The Daily Shot: 20-May-24

• The United States

• The United Kingdom

• Europe

• China

• Emerging Markets

• Commodities

• Energy

• Equities

• Credit

• Global Developments

• Food for Thought

The United States

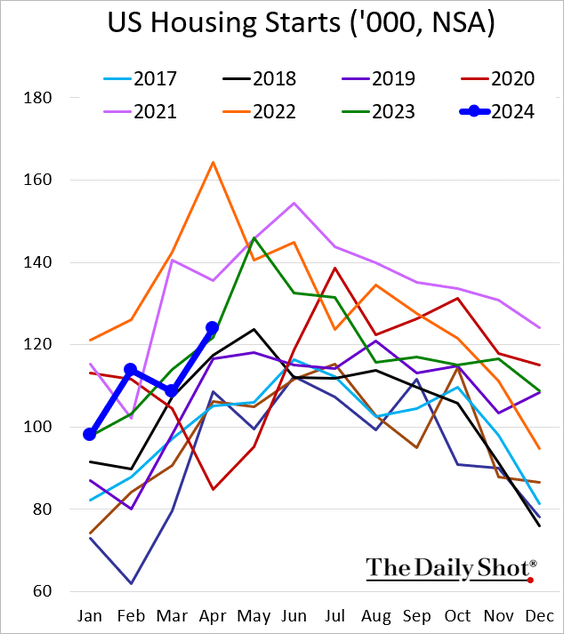

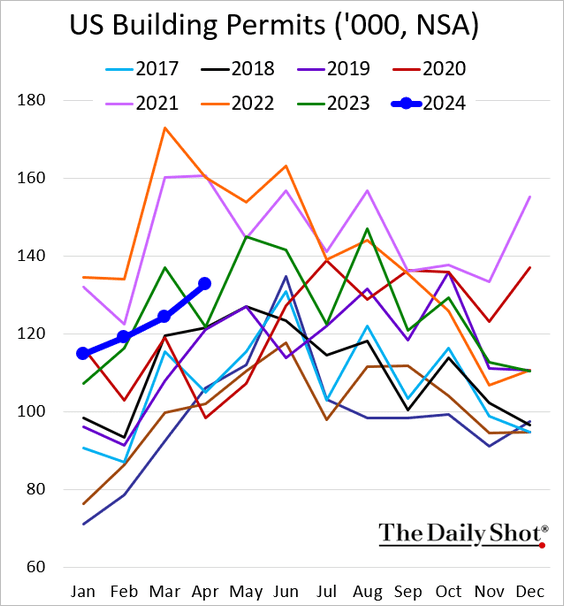

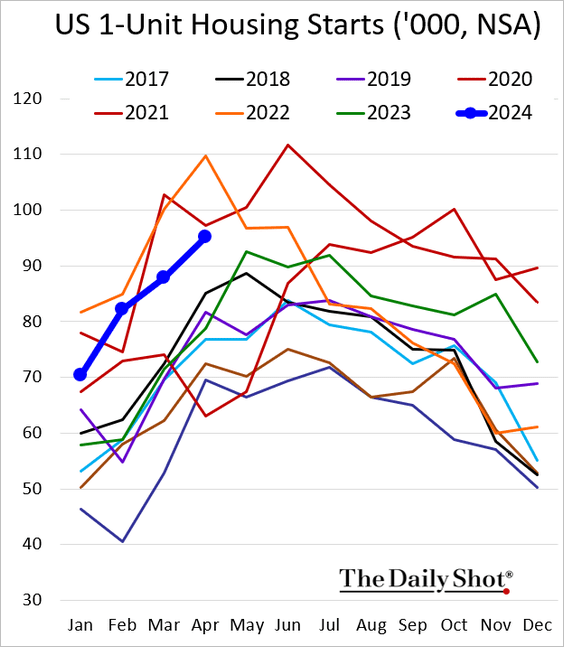

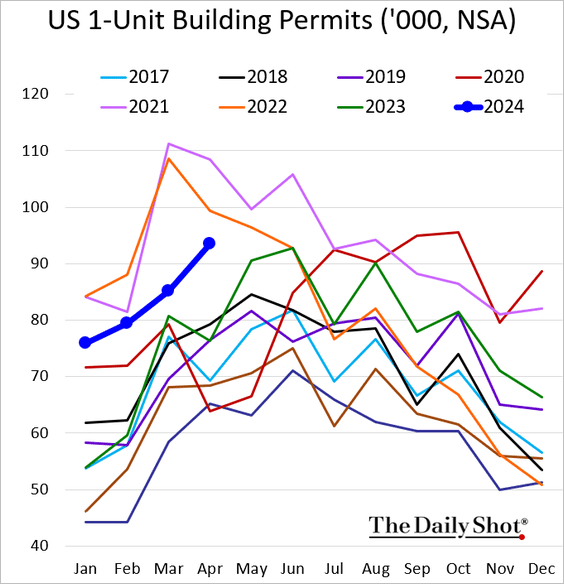

1. Let’s begin with the housing market.

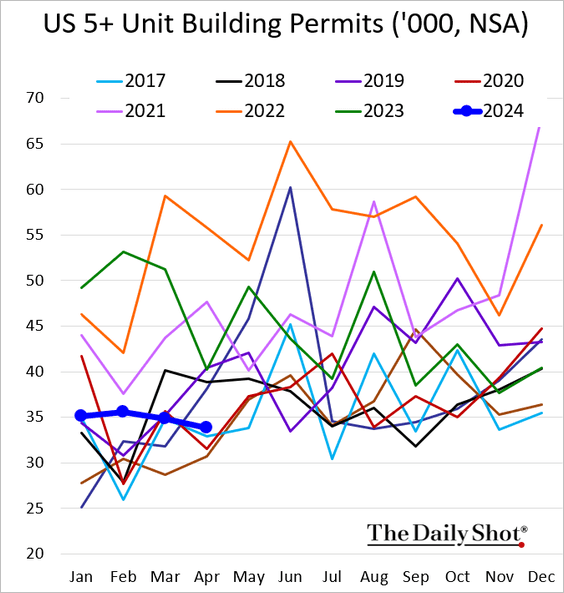

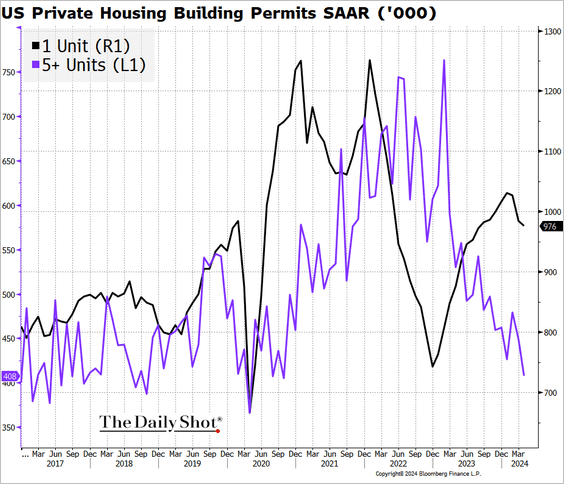

• Housing starts and building permits were above last year’s levels in April, …

…. supported by single-family construction.

– Multifamily activity remains depressed.

This seasonally adjusted chart illustrates the divergence between single-family and multifamily trends.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

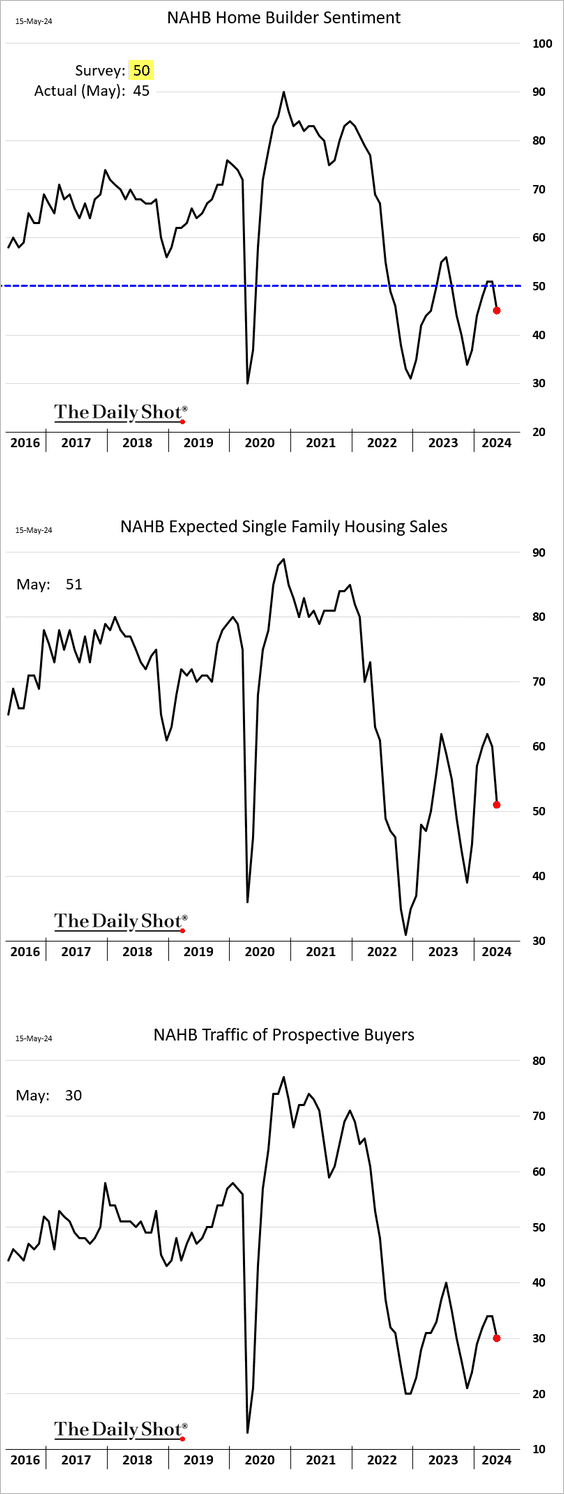

• Homebuilder sentiment declined this month.

Source: NAHB Read full article

Source: NAHB Read full article

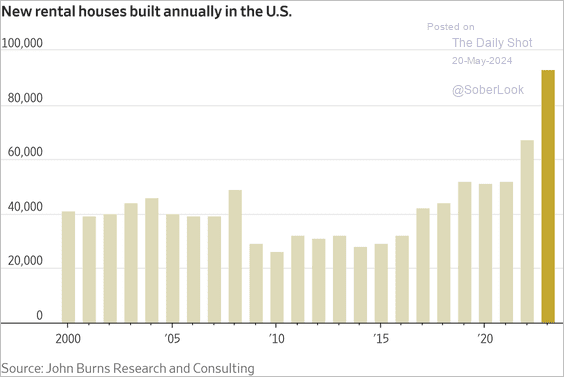

• Builders are increasingly focused on rental units.

Source: @WSJ Read full article

Source: @WSJ Read full article

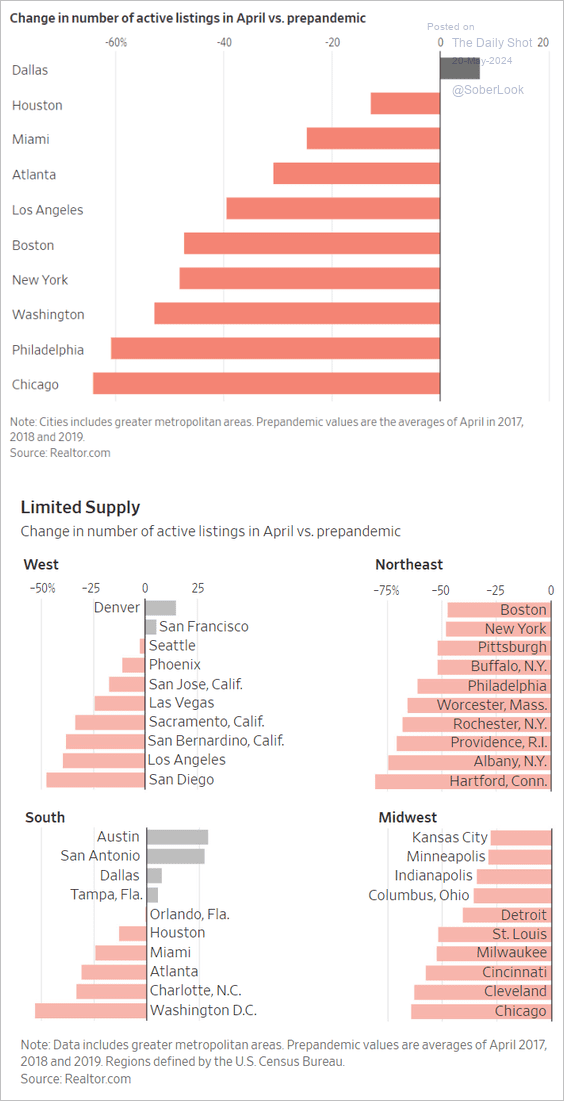

• Active listings are well below pre-pandemic levels in most metro areas.

Source: @WSJ Read full article

Source: @WSJ Read full article

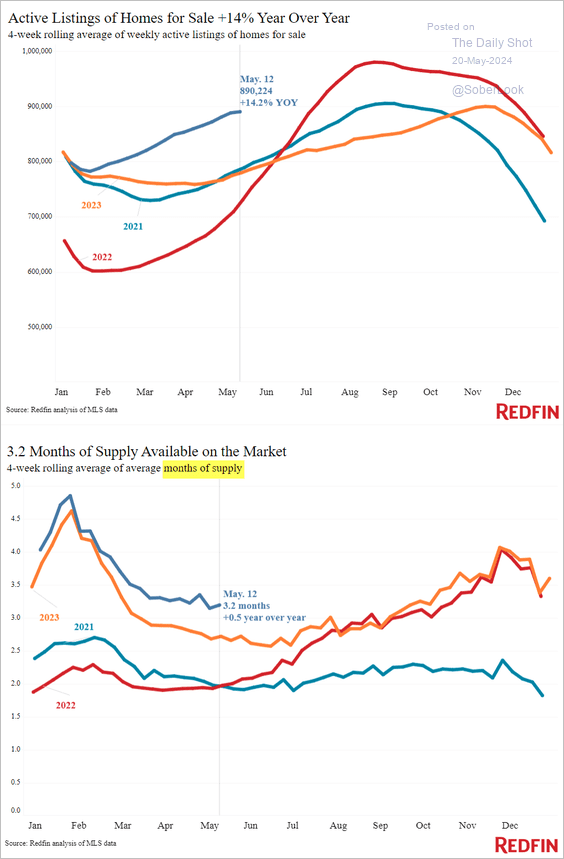

• But existing home inventories are now above last year’s levels.

Source: Redfin

Source: Redfin

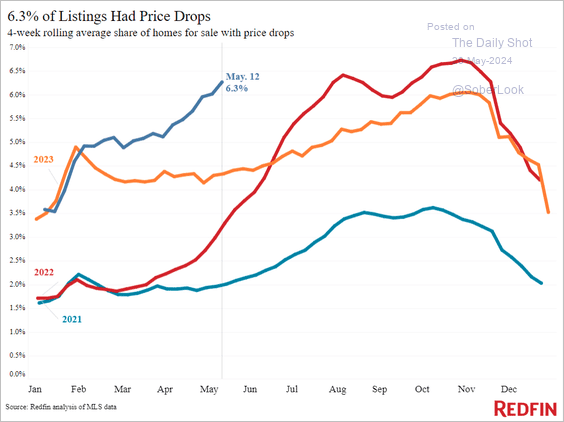

– More sellers are forced to cut prices to attract buyers.

Source: Redfin

Source: Redfin

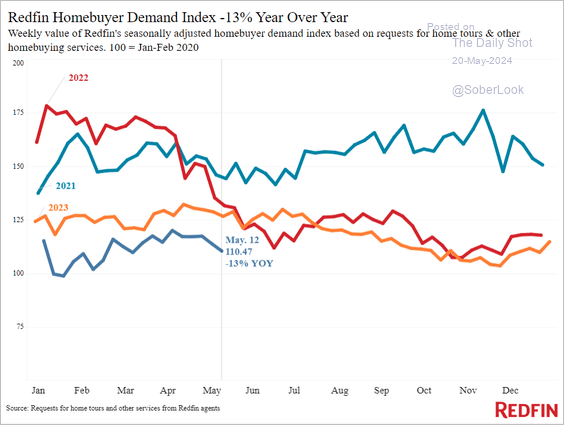

– Housing demand has softened further this year.

Source: Redfin

Source: Redfin

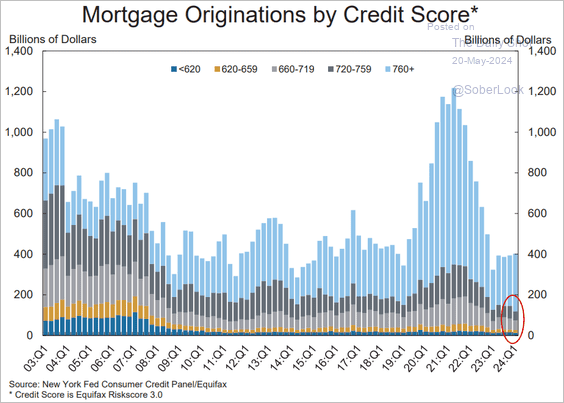

• Mortgage originations for households with credit scores below 760 reached a multi-year low in the first quarter.

Source: Federal Reserve Bank of New York

Source: Federal Reserve Bank of New York

——————–

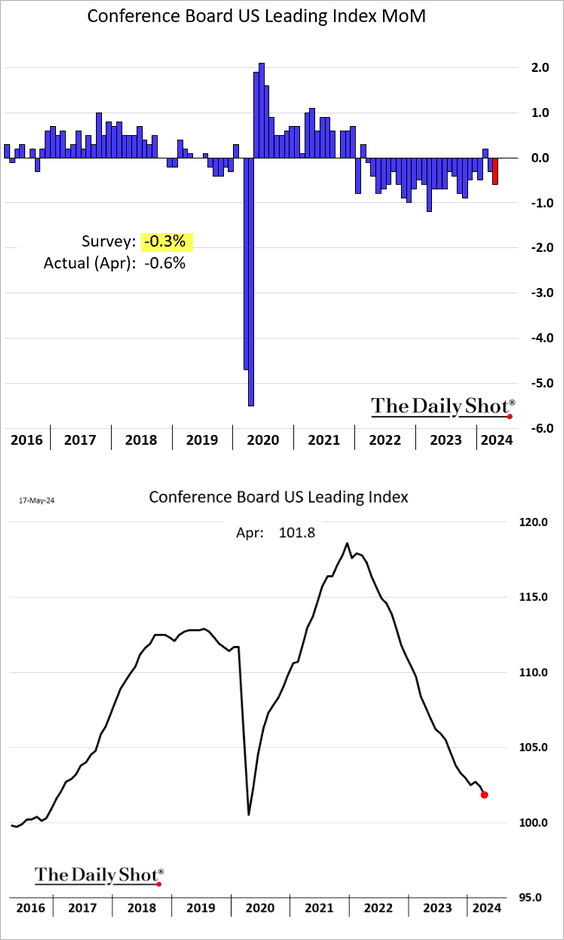

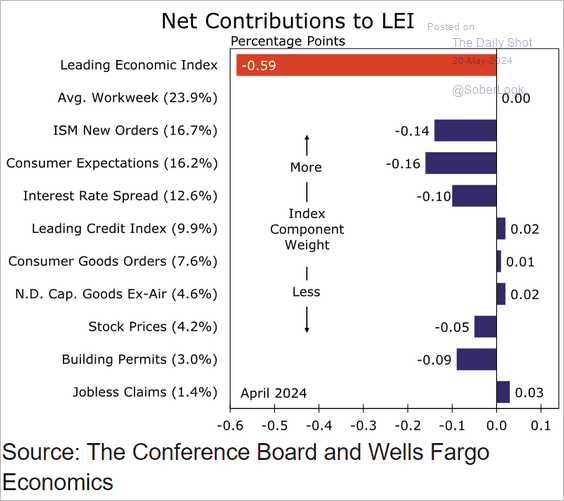

2. The Conference Board’s US leading index declined again last month.

• Here are the contributions.

Source: Wells Fargo Securities

Source: Wells Fargo Securities

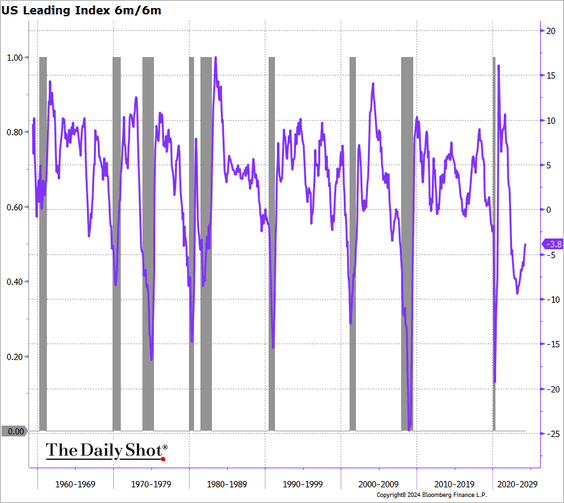

• Based on historical precedent, the 6-month changes in the leading index suggest that the economy should be in recession.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

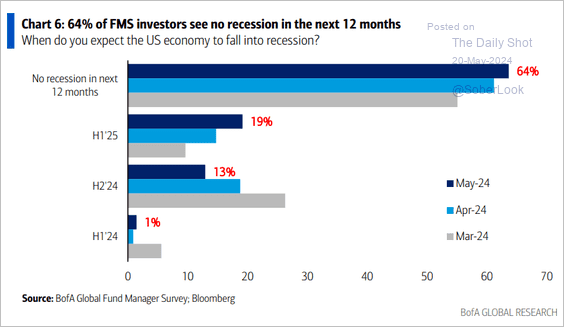

By the way, a majority of investors don’t expect a US recession over the next 12 months.

Source: BofA Global Research

Source: BofA Global Research

——————–

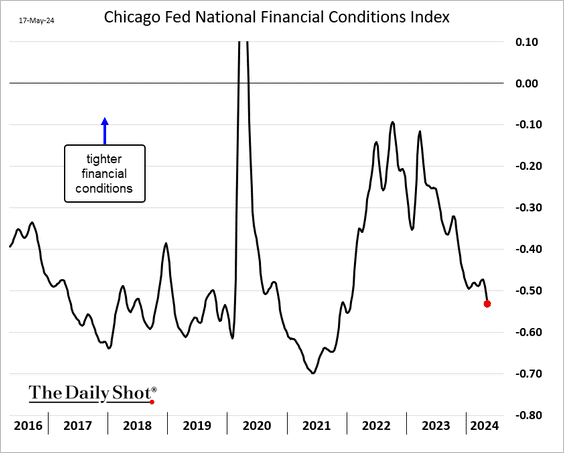

3. US financial conditions continue to ease.

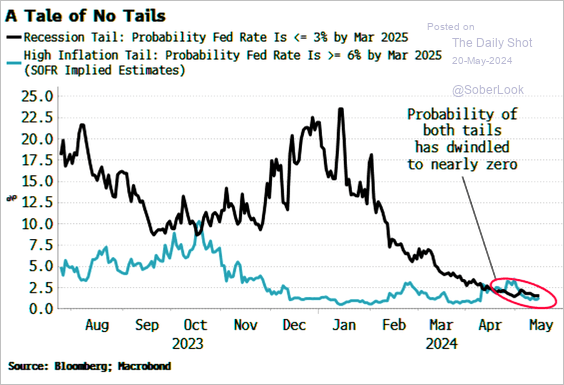

• The market does not anticipate either a recession or a rebound in inflation.

Source: Simon White, Bloomberg Markets Live Blog

Source: Simon White, Bloomberg Markets Live Blog

——————–

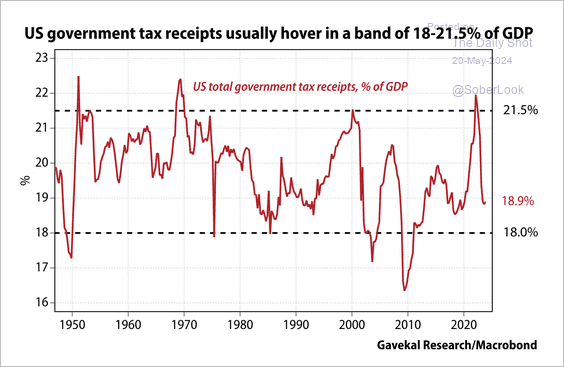

4. Total tax receipts as a percent of GDP are now at the low end of the historical range.

Source: Gavekal Research

Source: Gavekal Research

Back to Index

The United Kingdom

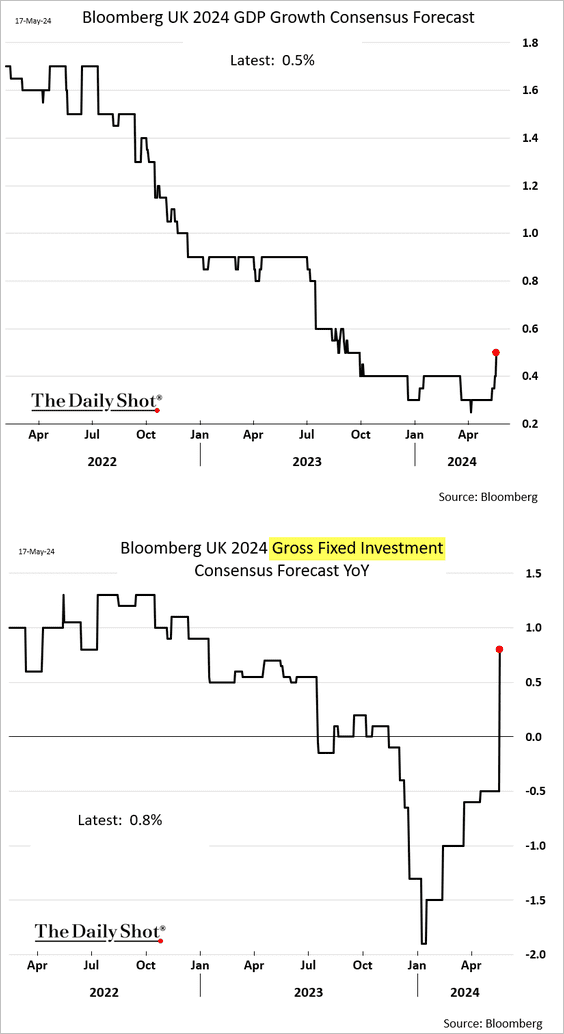

1. Economists have upgraded their estimates for UK GDP growth this year.

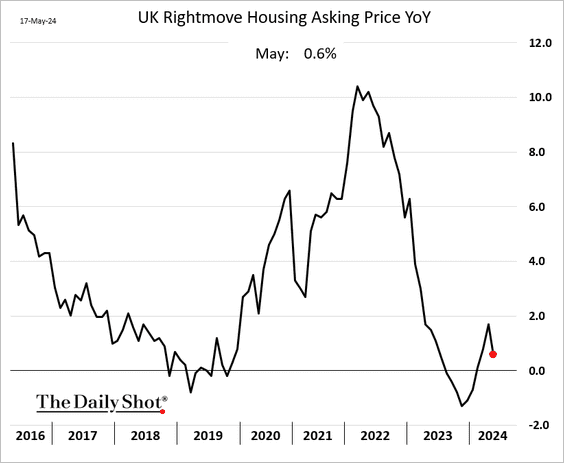

2. Home price appreciation slowed in May.

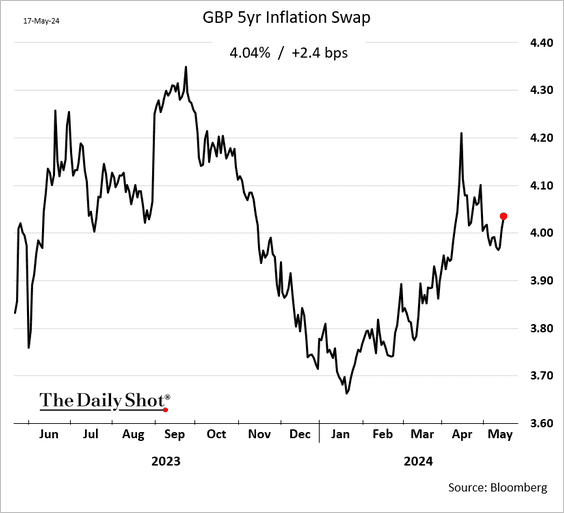

3. Market-based inflation expectations are rising again.

h/t Nour Al Ali

h/t Nour Al Ali

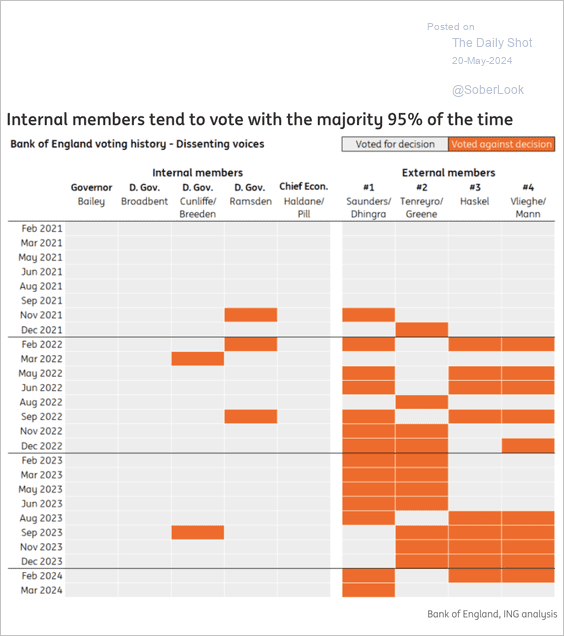

4. Here is a look at the Bank of England’s voting history and dissenting voices.

Source: ING

Source: ING

Back to Index

Europe

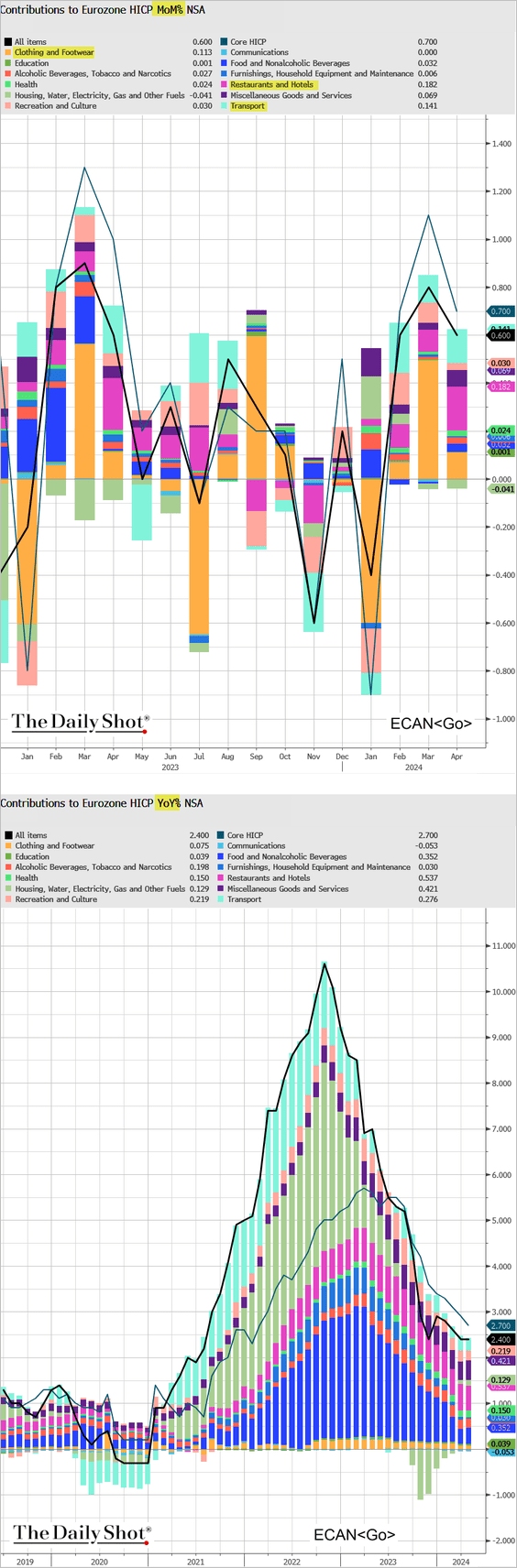

1. Here is a look at the euro-area CPI contributions (month-over-month and year-over-year).

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

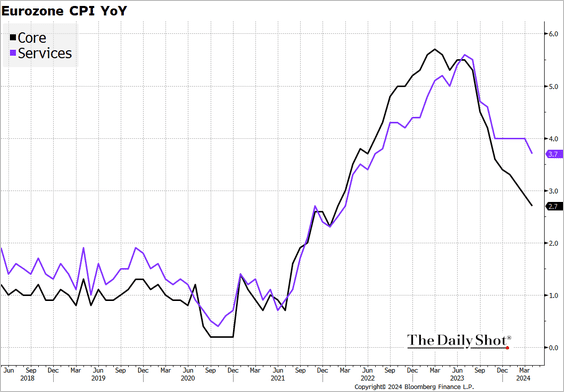

• Services inflation has been sticky.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

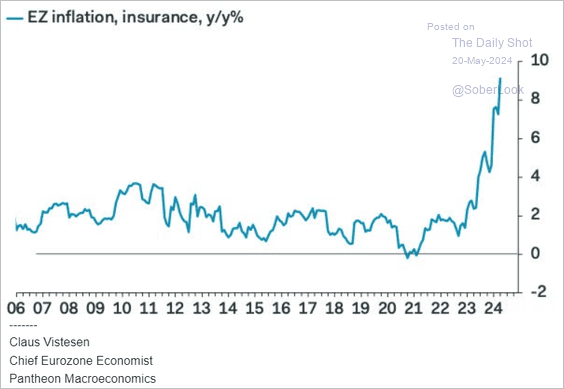

– Gains in insurance costs have been accelerating.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

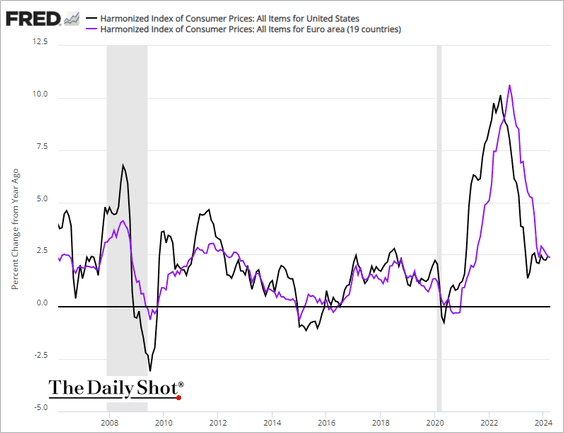

• On an EU-harmonized basis, the euro-area CPI matches that of the US.

——————–

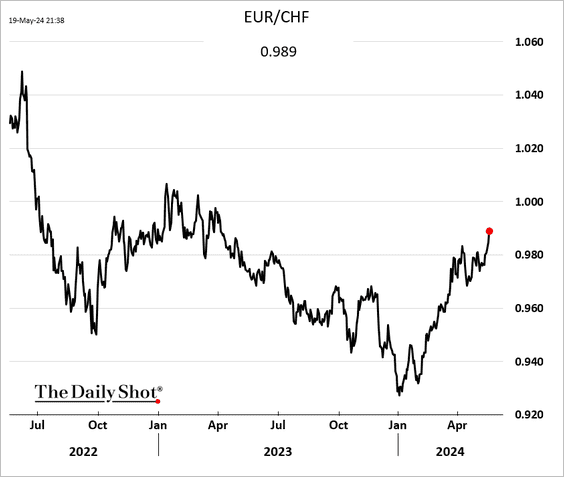

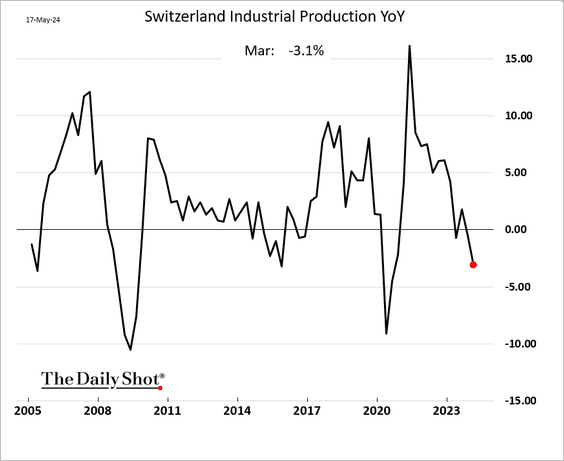

2. The Swiss franc continues to weaken, …

… as Swiss industrial production slows.

——————–

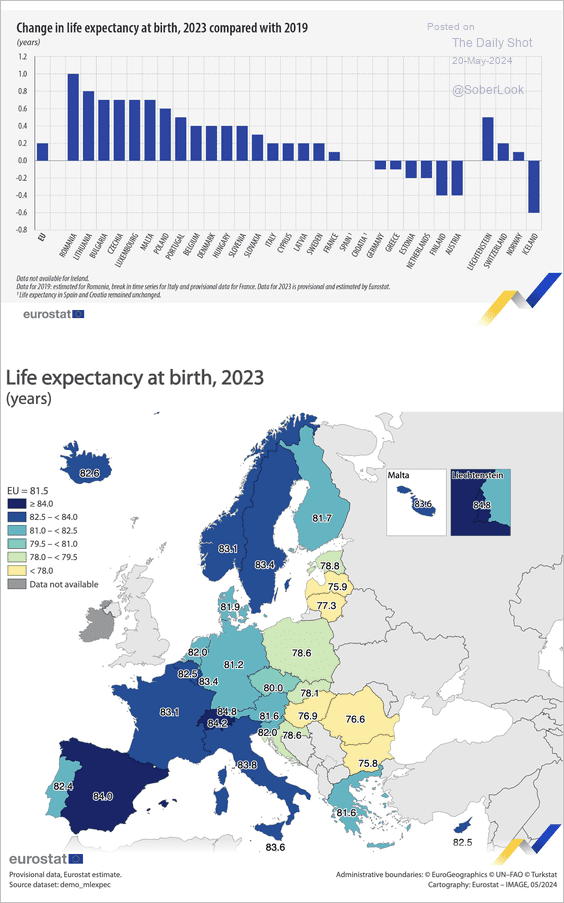

3. This chart shows the change in EU life expectancy at birth in 2023 compared to 2019 and life expectancy at birth.

Source: Eurostat Read full article

Source: Eurostat Read full article

Back to Index

China

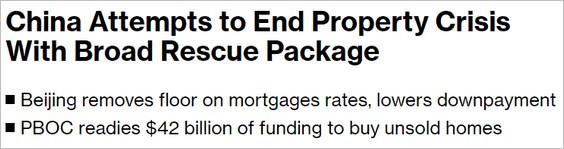

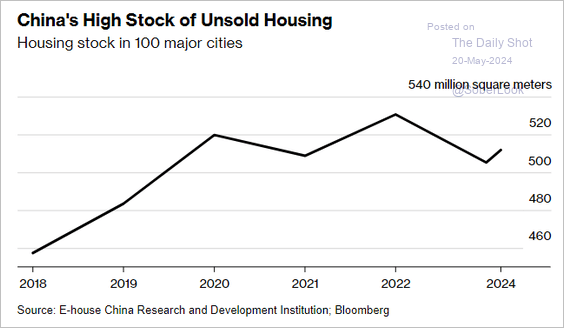

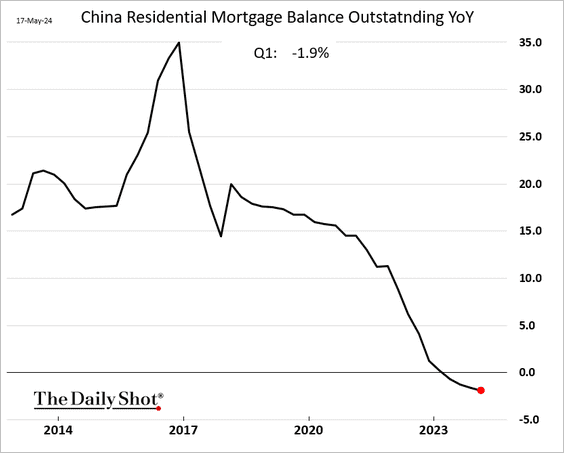

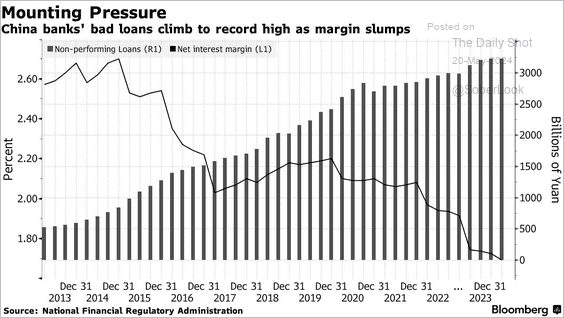

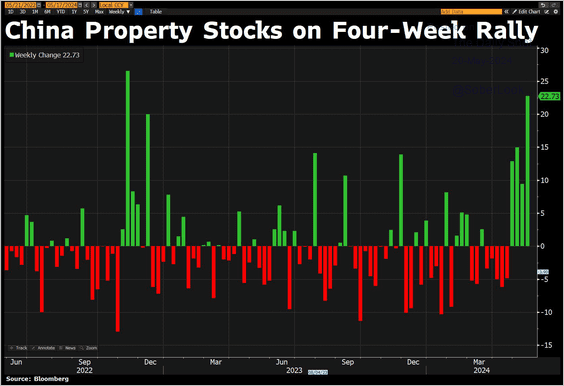

1. Beijing is once again intensifying its efforts to bail out the housing market.

Source: @wealth Read full article

Source: @wealth Read full article

• Here are some recent trends.

– The inventory of unsold homes remains elevated.

Source: @markets Read full article

Source: @markets Read full article

– Mortgage balances are now down on a year-over-year basis.

– China’s banks are struggling with bad loans and shrinking NIM.

Source: @markets Read full article

Source: @markets Read full article

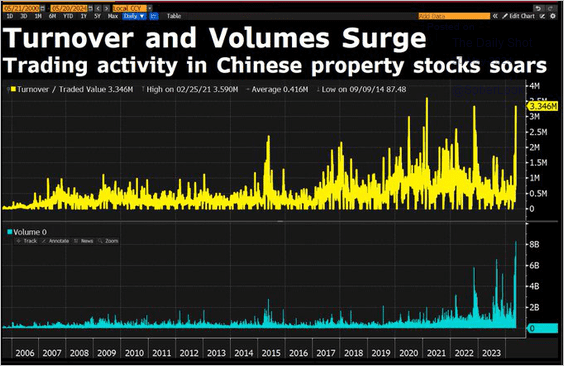

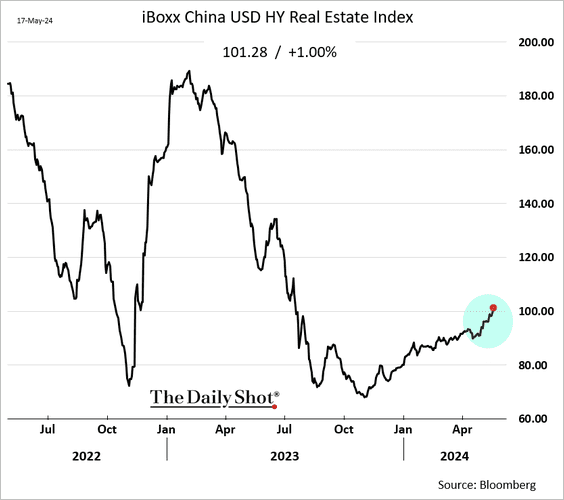

• The market likes what Beijing is offering.

– Property stocks (2 charts):

Source: @DavidInglesTV, @BloombergTV

Source: @DavidInglesTV, @BloombergTV

Source: @DavidInglesTV, @BloombergTV

Source: @DavidInglesTV, @BloombergTV

– Distressed developers’ USD bonds (price):

——————–

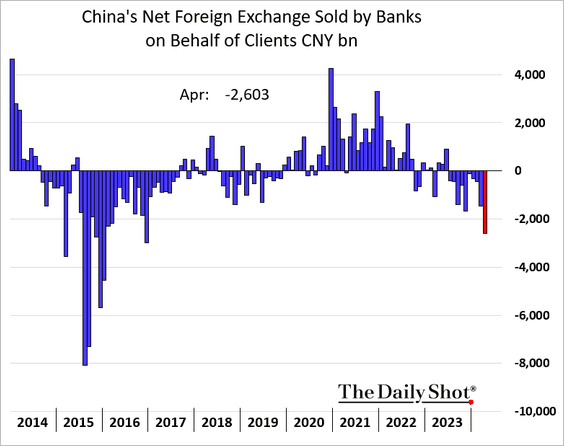

2. Last month, Chinese bank clients purchased the most foreign currency since 2016.

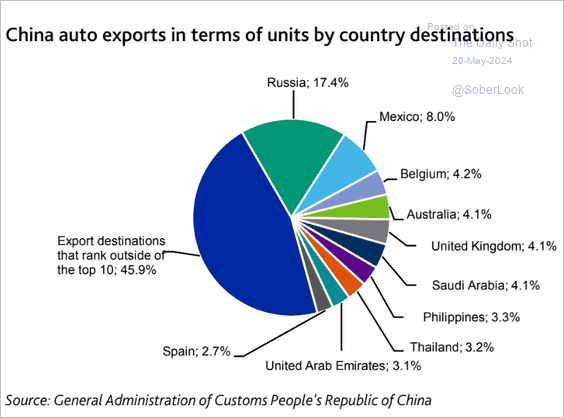

3. Here is a look at China’s auto exports.

Source: Moody’s Investors Service

Source: Moody’s Investors Service

Back to Index

Emerging Markets

1. The Chilean peso has been rallying with copper prices (chart shows USD weakening against CLP).

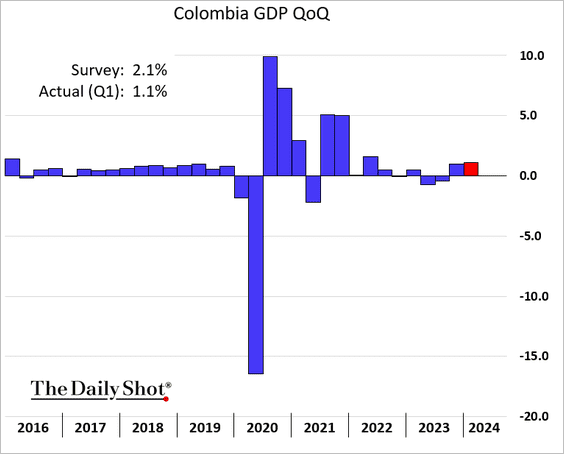

2. Colombia’s GDP growth was softer than expected in Q1.

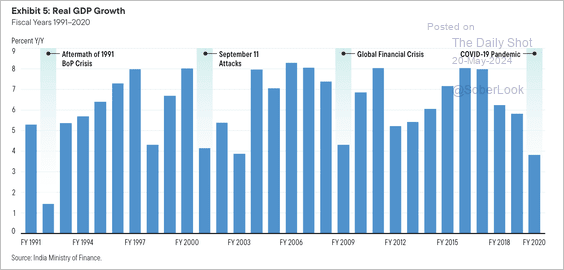

3. Here are some updates on India.

• Economic growth has been impacted by global and domestic shocks.

Source: Franklin Templeton

Source: Franklin Templeton

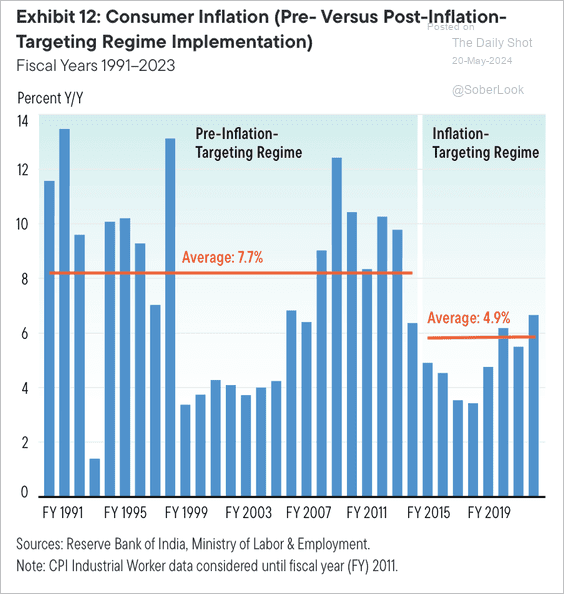

• Inflation has become lower and less volatile under the inflation-targeting regime.

Source: Franklin Templeton

Source: Franklin Templeton

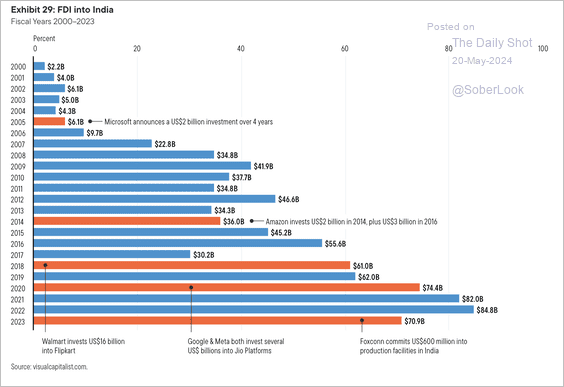

• Foreign direct investment has increased considerably over the past 20 years, especially among large global firms.

Source: Franklin Templeton

Source: Franklin Templeton

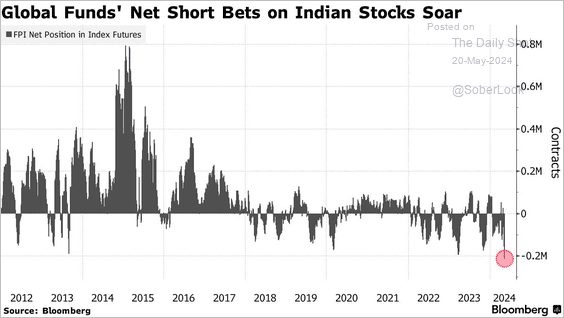

• Global funds have been shorting Indian shares.

Source: @markets Read full article

Source: @markets Read full article

——————–

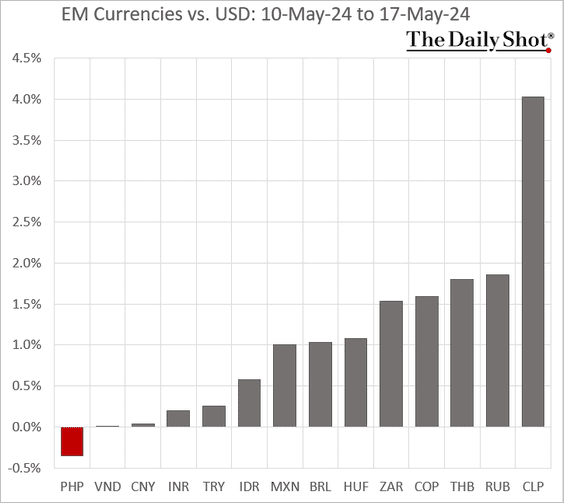

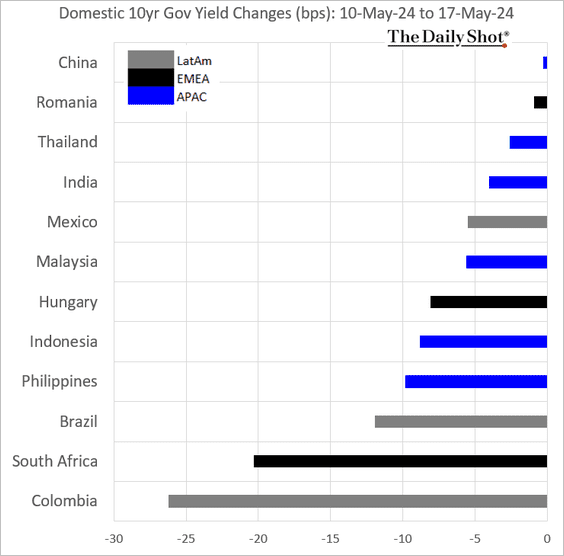

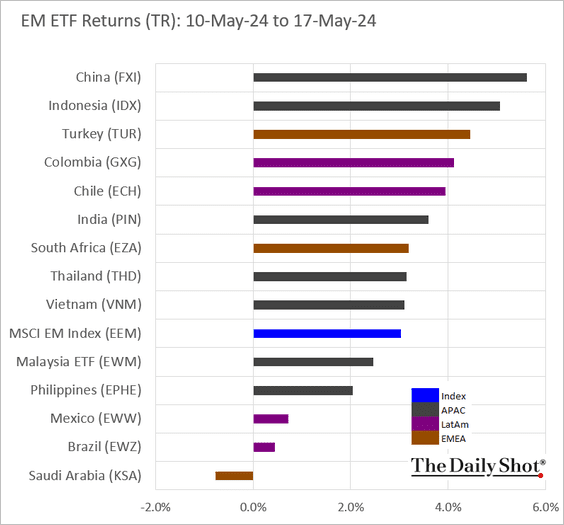

4. Finally, here is a look at last week’s performance.

• Currencies:

• Bond yields:

• Equity ETFs:

Back to Index

Commodities

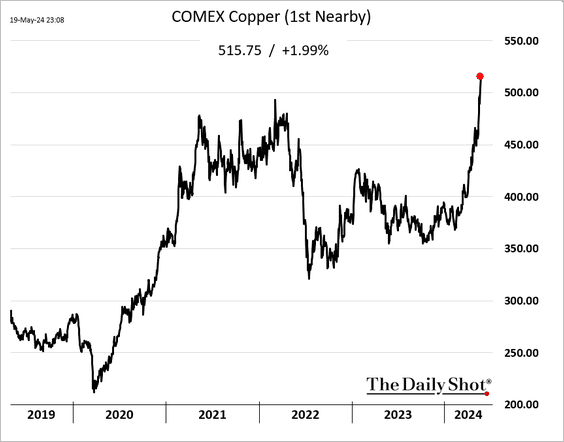

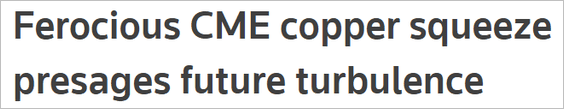

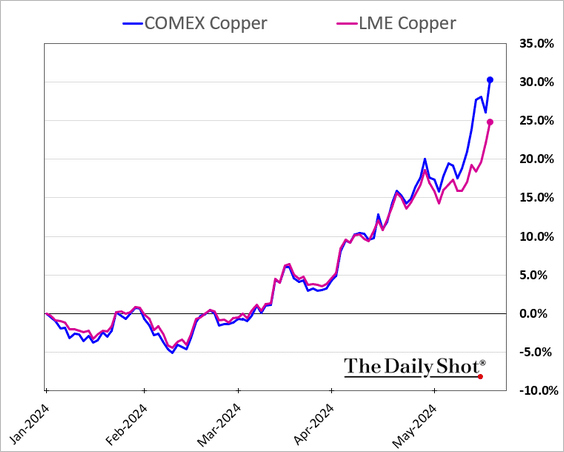

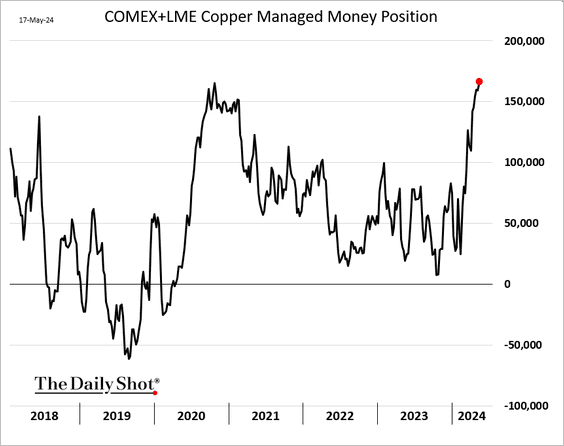

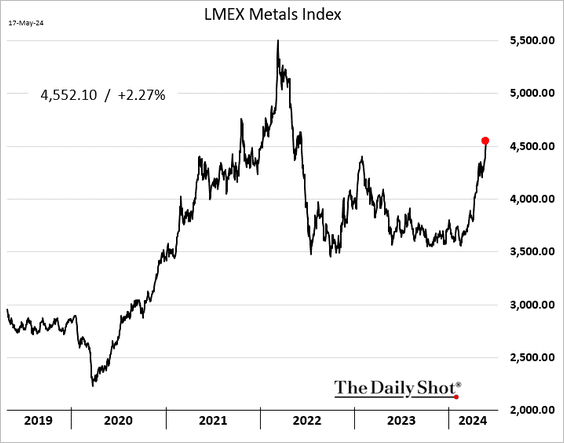

1. Copper continues to surge as funds squeeze out short sellers.

Source: Reuters Read full article

Source: Reuters Read full article

• The short squeeze has created a substantial spread between COMEX and LME prices. (2 charts).

Source: Simon White, Bloomberg Markets Live Blog

Source: Simon White, Bloomberg Markets Live Blog

• Speculative bets continue to rise.

• Here is the LME’s industrial metals index.

——————–

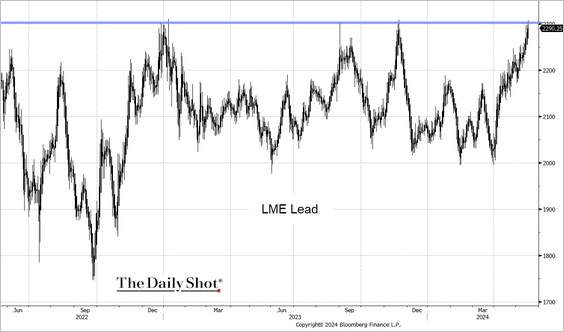

2. LME lead is testing resistance.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

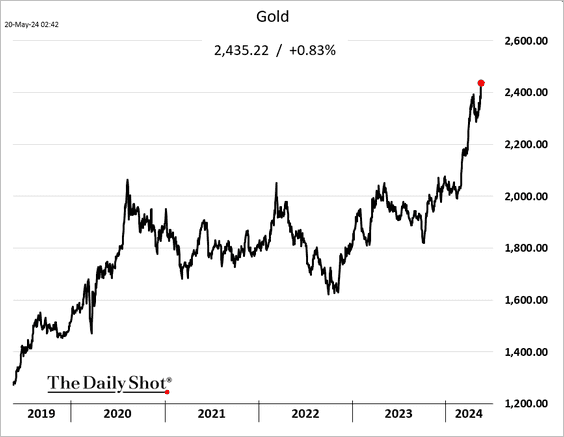

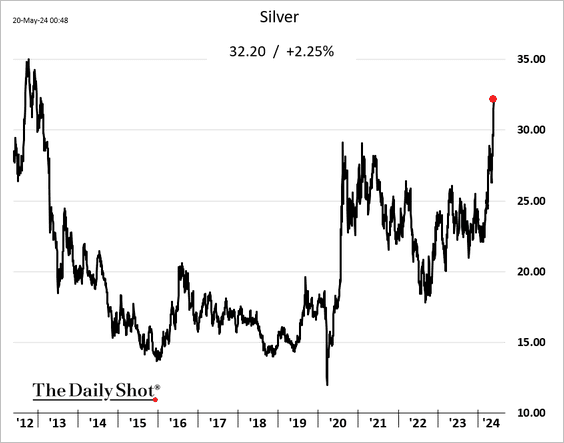

3. Precious metals continue to rally.

• Gold:

• Silver:

——————–

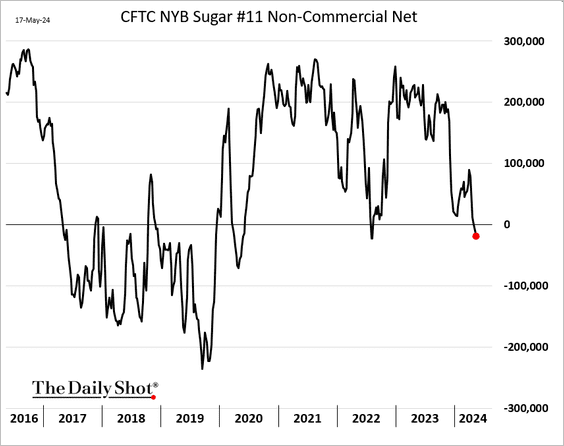

4. Speculative accounts are now net-short sugar futures.

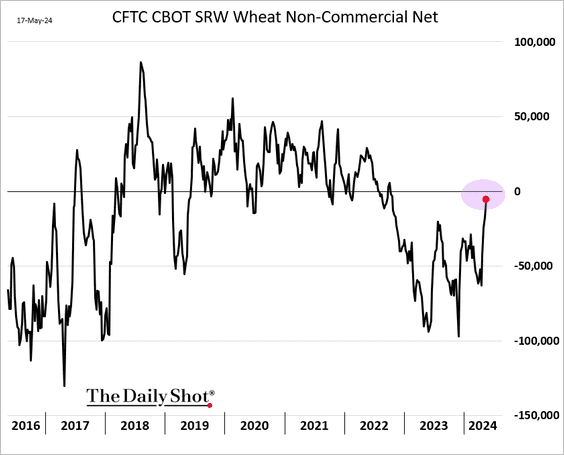

5. Wheat positioning continues to improve.

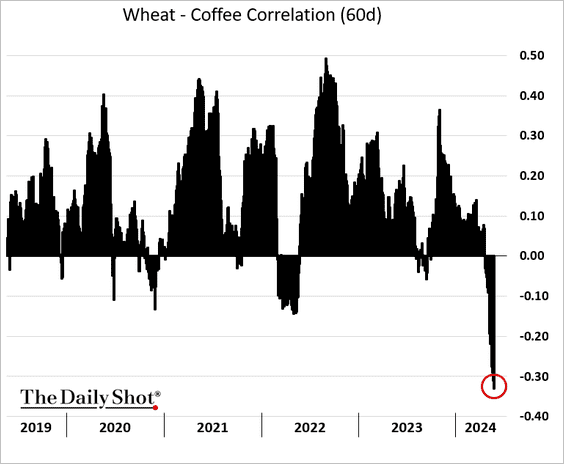

6. Funds have been rotating between coffee and wheat, resulting in a record inverse correlation.

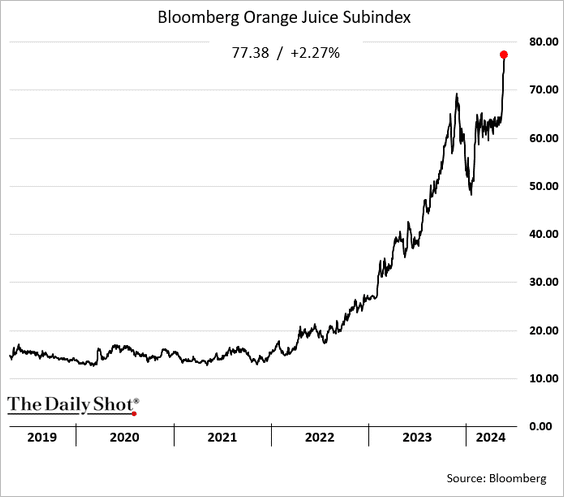

7. Orange juice prices are hitting record highs.

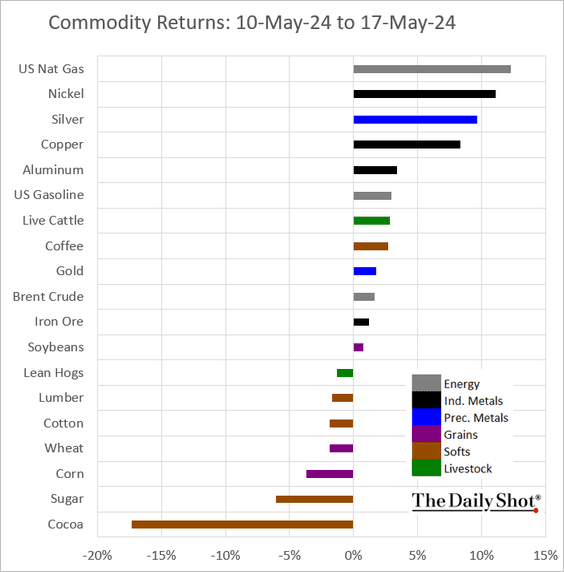

8. Here is last week’s performance across key commodity markets.

Back to Index

Energy

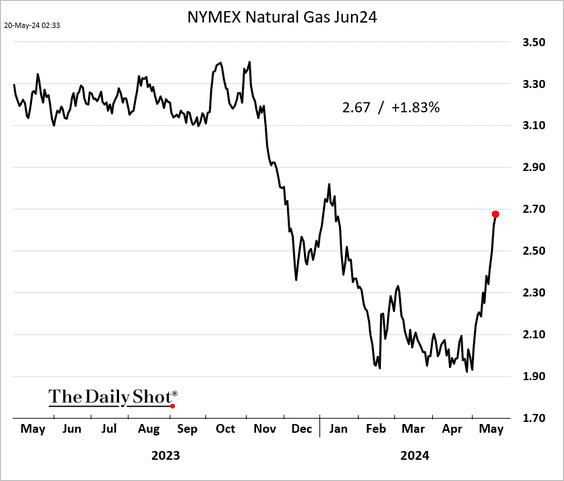

1. US natural gas futures are surging.

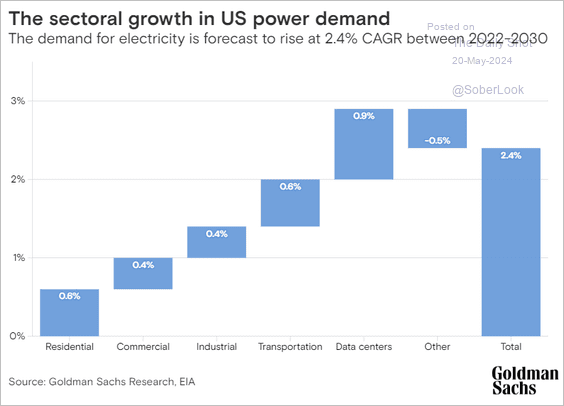

2. Here is Goldman’s forecast for US electricity demand growth.

Source: Goldman Sachs

Source: Goldman Sachs

Back to Index

Equities

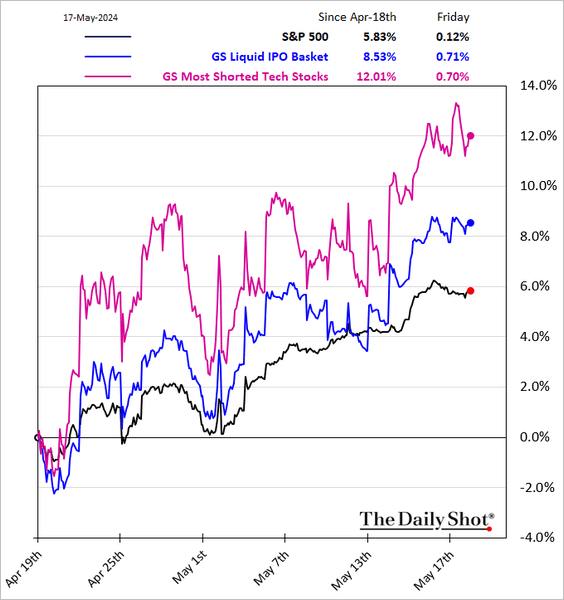

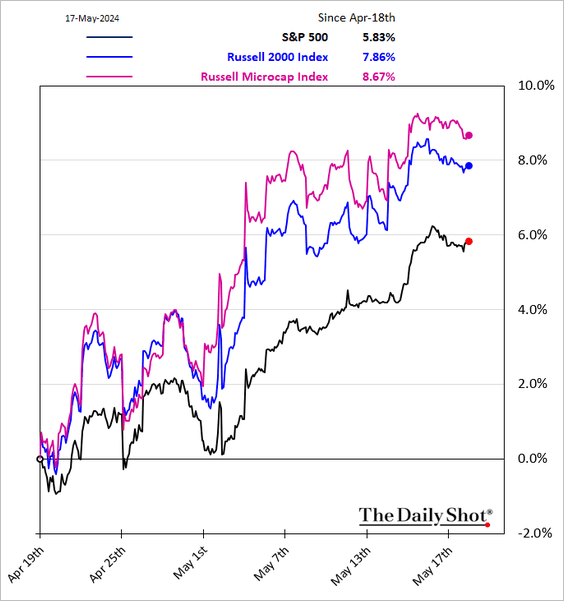

1. Retail investors have been moving in, driving up speculative stocks.

• Microcaps have been outperforming.

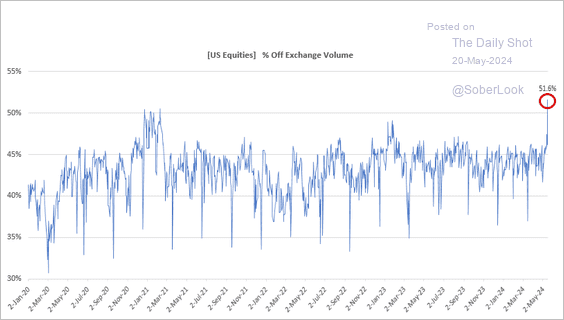

• Off-exchange activity has been surging, indicating increased retail participation. Platforms like Robinhood, E*TRADE, and Schwab frequently route orders to off-exchange venues, such as dark pools or internalizers.

Source: Goldman Sachs; @markets Read full article

Source: Goldman Sachs; @markets Read full article

——————–

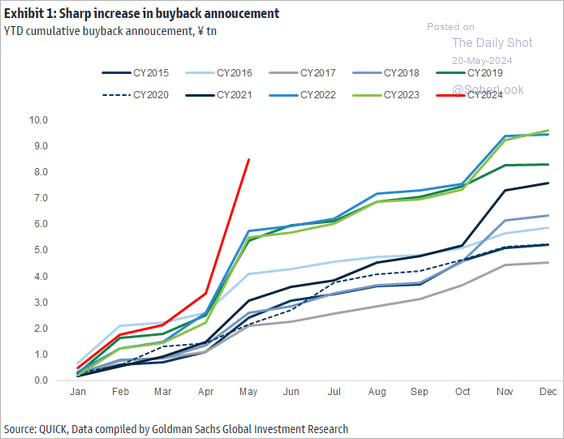

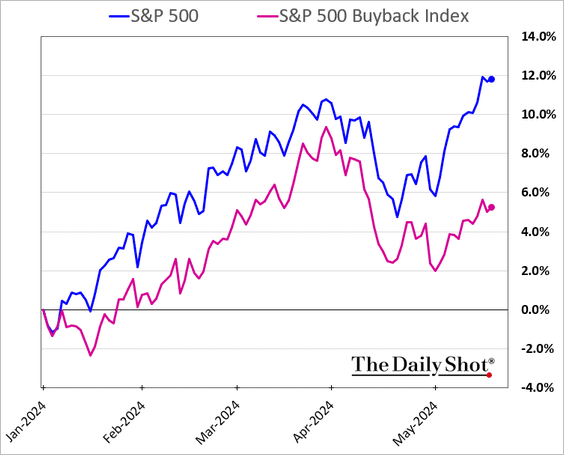

2. Share buyback announcements are up sharply.

Source: Goldman Sachs; @MikeZaccardi

Source: Goldman Sachs; @MikeZaccardi

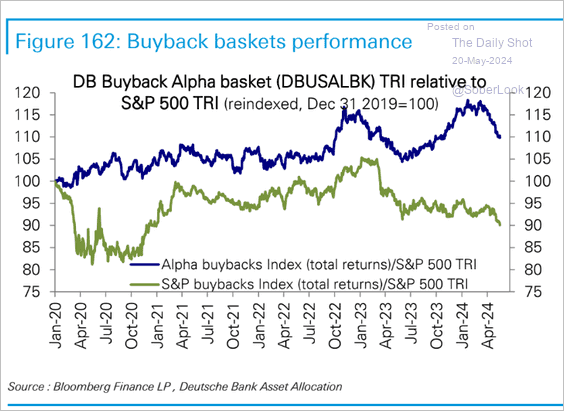

And yet, companies known for share buybacks have been underperforming (2 charts).

Source: Deutsche Bank Research

Source: Deutsche Bank Research

——————–

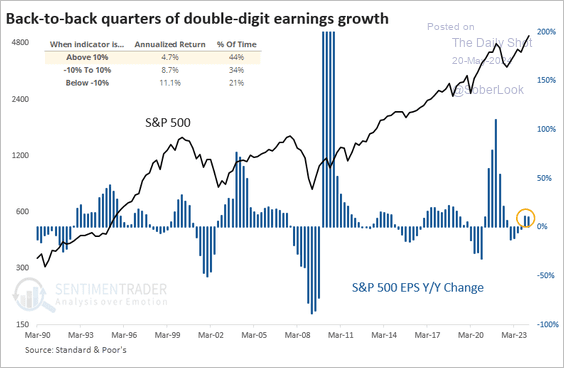

3. The S&P 500 is on track for another double-digit earnings growth.

Source: SentimenTrader

Source: SentimenTrader

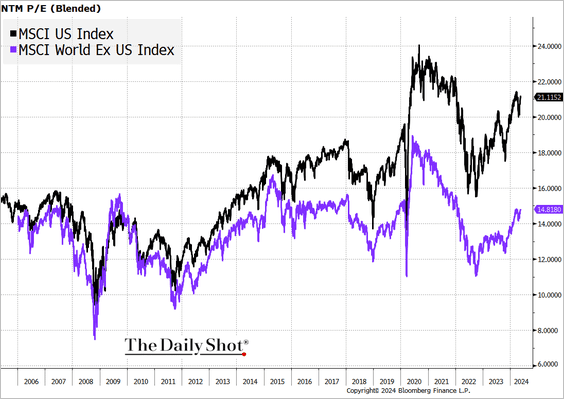

4. The valuation gap between US shares and those in the rest of the world continues to widen.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

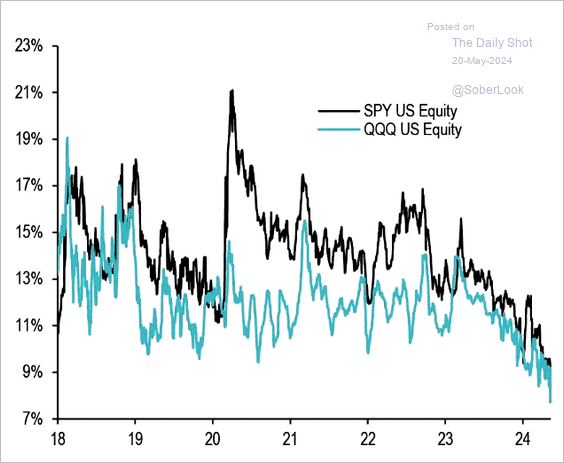

5. Short interest in US index ETFs has collapsed.

Source: JP Morgan Research; @themarketear

Source: JP Morgan Research; @themarketear

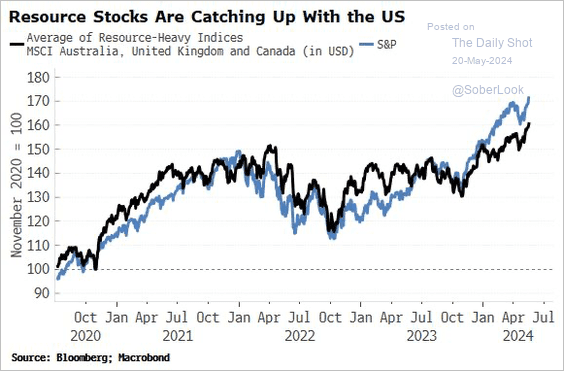

6. Resource-heavy stock indices are catching up to the US.

Source: Simon White, Bloomberg Markets Live Blog

Source: Simon White, Bloomberg Markets Live Blog

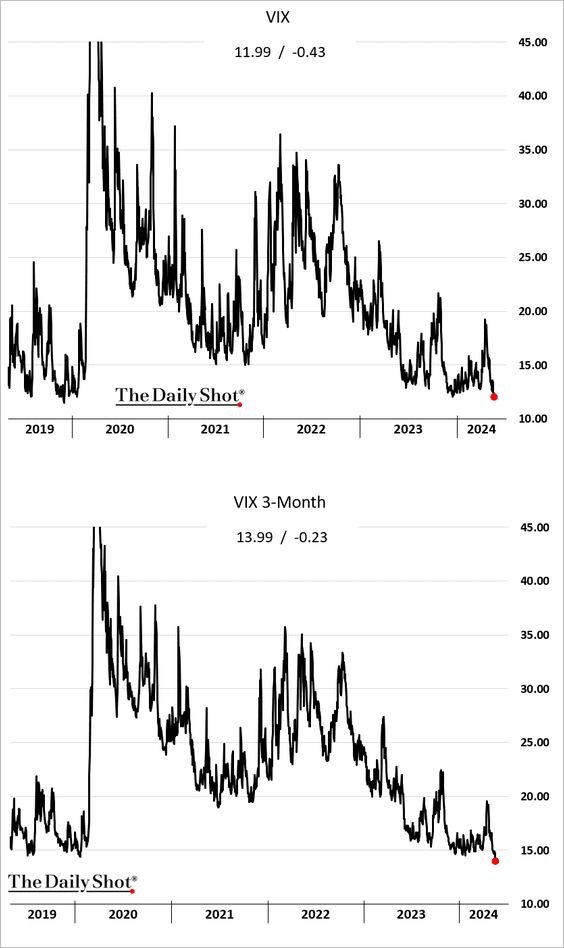

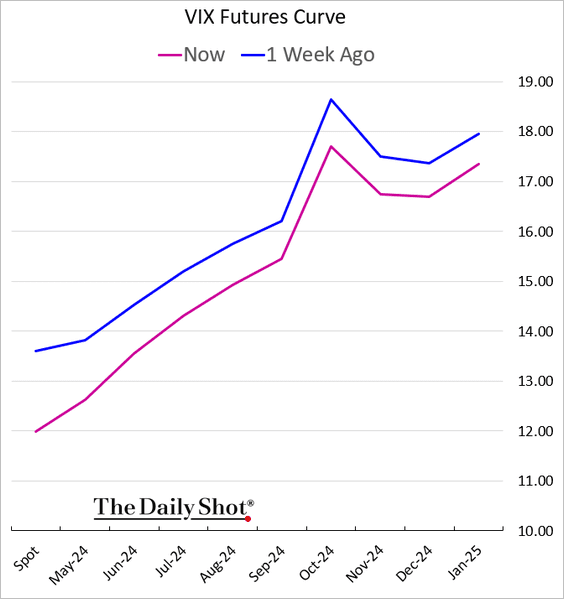

7. VIX closed below 12 for the first time since 2019. The 3-month VIX dipped below 14.

• The VIX curve contango continues to intensify.

——————–

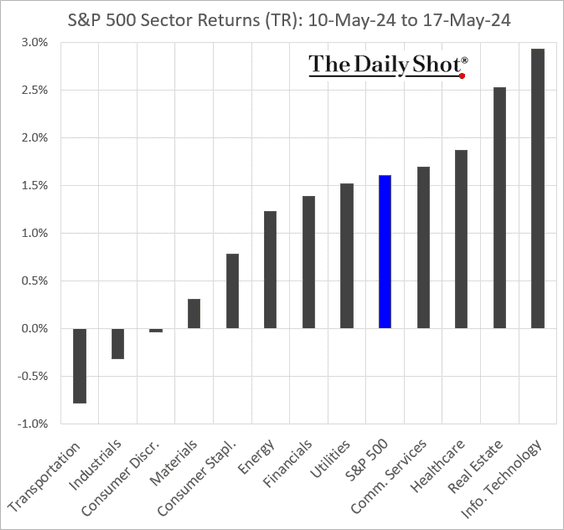

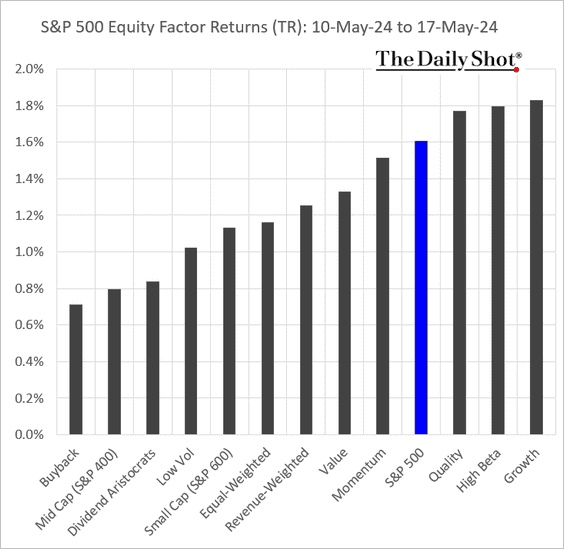

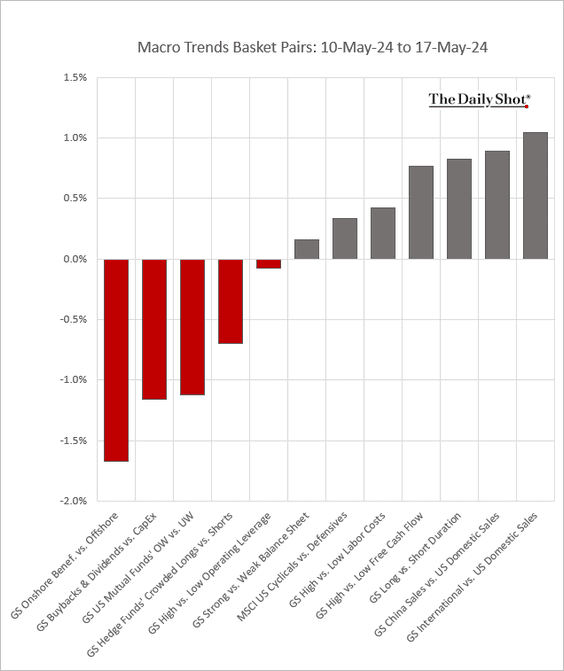

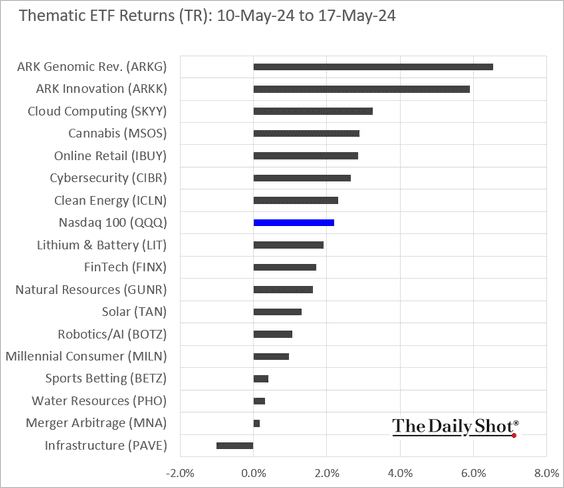

8. Finally, we have some performance data from last week.

• Sectors:

• Equity factors:

• Macro basket pairs’ relative performance:

• Thematic ETFs:

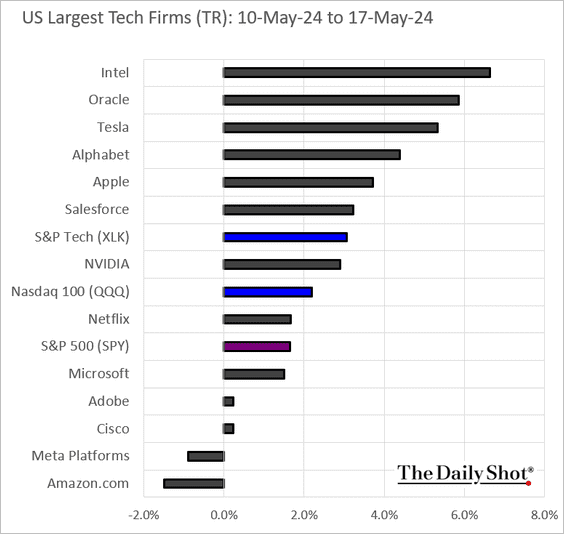

• Largest US tech firms:

Back to Index

Credit

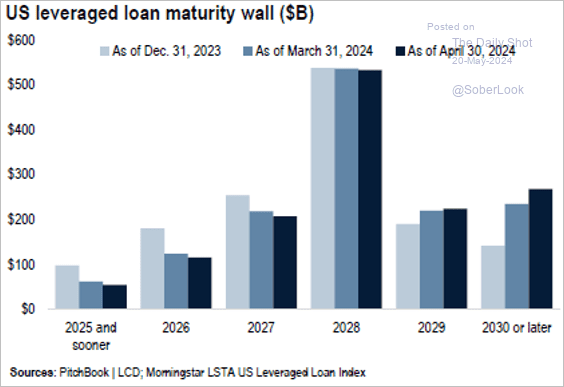

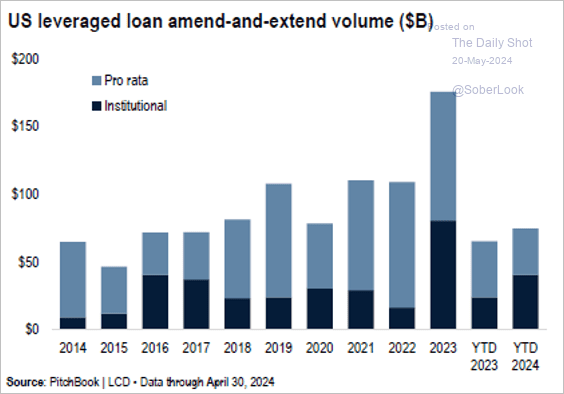

1. US leveraged loans will face a large maturity wall as issuers choose to “amend and extend.” (2 charts)

Source: PitchBook

Source: PitchBook

Source: PitchBook

Source: PitchBook

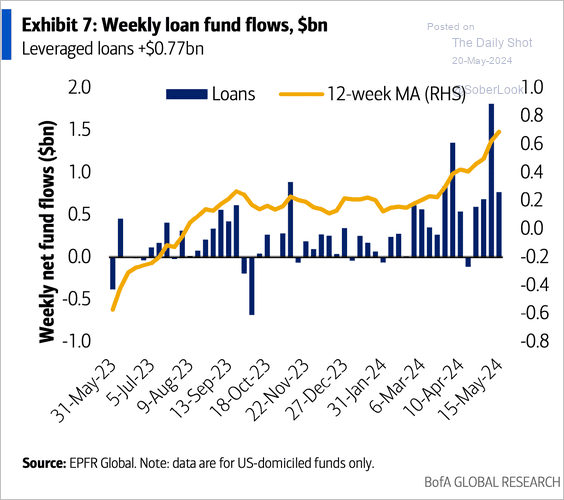

• Flows into leveraged loan funds remain robust.

Source: BofA Global Research; @dailychartbook

Source: BofA Global Research; @dailychartbook

——————–

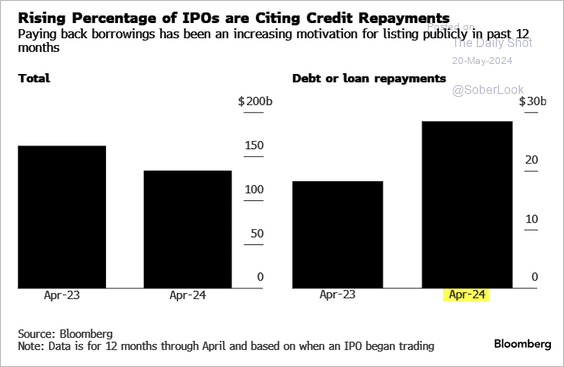

2. More IPO deals are being undertaken to pay off debt.

Source: Bloomberg Law Read full article

Source: Bloomberg Law Read full article

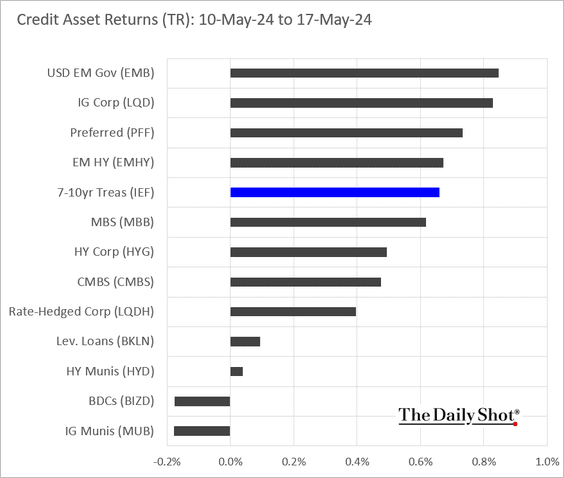

3. Here is last week’s performance.

Back to Index

Global Developments

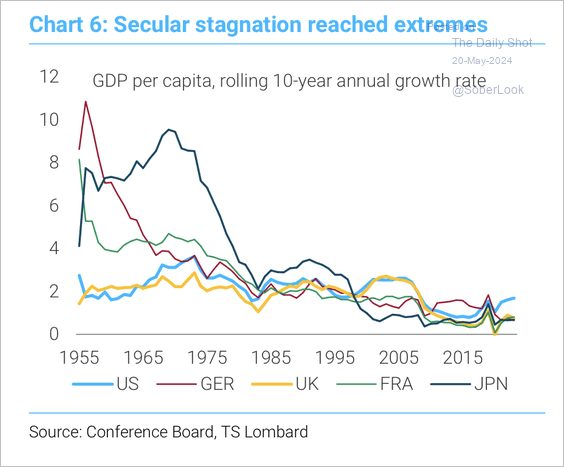

1. The growth in GDP per capita among select developed economies has trended lower over the past 60 years.

Source: TS Lombard

Source: TS Lombard

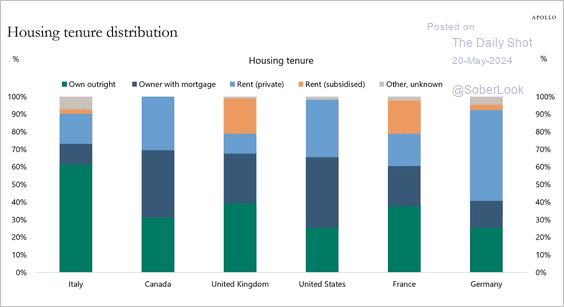

2. Here is a look at housing ownership and rental distribution by country.

Source: Torsten Slok, Apollo

Source: Torsten Slok, Apollo

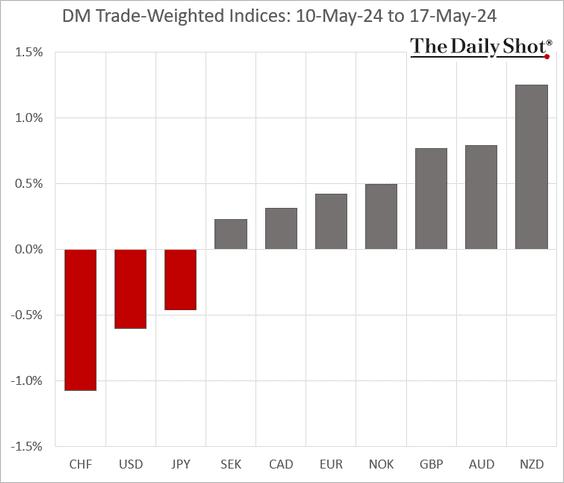

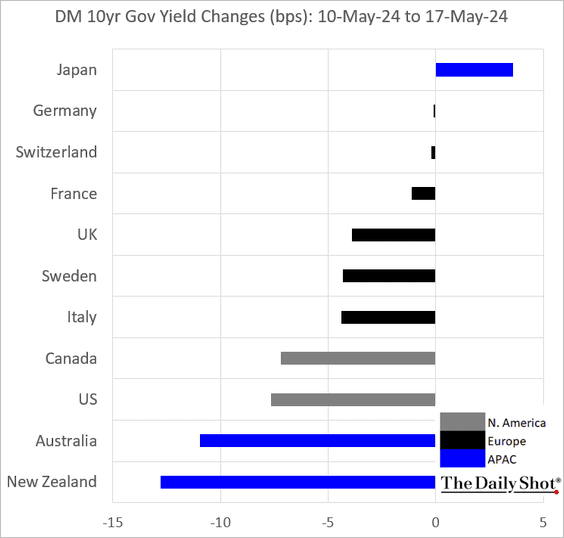

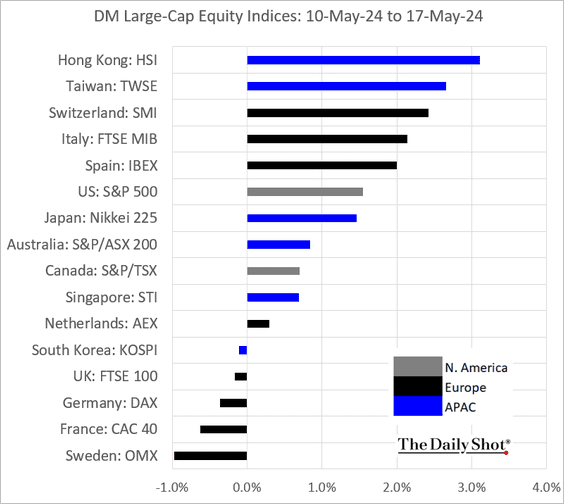

3. Finally, we have some performance data from last week.

• Currencies:

• Bond yields:

• Equities:

——————–

Food for Thought

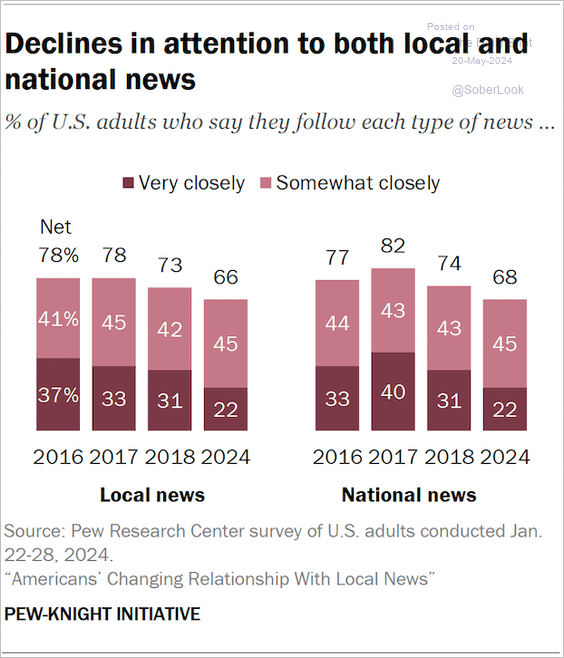

1. Americans are paying less attention to the news.

Source: Pew Research Center Read full article

Source: Pew Research Center Read full article

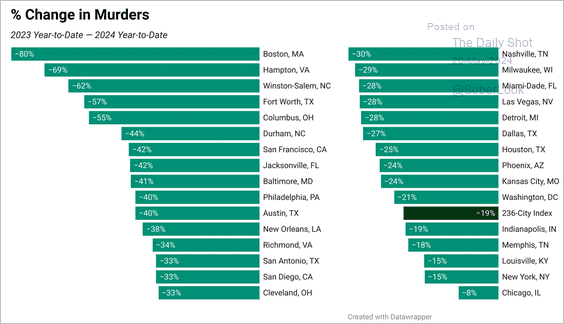

2. Declining murder rates:

Source: @SteveRattner

Source: @SteveRattner

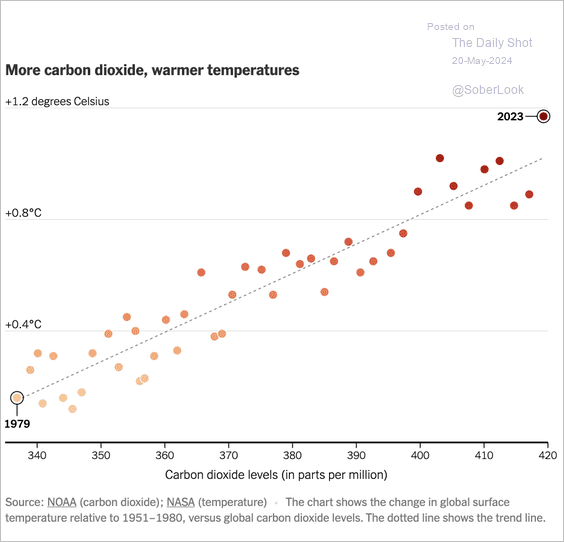

3. Changes in global surface temperature vs. carbon dioxide levels:

Source: The New York Times Read full article

Source: The New York Times Read full article

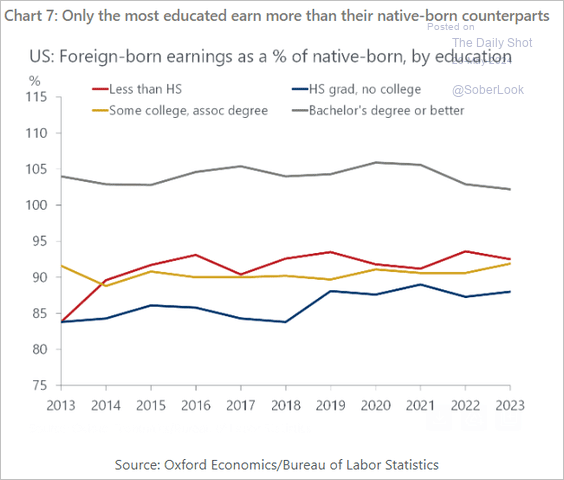

4. Earnings comparison of foreign-born to native-born Americans by education level:

Source: Oxford Economics

Source: Oxford Economics

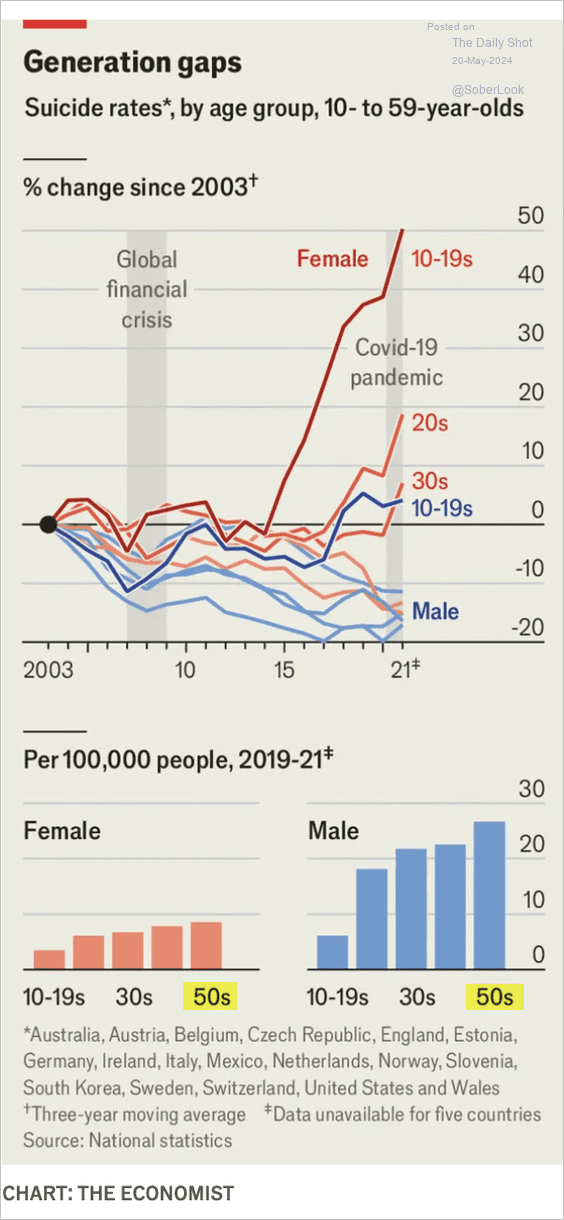

5. Trends in suicide rates by age and gender (globally):

Source: The Economist Read full article

Source: The Economist Read full article

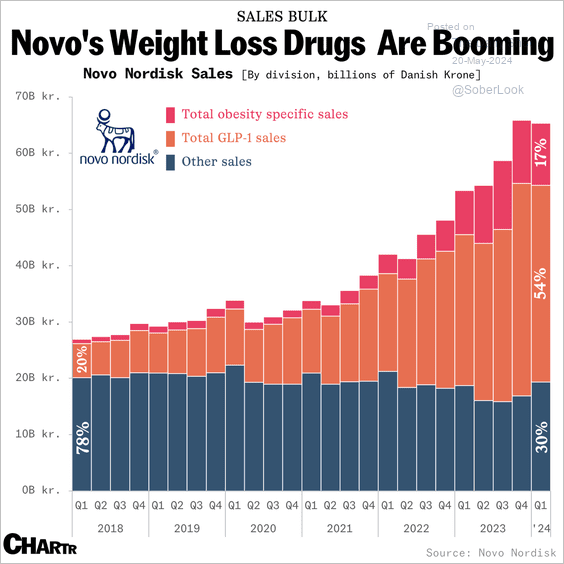

6. Quarterly sales of Novo Nordisk’s weight loss drugs:

Source: @chartrdaily

Source: @chartrdaily

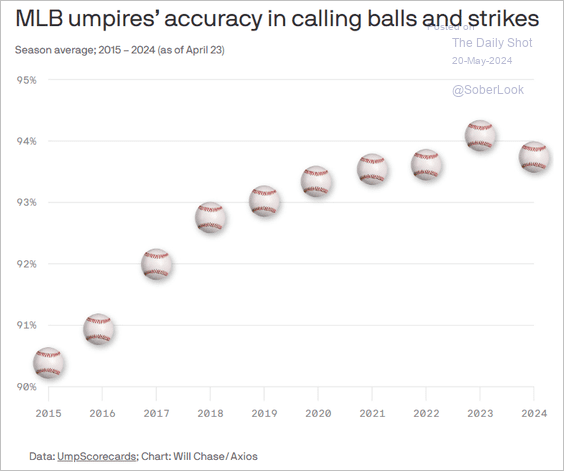

7. Evolution of MLB umpires’ accuracy in calling balls and strikes:

Source: @axios Read full article

Source: @axios Read full article

——————–

Back to Index