The Daily Shot: 10-Apr-24

• The United States

• The United Kingdom

• The Eurozone

• Japan

• China

• Emerging Markets

• Commodities

• Energy

• Equities

• Rates

• Global Developments

• Food for Thought

The United States

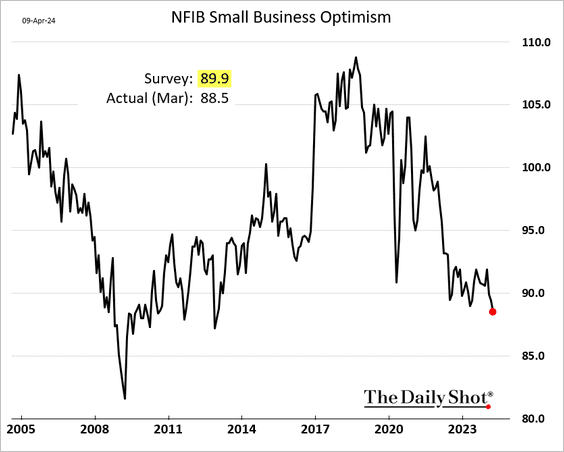

1. The NFIB’s small business sentiment index hit its lowest level since 2012, …

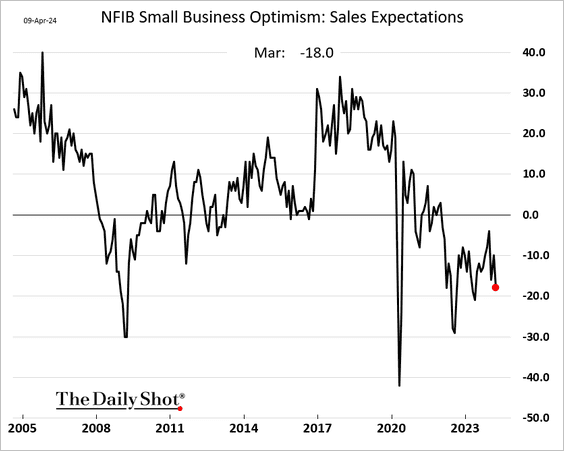

… as sales expectations deteriorate.

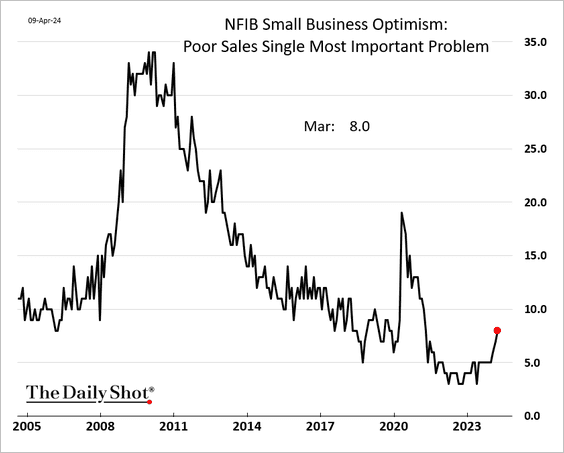

• “Poor sales” remains low on the list of the NFIB’s most pressing business problems, but it saw an uptick in March.

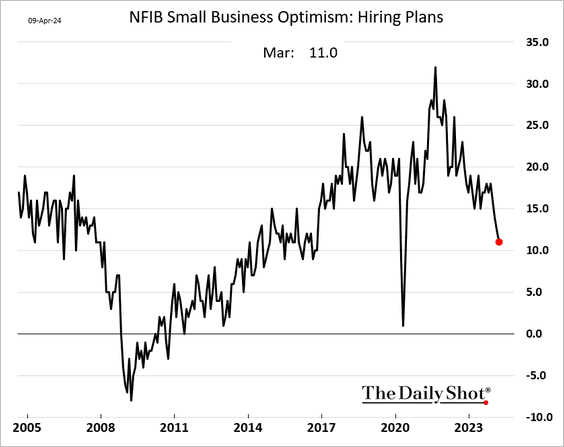

• The index of hiring plans continues to sink, which signals a slowdown in US payrolls growth this quarter.

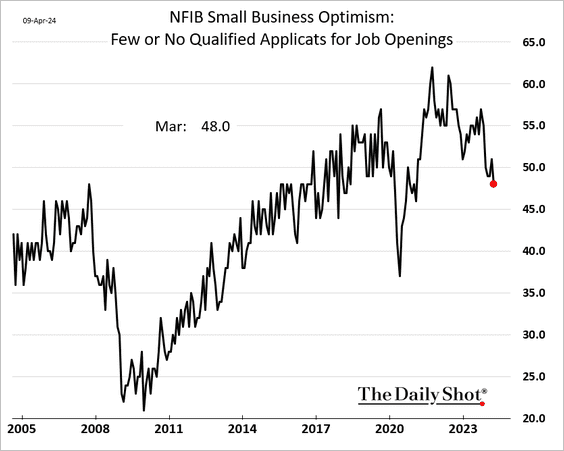

– Fewer firms are reporting a lack of qualified applicants for job openings as demand for labor eases.

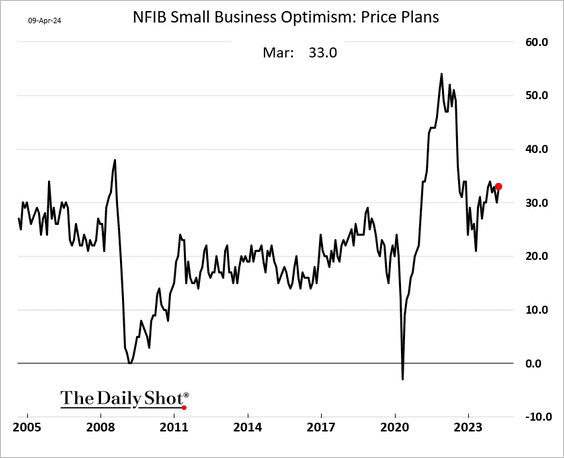

• A higher percentage of companies plan to boost prices.

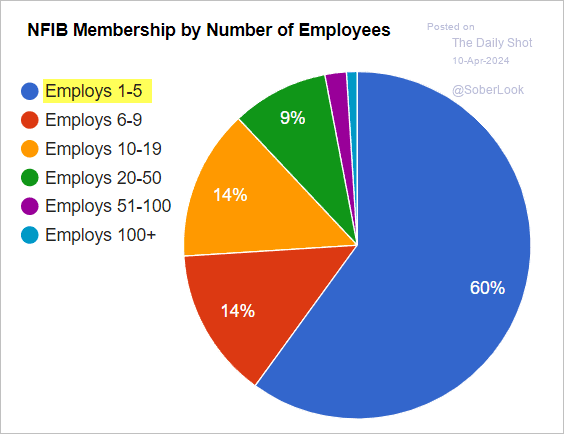

• It’s important to recognize that other small business surveys appear less pessimistic, partially because NFIB members often represent very small companies.

Source: NFIB

Source: NFIB

——————–

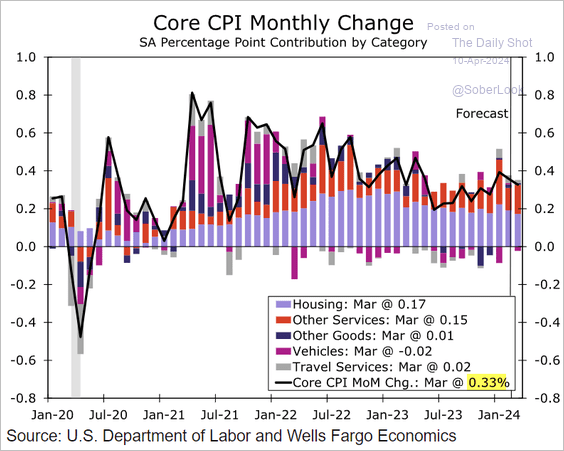

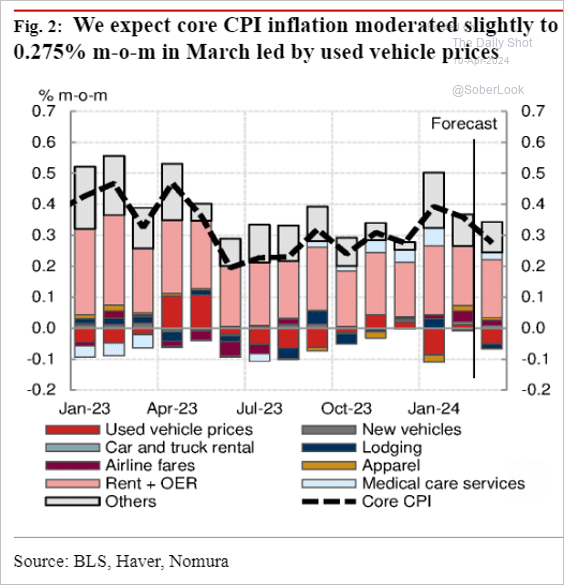

2. What should we expect from today’s CPI report?

• Wells Fargo sees a 0.33% monthly increase in the core CPI, which is consistent with the consensus estimate of 0.3%.

Source: Wells Fargo Securities

Source: Wells Fargo Securities

• Nomura expects a 0.275% increase in core inflation, …

Source: Nomura Securities

Source: Nomura Securities

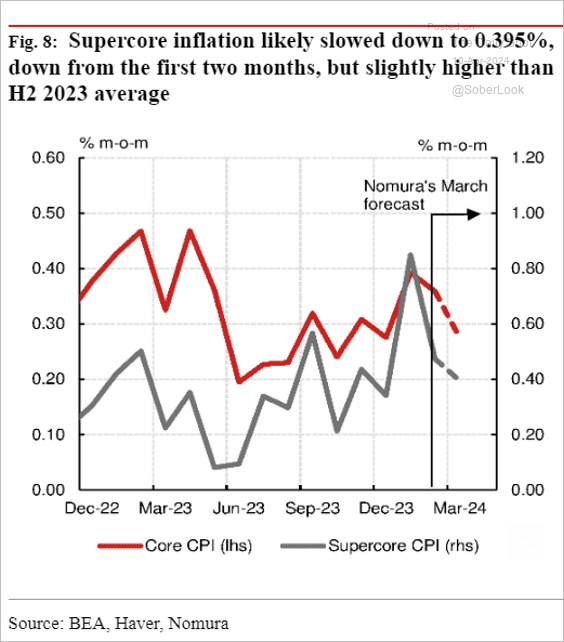

… and a 0.395% in the supercore CPI.

Source: Nomura Securities

Source: Nomura Securities

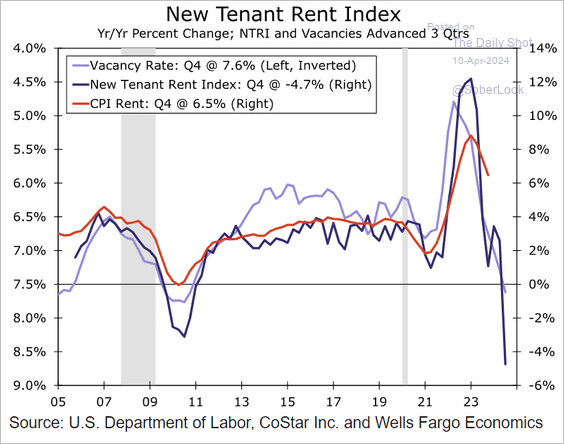

• The pace of declines in rent inflation has been more gradual than economists had anticipated.

Source: Wells Fargo Securities

Source: Wells Fargo Securities

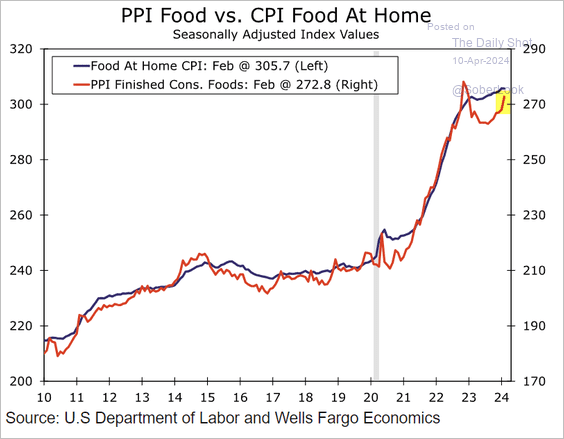

• The PPI data signals a pickup in the rate of food inflation.

Source: Wells Fargo Securities

Source: Wells Fargo Securities

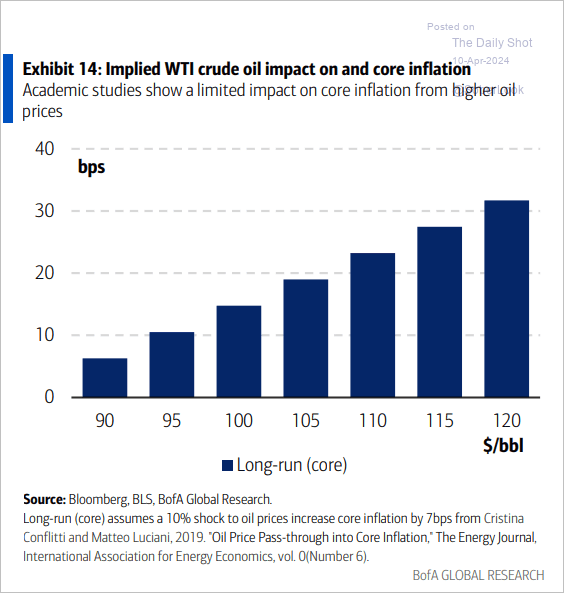

• Separately, what is the impact of crude oil prices on core inflation?

Source: BofA Global Research

Source: BofA Global Research

——————–

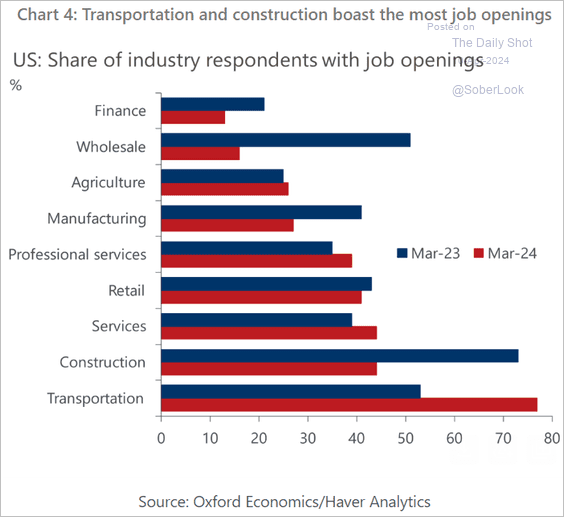

3. Which industries have the highest percentage of firms reporting job vacancies?

Source: Oxford Economics

Source: Oxford Economics

Back to Index

The United Kingdom

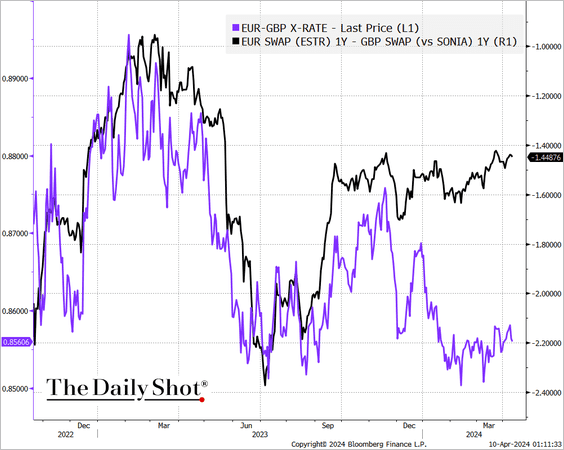

1. Rate differentials point to downside risks for the pound vs. the euro.

Source: @TheTerminal, Bloomberg Finance L.P.; h/t Mary Nicola, MLIV Macro Strategist

Source: @TheTerminal, Bloomberg Finance L.P.; h/t Mary Nicola, MLIV Macro Strategist

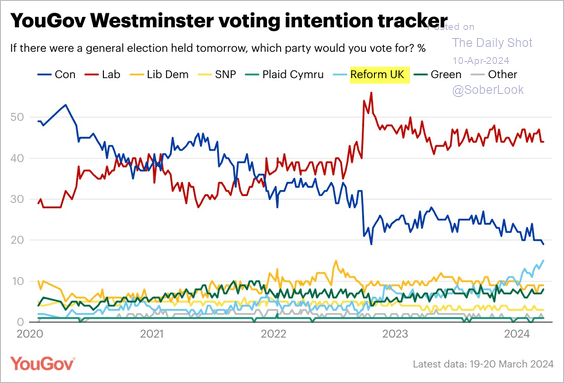

2. This chart presents the latest UK voting intention poll results.

Source: @YouGov Read full article

Source: @YouGov Read full article

Back to Index

The Eurozone

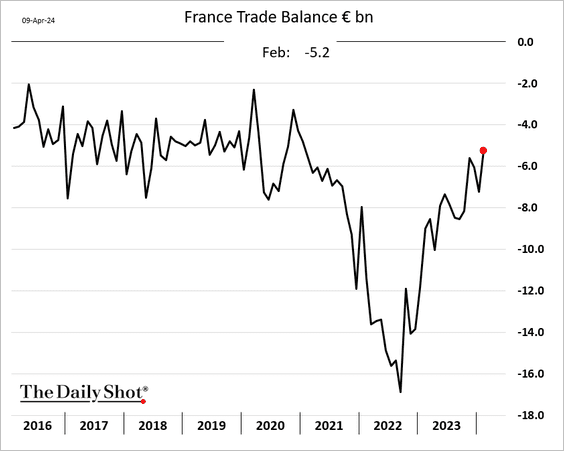

1. The French trade deficit continues to narrow.

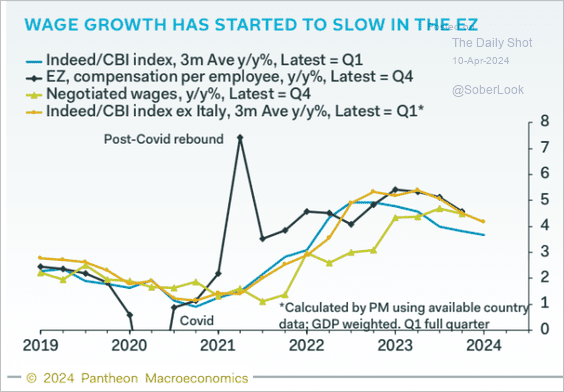

2. Euro-area wage growth is moderating.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

Back to Index

Japan

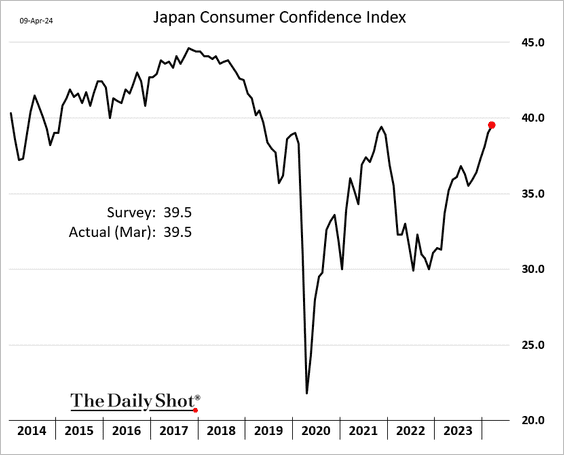

1. Consumer confidence keeps climbing.

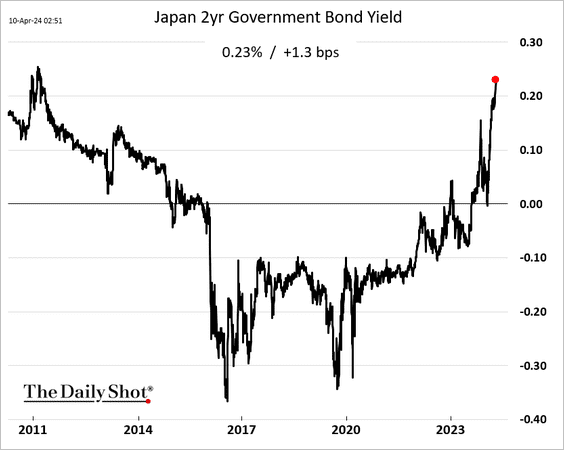

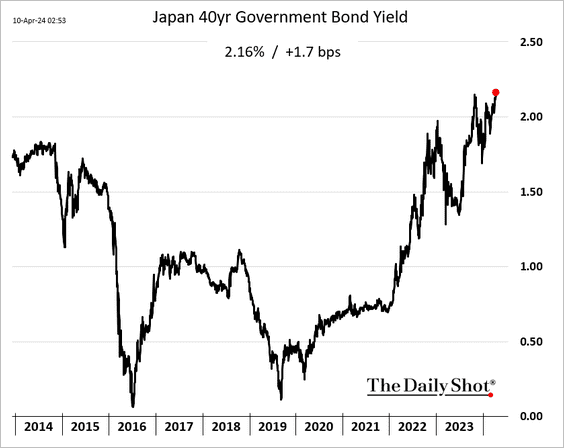

2. JGBs remain under pressure.

Back to Index

China

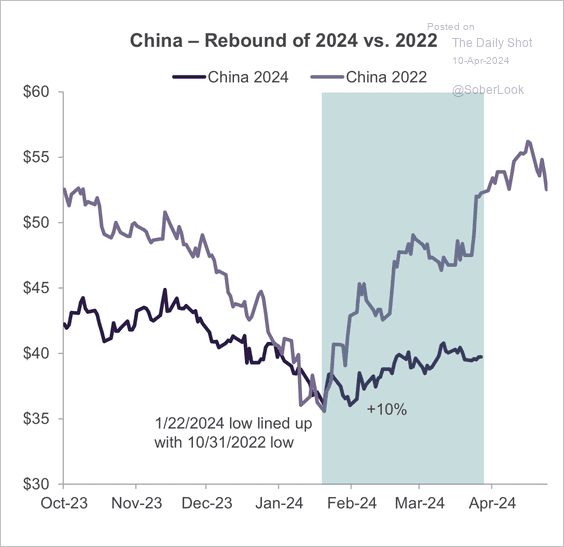

1. Chinese equities have been recovering at a slower pace than the late-2022 rebound.

Source: Truist Advisory Services

Source: Truist Advisory Services

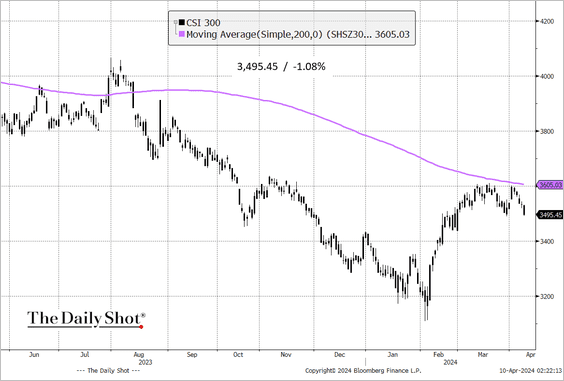

The CSI 300 Index appears to be rolling over.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

——————–

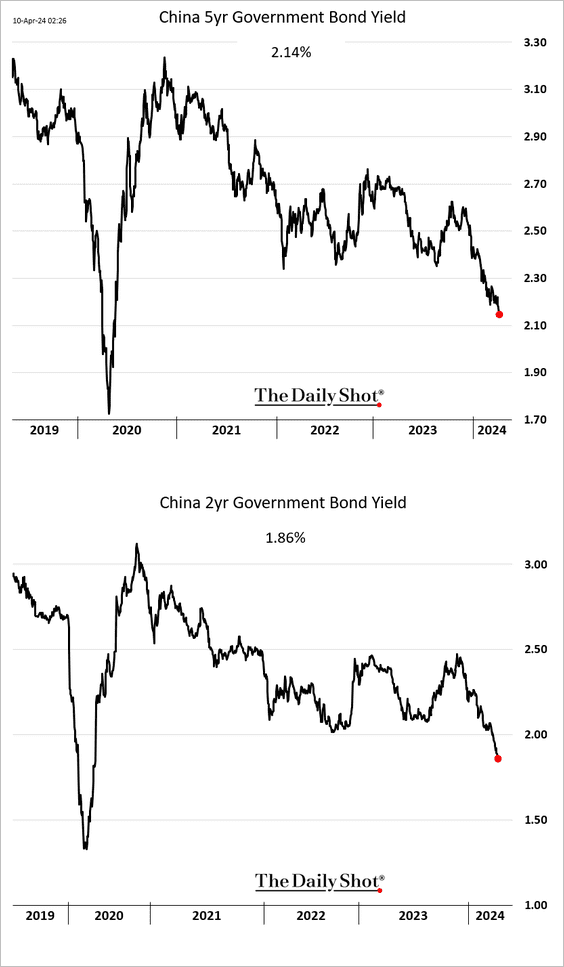

2. Bond yields continue to sink.

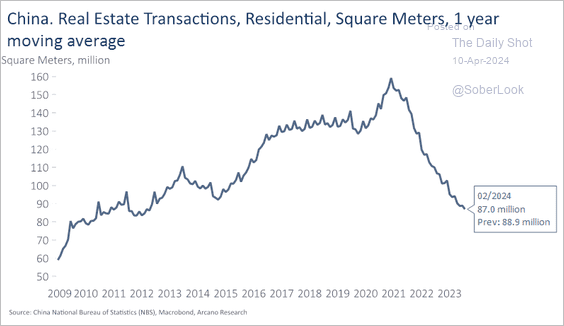

3. This chart shows China’s residential real estate transactions.

Source: Arcano Economics

Source: Arcano Economics

Back to Index

Emerging Markets

1. Let’s begin with some updates on India.

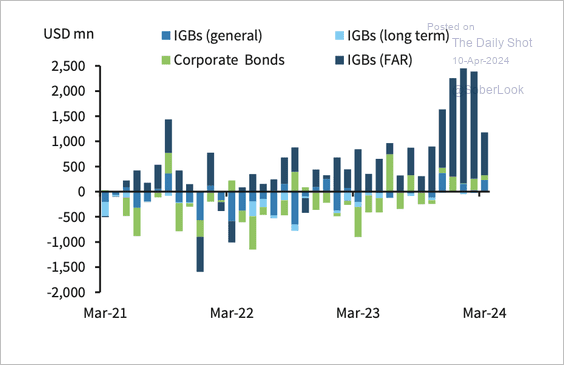

• Flows into Indian government bonds (IGBs) have been strong in recent months.

Source: Barclays Research

Source: Barclays Research

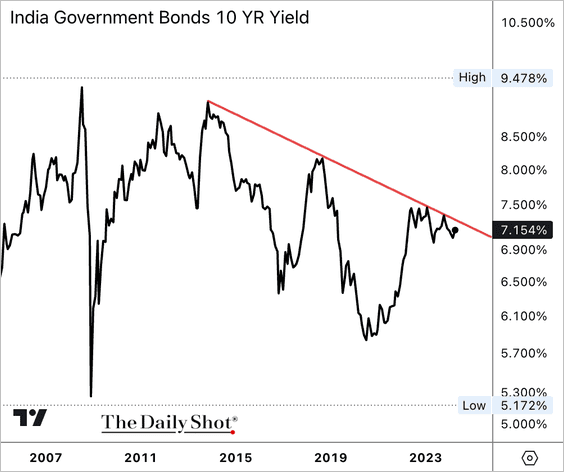

– The 10-year government bond yield is testing downtrend resistance.

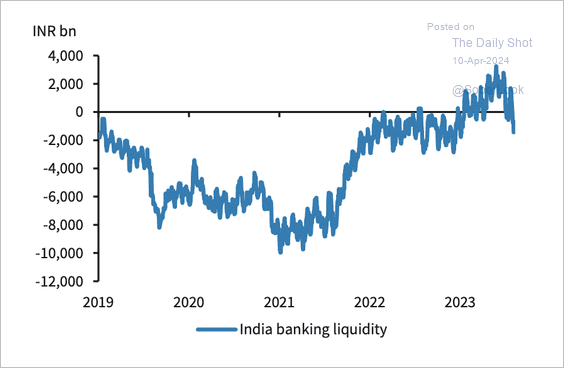

– Easing banking liquidity conditions could bode well for IGBs as the market begins to discount the end of the rate hike cycle.

Source: Barclays Research

Source: Barclays Research

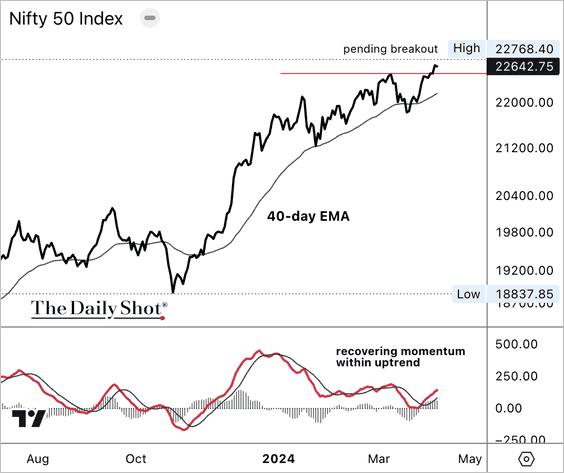

• The NIFTY 50 Index is attempting another breakout.

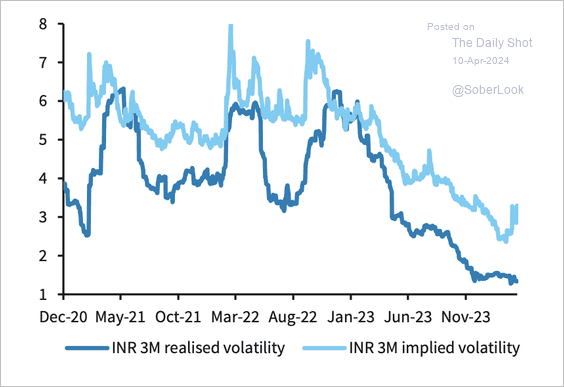

• The Indian rupee’s implied volatility has picked up, although realized volatility remains low.

Source: Barclays Research

Source: Barclays Research

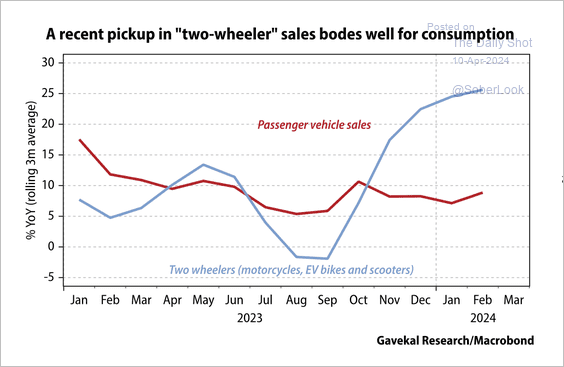

• The growth in India’s two-wheeler sales has outpaced passenger vehicle sales.

Source: Gavekal Research

Source: Gavekal Research

——————–

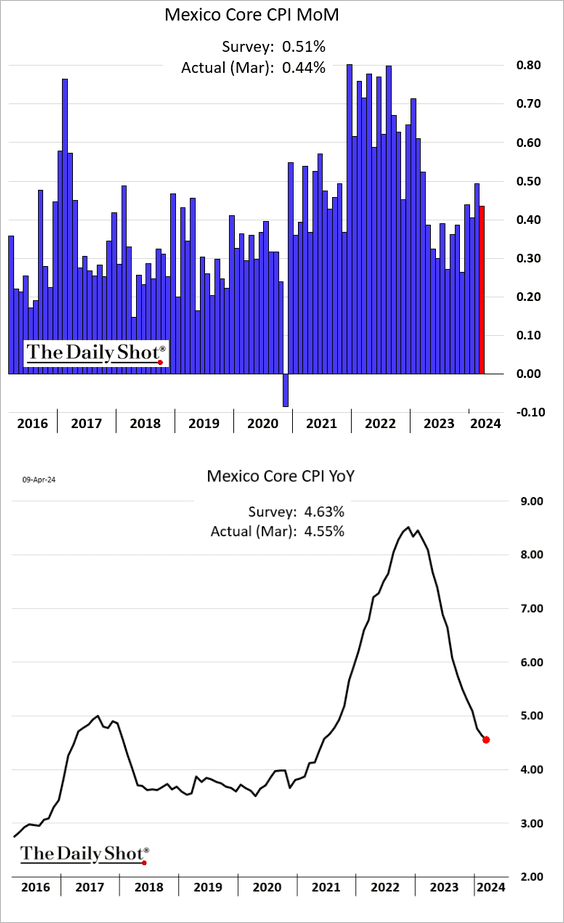

2. Mexican March CPI figures were below forecasts.

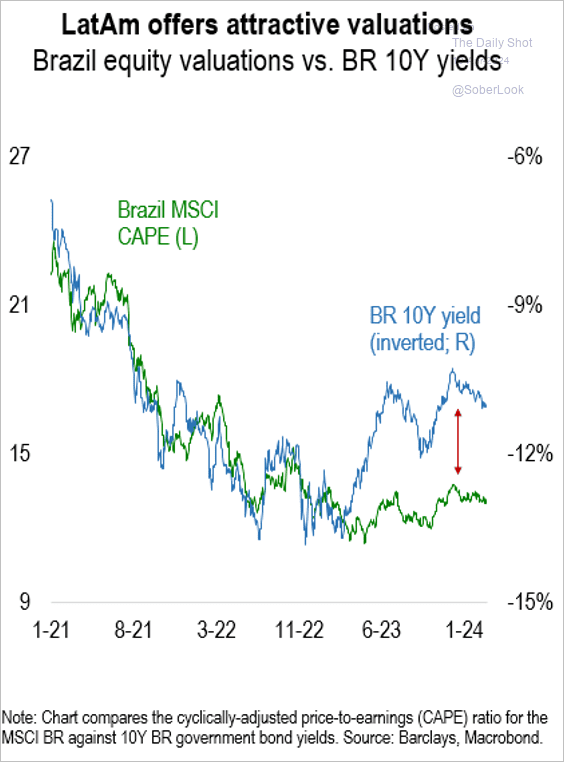

3. Rate cuts could support Brazilian equity valuations, which remain historically low.

Source: Numera Analytics (@NumeraAnalytics)

Source: Numera Analytics (@NumeraAnalytics)

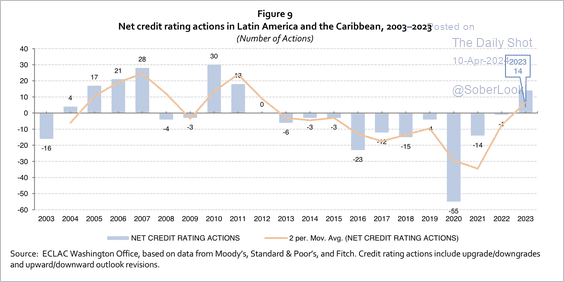

4. Sovereign credit quality improved for LatAm and the Caribbean last year after a long streak of overwhelming downgrades.

Source: ECLAC

Source: ECLAC

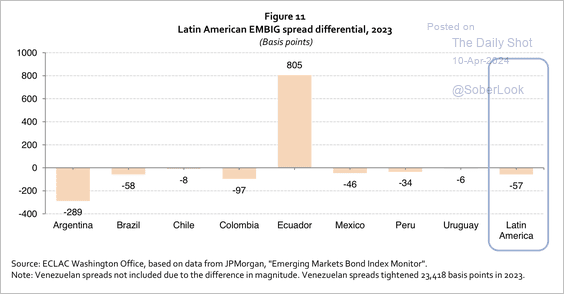

– Outside of Ecuador, spreads tightened for LatAm sovereign debt issuers.

Source: ECLAC

Source: ECLAC

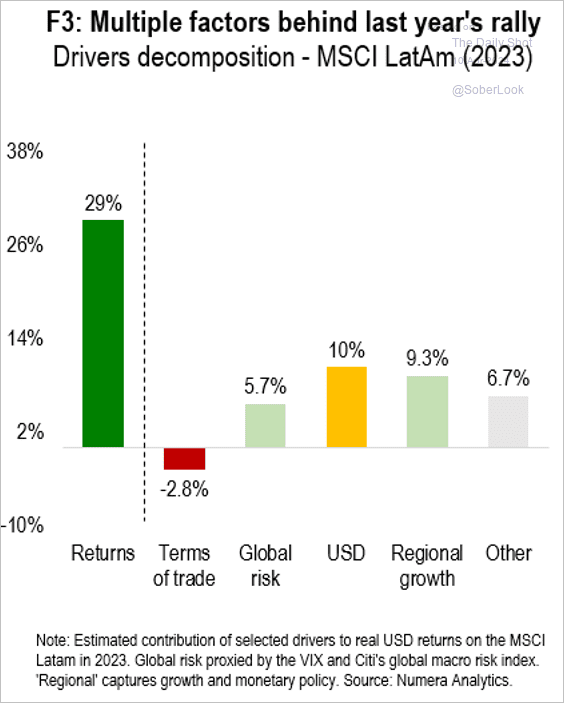

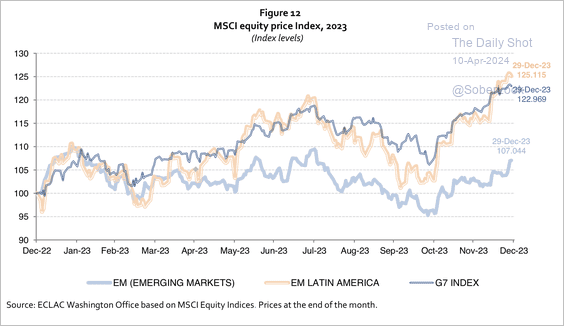

• Favorable macro and currency conditions supported LatAm equities last year. (2 charts)

Source: Numera Analytics (@NumeraAnalytics)

Source: Numera Analytics (@NumeraAnalytics)

Source: ECLAC

Source: ECLAC

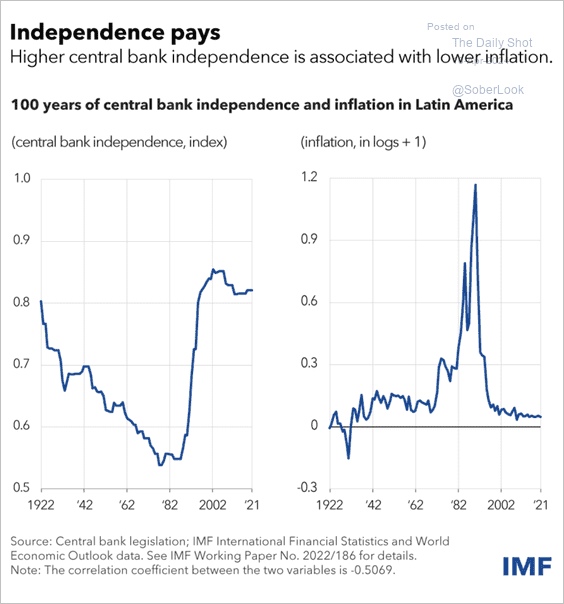

• Separately, the establishment of central bank independence in Latin America led to reduced inflation rates.

Source: IMF Read full article

Source: IMF Read full article

——————–

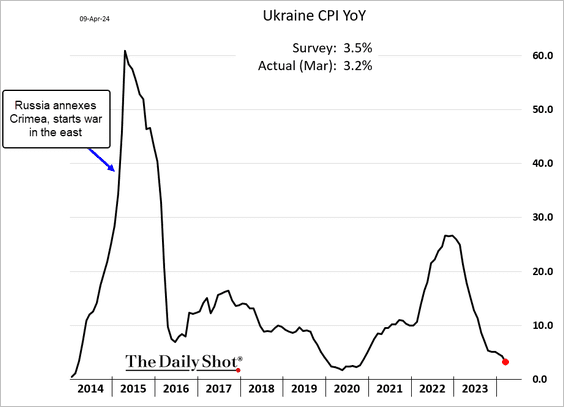

5. Ukrainian inflation continues to moderate.

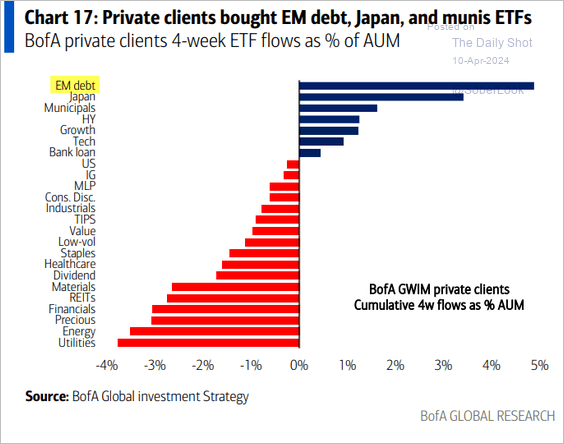

6. BofA’s private clients have been buying EM debt.

Source: BofA Global Research

Source: BofA Global Research

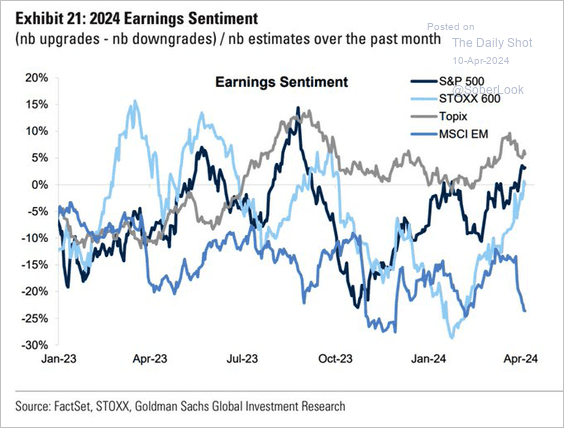

7. EM earnings sentiment for 2024 has been deteriorating.

Source: Goldman Sachs; @AyeshaTariq

Source: Goldman Sachs; @AyeshaTariq

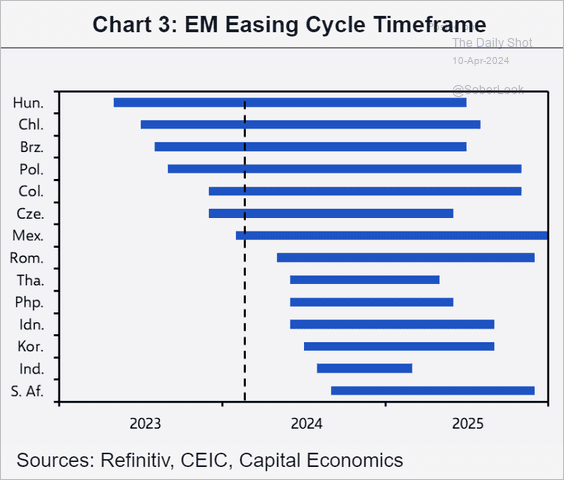

8. This chart from Capital Economics illustrates the timeline of the easing cycle among emerging market central banks.

Source: Capital Economics

Source: Capital Economics

Back to Index

Commodities

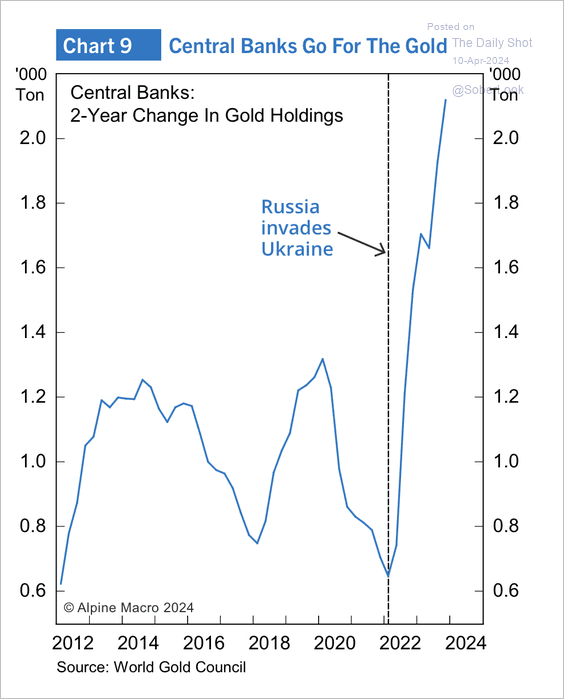

1. Central banks loaded up on gold after the recent Russia/Ukraine war.

Source: Alpine Macro

Source: Alpine Macro

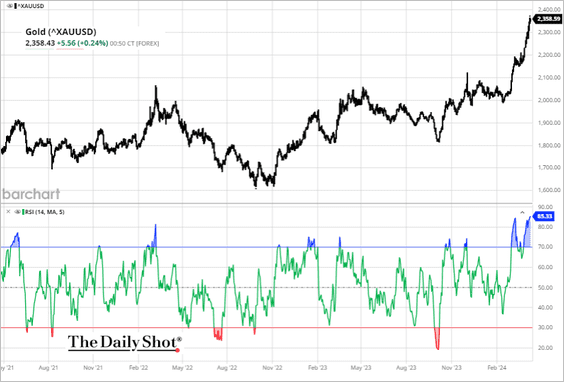

• Technicals suggest that gold is overbought.

——————–

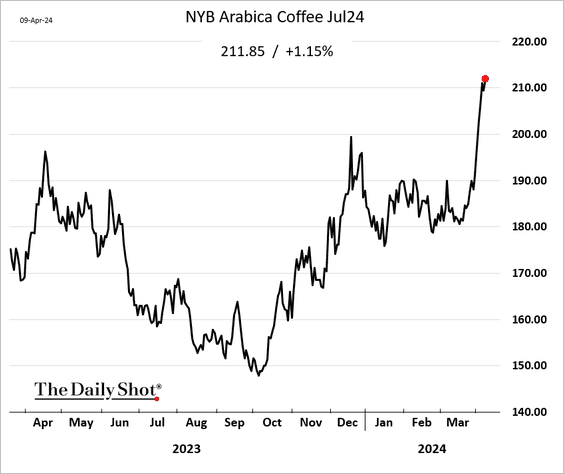

2. Coffee futures are surging.

Source: @markets Read full article

Source: @markets Read full article

Back to Index

Energy

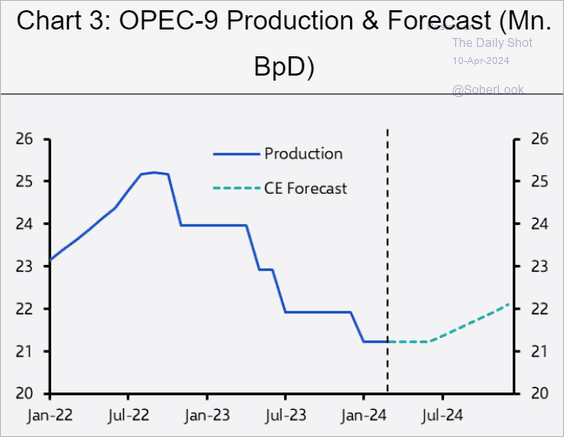

1. Capital Economics sees OPEC production rising later this year.

Source: Capital Economics

Source: Capital Economics

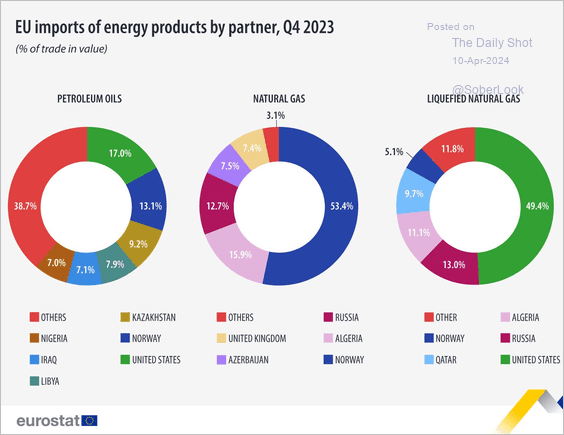

2. This chart depicts the EU’s energy imports by product and trading partner.

Source: Eurostat Read full article

Source: Eurostat Read full article

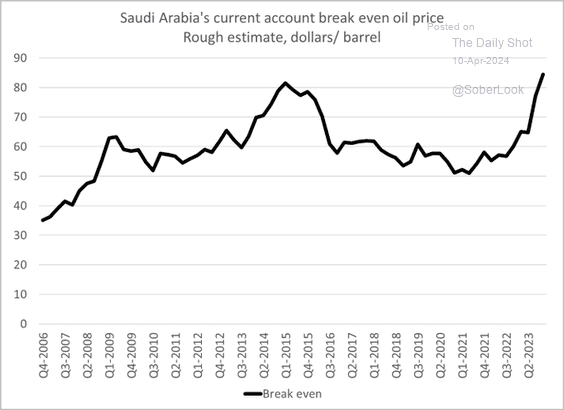

3. Saudi Arabia requires a crude oil price above $85 per barrel to prevent a current account deficit.

Source: @AyeshaTariq

Source: @AyeshaTariq

Back to Index

Equities

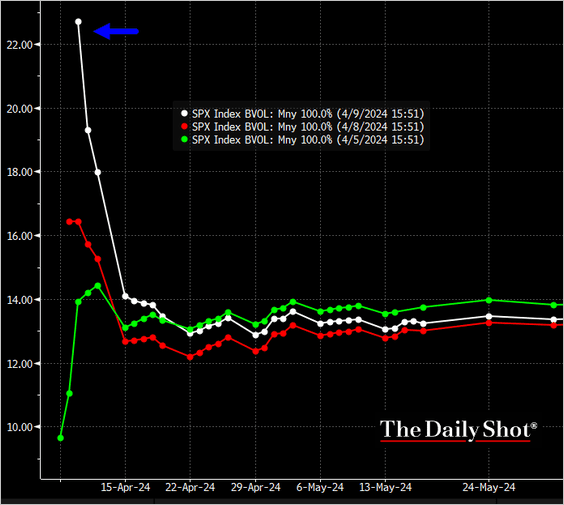

1. The short end of the volatility curve inverted sharply ahead of the CPI report.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

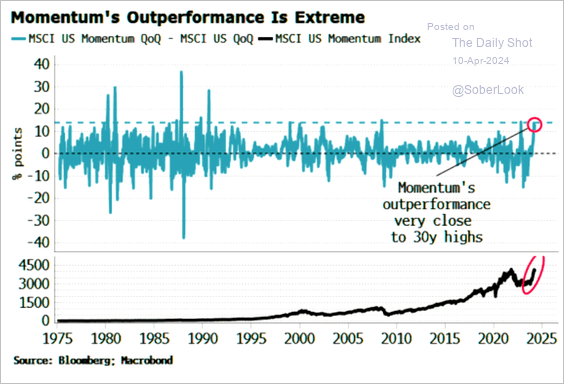

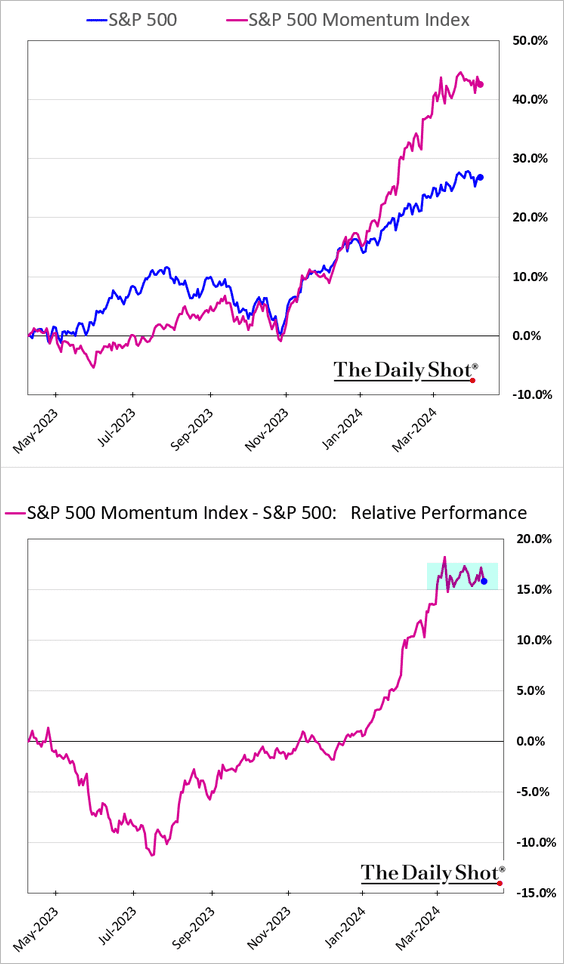

2. Momentum stocks’ outperformance hit extreme levels recently.

Source: Simon White, Bloomberg Markets Live Blog

Source: Simon White, Bloomberg Markets Live Blog

But it has plateaued since February.

——————–

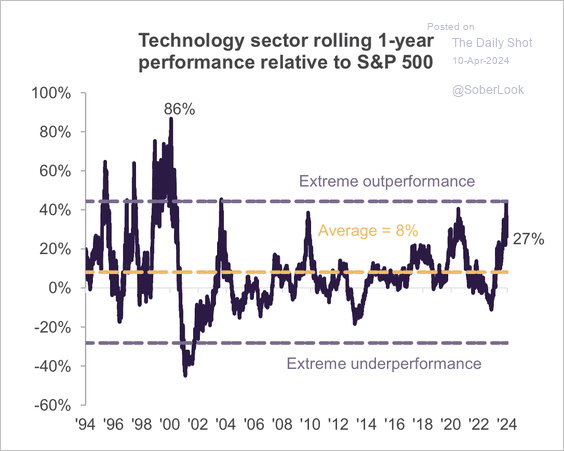

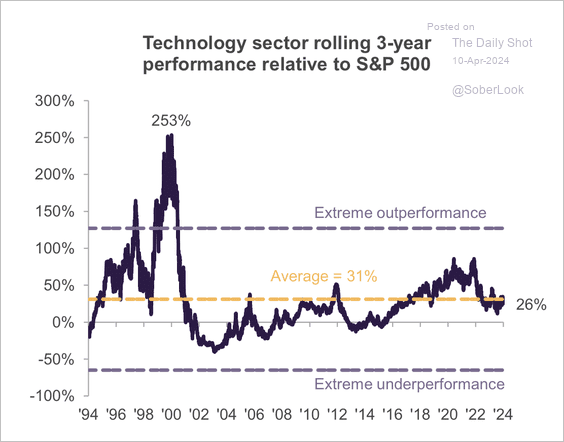

3. S&P 500 tech sector returns are extended on a short-term basis, yet less so longer term. (2 charts)

Source: Truist Advisory Services

Source: Truist Advisory Services

Source: Truist Advisory Services

Source: Truist Advisory Services

——————–

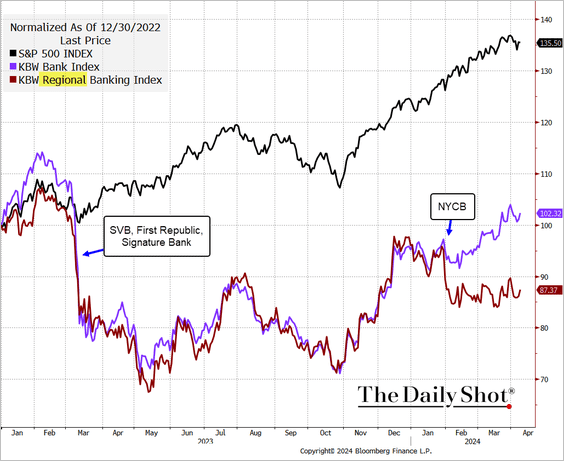

4. Following the SVB crisis, banks’ performance diverged from the S&P 500. Subsequent to the NYCB debacle, the regional bank index began to underperform the broader bank index.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

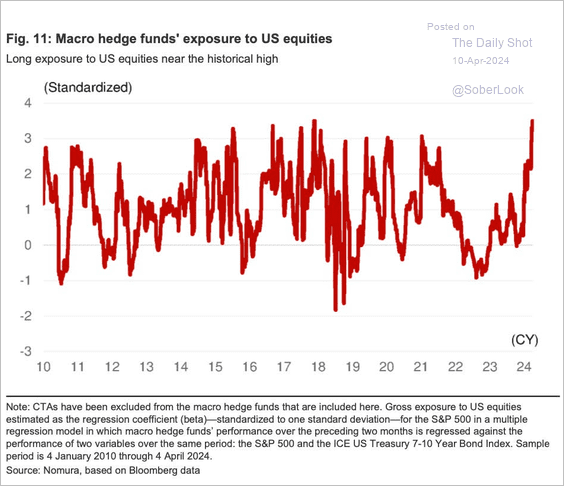

5. Macro hedge funds haven’t been this exposed to stocks in years.

Source: Nomura Securities; @dailychartbook

Source: Nomura Securities; @dailychartbook

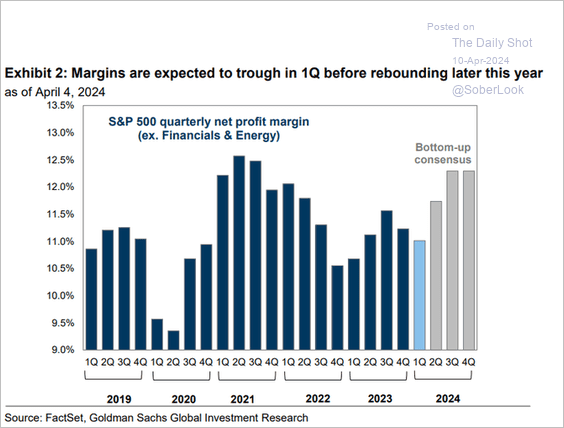

6. Goldman expects S&P 500 margins to trough this quarter.

Source: Goldman Sachs; @MikeZaccardi

Source: Goldman Sachs; @MikeZaccardi

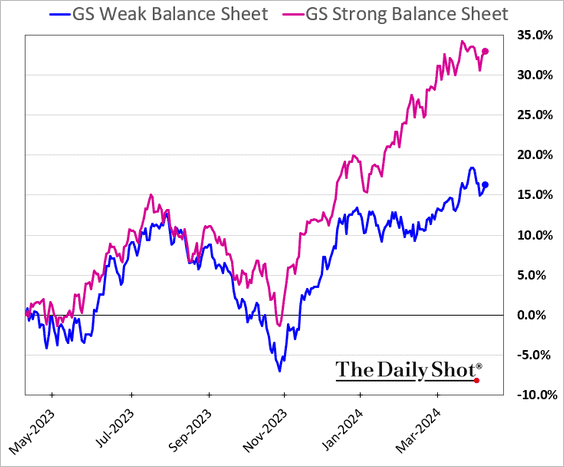

7. Companies with strong balance sheets have been outperforming leveraged firms.

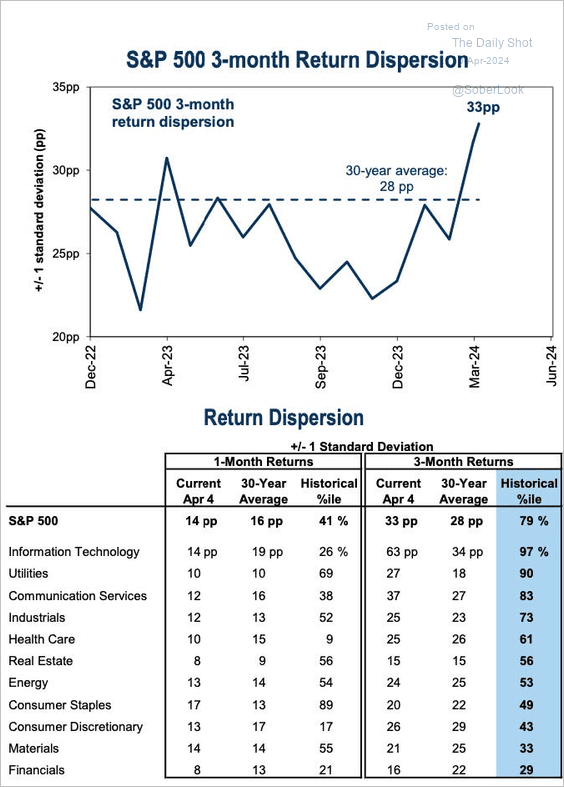

8. Return dispersion in the S&P 500 has increased sharply in recent weeks.

Source: @dailychartbook; @dailychartbook

Source: @dailychartbook; @dailychartbook

Back to Index

Rates

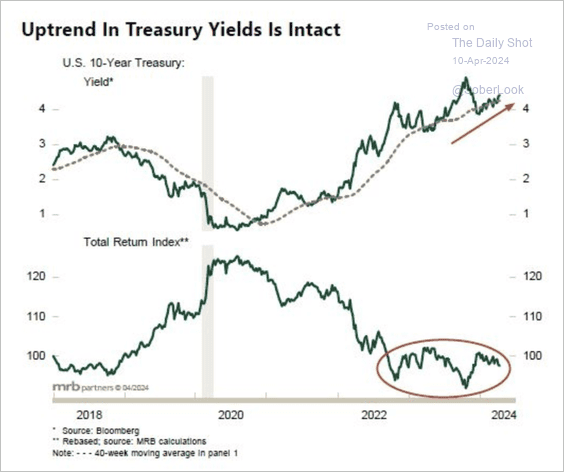

1. The 10-year Treasury yield is holding long-term support within an uptrend.

Source: MRB Partners

Source: MRB Partners

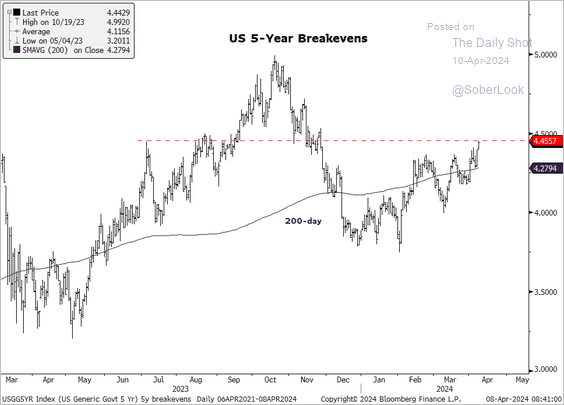

2. Could we see a breakout in the five-year breakeven rate if inflationary pressures rise?

Source: Aazan Habib, Paradigm Capital

Source: Aazan Habib, Paradigm Capital

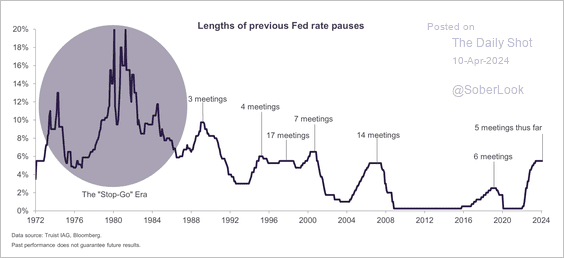

3. On average, the Fed has held the policy rate steady for about nine meetings before cutting rates.

Source: Truist Advisory Services

Source: Truist Advisory Services

Back to Index

Global Developments

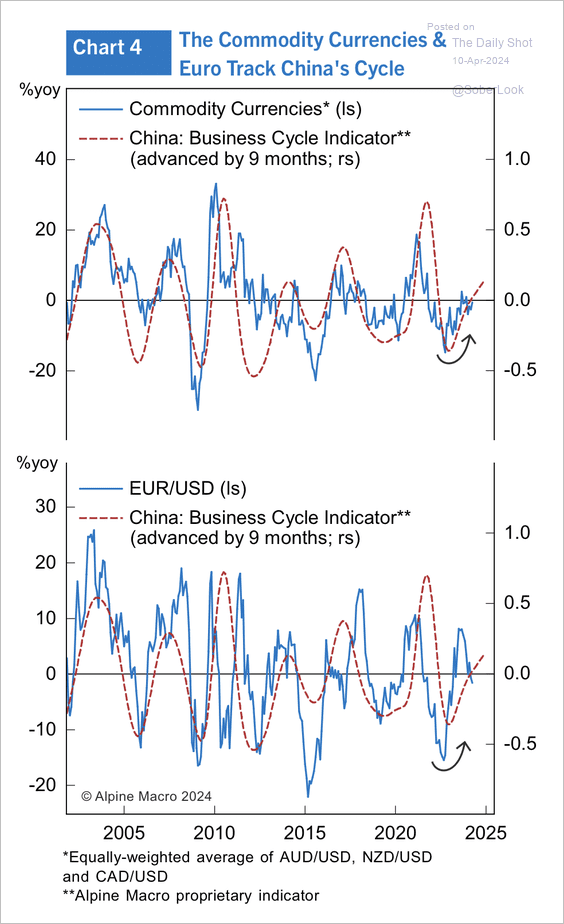

1. A recovery in China’s business cycle could bode well for commodity currencies and the euro.

Source: Alpine Macro

Source: Alpine Macro

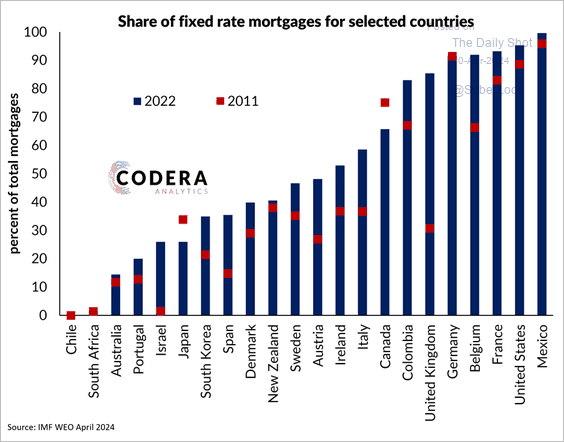

2. Here is a look at the share of fixed-rate mortgages in select countries.

Source: Codera Analytics Read full article

Source: Codera Analytics Read full article

——————–

Food for Thought

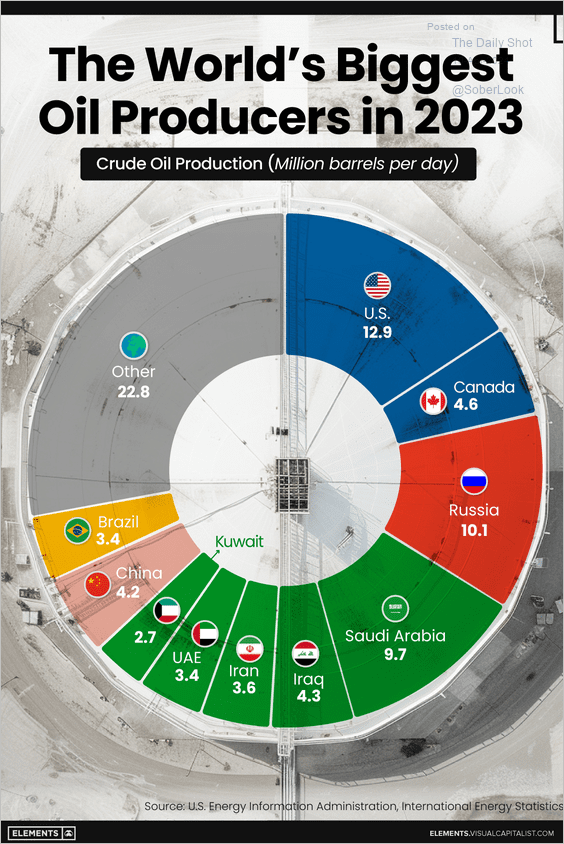

1. Global crude oil production leaders in 2023:

Source: Visual Capitalist Read full article

Source: Visual Capitalist Read full article

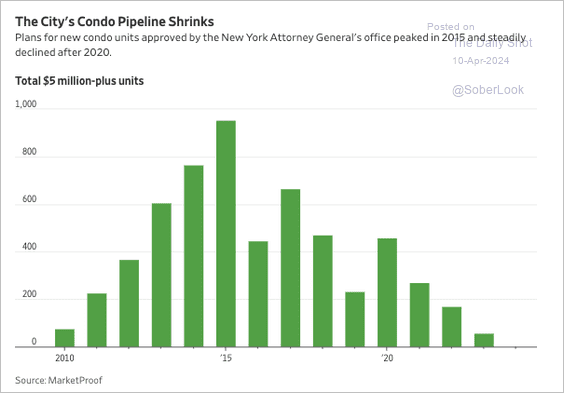

2. Trend in New York Citi’s luxury condo construction approvals:

Source: @WSJ Read full article

Source: @WSJ Read full article

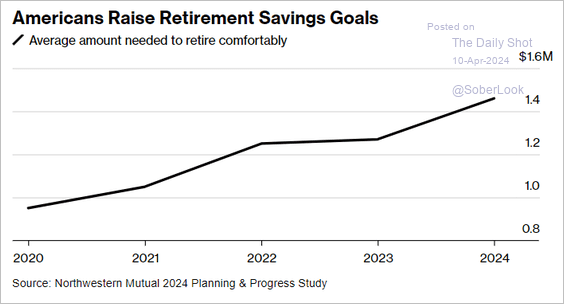

3. Rising retirement savings targets among Americans:

Source: @wealth Read full article

Source: @wealth Read full article

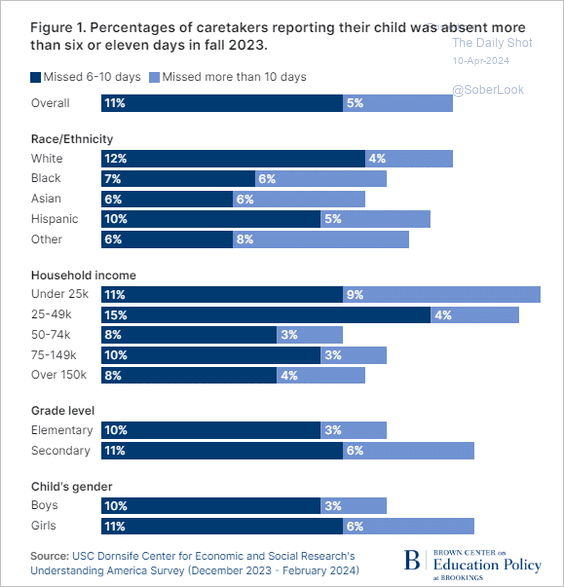

4. Fall 2023 school attendance report by demographics in the US:

Source: Brookings Read full article

Source: Brookings Read full article

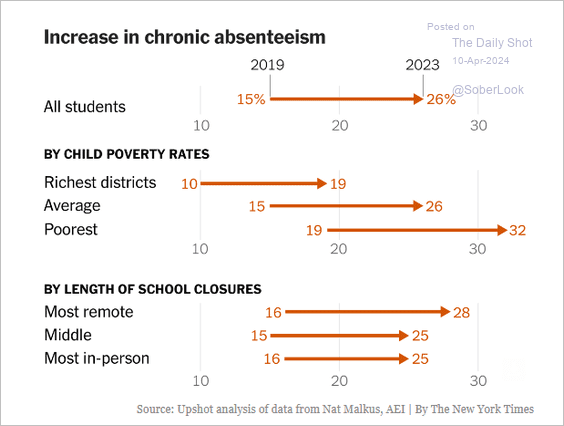

• Rising rates of chronic school absenteeism in 2023 compared to 2019:

Source: The New York Times Read full article

Source: The New York Times Read full article

——————–

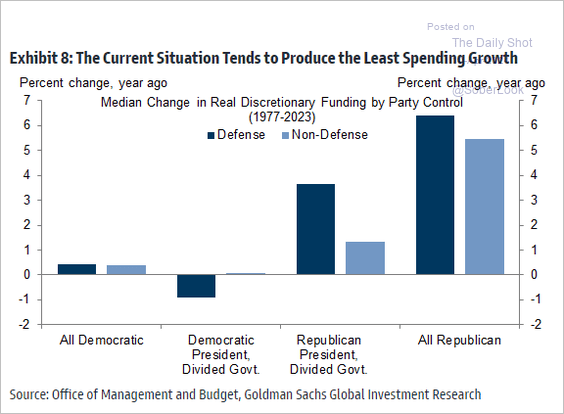

5. Discretionary spending changes, by US government party control:

Source: Goldman Sachs; @MikeZaccardi

Source: Goldman Sachs; @MikeZaccardi

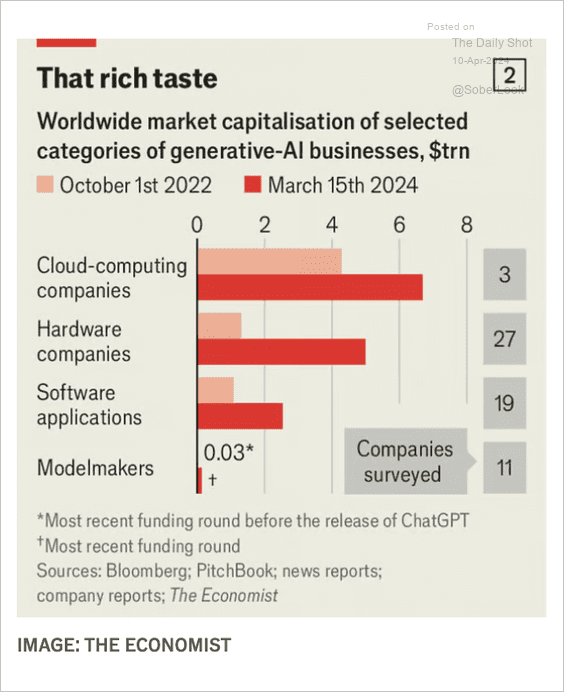

6. Preferred generative AI model providers for business collaboration:

Source: The Economist Read full article

Source: The Economist Read full article

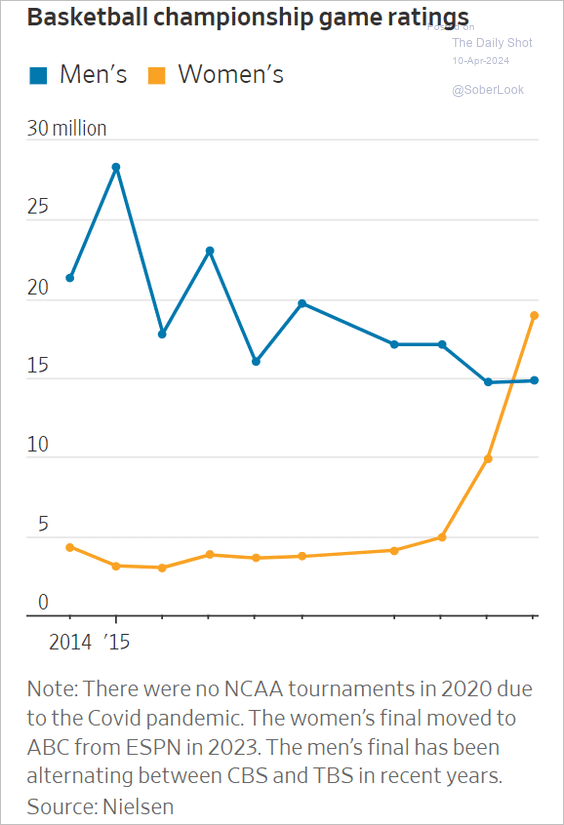

7. Basketball championship game ratings:

Source: @WSJ Read full article

Source: @WSJ Read full article

——————–

Back to Index