The Daily Shot: 07-May-24

• The United States

• Canada

• The United Kingdom

• The Eurozone

• Europe

• Asia-Pacific

• China

• Emerging Markets

• Cryptocurrency

• Commodities

• Energy

• Equities

• Alternatives

• Credit

• Rates

• Global Developments

• Food for Thought

The United States

1. According to the Fed’s Senior Loan Officer Opinion Survey, banks continue to tighten lending standards for consumer loans such as credit cards and auto loans. However, the number of banks tightening standards is lower than last year.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

Demand for consumer loans has been deteriorating.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

• The net percentage of lenders tightening mortgage loan standards has declined sharply.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

Demand for mortgages appears to be stabilizing.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

We have more data from the Senior Loan Officer Opinion Survey in the Credit section.

——————–

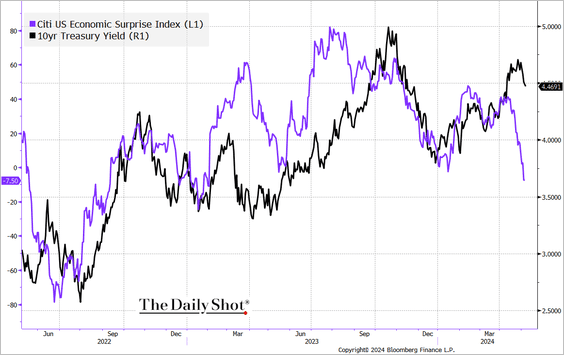

2. The sharp decline in the Citi Economic Surprise Index points to downside risks in Treasury yields.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

• In the Citi Economic Surprise Index, both hard and soft (survey-based) data surprises have been declining, with the soft data now aligning more closely with the hard data.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

——————–

3. Goldman’s US core inflation tracker is nearing 2%.

![]() Source: Goldman Sachs; @MikeZaccardi

Source: Goldman Sachs; @MikeZaccardi

– GS expects softer inflation data later this year to prompt the Fed to cut rates.

Source: Goldman Sachs; @MikeZaccardi

Source: Goldman Sachs; @MikeZaccardi

• However, MRB Partners expects the core PCE inflation to track in a 3-4% range.

Source: MRB Partners

Source: MRB Partners

• Bloomberg stories mentioning “stagflation” are surging again.

Source: BofA Global Research; @MikeZaccardi

Source: BofA Global Research; @MikeZaccardi

——————–

4. The percentage of Bank of America customers receiving income from gig platforms like ridesharing, deliveries, and social commerce remains elevated.

Source: Bank of America Institute

Source: Bank of America Institute

• BofA’s internal data suggests ride-sharing demand has been strengthening.

Source: Bank of America Institute

Source: Bank of America Institute

• There are signs that gig workers rely more consistently on this type of work.

Source: Bank of America Institute

Source: Bank of America Institute

——————–

5. Household deposit levels appear to have stabilized.

Source: Torsten Slok, Apollo

Source: Torsten Slok, Apollo

Back to Index

Canada

1. Consumer confidence is trending lower again.

2. Economists expect the BoC’s and Fed’s policy trajectories to diverge.

• Capital Economics:

Source: Capital Economics

Source: Capital Economics

• Morgan Stanley (Fed = blue, BoC = yellow):

Source: Morgan Stanley Research

Source: Morgan Stanley Research

——————–

3. BofA’s Canada Cycle Indicator is improving, which could bode well for the TSX Index relative to the S&P 500.

Source: BofA Global Research

Source: BofA Global Research

• Canadian stocks are trading at a historic discount versus the US.

Source: BofA Global Research

Source: BofA Global Research

• TSX’s dividend yield versus the S&P 500 continues to widen.

Source: BofA Global Research

Source: BofA Global Research

• The iShares MSCI Canada ETF (EWC) is testing long-term support relative to the SPDR S&P 500 ETF (SPY).

Back to Index

The United Kingdom

1. The BRC/KPMG retail sales index fell sharply last month compared to 2023. A contributing factor, though not the sole reason, was the earlier occurrence of Easter this year (March versus April).

2. The final PMI report for April confirmed an acceleration in service sector activity.

Source: S&P Global PMI

Source: S&P Global PMI

3. Here is a look at perceptions of teenagers’ prospects compared to their parents’ generation.

Source: YouGov Read full article

Source: YouGov Read full article

Back to Index

The Eurozone

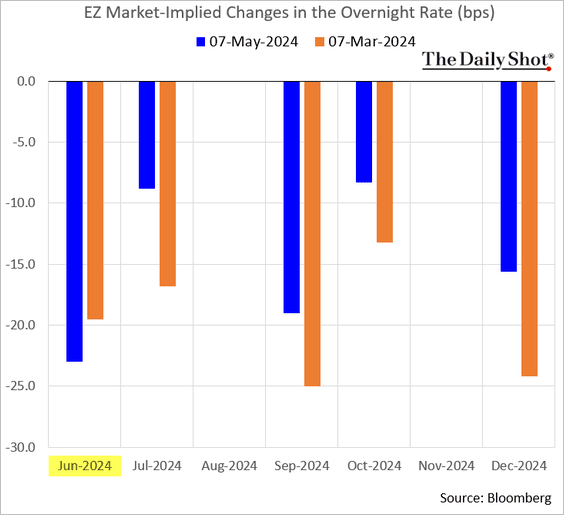

1. The ECB is on track to cut rates next month.

Source: Reuters Read full article

Source: Reuters Read full article

Short-term rates have declined in recent days.

——————–

2. The Sentix investor sentiment index has continued to rise, now up for seven consecutive months.

Source: RTT News Read full article

Source: RTT News Read full article

——————–

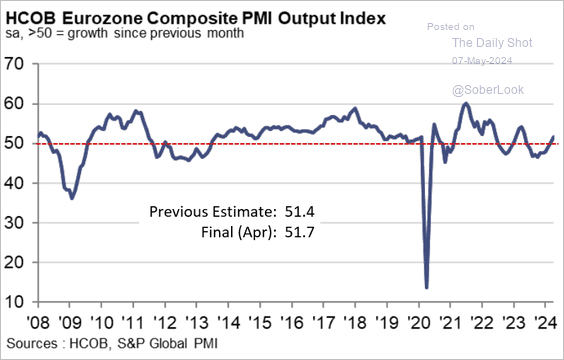

3. The composite April PMI index confirmed the Eurozone’s return to growth, …

Source: S&P Global PMI

Source: S&P Global PMI

… boosted by services.

• Spain:

• France:

• Eurozone:

——————–

4. The Citi Eurozone Economic Surprise Index has been outperforming its US counterpart.

Back to Index

Europe

1. Sweden’s services PMI unexpectedly dipped into contraction territory last month.

2. European corporate earnings are starting to rebound.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

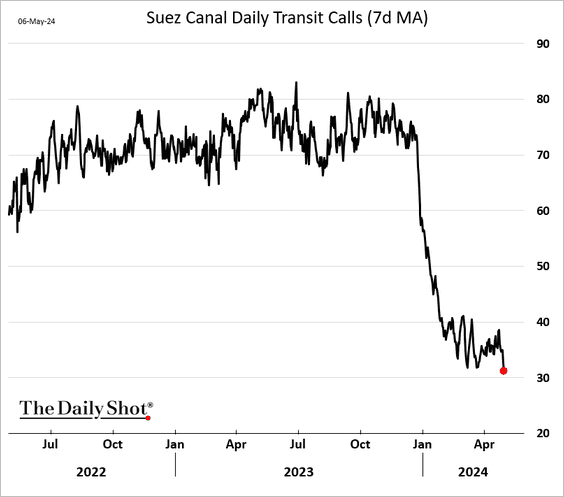

3. Container shipping costs are turning higher as the Suez Canal situation worsens (see the Global Developments section).

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

Back to Index

Asia-Pacific

1. The yen is weakening again after USD/JPY held support at the 50-day moving average.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

EUR/JPY also held (uptrend) support.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

——————–

2. Australia’s inflation tracker has been trending lower but remains elevated.

Back to Index

China

1. Service sector growth remained stable last month.

2. BCA Research lacks confidence in the sustainability of China’s equity market rally.

Source: BCA Research

Source: BCA Research

3. Retail sales volumes have weakened.

Source: China Beige Book

Source: China Beige Book

4. Residential and commercial property sales volumes slowed over the past month.

Source: China Beige Book

Source: China Beige Book

5. Tourism has been strengthening.

Source: Gavekal Research

Source: Gavekal Research

Back to Index

Emerging Markets

1. Brazil’s service sector continues to grow.

Source: S&P Global PMI

Source: S&P Global PMI

• The nation’s debt-to-GDP ratio keeps grinding higher.

——————–

2. Mexico’s job creation rebounded in April.

3. Vehicle sales in Argentina reflect the deterioration in economic activity …

… as the country grapples with fiscal austerity.

Source: Alpine Macro

Source: Alpine Macro

——————–

4. China has been a drag on EM corporate earnings beats.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

5. What are the best funding currencies for carry trades?

Source: Mary Nicola, MLIV Macro Strategist Read full article

Source: Mary Nicola, MLIV Macro Strategist Read full article

Back to Index

Cryptocurrency

1. Bitcoin is testing resistance at the 50-day moving average.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

• So far, bitcoin is holding trend support above $51.6K after last week’s decline triggered a loss of momentum.

——————–

2. The Crypto Fear & Greed Index snapped back into “greed” territory after BTC returned above $60K.

Source: Alternative.me

Source: Alternative.me

3. The pace of bitcoin ETF inflows has slowed.

Source: @KaikoData

Source: @KaikoData

4. Only 25% of the top altcoins have outperformed bitcoin over the past month.

Source: Blockchain Center

Source: Blockchain Center

Back to Index

Commodities

1. Funds have been rotating out of softs …

… into grains.

• Soybeans:

• Wheat:

——————–

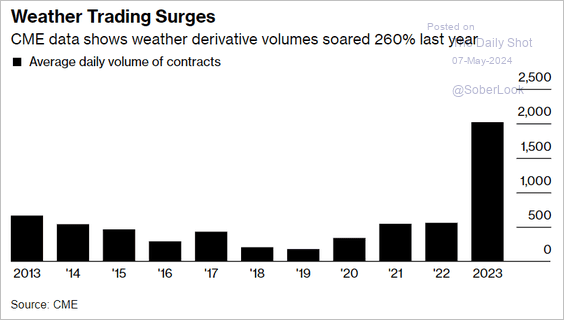

2. Weather derivatives have become very popular.

Source: @markets Read full article

Source: @markets Read full article

Back to Index

Energy

1. Refining margins have declined in Europe and North America.

Source: Reuters Read full article

Source: Reuters Read full article

2. Russia is rapidly adding LNG production capacity.

Source: CREA Read full article

Source: CREA Read full article

3. Here is a look at projected US power demand.

Source: Goldman Sachs; @MikeZaccardi

Source: Goldman Sachs; @MikeZaccardi

Back to Index

Equities

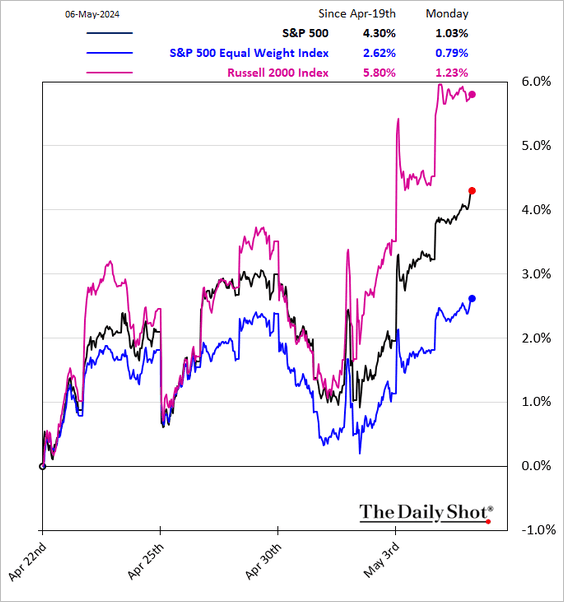

1. It’s been a good three days for stocks.

2. Key US indices have reclaimed their 50-day moving averages.

3. The rally has been partially fueled by short covering.

4. The S&P 500 equal-weight index has been underperforming the capitalization-weighted index, while small caps have been outperforming, marking an unusual trend.

5. Earnings reports continue to show strong profit growth last quarter.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

6. Retail trading activity at Schwab saw a modest pullback in April.

Source: Charles Schwab

Source: Charles Schwab

7. Growth stocks “found religion,” with their correlation to Treasury prices jumping in recent weeks.

Here is the Magnificent 7 and the S&P 500 equal-weight index.

——————–

8. The three-month VIX index is nearing its pre-pandemic lows as the Fed-related concerns ease while earnings remain strong.

• The S&P 500 three-month skew has been tumbling.

Back to Index

Alternatives

1. Hedge funds had a strong quarter.

Source: Goldman Sachs

Source: Goldman Sachs

2. Private debt fundraising has slowed.

Source: @theleadleft

Source: @theleadleft

3. US startup fundraising is off to a slow start this year.

Source: Carta

Source: Carta

4. VC funding in US healthcare innovation has been surging.

Source: Goldman Sachs

Source: Goldman Sachs

Back to Index

Credit

1. Banks continue to exercise caution in business lending.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

Demand for business loans remains depressed.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

• While fewer banks are tightening lending standards on commercial real estate (CRE) loans, overall, banks remain far more conservative than they were two years ago.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

CRE loan demand has improved substantially since the beginning of 2023 but remains soft.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

——————–

2. Bank loan leverage has been trending lower.

Source: @theleadleft

Source: @theleadleft

3. More European leveraged loans were quoted at or above par last month – the most since January 2022.

Source: PitchBook

Source: PitchBook

4. Corporate bond liquidity has been improving (“PT volumes” = the amount of bond trading done by dealers trading for their own accounts).

Source: Barclays Research; III Capital Management

Source: Barclays Research; III Capital Management

Back to Index

Rates

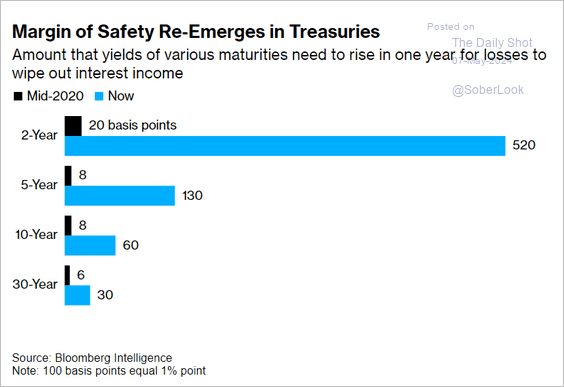

1. How much would yields need to rise to wipe out a year’s worth of interest income?

Source: @markets Read full article

Source: @markets Read full article

2. Here is a projection of the Fed’s securities holdings over time, provided by Oxford Economics.

Source: Oxford Economics

Source: Oxford Economics

Back to Index

Global Developments

1. Global equity risk premia are hitting multi-year lows, making stocks more vulnerable to corrections.

Source: Goldman Sachs; @AyeshaTariq

Source: Goldman Sachs; @AyeshaTariq

2. The Suez Canal ship transit volume has deteriorated further.

——————–

Food for Thought

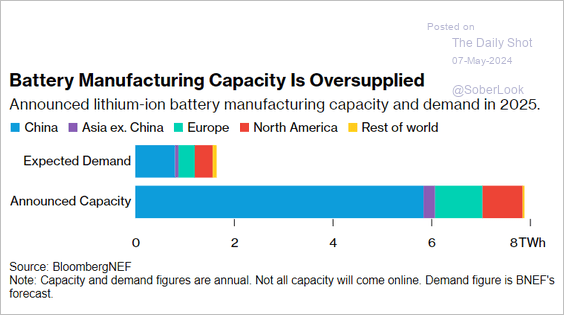

1. Battery manufacturing overcapacity:

Source: @colinmckerrache, @BloombergNEF Read full article

Source: @colinmckerrache, @BloombergNEF Read full article

2. Mobile phone supply chain diversification away from China:

Source: Goldman Sachs

Source: Goldman Sachs

3. Trends in acreage for major permanent crops in the US:

Source: The Washington Post Read full article

Source: The Washington Post Read full article

4. NATO’s military strength on the Eastern European flank:

Source: @financialtimes Read full article

Source: @financialtimes Read full article

5. Dairy cows infected with the avian flu:

Source: @axios Read full article

Source: @axios Read full article

6. Religion in the US:

Source: Quill Intelligence

Source: Quill Intelligence

7. The world’s longest caves:

Source: Statista

Source: Statista

——————–

Back to Index