The Daily Shot: 11-Apr-24

• The United States

• Canada

• Europe

• Asia-Pacific

• China

• Emerging Markets

• Commodities

• Energy

• Equities

• Credit

• Rates

• Global Developments

• Food for Thought

The United States

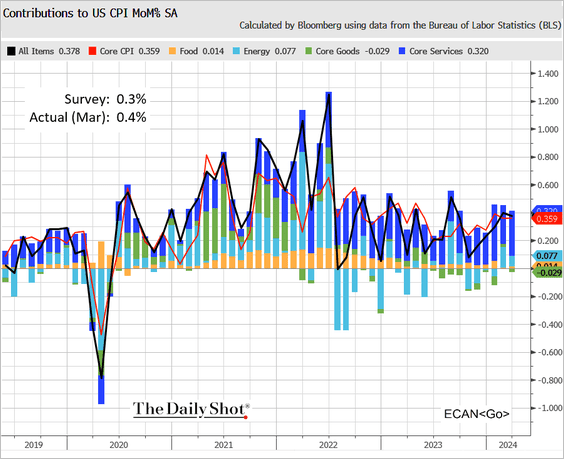

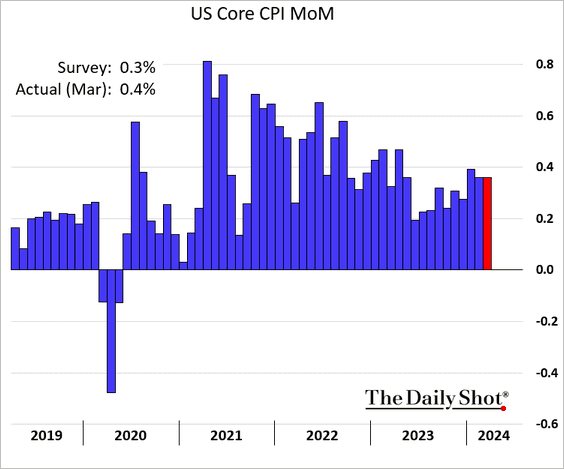

1. The March CPI report exceeded expectations, suggesting that inflation remains sticky and achieving a 2% rate may take longer than many economists initially projected.

– Headline CPI (monthly changes and contributions):

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

– Core CPI:

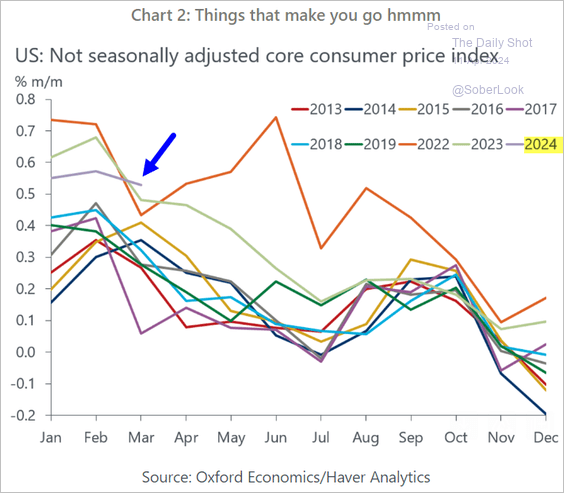

• Here are the monthly changes in the core CPI without the seasonal adjustments.

Source: Oxford Economics

Source: Oxford Economics

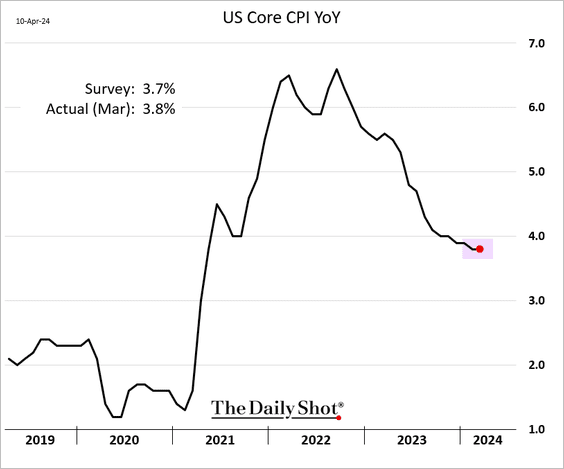

– On a year-over-year basis, the declines in the core CPI have stalled.

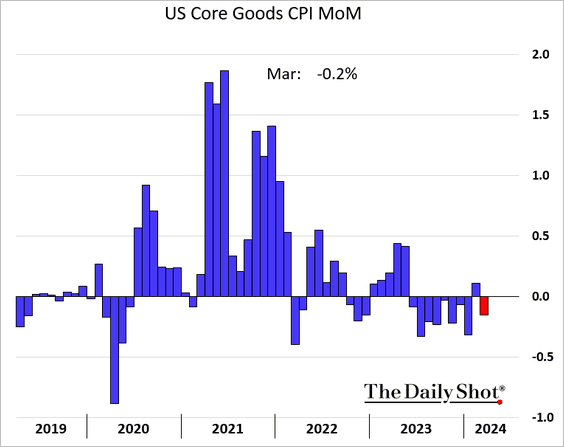

• The core goods CPI declined in March, …

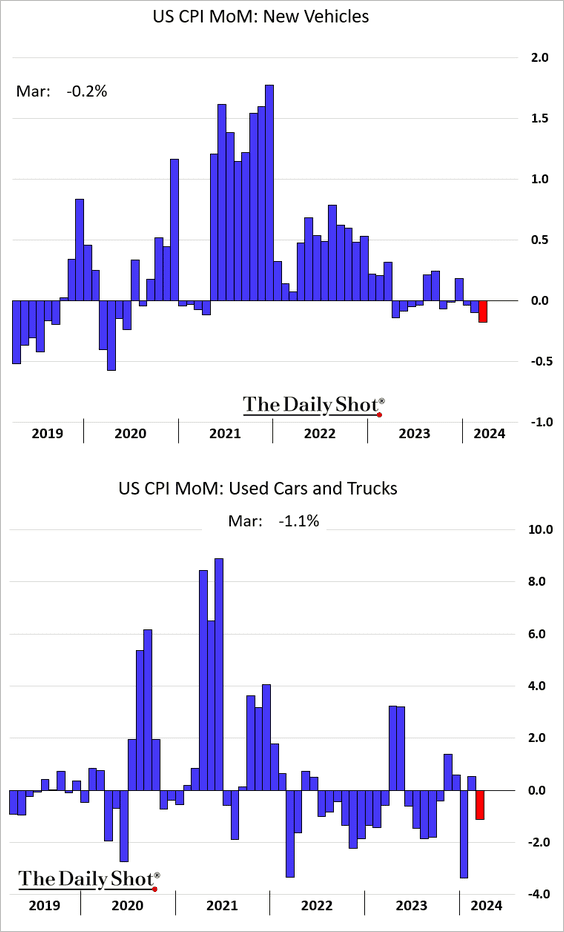

… with vehicle prices decreasing, although not as much as some economists had hoped.

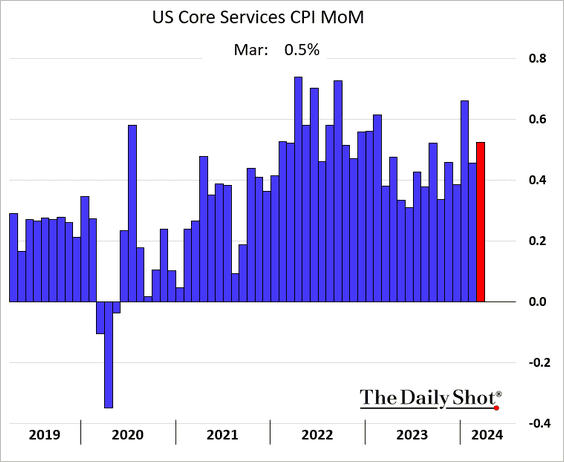

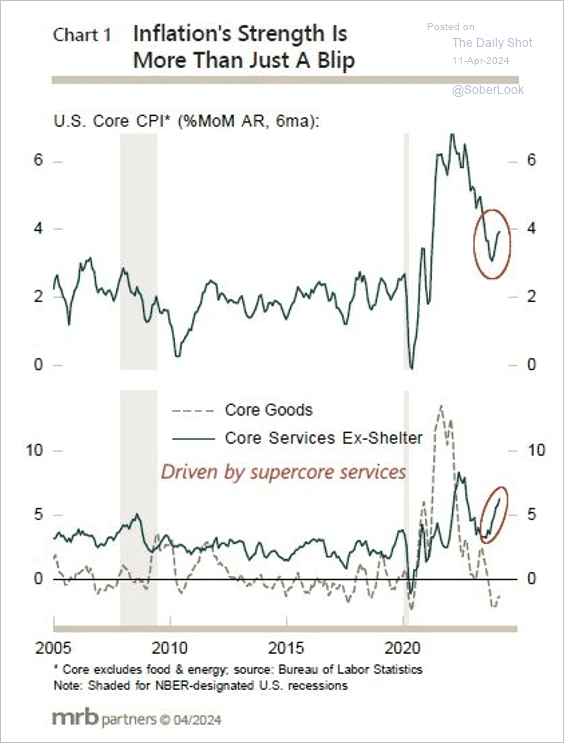

• The recent inflationary pressures have been all about services, …

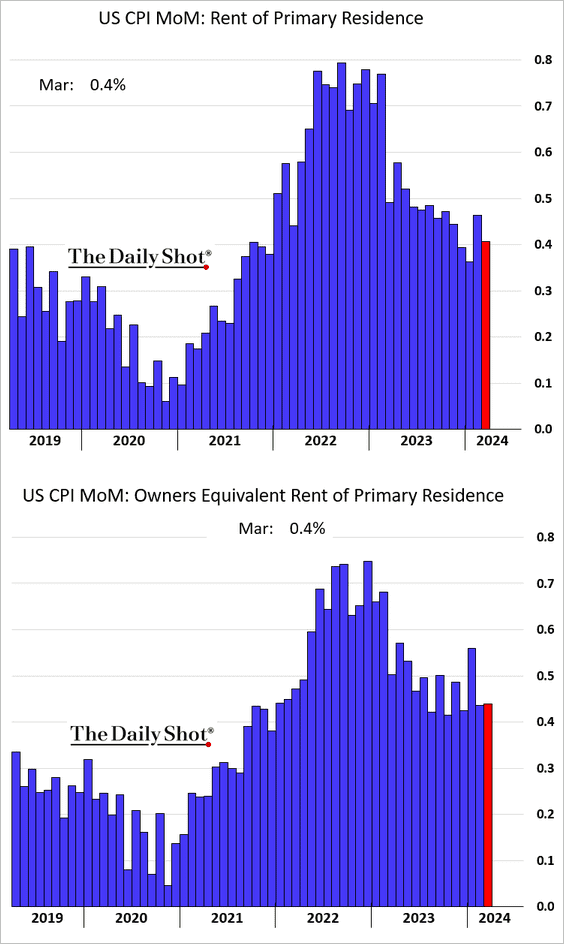

… as housing-related price gains remain elevated.

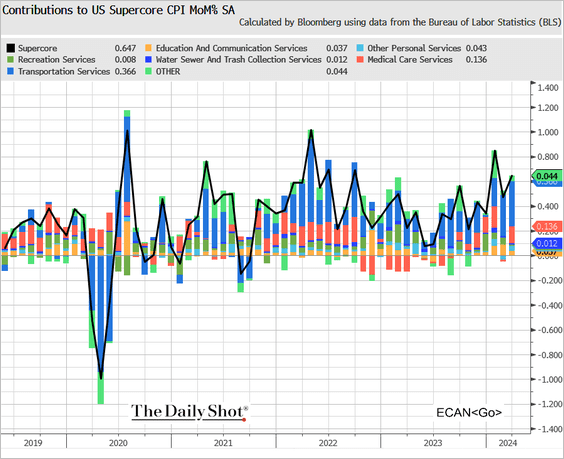

– The supercore CPI was well above forecasts (2 charts), …

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: MRB Partners

Source: MRB Partners

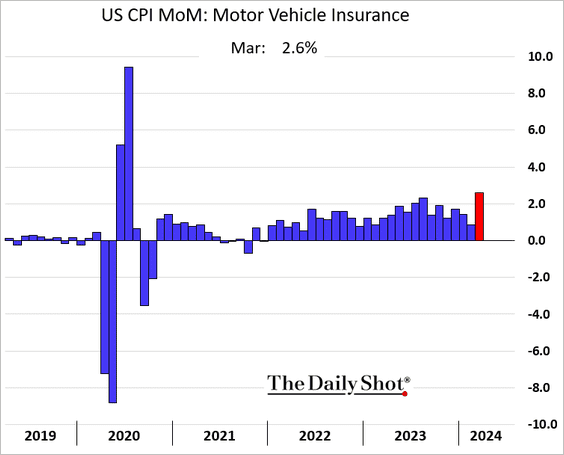

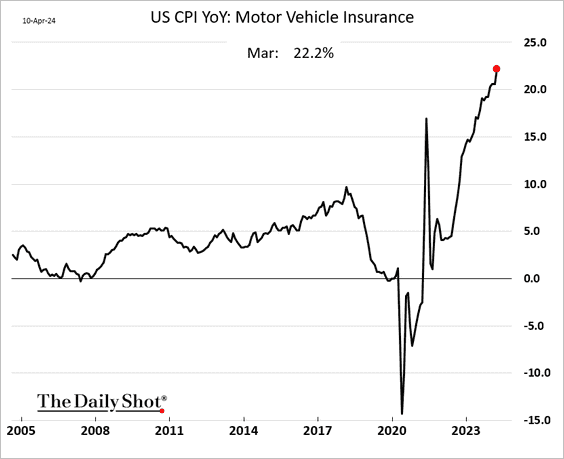

… with the March gains driven by vehicle insurance …

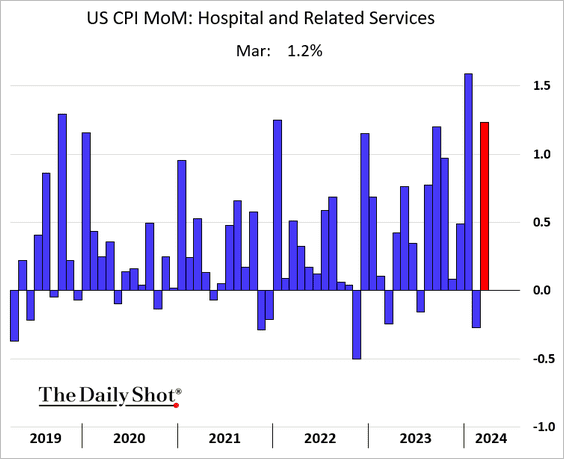

… and to a lesser extent, healthcare.

We will have more on the CPI report tomorrow.

——————–

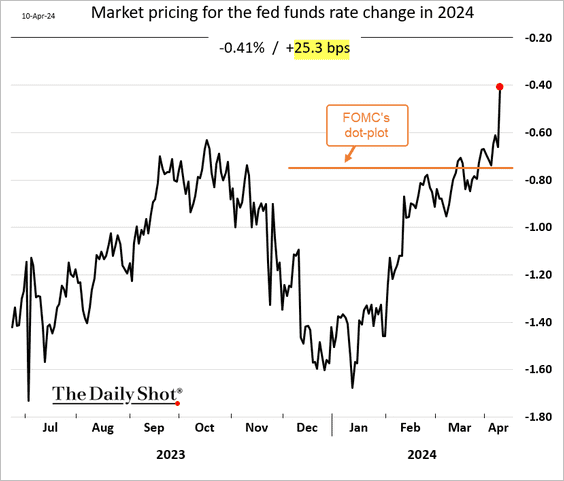

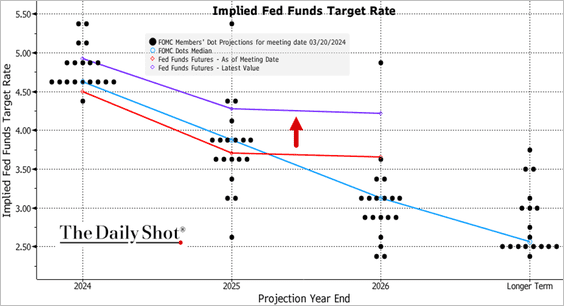

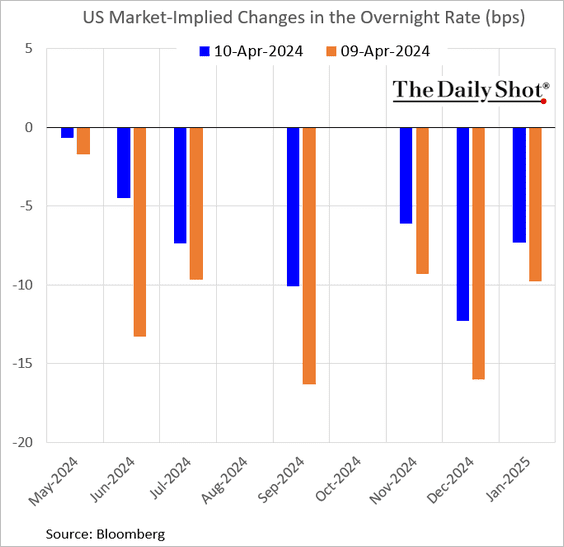

2. The market is now pricing only 41 bps of Fed rate cuts this year, …

… fading the FOMC’s dot plot.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

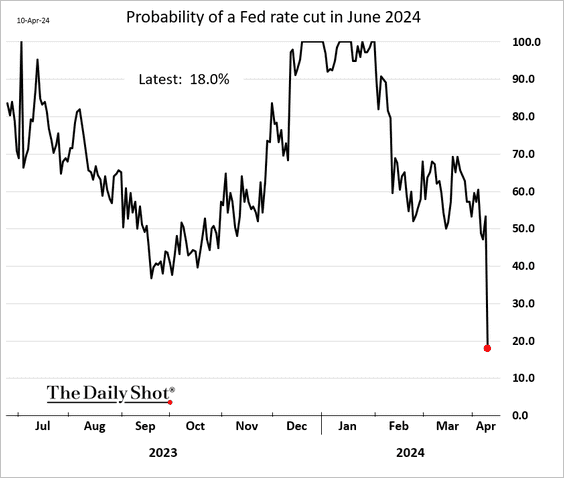

– The probability of a Fed rate cut in June has collapsed. Will we see any rate reductions at all this summer?

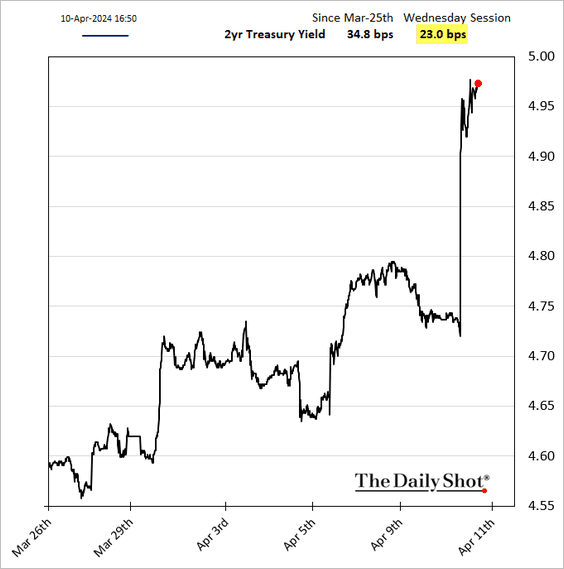

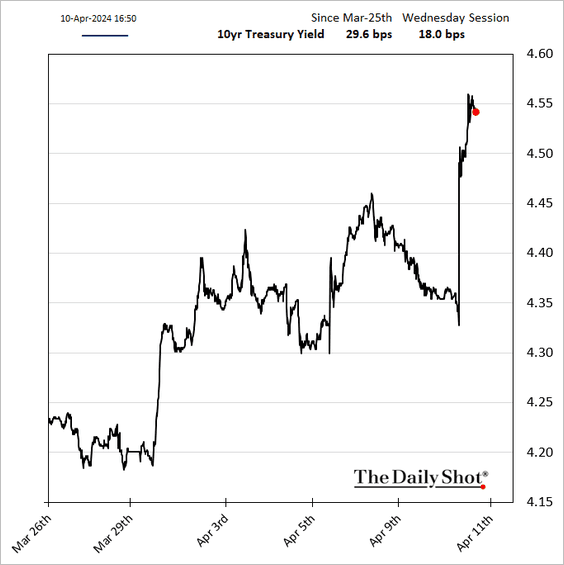

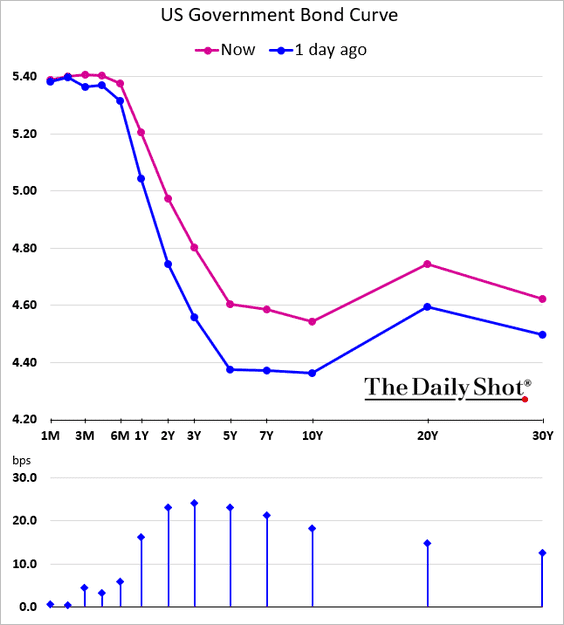

• Treasury yields surged, with the 2-year rate nearing 5%,

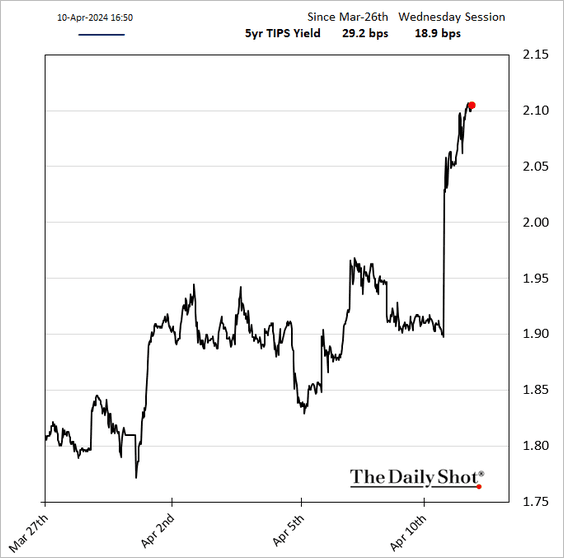

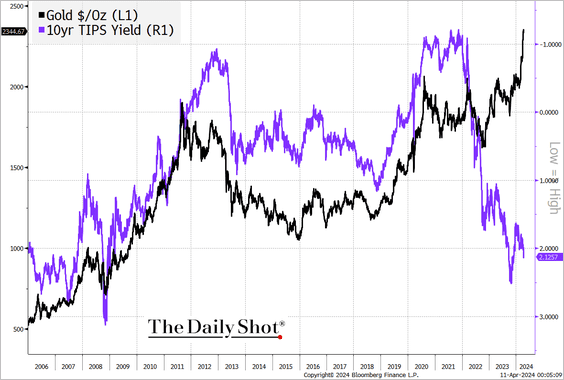

Real yields were higher as well.

• Short-term inflation expectations jumped.

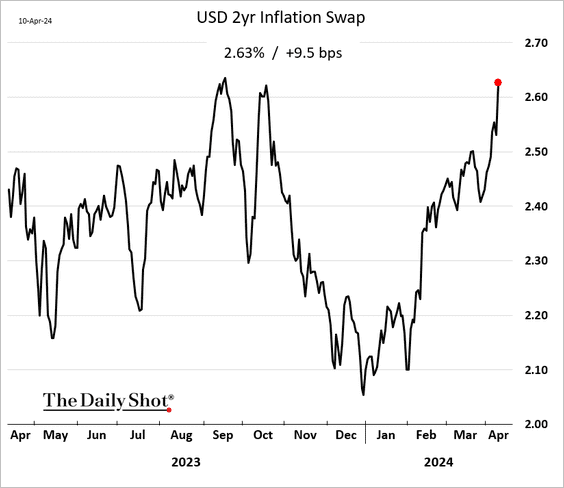

• Equities retreated.

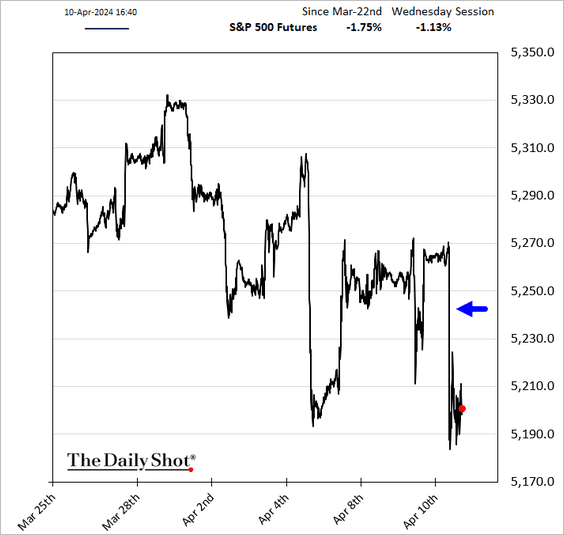

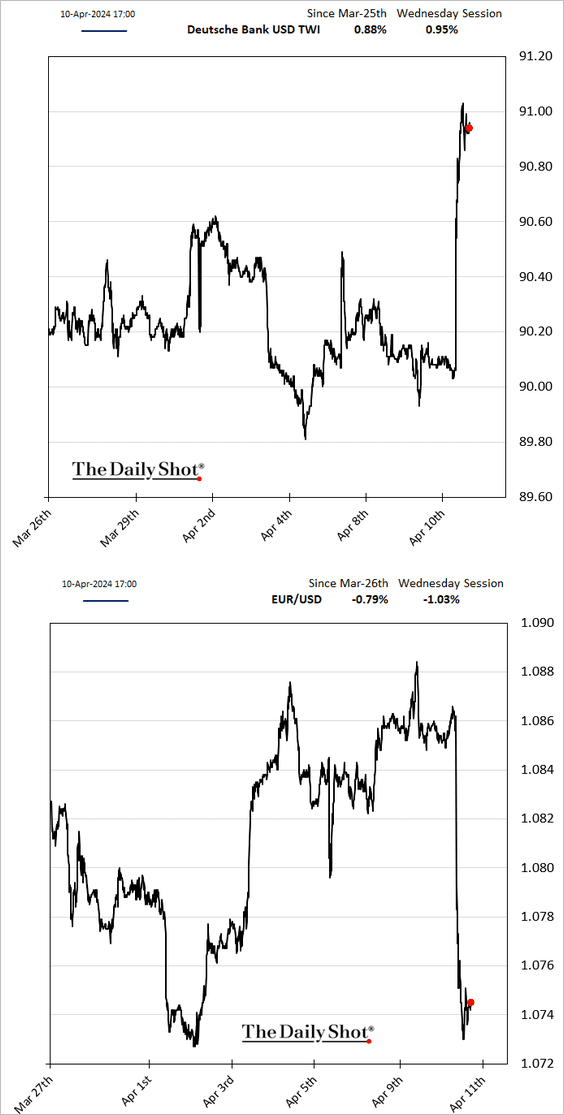

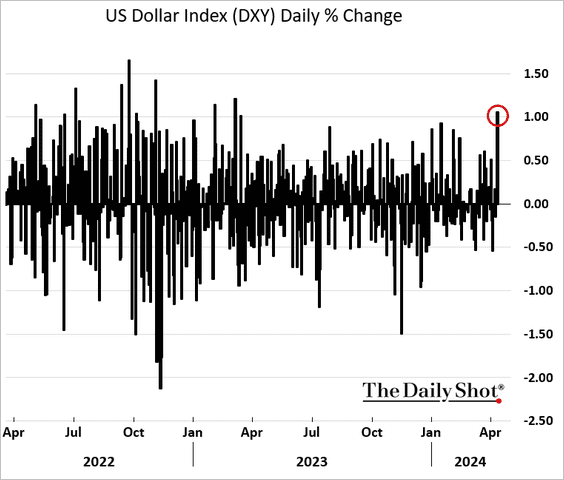

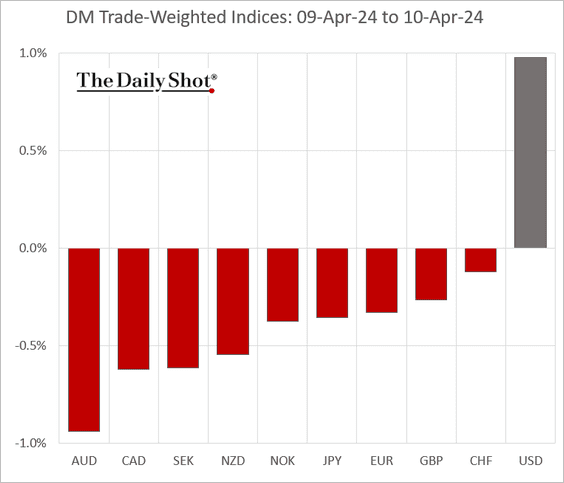

• The dollar moved sharply higher.

——————–

3. The Atlanta Fed’s wage growth tracker has been trending lower but remains close to 5%.

![]()

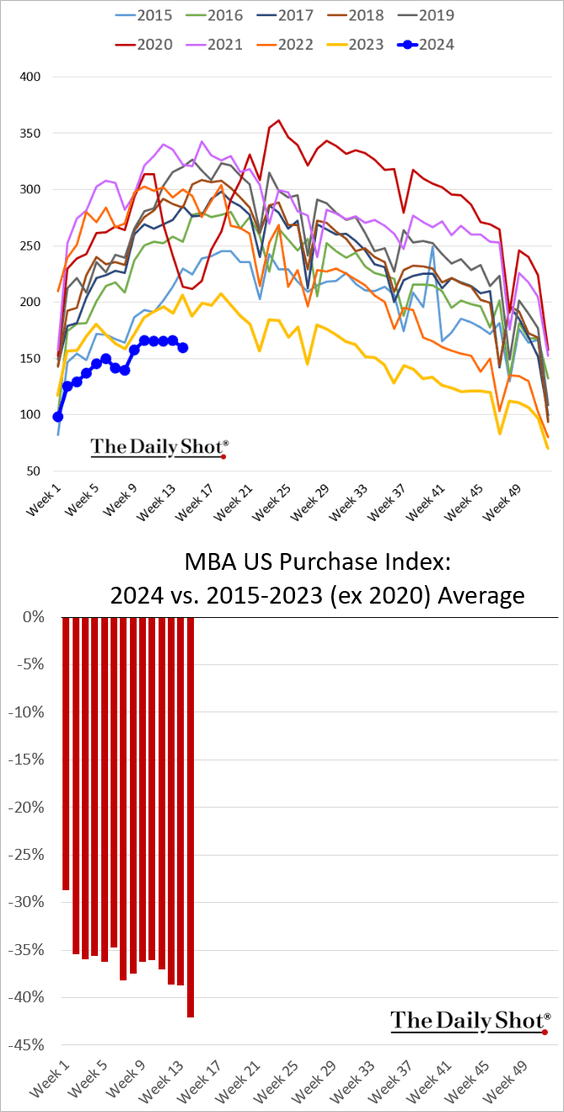

4. Mortgae applications were very soft last week.

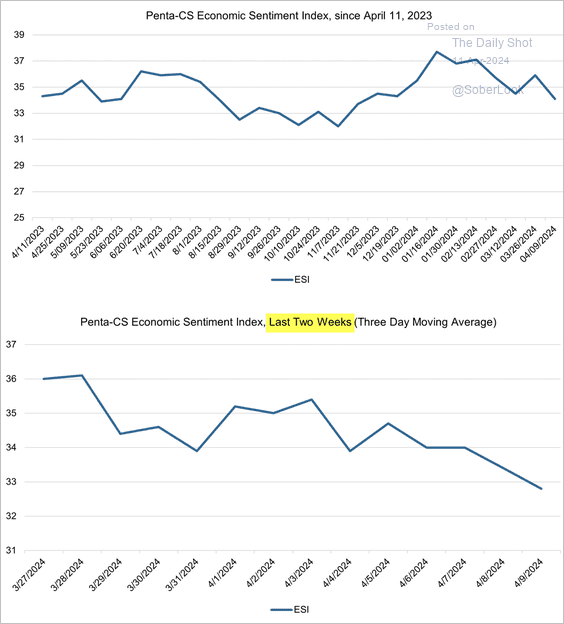

5. The Penta-CivicScience Economic Sentiment Index showed consumer mood deteriorating over the past couple of weeks as gasoline prices climbed.

Source: ESI Read full article

Source: ESI Read full article

Back to Index

Canada

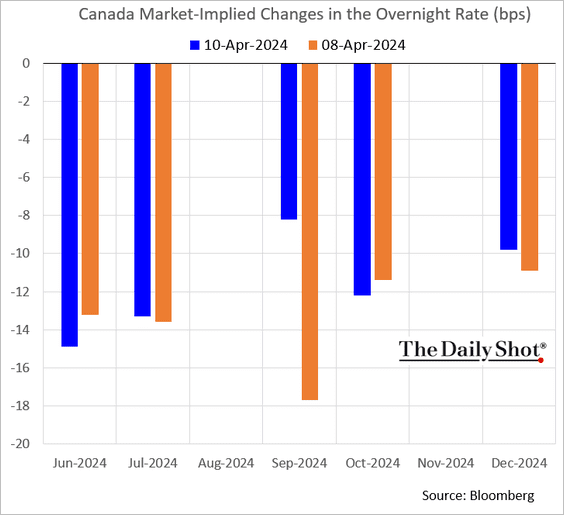

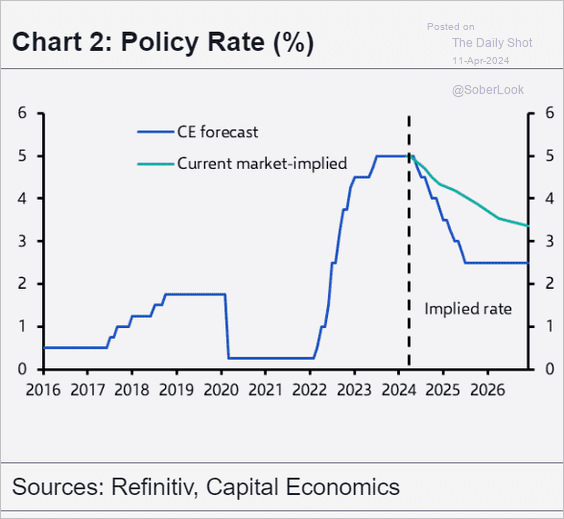

1. The BoC signaled a possible rate cut in June.

Source: Reuters Read full article

Source: Reuters Read full article

– Here is a forecast from Capital Economics.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

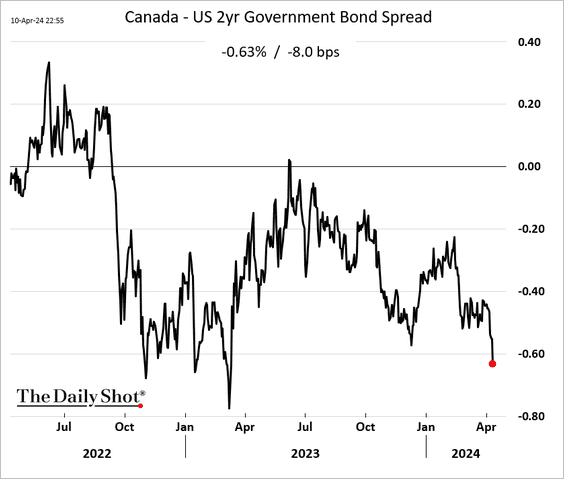

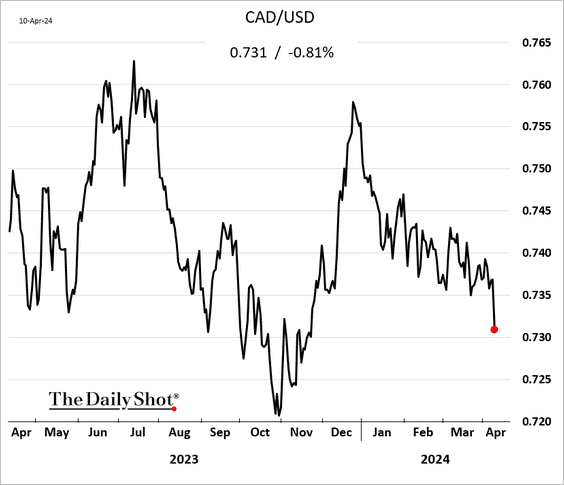

2. With the Fed likely on hold this summer, the US-Canada bond spreads widened further.

The loonie was sharply lower after the US CPI report.

——————–

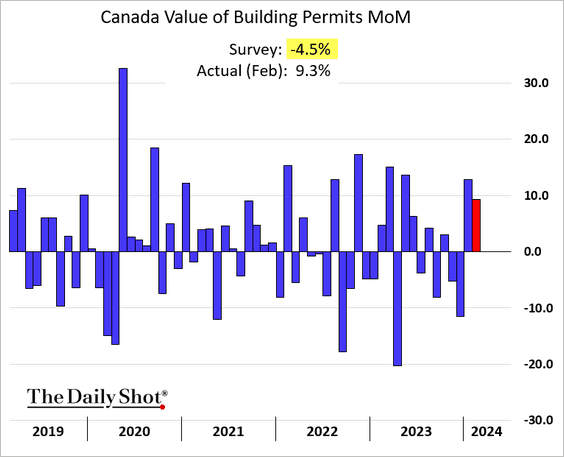

3. Building permits increased again in February.

Back to Index

Europe

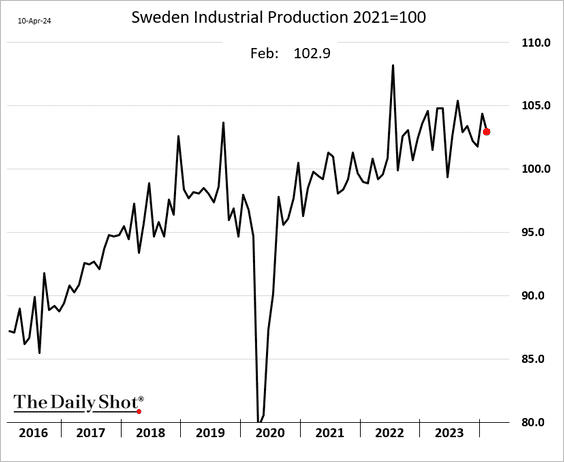

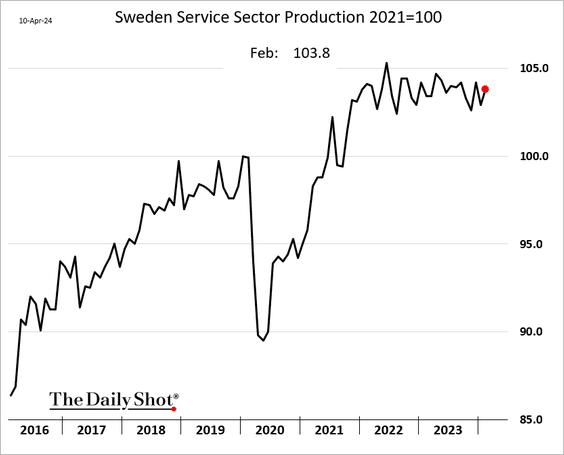

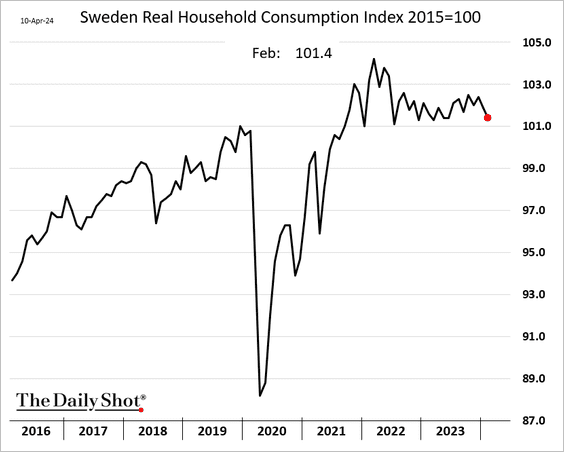

1. Sweden’s economic indicators were mixed in February.

• Industrial production:

• Services output:

• Household consumption:

——————–

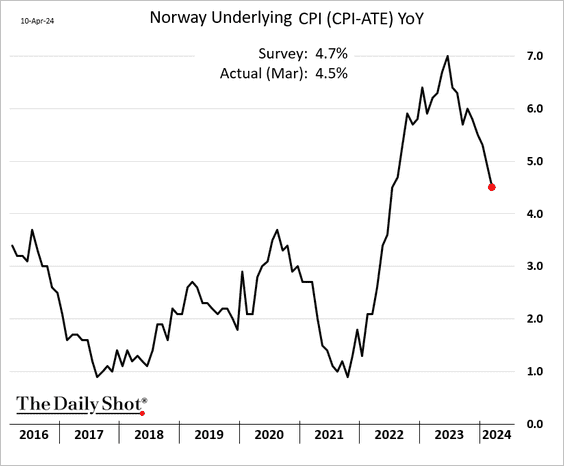

2. Norway’s CPI surprised to the downside.

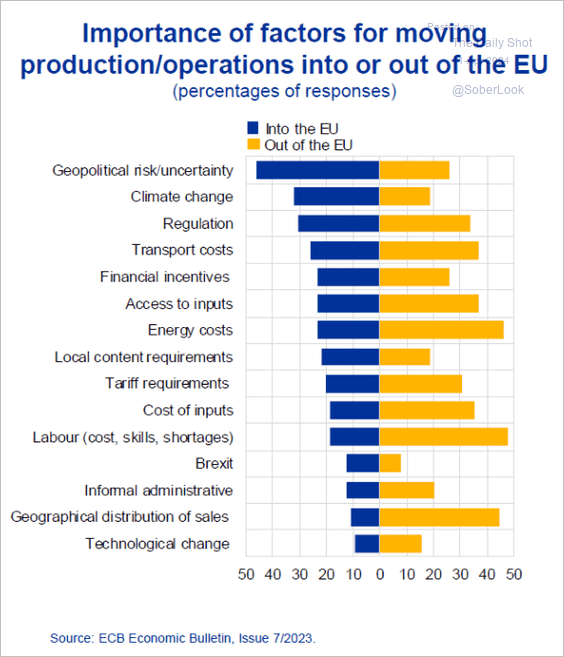

3. Here are the factors influencing company moves into or out of the EU in 2023.

Source: @Isabel_Schnabel

Source: @Isabel_Schnabel

Back to Index

Asia-Pacific

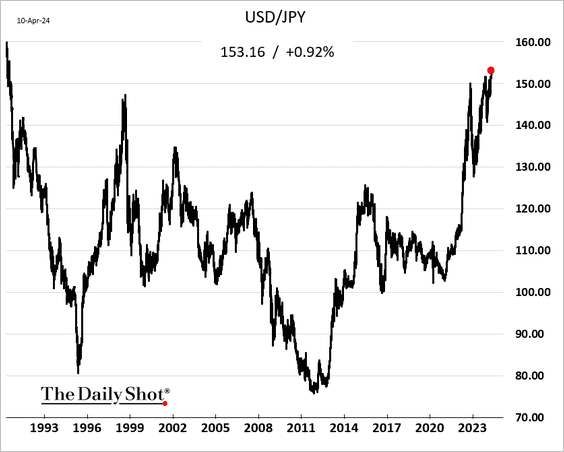

1. The yen hit the lowest level against the US dollar since 1990 after the hot US CPI report.

Source: Reuters Read full article

Source: Reuters Read full article

——————–

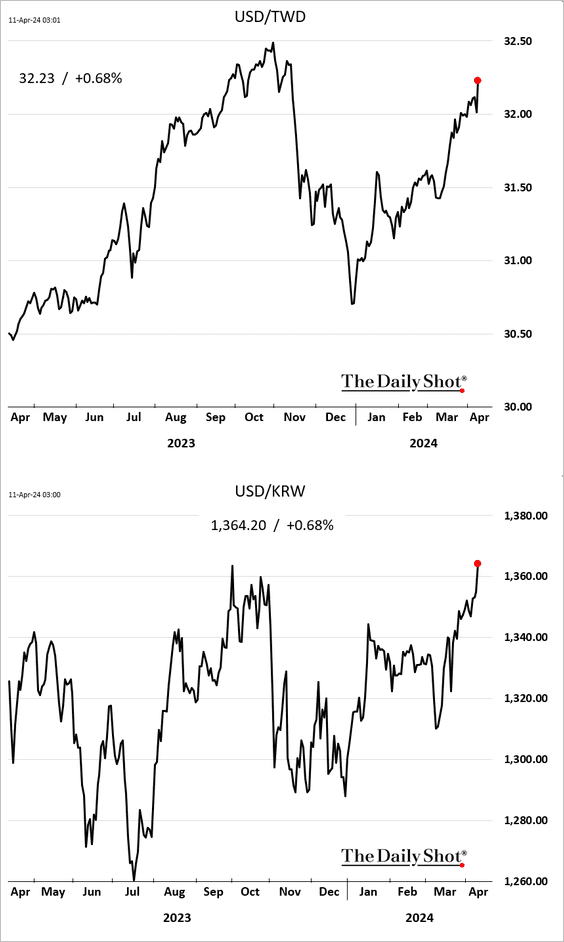

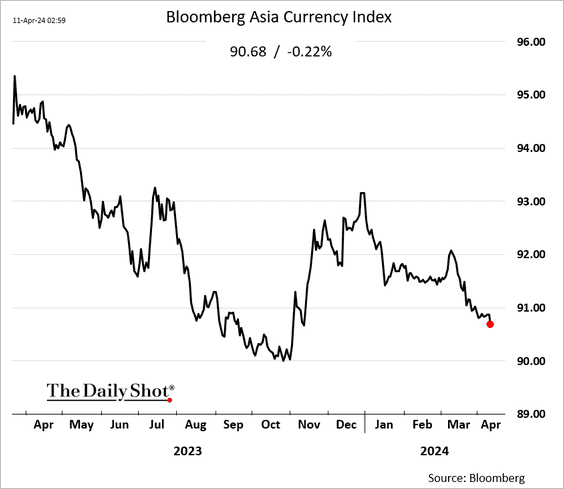

2. The US dollar climbed sharply against the Tawan dollar and the South Korean won.

Here is Bloomberg’s Asia currency index.

——————–

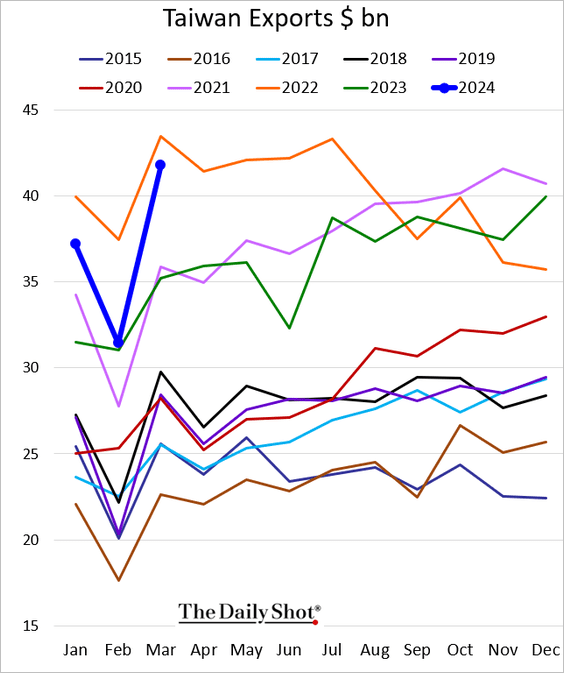

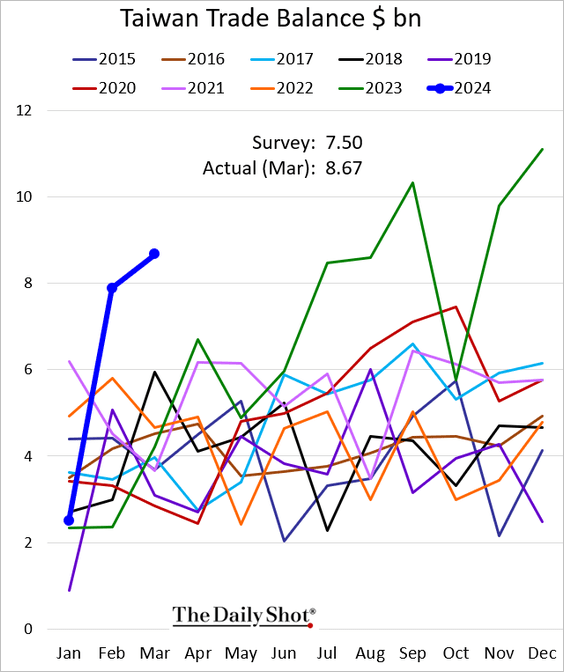

3. Taiwan’s exports surprised to the upside.

Source: @economics Read full article

Source: @economics Read full article

——————–

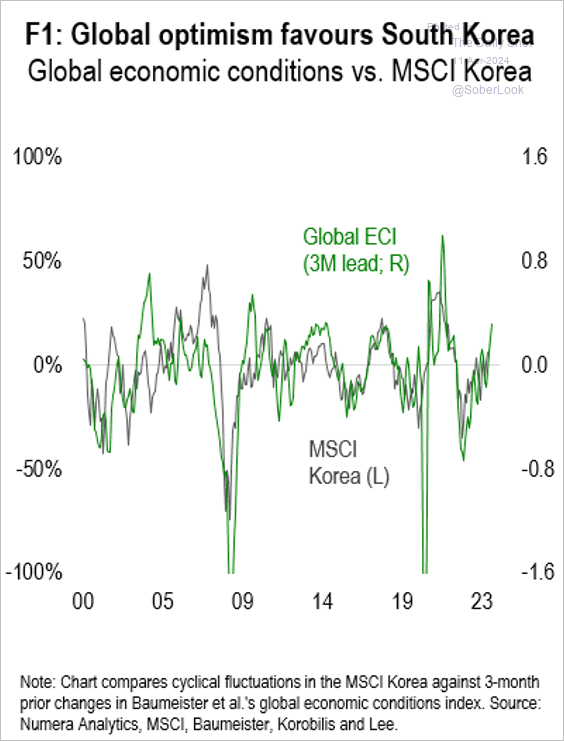

4. South Korean equities could benefit from improving global economic conditions.

Source: Numera Analytics (@NumeraAnalytics)

Source: Numera Analytics (@NumeraAnalytics)

Back to Index

China

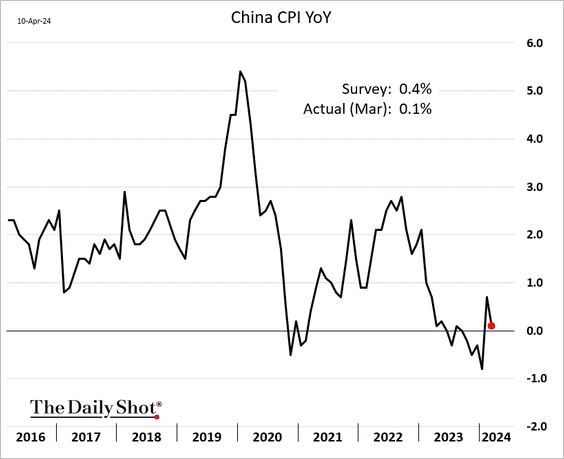

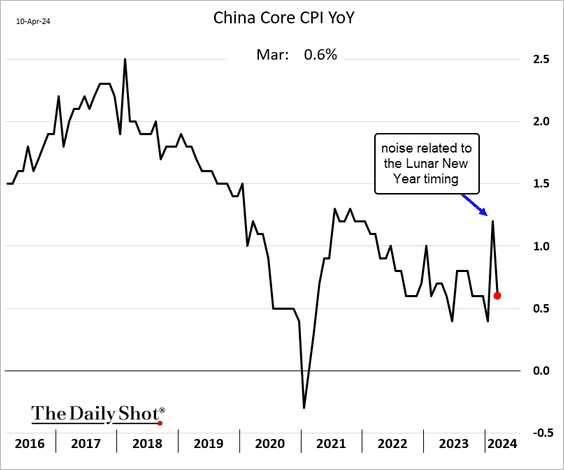

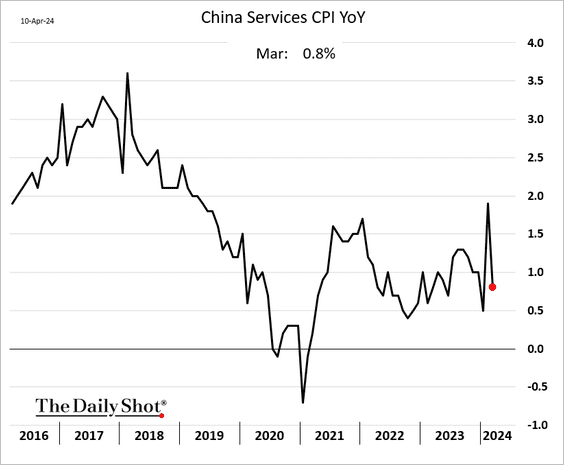

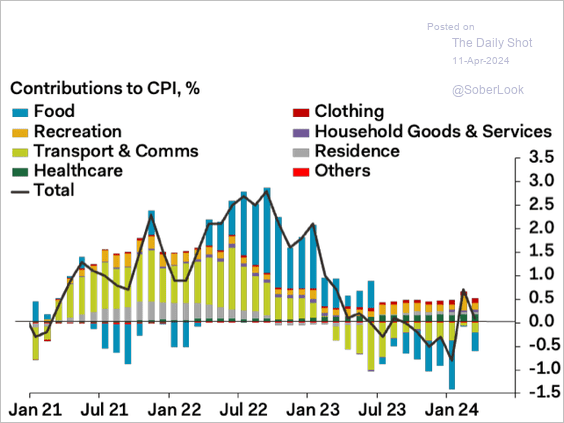

1. The CPI report was softer than expected, …

… with core inflation dipping back below 1%.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

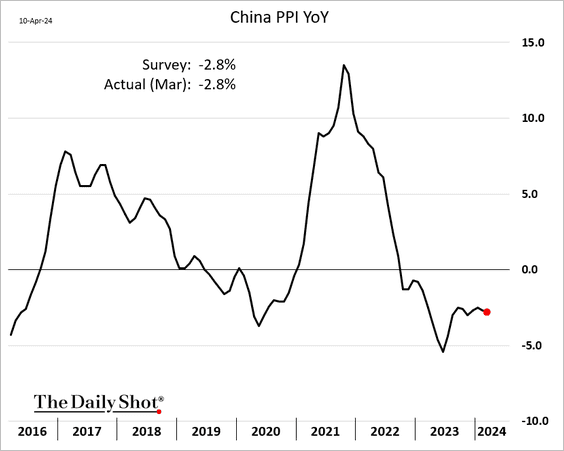

• The PPI remains deep in deflation territory.

——————–

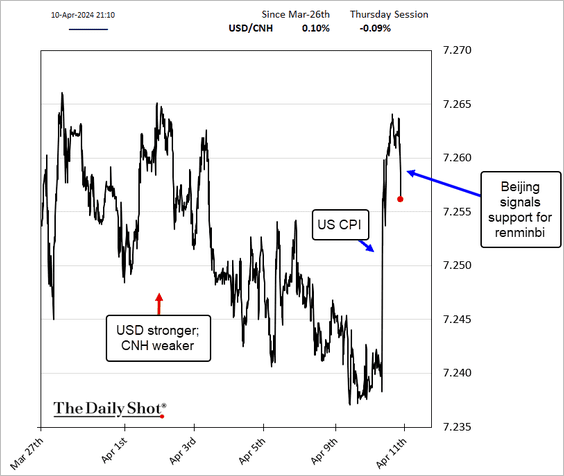

2. The renminbi took a hit after the US CPI report, but Beijing is trying to jawbone it higher.

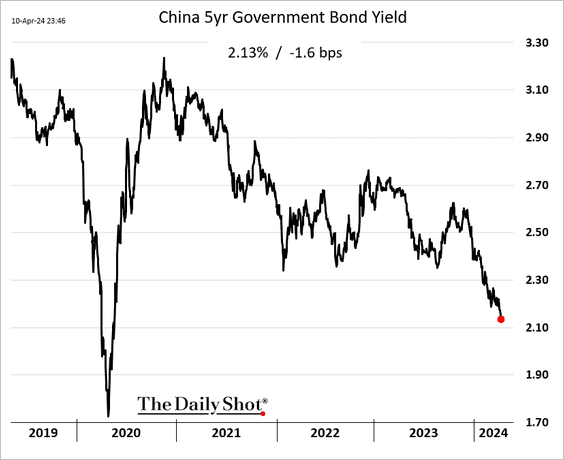

3. Bond yields continue to sink.

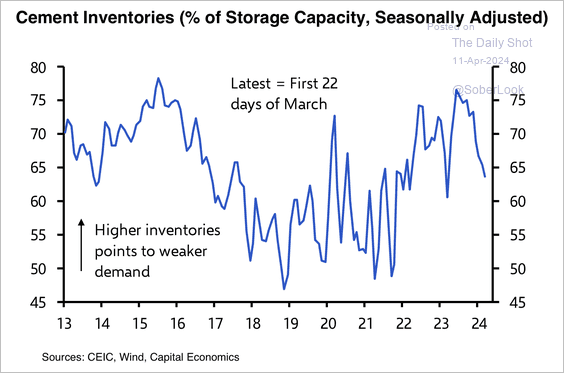

4. Cement inventories have fallen sharply, which could point to higher construction activity.

Source: Capital Economics

Source: Capital Economics

Back to Index

Emerging Markets

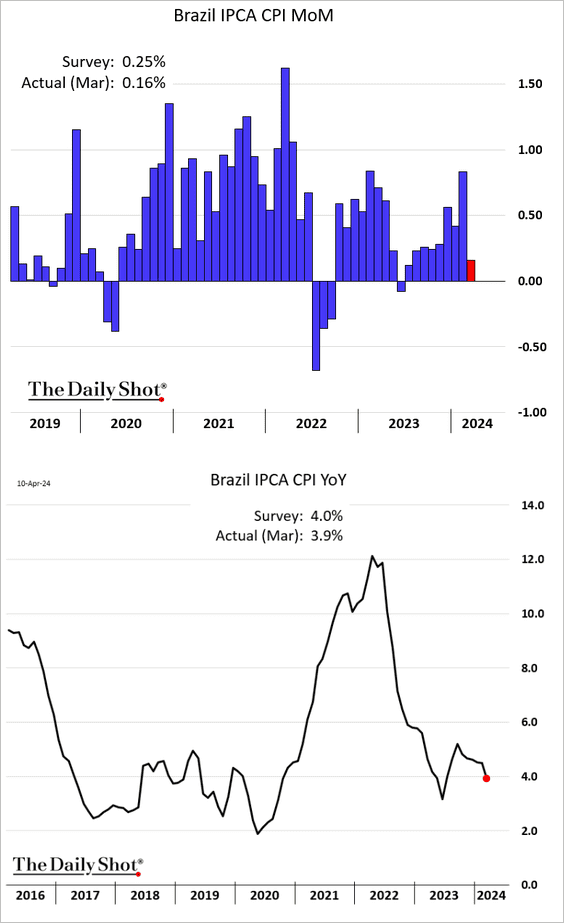

1. Brazil’s CPI print was weaker than expected.

Source: Barron’s Read full article

Source: Barron’s Read full article

——————–

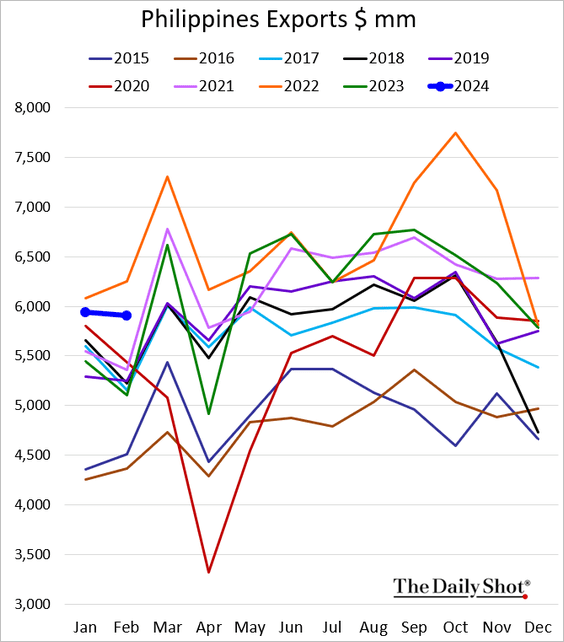

2. Philippine exports were running 16% above last year’s levels in February.

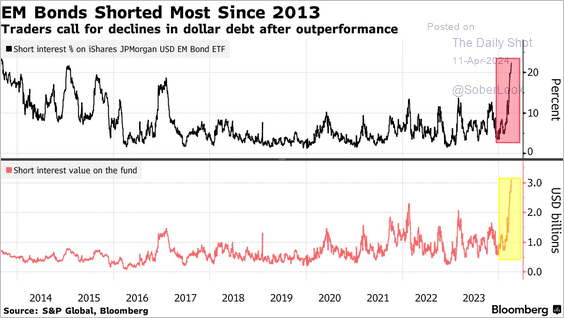

3. Traders have been shorting dollar-denominated EM debt.

Source: @markets Read full article

Source: @markets Read full article

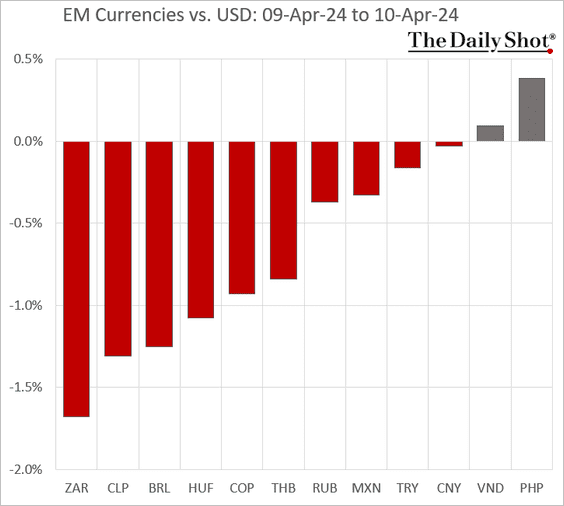

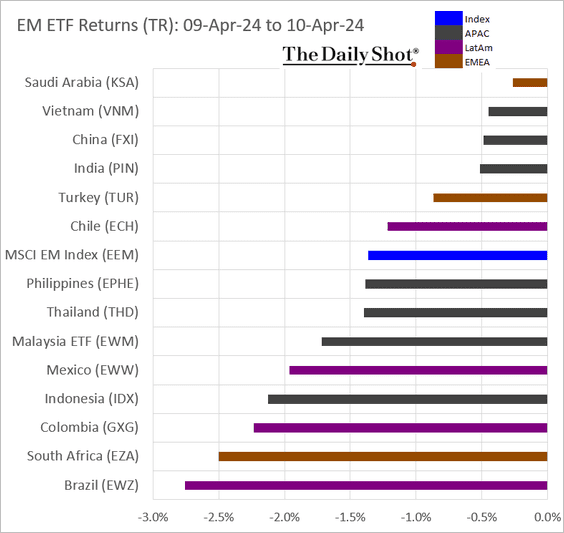

4. How did emerging markets perform in response to the stronger-than-expected US CPI report?

• Currencies:

• Equity ETFs:

Back to Index

Commodities

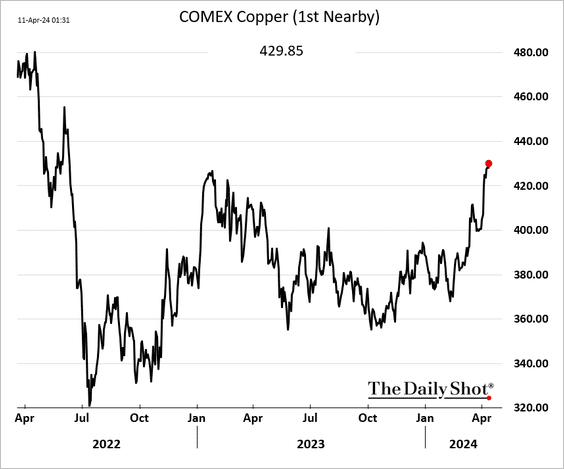

1. Copper continues to rally.

Source: CNBC Read full article

Source: CNBC Read full article

——————–

2. Gold investors keep ignoring rising real rates.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

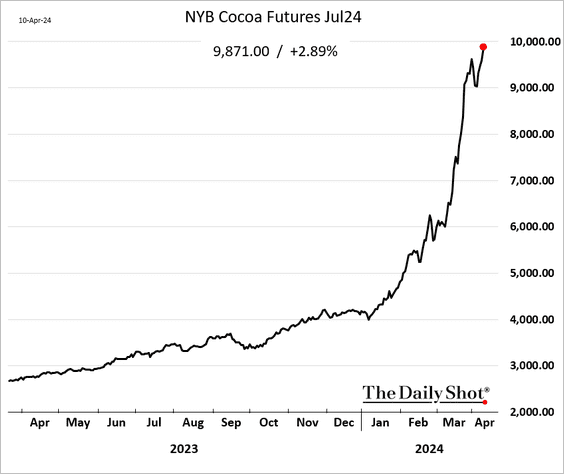

3. Cocoa futures are hitting new record highs.

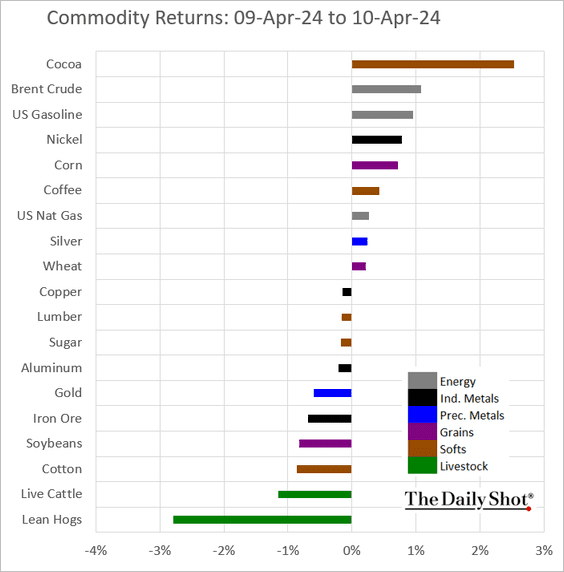

4. How did commodity markets respond to the hot US CPI report?

Back to Index

Energy

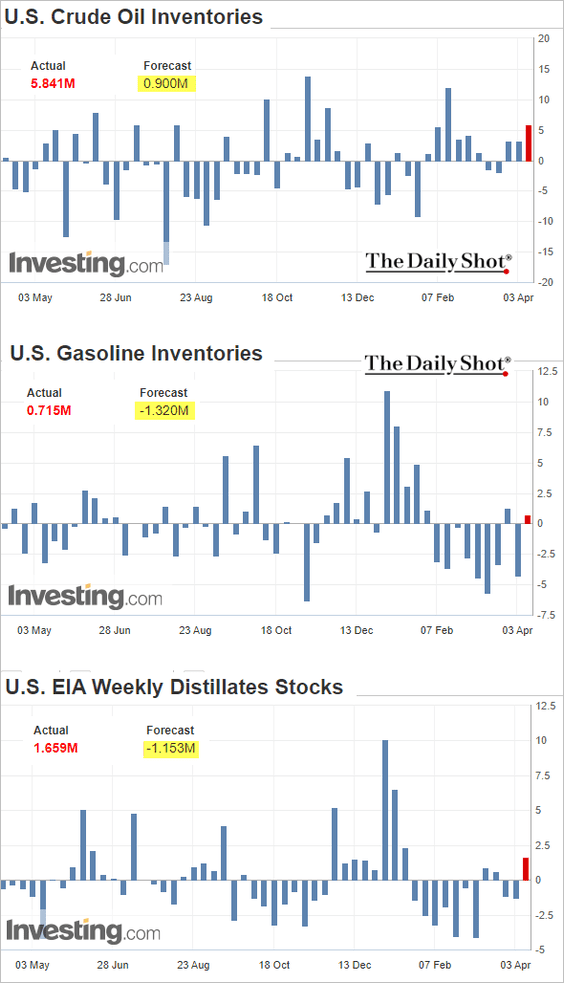

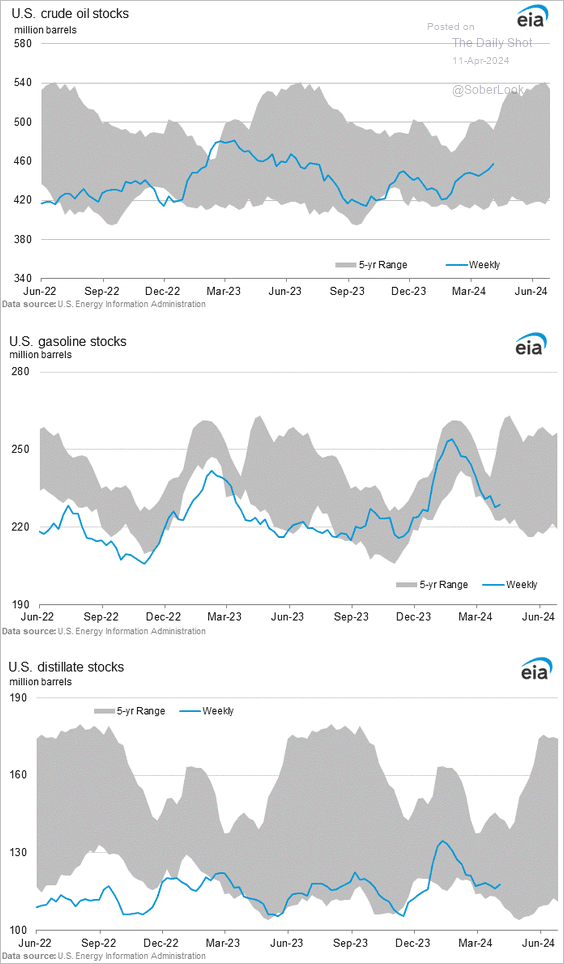

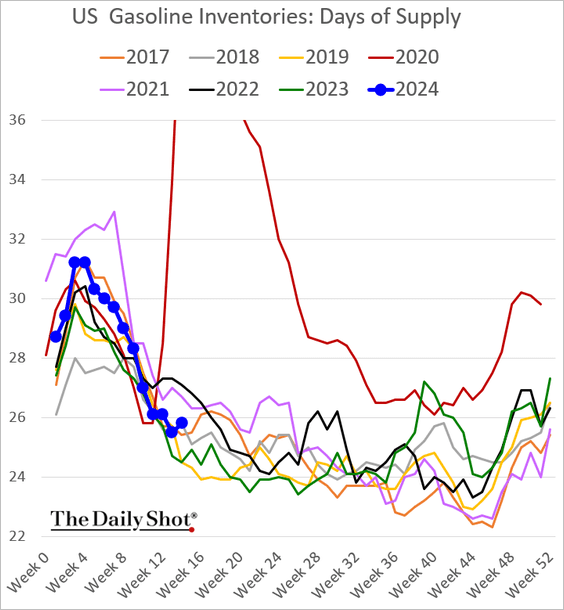

1. The US petroleum inventory report was bearish, with stockpiles of crude oil and refined products climbing last week.

• Weekly changes:

• Barrels:

• Gasoline days of supply:

——————–

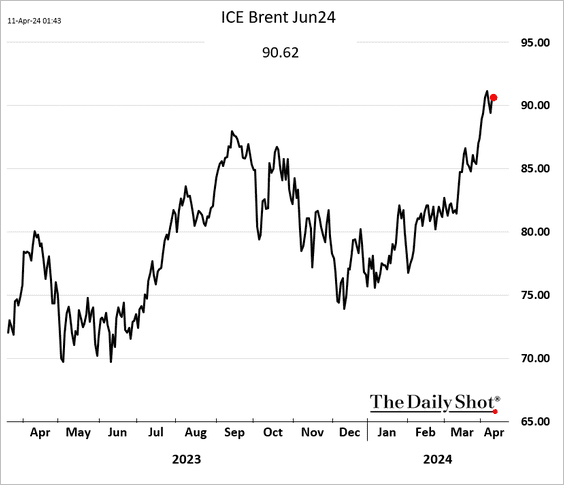

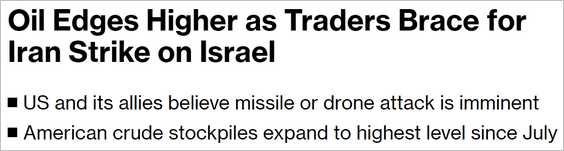

2. Nonetheless, crude oil climbed on geopolitical concerns.

Source: @markets Read full article

Source: @markets Read full article

——————–

3. The latest oil price rallies have diverged from industrial commodities.

Source: TS Lombard

Source: TS Lombard

Back to Index

Equities

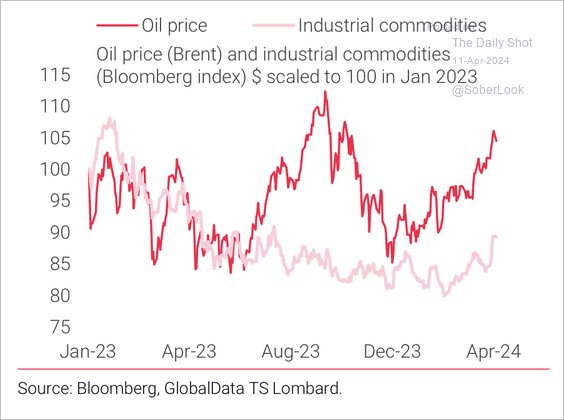

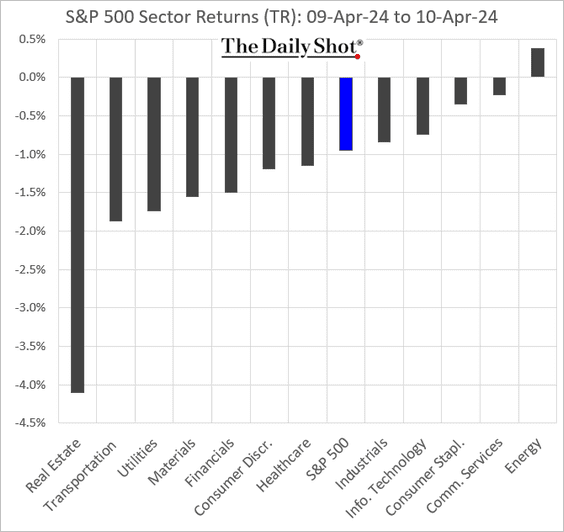

1. How did US stocks respond to the hot CPI report?

– Sectors:

– Equity factors:

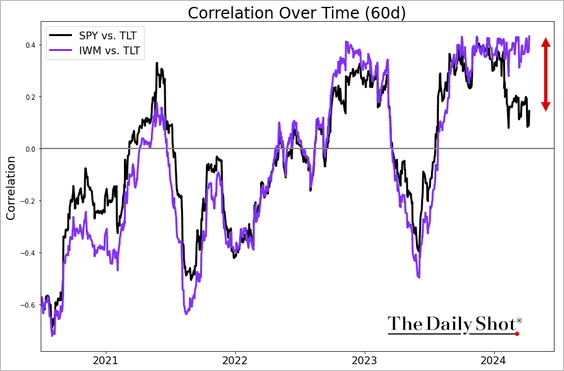

2. Small caps remain more exposed to rates than large caps.

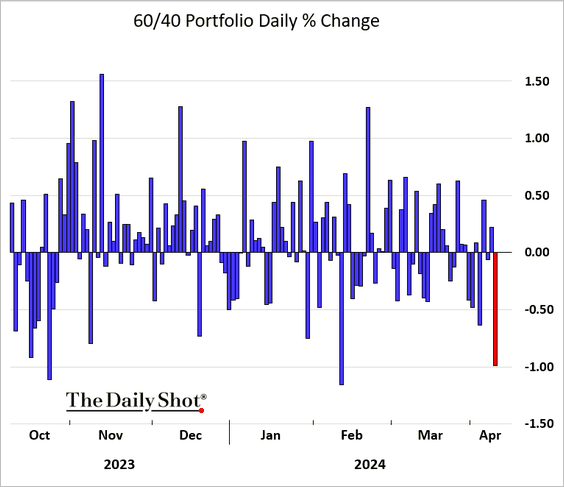

3. The 60/40 portfolio was down sharply.

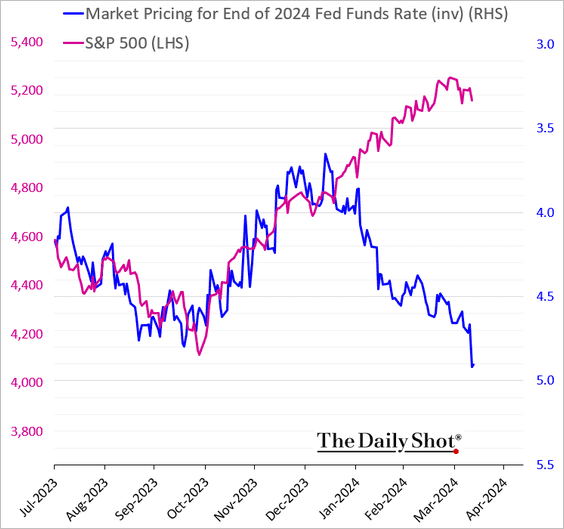

4. The rally has been partly driven by expectations of Fed rate cuts, many of which are no longer anticipated.

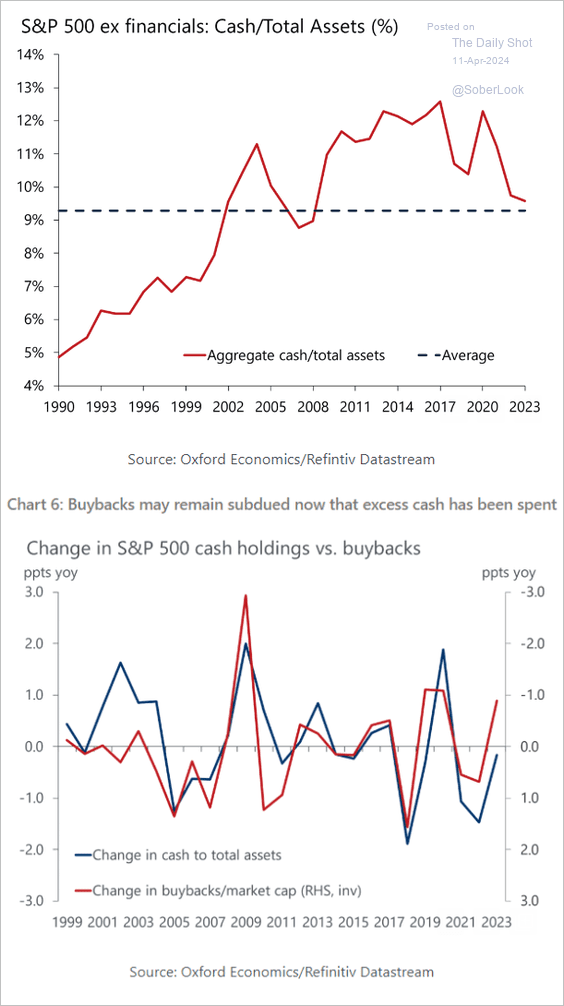

5. WIll decreased cash balances become a drag on share buybacks?

Source: Oxford Economics

Source: Oxford Economics

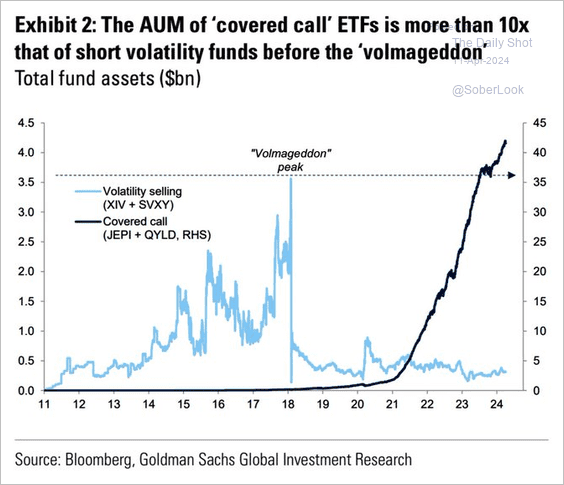

6. Covered call ETFs have been very popular.

Source: Goldman Sachs; @WallStJesus

Source: Goldman Sachs; @WallStJesus

7. The volatility skew has risen this month.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

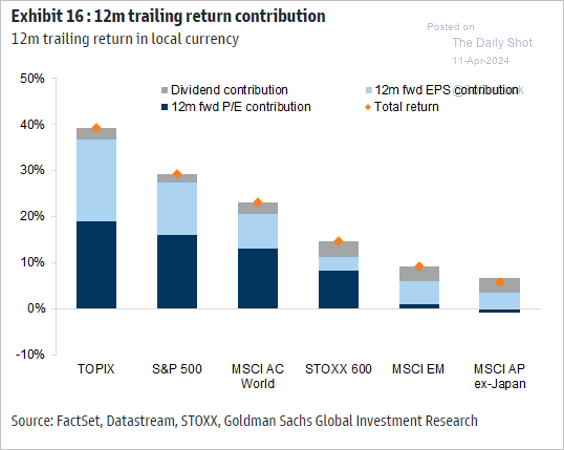

8. Here is a look at the 12-month return attribution in select markets.

Source: Goldman Sachs; @MikeZaccardi

Source: Goldman Sachs; @MikeZaccardi

Back to Index

Credit

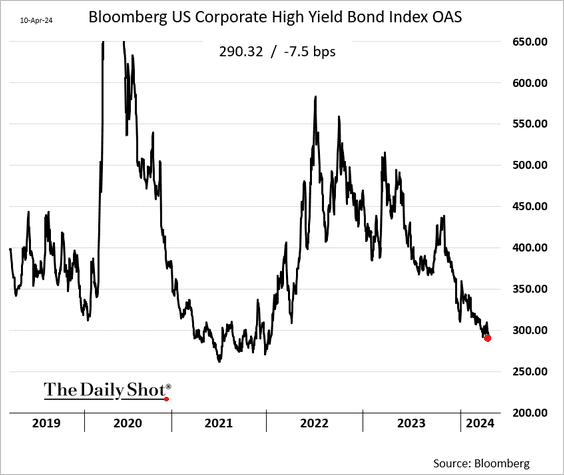

1. Remarkably, high-yield spreads tightened this week.

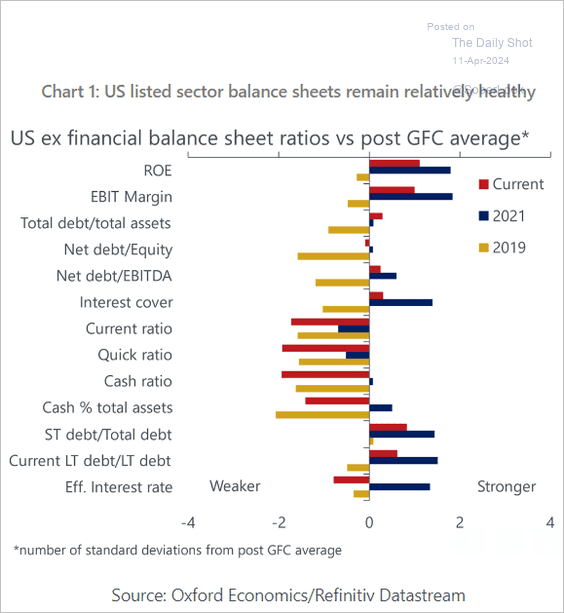

2. US-listed companies’ balance sheets remain relatively healthy.

Source: Oxford Economics

Source: Oxford Economics

Back to Index

Rates

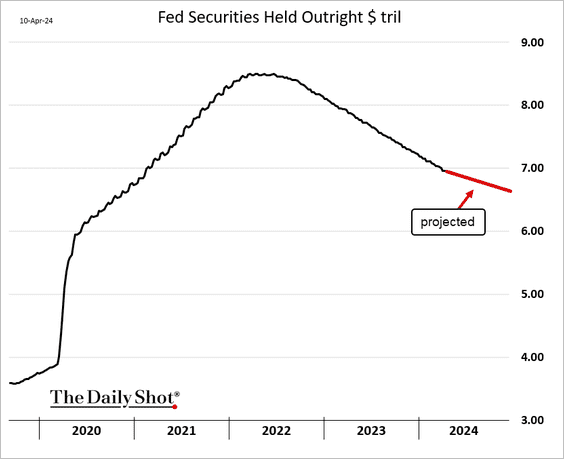

1. The Fed is talking about tapering QT to roughly half the current pace.

Source: Reuters Read full article

Source: Reuters Read full article

——————–

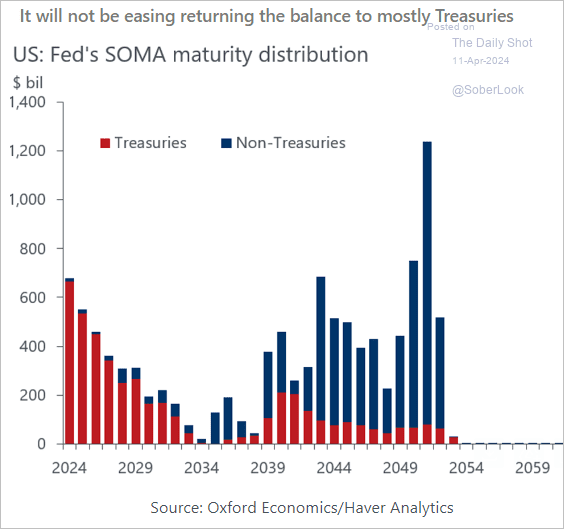

2. Given the MBS portfolio’s long duration, the Fed will find it challenging to return to Treasuries-only holdings.

Source: Oxford Economics

Source: Oxford Economics

Back to Index

Global Developments

1. The dollar surged after the US CPI report (2 charts).

——————–

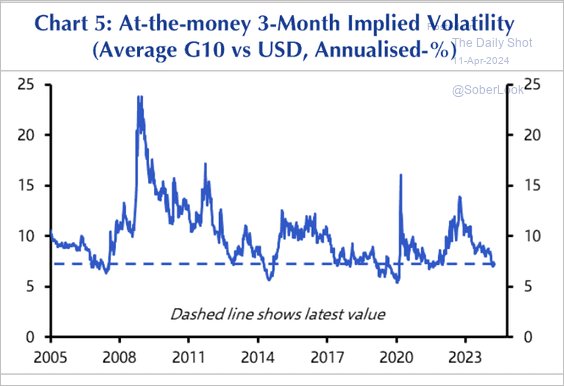

2. G10 F/X volatility is historically low.

Source: Capital Economics

Source: Capital Economics

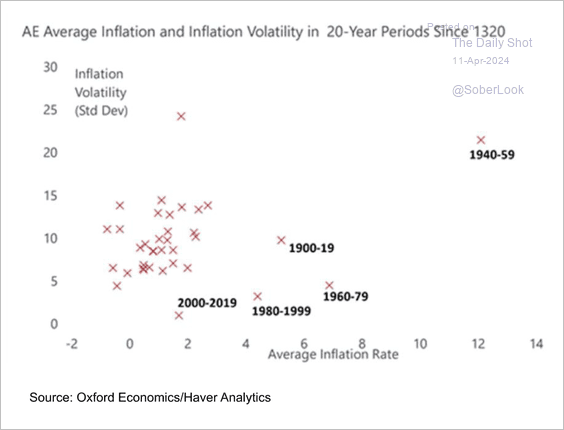

3. Inflation volatility was historically low across advanced economies between 2000-2019.

Source: Oxford Economics

Source: Oxford Economics

——————–

Food for Thought

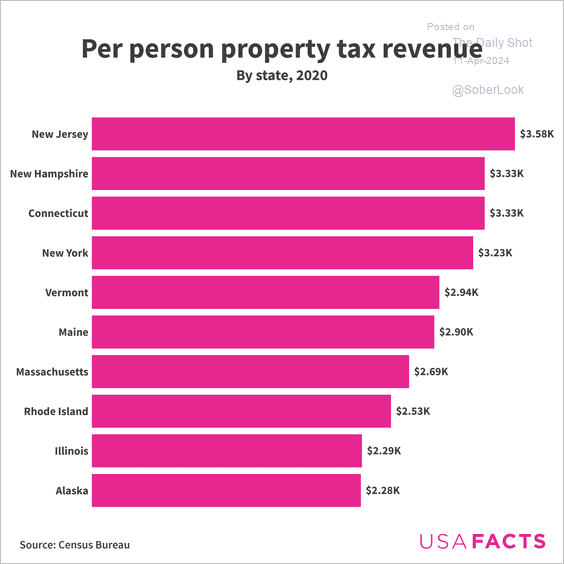

1. Property tax revenue per person, by state:

Source: USAFacts

Source: USAFacts

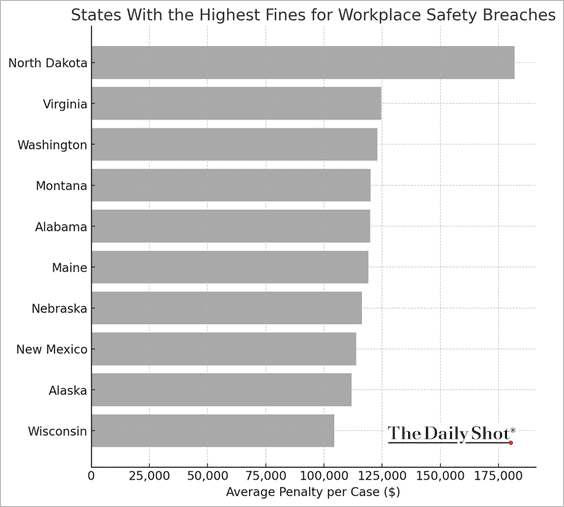

2. States with the highest fines for workplace safety breaches:

Source: John Fitch Further reading

Source: John Fitch Further reading

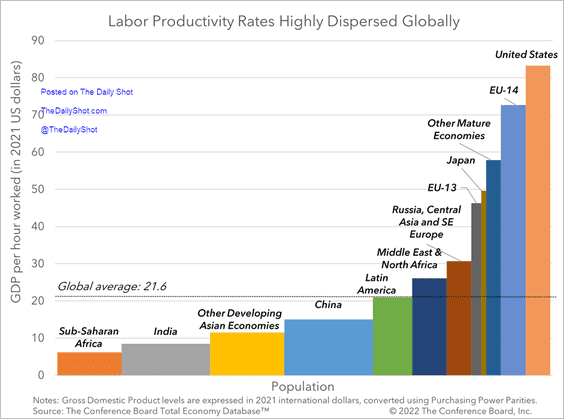

3. Labor productivity in select economies:

Source: The Conference Board Read full article

Source: The Conference Board Read full article

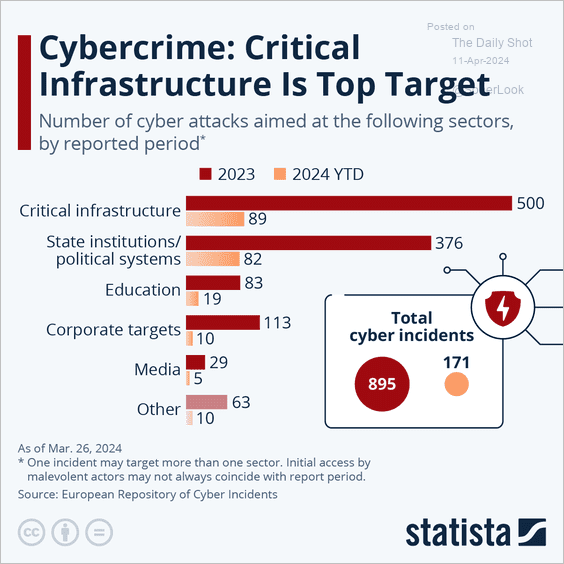

4. Sector-wise distribution of cyber attacks in 2023 and 2024:

Source: Statista

Source: Statista

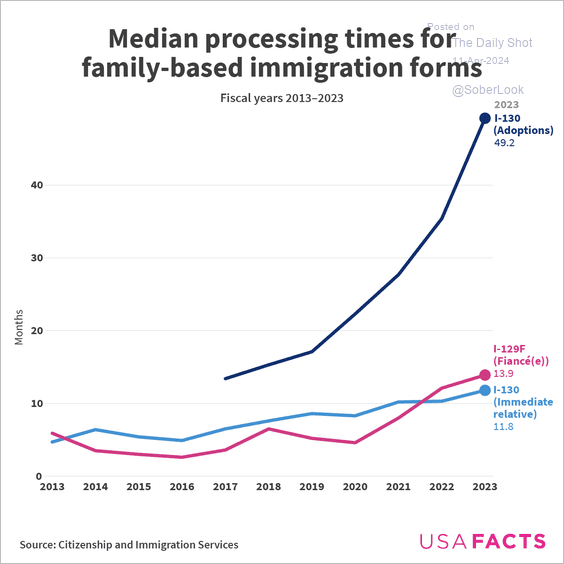

5. Processing times for family-based immigration forms in the US:

Source: USAFacts

Source: USAFacts

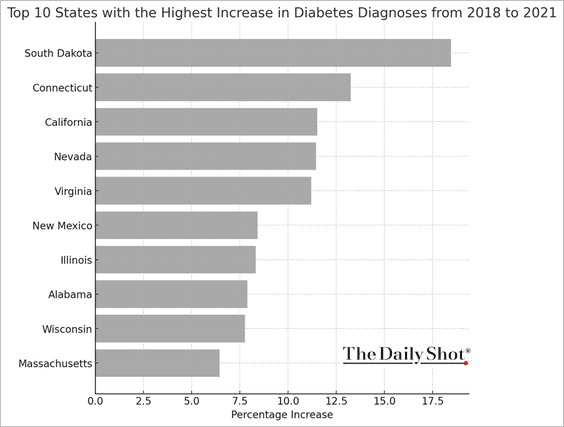

6. Top 10 states with the highest increase in diabetes diagnoses from 2018 to 2021:

Source: Diabetes Strong

Source: Diabetes Strong

7. The most iconic rivalries in film history:

![]() Source: Vegas Gems

Source: Vegas Gems

——————–

Back to Index