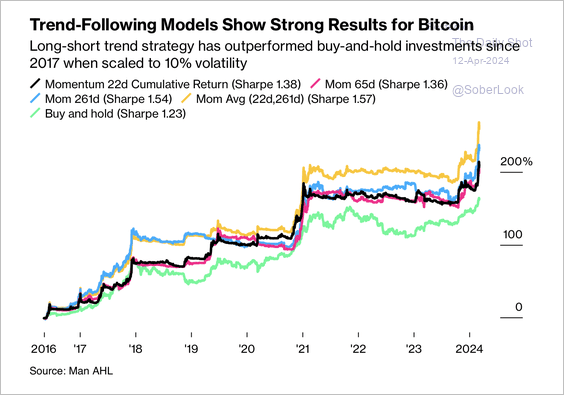

5. Long/short trend following has historically outperformed a long-only bitcoin strategy.

Source: @crypto Read full article

Source: @crypto Read full article

Back to Index

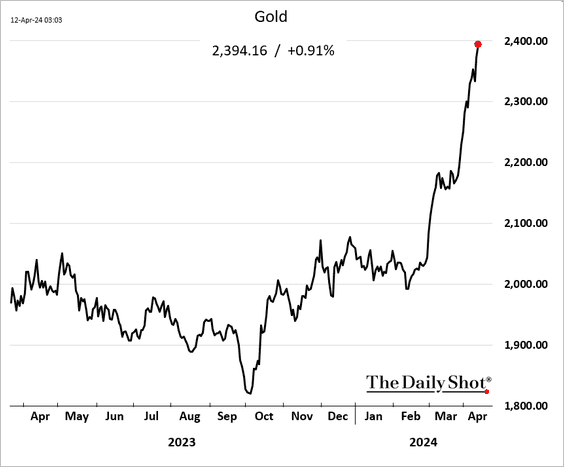

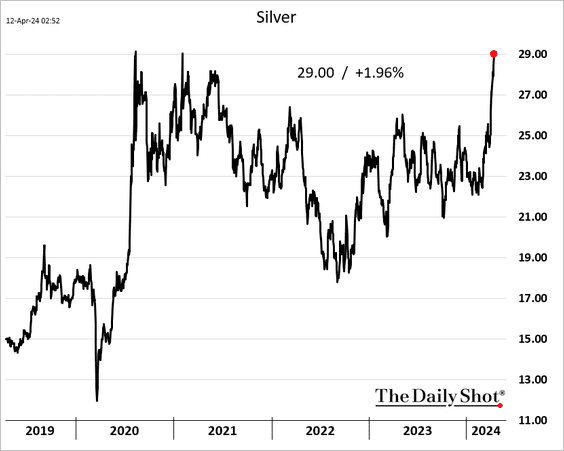

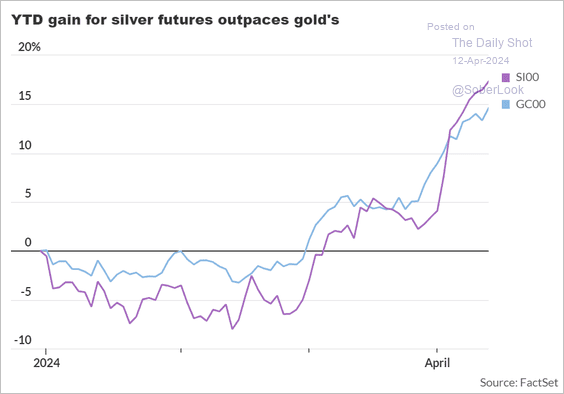

Commodities

1. Precious metals continue to surge.

• Gold:

• Silver:

Silver has outperformed gold this year.

Source: MarketWatch Read full article

Source: MarketWatch Read full article

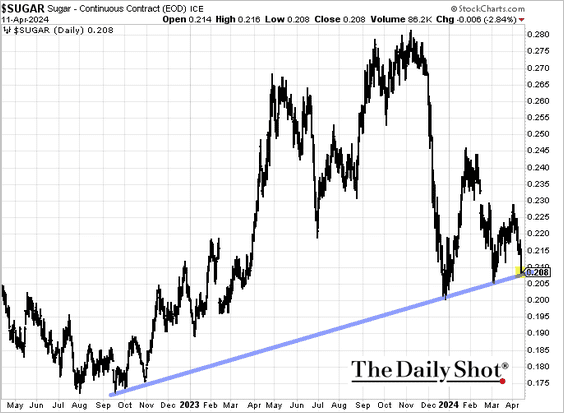

——————–

2. Sugar futures are testing support.

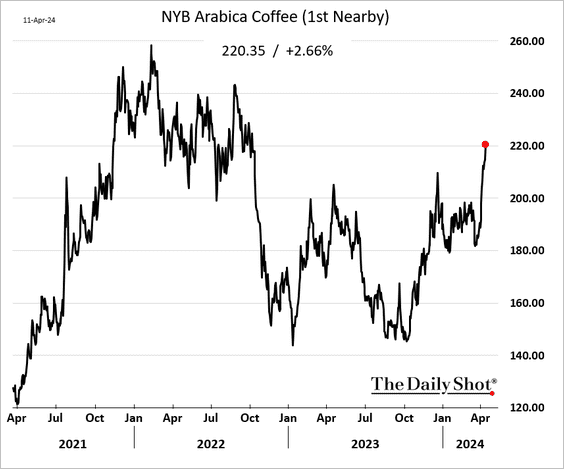

3. Coffee futures continue to climb.

Back to Index

Energy

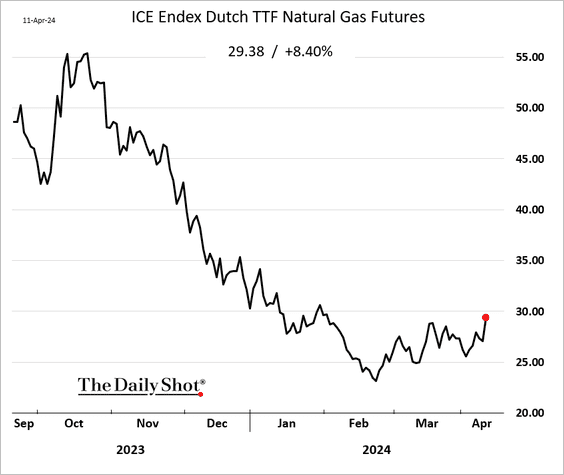

1. European natural gas has been rising as Russia targets Ukraine’s natural gas storage facilities.

Source: Reuters Read full article

Source: Reuters Read full article

——————–

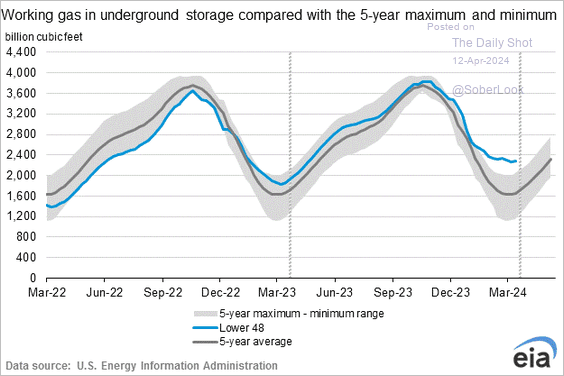

2. US natural gas in storage remains well above its five-year range.

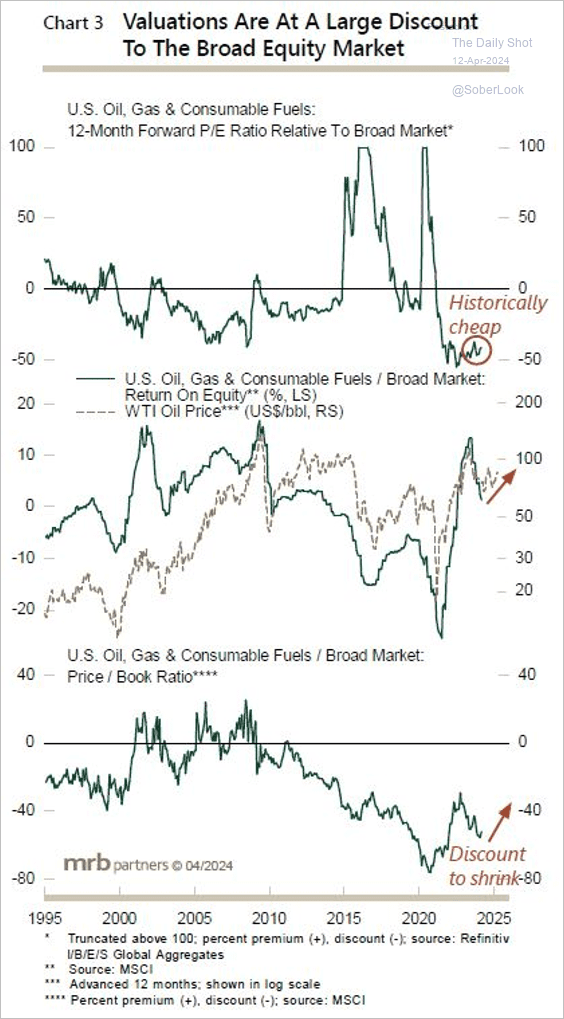

3. US oil and gas stocks still trade at a significant valuation discount relative to the broader market.

Source: MRB Partners

Source: MRB Partners

Back to Index

Equities

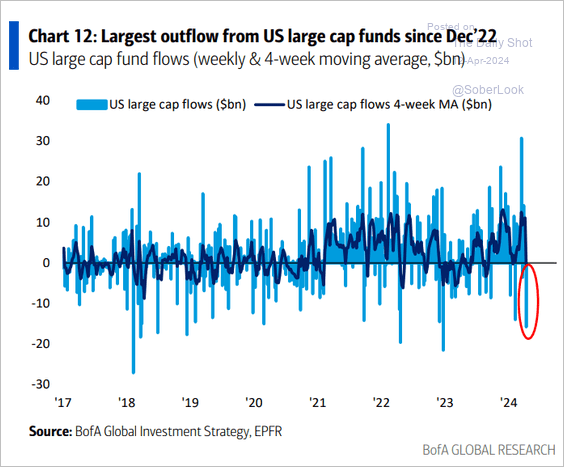

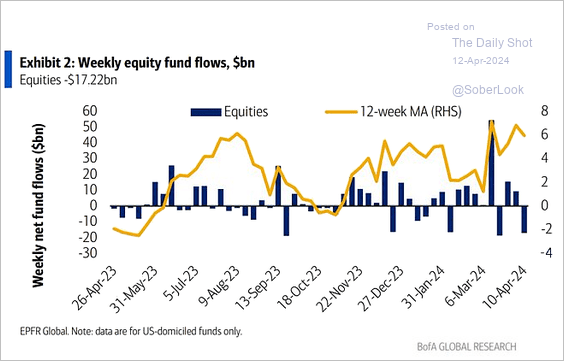

1. Equity funds are seeing some outflows.

Source: BofA Global Research

Source: BofA Global Research

Source: BofA Global Research

Source: BofA Global Research

——————–

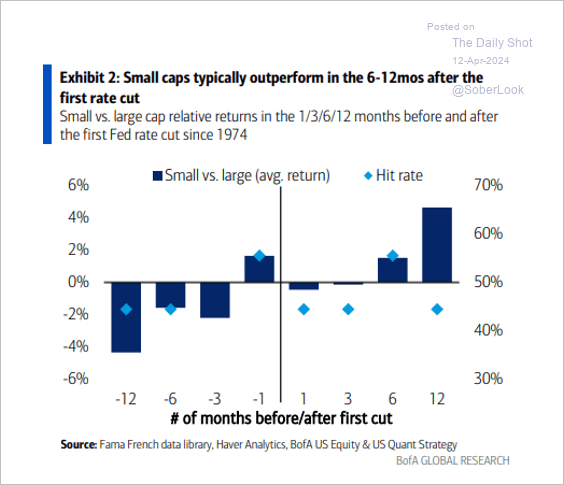

2. Small caps typically perform well following the first Fed rate cut, which may not occur for some time

Source: BofA Global Research

Source: BofA Global Research

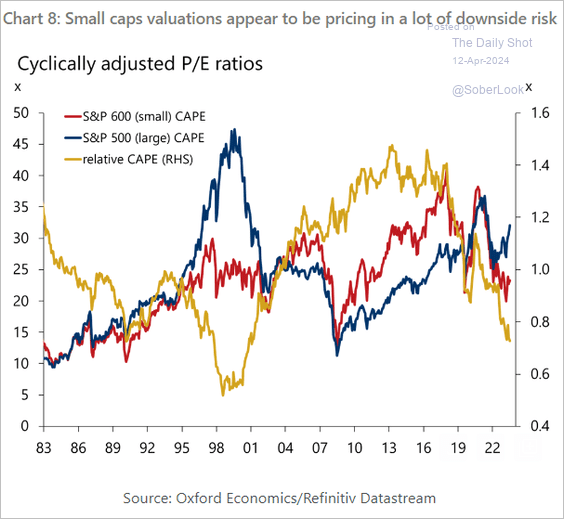

• Small caps are pricing in a lot of downside risk.

Source: Oxford Economics

Source: Oxford Economics

——————–

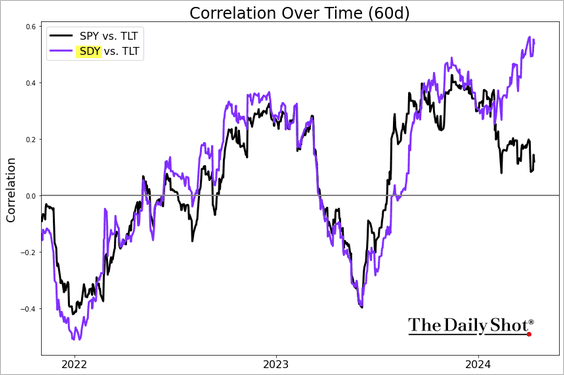

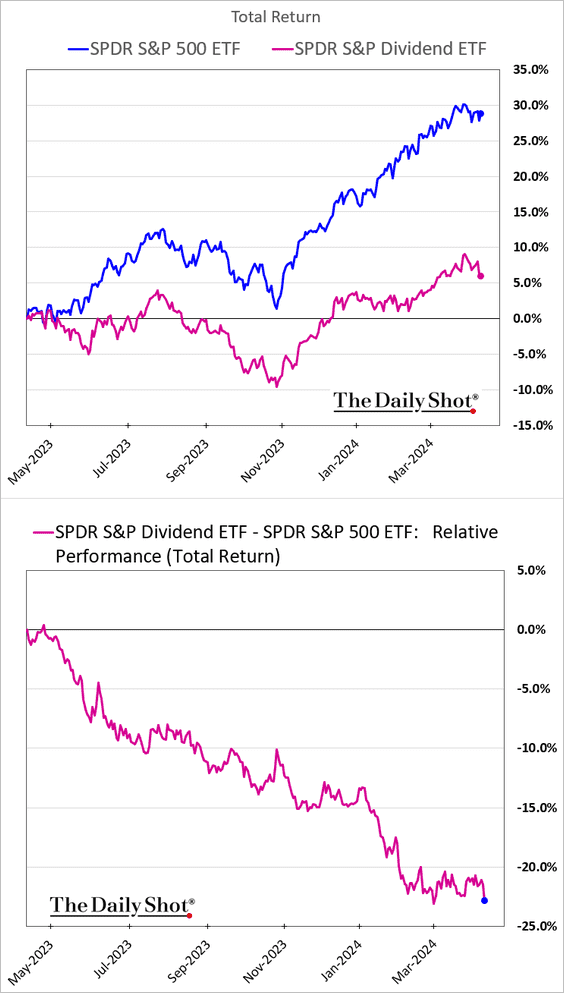

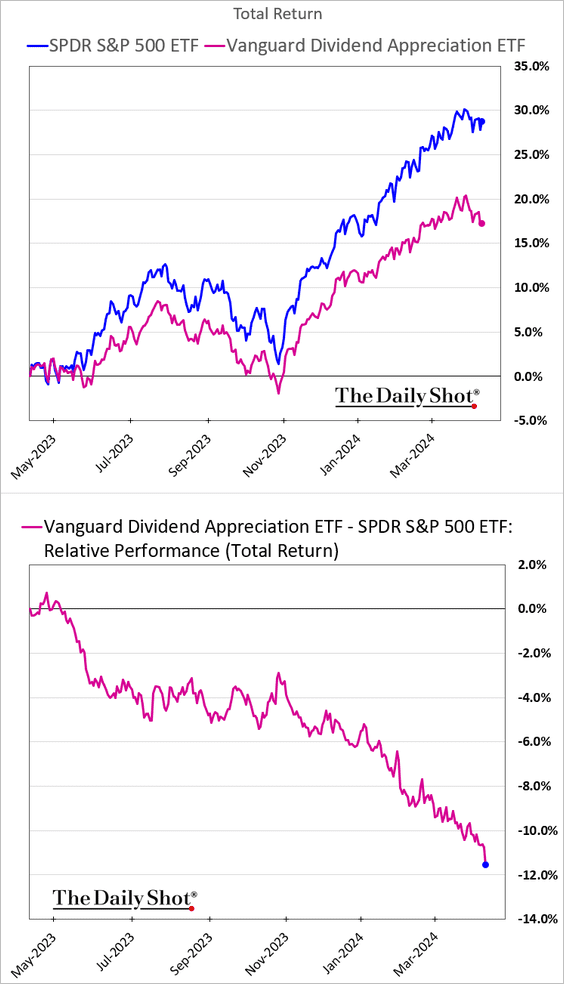

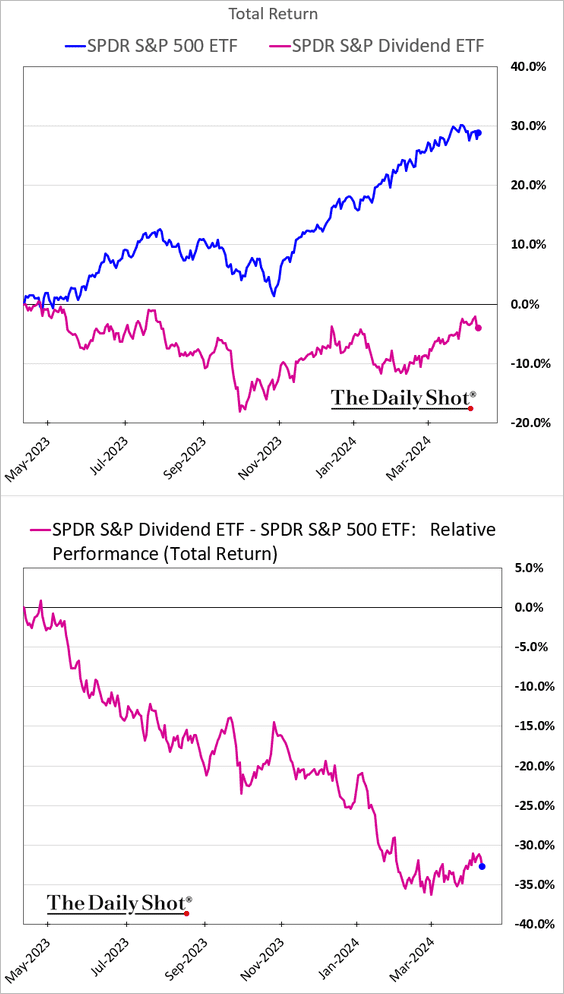

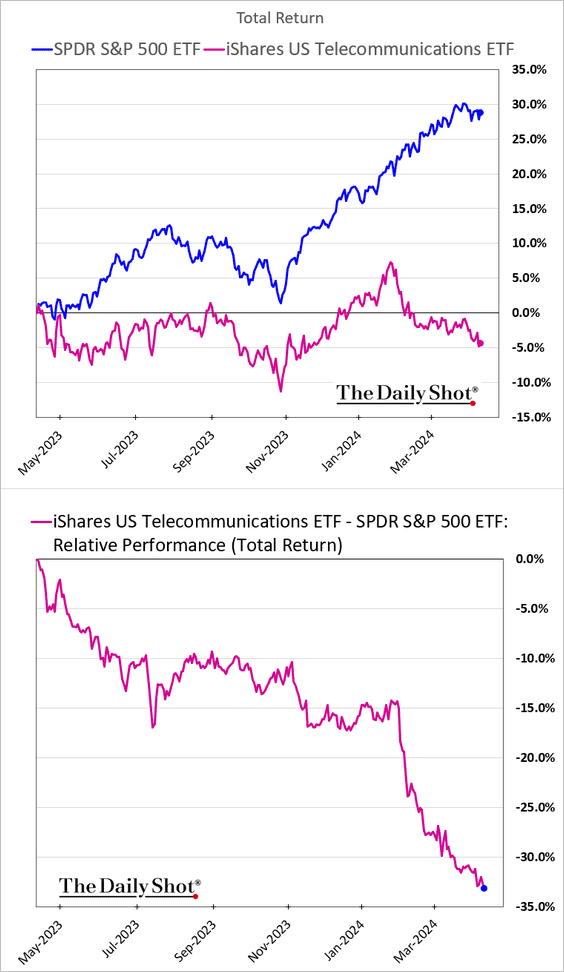

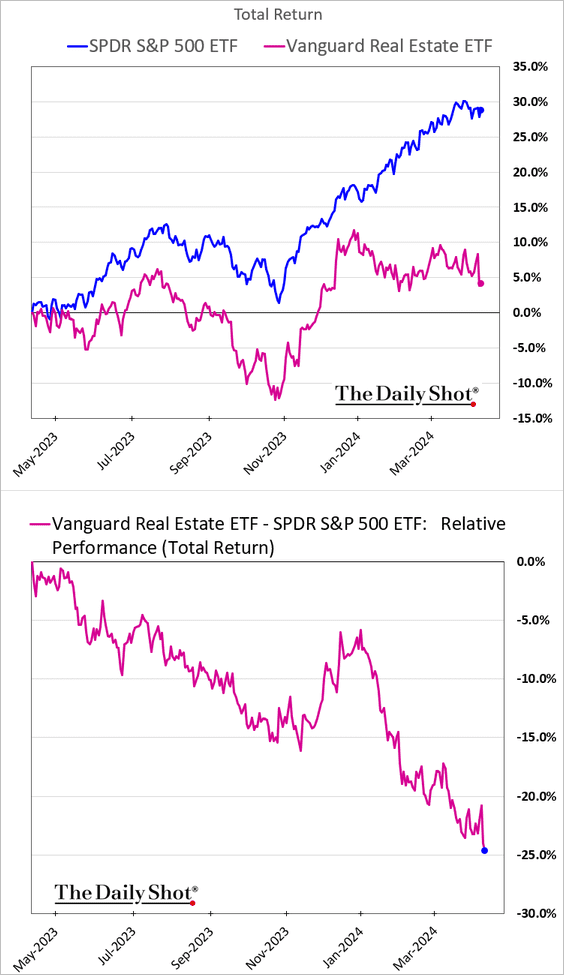

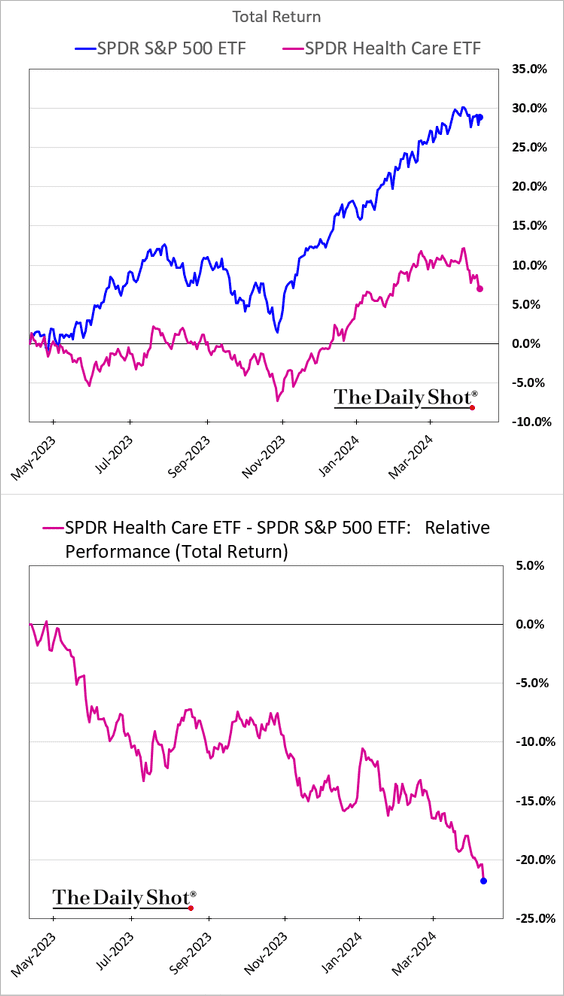

3. High-dividend stocks are now much more exposed to rates than the S&P 500.

As a result, we are seeing substantial underperformance for high-dividend sectors.

Dividend growers are also underperforming.

Here are some examples.

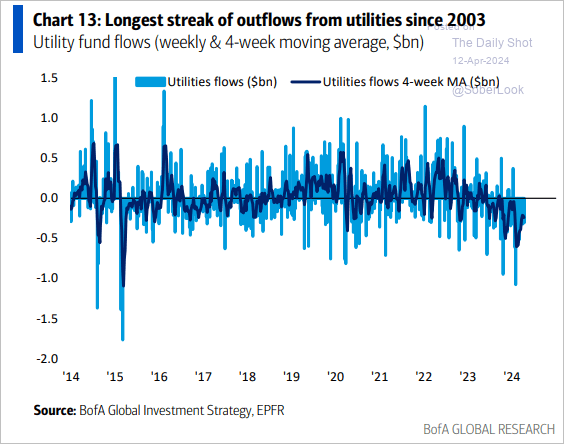

– Utilities:

Source: BofA Global Research

Source: BofA Global Research

– Telecoms:

– REITs:

Source: @business Read full article

Source: @business Read full article

• Healthcare stocks are also struggling.

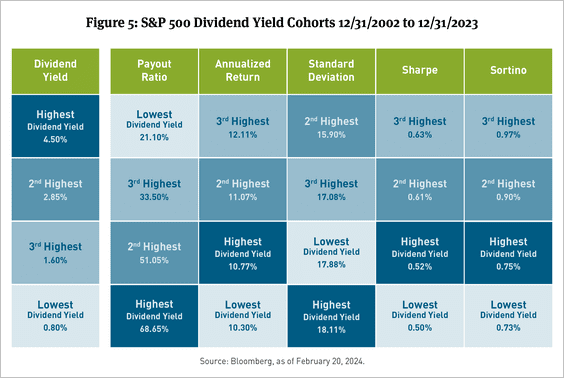

• Historically, the highest dividend yielding companies in the S&P 500 have elevated payout ratios, but that has not necessarily translated into outperformance or sustainable dividend payments going forward.

Source: Breckinridge Read full article

Source: Breckinridge Read full article

Back to Index

Rates

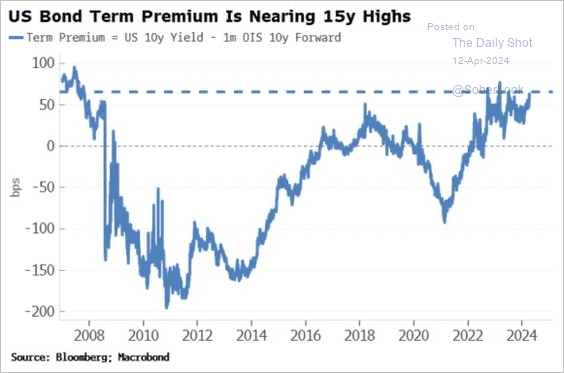

1. Investors are demanding extra premiums for rising inflation risks.

Source: Simon White, Bloomberg Markets Live Blog

Source: Simon White, Bloomberg Markets Live Blog

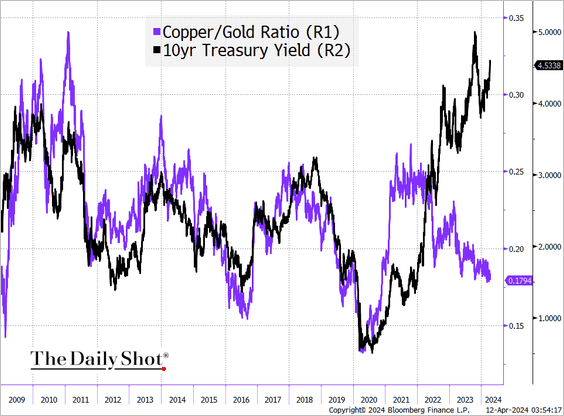

2. Treasury yields have diverged further from the copper-to-gold ratio.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

Back to Index

Global Developments

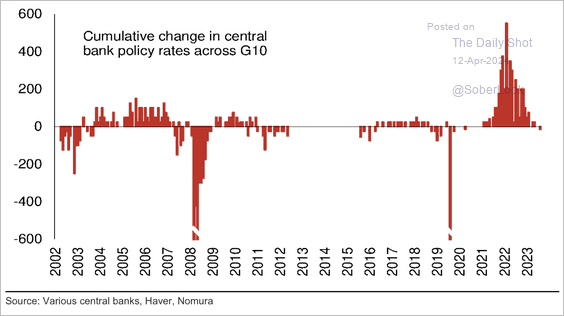

1. March was the first month of lower G10 policy rates since 2020.

Source: Nomura Securities

Source: Nomura Securities

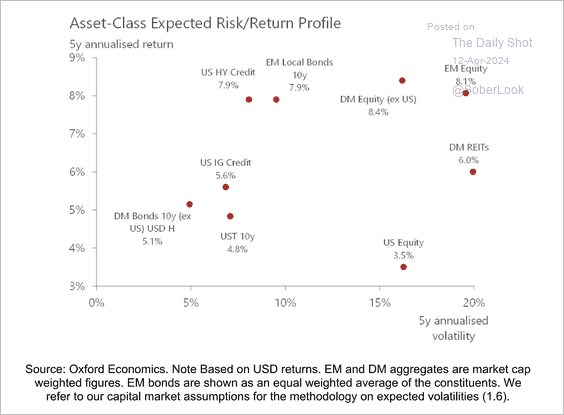

2. Here is a look at risk/reward across assets.

Source: Oxford Economics

Source: Oxford Economics

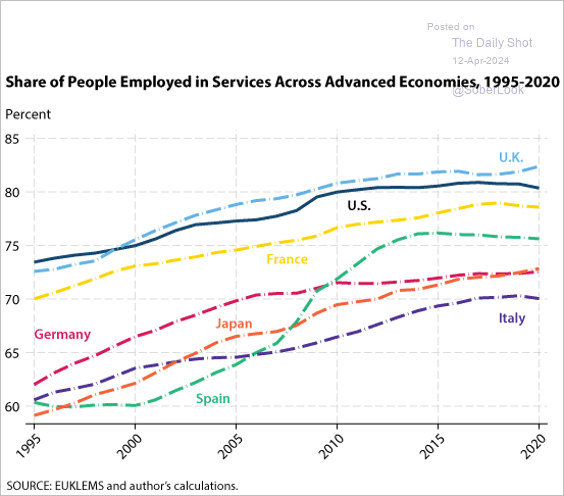

3. This chart shows the services sector employment in advanced economies.

Source: Federal Reserve Bank of St. Louis Read full article

Source: Federal Reserve Bank of St. Louis Read full article

——————–

Food for Thought

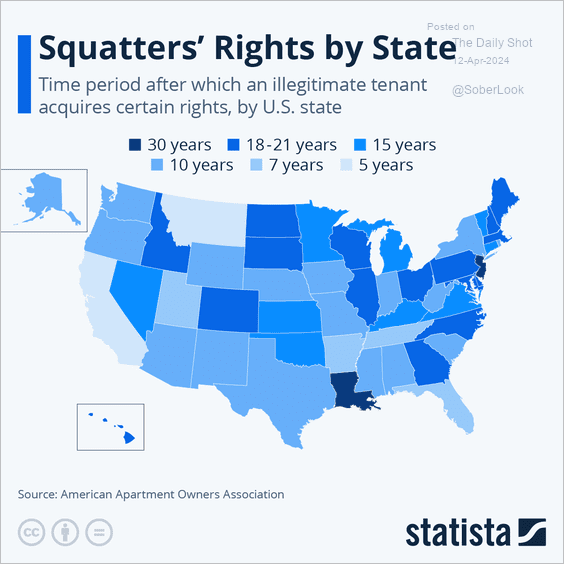

1. Duration of adverse possession laws by state:

Source: Statista

Source: Statista

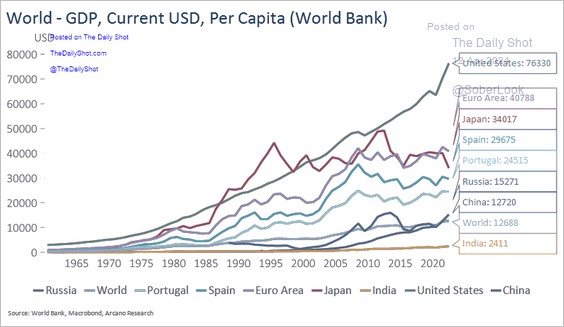

2. GDP per capita:

Source: Arcano Economics

Source: Arcano Economics

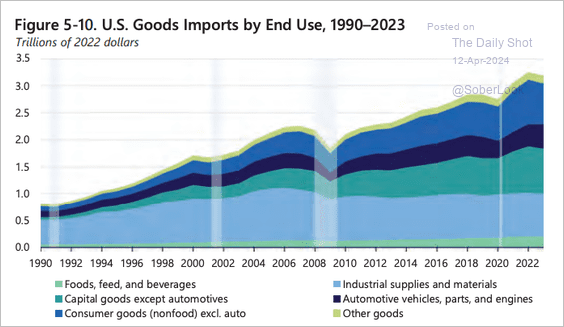

3. US goods imports by end use:

Source: Council of Economic Advisers Read full article

Source: Council of Economic Advisers Read full article

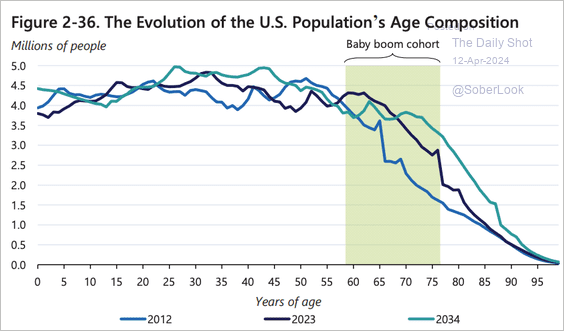

4. Shifting age demographics:

Source: Council of Economic Advisers Read full article

Source: Council of Economic Advisers Read full article

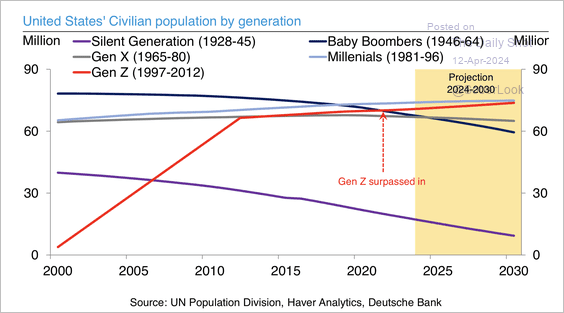

• Gen Z now outnumbers baby boomers.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

——————–

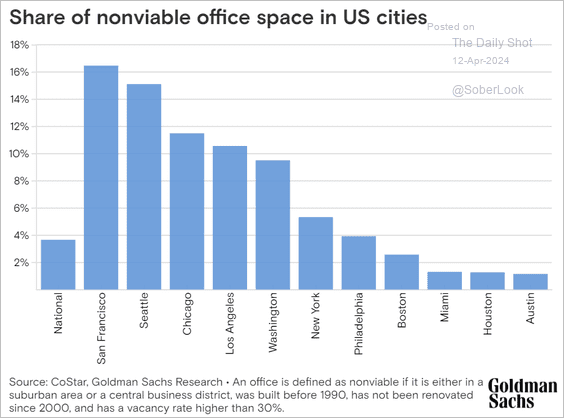

5. Office space that is no longer viable to be used for its intended purposes:

Source: Goldman Sachs

Source: Goldman Sachs

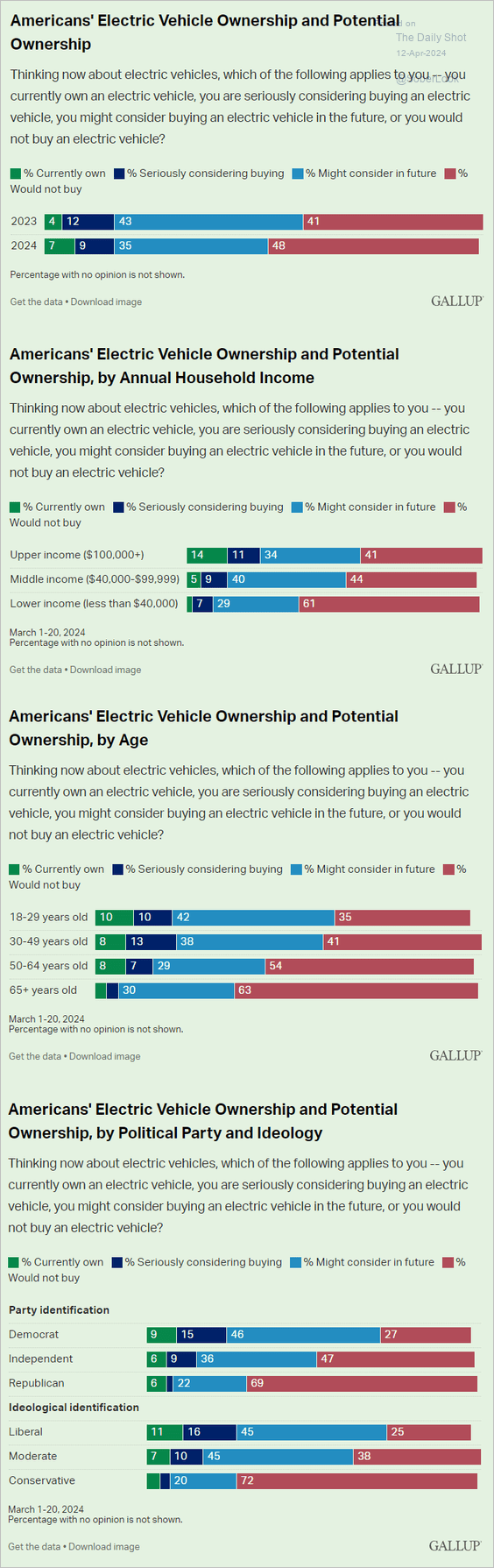

6. Interest in electric vehicles among Americans by income, age, and political ideology:

Source: Gallup Read full article

Source: Gallup Read full article

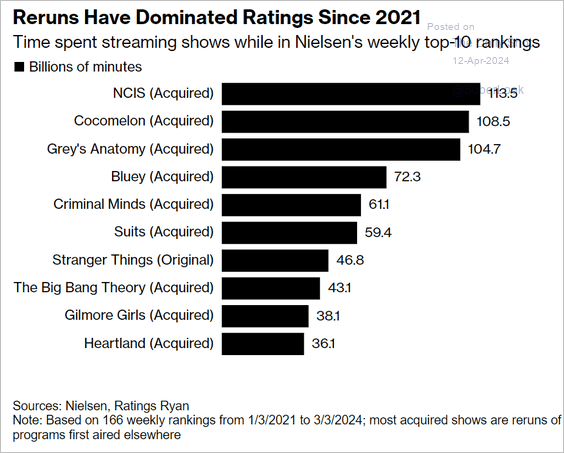

7. Most streamed shows on Netflix since 2021:

Source: @technology Read full article

Source: @technology Read full article

——————–

Have a great weekend!

Back to Index